Dial-up

EFTPOS Merchant

Operating Guide

Phone Numbers

THE FOLLOWING HELP DESK’S AND AUTHORISATION CENTRE’S ARE AVAILABLE

TO YOU 24 HOURS A DAY, 7 DAYS A WEEK.

Bank of Melbourne Electronic Banking Service Centre

Service and Sales Support Help Desk

(including stationery orders).

Touch© Help Desk

For General Touch© Enquiries.

Authorisations - For Fall Back Purposes Only.

Cardlink Authorisation Centre

(credit cards only).

EFTPOS Help Desk (debit cards only). 1300 603 266

American Express® Authorisations 1300 363 614

Diners Club® Authorisations

1300 301 831

1800 331 112

JCB Authorisations 1300 363 614

Merchant details

Please complete the details below for your merchant facility.

Trading name:

Merchant number:

1300 603 266

1300 305 066

Terminal number(s):

American Express® is a registered trademark of American Express Company.

Diners Club® is the registered trademark of Diners Club International Limited.

© Copyright Touch Networks

Dial-up EFTPOS Merchant Operating Guide - May 2011

Contents page

1.0 Introduction 2

1.1 Merchant Responsibility

for Equipment and

Materials Provided 2

1.2 Cancellation of Facility

3

1.3 Damaged, Lost or Stolen

Equipment

1.4 Merchant Receipts

2.0 Getting Started

2.1 i5100 EFTPOS

2.2 Keyboard Layout

2.3 Connecting the Terminal

3

3

5

5

6

7

2.4 Printer and Paper Load

Function

3.0 Passwords and Codes

3.1 Refund password

3.2 Settlement password

3.3 Void password

3.4 Terminal password

3.5 User Management Code

4.0 Procedures

4.1 Inserting a Chip Card

9

10

10

10

10

10

11

12

12

4.2 Swiping a Magnetic

Stripe Card

4.3 Operating Training Mode

13

13

4.4 Locking/Unlocking

Terminal Keyboard

5.0 Transaction Procedures

5.1 How to Process a Sale

14

18

16

5.2 How to Process a Cash

Only Transaction

5.3 How to Process a Refund

5.4 How to Void a Transaction

22

22

24

5.5 How to Process a

Sale with Tip

26

5.6 How to Process a

Tip Adjustment

28

5.7 How to Process Multiple

Tip Adjustments

32

5.8 How to Process a Mail/

Telephone Order/

e-Commerce transaction

33

5.9 How to Process a

Pre-Authorisation

36

5.10 How to Process

a Checkout

38

6.0 How to Operate

User Management

(Shift) Function

41

6.1 How to Activate/

Deactivate User

Management (Shi) mode

6.2 How to Set User ID’s

6.3 How to Start Shift

6.4 How to End Shift

7.0 Reporting Functions

42

43

43

45

7.1 How to Print Sub

Totals Report

7.2 Terminal Settlement

45

47

7.3 How to Reprint

Last Settlement

7.4 Tip Reporting

49

49

7.5 How to Print Tip Report

7.6 How to Reprint

Last Transaction

52

7.7 How to do a

Transaction Scroll

53

7.8 How to View

Specific Transaction

54

7.9 How to Reprint

Specific Transaction

55

7.10 How to Print

Transaction Log

55

8.0 Fall Back

Sales Procedures

8.1 Electronic Fall Back

8.2 Manual Fall Back

9.0 Interfaced EFTPOS

10.0 Minimising Fraud

10.1 CCV Security Codes

11.0 Trouble Shooting

11.1 Hardware Faults

11.2 Response Codes

12.0 Glossary

67

57

57

58

59

60

60

62

62

63

41

50

Dial-up EFTPOS Merchant Operating Guide – May 2011

1

1.0 Introduction

The Ingenico EFTPOS terminal enables online transactions to be processed for

Debit Cards (Savings and Cheque accounts), Credit Cards (Visa and MasterCard®)

and Charge Cards (American Express®, Diners Club® and JCB). To accept Charge

Card transactions please contact the Charge Card provider.

The features of the EFTPOS terminal include:

Process Purchases

•

Process Refunds

•

Process Voids

•

Process Mail/Telephone Order Transactions

•

Process Cash Out Transactions for Debit Cards

•

Process Pre-Authorisation and Checkout Transactions

•

Process Tips

•

Shift Management and Reporting

•

Tip Management and Reporting

•

1.1 Merchant Responsibility for Equipment and Materials Provided

Imprinters, terminals, any other hardware or equipment and any unused

stationery and promotional materials supplied by the Bank, remain the property

of the Bank.

You must not sell, assign or in any way encumber them.

•

You shall not part with possession of them to a third party or give access

•

to a third party.

You must ensure that the terminals are covered by your business

•

or contents insurance.

Terminals must not be relocated without prior authorisation.

Terminals must be located where customers can use the pinpad without the risk

of other people seeing them key in their PIN.

MasterCard® is a registered trademark of MasterCard International Incorporated.

Dial-up EFTPOS Merchant Operating Guide – May 2011

2

1.2 Cancellation of Facility

If your merchant facility is cancelled for any reason, this equipment and

materials must be returned to us. To make arrangements for return call the

EFTPOS Helpdesk on 1300 603 266. You must ensure that all equipment and

materials are available to be returned within ive business days of our request.

Fees and charges will continue to be incurred until the equipment is returned to

the bank as instructed.

1.3 Damaged, Lost or Stolen Equipment

You are responsible for your equipment. If equipment is damaged, lost or stolen,

you will be charged for their replacement.

1.4 Merchant Receipts

You must retain all merchant receipts printed in a secure manner for

reconciliation and in case of terminal failure.

You must provide the customer with a receipt unless he or she

requests otherwise.

1.5 EFTPOS Stationery

All items of stationery relating to your EFTPOS terminal and fall back procedures

can be ordered by phone or online on the internet.

Please place your orders before running your stocks too low. Orders will

be delivered to you within ive business days.

There are no additional fees for stationery supplies.

Ordering Stationery Online

Log on to http://www.bankofmelbourne.com.au/business/payment-solutions

to order stationery online. Select ‘Order Merchant Stationery’ from the menu

on the left of the page, which will direct you to the stationery order page on the

Bank of Melbourne website and enter the following details:

* Merchant Number (MID)

* Trading Address Postcode

then:

* Select your stationery items and quantities and follow the prompts.

Dial-up EFTPOS Merchant Operating Guide – May 2011

3

Ordering Stationery By Phone

Call the EFTPOS Helpdesk on 1300 603 266 (available 24/7). Follow the prompts

and use your phone keypad to enter the following details:

* Select your stationery items and quantities

then:

* Merchant Number (MID)

* Trading Address Postcode

Dial-up EFTPOS Merchant Operating Guide – May 2011

4

2.0 Getting Started

2.1 i5100 EFTPOS

The i5100 EFTPOS terminal is a complete unit that includes a terminal, a detachable

power supply and a telephone cable. The terminal also operates as a PIN Pad for

the customer and has an internal thermal printer for fast, quiet printing.

Dial-up EFTPOS Merchant Operating Guide – May 2011

5

2.2 Keyboard Layout

3

def

6

mno

9

wxy

2

abc

5

jkl

8

tuv

1

Q Z

4

ghi

7

pqr

Cancel

Clear

E

N

T

E

R

0

Func

Feed

CHQSAV

CR

(Soft Function Keys)

CHQ/ SAV

CREDIT

(Soft Function Key)

Cancel Key

Clear Key

Enter Key

Paper Feed Key

Function key

Account keys: The CHQ (Cheque), SAV (Savings) and CR (Credit) keys (also

referred to as Soft Function Keys) allow the user to access the

particular account type required when prompted. These keys are

also used to access the terminal function menus.

Paper feed: The FEED key performs a 20mm paper feed.

Cancel key: The CANCEL key is used to cancel the current function and return

the terminal to the idle state.

Clear key: The CLEAR key is used to correct any invalid data entered. It is also

used to cycle backwards through the transaction steps if an error is

made.

Enter key: The ENTER key is used to conirm data entered or displayed, and to

cycle forwards through the menus. It is also used to Power on the

terminal.

Function Key: The FUNCTION key is used to access the terminal functions.

Dial-up EFTPOS Merchant Operating Guide – May 2011

6

2.3 Connecting the Terminal

Plug

It

Cable Management Clip

Telephone Line

(RJ12)

COM Port 1

(RJ12)

Power Socket

COM Port 2

(RJ12)

Ethernet Socket

(RJ45)

Dial-up EFTPOS Merchant Operating Guide – May 2011

7

1. Place the terminal on a clear, lat surface close to an electrical socket and

telephone socket. The connectors are located on the underneath of the terminal

as shown.

2. Plug the RJ12 phone connector on the curly end of the Y powered curly cord into

the socket marked

.

3. Plug the opposite end of the RJ12 curly cord into the telephone cable adaptor,

which inserts into the telephone wall socket.

4. Plug the DC connector on the curly end of the Y powered curly cord into the

terminal’s power socket.

5. Plug the opposite ends DC connector into the terminal power supply.

6. Connect the power cord to the terminal power supply and then into a mains

power outlet.

Y Powered Curly Cord

CAB321359b

Dial-up EFTPOS Merchant Operating Guide – May 2011

8

Terminal Connections

ALI0142

Power Cord

CAB0092

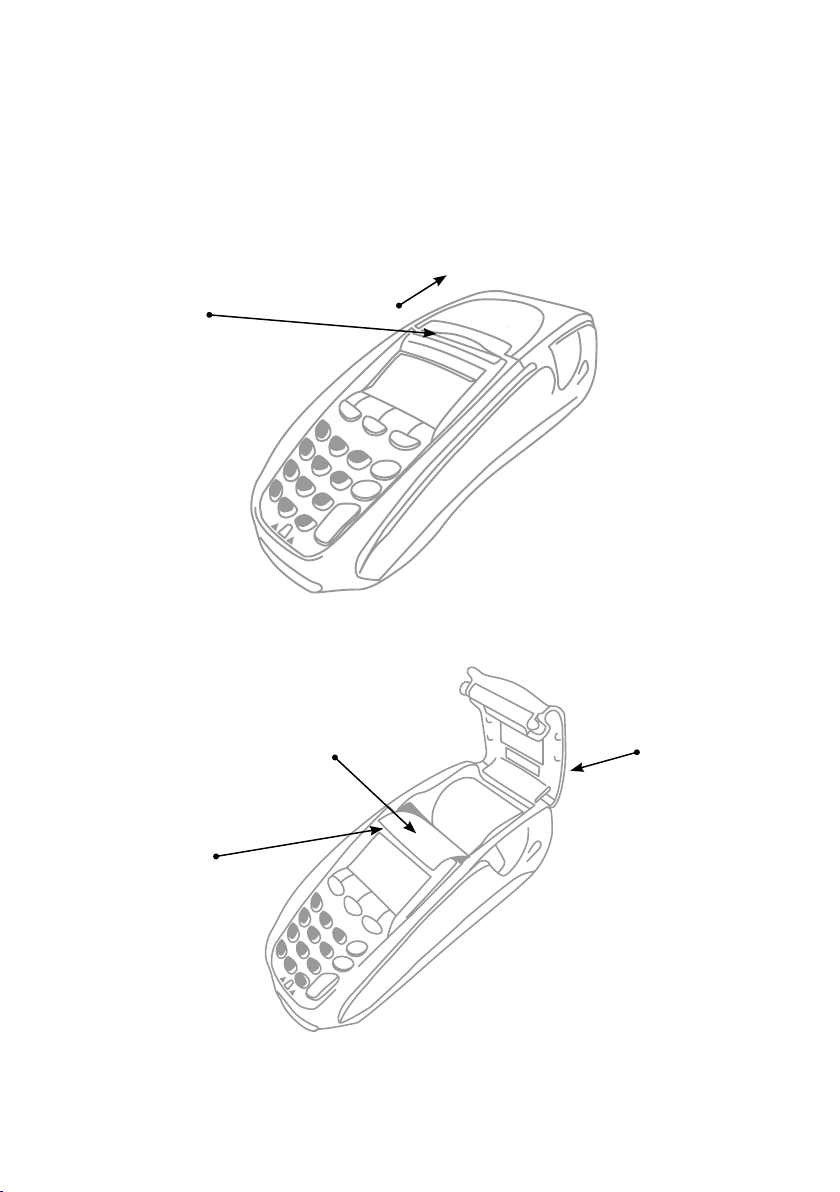

2.4 Printer and Paper Load Function

The i5100 EFTPOS terminal has an in-built thermal printer. To load paper:

a) Ensure the terminal is powered on.

b) Open the paper compartment cover by pressing the button located towards

the top of the terminal, above the metal blade, as shown below.

Press button in

Paper

compartment

button

this direction

c) Position the paper roll with the end of the roll protruding from underneath the roll.

Correct paper

position

Metal blade to

tear o paper

d) Pull the paper out slightly and close the cover.

e) Test the operation of the printer by pressing the paper FEED button.

Dial-up EFTPOS Merchant Operating Guide – May 2011

Paper

compartment

cover

9

3.0 Passwords and Codes

The following information describes the passwords and codes used in this guide.

Ensure that your passwords are changed regularly to prevent unauthorised use.

3.1 Refund Password

This password is a security measure to ensure only those personnel who are

authorised by you (as the authorised signatory) can process refunds through

your terminal.

You are responsible for protecting this password against unauthorised use.

Do not key in your password in a manner that enables customers or

unauthorised staf to observe the number

3.2 Settlement Password

This password is a general security password that allows you to restrict access to

the SETTLEMENT function. Automatic settlement does not require a password.

Access to the settlement function can be limited at your discretion.

3.3 Void Password

This password is a general security password that allows you to restrict access to

the VOID function. Access to the void function can be limited at your discretion.

3.4 Terminal Password

This password is a general security password that allows you to restrict access

to the following functions:

Checkout Function (User Guide section 5.10)

•

User Management Function

•

– Activating/Deactivating Shift Function (User Guide section 6.1)

– Setting User ID’s (User Guide section 6.2)

– Starting Shifts (User Guide section 6.3)

– Ending shifts (User Guide section 6.4)

Tip Adjustments (User Guide section 5.6 and 5.7)

•

Activating/Deactivating Tip Reporting (User Guide section 7.4)

•

Locking/Unlocking the terminal (User Guide section 4.5)

•

Training Mode (User Guide section 4.4)

•

Dial-up EFTPOS Merchant Operating Guide – May 2011

10

Access to these functions can be limited at your discretion.

You are responsible for protecting this password against unauthorised use.

You (as the authorised signatory) will need to contact the EFTPOS Helpdesk

to change your passwords on 1300 603 266.

Refund, Settlement, Void and Terminal passwords will have a default setting

(unless nominated by you at the time of application) when you receive

your terminal(s).

3.5 User Management Code

(See User Guide section 6.0).

The USER MANAGEMENT code is only used when the SHIFT feature is enabled

on the terminal. Each “user” must be assigned a “user ID”. The user cannot log

in or out of a shift without using the USER MANAGEMENT code. Up to 10 users

IDs can be programmed into the terminal.

The User Management code is selected by the user at a time the “user ID”

is being established on the terminal (generally at the start of the shift).

The code is a four digit number nominated by the user.

Dial-up EFTPOS Merchant Operating Guide – May 2011

11

4.0 Procedures

4.1 Inserting a Chip Card

When your terminal is enabled for chip card acceptance, chip cards are inserted

into the terminal and left there for the duration of the transaction.

The chip card reader is located at the bottom of the terminal below the keypad.

1. Check the terminal is displaying the message INSERT/SWIPE CARD.

2. Hold the card face-up with the chip towards the terminal.

3. Insert the card as far as it will go into the reader and continue processing

the transaction.

4. Leave the card in the terminal until prompted to remove.

Dial-up EFTPOS Merchant Operating Guide – May 2011

12

4.2 Swiping a Magnetic Stripe Card

The magnetic stripe reader is located on the right hand side of the terminal.

1. Check the terminal is displaying the message INSERT/SWIPE CARD.

2. Hold the card upside-down with the magnetic strip facing inwards.

3. Swipe the card smoothly through the card reader, in either direction. Ensure

the whole magnetic strip is swiped through the reader.

4. If there is no response from the terminal, or CARD ERROR message is

displayed, swipe the card again. You might need to swipe faster or slower.

4.3 Damaged Cards

If a credit card will not read, when inserted in the chip card reader or when

swiped, while performing a credit account transaction, the manual key process

should not be used.

Warning: Where the manual key process has been used to perform a credit

card transaction (contrary to the MOTO or ECOM instructions outlined in

section 5.8, How to Process a MOTO/ECOM Transaction), and that transaction

is subsequently disputed by the cardholder, the merchant will be liable for the

amount of the transaction.

A manual fall back voucher can be used to fulil the sale as per the instructions

outlined in section 8.2, Manual Fall Back.

The option of completing a manual voucher ONLY applies to credit account

transactions where the credit card will not read.

Dial-up EFTPOS Merchant Operating Guide – May 2011

13

In the following situations, the cardholder must be referred to their card issuer

and an alternative form of payment requested.

- Credit account transaction DECLINED

- Savings/Cheque account transaction DECLINED

- Credit/Debit card will NOT READ when performing a Savings/Cheque

account transaction.

Note: The non compliance to the above procedure will be considered a serious

breach of the merchant agreement and may result in termination of your

merchant facility.

4.4 Operating Training Mode

Training mode helps you train new staf members in the operation of the

terminal. Training mode can be initiated at any time during the day without

afecting live value totals. During training mode the terminal will not connect

to the host but will perform all transactions oline. Transactions performed

in training mode will not afect your settlement total.

This function will either start or end the training mode session.

Please Note:

Training mode cannot be used for chip cards. If attempted you will receive

•

the error message ‘CHIP CARDS NOT SUPPORTED IN TRAINING MODE’.

If training mode has been inactive for 2 minutes, it will revert back to

•

live mode.

In training mode, whole dollar amounts will generate an approved

•

transaction. Other amounts will result in a ‘response code’ corresponding

to the number of cents. For example an amount of $2.01 or $0.01 will result

in a response code of 01 Declined, Contact Bank.

Dial-up EFTPOS Merchant Operating Guide – May 2011

14

To start training mode:

TERMINAL DISPLAY PROCEDURE

22/05/2009 12.21

ENTER AMOUNT

FUNCTION? Key in 101 and press ENTER.

TRAINING MODE

PASSWORD?

22/05/2009 12.21

TRAINING MODE

ENTER AMOUNT

Press the Function (FUNC) button.

Key in the terminal password and press ENTER.

When the terminal runs in training mode the idle

screen is changed to display TRAINING MODE.

Process transactions as per procedures in Section 5.0. Receipts will display TRAINING

on them. After three minutes of inactivity the terminal will exit training mode and

return to the idle prompt.

To exit training mode:

TERMINAL DISPLAY PROCEDURE

22/05/2009 12.30

TRAINING MODE

ENTER AMOUNT

FUNCTION? Key in 101 and press ENTER.

TRAINING MODE

PASSWORD?

END TRAINING?

CORRECT? YES/NO

Press the Function (FUNC) button.

Key in the terminal password and press ENTER.

Press ENTER again to exit training mode.

Dial-up EFTPOS Merchant Operating Guide – May 2011

15

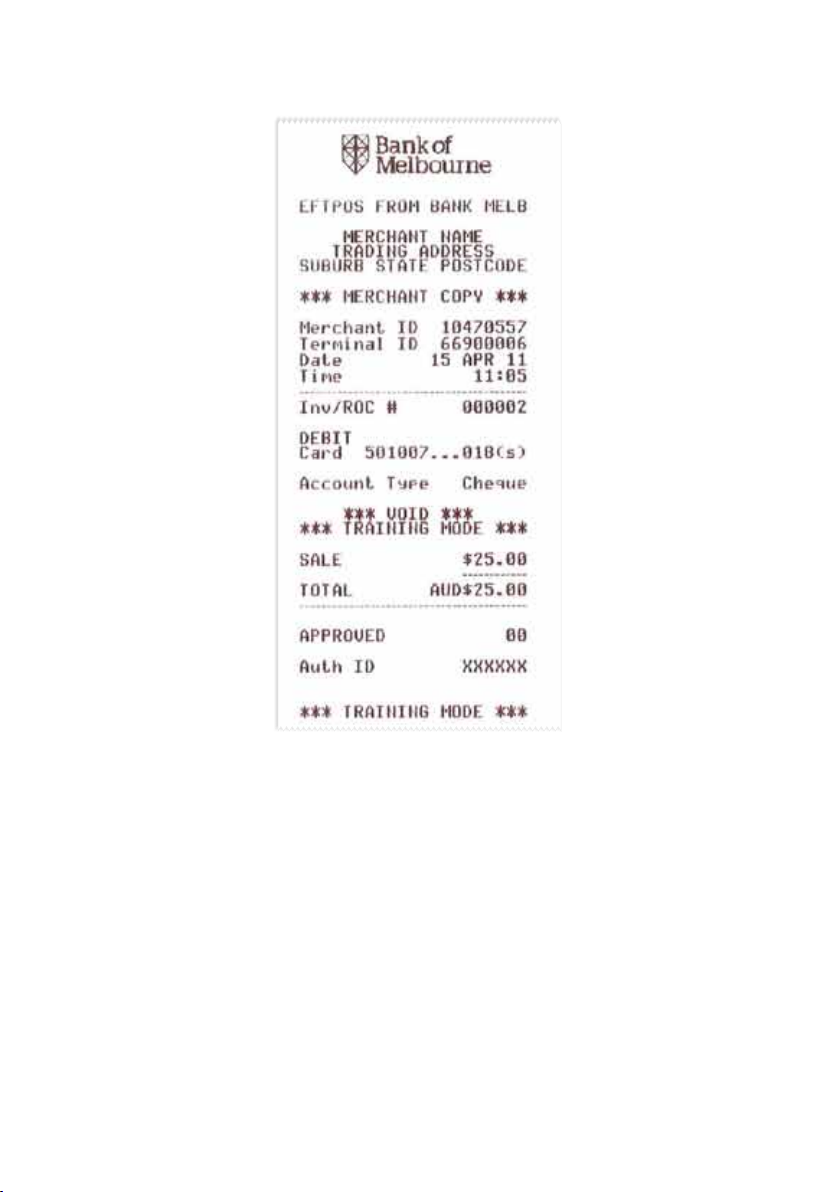

Receipt in Training Mode

At the end of training mode all tran sactions are res et and previous va lues are restored to

batch and RO C (Record of Charg e) number.

Dial-up EFTPOS Merchant Operating Guide – May 2011

16

4.5 Locking/Unlocking Terminal Keyboard

This function locks the terminal keyboard and prevents any unauthorised transactions

taking place. The terminal remains locked even if powered o and on.

TERMINAL DISPLAY PROCEDURE

22/05/2009 12.21

Press the Function (FUNC) button.

ENTER AMOUNT

FUNCTION? Key in 4 and press ENTER.

LOCK TERMINAL

Key in the terminal password and press ENTER

CORRECT? YES/NO

TERMINAL LOCKED

The terminal is now locked. To unlock press ENTER

UNLOCK?

PASSWORD? Key in the terminal password and press ENTER

Dial-up EFTPOS Merchant Operating Guide – May 2011

17

5.0 Transaction Procedures

5.1 How to Process a Sale

TERMINAL DISPLAY PROCEDURE

22/05/2009 12.28

ENTER AMOUNT

SALE $4.00

ADD CASH AMT

& / OR ENTER

SALE $4.00

INSERT / SWIPE CRD

SALE $4.00

SELECT ACCOUNT

HQ SAV CR

SALE $4.00

PIN & / OR ENTER

CREDIT SALE

PROCESSING

VERIFY SIGNATURE

CORRECT? YES/NO

**REMOVE CARD**

CUSTOMER COPY

PRESS ENTER

Key in the purchase amount and press ENTER.

If ‘Purchase with Cash’ transactions are enabled on

the terminal, you can enter a cash-out amount. The

cash-out amount may be left at $0.00.

If presented with a chip card, insert the customer’s

card into the chip card reader. Refer to Inserting a

Chip Card in section 4.1

OR:

If presented with a magnetic stripe card, swipe the

customer’s card through the card reader. Refer to

Swiping a Magnetic Stripe Card in section 4.2.

Press the soft key beneath the account type

needed.

Where prompted, have the cardholder key in their

PIN and press ENTER, or just press ENTER.

The terminal is connecting to the bank and

processing the sale.

2

1

If the card was inserted, remove the card from the

reader.

If signature is required: Have the customer sign the

receipt. If the signature matches the signature on

the card, press ENTER. Otherwise press CANCEL.

Press ENTER to print customer receipt.

Notes:

1. The entering of PIN on credit is opt ional. Allow the cardholder to enter t heir PIN

at the ter minal prompt. I f the cardholder by passes PIN entry a signat ure will

need to b e obtained to author ise the tran saction.

2. If the terminal reads ‘OVER EF B LIMIT ’, please refer to Section 8 .2.

Before completi ng the sale, check that the transaction was approved. If the t ransaction is

decline d, the termi nal will di splay an error me ssage giving the reason. A n explanation of

the error code is available i n Chapter 11. 2, Response Codes.

Dial-up EFTPOS Merchant Operating Guide – May 2011

18

Approved Receipt (approved with

PIN, no signature required)

Approved Credit Card Receipt

(signature required)

Remember to a lways che ck the

receipt to ver ify if a tran saction

has be en approved.

Dial-up EFTPOS Merchant Operating Guide – May 2011

19

5.2 How to Process a Cash Only Transaction

If ‘Cash’ is enabled on the terminal, customers can be given cash out. Cash is available

from cheque and savings accounts only.

TERMINAL DISPLAY PROCEDURE

22/05/2009 12.30

Press ENTER until CASH is displayed on the screen.

ENTER AMOUNT

22/05/2009 12.30

Press the select key beneath CASH.

PRCH CASH RFND

ENTER CASH AMT Key in the cash amount and press ENTER.

CASH $10.00

INSERT/SWIPE CRD

Insert the customer’s chip card into the chip card

reader.

Or:

Swipe the customer’s card through the card reader.

CASH $10.00

SELECT ACCOUNT

Select either CHQ or SAV .

Note: CR is not an option.

CHQ SAV

CASH $10.00

PIN & ENTER

DEBIT CASH

PROCESSING

CUSTOMER COPY

PRESS ENTER

**REMOVE CARD**

Before completi ng the sale, check that the transaction was approved. Hand the customer

their copy of the transac tion record and the ir card. If t he transaction is declined, the

termin al will di splay an error me ssage givin g the reason. An explanatio n of the error co de

is availa ble in Chapter 11 .2, Respon se Codes.

When prompted, have the cardholder key in their

PIN and press ENTER.

The terminal is connecting to the bank and

processing the transaction.

Press ENTER to print customer’s receipt.

If the card was inserted, remove the card from the

reader.

Dial-up EFTPOS Merchant Operating Guide – May 2011

20

Loading...

Loading...