Page 1

ELECTRONIC PRINTING CALCULATOR

DRUCKENDER TISCHRECHNER

CALCULATRICE IMPRIMANTE ÉLECTRONIQUE

CALCULADORA IMPRESORA ELECTRÓNICA

CALCOLATRICE ELETTRONICA STAMPANTE

ELEKTRONISK SKRIVANDE OCH VISANDE RÄKNARE

ELEKTRONISCHE REKENMACHINE MET AFDRUK

OPERATION MANUAL

BEDIENUNGSANLEITUNG

MODE D’EMPLOI

MANUAL DE MANEJO

MANUALE DI ISTRUZIONI

BRUKSANVISNING

GEBRUIKSAANWIJZING

ENGLISH ............................................................ Page 1

CALCULATION EXAMPLES .............................. Page 50

DEUTSCH ........................................................... Seite 8

RECHNUNGSBEISPIELE .................................. Seite 50

FRANÇAIS .......................................................... Page 15

EXEMPLES DE CALCULS ................................. Page 50

ESPAÑOL ........................................................ Página 22

EJEMPLOS DE CALCULOS ........................... Página 50

ITALIANO ........................................................ Pagina 29

ESEMPI DI CALCOLO .................................... Pagina 51

SVENSKA ............................................................ Sida 36

GRUNDLÄGGANDE RÄKNEEXEMPEL ............. Sida 51

NEDERLANDS ................................................ Pagina 43

REKENVOORBEELDEN ................................. Pagina 51

EL-2901C

Page 2

This equipment complies with the requirements of Directives 89/336/EEC and

73/23/EEC as amended by 93/68/EEC.

Dieses Gerät entspricht den Anforderungen der EG-Richtlinien 89/336/EWG und

73/23/EWG mit Änderung 93/68/EWG.

Ce matériel répond aux exigences contenues dans les directives 89/336/CEE et

73/23/CEE modifiées par la directive 93/68/CEE.

Dit apparaat voldoet aan de eisen van de richtlijnen 89/336/EEG en 73/23/EEG,

gewijzigd door 93/68/EEG.

Dette udstyr overholder kravene i direktiv nr. 89/336/EEC og 73/23/EEC med

tillæg nr. 93/68/EEC.

Quest’apparecchio è conforme ai requisiti delle direttive 89/336/EEC e 73/23/EEC,

come emendata dalla direttiva 93/68/EEC.

89/336/ 73/23/EO, % &

&'( % 93/68/.

Este equipamento obedece às exigências das directivas 89/336/CEE e

73/23/CEE, na sua versão corrigida pela directiva 93/68/CEE.

Este aparato satisface las exigencias de las Directivas 89/336/CEE y

73/23/CEE, modificadas por medio de la 93/68/CEE.

Denna utrustning uppfyller kraven enligt riktlinjerna 89/336/EEC och 73/23/EEC så

som kompletteras av 93/68/EEC.

Dette produktet oppfyller betingelsene i direktivene 89/336/EEC og 73/23/EEC i

endringen 93/68/EEC.

Tämä laite täyttää direktiivien 89/336/EEC ja 73/23/EEC vaatimukset, joita on

muutettu direktiivillä 93/68/EEC.

Caution!

The socket outlet shall be installed near the equipment and shall be easily

accessible.

Vorsicht!

Die Netzsteckdose muß nahe bei dem Gerät angebracht und leicht zugänglich sein.

Observera!

Det matande vägguttaget skall placeras nära åpparaten och vara lätt åtkomligt.

Advarsel!

Stickkontakten for dette materiel skall væra anbragt i nærheden af materiellet og

vare let tilgængenlig.

Observera!

Stikkontakt for nettilkopling skal forefinnes i naerhaten av apparatet og skal vare

lett tilgjengelig.

Attention!

La prise de courant murale doit être installée à proximité de l’appareil et doit être

facilement accessible.

Aviso!

El tomacorriente debe estar instalado cerca del equipo y debe quedar bien

accesible.

Attenzione!

El presa della corrente, deue essere installata in prossimità dell’acessorio ed

essere facilmente acessibile.

Page 3

ENGLISH

INTRODUCTION

Thank you for your purchase of the SHARP electronic calculator, model EL-2901C. Your

SHARP calculator is specially designed to save work and increase efficiency in all business

applications and general office calculations. Careful reading of this manual will enable

you to use your new SHARP calculator to its fullest capability.

CONTENTS

Page

• OPERATING CONTROLS .................................................................................. 2

• PAPER ROLL REPLACEMENT .......................................................................... 5

• INK ROLLER REPLACEMENT ........................................................................... 5

• ERRORS ............................................................................................................. 6

• SPECIFICATIONS .............................................................................................. 7

• CALCULATION EXAMPLES ............................................................................... 50

• TAX RATE CALCULATIONS............................................................................... 63

OPERATIONAL NOTES

To insure trouble-free operation of your SHARP calculator, we recommend the following:

1. The calculator should be kept in areas free from extreme temperature changes,

moisture, and dust.

2. A soft, dry cloth should be used to clean the calculator. Do not use solvents or a wet

cloth.

3. Since this product is not waterproof, do not use it or store it where fluids, for example

water, can splash onto it. Raindrops, water spray, juice,coffee, steam, perspiration,

etc. will also cause malfunction.

4. If service should be required, use only a SHARP servicing dealer, a SHARP approved

service facility or SHARP repair service.

5. If you pull out the power cord to cut electricity completely, the presently stored tax

rate will be cleared.

1

Page 4

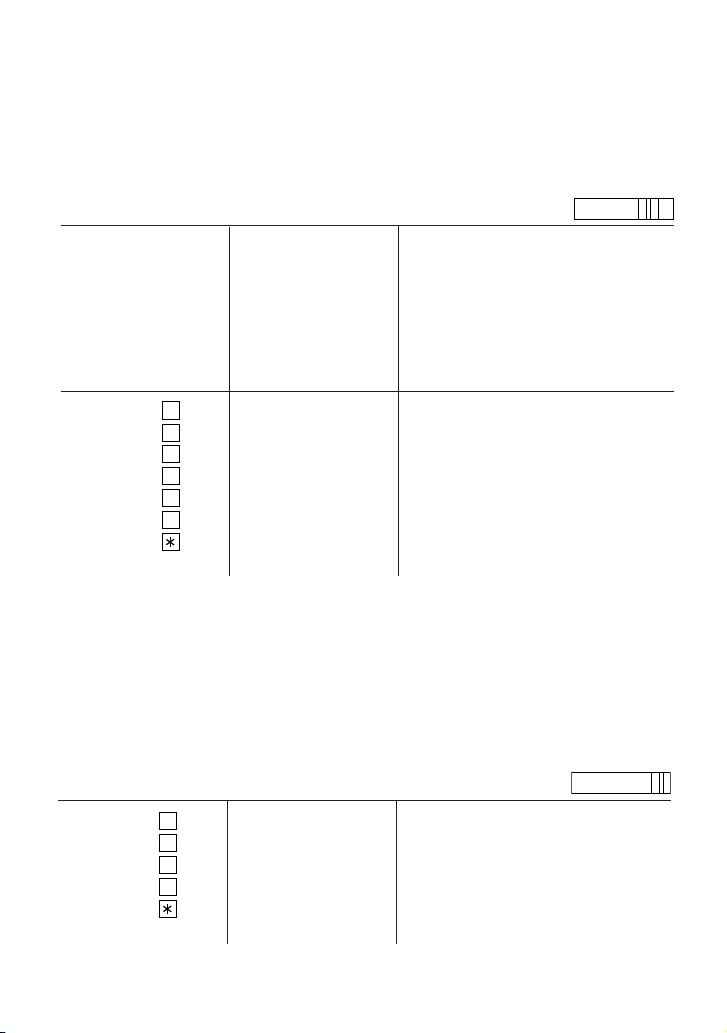

OPERATING CONTROLS

C

CE

OFFON• P•ICP

F 3 2 1 0 A

5/4

POWER SWITCH; PRINT / ITEM COUNT MODE SELECTOR:

“OFF”: Power OFF

“•”: Power ON. Set to the non-print mode.

“P”: Power ON. Set to the print mode.

“P•IC”: Power ON. Set to the print and item count mode.

For addition or subtraction, each time + is pressed, 1 is added to

the item counter, and each time – is pressed, 1 is subtracted.

• The count is printed when the calculated result is obtained.

C

• Pressing of ,

CE

clears the counter.

Note: The counter has a maximum capacity of 3 digits (up to ±999). If the

count exceeds the maximum, the counter will recount from zero.

DECIMAL / ADD MODE SELECTOR:

“3, 2, 1, 0”: Presets the number of decimal places in the answer.

“F”: The answer is displayed in the floating decimal system.

“A”: The decimal point in addition and subtraction entries is automatically

positioned to the 2nd digit from the lowest digit of entry number.

Use of the add mode permits addition and subtraction of numbers

without entry of the decimal point. Use of , and will

automatically override the add mode and decimally correct answers

will be printed.

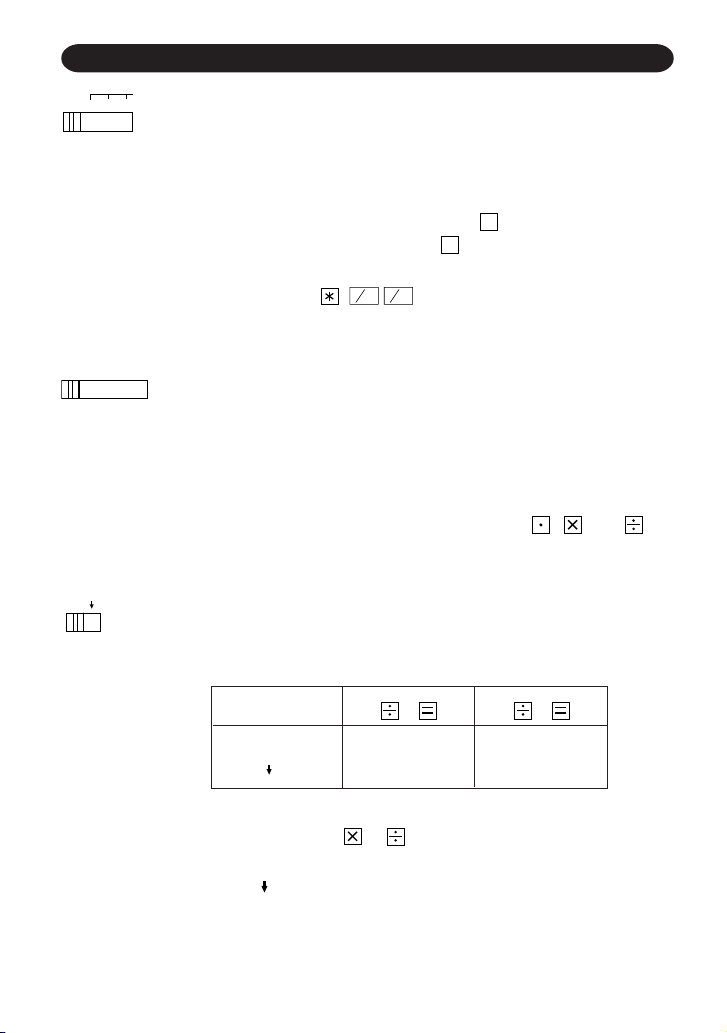

ROUNDING SELECTOR:

Set Decimal Selector to 2.

4 ÷ 9 = 0.444 ... , 5 ÷ 9 = 0.555 ...

4 9 5 9

5/4 0.44 0.56

0.44 0.55

Note: The decimal point floats during successive calculation by

the use of or .

If the decimal selector is set to “F” then the answer is always rounded

down ( ).

2

Page 5

GT

•

GRAND TOTAL MODE SELECTOR:

“GT”: This selector will accumulate the following:

(“ + “ will be printed.)

1. Addition and subtraction totals obtained with .

2. Product and quotient totals obtained with + or –.

3. Answers obtained with % or MU.

“•”: Neutral

PAPER FEED KEY

LAST DIGIT CORRECTION KEY

GT

GRAND TOTAL KEY:

Prints and clears the “GT” memory contents.

#

NON-ADD / SUBTOTAL KEY:

Non-add — When this key is pressed right after an entry of a number in the Print

mode, the entry is printed on the left-hand side with “#”.

This key is used to print out numbers not subjects to calculation

such as code, date, etc

Subtotal — Used to get subtotal(s) of additions and/or subtractions. When

pressed following + or –, the subtotal is printed with “ ” and the

calculation may be continued.

C

CLEAR / CLEAR ENTRY KEY:

CE

Clear — This key also serves as a clear key for the calculation register and

resets an error condition.

Clear entry — When pressed after a number and before a function, clear the

number.

TOTAL KEY:

When pressed after + or –, prints the total of addition and subtraction with “∗”.

EQUAL KEY:

Gives the results of multiplication and division and performs repeat calculation

with a constant.

Multiplication:

The calculator will automatically remember the first number entered (the

multiplicand) and instruction.

Division:

The calculator will automatically remember the second number entered (the divisor)

and instruction.

3

Page 6

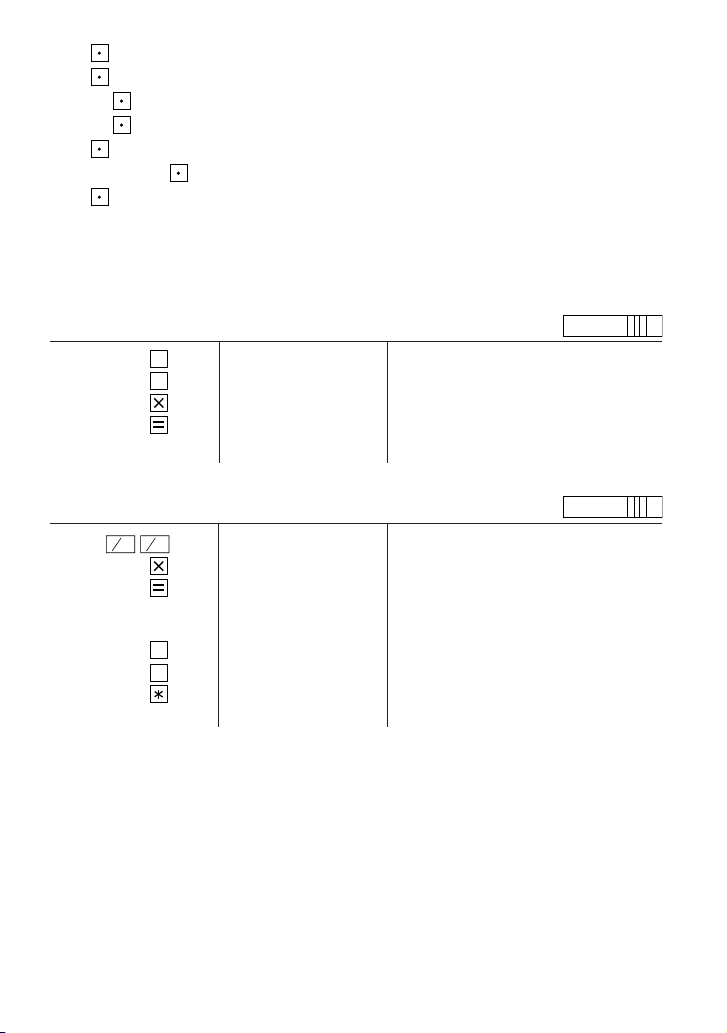

+

MU

–

CHANGE SIGN KEY:

Changes the algebraic sign of a number (i.e., positive to negative or negative

to positive).

MARKUP KEY:

Used to perform mark-ups, percent change and automatic add-on/discount.

M

RECALL AND CLEAR MEMORY KEY

M

RECALL MEMORY KEY

STR

STORE KEY:

This key is used to store the tax rate.

• A maximum of 4 digits can be stored (decimal point is not counted as a digit).

• Only one rate can be stored. If you enter a new rate, the previous rate will be

cleared.

TAX-INCLUDING KEY

+

TAX

PRE-TAX KEY

-

TAX

DISPLAY SYMBOLS:

M : Memory symbol

Appears when a number is in the memory.

– : Minus symbol

Appears when a number is negative.

E : Error symbol

Appears when an overflow or other error is detected.

G : Grand total memory symbol

Appears when a number is in the grand total memory.

TAX+ : Tax-including symbol

Appears when the total calculated includes tax.

TAX- : Pre-tax symbol

Appears when the total calculated excludes tax.

TAX : Tax rate symbol

Appears when the tax rate is set.

4

Page 7

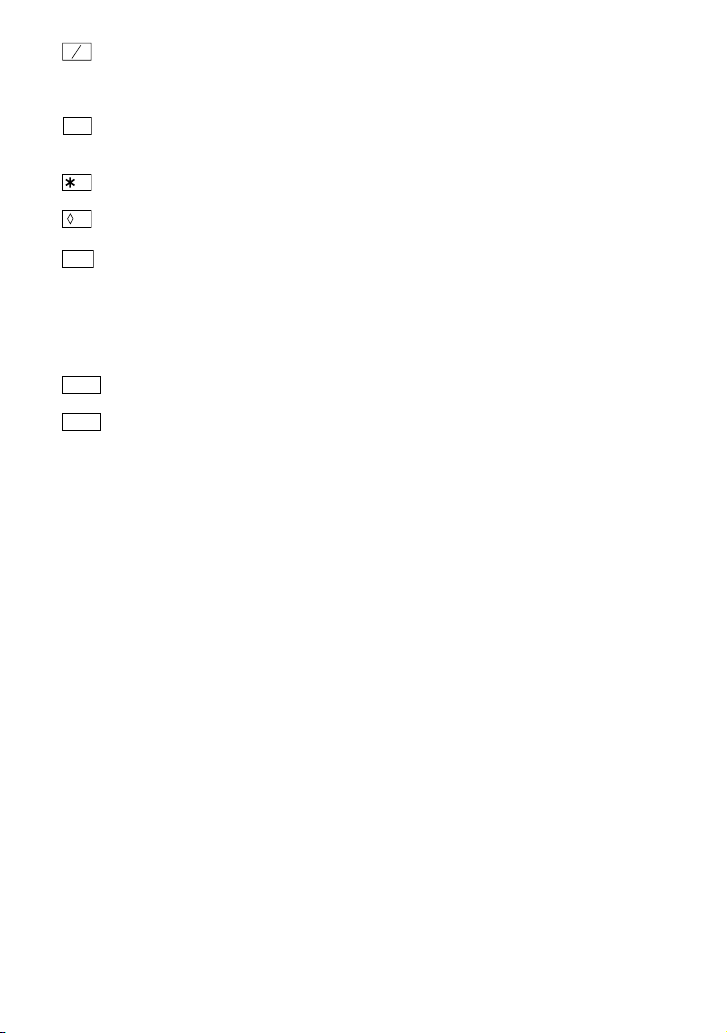

PAPER ROLL REPLACEMENT

Never insert paper roll if torn. Doing so will cause paper to jam. Always cut

leading edge with scissors first.

1) Insert the leading edge of the paper roll into the opening. (Fig.1)

2) Turn the power on and feed the paper by pressing . (Fig.2)

3) Lift the attached metal paper holder up and insert the paper roll to the paper holder.

(Fig.3)

Fig. 1

DO NOT PULL PAPER BACKWARDS AS THIS MAY CAUSE DAMAGE TO

PRINTING MECHANISM.

Fig. 2

Fig. 3

INK ROLLER REPLACEMENT

If printing is blurry even when the ink roller is in the proper position, replace the roller.

Ink roller: Type EA-781R-BK (Black)

Type EA-781R-RD (Red)

WARNING

APPLYING INK TO WORN INK ROLLER OR USE OF UNAPPROVED INK

ROLLER MAY CAUSE SERIOUS DAMAGE TO PRINTER.

1) Set the power switch to OFF.

2) Remove the printer cover. (Fig. 1)

3) Remove the ink roller by turning it counterclockwise and pulling it upward. (Fig. 2)

4) Install the correct color new ink roller and press it in the correct position. Make sure

that the ink roller is securely in place. (Fig. 3)

5) Put back the printer cover.

5

Page 8

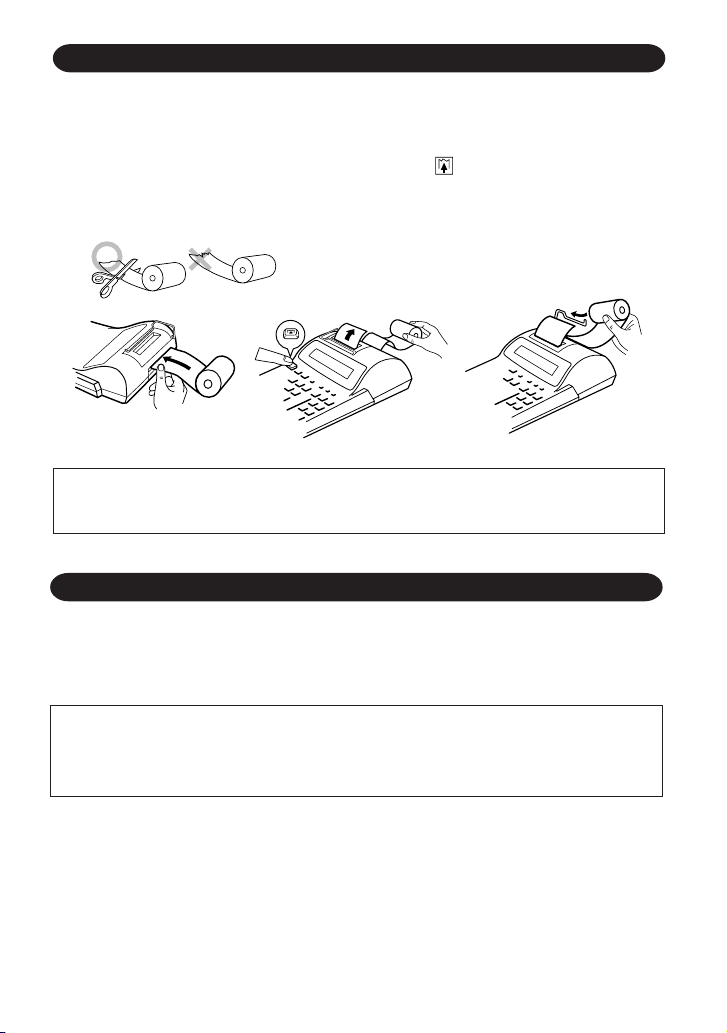

Red Black

Fig. 2Fig. 1 Fig. 3

Cleaning the printing mechanism

If the print becomes dull after long time usage, clean the printing wheel according to the following procedures:

1) Remove the printer cover and the ink roller.

2) Install the paper roll and feed it until it comes out of the front of the printing mechanism.

3) Put a small brush (like a tooth brush) lightly to the printing wheel and clean it by

pressing .

4) Put back the ink roller and the printer cover.

Notes: • Do not rotate the printing mechanism manually, this may damage the printer.

• Never attempt to turn the printing belt or restrict its movement while printing.

This may cause incorrect printing.

ERRORS

There are several situations which will cause an overflow or an error condition. When

this occurs, “E” will be displayed. The contents of the memory at the time of the error are

retained.

C

If “0 • E” is displayed at the time of the error, “– – – – – – –” will be printed in red and

CE

must be used to clear the calculator.

Error conditions:

1. When the integer portion of an answer exceeds 12 digits.

2. When the integer portion of the contents of the memory exceeds 12 digits.

(Ex. M 999999999999 M+ 1 M+)

3. When any number is divided by zero. (Ex. 5 0 ).

6

Page 9

SPECIFICATIONS

Operating capacity: 12 digits

Power supply: AC: 220V – 230V, 50Hz

Calculations: Four arithmetic, constant multiplication and division, power,

add-on, repeat addition and subtraction, reciprocal, grand

total, item count calculation, markup, memory, tax, etc.

PRINTING SECTION

Printer: Mechanical printer

Printing speed: Approx. 2.6 lines/sec.

Printing paper: 57 mm (2-1/4”) – 58 mm (2-9/32”) wide

80 mm (3-5/32”) in diameter (max.)

Operating temperature: 0°C – 40°C (32°F - 104°F)

Power consumption: 30 mA

Dimensions: 200 mm (W) × 251 mm (D) × 60 mm (H)

(7-7/8” (W) × 9-7/8” (D) × 2-3/8” (H))

Weight: Approx. 950 g (2.09 lb.)

Accessories: 1 paper roll, 2 ink rollers (installed), and operation manual

7

Page 10

CALCULATION EXAMPLES

C

CE

C

CE

1. Set the decimal selector as specified in each example.

The rounding selector should be in the “5/4” position unless otherwise specified.

2. The grand total mode selector should be in the “•” position (off position) unless otherwise

specified.

3. The print / item count mode selector should be in the “P•IC” position unless otherwise

specified.

C

C

CE

4. Press

5. If an error is made while entering a number, press

CE

prior to beginning any calculation.

C

CE

or and enter the correct number.

RECHNUNGSBEISPIELE

1. Die Einstellung des Komma-Tabulators nimmt man den Anleitungen in den einzelnen

Beispielen entsprechend vor.

Den Rundungsschalter läßt man, falls nicht anders ausgewiesen, in der “5/4”-Stellung.

2. Den Wahlschalter der Endsummen-Betriebsart läßt man, falls nicht anders

ausgewiesen, in der Stellung “•” (Aus-Stellung).

3. Der Schalter Druck/Ereigniszählmodus sollte auf der Stellung “P•IC” stehen, sofern

nicht anders angegeben.

C

4. Vor dem Beginn einer Berechnung

5. Zur Korrektur von Eingabefehlern drückt man

CE

drücken.

oder und gibt die Zahl korrekt ein.

EXEMPLES DE CALCULS

1. Régler le sélecteur de décimale tel que spécifié dans chaque exemple.

Le sélecteur d’arrondi, doit être placé sur la position “5/4” sauf indication contraire.

2. Le sélecteur de mode de totale général doit être placé à la position “•” (position arrêt)

sauf indication contraire.

3 Sauf indication contraire, le sélecteur d’impression / comptage d’articles doit être

placé sur la position “P•IC”.

4. Appuyez sur

5. En cas d’erreur à l’introduction d’un nombre, appuyer sur

nombre correct.

C

C

CE

CE

avant tout calcul.

C

CE

ou et introduire le

EJEMPLOS DE CALCULOS

1. Colocar el selector decimal según se especifica en cada ejemplo.

El selector de redondeo debe estar en la posición “5/4” salvo que se especifique lo

contrario.

50

Page 11

C

CE

2. El selector del modo de total global debe estar en la posición “•” (posición de

desconexión) salvo que se especifique lo contrario.

3. El selector de impresión / cuenta de articulos debe estar en la posición “P•IC” salvo

que se especifique lo contrario.

C

C

CE

4. Pulse

5. Si se hace un error al ingresar un número, apretar

CE

antes de empezar cualquier cálculo.

C

CE

o e ingresar el número correcto.

ESEMPI DI CALCOLO

1. Regolare il selettore decimale come specificato in ciascum esempio.

Salvo indicazione contraria, il selettore di arrotondamento deve essere lasciato in

posizione “5/4”.

2. Il selettore del calcolo totale deve essere in posizione “•” (posizione spento) salvo

indicazioni altrimenti.

3. Il selettore della modalità stampa/conteggio articolo deve essere impostato su “P•IC”

a meno che non sia specificato altrimenti.

C

C

CE

4. Premete

5. Se impostando un numero si fa un errore, premere

CE

prima di cominciare qualsiasi calcolo.

C

CE

o e impostare di nuovo il

numero corretto.

GRUNDLÄGGANDE RÄKNEEXEMPEL

1. Sätt decimalväljaren som anges i de olika exemplen.

Avrundningsväljaren ska vara i läget “5/4” om inte annat anges.

2. Väljaren för slutsvar ska vara i läget “•” (urkopplat läge) om inte annat anges.

3. Funktionsväljaren för utskrift/styckeräkning skall vara i läget “P•IC”, såvida inte annat

anges.

4. Tryck på

5. Felinslagning rättas till genom att trycka på

C

C

CE

CE

innan en beräkning påbörjas.

eller och sedan slå in rätt tal.

REKENVOORBEELDEN

1. Stel de decimaal-keuzeschakelaar in zoals aangegeven in ieder voorbeeld.

De afrondingskeuzechakelaar dient op “5/4” te staan, tenzij anders vermeld.

2. De eindtotaal-keuzeschakelaar dient op “•” (uitgeschakeld) te staan, tenzij anders vermeld.

3. Tenzij anders aangegeven moet de keuzeschakelaar voor afdrukken/postenteller in

de “P•IC” stand staan.

C

C

CE

4. Druk op

5. Maakt u een fout tijdens het invoeren van een getal, druk dan op

het juiste getal in.

CE

alvorens te beginnen met een maken van een berekening.

51

C

CE

of en voer

Page 12

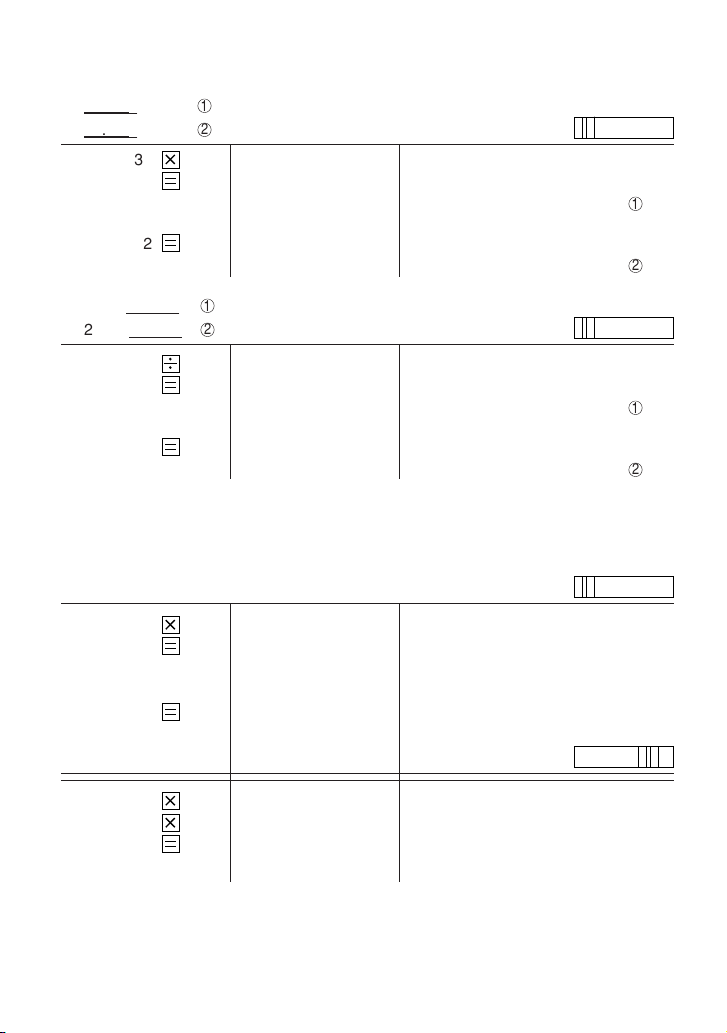

REPEAT ADDITION AND SUBTRACTION

WIEDERHOLTE ADDITION UND SUBTRAKTION

ADDITION ET SOUSTRACTION SUCCESSIVES

REPETICION DE SUMAS Y RESTAS

ADDIZONI E SOTTRAZIONI SUCCESSIVE

UPPREPA ADDITION OCH SUBTRAKTION

HERHAALD OPTELLEN EN AFTREKKEN

123 + 123 + 123 + 456 – 100 – 100 =

Operation Display Print

Bedienung Anzeige Druck

Opération Affichage Impression

Operación Exhibición Impresión

Operazione Display Stampa

Operation Sifferskärm Utskrift

Bediening Display Afdruk

+

123

+

+

+

456

–

100

–

ADDITION AND SUBTRACTION WITH ADD MODE

ADDITON UND SUBTRAKTION MIT ADDITIONSHILFE

ADDTION ET SOUSTRACTION AVEC MODE D’ADDITION

SUMA Y RESTA CON MODO DE SUMA

ADDZIONI E SOTTRAZIONI CON VIRGOLA AUTOMATICA

ADDITION OCH SUBTRAKTION I ADD-LÄGE

OPTELLEN EN AFTREKKEN MET DE DECIMAAL-INVOEGINGSFUNCTIE

12.45 + 16.24 + 19.35 – 5.21 =

123. 123· +

246. 123· +

369. 123· +

825. 456· +

725. 100· –

625. 100·–

002

625. 625·

F 3 2 1 0 A

∗

F 3 2 1 0 A

*1 1245

1624

1935

521

+

+

+

–

12.45 12·45 +

28.69 16·24 +

48.04 19·35 +

42.83 5·21 –

002

42.83 42·83

52

∗

Page 13

*1 : was not used in the entries.

*1 : wurde nicht für die Eingabe verwendet.

*1 : La n’a pas été utilisée dans les entrées.

*1 : La no ha sido usada en los registros.

*1 : non è stato usato per l’impostazione.

*1 : Tangenten användes ej vid inslagningen av talen.

*1 : werd niet gebruikt tijdens het invoeren van de getallen.

MIXED CALCULATIONS / GEMISCHTE RECHNUNG / CALCUL COMPLEXE /

CALCULOS MIXTOS / CALCOLI MISTI / BLANDAD RÄKNING / GEMENGDE

BEREKENINGEN

F 3 2 1 0 A

A. (10 + 2) × 5 =

+

10

+

2

10. 10· +

12. 2· +

12. 12· ×

5 5· =

60. 60·

∗

F 3 2 1 0 A

B. 5 × 2 + 12 =

C

C

CE

CE

5 5. 5· ×

2 2· =

10. 10·

∗

12

+

+

10. 10· +

22. 12· +

002

22. 22·

∗

53

Page 14

CONSTANT / KONSTANTEN / CONSTANTE / CONSTANTE / CONSTANTI /

KONSTANTER / CONSTANTEN

A. 62.35 × 11.11 =

62.35 × 22.22 =

62.35 62.35 62.35 ×

11.11 11·11 =

22.22 22·22 =

B. 11.11 ÷ 77.77 =

22.22 ÷ 77.77 =

11.11 11.11 11·11 ÷

77.77 77·77 =

22.22 22·22 =

POWER / POTENZBERECHNUNGEN / PUISSANCE / POTENCIA CALCOLI DELLE /

POTENZE / POTENSRÄKNING / MACHTSVERHEFFEN

53 =

1

2

692.7085 692·7085

1’385.417 1,385·417

1

2

0.14285714285 0·14285714285

0.28571428571 0·28571428571

5 5. 5· ×

5· =

25. 25·

F 3 2 1 0 A

∗

∗

F 3 2 1 0 A

∗

∗

F 3 2 1 0 A

∗

1

2

1

2

25· =

125. 125·

5 5. 5· ×

25. 5· ×

5· =

125. 125·

54

F 3 2 1 0 A

∗

∗

Page 15

PERCENT / PROZENT / POURCENTAGE / PORCENTAJES / PERCENTUALI /

PROCENT / PROCENTBEREKENINGEN

F 3 2 1 0 A

100 × 25 % =

100 100. 100· ×

%

25

25.00 25·00

25· %

∗

RECIPROCAL / REZIPROKRECHNUNGEN / INVERSES / RECIPROCOS /

RECIPROCI / RÄKNING / RECIPROQUE BEREKENINGEN

1

=

7

F 3 2 1 0 A

5/4

7 7. 7·÷

1. 7·÷

7· =

0.14285714285 0·14285714285

∗

ADD-ON AND DISCOUNT / AUFSCHLAG UND ABSCHLAG / MAJORATION ET

RABAIS / RECARGOS Y DESCUENTOS / MAGGIORAZIONE E SCONTO /

PÅLÄGG OCH RABATT / OPSLAG EN KORTING

A. 5% add-on to 100. / Ein Aufschlag von 5% zu 100. / Majoration de 5% de 100. / Un

5 % de recargo sobre 100. / Una maggiorazione del 5% su 100. / 5% pålägg på 100.

/ Een opslag van 5% op 100.

F 3 2 1 0 A

100 100. 100· ×

MU

5

5· %

5·00

105.00 105·00

55

∗

Increased amount

Zusatzbetrag

Majoration

Incremento

Maggiorazione

Tilläggsbelopp

Extra bedrag

New amount

Neuer Betrag

Total majoré

Nueva cantidad

Nuovo totale

Nytt belopp

Nieuwe bedrag

Page 16

B. 10% discount on 100. / Abschlag von 10% von 100. / Rabais de 10% sur 100. / Un

10% de descuento sobre 100. / Uno sconto del 10 % su 100. / 10% rabatt på 100. /

Een korting van 10% op 100.

100 100. 100· ×

+

–

10

MU

–10· %

–10·00

90.00 90·00

∗

Discount

Abschlag

Remise

Descuento

Sconto

Rabatt

Korting

Net amount

Netto-Betrag

Montant net

Cantidad neta

Totale netto

Nettobelopp

Nettobedrag

F 3 2 1 0 A

MARKUP AND MARGIN

Markup and Profit Margin are both ways of calculating percent profit.

• Profit margin is percent profit vs. selling price.

• Markup is percent profit vs. cost.

– Cost is the cost.

– Sell is the selling price.

– GP is the gross profit.

– Mkup is the percent profit based on cost.

– Mrgn is the percent profit based on selling price.

AUFSCHLAG UND GEWINNSPANNE

Aufshlag und Gewinnspanne sind beides Möglichkeiten zur Berechnung des Gewinns in

Prozent.

• Gewinnspanne ist der Gewinn in Prozent, basierend auf dem Verkaufspreis.

• Gewinnaufschlag in der Gewinn in Prozent, basierend auf dem Einkaufspreis.

– Cost ist der Einkaufspreis.

– Sell ist der Verkaufspreis.

– GP ist der Brutto-Verdienst.

– Mkup ist der Gewinnaufschlag in Prozent, basierend auf dem Einkaufspreis.

– Mrgn ist die Gewinnspanne in Prozent, basierend auf dem Verkaufspreis.

HAUSSE ET MARGE BÉNÉFICIAIRE

Le calcul des majorations et des marges bénéficiaires sont deux façons de calculer un

pourcentage de profit.

• La marge bénéficiaire est un pourcentage de profit par rapport au prix de vente.

• La majoration est un pourcentage de profit par rapport au prix d’achat.

– Cost est le prix d’achat.

– Sell est le prix de vente.

56

Page 17

– GP est le bénéfice brut.

– Mkup est le bénéfice par rapport au coût.

– Mrgn est le bénéfice par rapport au prix de vente.

INCREMENTO PORCENTUAL Y MARGEN

Tanto la función del incremento porcentual como la del margen de beneficio son formas

de calcular el beneficio porcentual.

• El margen de beneficio es el beneficio porcentual con respecto al precio de venta.

• El incremento porcentual es el beneficio porcentual con respecto al coste.

– Cost es el coste.

– Sell es el precio de venta.

– GP es el beneficio bruto.

– Mkup es el beneficio porcentual basado en el coste.

– Mrgn es el beneficio porcentual basado en el precio de venta.

MAGGIORAZIONE E MARGINE

La maggiorazione percentuale ed il margine di profitto sono ambedue mezzi di calcolare

le percentuali di profitto.

• Il margine di profitto e la percentuale di profitto rispetto al prezzo di vendita.

• La maggiorazione è la percentuale di profitto rispetto al costo.

– Cost è il costo.

– Sell è il prezzo di vendita.

– GP è il profitto lordo.

– Mkup è la percentuale di profitto basata sul costo.

– Mrgn è la percentuale di profitto basata sul prezzo di vendita.

PÅSLAG OCH MARGINAL

Påslag och vinstmarginal är två sätt att beräkna visten i procent.

• Vinstmarginalen är den procentuella vinsten i förhållande till försäljningspriset.

• Påslaget är den procentuella vinsten i förhllande till kostnaden.

– Cost är kostnaden.

– Sell är försäljningspriset.

– GP är bruttovinsten.

– Mkup är den procentuella vinsten baserad på kostnaden.

– Mrgn är den procentuella vinsten baserad på försäljningspriset.

PROCENTUELE VERHOGING EN WINSTMARGE

Procentuele verhoging en winstmarge zijn twee mogelijkheden om de winst in procenten

te berekenen.

• Bij winstmarge wordt de winst uitgedrukt in een bepaald percentage van de

verkoopsprijs.

• Bij procentuele verhoging wordt de winst uitgedrukt in een bepaald percentage van

de inkoopsprijs.

- Cost is de inkoopsprijs.

- Sell is de verkoopsprijs.

- GP is de brutowinst.

- Mkup is de winst uitgedrukt in een bepaald percentage van de inkoopsprijs.

- Mrgn is de winst uitgedrukt in een bepaald percentage van de verkoopsprijs.

57

Page 18

To find Knowing Operation

Gesucht wird Bekannt ist Vorgehen

Pour trouver Quand on connaîtOpération

Para encontrar Sabiendo Operación

Per trovare Conoscendo Operazione

Att finna När du vet Operation

U wilt weten Bekend is Bediening

Mrgn Sell, Cost Cost

Mkup Sell, Cost Sell+Cost–

Sell Cost, Mrgn Cost Mrgn

Cost Sell, Mrgn Sell Mrgn

Sell Cost, Mkup Cost Mkup

Cost Sell, Mkup Sell Mkup

–

Sell+

MU

+

MU

+

Example / Beispiel / Exemple

/ Ejemplo / Esempio /

Exempel / Voorbeeld

Cost $200

Sell $250

MU

MU

GP $50

Mkup 25%

MU

–

MU

–

Mrgn 20%

F 3 2 1 0 A

200 200. 200·÷ Cost

MU

20

20· %M Mrgn

250·00

∗

Sell

50.00 50·00 GP

PERCENT CHANGE / PROZENTUALE VERÄNDERUNG / VARIATION EN POUR

CENT / CAMBIO PORCENTUAL / CAMBIO DI PERCENTUALE / PROCENTUELL

FÖRÄNDRING / PROCENTUELE VERANDERING

• Calculate the dollar difference (a) and the percent change (b) between two yearly

sales figures $1,500 in one year and $1,300 in the previous.

• Berechnung der Dollardifferenz (a) und der prozentualen Veränderung b) zwischen

den beiden Jahresumsatzzahlen $1.500 in einem Jahr und $1.300 im vorherigen

Jahr.

• Calculer la différence en dollars (a) et la variation en pour cent (b) entre deux prix.

1.500 $ pour cette année et 1.300 $ pour l’année précédente.

• Calcular la diferencia en dólares (a) y el cambio porcentual (b) entre dos cifras de

ventas anuales, $1.500 en un año y $1.300 en el año anterior.

• Calcolare la differenza in dollari (a) ed il cambio di percentuale (b) fra due cifre di

vendita annuale di $1.500 in un anno e di $1.300 nell’anno precedente.

• Räkna ut värdeskillnaden (a) och den procentuella förändringen (b) med två års

försäljningssiffror: $1.500 under det ena året och $1.300 under det föregående året.

• Bereken het verschil in dollars (a) en de procentuele verandering (b) tussen twee

jaarlijkse verkoopscijfers: $1.500 in een bepaald jaar en $1.300 het jaar ervoor.

F 3 2 1 0 A

1500

1300

+

–

MU

1’500.00 1,500·00 +

200.00 1,300·00 –

200·00

∗

15.38 15·38 % (b)

58

(a)

Page 19

PERCENT PRORATION / PROZENTUALES VERHÄLTNIS / DISTRIBUTION

PROPORTIONNELLE EN POURCENTAGE / DISTRIBUCION PROPORCIONAL DE

PORCENTAJE / DISTRIBUZIONE PERCENTUALE / PROCENTUELL

PROPORTION / PROCENTUELE VERHOUDING

• Calculate the percentage of each of the parts to the whole.

• Ermitteln Sie den Prozentanteil von Aufwand zum

Gesamtaufwand.

• Calculer le pourcentage que chaque article représente par

rapport au tout.

• Calcular el porcentaje de cada artículo.

• Calcolare la percentuale di ogni singola parte rispetto al totale.

• Räkna ut de procentuella delarna i förhållande till helheten.

• Bereken het percentage van iedere uitgave ten opzichte van

het totaal.

Expenses

Aufwand

Dépenses

Gastos %

Costi

Utgifter

Uitgaven

$123 (a)

456 (b)

789 (c)

(D) (d)

F 3 2 1 0 A

123

456

789

123

+

+

+

MU

M

123.00 123·00 +

579.00 456·00 +

1’368.00 789·00 +

003

1,368·00

(D)

∗

*2

123· =

8.99 8·99 % (a)

M

8.99

8·99 +M

456· =

M

33.33

33.33

M

33·33 % (b)

33·33 +M

789· =

M

57.68

57.68

M

57·68 % (c)

57·68 +M

100·00 M (d)

M

100.00

100.00 100·00∗M

456

789

M+

MU

M+

MU

M+

M

M

59

Page 20

*2: Press

*2: Zum Löschen aller früheren Eingaben in den Speicher drückt man

*2: Effacer le contenu de la mémoire (

*2: Apretar

M

to clear the memory before starting a memory calculation.

M

M

para cancelar la memoria antes de empezar a efectuar un cálculo con

) avant de procéder à un calcul avec mémoire.

M

.

memoria.

*2: Prima di eseguire il calcolo con la memoria, premere il

*2: Tryck ned

*2: Druk op

M

för att rensa minnet innan räkning med minnet påbörjas.

om het geheugen te wissen, alvorens u begint met het maken van een

M

M

per azzerare quest’ultima.

geheugenberekening.

ITEM COUNT CALCULATION / RECHNEN MIT POSTENZÄHLER / CALCUL DE

COMPTE D’ARTICLES / CALCULO DE CUENTA DE ARTICULOS / CALCOLI CON

FUNZIONE / CONTADDENDI POSTRÄKNING / REKENEN MET DE POSTENTELLER

Bill No. Number of bills Amount

Rechnungs-Nr. Anzahl der Rechnungen Betrag

Facture n° Nbre de factures Montant

N.° de factura Cantidad de facturas Importe

Fattura No. Numero di fatture Ammontare

Räkningsnr Antal räkningar Belopp

Rekeningnr. Aantal rekeningen Bedrag

1 1 $100.55

2 1 $200.00

3 1 $200.00

4 1 $400.55

5 1 $500.65

Total Total Total

Total Totale Totalt (a) (b)

Totaal

CCEC

100.55

200

400.55

500.65

F 3 2 1 0 A

CE

+

+

+

+

+

100.55 100·55 +

300.55 200·00 +

500.55 200·00 +

901.10 400·55 +

1’401.75 500·65 +

005 (a)

1’401.75 1,401·75

(b)

∗

60

Page 21

GRAND TOTAL / ENDSUMME / TOTAL GÉNÉRAL / TOTAL GLOBAL / TOTALE

FINALE / SLUTSVAR / EINDTOTAAL

100 + 200 + 300 =

+) 300 + 400 + 500 =

+) 500 – 600 + 700 =

Grand total / Endsumme / Total général / Total global / Totale finale /

Slutsvar / Eindtotaal

GT

+

100

+

200

+

300

1

2

3

4

100. 100· +

300. 200· +

600. 300· +

F 3 2 1 0 A

003

300

400

500

600.

G

+

+

+

300.

700.

1’200.

G

G

G

600·∗+

300· +

400· +

500· +

1

003

500

600

700

1’200.

G

+

–

+

500.

100.

600.

G

G

G

1,200· ∗+

500· +

600·–

700· +

2

001

600.

G

600·∗+

3

GT

•

GT

2’400. 2

61

,

400· ∗∗

4

Page 22

MEMORY / SPEICHERRECHNUNG / MEMOIRE / MEMORIA / MEMORIA / MINNE /

GEHEUGENBEREKENINGEN

A. 46 × 78 =

+) 125 ÷ 5=

–)72× 8=

1

+ 2 – 3=

1

2

3

4

M

F 3 2 1 0 A

46 46. 46· ×

M+

78

3’588.

125 125.

M+

5

25.

72 72.

M

–

8

576.

M

3’037.

M

M

M

M

M

M

78· =

3,588· +M

125·÷

5· =

25· +M

72· ×

8· =

576·–M

3,037· M

1

2

3

4

F 3 2 1 0 A

B. (123 + 45) × (456 – 89) =

M

123

45

456

89

M+

M+

+

–

M

123.

45.

456.

367.

367.

168.

M

M

M

M

M

123· +M

45· +M

456· +

89·–

367· ×

168· M

M

168· =

M

61’656.

M

168. 168·∗M

61,656·

∗

62

Page 23

TAX RATE CALCULATIONS / STEUER-BERECHNUNGEN / CALCULS DE TAXE /

CALCULOS CON EL TIPO DE IMPUESTO / CALCOLI DEL TASSO DI TASSAZIONE /

RÄKING MED SKATTESATSER / BEREKENING VAN BELASTINGTARIEVEN

EXAMPLE 1: Set a 5% tax rate.

BEISPIEL 1: Die Steuerrate wird auf 5% festgelegt.

EXEMPLE 1: Choisir une taxe de 5%.

EJEMPLO 1: Fijar el tipo de impuesto al 5%.

ESEMPIO 1: Impostare un tasso di tassazione del 5%.

EXEMPEL 1: Ställ in en skattesats på 5%.

VOORBEELD 1: Stel een 5% belastingtarief in.

5

STR

+

TAX

EXAMPLE 2: Calculate the tax on $800 and calculate the total including tax. (tax

BEISPIEL 2: Berechnung der Steuer auf $800 und Berechnung der Gesamtsumme

EXEMPLE 2: Calcule la taxe sur $800 et calcule le total incluant la taxe. (taux de la

EJEMPLO 2: Calcule el impuesto sobre $800 y calcule el total incluyendo el impuesto.

ESEMPIO 2: Calcolare le tasse su 800 $ e calcolare il totale tasse incluse. (Aliquota

EXEMPEL 2: Beräkna skatten på $800 och beräkna sedan summan inklusive skatt.

VOORBEELD 2: Bereken de belasting op $800 en bereken het totaal inclusief belasting.

EXAMPLE 3: Perform two calculations using $840 and $525, both of which already

rate: 5%)

einschließlich der Steuem. (Steuerrate ist 5%)

taxe: 5%)

(Tasa de impuestos: 5%)

d'imposta: 5%)

(skattesats: 5%)

(Belastingtarief: 5%)

800

TAX

+

include tax. Calculate the tax on the total and the total without tax. (tax

5.

5.000

...5.

840. 840

000 %

800

...40.

F 3 2 1 0 A

.

.

rate: 5%)

BEISPIEL 3: Zwei Berechnung mit $840 und $525 ausführen, die beide jeweils den

Steueranteil enthalten. Berechne die Steuern für die Gesamtsumme

und die Gesamtsumme ohne Steuern. (Steuerrate ist 5%)

EXEMPLE 3: Réalise deux calculs en utilisant $840 et $525, les deux incluant déjè

la taxe. Calcule la taxe sur le total et le total sans la taxe. (taux de la

taxe: 5%)

63

Page 24

EJEMPLO 3: Realice dos cálculos utilizando $840 y $525, los cuales ya incluyen

impuesto. Calcule et impuesto sobre el total y el total sin impuesto.

(Tasa de impuestos: 5%)

ESEMPIO 3: Eseguire due calcoli usando i valori 840 $ e 525 $, entrambi con tasse

incluse. Calcolare le tasse che sono incluse nel totale e il totale senza

EXEMPEL 3: Utför två beräkningar med $840 och $525, vilka båda redan inkluderar

tasse. (Aliquota d'imposta: 5%)

skatt. Beräkna skatten på summan samt summan utan skatt.

(skattesats: 5%)

VOORBEELD 3: Voer twee berekeningen uit met $840 en $525; beide bedragen zijn

inclusief belasting. Bereken de belasting op het totaal en het totaal

zonder belasting. (Belastingtarief: 5%)

F 3 2 1 0 A

+

840

525

TAX

+

-

840. 840. +

1’365. 525. +

.

1’365

1’300.

...65.

1’300

.

–

64

Page 25

SHARP CORPORATION

PRINTED IN CHINA / IMPRIMÉ EN CHINE / IMPRESO EN CHINA

01GUP(TINSZ0495EHZZ)

Loading...

Loading...