Page 1

hp

12c financial calculator

user's guide

H

Edition 4

HP Part Number 0012C-90001

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 1 of 209

Printed Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 2

Notice

REGISTER YOUR PRODUCT AT: www.register.hp.com

THIS MANUAL AND ANY EXAMPLES CONTAINED HEREIN ARE

PROVIDED “AS IS” AND ARE SUBJECT TO CHANGE WITHOUT NOTICE.

HEWLETT-PACKARD COMPANY MAKES NO WARRANTY OF ANY

KIND WITH REGARD TO THIS MANUAL, INCLUDING, BUT NOT

LIMITED TO, THE IMPLIED WARRANTIES OF MERCHANTABILITY,

NON-INFRINGEMENT AND FITNESS FOR A PARTICULAR PURPOSE.

HEWLETT-PACKARD CO. SHALL NOT BE LIABLE FOR ANY ERRORS OR

FOR INCIDENTAL OR CONSEQUENTIAL DAMAGES IN CONNECTION

WITH THE FURNISHING, PERFORMANCE, OR USE OF THIS MANUAL

OR THE EXAMPLES CONTAINED HEREIN.

©

Copyright 1981, 2004 Hewlett-Packard Development Company, L.P.

Reproduction, adaptation, or translation of this manual is prohibited without prior

written permission of Hewlett-Packard Company, except as allowed under the

copyright laws.

Hewlett-Packard Company

4995 Murphy Canyon Rd,

Suite 301

San Diego, CA 92123

Printing History

Edition 4 August 2004

2

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 2 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 3

Introduction

About This Handbook

This hp 12c user's guide is intended to help you get the most out of your

investment in your hp 12c Programmable Financial Calculator. Although the

excitement of acquiring this powerful financial tool may prompt you to set this

handbook aside and immediately begin “pressing buttons,” in the long run you’ll

profit by reading through this handbook and working through the examples it

contains.

Following this introduction is a brief section called Making Financial Calculations

Easy—which shows you that your hp 12c does just that! The remainder of this

handbook is organized basically into three parts:

z Part I (sections 1 through 7) describes how to use the various financial,

mathematics, statistics, and other functions (except for programming)

provided in the calculator:

z Section 1 is about Getting Started. It tells you how to use the keyboard,

how to do simple arithmetic calculations and chain calculations, and

how to use the storage registers (“memories”).

z Section 2 tells you how to use the percentage and calendar functions.

z Section 3 tells you how to use the simple interest, compound interest, and

amortization functions.

z Section 4 tells you how to do discounted cash flow analysis, bond, and

depreciation calculations.

z Section 5 tells you about miscellaneous operating features such as

Continuous Memory, the display, and special function keys.

z Sections 6 and 7 tell you how to use the statistics, mathematics, and

number-alteration functions.

z Part II (sections 8 through 11) describe how to use the powerful

programming capabilities of the hp 12c.

z Part III (sections 12 through 16) give you step-by-step solutions to specialized

problems in real estate, lending, savings, investment analysis, and bonds.

Some of these solutions can be done manually, while others involve running

a program. Since the programmed solutions are both self-contained and

step-by-step, you can easily employ them even if you don’t care to learn how

to create your own programs. But if you do start to create your own

programs, look over the programs used in the solutions: they contain

examples of good programming techniques and practices.

3

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 3 of 209

Printed Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 4

4 Introduction

z The various appendices describe additional details of calculator operation as

well as warranty and service information.

z The Function Key Index and Programming Key Index at the back of the

handbook can be used as a handy page reference to the comprehensive

information inside the manual

Financial Calculations in the United Kingdom

The calculations for most financial problems in the United Kingdom are identical to

the calculations for those problems in the United States — which are described in

this handbook. Certain problems, however, require different calculation methods in

the United Kingdom than in the United States. Refer to Appendix F for more

information.

For More Solutions to Financial Problems

In addition to the specialized solutions found in Sections 12 through 16 of this

handbook, many more are available in the optional hp 12c Solutions Handbook.

Included are solutions to problems in lending, forecasting, pricing, statistics,

savings, investment analysis, personal finance, securities, Canadian mortgages,

learning curves in manufacturing, and queuing theory. A Solutions Handbook is

available online (www.hp.com/calculators

).

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 4 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 5

Contents

Introduction.................................................................... 3

About This Handbook.....................................................................3

Financial Calculations in the United Kingdom.....................................4

For More Solutions to Financial Problems...........................................4

Part I. Problem Solving ......................................... 15

Section 1: Getting Started............................................. 16

Power On and Off........................................................................16

Low-Power Indication..............................................................16

The Keyboard ..............................................................................16

Keying in Numbers ................................................................17

Digit Separators ....................................................................17

Negative Numbers ................................................................17

Keying in Large Numbers .......................................................18

The CLEAR Keys ....................................................................18

Simple Arithmetic Calculations .......................................................19

Chain Calculations.......................................................................20

Storage Registers..........................................................................23

Storing and Recalling Numbers...............................................23

Clearing Storage Registers......................................................24

Storage Register Arithmetic .....................................................24

Section 2: Percentage and Calendar Functions................ 26

Percentage Functions.....................................................................26

Percentages ..........................................................................26

Net Amount..........................................................................27

Percent Difference..................................................................27

Percent of Total......................................................................28

Calendar Functions.......................................................................29

Date Format..........................................................................29

Future or Past Dates................................................................30

Number of Days Between Dates..............................................31

Section 3: Basic Financial Functions ............................... 32

The Financial Registers..................................................................32

Storing Numbers Into the Financial Registers .............................32

Displaying Numbers in the Financial Registers...........................32

5

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 5 of 209

Printed Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 6

6 Contents

Clearing the Financial Registers.............................................. 33

Simple Interest Calculations........................................................... 33

Financial Calculations and the Cash Flow Diagram.......................... 34

The Cash Flow Sign Convention.............................................. 36

The Payment Mode ............................................................... 37

Generalized Cash Flow Diagrams........................................... 37

Compound Interest Calculations..................................................... 39

Specifying the Number of Compounding Periods and the Periodic

Interest Rate ......................................................................... 39

Calculating the Number of Payments or Compounding Periods ... 39

Calculating the Periodic and Annual Interest Rates..................... 43

Calculating the Present Value ................................................. 44

Calculating the Payment Amount............................................. 46

Calculating the Future Value................................................... 48

Odd-Period Calculations ........................................................ 50

Amortization ............................................................................... 54

Section 4: Additional Financial Functions ....................... 57

Discounted Cash Flow Analysis: NPV and IRR................................. 57

Calculating Net Present Value (NPV) ....................................... 58

Calculating Internal Rate of Return (IRR) ................................... 63

Reviewing Cash Flow Entries................................................... 64

Changing Cash Flow Entries................................................... 65

Bond Calculations ....................................................................... 66

Bond Price ............................................................................67

Bond Yield............................................................................67

Depreciation Calculations ............................................................. 68

Section 5: Additional Operating Features ....................... 70

Continuous Memory..................................................................... 70

The Display................................................................................. 71

Status Indicators ................................................................... 71

Number Display Formats ....................................................... 71

Scientific Notation Display Format........................................... 72

Special Displays ................................................................... 73

The key ..............................................................................74

The Key..............................................................................74

Arithmetic Calculations With Constants.................................... 75

Recovering From Errors in Digit Entry....................................... 75

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 6 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 7

Contents 7

Section 6: Statistics Functions........................................ 76

Accumulating Statistics..................................................................76

Correcting Accumulated Statistics ...................................................77

Mean .........................................................................................77

Standard Deviation.......................................................................79

Linear Estimation ..........................................................................80

Weighted Mean...........................................................................81

Section 7: Mathematics and Number-Alteration Functions 83

One-Number Functions .................................................................83

The Power Function.......................................................................85

Part II. Programming............................................. 87

Section 8: Programming Basics ..................................... 88

Why Use Programs?.....................................................................88

Creating a Program......................................................................88

Running a Program.......................................................................89

Program Memory .........................................................................90

Identifying Instructions in Program Lines....................................91

Displaying Program Lines........................................................92

The 00 Instruction and Program Line 00 ............................93

Expanding Program Memory ..................................................94

Setting the Calculator to a Particular Program Line .....................95

Executing a Program One Line at a Time.........................................96

Interrupting Program Execution.......................................................97

Pausing During Program Execution...........................................97

Stopping Program Execution .................................................101

Section 9: Branching and Looping ............................... 103

Simple Branching.......................................................................103

Looping ....................................................................................104

Conditional Branching ................................................................107

Section 10: Program Editing ......................................... 113

Changing the Instruction in a Program Line....................................113

Adding Instructions at the End of a Program ..................................114

Adding Instructions Within a Program...........................................115

Adding Instructions by Replacement.......................................115

Adding Instructions by Branching...........................................116

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 7 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 8

8 Contents

Section 11: Multiple Programs ...................................... 120

Storing Another Program ............................................................ 120

Running Another Program........................................................... 122

Part III. Solutions .................................................. 123

Section 12: Real Estate and Lending .............................. 124

Annual Percentage Rate Calculations With Fees............................. 124

Price of a Mortgage Traded at a Discount or Premium.................... 126

Yield of a Mortgage Traded at a Discount or Premium ................... 128

The Rent or Buy Decision ............................................................ 130

Deferred Annuities ..................................................................... 134

Section 13: Investment Analysis .................................... 136

Partial-Year Depreciation............................................................. 136

Straight-Line Depreciation..................................................... 136

Declining-Balance Depreciation ............................................ 139

Sum-of-the-Years-Digits Depreciation ...................................... 141

Full- and Partial-Year Depreciation with Crossover .......................... 144

Excess Depreciation................................................................... 148

Modified Internal Rate of Return................................................... 148

Section 14: Leasing...................................................... 151

Advance Payments..................................................................... 151

Solving For Payment ............................................................ 151

Solving for Yield ................................................................. 154

Advance Payments With Residual ................................................ 156

Solving for Payment............................................................. 156

Solving For Yield................................................................. 158

Section 15: Savings...................................................... 160

Nominal Rate Converted to Effective Rate ..................................... 160

Effective Rate Converted to Nominal Rate ..................................... 161

Nominal Rate Converted to Continuous Effective Rate..................... 162

Section 16: Bonds ........................................................ 163

30/360 Day Basis Bonds........................................................... 163

Annual Coupon Bonds ............................................................... 166

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 8 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 9

Contents 9

Appendixes................................................................ 169

Appendix A: The Automatic Memory Stack ................... 170

Getting Numbers Into the Stack: The Key..............................171

Termination of Digit Entry .....................................................172

Stack Lift.............................................................................172

Rearranging Numbers in the Stack ...............................................172

The key .....................................................................172

The Key.......................................................................172

One-Number Functions and the Stack...........................................173

Two-Number Functions and the Stack............................................173

Mathematics Functions .........................................................173

Percentage Functions............................................................ 174

Calendar and Financial Functions.................................................175

The LAST X Register and the Key .........................................176

Chain Calculations.....................................................................176

Arithmetic Calculations with Constants ..........................................177

Appendix B: More About L...................................... 179

Appendix C: Error Conditions ...................................... 181

Error 0: Mathematics..................................................................181

Error 1: Storage Register Overflow ...............................................182

Error 2: Statistics ........................................................................182

Error 3: IRR................................................................................182

Error 4: Memory ........................................................................182

Error 5: Compound Interest..........................................................183

Error 6: Storage Registers............................................................183

Error 7: IRR................................................................................184

Error 8: Calendar.......................................................................184

Error 9: Service..........................................................................184

Pr Error .....................................................................................184

Appendix D: Formulas Used ........................................ 185

Percentage ................................................................................185

Interest......................................................................................185

Simple Interest.....................................................................185

Compound Interest...............................................................186

Amortization..............................................................................186

Discounted Cash Flow Analysis....................................................187

Net Present Value ................................................................187

Internal Rate of Return ..........................................................187

Calendar ..................................................................................187

Actual Day Basis .................................................................187

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 9 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 10

10 Contents

30/360 Day Basis.............................................................. 187

Bonds ...................................................................................... 188

Depreciation ............................................................................. 189

Straight-Line Depreciation..................................................... 189

Sum-of-the-Years-Digits Depreciation ...................................... 189

Declining-Balance Depreciation ............................................ 190

Modified Internal Rate of Return................................................... 190

Advance Payments..................................................................... 190

Interest Rate Conversions ............................................................ 191

Finite Compounding............................................................ 191

Continuous Compounding.................................................... 191

Statistics ................................................................................... 191

Mean................................................................................ 191

Weighted Mean ................................................................. 191

Linear Estimation................................................................. 191

Standard Deviation ............................................................. 192

Factorial ............................................................................ 192

The Rent or Buy Decision ............................................................ 192

Appendix E: Battery, Warranty, and Service Information 193

Battery ..................................................................................... 193

Low-Power Indication.................................................................. 193

Installing a New Battery ...................................................... 193

Verifying Proper Operation (Self-Tests) .......................................... 194

Warranty.................................................................................. 196

Service..................................................................................... 197

Regulatory Information ............................................................... 199

Temperature Specifications.......................................................... 199

Noise Declaration ..................................................................... 199

Disposal of Waste Equipment by Users in Private Household in the

European Union ........................................................................ 200

Appendix F: United Kingdom Calculations .................... 201

Mortgages................................................................................ 201

Annual Percentage Rate (APR) Calculations ................................... 202

Bond Calculations ..................................................................... 202

Function Key Index...................................................... 203

Programming Key Index .............................................. 206

Subject Index.............................................................. 208

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 10 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 11

Making Financial

Calculations Easy

Before you begin to read through this handbook, let’s take a look at how easy

financial calculations can be with your hp 12c. While working through the

examples below, don’t be concerned about learning how to use the calculator;

we’ll cover that thoroughly beginning with Section 1.

Example 1:

college education 14 years from today. You expect that the cost will be about

$6,000 a year ($500 a month) for 4 years. Assume she will withdraw $500 at the

beginning of each month from a savings account. How much would you have to

deposit into the account when she enters college if the account pays 6% annual

interest compounded monthly?

This is an example of a compound interest calculation. All such problems involve at

least three of the following quantities:

z n: the number of compounding periods.

z i: the interest rate per compounding period.

z PV: the present value of a compounded amount.

z PMT: the periodic payment amount.

z FV: the future value of a compounded amount.

In this particular example:

z n is 4 years × 12 periods per year = 48 periods.

z i is 6% per year ÷ 12 periods per year = 0.5% per period.

z PV is the quantity to be calculated — the present value when the financial

z PMT is $500.

z FV is zero, since by the time your daughter graduates she (hopefully!) will

To begin, turn the calculator on by pressing the ; key. Then, press the keys

shown in the

Suppose you want to ensure that you can finance your daughter’s

transaction begins.

not need any more money.

Keystrokes

column below.

*

If you are not familiar with the use of an hp calculator keyboard, refer to the description on

*

pages 16 and 17.

11

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 11 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 12

12 Making Financial Calculations Easy

Note: A battery symbol (¼) shown in the lower-left corner of the display

when the calculator is on signifies that the available battery power is nearly

exhausted. To install new batteries, refer to Appendix E.

The calendar functions and nearly all of the financial functions take some

time to produce an answer. (This is typically just a few seconds, but the ¼,

!, L, and S functions could require a half-minute or more.) During

these calculations, the word running flashes in the display to let you know

that the calculator is running.

Keystrokes Display

fCLEARHf2

4gA

6gC

500P

g×

$

0.00

48.00

0.50

500.00

500.00

-21,396.61

Clears previous data inside the

calculator and sets display to show

two decimal places.

Calculates and stores the number of

compounding periods.

Calculates and stores the periodic

interest rate.

Stores periodic payment amount.

Sets payment mode to Begin.

Amount required to be deposited.

*

Example 2:

by the time your daughter enters college 14 years from now. Let’s say that she has

a paid-up $5,000 insurance policy that pays 5.35% annually, compounded

semiannually. How much would it be worth by the time she enters college?

In this example, we need to calculate FV, the future value.

Keystrokes Display

fCLEARG

14\2µn

5.35\2z¼

5000Þ$

M

We now need to determine how to accumulate the required deposit

-21,396.61

28.00

2.68

-5,000.00

10,470.85

Clears previous financial data inside

the calculator.

Calculates and stores the number of

compounding periods.

Calculates and stores the periodic

interest rate.

Stores the present value of the

policy.

Value of policy in 14 years.

Don’t be concerned now about the minus sign in the display. That and other details will be

*

explained in Section 3.

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 12 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 13

Making Financial Calculations Easy 13

Example 3:

provide about half the required amount. An additional amount must be set aside to

provide the balance (21,396.61 – 10,470.85 = 10,925.76). Suppose you make

monthly payments, beginning at the end of next month, into an account that pays

6% annually, compounded monthly. What payment amount would be required in

order to accumulate $10,925.75 in the 14 years remaining?

Keystrokes Display

fCLEARG

14gA

6gC

10925.76M

gÂ

P

Example 4:

with 6% annual interest compounded monthly, but you can afford to make $45.00

monthly payments. What is the minimum interest rate that will enable you to

accumulate the required amount?

In this problem, we do not need to clear the previous financial data inside the

calculator, since most of it is unchanged from the preceding example.

Keystrokes Display

45ÞP

¼

12§

The preceding example showed that the insurance policy will

10,470.85

168.00

0.50

10.925.76

10.925.76

–41.65

Suppose you cannot find a bank that currently offers an account

–45.00

0.42

5.01

Clears previous financial data

inside the calculator.

Calculates and stores the number of

compounding periods.

Calculates and stores the periodic

interest rate.

Stores the future value required.

Sets payment mode to End.

Monthly payment required.

Stores payment amount.

Periodic interest rate.

Annual interest rate.

This is only a small sampling of the many financial calculations that can now be

done easily with your hp 12c. To begin learning about this powerful financial tool,

just turn the page.

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 13 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 14

Page 15

Part I

Problem Solving

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 15 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 16

g

r

Section 1

Getting Started

Power On and Off

To begin using your hp 12c, press the ; key*. Pressing ; again turns the

calculator off. If not manually turned off, the calculator will turn off automatically 8

to 17 minutes after it was last used.

Low-Power Indication

A battery symbol (¼) shown in the upper-left corner of the display when the

calculator is on signifies that the available battery power is nearly exhausted. To

replace the batteries, refer to Appendix E.

The Keyboard

Many keys on the hp 12c perform two or even three functions. The primary

function of a key is indicated by the characters printed in white on the upper face

of the key. The alternate function(s) of a key are indicated by the characters

printed in gold above the key and the characters printed in blue on the lower face

of the key. These alternate functions are specified by pressing the appropriate

prefix key before the function key:

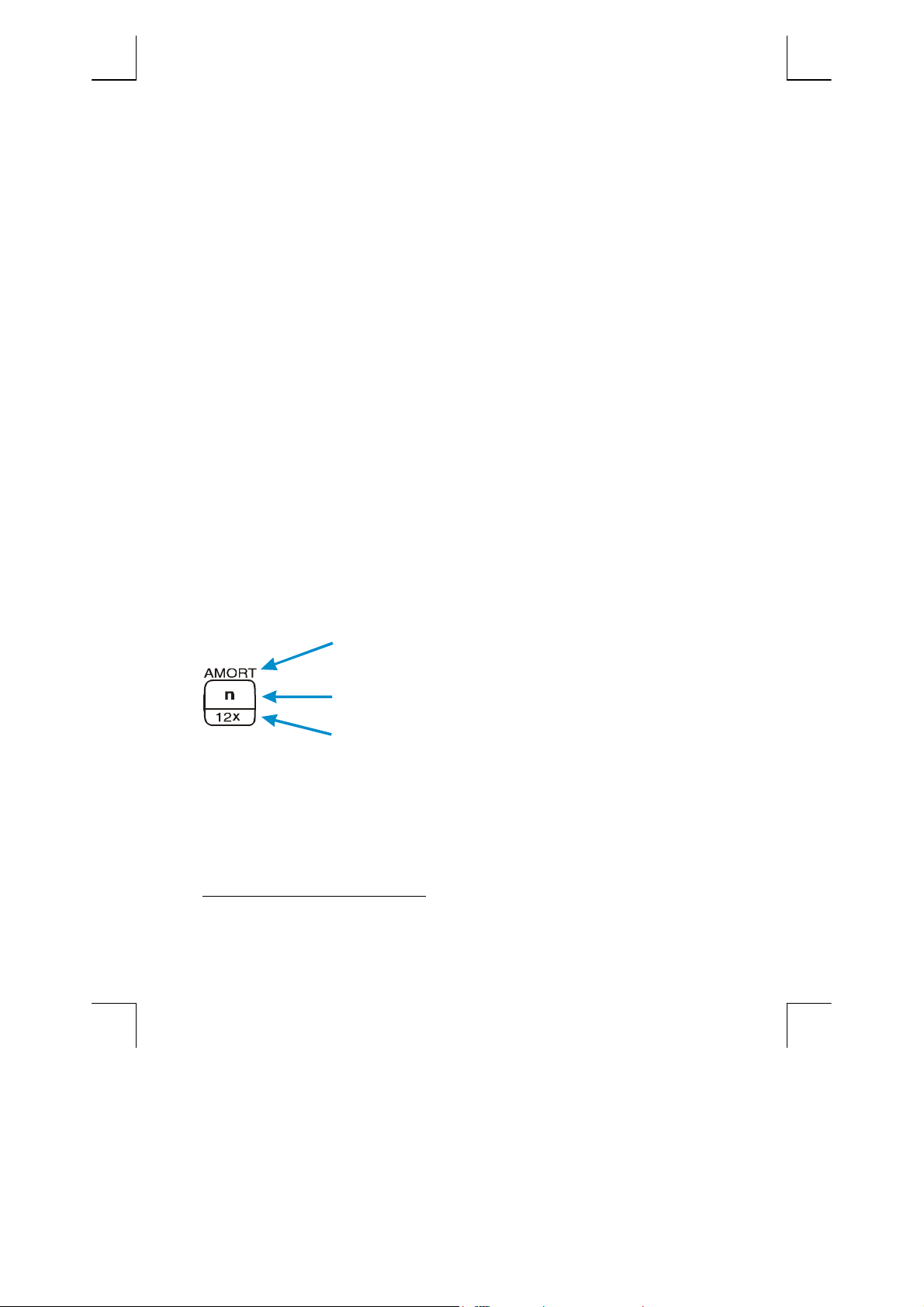

z To specify the alternate function printed in

above a key, press the gold prefix key (f), then

press the function key.

z To specify the primary function printed on the uppe

face of a key, press the key alone.

z To specify the alternate function printed in blue on the

lower face of a key, press the blue prefix key (g),

then press the function key.

Note that the ; key is lower than the other keys to help prevent its being pressed

*

inadvertently.

16

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 16 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

old

Page 17

Section 1: Getting Started 17

Throughout this handbook, references to the operation of an alternate function

appear as only the function name in a box (for example, “The L function …”).

References to the selection of an alternate function appear preceded by the

appropriate prefix key (for example, “Pressing

functions shown on the keyboard in gold under the bracket labeled “CLEAR”

appear throughout this handbook preceded by the word “CLEAR” (for example,

“The CLEARH function …” or “Pressing fCLEARH …”).

If you press the f or g prefix key mistakenly, you can cancel it by pressing

f

CLEARX. This can also be pressed to cancel the ?, :, and i keys.

(These keys are “prefix” keys in the sense that other keys must be pressed after

them in order to execute the corresponding function.) Since the X key is also

used to display the mantissa (all 10 digits) of a displayed number, the mantissa of

the number in the display will appear for a moment after the X key is released.

Pressing the f or g prefix key turns on the corresponding status indicator — f

or g — in the display. Each indicator turns off when you press a function key

(executing an alternate function of that key), another prefix key, or fCLEARX.

fL

…”). References to the

Keying in Numbers

To key a number into the calculator, press the digit keys in sequence, just as if you

were writing the number on paper. A decimal point must be keyed in (using the

decimal point key) if it is part of the number unless it appears to the right of the last

digit.

Digit Separators

As a number is keyed in, each group of three digits to the left of the decimal point

is automatically separated in the display. When the calculator is first turned on

after coming from the factory — or after Continuous Memory is reset — the

decimal point in displayed numbers is a dot, and the separator between each

group of three digits is a comma. If you wish, you can set the calculator to display

a comma for the decimal point and a dot for the three-digit separator. To do so,

turn the calculator off, then press and hold down the . key while you press ;.

Doing so again sets the calculator to use the original digit separators in the

display.

Negative Numbers

To make a displayed number negative — either one that has just been keyed in or

one that has resulted from a calculation — simply press Þ (change sign) . When

the display shows a negative number — that is, the number is preceded by a

minus sign — pressing Þ removes the minus sign from the display, making the

number positive.

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 17 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 18

18 Section 1: Getting Started

Keying in Large Numbers

Since the display cannot show more than 10 digits of a number, numbers greater

than 9,999,999,999 cannot be entered into the display by keying in all the digits

in the number. However, such numbers can be easily entered into the display if the

number is expressed in a mathematical shorthand called “scientific notation.” To

convert a number into scientific notation, move the decimal point until there is only

one digit (a nonzero digit) to its left. The resulting number is called the “mantissa”

of the original number, and the number of decimal places you moved the decimal

point is called the “exponent” of the original number. If you moved the decimal

point to the left, the exponent is positive; if you moved the decimal point to the

right (this would occur for numbers less than one), the exponent is negative. To key

the number into the display, simply key in the mantissa, press Æ (enter exponent),

then key in the exponent. If the exponent is negative, press Þ after pressing

Æ

.

For example, to key in $1,781,400,000,000, we move the decimal point 12

places to the left, giving a mantissa of 1.7814 and an exponent of 12:

Keystrokes Display

1.7814Æ12

Numbers entered in scientific notation can be used in calculations just like any

other number.

1.7814 12

1,781,400,000,000 entered in

scientific notation.

The CLEAR Keys

Clearing a register or the display replaces the number in it with zero. Clearing

program memory replaces the instructions there with

clearing operations on the hp 12c, as shown in the table below:

gi

00. There are several

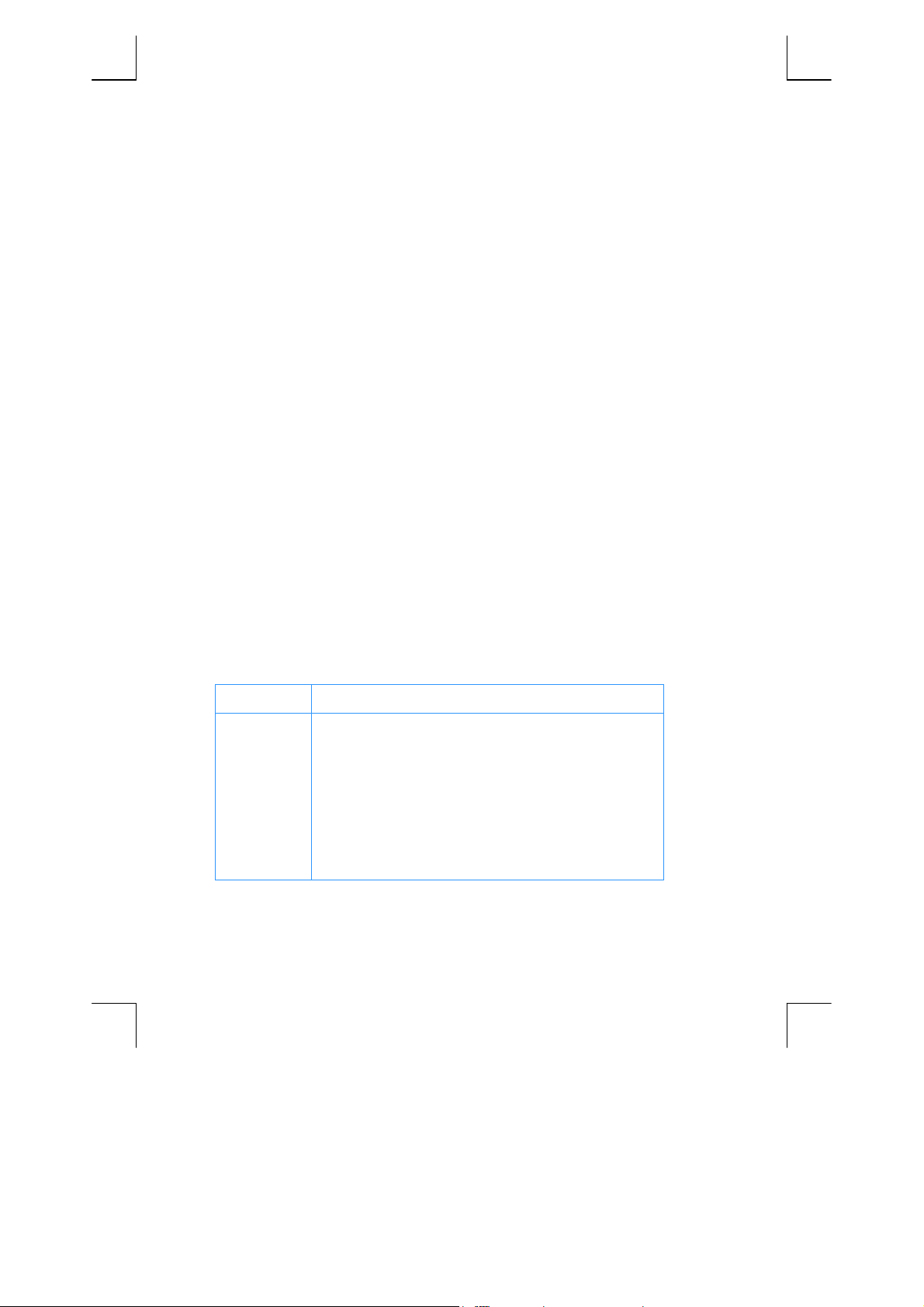

Key(s) Clears:

O

fCLEAR² Statistics registers (R1 through R6), stack registers, and

fCLEARÎ Program memory (only when pressed in Program mode).

fCLEARG Financial registers.

fCLEARH Data storage registers, financial registers, stack and LAST X

Display and X-register.

display.

registers, and display.

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 18 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 19

Section 1: Getting Started 19

Simple Arithmetic Calculations

Any simple arithmetic calculation involves two numbers and an operation —

addition, subtraction, multiplication, or division. To do such a calculation on your

hp 12c, you first tell the calculator the two numbers, then tell the calculator the

operation to be performed. The answer is calculated when the operation key

(+,-,§, or z) is pressed.

The two numbers should be keyed into the calculator in the order they would

appear if the calculation were written down on paper left-to-right. After keying in

the first number, press the \ key to tell the calculator that you have completed

entering the number. Pressing \ separates the second number to be entered

from the first number already entered.

In summary, to perform an arithmetic operation:

1. Key in the first number.

2. Press \ to separate the second number from the first.

3. Key in the second number.

4. Press +,-,§, or z to perform the desired operation.

For example to calculate 13 ÷ 2, proceed as follows:

Keystrokes Display

13

\

2

z

13.

13.00

2.

6.50

Keys the first number into the

calculator.

Pressing \ separates the second

number from the first.

Keys the second number into the

calculator.

Pressing the operation key calculates

the answer.

Notice that after you pressed \, two zeroes appeared following the decimal

point. This is nothing magical: the calculator’s display is currently set to show two

decimal places of every number that has been entered or calculated. Before you

pressed \, the calculator had no way of knowing that you had completed

entering the number, and so displayed only the digits you had keyed in. Pressing

\

tells the calculator that you have completed entering the number: it terminates

digit entry. You need not press \ after keying in the second number because

the +,-,§ and z keys also terminate digit entry. (In fact, all keys terminate

digit entry except for digit entry keys — digit keys, ., Þ, and Æ — and

prefix keys — f, g, ?, :, and (.)

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 19 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 20

20 Section 1: Getting Started

Chain Calculations

Whenever the answer has just been calculated and is therefore in the display, you

can perform another operation with this number by simply keying in the second

number and then pressing the operation key: you need not press \ to separate

the second number from the first. This is because when a number is keyed in after

a function key (such as +,-,§, z, etc.) is pressed, the result of that prior

calculation is stored inside the calculator — just as when the \ key is pressed.

The only time you must press the \ key to separate two numbers is when you

are keying them both in, one immediately following the other.

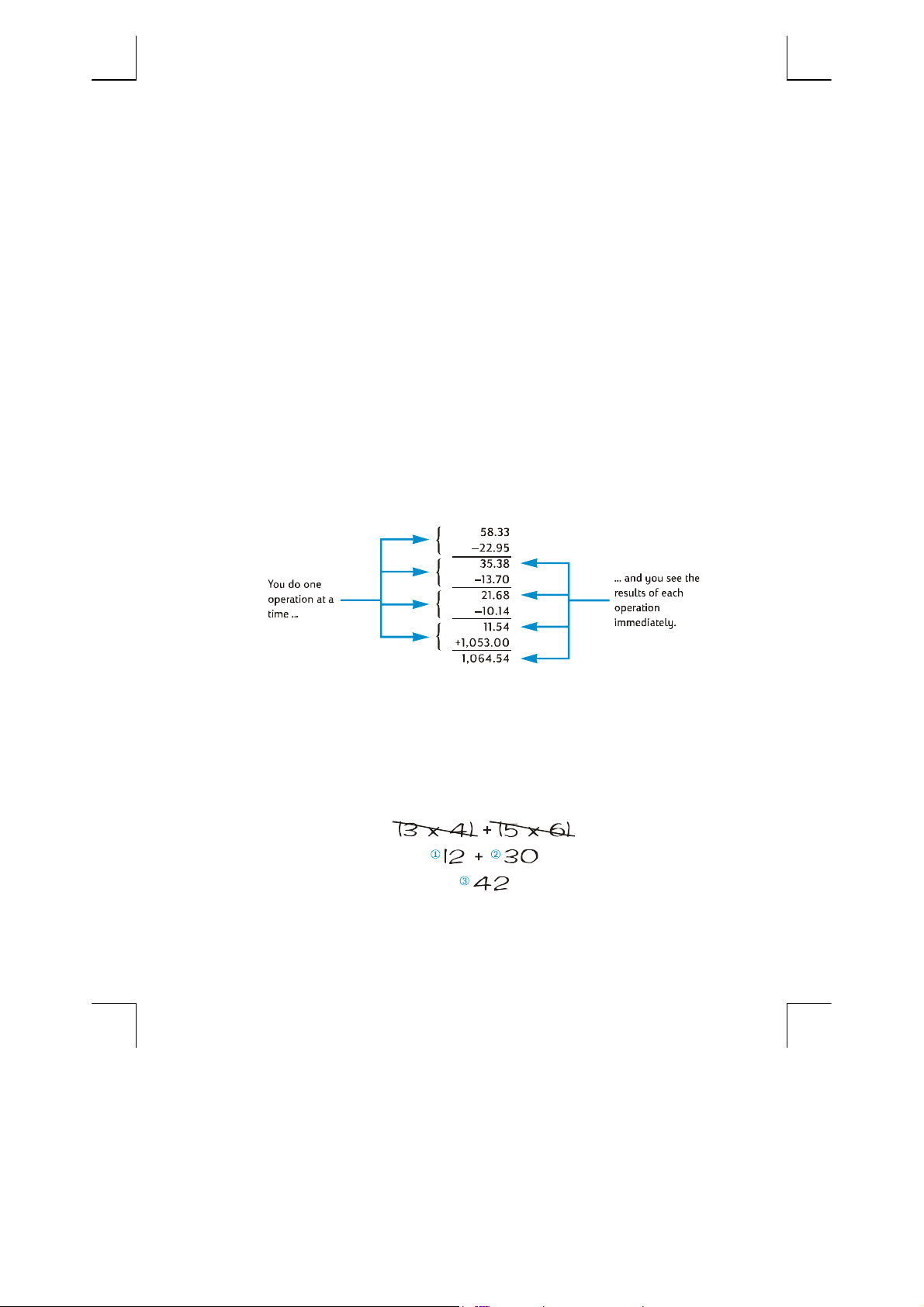

The hp 12c is designed so that each time you press a function key in RPN mode,

the calculator performs the operation then — not later — so that you see the results

of all intermediate calculations, as well as the “bottom line.”

Example:

and you’ve just deposited your paycheck for $1,053.00 into your checking

account. If your latest balance was $58.33 and the checks were written for

$22.95, $13.70, and $10.14, what is the new balance?

Solution:

Keystrokes Display

58.33

\

22.95

-

13.70

Suppose you’ve written three checks without updating your checkbook,

When written down on paper, this problem would read

58.33 – 22.95 – 13.70 – 10.14 + 1053

58.33

58.33

22.95

35.38

13.70

Keys the first number.

Pressing \ separates the second

number from the first.

Keys in the second number.

Pressing - subtracts the second

number from the first. The calculator

displays the result of this calculation,

which is the balance after subtracting

the first check.

Keys in the next number. Since a

calculation has just been performed,

do not press \; the next number

entered (13.70) is automatically

separated from the one previously in

the display (35.38).

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 20 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 21

Section 1: Getting Started 21

Keystrokes Display

-

10.14-

1053+

The preceding example demonstrates how the hp 12c calculates just as you would

using pencil and paper (except a lot faster!):

21.68

11.54

1,064.54

Pressing - subtracts the number just

entered from the number previously in

the display. The calculator displays the

result of this calculation, which is the

balance after subtracting the second

check.

Keys in the next number and subtracts

it from the previous balance. The new

balance appears in the display. (It’s

getting rather low!)

Keys in the next number — the

paycheck deposited — and adds it to

the previous balance. The new,

current balance appears in the

display.

Let’s see this happening in a different type of calculation — one that involves

multiplying groups of two numbers and then adding the results. (This is the type of

calculation that would be required to total up an invoice consisting of several items

with different quantities and different prices.)

For example, consider the calculation of (3 × 4) + (5 × 6). If you were doing this

on paper, you would first do the multiplication in the first parentheses, then the

multiplication in the second parentheses, and finally add the results of the two

multiplications:

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 21 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 22

22 Section 1: Getting Started

=+×

Your hp 12c calculates the answer in just the same way:

Keystrokes Display

3\4§

5\6§

+

Notice that before doing step 2, you did not need to store or write down the result

of step 1: it was stored inside the calculator automatically. And after you keyed in

the 5 and the 6 in step 2, the calculator was holding two numbers (12 and 5)

inside for you, in addition to the 6 in the display. (The hp 12c can hold a total of

three numbers inside, in addition to the number in the display.) After step 2, the

calculator was still holding the 12 inside for you, in addition to the 30 in the

display. You can see that the calculator holds the number for you, just as you

would have them written on paper, and then calculates with them at the proper

time, just as you would yourself.

down the results of an intermediate calculation, and you don’t even need to

manually store it and recall it later.

By the way, notice that in step 2 you needed to press \ again. This is simply

because you were again keying in two numbers immediately following each other,

without performing a calculation in between.

To check your understanding of how to calculate with your hp 12c, try the

following problems yourself. Although these problems are relatively simple, more

complicated problems can be solved using the same basic steps. If you have

difficulty obtaining the answers shown, review the last few pages.

12.00

30.00

42.00

But with the hp 12c, you don’t need to write

*

+

Step 1: Multiply the numbers in the

first parentheses.

Step 2: Multiply the numbers in the

second parentheses.

Step 3: Add the results of the two

multiplications.

00.77)65()43(

)1427(

−

+

5

++

25.0

=

)3814(

21163

13.0

=

Although you don’t need to know just how these numbers are stored and brought back at just

*

the right time, if you’re interested you can read all about it in Appendix A. By gaining a more

complete understanding of the calculator’s operation, you’ll use it more efficiently and

confidently, yielding a better return on the investment in your hp 12c.

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 22 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 23

Section 1: Getting Started 23

Storage Registers

Numbers (data) in the hp 12c are stored in memories called “storage registers” or

simply “registers.” (The singular term “ memory” is sometimes used in this

handbook to refer to the entire collection of storage registers.) Four special

registers are used for storing numbers during calculations (these “stack registers”

are described in Appendix A), and another (called the “LAST X” register) is used

for storing the number last in the display before an operation is performed. In

addition to these registers into which numbers are stored automatically, up to 20

“data storage” registers are available for manual storage of numbers. These data

storage registers are designated R

are available for data storage if a program has been stored in the calculator (since

the program is stored in some of those 20 registers), but a minimum of 7 registers

is always available. Still other storage registers — referred to as the “financial

registers” — are reserved for numbers used in financial calculations.

Storing and Recalling Numbers

To store the number from the display into a data storage register:

1. Press ? (store).

2. Key in the register number: 0 through 9 for registers R

through .9 for registers R

Similarly, to recall a number from a storage register into the display, press :

(recall), then key in the register number. This copies the number from the storage

register into the display; the number remains unaltered in the storage register.

Furthermore, when this is done, the number previously in the display is

automatically held inside the calculator for a subsequent calculation, just as the

number in the display is held when you key in another number.

Example:

Before you leave to call on a customer interested in your personal

computer, you store the cost of the computer ($3,250) and also the cost of a

printer ($2,500) in data storage registers. Later, the customer decides to buy six

computers and one printer. You recall the cost of the computer, multiply by the

quantity ordered, and then recall and add the cost of the printer to get the total

invoice.

Keystrokes Display

3250?1

2500?2

;

through R9 and R.0 through R.9. Fewer registers

0

through R9, or .0

through R.9.

.0

3,250.00

2,500.00

Stores the cost of the computer in R1.

Stores the cost of the printer in R2.

0

Turns the calculator off.

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 23 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 24

24 Section 1: Getting Started

Later that same day …

Keystrokes Display

;

:1

6§

:2

+

2,500.00

3,250.00

19,500.00

2,500.00

22,000.00

Turns the calculator back on.

Recalls the cost of the computer to the

display.

Multiplies the quantity ordered to get

the cost of the computers.

Recalls the cost of the printer to the

display.

Total invoice.

Clearing Storage Registers

To clear a single storage register — that is, to replace the number in it with

zero — merely store zero into it. You need not clear a storage register before

storing data into it; the storing operation automatically clears the register before

the data is stored.

To clear all storage registers at once — including the financial registers, the stack

registers, and the LAST X register — press fCLEARH.

display.

All storage registers are also cleared when Continuous Memory is reset (as

described on page 70).

This also clears the

*

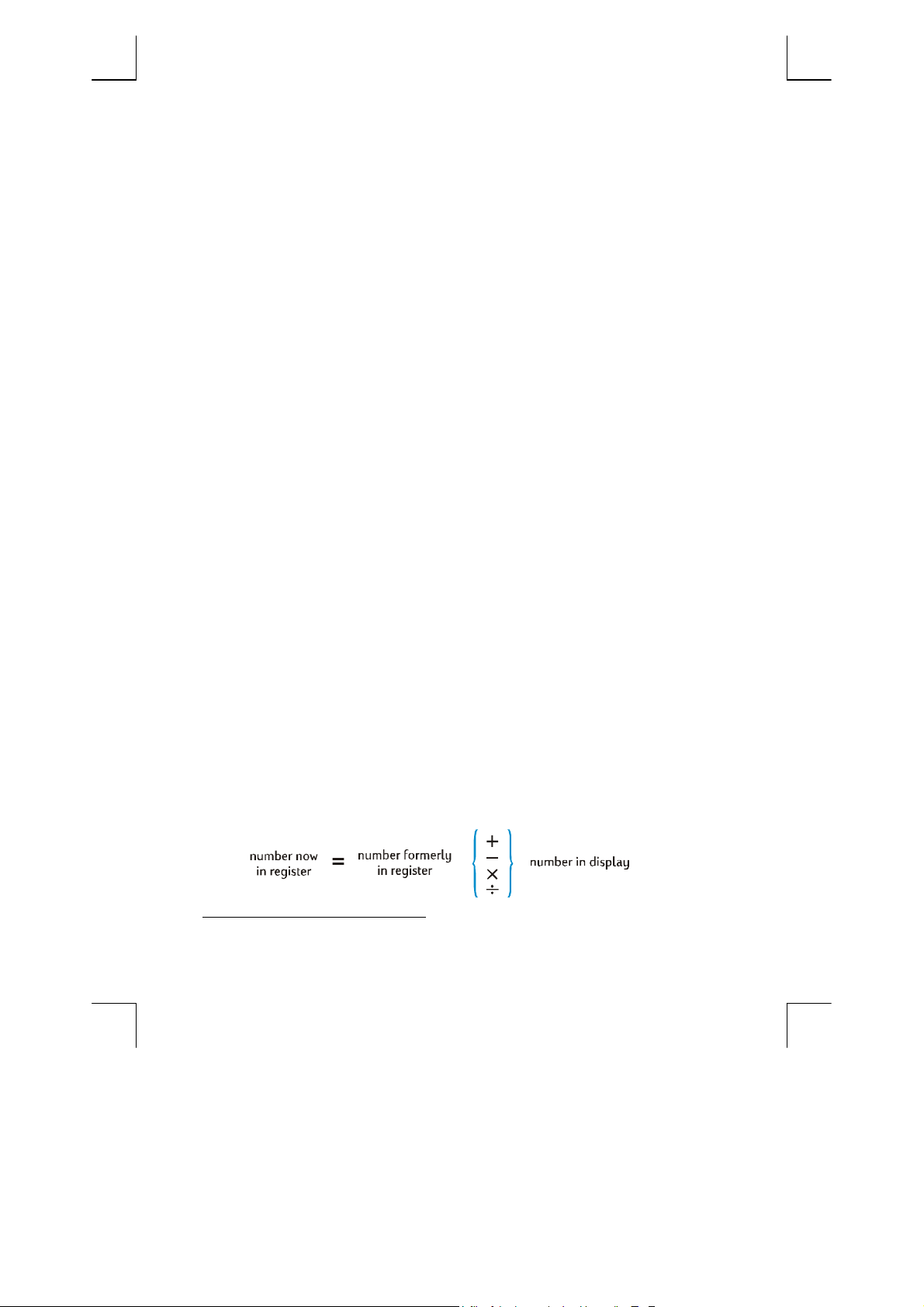

Storage Register Arithmetic

Suppose you wanted to perform an arithmetic operation with the number in the

display and the number in a storage register, then store the result back into the

same register without altering the number in the display. The hp 12c enables you

to do all this in a single operation:

1. Press ?.

2. Press +, -, §, or z to specify the desired operation.

3. Key in the register number.

When storage register arithmetic is performed, the new number in the register is

determined according to the following rule:

CLEARH is not programmable.

*

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 24 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 25

Section 1: Getting Started 25

Storage register arithmetic is possible with only registers R0 through R

Example:

In the example on page 20, we updated the balance in your

.

4

checkbook. Let’s suppose that because data is stored indefinitely in your

calculator’s Continuous Memory, you keep track of your checking account balance

in the calculator. You could use storage register arithmetic to quickly update the

balance after depositing or writing checks.

Keystrokes Display

58.33?0

22.95?-0

58.33

22.95

Stores the current balance in register

.

R

0

Subtracts the first check from the

balance in R

. Note that the display

0

continues to show the amount

subtracted; the answer is placed only

in R

.

0

13.70?-0

10.14?-0

1053?+0

:0

13.70

10.14

1,053.00

1,064.54

Subtracts the second check.

Subtracts the third check.

Adds the deposit.

Recalls the number in R0 to check the

new balance.

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 25 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 26

Section 2

Percentage and Calendar

Functions

Percentage Functions

The hp 12c includes three keys for solving percentage problems: b, à, and Z.

You don’t need to convert percentages to their decimal equivalents; this is done

automatically when you press any of these keys. Thus, 4% need not be changed to

0.04; you key it in the way you see and say it: 4b.

Percentages

To find the amount corresponding to a percentage of a number:

1. Key in the base number.

2. Press \.

3. Key in the percentage.

4. Press b.

For example, to find 14% of $300:

Keystrokes Display

300

\

14

b

300.

300.00

14.

42.00

Keys in the base number.

Pressing \ separates the next

number entered from the first number,

just as when an ordinary arithmetic

calculation is performed.

Keys in the percentage.

Calculates the amount.

If the base number is already in the display as a result of a previous calculation,

you should not press \ before keying in the percentage — just as in a chain

arithmetic calculation.

26

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 26 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 27

Section 2: Percentage and Calendar Functions 27

Net Amount

A net amount — that is, the base amount plus or minus the percentage amount —

can be calculated easily with your hp 12c, since the calculator holds the base

amount inside after you calculate a percentage amount. To calculate a net amount,

simply calculate the percentage amount, then press = or -.

Example:

a discount of 8%, and the sales tax is 6%. Find the amount the dealer is charging

you, then find the total cost to you, including tax.

Keystrokes Display

13250\

8b

-

6b

=

You’re buying a new car that lists for $13,250. The dealer offers you

13,250.00

1,060.00

12,190.00

731.40

12,921.40

Keys in the base amount and

separates it from the percentage.

Amount of discount.

Base amount less discount.

Amount of tax (on $12,190).

Total cost: base amount less discount

plus tax.

Percent Difference

To find the percent difference between two numbers:

1. Key in the base number.

2. Press \ to separate the other number from the base number.

3. Key in the other number.

4. Press à.

If the other number is greater than the base number, the percent difference will be

positive. If the other number is less than the base number, the percent difference

will be negative. Therefore, a positive answer indicates an increase, while a

negative answer indicates a decrease.

If you are calculating a percent difference over time, the base number is typically

the amount occurring first.

Example:

percent change?

Keystrokes Display

58.5\

53.25

à

Yesterday your stock fell from 58

58.50

53.25

–8.97

1

/2 to 531/4 per share. What is the

Keys in the base number and

separates it from the other number.

Keys in the other number.

Nearly a 9% decrease.

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 27 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 28

28 Section 2: Percentage and Calendar Functions

The à key can be used for calculations of the percent difference between a

wholesale cost and a retail cost. If the base number entered is the wholesale cost,

the percent difference is called the markup; if the base number entered is the retail

cost, the percent difference is called the margin. Examples of markup and margin

calculations are included in the hp 12c Solutions Handbook.

Percent of Total

To calculate what percentage one number is of another:

1. Calculate the total amount by adding the individual amounts, just as in a

chain arithmetic calculation.

2. Key in the number whose percentage equivalent you wish to find.

3. Press Z.

Example:

$2.36 million in Europe, and $1.67 million in the rest of the world. What

percentage of the total sales occurred in Europe?

Keystrokes Display

3.92\

2.36+

1.67+

2.36

Z

Last month, your company posted sales of $3.92 million in the U.S.,

3.92

6.28

7.95

2.36

29.69

Keys in the first number and separates

it from the second.

Adds the second number.

Adds the third number to get the total.

Keys in 2.36 to find what percentage

it is of the number in the display.

Europe had nearly 30% of the total

sales.

The hp 12c holds the total amount inside after a percent of total is calculated.

Therefore, to calculate what percentage another amount is of the total:

1. Clear the display by pressing O.

2. Key in that amount.

3. Press Z again.

For example, to calculate what percent of the total sales in the preceding example

occurred in the U.S. and what percent occurred in the rest of the world:

Keystrokes Display

O3.92Z

O1.67 Z

49.31

21.01

The U.S. had about 49% of the total

sales.

The rest of the world had about 21%

of the total sales.

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 28 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 29

Section 2: Percentage and Calendar Functions 29

To find what percentage a number is of a total, when you already know the total

number:

1. Key in the total number.

2. Press \ to separate the other number from the total number.

3. Key in the number whose percentage equivalent you wish to find.

4. Press Z.

For example, if you already knew in the preceding example that the total sales

were $7.95 million and you wanted to find what percentage of that total occurred

in Europe:

Keystrokes Display

7.95\

2.36

Z

7.95

2.36

29.69

Keys in the total amount and separates

it from the next number.

Keys in 2.36 to find what percentage

it is of the number in the display.

Europe had nearly 30% of the total

sales.

Calendar Functions

The calendar functions provided by the hp 12c — D and Ò — can handle

dates from October 15, 1582 through November 25, 4046.

Date Format

For each of the calendar functions — and also for bond calculations (E and

S

)

the calculator uses one of two date formats. The date format is used to

—

interpret dates when they are keyed into the calculator as well as for displaying

dates.

Month-Day-Year.

key in a date with this format in effect:

1. Key in the one or two digits of the month.

2. Press the decimal point key (.).

3. Key in the two digits of the day.

4. Key in the four digits of the year.

Dates are displayed in the same format.

For example, to key in April 7, 2004:

Keystrokes Display

4.072004

To set the date format to month-day-year, press

4.072004

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 29 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

gÕ

. To

Page 30

30 Section 2: Percentage and Calendar Functions

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 30 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 31

Section 2: Percentage and Calendar Functions 31

Keystrokes Display

14.052004\

120gD

When D is executed as an instruction in a running program, the calculator

pauses for about 1 second to display the result, then resumes program execution.

14.05

11,09,2004 6

Keys in date and separates it from

number of days to be entered.

The expiration date is 11 September

2004, a Saturday.

Number of Days Between Dates

To calculate the number of days between two given dates:

1. Key in the earlier date and press \.

2. Key in the later date and press gÒ.

The answer shown in the display is the actual number of days between the two

dates, including leap days (the extra days occurring in leap years), if any. In

addition, the hp 12c also calculates the number of days between the two dates on

the basis of a 30-day month. This answer is held inside the calculator; to display it,

press ~. Pressing ~ again will return the original answer to the display.

Example:

of days or the number of days counted on the basis of a 30-day month. What

would be the number of days counted each way, to be used in calculating the

simple interest accruing from June 3, 2004 to October 14, 2005? Assume that

you normally express dates in the month-day-year format.

Keystrokes Display

gÕ

6.032004\

10.142005gÒ

~

Simple interest calculations can be done using either the actual number

11.09

6.03

498.00

491.00

Sets date format to month-day-year.

(Display shown assumes date remains

from preceding example.)

Keys in earlier date and separates it

from the later date.

Keys in later date. Display shows

actual number of days.

Number of days counted on the basis

of a 30-day month.

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 31 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 32

Section 3

Basic Financial Functions

The Financial Registers

In addition to the data storage registers discussed on page 23, the hp 12c has five

special registers in which numbers are stored for financial calculations. These

registers are designated n, i, PV, PMT, and FV. The first five keys on the top row of

the calculator are used to store a number from the display into the corresponding

register, to calculate the corresponding financial value and store the result into the

corresponding register, or to display the number stored in the corresponding

register.

Storing Numbers Into the Financial Registers

To store a number into a financial register, key the number into the display, then

press the corresponding key (n, ¼, $, P, or M).

Displaying Numbers in the Financial Registers

To display a number stored in a financial register, press : followed by the

corresponding key.

*

†

Which operation is performed when one of these keys is pressed depends upon the last

*

preceding operation performed: If a number was just stored into a financial register (using

n, ¼, $, P, M, A, or C), pressing one of these five keys calculates the

corresponding value and stores it into the corresponding register; otherwise pressing one of

these five keys merely stores the number from the display into the corresponding register.

It’s good practice to press the corresponding key twice after :, since often you may want

†

to calculate a financial value right after displaying another financial value. As indicated in

the preceding footnote, if you wanted to display FV and then calculate PV, for example, you

should press :MM$. If you didn’t press M the second time, pressing $ would

store FV in the PV register rather than calculating PV, and to calculate PV you would have to

press $ again.

32

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 32 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 33

Section 3: Basic Financial Functions 33

Clearing the Financial Registers

Every financial function uses numbers stored in several of the financial registers.

Before beginning a new financial calculation, it is good practice to clear all of the

financial registers by pressing fCLEARG. Frequently, however, you may want

to repeat a calculation after changing a number in only one of the financial

registers. To do so, do not press fCLEARG; instead, simply store the new

number in the register. The numbers in the other financial registers remain

unchanged.

The financial registers are also cleared when you press fCLEARH and when

Continuous Memory is reset (as described on page 70).

Simple Interest Calculations

The hp 12c simultaneously calculates simple interest on both a 360-day basis and

a 365-day basis. You can display either one, as described below. Furthermore,

with the accrued interest in the display, you can calculate the total amount

(principal plus accrued interest) by pressing +.

1. Key in or calculate the number of days, then press n.

2. Key in the annual interest rate, then press ¼.

3. Key in the principal amount, then press Þ$.

4. Press fÏ to calculate and display the interest accrued on a 360-day

basis.

5. If you want to display the interest accrued on a 365-day basis, press

d~.

6. Press + to calculate the total of the principal and the accrued interest now

in the display.

The quantities n, i, and PV can be entered in any order.

Example 1:

requested that you lend him $450 for 60 days. You lend him the money at 7%

simple interest, to be calculated on a 360-day basis. What is the amount of

accrued interest he will owe you in 60 days, and what is the total amount owed?

Keystrokes Display

60n

Your good friend needs a loan to start his latest enterprise and has

60.00

Stores the number of days.

*

Pressing the $ key stores the principal amount in the PV register, which then contains the

*

present value of the amount on which interest will accrue. The Þ key is pressed first to

change the sign of the principal amount before storing it in the PV register. This is required by

the cash flow sign convention, which is applicable primarily to compound interest

calculations.

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 33 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 34

34 Section 3: Basic Financial Functions

Keystrokes Display

7¼

450Þ$

fÏ

+

7.00

–450.00

5.25

455.25

Stores the annual interest rate.

Stores the principal.

Accrued interest, 360-day basis.

Total amount: principal plus accrued

interest.

Example 2:

example, but asks that you compute it on a 365-day basis rather than a 360-day

basis. What is the amount of accrued interest he will owe you in 60 days, and

what is the total amount owed?

Keystrokes Display

60n

7¼

450Þ$

fÏd~

+

Your friend agrees to the 7% interest on the loan from the preceding

60.00

7.00

–450.00

5.18

455.18

If you have not altered the numbers in

the n, i, and PV registers since the

preceding example, you may skip

these keystrokes.

Accrued interest, 365-day basis.

Total amount: principal plus accrued

interest.

Financial Calculations and the Cash Flow Diagram

The concepts and examples presented in this section are representative of a wide

range of financial calculations. If your specific problem does not appear to be

illustrated in the pages that follow, don’t assume that the calculator is not capable

of solving it. Every financial calculation involves certain basic elements; but the

terminology used to refer to these elements typically differs among the various

segments of the business and financial communities. All you need to do is identify

the basic elements in your problem, and then structure the problem so that it will

be readily apparent what quantities you need to tell the calculator and what

quantity you want to solve for.

An invaluable aid for using your calculator in a financial calculation is the cash

flow diagram. This is simply a pictorial representation of the timing and direction

of financial transactions, labeled in terms that correspond to keys on the calculator.

The diagram begins with a horizontal line, called a time line. It represents the

duration of a financial problem, and is divided into compounding periods. For

example, a financial problem that transpires over 6 months with monthly

compounding would be diagrammed like this:

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 34 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 35

Section 3: Basic Financial Functions 35

The exchange of money in a problem is depicted by vertical arrows. Money you

receive is represented by an arrow pointing up from the point in the time line when

the transaction occurs; money you pay out is represented by an arrow pointing

down.

Suppose you deposited (paid out) $1,000 into an account that pays 6% annual

interest and is compounded monthly, and you subsequently deposited an

additional $50 at the end of each month for the next 2 years. The cash flow

diagram describing the problem would look like this:

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 35 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 36

36 Section 3: Basic Financial Functions

The form in which n is entered determines whether or not the calculator

performs financial calculations in Odd-Period mode (as described on pages

50 through 53). If n is a noninteger (that is, there is at least one nonzero

digit to the right of the decimal point), calculations of i, PV, PMT, and FV are

performed in Odd-Period mode.

z i is the interest rate per compounding period. The interest rate shown in the

cash flow diagram and entered into the calculator is determined by dividing

the annual interest rate by the number of compounding periods. In the

problem illustrated above, i = 6% ÷ 12.

z PV — the present value — is the initial cash flow or the present value of a

series of future cash flows. In the problem illustrated above, PV is the $1,000

initial deposit.

z PMT is the period payment. In the problem illustrated above PMT is the $50

deposited each month. When all payments are equal, they are referred to as

annuities. (Problems involving equal payments are described in this section

under Compound Interest Calculations; problems involving unequal

payments can be handled as described in under Discounted Cash Flow

Analysis: NPV and IRR. Procedures for calculating the balance in a savings

account after a series of irregular and/or unequal deposits are included in

the hp 12c Solutions Handbook.)

z FV — the future value — is the final cash flow or the compounded value of a

series of prior cash flows. In the particular problem illustrated above, FV is

unknown (but can be calculated).

Solving the problem is now basically a matter of keying in the quantities identified

in the cash flow diagram using the corresponding keys, and then calculating the

unknown quantity by pressing the corresponding key. In the particular problem

illustrated in the cash flow diagram above, FV is the unknown quantity; but in other

problems, as we shall see later, n, i, PV, or PMT could be the unknown quantity.

Likewise, in the particular problem illustrated above there are four known

quantities that must be entered into the calculator before solving for the unknown

quantity; but in other problems only three quantities may be known — which must

always include n or i.

The Cash Flow Sign Convention

When entering the PV, PMT, and FV cash flows, the quantities must be keyed into

the calculator with the proper sign, + (plus) or – (minus), in accordance with …

The Cash Flow Sign Convention: Money received (arrow pointing up)

is entered or displayed as a positive value (+). Money paid out (arrow

pointing down) is entered or displayed as a negative value (–).

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 36 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 37

Section 3: Basic Financial Functions 37

The Payment Mode

One more bit of information must be specified before you can solve a problem

involving periodic payments. Such payments can be made either at the beginning

of a compounding period (payments in advance, or annuities due) or at the end of

the period (payments in arrears, or ordinary annuities). Calculations involving

payments in advance yield different results than calculations involving payments in

arrears. Illustrated below are portions of cash flow diagrams showing payments in

advance (Begin) and payments in arrears (End). In the problem illustrated in the

cash flow diagram above, payments are made in arrears.

Regardless of whether payments are made in advance or in arrears, the number of

payments must be the same as the number of compounding periods.

To specify the payment mode:

z Press g× if payments are made at the beginning of the compounding

periods.

z Press g if payments are made at the end of the compounding periods.

BEGIN

The

is not lit, the payment mode is set to End.

The payment mode remains set to what you last specified until you change it; it is

not reset each time the calculator is turned on. However, if Continuous Memory is

reset, the payment mode will be set to End.

status indicator is lit when the payment mode is set to Begin. If

BEGIN

Generalized Cash Flow Diagrams

Examples of various kinds of financial calculations, together with the applicable

cash flow diagrams, appear under Compound Interest Calculations later in this

section. If your particular problem does not match any of those shown, you can

solve it nevertheless by first drawing a cash flow diagram, then keying the

quantities identified in the diagram into the corresponding registers. Remember

always to observe the sign convention when keying in PV, PMT, and FV.

The terminology used for describing financial problems varies among the different

segments of the business and financial communities. Nevertheless, most problems

involving compound interest can be solved by drawing a cash flow diagram in

one of the following basic forms. Listed below each form are some of the problems

to which that diagram applies.

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 37 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 38

38 Section 3: Basic Financial Functions

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 38 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Page 39

Section 3: Basic Financial Functions 39

Compound Interest Calculations

Specifying the Number of Compounding Periods and the Periodic

Interest Rate

Interest rates are usually quoted at the annual rate (also called the nominal rate):

that is, the interest rate per year. However, in compound interest problems, the

interest rate entered into i must always be expressed in terms of the basic

compounding period, which may be years, months, days, or any other time unit.

For example, if a problem involves 6% annual interest compounded quarterly for 5

years, n — the number of quarters — would be 5 × 4 = 20 and i — the interest

rate per quarter — would be 6% ÷ 4 = 1.5%. If the interest were instead

compounded monthly, n would be 5 × 12 = 60 and i would be 6% ÷ 12 = 0.5%.

If you use the calculator to multiply the number of years by the number of

compounding periods per year, pressing n then stores the result into n. The same

is true for i. Values of n and i are calculated and stored like this in Example 2 on

page 47.

If interest is compounded monthly, you can use a shortcut provided on the

calculator to calculate and store n and i:

z To calculate and store n, key the number of years into the display, then press

gA.

z To calculate and store i, key the annual rate into the display, then press

gC.

Note that these keys not only multiply or divide the displayed number by 12; they

also automatically store the result in the corresponding register, so you need not

press the n or ¼ key next. The A and C keys are used in Example 1 on

page 46.

Calculating the Number of Payments or Compounding Periods

1. Press fCLEARG to clear the financial registers.

2. Enter the periodic interest rate, using ¼ or C.

3. Enter at least two of the following values:

z Present value, using $.

z Payment amount, using P.

z Future value, using M.