Page 1

Contents

Page 10 At a Glance

21 1: Getting Started

31 2: Business Percentages

35 3: Number Storage and Arithmetic

43 4: Picturing Financial Problems

51 5: Time Value of Money Calculations

75 6; Cash Flow Calculations

85 7: Statistical Calculations

95 8: Additional Examples

116 A; Assistance, Batteries, and Service

127 B: More About Calculations

133 Messages

136 Index

F.nglisli

Hriiileil in Singapore

11/>-)4

(P)

HEWLETT

PACKARD

00010-90037

Page 2

HP-lOB

Who% HEWLETT

mLnM PACKARD

Page 3

HfiWLBTT

PACKAnO

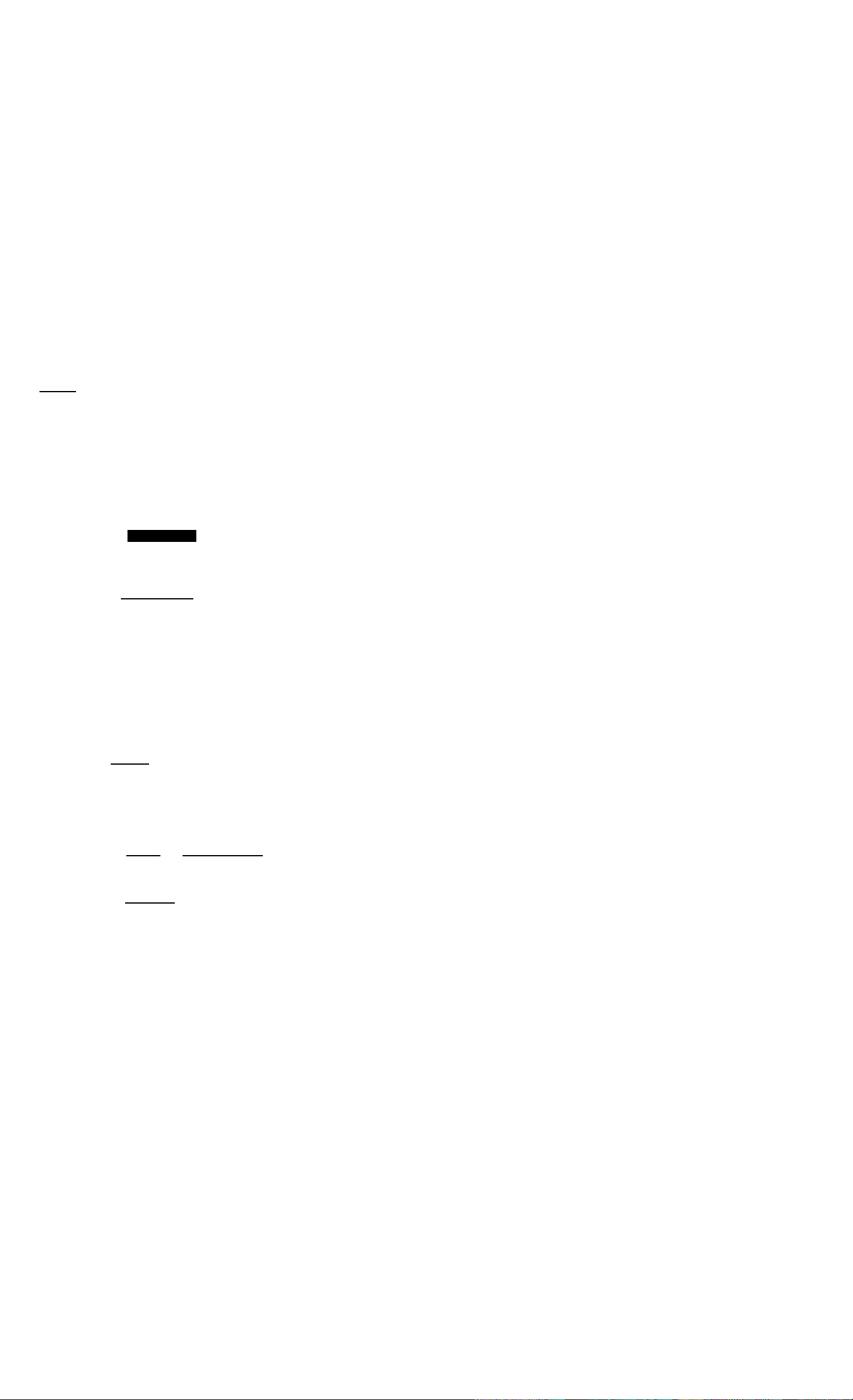

Toe

BUSINESS

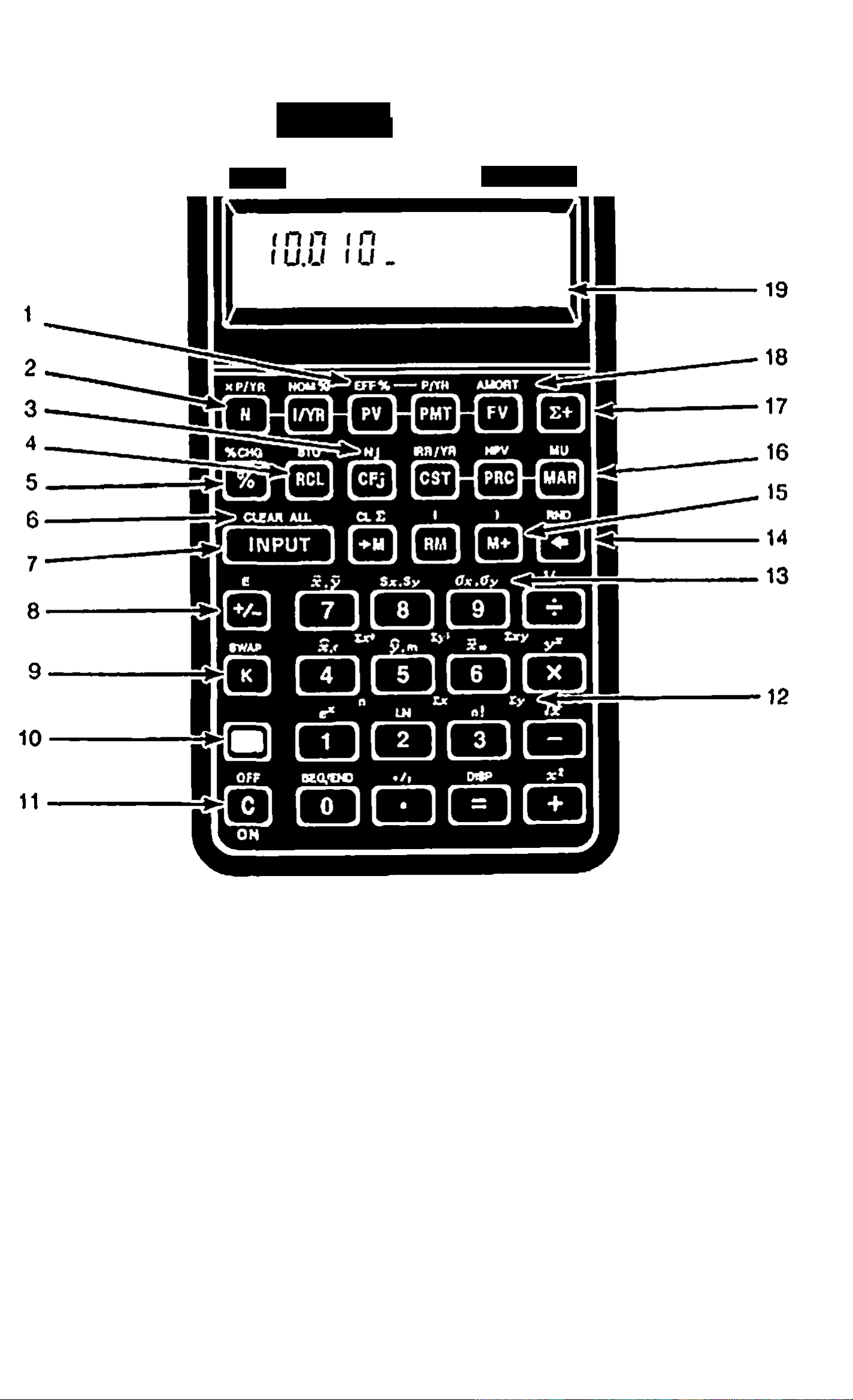

1. Interest conversion (page 71).

2. Time value of money (page 51).

3. Cash flows (page 75).

4. Store and recall (page 38).

5. Percent (page 31).

6. Clear all memory (page 23).

7. Separate two numbers (page 25),

8. Change sign (page 22).

9. Constant (page 35).

10. Shift: activate yellow labeled

functions (page 24).

11. On. clear display.cancel

operation (page 21).

12. n through Sxy: statistical summation

registers (page 89).

13. Statistical functions (page 88).

14. Backspace (page 23).

15. 3'key memory (page 37).

16. Margin and markup (page 33).

17. Accumulate statistical data

(page 86 and 87).

18. Amortization (page 66).

19. Annunciator line (page 24).

Page 4

HP-1 OB Business Calculator

Owner’s Manual

HEWLETT

PACKARD

Edition 6

Pan Number 00010-^)0037

Page 5

Notice

For warranly and regulatory information for this calculator, see pages 123

and 126.

This manual and any examples contained herein arc provided "as is" and

arc subject to change without notice. Hewlett-Packard Company makes

no warranty of any kind with regard to this manual, including, but not

limited to, the implied warranties of merchantability and fitness for a

particular purpose. Hewlett-Packard Co. shall not l>c liable for any

errors or for incidental or consequential damages in connection with the

furnishing, performance, or use of this manual or the keystroke programs

contained herein.

o Hewlett-Packard Co. 1988. All rights rcscr\'cd. Reproduction,

adaptation, or translation of this manual is prohibited without prior

written permission of Hewlett-Packard Company, except as allowed under

the copyright laws.

The programs that control your calculator arc copyrighted and all rights

arc reserved. Reproduction, adaptation, or translation of those programs

without prior written permission of Hewlett-Packard Co. i.s also

prohibited.

Corvallis Division

1000 N.E. Circle Blvd.

Corvallis, OR 97330, U.S.A.

Printing History

Edition I

Edition 2

Edition 3

Edition 4

Edition 6

October 1988

June 1989

June 1990

August 1992

November 1994

Page 6

Welcome to the HP-1 OB

Your HP-lOB rcflccls ihc superior quality and attention to detail in

engineering and manufacturing that have distinguished Hewlett-Packard

products for 50 years. Hewlett-Packard stands behind this calculator —we

offer expertise to support its use (see inside the back cover) and world

wide scr\icc.

Hewlett-Packard Quality

Our calculators arc made to excel and to be easy to use.

■ This calculator is designed to withstand (he drops, vibrations, pollu

tants (smog, ozone), temperature extremes, and humidity variations

that it may encounter in everyday work life.

■ The calculator and its manual have been designed and tested for ease

of use. We added many examples to highlight (he varied uses of the

calculator. Advanced materials and permanent, molded key lettering

provide a long keyboard life and a positive feel to the keyboard.

■ CMOS (low-power) electronics and a liquid-crystal display allow data

to be retained indefinitely and the batteries to last a long time.

■ The microprocessor has been optimized for fast and reliable compu

tations using IS digits internally for precise results.

■ Extensive research has created a design that has minimized the

adverse effects of static electricity, a potential cause of malfunctions

and data loss in calculators.

Welcome to the HP-10B

Page 7

Features

The fc;iUircs of ihc HP-lOB and ihc manual reflect the needs and wishes

of many customers;

■ A large 12-charactcr display.

■ An At-a-Glancc section in the manual for quick reference.

■ Applications to solve business and financial tasks:

■ Time Value of Money. Loans, savings, leases, and amortiza

tion schedules.

m Interest Conversion. Nominal and effective rates.

■ Cash Flows. Net present value and internal rate of return.

■ Business Percentages. Percent change, markup, and margin

calculations.

■ Statistics. Mean, standard deviation, correlation cocITicicnt,

and linear regression forecasting, plus other statistical calcula

tions.

■ Enough memory to store an initial cash flow and 14 cash flow groups,

with up to 99 cash flows per group.

■ Fifteen numbered storage registers.

■ Easy access to functions saves keystrokes and adds convenience.

■ Auto-incrcmcnt capability for amortization schedules.

■ Labels for amorti/;ilion and cash flows.

■ Automatic constant.

■ 3-key memory.

■ Many examples are included in the manual .so you can combine them

for your specific needs.

Welcome to the HP-10B

Page 8

Contents

10 At a Glance...

10 Basics

11 Percentages

12 Memory Keys

13 Time Value of Money (TVM)

14 TVM Whal if...

15 Amort iziU ion

16 Interest Rale Conversion

17 IRR/YR and NPV

19 Statistics

21 Getting Started

21 Power On and Off

21 Adjusting the Display Contrast

21 Simple Arithmetic Calculations

23 Understanding the Display and Keyboard

23 Cursor

23 Clearing the Calculator

23 Clearing Memory

24 Annunciators

24 Shift Key

25 INPUT Key

25 SWAP Key

25 Math Functions

26 Display Formal of Numbers

27 Specifying Displayed Decimal Places

27 Scientific Notation

28 Displaying the Full Precision of Numbers

Contents

Page 9

28

Interchanging the Period and Comma

2

28

29

29

Rounding Numbers

Messages

Picturing Memory

31 Business Percentages

31 Percent Key

31 Finding a Percent

32

32

33

Adding or Subtracting a Percent

Percent Change

Margin and Markup Culculalinns

33

34

34

3 35

35

35

37

38

39

Margin Calculations

Markup on Cost Calculations

Using Margin and Markup Together

Number Storage and Arithmetic

Using Stored Numbers in Calculations

Using Constants

Using the M Register

Using Numbered Registers

Doing Arithmetic Inside Registers

4

40

41

41

43

Doing Arithmetic

Power Operator

Using Parentheses in Calculations

Picturing Financial Problems

43 How to Approach a Financial Problem

44

Signs of Cash Flows

45 Periods and Cash Flows

45

45

Simple and Compound Interest

Simple Interest

Contenu

46

47

47

47

49

Compound Interest

Interest Rales

Two Types of Financial Problems

Recognizing a TVM Problem

Recognizing a Cash Flow Problem

Page 10

5 51

51 Using the TVM Application

53 Clearing TVM

53 Begin and End Modes

Time Value of Money Calculations

6

53

58

62

66

Loan Calculations

Savings Calculations

Lease Calculations

Amortization

71 Interest Rate Conversions

71

73

75

75

Investments With Different Compounding Periods

Compounding and Payment Periods Differ

Cash Flow Calculations

How to Use the Cash Flow Application

7

77

NPV and IRR/YR: Discounting Cash Flows

77 Organizing Cash Flows

78 Entering Cash Flows

79

80

Viewing and Replacing Cash Flows

Calculating Net Present Value

83 Calculating Internal Rate of Return

84 Automatic Storage of IRR/YR and NPV

85 Statistical Calculations

85 Clearing Statistical Data

86 Entering Statistical Data

86 One-Variable Statistics

86 Two-Variable Statistics and Weighted Mean

87

Correcting Statistical Data

87 Correcting One-Variable Data

87

Correcting Two-Variable Data

88 Summary of Slatislical Calculations

89 Mean, Standard Devaations, and Summation Statistics

91 Linear Regression and Estimation

94

Weighted Mean

Contents

Page 11

8

95

Additional Examples

95

95

95

96

97

97

98

99

101

102

104

105

Business Applications

Setting a Sales Price

Forecasting Bused on History

Cost of Not Taking a Cash Discount

Loans and Mortgages

E

Simple Annual Interest

Continuous Compounding

Yield of a Discounted (or Premium) Mortgage

Annual Percentage Rate for a Loan With Fees

Loan With a Partial (Odd) First Period

Automobile Loan

Canadian Mortgages

106

107

107

109

111

112

112

114

116

What if ...TVM Calculations

Savings

Saving for College Costs

Gains That Go Untaxed Until Withdrawal

Value of a Taxable Retirement Account

Cash Flow Examples

Wrap-Around Mortgages

Net Future Value

Assistance, Batteries, and Service

116

117

118

118

119

120

121

123

123

123

124

124

Answers (0 Comnu)a Questions

Environmental Limits

Power and Batteries

Low Power Annunciator

Installing Batteries

Determining if the Calculator Requires Service

Confirming Calculator Operation — the Self-Test

Limited One-Year Warranty

What Is Covered

What Is Not Covered

Consumer Transactions in the United Kingdom

If the Calculator Requires Service

8 Contents

124

125

Obtaining Service

Service Charge

Page 12

125 Shipping Instructions

126 Warranty on Service

126 Service Agreements

126 Regulatory lnform<ilion

127 More About Calculations

127 IRR/YR Calculations

127 Possible Outcomes of Calculating IRR/YR

128 Halting and Restarting IRR/YR

128 Entering a Guess for IRR/YR

129 Effect of Using S- to Correct Data

129 Range of Numbers

129 Equations

129 Margin and Markup Calculations

130 Time Value of Money (TVM)

130 Amortization

131 Interest Rate Conversions

131 Cash-Flow Calculations

132 Statistics

133 Messages 136 Index

Contents

Page 13

At a Glance...

This section is designed Гог you if you're already familiar with calculator

operation or financial concepts. You can use it for quick reference. The

rest of the manual is filled with explanations and examples of the concepts

presented in this section.

Basics—At a Glance.

!'

-------------

onoocju

Qoaooo

mmmoom

ODOoa

oaaao

• aaoo

[■aaoaj

>—

---------

Keys:

m

■

'

О

Display:

0.00 Turns calculator on.

0.00 Displays shift annuncia-

Description:

lor(.^).

■

123 0

■(cm

■(CLEAR ALLI

шт

10 At a Glance...

0.00

12_ Erases last character.

0.00

0.00

0.00

Discontinues shift.

Clears display.

Clears statistics memory.

Clears all memory.

Turns calculator off.

Page 14

Percentages—At a Glance...

— ' •

OUOUDcl'

CDOOCCi

oaoco!.

Doaoc,

ooGOc:«

loonoci

Percent.

(CST)

i^ARl

Add 15% to $17.50.

Cost.

Price.

Margin.

Markup.

Keys:

17.50 0

Display:

17.50

Description:

Enters number.

15® 0

Find (he margin if the cost is $15.00 and

20.13

15 iesD 15.00

22 iP^ 22.00

fMM]

If the cost

20 (cUl

33IIMI

is $20.00 and the markup is 33%, what is the selling price?

31.82

20.00

33.00

Adds 15 %.

.selling price Ls $22.00.

Enters cost.

Enters price.

Calculates margin.

Enters cost.

Enters markup.

(PRC)

26.60

Calculates price.

At a Glance... 11

Page 15

Memory Keys—At a Glance...

pooooo

paaaoo

xz=)aaao

□ oooo

• OCDOO

ooooa

Doaoa

0

Em)

m

m

Multiply 17, 22, and 25

Stores a constant operation.

Stores a value in the M register (memory location).

Recalls a value from the M register.

Adds a value to the number .stored in the M register.

Stores a value in a numbered register.

Recalls a value from a numbered register.

by 7, storing

“x

7*

as a constant operation.

Keys:

170711

0

22 0

25 0

Store 519 in register 2, then recall it.

5191 ST012

Display: Description:

7.00 Stores “x 7” as a co

119.00

154.00 Multiplies 22x7.

175.00

519.00 Stores in register 2.

operation.

Multiplies 17

Multiplies 25x7.

X

7.

m

iRCO 2

12 At a Glance...

0.00 Clears display.

519.00 Recalls register 2.

Page 16

Time Value of Money (TVM)—At a Glance..

Ji’ Enter any four of the five values and solve for the fifth.

immmmc

DOOOOO

C3000C

{OOOOO

oooed

oaac

MOOC

A negative sign in the display represents money paid out;

money received is positive.

(N)

[iTyrI

m

iasfl

(Ey)

liPTYR]

Number of payments.

Interest per year.

Present value.

Payment.

Future value.

Begin or End mode.

Number of payments per year mode.

If you borrow $14,000 for 360 months (N) at 10% interest (I/YR),

what is the monthly payment?

Set to End mode. Press

Keys:

12lfP7YR

360®

10 ii/YRl

14000 fPV]

1 lfiI3e?KiIill if BEGIN annunciator is displayed.

Display:

12.00

360.00

10.00

14,000.00

Description:

Sets payments per year.

Enters number of

payments.

Enters interest per year.

Enters present value.

om

(PM3

0.00

-122.86

Enters future value.

Calculates payment if

paid at end of period.

At a Glance...

13

Page 17

TVM What if...—At a Glance...

U is nol necessary to reenter TVM values Гог each example.

ommma

ooooool

aoooo

ooooo;

□ oooc

Qoaac:

OOOOC!;

Keys:

100 Ea

(pg

Using the values you just entered (page 13), how much can

you borrow if you want a payment of $100.00?

ши

Display:

-100.00

11.395.08

Description:

Enters new payment

amount. (Money paid out

is negative.)

Calculates amount you

How much can you borrow at a 9.5% interest rate?

9.5 IÌ7YRÌ (pg

lOfiTVRi

14000

[22

9.50

11,892.67

10.00

14,000.00

can borrow.

Enters new interest rate.

Calculates new present

value for $100.00 pay

ment and 9.5% interest.

Reenters original interest

rate.

Reenters original present

ВШ

-122.86

value.

Calculates original

payment.

14 At a Glance...

Page 18

Amortization—At a Glance...

t

ooooao

oooooo

moooo

oaooo

□ oaoo

aoooD

□ OOMO

Amortize the 20th payment of the loan.

Keys:

20 lINPUTi

After calculating a payment using Time Value of Money

(TVM), enter the periods to amortize, then press BlAMORTI.

Using the previous TVM example (page 13), amortize a

single payment and then a range of payments.

Display:

20.00

Description:

Enters payment to

amortize.

msEo

Q

0

PEr20- 20

Int

-115.61

Prin

-7.25

0

bAL

13,865.83

Amortize (he 1st through 12lh loan paymcnl.s.

Displays payment to

amortize.

Displays interest. (Money

paid out is negative.)

Displays principal.

Displays balance.

1

QüjjQD

0

0

0

12

12_

PEr1 - 12

Int

-1.396.50

PrIn

-77.82

bAL

13,922.18

Enters range of payments

to amortize.

Displays range of periods

(payments).

Displays interest. (Money

paid out is negative.)

Displays principal.

Displays balance.

Ata Glano«... IS

Page 19

Interest Rate Conversion—At a Glance...

To convert between nominal and cfTcctive interest rates,

ommmoo

oooooo

fCDOnOO

aooao

nooao

OOOCTO

UOOOf )

■FES

■ÎP7ŸR1

enter the known rale and the number of periods per year,

then solve for the unknown rate.

Nominal interest percent.

Effective interest percent.

Periods per year.

Find the annual cfTcctive interest rate of 10% nominal interest com

pounded monthly.

Keys:

10

12KEZŸH1

i(ËFF%

Display:

10.00

12.00

10.47

Description:

Enters nominal rate.

Enters payments per

year.

Calculates annual

cfTcclive interest.

16 At a Glance...

Page 20

IRR/YR and NPV—At a Glance...

oooaoci

oommmzi

t300CC‘

ooDc:c

poncoc

nnc( K:i

C)i3Duc::|

V. -------------------

/

■rpTVRl

[cRl

■(Nj]

onmoD

■I

If you have an initial cash outflow of $-40,(XX), followcii by monthly caslt

inflows of $4,700. $7,OCX). $7,000, and $23,000. what is tlic IRR/YR? What

is the IRR per month?

Number of periods per year (default is 12).

Cash flows, up to 15 (“y“ identifies the cash flowii///?i/?cT),

Number of consecutive times cash flow **y’* occurs.

Internal rale of return per year.

Net present value.

Keys:

ai CLEAR ALp

laliPTYRl

40000 ^ (CF]]

4700 pF]]

7000 fCFj]

Display:

0.00

12.00

CFO

- 40,000.00

CF 1

4,700.00

CF2

7,000.00

Description:

Clears all memorv.

Sets payments ()cr year.

Enters initial outflow.

Enters first casli flow.

Enters second cash flow.

9

2|[^

n2

2.00

Enters number of con-

sccutivc times cash flow

occurs.

At a Glance... 17

Page 21

23000 (cEB

CF3

23,000.00

Enters third cash flow.

onifili]

a 12 0

What is the NPy if the discount rate is 10%7

10 E

15.96

1.33

10.00

622.85

Calculates IRR/YR.

Calculates IRR per

month.

Enters l/YR,

Calculates NPV.

18 At a Glance...

Page 22

Statistics—At a Glance.

I

000008

OOOOOO

^•OOC

ommmc^

ocir joc:'

aaoocj

■fcm

number

number BfZ^

numberl

number2 (|3 Enter two-variable statistical data.

Clear statistical registers.

Enter one-variable statistical data.

Delete one-variable statistical data.

numberJ liNPUTi number! BO Delete two-variable statistical data.

WED Emm

Bd^

Mean of.v and}».

Mean of.v weighted by>^.

BdEiD wmm BE5ZZ1 EMM

y-vatue BiEf] Bf§WÁPl x-value Bl?.ml

OBC® Bdffil

Sample standard deviation o(x andy.

Population standard deviation of.v and}».

Estimate of.v and correlation coefficient.

Estimate ofy.

y-interccpl and slope.

At a Glance... 19

Page 23

Using the following data, find the mean of j; aiidy, the sample standard

deviation of at andy, and they-intcrcept and the slope of the linear regres

sion forecast line. Then, use summation statistics to find n and Sty.

Keys:

■fern

2iiNPUTl50

4 fiNPDTl90

x-data

y-data

Display:

0.00

1.00

2.00

2 4

50 90 160

6

Description:

Clears stalistics registers.

Enters first .V,)» pair.

Enters second pair.

SfiNRJTl 160

IdiD

mna

■dim

mm

0|[^

3.00

4.00

100.00

2.00

55.68

-10.00

Enters third pair.

Displays mean ofx.

Displays mean of>'.

Displays .sample standard

deviation of.v.

Displays sample standard

deviation ofy.

Displays j'-inlcrccpl of

regression line (predicted

y value for.r *= 0).

mm

iRCLl 4

27.50

3.00

1,420.00

Displays slope of regres

sion line.

Displays n, number of

data points entered.

Displays sum of the

products ofjc- and

y-valucs.

20 At a Glance...

Page 24

Getting Started

Power On and Off

To turn on your HP-lOB, press O (ihc key above ihe “ON

oocoao

oooaoo

ki^ooon

□ DOOO

{oaooc

»oao

loao

label). To turn the calculator off, press the yellow shift key

(I )> then [§ (also written BIOPFI).

Since the calculator has continuous memory, turning it off

^ docs not affect the information you’ve stored. To conserve

1

energy, the calculator turns itself off approximately 10 minutes after you

stop using it. The calculator’s three alkaline batteries last approximately

one year. If you .see the low-battery symbol (CD) in the display, replace

the batteries. Refer to appendbe A for more information.

Adjusting the Display Contrast

To change the brightness of the display, hold down and press (T) or

0.

Simple Arithmetic Calculations

Arithmetic Operators. The following examples demonstrate using the

arithmetic operators 0, 0, 0, and 0.

If you press more than one operator consecutively, for example 0 0 0

0 0, all are ignored except the last one.

1: GetUng Startod 21

Page 25

If you make a typing mistake while entering a number, press [♦] to erase

the incorrect digits.

Keys:

24.71 0 62.47 0

When a calculation has been completed (by pressing 0), pressing a

number key starts a new calculation.

19 0 12.68 0

If you press an operator key after completing a calculation, the calculation

is continued.

0 115.5 0

Display:

87.18

240.92

356.42

Description:

Adds 24.71 and 62.47.

Calculates 19 x 12.68.

Completes calculation of

240.92 + 115.5.

You can do chain calculations without using 0 after each step.

6.9 0 5.35 0 36.92

.91 0

Chain calculations are interpreted in the order in which they arc entered.

Calculate 4 + 9x3.

40.57

Pressing 0 displays

intermediate result (6.9 x

5.35).

Completes calculation.

4090

30

13.00

39.00

Adds 4 + 9.

Multiplies 13x3.

Negative Numbers. Enter the number and press I*/-! to change the

sign. Calculate -75 -f 3.

Keys:

75

030

Display:

-75_

-25.00

Description:

Changes the sign of 75.

Calculates result.

22 1: Getting Started

Page 26

Understanding the Display and Keyboard

Cursor

The cursor (_) is visible when you arc entering a number.

Clearing the Calculator

L

oooooc

OOODOO

=JOOC«

oooac

aooooi

oonnr'.

ooeg

ill

When the cursor is on, 0 erases the last digit you entered.

Otherwise, 0 clears the display and cancels the calculation.

While you arc entering a number, pressing (C) clears it to

zero. Otherwise, (c) clears (he display of its current contents

and cancels the current calculation.

Clearing Messages. When the HP-lOB is displaying an error mes

sage, 0 or clears the message and restores the original contents of the

display. Refer Co “Messages,” on page 133 for a complete list of messages

and meanings.

Clearing Memory

nooooo

DOOODO

^mooo

oaooc

ooooo

ooooo!

OOOOCj

Keys

Description

■ CLEAR ALLI

Clears all memory. Does not reset modes.*

Clears statistical memory.

• Modoc on youf HP-10D aro number ol payments per year (page 52), Begin and

End (page and the display formats (page 26).

1: Getting Started 23

Page 27

To dear all memory and reset calculator inodes, press and hold down O,

then press and hold down both and When you release all three,

all memory is cleared. The ALL CLr message is displayed.

Annunciators

Annunciators are symbols in the display that indicate the status of the

calculator.

Annunciator Status

Shift Is active: when a key is pressed, the function

labeled in yellow above the key, is executed

(below).

•

• liNPUTi has been oressed. or two values have

been entered or returned (page 25).

PEND

An arithmetic operator is pending ((+). for exam

ple).

BEGIN

Begin mode is active (page 53).

Battery power is low (page 118).

Shift Key

All of the HP-lOB keys have a second or “shifted” function

ooaoQu

ooaoocH

dDOOOO

printed in yellow above the key. The yellow shift key (|) is

used to access these functions.

ooooo

aaooo

• OOCDO

When you pres.s (he .shift annunciator is displayed

□ oooo

to indicate that the shifted functions arc active. To turn the

annunciator off, press

For example, press | followed by ED (also shov^n BED) to multiply a

number in the display by itself.

I

again.

To perform consecutive shifted operations, hold down the shift key while

pressing the desired keys.

24 1: Getting Started

Page 28

INPUT Key

The lINPUTI key is used lo separate two numbers when using

OOODOD

OOOOOO

BaOOG

ooooc

two-number functions or two-variable statistics.

The : annunciator is displayed if lINPUTI has been pressed. If

оооос

ooooa

a number is in the display, press [c] to erase the : annuncia

ooooo

tor and clear the display. If the cursor or an error message is

visible in the display, press O twice lo erase the :

annunciator.

SWAP Key

IL

I

Pressing |{ exchanges the following:

OODOOO

OOOODO

IczDooao

ooooo

lOOOC

ooooc

aoooc

'S:

The last two numbers that you enlcrcd; for instance, to change the

order of division or subtraction.

The results of functions that return two values. The : annunciator

indicates that two results have been returned; press ■(SWAP) to sec

the hidden result.

The X- and y-valucs when using .statistics.

Math Functions

One-Number Functions. Math functions involving one

ooooocj

OOOOOG

CZDOOOOj

OCDOOI

ОООСЭС1

OCDOOI

looooc:

number use the number in the display.

1: Getting Sterted 25

Page 29

Keys: Display; Description;

89.25 Ш{Щ\ 9.45

3.57 0 2.36 Ш\Ш} 0.42

a 3.99

Two-Number Functions. When a function requires two

DCOOOO

lOOCOO

■■nacD

aDOCio

ooooa

оезооа

ooaoc

numbers, the numbers are entered like this: number I №UT

number2 followed by the operation. Pressing lINPUTi evalu

ates the current expression and displays the : annunciator.

For example, the following keystrokes calculate the percent

change between 17 and 29.

Calculates square root.

1/2,36 is calculated first.

Adds 3.57 and 1/2.36.

Keys:

17IINPUTI

Display:

17.00

29 29_

■l%CHQ|

70.59

Display Format of Numbers

Description:

Enters number I y displays

: annunciator.

Enters number2.

Calculates the percent

change.

When you turn on the HP-lOB for the first time, numbers

□QOOOQ

aooooQ

[СЭОООО

oaooa

OOOOQ

are displayed with two decimal places and a period as the

decimal point. The display format controls how many digits

appear in the display.

ooaoQ

oaoaoi

If the result of a calculation is a number containing more

significant digits than can be displayed in the current display format, the

number is rounded to fit the current display setting.

Regardless of the current display format, each number is stored internally

as a signed, 12-digit number with a signed, three-digit exponent.

26 1: Getting Started

Page 30

Specifying Displayed Decimal Places

To specify the number of displayed decimal places;

1. Press

2. Enter the number of digits (0 through 9) that you wish to appear

after the decimal point.

Keys:

та

45.6 0.1256 0

■в) 9

■fPiSPl 2

Display:

0.00

0.000

5.727

5.727360000

5.73

Description:

Clears display.

Displays three decimal

places.

Displays nine decimal

places.

Restores two decimal

places and rounds

number in display.

When a number is too large or too small to be displayed in DISP format,

it automatically displays in .scientific notation.

Scientific Notation

Scientific notation is used to represent numbers that are loo

OOOOOO

oooooo

iZ^OOOO

• oooo

ooooo

□ aaoo

ooooo

large or too small to fit in the display. For example, if you

enter the number 10,000,000 0 10,000,000 0, the result

is 1.00E14, which means “one times ten to the fourteenth

power” or “1.00 with the decimal point moved fourteen

places to the right.” You can enter this number by pressing

14. The E stands for “exponent of ten.”

Exponents can also be negative for very small numbers. The number

0.000000000004 is displayed as 4.00E-12, which means “four times ten to

the negative twelfth power” or “4.0 with the decimal point moved 12

places to the left.” You can enter this number by pressing 4 ШШ IV-112.

1: Getting Started 27

Page 31

Displaying the Full Precision of Numbers

To SCI your calculator to display numbers as precisely as pos

ooQooa

□OOGOO

C3GOOO

oaooo

oaaoo

cooao

ooMMc:

Start with two decimal places (|

Keys:

10 0 7 0

Esa

sible, press BlDlSPl 0 (trailing zeros arc not displayed.) To

temporarily \aew all 12 digits of the number in the display

(regardless of the current display format setting), press

BloiSPl and hold 0* The number is displayed as long as you

continue holding 0. The decimal point is not shown.

Display:

1.43

142857142857

[■Ma

2).

Description:

Divides.

Displays all 12 digits.

Interchanging the Period and Comma

To switch between the period and comma (United States and

ooaooo

ooooao

CZ5COOO

International display) used as the decimal point and digit

separator, press BEZD-

ooooo

oaaoo

ooaao

[QO«ao

For example, one million can be displayed as 1,000,000.00

or 1.000.000,00.

Rounding Numbers

GOGOGO

OGGGOO

[aoool

ooooo

ooooo

ooooo

00000

The calculator stores and calculates using 12 digit numbers.

When 12 digit accuracy is not desirable, use BiRNDl to round

the number to the displayed format before using it in a calcu

lation. Rounding numbers is useful when you want the actual

(dollars and cents) monthly payment.

28 1: Gotting Started

Page 32

Keys:

Display:

Description:

9.87654321

raiga

fiHSTl]

a

|(RND)

9.87654321

9.88

987654321000

9.88

Enters a number with

more than Iwo non-zero

decimal places.

Displays two decimal

places.

Displays all digits without

the decimal while you

press 0.

Rounds to two decimal

places (specified by

pressing BiDISR 2).

0

988000000000

Shows rounded, stored

number.

Messages

The HP-lOB displays messages about the status of the calculator or

informs you that you have attempted an incorrect operation. To clear a

message from the display, press (Cj or 0. Refer to ‘"Messages” on page

133 for a list of meanings.

Picturing Memory

The available memory in the HP-lOB consists of:

■ Ten business application registers.

■ A convenient M (memory) register.

■ Fifteen registers for storing numbers, cash flows, and summary

statistics.

1 : Getting Started 29

Page 33

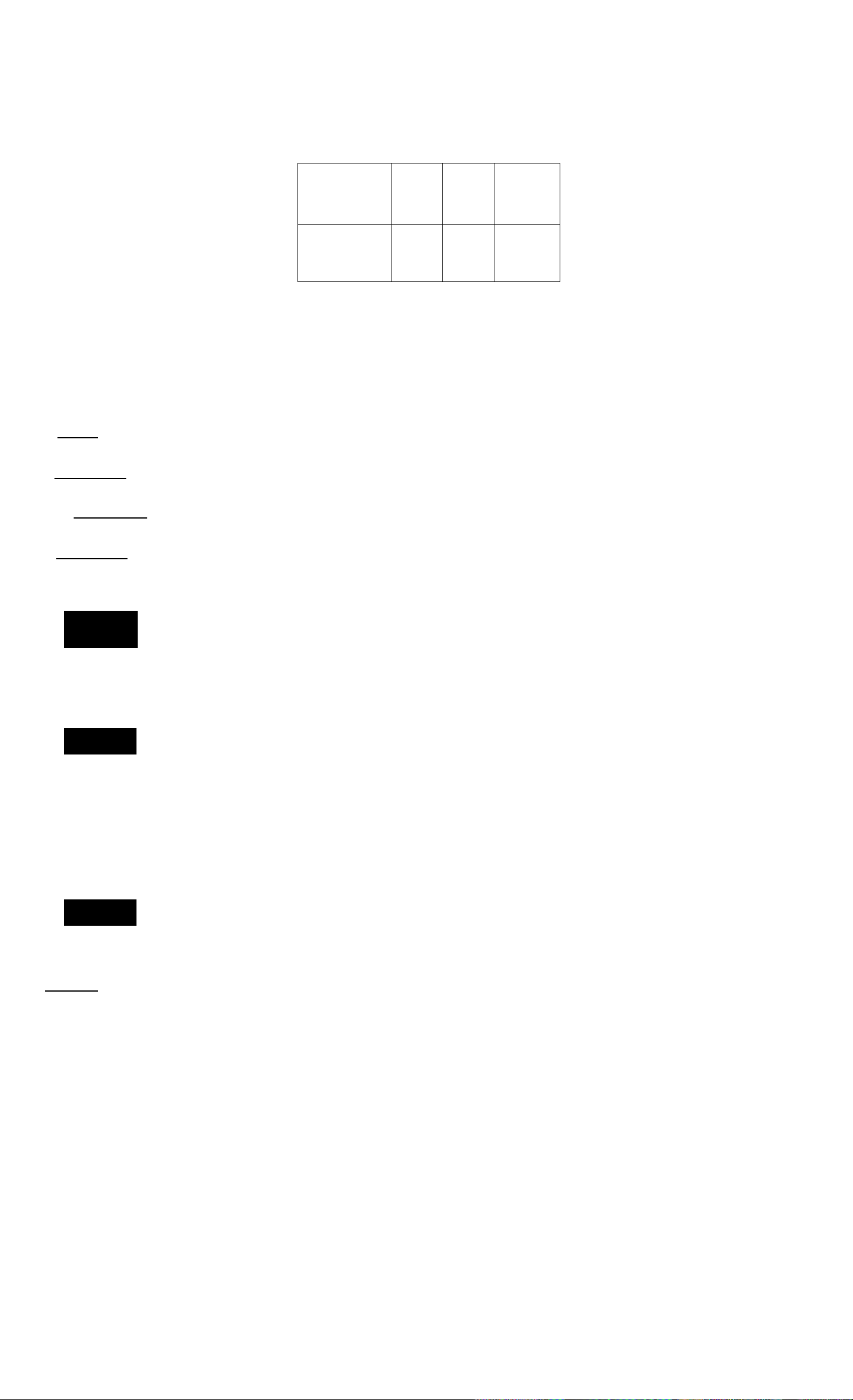

N l/YR

or

NOM%

PV

M

PMT

FV

CST

General Storage

and Cash Flows

PRC MAR

or

MU

Ro

Ri

R2

R3

«4

Re

R?

«8

P/YR

> Summation

Statistics

EFF%

R9

R.0

R.1

R.2

R.3

R.4

Numbered Memory Registers

You can picture each memory register as a separate box (hat has a name

and can hold one number at a time. If you store a number in a register,

you write over the number that was previously stored there.

Notice that I/YR and NOM% share the same register, and that MAR and

MU share the same register.

30 1: Getting Started

Page 34

Business Percentages

You can U.SC (he HP-lOB to calculate simple percent, percent change,

cost, price, margin, and markup.

Percent Key

2

The key has two functions: finding a percent and adding

oooaoo

lOOOQO

CZJOOQO

oooao

ooocao

ooooo

OODOC

or subtracting a percent.

Finding a Percent

The @ key divides a number by 100 unless it is preceded by an addition

or subtraction sign.

Example. Find 25% of 200.

Keys:

2000 200.00 Enters 200.

25®

0

Display:

0.25

50.00

Description:

Converts 25% to a

decimal.

Multiplies 200 by 25%.

2: ButiiiMt Percentages 31

Page 35

Adding or Subtracting a Percent

You can add or subtract a percent in one calculation.

Example. Decrease 200 by 25%. Keys:

200 0 200.00 Enters 200.

25 ® 50.00

0

Display:

150.00

Description:

Multiplies 200 by 0.25.

Subtracts 50 from 200.

Example. You borrow $1,2S0 from a relative, and you agree to repay the

loan in a year with 7% simple Interest. How much money will you owe?

Keys;

1250 07®

Display:

87.50

Description:

Calculates loan interest.

0

Percent Change

Calculate the percent change between two numbers (/ij and

1

onoODO

looaoD

BOOOO

ooooo

oacDoo

QOCDOO'

aoaao

I

/12, expressed as a percent of/t|) by entering/i| lINPUTi /I2,

then press ||

1.337.50

Adds $87.50 and

$1,250.00 to show repay

ment amount.

Example. Calculate the percent change between 291.7 and 316.8.

Keys:

291.7

316.8 idCHQ)

n?ijm

Display:

291.70

8.60

Description:

Enters ni.

Calculates percent

change.

32 2: Butinett PercenUget

Page 36

Example. Calculate the percent change between (12 x S) and (65 + 18).

Keys: Display: Description:

12 fx] 5 lINPUTI 60.00 Calculates and enters D|.

65 0 18 Bi%CHGl 38.33 Calculates percent

change.

Margin and Markup Calculations

The MP-lOB can calculate cost, selling price, margin, or markup.

Application

Margin

Markup

Keys

iesn. (PRÇ],

CŒID

(MS. (PRÇ].

wm

Margin is markup expressed as a percent of price.

Markup calculations are expressed as a percent of cost.

Description

To see any value used by the Margin and Markup application, press

and then the key you wish to see. For example, to see the value stored as

[CSTI, press {RCL\ iCSfl. Margin and Markup share the same storage

register. For example, if you store 20 in IMARI. then press [RCLI B(M3J>

you will sec 20.00 displayed.

Margin Calculations

Example. Kilowatt Electronics purchases televisions for $255. The tele

visions are sold for $300. What is the //iflrgi/i?

Keys:

Display: Description:

GHI

255 (EH)

300ÎPRC1

EM)

255.00 Stores cost in CST.

300.00 Stores selling price in

PRC.

15.00

Calculates margin.

2: Business Percentages

Page 37

Markup on Cost Calculations

Example. The standard markup on costume jewelry at Kleiner’s

Knsmetique is 60%. They just received a shipment of chokers costing

$19.00 each. What is the retail price per choker?

Keys:

19 IC^

60

GIIS

Display:

19.00 Stores cost.

60.00

30.40 Calculates retail price.

Description:

Stores markup.

Using Margin and Markup Together

Example. A food cooperative buys eases of canned .soup with an invoice

cost of $9.60 per ease. If the co-op routinely uses a 15% markup, for what

price should it sell a case of soup? What is the margin?

Keys:

9.6[CST|

15

mD

[¡I!]

Display:

9.60

15.00

11.04

13.04

Description:

Stores invoice cost.

Stores markup.

Calculates the price on a

case of soup.

Calculates mar^u.

34 2: Busines» Percentages

Page 38

Number Storage and Arithmetic

Using Stored Numbers in Calculations

You can Store numbers, for reuse, in several different ways:

■ Use E) (Constant) to store a number and its operator for repetitive

operations.

■ Use 3 Key Memory [RMl. and (M+J) to store, recall, and sum

3

numbers with a single keystroke.

« Use mstQl and IRCLI to store and recall the 15 numbered registers.

Using Constants

L

oooooc

oooooc

CTDOODO

OOQOCD

oaor^

PLjooc:

Use [K] to store a number and arithmetic operator for repeti

tive calculations. Once the constant operation is stored, enter

a number and press 0. The stored operation is performed

on the number in the display.

3: Number Storage and Arithmetic 35

Page 39

Keys

Operation

0 number (Q 0

0 number 0 0 Stores number" as constant.

0 number 0 0

0 number 0 0

KFl X value (K) 0 Stores *y * ” as constant.

0 number 0 0 0

0 number 0 0 0

0 number 0 0 0

Stores "+ number" as constant.

Stores “x number " as constant.

Stores ‘‘-f number " as constant.

Stores “ + number %" as constant.

Stores " - number %" as constant.

Stores "x number %" as constant.

0 number 0 0 0 Stores number %” as constant.

Example. Calculate 5 + 2,6 + 2, and 7 + 2.

Keys: Display:

5 0 2 (K) 2.00

0 7.00

6 0 8.00

7 0 9.00

Description:

Stores “+ 2” as constant.

Adds 5 + 2.

Adds 6 + 2.

Adds? + 2.

Example. Calculate 10 + 10%, 11 + 10%, and 25 + 10%.

Keys:

10 0 io(D (K)

0

0

25 0

Display;

1.00

11.00

12.10

27.50

Description:

Stores “ + 10%” as con

stant.

Adds 10% to 10.

Adds 10% to 11.

Adds 10% to 25.

36 3: Number Storage and Arithmetic

Page 40

Example. Calculate 2^ and 4^.

Keys: Display:

2i(Z] 3 (K)

0

3.00

8.00 Calculates 2\

Description:

Stores as constant.

40 64.00 Calculates 4^

Using the M Register

The I-»ML IRMI. and keys perform memory operations

oooooo

oooooa

l■ •0

00000

ooooa

oaaac)

000001

on a single storage register, called the M register. In most

eases, it is unnecessary to clear the M register, since I-»Ml

replaces the previous contents. However, you can clear the

M register by pressing 0 I-»Ml. To add a series of numbers

to the M register, use i-»MI to store the first number and IM+I

to add subsequent numbers. To subtract the displayed number from the

number in the M register, press I•*•/-! followed by IM-t-l.

Description

Em]

m

Keys

Stores displayed number in the M register.

Recalls number from the M register.

Adds displayed number to the M register.

Example. Use the M register to add 17,14.25, and 16.95. Then subtract

4.65 and recall the re.sult.

Keys:

ITEM)

14.25 fi4+l

Display: Description:

17.00

Stores 17 in M register.

14.25 Adds 14.25 to M register.

16.95 (m3 16.95 Adds 16.95 to M register.

3: Number Storage and Arithmetic 37

Page 41

4.65 Ea (M±]

-4.65

Adds -4.65 lo M

register.

m

43.55

Using Numbered Registers

L

oooooo

oaoooo

C300DD

oasMO

The BiSTOI and IRCLI keys access storage registers Rq

through R9 and R 0 through R.4. (Refer to “Picturing

Memory*' on page 29.) The BISTOI key is used to copy the

displayed number to a designated register. The IRCLI key is

used to copy a number from a register to the display.

Recalls contents of the

M register.

To store or recall a number in two steps:

1- Press BlSTOl or [RCLl. (To cancel this step, press 0 or (§.)

2- Enter the register number (0 through 9 for registers Rq through R9

or 0 0 through 0 4 for registers R.o through R 4).

In the following example, two storage registers are used. Calculate the

following:

Keys:

475.6 ,

39,15

Display: Description:

560.1 + 475.6

39.15

475.6 ifSTO 1

m 39.15^8101 2

0

560.1 0 fRCLl 1

0 iRCLl2

0

475.60

39.15

12.15 Completes first

475.60

39.15

26.45

Stores 475.60 (displayed

number) in Rj.

Stores 39.15 in R2.

calculation.

Recalls R|.

Recalls R2.

Completes second

calculation.

You can also use B(STO] and iRCLl for application registers. For exam

ple, BdlO) il/YRI stores the number from the display in the [l7^ regis

ter. iRCLl II/YRI copies the contents from Il/YRI to the display.

36 3: Number Storage and Arithmetic

Page 42

In most cases, it is unnecessary to clear a storage register since storing a

number replaces the previous contents. However, you can clear a sin^e

register by storing 0 in it. To clear all the registers at once, press

■l CLEAR ALD.

Doing Arithmetic Inside Registers

You can do arithmetic inside storage registers Rq through R9. The result

is stored in the register.

Keys

B|STO| (+) register number

■|STO| □ register number

B|STO| 0 register number

BjsTO] (±) register number

Old contents + displayed number

Old contents - displayed number

Old contents X displayed number

Old contents - displayed number

New Number in Register

Example. Store 45.7 in R3, multiply by 2.5, and store the result in R3.

Keys:

45.7 ■ STÓ1 3

2.5 B STO] 0 3 2.50 Multiplies 45.7 in R3 by

fRCLl3

Display:

45.70 Stores 45.7 in R3.

114.25 Displays R3.

Description:

2.5 and stores result

(114.25) in R3.

3: Number Storage and Arithmetic 39

Page 43

Doing Arithmetic

Math functions operate on the number in the display.

oooooo

□GOOD

CZDOOOO

OOOO

QOOO

ommm

jOOCDO

Example. Calculate Ihcn calculate + 47.2 + 1.1^.

'J

Keys: Display:

4 loa

20 i(^

0 47.2 0

1.1 iE)

0

0.25

4.47

51.67

1.21

52.88

Description:

Calculates the reciprocal

of 4.

Calculates

Calculates47.20.

Calculates 1.1^.

Completes the calcula

tion.

Example. Calculate natural logarithm (c^). Then calculate 790 + 4!

Keys:

2.5 Id!) 12.18

790 0 4 |(ñ0

0

Display: Description:

2.50

24.00 Calculates 4 factorial.

814.00

Calculates e^-*.

Calculates natural loga

rithm of the result.

Completes calculation.

40 3: Number Storage and Arithmetic

Page 44

Power Operator

The power operator, B0> raises the preceding number (y-

oooooo

OOOOOOj

K=)OOOD

ooooo

OQoai

oaoooj

ooooo

—■ ')

Example. Calculate 125^ then find the cube root of 125.

valuc) to the power of the following number (x-valuc).

Keys:

125i(Z)3tJ 1,953,125.00

1251(0 3100 (3 5.00

Display:

Description:

Calculates 125’.

Calculates cube root of

125, which is the same as

125'/’.

Using Parentheses in Calculations

Use parentheses to postpone calculating an intermediate result until

you’ve entered more numbers. For example, suppose you want to

calculate

30

x9

(85 - 12)

If you enter 30 0 85 0, the calculator displays the intermediate result,

0.35. This is because calculations without parentheses arc performed from

left to right, as you enter them. To delay the division until you’ve sub

tracted 12 from 85, use parentheses. Closing parentheses at the end of the

expression can be omitted. For example, entering “25 -f (3 x (9 + 12 =”

is equivalent to “25 -r (3 x (9 + 12))

3: Number Storage and Arithmetic 41

Page 45

Keys:

Display: Description:

30 0 10 85 0 85.00

12|(B

a

90 3.70 Multiplies the result by 9.

73.00 Calculates 85 - 12.

0.41

No calculation yet.

Calculates 30 *r 73.

42 3: Number Storage and Arithmetic

Page 46

4

Picturing Financial Problems

How to Approach a Financial Problem

The financial vocabulary of the HP-lOB is simplified to apply to all finan

cial fields. For example, your profession may use the term balance, bal

loon payment, residual, maturity \^alue, or remaining amount to designate a

value that the HP-lOB knows as (E3 (future value).

The simplified terminology of the HP-lOB is based on cash flow diagrams.

Cash flow diagrams are pictures of financial problems that show cash

flows over time. Drawing a cash flow diagram is the first step to solving a

financial problem.

The following cash flow diagram represents investments in a mutual fund.

The original investment was $7,000.00, followed by investments of

$5,000.00 and $6,000.00 at the end of the third and sixth months. At the

end of the 11th month, $5,000.00 was withdrawn. At the end of the 16lh

month, $16,567.20 was withdrawn.

4: Picturing Financial Problema 43

Page 47

Up-arrows represent positive A

cash flows (money received). ' * '

The horizontal line represents

time. It is divided into regular

periods.

1 I 2 I 3 4 I 5 I 6

- 5,000.00

- 7.000.00

5,000.00

7 I 8 I 9 I 10i 11 12 113 114 115 116

\-\-r\

Down-arrows represent negative

cash flows (money paid out).

- 6.000.00

Any cash flow example can be represented by a cash flow diagram. As you

draw a cash flow diagram, identify what is known and unknown about the

transaction.

Time is represented by a horizontal line divided into regular time periods.

Cash flows arc placed on the horizontal line when they occur. Where no

arrows arc drawn, no cash flows occur.

Signs of Cash Flows

In cash flow diagrams, money invested is shown as negative and money

withdrawn is shown as positive. Cash flowing our isnegatiycy cash flowing

in IS positive.

For example, from the lender’s perspective, cash flows to customers for

loans arc represented as negative. Likewise, when a lender receives

money from cuslomcns, cash flows arc represented as positive. In contrast,

from the borrower’s perspective, cash borrowed is positive while cash paid

back IS negative.

44 4: Picturing Financial Problems

Page 48

Periods and Cash Flows

In addition to the sign convention (cash flowing out is negative, cash

flowing in is positive) on cash flow diagrams, there arc several more

considerations;

■ The time line is divided into equal time intervals. The most common

period is a month, but days, quarters, and annual periods are also

common. The period is normally defined in a contract and must be

known before you can begin calculating.

■ To solve a financial problem with the HP-lOB, all cash flows must

occur at either the beginning or end of a period.

■ If more than one cash flow occurs at the same place on the cash flow

diagram, they arc added together or netted. For example, a negative

cash flow of $-250.00 and a positive cash How of $750.00 occurring at

the same time on the cash flow diagram arc entered as a $500.00 cash

flow (750 - 250 = 500).

■ A valid financial transaction must have at least one positive and one

negative cash flow.

Simple and Compound Interest

Financial calculations arc based on the fact that money earns interest over

time. There arc two types of interest: simple intere.st and compound

interest. The basis for Time Value of Money and cash flow calculations is

compound interest.

Simple Interest

In simple-interest contracts, interest Lsa percent of the original principal.

The interest and principal arc due at the end of the contract. For example,

say you loan $500 to a f^riend for a year, and you want to be repaid with

10% simple interest. At the end of the year, your friend owes you $550.00

(50 is 10% of 500). Simple interest calculations arc done using the ® key

on your HP-IOB. An example of a simple ¡nterc.st calculation is on page

97,

4: Picturing Financial Problema 4S

Page 49

Compound Interest

A compound-interest contract is like a scries of simplc-intcrcst contracts

that arc connected. The length of each simplc-intcrcst contract is equal to

one compounding period. At the end of each period the interest earned

on each simple-interest contract is added to the principal. For example, if

you deposit $1,000.00 in a savings account that pays 6% annual interest,

compounded monthly, your earnings for the first month look like a

simplc-intcrcst contract written for 1 month at V2% (6% 12). At the

end of the first month the balance of the account is $1,005.00 (5 is V2% of

1,000).

The second month, the same process takes place on the new balance of

$1,005.00. The amount of interest paid at the end of the second month is

V2% of $1,005.00, or $5.03. The compounding process continues for the

third, fourth, and fifth months. The intermediate results in this illustration

arc rounded to dollars and cents.

1,005.00

1,010.03

1,015.08

-1,000.00

1,020.16

-1,005.00

1,025.26

-1,010.03

-1,015.08

-1,020.16

The word compound in compound interest comes from the idea that

interest previously earned or owed is added to the principal. Thus, it can

earn more interest. The Tmancial calculation capabilities on the HP-lOB

arc based on compound interest.

4S 4: Picturing Financial Problema

Page 50

Interest Rates

When you approach a financial problem, it is important to rccogni/e that

the interest rate or rate of return can be described in at least three

different ways:

■ As a periodic rate. This is the rate that is applied to your money from

period to period.

■ As an annual nominal rate. This is the periodic rate multiplied by the

number of periods in a year.

■ As an annual effective rate. This is an annual rate that considers com

pounding.

In the previous example of a $1,000.00 savings account, the periodic rate is

1/2% (per month), quoted as an annual nominal rate of 6% (I/2 ^ 12).

This same periodic rate could be quoted as an annual effective rate, which

considers compounding. The balance after 12 months of compounding is

$1,061.68, which means the annual effective interest rate is 6.168%.

Examples of converting between nominal and annual effective rates arc on

pages 71 through 72.

Two Types of Financial Problems

The financial problems in this manual use compound interest unless

specifically stated as simple interest calculations. Financial problems arc

divided into two groups: TVM problems and cash flow problems.

Recognizing a TVM Problem

If uniform cash flows occur between the first and last periods on the cash

How diagram, the financial problem is a TVM (lime value of money)

problem. There arc five main keys used to solve a TVM problem.

4; Picturing Financial Problems 47

Page 51

m

Number of periods or payments.

шш

ш

Ш]

(ЁУ)

You can calculate any value after entering the other four. Cash flow

diagrams for loans, mortgages, leases, savings accounts, or any contract

Annual percentage interest rate (usually the annual nomi

nal rate).

Present value (the cash flow at the beginning of the time

line).

Periodic payment.

Future value (the cash flow at the end of the cash flow

diagram, in addition to any regular periodic payment).

with regular cash flows of the same amount arc normally treated as TVM

problems. For example, following is a cash flow diagram, from the

borrower’s perspective, for a 30-ycar, $75,000.00 mortgage, with a pay

ment of $-684.07, at 10.5% annual interest, with a $5,000 balloon pay

ment.

One of the values for PV^ PA/T, FV can be zero. For example, following is

a cash flow diagram (from the saver’s perspective) for a savings account

with a single deposit and a single withdrawal five years later. Interest

compounds monthly. In this example, PA/r is zero.

4в 4: Picturing Financial Problems

Page 52

l/YR = 8.00%

PMT - 0.00

■ -I --i I ^ I ^ h • -I— I I ^ I ^

PV = -17,000.00

FV « 25,327.38

N « 60

Time value of money calculations arc described in the next chapter.

Recognizing a Cash Flow Problem

A financial problem that docs not have regular, uniform payments (some

times called uneven cash flows) is a cash flow problem rather than a TVM

problem.

A cash flow diagram for an investment in a mutual fund follows. This is an

example of a problem that is solved using either BiNPVl (Net Present

Value) or BlIRR/YRl (Internal Rate of Return per Year).

4: Picturing Financial Problems 49

Page 53

5,000.00

A

16,567.20

1 I 2 1 3

1 1

^ -7,000.00

Cash flow problems arc described in chapter 6.

4 1 5 1 6

1 1 ■

•5,000.00

T

>

r

7 1 8 1 9 1 10 ill

1111

- 6.000.00

12|13|14|15

1 1 I

50 4: Picturing Financial Problama

Page 54

Time Value of Money Calculations

Using the TVM Application

5

____

joooooo* ‘ ,, ,

eZDOODO

oaooo

ooooc

oaooc

ocaoowj

To use TVM, several prerequisites must be met:

■ The amount of each payment must be the same. If the payment

amounts vary, use the procedures described in chapter 6, “Cash Flow

Calculations.”

Bt Payments must occur at regular intervals.

i.i The time value of money (TVM) application is used for com-

pound interest calculations that involve regular, uniform cash

^ I , .

nows —called payments. Once the values arc entered you

can vary one value at a time, without entering all (he values

again.

■ The payment period must coincide with the interest compounding

period. (If it docs not, convert (lie inlercsl rate using the B|

BiEFF%l. and B(EZyr) keys described on page 71.)

o There must be at least one positive and one negative cash flow.

5: Time Value of Money Catculationt 51

Page 55

Key Stores or Calculates

The number of payments or compounding

periods.

mm

IE3

fp^

The annual nominal interest rate.

The present value of future cash flows. PV is

usually an initial Investment or loan amount and

always occurs at the beginning of the first period.

The amount of periodic payments. All payments

are equal, and none are skipped; payments can

occur at the beginning or end of each period.

The future value. FV is either a final cash flow or

compounded value of a series of previous cash

flows. FV occurs at the end of the last period.

■Eyr)

Stores the number of periods per year. The default

is 12. Reset only when you wish to change.

■(xPZ^ Optional shortcut for storing N: Number in display

is multiplied by the value in P/YR and stores result

in A/.

■IBEG/ENDI Switches between Begin and End mode. In Begin

mode, the begin annunciator is displayed.

■f AMORT 1 Calculates an amortization table.

To verify values, press (RlSL'l (R)> IRCLI li/VRl, IftCLI iPVi. IRCLI IPMTl. and

iRCLl (f3* Pressing IRCLI BixP/YRi recalls ihc lolal number of paymcnls

in years and IRCLI B(EZXH) shows you ihc number of paymcnls per year.

Recalling these numbers docs noi change the content of the registers.

52 5: Time Value of Money Calcufatlont

Page 56

Clearing TVM

Press BICLEAR ALLI lo dear the TVM registers. This sets N, f/YR, PV,

PMTy and FV to zero and briefly displays the current value in P/YR,

Begin and End Modes

IL

OOODOQj

OOOOOC'

CZDOOOCii

OOOOCl

ooooc^

oooac

{OBOOc:

To switch between modes, press BlBEG/ENDl. The BEGIN annunciator is

displayed when your calculator is in Begin mode. No annunciator is

displayed when you arc in End mode.

Mortgages and loans typically use End mode. Leases and savings plans

Before you start a TVM calculation, identify whether the

first periodic payment occurs at the beginning or end of the

first period. If the first payment occurs at the end of the first

period, set your HP-lOB to End mode; if it occurs at the

beginning of the first period, set your calculator to Begin

mode.

typically use Begin mode.

Loan Calculations

Example: A Car Loan. You arc financing a new car with a three year

loan at 10.5% annual nominal interest, compounded monthly. The price

of the car is S7,250. Your down payment is $1,500.

Part 1. What arc your monthly payments at 10.5% interest? (Assume

your payments start one month after the purchase or at the end of the

first period.)

5: Time Value of Money Calculations S3

Page 57

PV = 7,250-1,500

PMT = ?

End Mode

Scl (o F.nd mode. Prc.s.s |

Keys:

12i(EZYR)

3 0 12®

10.5 [¡TYRI

7250 0 1500 (Py] 5,750.00

lIS7iiZBl

Display:

12.00

36.00

10.50

0 (pg 0.00

if BEGIN annuncialor is displayed.

Description:

Sets periods per year.

Stores number of periods

in loan.

Stores annual nominal

interest rate.

Stores amount borrowed.

Stores the amount left to

pay after 3 years.

-186.89

Calculates the monthly

payment. The negative

sign indicates money paid

out.

Part 2. At a price of $7,250.00, what interest rate is necessary to lower

your payment by $10.00, to -176.89?

0 10 (PMT

fiTTRl

-176.89

6.75

Decreases payment from

-186.89.

Calculates annual interest

54 5: Time Value of Money Catculatlona

rate for the reduced

payment.

Page 58

Part 3. If interest is 10.5%, what is the maximum you can spend on the

car to lower your car payment to $175.00?

10.5 flTYRl

175 m

01500 0

Slil

10.50

-175.00

5.384.21

6,884.21 Adds the down payment

Stores original interest

rate.

Stores desired payment.

Calculates amount of

money to finance.

to the amount financed

for total price of the car.

Example: A Home Mortgage. You decide tha( the maximum

monthly mortgage payment you can afford is $630.00. You can make a

$12,000 down payment, and annual interest rates arc currently 11.5%. If

you obtain a 30 year mortgage, what is the maximum purchase price you

can afford?

A PV-?

I/YR - 11.5%

N - 30x 12

P/YR = 12

• #

356

357

358

359

360

y y I Y

PMT - - 630.00

End Mode

Set tu End mode. Press |

Keys:

12lfP7YRl

Display:

12.00

y y y y y y

if BEGIN annunciator is displayed.

Description:

Sets periods per year.

5: Time Value of Money Calculations 55

Page 59

30 WxP/YRI

360.00

Stores the length of the

mortgage (30 X 12).

11.5 n/YRl

630(S (PmT)

m

a 12000 a

0.00

11.50

-630.00

63,617.64

75,617.64

Pays mortgage off in 30

years.

Stores interest rate.

Stores desired payment

(money paid out is

negative).

Calculates the loan you

can afford with a $630

payment.

Adds $12,000 down

payment for the total

purchase price.

Example: A Mortgage With a Balloon Payment. You’ve obtained

a 25 year, $72,500 mortgage at 13.8% annual interest. You anticipate (hat

you will own the house for four years and then sell it, repaying the loan

with a balloon payment. What will your balloon payment be?

Solve this problem using (wo steps:

1. Calculate (he loan payment using a 25 year term.

2. Calculate the remaining balance after 4 years.

Step 1. First calculate the loan payment using a 25 year term.

PV » 72.500

PMT - ?

End Mode

56 5: Time Value of Money Calculationa

Page 60

Set (o End mode. Press

if BEGIN annunciator is displayed.

Keys:

12

25 KxPZVr)

0 (FV)

72500 (PyJ

13.8 QZŸR]

Display:

12.00

300.00 Stores length of mortgage

0.00 Stores loan balance after

72,500.00

13.80 Stores annual interest

Description:

Sets periods per year.

(25 X 12 = 300 months).

25 years.

Stores original loan

balance.

rate.

-861.65 Calculates monthly

payment.

Step 2. Since (he payment is at the end of the month, the last payment

and the balloon payment occur at the same time. The final payment is the

sum of PMT and FV,

PV = 72,500.00

A

l/YR - 13.8%

t Y Y Y

PMT = - 861.65

End Mode

N - 4x 12

P/YR - 12

44

45 46

Y Y I Y

47 48

FV = ?

5: Time Velue o( Money Calculations 57

Page 61

I

The value in PMT should always be rounded lo two decimal

000*00

[OOOOOO

nOQC*

taoooo

boooo.

jOOOOC

^ooocjj

places when calculating FU'or PVio avoid small» accumula

tive discrepancies between non-rounded numbers and actual

(dollars and cents) payments. If the display is not set to two

decimal places» press BlDISPi 2.

Keys: Display: Description:

■ÍRÑDl ÍPMD

48®

-861.65 Rounds payment lo two

decimal places, then

stores.

48.00 Stores 4 year term (12 x

m

í+lÍRCLlfmR

4) that you expect to own

house.

-70,725.90

-71.587.55 Calculates total 4Slh

Calculates loan balance

after 4 years.

payment (/^A//’and Fl'^

lo pay olTloan (money

paid out is negative).

Savings Calculations

Example: A Savings Account. If you deposit $2»000 in a savings

account that pays 7.2% annual interest compounded annually, and make

no other deposits to the account, how long will it take for the account to

grow to $3,000?

58 5: Time Value of Money Calculations

Page 62

FV » 3.000.00

Since this account has no regular payments {PMT = 0), the payment

mode (End or Begin) is irrelevant.

Keys:

■I CLEAR ALLI 12 P Yr

Display:

o.oo”

1 liPTYRl

2000

1.00

-2,000.00

Description:

Displays a temporary

message and clears all

registers.

Sets P/YR to 1 since

interest is compounded

annually.

Stores amount paid out

for first deposit.

3000 iFVl

7.2

i] 5.83 Calculates number of

3,000.00

7.20 Stores annual interest

Stores the amount you

wish to accumulate.

rate.

years it takes to reach

$3,000.

5: Time Value of Money Calculations 59

Page 63

Since (he calculated value of N is between S and 6, it will take six years of

annual compounding to achieve a balance of at least $3,000. Calculate the

actual balance at the end of six years.

6®

m

6.00

3,035,28

Sets ® to 6 years.

Calculates amount you

can withdraw after 6

years.

Example: An Individual Retirement Account. You opened an

individual retirement account on April IS, 1985, ^^ith a deposit of $2,000.

Thereafter, you deposit $80.00 to the account at the end of each half

month. The account pays 8.3% annual interest compounded semimonthly.

How much will be in the account on April 15, 2000?

(Half-month periods)

Y t i i

FV =. ?

A

l/YR - 8.3%

N - 360 (15 years x 24 half-months)

P/YR » 24

« • •

360

Y Y Y Y Y Y

PMT = - 80.00

Y

PV = -2,000.00

Set to End mode. Prcs,s BÍBÉG/ENDI if BEGIN annunciator i.s displayed.

Keys:

24 iEZYR]

2000FniPv|

Display:

24.00

- 2,000.00

Description:

Sets number of periods

per year.

Stores initial deposit.

60 5: Time Value of Money Calculations

Page 64

80

ши

-80.00 Stores regular semi

monthly deposits.

8.3

15 lIxP/YRl

8.30

360.00

63.963.84

Stores interest rate.

Stores number of

deposits.

Calculates balance.

Example: An Annuity Account. You opt Гог an early retirement

after a successful business career. You have accumulated a savings of

$400,000 that earns an average of 10% annual interest, compounded

monthly. What annuity (repetitive, uniform, withdrawal of funds) will you

receive at the beginning of each month if you wish that savings account to

support you for the next 50 years?

pv = . 400,000.00

Begin Mode

PMT « ?

Set to Begin mode. Press |

Keys:

1211

400000 E3 (py)

10

[ШВ

шлш

Display:

12.00

-400,000.00

10.00

if annunciator is not displayed.

Description:

Sets payments per year.

Stores your nest egg as

an outgoing deposit.

Stores annual interest

rate you expect to earn.

5: 'Лтв Vatue of Mono, Catculations 61

Page 65

50BxP/YRI

600.00

Stores number of

withdrawals.

0 (FV] 0.00

Ш)

3.328.68

Stores balance of account

after 50 years.

Calculates amount that

you can withdraw at the

beginning of each month.

Lease Calculations

A lease is a loan of valuable properly (Икс real estate, automobiles, or

equipment) for a specific amount of lime, in exchange for regular pay*

mcnls. Some leases arc written as purchase agreements, with an option to

buy at the end of the lca.se (sometimes for as little as Sl.OO). The defined

future value (Fl^ of the property at the end of a lease is sometimes called

19

the “residual value” or “buy out value.'

All five TVM application keys can be used in lease calculations. There arc

two common lease calculations.

■ Finding the lease payment necessary to achieve a specified yield.

■ Finding the present value (capitalized value) of a lease.

The first payment on a lease usually occurs at the beginning of the first

period. Thus, most lca.se calculations use Begin mode.

Example: Calculating a Lease Payment. A customer wishes to

lease a $13,500 car for three years. The lease includes an option to buy

the car for $7,500 at the end of the lease. The first monthly payment is

due the day the customer drives the car off the lot. If you want to yield

14% annually, compounded monthly, what will the payments be? Calcu

late the payments from your (the dealer’s) point of view.

62 5: Tim« Vatu« of 1У1опеу Calculations

Page 66

РМТ - ?

FV = 7,500.00

Ж

PV «■ -13,500.00

Begin Mode

Set to Begin mode.

ж Ж

I/YR - 14%

N - 36

P/YR - 12

Money received

by lessor is

35

if annunciator is not displayed.

36

positive.

Money paid out

by lessor is

negative.

Keys:

12а[р7щ

14 [ITYRI

13500 Ea (pg

7500 7,500.00

36 (n]

[рШ1

Display:

12.00

14.00

-13,500.00

36.00

289.19 Calculates monthly lease

Description:

Sets payments per year.

Stores desired annual

yield.

Stores lease price.

Stores residual (buy out

value).

Stores length of lease, in

month.s.

payment.

Notice that even if the customer chooses not to buy (he car, the lessor still

includes a cash flow coming in at the end of the lease equal to the residual

value of the car. Whether the customer buys the car or it is sold on the

open market, the lessor expects to recover $7,500.

Example: Lease With Advance Payments. Your company, Quick-

Kit Pole Barns, plans to lease a forklift for the warehouse. The lease is

written for a term of 4 years with monthly payments of $2,400. Payments

arc due at the beginning of the month with the first and last payments due

at the onset of the lease. You have an option to buy the forklift for $15,000

at the end of the leasing period.

5: Timo Value of Money CalculaUont S3

Page 67

Ii‘ the annual interest rate is 18%, what is the capitalized value of the

lease?

Begin Mode

PV = ?

This solution requires four steps.

1. Calculate the present value of the 47 monthly payments:

(4x12) -1 = 47.

2. Add the value of the additional advance payment.

3. Find the present value of the buy option.

4. Sum the values calculated in steps 2 and 3.

Step 1- Find the present value of the monthly payments.

Set to Begin mode. Press BIBEG/ENDI if annunciator is not displayed.

Keys:

121[P/Y~R1

47(H)

2400 (EMI

Display:

12.00

47.00

-2,400.00

Description:

Sets payments per year.

Stores number of

payments.

Stores monthly payment.

64 5: Time Value of Money Calculations

Page 68

oEy)

0.00

Stores FV for step 1.

18 il/YR

m

18.00

81.735.58

Stores interest rate.

Calculates present value

of 47 monthly payments.

Step 2. Add the additional advance payment to PV. Store the answer.

m iRCLi iPMTi m

S

Fm]

84,135.58

84,135.58

Adds additional advance

payment.

Stores result in M

register.

Step 3. Find the present value of the buy option.

48 El

0 fPMTl

15000 m iFVI

m

48.00

0.00

-15,000.00

7,340.43

Step 4, Add the results of steps 2 and 3.

Keys:

Display:

Stores month when buy

option occurs.

Stores zero payment for

this step of solution.

Stores value to discount.

Calculates present value

of last cash flow.

Description:

(±)[BM]0

91,476.00

Calculates present

(capitalized) value of

lease. (Rounding

discrepancies are

explained on page 58.)

5: Time Value of Money Calculations 65

Page 69

Amortization

Amorlization is the process of dividing a payment into the

ooooaoi

oooooo

^30000

ooooo

OOOQO

oooac

OOOOC3

amount that applies to interest and the amount that applies

to principal. Payments near the beginning of a loan

contribute more interest, and less principal, than payments

near the end of a loan.

TIME

The Miamorti key on the HP-lOB allows you to calculate.

■ The amount applied to interest in a range of payments.

m The amount applied to principal in a range of payments.

■ The loan balance after a specified number of payments are made.

66 5: Time Value of Money Calculations

Page 70

The BlAMQRTI function assumes you have just calculated a payment or

you have stored the appropriate amortization values in I/YR^ FV, PMT^

wdP/YR.

msi

QQÛI

■iP/YRl

The numbers displayed for interest, principal, and balance arc rounded to

the current display setting.

Annual nominal interest rate.

Starting balance.

Payment amount (rounded to the display format),

Number of payments per year.

To Amortize. To amortize a single payment, enter the period number

and press lINPUTi, then press BlAMORTl. The HP-lOB displays the

message PEr followed by the starling and ending payments that will be

amortized.

Hold 0 down to display the label of the value that you are about to view.

Press 0 to see interest (Int). Press 0 again to sec the principal (Prin)

and again to see the balance (bAL). Continue pressing 0 to cycle

through the same values again.

To amortize a range of pajTOcnts, enter siarling period number I INPUT I

ending period number, then press BlAMORTl. The HP-lOB displays the

message PEr followed by the starting and ending payments that will be

amortized. Then press 0 repeatedly to cycle through interest, principal,

and balance.

Press BiAMORTl again to move to the next set of periods. This autoincrement feature saves you the keystrokes of entering the new starling

and ending periods.

If you store, recall, or perform any other calculations during amorli/aliun,

pressing 0 will no longer cycle through interest, principal, and balance.

To resume amortization with the same set of periods, press IRCLI

■ I

5: Time Value of Money Calculations 67

Page 71

Exampio: Amortizing a Range of Paymanta. Calcuiate the first

tvb-o years of (he annual amortization schedule for a 30 year, $80,000

mortgage, at 9.75% annual interest with monthly payments.

Set to End mode. Press №B£0/ENDI if aEOIN annunciator is displayed.

Keya:

9.75

80000 fPVl

o(E3

[РЙТ1

Display:

12.00

360.00

9.75

80.000.00

0.00

-687.32

Deacrlption:

Sets payments per year.

Stores total number of

payments.

Stores interest per year.

Stores present value.

Stores future value.

Calculates monthly

payment.

If you already know (he mortgage payment, you ean enter and store it just

like you store (he other four values. Next, amortize the first year.