SageAccpac SIMPLY ACCOUNTING Accounting Manual

Simply Accounting

Accounting Manual

Canadian Version

© Copyright 1998 ACCPAC® INTERNATIONAL, INC. All rights reserved.

ACCPAC INTERNATIONAL, INC., Publisher

No part of this documentation may be copied, photocop ied, repro duced, translated,

microfilmed, o r o therwise duplic ated on any m edium w ithou t written consent o f

ACCPAC INTERNATIONAL.

Use of the software programs described herein and this documentation is subject to the

ACCPAC IN TERN A TIO N A L Lic ense A greem ent enc lo sed in the so f tware p ack age.

This software and its documentation are intended to provide guidance in regard to the subject

matter covered. They are sold with the understanding that the author and publisher are not

herein engaged in rendering legal, investment, tax, or other pro f essio nal services. If such

services are required, professional assistance should be sought.

All product names referenced herein are trademarks of their respective companies.

Contents

Chapter 1: Listing the Things a Business Owns and

Owes

Starting a Business

.............................................................

Chapter 2: The Balance Sheet

Assets, Liabilities and Equity

Changes in Assets, Liabilities and Equity

....................................................

.........................................

Chapter 3: Changes in Equity

Changes Caused by Withdrawals

Changes Caused by Earnings

................................................

....................................................

Chapter 4: Recording How Earnings Were Made

Revenues and Expenses

When to Record Revenues and Expenses

........................................................

.........................................

Chapter 5: Recording Changes to the Balance

1–1

2–1

2–2

3–1

3–1

4–1

4–3

Sheet

Recording Transactions

Debits and Credits

Debits and Credits on the Balance Sheet

Revenues and Expenses

.........................................................

.............................................................

.....................................................

......................................

Accounting Manual iii

5–1

5–4

5–7

5–8

Chapter 6: A Separate Income Statement

Why and How

Debits and Credits Affect Both Statements

................................................................

.......................................

Chapter 7: The Journal

Why and How

National Construction's Journal

................................................................

.................................................

Chapter 8: The Ledger

Why and How

Posting

.......................................................................

................................................................

Chapter 9: Manual Accounting Systems

Chapter 10: Classified Financial Statements

The Balance Sheet

Assets

Liabilities

Equity

The Income Statement

Revenues

Expenses

Net Income

...................................................................

...................................................................

............................................................

................................................................

........................................................

.................................................................

.................................................................

...............................................................

6–1

6–2

7–1

7–3

8–1

8–2

10–1

10–1

10–2

10–2

10–3

10–4

10–4

10–4

Chapter 11: Adjusting Entries

When and Why

Prepaid Expenses

iv Simply Accounting

...............................................................

.............................................................

11–1

11–2

Use of Supplies

Bad Debts

Depreciation

Accrued Expenses

Accrued Revenues

...............................................................

....................................................................

..................................................................

.............................................................

............................................................

Chapter 12: The Finished Financial Statements

Chapter 13: Starting the Next Accounting Period

11–3

11–3

11–4

11–5

11–7

Closing the Books

Opening the Books

.............................................................

............................................................

Chapter 14: Summary of Financial Statement

Preparation

Chapter 15: Other Types of Legal Organizations

Partnerships

Corporations

..................................................................

.................................................................

Chapter 16: Subsidiary Ledgers

Why and How

Accounts Receivable

Accounts Payable

Payroll

Inventory

.......................................................................

................................................................

..........................................................

.............................................................

.....................................................................

13–1

13–3

15–1

15–3

16–1

16–2

16–2

16–3

16–3

Accounting Manual v

Chapter 17: Open Invoice Accounting for

Payables and Receivables

Late Payment Charges

Discounts

Bad Debts

Prepayments

....................................................................

....................................................................

.................................................................

........................................................

Chapter 18: Payroll Accounting

Determining an Employee's Gross Earnings

Regular Pay

Overtime Pay

Salary

Commission

Taxable Benefits

Vacation Pay

..............................................................

.............................................................

....................................................................

..............................................................

..........................................................

.............................................................

Determining the Employee's Deductions

CPP Contribution

EI Premiums

.........................................................

............................................................

Registered Pension Plan Contributions

...................................................................

Union

Income Tax

Medical

GST Payroll Deductions

..............................................................

.................................................................

..................................................

Calculating the Employer's Associated Expenses

CPP and EI Expenses

Employer's WCB Expenses

.....................................................

...............................................

Updating the Employee's Payroll Record

Creating the Journal Entries

..................................................

Remitting Funds to the Receiver General and Other Agencies

Ontario Employer Health Tax

................................................

Payroll Accounting in the Province of Quebec

.....................................

........................................

.....................................

...............................

......................................

..................................

...................

17–1

17–1

17–2

17–3

18–3

18–4

18–4

18–5

18–5

18–6

18–6

18–8

18–9

18–10

18–12

18–13

18–13

18–14

18–15

18–16

18–16

18–17

18–17

18–19

18–19

18–20

18–22

vi Simply Accounting

Chapter 19: Inventory Accounting

Accounting Control of Inventory

General Ledger Accounts in Inventory Accounting

Tax Considerations in Accounting for Inventory

Goods and Services Tax

Provincial Sales Tax

......................................................

...............................................

...............................

.................................

....................................................

Chapter 20: Cost Accounting

Project Costs

Profit Centres

..................................................................

.................................................................

Chapter 21: Accounting for the GST and PST

Preparing for Tax Accounting

Setting Up General Ledger Accounts

Accounting for Purchases

Accounting for Sales

..........................................................

GST Payroll Deductions

Adjustments

..................................................................

Clearing the Tax Accounts

..................................................

........................................

......................................................

.......................................................

.....................................................

19–3

19–4

19–8

19–8

19–10

20–1

20–2

21–1

21–1

21–2

21–3

21–4

21–4

21–5

Glossary

Index

Accounting Manual vii

Chapter 1

Listing the Things a Business

Owns and Owes

This chapter discusses starting a company, and the relationship

between the things a company owns and the money it owes.

Starting a Business

Jim Brown quits his job and starts his own company to do small

construction contracts. The company is called National

Construction and is a proprietorship. A proprietorship is a

business which keeps accounting records separate from those of

its owner but is not legally separate from its owner. On

February 1, 1995, Brown deposits $50,000 in National

Construction's bank account.

The financial position of the company is a summary of what it

owns and the claims against the things that it owns on the

date of the summary. It can be compared to a snapshot that

shows the position at a specific point in time.

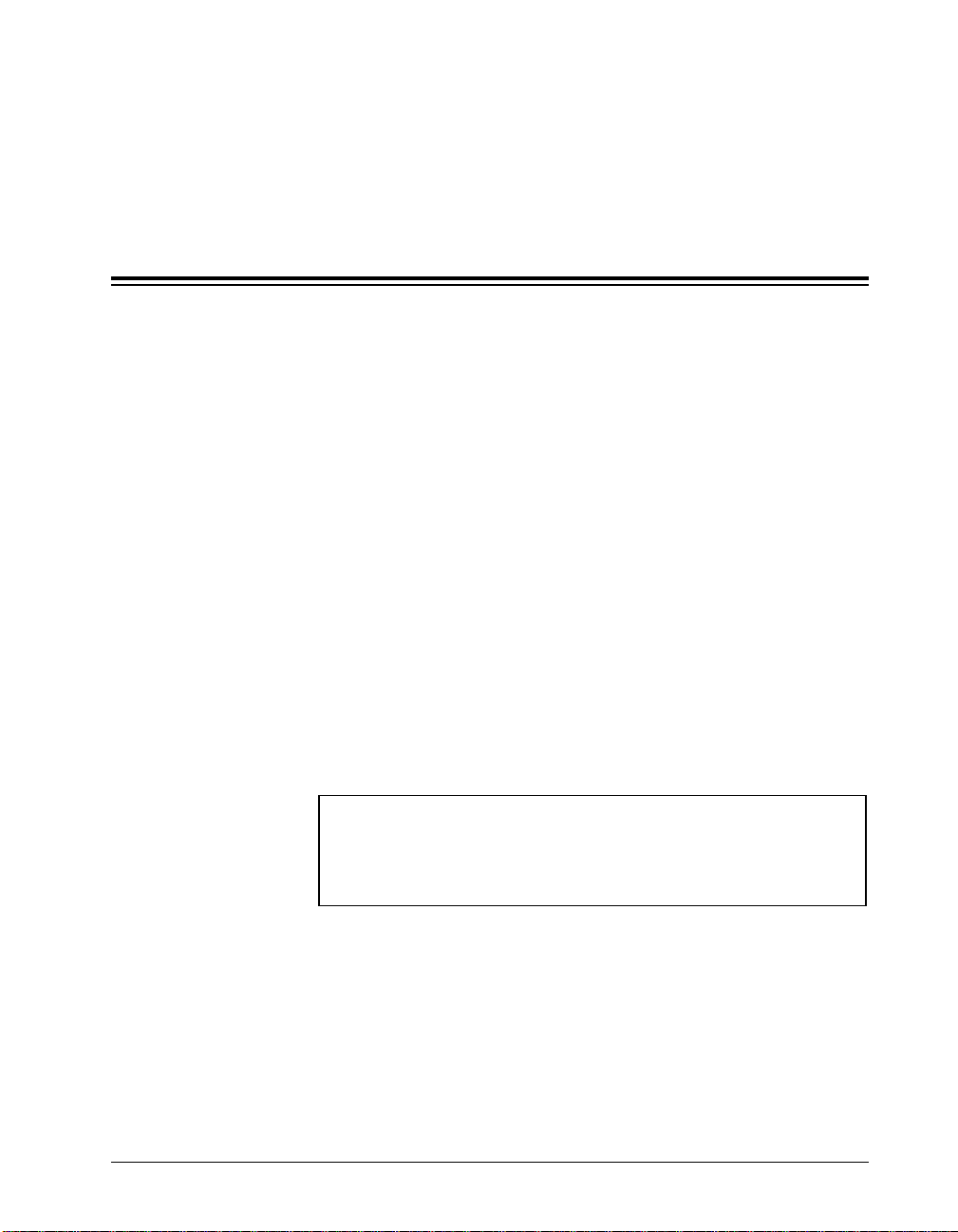

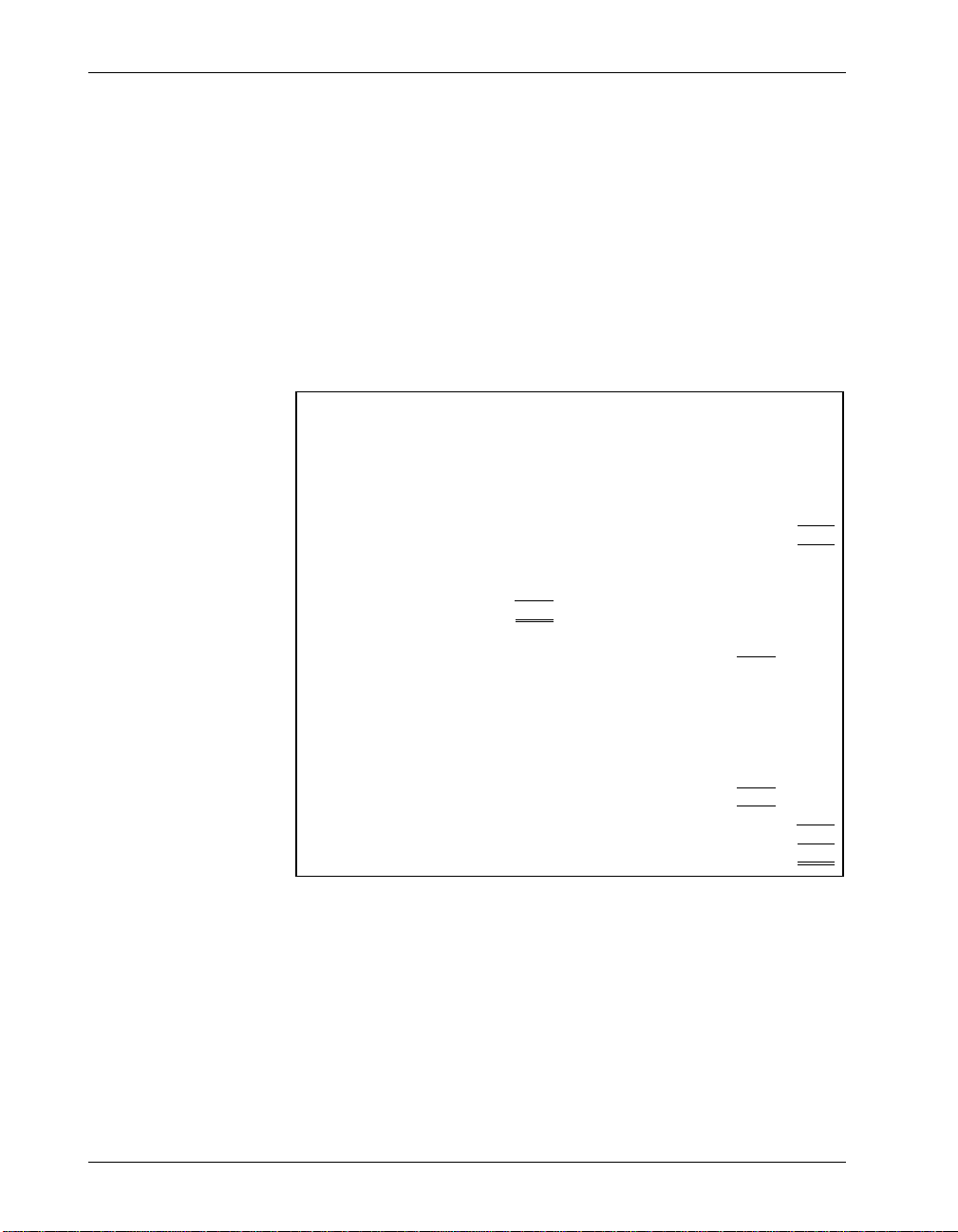

National Construction

February 1, 1995

Things Owned: Claims Against Things Owned:

Cash in Bank $50,000 Jim Brown $50,000

On February 2, National Construction pays cash to buy a dump

truck that costs $10,000. This makes the company's list of things

owned and claims against things owned look like this:

Accounting Manual 1–1

Starting a Business

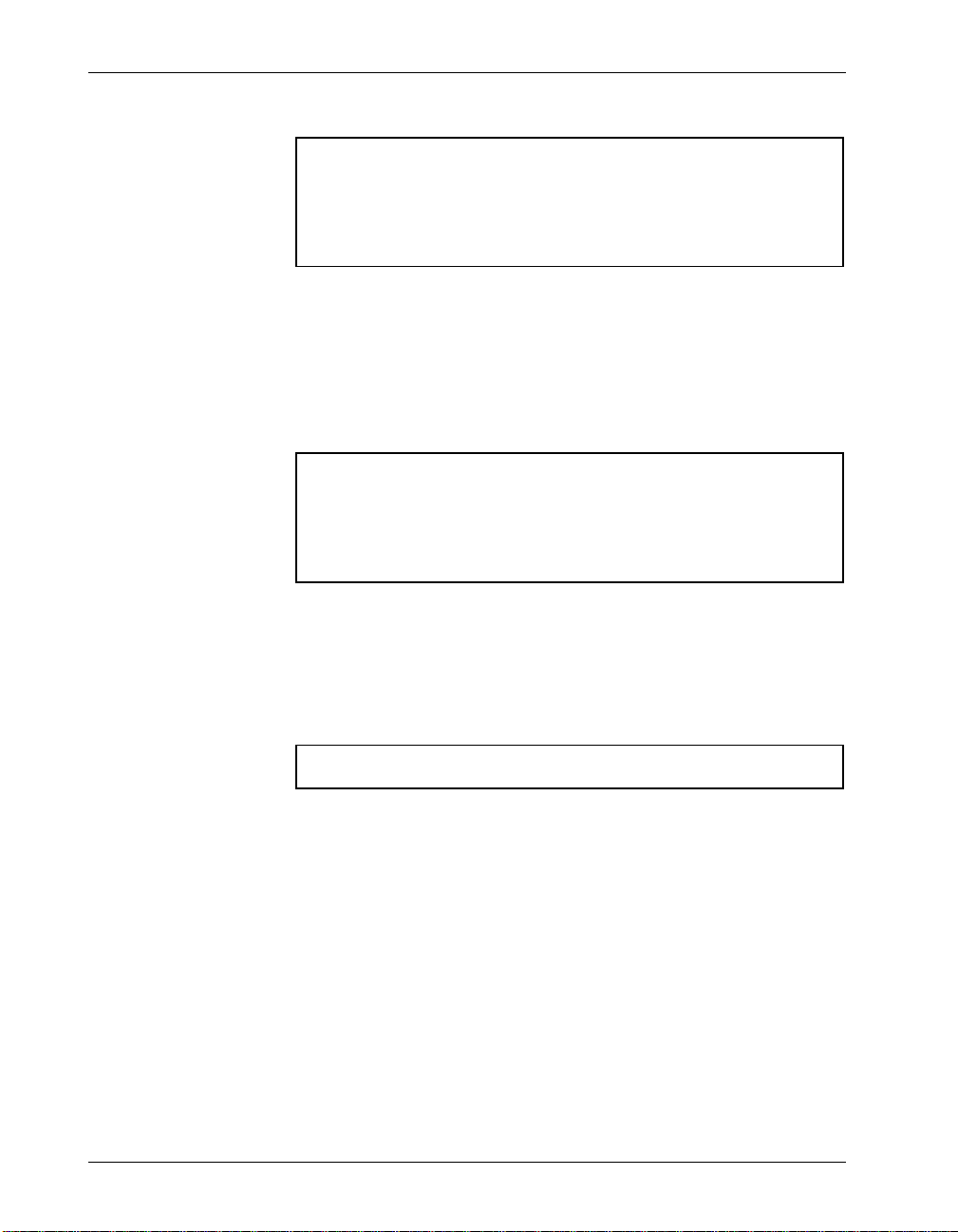

National Construction

February 2, 1995

Things Owned: Claims Against Things Owned:

Cash in Bank $40,000 Jim Brown $50,000

Truck 10,000

Brown gets his first contract, but to complete it he needs to buy

another truck. It costs $12,000, and on February 3 he convinces

his banker to lend National Construction the money to buy it.

The loan is for a five-year term. National Construction now has

more trucks, but a new category is needed to describe the

bank's claim:

National Construction

February 3, 1995

Things Owned: Claims Against Things Owned:

Cash in Bank $40,000 Bank Loan $12,000

Trucks 22,000 Jim Brown 50,000

Everything the company owns was paid for with either the

bank's money or the money invested by the owner. Notice that

the value of the things owned equals the value of the claims

against things owned. This relationship is always true, and is

the basis for the entire accounting process:

Things Owned = Claims Against Things Owned

Let's look at another example. On February 4, National

Construction buys $1,000 worth of maintenance supplies for the

trucks and the supplier gives National 30 days to pay. Amounts

owed to a supplier who has given you credit are called accounts

payable.

1–2 Simply Accounting

Starting a Business

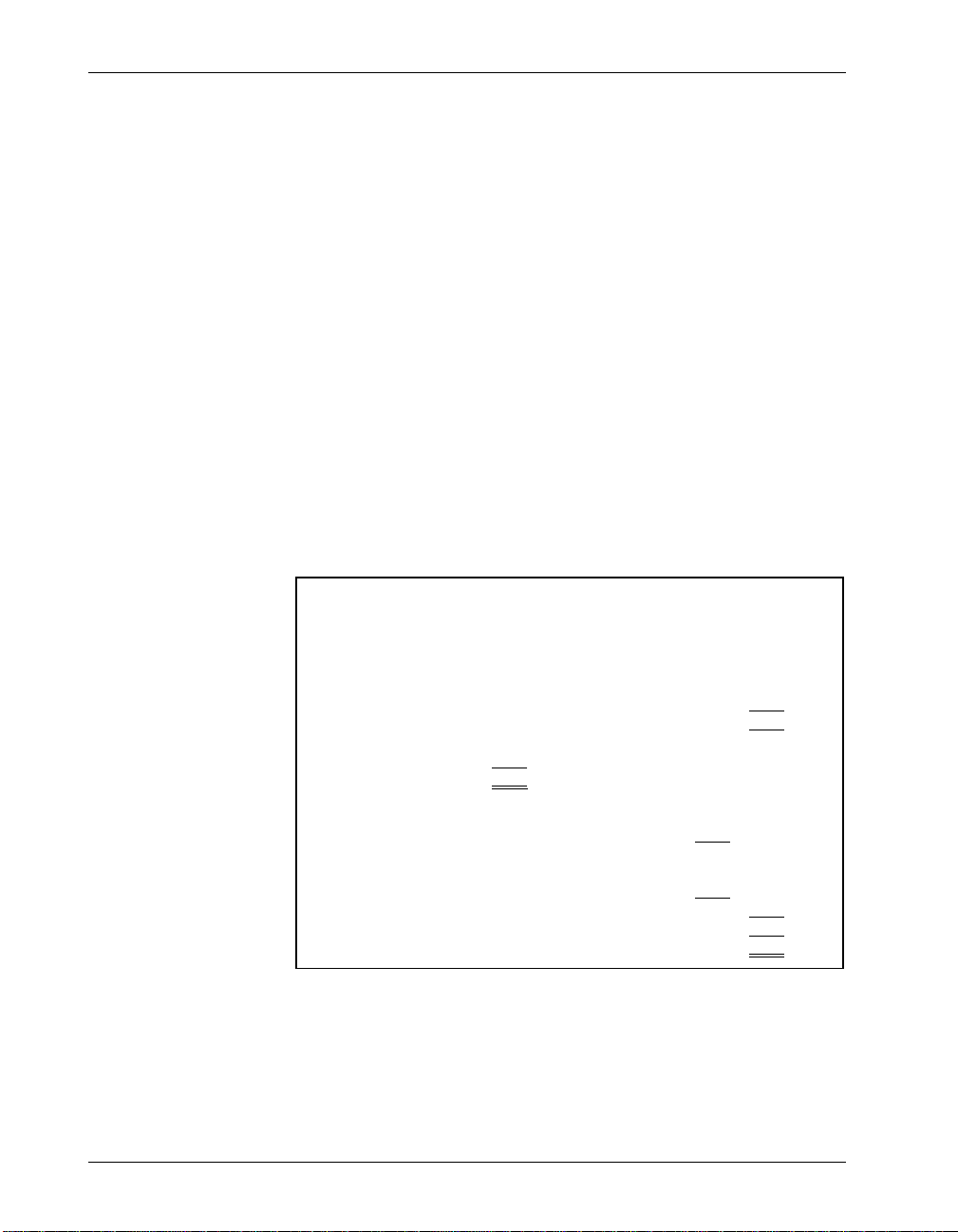

Here is the updated summary:

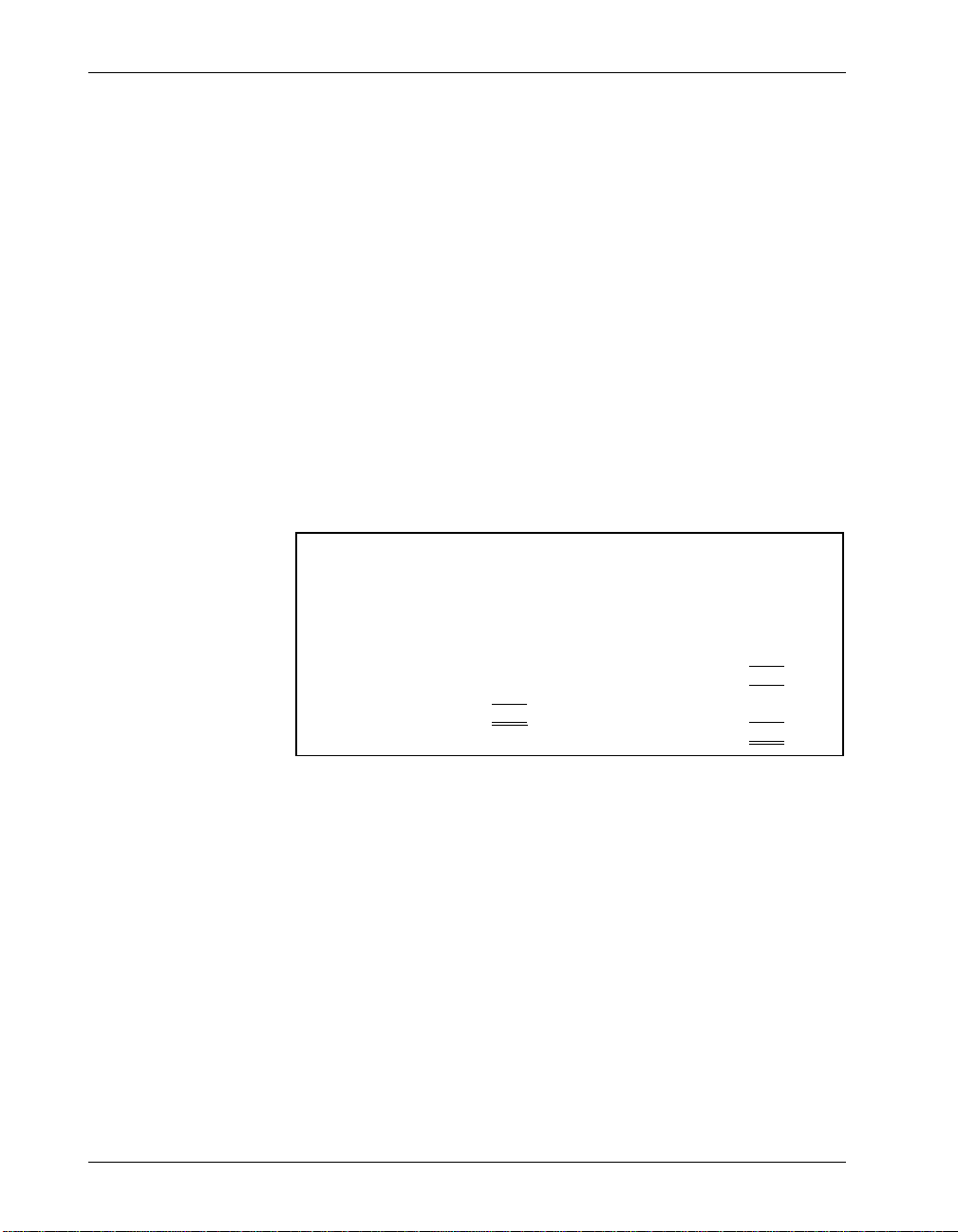

National Construction

February 4, 1995

Things Owned: Claims Against Things Owned:

Cash in Bank $40,000 Accounts Payable $ 1,000

Trucks 22,000 Bank Loan 12,000

Maintenance Supplies 1,000

63,000 63,000

Jim Brown 50,000

"Things owned" still equal the "claims against things owned,"

and the changes which were made resulted in an increase of the

same size to both the things owned and the claims against

things owned. Because this summary always balances, we call

this summary of things owned and claims against things owned

a balance sheet. On the balance sheet, things owned are listed

on the left, and claims against things owned on the right.

The claims against things owned are made by two groups of

people: the owner, and others. In law, the owner does not get

his investment back until others have been paid back. For this

reason, it makes sense to break the claims into two groups, with

claims by others ranked first:

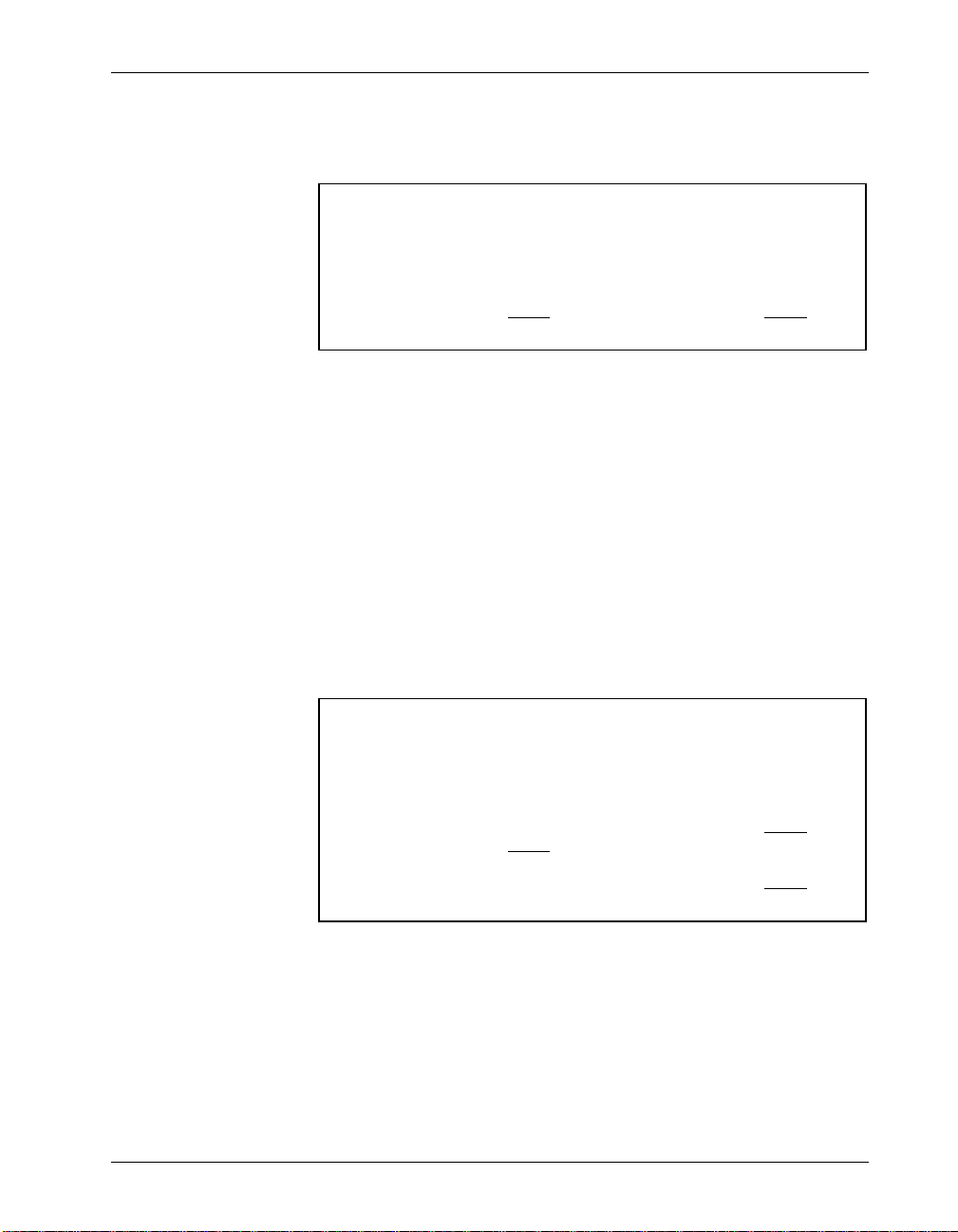

National Construction

Balance Sheet

February 4, 1995

Things Owned: Claims Against Things Owned:

Cash in Bank $ 40,000 Accounts Payable $ 1,000

Trucks 22,000 Bank Loan 12,000

Maintenance Supplies 1,000 13,000

$ 63,000 Claims by Owner:

Jim Brown 50,000

$ 63,000

You are now ready to go to Chapter 2 to find out more about

the balance sheet.

Accounting Manual 1–3

Chapter 2

The Balance Sheet

This chapter discusses a company's assets, liabilities, and

equity, and shows how changes in any one of these affect the

other two.

Assets, Liabilities and Equity

Things owned by the company are called assets. Claims by

others are called liabilities. If the owner wants to get back his

investment, he must sell the assets and pay off the liabilities.

What is left over is the owner's equity in the company. The

balance sheet is now presented with the new words:

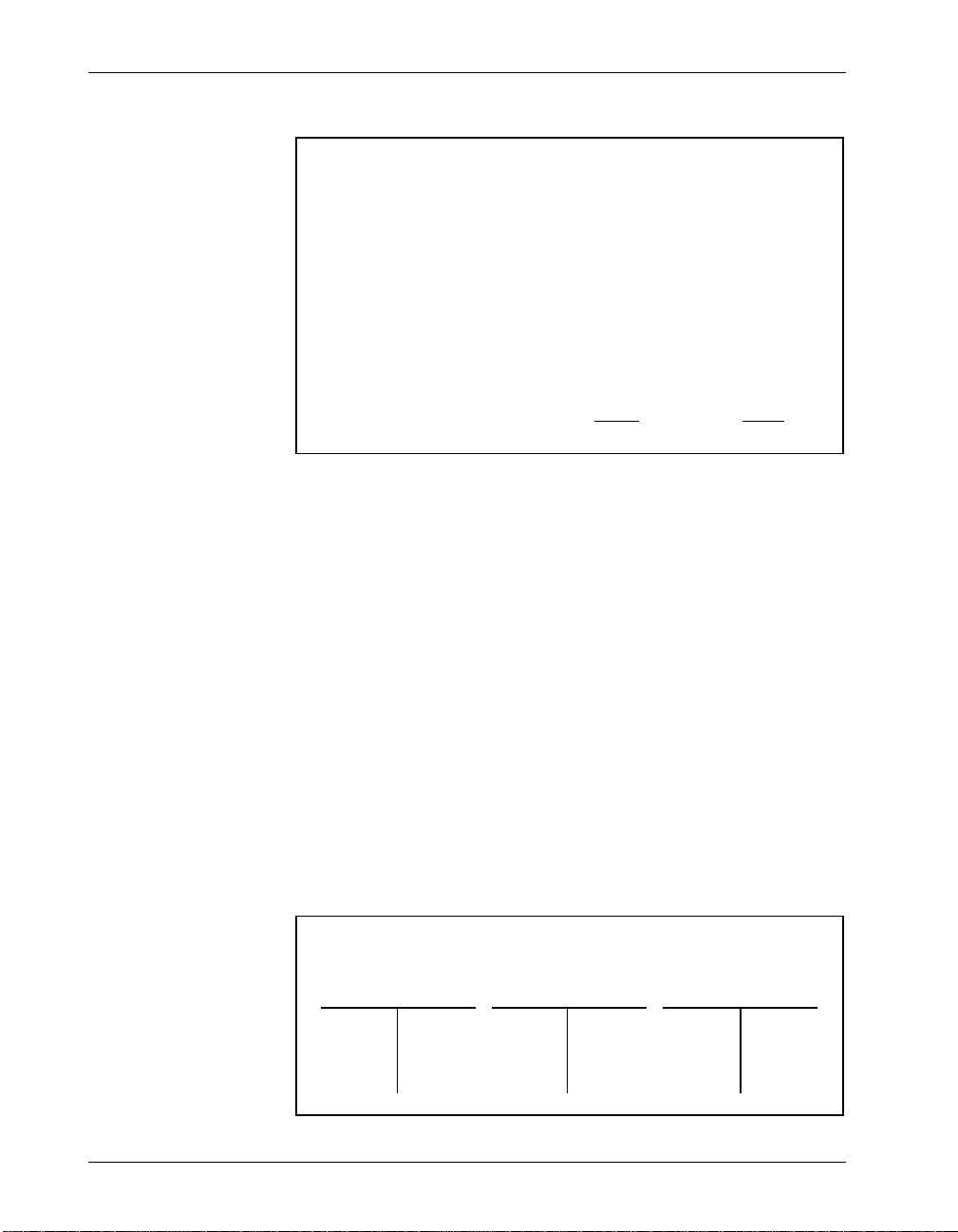

Assets: Liabilities:

Cash in Bank $ 40,000 Accounts Payable $ 1,000

Trucks 22,000 Bank Loan 12,000

Maintenance Supplies 1,000 13,000

$ 63,000

National Construction

Balance Sheet

February 4, 1995

Equity:

Jim Brown 50,000

$ 63,000

Our statement "Things Owned = Claims Against Things

Owned" can now be rewritten:

Assets = Liabilities + Equity

This statement is the basis of accounting and is accounting's

single most important concept. It is called the accounting

equation.

Accounting Manual 2–1

Changes in Assets, Liabilities and Equity

Changes in Assets, Liabilities and Equity

Since assets equal liabilities plus equity, we know that if assets

increase, then liabilities plus equity must increase by the same

amount. The accounting equation can also be used to say that

changes in assets equal changes in liabilities plus changes in

equity.

Here are some more examples so we can see how assets,

liabilities, and equity are related.

On February 5, National Construction buys some furniture

costing $2,000 for the office Jim Brown has set up in his home.

The supplier gives National 30 days to pay the bill. Our updated

balance sheet has a new asset called furniture, and accounts

payable has increased by the amount of the supplier's bill:

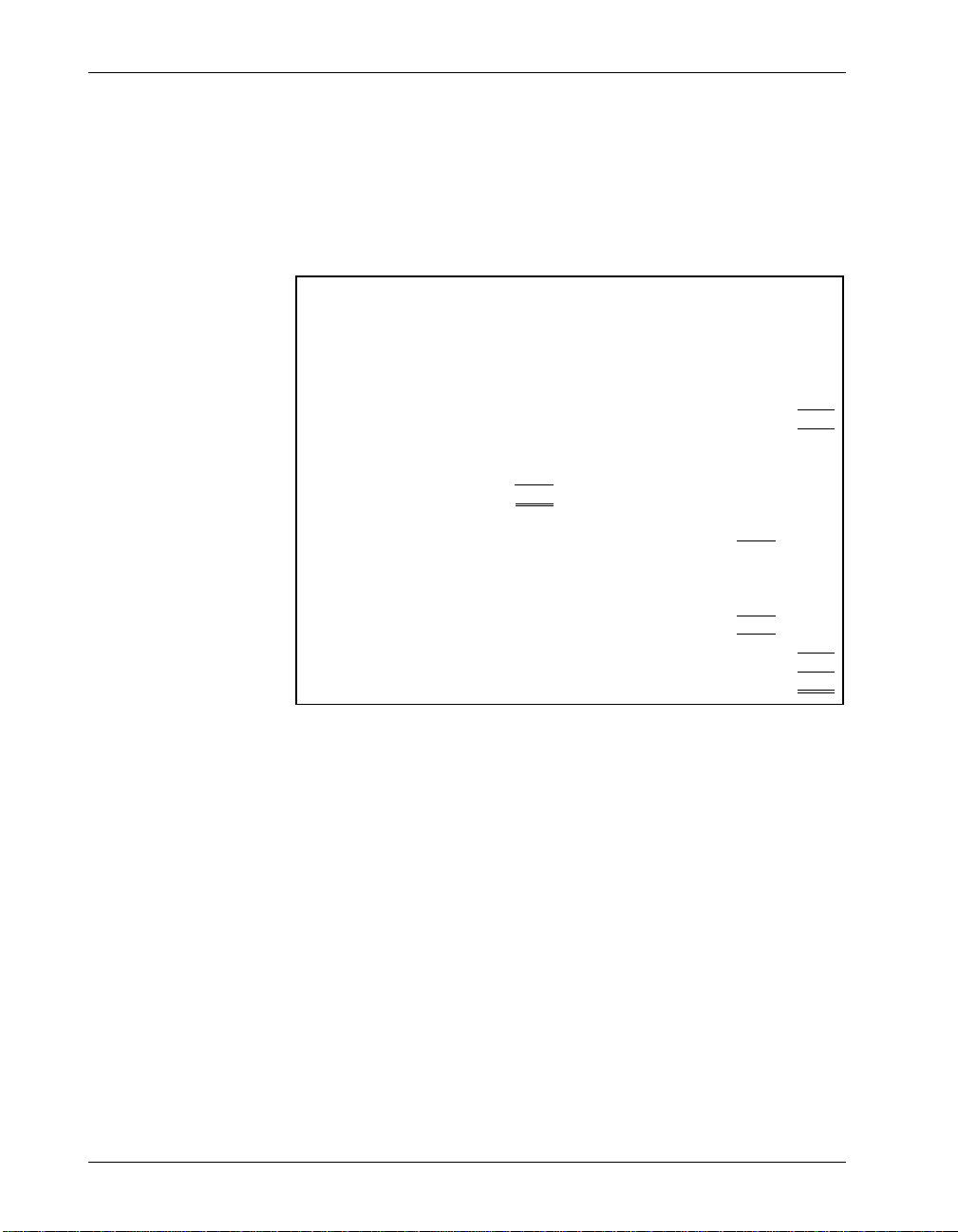

National Construction

Balance Sheet

February 5, 1995

Assets: Liabilities:

Cash in Bank $ 40,000 Accounts Payable $ 3,000

Trucks 22,000 Bank Loan 12,000

Maintenance Supplies 1,000 15,000

Furniture 2,000

$ 65,000

Equity:

Jim Brown 50,000

$ 65,000

2–2 Simply Accounting

On February 7, National buys a front-end loader which costs

$20,000, but this time the bank will only lend $15,000 and the

company must make a down payment of $5,000. Because Brown

expects to buy more equipment related to construction, he

categorizes the front-end loader as Construction Equipment and

puts a value of $20,000 beside it.

Changes in Assets, Liabilities and Equity

He also records the decrease in Cash in Bank of $5,000 (to

$35,000) and the increase in the Bank Loan of $15,000 (to

$27,000):

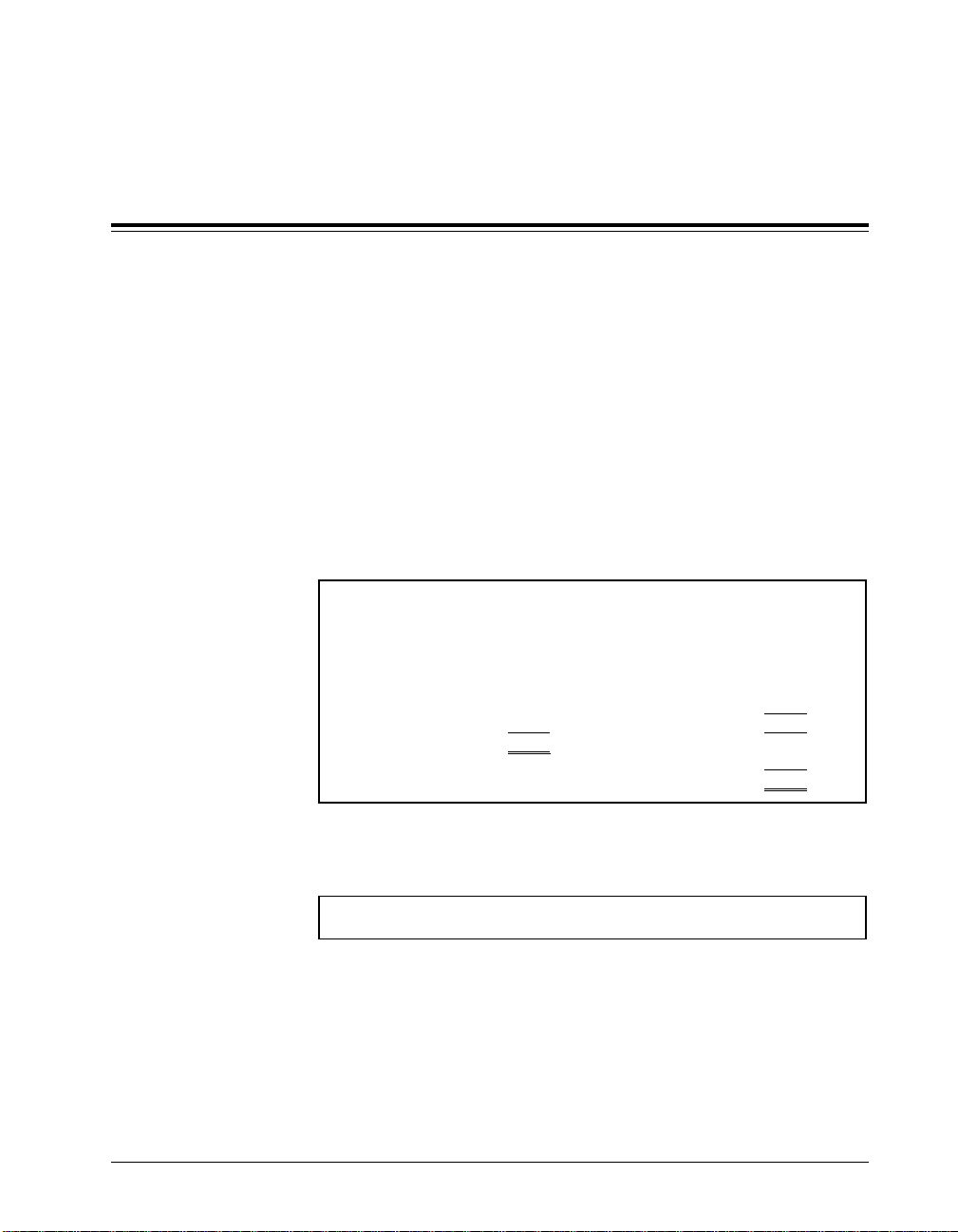

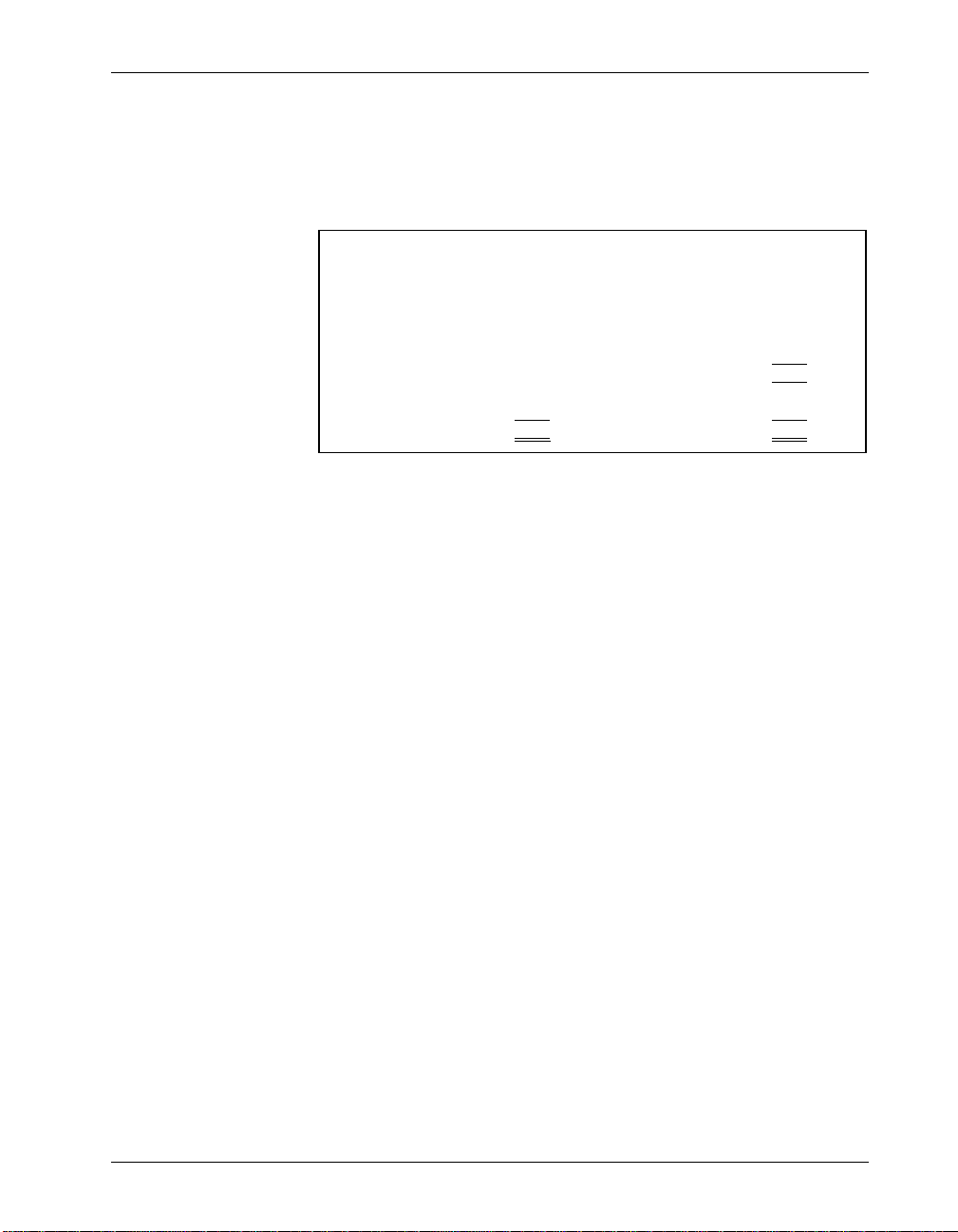

National Construction

Balance Sheet

February 7, 1995

Assets: Liabilities:

Cash in Bank $ 35,000 Accounts Payable $ 3,000

Trucks 22,000 Bank Loan 27,000

Maintenance Supplies 1,000 30,000

Furniture 2,000 Equity:

Construction Equipment 20,000

$ 80,000

Jim Brown 50,000

$ 80,000

You are now ready to go to Chapter 3 to find out more about

changes in withdrawals, earnings, and losses.

Accounting Manual 2–3

Chapter 3

Changes in Equity

There are two ways for equity to change. They are investments

or withdrawals by the owner, and earnings or losses by the

company. We have already covered investments by the owner,

so this section will now cover withdrawals, earnings, and

losses.

Changes Caused by Withdrawals

On February 22, Brown needs $2,000 to repair the family car

and takes it out of the company's bank account because he

doesn't have enough money personally. When a proprietor

takes money out of his business, it is called a withdrawal.

The Cash in Bank category goes down by $2,000 (to $33,000)

and the equity category goes down by $2,000 (to $48,000):

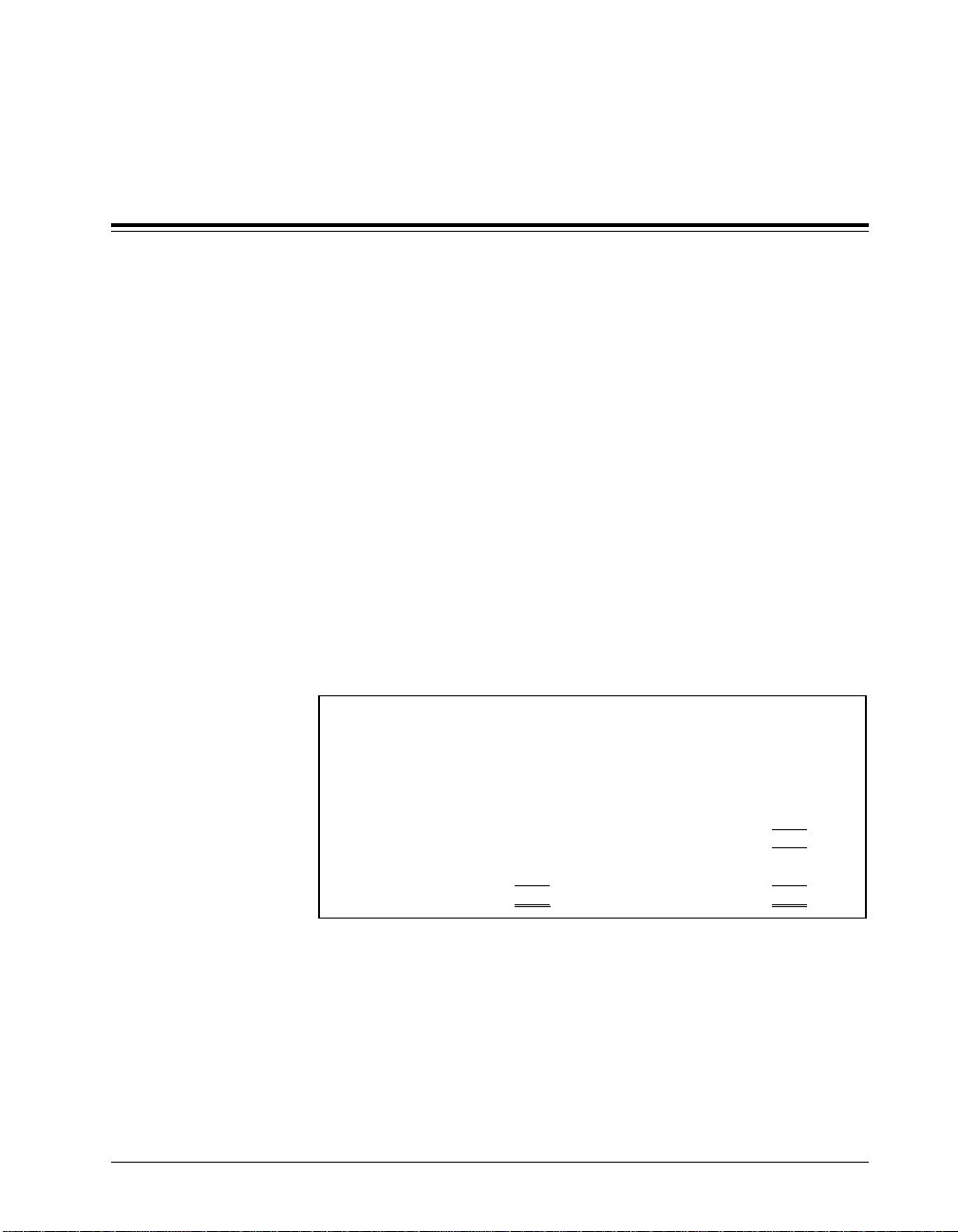

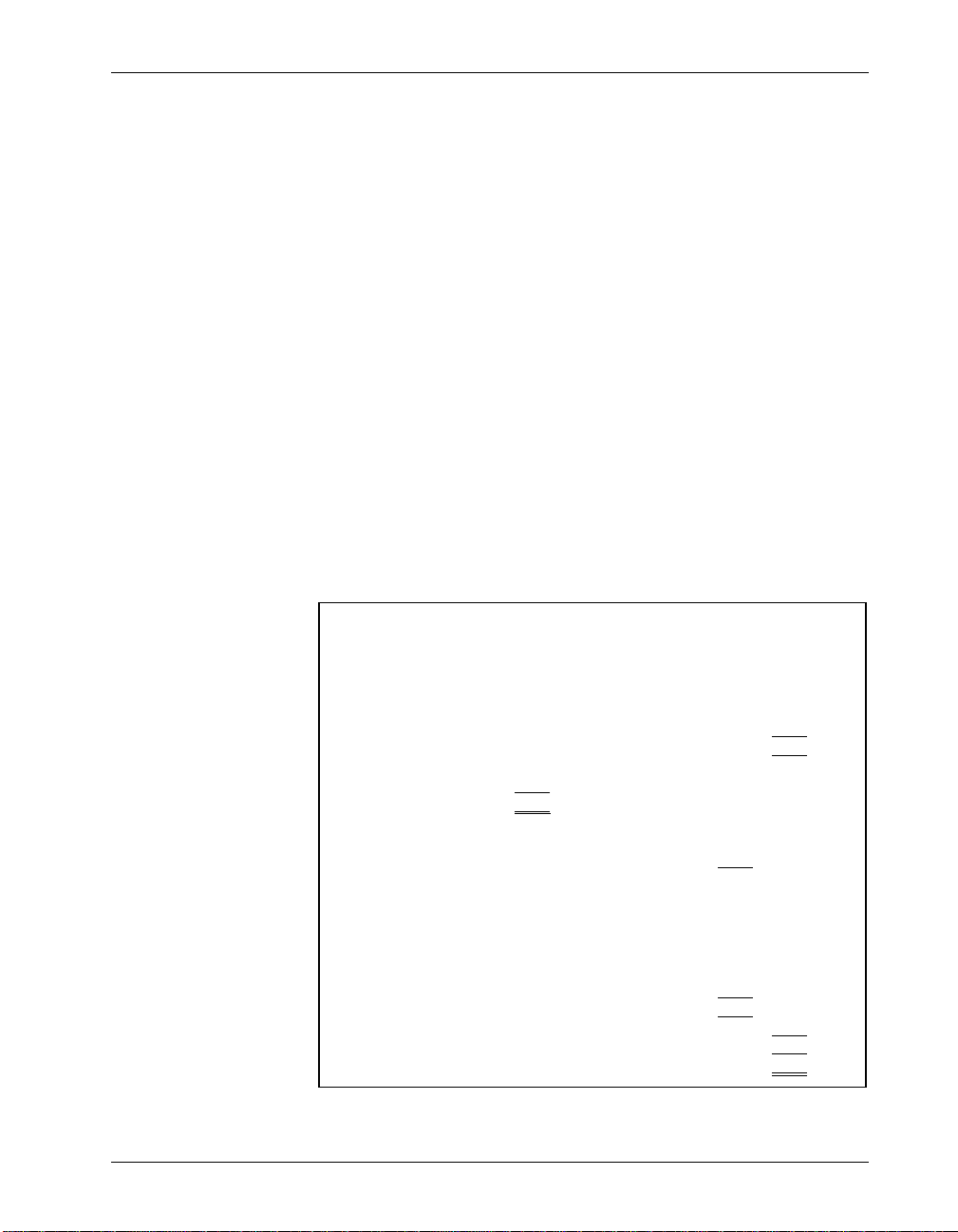

National Construction

Assets: Liabilities:

Cash in Bank $ 33,000 Accounts Payable $ 3,000

Trucks 22,000 Bank Loan 27,000

Maintenance Supplies 1,000 30,000

Furniture 2,000 Equity:

Construction Equipment 20,000

$ 78,000

Changes Caused by Earnings

Brown completes his first gravel hauling contract on February

27 and National Construction is paid $5,000 cash. The Cash in

Bank category therefore increases by $5,000 to $38,000.

Balance Sheet

February 22, 1995

Jim Brown 48,000

$ 78,000

Accounting Manual 3–1

Changes Caused by Earnings

The client paid for the gas, so the hauling contract didn't cost

National anything except Brown's time. This means that

National doesn't owe any of the money to anyone else, and

therefore earned the entire $5,000. Now Brown has to decide

where to record the money that the company earned.

Since assets increased by $5,000 (cash was received), and the

amount of liabilities didn't change (National doesn't owe

anyone anything extra as a result of earning the $5,000), we

know that equity must increase by $5,000 in order to keep the

accounting equation in balance.

This increase in equity was earned by the company, not

invested by the owner, so we show it as a separate category of

equity called Earnings.

Assets: Liabilities:

National Construction

Balance Sheet

February 27, 1995

Cash in Bank $ 38,000 Accounts Payable $ 3,000

Trucks 22,000 Bank Loan 27,000

Maintenance Supplies 1,000 30,000

Furniture 2,000 Equity:

Construction Equipment 20,000

$ 83,000

Jim Brown 48,000

Earnings 5,000

53,000

$ 83,000

3–2 Simply Accounting

If the company lost money in the future, the losses would

reduce the amount of the earnings by the amount of the loss.

For the same reasons that earnings has its own category,

withdrawals could also have its own category. It has not been

added at this point, though, in order to keep the balance sheet

relatively uncluttered.

You are now ready to go to Chapter 4 to find out about

revenues and expenses.

Chapter 4

Recording How Earnings Were Made

This chapter tells you how to record the money a company

takes in for the goods and services it provides for its customers,

and the money it spends to provide those goods and services.

Revenues and Expenses

Brown completes an excavating contract on March 1 for which

National is paid $6,000 cash. This time he has to pay an

equipment operator $2,000 in wages, which is paid in cash on

March 1.

National took in $6,000 cash and paid out $2,000 in cash. Cash

in Bank therefore increases by $4,000 (to $42,000). Again,

liabilities didn't increase as a result of the contract, so the

earnings section of equity on the balance sheet increases by

$4,000 (to $9,000) to keep it balanced.

Brown can now update his balance sheet for the increase of

$4,000 in Cash in Bank (to $42,000) and the $4,000 increase in

earnings (to $9,000) and be correct, but he will have left out

some very useful and important information. He will not be

able to see on the balance sheet how much cash was received

and spent in order to earn the $4,000.

To show this on the balance sheet, he breaks the earnings

category into two parts, revenues, and expenses; which he uses

to show how much money the company took in and paid out in

order to earn the total of $9,000.

Revenues are the money a company is paid, or expects to be

paid, for goods or services it provides to its customers. The

word Sales is sometimes used in its place for a company that

sells products instead of services. National was paid $5,000 for

Accounting Manual 4–1

Revenues and Expenses

the hauling contract and $6,000 for the excavating contract. Its

total revenues are therefore $11,000.

Expenses are the amount a company spends to provide goods

or services to its customers. National's only expenses for the

contracts are $2,000 in wages. Earnings are what is left over

after expenses are deducted from revenues.

Brown can now update his balance sheet to show the increases

in Cash in Bank and Earnings, as well as show how the earnings

were earned.

He does not have to record the fact that he earned $4,000 for

this last contract directly ($6,000 revenues minus $2,000

expenses), because after expenses are subtracted from revenues

within the earnings category of the balance sheet, this increase

of $4,000 in earnings will have been taken into account

automatically:

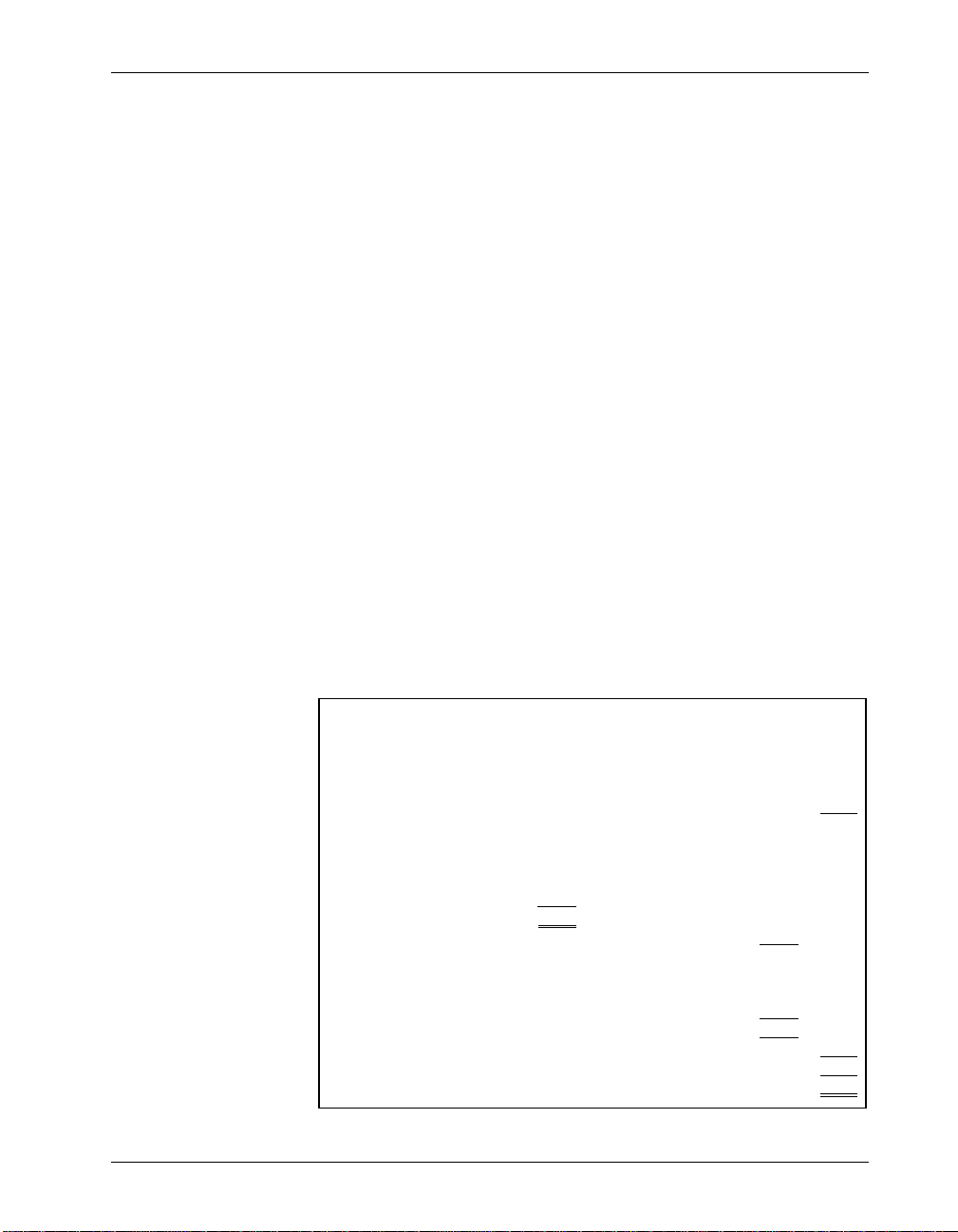

National Construction

Balance Sheet

March 1, 1995

Assets: Liabilities:

Cash in Bank $ 42,000 Accounts Payable $ 3,000

Trucks 22,000 Bank Loan 27,000

Maintenance Supplies 1,000 30,000

Furniture 2,000 Equity:

Construction Equipment 20,000

$ 87,000

Jim Brown 48,000

Earnings

Revenues:

Hauling $ 5,000

Excavating 6,000

Expenses:

Wages 2,000

Earnings 9,000

11,000

57,000

$ 87,000

4–2 Simply Accounting

When to Record Revenues and Expenses

When to Record Revenues and Expenses

Revenue is recorded in the financial records at the time the title

or ownership of the goods or services passes to the customer.

For a company that provides services, this usually means when

the services or the contract for the services are completed.

This means that National doesn't actually have to be paid for

the revenue in order to record the revenue on its balance sheet.

It just has to complete the contract and bill the customer. The

amount receivable from a customer for goods or services is an

asset (it is actually a promise to pay in cash) called an account

receivable.

Expenses are recorded in the financial records either at the time

they are incurred (for example, advertising), or if they can be

matched to a certain good or service provided (for example,

wages for a particular contract). The matching of expenses with

the revenues that they helped generate is called the matching

concept.

This means that National doesn't have to pay for an expense to

be able to record the expense on its balance sheet. It just has to

incur the expense and then record the amount owed to someone

for the expense as an account payable.

Brown completes another hauling contract on March 3 for

which National will be paid $3,000 within 30 days. His expenses

are $2,000 in wages which he pays on March 3 out of cash.

The $3,000 owed to National by the customer is an account

receivable, so Brown sets up an asset category with that name

and assigns it $3,000. At the same time, he increases Hauling

Revenue by $3,000 (to $8,000) because it is the source of the

account receivable.

He records revenue now, even though National hasn't yet been

paid, because for service contracts, revenue is recorded when

the contract is completed.

His expenses for the contract are $2,000 in wages so he increases

Wage Expense by this amount (to $4,000). He records it now

Accounting Manual 4–3

When to Record Revenues and Expenses

because he has already recorded revenue, and wants to match

the expenses for the contract with the revenue for the contract.

At the same time, he decreases Cash in Bank by $2,000 (to

$40,000) to record the payment of the wages.

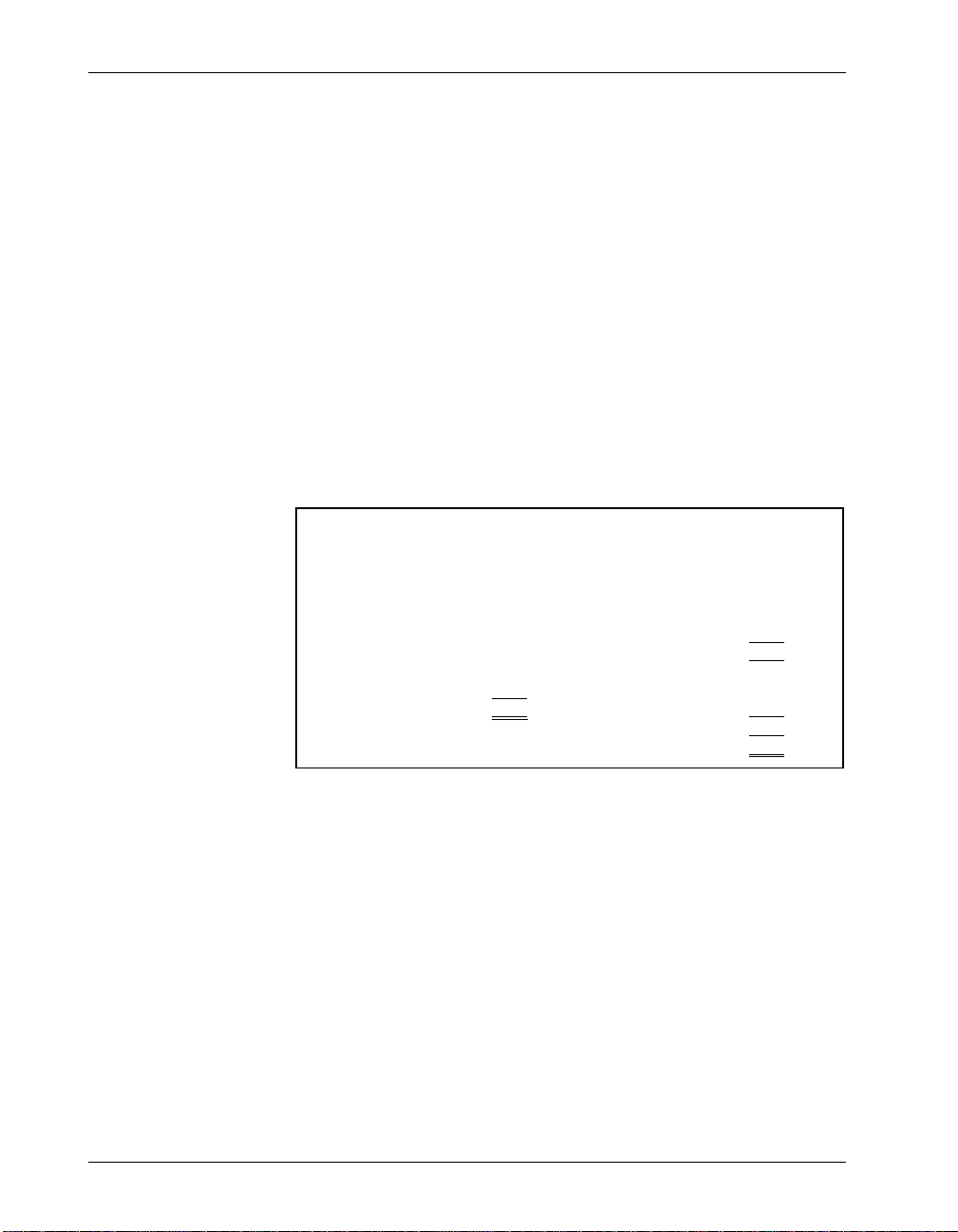

Assets: Liabilities:

Cash in Bank $ 40,000 Accounts Payable $ 3,000

Trucks 22,000 Bank Loan 27,000

Maintenance Supplies 1,000 30,000

Furniture 2,000 Equity:

Construction Equipment 20,000 Jim Brown 48,000

Accounts Receivable 3,000

National Construction

Balance Sheet

March 3, 1995

$ 88,000

Earnings

Revenues:

Hauling $ 8,000

Excavating 6,000

14,000

Expenses:

Wages 4,000

Earnings 10,000

58,000

$ 88,000

4–4 Simply Accounting

You are now ready to go to Chapter 5 to learn more about

recording changes to the balance sheet.

Chapter 5

Recording Changes to the

Balance Sheet

In this chapter, you will learn why you record revenues and

expenses when they are earned, rather than when they are

actually received and paid. You will also learn how to use

debits and credits to record changes to the balance sheet.

Recording Transactions

Brown can use the version of the balance sheet in Chapter 4 to

record any changes caused by transactions. A transaction is the

exchange of something of value (cash, a service) for something

else of value (a truck, a promise to pay). All the changes

recorded between February 1 and March 3 have been due to

transactions.

National Construction's next completed project is an excavation

contract. On March 5, Brown bills the customer the full amount

of $3,000 and pays $2,000 cash to the subcontractor who did the

work and $500 cash for wages to his employee who supervised

the work. These are two transactions. The first bills the

customer and the second pays the subcontractor and employee.

To record these transactions, he deals with each one separately.

Brown increases Accounts Receivable by $3,000 (to $6,000) and

increases Excavating Revenue by $3,000 (to $9,000). He records

the revenue now because the job is complete.

He decreases Cash in Bank by $2,500 (to $37,500), increases

Wage Expense by $500 (to $4,500), and sets up a new category

called Subcontracts Expenses for $2,000. He records the

Accounting Manual 5–1

Recording Transactions

expenses now because he wants to match them to the revenue

that he has already recorded.

Finished recording, he totals the balance sheet again, with the

following result:

National Construction

Balance Sheet

March 5, 1995

Assets: Liabilities:

Cash in Bank $ 37,500 Accounts Payable $ 3,000

Trucks 22,000 Bank Loan 27,000

Maintenance Supplies 1,000 30,000

Furniture 2,000 Equity:

Construction Equipment 20,000 Jim Brown 48,000

Accounts Receivable 6,000

$ 88,500

Earnings

Revenues:

Hauling $ 8,000

Excavating 9,000

17,000

Expenses:

Wages 4,500

Subcontracts 2,000

6,500

Earnings 10,500

$ 88,500

58,500

5–2 Simply Accounting

On March 6, National receives the $3,000 owed from the hauling

contract completed on March 3. Brown had accounted for the

money owed to National by increasing Accounts Receivable by

$3,000. Now that National has been paid, Brown must reduce

Accounts Receivable by $3,000 (to $3,000), and increase Cash in

Bank by $3,000 (to $40,500).

Notice that National was paid the $3,000 that it was owed for

the contract, but that no revenue or earnings were recorded as a

result of this payment. This is because the revenue was

recorded at the time the contract was completed.

National is now simply recording the payment of an amount

owed to it. The act of collecting cash owed reduces Accounts

Receivable and increases Cash in Bank, but does not increase

Recording Transactions

National's earnings. Do not confuse the collection of cash with

the earnings earned by providing the goods or services.

This method of accounting for revenue and expenses when they

are earned or incurred, rather than when the cash is actually

received or paid, is called the accrual method. It is one of the

main principles of accounting. The goal of the accrual method is

to accurately match earnings with the events that resulted in the

earnings. These events are the generation of revenue and the

incurring of expenses, not the collection of accounts receivable

and the payment of accounts payable.

This is why revenues and expenses are recorded when they are

earned or incurred, rather than when they are received or paid.

The categories under Assets, Liabilities, Equity, Revenues and

Expenses are called accounts, and that word will be used from

now on. The value assigned to any account (such as Furniture

$2,000) is called the account balance, or balance for short.

Also, on March 6, Brown pays for the maintenance supplies ($1,000)

and furniture ($2,000) purchased earlier on credit. He therefore

reduces the balance of the Cash in Bank account by $3,000 (to

$37,500) and the Accounts Payable account by $3,000 (to zero):

National Construction

Balance Sheet

March 6, 1995

Assets: Liabilities:

Cash in Bank $ 37,500 Bank Loan $ 27,000

Trucks 22,000

Maintenance Supplies 1,000 Equity:

Furniture 2,000 Jim Brown 48,000

Construction Equipment 20,000 Earnings

Accounts Receivable 3,000

$ 85,500

Revenues:

Hauling 8,000

Excavating 9,000

17,000

Expenses:

Wages 4,500

Subcontracts 2,000

6,500

Earnings 10,500

$ 85,500

Accounting Manual 5–3

58,500

Debits and Credits

On the same day, he gets an invoice for a truck tune-up ($200)

and a telephone bill ($100), and interest on National's bank loan

is taken out of the company's bank account by the bank ($400).

He increases Accounts Payable by $300 (to $300), decreases

Cash in Bank by $400 (to $37,100), and at the same time sets up

a Maintenance expense account for $200, a Telephone expense

account for $100 and an Interest expense account for $400.

Finished recording, he now totals the balance sheet again:

National Construction

Balance Sheet

March 6, 1995

Assets: Liabilities:

Cash in Bank $ 37,100 Accounts Payable $ 300

Trucks 22,000 Bank Loan 27,000

Maintenance Supplies 1,000 27,300

Furniture 2,000 Equity:

Construction Equipment 20,000 Jim Brown 48,000

Accounts Receivable 3,000

$ 85,100

Earnings

Revenues:

Hauling 8,000

Excavating 9,000

17,000

Expenses:

Wages 4,500

Subcontracts 2,000

Telephone 100

Maintenance 200

Interest 400

7,200

Earnings 9,800

$ 85,100

57,800

Debits and Credits

Over time, an easy-to-use and logical system has developed to

record any changes to a balance sheet. It will be used from now

on to explain how to record changes to National's balance sheet.

5–4 Simply Accounting

Debits and Credits

The system involves using the words debit and credit, which

we will now define.

First, it is important to know that any of the accounts can be on

the left or right side of the balance sheet. Because this is true,

the account names could be put in one vertical column, and the

account balances that pertain to each could be placed on the left

or right side of the balance sheet beside them. Accounts then

can have either a left or right balance.

Debit refers to the left side of an account and credit refers to the

right side of an account. Similarly, accounts which have

balances on the left side of a balance sheet have debit balances,

and accounts which have balances on the right side of a balance

sheet have credit balances.

Do not place any additional meanings on these words. In the

practice of accounting, these two words refer only to the left

(debit) and right (credit) sides of an account.

Asset accounts are on the left side of a balance sheet and

therefore have debit balances. Liability and equity accounts are

on the right side of a balance sheet and therefore have credit

balances.

The statement on the next page is National's balance sheet, but

we have set up each account so that it can have either a left

(debit) or right (credit) balance.

For each account, we have put its balance on either the debit or

credit side of the account, whichever is correct for that

particular account. Because we usually rank revenues and

expenses vertically, we have left them out temporarily and only

show Earnings in their place.

Notice that the total of the debit balances equals the total of the

credit balances. We expect this, since this is just another way of

saying that assets equal liabilities plus equity. It is also true then

that if we make any changes to a balance sheet, the total amount

of the debit changes equals the total amount of the credit

changes.

Accounting Manual 5–5

Debits and Credits

National Construction

Trial Balance

March 6, 1995

Cash in Bank 37,100

Trucks 22,000

Maintenance Supplies 1,000

Furniture 2,000

Construction Equipment 20,000

Accounts Receivable 3,000

Accounts Payable 300

Bank Loan 27,000

Jim Brown 48,000

Earnings .

Debit Balanc e Credit Balance

9,800

85,100 85,100

Notice that it is possible for asset accounts to have credit

balances (as long as the balance sheet still balances). For

instance, if Cash in Bank had a credit balance of $3,000, it would

mean that you were overdrawn at the bank by $3,000. Cash in

Bank would still be shown as an asset, but the account balance

displayed beside it would have a negative sign beside it.

5–6 Simply Accounting

The act of increasing the account balance of an account that has

a debit balance is called debiting. Instead of saying "debiting

the account," we could say "debit the account."

The act of increasing the account balance of an account that has

a credit balance is called crediting. Instead of saying "crediting

the account," we could say "credit the account."

To decrease the account balance of an account that has a debit

balance, we would do the opposite of what we would do to

increase it, and therefore credit the account.

Summary of Debit and Credit Theory

Assets = Liabilities + Equity

Asset Accounts Liability Accounts Equity Accounts

Debit to+Credit to

-

Debit to-Credit to

+

Debit to-Credit to

+

Similarly, to decrease the account balance of an account that has

a credit balance, we would debit it.

Debits and Credits on the Balance Sheet

On March 7, National Construction receives $3,000 cash which

was receivable for its first contract. To record this, Brown debits

the Cash in Bank account by $3,000 to record the increase (to

$40,100) and credits the Accounts Receivable account by $3,000

to record the decrease (to zero).

On the same day, he pays his truck tune-up bill of $200. To

record this, he debits the Accounts Payable account by $200 to

record the decrease (to $100) and credits the Cash in the Bank

account by $200 to record the decrease (to $39,900).

Finished recording, he totals the balance sheet again.

Debits and Credits

National Construction

Balance Sheet

March 7, 1995

Assets: Liabilities:

Cash in Bank $ 39,900 Accounts Payable $ 100

Trucks 22,000 Bank Loan 27,000

Maintenance Supplies 1,000 27,100

Furniture 2,000 Equity:

Construction Equipment 20,000

$ 84,900

Jim Brown 48,000

Earnings

Revenues:

Hauling 8,000

Excavating 9,000

17,000

Expenses:

Wages 4,500

Subcontracts 2,000

Telephone 100

Maintenance 200

Interest 400

7,200

Earnings 9,800

57,800

$ 84,900

Accounting Manual 5–7

Debits and Credits

Revenues and Expenses

The debit and credit system also works for revenues and

expenses, but since we place these accounts vertically on the

balance sheet instead of on the left and right, more explanation

is required.

As explained earlier, to increase the balance of an equity

account (invested capital or earnings) we credit it. Increases in

revenue increase the company's earnings, and therefore increase

the equity in the company. Additional revenues should

therefore be recorded as credits to revenue accounts, and

revenue accounts would normally have credit balances.

Similarly, to decrease the balance of an equity account (invested

capital or earnings) we debit it. Increases in expense decrease

the company's earnings, and therefore decrease the equity in the

company. Additional expenses should therefore be recorded as

debits to expense accounts, and expense accounts would

normally have debit balances.

5–8 Simply Accounting

Here is an example. On March 15, Brown completes another

excavating contract for $7,000, for which National Construction

will be paid in 30 days. His expenses are a subcontractor

($5,000, payable in 30 days) and his crew supervisor's wages

($1,000, paid in cash on March 15).

To record the completion of this contract and the related

transactions, Brown first debits Accounts Receivable by $7,000

to record the increase (to $7,000) and credits Excavating

revenue by $7,000 to record the increase (to $16,000), since it

was the source of the account receivable.

He then debits Subcontracts expenses by $5,000 to record the

increase (to $7,000) and credits Accounts Payable by $5,000 to

record the increase (to $5,100).

He then debits Wage expense by $1,000 to record the increase

(to $5,500) and credits Cash in Bank by $1,000 to record the

decrease because the wages have been paid.

Loading...

Loading...