Page 1

WARNING

FCC Regulations state that any unauthorized changes or modifications to this equipment not

expressly approved by the manufacturer could void the user’s authority to operate this equipment.

Note: This equipment has been tested and found to comply with the limits for a Class A digital device,

pursuant to Part 15 of the FCC Rules. These limits are designed to provide reasonable protection

against harmful interference when this equipment is operated in a commercial environment.

This equipment generates, uses, and can radiate radio frequency energy and, if not installed and used

in accordance with the instruction manual, may cause harmful interference to radio communications.

Operation of this equipment in a residential area is likely to cause harmful interference in which case

the user will be required to correct the interference at his own expense.

CAUTION

The socket-outlet shall be installed near the equipment and shall be easily accessible.

FOR YOUR RECORDS

Please record below the model number and serial number, for easy reference, in case of loss or theft.

These numbers are located on the right side of the unit. Space is provided for further pertinent data.

Model Number_______________________________________________________

Serial Number_______________________________________________________

Date of Purchase_____________________________________________________

Place of Purchase____________________________________________________

SHARP ELECTRONIC CASH REGISTER

MODEL

XE-A102

INSTRUCTION MANUAL

Printed in China

O(TINSE2539RCZZ) 1

Thank you for purchasing the SHARP Electronic Cash Register Model XE-A102. Please

read this manual carefully before operating your machine. Keep this manual for future

reference. It will help you solve any operational problems that you may encounter.

Handling Cautions

Install the cash register in a location not subject to direct sunlight, unusual temperature

changes, high humidity, or splashing water.

Do not operate the cash register with wet hands. Water can cause internal component failure.

The cash register plugs into any standard wall outlet (120V AC ± 10%). Avoid connecting any

other electrical devices on the same electrical circuit since such connection could cause the

cash register to malfunction.

When cleaning the cash register, use a dry, soft cloth. Never use volatile liquids, such as

benzine or thinner. Chemicals can discolor or damage the cabinet.

For protection against data loss, please install three new “AA” batteries before using the cash

register. However, never forget you must initialize the cash register before installation of

batteries; otherwise damage to memory contents or malfunctioning of the register will occur. You

can start operating it only after initializing it and then installing batteries.

For complete electrical disconnection, pull out the main plug.

Getting Started

Initializing the Cash Register

For your cash register to operate properly, you must

initialize it before programming for the first time.

Follow this procedure.

1. Remove the register from its packing carton.

2. Insert one of the supplied mode keys into the

mode switch and turn it to the REG position.

3. Insert the plug into the AC outlet.

IMPORTANT: This operation must be performed

without batteries loaded.

4. The buzzer will sound three times. Now your

cash register has been initialized. The display

will show "0.00" with “ ”.

Installing Batteries

Batteries must be installed in the cash register to

prevent data and programmed contents from being

lost from the memory in case of accidental

disconnection of the AC cord or power failure. Please

install three new “AA” batteries before programming

and operating the cash register. Once installed, the

batteries will last approximately one year. When it is

time to replace them, the “l” symbol will appear on

the display to indicate a low battery voltage. If the

symbol appears, you must replace them within two

days.

Install the batteries according to this procedure with

the AC cord connected:

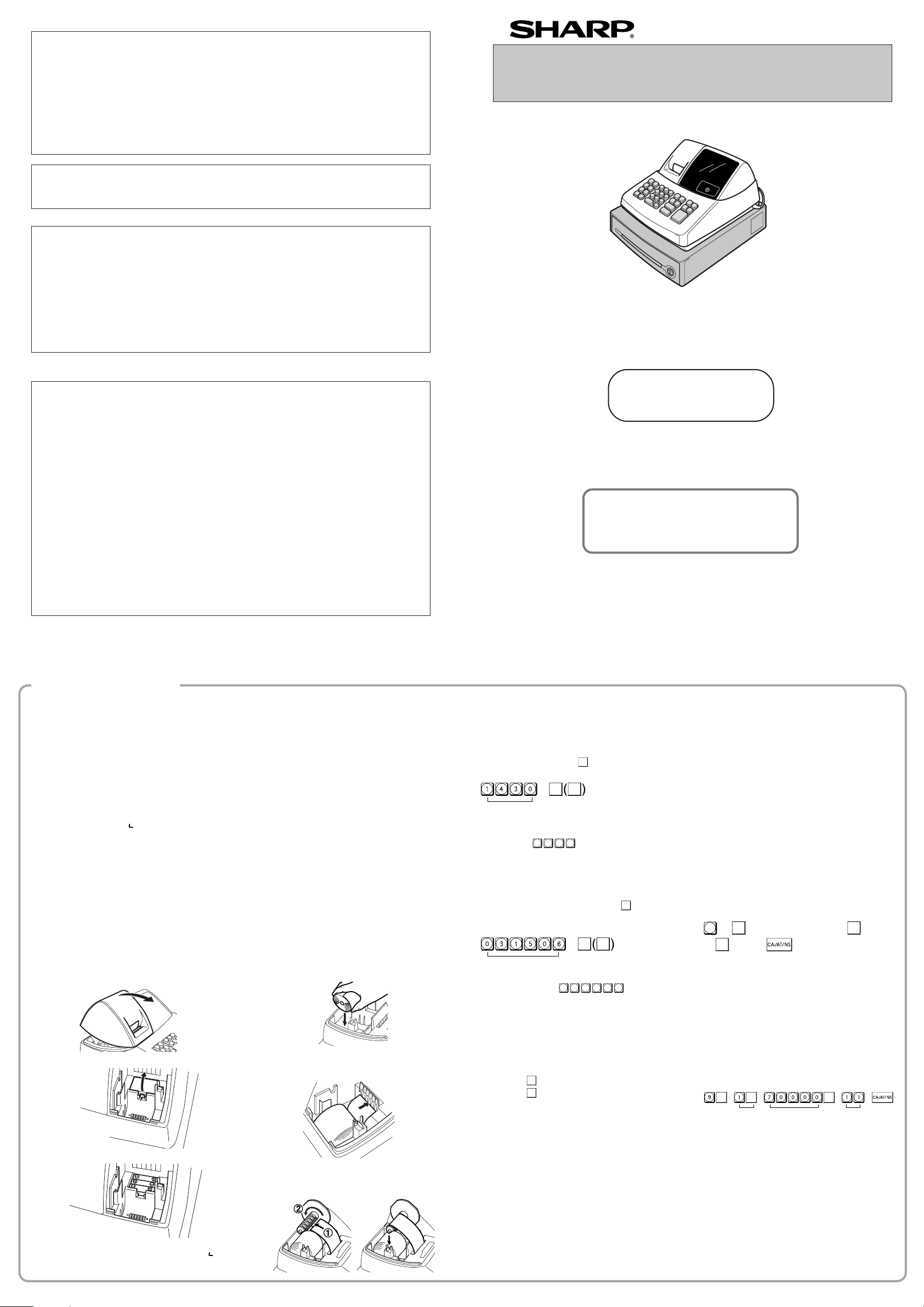

1. Push the printer cover forward and detach it.

2. Open the battery cover next to the paper roll

cradle.

View from rear

3. Insert three new AA batteries.

View from rear

4. When the batteries are properly installed, “ ”

on the display will disappear. Close the battery

cover.

5. Attach the printer cover.

Improper use of batteries could cause

C

them to burst or leak, which might damage

the interior of the cash register. Please

take the following precautions:

•Be sure that the positive (+) and negative

(-) poles of each battery are oriented

properly.

•Never mix batteries of different types.

•Never mix old batteries and new ones.

•Never leave dead batteries in the battery

compartment.

•Remove the batteries if you plan not to

use the cash register for long periods.

•Should a battery leak, clean out the

battery compartment immediately, taking

care not to let the battery fluid come into

direct contact with your skin.

•If an incorrect battery is used, it may

explode or leak.

•For battery disposal, follow the relevant

law or regulation in your country.

Installing a Paper Roll

Always install the paper roll even when you set the

register for not printing journal or receipt in REG

mode.

1. Push the printer cover forward and detach it.

2. Place a paper roll in the paper roll cradle so

that the paper unrolls from the bottom.

3. Insert the paper straight into the paper inlet,

and press the

comes out at the printing area.

4. (For journal printing) Insert the top end of

the paper into the slit in the take-up spool

shaft and wind the paper two or three turns.

Then place the take-up spool on the bearing.

ff

f key. The inserted end

ff

For assistance call

1-800-BE-SHARP

For Easy Set-up,

See “Getting Started”

5. Attach the printer cover.

(For receipt printing, step 4 should be omitted.)

Setting the Time

Turn the mode switch to the Z/PGM position and

enter the time in 4 digits (“hhmm” format) using the

24 hour system. Press the

programming or twice to exit the program mode.

Time (2:30 p.m.)

•Always enter the time in 4 digits even when

DD

D

DD

the hour is in the single digit. For example,

0 6 3 0

enter

• 6:30 a.m. prints as “06-30” and 6:30 p.m.

prints as “06-30@”.

Setting the Date

In the Z/PGM mode, enter the date in 6 digits using

the month-day-year format. Press the

to continue programming or twice to exit the

program mode.

Date (March 15, 2006)

Always enter the date in 6 digits. For

DD

D

DD

example, enter

15, 2006. If you change the date format in

the Z/PGM mode, follow the newly specified

format when setting the date.

Checking the Time and Date

You can display the time and date to check if they

are correctly set.

1. Turn the mode switch in the REG position.

2. Press the

3. Press the

date.

@/TM

key once to display the time.

@/TM

key a second time to display the

Programming the Tax Rate

Before you can proceed with registration of sales,

you must first program the tax that is levied in

accordance with the law of your state. Your cash

register comes with the ability to program four

different tax rates. In most states, you will only

need to program Tax 1. However, if you live in an

area that has a separate local tax (such as a Parish

tax) or a hospitality tax, your register can be

programmed to calculate these separate taxes.

In order to program the tax to be collected in

accordance with the law of your state, you must

specify the tax rate(s) and minimum taxable

amount(s).

#/

SBTL

key once to continue

#/

SBTL#/SBTL

for 6:30 a.m.

#/

SBTL#/SBTL

0 3 1 5 0 6

#/

SBTL

key once

for March

When you program the tax status for a department,

tax will be automatically added to sales of items

assigned to the department according to the

programmed tax status for the department. You can

also enter tax manually.

There are two tax programming methods. The tax

rate method uses a straight percentage rate per

dollar. The tax table method requires tax break

information from your state or local tax offices. Use

the method which is acceptable in your state. You

can obtain necessary data for tax programming from

your local tax office.

For tax table programming, see "programming"

DD

D

DD

Tax Rate Programming

The percent rate specified here is used for tax

calculation on taxable subtotals. Turn the mode

switch to the Z/PGM position and use the following

sequence to program the tax rate:

#/

9

SBTL

➝

➝ Tax number(1-4) ➝

@/TM

➝

➝ Q ➝

where R and Q represent the following.

R: Tax rate (0.0000% to 99.9999%) x 10000

Enter the rate in 6 digits (leading zeros may be

omitted). If the rate is fractional (e.g., 4 3/8%), it

should be converted to its decimal equivalent

(4.375) before entering.

Q: Minimum taxable amount (0.01 to 99.99) x 100

Smallest amount for which tax must be collected. In

some states, sales whose amounts are less than the

minimum taxable amount are not subject to tax. If

amounts $0.01 to $0.10 are not taxed, the value of

Q would be 11 (for $0.11), the lowest of the first

taxable category.

#/

@/TM

SBTL

Tax rate (7.0000%) Min. taxable

Tax 1

@/TM

@/TM

➝ R

amount ($0.11)

Changing Other Settings As Necessary

Your cash register is pre-programmed so that you

can use it with minimum setup. To change the initial

settings, see the appropriate sections.

Initial Settings

Departments 1 to 4:

Taxable 1. Positive (+). Preset price: 0.00

Departments 5 to 8:

Non-taxable. Positive (+). Preset price: 0.00

PLU codes 1-10:

Assigned to dept. 1. Preset price: 0.00

PLU codes 11-80:

Not used

Page 2

Entries

Operation Examples

When Paid by Cash

1. Turn the mode switch to the REG position.

2. Enter the clerk code (1 to 4) and press

the clerk code is entered, you need not enter the

clerk code at the start of each transaction until the

clerk is changed.)

3 Enter the price for the first item.

4. Press the appropriate department key.

5. Repeat steps 2 and 3 for all the remaining items.

6. Press

#/

SBTL

to display the amount due including any

tax (you can omit this step).

7. Enter the amount received from the customer (you

can omit this step if the amount tendered is the

same as the subtotal).

8. Press , and the change due is displayed and

the drawer opens.

9. Close the drawer.

CLK#

Clerk code

Amount tendered

5

1

Price and dept.Price and dept.

When Paid by a Credit Card

Press CH at the end of the transaction. The amount

tendered cannot be entered.

When Paid by Check

CHK

Press

at the end of the transaction. The amount

tendered can be entered like a cash sale and the

change due is displayed.

Mixed Tender Sale

When the amount tendered by cash or check is less

than the sales amount including tax, the display shows

a deficit and “o”. To compensate for the deficit, make

an additional amount-tendered entry or make a charge

entry.

Department

Repetitive Department Entries

To enter two or more of the same item, press the

appropriate department key repeatedly.

Multiplication Entries

To enter a sale of two or more of the same item, use

key for multiplication.

Example:

Selling five pieces of $1.50 item (department 1)

and three pieces of $3.50 item (department 3)

for check payment.

CLK#

3

. (Once

7

SBTL

#/

@/TM @/TM

#/

CHK

SBTL

5

1

3 3

Single Item Cash Sale (SICS) Entry

This function is used for the sale of one item to be paid

by cash. It is applicable only to departments

programmed for single-item cash sales or to PLUs

associated with such departments. After the appropriate

department or P key is pressed, the transaction is

complete and the drawer opens. For the programming of

SICS, see the Department Status section in

“Programming.”

PLU (Price Look Up)

The PLU function allows speedy key entries. When a

PLU code has been assigned to an item and a price for

it has been programmed, entry of the code

automatically calls up the price for the item. Up to 80

PLU codes are programmable. See the PLU

programming section in “Programming”

To enter a sale of a PLU item, simply enter its code and

press P.

Tax Calculation

Automatic Tax Calculation

When the register is programmed with a tax table or tax

rate method and the tax status of a department is

programmed as taxable, the register automatically

computes the tax on any item entered using the

department key for that department or a PLU code

associated with that department.

Taxable Subtotal

You can display the taxable 1 or taxable 2 subtotal by

pressing either tax shift key and then

of taxable 1 or taxable 2 entries is displayed. You

cannot display the subtotal of taxable 3 or 4 items.

Tax Shift

You can change the programmed taxable 1 or 2 status

of each department key by pressing one or both of the

two tax shift keys

TAX1

SHIFT

/RA

TAX2

SHIFT

and

. To change the taxable

/PO

status, press the appropriate tax shift key just before

the department, P or % key. In case of repetitive

entries, the shifted tax status is used.

Tax Delete

This function is used when the taxable item or items

@/TM

once entered need to be made non-taxable. Press

TAX2

SHIFT

or

, then s, and v and all entries made so far in

/PO

the transaction for items with the specified taxable

status will be made non-taxable.

#/

SBTL

7

3

. The subtotal

TAX1

SHIFT

TAX1

transactions. Non-add code numbers can be entered

To make all entries up to that point non-taxable, press

and

TAX2

SHIFT

/PO

#/

SBTL

, then

, and v. Subsequent entries in the

transaction remain unaffected and will be taxed normally.

Manual Tax

SHIFT

/RA

in the REG or VOID mode.

Non-add code number entry procedure:

a code number of up to 8 digits

➝ s.

You can apply tax manually when the automatic tax

calculation function cannot be used. Each manual tax

entry (for Tax 1 or Tax 2) can be made only once during

a transaction. After a manual tax entry, you cannot

make any further item entries.

Manual tax 1 entry:

TAX1

#/

SHIFT

SBTL

and

/RA

Manual tax 2 entry:

TAX2

SHIFT

/PO

➝ tax amount ➝

#/

SBTL

and

➝ tax amount ➝

#/

SBTL

#/

SBTL

Opening the Drawer

with No Sale

Just press and the drawer opens.

Percent Key

The percent key is used to apply a discount or premium

to an item or to a subtotal.

You can manually enter a discount (or premium) rate.

Once the rate is preset for % , you can skip the step of

entering the rate.

Discount for an item:

entry of an item ➝ percentage rate ➝ %

(ex. For 20%, enter

Discount for a subtotal:

entry of all items➝

#/

SBTL

(ex. For 5%, enter

➝ percentage rate ➝ %

2 0 0 0

5 0 0

.)

.)

Entering a Refund

The cash register has no refund key. You must use the

following alternative method to make a refund entry: A

negative department for refund must be programmed in

advance. Check the taxable status of the returned item

is the same as that of the programmed negative

department. If not, use the appropriate tax shift key to

change the taxable status.

Procedure

unit price of the returned item ➝ negative dept. key

➝ or g.

Non-add Code Number

/RA

Non-add code numbers can be entered and printed on

Received-on-Account

and Paid-Out Entries

The received-on-account (RA) entry function is used

for entering the cash received not directly connected

with a sale. The paid-out (PO) entry function is used

for recording the money taken from the drawer for

payment not directly connected with a sale. These

functions are available in the X/Flash mode.

Received-on-account entry (X/Flash mode):

amount received (up to $799999.99) ➝

Paid-out entry (X/Flash mode):

amount paid out (up to $799999.99) ➝

TAX1

SHIFT

/RA

TAX2

SHIFT

.

/PO

When an Error Occurs

When your register goes into an error mode, it will

display the error symbol “e” accompanied with a

warning beep. Clear the error state by pressing the

key and take the appropriate action.

1. You enter a number of more than 7 digits for

the department price or a number larger than

the 79999999 (8 digits) for other amounts.

Press CL and re-enter a correct number.

2. You make an error in key operation:

3. You make an entry beyond a programmed

4. A subtotal exceeds 79999999 (eight digits):

5. The number of an item exceeds 3 digits in

Error Escape Function

When an error or something uncontrollable occurs

during a transaction entry and you cannot keep the

customer waiting, press

in the error state). You can escape the situation and

finalize the transaction as a cash sale at that time.

Transaction entries to that point are registered.

CL

Press

and operate keys correctly.

entry digit limit:

CL

Press

and check if the entered amount is

correct. If not correct, re-enter a correct number. If

correct, check the setting of the entry digit limit.

Press CL and then press , g or k to finish

the transaction.

multiplication entry:

Press CL and re-enter the correct number.

ESC

twice (following

CL

when

CL

the journal (or receipt) during the entry of a sale. Nonadd codes can be used for credit numbers, check

numbers, serial numbers, product codes, service charge

codes or any other numbers for reference to

specific

Part Names and Functions

X/Flash

Z/PGM

SHIFT PLU

3

2

1

1

Display

Mode switch

Drawer lock

CHK CLK#

7

8

#/

SBTL

4

6

CA/AT/NS

5

5

8

to

keys.

4

CH

Printer cover

Keyboard

Drawer

Mode Switch

The mode switch enables the register to perform a

variety of functions. The mode switch can be

operated by inserting one of the two supplied mode

keys. These keys can be inserted into or withdrawn

from the switch only in the REG or OFF position.

REG

OFF

VOID

You can select the following functions:

REG: Permits transaction entries.

OFF: Turns the display off.

VOID: Permits you to cancel transaction entries.

X/

Flash

: Permits printing of sales reports and

displaying of flash reports.

Z/PGM: Permits printing of sales reports, resetting

of sales data and programming.

Keyboard Layout

TAX1

@/TM

SHIFT

/RA

TAX2

%

SHIFT

/PO

VOID

ESC

In order to enter the departments 5 to 8,

DD

D

DD

press

SHIFT

and then the

Display

The XE-A102 is equipped with a front LED (LightEmitting Diode) display that affords easy visibility

during transactions.

Symbols and figures appearing on the display:

Department code

PLU code

87654321

Repeat

Departments/PLU Code: The department code or

PLU code entered appears on the left. For

example, if the key for department 1 is pressed,

“1” would appear in the extreme left position.

Repeat: Indicates the number of times the same

department key is pressed. If an entry is repeated

more than ten times, only the first digit is displayed

(12 displays as “2”).

ee

(

e) Error: This symbol appears, accompanied by a

ee

warning beep, when an error is made. If this

occurs during a transaction because of an

excessive digit entry, simply press CL and re-enter

correctly.

pp

(

p) Program: This symbol remains on the display

pp

when the cash register is being programmed in the

Z/PGM mode.

ff

(

f) Finalization: This symbol appears when a

ff

transaction is finalized by pressing ,g or k.

oo

(

o) Subtotal: This symbol appears when

oo

pressed and the cash register computes the

subtotal, and also when the amount tendered is

less than the total sale amount.

cc

(

c) Change: This symbol appears whenever the

cc

change due amount is displayed.

ll

(

l) Low battery: This symbol appears when the

ll

power of the installed batteries is below a certain

level or you need to replace the batteries with new

ones. (see the “Maintenance” section for

explanation.)

( ) No battery: This symbol appears when no

batteries are installed. (see “Maintenance” and

“Getting Started” sections for explanation.)

In addition, the following appear when appropriate:

• The minus sign (-) can appear in positions 2 to 8.

• The decimal point appears in positions 1 to 3.

•

When entry of the secret code is necessary,

“----” appears in positions 1 to 4 .

#/

SBTL

is

Reading and Resetting

of Sales

X Reports

This report, when taken in the X/Flash mode, prints

the accumulated information of sales. Taking an X

report is a good way to do a mid-day check on

daily sales. You can take X reports any number of

times, because they do not affect the cash

register’s memory.

To issue an X report, turn the mode switch to the

X/Flash position and press .

Z Reports

The contents of Z reports are the same as those of

X reports, but issuance of a Z report resets all the

transaction totals to zero. To issue a Z report, turn

the mode switch to the Z/PGM position.

If the secret code is programmed, you must

DD

D

DD

enter the secret code and press after

this step.

For Z reports without grand total resetting

Press .

If the secret code is programmed, you have

DD

D

DD

to enter the secret code and press

again after this step.

For Z reports with grand total resetting

If you want to reset the grand total(GT)when taking

the Z report, press k instead of .

Other than resetting the grand total, this report is

the same as the normal Z reports.

If the secret code is programmed, you have

DD

D

DD

to enter the secret code and press k again

after this step.

Flash Reports (displayed but not printed)

Press the following key in the X/Flash mode:

Department Total Department key

Sales Total

Cash in Drawer

#/

SBTL

CH

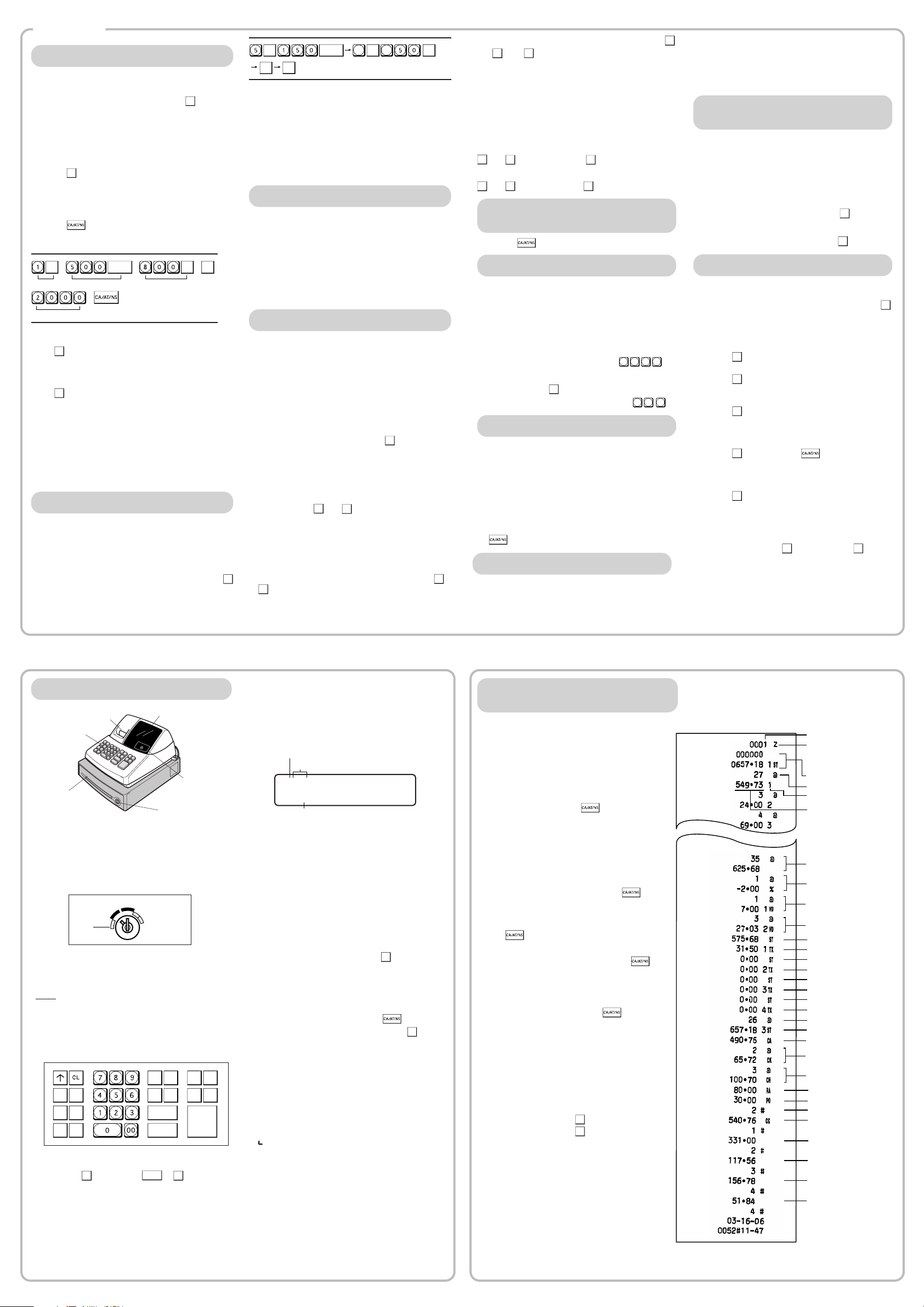

X/Z Report Sample

Reset counter

Reset symbol

("X" is printed in the

case of X reports.)

Grand total

Quantity

Dept. code

Amount

All Depts. counter and

total

Percent counter and

total

Item void counter and

total

Void mode counter

and total

Taxable 1 total

Tax 1 total

Taxable 2 total

Tax 2 total

Taxable 3 total

Tax 3 total

Taxable 4 total

Tax 4 total

Count of transactions

Sales total

Cash sale total

Check sale counter and

total

Charge sale counter and

total

Received-on-account total

Paid-out total

No sale counter

Cash in drawer

Clerk 1 sale total

Clerk 2 sale total

Clerk 3 sale total

Clerk 4 sale total

Page 3

Programming

Before you begin programming, turn the mode switch to

the Z/PGM position.

Follow these steps as needed.

If you do not press the

DD

D

programming step, you can continue program-

DD

ming without printing the programming report.

Programming by Departments

Preset Unit Price

The preset unit price function assigns a frequently

purchased item to a department key and enables you to

enter the price simply by pressing the department key.

Specify a price using the following sequence:

Unit Price (Max. 5 digits) ➝ Dept. key (➝

Department Status

You can specify various status parameters (+/- sign,

single item cash sale function, taxable status and entry

digit limit) for a department key. Use the following

sequence:

ABCDEFG➝

where A to G represent the following choices.

A: Choice of + or - sign

Enter 0 for + or 1 for -.

B: Choice of single item cash sale (SICS) function

Enter 0 for normal or 1 for single item cash sale.

C, D, E and F: Choice of taxable status

Enter 0000 for non-taxable, 0001 for taxable 1, 0010

for taxable 2, 0100 for taxable 3, 1000 for taxable 4 or

0011 for taxable 1 and 2.

G: Entry digit limit (0 to 7 digits)

Enter 0, 1, 2, 3, 4, 5, 6 or 7

@/TM

PLU (Price Look-Up) Programming

Each PLU is associated to a department and the

programmed contents for the department are

automatically applied. Your cash register is preprogrammed so PLU codes 1-10 are assigned to

department 1 and PLU codes 11-80 are disabled. To set

the price or change the associated department, use the

following sequence:

PLU code ➝ P ➝ Price ➝ Dept. key (➝

Ex.:

PLU code Price

To disable a PLU code, use the following sequence:

PLU code ➝ P ➝ v (➝

REG

OFF

VOID

X/Flash

#/

SBTL

➝ Dept. key (➝

2

Associated dept.

#/

SBTL

Z/PGM

key at the end of each

#/

SBTL

)

#/

SBTL

)

#/

SBTL

)

6

#/

SBTL

)

Tax Programming

Tax Table Programming

If you are in an area that uses a tax table for tax

calculation, you can program the cash register accordingly.

Tax table programming can be performed for Tax 1 and

Tax 2.

Sample tax table 1 (6%):

Tax Breakpoint

.00

.01

.02

.03

.04

.05

.06

.07

.08

.09

.10

.11

.12

.13

Sample tax table 2:

Tax Breakpoint

.00

.01

.02

.03

.04

.06

.09

.10

.11

.12

.14

.17

1.11

1.23

1.39

1.57

1.73

1.89

2.11

1.11

1.26

1.47

1.68

1.89

2.11

If tax is not shown for every cent, use the

breakpoint of the next highest tax amount for each

DD

D

DD

missing breakpoint. In sample tax table 2, tax is

not shown for .05, .07, .08, .13, .15 and .16.

Likewise, the corresponding breakpoints are not

shown. To complete the table, simply insert the

next highest breakpoint after each missing figure.

Therefore, the breakpoint for .05 would be .89, .07

and .08 would be 1.11, etc.

Use the following sequence for tax programming:

#/

8

R ➝

➝

@/TM

SBTL

➝

➝ M ➝

1

Breakpoint

difference

.01

.11

.23

.39

.57

.73

.89

.01

.11

.26

.47

.68

.89

.10

.12

.16

.18

.16

.16

.22

.12

.16

.18

.16

.16

.22

Non-cyclic

Cyclic I

Cyclic II

for Tax 1 or 2 for Tax 2 ➝

@/TM

➝ Q ➝

@/TM

➝ Breakpoint ➝

@/TM

➝

where R, M and Q represent the following:

R: Tax rate (0.0000% to 99.9999%) x 10000

If the rate is fractional, it should be converted to its

decimal equivalent before entering.

M: Cycle (0.01 to 99.99) x 100

In tax table 1, you can see that the breakpoint

differences repeat in cycle. The value of M may be

viewed as the taxable amount which is covered by a

cycle. Thus, it can be determined by adding all of the

breakpoint differences in a cycle or by simply taking the

difference between the first breakpoint of the cycle and

the first breakpoint of the next cycle.

Q: Minimum taxable amount (0.01 to 99.99) x 100

This represents the smallest amount for which tax must

be collected. In some states, sales whose amounts are

less than a specific minimum taxable amount are not

subject to taxation.

Breakpoints (0.01 to 99.99) x 100

The tax amount increases in stages. The value of a

taxable subtotal at which the tax amount changes is

called a breakpoint. The difference between one

breakpoint and the next is called the breakpoint

difference. A group of breakpoint differences is

repeated at regular intervals and each of these intervals

is called a cycle. A maximum of 18 breakpoints (for tax

types 1 and 2), between 0.01 to 99.99, can be

programmed. Intervals between breakpoints must be

less than one dollar.

Example: Programmig Tax 1 as 6% sales tax using

sample tax table 1.

#/

SBTL

@/TM

Minimum taxable

amount(Q)

(First breakpoint)

@/TM

Breakpoint Breakpoint Breakpoint

@/TM @/TM

Tax 1 Tax rate(R)

0 0 0 00 0

Cycle(M)

@/TM

Breakpoint Breakpoint Breakpoint

@/TM

@/TM

@/TM

(First breakpoint of the next cycle)

@/TM

Programming the Percent key

Percent Key Function

The % key can be programmed as a discount key or

as a premium key. The taxable status of the % key can

also be programmed though it is pre-programmed as a

non-taxable discount key. Use the following sequence:

ABCDE ➝

@/TM

➝ % (➝

where A to E represent the following choices

A: Choice of + or - sign

Enter 0 for + or 1 for - .

SBTL

#/

)

B, C, D and E: Choice of taxable status

Enter 0000 for non-taxable, 0001 for taxable 1,

0010 for taxable 2, 0100 for taxable 3, 1000 for

taxable 4 or 0011 for taxable 1 and 2.

Initial setting: - (discount), non-taxable ("10000")

Programming the percent rate

Use the following sequence:

Percent rate (0.01% to 99.99%)

(ex. For 10.00% enter

1 0 0 0

Initial setting: 0.00(%)

➝ % (➝

.)

SBTL

#/

)

Printing Format

You can choose either a journal or receipt format and

specify other options for the printing format. Use the

following sequence:

#/

2

SBTL

➝

➝ ABCDEFG ➝

SBTL

#/

#/

SBTL

(➝

)

A: Printing journal/receipt in the REG mode

Enter 0 for printing or 1 for no printing.

B: Journal or receipt format

Enter 0 for journal format or 1 for receipt format.

(In the receipt format, the paper is fed by a few

lines upon finalization of each transaction. In the

journal format, the paper is wound around the takeup spool.)

C: Printing date

Enter 0 to print or 1 not to print

D: Printing time

Enter 0 to print or 1 not to print

E: Printing consecutive numbers

Enter 0 to print or 1 not to print

F: Printing taxable subtotal

Enter 0 to print or 1 not to print

G: Printing merchandise subtotal with

#/

SBTL

Enter 0 to print or 1 not to print

Initial setting: printing in the REG mode, journal

format, printing date, time and consecutive number,

and not printing taxable subtotal and merchandise

subtotal ("0000011")

Consecutive Receipt Number

Consecutive receipt number can be printed on every

transaction or receipt and report with the date and

time. Use the following sequence to set the receipt

start number. To start from a specific number, enter

the number less one (e.g. if you want to start from

receipt number 1001, enter 1000).

#/

SBTL

(➝

SBTL

#/

)

Consecutive (receipt) number ➝

@/TM

➝

Initial setting: starting from 0001("0000")

(For miscellaneous settings, secret code and checking

machine settings, see the columns below. )

Miscellaneous Settings

You can program miscellaneous settings using the

following sequence:

#/

1

SBTL

➝

➝ ABCDEFGH ➝

SBTL

#/

#/

SBTL

(➝

)

where A, B, C, D, E, F, G and H represent the

following choices.

A: Date format

Enter 0 for mmddyy, 1 for ddmmyy or 2 for yymmdd.

B: Time format

Enter 0 for 12 hour system or 1 for 24 hour system.

C: Decimal point setting

Enter 0, 1, 2 or 3 for the decimal point position.

D: Resetting receipt no. when issuing Z report

Enter 0 to not reset or 1 to reset

E: Amount tendered compulsory

Enter 0 for non compulsory or 1 for compulsory.

F: Choice of

Enter 0 for non compulsory or 1 for compulsory.

G: Entry digit limit for g, k,

#/

SBTL

compulsory

TAX1

TAX2

SHIFT

SHIFT

,

and

/RA

/PO

manual tax

Enter 0, 1, 2, 3, 4, 5, 6, 7 or 8 for the entry digit limit.

H: Rounding

Enter 0 for rounding off, 1 for rounding up or 2

for rounding down

Initial setting: date format "mmddyy", time format

“12 hour system”, decimal point position “2”, not

resetting, amount tendered non compulsory, s

non compulsory, entry digit limit “8” and rounding

off ("00200080")

Secret Code

A secret code can be specified so that only those

who know the secret code may issue Z reports for

reading and resetting of sales, perform

programming in the Z/PGM mode and void

operation in the VOID mode. The pre-programmed

secret code setting is 0000 (no secret code). Use

the following sequence to enter a secret code (4

digits).

Secret code ➝

The secret code function can be disabled by

entering

the above sequence.

When entry of secret code is necessary, “----” is

displayed. Each time you enter a number for the

secret code, the corresponding symbol “-”

changes to “_”.

@/TM

0 0 0 0

➝

(or nothing) for the code in

Checking the Machine

Settings

To obtain a printout that shows the cash register

settings, turn the mode switch to the Z/PGM

position and use the following sequence:

General & Tax Settings

To see the general and tax settings, turn the mode

switch to the Z/PGM position and press

PLU Settings

To see the PLU settings, turn the mode switch to

the Z/PGM position and press P.

Associated department

Unit price

#/

SBTL

.

Taxable status

Dept. code

Sign and unit price

Entry digit limit

SICS (1) / Normal (0)

Taxable status for %

Sign and rate for %

Secret code

Miscellaneous settings

Printing format

Tax table(Tax1)

Percentage tax rate(Tax2)

Minimum taxable amount

Clerk code

Date

Time

Receipt number

PLU code

Correction

Correction of Entered Number

When you enter an incorrect number, delete it by

pressing CL immediately after the entry.

Correction of the Last Entry

If you make a mistake when making a department

entry, PLU entry, repetitive or multiplication entry,

discount or premium entry by % , or manual tax

entry, you can correct this by pressing v.

Correction of Earlier Entries

You can correct any incorrect entry made during a

transaction if you find it before finalizing the

transaction by pressing , g, k, etc.

For example, to correct 3

P entry to

another correct entry has been made, enter the

following:

3

4

P

P

1 1 5 0

1

Void Mode

This function allows you to reverse the entries

made in an incorrect receipt. The entries are

subtracted from each totalizer and added to a void

totalizer.

To use this function, turn the mode switch to the

VOID position and enter the same details that are

on the incorrect receipt. The VOID mode

symbol(VD) is printed at the bottom of the receipt.

If the secret code is programmed, you have

DD

D

to enter the secret code and press after

DD

setting the mode switch to the VOID position.

Void Operation in the X/Flash Mode

Received-on-account(RA) and paid-out(PO)

entries can be corrected in the X/Flash mode.

Void operation for RA(X/Flash mode)

TAX1

VOID

* ➝ amount ➝

Void operation for PO(X/Flash mode)

VOID

* ➝ amount ➝

*If the secret code is programmed, you have to

enter the secret code here and press

before entering the amount and pressing

SHIFT

TAX2

SHIFT

/RA

/PO

4

P after

5

3

vP

VOID

again

TAX1

TAX2

SHIFT

SHIFT

or

/RA

/PO

In Case of a Power Failure or

Paper Jam

The following situations may arise during a power

failure or paper jam. (Make sure that batteries are

correctly installed.) As the power is recovered or a

paper jam is removed, the register will resume

normal operation with a next key operation.

When a power failure occurs with the register

turned on or during a computation process:

Upon power recovery, the register resumes

operation from the point of failure.

When a power failure occurs during printing of

transaction data:

Upon power recovery, the register prints

“############” and resumes printing of the

transaction data.

When a power failure occurs during printing of

an X (reading) or Z (reading and resetting)

report:

Upon power recovery, the register prints

“############” and resumes printing of the

report.

Before power failure

Power failure mark

After power failure

When the printer motor is locked due to a

paper jam:

Printing stops and intermittent beeping starts. First,

unplug the power cord and clear the paper jam.

Then plug in the power cord, feed the roll paper to

the proper position and press CL. The register will

then resume printing after printing

“############”.

.

Page 4

Maintenance

Batteries

This cash register provides a low battery symbol

(l) and a no battery symbol ( ) which appears on

the far left of the display in one of the following

situations:

Low battery symbol (l)

• When the voltage of the batteries installed in the

cash register is under the required level.

No battery symbol ( )

• When three batteries are not installed in the cash

register.

• When the batteries installed in the cash register

are dead.

When either of these symbols appear, check

batteries. If no batteries are installed, install three

new “AA” batteries at once. If batteries are already

installed, replace them with new ones as soon as

possible. If the AC power cord is disconnected or a

power failure occurs when the batteries are dead

or not installed, all the programmed settings will be

reset to the default settings and any data stored in

memory will be cleared.

If the low battery symbol appears while

DD

D

DD

making a transaction, complete the

transaction before replacing the batteries.

Replacement

1. Be sure the cash register is plugged in.

2. Turn the mode switch to the REG position.

3. Pull the printer cover upward and detach it.

4. Open the battery cover and remove the old

batteries.

5. Install three new “AA” batteries into the

battery compartment.

View from rear

6. Check that the “ ” symbol has disappeared.

7. Close the battery cover.

8. Replace the printer cover.

Improper use of batteries could cause

C

them to burst or leak, which might damage

the interior of the machine. See the

cautions in the "Getting Started" section.

Paper Roll

When colored dye appears on the edges of the

paper roll, it is time to replace the roll. Use paper

of 2 1/4" (57 mm) in width. To prevent jamming be

sure to use paper specified by SHARP.

Replacement (Journal printing)

1. Turn the mode switch to the REG position.

2. Open the printer cover.

3. Press f to advance the paper several lines.

Remove the take-up spool from the bearing.

4. After cutting the existing paper, remove the

paper roll. Then remove the remaining paper

by pressing f.

5. Remove the used journal paper roll (if used)

from the take-up spool.

6. Install a new paper roll and the take-up spool

according to the instructions in "Getting

Started."

In the case of receipt printing, steps 3 and

C

5 should be omitted and the take-up spool

need not be installed in step 6.

Replacing the Ink Roller

1. Open the printer cover.

2. Remove the ink roller by pulling it upward.

3. Install a new ink roller.

4. Close the printer cover.

Drawer Handling

Locking the Drawer

Develop the habit of locking the drawer when not

using the register for any extended period of time.

To lock: Insert the key into the drawer lock and

To unlock: Insert the key into the drawer lock and

Removing the Drawer

To remove the drawer, pull it out and lift it up.

DD

D

DD

Manually Opening the Drawer

In case of a power failure or if the machine is out of

order, locate the lever at the bottom of the machine

and move it in the direction of the arrow to open

the drawer. The drawer will not open if it is locked

with the drawer lock key.

turn it 90 degrees counter-clockwise.

turn it 90 degrees clockwise.

Coin case

• To prevent burglary, it is a good idea to

empty the drawer after work and leave it

open at the end of the day.

• Coin case is detachable. Also the

separators of the coin case are

removable.

View from rear

Installing the Mounting

Bracket

A mounting bracket which prevents the register

from moving accidentally is supplied with your

XE-A102 register. Attach the bracket to a table

where the register rests, as follows:

B

A

A

B

How to attach the mounting bracket

1.Thoroughly clean the table surface where you

wish to place the bracket (B).

2.Peel off the release paper of the adhesive tape

on the bracket.

3.Hook the bracket onto the hook (A) at the

bottom of the back of the register.

4.Hold down the bracket so that it firmly sticks to

the table surface.

How to release the register from the mounting

bracket

Lift up the front of the register and pull it towards

you.

Before Calling for Service

If you encounter any of the following problems,

please read below before calling for service.

The display shows symbols that do not make

sense.

• Has the machine been initialized properly as

shown in “Getting Started”?

The display will not illuminate while the

machine is turned on. The machine will not

operate when any key is pressed.

• Is the power supplied to the electrical outlet?

(Plug another electrical device into the outlet for

confirmation.)

• Is the power cord firmly connected to the

electrical outlet?

Specifications

Model:

XE-A102

Size:

Inches: 13.0 (W) x 14.3 (D) x 9.21 (H)

Millimeters: 330 (W) x 363 (D) x 234 (H)

Weight:

Approx. 11.0 lbs. (5.0 kg)

Power Source:

120V AC±10%, 60Hz

Power Consumption:

Stand-by: 4 W, Operating: 12.5 W

Working Temperature:

32 to 104˚F (0 to 40˚C)

Display:

LED (Light-Emitting Diode) numeric display

Printer:

1 station, print wheel selective type

Printing Capacity:

Max. 13 characters

Paper Roll:

Width: 2 1/4" + 1/64" (57.5mm + 0.5mm)

Max. external diameter: 3-5/32" (80mm)

Min. internal diameter: 15/32" (12mm)

Cash Drawer:

4 slots for bills, 5 for coins

Accessories (supplied):

Paper roll: 1 roll

Mode key: 2

Drawer lock key: 2

Instruction manual (English): 1 copy

Instruction manual (Spanish): 1 copy

Quick Start Guide (English/Spanish): 1 copy

Ink roller: 1 (installed)

Take-up spool: 1

Mounting bracket: 1

• Specifications and appearance are subject to

change without notice for improvement.

The display is illuminated, but the machine will

not accept key entries.

• Is the mode switch properly set to the REG

position?

• Has the machine been initialized properly as

shown in “Getting Started”?

Journal paper will not feed properly in the printer.

• Is the take-up spool installed properly?

• Is there a paper jam?

• Is the journal format selected in the printing

format programming?

(If the receipt format is selected, the paper is not

wound around the take-up spool.)

Printing is faded or illegible.

• Is the ink roller used up?

• Has the ink roller been installed properly?

Lever

LIIMITED WARRANTY

SHARP ELECTRONICS CORPORATION warrants to the first consumer purchaser that this Sharp brand product

(the "Product"), when shipped in its original container, will be free from defective workmanship and materials and

agrees that it will, at its option, either repair the defect or replace the defective Product or part thereof at no charge

to the purchaser for parts or labor for the time period(s) set forth below.

This warranty does not apply to any appearance items of the Product nor to the additional excluded item(s) set

forth below nor to any product the exterior of which has been damaged or defaced, which has been subjected to

misuse, abnormal service or handling or which has been altered or modified in design or construction.

In order to enforce the rights under this limited warranty, the purchaser should follow the steps set forth below and

provide proof of purchase to the servicer.

The limited warranty described herein is in addition to whatever implied warranties may be granted to purchasers

by law. ALL IMPLIED WARRANTIES INCLUDING THE WARRANTIES OF MERCHANTABILITY AND FITNESS

FOR USE ARE LIMITED TO THE PERIOD(S) FROM THE DATE OF PURCHASE SET FORTH BELOW. Some

states do not allow limitations on how long an implied warranty lasts, so the above limitation may not apply to you.

Neither the sales personnel of the seller nor any other person is authorized to make any warranties other than

those described herein or to extend the duration of any warranties beyond the time period described herein on

behalf of Sharp.

The warranties described herein shall be the sole and exclusive warranties granted by Sharp and shall be the sole

and exclusive remedy available to the purchaser. Correction of defects, in the manner and for the period of time

described herein, shall constitute complete fulfillment of all liabilities and responsibilities of Sharp to the purchaser

with respect to the Product and shall constitute full satisfaction of all claims, whether based on contract,

negligence, strict liability or otherwise. In no event shall Sharp be liable, or in any way responsible, for any

damages or defects in the Product which were caused by repairs or attempted repairs performed by anyone other

than an authorizezd servicer. Nor shall Sharp be liable, or in any way responsible, for any incidental or

consequential economic or property damage. Some states do not allow the exclusion or incidental or

consequential damages, so the above exclusion may not apply to you.

THE WARANTY GIVES YOU SPECIFIC LEGAL RIGHTS. YOU MAY ALSO HAVE OTHER RIGHTS WHICH

VARY FROM STATE TO STATE.

Your Product: XE series Electronic Cash Register

Warranty Period of this Product: One (1) year for parts and ninety (90) days parts and labor from the date of

purchase.

Additional items excluded from Any consumable items such as paper supplied with the Product.

warranty coverage:

Where to obtain service: At a Sharp Authorized Servicer located in the United States. To find the

location of the nearest Sharp Authorized Servicer, call toll free at

1-800-BE-SHARP.

What to do to obtain service: Ship (prepaid) or carry your Product to a Sharp Authorized Servicer. Be

sure to have proof of purchase available. If you ship or mail the Product, be

sure it is packaged carefully.

TO OBTAIN SUPPLIES, ACCESSORIES OR PRODUCT INFORMATION, CALL 1-800-BE-SHARP.

SHARP ELECTRONICS CORPORATION

Sharp Plaza, Mahwah, New Jersey 07430-2135

1-800-BE-SHARP

http://www.sharpusa.com

Page 5

Precauciones para el uso

Coloque la caja registradora en un lugar alejado de los

rayos directos del sol, las variaciones extremas de

temperatura, humedad alta o salpicaduras de agua.

No use la caja registradora con las manos mojadas. El

agua puede causar daños internos.

Enchufe la caja registradora en un tomacorriente en la

pared (120V CA ± 10%). Evite conectar otros aparatos

eléctricos en el mismo circuito eléctrico ya que la caja

registradora podría funcionar mal.

Limpie la caja registradora con un paño suave y seco.

Nunca use líquidos volátiles, como bencina o

diluyentes. Los productos químicos pueden desteñir o

dañar el exterior de la caja registradora.

Antes de usar la caja registradora, por favor instale tres

pilas “AA” para evitar que los datos se borren de la

memoria. Sin embargo, nunca se debe de olvidar de

inicializar la caja registradora antes de instalar las

pilas; de otro modo se pueden dañar los datos de la

memoria o pueden ocurrir desperfectos en la caja

registradora. Se puede iniciar el funcionamiento de la

caja registradora solamente si después de inicializar la

máquina se instalan las pilas.

Para una completa desconexión eléctrica, desenchufar

el enchufe del tomacorriente.

El tomacorriente debe estar instalada cerca del equipo

y debe quedar bien accesible.

Preparaciones para el uso

Inicialización de la caja registradora

Para que su caja registradora funcione

adecuadamente debe inicializarla antes de

programarla por primera vez. Siga el siguiente

procedimiento:

1. Saque la registradora de la caja de embalaje.

2. Coloque una de las llaves provistas del modo en el

interruptor del modo y gire a la posición “REG”.

3. Introducir el enchufe en el tomacorriente.

IMPORTANTE: Esta operación debe realizarse sin

instalar las pilas.

4. El timbre sonará tres veces. Ahora la caja

registradora ha sido inicializada. En la pantalla

aparecerá “0.00” con el símbolo “ ”.

Instalación de las pilas

Las pilas deben instalarse en la caja registradora para

evitar que los datos y los ajustes programados por el

usuario se borren de la memoria en caso de que el

cable de CA se desconecte accidentalmente o falle la

corriente eléctrica. Por favor instale tres pilas nuevas

“AA” antes de empezar la programación y uso de la

caja registradora. Una vez instaladas, las pilas durarán

aproximadamente un año. Cuando llegue el momento

para cambiar las pilas, el símbolo “

ll

l” aparecerá en la

ll

pantalla indicando que las pilas están gastadas. Si

aparece este símbolo, las pilas deben ser cambiadas

dentro del plazo de dos días.

Instale las pilas según el siguiente procedimiento con

el cable de CA conectado:

1. Tire hacia delante la tapa de la impresora y sáquela.

2. Abra la tapa de las pilas situada cerca del soporte

del rollo de papel.

3. Meta tres pilas nuevas “AA”.

4. Si las pilas están colocadas correctamente, el

símbolo “

” desaparecerá en la pantalla. Cierre la

tapa de las pilas.

5. Vuelva a colocar la tapa de la impresora.

Instalación del rollo de papel

Instale siempre el rollo de papel aunque la registradora

sea ajustada para que no imprima los registros diarios

o los recibos en el modo REG.

1. Eche hacia delante la tapa de la impresora y

sáquela.

2. En el compartimiento del rollo de papel, coloque el

rollo de papel de tal forma que el papel se

desenrrolle desde abajo.

3. Meta el papel recto en la ranura de entrada y pulse

la tecla . El extremo metido aparecerá en la zona

de impresión.

4. (Para la impresión del registro diario) Meta el

extremo superior del papel en la ranura del eje del

carrete y bobine el papel dos o tres vueltas. Luego

coloque el carrete de toma en el cojinete.

5.

Vuelva a colocar la tapa de la impresora.

(En caso de impresión del recibo, se omitirá el paso 4.)

Ajuste de la hora

Gire el interruptor del modo a la posición Z/PGM

registre la hora con 4 dígitos (formato “hhmm”) usando

el sistema de las 24 horas. Luego pulse una vez la

#/

SBTL

tecla

para continuar con la siguiente programación

o pulse dos veces para salir del modo de

programación.

Ajuste de la fecha

En el modo Z/PGM, registre la fecha con 6 dígitos

usando el formato de mes-día-año. Luego pulse una

vez la tecla

#/

SBTL

para continuar con la siguiente

programación o pulse dos veces para salir del modo de

programación.

Verificación de la hora y de la fecha

Se puede mostrar la hora y la fecha en la pantalla para

verificar si dichos datos están correctamente

ajustados.

1. Gire el interruptor del modo a la posición REG.

2. Pulse la tecla

@/TM

una vez para mostrar la hora en la

pantalla.

3. Pulse la tecla

@/TM

una segunda vez para mostrar la

fecha en la pantalla.

CAJA REGISTRADORA ELECTRONICA DE SHARP

MODELO

XE-A102

MANUAL DE INSTRUCCIONES

Impreso en China

O(TINSS2540RCZZ) 1

Le felicitamos por haber comprado una caja registradora electrónica de SHARP

modelo XE-A102. Lea cuidadosamente este manual antes de usarla. Mantenga este

manual de instrucciones para futuras consultas, pues le ayudará resolver

cualquier problema que encuentre.

Por ayuda llame al

1-800-BE-SHARP

Para una instalación fácil,

véase “Preparaciones para el uso”

Programación de los impuestos

Antes de que pueda proseguir con los registros de

las ventas, debe primero programar el impuesto que

se aplica de acuerdo con la ley de su estado. Esta

caja registradora le ofrece la posibilidad de

programar cuatro diferentes tasas de impuestos. En

la mayoría de los estados, solamente se necesita

programar el Impuesto 1. Sin embargo, si vive en una

zona que tiene un impuesto local propio (como por

ejemplo un impuesto parroquial) o un impuesto de

hospitalidad, su registradora puede ser programada

para calcular estos impuestos por separado.

Para programar el impuesto que debe ser cobrado de

acuerdo con la ley de su estado, se debe especificar

las tasas de impuesto y las mínimas cantidades

imponibles.

Cuando se programa el estado de impuesto de una

sección, el impuesto será automáticamente añadido

a las ventas de los artículos designados a esa

sección de acuerdo al estado de impuesto

programado para dicha sección. También se puede

registrar el impuesto manualmente.

Existen dos métodos de programación del impuesto.

El método de la tasa de impuesto emplea una tasa

de porcentaje constante por dólar. El método de la

tabla de impuestos requiere información de los

niveles impositivos que dan a conocer las oficinas de

impuestos de su zona o estado. Emplee el método

aprobado en su estado. Puede obtener los datos

necesarios para la programación de los impuestos en

la oficina local de impuestos.

NOTA: Para la programamación de la tabla de

impuestos, véase “Programación”.

Programación de la tasa de impuesto

La tasa de porcentaje aquí especificada se emplea

para el cálculo del impuesto en los subtotales

imponibles. Gire el interruptor del modo a la posición

Z/PGM y emplee la siguiente secuencia para

programar el impuesto:

#/

➝

9

➝

donde R y Q representan los siguientes datos:

R: Tasa de impuesto (0.0000% a 99.9999%) x 10000

Registre la tasa con 6 dígitos (puede omitir los ceros

iniciales). Si la tasa es fraccionaria (ej. 4 3/8%) debe

convertirla a su decimal equivalente (4.375) antes de

registrarla.

Q: Mínima cantidad imponible (0.01 a 99.99) x 100

Es la menor cantidad por la que el impuesto debe ser

recaudado. En algunos estados, las ventas cuyas

cantidades son menores que la mínima cantidad

imponible no están sujetas a impuestos. Si las

cantidades de $0.01 a $0.10 no son imponibles, el

valor de Q sería 11 (para $0.11), el más bajo de la

primera categoría imponible.

➝ No. del impuesto (1 – 4) ➝

SBTL

@/TM

➝ Q ➝

#/

@/TM

SBTL

Impuesto1

Tasa de impuesto

(7.0000%)

@/TM

@/TM

Mínima cantidad

imponible ($0.11)

➝ R

Cambie otros ajustes como sea necesario

Su caja registradora está preprogramada como para

que la pueda utilizar con una configuración mínima.

Para cambiar los ajustes preestablecidos, vea las

secciones que correspondan.

Ajustes preestablecidos:

Secciones del 1 al 4:

Imponible 1. Positiva (+). Precio preajustado:

0.00

Secciones del 5 al 8:

No imponible. Positiva (+). Precio preajustado:

0.00

Los códigos PLU 1-10:

Asignados a la sección 1. Precio preajustado: 0.00

Los códigos PLU 11-80:

No se utilizan.

Registros

Ejemplos de funcionamiento

Pagos en efectivo

1. Gire el interruptor del modo a la posición REG.

2. Registre el código del empleado (del 1 al 4) y pulse

3. Registre el precio del primer artículo.

4. Pulse la tecla de la sección apropiada.

5. Repita los pasos 2 y 3 para los artículos restantes.

6. Pulse la tecla

7. Registre el importe recibido del cliente (puede

8. Pulse la tecla y el cambio debido aparecerá

9. Cierre el cajón.

Pagos con tarjeta de crédito

Pulse la tecla CH al final de la transacción. El importe

recibido no puede ser registrado.

Pagos con cheque

Pulse la tecla

recibido puede ser registrado como una venta en

efectivo y el cambio debido aparece en la pantalla.

Venta con importe recibido mixto

Cuando el importe recibido en efectivo o en cheque

es menor que el importe de la venta incluyendo los

impuestos, la pantalla mostrará un déficit y el símbolo

“o”. Para compensar este déficit, haga un registro de

importe recibido adicional o un registro a cargo.

CLK#

la tecla

.

(Una vez que se registra el código de un empleado,

no es necesario registrarlo al inicio de cada

transacción hasta que el empleado sea cambiado.)

#/

SBTL

para que aparezca en la pantalla

el importe debido incluyendo cualquier impuesto

(puede omitir este paso).

omitir este paso si el importe recibido es igual que

el subtotal.)

en la pantalla y el cajón se abrirá.

CHK

al final de la transacción. El importe

Sección

Registros de sección repetidos

Para registrar dos o más unidades del mismo artículo,

pulse la tecla de sección apropiada repetidamente.

Registros de multiplicación

Para registrar una venta de dos o más unidades del

mismo artículo, use la tecla

@/TM

para multiplicación.

Registro de ventas en efectivo de un solo artículo

(SICS)

Esta función se emplea para la venta de solamente un

artículo que será pagado en efectivo. Esto se aplica

sólo a las secciones programadas para ventas en

efectivo de un solo artículo o a los PLU asociados con

tales secciones. Después de pulsar la tecla de la

sección apropiada o la tecla de PLU, la transacción se

cierra y el cajón se abre. Para la programación de

ventas en efectivo de un solo artículo (SICS), véase la

sección de Estado de la Sección en “Programación”.

PLU (codificación de precios)

La función de PLU permite registros rápidos vía las

teclas. Cuando se le ha asignado un código de PLU a

un artículo y se ha programado el precio

correspondiente de dicho artículo, al registrar el código

del artículo automáticamente aparecerá su precio. Se

pueden programar hasta un máximo de 80 códigos de

PLU. Véase la sección de Programación de PLU en

“Programación”.

Para registrar la venta de un artículo de PLU,

simplemente registre su código y pulse la tecla

PLU

.

Cálculo de los impuestos

Cálculo automático del impuesto

Cuando se programa la registradora con el método de

la tabla de impuestos o el de la tasa de impuestos y el

estado de impuesto de una sección se programa como

imponible, la registradora computará automáticamente

el impuesto de cualquier artículo registrado empleando

la tecla de sección o un código de PLU asociado con

dicha sección.

Subtotal imponible

Puede mostrar en la pantalla el subtotal imponible 1 o

imponible 2 pulsando la tecla de cambio de impuesto y

luego la tecla

o imponible 2 aparecerán en la pantalla. No se pueden

mostrar el subtotal imponible de 3 ó 4 artículos.

Cambio de impuesto

Puede cambiar el estado imponible 1 ó 2 programado

de cada tecla de sección pulsando una o las dos teclas

de cambio de impuesto

estado imponible, pulse la tecla apropiada de cambio

de impuesto justo antes de la tecla de sección,

%

. En caso de registros repetidos se emplea el estado

de impuesto cambiado.

#/

SBTL

. Los registros del subtotal imponible 1

TAX1

TAX2

SHIFT

SHIFT

y

. Para cambiar el

/RA

/PO

PLU

o

Borrado del impuesto

Esta función se emplea cuando el artículo o artículos

imponibles registrados necesitan ser convertidos a

“no imponibles”. Pulse

todos los registros hechos hasta entonces en la

transacción de artículos con el estado imponible

especificado se convertirán en “no imponibles”.

Para hacer que todos los registros hechos hasta ese

momento sean “no imponibles”, pulse

#/

VOID

SBTL

luego

y

transacción no serán afectados y serán gravados con

el impuesto normal.

. Los registros subsiguientes en la

TAX1

TAX2

SHIFT

SHIFT

o

/RA

/PO

, luego

#/

VOID

SBTL

y

y

TAX1

TAX2

SHIFT

SHIFT

y/o

,

/RA

/PO

Registro manual del impuesto

Puede aplicar el impuesto manualmente cuando el

cálculo automático del impuesto no puede ser

utilizado. Cada registro manual del impuesto (para el

impuesto 1 y para el impuesto 2) puede hacerse sólo

una vez durante la transacción. Después de hacer un

registro manual del impuesto no podrá realizar

cualquier registro adicional de artículos.

Registro manual del impuesto 1

TAX1

#/

SHIFT

SBTL

y

➝ cantidad del impuesto ➝

/RA

Registro manual del impuesto 2

TAX2

#/

SHIFT

SBTL

y

➝ cantidad del impuesto ➝

/PO

#/

SBTL

#/

SBTL

Para abrir el cajón sin venta

Solamente pulse la tecla y el cajón se abrirá.

Tecla del porcentaje

La tecla del porcentaje se usa para aplicar un

descuento o incremento a un artículo o a un subtotal.

Puede registrar manualmente una tasa de descuento

(o de incremento).

Una vez que la tasa ha sido preajustada para la tecla

de porcentaje %, se puede omitir el paso de registro

de la tasa de porcentaje.

Descuento para un artículo:

registro de un artículo ➝ tasa de porcentaje ➝

(ej. Para el 20%, registre 2000.)

Descuento para un subtotal:

registro de todos artículos ➝

porcentaje ➝

(ej. Para el 5%, registre 500.)

%

#/

SBTL

➝ tasa de

%

Registro de una devolución

Como esta caja registradora no tiene la tecla de

devolución, se debe emplear un método alternativo

para realizar el registro de una devolución: De

antemano, se programa una sección negativa para las

devoluciones. Verifique que el estado imponible del

artículo devuelto es el mismo que el de la sección

negativa programada. Si no, use la tecla apropiada de

cambio de impuesto para cambiar el estado imponible.

Procedimiento:

precio unitario del artículo devuelto ➝ tecla de la

sección negativa ➝ o CH.

Page 6

Número de código de no suma

Los números de código de no suma pueden ser

registrados e imprimidos en el registro diario (o

recibo) durante el registro de una venta. Los números

de código de no suma pueden ser utilizados para:

números de tarjetas de crédito, números de cheques,

números de serie, códigos de productos, códigos de

cargos por servicios o cualquier otro número que

sirvan de referencia a transacciones específicas. Los

números de código de no suma pueden ser

registrados en el modo de REG o de VOID.

Procedimiento para registrar un

no suma:

un código numérico de hasta 8 dígitos ➝

número

de código de

#/

SBTL

.

5. Cuando la cantidad de un artículo supera los 3

dígitos en el registro de la multiplicación:

Pulse la tecla

correcto.

Función de evasión de error

Cuando algún error o algo inevitable ocurre durante

el registro de una transacción y no se puede tener al

cliente esperando, pulse dos veces la tecla

(seguidamente la tecla CL si se encuentra en el

estado de error).

Se puede evadir dicha situación y cerrar la

transacción en ese momento como si fuera una venta

en efectivo.

Los registros realizados hasta ese momento serán

registrados.

Registros de recibido a cuenta y pagos

La función de registro de recibido a cuenta (RA) se

emplea para registrar el dinero recibido que no tiene

relación directa con las ventas. La función de

registro de pagos (PO) se emplea para llevar la

cuenta del dinero recogido de la caja para los pagos

que no se relacionan directamente con las ventas.

Estas funciones estan disponibles en el modo X/Flash

Registro de recibido a cuenta (modo X/Flash):

cantidad recibida (hasta $799999.99)

Registro de pago (modo X/Flash):

cantidad pagada (hasta $799999.99)

➝

➝

TAX1

SHIFT

/RA

TAX2

SHIFT

/PO

Cuando ocurre un error

Cuando su caja registradora detecta una situación de

error, el símbolo de error “e” aparecerá en la pantalla

acompañado con una señal de advertencia. Anule el

estado de error presionando la tecla CL y ejecute el

paso que corresponda.

1. Cuando se registra un número de más de 7 dígitos

para el precio de la sección o un número mayor

que 79999999 (8 dígitos) para las otras

cantidades:

Pulse la tecla CL y vuelva a registrar un número

correcto.

2. Cuando se equivoca al presionar las teclas:

Pulse la tecla CL y pulse las teclas correctamente.

3. Cuando se realiza un registro superior al límite

programado del registro de dígitos:

Pulse la tecla CL y verifique si la cantidad

registrada está correcta. Si no está correcta,

vuelva a registrar un número correcto. Si está

correcta, verifique el ajuste del límite del registro

de dígitos.

4. Cuando un sub-total excede a 79999999 (8

dígitos):

Pulse la tecla CL y luego las teclas , CH o

para cerrar la transacción en ese momento.

CHK

Corrección del número registrado

Cuando registre un número incorrecto, bórrelo

pulsando la tecla CL inmediatamente después del

registro.

Corrección del último registro

Si comete un error cuando realiza: un registro de la

.

sección, un registro del PLU, un registro repetido o

de multiplicación, un registro de descuento o

incremento mediante la tecla % o un registro manual

del impuesto, puede corregir estos registros pulsando

la tecla

Corrección de registros anteriores

Puede corregir cualquier registro incorrecto realizado

durante una transacción si lo encuentra antes de

finalizar la transacción, pulsando

Por ejemplo, para corregir el registro 3

después de haber realizado otro registro correcto,

registre lo siguiente:

3

4

Modo de Anulación (“VOID”)

Esta función le permite invertir los registros

realizados en un recibo incorrecto. Los registros son

restados de cada totalizador y son añadidos a un

totalizador de anulación.

Para utilizar esta función, gire el interruptor del modo

a la posición de VOID (anulación) y registre los

mismos detalles tal como aparecen en el recibo

incorrecto. El símbolo del modo VOID(VD) es

impreso en la parte inferior del recibo.

NOTA: Si está programado el código secreto, tiene

CL

y vuelva a registrar un número

Corrección

VOID

.

, CH,

1 1 5 0

P

P

que registrar dicho código y pulsar la tecla

después de poner el interruptor del

modo en la posición de VOID (anulación).

5

1

3

vP

PLU

ESC

CHK

, etc.

a 4

Operación de anulación en el modo X/Flash

Los registros de recibido a cuenta (RA) y de pagos

(PO) pueden ser corregidos en el modo de X/Flash.

Operación de anulación para RA (modo X/Flash)

VOID

* ➝ Cantidad ➝

TAX1

SHIFT

/RA

Operación de anulación para PO (modo X/Flash)

TAX2

VOID

* ➝ Cantidad ➝

SHIFT

/PO

* Si el código secreto está programado, tiene que

registrar aquí dicho código y pulsar otra vez la tecla

VOID

antes de registrar la cantidad y luego presionar la

TAX1

TAX2

SHIFT

tecla

SHIFT

o

.

/RA

/PO

Antes de empezar la programación, gire el interruptor

del modo a la posición “Z/PGM”. Emplee los siguiente

procedimientos como sea necesario.

NOTA: Si no pulsa la tecla

Precio unitario prefijado

Precio unitario (5 dígitos máximos) ➝ Tecla de

sección (➝

Programación

#/

SBTL

la programación, puede continuar programando

sin imprimir el informe de la programación.

Programación para las

secciones

#/

SBTL

)

al final de cada paso de

Estado de la sección

Lectura y reposición de

ABCDEFG ➝

@/TM

➝ Tecla de sección (➝

SBTL

#/

)

donde:

las ventas

A: Selección del signo + o -

Registre 0 para + ó 1 para -.

B: Selección de la función de ventas en efectivo de un

Informes X

Para obtener un informe X, gire el interruptor del modo

a la posición X/Flash y pulse la tecla .

Informes Z

Para obtener un informe Z, gire el interruptor del modo

a la posición Z/PGM.

NOTA: Si el código secreto está programado, registre

dicho código y pulse la tecla

PLU

Para informes Z sin reposición del total global (GT)

.

Pulse la tecla .

NOTA: Si el código secreto está programado, registre

dicho código y pulse otra vez la tecla .

Para informes Z con reposición del total global (GT)

Si desea reajustar el total global (GT) al obtener el

informe Z, pulse la tecla

CHK

en vez de .

Exceptuando el reajuste del total global, este informe

es igual que los informes normales Z.

NOTA: Si el código secreto está programado, registre

dicho código y pulse otra vez la tecla

CHK

.

Informes instantáneos

(mostrados en la pantalla solamente)

Pulse la tecla que corresponda en el modo X/Flash:

Total de secciones Tecla de sección

Total de ventas

Efectivo en el cajón

#/

SBTL

CH

solo artículo (SICS)

Registre 0 para normal ó 1 para la venta en efectivo

de un solo artículo.

C, D, E y F: Selección del estado imponible

Registre 0000 para no imponible, 0001 para

imponible 1, 0010 para imponible 2, 0100 para

imponible 3, 1000 para imponible 4 ó 0011 para

imponibles 1 y 2.

G: Límite de dígitos del registro (0 a 7 dígitos)

Registre 0, 1, 2, 3, 4, 5, 6 ó 7.

Programación de PLU

Código de PLU ➝

PLU

➝ Precio ➝ Tecla de sección ( ➝

Para inhabilitar un código de PLU, utilice la siguiente

secuencia:

Código de PLU ➝

PLU

➝

VOID

( ➝

SBTL

#/

)

SBTL

#/

Programación de impuestos

Programación de la tabla de impuestos

Si está en una zona que utiliza una tabla de impuestos,

puede programar la caja registradora en base a dicha

tabla.

Se puede ejecutar la programación de la tabla de

impuestos para el impuesto 1 y el impuesto 2.

Utilice la siguiente secuencia para programar los

impuestos:

#/

8

SBTL

➝

➝ 1

@/TM

➝

➝ R ➝

@/TM

➝

➝ Punto de ruptura ➝

para Impuesto 1 ó

@/TM

➝ M ➝

@/TM

2

➝ Q

para Impuesto 2

)

donde:

R: Tasa de impuesto (0.0000% a 99.9999%) x 10000

Si la tasa es fraccionaria debe convertirla en su

decimal equivalente antes de registrarla.

M: Ciclo (0.01 a 99.99) x 100

En la tabla de impuestos puede ver que las diferencias

de puntos de ruptura se repiten en ciclos. El valor de M

puede considerarse como la cantidad imponible que

está cubierta por un ciclo. Así, el valor de M puede ser

determinado sumando todas las diferencias de puntos

de ruptura en un ciclo o simplemente tomando la

diferencia entre el primer punto de ruptura del ciclo y el

primer punto de ruptura del ciclo siguiente.