Page 1

THANK YOU

YOUR RECEIPT

CALL AGAIN !

HAMBURGER

COFFEE

FRENCH-

FRIED

SANDWICH

ICE CREAM

ELECTRONIC CASH REGISTER

TK-800

OPERATOR'S INSTRUCTION MANUAL

CI

7

4

1

0

8

5

2

00

9

6

3

C

TK-800

•00

Page 2

2

Introduction & Contents

Unpacking the register

Welcome to the CASIO TK-800!

Congratulations upon your selection of a CASIO Electronic Cash Register, which is designed to

provide years of reliable operation.

Operation of a CASIO cash register is simple enough to be mastered without special training.

Everything you need to know is included in this manual, so keep it on hand for reference.

Consult your CASIO dealer if you have any questions about points not specifically covered in this

manual.

The main plug on this equipment must be used to disconnect mains power.

Please ensure that the socket outlet is installed near the equipment and shall be easily accessible.

Please keep all information for future reference.

Operators

Instruction

Manual

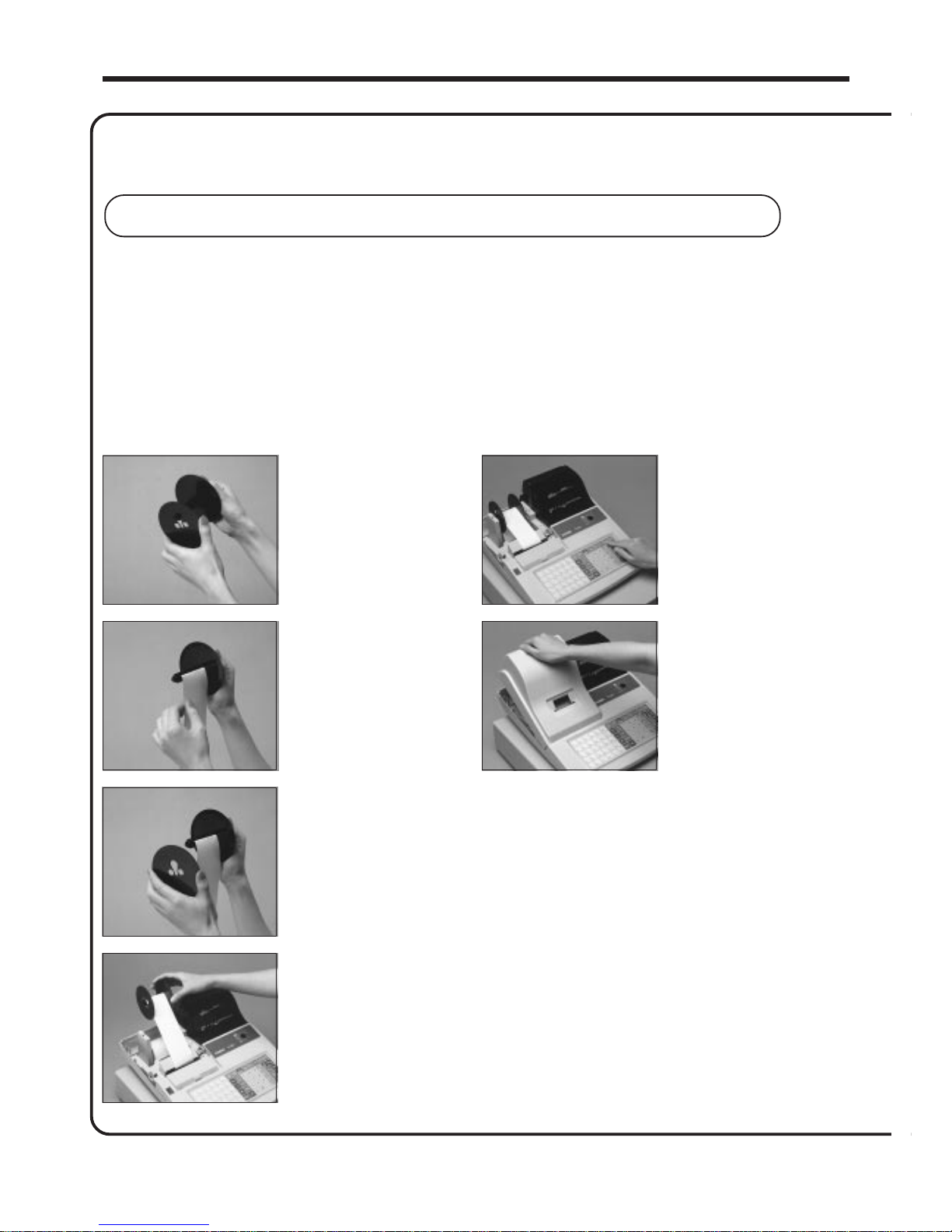

Take-up reel

Roll paper

Operator's

instruction manual/

Character sheet/

Drawer key

Operator/Program key

7

4

1

0

8

5

2

00

9

6

3

MENU

SHIFT

FEED

PLU

C

#-2

#-1

1

B

I

P

W

2

C

J

Q

X

3

D

K

R

Y

4

E

L

S

Z

5

F

M

T

(

G

N

U

A

H

O

V

@

#

%

&

/

*

!

SPACE

DBL

SIZE

•

'

:

Page 3

3

Introduction & Contents

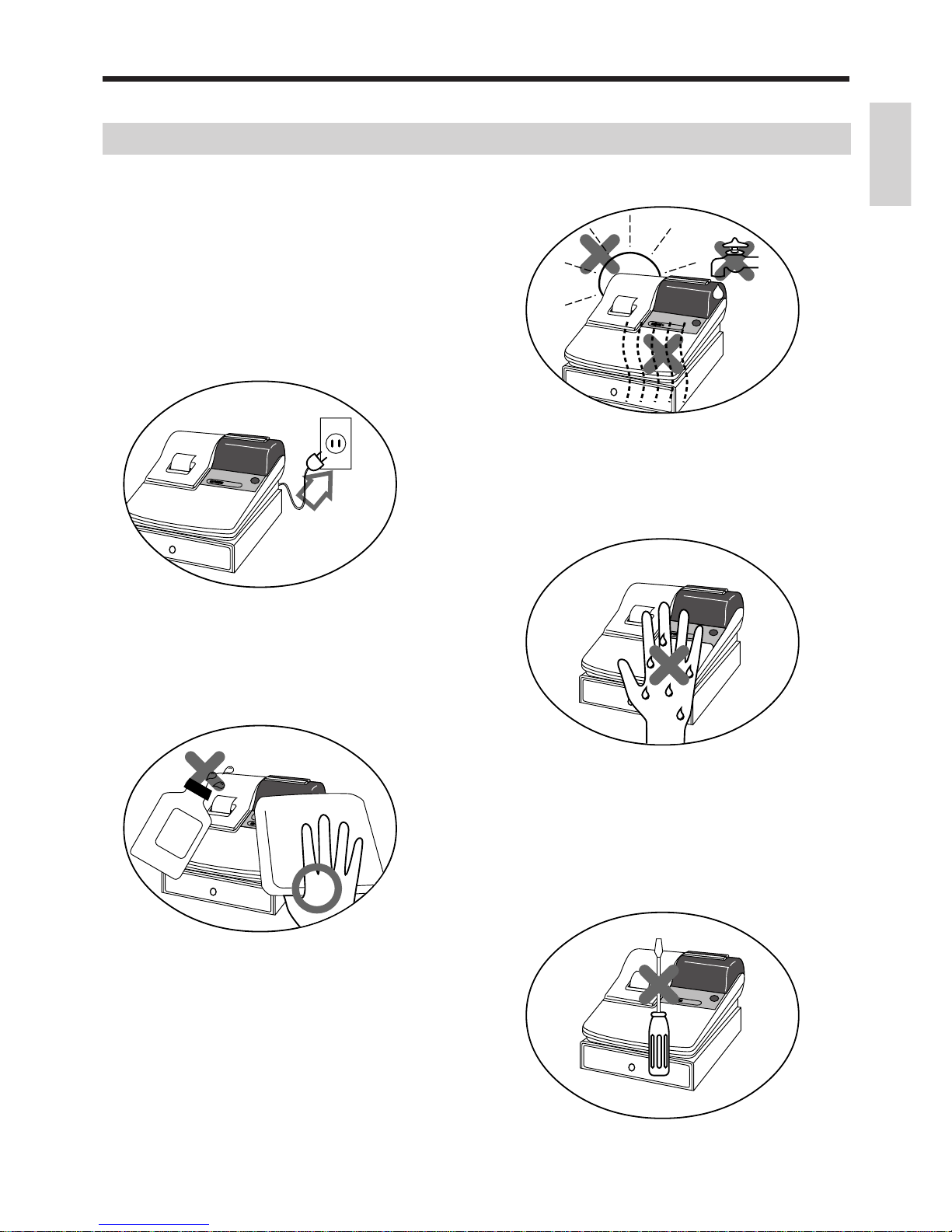

Do not locate the cash register where it will be

subjected to direct sunlight, high humidity,

splashing with water or other liquids, or high

temperature (such as near a heater).

Never try to open the cash register or attempt

your own repairs. Take the cash register to your

authorized CASIO dealer for repairs.

Use a soft, dry cloth to clean the exterior of the

cash register. Never use benzene, thinner, or

any other volatile agent.

Never operate the cash register while your

hands are wet.

Be sure to check the sticker on the side of the

cash register to make sure that its voltage

matches that of the power supply in the area.

Important!

Before you do anything, be sure to note the following important precautions!

ECR

ECR

ECR

PCR-360

PCR-360

PCR-360

Page 4

4

Introduction & Contents

Introduction & Contents .........................................................2

Unpacking the register....................................................................................................... 2

Getting Started ........................................................................6

Remove the cash register from its box .............................................................................. 6

Remove the tape holding parts of the cash register in place............................................. 6

Plug the cash register into a wall outlet ............................................................................. 6

Insert the mode key marked "PGM" into the mode switch................................................. 6

Install receipt/journal paper ............................................................................................... 7

To load 1-ply paper for printing of receipts ...............................................................................7

To load 1-ply paper for printing of journal ................................................................................ 8

To load 2-ply paper for printing of receipts ...............................................................................9

Set the date ..................................................................................................................... 10

Set the time ..................................................................................................................... 10

Select printouts receipt or journal .................................................................................... 10

Tax table programming .....................................................................................................11

Programming automatic tax calculation ................................................................................. 11

Setting the bottom message............................................................................................ 16

Setting the CV-10 ............................................................................................................ 17

Features of CV-10..................................................................................................................17

Preparations ..........................................................................................................................17

Introducing TK-800................................................................20

General guide .................................................................................................................. 20

Mode key, drawer, mode switch.............................................................................................20

Displays .................................................................................................................................22

Keyboard ...............................................................................................................................24

Basic Operations and Setups ..............................................26

How to read the printouts ................................................................................................ 26

How to use your cash register ......................................................................................... 27

Displaying the time and date .................................................................................................28

Preparing coins for change....................................................................................................28

Preparing and using department keys............................................................................. 29

Registering department keys ................................................................................................. 29

Programming department keys.............................................................................................. 31

Registering department keys by programming data .............................................................. 32

Preparing and using PLUs............................................................................................... 33

Programming PLUs ...............................................................................................................33

Registering PLUs ...................................................................................................................34

Preparing and using flat-PLUs......................................................................................... 35

Programming flat-PLUs .........................................................................................................35

Registering flat-PLUs .............................................................................................................36

Preparing and using discounts ........................................................................................ 38

Programming discounts ......................................................................................................... 38

Registering discounts ............................................................................................................39

Preparing and using reductions....................................................................................... 40

Programming for reductions ..................................................................................................40

Registering reductions ........................................................................................................... 41

Shifting the taxable status of an item............................................................................... 42

Registering credit and check payments........................................................................... 43

Registering returned goods in the REG mode................................................................. 44

Page 5

5

Introduction & Contents

Registering returned goods in the RF mode.................................................................... 45

Registering money received on account ......................................................................... 46

Registering money paid out............................................................................................. 47

Making corrections in a registration................................................................................. 48

No sale registration.......................................................................................................... 50

Printing the daily sales reset report ................................................................................. 51

Convenient Operations and Setups ....................................52

Clerk control function, Post-finalization receipt format, General printing control,

Compulsory, Machine features ................................................................................... 52

About the clerk control function .............................................................................................52

About post-finalization receipt................................................................................................ 53

Programming general printing control.................................................................................... 54

Programming compulsory and clerk control function .............................................................55

Programming read/reset report printing control ..................................................................... 56

Setting a store/machine number...................................................................................... 57

Programming to clerk ...................................................................................................... 58

Programming descriptors and messages ........................................................................ 60

Programming report descriptor, grand total, special character, report title,

receipt message and clerk name ......................................................................................60

Programming department key decriptor.................................................................................62

Programming PLU descriptor ................................................................................................ 63

Programming flat-PLU descriiptor.......................................................................................... 64

Programming function key descriptor ....................................................................................65

Entering characters ......................................................................................................... 66

Department key programming ......................................................................................... 68

PLU feature programming ............................................................................................... 70

Flat-PLU feature programming ........................................................................................ 72

Discount/premium key feature programming................................................................... 77

Currency exchange programming ................................................................................... 79

Check tracking system .................................................................................................... 82

Arrangement programming.............................................................................................. 87

Other function key programming ..................................................................................... 89

Calculator functions ......................................................................................................... 92

Keyboard layout change.................................................................................................. 94

Printing read/reset reports ............................................................................................... 96

Reading the cash register's program............................................................................. 103

Troubleshooting ..................................................................108

When an error occurs .................................................................................................... 108

When the register does not operate at all...................................................................... 109

Clearing a machine lock up ............................................................................................110

In case of power failure .................................................................................................. 110

User Maintenance and Options.......................................... 111

To replace the ink ribbon ................................................................................................ 111

To replace journal paper .................................................................................................112

To replace receipt paper .................................................................................................113

Specifications......................................................................114

Index.....................................................................................115

Page 6

6

Getting Started

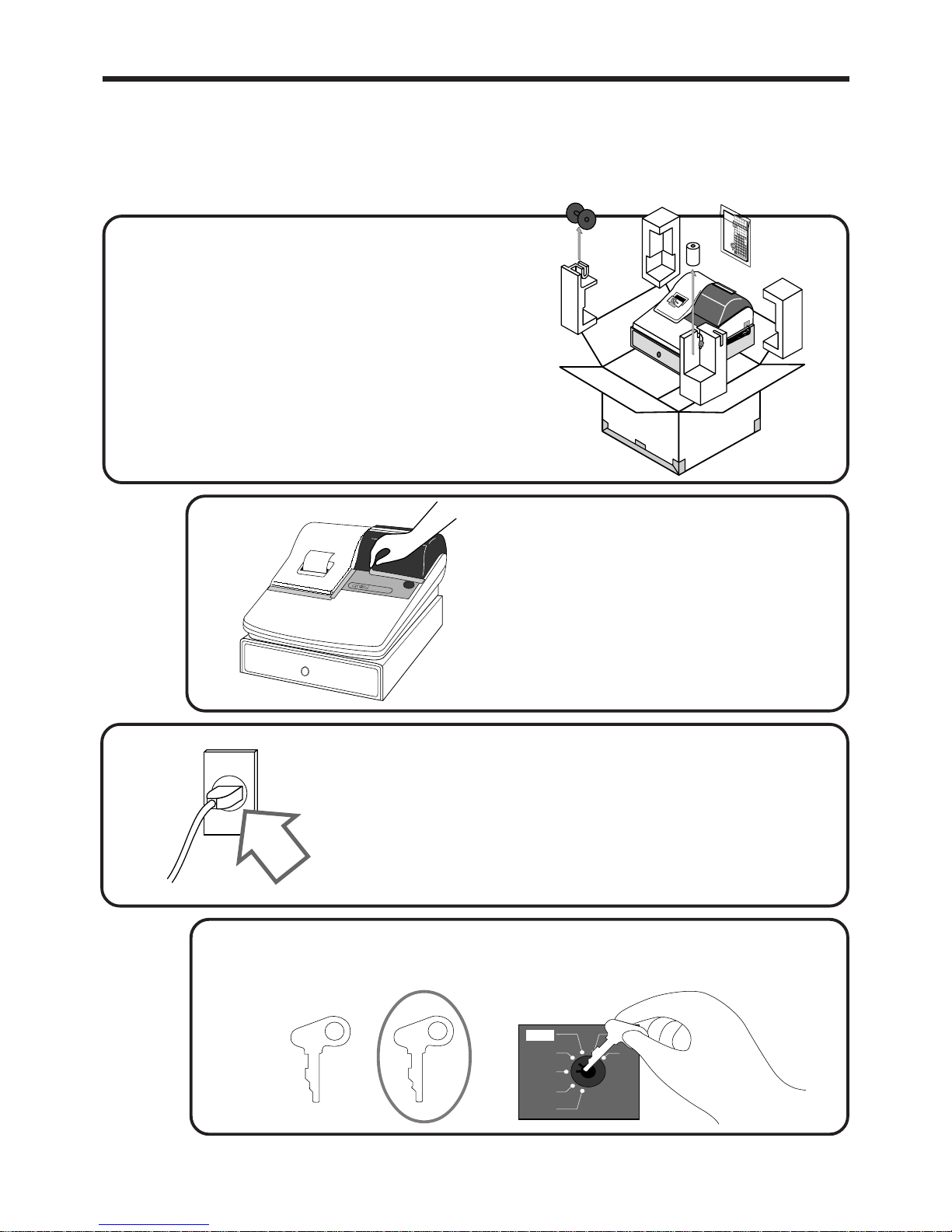

This section outlines how to unpack the cash register and get it ready to operate. Y ou should read this part of

the manual even if you have used a cash register before. The following is the basic set up procedure, along

with page references where you should look for more details.

3.

Plug the cash register into a wall outlet.

Be sure to check the sticker on the side of the cash

register to make sure that its voltage matches that of

the power supply in your area. The printer will

operate for a few seconds.

1.

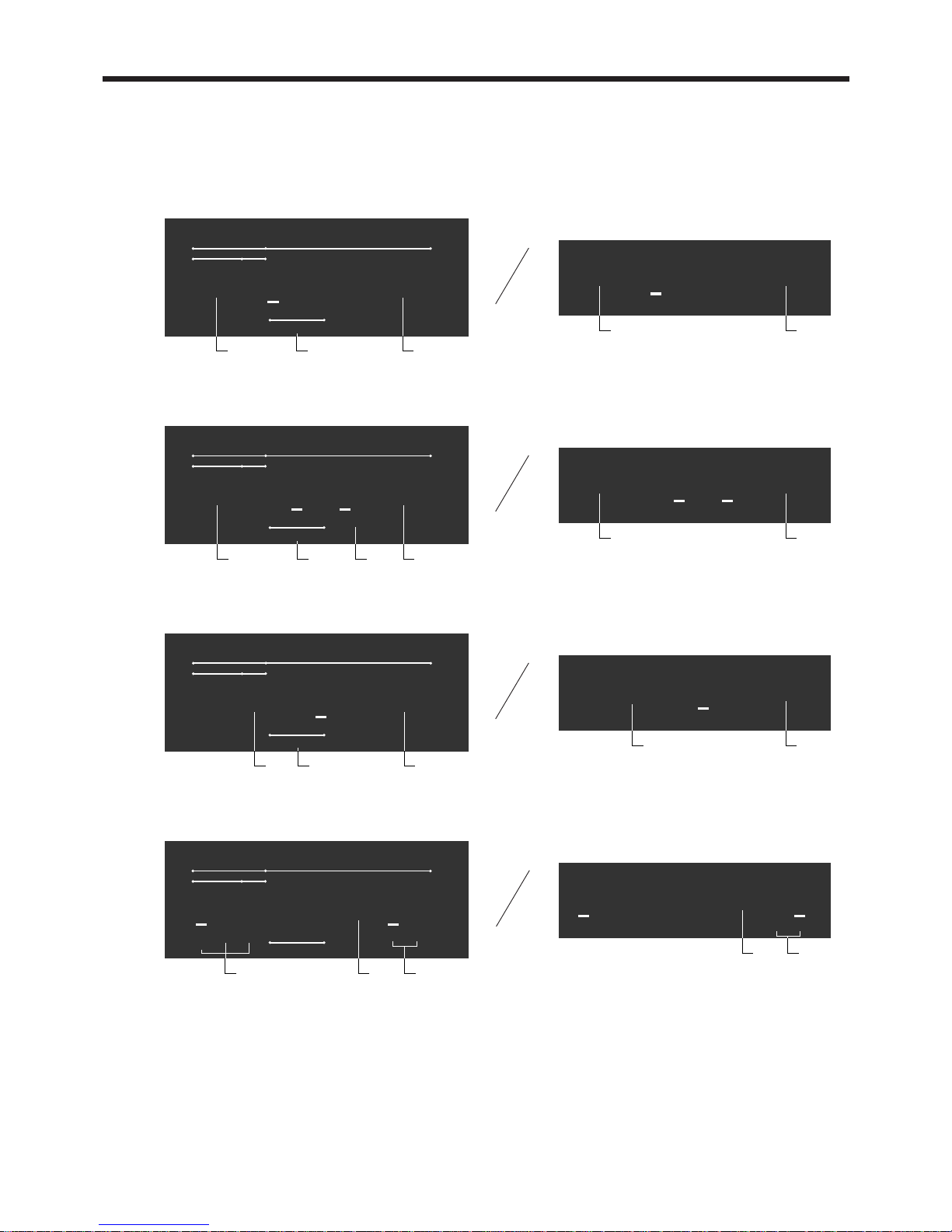

Remove the cash register from its box.

Make sure that all of the parts and accessories

are included.

2.

Remove the tape holding parts

of the cash register in place.

Also remove the small plastic bag taped

to the printer cover . Inside you will find

the mode keys.

Operators

Instruction

Manual

7

4

1

0

8

5

2

00

9

6

3

M

EN

U

SHIFT

FEED

PLU

C

#-2

#-1

1

B

I

P

W

2

C

J

Q

X

3

D

K

R

Y

4

E

L

S

Z

5

F

M

T

(

G

N

U

A

H

O

V

@

#

%

&

/

*

!

SPACE

D

B

L

S

IZ

E

•

'

:

OP

A-A08

PGM

A-A08

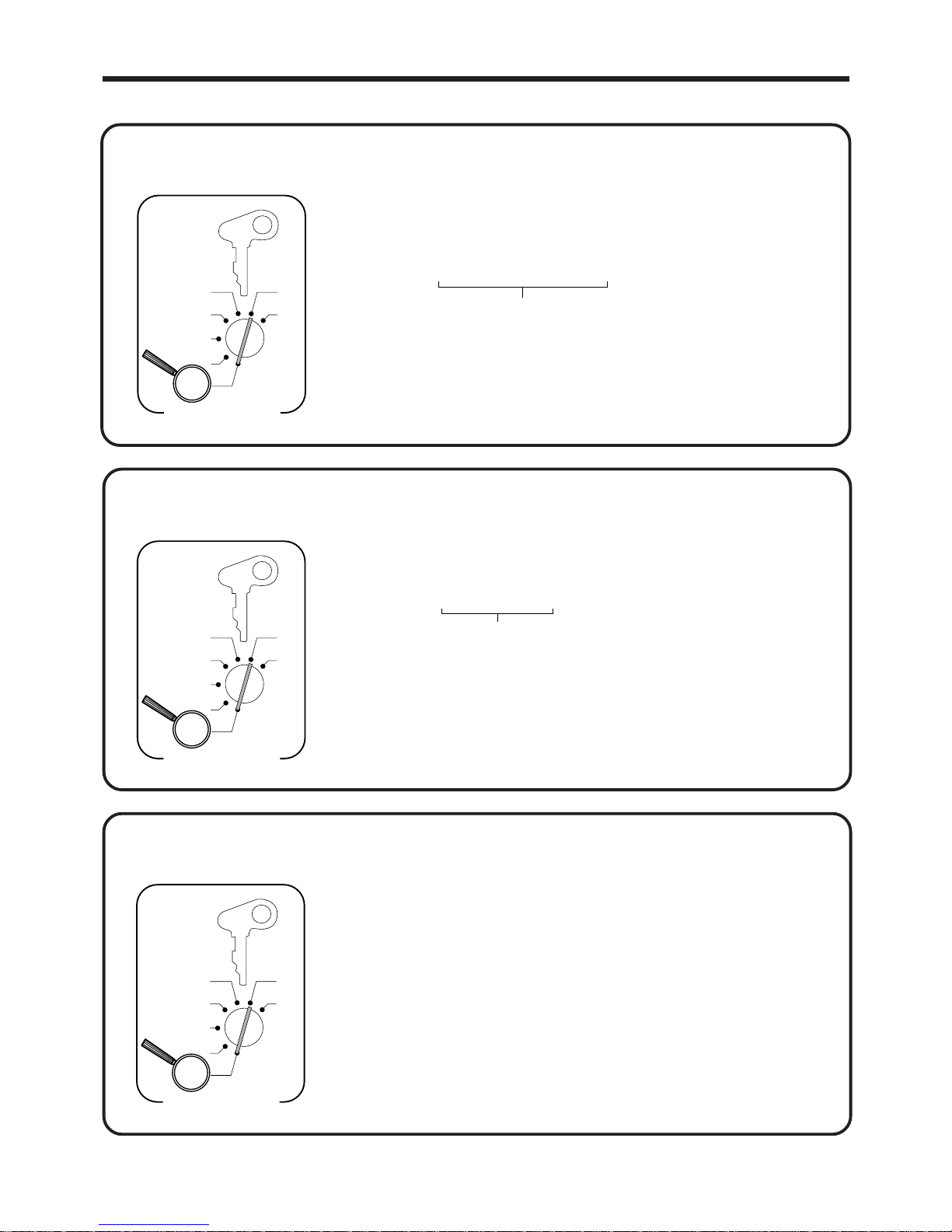

4.

Insert the mode key marked "PGM" into the mode switch.

Z

X

Z

PGM

A-A08

REG

OFF

RF

PGM

CAL

ECR

Page 7

7

Getting Started

X

Z

REG

OFF

RF

PGM

CAL

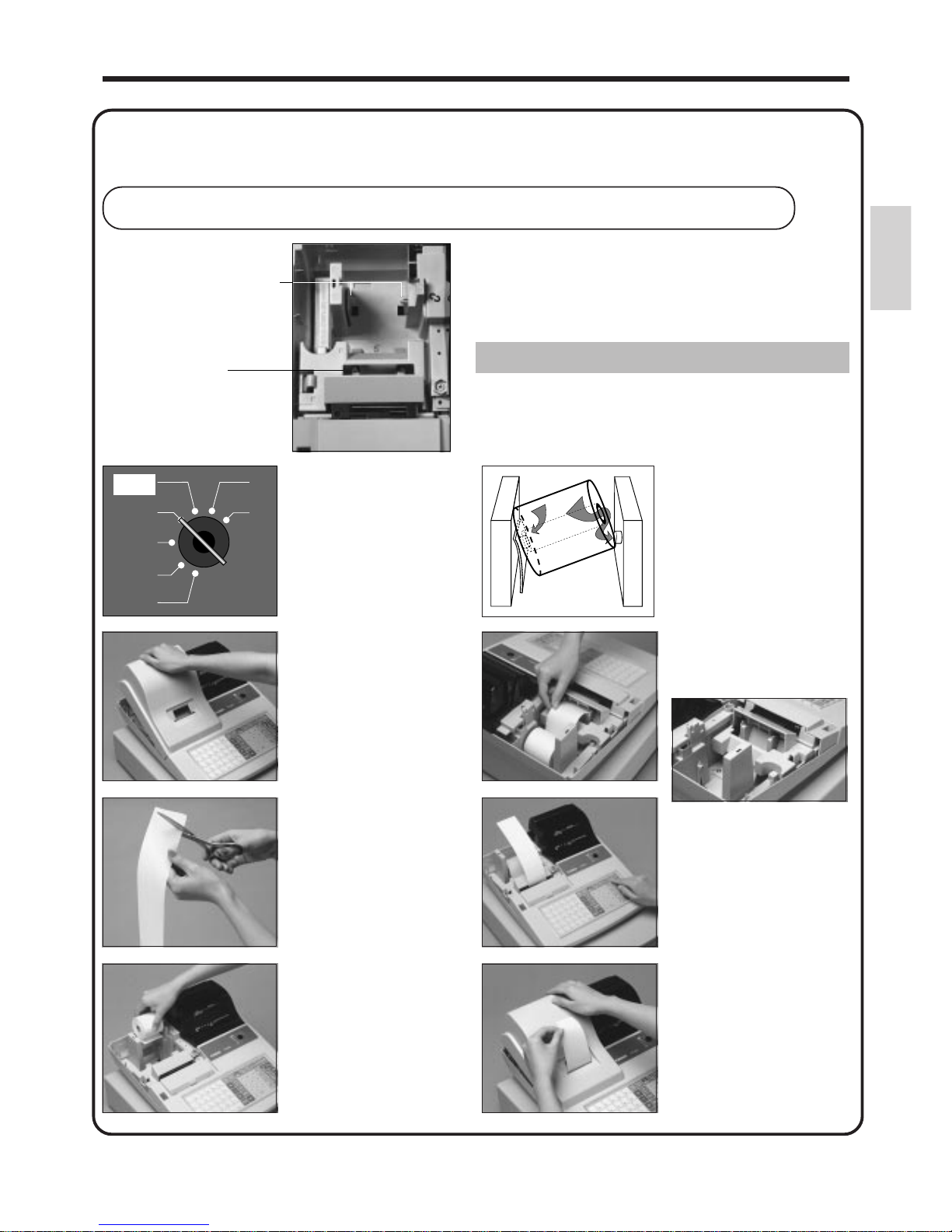

Important!

Never operate the cash register without paper.

It can damage the printer.

55

55

5

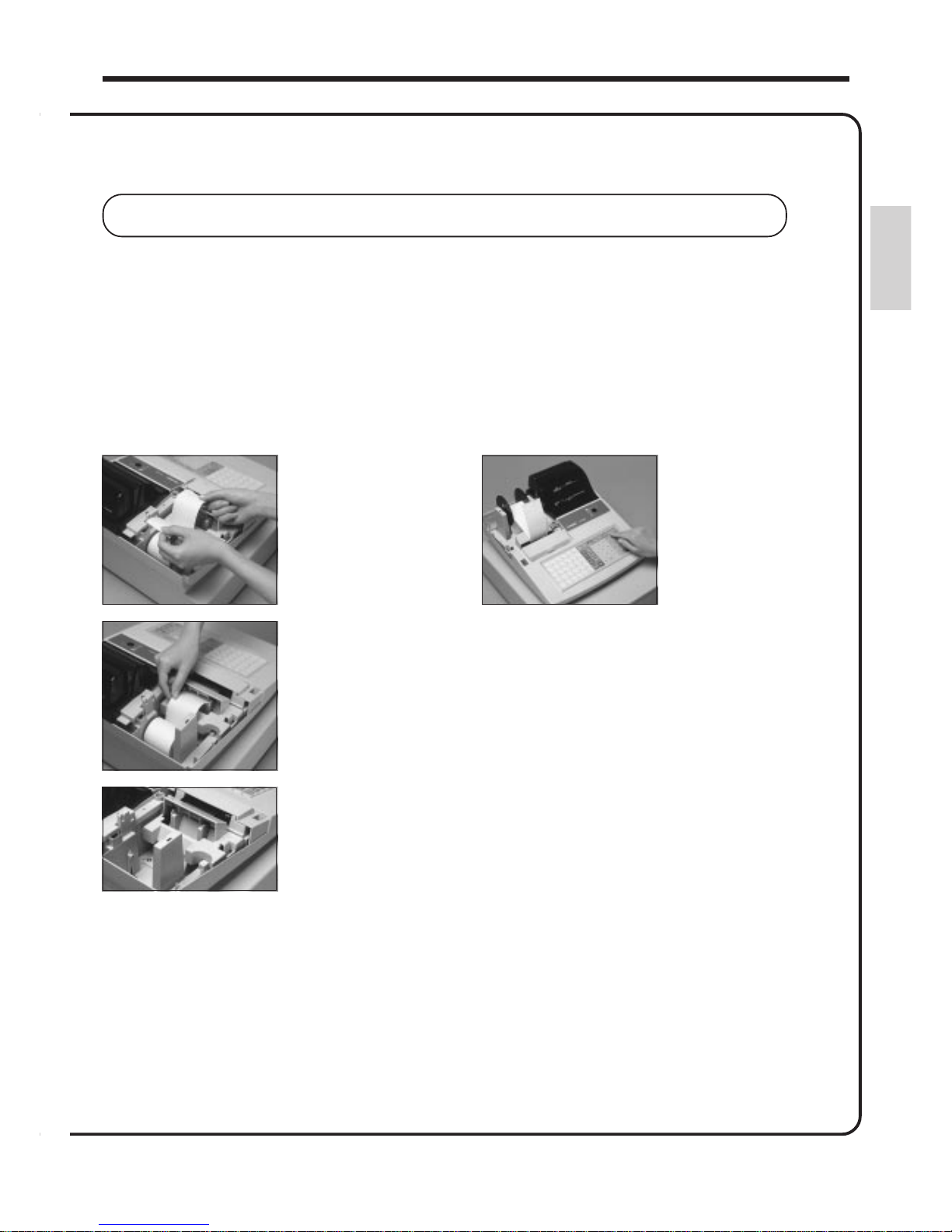

Work the paper roll gently

between the two spindles

so that they slip into the

center hubs of the roll.

11

11

1

Use a mode key to set the

mode switch to REG

position.

22

22

2

Remove the printer cover.

33

33

3

Cut off the leading end of

the paper so it is even.

44

44

4

Ensuring the paper is being

fed from the bottom of the

roll, lower the roll into the

space behind the printer.

1

2

88

88

8

Replace the printer cover,

passing the leading end of

the paper through the

cutter slot. Tear off the

excess paper.

77

77

7

Press the f key until

about 20 cm to 30 cm of

paper is fed from the

printer.

66

66

6

Insert paper to the paper

inlet.

5.

Install receipt/journal paper.

To load 1-ply paper for printing of receipts

Roll paper spindle

Paper inlet

Page 8

8

Getting Started

To load 1-ply paper for printing of journal

Follow steps

11

11

1 through

77

77

7 under "To load 1-ply paper for printing receipts" on the previous page.

5.

Install receipt/journal paper . (continued…)

88

88

8

Remove the flat side plate

of the take-up reel.

99

99

9

Slide the leading end of

the paper into the groove

on the spindle of the takeup reel and wind it onto

the reel two or three turns.

00

00

0

Replace the flat side plate

of the take-up reel.

AA

AA

A

Place the take-up reel into

place behind the printer,

above the roll paper.

BB

BB

B

Press the f key to take

up any slack in the paper.

CC

CC

C

Replace the printer cover.

Page 9

9

Getting Started

To load 2-ply paper for printing of receipts

Follow steps

11

11

1 through

55

55

5 under "To load 1-ply paper for printing of receipts" above.

5.

Install receipt/journal paper . (continued…)

66

66

6

Separate the two sheets of

the paper.

88

88

8

Press the f key until

about 20 cm to 30 cm of

paper is fed from the

printer.

99

99

9

Insert the leading end of the inner sheet (which will be

your journal) into the take-up reel, as described

starting from

step

88

88

8 under "To load 1-ply paper for printing of a

journal."

00

00

0

Replace the printer cover, passing the leading end of the

outer sheet through the cutter slot. Tear off the excess

paper.

77

77

7

Join the ends of the paper

again and insert them into

the paper inlet.

Page 10

10

Getting Started

6 1s 6 : : : : : : 6 x 6 C

Current date

Example:

21, August 1997 2

970821

X

Z

CAL

REG

OFF

RF

PGM

PGM

A-A08

Mode Switch

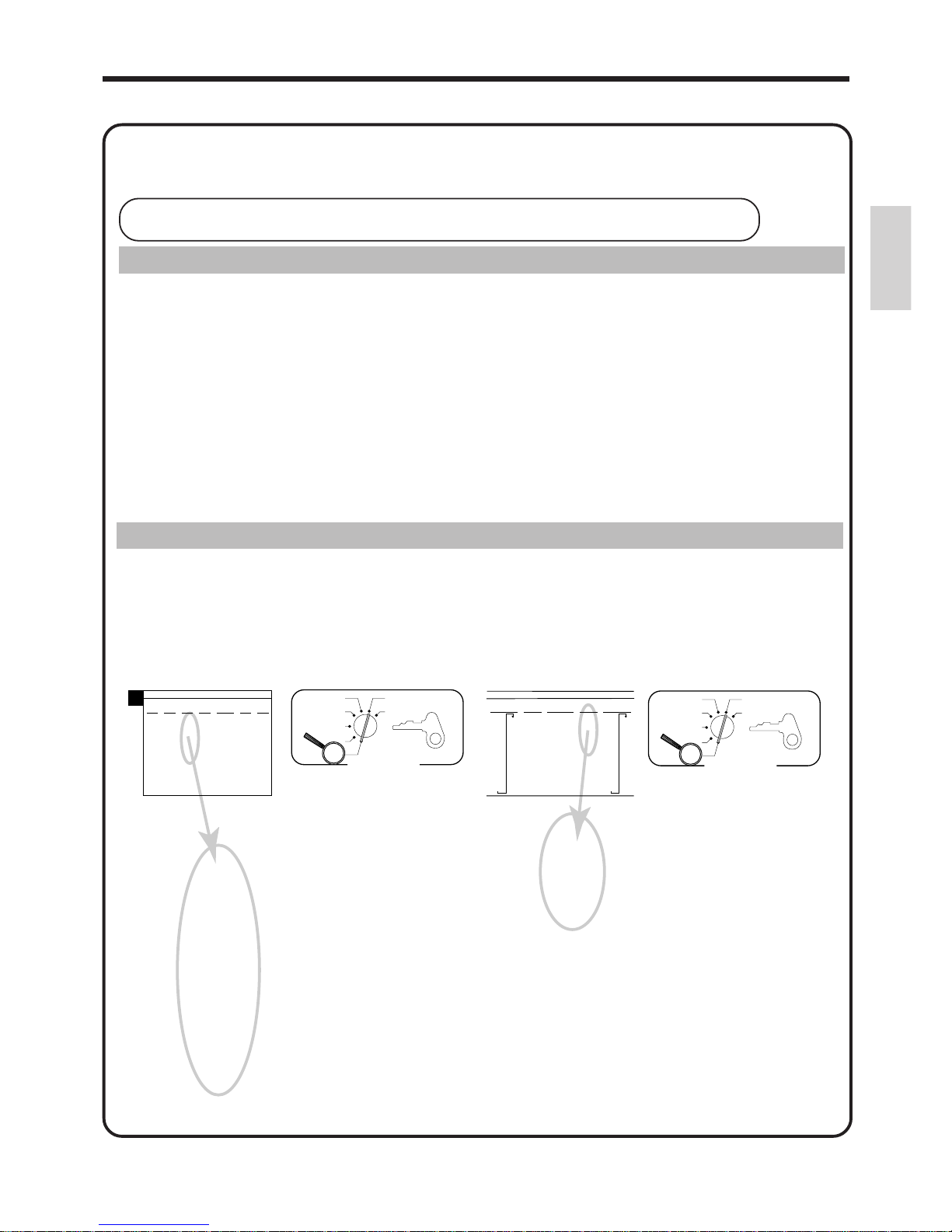

6.

Set the date.

6 1s 6 { } 6 c 6 s

Note:

Be sure to select 0 (receipt) when you use 2-ply paper.

Issue receipt =

0

Print journal =

1

X

Z

CAL

REG

OFF

RF

PGM

PGM

A-A08

Mode Switch

8.

Select printouts receipt or journal.

7.

Set the time.

6 1s 6 : : : : 6 x 6 C

Current time

Example:

08:20 AM

2 0820

09:45 PM

2 2145

X

Z

CAL

REG

OFF

RF

PGM

PGM

A-A08

Mode Switch

Page 11

11

Getting Started

9.

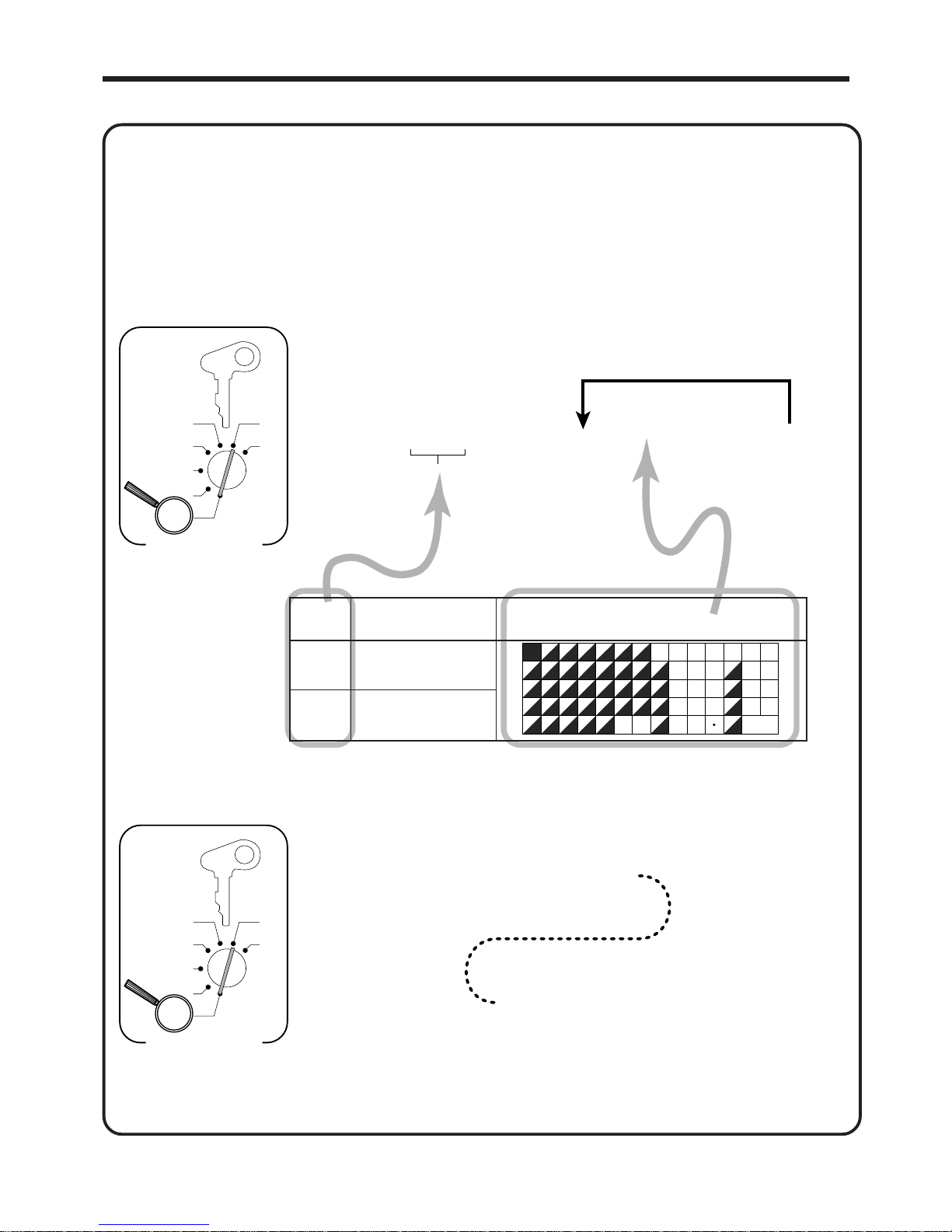

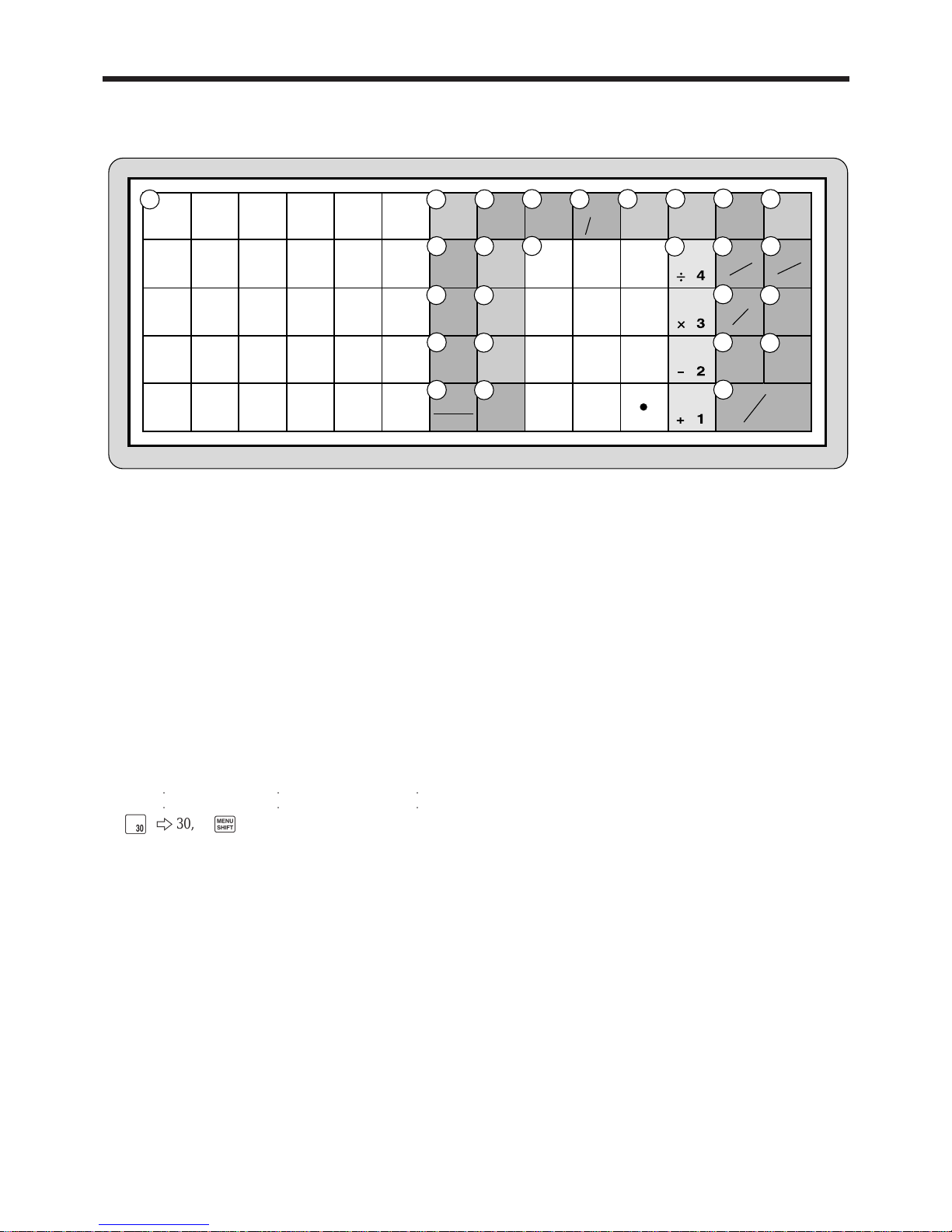

Tax table programming

Programming automatic tax calculation

Important!

After you program the tax calculations, you also have to individually specify which departments (page 31) , PLUs (page 33) and flat PLUs (page 35) are to be taxed.

For this cash register to be able to automatically register state sales tax, you must program its tax

tables with tax calculation data from the tax table for your state. There are two tax tables that you can

program for automatic calculation of two separate sales taxes.

Programming Tax Tables Procedure

Find your state in the tables (page 12 ~ 15) and input the data shown in the table.

State sales tax calculation data tables for all of the states that make up the United States are included

on the following pages. This data is current as of October 30, 1994.

*

*

Some data are revised after Oct.30,1994.

Important!

Be sure you use the state sales tax data specifically for your state. Even if your state

uses the same tax rate percentage as another state, inputting the wrong data will cause

incorrect result.

Programming procedure

Example 1 (Alabama 6% sales tax to Tax Table 1)

ALABAMA

4%

0

1

1

10

30

54

73

110

5%

0

1

1

10

29

49

69

89

110

6%

0

1

1

8

24

41

58

6%

0

1

1

9

20

40

55

70

90

109

7%

0

1

1

7

21

35

49

64

78

92

107

8%

0

1

1

6

18

31

43

56

68

81

93

106

6%

(4+1+1)

0

1

1

10

20

36

54

70

85

110

A

PGM

A-A08

Mode Switch

X

Z

CAL

REG

OFF

RF

PGM

Assign Tax Table 1

0

1

1

8

24

41

58

Terminate program

6

6

6

6

6

6

6

6

6

4

3s

4

0125s

4

0F

4

1F

4

1F

4

8F

4

24F

4

41F

4

58F

4

s

Example 2 (Colorado 5.25% sales tax to Tax Table 2)

PGM

A-A08

Mode Switch

X

Z

CAL

REG

OFF

RF

PGM

Assign Tax Table 2

5.25

5002

Terminate program

6

6

6

6

4

3s

4

0225s

4

5^25F

4

5002F

4

s

COLORADO

4.5%

0

1

5

17

33

55

77

99

122

144

166

188

211

233

255

277

299

5.5%

0

1

6

17

27

45

63

81

99

118

136

154

172

190

209

227

245

263

281

299

5.25%

5.25

5002

5%

0

1

2

17

29

49

LOVELAND

5%

0

1

1

18

18

51

68

84

118

Page 12

12

Getting Started

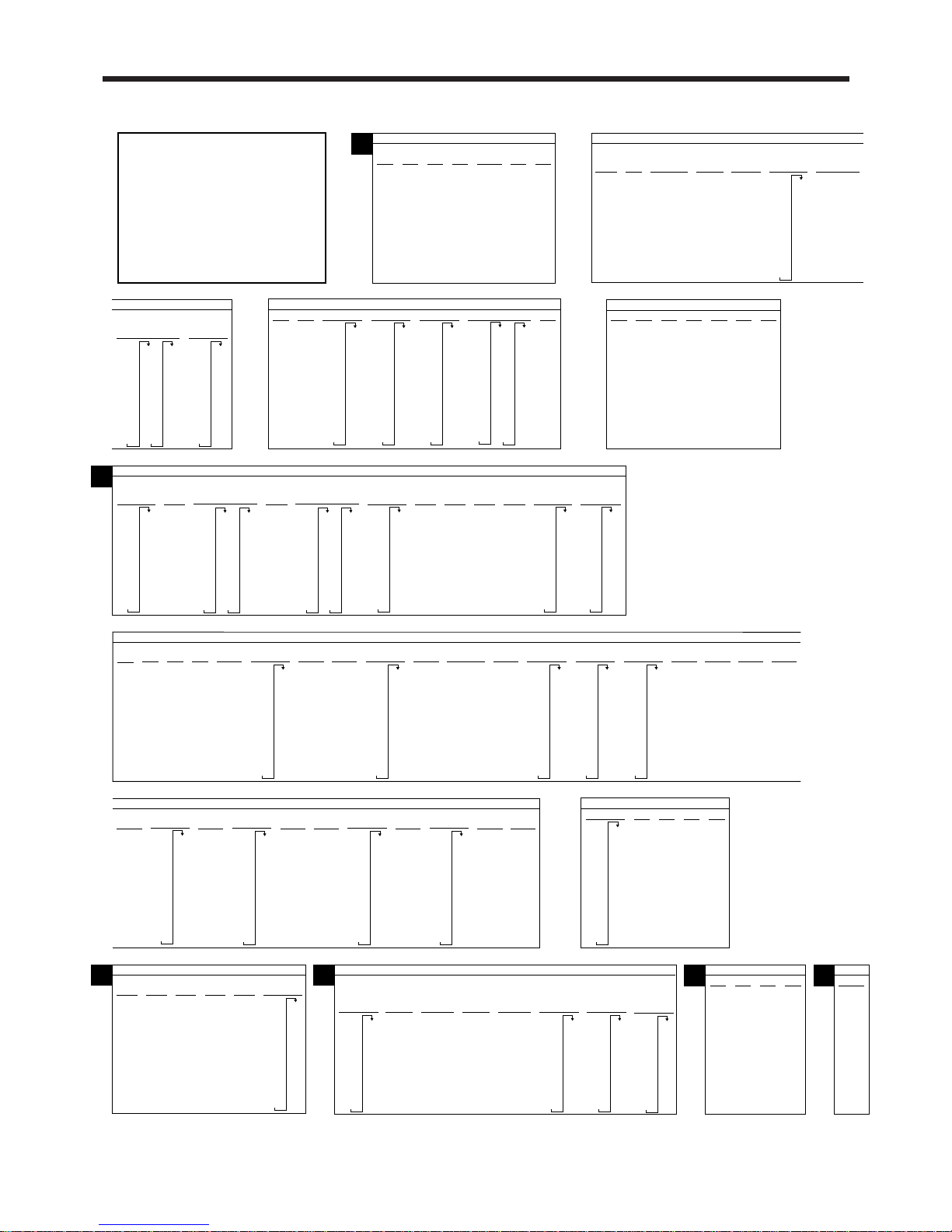

U.S.A. TAX TABLES

ALABAMA

4%

0

1

1

10

30

54

73

110

5%

0

1

1

10

29

49

69

89

110

6%

0

1

1

8

24

41

58

6%

0

1

1

9

20

40

55

70

90

109

7%

0

1

1

7

21

35

49

64

78

92

107

8%

0

1

1

6

18

31

43

56

68

81

93

106

6%

(4+1+1)

0

1

1

10

20

36

54

70

85

110

A

ALASKA

KENAI

2%

HOMER/

SELDOVIA

3%

0

1

4

25

34

75

127

155

177

227

HAINES

4%

0

1

2

19

37

62

JUNEAU

4%

0

1

1

12

37

KENAI

5%

0

1

6

13

25

46

75

79

118

127

151

177

184

218

KENAI,SEWARD

& SOLDOTNA

5%

0

1

1

09

29

49

69

89

109

0

1

1

25

75

3%

0

1

4

34

49

83

116

150

183

216

ALASKA

HOMER

5.5%

0

1

1

8

27

45

63

81

99

108

127

6%

6

2

29

29

49

69

89

109

109

129

159

159

179

199

219

239

259

259

279

300

145

163

181

208

227

245

263

281

299

308

327

345

363

381

408

ARIZONA

4%

0

1

1

12

37

5%

0

1

5

10

27

47

68

89

109

6% 6.8%

0

1

9

10

22

39

56

73

90

107

125

141

158

175

191

6.5%

0

1

7

7

23

38

53

69

84

99

115

130

146

161

176

192

207

223

238

253

269

284

299

6.7%

0

1

7

7

22

37

52

67

82

97

111

126

141

156

171

186

201

216

231

246

261

276

291

0

1

3

6

21

36

50

65

80

95

109

124

139

153

168

183

198

212

227

242

256

271

286

300

315

330

345

359

374

389

403

418

433

448

452

477

492

506

7%

0

1

1

7

21

35

49

64

78

92

107

ARKANSAS

3%

0

1

1

14

44

74

114

4%

0

1

1

12

37

5%

0

1

1

10

20

40

60

80

110

6%

0

1

1

8

24

41

58

7%

0

1

1

7

21

35

49

64

78

92

107

7.5%

0

1

2

6

19

33

46

6.8%

0

1

2

6

19

33

46

CALIFORNIA

6%

0

1

7

10

22

39

56

73

90

108

124

141

158

6.5%

0

1

7

10

20

35

51

67

83

99

115

130

146

161

176

192

207

223

238

253

269

284

299

7.25%

7.25

5002

0

10

20

32

46

60

74

88

103

117

131

8.5%

0

1

1

5

17

29

41

52

64

76

88

99

111

123

135

147

158

170

182

194

205

LOS ANGELES

10%

Parking

0

1

11

99

99

99

99

99

99

99

99

99

99

104

114

124

134

144

154

6.25%

0

1

7

10

21

37

54

70

86

103

119

7.5%

0

1

3

6

19

33

46

59

73

7%

0

1

8

10

20

33

47

62

76

91

107

121

135

149

164

178

192

207

221

235

249

264

278

292

307

6.75%

6.75

5002

0

10

20

34

48

64

80

96

111

7.25%

7.25

5002

7.75%

7.75

5002

8.25%

8.25

5002

C

COLORADO

1.5%

0

1

1

33

99

166

233

2%

0

1

1

24

74

2.5%

0

1

1

19

59

3%

0

1

3

17

49

83

116

149

183

3.5%

0

1

2

17

42

71

99

128

157

185

214

242

3.6%

0

1

5

17

41

69

97

124

152

180

208

236

264

291

319

347

375

4.5%

0

1

5

17

33

55

77

99

122

144

166

188

211

233

255

277

299

5.5%

0

1

6

17

27

45

63

81

99

118

136

154

172

190

209

227

245

263

281

299

5.6%

0

1

7

16

25

43

61

79

97

115

132

150

168

186

204

222

240

5.75%

0

1

8

17

26

43

60

78

95

113

130

147

165

182

199

217

3.85%

0

1

2

16

37

63

5.25%

5.25

5002

6.1%

6.1

5002

0

17

6.4%

6.4

5002

0

17

6.35%

6.35

5002

4%

0

1

2

17

37

62

5%

0

1

2

17

29

49

6%

0

1

2

17

24

41

58

74

LOVELAND

5%

0

1

1

18

18

51

68

84

118

COLORADO

6.5%

0

1

2

17

23

38

53

69

84

99

115

130

146

161

176

192

207

223

7%

0

1

4

17

21

35

49

64

78

92

107

121

135

149

7.2%

0

1

2

17

20

34

48

62

76

90

104

118

131

145

159

173

187

201

215

229

243

256

6.6%

6.6

5002

7.3%

0

1

3

6

20

34

47

61

75

89

102

116

130

143

157

171

7.25%

7.25

5002

7.01%

7.01

5002

0

17

21

35

49

64

7.1%

7.1

5002

7.5%

0

1

3

17

19

33

46

59

73

8%

0

1

1

6

18

31

43

56

68

81

93

106

6.45%

6.45

5002

0

17

CONNECTICUT

6%

0

1

2

8

24

41

58

74

91

108

124

7%

0

1

1

7

21

35

49

64

78

92

107

7.5%

0

1

3

6

19

33

46

59

73

8%

0

1

1

6

18

31

5.25%

0

1

2

16

27

46

65

84

103

122

141

160

179

198

218

DISTRICT OF COLUMBIA

D.C.

9%

0

1

6

6

16

27

38

49

61

72

83

94

105

116

127

138

149

161

D.C.

5%

0

1

1

10

22

42

82

62

110

D.C.

5.75%

5.75

5002

0

8

D.C.

6%

0

1

1

12

17

35

53

71

89

112

D.C.

6%

0

1

1

8

24

41

58

74

91

108

D.C.

8%

0

1

1

12

16

27

39

50

62

75

90

112

D

FLORIDA

Combined

5.25%

5%

5.25

5002

6.2%

6.2

5002

0

1

5

9

25

50

75

109

125

150

175

209

4%

0

1

1

9

20

40

60

80

109

PANAMA

CITY

BEACH

6.5%

0

1

1

9

15

30

46

61

76

92

107

123

138

153

169

184

209

6%

0

1

1

9

16

33

50

66

83

109

0

1

1

9

14

28

42

57

71

85

109

7%

0

1

1

9

13

26

40

53

66

80

93

106

120

133

146

160

173

186

209

7.5%

F

GEORGIA

3%

0

1

1

10

35

66

110

4%

0

1

1

10

25

50

75

110

5%

0

1

1

10

20

40

60

80

110

6%

0

1

1

10

20

35

50

67

85

110

G

HAWAII

4%

0

1

1

12

37

H

Page 13

13

Getting Started

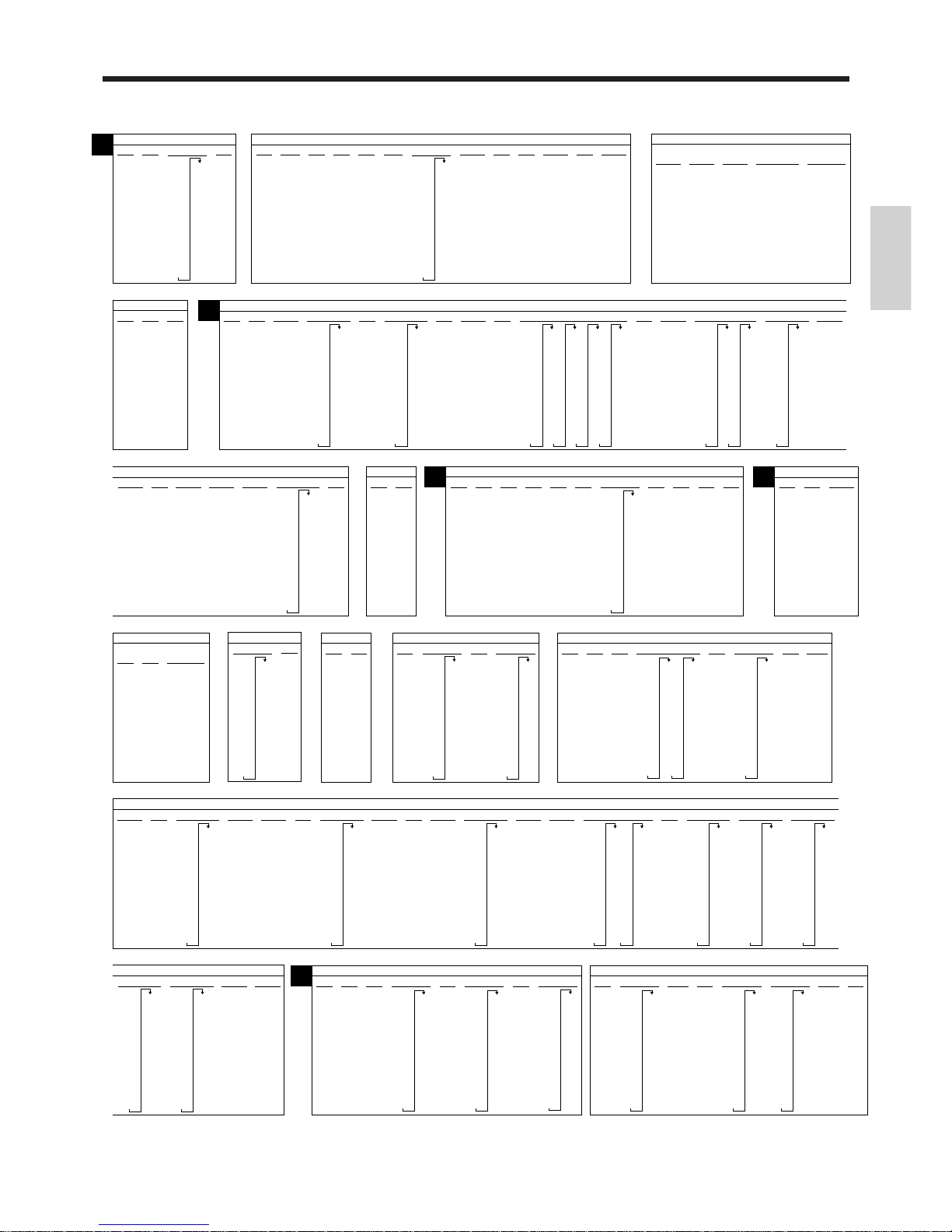

IDAHO

3%

0

1

1

15

42

72

115

4%

0

1

2

11

32

57

5%

0

1

2

11

25

45

4.5%

0

1

2

15

27

49

71

93

115

137

160

183

205

227

I

ILLINOIS

1.25%

0

1

1

39

119

6.25%

0

1

1

7

23

1%

0

1

1

49

148

7.5%

0

1

1

6

19

33

46

6.5%

0

1

1

7

23

38

53

69

84

99

115

130

146

161

176

192

207

2%

0

1

1

24

74

7%

0

1

1

8

22

36

50

65

79

93

108

8%

0

1

1

6

18

31

5%

0

1

6

12

25

46

67

88

109

129

6%

0

1

1

8

24

41

58

6.75%

6.75

5002

7.75%

7.75

5002

0

6

8.75%

8.75

5002

0

5

INDIANA

1%

0

1

1

49

148

4%

0

1

2

15

37

62

5%

0

1

1

9

29

MARION County

5%

0

1

2

15

37

49

62

87

112

137

RESTAURANT

6%

0

1

1

9

29

49

49

69

89

109

IOWA

4%

0

1

3

12

37

50

75

5%

0

1

1

9

29

6%

0

1

1

8

24

41

58

74

91

108

3%

0

1

1

16

49

83

116

3.5%

0

1

1

14

42

71

99

128

157

185

4%

0

1

1

12

37

62

87

112

5%

0

1

1

9

29

4.5%

0

1

1

11

33

55

77

99

122

144

166

188

211

2.5%

0

1

1

19

59

99

139

179

3.1%

3.1

5002

0

16

KANSAS

3.25%

0

1

1

15

46

76

107

138

169

199

230

261

292

323

353

384

415

3.75%

0

1

1

13

39

66

93

119

146

173

199

226

253

279

306

333

359

386

413

4.1%

4.1

5002

0

12

5.25%

5.25

5002

5.65%

5.65

5002

0

8

4.9%

0

1

1

10

30

51

71

91

112

132

153

173

193

214

234

255

275

295

316

336

357

377

397

418

438

459

479

499

520

540

561

581

602

622

642

663

683

704

724

744

765

785

806

826

846

867

887

908

928

948

969

989

1010

5.4%

0

1

1

9

27

46

64

83

101

120

138

157

175

194

212

231

249

268

287

305

324

342

361

379

398

416

435

453

472

490

509

5.5%

0

1

1

9

27

45

63

81

99

118

136

154

172

190

209

K

10%

0

1

1

4

14

24

34

44

54

64

74

84

94

6.5%

6.5

5002

0

7

KANSAS

9.5%

0

1

1

5

15

26

36

47

57

68

78

89

99

110

121

131

142

152

163

173

184

194

6.4%

6.4

5002

0

7

6%

0

1

7

8

24

41

58

74

91

108

124

141

158

5.9%

5.9

5002

0

8

6.15%

6.15

5002

0

8

KENTUCKY

5%

0

1

6

10

25

46

67

88

109

129

6%

0

1

2

8

24

41

58

74

LOUISIANA

7.5%

0

1

2

6

19

33

46

59

7%

0

1

1

7

21

35

49

64

8%

0

1

7

4

16

29

42

55

67

80

93

106

9%

0

1

1

5

16

27

38

49

61

72

83

94

105

5%

0

1

6

10

27

47

67

87

109

129

4.5%

0

1

1

11

33

55

77

99

122

144

166

188

211

4%

0

1

2

12

37

62

87

112

3%

0

1

2

16

49

82

116

149

2%

0

1

2

24

74

124

174

224

6%

0

1

2

8

24

41

58

74

6%

0

1

17

7

23

38

53

69

84

99

115

130

146

161

176

192

207

223

238

253

269

284

299

315

330

L

MAINE

5%

0

1

1

10

20

40

60

80

110

6%

0

1

1

9

16

33

50

66

83

109

7%

7

2

0

7

21

35

49

64

78

92

100

M

MARYLAND

4%

0

1

2

24

25

50

5%

0

1

2

19

20

40

Meals Tax

5%

0

1

7

99

99

99

99

99

100

120

140

MASSACHUSETTS

5%

0

1

1

9

29

4.625%

0

1

13

10

32

54

75

97

118

140

162

183

205

227

248

270

291

313

335

356

378

399

421

443

MICHIGAN

4%

0

1

7

12

31

54

81

108

135

162

187

6%

0

1

2

10

24

41

58

74

91

108

124

MINNESOTA

7%

0

1

1

7

21

35

49

64

78

92

107

6%

0

1

1

8

24

41

58

6.5%

0

1

1

7

23

38

53

69

84

99

115

130

146

161

176

192

207

8.5%

0

1

1

5

17

29

41

52

64

76

88

99

111

123

135

147

158

170

182

194

205

MISSISSIPPI

5%

0

1

6

11

26

47

68

88

109

129

6%

0

1

1

8

24

41

58

74

91

108

8.5%

0

1

1

5

17

29

41

52

64

76

88

99

111

123

135

147

158

170

182

194

205

7%

0

1

1

7

21

35

49

64

78

92

107

7.25%

0

1

1

6

20

34

48

62

75

89

103

117

131

144

158

172

186

199

213

227

241

255

268

282

296

310

324

337

351

365

379

393

406

8%

0

1

1

6

18

31

43

56

68

81

93

106

9%

0

1

1

5

16

27

38

49

61

72

83

94

105

9.25%

9.25

5002

0

5

MISSOURI

4.6%

0

1

1

10

32

54

76

97

4.8%

0

1

3

10

31

52

72

93

114

135

156

177

4.625%

0

1

13

10

32

54

75

97

118

140

162

183

205

227

248

270

291

313

335

356

378

399

421

443

4.975%

0

1

1

10

30

50

70

90

110

130

150

170

190

211

6.225%

0

1

2

8

24

40

56

72

88

104

120

136

152

168

184

200

216

232

248

265

6.3%

0

1

8

7

23

39

55

71

87

103

119

134

150

166

182

198

214

230

246

6.425%

0

1

1

7

23

38

54

70

85

101

116

132

147

163

178

194

210

225

241

256

272

287

5.6%

0

1

15

8

26

44

62

80

98

115

133

151

169

187

205

223

241

258

276

294

312

330

348

366

383

5.225%

5.225

5002

5.975%

0

1

2

8

25

41

58

75

92

108

125

142

158

175

192

209

225

242

259

276

292

309

326

342

359

376

5.725%

5.725

5002

4.225%

0

1

1

11

35

59

82

4.725%

0

1

4

10

31

52

74

95

116

137

158

179

201

4.75%

0

1

3

10

22

43

65

86

107

128

149

170

5.1%

0

1

1

9

29

49

68

88

107

6.1%

0

1

1

8

24

40

57

73

90

5.05%

0

1

5

9

19

39

59

79

98

118

138

158

178

5.625%

0

1

1

8

26

44

62

79

97

115

133

151

168

392

410

MISSOURI

6.475%

0

1

13

7

23

38

54

69

84

100

115

131

146

162

177

193

208

223

239

254

270

285

301

316

332

6.55%

0

1

9

7

22

38

53

68

83

99

114

129

145

160

175

190

6.725%

6.725

5002

7.225%

7.225

5002

NEBRASKA

3%

0

1

3

16

49

83

116

149

183

3.5%

0

1

3

14

42

71

99

128

157

185

214

242

271

5.5%

0

1

2

14

27

45

63

81

99

118

136

154

172

190

209

227

4%

0

1

2

14

37

62

5%

0

1

2

14

29

49

6%

0

1

1

8

24

41

58

4.5%

0

1

6

14

33

55

77

99

122

144

166

188

211

233

255

277

299

322

6.5%

0

1

1

7

23

38

53

69

84

99

115

130

146

161

176

192

207

N

NEVADA

3%

0

1

2

14

49

83

116

149

5.75%

5.75

5002

6%

0

1

2

8

24

41

58

74

6.25%

0

1

2

7

23

39

55

71

87

103

119

135

151

167

183

199

215

3.5%

0

1

6

14

38

64

88

118

157

185

214

242

271

299

326

357

6.5%

0

1

1

7

23

38

53

69

84

99

115

130

146

161

176

192

207

6.75%

6.75

5002

0

7

22

37

7%

0

1

1

7

21

35

49

64

78

92

107

Page 14

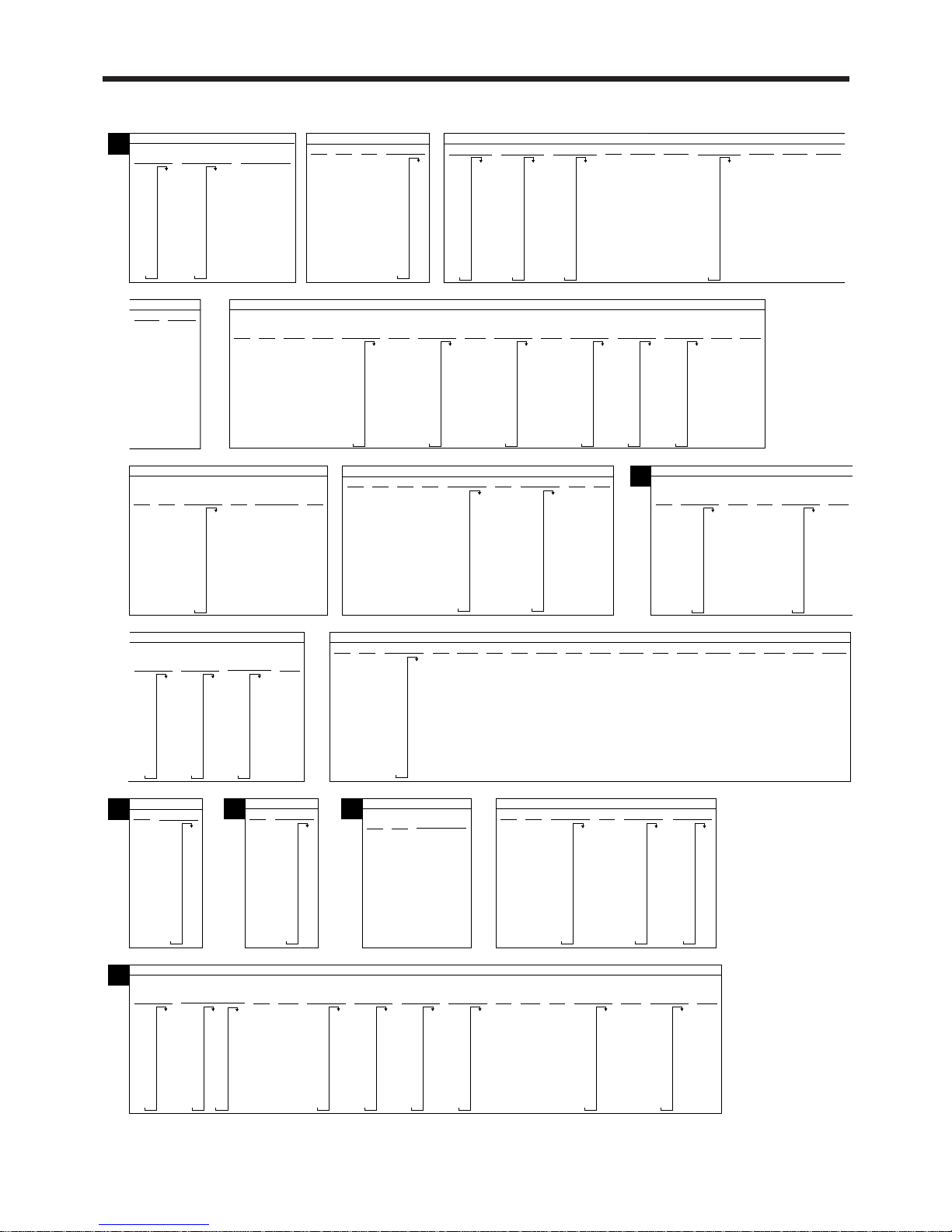

14

Getting Started

NEW HAMPSHIRE

0

1

4

35

35

35

37

50

62

7%

0

1

8

14

26

39

51

63

75

88

101

115

129

143

158

172

186

201

Rooms & Meals

7%

0

1

8

35

35

38

50

62

74

87

100

114

128

142

157

171

185

200

Rooms & Meals

8%

N

NEW JERSEY

3%

0

1

1

17

41

71

117

3.5%

0

1

1

14

42

71

100

128

157

185

214

7%

0

1

8

10

21

35

50

64

78

92

107

121

135

150

164

178

192

207

6%

0

1

1

10

22

38

56

72

88

110

NEW MEXICO

4.5%

0

1

1

11

33

55

78

100

122

144

167

189

211

4.25%

0

1

1

11

35

58

82

105

129

152

176

199

223

247

270

294

317

341

364

388

411

5.25%

0

1

11

9

28

47

66

85

104

123

142

161

180

199

217

5.375%

5.375

5002

5.575%

5.575

5002

5.75%

5.75

5002

4.875%

4.875

5002

5.175%

5.175

5002

4.375%

0

1

4

11

34

57

79

102

125

148

171

194

217

239

3.75%

0

1

6

13

40

67

93

120

146

173

200

226

253

280

306

333

359

NEW MEXICO

6.187%

0

1

4

9

23

40

56

72

88

104

120

136

153

6.1875%

6.1875

5002

0

8

NEW YORK

6%

0

1

7

10

22

38

56

72

88

108

124

141

158

5%

0

1

6

10

27

47

67

87

109

129

4%

0

1

5

12

33

58

83

112

137

5.25%

5.25

5002

5.75%

5.75

5002

6.25%

0

1

7

10

22

38

54

70

86

103

119

6.5%

0

1

1

7

23

38

53

69

84

99

115

130

146

161

176

192

207

6.75%

6.75

5002

7%

0

1

8

10

20

33

47

62

76

91

107

121

135

149

164

178

192

207

7.25%

7.25

5002

7.5%

0

1

8

10

18

31

45

58

71

85

99

113

126

139

ERIE

8%

0

1

10

10

17

29

42

55

67

80

92

105

119

131

144

SUFFOLK

County

8%

0

1

9

10

17

29

42

54

67

79

92

106

118

131

8.25%

8.25

5002

8.5%

8.5

5002

NORTH CAROLINA

4.5%

0

1

6

9

25

53

75

95

122

144

166

188

211

233

255

277

299

322

CHROKEE

Reservations

6%

0

1

2

10

24

41

58

74

4%

0

1

5

9

29

59

84

112

137

5%

0

1

6

8

23

48

67

85

109

129

6%

0

1

2

8

24

41

58

74

91

108

124

3%

0

1

4

9

35

70

116

149

183

216

NORTH DAKOTA

3%

0

1

3

15

33

67

100

133

166

200

4%

0

1

5

15

31

51

71

100

125

5.5%

0

1

2

15

19

37

55

73

91

110

128

146

164

182

200

219

4%

0

1

2

15

25

50

75

100

125

6%

0

1

3

15

17

34

50

67

84

5%

0

1

2

15

20

40

6.5%

0

1

2

15

31

47

62

77

93

108

124

139

154

170

185

200

216

231

7%

0

1

2

15

15

29

43

58

72

86

100

115

8%

0

1

3

15

15

25

38

50

63

75

88

100

OHIO

5.5%

0

1

2

15

18

36

54

72

90

109

127

146

164

182

200

218

5%

0

1

2

15

20

40

5.75%

5.75

5002

6%

0

1

2

15

17

34

50

67

83

100

117

MEIGS

Co.

6%

0

1

3

16

17

34

50

67

83

100

117

134

6.25%

0

1

2

15

16

32

O

OHIO

CUYAHOGA

Co.

7%

6.5%

0

1

3

15

15

30

46

61

76

92

107

123

138

153

169

184

200

215

230

7%

0

1

3

15

15

28

42

57

71

85

100

115

128

0

1

3

15

15

28

42

57

71

85

100

115

128

7.75%

7.75

5002

OKLAHOMA

2%

0

1

1

24

74

3%

0

1

1

16

49

83

116

3.25%

0

1

7

15

46

76

107

138

169

199

230

261

292

323

353

384

415

446

476

507

538

569

599

4%

0

1

1

12

37

4.25%

4.25

5002

4.5%

0

1

2

11

33

55

77

99

121

144

5%

0

1

1

9

29

5.25%

5.25

5002

6%

0

1

1

8

24

41

58

6.25%

0

1

1

7

23

6.725%

6.725

5002

7%

0

1

6

8

22

37

51

65

79

94

108

122

7.25%

7.25

5002

7.375%

7.375

5002

0

6

8%

0

1

1

6

18

31

8.25%

0

1

1

6

18

30

42

54

66

78

90

103

9.25%

0

1

4

5

16

27

37

48

59

70

81

91

10.25%

0

1

1

4

14

24

34

43

PENNSYLVANIA

6%

0

1

1

10

17

34

50

67

84

110

7%

0

1

5

10

17

34

50

50

67

84

110

117

134

150

150

167

184

210

217

234

250

250

P

RHODE ISLAND

6%

0

1

6

9

26

42

57

73

90

106

123

140

7%

0

1

5

7

21

35

49

64

78

92

107

121

135

149

164

178

192

207

221

235

249

264

R

SOUTH CAROLINA

CHARLESTON

6%

4%

0

1

5

10

25

50

75

112

137

5%

0

1

6

10

20

40

60

80

109

129

0

1

2

10

24

41

41

58

74

91

108

124

S

SOUTH DAKOTA

4%

0

1

1

12

37

5.5%

0

1

1

10

28

46

64

82

100

118

136

154

172

190

210

5%

0

1

1

10

30

6.5%

0

1

1

7

23

38

53

69

84

99

115

130

146

161

176

192

207

6%

0

1

1

9

26

43

60

76

92

109

7%

0

1

4

7

21

35

49

64

78

92

107

121

135

149

TENNESSE

4.5%

0

1

1

11

33

55

77

99

122

144

166

188

211

6%

0

1

2

10

24

41

58

74

COUNTY

TAX

7.25%

0

1

10

10

20

34

48

61

75

89

103

117

130

144

158

172

185

6.25%

0

1

2

10

23

39

55

71

87

6.5%

0

1

2

10

23

38

53

69

84

99

115

130

146

161

176

192

207

223

6.75%

0

1

8

10

22

37

51

66

81

96

111

125

140

155

170

185

199

214

229

244

259

274

5.5%

0

1

11

10

27

45

63

81

99

119

136

154

172

190

209

227

245

263

281

299

318

336

354

372

390

7.5%

0

1

2

10

19

33

46

59

7.75%

7.75

5002

8%

0

1

2

10

18

31

43

8%

0

1

2

10

18

31

43

56

68

81

93

106

118

8.25%

8.25

5002

8.5%

0

1

2

10

17

29

41

52

64

76

88

99

111

123

135

147

158

170

182

194

205

217

8.75%

8.75

5002

7%

0

1

2

10

21

35

49

64

78

92

107

121

T

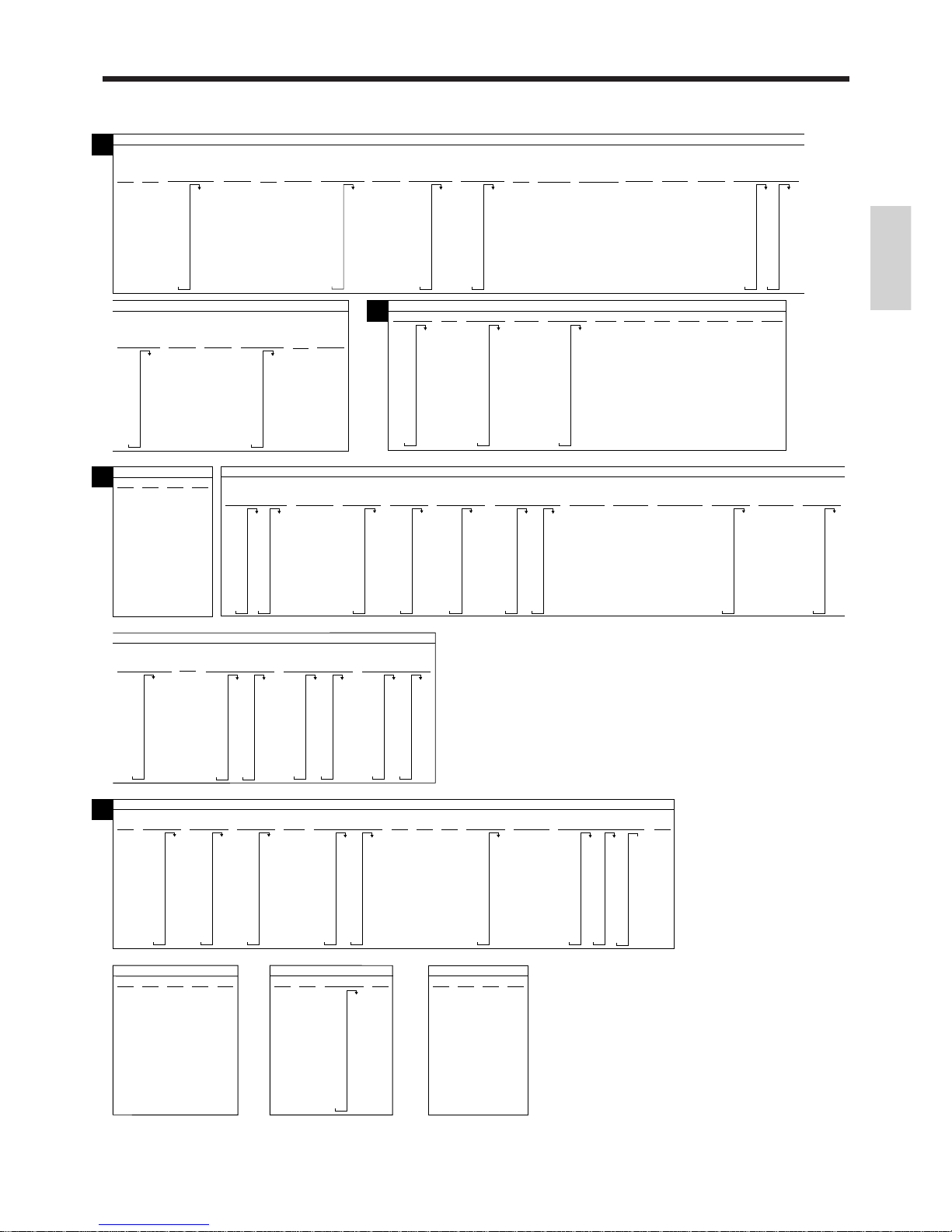

Page 15

15

Getting Started

TEXAS

DALLAS

6%

0

1

1

9

25

42

59

HOUSTON

(Harris

County)

6%

4.625%

4.625

5002

4%

0

1

1

12

37

4%

0

1

1

12

37

62

87

4.125%

0

1

1

12

36

60

84

109

133

157

181

206

230

254

278

303

327

351

375

399

424

5%

0

1

1

9

29

49

69

5.125%

5.125

5002

5.25%

0

1

12

9

28

47

66

85

104

123

142

161

180

199

219

238

5.375%

5.375

5002

5.5%

0

1

1

9

27

45

63

81

99

118

137

155

173

191

209

5.625%

0

1

1

8

26

44

62

79

97

115

133

151

168

6%

0

1

1

8

24

41

58

0

1

1

8

24

41

58

74

91

108

6.125%

6.125

5002

6.25%

0

1

1

7

23

39

55

71

87

103

119

6.25%

6.25

5002

6.75%

0

1

3

8

22

37

51

66

81

96

111

125

140

155

170

185

199

215

229

244

259

274

288

303

318

333

348

362

377

392

407

422

437

T

TEXAS

7.75%

0

1

5

6

19

32

45

58

70

83

96

109

122

135

148

161

174

187

7.25%

7.25

5002

7.5%

0

1

1

6

19

33

46

59

73

86

8%

0

1

1

6

18

31

8.25%

8.25

5002

7%

0

1

1

7

21

35

49

64

78

92

107

4.75%

0

1

1

10

31

52

73

94

115

136

157

178

199

221

242

263

284

305

326

347

368

389

410

5%

0

1

1

9

29

5.375%

0

1

1

9

27

46

65

83

102

6%

0

1

2

8

24

41

58

74

6.25%

0

1

4

7

23

27

47

63

5.25%

0

1

1

9

28

47

66

85

104

123

142

161

180

199

219

238

257

276

295

314

333

352

371

390

409

5.5%

0

1

1

9

27

45

63

81

99

118

136

154

172

190

209

5.875%

5.875

5002

0

8

7%

0

1

2

7

21

35

49

64

78

92

107

7.25%

7.25

5002

UTAH

6.125%

6.125

5002

0

8

5.75%

5.75

5002

U

VERMONT

3%

0

1

4

13

33

66

100

133

166

200

4%

0

1

2

10

25

50

5%

0

1

2

10

20

40

80

100

120

140

8%

0

1

0

18

31

43

56

68

81

93

100

V

VIRGINIA

0

1

2

12

37

62

87

112

137

4.5%

0

1

5

15

33

55

77

99

122

144

166

188

211

233

255

277

299

4%

0

1

21

14

34

59

84

114

134

159

184

214

234

259

284

314

334

359

384

414

434

459

484

512

537

ARLINGTON

COUNTY

4%

FAIRFAX

5.5%

0

1

4

11

14

33

55

77

99

122

144

149

166

188

211

233

249

255

FAIRFAX CITY

Meals tax

6.5%

0

1

1

11

24

33

55

74

77

99

122

124

144

166

174

188

211

0

1

1

7

21

35

49

64

78

92

107

LEESBURG

Meal tax

7%

0

1

1

14

14

34

59

59

84

84

114

RICHMOND

Restaurant

7%

7.5

5002

ALEXANDRIA

7.5%

NEWPORT

NEWS

7.5%

0

1

1

11

16

33

49

55

77

83

99

116

122

144

149

166

183

188

211

Restaurant

8%

0

1

5

14

34

44

44

59

59

84

84

114

114

134

134

159

HAMPTON

Restaurant

7%

0

1

13

14

29

34

44

59

74

84

114

114

134

149

159

184

184

214

214

234

249

259

284

0

1

2

6

19

33

46

59

RICHMOND

7.5%

VIRGINIA

CITY OF RICHMOND

Food tax

9.5%

0

1

1

5

15

26

36

47

57

68

78

89

99

110

121

131

142

152

163

173

184

194

205

9.5%

89

99

109

122

129

144

149

166

169

188

189

209

0

1

1

9

11

29

33

49

55

69

77

NORFOLK CITY

Meal tax

9%

0

1

6

11

33

44

44

55

55

77

77

99

99

122

122

144

144

166

166

188

188

211

211

233

233

ROANOKE CITY

VA BEACH

8.5%

0

1

1

11

12

33

37

55

62

77

87

99

112

122

137

144

162

166

187

188

211

9%

9

5002

WASHINGTON

8.1

2

0

6

18

30

43

55

67

80

7.2%

0

1

1

6

20

34

48

62

76

90

104

118

131

7%

0

1

1

7

21

35

49

64

78

92

107

7.3%

0

1

1

6

19

33

47

61

74

88

102

115

129

143

156

170

184

198

211

225

239

252

7.5%

0

1

1

6

19

33

46

59

73

86

99

113

126

139

153

166

179

193

206

7.55%

0

1

2

7

19

33

46

59

72

4.125%

0

1

3

6

19

32

46

59

72

85

98

111

124

138

151

164

177

190

203

217

230

243

256

269

282

7.8%

7.8

2

0

7

19

32

44

57

70

83

7.9%

0

1

2

6

18

31

44

56

8%

0

1

1

6

18

31

8.1%

0

1

14

6

18

30

43

55

67

80

92

104

117

129

141

154

166

179

191

203

Combined

8.1%

8.2%

0

1

1

6

18

30

42

54

67

79

91

103

115

128

140

152

164

176

189

201

213

225

237

249

262

274

286

296

310

323

335

347

359

371

384

396

408

420

432

445

457

469

481

493

506

8.7%

0

1

1

5

17

28

W

WEST VIRGINIA

2%

0

1

2

25

50

100

3%

0

1

2

5

35

70

100

135

4%

0

1

1

12

37

5%

0

1

2

5

20

40

6%

0

1

2

5

16

33

50

67

84

100

116

WISCONSIN

4%

0

1

1

12

37

5%

0

1

1

10

21

41

61

81

110

5.5%

0

1

1

9

27

45

63

81

99

118

136

154

172

190

209

5.6%

0

1

1

8

26

44

62

80

98

116

133

WYOMING

3%

0

1

2

24

49

83

116

149

4%

0

1

2

24

37

62

5%

0

1

2

24

29

49

69

89

109

6%

0

1

3

24

24

34

51

68

84

Page 16

16

Getting Started

62s6

: :

32s 6

Characters

6 –a 6 s

X

Z

CAL

REG

OFF

RF

PGM

PGM

A-A08

Mode Switch

Memory

No.

To the next memory No.

Note: If you have already set other programmable options in the general printing control, please add "4" to your

prior program value. (For more details, please refer to page 54.)

6 3s 6 0522s 6

6 00144a 6 s

X

Z

CAL

REG

OFF

RF

PGM

PGM

A-A08

Mode Switch

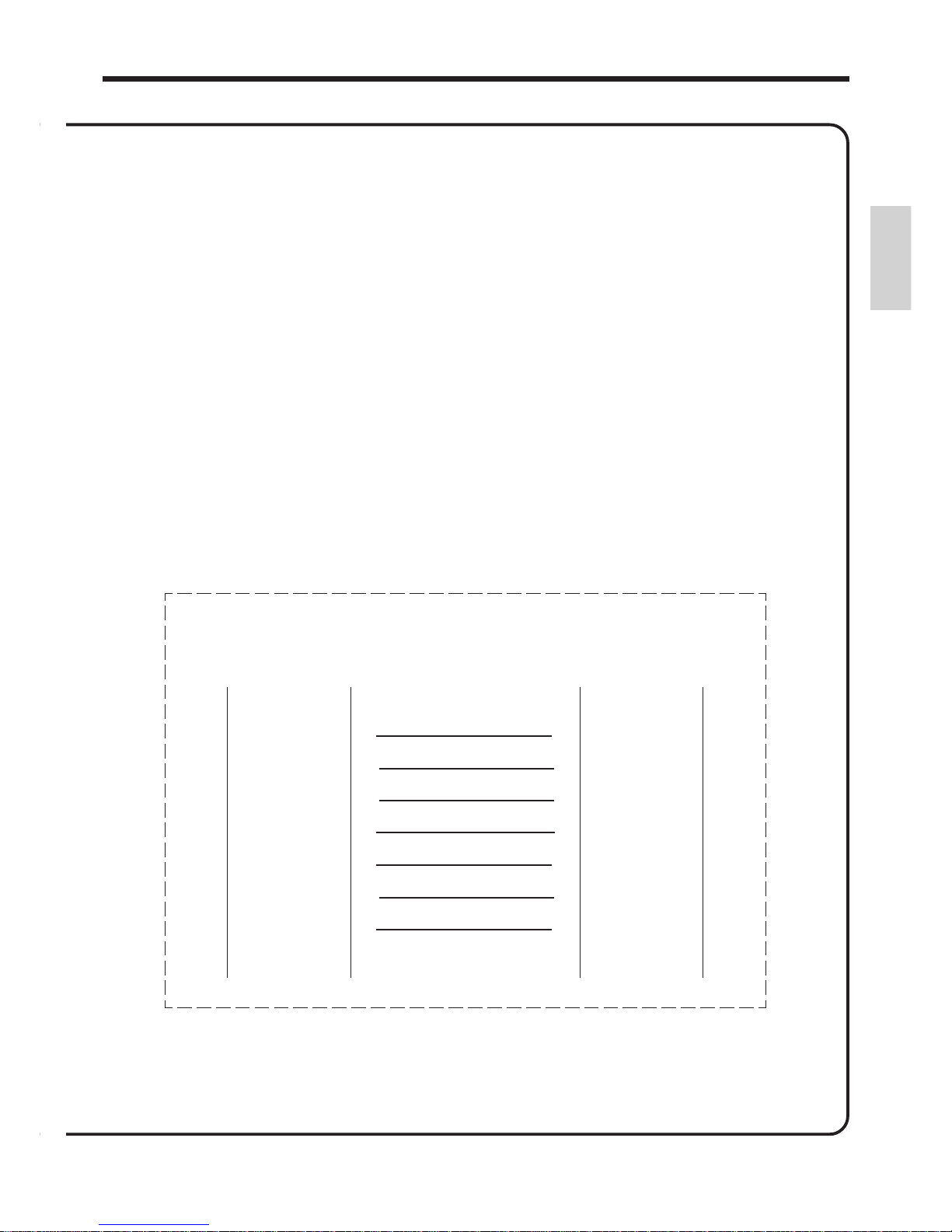

10.

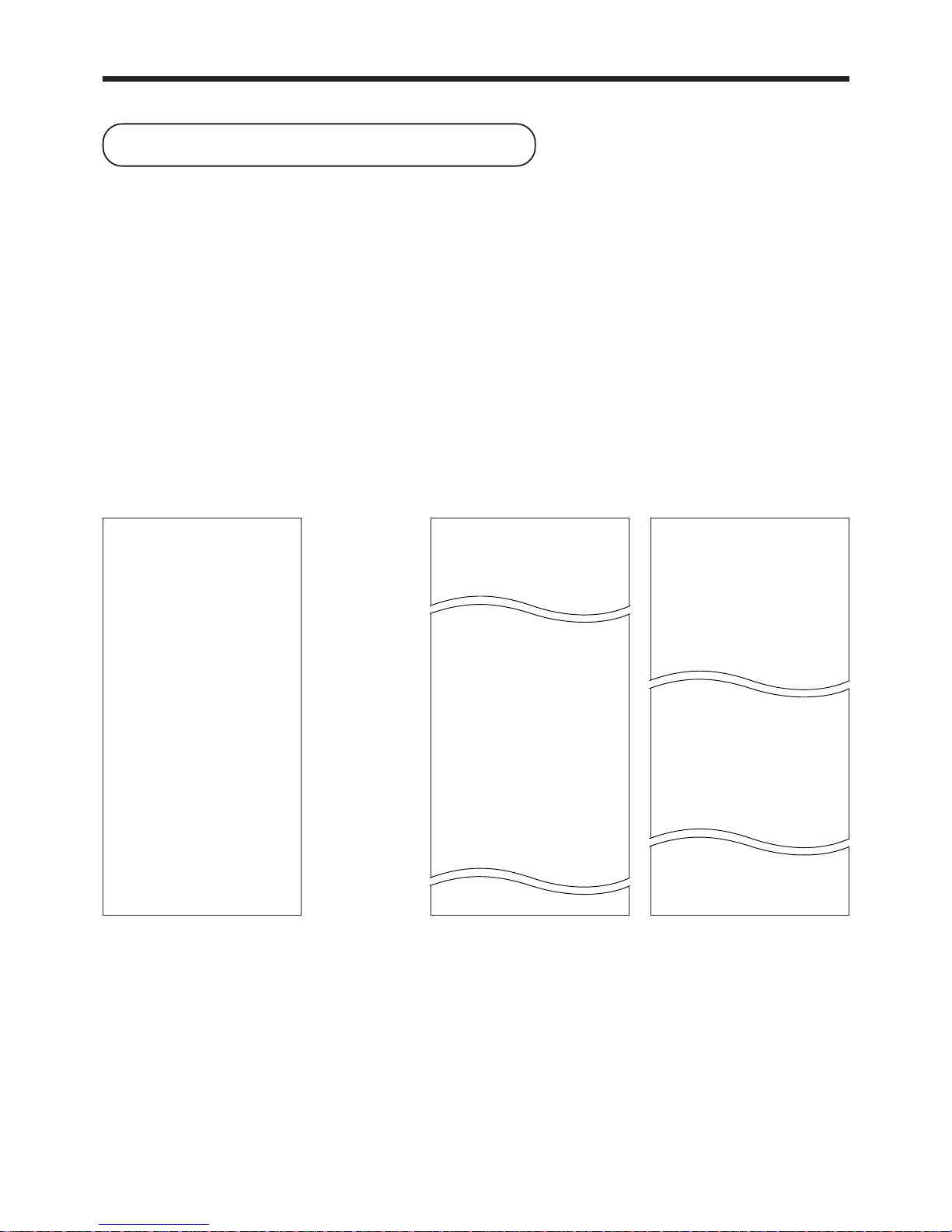

Setting the bottom message (This step can be skipped.)

The procedure setting the logo message includes two steps.

1. Setting the bottom message you want.

2. Turning on the bottom message printing status in the general printing control.

Setting the bottom message you want.

Set "CLEARANCE SALE" to line 1 and "JAN. 20 TO JAN. 31" to line 2.

For more details, please refer page 62.

Turning on the bottom message printing status in the general printing control.

yromeM

.oN

gnimmargorP

sretcarahc

sretcarahC

90

ELASECNARAELC

01

NAJOT02.NAJ

.13

7

4

1

0

8

5

2

00

9

6

3

MENU

SHIFT

FEED

PLU

C

#-2

#-1

1

B

I

P

W

CHAR.

SHIFT

2

C

J

Q

X

3

D

K

R

Y

4

E

L

S

Z

5

F

M

T

(

G

N

U

A

H

O

V

@

#

%

&

/

*

-

!

SPACE

DBL

SIZE

6

b

i

p

w

7

c

j

q

x

8

d

k

r

y

9

e

l

s

z

0

f

m

t

)

g

n

u

a

h

o

v

•

'

:

.

,

+

?

Page 17

17

Getting Started

11.

Setting the CV-10 (This step can be skipped.)

Features of CV-10

• Data for each day as well as data for predetermined periods can be processed

collectively.

• The bothersome task of setting up registers can be performed easily with a

personal computer.

• Register setting data and sales data can be backed up for greater security.

Preparations

V arious preparations are required to use this software.

1. Preparing your personal computer

Applicable personal computers

This software can be run on personal computers like that shown below .

Please confirm whether or not your personal computer satisfies the following conditions.

If you intend to purchase a personal computer for use with this software, please refer to the

conditions listed below .

* The illustrations below do not refer to a specific model of personal c omputer .

Personal computer

CPU: 80386SX or higher when using with Microsoft

Windows 3.1

80486SX or higher when using with Microsoft

Windows 95 (80486DX2 or higher recommended)

Memory: Minimum 8 MB

Hard disk: Minimum 30 MB of available space

3.5-inch floppy disk drive

RS-232C port (D-Sub 9-pin)

Mouse

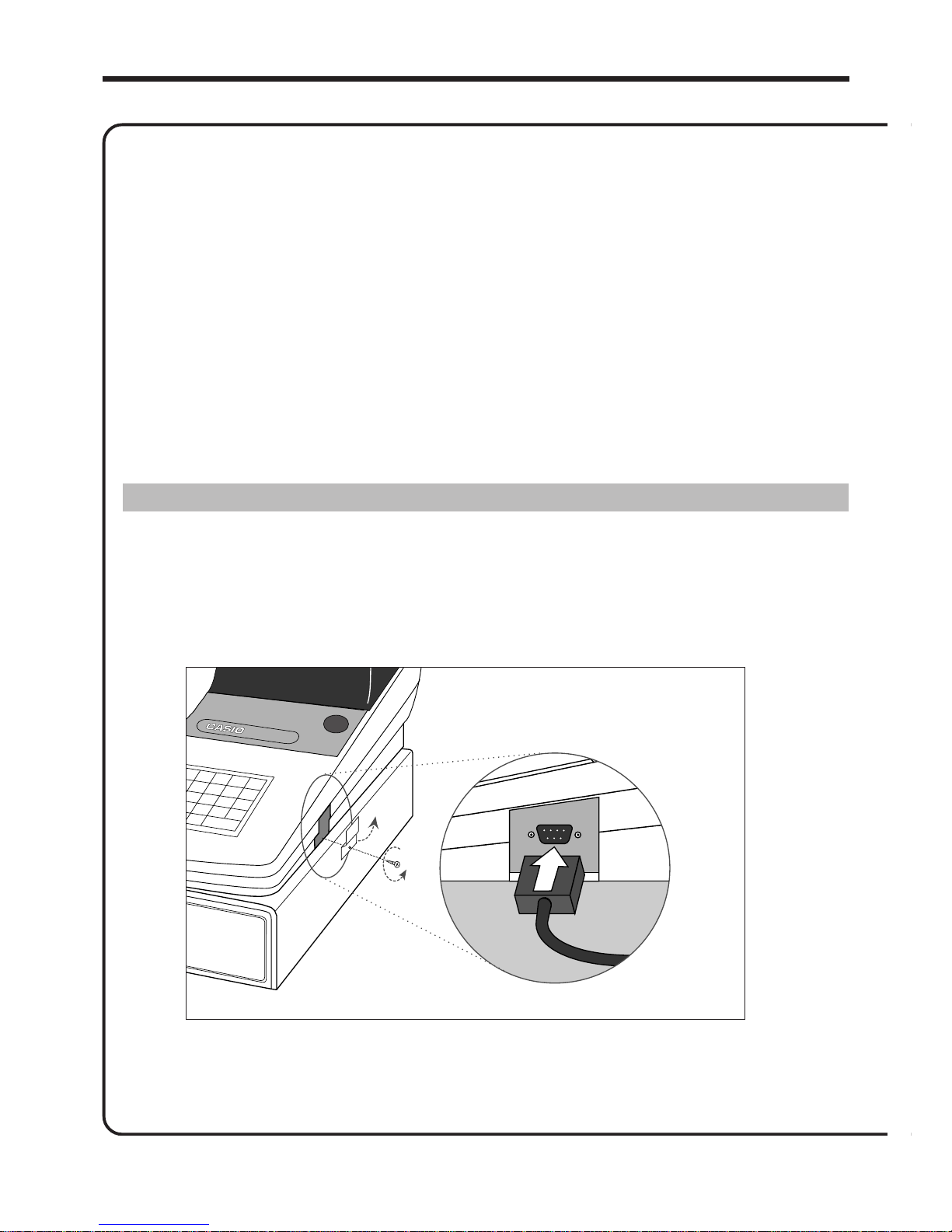

Page 18

18

Getting Started

TK-800

1

2

→ PC COM 1 port

3

Required software

The following software is required to use this software. Please confirm that they are installed on the

hard disk of your personal computer .

• Microsoft® Windows® 3.1 or Microsoft® Windows® 95

If any of these software products are not installed on your hard disk, please install them before

installing this software.

Reference: Please refer to the instruction manuals provided with each software for information

regarding installation.

* Operation of this software with Microsoft

®

Windows NT® has not been verified.

2. Connecting the personal computer and register

IMPORTANT :

Make sure to use the RS-232C cable (D-Sub 9-pin female-female) provided when

making this connection.

For safety reasons, connect the cable after first turning off the personal computer .

Page 19

19

Getting Started

3. Installing this software

Reference: Please take out the two floppy disks provided.

• Turn on the power switch of the personal computer and start up Microsoft

Windows 3.1 or Microsoft Windows 95.