Rheem R96PA1002521MSA Tax Credit Form

The Tax Increase Prevention

Act of 2014

Proof of Qualified Energy Property for Claiming

Tax Credits for Residential Heating & Cooling Equipment

The U.S. Internal Revenue Service (IRS) is now providing Consumers with a tax credit on high-efficiency

heating and cooling equipment. The Rheem Air Conditioning Division of Rheem Sales Company, Inc. certifies that the following models (if placed in service after December 31, 2013 and before January 1, 2015 in a

homeowner’s primary residence) meet the criteria of “Qualified Energy Property” as set forth by Section

25C of the Internal Revenue Code.

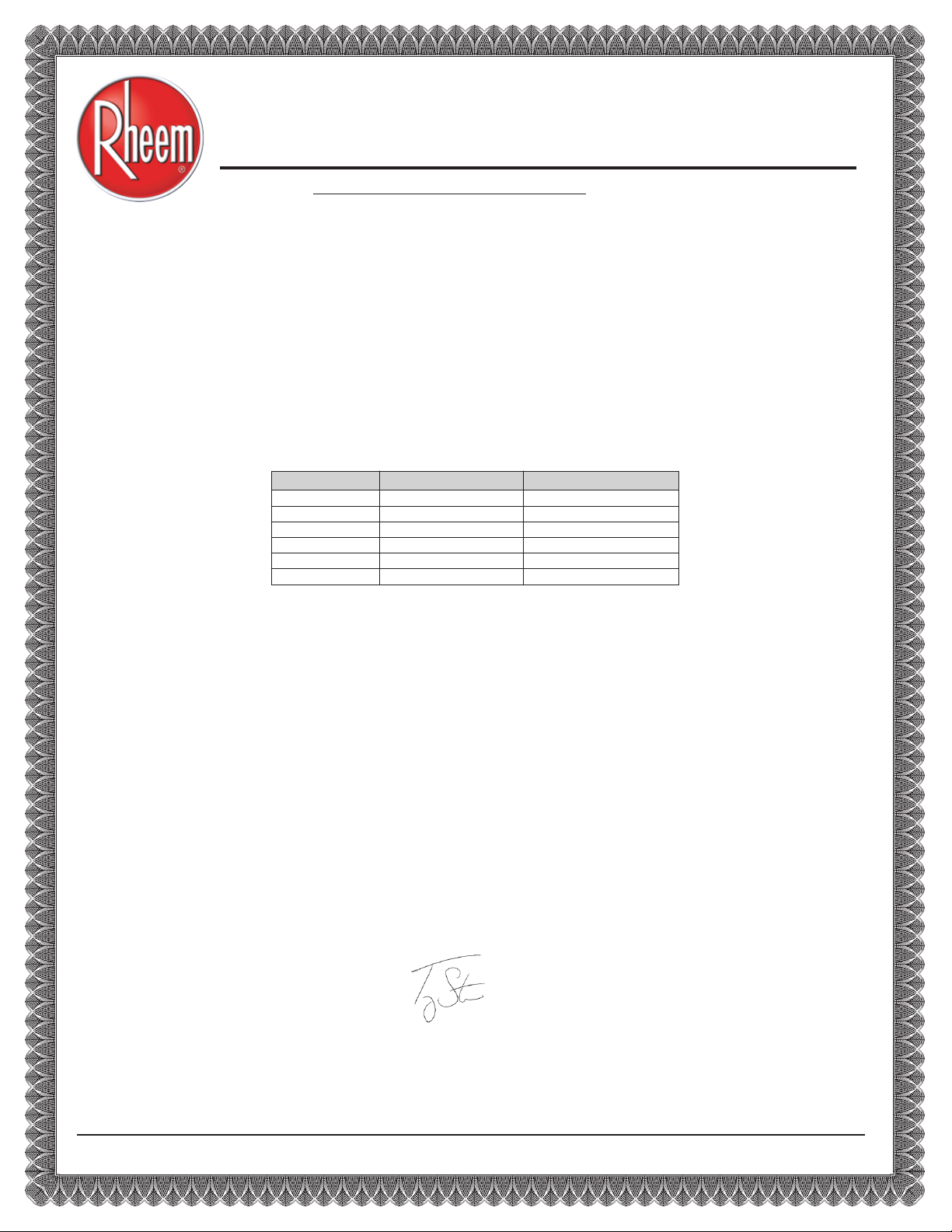

TAX CREDIT - 10% OF INSTALLATION COSTS, UP TO $150

AHRI Ref. # Model Number

7501309 R96PA0402317MSA 96.0

6482959 R96PA0602317MSA 96.0

482960 R96PA0702317MSA 96.0

6

6482961 R96PA0852521MSA 95.0

6482962 R96PA1002521MSA 95.0

7501304 R96PA1152524MSA 96.0

AFUE

IMPORTANT NOTICE:

MANUFACTURER:

EQUIPMENT CLASSIFICATION:

CERTIFICATION STATEMENT:

Under penalties of perjury, I declare that I have examined this certification statement, and to the best of my

knowledge and belief, the facts presented are true, correct, and complete.

Before filing for a tax credit on one of the listed models, Rheem Air Conditioning Division recommends that Consumers consult with a tax professional to review The Tax Increase Prevention Act

of 2014 and its application in reference to Section 25C of the Internal Revenue Code.

Rheem Air Conditioning Division

5600 Old Greenwood Road

Fort Smith, AR 72908

Natural Gas Furnace

Terry Stern

Product Manager, Residential Indoor Heating

Rheem Air Conditioning Division

Rheem Air Conditioning Division • Fort Smith, Arkansas • 479-648-4900

TC-R96P-RH-00

Loading...

Loading...