TI-86 Financial Functions

Loading and Installing Finance Features on Your TI-86...............................2

Loading the Finance Features into TI-86 Memory..............................................................................2

Installing the Finance Features for Use...............................................................................................2

Displaying the FIN (Finance) Menu..................................................................................................... 3

The FIN Menu.....................................................................................................................................3

Uninstalling the Finance Features.......................................................................................................3

Deleting the Finance Program from TI-86 Memory ............................................................................ 3

The TVM (Time-Value-of-Money) Variables................................................... 4

FIN VARS (Finance Variables) Menu...................................................................................................4

Setting the Payment Format...........................................................................4

Payment Format Editor....................................................................................................................... 4

Entering Cash Inflows and Cash Outflows..........................................................................................4

Using the TVM (Time-Value-of-Money) Solver.............................................. 5

FIN TVM Solver Menu.........................................................................................................................5

Solving for an Unknown TVM Variable (Payment Amount)................................................................5

Financing a Car...................................................................................................................................6

Computing Compound Interest........................................................................................................... 6

Using the Financial Functions.......................................................................... 7

Entering Cash Inflows and Cash Outflows..........................................................................................7

FIN FUNC (Financial Functions) Menu................................................................................................ 7

Calculating Time-Value-of-Money......................................................................................................7

Calculating Cash Flows.......................................................................................................................8

Calculating Amortization.................................................................................................................... 9

Amortization Example: Calculating an Outstanding Loan Balance................................................... 10

Calculating Interest Conversion........................................................................................................ 11

Finding Days Between Dates............................................................................................................ 11

Defining the Payment Method..........................................................................................................11

Menu Map for Financial Functions ............................................................... 12

MATH Menu (where FIN is automatically placed).............................................................................12

(MATH) FIN (Financial) Menu...........................................................................................................12

FIN TVM (Time-Value-of-Money) Solver Menu................................................................................. 12

FIN FUNC (Financial Functions) Menu.............................................................................................. 12

FIN VARS (Financial Variables) Menu...............................................................................................12

FIN FORMT (Financial Format) Menu................................................................................................12

Assembly Language Programming: Financial Functions

t

Loading and Installing Finance Features on Your TI-86

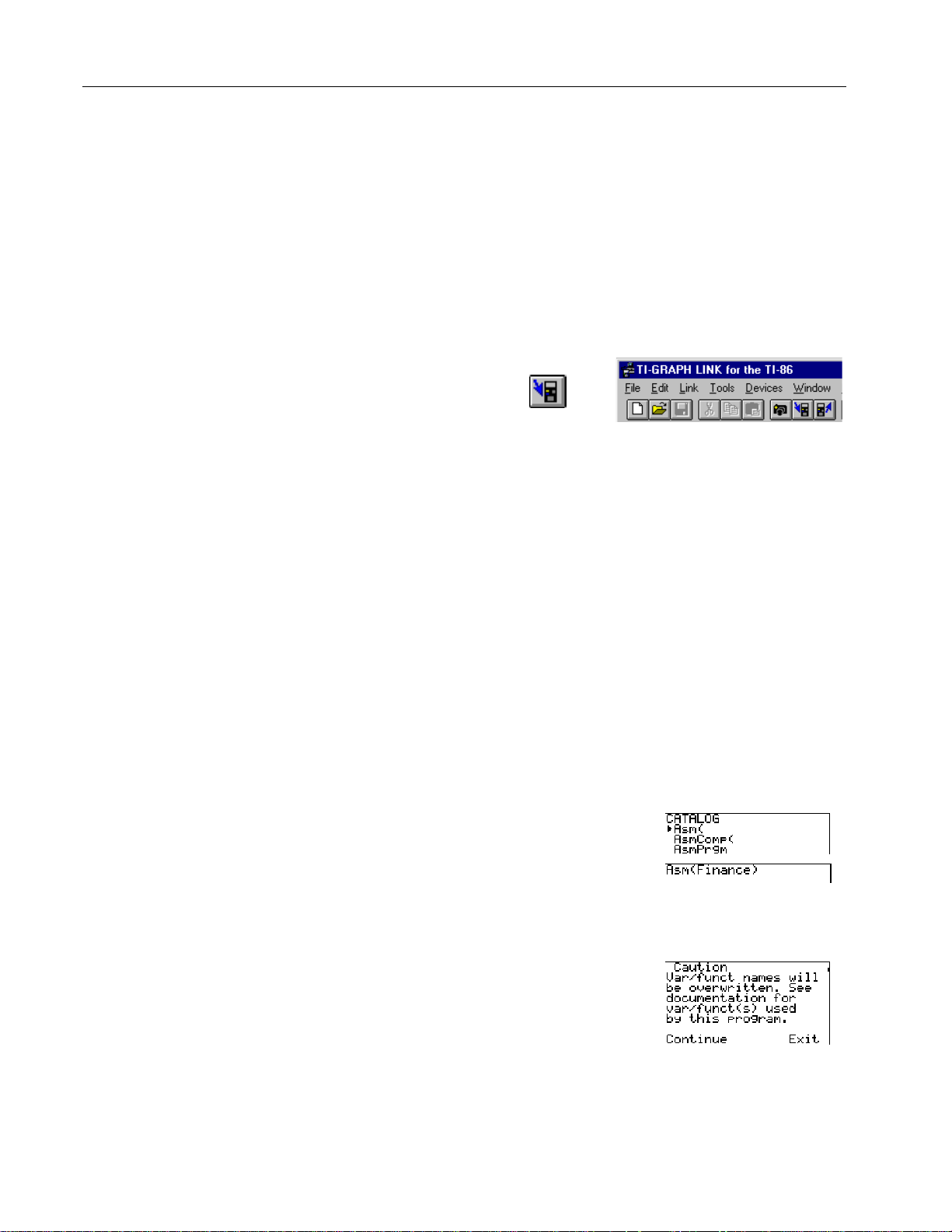

To load the financial features onto your TI-86, you need a computer and the TI-86

Graph Link software and cable. You also need to download the finance program

file from the Internet and save it on your computer.

Loading the Finance Features into TI-86 Memory

When sending a program

from your computer to the

TI-86, the calculator must no

be in Receive mode. The

Receive mode is used when

sending programs or data

from one calculator to

another.

The executable file

associated with the assembly

language program (

appears on the

menu, but you need

NAMES

not do anything with it.

finexe

PRGM

)

1

Start the TI-86 Graph Link on

your computer.

2

Turn on your TI-86 and display

the home screen.

3

Click on the Send button on the

TI-86 Graph Link toolbar to

display the Send dialog box.

4

Specify the finance program file

as the file you want to send.

5

Send the program to the TI-86.

The program and its associated

executable file become items on

PRGM NAMES

the

6

Exit Graph Link

2

(WLink86.exe)

^

- l

finance1.86g

menu.

For assembly language

programs that must be

installed, up to three can be

installed at a time (although

the TI-86 can store as many

as permitted by memory). To

install a fourth, you must first

uninstall (page 3) one of the

others.

The variables that will be

overwritten are listed on the

FIN FUNC

menus (page 12).

and

FIN VARS

Installing the Finance Features for Use

Use the assembly language program

Finance

to install the finance features directly

into the TI-86’s built-in functions and menus. After installation, the finance

features are available each time you turn on the calculator. You do not need to

reinstall them each time. When you run assembly language programs that do not

install themselves into the - Π/ menu, their features are lost when you

turn off the calculator.

All examples assume that

on your TI-86. The position of

Finance

FIN

is the only assembly language program installed

on the

MATH

menu may vary, depending on how

many other assembly language programs are installed.

from the

CATALOG

PRGM

Finance

- w &

#

(move 4 to

Asm(

b

)

8 &

Financ

(select

E

)

b

Select

Asm(

from the

1

to paste it to a blank line on the

home screen.

Select

NAMES

Financ

menu to paste

2

to the home screen as an

argument.

3

Run the installation program.

Caution:

If you have values

stored to variables used by the

finance features, they will be

overwritten. To save your

values, press * to exit and then

store them to different variables.

Then repeat this installation.

Assembly Language Programming: Financial Functions

s

n

3

If other assembly language

programs are installed,

may be in a menu cell other

- Π/

than

'

FIN

.

4

Continue the installation. (Your

&

version number may differ from

the one shown in the example.)

5

Display the home screen.

:

Displaying the FIN (Finance) Menu - Π/

When you install the financial program on your TI-86 and activate it,

the last item on the

NUM PROB ANGLE HYP MISC 4 INTER FIN

MATH

menu.

Finance Menu

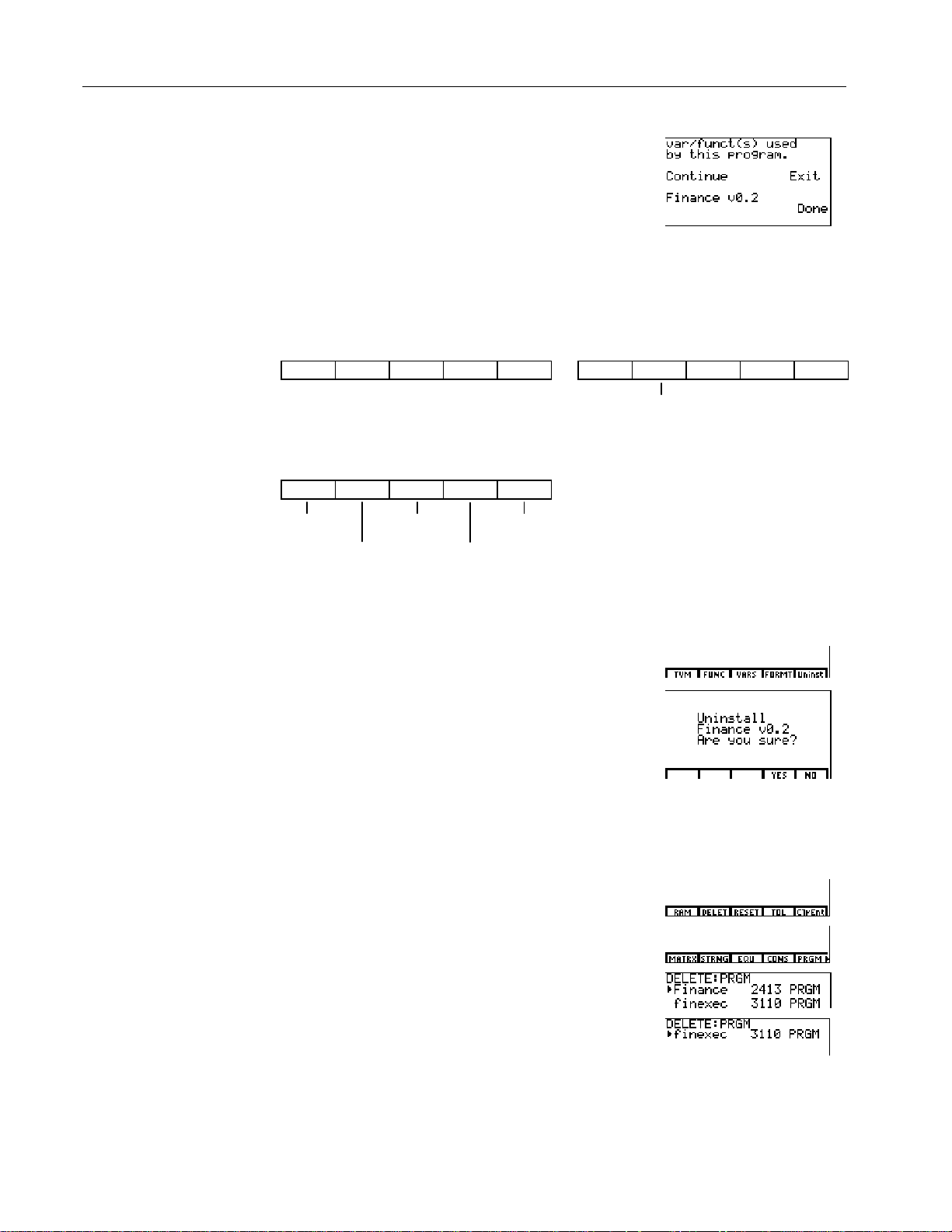

The FIN Menu - Π/ '

TVM FUNC VARS FORMT Uninst

TVM Finance Uninstall

Solver Variables Menu Instruction

Functions Menu Format Editor

Financial Payment

FIN

becomes

When you uninstall the

finance features, the finance

assembly language program

Finance

(

in memory, but the

is removed from the

menu.

Deleting the program does

not delete the variables

associated with the program.

and

finexec

) remain

FIN

optio

MATH

Uninstalling the Finance Features

Uninst

FIN

menu, and then

.

Yes

from the

- Π/ '

*

)

FIN

1

Display the

select

2

If you are sure you want to

uninstall, select

confirmation menu. The

menu is removed and the home

screen is displayed. (Your

version number may differ from

the one shown in the example.)

Deleting the Finance Program from TI-86 Memory

Select

DELET

from the

1

menu.

2

3

4

PRGM

Select

DELET

from the

menu.

Move the selection cursor to

Finance

, and then delete it.

Move the selection cursor to

finexec

, and then delete it.

MEM

MEM

- ™ '

/ *

#

(as needed)

b

#

(as needed)

b

Assembly Language Programming: Financial Functions

The TVM (Time-Value-of-Money) Variables

FIN VARS (Finance Variables) Menu - Π/ ' (

TVM FUNC VARS FORMT Uninst

ç

I PV PMT FV

4

4

PY CY

Prompts that correspond to

some TVM variables are

shown in parentheses.

Number of payment periods

N

Interest rate (

I

Present value of loan or lease

PV

Payment amount

PMT

I%=

)

Future value of loan or lease

FV

Payments per year (

PY

Compounding periods per year(

CY

P/Y=

)

C/Y=

♦ When you enter a value at prompts in the payment format editor (page 4) or

the TVM Solver (page 5), the corresponding variable values are updated.

♦ When you solve for a TVM variable using the TVM Solver, the corresponding

variable value is updated.

♦ When you enter numbers as arguments for a TVM function, the corresponding

variable values are not updated.

♦ When you solve for a TVM variable using a TVM function, the corresponding

variable value is not updated.

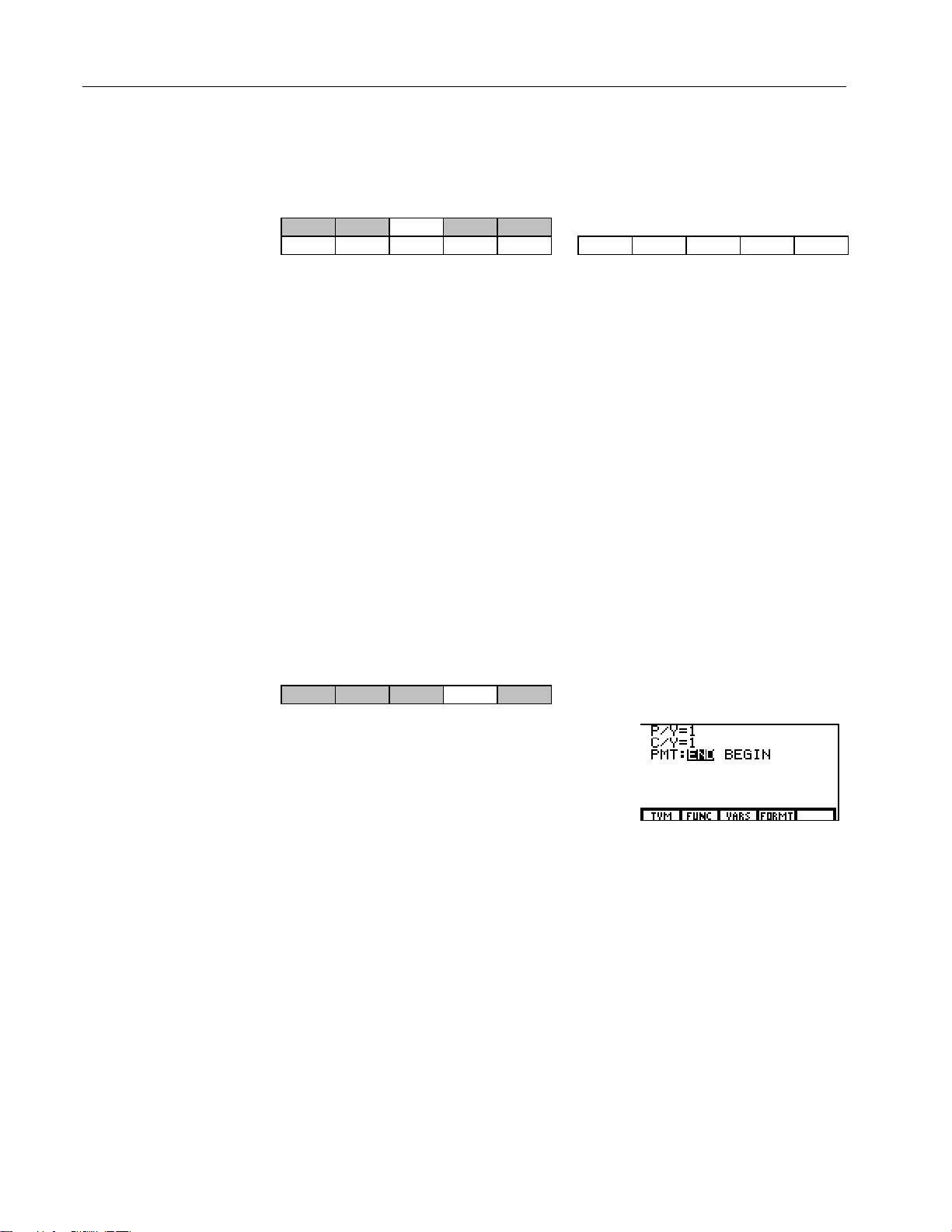

Setting the Payment Format

Payment Format Editor - Π/ ' )

TVM FUNC VARS FORMT Uninst

)

You also can change a

setting by storing a value to

or CY or by executing

PY

pEnd

or

pBegin

(page 11).

The payment format settings define the number

of payments per year (

compounding periods per year (

), the number of

P/Y

C/Y

), and

whether the payments are received at the end or

beginning of each period (

PMT:END BEGIN

).

The payment format editor to the right shows

the defaults. To change payments per year or compounding periods per year, enter a

new value. To change the payment due setting, move the cursor onto

END

or

BEGIN

and then press b.

Entering Cash Inflows and Cash Outflows

When using the financial functions, you must enter cash inflows (cash received) as

positive numbers and cash outflows (cash paid) as negative numbers. The financial

functions follow this convention when computing and displaying answers.

,

Assembly Language Programming: Financial Functions

e

Using the TVM (Time-Value-of-Money) Solver

FIN TVM Solver Menu - Π/ ' &

TVM FUNC VARS FORMT SOLVE

The TVM Solver displays prompts for the five

time-value-of-money (TVM) variables.

To solve for an unknown variable, enter the four

known variable values, move the cursor to the

When the TVM Solver is

displayed,

on the

Uninst

SOLVE

FIN

replaces

menu.

unknown variable prompt, and then select

(*) from the

FIN

displayed on the TVM Solver are stored to corresponding TVM variables.

Solving for an Unknown TVM Variable (Payment Amount)

You want to buy a $100,000 house with a 30-year mortgage. If the annual

percentage rate (APR) is 18%, what are the monthly payments?

5

SOLVE

TVM Solver menu. Values

Enter cash inflows as positiv

numbers and cash outflows

as negative numbers.

You cannot leave a variable

blank. If you do not have a

value, set it to zero.

1

Set the fixed-decimal mode to 2

decimal places to display all

numbers as dollars and cents.

2

Select

to display the

3

Select

from the

FIN

FORMT

MATH

FIN

menu.

from the

menu to display the payment

format editor. Set 12 payments

per year, 12 compounding

periods per year, and payments

received at the end of each

payment period.

4

Display the TVM Solver and

enter the known values for four

TVM variables. The

value of

N

360 was derived from 30 (years)

M

12 (months).

5

Move the cursor to the

TVM variable.

6

Select

SOLVE

to compute the

answer. A small square is

displayed next to the solution

variable. The answer is stored to

the corresponding TVM variable.

FIN

PMT

menu

- m #

" " " b

- Π/ '

)

12

# 12

#

b

# 18

# #

#

0

&

360

100000

b

$

*

Assembly Language Programming: Financial Functions

Financing a Car

You have found a car you would like to buy. The car costs $9,000. You can afford

payments of $250 per month for four years. What annual percentage rate (APR)

will make it possible for you to afford the car?

6

PMT

P/Y, C/Y

to 0 and

When you change

changes automatically.

As you enter a value at any

TVM Solver prompt, the

corresponding TVM variable

value is updated.

Because there are no

payments when you solve

compound interest problems,

you must set

P/Y

to 1.

set

The decimal mode is fixed at

2

from the previous example.

1

Set the fixed-decimal mode to 2

decimal places to display all

- m #

" " " b

numbers as dollars and cents.

2

Display the payment format

editor. Set payments per year

- Π/ '

12

)

# #

b

and compounding periods per

year to 12. Set payment due at

the end of each period.

3

Display the TVM Solver. Enter

48 monthly payments, present

value of $9,000, payment amount

48

&

# a

b

# #

250

#

9000

0

of L$250 (negation indicates

cash outflow), and future value

of $0. The

derived from 4 (years)

N

value (48) was

M

12 (months).

4

Move the cursor to

rate) and then select

=

æ

(interest

SOLVE

$ $ $ *

from the TVM Solver menu. A

small square is displayed next to

the solution. The solution value

is stored to the TVM variable

I

.

Computing Compound Interest

At what annual interest rate, compounded monthly, will $1,250 accumulate to

$2,000 in 7 years?

1

Display the payment format

editor. Set payments per year to

1 and compounding periods per

year to 12. Set payment due at

the end of each period.

2

Display the TVM Solver. Enter 7

annual payments, present value

of L$1,250 (negation indicates

cash outflow), payment amount

of $0, and future value of $2,000.

- Π/ '

1

)

# 12

#

b

&

#

7

# # a

0

#

2000

1250

b

3

Move the cursor to

rate) and then select

æ

SOLVE

from the TVM Solver menu. A

small square is displayed next to

the solution. The solution value

is stored to the TVM variable

=

(interest

I

.

$ $ $ *

Assembly Language Programming: Financial Functions

Using the Financial Functions

Entering Cash Inflows and Cash Outflows

When using the financial functions, you must enter cash inflows (cash received) as

positive numbers and cash outflows (cash paid) as negative numbers. The financial

functions follow this convention when computing and displaying answers.

FIN FUNC (Financial Functions) Menu - Π/ '

TVM FUNC VARS FORMT Uninst

tvmN tvmI tvmPV tvmP tvmFV

Calculating Time-Value-of-Money

The first five items on the

functions. You can use them to analyze financial instruments, such as annuities,

loans, mortgages, leases, and savings, on the home screen or in a program.

All arguments and

punctuation inside the

brackets are optional.

To store a value to a TVM

variable, use the TVM Solver

X

or use

variable on the

menu.

and any TVM

[ ]

FIN VARS

tvmN [(æ,PV,

tvmI [(N,PV,

tvmPV [(N,æ,

tvmP [(N,æ,PV,FV,

tvmFV [(N,æ,PV,

Each TVM function takes zero to six arguments. Each argument must be a real

number or a TVM variable. The values that you specify as arguments for these

functions are not stored to the TVM variables.

PMT,FV,P/Y,C/Y

PMT,FV,P/Y,C/Y

PMT,FV,P/Y,C/Y

P/Y,C/Y

PMT,P/Y,C/Y

4

npv irr bal

4

nom eff dbd pBegin pEnd

FIN FUNC

] Computes the number of payment periods

)

] Computes the annual interest rate

)

] Computes the present value

)

] Computes the amount of each payment

)

] Computes the future value

)

menu are the time-value-of-money (TVM)

G

prn

7

G

int

If you enter less than six arguments, you must enter arguments in the order of the

syntax, up to the last argument you want to enter. The program substitutes a

previously stored TVM variable value for each subsequent unspecified argument.

If you enter any arguments with a TVM function, you must place the argument or

arguments in parentheses. The following examples show some ways to use the

TVM functions.

Assembly Language Programming: Financial Functions

Assume these values are stored to the TVM variables in the payment format editor and TVM Solver.

8

When you execute a TVM

function on the home screen

with no specified arguments,

the TVM function (

the example) uses stored TVM

variable values.

You can enter arguments

directly on the home screen.

Remember, neither the answer

nor the arguments are stored to

the TVM variables.

If you prefer, you can store

values to the TVM variables on

the home screen.

tvmPMT

in

To change an argument without

changing the value stored to a

TVM variable, enter arguments

up to the argument you want to

change. In the example, the

interest rate is changed to

To store an answer to the

appropriate TVM variable, use

X

and the

When you execute a TVM

function (

example), it uses the newly

stored TVM variable values.

FIN VARS

tvmPV

menu.

in the

Calculating Cash Flows

The next

FIN FUNC

menu items are cash flow functions. Use them to analyze the

value of money over equal time periods. You can enter unequal cash flows. You

can enter cash inflows or outflows.

9.5

.

npv(

interestRate,cashFlow0

cashFlowList[,cashFlowFrequency]

irr(

cashFlow0,cashFlowList

,

cashFlowFrequency]

[

,

Returns the sum of the present values for the

)

cash inflows and outflows

Returns the interest rate at which the net

)

present value of the cash flows is equal to 0

♦ interestRate is the rate by which to discount the cash flows (the cost of

money) over one period.

♦ cashFlow0 is the initial cash flow at time 0; it must be a real number.

♦ cashFlowList is a list of cash flow amounts after the initial cash flow cashFlow0.

♦ cashFlowFrequency is a list in which each element specifies the frequency of

occurrence for a grouped (consecutive) cash flow amount, which is the

corresponding element of cashFlowList. The default is 1; if you enter values,

they must be positive integers <10,000.

Assembly Language Programming: Financial Functions

The uneven cash flow below is expressed in lists. cashFlowFrequency indicates

that the first element in cashFlowList (

L

3000

(

) occurs once (1), and the third element (

2000 2000 2000 4000 4000

2000

) occurs twice (2), the second element

4000

) occurs twice (2).

9

CF

0

cashFlow0 =

cashFlowList =

cashFlowFrequency =

6

I% =

cashFlow0 =

cashFlowList =

2000

{2000,L3000,4000}

{2,1,2}

CF

0

L

2000

L

2000

L

{L2000,1000, L2500,0,5000,3000}

cashFlowFrequency =

2000

N/A

CF

CF

1

1

CF

2

1000 5000 3000

CF

2

L

2500

CF

3

L

3000

CF

CF

3

0

CF

4

4

CF

CF

5

5

CF

6

roundValue

internal precision used to

calculate the balance.

effectiveRate, nominalRate

and

must be real numbers;

compoundingPeriods

be > 0.

bal(

stored values for

PMT

to these variables before

computing the principal.

specifies the

compoundingPeriods

must

G

Prn(

,

. You must store values

, and

G

Int(

, PV, and

æ

use

Calculating Amortization

Items eight, nine, and ten are the amortization functions. Use them to calculate

balance, sum of principal, and sum of interest for an amortization schedule.

bal(

nPayment[,roundValue]

,

G

Prn(

paymentA,paymentB

,

roundValue]

[

G

Int(

paymentA,paymentB

,

roundValue]

[

)

)

)

Computes the balance for an amortization schedule;

nPayment (the number of the payment at which to

calculate a balance) must be a positive integer

<10,000

Computes the sum of the principal during a specified

period for an amortization schedule; paymentA (the

starting payment) and paymentB (the ending

payment in the range) must be positive integers

<10,000

Computes the sum of the interest during a specified

period for an amortization schedule; paymentA (the

starting payment) and paymentB (the ending

payment in the range) must be positive integers

<10,000

Assembly Language Programming: Financial Functions

Amortization Example: Calculating an Outstanding Loan Balance

You want to buy a home with a 30-year mortgage at 8 percent annual percentage

rate (APR). Monthly payments are $800. Calculate the outstanding loan balance

after each payment and display the results in a graph and in the table.

10

A stat plot is turned on if it is

highlighted with a box.

1

Display the mode screen and set

the fixed-decimal setting to

in dollars and cents. Also, set

Param

graphing mode.

2

Display the payment format

editor, and then set payments

and compounding periods per

year to 12, to be received at the

end of each period.

3

Display the TVM Solver, and

then enter the known TVM

variable values:

N=360 PMT=L800

I=8 FV=0

4

Move the cursor to the

prompt and solve for the present

value of the loan. A small square

specifies the solution.

5

Display the parametric equation

editor. Turn off all stat plots.

PV=

- m #

2

, as

" " " b

# # # " "

b

- Π/ '

12

)

&

a

800

360

# #

# 8 #

# 0

b

#

b

$ $ *

6 &

is on, press $,

(if a plot

"

to highlight it, and

b

; then #)

6

7

xt1

Define

as t and

Display the window variable

yt1

editor, and then enter these

window variable values as

shown.

8

Draw the graph and activate the

trace cursor. Explore the graph

of the outstanding balance over

time.

9

Enter a value for

t

to view the

balance at a specific time.

as

bal(t)

& # - Œ

.

/ ' ' /

( - & E

6 '

12

#

# 0 #

50

#

# 0

125000

*

)

! "

24

b

#

0

#

#

10000

360

360

Assembly Language Programming: Financial Functions

J

Display the table setup editor,

and then enter these values:

TblStart=0@Tbl=12

Indpnt: Auto

K

Display the table of outstanding

balances, where

time and

at that point in time.

yt1

represents balance

Calculating Interest Conversion

Use the interest conversion functions

annual effective rate to a nominal rate (

effective rate (

effectiveRate,compoundingPeriods

nom(

nominalRate,compoundingPeriods

eff(

eff

).

xt1

represents

7 '

0

# 12 #

&

nom

and

nom

)

)

b

eff

to convert interest rates from an

), or from a nominal rate to an annual

Computes the nominal interest rate

Computes the effective interest rate

11

Dates must fall between the

years 1950 and 2049.

On the payment format

PMT:END BEGIN

editor’s

END

select

annuity or select

set annuity due.

to set ordinary

BEGIN

line,

to

Finding Days Between Dates

dbd

Use the date function

to calculate the number of days between two dates

using the actual-day-count method. dateA and dateB can be numbers or lists of

numbers within the range of the dates on the standard calendar.

dateA,dateB

dbd(

)

Calculates the number of days between dates; enter dateA and

dateB in either of two formats: MM.DDYY (for U.S.) or DDMM.YY

(for Europe)

Defining the Payment Method

pEnd

and

pBegin

specify a transaction as an ordinary annuity or an annuity due.

Executing either instruction sets the payment method for subsequent financial

calculations. The current setting is displayed in the payment format editor

(page 4).

pBegin

pEnd

Specifies an annuity due, where payments occur at the beginning

of each payment period (Most leases are in this category.)

Specifies an ordinary annuity, where payments occur at the end

of each payment period (Most loans are in this category;

Pmt_End

is the default.)

Assembly Language Programming: Financial Functions

Menu Map for Financial Functions

MATH Menu (where FIN is automatically placed) - Œ

12

NUM PROB ANGLE HYP MISC

4

INTER FIN

(MATH) FIN (Financial) Menu - Π/ '

TVM FUNC VARS FORMT Uninst

FIN TVM (Time-Value-of-Money) Solver Menu - Π/ ' &

TVM FUNC VARS FORMT SOLVE

FIN FUNC (Financial Functions) Menu - Π/ ' '

TVM FUNC VARS FORMT Uninst

tvmN tvmI tvmPV tvmP tvmFV

4

npv irr bal

4

nom eff dbd pBegin pEnd

G

prn

G

int

FIN VARS (Financial Variables) Menu - Π/ ' (

TVM FUNC VARS FORMT Uninst

ç

I PV PMT FV

4

PY CY

FIN FORMT (Financial Format) Menu - Π/ ' )

TVM FUNC VARS FORMT

Loading...

Loading...