Xerox DOCUPRINT 65, DOCUPRINT 115, DOCUPRINT 75MX, DOCUPRINT 155MX, DOCUPRINT 115MX User Manual

...Page 1

Generic MICR

Fundamentals Guide

701P22140

January 2003

Page 2

Xerox Corporation

701 S. Aviation Boulevard

El Segundo, CA 90245

©2002, 2003 by Xerox Corporation. All rights reserved.

Copyright protection claimed includes all forms and matters of copyrightable

material and information now allowed by statutory or judicial law or hereinafter

granted, including without limitation, material generated from the software

programs which are displayed on the screen, such as icons, screen displays,

looks, etc.

Printed in the United States of America.

Publication number: 701P22140

Xerox® and all Xerox products mentioned in this publication are trademarks of

Xerox Corporation. Other products and trademarks of other companies,

including Dataglyph™, are also acknowledged.

Changes are periodically made to this document. Changes, technical

inaccuracies, and typographic errors will be corrected in subsequent editions.

Page 3

Table of contents

Introduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ix

About this guide . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .ix

How to use this guide . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . x

1. Overview. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1-1

A brief history . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1-2

Why MICR? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1-5

Check printing capabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1-5

Check processing procedure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1-6

Production cycle of a check . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1-9

Changes in check creation role . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1-11

2. Environment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2-1

Types of MICR applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2-1

Manufacturing checks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2-1

Issuing checks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2-2

Issuing turnaround documents . . . . . . . . . . . . . . . . . . . . . . . . . . 2-2

Printing financial forms . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2-3

Xerox MICR printing systems . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2-3

MICR printing technologies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2-4

Printer technical optimization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2-5

Typical MICR printing concerns . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2-5

3. Paper facts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3-1

Paper guidelines . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-1

MICR paper requirements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-2

Basis weight . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-2

Sheffield smoothness scale . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-3

Grain direction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-4

Moisture content . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-5

Reflectance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-5

Curl . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-6

Perforation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-6

Metallic content . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-7

Stiffness . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-7

Cutting precision . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-8

Xerox paper . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-8

Generic MICR Fundamentals Guide iii

Page 4

Table of contents

Paper maintenance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-9

Wrapping factors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-9

Storage factors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-9

Temperature and humidity conditions . . . . . . . . . . . . . . . . . . . 3-10

Paper runability criteria . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-11

Preprinted forms considerations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-13

Inks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-13

Security features . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-14

Duplication detection . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-14

Alteration prevention . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-15

Application design . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-15

Numbered stocks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-15

Features to avoid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-16

4. Document design. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4-1

Check document content . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-1

Security features . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-1

Background printing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-2

Fixed information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-2

Date line . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-2

Amount lines . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-3

Payee line . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-3

Signature lines . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-4

Name of financial institution . . . . . . . . . . . . . . . . . . . . . . . 4-4

Memo line . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-4

Account title . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-4

Check serial number . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-5

Fractional routing number . . . . . . . . . . . . . . . . . . . . . . . . 4-5

MICR line . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-5

MICR line (clear band) format requirements . . . . . . . . . . . . . . . . . . . . . 4-5

Format specifications using E13B . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-7

E13B character set . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-7

E13B numbers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-7

E13B symbols . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-7

On-Us symbol . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-7

Transit symbol . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-8

Amount symbol . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-8

Dash symbol . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-8

E13B character design . . . . . . . . . . . . . . . . . . . . . . . . . . 4-9

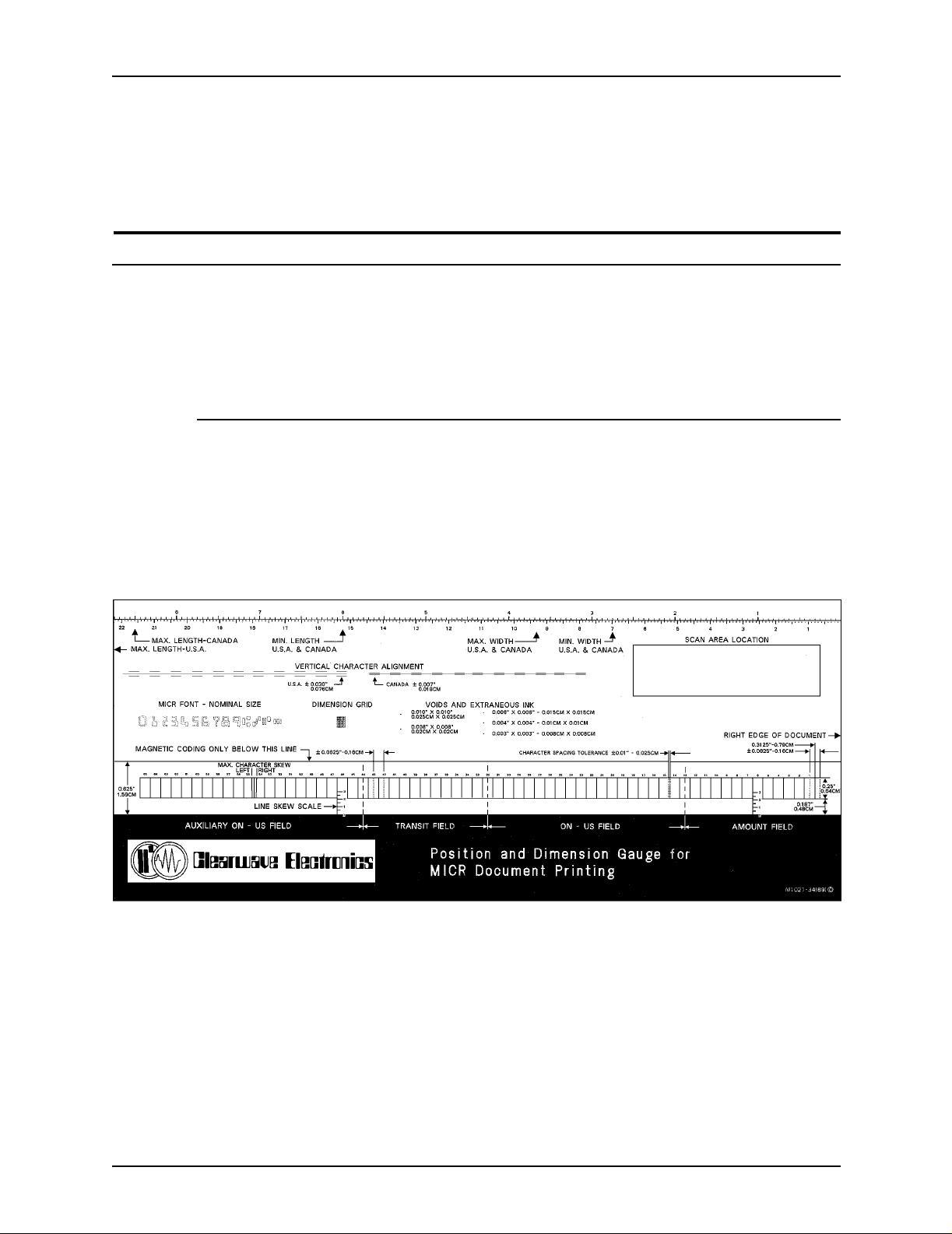

Field formats—E13B font . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-9

Document Specifications form . . . . . . . . . . . . . . . . . . . . 4-11

Amount field . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-13

On-Us field . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-13

Transit field . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-13

External processing code (EPC) field . . . . . . . . . . . . . . 4-14

Auxiliary On-Us field . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-14

iv Generic MICR Fundamentals Guide

Page 5

Table of conte nts

Field formats summary . . . . . . . . . . . . . . . . . . . . . . . . . 4-14

Character alignment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-16

CMC7 font . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-16

CMC7 numbers and symbols . . . . . . . . . . . . . . . . . . . . . . . . . . 4-16

Character design . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-18

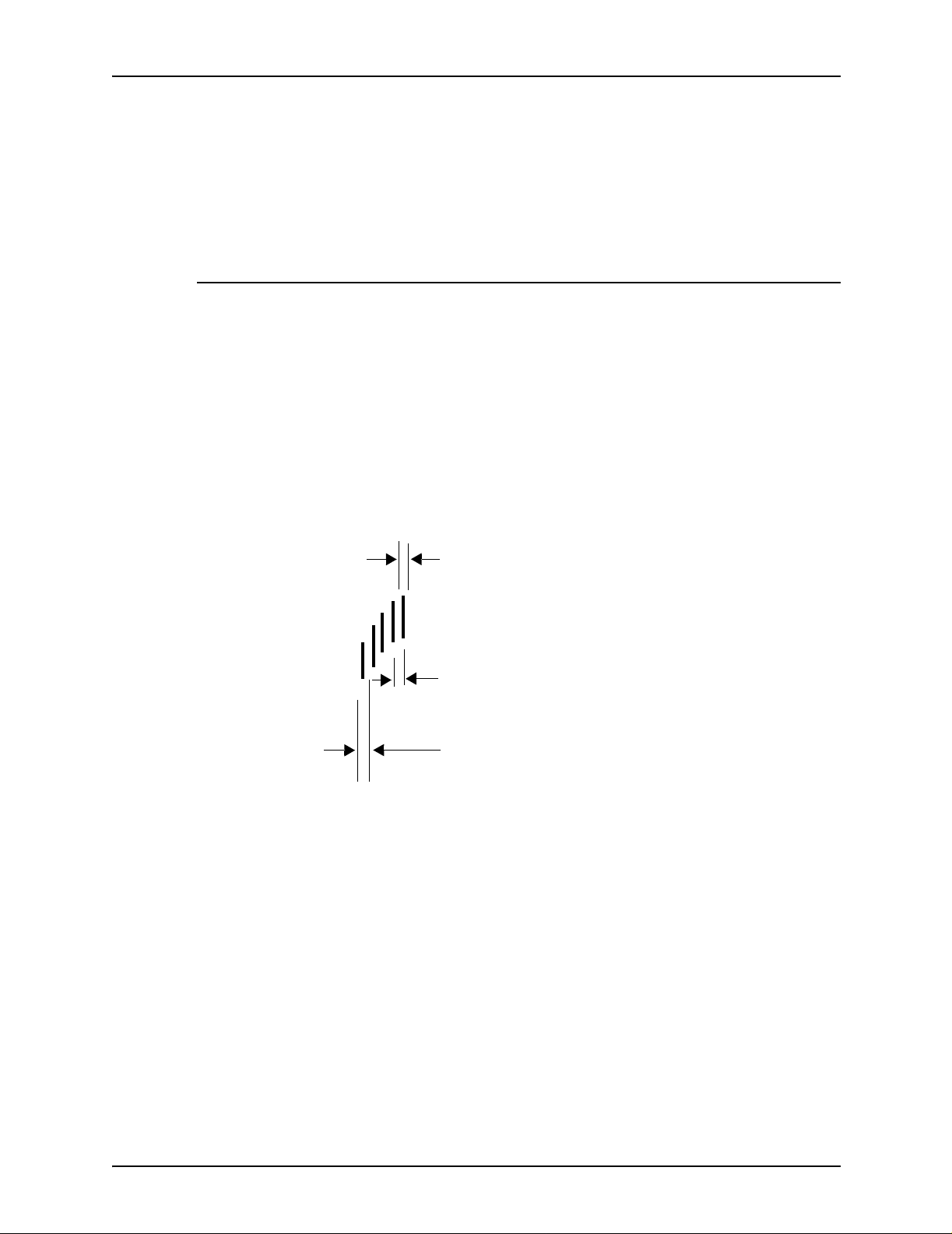

MICR character spacing requirements . . . . . . . . . . . . . . . . . . . . . . . . 4-19

Character spacing algorithm for 300 dpi . . . . . . . . . . . . . . . . . . 4-19

Fixed pitch and proportional font spacing . . . . . . . . . . . . . . . . . 4-19

Check size . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-23

Other application considerations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-25

Two sided printing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-25

Perforations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-25

Multiple-up printing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-25

Readability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-27

5. Document processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5-1

Proofing checks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5-2

Amount determination errors . . . . . . . . . . . . . . . . . . . . . . . . . . . 5-2

Proofing equipment errors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5-2

Reader sorter function . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5-3

Waveform generation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5-4

Types of reader sorters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5-5

Waveform reader sorters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5-5

Matrix or AC reader sorters . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5-5

Optical reader sorters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5-6

Dual read magnetic reader sorters . . . . . . . . . . . . . . . . . . . . . . . 5-6

Hybrid magnetic and optical reader sorters . . . . . . . . . . . . . . . . 5-7

Processing speeds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5-7

Paper handling by reader sorters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5-8

Hopper jogger . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5-8

Separator . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5-8

Aligner . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5-9

Read/write heads . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5-9

Item numbering and endorsing stations . . . . . . . . . . . . . . . . . . . 5-9

Microfilm or image capture unit . . . . . . . . . . . . . . . . . . . . . . . . . 5-9

Sorter pockets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5-10

Reject repair . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5-10

6. Quality control . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6-1

Print quality specifications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6-1

Optical tools used to check MICR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6-2

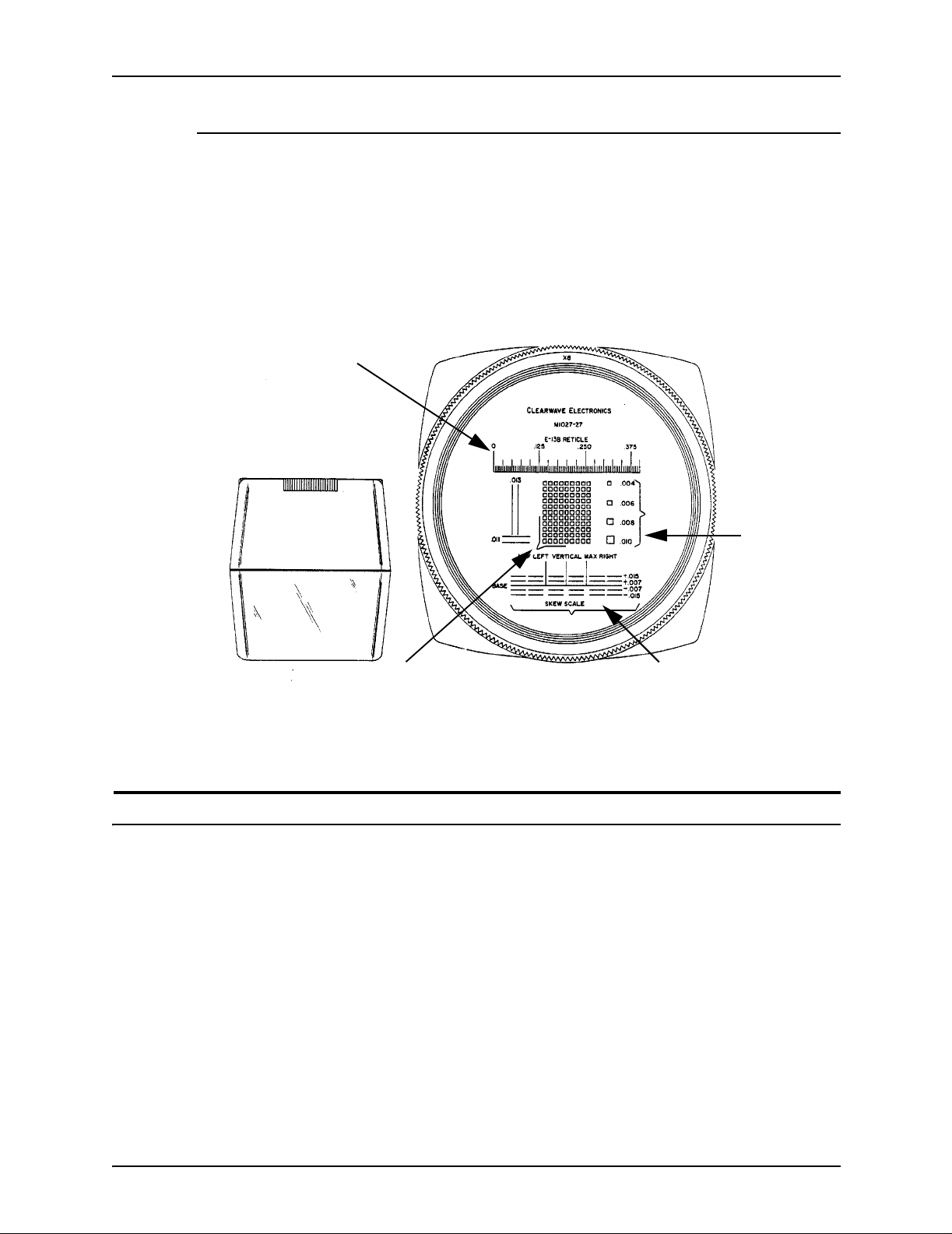

MICR Gauge . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6-2

Small Optical Comparator . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6-3

Magnetic testing equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6-3

E13B calibration document . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6-4

Testing sample documents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6-5

Generic MICR Fundamentals Guide v

Page 6

Table of contents

Specifications for testing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6-6

Operational maintenance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6-22

Quality measurements: magnetic versus optical . . . . . . . . . . . . . . . . . 6-23

Horizontal position . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6-6

Vertical position . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6-7

Skew . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6-9

Character-to-character spacing . . . . . . . . . . . . . . . . . . . . . . . . 6-11

Voids . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6-13

Extraneous ink spots . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6-14

Signal strength . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6-17

Debossment and embossment . . . . . . . . . . . . . . . . . . . . . . . . . 6-20

Summary of ANSI standards . . . . . . . . . . . . . . . . . . . . . . . . . . 6-21

Additional perform ance considerations . . . . . . . . . . . . . . . . . . 6-22

Dry ink slivers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6-22

Damaged or ragged characters . . . . . . . . . . . . . . . . . . . 6-22

Crayoning . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6-22

Magnetic testing equipment usage . . . . . . . . . . . . . . . . . . . . . . 6-23

Optical testing equipment usage . . . . . . . . . . . . . . . . . . . . . . . 6-25

Recommendation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6-26

7. Problem solving. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7-1

When problem solving is required . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7-1

New accounts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7-1

Existing applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7-1

Possible misinterpret ati o ns . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7-2

Problem solving process . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7-2

Determining the problem source . . . . . . . . . . . . . . . . . . . . . . . . 7-4

Reader sorter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7-4

Printer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7-4

Operator training . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7-4

Application software . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7-5

Unknown cause . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7-5

Reader sorter testing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7-5

Interpreting test results . . . . . . . . . . . . . . . . . . . . . . . . . . 7-6

Questions to consider . . . . . . . . . . . . . . . . . . . . . . . . . . . 7-7

Expected reject rates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7-9

Reducing reject rates . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7-9

Inspecting documents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7-12

Correct font placement or format . . . . . . . . . . . . . . . . . . 7-12

MICR character defects . . . . . . . . . . . . . . . . . . . . . . . . . 7-12

Document damage . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7-13

Excessive ink smears . . . . . . . . . . . . . . . . . . . . . . . . . . 7-13

Paper size and characteristics . . . . . . . . . . . . . . . . . . . . 7-13

MICR line format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7-13

Job history or results . . . . . . . . . . . . . . . . . . . . . . . . . . . 7-14

Compare the documents with previous samples . . . . . . 7-14

vi Generic MICR Fundamentals Guide

Page 7

Table of conte nts

Analyzing reader sorter printout . . . . . . . . . . . . . . . . . . . . . . . . 7-14

Test patterns: alternative to reader sorter testing . . . . . . . . . . . 7-15

Verifying problem resolution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7-16

8. Security. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .8-1

Xerox printing systems security . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-1

Physical security . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-2

Restricting physical access . . . . . . . . . . . . . . . . . . . . . . . 8-2

Securing paper stocks . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-3

Storage and disposal . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-3

Responsible presence . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-4

Software security . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-4

Logon levels . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-4

Memory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-4

System commands . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-5

Audit control processes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-5

Accounting information . . . . . . . . . . . . . . . . . . . . . . . . . . 8-5

Paper jams . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-5

Samples . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-6

Tampering methods . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-7

Chemical tampering . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-7

Mechanical tampering . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-7

Modifying printed checks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-8

Lithographic printing . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-8

Impact printing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-8

Cold pressure fix . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-9

Xerography . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-9

Preventing tampering . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-10

Safety papers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-11

Overprints . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-11

Textures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-11

Amount limit statements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-12

Amount in Words fields . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-12

Preventing check duplication . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-12

Microprint . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-13

Watermarks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-13

Drop-out print . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-13

Dataglyph™ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-14

VOID pantograph . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-14

Avoiding counterfeit and stolen checks . . . . . . . . . . . . . . . . . . . . . . . . 8-14

Alteration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-14

Embezzlement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-15

Stolen checks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-16

Counterfeits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-16

Cost considerations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-17

Generic MICR Fundamentals Guide vii

Page 8

Table of contents

A. References . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .A-1

Standards documentation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . A-1

Instructions for ordering U. S. standards . . . . . . . . . . . . . . . . . . . . . . . . A-2

Ordering online . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . A-2

Ordering hardcopy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . A-2

Standards development process information (U. S. only) . . . . . A-3

Glossary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Glossary-1

Index . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Index-1

viii Generic MICR Fundamentals Guide

Page 9

About this guide

Introduction

The purpose of the Gene ric MICR Fundamentals Guide is to

provide a reference for the various facets of the MICR

environment within the context of the Xerox MICR printing

products. This document does not contain specific information

on individual Xerox MICR printers.

Since the printing of MICR documents involves application and

operational considerations not normally associated with any of

the standard Xerox pr inting systems, this document provides

principles and guidelines to ensure successful MICR printing.

This document has been developed with the assumption that

readers have knowledge of standard Xerox printing systems

products, and the skills to develop applications and job source

libraries.

The Generic MICR Fundamentals Guide contains the following

chapters and appendices:

Chapter 1: Overview. Describes MICR, its historical

background, and the printing and processing procedures for the

MICR document.

Chapter 2: Environment. Examines the types of applications

that use MICR, trends within the industry, and typical MICR

printing methods and concerns.

Chapter 3: Paper facts. Identifies paper grades and properties

required for MICR printing , and describes paper maintenance

procedures.

Chapter 4: Document design. Describes the standard format,

features, and requirements of a check document.

Chapter 5: Document processing. Examines the common

types of reader sorter technology and the way these systems

function.

Generic MICR Fundamentals Guide ix

Page 10

Introduction

Chapter 6: Quality control. D escribes MICR document print

quality specifications, the tools available to determine if a

document is within specifications, and general operator

maintenance procedures.

Chapter 7: Problem solving. Provides information on

identifying MICR printer related problems and using rejection

rate information to isolate the problem source.

Chapter 8: Security. Provides an overview of the security

procedures used to control and audit access to a Xerox MICR

printing system and to check printing functions.

Appendix A: MICR references. Lists the domestic and

international standards documents that apply to MICR

publications. Also contains a list of Xerox documents containing

MICR information.

Glossary: Lists terms and definitions related to MICR printing

and banking envi ro nm en ts.

How to use this guide

• First, become thoroughly familiar with the operation of your

• Read through this guide to acquaint yourself with all of the

• As needed, ref er to sections of th is guid e that are p ertinent to

own MICR system.

topics.

your work.

x Generic MICR Fundamentals Guide

Page 11

1. Overview

MICR (Magnetic Ink Character Recognition) is a process by

which documents are printed using magnetic ink and special

fonts to cre ate ma chin e reada b le in f ormation f or quick document

processing.

Although traditionally MICR has been used to print accou nting

and routing information on bank checks and other negotiable

documents, the magnetic encoding lends itself to any form of

document processing.

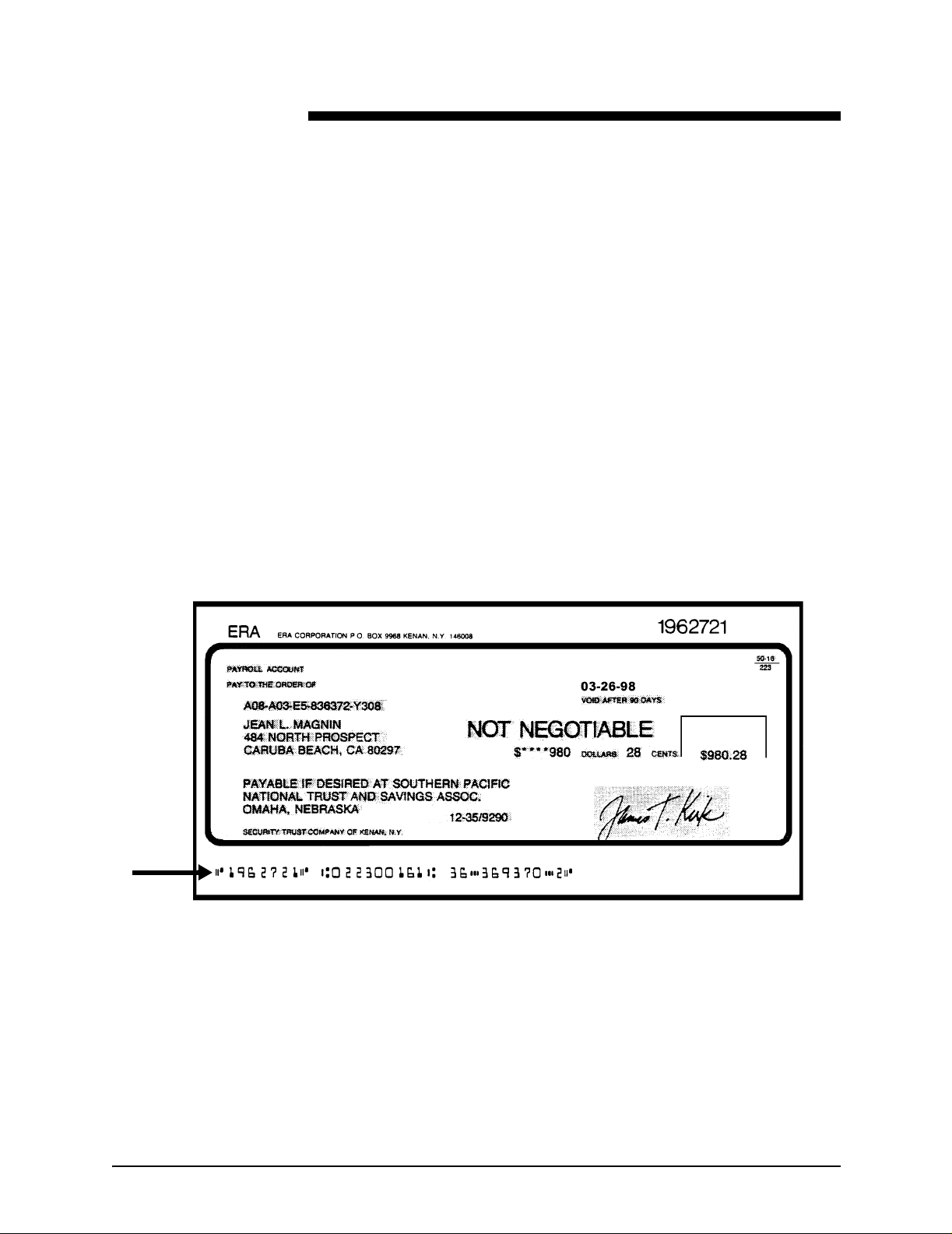

The following figure shows a check with a MICR line. This line

contains block-shaped numbers running along the bottom of the

check, and non-numeric characters called “symbols.” This entire

string of numbers and symbols is printed using magnetic ink.

Figure 1-1. MICR line on a check

Generic MICR Fundamentals Guide 1-1

Page 12

Overview

A brief history

Originally, checks were processed manually. However, by the

mid-1940s the banking system became inu ndate d wit h pape r as

society grew more mobile and affluent. Finding a means of

handling the growing number of paper documents became vital

to bankers. The banking and electronics industries searched for

a standard process that could be used in all banks throughout

the country.

In the mid-1950s, the first automated processing of checks was

initiated. The system that is now kno wn as MICR was developed

by the Stanford Research Institute, using equipment designed by

the General Electric Computer Laboratory. The E13B MICR font

was also developed.

The specifications for producing the E13B font using magnetic

ink were accepted as a standard by the American Bankers

Association (ABA) in 1958. In April 1959, the ABA issued

Publicat ion 147, The Common Machine Language for

Mechanized Check Handling.

Deluxe Check Printers had the task of translating the

specifications in to a wo rking pr oce ss. By the end of 1959,

Deluxe successfully produced checks using magnetic ink.

In countries throughout the world there are groups that s et

standards and di ctate the design specifications for document

encoding, processing equipment, and quality criteria for MICR

printing. Some of these are:

• American Banking Association (ABA)

• American National Standards Institute (ANSI)

• United Kingdom—Association for Payment Clearing Services

(APACS)

• Canadian Payments Associa ti on (CPA)

• Australian Bankers Association (ABA)

• International Organization for Standardization (ISO)

• France—L'Association Francaise de Normalisation

1-2 Generic MICR Fundamentals Guide

Page 13

Overview

In 1963, the American National Standards Institute (ANSI)

accepted the ABA specifications, with minor revisions, as the

American standard for MICR printing. The ANSI publication

covering th ese st an dar d s is Print Specifications for Magnetic Ink

Character Recognition, first issued in 1969. Although compliance

with the standards is voluntary in the U. S., the banking industry

considers them to be the definitive basis for determining

acceptable quality of a MICR document.

Another MICR font, called CMC7, was developed by the French

computer company Machines Bull and has been the official

French standard since September 1964. The CMC7 font is also

used in other co untries, includ ing Italy, Spain, and Brazil. Like the

E13B font, CMC7 is a magnetically readable font, but with a

different character design and recognition criteria.

Some countries also use OCR-A or OCR-B, which are optically

read check processing fonts. These fonts do not need to be

printed with magnetic ink in order to be processed. The following

table show s which countrie s use the four check printing fonts.

Generic MICR Fundamentals Guide 1-3

Page 14

Overview

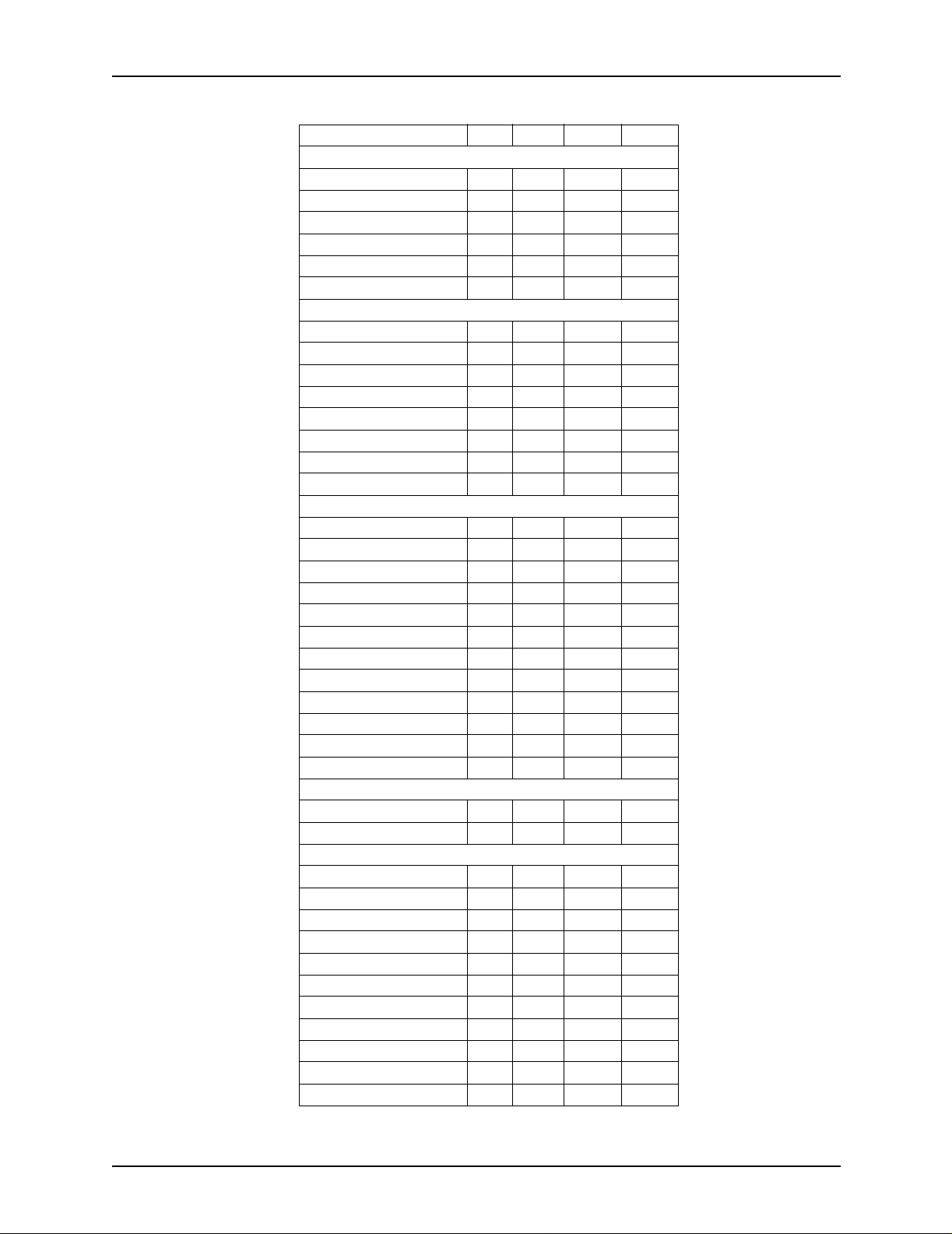

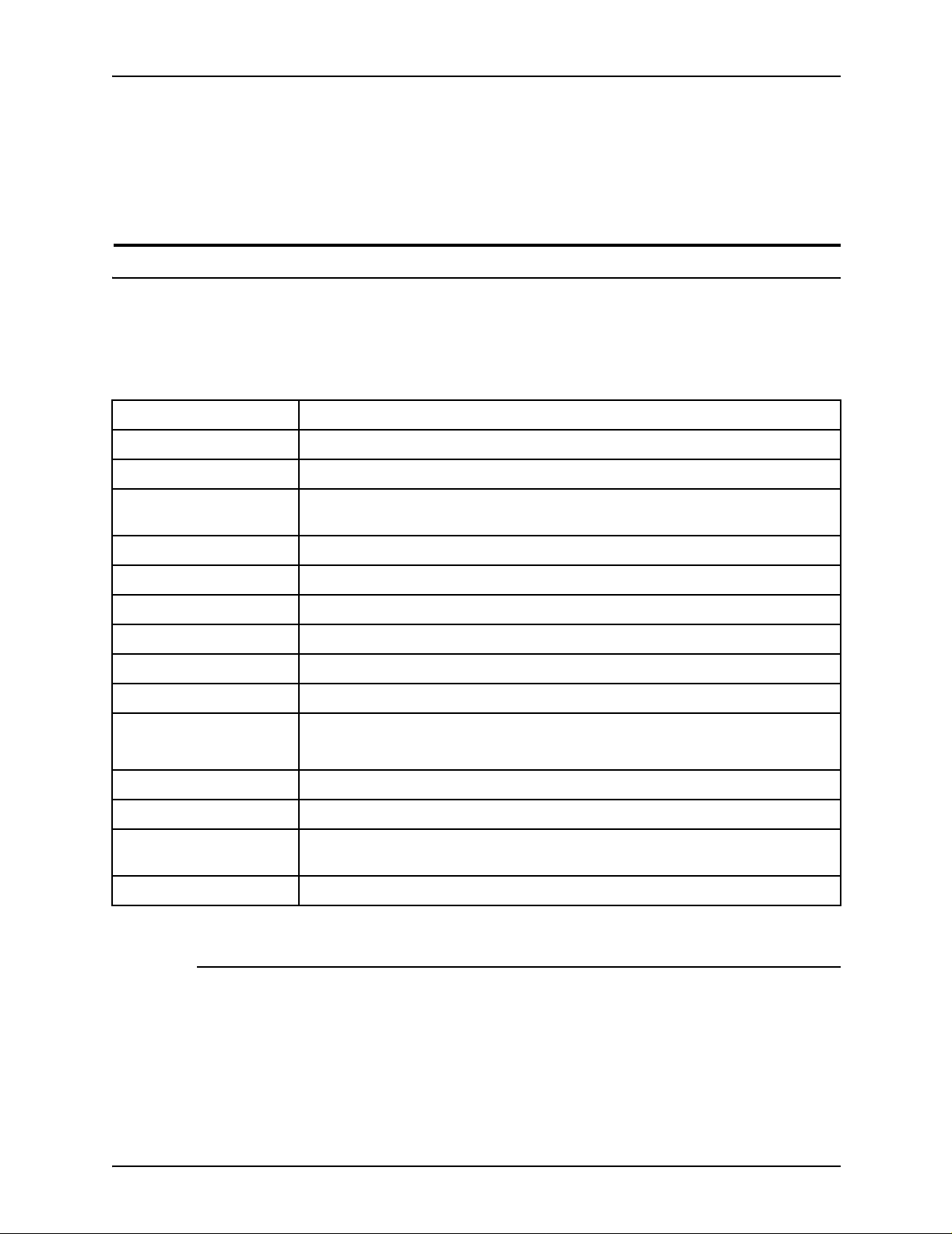

Country E13B CMC7 OCR-A OCR-B

North America:

USA X

Canada X

Central America

Bermuda X

Mexico X

Panama X

South America:

Argentina X

Brazil X

Chile X

Columbia X

Ecuador X

Peru X

Uruguay X

Venezuela X

Europe:

Austria X

Belgium X X

Denmark X X

Finland X X

France X

Germany X

Holland X X

Italy X X

Norway X X

Spain X

Sweden X X

United Kingdom X X

Middle East and Africa:

Israel X

South Africa X

Far East:

Australia X

Hong Kong X

India X

Japan X X

Kuala Lumur X

Malaysia X

New Zealand X

Philippines X

Singapore X

Taiwan X

Thailand X

1-4 Generic MICR Fundamentals Guide

Page 15

Why MICR?

Overview

Recognizing significant market value in combining the

advantage s of electronic la ser xerog raph y with MICR t echnolog y,

Xerox initiated investigations in late 1979 and early 1980. Early

efforts at the Xerox Webster Research Center concentrated on

basic material physics. The objective was to provide a

xerog raphic dry ink and de v eloper that wou ld produce high visual

quality images that could be read using the standard banking

reader sorter equipment.

Xerox’s MICR printing products combine the following:

• A modified xerograph ic engine

• A unique magnetic materials package

• The standard ANSI and ISO MICR character sets

The Xerox MICR systems meet ANSI, CPA, and ISO

specifications for automatic check handling.

MICR was chosen by th e ABA beca use it can be read accur ately

by machine, it uses existing printing technology, and the printed

documents are durable to withstand mutilation.

A MICR encoded document can be read through overstamping,

pen and pencil marks, oils and greases, and carbon smudges.

However, MICR printing is one of the most quality-conscious

application areas within the printing industry. It meets ABA

security requirements for negotiable documents. MICR is the

only system that produces reliable results at high processing

speed.

Check printing capabilities

A Xerox MICR printing system with a magnetic material package

and MICR fonts can print a character line at the bottom of a

check form that is machine read able by standard banking re ader

sorter equipment. On blank security paper, the Xerox MICR

printing system can produce the entire check image, including

the form, all fixed and variable data, logos and signatures, and

the MICR line, in a single pass.

Generic MICR Fundamentals Guide 1-5

Page 16

Overview

The printing process is one small part of the total processing

procedure for a MICR printing system user . Quality and accura cy

of the check documents must be closely controlled during

printing to prevent problems from occurrin g when the documen t

is processed off-site.

Check processing procedure

All checks impact at least three parties:

• The person who writes the check

• The person to wh om the check is being pai d

• The bank at which the check writer has an account

Depending on where and by whom the check is deposited, how

the check is processed, and how the check is handled for funds

clearance, many different parties can handle the same check.

Fraud can occur at any of the steps or access points in this

process.

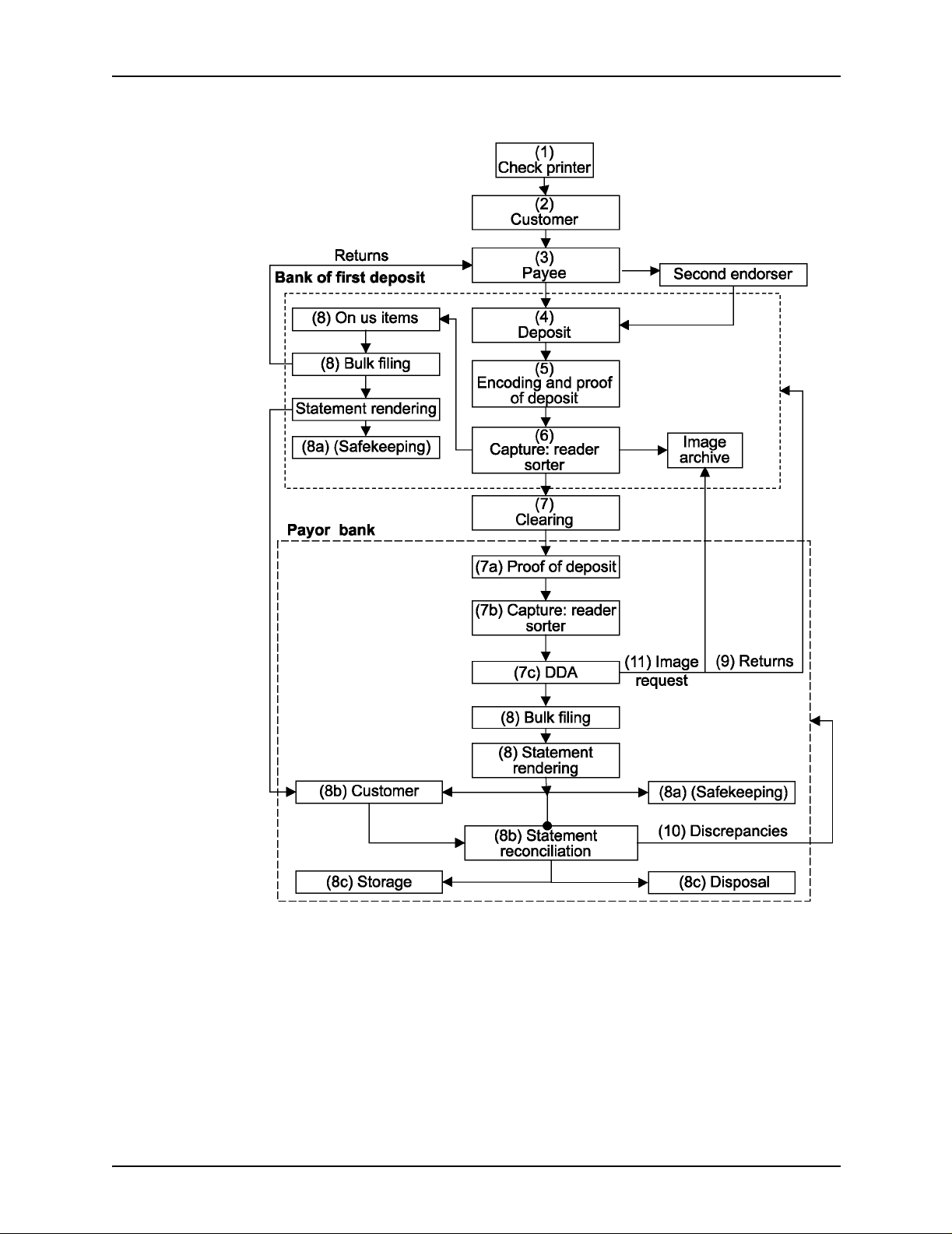

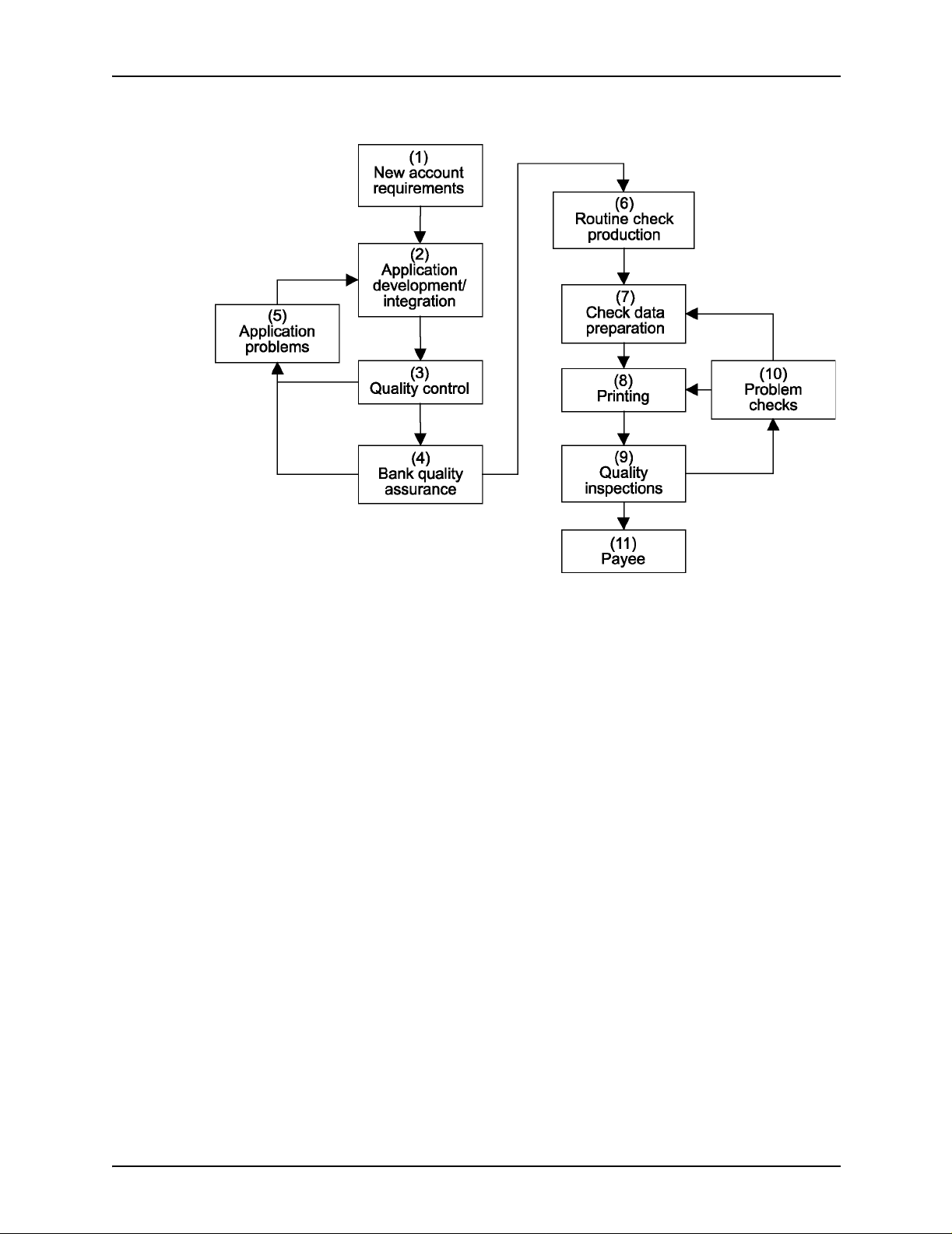

The following steps, illustrated in figure 1-2, trace a document

through a series of corporate and banking system procedures

typical of the MICR environment.

1-6 Generic MICR Fundamentals Guide

Page 17

Overview

Figure 1-2. Life cycle of a check

Generic MICR Fundamentals Guide 1-7

Page 18

Overview

1. The check printer (1) produces a blank check that will be

completed later. This check includes the static data that is

needed for a negotiable document:

• Financial institution name and address, issuer name and

address, che ck form, company logo, etc.

• The MICR line, containing the account and routing

information that is needed to process the check

• Other audit, account, and report information as required

by the customer

2. The customer (2) adds the transaction information—payee,

amount, and date—and authorizes the funds transfer with a

signature.

NOTE: When using a MICR laser printer, steps 1 and 2 may

happen simultaneously.

3. The completed check is transferred to the payee (3), who

deposits it in the bank of fir st deposit (BOFD). The pa y ee may

receive the check in person, by mail, or through a third party.

A third party check may require a second endorsement.

4. Deposits (4) are mad e in se v er al ways: through a teller, u sing

an automated teller machine (ATM), us ing a drop box, or

through a postal lock box. Deposited items are accompanied

by a deposit ticket that lists and totals the items and identifies

the payee account.

This is the entry point for the automated payment processing

system.

5. The BOFD encodes the amou nt of the chec k in the MICR line

(5) and balances the check against the deposit ticket to verify

that the correct amount is being credited to the payee

account (proof of deposit) .

6. MICR documents that are printed on a Xerox MICR printing

system are usually corporate paychecks, stock dividend

checks, etc. After printing, these type of documents require

additional processing using a high-speed device called a

“reader sorter .” The r e ade r sorter identifie s ea ch m ag ne ti z e d

character and symbol of the MICR line using logical analysis

algorithms of the electronic wave patterns that the characters

produce.

In the “capture pass,” checks are read in a reader sorter for

the first time (6). At this time, they are sorted into checks

drawn on the BOFD, known as “On-us items” (8), an d chec ks

drawn on other banks.

1-8 Generic MICR Fundamentals Guide

Page 19

Overview

7. Checks drawn on other banks are sent to the payor bank

through a clearing (7) arrangement. The check may be

cleared through the Federal Reserve, a correspondent bank,

a clearing house, or directly by the issuing bank.

The payor bank also balances the check against the deposit

ticket (proof of deposit) (7a) to verify the check amount, and

performs its capture pass (7b) on the reader sorter in order to

identify the issuer account (7c). (Refer to the “Proofing

checks” section of chapter 5 f or more information on this part

of the process.)

8. In most cases, the check is debited from the issuer account

and moved to bulk filing (8), where it is stored until time for

monthly statement rendering.

Fro m this point f orward, an On-Us item is treated the same as

one that was cleared to anothe r bank.

Two exceptions may occur:

• If the payor bank does not honor the check, it is returned

(9) through the BOFD to the payee. The amount is then

deducted fr om the payee account.

• During reconciliation, the account holder may discover a

discrepancy (10) between its records and those of the

bank. Their bank then researches any discrepancies.

NOTE: Account holders may contract with their banks to

perform reconc ili at i on before clearing the check.

Production cycle of a check

The check production process starts as soon as the need is

identified. Design requirements shou l d co mp re he nd purchasing,

distribution, warehousing, manufacturing, internal and external

processing requirements, and the needs of the check issuer.

Banks frequently require new corporate accounts to submit

checks for approval before the banks approve the account.

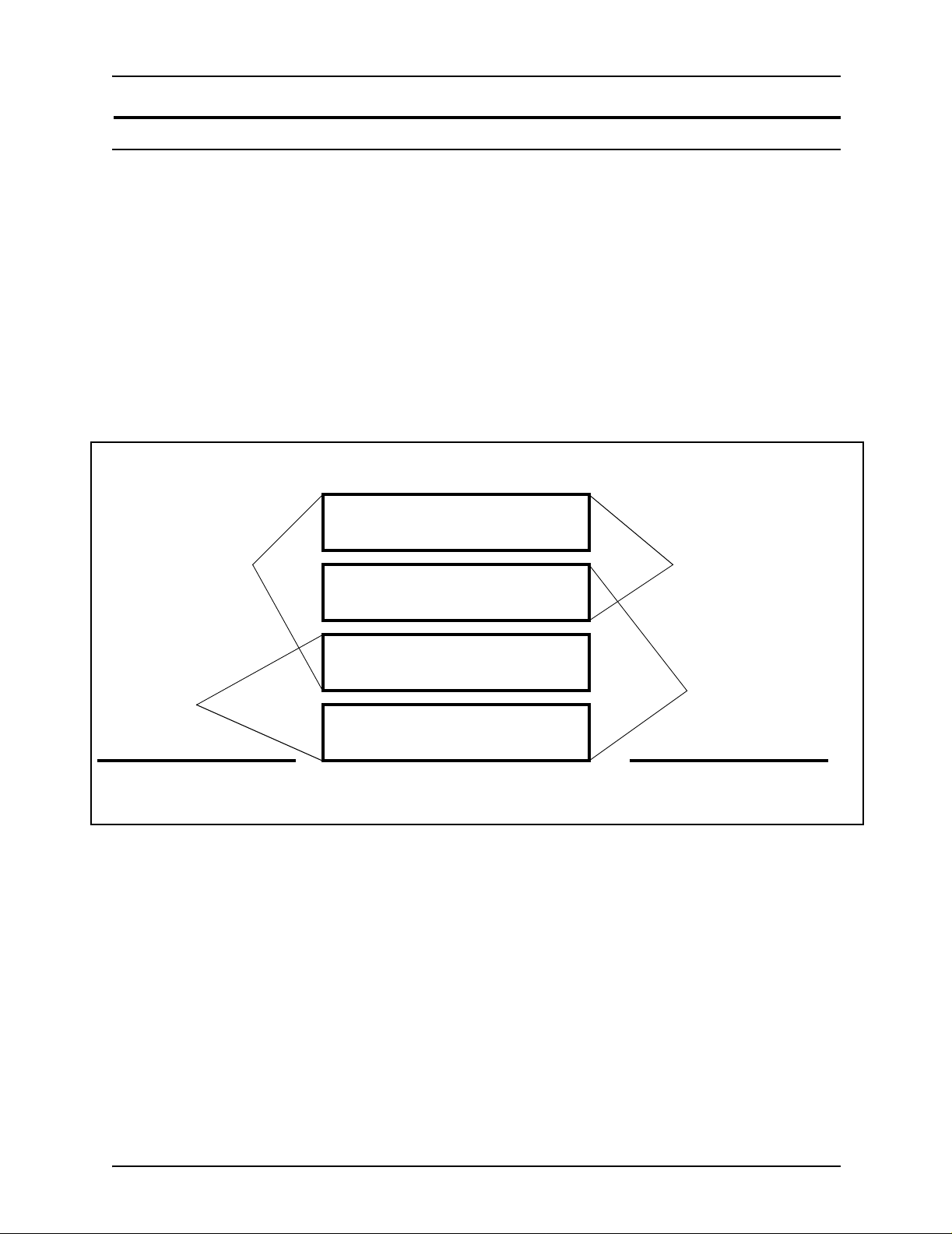

The following steps, illustrated in figure 1-4, describe the typical

process that is required before the first negotiable checks are

delivered to the payee.

Generic MICR Fundamentals Guide 1-9

Page 20

Overview

Figure 1-3. Check ordering and production cycle

1. Design requirements are defined for a new account.

2. Requirements are passed to application development.

3. Samples pass internal quality checks.

4. Samples are forwarded to the bank for approval.

5. Any problems are referred to application developers, who

ensure that th e problems cannot occur in production.

6. After approval by the bank, the check design becomes

available for routine production.

7. Variable check data is prepared for incorporation.

8. The checks are printed.

9. The printed checks are inspected.

10.Any problems are repo rted to the source f o r cor r ection and

reprinting.

11.When they have pa ssed ban k validation and quality

inspection by the issuer, the checks are issued to the payee.

1-10 Generic MICR Funda m entals Guide

Page 21

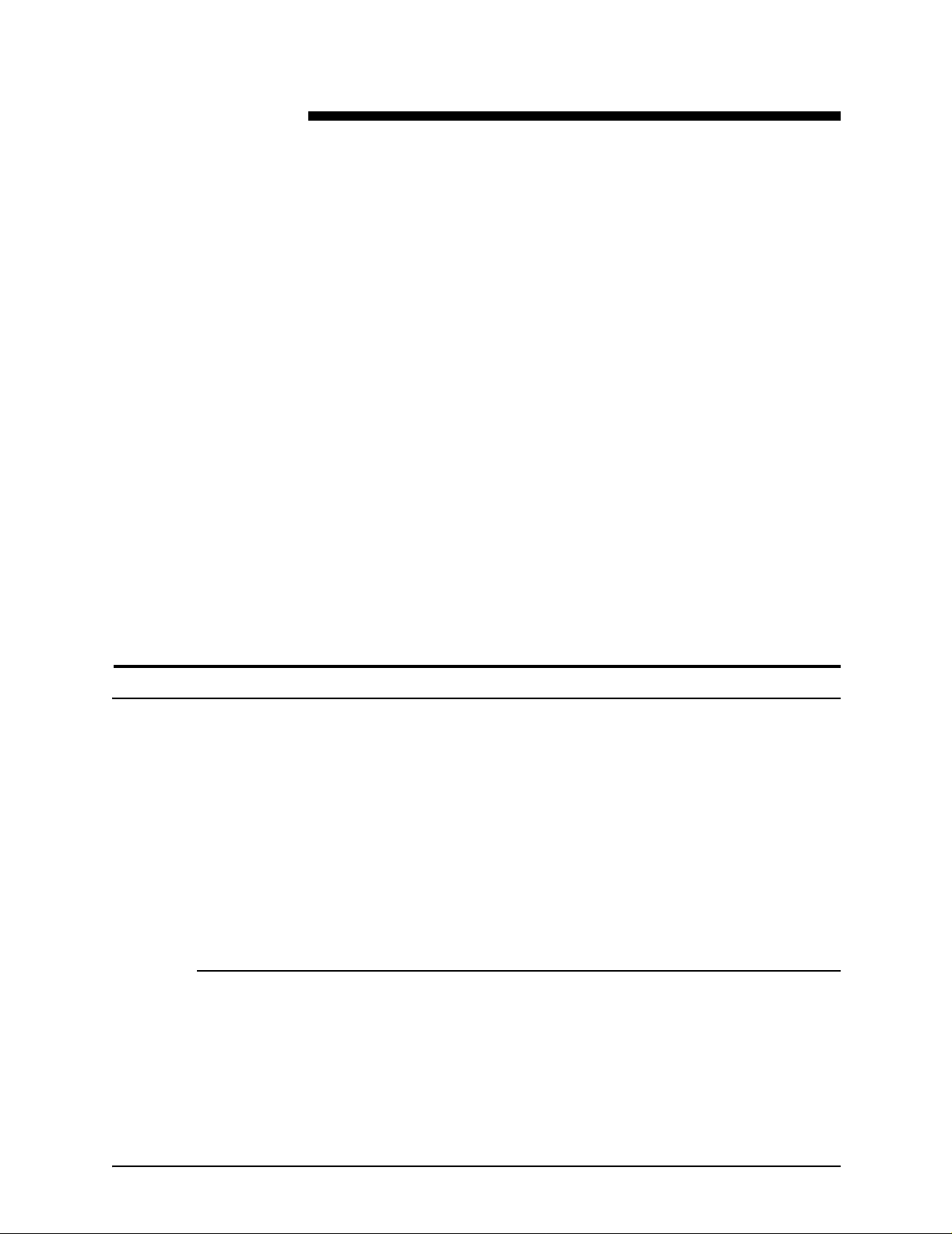

Changes in check creation role

In the past, the roles of manufacturer and check issuer were

distinct. Because the technical requirements of doing MICR

printing were f airly diffi cult, the man uf acturer usuall y did all of the

process steps that involved the generation of the check, except

for entering the amount, date, and payee.

The introduction of MICR impact printers allowed the check

issuer to sometimes take over printing the MICR line. With

further technological adv ances , such as t he Xero x MIC R printing

systems, the check issuer has assumed still more

responsibilities that previously belonged to the manufacturer.

- - - - - Printing functions - - - - -

Overview

Manufacturer

Check

issuer

Old areas of

responsibility

Background

Manufacturer

Form and border

MICR line and serial number

Check

issuer

Amount and payee

New areas of

responsibility

Figure 1-4. Changes in check creation roles

Because MICR documents are typically negotiable documents,

every possible measure must be taken to ensure successful

processing. With a less clear division between check

manufacturer and check issuer responsibilities, the check issuer

becomes more involved in the development of a new check

issuance application.

Generic MICR Fundamentals Guide 1-11

Page 22

Overview

1-12 Generic MICR Funda m entals Guide

Page 23

2. Environment

Checks and other bank forms constitute the most frequent uses

of MICR printing. All businesses issue checks to meet payroll

and accounts payable obligations. In addition, all profitable

publicly owned businesses make periodic stock dividend

distributions by chec k.

Most medium and small companies buy check production

services from a service bureau or a bank. Individuals who once

obtained personal checks through their banks can now buy

checks through the mail from check printers.

A major trend in the banking industry is check truncation.

Truncation refers to the ability of the bank of first deposit to

process MICR documents, both theirs a nd those belonging to

other banks, without further transfers of the paper document

(check). The check is processed electronically. This reduces

cost and improves check clearance.

Types of MICR applications

A MICR system need not be dedicated to chec k printing or to any

other MICR-specific application. A MICR system operates no

differently from an identical system that does not have MICR.

MICR and non-MICR systems ma y be mixed at a site and do not

impact scheduling of jobs that do not require MICR magnetic

materials.

MICR printing is most frequently used for the following types of

applications.

Manufacturing checks

Check manufacturing refers to the process of converting milled

paper into finished check and deposit books, computer

stationery, etc. This is usually done by a small group of specialty

or security printers, mail order check printers, and others. MICR

printing systems are becoming more popular in this market.

Generic MICR Fundamentals Guide 2-1

Page 24

Environment

Issuing checks

Issuing turnaround documents

The most common use of MICR printing systems is the process

of obtaining check stationery from the manufacturer and

encoding it with MICR information. Most businesses regularly

issue checks in at least two of the following categories.

• Payroll checks

• Accounts payable checks

• Dividend checks

• Benefit checks

•Drafts

•Warrants

• Negotiab l e or de rs of wit h drawal

Turnaround documents refer to any type of volume transaction,

whether negotia ble or not, that requires data capture. Familiar

examples of turnaround docum en ts are :

• Credit card invoices

• Insurance payment booklets

• Instant re bate coupons

Turnaround document s are also used in remittance processing,

which is a procedure for handling items returned with a payment.

MICR encoded tu rnaround documents enable organizations to

cut their resource and equipment costs. For example:

1. A bank card compan y MICR enco de s an accou nt number on

the bill and remittance slip that is sent to the customer.

2. The payment is returned with the remittance slip. When the

bank card company receives the check and payment slip, the

two documents are visually checked to see that the amounts

are the same on both.

3. The documents are processed by a MICR reader sorter,

which reads magnetic ink characters.

2-2 Generic MICR Fundamentals Guide

Page 25

Printing financial forms

MICR is also used for printing a variety of financial forms.

Examples of MICR financial forms include:

• Personal checkbooks

• Limited transaction checks, such as money market checks

• Direct mail promotional coupons

• Credit remittance instruments

• Internal bank control documents, such as batch tickets

Xerox MICR printing systems

The Xerox MICR printing systems are a unique range of

products that combine speed, intelligence, and high print quality.

They also provide great flexibility in font selectivity, graphics

capability, and dynamic page f ormatting .

Environment

An advantage to Xerox printing systems is their ability to print a

document in a si ngle pass, as shown in the following figure. The

form design, variable data, logos, and signatures can all be

printed together. With MICR enablement, the MICR line can be

included.

Additional benefits incl ud e:

• The elimination of expensive production and inventory of preprinted forms

• The ability to produce multiple checks on one physical page

• Reduced handling steps by using cut sheet rather than

fanfold paper

• The reduction of additional equipment, such as burste rs,

decollators, trimmers, and signature machines

• Reduced turnaround time

• Ability to print checks against multiple accounts

With the introduction of the latest MICR printing systems, Xerox

has expanded its application base, using more paper sizes and

multiple paper stocks.

Generic MICR Fundamentals Guide 2-3

Page 26

Environment

MICR printing technologies

The following basic printing techniques are capable of

generating magnet ic characters:

• Letterpress

Letterpress is based upon a raised typeface that sits above

the plane of the image carrier. The typeface is inked with

special magnetic ink and applied to the paper under

pressure. Common forms of letterpress are: hot metal type,

sequential number machines, and ribbon encoders.

• Offset lithography

Large offset devices are typically used to produce check

stationery. The lithographic process uses magnetic ink and

water to shap e the image on a plate . The i mage is tran sf erred

to a rubber sheet called a blanket. The image is then “offset”

to the paper.

• Impact ribbon encoding

Ribbon encodin g, al so ca l led “ d ir e c t prin ti ng ,” i s a le tterpress

technology with a different delivery method. Instead of the ink

being applied to the typeface and then to the paper, the ink is

suspended on a thin sheet of backing (usually a polymer

base) called a ribbon.

The ribbon is held between the typeface medium (drum,

daisy wheel, or hammer) and the pap er, so that when the

typeface is struck against the paper, the components on the

ribbon are trapped and pressed onto the document to be

printed.

• Non-impact (xerography and ionography)

Non-impact printing technologies have been growing in

market penetration. They require highly sophisticated and

consistent equipment utilizing magnetic materials.

• Thermal ribbon encoding

A non-impact, thermal transfer version of ribbon encoding

combines some of the charac terist ics of the conventi o nal

ribbon encoding with those of non-impact technology.

2-4 Generic MICR Fundamentals Guide

Page 27

Printer technical optimization

The Xerox MICR systems use the same operating software as

their standard configuration counterparts. In addition, the MICR

systems have been enhanced to include the following features:

• Optimized print engine

• MICR materia l s package

• Optimized paper handling system

• Digitized MICR font

Optimization of the MICR print engines subsystem is required b y

the physical properties of the dry ink. As a result of these

changes, dry ink and de v eloper a re not intercha ngeable between

MICR and non-MICR printers, unless specifically designed to

accept more than one type of materials.

The Xerox MICR systems have a paper handling system

designed for the highly accurate registration. This is required for

precise placement of the MICR line t o maximize readability

during check processing.

Environment

Typical MICR printing concerns

The following areas of MICR user concerns have made banks

want to increas e reli ab ili ty of the MIC R docum en t gene r a ti ng

process:

• Security: This can be addressed by providin g high security

within the document creation process. In addit ion,

counterf ei t in g can be reduced by the use of v a rious des ig n

and production technique s.

• Quality: Sensitive to the banking industry demands, printing

businesses maintain tight quality control procedures.

• Production speed

• Cost

In addition to their need to adhere to required print quality

standards, they have the following concerns about the pr inting

operation:

• Traditional MICR printing devices are labor intensive.

Generic MICR Fundamentals Guide 2-5

Page 28

Environment

• High security measures are needed in any environment that

uses check stationery. These measures affect physical

access restrictions and staff supervision.

• Check printing usually requires frequent starting and

stopping, which is time-consuming and degrades print speed.

• Storing hundreds of different preprinted check and deposit

forms can be costly.

• Short print runs of continuous forms can waste materials.

• Check production requires short lead times.

Xerox MICR printing systems reduce many of these concerns.

There is no need to store dif f erent type s of preprinted f o rms, and

single pass printing eliminates many time constraint s.

2-6 Generic MICR Fundamentals Guide

Page 29

Paper guidelines

3. Paper facts

MICR applicatio ns have special pa per, print, and finishing

requirements . Ref e r to y our printer ope rato r guid e f or a co mplete

list of supplies and options.

Refer to Helpful Facts about Paper for information on solving

printer problems relating to paper.

The paper that you use to print MICR documents must meet the

criteria for the Xerox MICR laser printer and the specifications

imposed by MICR industry standards. In addition, papers must

resist alteration and prevent duplication of negotiable

documents. They must support hi gh print quality and feed

through the printers properly.

NOTE: Some b ankin g a uth oritie s spe cify the type and weight o f

paper that should be used for check printing in that country. It is

essential that only the specified paper be used.

Follow these guidelines for best results:

• Understand check stock security requirements, and use

security features that do not degrade printer performance.

• Do not accept delivery of paper or forms that are not reamwrapped in a moisture barrier.

• Do not open paper reams until you are ready to load the

paper into the printer.

• Store paper in the printer room for at least 24 hours before

using it. This allows the paper to stabilize to the temperature

and relative humidity of the room.

• Do not allow the printer room t o become e xcessive ly humid or

dry. This can cause a differ en ce i n moi stu re content between

the edges and center of each s heet of paper, and result in

feeding, image permanence, or image deletion problems.

Generic MICR Fundamentals Guide 3-1

Page 30

Paper facts

• Do not use cut-sheet check paper that was converted from

fanfold by the paper distributor. This conversion process can

result in dimensional inaccuracy, poorly cut edges, and

unacceptable paper curl.

MICR paper requirements

The following table summarizes Xerox’s recommendations for

papers that are use d f or MI CR printing. P ap ers with the f ollo win g

characteristics perform best in Xerox MICR printers.

Table 3-1. Xerox paper recommendations

Paper characteristics Recommended for optimal printer and reader/sorter performance

Basis weight 24-pound/90 gsm

Sheffield smoothness 80 to 150

Grain direction Parallel to the long edge of check or MICR document. Short grain direction

may be acceptable for personal, 6 inch/152 mm checks.

Moisture content 3.9 to 5.e per cent

Reflectance 60 percent minimum

Curl Refer to instructions in your MICR printing system operator guide

Perforations 60 to 80 ties per inch

Metallic content No ferromagnetic materials can be present in the paper.

Stiffness For recommendations, refer to “Paper stiffness,” later in this chapter.

Cutting precision +/- 0.030 inch/0.762 mm length

+/- 0.030 inch/0.762 mm width

Coating Do not use paper containing clay or resin coatings.

Lamination Do not use stock that is a combination of paper and plastic.

Preprinting ink Must be heat resistant to approximately 400 degrees F/204 degrees C for laser

printing. Heat resistance varies according to manufacturer.

Size Refer to instructions in your MICR printing system operator guide

Basis weight

Basis weight is an industry term for expressing the weight per

unit area of paper . P aper weig ht is generally e xpressed as g rams

per square meter (gsm), a measure that makes it easy to

compare any two pieces of paper, even if the papers are of

different types, such as offset and index.

3-2 Generic MICR Fundamentals Guide

Page 31

Paper facts

In the United St ates, paper weights ar e given as the weight of

500 sheets of paper of a particular size. The size of the basis

sheet, however , v aries with the type of paper. This makes difficult

any comparison of weight between different types of paper. For

example, 50 pound xerographic bond is not the same as a 50

pound offset pa per, and both are different from a 50 pound in dex

stock.

Xerox MICR printing systems produce the best quality and

highest throughput using the Xerox recommended 24 pound

(U.S. market) or 90 gsm xero g raphic paper. Lighter papers often

cause misfeeds, and heavier papers are more subject to jams

(although most Xerox printing system s can handle a wide range

of paper weights).

In multi-pass reader sorter processing, lighter weight papers

subject to frequent misfeeds and mechanical stresses, and are

not as reliable as 24 pound paper.

Sheffield smoothness scale

The smoothness of your paper can impact image quality. With

increasing roughness, the print quality of solids and halftones

degrades. Extremely rough paper does not properly accept

fused dry ink, which rubs or flakes off.

Rough papers require a higher density setting and more ink than

smooth papers to achieve the desired level of image darkness,

because surface irregularities must be filled in with ink.

Papers must measure 50 to 200 when they are measured by a

Sheffield smoothness instrument, in order to meet ANSI

standards. Higher numbers indicate roug her paper.

Xerox has conducted extensive image quality testing on

xerog r aphi c , bo nd, an d offset paper s . The smoot her xerographic

and bond grade papers provide the best image quality. Xerox

recommends a Sheffield smoothness of 80 to 150.

If you use preprinted forms, check with your forms supplier for

the smoothness quality of the form before you make a bulk

purchase.

Generic MICR Fundamentals Guide 3-3

Page 32

Paper facts

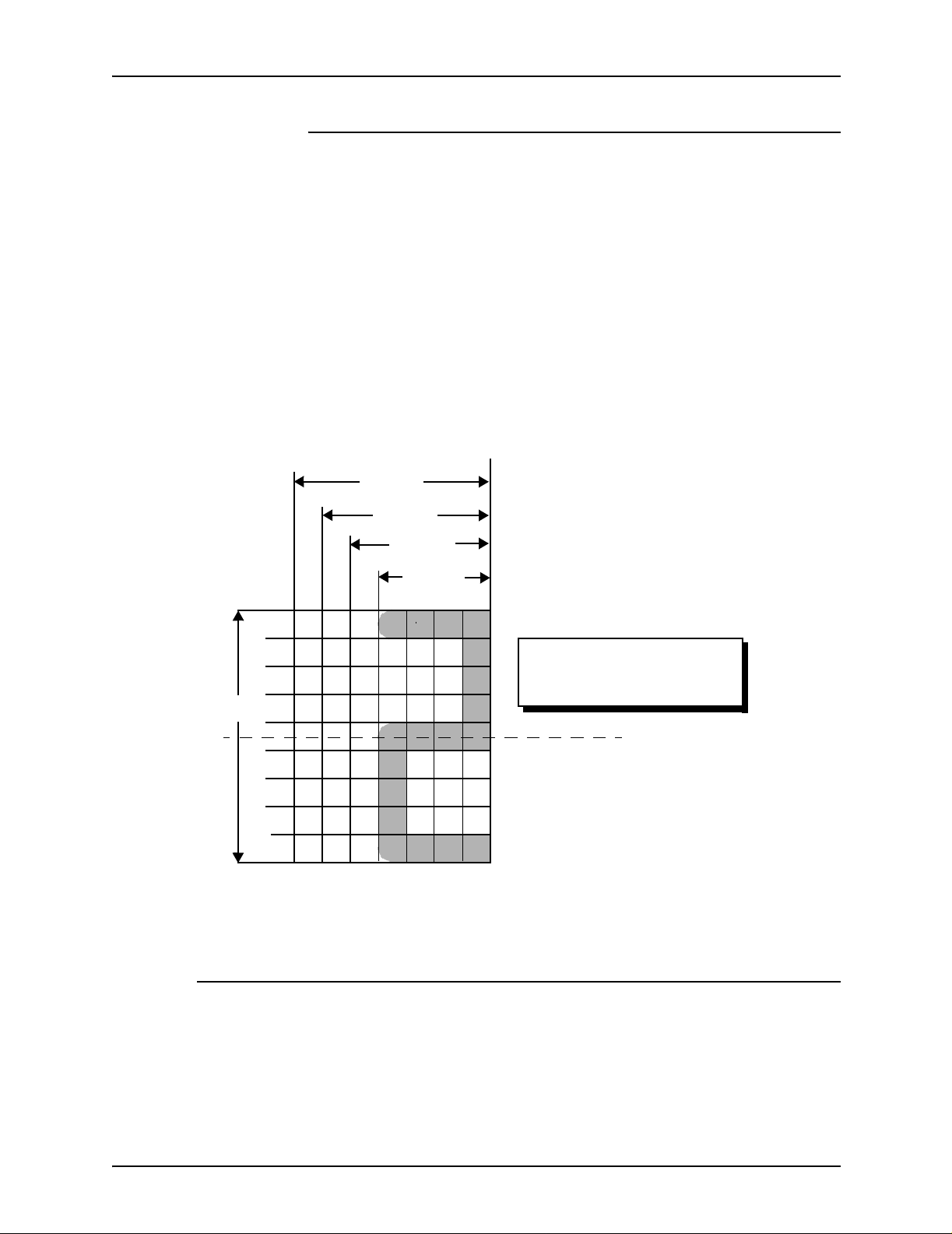

Grain direction

Pape r prop erties are related to the g ra in di rect ion. The g r ain of a

paper is the direction in which most of its fibers lie, as shown in

the following figure. Long grain papers are cut so that the fibers

are aligned with the long dimension of the cut sheet. Short grain

papers have the fibers aligned with the short dimension of the

sheet.

You can use 24 pound paper in either grain direction. If your

paper is light er than 24 pound, use it only for document s in which

the grain is in the long dimension of the finished document. For

long grain MICR-processed documents, the minimum paper

weight is 20 pounds.

NOTE: 24 pound, long grain paper is recommended for MICR

printing.

Long grain sheet cut from

paper web

Paper web - made during

paper making process

The following figure shows the relationship between long and

short grain documents and the MICR processing direction. The

shaded areas represent typical documents that would be cut

from these s heets for MICR processing.

Pulp fibers

Short grain sheet cut from

paper web

Paper making

process direction

Figure 3-1. Long and short grain

3-4 Generic MICR Fundamentals Guide

Page 33

Paper facts

11" 11"

Moisture content

Too much moisture in paper causes excessive curl, jams,

degraded image permanence, and print quality problems. Too

little moisture causes static problems, which can lead to jams,

misfeeds, and difficulties in post-processing paper handling.

Papers with a nominal moisture content of 4.7 per cent perform

best in Xerox MICR laser printers. Offset and bond papers may

have a higher moisture con tent than xerographic pape rs.

Xerox brand papers have a maximum moisture content of 5.3

percent, with an average of 4.7 per cent. Several other MICR

bond papers have moisture content of less than 5.3 percent.

Preprinted papers must have a moisture content within these

limits after preprinting.

8.5"

8.5"

Figure 3-2. Long and short grain documents

Reflectance

All MICR materials must meet a background reflectance

standard of 60 per cent minimum, as measured by equipment

having a CIE Photopic Spectral Response. Backgrounds

containing patterns, designs, logos, or scenes must meet

additional limits on the contrast of the preprinted areas. These

background reflectance standards were developed to permit

machines to read information on the check, such as the

convenience amount field.

Generic MICR Fundamentals Guide 3-5

Page 34

Paper facts

Requirements for background reflectance are discussed in

chapter 4, “Document design.”

Curl

All papers curl to some degree. Excessiv e curl is one of the most

common causes of paper jams. Selecting a low-curl paper with

the proper moisture conte nt mak es a signi fica nt difference in the

productivity of your system. Refer to the operator guide for your

printer for paper curl recommendations specific to your printer.

Because the front and bac k surf aces of th e paper, as determined

during the paper making process, differ slightly in their makeup,

one side is preferred as the side to image firs t. If you are using a

quality 24 pound/90 gsm paper intended for xerographic

purposes, the ream wrapper is marked with an arrow that

indicates the preferred printing side. Print on this side for onesided printing. For two-sided printing, print on this side first

(unless instructed otherwise in the operator guide for your laser

printer).

Perforation

How you load preprinted paper is determined by the preprinting.

Preprinted forms should be produced so that their curl is

compatible with the requirements in your MICR printer operator

guide.

When you use perforated paper, your objective is to have a

smooth, free-feeding sheet that retains sufficient beam strength

to prevent sheet fold-over, buckling, or jams.

If you use preperforated forms, consider the following fa ctors:

• Use 24 pound/90 gsm paper.

• Use a perforation that lets the sheets retain as much stiffness

as possible. Reduced stiffness may result in jamming and

paper mutilation.

• Perforations should be nine per inch.

• All holes should be the same size.

• The ratio of holes to paper (tie size) should be less than or

equal to 1:1. In oth er w or d s, the tie size sh oul d be at l e ast a s

large as the hole size.

3-6 Generic MICR Fundamentals Guide

Page 35

Paper facts

• If you are using micro-perf orati ons, be sur e to hav e more than

60 ties to the inch.

• Make sure that the perforation line is rolled sufficiently to

eliminate the underside bulge (debossment). Otherwise,

feeding and stacking may be unreliable and print deletions

may occur.

• When paper is perforated, a ridge or dimple forms around the

holes. Make sure that the design and placement of the

perforation does not cause document edge irre gularities.

• Do not use puncture-type perforations that are not ironed

smooth. They prevent the stack from lying flat, which can

cause feeding problems and deletions. Use rolled

perforations instead.

• Make sure that the perforation design and placement do not

cause document edge irregularities.

• Make sure that die-cut perforated papers are free of paper

dust and chaff.

• Avoid printing any text or forms data within 1/8 inch/3.2 mm of

• For printers that use edge registration: Full-length perforation

Metallic content

Paper stock materials for MICR applications cannot contain

ferromagnetic particles.

Stiffness

Stiffness ref er s to th e rigidity or be ndi n g re si stan ce of the pa pe r.

Thicker papers are usually stiffer. In general, 16 pound/60 gsm

and lighter papers are not as stiff as heavier stocks. They may

bunch up or wrinkle in the printer, causing jams and misfeeds.

Heavier papers, such as cover and index stock, may jam more

frequently and have more print quality defects (skips, blurs, and

deletions) due to their reduced ability to bend.

any perforation.

that is parallel to the registration edge should not be closer

than 1.5 inches/37.5 mm to that edge.

24 pound/90 gsm paper usually provides stiffness levels in the

range needed by the Xerox MI CR la ser printer and the proofing,

reader sorter, and remittance-processing systems used in

banking environments.

Generic MICR Fundamentals Guide 3-7

Page 36

Paper facts

Stiffness is lower across the grain direction than in the grain

direction. Documents having the grain r unning parallel to the

short dimension of the pa per require special consideration to

ensure adequate stiffness. Sh ort grain MI CR documents are

restricted to papers with a basis weight of 24 pound/90 gsm or

higher.

Cutting precision

Pape r for MICR printing applicatio ns sho uld be fr ee o f al l de f ect s

that could interfere with reliable feeding, such as edge-padding

and folded or bent she ets.

NOTE: Fan all paper before loading it.

The squareness of each sheet must be precisely controlled to

ensure optimum MICR ba nd re gi stration. The dimensions must

be controlled to ±.030 inch/0.762 mm.

Xero x paper

Papers that have been converted from continuous for m paper

present a risk of jams and poorly registered forms in a Xerox

MICR laser printer.

To ensure reliability, X erox has developed paper w i th the

optimum characteristics for xerographic printing. Every lot of

Xerox paper is tested at least three times:

1. At the mill by the manufacturer

2. In Xerox quality-assurance laboratories

3. In Xerox laser printing systems prior to shipment

Xerox 4024 Dual Purpose 24 pound paper is recommended for

MICR printing in the U. S. and Canada. This paper has been

extensively run on Xerox MICR laser printing systems. It closely

complies with all MICR paper specifications and is suitable for

printing MICR encoded documents that will be proces sed

through high-speed reader sorters.

3-8 Generic MICR Fundamentals Guide

Page 37

Paper maintenance

Wrapping factors

Paper facts

The physical condition of your MICR paper is extremely

important. In addition to being free from holes, wrinkles, tears,

damaged edges, and foreign material, MICR paper must be

carefully maintained, both before and after printing.

Paper with a moisture content below 5.5 per cent is best for a

Xerox MICR laser printer. The moisture content must be uniform

within the ream, which should not be allowed to lose or gain

moisture duri ng storage.

To best preserve paper and pr eprinted f orms, use moistu re-proof

ream wrappers, which maintain critical moisture balance.

Xerox paper is covered with a polyethylene laminate ream

wrapper. This material is the most effective in resisting the

transfer of moisture from the environment. Unlike wax laminate

wrappers, polyethylene does not bleed through the paper covers

when exposed to heat. Wax bleed-through can cause f e ed i ng

problems. Discard the top and bottom sheets if you suspect wax

contamination.

Storage factors

Xerox paper are packaged in protective heavyweight cartons,

which you can reuse for storage. These cart ons are transported

on a wooden pallet that provides uniform support and protection

to the bottom layer of cartons. The cartons are protected with a

moisture barrier of plastic shrink-wrapping.

Generic MICR Fundamentals Guide 3-9

Page 38

Paper facts

Temperature and humidity conditions

The temperature and humidity in the printer environment can

affect runability and print quality. Use the following guidelines for

the best MICR printing performance:

• Optimum temperature and humidity range

– 68 to 76 degrees F / 2 0 to 14 degrees C

– 35 to 55 percent humidity.

Store all paper on a wooden pallet. Placing paper directly on

the floor increases moisture absorption.

• If you move paper from a storage area to a location with a

differen t t empe ratur e an d hum idit y, condition the paper to the

new environment before using it. The time you should wait

between paper storage and use is listed in the following table.

Table 3-2. Temperature conditioning chart

Temperature

difference 10° F 15° F 20° F 25° F 30° F 40° F 50° F

Number of boxes Hours Hours Hours Hours Hours Hours Hours

1 4 8 11 14 17 24 34

5 5 9 12 15 18 25 35

10 8 141822273851

20 11 16 23 28 35 38 67

40 14 19 26 32 38 54 75

For example, if you want to move 10 cartons (boxes) from

your storage area at 55 degr ees F to you r printing room at 75

degrees F, (a change of 20 degrees), you should let the

cartons stand unopen ed in your printing room for at least 18

hours before use.

• Store paper inside the original carton and ream wrappers

until shortly before use.

• Reduce excessive curl by storing the paper in a dry

environment for several days.

3-10 Generic MICR Funda m entals Guide

Page 39

Paper runability criteria

Use the f ol l owing criteria to a void paper jams and to assure high

image quality:

• Use 24 pound/90 gsm xerographic or dual purpose MICR

bond paper. The paper should have the following

characteristics:

– Low moistur e cont en t (be lo w 5.3 per cent)

– Built-in curl control

– Smooth surface (smooth er than most offset or bond

– No mechanical defects

– Moisture-proof wrapping

• Correct temperature and humidity are also important. Refer

to the “Temperature and humidity conditions,” earlier in this

chapter.

Paper facts

papers)

Your service representative can verify that the MICR printing

system is adjusted within design tolerances. If a paper runability

problem persists, consider changing:

• The ream, carton, or request paper from a different lot

• Your type, weight, or brand of paper

• The conditi ons under which the paper is stored

• The temperature or humidity of the printer environment

• The time elapsed between unwrapping and printing

Generic MICR Fundamentals Guide 3-11

Page 40

Paper facts

Malfunction Possible causes

Repeated processor jams • Excessive curl

Paper multi-feeds or skew feeds • Poorly cut paper

The follo wing tab l e is a troub leshoo ting gui de f or pape r runability

issues.

Table 3-3. Paper runability issues

• High moisture content in paper

• Excessive paper smoothness

• Bent corners

• Predrilled paper plugs

• Excessive moistu re in printer or paper

storage environment

• Paper not acclimated to printer environment

• Wrapper wax or glue on sheets

• Low humidity in printer environment

• Poorly drilled paper

• Paper too porous

Paper misfeeds • Poorly cut paper

• Excessive curl

Jams in stacker bin • Excessive curl

• High moisture content in paper

• Excessive moistu re in printer or paper

storage environment

Sheets stick together in stacker • Low humidity

• Paper dust on static eliminator

Poor copy quality • Rough paper

• Incorrect paper conductivity

Leading edge of the paper tears • Poorly cut paper

• Paper too lightweight

• Excessive curl

Spots on copy • Wrapper wax or glue on sheets

• Excessive paper dust

• Dust from poor perforations

• Wax or soap used on drill

3-12 Generic MICR Funda m entals Guide

Page 41

Preprinted forms considerations

The combination of consistent data format and element location

makes preprinted forms useful in M ICR applications. Additional

requirements for security features, either in the base paper stock

or in the preprinted for m, come from the need to protect a

financially negotiable documen t .

You need to consider several factors related to ink and paper

when selecting a preprinted form for any type of laser printer.

Preprinted check stock must not offset (transfer from a printed

sheet onto other surfaces). Work closely with the forms vendor to

ensure that requirements are und erstood and met. Always test

the application on the appropriate printer before production

printing.

Inks

Paper facts

Choosing the correct ink is the first step in designing forms that

function well in Xerox printers. Inks for these forms must cure

well, must not be tacky, and must not offset. In choosing an ink,

you must consi der the am oun t of heat a nd pressur e to whic h the

forms will be ex po sed whil e passin g thr ou gh the printer. You

must also consider the dwell time–the amount of time that the

preprinted paper is subjected to those conditions.

Good performance has been reported with the following ink

types:

• Oxidative inks: The following qualities are desirable in

oxidative inks:

– Non-volatile, cross-linkable vehicles

– Internal and surface-curing driers

– Minimal use of anti oxidants

– No slip agents

– pH in the press fountain high enough to permit curing

NOTE: Oxidative inks can require several days to harden

satisfactorily.

• UV cured inks: Inks that are cured using UV (ultr avi olet) li ght

change immediately from liquid to solid upon exposure to an

intense UV light source.

Generic MICR Fundamentals Guide 3-13

Page 42

Paper facts

• Laser inks: Inks that are formulated specifically for use on

forms that will pass through laser pri nters are a recent

development that holds considerable promise. These inks

cure promptly (usually within 24 hours) and are formulated

with laser printer conditions a s a de sign criterion. They can

be expected to reduce offsetting and other problems

encountered with other types of inks.

Laser inks may be oxidative, UV, or heat set types.

Another option is to use Xerox forms, whose performance is

guaranteed. The s ame guarantee should be expected of the

forms vendor chosen by the customer.

Security features

Checks and other negotiable require protection against

fraudulent use. Security features can be incorporated into the

base stock when the paper is made, or they can be part of the

preprinted form. These features should be chosen to achieve

sufficient document security without negative effe cts on printer

operation.

A secure document is protected against both duplication and

alteration. Security features should be selected to address each

of these aspects effectively when they are used in a MICR laser

printing system.

A detailed discussion of check security is contained in chap ter 8,

“Security.”

Duplication detection

The most common security features for detecting duplication of

forms include:

• Microprint: Extremely small type used to print a message or

phrase that is readable under magnification

• VOID pantograph: A pattern of varying halftone screen

frequencies in the check background that causes the word

VOID to appear in the background of a copied check

• Split fountain backgrounds: Continuous fade from one

color to another across the docu ment

• Microfibers: Tiny colored or UV treated fibers that are

incorporated into the base paper stock and are easily visible

under normal or UV illumination.

3-14 Generic MICR Funda m entals Guide

Page 43

Paper facts

• Watermark: A variation that is made in the opacity of the

paper during manufacturing. An artificial watermark is

typically a white ink image that is printed on the back of the

check.

• Drop-out ink: Very low density ink that is used to print a

message, usually on the back of the check

• Thermochromic ink: An ink that is used to create an image

that changes color when warmed by a finger

Alteration prevention

The most common security features for detecting alteration of

forms include:

• Security backgrounds: Patterns printed in the check

background that show any attempt to alter the image.

Regular patterns are preferable; irregular patterns may

merge with altered areas.

• Fugitive inks: Inks that run when they come in contact with

liquids

Application design

Intelligent application design can provide add itional protection

against alteration.

• In left- and right-fill fields, pad any open space with additional

characters. Asterisks (*) are recommended to fill in the

convenience amount field (the amount written in numerals).

• Redundant data—duplicate information, such as the amount

written in both numbers and words—makes altering the valid

check data more difficult.

• Fonts with large, wide-stroke characters are more difficult to

alter than small, narrow type faces.

Numbered stocks

Preprinting sequential nu mbers on the sheets of MICR stoc k is a

useful tool fo r tracking stock usage. Numbered stock is helpful

for determining the number of sheets that were used for a check

printing job, reconciling against the size of the job and the

number of sheets that were used but not issued as checks.

Following are some points to note for using numbered stocks:

Generic MICR Fundamentals Guide 3-15

Page 44

Paper facts

• To achieve reconciliation without substantial waste, always

use the stock sheets in the same order—lowest to highest—

so that the sequence remains intact.

• Avoid gaps in the sequence.

• Storing unused stock without wrapping may cause runability

problems the next time it is used.

• The numbering or de r de pends on how the pape r is lo aded in

the feeder tray. If the paper is loaded face up, the lowest

numbers must be at the top of the stack. If the paper is

loaded face down, the lowest numbers must be at the bottom

of the stack. For face down printing, eith er th e p ap er must be

boxed face down or the paper boxes must be inverted before

the paper is used .

• Synchronizing the sequential numbers with the check ser ial

numbers is not recommended because of the complexity it

adds to the production process. Operators are required to

input the starting sequence number, and the job must be

restarted any time a jam occurs.

Features to avoid

Some security features may either be ineffective or cause

damage to the printer. Before making a major forms investment,

always test new preprinted forms to verify that security claims

are delivered without printer impact.

• Some security papers contain chemical indicators that

produce vivid dye images in areas where erasers, bleaches,

or chemical eradi cators have been applied. These indicators

are intended for wet ink images and do not effectively protect

dry ink images. They may degrade image quality, reduce

document security, and severely impact printer reliability.

• Another type of chemical treatment of the base stock

attempts to reduce the risk of alteration through improved

image performance. Some, but not all, of these treatments

improve permanence. There remains a risk of printer

contamination, with associated degradation in image qual ity,

reduction in image permanence, and potential printer

reliabi lity impact s.

3-16 Generic MICR Funda m entals Guide

Page 45

Paper facts

• Many security features must be located in areas of the

document where the printer places critical information, such

as the payee name and the che ck am ount fields. However, if

the feature interferes with the bonding of dry ink to paper,

poor image permanence results. This negates the value of

the feature and makes alteration harder to detect. If the