Page 1

Electronic Payment Processing Software

Setup Guide and User's Manual

Copyright October 2005, VeriFone Inc.

PCC-5-7-1h

Page 2

Notice

Copyright October 2005, VeriFone Inc. All rights reserved. active-Charge, active-Charge

SDK, PCCharge Payment Server, PCCharge Pro, PCCharge DevKit, Virtual-Charge, IPCharge are trademarks and PC-Charge is a registered trademark of VeriFone Inc.

Microsoft is a registered trademark and Windows is a trademark of Microsoft Corporation.

Other brands and their products are trademarks or registered trademarks of their respective

holders and should be noted as such.

© VeriFone Inc.

Parkway Business Center

5000 Business Center Drive, Suite 1000

Savannah, Georgia 31405

Technical Support: (877) 659-8981

Fax: (912) 527-4596

2

Page 3

Software License

IMPORTANT

CAREFULLY REVIEW THIS AGREEMENT BEFORE CONTINUING THE

INSTALLATION OR USE OF THE VERIFONE, INC. ("VERIFONE") SOFTWARE

("SOFTWARE"). THIS END-USER LICENSE AGREEMENT ("AGREEMENT") IS

A LEGAL AGREEMENT BETWEEN YOU (EITHER AN INDIVIDUAL OR A

SINGLE ENTITY) ("YOU") AND VERIFONE. IF YOU DO NOT AGREE TO THE

TERMS OF THIS AGREEMENT, TERMINATE THIS INSTALLATION AND

PROMPTLY RETURN ALL SOFTWARE AND DOCUMENTATION, IF

APPLICABLE, TO THE PLACE YOU OBTAINED THE SOFTWARE FOR A

FULL REFUND. THE SOFTWARE INCLUDES COMPUTER SOFTWARE, THE

ASSOCIATED MEDIA, ANY PRINTED MATERIALS, AND ANY "ONLINE" OR

ELECTRONIC DOCUMENTATION. BY DOWNLOADING THE SOFTWARE

AND/OR OPENING THE SOFTWARE PACKET(S) AND/OR USING THE

SOFTWARE, YOU ACKNOWLEDGE THAT YOU HAVE READ THIS

AGREEMENT, UNDERSTAND IT AND AGREE TO BE BOUND BY ITS TERMS.

1. GRANT OF LICENSE. Subject to the terms and conditions of this Agreement and

your payment of the applicable license fees, VERIFONE grants You a limited,

nontransferable, nonexclusive license to use the Software solely (i) in object

(executable) code form, (ii) on a single computer (the "Computer"), and (iii) for your

internal use and without any further rights. You understand that You must comply with

VERIFONE's Software registration policies and the failure to comply with those

policies may result in the disablement of the Software. The Software is in "use" on a

computer when it is loaded into temporary memory (i.e. RAM) or installed into

permanent memory (e.g. hard disk, CD-ROM, or other storage device) of a computer.

2. COPYRIGHT. The Software and all copies provided to you are licensed and not sold.

All title to the Software resides and remains in VERIFONE and its suppliers. The

Software is protected by U.S. copyright laws and international copyright treaties. You

may make one copy of the Software solely for backup or archival purposes. You may

not copy any documentation accompanying the Software.

3. OTHER RESTRICTIONS. You may not decompile, disassemble, or otherwise reverse

engineer the Software, except to the extent that the foregoing restriction is expressly

prohibited by applicable law. You may not sublicense, lend, lease, donate, sell, load,

pledge, transfer, or distribute (on a temporary or permanent basis) the Software. You

may not use the Software for commercial time-sharing, rental, or service bureau use.

4. U.S. GOVERNMENT RESTRICTED RIGHTS. The Software is provided with

RESTRICTED RIGHTS. Use, duplication, or disclosure by the Government is subject

to restrictions as set forth in subparagraph (c)(1)(ii) of the Rights in Technical Data

and Computer Software clause at DFARS 252.227-7013 or subparagraphs (c)(1) and

(2) of the Commercial Computer Software -- Restricted Rights at 48 CFR 52.227-19,

as applicable. Contractor/manufacturer is VeriFone, Inc., 5000 Business Center Drive,

Suite 1000, Savannah, GA 31405.

3

Page 4

5. LIMITED WARRANTY/REFUND/SUPPORT. VERIFONE warrants that the magnetic

media on which the Software is contained shall be free from defects in materials and

workmanship under normal use for a period of (60) days after the purchase date. If

you discover physical defects in the media on which the Software is distributed,

VERIFONE will replace the media within that warranty period. If You are not

completely satisfied with the Software, you may return it to the reseller or other place

of purchase ("Reseller") for a refund, provided that you do so within thirty (30) days of

installation and provided that in no event shall You return the Software later than one

(1) year after VERIFONE provided the Software to the Reseller. VERIFONE agrees to

provide you with free telephone support for a period of sixty (60) days from installation,

provided that in no event shall You be entitled to such support no later than one (1)

year after VERIFONE provided the Software to the Reseller. You agree that it is Your

responsibility to determine when VERIFONE provided the Software to the Reseller.

Telephone support shall occur during the hours of 9 a.m. to 8 p.m. Eastern Time,

Monday through Friday (excluding holidays) and is subject to change.

6. NO OTHER WARRANTIES. EXCEPT FOR THE WARRANTIES PROVIDED

HEREIN, THE SOFTWARE IS PROVIDED "AS IS" AND, TO THE MAXIMUM

EXTENT PERMITTED BY APPLICABLE LAW, VERIFONE DISCLAIMS ALL OTHER

WARRANTIES REGARDING THE SOFTWARE, EXPRESSED OR IMPLIED, AND

INCLUDING, BUT NOT LIMITED TO, THE IMPLIED WARRANTIES OF

MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. THIS

LIMITED WARRANTY GIVES YOU SPECIFIC LEGAL RIGHTS. YOU MAY HAVE

OTHER RIGHTS THAT VARY FROM JURISDICTION TO JURISDICTION.

7. NO LIABILITY FOR CONSEQUENTIAL DAMAGES. VERIFONE AND ALL PARTIES

INVOLVED IN THE CREATION OR DELIVERY OF THE SOFTWARE TO YOU

SHALL HAVE NO LIABILITY TO YOU OR ANY THIRD PARTY FOR SPECIAL,

INCIDENTAL, INDIRECT, EXEMPLARY, AND CONSEQUENTIAL DAMAGES

(INCLUDING, BUT NOT LIMITED TO, LOSS OF PROFITS, GOODWILL OR

SAVINGS, DOWNTIME, DAMAGE TO OR REPLACEMENT OF SOFTWARE AND

DATA) ARISING FROM CLAIMS BASED IN WARRANTY, CONTRACT, TORT OR

OTHERWISE, RELATING IN ANY MANNER TO THE SOFTWARE, EVEN IF

VERIFONE HAS BEEN ADVISED OF THE POSSIBILITY OF SUCH CLAIM OR

DAMAGE. IN ANY CASE, VERIFONE'S ENTIRE LIABILITY RELATING IN ANY

MANNER TO THE SOFTWARE, REGARDLESS OF THE FORM OR NATURE OF

THE CLAIM, SHALL BE LIMITED TO THE AMOUNT ACTUALLY PAID BY YOU FOR

THE SOFTWARE. ANY WRITTEN OR ORAL INFORMATION OR ADVICE GIVEN BY

VERIFONE'S DEALERS, DISTRIBUTORS, AGENTS OR EMPLOYEES WILL IN NO

WAY INCREASE THE SCOPE OF THIS WARRANTY. BECAUSE SOME STATES

DO NOT ALLOW THE EXCLUSION OR LIMITATION OF IMPLIED WARRANTIES

OR LIABILITY FOR CONSEQUENTIAL OR INCIDENTAL DAMAGES, THE ABOVE

LIMITATION MAY NOT APPLY TO YOU.

8. TERMINATION. Either party may terminate this Agreement at any time as a result of a

material breach by the other party by giving written notice of termination to the other

party. Unless otherwise agreed to by the parties in writing, upon the expiration or

termination of this Agreement, You shall immediately remove from your Computer all

copies of the Software.

9. EXPORT/LAWS. You shall fully comply with all laws and regulations of the United

States and other countries relating to the export, import and use of the Software. You

will defend, indemnify and hold harmless VERIFONE from and against any and all

claims, proceedings, losses, damages, liabilities, fines, penalties, costs, and fees

(including reasonable attorneys' fees) arising in connection with any violation of any

regulation of any United States or other governmental authority relating to the use of

the Software by You or your agents.

4

Page 5

10. THIRD PARTY BENEFICIARIES. You are hereby notified that persons and entities

that have licensed software to VERIFONE for inclusion in the Software are third party

beneficiaries to this Agreement as it applies to their respective software product(s)

included in the Software.

11. MISCELLANEOUS. The Agreement and any attached Exhibits constitutes the entire

agreement between VERIFONE and You and it supersedes all prior or

contemporaneous communications and proposals, whether electronic, oral or written

that relate to its subject matter. This Agreement will be governed by the laws of the

State of Georgia without regard to its conflict of law provisions. Each party consents to

the exclusive jurisdiction and venue of the appropriate courts in Chatham County,

Georgia, for all disputes arising out of or relating to this Agreement. The prevailing

party in any action or proceeding to enforce its rights hereunder shall be entitled to

recover reasonable attorneys' fees and other reasonable costs incurred in the action

or proceedings. The failure of a party to exercise or enforce any right or provision of

this Agreement will not constitute a waiver of such right or provision. This Agreement

is between independent contractors and no joint venture, partnership, or employment

relationship exists between the parties as a result of this Agreement and neither party

has the authority to make representations on behalf of or legally bind the other.

Neither party may assign this Agreement, in whole or in part, without the other party's

written consent, which consent shall not be unreasonably withheld. If any provision of

this Agreement is found by a court of competent jurisdiction to be invalid, the parties

nevertheless agree that the court should endeavor to give the maximum effect to the

parties' intentions as reflected in the provision, and that the other provisions of the

Agreement shall remain in full force and effect. Neither party shall use the name or

marks, refer to or identify the other party in advertising or publicity releases, promotional or

marketing correspondence to others without first securing the written consent of such

other party. Each party agrees that it will not unduly delay in responding to such a request.

In addition to those obligations that have accrued prior to termination, Sections 3, 4

and 6 through 11 shall survive any termination of this Agreement. All notices,

demands, or consents required or permitted hereunder shall be in writing and shall be

delivered in person or sent via overnight delivery or certified mail to the respective

parties at the addresses set forth herein or at such other address as shall have been

given to the other party in writing. Such notices shall be deemed effective upon the

earliest to occur of: (i) actual delivery; or (ii) three days after mailing, addressed and

postage prepaid, return receipt requested. All notices to VERIFONE shall be sent to

the attention of VERIFONE's Executive Vice President.

5

Page 6

Table of Contents

Notice...................................................................................2

Software License ................................................................3

Introduction.......................................................................10

Important Security Notice ................................................11

System Requirements ......................................................14

SSL Requirements.............................................................................................................. 14

Windows 98 SSL Upgrade Instructions ...................................................................... 15

Windows NT SSL Upgrade Instructions...................................................................... 16

Upgrade Preparation ........................................................18

Upgrading PCCharge........................................................20

Installation.........................................................................21

Welcome!............................................................................................................................ 22

License Agreement............................................................................................................. 23

Setup Type.......................................................................................................................... 24

Choose Destination Location.............................................................................................. 25

Select Features................................................................................................................... 26

Ready to Install! .................................................................................................................. 27

Installing.............................................................................................................................. 28

Installation Completed!........................................................................................................ 29

The Setup Process............................................................30

Starting PCCharge Payment Server ................................................................................... 31

Accessing the User Interface.............................................................................................. 32

Do you have a Configuration Disk?..................................................................................... 33

Entering your Serial Number...............................................................................................34

Preferences......................................................................................................................... 35

Advanced Configuration Setup ........................................................................................... 39

Merchant Setup Wizard....................................................................................................... 41

Credit Card Processing Company Setup.................................................................... 42

Register New Merchant License................................................................................. 43

Credit Card Processing Company Extended Data Fields........................................... 44

Split Dial/Settle Setup ................................................................................................. 45

American Express Split Dial Setup ............................................................................. 46

AMEX Settle Setup ..................................................................................................... 50

Debit Card Company Setup........................................................................................ 53

Debit Card Company Extended Data Fields............................................................... 55

Check Services Company Setup ................................................................................ 56

Check Services Company Extended Data Fields ....................................................... 58

EBT Processing Company Setup................................................................................ 59

EBT Company Extended Data Fields ......................................................................... 61

Gift Card Processing Company Setup........................................................................ 62

6

Page 7

Gift Card Company Extended Data Fields.................................................................. 64

Company Information Setup ....................................................................................... 65

Address Verification Setup.......................................................................................... 66

Card Verification Setup............................................................................................... 69

End of Merchant Setup Wizard................................................................................... 72

Update Configuration Disk.................................................................................................. 73

Simple Modem Setup..........................................................................................................75

Manual Modem Setup......................................................................................................... 76

Advanced Modem Setup.....................................................................................................79

Performing Test Transactions............................................................................................. 81

Basic Setup Complete......................................................................................................... 85

Continuing Setup..............................................................86

Devices Setup..................................................................................................................... 87

Card Reader Setup..................................................................................................... 88

Check Reader Setup................................................................................................... 91

PIN Pad Setup ............................................................................................................ 93

Touch Screen Setup ................................................................................................... 96

Report Printer Setup ................................................................................................... 98

Receipt Printer Setup.................................................................................................. 99

Example Receipt With Comments ............................................................................ 103

Cashier Privileges Setup...................................................................................................104

Users Setup ...................................................................................................................... 108

Private Label Card Setup.................................................................................................. 110

Remove TID Number ........................................................................................................ 112

Numbers Setup ................................................................................................................. 113

User's Guide....................................................................114

Main Window..................................................................................................................... 115

Icon Bar............................................................................................................................. 117

Menu System .................................................................................................................... 118

Credit Card Processing..................................................................................................... 119

All about Credit Card Transactions........................................................................... 121

Using Credit Card Transaction Processing...............................................................123

Credit Card Processing -- A Typical Day .................................................................. 127

All about Restaurant Transaction Processing...........................................................128

Using Restaurant Transaction Processing................................................................ 129

All about Commercial Card Processing .................................................................... 131

Using Commercial Card Processing......................................................................... 132

All about Voice Auth Processing...............................................................................133

Using Voice Auth Processing.................................................................................... 134

Debit Card Processing...................................................................................................... 136

All about Debit Card Transactions ............................................................................ 138

Debit Card Processing -- A Typical Day.................................................................... 140

Check Processing............................................................................................................. 141

All about Check Transactions ................................................................................... 143

All about Check Verification/Guarantee.................................................................... 144

All about Check Conversion/Truncation.................................................................... 145

All about ECC Check Transactions........................................................................... 146

EBT (Electronic Benefits Transfer) Processing................................................................. 147

All about EBT Card Transactions.............................................................................. 149

Cash EBT Transactions............................................................................................ 150

Food Stamp EBT Transactions................................................................................. 151

Food Stamp Credit EBT Transactions ...................................................................... 152

Account Inquiry EBT Transaction.............................................................................. 153

Processing EBT Transactions -- A Typical Day........................................................ 154

Gift Card Transaction Processing..................................................................................... 155

7

Page 8

All about Gift Card Transactions............................................................................... 157

Processing Gift Card Transactions -- A Typical Day................................................. 158

Offline Processing and Import Files..............................159

Offline Processing............................................................................................................. 160

How to Process Offline Transactions........................................................................ 160

File Import ......................................................................................................................... 162

Processing an Import File ......................................................................................... 162

Utilities Menu...................................................................164

Configuration Disk.............................................................................................................165

Updating/Creating a Configuration Disk.................................................................... 165

Restoring from a Configuration Disk......................................................................... 165

Backup/Restore................................................................................................................. 166

Backing Up Your PCCharge Files............................................................................. 167

Restoring PCCharge Backup Files ........................................................................... 167

Transferring PCCharge to a Different Computer ...................................................... 168

Transaction Database Archiving....................................................................................... 169

Setting Up Transaction Database Archiving ............................................................. 169

Using Transaction Database Archiving.....................................................................171

Transaction Database Purging.......................................................................................... 173

Setting Up Transaction Database Purging................................................................ 173

Using Transaction Database Purging ....................................................................... 174

Repair/Compact Database................................................................................................176

Repairing and Compacting the PCCharge Database ............................................... 176

Retrieve Account Number................................................................................................. 177

Batch

Close................................................................................................................................. 179

Inquire ............................................................................................................................... 181

Settle................................................................................................................................. 183

Batch Management........................................................................................................... 186

Amex Batch Management.................................................................................................193

Auto-Settle Utility............................................................................................................... 199

Upload Check Images.......................................................................................................202

Functions.............................................................178

Closing Your Batch ................................................................................................... 179

Performing a Batch Inquiry........................................................................................ 181

Settling Your Batch ................................................................................................... 183

Installation of Batch Management Utility...................................................................186

Usage of Batch Management Utility.......................................................................... 187

Batch File Details...................................................................................................... 188

Indeterminate Batch.................................................................................................. 190

Batch History............................................................................................................. 191

Installation of Batch Management Utility...................................................................193

Usage of Amex Batch Management Tools ............................................................... 193

Open Amex Batch Editor........................................................................................... 194

Amex Batch Archive.................................................................................................. 196

Settle Amex Batch..................................................................................................... 197

Installing and Using the Auto-Settle Utility................................................................ 199

How to Upload Check Images................................................................................... 202

Reports ............................................................................204

Viewing a Report...............................................................................................................207

Daily Transaction Summary.............................................................................................. 209

Credit Card Detail.............................................................................................................. 210

Debit Summary ................................................................................................................. 211

8

Page 9

Check Detail...................................................................................................................... 212

EBT Summary...................................................................................................................213

Batch Pre-Settle................................................................................................................ 214

Batch Post-Settle .............................................................................................................. 215

Cashier Audit..................................................................................................................... 216

Restaurant Pre-Settle........................................................................................................ 217

Restaurant Detail .............................................................................................................. 218

Gift Card............................................................................................................................219

9

Page 10

Introduction

Congratulations on the purchase of PCCharge Payment Server--the most advanced

solution in the industry for processing credit cards on your PC. This software provides you

with a fast, reliable way to process a variety of transaction types in an easy to use Windows

environment. This manual prepares you with the detailed information that you will need to

configure your new software and use it to its fullest extent.

Please direct any comments or suggestions regarding your PCCharge documentation to

pccharge_manuals@verifone.com. Please note that this address should not be considered

as a source for technical support. Any such requests should be directed to the normal

support channels.

Using This Manual

As you use this manual, you'll come across the following text boxes. These are meant to

draw your attention to certain concepts, and are easily identifiable by their icons.

Simple Explanation: The simple explanations found in the PCCharge

(

manual will provide you with an easy-to-digest summary of the information in

that section. If you want to get through the manual as quickly and easily as

possible, pay special attention to the simple explanations.

Note: A note is important information that either helps to explain a concept or

draws attention to ideas that should be kept in mind. We recommend that you

carefully review the notes you encounter.

WARNING: We HIGHLY recommend that you read ALL warnings in the

sections of the manual that you read. These warnings will help to prevent

serious issues from occurring.

Technical Details: These technical details give more in-depth

/

explanations of concepts described in this manual. These extra bits of

information are often useful, but are not necessarily pertinent to all users.

PCCharge Appendices

PCCharge includes some extra documentation that isn't found in this manual. This

documentation, the PCCharge Appendices, contains specific information on the various

payment processing companies. You'll need to refer to this information as you use the

PCCharge manual. We recommend that you print out those sections related to your

payment processing company.

To access the PCCharge Appendices, click the Windows Start button, then Programs (or

All Programs), then VeriFone, then PCCharge Payment Server, then PCCharge

Payment Server Appendices.

10

Page 11

Important Security Notice

Simple Explanation: In June 2001, Visa mandated its Cardholder

CISP Requirements

In order for you to protect yourself, you must comply with the twelve basic CISP

requirements listed below. These are the most current requirements as of the printing of

this manual, but you should check Visa's website (

up-to-date requirements.

In addition to these requirements, Visa also provides sub-requirements to which merchants

must adhere. It is suggested that you contact Visa or visit their website

http://www.visa.com/cisp) to learn more about CISP requirements and compliance.

(

(

Merchant Responsibility

The following guidelines should be implemented in your payment processing environment.

This information will help you to protect all areas (the network, individual PCs, laptops,

servers, databases, backup data, logs, etc.) that store or transmit cardholder data.

Information Security Program (CISP). This program is a standard for securing

cardholder data, wherever it is located. Visa states that CISP compliance is

required of all entities that store, process, or transmit Visa cardholder data.

This includes merchants who use PCCharge to process transactions. The

information given in this section explains how CISP may affect your business.

http://www.visa.com/cisp) for the most

1. Install and maintain a working firewall to protect data

2. Keep security patches up-to-date

3. Protect stored data

4. Encrypt data sent across public networks

5. Use and regularly update anti-virus software

6. Restrict access by "need to know"

7. Assign unique ID to each person with computer access

8. Don't use vendor-supplied defaults for passwords and security parameters

9. Track all access to data by unique ID

10. Regularly test security systems and processes

11. Implement and maintain an information security policy

12. Restrict physical access to data

Note: Other card associations, such as MasterCard, Discover, and American

Express, have established programs cardholder security programs as well.

These programs are similar to CISP. You should become familiar with these

other security programs as well.

WARNING: Although VeriFone, Inc. has designed PCCharge to properly

secure cardholder information according to CISP guidelines, it is ultimately the

merchant’s responsibility to secure the system on which PCCharge resides and

the environment in which it is used.

11

Page 12

Data Protection Guidelines

Although the following information will help you to comply with the Cardholder Information

Security Program (CISP), it is important to Visa’s website (

review the most up-to-date information available. PCCharge, when implemented according

to CISP guidelines (and when implemented into a secure environment), will not keep a

merchant from being CISP compliant.

1. PCCharge does NOT store credit card magnetic stripe data (track I/II data), so this is

not an issue that would endanger a merchant's CISP compliancy.

2. PCCharge does NOT store credit card CVV2/CVC2/CID data (the verification number

that appears on the front or back of the credit card), so this is not an issue that would

endanger a merchant's CISP compliancy.

3. PCCharge stores credit card numbers (Primary Account Number) and expiration

dates. However, this data is encrypted per a CISP accepted method. Therefore, this is

not an issue that would endanger a merchant's CISP compliancy.

4. If the computer running PCCharge is on a network that has any kind of an Internet

connection, a firewall must used on that network. Even if a firewall is already in place,

ensure that all patches have been installed. Industry standards should be followed for

strengthening the firewall prior to processing financial transactions. Perimeter scans

and intrusion detection are recommended.

5. Printed material documenting sensitive merchant information (Merchant ID, Terminal

ID, etc.) should be safeguarded.

6. Keep software up to date, including (but not limited to): operating systems, e-mail

programs, and Internet browsers. For example, Microsoft security updates and

patches can be downloaded by visiting

7. Use appropriate facility entry controls to limit physical access to systems that store or

process cardholder data. Visa recommends the use of complex passwords to facilitate

a secure environment. Complex passwords are longer than 6 characters and use a

combination of alphanumeric and non-alphanumeric characters. PCCharge provides

users with the ability to use usernames and passwords.

8. PCCharge allows users to purge (delete) transactions from their PCCharge databases

that are older than a configurable amount. The default value is 2556 days (7 years).

You should change this value according to your business's requirements. Some

possible variables that would affect this value include:

• Your merchant service provider's regulations

• Your accountant's advice

• Your local laws

http://www.microsoft.com/.

http://www.visa.com/cisp) and

CISP Implementation Documentation

In addition to the Data Protection Guidelines, it is important that merchants review the

information that is available on Visa’s website (

Visa directly for more information regarding CISP compliance.

http://www.visa.com/cisp) and/or contact

12

Page 13

Why Comply with CISP?

The following information was taken directly from Visa’s website (

The CISP requirements help Visa members, merchants, and service providers protect their

information assets and meet the obligations to the Visa payment structure. Other benefits

include:

• Consumer confidence: Reports of hacker attacks, stolen credit card numbers,

and identity theft have left consumers demanding absolute assurance that their

account data and other personal information is safe.

• Minimized threat to your reputation and financial health: Financial and

resource outlay is minimal compared to the costs associated with the reactive

hiring of security and public relations specialists, or the loss of significant revenue

and customer goodwill that can result from a compromise.

If a merchant or service provider refuses to participate in CISP, Visa may impose a fine on

the responsible Visa Member. Ultimately, merchants and their service providers must meet

the CISP requirements to continue to accept Visa Payment products.

http://www.visa.com/cisp):

CISP compliance penalties

Failure to comply with CISP standards or to rectify a security issue may result in:

• Fines (described below)

• Restrictions on the merchant; or

• Permanent prohibition of the merchant or service provider's participation in Visa

The following fines apply for non-compliance, within a rolling 12-month period:

programs.

• First violation: $50,000

• Second violation: $100,000

• Third violation: Management discretion

More Information

Note: VeriFone, Inc. highly recommends that you contact whoever set up

(

your ability to process transactions and find out exactly what they mandate

and/or recommend. Doing so may help merchants protect themselves from

fines and fraud. For more information related to security, visit:

http://www.visa.com/cisp

•

•

http://www.sans.org/resources

•

http://www.microsoft.com/security/default.asp

https://sdp.mastercardintl.com

•

13

Page 14

System Requirements

YOU MUST HAVE THE FOLLOWING:

• PC with Windows 98, XP, NT, 2000, or 2003

• 64 MB minimum of RAM, 256 MB preferred

• 30 MB of available hard-disk space, 100 MB preferred

• An Internet connection OR a Hayes compatible modem (capable of 1200 baud or less)

and an analog phone line

• CD-ROM drive

• 400 MHz or higher processor

• Latest Microsoft service pack updates installed

• Merchant Account with a PCCharge-certified processor

• SSL updates if required (see SSL Requirements below)

• Latest version of Microsoft's Internet Explorer (version 6 or later)

Technical Details: We require that you install the latest version of

/

THE FOLLOWING ARE OPTIONAL:

• Track I & II reader

• Check Reader/Scanner

• Debit Card PIN pad

• Windows compatible receipt printer

SSL Requirements

(

If you're using Windows 98 or NT and you're using one the following payment processing

companies, you'll need to install some upgrades/enhancements to your operating system.

• Heartland Payment Systems (HPTS)

• NPC (NPC)

• Paymentech (GSAR)

• Vital (VISA)

Windows 98 users should consult the section Windows 98 SSL Upgrade Instructions

(see page 15). Windows NT users should consult the section Windows NT SSL Upgrade

Instructions (see page 16).

Microsoft's Internet Explorer no matter how you connect to your processor.

Some processors require Internet Explorer version 6 or later to be installed in

order to process transactions. Internet Explorer is more than just an Internet

browser; it actually upgrades your operating system.

Note: If you're using Windows XP, 2000, or 2003, you can safely ignore this

section and continue on to the section Upgrade Preparation (see page 18).

14

Page 15

Technical Details: Some payment processing companies are beginning

/

to process transactions via SSL2 (a highly secure Internet protocol). In order to

be able to process via SSL2, users of Windows 98 and Windows NT must

install certain upgrades. The following instructions help explain how to obtain

and install these system upgrades/enhancements. It is necessary that you

install DCOM and DSCLIENT prior to running the SChannel Registry

Updater. After completing these instructions, restart your system.

Windows 98 SSL Upgrade Instructions

INSTALLING DCOM

1. Shut down all active programs (PCCharge, word processors, media players, etc.).

2. Open your Internet browser. Visit and review the following site:

http://www.microsoft.com/com/dcom/dcom98/download.asp

3. Download the DCOM installation software using the link provided on that page.

4. Save the file to your Windows Desktop, or open the file from its present location.

5. Follow the installation instructions provided.

INSTALLING DSCLIENT

1. Shut down all active programs (PCCharge, word processors, media players, etc.).

2. Open your Internet browser. Visit the following site and carefully review the

3. Open your Windows Explorer (click Start, then Programs, then Accessories, then

4. Double-click the file named DSCLIENT.EXE.

5. Follow the installation instructions provided.

SCHANNEL REGISTRY UPDATER

1. Shut down all active programs (PCCharge, word processors, media players, etc.).

2. Open your Windows Explorer (click Start, then Programs, then Accessories, then

documentation provided to determine whether or not you want to install this service.

This service cannot be reliably uninstalled. Additionally, installing it may change

various security options and may affect other third-party applications.

http://www.microsoft.com/windows2000/server/evaluation/news/bulletins/adextension.

asp

Windows Explorer). Look on your PCCharge CD in the directory: SSL

Files\WIN98\.

Windows Explorer). Look on your PCCharge CD in the directory: SSL Files\.

15

Page 16

3. Double-click the file named SChannelRegEdit.exe.

4. The utility will update your system as necessary.

The W indows 98 SSL Upgrade Instructions are complete. You may now continue on to

the section Upgrade Preparation (see page 18).

Windows NT SSL Upgrade Instructions

INSTALLING DCOM

1. It is necessary that someone with System Administrator access to your operating

system make the following changes.

2. Shut down all active programs (PCCharge, word processors, media players, etc.).

3. Determine if you've already installed NT Service Pack 6a or higher. To do this, rightclick the My Computer icon on your Windows desktop. Left-click Properties. Look

near the top-right of the System Properties window that appears. The service pack

version is listed under the heading System:. If your service pack version is lower than

6a, visit the following site and install the latest service pack:

http://www.microsoft.com/NTServer/nts/downloads/recommended/SP6/allsp6.asp

INSTALLING DSCLIENT

1. It is necessary that someone with System Administrator access to your operating

system make the following changes.

2. Shut down all active programs (PCCharge, word processors, media players, etc.).

3. Open your Internet browser. Visit the following site and carefully review the

documentation provided to determine whether or not you want to install this service.

This service cannot be reliably uninstalled. Additionally, installing it may change

various security options and may affect other third-party applications.

http://www.microsoft.com/windows2000/server/evaluation/news/bulletins/adextension.

asp

4. Determine if you've already installed NT Service Pack 6a or higher. To do this, rightclick the My Computer icon on your Windows desktop. Left-click Properties. Look

near the top-right of the System Properties window that appears. The service pack

version is listed under the heading System:. If your service pack version is lower than

6a, visit the following site and install the latest service pack:

http://www.microsoft.com/NTServer/nts/downloads/recommended/SP6/allsp6.asp

5. Open your Windows Explorer (click Start, then Programs, then Accessories, then

Windows Explorer). Look on your PCCharge CD in the directory: SSL

Files\WINNT\.

6. Double-click the file named DSCLIENT.EXE.

7. Follow the installation instructions provided.

16

Page 17

SCHANNEL REGISTRY UPDATER

1. It is necessary that someone with System Administrator access to your operating

system make the following changes.

2. Shut down all active programs (PCCharge, word processors, media players, etc.).

3. Open your Windows Explorer (click Start, then Programs, then Accessories, then

Windows Explorer). Look on your PCCharge CD in the directory: SSL Files\.

4. Double-click the file named SChannelRegEdit.exe.

5. The utility will update your system as necessary.

The Window s NT SSL Upgrade Instructions are complete. You may now continue on to

the section Upgrade Preparation (see page 18).

17

Page 18

Upgrade Preparation

Note: The following section pertains only to those users who are upgrading

(

The following instructions must be followed PRIOR to upgrading your existing version of

PCCharge Payment Server. We recommend that you work with whoever generally uses or

originally installed PCCharge. Make a check next to each step after its completion.

__ 1. If you are using any sort of point of sale (POS) software in combination with

__ 2. Review the section System Requirements to make sure that your system meets the

__ 3. Start your copy of PCCharge Payment Server if it isn't already running. To open

__ 4. The person who normally settles/closes batches should complete this step.

__ 5. Click Setup on the PCCharge menu bar. Click Configure System. The Configure

their existing copy of PCCharge. If you are installing PCCharge for the first

time, you can skip ahead to the section Installation (see page 21).

WARNING: Failure to observe proper upgrade procedure may result in loss

of data and/or program functionality.

PCCharge, check with that software's manufacturer to make sure it's compatible with

the version of PCCharge to which you are upgrading.

requirements of PCCharge (see page 14). The system requirements may have

changed since you last installed PCCharge.

PCCharge Payment Server:

• Click the Windows Start button at the bottom-left of your screen.

• Click Programs.

• Click VeriFone.

• Click PCCharge Payment Server.

• Click the PCCharge Payment Server icon.

Settle or close any batches you may have that are open. To do so, click Batch on

the PCCharge menu bar (near the top of the PCCharge Payment Server main

screen). Click Settle… or Close… (varies by processing company). Proceed with

normal batch settle/close steps. You must settle/close ALL open batches for ALL

accounts before upgrading--otherwise, data may be lost and money may not be

transferred to your account(s).

If your account is host-based and set to "auto close", it is recommended that you

upgrade after the auto close has taken place and before any new transactions are

processed.

Setup window will appear. Uncheck the option Secure Card Numbers if it isn't

already unchecked (and if it is accessible in your version of PCCharge). Click OK.

Depending on the size of your database, it may take a few minutes for PCCharge to

complete this procedure.

18

Page 19

__ 6. Click Utilities on the PCCharge menu bar. Click Repair. Depending on the size of

your database, it may take a few minutes for PCCharge to complete this procedure.

Click OK when you see the message "Process Complete".

__ 7. Click Utilities on the PCCharge menu bar. Click Compact. Depending on the size of

your database, it may take a few minutes for PCCharge to complete this procedure.

Click OK when you see the message "Process Complete".

__ 8. Click Utilities on the PCCharge menu bar. Click Configuration Disk.

• Select the option Update/Create Config Disk.

• PCCharge may display a warning message. If so, disregard this message and

click Yes.

• Insert a blank 3½" floppy disk into your computer's disk drive. Click OK.

• The Copy Configuration Files To… window will appear. Click Open.

• It may take a few minutes for PCCharge to complete this procedure. Click OK

when you see the message "Your Configuration Disk has been

updated".

• Remove the 3½" floppy disk from your computer's disk drive. Label it

PCCharge Config Disk and store it. Certain PCCharge files can be recovered

__ 9. Click Utilities on the menu bar. Click Backup Files….

__ 10. You may now shut down PCCharge. Click File on the menu bar. Click Exit.

You may now proceed to the following section, Upgrading PCCharge.

from this disk in case of data loss.

• Click BackUp. The Backup Data Files To… window will appear. Click Open.

• It may take a few moments for PCCharge to complete this procedure. Click OK

when you see the message "Backup was Successful

• PCCharge has created a file named BACKUPID.ZIP and placed it the

PCCharge installation directory. Do not delete this file, as certain PCCharge

files can be recovered from this file in case of data loss.

".

19

Page 20

Upgrading PCCharge

Note: The following section pertains only to those users who are upgrading

(

The following instructions may be followed AFTER completing the steps in the previous

section, Upgrade Preparation. We recommend that you work with whoever generally uses

or originally installed PCCharge. Make a check next to each step after its completion.

__ 1. Review the section System Requirements to make sure that your system meets the

__ 2. Review the PCCharge Appendices to find out if your payment processing company

__ 3. If you are upgrading using a PCCharge Payment Server CD-ROM, you'll use the

__ 4. If you are upgrading using a PCCharge Payment Server installation file received via

their existing copy of PCCharge. If you are installing PCCharge for the first

time, you can skip ahead to the section Installation (see page 21).

WARNING: Failure to observe proper upgrade procedure may result in loss

of data and/or program functionality.

requirements of PCCharge (see page 14). The system requirements may have

changed since you last installed PCCharge.

has changed its merchant account settings and/or requirements. Your payment

processing company may have changed the way it does business since you last

installed PCCharge.

• To access the PCCharge Appendices before you have installed PCCharge,

you'll need to look on the PCCharge installation CD.

o Insert the PCCharge installation CD into your computer.

o The PCCharge installer should automatically appear. If it does, click

Cancel, and then click Exit Setup.

o Click the Windows Start button, and then click Run. Enter the letter of your

CDROM drive followed by a colon. Most users should input D: and click

the OK button.

o Look for the file named Payment Server Appendices. Double-click it

to view the PCCharge Appendices in Adobe PDF format.

standard installation process described in the next section. Be sure to use the

program directory of your existing PCCharge Payment Server when asked to select a

destination directory. Skip step 4 and proceed to the next section, Installation.

the Internet, complete the following steps.

• The file received from VeriFone, Inc. will almost always be named Setup.exe.

• Locate Setup.exe. It will be in whatever directory you specified when you

downloaded the file. You may need to detach the file, if it was sent via e-mail.

• Double-click Setup.exe. You may now follow the steps in the next section,

Installation, beginning with the step Welcome!. Be sure to specify the program

directory of your existing PCCharge Pro when asked to select a destination

directory.

20

Page 21

Installation

Insert the PCCharge Payment Server CD into CD-ROM drive of your computer. The

installation process should begin automatically.

If the installation process does not start manually, your copy of Windows may be set up to

not allow auto-run of CD-ROMs. If so, you'll need to manually begin the installation

process. You can do so by clicking your Windows Start button, then Run.... Click the

Browse button. Click the drop-down list to the right of the Look In: field. Select your CDROM drive. Double-click the file Setup.exe. The PCCharge installation process will begin.

21

Page 22

Welcome!

Click Next > to proceed to the next step in the installation process.

22

Page 23

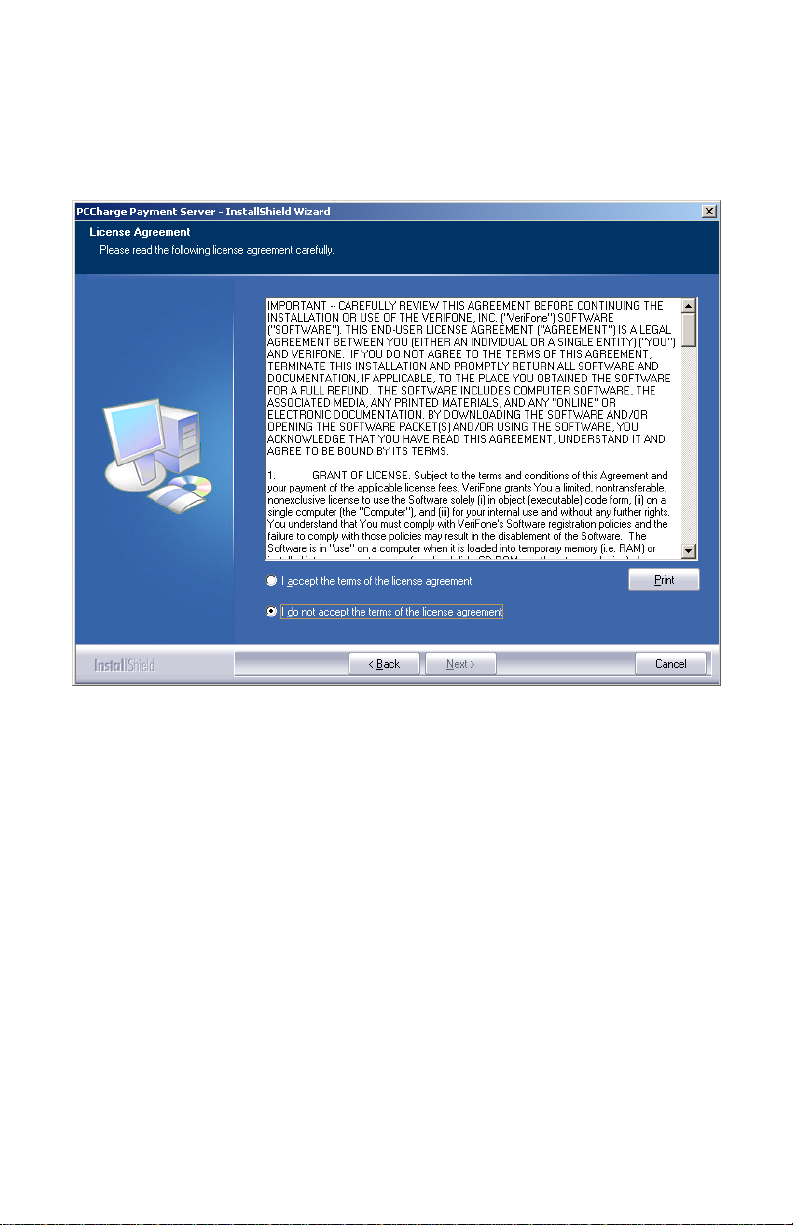

License Agreement

Select I accept the terms of the license agreement and click Next > to proceed to the

next step in the installation process.

23

Page 24

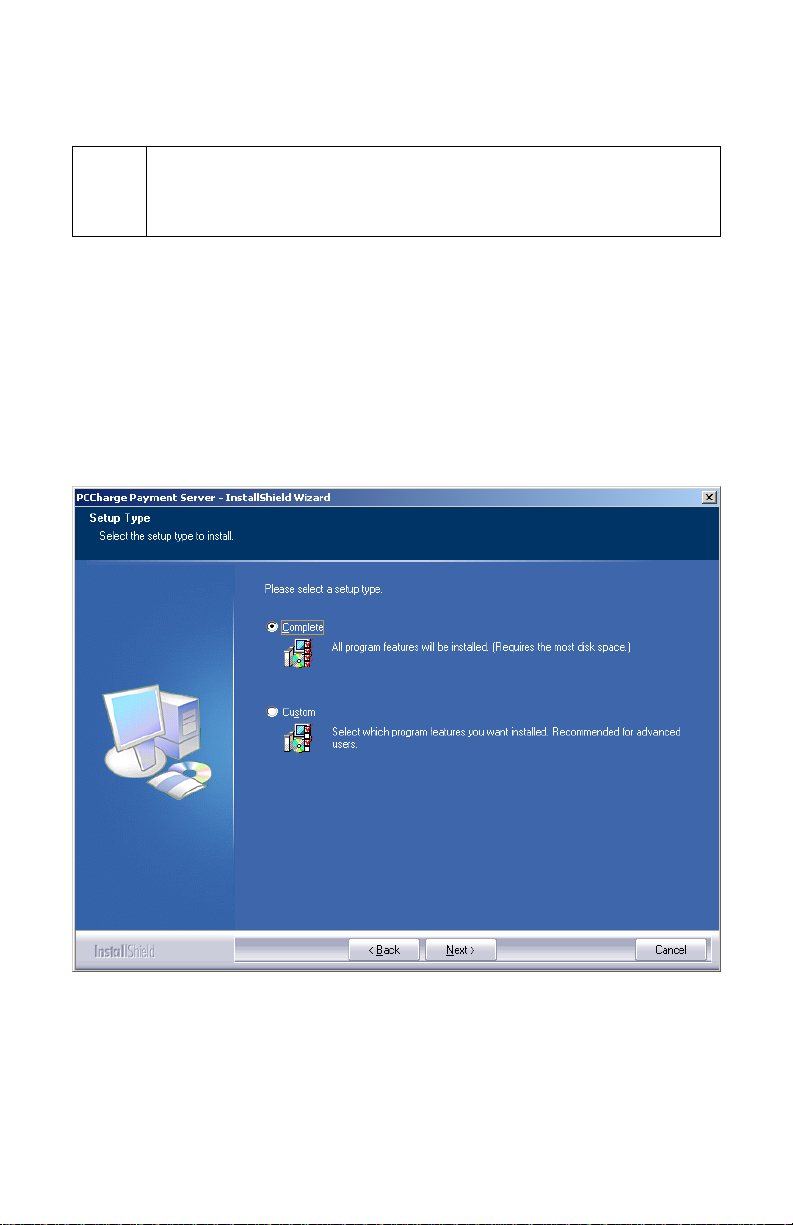

Setup Type

Simple Explanation: Most users should simply select Complete and

You may select either Complete setup or Custom setup. Select Complete setup if you

want to install all PCCharge program files and features. If you select Custom setup, you

will be able to:

•

• Specify which PCCharge utilities are installed

After you've selected a setup type, click Next > to proceed to the next step in the

installation process. If you have selected Complete setup, you may then skip ahead to the

section Ready To Install (see page Error! Bookmark not defined.). Otherwise, continue

n to the next section. o

click Next > to proceed to the next step in the installation process. You may

then skip ahead to the section Ready To Install (see page Error! Bookmark

not defined.).

Specify the PCCharge installation directory

24

Page 25

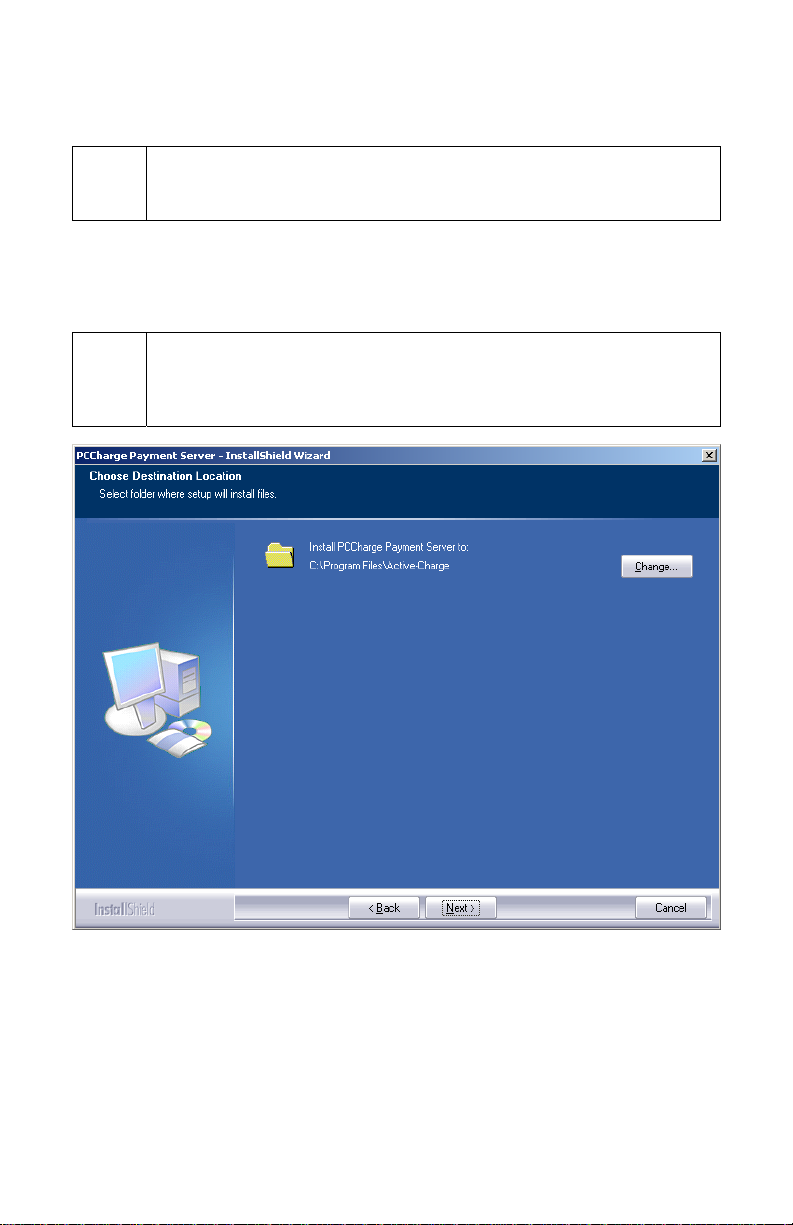

Choose Destination Location

Simple Explanation: If you selected Complete as your setup type, you

This window allows you to specify where on your local hard drive you'd like to install

PCCharge Payment Server. If you're upgrading PCCharge, use the Browse… button to

specify the location of your existing installation directory. Most users should click Next > to

proceed to the next step in the installation process.

may skip this section.

WARNING: If you change the destination directory, it is vitally important that

you install to your computer's local hard drive. You should not install PCCharge

across a network to another computer's local hard drive. PCCharge uses

system files that must be on the local computer's hard drive.

25

Page 26

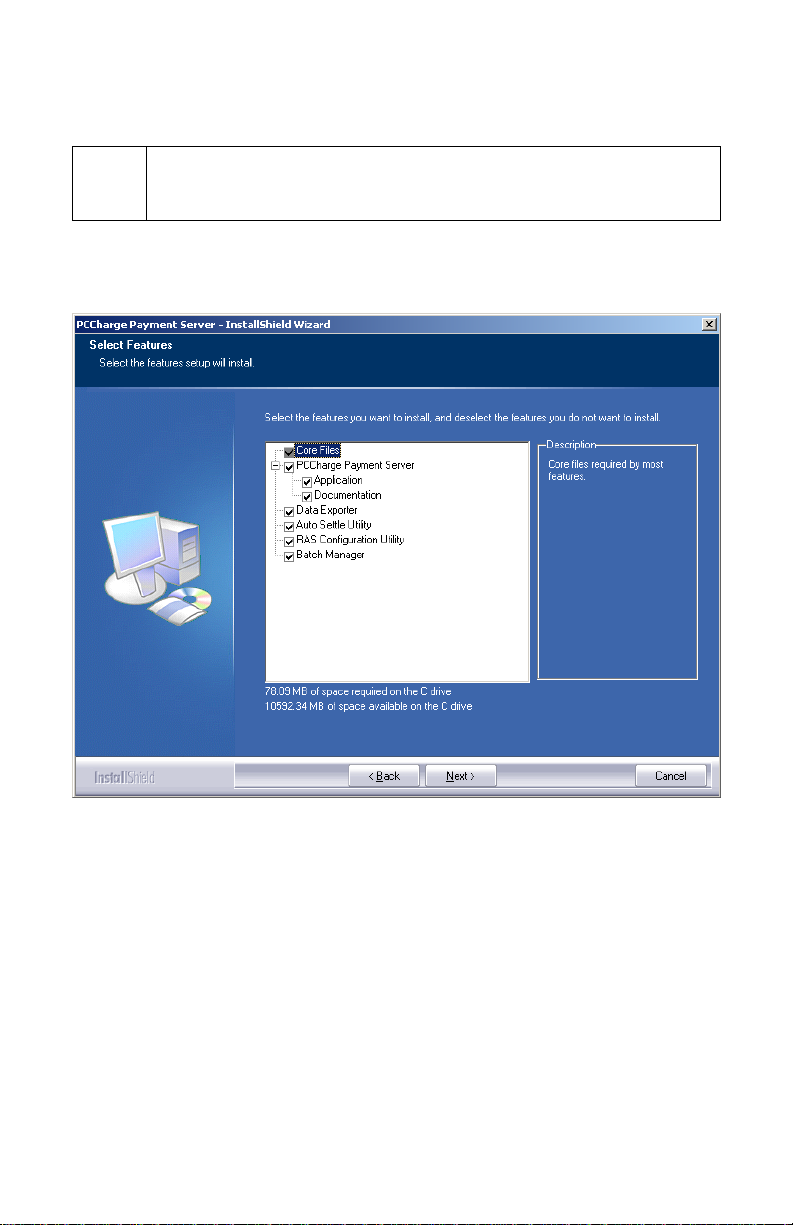

Select Features

Simple Explanation: If you selected Complete as your setup type, you

This window allows you to specify which PCCharge features you'd like to install. You can

uncheck a feature if you do not want that feature to be installed. Most users should click

Next > to proceed to the next step in the installation process.

may skip this section.

26

Page 27

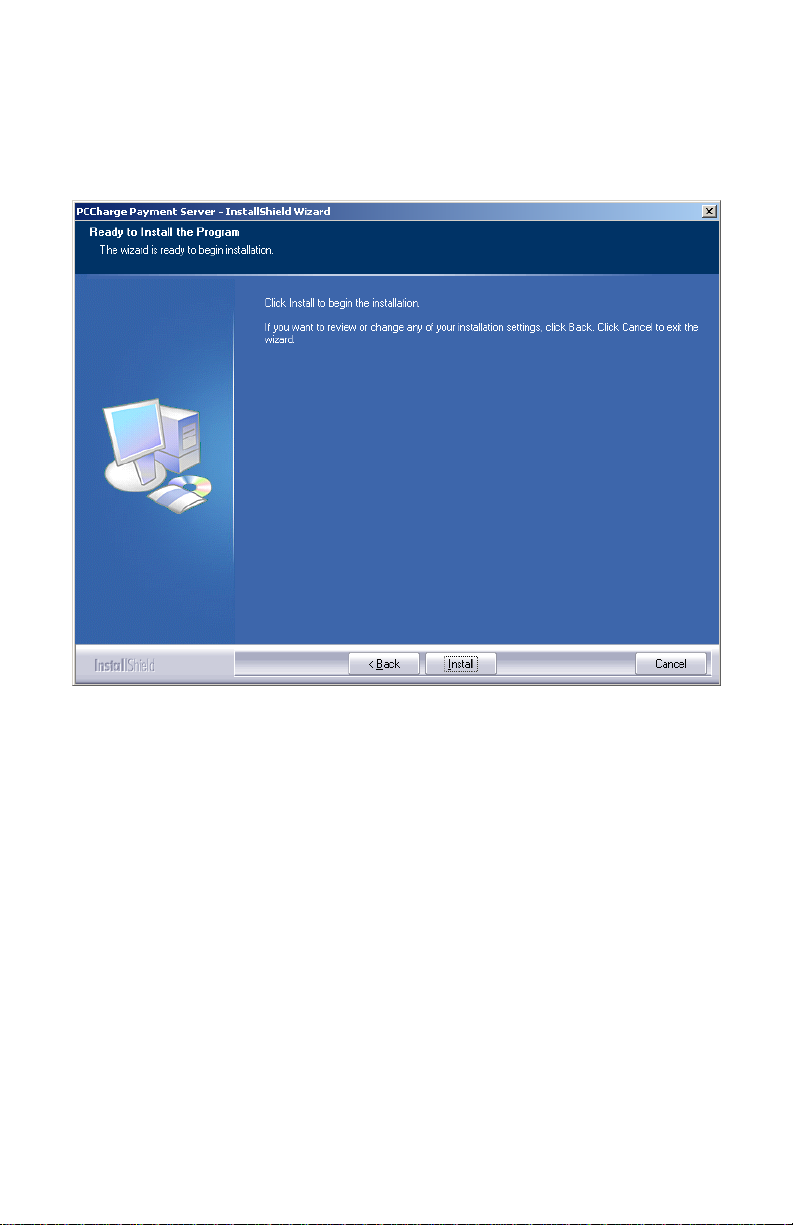

Ready to Install!

You are now ready to install PCCharge Payment Server. Click Next > to proceed to the

next step in the installation process.

27

Page 28

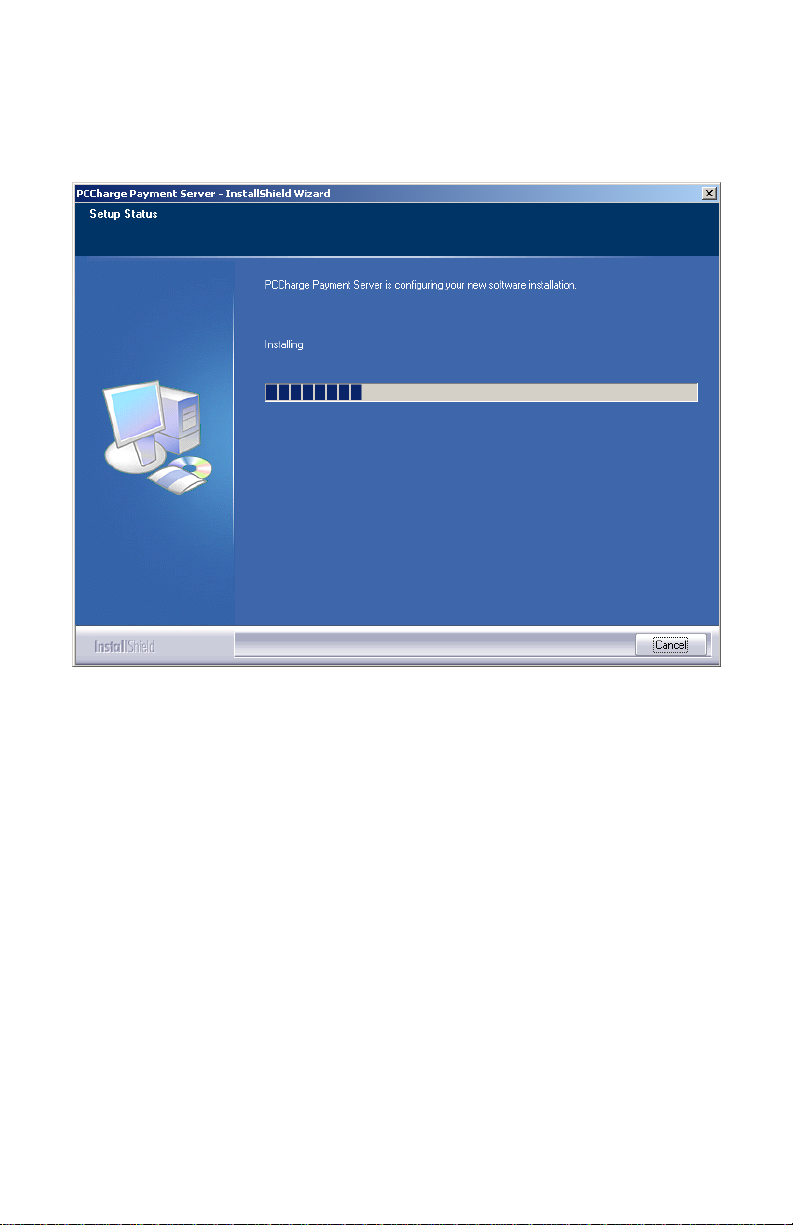

Installing

PCCharge is now being installed to your system. This process should only take a few

minutes.

28

Page 29

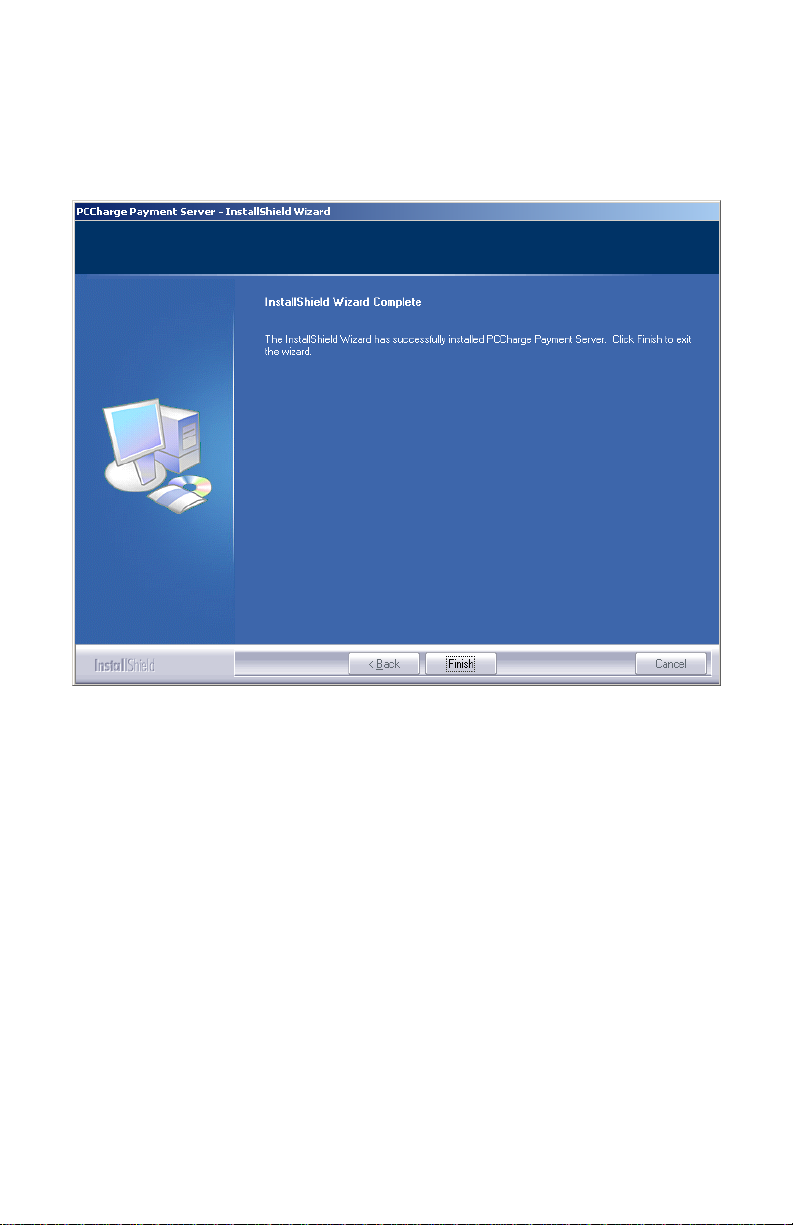

Installation Completed!

The installation process is complete. You may now remove the PCCharge Installation CD

from your computer. Click Finish to proceed to The Setup Process.

29

Page 30

The Setup Process

During the first use of PCCharge, you are automatically taken through a setup process. If

you need to make changes to the following settings at any time after the initial software

setup, you can access all of the setup parameters from the Setup menu.

30

Page 31

Starting PCCharge Payment Server

1. Click the Windows Start button (its default location is the bottom-left of your screen).

2. Click Programs (or Program Files).

3. Click VeriFone.

4. Click PCCharge Payment Server.

5. The following shortcuts are available:

• PCCharge Payment Server Help File - Also available within PCCharge

• PCCharge Payment Server Manual - PDF version of the PCCharge manual

• PCCharge Payment Server Appendices - PDF version of PCCharge

Appendices

• PCCharge Payment Server Read Me - The PCCharge "Readme" file

• PCCharge Payment Server - The PCCharge executable

• Uninstall PCCharge Payment Server - Uninstalls PCCharge

If you installed the Complete setup of PCCharge, you will also see:

• Auto Settle Utility - Explained in the section Auto-Settle Utility (see page 199)

• Batch Utility - Explained in the section Batch Management (see page 186)

• RAS Setup Utility - For American Express Split Dial users (see page 46)

6. Click PCCharge Payment Server to start PCCharge Payment Server.

Note: At startup, PCCharge will check to see if you're upgrading from a

(

/

version of PCCharge older than 5.7. If you are, a window will appear that briefly

describes our database-purging feature. For detailed information on this feature

and its usage, consult the section Transaction Database Purging (see page

173).

Technical Details: If you chose to not have PCCharge added to the

Windows Start Menu, you'll need to manually start PCCharge. You can do so

by browsing to the PCCharge installation directory via Windows Explorer. The

default location of the PCCharge executable is C:\Program

Files\Active-Charge\Active-Charge.exe.

31

Page 32

Accessing the User Interface

Simple Explanation: The PCCharge Payment Server user interface does

If you're going to use Payment Server directly, then you'll want to enable the user interface

to show up all the time. To enable the user interface to always appear onscreen, you'll have

to manually edit the PCCharge Payment Server shortcut.

Enabling the User Interface

1. Click the Windows Start button. Click Programs (or All Programs). Click VeriFone.

2. Right-click the PCCharge Payment Server shortcut. A menu will appear, listing

3. PCCharge Payment Server Properties will appear onscreen, and the Shortcut tab

4. Add /ui to the end of the program location shown in the Target: tab. There must be a

Example: "C:\Program Files\Active-Charge\Active-Charge.exe" /ui

5. Click OK. PCCharge Payment Server will now start up with its user interface

not appear by default, except during the installation of PCCharge. After

PCCharge has been completely set up and closed, the user interface will not

appear when the program is executed. This is because most users will use the

Payment Server in conjunction with some other software and will not need to

access the PCCharge interface.

Click PCCharge Payment Server.

several options. Left-click Properties.

should be shown as selected.

space between /ui and the last quote.

displayed.

32

Page 33

Do you have a Configuration Disk?

When PCCharge Payment Server is initially started, you will be asked if you have a

Configuration Disk. Did you get a companion disk (3½ inch floppy disk or CD) with the

installation CD? It may be labeled Configuration Disk or License Disk.

1. If you did NOT receive a companion floppy disk with your copy of PCCharge, click the

No button and proceed to the section Entering Your Serial Number (see page 34).

2. If you did receive a companion disk with your copy of PCCharge, insert it and click the

Yes button.

3. Click OK on the next message box after you have inserted the configuration disk.

• If your configuration disk is on CD, it should be automatically detected. If it is not,

PCCharge will display a window asking you to insert a disk into drive A. Click

4. PCCharge will display a Copy Configuration Files From… window (see figure

5. Click the file named Tid.pcc located on your companion disk to select it. The file's

Cancel.

below).

• If your configuration disk is on CD, you may need to select your CD drive. Click

the drop-down arrow next to the field labeled Look in: (near the top of this

window) in order to change to your CD drive.

name will become highlighted.

6. Click the Open button. You will be taken to a later step of the setup process -- the

exact step depends on what information has been installed on your companion disk.

Skip ahead to that step.

33

Page 34

Entering your Serial Number

The serial number is a sixteen-digit number in the format:

####-####-######-##

WARNING: PCCharge will not operate without a valid serial number.

Locating your Serial Number

• Look for the serial number on the back of the installation CD jewel case, on the

documentation provided with PCCharge, or on the software's packaging.

• If you can't find the serial number, contact the company that sold you PCCharge.

Entering your Serial Number

1. Type in your serial number in the serial number input boxes. It is not necessary to type

in the dashes (-).

2. Click the OK button to proceed to the next step of The Setup Process.

34

Page 35

Preferences

Simple Explanation: This Preferences window allows you to set up and

configure your copy of PCCharge. Many users will want to use the default

settings. However, we HIGHLY recommend that you review the descriptions of

the different options and settings listed below.

Click the OK button to exit the Preferences window. This will save any

changes you have made. If you've left the Password for the ‘system' user ID

blank, PCCharge will notify you of this. Click OK and continue on to the next

section, Advanced Configuration Setup (see page 39).

Configure System Options

Password for the ‘system' user ID -- (Default = Empty) (10 alpha/numeric characters) –

You may leave this blank unless you intend to use PCCharge in a multi-user environment

and would like to provide different levels of access. If you fill it out, PCCharge will

occasionally prompt you to enter a User Name and Password. The Password that you

enter in this Preferences window will be associated with the User Name System. Consult

the section Cashier Privileges Setup for more information on this subject (see page 104).

35

Page 36

Note: The password is case sensitive. Letters entered in upper or lower case

(

Last Valid Year -- (Default = 12) -- This allows you to set a maximum year for acceptable

expiration dates. You must make a business decision on what will be the latest expiration

date you will accept for credit cards. By default, PCCharge will only accept credit cards

within the expiration date range of the present year through 2012. Enter only the last two

digits of the maximum year.

must be re-entered in that same case whenever accessing a password

protected function.

WARNING: PCCharge is preprogrammed with an initial Last Valid Year.

Periodically, the Last Valid Year for credit cards will need to be advanced. You

are responsible for updating the Last Valid Year in the future.

Preferences

Require Duplicate Transactions to be Forced -- (Default = Checked) -- This option is a

safety feature. When checked, only one transaction for a certain amount can be processed

on a particular credit card number per day. This does not mean that you can't process other

transactions. It just prevents accidental duplicate transactions.

If this option is enabled, you can still charge a card for an amount already charged to that

card on the same day: simply put an "F" in front of the credit card number to force the

transaction.

Prompt for CPS 2000 Qualifiers -- (Default = Checked) -- Checking this option turns on a

reminder: if you forget to enter a Ticket Number, Address, or Zip Code when performing

a transaction, PCCharge will remind you to enter the missing information. Depending on

which processor you use, entering this information may qualify you for lower rates per

transaction.

Note: The CPS 2000 information must be entered for all non-swiped

(

Notify When Contract Transactions are Due on Startup -- (Default = Unchecked) -- Not

available in “Payment Server” version of PCCharge.

Magnetic Strip Verification (sm) -- (Default = Unchecked) -- This function is intended for

face-to-face swiped transactions. Checking this option enables PCCharge to prompt you for

the last four digits of the raised account number on the customer's credit card. You'll be

prompted for this number after a card is swiped into PCCharge and Process is clicked.

transactions to meet CPS Qualifications for Visa/MasterCard transactions.

36

Page 37

Credit Card Company

0000 0000 0000 0000

1234

GOOD THRU 09/09

John Q Smith

Note: MSV protects you from fraud related to credit cards with forged

(

Do not process Post-Auth if amount greater than Pre-Auth -- (Default = Unchecked) -When this option is checked, PCCharge will not allow a Post-Authorization transaction to

be processed if that amount is greater than the corresponding Pre-Authorization transaction

amount.

Prompt to Add Customer to Database -- (Default = Unchecked) -- Not available in

“Payment Server” version of PCCharge.

Use Default Processor -- (Default = Unchecked) -- This feature is utilized by third-party

integrated software. Leave this option unchecked unless otherwise instructed by the

developers of your integrated software or a PCCharge Technical Support Representative.

Display Transaction Elapsed Time -- (Default = Unchecked) -- If this option is checked,

the PCCharge transaction result message box will also display the amount of time elapsed

in between connecting to the processing company and receiving a result for the

transaction(s). This is a diagnostic / benchmarking feature.

Display Total Elapsed Time -- (Default = Unchecked) -- If this option is checked, the

PCCharge transaction result message box will also display the amount of time elapsed in

between a transaction (or batch of transactions) entering the PCCharge queue and

receiving a result for the transaction(s). This is a diagnostic / benchmarking feature.

Enable TCP/IP Client Reversals -- (Default = Checked) -- This feature is utilized by thirdparty integrated software. Leave this option unchecked unless otherwise instructed by the

developers of your integrated software or a PCCharge Technical Support Representative.

Mask Card Numbers on Customer Database Screen -- (Default = Checked) -- Not

available in “Payment Server” version of PCCharge.

magnetic strip information. If the information encrypted on the magnetic strip

does not match the last four digits of the raised credit card number on the front

of the card, PCCharge will not allow the transaction to be processed (if MSV is

enabled).

37

Page 38

Prompt for Visa Bill Payment -- (Default = Checked) -- If this option is checked and the

active processor is either NPC or Vital (VISA), PCCharge will display a prompt during a

transaction asking if it is a bill payment transaction. For more information on bill payment,

consult the Notes for these processors in the PCCharge Appendices.

Cards Accepted

(VISA, MasterCard, AMEX, Discover, and Private Label Cards are checked by default.

All other options are unchecked by default)

Some credit card processing companies will authorize a credit card transaction even if your

company's account is not set up to process that type of credit card. However, transactions

for that card type will not be settled. If your company's account is not set up to process

transactions for a particular type of credit card and you want to avoid any accidental

authorizations of that card type, uncheck the option that applies to that card type.

Example: Your company's credit card processing account is not set up to process

American Express cards, but your credit card processing company authorizes them

anyway. If you check the option AMEX, American Express transactions will be authorized

even though your company's credit card processing account can't settle those transactions.

If you uncheck the option AMEX, PCCharge will prevent American Express transactions

from accidentally being authorized.

Private Label Cards -- (Default = Checked) -- If you check this box, private label cards will

be accepted. Uncheck this option if you only want to process transactions using major

credit cards. Consult the section Private Label Card Setup for more information (see page

110).

Advanced

Click the Advanced button if you want to access the Advanced Configuration Setup

window (see page 39). The Advanced Configuration Setup window includes some of the

more advanced options of PCCharge. Most users should click OK and skip ahead to the

section Merchant Setup Wizard (see page 41).

38

Page 39

Advanced Configuration Setup

Simple Explanation: This Advanced Configuration Setup window

allows you to fine-tune your copy of PCCharge. You may access this window

by clicking the Advanced button on the Preferences window (described in the

previous section).

Most users will want to use the default settings. Click the OK button to exit the

Advanced Configuration Setup window (this will save any changes you have

made). Next, click the OK button in the Preferences window. Continue on to

the next section, Merchant Setup Wizard (see page 41)

Timer Setup

Queue Timer Interval: -- (Default = 00.50) -- For initial set up, we recommend using the

default value. This value sets how often PCCharge checks for communication (via .inp

files) from other software. At its default, PCCharge checks every half-second for

communications. Do not lower the value of the interval. Checking more often would

consume too much of the system's resources. The default setting is generally the optimum

value for the interval.

39

Page 40

Multi-Trans Wait: -- (Default = Unchecked) -- If this option is unchecked, PCCharge will

hang up after every transaction when authorizing a group of transactions. Checking this

option allows PCCharge to attempt to keep the connection open when authorizing a group

of transactions. PCCharge can only keep the connection open if the credit card processing

company allows the connection to be kept open. Check with your payment processing

company to determine if they support this feature.

TCP/IP Communications

Use TCP/IP Connection -- (Default = Unchecked) -- Enable this option if you have an

interfaced program that will communicate with PCCharge Payment Server via sockets.

Local Port Number -- (Default = 31419) -- This is the port number/socket number used for

the TCP/IP connection.

Proxy Server Information

Use Proxy Server -- (Default = Unchecked) -- Not yet implemented.

IP Address: -- (Default = Empty) -- Not yet implemented.

Encryption Information

Private Key: -- (Default = Empty) -- Not yet implemented.

40

Page 41

Merchant Setup Wizard

Simple Explanation: The Merchant Setup Wizard makes it easy to

enter all of your credit card processing company information. Just follow the

simple on-screen instructions and refer to this manual for further explanation of

each section. All of the windows in the Wizard are accessible at any time after

initial setup.

Click OK and continue on to the next section, Credit Card Processing

Company Setup.

41

Page 42

Credit Card Processing Company Setup

Simple Explanation: This window allows you to set up your merchant

account in PCCharge. This is the information that identifies your payment

processing account. You should have received these numbers from your bank

or your merchant service provider. Different payment processing companies

may refer to these numbers by different names, but PCCharge refers to them

all as Credit Card Company Numbers.

Setting Up Your Credit Card Processing Account

1. Click the small drop-down arrow button (to the right of the Credit Card Company

field). Select the Credit Card Company that your business will be using. If you don't

know which to select, check with your processing company, bank, or merchant service

provider (or whoever set up your account).

2. Check to see if your account number already appears in the Credit Card Company

Numbers section of this window.

• If your account number isn't shown in the Credit Card Company Numbers

section of this window, click the Add button. Proceed to the next section,

Register New Merchant License.

• If it does, your account has already been set up for you. Click your Credit Card

Company Number to select it. Click the Next button and proceed to the section

Credit Card Processing Company Extended Data Fields (see page 44).

42

Page 43

Register New Merchant License

1. Before you enter your credit card company number into this window, refer to your

PCCharge Appendices. As you go through the following steps, you'll need to review

the section of Appendix A that gives detailed information on your credit card

processing company. We HIGHLY recommend that you print out and store that

section of the PCCharge Appendices.

• To access the PCCharge Appendices, click the Windows Start button, then

Programs (or All Programs), then VeriFone, then PCCharge Payment Server,

then PCCharge Payment Server Appendices.

2. The PCCharge Appendices will describe how your credit card company number

should look, how long it should be, etc.

3. Enter your credit card company number into the box labeled Merchant/TID. Type it in

just as it appears on the paperwork you received from your processing company,

bank, or merchant service provider (or whoever set up your account). This information

may be case-sensitive, so use uppercase or lowercase as necessary.

4. Click OK. PCCharge will present you with a System Code and will ask you to type in

a Security Code. This number will be supplied to you by VeriFone via one of the two

following methods:

• Internet Setup -- You can get your Security Code online by visiting

register.pccharge.com. This is typically the fastest way to get a Security Code.

• Phone Setup – You can call us at 1-877-659-8981. The time it takes to obtain a

Security Code via phone depends on our current level of support activity.

5. After entering your Security Code, click OK. PCCharge will return to the previous

window. You may now proceed to the following section, Credit Card Processing

Company Extended Data Fields.

43

Page 44

Credit Card Processing Company Extended Data Fields

Note: As you can see, there isn't a picture of your Credit Card Processing

(

1. Enter the extended information as required by your credit card processing company.