NOKIA X X

January 22, 2004

PRESS RELEASE

1 (21)

NOKIA CLOSES 2003 WITH EXCELLENT FOURTH QUARTER

Nokia Mobile Phones grows sales and delivers record profits for Q4 and full year 2003

Nokia Networks demonstrates good profitability in Q4 due to strong seasonality and

favorable product mix as well as impact of restructuring measures

Highlights 4Q 2003 (all comparisons are year on year):

Net sales decreased 1% to EUR 8.8 billion (up 8% at constant currency)

•

• Nokia Mobile Phones net sales increased 4% to EUR 7.0 billion (up 15% at constant currency)

• Nokia Mobile Phones volumes grew 20% to 55.3 million units, leading to an estimated 38%

market share

Mobile phone industry volumes were an estimated 145 million units

•

• Excellent profitability with Nokia Mobile Phones pro forma and reported operating margins of

24.7% and 24.4%, respectively

• Color-screen phones made up half of Nokia Mobile Phones volumes

• Nokia Networks sales were EUR 1.7 billion, exceeding Nokia expectations

• Nokia Networks pro forma and reported operating margins improved to 12.1% and 2.4%,

respectively

Pro forma EPS (diluted) grew 12% to EUR 0.29; reported EPS (diluted) grew 14% to EUR 0.25

•

Highlights full-year 2003 (all comparisons to full-year 2002):

• Net sales decreased 2% to EUR 29.5 billion (up 7% at constant currency)

• Nokia Mobile Phones net sales were up 2% to EUR 23.6 billion (up 12% at constant currency)

• Nokia Mobile Phones volumes grew 18% to 179.3 million units

• Total mobile phone industry volumes grew 16% to an estimated 471 million units

Nokia’s estimated mobile phone market share was slightly above 38%

•

• Nokia Mobile Phones achieved record pro forma operating margins of 23.6% (reported 23.2%)

• Nokia Networks sales decreased 14% to EUR 5.6 billion with a pro forma operating margin of

- 4.2% (reported -3.9%)

Pro forma EPS (diluted) decreased 4% to EUR 0.79, reported EPS (diluted) grew 6% to

•

EUR 0.75

Nokia’s Board of Directors will propose a dividend of EUR 0.30 per share for 2003 (EUR 0.28 per share

for 2002).

JORMA OLLILA, CHAIRMAN AND CEO:

2003 was a record year for the mobile handset industry and for Nokia Mobile Phones. With volume

growth of 16%, the mobile phone market achieved record volumes of 471 million units for the year, and

culminated in high fourth quarter volumes of 145 million units, according to our preliminary estimates.

Nokia Mobile Phones reached not only record profits, but also higher-than-ever sales and volumes. In

addition, we managed to slightly increase our mobile phone market share to just above 38% for the full

year. This is a remarkable achievement from the Nokia team.

We strengthened our position in three strategic areas by attaining the number one market position in the

United States and the number one position in GSM in China, as well as significantly increasing global

CDMA market share. I am also very pleased with the 12% pro forma operating margin achieved by

Nokia Networks in the fourth quarter. Towards the end of the year, the infrastructure market showed

encouraging signs of recovery as the mobile operators increased investments and the market began to

stabilize.

(continued on page 3)

PRESS RELEASE

2 (21)

January 22, 2004

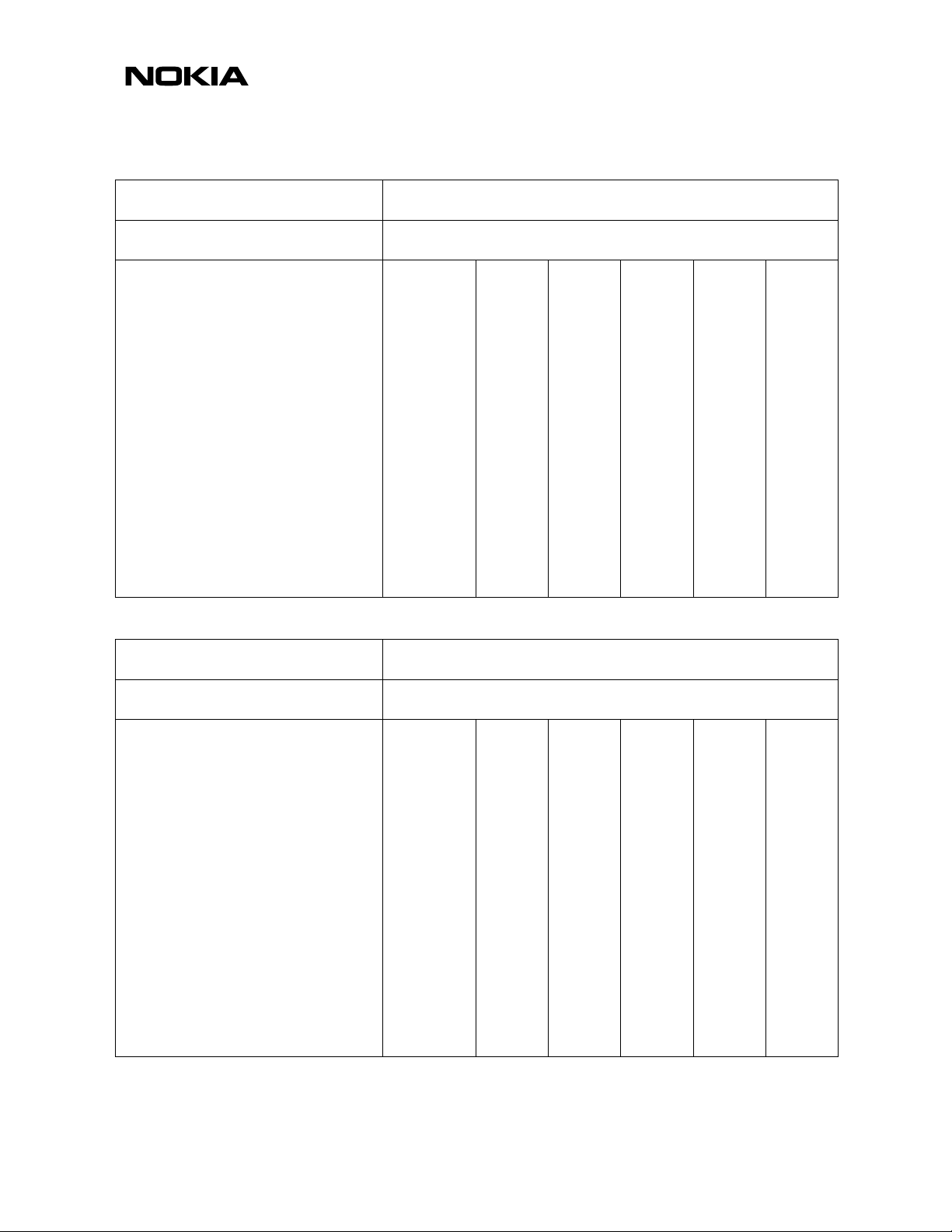

(excludes goodwill amortization and non-recurring items)

EUR million

4Q/2003 4Q/2002 Change

Net sales 8 789 8 843 -1 29 455 30 016 -2

Nokia Mobile Phones 7 009 6 742 4 23 618 23 211 2

Nokia Networks 1 706 2 084 -18 5 620 6 539 -14

Nokia Ventures Organization 108 107 1 366 459 -20

Operating profit 1 858 1 655 12 5 095 5 420 -6

Nokia Mobile Phones 1 731 1 665 4 5 575 5 293 5

Nokia Networks 206 19 -236 416

Nokia Ventures Organization -36 59 -159 -59

Common Group Expenses -43 -88 -85 -230

Operating margin (%) 21.1 18.7 17.3 18.1

Nokia Mobile Phones (%) 24.7 24.7 23.6 22.8

Nokia Networks (%) 12.1 0.9 -4.2 6.4

Nokia Ventures Organization (%) -33.3 55.1 -43.4 -12.9

Financial income and expenses 71 52 37 352 156 126

Profit before tax and minority interests 1 920 1 707 12 5 429 5 557 -2

Net profit 1 357 1 247 9 3 742 3 948 -5

EPS, EUR

Basic 0.29 0.26 12 0.79 0.83 -5

Diluted 0.29 0.26 12 0.79 0.82 -4

- All pro forma 4Q and 2003 figures can be found in the tables on pages (9-11) and (17-21). A reconciliation of the

pro forma figures to our reported results can be found in the tables on page 11.

EUR million

4Q/2003 4Q/2002 Change

Net sales 8 789 8 843 -1 29 455 30 016 -2

Nokia Mobile Phones 7 009 6 742 4 23 618 23 211 2

Nokia Networks 1 706 2 084 -18 5 620 6 539 -14

Nokia Ventures Organization 108 107 1 366 459 -20

Operating profit 1 669 1 466 14 5 011 4 780 5

Nokia Mobile Phones 1 707 1 642 4 5 483 5 201 5

Nokia Networks 41 -82 -219 -49

Nokia Ventures Organization -37 -6 -161 -141

Common Group Expenses -42 -88 -92 -231

Operating margin (%) 19.0 16.6 17.0 15.9

Nokia Mobile Phones (%) 24.4 24.4 23.2 22.4

Nokia Networks (%) 2.4 -3.9 -3.9 -0.7

Nokia Ventures Organization (%) -34.3 -5.6 -44.0 -30.7

Financial income and expenses 71 52 37 352 156 126

Profit before tax and minority interests 1 731 1 518 14 5 345 4 917 9

Net profit 1 168 1 046 12 3 592 3 381 6

EPS, EUR

Basic 0.25 0.22 14 0.75 0.71 6

Diluted 0.25 0.22 14 0.75 0.71 6

NOKIA 4Q and 2003 - PRO FORMA

(%)

2003 2002 Change

NOKIA 4Q and 2003 - REPORTED

(%)

2003

(audited)

2002

(audited)

(%)

Change

(%)

All reported 4Q and 2003 figures can be found in the tables on pages (9-11) and (17-21).

January 22, 2004

(continued from page 1)

In 2003, Nokia achieved excellent profitability and pro forma operating profit of EUR 5.1 billion. In

addition, our cash flow remained at an excellent level. At constant currency, Nokia sales would have

grown 7% and Nokia Mobile Phones sales would have grown 12%. Sales were muted by the continued

weakness of the US dollar, which depreciated by about 17% against the euro during the year.

We saw an increase in the average selling price of mobile phones compared with the third quarter as

consumers upgraded to more advanced devices. Half of Nokia’s handset volumes for the fourth quarter

had color screens. Nokia also has the broadest camera phone portfolio with 12 models announced by

the end of 2003. We have been able to establish Series 60 as the leading mobile device platform and

the Nokia 6600 smart phone, which exemplifies the convergence trend, has been an instant commercial

success after its sales debut in October.

In addition to the mass-market adoption of more advanced phones, there was strong growth in emerging

markets. Low penetration markets, such as India, Brazil and Russia, experienced significant volume

growth, and Nokia Mobile Phones built on its leading position in many of the high growth and emerging

markets.

Nokia Networks positive Q4 pro forma result comes from stronger-than-expected year-end operator

investments combined with a favorable product mix and the success of the decisive restructuring

measures we took in early 2003. It also reflects the improved profitability of 3G WCDMA as we have

successfully addressed temporary quality issues experienced in the first part of 2003.

In 2004, Nokia expects market growth to continue. We expect total mobile phone market volumes to

grow somewhat over 10% and the infrastructure market to be flat to slightly up.

We are energized by our reorganization into four business groups, which better reflect our strategy to

expand mobile voice, drive consumer mobile multimedia and mobilize enterprise solutions. We enter

2004 ready to build on our already strong positions in Mobile Phones and Networks and to lay the

foundations for future growth with the Multimedia and Enterprise Solutions business groups.

PRESS RELEASE

3 (21)

Nokia achieved its continued solid performance and high profitability with the commitment of our

dedicated and hard-working employees. I thank everyone at Nokia for being passionate about what we

do - Connecting People - and for contributing to our continued progress.

BUSINESS DEVELOPMENT AND OUTLOOK

Fourth quarter delivers strong Nokia Mobile Phones and Nokia Networks sales

Nokia fourth-quarter net sales decreased by 1% to EUR 8.8 billion, compared to fourth quarter 2002.

However, at constant currency, group net sales would have been up by 8% year on year.

In the fourth quarter, Nokia Mobile Phones net sales climbed 4% year on year, reaching EUR 7.0 billion,

driven by high volumes and a favorable product mix featuring color-screen and camera phones. Sales

continued to be strong in low penetration markets such as India, Brazil and Russia. On a regional level,

the Americas had excellent sales growth and the Europe/Middle East/Africa region had solid growth,

while sales in the Asia-Pacific region declined slightly. At constant currency, Nokia Mobile Phones net

sales would have increased 15% year on year.

Nokia Networks net sales declined 18% year on year and were EUR 1.7 billion in the fourth quarter,

exceeding our earlier expectations, primarily because of especially strong year-end investments from

operators. Sales declined in all three geographical regions, Europe/Middle East/Africa, the Americas,

January 22, 2004

and Asia-Pacific. However, sales growth was strong in China. At constant currency, Nokia Networks net

sales would have been EUR 1.8 billion.

Higher Nokia Mobile Phones sales for 2003, Nokia Networks sales were low until fourth quarter

For the full year 2003, Nokia net sales decreased by 2% year on year to EUR 29.5 billion, but would

have been up 7% at constant currency. This reflects the significant impact of the weak US dollar, which

depreciated by about 17% against the euro in 2003.

Full-year net sales for Nokia Mobile Phones reached their highest level ever at EUR 23.6 billion, up 2%

compared to 2002, driven by the consumer uptake of color-screen and camera phones, Nokia’s growing

presence in low penetration markets, and Nokia’s increased share of the US, China and CDMA markets.

Nokia Mobile Phones net sales growth was more than offset by the decline in Nokia Networks net sales,

which decreased 14% year over year to EUR 5.6 billion. This was due to the continued decline in the

infrastructure market in 2003. Nokia Networks made a small gain in market share, reaching slightly

above 15% of the overall mobile infrastructure market. Despite the continued decline in 2003,

encouraging signs in the fourth quarter indicated that the market was beginning to stabilize as the

financial position of operators improved, leading to an overall spending increase in all markets.

Record profit in Nokia Mobile Phones for fourth quarter and 2003

In the fourth quarter 2003, Nokia Mobile Phones achieved record pro forma operating profit of EUR 1.7

billion (reported EUR 1.7 billion), up 4% compared to the fourth quarter 2002, and maintained a strong

pro forma operating margin of 24.7% (reported 24.4%).

Full-year pro forma operating profit also reached a record high of EUR 5.6 billion, up 5% compared to

2002 (reported increased 5% to EUR 5.5 billion), with the pro forma operating margin increasing to

23.6% (reported increasing to 23.2%).

Nokia Networks improves fourth quarter profitability in a challenging year following its

restructuring

In the fourth quarter, Nokia Networks pro forma operating profit was EUR 206 million, including

EUR 108 million in impairments and write-offs of capitalized research and development expenses

(reported operating profit EUR 41 million, including goodwill impairments of EUR 151 million), compared

to EUR 19 million (reported operating loss EUR 82 million) in the fourth quarter 2002. Nokia Networks

pro forma operating margin reached 12.1% (reported 2.4%) in the quarter reflecting stronger-thanexpected year-end operator investments combined with a favorable product mix and the positive impact

of the restructuring measures taken earlier in 2003. The level of profitability in the fourth quarter is not

indicative of a trend.

For the full year 2003, Nokia Networks had a pro forma operating loss of EUR 236 million (reported

EUR 219 million operating loss, including a EUR 151 million goodwill impairment and a positive

adjustment of EUR 226 million related to customer finance impairments), compared to a pro forma

operating profit of EUR 416 million (reported EUR 49 million operating loss) in 2002. The 2003 pro

forma operating result was adversely affected by charges related to restructuring costs as well as

impairments and write-offs of capitalized R&D expenses at Nokia Networks totaling EUR 550 million.

Cash position remains excellent

Nokia’s cash position remained excellent at EUR 11.3 billion as of December 31, 2003. During 2003,

Nokia paid EUR 1.4 billion in dividends and used a record EUR 1.4 billion for share buy-backs.

Nokia and industry mobile phone volume growth robust in Q4 and 2003

For the fourth quarter 2003, overall mobile phone market volumes are estimated to be about 145 million

units, a 23% increase year on year. Nokia achieved a record volume of 55.3 million units, a 20%

PRESS RELEASE

4 (21)

January 22, 2004

increase year-on-year and a 22% increase sequentially, resulting in an estimated 38% market share in

the fourth quarter.

According to Nokia’s preliminary estimates for the full year, Nokia Mobile Phones volume growth of 18%

was faster than the market volume growth of 16%. Nokia’s market share reached slightly above 38%

with Nokia Mobile Phones volumes of 179.3 million units in a global market of an estimated 471 million

units. Year-on-year market volume growth was 20% in Europe, 17% in the Americas and about 11% the

Asia-Pacific region. Nokia continues to aim for 40% market share in the mobile device market.

In 2003, the company estimates the number of global mobile subscribers has grown to 1.3 billion and

forecasts this number to reach two billion in 2008.

Industry Outlook

Nokia continues to expect that mobile device market volumes will grow somewhat over 10% in 2004.

Volume growth in mobile devices in 2004 is expected to come from increased penetration in growth

markets and ongoing upgrades in developed markets.

In 2004, the network infrastructure market is expected to be at the same level as 2003 or slightly up, in

euro terms.

In 2004, the mobile multimedia market will be in its infancy. However, Nokia expects to see demand

continue to develop for mobile imaging, games, media and music devices as consumers become more

aware of mobile multimedia services.

For the enterprise solutions market, Nokia sees that complete end-to-end solutions, covering mobile

devices, gateway platforms, network security and applications will be key growth drivers. The company

anticipates that 2004 will be of a year of initial building in the mobile enterprise solutions market by the

industry and Nokia.

Nokia believes that 2004 will be the year of full-scale commercialization of 3G WCDMA. By the end of

2004, Nokia expects that more than 50 WCDMA networks will have been launched and that a large

number of WCDMA handsets from different vendors will be available.

Nokia outlook for Q1 2004

First quarter net sales for Nokia Group are expected to increase in the range of 3% – 7%, compared to

the first quarter of 2003. First quarter reported EPS (diluted) is expected to be in the range of EUR 0.17

and EUR 0.19.

As of the Q1 2004 results announcement, Nokia will no longer provide pro forma results.

NOKIA MOBILE PHONES IN THE FOURTH QUARTER 2003

Nokia mobilizes media, launches first media device - Nokia 7700

Mobilizing media consumption is a key element in Nokia’s multimedia strategy. In October, Nokia

unveiled its first media category device, the pen-based Nokia 7700 with its high-resolution screen. The

Nokia 7700 provides mobile access to the Internet and the ability to create and share personal digital

content.

Nokia opens mobile games market with sales start of Nokia N-Gage™

The N-Gage game deck started selling in over 60 countries on October 7 with total shipments for 2003

reaching more than 600,000 units. Early market reaction has been positive in most European and AsiaPacific markets with slower uptake in North America. Nokia is confident about the long-term success of

the N-Gage platform given the continued introduction of new game titles and the value added by mobile

multiplayer game play.

PRESS RELEASE

5 (21)

January 22, 2004

During the quarter, several key games were announced for the N-Gage game deck, bringing mobility to

the strategy, action, sports, and racing genres, allowing mobile gamers to play a range of both exclusive

N-Gage games and blockbuster titles in new and exciting ways.

Milestones reached in Imaging and 3G WCDMA markets

Shipping since October, the Nokia 6600 brings together a digital camera, PDA and mobile phone

supported by the easy-to-use Series 60 platform. It has been an instant commercial success and a

benchmark product for the entire industry, showing that consumers and business users are ready to

upgrade to feature-rich devices.

Nokia’s second 3G WCDMA phone, the Nokia 7600, went on sale in December and received positive

feedback on its innovative design and features. During 2003, Nokia together with several operators

achieved major milestones in ensuring that the technology maturity of 3G WCDMA will pave the way for

mass-market 3G services during 2004.

World’s first GSM push-to-talk phone

Nokia is the industry leader in bringing push-to-talk services to the GSM world and is active in

developing the push-to-talk standard as part of the Open Mobile Alliance specifications. In October,

Nokia unveiled the world's first GSM push-to-talk handset, the Nokia 5140, to be sold in the Americas,

Europe/Middle East/Africa and Asia-Pacific markets.

Nokia continues to strengthen CDMA market position

During the fourth quarter, Nokia's CDMA business launched four new handsets and developed nextgeneration technology. Nokia began shipments of CDMA handsets to some of the world's leading

CDMA operators in India, China and the United States, where the top five CDMA carriers are Nokia

CDMA customers. Availability of the color-screen Nokia 3589i for Verizon Wireless was announced

during the quarter.

Lab tests and live demonstrations of cdma2000 1xEV-DV technology have moved this new technology

closer to commercialization. In November, Nokia demonstrated live video streaming over 1xEV-DV and

showcased the world's first prototype dual-stack IPv4/IPv6 handset, designed to support future IPv6

based networks.

Mobile software

The active developer community already supporting Series 40 and Series 60 was strengthened with the

release of Series 40, Series 60, and the new Series 90 Developer Platforms. New developer platform

categories aim to provide developers with mass-market reach and attractive business opportunities.

Nokia continued to work with several operators around the world and received positive feedback about

the user-friendliness and the technical superiority of Series 60 for rapidly launching mobile operator

services. Nokia recognized five companies for their excellence in the Series 60 Platform Community

Awards 2003.

NOKIA NETWORKS IN THE FOURTH QUARTER

Strong progress in WCDMA and EDGE rollouts

During the fourth quarter, Nokia announced 3G WCDMA deals with M1 and StarHub in Singapore and

with MTC Vodafone in Bahrain, as well as a 3G core network deal with Hutchison in Hong Kong. Nokia

also demonstrated its end-to-end WCDMA capabilities together with Orange at Telecom 2003. The

fourth quarter deals and customer feedback further reinforced the solid performance of the Nokia

WCDMA solution. In November, AT&T Wireless Services opened a nationwide EDGE network in the

United States with Nokia as the major supplier.

PRESS RELEASE

6 (21)

January 22, 2004

Nokia first with push-to-talk solution

In October, Nokia introduced its carrier grade push-to-talk over cellular network products for early market

entry and has 30 trials underway with operators globally. Based on open specifications, the Nokia

system offers a full feature set and a smooth migration path to the upcoming Push to talk over Cellular

Open Mobile Alliance standard.

In addition to the push-to-talk solutions, Nokia also introduced a solution to support fixed-to-mobile

substitution in enterprises, as well as solutions for optimal total cost of ownership and greater coverage

in TETRA professional mobile radio networks.

Strong flow of GSM/GPRS/EDGE deals in Asia, China and Europe

During the fourth quarter, Nokia announced a USD 125 million GSM expansion deal with Henan MCC in

China, a GSM expansion deal with China Unicom Zhejiang, a GSM/EDGE deal with Globe in the

Philippines, a GSM deal with Millicom in Sierra Leone, a USD 70 million GSM/GPRS deal with

VimpelCom in Russia, and GSM/GPRS/EDGE deals with DTAC and AIS in Thailand. Nokia also made

MMS deals with GloBul in Bulgaria and with Cingular in the US.

In TETRA networks, Nokia made agreements with Communauté Urbaine de Bordeaux in France and

with Shenzhen Metro in China.

NOKIA VENTURES ORGANIZATION IN THE FOURTH QUARTER

In the fourth quarter 2003, Nokia Internet Communications performed well and sales were higher than in

the previous quarter due primarily to the uptake of its core Network Integrity products and services, and

growth in new business. Year-on-year sales remained flat, reflecting the continued weakness of the US

dollar.

The unit expanded its reach into the Government sector and the Chinese market. It also added new

products to its broad portfolio of network appliance products, and continued to maintain a leading market

share position. Sales of its recently launched SSL VPN and mobile middleware products also continued

on track as more customers expressed an interest in infrastructure investments aimed at securely

mobilizing their workforces.

Nokia Ventures Organization continued to contribute to Nokia’s renewal by developing projects falling

outside the scope of Nokia’s core businesses. One example is the development of the mobile broadcast

of TV-like content with IP Datacasting technology over DVB-H (Digital Video Broadcast – Handheld) to

complement the multimedia content consumers can access with cellular technologies, such as GPRS,

CDMA1X and WCDMA. In December, Nokia and other industry players in Finland launched a

commercial pilot for mobile broadcast services based on the emerging and widely supported DVB-H

standard.

NOKIA IN OCTOBER-DECEMBER 2003 REPORTED

(International Accounting Standards, IAS, comparisons given to fourth quarter 2002 results)

Nokia's net sales decreased by 1% to EUR 8 789 million (EUR 8 843 million). Sales of Nokia Mobile

Phones were up 4% at EUR 7 009 million (EUR 6 742 million). Sales of Nokia Networks decreased by

18% to EUR 1 706 million (EUR 2 084 million). Sales of Nokia Ventures Organization were up 1% and

totalled EUR 108 million (EUR 107 million).

Operating profit increased by 14% to EUR 1 669 million (EUR 1 466 million), representing an operating

margin of 19.0% (16.6%). Operating profit in Nokia Mobile Phones increased by 4% to EUR 1 707 million

(EUR 1 642 million), representing an operating margin of 24.4% (24.4%). Operating profit in Nokia

Networks was EUR 41 million (operating loss EUR 82 million), including a goodwill impairment of

EUR 151 million during the fourth quarter as well as impairments and write-offs of capitalized R&D

totaling EUR 108 million, resulting in an operating margin of 2.4% (-3.9%). Nokia Ventures Organization

PRESS RELEASE

7 (21)

Loading...

Loading...