Page 1

Installing a Paper Roll

Always install the paper roll even when you set the

register for not printing journal or receipt in REG mode.

1. Push the printer cover forward and detach it.

2. Place a paper roll in the paper roll cradle so

that the paper unrolls from the bottom.

Tax 1

@/TM

@/TM

Tax rate (7.0000%) Min. taxable

amount ($0.11)

#/

SBTL

Changing Other Settings As Necessary

Your cash register is pre-programmed so that you

can use it with minimum setup. To change the initial

settings, see the appropriate sections.

Initial Settings

Departments 1 to 4:

Taxable 1. Positive (+). Preset price: 0.00

Departments 5 to 8:

Non-taxable. Positive (+). Preset price: 0.00

PLU codes 1-10:

Assigned to dept. 1. Preset price: 0.00

PLU codes 11-80:

Not used

When you program the tax status for a department,

tax will be automatically added to sales of items

assigned to the department according to the

programmed tax status for the department. You can

also enter tax manually.

There are two tax programming methods. The tax

rate method uses a straight percentage rate per

dollar. The tax table method requires tax break

information from your state or local tax offices. Use

the method which is acceptable in your state. You

can obtain necessary data for tax programming from

your local tax office.

DD

DD

D

For tax table programming, see "programming"

Tax Rate Programming

The percent rate specified here is used for tax

calculation on taxable subtotals. Turn the mode

switch to the Z/PGM position and use the following

sequence to program the tax rate:

9

➝

#/

SBTL

➝ Tax number(1-4) ➝

@/TM

➝ R

➝

@/TM

➝ Q ➝

where R and Q represent the following.

R: Tax rate (0.0000% to 99.9999%) x 10000

Enter the rate in 6 digits (leading zeros may be

omitted). If the rate is fractional (e.g., 4 3/8%), it

should be converted to its decimal equivalent

(4.375) before entering.

Q: Minimum taxable amount (0.01 to 99.99) x 100

Smallest amount for which tax must be collected. In

some states, sales whose amounts are less than the

minimum taxable amount are not subject to tax. If

amounts $0.01 to $0.10 are not taxed, the value of

Q would be 11 (for $0.11), the lowest of the first

taxable category.

Time (2:30 p.m.)

#/

SBTL#/SBTL

DD

DD

D

Always enter the date in 6 digits. For

example, enter

0 2 1 5 1 0

for

February 15, 2010. If you change the date

format in the Z/PGM mode, follow the newly

specified format when setting the date.

DD

DD

D

•Always enter the time in 4 digits even when

the hour is in the single digit. For example,

enter

0 6 3 0

for 6:30 a.m.

• 6:30 a.m. prints as “06-30” and 6:30 p.m.

prints as “06-30@”.

Setting the Time

Turn the mode switch to the Z/PGM position and

enter the time in 4 digits (“hhmm” format) using the

24 hour system. Press the

#/

SBTL

key once to continue

programming or twice to exit the program mode.

3. Insert three new AA batteries.

Initializing the Cash Register

For your cash register to operate properly, you must

initialize it before programming for the first time.

Follow this procedure.

1. Remove the register from its packing carton.

2. Insert the supplied mode key into the mode

switch and turn it to the REG position.

3. Insert the plug into the AC outlet.

IMPORTANT: This operation must be performed

without batteries loaded.

4. The buzzer will sound three times. Now your

cash register has been initialized. The display

will show "0.00" with “ ”.

Installing Batteries

Batteries must be installed in the cash register to

prevent data and programmed contents from being

lost from the memory in case of accidental

disconnection of the AC cord or power failure. Please

install three new “AA” batteries before programming

and operating the cash register. Once installed, the

batteries will last approximately one year. When it is

time to replace them, the “l” symbol will appear on

the display to indicate a low battery voltage. If the

symbol appears, you must replace them within two

days.

Install the batteries according to this procedure with

the AC cord connected:

1. Push the printer cover forward and detach it.

4. When the batteries are properly installed, “ ”

on the display will disappear. Close the battery

cover.

5. Attach the printer cover.

Thank you for purchasing the SHARP Electronic Cash Register Model XE-A106. Please

read this manual carefully before operating your machine. Keep this manual for future

reference. It will help you solve any operational problems that you may encounter.

For assistance call

1-800-BE-SHARP

SHARP ELECTRONIC CASH REGISTER

MODEL

XE-A106

INSTRUCTION MANUAL

WARNING

FCC Regulations state that any unauthorized changes or modifications to this equipment not

expressly approved by the manufacturer could void the user’s authority to operate this equipment.

Note: This equipment has been tested and found to comply with the limits for a Class A digital device,

pursuant to Part 15 of the FCC Rules. These limits are designed to provide reasonable protection

against harmful interference when the equipment is operated in a commercial environment.

This equipment generates, uses, and can radiate radio frequency energy and, if not installed and used

in accordance with the instruction manual, may cause harmful interference to radio communications.

Operation of this equipment in a residential area is likely to cause harmful interference in which case

the user will be required to correct the interference at his own expense.

CAUTION

The socket-outlet shall be installed near the equipment and shall be easily accessible.

FOR YOUR RECORDS

Please record below the model number and serial number, for easy reference, in case of loss or theft.

These numbers are located on the right side of the unit. Space is provided for further pertinent data.

Model Number_______________________________________________________

Serial Number_______________________________________________________

Date of Purchase_____________________________________________________

Place of Purchase____________________________________________________

Handling Cautions

Install the cash register in a location not subject to direct sunlight, unusual temperature

changes, high humidity, or splashing water.

Do not operate the cash register with wet hands. Water can cause internal component failure.

The cash register plugs into any standard wall outlet (120V AC ± 10%). Avoid connecting any

other electrical devices on the same electrical circuit since such connection could cause the

cash register to malfunction.

When cleaning the cash register, use a dry, soft cloth. Never use volatile liquids, such as

benzine or thinner. Chemicals can discolor or damage the cabinet.

For protection against data loss, please install three new “AA” batteries before using the cash

register. However, never forget you must initialize the cash register before installation of

batteries; otherwise damage to memory contents or malfunctioning of the register will occur. You

can start operating it only after initializing it and then installing batteries.

For complete electrical disconnection, pull out the main plug.

Printed in China

O(TINSE2598RCZZ) 1

Getting Started

For Easy Set-up,

See “Getting Started”

View from rear

View from rear

2. Open the battery cover next to the paper roll

cradle.

3. Insert the paper straight into the paper inlet,

and press the

ff

ff

f key. The inserted end

comes out at the printing area.

4. (For journal printing)

11

11

1Insert the top end of the paper into the

slit in the take-up spool shaft and fold

the inserted end toward you.

22

22

2Wind the paper two or three turns.

33

33

3Mount the paper holding plate onto the

take-up spool.

44

44

4Place the take-up spool on the bearing.

Date (February 15, 2010)

#/

SBTL#/SBTL

Put the spool shaft in the larger hole of the paper

holding plate and push the plate in the direction

of the arrow.

5. Attach the printer cover.

(For receipt printing, step 4 should be omitted.)

Programming the Tax Rate

Before you can proceed with registration of sales,

you must first program the tax that is levied in

accordance with the law of your state. Your cash

register comes with the ability to program four

different tax rates. In most states, you will only

need to program Tax 1. However, if you live in an

area that has a separate local tax (such as a Parish

tax) or a hospitality tax, your register can be

programmed to calculate these separate taxes.

In order to program the tax to be collected in

accordance with the law of your state, you must

specify the tax rate(s) and minimum taxable

amount(s).

Checking the Time and Date

You can display the time and date to check if they

are correctly set.

1. Turn the mode switch in the REG position.

2. Press the

@/TM

key once to display the time.

3. Press the

@/TM

key a second time to display the

date.

Setting the Date

In the Z/PGM mode, enter the date in 6 digits using

the month-day-year format. Press the

#/

SBTL

key once

to continue programming or twice to exit the

program mode.

DD

DD

D

Before placing a new paper roll in the paper

roll cradle, cut off the pasted (taped) part of

the paper and confirm that the cut end of the

paper is straight.

Maintenance

Batteries

This cash register provides a low battery symbol

(l) and a no battery symbol ( ) which appears on

the far left of the display in one of the following

situations:

Low battery symbol (l)

• When the voltage of the batteries installed in the

cash register is under the required level.

No battery symbol ( )

• When three batteries are not installed in the cash

register.

• When the batteries installed in the cash register

are dead.

When either of these symbols appear, check

batteries. If no batteries are installed, install three

new “AA” batteries at once. If batteries are already

installed, replace them with new ones as soon as

possible. If the AC power cord is disconnected or a

power failure occurs when the batteries are dead

or not installed, all the programmed settings will be

reset to the default settings and any data stored in

memory will be cleared.

DD

DD

D

If the low battery symbol appears while

making a transaction, complete the

transaction before replacing the batteries.

C

Improper use of batteries could cause them to burst

or leak, which might damage the interior of the cash

register. Please take the following precautions:

•Be sure that the positive (+) and negative (-) poles

of each battery are oriented properly.

•Never mix batteries of different types.

•Never mix old batteries and new ones.

•Never leave dead batteries in the battery

compartment.

•Remove the batteries if you plan not to use the cash

register for long periods.

•Should a battery leak, clean out the battery

compartment immediately, taking care not to let the

battery fluid come into direct contact with your skin.

•If an incorrect battery is used, it may explode or

leak.

•For battery disposal, follow the relevant law or

regulation in your country.

Replacement

1. Be sure the cash register is plugged in.

2. Turn the mode switch to the REG position.

6. Check that the “ ” symbol has disappeared.

7. Close the battery cover.

8. Replace the printer cover.

C

Improper use of batteries could cause them

to burst or leak, which might damage the

interior of the machine. See the cautions in

the "Getting Started" section.

Paper Roll

When colored dye appears on the edges of the

paper roll, it is time to replace the roll. Use paper

of 2 1/4" (57 mm) in width. To prevent jamming be

sure to use paper specified by SHARP.

Replacement (Journal printing)

1. Turn the mode switch to the REG position.

2. Open the printer cover.

3. Press f to advance the paper by several

lines and then cut the paper to remove the

take-up spool from the bearing.

5. Install three new “AA” batteries into the

battery compartment.

SHARP ELECTRONICS CORPORATION

Sharp Plaza, Mahwah, New Jersey 07495-1163

1-800-BE-SHARP

http://www.sharpusa.com

Drawer Handling

Locking the Drawer

Develop the habit of locking the drawer when not

using the register for any extended period of time.

To lock: Insert the key into the drawer lock and

turn it 90 degrees counter-clockwise.

To unlock: Insert the key into the drawer lock and

turn it 90 degrees clockwise.

Removing the Drawer

To remove the drawer, pull it out and lift it up.

DD

DD

D

• To prevent burglary, it is a good idea to

empty the drawer after work and leave it

open at the end of the day.

• Coin case is detachable. Also the

separators of the coin case are

removable.

Manually Opening the Drawer

In case of a power failure or if the machine is out of

order, locate the lever at the bottom of the machine

and move it in the direction of the arrow to open

the drawer. The drawer will not open if it is locked

with the drawer lock key.

Coin case

View from rear

4. After cutting the existing paper, remove the

paper roll. Then remove the remaining paper

by pressing

f .

5. Remove the paper holding plate from the

spool.

View from rear

4. Open the battery cover and remove the old

batteries.

6. Remove the used journal paper roll (if used)

from the take-up spool.

7. Install a new paper roll, the paper holding

plate and the take-up spool according to the

instructions in "Getting Started."

C

In the case of receipt printing, steps 3, 5 and

6 should be omitted and the paper holding

plate and the take-up spool need not be

installed in step 7.

Replacing the Ink Roller

1. Open the printer cover.

2. Remove the ink roller by pulling it upward.

3. Install a new ink roller.

4. Close the printer cover.

Installing the Mounting

Bracket

A

A

B

B

How to attach the mounting bracket

1.Thoroughly clean the table surface where you

wish to place the bracket (B).

2.Peel off the release paper of the adhesive tape

on the bracket.

3.Hook the bracket onto the hook (A) at the

bottom of the back of the register.

4.Hold down the bracket so that it firmly sticks to

the table surface.

How to release the register from the mounting

bracket

Lift up the front of the register and pull it towards

you.

A mounting bracket which prevents the register

from moving accidentally is supplied with your

XE-A106 register. Attach the bracket to a table

where the register rests, as follows:

Specifications

Model:

XE-A106

Size:

Inches: 13.0 (W) x 14.3 (D) x 9.21 (H)

Millimeters: 330 (W) x 363 (D) x 234 (H)

Weight:

Approx. 11.0 lbs. (5.0 kg)

Power Source:

120V AC±10%, 60Hz

Power Consumption:

Stand-by: 4 W, Operating: 12.5 W

Working Temperature:

32 to 104˚F (0 to 40˚C)

Display:

LED (Light-Emitting Diode) numeric display

Printer:

1 station, print wheel selective type

Printing Capacity:

Max. 13 characters

Paper Roll:

Width: 2 1/4"

+ 1/64" (57.5mm + 0.5mm)

Max. external diameter: 3-5/32" (80mm)

Min. internal diameter: 15/32" (12mm)

Cash Drawer:

4 slots for bills, 5 for coins

Accessories (supplied):

Paper roll: 1 roll

Mode key: 1

Drawer lock key: 1

Instruction manual (English): 1 copy

Instruction manual (Spanish): 1 copy

Quick Start Guide (English): 1 copy

Quick Start Guide (Spanish): 1 copy

Ink roller: 1 (installed)

Take-up spool: 1

Paper holding plate: 1

Mounting bracket: 1

• Specifications and appearance are subject to

change without notice for improvement.

Before Calling for Service

If you encounter any of the following problems,

please read below before calling for service.

The display shows symbols that do not make

sense.

• Has the machine been initialized properly as

shown in “Getting Started”?

The display will not illuminate while the

machine is turned on. The machine will not

operate when any key is pressed.

• Is the power supplied to the electrical outlet?

(Plug another electrical device into the outlet for

confirmation.)

• Is the power cord firmly connected to the

electrical outlet?

The display is illuminated, but the machine will

not accept key entries.

• Is the mode switch properly set to the REG

position?

• Has the machine been initialized properly as

shown in “Getting Started”?

Journal paper will not feed properly in the printer.

• Is the take-up spool installed properly?

• Is there a paper jam?

• Is the journal format selected in the printing

format programming?

(If the receipt format is selected, the paper is not

wound around the take-up spool.)

Printing is faded or illegible.

• Is the ink roller used up?

• Has the ink roller been installed properly?

Lever

Push this part in the direction of the

arrow to remove paper holding plate.

END-USER LIMITED WARRANTY

Model Specific Section (Carry-in Service)

Your Product Model Number & Description:

XE-A106 Cash Register

(Be sure to have this information available when you need

service for your product.)

Warranty Period for this Product:

One (1) Year Parts and 90 Days labor from date of purchase

Additional Item(s) Excluded from

Warranty Coverage (if any): Any consumable items such as paper supplied with the Product.

Where to Obtain Service:

From a Sharp Authorized Servicer located in the United States.

To find the location of the nearest Sharp Authorized Servicer,

call Sharp toll free at 1- 800-BE-SHARP.

What to do to Obtain Service:

Ship prepaid or carry in your Product to a Sharp

Authorized Servicer. Be sure to have

Proof of

Purchase

available. If you ship the Product, be sure it is insured and

packaged securely.

TO OBTAIN PRODUCT INFORMATION, CALL 1-800-BE-SHARP OR VISIT www.sharpusa.com.

SHARP ELECTRONICS CORPORATION warrants to the first end-user purchaser (the “Purchaser”) that this Sharp

brand product (the “Product”), when new and shipped in its original container, will be free from defective

workmanship and materials, and agrees that it will, at its option, either repair the defect or replace the defective

Product or part thereof with a new or remanufactured equivalent at no charge to the Purchaser for parts or labor for

the period(s) set forth below.

This warranty does not apply to any appearance items of the Product nor to the additional excluded item(s) set forth

below nor to any Product the exterior of which has been damaged or defaced, which has been subjected to improper

voltage or other misuse, abnormal service or handling, or which has been altered or modified in design or

construction.

In order to enforce the rights under this limited warranty, the Purchaser should follow the steps set forth below and

provide proof of purchase to the servicer.

To the extent permitted by applicable state law, the warranties set forth herein are in lieu of, and exclusive of, all

other warranties, express or implied. Specifically, ALL OTHER WARRANTIES OTHER THAN THOSE SET FORTH

ABOVE ARE EXCLUDED. ALL EXPRESS AND IMPLIED WARRANTIES INCLUDING THE WARRANTIES OF

MERCHANTABILITY, FITNESS FOR USE, AND FITNESS FOR A PARTICULAR PURPOSE ARE SPECIFICALLY

EXCLUDED. If, under applicable warranties is limited to the period(s) from the date of purchase set forth below.

Neither the sales personnel of the seller nor any other person is authorized to make any warranties other than those

described herein, or to extend the duration of any warranties beyond the time period described herein on behalf of

Sharp.

The warranties described herein shall be the sole and exclusive warranties granted by Sharp and shall be the sole

and exclusive remedy available to the Purchaser. Correction of defects, in the manner and for the period of time

described herein, shall constitute complete fulfillment of all liabilities and responsibilities of Sharp to the Purchaser

with respect to the Product, and shall constitute full satisfaction of all claims, whether based on contract, negligence,

strict liability or otherwise. In no event shall Sharp be liable, or in any way responsible, for any damages or defects

in the Product which were caused by repairs or attempted repairs performed by anyone other than an authorized

servicer. Nor shall Sharp be liable or in any way responsible for any incidental or consequential economic or

property damage. Some states do not allow limits on warranties or on remedies for breach in certain transactions; in

such states, the limits herein may not apply.

3. Pull the printer cover upward and detach it.

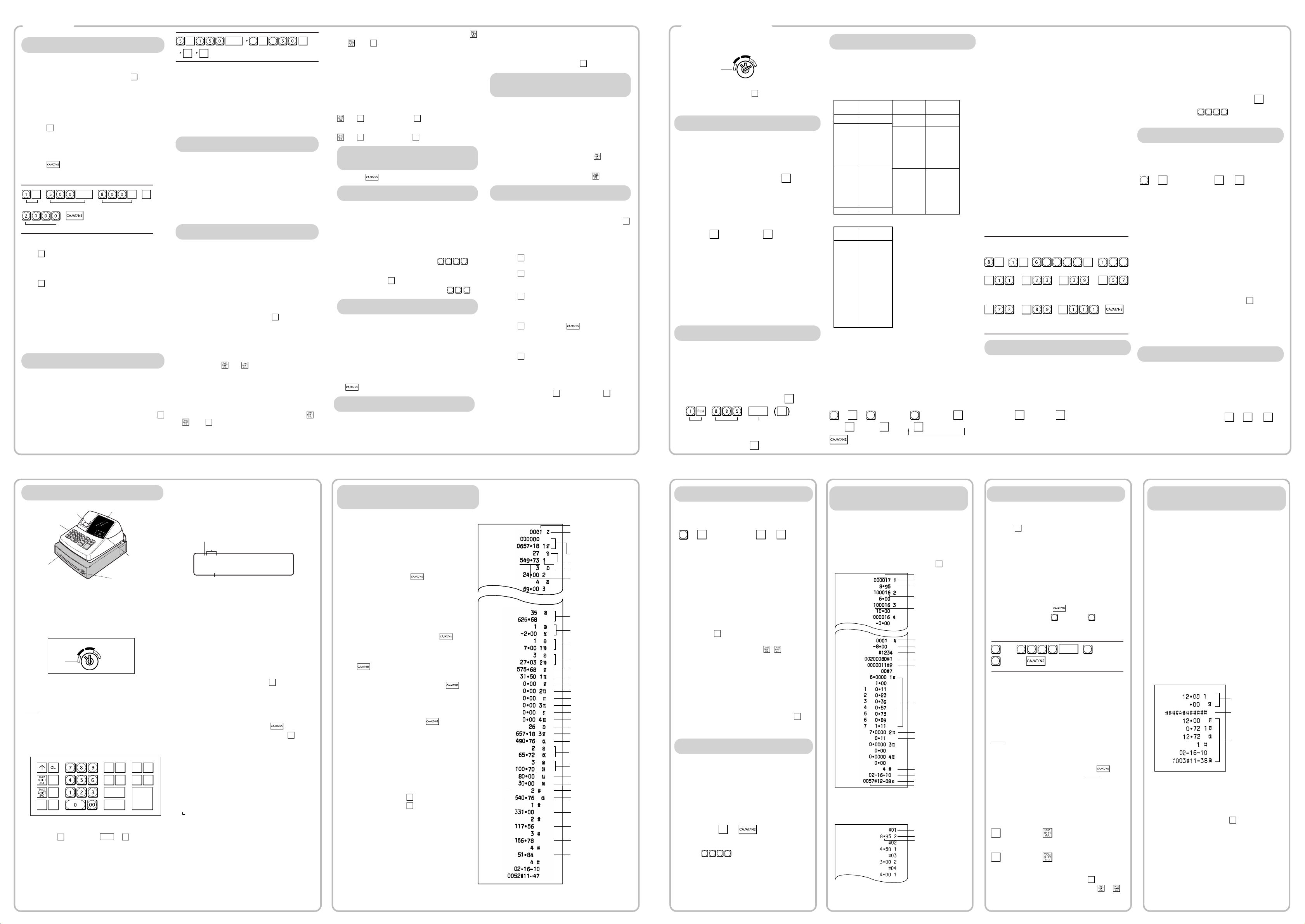

Page 2

Departments/PLU Code: The department code or

PLU code entered appears on the left. For

example, if the key for department 1 is pressed,

“1” would appear in the extreme left position.

Repeat: Indicates the number of times the same

department key is pressed. If an entry is repeated

more than ten times, only the first digit is displayed

(12 displays as “2”).

(

ee

ee

e) Error: This symbol appears, accompanied by a

warning beep, when an error is made. If this

occurs during a transaction because of an

excessive digit entry, simply press CL and re-enter

correctly.

(

pp

pp

p) Program: This symbol remains on the display

when the cash register is being programmed in the

Z/PGM mode.

(

ff

ff

f) Finalization: This symbol appears when a

transaction is finalized by pressing ,g or k.

(

oo

oo

o) Subtotal: This symbol appears when

#/

SBTL

is

pressed and the cash register computes the

subtotal, and also when the amount tendered is

less than the total sale amount.

(

cc

cc

c) Change: This symbol appears whenever the

change due amount is displayed.

(

ll

ll

l) Low battery: This symbol appears when the

power of the installed batteries is below a certain

level or you need to replace the batteries with new

ones. (see the “Maintenance” section for

explanation.)

( ) No battery: This symbol appears when no

batteries are installed. (see “Maintenance” and

“Getting Started” sections for explanation.)

In addition, the following appear when appropriate:

• The minus sign (-) can appear in positions 2 to 8.

• The decimal point appears in positions 1 to 3.

•

When entry of the secret code is necessary,

“----” appears in positions 1 to 4 .

Display

The XE-A106 is equipped with a front LED (LightEmitting Diode) display that affords easy visibility

during transactions.

Symbols and figures appearing on the display:

REG

X/Flash

Z/PGM

VOID

OFF

DD

DD

D

In order to enter the departments 5 to 8,

press

SHIFT

and then the

1

5

to

4

8

keys.

transactions. Non-add code numbers can be entered

in the REG or VOID mode.

Non-add code number entry procedure:

a code number of up to 8 digits

➝ .

Received-on-Account

and Paid-Out Entries

The received-on-account (RA) entry function is used

for entering the cash received not directly connected

with a sale. The paid-out (PO) entry function is used

for recording the money taken from the drawer for

payment not directly connected with a sale. These

functions are available in the X/Flash mode.

Received-on-account entry (X/Flash mode):

amount received (up to $799999.99)

➝

Paid-out entry (X/Flash mode):

amount paid out (up to $799999.99)

➝ .

Reset counter

Reset symbol

("X" is printed in the

case of X reports.)

Grand total

Quantity

Amount

Dept. code

Count of transactions

All Depts. counter and

total

Percent counter and

total

Taxable 1 total

Tax 1 total

Cash sale total

Check sale counter and

total

Charge sale counter and

total

Received-on-account total

Paid-out total

No sale counter

Sales total

Item void counter and

total

Void mode counter

and total

Cash in drawer

Clerk 1 sale total

Clerk 2 sale total

Clerk 3 sale total

Clerk 4 sale total

Tax 3 total

Taxable 2 total

Taxable 3 total

Tax 4 total

Taxable 4 total

Tax 2 total

@/TM

VOID

SHIFT PLU

ESC

%

3

7

2

6

1

5

4

8

CHK CLK#

CH

CA/AT/NS

#/

SBTL

Single Item Cash Sale (SICS) Entry

This function is used for the sale of one item to be paid

by cash. It is applicable only to departments

programmed for single-item cash sales or to PLUs

associated with such departments. After the appropriate

department or P key is pressed, the transaction is

complete and the drawer opens. For the programming of

SICS, see the Department Status section in

“Programming.”

PLU (Price Look Up)

The PLU function allows speedy key entries. When a

PLU code has been assigned to an item and a price for

it has been programmed, entry of the code

automatically calls up the price for the item. Up to 80

PLU codes are programmable. See the PLU

programming section in “Programming”

To enter a sale of a PLU item, simply enter its code and

press P.

Tax Calculation

Automatic Tax Calculation

When the register is programmed with a tax table or tax

rate method and the tax status of a department is

programmed as taxable, the register automatically

computes the tax on any item entered using the

department key for that department or a PLU code

associated with that department.

Taxable Subtotal

You can display the taxable 1 or taxable 2 subtotal by

pressing either tax shift key and then

#/

SBTL

. The subtotal

of taxable 1 or taxable 2 entries is displayed. You

cannot display the subtotal of taxable 3 or 4 items.

Tax Shift

You can change the programmed taxable 1 or 2 status

of each department key by pressing one or both of the

two tax shift keys and . To change the taxable

status, press the appropriate tax shift key just before

the department,

P or % key. In case of repetitive

entries, the shifted tax status is used.

Tax Delete

This function is used when the taxable item or items

once entered need to be made non-taxable. Press

or , then

#/

SBTL

, and v and all entries made so far in

the transaction for items with the specified taxable

status will be made non-taxable.

Operation Examples

When Paid by Cash

1. Turn the mode switch to the REG position.

2. Enter the clerk code (1 to 4) and press

CLK#

. (Once

the clerk code is entered, you need not enter the

clerk code at the start of each transaction until the

clerk is changed.)

3 Enter the price for the first item.

4. Press the appropriate department key.

5. Repeat steps 2 and 3 for all the remaining items.

6. Press

#/

SBTL

to display the amount due including any

tax (you can omit this step).

7. Enter the amount received from the customer (you

can omit this step if the amount tendered is the

same as the subtotal).

8. Press , and the change due is displayed and

the drawer opens.

9. Close the drawer.

Reading and Resetting

of Sales

X Reports

This report, when taken in the X/Flash mode, prints

the accumulated information of sales. Taking an X

report is a good way to do a mid-day check on

daily sales. You can take X reports any number of

times, because they do not affect the cash

register’s memory.

To issue an X report, turn the mode switch to the

X/Flash position and press .

Z Reports

The contents of Z reports are the same as those of

X reports, but issuance of a Z report resets all the

transaction totals to zero. To issue a Z report, turn

the mode switch to the Z/PGM position.

DD

DD

D

If the secret code is programmed, you must

enter the secret code and press

after

this step.

For Z reports without grand total resetting

Press

.

DD

DD

D

If the secret code is programmed, you have

to enter the secret code and press

again after this step.

For Z reports with grand total resetting

If you want to reset the grand total(GT)when taking

the Z report, press

k instead of .

Other than resetting the grand total, this report is

the same as the normal Z reports.

DD

DD

D

If the secret code is programmed, you have

to enter the secret code and press k again

after this step.

Flash Reports (displayed but not printed)

Press the following key in the X/Flash mode:

Department Total Department key

Sales Total

#/

SBTL

Cash in Drawer

CH

Display

Drawer

Drawer lock

When an Error Occurs

When your register goes into an error mode, it will

display the error symbol “e” accompanied with a

warning beep. Clear the error state by pressing the

CL

key and take the appropriate action.

1. You enter a number of more than 7 digits for

the department price or a number larger than

the 79999999 (8 digits) for other amounts.

Press

CL

and re-enter a correct number.

2. You make an error in key operation:

Press

CL

and operate keys correctly.

3. You make an entry beyond a programmed

entry digit limit:

Press

CL

and check if the entered amount is

correct. If not correct, re-enter a correct number. If

correct, check the setting of the entry digit limit.

4. A subtotal exceeds 79999999 (eight digits):

Press

CL

and then press , g or k to finish

the transaction.

5. The number of an item exceeds 3 digits in

multiplication entry:

Press CL and re-enter the correct number.

Error Escape Function

When an error or something uncontrollable occurs

during a transaction entry and you cannot keep the

customer waiting, press

ESC

twice (following

CL

when

in the error state). You can escape the situation and

finalize the transaction as a cash sale at that time.

Transaction entries to that point are registered.

Clerk code

CLK#

1

5

3

7

Price and dept.Price and dept.

Amount tendered

#/

SBTL

1

5

3

7

@/TM @/TM

3 3

CHK

#/

SBTL

When Paid by a Credit Card

Press CH at the end of the transaction. The amount

tendered cannot be entered.

When Paid by Check

Press

CHK

at the end of the transaction. The amount

tendered can be entered like a cash sale and the

change due is displayed.

Mixed Tender Sale

When the amount tendered by cash or check is less

than the sales amount including tax, the display shows

a deficit and “o”. To compensate for the deficit, make

an additional amount-tendered entry or make a charge

entry.

Department

Repetitive Department Entries

To enter two or more of the same item, press the

appropriate department key repeatedly.

Multiplication Entries

To enter a sale of two or more of the same item, use

@/TM

key for multiplication.

Example:

Selling five pieces of $1.50 item (department 1)

and three pieces of $3.50 item (department 3)

for check payment.

Keyboard

Printer cover

Mode switch

87654321

PLU code

Repeat

Department code

X/Z Report Sample

To make all entries up to that point non-taxable, press

and , then

#/

SBTL

, and v. Subsequent entries in the

transaction remain unaffected and will be taxed normally.

Manual Tax

You can apply tax manually when the automatic tax

calculation function cannot be used. Each manual tax

entry (for Tax 1 or Tax 2) can be made only once during

a transaction. After a manual tax entry, you cannot

make any further item entries.

Manual tax 1 entry:

and

#/

SBTL

➝ tax amount ➝

#/

SBTL

Manual tax 2 entry:

and

#/

SBTL

➝ tax amount ➝

#/

SBTL

Opening the Drawer

with No Sale

Just press and the drawer opens.

Percent Key

The percent key is used to apply a discount or premium

to an item or to a subtotal.

You can manually enter a discount (or premium) rate.

Once the rate is preset for

%

, you can skip the step of

entering the rate.

Discount for an item:

entry of an item

➝ percentage rate ➝ %

(ex. For 20%, enter

2 0 0 0

.)

Discount for a subtotal:

entry of all items

➝

#/

SBTL

➝ percentage rate ➝ %

(ex. For 5%, enter

5 0 0

.)

Entering a Refund

The cash register has no refund key. You must use the

following alternative method to make a refund entry: A

negative department for refund must be programmed in

advance. Check the taxable status of the returned item

is the same as that of the programmed negative

department. If not, use the appropriate tax shift key to

change the taxable status.

Procedure

unit price of the returned item ➝ negative dept. key

➝ or g.

Non-add Code Number

Non-add code numbers can be entered and printed on

the journal (or receipt) during the entry of a sale. Nonadd codes can be used for credit numbers, check

numbers, serial numbers, product codes, service charge

codes or any other numbers for reference to

specific

Part Names and Functions

Mode Switch

The mode switch enables the register to perform a

variety of functions. The mode switch can be

operated by inserting the supplied mode key.

The key can be inserted into or withdrawn from the

switch only in the REG or OFF position.

You can select the following functions:

REG: Permits transaction entries.

OFF: Turns the display off.

VOID: Permits you to cancel transaction entries.

X/

Flash

: Permits printing of sales reports and

displaying of flash reports.

Z/PGM: Permits printing of sales reports, resetting

of sales data and programming.

Keyboard Layout

Entries

#/

SBTL

2

6

PLU code Price

Associated dept.

#/

SBTL

PLU code ➝ P ➝ Price ➝ Dept. key (➝

#/

SBTL

)

Ex.:

To disable a PLU code, use the following sequence:

PLU code ➝ P ➝ v (➝

#/

SBTL

)

Before you begin programming, turn the mode switch to

the Z/PGM position.

B, C, D and E: Choice of taxable status

Enter 0000 for non-taxable, 0001 for taxable 1,

0010 for taxable 2, 0100 for taxable 3, 1000 for

taxable 4 or 0011 for taxable 1 and 2.

Initial setting: - (discount), non-taxable ("10000")

Programming the percent rate

Use the following sequence:

Percent rate (0.01% to 99.99%)

➝ % (➝

#/

SBTL

)

(ex. For 10.00% enter

1 0 0 0

.)

Initial setting: 0.00(%)

Printing Format

You can choose either a journal or receipt format and

specify other options for the printing format. Use the

following sequence:

2

➝

#/

SBTL

➝ ABCDEFG ➝

#/

SBTL

(➝

#/

SBTL

)

A: Printing journal/receipt in the REG mode

Enter 0 for printing or 1 for no printing.

B: Journal or receipt format

Enter 0 for journal format or 1 for receipt format.

(In the receipt format, the paper is fed by a few

lines upon finalization of each transaction. In the

journal format, the paper is wound around the takeup spool.)

C: Printing date

Enter 0 to print or 1 not to print

D: Printing time

Enter 0 to print or 1 not to print

E: Printing consecutive numbers

Enter 0 to print or 1 not to print

F: Printing taxable subtotal

Enter 0 to print or 1 not to print

G: Printing merchandise subtotal with

#/

SBTL

Enter 0 to print or 1 not to print

Initial setting: printing in the REG mode, journal

format, printing date, time and consecutive number,

and not printing taxable subtotal and merchandise

subtotal ("0000011")

Consecutive Receipt Number

Consecutive receipt number can be printed on every

transaction or receipt and report with the date and

time. Use the following sequence to set the receipt

start number. To start from a specific number, enter

the number less one (e.g. if you want to start from

receipt number 1001, enter 1000).

Consecutive (receipt) number ➝

@/TM

➝

#/

SBTL

(➝

#/

SBTL

)

Initial setting: starting from 0001("0000")

(For miscellaneous settings, secret code and checking

machine settings, see the columns below. )

where R, M and Q represent the following:

R: Tax rate (0.0000% to 99.9999%) x 10000

If the rate is fractional, it should be converted to its

decimal equivalent before entering.

M: Cycle (0.01 to 99.99) x 100

In tax table 1, you can see that the breakpoint

differences repeat in cycle. The value of M may be

viewed as the taxable amount which is covered by a

cycle. Thus, it can be determined by adding all of the

breakpoint differences in a cycle or by simply taking the

difference between the first breakpoint of the cycle and

the first breakpoint of the next cycle.

Q: Minimum taxable amount (0.01 to 99.99) x 100

This represents the smallest amount for which tax must

be collected. In some states, sales whose amounts are

less than a specific minimum taxable amount are not

subject to taxation.

Breakpoints (0.01 to 99.99) x 100

The tax amount increases in stages. The value of a

taxable subtotal at which the tax amount changes is

called a breakpoint. The difference between one

breakpoint and the next is called the breakpoint

difference. A group of breakpoint differences is

repeated at regular intervals and each of these intervals

is called a cycle. A maximum of 18 breakpoints (for tax

types 1 and 2), between 0.01 to 99.99, can be

programmed. Intervals between breakpoints must be

less than one dollar.

Example: Programmig Tax 1 as 6% sales tax using

sample tax table 1.

Tax Breakpoint

Breakpoint

.00

.01

.02

.03

.04

.05

.06

.07

.08

.09

.10

.11

.12

.13

.01

.11

.23

.39

.57

.73

.89

1.11

1.23

1.39

1.57

1.73

1.89

2.11

.10

.12

.16

.18

.16

.16

.22

.12

.16

.18

.16

.16

.22

Non-cyclic

Cyclic I

Cyclic II

Sample tax table 1 (6%):

Tax Breakpoint

.00

.01

.02

.03

.04

.06

.09

.10

.11

.12

.14

.17

.01

.11

.26

.47

.68

.89

1.11

1.26

1.47

1.68

1.89

2.11

Sample tax table 2:

difference

DD

DD

D

If tax is not shown for every cent, use the

breakpoint of the next highest tax amount for each

missing breakpoint. In sample tax table 2, tax is

not shown for .05, .07, .08, .13, .15 and .16.

Likewise, the corresponding breakpoints are not

shown. To complete the table, simply insert the

next highest breakpoint after each missing figure.

Therefore, the breakpoint for .05 would be .89, .07

and .08 would be 1.11, etc.

Use the following sequence for tax programming:

8

➝

#/

SBTL

➝

1

for Tax 1 or 2 for Tax 2 ➝

@/TM

➝

R ➝

@/TM

➝ M ➝

@/TM

➝ Q ➝

@/TM

➝ Breakpoint ➝

Checking the Machine

Settings

To obtain a printout that shows the cash register

settings, turn the mode switch to the Z/PGM

position and use the following sequence:

General & Tax Settings

To see the general and tax settings, turn the mode

switch to the Z/PGM position and press

#/

SBTL

.

In Case of a Power Failure or

Paper Jam

The following situations may arise during a power

failure or paper jam. (Make sure that batteries are

correctly installed.) As the power is recovered or a

paper jam is removed, the register will resume

normal operation with a next key operation.

When a power failure occurs with the register

turned on or during a computation process:

Upon power recovery, the register resumes

operation from the point of failure.

When a power failure occurs during printing of

transaction data:

Upon power recovery, the register prints

“############” and resumes printing of the

transaction data.

When a power failure occurs during printing of

an X (reading) or Z (reading and resetting)

report:

Upon power recovery, the register prints

“############” and resumes printing of the

report.

Miscellaneous Settings

You can program miscellaneous settings using the

following sequence:

1

➝

#/

SBTL

➝ ABCDEFGH ➝

#/

SBTL

(➝

#/

SBTL

)

where A, B, C, D, E, F, G and H represent the

following choices.

A: Date format

Enter 0 for mmddyy, 1 for ddmmyy or 2 for yymmdd.

B: Time format

Enter 0 for 12 hour system or 1 for 24 hour system.

C: Decimal point setting

Enter 0, 1, 2 or 3 for the decimal point position.

D: Resetting receipt no. when issuing Z report

Enter 0 to not reset or 1 to reset

E: Amount tendered compulsory

Enter 0 for non compulsory or 1 for compulsory.

F: Choice of

#/

SBTL

compulsory

Enter 0 for non compulsory or 1 for compulsory.

G: Entry digit limit for g, k, , and

manual tax

Enter 0, 1, 2, 3, 4, 5, 6, 7 or 8 for the entry digit limit.

H: Rounding

Enter 0 for rounding off, 1 for rounding up or 2

for rounding down

Initial setting: date format "mmddyy", time format

“12 hour system”, decimal point position “2”, not

resetting, amount tendered non compulsory,

non compulsory, entry digit limit “8” and rounding

off ("00200080")

Secret Code

A secret code can be specified so that only those

who know the secret code may issue Z reports for

reading and resetting of sales, perform

programming in the Z/PGM mode and void

operation in the VOID mode. The pre-programmed

secret code setting is 0000 (no secret code). Use

the following sequence to enter a secret code (4

digits).

Secret code ➝

@/TM

➝

The secret code function can be disabled by

entering

0 0 0 0

(or nothing) for the code in

the above sequence.

When entry of secret code is necessary, “----” is

displayed. Each time you enter a number for the

secret code, the corresponding symbol “-”

changes to “_”.

Programming

Correction

Correction of Entered Number

When you enter an incorrect number, delete it by

pressing CL immediately after the entry.

Correction of the Last Entry

If you make a mistake when making a department

entry, PLU entry, repetitive or multiplication entry,

discount or premium entry by % , or manual tax

entry, you can correct this by pressing v.

Correction of Earlier Entries

You can correct any incorrect entry made during a

transaction if you find it before finalizing the

transaction by pressing , g, k, etc.

For example, to correct 3

P entry to

4

P after

another correct entry has been made, enter the

following:

3

P

1 1 5 0

1

5

3

vP

4

P

Void Mode

This function allows you to reverse the entries

made in an incorrect receipt. The entries are

subtracted from each totalizer and added to a void

totalizer.

To use this function, turn the mode switch to the

VOID position and enter the same details that are

on the incorrect receipt. The VOID mode

symbol (VD) is printed at the bottom of the receipt.

DD

DD

D

If the secret code is programmed, you have

to enter the secret code and press after

setting the mode switch to the VOID position.

Void Operation in the X/Flash Mode

Received-on-account (RA) and paid-out (PO)

entries can be corrected in the X/Flash mode.

Void operation for RA (X/Flash mode)

VOID

* ➝ amount ➝

Void operation for PO (X/Flash mode)

VOID

* ➝ amount ➝

*If the secret code is programmed, you have to

enter the secret code here and press

VOID

again

before entering the amount and pressing or .

REG

X/Flash

Z/PGM

VOID

OFF

Tax Programming

Tax Table Programming

If you are in an area that uses a tax table for tax

calculation, you can program the cash register accordingly.

Tax table programming can be performed for Tax 1 and

Tax 2.

@/TM @/TM

@/TM

0 0 0 00 0

@/TM

@/TM

@/TM

@/TM

@/TM

@/TM

Tax 1 Tax rate(R)

Minimum taxable

amount(Q)

(First breakpoint)

Breakpoint Breakpoint Breakpoint

Breakpoint Breakpoint Breakpoint

Cycle(M)

(First breakpoint of the next cycle)

#/

SBTL

Programming the Percent key

Percent Key Function

The % key can be programmed as a discount key or

as a premium key. The taxable status of the % key can

also be programmed though it is pre-programmed as a

non-taxable discount key. Use the following sequence:

ABCDE ➝

@/TM

➝ % (➝

#/

SBTL

)

where A to E represent the following choices

A: Choice of + or - sign

Enter 0 for + or 1 for - .

PLU Settings

To see the PLU settings, turn the mode switch to

the Z/PGM position and press P.

Taxable status

Dept. code

Sign and unit price

SICS (1) / Normal (0)

Sign and rate for %

Secret code

Miscellaneous settings

Printing format

Entry digit limit

Taxable status for %

Percentage tax rate(Tax2)

Tax table(Tax1)

Clerk code

Minimum taxable amount

Date

Time

Receipt number

PLU code

Associated department

Unit price

Before power failure

After power failure

Power failure mark

When the printer motor is locked due to a

paper jam:

Printing stops and intermittent beeping starts. First,

unplug the power cord and clear the paper jam.

Then plug in the power cord, feed the roll paper to

the proper position and press CL. The register will

then resume printing after printing

“############”.

Follow these steps as needed.

DD

DD

D

If you do not press the

#/

SBTL

key at the end of each

programming step, you can continue programming without printing the programming report.

Programming by Departments

Preset Unit Price

The preset unit price function assigns a frequently

purchased item to a department key and enables you to

enter the price simply by pressing the department key.

Specify a price using the following sequence:

Unit Price (Max. 5 digits) ➝ Dept. key (➝

#/

SBTL

)

Department Status

You can specify various status parameters (+/- sign,

single item cash sale function, taxable status and entry

digit limit) for a department key. Use the following

sequence:

ABCDEFG➝

@/TM

➝ Dept. key (➝

#/

SBTL

)

where A to G represent the following choices.

A: Choice of + or - sign

Enter 0 for + or 1 for -.

B: Choice of single item cash sale (SICS) function

Enter 0 for normal or 1 for single item cash sale.

C, D, E and F: Choice of taxable status

Enter 0000 for non-taxable, 0001 for taxable 1, 0010

for taxable 2, 0100 for taxable 3, 1000 for taxable 4 or

0011 for taxable 1 and 2.

G: Entry digit limit (0 to 7 digits)

Enter 0, 1, 2, 3, 4, 5, 6 or 7

PLU (Price Look-Up) Programming

Each PLU is associated to a department and the

programmed contents for the department are

automatically applied. Your cash register is preprogrammed so PLU codes 1-10 are assigned to

department 1 and PLU codes 11-80 are disabled. To set

the price or change the associated department, use the

following sequence:

#/

SBTL

Loading...

Loading...