Page 1

ELECTRONIC CASH REGISTER

ELEKTRONISCHE REGISTRIERKASSE

CAISSE ENREGISTREUSE ELECTRONIQUE

CAJA REGISTRADORA ELECTRONICA

MODEL

MODELL

MODELE

MODELO

ER-A160

ER-A180

INSTRUCTION MANUAL

BEDIENUNGSANLEITUNG

MANUEL D’INSTRUCTIONS

MANUAL DE INSTRUCCIONES

The above illustration shows model ER-A180.

Die obenstehende Abbildung zeigt das Modell ER-A180.

L’illustration ci-dessus montre le modèle ER-A180.

La ilustración anterior muestra el modelo ER-A180.

Page 2

CAUTION:

The socket-outlet shall be installed near the equipment and shall be easily accessible.

VORSICHT:

Die Netzsteckdose muß nahe dem Gerät angebracht und leicht zugänglich sein.

ATTENTION:

La prise de courant murale devra être installée a proximité de l’équipement et devra être

facilement accessible.

AVISO:

El tomacorriente debe estar instalado cerca del equipo y debe quedar bien accesible.

VARNING:

Det matande vägguttaget skall placeras nära apparaten och vara lätt atkomligt.

CAUTION:

For a complete electrical disconnection pull out the mains plug.

VORSICHT:

Zur vollständigen elektrischen Trennung vom Netz den Netzstecker ziehen.

ATTENTION:

Pour obtenir une mise hors-circuit totale, débrancher la prise de courant secteur.

AVISO:

Para una desconexión eléctrica completa, desenchufar el enchufe de tomacorriente.

VARNING:

För att helt koppla fran strömmen, dra ut stickproppen.

CAUTION:

The cash register should be securely fitted to the supporting platforms to avoid instability

when the drawers are open.

Page 3

INTRODUCTION

Thank you very much for your purchase of the SHARP Electronic Cash Register, Model ER-A160/ER-A180.

Please read this manual carefully before operating your machine in order to gain full understanding of

functions and features.

Please keep this manual for future reference, it will help you, if you encounter any operational problems.

CAUTION!

Never install the batteries into the cash register before initializing it. Before you start operating the cash

register, you must first initialize it, then install the batteries. Otherwise, distorted memory contents and

malfunction of the cash register will occur. For their procedures, please refer to page 6.

IMPORTANT

• Install your register in a location that is not subject to direct radiation, unusual temperature changes,

high humidity or exposed to water sources.

Installation in such locations could cause damage to the cabinet and the electronic components.

• Never operate the register with wet hands.

The water could seep into the interior of the register and cause component failure.

• When cleaning your register, use a dry, soft cloth. Never use solvents, such as benzine and/or

thinner.

The use of such chemicals will lead to discoloration or deterioration of the cabinet.

• The register plugs into any standard wall outlet (Official (nominal) voltage).

Other electrical devices on the same electrical circuit could cause the register to malfunction.

• If the register malfunctions, call your local dealer for service - do not try to repair the register

yourself.

• For a complete electrical disconnection, pull out the mains plug.

English

English

English

English

1

Page 4

CONTENTS

INTRODUCTION............................................................................................................................................1

IMPORTANT..................................................................................................................................................1

CONTENTS....................................................................................................................................................2

PARTS AND THEIR FUNCTIONS.................................................................................................................3

GETTING STARTED......................................................................................................................................6

BASIC SALES ENTRY................................................................................................................................10

OTHER TYPES OF ENTRIES......................................................................................................................12

1 Item entries..........................................................................................................................................12

Single item entries........................................................................................................................12

Repeat entries ..............................................................................................................................12

Multiplication entries.....................................................................................................................13

Single item cash sale (SICS) entry...............................................................................................13

2 Displaying subtotals ............................................................................................................................14

3 Finalization of transaction....................................................................................................................14

Cheque or credit sale ...................................................................................................................14

4 Computation of VAT/tax ......................................................................................................................14

VAT/tax system ............................................................................................................................14

5 Auxiliary entries...................................................................................................................................15

Percent calculations (premium or discount) .................................................................................15

Discount entries............................................................................................................................16

Refund entries ..............................................................................................................................16

Printing of non-add code numbers ...............................................................................................16

6 Payment treatment..............................................................................................................................17

Currency exchange ......................................................................................................................17

Received on account entries ........................................................................................................18

Paid out entries.............................................................................................................................18

No sale (exchange) ......................................................................................................................18

7 Receipt issuance after finalization.......................................................................................................18

8 Automatic sequence key (

9 Override entries...................................................................................................................................19

CORRECTION .............................................................................................................................................19

READING (X) AND RESETTING (Z) OF SALES TOTALS ........................................................................21

1 Summery of reading (X) and resetting (Z) reports...............................................................................21

2 Sample reports....................................................................................................................................22

PROGRAMMING .........................................................................................................................................24

1 Programming the VAT/tax rate............................................................................................................24

2 Programming for departments.............................................................................................................24

3 PLU(Price Lookup) programming........................................................................................................26

4 Programming for miscellaneous keys .................................................................................................27

5 Programming various functions...........................................................................................................29

6 Reading stored program......................................................................................................................33

PROGRAMMING FOR EURO .....................................................................................................................34

OPERATOR MAINTENANCE......................................................................................................................37

1 Replacing the batteries........................................................................................................................37

2 Replacing the paper roll ......................................................................................................................38

3 Replacing the ink ribbon......................................................................................................................39

4 Ink refill (ER-A180 only) ......................................................................................................................40

5 Drawer handling ..................................................................................................................................41

6 Opening the drawing by hand .............................................................................................................42

7 Installing the fixing angle bracket ........................................................................................................42

8 In case of power failure or paper jam..................................................................................................43

9 Program resetting................................................................................................................................43

10 Before calling for service.....................................................................................................................43

LIST OF OPTIONS.......................................................................................................................................44

SPECIFICATIONS .......................................................................................................................................44

2

key) entries..........................................................................................18

`

Page 5

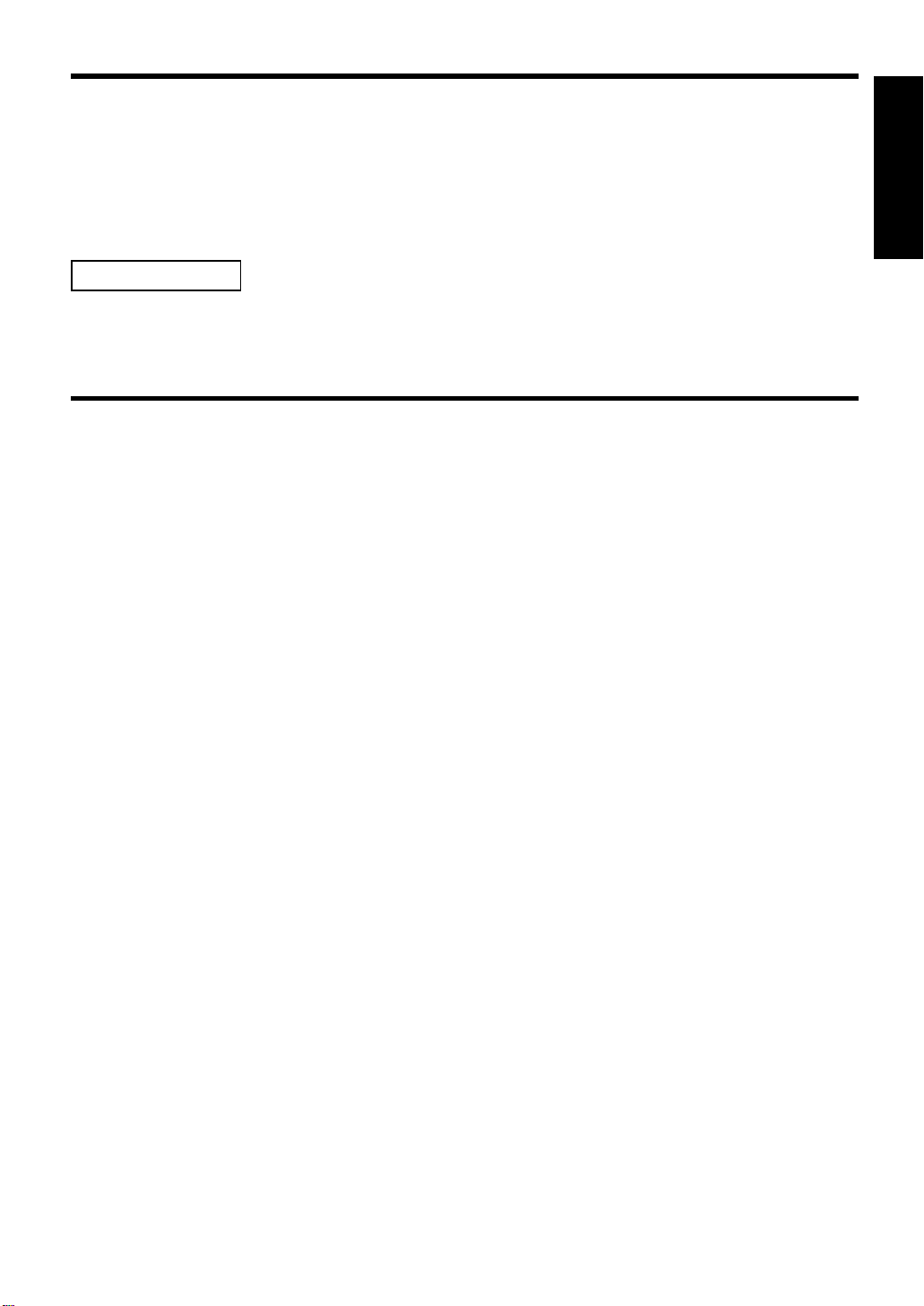

PARTS AND THEIR FUNCTIONS

Operator display

Receipt paper

Drawer lock

Drawer

Printer cover

Mode switch

Power cord

Keyboard

Battery compartment

cover

Paper bed

Take-up spool

Ink ribbon cover

Customer display

(Pop-up type)

Front view Rear view Printer

Operator display

Receipt paper

Drawer lock

Drawer

Printer cover

Mode switch

Power cord

Keyboard

Battery compartment

cover

Paper bed

Take-up spool

Ink ribbon cover

Logo stamp

Customer display

(Pop-up type)

Front view Rear view Printer

External view

1

ER-A160

ER-A180

3

Page 6

11

12

13

14

15

AMT

PLU

30

29

28

27

26

6

7

8

9

10

25

24

23

22

21

1

2

3

4

5

20

19

18

17

16

6

7

8

9

105

AMT

PLU

4

3

2

1

15

14

13

12

11

20

19

18

17

16

1

4

3

2

5

11

12

13

14

15

6

7

8

9

10

AMT

PLU

VAT

(SHIFT)

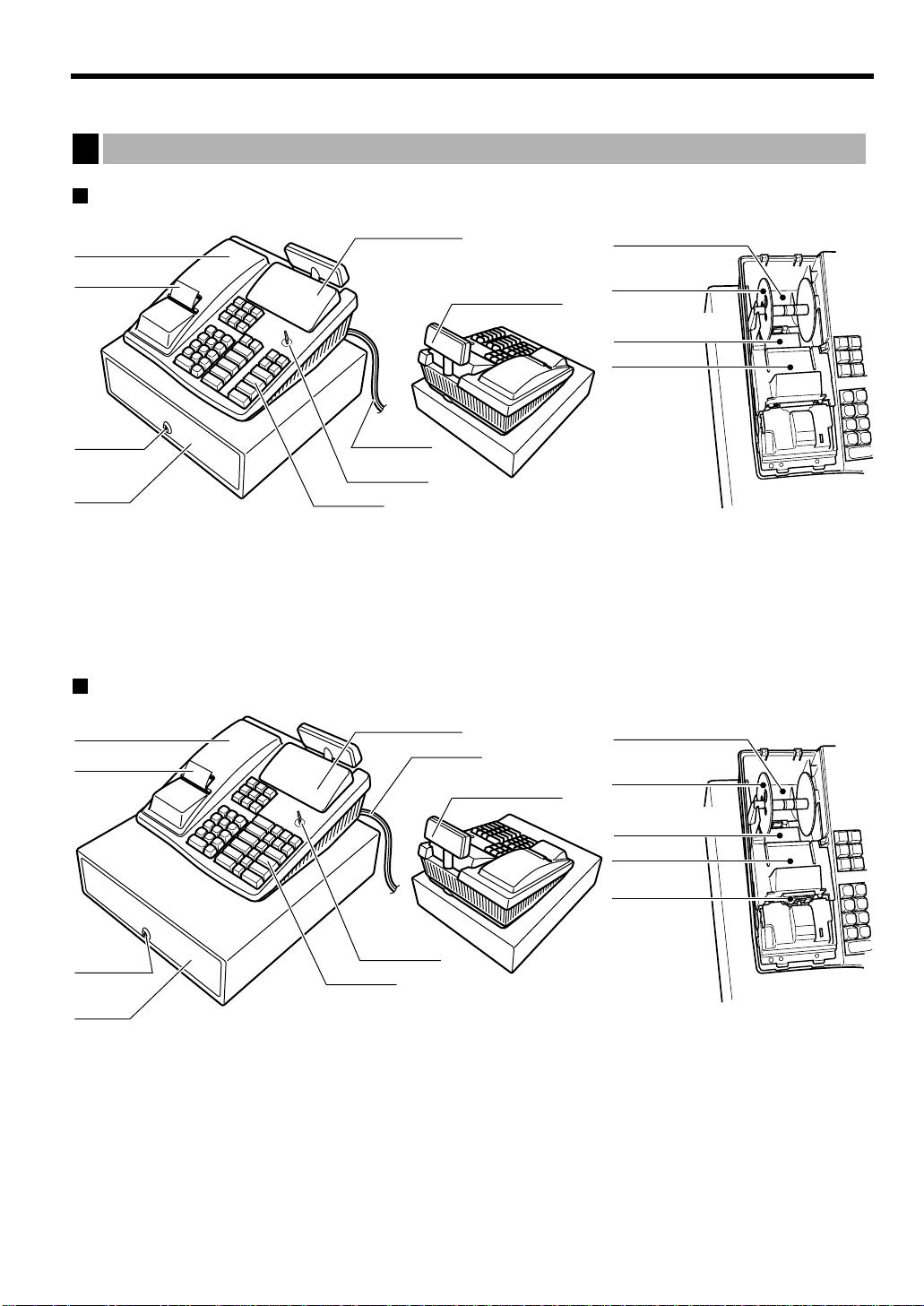

Value added tax key (ER-A180 only) Department shift key

(Ex. Ó ö =Department 16)

Keyboard

2

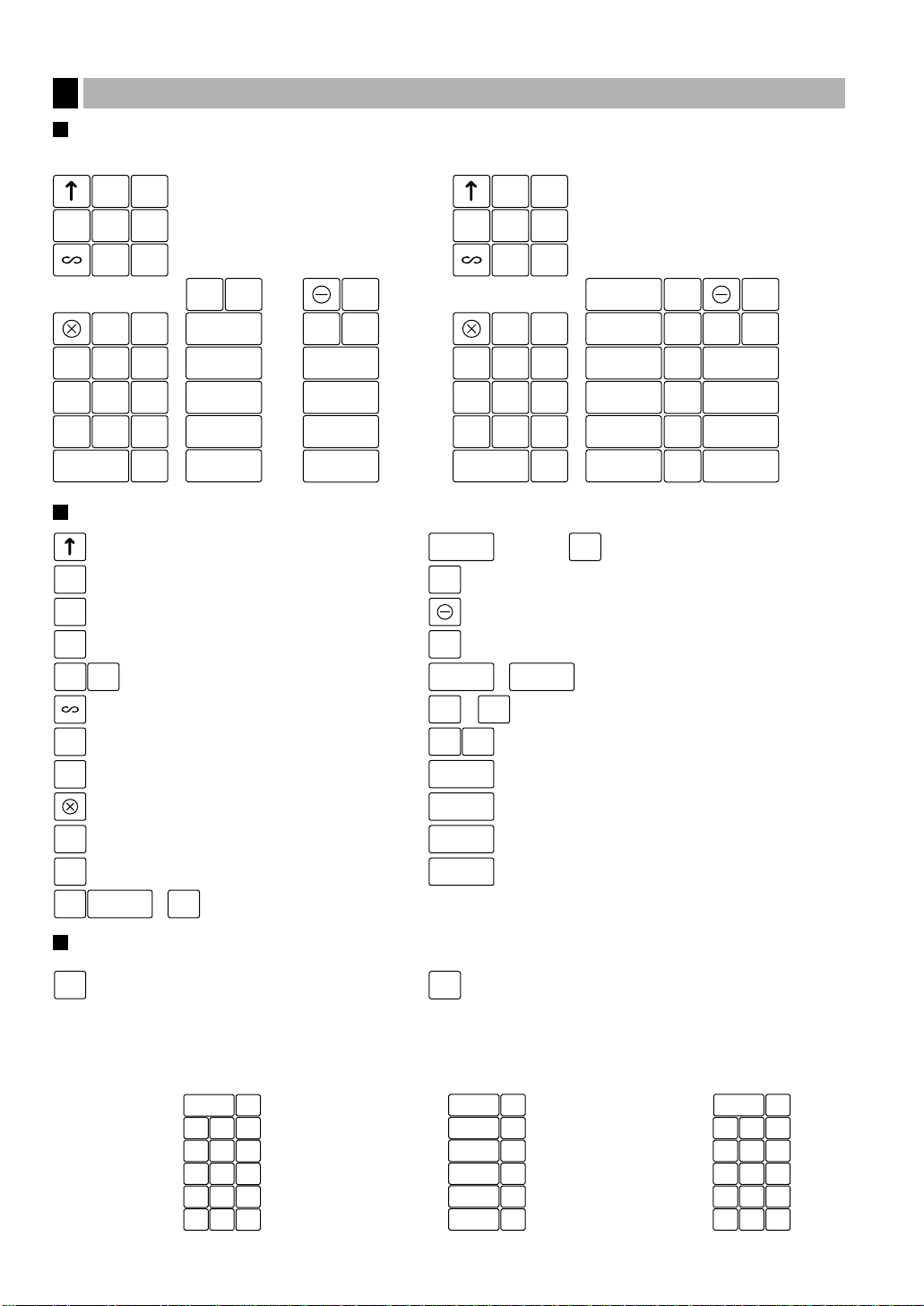

Standard keyboard layout

ER-A160 ER-A180

RCPT

/PO

RA

AUTO

1

RF

CASH

#

AUTO

2

ESC

RCPT

/PO

RA

AUTO

1

RF

CASH

#

AUTO

2

ESC

PLU AMT

CL

•

789

456

123

0

00

Standard key names

Paper feed key

RA

Received-on account key

CASH

Cashier code entry key

#

RCPT

Receipt print/Paid-out key

/PO

AUTO

AUTO

1

RF

ESC

Auto 1 and 2 keys

2

Void key

Refund key

Escape key

Multiplication key

EX

%2

5

4

3

2

1

%1

CR

CH

#/TM/ST

TL/NS

789

456

123

PLU

AMT

Amount key

CL

•

0

00

(ER-A180) (ER-A160) PLU/Subdepartment key

PLU

PLU

AMT

10

5

4

9

3

8

2

7

6

1

EX

%2

%1

CR

CH

#/TM/ST

TL/NS

Discount key

EX

Foreign currency exchange key

6 10

%1

CR

CH

~

1

~

%2

(ER-A180 only) Department keys

Percent 1 and 2 keys

Credit key

Cheque key

Department keys

5

•

Decimal point key

CL

Clear key

0

00

Numeric keys

9

~

#/TM/ST

TL/NS

Non-add code/Time display/Subtotal key

Total/No sale key

Option keys

You can change the number of departments to 10 or 15 (ER-A160), or to 5, 15, 20 or 30 (ER-A180). The key

layout of 15, 20, 30 departments are as follows. (The layout of 5 and 10 departments are as shown above.)

Consult your dealer for changing the number of departments.

15 departments 20 departments 30 departments

4

Page 7

PGM

OP

X/Z

REG

MGR

X

1/Z1

X2/Z2

OP

MA

MA

OP

Manager key (MA)

Operator key (OP)

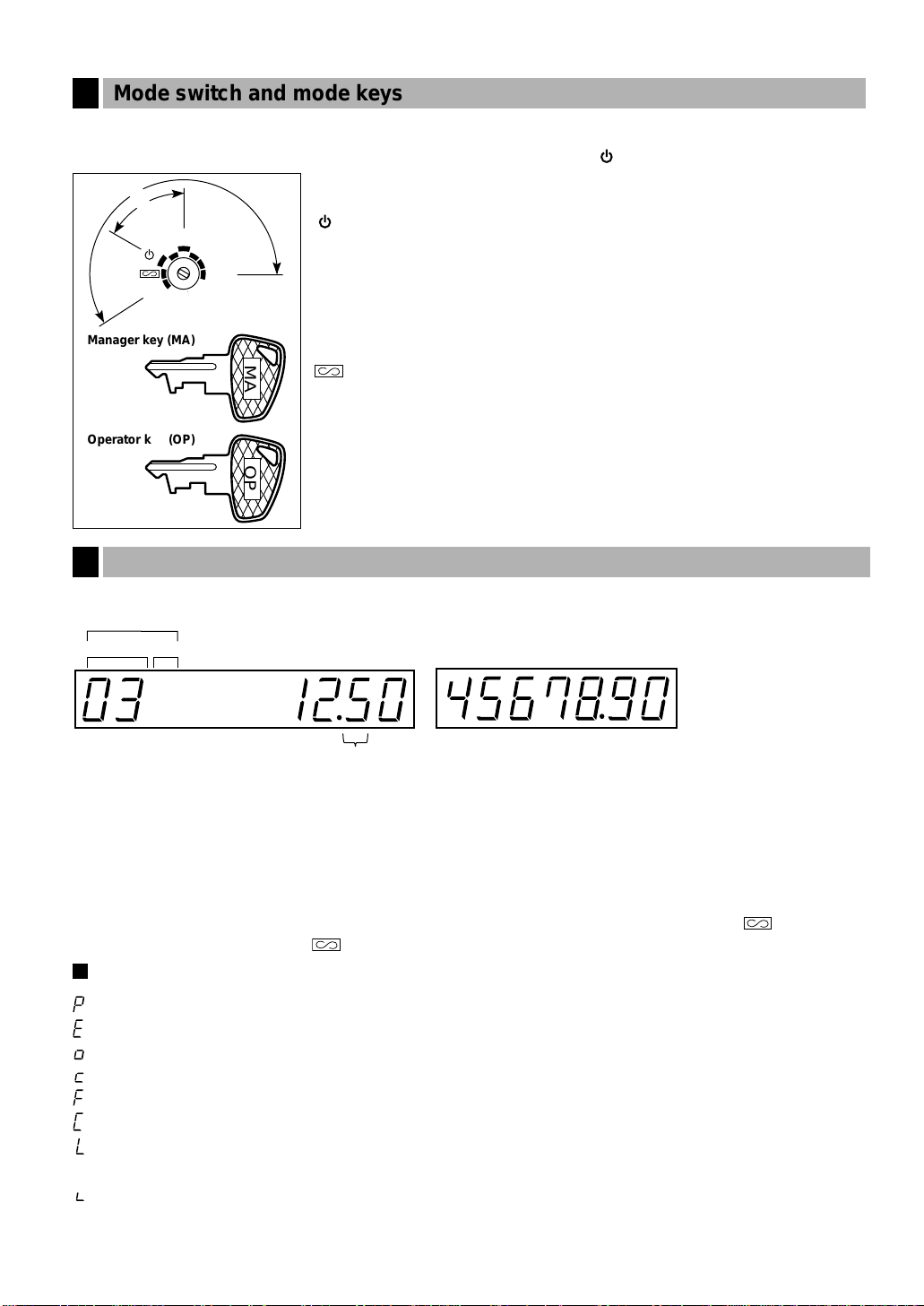

Mode switch and mode keys

3

The mode switch can be operated by inserting one of the two supplied mode keys - manager (MA) and operator

(OP) keys. These keys can be inserted or removed only in the “REG” or “” position.

The mode switch has these settings:

: This mode locks all register operations. (AC power becomes off.)

No change occurs to register data.

OP X/Z: To take individual cashier X or Z reports, and to take flash reports.

And it can be used to toggle receipt state “ON” and “OFF” by

pressing the

Ü

key.

REG: For entering sales.

PGM: To program various items.

: Enters into the void mode. This mode allows correction after

finalizing a transaction.

MGR: For manager's entries. The manager can use this mode for an

override entry.

X1/Z1: To take the X/Z report for various daily totals

X2/Z2: To take the X/Z report for periodic (weekly or monthly)

consolidation

Displays

4

Operator display Customer display (Pop-up type)

PLU

DEPT REPEAT

Amount: Appears in the far-right eight (max.) positions. When the amount is minus, the minus symbol “-”

Number of repeats for repetitive registrations:

Receipt function status:

Time: Appears in the first to fifth positions (using 24-hour format) in the OP X/Z, REG,

Machine state symbols (appears in the tenth place)

: Appears during programming.

: Appears when an error is detected.

: Appears when the subtotal is displayed or when the amount tendered is smaller than the sale amount.

: Appears when the

: Appears when a transaction is finalized by pressing the

: Appears when the change due amount is displayed.

: Appears when the voltage of the installed batteries is under the required level. You must replace them

: Appears when the batteries are not installed, or the installed batteries are dead. You must replace

RCPT

OFF

cashier code

appears before the amount.

The number of repeats is displayed, starting at “2” and incremented with each repeat. When you

have registered ten times, the display will show “0.”(2 → 3

The indicator “_” appears in the ninth position when the receipt function is in the OFF status.

mode. In the REG,

key is pressed to calculate a subtotal in foreign currency.

e

or MGR mode, press the

,

with new ones within two days. Refer to page 37 for details.

them with new ones immediately. Refer to page 37 for details.

.....

9 → 0 → 1 → 2

key to display the time.

Ñ

, 'or îkey.

É

...

)

or MGR

,

5

Page 8

6

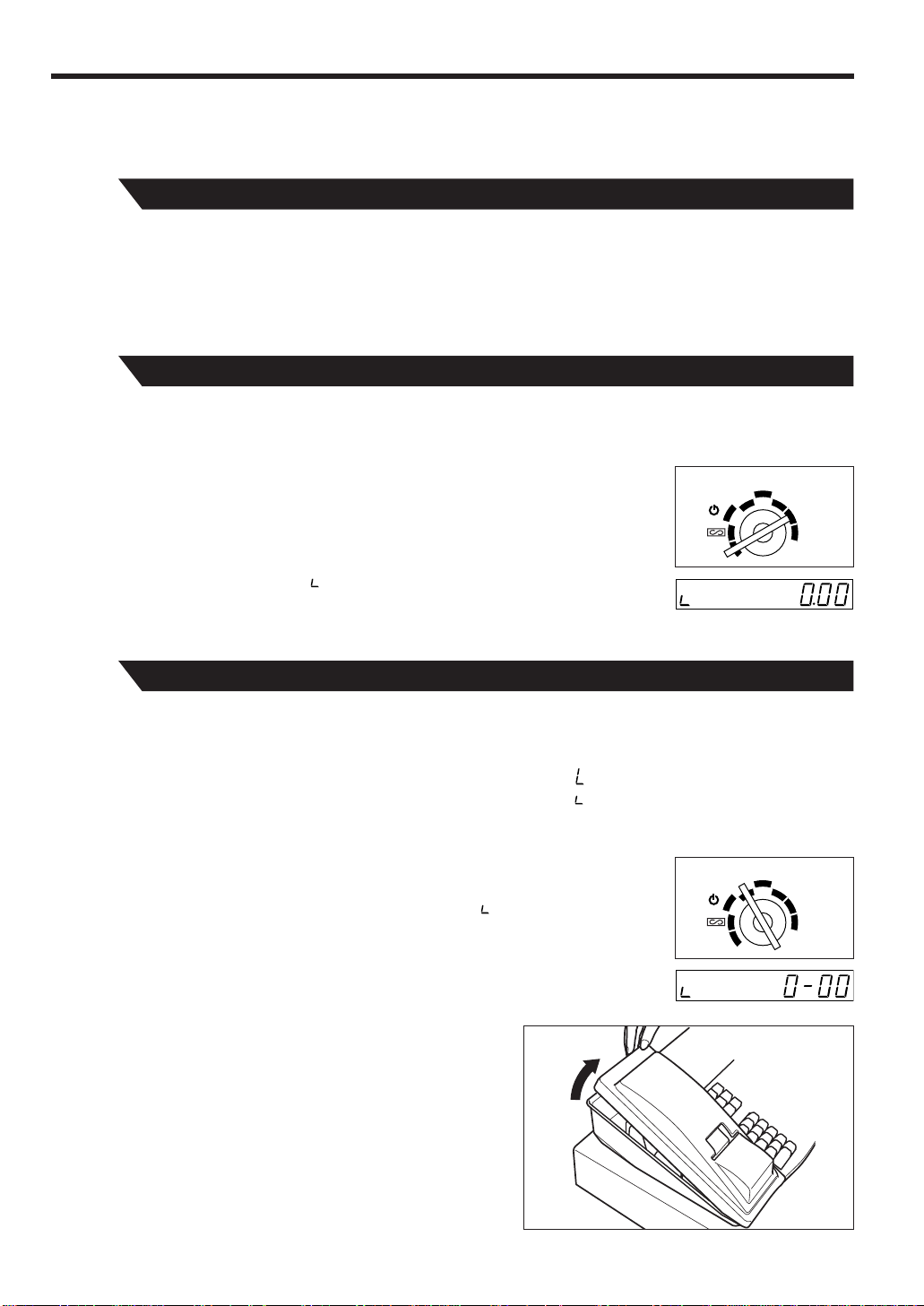

GETTING STARTED

Follow these steps when you use the cash register for the first time.

Purchase and install three R6 or LR 6 batteries (“AA” size). The batteries prevent the data and userprogrammed settings from being erased, when the AC cord is accidentally disconnected or in case of a power

failure.

The batteries will last approximately one year. If the low battery symbol “ ” appears on the far left of the

display, you must replace within two days. And if the no battery symbol “ ” appears, you must replace them at

once.

To install the batteries, use the following procedure.

1. Turn the mode switch to the “OP X/Z” position.

The display will change to time display with the symbol “ ”.

2. Remove the printer cover.

Lift up the rear of the printer and detach it.

Be very careful with the manual cutter mounted on the

cover, so as not to cut yourself.

Initialize the Cash Register

In order for your cash register to operate properly, you must initialize the cash register before

programming for the first time. Use the following procedure:

Before initializing the cash register, make sure that the plug is not connected to the

outlet, and the batteries are not mounted in the register.

1. Turn the mode switch to the “PGM” position.

2. Insert the plug into the outlet.

The right most decimal point will blink for a few seconds, then the register will

sound three beeps and display “ 0.00” .

Unpack the cash register and place it in a location near a wall outlet. Be sure to locate it in such a

location as described in “IMPORTANT” (page 1).

To prevent the register from moving the drawer, fix the drawer with the fixing angle bracket. To fix the drawer,

please refer “Installing the fixing angle bracket” of “OPERATOR MAINTENANCE” (page 42).

OPX/Z

REG

MGR

PGM

X1/Z1

X2/Z2

2

Install the Cash Register

1

Install Batteries

3

REG

OPX/Z MGR

PGM

X1/Z1

X2/Z2

Page 9

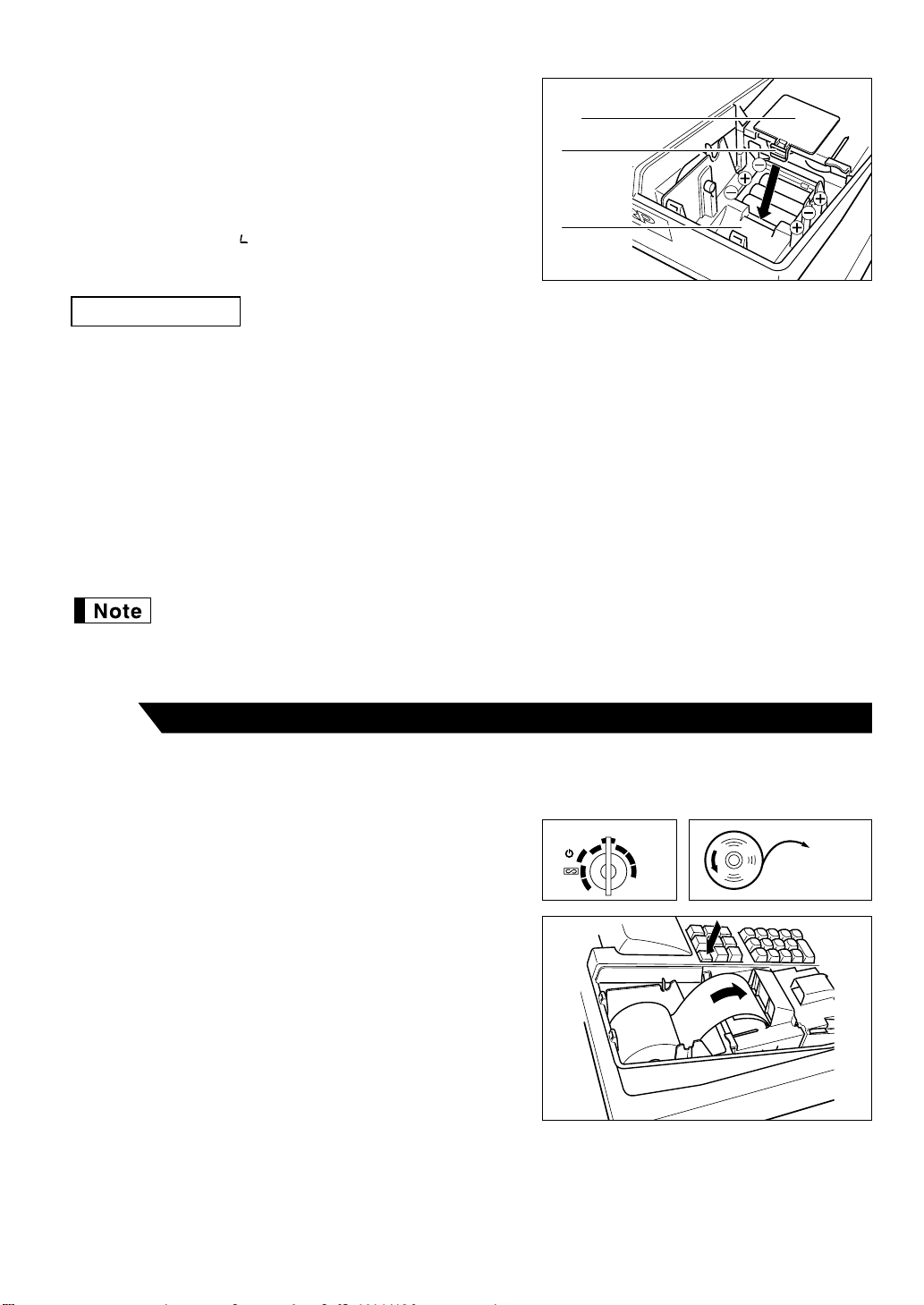

7

3. Open the battery compartment cover located in front of the

paper bed.

Press the tab toward you then pull and lift the cover to

expose the battery compartment.

4. Install three new batteries in the battery compartment. Be

sure that the positive (+) and negative (-) poles of each

battery are facing in the proper direction. When they are

correctly installed, “ ” symbol will disappear.

5. Close the battery compartment cover.

Incorrectly using batteries can cause them to burst or leak, possibly damaging the interior of the cash register.

Note the following precautions:

• Be sure that the positive (+) and negative (-) poles of each battery are facing in the proper direction.

• Never mix batteries of different types.

• Never mix old batteries and new ones.

• Never leave dead batteries in the battery compartment.

• Remove the batteries if you do not plan to use the cash register for long periods. However, the data and user-

programmed settings will be erased.

• If a battery leaks, clean out the battery compartment immediately, taking care to avoid letting the battery fluid

come into direct contact with your skin.

• Do not throw any spent batteries into combustible waste and do not burn any spent batteries.

Your cash register comes with a battery caution label. Please cut off the appropriate half and

attach it to the battery compartment cover.

Precaution: Be very careful for the manual cutter mounted on the printer cover when removing

and replacing the cover, so as not to hurt yourself.

1. Turn the mode switch to the “REG” position.

2. Set the provided paper roll correctly and drop it in the paper

bed.

3. Make a fold in the paper five centimeters from the end.

4. While press the

á

key, insert the folded end straight into the

paper inlet. The inserted end appears at the printing area.

5. When not using the take-up spool (using as receipt

paper):

• Lead the end of the paper out through the manual cutter

on the printer cover. (Press the

á

key to advance the

paper more if required.)

Paper bed

Tab

Battery compartment

cover

View from rear

CAUTION!

Install the Paper Roll

4

REG

OPX/Z MGR

PGM

X1/Z1

X2/Z2

To the printer

Page 10

8

When using the take-up spool (using as journal paper):

• Insert the end of the paper into the slit in the spool. (Press the

á

key to feed more paper if required.)

• Wind the paper two or three turns around the spool shaft.

• If the holding plate is not attached to the spool, attach it by

inserting the spool shaft into the large hole and sliding it into the

small one.

• Set the spool on the bearing, and press the

á

key to take up

excess slack in the paper.

6. Replace the printer cover.

Hook the cover on the pawls on the cabinet and shut it.

• When using a paper roll as journal paper, you must change the printer type. Refer to

“Programming print format” on page 30.

• You can use 2-ply journal/receipt paper. For the installation procedure, refer to Note on “Installing

the paper roll” (page 39).

Before programming, insert the manager (MA) key and turn the mode switch to

“PGM”.

• On the key operation examples shown below, numeric such as 1234

indicates the number or parameter which must be entered using the

corresponding numeric keys.

• On the receipt, the programmed data is printed together with header (date) and footer (e.g.

consecutive number).

Setting the date

Enter day (one or two digits), month (two digits), and year (two digits) in this sequence.

Example: March 26, 2001

Setting the time

Set the time using the 24-hour format. For example, when the time is set to 2:30 AM, enter 230; and when it is

set to 2:30 PM, enter 1430.

Example: 14:30

Time (Hour-Minute)

Ñ4 ≈

1430

ÑÉ

PrintKey operation example

4Ñ

≈

Ñ É

Time (max. four digits)

Ñ3 ≈

260301

ÑÉ

PrintKey operation example

3Ñ

≈

Ñ É

Date (five or six digits)

Program Items as Necessary

5

REG

OPX/Z MGR

PGM

X1/Z1

X2/Z2

Date (Day-Month-Year)

Page 11

9

Programming the VAT(Value Added Tax) rate

If you program the VAT/tax rate, your cash register can calculate the sales tax. In the VAT system, the tax is

included in the price you enter in the register, and the tax amount is calculated when tendered according to the

VAT rate programmed. In the tax system, the tax is calculated when tendered according to the tax rate

programmed, and added to the price. Your cash register can provide totally 6 kinds of tax system and 3 kinds of

rates.

In the factory setting, the VAT/tax system is set to "Automatic VAT 1-3 system", and all the departments are

programmed as taxable in VAT 1/tax 1 rate. So, if you set VAT 1 rate by executing the procedure shown below,

VAT 1 can be calculated automatically to all the goods sold.

In the current VAT/tax system, you can also use VAT 2 and VAT 3 rates when you need more than one VAT

rate. Refer to "Programming the VAT/tax rate" to program multiple VAT rates, and "Programming for

departments" to allocate the taxable status to departments.

If you make nontaxable for some goods, program a department as nontaxable for all VAT rates. (Please note

that all the goods belonging to that department are subjected to nontaxable.)

If you need other types of VAT/tax system, refer to "Computation of VAT/tax" on page 14, and consult your

dealer for the change of your VAT/tax system.

*1: VAT rate: 0.0001 to 100.0000

Example: VAT 1 rate 10%

VAT1 rate

Ñ9 ≈

1

≈

10

ÑÉ

PrintKey operation example

ń

≈

?

*1VAT rate

Ñ É

To program "0"

To inhibit this VAT rate

VAT rate

number (1)

9 1

Your register can be modified to correspond with each period set for the introduction of EURO. To

execute the automatic modification operation, please refer to “PROGRAMMING FOR EURO” on page 34.

Before the modification operation, you must go to X2/Z2 mode and make cashier assignment first. For cashier

assignment, please refer to page 10.

Now you are ready for the sales operation. However, you can program other various convenient functions

depending on your need. For details, please refer to “PROGRAMMING”.

Program for EURO

6

Page 12

10

BASIC SALES ENTRY

Before registrations, insert the operator or manager key into the mode switch and turn it to the “REG” position

and check the following items:

Receipt ON/OFF function

When you use the printer to issue receipts, you can disable receipt printing in the REG mode to save paper

using the receipt function. To disable receipt printing, press the

Ü

key in the OP X/Z position. This key toggles

the receipt printing status “ON” and “OFF”. When the status is “OFF”, the receipt off indicator “_” illuminates in

the display. Your register will print reports regardless of the receipt state, so the paper roll must be installed

even when the receipt state is “OFF”.

Cashier assignment

Prior to any item entries, cashiers must enter their cashier codes into the register. However, the code entry may

not be necessary when the same cashier handles the next transaction.

1. Enter the price for the first item with numeric keys.

2. Press the appropriate department key.

3. Repeat steps 1 and 2 for all the items.

4. Press the

Ñ

key to display the amount due. (You can omit this step.)

5. Enter the amount received from the customer with numeric keys. (You can omit this step if the amount

tendered is the same as the subtotal.)

6. Press the

É

key, and change due is displayed with the symbol “ ” and the drawer is opened.

7. Tear off the receipt and give it to the customer with his or her change displayed.

8. Close the drawer.

• When you finalize the transaction with the

É

key without tendering, the total sales amount is

displayed.

• If you enter the amount tendered which is smaller than the subtotal, the register shows a deficit

with the symbol “ ”. Make an additional tender entry.

Basic sales entry

2

‹

*Cashier code

To display the signed-on cashier code

*Cashier code: 1-6(ER-A160) 1-8(ER-A180)

Enter the code using numeric keys.

‹‹

■ Sign-on (in REG, MGR, , OP X/Z, X1/Z1, X2/Z2 mode) ■ Sign-off (in REG, MGR, mode)

Prior to entries

1

REG

OPX/Z MGR

PGM

X1/Z1

X2/Z2

Page 13

11

Example:

In this example, the department 4 and 5 are set as taxable 1(default setting) and VAT 1 rate is programmed as

10%.

In the following examples, your register will go into an error state accompanied with a warning beep and the

error symbol “ ” on the display. Clear the error state by pressing the

c

key and take proper action.

• When you enter an over 13-digit number (entry limit overflow): Cancel the entry and re-enter a correct number.

• When you make an error in key operation: Clear the error and continue operation.

• When you make an entry beyond a programmed amount entry limit: Check to see if the entered amount is

correct. If it is correct, it can be rung up in the MGR mode.

• When an including-tax subtotal exceeds eight digits: Delete the subtotal by pressing the

c

key and press the

É, '

or îkey to finalize the transaction.

Error escape function

When you want to quit a transaction because of an error or something uncontrollable, use the error escape

function as shown below:

The transaction is voided (treated as a subtotal void) and the receipt is issued by this function. If you have

already entered tendered amount, the operation is finalized as a cash sale.

When you use the error escape function, “” is printed on the receipt.

c

Transaction

To clear the error state

Ã

Ã

Error warning

3

Date

Department code

Unit price

Subtotal

VAT 1

Sales total

Amount tendered

Change

Register number

Consecutive number

Cashier code

Time

500

ù

800

û

Ñ

2000

É

PrintKey operation example

Page 14

12

OTHER TYPES OF ENTRIES

On the key operation examples except that of "Computation of VAT/tax", all

the departments are programmed as non-taxable. Also on all the examples,

numeric such as 1234 indicates that they are entered using the corresponding numeric keys.

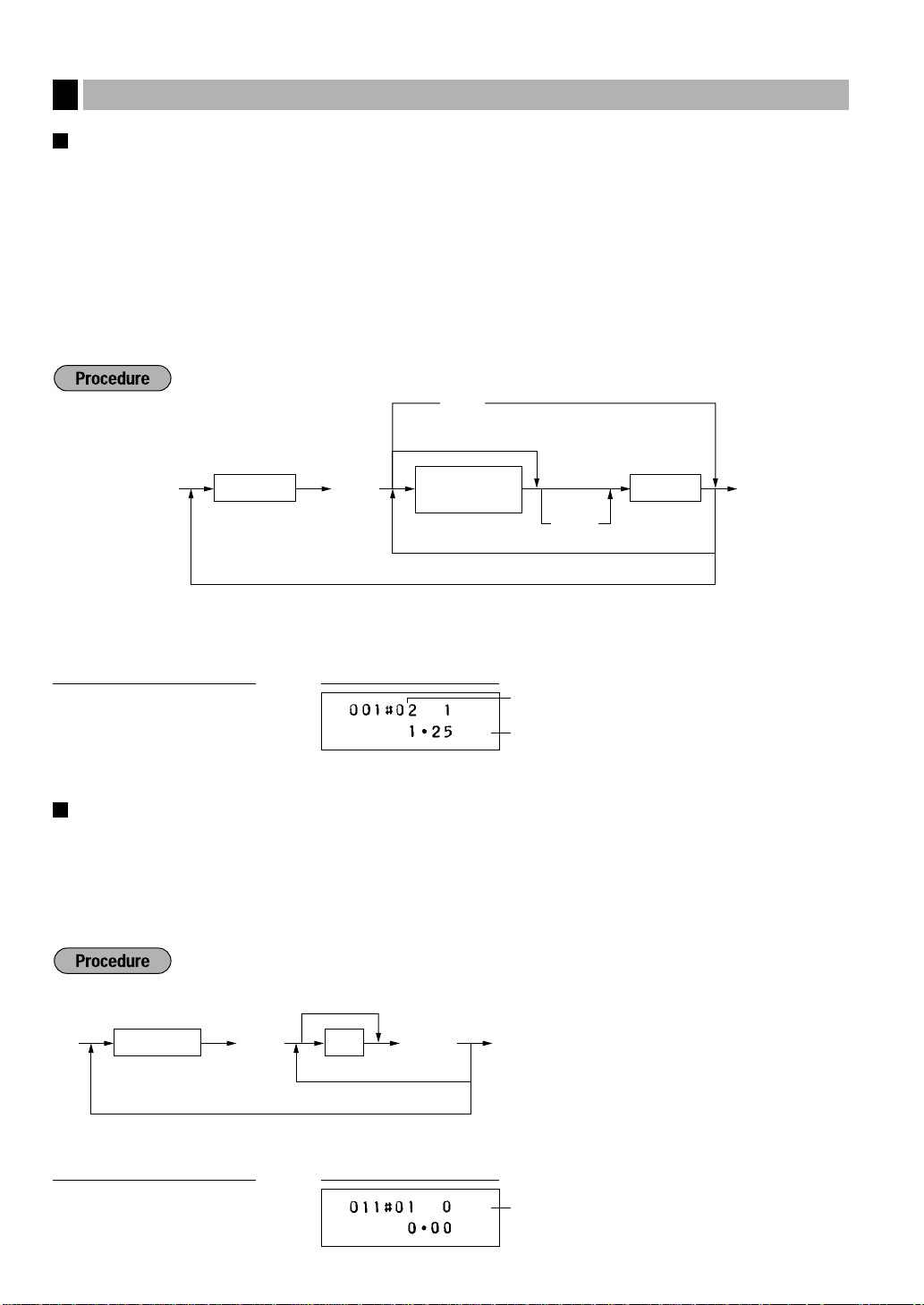

Single item entries

Department

*To shift the department key,

press the department shift key at

this point. (ER-A180 only)

PLU

Subdepartment

*

1

Less than the programmed entry digit limit

• When those departments and PLUs for which the unit price has been programmed as zero (0) are

entered, only the sales quantity is added.

• When using PLU function, you must program the preset price, and associated department.

When using subdepartment function, you must change the mode to subdepartment mode, and

program the associated department. Refer to page 26 for programming details.

Repeat entries

You can use this function for entering a sale of two or more same items.

200 ¯

¯

10 Ö

Ö

500 å

11 Ö

Ö

É

Repeated

subdepartment

entry

Repeated PLU

entry

Repeated

department entry

PrintKey operation example

1200

¯

˘

2

Ö

1200 å11

Ö

É

PrintKey operation example

Unit price *

1

(max. 7 digits)

å

PLU code

Ö

PLU code

Ö

Department keyUnit price *

1

(max. 7 digits)

When using a programmed unit price

Ó

*

Item entries

1

REG

OPX/Z MGR

PGM

X1/Z1

X2/Z2

Page 15

13

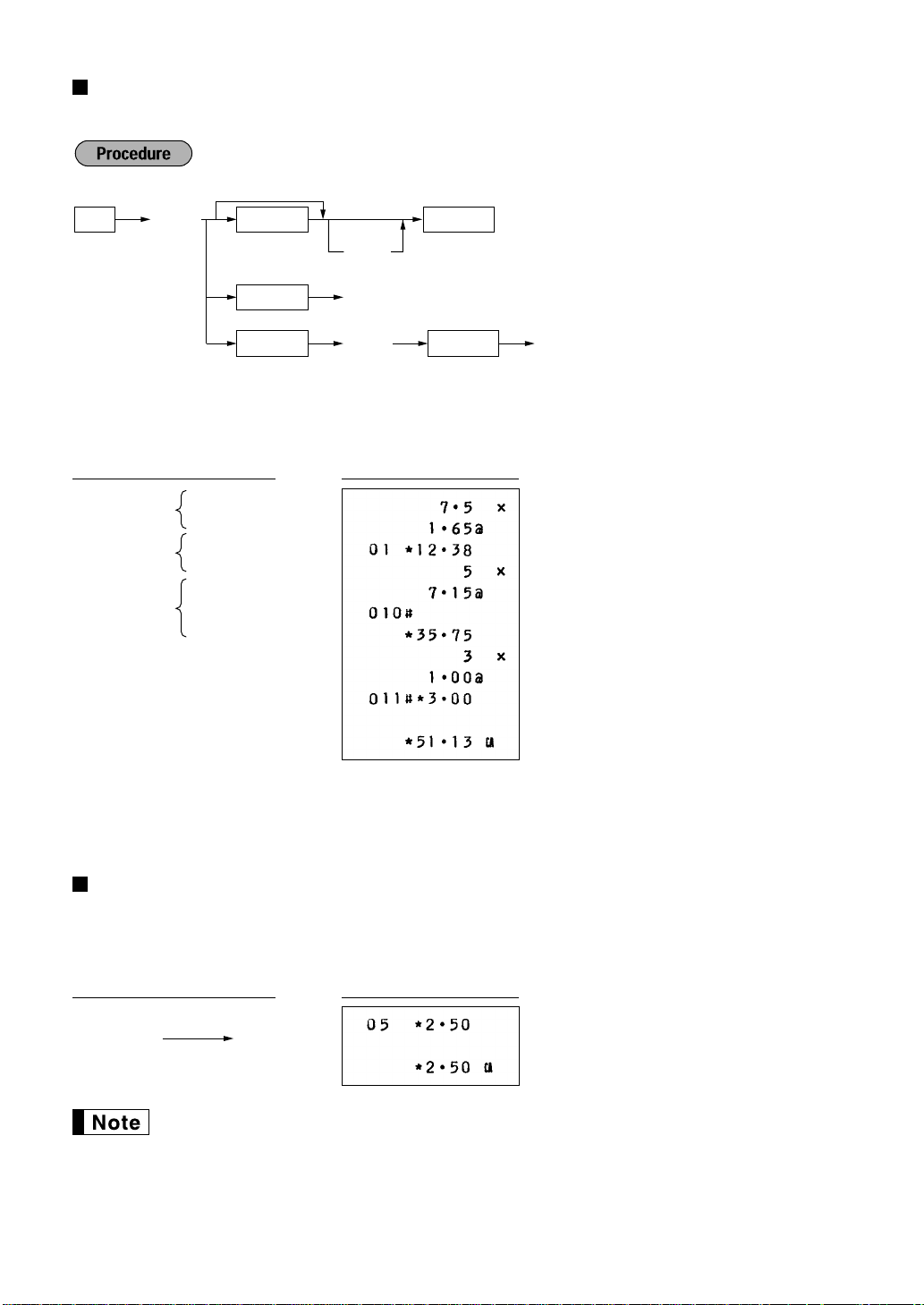

Multiplication entries

Use this feature when you sell a large quantity of items or need to enter quantities that contain decimals.

*To shift the department key, press the

department shift key before pressing

the department key. (ER-A180 only)

• Q'ty: Up to three digits integer + three digits decimal or four digits integer + two digits decimal

• Unit price: Less than a programmed entry digit limit

• Q'ty x unit price: Up to seven digits

Single item cash sale (SICS) entry

• This function is useful when a sale is for only one item and is for cash; such as a pack of cigarettes. It is

applicable only to those departments programmed as SICS or to their associated PLUs or subdepartments.

• The transaction is finalized as soon as you press the department key or

Ö

key.

If an entry to a department or PLU/subdepartment set for SICS follows the ones to departments or

PLUs/subdepartments not set for SICS, it does not finalize and results in a normal sale.

For finishing

the transaction

250

û

PrintKey operation example

PrintKey operation example

≈

Ö

Unit price

PLU code

å

Unit price

Ö

PLU code

Q'ty Dept. key

When you use a programmed unit price

Ó

*

Department

entry

PLU entry

Subdepartment

entry

7 . 5 ≈

165 ¯

5 ≈

10 Ö

3 ≈

100 å

11 Ö

É

Page 16

14

The subtotal is displayed by pressing the

Ñ

key. When you press it, the subtotal of all entries which have

been made is displayed and the symbol “ ” will light up in the display.

If you want to print the subtotal when you press the

Ñ

key, change the setting by programming.

Refer to “Selection of the subtotal printing” (page 31).

Cheque or credit sale

Cheque sale

Press the

'

key at the end of the transaction. The amount tendered can be entered like a cash sale and the

change due is displayed.

*The amount tendered: Less than

programmed entry digit limit

Credit sale

Press the

î

key at the end of the transaction. The amount tendered cannot be entered.

*The total sales amount: Less than

programmed entry digit limit

Mixed-tender sale

You can perform mixed-tendering of cheque and cash, cash and credit, and cheque and credit.

VAT/ tax system

The machine may be programmed for the following six tax systems by your dealer.

Automatic VAT 1-3 system (This is the factory default system)

This system, at settlement, calculates VAT for taxable 1 through 3 subtotals by using the corresponding

programmed rate.

Automatic tax 1-3 system

This system, at settlement, calculates taxes for taxable 1 through 3 subtotals by using the corresponding

programmed rate, and also adds the calculated taxes to those subtotals, respectively.

Computation of VAT/tax

4

Ñ

950

É

î

PrintKey operation example

Ñ

î

PrintKey operation example

Ñ

1000

'

PrintKey operation example

Finalization of transaction

3

Displaying subtotals

2

Page 17

15

Manual VAT 1-3 system

This system provides the VAT calculation for taxable 1 through 3 subtotals. This calculation is performed using

the corresponding programmed rate when the

◊

key is pressed just after the

Ñ

key.

Manual VAT 1 system

This system enables the VAT calculation for the then subtotal. This calculation is performed using the VAT 1

preset rate when the

◊

key is pressed just after the

Ñ

key. For this system, the keyed-in VAT rate(0.0001 to

99.9999) can be used.

Manual tax 1-3 system

This system provides the tax calculation for taxable 1 through 3 subtotals. This calculation is performed using

the corresponding programmed rate when the

◊

key is pressed just after the

Ñ

key. After this calculation,

you must finalize the transaction.

Automatic tax 1-2 and automatic VAT 3 system

This system enables the calculation in the combination with automatic tax 1 and 2 and automatic VAT 3. The

combination can be VAT3 corresponding to taxable 3 and any of tax 1 and 2 corresponding to taxable 1 and

taxable 2 for each item. The tax amount is calculated automatically with the corresponding programmed rates.

• Tax statuses of PLU is depending on that of the department which the PLU belongs to.

• VAT/tax assignment symbol can be printed at the fixed right position near the amount on the

receipt as follows:

VAT1 VT1 Tax1 TX1

VAT2 VT2 Tax2 TX2

VAT3 VT Tax3 TX

When the multiple VAT/tax is assigned to a department or a PLU, a symbol of the lowest number

assigned to VAT/tax rate will be printed. For details, contact your authorized SHARP dealer.

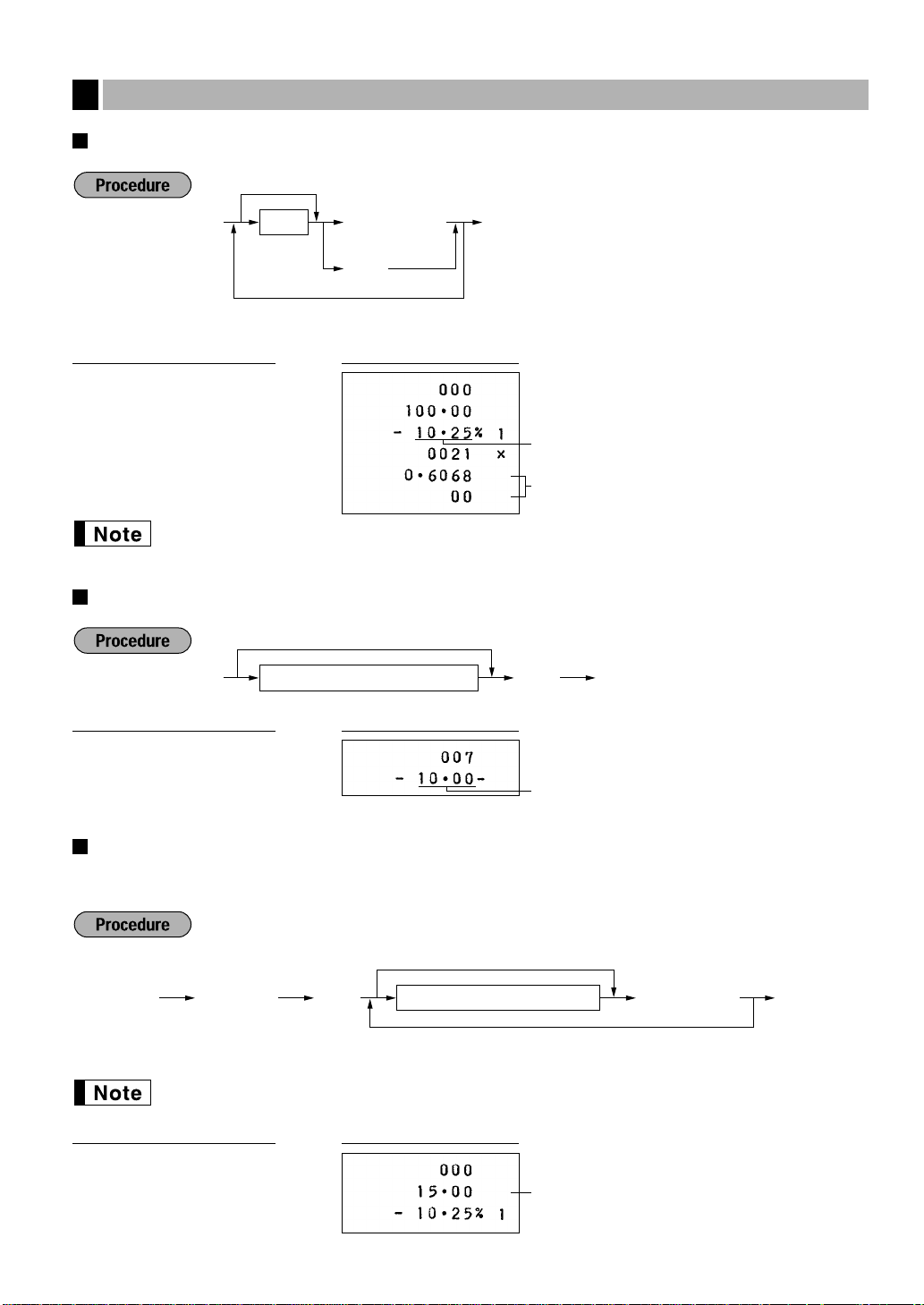

Percent calculations (premium or discount)

• Your register provides the percent calculation for subtotal and/or each item entry depending on programming.

• Percentage: 0.01 to 100.00% (Depending on programming) (Application of preset rate (if programmed) and

manual rate entry are available.)

Auxiliary entries

5

550

ù

Ñ

(When the manual VAT

◊

1-3 system is selected)

É

PrintKey operation example

Ñ ◊

Ñ ◊

VAT rate

To use a programmed rate

Ñ ◊

Page 18

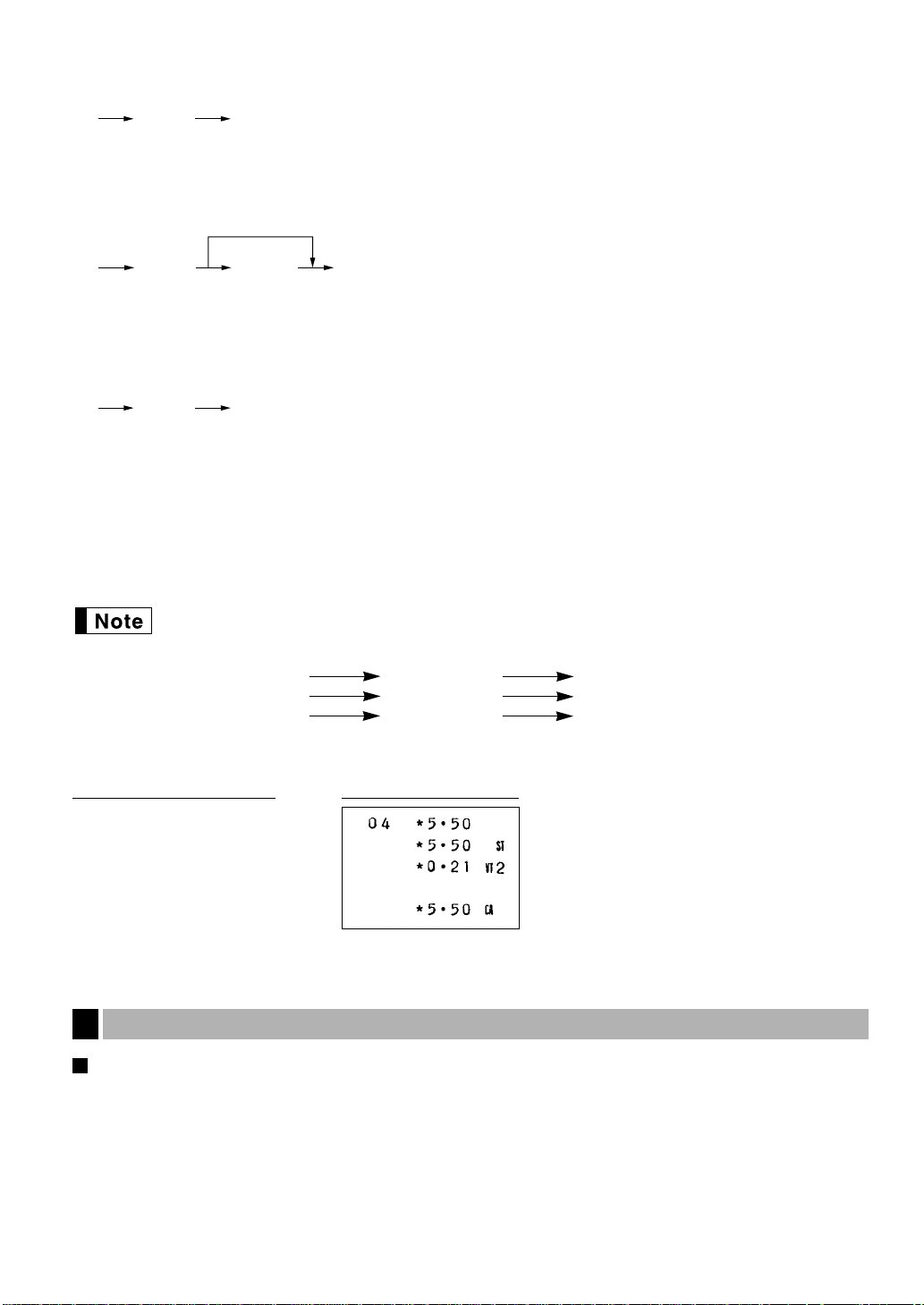

16

Percent calculation for the subtotal Percent calculation for item entries

Discount entries

Your register allows you to deduct a preset amount or a certain amount manually entered, which are less than a

programmed upper limit. These calculations can be after the entry of an item and/or the computation of subtotal

depending on the programming.

Discount for the subtotal Discount for item entries

Refund entries

If a refund item is the one entered into a department, enter the amount of the refund, then press the ©key and

the corresponding department key in this order; and if an item entered into a PLU is returned, enter the

corresponding PLU code, then press the

©

and Ökeys.

Printing of non-add code numbers

Enter a non-add code number such as a customer’s code number and credit card number within a maximum of

8 digits and press the

Ñ

key at any point during the entry of a sale. Your register will print it at once.

1230

Ñ

1500

¯

î

PrintKey operation example

250

©¯

10

©Ö

É

PrintKey operation example

675

˘

-

É

(When a discount amount

of 75 is programmed.)

575

¯

10

Ö

Ñ

100

-

É

Print

Key operation example

Print

Key operation example

800

¯

§

2

Ö

7 .5

§

É

(When premium and 15% are

programmed for the §key)

140

¯

570

˘

Ñ

∞

É

(When 10% is programmed

for the ∞key)

Print

Key operation example

Print

Key operation example

Page 19

17

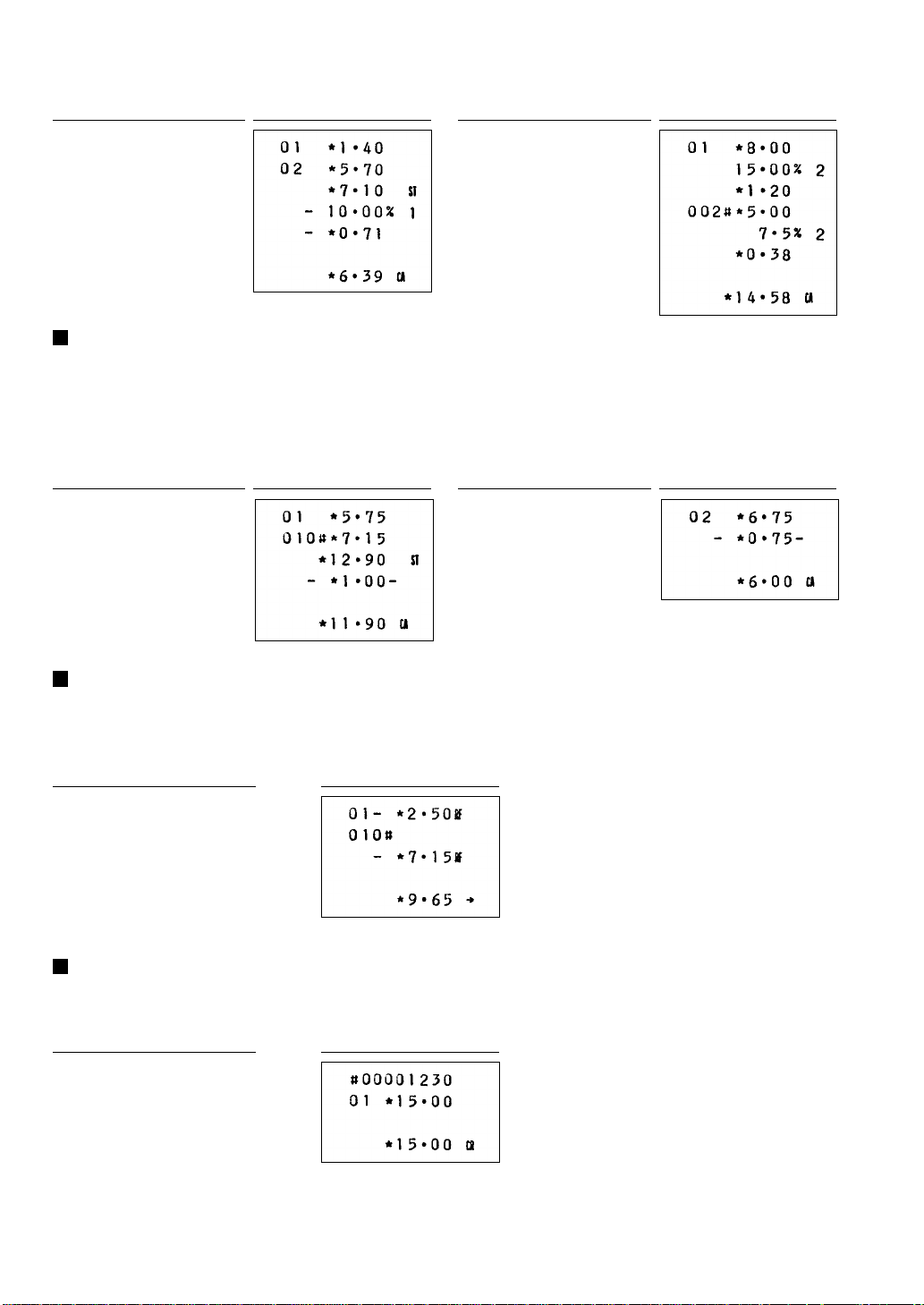

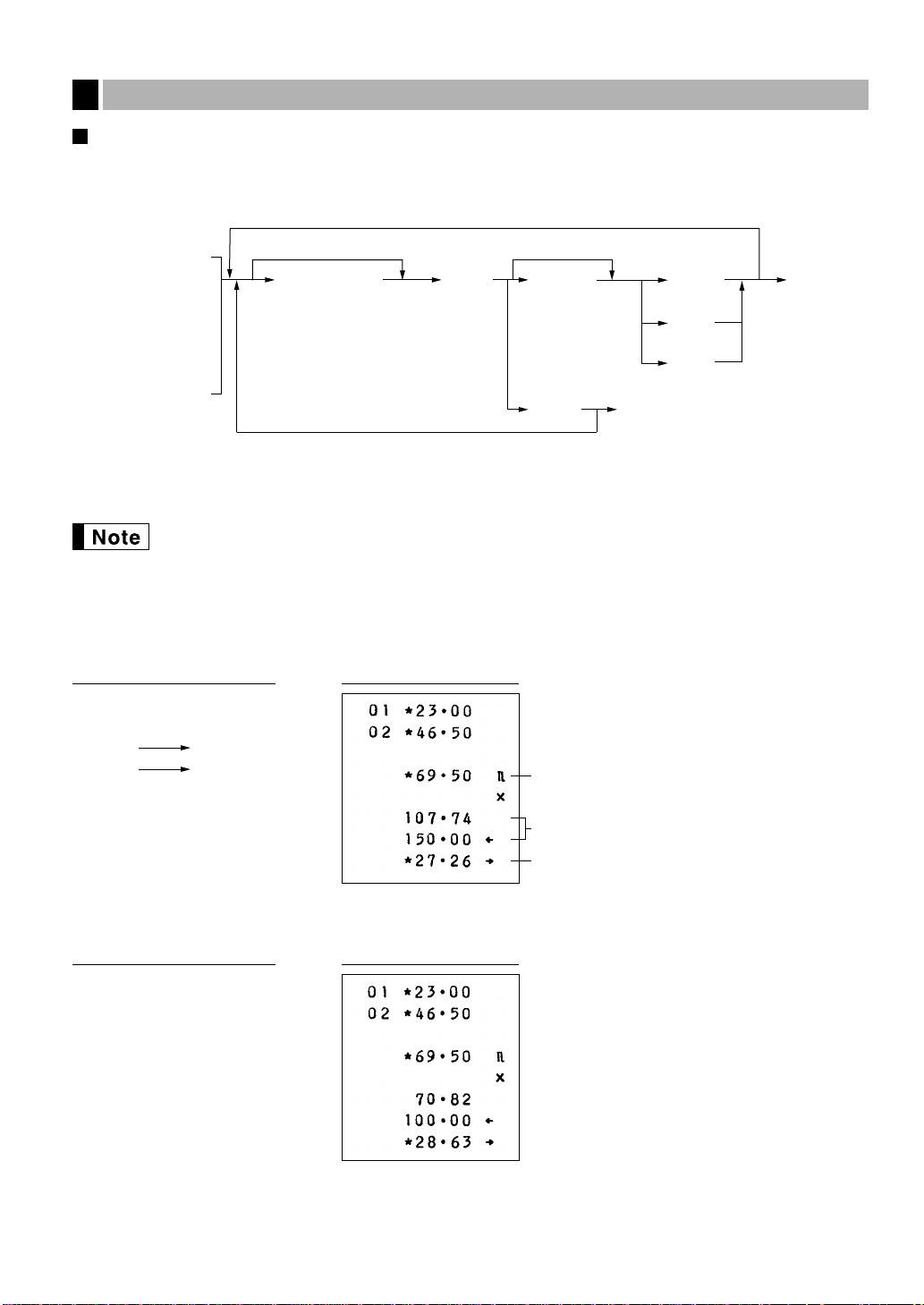

Currency exchange

Your register allows payment entries of foreign currency. Pressing the ekey creates a subtotal in foreign

currency.

*Exchange rate: 0.000000 to 999.999999

• When the amount tendered is short, the deficit is shown in domestic currency.

• Availability of credit and cheque tendering is depending on programming (only for preset

exchange rate).

• A programmed foreign currency symbol is printed when you apply preset rate.

• If you want to print the exchange rate on receipt/journal, please consult your dealer.

Applying preset exchange rate

Applying manual exchange rate

2300

¯

4650

˘

1 .0190

e

10000

É

PrintKey operation example

Domestic currency

Foreign currency

Domestic currency

Currency

exchange

Amount

tendered in

foreign currency

2300 ¯

4650 ˘

e

15000 É

PrintKey operation example

e

c

É

'

î

Reentry

Amount

tendered

(max. 8 digits)

*Exchange rate

For direct finalizationPreset exchange rate

After an entry

is completed

or

After the amount

tendered is found

smaller than the

sales amount in

a sales entry

Next registration

or

payment in

domestic currency

For an additional payment in foreign currency

Payment treatment

6

Page 20

18

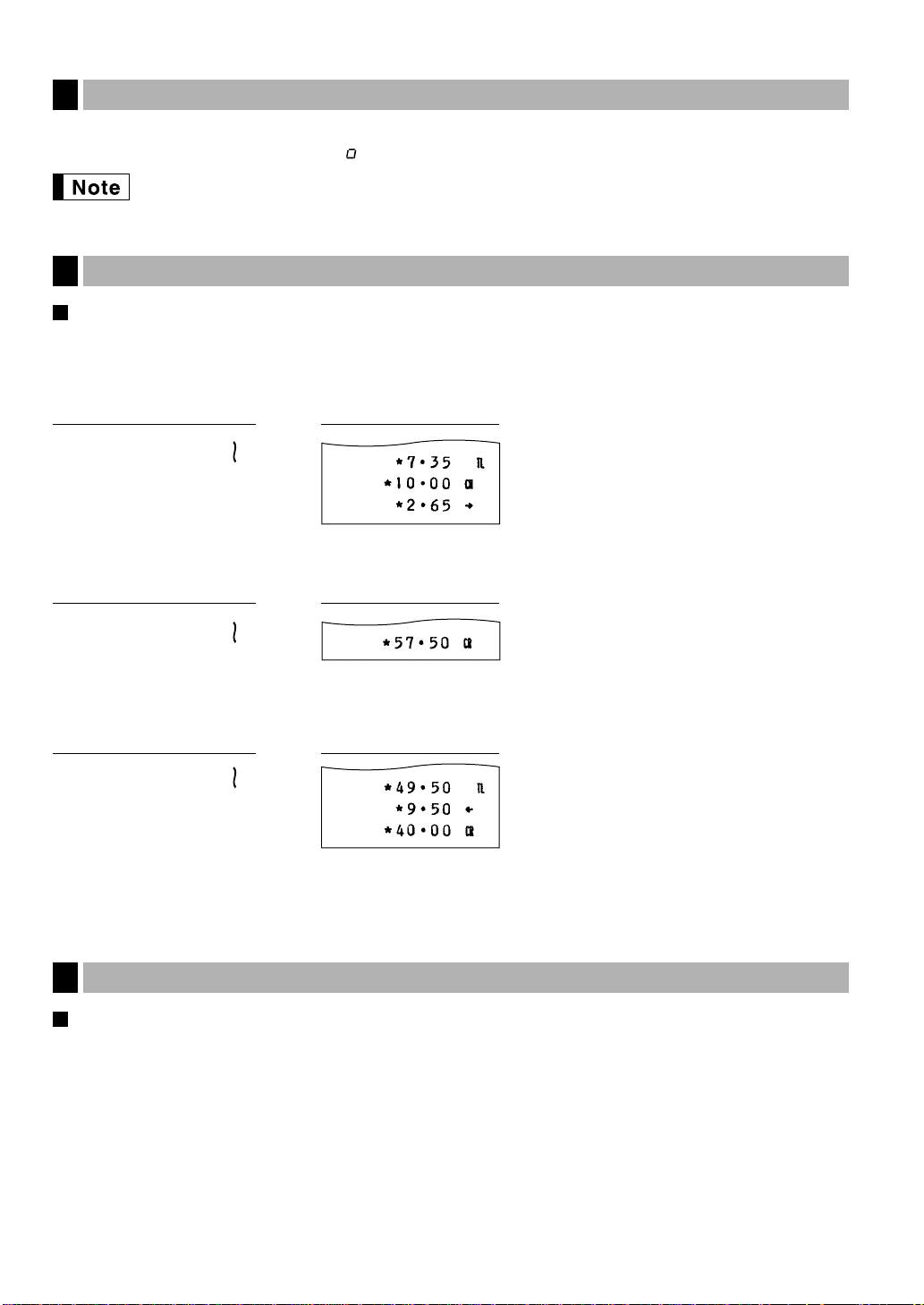

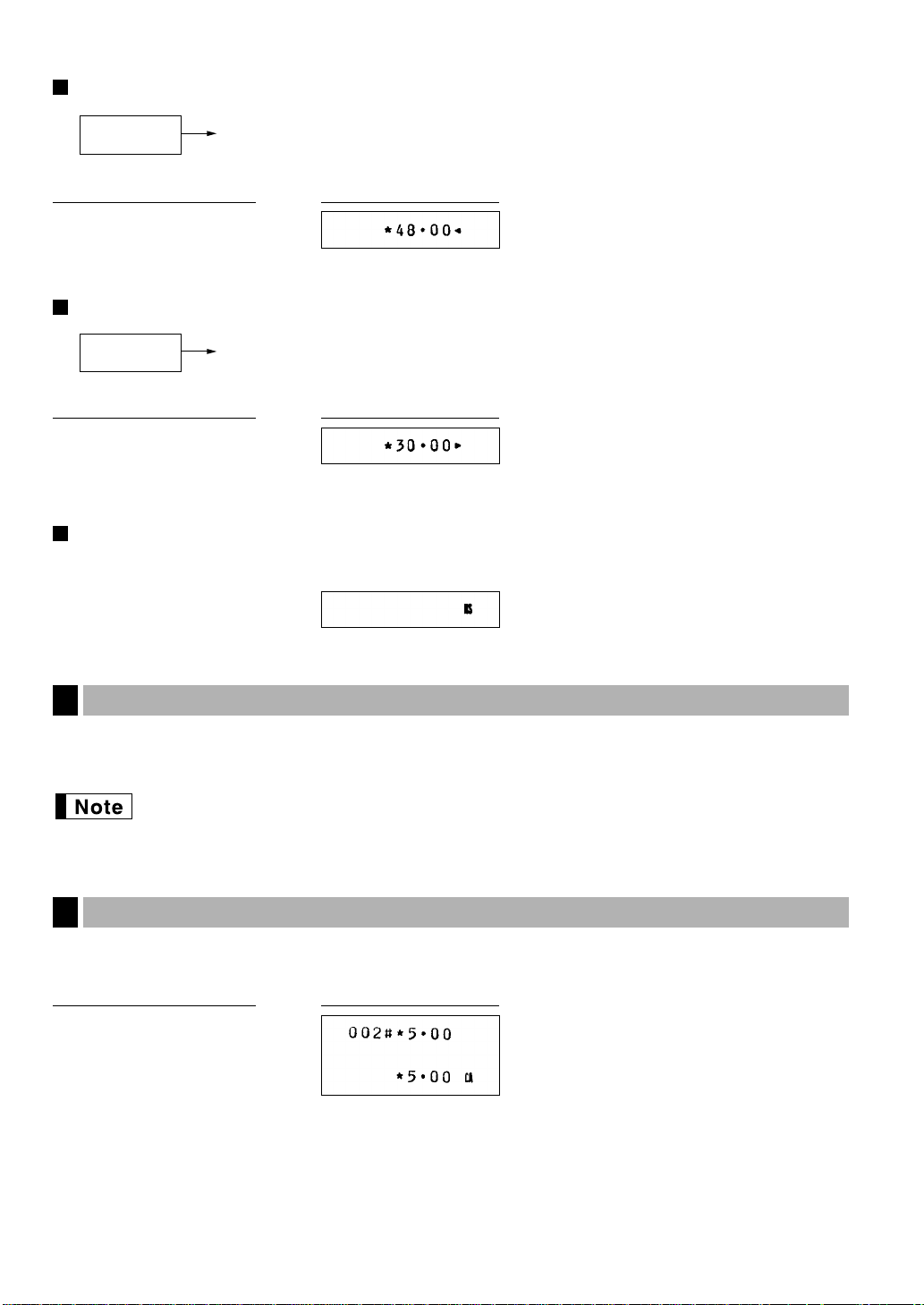

Received on account entries

Paid out entries

No sale (exchange)

Simply press the Ékey without any entry. The drawer will open and the printer will print “NS” on the journal or

the receipt.

If your customer wants a receipt after you have finalized a transaction with the receipt function being in the

“OFF” status (no receipting), press the

Ü

key after transaction. This will produce a receipt.

• Pressing the

Ü

key in the OP X/Z mode before registration toggles the status “ON” and “OFF”.

• When more than 64 lines are entered, the receipt will be issued in the format of summary receipt

print.

You can achieve a programmed transaction simply by pressing a corresponding automatic sequencing key.

For programming the

`

key, refer to page 32.

~É

(~= 2 Ö)

PrintKey operation example

Automatic sequencing key (`key) entries

8

Receipt issuance after finalization

7

3000

Ü

PrintKey operation example

*Less than the programmed entry digit limit

Amount

(max. 8 digits)

Ü

(Available cash only)

*

4800

r

PrintKey operation example

*Less than the programmed entry digit limit

Amount

(max. 8 digits)

r

(Available cash only)

*

Page 21

19

You can override the entry digit limit setting by making an entry in the MGR mode.

1. Turn the mode switch to the MGR position using the manager (MA) key.

2. Make an override entry.

On this example, the register has been programmed not to allow discount entries over 2

digits.

REG-mode entries 1500

˘

250

-

... Error

c

Turn the mode switch to the MGR position.

250

-

Return the mode switch to the REG position.

É

Key operation example

Override entries

9

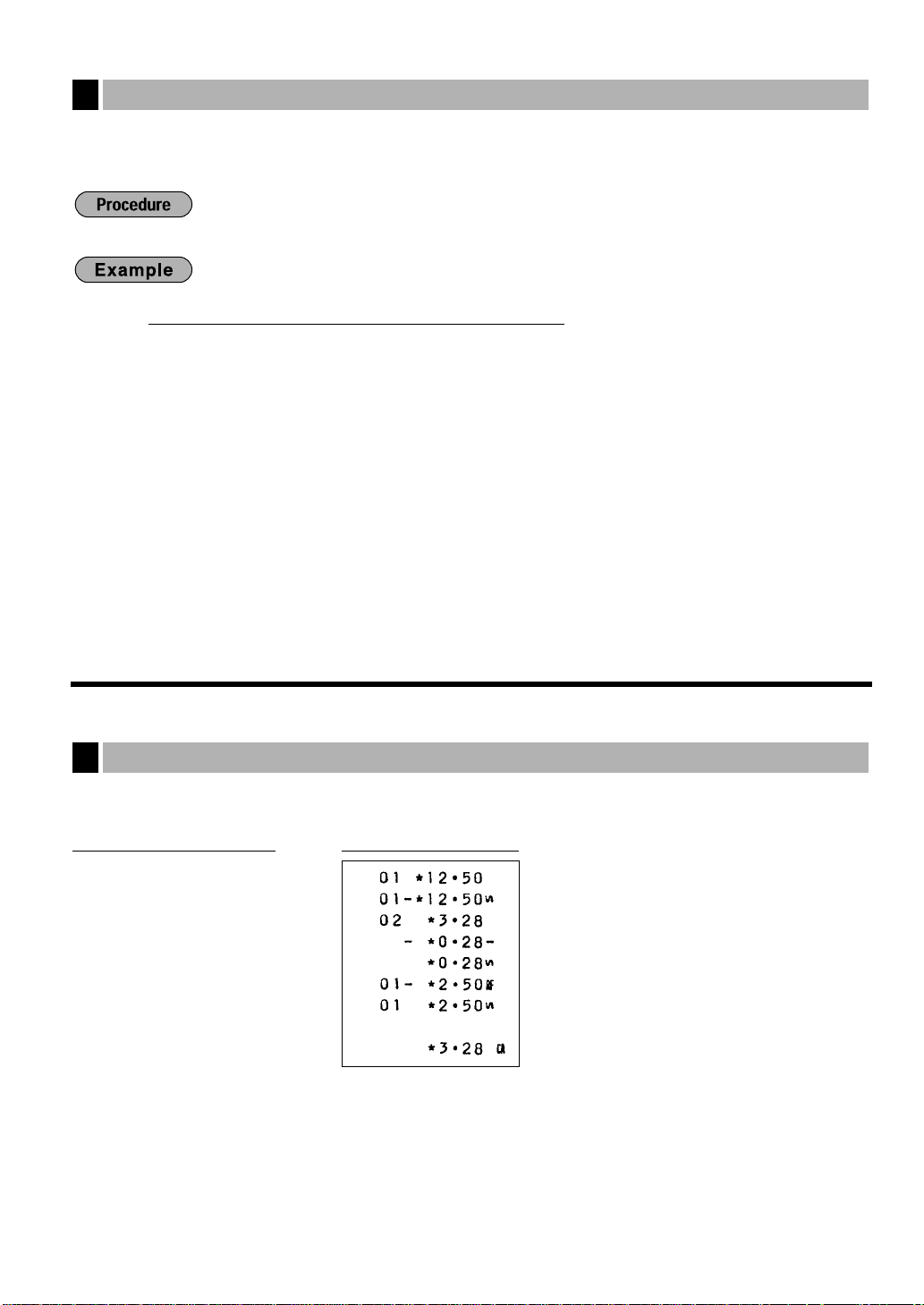

CORRECTION

If you make an incorrect entry relating to a department, PLU/subdepartment, percentage (∞and §),

discount (

-

) or refund, you can void this entry by pressing the ?key immediately after the incorrect entry.

1250

¯

?

328

˘

28

?

250

©

¯

?

É

PrintKey operation example

Correction of the last entry (direct void)

1

Page 22

20

With the ?key, you can void any incorrect department entry, PLU/subdepartment entry or item refund entry

made during a transaction if you find it before finalizing the transaction (e.g. pressing the

É

key).

You can void an entire transaction. Once subtotal void is executed, the transaction is aborted and the register

issues a receipt.

If you find errors during the tendering operation or after finalizing a transaction, you can void the whole entries

made in an incorrect receipt in the void mode in the following procedure. (If you find the errors during the

tendering operation, enter the void mode after finalizing a transaction.)

1. Turn the mode switch to the position using the manager (MA) key to enter

the void mode.

2. Repeat the entries that are recorded on an incorrect receipt. (All data for the

incorrect receipt are removed from register memory; the voided amounts are

added to the void-mode transaction totalizer.)

Correction after finalizing a transaction

4

Subtotal void

1310 ˘

10 Ö

Ñ

?

Ñ

PrintKey operation example

Subtotal void

3

Correction of a PLU entry

Correction of a refund entry

Correction of a

department entry

1310 ¯

1755 ˘

10 Ö

2 Ö

250 © ¯

825 ˘

1310 ? ¯

2 ? Ö

250 © ? ¯

É

PrintKey operation example

Correction of the next-to-last or earlier entry (indirect void)

2

Void mode symbol

Cancellation receipt

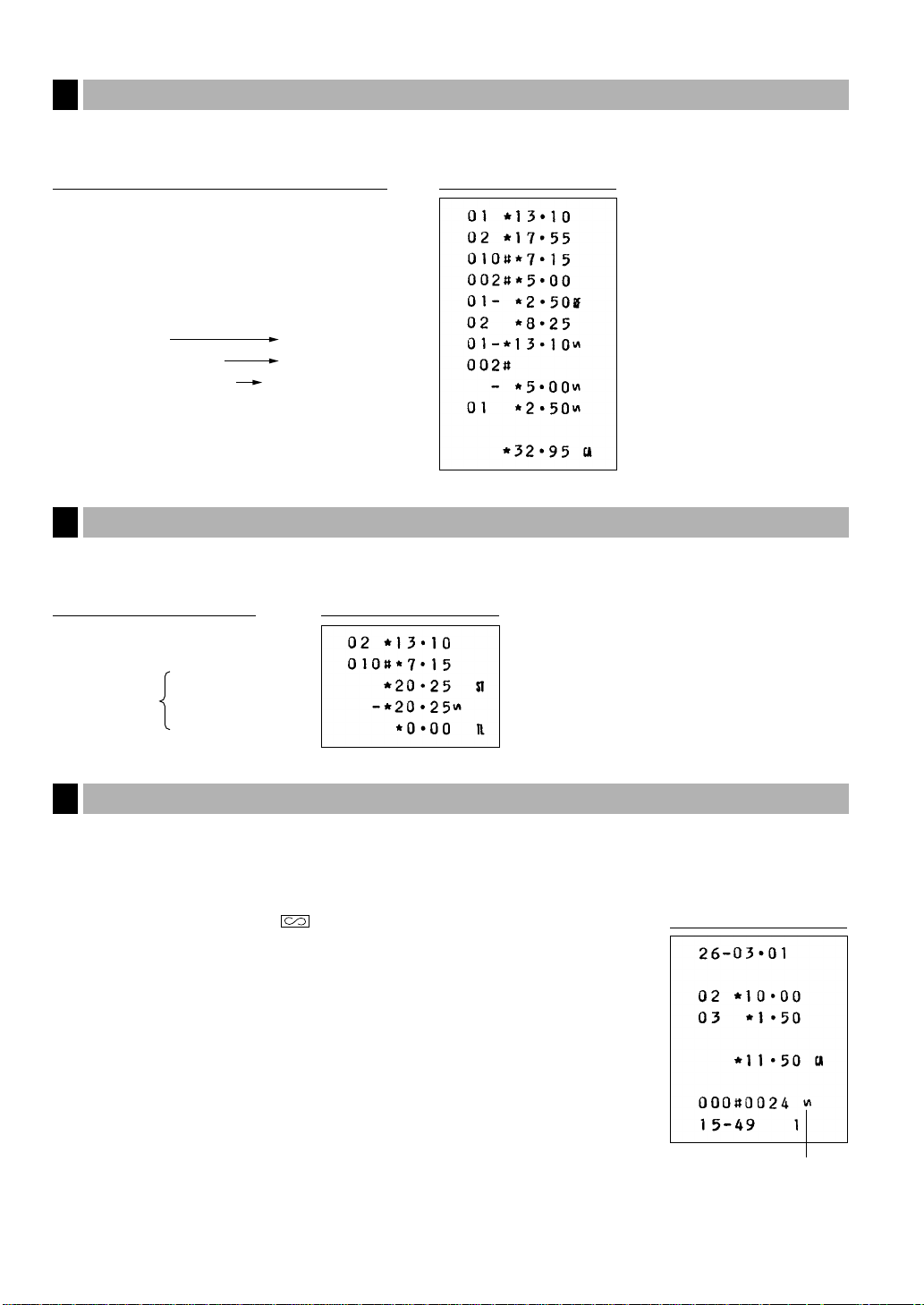

Page 23

21

READING (X) AND RESETTING (Z)

OF SALES TOTALS

• Use the reading function (X) when you need to take a reading of sales information entered since the last

resetting. You can take this reading any number of times. It does not affect the register’s memory.

• Use the resetting function (Z) when you need to clear the register’s memory. Resetting prints all sales

information and clears the entire memory except for the GT, reset count, and consecutive number.

X1 and Z1 reports: Daily sales reports

X2 and Z2 reports: Periodic (monthly) consolidation reports

• In the reports, when both of sales quantity and sales amount are zero, their printing is skipped. If

you do not want to skip, change the programming. (Refer to “Programming print format”.)

• “X” represents read symbol and “Z” represents reset symbol in the reports.

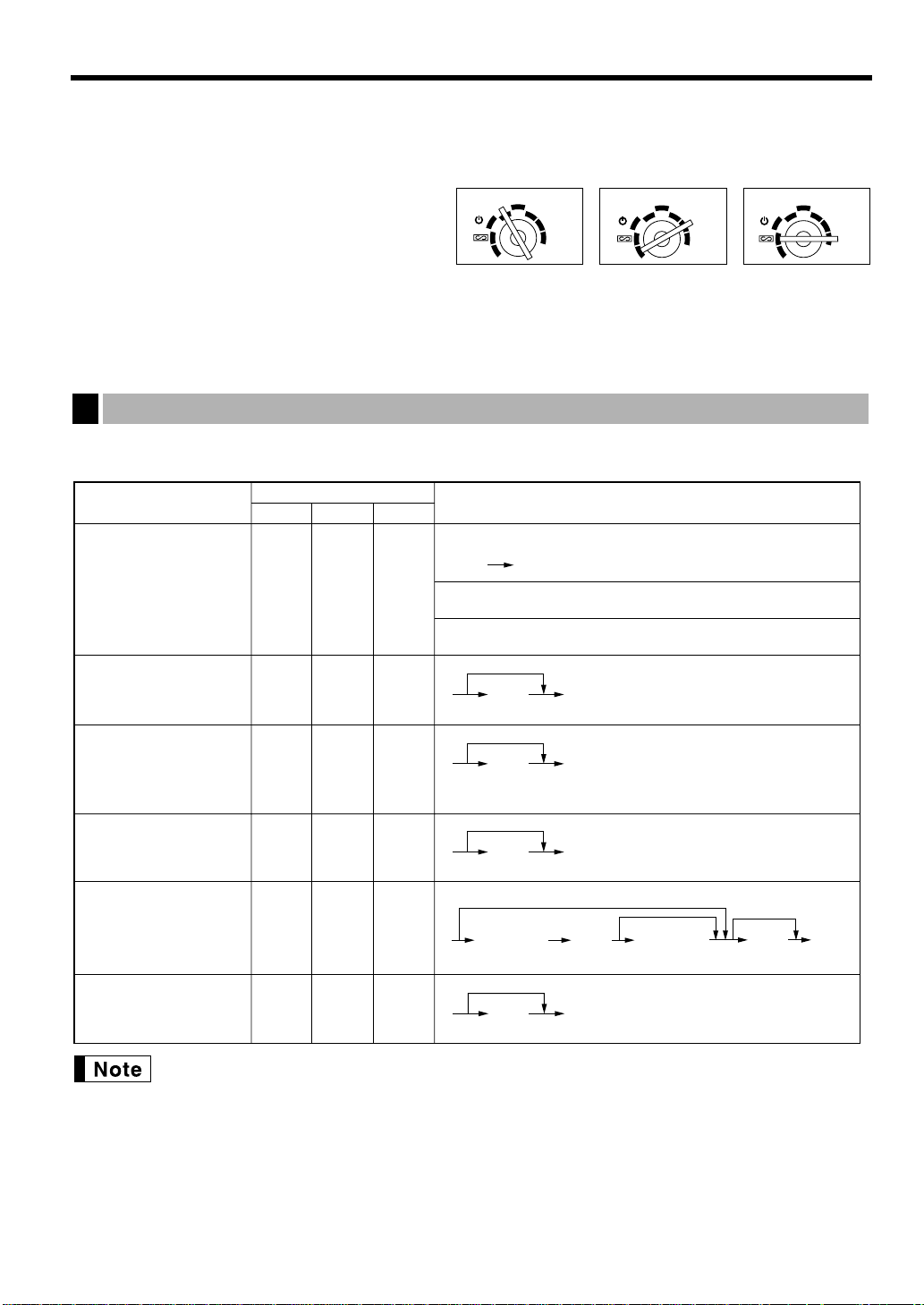

Item

Mode switch position

Key operation

.

Ó

É

Reading

Resetting

X1/Z1 X2/Z2

X1, Z1

--

X

-- --

X, Z

-- --

X2, Z2

X1, Z1

--

X1, Z1

--

X1, Z1

--

--

--

--

É

key: Sales total

≈

key: Amount of cash in drawer

Dept. key or

(The report of the cashier currently signed-on)

:Department total amount

Dept. key (ER-A180 only)

Full cashier report

PLU sales report

Hourly sales report

.

‹

Reading

Resetting

OPX/Z

.

All PLUs

End

PLU code

Start

PLU code

Ö≈

Reading

Resetting

.

Ñ

Reading

Resetting

Flash report:

(Only display)

To clear the display,

press the

c

key or

turn the mode switch to

another position.

General report

Individual cashier

report

.

‹

Reading

Resetting

Summary of reading (X) and resetting (Z) reports

1

REG

OPX/Z MGR

PGM

X1/Z1

X2/Z2

PGM

OPX/Z

REG

MGR

X1/Z1

X2/Z2

REG

OPX/Z MGR

PGM

X1/Z1

X2/Z2

Page 24

22

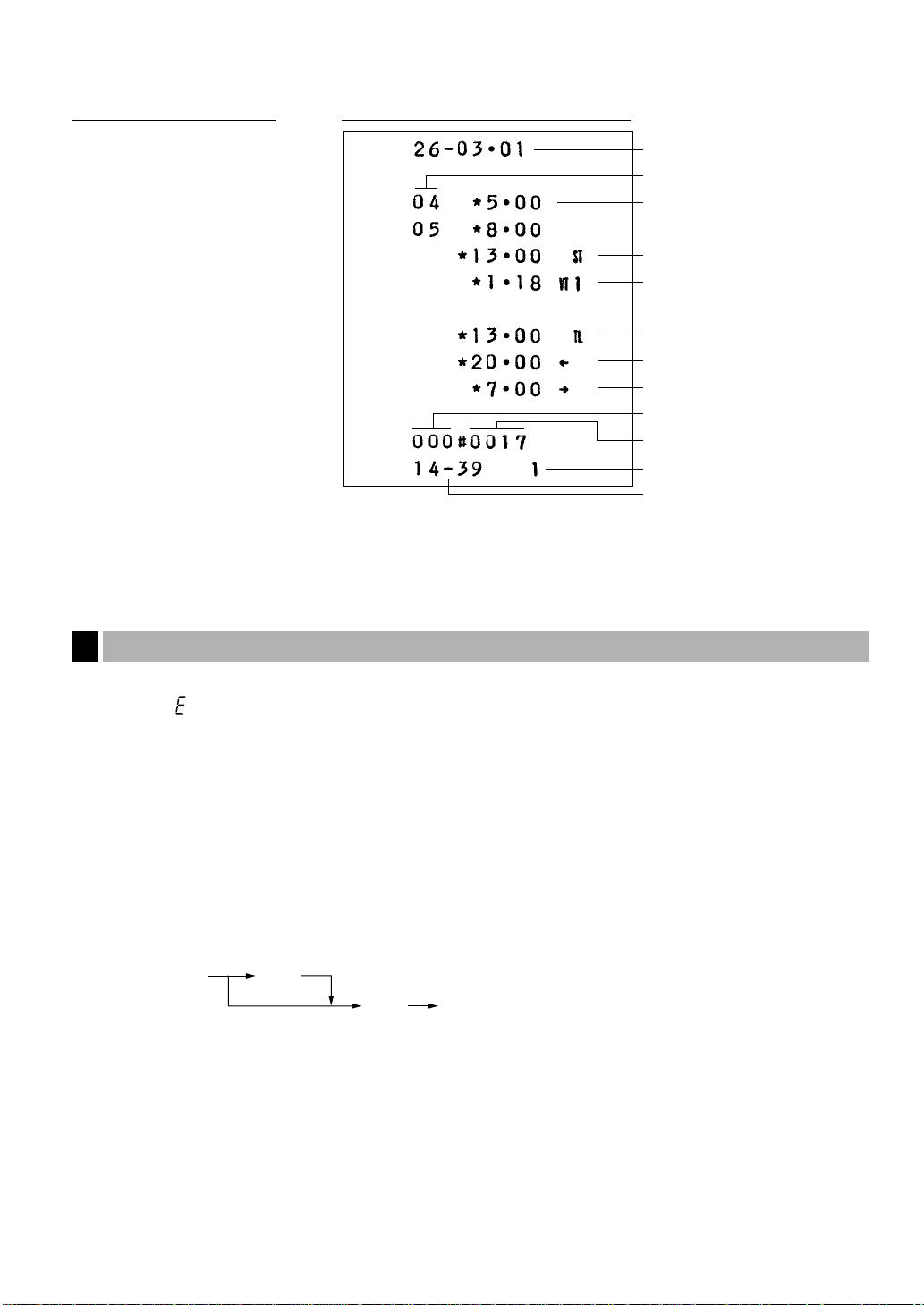

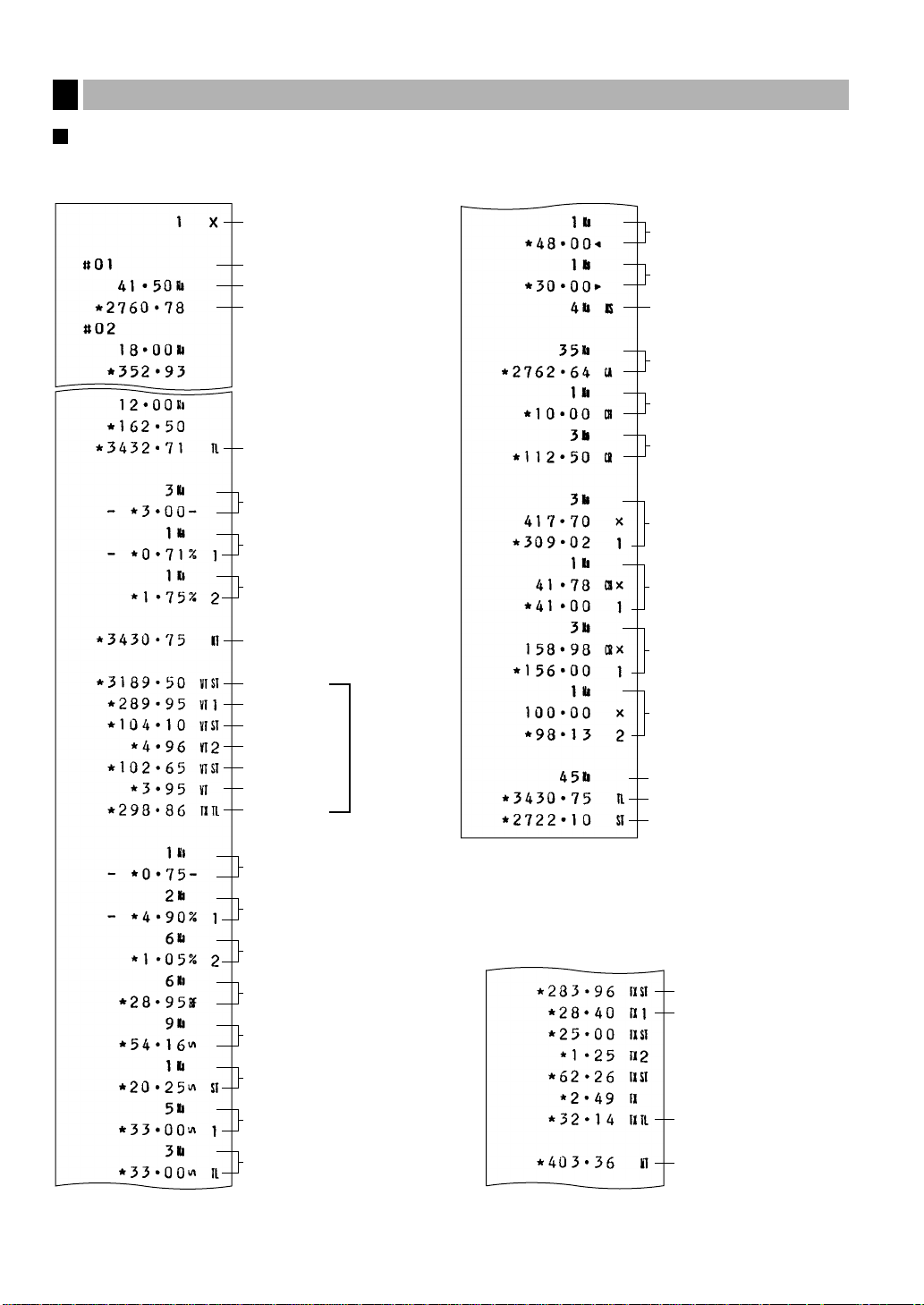

General report

• Sample X1 report

Read symbol*1

Dept. code

Sales q'ty

Sales amount

Dept. total

Subtotal

â

counter

and total

Customer counter

Sales total

Cash in drawer

Net sales total plus tax

VAT/tax total

Item â counter

and total

Received on account

counter and total

Paid-out counter

and total

No-sale counter

Cash sale

counter and total

Cheque sale

counter and total

Credit sale

counter and total

Item percent 1

counter and total

Item percent 2

counter and total

Refund counter

and total

Direct & indirect void

counter and total

Subtotal void counter

and total

Void-mode item

counter and total

Void-mode transaction

counter and total

Subtotal percent 1

counter and total

Subtotal percent 2

counter and total

Net sales total

Taxable 1 total

VAT 1 total

Taxable 2 total

VAT 2 total

Taxable 3 total

VAT 3 total

VAT total

Taxable 1 total

Tax 1 total

*2

*2: When the tax system is automatic tax 1-3,

manual tax 1-3, or the combination of automatic

tax 1-2 and automatic VAT 3, the net sales total

plus tax 1, 2, 3 are printed here.

Exchange

(in preset rate entry)

Counter, total and amount

in domestic currency

Exchange cheque

(in preset rate entry)

Exchange credit

(in preset rate entry)

Exchange

(in manual rate entry)

*1: In X2 report, 2 is printed here.

Sample report

2

Page 25

23

• Sample Z1 report • Sample Z2 report

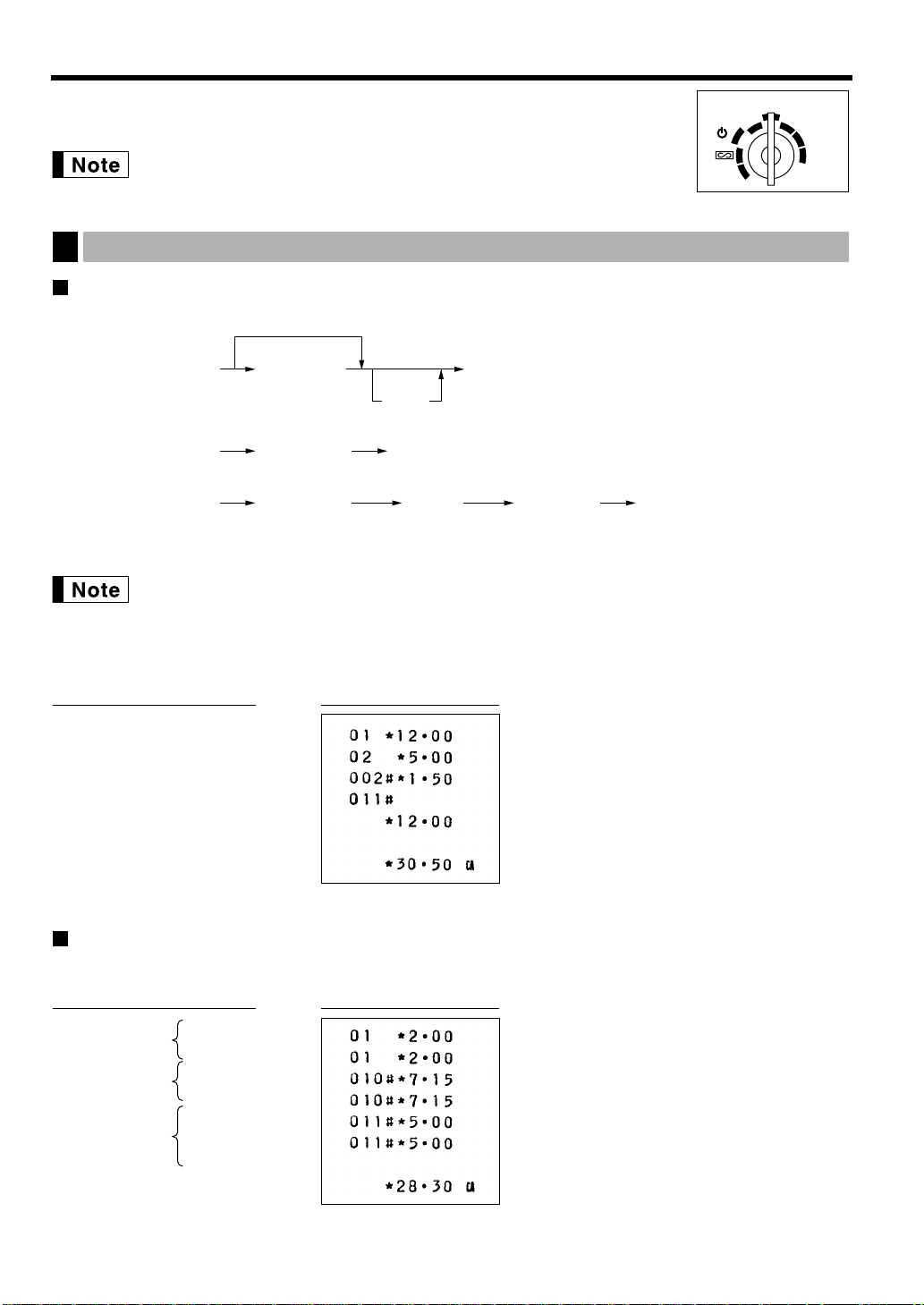

Cashier reports

Individual cashier report

• Sample X1 report Full cashier report

The printout occurs in the same format as in the

sample report of individual cashier, but all cashier’s

sales data are printed in the order of cashier code

number (from #1 to #6 for ER-A160, from #1 to #8

for ER-A180).

Hourly sales report PLU sales report

• Sample X1 report • Sample X1 report

Read symbol*

PLU code

Sales q'ty and total

*:When you take Z report,“Z” is printed.

Read symbol*

Time

Customer counter

Sales total

*:When you take Z report,“Z” is printed.

Reset symbol

Reset symbol

Reset counter for Z1 report

GT (Net Grand total)

The subsequent printout occurs in the same

format as in the sample X1 report.

The subsequent printout occurs in the same

format as in the sample X1 report.

Read symbol*

Cashier code

Customer counter

Sales total

Direct + Indirect void counter and total

Subtotal void counter and total

Void mode item counter and total

Void mode transaction counter and total

Reset counter for Z1 report

Reset counter for Z2 report

GT (Net Grand total)

*:When you take Z report,“Z” is printed.

Page 26

PROGRAMMING

This chapter illustrates how to program your cash register. Program every item

necessary for your store by following the appropriate procedure.

On the key operation examples, numeric such as 1234 indicates the number or parameter which

must be entered using the corresponding numeric keys.

*1: VAT/tax rate number (1-3)

*2: Sign and VAT/tax rate: XYYY.YYYY (X:Sign -/+ = 1/0, YYY.YYYY:VAT/tax rate = 000.0001 to 100.0000)

*3: Max. five digits: 0 to 99999

In VAT system, the sign and the lowest taxable amount are ignored. They are valid only when you

select add on tax system.

Your machine is equipped with 5 (ER-A160) or 10 (ER-A180) standard departments. You can increase the

number of departments up to 15 (ER-A160) or 30 (ER-A180).

Functional programming

Sign

Assign plus department for normal sales, or minus department for minus transaction.

Tax status

Assign a tax status to each department. When entries are made into taxable departments in a

transaction, tax is automatically computed according to the associated tax rate as soon as the

transaction is completed.

SICS (Single Item Cash Sale)

If the first registration is to a department set for SICS, the sale is finalized as soon as the department

key is pressed.

Entry digit limits

Set the number of allowable digits for the maximum entry amount for each department. The limit is

effective for operations in the REG mode and can be overridden in the MGR mode.

Programming for departments

2

VAT/tax rate

Lowest taxable amount

Ñ9 ≈

2

≈

4

≈

12

ÑÉ

PrintKey operation example

Programming the VAT/tax rate

1

24

ń

*

1

A

≈ ≈

?

1-3

*2Sign and

VAT/tax rate

*3Lowest taxable

amount

Ñ É

To program "0"

To inhibit this VAT/tax rate

To program "0"

For VAT rate

9

REG

OPX/Z MGR

PGM

X1/Z1

X2/Z2

Page 27

25

*To shift the department key, press the

department shift key at this point.(ERA180 only)

* Item: Selection: Entry:

A Sign Minus department 1

Plus department 0

B Taxable in VAT 3/tax 3 rate Yes 1

No 0

C Taxable in VAT 2/tax 2 rate Yes 1

No 0

D Taxable in VAT 1/tax 1 rate Yes 1

No 0

E SICS / Normal SICS 1

Normal 0

F Entry digit limit 0-7

• The tax system of your machine has been factory–set to automatic VAT1–3. If you desire to

select any of automatic tax 1–3, manual VAT1–3, manual VAT1, manual tax 1–3, and the

combination of the automatic tax 1–2 and the automatic VAT 3, consult your dealer.

• When the combination of the automatic tax 1–2 and the automatic VAT 3 system is selected, one

of the tax 1–2 can be selected in combination with VAT3(B).

Example: BCD = 101 or 110

Unit price

*To shift the department key, press

the department shift key at this

point. (ER-A180 only)

Unit price

1000

¯

É

PrintKey operation example

To set zero

To program another dept.

Dept. keyUnit price(max. six digits)

É

Ó

*

011007

≈

úÉ

PrintKey operation example

To set all zeros

≈

Dept. keyABCDEF

É

To program another dept.

Ó

*

SICS/Normal / Entry digit limit (E,F)

Tax status (BCD)

Sign (A)

Page 28

26

Unit price and associated department assignment

Unit price (max. six digits)

You will usually have unit prices programmed for individual PLUs as PLU preset unit prices. If you program

unit price “0” for a PLU, you can enter only the selling quantity of the PLU, i.e. the PLU can be used only

as a counter.

Associated department

When a PLU is associated with a department, the following functions of the PLU depend on the

programming for the corresponding department.

• Tax status, entry digit limit (only for the subdepartment), single item cash sale, and sign

*1: 1 through 200 (ER-A160) or 1 through 400 (ER-A180)

*2: To shift the department key, press the department shift key at this point. (ER-A180 only)

PLU/subdepartment mode

If the PLU mode (i.e. automatic preset unit price entry) is selected, individual PLU entries can be made by

entering the assigned code and depressing the

Ö

key. If the subdepartment mode is selected, the following

key operations must be performed: Enter the price, press the

å

key, enter the PLU code, and press the

Ö

key.

*1: 1 through 200 (ER-A160) or

1 through 400 (ER-A180)

*2: 0 for subdepartment mode or 1 for

PLU mode

Subdepartment mode

1

Ö

0

ÑÉ

PrintKey operation example

*1PLU code

Ö

To program "0"

To program the following PLU

To program another PLU

ÉÑ

*2A

1

Ö

125

˘

É

PrintKey operation example

PLU code*

1

Dept. key

Unit price

(max. six digits)

Ö

?

To program zero

To inhibit

To program the following PLU

To program another PLU

É

Ó

*

2

PLU (Price lookup) programming

3

Associated dept.

Unit price

Page 29

27

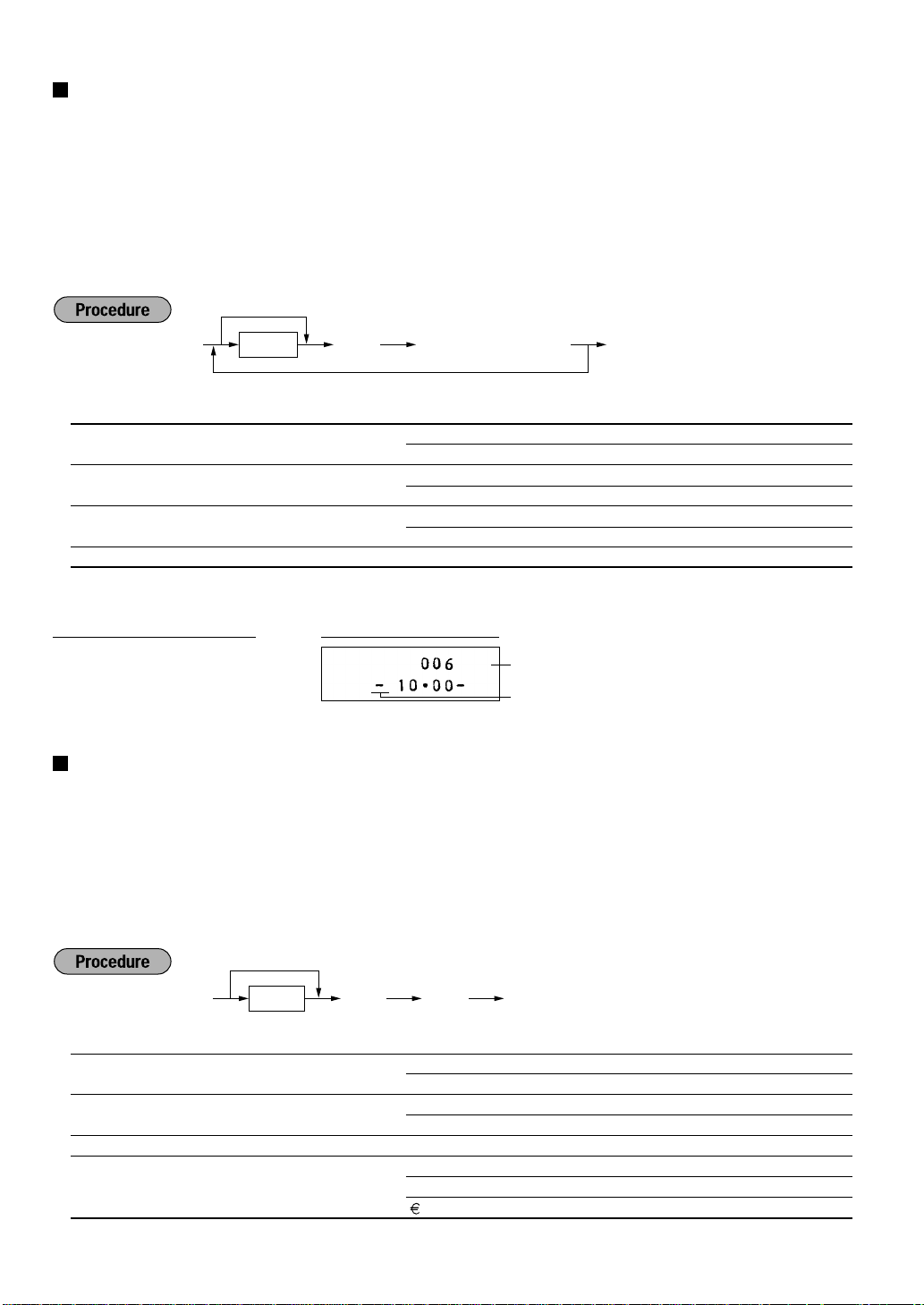

Programming the rate (%, e)

*: Rate

0.00 — 100.00 (% rate)

0.000000 — 999.999999 (Currency

exchange rate)

You must use a decimal point when setting rates that are fractional.

Programming the discount key amount (-)

Programming the percent rate limitation (%)

You can program the upper limit of percent rates for percent entries. Percent entries that exceed the upper limit

may be overridden in the MGR mode.

10.00% can be entered as

10

or

10.00

. The .key is needed only for

fractional entry.

Percentage limit

Ñ10≈

15.00

∞

É

PrintKey operation example

Ñ ≈10

Percentage limit (0.00 -100.00)

É

To program zero

To program for another percent key

or

∞§

1000

-

É

PrintKey operation example

Discount amount (max. six digits)

É-

To program zero

10 .25

∞

0 .6068

e

É

PrintKey operation example

*Rate or

∞

e

ɧ

To program another rate

To program zero

Programming for miscellaneous keys

4

Percent rate

Currency exchange rate (0.606800)

Discount amount

Page 30

28

Programming function parameters for -and %keys

+/- sign

Programming of the +/- sign assigns the premium or discount function for each key.

Item % / Item

â

Percent/discount calculation for the individual department and PLU

Subtotal % / Subtotal

â

Percent/discount calculation for the subtotals

Entry digit limit (For discount key only)

The limit is in effect for the REG-mode operations but can be overridden in the MGR mode.

*: Item: Selection: Entry:

A +/- sign + (premium) sign 0

- (discount) sign 1

B Item % / Item

â

Enable 0

Disable 1

C Subtotal % / Subtotal

â

Enable 0

Disable 1

D Entry digit limit* 0-7

* When programming for percent keys, always enter 0.

The default setting is ABCD = 1007 for

-

key and 1000 for %key.

Programming function parameters for ekey

Currency exchange rate entry selection

You can enable or disable preset and manual entry of currency exchange rate.

Number of digits after decimal point

Set the number of digits after decimal point which is printed on the receipts for currency exchange amount.

Foreign currency symbol

Foreign currency symbol for

e

key is printed on a foreign currency exchange amount of which rate is preset by

programming.

*: Item: Selection: Entry:

A Manual rate entry Enable 0

Disable 1

B Preset rate entry Enable 0

Disable 1

C Number of digits after decimal point 0-3

D Foreign currency symbol 0

(space) 1

2

The default setting is ABCD = 0021.

*ABCD

É

To program “0” for all items

≈e

1006

≈

-É

PrintKey operation example

*ABCD or,

∞≈

-

ɧ

To program for another key

To program “0” for all items

From left, BCD

Sign

Page 31

29

Programming an entry digit limit for ', î, rand pkeys

The limit is in effect for REG-mode operation but can be overridden in the MGR mode.

When “0” is set, the operation of the corresponding key is prohibited.

• Be very careful not to enter a wrong number for the number entry after the first

Ñ

key. Be sure

to enter the number described in the "Procedure".

• You can continue programming until

É

key is pressed for the programming described in this

section. To continue programming, repeat from the first numeric key entry.

Setting the register number

When your store has two or more registers, it is practical to set separate register numbers for their identification.

Setting the consecutive number

The consecutive number is increased by one each time a receipt is issued.

Ñ2 ≈

1000

ÑÉ

PrintKey operation example

Ñ1 ≈

123

ÑÉ

PrintKey operation example

Programming various functions

5

Entry digit limit

8

≈î É

PrintKey operation example

Entry digit limit(0-8) or

É

To program “0”

To program for another key

≈',î,rp

0001

≈

eÉ

PrintKey operation example

1Ñ

≈

Ñ É

Register number (one to three digits)

To set the register number “0”

2Ñ

≈

Ñ É

A number (one to four digits) that is one

less than the desired starting number

To begin the count from 0001

From left, ABCD

Page 32

30

Programming optional feature selection

You can enable or disable the operation of Paid out, Received-on account, Refund, No-sale, Void in the

REG-mode, and also select if you enable fractional quantity entry or not.

* Item: Selection: Entry:

A Paid-out in the REG-mode Enable 0

Disable 1

B Received on account in the REG-mode Enable 0

Disable 1

C Subtotal void in the REG-mode Enable 0

Disable 1

D Indirect void in the REG-mode Enable 0

Disable 1

E Direct void in the REG-mode Enable 0

Disable 1

F Refund entry in the REG-mode Enable 0

Disable 1

G No sale in the REG-mode Enable 0

Disable 1

H Fractional quantity entry Enable 0

Disable 1

The default setting is ABCDEFGH = 00000000.

Programming print format

You can program;

Printer type - Use printer as journal printer or for issuance of receipt

If you select the journal printer type and complete journal information is mandatory, the receipt

ON/OFF function should be in the “ON” state.

Receipt print form - Detailed receipt print or summary receipt print

On the summary receipt print, the details of each item are not printed.

Date print selection

Consecutive number print selection

Zero skip for reports

Ñ6≈

*ABCDEFGH

ÉÑ

To set “0” for all items

Ñ5 ≈

00000100

ÑÉ

PrintKey operation example

Ñ5≈

*ABCDEFGH

ÉÑ

To set “0” for all items

Page 33

31

* Item: Selection: Entry:

A Printer type Journal printer 0

Receipt printer 1

B Receipt print form Total 0

Detailed 1

C Always enter 0. 0

D Date print Yes 0

No 1

E Consecutive no. print Yes 0

No 1

F Always enter 0. 0

G Zero skip in PLU report Yes 1

No 0

H Zero skip in general/cashier/hourly Yes 1

report No 0

The default setting is ABCDEFGH = 11000011.

Selection of the subtotal printing

You can make selection of subtotal print when

Ñ

key is pressed.

* Item: Selection: Entry:

A - B Always enter 0. 0

C Subtotal print with a press of subtotal key Yes 1

No 0

D - H Always enter 0. 0

Programming EURO system settings

For details of EURO system settings, please refer to “PROGRAMMING FOR EURO”.

Printing exchange total amount and change amount on receipt or journal

Total and change amounts in exchange currency are printed respectively below each of the total and change

amounts in domestic currency.

Cheque and credit operation when tendering in foreign currency

Exchange calculation method

“Division” or “Multiplication” can be selected for the conversion method from domestic currency to exchange

currency, and the calculation is performed as follows:

In case that “Division” is selected:

Domestic currency amount Exchange rate = Exchange amount

In case that “Multiplication” is selected

Domestic currency amount Exchange rate = Exchange amount

Ñ7 ≈

00100000

ÑÉ

PrintKey operation example

Ñ7≈

*ABCDEFGH

ÉÑ

To set “0” for all items

Ñ6 ≈

10000011

ÑÉ

PrintKey operation example

Page 34

32

* Item: Selection: Entry:

A Printing exchange total amount and Yes 1

change amount on receipt or journal No 0

B Always enter 0. 0

C Cheque and credit operation when Yes 1

tendering in foreign currency No 0

D Exchange calculation method Division 1

Multiplication 0

Programming the AUTO key — Automatic sequencing key —

If you program frequently performed transactions or report sequences for the AUTO keys, you can call those

transactions and/or reports simply by pressing the corresponding AUTO keys in key operations in the

appropriate mode (REG, MGR,

,

OP X/Z, X1/Z1 or X2/Z2).

Programming for

~

; entering a PLU 2 item (programmed unit price: 1.50)

Key number list

keys nos.

0 00

1 01

2 02

3 03

4 04

5 05

6 06

7 07

8 08

9 09

º 10

keys nos.

. 11

≈ 12

c 13

É 14

Ñ 15

' 16

î 17

∞ 18

§ 19

- 20

keys nos.

e 21

Ö 22

å 23

? 24

© 25

Ü 26

r 27

‹ 28

◊ 29

Ó 30

keys nos.

¯ 51

˘ 52

ú 53

ù 54

û 55

ü 56

ä 57

ô 58

ã 59

Ä 60

keys nos.

ñ 61

à 62

è 63

Õ 64

ì 65

Step

Key no.

~

2

Ö

~

É

AUTO1 setting

PrintKey operation example

~

¡

É

Transaction

Delete

max. 20 times

~

¡

Ñ8 ≈

1000

ÑÉ

PrintKey operation example

Ñ8≈

*ABCD

ÉÑ

To set “0” for all items

Page 35

33

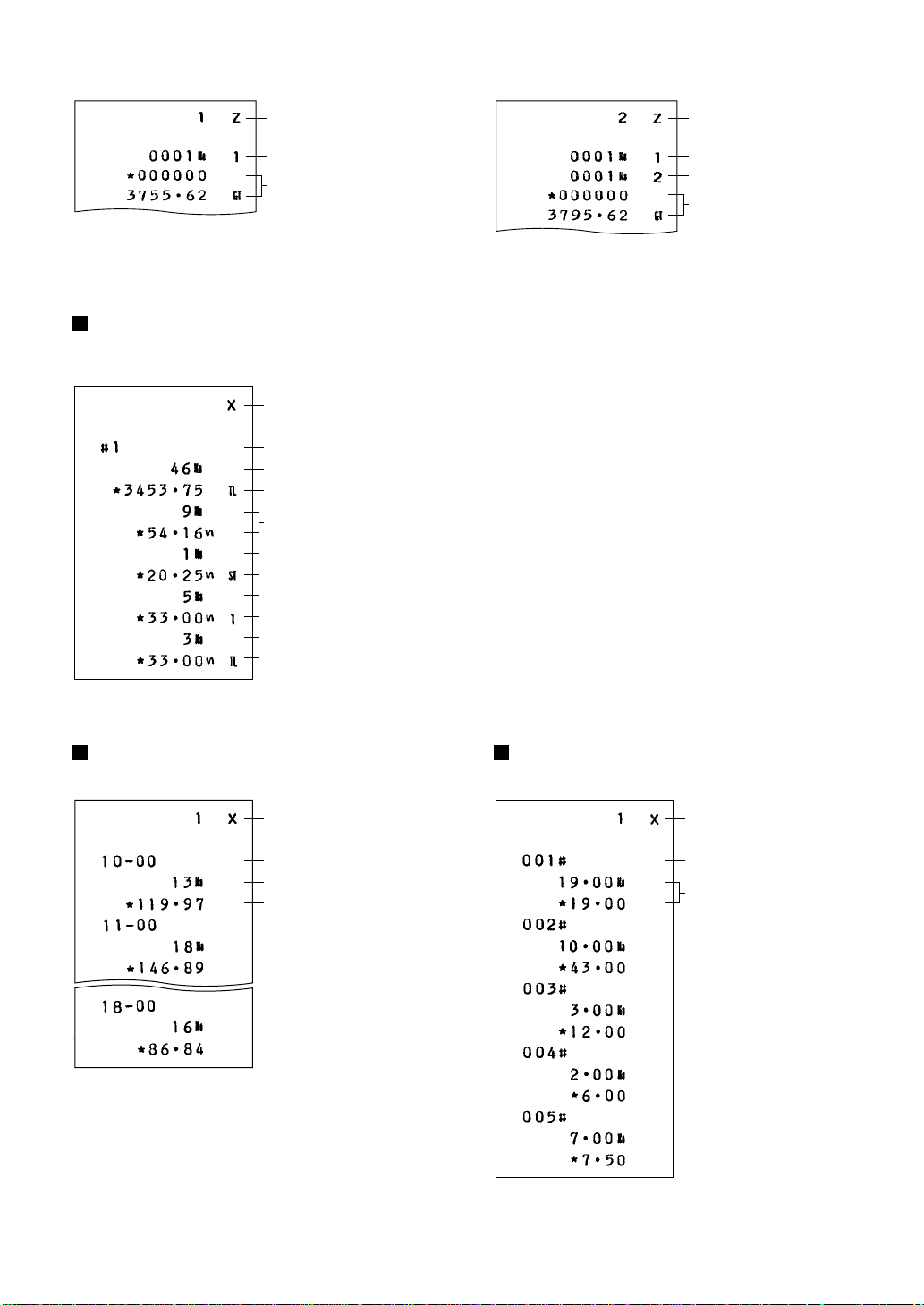

Key sequence for reading stored program

Sample printouts

1 Programming report

2 Auto key programming report

3 PLU programming report

PLU code

Mode parameter

Unit price

Associated department code

Step

Key no.

*When the tax system is automatic tax 1-3,

manual tax 1-3,or the combination of automatic

tax 1-2 and automatic VAT 3, the lowest taxable

amount is printed under the tax rate.

Tax rate

Lowest taxable amount

Date

Dept. code

Dept. function (E&F)

Tax status

Dept. unit price w/sign

Minus sign

' entry digit limit

î entry digit limit

r entry digit limit

p entry digit limit

Optional feature selection (A-H)

Print format (A-H)

Subtotal printing (C only)

EURO system setting (A-D)

VAT rate*

Machine no./Conseutive no.

Time/Cashier code

Discount

function parameters (B-D)

Discount amount w/sign

Percent

function parameters (B-D)

Percent limit

Percent rate with sign

Exchange

function parameters (A-D)

Exchange rate (0.606800)

Reading stored programs

6

Report name Key sequence

Programming report

Auto key programming report 1 É

PLU programming report Start PLU code ≈ End PLU code Ö

É

Page 36

34

PROGRAMMING FOR EURO

Your register can be modified to correspond with each period set for the introduction of EURO, and in your

register each currency is treated as shown on the table below depending on which period you are in.

Basically your register can be automatically modified to correspond to the introduction of EURO by executing the

modification operation in the X2/Z2 mode. However, there are several options you must set depending on your

needs.

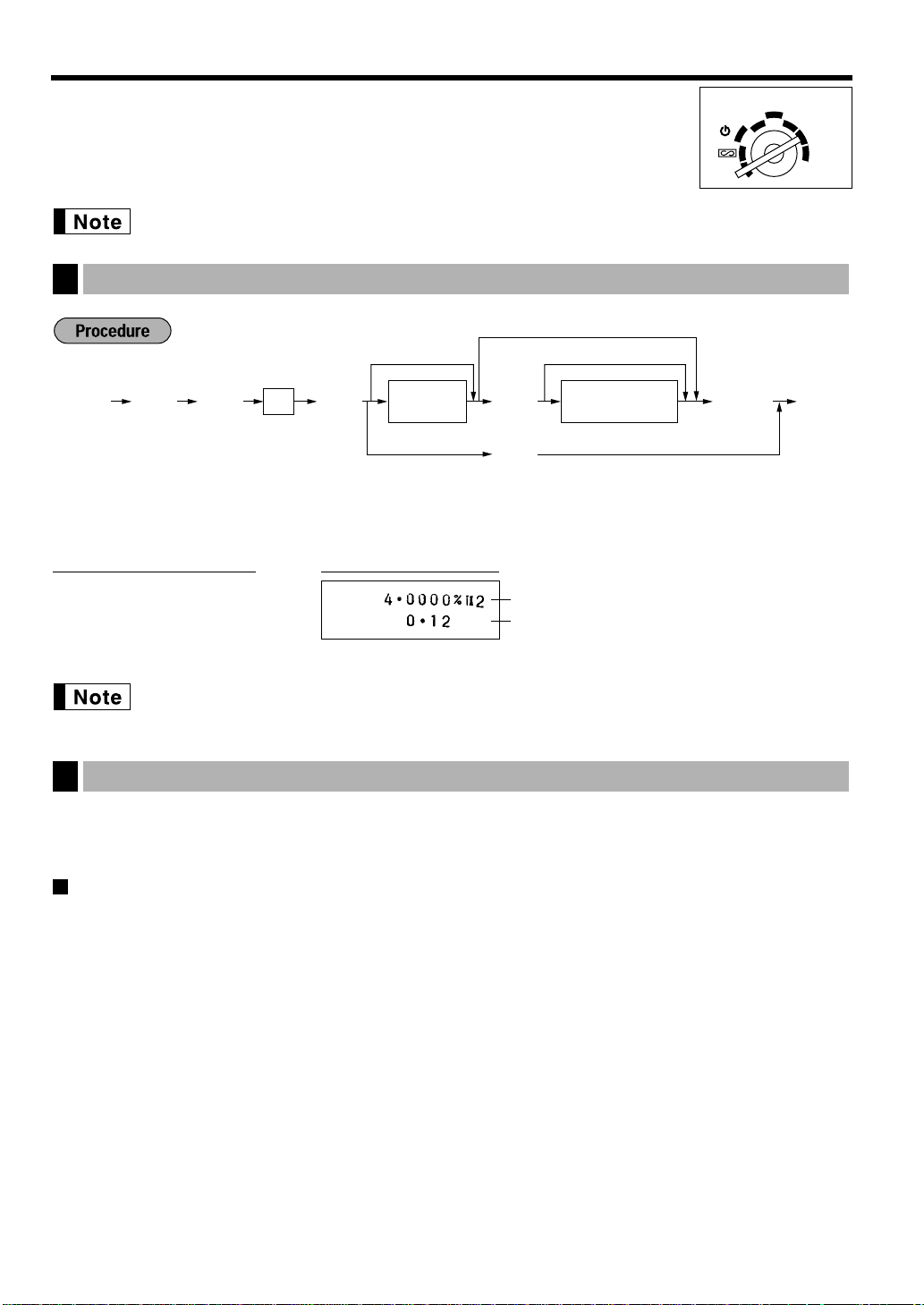

How currencies are treated in your register

Receipt samples

Period 1

Period 2

Period 3

Sales total amount in EURO (as domestic currency)

Sales total amount in national currency*

Tendered amount in EURO

Change in EURO

Change in national currency*

*: They are printed for infomation purposes only.

Sales total amount in national currency (as domestic currency)

Sales total amount in EURO*

Tendered amount in national currency

Change in national currency

Change in EURO*

*: They are printed for infomation purposes only.

Period 1

After the introduction of

EURO, and before EURO

banknotes and coins begin to

circulate

Exchange key

(Preset rate entry)

Domestic currency

Exchange key

(Manual rate entry)

Period 2

After EURO banknotes and

coins begin to circulate, and

before national currency is

withdrawn from circulation.

(Co-existence of EURO and

national currency)

Domestic currency

Exchange key

(Preset rate entry)

Exchange key

(Manual rate entry)

Period 3

After the national currency is

withdrawn from circulation

Domestic currency

Exchange key

EURO

National currency

(DM, F, etc.)

Foreign currency

Currency

Page 37

35

Automatic Modification of Register System for Introduction of EURO

To make your register correspond to the introduction of EURO, your register system can be automatically

modified. According to the steps of the introduction, you can make your register correspond to EURO.

Set the manager key (MA) to X2/Z2 position, and use the following sequence.

*A=1: Applicable for period 1

*A=2: Applicable for period 2

*A=3: Applicable for period 3

• A cashier must be signed-on before this operation.

• You can perform each operation only once with the substitution of “A=1”, “A=2” and “A=3”. If you

perform the operation with the substitution of “A=2” first, you cannot perform the operation with

the substitution of “A=1”. If you perform the operation with the substitution of “A=3” first, you

cannot perform the operation with the substitution of “A=1” and “A=2”.

The details of the automatic register system modification are as follows:

(As for PGM functions described below, please refer to “Programming EURO system settings” and

“Programming function parameters for

e

key”.)

When “1” is substituted to “A”:

1. Issuing a general Z1 report

2. Issuing a general Z2 report

3. Setting “printing” for a PGM function “Printing exchange total amount and change amount on receipt or

journal”

4. Setting “division” for a PGM function “Exchange calculation method”

5. Setting the EURO symbol ( ) for the currency symbol of exchange key, and setting “2” for the number of

digits after decimal point of exchange amount

6. Setting the round-off function for currency exchange

After the execution of the procedure with the substitution of “1”, treat EURO as foreign currency using the

exchange key (

e

) with the preset rate entry.

When “2” is substituted to “A”:

1. Issuing a general Z1 report

2. Issuing a general Z2 report

3. Resetting GT

4. Setting “printing” for a PGM function “Printing exchange total amount and change amount on receipt or

journal”

5. Setting “multiplication” for a PGM function “Exchange calculation method”

6. Changing the domestic currency symbol to the EURO symbol ( ) and setting the number of digits after

decimal point of the domestic currency amount to 2

7. For the setting of the currency symbol and the number of digits after decimal point of exchange amount, the

ones that had been set to the domestic currency are set.

8. Setting the round-off function for currency exchange

After the execution of the procedure with the substitution of “2”, treat EURO as domestic currency, and previous

national currency as foreign currency using the exchange key (

e

) with the preset rate entry.

Since EURO becomes domestic currency in your register after execution of the procedure with the substitution

of “2”, you must change unit prices in each department and PLU to make prices correspond to EURO before

actually you start operating your register again. As for the miscellaneous keys, also please change the rates or

amounts so that they are based on amounts in EURO.

REG

OPX/Z MGR

PGM

X1/Z1

X2/Z2

800 . É≈

*A

Page 38

36

When “3” is substituted to “A”:

1. Issuing a general Z1 report

2. Issuing a general Z2 report

3. Resetting GT

4. Setting “not printing” for a PGM function “Printing exchange total amount and change amount on receipt or

journal”

5. Setting “multiplication” for a PGM function “Exchange calculation method”

6. Changing the domestic currency symbol to the EURO symbol ( ) and setting the number of digits after

decimal of the domestic currency amount to 2

7. Setting the round-off function for currency exchange

After the execution of the procedure with the substitution of “3”, treat EURO as domestic currency.

When the operation with the substitution of “2” has been performed already, “3. Resetting GT” is not executed.

When the operation with the substitution of “1” or “2” has been performed already, the currency symbol of

exchange key is overwritten with a space.

• If you want to check the current status you are in, set the manager key (MA) to X2/Z2 position,

and use the following sequence.

Optional Programming for the Introduction of EURO

Some programming relating with the function of exchange key (e) cannot be changed automatically with the

execution of modification operation described in the previous section.

Currency exchange rate for eekey

For period 1 and period 2, set the EURO conversion rate. For programming details, refer to “Programming the

rate”.

Exchange rate entry selection

When you treat EURO currency in the exchange key, you must apply preset rate entry. So, make enable for

preset rate entry for period 1 and period 2. For programming details, refer to “Programming function parameters

for

e

key”.

Cheque/credit operation

For period 1 and period 2, enable cheque/credit operation when tendering in foreign currency so that you can

treat cheque and credit for EURO currency and national currency. For programming details, refer to

“Programming EURO system setting”.

Displaying the Change Amount in Exchange Currency

You can display a change amount in exchange currency by pressing the ekey when the change amount is

displayed. This may be convenient when you want to give the change in exchange currency in the period 1 and

2. When pressing the

e

key again, the displayed amount returns to the amount in domestic currency.

The conditions that you can display a change amount in exchange currency are as follows:

• "Printing" is selected for a PGM function "Printing exchange total amount and change amount on receipt or

journal.

• Exchange rate is not zero.

800 É≈

Current status

Page 39

OPERATOR MAINTENANCE

If the low battery symbol “ ” appears on the far left of the display, the voltage of the batteries is less than the

required level. In this situation, you must replace new batteries within two days.

And if the no battery symbol “ ” appears on the far left of the display, less than three batteries are installed in

your register, or the batteries are dead. In this situation, you must replace new ones immediately. If the AC

power is accidentally disconnected or in case of a power failure, all programmed settings will be reset to the

default settings and any data stored in memory will be cleared.

Incorrectly using batteries can cause them to burst or leak, possibly damaging the interior of the cash register.

Note the following precautions:

• Be sure that the positive (+) and negative (-) poles of each battery are facing in the proper direction.

• Never mix batteries of different types.

• Never mix old batteries and new ones.

• Never leave dead batteries in the battery compartment.

• Remove the batteries if you do not plan to use the cash register for long periods. However, the data and

user-programmed settings will be erased.

• If a battery leaks, clean out the battery compartment immediately, taking care to avoid letting the battery

fluid come into direct contact with your skin.

• Do not throw any spent batteries into combustible waste and do not burn any spent batteries.

To replace the batteries:

1. Make sure that the register is plugged in.

2. Turn the mode switch to the “OP X/Z” position.

3. Remove the printer cover.

4. Open the battery compartment cover located in front of

the paper bed and remove the old batteries.

5. Install three new R6 or LR6 batteries (“AA” size) in the

battery compartment. Be sure that the positive and

negative poles of each battery are facing in the proper

direction.

When they are installed correctly, the “ ” or “ ”

symbol will disappear.

6. Close the battery compartment cover.

7. Replace the printer cover.