Page 1

ELECTRONIC CASH REGISTER

PCR

-

GROCERY

DAIRY

H.B.A.

1000

1~00

FROZEN

FOOD

DELICATESSEN

CI Canada

USER'S MANUAL

Page 2

Introduction & Contents

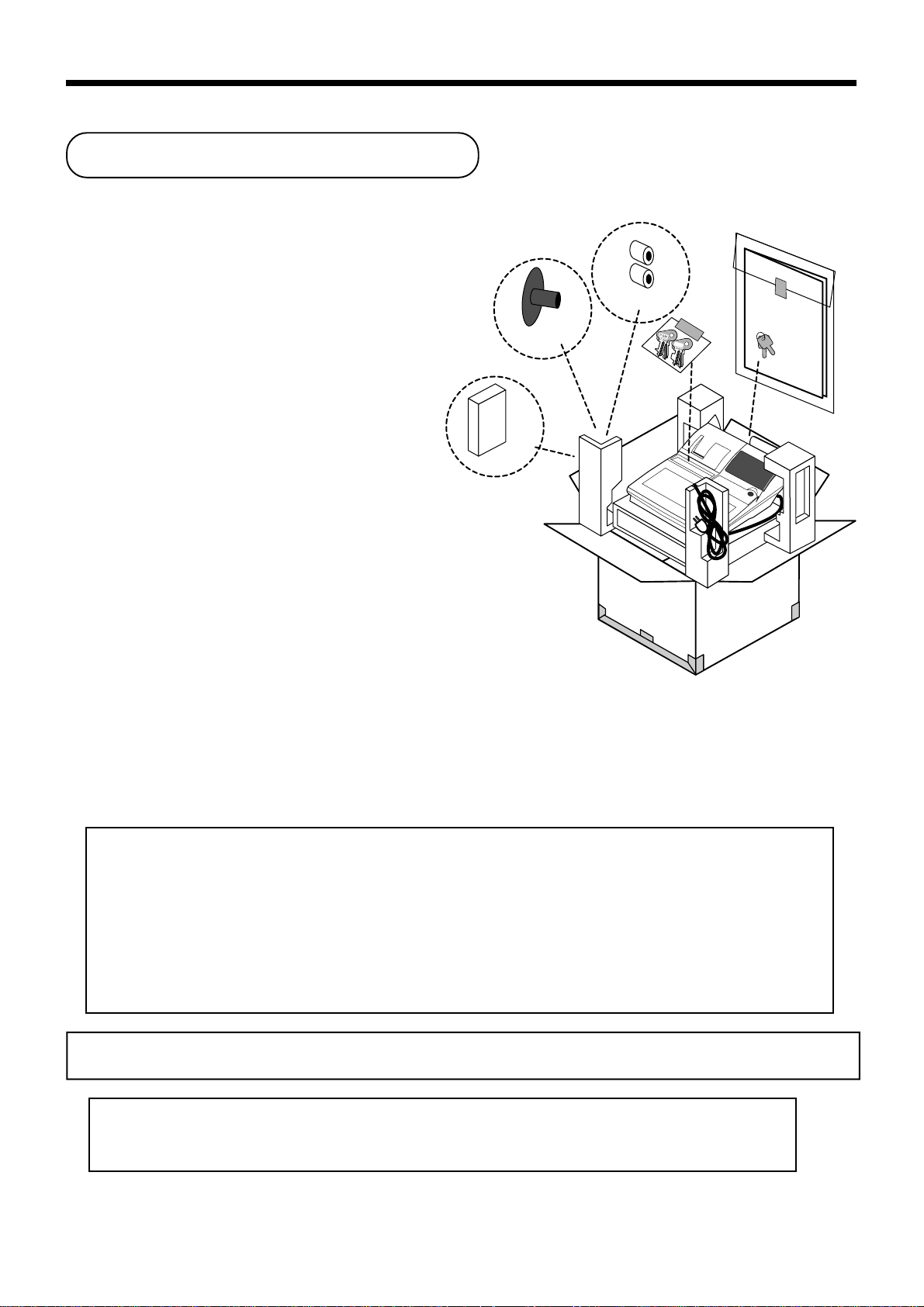

Unpacking the register

Welcome to the CASIO PCR-1000!

Congratulations upon your selection of a CASIO

Electronic Cash Register, which is designed to provide years of reliable operation.

Operation of a CASIO cash register is simple

enough to be mastered without special training.

Everything you need to know is included in this

manual, so keep it on hand for reference.

If you need programming assistance,

please call 1-800-638-9228.

In Canada, Call 1-800-661-2274.

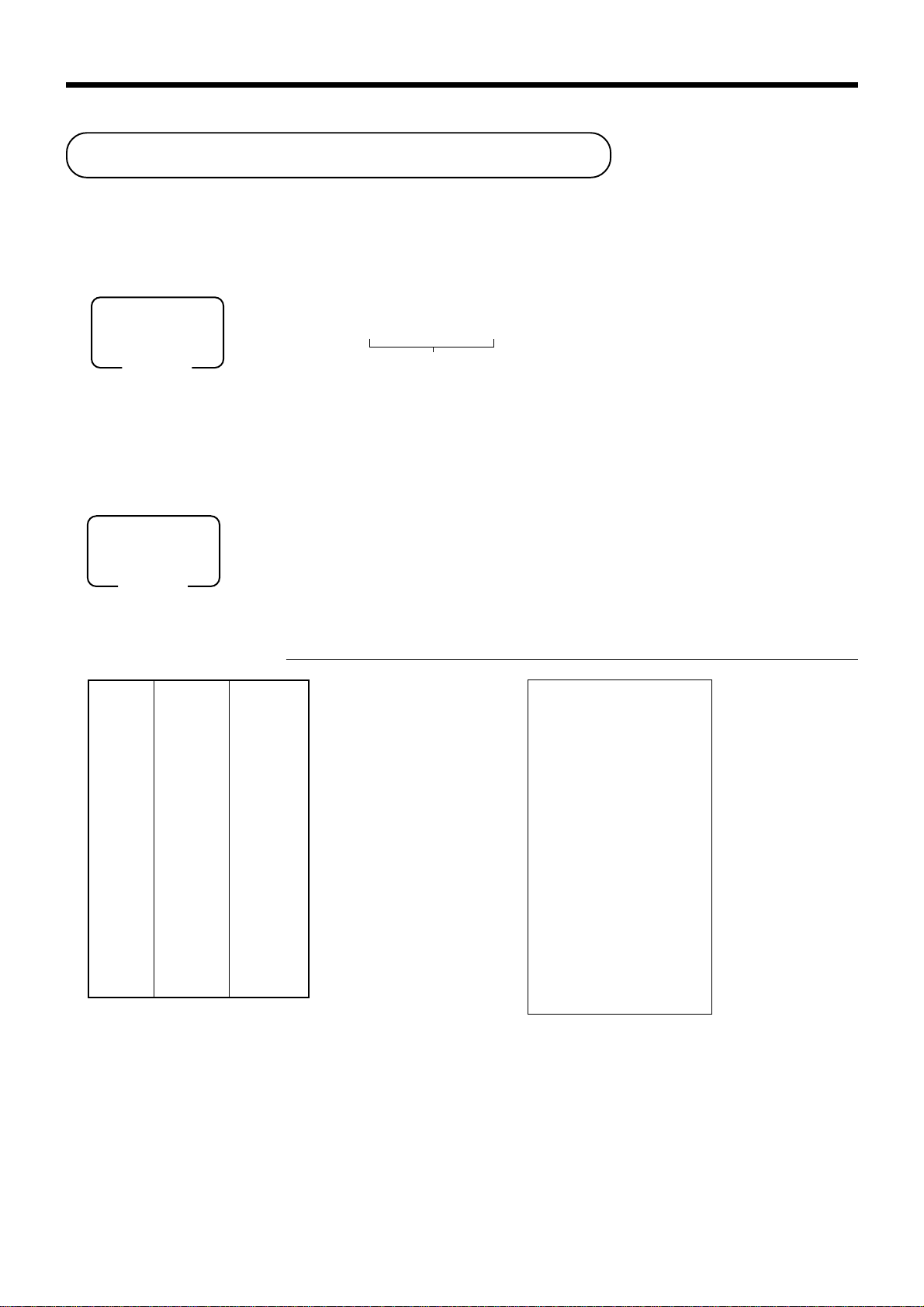

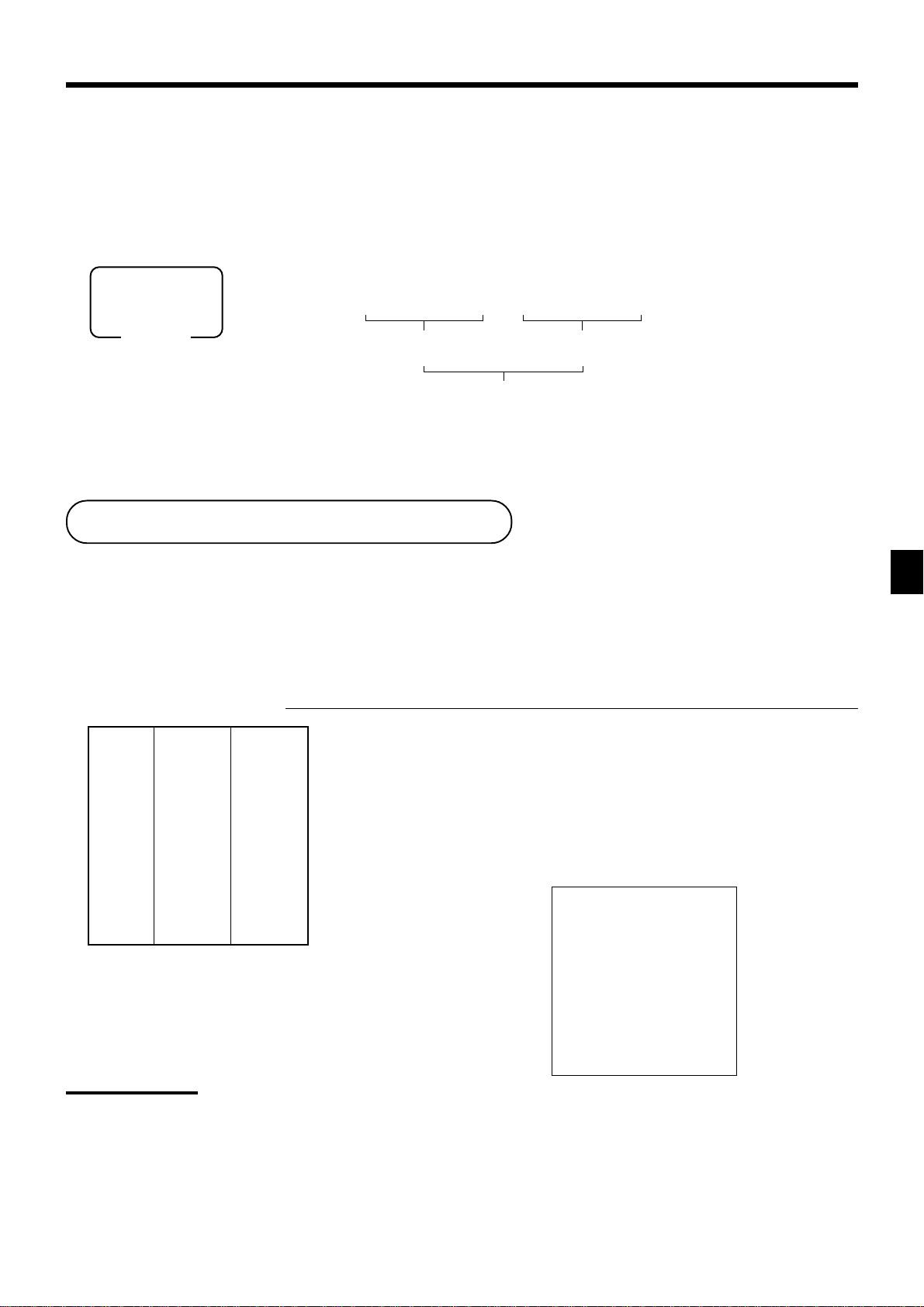

Journal spool

Ink ribbon

cassette

Roll paper

Mode keys

User's

Manual

O

P

OP

Drawer keys

CASIO AUTHORIZED SERVICE CENTER

If your Casio product needs repair, or you wish to purchase replacement parts, please

call 1-800-YO-CASIO for the authorized service center nearest your home.

If for any reason this product is to be returned to the store where purchased, it must be

packed in the original carton/package.

GUIDELINES LAID DO WN BY FCC R ULES FOR USE OF THE UNIT IN THE U.S.A.

(Not applicable to other areas)

WARNING: This equipment has been tested and found to comply with the limits for a Class A digital device,

pursuant to Part 15 of the FCC Rules. These limits are designed to provide reasonable protection against harmful

interference when the equipment is operated in a commercial environment. This equipment generates, uses, and

can radiate radio frequency energy and, if not installed and used in accordance with the instruction manual, may

cause harmful interference to radio communications. Operation of this equipment in a residential area is likely to

cause harmful interference in which case the user will be required to correct the interference at his own expense.

FCC WARNING: Changes or modifications not expressly approved by the party responsible for compliance

could void the user’s authority to operate the equipment.

The main plug on this equipment must be used to disconnect mains power.

Please ensure that the socket outlet is installed near the equipment and shall be easily

accessible.

Please keep all information for future reference.

2

Page 3

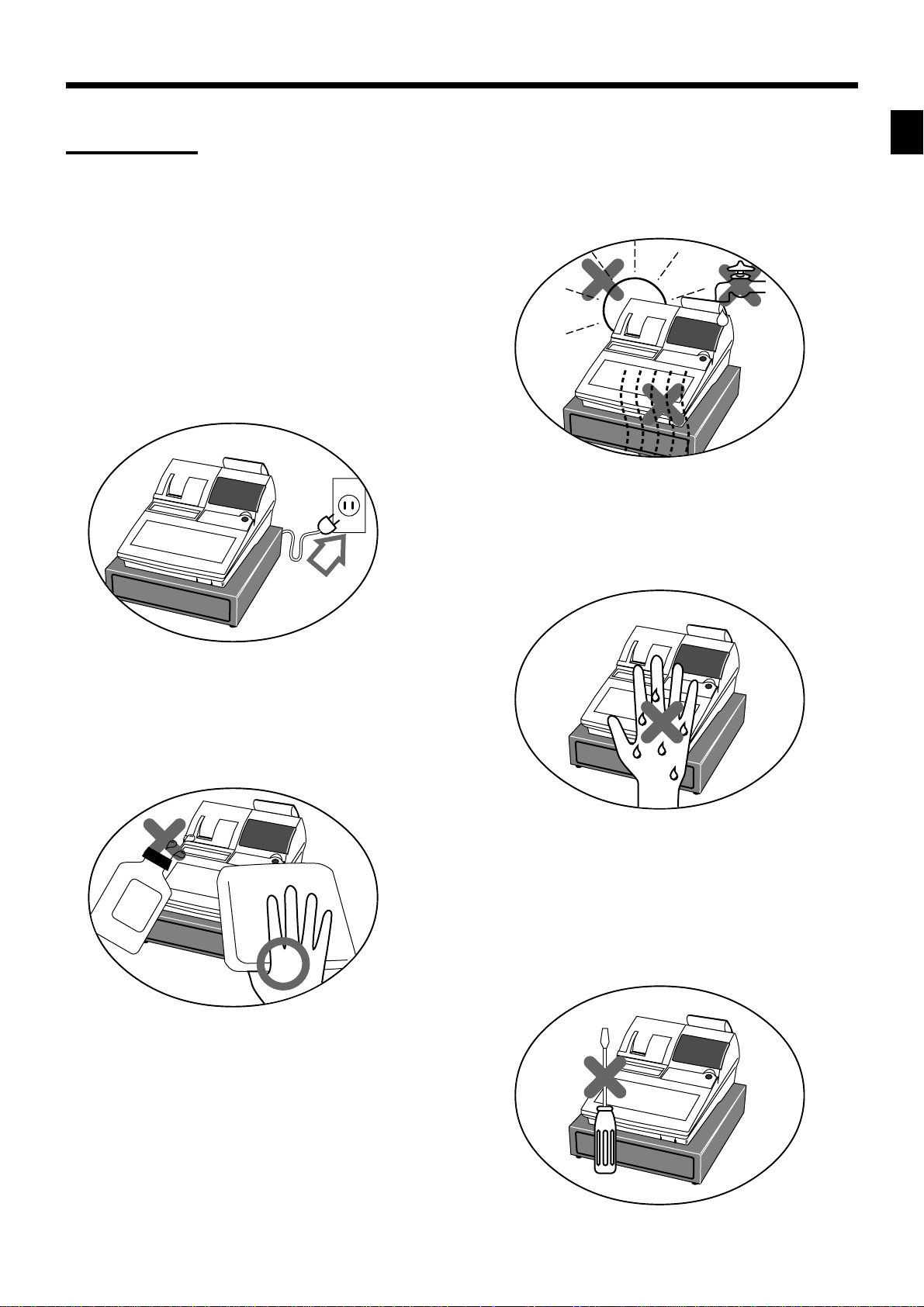

Important!

Your new cash register has been carefully tested before shipment to ensure proper operation. Safety

devices eliminate worries about breakdowns resulting from operator errors or improper handling. In

order to ensure years of trouble-free operation, however, the following points should be noted when

handling the cash register.

Do not locate the cash register where it will be

subjected to direct sunlight, high humidity,

splashing with water or other liquids, or high

temperature (such as near a heater).

Be sure to check the sticker on the side of the

cash register to make sure that its voltage

matches that of the power supply in the area.

Introduction & Contents

Never operate the cash register while your

hands are wet.

Never try to open the cash register or attempt

your own repairs. Take the cash register to your

authorized CASIO dealer for repairs.

Use a soft, dry cloth to clean the exterior of the

cash register. Never use benzene, thinner, or

any other volatile agent.

PCR-1000 User's Manual

3

Page 4

Introduction & Contents

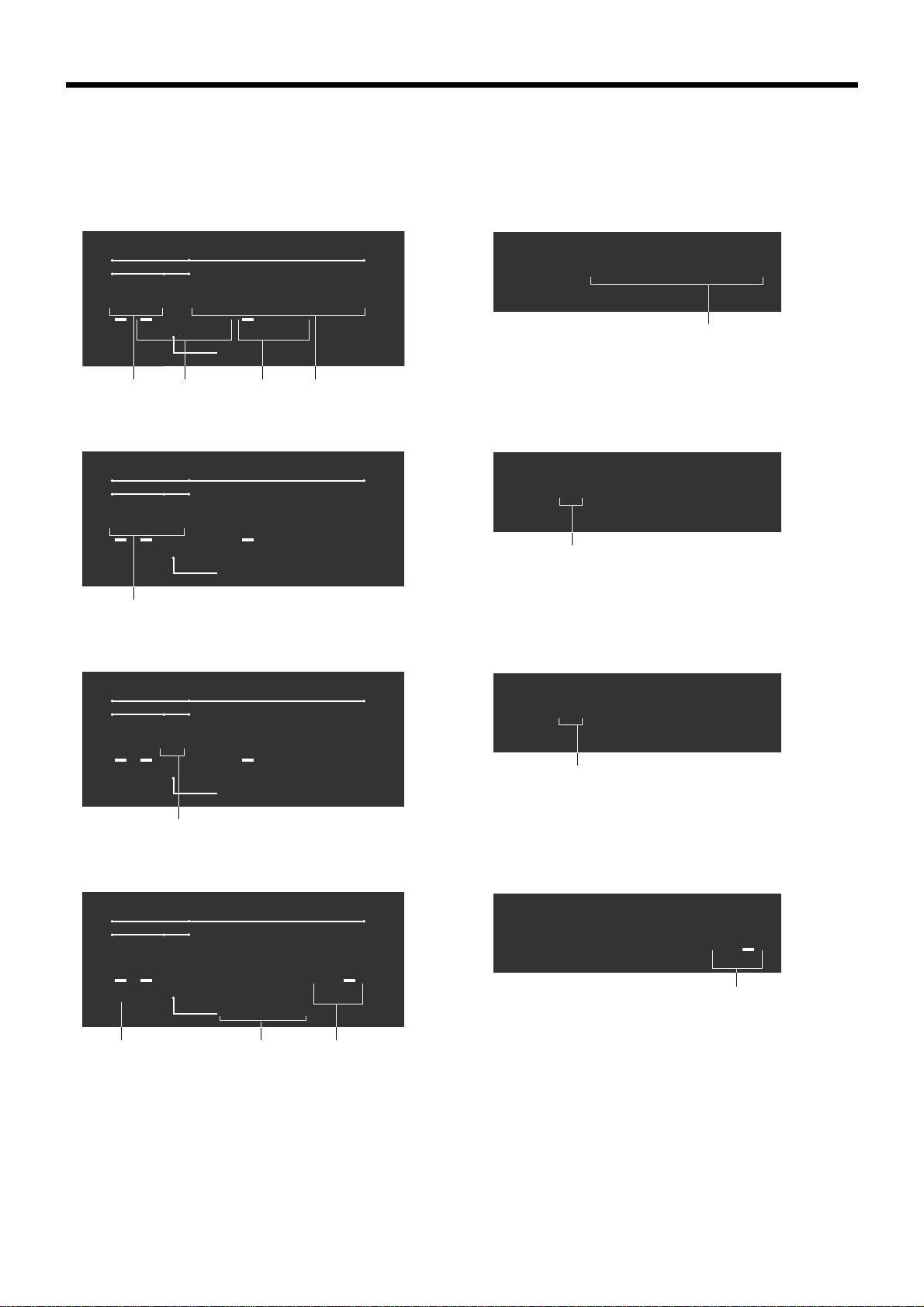

Introduction & Contents ............................................................................................................ 2

Getting Started ........................................................................................................................... 8

Remove the cash register from its box.................................................................................................. 8

Remove the tape holding parts of the cash register in place................................................................ 8

Plug the cash register into a wall outlet................................................................................................. 8

Insert the mode key marked “PGM” into the mode switch. ................................................................... 8

Install receipt/journal paper. .................................................................................................................. 9

To set the ink ribbon .............................................................................................................................11

Machine initialization ........................................................................................................................... 12

Set the date. ........................................................................................................................................ 13

Set the time.......................................................................................................................................... 13

Tax table programming ........................................................................................................................ 14

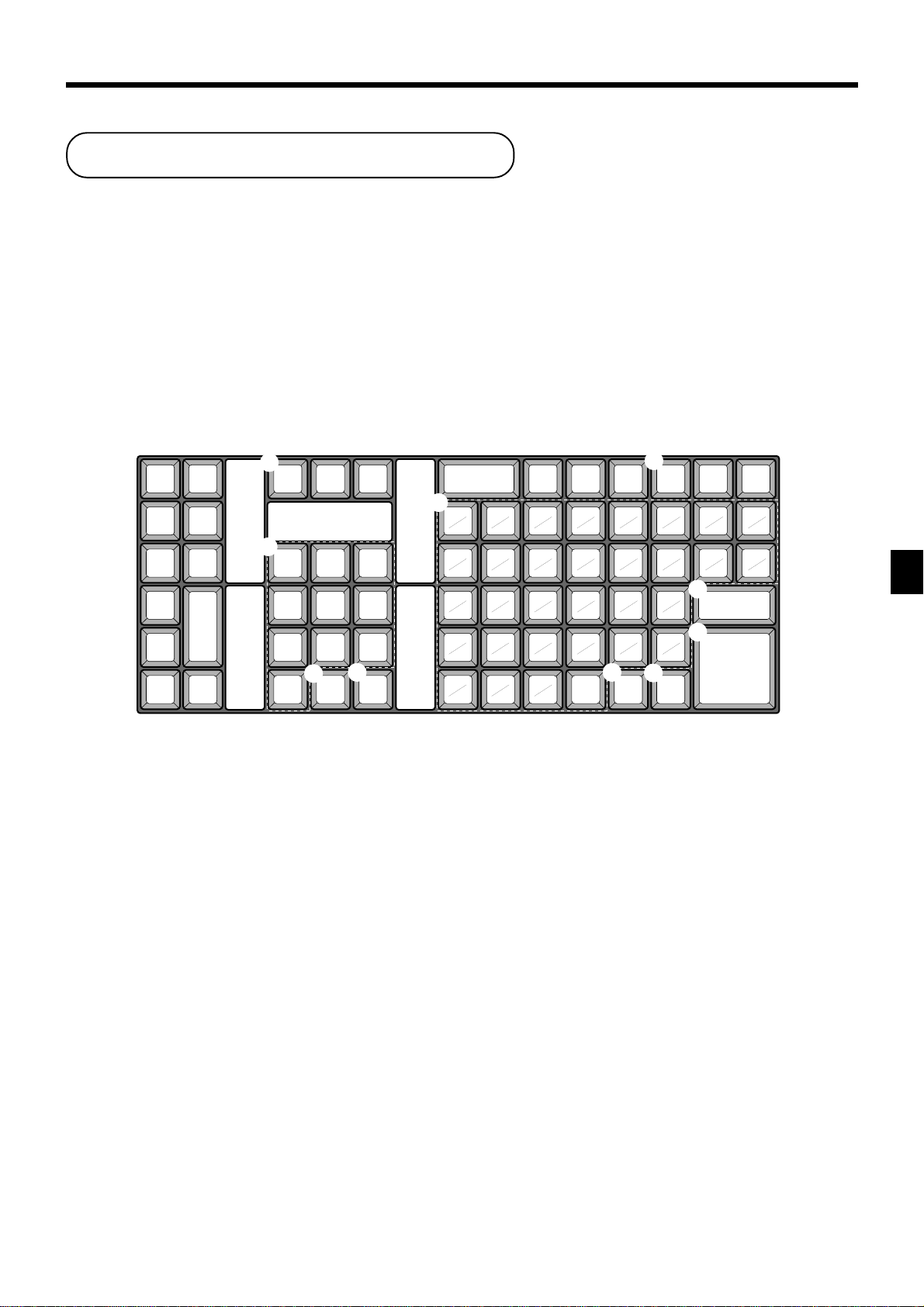

Introducing PCR-1000.............................................................................................................. 20

General guide ...................................................................................................................................... 20

Display ................................................................................................................................................. 22

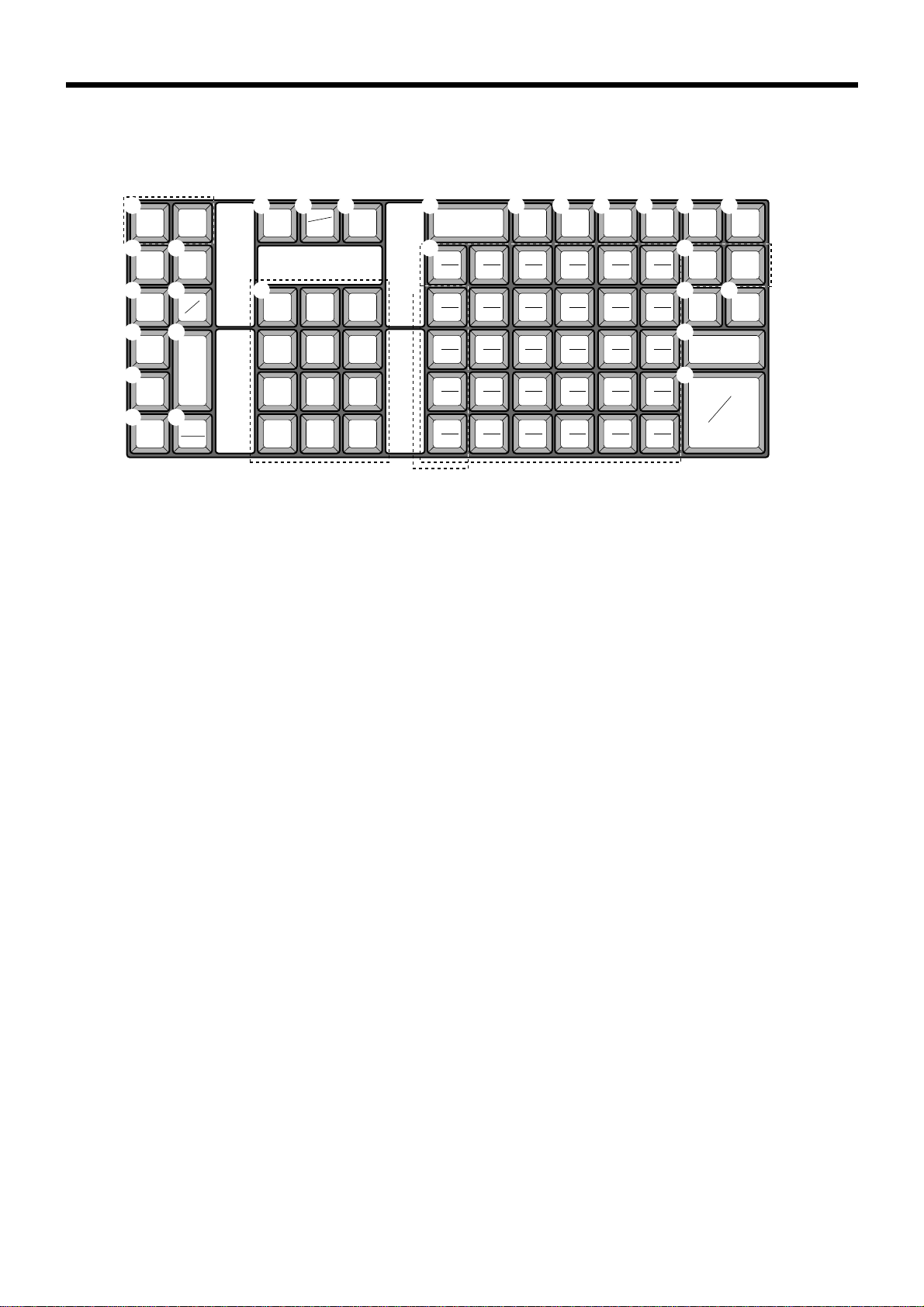

Keyboard ............................................................................................................................................. 24

Basic Operations and Setups ................................................................................................. 26

How to read the printouts ............................................................................................................... 26

How to use your cash register........................................................................................................ 27

Assigning a clerk ................................................................................................................................. 28

Clerk secret number key .................................................................................................................. 28

Displaying the time and date ............................................................................................................... 29

To display and clear the time............................................................................................................ 29

To display and clear the date............................................................................................................ 29

Preparing coins for change ................................................................................................................. 29

Preparing and using department keys ........................................................................................... 30

Registering department keys............................................................................................................... 30

Programming department keys ........................................................................................................... 32

To program a unit price for each depar tment ................................................................................... 32

To program the tax calculation status for each department ............................................................. 32

To program high amount limit for each department ......................................................................... 32

Registering department keys by programming data ........................................................................... 34

Preparing and using PLUs ............................................................................................................. 35

Programming PLUs ............................................................................................................................. 35

To program a unit price for each PLU .............................................................................................. 35

To program tax calculation status for each PLU .............................................................................. 35

Registering PLUs................................................................................................................................. 36

Shifting the taxable status of an item ............................................................................................. 37

Calculation merchandise subtotal ....................................................................................................... 37

Preparing and using discounts....................................................................................................... 38

Programming discounts....................................................................................................................... 38

Registering discounts .......................................................................................................................... 38

Discount for items and subtotals ...................................................................................................... 38

Preparing and using reductions ..................................................................................................... 39

Programming for reductions ................................................................................................................ 39

Registering reductions......................................................................................................................... 39

Reduction for items........................................................................................................................... 39

4

Page 5

Registering credit and check payments ......................................................................................... 40

Check................................................................................................................................................ 40

Credit ................................................................................................................................................ 40

Mixed tender (cash, credit and check) ............................................................................................. 41

V alidation printing........................................................................................................................... 41

Registering returned goods in the REG mode ............................................................................... 42

Registering returned goods in the RF mode .................................................................................. 43

Normal refund transaction ................................................................................................................... 43

Reduction of amounts paid on refund ................................................................................................. 43

Registering money received on account ........................................................................................ 44

Registering money paid out ........................................................................................................... 44

Making corrections in a registration ............................................................................................... 45

To correct an item you input but not yet registered .............................................................................45

To correct an item you input and registered ........................................................................................ 46

To cancel all items in a transaction...................................................................................................... 47

No sale registration ........................................................................................................................ 47

Printing the daily sales reset report................................................................................................ 48

Advanced Operations and Setups.......................................................................................... 50

Single item cash sales.................................................................................................................... 50

Currency exchange function .......................................................................................................... 51

Registering foreign currency ............................................................................................................... 51

Full amount tender in foreign currency............................................................................................. 51

Partial tender in a foreign currency .................................................................................................. 52

Currency exchange programming ....................................................................................................... 53

Post-finalization receipt .................................................................................................................. 53

Calculator functions........................................................................................................................ 54

Programming to clerk ..................................................................................................................... 55

Programming clerk number ................................................................................................................. 55

Programming trainee status ................................................................................................................ 55

Programming machine features ..................................................................................................... 56

Programming to general control file .................................................................................................... 56

Programming department/PLU ......................................................................................................61

Batch feature programming to department/PLU ................................................................................. 61

Individual feature programming to department/PLU ........................................................................... 62

Programming to transaction keys................................................................................................... 64

Procedure ......................................................................................................................................... 64

<CASH>, <CHARGE>, <CHECK> ....................................................................................................................64

<CREDIT> ......................................................................................................................................................... 65

<RECEIVED ON ACCOUNT>, <PAID OUT> ....................................................................................................65

<#/NO SALE> .................................................................................................................................................... 6 6

<%–>..................................................................................................................................................................66

<–> .....................................................................................................................................................................67

<CURRENCY EXCHANGE> .............................................................................................................................67

<POST RECEIPT> ............................................................................................................................................68

<QUANTITY/FOR>............................................................................................................................................ 68

Allocating three zero key................................................................................................................ 68

Procedure ......................................................................................................................................... 68

Introduction & Contents

PCR-1000 User's Manual

5

Page 6

Introduction & Contents

Character programming ................................................................................................................. 69

Using character keyboard.................................................................................................................... 69

Entering characters by code................................................................................................................ 70

Character code list............................................................................................................................ 70

Procedures for programming descriptors and messages .............................................................. 71

Programming clerk name and messages........................................................................................... 71

Programming department/transaction key descriptor ......................................................................... 75

Programming PLU descriptor .............................................................................................................. 76

Printing read/reset reports.............................................................................................................. 77

To print the individual department, PLU read report ........................................................................... 77

To print the financial read report .......................................................................................................... 78

To print the individual clerk read/reset report ...................................................................................... 78

To print the daily sales read/reset report ............................................................................................. 79

To print the PLU read/reset report ....................................................................................................... 80

To print the hourly sales read/reset report........................................................................................... 80

To print the monthly sales read/reset report........................................................................................ 81

To print the group read/reset report..................................................................................................... 81

Reading the cash register's program .............................................................................................82

To pr int unit price/rate program (except PLU) ..................................................................................... 82

To pr int key descriptor, name, message program (except PLU) ......................................................... 83

To pr int the general control program, compulsor y and key program .................................................. 84

To print the PLU program .................................................................................................................... 85

Troubleshooting ....................................................................................................................... 86

When an error occurs..................................................................................................................... 86

When the register does not operate at all ...................................................................................... 87

Clearing a machine lock up............................................................................................................ 88

In case of power failure .................................................................................................................. 88

User Maintenance and Options .............................................................................................. 89

To replace the ink r i bbon ................................................................................................................ 89

To replace journal paper................................................................................................................. 90

To replace receipt paper................................................................................................................. 91

Options ........................................................................................................................................... 91

Specifications................................................................................................................. .......... 92

Index.......................................................................................................................... ................ 93

6

Page 7

Introduction & Contents

PCR-1000 User's Manual

7

Page 8

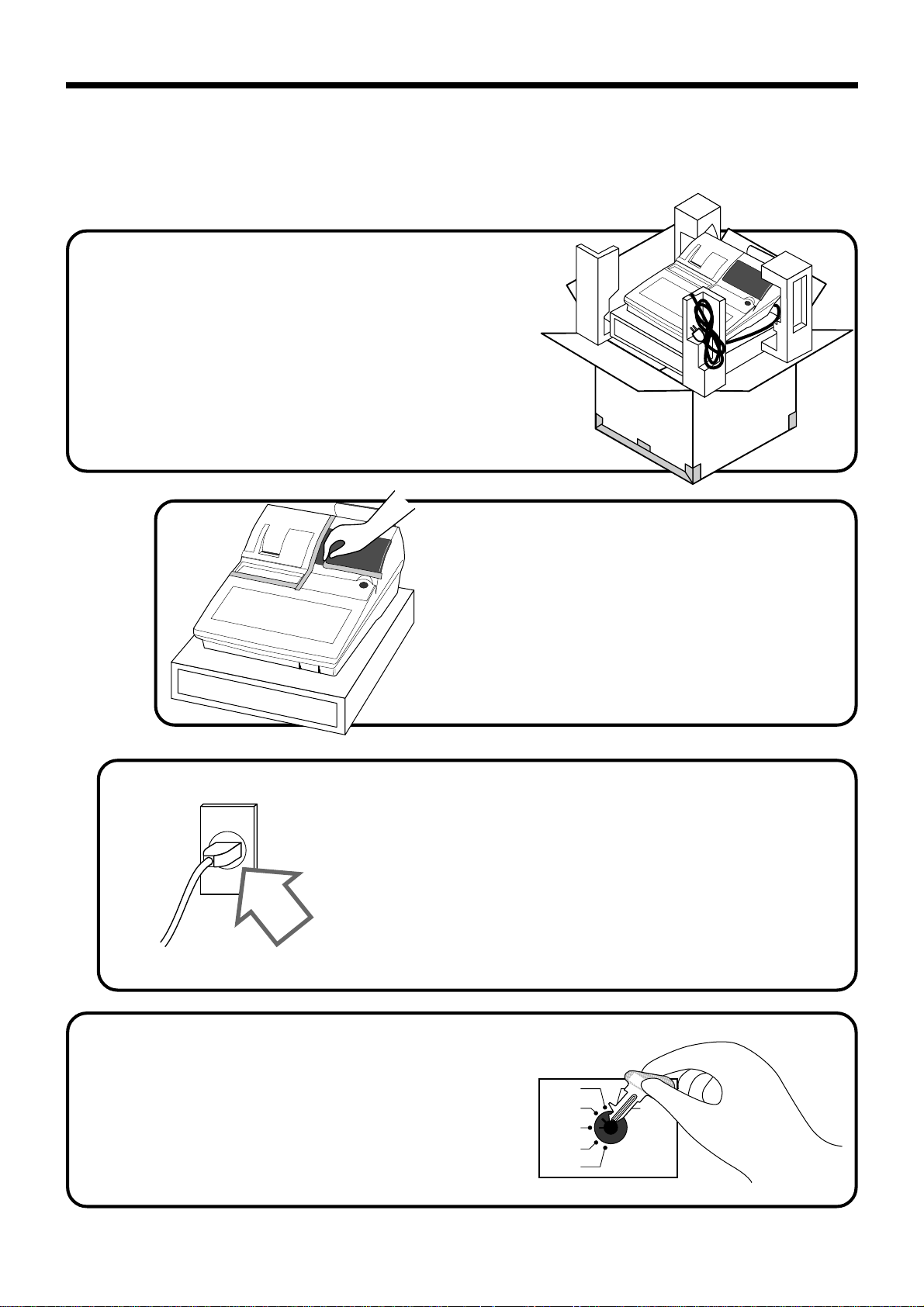

Getting Started

This section outlines how to unpack the cash register and get it ready to operate. You should read this part

of the manual even if you have used a cash register before. The following is the basic set up procedure,

along with page references where you should look for more details.

1.

Remove the cash register from its box.

2.

Remove the tape holding parts

of the cash register in place.

Also remove the small plastic bag taped to the

printer cover. Inside you will find the mode

keys.

8

4.

3.

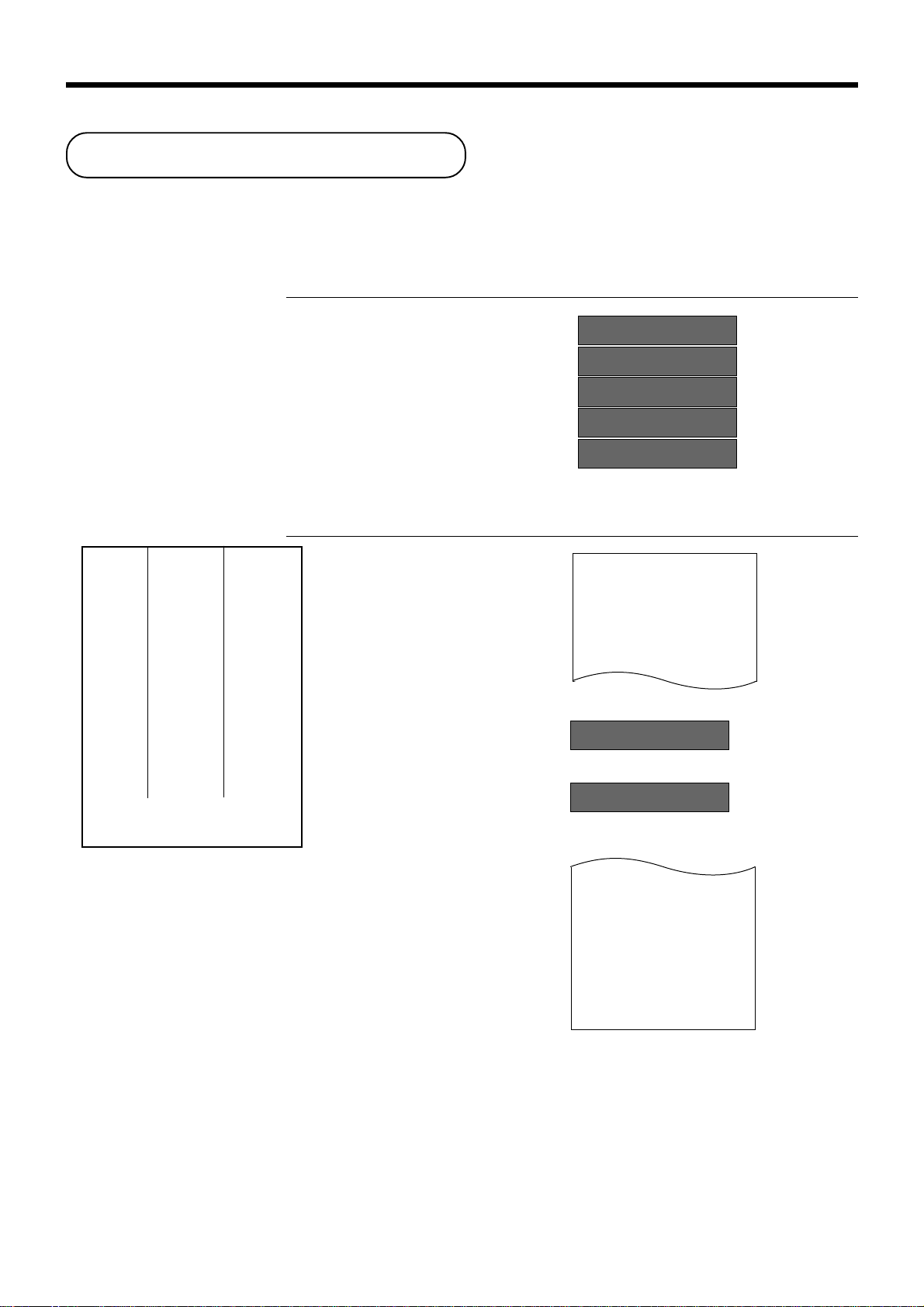

Insert the mode key marked

“PGM” into the mode switch.

Plug the cash register into a wall outlet.

Be sure to check the sticker on the side of the cash

register to make sure that its voltage matches that

of the power supply in your area. The printer will

operate for a few seconds. Please do not pass the

power cable under the drawer.

PGM

C-A32

CAL

REG

OFF

RF

PGM

X

Z

Page 9

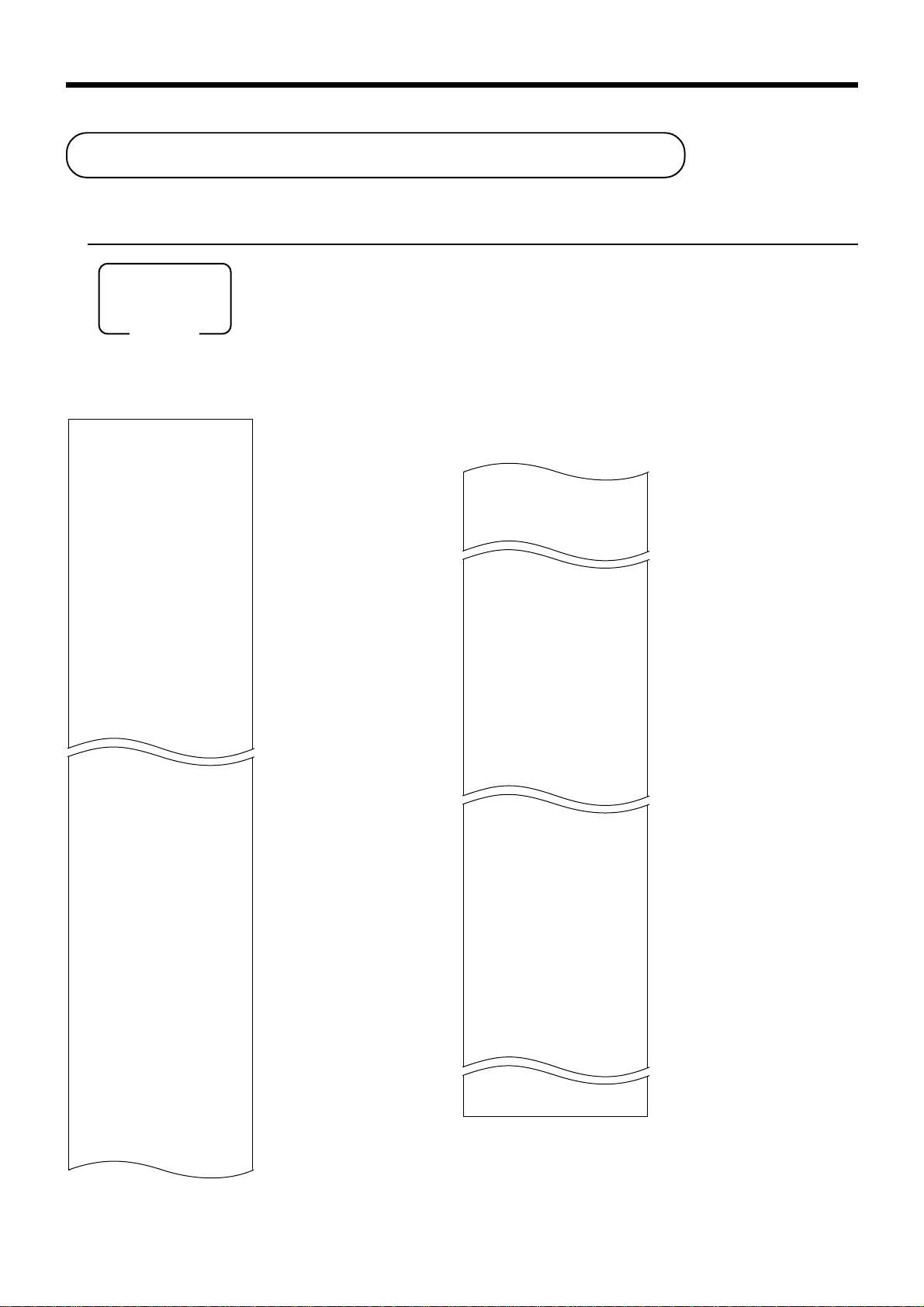

5.

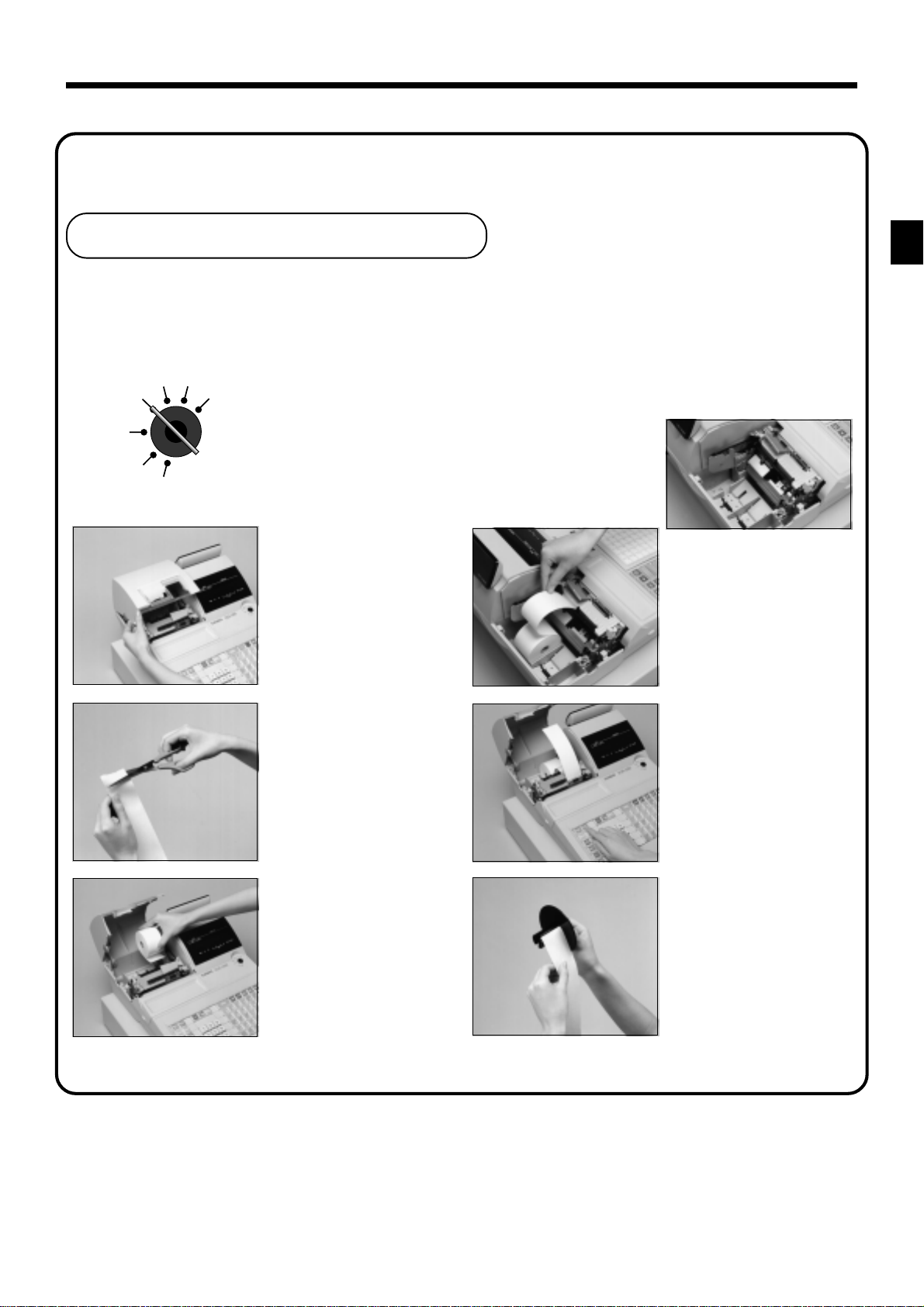

Install receipt/journal paper .

Loading journal paper

The same type of paper (45 mm × 83 mm i.d.) is used for receipts and journal. Load the new paper before first

operating the cash register or when red paper appears from the printer.

CAL X

REG Z

OFF

RF

PGM

11

1

11

Use a mode key to set the

mode switch to REG

position.

22

2

22

Open the printer cover.

33

3

33

Cut off the leading end of

the paper so it is even.

55

5

55

Drop the paper roll gently

and insert paper to the

paper inlet.

66

6

66

Press the j key until

about 20 cm to 30 cm of

paper is fed from the

printer.

Getting Started

PCR-1000 User’s Manual

44

4

44

Ensuring the paper is being

fed from the bottom of the

roll, lower the roll into the

space behind the printer.

77

7

77

Slide the leading end of the

paper into the groove on

the spindle of the take-up

reel and wind it onto the

reel two or three turns.

9

Page 10

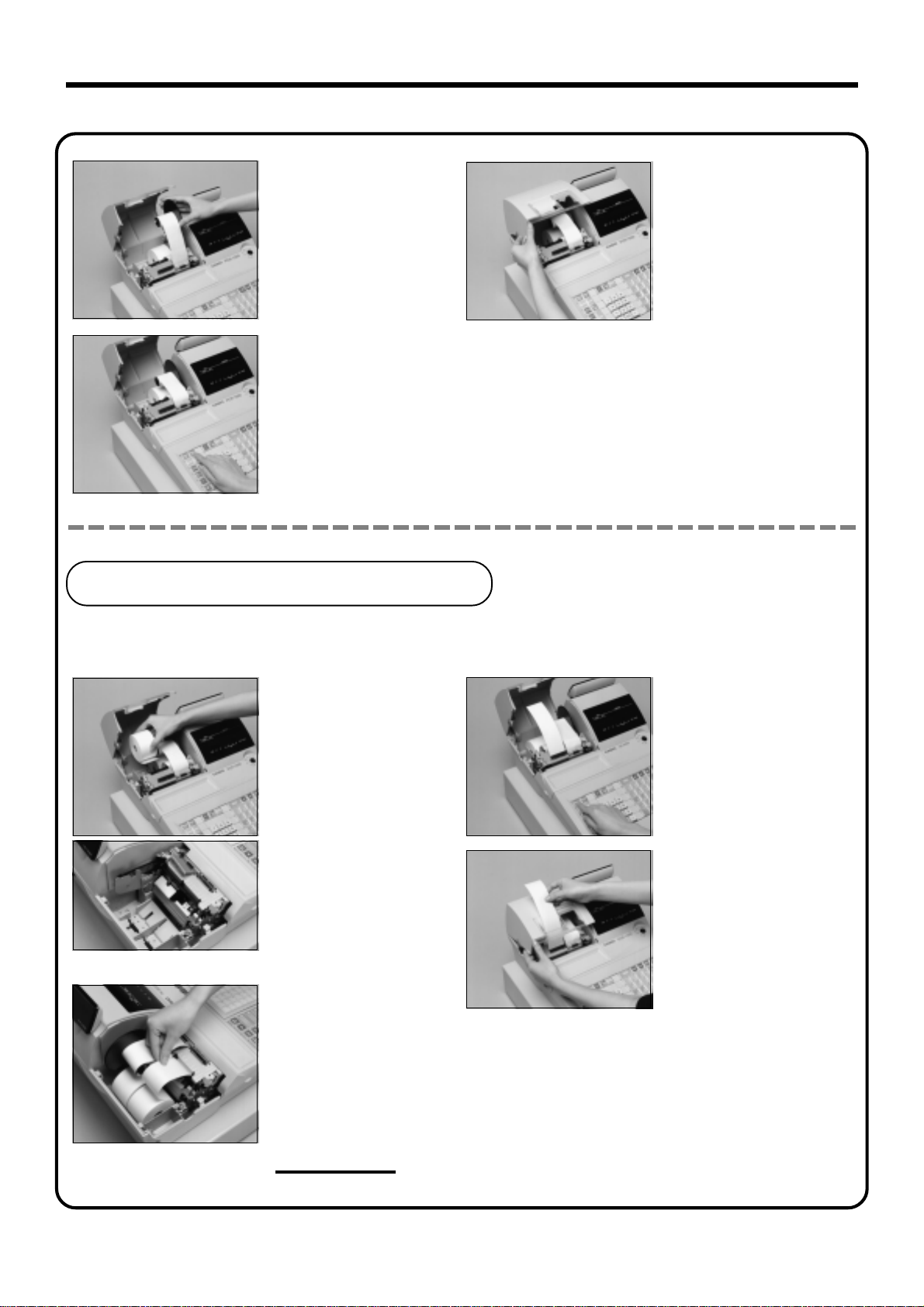

Getting Started

88

8

88

Place the take-up reel into

place behind the printer,

above the roll paper.

99

9

99

Press the j key to take

up any slack in the paper.

00

0

00

Close the printer cover.

Loading receipt paper

Follow steps

11

1 through

11

33

3 under “Loading journal paper” on the previous page.

33

44

4

44

Ensuring the paper is being

fed from the bottom of the

roll, lower the roll into the

space behind the printer.

55

5

55

Drop the paper roll gently

and insert paper to the

paper inlet.

66

6

66

Press the f key until

about 20 cm to 30 cm of

paper is fed from the

printer.

77

7

77

Set the printer cover,

passing the leading end of

the paper through the paper

outlet. Close the printer

cover and tear off the

excess paper.

10

Important!

Never operate the cash register without paper. It can damage the printer.

Page 11

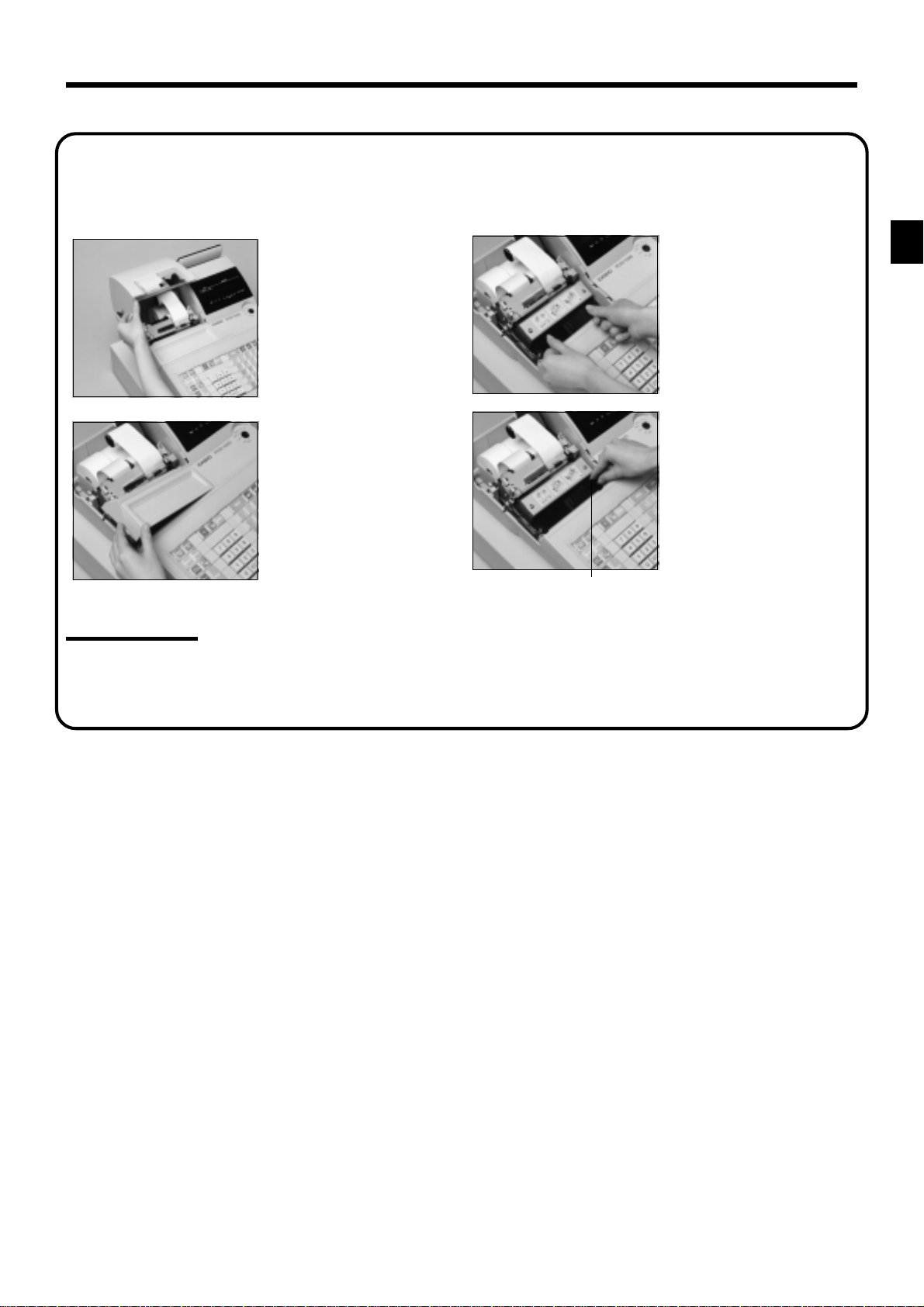

6.

To set the ink ribbon

11

1

11

Open the printer cover.

33

3

33

Load a new ink ribbon

cassette into the unit.

Important!

Use ERC-32 ink ribbon.

22

2

22

Remove the printer sub

cover.

44

4

44

Turn the knob on the right

side of the cassette to take

up any slack in the ribbon.

Knob

55

5

55

Replace the printer cover and printer sub cover.

Getting Started

PCR-1000 User’s Manual

11

Page 12

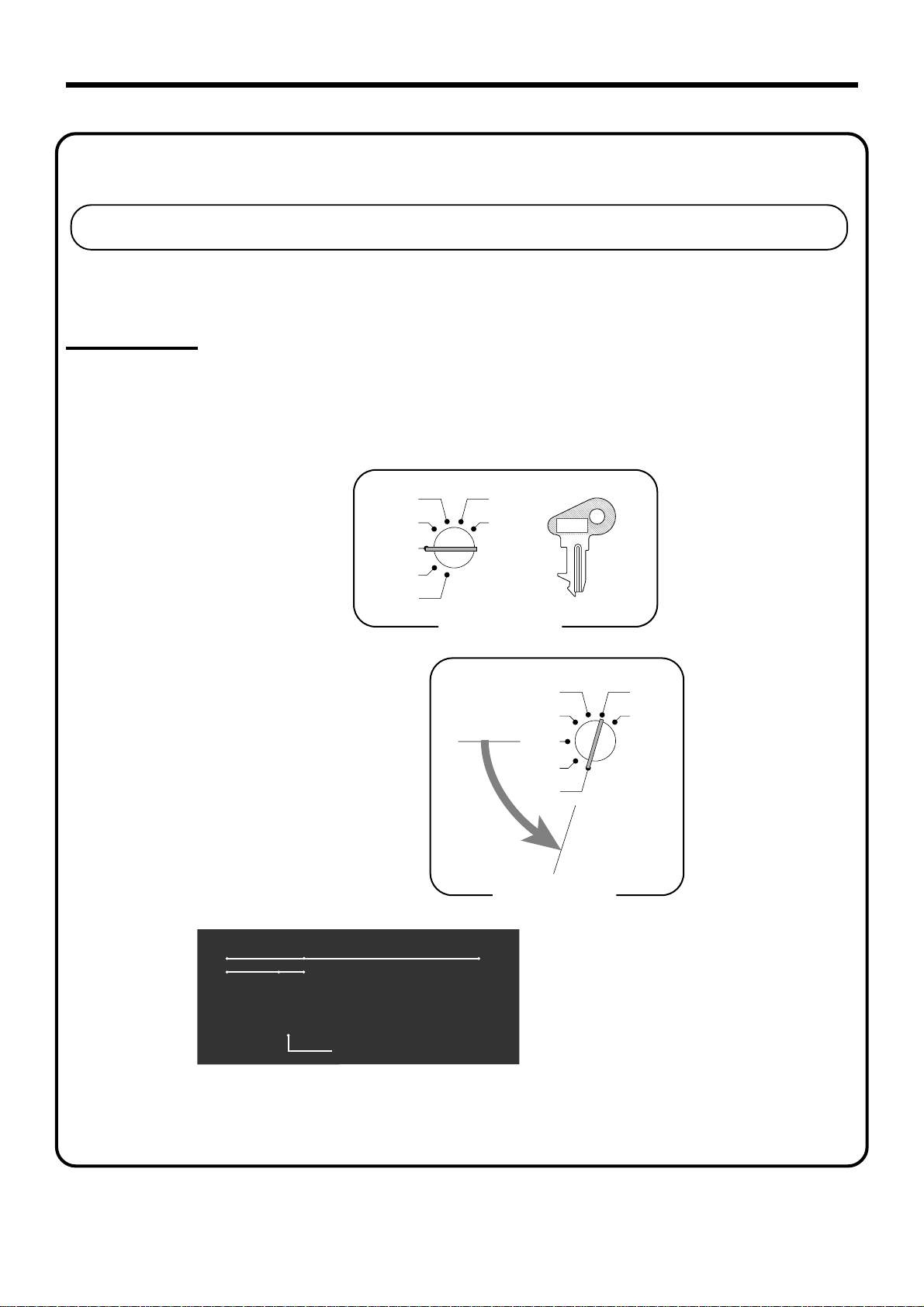

Getting Started

7.

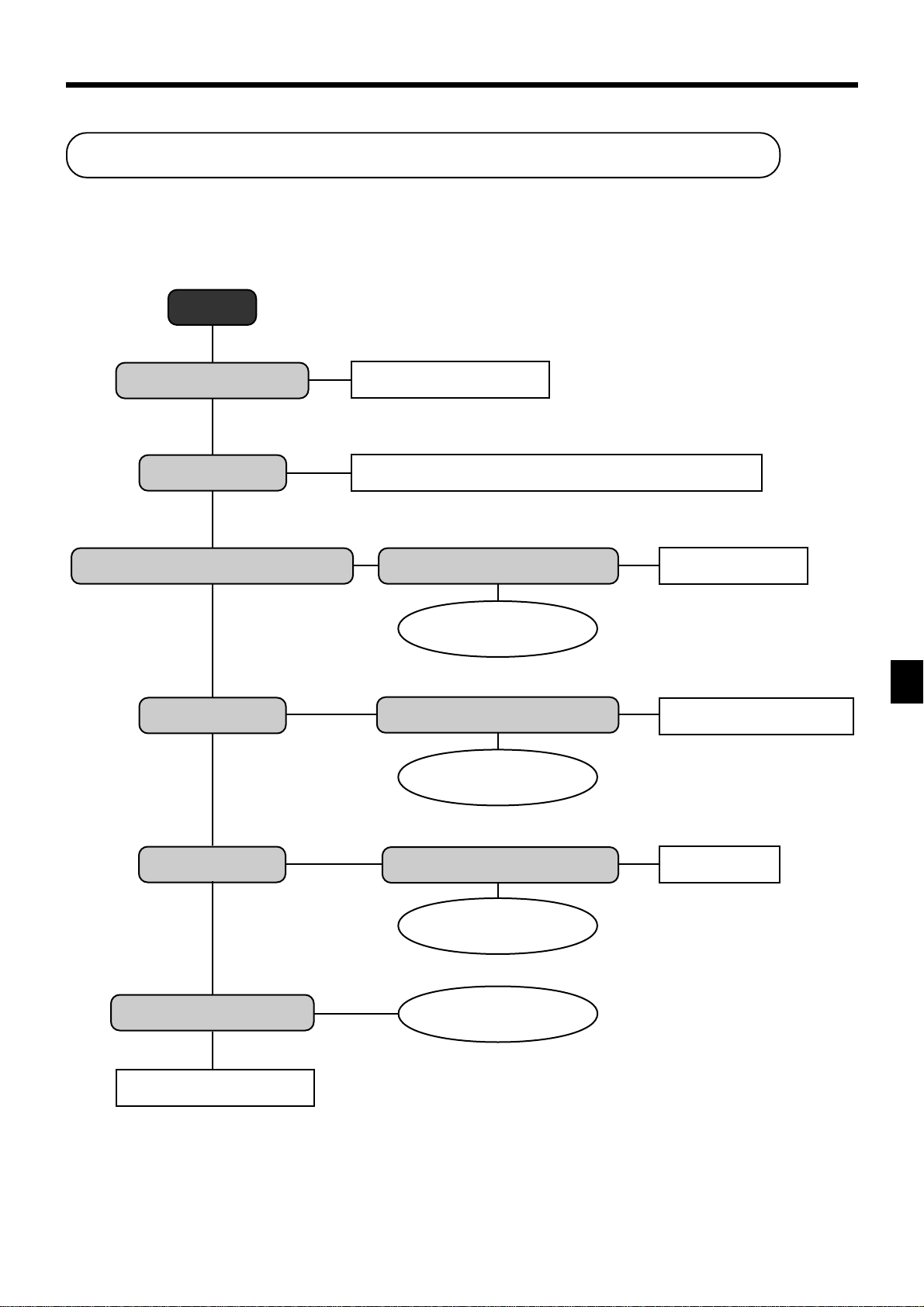

Machine initialization

Machine initialization and pr ogram auto loading

You must perform the following procedure to initialize the cash register before using it for the first time.

Important

This procedure clears all of the totalizers and programs currently contained in the memory, and

reload the standard program into memory.

This operation should be performed before using the cash register for the first time only.

(1) Plug the power code into an AC outlet.

X

Z

Mode Switch

PGM

C-A32

(2) Set the Mode Switch to OFF.

CAL

REG

OFF

RF

PGM

(3) While holding down the

turn the Mode Switch to PGM.

(4) Release the

j

DEPT RPT

0000000000

RCT

REG

and enter

23010s

j,

XCAL Z

+–×÷

AMOUNTPLU

T/S1 T/S2 T/S3

CAL

REG

OFF

RF

X

Z

PGM

Mode Switch

You should see “0000000000” on the display.

If another character is shown,

immediately set the Mode Switch to OFF

TOTAL CHANGE

Initialization and program auto loading are complete,

and initialization receipt issued.

and start the beginning of this procedure.

12

Page 13

8.

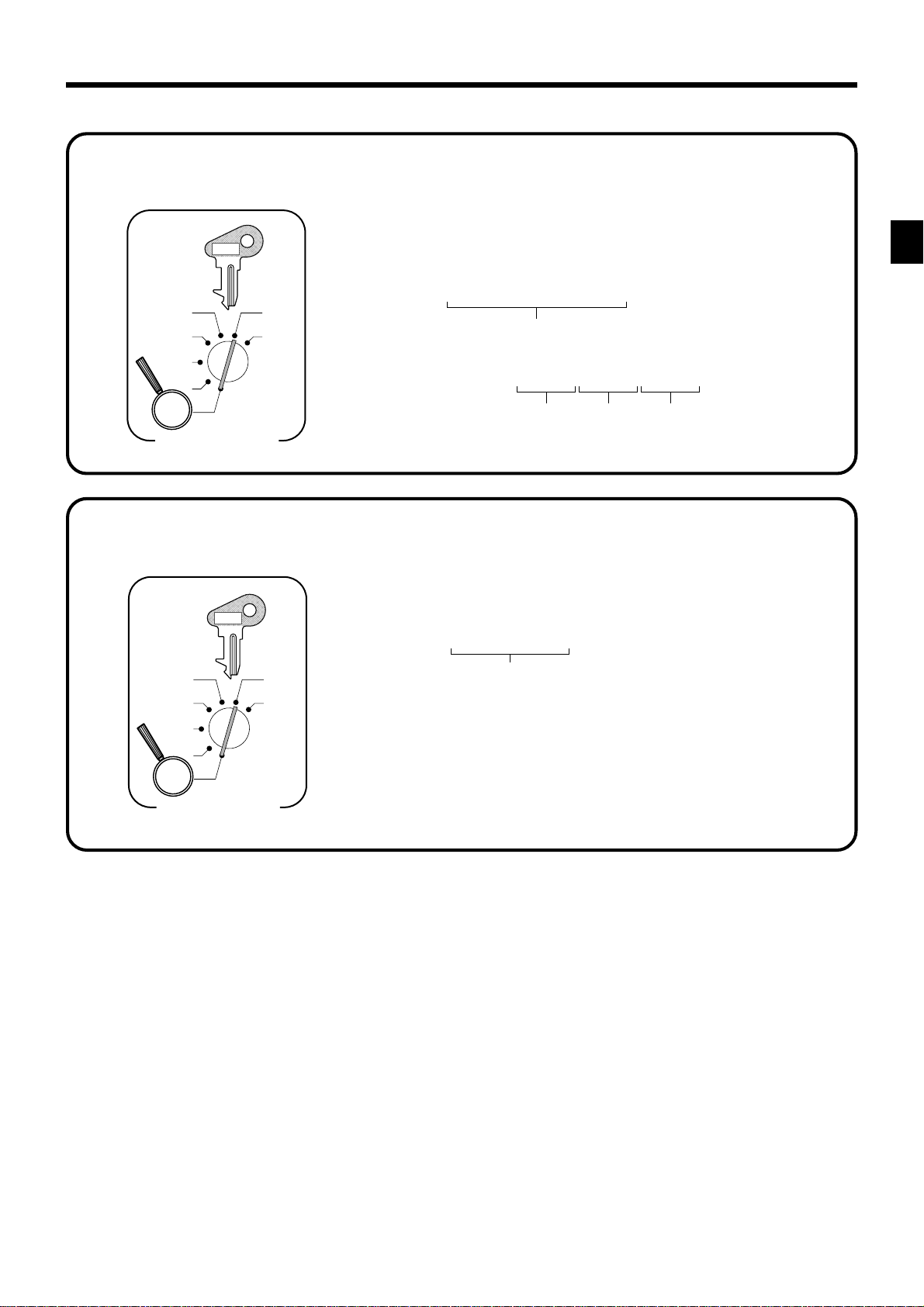

Set the date.

PGM

C-A32

9.

CAL

REG

OFF

RF

X

Z

PGM

Mode Switch

Set the time.

PGM

C-A32

CAL

REG

OFF

RF

X

Z

PGM

Mode Switch

6 1s 6 : : : : : : 6

Current date

Example:

March, 4, 2001 2

6 1s 6 : : : : 6

Example:

08:20 AM

09:45 PM

010304

Year Month Day

x

Current time

2 0820

2 2145

(24-hour military time)

6 C

x

6 C

Getting Started

PCR-1000 User’s Manual

13

Page 14

Getting Started

10.

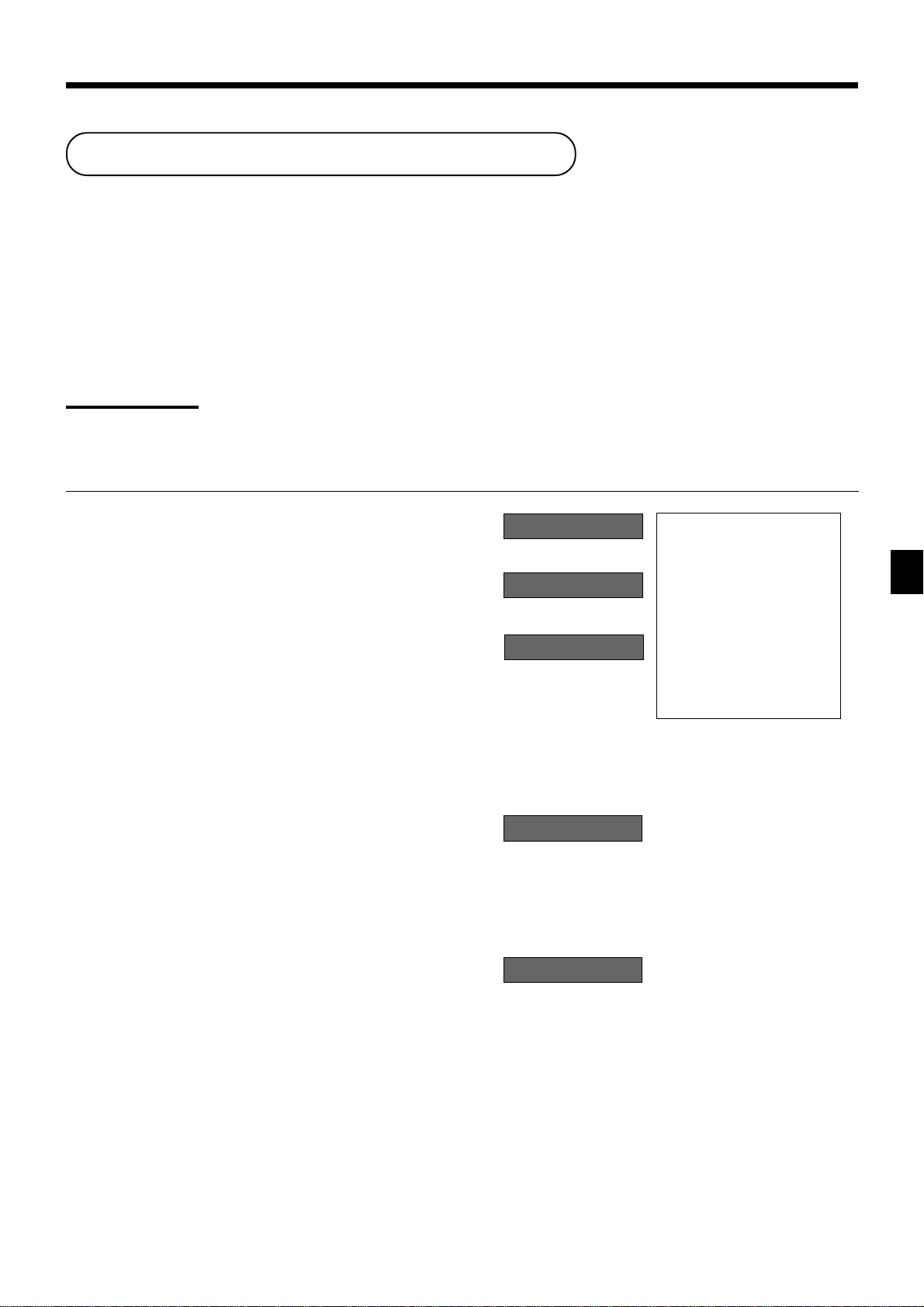

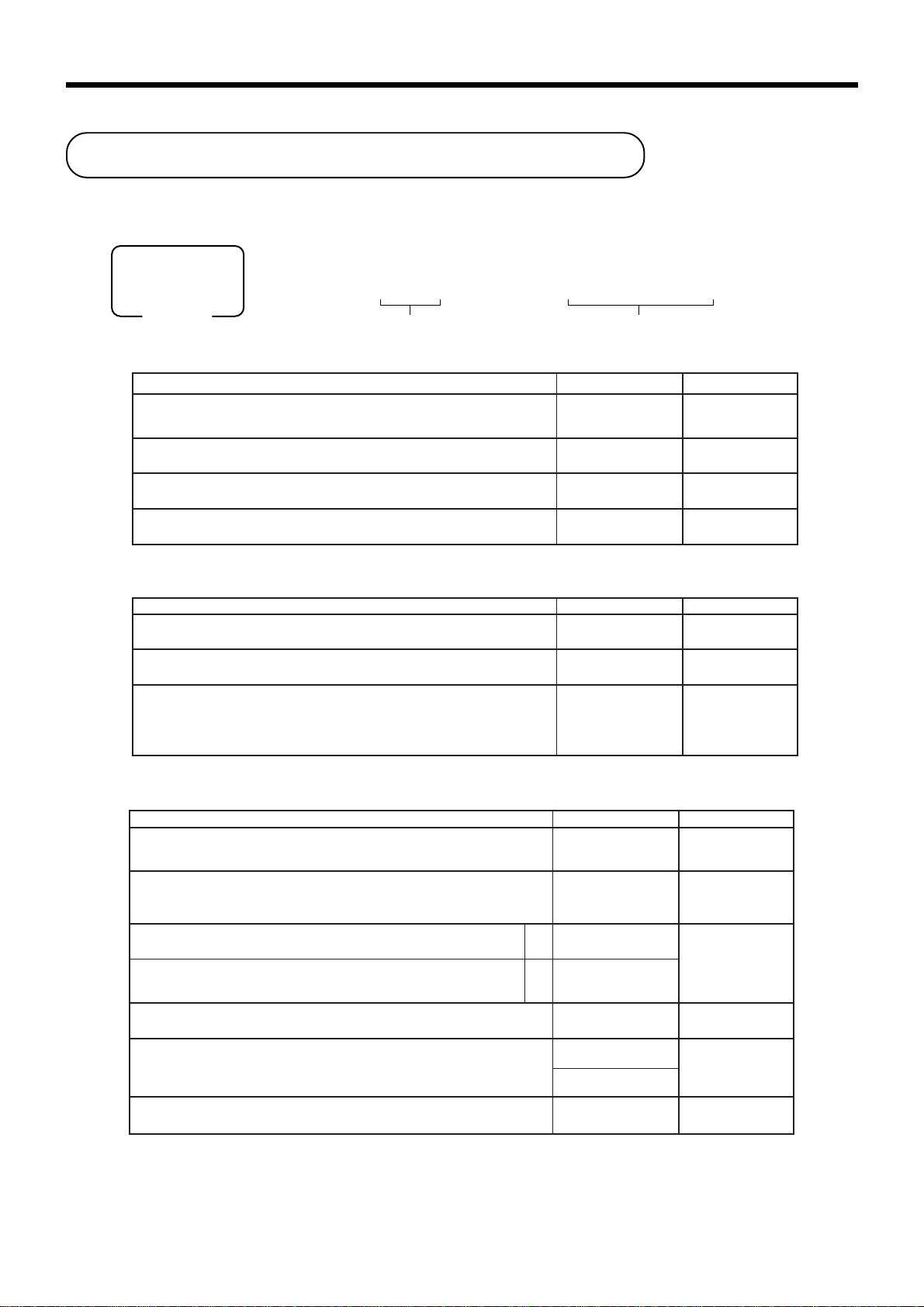

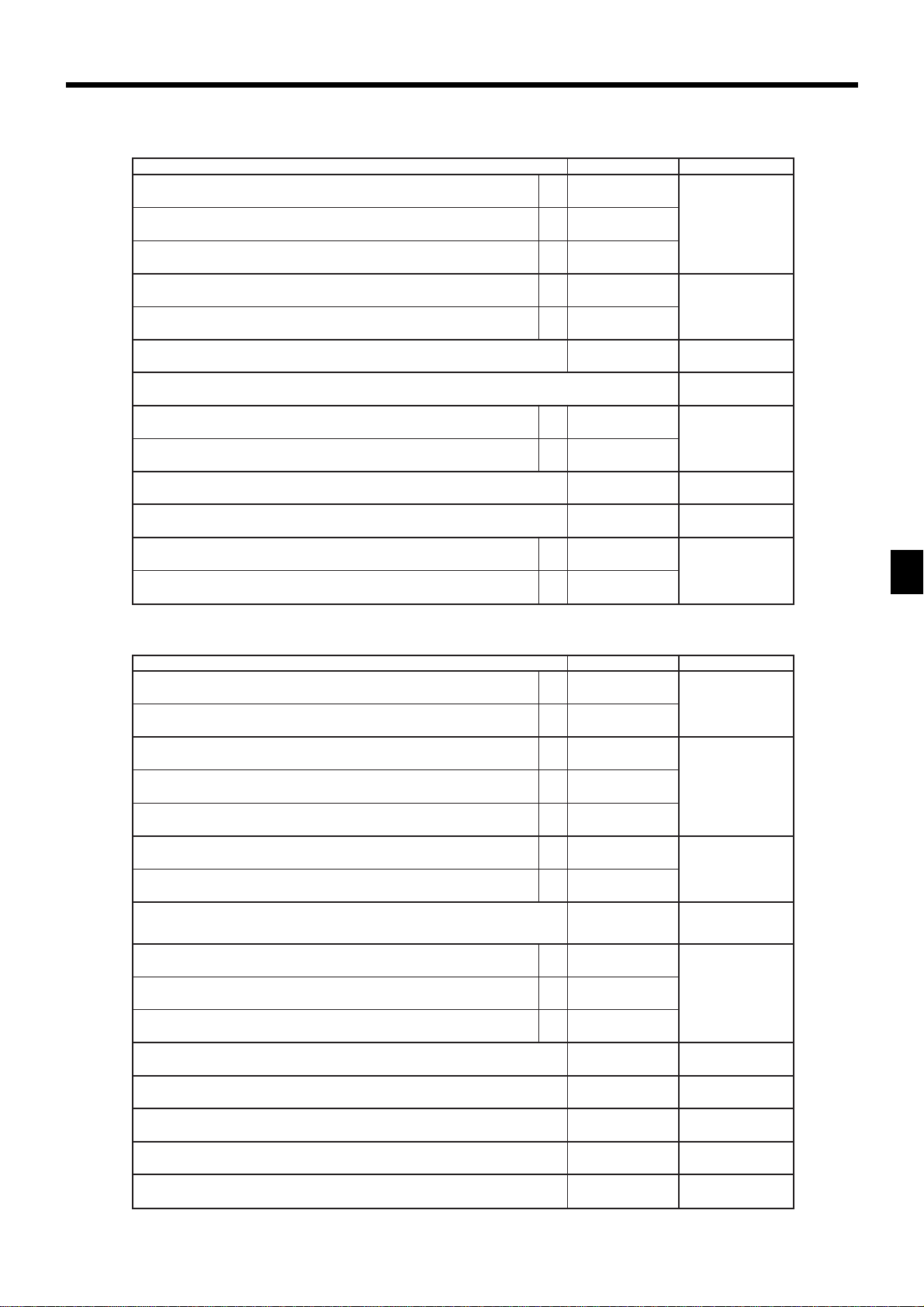

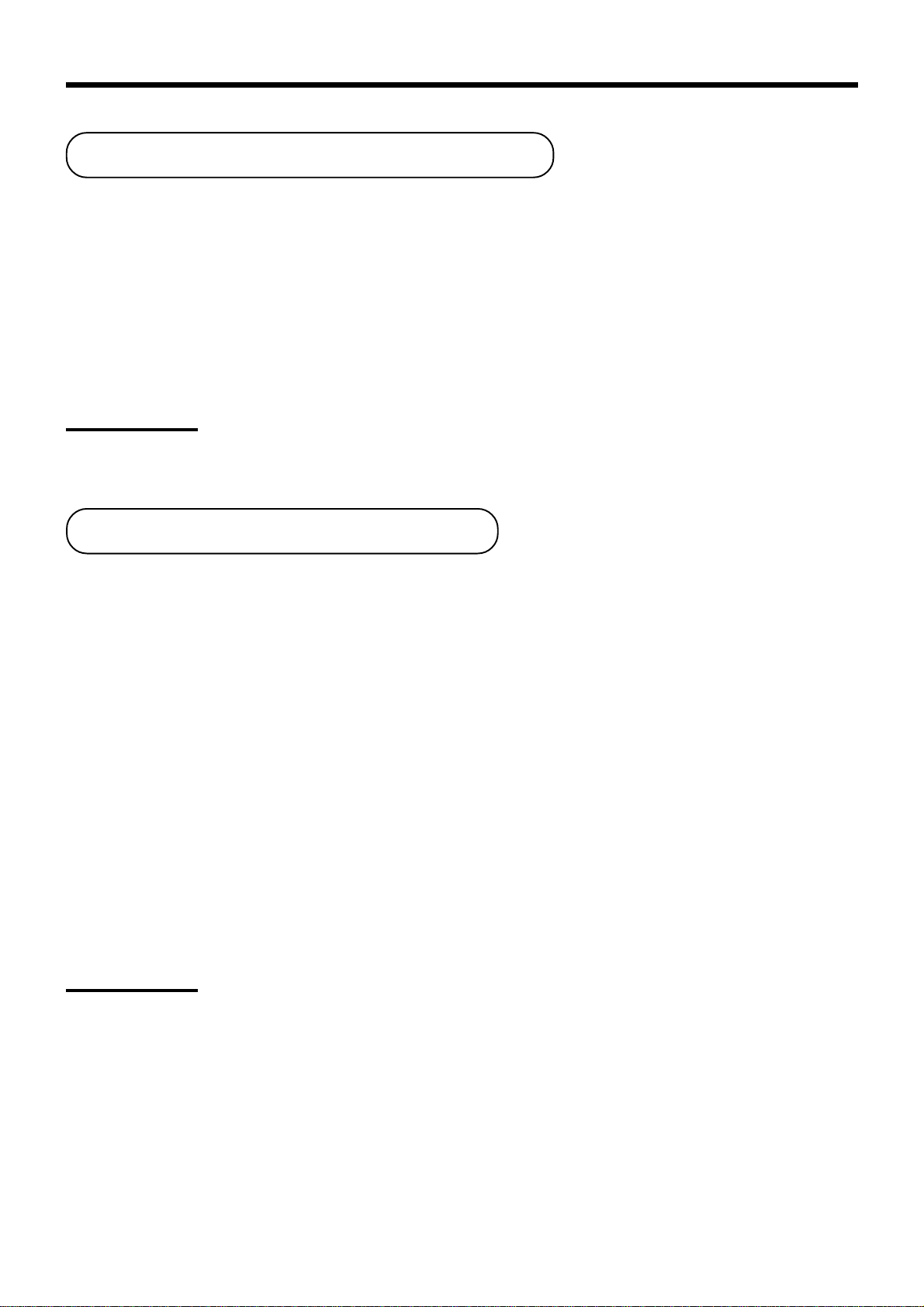

Tax table programming

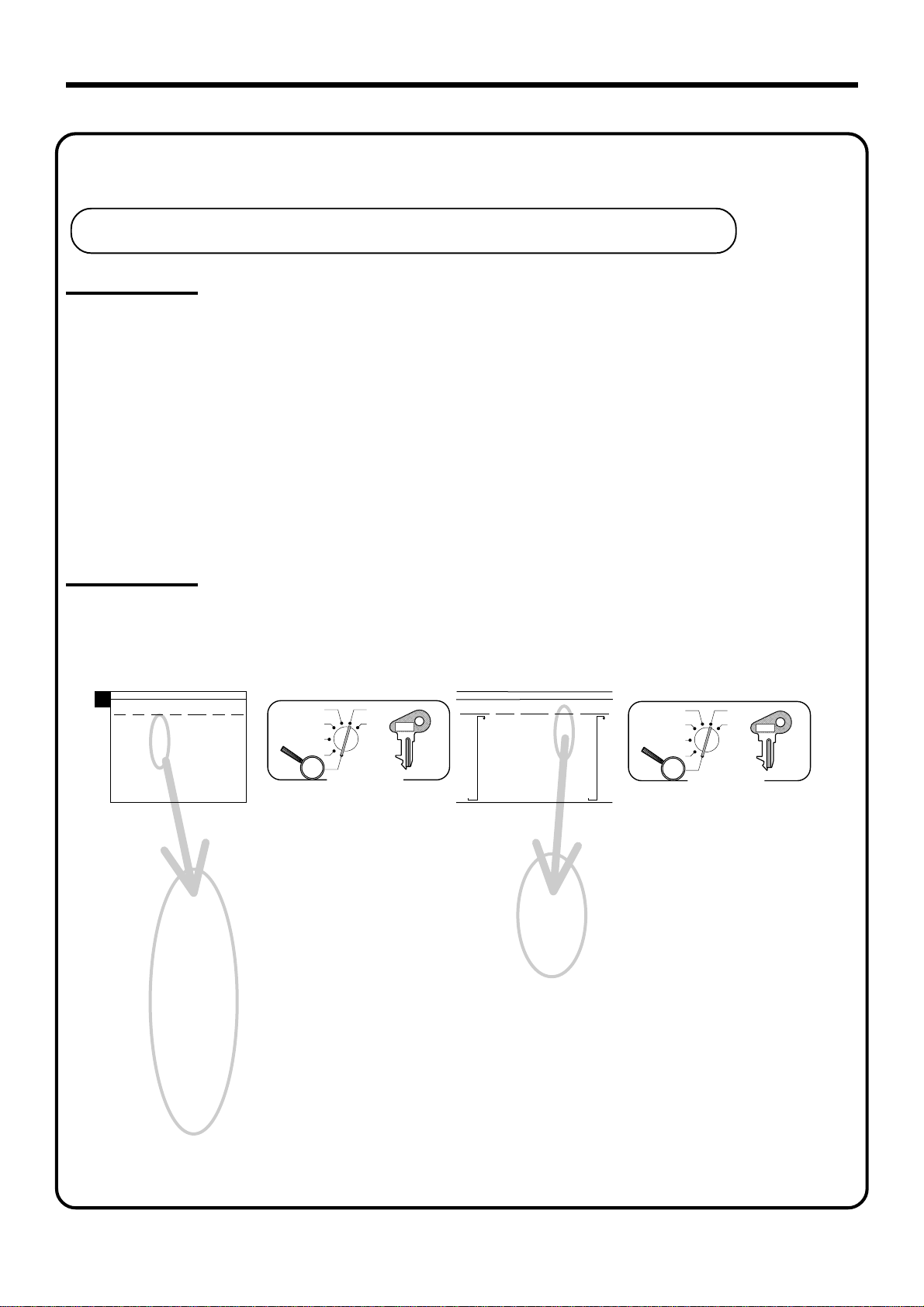

Programming automatic tax calculation

Important!

After you program the tax calculations, you also have to individually specify which departments

(page 32) and PLUs (page 35) are to be taxed.

For this cash register to be able to automatically register state sales tax, you must program its tax tables

with tax calculation data from the tax table for your state. There are three tax tables (U.S.) and four tax

tables (Canada) that you can program for automatic calculation of three separate sales taxes.

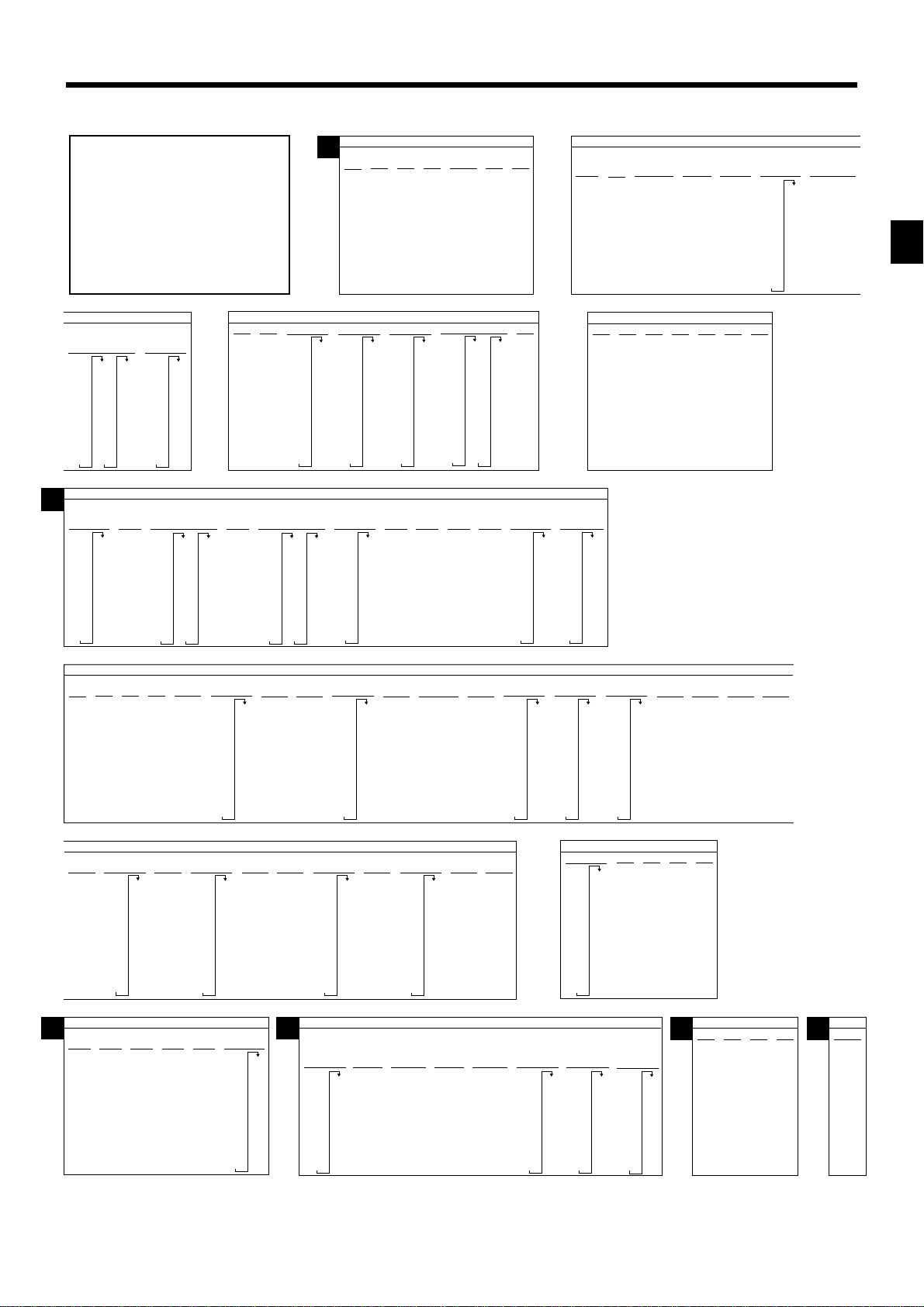

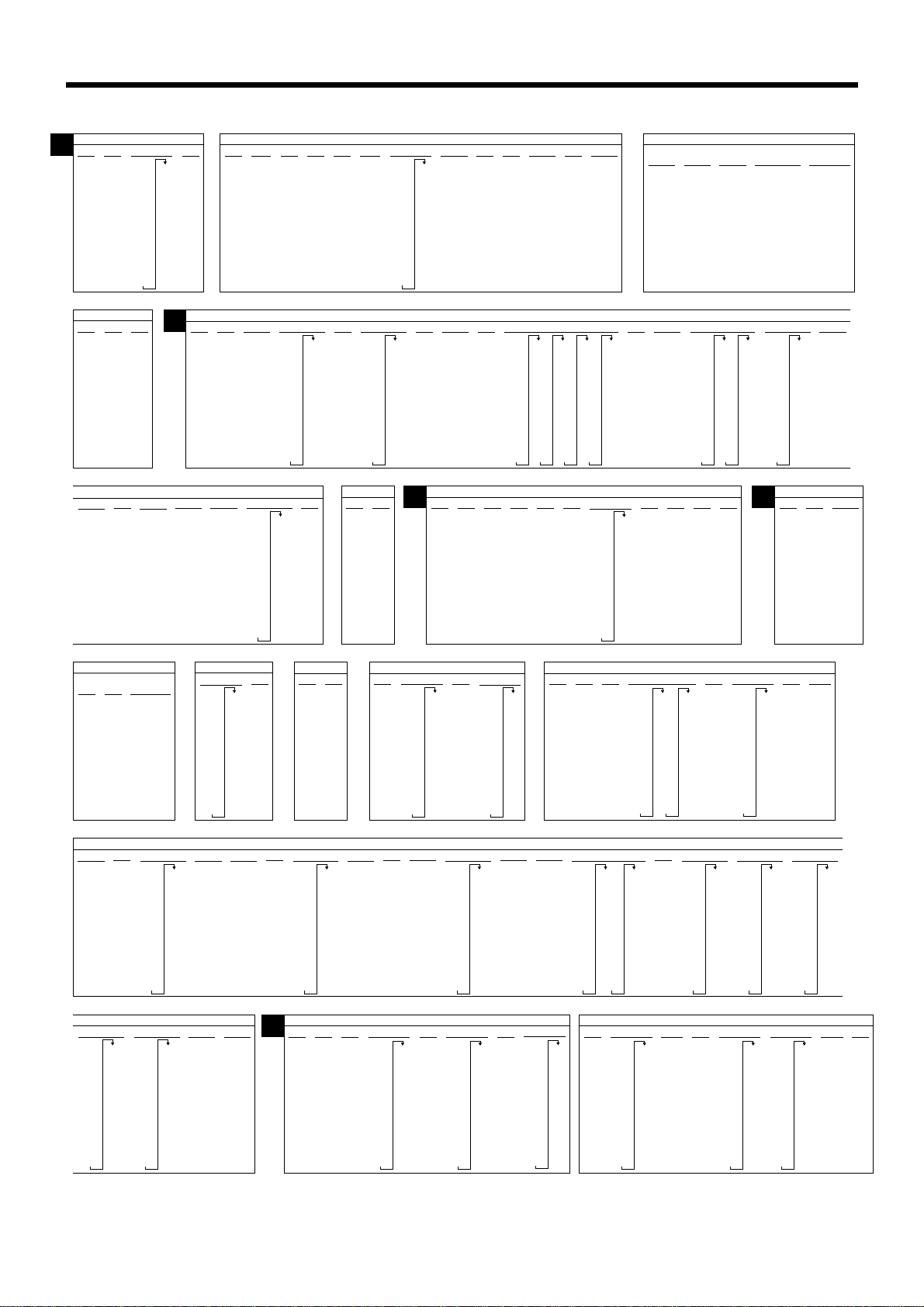

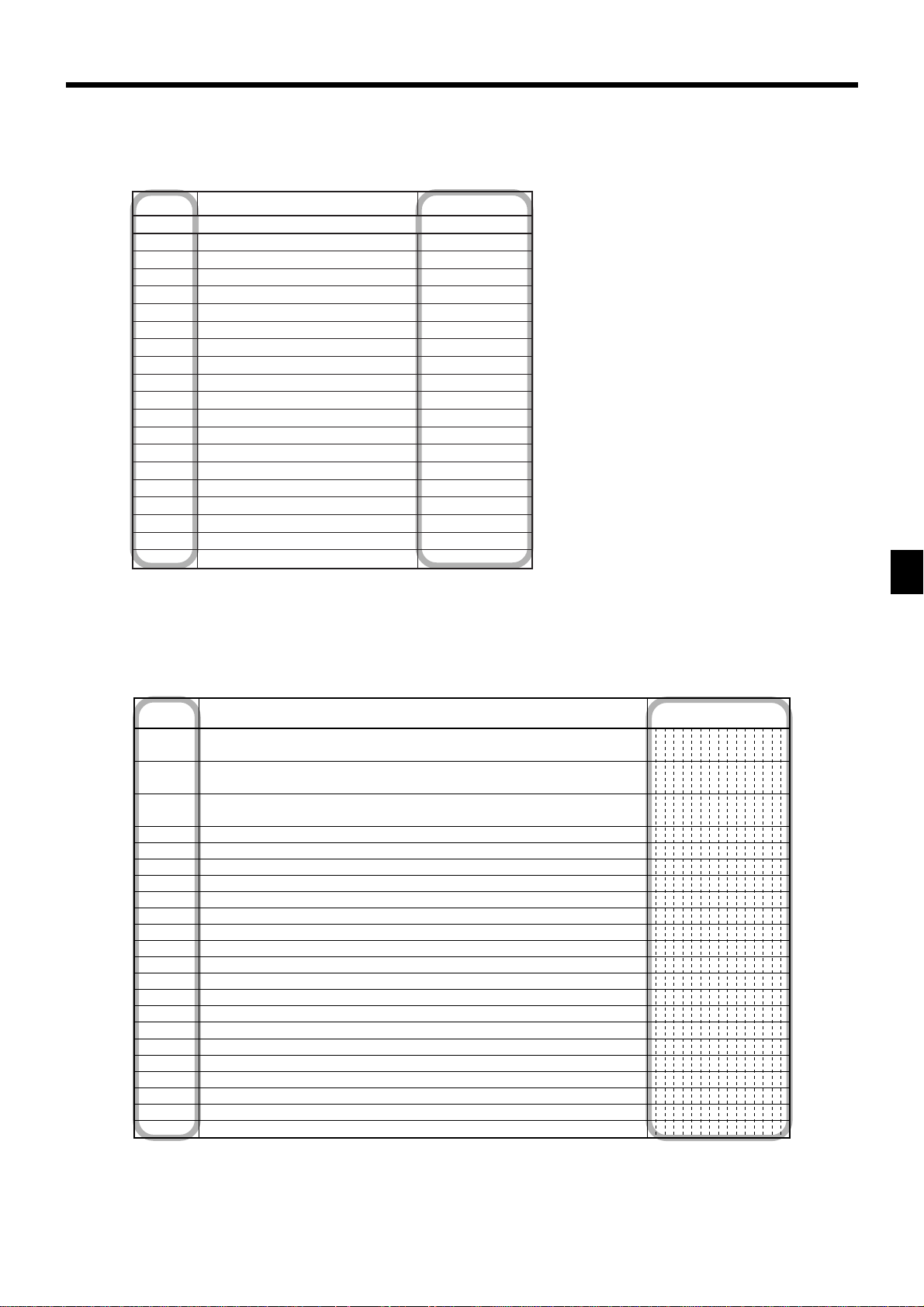

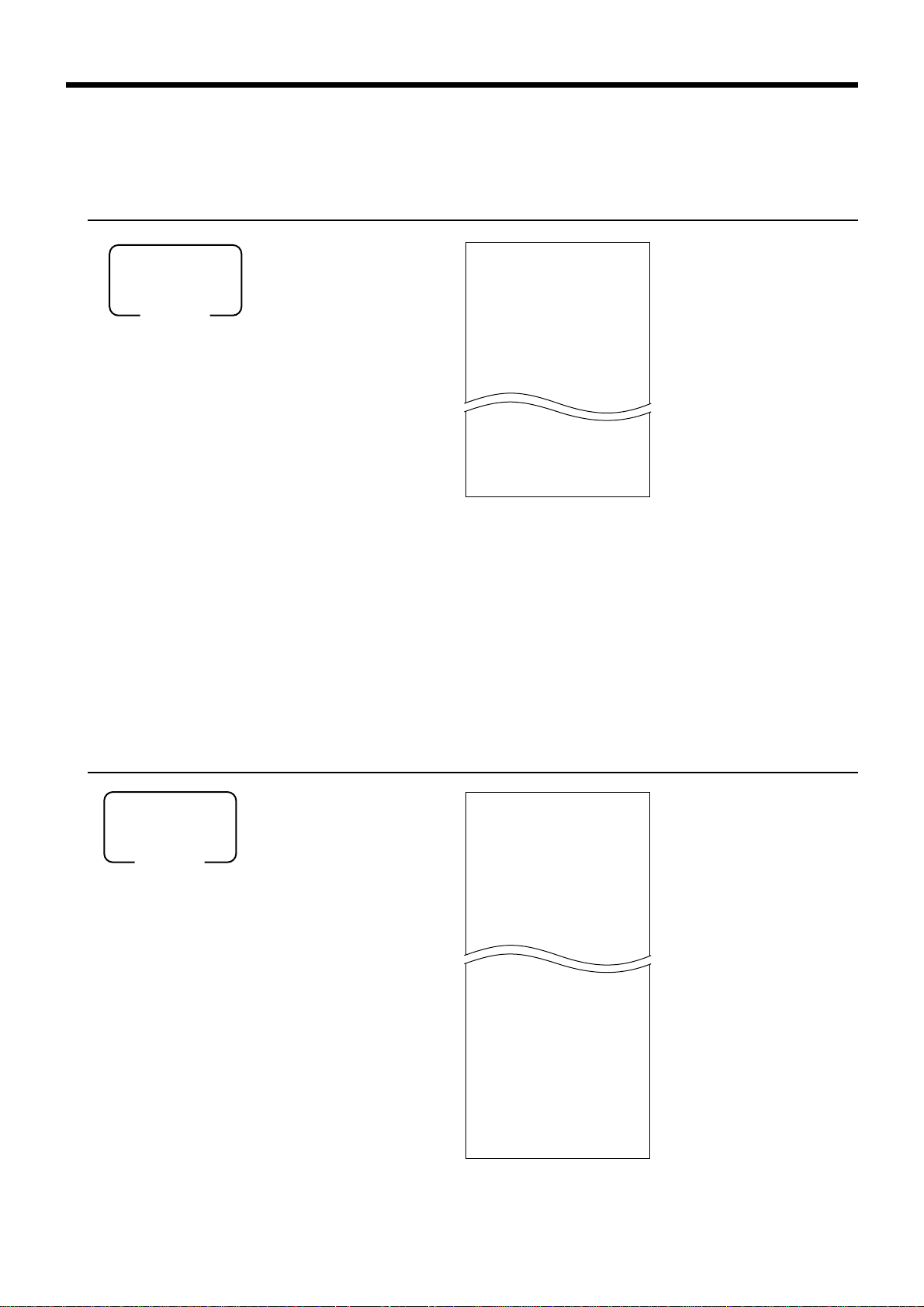

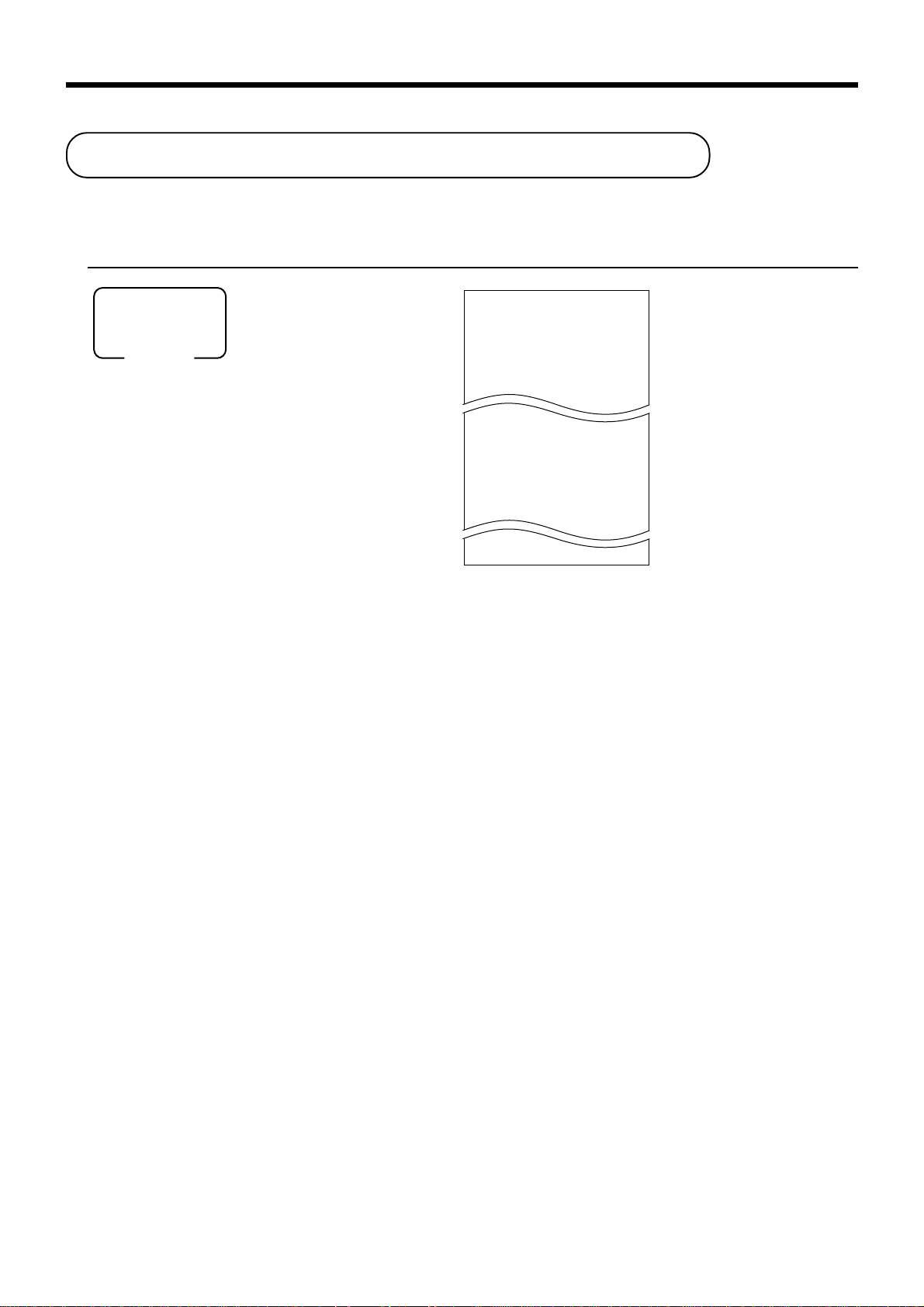

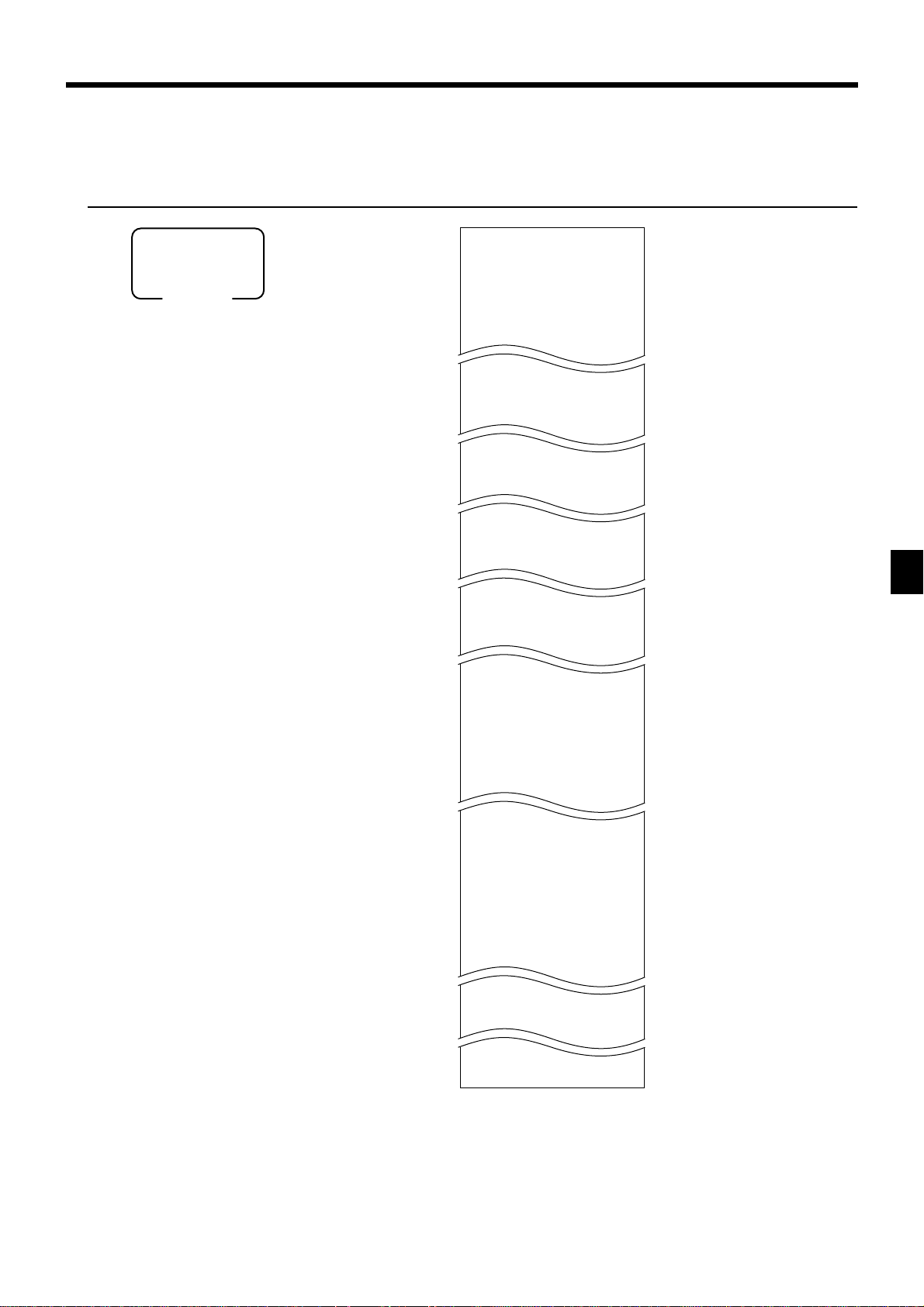

Programming for the U.S. Tax Tables Procedure

Find your state in the table (page 15 ~ 18) and input the data shown in the table.

State sales tax calculation data tables for all of the states that make up the United States are included on

the following pages.

Important!

Be sure you use the state sales tax data specifically for your state. Even if your state uses the

same tax rate percentage as another state, inputting the wrong data will cause incorrect result.

Programming procedure

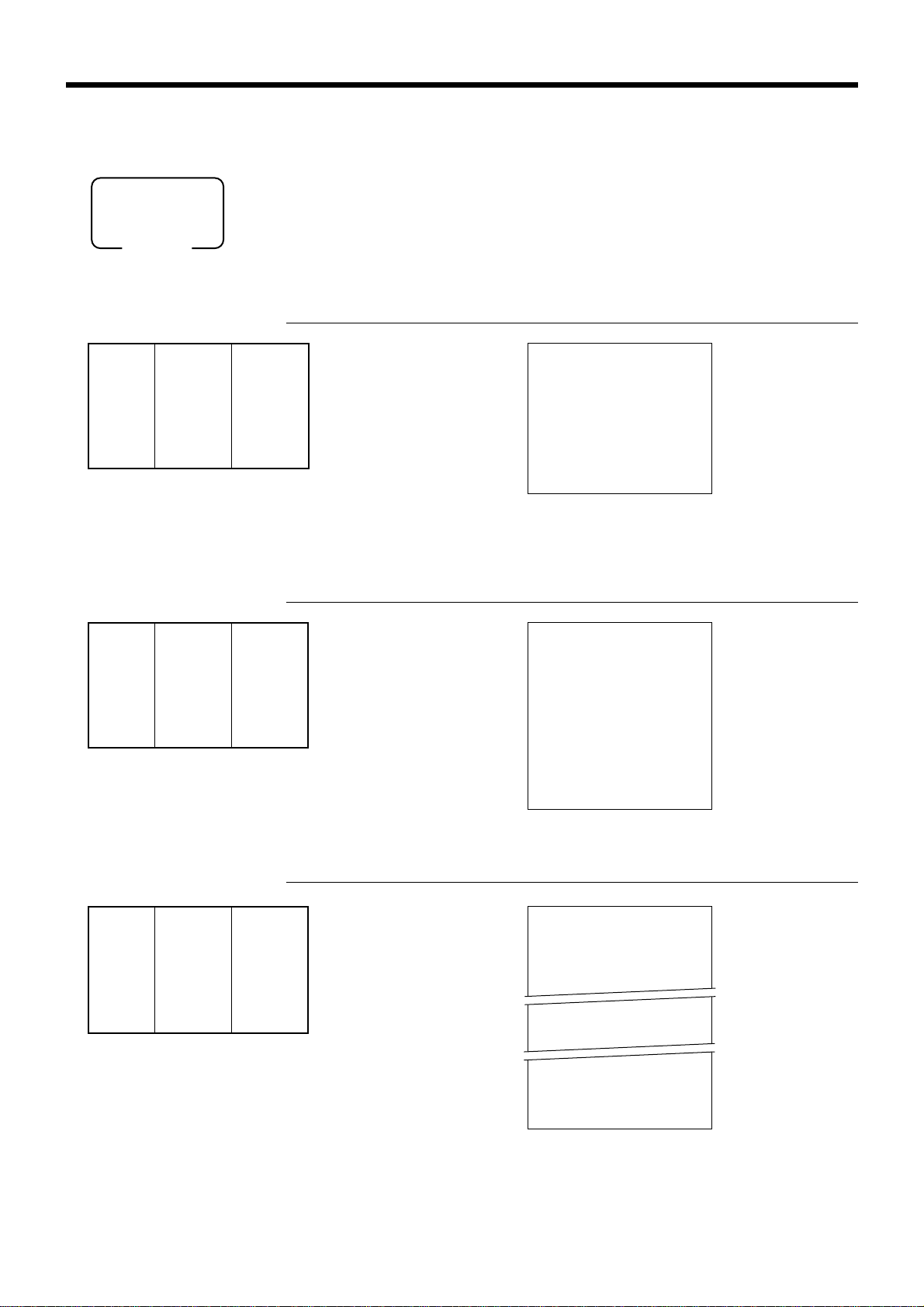

Example 1 (Alabama 6% sales tax to Tax Table 1) Example 2 (Colorado 5.25% sales tax to Tax Table 2)

A

4%

110

ALABAMA

5%

6%

6%

0

0

0

1

1

1

1

1

1

10

10

8

30

29

24

54

73

20

49

41

40

69

58

55

89

70

110

90

109

Assign Tax Table 1

Press a

Terminate program

6%

7%

8%

(4+1+1)

0

0

0

0

1

1

1

1

1

1

1

1

10

9

7

6

20

21

18

36

35

31

54

49

43

70

64

56

85

78

68

110

92

81

107

93

106

CAL

REG

OFF

RF

PGM

X

Z

Mode Switch

$

3s

PGM

C-A32

$

0125a

2

$

0a

$

1a

$

1a

$

8a

$

24a

$

41a

$

58a

$

a

$

s

24

41

58

0

2

1

2

1

2

8

2

2

2

2

2

2

COLORADO

LOVELAND

5.25%

5%

5%

4.5%

0

211

0

1

233

1

2

255

5

17

277

17

29

299

33

49

55

77

99

122

144

166

188

5.25

0

5002

1

1

18

18

51

68

84

118

Assign Tax Table 2

(Tax Table 3: 0325)

5.25

5002

Press a

Terminate program

5.5%

172

0

190

1

209

6

227

17

245

27

263

45

281

63

299

81

99

118

136

154

CAL

REG

OFF

RF

PGM

X

Z

Mode Switch

$

3s

$

2

0225a

2

5^25a

2

5002a

2

2

$

$

$

a

$

s

PGM

C-A32

14

Page 15

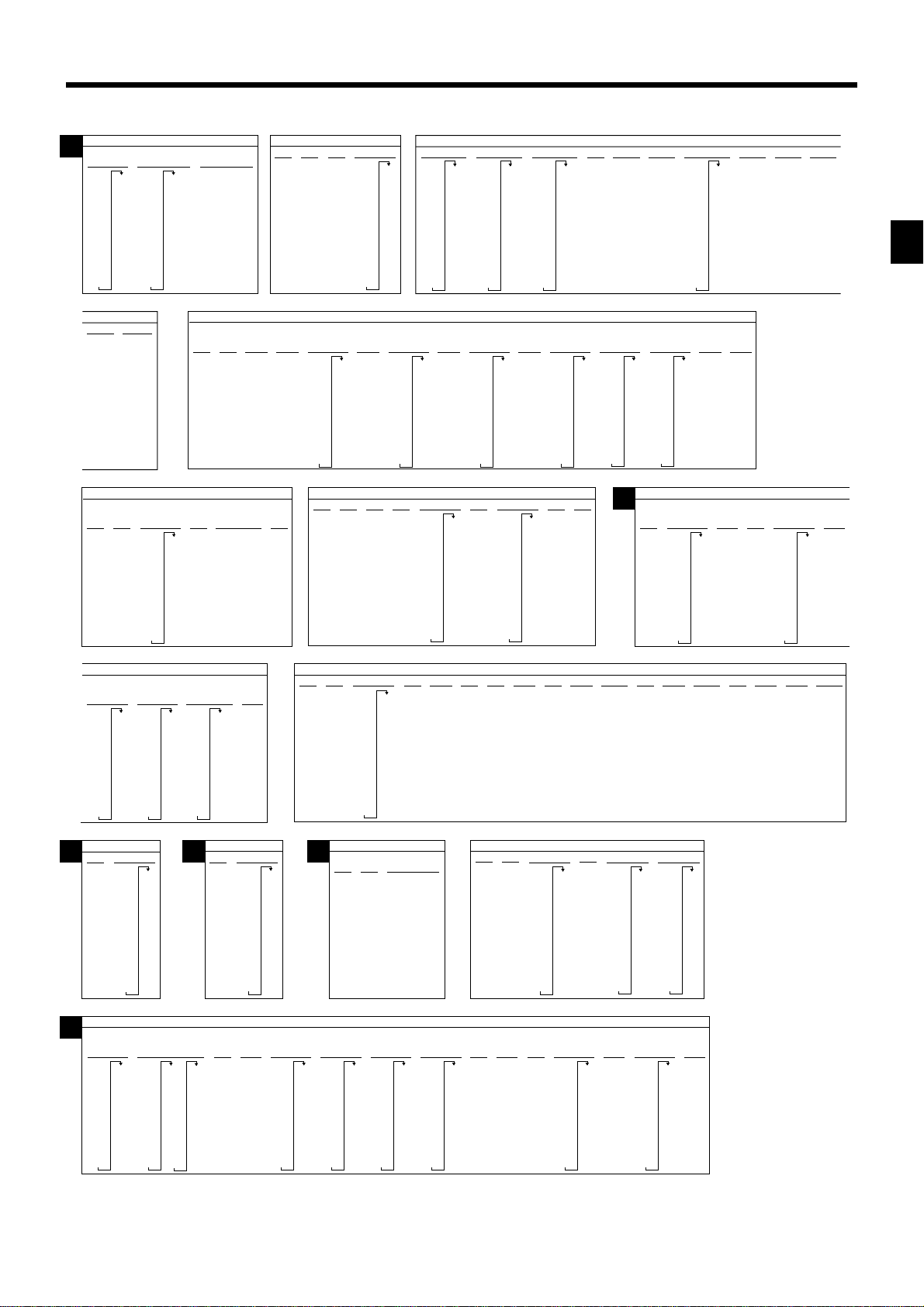

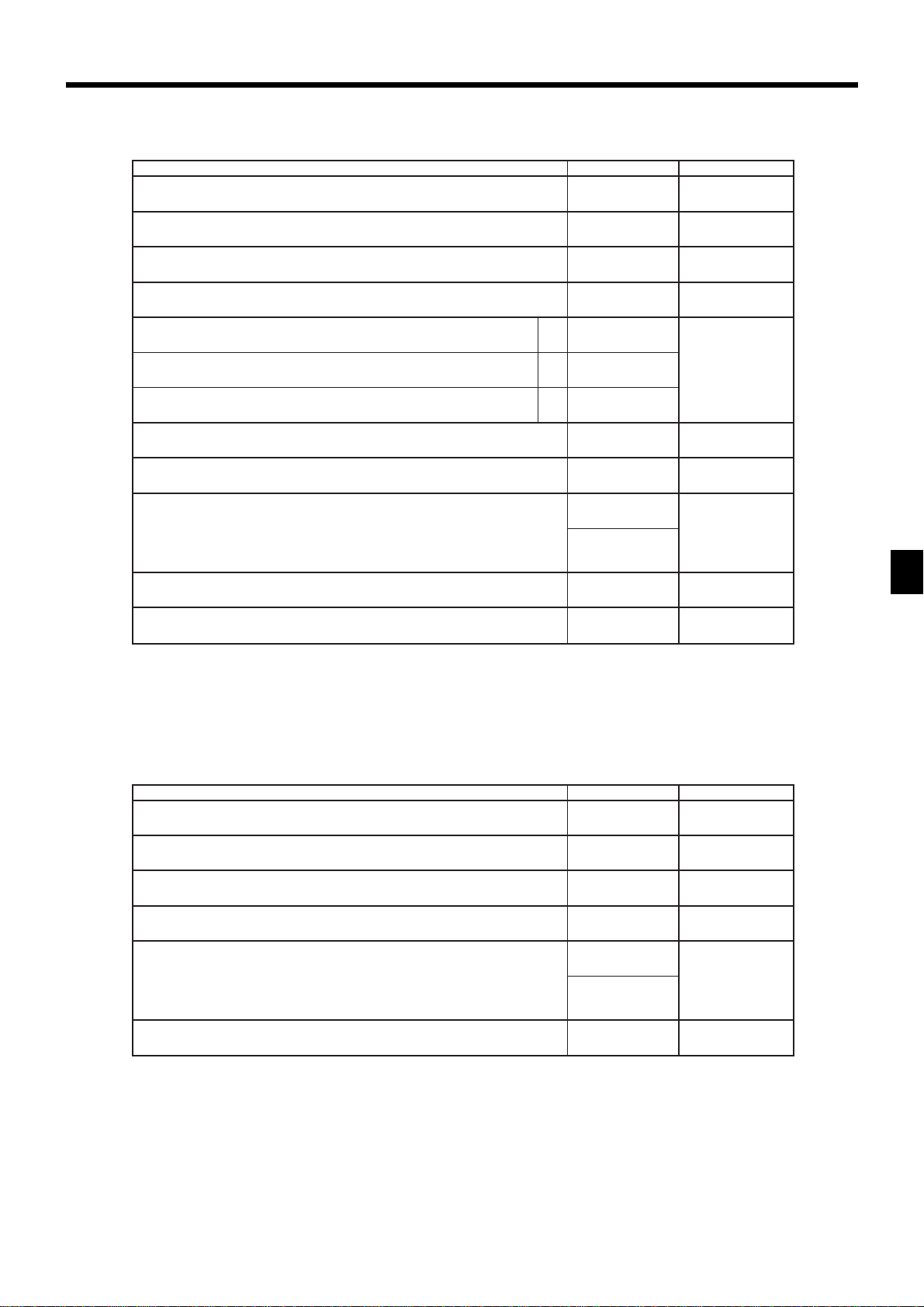

U.S. TAX TABLES

A

4%

110

JUNEAU

4%

0

1

1

12

37

ALASKA

KENAI

5%

0

1

6

13

25

46

75

79

118

127

151

KENAI,SEWARD

& SOLDOTNA

177

184

218

5%

109

0

1

1

09

29

49

69

89

ALABAMA

5%

6%

0

0

110

0

1

1

1

1

10

8

29

24

49

41

69

58

89

1

1

10

30

54

73

6%

109

6%

7%

107

8%

0

0

1

1

1

1

7

6

21

18

35

31

49

43

64

56

78

68

92

81

93

106

(4+1+1)

0

0

1

1

1

1

10

9

20

20

36

40

54

55

70

70

85

90

110

KENAI

2%

25

75

0

1

1

3%

116

150

183

216

0

1

4

34

49

83

HOMER/

SELDOVIA

3%

0

1

4

25

34

75

127

155

177

227

HAINES

4%

0

1

2

19

37

62

C

108

127

108

124

1.5%

166

233

0

1

1

8

27

45

63

81

99

0

1

7

10

22

39

56

73

90

0

1

1

33

99

HOMER

5.5%

145

163

181

208

227

245

263

281

299

308

327

6%

141

158

2%

24

74

ALASKA

345

363

381

408

6.25%

10

21

37

54

70

86

103

119

2.5%

0

1

1

19

59

ARIZONA

117

131

211

233

255

277

299

161

176

192

207

223

238

253

269

284

299

6.7%

0

1

7

7

22

37

52

67

82

97

111

126

141

7.25%

7.25

5002

COLORADO

5%

0

1

2

17

29

49

156

171

186

201

216

231

246

261

276

291

109

124

139

7.75%

7.5%

0

1

3

6

19

33

46

59

73

LOVELAND

5%

0

1

1

18

18

51

68

84

118

21

36

50

65

80

95

5002

0

1

3

6

7.75

153

168

183

198

212

227

242

256

271

286

300

315

330

5.25%

5.25

5002

8.25%

8.25

5002

345

359

374

389

403

418

433

448

452

477

492

506

118

136

154

5.5%

17

27

45

63

81

99

107

17

29

41

52

64

76

88

0

1

6

7%

21

35

49

64

78

92

8.5%

0

1

1

5

0

1

1

7

111

123

135

147

158

170

182

194

205

172

190

209

227

245

263

281

299

LOS ANGELES

Parking

99

0

1

11

99

99

99

99

99

99

99

99

5.6%

0

1

7

16

25

43

61

79

97

115

132

150

10%

168

186

204

222

240

104

114

124

134

144

154

3%

0

1

1

14

44

74

114

99

99

4%

299

124

152

180

208

236

3.6%

17

41

69

97

6.75%

5002

0

1

5

6.75

111

10

20

34

48

64

80

96

264

291

319

347

375

0

1

1

12

37

0

6%

159

6

179

2

199

29

219

29

239

49

259

69

259

89

279

109

300

109

129

159

6.5%

130

0

0

1

7

0

1

1

116

149

183

146

1

161

7

176

10

192

20

207

35

223

51

238

67

253

83

269

99

284

115

3.5%

3%

0

0

1

1

2

3

17

17

42

49

71

83

99

128

157

185

214

242

6% 6.8%

5%

0

0

1

1

5

9

10

10

27

22

47

39

68

56

89

73

109

90

107

125

141

158

7%

121

0

135

1

149

8

164

10

178

20

192

33

207

47

221

62

235

76

249

91

264

107

3.85%

0

1

2

16

37

63

175

191

115

130

146

CALIFORNIA

278

7.25

292

5002

307

103

4%

0

1

2

17

17

37

33

62

55

77

99

122

144

166

188

6.5%

0

1

7

7

23

38

53

69

84

99

7.25%

0

10

20

32

46

60

74

88

4.5%

0

1

5

113

130

147

17

26

43

60

78

95

4%

12

37

5.75%

0

1

8

0

1

1

165

182

199

217

ARKANSAS

5%

6%

0

1

1

10

20

40

60

80

110

6%

0

1

2

17

24

41

58

74

7%

6.8%

0

1

1

8

24

41

58

6.1%

6.1

5002

7.5%

0

21

35

49

64

78

92

107

6.35%

5002

1

1

7

6.35

0

1

2

6

19

33

46

Getting Started

6.4%

6.4

5002

0

17

0

1

2

6

19

33

46

0

17

6.6%

D

6.5%

6.45%

0

6.45

1

5002

2

0

17

17

23

38

53

69

84

99

115

130

DISTRICT OF COLUMBIA

D.C.

D.C.

5%

5.75%

0

5.75

1

5002

1

0

10

8

22

42

82

62

110

146

161

176

192

207

223

D.C.

6%

112

5002

0

1

1

12

17

35

53

71

89

6.6

D.C.

6%

108

7%

0

1

4

17

21

35

49

64

78

92

107

121

D.C.

8%

0

0

1

1

1

1

8

12

24

16

41

27

58

39

74

50

91

62

75

90

112

PCR-1000 User’s Manual

135

149

16

27

38

49

61

72

83

94

0

1

6

6

D.C.

7.01%

9%

7.01

5002

105

116

127

138

149

161

0

17

21

35

49

64

COLORADO

7.1%

7.1

5002

F

109

125

150

CONNECTICUT

6%

7%

7.5%

8%

0

0

19

33

46

59

73

G

0

1

1

3

1

6

6

18

31

3%

110

0

1

1

10

35

66

GEORGIA

4%

5%

0

1

1

10

25

50

75

110

110

6%

0

1

1

10

10

20

20

40

35

60

50

80

67

85

110

HAWAII

H

4%

0

1

1

0

1

1

12

37

1

1

7

CITY

6.5%

0

1

1

9

107

123

138

153

169

184

209

103

122

141

160

179

5.25%

0

1

2

16

27

46

65

84

0

1

1

9

14

28

42

57

71

85

0

198

1

218

2

8

24

21

41

35

58

49

74

64

91

78

108

92

124

107

7%

109

13

26

40

53

66

80

7.5%

0

1

1

9

106

120

133

146

160

173

186

209

93

7.25%

7.2%

7.25

131

0

5002

145

1

159

2

173

17

187

20

201

34

215

48

229

62

243

76

256

90

104

118

4%

175

0

209

1

5

9

25

50

75

5%

109

102

116

Combined

5.25%

0

5.25

1

5002

1

9

20

40

60

80

20

34

47

61

75

89

7.3%

0

1

3

6

130

143

157

171

109

6%

0

1

1

9

16

33

50

66

83

7.5%

17

19

33

46

59

73

0

1

3

8%

18

31

43

56

68

81

93

106

FLORIDA

6.2%

6.2

5002

0

1

1

6

PANAMA

BEACH

15

30

46

61

76

92

15

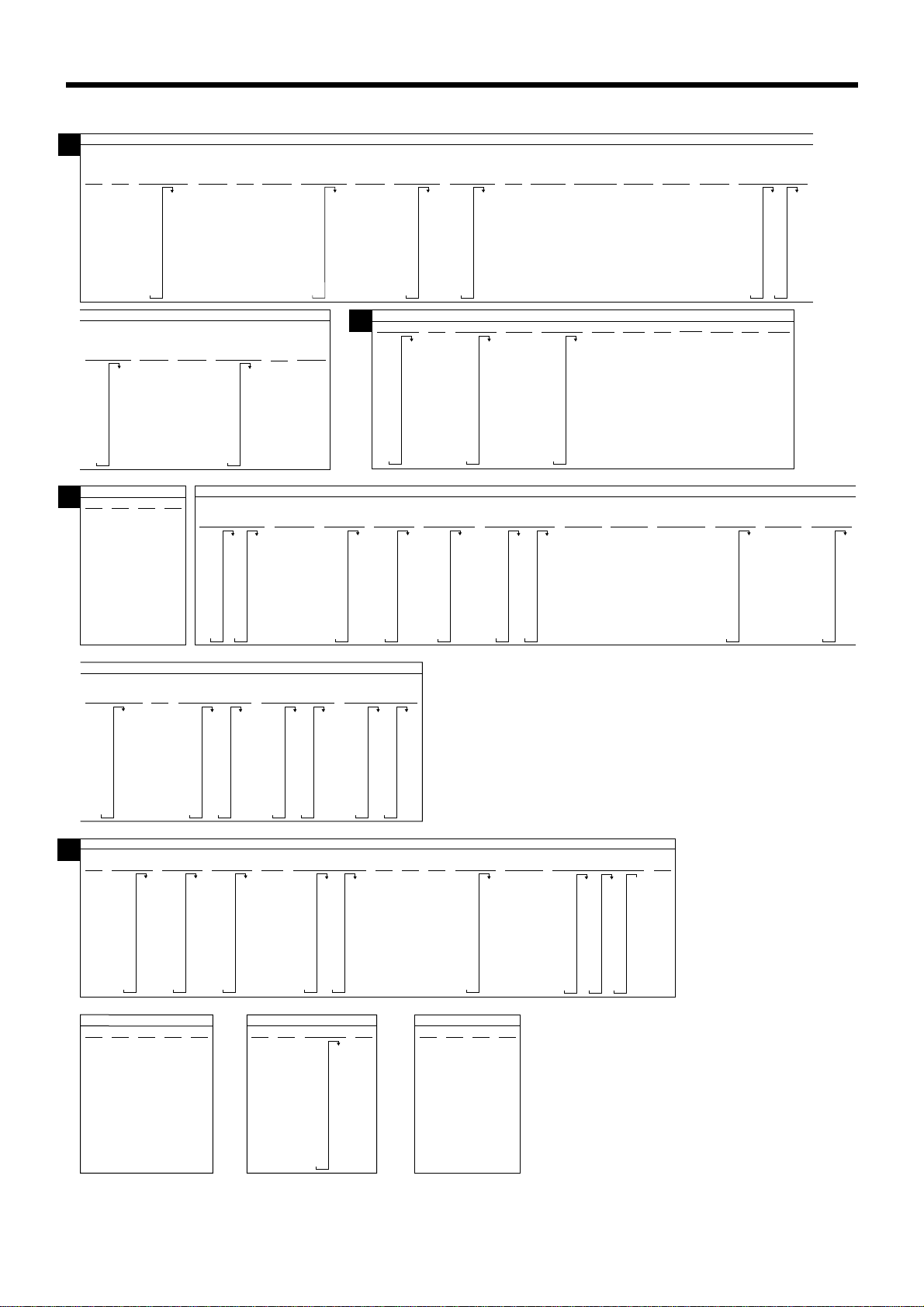

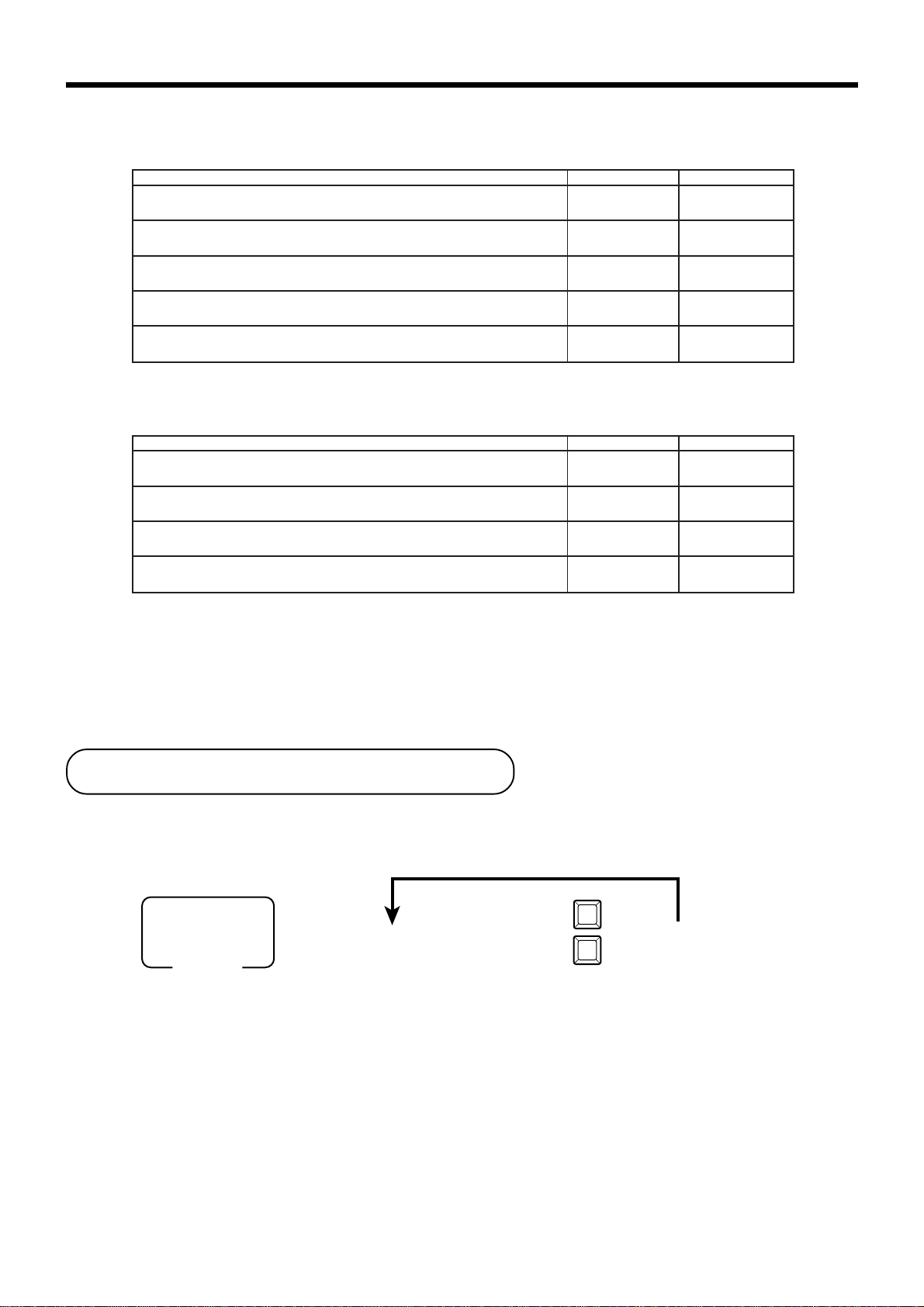

Page 16

Getting Started

6.25%

0

1

6

119

146

173

199

226

253

23

0

1

1

7

3.75%

0

1

1

13

39

66

93

6%

0

1

2

8

24

41

58

74

ILLINOIS

6.5%

0

1

1

7

23

38

53

69

84

99

115

130

146

279

306

333

359

386

413

6.75%

7%

6.75

161

5002

176

192

207

4%

0

1

1

12

37

62

87

112

L

2%

124

174

224

22

36

50

65

79

93

108

4.1%

4.5%

4.1

5002

0

11

12

33

55

77

99

122

144

166

188

211

3%

0

0

1

1

2

2

16

24

49

74

82

116

149

7.5%

0

1

1

8

KANSAS

0

1

1

4%

0

1

2

12

37

62

87

112

0

1

1

6

19

33

46

10

30

51

71

91

112

132

153

173

193

4.5%

122

144

166

188

211

7.75%

7.75

5002

0

6

214

0

234

1

255

1

275

295

316

336

357

377

397

418

438

459

5%

0

1

1

10

11

27

33

47

55

67

77

87

99

109

129

8%

4.9%

479

499

520

540

561

581

602

622

642

663

683

704

724

LOUISIANA

6%

0

1

6

24

41

58

74

8.75%

0

8.75

1

5002

1

0

6

5

18

31

744

1010

765

785

806

826

846

867

887

908

928

948

969

989

6%

0

0

1

1

2

17

8

7

23

38

53

69

84

99

115

130

146

161

176

192

207

223

238

253

269

284

299

315

330

1%

0

1

1

49

148

5.25%

5%

0

5.25

1

5002

1

9

29

7.5%

7%

0

0

1

1

2

1

6

7

19

21

33

35

46

49

59

64

115

3%

4%

0

1

1

15

42

72

0

1

3

12

37

50

75

5.9%

5002

5.9

4%

IOWA

0

8

5%

11

32

57

29

0

1

2

0

1

1

9

6%

24

41

58

74

91

108

124

141

158

IDAHO

115

137

160

183

205

6%

24

41

58

74

91

108

0

1

7

8

4.5%

0

1

2

15

27

49

71

93

0

1

1

8

6.15%

6.15

5002

1.25%

1%

5%

0

227

1

2

49

11

148

25

45

K

0

8

2.5%

19

59

99

139

179

KANSAS

6.4%

6.4

5002

0

7

3%

0

0

1

1

1

1

16

49

83

116

6.5%

6.5

5002

0

7

2%

5%

6%

0

0

1

1

119

3.1%

3.1

5002

16

15

26

36

47

57

68

78

89

99

1

1

39

0

9.5%

0

1

1

5

110

121

131

142

152

163

173

184

194

107

138

169

199

230

261

292

24

74

0

1

1

3.25%

0

1

1

15

46

76

10%

109

129

323

353

384

415

14

24

34

44

54

64

74

84

94

0

1

6

12

25

46

67

88

0

1

1

4

0

1

1

8

24

41

58

3.5%

0

1

1

14

42

71

99

128

157

185

KENTUCKY

5%

10

25

46

67

88

109

129

I

INDIANA

5.4%

194

212

231

249

268

287

305

324

342

361

379

398

416

9%

105

5%

0

1

1

9

29

435

453

472

490

509

0

1

1

5

16

27

38

49

61

72

83

94

MARION County

M

4%

0

1

2

15

37

62

0

1

1

9

27

46

64

83

101

120

138

157

175

8%

0

1

7

4

16

29

42

55

67

80

93

106

112

137

118

136

154

172

5%

15

37

49

62

87

27

45

63

81

99

0

1

2

5.5%

0

1

1

9

110

5%

0

1

1

10

20

40

60

80

RESTAURANT

6%

109

5.65%

190

5002

209

MAINE

6%

0

1

1

9

16

33

50

66

83

109

29

49

49

69

89

5.65

0

1

1

9

0

8

7%

7

2

0

7

21

35

49

64

78

92

100

4%

0

1

2

24

25

50

4.225%

11

35

59

82

6.475%

0

1

13

7

23

38

54

69

84

100

115

131

146

MARYLAND

Meals Tax

5%

0

1

2

19

20

40

4.6%

0

0

1

1

1

1

10

32

54

76

97

162

177

193

208

223

239

254

270

285

301

316

332

5%

0

1

7

99

99

99

99

99

100

120

140

4.625%

0

1

13

10

32

54

75

97

118

140

162

183

205

MISSOURI

6.55%

160

0

175

1

190

9

7

22

38

53

68

83

99

114

129

145

MASSACHUSETTS

4.725%

227

248

270

291

313

335

356

378

399

421

443

6.725%

6.725

5002

4.625%

0

1

13

10

32

54

75

97

118

140

162

183

205

0

1

4

10

31

52

74

95

116

137

158

179

201

227

248

270

291

313

335

356

378

399

421

443

4.75%

7.225%

7.225

5002

107

128

149

170

MICHIGAN

5%

0

1

3

10

22

43

65

86

4%

6%

0

1

1

9

29

4.8%

114

135

156

177

N

0

0

1

1

7

2

12

10

31

24

54

41

81

58

108

74

135

91

162

108

187

124

5.05%

4.975%

0

0

1

1

3

1

10

10

31

30

52

50

72

70

93

90

110

130

150

170

190

3%

3.5%

0

1

3

16

49

83

116

149

128

183

157

185

214

242

271

211

14

42

71

99

0

1

5

9

19

39

59

79

98

118

138

158

178

4%

0

0

1

1

3

2

14

37

62

122

144

166

188

211

6%

14

33

55

77

99

0

1

1

8

24

41

58

5.1%

107

4.5%

0

1

6

23

38

53

69

84

99

115

130

146

5.225%

0

5.225

1

1

9

29

49

68

88

NEBRASKA

233

255

277

299

322

MINNESOTA

6.5%

161

0

176

1

192

1

207

7

MISSOURI

5002

5%

0

1

2

14

29

49

115

133

151

169

118

136

154

172

107

15

26

44

62

80

98

7%

14

27

45

63

81

99

21

35

49

64

78

92

5.6%

0

1

8

5.5%

0

1

2

5%

5.725%

5.725

5002

6.5%

0

1

1

7

23

38

53

69

84

99

109

129

161

176

192

207

6%

0

0

1

1

6

1

11

8

26

24

47

41

68

58

88

74

91

108

107

5.975%

0

1

2

8

25

41

58

75

92

108

125

142

158

3%

0

1

2

14

49

83

116

149

8.5%

0

123

0

1

135

1

1

147

1

7

158

5

170

17

182

29

194

41

205

52

64

76

88

99

111

5.625%

0

187

1

205

1

223

8

241

26

258

44

276

62

294

79

312

97

330

115

348

133

366

151

383

168

6%

190

0

209

1

227

1

8

24

41

58

115

130

146

7%

175

192

209

225

242

259

276

292

309

326

342

359

376

7.25%

324

144

0

0

1

1

7

21

35

49

64

78

92

103

117

131

392

410

3.5%

0

1

6

14

38

64

88

118

157

185

214

242

271

337

158

1

351

172

1

365

186

6

379

199

20

393

213

34

406

227

48

241

62

255

75

268

89

282

296

310

6.1%

6.225%

0

0

1

1

1

2

8

8

24

24

40

40

57

56

73

72

90

88

104

120

136

152

5.75%

6%

299

5.75

326

5002

357

8%

106

NEVADA

0

1

2

8

24

41

58

74

18

31

43

56

68

81

93

168

184

200

216

232

248

265

8.5%

9%

9.25%

123

0

0

1

1

1

1

5

6

17

29

41

52

64

76

88

99

111

23

39

55

71

87

103

119

134

150

6.25%

0

1

2

7

23

39

55

71

87

103

119

135

151

6.3%

0

1

8

7

167

183

199

215

135

147

158

170

182

194

205

166

182

198

214

230

246

115

130

146

23

38

53

69

84

99

105

6.5%

0

1

1

7

16

27

38

49

61

72

83

94

0

1

1

5

101

116

132

147

161

176

192

207

9.25

5002

6.425%

0

1

1

7

23

38

54

70

85

0

5

163

178

194

210

225

241

256

272

287

6.75%

6.75

5002

7%

0

1

0

1

7

7

22

21

37

35

49

64

78

92

107

MISSISSIPPI

16

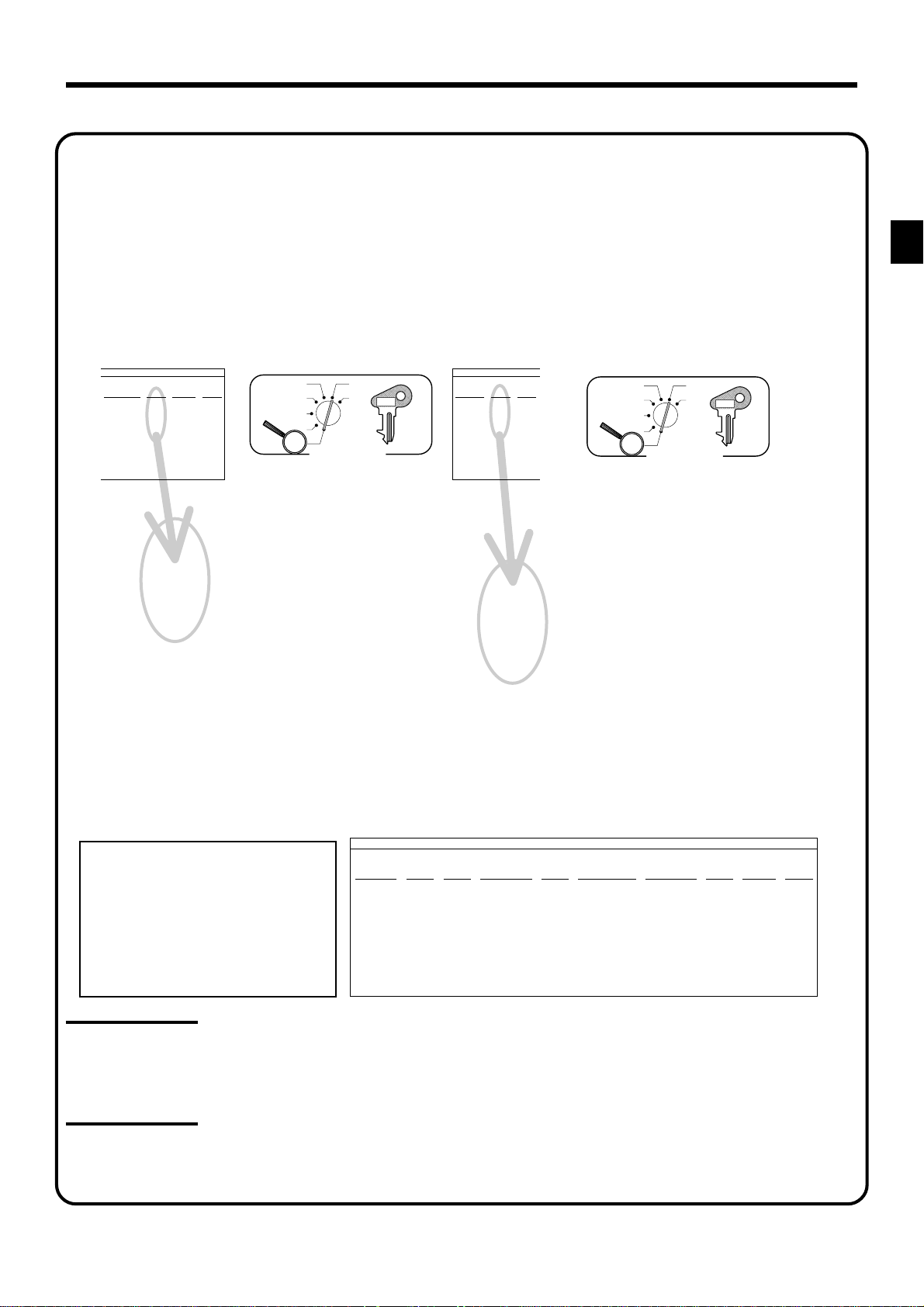

Page 17

N

101

115

7%

129

0

143

1

158

8

172

14

186

26

201

39

51

63

75

88

NEW HAMPSHIRE

Rooms & Meals

7%

128

0

142

1

157

8

171

35

185

35

200

38

50

62

74

87

100

114

Rooms & Meals

8%

0

1

4

35

35

35

37

50

62

117

3%

0

1

1

17

41

71

NEW JERSEY

3.5%

6%

0

1

1

14

10

42

22

71

38

100

56

128

72

157

88

185

110

214

NEW MEXICO

4.875%

4.875

5002

5.175%

5.175

5002

104

123

142

161

180

11

28

47

66

85

7%

150

0

0

164

1

1

178

1

8

192

10

207

21

35

50

64

78

92

107

121

135

120

146

173

200

226

253

3.75%

0

1

6

13

40

67

93

280

306

333

359

105

129

152

176

199

223

4.25%

0

1

1

11

35

58

82

247

270

294

317

341

364

388

411

102

125

148

171

194

217

4.375%

0

1

4

11

34

57

79

239

4.5%

100

122

144

167

189

211

0

1

1

11

33

55

78

5.25%

0

1

9

199

217

5.375%

5.375

5002

5.575%

5.575

5002

5.75%

5.75

5002

NEW MEXICO

6.1875%

6.187%

0

6.1875

1

5002

4

9

23

40

56

72

88

104

120

136

153

4%

3%

0

0

1

1

5

4

9

9

29

35

59

70

84

116

112

149

137

183

216

6.5%

123

0

138

1

153

3

169

15

184

15

200

30

215

46

230

61

76

92

107

4%

0

8

12

33

58

83

112

137

NORTH CAROLINA

4.5%

5%

0

188

OHIO

7%

115

128

211

233

255

277

299

322

0

1

6

8

23

48

67

85

109

129

CUYAHOGA

0

1

3

15

15

28

42

57

71

85

100

100

122

144

166

1

6

9

25

53

75

95

0

1

3

15

15

28

42

57

71

85

5%

0

1

5

109

129

CHROKEE

Reservations

Co.

7%

115

128

NEW YORK

6.25%

103

119

3.25%

0

1

7

15

46

76

107

138

169

199

230

261

292

10

22

38

54

70

86

100

125

6.5%

6.75%

0

130

0

1

146

1

7

161

1

176

7

192

23

207

38

53

69

84

99

115

NORTH DAKOTA

4%

0

1

2

15

25

50

75

323

353

384

415

446

476

507

538

569

599

5.5%

5%

0

0

1

1

2

2

15

15

20

19

40

37

55

73

91

110

128

146

164

4%

4.25%

0

4.25

1

5002

1

12

37

6.75

5002

182

200

219

4.5%

121

144

7%

121

0

135

1

149

8

164

10

178

20

192

33

207

47

62

76

91

107

6.5%

6%

0

0

1

1

3

2

15

15

17

31

34

47

50

62

67

77

84

93

108

124

139

154

5%

5.25%

0

0

1

1

5002

2

1

11

9

33

29

55

77

99

7.25%

7.25

5002

170

185

200

216

231

5.25

7.5%

113

0

126

1

139

8

10

18

31

45

58

71

85

99

7%

8%

0

1

2

15

15

15

15

29

25

43

38

58

50

72

63

86

75

100

88

115

100

OKLAHOMA

6%

6.25%

0

1

1

8

24

23

41

58

10

10

17

29

42

55

67

80

92

0

1

3

6.725%

0

6.725

1

5002

1

7

5.75

0

1

2

8

6%

141

0

158

1

7

10

22

38

56

72

88

108

124

3%

4%

0

0

1

1

5

3

15

15

31

33

51

67

71

100

100

133

125

166

200

2%

3%

0

0

1

1

1

1

16

24

49

74

83

116

5.25%

5.75%

5.25

0

5002

6%

10

24

41

58

74

0

1

2

7.75%

7.75

5002

6%

108

124

5002

24

41

58

74

91

1

6

10

27

47

67

87

ERIE

8%

0

1

O

105

119

131

144

108

122

5%

15

20

40

7%

0

1

6

8

22

37

51

65

79

94

SUFFOLK

County

8%

0

1

9

10

17

29

42

54

67

79

92

0

1

2

109

127

7.25%

7.25

5002

15

18

36

54

72

90

106

118

131

5.5%

0

1

2

8.25%

8.25

5002

146

164

182

200

218

7.375%

7.375

5002

0

6

5.75%

5.75

5002

8.5%

8.5

5002

OHIO

8%

0

1

1

6

18

31

100

117

6%

0

1

2

15

17

34

50

67

83

8.25%

103

Getting Started

MEIGS

Co.

6%

6.25%

134

0

1

3

16

17

34

50

67

83

100

117

9.25%

0

1

1

6

18

30

42

54

66

78

90

0

1

2

15

16

32

10.25%

0

0

1

1

4

1

5

4

16

14

27

24

37

34

48

43

59

70

81

91

PENNSYLVANIA

P

6%

0

1

1

10

17

34

50

67

84

110

110

117

134

7%

150

0

150

1

167

5

184

10

210

17

217

34

234

50

250

50

250

67

84

RHODE ISLAND

R

6%

26

42

57

73

90

106

123

140

7%

0

0

1

1

6

5

9

7

21

35

49

64

78

92

107

121

135

T

4.5%

0

1

1

11

33

55

77

99

122

144

166

PCR-1000 User’s Manual

188

211

119

136

5.5%

154

0

172

1

190

11

209

10

227

27

245

45

263

63

281

81

299

99

318

336

354

372

390

6%

6.25%

0

0

1

1

2

2

10

10

24

23

41

39

58

55

74

71

87

149

164

178

192

207

221

235

249

264

115

10

23

38

53

69

84

99

6.5%

0

1

2

130

146

161

176

192

207

223

S

111

6.75%

0

1

8

10

22

37

51

66

81

96

4%

112

137

10

25

50

75

SOUTH CAROLINA

CHARLESTON

5%

0

0

1

1

5

6

10

20

40

60

80

109

129

108

124

TENNESSE

7%

125

140

155

170

185

199

214

229

244

259

274

107

121

0

1

2

10

21

35

49

64

78

92

6%

10

24

41

41

58

74

91

0

1

2

COUNTY

103

TAX

7.25%

0

1

10

10

20

34

48

61

75

89

117

130

144

158

172

185

7.5%

5%

7.75%

7.75

5002

5.5%

190

0

0

210

1

1

1

1

10

10

30

28

46

64

82

100

118

136

154

172

8%

8%

0

0

1

1

2

2

10

10

18

18

31

31

43

43

56

68

81

93

4%

0

1

1

12

37

0

1

2

10

19

33

46

59

SOUTH DAKOTA

6%

109

106

118

6.5%

0

0

1

1

1

1

9

7

26

23

43

38

60

53

76

69

92

84

99

115

130

146

8.25%

8.25

5002

161

176

192

207

10

17

29

41

52

64

76

88

8.5%

0

1

2

107

121

135

111

123

135

147

158

170

182

194

205

217

7%

0

149

1

4

7

21

35

49

64

78

92

8.75%

99

8.75

5002

17

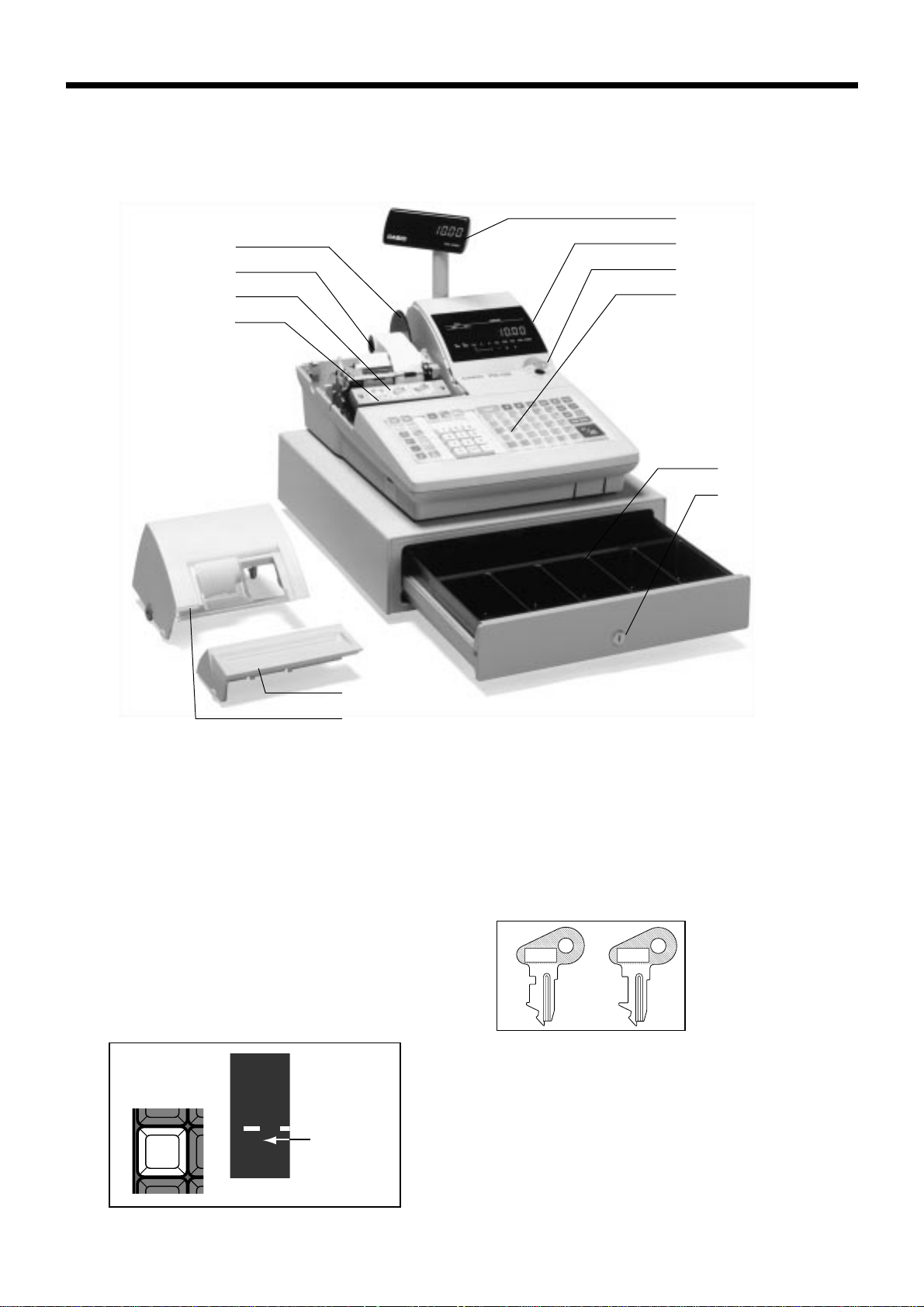

Page 18

Getting Started

V

5.5%

0

1

1

9

27

45

63

81

99

118

137

221

0

242

1

263

1

284

305

326

347

368

389

410

149

166

188

211

233

249

255

TEXAS

5.625%

155

0

173

1

191

1

209

8

26

44

62

79

97

115

133

5%

0

1

1

9

29

28

47

66

85

104

123

142

161

180

FAIRFAX CITY

Meals tax

6.5%

124

0

144

1

166

1

174

11

188

24

211

33

55

74

77

99

122

5.25%

0

1

1

9

151

168

199

219

238

257

276

295

314

333

352

371

390

409

6%

5.375%

HAMPTON

Restaurant

0

1

13

14

29

34

44

59

74

84

114

DALLAS

0

1

1

8

24

41

58

0

1

1

9

27

46

65

83

102

VIRGINIA

7%

114

134

149

159

184

184

214

214

234

249

259

284

6%

0

1

1

9

25

42

59

27

45

63

81

99

118

136

154

172

UTAH

5.5%

190

0

209

1

1

9

LEESBURG

Meal tax

HOUSTON

(Harris

County)

6%

0

1

1

8

24

41

58

74

91

108

5.75%

5.75

5002

7%

0

1

1

7

21

35

49

64

78

92

107

6.125%

6.125

5002

5.875%

5.875

5002

0

8

RICHMOND

Restaurant

7%

0

1

1

14

14

34

59

59

84

84

114

6.25%

0

1

1

7

23

39

55

71

87

103

119

6.125%

6%

6.125

0

5002

1

0

2

8

8

24

41

58

74

ALEXANDRIA

7.5%

7.5

5002

6.25%

6.25

5002

6.25%

NEWPORT

0

1

4

7

23

27

47

63

NEWS

7.5%

0

1

1

11

16

33

49

55

77

83

99

111

116

122

144

149

166

183

188

211

7%

107

0

1

3

8

22

37

51

66

81

96

0

1

2

7

21

35

49

64

78

92

6.75%

125

288

140

303

155

318

170

333

185

348

199

362

215

377

229

392

244

407

259

422

274

437

7.25%

7.25

5002

RICHMOND

7.5%

0

1

2

6

19

33

46

59

Restaurant

8%

0

1

5

14

34

44

44

59

59

84

84

114

114

134

134

159

T

7.75%

0

1

5

6

19

32

45

58

70

83

4%

214

234

259

284

314

334

359

384

414

434

459

5%

0

1

1

9

29

49

69

96

109

122

135

148

161

174

187

484

512

537

5.125%

5.125

5002

12

28

47

66

85

104

123

142

8.25%

8%

0

8.25

1

5002

1

6

18

31

ARLINGTON

COUNTY

4%

0

1

2

12

37

62

87

112

137

5.25%

0

1

9

122

144

166

161

180

199

219

238

5.375%

5.375

5002

U

4.75%

10

31

52

73

94

115

136

157

178

199

FAIRFAX

4.5%

0

1

5

15

33

55

77

99

188

211

233

255

277

299

122

144

11

14

33

55

77

99

5.5%

0

1

4

4%

3%

100

133

166

200

0

1

1

12

37

21

35

49

64

78

92

0

1

4

13

33

66

4%

12

37

62

87

7%

107

0

1

1

7

VERMONT

4%

10

25

50

100

4.625%

206

4.625

230

5002

254

278

303

327

351

375

399

424

TEXAS

7.5%

0

1

1

6

19

33

46

59

73

86

8%

0

1

0

0

18

1

31

21

43

14

56

34

68

59

81

84

93

114

134

159

184

4.125%

0

0

1

1

1

1

12

36

60

84

109

133

157

181

7.25%

7.25

5002

5%

0

0

1

1

2

2

10

20

40

80

100

120

140

ROANOKE CITY

W

7%

107

2%

100

VA BEACH

8.5%

99

0

112

1

122

1

137

11

144

12

162

33

166

37

187

55

188

62

211

77

87

7.2%

0

0

1

1

1

1

7

6

21

20

35

34

49

48

64

62

78

76

92

90

104

118

WEST VIRGINIA

3%

0

0

1

1

2

2

25

5

50

35

70

100

135

131

4%

12

37

9%

5002

0

1

1

NORFOLK CITY

0

9

1

6

11

33

44

44

55

55

77

77

7.3%

129

0

143

1

156

1

170

6

184

19

198

33

211

47

225

61

239

74

252

88

102

115

5%

6%

0

1

2

5

20

40

100

116

Meal tax

9%

122

122

144

144

166

166

188

188

211

0

1

2

5

16

33

50

67

84

99

99

113

0

1

1

6

19

33

46

59

73

86

99

VIRGINIA

211

233

233

7.5%

126

139

153

166

179