Page 1

506526M

Page 2

Olivetti Lexikon, S.p.A.

Divisione Home/Office

77, Via Jervis - 10015 Ivrea (Italy)

Copyright © 2001, by Olivetti

All rights reserved

Page 3

The mark affixed to the product

certifies that the product satisfies the

basic quality requirements.

Your attention is drawn to the following actions that could compromise the

characteristics of the product:

• incorrect electrical supply;

• incorrect installation; incorrect or improper use, or, in any case, not in

accordance with the warnings given in the User Manual supplied with the

product;

• replacement of original components or accessories with others of a type

not approved by the manufacturer, or carried out by unauthorized personnel.

ENGLISH

Page 4

WARNING: THIS EQUIPMENT MUST BE EARTHED.

ATTENTION: CETTE UNITE DOIT ETRE CONNECTEE A LA TERRE.

ACHTUNG: DIESES GERÄT MUSS EINEN ERDUNGSANSCHLUSS

HABEN.

ATENCION: ESTE EQUIPO DEBE ESTAR CONECTADO A UNA TOMA

DI TIERRA.

APPARATET MÅ KUN TILKOPLES JORDET STIKKONTACT.

APPARATEN SKALL ANSLUTAS TILL JORDAT NÄTUKKAT.

LAITE ON LITTETTÄVÄ SUKO-RASIAAN.

Lederen med grøn/gul isolation ma kun tilsluttes en klemme maerkrt

eller

.

To disconnect the cash register from the line voltage, unplug its

power cord from the power outlet. The power outlet must be located

on a wall, near the cash register and easily accessible.

Page 5

Preface

The electronic cash register described in this manual is designed to

help your business function smoothly by providing efficient register

operations and accurate management reports. Startup is quick and easy,

yet there are many options that can be added and revised so that you

can customize your operations for optimum productivity. Here are just a

few of the cash register’s many valuable features:

• 40 departments and 999 Price Look-Up (PLU) settings;

• 26 clerk numbers to monitor the sales of individual employees;

• possibility of assigning a three-digit security code to prevent

unauthorized access to individual clerk transactions (during register

mode only);

• possibility of defining manager passwords to prevent unauthorized

access to the machine's programming mode (PRG), Z mode and X

mode;

• possibility of assigning a name to each clerk for rapid identification;

• dot-matrix printer with journal record and receipt printing

capabilities;

• customer sales receipt header personalization;

• personalization of currency convert captions and credit captions on

the sales receipts and reports

• possibility of reserving two departments for registering credit sales

paid with two different types of credit cards;

• Euro exchange rate programming;

• possibility of programming the machine to work with one of two

base currencies, Local or Euro, so that cash register computes in the

currency set and automatically converts the related transaction totals

into the other currency;

• rear customer display for transaction viewing;

• front operator display consisting of a 10-character message line on

top and a 10-character transaction line on the bottom;

• automatic tax computations for 4 different VAT rates;

• department-linked entry options that streamline and speed-up

operation;

• periodic management and financial reports which provide up-to-date

sales analysis;

• battery back-up protection for the records and programming data

stored in memory;

• automatic time display after a period of system inactivity;

• automatic time and date printing on receipt and journal records;

• programmable customer receipt and journal record printing in any

one of four languages (English, French, German and Spanish).

ENGLISH

I

Page 6

Table of Contents

GETTING ACQUAINTED WITH

YOUR CASH REGISTER .............................................. 1

Standard Accessories..................................................... 2

Using this Manual........................................................... 2

Unpacking and Setting Up the Cash Register ................ 3

Maintaining the Cash Register ....................................... 3

BACK-UP BATTERY SYSTEM ..................................... 9

Inserting/Replacing Batteries ......................................... 9

PRINTER COMPARTMENT ........................................ 10

Ribbon Cartridge .......................................................... 10

Installing the Ribbon Cartridge ......................................11

Paper Tape ................................................................... 12

Loading Single-Ply and Dual-Ply Paper ....................... 12

THE KEYPAD ................................................................ 4

Keypad Functions........................................................... 5

THE CONTROL SYSTEM ............................................. 6

The Control Lock ............................................................ 6

Cash Drawer with Removable Cash Bin ........................ 7

Deposit Drawer............................................................... 7

Operator and Customer Displays ................................... 7

Automatic Time Display ................................................. 7

Date Display ................................................................... 7

Special Symbol Indicators.............................................. 7

Positioning the Customer Display .................................. 8

ERROR CONDITIONS .................................................. 8

The Error Alarm ............................................................. 8

Clearing an Error ............................................................ 8

General Clearance ......................................................... 8

Voiding Errors ................................................................. 9

II

QUICK START ............................................................. 13

Helpful Hints for a Successfull Start-Up ....................... 14

TRAINING MODE ........................................................ 14

Activating the Training Mode ....................................... 15

Exiting the Training Mode ............................................ 15

CASH REGISTER PROGRAMMING .......................... 15

Setting Cash Register Features ................................... 16

Making Changes to Cash Register Programming ........ 16

Entering the Program Mode ......................................... 16

Exiting the Program Mode ........................................... 16

Clearing Errors ............................................................. 16

Clerk Numbers, Secret Codes and Names .................. 17

Machine Numbers ........................................................ 18

Date and Time.............................................................. 18

Receipt Header ............................................................ 19

Percent Discount (-%) .................................................. 20

Percent Plus Rate (+%)................................................ 20

Fraction Rounding ........................................................ 21

Page 7

Decimal Point Position ................................................. 21

Value Added Tax (VAT) Rates ...................................... 22

High Digit Lock Out (HDLO) and Tax Status

Assigned to the Minus Key (-) ...................................... 22

Tax Status, High Digit Lock Out, Single/Multiple

Item Sale and Price Linked to a Department ............... 23

Price Look-Ups (PLUs) ................................................. 24

Euro Exchange Rate and Receipt Caption

Programming ............................................................... 24

Credit 1, Credit 2 Captions Programming .................... 26

Programming System Options ..................................... 26

PLU Programming Dump Report ................................. 28

Overall Programming Dump Report ............................ 29

Programming Manager Passwords .............................. 30

Using the Cash Register in a Password

Protected Mode ............................................................ 31

TRANSACTION EXAMPLES ...................................... 31

Entering the Register Mode.......................................... 31

Exiting the Register Mode ............................................ 32

Clearing Errors ............................................................. 32

Sample Receipt ............................................................ 32

Standard Transactions in Local Base Currency ........... 32

Examples of Transactions in Euro Base Currency ....... 39

Minus (-) Key Transactions........................................... 43

Percent Discount (-%) Transactions............................. 45

Percent Plus (+%) Transactions................................... 48

PLU Codes ................................................................... 52

Voids and Refunds ....................................................... 53

Other Transactions....................................................... 56

MANAGEMENT REPORTS ......................................... 60

X and Z Reports ........................................................... 60

Cash-In-Drawer Report ................................................ 60

Time Report ................................................................. 61

Clerk Report ................................................................. 61

All PLU Report ............................................................. 62

PLU Range Report ....................................................... 62

Department Range Report ........................................... 63

Z1 and X1 Financial Report ......................................... 63

Z2 and X2 Financial Report ......................................... 64

Duplicate Z Report ....................................................... 65

Balancing Formulas ..................................................... 65

APPENDIX ................................................................... 66

Character Code Table .................................................. 66

Caption Table ............................................................... 67

Totalizers and Counters Table ...................................... 70

Cash Register Specifications and Safety ..................... 71

ENGLISH

III

Page 8

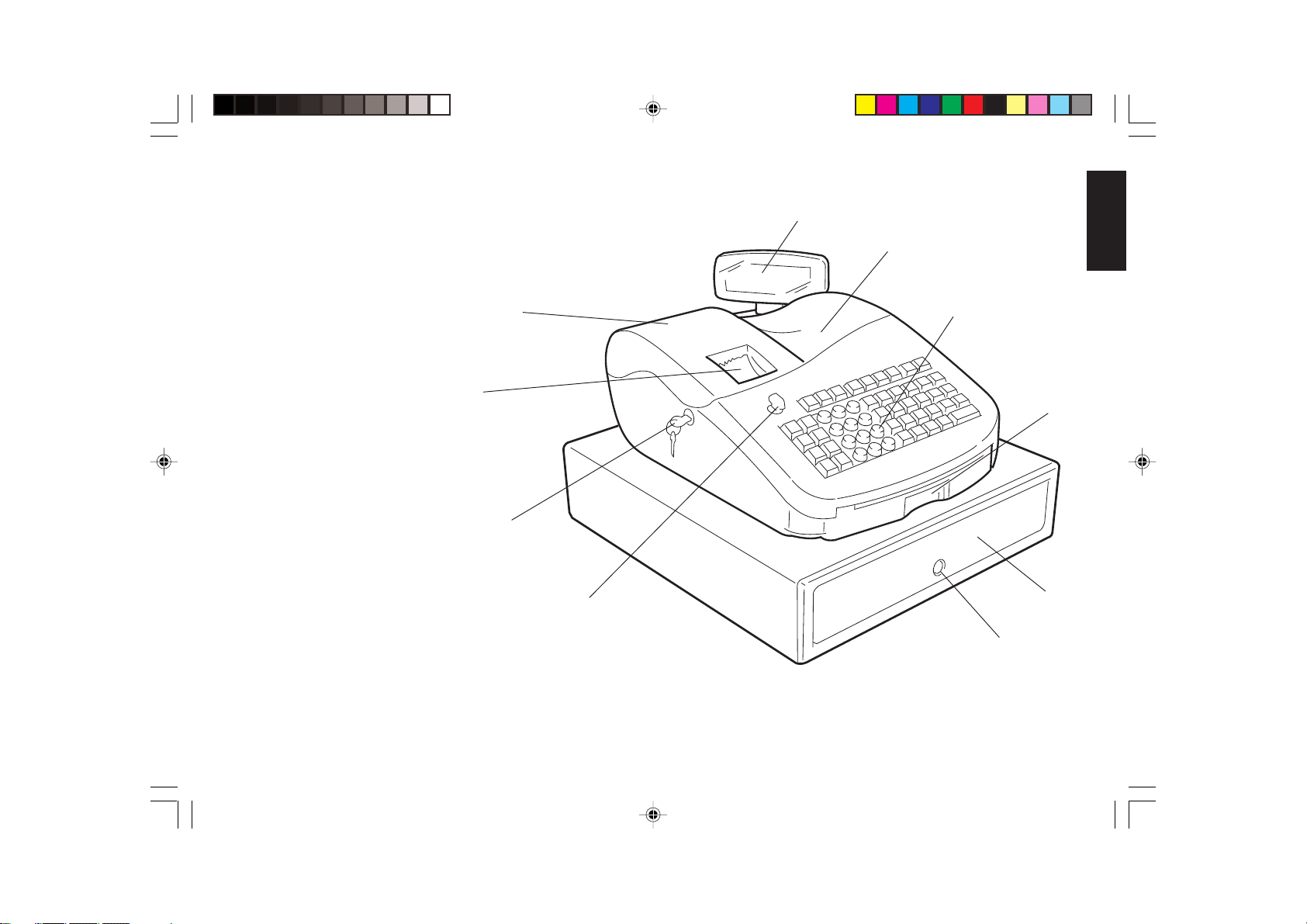

Getting Acquainted with Your Cash Register

The figure below shows an overall view of your cash register.

1

2

ENGLISH

10

9

8

7

1. Customer Display 7. Control Lock

2. Operator Display 8. Printer Compartment Lock

3. Keypad 9. Customer Receipt Output Window

4. Item Deposit Drawer 10. Printer Compartment Cover

5. Cash Drawer

6. Cash Drawer Lock

3

4

5

6

1

Page 9

Standard Accessories

Your cash register comes with the following items:

• One black plastic journal winder spindle

• One roll of standard paper tape

• One inked ribbon cartridge

• Four standard "AA" size batteries for the battery back-up system

• This Instruction Manual

• A set of Program keys (PRG) for accessing the machine program-

ming functions

• A set of Register keys (REG) for accessing the machine cash register

functions

• A set of Z keys for accessing the X and Z functions

• A set of keys for locking the cash drawer and printer compartment

cover.

Make sure that the cash register and all of the above items are

included in the shipping carton.

Using this Manual

Your cash register manual is organized for easy reference. The front

portion contains general information on all the features and functions of

the cash register. Instructions for setting the optional programs come

next. Transaction examples for operating the cash register are at the

back of the manual with a Character Code Table to use to program

character strings as an alternative to using the alphanumeric keypad, a

Caption Table indicating the cash register's preprogrammed character

strings in the four languages available, and a Totalizers and Counters

Table. At the back of the manual you will also find your cash register's

techinical specifications and some safety information. Use the Table of

Contents to locate a particular item.

Getting Started

Before you begin to operate or program the cash register, read the

section entitled Unpacking and Setting Up the Cash Register for

information on how to get yourself ready to work. Read also Keypad

Functions, The Control System and Operator and Customer Displays to

become familiar with their operations.

NOTE: Programs and transaction information for management reports

are stored in the memory of the cash register. Batteries are

provided to save this information in the event of a power

failure or if the cash register is unplugged from the power

outlet.

Programming the Cash Register

Simple step-by-step instructions are included for each program. Also

provided are examples which can be used for practice.

Carrying Out Sales Transactions

Transaction examples provide steps for key operations. Sample

receipts are included.

ENGLISH

2

Page 10

Unpacking and Setting Up the Cash Register

NOTE: Please read this section carefully before attempting to program

the cash register or perform sales transactions.

As soon as you receive the cash register, open its shipping carton and

carefully withdraw each component. Make sure that the cash register

and all of its accessories, listed in the section entitled Standard

Accessories, are present in order to setup the cash register by following

these guidelines:

1. Place the cash register on a level, stable, vibration-free and dust-

free surface. Make sure that it is near a grounded power outlet.

2. Plug the cash register into a grounded power outlet.

3. Insert the batteries as explained in the section entitied Inserting/

Replacing Batteries. Do not insert the batteries unless the cash

register is plugged into an electrical wall outlet.

WARNING: Before inserting the memory backup batteries, make

sure that the cash register is plugged into an electrical

power outlet. The machine must be plugged into an

electrical outlet before you insert the batteries.

4. If necessary, install the inked ribbon cartridge as explained in the

section entitled Installing the Ribbon Cartridge.

5. Load the paper tape as explained in the section entitled Loading

Single-Ply and Dual-Ply Paper.

6. Set the desired program options as explained in the section Cash

Register Programming.

7. Once the desired program options have been set, turn the control

key to the REG 1 or REG 2 position and you are ready to perform

sales transactions. In the REG 2 position the cash register will not

print the programmed receipt header.

Maintaining the Cash Register

Provided below is information on how to maintain your cash register.

NOTE: Before cleaning the cash register, make sure it is powered off

and/or unplugged from the wall outlet. Before unplugging the

cash register from the wall outlet, make sure that four charged

AA standard backup batteries are installed in the battery

compartment. All data stored in memory will be cancelled if

you unplug the cash register from the electrical wall outlet

without back-up battery supply.

1. Keep all liquids away from the cash register so as to avoid spills

which could damage the electronic components.

2. To clean the cash register firstly turn it off and/or unplug it from the

wall outlet (be sure the back-up batteries are installed), then use

just a damp cloth. Do not use corrosive substances such as solvents,

alcohol, petrol, or abrasive components.

3. If the cash register is stored in extreme hot or cold temperatures

(below 32 degrees or above 104 degrees Fahrenheit), allow the

temperature inside the cash register to reach room temperature

before turning it on.

4. DO NOT attempt to pull the paper tape when the cash register is

printing or when you are loading paper. Always use the [Feed] key

to feed paper. Pulling the paper tape could damage the print

mechanism.

ENGLISH

3

Page 11

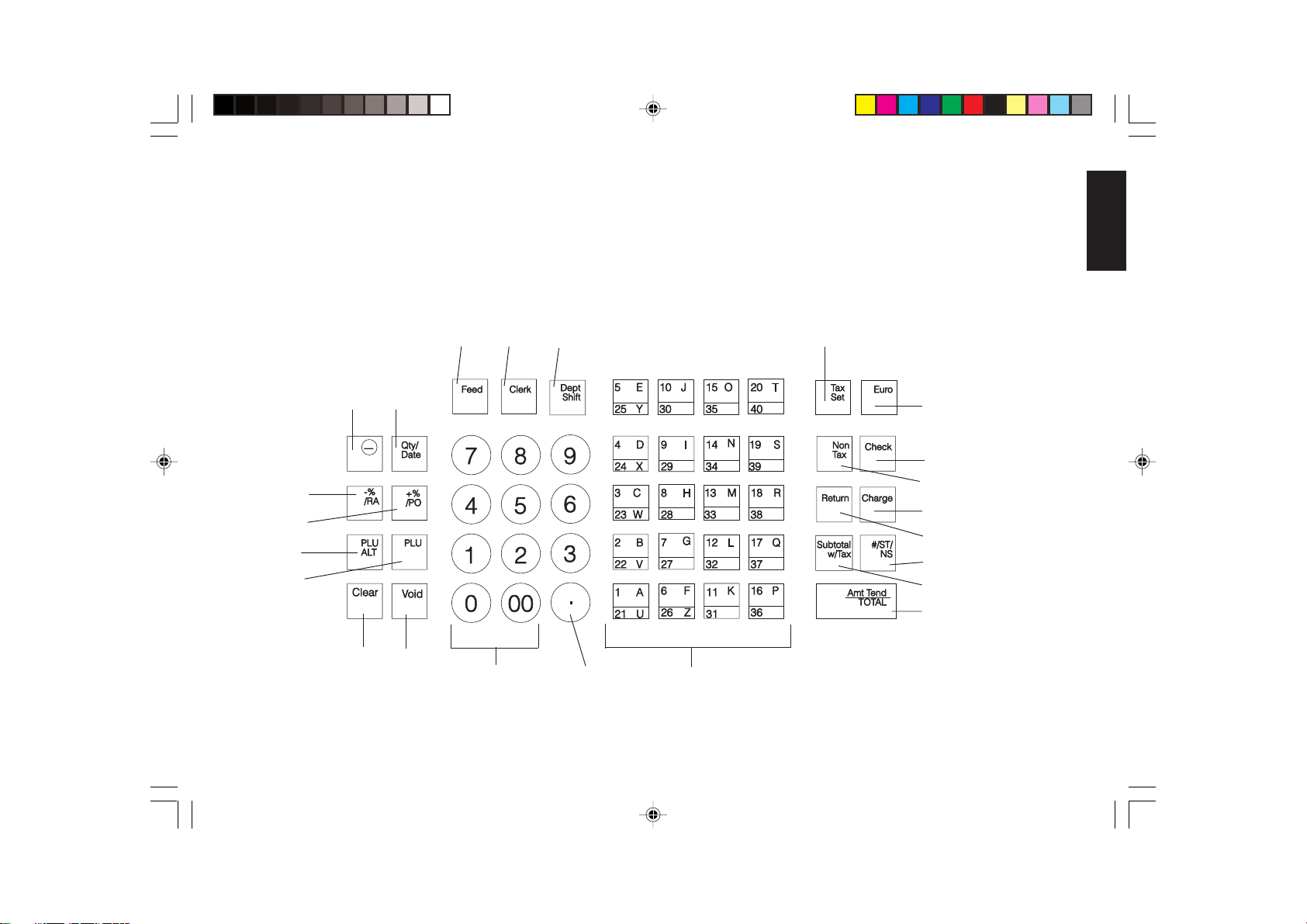

The Keypad

Your cash register is equipped with a 52-key keypad by means of

which you can perform all cash register functions.

The figure below shows the keypad layout.

ENGLISH

12

11

5

6

14

15

1

3

13

2 7

17

10

22

19

9

20

8

4

21

23

1816

4

Page 12

Keypad Functions

1. [Feed] (Paper Feed) - Advances the receipt or journal paper one

line feed; advances the paper continuously when held down.

2. [Clerk] - Confirms an entered clerk number and three-digit

security code. Also used to print a Clerk Report.

3. [Qty/Date] (Dual function: Multiply and time display) - Multiplies

[DEPARTMENT], [PLU] or [-] key entries; also displays the

current time, if set, and is used to print the Cash-In-Drawer Report.

4. [#/ST/NS] (Dual function: ST - Subtotal and NS - No Sale) - As the

No Sale key, opens the cash drawer without registering any amount

or when changing cash for a non-sales transaction. As the Subtotal

key, calculates a subtotal during a transaction consisting of a

number of items to be individually discounted or increased by a

fixed percentage and prints this on the receipt.

5. [PLU ALT] - Temporarily overwrites a price which was assigned to

a PLU number.

6. [PLU] (Price Look Up) - Registers a preset price of an individual

item to the appropriate department. Also used to print PLU Reports.

7. [Dept Shift] (Department Shift) - Allows price entries for departments 21-40. Press this key before entering applicable department

keys 21-40.

8. [Return] - Issues refunds for returned merchandise. Refund totals

are printed in the management report.

9. [Non Tax] - Used when no tax is to be registered for a department

which is programmed for tax.

10. [Set Tax] - Used to program VAT rates.

11. [+%/PO] (Dual function: Percent Plus and Paid Out) - When used

as the +% key, adds a percentage to an item or to the sales total.

Total percent plus amounts are shown in the management report.

When used as the PO key, registers any money paid out. Paid out

totals appear in the management report. Also used to set a machine

number.

12. [-%/RA] (Dual function: Percent Discount and Received On

Account) - When used as the -% key, subtracts a percentage from an

item or from the sales total. Total discount amounts are shown in

the management report. When used as the RA key, registers any

payment made to the cash drawer. Amounts are added to the

received on account total in the management report.

13. [Void] - Deletes the last item entered and used for correcting a

particular entry after it is processed and printed. Void totals are

reported in the management report. Also used during cash register

options programming.

14. [-] - Subtracts an amount from an item or the sales total. Minus key

totals are printed in the management report.

15. [Clear] - Clears an entry made from the numeric keypad or

with the [Qty/Date] key before finalizing a transaction with a

Department or function key. This key is also used to clear error

conditions.

16. [.] (Decimal Point) - Used to enter fractional quantities of items

being sold. In all modes, the decimal point is not to be used when

entering a price.

17. [0 - 9/00] - Input amounts, indicate how many times a particular

item repeats, add and subtract percentage rates, input department

code numbers, handle figures which require a decimal point. The

double key allows the quick entry of numbers with two or more

zeros.

18. [1-40] (Departments 1 through 40) - Used to enter single or

multiple item sales to a particular department. Department totals

are shown in the management report. Also used to input characters

for clerk names, captions, etc.

19. [Check] - Totals sales paid by check. Check totals are printed in the

management report. Also stores character code entries during cash

register programming.

20. [Charge] - Totals sales that are charged. Charge totals are printed

in the management report.

ENGLISH

5

Page 13

21. [Subtotal w/Tax] - Displays the subtotal of a sale with sales tax.

22. [Euro] - When the cash register is in its default Local base cur-

rency, this key is used to program the Euro exchange rate and to

automatically calculate and display the value in Euro of the total

amount of a sale or of a particular amount registered. When the cash

register is programmed to work in the Euro base currency, pressing

this key converts the sales total to the Local currency.

23. [Amt Tend/TOTAL] (Amount Tendered/TOTAL) - Totals exact

cash transactions, computes change and totals check and charge

transactions.

The Control System

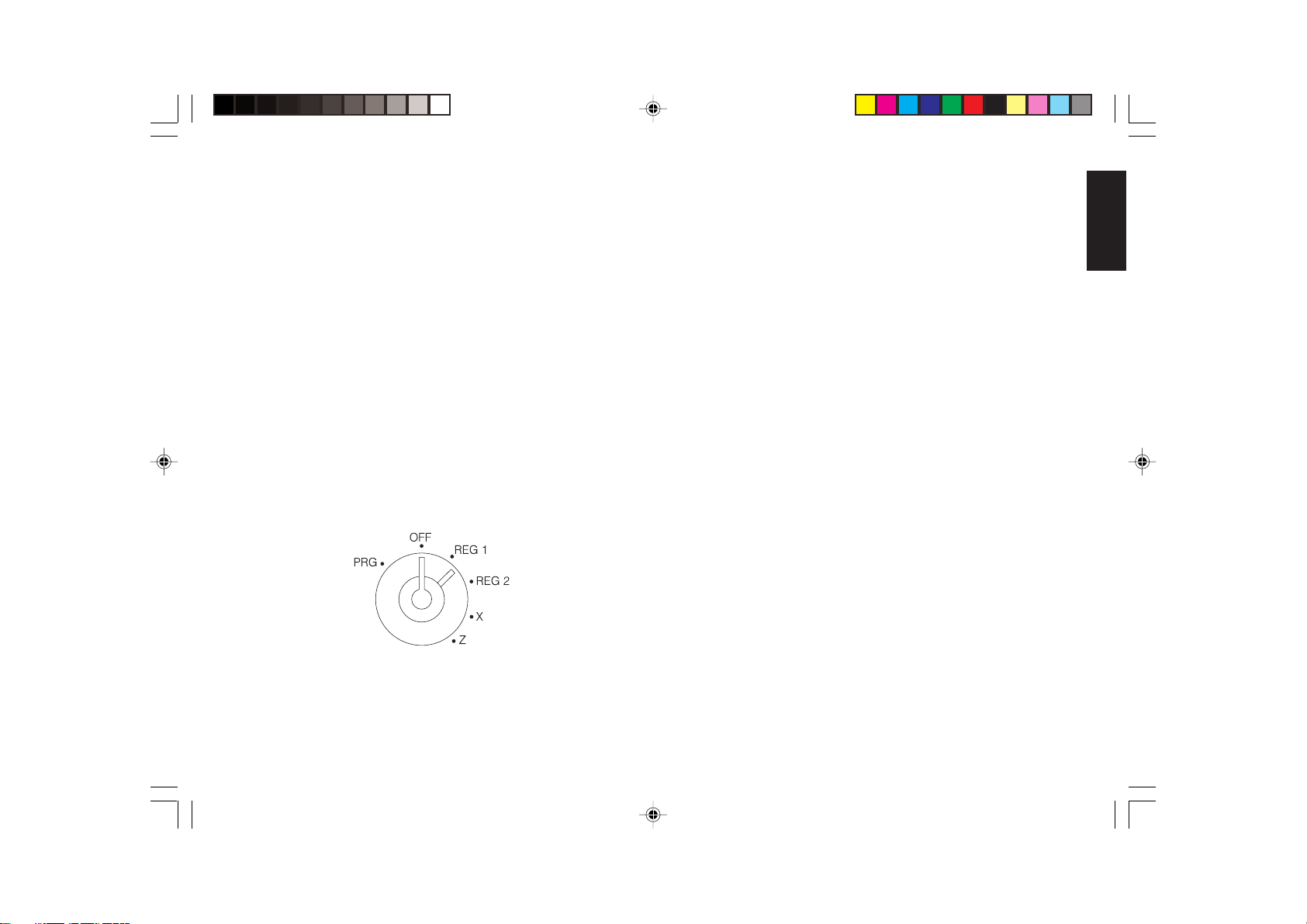

The Control Lock

The control lock is located on the upper left-hand side of the keypad.

The PRG REG or Z key must be properly inserted in the Control Lock

in order for you to be able to use the different cash register functions

available. The following figure shows the Control Lock and the

different modes which can be used.

Depending on the desired operation, insert the key in the Control

Lock and turn it to the following positions:

PRG Used to program the cash register according to your

specific needs.

OFF The cash register is turned off and cannot be used.

REG 1 The cash register can perform the standard sales transac-

tions. In this mode the preset or programmed header is

printed on both the customer receipt and journal (if

loaded). This is also called the Receipt Mode.

REG 2 Same as the REG 1 mode with the only exception that the

preset or programmed header is not printed on the

customer receipt nor journal. This is also called the

Journal Mode.

X Prints the X management report, Cash-in-Drawer report,

PLU report, clerk report, cash declaration and periodical

financial reports.

Z Prints the Z management report and resets totals (except

the grand total) to zero. Prints the PLU report, clerk

report, cash declaration and periodical financial reports.

Control Keys

The following sets of keys are provided as well as a set of keys to

open the cash drawer and printer compartment:

REG The REGISTER key can be used in the OFF, REG 1,

REG 2 and X modes, granting both Clerk and Supervisor

access to cash register functions.

PRG The PROGRAM key works in all modes (PRG, OFF,

REG 1, REG 2, X and Z). It is usually used by the

Supervisor to program the cash register and print X and Z

management reports.

Z The Z key can be used in the OFF, REG 1, REG 2, X and

Z modes granting a higher level access with respect to the

REG key.

ENGLISH

6

Page 14

Cash Drawer with Removable Cash Bin

The cash drawer features a cash bin with slots for banknotes and slots

for coins. Pressing the [#/ST/NS] with the control key in the REG 1 or

REG 2 position opens the drawer. If a clerk number and secret code

have been set, pressing this key will open the cash drawer only after the

clerk number and code have been specified. This drawer can be locked

for security to prevent accidental opening when moving the cash

register by using the printer compartment key.

If desired, the cash bin inside the cash drawer can be completely

removed from the cash register. To do so, gently lift the bin and pull it

out.

Deposit Drawer

This extra drawer provides sufficient space for miscellaneous items.

Operator and Customer Displays

Your cash register offers two displays which provide easy viewing for

both the customer and operator during a sales transaction. The customer

display shows entry amounts and related transaction information

through the use of numbers and special symbols. The operator display

shows specific operator messages on the upper 10-character line and

the same transaction data as shown on the customer display on the

lower 10-character line. Both displays are read from left to right.

Automatic Time Display

The current time is automatically displayed after 30 seconds of cash

register inactivity when the control key is in the REG 1 or REG 2

position.

Date Display

You can display the date by simply pressing the [Qty/Date] key with

the cash register in the REG 1 or REG 2 mode. Once the date is

displayed, the time will be automatically redisplayed after 30 seconds

of cash register inactivity.

Special Symbol Indicators

Special symbols appear at the far left-hand side of the displays during

cash register operation. These symbols identify the amount shown, or

warn of an error condition. They include:

C (Change) Indicates that the displayed amount is the change due

to the customer.

E (Error) Indicates when an error is made during operation or

when programming the cash register. An error tone sounds

to alert the operator.

S (Sub-total) Indicates that the amount shown is the subtotal of a

transaction, including sales tax if applicable.

= (Total) Indicates that the amount shown is the transaction total.

- (Minus) Displays a negative entry. Also displays if subtotal or cash

tendered total is a negative number due to a return or

refund.

Indicates when the journal paper is low.

CA (Cash) Indicates when the total displayed refers to a sales

transaction paid by cash.

Ch (Check) Indicates when the total displayed refers to a sales

transaction paid by check.

Cr (Charge) Indicates when the total displayed refers to a sales

transaction paid by charge.

Displayed when the Euro key is pressed to indicate that

the amount is displayed in the Euro currency.

ENGLISH

7

Page 15

These symbols clear automatically when you start the next entry or

press the [Clear] key.

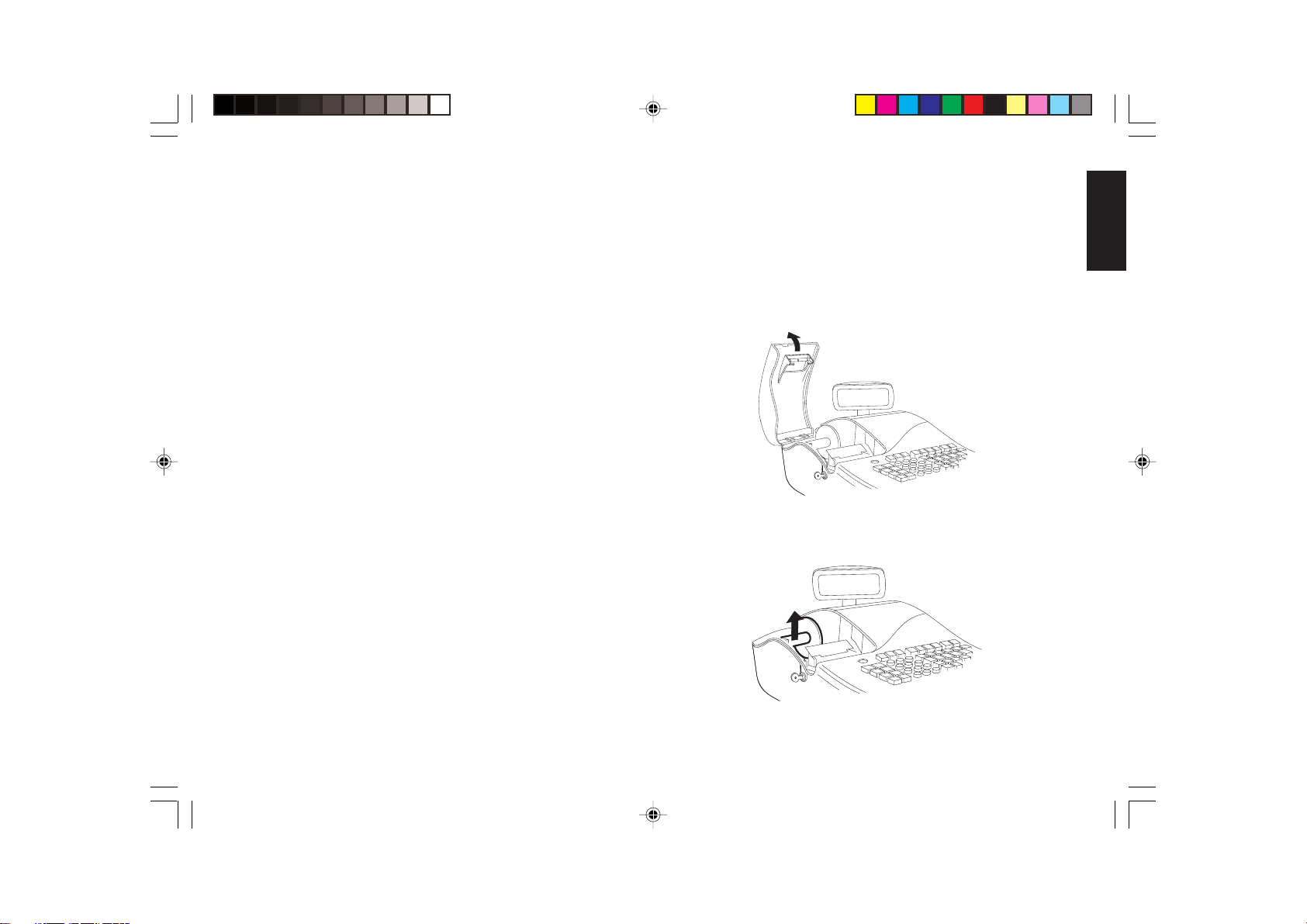

Positioning the Customer Display

To position the customer display, simply raise it out of its slot and

then rotate it to the desired position.

Error Conditions

The Error Alarm

The error alarm warns of an operator error (usually when a wrong key

is pressed for a specific type of entry) or of an error made during cash

register programming. The error alarm can also indicate that the

Control Lock is in the wrong position for the current operation. In case

of error, the error tone sounds, the letter E is displayed on the customer

display, the message ERROR is displayed on the operator display and

the keypad locks.

General Clearance

If the cash register does not function, for example while programming

and the error signal cannot be stopped by pressing the [Clear] key,

perform a general clearance. There are two ways of performing a

general clearance, whereby the second method resets all totals and

counters and cancels the programming. Use this method only as

last resort.

General Clearance without Clearing Totals and the

Programming

1. Turn the Control Key to the OFF position.

2. Make sure four charged AA batteries are inserted in the battery

compartment.

3. Unplug the cash register from the power socket.

4. Wait ten seconds and then reconnect the cash register to the power

socket and resume your operation.

If the cash register remains in an error condition, proceed with the

second general clearance method.

ENGLISH

Clearing an Error

Press the [Clear] key to clear an error. The tone ends, the displays

clear and the keypad unlocks, allowing you to continue with the

transaction or restart the program.

If an error condition cannot be cleared, perform a general clearance.

Bear in mind, however, that one of the two general clearance

procedures, explained in the next section, will set all counters and

totals to zero and will cancel all programmed functions.

NOTE: The [Clear] key also clears an incorrect entry from the display

prior to pressing a registration key. Once an entry is printed,

the [Void] key must be used to correct an error.

General Clearance with the Clearing of Totals and all

Cash Register Programming

NOTE: Be careful that this procedure erases all totals and counters,

and cancels the programming of the cash register.

1. Turn the control key to the OFF position.

2. Open the printer compartment cover and remove the back-up

batteries.

3. Unplug the cash register from the power socket.

4. Wait for 15 minutes and then plug the cash register back to the

electrical power outlet.

5. Insert the batteries once again.

6. Reprogram the cash register.

8

Page 16

Voiding Errors

Once an entry is printed, the [Clear] key cannot be used to clear an

error. Press the [Void] key to correct an error already registered.

Voiding the Entry Just Completed

Simply press the [Void] key. The entry is reprinted with a "-" symbol

followed by the amount and erased from the transaction.

Voiding an Earlier Entry

To void an earlier entry, register it again and then cancel it using the

[Void] key. When a transaction including the error is completed,

proceed with the following steps to void the error.

1. Retype the incorrect information, exactly as originally entered, and

press the [Void] key.

2. Enter the correct amount.

3. Total the transaction by pressing the [Amt Tend/TOTAL] key.

Back-up Battery System

Inserting/Replacing Batteries

NOTE: Before inserting the batteries, make sure that the cash register

is plugged into the power socket and that the control key is

switched to the OFF position.

Proceed as follows to insert or replace the batteries:

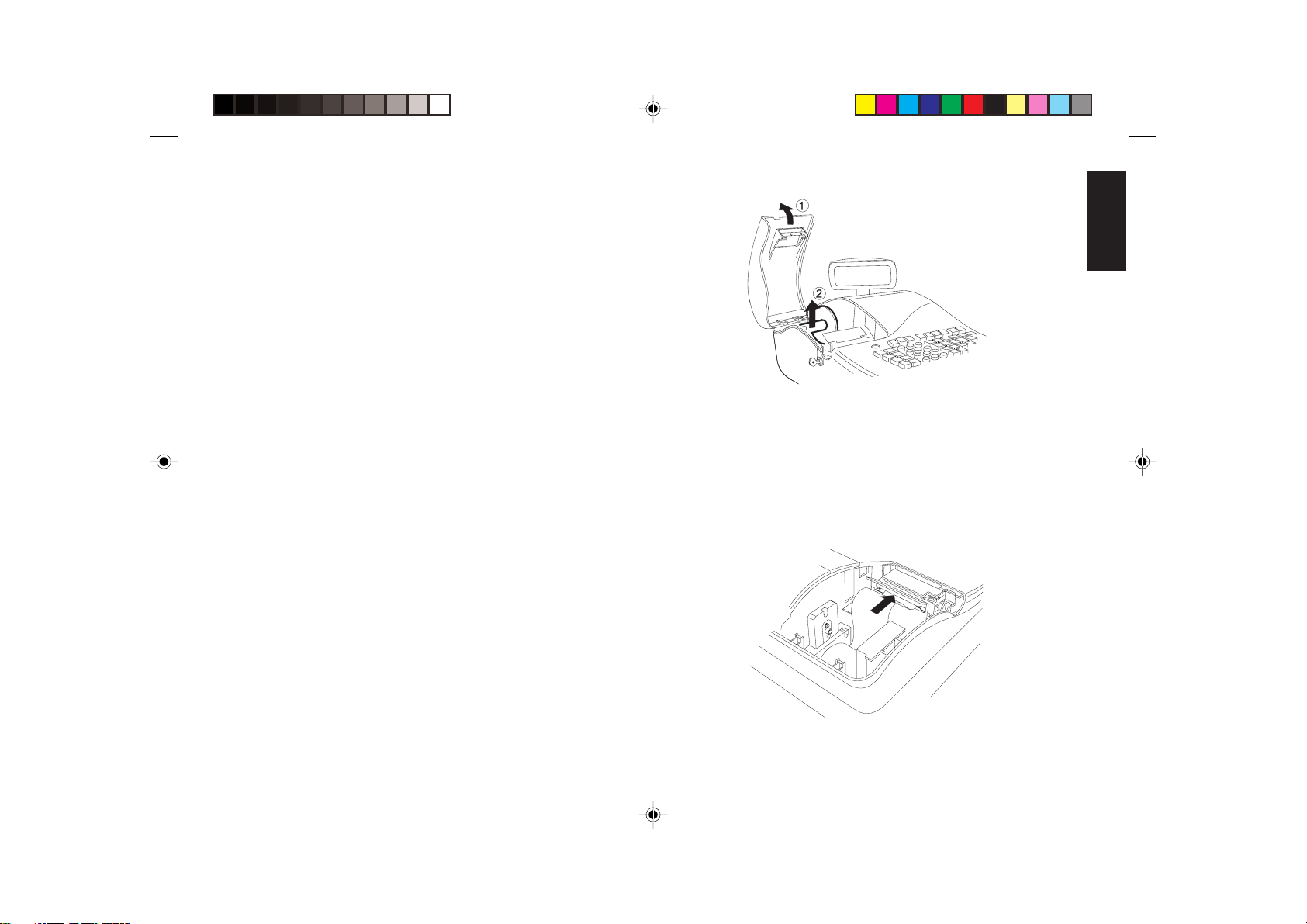

1. Unlock the printer compartment cover, grip the left side of the

compartment cover, gently pull it back and then lift it off the cash

register.

ENGLISH

During cash register operation, all transaction data for the management report is stored in the register's memory. This memory also holds

all optional programming information. The memory back-up system

keeps this information stored in memory when the cash register is

turned off.

The memory is protected by four "AA" size batteries that come with

your cash register. In order to guarantee continuous back-up protection,

insert the batteries before beginning to program the cash register.

The cash register must be plugged into an electrical power outlet

before you insert the batteries.

2. Lift the paper journal winder spindle out of the printer compartment.

9

Page 17

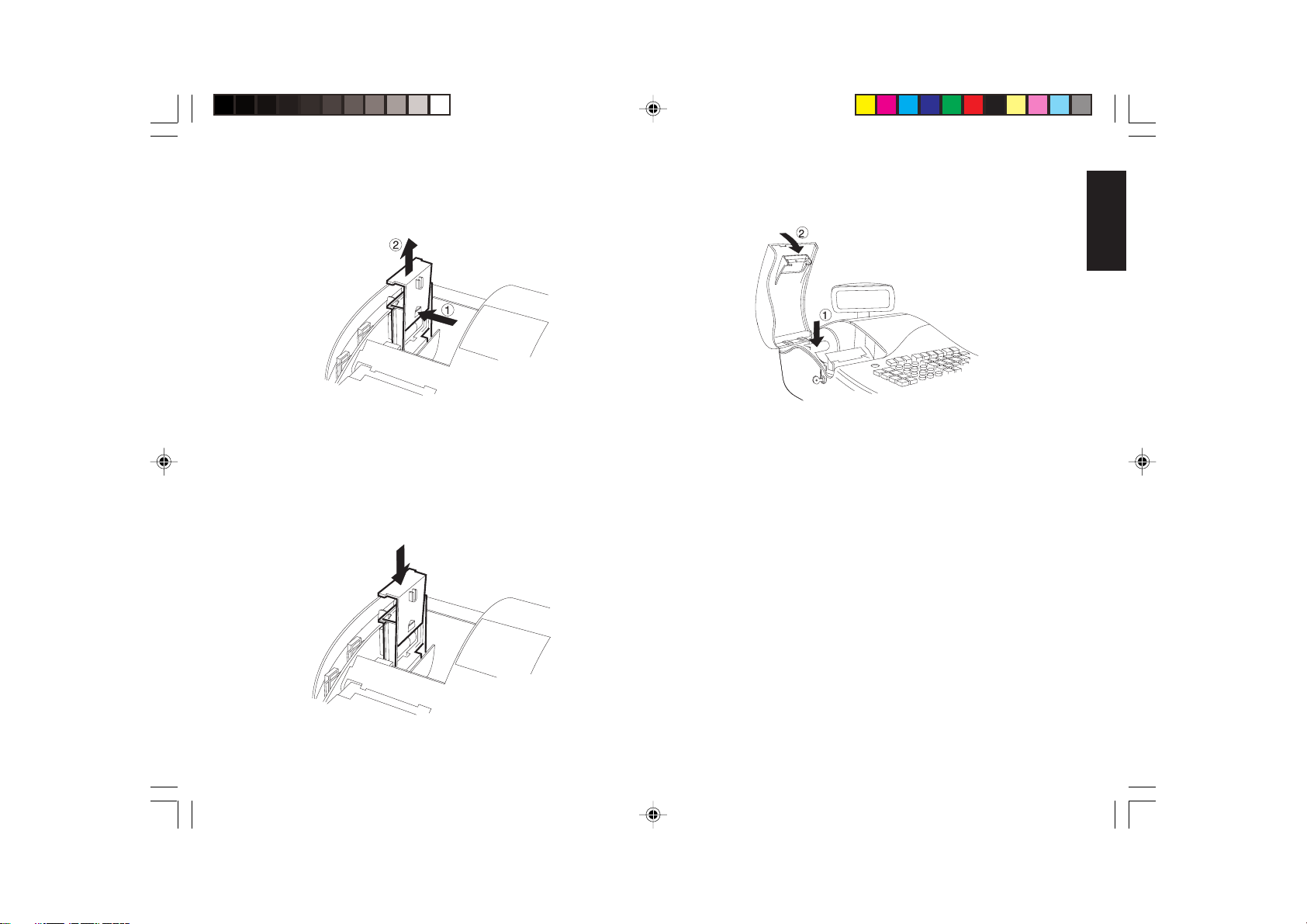

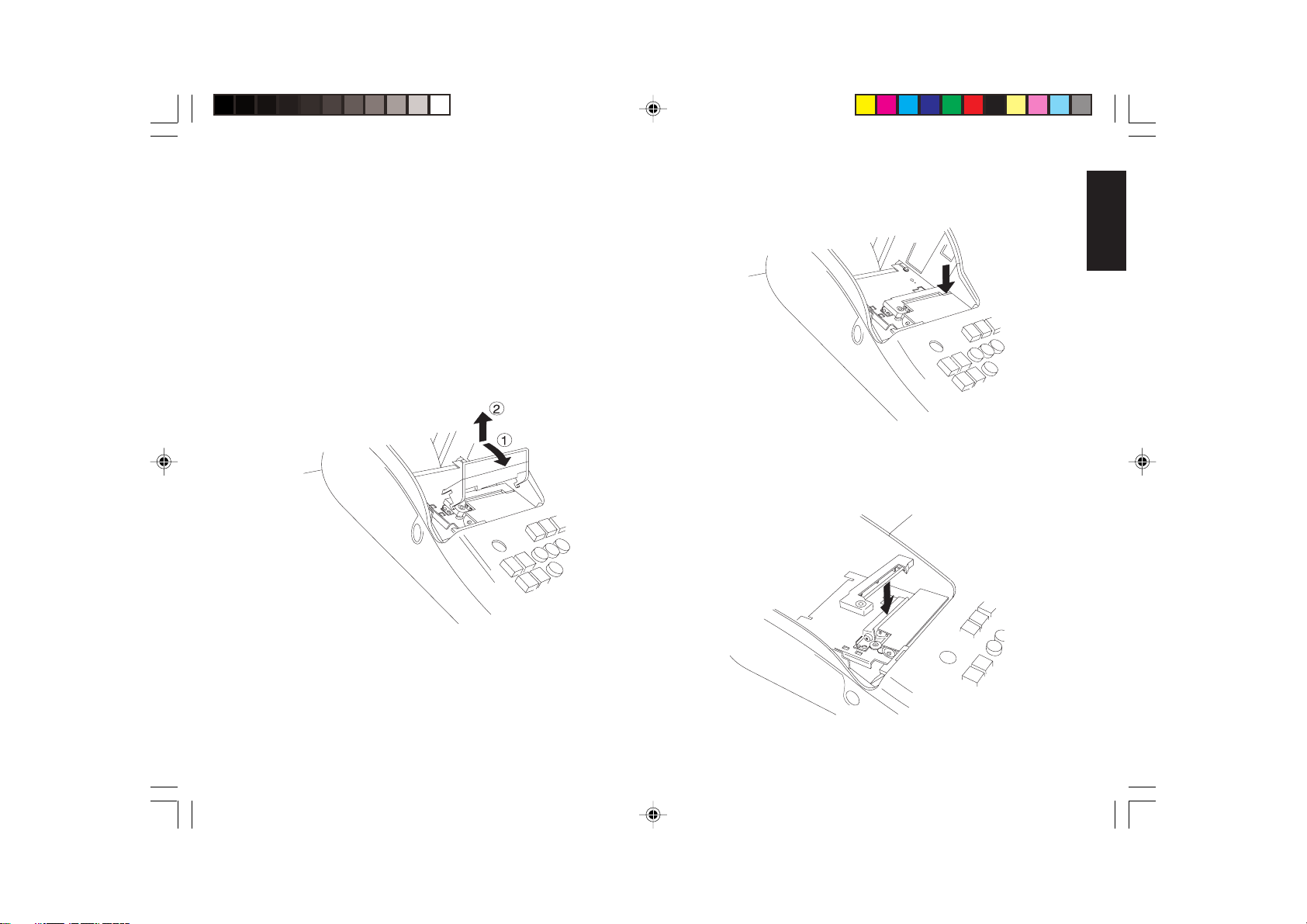

3. Remove the battery compartment cover by pressing on the arrow

impressed on the cover and lifting upwards, as shown by the arrows

in the figure.

7. Reposition the journal winder spindle, then reposition, close and

lock the printer compartment cover.

ENGLISH

4. Remove the discharged batteries if you are replacing the batteries.

5. Position the new batteries making sure that the positive and

negative poles are aligned correctly. Drawings inside the battery

compatment show how the batteries must be positioned.

6. Replace the battery compartment cover by sliding it down until it

clicks into place.

NOTE: If the cash register will not be used for an extended period of

time, you may want to remove the back-up batteries to prolong

their usage. Doing this will erase all transaction and

programming data stored.

Printer Compartment

The printer compartment is on the top left-hand side of the cash

register. It houses the paper tape, journal winder spindle, inked ribbon

cartridge, back-up batteries and the dot-matrix printer.

Ribbon Cartridge

This cash register uses a standard inked ribbon cartridge which needs

replacing when faded characters are starting to print. The next section

explains how to install the ribbon cartridge.

10

Page 18

Installing the Ribbon Cartridge

Proceed as follows to install the inked ribbon cartridge:

1. Unlock and open the printer compartment.

If dual-ply paper is loaded in the cash register, lift the plastic

journal winder out of the cash register and unwind and free the

journal record from the winder spindle. Then remove the paper tape

from the print mechanism by sliding it backwards towards the rear

of the cash register.

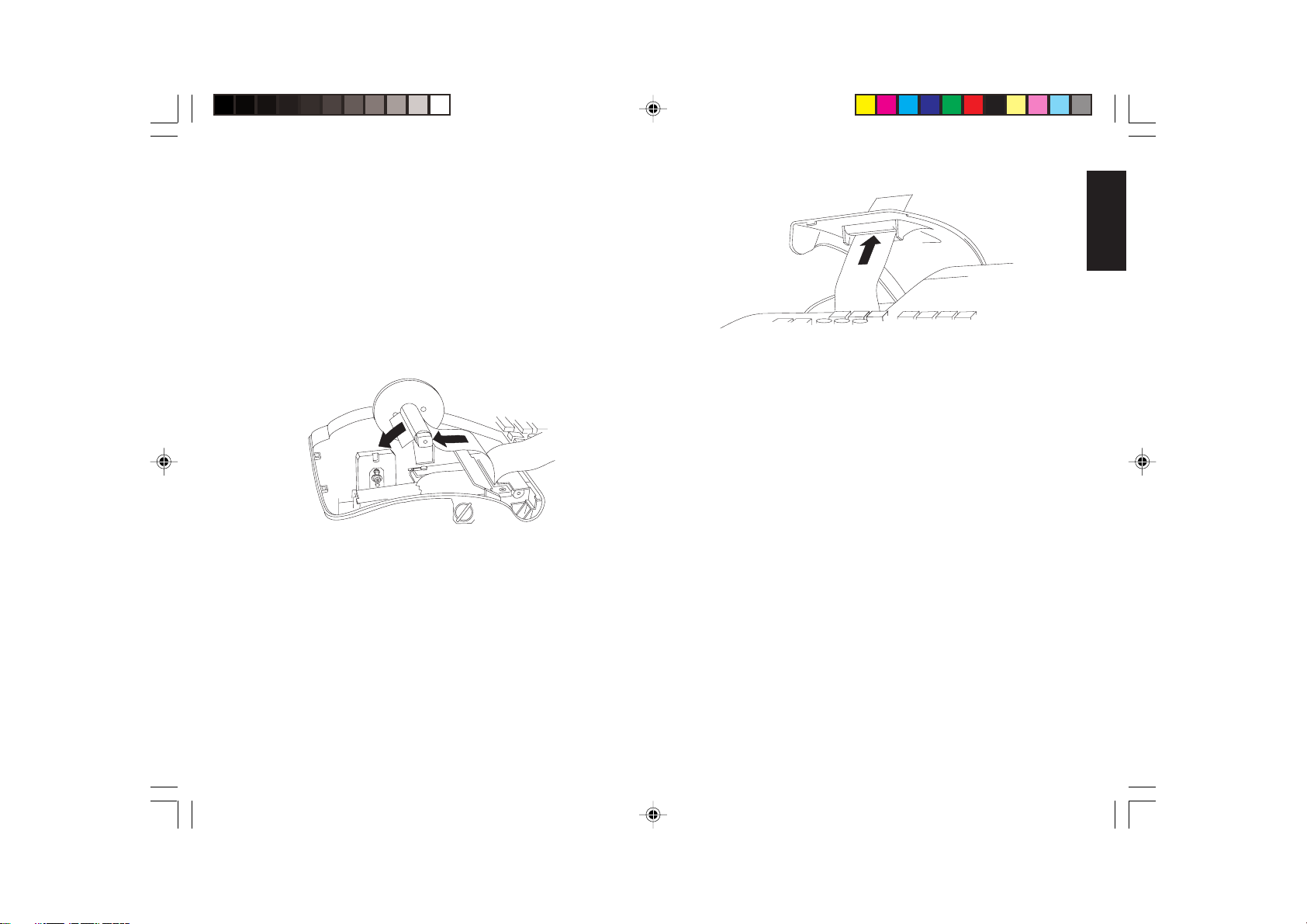

2. Lift the plastic paper guide out of the printer compartment by

pulling it forward and then upward as indicated by the arrows in the

figure.

3. Press the right-hand side of the cartridge to release it from its

catches and then remove it from its slot.

ENGLISH

4. Install the new ribbon cartridge by inserting the inked ribbon into

the slot and then pressing the cartridge downward until it clicks into

place.

11

Page 19

5. Turn the ribbon tension knob on the left-hand side cartridge

clockwise (in the direction of the arrow on the cartridge) to properly

tension the ribbon.

6. Replace the plastic paper guide by following its removal procedure

in reverse order.

7. If the cash register was using dual-ply paper, load the paper tape

back through the print mechanism, and wind the journal back onto

the plastic journal winder spindle. Instructions on how to load dualply paper are provided in the next section.

8. Reposition, close and lock the printer compartment cover.

Paper Tape

This cash register uses standard 2 1/4" (57 mm) paper. The paper

needs to be changed when a red line appears on the tape. You can use

either single-ply or dual-ply paper. Use dual-ply paper whenever you

want to print customer receipts and journal records, single-ply when

just customer receipts need to be printed.

Loading Single-Ply and Dual-Ply Paper

Proceed as follows to load the cash register with either single-ply or

dual-ply paper.

1. Make sure the cash register is plugged into a grounded power outlet

and that the control key is in either one of the two REG positions.

2. Unlock and open the printer compartment, then remove the plastic

journal winder spindle.

ENGLISH

3. With a pair of scissors, cut the end of the paper tape to create a

straight, even edge so that the paper can be properly fed through the

print mechanism.

4. Set the paper roll in the bottom of the printer compartment so that

the paper feeds out from the bottom of the roll.

5. Insert the edge of the paper into the paper slot as shown in the

figure.

12

Page 20

6. Press the [Feed] key and manually feed the paper into the slot until

the paper catches and advances approximately six to ten inches

above the print mechanism.

NOTE: If the paper does not feed properly, check the alignment of the

paper in the slot and/or for the straight edge on the end of the

paper roll.

7. If you are loading dual-ply paper for a journal record, slide the top

edge of the inner ply through the slots on the plastic journal winder

spindle and manually roll the winder toward the rear of the rear of

the cash register to take up slack in the tape. Make sure that the two

wheels on the spindle are positioned towards the right-hand side.

8. Replace the journal winder spindle in the printer compartment (the

two wheels must be positioned towards the right-hand side).

9. Pass the edge of the customer receipt (or the outer ply when using

dual-ply paper) through the receipt window on the compartment

cover.

ENGLISH

10. Reposition, close and lock the printer compartment cover.

Quick Start

Quick Start is a brief but complete start-up procedure that allows you

to begin using your new cash register as quickly as possible. Carefully

follow the steps listed below:

1. Make sure the cash register is plugged into an electrical power

outlet and that 4 charged AA size memory batteries have been

inserted as explained in the related section.

2. Insert the PRG key into the Control Lock and turn it to the PRG

position.

3. Set the current date in the day/month/year format by typing the

corresponding numeric keys and then pressing [#/ST/NS]. Single

digits must be preceded by a zero. For example, to set January 12,

2001, type [120101] and then press the [#/ST/NS] key to store your

entry. The newly entered date is printed.

If you wish that the date just entered be printed and displayed

in the month/day/year format, type [40] and then press the

[Void] Key.

13

Page 21

4. Set the current time using the 24-hour (military) format and then

pressing [Qty/Date]. Also in this case single digits must be

preceded by a zero. For example, to set 1:05 P.M., type [1305] and

then press the [Qty/Date] to store your entry. To set 9:15 A.M., type

[0915] and then press [Qty/Date]. The newly defined time is

printed.

If you wish that the time just entered be printed and displayed in the

24-hour format, type [180] and then press the [Void] Key.

5. Set a machine number by entering a four digit number and then

pressing [+%/PO]. For example, to set machine number 5, type

[0005] and then press [+%/PO]. The newly assigned machine

number is printed.

6. Set the first of up to four possible VAT rates. For example, to set a

VAT1 rate of 16%, type [1] and then press the [Tax Set] key, type

[16000] (three digits must be entered after the desired decimal

point) and then confirm with the [Amt Tend/TOTAL] key. The

VAT rate followed by T1 is printed.

7. Program department 1 as a standard sales department with VAT1,

for multiple item sales and no HDLO. For example, to assign VAT1,

multiple items sales, no HDLO and a price of £3.00 to standard

Department 1, type [00001] and then press [Subtotal w/Tax],

type [300] and then press [Department 1/9]. Press the [Clear] key

to clear the displays.

8. Change, if necessary, the language in which the cash register prints

the customer receipt and journal record. The cash register is

programmed to print the customer receipt and journal record in

English. If you wish to reprogram the cash register to print in

Spanish, French or German:

Type [19] followed by [1] and [Void] to print in Spanish, [19]

followed by [2] and [Void] to print in French or [19] followed by [3]

and [Void] to print in German.

To print in English again, type [19] followed by [0].

9. When programming is complete, exit the program mode by turning

the PRG key to the OFF position.

10. Practice normal sales transactions by switching the cash register

into the Training Mode. This mode is very useful to new users as it

allows them to simulate sales transactions without recording these

trials in the X or Z management reports. More information on this

mode is give in the section entitled Training Mode.

Once you have mastered the Quick Start operations, you will undoubtedly want to expand your use of the machine by studying other

sections of this manual and incorporating new programming into your

personalized cash management system. For example, other valueable

functions include Percent Discount Rate, Percent Plus Rate, Price

Look-Ups (PLUs), Euro Currency Conversions, and many more.

Helpful Hints for a Successfull Start-Up

This cash register has up to 40 departments available. You may

assign the taxable status to any other department by repeating the tax

assignment procedure used for Department 1. For departments 21-40,

press the [Dept Shift] key before the applicable department key. For

example, to select Department 26 press [Dept Shift] followed by the

[Department 6/26] key.

Training Mode

The optional training mode is designed to help you become better

acquainted with the register mode and offers an ideal place for

beginners to practice transaction examples. Once the training mode is

activated, you cannot operate in the PRG, X or Z modes. The transactions made in the training mode are not recorded in the X or Z reports

and are not summed to machine totals. Receipt numbers are not

counted either; four asterisks (****) are printed instead of the

consecutive receipt number.

ENGLISH

14

Page 22

Activating the Training Mode

Proceed as follows to switch the cash register into the training

mode:

1. Turn the PRG control key to the PRG position.

2. Type [666666] and press the [Amt Tend/TOTAL] key. A dot

indicating the Training Mode On condition is displayed on the lefthand side of the operator and customer displays.

3. Turn the key to the REG 1 or REG 2 position to perform normal

cash register operations.

Exiting the Training Mode

Proceed as follows to exit the training mode and therefore re-enable

the cash register to record all sales transactions in the X and Z

management reports and in the machine totals.

1. Turn the PRG control key to the PRG position.

2. Type [555555] and press the [Amt Tend/TOTAL] key.

3. Turn the key to the desired operating position.

Cash Register Programming

This cash register can be programmed to tailor its features according

to your specific needs. This programming facility allows you to:

• Define three-digit secret codes for each of the 26 programmable

clerks

• Define clerk names

• Set a machine number

• Set the date and time

• Personalize customer receipt headers

• Set percent discount (-%) rates

• Set percent plus (+%) rates

• Define fraction rounding

• Define decimal point positions

• Define up to four VAT rates

• Define Price Look-Ups (PLUs) for individual items and enter an

item description

• Define tax status and High Digit Lock Out to the minus key

• Define tax status, High Digit Lock Out, Single/Multiple item sale

and relative price to a determined defined department

• Set an exchange rate for the Euro currency

• Personalize currency convert captions and credit captions on the

receipts and reports

• Program time reports

• Program the different system options available

• Define manager passwords for the PRG, X and Z modes.

ENGLISH

Set some of or all of the above features, depending on your business

needs. These program settings will reside in the cash register's memory

until you change them or deactivate the battery back-up system.

15

Page 23

Setting Cash Register Features

All cash register features are programmed by first switching the

cash register into the program (PRG) mode.

This chapter provides simple step-by-step procedures on how to

program the cash register. An example is provided after each procedure.

It is suggested that you first run through all the examples to become

familiar with the cash register's programming facilities, then program

the cash register according to your own specific needs.

NOTE: Program all the desired features at the same time in order to

create a single receipt of all selections. Keep the receipt in a

safe place for future reference.

Exiting the Program Mode

Proceed as follows to exit the program mode once you have finished

programming the cash register:

1. Print a Program Tape by pressing [999999] followed by the

[Amt Tend/TOTAL] key, as explained in the section entitled

Overall Programming Dump Report, for a printed report on how the

cash register is currently programmed.

2. Store the program tape in a safe place for future reference.

3. Turn the PRG key to the REG position if you wish to carry out sales

transactions, or to the OFF position if you wish to exit.

ENGLISH

Making Changes to Cash Register Programming

Once the cash register is programmed to satisfy your specific needs,

there is no need to reprogram the entire machine to make single

program changes or corrections. If you wish to make a change (such as

an update to VAT rates, PLUs or Euro exchange rates), be sure you are

in the program mode, re-do the program in question and finalize when

you are ready to exit the programming mode. A new program entry will

automatically overwrite a previous entry for the same program.

Entering the Program Mode

To enter into the program mode simply insert the PRG key into the

Control Lock and turn it to the PRG position.

Clearing Errors

To clear an error made during the programming phase, simply press

the [Clear] key. The error tone ends, the display clears and the keypad

unlocks.

In case an error condition cannot be cleared, perform one of the two

general clearance methods explained in the section entitled General

Clearance. Remember that the second general clearance sets all

counters and totals to zero, and cancels all features programmed.

16

Page 24

Clerk Numbers, Secret Codes and Names

Clerk codes are a special security feature to control access to the

register. You can program up to 26 individual clerk numbers linked to

secret entry codes of three digits each. By enabling the Clerk System

Active option as indicated in the Programming System Options section,

the register assigns the default security [000] to all clerks. You can also

assign a name to each of the 26 Clerks, which will be printed on the

customer receipts, on the journal (if used) and on all management

reports analysing the transactions of that specific Clerk.

Programming a Secret Code Linked to a Clerk

Number

1. Insert the PRG key into the Control Lock and turn it to the PRG

position.

2. Type [121] and then press the [Void] Key to activate the Clerk

system.

3. Type [444444] and press the [Amt Tend/TOTAL] key. The symbol

"C" is displayed on the left-hand of the displays and the message

"CLERK PASS" is displayed on the upper row of the operator

display.

4. Type a number to which the secret code will be linked.

5. Set a three-digit secret code by typing three [numeric keys].

6. Press the [Clerk] key.

Repeat the above operations (from step 4 to step 6) to assign a secret

code to the remaining 25 Clerks or use the [Clear] key to exit from

Clerk Secret Code programming.

If you wish to change the clerk's secret code and the Clerk system is

already activated, there is no need to perform step 2 above.

Example: Assign secret code 106 to Clerk 1 for the first time.

Type/Press:

[121] + [Void] + [444444] + [Amt Tend/TOTAL] + [1106] + [Clerk]

Deactivating the Clerk System

Proceed as follows if for any reason you wish to deactivate the Clerk

system, in other words if you no longer want to enter a clerk number

and related secret code to perform sales transactions.

1. Insert the PRG key into the Control Lock and turn it to the PRG

position.

2. Type [120] and then press the [Void] key.

Entering a Clerk Number/Secret Code Before Cash

Register Operations

Proceed as follows to enter a defined Clerk number and secret code

before using the cash register in REG 1/REG 2 operating mode.

1. Turn the Control Lock to the REG 1/REG 2 position.

2. Type a Clerk number [1, 2, ... or 26].

3. Type the corresponding three-digit code.

4. Press the [Clerk] Key.

The clerk number appears on the left-hand side of the operator and

customer displays and the message "CLERK 1" or the name of the clerk

is displayed on the upper line of the operator display and is printed

under the date on the customer receipt and journal.

Assigning Clerk Names

This cash register feature is useful for rapid identification of the

different clerks which are enabled to use the cash register. You can

program a clerk name or identifier of up to 24 characters long by using

the Character Code Table provided in the Appendix of this manual or

by using the alphanumeric keypad. The assigned Clerk name will be

automatically printed on all receipts, journal records and management

reports carried out with the associated clerk number and displayed on

the upper row of the operator display. However, you can also program

the cash register not to print the assigned Clerk name. Refer to the

section entitled Programming System Options for more information.

17

ENGLISH

Page 25

Proceed as follows to define a clerk name using the Character Code

Table:

1. Turn the PRG key to the PRG position.

2. Type the number of the Clerk whose name is to be defined.

3. Press the [Return] key. The letter "P" appears on the left-hand side

of the operator and customer displays while the message "CLERK

NAME" is displayed on the operator display.

4. With reference to the Character Code Table in the Appendix, type

the string of character codes to define the letters of a name and then

press the [Check] key. The name entered will be automatically

printed.

Example: Program Christina as the name for Clerk number 1.

Type/Press:

1 + [Return] + [43 09 19 10 20 21 10 15 02] + [Check]

You can also define a clerk name by using the alphanumeric keypad.

Proceed as follows to do so:

1. Turn the PRG key to the PRG position.

2. Type the number of the Clerk whose name is to be defined.

3. Press the [Return] key. The letter "P" appears on the left-hand side

of the operator and customer display while the message "CLERK

NAME" is displayed on the operator display.

4. Type the [Dept] key corresponding to the letter wanted. If the letter

wanted is on the bottom half of the [Dept] key, press the [Dept

Shift] key first then the related [Dept] key. After entering the letter

string wanted, press the [Check] key.

Example: Program Alex as the name for Clerk number 2.

Type/Press:

2 + [Return] + [1/21 12/32 5/25] + [Dept Shift] + [4/24] + [Check]

Machine Numbers

The machine number is a four-digit number used to identify the cash

register. The machine number is printed on all receipts, journal records

and management report.

Proceed as follows to set a machine number:

1. Turn the PRG key to the PRG position.

2. Type the [numeric keys] corresponding to the machine number to

be assigned (up to 4 digits, 0-9999).

3. Press the [+%/PO] key.

Example: Program machine number 1234.

Type/Press:

[1234] + [+%/PO]

Date and Time

Set the date option to print the current date at the top of each receipt,

journal record or management report. The date will print in the day/

month/year format unless otherwise programmed as explained in the

section entitled Programming System Options. You can display the date

by pressing the [Qty/Date] key when the cash register is in the REG

mode.

Set the time option to print the current time at the bottom of the

receipt. The time prints in the hour:minutes format. The time is

automatically shown on both customer and operator displays after 30

seconds of cash register inactivity.

The date and time change automatically as long as the cash register is

plugged into the wall outlet or the battery back-up system remains

active.

ENGLISH

18

Page 26

Setting the Date

Proceed as follows to set the current date:

1. Turn the PRG key to the PRG position.

2. Type the [numeric keys] representing the current date. Remember

to use the DDMMYY format. Single digit numbers for months and

days must be preceded by a zero (0).

3. Press the [#/ST/NS] key to store the date. The date entered is

printed.

4. Press the [Clear] key to program another feature or exit the program

mode by turning the PRG key to the OFF position.

Example: Set a date of January 12, 2001.

Type/Press:

[120101] + [#/ST/NS]

NOTE: If you wish that the date just entered be printed and displayed

in the month/day/year format, type [40] and then press the

[Void] Key. More information on how to change the cash

register's basic programming is explained in the section

Programming System Options.

Setting the Time

Proceed as follows to set the correct time in the hour:minutes format:

1. Turn the PRG key to the PRG position.

2. Type the [current time] using the HH:MM format.

NOTE: Time is set according to international, or military time

(24-hour clock format). To correctly enter this time, simply

add 12 to all hours in the PM. For example, to set the time to

9:00 AM, type [0900]; to set the time to 2:15 PM, type [1415].

3. Press the [Qty/Date] key to store the entered time. The newly

defined time is automatically printed.

4. Press the [Clear] key to program another feature or exit program

mode by turning the PRG key to the OFF position.

Example: Set the time at 3:30 PM.

Type/Press:

[1530] + [Qty/Date]

NOTE: If you wish that the time just entered be printed and displayed

in the 24-hour format, type [180] and then press the [Void]

Key. More information on how to change the cash register's

basic programming is explained in the section Programming

System Options.

Receipt Header

Your cash register is programmed to print a courtesy header enclosed

in a box delimited by asteriscs, on all customer receipts when the

control lock is in the REG 1, X and Z positions. With the control lock

in the REG 2 and PRG positions, the header will not be printed.

NOTE: You can change the programmed language in which the cash

register prints the header on the customer receipt and journal

record. Turn to the section Programming System Options,

Machine Condition 19, to see in which languages the cash

register can print the receipt header.

The receipt header can consist of up to five lines of 24 characters

each. You can change the cash register's default header according to

your own business needs by using the alphanumeric keypad or the

Character Code Table provided in the Appendix, to enter the characters

for your new header.

Personalizing the Receipt Header

Proceed as follows to change the default receipt header:

1. Turn the PRG key to the PRG position.

2. Type [3] followed by the [number] of the line (n = 1....5) you wish

to modify and then press the [Return] key. The letter "P" appears

on the left-hand side of the displays and the message "LOGO LINE

n" is displayed on the operator display where n is the number of the

line to change.

19

ENGLISH

Page 27

3. Using the cash register's aphanumeric keypad or the Character Code

Table in the Appendix, type the character code string for the letters

to be entered on this particular line selected. Remember that up to

24 characters can be entered. If you wish to center a writing, you

will need to calculate the empty character spaces before and after

your string and type the appropriate blank space code (00) in the

corresponding places.

4. Press the [Check] key again to store the newly defined header line.

This new line is automatically printed.

5. Repeat steps 3 and 4 if you wish to program the remaining three

programmable header lines.

Example: Change the fourth line of the default header to *PLEASE

COME AGAIN* with the appropriate spaces before and after to center

this new string and using the Character Code Table provided in the

Appendix.

Type/Press:

[3] + [4] + [Return] + [76 00 00] + [56 52 45 41 59 45 00] +

[43 55 53 45 00] + [41 47 41 49 54] + [00 00 00 76] + [Check]

NOTE: If you wish to use the alphanumeric keypad to type the header

PLEASE COME AGAIN, type [00] for the spaces and then

press the Dept key corresponding to the letter wanted. If the

letter wanted is on the bottom half of the key, firstly press the

[Dept Shift] key and then the related [Dept] key. The asterisk

can only be entered by typing its corresponding code (76) from

the Character Code Table in the Appendix.

Percent Discount (-%)

Setting this option automatically calculates the preset rate each time

the [-%/RA] key is pressed. The percentage rate can be discounted from

an individual item or from a sales transaction total.

Setting a Percent Discount (-%) Rate

Proceed as follows to define a standard discount rate:

1. Turn the PRG key to the PRG position.

2. Type the [numbers] representing the desired percentage rate. Up to

four digits ranging from 0 to 99.99 can be used, and you MUST

enter a total of four digits, two before and two after the desired

decimal place. For example, to enter 10%, type [1000], to enter

6.5% type [0650].

3. Press the [0] key followed by the [-%/RA] key to store the rate.

The programmed rate is printed with the caption "DISCOUNT".

4. Press the [Clear] key to program another feature otherwise exit the

program mode by turning the key to the OFF position.

Example: Program a standard 10% discount rate.

Type/Press:

[1000] + [0] + [-%/RA] + [Clear]

Percent Plus Rate (+%)

Setting this option automatically calculates the preset add-on rate

each time the [+%/PO] key is pressed. This percentage rate can be

added to an individual item or to a transaction total.

Setting a Percent Plus (+%) Rate

Proceed as follows to define a standard add-on rate:

1. Turn the PRG key to the PRG position.

2. Type the [numbers] representing the desired percentage rate. Up to

four digits ranging from 0 to 99.99 can be used, and you MUST

enter a total of four digits, two before and two after the desired

decimal place. For example, to enter 10%, type [1000], to enter

6.5% type [0650].

3. Press the [0] key followed by the [+%/PO] key to store the rate.

The programmed rate is printed along with the caption "ADD ON".

ENGLISH

20

Page 28

4. Press the [Clear] key to program another feature otherwise exit the

program mode by turning the PRG key to the OFF position.

Example: Program a standard 3% add-on rate.

Type/Press:

[0300] + [0] + [+%/PO] + [Clear]

Example: Program the rounding code so that a fraction under one half

pence is rounded down one pence, a fraction above one half pence

is rounded up one pence up.

Type/Press:

[50] + [Charge] + [Clear]

ENGLISH

Fraction Rounding

Fraction rounding is used to round figures with decimals up or down

to the nearest whole numbers and is used for percent tax, percent

discount and percent add-on calculations. Choose from the following

three options to select the rounding as needed:

Rounding Code Fraction Rounding

00 a fraction of a pence is rounded down one pence

50 a fraction under one half pence is rounded

down one pence, a fraction above one half pence

is rounded up one pence

99 a fraction of a pence is rounded up one pence

Setting the Rounding Code

Proceed as follows to program fraction rounding:

1. Turn the PRG key to the PRG position.

2. Type the [rounding code] and press the [Charge] key. The

programmed rounding code is automatically printed along with the

caption "CHARGE".

3. Press the [Clear] key to program another feature, otherwise exit the

program mode by turning the PRG to the OFF position.

Decimal Point Position

The decimal point setting is preset to the x.xx format. This format

can be changed, as needed, to one of the other settings below.

Changing the Decimal Point Position

Proceed as follows to define a new position for the decimal point.

1. Turn the PRG key to the PRG position.

2. Type the status number [0, 1, 2 or 3] to select the desired format as

indicated in the following table:

Status Number Format

0x

1 x.x

2 x.xx

3 x.xxx

3. Press the [-%/RA] key to set the new format. The setting made is

automatically printed along with the caption "R-A-".

4. Press the [Clear] key to program another feature, otherwise exit the

program mode by turning the PRG to the OFF position.

Example: Program the cash register so that two digits are left after the

decimal point.

Type/Press:

[2] + [-%/RA] + [Clear]

21

Page 29

Value Added Tax (VAT) Rates

Up to four VAT rates (VAT1, VAT2, VAT3 and VAT4) can be preset in

the cash register. A maximum 5-digit VAT rate can be programmed (0-

99.999%).

Setting a Fixed VAT Rate

Proceed as follows to program a fixed tax rate:

1. Turn the PRG key to the PRG position.

2. Type the [numbers] which represent the VAT (1 for VAT1, 2 for

VAT2, 3 for VAT3 and 4 for VAT4).

3. Press the [Tax Set] key. The message "TAX n RATE" appears on

the operator display where n is the number representing the VAT

rate.

4. Type the VAT rate. Up to five digits can be used, and you MUST

enter three digits after the desired decimal place. For example, to

enter a 5.5% VAT rate, type [5500]; to enter a 16% VAT rate, type

[16000].

5. Press the [Amt Tend/TOTAL] key. The tax rate entered followed

by its alphanumeric identifier (T1, T2, T3 or T4) is printed.

NOTE: If you make an error, press the [Clear] key and start again

from step 3.

6. Press the [Clear] key to program another feature, otherwise exit the

program mode by turning the PRG key to the OFF position.

Example: Set a VAT1 rate of 5.5%, VAT2 rate of 7%, VAT3 rate of

16% and a VAT4 rate of 20%.

Type/Press:

[1] + [Tax Set] + [5500] + [Amt Tend/TOTAL]

[2] + [Tax Set] + [7000] + [Amt Tend/TOTAL]

[3] + [Tax Set] + [16000] + [Amt Tend/TOTAL]

[4] + [Tax Set] + [20000] + [Amt Tend/TOTAL]

High Digit Lock Out (HDLO) and Tax Status

Assigned to the Minus Key (-)

You can limit the number of digits, i.e. the maximum value of a

minus key operation, from 1 to 6 digits. This makes sure that minus key

amounts do not exceed a maximum amount. You can also assign a VAT

rate or a non tax status to the minus key.

Make your selections for this feature from the following options:

High Digit Lock Out Taxation

0 = No HDLO 00 = Non taxable

1 = 1 digit (0.09) 01 = VAT1

2 = 2 digits (0.99) 02 = VAT2

3 = 3 digits (9.99) 03 = VAT3

4 = 4 digits (99.99) 04 = VAT4

5 = 5 digits (999.99)

6 = 6 digits (9999.99)

Programming the High Digit Lock Out and Tax Status

1. Turn the PRG key to the PRG position.

2. Type the HDLO code [0-6].

3. Type the tax status code [00-04].

4. Press the [-] key. A minus sign appears on the displays and the

caption "COUPON" is printed on the receipt along with the

programmed tax status.

5. Press the [Clear] key to program another feature, otherwise exit the

program mode by turning the PRG key to the OFF position.

Example: Allocate a maximum of 5 digits and VAT 2 to the minus key.

Type/Press:

[5] + [02] + [-]

ENGLISH

22

Page 30

Tax Status, High Digit Lock Out, Single/Multiple

Item Sale and Price Linked to a Department

You can assign the following to individual departments:

• A department status, consisting of:

- Department definition, meaning a Standard department where

ordinary items are sold or a Gallonage department where oil,

liquids, etc. are sold at unit price per gallon, liter, etc.

- Single item sale or multiple item sale capability whereby

the department will ring up each item entered as a single item

sale with exact change tender or as a multiple item sale.

- A High Digit Lock Out code whereby you prohibit item entries

for a certain number of digits and above.

- A taxable or non-taxable status.

• The price which will ring up automatically every time the appropriate department key has been pressed. You can also skip this option,

in which case the price has to be entered manually before pressing

the department key.

• A maximum 12-character description of the item associated to the

specific department key.

The 5-digit department status can be programmed using the following

options:

Dept. Def. Single/Multiple Item High Digit Lock Out Tax Status

Sale

0 = Standard 0 = Normal sale 0 = No HDLO 00 = Non tax.

Dept. 1 = Single item cash sale 1 = 1 digit (0.09) 01 = VAT1

1 = Gallonage 2 = 2 digits (0.99) 02 = VAT2

Dept. 3 = 3 digits (9.99) 03 = VAT3

4 = 4 digits (99.99) 04 = VAT4

5 = 5 digits (999.99)

6 = 6 digits (9999.99)

If Gallonage is selected as the department definition, during a sales

transaction the three numbers entered after the decimal point will be

rounded off according to the fraction rounding setting.

Linking an HDLO, Tax Status, Single/Multiple Item Sale,

Item Price and Description to a Department

1. Turn the PRG key to the PRG position.

2. Type the [Department definition], [Single/Multiple Item Cash

Sale], [HDLO] and [Tax Status] options by referring to the

previous table.

3. Press the [Subtotal w/Tax] key to confirm your entry. The message

"DEPT PRICE" appears on the operator display and the codes of the

options programmed will be printed along with the caption

"SUBTTL".

4. Type a [price] to assign to a specific item and then press the

relative [Department] key. The message "DEP n NAME" appears

on the operator display and the amount entered is printed along with

the caption "DEPT n", where the n in both cases represents the

department number.

5. With reference to the Character Code Table in the Appendix or by

using the alphanumeric keypad, define the department descriptor

(max 12 chars, spaces included).

6. Store the item descriptor entered by pressing the [Check] key.

7. Press the [Clear] key to program another feature, otherwise exit the

program mode by turning the PRG key to the OFF position.

Example: Assign no HDLO, VAT1, multiple item sale, a price of £2.65

to an item in Standard Department 1 named Groceries defined using

the Character Code Table.

Type/Press:

[0] + [0] + [0] + [01] + [Subtotal w/Tax] + [265] + [Department 1/21] +

[47 58 55 43 45 58 49 45 59] + [Check]

ENGLISH

23

Page 31

NOTE: If you wish to rename the Groceries department back to

DEPT 1, repeate the procedure and enter the character code

string [44 45 56 60 00 31] (or type the related characters on

the alphanumeric keypad).

Price Look-Ups (PLUs)

Price Look-Ups simplify cash register operations by automatically

registering an individual item's price (up to 999 can be registered),

maximum 12-character description (spaces included), department

number, tax status and rate (if applicable). To look up individual item

prices, simply type the item's corresponding PLU number [1] and press

the [PLU] key.

7. Press the [Qty/Date] key to program another feature, otherwise exit

the program mode.

Example: Create PLU 1 with a unit price of £2.69 assigned to Department 1 and name this item Coffee by using the Character Code Table

and then create PLU 320 with a unit price of £5.99 assigned to Department 33 and name this item Paperback by using the alphanumeric

keypad.

Type/Press:

[Qty/Date] + [269] + [Department 1/21] + [43 55 46 46 45 45] +

[Check] + [320] + [PLU] + [500] + [Dept Shift] + [Dept 13/33] +

[Dept 16/36 Dept 1/21 Dept 16/36 Dept 5/25 Dept 18/38 Dept 2/22

Dept 1/21 Dept 3/23 Dept 11/31] + [Check] + [Qty/Date]

ENGLISH

Creating Price Look-Ups

Proceed as follows to create a price look-up:

1. Turn the PRG key to the PRG position.

2. Press the [Qty/Date] key. The message "PLU PRICE" appears on

the operator display and the number 001 is displayed on the lefthand side of the displays to indicate the first PLU number.

If you wish to change the PLU number from 001 to another number

such as 30, type [030] and then press the [PLU] key.

3. Type the [unit price] that you wish to assign to that PLU.

4. Press the appropriate [Department] key to assign the PLU to a

Department from 1 to 20. Use the [Dept Shift] key for departments

from 21-40. The message "PLU NAME" is displayed while the PLU

number, item price and department number are printed.

5. With reference to the Character Code Table in the Appendix or by

using the alphanumeric keypad, define a maximum 10-character

description to the PLU item. For example, the item Coffee will have

the [43 55 46 46 45 45] character code string if the Character Code

Table is used.

6. Press the [Check] key to store the PLU item description which is

printed. The cash register automatically switches to the next PLU

item number.

Euro Exchange Rate and Receipt Caption Programming

You can program the Euro exchange rate so that the cash register can

automatically calculate the transaction from your local currency into the

Euro currency and vice versa depending on the cash register's base

currency (Local or Euro). The cash register is programmed by default so

that your local currency is the base currency. If you wish to change the

base currency to Euro, refer to the "Programming System Options"

section in this manual, Machine Condition 31.

This cash register model also gives you the possibility of programming the receipt currency caption, from the default Local caption to, for

example, your actual local currency descriptor (for example UK

Pounds) or from the Euro caption to any other descriptor you wish. You

can also change the convert total net sales caption on financial and

management reports from the default CNV.NET to any other descriptor

as required.

24

Page 32

Programming the Euro Exchange Rate

Euro exchange rate programming consists of firstly defining the

position of the decimal point of the Euro exchange rate (0-8 digits after

the decimal point), the position for the decimal point of the changed

amount which is also printed on the sales receipt (0-3 digits after the

decimal point), and then the actual current exchange rate (up to 6

digits). To provide you with the Euro currency value, the cash register

divides the local currency value by the exchange rate defined.

Proceed as follows to program or update the exchange rate of your

local currency into Euro:

1. Turn the PRG key to the PRG position.

2. Type the [decimal point position] of the exchange rate (0-8 digits

after the decimal point).

3. Type the [decimal point position] of the converted amount (0-3

digits after the decimal point).

4. Type the [exchange rate] using up to six digits without specifying

any decimal point.

5. Press the [Euro] key to store the exchange rate. The rate entered is

automatically printed along with the caption "EURO".

Example: Program an exchange rate of £ 0.63 to the Euro.

Type/Press:

[2] + [2] + [000063] + [Euro]

Changing the Convert Captions Printed on the Sales

Receipt

By default the cash register prints one of two programmable convert

captions to indicate a converted sales transaction total on the receipt; if

the cash register is programmed with a Local base currency, the convert

caption printed is "EURO" while if it is programmed with a Euro base

currency, the convert caption printed is "LOCAL". If an exchange rate

has been defined, the amounts indicated in both cases are the sales

totals converted into the respective currency. If an exchange rate has not

been defined, by default the cash register assumes a 1:1 conversion

rate.

If you wish to avoid printing the Local or Euro converted sales total

and just print the transaction total of the base currency, program the

cash register to do so as indicated in the section entitled Programming

System Options, Machine Condition 30.

If you have programmed the cash register for a Euro base currency,

proceed as follows to change the LOCAL caption printed:

1. Turn the PRG key to the PRG position.

2. Type [41] and then press the [Return] key. The caption "LOCAL"

appears on the operator display.

3. With reference to the Character Code Table in the Appendix or by

using the alphanumeric keypad, define the new caption (max 10

characters, spaces included).

4. Press the [Check] key to confirm the new caption which is auto-

matically printed.

Example: Change the caption LOCAL to UK POUNDS by using the

alphanumeric keypad.

Type/Press:

[41] + [Return] + [Dept Shift] [Dept. 1/21] + [Dept. 11/31] + [00] +

[Dept. 16/36] + [Dept. 15/35] + [Dept Shift ] + [Dept. 1/21] + [Dept.

14/34] + [Dept. 4/24] + [Dept. 19/39] + [Check]

ENGLISH

25

Page 33

You can proceed in the same way the change the convert caption

printed when the Local base currency is programmed. In this case the

only difference is that you need to type [42] in step 2 and the caption

"EURO" appears on the operator display; you can then program

whatever caption you wish as long as it is up to 10 characters long.

Similarly, you can change the default Convert Total caption

"CNV.NET" which indicates a net sales total as converted and which is

printed on the financial and management reports. In this case proceed

in the same was as explained above, the only difference being is that

you need to type [43] in step 2 and the caption "CONV.NET" appears

on the operator display.

Credit 1, Credit 2 Captions Programming

With reference to the Programming System Options section in this

manual, you can set Machine Condition 16 so that the cash register

reserves department 19 or 20, or both, for the registration of credits

deriving from sales transactions. By means of this function, you can

assign Credit 1 to the transactions paid with one type of credit card and

Credit 2 to those paid with another. In this way you can sort the sales

that have been paid with two different credit cards. The related Credit 1

(referring to the credits registered in Department 20) and Credit 2

(referring to the credits registered in Department 19) captions can be

personalized according to your needs or according to the related credit

card. Proceed as follows to do so:

1. Turn the PRG key to the PRG position.

2. Type [2] followed by the [number] of the credit (1 or 2) whose

caption you wish to personalize.

3. Press the [Return] key. The message "CRED n NAME" is dis-

played where n represents the credit number.

4. Define a [new caption] of up to 12 characters by using either the

Character Code Table found in the Appendix or by typing it directly

on the alphanumeric keypad. Remember that you can use the [Void]

key as backspace function during caption entry.

5. Press the [Check] key.

Programming System Options

Your cash register's system options programmig feature includes 31