Page 1

User Documentation

Last Update:

September 24,

2005

AssureBuy Payment

Processing

for

Microsoft Business Solutions

Great Plains

Release 8.0

Distributed By:

AssureBuy

1340 Remington Road – Suite E

Schaumburg, Illinois 60173

Phone: 847-843-7400

Fax: 847-843-7676

URL:

www.assurebuy.com

Page 2

Page 3

IMPORTANT NOTICE

The information contained in this publication is provided as a courtesy to AssureBuy clients,

partners, employees and sub-contractors. Certain information contained herein is confidential and

may be considered proprietary. As a result, please obtain the written consent of AssureBuy, Inc.

prior to using or reproducing any of its contents.

Page 4

Page 5

Contents

Introduction to AssureBuy 7

Overview ...................................................................................................................................7

AssureBuy Setup .....................................................................................................................13

Data Validation............................................................................................................8

Shipping Calculation...................................................................................................9

Tax Calculation ...........................................................................................................9

Risk Management......................................................................................................10

Payment Processing...................................................................................................10

Messaging Features...................................................................................................11

Remote Integration....................................................................................................11

Administration...........................................................................................................12

Data Collection..........................................................................................................12

Systems and Technology...........................................................................................13

Merchant Account Setup...........................................................................................13

Credit Card Network Setup.......................................................................................14

Gateway Options Setup.............................................................................................16

Fraud System Setup...................................................................................................16

Watch Codes..............................................................................................................19

Watch Actions...........................................................................................................23

Payment Gateway 25

Overview .................................................................................................................................25

Data Required..........................................................................................................................25

Credit Card Types .....................................................................................................25

Transaction Types .....................................................................................................26

IP Address .................................................................................................................27

Data Returned..........................................................................................................................27

Transaction Result.....................................................................................................28

Authorization Errors..................................................................................................28

Address Verification Service.....................................................................................30

CVV2 Response Codes .............................................................................................31

Watch Codes..............................................................................................................31

Settlements...............................................................................................................................31

Installation and Setup 33

Overview .................................................................................................................................33

System Requirements................................................................................................33

Installation...............................................................................................................................34

Step 1.........................................................................................................................34

Step 2.........................................................................................................................34

Step 3.........................................................................................................................35

Step 4.........................................................................................................................36

Step 5.........................................................................................................................36

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Contents • 5

Page 6

Step 6.........................................................................................................................37

Step 7.........................................................................................................................37

Uninstall...................................................................................................................................37

Uninstall Warning......................................................................................................38

Instructions................................................................................................................38

Setting up AssureBuy Inside Great Plains...............................................................................39

AssureBuy Processing Setup.....................................................................................39

AssureBuy Credit Card Setup....................................................................................49

AssureBuy Functionality 53

Introduction..............................................................................................................................53

Transaction Types......................................................................................................53

Attaching Transactions to Great Plains Documents ..................................................54

Transaction Life Cycle ..............................................................................................55

AssureBuy Payment Processing Window................................................................................61

Sales Order Processing ............................................................................................................68

Sales Transaction Entry.............................................................................................68

Sales Payment Entry..................................................................................................71

Sales Batches.............................................................................................................73

Order Fulfillment.......................................................................................................80

Process Holds Warning .............................................................................................80

Receivables Management........................................................................................................81

Transaction Entry ......................................................................................................81

Cash Receipts Entry...................................................................................................83

Posted Transactions...................................................................................................85

Receivables Batches..................................................................................................85

Invoices....................................................................................................................................89

Invoice Entry.............................................................................................................89

Invoice Payment Entry ..............................................................................................92

Invoicing Batches......................................................................................................93

Technical Support 99

How To Obtain Technical Support..........................................................................................99

AssureBuy Version Information................................................................................99

Appendix 101

AssureBuy Gateway Errors....................................................................................................101

Time Zone Chart....................................................................................................................103

ISO 3166 Standard Country Codes........................................................................................105

VisaNet(Vital) – IP Frame.....................................................................................................112

FDMS South..........................................................................................................................114

FDMS Nashville (FDC).........................................................................................................115

Glossary of Terms 117

Index 125

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Contents • 6

Page 7

Introduction to AssureBuy

Overview

AssureBuy offers a reliable, scalable and secure method of outsourcin g the

mission critical back office payment processing infrastructure without the

technical issues and historically high cost associated with an in-house

developed solution. Additionally, use of the AssureBuy infrastructure affords

the seller access to industry leading transaction and payment processing

expertise, which can reduce overall processing costs and prevent losses

from fraudulent transactions.

The AssureBuy Internet Payment Gateway provides businesses with realtime access to AssureBuy’s proven back office processing infrastructure.

Using any secure SSL server-to-server communication technology ,

businesses can send transactions using either standard name-value pairs o r

xml formatted requests and obtain processing results in typically 3 to 5

seconds.

The AssureBuy processing and risk management technology is the result of

years of Internet and payment processing experience, large infrastructure

investments, and proven security techniques. Having processed Internet

transactions since 1995, AssureBuy is among the most experienced

companies in the industry.

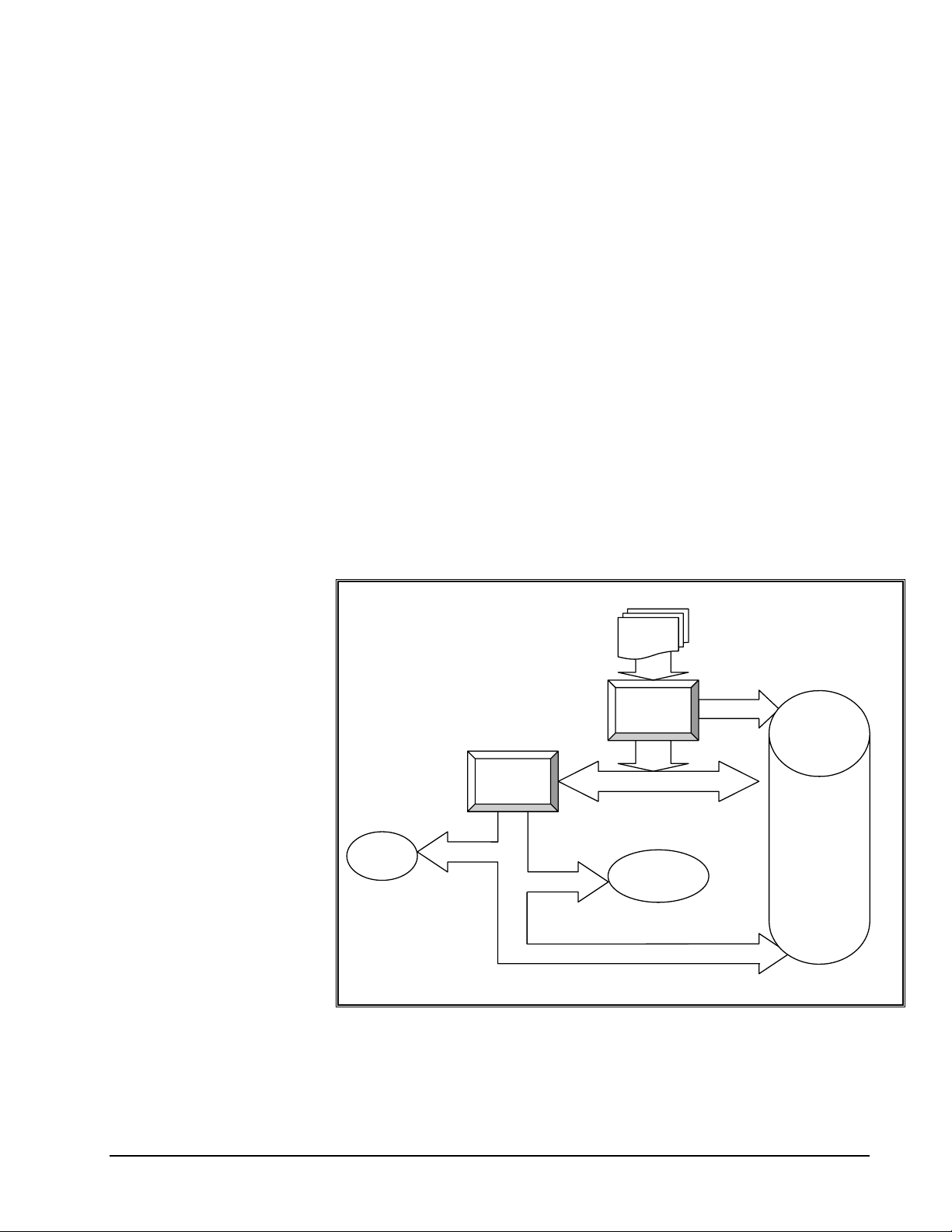

Figure 1 AssureBuy Communication

The above diagram shows the communication methodology employed in a

typical transaction. The buyer communicates directly with the business web

site, selects the products to be purchased and initiates the payment

transaction by clicking on the order button. The business web site configures

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Introduction to AssureBuy • 7

Page 8

the request and securely sends it to AssureBuy for processing. Processing

center firewall security controls access to the AssureBuy processing

services. Once inside the processing center, the seller’s request is

authenticated, the request is validated and the appropriate services are

performed. The response is then packaged and returned to the seller’s

server. The AssureBuy servers typically do not communicate directly with

the buyer.

For sales originating from sources other than an Internet Web Site, the

AssureBuy payment gateway can be accessed from any existing business

computer (server or workstation) that is connected to the Internet. This

feature allows traditional payment processing applications and in-house

accounting systems to access the same reliable and powerful payment

processing services offered by AssureBuy to Internet merchants.

AssureBuy services can be easily customized to provide the exact level of

functionality desired by an individual seller. From credit card processing and

risk management to tax calculation and remote integration, a seller may

select just the right mix of services to complete an existing back-office

processing solution, or use the entire suite, which works seamlessly to

provide a robust, feature rich solution offering high-availability, reliability and

scalability.

In addition to the payment gateway services, AssureBuy also offers a secure

administration system for remote access to order and transaction data. For

sellers who would also like to outsource the entire buying experience,

AssureBuy offers its IntegriCharge® service, which is capable of securely

collecting and validating billing, shipping and payment information from

buyers using a normal web browser.

Figure 2: Processing Methodology

The above figure demonstrates how the various AssureBuy services work

together to provide a complete back-office transaction and payment

processing solution.

Data Validation

All information contained in any request made to the AssureBuy system is

first validated before any other AssureBuy services are performed. This

validation includes verifying the length, size and type of all data elements, the

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Introduction to AssureBuy • 8

Page 9

validity of all processing codes, and the relationship of the data elements

contained within the request. Certain data elements are required in order to

complete a transaction request and others are required based on the values

contained in related elements. In all cases, the validity of the request is

verified; in the event an invalid data element is located, an error response

and error message are returned to the seller.

Sellers may also identify certain user-defined fields as being required

elements for their requests only. AssureBuy allows validation rules to be

established by a particular seller, so long as these validation rules specify

only that a data element be required or optional in the request.

Depending on the type of error and the configuration of the system, sellers

may display the AssureBuy error messages directly on a web site so that a

buyer will know which elements have been entered incorrectly.

Shipping Calculation

Accurate shipping and handling charges are critical to the successful

completion of a transaction in real-time. Because the complexity of such

calculations varies widely amongst sellers, AssureBuy offers several different

levels of shipping and handling calculation services, all of which may be

customized to meet the exact needs of the seller.

For sellers with no shipping and handling or where the shipping and handling

can be calculated easily by the seller, AssureBuy allows the seller to pass a

specific value for shipping along with the other transaction details. This value

is simply added into the total amount for the transaction.

For more complex shipping and handling calculations, AssureBuy offers a

service to calculate the total shipping and handling for the order. Each

product ordered can be individually identified as a shippable item. For all

shippable items, AssureBuy supports shipping calculations based on order

total, order weight, quantity of items ordered, or a flat rate. The ranges for

each of these methods are set by the seller and are entered into a shipping

calculation database at AssureBuy.

For the most accurate and up-to-date shipping information, some sellers

prefer to rely on real-time data from their primary shipper. AssureBuy is

capable of configuring real-time connections to major shipping carriers,

including United Parcel Service (UPS), Federal Express (FedEx), and the

United States Postal Service (USPS). In this case, the seller is required to

have an established billing relationship and active account with the thirdparty shipper.

Tax Calculation

Tax calculation can be a tedious undertaking, especially given the real-time

nature of the on-line business world. Type of product, location of the buyer

or seller, and even the shipping location can all affect the taxability and tax

rate of a particular transaction. To accommodate the complex nature of tax

calculation, AssureBuy offers three levels of tax calculation.

For some sellers, there is either no taxing requirement, or the tax calculations

are so complex that the seller has already implemented a method for

determining taxability. In these cases, the AssureBuy payment gateway is

capable of accepting any tax amount the seller might wish to include in the

transaction. The AssureBuy payment gateway simply accepts this number,

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Introduction to AssureBuy • 9

Page 10

along with a seller identified tax jurisdiction and adds that amount into the

total amount for the current transaction.

For simple mail order type businesses, the AssureBuy payment gateway

allows sellers to establish tax rates which apply only to the shipping location

of the order. For all applicable seller jurisdictions, a simple tax rate is

entered into a tax calculation database. Tax is applied to all taxable items for

each order shipped to one of these jurisdictions. For all levels of tax service,

the seller may identify which individual items on each order are taxable.

Finally, through a partnership with TAXWARE International, AssureBuy is

able to offer its sellers a comprehensive worldwide tax calculation system

that is updated on a regular basis with the latest jurisdiction and rate

information. When using this level of tax calculation service, the system

determines the appropriate jurisdiction and rate by examining the type of

product being sold, the location of the buyer and seller, and the location from

which the product is shipped. Tax liability reports are available that identify

the taxes collected in each jurisdiction.

Risk Management

Available in the AssureBuy payment gateway is a proprietary risk

management service. The risk management service is the result of many

years of Internet related transaction and payment processing experience and

is designed specifically to assist a seller in identifying potentially fraudulent

buyer transactions.

The service is easily configured for the source and level of risk associated

with a particular type of business and makes considerations for the type of

product being sold, the location of the seller, the amount of a typical

transaction and the delivery method. The service combines inherent

knowledge of overall potential risk and learned knowledge from the

experience of the individual seller. The databases used for scanning each

transaction are updated as new fraud methods and perpetrators are

identified.

Risk management is an extremely important function in any business, but is

exponentially more difficult to monitor given the nature of the Internet. By

using the AssureBuy risk management service, sellers are protected from

potential fraud occurring across the entire AssureBuy seller base. And, more

importantly, sellers can maintain control of a potentially serious and costly

problem inherent in the on-line business world.

Payment Processing

The primary feature of the AssureBuy payment gateway is its ability to

process payment transactions. The payment processing service inclu des the

ability to accept credit card transactions, electronic checks and ACH

transactions, purchase orders, invoices, gift certificates, coupons and

giveaways.

Credit card authorizations are preformed in real-time through multiple

redundant connections to major processing networks. The system currently

has the capability of processing all major credit card types, including

American Express, Carte Blanche, Diner’s Club, MasterCard,

Novus/Discover, Eurocard, JCB Card and Visa. The system processes most

major debit and purchasing cards as well. Support for PIN numbers and the

new CVV2 and CVC2 card verification values are also available.

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Introduction to AssureBuy • 10

Page 11

The system accepts transactions identified as check, money order, COD,

cash, ACH, purchase order, invoice, gift certificate and giveaways. The

system can also be set up to automatically transfer electronic check and

ACH payments to a seller’s bank for processing.

Unlike many other payment processing services, AssureBuy rigorously scans

all orders prior to processing and reviews all processing information returned

by the processor. A review of this information may result in a situation where

the transaction should not be processed, as in the case of an order that doe s

not pass risk management, or when the cardholder’s bank is not available for

authorization at the time of purchase. In these cases, the AssureBuy

payment gateway returns neither an approval nor decline, but rather sends

the order to a hold status for further review. In all instances, AssureBuy

attempts to provide the highest level of valid and approved orders possible.

Simply declining such transactions, as many other processors do, would

potentially have the effect of turning away valid buyers.

View N Pay Processing

The second major feature of the AssureBuy payment gateway is its ability to

process invoice transactions. The invoice processing service supports the

View ‘N Pay hosted application.

Messaging Features

Upon completion of any transaction, the AssureBuy payment gateway has

the ability to send out one or more e-mail messages. These messages are

completely customizable by the seller and can include sales receipts or

purchase confirmations to the buyer, order notifications to the seller or to a

fulfillment center, order problem messages to a buyer, hold order

notifications to the seller’s customer service department or any other type of

message sent to any seller identified destination.

For regular order confirmations to the buyer and order notifications to the

seller, the AssureBuy payment gateway verifies that the messages were sent

by recording the time and date the message was delivered to the mail server.

Remote Integration

While the AssureBuy payment gateway provides a response to each request,

it has the capability to communicate with other remote applications as well.

Standard responses are sent back to the calling application in either namevalue pair or xml format. Similarly formatted responses can also be posted

to any remote URL capable of using secure HTTPS technology with SSL

encryption.

The AssureBuy payment gateway can also securely post any custo m

configured data stream to any remote URL and verify that the remote

processing script properly received the data by storing a response from the

remote script. The format of any data posted to a remote script is completely

user-defined for each remote script and the system is capable of sending

information to multiple scripts.

Transaction data may also be sent via e-mail on a regular basis to any e-mail

address supplied by the seller. Data sent in this fashion is usually configured

as delimited ASCII files for import into third-party applications. Again, the

format of the data sent via e-mail is completely customizable to the seller’s

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Introduction to AssureBuy • 11

Page 12

specific requirements. Data containing sensitive information, such as credit

card or bank account numbers, is encrypted using standard public/private

key encryption technology.

Although the AssureBuy payment gateway can be easily integrated into any

existing environment, interfaces to existing environments and applications

may be available. An interface to the Microsoft Great Plains accounting

applications is currently available for Dynamics and eEnterprise customers

using Release 6.0 and higher.

Administration

AssureBuy offers a robust transaction and payment administration system

that allows secure access to the transaction information on file at AssureBuy.

Sellers are allowed to establish system users that can gain instant access to

the AssureBuy information at any time. Each user is assigned a unique ID

and password that controls access to the system and specifies the type of

information that can be viewed. Existing security levels include users,

maintenance users, order processors and administrators. Only order

processors and administrators are allowed to view sensitive payment

information, such as credit card and bank account numbers.

The AssureBuy administration system allows sellers to access and review

order information for all transactions sent through AssureBuy. This includes

billing information, shipping information, payment information and order

details. Additionally, some users may view pending orders which have not

yet been processed or which have been identified as being potentially

fraudulent by AssureBuy. Users with processor level access or above are

allowed to process orders, resubmit orders with new payment information,

decline orders and issue credits.

An order search utility is available that allows orders to be located by order

number, date, credit card number, buyer name, e-mail address or IP

address. For recurring type orders, the system allows access to all

transactions associated with a particular order.

A variety of reports allow users to view order notifications, obtain information

for buyer disputes and chargebacks, or print credit statements. Users may

also re-send or re-print order notifications and buyer confirmations.

Please contact AssureBuy Support for access to the AssureBuy

Administration System or to obtain a copy of the Administration System User

Help manual.

Data Collection

When using the AssureBuy IntegriCharge® service, the AssureBuy secure

servers collect and validate the buyer’s billing, shipping and payment

information, including any custom information required by the seller. In

addition to certain order processing requirements, the seller is able to identify

which data items are required and which are optional. The AssureBuy

servers confirm that the order information has been entered completely and,

in some cases, also verify the validity of the information entered. When a

problem is detected, the buyer is notified with a message and prompted to

return to the order page to correct the invalid information. Using the data

collection and validation services provided by IntegriCharge®, sellers are

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Introduction to AssureBuy • 12

Page 13

freed from the burden of writing complex error processing scripts to validate

buyer information entered through the web browser.

Systems and Technology

AssureBuy houses its transaction and payment processing system in a stateof-the-art, ultra-secure Exodus data center containing the most advanced,

fault-tolerant Internet technology available, including power backup, fire

suppression, network redundancy and built-in disaster recovery. Exodus

operates a global network of inter-connected data centers that are linked by

a high-speed, switched infrastructure, providing seamless transaction

integration from anywhere in the world. These data centers, located

throughout the world, provide redundancy and data backup facilities,

ensuring high-availability of AssureBuy's mission-critical transaction

processing infrastructure. AssureBuy operates its system on high-speed,

load-balanced servers, with redundant frame-relay connections to major

credit card processing and banking networks.

AssureBuy utilizes only mature, enterprise class, hardware and software

solutions, which have been tested and proven in high-performance, highavailability server environments. All operating systems are stable for

business and transaction processing environments. All production level

operating systems, applications software and databases reside on either

mirrored disk devices or redundant disk array storage. Server and

networking hardware is scalable and redundant, utilizing industry standard

RAS (reliability, availability and serviceability) technology for optimal uptime.

AssureBuy Setup

Before installing and using the AssureBuy Payment Processing application

within Great Plains, the seller must establish a processing account with

AssureBuy. Setting up a processing account with AssureBuy involves four

components: a credit card merchant account, the credit card processing

network, the payment gateway options, and the fraud management system.

Merchant Account Setup

A merchant account gives a business the ability to accept credit cards as a

form of payment. Many businesses already have a credit card merchant

account. In most cases, the existing merchant account will work with the

AssureBuy payment gateway. If the business does not already have a

merchant account, one will need to be obtained before setting up an account

with AssureBuy.

Visa and MasterCard are associations of financial institutions that offer credit

card services through member banks, identified as either acquiring banks or

issuing banks. For a credit card to be used as a form of payment, a buyer

must own a credit card and a seller must have a merchant account. When a

buyer applies for a credit card, the application is sent to a banking institution

that can issue credit cards. This banking institution is referred to as an

issuing bank. When a seller applies for a merchant account, the application

is sent to a banking institution that can issue merchant accounts and process

payments. This banking institution is referred to as an acquiring bank.

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Introduction to AssureBuy • 13

Page 14

The acquiring bank that provides the merchant account will act as a

clearinghouse for the credit card payments. Each day, the acquiring bank

transmits instructions to the issuing banks telling them to remove funds from

the buyer’s credit card account and transfer the money back to the acquiring

bank. Once the issuing bank has transferred the funds to the acquiring bank,

the acquiring bank will then transmit the payment to the seller’s regular

business bank account. The missing link in the above transaction is how the

seller connects to the acquiring bank to send the credit card transactions. In

standard retail stores, the connection is usually through a swipe terminal and

a phone line, but in non-retail environments the connection is through card

processing software and a payment gateway.

Both the swipe terminal and the card processing software require a

connection to the acquiring bank. A credit card processing network provides

this connection. As with issuing and acquiring banks, there are multiple card

processing networks. The acquiring bank usually determin es which network

the seller’s merchant account will need to use. The swipe terminals or the

card processing software will dial directly into the card processing network to

transmit the credit card transaction.

Once the seller has established a Visa/MasterCard merchant account, they

will also want to consider accepting American Express, Discover, Diners

Club, and other card types. In order to accept other credit cards, the seller

must also obtain merchant accounts from the other credit issuing card

companies. Many times the organizations providing the Visa/MasterCard

accounts can assist the seller with obtaining the additional credit card

merchant accounts. The seller can also contact the organizations directly to

sign up for a merchant account. Once the seller has obtained the additional

merchant accounts, then all that needs to be done is to add the additional

merchant accounts to the seller’s Visa/MasterCard merchant account at both

the acquiring bank and the card network. The Visa/MasterCard acquiring

bank will be able to transmit to American Express, Discover, or Diners Club

directly to move funds just like a normal Visa/MasterCard transaction. The

AssureBuy payment gateway needs no special programming to accept the

additional cards other than adding the additional payment options to the

seller configuration.

Credit Card Network Setup

The AssureBuy payment gateway is connected to several predominant card

processing networks, including VisaNet(Vital) and First Data(FDMS). The

First Data network has a variety of platforms that merchants can use to

process credit card transactions. AssureBuy currently connects to the

Nashville platform and the South platform. Each network has a unique set of

informational requirements that must be entered into the AssureBuy payment

gateway before the merchant can process credit cards. The acquiring bank

determines the credit card processing network to be used, so the business

must contact their merchant account provider to verify whether they are

compatible with the AssureBuy payment gateway.

VisaNet(Vital)

In order for VisaNet to configure your merchant account to work with the

AssureBuy payment gateway, the following information will need to be

provided to VisaNet about the AssureBuy payment gateway.

Software Type: PaylinX version 3.1.9

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Introduction to AssureBuy • 14

Page 15

Connection: High speed frame relay

In order for AssureBuy to set up the payment gateway to work with a VisaNet

merchant account, the merchant account provider will need to provide the

following information to AssureBuy. These details are necessary so

AssureBuy and the acquiring bank will be able to identify the merchant for

each transaction. Typically, the acquiring bank will fax a document

containing this information once the merchant account has been set up in

their system. Failure to provide any of the requirements in the table below

will prevent AssureBuy from properly configuring the payment gateway and

transactions will not be processed correctly.

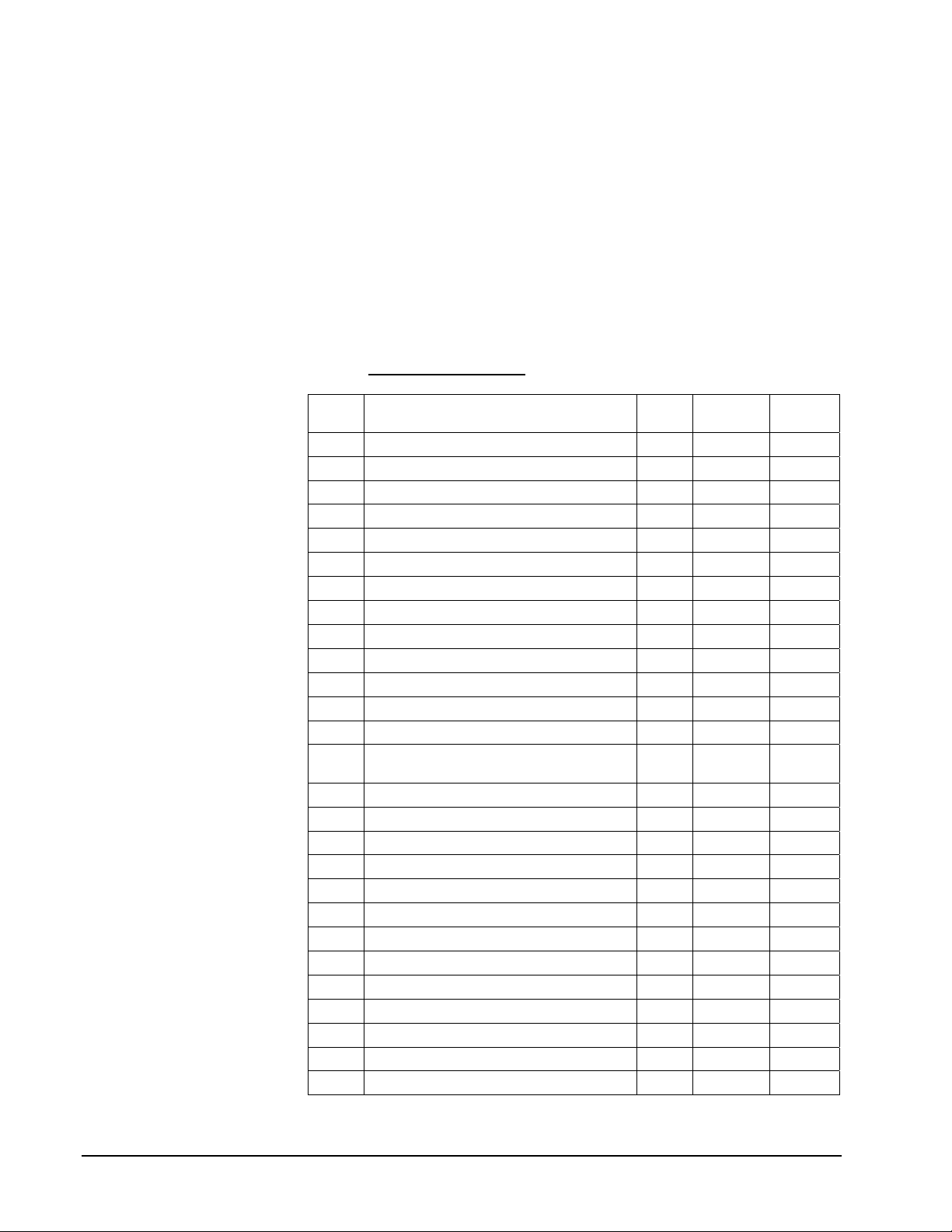

Description Characters Field Type

Location/City Up to 13 Alpha

State 2 Alpha

Agent Bank Number 6 Numeric

Agent Chain Number 6 Numeric

Category Code 4 Numeric

Merchant Location Number 5(zero fill) Numeric

Merchant Number 11(zero fill) Numeric

Terminal ID 8(zero fill) Numeric

Store Number 4 Numeric

Store Name Up to 25 Numeric

Acquirer BIN 6 Numeric

Terminal Number 4 Numeric

Industry Code Direct Marketing or

Choice

Retail

Currency USA ----Country Code USA ----Zip Code Up to 9 Numeric

Language Indicator ---- ----Time Zone ---- -----

Once the bank has provided the information to the seller, the seller then

needs to forward the information on to AssureBuy. AssureBuy staff will set

up and verify that the merchant account is working properly. Please be sure

to also provide a list of the credit card types your merchant account can

accept, such as American Express or Discover.

First Data (FDMS)

AssureBuy is a certified payment gateway for both the FDMS Nashville

platform and a certified multi-currency gateway for the FDMS South platform.

The setup process for each of these platforms will differ slightly because

each have unique settings.

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Introduction to AssureBuy • 15

Page 16

Nashville Platform

If the seller’s merchant bank is set up to process on the Nashville platform,

the seller’s bank will need to know the following information about the

AssureBuy payment gateway.

Product Name IntegriCharge (g/w)

Product ID 819806

Vendor Name PaylinX

Vendor ID 198

If the seller’s merchant account is not set up with the above specifications

then the seller’s merchant account will not work with the AssureBuy payment

gateway. To complete the setup process for AssureBuy, the seller’ s bank

needs to provide a merchant ID (mid) and a terminal ID (tid), which will be

entered into the AssureBuy payment gateway.

Description Characters Field Type

FDC Merchant ID 11(zero fill) Numeric

Terminal ID 11(zero fill) Numeric

South Platform

The FDMS South platform is a high-volume processing network that is only

available to certain businesses. As a result, the setup process is different for

each merchant account. When setting up a seller that uses the FDMS South

platform, AssureBuy will need to work directly with the seller’s bank and First

Data to complete the setup process for the seller. AssureBuy is a certified

payment gateway, which will help speed the setup process along. However,

AssureBuy will need to schedule testing time with the FDMS South platform

and be approved for processing before the seller will be allowed to start

sending live credit card transactions. Since AssureBuy is directly involved

with both the acquiring bank and First Data, the seller does not need to

obtain any special information from the bank.

Gateway Options Setup

In order for AssureBuy to complete the setup of the seller’s account in the

payment gateway, the seller must decide which of the payment gateway

options will be used. The payment gateway options include the settings that

tell AssureBuy how to handle the data passed to the gateway, such as how

to handle tax and shipping calculations. These gateway options are

collected by AssureBuy during the setup process.

Fraud System Setup

AssureBuy’s fraud system is a filtering technology consisting of multiple fraud

tests that center on validating the information contained within the

transaction. The filters use a variety of methods that allow the seller to set

thresholds, restrictions, and establish lists of fraudulent transaction data.

Certain fraud filters also allow a seller to enter an override to avoid flagging

orders from valuable customers as potential fraud. The override will allow

the buyer’s transaction to process despite having failed that fraud test.

The AssureBuy fraud system is comprised of three main components: the

fraud filter, the watch code and the watch action. The fraud filters perform the

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Introduction to AssureBuy • 16

Page 17

y

actual validation of the transaction data and are grouped into various levels.

The watch codes identify each of the fraud filters for maintenance and for

displaying the results of the fraud tests on the transaction. Each watch code

that is triggered for a transaction will be displayed on the transaction record.

The final piece of the fraud system is the watch action. A watch action is the

seller-defined procedure that the system will follow after a transaction has

triggered a watch code. During fraud maintenance, the seller is allowed to

set the watch actions on each individual watch code.

Here’s how it works. Transaction information is passed to the AssureBuy

payment gateway. The gateway will then validate the transaction information

before passing the customer credit card information on to the credit card

network. The process of validating the transaction information includes

running the transaction information through any fraud tests that have been

enabled by the seller. These fraud tests are identified by watch codes. If the

fraud tests do not trigger any watch codes, the transaction is processed

normally. If the fraud tests trigger one or more watch codes, then the watch

codes are added to the transaction. The system also checks to see if the

watch code is listed as an override filter for the current transaction. If there is

an override, and no other watch codes have been added, then the

transaction will be processed. If the transaction does not contain any

override information, the watch action processing is performed for the current

transaction. Watch action processing then determines whether the

transaction will be processed, declined or placed on hold, according the

seller’s predefined instructions. The route the transaction takes through the

fraud system is mapped out in detail below.

Watch

Action

Processing

Decline

Order

Any decline actions?

An

hold actions?

Order is processed.

Figure 3: Fraud System Diagram

Order

Data

Fraud

System

Fail

Watch Actions Override

Further

Verification

Pass

Payment

Processing

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Introduction to AssureBuy • 17

Page 18

Levels of Service

The AssureBuy fraud prevention system is offered in three levels of service.

The basic level of service includes five common tests, checking for things

such as duplicate transactions or restricted email addresses. The advanced

level of service offers more sophisticated testing that checks for matching

values across all the transaction data, allows for more restrictions, and does

some validating of the transaction data. The custom level of service offers

the option of adding third party services, such as more robust address

verification services or credit checks. These custom fraud filters can add an

additional layer of protection by validating transaction information with

outside data sources. Since the custom level consists of third party services,

each watch code is purchased on an individual basis and is priced

individually. For more information and pricing, please contact AssureBuy

Sales at

corresponding level of service are displayed below.

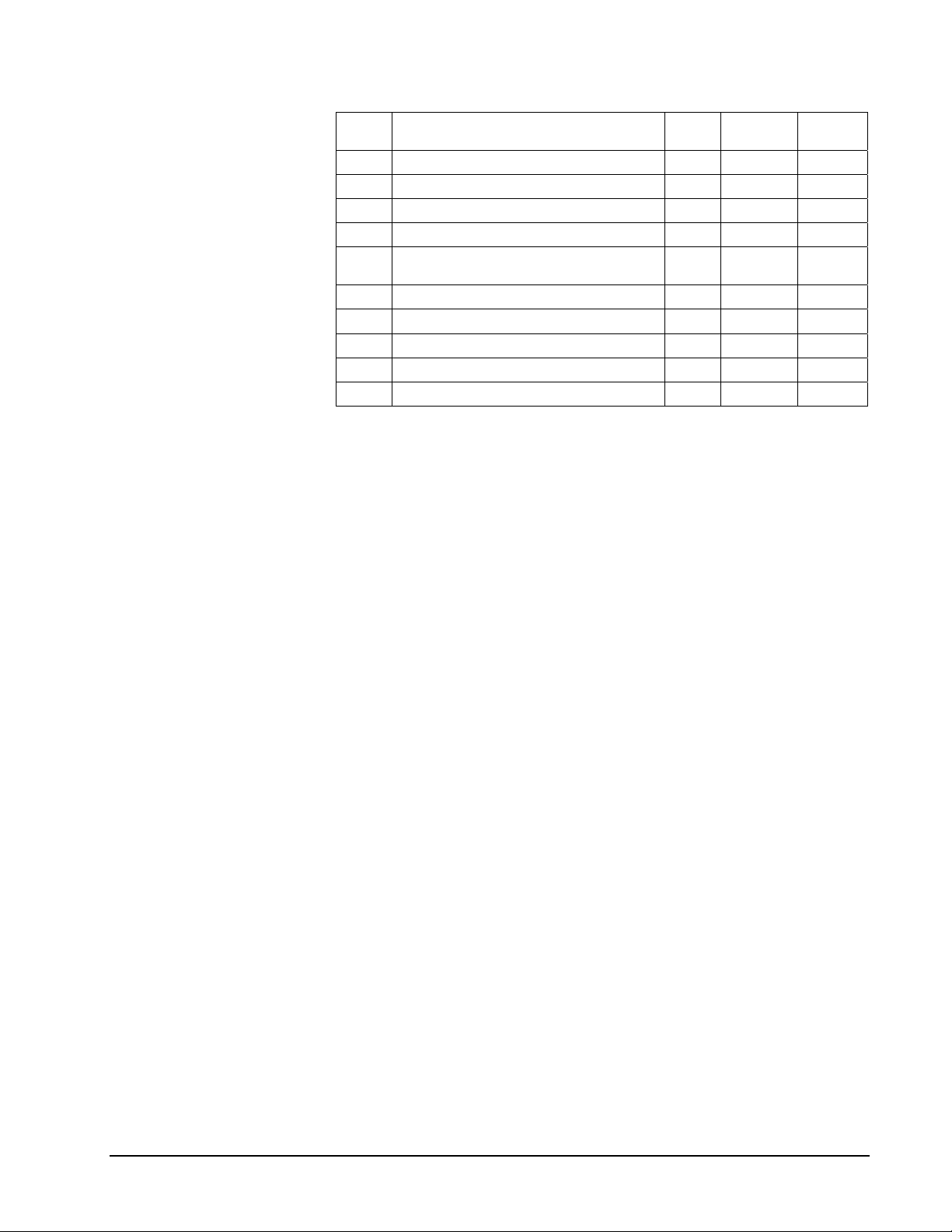

Watch

Codes

CD Restricted Credit Card X X X

EM Restricted Email Address X X X

IP Restricted IP Address X X X

OV Order Value Too High X X X

RD Restricted Email Domain X X X

XP Too Many Orders From Same IP Address X X X

AC Address/City Contain Matching Values X X

AR Invalid Phone Number Area Code X X

CH Cardholder Does Not Match Billing Name X X

CI Restricted City X X

CO Restricted Company X X

CT Restricted Country X X

CZ City/Zip Contain Matching Values X X

FL First Name/Last Name Contain Matching

FM Free Email Account Used X X

IC Too Many Items Ordered X X

ID Invalid Email Domain X X

IQ Too High Quantity on a Single Item X X

NA Last Name/Address Contain Matching Values X X

NC No Capital Letters in Name X X

NM Restricted Name X X

PD High Risk Product X X

RB Restricted Buyer X X

SM High Risk Shipping Method X X

SZ Invalid State/Zip Code Combination X X

TM Restricted Time of Day X X

TX Invalid Phone Number Format X X

sales@assurebuy.com. Each of the watch codes and their

Description Basic Advanced Custom

X X

Values

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Introduction to AssureBuy • 18

Page 19

Watch Codes

VC Suspect Vowel Count X X

VO Missing Vowels X X

WD Restricted Words X X

XB Too Many Orders From Same Billing Address X X

XC Too Many Orders From Same Credit Card

XR Too Many Orders From Same IP Range X X

AU

AV Bad Response from AVS System X

DL High Risk Delivery Location X

IT IP Address/Billing Country Check X

Description Basic Advanced Custom

Number

Failed Authentify™ Confirmation

X X

X

Watch Codes

All watch codes have two common features. Each watch code can be turned

on or off and each has a specific watch action. Watch actions determine the

next step after the fraud filters have trigger a watch code. For more

information on watch actions, please see “

Beyond these two basic features, the watch codes can be categorized into

six different types.

Watch Actions” on page 23.

System Watch Codes

System watch codes are fraud filters whose settings are fully controlled

within the AssureBuy system. These filters will test the transaction data for

certain characteristics and a few of the filters will be able to verify certain

transaction data. The seller only controls turning the system watch codes on

or off.

Watch

Code

AC The address field and the city field contain the same

AR The area code for the entered phone number is not

CD The buyer's credit card is listed in the ba d card database.

CH The cardholder name does not match the billing name

CZ The city field and the postal code field contain the same

Filter Description

information. This usually indicates that a customer has

either typed or copied garbage information into the

transaction fields.

consistent with the address specified for the transaction.

This test is valid for US transactions only.

Credit cards are only added to the bad card database if they

have been used to place fraudulent transactions in the past.

entered for the transaction.

information. This usually indicates that a customer has

either typed or copied garbage information into the

transaction fields.

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Introduction to AssureBuy • 19

Page 20

Watch

Filter Description

Code

FL The first name and last name fields contain the same

information. This usually indicates that a customer has

either typed or copied garbage information into the

transaction fields.

ID The domain for the specified e-mail address is invalid or

cannot be identified as a valid Internet domain.

NC No capital letters were entered in any of the name fields.

This practice sometimes indicates that a transaction is

fraudulent.

NA The last name field and the address field contain the same

information. This usually indicates that a customer has

either typed or copied garbage information into the

transaction fields.

SZ The postal code entered for the current transaction is not

consistent with the state/province entered.

TX The format of the entered telephone number is not

consistent with the address for the current transaction.

VC The number of vowels located in one of the name fields is

inconsistent with the numbers found in valid names.

VO No vowels were found in a value entered into the one of the

name fields.

Value Watch Codes

Value watch codes require the seller to enter a threshold or value against

which the filter may compare the transaction data. The values should be set

according to the seller’s business. For example, a seller whose main product

is $500.00 would not want to set a transaction total limit to $200.00.

However, a seller with items costing $5.00 might want to consider a

transaction total limit of $100.00.

Code Fraud Test Description

IC Too many items have been ordered. A high number of line

items on a transaction can sometimes indicate fraud.

IQ An item being purchased on this transaction has an unusually

high quantity. Ordering a high number of a single item

sometimes indicates fraud.

OV The buyer's transaction total exceeds the seller threshold limit.

The seller determines the high limit during the payment

gateway setup. High limit should be set according to a seller's

typical transaction amount. If a seller's average transaction

amount is $100.00, then the high limit might be set at $150.00.

TM The current transaction was placed at a time of day

considered to be high risk for the products being offered by

this seller.

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Introduction to AssureBuy • 20

Page 21

List Watch Codes

List watch codes require a list of data that is compared to all incoming

transaction data. If any of the transaction data contains an entry on the

restricted data lists, then the transaction will fail the fraud filter and the

appropriate watch codes will be applied to the transaction. Some of the

watch lists, such as restricted e-mail addresses, will require the seller to input

data. Other lists, such as the list of free e-mail domains, are system

controlled. Each seller is able to add and remove items from the non-system

controlled watch lists. The system controlled watch lists are maintained by

AssureBuy, so the seller does not have access to the data contained in those

lists. The table below indicates which watch lists are seller maintained and

which are system maintained.

Code Owner Fraud Test Description

CI Seller Either the buyer's shipping city or the billing city is on

the restricted city watch list.

CO Seller The co mpany name entered for the specific

transaction is currently on the restricted company

watch list.

EM Seller The e-mail addre ss entered for this transaction is on

the restricted e-mail watch list.

IP Seller The IP address used to place the current transaction

is in a range of IP addresses on the restricted watch

list. The seller should be cautious when entering an

IP range. The broader the range of the IP address,

the greater the chance that more transactions will go

on hold. For more information, please see “

Address

” on page 27.

IP

RB Seller A buyer number entered is from a buyer that has been

restricted from ordering. The buyer number is a

number the seller has specifically given to the buyer.

RD Seller The domain for the specified e-mail address is located

in the restricted e-mail domains watch list.

NM Seller The buyer's name is listed on the restricted name

watch list. This fraud test is an inclusive test, meaning

that if the name on the transaction contains the

restricted text in the watch list, then the transaction

will fail the test. For example, if the watch list contains

the text Rob, a transaction with a name of Robert will

cause the fraud test to fail.

PD Seller The item number (SKU) of a product purchased on

the current transaction is listed as a "high risk"

product. Certain products naturally attract fraudulent

orders and can be flagged as high-risk products for a

particular seller.

SM Seller The shipping method has been identified as high risk.

For certain products, use of a particular type of

shipping may indicate a fraudulent transaction.

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Introduction to AssureBuy • 21

Page 22

Code Owner Fraud Test Description

FM System The buyer's email address contains the domain of a

free Web-based email provider. Free e-mail accounts

are often used to place fraudulent on-line

transactions.

WD System One or many of the transaction fields contains a word

or phrase from the restricted words watch list.

Combined Watch Codes

The combined watch code is similar to the list filters in how it performs the

fraud tests. However, the combined filter has an added feature, the list

entered by the seller can be either a list of restricted data or it can be a list of

allowed data. Currently, only one filter, the restricted country filter, has this

dual functionality. If the restricted country filter is set to “list is restricted

countries”, then only transactions with countries on the seller’s restricted list

will fail the fraud test. If the restrict country filter is set to “list is allowed

countries”, then all transactions with a billing country not on the list will fail

the fraud test. The seller can make exemptions to this test by entering the

allowed countries into the list.

Watch

Code

CT List is

CT List is

Allow Flag

Setting

Restricted

Countries

Allowed

Countries

Fraud Test Description

Either the buyer's shipping country or the billing

country is on the restricted country watch list.

Either the buyer's shipping country or the billing

country is not on the seller’s allow watch list.

Override Watch Codes

Override watch codes perform two functions. The first function is a normal

fraud test that the transaction can fail; this part of the fraud filter is system

controlled. The second function is as an override, used in cases where a

seller has a valuable buyer whose transactions consistently fail one of the

override watch codes. In this case, the seller wants this buyer’s transactions

to process despite failing the fraud test for the override watch code. The

seller can enter a piece of the buyer’s transaction information into the

override watch list. Then, if the buyer’s transaction triggers the override

watch code, the watch code will allow the transaction to process anyway.

Watch

Code

XB Too many transactions have been

Filter Description Override

Enter a buyer’s

received from the same billing address.

This sometimes indicates the use of a

stolen credit card.

street address to

allow their

transactions to

process.

XC Too many transactions have been

received using the same credit card

number. This sometimes indicates the

use of a stolen or fraudulent credit

card.

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Introduction to AssureBuy • 22

Enter a buyer’s

credit card number

to allow their

transactions to

process.

Page 23

XP The buyer has placed multiple

transactions from the same IP address

in a given period of time.

XR XR is similar to the functionality of the

XP watch code above, except that this

test looks for too many transactions

placed from a specified IP address

range instead of a single IP address.

The IP range must contain the

numbers up to the class C.

Enter a buyer’s IP

address to allow

their transaction to

process.

Enter a buyer’s IP

range up to the

Class C to allow

their transaction to

process.

Custom Third Party Watch Codes

Custom third party watch codes will depend greatly on what information the

third party will need to perform their validations. For this reason, the third

party watch codes are grouped by themselves. Each of the services will

come with their own unique settings.

AU The Authentify service is provided by Authentify Inc.

Authentify verifies the buyer by placing a phone call to the

phone number entered on the buyer’s transaction. This

service helps to eliminate a little of the anonymity of buyers by

forcing them to enter a phone number directly connected to

them. The Authentify service performs two functions, as a

watch code and watch action. The watch code function of

Authentify controls whether the service is on or off and also

controls result of the Authentify watch action. The Authentify

watch action is available on all of the seller’s watch codes so

that if a transaction fails a designated watch code, the system

will initiate the Authentify service that will call the buyer.

Based on the Authentify service’s response, the system will

take the watch action determined on the Authentify watch

code and process, decline or place the transaction on hold.

AV Invalid response from a third-party Address Verification

Service (AVS). This address verification is on a higher level

and is provided by a third party.

DL The shipping address specified for this transaction has been

listed as a "high risk" delivery address by the United States

Postal Service. High-risk delivery addresses usually include

post office boxes and abandoned buildings. This watch code

is a level three watch code so the information provided by the

United State Postal Service might require additional fees.

IT The IP address used to place the current transaction

originates from a country that does not match the country

entered for the billing address.

Watch Actions

Watch actions allow each watch code to have its own predetermined action.

Some watch codes are more serious indicators of fraud than others. For

example, the watch code that tests for no capital letters in a buyer’s name

can sometimes indicate fraud, but it could also just signify a buyer who is

rushing through the transaction entry process and does not use capital

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Introduction to AssureBuy • 23

Page 24

letters. The seller can decide that the transactions that fail this watch code

can be allowed to process. However, if a transaction were placed using a

credit card on the bad credit card database, the seller would typically want

this transaction to be automatically declined. The watch action on the watch

code for the bad card database would then be set to decline.

Action Description

Process If the watch action of process is selected for a

watch code, then the transaction will be allowed to

process despite failing the watch code.

Decline If the watch action of decline is selected for a

watch code, then the transaction will be

automatically declined if the transaction fails that

fraud filter.

Hold If the watch action of hold is selected for a watch

code, then the transaction will be placed on hold

awaiting manual review.

Authentify This watch action only applies when the Authentify

service is active. If the watch action of Authentify

is selected for a watch code, then the buyer will

receive a phone call from the Authentify system. If

the buyer fails to confirm with Authentify, then the

transaction will be processed according to the

watch action set on the AU (Authentify) watch

code.

If more than one watch code is applied to a transaction, then the fraud

system follows a set hierarchy when determining what action to take on a

particular transaction. The hierarchy is listed below.

1 Decline

2 Hold

3 Authentify (If service is active.)

4 Process

For example, if a transaction has been entered and has failed four of the

watch tests,

Watch

Code

Watch

Action

FM Process

OV Hold

XP Decline

IQ Authentify

The transaction would be declined and Authentify would not be used.

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Introduction to AssureBuy • 24

Page 25

Payment Gateway

Overview

The AssureBuy payment gateway requires certain information to complete

the processing of each transaction. This required data will automatically be

sent to the payment gateway by the AssureBuy Payment Processing

application. The AssureBuy Payment Processing application will also

receive the data that is returned from the payment gateway and complete the

processing within the Great Plains software. Most of the processing is done

behind the scenes within the two software applications, but some of returned

data, such as approval code, is displayed. The Data Required and Data

Returned sections will explain the data used during payment processing.

The AssureBuy payment gateway performs the step of settlement after the

transaction results have been returned to the Great Plains Dynamics

software.

Data Required

Most of the information sent to the AssureBuy payment gateway is the same

type of information collected for any other type of payment. In addition to the

credit card number and expiration date, the payment gateway needs three

additional pieces of information to complete processing: the credit card type,

the transaction type and the IP address.

Credit Card Types

Each transaction accepted by the payment gateway will have a code

assigned to it based on the method of payment. The payment codes help

the seller identify the method of payment for the transaction. The

AssureBuy Payment Processing application enhances the Great Plains credit

card types by linking them to a set of predefined card types used by

AssureBuy. The AssureBuy payment gateway actually makes use of a 2character code that represents the credit card type. This 2-character code

may be seen on AssureBuy reports and within the AssureBuy Online

Administration system. The following table shows how these card type

identifiers are used within the Great Plains software.

Great Plains Card

Type

AssureBuy Payment Type AssureBuy

Code

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Payment Gateway • 25

Page 26

Great Plains Card

Type

User-defined American Express AM

User-defined Bravo Card BR

User-defined Carte Blanche CB

User-defined Diners Club DC

User-defined Discover DI

User-defined EuroCard EC

User-defined JCB Card JC

User-defined MasterCard MC

User-defined Visa VI

AssureBuy Payment Type AssureBuy

Code

Transaction Types

Each of the credit card transaction types available within the Great Plains

software is listed below with a description of each type. Not all of these

transaction types are available for every module or every document type in

Great Plains. For more information, see the section on “

Transactions to Great Plains Documents

Transaction Type Description

” on page 54.

Attaching

Authorization An authorization transaction contacts the cardholder’s

bank to verify that the cardholder has enough funds

available to cover the transaction. An authorization

will not transfer money from the cardholder’s account

until a capture transaction is performed. The number

of days an authorization remains valid is determined

by the cardholder’s bank.

Capture A capture transaction is performed only on an existing

approved authorization transaction. The capture will

complete the authorization transaction and instruct

the cardholder’s bank to release the funds to the

seller once a settlement has occurred.

Sale A sale transaction is a combination authorization and

capture in one transaction. The cardholder’s bank is

asked to verify the cardholder has sufficient funds to

cover the transaction and then the bank is instructed

to release the funds once a settlement has occurred.

Refund A refund, or credit, transaction is used to return

money to a cardholder’s account. In order to use this

type of transaction, a sale or capture transaction must

have been previously performed. Do not use this

type of transaction after only performing an

authorization transaction.

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Payment Gateway • 26

Page 27

Transaction Type Description

Manual Sale A manual sale or a force transaction allows a

transaction to be entered after an authorization has

been obtained from a voice authorization process. A

voice authorization is provided when calling a

processing center in response to a decline

transaction where the cardholder’s bank replied with

a message indicating the transaction requires a voice

approval.

Void The void transaction is u se d to cancel a sale, capture

or refund transaction that has not yet been settled.

Typically, a void transaction is only used to undo a

transaction during the same day, before a settlement

takes place. Issuing a void on a settled transaction

will result in an error from the AssureBuy payment

gateway.

IP Address

The Internet protocol (IP) address of a transaction is the buyer’s Internet

address. Each Internet user is assigned a unique IP address for a particular

connection. This IP address functions similarly to a “caller ID” and may be

fixed to a user’s computer or may be randomly assigned by the user’s ISP or

proxy server when a dial-up connection is initiated.

Data Returned

Each IP Address is comprised of four sections. Each of these sections is

referred to as a “class” and will contain a number from 0 to 255. The

sections are separated by a period. The first set of numbers is referred to as

Class A, the second set of numbers is referred to as Class B, and the third

and fourth sections are classes C and D. The classes of an IP address can

be very important in helping to prevent fraud. The fraud system can use the

IP addresses to trap transactions that come from a single IP address or

ranges of addresses. An IP address contains all four classes, while an IP

range must contain at least the class A portion.

IP Address An IP address has all four classes

(123.123.123.10) of an IP address

and points to a specific computer or

system.

IP Range An IP range has at least 1 of the

classes of an IP range (123.123).

Along with the information required by the payment gateway to complete

processing is the information passed back from the gateway with the results

of the transaction processing. The first and most important piece of

information passed back to the Great Plains software is the result of the

processing or the transaction result. Included with the transaction result are

the responses from the Address Verification System and the CVV

verification. If the seller has chosen to utilize the AssureBuy fraud system,

then the fraud results will also be passed back to the Great Plains software.

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Payment Gateway • 27

Page 28

Transaction Result

The transaction result field contains the result of the payment processing.

The possible transaction results are listed below.

Code Status Description Corresponding

AssureBuy

Code

1 Unprocessed A status of “1”, or

unprocessed indicates that

payment has not been

processed.

2 Approved A status of “2”, or approved,

indicates that the payment

has been approved.

3 Declined A status of “3”, or declined,

indicates that the payment

has been declined.

4 Void A status of “4”, or void,

indicates that the payment

has been voided.

5 Manual Decline A status of “5”, or manual

decline, indicates that the

payment has been

manually declined by a

system administrator.

6 Auto Cancel A status of “6”, or auto

cancel, indicates that the

payment has been

automatically declined by

the fraud prevention

system.

blank

Y

N

V

D

C

7 Expired A status of “7”, or expired,

indicates that the payment

has been on hold for an

extended period of time and

the system has canceled

the transaction.

8 Hold/Pending A status of “8”, or

hold/pending, indicates the

transaction has been

placed on hold by the fraud

system or the gateway has

returned an error.

E

H

Authorization Errors

The process of authorizing credit cards has three possible results. The first

is an approval with a bank determined approval code. The second is a

decline. Declines are accompanied either with a DECLINE message or a

message describing the problem. Examples of possible decline messages

are listed below:

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Payment Gateway • 28

Page 29

CALL CENTER

PICK UP

INVALID CARD

The CALL CENTER code is a decline—so the

AssureBuy payment gateway treats the

transaction as though it is declined; however,

if a transaction receives a Call Center code, it

indicates that the bank would like you to call

the voice authorization center. Sometimes,

the charge just needs additional verification

before the card company will approve the

transaction, but in most cases, the transaction

will still be declined. The bank will charge

sellers additional fees for a voice

authorization.

The PICK UP code is intended for sellers who

have the buyer’s credit card at the time of the

transaction. The Pick Up code means that the

credit card is no good and if the cardholder is

present, the seller should confiscate the credit

card. In the case of Internet/phone

transactions, this code is treated as a declined

transaction.

The INVALID CARD code means that the

credit card number supplied is not a valid card

number for the card issuing bank. This code

is received when buyers incorrectly enter their

credit card numbers or attempt fraudulent

transactions. Note that all credit card

networks do not check every credit card

number against the credit card number

database. Not receiving an invalid card code

does not guarantee that the credit card

number is good.

EXPIRED CARD

The EXPIRED CARD code indicates that the

card number is expired or the buyer has

entered an invalid expiration date.

CVV2 MISMATCH

The CVV2 mismatch code indicates that the

card verification value entered does not match

the CVV value on record at the bank. Since

the CVV2 code is an added security measure,

the bank usually declines the transactions.

However, some credit card networks might

treat this as an error and this would require

the seller to cancel the transaction from within

the system. Either way the transaction should

not be processed.

The final possible result is an error code. Error codes indicate a problem

with either the cardholder’s credit card number, a problem with the

cardholder’s bank, or a problem with the seller’s merchant account.

Depending on both the bank and the credit card networks, the error may

automatically be declined while others might just consider the transaction an

error.

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Payment Gateway • 29

Page 30

RE-ENTER

The RE-ENTER code indicates

that the credit card transaction

could not be completed. The

seller should cancel the payment,

as the system considers this an

error and does not automatically

decline the payment.

Address Verification Service

The Address Verification Service (AVS) is provided to a seller through the

cardholder’s bank. The AVS system is owned and operated by the card

processing banks. When a credit card is sent to the card network for an

authorization, the payment gateway also transmits all the information

required for the AVS system to verify the cardholder’s address. The AVS

system works based on the numbers in a cardholder’s billing addre ss and

postal code—only the numbers in the street address and the zip code are

verified. The card network will respond with the authorization for the card

and the AVS response at the same time. The payment gateway interprets

the AVS response and returns the response in two parts:

ADDR=

If the numbers of the street address

match, a “Y” (Yes) will display. If the

numbers of the street address do not

match, then an “N” (No) will display.

If the AVS system cannot verify the

address for any reason, then a “U”

(Unavailable) will display.

ZIP=

Drawbacks to the AVS System

The seller should be aware of the AVS system’s limitations:

1) The AVS system works only for credit cards issued in the United

States. All international cards including Canada and Mexico will

receive a “No Response” (N) or an “AVS Unavailable” (U) code from

the AVS system.

2) The AVS response is only received once the transaction has been

forwarded to the card processor for charging. If the AVS responses

are both NO and the seller decides to refund the transaction, the

seller will still be responsible for the fees from the credit card

processor for charging the card and issuing the refund.

3) The AVS system is only checking the numbers of the address and

zip code, not the cardholder name or the exact wording of an

address.

If the numbers of the zip code match,

a “Y” (Yes) will display. If the

numbers of the zip code do not

match, then an “N“ (No) will display.

If the AVS system cannot verify the

zip code for any reason, then a “U”

(Unavailable) will display.

AssureBuy Payment Processing Microsoft Great Plains Dynamics/eEnterprise Payment Gateway • 30

Page 31

CVV2 Response Codes

The CVV2 Response codes will vary greatly depending on the card type and

the credit card issuer. The table below lists the valid response codes for Visa

and MasterCard as of the printing of this manual.

Code Description

M Match

N No match

P Not Processed

S Should be on card but was not provided (Visa only)

U Issuer not certified

Watch Codes

If the seller has chosen to use the AssureBuy Fraud System, then the result

fields could include additional data that pertains to the fraud system. The

gateway will return a fraud response of “Y” if the transaction has passed all

the fraud tests or a response of “N” if the transaction failed any of the fraud

tests. In addition to the fraud response, each watch code that the transaction

failed will be returned as a two-letter code as part of the fraud value. For

more information on watch codes, please see “

The fraud filters themselves are controlled through the AssureBuy Online

Administration System.

Watch Codes” on page 19.

Settlements

The final step in transaction processing is the settlement. All transactions

must be settled in order for the cardholder’s bank to release the funds to the

seller. Settlements are run in accordance with the acquiring bank’s

requirements. Batches are normally settled at least once a day but can also

be settled based on when the batch reaches a certain dollar amount, a

certain number of transactions, or based on how many hours the batch has

been open. The specific instructions for how and when a batch should be

settled will be determined at the time the seller is set up within the AssureBuy