Page 1

506524K

Page 2

Olivetti Lexikon, S.p.A.

Divisione Home/Office

77, Via Jervis - 10015 Ivrea (Italy)

Copyright © 2001, by Olivetti

All rights reserved

Page 3

The mark affixed to the product

certifies that the product satisfies the

basic quality requirements.

Your attention is drawn to the following actions that could compromise the

characteristics of the product:

• incorrect electrical supply;

• incorrect installation; incorrect or improper use, or, in any case, not in

accordance with the warnings given in the User Manual supplied with the

product;

• replacement of original components or accessories with others of a type

not approved by the manufacturer , or carried out by unauthorized personnel.

ENGLISH

Page 4

WARNING: THIS EQUIPMENT MUST BE EARTHED .

ATTENTION: CETTE UNITE DOIT ETRE CONNECTEE A LA TERRE.

ACHTUNG: DIESES GERÄT MUSS EINEN ERDUNGSANSCHLUSS

HABEN.

ATENCION: ESTE EQUIPO DEBE ESTAR CONECTADO A UNA TOMA

DI TIERRA.

APP ARA TET MÅ KUN TILK OPLES JORDET STIKKONT A CT .

APP ARA TEN SKALL ANSLUTAS TILL JORDAT NÄTUKKAT.

LAITE ON LITTETTÄVÄ SUKO-RASIAAN.

Lederen med grøn/gul isolation ma kun tilsluttes en klemme maerkrt

eller

.

To disconnect the cash register from the line voltage, unplug its

power cord from the power outlet. The po wer outlet m ust be located

on a wall, near the cash register and easily accessible.

Page 5

Preface

The electronic cash register described in this manual is designed to

help your business function smoothly by providing efficient register

operations and accurate management reports. Startup is quick and easy,

yet there are many options that can be added and revised so that you

can customize your operations for optimum productivity. Here are just a

few of the cash register’s many valuable features:

• 40 departments and 999 Price Look-Up (PLU) settings;

• 15 clerk numbers to monitor the sales of individual employees;

• possibility of assigning a three-digit security code to prevent

unauthorized access to individual clerk transactions (during register

mode only);

• possibility of defining manager passwords to prevent unauthorized

access to the machine's programming mode (PRG), Z mode and X

mode;

• printer with journal record and receipt printing capabilities;

• possibility of reserving two departments for registering credit sales

paid with two different types of credit cards;

• Euro exchange rate programming;

• possibility of programming the machine to work with one of two

base currencies, Local or Euro, so that cash register computes in the

currency set and automatically converts the related transaction totals

into the other currency;

• rear customer display and front operator display each consisting of a

10-character transaction and message line;

• automatic tax computations for 4 different VAT rates;

• department-linked entry options that streamline and speed-up

operation;

• periodic management and financial reports which provide up-to-date

sales analysis;

• battery back-up protection for the records and programming data

stored in memory;

• automatic time display after a period of system inactivity;

• automatic time and date printing on receipt and journal records.

ENGLISH

I

Page 6

T able of Contents

GETTING ACQUAINTED WITH YOUR CASH

REGISTER..................................................................... 1

Standard Accessories..................................................... 2

Using this Manual........................................................... 2

Unpacking and Setting Up the Cash Register ................ 3

Maintaining the Cash Register ....................................... 3

THE KEYPAD ................................................................ 4

Keypad Functions........................................................... 5

THE CONTROL SYSTEM ............................................. 6

The Control Lock............................................................ 6

Cash Drawer with Removable Cash Bin ........................ 7

Deposit Drawer............................................................... 7

Operator and Customer Displays ................................... 7

Time Display .................................................................. 7

Special Symbol Indicators.............................................. 7

Positioning the Customer Display .................................. 8

ERROR CONDITIONS .................................................. 8

The Error Alarm ............................................................. 8

Clearing an Error ............................................................ 8

General Clearance ......................................................... 8

Voiding Errors................................................................. 9

BACK-UP BATTERY SYSTEM ..................................... 9

Inserting/Replacing Batteries ......................................... 9

II

PRINTER COMPARTMENT ........................................ 10

The Inked Ribbon ......................................................... 10

Installing the Inked Ribbon............................................11

Re-inking the Thank You Stamp................................... 12

Paper Tape................................................................... 12

Loading Single-Ply and Dual-Ply Paper ....................... 12

QUICK START............................................................. 14

Helpful Hints for a Successful Start-Up........................ 14

TRAINING MODE ........................................................ 15

Activating the Training Mode ....................................... 15

Exiting the Training Mode ............................................ 15

CASH REGISTER PROGRAMMING .......................... 15

Setting Cash Register Features ................................... 16

Making Changes to Cash Register Programming ........ 16

Entering the Program Mode ......................................... 16

Exiting the Program Mode ........................................... 16

Clearing Errors ............................................................. 16

Clerk Numbers and Secret Codes................................ 17

Machine Numbers ........................................................ 18

Date and Time .............................................................. 18

Percent Discount (-%) .................................................. 19

Percent Plus Rate (+%)................................................ 19

Fraction Rounding ........................................................ 20

Decimal Point Position ................................................. 20

Value Added Tax (VAT) Rates ...................................... 21

Page 7

High Digit Lock Out (HDLO) and Tax Status

Assigned to the Minus Key (-) ...................................... 21

Tax Status, High Digit Lock Out, Pos./Neg.

Single/Multiple Item Sale and Price Linked to a

Defined Department ..................................................... 22

Price Look-Ups (PLUs)................................................. 23

Euro Exchange Rate Programming ............................. 23

Department Programming for Credit 1, Credit 2

Tenders......................................................................... 24

Programming System Options ..................................... 24

PLU Programming Dump Report ................................. 26

Overall Programming Dump Report ............................ 27

Programming Manager Passwords .............................. 28

Using the Cash Register in a Password Protected

Mode ............................................................................ 28

TRANSACTION EXAMPLES ...................................... 29

Entering the Register Mode.......................................... 29

Exiting the Register Mode ............................................ 29

Clearing Errors ............................................................. 29

Transaction Symbols.................................................... 29

Sample Receipt............................................................ 30

Standard Transactions in Local Base Currency ........... 30

Examples of Transactions in Euro Base Currency ....... 40

Minus (-) Key Transactions ........................................... 45

Percent Discount (-%) Transactions............................. 46

Percent Plus (+%) Transactions................................... 51

PLU Codes ................................................................... 55

Voids and Refunds ....................................................... 57

Other Transactions....................................................... 60

MANAGEMENT REPORTS ......................................... 64

X and Z Reports ........................................................... 65

Cash-In-Drawer Report ................................................ 65

Hourly Report ............................................................... 65

Clerk Report ................................................................. 67

All PLU Report ............................................................. 68

PLU Range Report ....................................................... 69

Department Range Report ........................................... 70

Cash Declaration.......................................................... 70

PLU Periodic Term Report ........................................... 71

Z1 and X1 Financial Report ......................................... 72

Z2 and X2 Financial Report ......................................... 73

Duplicate Z Report ....................................................... 74

Balancing Formulas ..................................................... 74

APPENDIX................................................................... 74

Totalizers and Counters Table ...................................... 74

Cash Register Specifications and Safety ..................... 75

ENGLISH

III

Page 8

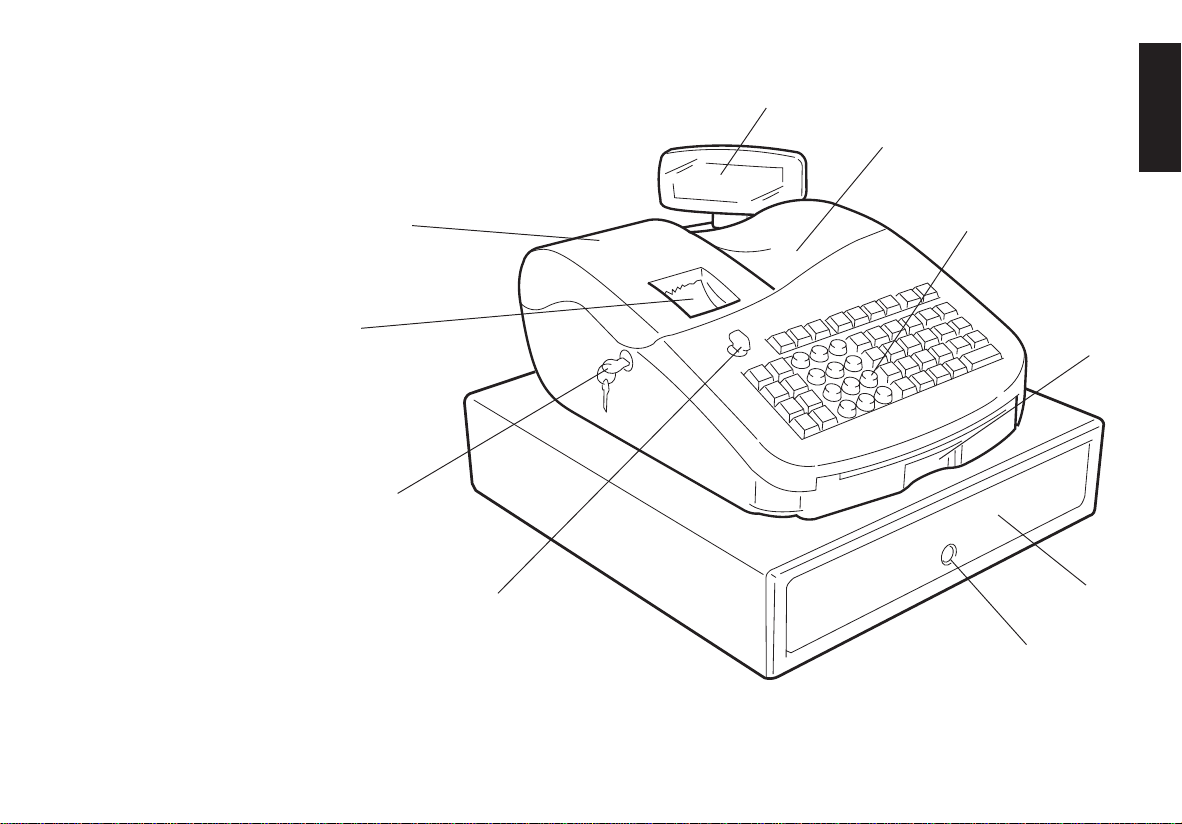

Getting Acquainted with Your Cash Register

The figure below shows an overall view of your cash register.

1

2

ENGLISH

10

9

8

7

1. Customer Display 7. Control Lock

2. Operator Display 8. Printer Compartment Lock

3. Keypad 9. Customer Receipt Output Window

4. Item Deposit Drawer 10. Printer Compartment Cover

5. Cash Drawer

6. Cash Drawer Lock

3

4

5

6

1

Page 9

Standard Accessories

Your cash register comes with the following items:

• One black plastic journal winder spindle

• One roll of standard paper tape

• One inked ribbon (already installed)

• Four standard "AA" batteries for the battery back-up system

• This User Manual

• A set of keys for locking the cash drawer and printer compartment

• A set of PRG keys for access to the PRG and X functions

• A set of REG keys for access to the REG, X and Z functions

• A "Thank You" stamp (already installed).

Make sure that the cash register and all of the above items are included

in the shipping carton.

Using this Manual

Your cash register manual is organized for easy reference. The front

portion contains general information on all the features and functions of

the cash register. Instructions for setting the optional programs come

next. Transaction examples for operating the cash register are at the

back of the manual along with a Totalizers and Counters Table. At the

back of the manual you will also find your cash register's techinical

specifications and some safety information. Use the Table of Contents

to locate a particular item.

Getting Started

Before you begin to operate or program the cash register, read the

section entitled Unpacking and Setting Up the Cash Register for

information on how to get yourself ready to work. Read also Keypad

Functions, The Control System and Operator and Customer Displays to

become familiar with their operations.

NOTE: Programs and transaction information for management reports

are stored in the memory of the cash register. Batteries are

provided to save this information in the event of a power

failure or if the cash register is unplugged from the power

outlet.

Programming the Cash Register

Simple step-by-step instructions are included for each program. Also

provided are examples which can be used for practice.

Carrying Out Sales Transactions

Transaction examples provide steps for key operations. Sample

receipts are included.

2

Page 10

Unpacking and Setting Up the Cash Register

NOTE: Please read this section carefully before attempting to program

the cash register or perform sales transactions.

As soon as you receive the cash register, open its shipping carton and

carefully withdraw each component. Make sure that the cash register

and all of its accessories, listed in the section entitled Standard

Accessories, are present in order to setup the cash register by following

these guidelines:

1. Place the cash register on a level, stable, vibration-free and dust-

free surface. Make sure it is near a grounded power outlet.

2. Plug the cash register into a grounded power outlet.

3. Insert the batteries as explained in the section entitled Inserting/

Replacing Batteries. Do not install batteries unless the register is

plugged in.

WARNING: Before inserting the memory backup batteries, make

sure that the cash register is plugged into an electrical

wall outlet. The machine must be plugged into an

electrical outlet before you insert the batteries.

4. Load the paper tape as explained in the section entitled Loading

Single-Ply and Dual-Ply Paper.

5. Set the desired program options as explained in the section Cash

Register Programming.

6. Once the desired program options have been set, turn the control

key to the REG position and you are ready to perform sales transactions.

Maintaining the Cash Register

Provided below is information on how to maintain your cash register.

NOTE: Before cleaning the cash register, make sure it is powered off

and/or unplugged from the wall outlet. Before unplugging the

cash register from the wall outlet, make sure that four charged

AA standard backup batteries are installed in the battery

compartment. All data stored in memory will be cancelled if

you unplug the cash register from the electrical wall outlet

without back-up battery supply.

1. Keep all liquids away from the cash register so as to avoid spills

which could damage the electronic components.

2. To clean the cash register firstly turn it off and/or unplug it from the

wall outlet (be sure the back-up batteries are installed), then use just

a damp cloth. Do not use corrosive substances such as solvents,

alcohol, petrol, or abrasive components.

3. If the cash register is stored in extreme hot or cold temperatures

(below 32 degrees or above 104 degrees Fahrenheit), allow the

temperature inside the cash register to reach room temperature

before turning it on.

4. DO NOT attempt to pull the paper tape when the cash register is

printing or when you are loading paper. Always use the [Feed] key

to feed paper. Pulling the paper tape could damage the print

mechanism.

ENGLISH

3

Page 11

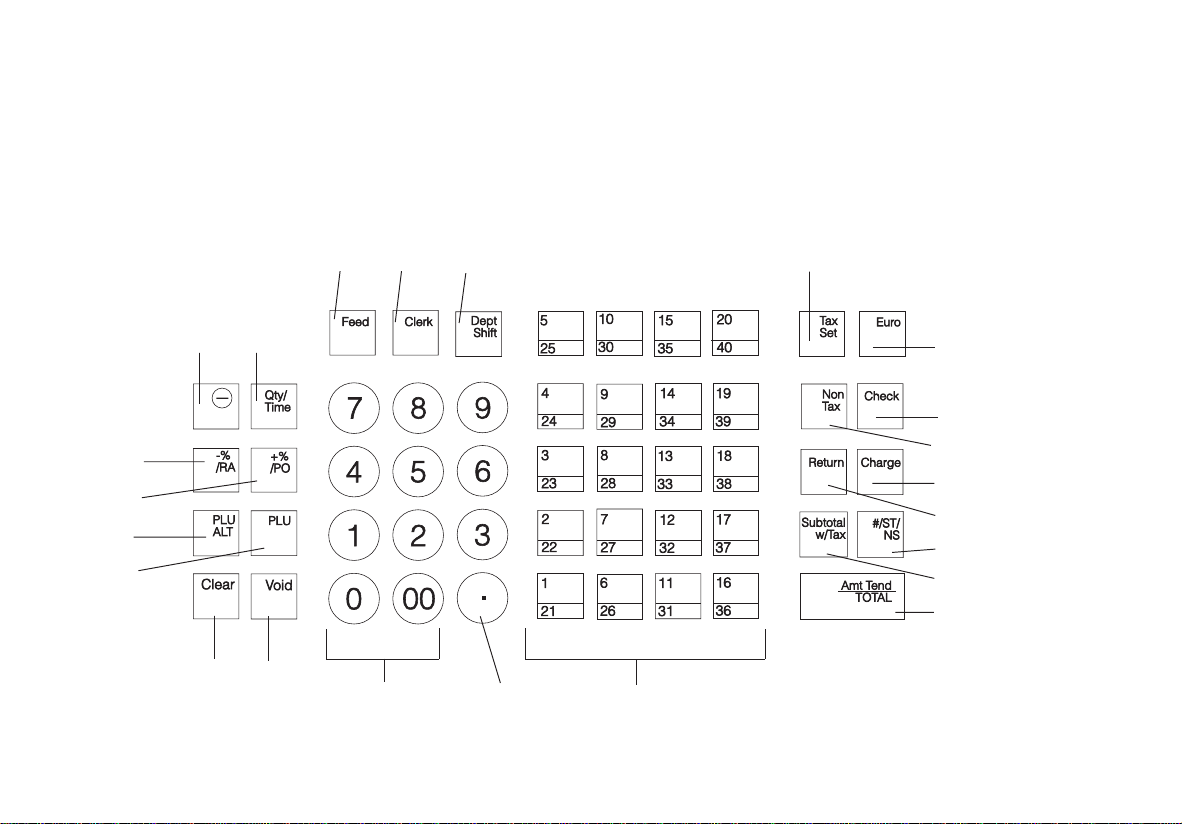

The Keypad

Your cash register is equipped with a 52-key keypad by means of

which you can perform all cash register functions.

The figure below shows the keypad layout.

12

11

5

6

14

15

1

3

13

2 7

17

10

22

19

9

20

8

4

21

23

1816

4

Page 12

Keypad Functions

1. [Feed] (Paper Feed) - Advances the receipt or journal paper one

line feed; advances the paper continuously when held down.

2. [Clerk] - Confirms an entered clerk number and three-digit

security code. Also used to print a Clerk Report.

3. [QtyTime] (Dual function: Multiply and time display) - Multiplies

[DEPARTMENT], [PLU] or [-] key entries; also displays the

current time, if set, and is used to print the Cash-In-Drawer Report.

4. [#/ST/NS] (Dual function: ST - Subtotal and NS - No Sale) - As the

No Sale key, opens the cash drawer without registering any amount

or when changing cash for a non-sales transaction. As the Subtotal

key, calculates a subtotal during a transaction consisting of a

number of items to be individually discounted or increased by a

fixed percentage and prints this on the receipt.

5. [PLU ALT] - Temporarily overwrites a price which was assigned to

a PLU number.

6. [PLU] (Price Look Up) - Registers a preset price of an individual

item to the appropriate department. Also used to print PLU Reports.

7. [Dept Shift] (Department Shift) - Allows price entries for depart-

ments 21-40. Press this key before entering applicable department

keys 21-40.

8. [Return] - Issues refunds for returned merchandise. Refund totals

are printed in the management report.

9. [Non Tax] - Used when no tax is to be registered for a department

which is programmed for tax.

10.[Tax Set] - Used to program VAT rates.

11. [+%/PO] (Dual function: Percent Plus and Paid Out) - When used

as the +% key, adds a percentage to an item or to the sales total.

Total percent plus amounts are shown in the management report.

When used as the PO key, registers any money paid out. Paid out

totals appear in the management report. Also used to set a machine

number.

12. [-%/RA] (Dual function: Percent Discount and Received On

Account) - When used as the -% key, subtracts a percentage from an

item or from the sales total. Total discount amounts are shown in

the management report. When used as the RA key, registers any

payment made to the cash drawer. Amounts are added to the

received on account total in the management report.

13. [ Void] - Deletes the last item entered and used for correcting a

particular entry after it is processed and printed. Void totals are

reported in the management report. Also used during cash register

options programming.

14. [-] - Subtracts an amount from an item or the sales total. Minus key

totals are printed in the management report.

15. [Clear] - Clears an entry made from the numeric keypad or

with the [Qty/Time] key before finalizing a transaction with a

Department or function key. This key is also used to clear error

conditions.

16. [.] (Decimal Point) - Used to enter fractional quantities of items

being sold. In all modes, the decimal point is not to be used when

entering a price.

17. [0 - 9/00] - Input amounts, indicate how many times a particular

item repeats, add and subtract percentage rates, input department

code numbers, handle figures which require a decimal point. The

double zero key allows the quick entry of numbers with two or more

zeros.

18.[1-40] (Departments 1 through 40) - Used to enter single or

multiple item sales to a particular department. A VAT rate is

automatically added, if set. Department totals are shown in the

management report.

19. [Check] - Totals sales paid by check. Check totals are printed in the

management report.

20. [Charge] - Totals sales that are charged. Charge totals are printed

in the management report.

ENGLISH

5

Page 13

21.[Subtotal w/Tax] - Displays the subtotal of a sale with sales tax.

22. [Euro] - When the cash register is in its default Local base cur-

rency, this key is used to program the Euro exchange rate and to

automatically calculate and display the value in Euro of the total

amount of a sale or of a particular amount registered. When the cash

register is programmed to work in the Euro base currency, pressing

this key converts the sales total to the Local currency.

23. [Amt Tend/TOTAL] (Amount Tendered/TOTAL) - Totals exact

cash transactions, computes change and totals check and charge

transactions.

The Control System

The Control Lock

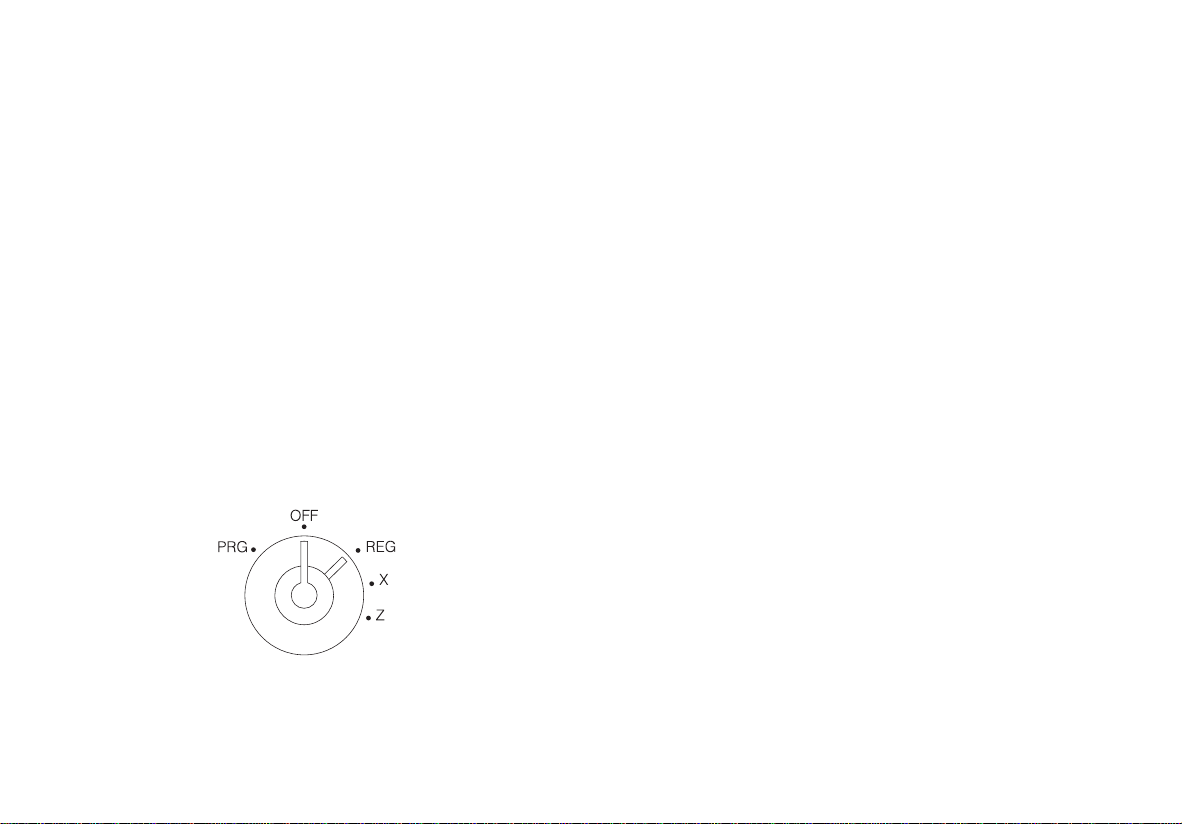

The control lock is located on the upper left-hand side of the keypad.

The PRG or REG key must be properly inserted in the Control Lock in

order for you to be able to use the different cash register functions

available. The following figure shows the Control Lock and the

different modes that can be used.

Depending on the desired operation, insert the appropriate key in the

Control Lock and turn it to the following positions:

OFF The cash register is turned off and cannot be used.

PRG Used to program the cash register according to your

specific needs.

REG The cash register can perform the standard sales transac-

tions, including preset options.

X Prints the X management report, Cash-in-Drawer report,

PLU report, clerk report, cash declaration and periodical

financial reports.

Z Prints the Z management report and resets totals (except

the grand total) to zero. Prints the PLU report, clerk

report, cash declaration and periodical financial reports.

Control Keys

A set of each of the following keys is provided along with a set of

keys to open the cash drawer and printer compartment:

PRG The PROGRAM key works in all modes (PRG, REG, X

and Z). It is usually used by the Supervisor to program the

cash register, access cash register functions and print X

and Z management reports.

REG The REGISTER key only works in the REG and X modes,

granting both Clerk and Supervisor access to the cash

register functions. This key cannot be used to access the

PRG and Z modes.

6

Page 14

Cash Drawer with Removable Cash Bin

The cash drawer features a cash bin with slots for banknotes and slots

for coins. Pressing the [#/ST/NS] with the control key in the REG

position opens the drawer. If a clerk number and secret code have been

set, pressing this key will open the cash drawer only after the clerk

number and code have been specified. This drawer can be locked for

security to prevent accidental opening when moving the cash register by

using the printer compartment key.

If desired, the cash bin inside the cash drawer can be completely

removed from the cash register. To do so, gently lift the bin and pull it

out.

Deposit Drawer

This extra drawer provides sufficient space for miscellaneous items.

Operator and Customer Displays

Your cash register offers two displays which provide easy viewing for

both the customer and operator during a sales transaction. The customer

display shows entry amounts and related transaction information

through the use of numbers and special symbols. The operator display

shows specific operator messages or the same transaction data as shown

on the customer display. Both displays are read from left to right.

Time Display

You can display the current time by simply pressing the [Qty/Time]

key with the cash register in the REG mode. Press the [Clear] key to

stop displaying the time and re-enable the keypad to start a transaction.

NOTE: Trying to use this feature during a transaction will result in an

error tone. If this occurs, press the [Clear] key to clear the

error and the tone.

Special Symbol Indicators

Special symbols appear at the far left-hand side of the displays during

cash register operation. These symbols identify the amount shown, or

warn of an error condition. They include:

C (Change) Indicates that the displayed amount is the change due

to the customer.

E (Error) Indicates when an error is made during operation or

when programming the cash register. An error tone sounds

to alert the operator.

S (Sub-total) Indicates that the amount shown is the subtotal of a

transaction, including sales tax if applicable.

= (Total) Indicates that the amount shown is the transaction total.

- (Minus) Displays a negative entry. Also displays if subtotal or cash

tendered total is a negative number due to a return or

refund.

Indicates when the journal paper is low.

CA (Cash) Indicates when the total displayed refers to a sales

transaction paid by cash.

Ch (Check) Indicates when the total displayed refers to a sales

transaction paid by check.

Cr (Charge) Indicates when the total displayed refers to a sales

transaction paid by charge.

Displayed when the Euro key is pressed to indicate that

the amount is displayed in the Euro currency.

These symbols clear automatically when you start the next entry or

press the [Clear] key.

ENGLISH

7

Page 15

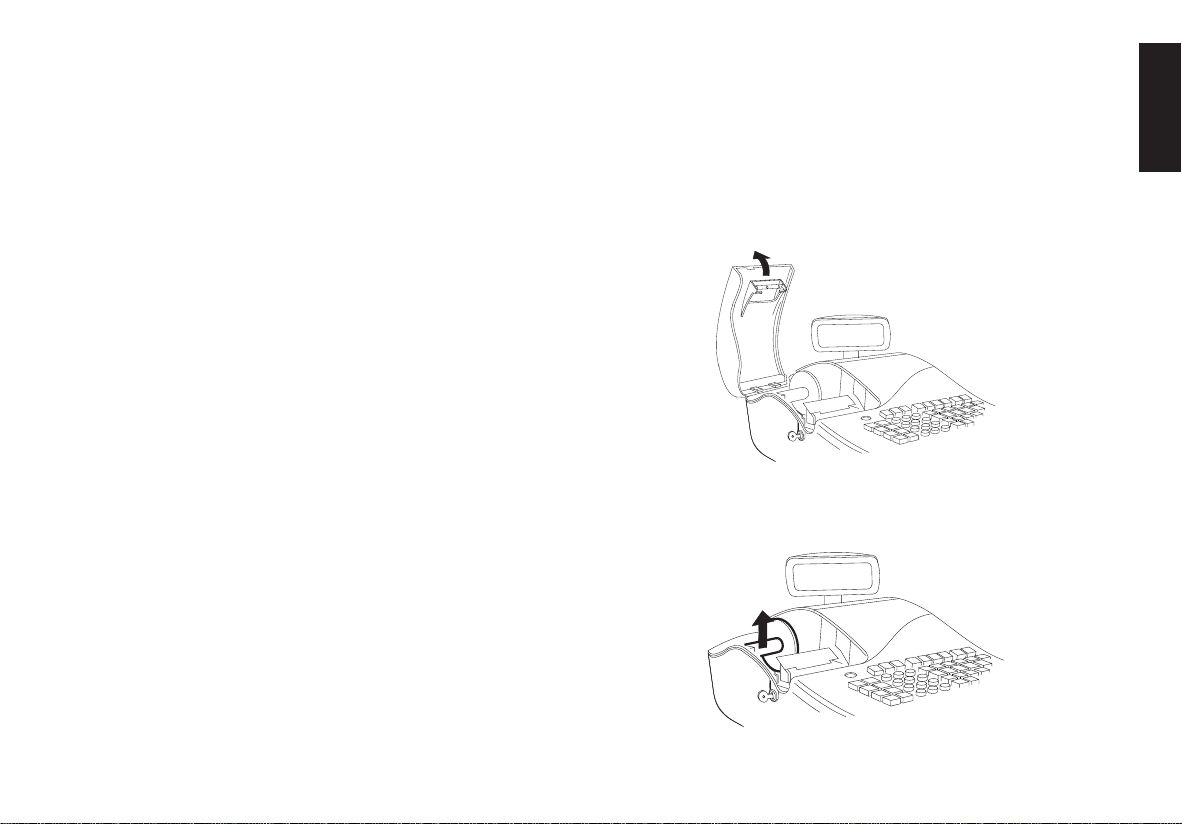

Positioning the Customer Display

To position the customer display, simply pull it up from its slot on the

casing and rotate it to the position desired.

Error Conditions

General Clearance

If the cash register does not function, for example while programming

and the error signal cannot be stopped by pressing the [Clear] key,

perform a general clearance. There are two ways of performing a

general clearance, whereby the second method resets all totals and

counters and cancels the programming. Use this method only as

last resort.

The Error Alarm

The error alarm warns of an operator error (usually when a wrong key

is pressed for a specific type of entry) or of an error made during cash

register programming. The error alarm can also indicate that the

Control Lock is in the wrong position for the current operation. In case

of error, the error tone sounds, the letter E is displayed on the customer

and operator displays and the keypad locks.

Clearing an Error

Press the [Clear] key to clear an error. The tone ends, the displays

clear and the keypad unlocks, allowing you to continue with the

transaction or restart the program.

If an error condition cannot be cleared, perform a general clearance.

Bear in mind, however, that one of the two general clearance

procedures, explained in the next section, will set all counters and

totals to zero and will cancel all programmed functions.

NOTE: The [Clear] key also clears an incorrect entry from the display

prior to pressing a registration key. Once an entry is printed,

the [Void] key must be used to correct an error.

8

General Clearance without Clearing Totals and the

Programming

1. Turn the Control Key to the OFF position.

2. Make sure four charged AA batteries are inserted in the battery

compartment.

3. Unplug the cash register from the power socket.

4. Wait ten seconds and then reconnect the cash register to the power

socket and resume your operation.

If the cash register remains in an error condition, proceed with the

second general clearance method.

General Clearance with the Clearing of Totals and all

Cash Register Programming

NOTE: Be careful that this procedure erases all totals and counters,

and cancels the programming of the cash register.

1. Turn the control key to the OFF position.

2. Open the printer compartment cover and remove the back-up

batteries.

3. Unplug the cash register from the power socket.

4. Wait for 15 minutes and then plug the cash register back to the

electrical power outlet.

5. Insert the batteries once again.

6. Reprogram the cash register.

Page 16

Voiding Errors

Once an entry is printed, the [Clear] key cannot be used to clear an

error. Press the [Void] key to correct an error already registered.

Voiding the Entry Just Completed

Simply press the [Void] key. The entry is reprinted with a "-" symbol

followed by the amount and erased from the transaction.

Voiding an Earlier Entry

To void an earlier entry, register it again and then cancel it using the

[Void] k ey. When a transaction including the error is completed,

proceed with the following steps to void the error.

1. Retype the incorrect information, exactly as originally entered, and

press the [Void] key.

2. Enter the correct amount.

3. Total the transaction by pressing the [Amt Tend/TOTAL] key.

Back-up Battery System

Inserting/Replacing Batteries

NOTE: Before inserting the batteries, make sure that the cash register

is plugged into the power socket and that the control key is

switched to the OFF position.

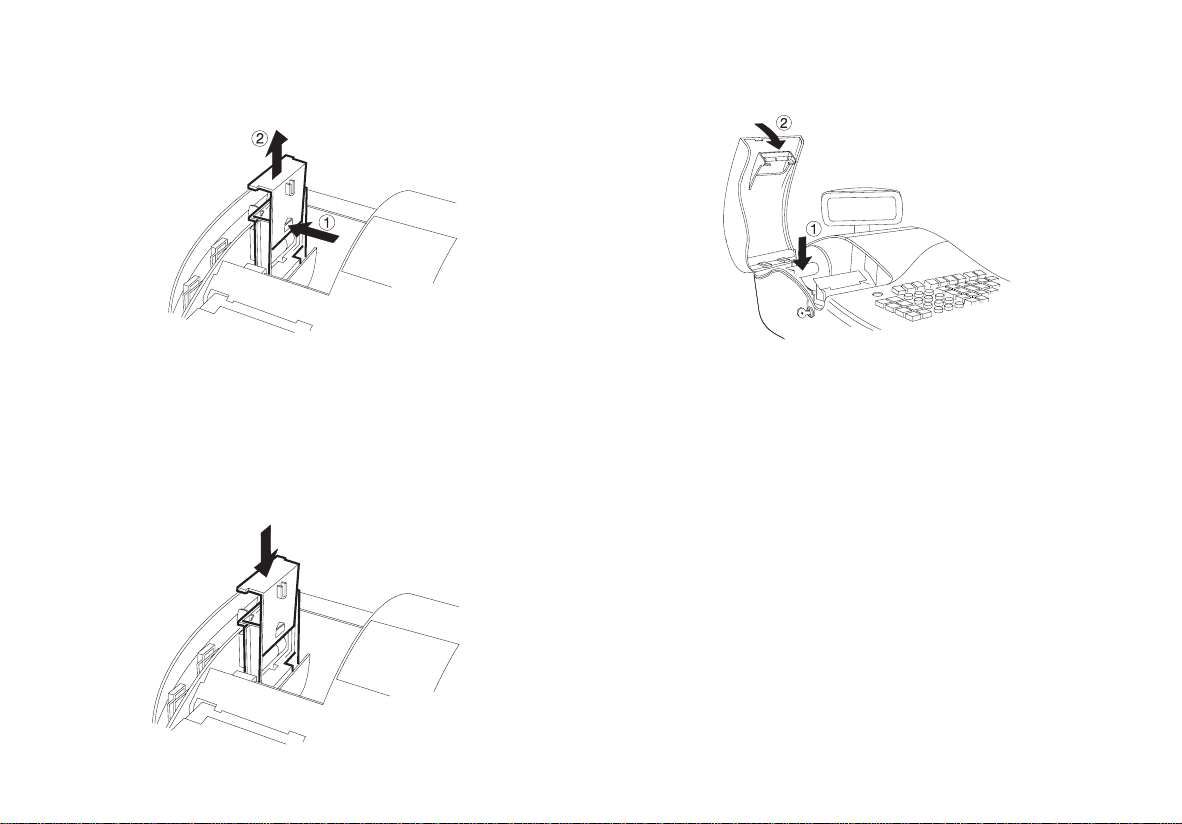

Proceed as follows to insert or replace the batteries:

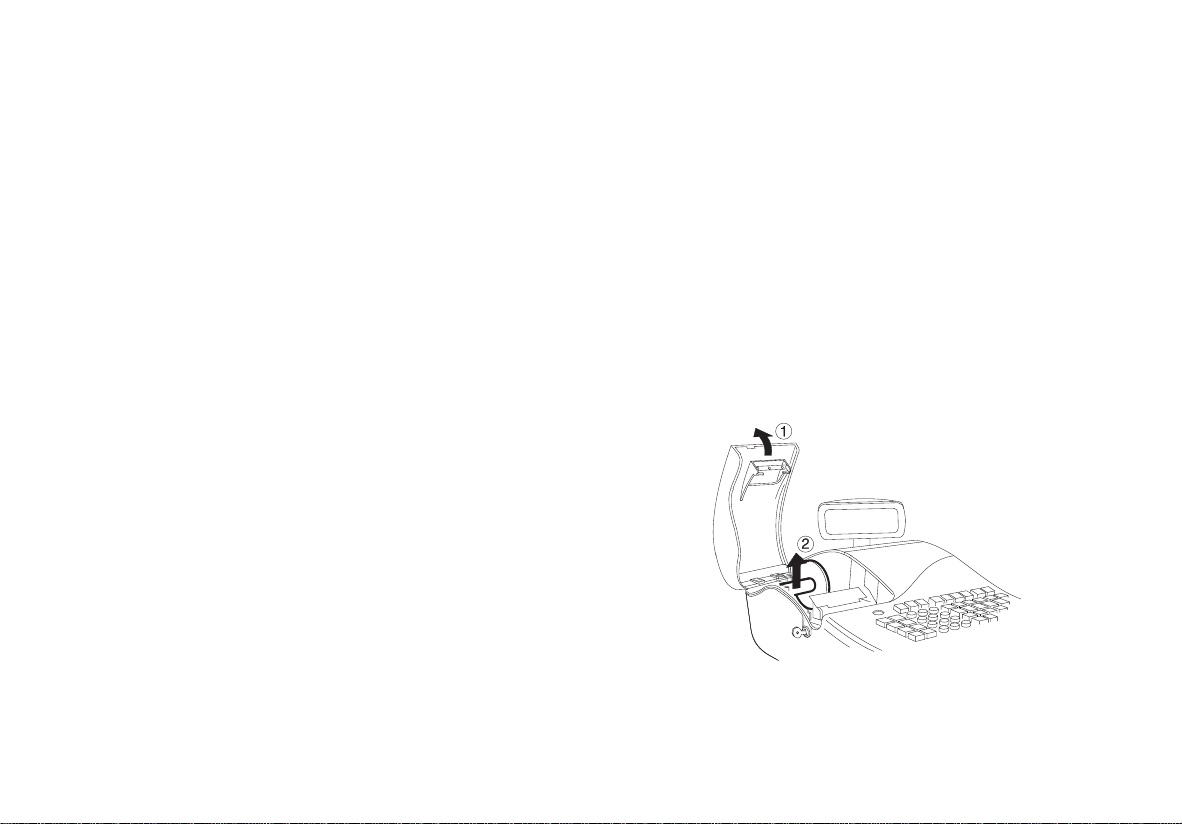

1. Unlock the printer compartment cover, grip the left side of the

compartment cover, gently pull it back and then lift it off the cash

register.

ENGLISH

During cash register operations, all transaction data for the management report is stored in the register's memory. This memory also holds

all optional programming information. The memory back-up system

keeps this information stored in memory when the cash register is

turned off.

The memory is protected by four "AA" batteries that come with your

cash register. In order to guarantee continuous back-up protection,

insert the batteries before beginning to program the cash register.

The machine must be plugged into an electrical outlet before you

insert the batteries.

2. Lift the paper journal winder spindle out of the printer compartment.

9

Page 17

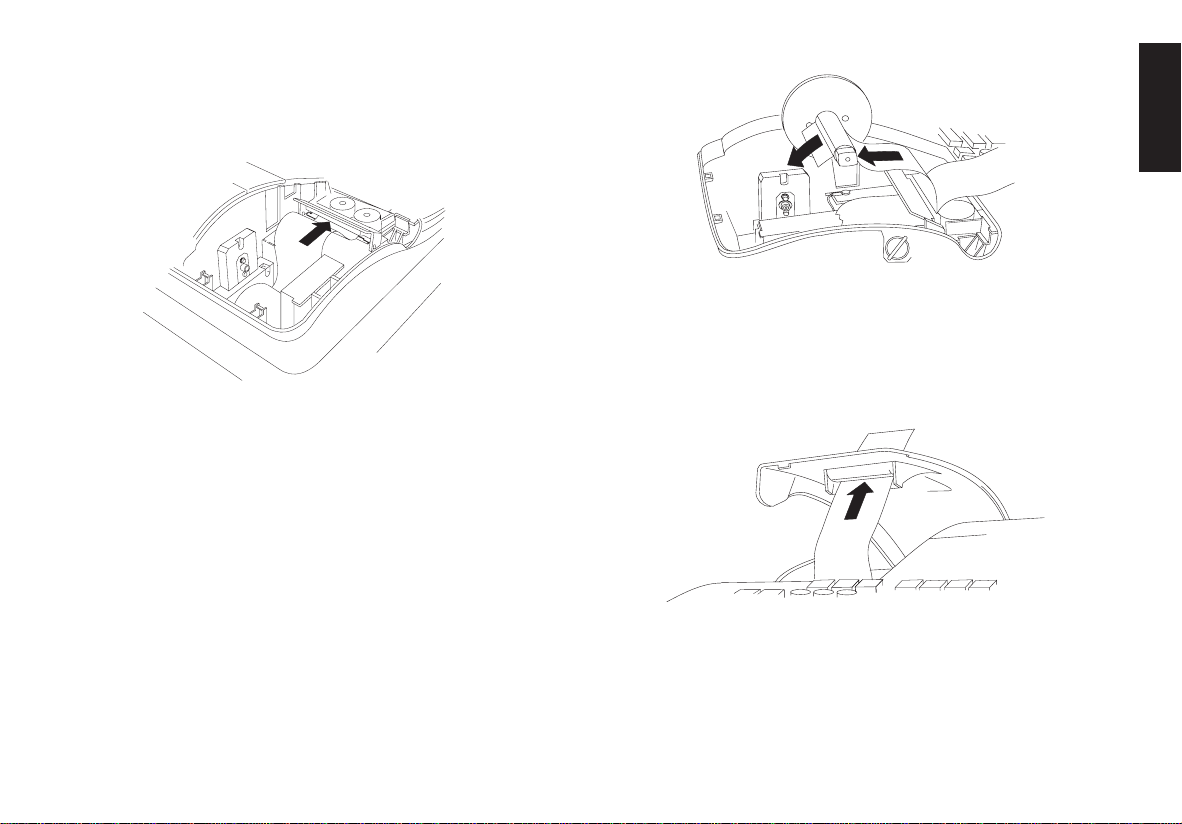

3. Remove the battery compartment cover by pressing on the arrow

impressed on the cover and lifting upwards, as shown by the arrows

in the figure.

7. Reposition the journal winder spindle, then reposition, close and

lock the printer compartment cover.

4. Remove the discharged batteries if you are replacing the batteries.

5. Position the new batteries making sure that the positive and

negative poles are aligned correctly. Drawings inside the battery

compatment show how the batteries must be positioned.

6. Replace the battery compartment cover by sliding it down until it

clicks into place.

10

NOTE: If the cash register will not be used for an extended period of

time, you may want to remove the back-up batteries to prolong

their usage. Doing this will erase all transaction and

programming data stored.

Printer Compartment

The printer compartment is on the top left-hand side of the cash

register. It houses the paper tape, journal winder spindle, inked ribbon,

back-up batteries and the printer.

The Inked Ribbon

This cash register uses a standard inked ribbon which needs replacing

when faded characters are printed. The next section explains how to

install the inked ribbon when printing becomes light.

Page 18

Installing the Inked Ribbon

Proceed as follows to install the inked ribbon:

1. Unlock, open and remove the printer compartment cover.

2. Remove the paper tape from the print mechanism by sliding it

backwards towards the rear of the cash register.

If dual-ply paper is loaded in the cash register, lift the plastic

journal winder out of the cash register and unwind and free the

journal record from the winder spindle. Then remove the paper tape

from the print mechanism by sliding it backwards towards the rear

of the cash register.

3. Remove the "THANK YOU" stamp as explained in the next section.

4. Remove the used ribbon by lifting the two spools from their related

spindles and the ribbon out of the print mechanism.

5. Place a full spool of ribbon on the left spindle and unwind approximately three inches of ribbon.

6. Place the ribbon along the outside of the metal brackets and through

the printer mechanism as shown in the following figure.

7. Place the take up spool on the right spindle and then turn it to take

up the slack in the ribbon.

ENGLISH

8. Refit the "THANK YOU" stamp.

9. Load the paper tape back into the printer and through the print

mechanism. If the cash register was using dual-ply paper, load the

paper tape back through the print mechanism, and wind the journal

back onto the plastic journal winder spindle. Instructions on how to

load dual-ply paper are provided further on.

10.Reposition, close and lock the printer compartment cover.

11

Page 19

Re-inking the Thank You Stamp

Your cash register is equipped with a pre-inked rubber stamp that

automatically prints "YOUR RECEIPT THANK YOU" on every

receipt.

If the print becomes unclear or faint, you will need to re-ink the

stamp as follows:

1. Unlock, open and remove the printer compartment cover.

2. The Thank You stamp is located directly in front of the printer.

Grasp the stamp pad on both ends and pull upward.

3. On the reverse side of the stamp pad is a small hole. Feed one drop

of ink into the hole.

4. Replace the stamp pad. Be sure that it snaps into place securely.

5. Reposition, close and lock the printer compartment cover.

Paper Tape

This cash register uses standard 2 1/4" (57 mm) paper. The paper

needs to be changed when a red line appears on the tape. You can use

either single-ply or dual-ply paper. Use dual-ply paper whenever you

want to print customer receipts and journal records, single-ply when

just customer receipts need to be printed.

Loading Single-Ply and Dual-Ply Paper

Proceed as follows to load the cash register with either single-ply or

dual-ply paper.

1. Make sure the cash register is plugged into a grounded power outlet

and that the control key is in the REG position.

2. Unlock, open and remove the printer compartment cover, then

remove the plastic journal winder spindle.

12

3. With a pair of scissors, cut the end of the paper tape to create a

straight, even edge so that the paper can be properly fed through the

print mechanism.

Page 20

4. Set the paper roll in the bottom of the printer compartment so that

the paper feeds out from the bottom of the roll.

5. Insert the edge of the paper into the paper slot as shown in the

figure.

6. Press the [Feed] key and manually feed the paper into the slot until

the paper catches and advances approximately six to ten inches

above the print mechanism.

NOTE: If the paper does not feed properly, check the alignment of the

paper in the slot and/or for the straight edge on the end of the

paper roll.

7. If you are loading dual-ply paper for a journal record, slide the top

edge of the inner ply through the slots on the plastic journal winder

spindle and manually roll the winder toward the rear of the rear of

the cash register to take up slack in the tape. Make sure that the two

wheels on the spindle are positioned towards the right-hand side.

ENGLISH

8. Replace the journal winder spindle in the printer compartment (the

two wheels must be positioned towards the right-hand side).

9. Pass the edge of the customer receipt (or the outer ply when using

dual-ply paper) through the receipt window on the compartment

cover.

10.Reposition, close and lock the printer compartment cover.

13

Page 21

Quick Start

Quick Start is a brief but complete start-up procedure that allows you

to begin using your new cash register as quickly as possible. Carefully

follow the steps listed below:

1. Make sure cash register is plugged into a grounded power outlet.

2. Insert the PRG key into the Control Lock and turn it to the PRG

position.

3. Set the current date in the day/month/year format by typing the

corresponding numeric keys and then pressing [#/ST/NS]. Single

digits must be preceded by a zero. For example, to set January 10,

2001, type [100101] and then press the [#/ST/NS] key to store your

entry.

If you wish that the date just entered be printed in the

month/day/year format, type [40] and then press the [Void] Key.

4. Set the current time using the 24-hour (military) format and then

pressing [Qty/Time]. Also in this case single digits must be

preceded by a zero. For example, to set 1:05 P.M., type [1305] and

then press the [Qty/Time] to store your entry. To set 9:15 A.M.,

type [0915] and then press [Qty/Time].

If you wish that the time just entered be printed in the 24-hour

format, type [220] and then press the [Void] Key.

5. Set a machine number by entering a four digit number and then

pressing [+%/PO]. For example, to set machine number 5, type

[0005] and then press [+%/PO].

6. Set the first of up to four possible VAT rates. For example, to set a

VAT1 rate of 16%, type [1] and then press the [Tax Set] key, type

[16000] (three digits must be entered after the desired decimal

point) and then confirm with the [Amt Tend/TOTAL] key.

7. Program standard Department 1 as VAT1 to a multiple positive item

price sale. For example, to assign VAT1, multiple single item cash

sale and a price of £3.00 to standard Department 1, type [000001]

and then press [Subtotal w/Tax], type [300] and then press

[Department 1/21].

8. When programming is complete, exit the program mode by turning

the PRG key to the OFF position.

9. Practice normal sales transactions by switching the cash register

into the Training Mode. This mode is very useful to new users as it

allows them to simulate sales transactions without recording these

trials in the X or Z management reports. More information on this

mode is give in the section entitled Training Mode.

Once you have mastered the Quick Start operations, you will undoubtedly want to expand your use of the machine by studying other

sections of this manual and incorporating new programming into your

personalized cash management system. For example, other valueable

functions include Percent Discount Rate, Percent Plus Rate, Price

Look-Ups (PLUs), Euro Currency Conversions, and many more.

Helpful Hints for a Successful Start-Up

This cash register has up to 40 departments available. You may

assign the taxable status to any other department by repeating the tax

assignment procedure used for Department 1. For departments 21-40,

press the [Dept Shift] key before the applicable department key. For

example, to select Department 26 press [Dept Shift] followed by the

[Department 6/26] key.

14

Page 22

Training Mode

Cash Register Programming

The optional training mode is designed to help you become better

acquainted with the register mode and offers an ideal place for beginners to practice transaction examples. Once the training mode is

activated, you cannot operate in the PRG, X or Z modes. The transactions made in the training mode are not recorded in the X or Z reports

and are not summed to machine totals. Receipt numbers are not

counted either.

Activating the Training Mode

Proceed as follows to switch the cash register into the training mode:

1. Turn the PRG control key to the PRG position.

2. Type [666666] and press the [Amt Tend/TOTAL] key. A dot

indicating the Training Mode On condition is displayed on the lefthand side of the operator and customer displays.

3. Turn the key to the REG position to perform normal cash register

operations.

Exiting the Training Mode

Proceed as follows to exit the training mode and therefore re-enable

the cash register to record all sales transactions in the X and Z management reports and in the machine totals.

1. Turn the PRG control key to the PRG position.

2. Type [555555] and press the [Amt Tend/TOTAL] key.

3. Turn the key to the desired operating position.

This cash register can be programmed to tailor its features according

to your specific needs. This programming facility allows you to:

• Define three-digit secret codes for each of the 15 programmable

clerks

• Set a machine number

• Set the date and time

• Set percent discount (-%) rates

• Set percent plus (+%) rates

• Define fraction rounding

• Define decimal point positions

• Define up to four VAT rates

• Define Price Look-Ups (PLUs) for individual items

• Define tax status and High Digit Lock Out to the minus key

• Define tax status, High Digit Lock Out, Positive/Negative Single/

Multiple item sale and relative price to a defined and activated

department

• Define a normal department for negative price registrations

• Set an exchange rate for the Euro currency

• Program time reports

• Program the different system options available

• Define manager passwords for the PRG, X and Z modes.

Set some of or all of the above features, depending on your business

needs. These program settings will reside in the cash register's memory

until you change them or deactivate the battery back-up system.

ENGLISH

15

Page 23

Setting Cash Register Features

All cash register features are programmed by first switching the

cash register into the program (PRG) mode by using the PRG key.

This chapter provides simple step-by-step procedures on how to

program the cash register. An example is provided after each procedure.

It is suggested that you first run through all the examples to become

familiar with the cash register's programming facilities, then program

the cash register according to your own specific needs.

NOTE: Program all the desired features at the same time in order to

create a single receipt of all selections. Keep the receipt in a

safe place for future reference.

Exiting the Program Mode

Proceed as follows to exit the program mode once you have finished

programming the cash register:

1. Print a Program Tape by pressing [999999] followed by the

[Amt Tend/TOTAL] key, as explained in the section entitled

Overall Programming Dump Report, for a printed report on how the

cash register is currently programmed.

2. Store the program tape in a safe place for future reference.

3. Turn the PRG key or REG key to the REG position if you wish to

carry out sales transactions, or to the OFF position if you wish to

exit.

Making Changes to Cash Register Programming

Once the cash register is programmed to satisfy your specific needs,

there is no need to reprogram the entire machine to make single

program changes or corrections. If you wish to make a change (such as

an update to VAT rates, PLUs or Euro exchange rates), be sure you are

in the program mode, re-do the program in question and finalize when

you are ready to exit the programming mode. A new program entry will

automatically overwrite a previous entry for the same program.

Entering the Program Mode

To enter into the program mode simply insert the PRG key into the

Control Lock and turn it to the PRG position.

16

Clearing Errors

To clear an error made during the programming phase, simply press

the [Clear] key. The error tone ends, the display clears and the keypad

unlocks.

In case an error condition cannot be cleared, perform one of the two

general clearance methods explained in the section entitled General

Clearance. Remember that the second general clearance sets all

counters and totals to zero, and cancels all features programmed.

Page 24

Clerk Numbers and Secret Codes

Clerk codes are a special security feature to control access to the

register. You can program up to 15 individual clerk numbers linked to

secret entry codes of three digits each. By enabling the Clerk System

Active option as indicated in the Programming System Options section,

the register assigns the default security [000] to all clerks.

Programming a Secret Code Linked to a Clerk

Number

1. Insert the PRG key into the Control Lock and turn it to the PRG

position.

2. Type [171] and then press the [Void] Key to activate the Clerk

system.

3. Type [444444] and press the [Amt Tend/TOTAL] key. The message

"CLERK SE.C" is displayed.

4. Type a number to which the secret code will be linked.

5. Set a three-digit secret code by typing three [numeric keys].

6. Press the [Clerk] key.

Repeat the above operations (from step 4 to step 6) to assign a secret

code to the remaining 14 Clerks or use the [Clear] key to exit from

Clerk Secret Code programming.

If you wish to change the clerk's secret code and the Clerk system is

already activated, there is no need to perform step 2 above.

Example: Assign secret code 106 to Clerk 1 for the first time.

Type/Press:

[171] + [Void] + [444444] + [Amt Tend/TOTAL] + [1106] + [Clerk]

Deactivating the Clerk System

Proceed as follows if for any reason you wish to deactivate the Clerk

system, in other words if you no longer want to enter a clerk number

and related secret code to perform sales transactions.

1. Insert the PRG key into the Control Lock and turn it to the PRG

position.

2. Type [170] and then press the [Void] key.

Entering a Clerk Number/Secret Code Before Cash

Register Operations

Proceed as follows to enter a defined Clerk number and secret code

before using the cash register in the REG operating mode.

1. Turn the Control Lock to the REG position.

2. Type a Clerk number [1, 2, ... or 15].

3. Type the corresponding three-digit code.

4. Press the [Clerk] key.

A small bar appears on the far left-hand side of the displays to

indicate that it is now possible to carry out transactions. During sales

transactions the clerk number is printed on the receipt, under the date

and alongside the machine number.

ENGLISH

17

Page 25

Machine Numbers

The machine number is a four-digit number used to identify the cash

register. The machine number is printed on all receipts, journal records

and management report.

Proceed as follows to set a machine number:

1. Turn the PRG key to the PRG position.

2. Type the [numeric keys] corresponding to the machine number to

be assigned (up to 4 digits, 0-9999).

3. Press the [+%/PO] key.

4. Program another feature or exit program mode by turning the PRG

key to the OFF position.

Example: Program machine number 1234.

Type/Press:

[1234] + [+%/PO]

Date and Time

Set the date option to print the current date at the top of each receipt,

journal record or management report. The date will print in the day/

month/year format unless otherwise programmed as explained in the

section entitled Programming System Options.

Set the time option to print the current time at the bottom of the

receipt. The time prints in the hour:minutes format. You can display the

time by pressing the [Qty/Time] key when the cash register is in the

REG mode. The keypad is locked when the time is displayed; to unlock

the keypad simply press one of the numeric keys (0-9/00) or press the

[Clear] key.

The date and time change automatically as long as the cash register is

plugged into the wall outlet or the battery back-up system remains

active.

Setting the Date

Proceed as follows to set the current date:

1. Turn the PRG key to the PRG position.

2. Type the [numeric keys] representing the current date. Remember

to use the DDMMYY format. Single digit numbers for months and

days must be preceded by a zero (0).

3. Press the [#/ST/NS] key to store the date.

4. Program another feature or exit program mode by turning the PRG

key to the OFF position.

Example: Set a date of January 10, 2001.

Type/Press:

[100101] + [#/ST/NS]

NOTE: If you wish that the date just entered be printed and displayed

in the month/day/year format, type [40] and then press the

[Void] Key. More information on how to change the cash

register's basic programming is explained in the section

Programming System Options.

Setting the Time

Proceed as follows to set the correct time in the hour:minutes format:

1. Turn the PRG key to the PRG position.

2. Type the [current time] using the HH:MM format.

NOTE: Time is set according to international, or military time

(24-hour clock format). To correctly enter this time, simply

add 12 to all hours in the PM. For example, to set the time to

9:00 AM, type [0900]; to set the time to 2:15 PM, type [1415].

3. Press the [Qty/Time] key to store the entered time.

4. Program another feature or exit program mode by turning the PRG

key to the OFF position.

18

Page 26

Example: Set the time at 3:30 PM.

Type/Press:

[1530] + [Qty/Time]

NOTE: If you wish that the time just entered be printed and displayed

in the 24-hour format, type [220] and then press the [Void]

Key. More information on how to change the cash register's

basic programming is explained in the section Programming

System Options.

Percent Discount (-%)

Setting this option automatically calculates the preset rate each time

the [-%/RA] key is pressed. The percentage rate can be discounted from

an individual item or from a sales transaction total.

Setting a Percent Discount (-%) Rate

Proceed as follows to define a standard discount rate:

1. Turn the PRG key to the PRG position.

2. Type the [numbers] representing the desired percentage rate. Up to

four digits ranging from 0 to 99.99 can be used, and you MUST

enter a total of four digits, two before and two after the desired

decimal place. For example, to enter 10%, type [1000], to enter

6.5% type [0650].

3. Press the [0] key followed by the [-%/RA] key to store the rate.

4. Program another feature or exit program mode by turning the PRG

key to the OFF position.

Example: Program a standard 10% discount rate.

Type/Press:

[1000] + [0] + [-%/RA]

Percent Plus Rate (+%)

Setting this option automatically calculates the preset add-on rate

each time the [+%/PO] key is pressed. This percentage rate can be

added to an individual item or to a transaction total.

Setting a Percent Plus (+%) Rate

Proceed as follows to define a standard add-on rate:

1. Turn the PRG key to the PRG position.

2. Type the [numbers] representing the desired percentage rate. Up to

four digits ranging from 0 to 99.99 can be used, and you MUST

enter a total of four digits, two before and two after the desired

decimal place. For example, to enter 10%, type [1000], to enter

6.5% type [0650].

3. Press the [0] key followed by the [+%/PO] key to store the rate.

4. Program another feature or exit program mode by turning the PRG

key to the OFF position.

Example: Program a standard 3% add-on rate.

Type/Press:

[0300] + [0] + [+%/PO]

ENGLISH

19

Page 27

Fraction Rounding

Fraction rounding is used to round figures with decimals up or down

to the nearest whole numbers and is used for percent tax, percent

discount and percent add-on calculations. Choose from the following

three options to select the rounding as needed:

Rounding Code Fraction Rounding

00 a fraction of a pence is rounded down one pence

50 a fraction under one half pence is rounded

down one pence, a fraction above one half pence

is rounded up one pence

99 a fraction of a pence is rounded up one pence

Setting the Rounding Code

Proceed as follows to program fraction rounding:

1. Turn the PRG key to the PRG position.

2. Type the [rounding code] and press the [Charge] key.

3. Program another feature or exit program mode by turning the PRG

key to the OFF position.

Example: Program the rounding code so that a fraction under one half

pence is rounded down one pence, a fraction above one half pence

is rounded up one pence up.

Type/Press:

[50] + [Charge]

Decimal Point Position

The decimal point setting is preset to the x.xx format. This format

can be changed, as needed, to one of the other settings below.

Changing the Decimal Point Position

Proceed as follows to define a new position for the decimal point.

1. Turn the PRG key to the PRG position.

2. Type the status number [0, 1, 2 or 3] to select the desired format as

indicated in the following table:

Status Number Format

0x

1 x.x

2 x.xx

3 x.xxx

3. Press the [-%/RA] key to set the new format.

4. Program another feature or exit program mode by turning the PRG

key to the OFF position.

Example: Program the cash register so that two digits are left after the

decimal point.

Type/Press:

[2] + [-%/RA]

20

Page 28

Value Added Tax (VAT) Rates

Up to four VAT rates (VAT 1, VAT 2, VAT 3 and VAT 4) can be preset

in the cash register. A maximum 5-digit VAT rate can be programmed

(0-99.999%).

Setting a Fixed VAT Rate

Proceed as follows to program a fixed tax rate:

1. Turn the PRG key to the PRG position.

2. Type the [numbers] which represent the VAT (1 for VAT 1, 2 for

VAT 2, 3 for VAT 3 and 4 for VAT 4).

3. Press the [Tax Set] key. The message "VAT n RATE" appears on the

operator display where n is the number representing the VAT rate.

4. Type the VAT rate. Up to five digits can be used, and you MUST

enter three digits after the desired decimal place. For example, to

enter a 5.5% VAT rate, type [5500]; to enter a 16% VAT rate, type

[16000].

5. Press the [Amt Tend/TOTAL] key.

6. Program another feature or exit program mode by turning the PRG

key to the OFF position.

Example: Set a VAT 1 rate of 5.5%, VAT 2 rate of 7%, VAT 3 rate of

16% and a VAT 4 rate of 20%.

Type/Press:

[1] + [Tax Set] + [5500] + [Amt Tend/TOTAL]

[2] + [Tax Set] + [7000] + [Amt Tend/TOTAL]

[3] + [Tax Set] + [16000] + [Amt Tend/TOTAL]

[4] + [Tax Set] + [20000] + [Amt Tend/TOTAL]

NOTE: The programmed VAT rates are identified on the sales receipt

with the following printed symbols: TI for VAT 1, TII for VAT

2, TIX for VAT 3 and TIIZ for VAT 4.

High Digit Lock Out (HDLO) and Tax Status

Assigned to the Minus Key (-)

You can limit the number of digits, i.e. the maximum value of a

minus key operation, from 1 to 7 digits. This makes sure that minus key

amounts do not exceed a maximum amount. You can also assign a VAT

rate or a non tax status to the minus key. Make your selections for this

feature from the following options:

High Digit Lock Out Taxation

0 = 7 digits (99999.99) 00 = Non taxable

1 = 1 digit (0.09) 01 = VAT 1

2 = 2 digits (0.99) 02 = VAT 2

3 = 3 digits (9.99) 03 = VAT 3

4 = 4 digits (99.99) 04 = VAT 4

5 = 5 digits (999.99)

6 = 6 digits (9999.99)

Programming the High Digit Lock Out and Tax Status

1. Turn the PRG key to the PRG position.

2. Type the HDLO code [0-6].

3. Type the tax status code [00-04].

4. Press the [-] key.

5. Program another feature or exit program mode by turning the PRG

key to the OFF position

Example: Allocate a maximum of 5 digits and VAT 2 to the minus key.

Type/Press:

[5] + [02] + [-]

ENGLISH

21

Page 29

Tax Status, High Digit Lock Out, Pos./Neg. Single/

Multiple Item Sale and Price Linked to a Defined

Department

You can assign the following to individual departments:

• A department status, consisting of:

- Department activation or deactivation, where a deactivated

department cannot be used during a sales transaction. If you try

to use a deactivated department an error tone is sounded and

the letter "E" is displayed on the left-hand side of the displays.

- Department definition, meaning a Standard department where

ordinary items are sold or a Gallonage department where oil,

liquids, etc. are sold at unit price per gallon, liter, etc.

- Positive or negative single item cash transaction or multiple

item transaction capability whereby the department will

ring up each item entered as a positive or negative single

item transaction or as a positive or negative multiple item

transaction. The negative status allows you to perform negative

transactions where by the clerk pays back money to

customers (such as refunds on deposits).

- A High Digit Lock Out code whereby you prohibit item entries

for a certain number of digits and above.

- A taxable or non-taxable status.

• The price which will ring up automatically every time the appropriate department key has been pressed. You can also skip this option,

in which case the price has to be entered manually before pressing

the department key.

The 6-digit department status can be programmed using the following

options:

Active Dept Dept. Def. Pos./Neg. Single/

Multiple Item Cash Sale

0 = Activate Dept 0 = Standard Dept 0 = Normal Dept (Pos.)

1 = Deactivate Dept 1 = Gallonage Dept 1 = Normal Dept (Neg.)

2 = Single item cash (Pos.)

3 = Single item cash (Neg.)

High Digit Lock Out T ax Status

0 = 7 digits (99999.99) 00 = Non tax.

1 = 1 digit (0.09) 01 = VAT 1

2 = 2 digits (0.99) 02 = VAT 2

3 = 3 digits (9.99) 03 = VAT 3

4 = 4 digits (99.99) 04 = VAT 4

5 = 5 digits (999.99)

6 = 6 digits (9999.99)

If Gallonage is selected as the department definition, during a sales

transaction the three numbers entered after the decimal point will be

rounded off according to the fraction rounding setting.

22

Page 30

Linking an HDLO, Tax Status, Pos./ Neg. Single/Multiple

Item Cash Sale and Item Price to a Defined

Department

1. Turn the PRG key to the PRG position.

2. Type the [Activate department], [Department definition], [Pos./

Neg. Single/Multiple Item Cash Sale], [HDLO] and [Tax Status]

options by referring to the previous table. A six-digit status code

must be entered.

3. Press the [Subtotal w/Tax] key to confirm your entry. The message

"DEPT PRICE" appears on the displays.

4. Type a [price] of up to 7 digits to assign to a specific item and then

press the relative [Department] key.

5. Program another feature or exit program mode by turning the PRG

key to the OFF position.

Example: Assign a 5-digit HDLO, VAT 1, positive multiple item sale,

a price of £2.50 to an item in activated standard Department 1.

Type/Press:

[0] + [0] + [0] + [5] + [01] + [Subtotal w/Tax] + [250] +

[Department 1/21]

Price Look-Ups (PLUs)

Price Look-Ups simplify cash register operations by automatically

registering an individual item's price (up to 999 can be registered),

department number, tax status and rate (if applicable). To look up

individual item prices, simply type the item's corresponding PLU

number [1] and press the [PLU] key.

Creating Price Look-Ups

Proceed as follows to create a price look-up:

1. Turn the PRG key to the PRG position.

2. Press the [Qty/Time] key. The message "PLU001 PRI" appears on

the displays, informing you of the PLU number (001). If you wish to

change the PLU number from 001 to another number such as 30,

type [030] and then press the [PLU] key.

3. Type the [unit price] that you wish to assign to that PLU.

4. Press the appropriate [Department] key to assign the PLU to a

Department from 1 to 20. Use the [Dept Shift] key for departments

from 21-40.

5. Press the [Qty/Time] key to program another feature, otherwise exit

the program mode.

Example: Create PLU 1 with a unit price of £2.69 assigned to Department 3 and then create PLU 320 with a unit price of £5.00 assigned to

Department 33.

Type/Press:

[Qty/Time] + [269] + [Department 3/23] + [320] + [PLU] + [500] +

[Dept Shift] + [Dept 13/33] + [Qty/Time]

Euro Exchange Rate Programming

You can program the Euro exchange rate so that the cash register can

automatically calculate the transaction from your local currency into the

Euro currency and vice versa depending on the cash register's base

currency (Local or Euro). The cash register is programmed by default so

that your local currency is the base currency. If you wish to change the

base currency to Euro, refer to the "Programming System Options"

section in this manual, Machine Condition 30.

Programming the Euro Exchange Rate

Euro exchange rate programming consists of firstly defining the

position of the decimal point of the Euro exchange rate (0-8 digits after

the decimal point), the position for the decimal point of the changed

amount which is also printed on the sales receipt (0-3 digits after the

decimal point), and then the actual current exchange rate (up to 5

digits). To provide you with the Euro currency value, the cash register

divides the local currency value by the exchange rate defined.

ENGLISH

23

Page 31

Proceed as follows to program or update the exchange rate of your

local currency into Euro:

1. Turn the PRG key to the PRG position.

2. Type the [decimal point position] of the exchange rate (0-8 digits

after the decimal point).

3. Type the [decimal point position] of the converted amount

(0-3 digits after the decimal point).

4. Type the [exchange rate] using up to six digits without specifying

any decimal point.

5. Press the [Euro] key to store the exchange rate.

Example: Program an exchange rate of £ 0.62 to the Euro.

Type/Press:

[2] + [2] + [000062] + [Euro]

Programming System Options

Your cash register's system options programmig feature includes 30

options for the operation of the cash register, receipt printing and

management report printing. Each of the functions described in this

section is already set upon delivery of the cash register to meet the most

frequent requirements. The cash register's factory default settings,

which you can reprogram at any time, are indicated in bold print in the

table below.

Machine Settings

Condition

1 0 = Grand Total will not reset after Z1 financial report

1 = Grand Total will reset after Z1 financial report

2 0 = Subtotal will print when the "#/ST/NS" key is pressed

1 = Subtotal will not print when the "#/ST/NS" key is pressed

Department Programming for Credit 1, Credit 2

Tenders

With reference to the section entitled Programming System Options,

you can set Machine Condition 21 so that the cash register reserves

Departments 20 or 15, or both, for the registration of credits deriving

from sales transactions. By means of this function, you can assign

Credit 1 to the transactions paid with one type of credit card and Credit

2 to those paid with another.

To change the default setting of Machine Condition 21 follow the

instructions provided in the section entitled "Changing the Cash

Register's Standard Settings".

24

3 0 = Amount tender is not compulsory

1 = Amount tender is compulsory

4 0 = Date setting in the "month - day - year" format

1 = Date setting in the "day - month - year" format

5 0 = Z1 and Z2 counter will not reset after a Z report

1 = Z1 and Z2 counter will reset after a Z report

6 0 = VAT amount is printed on the receipt

1 = VAT amount is not printed on the receipt

7 0 = Zero skip on financial report

1 = Non-skip on financial report

8 0 = Date will print

1 = Date will not print

9 0 = Time will print

1 = Time will not print

Page 32

Machine Settings

Condition

Machine Settings

Condition

10 0 = Consecutive # will reset after a Z1 report

1 = Consecutive # will not reset after a Z1 report

11 0 = Item counter is printed on the receipt

1 = Item counter is not printed on the receipt

12 0 = Not mandatory to enter clerk number at each transaction

1 = Mandatory to enter clerk number at each transaction

13 0 = +%/-% addition and subtraction result to the department

1 = No +%/-% addition and subtraction result to the depart-

ment

14 0 = Receipt mode

1 = Journal mode

15 0 = Cash declaration not mandatory

1 = Cash declaration mandatory

16 0 = Cash drawer will open upon finalizing a sale with the Amt

Tend/TOTAL, Check, Charge or Credit 1-2 key

1 = Cash drawer will not open upon finalizing a sale with the

Amt Tend/TOTAL, Check, Charge or Credit 1-2 key

17 0 = Clerk system inactive

1 = Clerk system active

18 0 = VAT amounts are separately printed on the receipt

1 = Only the total VAT amount is printed on the receipt

19 0 = Reserved

1 = Reserved

21 0 = Normal keypad layout

1 = Dept. 20/40 used as Credit 1

2 = Dept. 15/35 used as Credit 2

3 = Dept 20/40 used as Credit 1 and Dept. 15/35 used as

Credit 2

22 0 = 24-hour indication

1 = 12-hour indication

23 0 = Duplicate Z report active

1 = Duplicate Z report inactive

24 0 = Type 1 keypad layout (40 departments)

1 = Type 2 keypad layout (24 departments)

25 0 = Non-selection of the Canadian taxation system of TAX ON

TAX

1 = Selection of Canadian taxation system of TAX ON TAX

26 0-7 = Reserved

27 0 = Euro convert function not allowed

1 = Euro convert function allowed

28 0 = Zero price entry not allowed

1 = Zero price entry allowed

29 0 = Print conversion tender only

1 = Always print tender

30 0 = Local base currency

1 = Euro base currency

ENGLISH

20 0-2 = Reserved

NOTE: Machine conditions 19, 20 and 26 are not available.

25

Page 33

Changing the Cash Register's Standard Settings

Proceed as follows if you wish to change any of the standard machine

settings indicated in the previous table:

1. Turn the PRG key to the PRG position.

2. Type the [number] of the machine condition (1-30 as indicated in

the table) that you wish to alter. Machine conditions 19, 20 and 26

are reserved and cannot be changed.

3. Type the [number] of the required setting.

4. Press the [Void] key.

5. Program another feature or exit the program mode by turning the

PRG key to the OFF position.

Example: Program the cash register so that the date is printed in the

MM/DD/YY format.

Type/Press:

[4] + [0] + [Void]

PLU Programming Dump Report

If a large number of PLUs are created (bear in mind that up to 999

PLUs can be programmed), a separate receipt can be printed indicating

all the PLUs programmed. Their number, associated price, VAT rate

indicator (if applicable) and associated department are reported on this

receipt, which should be kept in a safe place for future reference.

Printing an All PLU Dump Report

Proceed as follows to print a PLU report:

1. Turn the PRG key to the PRG position.

2. Press the [PLU] key to print the list.

3. Turn the PRG key to the OFF position to exit the program mode.

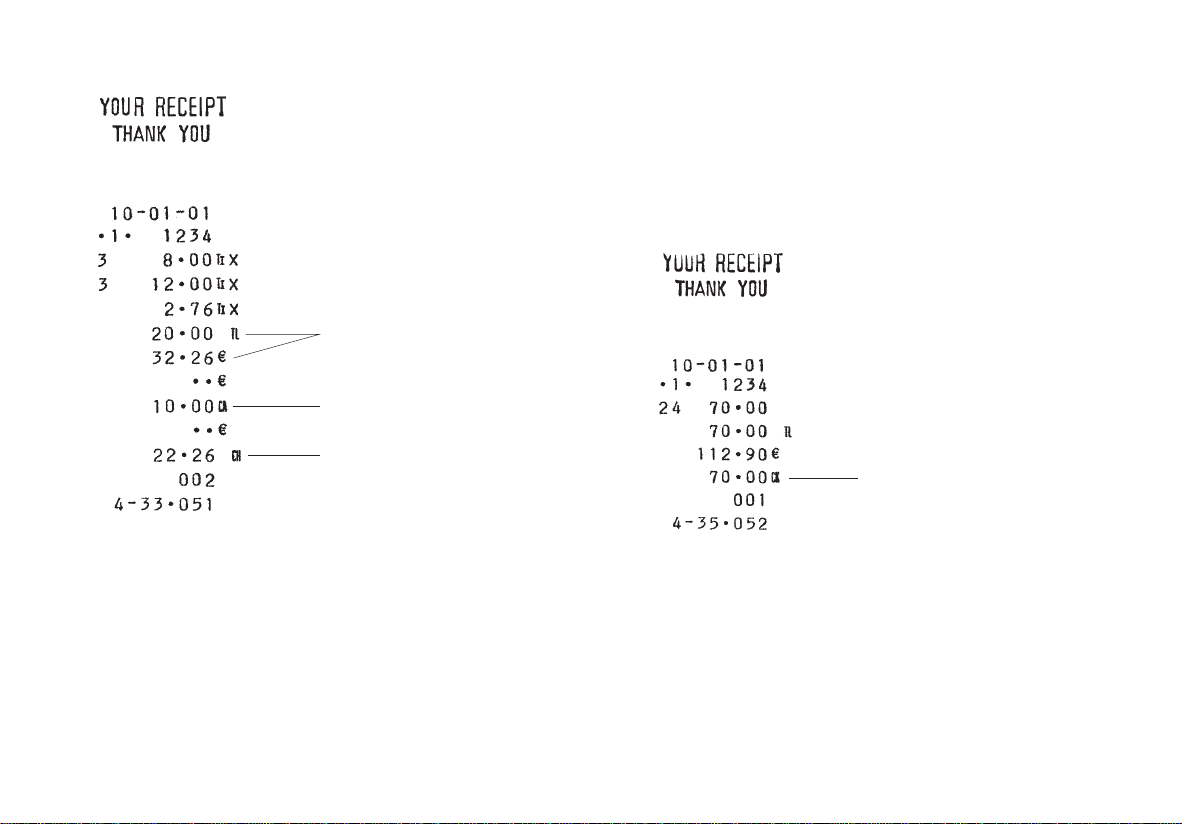

Shown below is an example PLU dump report.

Date

Machine number

PLU number

Time

Item price and

associated VA T

Consecutive

receipt number

26

Page 34

Overall Programming Dump Report

After programming your cash register to best suit the needs of your

business, you can print a tape record providing information on how the

cash register is programmed.

Printing the Programming Dump Report

Proceed as follows to print the program tape:

1. Turn the PRG key to the PRG position.

2. Type [999999] and press the [Amt Tend/TOTAL] key.

3. Turn the PRG key to the OFF position to exit the program mode.

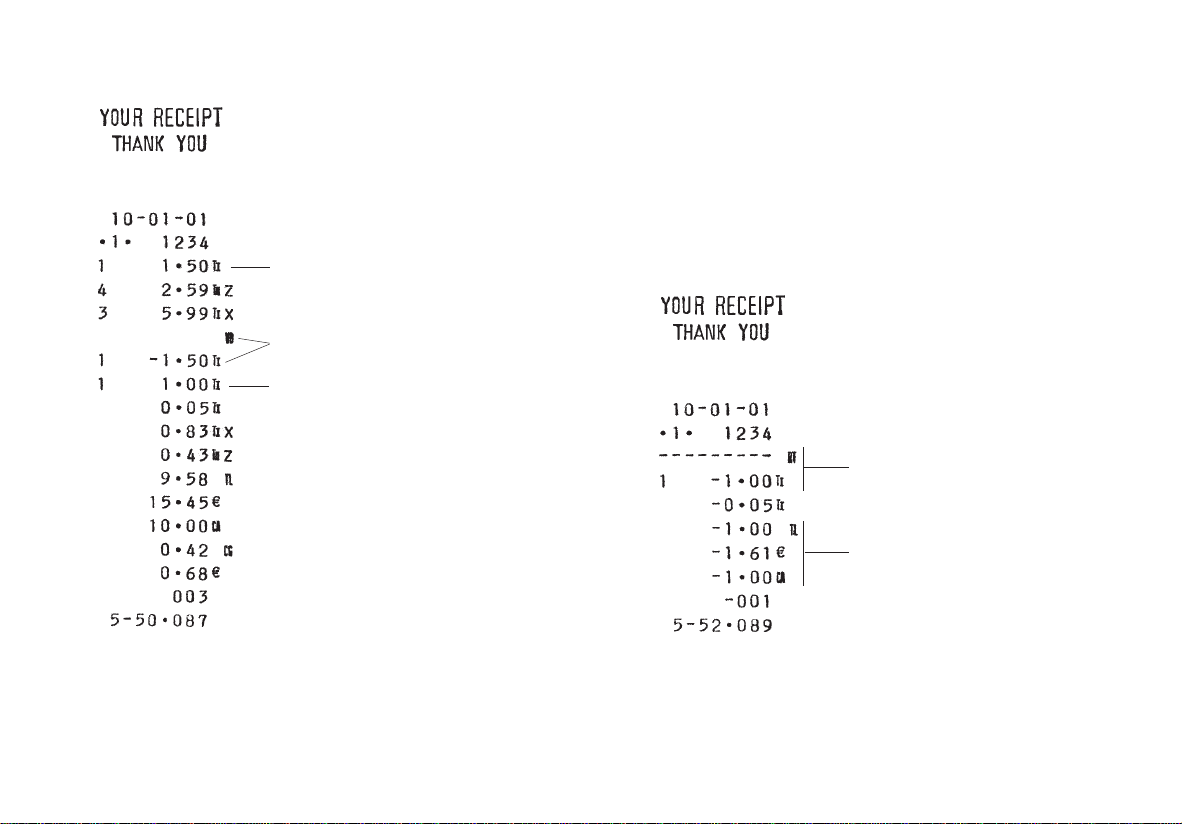

On the side you will find an example of the cash register's overall

programming dump report.

Shown below is an example printout of how your cash register is

programmed.

Date

Department

status

Department

number

Euro

exchange

rate

Machine number

Price linked to DEPT 1 with

VAT rate

Price linked to DEPT

2 with VAT rate

HDLO, minus key

VAT rate 1, 2, 3 and 4

Discount rate

Percent plus rate

Fraction rounding

ENGLISH

Time

System options

programming condition

Consecutive receipt number

27

Page 35

Programming Manager Passwords

You can define two individual manager passwords to prevent

unauthorized access to the machine's programming mode (PRG), Z

mode and X mode. One manager password grants access to the PRG

and Z modes, while another grants access to the X mode.

Defining a PRG and Z Mode Manager Password

Proceed as follows to define a manager password that grants access to

the PRG and Z modes:

1. Turn the PRG key to the PRG position.

2. Type [111111] and press the [Amt Tend/TOTAL] key. The message

"P Z PASS" appears on the displays.

3. Type your 4-digit manager password and then press the [Non Tax]

key.

NOTE: If you define a manager password of 0000, the password

security protection feature will not work.

Example: Define manager password 9876 for the PRG and Z modes.

Type/Press:

[111111] + [Amt Tend/TOTAL] + [9876] + [Non Tax]

Defining an X Mode Manager Password

Proceed as follows to define a manager password that grants access to

the X mode:

1. Turn the PRG key to the PRG position.

2. Type [222222] and press the [Amt Tend/TOTAL] key. The

message "X PASS" appears on the displays.

3. Type your 4-digit manager password and then press the [Non Tax]

key.

NOTE: If you define a manager password of 0000, the password

security protection feature will not work.

Example: Define manager password 7654 for the X mode.

Type/Press:

[222222] + [Amt Tend/TOTAL] + [7654] + [Non Tax]

Using the Cash Register in a Password Protected

Mode

If a manager password was defined to protect unauthorized access to

the PRG, Z and X machine modes, proceed as follows to enter the

specific passwords so that you can work normally in these modes:

1. Turn the PRG key to the PRG, X or Z position.

2. Type the specific 4-digit password that grants you access to the

required mode.

3. Press the [Check] key.

NOTE: If you attempt to use a protected machine mode without typing

the correct password, the cash register emits an error signal

and the message "PSEC ERR" or "X SECERR" appears on the

displays.

28

Page 36

Transaction Examples

This section provides examples on how to complete different types of

transactions. Sample receipts are included which reflect some of the

programming examples used in the chapter entitled Cash Register

Programming.

Entering the Register Mode

The cash register has a register mode (REG) which is used to record

ordinary sales transactions. Proceed as follows to enter the register

mode:

1. Insert the control key (PRG or REG) into the Control Lock and

simply turn it to the REG position.

2. If the Clerk System option was set to active as explained in the

section entitled Clerk Numbers and Secret Codes, enter the related

Clerk number assigned and its associated three-digit secret code. If

the Clerk System option was set to active and a secret code was not

programmed, type any Clerk number [1-15], the default secret code

[000] and then press the [Clerk] key.

Exiting the Register Mode

To exit the register mode at the end of a transaction, simply turn the

control key to the OFF position.

Clearing Errors

Detailed instructions on how to clear all kinds of errors which may

occur during cash register operations are explained in the section

entitled Error Conditions at the beginning of this manual.

Transaction Symbols

The following symbols appear on the paper tape. They are printed to

the right of the entries to identify various totals and transaction

operations. Some of these symbols also appear on the management

report. They include:

1-15 Clerk number

CA Cash transaction total

CH Charge transaction total

CK Check transaction total

CD Cash in Drawer amount

ST Subtotal

TL Total

RT Refund total

T1CH Credit 1 sales

T2CH Credit 2 sales

CG Change

TI VAT1 applied to a sale

TII VAT2 applied to a sale

TIX VAT3 applied to a sale

TIIZ VAT4 applied to a sale

% Percent discount applied to an item or sale

% Percent plus applied to an item or sale

- Coupon or discount/refund

X Quantity being multiplied

@ Item price being multiplied

VD Voided entry

# Total or change in local currency

NS No Sale

RA Amount Received on Account

PO Amount Paid Out

Value in the Euro currency

ENGLISH

29

Page 37

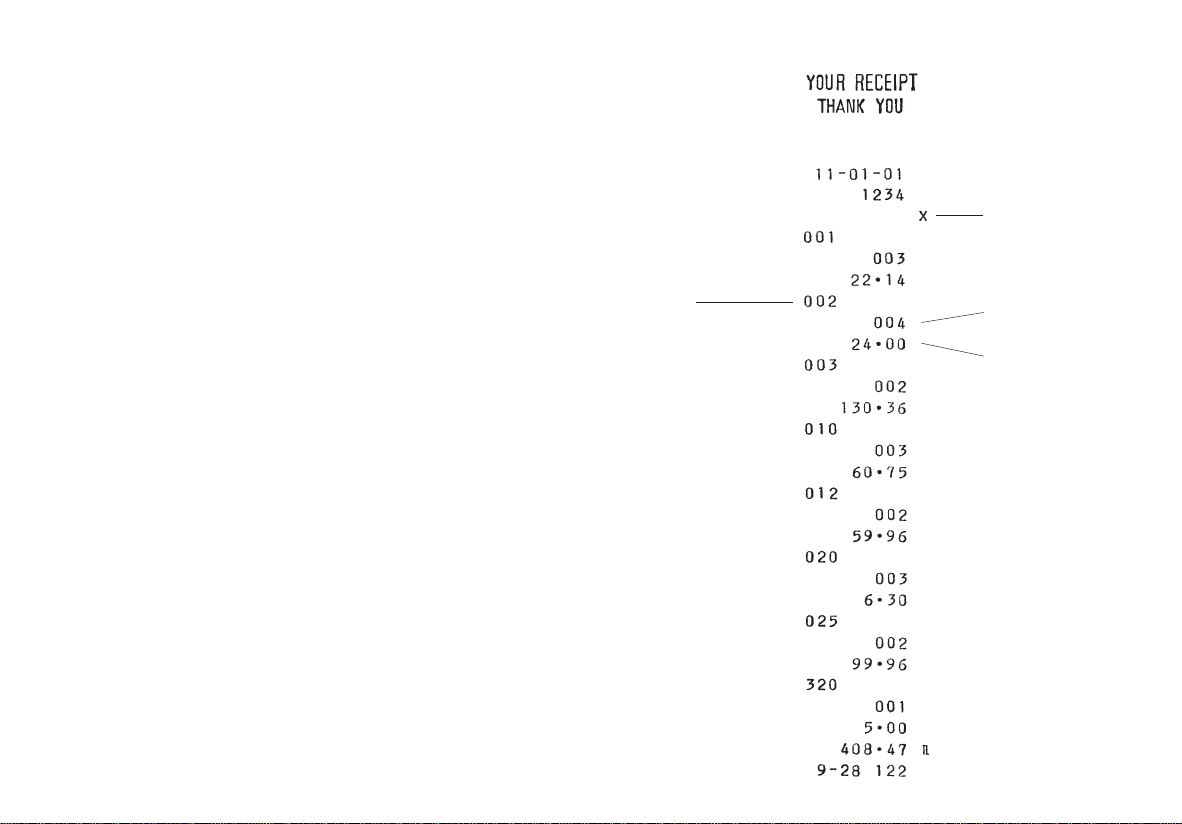

Sample Receipt

The following sample receipt shows where general transaction

information is printed on a customer receipt.

Date

Clerk

number

Departments

VAT totals

Cash

tendered

Time

Machine number

Item price with

department VA T rate

Item price in non-

taxable department

T otal balance due

T otal balance due in

converted currency

Change due

Change due in

converted currency

Consecutive receipt

number

Standard Transactions in Local Base Currency

Registering a Single Item Sale with Change Tender

Up to seven digits can be used for the amount of the entry.

Example: Register a £1.00 item in Department 1 (programmed at a

5.5% fixed VAT rate). Subtotal the transaction and compute change for

£5.00.

Proceed as follows:

1. Type [100] and press the [Department 1/21] key.

2. Type the amount tendered [500] and press the [Amt Tend/TOTAL]

key. The transaction is ended and the change due to the customer is

displayed.

30

Change on a cash tender

Change in converted

currency (Euro)

Page 38

Registering a Multiple Item Sale with Exact Cash

Tender in Local Currency

Example: Register a £2.50 item to Department 1, a £.50 item to

Department 5 and a £1.65 item to Department 8, with an exact tender

of £4.65.

Proceed as follows:

1. Type [250] and press the [Department 1/21] key.

2. Type [50] and press the [Department 5/25] key.

3. Type [165] and press the [Depar tment 8/28] key.

4. Press the [Subtotal w/Tax] key to display the current balance due.

5. Press the [Amt Tend/TOTAL] key to end the transaction.

Registering a Multiple Item Sale with Exact Cash

Tender in Euro

Example: Register a £10.00 item to Department 1, a £20.00 item to

Department 2, with an exact tender of 48.39e.

Proceed as follows:

1. Type [1000] and press the [Department 1/21] key.

2. Type [2000] and press the [Department 2/22] key.

3. Press the [Subtotal w/Tax] key to display the current balance due

in Local currency.

4. Press the [Euro] key to display the current balance due in Euro.

5. Press the [Amt Tend/TOTAL] key to end the transaction.

ENGLISH

T ransaction total in local

and converted currency

Exact cash tender in

local currency

T r ansaction total in local and

converted currency

Exact cash tender in converted