M A N U A L P E N G G U N A

COPYRIGHT NOTICE

All rights reserved. N o pa rt o f this

book may b e reproduced or transmitted in any form or by any means,

electr onic or mechanical, including

photoc opying, recording, or by any

inform ation storag e and r etrieval

system , without wri tten permission

from PUC Founder (MSC) Bhd. Every

precau tion has been made to supply

comple te and accurate info rmation.

Inform ation in this docum ent is subject t o change without prior notice.

DISCLAIMER

No person should rely on the cont ents

of this p ublication without firs t obtainin g advice from a qualified professional person. The company expressly

discla ims all and any l iability and

respon sibility to any reader or user

of this book, in respect of anything,

and of the consequences of anything,

done by any such person in reliance,

whethe r wholly or partially, upon the

whole or any part of the contents of

this b ook.

PUC FO UNDER (MSC) BHD

For enquiri es on technical matters,

please forward the emai l to

suppor t@fingertec.com

CHP 1 • BASIC SETUP 1-14

Minimu m System Requirem ents

CONTENTS

Instal lation

Gettin g Started

Login and Quitting

New Co mpany and Setup W izard

Main M enu

Payrol l Advisor

Update Service

User A ccess and Passwor d

Toolba r

CHP 2 • SYSTEM CONFIGURATION 15-25

Payrol l Settings

Prefer red Language

Re-bui ld Database Index

Backup /Restore Database Files

Day Ty pe

Leave Type

Allowa nce/Deduction Cod e

Nation ality/Ethnic/Reli gion/Education

Positi on/Branch/Departm ent/Cost Center/

Job Gr ade/Category

Branch Address Book

Earnin gs Subject to Sta tutory

CHP 3 • EMPLOYEE MASTER 26-31

To Add a New Staff

To Att ach/Remove Photog raph

To Cha nge Staff Informa tion

To Rem ove a Staff

Payrol l Policy

Resign ation

Payrol l Summary & Misce llaneous

CHP 4 • PAYROLL OPERATIONS 32-46

Activa te Program

Loan R epayment Entry

Tax Sc hedule Entry

Advanc e Payment Entry

Leave Taken Entry

Attend ance Sheet

Create Journal Entry

Bonus

Report Printing

Bank A uto-Pay System

Fulfil ling Statutory Re quirements

Backup

Payrol l Closing

To Shu tdown from DiGiPA Y

CHP 5 • OTHER OPERATIONS 47-57

Leave Entitlement Setti ng

Histor y Files

Year E nd Tax Return

• Tax CP8A (EA Form)

• How to assign accumula tion into CP8A

• Tax CP159/Receipt

Runnin g DiGiPAY in the Network

APPENDIX A •

FLOW CHART 58-59

Settin g-up

Payrol l Operations

APPENDIX B •

SAMPLE REPORTS 60-65

Paysli p

Pay Sh eet

Pay Ch eque

Coinag e Analysis

Bank O rder

Payrol l Journal

Journa l Summary

Employ ee Personal Record

Leave Taken List

Loan R epayment List

APPENDIX C •

FREQUENTLY ASKED

QUESTIONS 66-70

CHAPTER 1

BASIC SETUP

This chapter gives you quick and simple instructions to get you up and running.

MINIMUM SYSTEMS REQUIREMENTS

• Pentium

• 32 MB of memory

• Windows 95 or higher

• At least 8 MB free disk space for oftware

• VGA monitor or higher

• Hard Disk Drive, CD ROM Drive

• Mouse or other pointing device

• Laser Printer (optional)

INSTALLATION

DiGiPAY files are shipped in a compressed format and automatically decompressed during the installation process. Therefore, to install and run software

on your computer, you must first run the setup program. Do not just copy DiGiPAY files into a directory on your hard disk.

There are 2 ways to run the setup program:

I) AU

TOOPEN

In

sert the DiGiPAY CD into your computer’s CD-ROM drive, the system will

automatically run the Setup program.

II)

ALLY (In case your CD drive doesn’t support AutoOpen feature)

MANU

• Insert the software CD into your computer’s CD-ROM drive.

• Make sure the Windows 95 or higher program is running on your compu

ter.

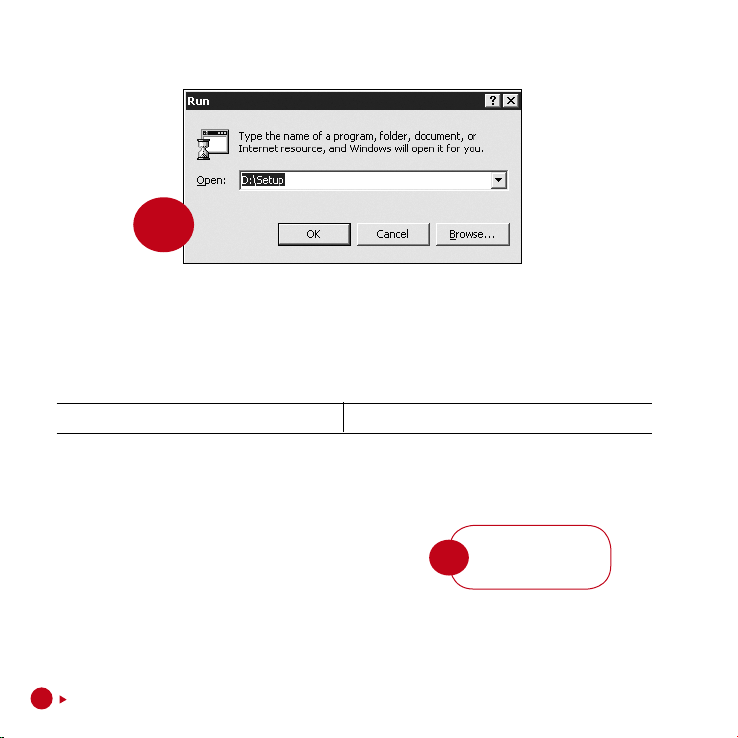

ose RUN from the Windows 95 or higher program - Start Menu and type

• Cho

D:\Setup in the Open text box, click “OK”.

NOTE

Recomm ended

alloca tion of 30MB

or hig her for company d atabas e

CONTENTS

-

1

For example: D:\SETUP

Figure

1.1

For AutoOpen and manually run setup program, please follow the on screen instruction. We recommend you to accept all the preset options for the most completed installation.

QUESTIO

N ASKE

D WHEN INSTALLING

What are the choices? Wha

Sel

ect Directory for DiGiPAY Accept the preset choice: C:\DiGiPAY

t should you do?

At the end of the installation, a shortcut will be created on the desktop. If it is not created, please

follow the following steps.

TO CRE

ATE A SHO

RTCUT ON THE DESKTOP

• Move the mouse or pointing device to the Start Menu at the bottom left of the screen.

• Cl

ick on the right mouse button, and a menu will appear.

• Click Explore, and a Windows Explorer will appear with

contents of Start Menu folder shown.

• Double click the Programs folder.

Do not maximize the

NOTE

Window s Explorer.

• Look for DiGiPAY.

• Use the right mouse button to click on the DiGiPAY and drag it to the desktop.

Release the mouse button, and a menu will appear.

• Click Create Shortcut(s) Here.

• The Shortcut will be shown on your desktop.

2

CONTENTS

GETTING STARTED

Once installation is completed, you may start to run DiGiPAY as shown in the following steps:

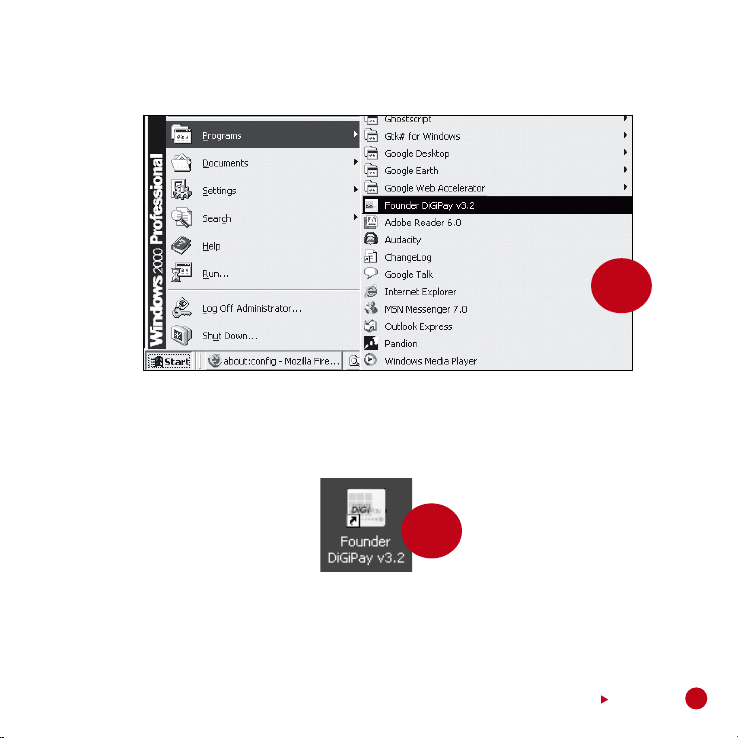

Figure

1.2

• Click on the Start Menu bar and choose PROGRAMS. Point to Founder Applications group icon

and double click DiGiPAY as shown in Figure 1.2

Figure

• Fro

m the Windows desktop, double click the DiGiPAY icon as shown in Figure 1.3

1.3

CONTENTS

3

LOGIN AND QUITTING

TO LOGGING ON TO DiGiPAY

Figure

1.4

When you start DiGiPAY, you may choose the directory that you want to log in by highlighting it and

entering your User ID and Password. Refer to Figure 1.4 above.

• Sin

gle click on the desired directory.

• In the User ID box, type your name. For first time usage, leave it blank.

• In the Password box, type a password. For first time usage, leave it blank.

• Click Login button to proceed.

TO QUIT FROM DiGiPAY

hen login window is prompted, click the Shut Down button to exit completely from DiGiPAY.

W

NEW COMPANY AND SETUP WIZARD

TO SETUP A NEW COMPANY/DIRECTORY

When the login window is prompted (refer to Figure 1.4.), click on the New button. The Setup

Wizard will be launched.

4

CONTENTS

Figure

1.5

• Language selection for the new company.

Figure

1.6

• Wel

come message for the Setup Wizard. Key in the CD key and click Next button to proceed.

You may find your CD key on the genuine hologram security sticker on your software setup

CD.

CONTENTS

5

Figure

1.7

ine the company profile. Click Next button to proceed.

• Def

Figure

1.8

ine payroll settings. Click Next button to proceed.

• Def

6

CONTENTS

Figure

1.9

• The setting up of employees particulars. Click Next button to proceed.

ADD - Add a new employee.

D

elete - Delete a current employee.

Auto no. -

Generate employee number based on 1st character of the employee name.

For example, J001 is generated for John Doe.

UPGRADE OT

HERS - This function will scan your hard drive for known payroll packages. If the

system discovered any, click on the entry and you will have the option to overwrite the existing

data entry with upgraded data or to include the upgraded data as part of the existing data.

CO

NTINUE NEXT T

IME - This will terminate the Setup Wizard and end the session for this newly

setup company/directory. Save the changes done to ensure that Setup Wizard will be launched

during next login session.

CONTENTS

7

Figure

1.10

• Assign fixed allowances for each employee. Click Next button to proceed.

Figure

1.11

• The

end of Setup Wizard. Click Finish button to save all settings.

8

CONTENTS

Figure

1.12

Once the Setup Wizard is completed, you will be presented with the Welcome window as per Figure 1.12. The Welcome window will be displayed every time you login to this company unless the

“Don’t show this message again” box is checked.

CONTENTS

9

MAIN MENU

PAYROLL TRANSA

end month journal, advance, bonus and

closin g.

NOTE

Figure

1.13

TDOWN

SHU

P

ROGRAM

allows you to quit

from D iGiPAY.

CTIONS conta in mid/

This portion will only be available

for registered company.

STER

E MA

EMPLOYE

contai ns detail s for each employee’s payroll package.

ORT GENERA

REP

list of report s provi ded

in the system.

TION a

HISTO

contai ns resigned

employ ees and

histor y payroll

journa ls.

RY FILE

INTERNET SERVER

CT TO

CONNE

allows you to register online and to

downlo ad the latest update . CD-RO M

update is also accessible here.

SPOT HELP allows you to view the

short note for items on the screen

select ed. Just drag the icon to the

item to seek sho rt note, th en th e

short note will a ppear in a popup

window .

TEM

SYS

NFIGURATION

CO

tells the company’s

payrol l requirements.

S

ROLL ADVISO

PAY

task. By selecting the task you want to learn,

the system will show you how to perform the

partic ular task.

Select ed payroll

month and year.

F-HEL

P provides you with

SEL

link to t he on line help and the

troubl eshooting gui de.

R prese nts a set of guided

10

CONTENTS

PAYROLL ADVISOR

By double clicking the option, the system

will guide you until the task is completed.

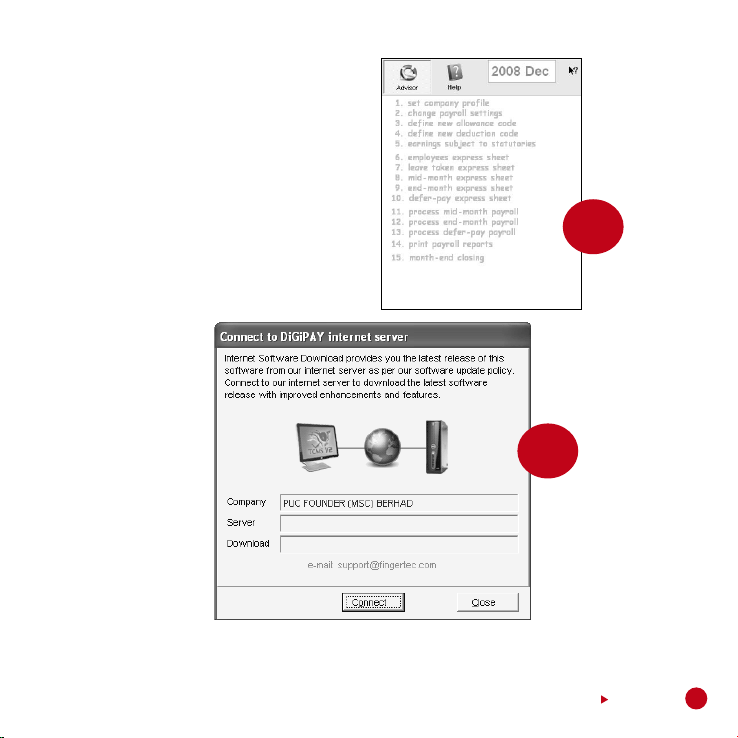

Figure

1.14

UPDATE SERVICE

Figure

1.15

As and when an update is available, it will be uploaded into the DiGiPAY Internet Server. If you do

not have an internet access for the DiGiPAY computer, you may request your vendor to send you

the latest updated CD.

CONTENTS

11

To retrieve the latest update from the Internet, make sure, that the computer is connected to the

Internet via modem, then click on the Connect to DiGiPAY Internet Server icon and click Connect

button to start the process.

To retrieve the latest update from the CD,

and click CD-ROM button. You will be presented with a select directory dialog. Point the directory

to your CD-ROM drive and click Select button to start the process.

As a new user of DiGiPAY, you are entitled to a free 12 months update service. Upon expiry of

the 12 months period, you are advised to extend the update service for another 12 months with

a minimal update fee. Print out the update service license from Company Profile/License within

System Configuration, fill it up and send it together with your payment to us.

click on the Connect to DiGiPAY Internet Server icon

USER ACCESS AND PASSWORD

Figure

1.16

1. Determine the access right for 9 user groups. Click on the icon and double click “Access

permission”. Put a check into menu option where the particular user group will have no access

to it. Click Apply button to save the changes.

12

CONTENTS

Figure

1.17

2. Determine the number of users allowed access to the system. Among all the users, only one of

them is allowed to be granted with administrator right. For each user, assign a password with

a maximum of 10 alphanumeric characters and his/her user group.

3

lect Company Profile/License. Put a check for option “requires password” and click Apply

. Se

button to activate the user login.

CONTENTS

13

TOOLBAR

VIEWING TOOLBAR

Go to last record

Add a new record.

Go to previous reco rd Editing toolba r will appear Copy i nto Clipboard

Figure

1.18

Go to fir st rec ord Search Cut/De lete

Dup licate from Clipbo ard

Go to next reco rd Edit t he selected record

Editing toolba r will appea r

Close this window

EDITING TOOLBAR

Refresh the record

Figure

1.19

Save the changes

Cancel all changes

Toolbar guides you in viewing and maintaining the records.

14

CONTENTS

CHAPTER 2

SYSTEM CONFIGURATION

This chapter guides you in setting up the system configuration based on your

company’s payroll requirements.

Figure

2.1

1. Pa yroll settings

2. Pr eferred language

3. Re -built database

indexe s

4. Ba ckup/R estore

databa se files

5. Da

y type

6. Le ave ty pe

7. Al lowanc e/ Deduction

code

tional ity/Et hnic/Re-

8. Na

ligion /Education

. Po

sition /Branch/

9

Depart ment/Cost

Center /Job Grade/

Catego ry

ranch address book

10. B

11. Earning subjec t to

statut ory

This function will be activated with a click on the icon

.

It tells the whole company’s payroll requirements. It consists of the following

topics as shown in Figure 2.1.

Please refer to individual topic for elaboration.

CONTENTS

15

PAYROLL SETTINGS

Figure

2.2

This function allows you to define basic payroll information for your company.

1. Double click “Payroll Settings” and define the settings available.

2. Three types of payroll journal calculation mode are available :-

•Calculate instantly •Calculate when save •Calculate on demand

3. For payments separated from mid-month and end-month, such as commission, overtime or

hers, deferred pay is introduced. You may conduct deferred pay before closing – after end-

ot

month payment. You may also opt to conduct deferred pay after closing – before next month

end-month payment.

4

r DiGiTime/TCMS V2 software users, attendance sheet will be utilized when you post your

. Fo

attendance records within DiGiTime/TCMS V2 software into DiGiPAY.

5. Up

on selection, click “Apply” to confirm the changes.

16

CONTENTS

PREFERRED LANGUAGE

Figure

2.3

This system is capable of displaying multi languages. Three languages are provided by default

and these are English, Bahasa Malaysia and Chinese. For other languages please check with your

nearest distributor or vendor.

Once activated, you will be presented with the various language options.

• Double click “Preferred language” and click on your preferred language.

• Cl

ick “Apply” to confirm.

The la nguage select ed wil l be u sed th e next time you log in.

NOTE

To dis play i n Chin ese, y ou mus t be running Windo ws operating syste m Chinese version.

If you are run ning a Windows operating syst em Englis h version , you may util ize a Chinese

Langua ge Input System suc h as C hinese Star o r NJSt ar.

RE-BUILD DATABASE INDEXES

This function is to rebuild all the database indexes. Normally, this is not required unless your

indexes are not up-to-date or corrupted.

• Double click “Re-build database indexes”, all the indexes will be re-built in a matter of sec-

ds.

on

CONTENTS

17

BACKUP/RESTORE DATABASE FILES

Figure

2.4

This function is to backup existing database to another storage media or restore database from

previous back-uped database into system.

SELECT BA

CKUP COMMAND RADIO BUTTON

If you are using ARJ command, your command will be similar to below:

arj a –va –i2 -y a:\DiGiPAY sample\*.dbf

SELE

CT RESTO

RE COMMAND RADIO BUTTON

If you are using ARJ command, your command will be similar to below:

arj x –va –y a:\DiGiPAY sample\*.dbf

NOTE

Substi tute the sample

direct ory wi th actual d irector y name. Yo u will

find the actual direct ory

being displa yed inside

the Pa th heading.

18

CONTENTS

DAY TYPE

Figure

2.5

This function is to specify the keywords that represent the day type for each day of the week. We

recommend you to maintain the default system setting.

1. Do

uble click “Day type” and specify the keyword that represent the day type for :-

• Normal Working Day (system default setting - WORKDAY)

on-working Holiday (system default setting - HOLIDAY)

• N

• Other non-working Days (system default setting - RESTDAY or OFFDAY)

2. Click “Close” to confirm day type keyword.

CONTENTS

19

LEAVE TYPE

Figure

2.6

This function is to specify the type of leave allowed in the system. A total of 8 leave types are made

available for your convenience. Feel free to change the default description.

1. Double click “Leave type” and specify the leave type that is implemented by your company.

lick “Close” to confirm leave type keyword.

2. C

20

CONTENTS

ALLOWANCE/DEDUCTION CODE

Setting up of both allowances and deductions are similar. In order to cut the explanation short,

information presented below is also applicable to deduction.

ALLOWANCE C

You can use this function to define your allowances. You can define unlimited numbers of allowances (constrained by hard disk size).

1. D

ouble click “Allowance Code”

2. Use the viewing toolbar & editing toolbar to work with its content.

3. Assign the standard rate, if applicable.

3. Click “Listing” to view the available allowances.

ODE

Figure

2.7

Figure

2.8

CONTENTS

21

NATIONALITY/ETHNIC/RELIGION/EDUCATION

Setting up of nationality, ethnic, religion and education are similar. In order to cut the explanation

short, information presented below is also applicable to other settings.

NATIONALITY

Figure

2.9

Y

ou can use this function to define a list of nationality for your employees. You can define unlim-

ited numbers of nationality (constrained by hard disk size).

1. Double click “Nationality”.

2. U

se the viewing toolbar & editing toolbar to work with its content.

3. You may also view and assign the employees to this nationality, during data entry.

4. Click “Listing” to view the available allowances.

22

CONTENTS

POSITION/BRANCH/DEPARTMENT/COST CENTER/

JOB GRADE/CATEGORY

Setting up of position, branch, department, cost center, job grade and category are similar. In

order to cut the explanation short, information presented below is also applicable to other settings.

POSITION

Figure

2.10

Y

ou can use this function to define a list of positions for your employees. You can define unlimited

numbers of position (constrained by hard disk size).

1. D

ouble click “Position”.

se the viewing toolbar & editing toolbar to work with its content.

2. U

3. You may also view and assign the employees to this position, during data entry.

4. Click “Listing” to view the available allowances.

CONTENTS

23

BRANCH ADDRESS BOOK

Figure

2.11

This function is used to specify banks and statutory bodies related information. You can define

unlimited numbers of branch addresses (constrained by hard disk size).

1. D

ouble click “Branch Address Book”.

se the viewing toolbar & editing toolbar to work with its content.

2. U

3. You will need to assign each address code to a specialised body.

4. For statutory bodies, Ref. No. will refer to company reference number for the said body.

5. For banks, Ref. No. will refer to company bank account number, while BNM # will refer to Bank

Negara Malaysia No.

6. Cl

ick “Listing” to view the available allowances.

24

CONTENTS

EARNINGS SUBJECT TO STATUTORY

Figure

2.12

This function specifies the construction of earnings for statutory deductions’ calculation.

1. D

ouble click “Earning Subject to Statutory”.

or each statutory body, assign the earning components that make up for its calculation by

2. F

passing the earning components from box on the right into the box on the left.

ick “Listing” to view the available allowances.

3. Cl

CONTENTS

25

CHAPTER 3

EMPLOYEE MASTER

Figure

3.1

A click on the people icon will activate this function. It consists of the following

topics as shown in Figure 3.1.

This chapter emphasizes on Employee Particulars. The other five topics are

covered in Chapter 4 & 5.

The function of Employee Particulars is to store the necessary payroll information of your staff. It also displays your staff’s photograph.

26

CONTENTS

There are four things you can do here.

1. Add a new staff.

2. A

ttach or change photograph of a particular staff.

3. Change staff information.

4. Remove a staff or photograph.

TO ADD A NEW STAFF

• Use Add Record button on the viewing toolbar to add a record.

• To save, click on the Save Record button on the editing toolbar.

TO ATTACH /REMOVE PHOTOGRAPH

Figure

3.2

• Use Edit Record button on the viewing toolbar to start this process.

• Click on the box with an up arrow and assign the scanned photo (JPEG, BMP, etc). The photo-

graph will be displayed immediately.

• T

change a photograph, you must first remove the current photograph by clicking on the box

o

with down arrow and then attach a new photograph.

confirm the changes, click on the Save Record button on the editing toolbar.

• To

CONTENTS

27

TO CHANGE STAFF INFORMATION

Figure

3.3

Figure

3.4

• Use Edit Record button on the viewing toolbar to start this process.

• Make the necessary changes on the staff information.

• To confirm the changes, click on the Save Record button on the editing toolbar.

28

CONTENTS

TO REMOVE A STAFF

• Use Delete Record button on the viewing toolbar.

• When prompted, click on Yes button to confirm deletion.

PAYROLL POLICY

Figure

3.5

In order to process for payroll, it is necessary to define the payroll policy. In DiGiPAY, payroll policy

is defined on page 3 of Employee Particulars.

• D

ine the information as per the payroll remuneration package offered to each of the em-

ef

ployee.

• A

er Edit Record button of the viewing toolbar is clicked, compulsory item will be shown with

ft

an asterisk (*).

allowances and deductions, a total of defer 8 codes are available. In the Per column, there

• For

are 7 choices: unit, month, mid/end, mid only, day and overtime. Unit will activate unit x rate

calculation. Month will activate payment of rate in End Month. Mid/end will activate payment

of rate in both Mid and End Month. Mid only will activate payment of rate in Mid Monthly only.

User will trigger the calculation based on an external function with the same name as per the

code. Day will use total working days in attendance sheet as units, whereas overtime will use

number of hours in attendance sheet as units.

CONTENTS

29

• For leave, as monthly rated staff, the first 7 types of leave is included as part of the salary.

Thus, they are checked to show its inclusion in the salary. For daily rated staff and hourly rated

staff, these leaves will not be checked to calculate their payments.

RESIGNATION

When an employee resigned, all you need to do is to update his/her resignation date and last date

on the job into Employee Particulars.

Execute the payroll process as usual and his/her payroll will be calculated with the resignation

date taken into consideration.

PAYROLL SUMMARY & MISCELLANEOUS

Figure

3.6

30

CONTENTS

Figure

3.7

In addition to personal information and payroll policy, Employee Particulars also provides a page

to view the payroll summary and a page to update other necessary information for statutory purpose.

CONTENTS

31

CHAPTER 4

PAYROLL OPERATIONS

This chapter covers the simple procedures to run the DiGiPAY. Follow the steps

below for the most efficient operations.

ASSUMPT

ION: Sys tem co nfigur ations and e mployee particulars have been s etup.

ACTIVATE DiGiPAY PROGRAM

• Click on the Start Menu bar and choose PROGRAMS.

• Double click on DiGiPAY.

OR

• D

ble click the DiGiPAY icon on the desktop.

ou

WHAT’S NEXT?

L

oan Repayment Entry, Tax Schedule Entry, Advance Payment Entry, Leave Taken Entry and Attendance Sheet are optional modules provided in the DiGiPAY

program. The purpose of incorporating these modules is to ease the operation

work needed to conduct the monthly payroll processing. The following pages

will show you how to utilize these modules.

32

CONTENTS

LOAN REPAYMENT ENTRY

Figure

4.1

Loan repayment allows you to specify deductions that will be effective for selective months. It is

useful for short-term loan, for example festival advance.

This function is available in Employee Master.

ick on the icon

1. Cl

2. Double click “Loan Management”.

3. To add record, click on the Add Record button on the viewing toolbar.

4. Assign a unique loan code for each loan taken by each employee. Update with the loan taken

date and total amount.

5. To

simplify the loan payment schedule, look for Generate button on the editing toolbar. Click

on it and you will be presented with a simple tool for schedule generation. Complete the data

entry.

confirm changes, click on Save Record button.

6. To

.

CONTENTS

33

TAX SCHEDULE ENTRY

Figure

4.2

Upon approval by income tax authority, some employees would be granted permission to pay the

monthly tax based on a fixed schedule by the body. There are two types of fixed schedule, PCB

and CP38. PCB is deducted based on current month income, whereas CP38 is deducted based

on last year income.

This function is available in Employee Master.

1. Cl

ick on the icon

2. Double click “Tax Schedule PCB/CP38”.

3. To add record, click on the Add Record button on the viewing toolbar.

4. As the records are stored in a yearly basis, you must assign the specific year before updating

the employee list at the bottom.

5. To

confirm changes, click on Save Record button.

.

34

CONTENTS

ADVANCE PAYMENT ENTRY

Figure

4.3

Advance payment refers to salary payment paid prior to month-end payroll processing. Thus, during month-end payroll processing, this amount will be deducted from the monthly salary.

This function is available in Payroll Transactions.

ick on the icon

1. Cl

2. Double click “Advance”.

3. To add record, click on the Add Record button on the viewing toolbar.

4. Assign a unique batch description, its payment year and month, before updating the employee

list at the bottom.

5. To

confirm changes, click on Save Record button.

.

CONTENTS

35

LEAVE TAKEN ENTRY

Figure

4.4

By utilizing the leave taken entry, leave taken will be updated into payroll journal and ease the

calculation of leave payment/deduction.

This function is available in Employee Master.

ick on the icon

1. Cl

2. Double click “Roster/Leave Management”.

3. Use the listing page to look for the employee.

4. To update leave taken, go to page and click on Edit Record button on the viewing toolbar.

5. Change the year accordingly and click on the month of leave taken.

6. To add in new leave taken, click on the leave type needed. The mouse pointer will change to a

hand pointing to the leave type. Click and drag the mouse pointer to the day on leave.

default, the leave taken will be 1 day. To change the leave taken or to add a remark line,

7. By

double click on the day on leave and make the necessary adjustment.

confirm changes, click on Save Record button.

8. To

36

CONTENTS

.

ATTENDANCE SHEET

Figure

4.5

Attendance sheet is available to help customers with DiGiTime/TCMS V2 program to speed up the

payroll calculation process. Data will be posted from DiGiTime/TCMS V2 into this screen.

This function is available in Payroll Transactions. This function can also be utilized as a data entry

screen.

1. Cl

ick on the icon

2. Double click “Daily Attendance”.

3. Use listing page to look for the employee. If he/she is not available, add a record for him/her

by clicking the Add Record button on the viewing toolbar.

date the attendance record as shown in his/her attendance sheet.

4. Up

5. To confirm changes, click on Save Record button.

.

CONTENTS

37

CREATE JOURNAL ENTRY

There are three types of journal, namely Mid-month, End-month and Deferred Pay. To create journal entry, you need to double click on the journal you plan to process.

If you had defined in Payroll Settings to automatically generate the journal records, the records

will be created immediately. If generation is not automated, click on the Generate Record button

on the viewing toolbar to start the process.

The generation process will retrieve its data from Employee

Particulars, Loan Repayment Entry, Tax Schedule Entry, Advance Payment Entry, Leave Taken Entry and Attendance

Sheet to create the unit payable/deduct. Once the generation is done, payroll calculation will take place.

After the journal is calculated, you may make additional

changes to the journal such as ad-hoc allowances, deductions and overtime.

In Payroll Settings, it is stated that there are three types of payroll journal calculation mode, they

are:

• Calculate instantly

• Calculate when save

• Calculate on demand

By setting payroll journal calculation mode to “Calculate instantly”, payroll calculation will be carried out during generation and changes on the journal contents. Setting to “Calculate when save”

will allow calculation to be carried out during generation and saving record. By setting payroll

journal calculation mode to “Calculate on demand”, you must click on the Calculate button on the

viewing toolbar in order to carry out the calculation process.

NOTE

If you make any changes

to any da ta after the generatio n, the journal wil l

NOT be updated with the

change s. You must run the

calcul ate function in the

journa l.

38

CONTENTS

In the next three pages, the 6 pages of the journal are presented.

Figure

4.6

Figure

4.7

CONTENTS

39

40

Figure

4.8

Figure

4.9

CONTENTS

Figure

4.10

Figure

4.11

CONTENTS

41

BONUS

Figure

4.12

This function is available in Payroll Transactions.

1. Click on the icon

2. Double click “Bonus”.

3. To add record, click on the Add Record button on the viewing toolbar.

4. Assign a unique batch description, its payment year and month. Set the payment to either

combine with End-month payment or separately.

5. Fo

r tax calculation, you have a choice of This-Month, Last-Month and Last December.

6. You can update the bonus records manually. You may also use the Generate Record button on

the editing toolbar to reduce the data entry.

confirm changes, click on Save Record button.

7. To

42

CONTENTS

.

REPORT PRINTING

Figure

4.13

Click icon , a Report Generation pop up screen will be displayed as shown in Figure 4.13.

All the reports available will be listed. Click on the report you want. You may shortlist your report

with selected group of employees. You may also change the sorting order based on selected

grouping. The groupings available are Employee No., Branch Code, Department Code, Cost Center

Code, Job Grade Code and Category Code.

• TO PRINT ON HARD COPY - Click “Print” button to have a hardcopy printed.

• TO VIEW ON S

• TO QUIT FROM REP

CREEN - Click “Preview” button for an on-screen view only

ORT - Click “Cancel” button to quit from report.

CONTENTS

43

BANK AUTO-PAY SYSTEM

Bank auto-pay system is provided by some of the banks in Malaysia in order to allow the salary

transfer to be done electronically. Currently, WinCom DiGiPAY program provides the interface for

a total of five different bank auto-pay systems.

The banks available are Bumiputra Commerce Bank (BCB), Hong Leong Bank Berhad (HLBB),

Maybank (MBB), Public Bank Berhad (PBB) and RHB. Additional banks will be included should

there is a demand for it.

This function is available in Report Generation.

FULFILLING STATUTORY REQUIREMENTS

The monthly contribution reports are available for EPF, SOCSO, income tax, ASB, Baitulmal,

Tabung Haji and Tabung Zakat.

In line with Malaysia government’s E-Government initiative, disk submission is included for EPF,

SOCSO and Income Tax.

This function is available in Report Generation.

BACKUP

It is important to make backup of existing database to prevent lost of data for future reference.

This function is available in System Configuration.

44

CONTENTS

PAYROLL CLOSING

Figure

4.14

Once you have completed the Monthly Payroll Operation, you are already at the last step of the

Payroll Operation – Payroll Closing.

This function is available in Payroll Transactions. It will transfer all journals to the history files and

move the date indicator at the toolbar to the next month pay period. Once it is completed, you are

ready for the next month payroll process.

1. Cl

ick on the icon

2. Double click “Payroll Closing”.

3. Type in the numeric of the month to confirm the payroll closing.

4. Once the numeric is entered correctly and Enter key is pressed, the Apply button will be acti

vated.

5. Cl

ick on Apply button to proceed.

Remember to backup BEFORE payroll closing and not after.

.

CONTENTS

-

45

TO SHUTDOWN FROM DiGiPAY

1. Click icon to exit from DiGiPAY.

2. At login screen, click “Shutdown” button.

CONGRATULA

Y ou hav e successfully comp leted the se ttings process of DiGiPAY .

46

CONTENTS

TION!

CHAPTER 5

OTHERS

LEAVE ENTITLEMENT SETTING

Figure

5.1

This function is available in Employee Master. It is made available to run and

setup the leave entitlement and taken.

You are required to specify each employee’s leave entitlement calculation

method based on length of service.

Leave entitlement is calculated during Payroll Closing. You may also use the

Generate button on the viewing toolbar to execute the leave entitlement process.

1. Cl

ick on the icon

2. Double click “Roster/Leave Management”.

3. Use the listing page to look for the employee.

.

CONTENTS

47

4. To configure the leave entitlement calculation method, go to Balance page and click on Edit

Record button on the viewing toolbar.

5. I

n the Automatic annual entitlement column, there are five choices. Namely: not applicable,

anniversaries of serviced, calendar with new join prorata, calendar without new join prorata

and 1st year anniversary than calendar.

ANNIVERS

L

ARY

eave entitlement is calculated upon anniversary of joining.

Calendar with new join prorata

Leave entitlement will be calculated in payroll closing of December and pro rata entitlement

for newly join employee within the year.

Calendar without new join prorata

Leave entitlement will be calculated in payroll closing of December. No pro rata entitlement

will be calculated for newl join employee within the year.

ST

1

ANNIVERSARY THAN CALENDAR

Leave entitlement is calculated 1st year upon anniversary of joining and subsequent year

entitlement will be calculated by the end of December each year.

6

the Year of Serviced column, enter the year of completed service ranges and the number

. In

of paid annual leave and sick leave eligible.

the Max. Untaken Annual Leave Can Be Reimbursed items; the maximum number of un-

7. In

taken annual leave to pay back to the employee is entered. The actual days to pay back in the

next payroll period will be shown in the Number of Untaken Annual Leave To Be Paid As Allowance item after the closing payroll. The allowance code used for the payment is assigned

in Reimburse Allowance item in Allowance Code.

8

Forfeit annual leave if absenteeism exceeds item, the percentage of forfeiture for annual

. In

leave is specified.

Untaken annual leave allow to C/F to next year item, the maximum number of untaken

9. In

annual leave that are allow to carry forward to next year is specified.

o change the leave entitlement, change at the left-hand portion.

10. T

11. To confirm changes, click on Save Record button.

48

CONTENTS

HISTORY FILES

Figure

5.2

Click on the icon on the main toolbar. As you can see in Figure 5.2, there are 4 options.

However, only the first 3 options are permanent.

RESIGNED EM

This function is available to maintain the employee particulars for those who had resigned prior

to January this year.

CREATE BLANK

To create new history journal, double click on “Create blank journal” and proceed with the process

as prompted. Once it is completed, a new history journal option will be created in History Files.

PLOYEES

JOURNAL

CONTENTS

49

DELETE HISTORY JOURNAL

To delete history journal, double click on “Delete history journal” and proceed as prompted. Once

it is completed, the deleted history journal will be removed from History Files.

YEAR END TAX RETURN

In DiGiPAY, there are two year-end tax return forms, namely: CP8A (EA Form) and CP159.

TAX CP8

A (EA FORM)

Figure

5.3

CP8A (EA Form) is printed for each employee for individual yearly income tax submission purpose.

This function is available in Employee Master.

ick on the icon

1. Cl

2. Double click “Tax return CP8A”.

50

CONTENTS

.

3. To generate the list of active employees, click on Generate button on the viewing toolbar and

generate accordingly.

4. On

ce generation is completed, review and make sure accumulation is accurate. Make neces-

sary changes by using Edit Record button and save the changes.

5

ick on the Sort button on the viewing toolbar to generate a No. Siri for each employee.

. Cl

Figure

5.4

CONTENTS

51

52

Figure

5.5

Figure

5.6

CONTENTS

HOW TO ASSIGN ACCUMULATION INTO CP8A (EA FORM)?

Figure

5.7

As you may have noticed on Page 3 & 4 of CP8A (EA Form), there are a number of triangular placed

in front of the amount box.

Double click on the triangular and below screen will appear. You are allowed to assign the earnings to be accumulated into each tax column.

CONTENTS

53

TAX CP159 / RECEIPTS

Figure

5.8

Form CP159 must be submitted by the company to IRB every year.

This function is available in Employee Master.

. Cl

ick on the icon

1

.

2. Double click “Tax CP159 / receipts”.

3. To generate the accumulation amount on Saraan page, click on Generate button on the viewing

toolbar.

date the tax receipts numbers and dates on Saraan page.

4. Up

5. Complete the other pages and clicks on Apply button to save the changes.

54

CONTENTS

Figure

5.9

Figure

5.10

CONTENTS

55

RUNNING DiGiPAY IN A NETWORK

This part is provided as a guideline for those who are planning to use a single copy of installed

DiGiPAY from a few workstations within the same network. You must assign a particular computer

as a Server.

SER

1. Install the DiGiPAY software in the Server as usual.

2. P

3. At Desktop, double click My Computer. Look for DiGiPAY directory and double click on it.

56

ETTING UP A SERVER:

VER S

Figure

5.11

Figure

5.12

lug in the Network Control Device at the Printer Port.

CONTENTS

4. In DiGiPAY directory, you will find a file called NETCFG.EXE.

5. Double click the NETCFG.EXE and the program will execute.

6. Click on Yes button to enable the network detection.

7. You will hear a beep sound and a new icon will be created at the taskbar.

8. Go back to My Computer. Right click on the DiGiPAY directory. Select Sharing and share the

directory as DiGiPAY.

SETTING UP A WO

1. At Desktop, double click My Network or Network Neighborhood.

2. L

ook for the Server’s computer name and double click on it.

3. You will find DiGiPAY directory in it. Right click on it. Select Map Network Drive and set it to

Drive F (You may change it to others).

Desktop, double click My Computer and look for Drive F and double click on it.

4. At

5. In Drive F, you will discover DiGiPAY programs.

6. Use the right mouse button to click on the DiGiPAY.E XE and drag it to the Desktop. Release the

mouse button, and a menu will appear.

ick Create Shortcut(s) Here.

7. Cl

8. The Shortcut is now created on your desktop.

9. From the Desktop, you may now utilize the shortcut to access the DiGiPAY software through

your network.

RKSTATION:

CONTENTS

57

APPENDIX A

FLOW CHART

SETTING-UP

Company Profile

Payroll Setting

Day Type

Leave Type

Allowance

Deduction

Earnings Subject To

Statutories

CONFIGURE CLASSIFICATION

- Nationality

- Ethnic

- Religion

- Education

Branch Address Book

Employee Master

Leave Management

(Optional: Entitlement)

This flow chart shows you how to set up the DiGiPAY software without the use

of Setup Wizard.

58

CONTENTS

CONFIGURE ORGANIZATION

HIERARCHY

- Branch

- Department

- Cost Center

- Job Grade

- Category

PAYROLL OPERATIONS

Employee Master

- Add new employee

- Update payroll settings

- Update resignation

- Increment

Advance

Bonus

(Before End-month)

Leave Management

(Optional: Leave Taken)

Loan Management (Optional)

Tax Schedule (Optional)

Deferred Pay (After Closing)

Mid-month Processing

Bonus (End-month)

End-month Processing

Bonus (After End-month)

Deferred Pay

(Before Closing)

Reports Printing

Backup

Closing

CONTENTS

59

APPENDIX B

SAMPLE REPORTS

All sample reports are for reference only. The fonts and layout may deter slightly from the original printouts.

PAYSLIP

60

CONTENTS

PAY SHEET

PAY CHEQUE

CONTENTS

61

COINAGE ANALYSIS

BANK ORDER

62

CONTENTS

PAYROLL JOURNAL

JOURNAL SUMMARY

CONTENTS

63

EMPLOYEE PERSONAL RECORD

LEAVE TAKEN LIST

64

CONTENTS

LOAN REPAYMENT LIST

CONTENTS

65

APPENDIX C

FREQUENTLY ASKED QUESTIONS

Q1. I realized that I had missed out some of the settings during the Setup Wizard session. How

can I update the information?

A. B

asically, each step in the Setup Wizard will help you to complete the setting up for a par-

cular entry. The linkage from Setup Wizard with the DiGiPAY software is shown in the table

ti

below.

SETUP WIZARD INFORMATION LINK TO

Step 1 Co

Step 2 Payroll settings System Configuration → Payroll Settings

Days working Employee Master → Roster/Leave Management

Step 3 Employee details Employee Master → Employee Particulars

Step 4 Allowance subject to statutory System Configuration → Earnings Subject to Statutories

Employee fixed allowances assignment Emp

Q2. I am planning to use loan repayment entry, tax schedule entry, advance payment entry, leave

aken entry and attendance sheet for my monthly transactions. During payroll processing,

t

how does DiGiPAY software make use of the information?

A. I

n DiGiPAY software, payroll processing is split to 2 portions. Namely: journal generation and

lculation.

ca

Whe

n the journal is accessed, there are 4 additional buttons in the viewing toolbar. The

Generate button is used to execute journal generation, whereas the Calculate button is for

journal calculation.

rnal generation is needed when deferred pay is used. For mid-month or end-month payroll

Jou

processing, journal generation is automatically executed when the journal is accessed for the

first time. Once generation is completed, journal calculation will be executed.

le below is showing the sequence of the journal generation.

Tab

mpany profile System Configuration → Company Profile

loyee Master → Employee Particulars

66

CONTENTS

STEPS DESC RIPTION

1 Based on

2 From Employee Particulars, select fixed allowances and deductions.

3 From Attendance Sheet, select actual working days, overtime hours and leave taken. (Optional: Refer

4 From Leave Management, select working days of the month and leave taken for the month.

From Advance, select advance payment transaction.

5

6 From Bonus, select bonus payment. (Optional: End-month)

7 From Mid-month journal, select mid-month statutory transaction. (Only during End-month)

8 From Deferred pay journal, select deferred pay statutory transaction. (Only during End-month, with

9 For new staff and resigning employee, calculate pro rata rate.

settings in Employee Particulars, select basic information, daily rate and hourly rate will be

calculated.

to Payroll Settings)

deferred pay done after closing)

Table below is showing the sequence of journal calculation.

STEPS DESCRIPTION

1 From Employee Particulars, select additional fixed allowances and deductions.

2 Repeat steps 3 & 4 in journal generation.

Calculate basic wages.

3

4 Calculate leave payment.

5 Calculate allowances payment.

6 Calculate deductions.

7 Calculate overtime payment.

8 Calculate loan repayments.

9 Calculate EPF contributions.

10 Calculate SOCSO contributions.

11 Calculate Zakat contributions. (Optional: Refer to Employee Particulars, References page)

12 Calculate income tax amount.

13 Calculate foreign levy. (Optional: Refer to Employee Particulars, References page)

14 Calculate Human Resource Development Fund contribution base on each employee’s gross income.

Q3. I made payroll adjustment within Employee Particulars. But, when I checked in journal, it was

not updated with the new adjustments. What should I do to update the information?

A. T

o refresh the journal with new adjustment, it is necessary to execute the journal calculation

ocess. Click on the Calculate button in the viewing toolbar, select the affected employees

pr

and click Apply button to complete the process.

CONTENTS

67

Q4. I understand mid-month and end-month. But, why there is an additional deferred pay?

A. In normal practice, salary would be paid either twice a month or once a month. Thus, twice

month payment will require the use of mid-month journal. However, some payroll transac-

a

tions, which require management approval such as overtime, commission and claims, may

be delayed due to unforeseen circumstances. As these transactions are needed in statutory

contribution calculations, deferred pay journal is introduced.

n

DiGiPAY software, there is a necessary setting for deferred pay behavior stored in Payroll

I

Settings: “Deferred pay after end-month processing is”. The options available are Before

Closing and After Closing.

Before Closing is chosen, the sequence of processing will be Mid-month, End-month and

If

finally Deferred Pay. If After Closing is chosen, the sequence of processing will be Deferred

pay, Mid-month and finally End-month. Failure to follow the sequence of processing will

cause the statutory contributions being calculated wrongly.

utilize the deferred pay journal, just access the Deferred Pay journal, add or look for the

To

employee and make the necessary transactions. Save it and click on the Calculate button to

complete it with the journal calculation.

Q5. I need to make bonus payment. What are the options available?

. Bonus transactions will be paid in one of the 3 methods offered: Before End-month, End-

A

nth or After End-month. By choosing Before end-month or After end-month, bonus trans-

mo

actions will be monitored separately from the monthly salary transactions. Thus, statutory

contributions will be calculated. By choosing End-month, bonus transactions will be added

into End-month journal and statutory contributions will include bonus amount.

or

the bonus amount, you may opt to make the bonus transaction entry manually. However,

F

if the bonus is calculated based on X months of basic, you may make use of the Calculate

button in the Editing toolbar.

As

bonus income tax calculation will require a monthly remuneration amount as the starting point, 3 options are available: This-month, Last-month and Last December. By choosing

This-month, current month salary tax remuneration will be used. By choosing Last-month,

last month salary tax remuneration will be used. By choosing Last December, last December

salary tax remuneration will be used.

. I am trying to add a new allowance where it should be included in EPF and income tax cal-

Q6

c

ulation. But, I cannot find the necessary setting in Allowance codes. Where can I make the

definition?

A. Go to System Configuration → Earnings Subject to Statutories. For EPF and Tax pages, move

e new allowance from box in the right to the box in the left. If journal processing was done,

th

run the journal calculation process to refresh the statutory contributions.

68

CONTENTS

Q7. Every transaction in the DiGiPAY software yields the same amount as my manual calculation.

But, why my manually calculated EPF contributions are higher than the result calculated by

DiGiPAY?

A. This scenario would happen, when multiple journals are in use in the same month. In manual

lculation, it is common that EPF contributions will be calculated separately from each

ca

journal and add up to show the full amount of the month.

iPAY software calculates its statutory amount in a slightly different manner. As journals

DiG

must be processed in sequence, the statutory calculation amount will be accumulated in

each journal. Each journal will calculate the EPF contributions based on the total accumulated amount. By deducting the EPF contributions paid in the previous journal(s), the balance

will be the actual EPF contributions payable from the current journal.

n

short, DiGiPAY software is using the total accumulated amount for the month to calculate

I

its statutory contributions.

. I noticed that EPF, SOCSO and income tax are providing diskette submission service and this

Q8

i

s available in the DiGiPAY software. What should I do to make use of this feature?

A. In order to utilize this feature, you must request approval from the relevant authority.

r example, lets discuss the procedure to request approval from EPF.

Fo

First, you must print the report. You should ask the EPF officer of your submission branch on

the type of report they need for diskette submission.

ond, generate the data into the diskette.

Sec

Third, write a letter to the relevant department to request approval for diskette submission.

Finally, send the letter together with the report and diskette to the diskette submission cent

er.

e the request is reviewed, EPF officer will send a letter to your company stating the status

Onc

of your request. If it was not approved, make the necessary adjustment as suggested in the

report attached and submit the newly-generated diskette and report for second review.

If

it was approved, every month EPF officer will send you a diskette. You should generate the

data into the EPF diskette and send it back to EPF diskette submission center together with

the report.

Q9. I noticed there is a zakat contribution in Employee Particulars, References page. How can I

tilize it?

u

A. Zakat contribution is available to allow Muslim employees to give authorization to the com-

ny to make monthly deduction from his/her salary. The payable amount will be determined

pa

by the employee himself/herself.

-

CONTENTS

69

Inland Revenue Department made a provision in its income tax regulation in 2000. The provi-

si

on says that Muslim employees who make zakat contribution for the month are entitled to

a rebate of the zakat amount from his/her income tax.

1. Fixed zakat contribution with fixed rebate.

Ke

2. Pay income tax to zakat authority.

Pu

3. Za

Key in the paid zakat amount into the RM box and put a tick in the box in front of Rebate.

Q10

A. E

The

• P

• Use the previous compatible version of this software.

• Key in the new Update Service license no.

Option 1 will print out the application form and you are required to make the necessary pay-

Option 2 allows you to ignore the latest update and execute the last workable software.

Option 3 allows you key in the new Update Service license no. and once it is validated, the

For

y in the zakat contribution amount into the RM box. Leave the boxes for From PCB and

bate empty.

Re

t a tick in the box in front of From PCB. Leave the RM box and Rebate box empty.

kat is already paid personally, but rebate is requested from the employee to the current

nth payroll.

mo

ave the box for From PCB empty.

Le

. I had downloaded the latest update from the Internet via the Connect to DiGiPAY Internet.

But, when I run the DiGiPAY software, it showed a message stating that “The installed dongle

control device is not longer compatible with this new version of DiGiPAY software”. What

should I do to continue using this software?

ach copy of installed DiGiPAY software is entitled to a free 12-month update service. Upon

ex

piry of the 12-month update service, you are required to renew the 12-month update service with a minimal fee. Although you are still allowed to download the latest update. But, you

are not allowed to use it until the update service license is renewed.

above mentioned message will appear when your update service is already expired and

you are trying to run the latest update of the software. You are presented with 3 options:

rint application form for new Update Service license no.

ment and fax the application form to us for processing. Once the form is received, the new

Update Service license no. will be faxed to you within 2 working days.

latest update will be executed.

the latest series of Frequently Asked Questions, refer to DiGiPAY web site.

http://user.fingertec.com.

70

CONTENTS

Sila daftarkan perisian DiGiPAY anda di http://user.fingertec.com

Untuk tip teknikal dan manual dalam bahasa lain, sila rujuk http://user.fingertec.com

c 2009 PUC FOUNDER (MSC) BHD. Semua Hak Cipta terpelihara

Loading...

Loading...