Page 1

Ethernet over Copper

Application Primer and Product Guide

New Prots from Old Copper

Learn how to drive new revenue growth with multi-megabit

Ethernet services over existing copper

Meet rising demand for access bandwidth in small/medium business, municipal, and

cellular backhaul applications, without the high capital cost of deploying ber

Offer...

• much more bandwidth than T1/E1 at lower cost

• Ethernet ease of use

• higher reliability of bonded pairs

• advanced networking services

• touchless provisioning

This guide will show you how.

Access for a Converging World

Page 2

Page 3

Your Opportunity

in Ethernet over

Copper Services

VINTRODUCTION

Demand for more bandwidth and service

sophistication continues to rise quickly across

every telecom segment. For small/medium

businesses, municipalities, and cellular

operators, obtaining higher-bandwidth

connectivity to the wide-area network is often

dicult. The cost of running fiber to the

premise is prohibitively high for many in these

segments, limiting them to the same T1/E1based services they’ve been using for years.

Fortunately, technology advances have brought

new life to copper loops. With Ethernet over

copper (also commonly referred to as EFM,

for Ethernet in the First Mile) solutions,

network operators can oer up to 15 Mbps

per pair, bonding up to 8 pairs together.

services that tie multiple locations together

seamlessly or monitor service levels with great

precision.

This application primer and product guide

will give you an overview of how to take

advantage of the clear opportunity in EFM

services — looking at:

• key drivers of demand in the relevant

market segments,

• how EFM technology can support

attractive new services targeted at these

segments,

• the ease of EFM implementation in a

scalable multi-service architecture,

• business cases for alternative operators,

and finally

These services oer advantages beyond raw

bandwidth, including very low capital costs,

the simplicity and ease of use of Ethernet,

higher reliability from fault-tolerant bonded

pairs, and the facility for advanced network

• how Zhone’s extensive EFM solution

portfolio can get you started quickly and

scale with you eciently as your EFM

business grows.

A C CE S S FO R A C O N V ER G I NG WO R L D

3

Page 4

4 Z HO N E T E CH N O LO G I ES E T H E RN E T O V ER CO P P ER

Customer Demand for Advanced

Services

The customer segments for which EFM-based services are

potentially valuable fall into two distinct groups. The

first and broader group consists of small and mediumsized organizations with inherently information- or

communication-intensive activity. These organizations

include commercial businesses as well as smaller publicsector entities such as municipalities and schools — all

with reasonably similar networking requirements today.

The needs of smaller remote locations of larger organizations are also very similar, with a few specific requirements for cross-organization connectivity that go beyond

those of independent small businesses or organizations.

The second group is the cellular operator community, in

particular the last-mile backhaul connectivity to their cell

towers.

Changes in communication and information processing

are increasing demand for bandwidth and more sophisticated services in both groups. For small/medium organizations (or SMOs), applications continue to involve ever

richer content, with more and higher-resolution digital

imagery, and increasing amounts of video content and

videoconferencing. The software-as-service model is

growing robustly in these segments because of its attractive economics especially for smaller-scale operations,

increasing network trac along the way. For large

organizations with distributed operations, the steady

increase in data-driven processes and management

approaches is turning remote sites into essentially small

data centers. This is particularly prevalent in the retail

segment. The mission-critical role of IT in these distributed operations complicates and increases the importance

of high-uptime, seamless network connectivity.

For wireless operators, the advent of 3G smartphones

with easy-to-use interfaces and compelling networkbased applications has substantially accelerated growth in

cellular wireless data trac. This trac growth is quickly

outpacing the ability of operators to put up new cell sites

or tap new spectrum bands to accommodate it, so the

capacity utilization of existing sites continues to rise.

Since the capacity of a radio network is only as good as

the bandwidth of its connection back to the core

network, the rising utilization of 3G and 3.5G cell sites is

creating similarly rising demand for backhaul

connectivity.

Page 5

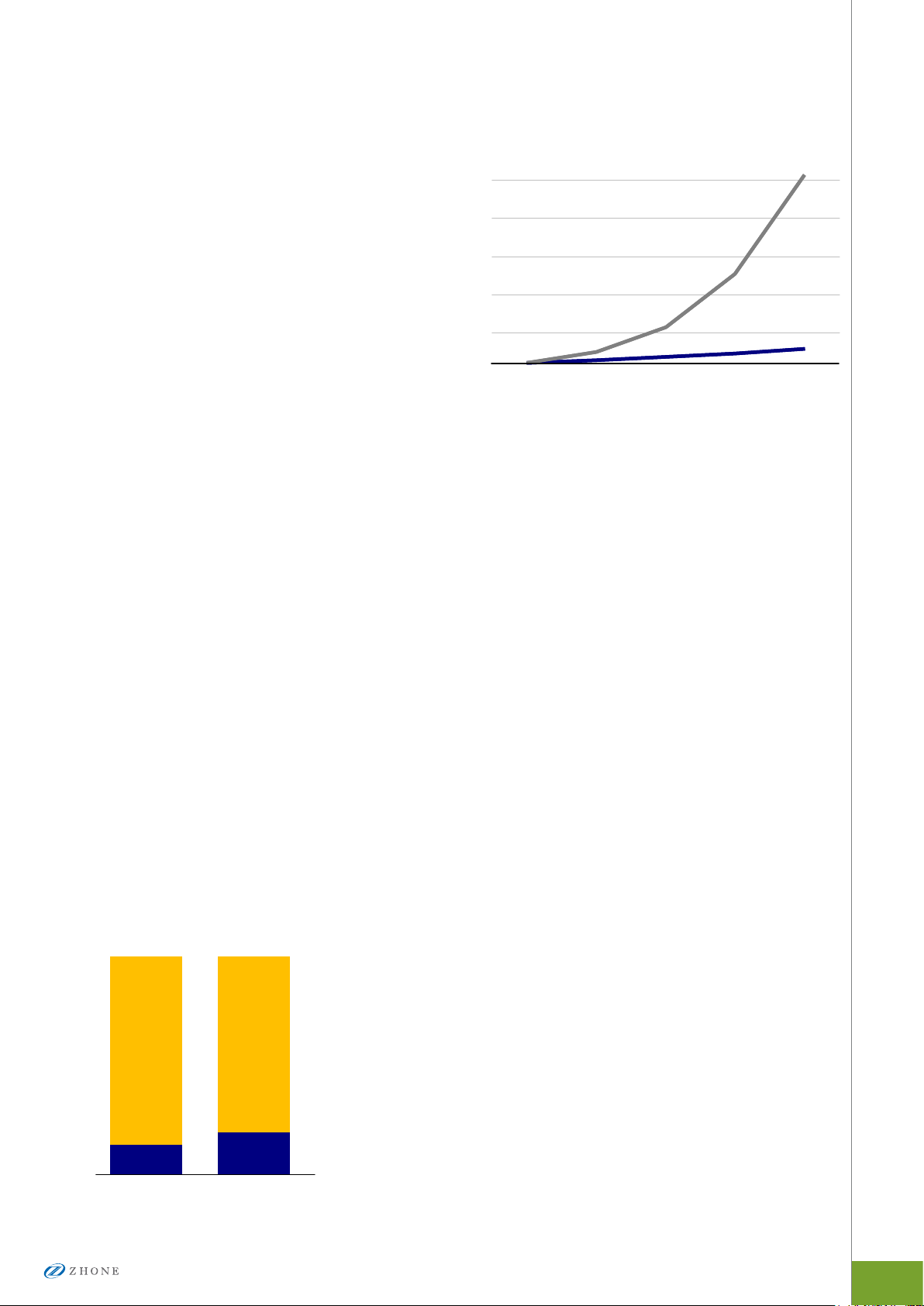

Forecasts aggregated from across the telecommunications

industry highlight clearly the magnitude of these changes

in non-residential wireline and cellular data trac —

with 32% and an astounding 125% compound annual

growth rates, respectively. Given the relatively slow

growth in the population of SMOs and cell sites, the

trac per location looks set to continue rising substantially.

The Opportunity in Last-Mile

Copper

While the telecom industry’s response to demand for

higher bandwidth is generally to push fiber closer to the

customer premise, for SMOs and many cell sites, there

are complications with that approach. While the forecast

trac growth rate in these segments is substantial, it’s

starting from a very small base — typically something on

the order of a 1.5 Mbps T1 or 2.0 Mbps E1 data service

line. For these smaller sites, it will take years of steady

trac growth to reach the point where service demand

and willingness to pay will justify the high costs of

running fiber to these premises. Unlike residential

neighborhoods where the cost of fiber deployment can be

more easily amortized over a number of subscribers, the

lower teledensity of SMOs and cell sites means the fiber

deployment business case for an individual location must

bear the full installation costs largely alone. Given these

realities, the slow rate of growth in fiber penetration to

businesses is unsurprising. One industry analyst, Vertical

IP Traffic Forecast

IP Traffic Forecast

(Normalized to 2009 = 100)

(Normalized to 2009 = 100)

2,500

2,500

2,000

2,000

1,500

1,500

1,000

1,000

500

500

100

100

2009 2010 2011 2012 2013

2009

Source: Cisco VNI 2009

2010 2011 2012 2013

Cellular Data

Cellular Data

(125% CAGR)

(125% CAGR)

Non-Residential

Non-Residential

(32% CAGR)

(32% CAGR)

Wireline

Wireline

Systems Group, reported in 2006 that only 13.4% of

businesses in the US were served by fiber. Two years later

their 2008 survey found just 19.1% penetration of fiber

connections in the business segment. The business case

for fiber deployment to these segments is obviously

improving, but at a modest rate that will leave the large

majority of these customers limited to copper-based

solutions for some time.

EFM Technology

Fortunately there is an excellent solution for these copperbound SMO and cell site applications in the form of

Ethernet over Copper, and in particular the industrystandard Ethernet in the First Mile technology (commonly referred to as EFM).

Last-Mile Fiber Penetration in SMO market.

100%

Copper

Fiber

2006

Source: Vertical S

A C CE S S FO R A C O N V ER G I NG WO R L D

y

2008

stems Grou

p

EFM in Context

To clarify terminology, it’s helpful to look at EFM in the

general context of the growing adoption of Ethernet.

Since Ethernet is taking dierent forms in access, distribution, and core networks, the jargon can be confusing.

The table on the next page provides a summary snapshot

of the various Ethernet technologies in use today outside

the LAN environment. The overlap between the application groupings (the horizontal axis) is the primary source

of confusion. The IEEE 802.3ah standard, the more

formal name for EFM, actually covers both fiber and

copper technologies. In practice, though, the term

“Active Ethernet” is used for 802.3ah standards over

point-to-point fiber, leaving EFM as the working term for

802.3ah over copper. The higher-speed Metro Ethernet

5

Page 6

6 Z HO N E T E CH N O LO G I ES E T H E RN E T O V ER CO P P ER

specification, coming out of the work of the Metro

Ethernet Forum, is used primarily for core and distribution network services over fiber and is not relevant to

SMO and cell site target segments under consideration

here. The last category, Pre-Standard Ethernet over

Copper, refers to the proprietary technology for Ethernet

on bonded copper loops that was originally developed by

a small company named Net to Net in the late 1990s and

acquired by Zhone in 2005. A number of Zhone customers continue to use this technology quite successfully.

One other term with some currency in the industry is

“carrier Ethernet” — used variously as an umbrella term

to refer to the services that operators can oer with any

of these technologies, or sometimes more specifically to

refer to Ethernet services in the core or distribution

networks. Our focus for the balance of this discussion is

on EFM over Copper, which in practice is usually shortened to just EFM.

How EFM Works

In simplest form, EFM is a straightforward combination

of packet data in Ethernet frames carried over an SHDSL

physical layer on one or more last-mile twisted pair

copper loops. An EFM connection is made between an

Ethernet access device (EAD) at the customer premise

and typically an EFM aggregation platform in the central

oce, or in some cases directly with an EAD at another

premise. EADs deliver WAN connectivity on the premise

through an Ethernet port to a standalone device or a

LAN switch, and they may also provide emulated legacy

interfaces (POTS, T1/E1) as well.

The IEEE 802.3ah standard incorporates a number of

advances in Ethernet over last-mile twisted pair, including:

• use of the SHDSL physical layer for high symmetric

data rates per twisted pair (up to 15 Mbps)

• direct connection between the Ethernet MAC layer and

the SHDSL PHY layer, avoiding latency and frame

overhead associated with prior approaches that

retained ATM encapsulation and adaptation in the

process

• support for multiple twisted pairs in a bond group that

are combined to form one virtual Ethernet connection

with higher speeds and resiliency — as shown in the

diagram on the facing page, individual inbound

Ethernet frames are divided by EFM devices into

fragments optimized for current loop performance

before being sent in parallel over the bond group, one

fragment to a pair, and then re-assembled on the

receiving end.

Choices for Ethernet in the Access Network

A quick reference guide to the four common technology categories

Ethernet

over

Copper

EFM over CopperActive Etherne

EFM over CopperActive Etherne

t

t

IEEE 802.3ah EFMIEEE 802.3ah EFMMEF* 10 Technical

IEEE 802.3ah EFMIEEE 802.3ah EFMMEF* 10 Technical

1 to 8 voice-grade

1 to 8 voice-grade

Cat-3 copper pairs

Cat-3 copper pairs

Up to 5.7 Mbps per

Up to 5.7 Mbps per

pair (max 45 Mbps)

pair (max 45 Mbps)

Up to 7 km (4.5 mi.)10–40 km (6–25 mi.)

Up to 7 km (4.5 mi.)10–40 km (6–25 mi.)

s

s

SME

SM

O

(inc. T1/E1 or frame

(inc. T1/E1 or frame

y

relay replacement)

relay replacement)

Category

Category

Standard

Standard

Physical

Physical

Medium

Medium

Layer

Layer

Rates

Rates

Reac

Reac

Segments

Segments

Ethernet

over

r

Fibe

Metro Ethernet

Metro Ethernet

Specific

Specific

1 single-mode optical

1 single-mode optical

fiber with WDM

fiber with WDM

10–40 km (6–25 mi.)

h

10–40 km (6–25 mi.)

h

depending on optic

depending on optic

Large enterprisesTarget

Large enterprisesTarget

n

n

atio

atio

*MEF = Metro Ethernet Foru

Ethernet in the First Mile (EFM)

1 single-mode optical

1 single-mode optical

fiber

fiber

10/100/1000 Mbps1–10 GbpsData

10/100/1000 Mbps1–10 GbpsData

depending on optic

depending on optic

s

s

Small/medium

SM

0

enterprises (SME)

Residential triple pla

Residential triple play

m

Pre-Standard

Pre-Standard

Ethernet over Copper

Ethernet over Copper

None

None

(Net-to-Net protocol)

(Net-to-Net protocol)

1 to 8 voice-grade

1 to 8 voice-grade

Cat-3 copper pairs

Cat-3 copper pairs

Point to pointPoint to pointPoint to pointRing, starTopology

Point to pointPoint to pointPoint to pointRing, starTopology

T1, E1, SHDSL.bisSHDSL.bis10/100/1000 Base T1000/10000 Base TPhysical

T1, E1, SHDSL.bisSHDSL.bis10/100/1000 Base T1000/10000 Base TPhysical

1.5–5.7 max Mbps

1.5–5.7 max Mbps

per pair (to 45 total)

per pair (to 45 total)

Unlimited for T1/E1;

Unlimited for T1/E1;

< 7 km / 4.5 mi. for

< 7 km / 4.5 mi. for

SHDSL.bi

SHDSL.bi

O

SM

SME

(inc. T1/E1 or frame

(inc. T1/E1 or frame

relay replacement)

relay replacement)

s

s

Page 7

The EFM standard supports on-the-fly adaptation of bond groups, allowing the bonding of pairs with unequal

Fr

ame

Fr

agments

From Dist’

n

n x SHDSL

PHY

Ethernet

MAC

How EFM Works

EFM Aggregation

Platform

Ethernet

Access

n x T

wisted

P

air Copper

Loops

Ethernet F

ra

me

R

eassembled F

r

ame

Theoretical Best-Case EFM Rate vs. Reach

(Zero-Noise Environment)

Co

nn

ec

t Ra

te

,

kb

ps

TC-PAM-128 Modulation

...- 64

...- 16

…-32

...- 8

TC-PAM-4

rates, as well as hitless adds or drops of individual pairs from the group. This resiliency translates into higher value

for EFM services in mission-critical business or public-sector applications where high link reliability and stability is

of utmost importance.

The performance of the EFM standard represents a nearly 10x improvement over legacy T1/E1-based services.

Rates for links without repeaters stay very robust over the typical “in town” distances required to serve SMOs. The

addition of repeaters can carry multi-megabit speeds over copper at the greater distances required for cell site

backhaul.

16,000

15,000

14,000

13,000

12,000

11,000

10,000

9,000

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

0

0 1 2 3 4 5 mi.

A C CE S S FO R A C O N V ER G I NG WO R L D

1 2 3 4 5 6 7 8 km

Up to 4 repeaters can be

used, on 6 kft. spacing

0.4mm / 26AWG Loop Length

T1 reference

7

Page 8

8 Z HO N E T E CH N O LO G I ES E T H E RN E T O V ER CO P P ER

Services Enabled by EFM

Up to 432 Ports

CO Model

As the rate and reach achievable with EFM suggest, the

most attractive application for the technology is simply

the delivery of much higher bandwidth services for SMOs

and cell sites at more aordable rates. As a rule of

thumb, operators are able to oer profitable EFM bandwidth today at about 1/6 the service charge per Mbps of

T1/E1. The flexible bond group design of EFM allows

customers to easily migrate from one bandwidth level to

the next by adding pairs one at a time.

Beyond just more bandwidth, the native Ethernet architecture of EFM also enables a number of other valueadded services, which create tiered pricing opportunities

for operators. These include:

SLA E-LAN Services — SMOs that are part of larger

organizations often need guaranteed bandwidth for TLS

services between their locations, to support missioncritical applications. Adding Service Level Management

via IP SLA provides an added value service tier for these

customers.

TDMoE Services — Some service providers merely use

Ethernet as a simplified means of delivering T1/E1 TDM

services due to the attractive operating economics.

TDMoE is transparent to the end subscriber, who still

sees a T1/E1 rate connection. TDMoE with a carefullycontrolled clock reference for TDM timing-critical

applications (such as cellular voice backhaul) is also

known as pseudo-wire, or PWE.

E-Line Services — Also known as Ethernet Private Line

(EPL), are point-to-point services over Ethernet in the

access network, generally Internet or VoIP connections.

These can also include VPN services. This is also an

alternative to traditional Frame Relay, as well as fractional

or full T1/E1 service and even dial-up service.

E-LAN Services — Also known as Transparent LAN

Service (TLS), E-LAN involves using Ethernet accessnetwork connectivity to create a seamless Ethernet LAN

extension from the subscriber/enterprise network to the

WAN & across the WAN to other locations. It is considered a native Ethernet multi-point service using Layer 2

functionality. E-LAN services are an attractive alternative

to Frame Relay and IP VPN services over T1/E1 infrastructure.

Easy, Fast Implementation

Beyond the higher bandwidth and advanced services EFM

supports, the technology also oers service providers

substantial time to market advantage and operating

savings, from its simplicity and flexibility in network

design, installation, turn-up, and maintenance. Especially

when embodied in a well-integrated and scalable multiservice access platform approach, as with Zhone’s EFM

portfolio, the equipment is capable of supporting a wide

range of configurations, from single point-to-point

installations through very high density aggregation, all

within the same interoperable hardware and software

architecture.

Page 9

The EFM standard’s provisions for configuration and

management allow well-designed system software to

make turning up carrier-class services on the equipment

very straightforward. Zhone’s EFM Application Guide

takes you from a sealed box of central oce gear to

bridged Ethernet service in just four simple steps — the

first of which is “unpack the box and plug it in.” With

the touchless EFM provisioning built into Zhone’s single-

line, multi-service (SLMS) access operating system, the

end customer needs to perform only that first step, and

the rest can be completely automated. EFM services can

be installed and brought up in a tiny fraction of the time

it would take to deploy fiber for a business customer or

cell site.

Recurring Revenues and Costs,

US$ per Month per Customer:

Offer: 10 Mbps service, requiring 3

leased dry-copper loops

Revenue ....................................... $400

Costs:

Loop lease.........................................45

(3 x $15 ea.)

Operation........................................ 100

Total............................................... 145

Monthly cash flow per customer ....... $255

1x Costs per Customer, US$

Customer acquisition (marketing) ...... 200

Zhone’s service provider customers have reported that

EFM’s simplicity and ease of use reduce the ongoing sta

costs of network configuration and maintenance per

subscriber by at least 20%, and in some cases as much as

50%. They also report that sta training time is dramatically reduced, as the technology taps directly the base of

experience in Ethernet that is common in today’s network

technicians.

The Business Case

A strong case for launching EFM services can be made for

each alternative carriers, and custom network service

operators. The cases for each dier in their particulars,

but the net result is the same in all segments: deploying

EFM is a very financially attractive concept. We’ll look at

each situation in turn.

Alternative Carrier or CLEC

For the alternative carrier / CLEC segment, EFM is all

about the upside of taking new market share with a

superior price/performance oer. In this case a representative customer cash-flow payback analysis would look

roughly like this:

Equipment, installation .................. 1,000

Total...........................................$1,200

The high profitability of this customer segment yields

very rapid payback for these alternative models where

service providers are building custom networks for SMOs.

Custom Network Service Provider

The third model is a variation on the alternative carrier

approach, and one pioneered by a Zhone customer in

Europe. In this case the network operator sells the service

concept to individual customers before buying and installing any equipment. The operation’s capacity is extended

only when the customer is signed on, and completely at

the customer’s expense. (The viability of this model in

other geographies is likely to be very dependent on the severity of unmet demand for aordable higher-bandwidth

options in the SMO segment.) The custom network provider operates a dedicated configuration of equipment for

each customer over leased unbundled local loops, becoming in eect an extension of their IT infrastructure. The

profitability of this customer segment carries through to

the custom network model as well — operating income

for this case is currently running in the mid 40% range.

A C CE S S FO R A C O N V ER G I NG WO R L D

9

Page 10

1 0 Z H O N E T E CH N OLO G I E S ET H E R NE T OV E R C O P PE R

Upside beyond Bandwidth

1999

Net to Net

introduces

Ethernet

over Copper

2002

Net to Net

introduces

Copper Loop

Bonding

2003

Paradyne

acquires

Net to Net

2005

Zhone

acquires

Net to Net

2006

Zhone

launches

802.3ah EFM

2007

Zhone number

one in world

wide EOC port

shipments

2009

Zhone adds EFM

to Terabit

Access

Architecture

Note that in establishing back-of-the-envelope business

case views of these three operator classes, the value of

more advanced services (such as E-LAN connectivity or

tiered performance and pricing based on SLA levels) has

not been incorporated. Whether included as part of the

baseline service in order to provide more tangible dierentiation of the oer in an eort to gain share, or oered

as incremental charges, the low cost of implementing

these additional features in EFM solutions will yield even

more upside to all three operator models.

Finally, the business case for cell site applications is

largely analogous to each of the three cases sketched out

above — whenever the cellular operator must buy backhaul from the open marketplace, i.e. it is not the wireless

arm of an operator group that includes wireline services

that can be purchased at cost. For wireless operators

with wireline assets, the case for EFM can be based on

more bandwidth over limited copper resources, comparatively lower maintenance and operating costs than for

legacy interfaces, or avoiding the costs of more expensive

alternatives such as microwave or fiber build-out.

Zhone’s Extensive EFM Solution

Portfolio

Zhone continues to play a pioneering role in the Ethernet

over Copper and EFM marketplace. From embracing and

carrying forward the early work of Net to Net, to launching our first 802.3ah standard products in 2006, equipping

one of the largest EFM deployments to date (at over

60,000 lines) in 2007, and most recently adding SHDSL

EFM support to our benchmark-setting MXK™ intelligent terabit access concentrator, we continue to set the

pace in truly scalable, carrier-class EFM solutions.

• Scalability - From 2 to 480 ports per chassis available

on Zhone’s MSAP platforms

•

Multi-Service Access Platform integration - Zhone’s

EFM solutions integrate with its MSAP platforms

allowing carriers to deploy multiple access services

from a single, high bandwidth Zhone platform

•

G.SHDSL or T1/E1 bonding - Numerous bonding

performance advantages including: 1) Aggregate rate

of bond group delivered via copper pairs of unequal

rate performance, 2) Continuous operation of lose

pair and bond group even if one pair is lost, and 3)

hitless adds or drops of pairs completed with ease.

•

Carrier Class redundancy and platform design -

Zhone’s SLMS based platforms meet all carrier

requirements enabling carriers to easily integrate

Zhone platforms into their network and launch EFM

services eciently.

•

Extensive Pseudowire Support, with multiple timing

options - Carriers can connect TDM networks with

IP networks and recover timing seamlessly, and

•

Full Management Automation - Comprehensive path

measurements are generated for a complete view of

the EFM network and fast IP SLA resolution.

•

Touchless Provisioning - Customers can simply

connect the Zhone EADs to the Zhone MSAP

platforms and have EFM services live in minutes.

The following pages will provide you the details of our

support for EFM in the MXK, MALC, and EtherXtend

product lines.

Our EFM portfolio includes a unique combination of:

PIONEERING EFM

Page 11

Ethernet Aggregation

MXK and MALC MSAP

MXK™-EFM-SHDSL-24 NTP

MXK™-EFM-SHDSL-24 NTWC

MALC™-EFM-T1 / E1-24

MALC™-EFM-SHDSL-24 NTP

MALC™-EFM-SHDSL-24 NTWC

•

802.1ad Q in Q transparent LAN support

•

Bridging and routing support on all ports

•

802.3ah (EFM) compliance with 802.3ah OAM

•

N2N loop bonding support with 802.3ah

•

IP SLA latency / jitter / data-loss measurements

•

Layer 2 and 3 functions

•

Gigabit Ethernet uplinks

•

Card and model options for network timing

and network powering

•

Cross card bonding

•

Support for TCPAM 4,8,16,32,64,128

•

Automatic SHDSL port bonding

•

Automatic removal of misbehaving loops from a

bond group

Raptor-XP

Raptor-XP-170-WC and -LP

•

802.1ad Q in Q transparent LAN support

•

Bridging and routing support on all ports

•

802.3ah (EFM) compliance with 802.3ah OAM

•

N2N loop bonding support

•

IP SLA latency / jitter / data-loss measurements

•

Layer 2 and 3 functions

•

Fast and Gigabit Ethernet uplinks

•

Model options for network timing

and network powering

•

Support for TCPAM 4,8,16,32,64,128

•

Automatic SHDSL port bonding

•

Automatic removal of misbehaving loops from a

bond group

A C CE S S FO R A C O N V ER G I NG WO R L D

RAPTOR XP 170

Compact, High-Performance 1U IP/EFM

Access Concentrator for eXpress Packet

Family

The Raptor-XP-170 provides the ideal

compact form factor and transport solution for appliances like EFM over copper,

Transparent LAN Services, Cellular Backhaul and Metro WiFi.

1 1

Page 12

1 2 Z H O N E T E CH N OLO G I E S ET H E R NE T OV E R C O P PE R

Aggregation Systems Summary

SLMS EFM

MXK-EFM-

Line Card

Access

Interface

Loop

Bonding

Ports per Card 24 24 24 24

Shelf Capacity

(card slots / ports)

Management

QoS

Layer 2

Layer 3

IP SLA

Optional

Equipment

SHDSL-24

SHDSL.bis

5.7 Mbps

802.3ah,

N2N

319: 8 / 192

819: 16 / 384

823: 20 / 480

CLI, Web,

SNMP

ZMS

802.1Q

802.1p

Bridging

Routing

· · · ·

Network Timing

Wetting Current

MALC-EFM-

T1/E1-24

T1/E1

N2N

319: 8/192

719: 16/384 723: 20/480

CLI, Web,

SNMP

ZMS

802.1Q

802.1p

Bridging

Routing

MALC-EFM-

SHDSL-24

SHDSL.bis

5.7 Mbps

802.3ah,

N2N

319: 8/192

719: 16/384

723: 20/480

CLI, Web,

SNMP

ZMS

802.1Q

802.1p

Bridging

Routing

Network Timing

Wetting Current

CLI, Web, SNMP ZMS

Network Timing

Wetting Current

Raptor-

XP-170

SHDSL.bis

5.7 Mbps

802.3ah

N2N

1 Card (1U)

802.1Q

802.1p

Bridging

Routing

EAD to Aggregation System Interoperability

EtherXtend

3400 Series

EtherXtend

3200 Series

EtherXtend

3100 Series

EtherXtend

3000 Series

EtherXtend

2100 Series

Network

Extender

TNE (T1)

EtherXtend

SNE Series

EtherXtend

ENE Series

MXK-EFM-

SHDSL-bis

· · ·

· · ·

· · ·

· · ·

· · ·

At

2.3 Mbps

MALC-EFM-

T1/E1

·

·

MALC-EFM-

SHDSL.bis

At

2.3 Mbps

Raptor-

XP-170

·

Page 13

... Easy, Proven, Deployed.

3000 Series EtherXtend EADS3400 Series EtherXtend EADS

Fully featured, high-capacity loop bonding and

multi-standard support all-in-one device using

extended rate SHDSL.bis with inband OAM

ETHX 3444: 4-port SHDSL.bis

ETHX 3484: 8-port SHDSL.bis

•

Up to 45.6 Mbps bonded capacity

•

802.3ah EFM or N2N selectable bonding

•

Bridged or routed on every port

•

4x10/100 Base-T LAN interfaces

•

4 or 8 WAN Port models

Fully managed and intelligent features using

802.3ah EFM standards with inband OAM over

bonded extended rate SHDSL.bis

ETHX 3014: 1-port SHDSL.bis

ETHX 3024: 2-port SHDSL.bis

ETHX 3044: 4-port SHDSL.bis

•

Up to 22.8 Mbps bonded capacity

•

802.3ah EFM bonding

•

Simplicity of bridged operation

•

4x10/100 Base-T LAN interfaces

•

1, 2 or 4 WAN port model

Delivering Ethernet-over-Copper Loop

Bonding on DS3

ETHX 2214: 1-port DS3

ETHX 2224: 2-port DS3

•

Up to 90 Mbps bonded capacity

•

Proven N2N bonding

•

Support Multimedia Trac Management (MTM)

2100 Series EtherXtend EADS 2200 Series EtherXtend EADS

The most widely used Ethernet-over-Copper

Loop Bonding technology combined with the

high bandwidth of SHDSL.bis

ETHX 2111: 1-port SHDSL.bis / 1-LAN port

ETHX 2112: 1-port SHDSL.bis / 2-LAN ports

ETHX 2122: 2-port SHDSL.bis / 2-LAN ports

•

Up to 11.4 Mbps bonded capacity

•

Proven N2N bonding

•

Either provider or subscriber units

•

Simplicity of bridged operation

A C CE S S FO R A C O N V ER G I NG WO R L D

1 3

Page 14

1 4 Z H O N E T E CH N OLO G I E S ET H E R NE T OV E R C O P PE R

TNE / ENE / SNE Family

T1 / E1 / SHDSL Network Extenders with proven performance — deployed worldwide

TNE

T1 Network Extenders

TNE 1500

•

1xT1 WAN port, 1x10/100

Ethernet LAN port

TNE 1520

•

2xT1 WAN ports, 1x10/100

Ethernet LAN port

TNE 1544

•

4xT1 WAN ports, 4x10/100

Ethernet LAN ports

•

Fully managed

TNE 1584

•

8xT1 WAN ports, 4x10/100

Ethernet LAN ports

•

Fully managed

SNE

G.SHDSL Network Extenders

SNE 2000

•

1xSHDSL 2.3 Mbps WAN

port, 1 10 Mbps LAN port

•

Provider and Subscriber units

SNE 2020

•

2xSHDSL 2.3 Mbps WAN ports,

1 10 Mbps LAN port

•

Provider and Subscriber units

SNE 2040

•

4xSHDSL 2.3 Mbps WAN

ports, 1x10/100 Ethernet

LAN port

•

Provider and Subscriber units

3100 Pseudowire EAD Series

ENE

E1 Network Extenders

ENE 2000

•

1xE1 WAN port, 1x10/100

Ethernet LAN port

ENE 2020

•

2xE1 WAN ports, 1x10/100

Ethernet LAN port

ENE 2044

•

4xE1 WAN ports, 4x10/100

Ethernet LAN ports

•

Fully managed

ENE 2084

•

8xE1 WAN ports, 4x10/100

Ethernet LAN ports

•

Fully managed

SHDSL EFM Pseudowire Access Device

The EtherXtend access devices with Pseudowire

Emulation Edge to Edge (PWE3) allow customers

to extend TDM services over a packet based

network. These devices connect to TDM and

Ethernet services simultaneously. The ETHX-

31xx units allow a standard T1/E1 circuit to be

transported over the EFM bonded connection

eliminating the need to maintain a separate T1/E1

connection to customers who are using bonded

Ethernet for their data needs

3100 Pseudowire EAD

•

MEF 18 Certified

•

Full VLAN support with priority and QoS

•

TLS mode

•

Units operate in back to back mode (CO and

CPE mode)

•

Multiple clock recovery mechanisms: Adaptive,

Synchronous, Dierential

•

Multiple Encapsulation methods: MEF, IP,

MPLS

•

Extended SHDSL data rates

•

Environmentally hardened for use in extreme

conditions or remote cabinets (DC Models)

•

3 models: 3141, 3142, and 3143

Page 15

3200 EAD with VoIP Series

SHDSL EFM Access Device with VoIP

Zhone’s EtherXtend SHDSL EAD with VoIP

allows Carriers, CLECs, ISPs and PTTs to deliver

Ethernet and Voice services to their customers

simply, quickly and cost-eectively over the

existing copper plant. Intended for deployment at

end-users’ locations, these devices allow delivery

of IEEE 802.3ah Ethernet in the First Mile (EFM)

3200 EAD with VoIP

•

Full VLAN support with priority and QoS

•

TLS mode

•

Units operate in back to back mode (CO and

CPE mode)

•

4 or 8 Voice Ports:

• MGCP

• SIP

• SIP-PLAR

• H.248

•

Extended SHDSL data rates

•

Environmentally hardened for use in extreme

conditions or remote cabinets (DC Models)

•

2 models: 3244 and 3248

ETHERNET ACCESS DEVICES

services using the latest in SHDSL standards.

EtherXtend Access Devices (EADs) Guide

WAN

Interface

WAN Ports

Bandwidth

(at max

ports)

Loop

Bonding

LAN

Interfaces

10 / 100

Base-T

Management

QoS

Layer 2

Layer 3

3400

Series

SHDSL.bis

5.7 Mbps

4 or 8 1, 2 or 4 4 1, 2 or 4 1 or 2 1 or 2

Up to

45.6 Mbps

802.3ah

EFM

N2N

4 4 4 4 4 1 or 2

CLI, Web,

SNMP

802.1p 802.1p 802.1p 802.1p 802.1p 802.1p 802.1p 802.1p

Bridging

Routing

3200

Series

SHDSL.bis

5.7 Mbps

Up to

22.8 Mbps

802.3ah

EFM

CLI, Web,

SNMP

Bridging

Routing

3100

Series

T1/E1,

SHDSL.bis

5.7Mbps

Up to

22.8Mbps

802.3ah

EFM

CLI, Web,

SNMP

Bridging

Routing

3000

Series

SHDSL.bis

5.7 Mbps

Up to

22.8 Mbps

802.3ah

EFM

CLI, Web,

SNMP

Bridging

Routing

2200

Series

DS3

45Mbps

Up to

90 Mbps

N2N N2N N2N N2N N2N

CLI, Web,

SNMP

Bridging

L3 aware

2100

Series TNE SNE ENE

SHDSL.bis

5.7 Mbps

Up to

11.4Mbps

CLI, Web,

SNMP

Bridging

L3 aware

T1

1.544 Mbps

1, 2, 4

or 8

Up to

12 Mbps

1 (1 / 2 port)

4 (4 / 8 port)

CLI, Web,

SNMP

(4 / 8 port)

Bridging

L3 aware

SHDSL

2.3 Mbps

1, 2 or 4

Up to

9.2 Mbps

1

Unmanaged

Bridging Bridging

2.048 Mbps

1 (1 / 2 port)

4 (4 / 8 port)

CLI, Web,

(4 / 8 port)

E1

1, 2, 4

or 8

Up to

16 Mbps

SNMP

L3 aware

Voice Ports

4 or 8

A C CE S S FO R A C O N V ER G I NG WO R L D

1 5

Page 16

Serving

Customer Needs

AccessCom

Cornerstone of Service Expansion

“When we evaluated Zhone’s offerings, particularly EFM, we felt that the cost and performance

claims made by Zhone had to be too good to be true. After testing the platform we were con-

vinced and we’ve been consistently amazed by the exibility, value and performance of the

MALC.”

Jeff Giles

CEO

Netmedia

Zhone Delivers Higher Bandwidth to Netmedia

“Using Zhone’s Ethernet-over-Copper solutions with both E1 and SHDSL lines has enabled delivery of higher bandwidth Ethernet business services in Finland over existing copper lines, thereby

creating new and protable Ethernet business services by reusing existing plant infrastructure.”

Martin Sten

Founder

Saudi Telecom

Dramatic Improvement in Service Capability

“We believe Zhone’s EFM solution will dramatically improve our service capability through copper

loop bonding for higher bandwidth along with symmetric data capabilities for our business customers demanding enhanced services. Zhone’s EFM standards-based access aggregation ensures

our service objectives are met, including simplifying provisioning and management.”

Sami Al-Zomaia

Access Engineering Manager

Zhone Technologies, Inc.

1 6 Z H O N E T E CH N OLO G I E S ET H E R NE T OV E R C O P PE R

@ Zhone Way

7001 Oakport Street

Oakland, CA 94621

+1 510.777.7000 Tel.

www.zhone.com

For more information about Zhone and its products, please visit the Zhone Web site at

www.zhone.com or e-mail info@zhone.com

Zhone, the Zhone logo, and all Zhone product names are trademarks of Zhone Technologies, Inc. Other brand and

product names are trademarks of their respective holders. Specications, products, and/or product names are all

subject to change without notice. Copyright 2009 Zhone Technologies, Inc. All rights reserved.

v2009_12wp

Loading...

Loading...