Page 1

ELECTRONIC CASH REGISTER

CAJA REGISTRADORA ELECTRONICA

MODEL

MODELO

INSTRUCTION MANUAL MANUAL DE INSTRUCCIONES

XE-A302

Page 2

FCC Regulations state that any unauthorized changes or modifications to

this equipment not expressly approved by the manufacturer could void

the user’s authority to operate this equipment.

Note: This equipment has been tested and found to comply with the

limits for a Class A digital device, pursuant to Part 15 of the FCC Rules.

These limits are designed to provide reasonable protection against

harmful interference when this equipment is operated in a commercial

environment.

This equipment generates, uses, and can radiate radio frequency energy

and, if not installed and used in accordance with the instruction manual,

may cause harmful interference to radio communications. Operation of

this equipment in a residential area is likely to cause harmful interference

in which case the user will be required to correct the interference at his

own expense.

WARNING

CAUTION

The AC power socket-outlet should be installed near the equipment

and should be easily accessible.

Please record below the model number and serial number for easy

reference in case of loss or theft. These numbers are located on the

right side of the unit. Space is provided for further pertinent data.

Model Number

Serial Number

Date of Purchase

Place of Purchase

FOR YOUR RECORDS

Page 3

INTRODUCTION

Thank you very much for your purchase of the SHARP Electronic Cash Register, Model XE-A302.

Please read this manual carefully before operating your machine in order to gain full understanding of

functions and features.

Please keep this manual for future reference. It will help you if you encounter any operational problems.

CAUTION!

Be sure to initialize the cash register before you start operating the cash register. Otherwise, distorted

memory contents and malfunction of the cash register will occur. For this procedure, please refer to page 8.

English

IMPORTANT

• On the printer cover, a paper cutter is mounted. Be careful not to cut yourself on the paper cutter.

• Install your register in a location that is not subject to direct radiation, unusual temperature changes,

high humidity or exposed to water sources. Please keep the register away from heat and magnetic

sources.

Installation in such locations could cause damage to the cabinet and the electric components.

• Never operate the register with wet hands.

The water could seep into the interior of the register and cause component failure.

• When cleaning your register, use a dry, soft cloth. Never use solvents, such as benzine and/or

thinner.

The use of such chemicals will lead to discoloration or deterioration of the cabinet.

• The register plugs into any standard wall outlet (120V AC ±10%) with a dedicated earth-guard.

Other electrical devices on the same electrical circuit could cause the register to malfunction.

• If the register malfunctions, call 1-800-BE-SHARP for service - do not try to repair the register

yourself.

• For complete electrical disconnection, remove the AC power cord from the wall outlet.

PRECAUTION

This Electronic Cash Register has a built-in memory protection circuit which is operated by rechargeable

batteries.

Please note that all batteries will, in time, dissipate their charge even if not used. Therefore to insure an

adequate initial charge in the protection circuit, and to prevent any possible loss of memory upon installation, it

is recommended that each unit be allowed to recharge for a period of 24 to 48 hours prior to use by the

customer.

After installation, the rechargeable batteries are charged when the machine is plugged in and its mode switch

is set to the ON position (other than OFF position). This recharging precaution can prevent unnecessary initial

service calls.

English

Customer Service Hotline

1-800-BE-SHARP

The Spanish version (summary of English version) is after the English version.

La versión española (el resumen de la versión inglesa) sigue a la versión inglesa.

For Easy Set-up, see

“GETTING STARTED” (page 8).

1

Page 4

CONTENTS

INTRODUCTION............................................................................................................................................1

IMPORTANT ..................................................................................................................................................1

PRECAUTION................................................................................................................................................1

CONTENTS....................................................................................................................................................2

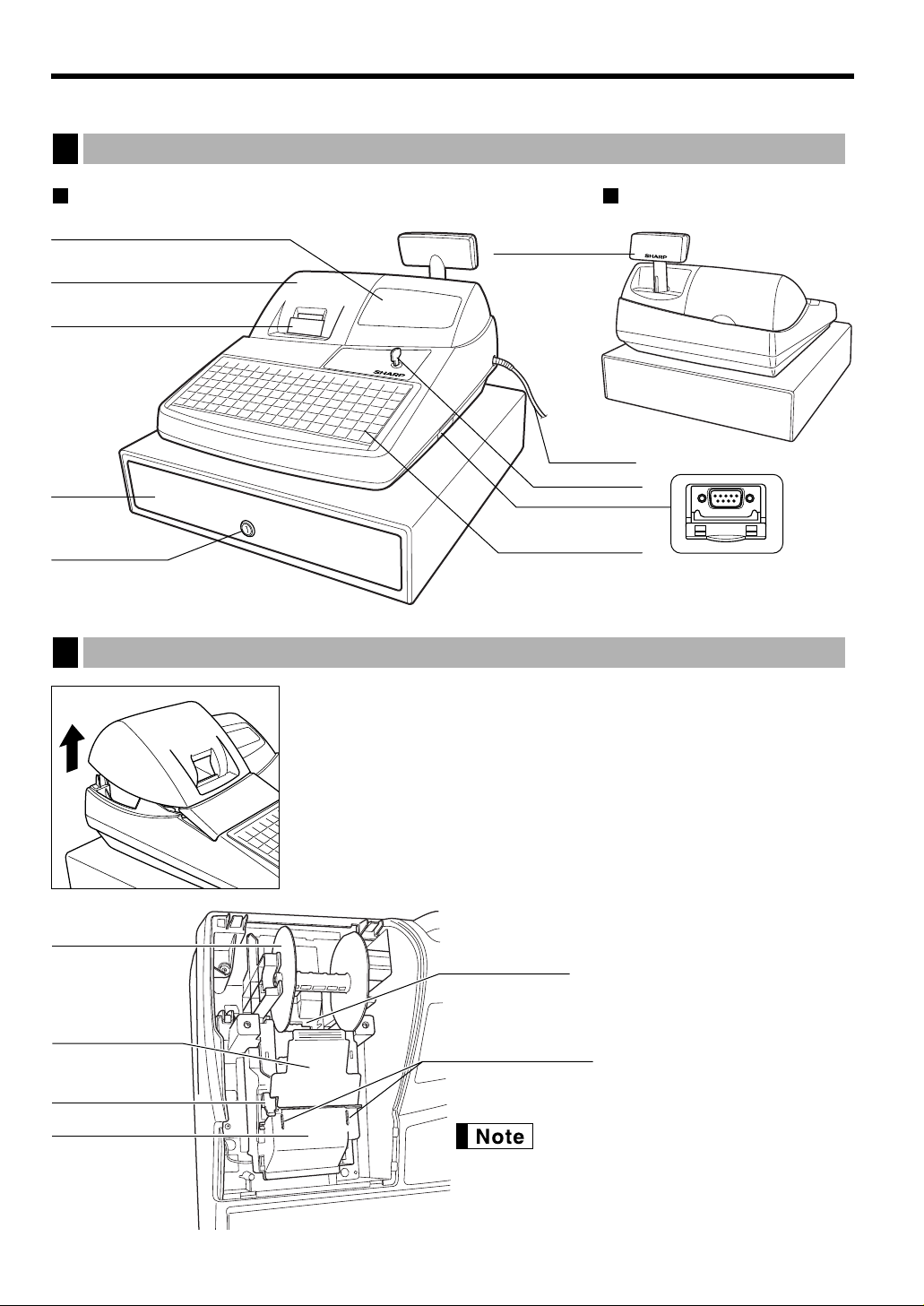

PARTS AND THEIR FUNCTIONS.................................................................................................................4

1 External View ........................................................................................................................................4

2 Printer....................................................................................................................................................4

3 Mode Switch and Mode Keys................................................................................................................5

4 Keyboard ...............................................................................................................................................5

5 Displays.................................................................................................................................................6

6 Drawer Lock Key ...................................................................................................................................6

GETTING STARTED......................................................................................................................................8

FOR THE OPERATOR

OVERVIEW OF FLOW OF DAILY SALES ENTRIES .................................................................................12

BASIC SALES ENTRY ................................................................................................................................13

1 Basic Sales Entry Example .................................................................................................................13

2Error Warning ......................................................................................................................................14

3 Item Entries .........................................................................................................................................15

Single item entries ........................................................................................................................15

Repeat entries ..............................................................................................................................16

Multiplication entries .....................................................................................................................16

Split pricing entries .......................................................................................................................17

Single item cash sale (SICS) entry...............................................................................................18

4 Displaying Subtotals............................................................................................................................18

5 Finalization of Transaction ..................................................................................................................18

Cash or check tendering...............................................................................................................18

Cash or check sale that does not require tender entry.................................................................19

Charge (credit) sale ......................................................................................................................19

Mixed-tender sale .........................................................................................................................19

6 Tax Calculation....................................................................................................................................20

Automatic tax................................................................................................................................20

Manual tax ....................................................................................................................................20

Tax delete.....................................................................................................................................20

Tax status shift .............................................................................................................................21

OPTIONAL FEATURES...............................................................................................................................22

1 Auxiliary Entries...................................................................................................................................22

Discount and premium entries using the percent key...................................................................22

Discount and premium entries using the discount key .................................................................22

Refund entries ..............................................................................................................................23

Non-add code number entries and printing ..................................................................................23

2 Auxiliary Payment Treatment ..............................................................................................................24

Currency conversion.....................................................................................................................24

Received-on account and paid-out entries ...................................................................................25

No sale (exchange) ......................................................................................................................25

Bottle return ..................................................................................................................................25

3 Automatic Sequence Key (

CORRECTION .............................................................................................................................................26

1 Correction of the Last Entry (direct void).............................................................................................26

2 Correction of the Next-to-last or Earlier Entry (indirect void)...............................................................26

3 Subtotal Void .......................................................................................................................................27

4 Correction of Incorrect Entries not Handled by the Direct or Indirect Void Function ...........................27

key) Entries.........................................................................................25

a

2

Page 5

FOR THE MANAGER

PRIOR TO PROGRAMMING ......................................................................................................................28

BASIC FUNCTION PROGRAMMING (For Quick Start) ............................................................................28

1 Date and Time Programming ..............................................................................................................28

2 Tax Programming for Automatic Tax Calculation Function .................................................................29

Tax programming using a tax rate................................................................................................29

The tax table (applicable to the add-on tax) .................................................................................30

Quantity for doughnut tax exempt (for Canadian tax system) ......................................................32

AUXILIARY FUNCTION PROGRAMMING .................................................................................................33

1Department Programming ...................................................................................................................33

2 PLU (Price Look-Up) and Subdepartment Programming ....................................................................35

3 Commission Rate Programming .........................................................................................................36

4 Miscellaneous Key Programming........................................................................................................37

Rate for

Amount for

Percent rate limitation for

Function parameters for

Function parameters for

Entry digit limit for

Function parameters for

5 Text Programming...............................................................................................................................41

ADVANCED PROGRAMMING....................................................................................................................48

1 Register Number and Consecutive Number Programming .................................................................48

2 Various Function Selection Programming 1 ........................................................................................48

Function selection for miscellaneous keys ...................................................................................49

Print format ...................................................................................................................................49

Receipt print format ......................................................................................................................50

Electronic journal (EJ) function parameters..................................................................................50

Function selection for tax..............................................................................................................51

Other programming ......................................................................................................................51

3 Various Function Selection Programming 2 ........................................................................................54

Power save mode.........................................................................................................................54

Logo message print format...........................................................................................................54

High amount lockout (HALO) for cash in drawer (CID) (sentinel).................................................55

RS-232C interface ........................................................................................................................55

Thermal printer density.................................................................................................................56

Language selection ......................................................................................................................56

Training clerk specification for training mode ...............................................................................57

AUTO key programming...............................................................................................................57

4 Reading Stored Programs...................................................................................................................57

TRAINING MODE ........................................................................................................................................59

READING (X) AND RESETTING (Z) OF SALES TOTALS ........................................................................60

EJ REPORT READING AND RESETTING .................................................................................................66

OVERRIDE ENTRIES ..................................................................................................................................67

CORRECTION AFTER FINALIZING A TRANSACTION (Void mode).......................................................67

OPERATOR MAINTENANCE......................................................................................................................68

1 In Case of Power Failure.....................................................................................................................68

2 In Case of Printer Error .......................................................................................................................68

3 Cautions in Handling the Printer and Recording Paper.......................................................................68

4 Replacing the Paper Roll.....................................................................................................................69

5 Removing a Paper Jam.......................................................................................................................71

6 Cleaning the Printer (Print Head / Sensor / Roller) .............................................................................71

7 Removing the Till and the Drawer .......................................................................................................72

8 Opening the Drawer by Hand..............................................................................................................72

9 Before Calling for Service....................................................................................................................73

SPECIFICATIONS .......................................................................................................................................74

MANUAL DE INSTRUCCIONES (VERSION EN ESPAÑOL)

%, &

and V..............................................................................................................37

..............................................................................................................................37

-

r, R

and &..........................................................................................38

%

%, &

V

C, X, Y

and -....................................................................................38

.........................................................................................................39

and t............................................................................................39

and A(when using as CA key).....................................40

3

Page 6

PARTS AND THEIR FUNCTIONS

RS-232C connector

Operator display

Receipt paper

Drawer lock

Drawer

Printer cover

Customer display

(Pop-up type)

Mode switch

Power cord

Keyboard

Take-up spool

Print roller

release rever

Print roller arm

Inner cover

Paper roll cradle

Paper positioning guides

External View

1

Front view Rear view

2

Printer

The printer is one station type thermal printer, therefore it does not require any

type of ink ribbon or cartridge.

Lift the rear of the printer cover to remove. To re-install, hook the pawls on

the cabinet and close.

Caution: The paper cutter is mounted on the printer cover. Be careful

not to cut yourself.

Do not attempt to remove the paper roll

with the print roller arm is locked. This may

result in damage to the printer and print

head.

4

Page 7

PGM

VOID

OFF

OP

X/Z

REG

MGR

X

1/Z1

X2/Z2

OP

MA

MA

OP

Manager key (MA)

Operator key (OP)

Mode Switch and Mode Keys

RCPT

/PO

CA/AT

Electronic journal print key

Receipt print/Paid-out key

Void key

Conversion key

Multiplication key

Decimal point key

Clear key

Department code entry key

PLU/Subdepartment key

Clerk code entry key

Department keys~

~

Numeric keys

90

00

VOID

@

FOR

CL

•

CONV

RFND

Refund key

%1

%2

Percent 1 and 2 keys

Discount key

PLU

/SUB

DEPT

#

TAX1

SHIFT

Merchandise subtotal key

MDSE

SBTL

Non-add code/Time display

/Subtotal key

Total/Amount tender

/No sale key

#/TM

SBTL

CLK

#

Tax key

Automatic sequence key

AUTO

CH1 CH2

16

TAX2

SHIFT

Tax 1 and 2 shift keys

Charge 1 and 2 keys

Paper feed key

E/J

PRINT

Direct PLU keys~

175

ESC

Escape key

RA

Received-on account key

Check key

CHK

TAX

1234567891011

12 13 14 15 16 17 18 19 20 21 22

23 24 25 26 27 28 29 30 31 32 33

34 35 36 37 38 39 40 41 42 43 44

45 46 47 48 49 50 51 52 53 54 55

56 57 58 59 60 61 62 63 64 65 66

67 68 69 70 71 72 73 74 75

1

2

3

4

5

6

0

1

2

3

456

78

9

CL

00

FOR

@

SUB

PLU

CA/AT

ESC

RA

CONV

CH2

CHK

AUTO

TAX

CH

1

%1

%2

RFND

VOID

E/J

PRINT

CLK

#

DEPT

#

TAX1

SHIFT

TAX2

SHIFT

#/TM

SBTL

MDSE

SBTL

RCPT

/PO

3

The mode switch can be operated by inserting one of the two supplied mode keys - manager (MA) and operator

(OP) keys. These keys can be inserted or removed only in the “REG” or “OFF” position.

The mode switch has these settings:

OFF: This mode locks all register operations. (AC power turns off.)

No change occurs to register data.

OP X/Z: To take individual clerk X or Z reports, and to take flash reports.

It can be used to toggle receipt state “ON” and “OFF” by pressing

the

R

key.

REG: For entering sales.

PGM: To program various items.

VOID

: Enters into the void mode. This mode allows correction after

finalizing a transaction.

MGR: For manager’s entries. The manager can use this mode for an

override entry.

X1/Z1: To take the X/Z report for various daily totals

X2/Z2: To take the X/Z report for periodic (weekly or monthly)

consolidation

Keyboard

4

Keyboard layout

Key names

In this manual, key tops are shown in one line, such as

are shown like

unless otherwise specified.

!

, and numeric keys are indicated with simple number indication, such as 1,

p

for easy reading. Department keys

5

Page 8

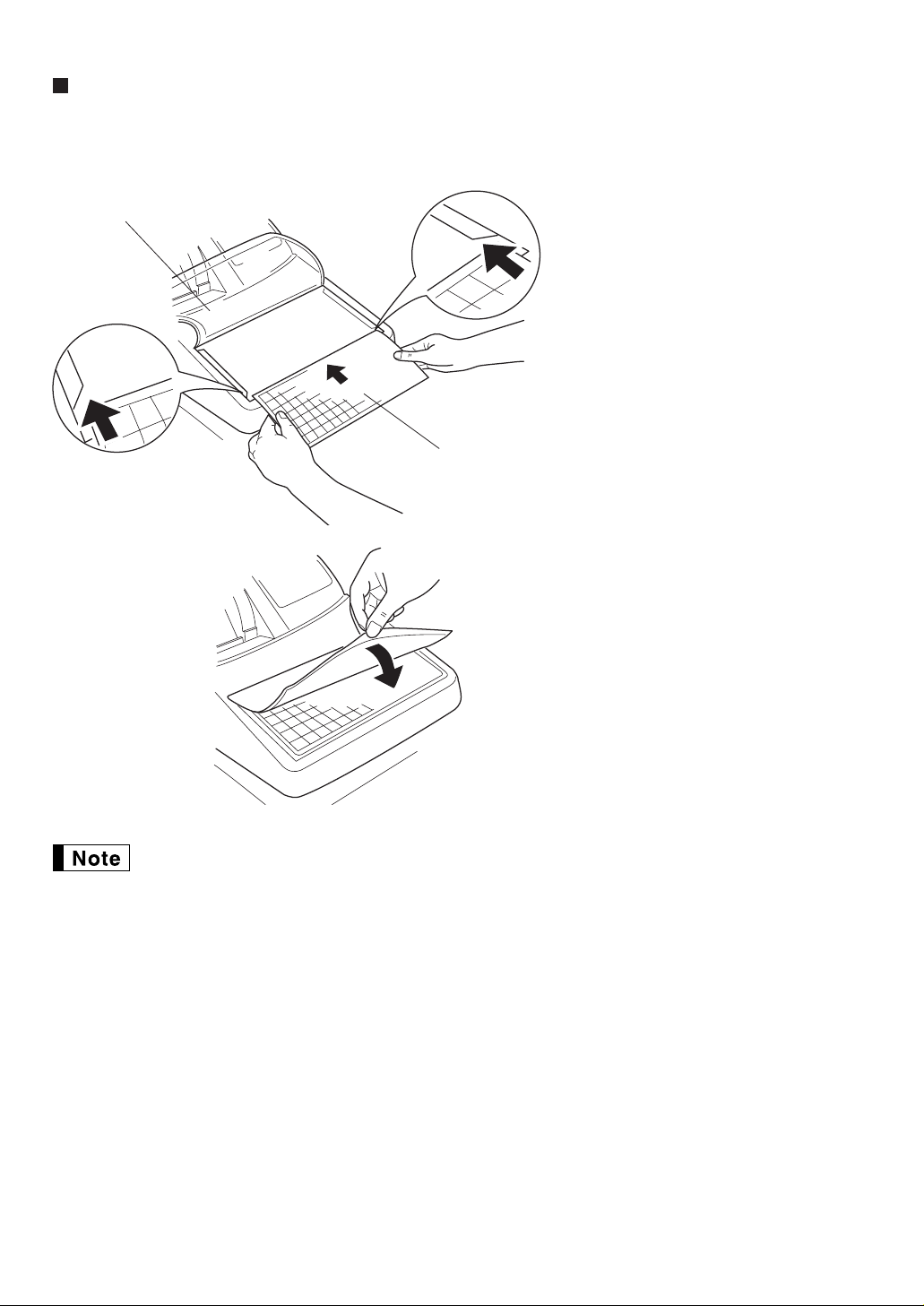

Keyboard sheet

Two types of keyboard sheets are installed on the cash register; one for ordinal use and one for text

programming.

To reinstall the keyboard sheet or a new sheet, please follow the procedure below.

Turn over the keyboard cover.

Keyboard cover

Keyboard sheet

➀

Insert the keyboard sheet into a slit.

➁

Close the keyboard cover.

➂

• Do not spread the keyboard cover too far as it might tear the tabs.

• Replace the keyboard sheet with a new one if chance it gets wet. Use of a wet keyboard sheet

may cause problems.

• Be sure to use only SHARP-supplied keyboard sheets. Thick or hard sheets can make key

operations difficult.

• Place the keyboard sheet evenly under the keyboard cover.

• If you require a new keyboard sheet, please call the customer service hotline.

• The keyboard cover will eventually wear out. If your keyboard cover is dirty or broken, replace the

cover with a new one. For details, please call the customer service hotline.

6

Page 9

Power save mark (Mark only lights up in the power save mode.)

Displays

SK1-1

Function message display area

Clerk code or mode name

Numeric entry display area

Receipt OFF indicator

Repeat / Sentinel mark / Power save mark

5

Operator display

• Clerk code or Mode name

The mode you are in is displayed. When a clerk is assigned, the clerk code is displayed in the REG or

OP X/Z mode. For example, “?01?” is displayed when clerk 01 is assigned.

• Repeat

The number of repeats is displayed, starting at “2” and incremental with each repeat. When you have

registered ten times, the display will show “0”. (2 ➞ 3 ......9 ➞ 0 ➞ 1 ➞ 2...)

• Sentinel mark

When amount in the drawer reaches the amount you preprogrammed, the sentinel mark “X” is displayed

advising you to remove the money to a safe place.

• Power save mark

When the cash register goes into the power save mode, the power save mark (decimal point) lights up.

• Function message display area

Item labels of departments and PLU/subdepartments and function texts you use, such as %1, (-) and

CASH are displayed. For the details of function texts, please refer to pages 45 and 46.

When an amount is to be entered or entered, “AMOUNT” is displayed: When an amount is to be

entered, ------- is displayed at the numeric entry area with “AMOUNT”. When a preset price has been

set, the price is displayed at the numeric entry area with “AMOUNT”.

• Numeric entry display area

Numbers entered using numeric keys are displayed here.

Date and time display

Date and time appear on the display in the OP X/Z, REG, or MGR mode. In the REG or MGR mode, press

the

Error message

When an error occurs, the corresponding error message is displayed in the function message display area.

For details of error messages, please refer to “Error message table” on page 73.

key to display the date and time.

s

Customer display (Pop-up type)

Drawer Lock Key

6

This key locks and unlocks the drawer. To lock it, turn 90

degrees counterclockwise. To unlock it, turn 90 degrees

clockwise.

7

Page 10

GETTING STARTED

REG

OPX/Z MGR

PGM

X1/Z1

X2/Z2

OFF

VOID

Please follow the procedure shown below.

Installing the cash register

1

direct sunlight .

Unpack the cash register and make sure all accessories are included. For details of accessories, please refer to

“Specifications” section.

2

Follow this procedure.

1. Make sure the power cord plug is not plugged into the AC outlet.

2. Insert the manager (MA) key into the mode switch and turn it to the PGM position.

Find a stable surface near an AC outlet where the cash register will not subject to water sources or

Initializing the cash register

In order for the cash register to operate properly, you must initialize it before operating for the first time.

3. While holding down both the

AC outlet. The buzzer will sound three times and “??? MRS. ???” will

be displayed.

4. The cash register has now been initialized. The register display will now

show “0.00” with “PGM”.

If the buzzer does not sound when the plug is inserted, the initialization has not been done

successfully. (This will occur when the voltage is high because you operated the cash register

before starting initialization.) Wait at least ten seconds after pulling out the plug and initialize the

cash register again.

The cash register has a built-in memory protection circuit which is operated by rechargeable

batteries. Since the rechargeable batteries have been discharged, please charge the batteries for

one or two days before using the cash register for the first time. To charge the batteries, set the

mode switch to a position other than “OFF” with the power cord plugged into the AC outlet.

Unless the batteries have been charged, all of the programmed data and sales data is not saved.

If you press a key by mistake, an error message such as “HEAD UP” or “PAPER EMPTY” may be

displayed. Press the

key and the / key, insert the plug into the

F

key to clear message after installing a paper roll.

l

*** MRS. ***

PGM

0.00

8

Page 11

Print roller

release lever

Print roller arm

Installing a paper roll

Paper positioning guides

3

The register can print receipts or journals. For the printer, you must install the paper roll provided with the

register.

Install the paper roll according to the procedure shown below with the power cord connected and the mode

switch set to the PGM position:

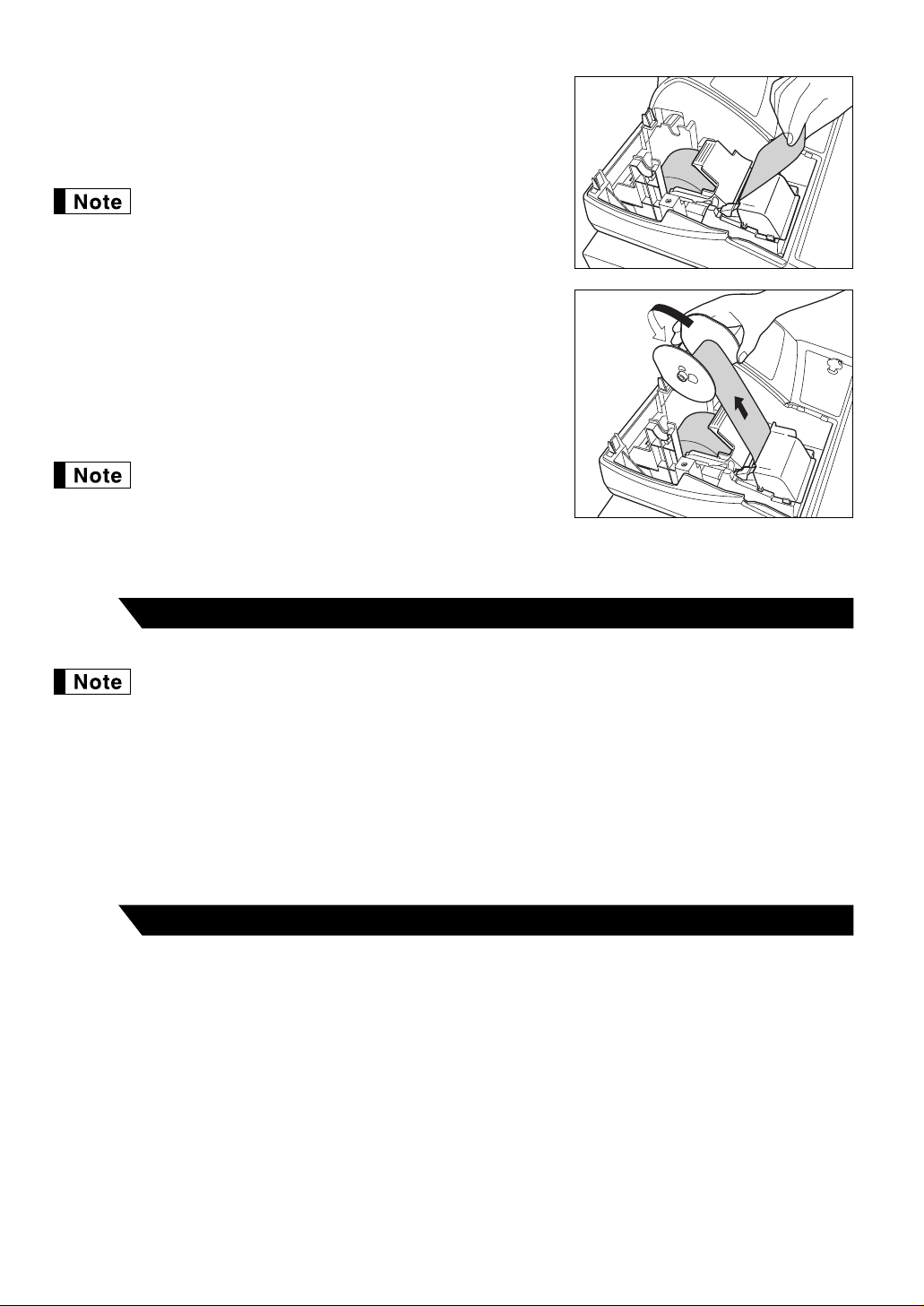

1. Push the printer cover forward and detach it.

2. Lift up the print roller release lever to unlock and open the

3. Set a paper roll in the paper roll cradle as illustrated at the

Precaution: The paper cutter is mounted on the printer cover. Take caution when installing

paper rolls.

print roller arm.

right.

To the printer

To the printer

4. Feed the end of the paper along with

the paper positioning guides as

illustrated at the right.

5. While holding down the paper, slowly close the print roller

arm, and push down the arm until you hear a click locking

the arm. Make sure securely you push down the center of

the wing part of the arm as illustrated at the right. The

paper will be fed automatically.

If the print roller arm is not securely locked,

printing is not done right. If this problem occurs,

open the arm, and close the arm as instructed

above.

Correct

Incorrect

9

Page 12

6. When not using the take-up spool (using as receipt paper):

• Cut off the excess paper using the edge of the inner cover, and

replace the printer cover. Press the

paper end comes out of the printer cover and clean paper

appears.

If the paper end does not come out, open the printer

cover, and pass the paper end between the paper cutter

and the paper guide of the printer cover, and replace the

cover.

When using the take-up spool (using as journal paper):

• Insert the end of the paper into the slit in the spool. (Press the

key to feed more paper if required.)

• Wind the paper two or three turns around the spool shaft.

• Set the spool on the bearing, and press the

excess slack in the paper.

• Replace the printer cover.

When using a paper roll as journal paper, you must change

the printing style. Refer to “Print Format” in “Various

Function Selection Programming 1” section (Job code 6)

for changing the printing style.

key to make sure the

F

key to take up

F

F

Programming date, time and tax

4

The cash register provides text languages of English, French and Spanish. It is preset to English.

If you want to change the language, you must change it before programming. Refer to “Language

selection” in “Various Function Selection Programming 2” section for changing the language.

Before you can proceed with registration of sales, you must program:

• date

• time

• tax

Please refer to the BASIC FUNCTION PROGRAMMING section for details (page 28).

Programming other necessary items

5

optional functions. Before you start programming, please read through the sales operations section to

understand optional functions. The main optional functions are listed below:

While the cash register is pre-programmed to be used with minimal setup, it does provide you with

• PLU (price lookup)/subdepartment

• Consecutive number

• Machine number

• Power save mode (factory setting: goes into power save mode after 30 minutes)

• Electronic Journal (EJ)

• Text programming for clerk names, department items, PLU/subdepartment items, logo messages printed

on the top or bottom of receipts, function texts and foreign currency symbol

• Bottle return department

• Split pricing entry

10

Page 13

This is not factory preset. You must enable this function.

• Foreign currency conversion rate

You must set a conversion rate to use

• Preset unit price for departments

• Preset amount for

• Preset rates for

You do not have to program these preset prices/amount/rates since they can be entered at

registration. It might be convenient to preset so you do not have to re-enter every time.

• Amount entry digit limit for PO amount, RA amount, Manual tax amount

The factory setting makes the maximum amount you can enter. You can program to limit the amount.

• Sentinel - High amount lockout (HALO) for cash in drawer (CID)

• Department group

You can classify departments into a maximum of 9 groups (0 to 9 groups: 0: non-group is assigned).

Sales in each group can later be printed on an individual group total report and full group total report.

• Commission

If you program commission rates (up to two) and classify departments and PLUs/subdepartments into

commission groups (0 to 2 groups: 0: non-commission), commission sales and amount in each

commission group can later be printed on individual and full clerk reports.

• Key sequence for AUTO key

• RS-232C programming

• Specification of clerk to be trained

Department programming:

The cash register is pre-programmed for departments as follows:

Department: Allow open price entry in normal department (group: 0, commission group: 0), taxable status-

taxable 1 for department 1 to 6, and non taxable for department 7 to 99

When you use department 7 or above, and/or you apply taxable status other than taxable 1 for department 1 to

6, you must change department settings. Please refer to the department programming section for programming

details.

-

%&

V

key.

PLU/subdepartment programming:

The cash register is preprogrammed for PLUs/subdepartments as follows:

PLU/subdepartment selection: PLU is selected for all PLU codes so that you only have to program unit prices

and associated departments for them (by default, unit price is set to 0 and associated department is set to

department 1). Function parameters including tax status depend on the status of associated department.

• For direct PLU keys, PLU codes 1 through 75 are assigned for PLU 1 through 75 keys respectively.

Starting sales entries

6

Now you are ready for sales registration.

11

Page 14

FOR THE OPERATOR

OVERVIEW OF FLOW OF DAILY SALES ENTRIES

Things to do before starting sales entries:

• Make sure the power cord is securely connected to the AC outlet.

• Turn the mode switch to OP X/Z position and check if date and time are correctly set.

• Replace the till, if removed for safety.

• Check if there is enough paper on the roll.

• Select receipt ON/OFF function.

• Make any necessary programming for the day in PGM mode.

For details, refer to BASIC SALES ENTRY, page 13. For the till and paper roll, refer to OPERATOR

MAINTENANCE, page 68 and for programming, refer to programming sections.

Things you can do for sales entries:

• Item entries

• Item repeat entries

• Item multiplication entries

• Single item cash sale (SICS), if programmed.

• Split pricing entries, if programmed.

• Displaying subtotals

• Cash/Check/Charge sale

• Cash tendering in a foreign currency, if the currency conversion rate is programmed.

• Manual tax entry

• Discount or premium using

• Refund entry

• No sale

• Paid-out entries

• Received on account entries

• Printing non-add code number

• Making corrections

• Checking sales reports

%&

and - key

For details of sales entry method, refer to BASIC SALES ENTRY (page 13) and OPTIONAL FEATURES

(page 22). For details of correcting sales entries, refer to CORRECTION (page 26). For details on reading

sales information, refer to READING (X) AND RESETTING (Z) OF SALES TOTAL (page 60).

Things to do after close of business:

• Print sales reports, and clear sales data for the day.

• Print Electronic Journal (EJ) reports, and clear Electronic Journal (EJ) data, if necessary.

• Account money - comparing it with the amount in cash in drawer printed on the general report.

• Remove the till for safety.

• Turn the mode switch to OFF position.

For details of reading sales information, refer to READING (X) AND RESETTING (Z) OF SALES TOTAL (page

60) and EJ REPORT READING AND RESETTING (page 66). For details of removing the till and maintenance

details, refer to OPERATOR MAINTENANCE (page 68).

12

Page 15

BASIC SALES ENTRY

REG

OPX/Z MGR

PGM

X1/Z1

X2/Z2

OFF

VOID

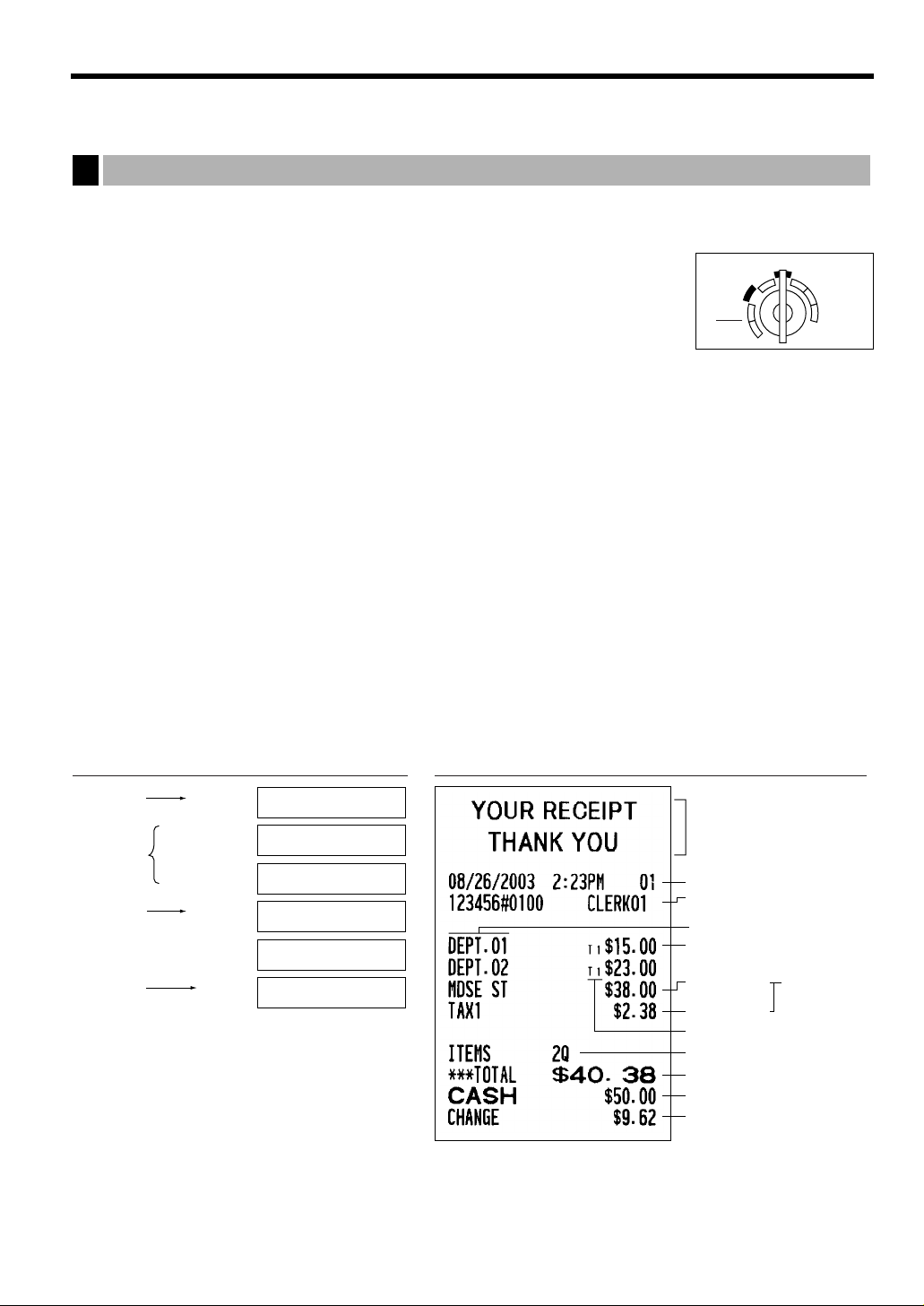

Graphic logo

Date/Time/Clerk code

Register number

/Consecutive number/Clerk name

Items

Tax status (T1: taxable 1)

Price

Merchandise

subtotal

Not printed when

non-taxable items

only are sold.

Tax amount

Total amount

Cash tendering/amount received

Change

Total quantity

1 L

1500 !

*

2300

"

*

s

5000

A

Item

entries

Clerk

assignment

Displaying

subtotal

Finalizing

the transaction

*

! "

:

(In this example, the tax rate is set to 6.25%.)

CLERK01 ?01

?

-01-

DEPT.01 ?01

?

15.00

DEPT.02 ?01

?

23.00

SUBTOTAL ?01

?

40.38

?01?

5000

CHANGE ?01

?

9.62

indicate department keys.

Basic Sales Entry Example

1

Listed below is a basic sales entry example when selling items by cash. For operation details, please refer to

each section.

Mode switch setting

1. Turn the mode switch to the REG position.

Clerk assignment

2. Enter your clerk code. (For example, clerk code is 1. Enter 1 using the numeric

key and press the

initialization of the cash register.

Item entries

3. Enter the price for the first department item. (For example, for 15.00, enter 1500 using the numeric keys, and

press the appropriate department key.)

For department 7 and above, enter the department code using numeric keys, and press the

then enter the price and press the

4. Repeat step 3 for all department items.

Displaying subtotals

5. Press the

s

Finalizing the transaction

6. Enter the amount received from the customer. (You can omit this step if the amount tendered is the same as

the subtotal.)

7. Press the

key, and the change due is displayed (when the amount received was not entered, the total

A

amount is displayed) and the drawer is opened.

8. Tear off the receipt and give it to the customer with his or her change.

9. Close the drawer.

key.) The clerk code 1 is automatically selected just after

L

key again.

d

key to display the amount due.

d

key,

Receipt printKey operation example

13

Page 16

Clerk assignment

L

Clerk code 1 to 40

To display the signed-on clerk code

LL

■ Sign-on (in REG, MGR, VOID mode) ■ Sign-off (in REG, MGR, VOID mode)

l

Transaction

To clear the error state

E

E

Prior to any item entries, clerks must enter their clerk codes into the register. However, the code entry may not

be necessary when the same clerk handles consecutive transactions.

Receipt ON/OFF function

You can disable receipt printing in the REG mode to save paper using the receipt ON/OFF function. To disable

receipt printing, press the

OFF.

To check the receipt printing status, turn the mode switch to the OP X/Z position or press the

mode. When the function is in the OFF mode, the receipt off indicator “_” is illuminated.

The register will print reports regardless of the receipt state, so the paper roll must be installed.

To issue a receipt when receipt ON/OFF function is set to OFF:

If your customer wants a receipt after you finalized a transaction with the receipt ON/OFF function in the OFF

mode, press the

issued in a summary receipt format.

Power Save Mode

The register will enter into power save mode when no entries are performed based on the pre-programmed time

limit (by default, 30 minutes).

When the register goes to the power save mode, all display lights will turn off except the decimal point at the

leftmost position of the lower line. The register will return to normal operation mode when any key is pressed or

a mode is changed with the mode key. Please note when the register is recovered by a key entry, its key entry

is invalid. After the recovery, start the key entry from the beginning.

key. This will produce a receipt. If more than 30 items were entered, the receipt will be

R

key in the OP X/Z position. This key toggles the receipt printing status ON and

R

key in the REG

l

Error Warning

2

In the following examples, your register will go into an error state accompanied with a warning beep and a

corresponding error message. Clear the error state by pressing the

Please refer to the error message table on page 73.

• Enter over a 32-digit number (entry limit overflow): Cancel the entry and re-enter the correct number.

• An error in key operation: Clear the error and continue operation.

• An entry beyond a programmed amount entry limit: Check to see if the entered amount is correct. If it is

correct, it can be rung up in the MGR mode. Contact your manager.

• An including-tax subtotal exceeds eight digits: Delete the subtotal by pressing the

C, X

Error escape function

To quit a transaction due to an error or an unforeseen event, use the error escape function as shown below:

The transaction is voided (treated as a subtotal void) and the receipt is issued by this function. If you have

already entered a tendered amount, the operation is finalized as a cash sale.

14

or Ykey to finalize the transaction.

key and take proper action.

l

key and press the A,

l

Page 17

PLU code

(1 to 1800)

p

Unit price *

(max. 7 digits)

p

Direct key entry

PLU code entry

Direct PLU key

Unit price *

(max. 7 digits)

PLU code

(1 to 1800)

Direct key entry

p

Direct PLU key

PLU code entry

Dept. code

(1 to 99)

Unit price *

(max. 7 digits)

When using a programmed unit price

(In case only preset price entry is allowed.)

dd

Department keyUnit price *

(max. 7 digits)

When using a programmed unit price

Item Entries

3

Single item entries

Department entries

The cash register provides a maximum of 99 departments for a merchandise classification. Group attributes,

such as taxable status, are applied to items when they are entered to the departments.

• When using the department keys (for department 1 to 6)

For department 1 to 6, enter a unit price and press a department key. If you use a programmed unit price,

press a department key only.

* Less than the programmed upper limit amounts

When zero is entered, only the sales quantity is

added.

• When using the department code entry key

Enter a department (dept.) code and press the

the dept. code is programmed to preset price entry style and a unit price is preset, the cash register will finish

its registration operation.

key, then enter a unit price and press the d key again. If

d

* Less than the programmed upper limit

amounts

When zero is entered, only the sales

quantity is added.

PLU/subdepartment entries

For another merchandise classification, the cash register provides a maximum of 1800 PLUs/subdepartments.

PLUs are used to call up preset prices by pressing direct PLU keys or entering PLU codes with a press of the

key. Subdepartments are used to classify merchandise into smaller groups under the departments.

p

Every PLU and subdepartment has a code from 1 to 1800, and should belong to a department to obtain

attributes of that department.

The cash register is pre-programmed to PLU mode (belonging to dept. 1) and zero for unit price. To use PLU

entries, their preset unit prices should be previously programmed. (Refer to page 35.)

To use subdepartment entries, change to subdepartment mode for the PLU codes.

• PLU entries

• Subdepartment (open PLU) entries

* Less than the programmed upper limit amounts

When zero is entered, only the sales quantity is added.

15

Page 18

Example: Selling a dept. 2 item ($12.00), a dept. 4 item (using preset price), a dept. 50 item ($15.00), a dept. 41

item (using preset price), a PLU 11 item (PLU entry using a direct key), a PLU 80 item (PLU entry

with a code entry), a PLU 15 item (subdept. entry using a direct key, $5.00) and a PLU 85 item

(subdept. entry with a code entry, $12.00)

Receipt printKey operation example

1200 "

Department entry

50 d 1500 d

$

41 d

PLU entry

Subdepartment

entry

85 p1200p

80 p

500 fi

A

Repeat entries

You can use this function for entering a sale of two or more of the same items. Consecutive pressing of a

department key,

key, a direct PLU key or

d

key is as shown on key operation example below.

p

Receipt printKey operation example

1200 " "

Department

entry

50 d 1500 d d

$ $

41 d d

PLU entry

Subdepartment entry

80 p p

500 fi fi

85 p 1200 p p

A

Multiplication entries

When selling a large quantity of items, it is convenient to use the multiplication entry method. Enter quantity

using numeric keys and press the

page.

key before starting item entry as shown in the example on the following

@

16

When programmed to allow fractional quantity entries, you can enter up to four integers and three

digit decimal, though the quantity is counted as one for sales reports. To enter a fractional quantity,

use the decimal point key between integer and decimal.

Page 19

Selling q'ty

(Up to 4 digits)

Base q'ty

(Up to 2 digits)

Unit price

per base q'ty

When using a programmed unit price

@ @

Dept. code

d

PLU code

p

Unit price

per base q'ty

PLU code Unit price

per base q'ty

p p

Unit price

per base q'ty

d

(Only preset entry is allowed.)

Department key

Direct PLU key

Direct PLU key

Receipt printKey operation example

3 @ 1200 "

Department

entry

PLU entry

Subdepartment entry

3 @ 50 d 1500 d

5@ 85p1200p

5 @ $

5 @ 41 d

3 @

5 @ 80 p

3 @ 500 fi

A

Split pricing entries

This function is practical when the customer wants to purchase items normally sold in bulk.

To realize this function, you must change the programmed setting. Refer to “Various Function Selection

Programming 1” (job code 70) for programming details.

To make split pricing entries, follow the procedure below:

Department entry

PLU entry

7 @ 10 @

600 (

8 @ 12 @

fl

A

Receipt printKey operation example

17

Page 20

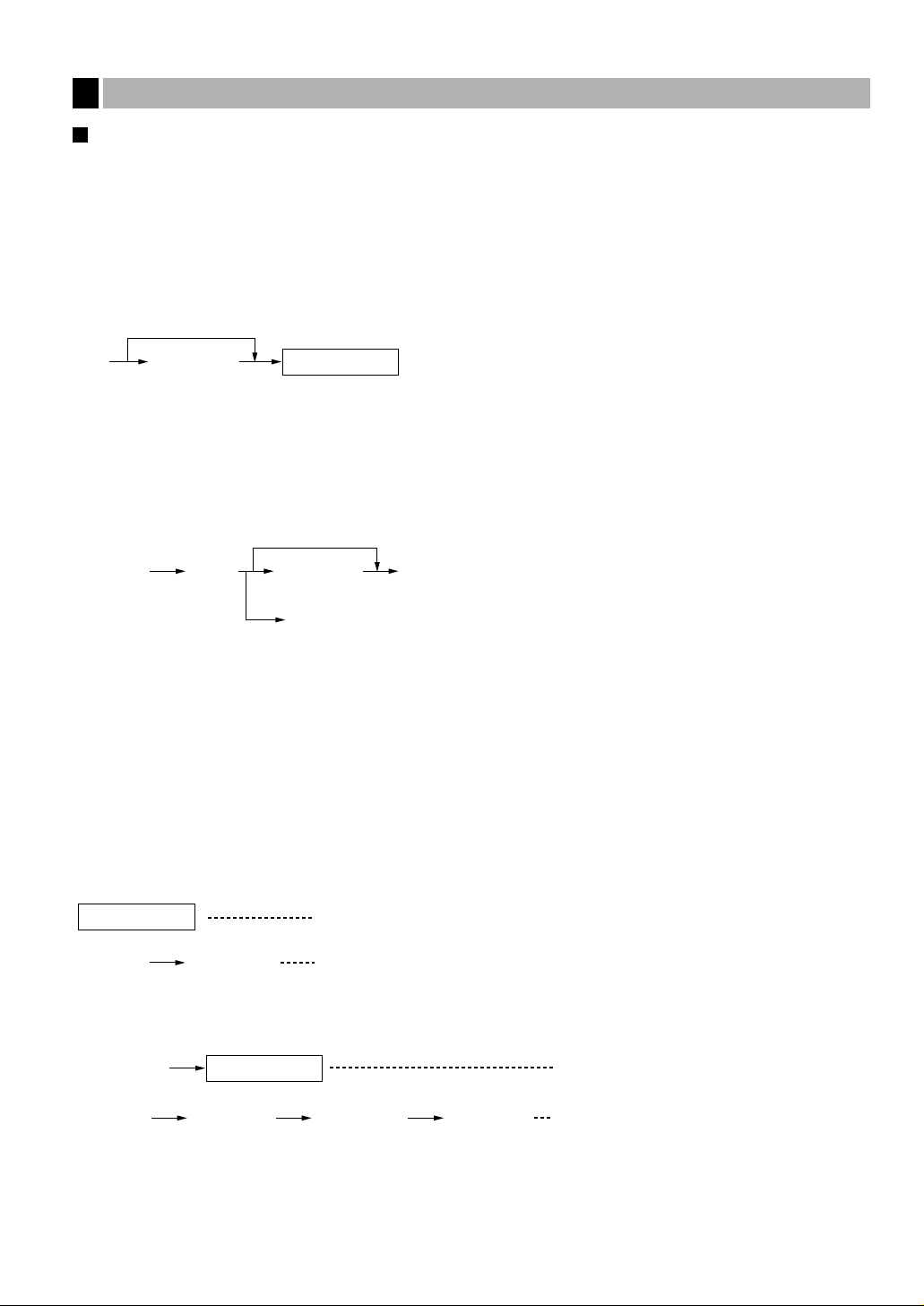

Single item cash sale (SICS) entry

s

1000 A

• This function is useful when a sale is for only one item and is for cash. This function is applicable only to those

departments that have been set for SICS or to their associated PLUs or subdepartments.

• The transaction is complete and the drawer opens as soon as you press the department key,

direct PLU key or

p

key.

Receipt printKey operation example

d

key, the

For finishing

the transaction

If an entry to a department or PLU/subdepartment set for SICS follows the ones to departments or

PLUs/subdepartments not set for SICS, it does not finalize and results in a normal sale.

Displaying Subtotals

4

The register provides three types of subtotals:

Merchandise subtotal

Press the

the display with the function message “MDSE ST”.

Taxable subtotal

Taxable 1 subtotal

Press the

taxable 1 items will appear in the display with the function message “TAX1 ST”.

Taxable 2 subtotal

Press the

taxable 2 items will appear in the display with the function message “TAX2 ST”.

key at any point during a transaction. The net sale subtotal - not including tax - will appear in

m

and

T

and

U

250

!

keys in this order at any point during a transaction. The sale subtotal of

s

keys in this order at any point during a transaction. The sale subtotal of

s

Including-tax subtotal (complete subtotal)

Press the

with the function message “SUBTOTAL”.

Finalization of Transaction

5

key at any point during a transaction. The sale subtotal including tax will appear in the display

s

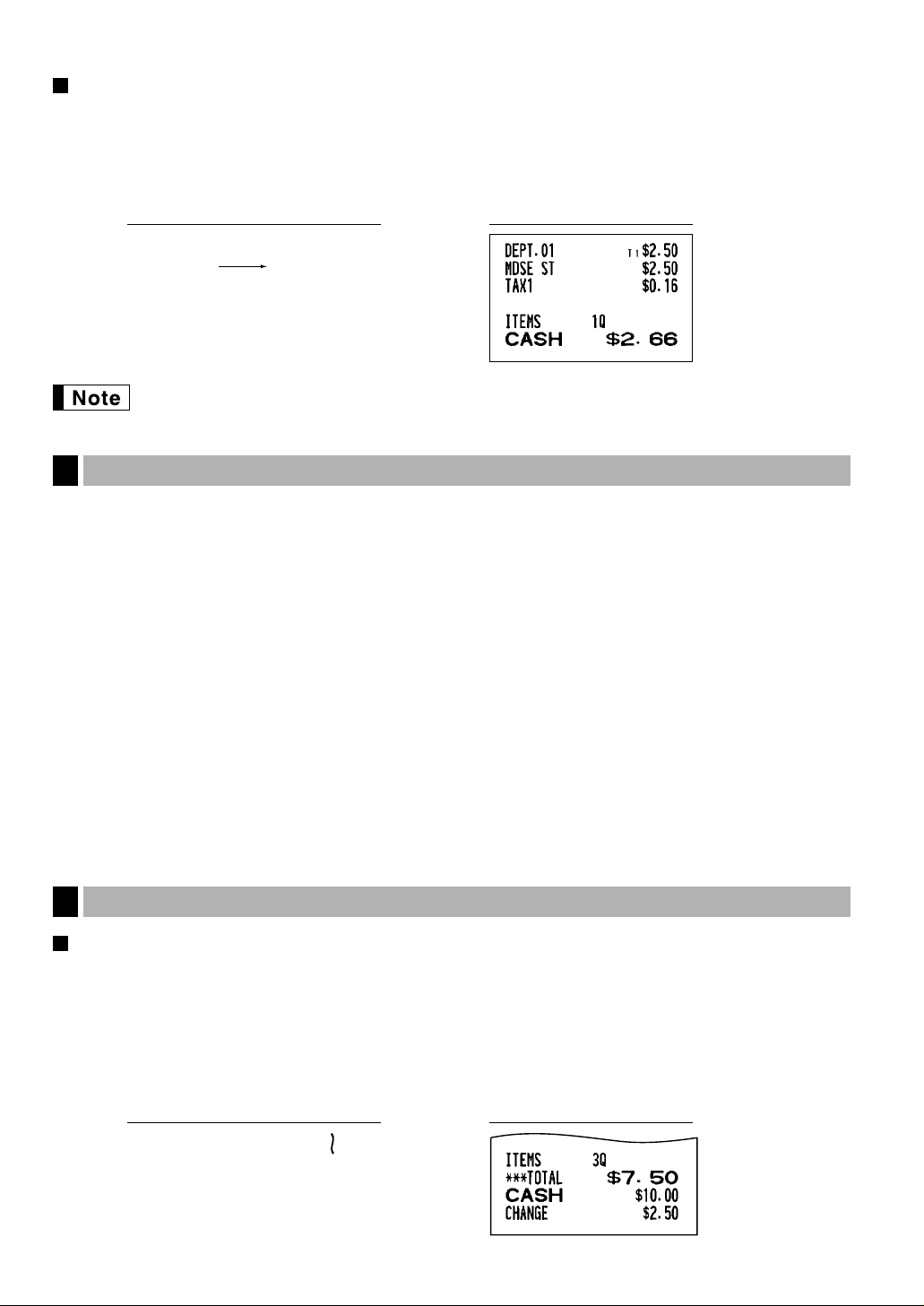

Cash or check tendering

Press the

key if it is a cash tender or press the Ckey if it is a check tender. When the amount tendered is greater

A

than the amount of the sale, the register will show the change due amount with the function message

“CHANGE”. Otherwise the register will show a deficit with the function message “DUE”. You now must make a

correct tender entry.

Cash tendering

18

key to get a complete tax subtotal, enter the amount tendered by your customer, then press the

s

Receipt printKey operation example

Page 21

Check tendering

s

950 A

Y

Receipt printKey operation example

s

1000 C

Cash or check sale that does not require entry

Enter items and press the Akey if it is a cash sale or press the Cif it is a check sale. The register will

display the total sale amount.

Receipt printKey operation example

300

(

º

A

In the case of check sale

Charge (credit) sale

Enter items and press a charge key (Xor Y).

Receipt printKey operation example

2500

(

‡

X

Mixed-tender sale

You can perform mixed-tendering of check and cash, cash and charge, and check and charge.

Example: The customer pays $9.50 in cash and $40.00 by charge 2 for an including-tax subtotal of $49.50.

Receipt printKey operation example

19

Page 22

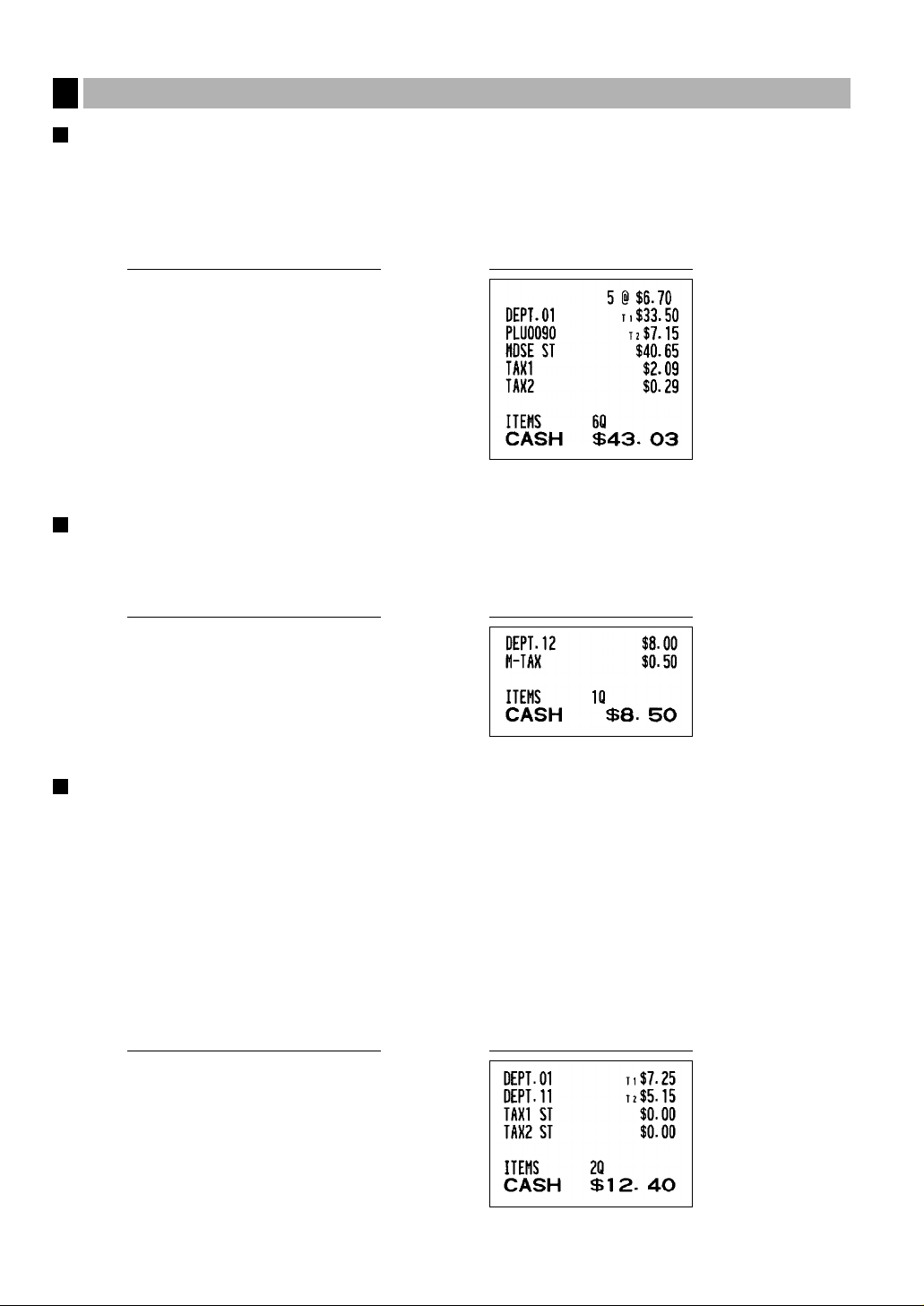

Tax Calculation

6

Automatic tax

When the register is programmed with a tax rate (or tax table) and the tax status of an individual department is

set for taxable, it computes the automatic tax on any item that is entered directly into the department or indirectly

via a related PLU.

Example: Selling five $6.70 items (dept. 1, taxable 1) and one $7.15 item (PLU 90, taxable 2) for cash

Receipt printKey operation example

5 @670

90

!

p

A

Manual tax

The machine allows you to enter tax manually after it finalizes an item entry.

Example: Selling an $8.00 item (dept. 12) for cash with 50 cents as tax

Receipt printKey operation example

12 d800

50

d

t

A

Tax delete

You can delete the automatic tax on the taxable 1 and taxable 2 subtotal of each transaction by pressing the

key after the subtotal is displayed.

To delete taxable 1 subtotal, press

subtotal.

To delete taxable 2 subtotal, press

subtotal.

To delete all taxable (1-4) subtotals, press

to delete all the taxable subtotals.

t

Example: Selling a $7.25 item (dept. 1, taxable 1) and another $5.15 item (dept. 11, taxable 2) for cash and

entering the sale as non-taxable

T, s

U, s

to get taxable 1 subtotal, and then press tto delete the

to get taxable 2 subtotal, and then press tto delete the

T, U

and

( “TAX ST 0.00” is displayed) and press

s

Receipt printKey operation example

t

20

725

11 d515

Ts

Us

!

d

t

t

A

Page 23

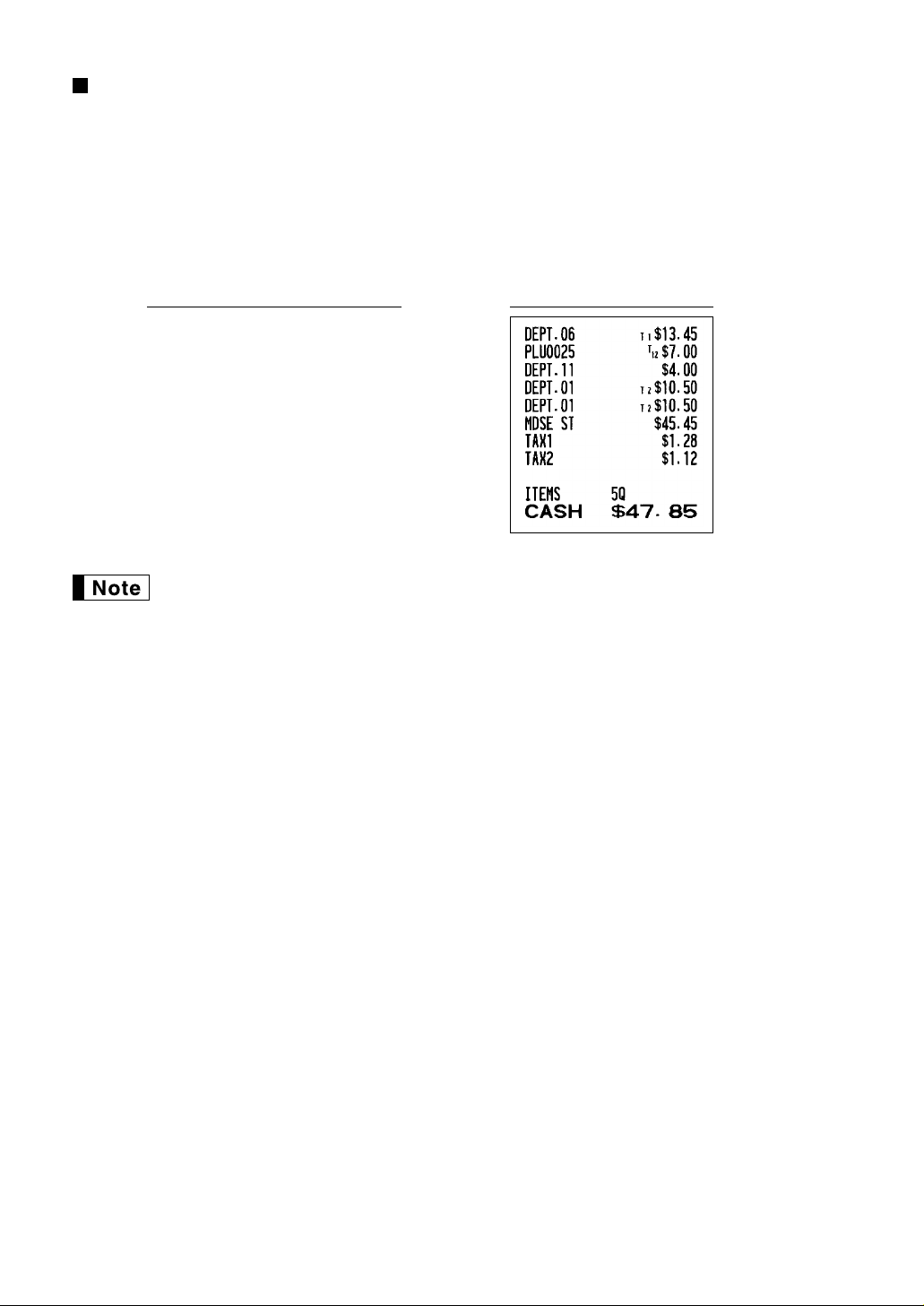

Tax status shift

The machine allows you to shift the programmed tax status of each department or PLU/subdepartment by

pressing the

status of each key is resumed.

Example: Selling the following items for cash with their programmed tax status reversed

• One $13.45 item of dept. 6 (non-taxable) as a taxable 1 item

• One $7.00 item of PLU 25 (non-taxable) as a taxable 1 and 2 item

• One $4.00 item of dept. 11 (taxable 2) as a non-taxable item

• Two $10.50 items of dept. 1 (taxable 1) as taxable 2 items

T

and/or

keys before those keys. After each entry is completed, the programmed tax

U

Receipt printKey operation example

1345

T(

TU›

11

Ud

1050

TU!

400

d

!

A

When Canadian tax system is applied:

When using a tax status shift, the entry of a multi-taxable item for PST or GST will be prohibited.

Please see below:

In case of; Tax 1: PST, Tax 2: PST,

Tax 3: PST, Tax 4: GST

Taxable 1 and 2 item ········· prohibited

Taxable 1 and 3 item········· prohibited

Taxable 2 and 3 item ········· prohibited

Taxable 1 and 4 item ············· allowed

Taxable 2 and 4 item ············· allowed

Taxable 3 and 4 item ············· allowed

In case of; Tax 1: PST, Tax 2: PST,

Tax 3: GST, Tax 4: GST

Taxable 1 and 2 item ········· prohibited

Taxable 1 and 3 item ············· allowed

Taxable 2 and 3 item ············· allowed

Taxable 1 and 4 item ············· allowed

Taxable 2 and 4 item ············· allowed

Taxable 3 and 4 item ········· prohibited

21

Page 24

OPTIONAL FEATURES

Auxiliary Entries

1

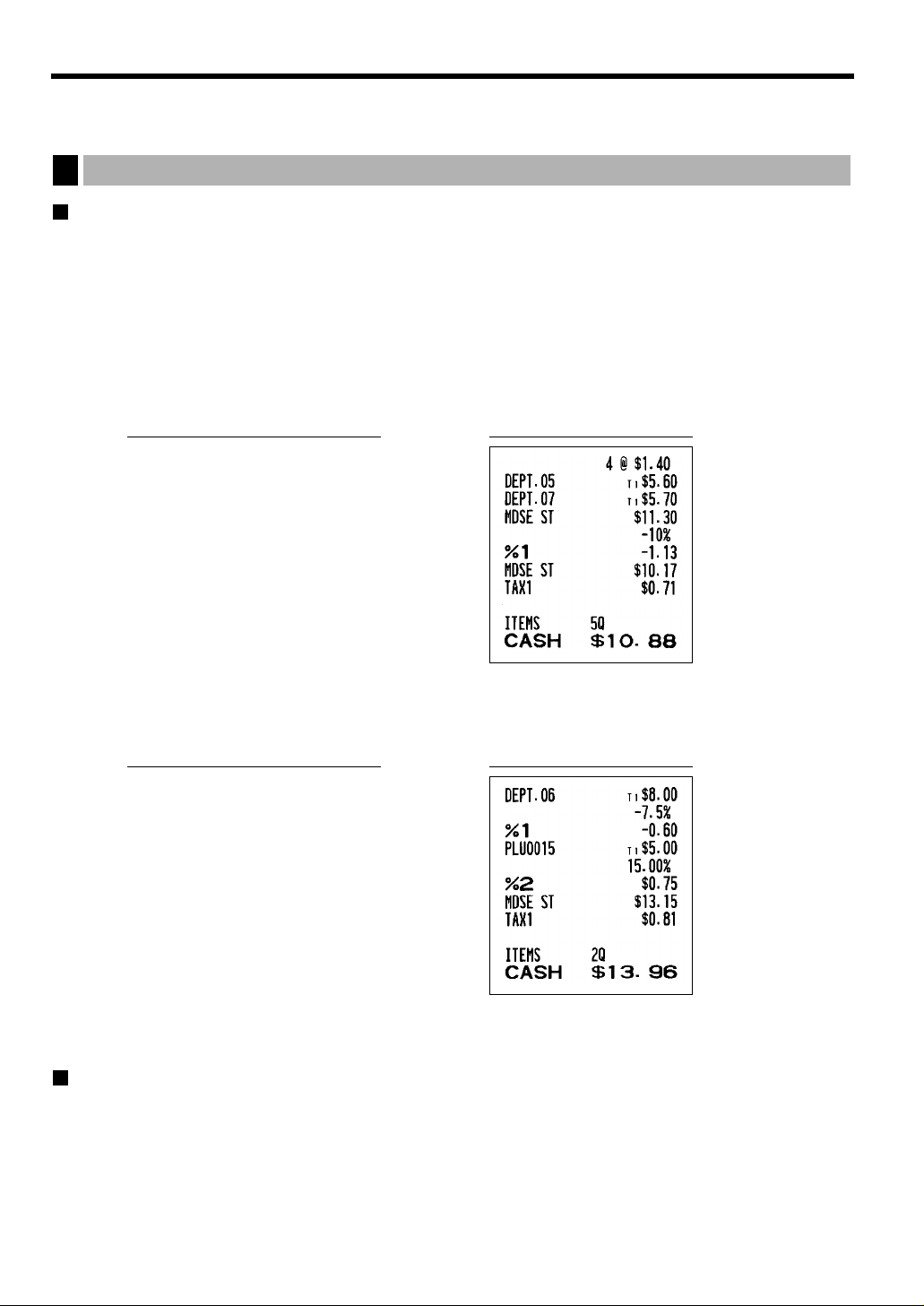

Discount and premium entries using the percent key

The percent key is used to apply a manually entered or preset discount or premium percent rate to individual

items or to a merchandise subtotal. In the default setting, you can manually enter a discount percent rate to

both individual items and merchandise subtotal. For manual entry of discount or premium percent rate, enter the

rate (up to 100.00) with the numeric keys (you need a decimal point when you enter a fractional percent rate),

and press a percent key. When using a preset rate (if programmed), press a percent key.

When entry limit is programmed for a percent key, you can not enter a rate over the limit.

Percent calculation for merchandise subtotal

Receipt printKey operation example

4

@

140

'

7 d570

d

m

10

A

%

Percent calculation for item entries

Receipt printKey operation example

800

(

7 P5

%

fi

&

A

(When premium and 15% are

programmed for the &key)

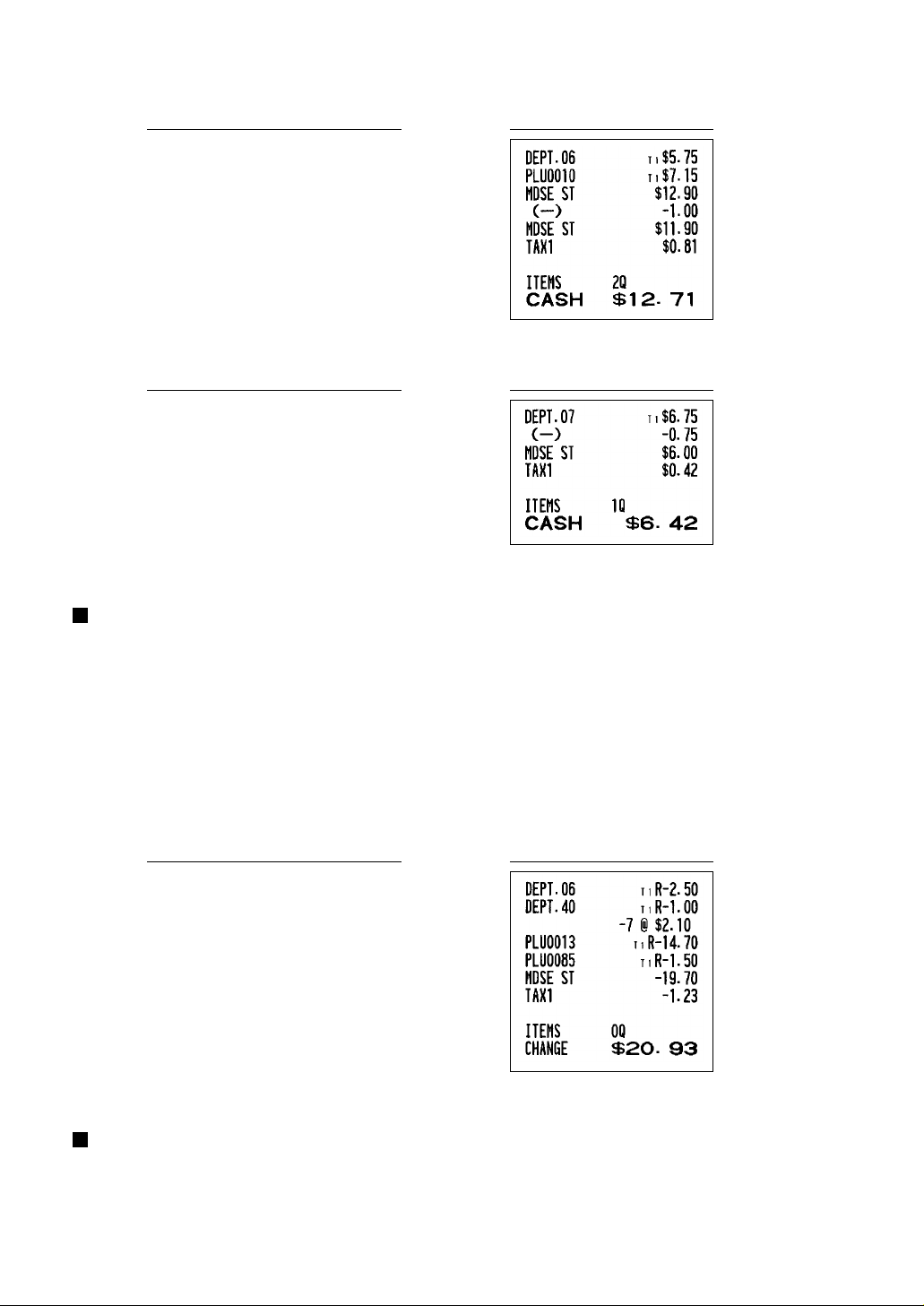

Discount and premium entries using the discount key

The discount key is used to apply a manually entered or preset discount or premium amount to individual items

or to a merchandise subtotal. In the default setting, you can manually enter a discount amount to both individual

items and merchandise subtotal. For manual entry of discount or premium amounts, enter the amount with the

numeric keys, and press the discount key. When using a preset amount (if programmed), press the discount

key.

When entry digit limit is programmed for the discount key, you can not enter an amount over the limit.

22

Page 25

Discount for merchandise subtotal

575

(

º

m

100

-

A

Discount for item entries

Receipt printKey operation example

Receipt printKey operation example

7 d675

d

-

A

(When a discount amount of

$0.75 is programmed.)

Refund entries

For departments 1 to 6, enter the refund amount and press the fkey, and then press the corresponding

department key (when using the preset price, omit entering the amount), and for departments 7 to 99, enter the

department code and press the

necessary.

For a refund of a PLU item, press the

press the

For a refund of a subdepartment item, enter the refund amount and press the

corresponding direct PLU key, or enter the PLU code and press the

amount and press the

key, then press the

f

p

40

fd

and dkeys, then enter the refund amount and press the dkey if

f

key and the corresponding direct PLU key, or enter the PLU code and

f

f(

d

7

@

key.

f

Receipt printKey operation example

and

key, then press the

f

keys, then enter the refund

p

p

key.

250

100

f‹

85

fp

150

p

A

Non-add code number entries and printing

You can enter a non-add code number such as a customer’s code number and credit card number, a maximum

of 16 digits, at any point during the entry of a sale. The cash register will print it at once.

To enter a non-add code number, enter the number and press the

s

key.

23

Page 26

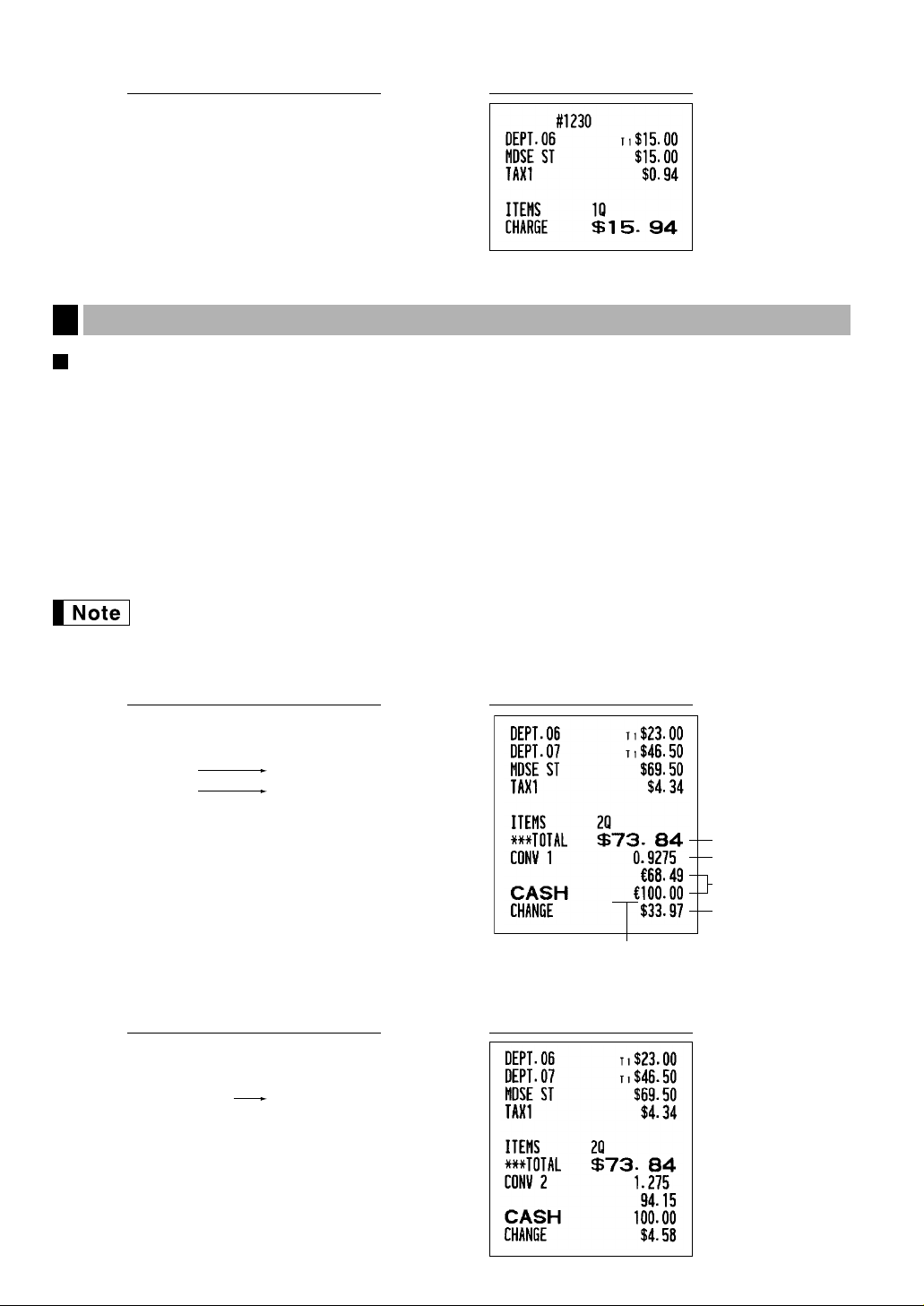

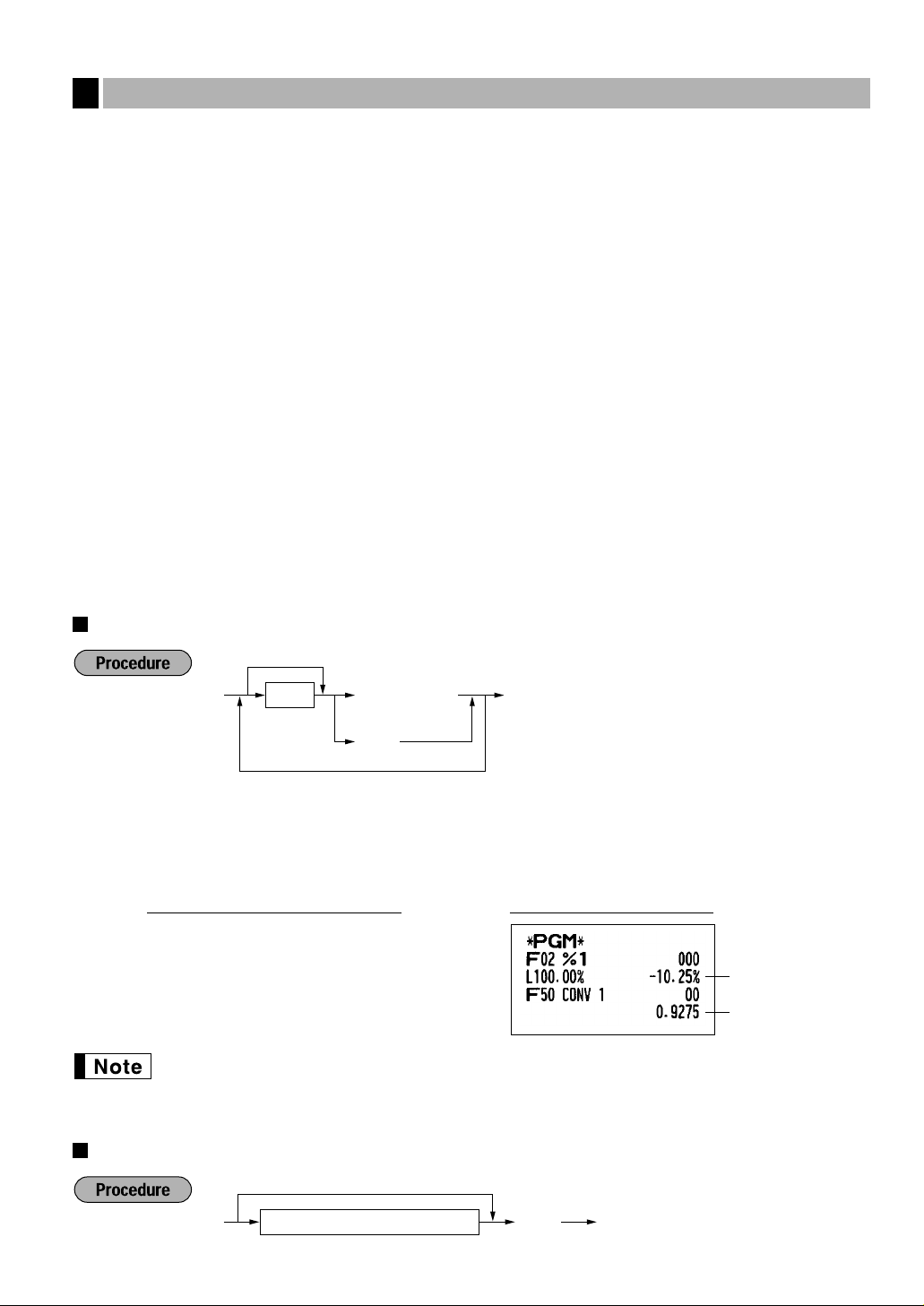

Domestic currency

Conversion rate

Domestic currency

Foreign currency

Foreign currency symbol

(Printed if programmed)

Currency conversion

Amount

tendered in

foreign currency

(When a currency conversion

rate of 0.9275 is programmed for

the V key.)

2300 (

7 d 4650 d

V

10000 A

Receipt printKey operation example

1230

s

1500

(

X

Auxiliary Payment Treatment

2

Currency conversion

The register allows payment entries in a foreign currency (only cash payment is available). Pressing the Vkey

creates a subtotal in the foreign currency.

When using a programmed currency conversion rate, press the

tendered amount in foreign currency if not exact amount payment, and press the

When making a manual entry of a currency conversion rate, after item entries, enter the conversion rate (0.0000

to 9999.9999; you need a decimal point when entering a fractional conversion rate) and press the

enter the tendered amount in foreign currency if not exact amount payment, and press the

In both cases, the change due will be displayed in domestic currency, and when the amount tendered is short,

the deficit is shown in domestic currency.

key after item entries, then enter the

V

key.

A

A

key.

V

key, then

• Press the

• If programmed, a foreign currency symbol is printed when you use a preset rate.

Applying preset conversion rate

Applying manual conversion rate

Conversion rate

24

key after pressing the Vkey to cancel payment in a foreign currency.

l

Receipt printKey operation example

Receipt printKey operation example

2300 (

7 d 4650 d

1 P 275 V

10000 A

Page 27

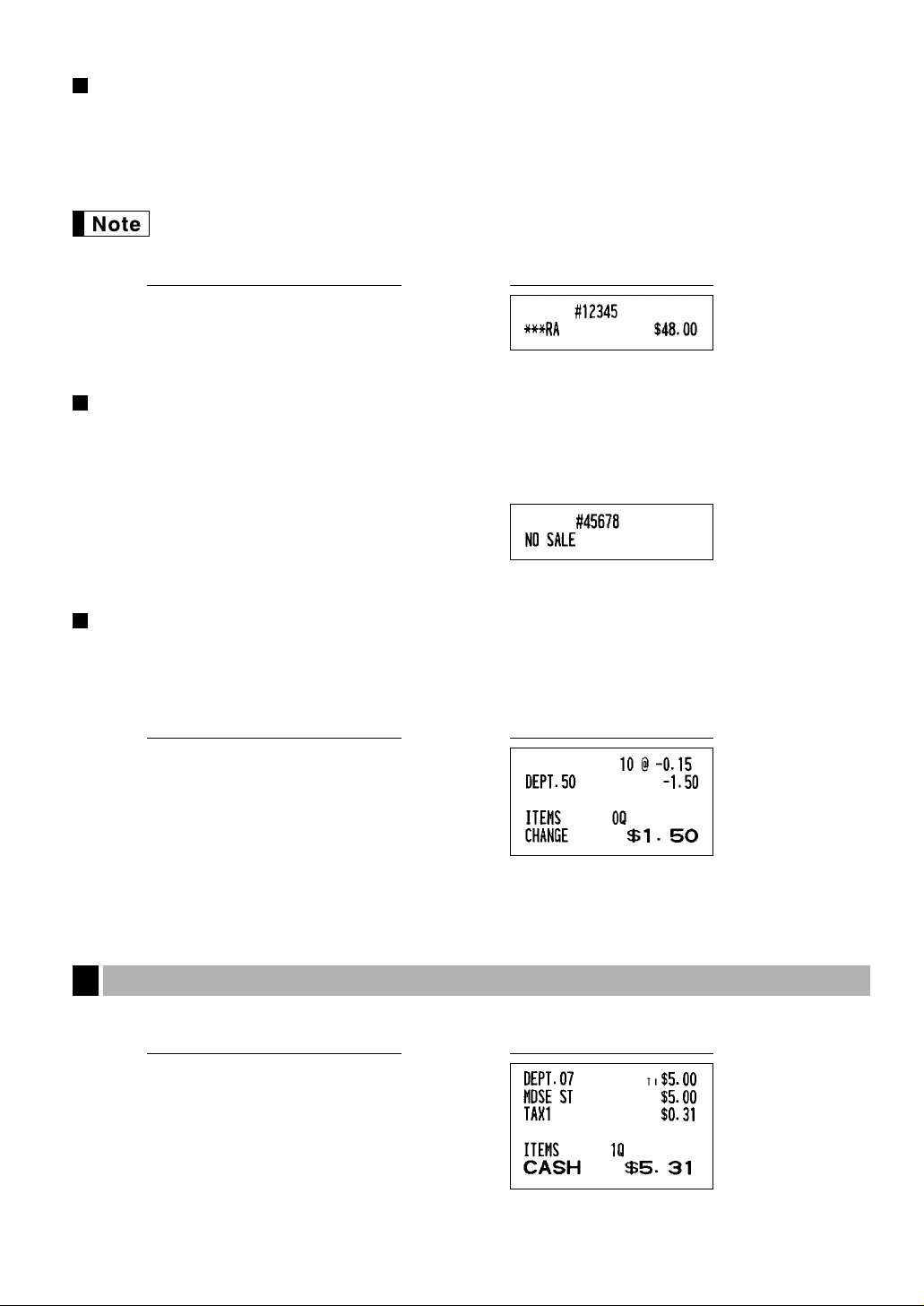

Received-on account and paid-out entries

When you receive on account from a customer or when you pay an amount to a vendor, use the rkey or the

key respectively.

R

For the received-on-account (RA) entry, enter the amount, and press the

For the paid-out (PO) entry, enter the amount and press the

Cash tendering only available for RA and PO operation.

R

key.

Receipt printKey operation example

r

key.

12345

s

4800

r

No sale (exchange)

When you need to open the drawer with no sale, press the Akey. The drawer will open and printer will print

“NO SALE” on the receipt or journal. If you let the machine print a non-add code number before pressing the

key, a no sale entry is achieved and a non-add code number is printed.

A

Bottle return

This function is used to handle the deposit and payment (paid out) for returned empty bottles or cans.

This function is applicable only to those departments that have been set for bottle return departments or their

associated PLUs or subdepartments.

Receipt printKey operation example

10 @50 d15

d

A

(When dept. 50 is preprogrammed as a

bottle return dept. and also a negative

dept.)

Automatic Sequence Key (akey) Entries

3

You can achieve a programmed transaction by pressing the

a

(a= 7 d500

dA

)

a

key.

Receipt printKey operation example

25

Page 28

CORRECTION

Correction of the Last Entry (direct void)

1

If you make an incorrect entry relating to a department, PLU/subdepartment, percentage (%and &), discount

(

) or refund, you can void this entry by pressing the vkey immediately after the incorrect entry.

-

Receipt printKey operation example

1250

(

v

™

v

8 d600

250

d

&

v

328

ª

28

v

f(

v

A

Correction of the Next-to-last or Earlier Entry (indirect void)

2

You can void any incorrect department entry, PLU/subdepartment entry or item refund entry made during a

transaction if you find it before finalizing the transaction (e.g. pressing the

to department, PLU/subdepartment and refund entries only.

Press the

case open and preset entries are allowed), direct PLU key or

key after you press the fkey.

v

26

key just before you press a department key, dkey (before the first depression of the dkey in

v

p

1310 (

7 d 1755 d

º

Correction

of a

department

entry

Correction

of a PLU entry

Correction of

a refund entry

250 f (

1310 v (

250 f v (

¤

825 #

v ¤

A

key. For the refund indirect void, press the

Receipt printKey operation example

key). This function is applicable

A

Page 29

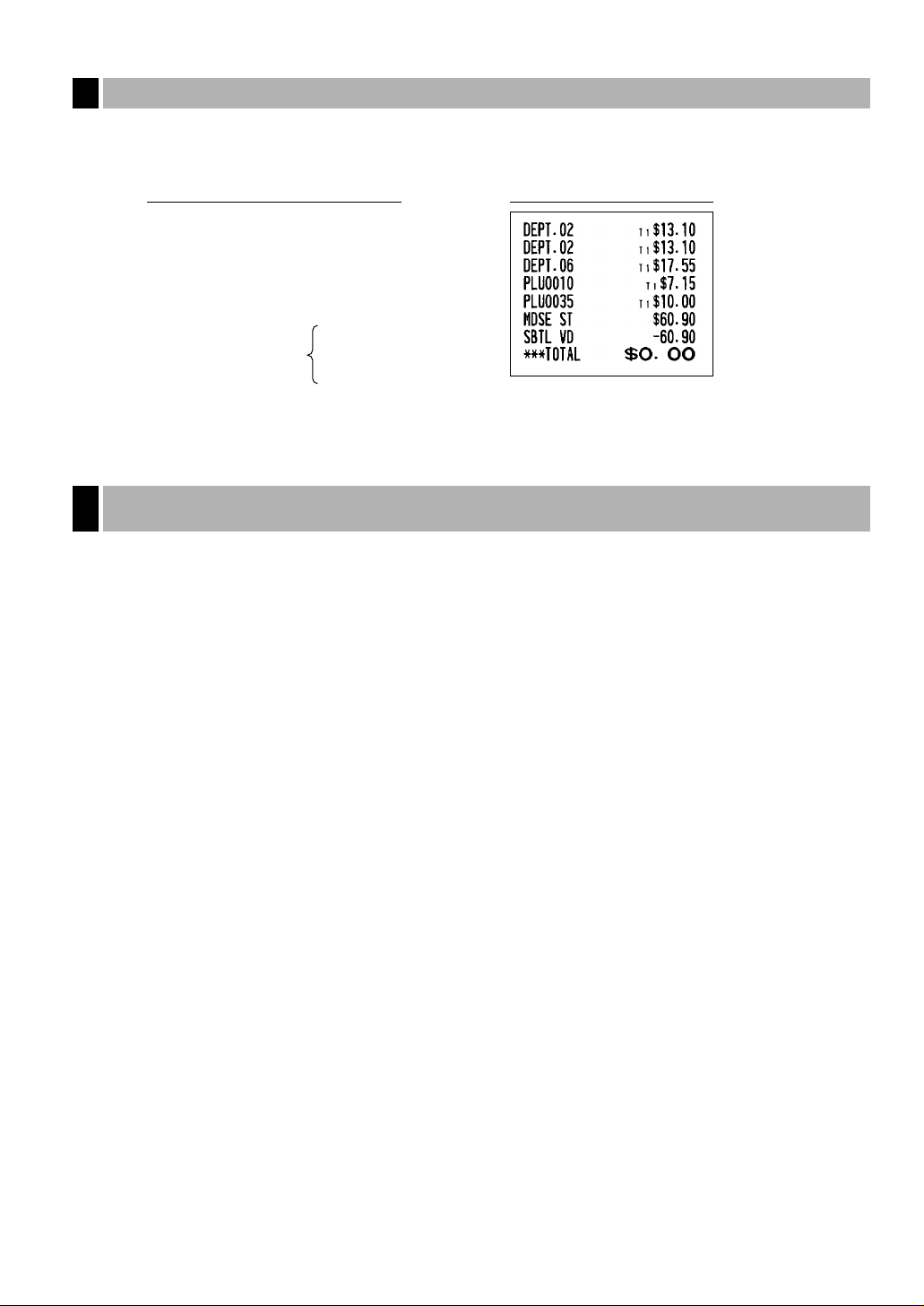

Subtotal Void

3

You can void an entire transaction. Once subtotal void is executed, the transaction is aborted and the register

issues a receipt. This function does not work when more than 30 items have been entered.

Receipt printKey operation example

1310 "

"

1755 (

º

fl

s

Subtotal void

v

s

Correction of Incorrect Entries not Handled by the Direct or Indirect Void

4

Function

Any errors found after the entry of a transaction has been completed or during an amount tendered entry cannot

be voided. These errors must be corrected by the manager.

The following steps should be taken:

1. If making the amount tendered entry, finalize the transaction.

2. Make correct entries from the beginning.

3. Hand the incorrect receipt to the manager for its cancellation.

27

Page 30

Date

Date(MM/DD/YYYY)

s

FOR THE MANAGER

PRIOR TO PROGRAMMING

Before starting sales entries, you must first program necessary items so the cash register suits your sales

needs. In this manual, there are three sections, BASIC FUNCTION PROGRAMMING where required items

must be programmed, AUXILIARY FUNCTION PROGRAMMING where you can program for more convenient

use of keys on the keyboard, and ADVANCED PROGRAMMING where various optional programming features

are provided. Find the appropriate features for your needs, and make the necessary programming.

You can select the language of text (English, French or Spanish) printed on receipts or journals.

For the language selection, please refer to “Language Selection” described later in this section.

Procedure for programming

Check to see whether a paper roll is present in the machine. If there is not enough paper on the roll, replace

1.

it with a new one (refer to MAINTENANCE section for the replacement).

2. Put the manager key in the mode switch and turn it to the PGM position.

3. Program necessary items into the cash register.

Every time you program an item, the cash register will print the setting. Please

refer to print samples in each section.

4. If necessary, issue programming reports for your reference.

• On the procedures and key operation examples shown in the programming details, numbers such

as “08262003” indicates the parameter which must be entered using the corresponding numeric

keys.

• Asterisks in the tables shown in the programming details indicate default settings.

VOID

PGM

REG

OPX/Z MGR

OFF

X1/Z1

X2/Z2

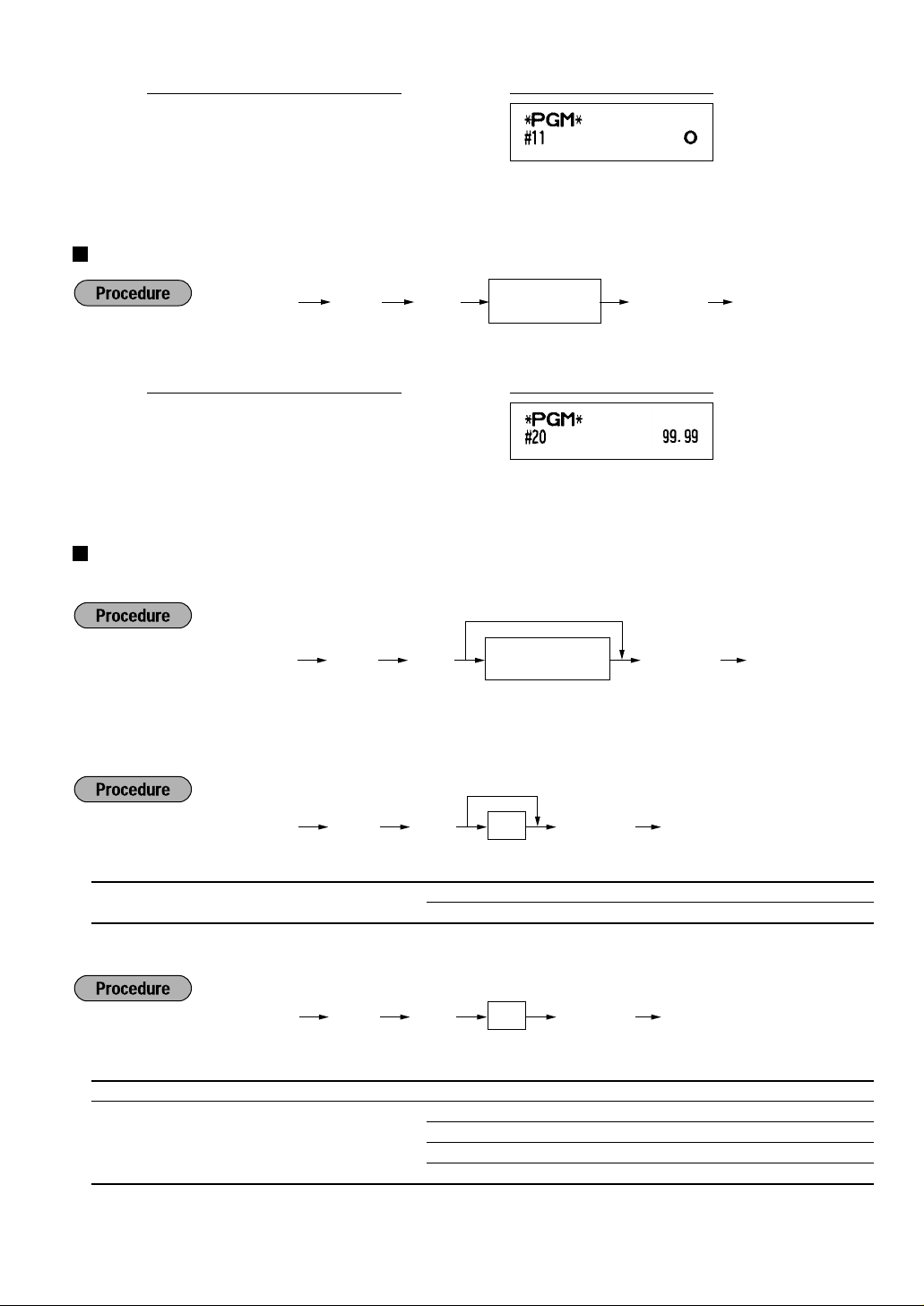

BASIC FUNCTION PROGRAMMING

(For Quick Start)

Date and Time Programming

1

Date

For setting the date, enter the date in 8 digits using the month-day-year (MM/DD/YYYY) format, then press the

key.

s

PrintKey operation example

28

08262003

(Aug. 26, 2003)

You can use the date format of day-month-year (DD/MM/YYYY) or year-month-day (YYYY/MM/DD)

format. To change the format, refer to “Various Function Selection Programming 1” section (Job

code 61).

s

Page 31

Time

To delete a tax rate, use the following sequence:

s @ v A@

Tax number (1 to 4)

9

s @

9

@

@ s A

When the lowest taxable amount is zero

Tax number (1 to 4)

Tax rate

(0.0000 to 100.0000)

Lowest taxable amount

(0.01 to 999.99)

Time

Time(max. 4 digits in 24-hour format)

s

For setting the time, enter the time in 4 digits using the 24-hour format. For example, when the time is set to

2:30 AM, enter 230; and when it is set to 2:30 PM, enter 1430.

PrintKey operation example

1430

s

For display and print,12-hour format is applied by default. To change it to 24-hour format, refer to

“Various Function Selection Programming 1” section (Job code 61).

Tax Programming for Automatic Tax Calculation Function

2

The cash register can support US and Canadian tax systems. If you use the Canadian tax system,

you must first change the tax system, then program the tax rate or tax table and quantity for

doughnut exempt which are described in this section. For changing the cash register’s tax system,

please refer to “Various Function Selection Programming 1” section (job code 70).

Before you can proceed with registration of sales, you must first program the tax that is levied in accordance

with the law of your state. The cash register comes with the ability to program four different tax rates. In most

states, you will only need to program Tax 1. However if you live in an area that has a separate local tax (such

as a Parish tax) or a hospitality tax, the register can be programmed to calculate these separate taxes.

When you program the tax status for a department, tax will automatically be added to sales of items assigned to

the department according to the programmed tax status for the department. You can also enter tax manually.

There are two tax programming methods. The tax rate method uses a straight percentage rate per dollar. The

tax table method requires tax break information from your state or local tax offices. Use the method which is

acceptable in your state. You can obtain necessary data for tax programming from your local tax office.

Tax programming using a tax rate

The percent rate specified here is used for tax calculation on taxable subtotals.

29

Page 32

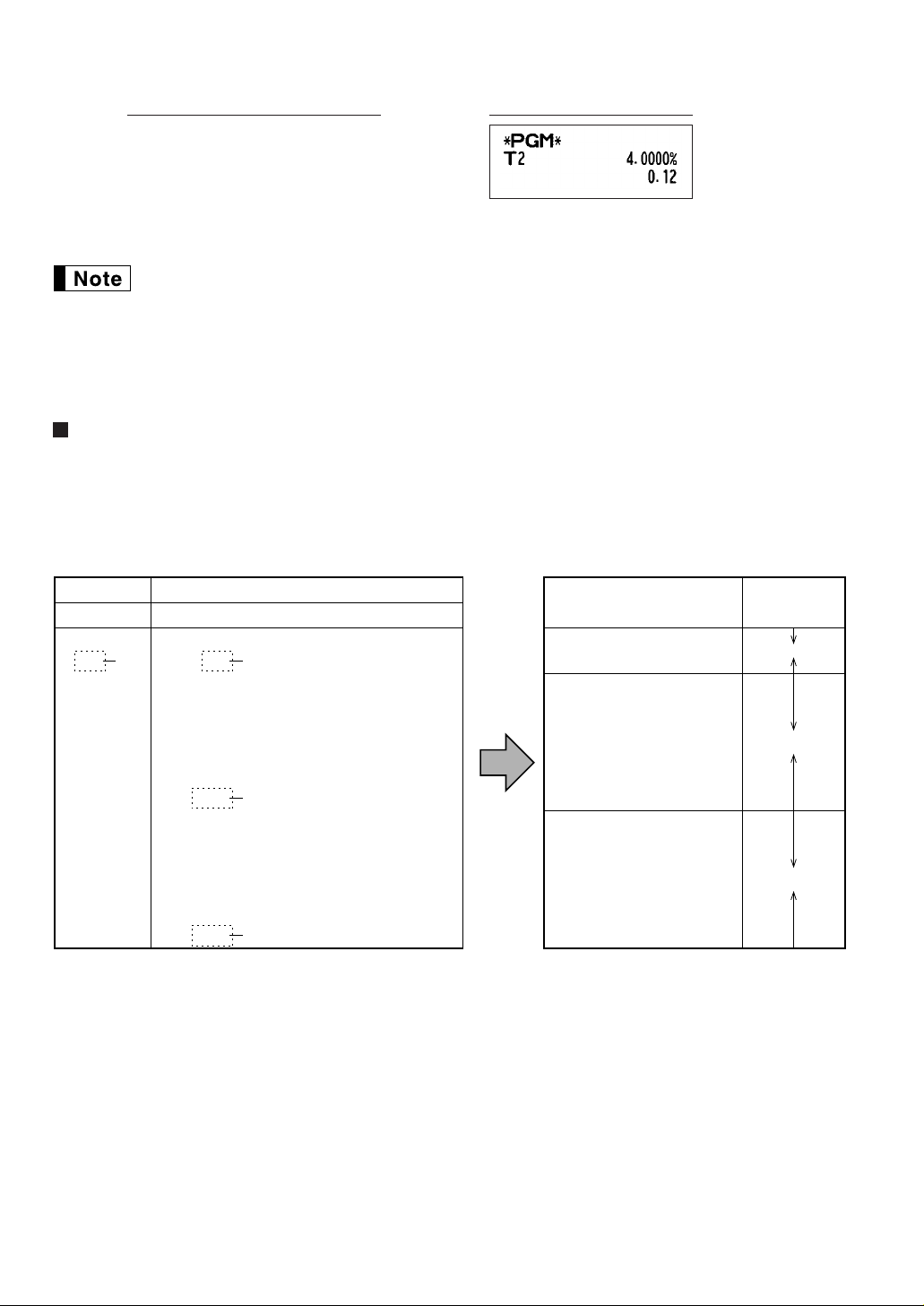

Example: Programming the tax rate 4% as tax rate 2 with tax exempt as 12¢

Taxes

Range of sales amount

Minimum breakpoint

.00

.01

.02

.03

.04

.05

.06

.07

.08

.09

.10

.11

.12

.13

.01

.11

.23

.39

.57

.73

.89

1.11

1.23

1.39

1.57

1.73

1.89

2.11

Maximum breakpoint

.10

.22

.38

.56

.72

.88

1.10

1.22

1.38

1.56

1.72

1.88

2.10

2.22

to

to

to

to

to

to

to

to

to

to

to

to

to

to

T Q

M1

M2

A: Difference between the

minimum breakpoint and

the next one (¢)

–

10 (0.11 - 0.01)

12 (0.23 - 0.11)

16 (0.39 - 0.23)

18 (0.57 - 0.39)

16 (0.73 - 0.57)

16 (0.89 - 0.73)

22 (1.11 - 0.89)

12 (1.23 - 1.11)

16 (1.39 - 1.23)

18 (1.57 - 1.39)

16 (1.73 - 1.57)

16 (1.89 - 1.73)

22 (2.11 - 1.89)

B: Non-cyclic

C: Cyclic-1

D: Cyclic-2

PrintKey operation example

s9 @

2

@

4

@

12

s

A

• If you make an incorrect entry before pressing the third

it with the

l

key.

key in programming a tax rate, cancel

@

• You do not need to enter the trailing zeros of a tax rate (after the decimal point), but you do need

to enter the decimal for fractions.

• The lowest taxable amount setting is ignored when you select VAT system for Canadian tax.

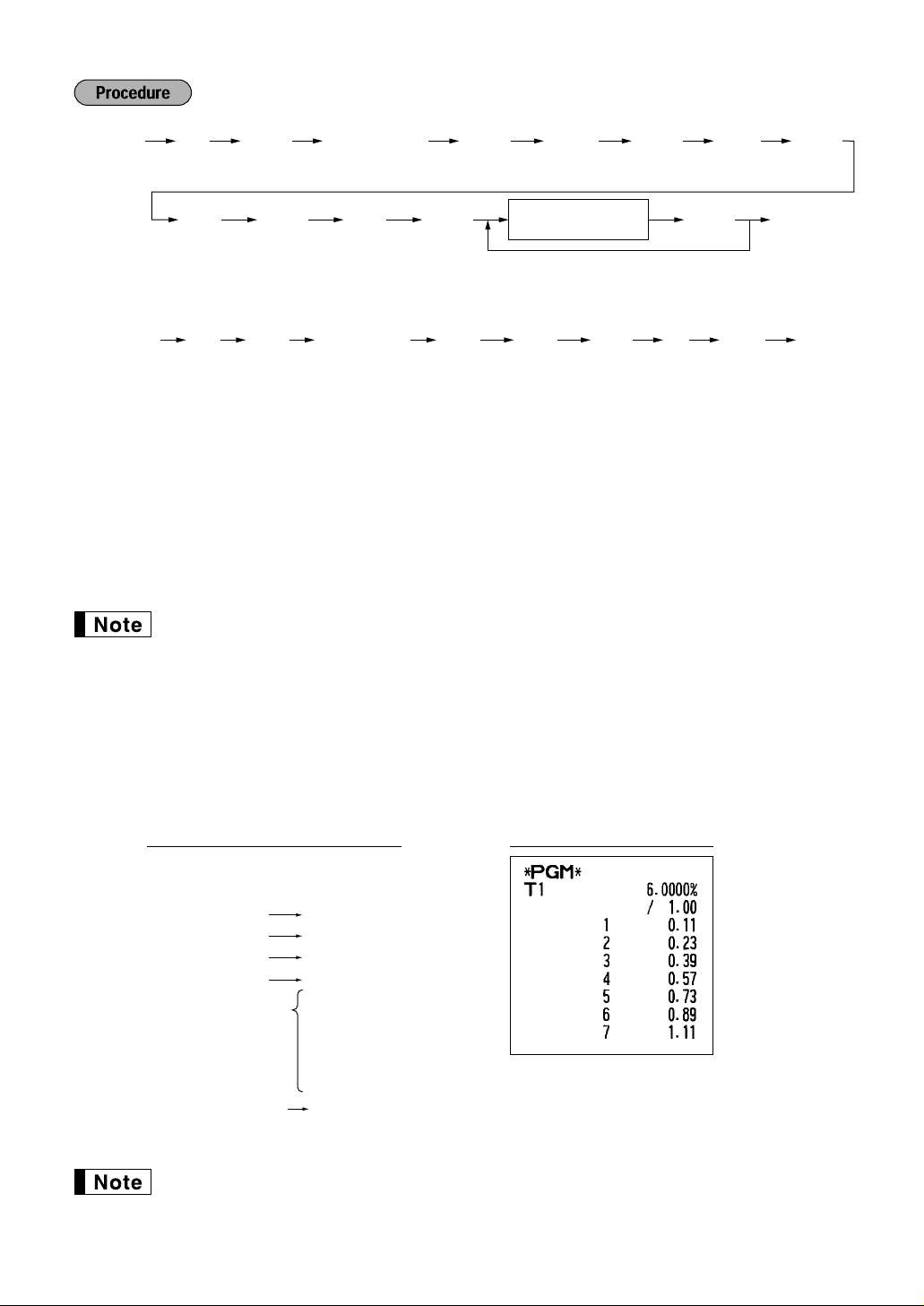

The tax table (applicable to the add-on tax)

If you are in an area that uses a tax table for tax calculation, you can program the cash register accordingly. Tax

table programming can be performed for Tax 1 through Tax 4.

Sample tax table

New Jersey tax table: 6%

To program a tax table, first make a table like the one shown above right.

30

From the tax table, calculate the differences between a minimum break point and the next one (A). Then, from

the differences, find irregular cycles (B) and regular cycles (C and D). These cycles will show you the following

items necessary to program the tax table:

T: The tax amount collected on the minimum taxable amount (Q)

Q: The minimum taxable amount

M1: The maximum value of the minimum breakpoint on a regular cycle (C)

We call this point “MAX point.”

M2: The maximum value of the minimum breakpoint on a regular cycle (D)

We call this point “MAX point.”

M: Range of the minimum breakpoint on a regular cycle: difference between Q and M1 or between M1 and M2

Page 33

*1 First figure:

s @ s@

max. six digits

(0.0001 - 99.9999%)

max. four

digits

One- or twodigit number

Rate

M

*1

*2

@@

To delete a tax table, use the following sequence:

8

s @ @

max. six digits

(0.0001 - 99.9999%)

max. four

digits

One- or twodigit number

Rate

M

*1

*2

@

max. three

digits

T

@

max. five

digits

Q

@ A

Minimum breakpoint

max. five digits

Repeat until the MAX point is entered.

@@

8

(1 or 0)

Second figure:

(1 to 4)

*2 If the rate is fractional (e.g. 4-3/8%), then the fractional portion (3/8) would be converted to its decimal

equivalent (i.e. .375) and the resulting rate of 4.375 would be entered. Note that the nominal rate (R) is

generally indicated on the tax table.

• Limitations to the entry of minimum breakpoints

The register can support a tax table consisting of no more than 72 breakpoints. (The maximum number of

breakpoints is 36 when the breakpoint difference is $1.00 or more.) If the number of breakpoints exceeds the

register’s table capacity, then the manual entry approach should be used.

Example: Programming the sample tax table shown on the previous page as tax table 1

The first figure to be entered depends upon whether the difference between a minimum

breakpoint to be entered and the preceding minimum breakpoint is not less than $1.00 or

more than 99¢. When the difference is not less than $1.00, enter “1,” and when it is not more

than 99¢, enter “0” or nothing.

The second figure depends upon whether your tax table is to be programmed as tax table 1,

2, 3 or 4.

If you make an incorrect entry before entering the M in programming a tax table, cancel it with the

key; and if you make an error after entering the M, cancel it with the

l

again from the beginning.

PrintKey operation example

key. Then program

s

s 8 @

1 @

Tax rate

M

T

Q

The first

cyclic

portion

M1

(MAX point)

You do not need to enter the trailing zeros of a tax rate (after the decimal point) but you do need to

enter the decimal point for fractions.

100 @

1 @

11 @

23 @

39 @

57 @

73 @

89 @

111 @

6 @

A

31

Page 34

• If the tax is not provided for every cent, modify the tax table by setting the tax for every cent

s @ s A

To program zero

Q’ty for doughnut

tax exempt

(max. 2 digits: 1 to 99)

19

in the following manner.

When setting the tax, consider the minimum breakpoint corresponding to unprovided tax to be the same as the

one corresponding to the tax provided on a large amount.

Sample tax table Modification of the left tax table

Example 8%

Tax

.00

.01

.02

.03

.04

.06

.09

.10

.11

.12

.14

.17

Minimum

breakpoint

.01

.11

.26

.47

.68

.89

1.11

1.26

1.47

1.68

1.89

2.11

Tax

.00

.01

.02

.03

.04

.05

.06

.07

.08

.09

.10

.11

.12

.13

.14

.15

.16

.17

Minimum

breakpoint

.01

T Q

.11

.26

.47

.68

.89

.89

1.11

1.11

1.11

1.26

1.47

1.68

1.89

1.89

2.11

2.11

2.11

difference (¢)

M1

M2

From the modified tax table above;

Rate = 8(%), T = $0.01 = 1¢, Q = $0.11 = 11¢, M1 = 1.11, M2 = 2.11, M = 100

Quantity for doughnut tax exempt (for Canadian tax system)

This option is available only when the Canadian tax system is selected.

Breakpoint

1

10 (0.11-0.01)

15 (0.26-0.11)

21 (0.47-0.26)

21 (0.68-0.47)

21 (0.89-0.68)

0 (0.89-0.89)

22 (1.11-0.89)

0 (1.11-1.11)

0 (1.11-1.11)

15 (1.26-1.11)

21 (1.47-1.26)

21 (1.68-1.47)

21 (1.89-1.68)

0 (1.89-1.89)

22 (2.11-1.89)

0 (2.11-2.11)

0 (2.11-2.11)

B: Non-cyclic

C: Cyclic-1

D: Cyclic-2

Example: To program the quantity “6”

PrintKey operation example

19

s

6

@

s

A

32

Page 35

AUXILIARY FUNCTION PROGRAMMING

For department 7-99:

d@

Dept. code

A

To set all zeros

ABCDEFGHIJK

*

To set all zeros

@

Dept. keyABCDEFGHIJK

A

*

Department Programming

1

Merchandise can be classified into a maximum of 99 departments. Items sold using the department keys can

later be printed on a report shown as the quantities sold and sales amounts classified by department. The data

is useful for making purchasing decisions and other store operations. Departments can be assigned to articles

whose prices were set using PLU/subdepartment function.