Sage LINE 50 V11 User Manual

Line50 v11 User Guide

Powerful accounting software for growing businesses

Copyright

This document and software described in it are copyrighted with all rights reserved. Under copyright laws, neither the documentation nor the software may be copied, photocopied, reproduced, translated, or reduced to any electronic medium or machine readable form, in whole or in part, without prior written consent of Sage (UK) Limited (‘Sage’). Failure to comply with this condition may result in prosecution.

This computer program is the property of Sage. The program is protected under copyright law and is licensed for use only by a user who has returned the completed registration card included with the computer program and further is licensed strictly in accordance with the conditions specified in the Software Licence. Sale, lease, hire rental or reassignment to, or by, a third party without the prior and written permission of Sage is expressly prohibited.

Sage does not warrant that the software package will function properly in every hardware/software environment. For example, the software may not work in combination with modified versions of the operating system, with certain print-spooling or file facility programs, or with certain printers supplied by independent manufacturers.

Although Sage has tested the software and reviewed the documentation, Sage makes no warranty, representation or condition, either express or implied, statutory or otherwise, with respect to this software or documentation, their performance, satisfactory quality, or fitness for a particular purpose. This software and documentation are licensed ‘as is’, and you, the licensee, by making use thereof, are assuming the entire risk as to their quality and performance.

In no event will Sage be liable for direct, indirect, special, incidental, or consequential damages (including but not limited to economic loss, such as loss of profits, loss of use of profits, loss of business or business

interruption, loss of revenue, loss of goodwill or loss of anticipated savings) arising out of the use or inability to use the software or documentation, even if advised of the possibility of such damages. In particular, and without prejudice to the generality of the foregoing, Sage has no liability for any programs or data stored or used with Sage software, including the costs of recovering such programs or data.

Nothing in this notice shall exclude or limit Sage’s liability for fraud, death or personal injury arising out of Sage’s wilful default or negligence.

Sage’s policy is one of constant development and improvement. We reserve the right to alter, modify, correct and upgrade our software programs and publications

Copyright: |

© 1999 - 2004 Sage (UK) Limited |

|

North Park |

|

Newcastle upon Tyne NE13 9AA |

|

All Worldwide Rights Reserved |

Issue date: |

02/08/2004 |

Pbn No: |

12701 |

Read This...

Your Sage Line 50 User Guide is made up of two parts.

The first part deals with setting up your accounting system (if you are a new user) and also the maintenance of your accounts (for established users, i.e. who are upgrading).

In the first part, Setting Up and Maintenance, we deal with:

Installing Sage Line 50 onto your computer and using it for the first time (for new users).

How to use Line 50.

Setting up your company details (defaults).

Setting up your nominal structure.

Setting up your customer and supplier records.

Entering your product or service details.

Entering your opening balances.

Setting up your regular monthly payments.

Setting up prices and discounts for your products or services.

Working with fixed assets.

Setting up an e-banking system.

As a new user, you will have to work through this first part to set up your accounting system. All of the sections may not apply to your business, so you will have to see which ones do apply to you and work through the relevant sections.

As an established user who is upgrading, your system will already have your opening balances on, as well as most of your company details. So, you can use this part of the manual to make changes to your company details and defaults.

The second part is concerned with Daily Activities and Processing and we deal with:

Completing everyday tasks, such as looking after your data, using the search, making journal entries, and so on.

Recording invoices and credit notes.

Sales and purchase order processing.

Recording payments and receipts.

How to carry out credit control activities, such as chasing unpaid bills and writing off bad debts.

Reconciling your bank accounts on your computer with your real bank accounts.

Using advanced stock features, such as working with bills of materials.

Working with Projects.

Producing your VAT Return.

Running a range of financial reports, including your profit and loss and balance sheet report.

Running your month and year end routines.

Working with Sage MIS, which is a management information system.

All the tasks contained in the second part are mostly concerned with processing, i.e. working with your finances as part of your day to day accounting activities. Sometimes you may have to consult the first part of the chapter, for example, if you want to learn how to reconcile your e-banking transactions. In these instances, the User Guide will clearly direct you to where you need to go.

Contents |

|

Chapter 1: Getting Started ................................................................... |

1 |

Transferring Accounting Systems ..................................................................... |

2 |

Installation........................................................................................................ |

3 |

The ActiveSetup Wizard................................................................................... |

4 |

Registering Sage Line 50 ............................................................................... |

13 |

Getting Started .............................................................................................. |

13 |

About SageCover .......................................................................................... |

14 |

SageCover Online Support ............................................................................ |

14 |

sage.co.uk & sage.ie...................................................................................... |

15 |

Sage Training ................................................................................................. |

15 |

Chapter 2: How to Use Sage Line 50 ................................................ |

17 |

Instructions in This Guide............................................................................... |

19 |

The Sage Line 50 Options ............................................................................. |

20 |

The Sage Line 50 Window............................................................................. |

21 |

Using Windows.............................................................................................. |

24 |

Menu Commands .......................................................................................... |

25 |

Getting Help .................................................................................................. |

41 |

Wizards ......................................................................................................... |

41 |

Debits and Credits ......................................................................................... |

42 |

Chapter 3: Setting Up Your Company Details .................................. |

43 |

The Configuration Editor ................................................................................ |

44 |

Entering Your Company Preferences.............................................................. |

68 |

Entering Your Company Defaults.................................................................... |

77 |

Setting the Financial Year ............................................................................... |

77 |

Entering Your Bank Defaults........................................................................... |

78 |

The Euro and Other Currencies...................................................................... |

80 |

The Countries Table ....................................................................................... |

82 |

Passwords and Access Rights....................................................................... |

83 |

Changing Your Password............................................................................... |

84 |

Working With Internet Resources................................................................... |

84 |

The Foreign Trader |

|

(Financial Controller only) ............................................................................... |

85 |

To Set Up the Foreign Trader ......................................................................... |

86 |

Opening Balances ......................................................................................... |

91 |

Sage Line 50 User Guide |

|

Chapter 4: Setting Up Your Nominal Structure ................................. |

93 |

Nominal Ledger Accounts Explained.............................................................. |

94 |

The Nominal Account Structure ..................................................................... |

99 |

Control Accounts......................................................................................... |

100 |

The Nominal Ledger Window....................................................................... |

102 |

Entering, Editing and Deleting Nominal Records .......................................... |

108 |

Entering Bank Account Records .................................................................. |

113 |

The Chart of Accounts................................................................................. |

116 |

Checking Your Chart of Accounts ................................................................ |

120 |

Chapter 5: Entering Customer and Supplier Records .................... |

123 |

Planning Your Customer and Supplier Codes............................................... |

124 |

Entering Customer Defaults ......................................................................... |

125 |

Setting an Account Status ........................................................................... |

128 |

Entering Customer Records......................................................................... |

129 |

Opening Balances for Customers ................................................................ |

133 |

Entering Supplier Defaults............................................................................ |

137 |

Entering Supplier Records ........................................................................... |

138 |

Opening Balances for Suppliers ................................................................... |

141 |

Checking and Clearing Your Customers’ and Suppliers’ Opening Balances .145 |

|

Chapter 6: Entering Product Details and |

|

Planning a Stock System ................................................................. |

151 |

Product Valuation......................................................................................... |

152 |

Setting Up Your Product List........................................................................ |

152 |

Creating Product Categories........................................................................ |

153 |

Entering Product Defaults ............................................................................ |

154 |

Entering Product Records............................................................................ |

157 |

Entering Your Product Opening Balances..................................................... |

161 |

Chapter 7: Entering Opening Balances for Nominal |

|

and Bank Accounts .......................................................................... |

163 |

The Opening Balance Sequence Consists of: .............................................. |

164 |

Entering the Opening Balances for Your |

|

Nominal Ledger Accounts............................................................................ |

165 |

Entering the Opening Balances for Your Bank Accounts .............................. |

167 |

Uncleared Items in Your Bank Opening Balance........................................... |

168 |

Checking Your Nominal and Bank Opening Balances .................................. |

169 |

Completing the Opening Balances Procedure.............................................. |

170 |

|

Contents |

Chapter 8: Setting Up Recurring Entries, |

|

Prepayments and Accruals .............................................................. |

173 |

Explaining Recurring Entries......................................................................... |

174 |

Prepayments |

|

(Accountant Plus and Financial Controller Only)............................................ |

186 |

Accruals |

|

(Accountant Plus and Financial Controller Only)............................................ |

189 |

Chapter 9: Pricing and Discounts .................................................... |

193 |

Using Customer Price Lists |

|

(Accountant Plus and Financial Controller Only)............................................ |

195 |

Importing Product Prices onto a Customer Price List |

|

(Accountant Plus and Financial Controller only) ............................................ |

201 |

Setting Special Customer Prices |

|

(Accountant Plus and Financial Controller Only)............................................ |

205 |

Supplier Price Lists |

|

(Financial Controller users only) .................................................................... |

210 |

Importing Supplier Price Lists |

|

(Financial Controller users only) .................................................................... |

212 |

'Good Customer' Discount .......................................................................... |

214 |

Early Settlement Discount ............................................................................ |

216 |

Discounting by Quantity of Product Sold |

|

(Accountant Plus and Financial Controller Only)............................................ |

219 |

Discounting by Invoice Value |

|

(Accountant Plus and Financial Controller Only)............................................ |

222 |

Checking Discount Amounts & Editing the Total Discount ............................ |

224 |

Other Discount Options ............................................................................... |

226 |

The Invoice and Order Defaults Options List................................................. |

228 |

Discounting by Unit Price |

|

(Accountant Plus and Financial Controller Only)............................................ |

230 |

Chapter 10: Working With Fixed Assets |

|

(Accountant Plus and Financial Controller Only) ............................ |

233 |

Fixed Assets ................................................................................................ |

234 |

Depreciation ................................................................................................ |

235 |

Depreciation Methods in Line 50.................................................................. |

235 |

Writing Off Fixed Assets ............................................................................... |

237 |

Selling Fixed Assets ..................................................................................... |

237 |

Creating Fixed Asset Categories .................................................................. |

237 |

Entering Your Fixed Asset Records .............................................................. |

238 |

Sage Line 50 User Guide |

|

Chapter 11: E-Business ................................................................... |

243 |

Contacting Sage.......................................................................................... |

244 |

e-Banking .................................................................................................... |

245 |

Configuring Your e-Banking Option .............................................................. |

246 |

Using the e-Payments Option ...................................................................... |

248 |

Entering Supplier Bank Details ..................................................................... |

248 |

Using the e-Reconcile Option ...................................................................... |

250 |

Importing e-Banking Transactions................................................................ |

250 |

Reconciling Your Bank Account ................................................................... |

251 |

Transaction e-Mail........................................................................................ |

255 |

Setting Up Transaction e-Mail ...................................................................... |

256 |

Configuring Transaction e-Mail ..................................................................... |

257 |

Processing Incoming Orders and Invoices in |

|

Transaction e-Mail........................................................................................ |

265 |

Matching in Transaction e-Mail..................................................................... |

267 |

Help with Transaction e-Mail ........................................................................ |

274 |

Sage WebTrader Professional ...................................................................... |

274 |

Chapter 12: Everyday Tasks ............................................................ |

275 |

Changing the Program Date ........................................................................ |

276 |

Checking Your Data ..................................................................................... |

277 |

Backing Up Your Data.................................................................................. |

279 |

Restoring Your Data..................................................................................... |

281 |

Event Logging.............................................................................................. |

282 |

Using the Search to Find Records................................................................ |

286 |

Building Your Search.................................................................................... |

289 |

Finding Transactions .................................................................................... |

291 |

Using ActiveSearch...................................................................................... |

293 |

Using the Spelling Checker .......................................................................... |

294 |

Printing What’s On Your Screen ................................................................... |

295 |

Working with Attachments using Document Manager .................................. |

298 |

Using The Task Manager.............................................................................. |

304 |

Exporting to Microsoft Word, Excel and Outlook .......................................... |

305 |

Journal Entries............................................................................................. |

307 |

Reversing Nominal Journals |

|

(Accountant Plus and Financial Controller Only)............................................ |

310 |

Paying Wages Using Journal Entries ............................................................ |

312 |

Setting Up a Petty Cash Account................................................................. |

317 |

|

Contents |

Chapter 13: Entering Invoices and Credit Notes ............................ |

319 |

Special Product Codes ................................................................................ |

320 |

Invoices and Credit Notes ............................................................................ |

321 |

Batch Invoices and Credit Notes.................................................................. |

322 |

Creating Invoices and Credit Notes From the Invoicing option...................... |

324 |

Memorising and Recalling Batch Invoices and Credit Notes |

|

(Accountant Plus and Financial Controller Only)............................................ |

349 |

Creating Recurring Transactions .................................................................. |

350 |

Entering Invoice and Order Defaults ............................................................. |

355 |

Updating the Ledgers .................................................................................. |

361 |

Invoice Profit Check |

|

(Accountant Plus and Financial Controller Only)............................................ |

362 |

Creating Mix and Match Invoices and Orders |

|

(Financial Controller Only)............................................................................. |

364 |

Invoicing From Telephone Calls |

|

(Financial Controller Only)............................................................................. |

372 |

Quotations and Proformas |

|

(Accountant Plus and Financial Controller Only)............................................ |

374 |

Chapter 14: Order Processing |

|

(Financial Controller Only) ................................................................ |

377 |

Sales Orders................................................................................................ |

378 |

The Sales Order Cycle ................................................................................. |

378 |

Creating a Sales Order................................................................................. |

379 |

Creating Recurring Orders ........................................................................... |

398 |

Completing Your Sales Order if it has Already Been Despatched.................. |

400 |

Saving Your Sales Order .............................................................................. |

400 |

Printing Your Sales Orders ........................................................................... |

400 |

Allocating Stock to Sales Orders.................................................................. |

401 |

Order Shortfalls............................................................................................ |

403 |

Despatching Sales Orders ........................................................................... |

406 |

Recording Delivery of Goods using Goods Despatched Notes..................... |

407 |

Recording Sales Order Despatches ............................................................. |

411 |

Manually Recording Sales Order Despatches............................................... |

411 |

Printing an Invoice Created From the Sales Order ........................................ |

412 |

Updating the Ledgers .................................................................................. |

412 |

Deleting a Sales Order ................................................................................. |

413 |

Converting Quotes and Proformas to Sales Orders...................................... |

414 |

Intrastat Reporting ....................................................................................... |

417 |

Sage Line 50 User Guide |

|

Confirming your Intrastat Dispatches............................................................ |

419 |

Working With Purchase Orders .................................................................... |

424 |

Creating Purchase Orders............................................................................ |

425 |

Completing Your Purchase Order if it has Already Been Delivered ................ |

440 |

Saving Your Purchase Orders ...................................................................... |

440 |

Printing Your Purchase Orders ..................................................................... |

440 |

Putting Purchase Orders 'On Order' ............................................................ |

441 |

Recording Delivery of Goods........................................................................ |

442 |

Recording Delivery of Goods Using Goods Received Notes......................... |

443 |

Recording Purchase Order Deliveries ........................................................... |

447 |

Manually Recording Purchase Order Deliveries ............................................ |

447 |

Creating Purchase Invoices From Your Purchase Orders.............................. |

448 |

Deleting a Purchase Order ........................................................................... |

448 |

Confirming your Intrastat Arrivals.................................................................. |

448 |

Chapter 15: Project Costing |

|

(Accountant Plus and Financial Controller Only) ............................ |

453 |

Introduction to Project Costing..................................................................... |

454 |

Who Can Use Project Costing?.................................................................... |

454 |

The Life Cycle of a Project ........................................................................... |

454 |

The Project Life Cycle in Line 50 .................................................................. |

455 |

Setting Up Project Costing........................................................................... |

457 |

Project Statuses .......................................................................................... |

458 |

Cost Codes ................................................................................................. |

459 |

Resources ................................................................................................... |

463 |

Working with Projects .................................................................................. |

465 |

Project Records ........................................................................................... |

465 |

Project Only Costs ....................................................................................... |

472 |

Stock Postings ............................................................................................ |

474 |

Cost Postings .............................................................................................. |

475 |

Billing Your Customer for a Project............................................................... |

477 |

Project Enquiries, Analysis and Reporting .................................................... |

481 |

Completing Your Project .............................................................................. |

483 |

Chapter 16: Recording Payments and Receipts ............................. |

485 |

Customer Receipts ...................................................................................... |

486 |

Bank Receipts ............................................................................................. |

488 |

Memorising and Recalling Bank Receipts |

|

(Accountant Plus and Financial Controller Only)............................................ |

492 |

Supplier Payments....................................................................................... |

494 |

|

Contents |

Recording Bank, Cash and Credit Card Payments....................................... |

498 |

Memorising and Recalling Bank Payments |

|

(Accountant Plus and Financial Controller Only)............................................ |

501 |

Batch Supplier Payments |

|

(Financial Controller Only)............................................................................. |

503 |

Producing Cheques |

|

(Accountant Plus and Financial Controller Only)............................................ |

505 |

Recording Expenses.................................................................................... |

512 |

Bank Transfers............................................................................................. |

514 |

Chapter 17: Credit Control ............................................................... |

525 |

The Cash Flow Option ................................................................................. |

526 |

Manual Entries in a Cash Flow ..................................................................... |

530 |

Credit Control .............................................................................................. |

531 |

Ageing Transactions in Line 50..................................................................... |

531 |

Producing a Retrospective Aged Balance Report......................................... |

535 |

Checking Aged Balances............................................................................. |

535 |

Credit Control for Each Customer ................................................................ |

538 |

The Credit Control Window.......................................................................... |

541 |

Recording Contact Details ........................................................................... |

543 |

Viewing Transaction History and Aged Balances .......................................... |

547 |

Handling Disputed Transactions |

|

(Accountant Plus and Financial Controller Only)............................................ |

550 |

Charging Your Customers for Late Payments............................................... |

551 |

Writing Off Bad Debts .................................................................................. |

552 |

Writing Off Bad Debt Transactions Using the Wizard .................................... |

553 |

Writing Off Bad Debts Manually.................................................................... |

555 |

Days Sales Analysis ..................................................................................... |

560 |

Suggested Payments................................................................................... |

566 |

Credit Control Reporting .............................................................................. |

569 |

Other Customer Reports.............................................................................. |

571 |

Supplier Reports.......................................................................................... |

572 |

Chapter 18: Reconciling Your Bank Accounts ................................ |

573 |

Bank Reconciliation ..................................................................................... |

574 |

Preparing to Reconcile................................................................................. |

574 |

Reconciling Your Bank Account ................................................................... |

574 |

Posting Bank Adjustments........................................................................... |

577 |

Printing a Bank Statement Report................................................................ |

578 |

Sage Line 50 User Guide |

|

Chapter 19: Using the Advanced Stock Features |

|

(Accountant Plus and Financial Controller Only) ............................ |

579 |

Bill of Materials............................................................................................. |

580 |

Checking Component Availability ................................................................. |

583 |

Making Stock Transfers................................................................................ |

584 |

Using the Stock Shortfall Option .................................................................. |

586 |

Running a Stock Take .................................................................................. |

590 |

Recording Stock Returns............................................................................. |

592 |

Adjusting Stock Levels................................................................................. |

594 |

Chapter 20: Running Your VAT Return ............................................ |

595 |

The VAT Return Checklist............................................................................. |

596 |

Producing the VAT Return............................................................................ |

597 |

Checking Your VAT Return........................................................................... |

599 |

Saving your VAT Return ............................................................................... |

601 |

Handling Late Transactions .......................................................................... |

603 |

Handling Future Transactions....................................................................... |

603 |

Reconciling Your VAT Return........................................................................ |

604 |

Clearing Your VAT Control Accounts ............................................................ |

605 |

Submitting the VAT Return to the Tax Authorities ......................................... |

606 |

VAT Audit Reports........................................................................................ |

607 |

Entering Scale Charges |

|

(Accountant Plus and Financial Controller Only)............................................ |

607 |

Chapter 21: Running Financial Reports .......................................... |

609 |

Reports........................................................................................................ |

610 |

Running the Audit Trail Report...................................................................... |

611 |

Running the Trial Balance Report ................................................................. |

612 |

Running the Profit and Loss Report ............................................................. |

613 |

Running the Balance Sheet Report .............................................................. |

614 |

Running the Quick Ratio Report |

|

(Accountant Plus and Financial Controller Only)............................................ |

615 |

Running the Budget Report ......................................................................... |

617 |

Running the Prior Year Report...................................................................... |

618 |

Running the Transactional-Based Management Reports |

|

(Accountant Plus and Financial Controller Only)............................................ |

619 |

Running the Audit Assistant ......................................................................... |

622 |

The Sage Management Information System (MIS)........................................ |

634 |

|

Contents |

Chapter 22: Running Your Month End ............................................ |

635 |

The Month End ............................................................................................ |

636 |

Month End Checklist.................................................................................... |

637 |

Changing Your Program Date ...................................................................... |

639 |

Running the Month End ............................................................................... |

640 |

Posting Opening and Closing Stock............................................................. |

642 |

Posting Monthly Accruals |

|

(Accountant Plus and Financial Controller Only)............................................ |

648 |

Clearing Your Stock Transactions................................................................. |

651 |

Printing Your Product Reports |

|

(Accountant Plus and Financial Controller) ................................................... |

652 |

Clearing the Audit Trail ................................................................................. |

653 |

Handling Late Entries................................................................................... |

653 |

Posting Late Entries..................................................................................... |

653 |

Chapter 23: Running Your Year End ............................................... |

657 |

The Year End ............................................................................................... |

658 |

Year End Checklist....................................................................................... |

659 |

Backing Up Your Data.................................................................................. |

660 |

Running the Accounts Year End................................................................... |

662 |

Historical Data Analysis................................................................................ |

664 |

Checking the Financial Year Start Date Setting............................................. |

667 |

Clearing the Audit Trail ................................................................................. |

667 |

Deleting Records ......................................................................................... |

672 |

Compressing Your Data ............................................................................... |

675 |

Chapter 24: Accountant Link ........................................................... |

677 |

What Is Accountant Link? ............................................................................ |

678 |

Using Accountant Link with Line 50 Accountant, Accountant Plus or Financial |

|

Controller..................................................................................................... |

680 |

Exporting Your Accounts Data to File to Send to Your Accountant ............... |

683 |

Recording Material Changes To Your Data ................................................... |

686 |

Importing and Applying Your Accountant's Adjustments .............................. |

688 |

Using Accountant Link with Line 50 Client Manager..................................... |

693 |

Importing Your Client's Accounts Data From a File....................................... |

696 |

Recording Adjustments................................................................................ |

698 |

Exporting Your Adjustments and Narratives to File ....................................... |

700 |

Sage Line 50 User Guide |

|

Appendix: Installing and Upgrading to Line 50 Version 11 ............ |

703 |

System Requirements.................................................................................. |

704 |

The Readme File.......................................................................................... |

705 |

Information for Users in the Republic of Ireland ............................................ |

705 |

Installing Sage Line 50 Version 11 for the First Time |

|

(Single User Version) .................................................................................... |

706 |

Installing Sage Line 50 Version 11 for the First Time |

|

(Multi User Version) ...................................................................................... |

709 |

Upgrading from Earlier Versions ................................................................... |

715 |

Preparing to Upgrade from Version 4 or Version 5........................................ |

718 |

Preparing to Upgrade from Version 6, Version 7 or Version 8 ....................... |

720 |

Preparing to Upgrade from Version 9 or Version 10...................................... |

722 |

Upgrading to Sage Line 50 Version 11 |

|

(Single User Version) .................................................................................... |

723 |

Upgrading to Sage Line 50 Version 11 |

|

(Multi-User Version) ...................................................................................... |

724 |

After Upgrading: Converting Line 50 Version 5 Layouts................................ |

725 |

Registering Your Program ............................................................................ |

727 |

Chapter 1

Getting Started

Welcome to Sage Line 50.

Sage Line 50 lets you record, control and examine your finances quickly in a traditional way, through a state-of-the-art computer program.

Sage Line 50 is a totally integrated system, which means that when you record a financial transaction into one ledger, all the other related ledgers are immediately updated with that information. Sage Line 50 does your double-entry bookkeeping for you.

Read this chapter to find out how to get started with Sage Line 50, including installation and using your program for the first time.

This User Guide covers Sage Line 50 Accountant, Sage Line 50 Accountant Plus, Sage Line 50 Financial Controller and Sage Line 50 Network Versions.

In this chapter: |

|

Transferring Accounting Systems |

.........2 |

Installation ........................................... |

3 |

The ActiveSetup Wizard....................... |

4 |

Registering Sage Line 50 ................... |

13 |

Getting Started .................................. |

13 |

About SageCover .............................. |

14 |

SageCover Online Support ................ |

14 |

sage.co.uk & sage.ie ......................... |

15 |

Sage Training..................................... |

15 |

Transferring Accounting Systems

To help you achieve a smooth transition from your current accounting system to your new Sage Line 50 program, you should decide on which features and functionality you will use, and when. For example, if you run a shop, you will not enter each customer transaction (so you will have no customer records), but you will need to use cash book functionality to enter the day’s takings. (For details about how to do this, see Bank Receipts on page 488.) Sage Line 50 lets you choose the accounting functions suitable to your business.

As a result of your business needs, you may need to do some, or all, of the following:

Enter your company details.

Set up and check your nominal account structure (this includes setting up bank accounts in Sage Line 50). For an explanation of the nominal account structure, see

Nominal Ledger Accounts Explained on page 94.

Enter your customer records and their opening balances.

Enter your supplier records and their opening balances.

Enter your product details and their opening balances.

Enter the opening balances for your nominal ledger.

Enter the opening balances for your bank accounts.

For many people, moving from one system of accounting to another is a staged process. It doesn’t happen overnight. Because of the nature of bookkeeping, where invoices may not be paid on time and bank statements do not arrive until the end of the month, you may have to make the transfer to your new system gradually.

Also, many people prefer to gain confidence in a new system by choosing to set up one ledger at a time, for example, first the sales ledger, then the purchase ledger (Customers and Suppliers in Sage Line 50), then the nominal ledger. However, other people choose to transfer their accounts in one go, and do so successfully.

Whatever the implementation strategy you choose, we recommend that, until you become familiar with Sage Line 50, you continue using your existing system for a short time. In this way you can check that you are getting the right figures from Sage Line 50, and you can also see the benefits of the new system, as many of your entries are automatically done for you. You should also use the Demonstration Data supplied with your Sage Line 50 program to experiment with all of the different areas of the program.

Getting Started

Installation

This section guides you through installing a single user version of Sage Line 50 for the first time. If you are installing a network version, or are upgrading from a previous version of Sage Line 50, refer to the Appendix at the back of this guide. New users of Sage Line 50 (single user) should follow these instructions:

Note: You must ensure that you are logged onto your computer as 'Administrator', or as a user with administrative access rights, before attempting to install Sage Line 50. The installation process cannot proceed if you do not have sufficient access rights.

1.Shut down any other programs you are running.

2.Put the Sage Line 50 CD into your CD-ROM drive.

If the Sage menu does not appear automatically after a few moments, open the Start menu from the Windows menu bar, choose Run and then type d:\start in the Open text box.

Note: If your drive letters are different to those shown above, replace them with the appropriate letter.

The Installation main menu appears.

3.Before you begin to install Sage Line 50, select ‘Readme’. This contains any additional or late-breaking information about your Sage product.

Note: Sage Line 50 version 11 requires Microsoft Internet Explorer version 6 to run. If you do not have Internet Explorer version 6 on your computer, a warning message appears advising you that you must install it before you continue with the Line 50 installation. Install Internet Explorer from the Line 50 CD, then start the Line 50 version 11 installation again.

4.Click Install and follow the on-screen instructions.

5.When the installation is complete, click Finish. You can now close the installation menu.

A Sage Accounts short-cut is created on your desktop, so that you can double-click on this icon to start the program.

If prompted, restart your PC.

You are now ready to run your Sage Line 50 program for the first time.

3

Sage Line 50 User Guide

The ActiveSetup Wizard

Once you have installed Sage Line 50 you are ready to use it for the first time. To activate Sage Line 50, double-click the Sage icon on your desktop or open the Start menu from the Windows menu bar, choose Programs, then select Sage and finally select Sage Accounts.

Important Note: If you are using a multi-user version of Sage Line 50, the Logon window appears every time that you start the program. When you first use Sage Line 50 program the default logon name is MANAGER, with no password. Once you have completed the ActiveSetup Wizard, you can then set up your access rights and passwords. For more information, read Passwords and Access Rights on page 83.

When you start the program, the ActiveSetup Wizard appears. Use this to enter all of your company information.

Click Next to progress onto the next step or click Back to return to the previous step to re-enter or edit any information.

There are nine screens in the ActiveSetup Wizard when you are using Sage Line 50 for the first time:

Welcome

My Company

My Details

My Financial Year

My VAT Details

My Currency

Program Activation

Program Registration

Next Steps

After the first Welcome screen, you should enter your company information into the relevant boxes on-screen. Information about each of these screens can be seen in the following pages.

If you need additional help on any of the screens in the ActiveSetup Wizard, press F1 or select the Help button for more information.

4

Getting Started

Step 2: My Company

If you are a new user you must select the first option ‘I would like to create a new company’. If you are upgrading from an earlier version, or if you have Sage Line 50 and want to set up a network version, refer to Appendix, Installing and Upgrading to Line 50 Version 11 on page 703.

You must also decide what type of chart of accounts your company needs. Sage Line 50 has a number of charts to suit different business types. For example, you can choose from construction, charities, medical, farming, garage and transport.

Note: There are more chart of accounts to choose from. To see details of the different chart of accounts, press F1, enter the words Chart of Accounts in the Index tab and then select ‘standard’.

From the list, choose the chart of accounts most suited to your needs. If you are in doubt, select the 'General Business - Standard Accounts' layout. This provides you with a basic chart of accounts layout that is suitable for most businesses. To select a chart of accounts, click Browse to access the Company Configurations window. Choose the chart you require and click Open. For more information, see To use an existing configuration file on page 6.

Alternatively, you may have been given a Sage Line 50 configuration file by your accountant, or someone in your company, to use. The configuration file holds all of your basic Sage Line 50 setup information, such as the nominal ledger details and the default settings for your company. For more information about the details held in the configuration file, see the section The Configuration Editor on page 44.

Important Note: You must select the configuration file before you exit the ActiveSetup Wizard. You cannot change the configuration file once you have completed the ActiveSetup Wizard.

5

Sage Line 50 User Guide

To use an existing configuration file

1.From the ActiveSetup Wizard’s ‘My Company’ window, click Browse. The Company Configurations window appears.

If your configuration file has been saved into the default file location, the file will appear in the list. The default file location is C:\Program Files\Sage\Accounts\Configs.

2.Select the appropriate file from the scrolling list. If the configuration file is not in the list, click Browse to find the file.

3.Once you have selected the configuration file, click Open.

Line 50 returns you to the ActiveSetup Wizard and displays the file you selected.

4.Click Next to continue through the ActiveSetup Wizard.

6

Getting Started

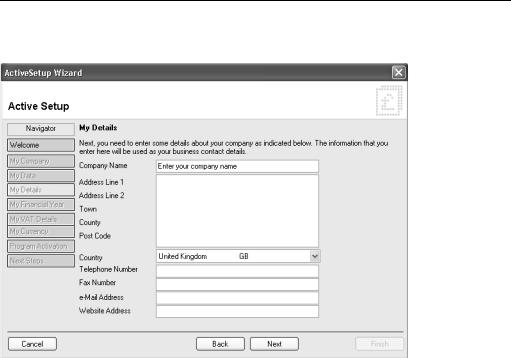

Step 3: My Details

Use this step to enter your company name and contact details. When you have completed the wizard, these details will be copied to your Sage Line 50 program. If your company details change, or if you make a mistake, you can change these details within your Sage Line 50 program.

7

Sage Line 50 User Guide

Step 4: My Financial Year

Use this step to enter your Financial Year start date.

Note: It is important that you enter the correct Financial Year start date as it is difficult to change this date once you have started to enter transactions. If you are in any doubt as to your Financial Year start date you should contact your accountant or your company’s accounts department before proceeding.

8

Getting Started

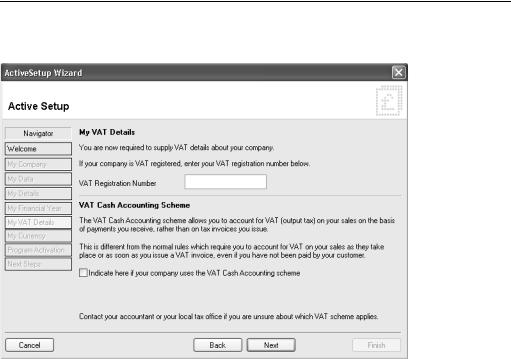

Step 5: My VAT Details

If your company is VAT registered, enter the VAT registration number in the relevant box. You must also specify if your company uses the VAT Cash Accounting scheme. By default, Sage Line 50 calculates tax liability using the Standard VAT scheme.

If you are in any doubt as to the VAT scheme that you are using, you should contact your accountant or your company’s accounts department.

9

Sage Line 50 User Guide

Step 6: My Currency

You now need to choose your base currency. This is the currency you will use most often to record your transactions.

Note: It is very important that you choose your base currency correctly, as you cannot change it once it has been selected.

10

Getting Started

Step 7: Program Activation

You must now enter your Serial Number and Activation Key in the relevant boxes. You can find these on the sticker sheet entitled 'Important Information', which comes within your program box.

If you cannot find your Serial Number and Activation Key, please contact our Customer Care department.

11

Sage Line 50 User Guide

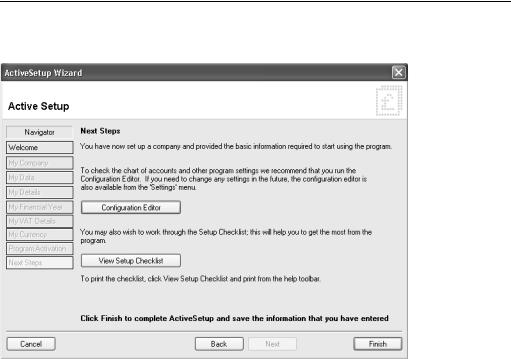

Step 8: Next Steps

This is the final screen of the ActiveSetup Wizard.

From this window you can access the Configuration Editor. You can use the Configuration Editor to set up the basic information about your company. For more information, see The Configuration Editor on page 44.

From here you can also open the help system to see the Setup Checklist. To do this, click View Setup Checklist.

Click Finish to close the ActiveSetup Wizard.

12

Getting Started

Registering Sage Line 50

Unless you register your Sage Line 50 program, you can only use your new Sage Line 50 for a maximum of 60 days. At the end of the unregistered period you will be unable to use the program (however, all of the information you entered during this period will be unaffected).

To register your Sage Line 50 program, call one of the following telephone numbers.

UK residents (mainland), 0845 111 66 66 Northern Ireland, 0845 245 0280 Republic of Ireland, 01 642 0800

If you have Internet access, you can register your program online. From the Tools menu, choose Activation and select Upgrade Program, then click Web Register from the Product Registration window. Follow the instructions on-screen to register your program.

Getting Started

You are now ready to begin entering information into your new Sage Line 50 program. Sage recommends that you follow the structure of Part One of this User Guide in order to lay the foundations of your new accounting system.

This chapter of the User's Guide introduces you to the new Sage Line 50 and shows you how to install the program and where to get help. Chapter two explains how to use Sage Line 50 and shows you some useful hints and tips. Chapter three starts with the first major task which you must complete and continues through to Chapter seven which is the last of the tasks which you should perform in sequence. Chapters eight to eleven explain other key setup tasks. In summary, the tasks you are advised to perform in sequence are:

Set your company defaults. Check that you have entered your company details correctly, including your financial year start date and your VAT scheme. For more information, see

Setting Up Your Company Details on page 43.

Check your nominal account structure (this includes setting up bank accounts in Sage Line 50). Sage Line 50 has already created a nominal account structure for you, but you should check that the structure is right for your company. At this stage you can rename your nominal accounts to suit your business, add additional accounts and delete others that you do not need. For more information, see chapter 4, Setting Up Your Nominal Structure.

Enter your customer and supplier information. If you need to keep details of your customers and suppliers, the next stage is to enter their records and their opening balances. A customer or supplier record is like a card in a card index box. Each record holds information about a specific customer or supplier, such as an address, telephone number, contact name, credit details and so on. Depending on your business you may need to complete both supplier and customer records or you may need only the supplier option. For more information, see chapter 5, Entering Customer and Supplier Records.

13

Sage Line 50 User Guide

Enter your product information. If your business has stock, you should now enter your product details, including their opening balances. For more information, see chapter 6, Entering Product Details and Planning a Stock System.

Enter the opening balances for your nominal ledger and bank accounts (in that order). Any figure listed on your opening trial balance should be entered as an opening balance against the relevant nominal account. You should enter the opening balance for your bank account after you have entered the balances of all your other nominal ledger accounts. This is the last task which you should complete in order. For more information, see Entering Opening Balances for Nominal and Bank Accounts on page 163.

The remaining chapters of Part One contain instructions on how to set up monthly payments, discounts for customers, your fixed asset details and e-Banking.

About SageCover

If you are new to Sage Line 50, you are entitled to receive free SageCover for a 60-day period. Your cover begins when you register your Sage product. This entitles you to unlimited assistance in registering, installing and starting to use your new software. During this period you can contact us by calling 0845 111 5555, e-mailing your query to support@sage.com or by visiting www.sage.co.uk. There is no limit to the amount of times you can use the SageCover service in this period.

Note: The free period of SageCover applies only to new users of Sage Line 50. If you are upgrading from an earlier version of Line 50, you should use your existing SageCover support contract if you have any queries. If you do not have an existing SageCover agreement, you can subscribe to SageCover as detailed below.

If you want to subscribe to a full annual SageCover period, which gives you additional benefits such as discounted program upgrades, call 0800 33 66 33 if you are resident in the UK (mainland), 0800 1690315 for residents of Northern Ireland, or 1800 255300 for residents of the Republic of Ireland. Alternatively, complete the order forms that are sent to you following registration of your Sage Line 50 program.

SageCover Online Support

If you have SageCover and access to e-mail, you can send online queries to SageCover support. To do this, from Sage Line 50's menu bar, open the Help menu, choose Email Support and follow the on-screen instructions.

On www.sage.co.uk you'll find a wealth of business advice as well as tips on how to get the maximum benefit from your new software. Business advice includes over 100 expertly written articles on topics ranging from "How to write a marketing plan" to "How to write a contract of employment".

14

Getting Started

sage.co.uk & sage.ie

The Sage UK website, www.sage.co.uk (or www.sage.ie for users in the Republic of Ireland), is a valuable resource available to you 24 hours a day, seven days a week. You can find information on our products and services, print your latest invoice from us or sign up for a free newsletter. It's a convenient place to buy Sage products, find out how to get help and advice locally from a Sage business partner and much more. We are constantly adding new features to the website, so visit regularly to take advantage of our online services.

To access the website, click the sage.com option from your Line 50 toolbar and choose Sage Home Page.

Sage Training

Sage offers a portfolio of classroom training courses for all of our users, designed to enable them to make the most of their Sage software packages. Every Sage training course is written and presented by staff who know and understand Sage software. There are training centres in Birmingham, Bristol, Croydon, Glasgow, Manchester, Newcastle upon Tyne, North London, Reading, Swansea and Leeds, all offering a range of training courses every month.

For customers who prefer to study in their own time, Sage has also developed a range of self study products, including on-line training courses, interactive CD-ROMs and workbooks with practice data.

For further details about our Training products and course availability, please contact one of our sales advisors on 0800 33 66 33.

15

Sage Line 50 User Guide

16

Loading...

Loading...