Page 1

ELECTRONIC CASH REGISTER

CE

-

6000

GROCERY

DAIRY

H.B.A.

6~00

FROZEN

FOOD

DELICATESSEN

CI Canada

USER'S MANUAL

www.cashregisters.net

Page 2

Introduction & Contents

Introduction

Congratulations on your selection of a CASIO CE-6000 electronic cash register. This ECR is the product of the

world's most advanced electronic technology, for outstanding versatility and reliability.

Simplified operation is made possible by a specially designed keyboard layout and a wide selection of

automated, programmable functions.

A specially designed keyboard layout and a bright, easy-to-read display help to take the fatigue out of long

hours operation.

GUIDELINES LAID DOWN BY FCC RULES FOR USE OF THE UNIT IN THE U.S.A.

(Not applicable to other areas)

WARNING: This equipment has been tested and found to comply with the limits for a Class A digital device,

pursuant to Part 15 of the FCC Rules. These limits are designed to provide reasonable protection against harmful

interference when the equipment is operated in a commercial environment. This equipment generates, uses, and

can radiate radio frequency energy and, if not installed and used in accordance with the instruction manual, may

cause harmful interference to radio communications. Operation of this equipment in a residential area is likely to

cause harmful interference in which case the user will be required to correct the interference at his own expense.

This digital apparatus does not exceed the Class A limits f or radio noise emissions from digital apparatus

as set out in the Radio Interference Regulations of Canadian Department of Communications.

The main plug on this equipment must be used to disconnect mains power.

Please ensure that the socket outlet is installed near the equipment and shall be easily

accessible.

Please keep all information for future reference.

2

www.cashregisters.net

Page 3

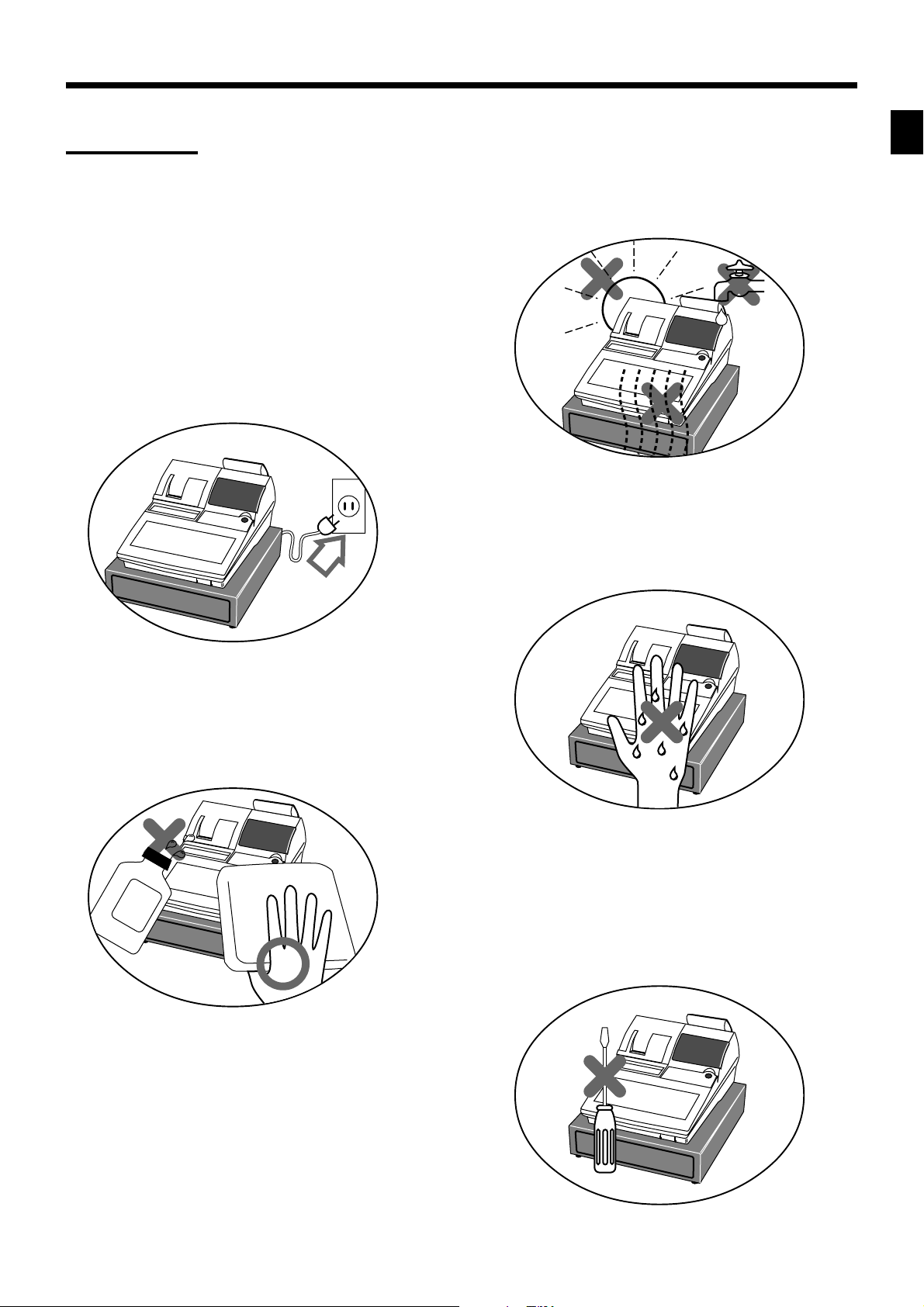

Important!

Your new cash register has been carefully tested before shipment to ensure proper operation. Safety

devices eliminate worries about breakdowns resulting from operator errors or improper handling. In

order to ensure years of trouble-free operation, however, the following points should be noted when

handling the cash register.

Do not locate the cash register where it will be

subjected to direct sunlight, high humidity,

splashing with water or other liquids, or high

temperature (such as near a heater).

Be sure to check the sticker on the side of the

cash register to make sure that its voltage

matches that of the power supply in the area.

Introduction & Contents

Never operate the cash register while your

hands are wet.

Never try to open the cash register or attempt

your own repairs. Take the cash register to your

authorized CASIO dealer for repairs.

Use a soft, dry cloth to clean the exterior of the

cash register. Never use benzene, thinner, or

any other volatile agent.

CE-6000 User's Manual

3

www.cashregisters.net

Page 4

Introduction & Contents

Introduction & Contents ............................................................................................................ 2

Getting Started ........................................................................................................................... 8

Remove the cash register from its box...................................................................................................8

Remove the tape holding parts of the cash register in place.................................................................8

Plug the cash register into a wall outlet..................................................................................................8

Insert the mode key marked “PGM” into the mode switch. ....................................................................8

Install receipt/journal paper. ...................................................................................................................9

Set the date. .........................................................................................................................................11

Set the time...........................................................................................................................................11

Tax table programming .........................................................................................................................11

Introducing CE-6000 ................................................................................................................ 16

General guide ....................................................................................................................................... 16

Display ..................................................................................................................................................18

Keyboard ..............................................................................................................................................20

Basic Operations and Setups ................................................................................................. 22

How to read the printouts ............................................................................................................... 22

How to use your cash register........................................................................................................ 23

Assigning a clerk ..................................................................................................................................24

Clerk secret number key ............................................................................................................. 24

Displaying the time and date ................................................................................................................25

To display and clear the time....................................................................................................... 25

To display and clear the date....................................................................................................... 25

Preparing coins for change ..................................................................................................................25

Preparing and using department keys ........................................................................................... 26

Registering department keys................................................................................................................26

Programming department keys ............................................................................................................27

To program a unit price for each department .............................................................................. 27

To program the tax calculation status for each department ........................................................ 27

To program high amount limit for each department .................................................................... 28

Registering department keys by programming data ............................................................................29

Preset price ................................................................................................................................. 29

Preset tax status.......................................................................................................................... 29

Locking out high amount limitation..............................................................................................29

Preparing and using PLUs ............................................................................................................. 30

Programming PLUs ..............................................................................................................................30

To program a unit price for each PLU ......................................................................................... 30

To program tax calculation status for each PLU ......................................................................... 30

Registering PLUs..................................................................................................................................31

Shifting the taxable status of an item ............................................................................................. 32

Calculation merchandise subtotal ........................................................................................................32

Preparing and using discounts....................................................................................................... 33

Programming discounts........................................................................................................................33

Registering discounts ...........................................................................................................................33

Discount for items and subtotals ................................................................................................. 33

Preparing and using reductions ..................................................................................................... 34

Programming for reductions .................................................................................................................34

Registering reductions..........................................................................................................................34

Reduction for items...................................................................................................................... 34

4

www.cashregisters.net

Page 5

Registering credit and check payments ......................................................................................... 35

Check........................................................................................................................................... 35

Credit ........................................................................................................................................... 35

Mixed tender (cash, credit and check) ........................................................................................ 36

V alidation printing........................................................................................................................... 36

Registering returned goods in the REG mode ............................................................................... 37

Registering returned goods in the RF mode .................................................................................. 38

Normal refund transaction ....................................................................................................................38

Reduction of amounts paid on refund ..................................................................................................38

Registering money received on account ........................................................................................ 39

Registering money paid out ........................................................................................................... 39

Making corrections in a registration ............................................................................................... 40

To correct an item you input but not yet registered ..............................................................................40

To correct an item you input and registered .........................................................................................41

To cancel all items in a transaction.......................................................................................................42

No sale registration ........................................................................................................................ 42

Printing the daily sales reset report................................................................................................ 43

Advanced Operations and Setups.......................................................................................... 44

Clerk interrupt function ................................................................................................................... 44

Single item cash sales.................................................................................................................... 45

Addition .......................................................................................................................................... 46

Addition (plus).......................................................................................................................................46

Premium (%+).......................................................................................................................................46

Coupon transactions ...................................................................................................................... 47

Coupon registration using <COUPON> (coupon key) .........................................................................47

Coupon registration using <COUPON2> (coupon 2 key) ....................................................................47

Arrangement key registrations ....................................................................................................... 48

Arrangement programming................................................................................................................... 48

Currency exchange function .......................................................................................................... 49

Registering foreign currency ................................................................................................................49

Full amount tender in foreign currency........................................................................................ 49

Partial tender in a foreign currency ............................................................................................. 50

Currency exchange programming ........................................................................................................50

Food stamp function....................................................................................................................... 51

Food stamp key programming..............................................................................................................51

Food stamp registration........................................................................................................................51

No change due ............................................................................................................................ 51

Mixed food stamp/cash change................................................................................................... 52

Food stamp registration (Illinois rule) ...................................................................................................54

No change due ............................................................................................................................ 54

Mixed food stamp/cash change................................................................................................... 56

Electronic benefits transfer...................................................................................................................60

About mixed EBT card tenders ................................................................................................... 60

Temporarily releasing compulsion .................................................................................................. 62

Introduction & Contents

CE-6000 User's Manual

5

www.cashregisters.net

Page 6

Introduction & Contents

Programming to clerk ..................................................................................................................... 63

Programming clerk number ..................................................................................................................63

Programming trainee status .................................................................................................................63

Programming commission rate.............................................................................................................63

Programming machine features ..................................................................................................... 64

Programming to general control file .....................................................................................................64

Programming department/PLU ......................................................................................................71

Batch feature programming to department/PLU ..................................................................................71

Individual feature programming to department/PLU ............................................................................72

Programming to transaction keys................................................................................................... 73

<CASH>, <CHARGE>, <CHECK> ....................................................................................................................73

<CREDIT> ......................................................................................................................................................... 74

<RECEIVED ON ACCOUNT>, <PAID OUT> ....................................................................................................74

<FOOD STAMP TENDER>, <EBT> ..................................................................................................................75

<#/NO SALE> ....................................................................................................................................................75

<%+>, <%–> ......................................................................................................................................................76

<+>, <–>, <COUPON> ......................................................................................................................................77

<ARRANGEMENT>...........................................................................................................................................78

<CURRENCY EXCHANGE> .............................................................................................................................78

<POST RECEIPT> ............................................................................................................................................79

<MULTIPLICATION>, <QUANTITY/FOR>, <SQUARE>, <CUBE>..................................................................79

Programming descriptors and messages....................................................................................... 80

Programming clerk name and messages............................................................................................80

Programming department/transaction key descriptor ..........................................................................84

Programming PLU descriptor ...............................................................................................................85

Entering characters ........................................................................................................................ 86

Using character keyboard.....................................................................................................................86

Entering characters by code.................................................................................................................87

Character code list....................................................................................................................... 87

Keyboard layout change................................................................................................................. 88

Configuration of the physical key layout............................................................................................... 88

Programming procedure.............................................................................................................. 88

The outline of functions ........................................................................................................................89

Printing read/reset reports.............................................................................................................. 90

To print the individual department, PLU read report ............................................................................90

To print the financial read report...........................................................................................................91

To print the individual clerk read/reset report .......................................................................................91

To print the daily sales read/reset report ..............................................................................................92

To print the PLU read/reset report ........................................................................................................93

To print the hourly sales read/reset report............................................................................................93

To print the monthly sales read/reset report.........................................................................................94

To print the group read/reset report......................................................................................................94

To print the periodic 1/2 sales read/reset reports .................................................................................95

Reading the cash register's program .............................................................................................96

To print unit price/rate program (except PLU) ......................................................................................96

To print key descriptor, name, message program (except PLU)..........................................................97

To print the general control program, compulsor y and key program ...................................................98

To print the keyboard layout program................................................................................................... 99

To pr int the PLU program .....................................................................................................................99

6

www.cashregisters.net

Page 7

Troubleshooting..................................................................................................................... 100

When an error occurs................................................................................................................... 100

When the register does not operate at all .................................................................................... 101

Clearing a machine lock up.......................................................................................................... 102

In case of power failure ................................................................................................................ 102

User Maintenance and Options ............................................................................................ 103

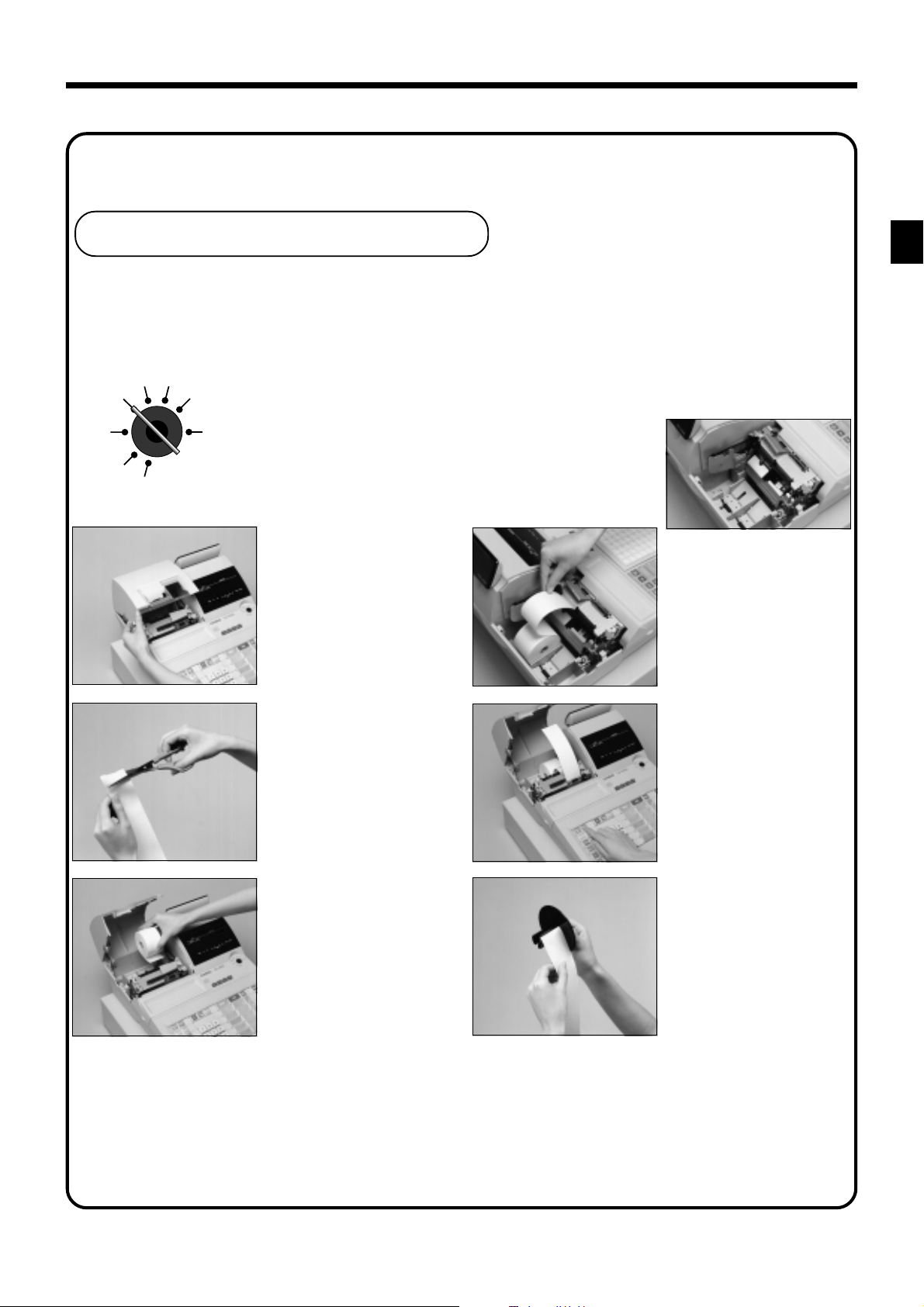

To replace the ink ribbon .............................................................................................................. 103

To replace journal paper............................................................................................................... 104

To replace receipt paper............................................................................................................... 105

Options ......................................................................................................................................... 105

Specifications................................................................................................................. ........ 106

Index.......................................................................................................................... .............. 107

Introduction & Contents

CE-6000 User's Manual

7

www.cashregisters.net

Page 8

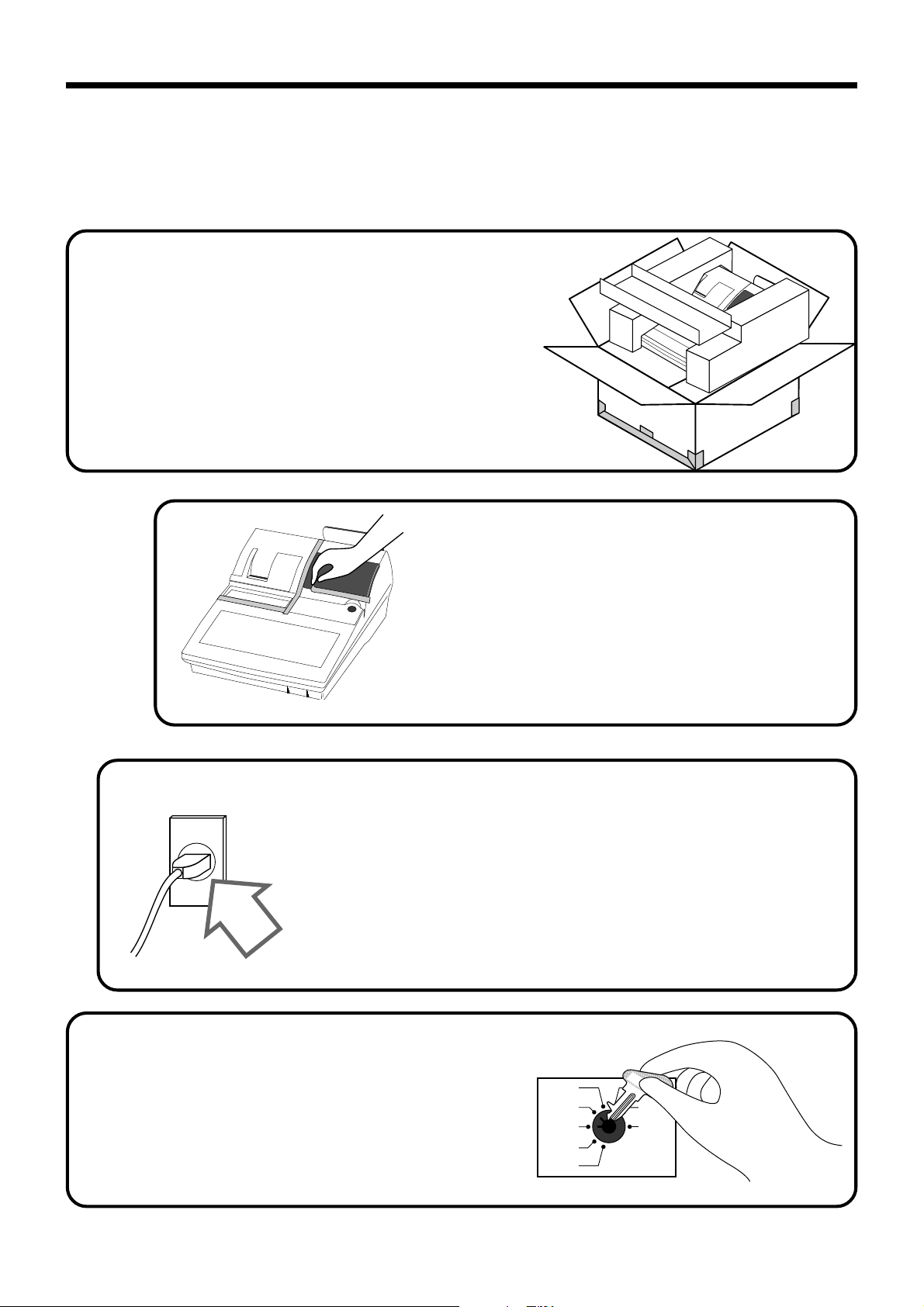

Getting Started

This section outlines how to unpack the cash register and get it ready to operate. You should read this part

of the manual even if you have used a cash register before. The following is the basic set up procedure,

along with page references where you should look for more details.

Remove the cash register from its box.

1.

3.

2.

Plug the cash register into a wall

outlet.

Be sure to check the sticker on the side of the cash

register to make sure that its voltage matches that

of the power supply in your area. The printer will

operate for a few seconds. Please do not pass the

power cable under the drawer.

Remove the tape holding parts

of the cash register in place.

Also remove the small plastic bag taped to the

printer cover. Inside you will find the mode

keys.

8

4.

Insert the mode key marked

“PGM” into the mode switch.

REG2

REG1

OFF

RF

PGM

C-A32

X1

Z1

X2/Z2

www.cashregisters.net

Page 9

5.

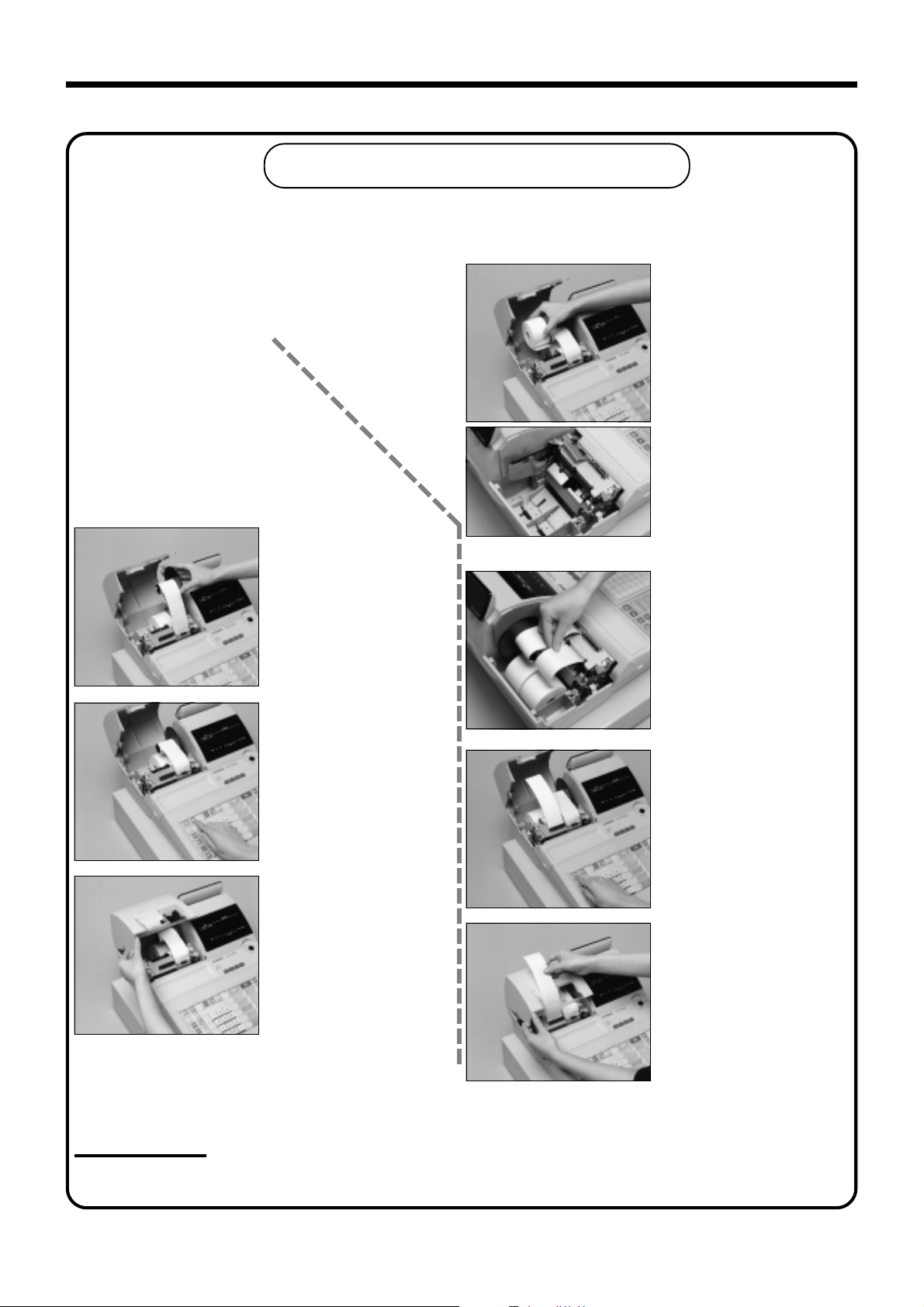

Install receipt/journal paper.

Loading journal paper

The same type of paper (45 mm × 83 mm i.d.) is used for receipts and journal. Load the new paper before first

operating the cash register or when red paper appears from the printer.

REG2 X1

REG1 Z1

OFF X2/Z2

RF

PGM

11

1

11

Use a mode key to set the

mode switch to REG1

position.

22

2

22

Open the printer cover.

33

3

33

Cut off the leading end of

the paper so it is even.

55

5

55

Drop the paper roll gently

and insert paper to the

paper inlet.

66

6

66

Press the j key until

about 20 cm to 30 cm of

paper is fed from the

printer.

Getting Started

CE-6000 User’s Manual

44

4

44

Ensuring the paper is being

fed from the bottom of the

roll, lower the roll into the

space behind the printer.

77

7

77

Slide the leading end of the

paper into the groove on

the spindle of the take-up

reel and wind it onto the

reel two or three turns.

www.cashregisters.net

9

Page 10

Getting Started

Loading receipt paper

Follow steps

previous page.

88

8

88

Place the take-up reel into

place behind the printer,

above the roll paper.

11

1 through

11

33

3 under “Loading journal paper” on the

33

44

4

44

Ensuring the paper is being

fed from the bottom of the

roll, lower the roll into the

space behind the printer.

55

5

55

Drop the paper roll gently

and insert paper to the

paper inlet.

99

9

99

Press the j key to take

up any slack in the paper.

00

0

00

Close the printer cover.

Important!

Never operate the cash register without paper. It can damage the printer.

66

6

66

Press the f key until

about 20 cm to 30 cm of

paper is fed from the

printer.

77

7

77

Set the printer cover,

passing the leading end of

the paper through the paper

outlet. Close the printer

cover and tear off the

excess paper.

10

www.cashregisters.net

Page 11

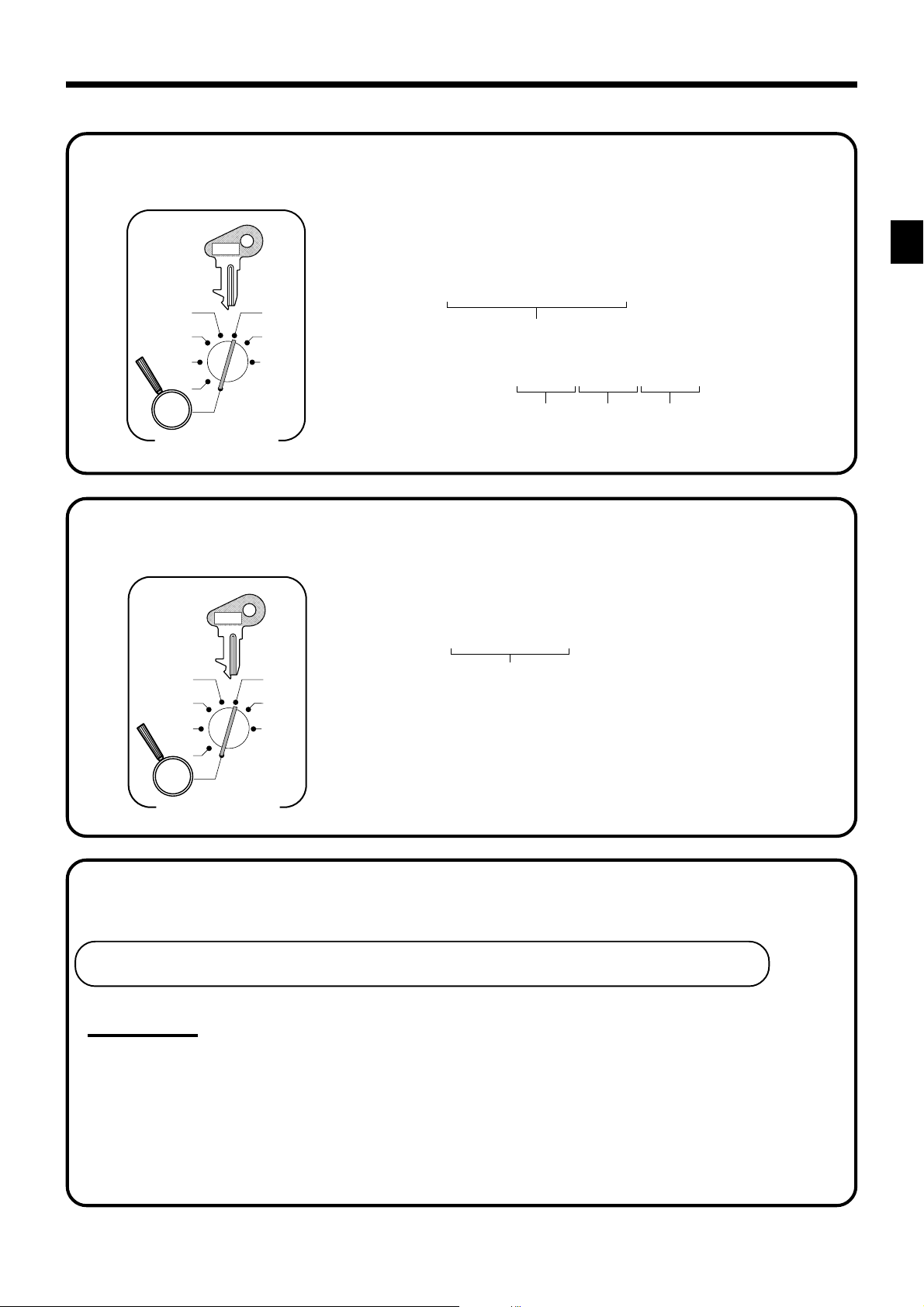

6.

Set the date.

PGM

C-A32

7.

REG2

REG1

OFF

RF

X1

Z1

X2/Z2

PGM

Mode Switch

Set the time.

PGM

C-A32

REG2

REG1

OFF

RF

PGM

Mode Switch

X1

Z1

X2/Z2

6 1s 6 : : : : : : 6

Current date

Example:

March, 4, 2000 2

6 1s 6 : : : : 6

Example:

08:20 AM

09:45 PM

000304

Year Month Day

x

Current time

2 0820

2 2145

(24-hour military time)

6 C

x

6 C

Getting Started

8.

Tax table programming

Programming automatic tax calculation

Important!

After you program the tax tables, you also have to individually specify which departments (page 27)

and PLUs (page 30) are to be taxed.

And also set the appropriate tax system (U.S. or Canadian) in the general function program address

0422 (see page 65).

For this cash register to be able to automatically register state sales tax, you must program its tax

tables with tax calculation data from the tax table for your state. There are three (U.S.)/four

(Canada) tax tables that you can program for automatic calculation of separate sales taxes.

CE-6000 User’s Manual

www.cashregisters.net

11

Page 12

Getting Started

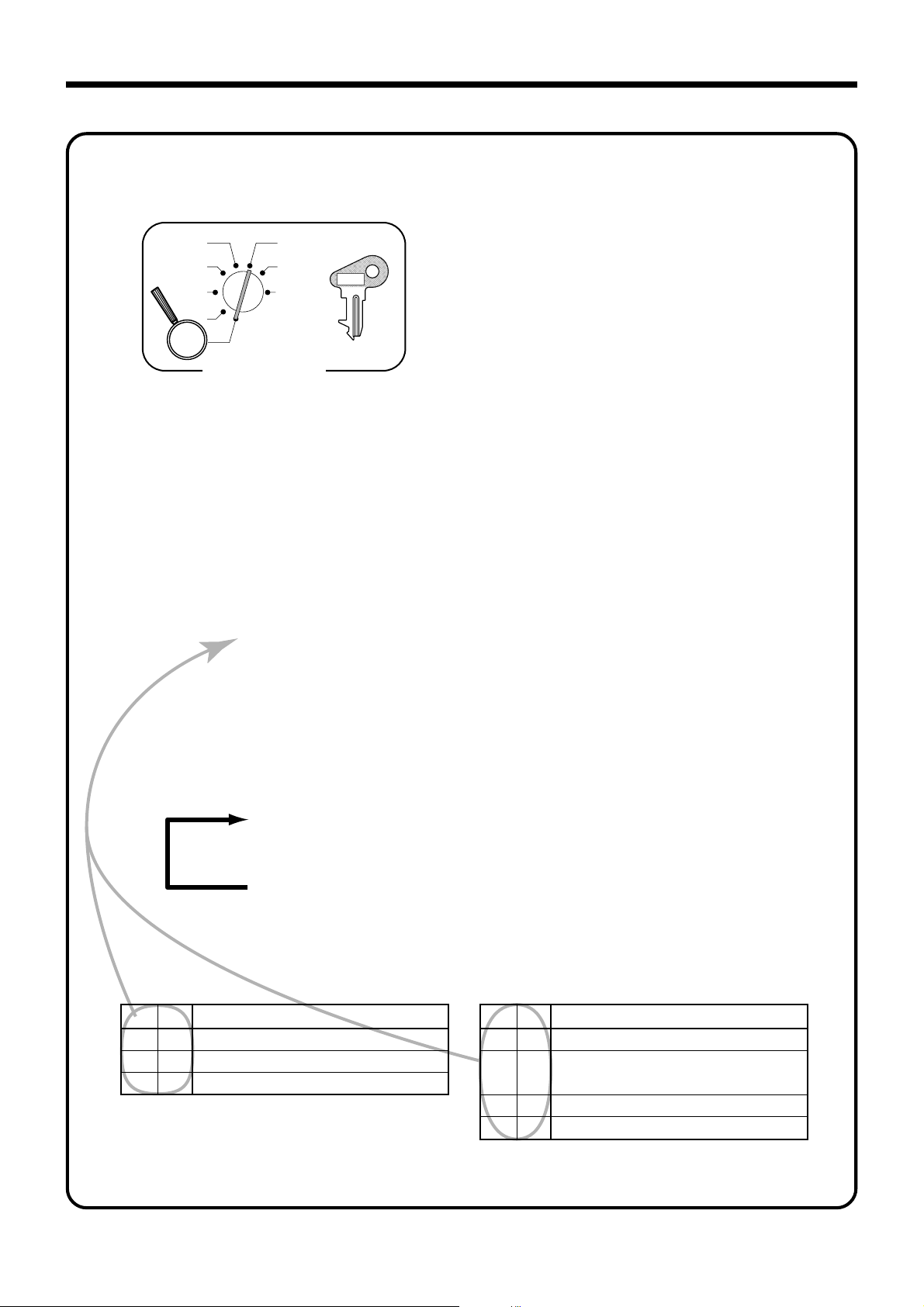

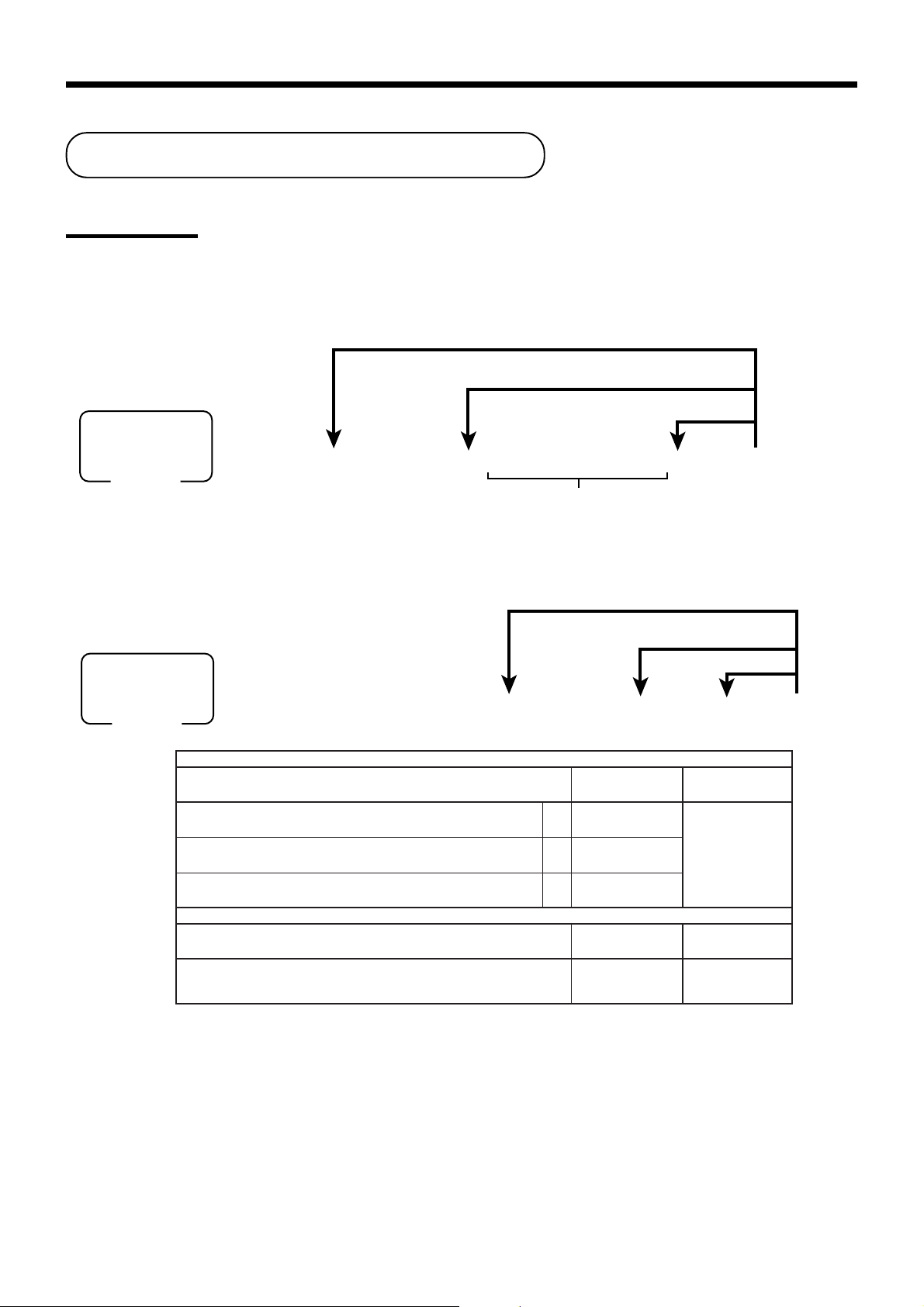

Tax table programming (continued…)

Programming procedure

REG2

REG1

OFF

RF

PGM

: : : :

: :

^

: : : :

D

: : : :

: : : :

X1

Z1

X2/Z2

Mode Switch

8

3s

8

8

: : : :

8

8

D

D

D

2

3

4

8

s

a

a

1

a

PGM

C-A32

a

Tax table 1 =

Tax table 2 =

Tax table 3 =

{

Tax table 4 =

Tax rate (4-digit for integer + 4-digit for decimal)

Tax table maximum value (“0” means unlimited).

Rounding/tax table system code

Sum of a cyclic pattern

0125

0225

0325

0425

(only for Canada)

*1

8

: : : :

a

Number of values in each cyclic pattern

8

: : : :

8

: : : :

8

a

a

Number of values in each non-cyclic pattern

Actual value of difference of the non-cyclic and cyclic values

You must enter these values in 4-digit block. If the last block

comes out to be only two digits, add two zeros.

Loop to input the next block.

s

*1

Rounding/tax table system code

Rounding code specification Tax system code specification

D

D

3

4

0

5

9

0

Canadian tax system

For both add-on and add-in tax systems.

To program Tax-on-tax system, you must use the tax address “0225”, “0325” or “0425.”

Rounding off two decimal places

0

Rounding up to two decimal places

0

Cut off to two decimal places

Rounding

D

D

1

2

1

0

0

0

0

Tax table only

U.S. tax table with tax rate or add-on

2

tax rate only

3

Add-in tax rate

4

Canadian tax system (Tax-on-tax)

Rounding

12

www.cashregisters.net

Page 13

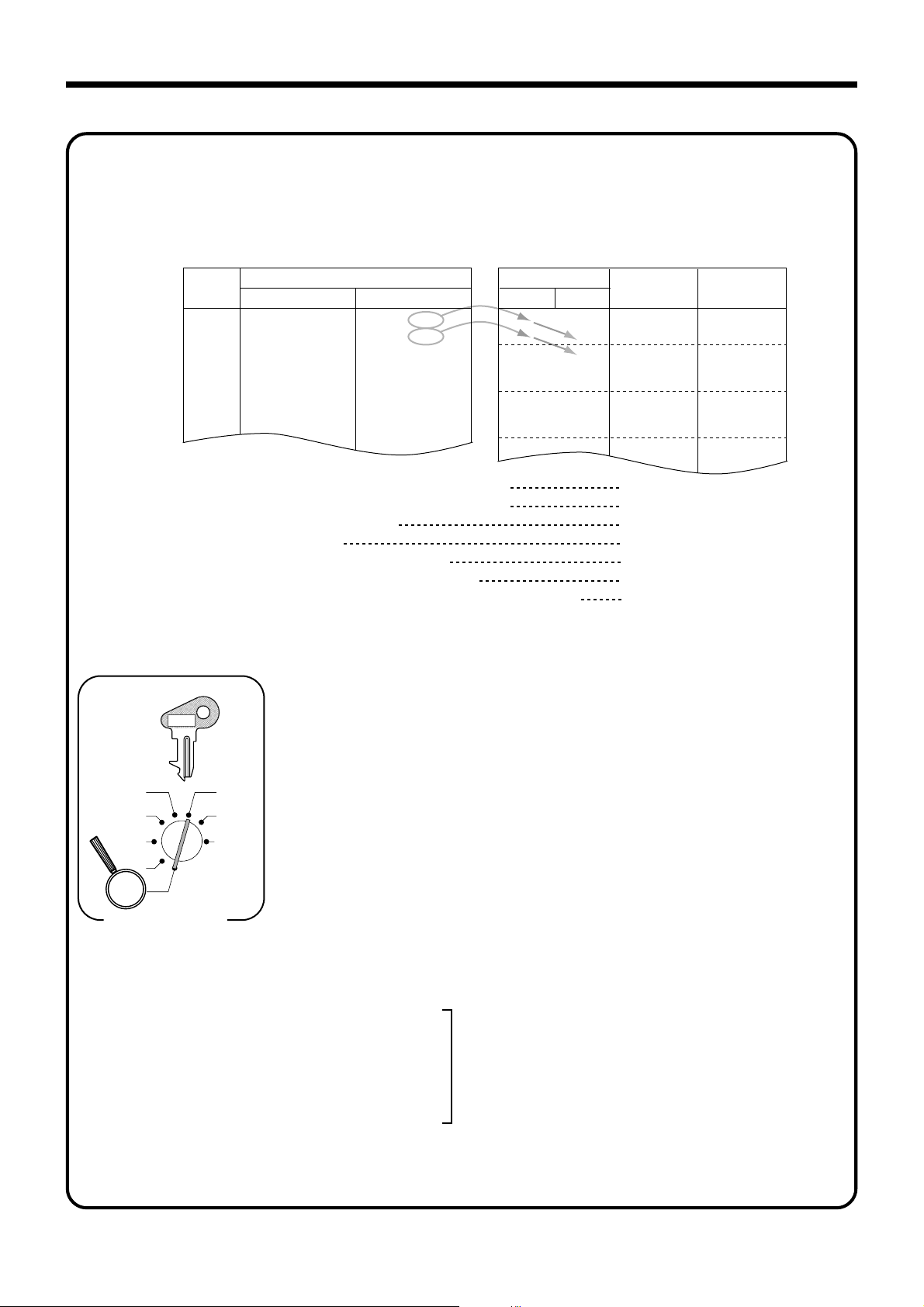

Tax table programming (continued…)

Programming U.S.tax tables

Before you can program a U.S. tax table, you must first calculate the program data.

The partial tax table shown below is for a tax rate of 6%. A tax amount is applied for each price range,

which is defined by a low end minimum break point. If you subtract each maximum break point from the

next lower maximum break point, you should soon be able to see certain patterns. In a cyclic pattern, the

differences in maximum breakpoints form a regularly repeating cycle. A pattern which does not fit the cyclic

pattern is called non-cyclic pattern.

Though rate, it is conceivable that you can find that subtracting maximum breakpoints results in an one big

non-cyclic pattern. In this case, you won’t be able to use automatic tax calculation, and must enter the tax

for each transaction manually or use a tax rate.

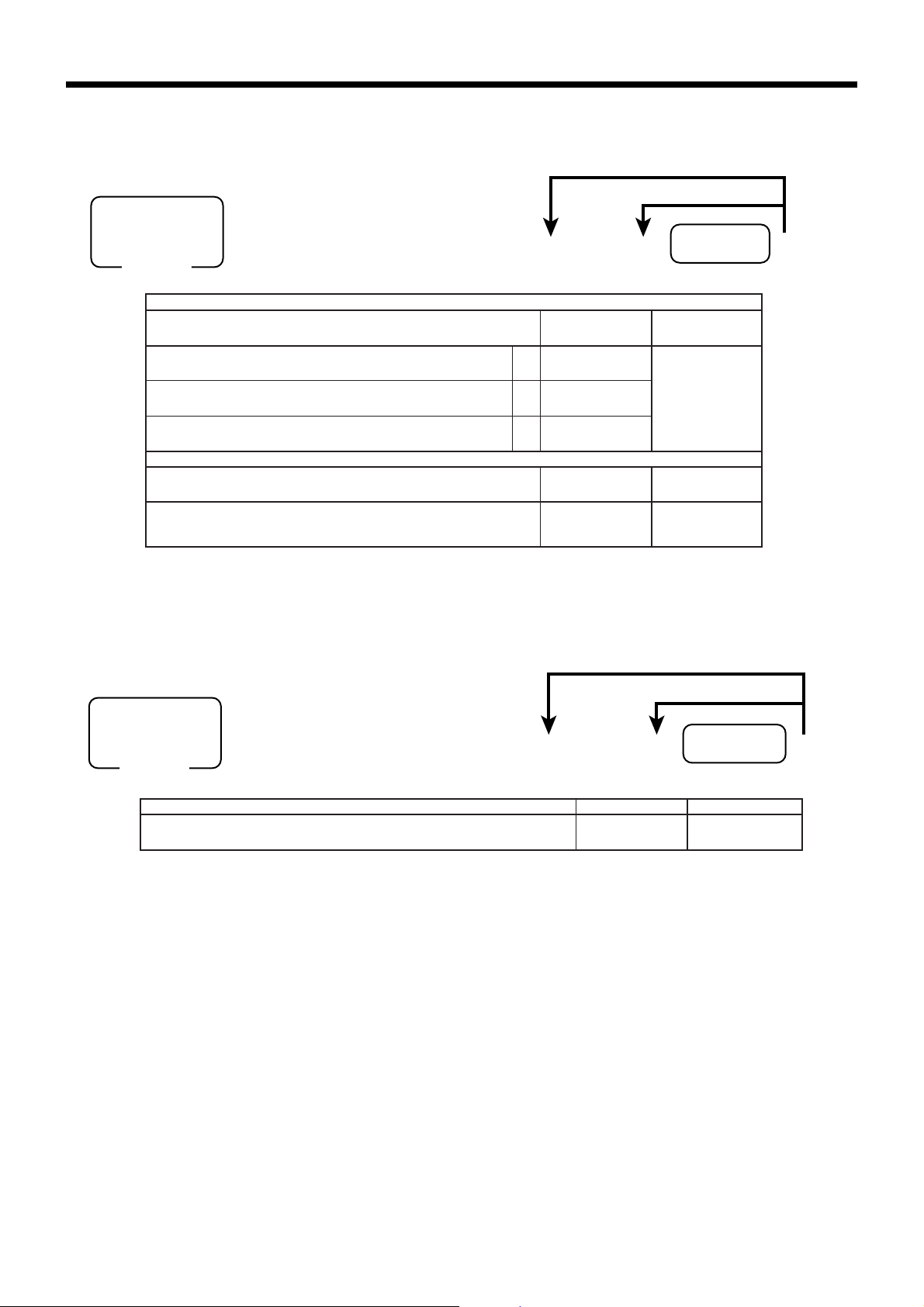

Example 1, Add-on rate tax:

Programming procedure:

Getting Started

Tax rate (2-digit for integer + 4- digit for decimal)

Tax table maximum value ("0" means unlimited).

Rounding/tax table system code

Sum of a cyclic pattern

Number of values in each cyclic pattern

Number of values in each non-cyclic pattern

Actual value of difference of the non-cyclic and cyclic values

PGM

C-A32

REG2

REG1

OFF

RF

PGM

Mode Switch

X1

Z1

X2/Z2

3s

: : : : s

8^25a

0a

5002a

s

8

8

8

8

8

Tax table 1 =

Tax table 2 =

{

Tax table 3 =

Tax rate (2-digit for integer + 4-digit for decimal)

Tax table maximum value (“0” means unlimited).

Rounding/tax table system code

8.25%

0 (no limitation)

5002 (Round off)

0

0

No need to enter.

}

0

0

0125

0225

0325

CE-6000 User’s Manual

13

www.cashregisters.net

Page 14

Getting Started

Tax table programming (continued…)

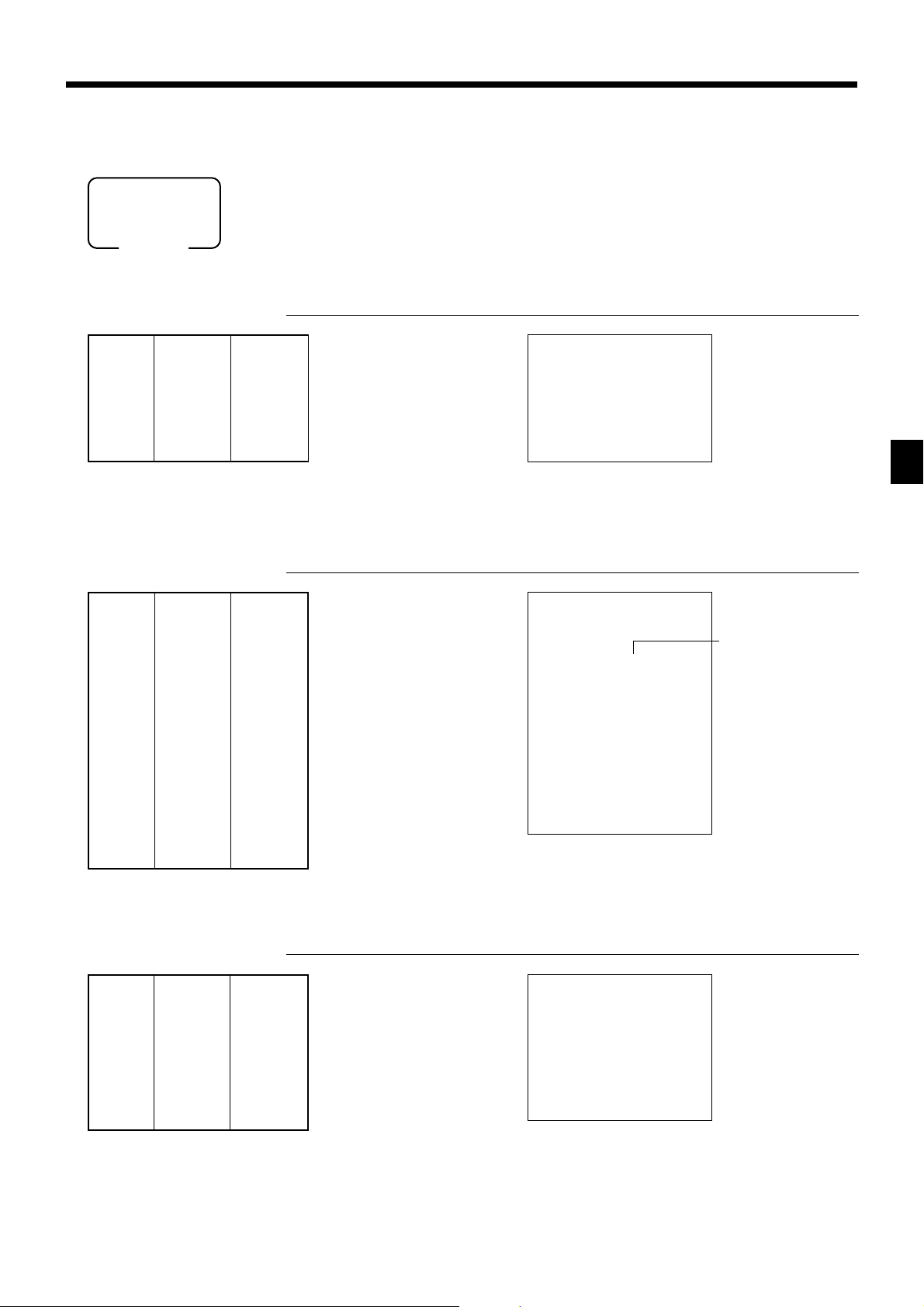

Example 2, Without rate tax:

Preparation

TAX

(6%)

$ .00

.01

.02

.03

.04

.05

.06

.07

Tax rate (2-digit for integer + 4- digit for decimal)

Tax table maximum value ("0" means unlimited).

Rounding/tax table system code

Sum of a cyclic pattern

Number of values in each cyclic pattern

Number of values in each non-cyclic pattern

Actual value of difference of the non-cyclic and cyclic values

Min. break point Max. break point

$ .01

1.09

Programming procedure:

: : : :

REG2

REG1

OFF

RF

PGM

C-A32

X1

Z1

X2/Z2

PGM

Mode Switch

1014a

1717a

1600a

Price range

.11

.25

.42

.59

.75

.92

3s

8

8

0a

8

0a

8

01a

8

50a

8

3a

8

24a

8

8

8

8

s

s

$ .10

.24

.41

.58

.74

.91

1.08

1.24

Max. break point

Upper Lower

–

10

–

24

10

–

41

24

–

58

41

–

74

58

–

91

74

–

108

124

Tax table 1 =

Tax table 2 =

{

Tax table 3 =

Tax rate (2-digit for integer + 4-digit for decimal)

Tax table maximum value (“0” means unlimited).

Rounding/tax table system code

Sum of a cyclic pattern

Number of values in each cyclic pattern

Number of values in each non-cyclic pattern

Actual value of difference of the non-cyclic and cyclic values

You must enter these values in 4-digit block. If the last block

comes out to be only two digits, add two zeros.

91

–

108

124

0125

0225

0325

0

Difference

=

10

=

14

=

17

=

17

=

16

=

17

=

17

=

16

=

17

17

0% (Table only)

0 (Table only)

01 (Table only)

50 (17 + 17 + 16)

3

24 (10 + 14)

10, 14, 17, 17, 16

Pattern

Non-cyclic

Cyclic

Cyclic

14

www.cashregisters.net

Page 15

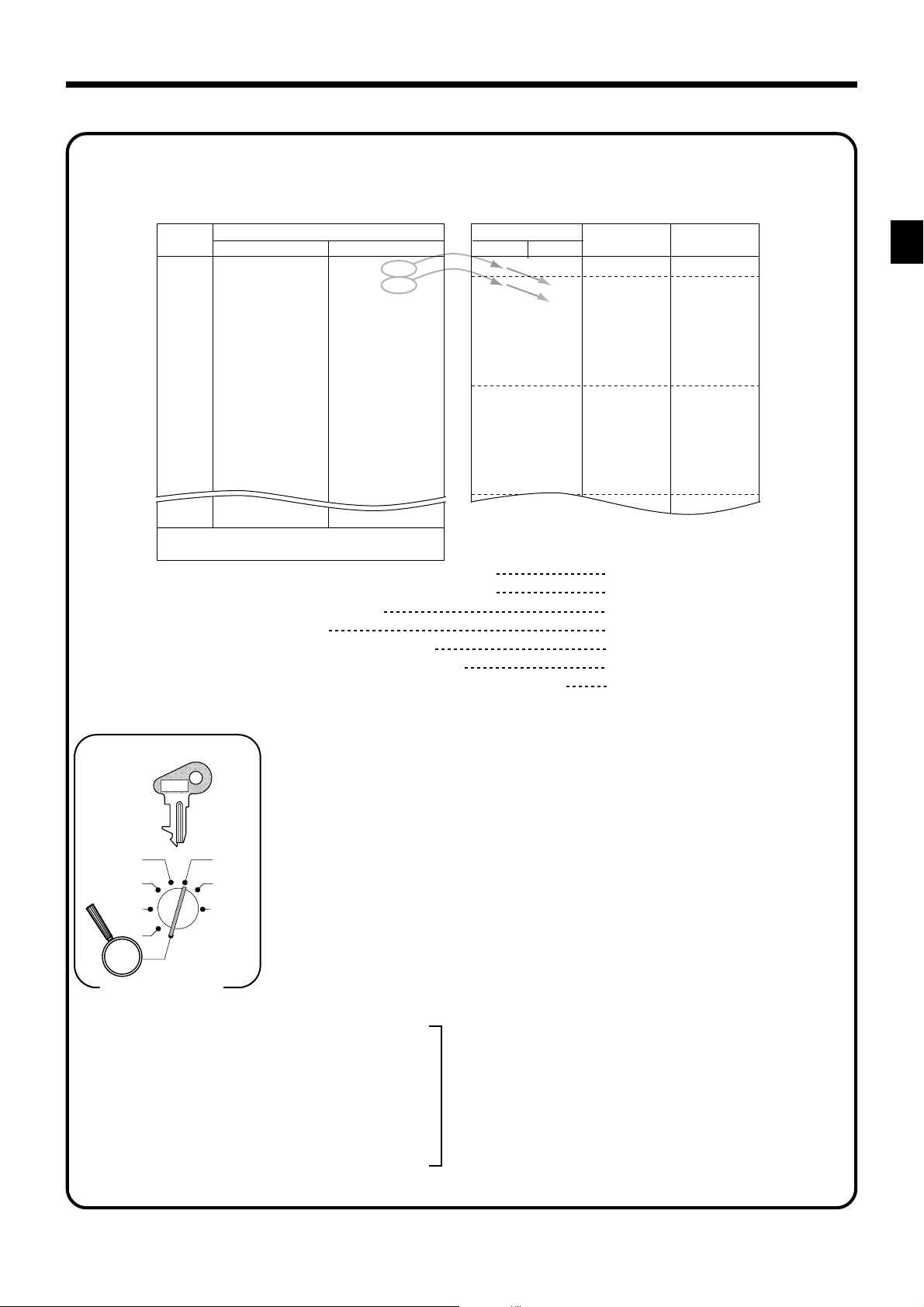

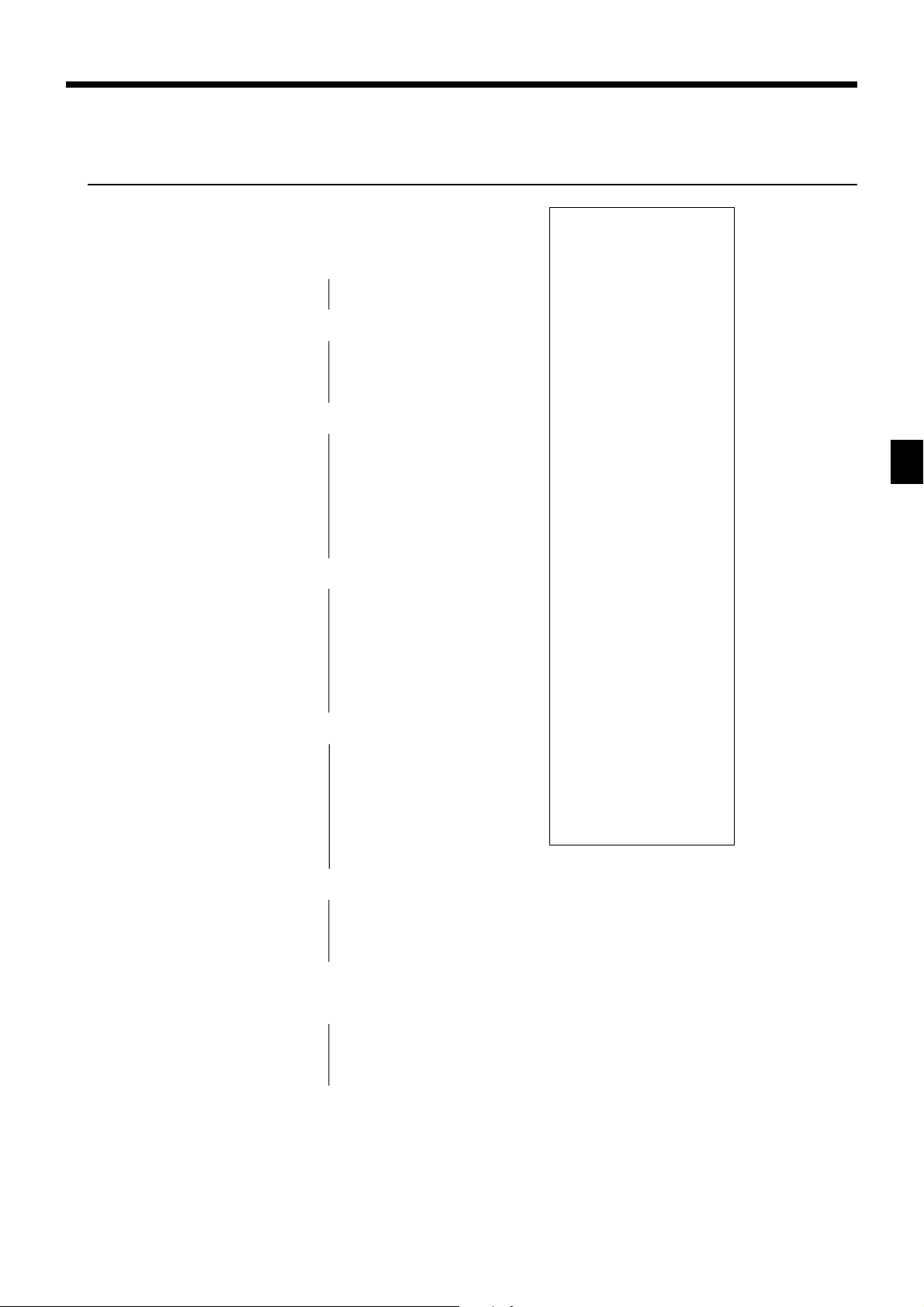

Tax table programming (continued…)

Example 3, With rate tax:

Preparation:

$ .01

.08

.22

.36

.50

.65

.79

.93

1.08

1.22

1.36

1.50

1.65

1.79

1.93

Price range

$ .07

.21

.35

.49

.64

.78

.92

1.07

1.21

1.35

1.49

1.64

1.78

1.92

2.07

TAX

(7%)

$ .00

.01

.02

.03

.04

.05

.06

.07

.08

.09

.10

.11

.12

.13

.14

Min. break point Max. break point

Max. break point

Upper Lower

–

7

21

35

49

64

78

92

107

121

135

149

164

178

192

207

0

–

7

–

21

–

35

–

49

–

64

–

78

–

92

–

107

–

121

–

135

–

149

–

164

–

178

–

192

Difference

=

=

=

=

=

=

=

=

=

=

=

=

=

=

=

14

14

14

15

14

14

15

14

14

14

15

14

14

15

Pattern

7

Non-cyclic

Cyclic

Cyclic

Getting Started

1.40

On all sales above $20.07, compute the tax

at the rate of 7 %.

Tax rate (2-digit for integer + 4- digit for decimal)

Tax table maximum value (“0” means unlimited).

Rounding/tax table system code

Sum of a cyclic pattern

Number of values in each cyclic pattern

Number of values in each non-cyclic pattern

Actual value of difference of the non-cyclic and cyclic values

19.93

Programming procedure:

PGM

C-A32

REG2

REG1

OFF

RF

X1

Z1

X2/Z2

2007a

0002a

PGM

Mode Switch

0714a

1414a

1514a

1415a

20.07

3s

8

: : : :

s

8

7a

8

8

8

100a

8

7a

8

7a

8

8

8

8

8

s

7%

2007

0002 (Cut off & table + rate)

100 (14+14+14+15+14+14+15)

7

7

14, 14, 14, 15, 14, 14, 15

Tax table 1 =

Tax table 2 =

{

Tax table 3 =

Tax rate (2-digit for integer + 4-digit for decimal)

Tax table maximum value (“0” means unlimited).

Rounding/tax table system code

Sum of a cyclic pattern

Number of values in each cyclic pattern

Number of values in each non-cyclic pattern

Actual value of difference of the non-cyclic and cyclic values

You must enter these values in 4-digit block. If the last block

comes out to be only two digits, add two zeros.

0125

0225

0325

CE-6000 User’s Manual

15

www.cashregisters.net

Page 16

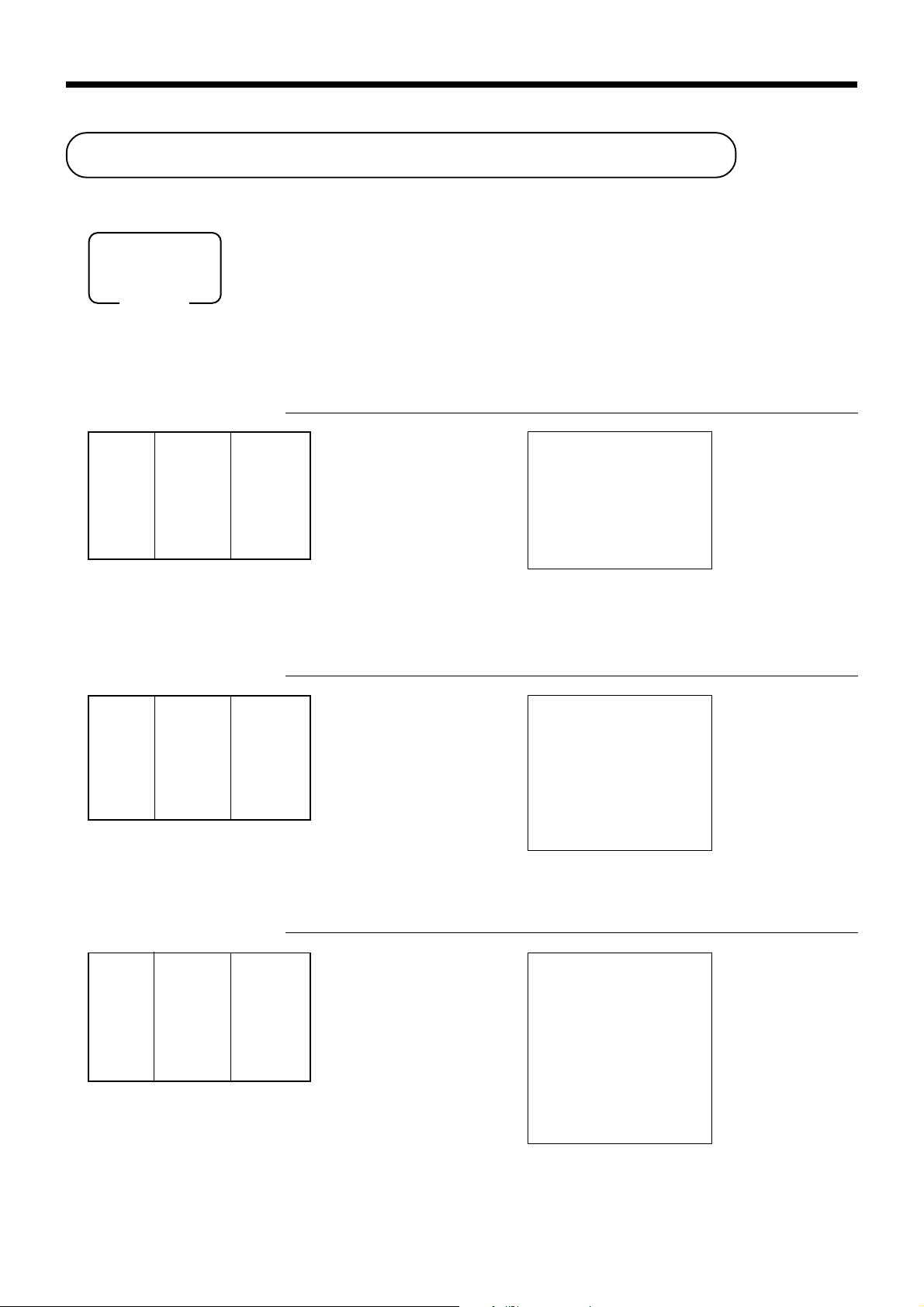

(

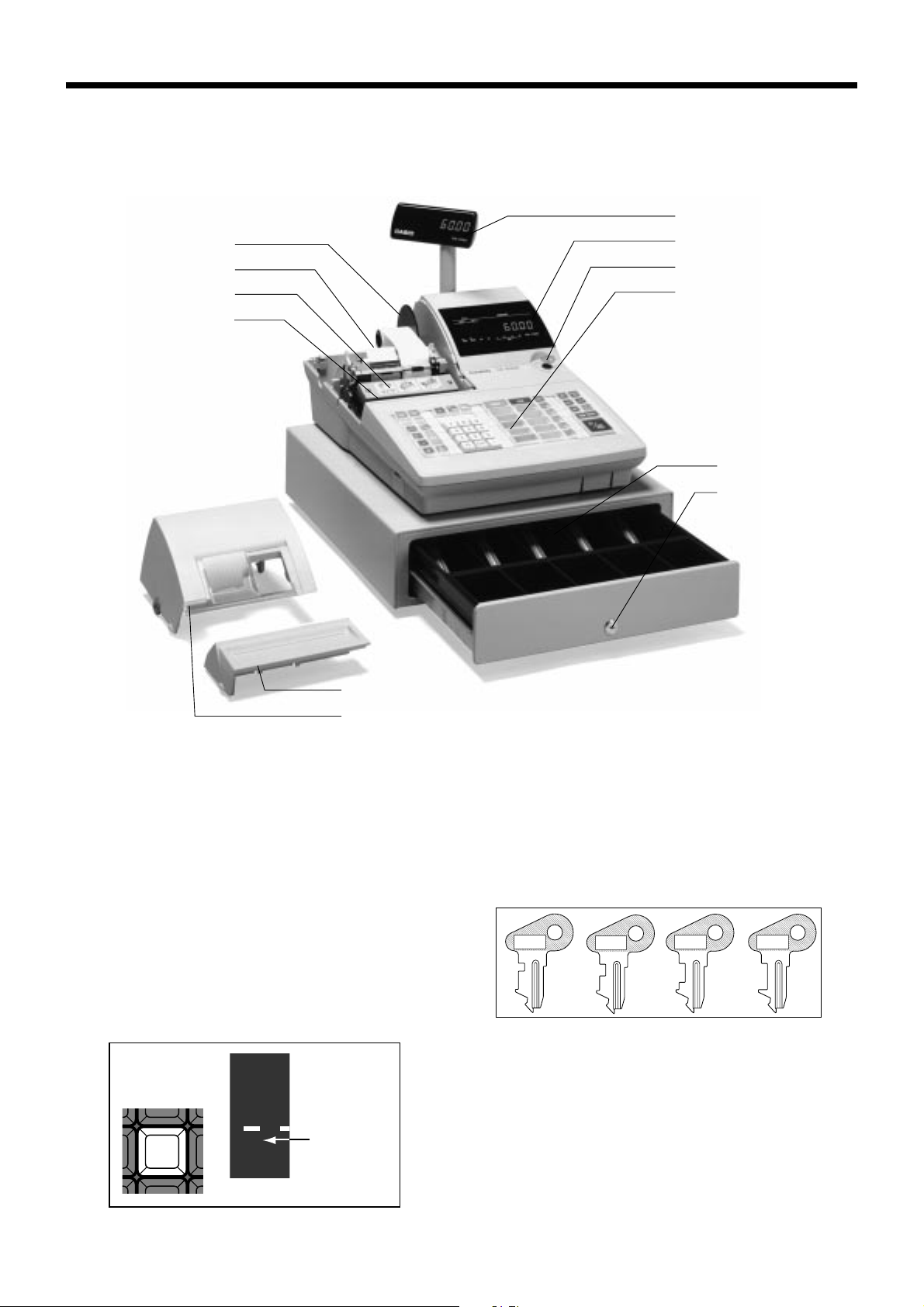

Introducing CE-6000

General guide

This part of the manual introduces you to the cash register and provides a general explanation of its various

parts.

Pop-up display

Take-up reel

Roll paper

Printer

Printer ink ribbon

Main display

Mode switch

Keyboard

Wetproof cover

Drawer

Drawer lock

Printer sub cover

Printer cover

Roll paper

You can use the roll paper to print receipts and a

journal (pages 9 ~ 10).

Receipt on/off key

Use the receipt on/off key in REG1, REG2 and RF

modes to control issuance of receipts. In other modes,

receipts or reports are printed regardless the receipt key

setting.

A post-finalization receipt can still be issued after

finalization when the key is set to off. The cash register

can also be programmed to issue a post-finalization

receipt even when the key is set to on.

When the register issues receipts, this indicator is lit.

8

RECEIPT

ON/OFF

RCT

Indicator

Printer ink ribbon

Provides ink for printing of registration details on the

roll paper (page 103).

Mode key

The following four types of mode keys are provided

with the unit.

OP

C-A02

M

C-A08

OW

C-A08

a. OP (Operator) key

Switches between OFF and REG1.

b. M (Master) key

Switches between OFF, REG1, REG2, X1 and RF.

c. OW (Owner) key

Switches between OFF, REG1, REG2, X1, Z1, X2/

Z2 and RF.

d. PGM (Program) key

Switches to any position.

PGM

C-A32

16

www.cashregisters.net

Page 17

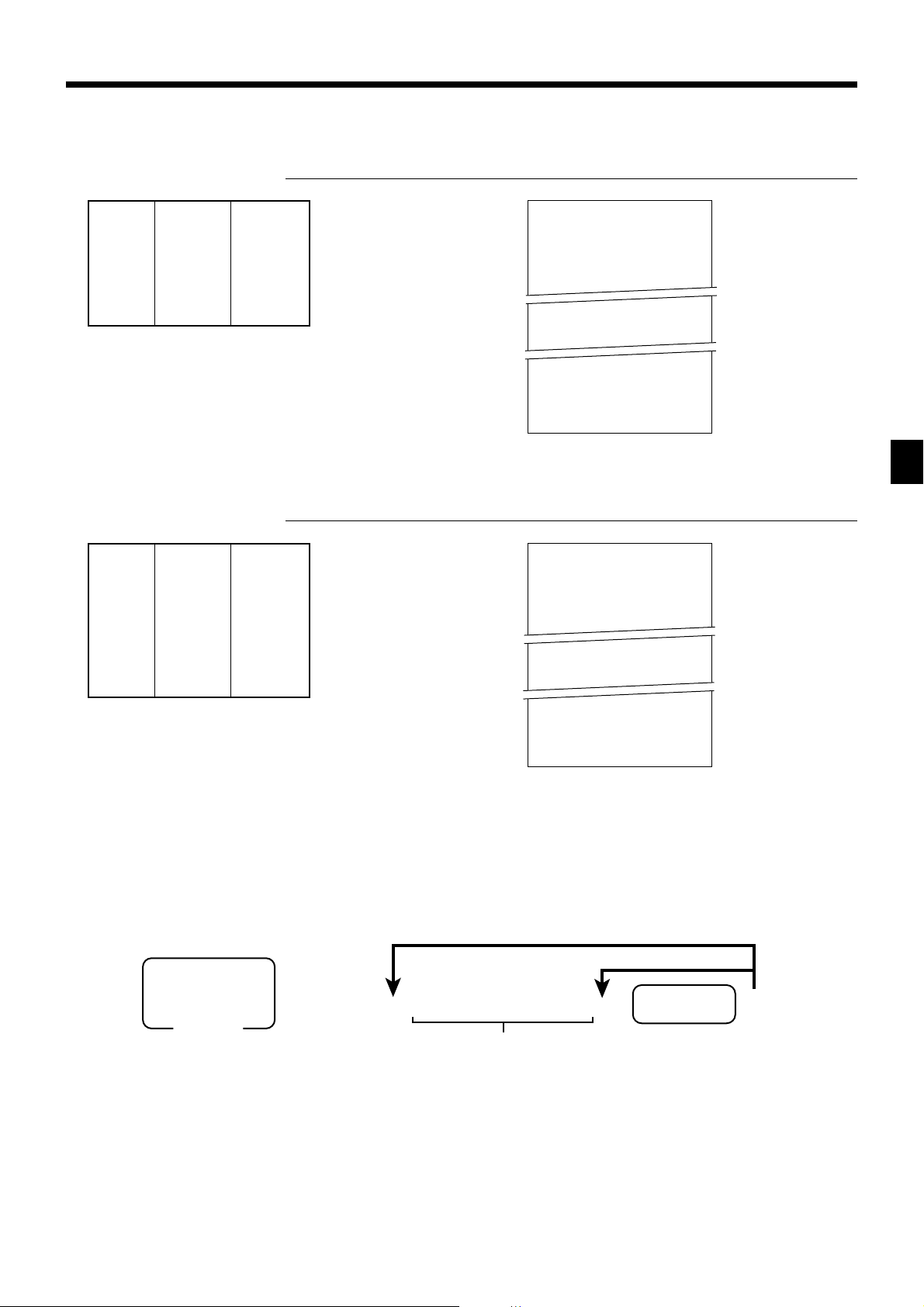

Mode switch

Use the mode keys to change the position of the mode

switch and select the mode you want to use.

REG2 X1

REG1 Z1

edoM

hctiws

FFO

1GER

2GER

FR

1X

emanedoMnoitpircseD

yb-dnatS

1retsigeR

2retsigeR

dnufeR

sunimgeR

selasyliaD

daer

.edomsunim

.atadlatotlla

dnadetresniebnacsyeklortnocedomehtfoynA

.noitisopsihtnihctiwsedomehtmorfdevomer

edomehtfoynA.snoitcasnartselaslamronrofdesU

edomehtmorfdevomerdnadetresniebnacsyeklortnoc

.noitisopsihtnihctiws

2GERotgnihctiwsecniS.snoitarepolaicepsrofdesU

tiderc,stnuocsidsasnoitcnufhcus,yeklaicepsaseriuqer

ebnacstuodiapdna,stnemyapkcehc,selasegrahc,selas

1GERnidetibihorpsamehtgnimmargorpybdellortnoc

.2GERnidewolladna

.sdnufergnissecorprofdesU

,noitisopFRnisiretsigerehtfohctiwsedomehtnehW

retsigerehtroedomdnuferehtrehtiesseccanacuoy

)gniraelc(gnittesertuohtiwstroperyliadniatbootdesU

OFF X2/Z2

RF

PGM

Introducing CE-6000

1Z

2Z/2X

selasyliaD

teser

elascidoireP

teser/daer

.atadlatot

.atadlatotllagnitteserelihwroatadlatot

lla)gniraelc(gnitteserelihwstroperyliadniatbootdesU

gnittesertuohtiwstroperselascidoirepniatbootdesU

MGP

margorP

.atadmargorp

Drawer

The drawer opens automatically whenever you finalize

a registration and whenever you issue a read or reset

report. The drawer will not open if it is locked with the

drawer key.

Drawer lock

Use the drawer key to lock and unlock the drawer.

hcusatadteserpdnasnoitcnufgnimmargorpnehwdesU

gnidaernehwdesuoslA.setarxatdnasecirptinusa

When the cash drawer does not open!

In case of power failure or the machine is in malfunction, the cash drawer does not open automatically.

Even in these cases, you can open the cash drawer by

pulling drawer release lever (see below).

Important!

The drawer will not open, if it is locked with a

drawer lock key.

CE-6000 User’s Manual

17

www.cashregisters.net

Page 18

Introducing CE-6000

Display

Main display for the U.S.

Department registration

DEPT RPT

01 !50

RCT

PLU registration

X1 Z1

REG

DEPT RPT

T/S1 T/S2 T/S3 F/S

37

025 "50

X1 Z1

REG

RCT

4

T/S1 T/S2 T/S3 F/S

Main display for Canada

AMOUNTPLU

DEPT RPT

AMOUNTPLU

01 !50

TOTAL CHANGE

RCT

12

AMOUNTPLU

X1 Z1

REG

DEPT RPT

1234

TAX

37

12

AMOUNTPLU

TOTAL CHANGE

025 "50

TOTAL CHANGE

RCT

4

REG

X1 Z1

1234

TAX

TOTAL CHANGE

Repeat registration

DEPT RPT

3 #50

X1 Z1

REG

RCT

5

Totalize operation

DEPT RPT

02 1"34

X1 Z1

REG

RCT

8

9

AMOUNTPLU

T/S1 T/S2 T/S3 F/S

AMOUNTPLU

T/S1 T/S2 T/S3 F/S

TOTAL CHANGE

TOTAL CHANGE

6

DEPT RPT

REG

RCT

DEPT RPT

REG

RCT

8

AMOUNTPLU

3 #50

X1 Z1

5

1234

TAX

AMOUNTPLU

TOTAL CHANGE

1"34

X1 Z1

1234

TAX

TOTAL CHANGE

6

18

www.cashregisters.net

Page 19

Customer display for all area

!50

1 Amount/Quantity

This part of the display shows monetary amounts. It

also can be used to show the current date and time.

TOTAL CHANGE

1

5 "50

TOTAL CHANGE

4

3 #50

TOTAL CHANGE

5

2 Department number

When you press a department key to register a unit

price, the corresponding department number (01 ~

15) appears here.

3 Taxable sales status indicators

When you register a taxable item, the corresponding

indicator is lit.

4 PLU number

When you register a PLU item, the corresponding

PLU number appears here.

5 Number of repeats

Anytime you perform a repeat registration (page

26), the number of repeats appears here.

Note that only one digit is displayed for the number

of repeats. This means that a “5” could mean 5, 15

or even 25 repeats.

6 Total/Change indicators

When the TOTAL indicator is lit, the displayed

value is monetary total or subtotal amount. When

the CHANGE indicator is lit, the displayed value is

the change due.

Introducing CE-6000

CE-6000 User’s Manual

1"34

TOTAL CHANGE

6

7 REG, X1, Z1 indicators

REG: Indicates register mode

X1: Indicates daily sales read mode

Z1: Indicates daily sales reset mode

8 RCT indicator

When the register issues receipts, this indicator is

lit.

9 Food stamp change amount

This part of display shows change amount of food

stamp in dollar. This means that a “02” means

$2.00.

19

www.cashregisters.net

Page 20

Introducing CE-6000

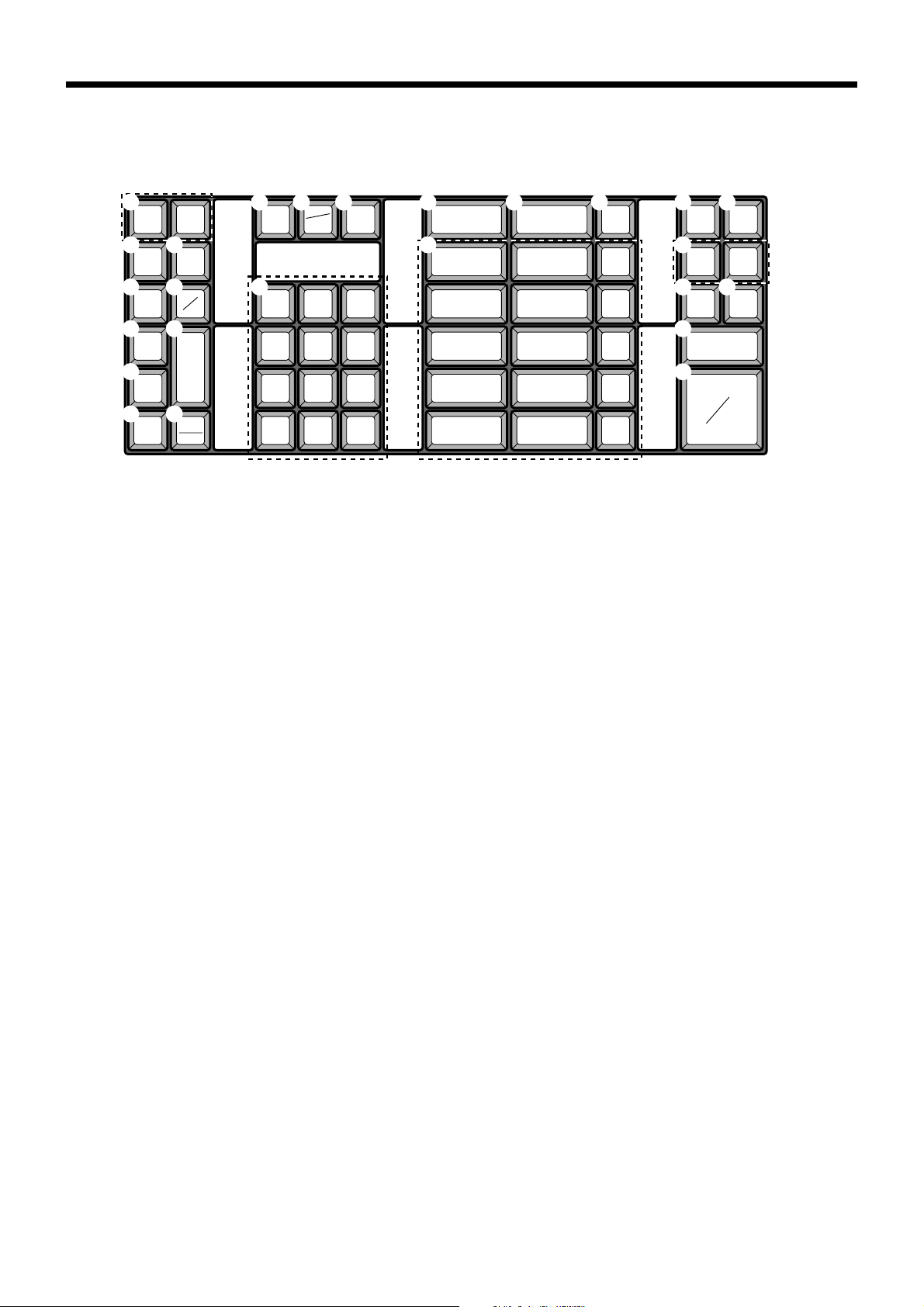

Keyboard

1

RECEIPT

2

RECEIPT

3

RECEIPT

ON/OFF

4

5

6

FEED

%

–

RF

–

JOURNAL

FEED

7

VALID

8

#

9

PLU

0

ERR.

CORR

CANCEL

NS

A C D

C

X/FOR

DATE

TIME

B

789

456

123

000•

CLK#

• Register Mode

1 Paper feed key f, j

Hold this key down to feed paper from the printer.

2 Post receipt key ;

Use this key to produce a post-finalization receipt.

3 Receipt on/off key Q

Use this key pressing two times to change the status

“receipt issue” or “no receipt.” In case of “receipt issue”,

the “RCT” indicator is lit.

4 Discount key p

Use this key to register discounts.

5 Minus key m

Use this key to input values for subtraction.

6 Refund key R

Use this key to input refund amounts and void certain

entries.

7 Validation key v

Use this key to validate transaction amounts on slip.

8 Non-add/No sale key N

Non-add key: To print reference number (to identify a

personal check, credit card, etc.) during a transaction, use

this key after some numerical entries.

No sale key: Use this key to open the drawer without

registering anything.

9 PLU key +

Use this key to input PLU numbers.

0 Error correction/Cancellation key e

Use this key to correct registration errors and to cancel

registration of entire transactions.

E G H

PRICE

T/S1

T/S2 RC PD

F

51015

4914

3 8 13

2 7 12

16 11

A Clear key C

Use this key to clear an entry that has not yet been

registered.

B Ten key pad 0, 1 ~ 9, -, ^

Use these keys to input numbers.

C Multiplication/For/Date/Time key x

Use this key to input a quantity for a multiplication

operation and registration of split sales of packaged

items. Between transactions, this key displays the current

time and date.

D Clerk number key o

Use this key to sign clerk on and off the register.

E Price key :

Use this key to register an amount to an open PLU when

a PLU is used as an open PLU.

F Department keys !, ", # ~ &

Use these keys to register items to departments.

G Tax status shift 1 key t

Use this key to change the Taxable 1 status of the next

item.

H Tax status shift 2 key T

Use this key to change the Taxable 2 status of the next

item.

I Received on account key r

Use this key following a numeric entry to register money

received for non-sale transactions.

I

J

CR1 CR2

KLM

CH

N

SUBTOTAL

O

CA

TEND

CHK/

TEND

AMT

20

www.cashregisters.net

Page 21

J Credit key c, d

Use this key to register a credit sale.

K Charge key h

Use this key to register a charge sale.

L Paid out key P

Press this key following a numeric entry to register

money paid out from the drawer.

M Check key k

Use this key to register a check tender.

N Subtotal key s

Use this key to display and print the current subtotal

(includes add-on tax) amount.

O Cash/Amount tendered key a

Use this key to register a cash tender.

Introducing CE-6000

CE-6000 User’s Manual

21

www.cashregisters.net

Page 22

Basic Operations and Setups

How to read the printouts

• The journal and receipts are records of all transactions and operations.

• The contents printed on receipts and journal are almost identical.

• You can choose the journal skip function (page 66).

If the journal skip function is selected, the cash register will print the total amount of each transaction, and the

details of premium, discount and reduction operations only, without printing department and PLU item registrations on the journal.

• The following items can be skipped on receipts and journal.

• Consecutive number

• Taxable status

• Taxable amount

• Item counter

Receipt Sample

************************

* THANK YOU *

** CALL AGAIN **

************************

* COMMERCIAL MESSAGE *

* COMMERCIAL MESSAGE *

* COMMERCIAL MESSAGE *

* COMMERCIAL MESSAGE *

REG 03-04-2000 11:58

C

01 MC#01 000123

1 DEPT01 T1 $1.00

1 DEPT02 T1 $2.00

5 DEPT03 $5.00

7 No

TA1 $3.00

TX1 $0.15

TL

CASH $10.00

CG $1.85

*** BOTTOM MESSAGE ***

*** BOTTOM MESSAGE ***

*** BOTTOM MESSAGE ***

*** BOTTOM MESSAGE ***

$8.15

— Logo message

— Commercial message

— Mode/Date/Time

Clerk/Machine No.

—

Consecutive No.

— Q’ty/Item

— Item counter

— Bottom message

Journal Sample Journal Sample

(Item lines Included) (Item lines Skipped)

REG 03-04-2000 11:58

C

01 MC#01 000123

1 DEPT01 T1 $1.00

1 DEPT02 T1 $2.00

5 DEPT03 $5.00

7 No

TA1 $3.00

TX1 $0.15

TL

CASH $10.00

CG $1.85

REG 03-04-2000 11:59

C

02 MC#01 000124

1 DEPT01 T1 $1.00

1 DEPT03 T1 $3.00

1 DEPT02 T1 $2.00

1 DEPT04 T1 $4.00

5 DEPT05 $5.00

9 No

TA1 $10.00

TX1 $0.50

TL

CASH $20.00

CG $4.50

$8.15

$15.50

REG 03-04-2000 11:57

C

01 MC#01 000123

7 No

TA1 $3.00

TX1 $0.15

TL

CASH $10.00

CG $1.85

REG 03-04-2000 11:57

C

02 MC#01 000124

9 No

TA1 $10.00

TX1 $0.50

TL

CASH $20.00

CG $4.50

REG 03-04-2000 11:58

C

01 MC#01 000125

7 No

TA1 $3.00

TX1 $0.15

TL

CASH $10.00

CG $0.65

REG 03-04-2000 11:59

$8.15

$15.50

$9.35

In the operation examples contained in this manual, the print samples are what would be produced if the roll

paper is being used for receipts. They are not actual size. Actual receipts are 45 mm wide. Also, all sample

receipts and journals are printout images.

22

www.cashregisters.net

Page 23

How to use your cash register

The following describes the general procedure you should use in order to get the most out of your cash register.

BEFORE business hours…

• Check to make sure that the cash register is

plugged in securely. Page 8

• Check to make sure there is enough paper

left on the roll. Pages 9, 10

• Read the financial totals to confirm that they are

all zero. Page 91

• Check the date and time. Page 25

DURING business hours…

• Register transactions. Page 26

• Periodically read totals. Page 90

AFTER business hours…

• Reset the daily totals. Page 43

• Remove the journal. Page 104

• Empty the cash drawer and leave it open. Page 17

• Take the cash and journal to the office.

Basic Operations and Setups

CE-6000 User’s Manual

23

www.cashregisters.net

Page 24

Basic Operations and Setups

Assigning a clerk

ALL

Mode switch

Clerk secret number key

When the cash register is programmed to use clerk secret numbers for clerk or cashier assignment, the clerk

buttons are not functional.

Clerk sign on

OPERATION RECEIPT

Signing clerk 1 on:

1 6 o

* COMMERCIAL MESSAGE *

Signing clerk 2 on: 2 6 o

○○○

Signing clerk 10 on: 10 6 o

Clerk secret number

(1 ~ 10 is set as default.)

REG 03-04-2000 11:58

C

01 MC#01 000123

1 DEPT01 T1 $1.00

— Clerk name/machine No./consecutive No.

• If you do not want the clerk secret number to be shown on the display, press o before entering the number.

Clerk sign off

OPERATION

Signing clerk off:

0 6 o

(except PGM mode)

• The current clerk is also signed off whenever you set the mode switch to OFF position.

Important!

• The error code “E008” appears on the display whenever you try to perform a registration, a read/

reset operation without signing on.

• A clerk cannot sign on unless other clerk is signed off.

• The signed on clerk is also identified on the receipt/journal.

24

www.cashregisters.net

Page 25

Displaying the time and date

You can show the time or date on the display of the cash register whenever there is

REG

Mode switch

To display and clear the time

no registration being made.

OPERATION DISPLAY

To display and clear the date

Preparing coins for change

x

Time appears on the display Hour Minutes

C

Clears the time display

OPERATION DISPLAY

x

x

Date appears on the display Month Day Year

C

Clears the date display

08-3~

~00

08-3!

(Time is displayed first)

03-04-2000

~00

You can use the following procedure to open the drawer without registering an item.

REG

Mode switch

This operation must be performed out of a sale.

(You can use the r key instead of the N key. See page 42.)

Opening the drawer without a sale

OPERATION RECEIPT

CE-6000 User’s Manual

N

REG 03-04-2000 10:00

C

01 MC#01 000001

#/NS •••••••••

Basic Operations and Setups

25

www.cashregisters.net

Page 26

Basic Operations and Setups

Preparing and using department keys

Registering department keys

The following examples show how you can use the department keys in various types

of registrations.

REG

Mode switch

Single item sale

Example 1

OPERATION RECEIPT

Unit price $1.00

——————————

Item Quantity 1

——————————

Dept. 1

—————————————

Payment Cash $1.00

1-

Unit price

!

Department

F

Example 2 (Subtotal registration and change computation)

OPERATION RECEIPT

Unit price $12.34

——————————

Item Quantity 1

——————————

Dept. 1

—————————————

Payment Cash $20.00

Repeat

1234

Unit price

20-

Amount tendered

!

Department

ss

s

ss

FF

F

FF

REG 03-04-2000 10:05

C

01 MC#01 000002

1 DEPT01 $1.00

TL

CASH $1.00

REG 03-04-2000 10:10

C

01 MC#01 000003

1 DEPT01 $12.34

TL

CASH $20.00

CG $7.66

$1.00

$12.34

— Date/time

— Mode/consecutive No.

— Department No./unit price

— Total amount

— Total amount

— Amount tendered

— Change

Unit price $1.50

——————————

Item Quantity 3

——————————

Dept. 1

—————————————

Payment Cash $10.00

26

OPERATION RECEIPT

150!

!!

!

!!

!!

!

!!

s

10-F

REG 03-04-2000 10:15

C

01 MC#01 00004

1 DEPT01 $1.50

1 DEPT01 $1.50

1 DEPT01 $1.50

TL

CASH $10.00

CG $5.50

— Repeat

— Repeat

$4.50

www.cashregisters.net

Page 27

Multiplication

OPERATION RECEIPT

Unit price $1.00

——————————

Item Quantity 12

——————————

Dept. 1

—————————————

Payment Cash $20.00

Split sales of packaged items

Unit price

——————————

Quantity 3

Item ——————————

Dept. 1

——————————

Taxable No

—————————————

Payment Cash $10.00

4 for $10.00

12

Quantity

(4-digit integer/2-digit decimal)

1-!

20-F

xx

x

xx

s

REG 03-04-2000 10:20

C

01 MC#01 000005

12 PLU0001 $12.00

12 @1/ 1.00

PLU00001 $12.00

TL

CASH $20.00

CG $8.00

OPERATION RECEIPT

xx

3

x

xx

Quantity being purchased

(4-digit integer/2-digit decimal)

xx

4

x

xx

(4-digit integer/2-digit decimal)

Package quantity

10-!

Package price

s

10-F

REG 03-04-2000 10:25

C

01 MC#01 000006

3 DEPT01 $7.50

3 @4/ 10.00

DEPT01 $7.50

TL

CASH $10.00

CG $2.50

$12.00

$7.50

— Quantity/result

*

or

— Quantity/unit q’ty/@

— Result

— Quantity/result

*

or

— Quantity/unit q’ty/@

— Result

* See address 0522 of the general function program.

Programming department keys

To program a unit price for each department

Different price

PGM

Mode switch

To program the tax calculation status for each department

Tax calculation status

This specification defines which tax table should be used for automatic tax calculation.

See page 11 for information on setting up the tax tables.

6 1s 6 : : : : : : 6

Unit price

Same price

Department

Basic Operations and Setups

6 s

CE-6000 User’s Manual

27

www.cashregisters.net

Page 28

Basic Operations and Setups

Programming procedure

To another department key

Same program

PGM

Mode switch

6 3s 60366s 6 : : 6

.S.Uehtrof

pmatsdooF

sutats1elbaxaTa

sutats2elbaxaTb

sutats3elbaxaTc

adanaCrof

sutatsstunoD

0=xatnoN

1=1elbaxaT

2=2elbaxaT

3=3elbaxaT

4=4elbaxaT

5=2&1elbaxaT

To program high amount limit for each department

Programming procedure

Department

D2 D1

1=seY

0=oN

1=seY

0=oN

2=seY

0=oN

4=seY

0=oN

1=seY

0=oN

6=3&1elbaxaT

7=4&1elbaxaT

rebmun

:

D

2

:

)c+b+a(

D

1

:

D

2

tnacifingiS

:

D

1

6 s

To another department key

PGM

Mode switch

6 3s 61566s 6

noitpircseDeciohCedocmargorP

.yllaunamecirptinugniretneroftimiltnuomahgiH

:

D

~

: 6

6

~ D

Same program

Department

1

tnacifingiS

srebmun

::

~

D6D5~D2D

::

1

6 s

28

www.cashregisters.net

Page 29

Registering department keys by programming data

REG

Mode switch

Preset price

OPERATION RECEIPT

""

"

Unit price($1.00)

—————————

Item Quantity 1

—————————

Dept. 2

—————————————

Payment Cash $1.00

Preset tax status

preset

""

F

OPERATION RECEIPT

REG 03-04-2000 10:30

C

01 MC#01 000007

1 DEPT02 $1.00

TL

CASH $1.00

— Department No./unit price

$1.00

Unit price ($2.00)

—————————

preset

Quantity 5

Item 1 —————————

Dept. 3

—————————

—————————————

Taxable (1)

Unit price ($2.00)

—————————

preset

preset

20-F

Quantity 1

Item 2 —————————

Dept. 4

—————————

—————————————

Taxable (2)

preset

Payment Cash $20.00

Locking out high amount limitation

OPERATION RECEIPT

Unit price $1.05

—————————

Quantity 1

Item —————————

Dept. 3

—————————

Max.amount

($10.00)

—————————————

Payment Cash $2.00

1050

ERROR ALARM (E037)

(Exceeding high amount)

preset

105#

5x

##

#

##

$$

$

$$

s

##

#

##

C

s

REG 03-04-2000 10:35

C

01 MC#01 000008

5 DEPT03 T1 $10.00

1 DEPT04 T2 $2.00

TA1 $10.00

TX1 $0.40

TA2 $2.00

TX2 $0.20

TL

CASH $20.00

CG $7.40

REG 03-04-2000 10:40

C

01 MC#01 000009

1 DEPT03 $1.05

TL

CASH $2.00

CG $0.95

$12.60

$1.05

Tax status

— Taxable Amount 1

— Tax 1

— Taxable Amount 2

— Tax 2

Basic Operations and Setups

CE-6000 User’s Manual

2-a

29

www.cashregisters.net

Page 30

Basic Operations and Setups

Preparing and using PLUs

This section describes how to prepare and use PLUs.

CAUTION:

• Before you use PLUs, you must first program the unit price.

Programming PLUs

To program a unit price for each PLU

To new (not sequencial) PLU

Different program to the next PLU

Same program

PGM

Mode switch

6 1s 6

PLU No.

+ 6 : : : : : : 6 a 6 s

To program tax calculation status for each PLU

PGM

Mode switch

6

3s

.S.Uehtrof

pmatsdooF

sutats1elbaxaTa

sutats2elbaxaTb

sutats3elbaxaTc

adanaCrof

sutatsstunoD

0=xatnoN

1=1elbaxaT

2=2elbaxaT

6

0366s

3=3elbaxaT

4=4elbaxaT

5=2&1elbaxaT

Unit price

To new (not sequencial) PLU

6

PLU No.+

6=3&1elbaxaT

7=4&1elbaxaT

Different program

to the next PLU

Same program

6 : : 6

D

2 D1

1=seY

0=oN

1=seY

0=oN

2=seY

0=oN

4=seY

0=oN

1=seY

0=oN

tnacifingiS

rebmun

:

D

:

D

:

D

:

D

a

2

1

2

1

6

s

)c+b+a(

30

www.cashregisters.net

Page 31

Registering PLUs

REG

Mode switch

PLU single item sale

The following examples show how you can use PLUs in various types of

registrations.

OPERATION RECEIPT

Unit price ($2.50)

—————————

Item Quantity 1

—————————

PLU 14

—————————————

Payment Cash $3.00

PLU repeat

Unit price ($2.50)

—————————

Item Quantity 3

—————————

PLU 14

—————————————

Payment Cash $10.00

preset

preset

14

PLU code

++

+

++

s

3-F

REG 03-04-2000 10:45

C

01 MC#01 000010

1 PLU0014 $2.50

TL

CASH $3.00

CG $0.50

OPERATION RECEIPT

14+

++

+

++

++

+

++

s

10-F

REG 03-04-2000 10:50

C

01 MC#01 000011

1 PLU0014 $2.50

1 PLU0014 $2.50

1 PLU0014 $2.50

TL

CASH $10.00

CG $2.50

— PLU No./unit price

$2.50

$7.50

Basic Operations and Setups

PLU multiplication

OPERATION RECEIPT

Unit price ($2.00)

—————————

Item Quantity 10

preset

10

Quantity

(4-digit integer/2-digit decimal)

—————————

PLU 7

—————————————

Payment Cash $20.00

20-F

* See address 0522 of the general function program.

CE-6000 User’s Manual

xx

x

xx

7+

s

REG 03-04-2000 10:55

C

01 MC#01 000012

10 PLU0007 $20.00

10 @1/ 2.00

PLU0007 $20.00

TL

CASH $20.00

CG $0.00

$20.00

— Quantity/result

*

or

— Quantity/unit q’ty/@

— Result

www.cashregisters.net

31

Page 32

Basic Operations and Setups

Split sales of packaged item

OPERATION RECEIPT

xx

3

x

5

xx

xx

x

xx

Unit price

——————————

Item Quantity 3

——————————

PLU 28

——————————————

Payment Cash $15.00

(5for$20.00)

preset

Quantity being purchased

(4-digit integer/2-digit decimal)

Package quantity

(4-digit integer/2-digit decimal)

28+

REG 03-04-2000 11:00

C

01 MC#01 000013

3 PLU0028 $12.00

3 @5/ 20.00

PLU0028 $12.00

— Quantity/result

*

or

— Quantity/unit q’ty/@

— Result

s

15-F

* See address 0522 of the general function program.

TL

CASH $15.00

CG $3.00

Shifting the taxable status of an item

By pressing “Tax Shift” key, you can shift the taxable status of an item.

REG

Mode switch

Calculation merchandise subtotal

OPERATION RECEIPT

Dept. 1 $4.00

Item 1 Quantity 1

—————————————

Item 2 Quantity 1

—————————————

Item 3 Quantity 1

—————————————

Item 4 —————————

—————————————

Payment Cash $20.00

—————————

—————————

Taxable (2)

Dept. 2 $2.00

—————————

—————————

Taxable (No)→1

Dept. 3 $6.00

—————————

—————————

Taxable (1)→1, 2

Dept. 4 $7.00

—————————

Quantity 1

Taxable (2)→No

preset

Pressing t changes the tax status

from Nontaxable to Taxable 1

Pressing T changes the tax status

from Taxable 1 to Taxable 1, 2

Pressing T changes the tax status

from Taxable 2 to Nontaxable

20-F

4-!

tt

t

tt

2-"

TT

T

TT

6-#

TT

T

TT

7-$

s

REG 03-04-2000 11:05

C

01 MC#01 000014

1 DEPT01 T1 $4.00

1 DEPT02 T2 $2.00

1 DEPT03 T12 $6.00

1 DEPT04 $7.00

TA1 $8.00

TX1 $0.32

TA2 $10.00

TX2 $0.50

TL

CASH $20.00

CG $0.18

$12.00

$19.82

32

www.cashregisters.net

Page 33

Preparing and using discounts

This section describes how to prepare and register discount.

Programming discounts

To program a rate to the p key

PGM

Mode switch

Registering discounts

REG

Mode switch

6 1s 6 : : : : 6 p 6 s

Preset rate

Example:

10% 2 10

5.5% 2 5^5

12.34% 2 12^34

The following example shows how you can use the p key in various types of

registration.

W

Discount for items and subtotals

OPERATION RECEIPT

Dept. 1 $5.00

Item 1 Quantity 1

—————————————

Item 2 Quantity 1

—————————————

Discount Rate (5%)

—————————————

Subtotal

discount

—————————————

Payment Cash $15.00

• You can manually input rates up to 4 digits long (0.01% to 99.99%).

—————————

—————————

Taxable (1)

PLU 16

—————————

—————————

Taxable (2)

Rate 3.5%

———————––––

Taxable

preset

($10.00)

Nontaxable

preset

preset

preset

Applies the preset discount

rate to the last item registered.

The input value takes priority

of the preset value.

15-F

5-!

16+

3^5

pp

p

pp

ss

s

ss

pp

p

pp

s

REG 03-04-2000 11:10

C

01 MC#01 000015

1 DEPT01 T1 $5.00

1 PLU0016 T2 $10.00

5%

%- -0.50

ST $14.50

3.5%

%- -0.51

TA1 $5.00

TX1 $0.20

TA2 $9.50

TX2 $0.48

TL

CASH $15.00

CG $0.33

Basic Operations and Setups

$14.67

Taxable status of the

• Whenever you perform a discount operation on the last item registered, the tax calculation for discount amount

is performed in accordance with the tax status programmed for that item.

• Whenever you perform a discount operation on a subtotal amount, the tax calculation for the subtotal amount is

performed in accordance with the tax status programmed for the

CE-6000 User’s Manual

p key

p key (see page 76).

33

www.cashregisters.net

Page 34

Basic Operations and Setups

Preparing and using reductions

This section describes how to prepare and register reductions.

Programming for reductions

You can use the m key to reduce single item or subtotal amounts.

To program preset reduction amount

PGM

Mode switch

6 1s 6 : : : : : : 6 m 6 s

Registering reductions

The following examples show how you can use the m key in various types of

registration.

REG

Mode switch

Reduction for items

Dept. 1 $5.00

Item 1 Quantity 1

—————————————

Reduction

—————————————

Item 2 Quantity 1

—————————————

Reduction

—————————————

Payment Cash $11.00

—————————

—————————

Taxable (1)

Amount $0.25

PLU 45 ($6.00)

—————————

—————————

Taxable (1)

Amount ($0.50)

preset

preset

preset

preset

Unit price

OPERATION RECEIPT

5-!

25

Reduces the last amount

registered by the value input.

mm

m

mm

45+

mm

m

mm

s

11-F

REG 03-04-2000 11:15

C

01 MC#01 000016

1 DEPT01 T1 $5.00

- T1 -0.25

1 PLU0045 T1 $6.00

- T1 -0.50

TA1 $10.25

TX1 $0.41

TL

CASH $11.00

CG $0.34

$10.66

• You can manually input reduction values up to 7 digits long.

• If you want to subtract the reduction amount from the department or PLU totalizer, program “Net totaling”

(refer to page 67).

34

www.cashregisters.net

Page 35

Reduction for subtotal

OPERATION RECEIPT

Dept. 1 $3.00

Item 1 Quantity 1

—————————————

Item 2 Quantity 1

—————————————

Subtotal

Reduction

—————————————

Payment Cash $7.00

—————————

———————––––

Taxable (1)

Dept. 2 $4.00

—————————

———————––––

Taxable (2)

Amount $0.75

———————––––

Taxable (No)

preset

preset

preset

3-!

4-"

s

75

Reduces the subtotal by the

value input here.

mm

m

mm

s

7-F

REG 03-04-2000 11:20

C

01 MC#01 000017

1 DEPT01 T1 $3.00

1 DEPT02 T2 $4.00

- -0.75

TA1 $3.00

TX1 $0.12

TA2 $4.00

TX2 $0.20

TL

CASH $7.00

CG $0.43

$6.57

Registering credit and check payments

The following examples show how to register credits and payments by check.

REG

Mode switch

Check

Item —————————

—————————————

Payment Check $20.00

Dept. 1 $11.00

Quantity 1

Credit

Dept. 4 $15.00

Item —————————

—————————————

Reference

—————————————

Payment Credit $15.00

Quantity 1

Number 1234

OPERATION RECEIPT

11-!

s

20-

OPERATION RECEIPT

kk

k

kk

15-$

s

1234

NN

N

NN

cc

c

cc

REG 03-04-2000 11:25

C

01 MC#01 000018

1 DEPT01 $11.00

TL

CHECK $20.00

CG $9.00

REG 03-04-2000 11:30

C

01 MC#01 000019

1 DEPT04 $15.00

#/NS 1234

TL

CREDIT1 $15.00

Basic Operations and Setups

$11.00

— Reference No.

$15.00

CE-6000 User’s Manual

35

www.cashregisters.net

Page 36

Basic Operations and Setups

Mixed tender (cash, credit and check)

OPERATION RECEIPT

Dept. 4 $55.00

Item —————————

Quantity 1

—————————————

Check $30.00

—————————

Payment Cash $5.00

—————————

Credit $20.00

Validation printing

You can perform total amount validation following finalization using a, h, k,

c, d keys and r, P keys. Also you can perform single item validation.

REG

Mode switch

Total amount validation

55-$

s

30-

5-

OPERATION RECEIPT

kk

k

kk

FF

F

FF

cc

c

cc

REG 03-04-2000 11:35

C

01 MC#01 000020

1 DEPT04 $55.00

TL

CHECK $30.00

CASH $5.00

CREDIT1 $20.00

$55.00

Dept. 1 $14.00

Item —————————

Quantity 1

—————————————

Payment Check $20.00

—————————————

Validation

14-!

s

20-k

1 Open the journal window.

2 Insert paper.

3 Press

vv

v.

vv

REG 03-04-2000 11:45

C

01 MC#01 000021

1 DEPT01 $14.00

TL

CHECK $20.00

CG $6.00

1

$14.00

2

36

www.cashregisters.net

Page 37

Validation sample

70 mm Min.

135 mm ~ 210 mm

Mode (4 digits)

Clerk name (6 digits)

Date (6 digits), Time (4 digits)

Machine/Cons. No. (6 digits ea.)

Key descriptor

Amount

Format A

Format B

REG C01 030400 1140 MC#01 000021 CHECK $14.00

REG C01 030400 1140 MC#01

021

CHECK $14.00

Registering returned goods in the REG mode

The following example shows how to use the R key in the REG mode to register

goods returned by customers.

REG

Mode switch

OPERATION RECEIPT

Dept. 1 $2.35

Item 1 —————————

Quantity 1

—————————————

Dept. 2 $2.00

Item 2 —————————

Quantity 1

—————————————

Item 3 —————————

PLU 1 ($1.20)

preset

Quantity 1

—————————————

Returned

Item 1

Dept. 1 $2.35

—————————

Quantity 1

—————————————

Returned

Item 3

PLU 1 ($1.20)

—————————

Quantity 1

preset

—————————————

Payment Cash $2.00

235!

2-"

1+

RR

R

RR

235!

Press R before the item you

want to return.

RR

R

RR

1+

s

F

REG 03-04-2000 11:50

C

01 MC#01 000022

1 DEPT01 $2.35

1 DEPT02 $2.00

1 PLU0001 $1.20

RF •••••••••

1 DEPT01 -2.35

RF •••••••••

1 PLU0001 -1.20

TL

CASH $2.00

$2.00

Basic Operations and Setups

CE-6000 User’s Manual

37

www.cashregisters.net

Page 38

Basic Operations and Setups

Registering returned goods in the RF mode

The following examples show how to use the RF mode to register goods returned by

customers.

RF

Mode switch

Normal refund transaction