Page 1

ELECTRONIC CASH REGISTER

CE

-

280

THANK YOU

YOUR RECEIPT

c

CALL AGAIN !

Year 2000

Compliance

GROCERY

DAIRY

H.B.A.

FROZEN

FOOD

CE-300

CE-280

£00

"80

DELICATESSEN

OPERATOR'S INSTRUCTION MANUAL

CI

Page 2

Introduction & Contents

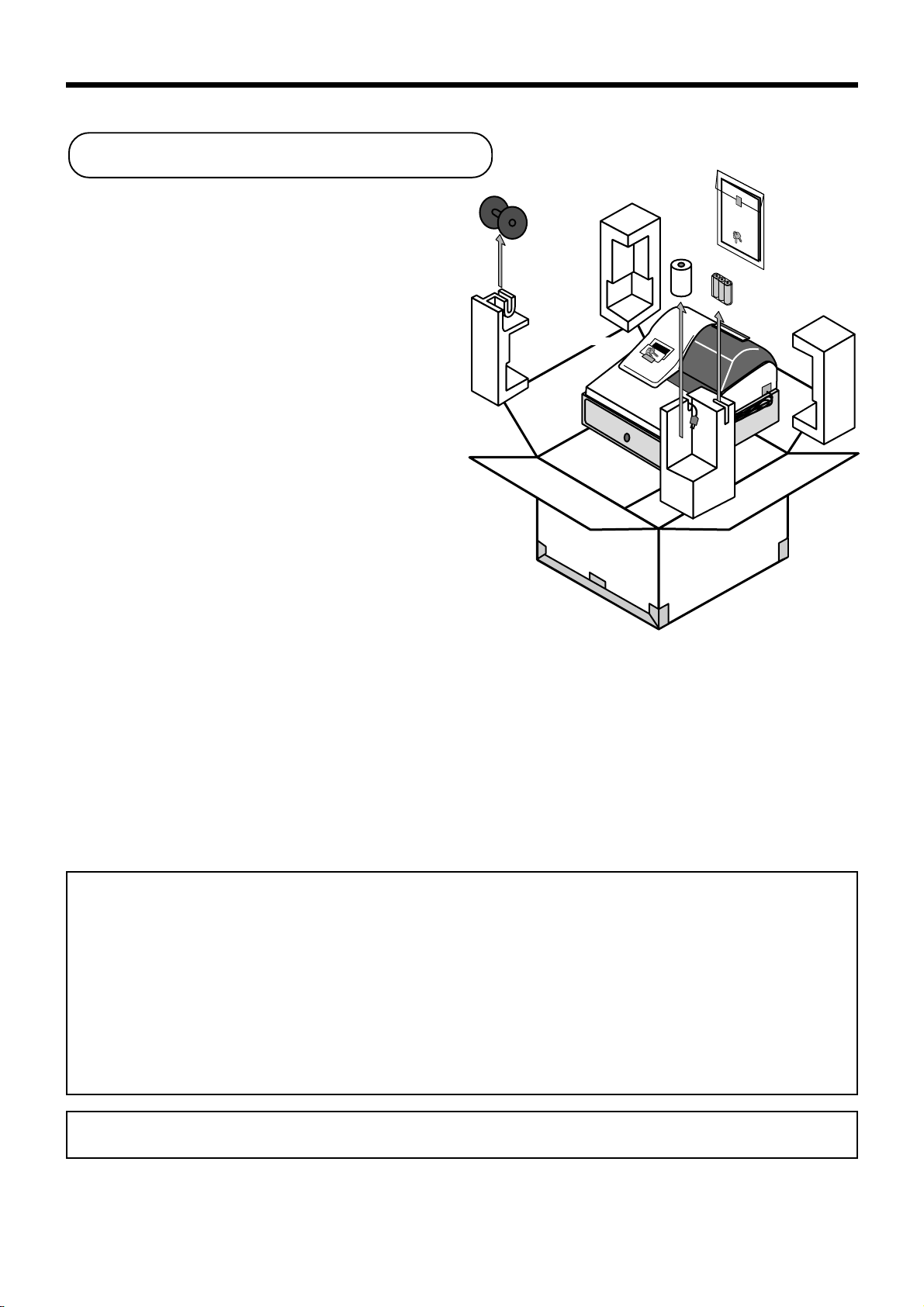

Unpacking the register

Welcome to the CASIO CE-280!

Congratulations upon your selection of a CASIO

Electronic Cash Register, which is designed to

provide years of reliable operation.

Operation of a CASIO cash register is simple

enough to be mastered without special training.

Everything you need to know is included in this

manual, so keep it on hand for reference.

If you need programming assistance, please

call 1-800-638-9228.

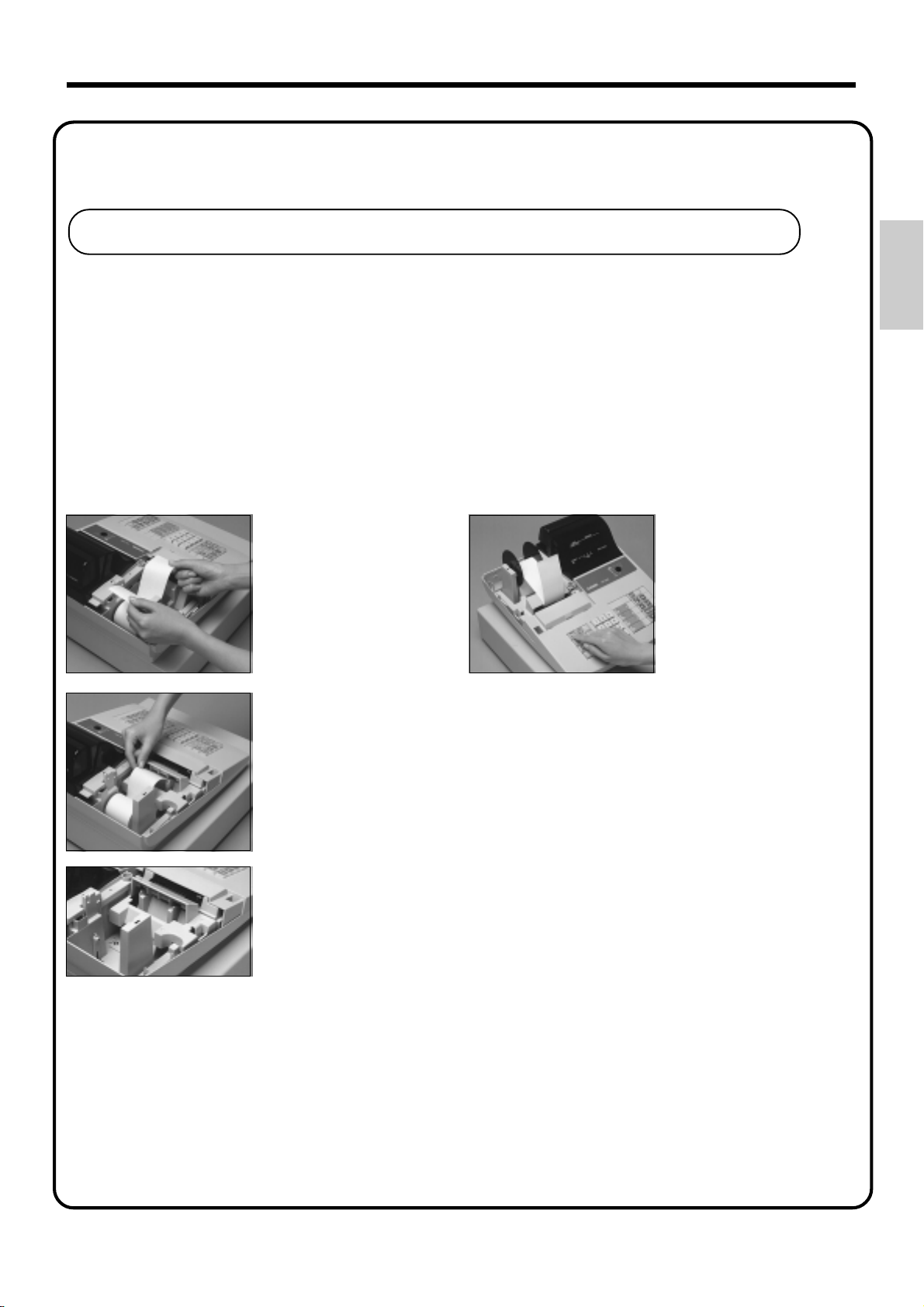

Take-up reel

Operator/Program key

Roll paper

Operators

Instruction

Manual

Operator's

instruction manual/

Drawer key

Memory backup batteries

(UM-3 "AA" × 3)

CASIO AUTHORIZED SERVICE CENTER

If your Casio product needs repair, or you wish to purchase replacement parts, please

call 1-800-YO-CASIO for the authorized service center nearest your home.

If for any reason this product is to be returned to the store where purchased, it must be

packed in the original carton/package.

GUIDELINES LAID DOWN BY FCC RULES FOR USE OF THE UNIT IN THE

U.S.A.

(Not applicable to other areas)

WARNING: This equipment generates, uses and can radiate radio frequency energy and if not installed and used

in accordance with the instruction manual, may cause interference to radio communications. It has been tested and

found to comply with the limits for a Class A computing device pursuant to Subpart J of Part 15 of the FCC Rules,

which are designed to provide reasonable protection against such interference when operated in a commercial

environment.

Operation of this equipment in a residential area is likely to cause interference in which case the user at his/her own

expense will be required to take whatever measures may be required to correct the interference.

The main plug on this equipment must be used to disconnect main power.

Please ensure that the socket outlet is installed near the equipment and shall be easily accessible.

Please keep all information for future reference.

2

Page 3

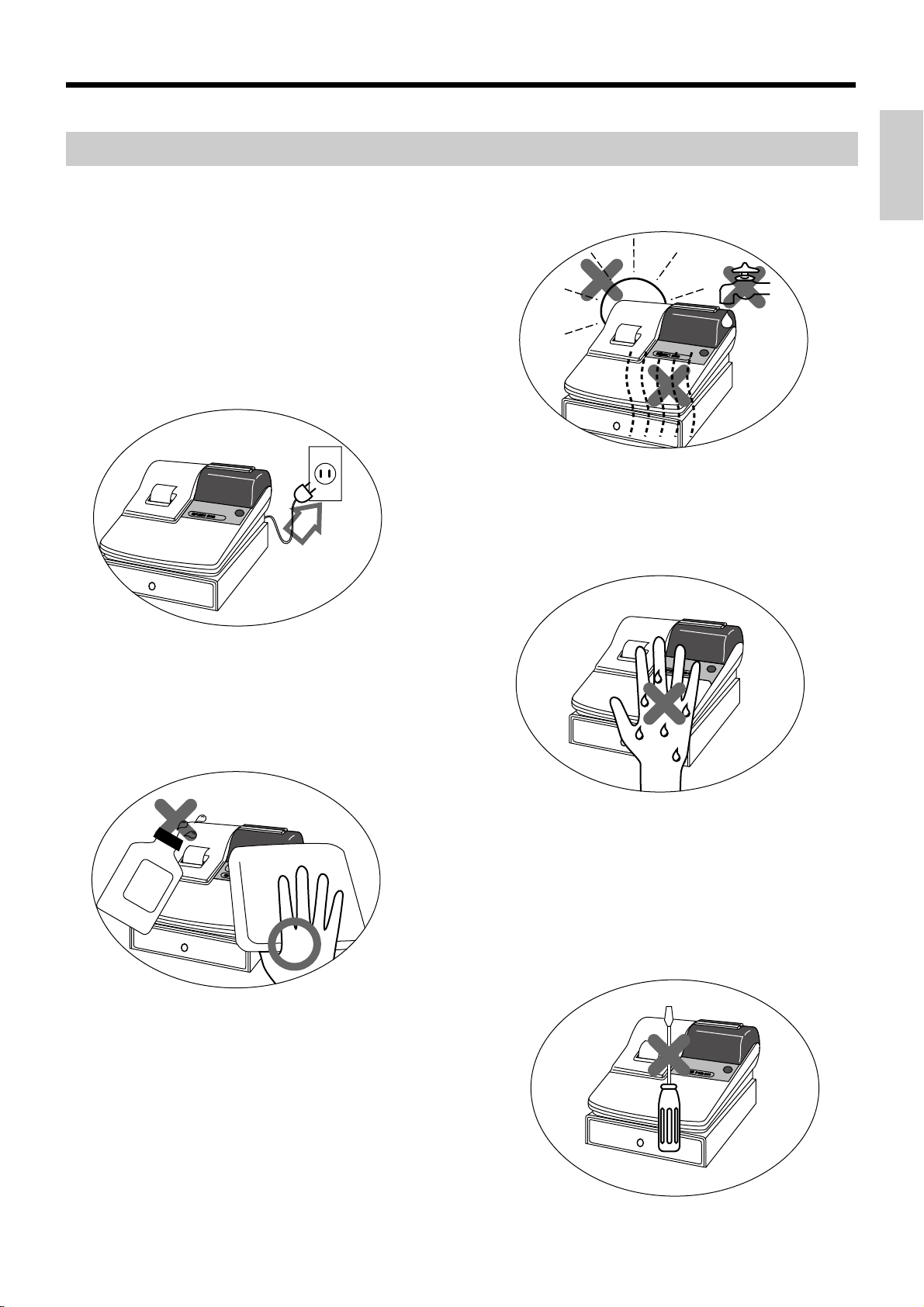

Important!

Before you do anything, be sure to note the following important precautions!

Do not locate the cash register where it will

be subjected to direct sunlight, high humidity,

splashing with water or other liquids, or high

temperature (such as near a heater).

Be sure to check the sticker on the side of

the cash register to make sure that its voltage matches that of the power supply in the

area.

Introduction & Contents

Never operate the cash register while your

hands are wet.

Never try to open the cash register or attempt your own repairs. Take the cash register to your authorized CASIO dealer for

repairs.

Use a soft, dry cloth to clean the exterior of

the cash register. Never use benzene, thinner, or any other volatile agent.

3

Page 4

Introduction & Contents

Introduction & Contents .........................................................2

Unpacking the register....................................................................................................... 2

Getting Started ........................................................................6

Remove the cash register from its box .............................................................................. 6

Remove the tape holding parts of the cash register in place............................................. 6

Install the three memory backup batteries......................................................................... 6

Plug the cash register into a wall outlet ............................................................................. 8

Insert the mode key marked "PGM" into the mode switch................................................. 8

Turn the mode key to the "REG" position.......................................................................... 8

To set the ink ribbon .......................................................................................................... 8

Install receipt/journal paper ............................................................................................... 9

To load 1-ply paper for printing of receipts...............................................................................9

To load 1-ply paper for printing of journal ..............................................................................10

To load 2-ply paper for printing of receipts............................................................................. 11

Set the date ..................................................................................................................... 12

Set the time ..................................................................................................................... 12

Select printouts receipt or journal .................................................................................... 12

Programming automatic tax calculation........................................................................... 13

Programming the U.S. tax table procedure ...........................................................................13

Introducing CE-280 ...............................................................18

General guide .................................................................................................................. 18

Mode key, drawer, mode switch.............................................................................................18

Displays .................................................................................................................................20

Keyboard ...............................................................................................................................22

Basic Operations and Setups ..............................................24

How to read the printouts ................................................................................................ 24

How to use your cash register ......................................................................................... 25

Displaying the time and date .................................................................................................26

Preparing coins for change....................................................................................................26

Preparing and using department keys............................................................................. 27

Registering department keys ................................................................................................. 27

Programming department keys.............................................................................................. 29

Registering department keys by programming data .............................................................. 30

Preparing and using PLUs............................................................................................... 31

Programming PLUs ...............................................................................................................31

Registering PLUs ...................................................................................................................32

Preparing and using discounts ........................................................................................ 34

Programming discounts ......................................................................................................... 34

Registering discounts ............................................................................................................35

Preparing and using reductions....................................................................................... 36

Programming for reductions ..................................................................................................36

Registering reductions ........................................................................................................... 37

Calculating the merchandise subtotal.............................................................................. 38

Shifting taxable 1/2 status of an item............................................................................... 39

Registering charge and check payments ........................................................................ 40

4

Page 5

Registering returned goods in the REG mode................................................................. 41

Registering returned goods in the RF mode.................................................................... 42

Registering money received on account ......................................................................... 43

Registering money paid out............................................................................................. 43

Making corrections in a registration................................................................................. 44

No sale registration.......................................................................................................... 46

Printing the daily sales reset report ................................................................................. 47

Convenient Operations and Setups ....................................48

Clerk control function, Post-finalization receipt format, General printing control,

Compulsory, Machine features ........................................................................................ 48

About the clerk control function .............................................................................................48

About post-finalization receipt................................................................................................ 49

Programming general printing control.................................................................................... 50

Programming compulsory and clerk control function .............................................................51

Programming read/reset report printing control ..................................................................... 52

Setting a store/machine number...................................................................................... 52

Programming to clerk ...................................................................................................... 53

Programming descriptors and messages ........................................................................ 54

Programming report descriptor, grand total, special character, report title,

receipt message and clerk name .................................................................................... 54

Programming department key descriptor............................................................................... 57

Programming PLU descriptor ................................................................................................ 58

Programming function key descriptor ....................................................................................59

Entering characters ......................................................................................................... 60

Department key programming ......................................................................................... 62

PLU feature programming ............................................................................................... 64

Percent key feature programming ................................................................................... 69

Currency exchange programming ................................................................................... 72

Other function key programming ..................................................................................... 75

Calculator functions ......................................................................................................... 76

Printing read/reset reports ............................................................................................... 78

Reading the cash register's program............................................................................... 84

Introduction & Contents

Troubleshooting ....................................................................88

When an error occurs ...................................................................................................... 88

When the register does not operate at all........................................................................ 89

In case of power failure ................................................................................................... 90

When the L sign appears on the display.......................................................................... 90

User Maintenance and Options............................................91

To replace the ink ribbon ................................................................................................. 91

To replace journal paper .................................................................................................. 92

To replace receipt paper .................................................................................................. 93

Specifications........................................................................94

Index.......................................................................................95

5

Page 6

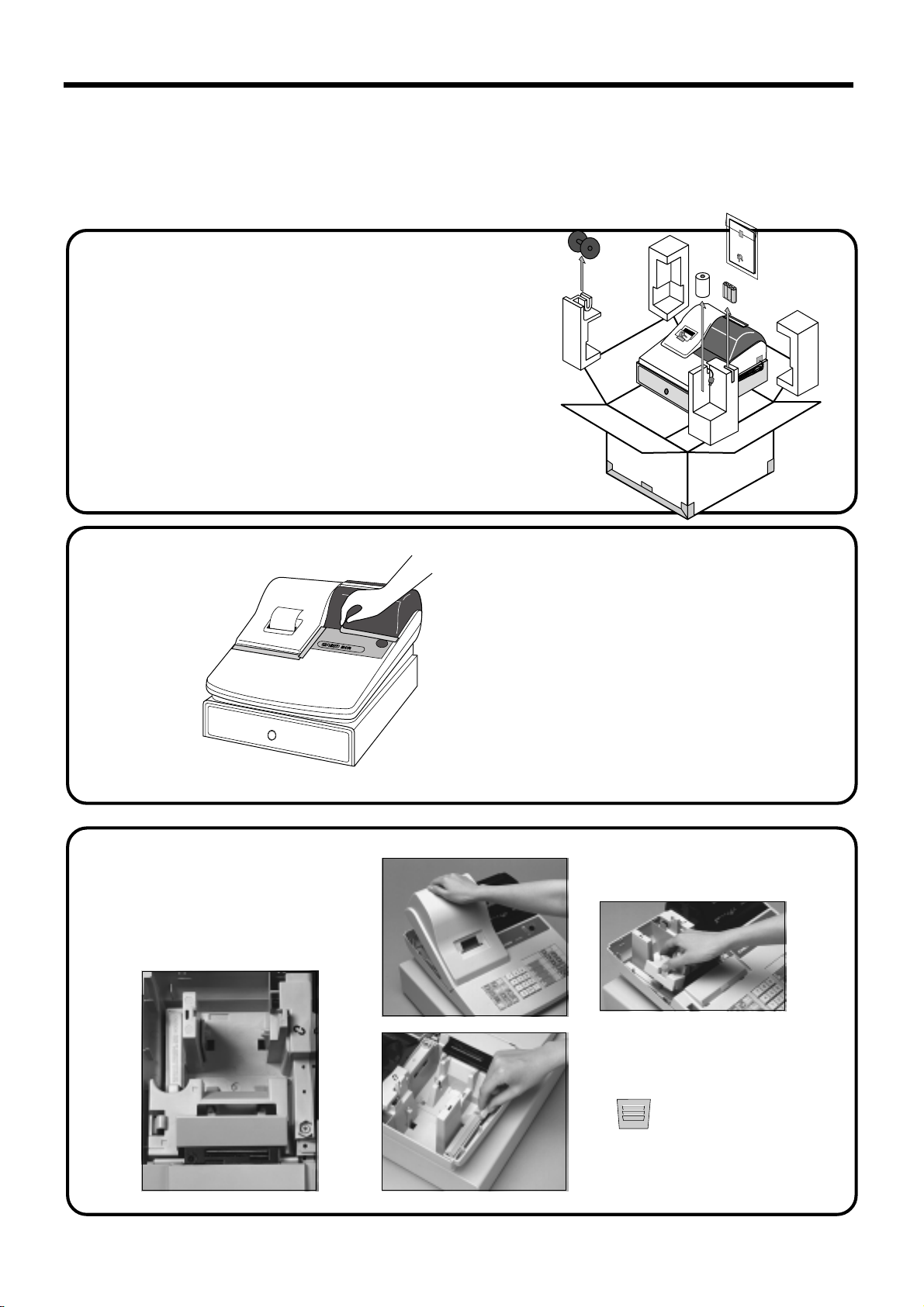

Getting Started

This section outlines how to unpack the cash register and get it ready to operate. You should read this part of the

manual even if you have used a cash register before. The following is the basic set up procedure, along with page

references where you should look for more details.

Operator's

Instruction

Manual

1.

Remove the cash register from its box.

Make sure that all of the parts and accessories

are included.

2.

Remove the tape holding parts

of the cash register in place.

Also remove the small plastic bag taped

to the printer cover . Inside you will find

the mode keys.

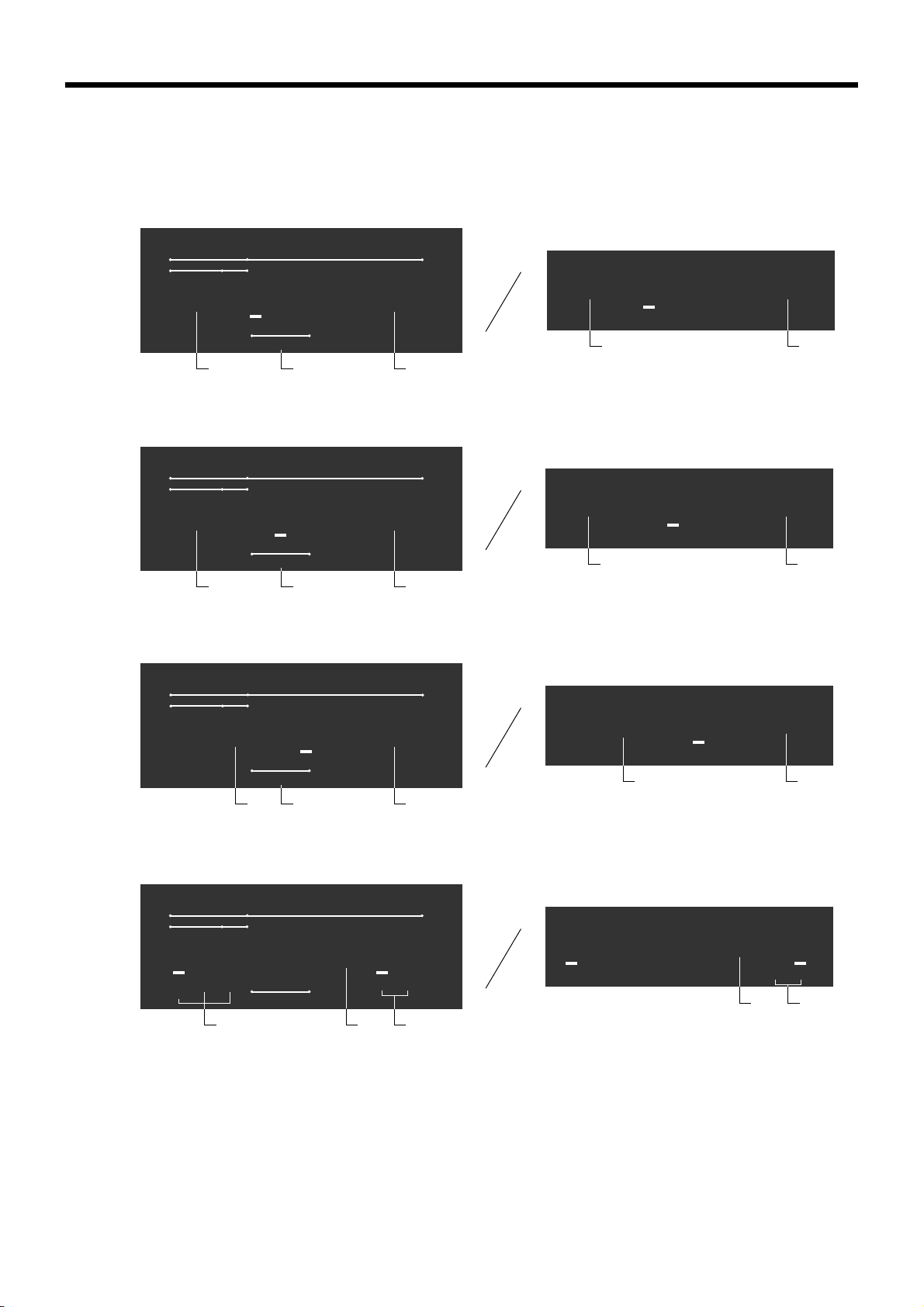

1. Remove the printer cover and

3.

6

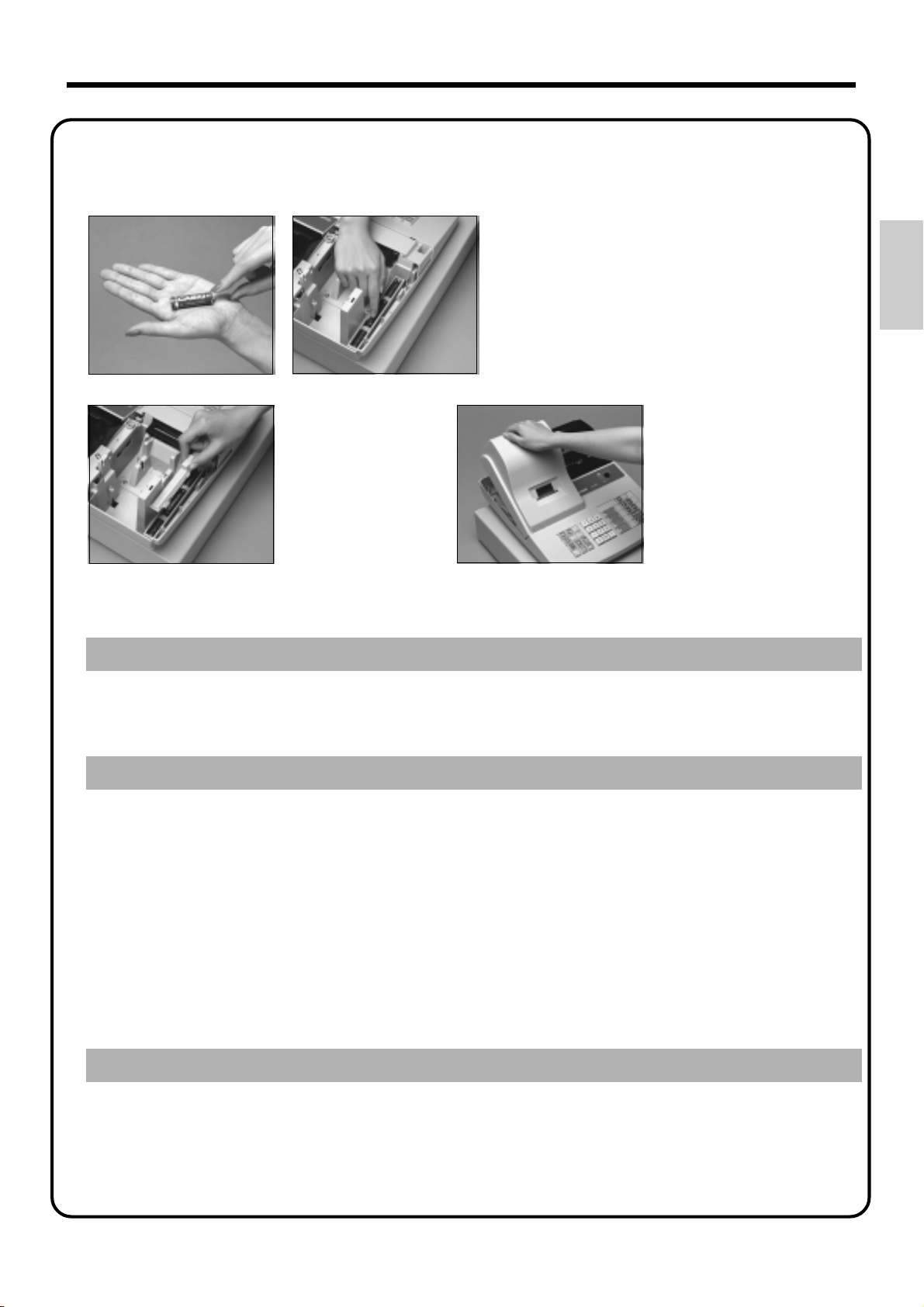

Install the three

memory backup

batteries.

inner cover .

2. Remove the battery compartment cover. Pressing down

where the cover is marked

" " and pull it up.

Page 7

3.

Install the three memory backup batteries. (continued…)

3. Note the (+) and (–) markings in the battery

compartment. Load a set of three new SUM-3

("AA") batteries so that their positive (+) and

negative (–) ends are facing as indicated by the

markings.

4. Replace the battery compartment cover . 5. Replace the inner cover and printer cover .

Getting Started

Important!

These batteries protected information stored in your cash register's memory when there is

a power failure or when you unplug the cash register . Be sure to install these batteries.

Precaution!

Incorrectly using batteries can cause them to burst or leak, possibly damaging the interior

of the cash register . Note the following.

• Be sure that the positive (+) and negative (–) ends of the batteries are facing as marked in the

battery compartment when you load them into the unit.

• Never mix batteries of different types.

• Never mix old batteries with new ones.

• Never leave dead batteries in the battery compartment.

• Remove the batteries if you do not plan to use the cash register for long periods.

• Replace the batteries at least once every two years, no matter how much the cash register is

used during the period.

WARNING!

• Never try to recharge the batteries supplied with the unit.

• Do not expose batteries to direct heat, let them become shorted or try to take them apart.

Keep batteries out of the reach of small children. If your child should swallow a battery ,

consult a physician immediately .

7

Page 8

Getting Started

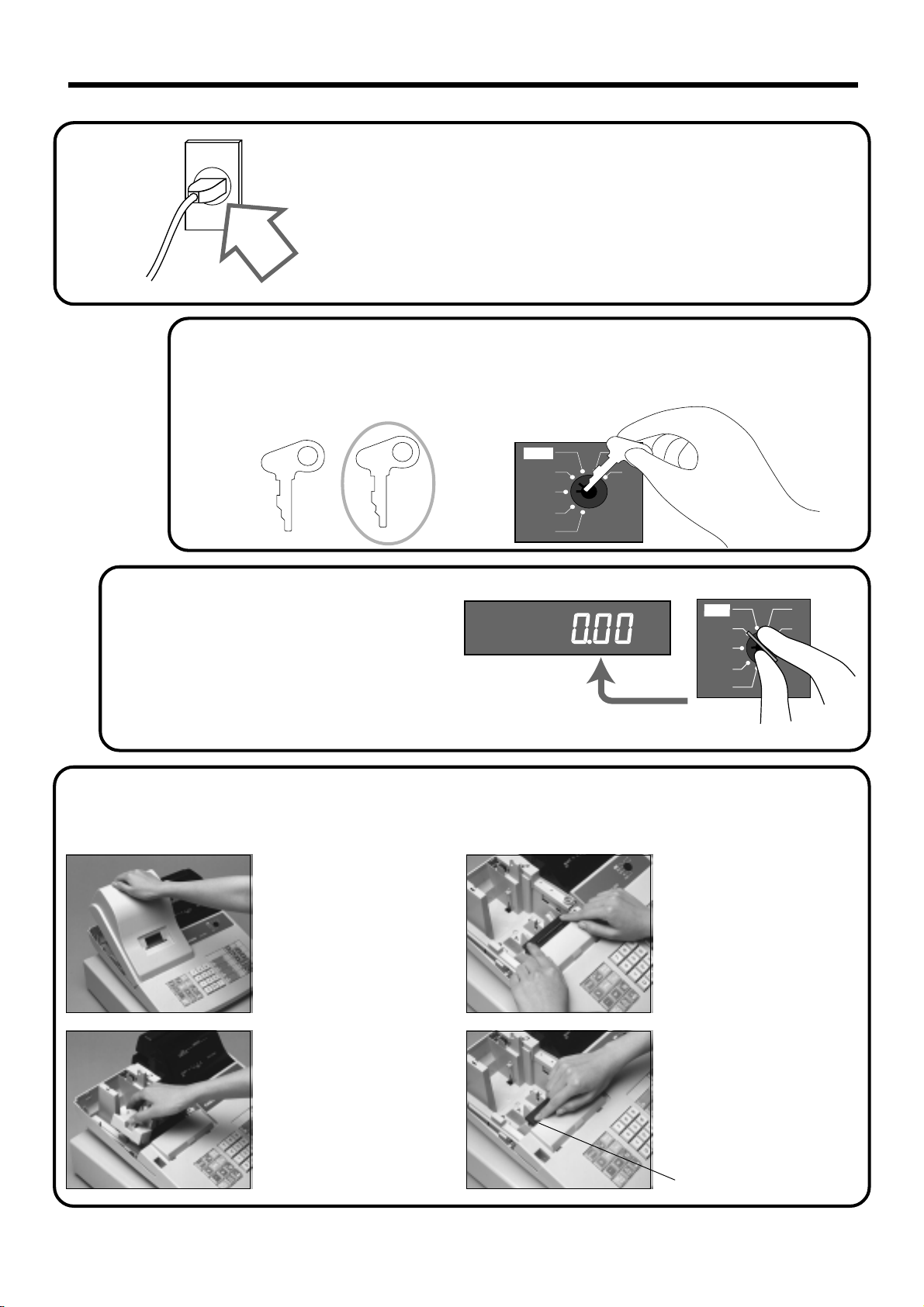

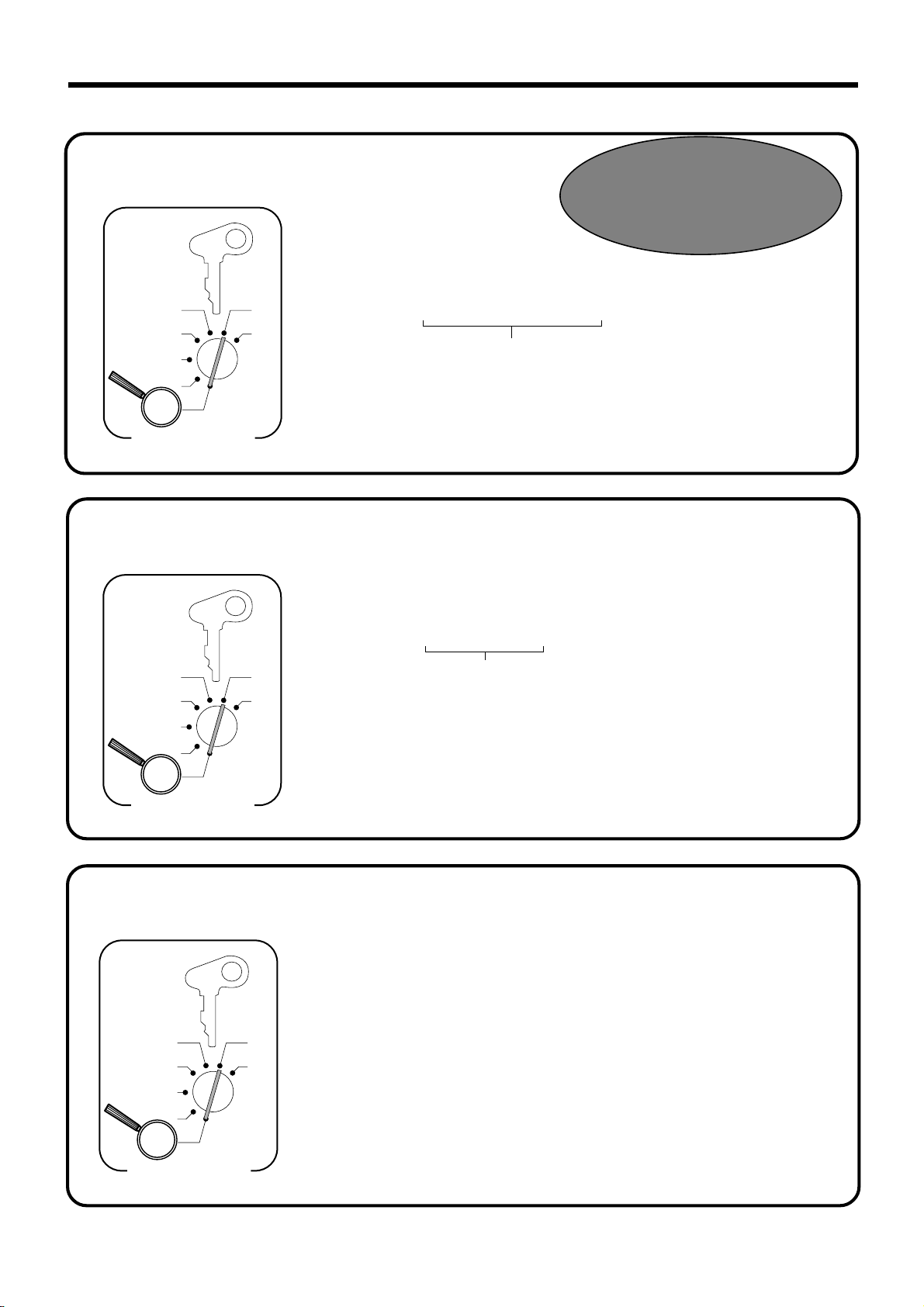

6.

4.

5.

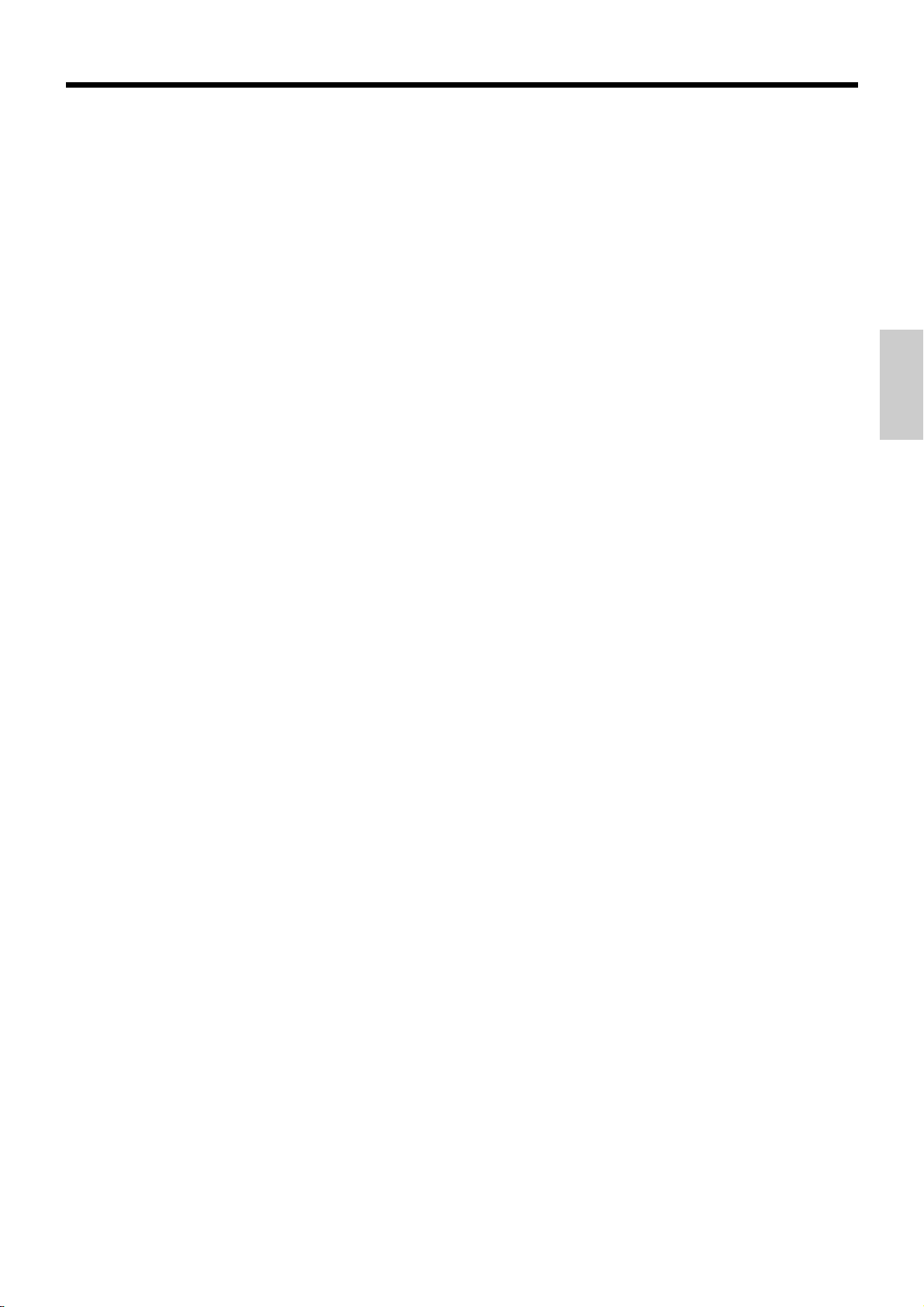

Turn the mode key to the

"REG" position.

The display should change to the following.

Insert the mode key marked "PGM" into the mode switch.

About the mode key and mode switch, please refer to page-18, 19.

OP

A-A08

PGM

A-A08

Plug the cash register into a wall outlet.

Be sure to check the sticker on the side of the cash

register to make sure that its voltage matches that of the

power supply in your area. The printer will operate for

a few seconds.

CAL

REG

OFF

RF

PGM

A-A08

PGM

Z

X

Z

CAL

REG

OFF

RF

PGM

X

Z

8

7.

To set the ink ribbon

11

1

11

Remove the printer cover.

22

2

22

Remove the inner cover.

33

3

33

Load a new ink ribbon

cassette into the unit.

44

4

44

Turn the knob on the left

side of the cassette to take

up any slack in the ribbon.

Knob

Page 9

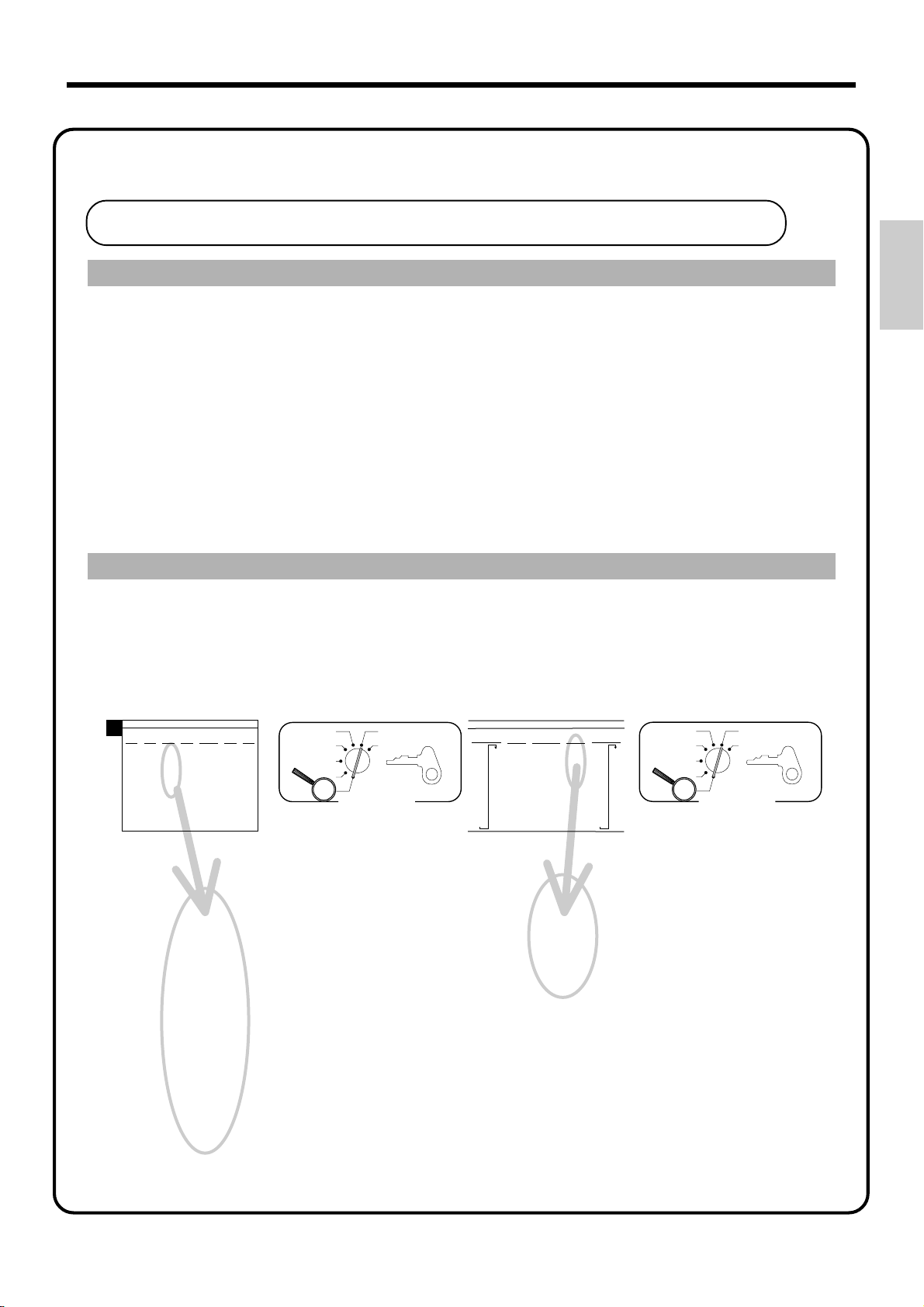

8.

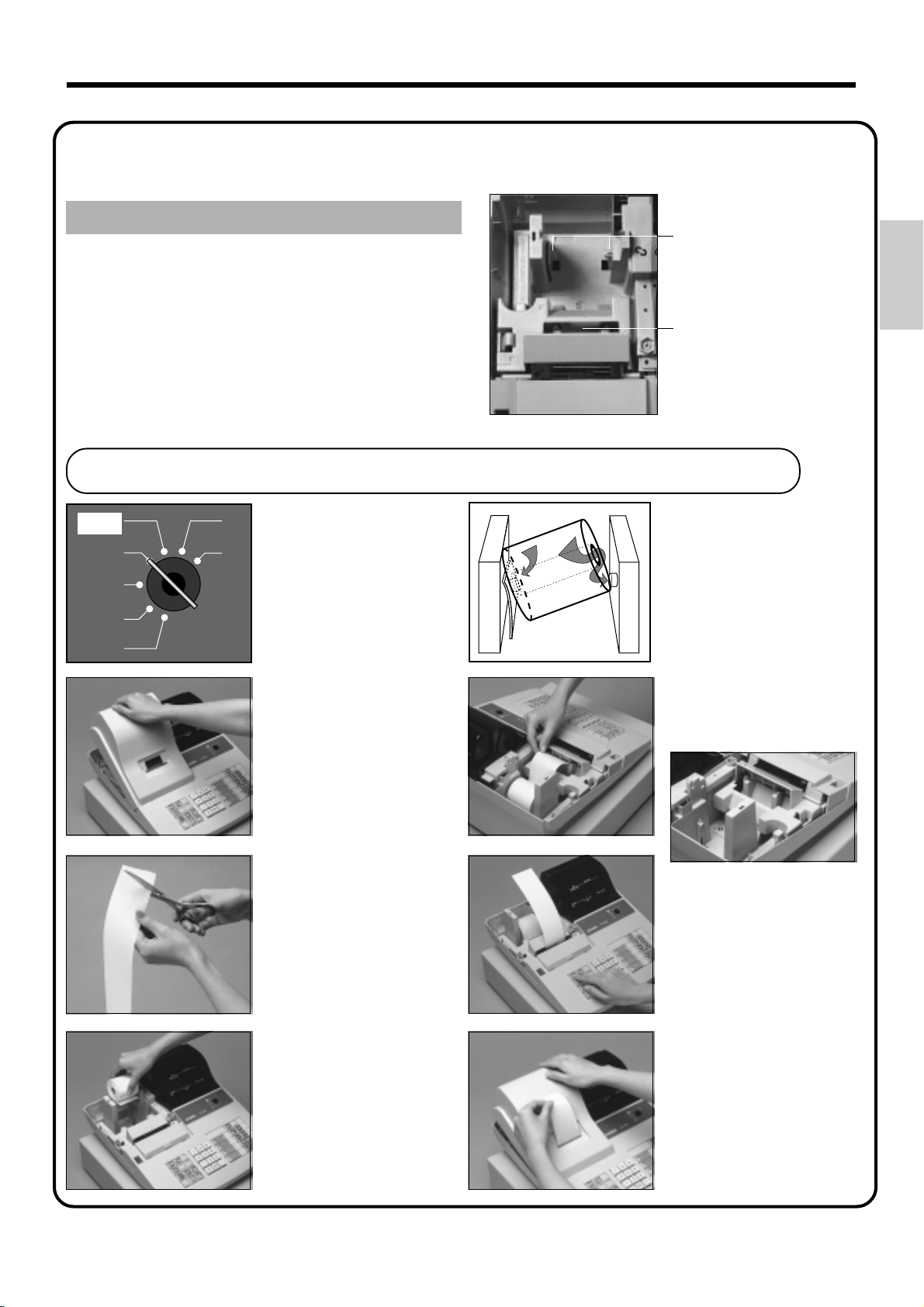

Never operate the cash register without paper.

It can damage the printer.

Install receipt/journal paper.

Important!

Roll paper spindle

Paper inlet

To load 1-ply paper for printing of receipts

CAL

REG

OFF

RF

PGM

X

11

1

11

Z

Use a mode key to set the

mode switch to REG

position.

55

5

1

2

55

Work the paper roll gently

between the two spindles

so that they slip into the

center hubs of the roll.

Getting Started

22

2

22

Remove the printer cover.

33

3

33

Cut off the leading end of

the paper so it is even.

44

4

44

Ensuring the paper is being

fed from the bottom of the

roll, lower the roll into the

space behind the printer.

66

6

66

Insert paper to the paper

inlet.

77

7

77

Press the f key until

about 20 cm to 30 cm of

paper is fed from the

printer.

88

8

88

Replace the printer cover,

passing the leading end of

the paper through the cutter

slot. Tear off the excess

paper.

9

Page 10

Getting Started

8.

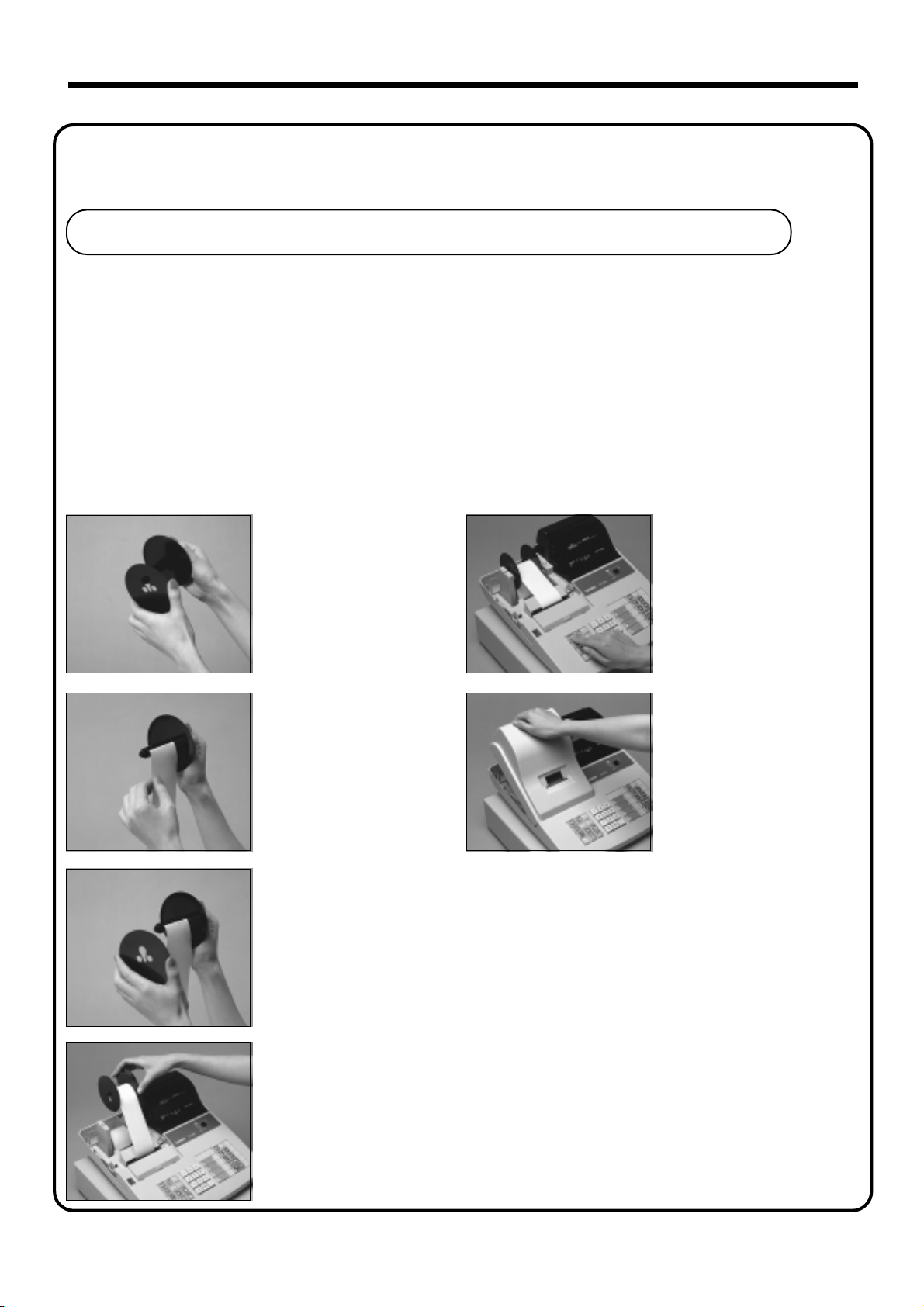

Follow steps

Install receipt/journal paper. (continued…)

To load 1-ply paper for printing of journal

11

1 through

11

77

7 under "To load 1-ply paper for printing of receipts" on the previous page.

77

88

8

88

Remove the flat side plate

of the take-up reel.

BB

B

BB

Press the f key to take

up any slack in the paper .

99

9

99

Slide the leading end of the

paper into the groove on

the spindle of the take-up

reel and wind it onto the

reel two or three turns.

00

0

00

Replace the flat side plate

of the take-up reel.

AA

A

AA

Place the take-up reel into

place behind the printer,

above the roll paper.

CC

C

CC

Replace the printer cover.

10

Page 11

8.

Install receipt/journal paper. (continued…)

To load 2-ply paper for printing of receipts

Follow steps

11

1 through

11

55

5 under "To load 1-ply paper for printing of receipts" above.

55

66

6

66

Separate the two sheets of

the paper.

77

7

77

88

8

88

Press the f key until

about 20 cm to 30 cm of

paper is fed from the

printer.

Getting Started

Join the ends of the paper

again and insert them into

the paper inlet.

99

9

99

Insert the leading end of the inner sheet (which will be

your journal) into the take-up reel, as described

starting from

88

8 under "To load 1-ply paper for printing of

step

88

journal."

00

0

00

Replace the printer cover, passing the leading end of the

outer sheet through the cutter slot. Tear off the excess

11

Page 12

Getting Started

c

9.

Set the date.

CAL

REG

OFF

RF

PGM

Mode Switch

10.

PGM

A-A08

X

Z

Set the time.

PGM

A-A08

Year 2000

Compliance

6 1s 6 : : : : : : 6 x 6 C

Current date

Example:

December 21, 1999 2

May 11, 2000 2

6 1s 6 : : : : 6 x 6 C

991221

000511

CAL

REG

OFF

PGM

Mode Switch

11.

CAL

REG

OFF

RF

PGM

X

Z

RF

Select printouts receipt or journal.

PGM

A-A08

Example:

08:20 AM

09:45 PM

6 1s 6 { } 6 h 6 s

X

Z

Note:

Be sure to select 0 (receipt) when you use 2-ply paper.

Current time

2 0820

2 2145

(24-hour military time format)

Issue receipt =

Print journal =

0

1

12

Mode Switch

Page 13

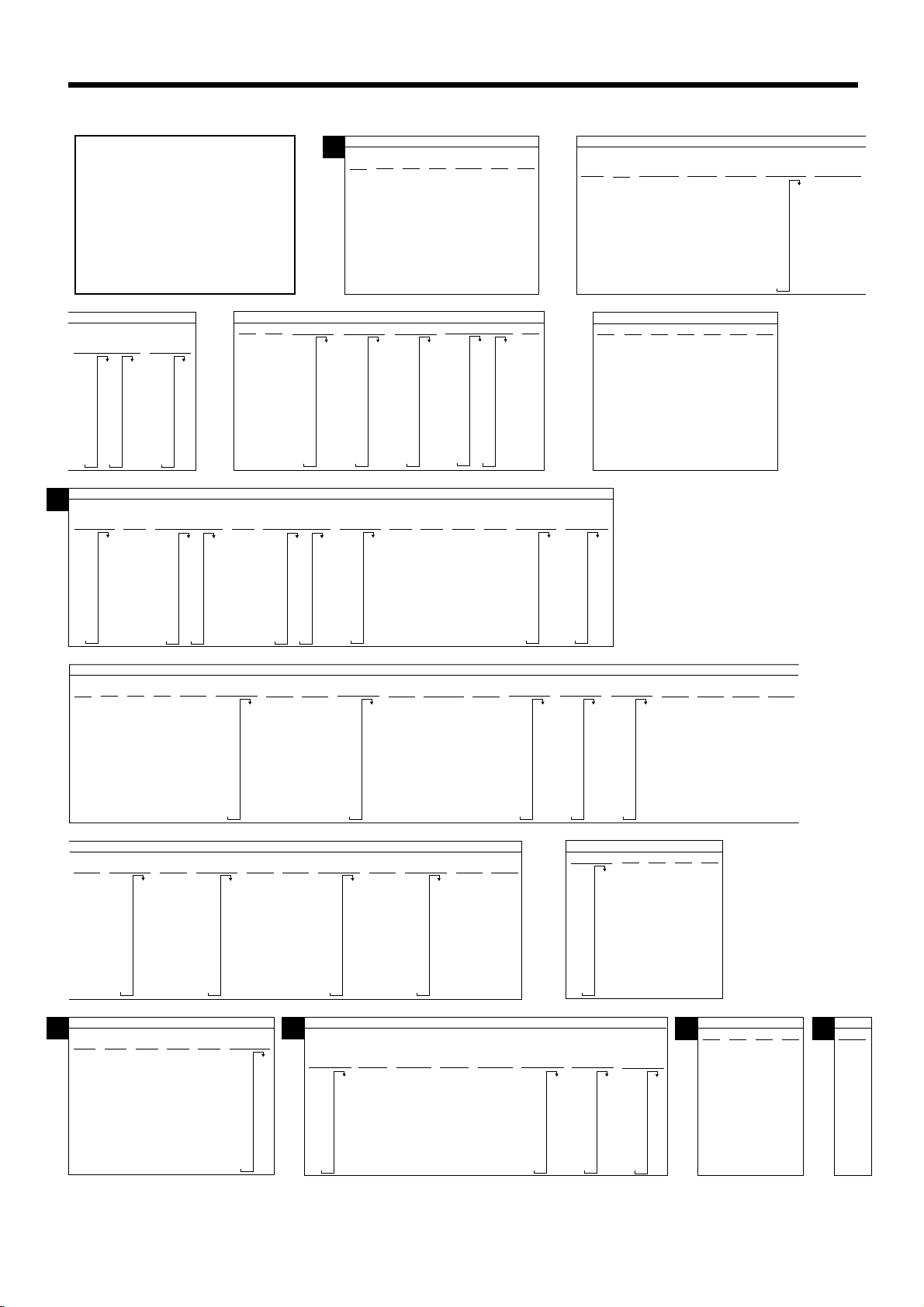

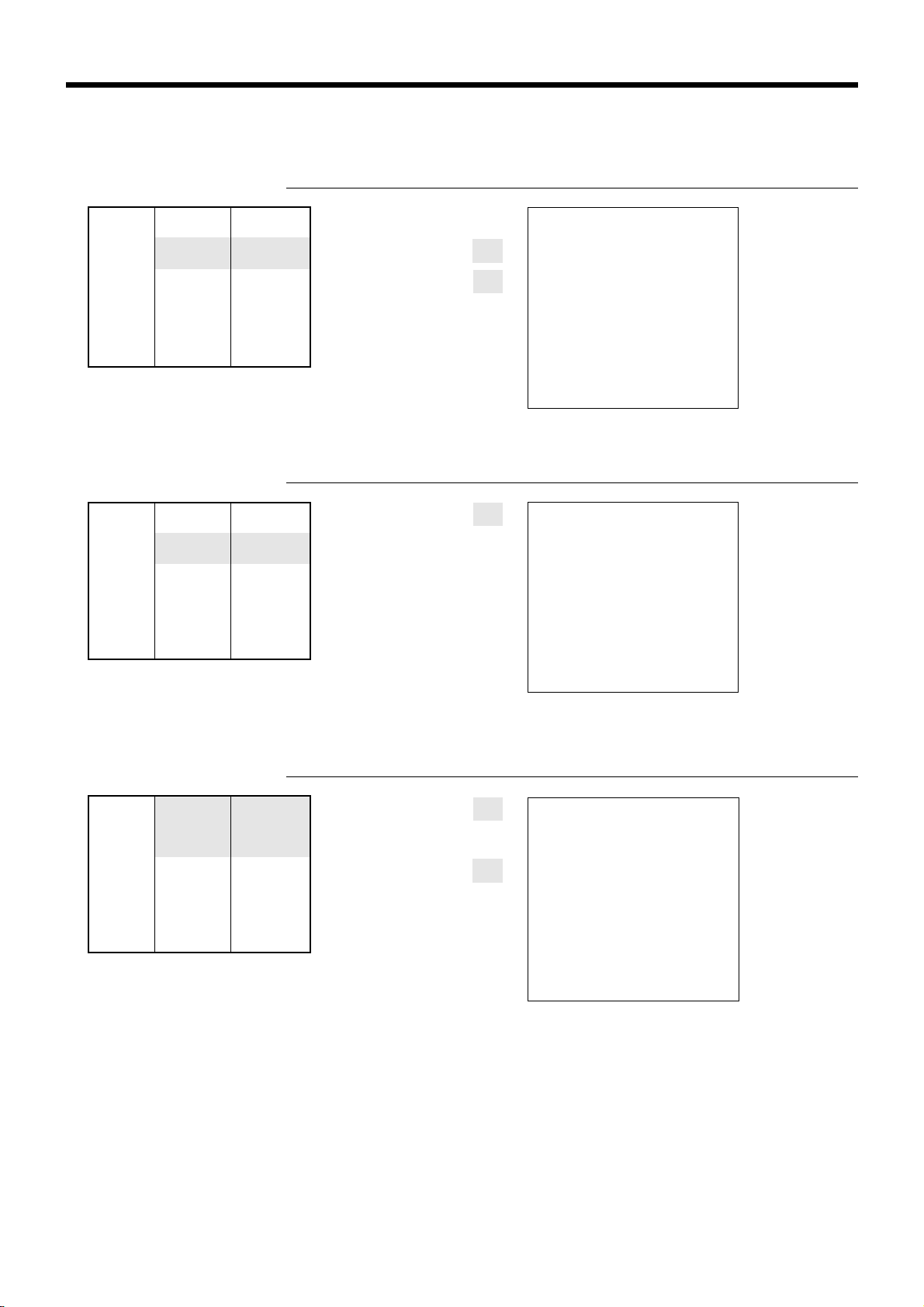

12.

Tax table programming

Programming automatic tax calculation

Important!

After you program the tax calculations, you also have to individually specify which

departments (page 29) and PLUs (page 31) are to be taxed.

For this cash register to be able to automatically register state sales tax, you must program its tax

tables with tax calculation data from the tax table for your state. There are three tax tables that you

can program for automatic calculation of three separate sales taxes.

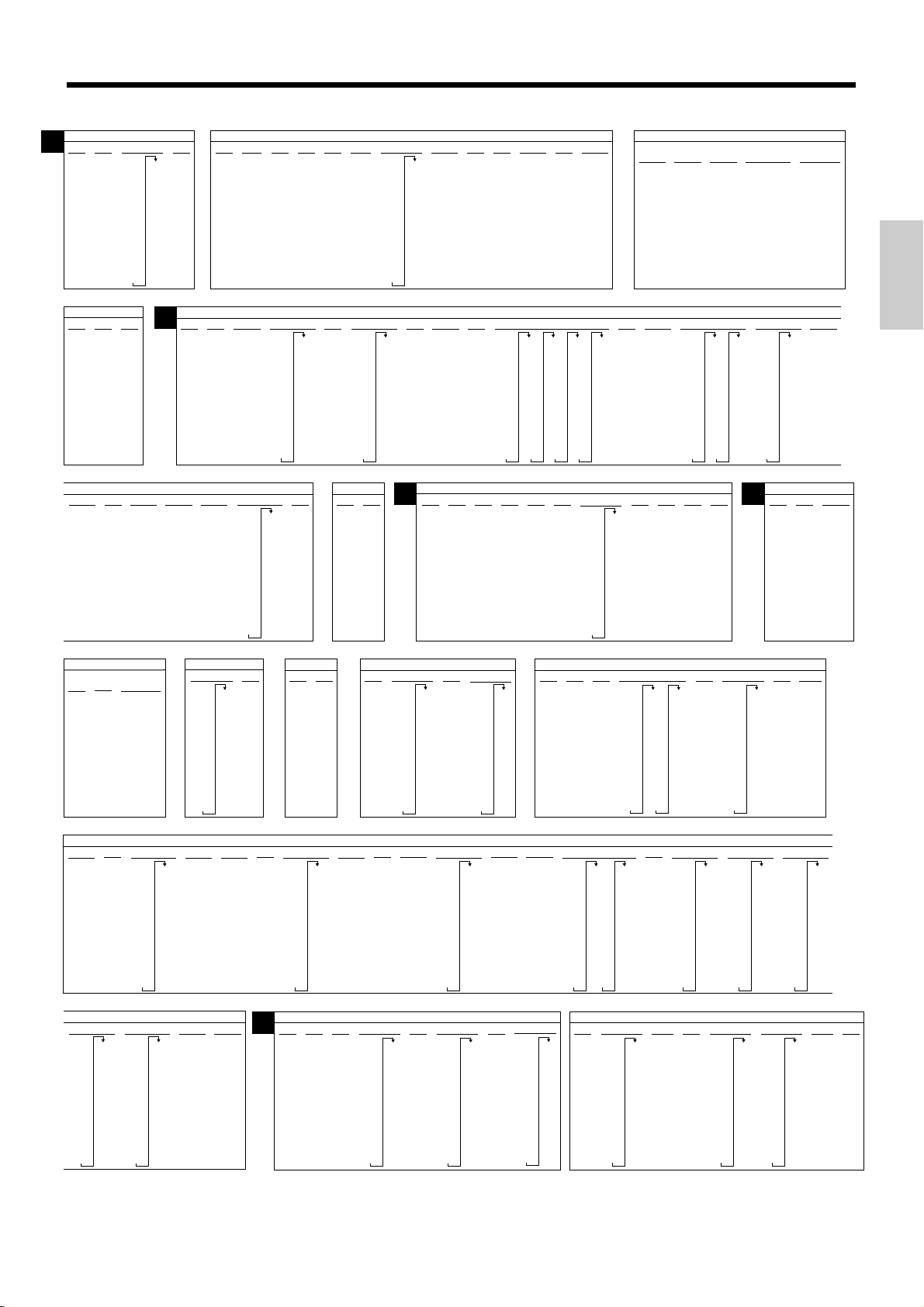

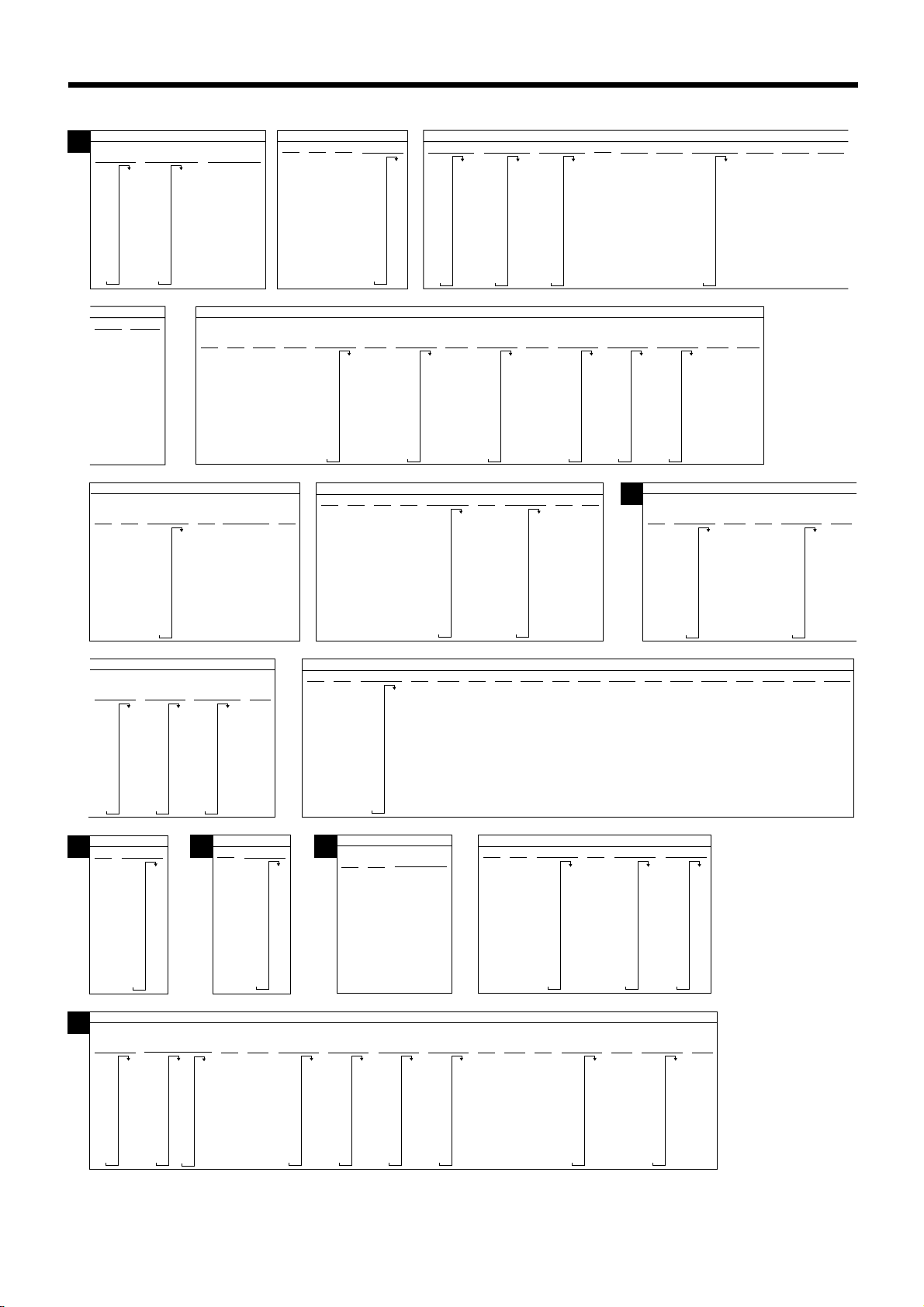

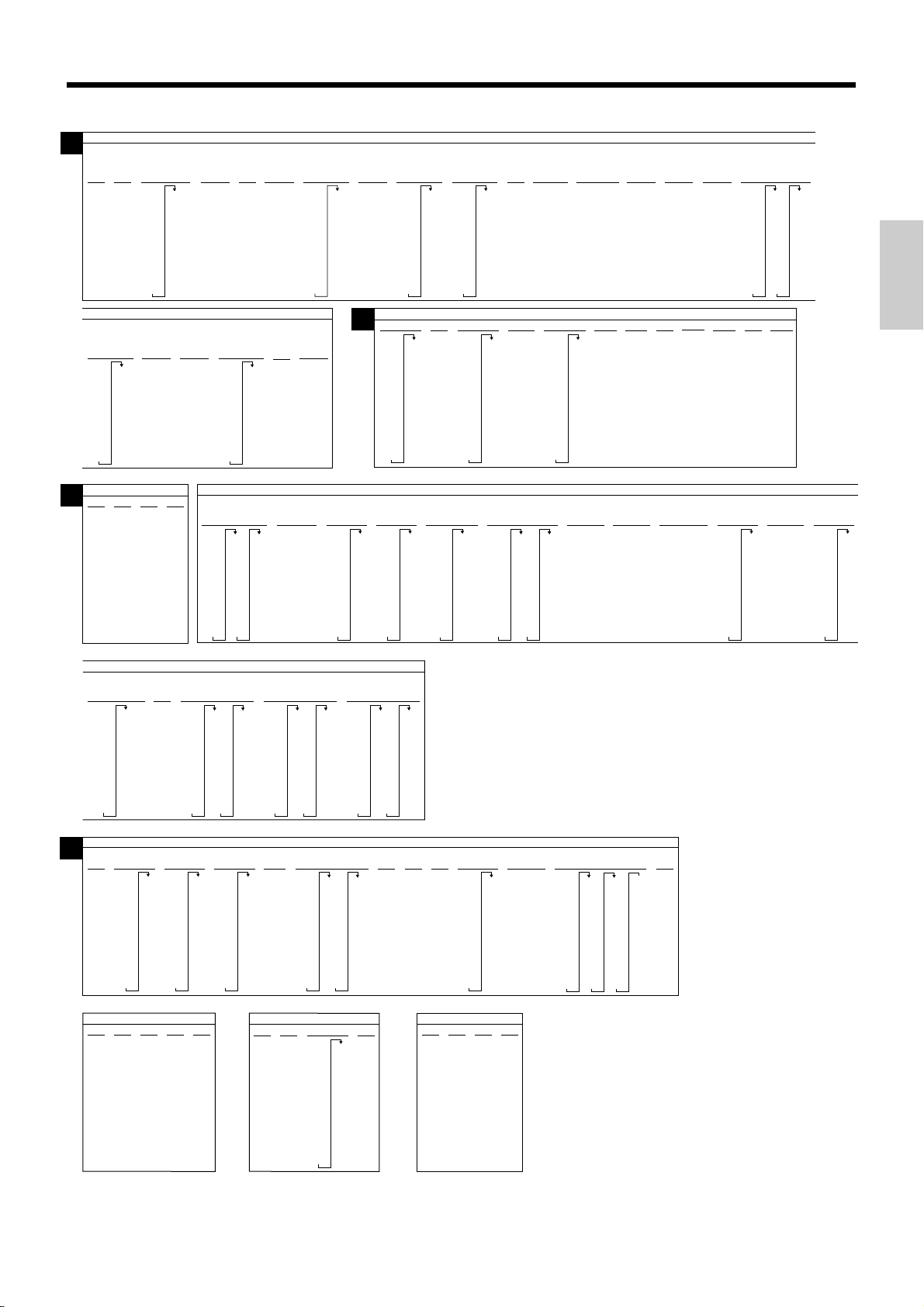

Programming for the U.S. tax tables procedure

Find your state in the table (page 14 ~ 17) and input the data shown in the table.

State sales tax calculation data tables for all of the states that make up the United States are included

on the following pages. This data is current as of October 30, 1994.*

*Some data are revised after Oct. 30, 1994.

Important!

Be sure you use the state sales tax data specifically for your state. Even if your

state uses the same tax rate percentage as another state, inputting the wrong data

will cause incorrect result.

Getting Started

Programming procedure

Example 1 (Alabama 6% sales tax to Tax Table 1) Example 2 (Colorado 5.25% sales tax to Tax Table 2)

A

4%

110

ALABAMA

5%

6%

6%

0

0

0

1

1

1

1

1

1

10

10

8

30

29

24

54

73

20

49

41

40

69

58

55

89

70

110

90

109

Assign Tax Table 1

Terminate program

6%

7%

8%

(4+1+1)

0

0

0

0

1

1

1

1

1

1

1

1

10

9

7

6

20

21

18

36

35

31

54

49

43

70

64

56

85

78

68

110

92

81

107

93

106

CAL

REG

OFF

RF

PGM

X

Z

Mode Switch

4

PGM

A-A08

3s

4

0125s

0

1

1

8

24

41

58

G

G

G

G

G

G

G

4

0a

4

1a

4

1a

4

8a

4

24a

4

41a

4

58a

G

4

s

G

COLORADO

LOVELAND

5%

5%

4.5%

0

211

0

233

1

255

5

277

17

299

33

55

77

99

122

144

166

188

0

1

1

2

1

17

18

29

18

49

51

68

84

118

Assign Tax Table 2

(Table 3:0325)

5.25

5002

Terminate program

5.25%

5002

5.5%

5.25

172

0

190

1

209

6

227

17

245

27

263

45

281

63

299

81

99

118

136

154

CAL

REG

OFF

RF

PGM

X

Z

Mode Switch

4Z

3s

4Z

G

0225s

4

G

5^25a

4

G

5002a

G

4

s

PGM

A-A08

13

Page 14

Getting Started

C

U.S. TAX TABLES

ALASKA

HOMER

108

127

108

124

5.5%

0

145

1

163

1

181

8

208

27

227

45

245

63

263

81

281

99

299

308

327

6%

141

0

158

1

7

10

22

39

56

73

90

345

363

381

408

6.25%

10

21

37

54

70

86

103

119

6%

159

6

179

2

199

29

219

29

239

49

259

69

259

89

279

109

300

109

129

159

6.5%

130

0

0

146

1

1

161

7

7

176

10

192

20

207

35

223

51

238

67

253

83

269

99

284

115

299

6.75%

6.75

5002

111

A

4%

0

1

1

10

30

54

73

110

7.25

5002

103

23

38

53

69

84

99

115

130

146

7.25%

10

20

32

46

60

74

88

ARIZONA

6.5%

0

1

7

7

117

131

0

161

176

192

207

223

238

253

269

284

299

4%

0

1

1

12

37

0

10

20

34

48

64

80

96

6% 6.8%

5%

0

175

0

1

191

1

5

9

10

10

27

22

47

39

68

56

89

73

109

90

107

125

141

158

CALIFORNIA

7%

121

0

278

135

1

292

149

8

307

164

10

178

20

192

33

207

47

221

62

235

76

249

91

264

107

5%

110

10

29

49

69

89

0

1

1

7.25%

7.25

5002

111

126

141

6%

22

37

52

67

82

97

24

41

58

6.7%

0

1

7

7

ALABAMA

6%

0

1

1

8

20

40

55

70

90

109

156

171

186

201

216

231

246

261

276

291

7.5%

0

1

3

6

19

33

46

59

73

0

1

1

9

(4+1+1)

110

0

1

3

6

21

36

50

65

80

95

109

124

139

7.75%

7.75

5002

6%

7%

8%

0

0

107

8.25%

8.25

5002

0

1

1

1

1

7

6

21

18

35

31

49

43

64

56

78

68

92

81

93

106

7%

345

359

374

389

21

403

35

418

49

433

64

448

78

452

92

477

107

492

506

8.5%

0

1

1

5

17

29

41

52

64

76

88

1

1

10

20

36

54

70

85

153

168

183

198

212

227

242

256

271

286

300

315

330

0

1

1

7

111

123

135

147

158

170

182

194

205

LOS ANGELES

Parking

99

11

99

99

99

99

99

99

99

99

KENAI

2%

10%

0

1

0

1

1

25

75

104

114

124

134

144

154

HOMER/

SELDOVIA

3%

0

1

4

34

49

83

116

150

183

216

3%

4%

0

0

1

1

1

1

12

14

37

44

74

114

99

99

3%

0

1

4

25

34

75

127

155

177

227

ARKANSAS

5%

6%

0

1

1

10

20

40

60

80

110

HAINES

4%

19

37

62

0

1

1

8

24

41

58

0

1

2

6.8%

0

1

2

6

19

33

46

JUNEAU

4%

0

1

1

12

37

7%

0

1

1

7

21

35

49

64

78

92

107

7.5%

19

33

46

ALASKA

KENAI

5%

0

1

6

13

25

46

75

79

118

127

151

0

1

2

6

KENAI,SEWARD

& SOLDOTNA

177

184

218

5%

109

0

1

1

09

29

49

69

89

D

1.5%

2%

0

0

1

1

1

1

33

24

99

74

166

233

6.5%

6.45%

6.45

5002

0

17

17

23

38

53

69

84

99

115

130

DISTRICT OF COLUMBIA

D.C.

D.C.

5%

5.75%

0

5.75

1

5002

1

0

10

8

22

42

82

62

110

0

1

2

2.5%

COLORADO

7.25

5002

0

1

1

9

5%

0

1

2

17

29

49

7.3%

0

1

3

6

20

34

47

61

75

89

102

116

Combined

5.25%

5.25

5002

LOVELAND

5%

0

1

1

18

18

51

68

84

118

130

143

157

171

6%

16

33

50

66

83

109

0

1

1

9

7.5%

17

19

33

46

59

73

5.25%

5.25

5002

0

1

3

FLORIDA

5002

6.2%

6.2

106

6.1%

0

1

8

6%

108

124

6%

6.1

0

165

182

199

217

7%

0

1

2

8

24

21

41

35

58

49

74

64

91

78

92

107

7.5%

93

0

106

1

120

1

133

9

146

13

160

26

173

40

186

53

209

66

80

5002

1

0

2

17

17

24

41

58

74

7.5%

8%

0

0

19

33

46

59

73

G

0

1

1

3

1

6

6

18

31

3%

0

1

1

10

35

66

110

1

1

7

5.5%

0

1

6

17

27

45

63

81

99

118

136

154

8%

0

1

1

6

18

31

43

56

68

81

93

172

190

209

227

245

263

281

299

PANAMA

CITY

BEACH

6.5%

107

0

123

1

138

1

153

9

169

15

184

30

209

46

61

76

92

115

132

150

16

25

43

61

79

97

5.6%

0

1

7

103

122

141

160

179

5.25%

0

1

2

16

27

46

65

84

0

1

1

9

14

28

42

57

71

85

168

186

204

222

240

7%

5.75%

17

26

43

60

78

95

113

130

147

CONNECTICUT

198

218

109

6.35%

6.35

5002

GEORGIA

4%

5%

0

1

1

10

25

50

75

110

110

6.4%

6.4

5002

0

17

HAWAII

H

6%

0

0

1

1

1

1

10

10

20

20

40

35

60

50

80

67

85

110

4%

0

1

1

12

37

3.5%

3%

0

1

1

19

59

146

161

176

192

207

223

D.C.

6%

12

17

35

53

71

89

112

0

0

1

1

2

3

17

17

42

49

71

83

99

116

128

149

183

6.6%

6.6

5002

D.C.

6%

0

1

1

108

124

157

152

185

180

214

208

242

236

7%

0

1

4

17

21

35

49

64

78

92

107

121

D.C.

8%

0

0

1

1

1

1

8

12

24

16

41

27

58

39

74

50

91

62

75

90

112

17

41

69

97

135

149

3.6%

0

1

5

16

27

38

49

61

72

83

94

D.C.

0

1

6

6

264

291

319

347

375

9%

7.01%

7.01

5002

105

116

127

138

149

161

0

17

21

35

49

64

3.85%

0

1

2

16

37

63

COLORADO

7.1%

7.1

5002

F

4%

4.5%

0

1

2

17

37

62

25

50

75

109

125

150

104

118

0

1

5

9

7.2%

17

20

34

48

62

76

90

4%

211

0

233

1

255

5

277

17

299

33

55

77

99

122

144

166

188

7.25%

131

0

145

1

159

2

173

187

201

215

229

243

256

5%

175

209

20

40

60

80

109

14

Page 15

3%

115

IDAHO

4%

0

0

1

1

2

1

11

15

32

42

57

72

115

137

160

183

205

15

27

49

71

93

4.5%

0

1

2

227

5%

0

1

2

11

25

45

1%

148

1.25%

2%

5%

6%

0

0

0

0

109

129

0

1

1

6

1

12

8

25

24

46

41

67

58

88

1

1

119

1

1

1

39

24

74

1

49

I

6.25%

23

ILLINOIS

6.75%

6.75

5002

7%

22

36

50

65

79

93

108

6.5%

0

161

0

1

176

1

1

192

1

7

207

7

23

38

53

69

84

99

115

130

146

7.75%

7.5%

0

0

1

1

8

7.75

1

5002

1

0

6

6

19

33

46

8%

8.75%

0

8.75

1

5002

1

0

6

5

18

31

148

1%

0

1

1

49

INDIANA

5%

0

1

1

9

29

MARION County

4%

0

1

2

15

37

62

112

137

5%

15

37

49

62

87

0

1

2

RESTAURANT

6%

0

1

1

9

29

49

49

69

89

109

IOWA

4%

0

1

3

12

37

50

75

5.9%

5.9

5002

0

8

MARYLAND

4%

0

1

2

24

25

50

0

1

2

4.1%

5002

KANSAS

4.5%

0

4.1

1

1

0

11

12

33

55

77

99

122

144

166

188

211

4%

3%

0

0

1

1

2

2

12

16

37

49

62

82

87

116

112

149

7%

8.5%

0

0

1

1

1

1

7

5

21

17

35

29

49

41

64

52

78

64

92

76

107

88

99

111

112

132

153

173

193

4.5%

123

135

147

158

170

182

194

205

10

30

51

71

91

122

144

166

188

211

4.9%

214

0

479

744

499

765

520

785

540

806

561

826

581

846

602

867

622

887

642

908

663

928

683

948

704

969

724

989

LOUISIANA

6%

0

1

2

8

24

41

58

74

6%

0

0

1

1

1

6

8

24

41

58

74

91

108

115

130

146

17

23

38

53

69

84

99

1010

6%

0

1

7

7%

107

21

35

49

64

78

92

234

1

255

1

275

295

316

336

357

377

397

418

438

459

5%

0

0

1

1

6

1

10

11

27

33

47

55

67

77

87

99

109

129

5%

11

26

47

68

88

109

129

5.25%

5%

0

5.25

1

5002

1

9

29

7.5%

7%

0

161

1

176

1

192

7

207

21

223

35

238

49

253

64

269

284

299

315

330

MISSISSIPPI

7.25%

144

0

0

158

1

1

172

1

1

186

7

6

199

20

213

34

227

48

241

62

255

75

268

89

282

103

296

117

310

131

5.4%

194

0

435

212

1

453

231

1

472

249

9

490

268

27

509

287

46

305

64

324

83

342

101

361

120

379

138

398

157

416

175

8%

9%

0

0

1

1

7

2

4

6

16

324

337

351

365

379

393

406

106

16

29

27

42

38

55

49

67

61

80

72

93

83

94

105

8%

0

1

1

6

18

31

43

56

68

81

93

106

19

33

46

59

27

45

63

81

99

118

136

154

172

M

0

1

1

5

8.5%

123

0

135

1

147

1

158

5

170

17

182

29

194

41

205

52

64

76

88

99

111

5.5%

0

1

1

9

5%

110

10

20

40

60

80

105

5.65%

5.65

190

5002

209

0

8

MAINE

7%

6%

0

0

1

1

9%

0

1

1

5

16

27

38

49

61

72

83

94

16

33

50

66

83

109

9.25%

9.25

5002

7

1

2

1

0

9

7

21

35

49

64

78

92

100

0

5

Getting Started

6%

24

41

58

74

91

108

0

1

7

8

Meals Tax

0

1

1

8

6.15%

6.15

5002

5%

0

1

7

99

99

99

99

99

100

120

140

K

0

8

2.5%

19

59

99

139

179

KANSAS

6.4%

6.4

5002

0

7

MASSACHUSETTS

5%

0

1

1

9

29

6%

24

41

58

74

91

108

124

141

158

5%

0

1

2

19

20

40

0

1

1

118

140

162

183

205

3%

116

6.5%

6.5

5002

4.625%

0

1

13

10

32

54

75

97

3.1%

3.25%

3.5%

0

3.1

5002

5%

15

26

36

47

57

68

78

89

99

16

29

0

9.5%

0

1

1

5

0

1

1

9

110

121

131

142

152

163

173

184

194

107

138

169

199

230

261

292

0

1

1

15

46

76

MICHIGAN

1

1

16

49

83

0

7

227

248

270

291

313

335

356

378

399

421

443

10%

4%

108

135

162

187

0

323

1

353

1

384

14

415

0

1

1

4

14

24

34

44

54

64

74

84

94

0

1

7

12

31

54

81

42

71

99

128

157

185

KENTUCKY

6%

0

1

2

10

24

41

58

74

91

108

124

109

129

13

39

66

93

119

146

173

199

226

253

5%

0

1

6

10

25

46

67

88

3.75%

0

1

1

6%

24

41

58

74

6%

24

41

58

0

1

2

8

0

1

1

8

279

306

333

359

386

413

4%

0

1

1

12

37

62

87

112

L

MINNESOTA

6.5%

0

1

1

7

23

38

53

69

84

99

115

130

146

161

176

192

207

2%

124

174

224

24

74

4.225%

11

35

59

82

6.475%

0

1

13

7

23

38

54

69

84

100

115

131

146

MISSOURI

4.625%

0

1

13

10

32

54

75

97

160

175

190

227

248

270

291

313

335

356

378

399

421

443

4.725%

6.725%

6.725

5002

116

137

158

179

201

0

1

4

10

31

52

74

95

4.6%

0

0

1

1

1

1

10

32

54

76

97

118

140

162

183

205

MISSOURI

6.55%

162

0

177

1

193

9

208

7

223

22

239

38

254

53

270

68

285

83

301

99

316

114

332

129

145

7.225%

7.225

5002

107

128

149

170

4.8%

0

0

1

1

3

3

10

10

22

43

65

86

N

114

135

156

177

10

31

30

52

50

72

70

93

90

110

130

150

170

190

3%

0

1

3

16

49

83

116

149

183

4.75%

4.975%

0

1

1

3.5%

128

157

185

214

242

271

211

14

42

71

99

5.05%

19

39

59

79

98

118

138

158

178

4%

0

0

1

1

3

2

14

37

62

5.225%

5.1%

0

122

144

166

188

211

4.5%

14

33

55

77

99

1

1

9

29

49

68

88

107

0

1

6

5.225

5002

NEBRASKA

5%

233

255

277

299

14

322

29

49

115

133

151

169

0

1

2

118

136

154

172

0

1

5

9

0

1

15

8

26

44

62

80

98

5.5%

0

1

2

14

27

45

63

81

99

5.6%

187

205

223

241

258

276

294

312

330

348

366

383

190

209

227

5.625%

26

44

62

79

97

115

133

151

168

6%

0

1

1

8

24

41

58

5.725%

0

5.725

1

5002

1

8

6.5%

0

1

1

7

23

38

53

69

84

99

115

130

146

161

176

192

207

108

125

142

158

5.975%

175

0

192

1

209

2

225

8

242

25

259

41

276

58

292

75

309

92

326

342

359

376

3%

0

1

2

14

49

83

116

149

118

157

185

214

242

271

14

38

64

88

3.5%

0

1

6

392

410

299

326

357

6.1%

0

1

1

8

24

40

57

73

90

5.75%

5.75

5002

6.225%

24

40

56

72

88

104

120

136

152

0

1

2

8

6%

0

1

2

8

24

41

58

74

168

184

200

216

232

248

265

NEVADA

6.25%

23

39

55

71

87

103

119

135

151

6.3%

0

1

8

7

23

39

55

71

87

103

119

134

150

167

0

183

1

199

2

215

7

166

182

198

214

230

246

115

130

146

23

38

53

69

84

99

6.5%

0

1

1

7

6.425%

0

1

1

7

23

38

54

70

85

101

116

132

147

161

176

192

207

163

178

194

210

225

241

256

272

287

6.75%

6.75

5002

22

37

7%

0

1

0

1

7

7

21

35

49

64

78

92

107

15

Page 16

Getting Started

N

NEW HAMPSHIRE

7%

129

0

143

1

158

8

172

14

186

26

201

39

51

63

75

88

101

115

NEW MEXICO

6.1875%

6.187%

0

6.1875

1

5002

4

9

23

40

56

72

88

104

120

136

153

4%

3%

0

0

1

1

5

4

9

9

29

35

59

70

84

116

112

149

137

183

216

Rooms & Meals

7%

128

0

142

1

157

8

171

35

185

35

200

38

50

62

74

87

100

114

0

8

NORTH CAROLINA

4.5%

5%

0

188

1

211

6

233

9

255

25

277

53

299

75

322

95

122

144

166

109

129

Rooms & Meals

8%

0

1

4

35

35

35

37

50

62

5%

4%

0

0

1

1

6

5

10

12

27

33

47

58

67

83

87

112

109

137

129

CHROKEE

Reservations

6%

0

1

6

8

23

48

67

85

NEW JERSEY

3%

3.5%

0

0

1

1

1

1

14

17

42

41

71

71

100

117

128

157

185

214

5.25%

5.75%

5.25

5.75

6%

5002

24

41

58

74

91

0

1

7

10

22

38

56

72

88

108

124

3%

0

1

3

0

15

1

33

2

67

8

100

133

166

200

5002

0

1

2

10

24

41

58

74

108

124

7%

6%

150

0

0

164

1

1

178

1

8

100

125

192

10

207

21

35

50

64

78

92

107

121

135

6.25%

0

1

7

10

22

38

54

70

86

103

119

4%

4%

0

0

1

1

5

2

15

15

31

25

51

50

71

75

100

125

10

22

38

56

72

88

110

6%

141

158

120

146

173

200

226

253

6.5%

130

0

146

1

161

1

176

7

192

23

207

38

53

69

84

99

115

NORTH DAKOTA

5%

0

1

2

15

20

40

110

128

146

164

3.75%

0

1

6

13

40

67

93

5.5%

0

1

2

15

19

37

55

73

91

6.75%

6.75

5002

280

306

333

359

NEW YORK

182

200

219

107

6%

4.25%

0

1

1

11

35

58

82

105

129

152

176

199

223

7%

0

1

8

10

20

33

47

62

76

91

0

1

3

15

17

34

50

67

84

121

135

149

164

178

192

207

108

124

139

154

247

270

294

317

341

364

388

411

15

31

47

62

77

93

6.5%

0

1

2

7.25%

7.25

5002

170

185

200

216

231

4.375%

11

34

57

79

102

125

148

171

194

217

4.5%

239

0

1

4

100

122

144

167

189

211

7.5%

113

0

126

1

139

8

10

18

31

45

58

71

85

99

7%

8%

0

0

1

1

2

3

15

15

15

15

29

25

43

38

58

50

72

63

86

75

100

88

115

100

11

33

55

78

0

1

1

4.875%

4.875

ERIE

8%

0

1

10

10

17

29

42

55

67

80

92

O

5002

NEW MEXICO

5.175%

5.175

5002

SUFFOLK

County

105

0

119

1

131

9

144

10

17

29

42

54

67

79

92

5%

0

1

2

15

20

40

5.375%

5.575%

5.575

5002

MEIGS

0

1

3

16

17

34

50

67

83

100

117

5.75%

5.75

5002

Co.

6%

6.25%

134

0

1

2

15

16

32

5.25%

5.375

199

0

5002

217

1

11

9

28

47

66

85

104

123

142

161

180

8%

8.25%

8.5%

8.25

146

164

182

200

218

5002

5.75%

5.75

5002

8.5

5002

OHIO

100

117

6%

0

1

2

15

17

34

50

67

83

109

127

106

118

131

5.5%

0

1

2

15

18

36

54

72

90

0

1

3

15

15

30

46

61

76

92

107

PENNSYLVANIA

P

6%

0

1

1

10

17

34

50

67

84

110

T

0

1

1

11

33

55

77

99

122

144

166

6.5%

4.5%

123

138

153

169

184

200

215

230

188

211

110

117

134

OHIO

CUYAHOGA

Co.

115

128

5.5%

154

172

190

209

227

245

263

281

299

318

336

7%

115

0

128

1

3

15

15

28

42

57

71

85

100

RHODE ISLAND

R

6%

26

42

57

73

90

106

123

140

6%

354

372

390

7.75%

7.75

5002

7%

0

0

1

1

6

5

9

7

21

35

49

64

78

92

107

121

135

6.25%

0

0

1

1

2

2

10

10

24

23

41

39

58

55

74

71

87

7%

0

1

3

15

15

28

42

57

71

85

100

7%

150

0

150

1

167

5

184

10

210

17

217

34

234

50

250

50

250

67

84

0

1

11

10

27

45

63

81

99

119

136

149

164

178

192

207

221

235

249

264

115

10

23

38

53

69

84

99

6.5%

0

1

2

130

146

161

176

192

207

223

2%

0

1

1

24

74

S

3.25%

3%

0

0

1

1

1

7

16

15

49

46

83

76

116

107

138

169

199

230

261

292

SOUTH CAROLINA

4%

5%

0

1

5

10

10

25

20

50

40

75

60

112

80

137

109

129

6.75%

125

0

140

1

155

8

170

10

185

22

199

37

214

51

229

66

244

81

259

96

274

111

323

353

384

415

446

476

507

538

569

599

CHARLESTON

0

1

6

TENNESSE

7%

121

0

1

2

10

21

35

49

64

78

92

107

4%

6%

108

124

12

37

0

1

1

0

1

2

10

24

41

41

58

74

91

4.25%

4.25

5002

COUNTY

TAX

7.25%

0

1

10

10

20

34

48

61

75

89

103

117

130

144

158

172

185

4.5%

121

144

11

33

55

77

99

0

1

2

7.5%

5%

29

4%

0

1

1

12

37

7.75%

0

1

2

10

19

33

46

59

0

1

1

9

5002

7.75

5%

10

30

5.25%

5.25

5002

0

1

1

8%

OKLAHOMA

6%

0

1

1

8

24

41

58

SOUTH DAKOTA

5.5%

190

0

210

1

1

10

28

46

64

82

100

118

136

154

172

0

0

1

1

2

2

10

10

18

18

31

31

43

43

56

68

81

93

6.25%

8%

23

109

106

118

6.725%

7%

7.25%

7.375%

8%

8.25%

9.25%

10.25%

0

6.725

0

7.25

7.375

0

0

0

1

5002

1

5002

5002

1

1

7

6%

0

1

1

9

26

43

60

76

92

115

130

146

8.25%

8.25

5002

23

38

53

69

84

99

6.5%

0

1

1

7

161

176

192

207

108

122

6

8

22

37

51

65

79

94

107

121

135

8.5%

0

111

1

123

2

135

10

147

17

158

29

170

41

182

52

194

64

205

76

217

88

0

6

7%

0

149

1

4

7

21

35

49

64

78

92

8.75%

99

8.75

5002

1

1

1

6

6

18

18

31

30

42

54

66

78

90

103

0

1

1

4

1

5

4

16

14

27

24

37

34

48

43

59

70

81

91

16

Page 17

T

7.75%

0

1

5

6

19

32

45

58

70

83

5.125%

5%

0

5.125

1

5002

1

9

29

49

69

104

123

142

8.25%

8%

96

0

109

122

135

148

161

174

187

8.25

1

5002

1

6

18

31

5.25%

0

1

12

9

28

47

66

85

161

180

199

219

238

5.375%

5.375

5002

U

115

136

157

178

199

4.75%

10

31

52

73

94

206

230

254

278

303

327

351

375

399

424

7.5%

TEXAS

0

1

1

6

19

33

46

59

73

86

4.625%

4.625

5002

4%

107

4.125%

0

0

1

1

1

1

12

12

36

37

60

62

84

87

109

133

157

181

7.25%

7.25

5002

4%

0

1

1

12

37

7%

0

1

1

7

21

35

49

64

78

92

TEXAS

5.5%

0

1

1

9

27

45

63

81

99

118

137

221

0

242

1

263

1

284

305

326

347

368

389

410

155

173

191

209

5.625%

26

44

62

79

97

115

133

5%

0

1

1

9

29

104

123

142

161

180

0

1

1

8

5.25%

0

1

1

9

28

47

66

85

151

168

199

219

238

257

276

295

314

333

352

371

390

409

6%

0

1

1

8

24

41

58

5.375%

27

46

65

83

102

0

1

1

9

DALLAS

6%

0

1

1

9

25

42

59

27

45

63

81

99

118

136

154

172

5.5%

0

1

1

9

HOUSTON

(Harris

County)

6%

108

UTAH

190

209

0

1

1

8

24

41

58

74

91

5.75%

5.75

5002

6.125%

6.125

5002

5.875%

5.875

5002

6.25%

6.25%

0

6.25

1

5002

1

7

23

39

55

71

87

103

119

6.125%

6%

0

8

24

41

58

74

6.25%

6.125

0

5002

1

0

2

8

8

6.75%

125

0

288

140

1

303

155

3

318

170

8

333

185

22

348

199

37

362

215

51

377

229

66

392

244

81

407

259

96

422

274

111

7%

0

1

4

7

23

27

47

63

107

437

7.25%

0

7.25

1

5002

2

7

21

35

49

64

78

92

V

3%

100

133

166

200

ROANOKE CITY

W

7%

107

VERMONT

4%

0

1

4

13

10

33

25

66

50

VA BEACH

8.5%

0

112

1

122

1

137

11

144

12

162

33

166

37

187

55

188

62

211

77

87

0

1

1

7

21

35

49

64

78

92

104

118

0

1

2

99

20

34

48

62

76

90

7.2%

0

1

1

6

100

120

140

131

5%

10

20

40

80

0

1

2

9%

5002

8%

0

1

0

18

31

43

56

68

81

93

100

NORFOLK CITY

0

9

1

6

11

33

44

44

55

55

77

77

7.3%

129

0

143

1

156

1

170

6

184

19

198

33

211

47

225

61

239

74

252

88

102

115

0

1

21

14

34

59

84

114

134

159

184

Meal tax

9%

99

99

122

122

144

144

166

166

188

188

211

113

4%

214

234

259

284

314

334

359

384

414

434

459

7.5%

0

1

1

6

19

33

46

59

73

86

99

484

512

537

VIRGINIA

211

233

233

126

139

153

166

179

193

206

ARLINGTON

COUNTY

4%

0

1

2

12

37

62

87

112

137

CITY OF RICHMOND

Food tax

9.5%

205

89

0

99

1

110

1

121

5

131

15

142

26

152

36

163

47

173

57

184

68

194

78

7.55%

4.125%

0

0

1

1

3

2

6

7

19

19

32

33

46

46

59

59

72

72

85

98

111

4.5%

188

0

211

1

233

5

255

15

277

33

299

55

77

99

122

144

166

0

1

1

9

11

29

33

49

55

69

77

WASHINGTON

282

124

138

151

164

177

190

203

217

230

243

256

269

FAIRFAX

5.5%

0

1

4

11

14

33

55

77

99

122

144

9.5%

89

99

109

122

129

144

149

166

169

188

189

7.8%

7.8

2

0

7

19

32

44

57

70

83

FAIRFAX CITY

149

166

188

211

233

249

255

122

209

7.9%

0

1

2

6

18

31

44

56

Meals tax

6.5%

0

1

1

11

24

33

55

74

77

99

8%

0

1

1

6

18

31

124

144

166

174

188

211

104

14

18

30

43

55

67

80

92

8.1%

0

1

6

117

129

141

154

166

179

191

203

114

0

1

13

14

29

34

44

59

74

84

VIRGINIA

HAMPTON

Restaurant

7%

114

134

149

159

184

184

214

214

234

249

259

Combined

8.1%

8.1

2

0

6

18

30

43

55

67

80

284

LEESBURG

Meal tax

7%

107

0

1

1

6

18

30

42

54

67

79

91

103

21

35

49

64

78

92

115

128

140

152

164

176

189

201

213

225

237

249

0

1

1

7

8.2%

RICHMOND

Restaurant

7%

0

1

1

14

14

34

59

59

84

84

114

408

262

420

274

432

286

445

296

457

310

469

323

481

335

493

347

506

359

371

384

396

ALEXANDRIA

7.5%

7.5

5002

8.7%

0

1

1

5

17

28

NEWPORT

NEWS

7.5%

116

0

122

1

144

1

149

11

166

16

183

33

188

49

211

55

77

83

99

RICHMOND

7.5%

0

1

2

6

19

33

46

59

Restaurant

8%

0

1

5

14

34

44

44

59

59

84

84

114

114

134

134

159

Getting Started

WEST VIRGINIA

2%

3%

0

1

2

25

50

100

100

135

4%

5%

6%

0

0

0

1

1

2

1

5

12

35

37

70

0

1

1

2

2

5

5

20

16

40

33

50

67

84

100

116

4%

12

37

0

1

1

WISCONSIN

5%

0

1

1

10

21

41

61

81

110

118

136

154

172

27

45

63

81

99

5.5%

0

1

1

9

190

209

5.6%

116

133

0

1

1

8

26

44

62

80

98

3%

116

149

0

1

2

24

49

83

WYOMING

4%

5%

0

1

2

24

24

37

29

62

49

69

89

109

6%

0

0

1

1

2

3

24

24

34

51

68

84

17

Page 18

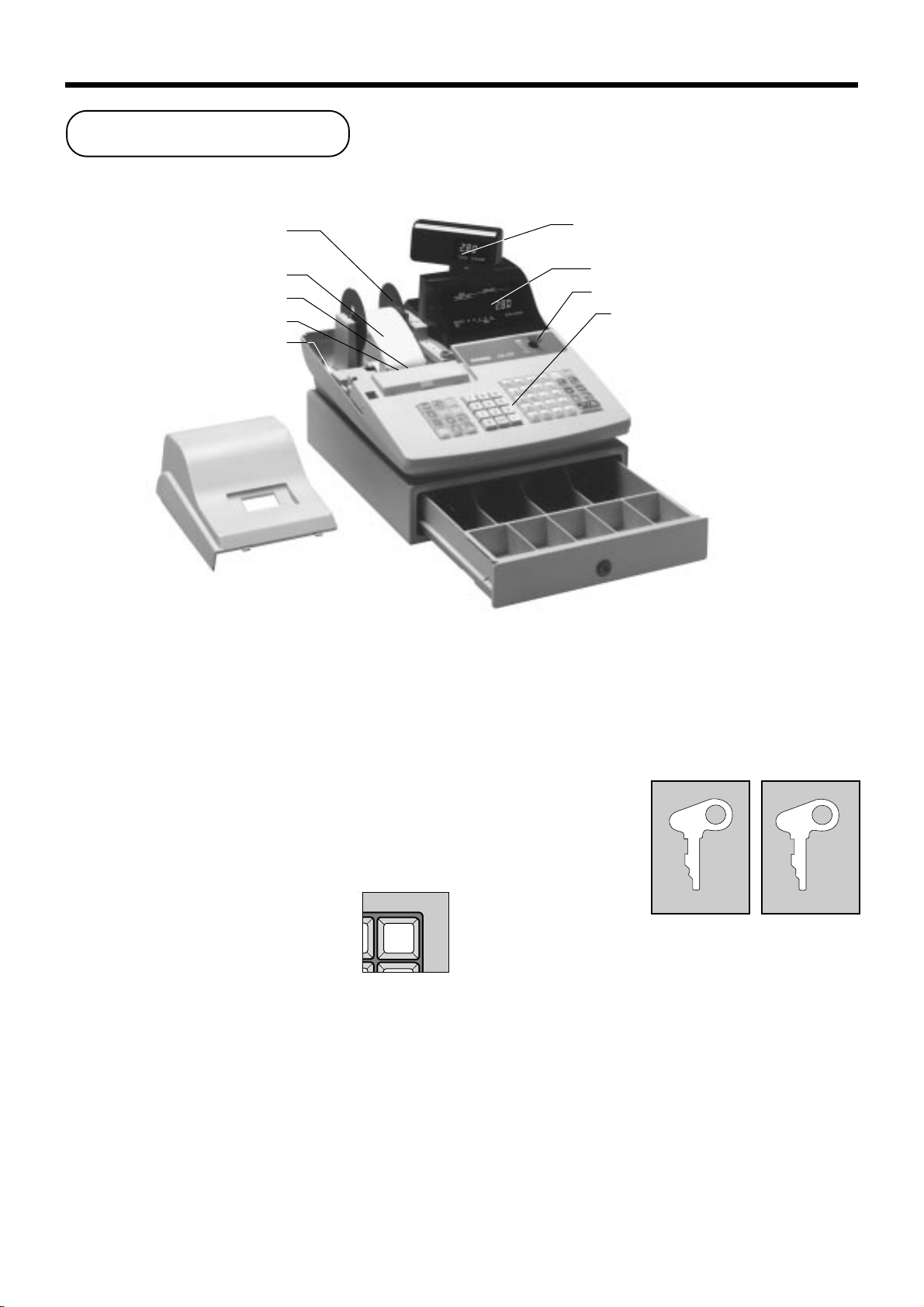

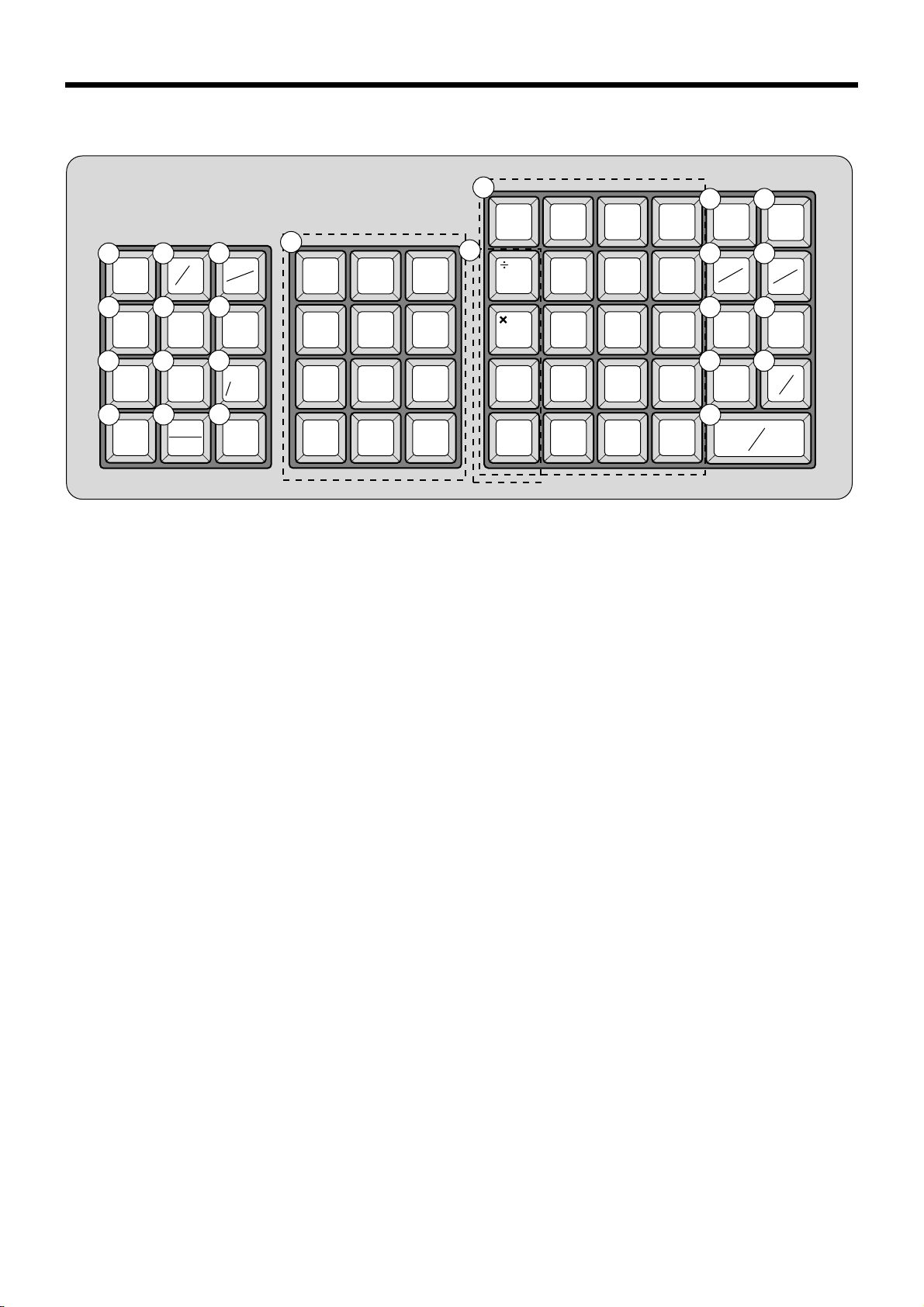

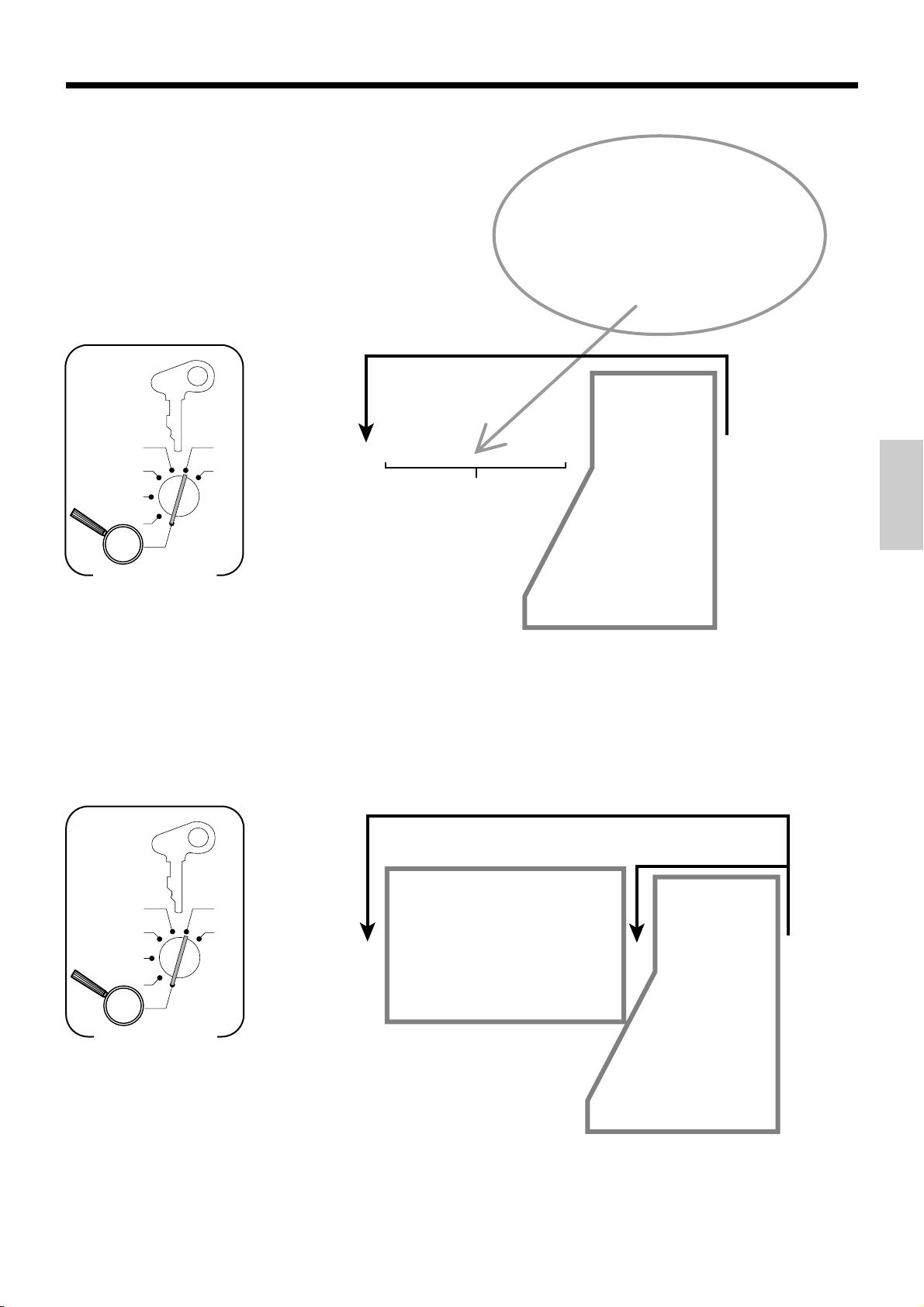

Introducing CE-280

General guide

This part of the manual introduces you to the cash register and provides a general explanation of its various parts.

Take-up reel

Roll paper

Printer

Printer ink ribbon

Battery compartment

Printer cover

Battery compartment

Holds memory backup batteries (page 8).

Roll paper

You can use the roll paper to print receipts and a journal

(page 9 ~ 11).

Pop-up display

Main display

Mode switch

Keyboard

Drawer

Drawer lock

Mode key

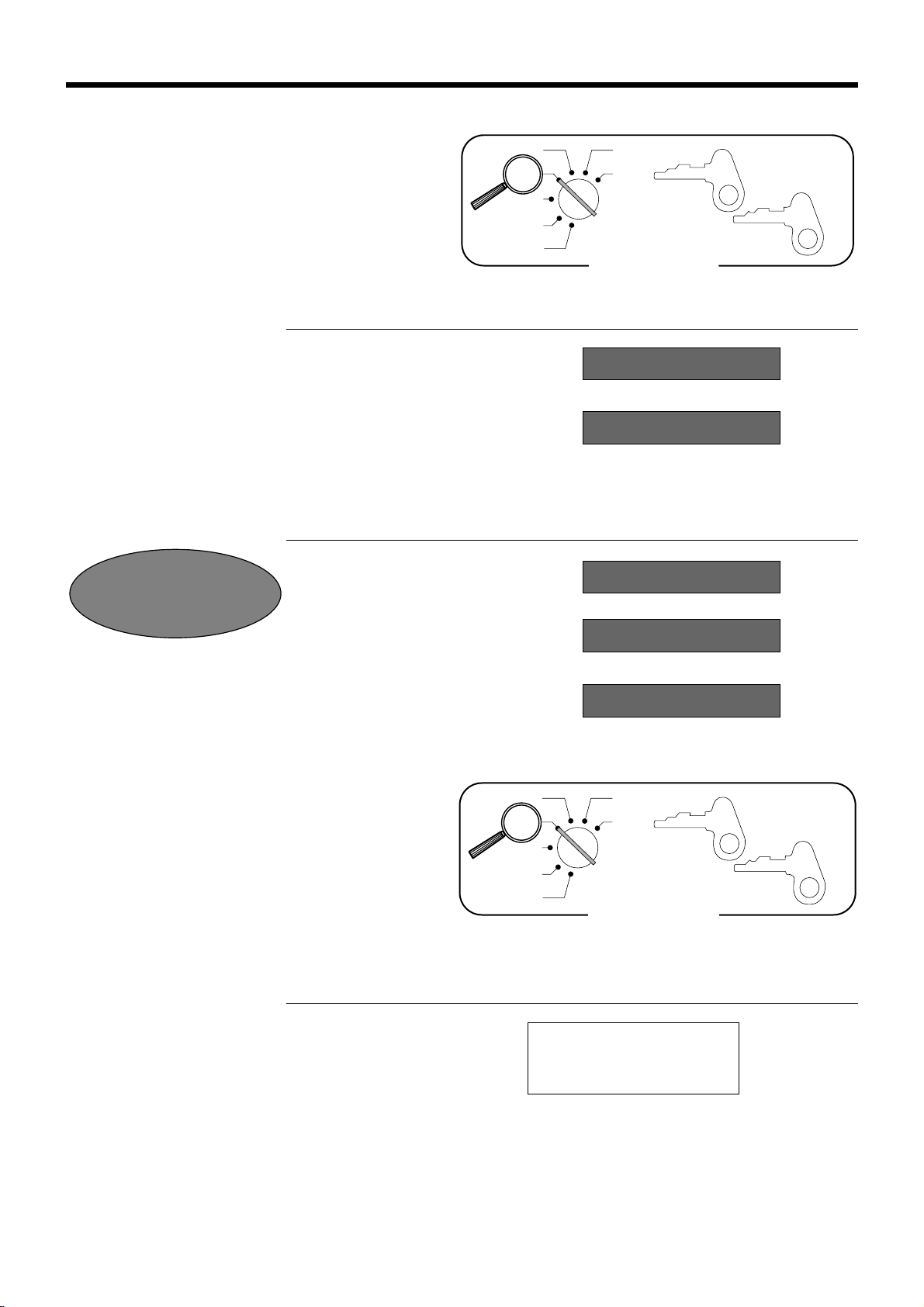

There are two types of mode keys: the program key

(marked "PGM") and the operator key (marked "OP").

The program key can be used to set the mode switch to

any position, while the operator key can select the

REG, CAL and OFF position

Printer ink ribbon

Provides ink for printing of registration details on the

roll paper (page 6, 91).

Receipt on/off key

When you are using the printer for receipt

printer, you can use this key (in the REG

and RF modes only) to turn the printer on

RECEIPT

ON/OFF

and off. If a customer asks for a receipt

while receipt printing is turned off by this

key, you can issue a post-finalization receipt (page 49).

Note: Instead of the receipt on/off switch, receipt

issuance is controlled by this key .

18

PGM

A-A08

OP

A-A08

Program Operator

key key

Page 19

Mode switch

Use the mode keys to change the position of the mode

switch and select the mode you want to use.

CAL

REG

OFF

RF

PGM

X

Z

Mode Switch

—————————————————————————————————

Z RESET

—————————————————————————————————

X READ

—————————————————————————————————

CAL

—————————————————————————————————

REG REGISTER Use this mode for normal registration.

—————————————————————————————————

OFF STAND-BY Cash register standing by.

—————————————————————————————————

RF REFUND Use this mode to register refund transaction.

—————————————————————————————————

PGM PROGRAM

Mode Name Description

CALCULATOR

Drawer

The drawer opens automatically whenever you finalize

a registration and whenever you issue a read or reset

report. The drawer will not open if it is locked with the

drawer key .

Drawer lock

Use the drawer key to lock and unlock the drawer.

Reads sales data in memory and clears the data.

Reads sales data in memory without clearing the data.

Use this mode for calculator.

Use this mode for cash register programming.

Introducing CE-280

When the cash drawer does not open!

In case of power failure or the machine is in

malfunction, the cash drawer does not open

automatically. Even in these cases, you can open the

cash drawer by pulling drawer release lever (see

below).

Important!

The drawer will not open, if it is locked with a drawer lock key.

19

Page 20

Introducing CE-280

Displays

Main Display Pop-up display