Page 1

Cash Register

ECR 3550 T ECR 3550 T

ECR 3550 T euro

ECR 3550 T ECR 3550 T

CLERK GUIDE

GUIDE VENDEUR

KASSIERERANLEITUNG

GUÍA PARA EL EMPLEADO

HANDLEIDING BEDIENDE

GUIA DO EMPREGADO

ENGLISH

FRANÇAISDEUTSCH

ESPAÑOL

NEDERLANDS

PORTUGUÊS

Page 2

PUBLICATION ISSUED BY:

Olivetti Tecnost, S.p.A.

77, Via Jervis - 10015 Ivrea (Italy)

Copyright

©

2002, Olivetti

All rights reserved

Page 3

PREFACE

This Clerk Guide explains how to use the numerous features that the cash register has to offer. This electronic

cash register is designed to help your business function smoothly by providing efficient register operations. Here

are just a few of the cash register’s many valuable features:

• 40 departments and 1000 Price Look-Ups (PLU);

• 9 major department group categories and 99 major PLU group categories;

• PLU-to-PLU linking so that PLUs can automatically register other PLUs when activated;

• possibility of connection to a Personal Computer;

• possibility of connection to a barcode reader;

• keypad programming so that the cash register's standard key functions can be personalized according to the

specific needs;

• with the cash register keypad programmed accordingly, possibility of using Take-out, House, Price Inquiry

and Tray subtotal functions;

• 26 clerk numbers with the possibility of assigning a three-digit security code to individual clerk transactions

to prevent unauthorized access;

• 2-station thermal printer that prints information on 2 separate rolls of paper, providing customer receipts and

a transaction journal;

• 7-line customer sales receipt header personalization plus a 5-line customer sales receipt advertisement string

personalization;

ENGLISH

• cash, check, charge and credit tender media keys;

• possibility of using up to 4 different currency exchange rates;

• swivel pole rear customer 10-character numeric display for transaction viewing;

• front operator alphanumeric display consisting of a 10-character message line on top and a 10-character

transaction line on the bottom;

• automatic tax computations for up to 8 different programmable VAT and Add-on tax rates;

• department-linked entry options that streamline and speed-up operation;

• time and date display, printing on customer receipts and journal records;

• customer receipt and journal record printing in any one of six languages (English, French, German, Spanish,

Dutch and Portuguese);

• possibility of issuing copies of a transaction receipt.

GB-I

Page 4

TABLE OF CONTENTS

GETTING ACQUAINTED WITH YOUR CASH REGISTER ...................................... 1

STANDARD ACCESSORIES ............................................................................................................................. 1

USING THIS MANUAL ....................................................................................................................................... 2

MAINTAINING THE CASH REGISTER .............................................................................................................. 2

THE KEYPAD ............................................................................................................. 3

KEYPAD FUNCTIONS ....................................................................................................................................... 3

OPTIONAL FUNCTIONS THAT CAN BE ASSIGNED TO KEYPAD KEYS ......................................................... 5

THE CONTROL SYSTEM .......................................................................................... 6

THE CONTROL LOCK ....................................................................................................................................... 6

CASH DRAWER WITH REMOVABLE CASH BIN .............................................................................................. 6

OPERATOR AND CUSTOMER DISPLAYS ........................................................................................................ 7

DATE AND TIME DISPLAY ................................................................................................................................. 7

SPECIAL SYMBOL INDICATORS ...................................................................................................................... 7

ERROR CONDITIONS ............................................................................................... 7

ERROR MESSAGES AND CODES ................................................................................................................... 7

THE ERROR ALARM ......................................................................................................................................... 8

CLEARING AN ERROR ..................................................................................................................................... 8

GENERAL CLEARANCE ................................................................................................................................... 8

VOIDING ERRORS ............................................................................................................................................ 9

MEMORY BACK-UP BATTERY SYSTEM ................................................................ 9

PRINTER COMPARTMENT ....................................................................................... 9

PAPER TAPE ..................................................................................................................................................... 9

LOADING THE CUSTOMER RECEIPT ROLL ................................................................................................. 10

LOADING THE JOURNAL ROLL ..................................................................................................................... 11

TRANSACTION EXAMPLES .................................................................................. 13

ENTERING THE REGISTER MODE ................................................................................................................ 13

EXITING THE REGISTER MODE.................................................................................................................... 13

CLEARING ERRORS ....................................................................................................................................... 13

SAMPLE RECEIPT .......................................................................................................................................... 13

REPRINTING A SALES RECEIPT ................................................................................................................... 14

STANDARD TRANSACTIONS .......................................................................................................................... 14

MINUS (-) KEY TRANSACTIONS .................................................................................................................... 19

PLUS (+) KEY TRANSACTIONS ..................................................................................................................... 20

PERCENT DISCOUNT (-%) TRANSACTIONS ................................................................................................ 21

PERCENT PLUS (+%) TRANSACTIONS ........................................................................................................ 24

PLU CODES ..................................................................................................................................................... 26

VOIDS AND REFUNDS ................................................................................................................................... 29

OTHER TRANSACTIONS ................................................................................................................................ 31

TRANSACTIONS USING THE OPTIONAL KEYS ASSIGNED ........................................................................ 34

TRANSACTIONS USING A FOREIGN CURRENCY ............................................................................. 34

CASH REGISTER SPECIFICATIONS AND SAFETY ...................................................................................... 41

GB-II

Page 5

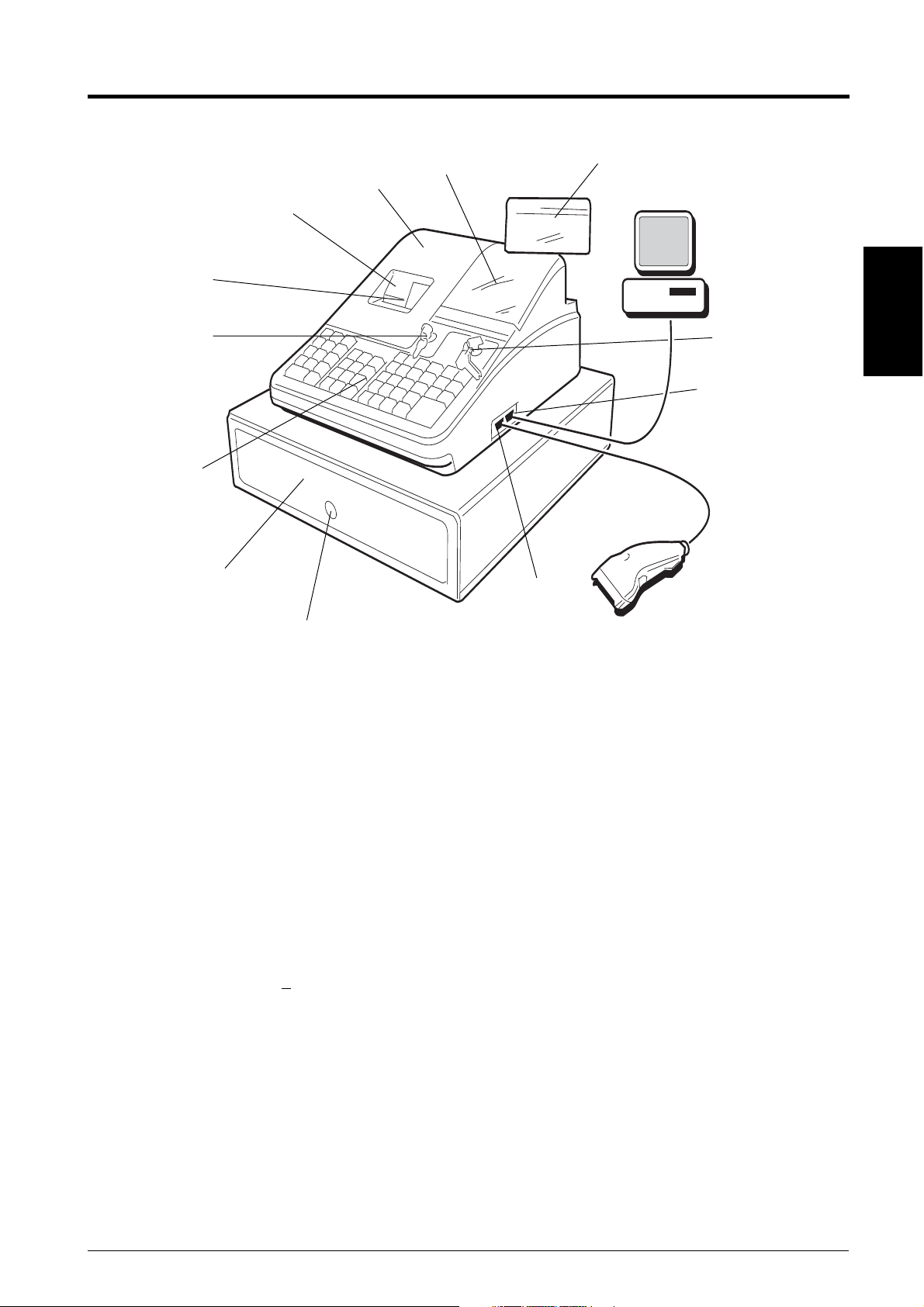

GETTING ACQUAINTED WITH YOUR CASH REGISTER

The figure below shows an overall view of your cash register.

11

10

9

8

7

6

12

4

1

4

2

3

ENGLISH

5

1. Customer Display 8. Printer Compartment Lock

2. Operations Control Lock 9. Journal Roll Display Window

3. Serial interface for connection to a PC 10. Customer Receipt Output Slot

4. Serial interface for connection to a 11. Printer Compartment Cover

barcode reader 12. Operator Display

5. Cash Drawer Lock

6. Cash Drawer

7. Keypad

STANDARD ACCESSORIES

Your cash register comes with the following items:

• One 2-piece black plastic journal winder spindle

• Two rolls of standard 37.5 + 0.5 mm thermal paper, one for customer receipts and the other for journal record

• This Clerk Guide, the System Configuration Guide and the Software Guide

• A set of Program keys (PRG) for accessing the machine programming functions

• A set of Register keys (REG) for accessing the machine cash register functions

• A set of Z keys for accessing the X and Z functions

• A set of keys for locking the cash drawer and printer compartment cover

• A serial interface cable for the connection of the cash register to a Personal Computer.

• Cash register configuration software to be installed on the Personal Computer.

GB-1

Page 6

USING THIS MANUAL

Your cash register Clerk Guide is organized for easy reference. The front portion gives an overall view of the

cash register and provides information on all the features and functions available. Next you will find transaction

examples showing you how to operate the cash register. Transaction examples provide steps for key operations

and include sample receipts. At the back of the manual you will find your cash register's technical specifications

and some safety information. Use the Table of Contents to locate a particular item.

Getting Started

Before you begin to use the cash register, read the sections entitled Keypad Functions, The Control System and

Operator and Customer Displays to become familiar with their operations.

Once the desired program options have been set by your Supervisor, insert the REG control key into the control

lock, turn it to the REG 1 or REG 2 position and you are ready to perform sales transactions. In the REG 2 position

the cash register will not print the customer receipt unless the [ST] key is pressed at the end of the transaction.

MAINTAINING THE CASH REGISTER

Provided below is information on how to maintain your cash register.

NOTE: Before cleaning the cash register, make sure it is powered off and/or unplugged from the wall outlet.

Machine programming data and transaction information for management reports are stored in the cash

register. A back-up battery inside the cash register saves this information when the cash register is

unplugged from the power outlet or the event of a power failure.

1. Keep all liquids away from the cash register so as to avoid spills which could damage the electronic

components.

2. To clean the cash register firstly turn it off and/or unplug it from the wall outlet, then use just a damp cloth.

Do not use corrosive substances such as solvents, alcohol, petrol, or abrasive components.

3. If the cash register is stored in extreme hot or cold temperatures (below 32 degrees or above 104 degrees

Fahrenheit), allow the temperature inside the cash register to reach room temperature before turning it on.

4. DO NOT attempt to pull the paper tape when the cash register is printing or when you are loading paper. Always

use the [R Feed] or [J Feed] key to feed paper. Pulling the paper tape could damage the print mechanism.

GB-2

Page 7

THE KEYPAD

Your cash register is equipped with a 53-key keypad by means of which you can perform all cash register

functions.

The figure below shows the keypad layout.

4

8

9

10

11

12

13

24

23

22

21

20

19

1

18

17

2

3 5 6 7

15

14

16

KEYPAD FUNCTIONS

1. [R Feed] (Receipt Paper Feed) - Advances the receipt paper one line feed; advances the paper continuously

when held down.

ENGLISH

2. [J Feed] (Journal Record Feed) - Advances the journal paper one line feed; advances the paper continuously

when held down.

3. [Dept Shift] (Department Shift) - Allows price entries to departments 21-40. Press this key before entering

applicable department keys 21-40.

4. [0 - 9/00] - Input amounts, indicate how many times a particular item repeats, determine percentage rates or

amounts to add or subtract. Used to enter Clerk identification numbers. The double zero key allows the

quick entry of numbers with two or more zeros.

5. [1-40] (Departments 1 through 40) - Register price entries to departments 1 to 40. To register a price entry

to departments 21 to 40, press the [Dept Shift] key followed by the related department number key.

6. [#/NS] - (NS: No Sale) - Opens the cash drawer without registering any amount such as when changing

cash for a non-sales transaction. Used to register a transaction number to a transaction or to the sale of

individual items.

7. [Price 2] - Registers an alternate price which has been programmed for the same product or department.

8. [Check] - Totals sales paid by check.

GB-3

Page 8

9. [Charge] - Totals sales that are charged.

10. [ST] - Displays and prints on the customer receipt and transaction journal, the subtotal of a sale. It calculates

a subtotal of a transaction consisting of a number of items to be individually discounted or increased by a

determined amount or percentage, and prints this on the customer receipt and transaction journal. Also used to

print a duplicate copy of the sales receipt just issued (the copy is not recorded on the transaction journal).

11. [Credit] - Totals sales that are put on credit, such as a debit card, or on a credit card which is alternative to the

one used for Charge tenders.

12. [Amt Tend/Total] (Amount Tendered/TOTAL) - Totals exact cash transactions and computes change.

13. [.] (Decimal Point) - Used to enter fractional quantities of items being sold. The decimal point is not to be

used when entering a price.

14. [Qty/Time] (Dual function: Multiply and date/time display) - Multiplies [department], [PLU] key entries; also

toggles between the display of the current date and time in the REG mode. Pressing this key during a transaction

displays alphanumeric captions that are longer than the 10-character display capabilities. For example, if the

caption is 18 characters long, the whole caption can be displayed in two steps.

15. [Void/EC] (Dual function: Void and Error Correct) - Deletes the last item entered and corrects a particular entry

after it is processed and printed.

16. [Clerk] - Confirms an entered clerk number.

17. [Return] - Issues refunds or registers the price of returned merchandise.

18. [Clear] - Clears an entry made from the numeric keypad or with the [Qty/Time] key before finalizing

a transaction with a Department or function key. This key is also used to clear error conditions.

19. [PLU] (Price Look Up) - Registers a preset price of an individual item to the appropriate department.

20. [PLU Price] - Temporarily overwrites a price that was assigned to a PLU number.

21. [-] - Subtracts an amount from an item.

22. [+] - Adds an amount to an item.

23. [+%/PO] (Dual function: Percent Plus and Paid Out) - When used as the +% key, adds a percentage to an

item or to the sales total. When used as the PO key, registers any money paid out.

24. [-%/RA] (Dual function: Percent Discount and Received On Account) - When used as the -% key, subtracts

a percentage from an item or from the sales total. When used as the RA key, registers any payment made

to the cash drawer.

GB-4

Page 9

OPTIONAL FUNCTIONS THAT CAN BE ASSIGNED TO KEYPAD KEYS

The cash register offers standard functions that can be invoked by pressing the related key on the cash

register's keypad (refer to the section The Keypad), but the keys that you may not use as frequently as others

can be reprogrammed to invoke other functions that the cash register has to offer. Listed below are the optional

key functions that can be assigned to specific keypad keys.

1. [Non tax] - Used when no tax is to be registered for a department or PLU which is programmed for tax.

2. [Tax1] - Tax change operations; overrides a preset tax rate with the rate defined for Tax 1.

3. [Tax 2] - Tax change operations, overrides a preset tax rate with the rate defined for Tax 2.

4. [000] - Triple zero entry function to quicken the entry of large amounts.

5. [Currency] - Currency conversion key. When the exchange rate of a foreign currency is programmed,

pressing this key after registering the price of an item displays the item price in the programmed foreign

currency. The currency alphanumeric descriptor, if programmed, is displayed on the upper row of the

operator display. Pressing this key a second time returns the display to the local currency.

6. [Price Inq.] - PLU price enquiry functions. Pressing this key before a PLU entry displays the programmed

price of the specific PLU.

7. [Take out] - Registers an alternate tax rate which is applied to restaurant items that are taken out and that

may be subject to a different tax rate with respect to the same item consumed in the restaurant.

8. [House] - Registers a priced item which is offered to the customer free of charge, in other words "on-thehouse".

9. [Tray Subtotal] - In cases when the customer forgets an article, instead of canceling or ending the sales

transaction underway so that the customer can go and collect the forgotten article, the clerk can store the entire

transaction in a "tray" where it can then be recalled successively. The tray subtotal is stored in the cash

register's memory. When the transaction is stored in the tray, the sales transaction of another customer can

be initiated and terminated. Recall the tray subtotal, add items and then end the interrupted sale.

ENGLISH

GB-5

Page 10

THE CONTROL SYSTEM

THE CONTROL LOCK

The control lock is located on the upper right-hand side of the keypad. The REG key must be properly inserted in the

Control Lock in order for you to be able to operate the cash register. The following figure shows the Control Lock and

the different modes that can be used.

Depending on the desired operation, inserting the related key in the Control Lock grants access to the following

positions:

OFF The cash register is turned off and cannot be used.

PRG Used to program the cash register.

REG 1 The cash register can perform the standard sales transactions that are recorded on both the customer

receipt and journal roll. In this mode the preset or programmed header is printed on the customer receipt.

This is also called the Receipt Mode.

REG 2 Same as the REG 1 mode with the only exception that the transaction record is only printed on the

journal roll. The customer receipt is not printed nor issued unless when a receipt reprint is requested by

pressing the [ST] key (copy not recorded on the transaction journal). This is also called the Journal

Mode.

X Prints the X management reports and periodical financial reports.

Z Prints the Z management reports and periodical financial reports, but resets totals (except the grand

total) to zero.

Control Keys

The following sets of keys are provided as well as a set of keys to open the cash drawer and printer compartment:

REG The REGISTER key can be used in the OFF, REG 1, REG 2 and X modes, granting both Clerk and

Supervisor access to cash register functions (as long as the Clerk's specific 3-digit secret code is

entered, if defined).

PRG The PROGRAM key works in all modes (PRG, OFF, REG 1, REG 2, X and Z) and is usually used to

program the cash register and print X and Z management reports.

Z The Z key can be used in the OFF, REG 1, REG 2, X and Z modes granting a higher level access with

respect to the REG key.

CASH DRAWER WITH REMOVABLE CASH BIN

The cash drawer features a cash bin with slots for banknotes and slots for coins. Pressing the [#/NS] key with the

control key in the REG 1 or REG 2 position opens the drawer. If a clerk number and secret code have been set,

pressing this key will open the cash drawer only after the clerk number and code have been specified. This drawer

can be locked for security to prevent accidental opening when moving the cash register by using the printer

compartment key.

A hidden emergency lever underneath the cash register lets you to open the cash drawer even when the machine

is powered off (as long as the cash drawer was not locked with the key).

If desired, the cash bin inside the cash drawer can be completely removed from the cash register. To do so, gently

lift the bin and pull it out.

GB-6

Page 11

OPERATOR AND CUSTOMER DISPLAYS

Your cash register offers two displays that provide easy viewing for both the customer and operator during a

sales transaction. The customer display shows entry amounts and related transaction information through the

use of numbers and special symbols. The operator display shows specific operator messages on the upper 10character line and the same transaction data as shown on the customer display on the lower 10-character line.

Both displays are read from left to right.

DATE AND TIME DISPLAY

Simply pressing the [Qty/Time] key with the cash register in the REG 1 or REG 2 mode toggles between

displaying the current date and time.

SPECIAL SYMBOL INDICATORS

Special symbols appear at the far left-hand side of the displays during cash register operation. These symbols

identify machine conditions and include:

C (Change) Indicates that the displayed amount is the change due to the customer.

S (Subtotal) Indicates that the amount shown is the subtotal of a transaction, including sales tax if applicable.

= (Total) Indicates that the amount shown is the transaction total and that the transaction payment was

finalized by cash, check, charge or credit.

- (Minus) Displays a negative entry. Also displayed if subtotal or cash tendered total is a negative number due

to a return or refund.

Depending on the currency base set, displayed when the reassigned [Currency] key is pressed

to indicate that the amount is displayed in the foreign currency programmed.

ENGLISH

These symbols clear automatically when you start the next entry or press the [Clear] key.

ERROR CONDITIONS

ERROR MESSAGES AND CODES

Error messages and codes appear when an incorrect entry is made or when the cash register is in a state that could

cause an error condition or is, in fact, in an error condition. Error messages are displayed on the upper row of the

operator display while error codes are displayed on the lower row of the operator display and on the customer

display. They include:

ERROR MESSAGE ERROR CODE DESCRIPTION

OPTION RAM E04 Error in the optional RAM.

PRINTER E05 Printer error.

FUNCTION E11 An error is made during operation or when

programming the cash register.

CLERK E12 The Clerk identification sequence is required.

CTRL LOCK E13 The control lock is set to a wrong position.

REPORT REQ E16 A report issue is requested.

GB-7

Page 12

ERROR MESSAGE ERROR CODE DESCRIPTION

PR PAPER 2 E22 Out of customer receipt paper; insert paper.

PR HEAD UP E23 Printhead at customer receipt station up; press the

printhead release lever down.

J PAPER 2 E25 Out of journal paper; insert paper.

J HEAD UP E26 Printhead at journal station up; press the printhead

release lever down.

Press the [Clear] key to clear an error condition.

THE ERROR ALARM

The error alarm warns of an operator error (usually when a wrong key is pressed for a specific type of entry) or of an

error made during cash register programming. The error alarm can also indicate that the Control Lock is in the wrong

position for the current operation. In case of error, the error tone sounds, a specific error code is displayed on the

customer display and on the right-hand side of the lower row of the operator display, the related error message is

displayed on the upper row of the operator display and the keypad locks.

CLEARING AN ERROR

Press the [Clear] key to clear an error. The tone ends, the displays clear and the keypad unlocks, allowing you to

continue with the transaction or restart the program.

If an error condition cannot be cleared, perform a general clearance.

NOTE: The [Clear] key also clears an incorrect entry from the display prior to pressing a registration key. Once an

entry is printed, the [Void/EC] key must be used to correct an error.

GENERAL CLEARANCE

If the cash register does not function, for example when the error signal cannot be stopped by pressing the [Clear]

key, perform a general clearance. There are two ways of performing a general clearance:

1. Turn the Control Key to the OFF position.

2. Unplug the cash register from the power socket.

3. Wait ten seconds and then reconnect the cash register to the power socket to continue.

If the cash register remains in an error condition, proceed with the second general clearance method:

1. Turn the Control Key to the OFF position.

2. With the cash register still plugged to the power outlet open the printer compartment cover and press the Reset

button on the rear left-hand side of this compartment. The Reset button is indicted in the following figure.

GB-8

Page 13

VOIDING ERRORS

Once an entry is printed, the [Clear] key cannot be used to clear an error. Press the [Void/EC] key to correct

an error already registered.

Voiding the Entry Just Completed

Simply press the [Void/EC] key. The entry is reprinted with a "-" symbol followed by the amount and erased

from the transaction.

Voiding an Earlier Entry

To void an earlier entry, register it again and then cancel it using the [Void/EC] key. When a transaction

including the error is completed, proceed with the following steps to void the error.

1. Retype the incorrect information, exactly as originally entered, and press the [Void/EC] key.

2. Enter the correct amount.

3. Total the transaction by pressing the [Amt Tend/Total] key.

MEMORY BACK-UP BATTERY SYSTEM

ENGLISH

During cash register operations, all transaction data for the management reports are stored in the cash register's

memory. This memory also holds all of the cash register's programming data. The memory back-up battery inside

the cash register keeps this information stored in memory when the cash register is unplugged from the power

outlet or when a power failure occurs.

To activate the memory back-up battery system, charge the backup battery by keeping the cash register plugged

into a grounded power outlet for at least 48 hours. The cash register can be used normally during this period of time.

PRINTER COMPARTMENT

The printer compartment is on the upper left-hand side of the cash register. It houses the customer receipt and

journal paper rolls, 2-piece journal winder spindle, thermal printer and the Reset button.

PAPER TAPE

This cash register uses two rolls of standard 37.5 + 0.5 mm paper. One roll is used for the customer receipt

while the other roll is used for the journal record. The cash register signals a receipt or journal out of paper

condition. The paper needs to be changed when a red line appears on the tape.

GB-9

Page 14

LOADING THE CUSTOMER RECEIPT ROLL

Proceed as follows to load a customer receipt roll into the cash register:

1. Make sure that the cash register is plugged into a grounded power outlet and that the Control Key in either

one of the two REG positions.

2. Unlock the printer compartment cover and remove it from the cash register by firmly gripping the back of

the cover and gently lifting the front upward to release its snap features from the case.

3. With a pair of scissors, cut the end of the new paper tape to create a straight, even edge so that the paper

can be properly fed through the print mechanism.

4. Set the customer receipt roll in its predefined slot at the rear left-hand side of the printer compartment so

that the paper feeds out from the bottom of the roll. Then insert the end of the paper into the related paper

feed slot as shown in the following figure.

A

5. Press the [R Feed] key and manually feed the paper into the slot until its catches and advances approximately

six to ten inches above the print mechanism.

NOTE: If the paper does not feed properly, make sure that the paper roll is properly aligned in the slot and that the

end of the paper roll is cut straight. If you need to remove the paper tape so that you can attempt to reload

it again, move the plastic release lever (A) on the right-hand side of the print assy forward and clear the

paper from the slot. Set the lever back to its original position when you are done.

6. Pass the end of the customer receipt through the opening on the compartment cover, then reposition, close and

lock the compartment cover.

GB-10

Page 15

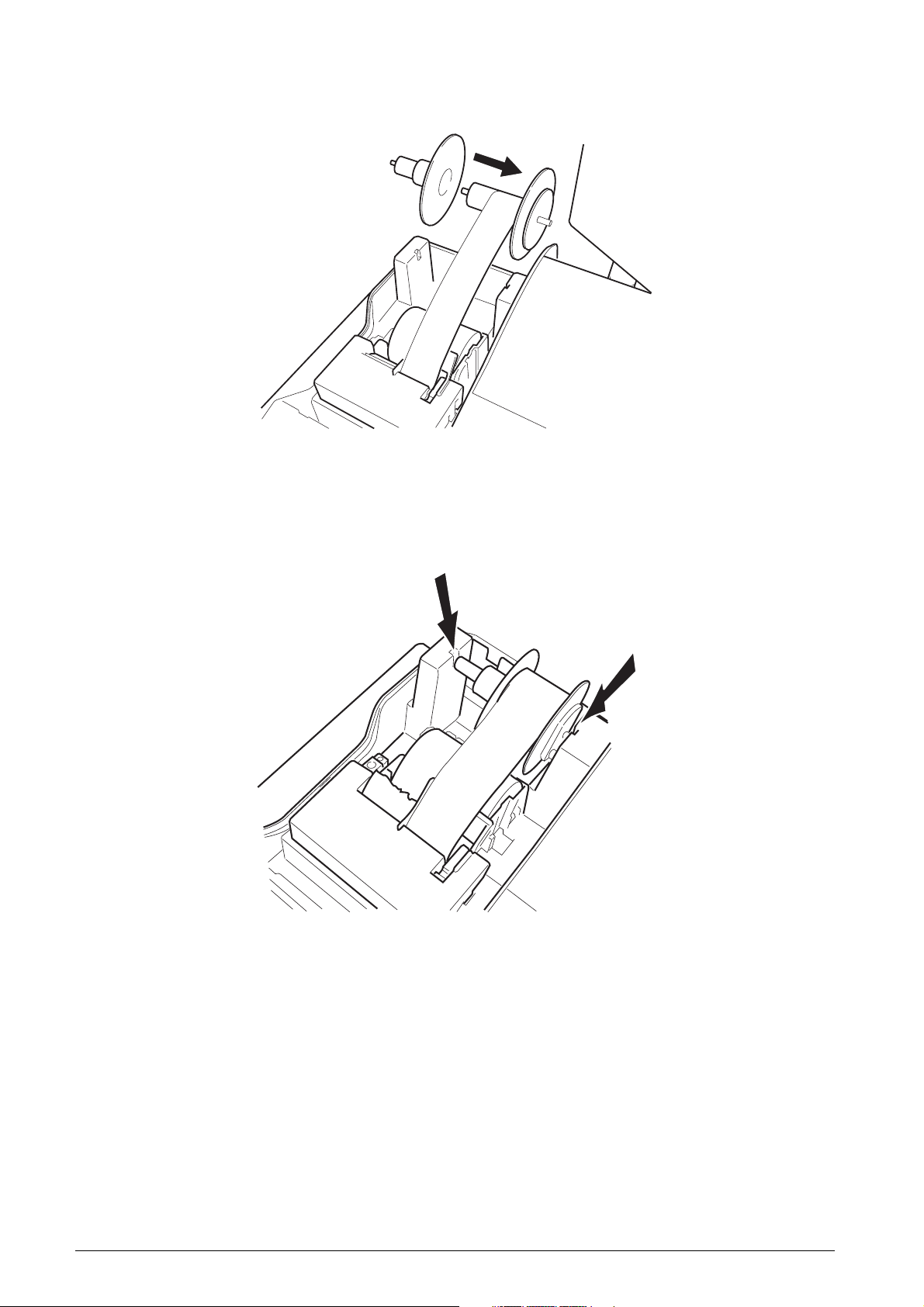

LOADING THE JOURNAL ROLL

Proceed as follows to load a journal roll into the cash register:

1. Make sure that the cash register is plugged into a grounded power outlet and that the Control Key is in either

one of the two REG positions.

2. Unlock and remove the printer compartment cover as explained in Loading the Customer Receipt Roll.

3. If you are replacing the journal roll, lift the 2-piece plastic journal winder spindle from its two supports on the

machine and, if necessary, move the plastic paper release lever (A) located to the right-hand side of the journal

paper insertion slot forward to release the paper which may still be present in the print mechanism. Then slide

the journal paper off the plastic winder.

4. With a pair of scissors, cut the end of the new paper tape to create a straight, even edge so that the paper can

be properly fed through the print mechanism.

5. Set the journal roll in its predefined slot at the rear right-hand side of the printer compartment so that the paper

feeds out from the bottom of the roll. Then insert the end of the paper into the related paper feed slot as shown

in the following figure.

A

6. Press the [J Feed] key and manually feed the paper into the slot until its catches and advances approximately

six to ten inches above the print mechanism.

NOTE: If the paper does not feed properly, make sure that the paper roll is properly aligned in the slot and that the

end of the paper roll is cut straight. If you need to remove the paper tape so that you can attempt to reload

it again, move the plastic release lever (A) on the right-hand side of the print assy forward, and clear the

paper from the slot.

ENGLISH

7. Holding the main body of the 2-piece plastic journal winder with the two wheels to the right-hand side, slide the

end of the paper tape through one of the slots on the plastic journal winder spindle (1) and manually roll the

winder toward the rear of the cash register (2) to take up the slack in the paper tape.

1

2

GB-11

Page 16

8. Attach the second part (3) of the 2-piece plastic journal winder spindle to the first as shown in the following

figure.

3

9. Place the 2-piece journal winder back onto its two support brackets indicated by the arrows in the following

figure.

10. Reposition, close and lock the compartment cover.

GB-12

Page 17

TRANSACTION EXAMPLES

This section provides examples on how to complete different types of transactions. Sample receipts are included

which reflect some of the programming examples used in the System Configuration Guide.

ENTERING THE REGISTER MODE

The cash register has two register modes which can be used to record ordinary sales transactions. These two

modes are called REG 1 and REG 2, where the only difference between the two is that in the REG 1 mode the

cash register will automatically print the programmed header on all customer receipts and journal records,

while in the REG 2 mode this header is not printed at all. In the REG 2 mode the customer receipts are not

printed unless the [ST] key is pressed at the end of the transaction.

Proceed as follows to enter the REG 1 mode:

1. Insert the control key into the Control Lock and turn it to the REG 1 position.

2. The number "0" is displayed prompting you to enter a Clerk identification sequence. Type a Clerk number

[1 to 26], press the [Clerk] key and the cash register will switch to the REG mode if there is no secret code

programmed. If, instead, the letter "o" is displayed three times in a row you are prompted to enter the secret

code that was previously associated to the Clerk number entered. Type the [3-digit] code and the cash

register will switch to the REG mode.

EXITING THE REGISTER MODE

To exit the register mode at the end of a transaction, simply turn the control key to the OFF position.

CLEARING ERRORS

Detailed instructions on how to clear all kinds of errors which may occur during cash register operations are

explained in the section Error Conditions at the beginning of this manual.

SAMPLE RECEIPT

The following sample receipt shows where general transaction information is printed on a customer receipt.

Machine number

Personalized customer receipt

header on 7 lines

ENGLISH

Clerk

identification

Department

Programmed

PLU read from

barcode reader

with related

number and

price

Department

VAT total

Programmed

advertisment

message

Date

Consecutive receipt number

Item price with department VAT rate

Programmed PLU name, number and

price

Non-taxed item price

Transaction subtotal

Total balance due

Cash tendered

Change due

Item counter

Time

GB-13

Page 18

REPRINTING A SALES RECEIPT

Your cash register allows you to reprint an exact copy of the sales receipt at the end of the current transaction

performed in the REG 1 mode or to print the transaction receipt in the REG 2 mode. The consecutive receipt

number is not increased on the reprinted receipt, and the reprinted receipt is not recorded in the journal record.

This function is particularly useful when working in the REG 2 mode, since it gives you the possibility of issuing

a sales receipt if one is required. Remember that the only difference between the REG 1 mode and the REG 2

mode is that in the REG 2 mode the sales receipt is not printed nor issued.

For this function, the cash register's RAM (Random Access Memory) can store a sales receipt of up to a

maximum of 60 lines. Therefore when a receipt reprint is requested, the cash register will only print up to 60

lines; if this threshold is exceeded, only the total amount will be printed.

Proceed as follows to reprint or print a sales receipt:

1. Perform a sales transaction with a tender in either the REG 1 or REG 2 mode. Refer to the transaction

examples provided further on in this chapter.

2. Press the [ST] key.

STANDARD TRANSACTIONS

Registering a Single Item Sale with Change Tender

Up to nine digits can be used for the amount of the entry.

Example: Register a £1.00 item in Department 1.

Compute change for a £5.00 tender.

Proceed as follows:

1. Type [100] and press the [department 1/21] key.

2. Type the amount tendered [500] and press the

[Amt Tend/Total] key. The transaction is ended

and the change due to the customer is displayed.

Registering a Multiple Item Sale with Exact

Cash Tender

Example: Register a £2.50 item to Department 1, a £.50

item to Department 5 and a £1.65 item to Department 8,

with an exact tender of £4.65.

Proceed as follows:

1. Type [250] and press the [department 1/21] key.

2. Type [50] and press the [department 5/25] key.

3. Type [165] and press the [department 8/28] key.

4. Press the [ST] key for the current balance due.

5. Press the [Amt Tend/Total] key to end the transaction.

Change on a

cash tender

Transaction total

Exact cash tender

GB-14

Page 19

Registering a Sale of Multiple Items at

Same Cost

Up to three digits can be used for the quantity multiplied.

Example: Multiply two items costing £1.50 and register

the sale to Department 1. Compute change for £5.00.

Proceed as follows:

1. Type the number of items [2] and press the [Qty/Time]

key.

2. Type their cost [150] and press the [department

1/21] key.

3. Press the [ST] key for the current balance due.

4. Type the amount tendered [500] and press the [Amt

Tend/Total] key. The transaction is ended and the

change due to the customer is displayed.

Registering a Sale of Individual Items Taken

from a Single Product Package (Split Price

Registration).

Number of items at

same cost multiplied

by unit price

Total cost with

VAT rate

ENGLISH

Item counter

Example: Calculate the cost of 3 items taken from a box

of 12 that costs £10.00. Registrer the sale to department

3 as an exact cash tender.

Proceed as follows:

1. Type the number of items taken from the box [3] and

press the [Qty/Time] key.

2. Type the original number of items that a new box has

[12] and press the [Qty/Time] key.

3. Type the cost of a new box [1000] and press the

[department 3/23] key.

4. Press the [Amt Tend/Total] key for an exact cash

tender. The transaction is ended.

Three items out of a

box of 12

Unit price

Total cost of the

three items

GB-15

Page 20

Registering a Multiple Department Sale with

Payment and Change Tender

Example: Register a £69.00 item to Department 1, a

£5.00 item to Department 4 and a £3.50 item to

Department 7. Compute change for £100.00.

Proceed as follows:

1. Type [6900] and press the [department 1/21] key.

2. Type [500] and press the [department 4/24] key.

3. Type [350] and press the [department 7/27] key.

4. Press the [ST] key for the current balance due.

5. Type the amount tendered [10000] and press the

[Amt Tend/Total] key. The transaction is ended and

the change due to the customer is displayed.

Registering Repeated Entries to the Same

Department

Example: Register the sale of a £20.00 item twice to

Department 3. Subtotal the sale and computer change for

£50.00.

Proceed as follows:

1. Type [2000] and press the [department 3/23] key.

2. Press the [department 3/23] key.

Cash payment

Change tendered

Sale of repeated

entries

Subtotal

3. Press the [ST] key for the current balance due.

4. Type [5000] and press the [Amt Tend/Total] key. The

transaction is ended and the change due to the

customer is displayed.

GB-16

Cash tender with

change

Page 21

Registering a Charge Transaction

Charge transactions are counted and registered to the

charge total in the financial report.

Example: Register a £2.50 item to Department 1 and a

£3.00 item to Department 2 as a charge transaction.

Proceed as follows:

1. Type [250] and press the [department 1/21] key.

2. Type [300] and press the [department 2/22] key.

3. Press the [ST] key for the current balance due.

4. Press the [Charge] key to end the transaction.

Split Cash/Charge Tendering

Example: Register a £10.00 item and a £15.00 item to

Department 2. Split the amount tendered between

£20.00 cash and £5.00 charge.

Proceed as follows:

1. Type [1000] and press the [department 2/22] key.

2. Type [1500] and press the [department 2/22] key.

3. Press the [ST] key for the current balance due.

4. Type the cash tendered [2000] and press the

[Amt Tend/Total] key. The remaining balance due is

displayed.

Amount charged

ENGLISH

Sales total

Cash payment

Charge payment

5. Press the [Charge] key to end the transaction.

Credit Tendering

Example: Register a £70.00 item paid by credit to

Department 21.

Proceed as follows:

1. Type [7000] and press the [dept shift] and

[department 1/21] keys.

2. Press the [Credit] key and the transaction ends

successfully.

Amount paid by

credit

GB-17

Page 22

Check Tendering

Example: Register a £70.00 item paid by check to

Department 21.

Proceed as follows:

1. Type [7000] and press the [Dept Shift] and

[department 1/21] keys.

2. Press the [Check] key and the transaction ends

successfully.

Check Tender with Change

Example: Register a £19.50 item to Department 2, a

£2.50 item to Department 5 and a £5.00 item to

Department 22. Compute the change for a £30.00 check

tender.

Check payment

Proceed as follows:

1. Type [1950] and press the [department 2/22] key.

2. Type [250] and press the [department 5/25] key.

3. Type [500] and press the [Dept Shift] and

[department 2/22] keys.

4. Press the [ST] key for the current balance due.

5. Type the amount paid by check [3000] and press the

[Check] key. The change due to the customer is

displayed and the transaction ends successfully.

Transaction subtotal

Check payment

Change tendered

GB-18

Page 23

Split Check/Cash Tender

Example: Register a £24.00 item to Department 1, a

£36.00 item to Department 3 and a £4.00 item to

Department 4. Split the tender between £60.00 check

and £4.00 cash.

Proceed as follows:

1. Type [2400] and press the [department 1/21] key.

2. Type [3600] and press the [department 3/23] key.

3. Type [400] and press the [department 4/24] key.

4. Press the [ST] key for the current balance due.

5. Type the amount to be tendered by check [6000] and

then press the [Check] key. The remaining balance

due is displayed.

6. Press the [Amt Tend/Total] key when the

corresponding cash is tendered. The transaction ends

successfully.

MINUS (-) KEY TRANSACTIONS

Registering a (-) Reduction (Coupon)

Up to nine digits can be used for the amount of the

transaction.

Example: Register a £.50 reduction (coupon) on a £2.00

item to Department 2. End the transaction with an exact

cash tender.

VAT total

Check payment

Cash payment

Item price

Reduction using manual

entry and minus key

ENGLISH

Proceed as follows:

1. Type [200] followed by the [department 2/22] key.

2. Type the amount to be reduced [50] followed by the

[-] key.

3. End the transaction by pressing the [Amt Tend/Total]

key.

Exact cash tender

GB-19

Page 24

Registering a Multiple (-) Reduction

Example: Register a £.50 reduction on a £2.50 item to

Department 1, a £2.60 item to Department 3, a £.60

reduction on a £4.50 item to Department 21, a £.50

discount to a £3.00 multiple item sale to Department 5

and a £.1.00 reduction to a £5.00 item to Department 22.

Compute change for a £30.00 tender.

Proceed as follows:

1. Type [250] and press the [department 1/21] key.

2. Type the £.50 discount [50] and press the [-] key.

3. Type [260] and press the [department 3/23] key.

4. Type [450] and press the [dept shift] and

[department 1/21] keys.

5. Type the £.60 discount [60] and press the [-] key.

6. Type the number of items of the multiple sale [3], press

the [Qty/Time] key then enter the unit price [300] and

press the [department 5/25] key.

Item price entry

Manual reduction

entry

Multiple item sale

multipled by unit

price

Resulting total

Manual reduction

entry

7. Type [500], press the [dept. shift] key followed by

the [department 2/22] key.

8. Type the £1.00 reduction [100] and press the [-] key.

9. Press the [ST] key for the current balance due.

10. Type the amount tendered [3000] and press the

[Amt Tend/Total] key to display the change due to

the customer and end the transaction.

PLUS (+) KEY TRANSACTIONS

Registering a (+) Add-on

Up to nine digits can be used for the amount of the

transaction.

Example: Register a £.1.00 add-on to a £5.00 item

registered to Department 2. End the transaction with an

exact cash tender.

Proceed as follows:

Total VAT

Cash tendered

Change due

Price entry

Manual add-on

1. Type [500] followed by the [department 2/22] key.

2. Type the amount to be added on [100] followed by the

[+] key.

3. End the transaction by pressing the [Amt Tend/Total]

key.

GB-20

Page 25

Registering a Programmed (+) Add-on

To perform this operation, the [(+)] key must have been

programmed with the add-on value.

Example: Register a programmed £1.00 add-on to a £3.00

item registered to Department 2 and end the transaction

with an exact cash tender.

Proceed as follows:

1. Type [300] and press the [department 1/21] key.

2. Press the [(+)] key.

3. Press the [Amt Tend/Total] key.

PERCENT DISCOUNT (-%) TRANSACTIONS

Discounting the Total Sale

You can call up a programmed discount rate during the

transaction by pressing the [-%/RA] key. If a percent

discount rate is not programmed, type in the discount rate

before pressing the [-%/RA] key. Up to four digits can be

used for the discount percentage (0-99.99%).

Example: Register a programmed 15% discount to an

entire sales transaction. Compute the change tender.

Proceed as follows:

1. Type [250] and press the [department 7/27] key.

Price entry

Programmed add-on

ENGLISH

Transaction subtotal

Programmed discount rate

Discount

Transaction subtotal

2. Type [99] and press the [department 3/23] key.

3. Press the [ST] key for the current balance due.

4. Press the [-%/RA] key to apply the programmed

discount. The amount discounted is displayed.

5. Press the [ST] key for the new balance due.

6. Type the amount tendered [500] and press the

[Amt Tend/Total] key. The change due to the customer

is displayed and the transaction ends successfully.

Cash tendered

Change due

GB-21

Page 26

Discounting the Total Sale by Using a Random

Discount Rate

Example: Register a 9.5% discount to a sales

transaction. Compute the change tender.

Proceed as follows:

1. Type [300] and press the [department 1/21] key.

2. Type [200] and press the [department 2/22] key.

3. Press the [ST] key for the subtotal.

4. Type the discount rate to apply [9.5] and press the

[-%/RA] key. The amount discounted is displayed.

5. Press the [ST] key for the new balance due.

6. Type the amount tendered [500] and press the

[Amt Tend/Total] key. The change due to the customer

is displayed and the transaction ends successfully.

Discounting (-%) Individual Items using the

Programmed Discount Rate

Up to four digits can be used for the discount percentage

(0-99.99).

Example: Register a programmed 15% discount on a

£3.00 item to Department 5, and a £2.50 item to

Department 4. Compute the change tender.

Proceed as follows:

1. Type [300] and press the [department 5/25] key.

2. Press the [-%/RA] key to apply the programmed

discount. The amount discounted is displayed.

3. Type [250] and press the [department 4/24] key.

4. Press the [ST] key for the current balance due.

5. Type the amount tendered [600] and press the [Amt

Tend/Total] key. The change due to the customer is

displayed and the transaction ends successfully.

Transaction subtotal

Manual discount entry

Discount

Transaction total

Programmed discount

rate

Discount

GB-22

Page 27

Discounting Individual Items using Programmed

and Random Discount Rates

Example: Register a £2.50 item to Department 1, apply

the programmed discount to a £3.50 item to Department

25 and apply a discount rate of 3% to a £5.00 item to

Department 2. Compute change tender.

Proceed as follows:

1. Type [250] and press the [department 1/21] key.

2. Type [350] and press the [dept shift] key followed by

the [department 5/25] key.

3. Press the [-%/RA] key to apply the programmed

discount. The amount discounted is displayed.

4. Type [500] and press the [department 2/22] key.

5. Type the discount rate [3] and press the [-%/RA] key.

The amount discounted is displayed.

6. Press the [ST] key for the current balance due.

7. Type the cash tendered [1100] and press the [Amt

Tend/Total] key. The change due to the customer is

displayed and the tranasction ends successfully.

Programmed

discount rate

Random discount

rate

ENGLISH

Discounting (-%) One Item Using the

Programmed Discount Rate

Up to four digits can be used for the discount percentage

(0-99.99%).

Example: Register a programmed 15% discount to a

£.99 cash transaction to Department 7.

Proceed as follows:

1. Type [99] and press the [department 7/27] key.

2. Press the [-%/RA] key to apply the programmed

discount. The amount discounted is displayed.

3. Press the [ST] key for the current balance due.

4. Press the [Amt Tend/Total] key to end the transaction

with an exact cash tender.

Programmed

discount rate

Discount

GB-23

Page 28

PERCENT PLUS (+%) TRANSACTIONS

Applying the Programmed Percent Plus Rate to a

Total Sale

You can call up a programmed percent plus rate during

the transaction by pressing the [+%/PO] key. If a percent

plus rate is not programmed, type in the discount rate

before pressing the [+%/PO] key. Up to four digits can be

used for the percent plus rate (0-99.99%).

Transaction subtotal

Example: Register a programmed 6.5% percent plus

rate to an entire sales transaction. Compute the change

tender.

Proceed as follows:

1. Type [250] and press the [department 7/27] key.

2. Type [99] and press the [department 3/23] key.

3. Press the [ST] key to display the current balance due.

4. Press the [+%/PO] key to apply the programmed addon. The amount added on is displayed.

5. Press the [ST] key again to display the new balance

due.

6. Type the amount tendered [500] and press the [Amt

Tend/Total] key. The change due to the customer is

displayed and the transaction ends successfully.

Applying a Random Percent Plus Rate to

a Total Sale

Programmed percent

plus rate

Amount added on

Example: Register a 20% percent plus rate to a sales

transaction. Compute the change tender.

Proceed as follows:

1. Type [300] and press the [department 1/21] key.

2. Type [250] and press the [department 2/22] key.

3. Press the [ST] key for the current balance due.

4. Type the percent plus rate to apply [20] and press the

[+%/PO] key. The amount added on is displayed.

5. Press the [ST] key for the current balance due.

6. Type the amount tendered [700] and press the

[Amt Tend/Total] key. The change due to the customer

is displayed and the transaction ends successfully.

Transaction subtotal

Random percent plus

rate

Amount added on

GB-24

Page 29

Adding a Percent Plus Rate to Individual Items

Using the Programmed Rate

Up to four digits can be used for the percent plus rate

(0-99.99%).

Example: Register a programmed 6.5% percent plus

rate on a £3.00 item to Department 5, and a £2.50 item

to Department 4. Compute the change tender. Proceed

as follows:

1. Type [300] and press the [department 5/25] key.

2. Press the [+%/PO] key to apply the programmed

percent plus rate. The amount added on is displayed.

Programmed percent

plus rate

Amount added on

3. Type [250] and press the [department 4/24] key.

4. Press the [ST] key for the current balance due.

5. Type the amount tendered [600] and press the

[Amt Tend/Total] key. The change due to the customer

is displayed and the transaction ends successfully.

Applying Programmed and Random Percent

Plus Rates to Individual Items

Example: Register a £2.50 item to Department 1, apply

the programmed percent plus rate to a £3.50 item to

Department 25, and apply a random precent plus rate of

5% to a £5.00 item to Department 2. Compute change

tender.

Proceed as follows:

1. Type [250] and press the [department 1/21] key.

2. Type [350] and press the [dept shift] key followed by

the [department 5/25] key.

3. Press the [+%/PO] key to apply the programmed

percent plus rate. The amount added on is displayed.

ENGLISH

Programmed percent

plus rate

Random percent

plus rate

4. Type [500] and press the [department 2/22] key.

5. Type the random percent plus rate [5] and press the

[+%/PO] key. The amount added on is displayed.

6. Press the [ST] key to display the current balance due.

7. Type the cash tendered [1200] and press the [Amt

Tend/Total] key. The change due to the customer is

displayed and the tranasction ends successfully.

GB-25

Page 30

Adding the Programmed Percent Plus Rate (+%)

to One Item

Up to four digits can be used for the percent plus rate

(0-99.99%).

Example: Register a programmed 6.5% add-on to a

£.50 cash transaction to Department 7.

Proceed as follows:

1. Type [50] and press the [department 7/27] key.

2. Press the [+%/PO] key to apply the programmed

percent plus rate. The amount added on is displayed.

3. Press the [ST] key for the current balance due.

4. Press the [Amt Tend/Total] key to end the transaction

with a correct cash tender.

PLU CODES

Registering a Sales Transaction Using Preset

PLU Codes

Programmed percent

plus rate

Amount added on

In order to be able to use this feature, PLU codes must

have been previously set.

Example: Use preset PLU codes to register an entire

transaction: register PLU 17 and multiply 3 PLU 24.

Compute change for a cash tender.

Proceed as follows:

1. Type [17] followed by the [PLU] key.

2. Type [3] followed by [Qty/Time], then press [24]

followed by the [PLU] key. The amount of the

multiplication is displayed.

3. Press the [ST] key for the current balance due.

4. Type the amount tendered [1000] and press the

[Amt Tend/Total] key. The change due to the customer

is displayed and the transaction is ended successfully.

Programmed

PLU

identifier

Preset PLU

price

Multiple sale

with same

preset PLU

GB-26

Page 31

Overwriting a Preset PLU Price

Example: Overwrite the preset PLU 17 with £2.00.

Compute change for a £5.00 tender.

Proceed as follows:

1. Type the new price [200] and press the [PLU Price]

key. The message PRICE is displayed on the operator

display.

2. Type [17] followed by the [PLU] key to define the PLU

to be overwritten.

3. Press the [ST] key to display the current balance due.

4. Type the cash tendered [500] and press the [Amt Tend/

Total] key. The change due to the customer is displayed

and the transaction ends successfully.

Overwritten

PLU descriptor

Entered PLU

price (manual

price entry)

ENGLISH

Registering a Sales Transaction Reading

Product Label Barcodes with a Barcode Reader

In order to be able to use this feature, the prices related to

product label barcodes must have been previously

assigned to a PLU.

Example: Use the barcode reader to read a price of

£0.45 from a product label barcode. Compute change for

a £5.00 cash tender.

Proceed as follows:

1. Scan the product barcode label with the barcode reader.

The product price previously programmed in the cash

register is automatically registered to the programmed

department.

2. Type the amount tendered [500] and press the

[Amt Tend/Total] key. The change due to the customer

is displayed and the transaction is ended successfully.

Programmed

PLU name with

barcode

number and

associated

price

GB-27

Page 32

Registering a Sales Transaction by Manually

Typing Product Label Barcode Numbers

In order to be able to use this feature, the prices related

to product label barcodes must have been previously

assigned to a PLU.

Example: Register the sale of a product by manually typing

the product barcode label number 4006856200898 on the

numeric keypad. End the transaction with an exact cash

tender.

1. Type the barcode label number [4006856200898] on

the cash register's numeric keypad.

2. Press the [PLU] key. The PLU associated to the

barcode number entered is registered and the product

name (if defined) and associated price is displayed.

3. Press the [Amt Tend/Total] key to end the transaction

with an exact cash tender.

Programmed

PLU name with

barcode

number and

associated

price

PLU-to-PLU Link Registration

A prerequisite to this operation is for linkable PLUs to

have been linked to a specific PLU. If the cash register

was programmed accordingly, by recalling the number of

a linked PLU you can register the sale of the PLU and of

all the linkable PLUs assigned to it. The transaction will

sum the sales price of the PLU and of the ones linked.

Example: Register the sale of PLU 55 named Eat-in Meal

programmed with a service charge of £1.00 and with

linkable PLUs Soft drink, burger and fries linked to it. End

the transaction with an exact cash tender.

1. Type [55] and press the [PLU] key.

2. Press the [Amt tend/Total] key to end the transaction

with an exact cash tender.

Programmed

PLU name with

number and

associated

price

Programmed

linkable PLUs

with name,

number, price

and linked to

PLU 55

GB-28

Page 33

Price 2 Transactions

Price 2 transactions are used when you wish to register a

department single item sale or a PLU sale with the alternate

price (Price 2) assigned to the related department or PLU.

You simply press the [Price 2] key prior to the department

or PLU key.

The cash register can be programmed so that the Price 2

is either temporary or fixed.

Example: Register the sale of PLU 17 with its normal

price of £1.50 and then register the sale of PLU 17 with

its alternate price (Price 2) of £1.00. End the transaction

with an exact cash tender.

Proceed as follows:

1. Type [17] and then press the [PLU] key.

2. Press the assigned [Price 2] key.

3. Type [17] and press the [PLU] key.

4. Press the [Amt Tend/Total] key. The transaction ends

successfully with the alternate price of PLU item 1

registered.

VOIDS AND REFUNDS

Voiding the Previous Entry in the Middle of

a Sale

Example: Void a £2.50 entry erroneously made to

Department 2. Then register a £3.00 item to this same

Department. End the transaction with an exact cash

tender.

Proceed as follows:

PLU17 price 1

PLU17 price 2

ENGLISH

Incorrect item price void

1. Type [250] and press the [department 2/22] key.

2. Press the [Void/EC] key to void the entry made in

the previous step.

The amount voided is displayed and printed.

3. Type [300] and press the [department 2/22] key.

4. Press the [ST] key for the current balance due.

5. Press the [Amt Tend/Total] key to end the transaction

with an exact cash tender.

Correct item price

GB-29

Page 34

Voiding a Previous Entry at the End of a Sale

Example: Register a £1.50 item to Department 1, a

£3.50 item to Department 4, a £5.00 item to Department

3. Then void the £1.50 item erroneously made to

Department 1 and replace it with a £1.00 entry to the

same Department. Compute change for a cash tender.

Proceed as follows:

1. Type [150] and press the [department 1/21] key.

2. Type [350] and press the [department 4/24] key.

3. Type [500] and press the [department 3/23] key.

4. Press the [Clear] key.

5. Type [150], press the [Void/EC] key and then the

[department 1/21] key. The amount voided is displayed

and printed.

6. Type [100] and press the [department 1/21] key.

7. Press the [ST] key for the current balance due.

8. Type the amount tendered [1000] and press the

[Amt Tend/Total] key. The change due to the customer

is displayed and the transaction is ended successfully.

Refunding a Single Item

Example: Refund a £1.00 item in Department 1.

Incorrect price entry

Incorrect item price void

Correct item price entry

Proceed as follows:

1. Press the [Return] key.

2. Type the amount to be refunded [100] and press the

[department 1/21] key. The amount refunded is

displayed.

3. Press the [Amt Tend/Total] key to successfully end

the transaction.

Single item returned

and refunded

Total refunded

GB-30

Page 35

Refunding Multiple Items

Example: Refund a £5.00 item to Department 4 and

three £2.00 items to Department 8.

Proceed as follows:

1. Press the [Return] key.

2. Type [500] and press the [department 4/24] key. The

item's department number and amount refunded are

displayed.

Single item refund

3. Press the [Return] key again.

4. Type the number of items to be refunded [3], press

the [Qty/Time] key, enter their unit price [200] and

then press their department key [department 8/28].

The Department number and the number of items

refunded are displayed.

5. Press the [ST] key for the total amount to be refunded.

6. Press the [Amt Tend/Total] key to successfully end

the transaction.

OTHER TRANSACTIONS

Registering Money Received on Account

Example: Register £100.00 received on account.

Proceed as follows:

1. Type [10000] and then press the [-%/RA] key.

2. Press the [Amt Tend/Tender] key.

Multiple item refund

ENGLISH

Total refund

Amount received

on account

The cash drawer will automatically open to indicate the

end of the transaction. Note that a Charge cannot be

received on account.

Paying Money Out

Example: Pay out £200.00.

Proceed as follows:

1. Type the amount to be paid out [20000] and then press

the [+%/PO] key.

2. Press the [Amt Tend/Total] key.

The cash drawer will automatically open to indicate the

end of the transaction. Note that Paid Out transactions

cannot be performed if the Media-In-Drawer total is a

negative value.

Amount paid out

GB-31

Page 36

Registering an Identification Number

to a Transaction

Up to 13 digits can be used for the identification number.

This entry can be made prior to any operation. The

identification number is not added to the management

report or totals.

Example: Assign the identification number 3456 to a

£1.00 sale to Department 4. Enter an exact cash tender

sale.

Proceed as follows:

1. Type [3456] and press the [#/NS] key.

2. Type [100] and press the [department 4/24] key.

3. Press the [Amt Tend/Total] key for an exact cash

tender sale.

Registering an Identification Number

to an Item Sale

Transaction number

You can also assign identification number of up to 13 digits

to an item sale.

Example: Assign the identification number 78910 to a £2.00

sale to Department 1 and number 111213 to a PLU 17

sale. End the transaction with an exact cash tender.

Proceed as follows:

1. Type [200] and press the [department 1/21] key.

2. Type [78910] and press the [#/NS] key.

3. Type [17] and then press the [PLU] key.

4. Type [111213] and then press the [#/NS] key.

5. Press the [Amt Tend/Total] key for an exact cash

tender sale.

Registering a No Sale

This operation opens the cash drawer and prints a no sale

receipt. The activity is registered to the activity counter in

the financial report.

Item sale identification

number

Proceed as follows:

1. Press the [#/NS] key.

GB-32

Page 37

Registering Negative Entries

For this operation to be performed, a department must

have been programmed with a negative sales status. If

you want to register negative sales value PLUs, also the

related PLU must have been programmed with a negative

status.

Example: Register £3.00 and £5.00 to department 16

programmed with a negative sales status.

1. Type [300] and press the [deptartment 16/36] key.

2. Type [500] and press the [department 16/36] key.

3. Press the [Amt Tend/Total] key to end the transaction.

Registering Returned Merchandise

Returned merchandise can be registered to departments

that have been programmed with a negative status.

Entries to a department

with negative status

ENGLISH

Example: Return a item costing £20.00 and register it to

department 16 programmed with a negative sales status.

1. Press the [Return] key.

2. Type [2000] and press the [department 16/36] key.

3. Press the [Amt tend/Total] key to end the transaction.

Merchandise returned to a

department with negative

status

GB-33

Page 38

TRANSACTIONS USING THE OPTIONAL

KEYS ASSIGNED

This section gives examples of the operations that can be

performed with the optional key functions (listed at the

beginning of this manual) when these are assigned to

specific keys on the keypad.

TRANSACTIONS USING A FOREIGN

CURRENCY

To perform transactions using a foreign currency, the

currency function must be assigned to one of the function

keys on the keypad.

NOTE: As prerequisite to the example currency

conversion transactions in this section, the related

foreign currency exchange rate must be

programmed in the cash register.

In such examples the Euro was programmed as

the foreign currency with an exchange rate of 1

Euro = 0.6221 GBP (with the cash register in the

non-Euro base currency mode (such as GBP) it

divides the price entered or transaction subtotal

by the exchange rate defined).

NOTE: The examples in this section use the first

exchange rate of the four that can be programmed.

If you wish to use any of the other three exchange

rates that may be programmed, press the

exchange rate’s related numeric key [2, 3 or 4]

followed by the assigned [Currency] key.

Registering a Multiple Item Sale with Exact

Cash Tender in Euro

To perform this transaction the Euro exchange rate must

have been programmed.

Example: Register a £10.00 item to Department 1, a

£20.00 item to Department 2, with an exact cash tender

in Euro.

Proceed as follows:

1. Type [1000] and press the [department 1/21] key.

2. Type [2000] and press the [department 2/22] key.

3. Press the [ST] key for the current balance due in Local

currency.

4. Press the assigned [Currency] key to display the

current balance due in Euro.

5. Press the [Amt Tend/Total] key to end the transaction.

Transaction total in

local currency

Exact cash tender

in foreign currency

Cash tender

converted in local

currency

GB-34

Page 39

Registering a Multiple Department Sale with

Payment in Euro and Change Tender in Local

Currency

To perform this transaction the Euro exchange rate must

have been programmed.

Example: Register a £69.00 item to Department 3, a

£5.00 item to Department 2 and a £3.50 item to

Department 4. Compute change for 150.00 Euro.

Proceed as follows:

1. Type [6900] and press the [department 3/23] key.

2. Type [500] and press the [department 2/22] key.

3. Type [350] and press the [department 4/24] key.

4. Press the [ST] key for the current balance due in Local

currency.

5. Press the assigned [Currency] key to display the

current balance due in Euro.

6. Type the amount tendered in Euro [15000] and press

the [Amt Tend/Total] key. The transaction is ended

and the change due to the customer is displayed.

Cash payment

in foreign currency

Change tendered in

local currency

ENGLISH

Split Cash/Charge Tendering in Euro

To perform this transaction the Euro exchange rate must

have been programmed.

Example: Register a £8.00 item and a £12.00 item to

Department 3. Split the amount tendered between

10.00 Euro cash and 22.15 Euro charge.

Proceed as follows:

1. Type [800] and press the [department 3/23] key.

2. Type [1200] and press the [department 3/23] key.

3. Press the [ST] key for the current balance due in Local

currency.

4. Press the assigned [Currency] key to display the

current balance due in Euro.

5. Type the cash tendered in Euro [1000] and press the

[Amt Tend/Total] key. The remaining balance due in

Local currency is displayed.

6. Press the assigned [Currency] key again. The

remaining balance due in Euro is displayed.

7. Press the [Charge] key to end the transaction.

Sales total in local

currency

Cash payment in

foreign currency

Charge payment in

foreign currency

GB-35

Page 40

Check Tender in Euro with Change in Local

Currency

To perform this transaction the Euro exchange rate must

have been programmed.

Example: Register a £19.50 item to Department 4, a

£2.50 item to Department 5 and a £5.00 item to

Department 23. Compute the change in Local currency

for a 50.00 Euro check tender.

Proceed as follows:

1. Type [1950] and press the [department 4/24] key.

2. Type [250] and press the [department 5/25] key.

3. Type [500] and press the [Dept Shift] and [department

3/23] keys.

4. Press the [ST] key for the current balance due in Local

currency.

5. Press the assigned [Currency] key for the current

balance due in Euro.

6. Type the amount tendered by check in Euro [5000]

and press the [Check] key. The change due in local

currency is displayed and the transaction ends

successfully.

Split Check Tender in Local Currency/Cash

Tender in Euro

To perform this transaction the Euro exchange rate must

have been programmed.

Example: Register a £18.00 item to Department 2, a

£24.00 item to Department 3 and a £2.50 item to

Department 4. Split the tender between a £20.00 check

and 39.38 Euro cash.

Sales total in local

currency

Check payment in

foreign currency

Change tendered in

local currency

Proceed as follows:

1. Type [1800] and press the [department 2/22] key.

2. Type [2400] and press the [department 3/23] key.

3. Type [250] and press the [department 4/24] key.

4. Press the [ST] key for the subtotal in local currency.

5. Type the amount to be tendered by check in local [2000]

and then press the [Check] key. The remaining balance

due is displayed in Local currency.

6. Press the assigned [Currency] key to display the

remaining balance due in Euro.

7. Press the [Amt Tend/Total] key when the correspon-

ding cash is tendered in Euro. The transaction ends

successfully.

GB-36

Check payment in

local currency

Cash payment in

foreign currency

Page 41

Take-out Key Transactions

To perform Take-out transactions the Take out function

must be assigned to one of the function keys on the keypad.

Take-out transactions are useful to define a different tax

rate for a product which is taken out with respect to the

same consumed indoors.

Example: Change the tax rate of three products registered

to Departments 1, 2 and 3 programmed with three different

tax rates (3%, 4% and 4.5%, respectively) and that are to

be taken out.

1. Type [2000] and press the [department 1/21] key.

Normal VAT total

2. Type [5000] and press the [department 2/22] key.

3. Type [4000] and press the [department 3/23] key.

4. Press the assigned [Take-out] key.

5. Press the [Amt tend/Total] key to successfully end

the transaction.

ENGLISH

Take-out increased

VAT total

Tax 1, Tax 2 and No Tax Key Operations

The cash register can be programmed so that Tax 1, Tax

2 and No Tax functions are assigned to function keys on

the keypad. With these functions enabled, you can override

the programmed tax status of departments and PLUs with

the Tax 1 rate defined, the Tax 2 rate defined or a No-tax

status by pressing the Tax 1, Tax 2 or No Tax key assigned

to the keypad. You simply press the assigned tax key

prior to the department or PLU key for which you wish to

change the tax status.

GB-37

Page 42

Overwriting a Preset Tax Rate on a Department

Sale with a No-Tax Status

Example: Register a £5.00 item to department 1

programmed with a Tax 1 rate and then register a nontaxable item to the same department. The No-tax key

functions must have been programmed to one of the

function keys on the keypad. End the transaction with an

exact cash tender.

Proceed as follows:

1. Type [500] and press the [department 1/21] key.

2. Press the assigned [No tax] key.

3. Type [200] and press the [department 1/21] key.

4. Press the [Amt Tend/Total] key. The transaction ends

successfully with no tax applied to the item registered

to department 1 programmed with a tax 1 status.

Overwriting a Department's Preset Tax Rate with

Programmed Tax Rate 1

Department

programmed with

VAT rate 1

Same department

with no VAT applied

Example: Register a £4.00 item to Department 3 and

then register a £20,00 item that you want to tax with

programmed tax rate 1 to Department 3 which is

programmed with a T3 tax rate. End the transaction with

an exact cash tender.

Proceed as follows:

1. Type [400] and press the [department 3/23] key.

2. Press the assigned [Tax 1] key.

3. Type [2000] and press the [department 3/23] key.

4. Press the [Amt Tend/Total] key. The transaction ends

successfully with tax 1 rate applied to the item