Page 1

Powerful accounting software for growing businesses

Line50 v11 User Guide

Page 2

Copyright

This document and software described in it are copyrighted with all rights

reserved. Under copyright laws, neither the documentation nor the software may

be copied, photocopied, reproduced, translated, or reduced to any electronic

medium or machine readable form, in whole or in part, without prior written

consent of Sage (UK) Limited (‘Sage’). Failure to comply with this condition may

result in prosecution.

This computer program is the property of Sage. The program is protected under

copyright law and is licensed for use only by a user who has returned the

completed registration card included with the computer program and further is

licensed strictly in accordance with the conditions specified in the Software

Licence. Sale, lease, hire rental or reassignment to, or by, a third party without the

prior and written permission of Sage is expressly prohibited.

Sage does not warrant that the software package will function properly in every

hardware/software environment. For example, the software may not work in

combination with modified versions of the operating system, with certain

print-spooling or file facility programs, or with certain printers supplied by

independent manufacturers.

Although Sage has tested the software and reviewed the documentation, Sage

makes no warranty, representation or condition, either express or implied,

statutory or otherwise, with respect to this software or documentation, their

performance, satisfactory quality, or fitness for a particular purpose. This

software and documentation are licensed ‘as is’, and you, the licensee, by

making use thereof, are assuming the entire risk as to their quality and

performance.

In no event will Sage be liable for direct, indirect, special, incidental, or

consequential damages (including but not limited to economic loss, such as

loss of profits, loss of use of profits, loss of business or business

interruption, loss of revenue, loss of goodwill or loss of anticipated savings)

arising out of the use or inability to use the software or documentation, even

if advised of the possibility of such damages. In particular, and without prejudice

to the generality of the foregoing, Sage has no liability for any programs or data

stored or used with Sage software, including the costs of recovering such

programs or data.

Nothing in this notice shall exclude or limit Sage’s liability for fraud, death or

personal injury arising out of Sage’s wilful default or negligence.

Sage’s policy is one of constant development and improvement. We reserve the

right to alter, modify, correct and upgrade our software programs and publications

Copyright: © 1999 - 2004 Sage (UK) Limited

North Park

Newcastle upon Tyne NE13 9AA

All Worldwide Rights Reserved

Issue date: 02/08/2004

Pbn No: 12701

Page 3

Read This...

Your Sage Line 50 User Guide is made up of two parts.

The first part deals with setting up your accounting system (if you are a new user) and also the

maintenance of your accounts (for established users, i.e. who are upgrading).

In the first part, Setting Up and Maintenance, we deal with:

Installing Sage Line 50 onto your computer and using it for the first time (for new users).

How to use Line 50.

Setting up your company details (defaults).

Setting up your nominal structure.

Setting up your customer and supplier records.

Entering your product or service details.

Entering your opening balances.

Setting up your regular monthly payments.

Setting up prices and discounts for your products or services.

Working with fixed assets.

Setting up an e-banking system.

As a new user, you will have to work through this first part to set up your accounting system. All

of the sections may not apply to your business, so you will have to see which ones do apply to

you and work through the relevant sections.

As an established user who is upgrading, your system will already have your opening balances

on, as well as most of your company details. So, you can use this part of the manual to make

changes to your company details and defaults.

The second part is concerned with Daily Activities and Processing and we deal with:

Completing everyday tasks, such as looking after your data, using the search, making

journal entries, and so on.

Recording invoices and credit notes.

Sales and purchase order processing.

Recording payments and receipts.

How to carry out credit control activities, such as chasing unpaid bills and writing off bad

debts.

Reconciling your bank accounts on your computer with your real bank accounts.

Using advanced stock features, such as working with bills of materials.

Working with Projects.

Producing your VAT Return.

Page 4

Running a range of financial reports, including your profit and loss and balance sheet

report.

Running your month and year end routines.

Working with Sage MIS, which is a management information system.

All the tasks contained in the second part are mostly concerned with processing, i.e. working

with your finances as part of your day to day accounting activities. Sometimes you may have to

consult the first part of the chapter, for example, if you want to learn how to reconcile your

e-banking transactions. In these instances, the User Guide will clearly direct you to where you

need to go.

Page 5

Contents

Chapter 1: Getting Started ................................................................... 1

Transferring Accounting Systems .....................................................................2

Installation........................................................................................................3

The ActiveSetup Wizard...................................................................................4

Registering Sage Line 50 ...............................................................................13

Getting Started ..............................................................................................13

About SageCover ..........................................................................................14

SageCover Online Support ............................................................................14

sage.co.uk & sage.ie......................................................................................15

Sage Training .................................................................................................15

Chapter 2: How to Use Sage Line 50 ................................................ 17

Instructions in This Guide ...............................................................................19

The Sage Line 50 Options .............................................................................20

The Sage Line 50 Window.............................................................................21

Using Windows..............................................................................................24

Menu Commands ..........................................................................................25

Getting Help ..................................................................................................41

Wizards .........................................................................................................41

Debits and Credits .........................................................................................42

Chapter 3: Setting Up Your Company Details .................................. 43

The Configuration Editor ................................................................................44

Entering Your Company Preferences..............................................................68

Entering Your Company Defaults....................................................................77

Setting the Financial Year ...............................................................................77

Entering Your Bank Defaults...........................................................................78

The Euro and Other Currencies......................................................................80

The Countries Table .......................................................................................82

Passwords and Access Rights.......................................................................83

Changing Your Password...............................................................................84

Working With Internet Resources...................................................................84

The Foreign Trader

(Financial Controller only) ...............................................................................85

To Set Up the Foreign Trader .........................................................................86

Opening Balances .........................................................................................91

Page 6

Sage Line 50 User Guide

Chapter 4: Setting Up Your Nominal Structure ................................. 93

Nominal Ledger Accounts Explained..............................................................94

The Nominal Account Structure .....................................................................99

Control Accounts.........................................................................................100

The Nominal Ledger Window.......................................................................102

Entering, Editing and Deleting Nominal Records ..........................................108

Entering Bank Account Records ..................................................................113

The Chart of Accounts .................................................................................116

Checking Your Chart of Accounts ................................................................120

Chapter 5: Entering Customer and Supplier Records .................... 123

Planning Your Customer and Supplier Codes...............................................124

Entering Customer Defaults .........................................................................125

Setting an Account Status ...........................................................................128

Entering Customer Records.........................................................................129

Opening Balances for Customers ................................................................133

Entering Supplier Defaults ............................................................................137

Entering Supplier Records ...........................................................................138

Opening Balances for Suppliers ...................................................................141

Checking and Clearing Your Customers’ and Suppliers’ Opening Balances .145

Chapter 6: Entering Product Details and

Planning a Stock System ................................................................. 151

Product Valuation.........................................................................................152

Setting Up Your Product List........................................................................152

Creating Product Categories........................................................................153

Entering Product Defaults ............................................................................154

Entering Product Records............................................................................157

Entering Your Product Opening Balances.....................................................161

Chapter 7: Entering Opening Balances for Nominal

and Bank Accounts .......................................................................... 163

The Opening Balance Sequence Consists of: ..............................................164

Entering the Opening Balances for Your

Nominal Ledger Accounts............................................................................165

Entering the Opening Balances for Your Bank Accounts ..............................167

Uncleared Items in Your Bank Opening Balance...........................................168

Checking Your Nominal and Bank Opening Balances ..................................169

Completing the Opening Balances Procedure..............................................170

Page 7

Contents

Chapter 8: Setting Up Recurring Entries,

Prepayments and Accruals .............................................................. 173

Explaining Recurring Entries.........................................................................174

Prepayments

(Accountant Plus and Financial Controller Only)............................................186

Accruals

(Accountant Plus and Financial Controller Only)............................................189

Chapter 9: Pricing and Discounts .................................................... 193

Using Customer Price Lists

(Accountant Plus and Financial Controller Only)............................................195

Importing Product Prices onto a Customer Price List

(Accountant Plus and Financial Controller only) ............................................201

Setting Special Customer Prices

(Accountant Plus and Financial Controller Only)............................................205

Supplier Price Lists

(Financial Controller users only) ....................................................................210

Importing Supplier Price Lists

(Financial Controller users only) ....................................................................212

'Good Customer' Discount ..........................................................................214

Early Settlement Discount ............................................................................216

Discounting by Quantity of Product Sold

(Accountant Plus and Financial Controller Only)............................................219

Discounting by Invoice Value

(Accountant Plus and Financial Controller Only)............................................222

Checking Discount Amounts & Editing the Total Discount ............................224

Other Discount Options ...............................................................................226

The Invoice and Order Defaults Options List.................................................228

Discounting by Unit Price

(Accountant Plus and Financial Controller Only)............................................230

Chapter 10: Working With Fixed Assets

(Accountant Plus and Financial Controller Only) ............................ 233

Fixed Assets ................................................................................................234

Depreciation ................................................................................................235

Depreciation Methods in Line 50..................................................................235

Writing Off Fixed Assets ...............................................................................237

Selling Fixed Assets .....................................................................................237

Creating Fixed Asset Categories ..................................................................237

Entering Your Fixed Asset Records ..............................................................238

Page 8

Sage Line 50 User Guide

Chapter 11: E-Business ................................................................... 243

Contacting Sage ..........................................................................................244

e-Banking ....................................................................................................245

Configuring Your e-Banking Option..............................................................246

Using the e-Payments Option ......................................................................248

Entering Supplier Bank Details .....................................................................248

Using the e-Reconcile Option ......................................................................250

Importing e-Banking Transactions................................................................250

Reconciling Your Bank Account ...................................................................251

Transaction e-Mail........................................................................................255

Setting Up Transaction e-Mail ......................................................................256

Configuring Transaction e-Mail.....................................................................257

Processing Incoming Orders and Invoices in

Transaction e-Mail........................................................................................265

Matching in Transaction e-Mail.....................................................................267

Help with Transaction e-Mail ........................................................................274

Sage WebTrader Professional ......................................................................274

Chapter 12: Everyday Tasks ............................................................ 275

Changing the Program Date ........................................................................276

Checking Your Data .....................................................................................277

Backing Up Your Data..................................................................................279

Restoring Your Data.....................................................................................281

Event Logging..............................................................................................282

Using the Search to Find Records................................................................286

Building Your Search....................................................................................289

Finding Transactions ....................................................................................291

Using ActiveSearch......................................................................................293

Using the Spelling Checker ..........................................................................294

Printing What’s On Your Screen ...................................................................295

Working with Attachments using Document Manager ..................................298

Using The Task Manager..............................................................................304

Exporting to Microsoft Word, Excel and Outlook ..........................................305

Journal Entries .............................................................................................307

Reversing Nominal Journals

(Accountant Plus and Financial Controller Only)............................................310

Paying Wages Using Journal Entries ............................................................312

Setting Up a Petty Cash Account.................................................................317

Page 9

Contents

Chapter 13: Entering Invoices and Credit Notes ............................ 319

Special Product Codes ................................................................................320

Invoices and Credit Notes ............................................................................321

Batch Invoices and Credit Notes..................................................................322

Creating Invoices and Credit Notes From the Invoicing option......................324

Memorising and Recalling Batch Invoices and Credit Notes

(Accountant Plus and Financial Controller Only)............................................349

Creating Recurring Transactions ..................................................................350

Entering Invoice and Order Defaults .............................................................355

Updating the Ledgers ..................................................................................361

Invoice Profit Check

(Accountant Plus and Financial Controller Only)............................................362

Creating Mix and Match Invoices and Orders

(Financial Controller Only) .............................................................................364

Invoicing From Telephone Calls

(Financial Controller Only) .............................................................................372

Quotations and Proformas

(Accountant Plus and Financial Controller Only)............................................374

Chapter 14: Order Processing

(Financial Controller Only) ................................................................ 377

Sales Orders................................................................................................378

The Sales Order Cycle .................................................................................378

Creating a Sales Order.................................................................................379

Creating Recurring Orders ...........................................................................398

Completing Your Sales Order if it has Already Been Despatched..................400

Saving Your Sales Order ..............................................................................400

Printing Your Sales Orders ...........................................................................400

Allocating Stock to Sales Orders ..................................................................401

Order Shortfalls............................................................................................403

Despatching Sales Orders ...........................................................................406

Recording Delivery of Goods using Goods Despatched Notes.....................407

Recording Sales Order Despatches .............................................................411

Manually Recording Sales Order Despatches...............................................411

Printing an Invoice Created From the Sales Order ........................................412

Updating the Ledgers ..................................................................................412

Deleting a Sales Order .................................................................................413

Converting Quotes and Proformas to Sales Orders......................................414

Intrastat Reporting .......................................................................................417

Page 10

Sage Line 50 User Guide

Confirming your Intrastat Dispatches............................................................419

Working With Purchase Orders ....................................................................424

Creating Purchase Orders............................................................................425

Completing Your Purchase Order if it has Already Been Delivered ................440

Saving Your Purchase Orders ......................................................................440

Printing Your Purchase Orders .....................................................................440

Putting Purchase Orders 'On Order' ............................................................441

Recording Delivery of Goods........................................................................442

Recording Delivery of Goods Using Goods Received Notes.........................443

Recording Purchase Order Deliveries ...........................................................447

Manually Recording Purchase Order Deliveries ............................................447

Creating Purchase Invoices From Your Purchase Orders..............................448

Deleting a Purchase Order ...........................................................................448

Confirming your Intrastat Arrivals..................................................................448

Chapter 15: Project Costing

(Accountant Plus and Financial Controller Only) ............................ 453

Introduction to Project Costing.....................................................................454

Who Can Use Project Costing?....................................................................454

The Life Cycle of a Project ...........................................................................454

The Project Life Cycle in Line 50 ..................................................................455

Setting Up Project Costing...........................................................................457

Project Statuses ..........................................................................................458

Cost Codes .................................................................................................459

Resources ...................................................................................................463

Working with Projects ..................................................................................465

Project Records...........................................................................................465

Project Only Costs .......................................................................................472

Stock Postings ............................................................................................474

Cost Postings ..............................................................................................475

Billing Your Customer for a Project...............................................................477

Project Enquiries, Analysis and Reporting ....................................................481

Completing Your Project ..............................................................................483

Chapter 16: Recording Payments and Receipts ............................. 485

Customer Receipts ......................................................................................486

Bank Receipts .............................................................................................488

Memorising and Recalling Bank Receipts

(Accountant Plus and Financial Controller Only)............................................492

Supplier Payments.......................................................................................494

Page 11

Contents

Recording Bank, Cash and Credit Card Payments .......................................498

Memorising and Recalling Bank Payments

(Accountant Plus and Financial Controller Only)............................................501

Batch Supplier Payments

(Financial Controller Only) .............................................................................503

Producing Cheques

(Accountant Plus and Financial Controller Only)............................................505

Recording Expenses....................................................................................512

Bank Transfers.............................................................................................514

Chapter 17: Credit Control ............................................................... 525

The Cash Flow Option .................................................................................526

Manual Entries in a Cash Flow .....................................................................530

Credit Control ..............................................................................................531

Ageing Transactions in Line 50.....................................................................531

Producing a Retrospective Aged Balance Report .........................................535

Checking Aged Balances .............................................................................535

Credit Control for Each Customer ................................................................538

The Credit Control Window ..........................................................................541

Recording Contact Details ...........................................................................543

Viewing Transaction History and Aged Balances ..........................................547

Handling Disputed Transactions

(Accountant Plus and Financial Controller Only)............................................550

Charging Your Customers for Late Payments...............................................551

Writing Off Bad Debts ..................................................................................552

Writing Off Bad Debt Transactions Using the Wizard ....................................553

Writing Off Bad Debts Manually....................................................................555

Days Sales Analysis .....................................................................................560

Suggested Payments...................................................................................566

Credit Control Reporting ..............................................................................569

Other Customer Reports..............................................................................571

Supplier Reports ..........................................................................................572

Chapter 18: Reconciling Your Bank Accounts ................................ 573

Bank Reconciliation .....................................................................................574

Preparing to Reconcile.................................................................................574

Reconciling Your Bank Account ...................................................................574

Posting Bank Adjustments...........................................................................577

Printing a Bank Statement Report ................................................................578

Page 12

Sage Line 50 User Guide

Chapter 19: Using the Advanced Stock Features

(Accountant Plus and Financial Controller Only) ............................ 579

Bill of Materials.............................................................................................580

Checking Component Availability .................................................................583

Making Stock Transfers................................................................................584

Using the Stock Shortfall Option ..................................................................586

Running a Stock Take..................................................................................590

Recording Stock Returns .............................................................................592

Adjusting Stock Levels.................................................................................594

Chapter 20: Running Your VAT Return ............................................ 595

The VAT Return Checklist.............................................................................596

Producing the VAT Return............................................................................597

Checking Your VAT Return...........................................................................599

Saving your VAT Return ...............................................................................601

Handling Late Transactions..........................................................................603

Handling Future Transactions .......................................................................603

Reconciling Your VAT Return........................................................................604

Clearing Your VAT Control Accounts ............................................................605

Submitting the VAT Return to the Tax Authorities .........................................606

VAT Audit Reports........................................................................................607

Entering Scale Charges

(Accountant Plus and Financial Controller Only)............................................607

Chapter 21: Running Financial Reports .......................................... 609

Reports........................................................................................................610

Running the Audit Trail Report......................................................................611

Running the Trial Balance Report .................................................................612

Running the Profit and Loss Report .............................................................613

Running the Balance Sheet Report ..............................................................614

Running the Quick Ratio Report

(Accountant Plus and Financial Controller Only)............................................615

Running the Budget Report .........................................................................617

Running the Prior Year Report......................................................................618

Running the Transactional-Based Management Reports

(Accountant Plus and Financial Controller Only)............................................619

Running the Audit Assistant .........................................................................622

The Sage Management Information System (MIS)........................................634

Page 13

Contents

Chapter 22: Running Your Month End ............................................ 635

The Month End ............................................................................................636

Month End Checklist....................................................................................637

Changing Your Program Date ......................................................................639

Running the Month End ...............................................................................640

Posting Opening and Closing Stock.............................................................642

Posting Monthly Accruals

(Accountant Plus and Financial Controller Only)............................................648

Clearing Your Stock Transactions.................................................................651

Printing Your Product Reports

(Accountant Plus and Financial Controller) ...................................................652

Clearing the Audit Trail .................................................................................653

Handling Late Entries ...................................................................................653

Posting Late Entries .....................................................................................653

Chapter 23: Running Your Year End ............................................... 657

The Year End ...............................................................................................658

Year End Checklist.......................................................................................659

Backing Up Your Data..................................................................................660

Running the Accounts Year End...................................................................662

Historical Data Analysis ................................................................................664

Checking the Financial Year Start Date Setting.............................................667

Clearing the Audit Trail .................................................................................667

Deleting Records .........................................................................................672

Compressing Your Data ...............................................................................675

Chapter 24: Accountant Link ........................................................... 677

What Is Accountant Link? ............................................................................678

Using Accountant Link with Line 50 Accountant, Accountant Plus or Financial

Controller.....................................................................................................680

Exporting Your Accounts Data to File to Send to Your Accountant ...............683

Recording Material Changes To Your Data ...................................................686

Importing and Applying Your Accountant's Adjustments ..............................688

Using Accountant Link with Line 50 Client Manager.....................................693

Importing Your Client's Accounts Data From a File.......................................696

Recording Adjustments................................................................................698

Exporting Your Adjustments and Narratives to File .......................................700

Page 14

Sage Line 50 User Guide

Appendix: Installing and Upgrading to Line 50 Version 11 ............ 703

System Requirements..................................................................................704

The Readme File..........................................................................................705

Information for Users in the Republic of Ireland ............................................705

Installing Sage Line 50 Version 11 for the First Time

(Single User Version) ....................................................................................706

Installing Sage Line 50 Version 11 for the First Time

(Multi User Version) ......................................................................................709

Upgrading from Earlier Versions ...................................................................715

Preparing to Upgrade from Version 4 or Version 5........................................718

Preparing to Upgrade from Version 6, Version 7 or Version 8 .......................720

Preparing to Upgrade from Version 9 or Version 10......................................722

Upgrading to Sage Line 50 Version 11

(Single User Version) ....................................................................................723

Upgrading to Sage Line 50 Version 11

(Multi-User Version)......................................................................................724

After Upgrading: Converting Line 50 Version 5 Layouts................................725

Registering Your Program ............................................................................727

Page 15

Chapter 1

Getting Started

Welcome to Sage Line 50.

Sage Line 50 lets you record, control and

examine your finances quickly in a

traditional way, through a state-of-the-art

computer program.

Sage Line 50 is a totally integrated

system, which means that when you

record a financial transaction into one

ledger, all the other related ledgers are

immediately updated with that

information. Sage Line 50 does your

double-entry bookkeeping for you.

Read this chapter to find out how to get

started with Sage Line 50, including

installation and using your program for the

first time.

This User Guide covers Sage Line 50

Accountant, Sage Line 50 Accountant

Plus, Sage Line 50 Financial Controller

and Sage Line 50 Network Versions.

In this chapter:

Transferring Accounting Systems.........2

Installation ...........................................3

The ActiveSetup Wizard.......................4

Registering Sage Line 50 ...................13

Getting Started ..................................13

About SageCover ..............................14

SageCover Online Support ................14

sage.co.uk & sage.ie .........................15

Sage Training.....................................15

Page 16

Transferring Accounting Systems

To help you achieve a smooth transition from your current accounting system to your new

Sage Line 50 program, you should decide on which features and functionality you will use,

and when. For example, if you run a shop, you will not enter each customer transaction

(so you will have no customer records), but you will need to use cash book functionality

to enter the day’s takings. (For details about how to do this, see Bank Receipts on page

488.) Sage Line 50 lets you choose the accounting functions suitable to your business.

As a result of your business needs, you may need to do some, or all, of the following:

Enter your company details.

Set up and check your nominal account structure (this includes setting up bank

accounts in Sage Line 50). For an explanation of the nominal account structure, see

Nominal Ledger Accounts Explained on page 94.

Enter your customer records and their opening balances.

Enter your supplier records and their opening balances.

Enter your product details and their opening balances.

Enter the opening balances for your nominal ledger.

Enter the opening balances for your bank accounts.

For many people, moving from one system of accounting to another is a staged process.

It doesn’t happen overnight. Because of the nature of bookkeeping, where invoices may

not be paid on time and bank statements do not arrive until the end of the month, you

may have to make the transfer to your new system gradually.

Also, many people prefer to gain confidence in a new system by choosing to set up one

ledger at a time, for example, first the sales ledger, then the purchase ledger (Customers

and Suppliers in Sage Line 50), then the nominal ledger. However, other people choose

to transfer their accounts in one go, and do so successfully.

Whatever the implementation strategy you choose, we recommend that, until you

become familiar with Sage Line 50, you continue using your existing system for a short

time. In this way you can check that you are getting the right figures from Sage Line 50,

and you can also see the benefits of the new system, as many of your entries are

automatically done for you. You should also use the Demonstration Data supplied with

your Sage Line 50 program to experiment with all of the different areas of the program.

Page 17

Getting Started

Installation

This section guides you through installing a single user version of Sage Line 50 for the first time.

If you are installing a network version, or are upgrading from a previous version of Sage Line 50,

refer to the Appendix at the back of this guide. New users of Sage Line 50 (single user) should

follow these instructions:

Note: You must ensure that you are logged onto your computer as 'Administrator', or as a user

with administrative access rights, before attempting to install Sage Line 50. The installation

process cannot proceed if you do not have sufficient access rights.

1. Shut down any other programs you are running.

2. Put the Sage Line 50 CD into your CD-ROM drive.

If the Sage menu does not appear automatically after a few moments, open the Start menu

from the Windows menu bar, choose Run and then type d:\start in the Open text box.

Note: If your drive letters are different to those shown above, replace them with the

appropriate letter.

The Installation main menu appears.

3. Before you begin to install Sage Line 50, select ‘Readme’. This contains any additional or

late-breaking information about your Sage product.

Note: Sage Line 50 version 11 requires Microsoft Internet Explorer version 6 to run. If you

do not have Internet Explorer version 6 on your computer, a warning message appears

advising you that you must install it before you continue with the Line 50 installation. Install

Internet Explorer from the Line 50 CD, then start the Line 50 version 11 installation again.

4. Click Install and follow the on-screen instructions.

5. When the installation is complete, click Finish.

You can now close the installation menu.

A Sage Accounts short-cut is created on your desktop, so that you can double-click on

this icon to start the program.

If prompted, restart your PC.

You are now ready to run your Sage Line 50 program for the first time.

3

Page 18

Sage Line 50 User Guide

The ActiveSetup Wizard

Once you have installed Sage Line 50 you are ready to use it for the first time. To activate Sage

Line 50, double-click the Sage icon on your desktop or open the Start menu from the Windows

menu bar, choose Programs, then select Sage and finally select Sage Accounts.

Important Note: If you are using a multi-user version of Sage Line 50, the Logon window

appears every time that you start the program. When you first use Sage Line 50 program the

default logon name is MANAGER, with no password. Once you have completed the

ActiveSetup Wizard, you can then set up your access rights and passwords. For more

information, read Passwords and Access Rights on page 83.

When you start the program, the ActiveSetup Wizard appears. Use this to enter all of your

company information.

Click Next to progress onto the next step or click Back to return to the previous step to re-enter

or edit any information.

There are nine screens in the ActiveSetup Wizard when you are using Sage Line 50 for the first

time:

Welcome

My Company

My Details

My Financial Year

My VAT Details

My Currency

Program Activation

Program Registration

Next Steps

After the first Welcome screen, you should enter your company information into the relevant

boxes on-screen. Information about each of these screens can be seen in the following pages.

If you need additional help on any of the screens in the ActiveSetup Wizard, press F1 or select

the Help button for more information.

4

Page 19

Getting Started

Step 2: My Company

If you are a new user you must select the first option ‘I would like to create a new company’. If

you are upgrading from an earlier version, or if you have Sage Line 50 and want to set up a

network version, refer to Appendix, Installing and Upgrading to Line 50 Version 11 on page 703.

You must also decide what type of chart of accounts your company needs. Sage Line 50 has

a number of charts to suit different business types. For example, you can choose from

construction, charities, medical, farming, garage and transport.

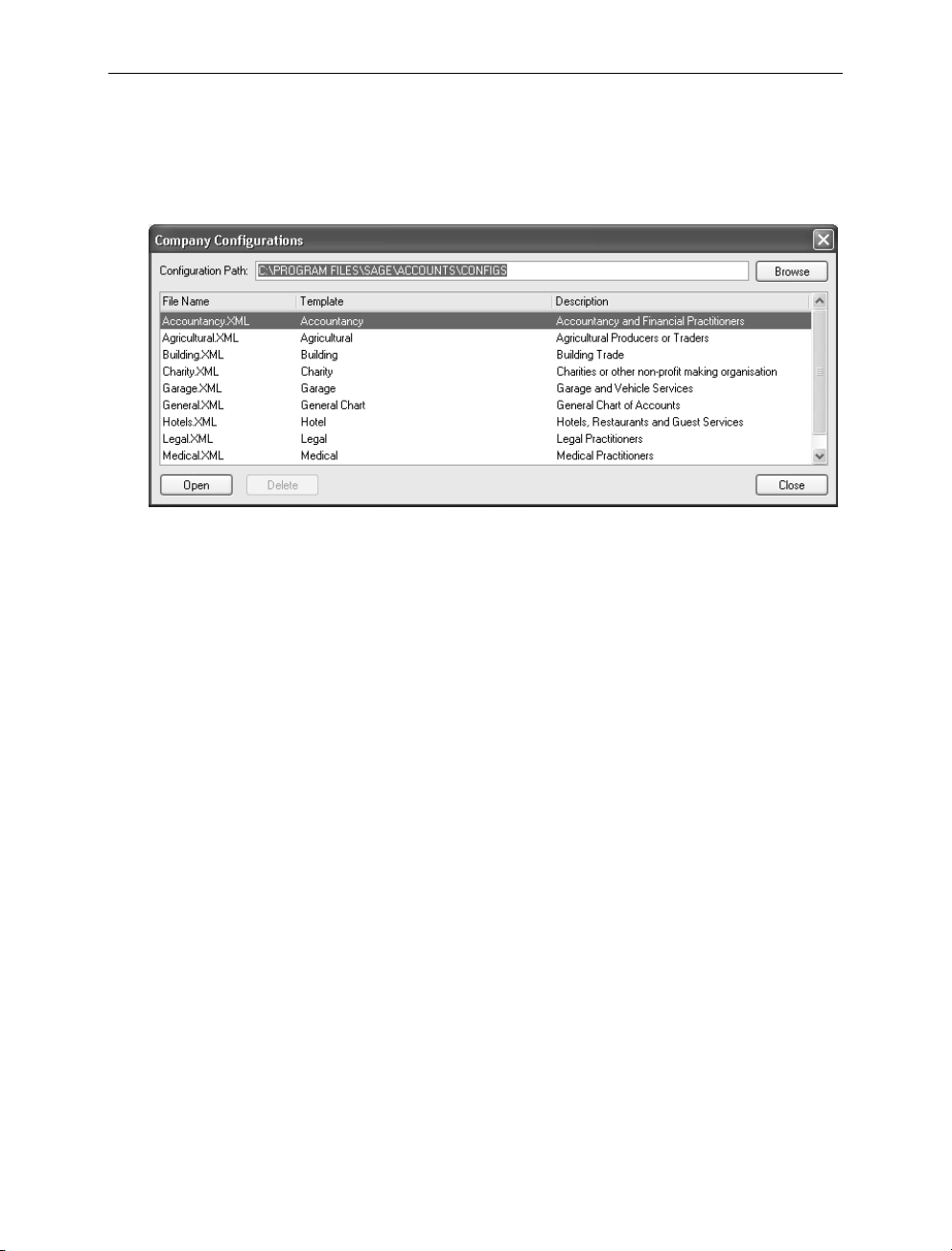

Note: There are more chart of accounts to choose from. To see details of the different chart of

accounts, press F1, enter the words Chart of Accounts in the Index tab and then select

‘standard’.

From the list, choose the chart of accounts most suited to your needs. If you are in doubt, select

the 'General Business - Standard Accounts' layout. This provides you with a basic chart of

accounts layout that is suitable for most businesses. To select a chart of accounts, click Browse

to access the Company Configurations window. Choose the chart you require and click Open.

For more information, see To use an existing configuration file on page 6.

Alternatively, you may have been given a Sage Line 50 configuration file by your accountant, or

someone in your company, to use. The configuration file holds all of your basic Sage Line 50

setup information, such as the nominal ledger details and the default settings for your company.

For more information about the details held in the configuration file, see the section The

Configuration Editor on page 44.

Important Note: You must select the configuration file before you exit the ActiveSetup Wizard.

You cannot change the configuration file once you have completed the ActiveSetup Wizard.

5

Page 20

Sage Line 50 User Guide

To use an existing configuration file

1. From the ActiveSetup Wizard’s ‘My Company’ window, click Browse.

The Company Configurations window appears.

If your configuration file has been saved into the default file location, the file will appear in

the list. The default file location is C:\Program Files\Sage\Accounts\Configs.

2. Select the appropriate file from the scrolling list. If the configuration file is not in the list, click

Browse to find the file.

3. Once you have selected the configuration file, click Open.

Line 50 returns you to the ActiveSetup Wizard and displays the file you selected.

4. Click Next to continue through the ActiveSetup Wizard.

6

Page 21

Getting Started

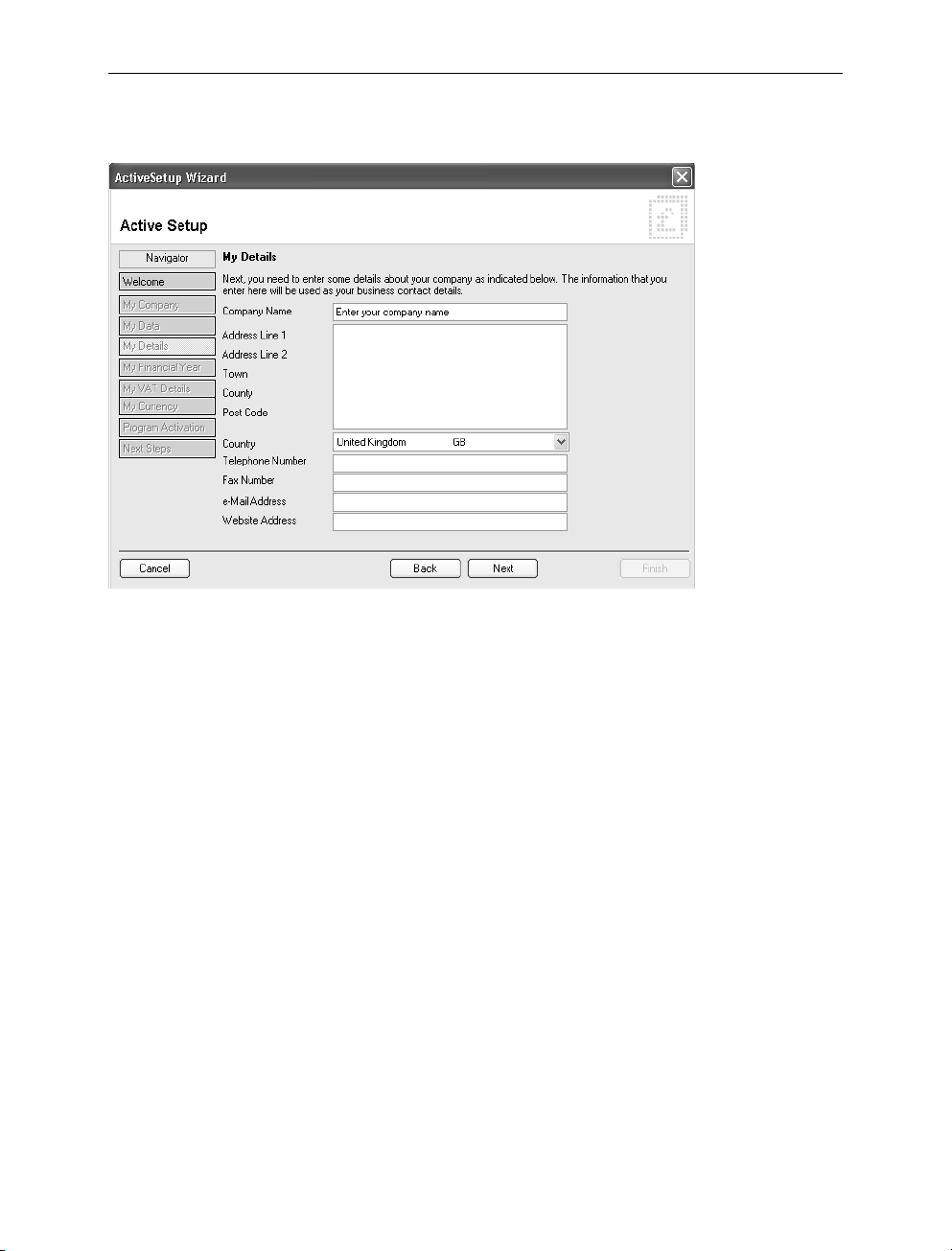

Step 3: My Details

Use this step to enter your company name and contact details. When you have completed the

wizard, these details will be copied to your Sage Line 50 program. If your company details

change, or if you make a mistake, you can change these details within your Sage Line 50

program.

7

Page 22

Sage Line 50 User Guide

Step 4: My Financial Year

Use this step to enter your Financial Year start date.

Note: It is important that you enter the correct Financial Year start date as it is difficult to change

this date once you have started to enter transactions. If you are in any doubt as to your Financial

Year start date you should contact your accountant or your company’s accounts department

before proceeding.

8

Page 23

Getting Started

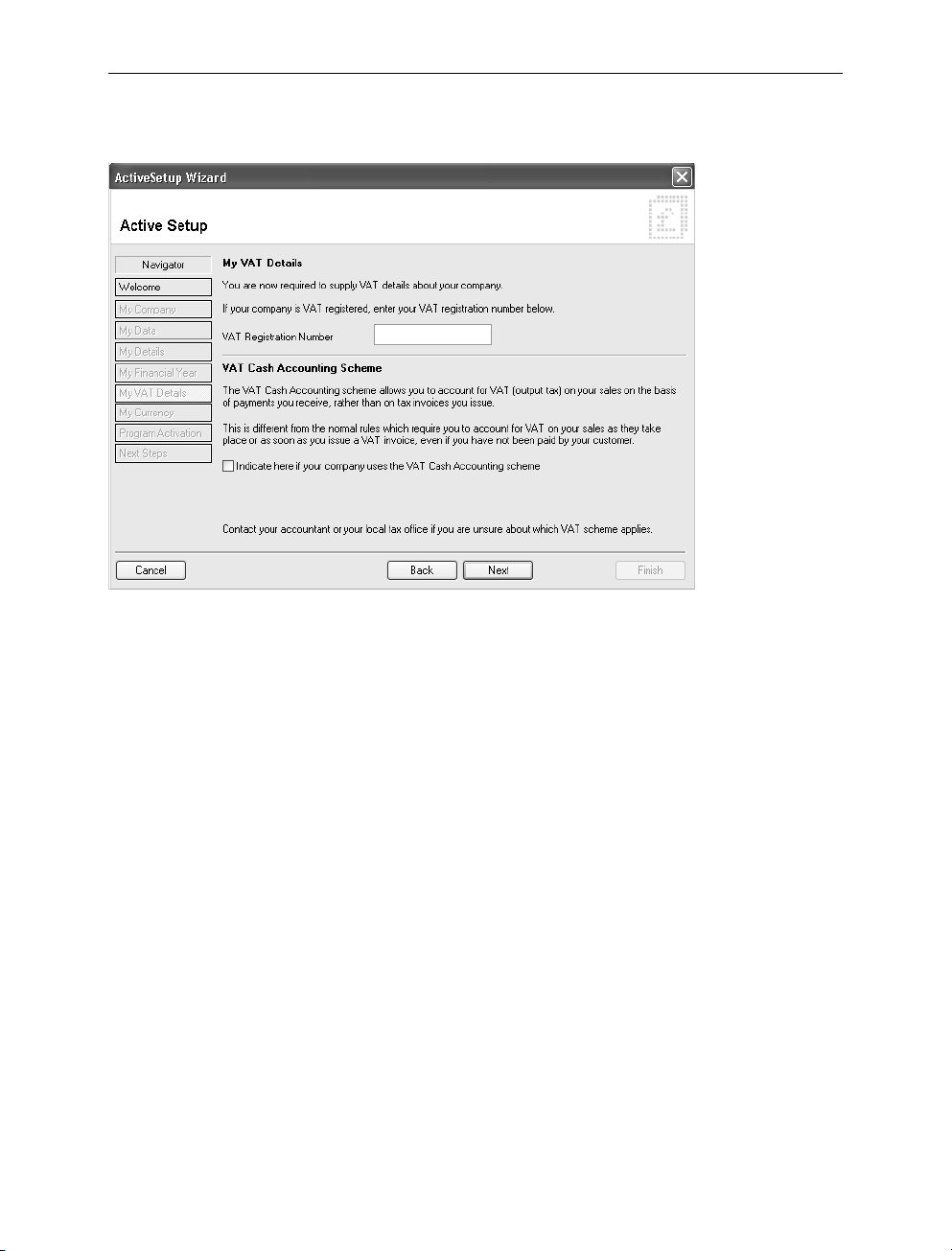

Step 5: My VAT Details

If your company is VAT registered, enter the VAT registration number in the relevant box. You

must also specify if your company uses the VAT Cash Accounting scheme. By default, Sage

Line 50 calculates tax liability using the Standard VAT scheme.

If you are in any doubt as to the VAT scheme that you are using, you should contact your

accountant or your company’s accounts department.

9

Page 24

Sage Line 50 User Guide

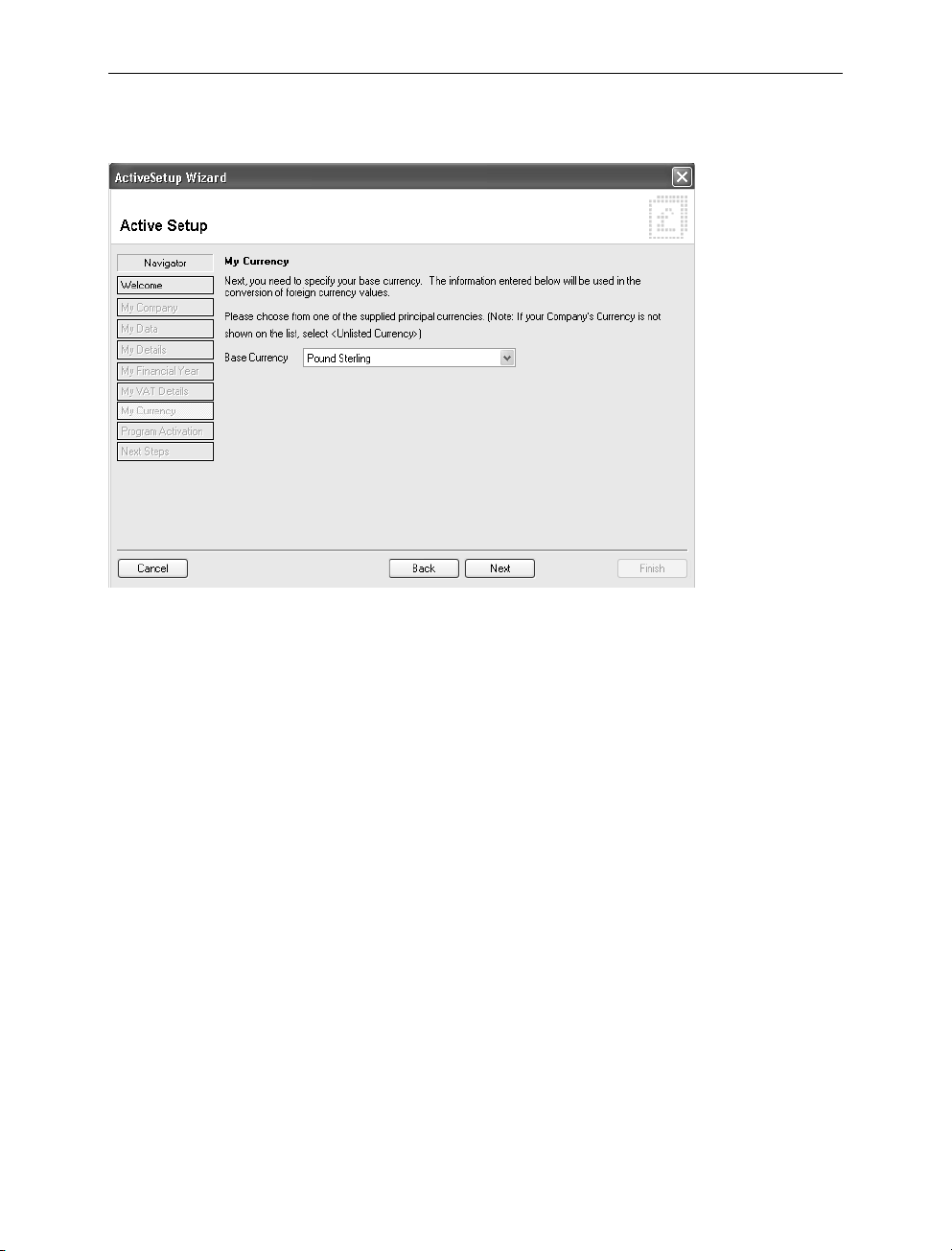

Step 6: My Currency

You now need to choose your base currency. This is the currency you will use most often to

record your transactions.

Note: It is very important that you choose your base currency correctly, as you cannot change

it once it has been selected.

10

Page 25

Getting Started

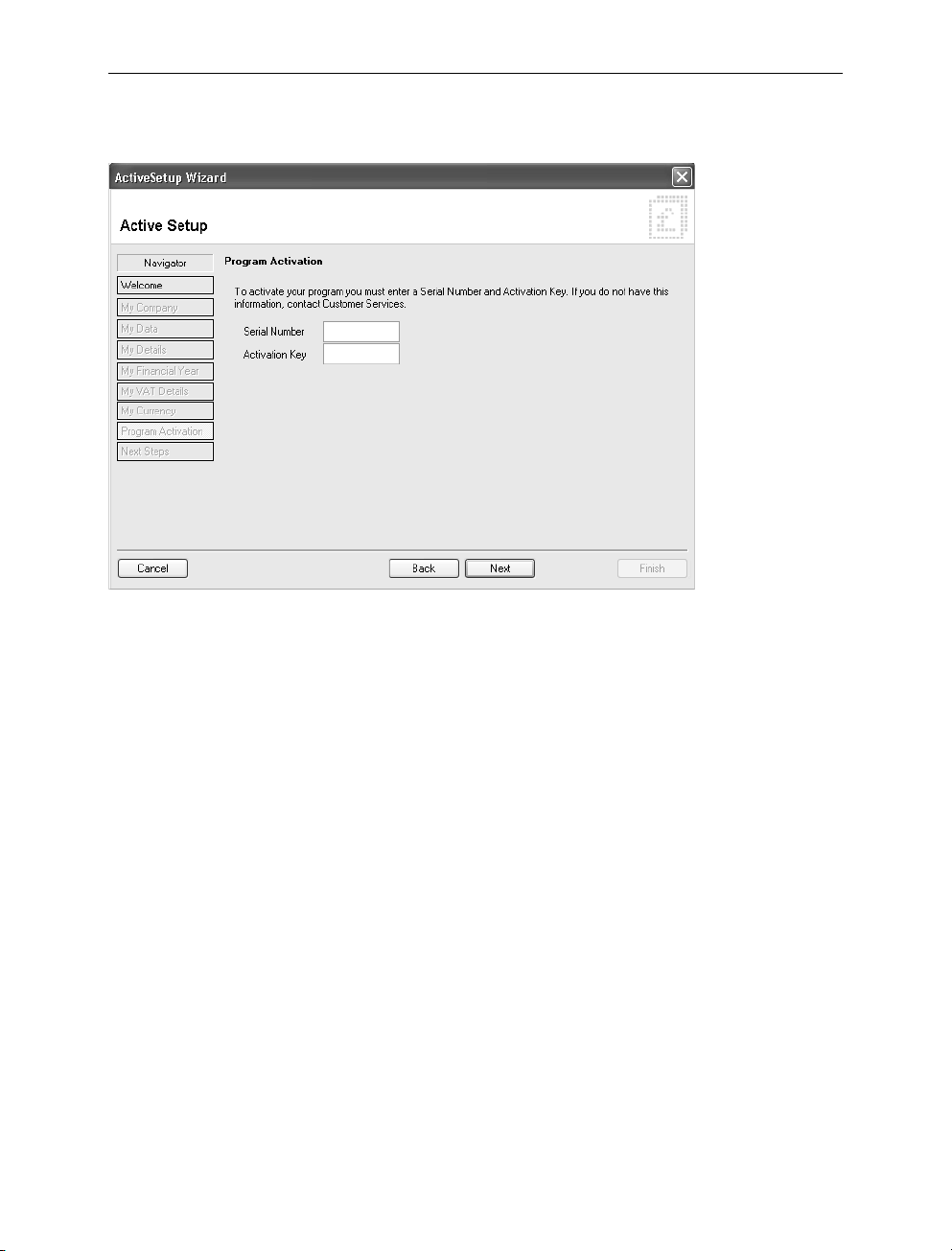

Step 7: Program Activation

You must now enter your Serial Number and Activation Key in the relevant boxes. You can find

these on the sticker sheet entitled 'Important Information', which comes within your program

box.

If you cannot find your Serial Number and Activation Key, please contact our Customer Care

department.

11

Page 26

Sage Line 50 User Guide

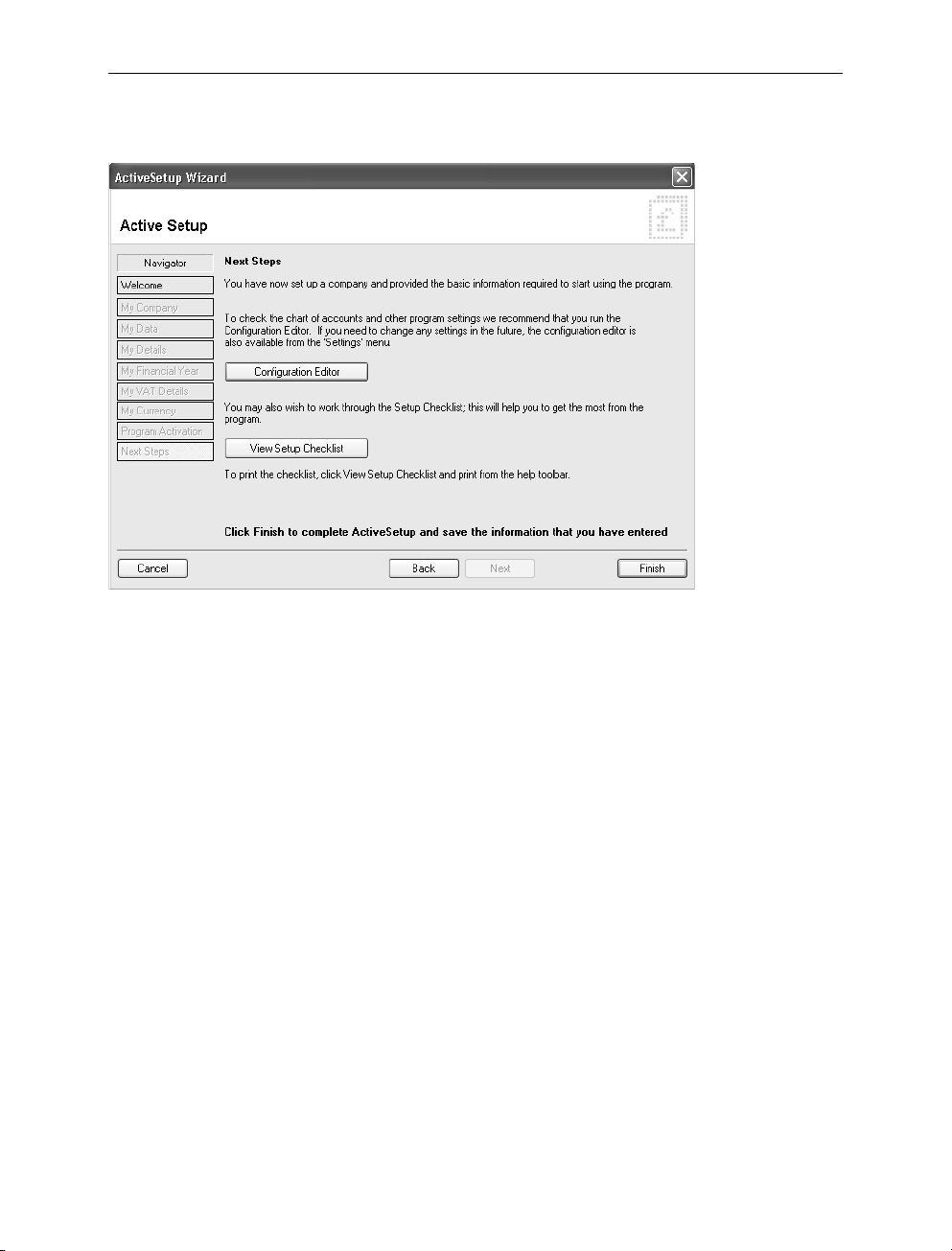

Step 8: Next Steps

This is the final screen of the ActiveSetup Wizard.

From this window you can access the Configuration Editor. You can use the Configuration

Editor to set up the basic information about your company. For more information, see The

Configuration Editor on page 44.

From here you can also open the help system to see the Setup Checklist. To do this, click View

Setup Checklist.

Click Finish to close the ActiveSetup Wizard.

12

Page 27

Getting Started

Registering Sage Line 50

Unless you register your Sage Line 50 program, you can only use your new Sage Line 50 for a

maximum of 60 days. At the end of the unregistered period you will be unable to use the

program (however, all of the information you entered during this period will be unaffected).

To register your Sage Line 50 program, call one of the following telephone numbers.

UK residents (mainland), 0845 111 66 66

Northern Ireland, 0845 245 0280

Republic of Ireland, 01 642 0800

If you have Internet access, you can register your program online. From the Tools menu, choose

Activation and select Upgrade Program, then click Web Register from the Product Registration

window. Follow the instructions on-screen to register your program.

Getting Started

You are now ready to begin entering information into your new Sage Line 50 program. Sage

recommends that you follow the structure of Part One of this User Guide in order to lay the

foundations of your new accounting system.

This chapter of the User's Guide introduces you to the new Sage Line 50 and shows you how

to install the program and where to get help. Chapter two explains how to use Sage Line 50

and shows you some useful hints and tips. Chapter three starts with the first major task which

you must complete and continues through to Chapter seven which is the last of the tasks which

you should perform in sequence. Chapters eight to eleven explain other key setup tasks. In

summary, the tasks you are advised to perform in sequence are:

Set your company defaults. Check that you have entered your company details correctly,

including your financial year start date and your VAT scheme. For more information, see

Setting Up Your Company Details on page 43.

Check your nominal account structure (this includes setting up bank accounts in Sage Line

50). Sage Line 50 has already created a nominal account structure for you, but you should

check that the structure is right for your company. At this stage you can rename your

nominal accounts to suit your business, add additional accounts and delete others that

you do not need. For more information, see chapter 4, Setting Up Your Nominal Structure.

Enter your customer and supplier information. If you need to keep details of your

customers and suppliers, the next stage is to enter their records and their opening

balances. A customer or supplier record is like a card in a card index box. Each record

holds information about a specific customer or supplier, such as an address, telephone

number, contact name, credit details and so on. Depending on your business you may

need to complete both supplier and customer records or you may need only the supplier

option. For more information, see chapter 5, Entering Customer and Supplier Records.

13

Page 28

Sage Line 50 User Guide

Enter your product information. If your business has stock, you should now enter your

product details, including their opening balances. For more information, see chapter 6,

Entering Product Details and Planning a Stock System.

Enter the opening balances for your nominal ledger and bank accounts (in that order). Any

figure listed on your opening trial balance should be entered as an opening balance against

the relevant nominal account. You should enter the opening balance for your bank account

after you have entered the balances of all your other nominal ledger accounts. This is the

last task which you should complete in order. For more information, see Entering Opening

Balances for Nominal and Bank Accounts on page 163.

The remaining chapters of Part One contain instructions on how to set up monthly payments,

discounts for customers, your fixed asset details and e-Banking.

About SageCover

If you are new to Sage Line 50, you are entitled to receive free SageCover for a 60-day period.

Your cover begins when you register your Sage product. This entitles you to unlimited

assistance in registering, installing and starting to use your new software. During this period you

can contact us by calling 0845 111 5555, e-mailing your query to support@sage.com or by

visiting www.sage.co.uk. There is no limit to the amount of times you can use the SageCover

service in this period.

Note: The free period of SageCover applies only to new users of Sage Line 50. If you are

upgrading from an earlier version of Line 50, you should use your existing SageCover support

contract if you have any queries. If you do not have an existing SageCover agreement, you can

subscribe to SageCover as detailed below.

If you want to subscribe to a full annual SageCover period, which gives you additional benefits

such as discounted program upgrades, call 0800 33 66 33 if you are resident in the UK

(mainland), 0800 1690315 for residents of Northern Ireland, or 1800 255300 for residents of the

Republic of Ireland. Alternatively, complete the order forms that are sent to you following

registration of your Sage Line 50 program.

SageCover Online Support

If you have SageCover and access to e-mail, you can send online queries to SageCover

support. To do this, from Sage Line 50's menu bar, open the Help menu, choose Email Support

and follow the on-screen instructions.

On www.sage.co.uk you'll find a wealth of business advice as well as tips on how to get the

maximum benefit from your new software. Business advice includes over 100 expertly written

articles on topics ranging from "How to write a marketing plan" to "How to write a contract of

employment".

14

Page 29

Getting Started

sage.co.uk & sage.ie

The Sage UK website, www.sage.co.uk (or www.sage.ie for users in the Republic of Ireland), is

a valuable resource available to you 24 hours a day, seven days a week. You can find

information on our products and services, print your latest invoice from us or sign up for a free

newsletter. It's a convenient place to buy Sage products, find out how to get help and advice

locally from a Sage business partner and much more. We are constantly adding new features

to the website, so visit regularly to take advantage of our online services.

To access the website, click the sage.com option from your Line 50 toolbar and choose Sage

Home Page.

Sage Training

Sage offers a portfolio of classroom training courses for all of our users, designed to enable

them to make the most of their Sage software packages. Every Sage training course is written

and presented by staff who know and understand Sage software. There are training centres in

Birmingham, Bristol, Croydon, Glasgow, Manchester, Newcastle upon Tyne, North London,

Reading, Swansea and Leeds, all offering a range of training courses every month.

For customers who prefer to study in their own time, Sage has also developed a range of self

study products, including on-line training courses, interactive CD-ROMs and workbooks with

practice data.

For further details about our Training products and course availability, please contact one of our

sales advisors on 0800 33 66 33.

15

Page 30

Sage Line 50 User Guide

16

Page 31

Chapter 2

How to Use Sage Line 50

Now you have installed Sage Line 50 and

run the ActiveSetup Wizard, you are ready

for a quick tour.

Sage Line 50 is compatible with most

Windows products. This means that it has

its own main window, which you can

maximise, minimise and resize, and keep

open while you work on other Windows

compatible applications.

This chapter will help you become familiar

with Sage Line 50. You will find out what

Sage Line 50 can do and you will learn

about the demonstration data.

This chapter also describes the different

ways that you can enter and manipulate

your data in the program.

Finally, this chapter provides an

explanation of debits and credits, and how

they work in an accounting system.

In this chapter:

Instructions in This Guide...................19

The Sage Line 50 Options .................20

The Sage Line 50 Window .................21

Using Windows..................................24

Menu Commands..............................25

Getting Help ......................................41

Wizards .............................................41

Debits and Credits .............................42

Page 32

The best way to become familiar with Sage Line 50 is to practise!

Sage Line 50 includes a demonstration data set for a fictitious company called Stationery

& Computer Mart UK. To access the demonstration data, go to File on the Sage Line 50

menu bar, then choose Open and select Open Demo Data. If Line 50 prompts you to

login, enter the default user name MANAGER, leave the password box empty, and click

OK.

Start using Sage Line 50 by experimenting with this demo data. Try moving around the

windows and familiarise yourself with list boxes, option buttons, check boxes and the

other elements of the program. Use the Search, Clear and Swap buttons on the Nominal

Ledger window to see how they work and then select some records from the Nominal list.

These are all activities you will use throughout Sage Line 50 and learning them now will

be a real help later on.

As you are working through this guide, you can swap between your own company

information and the demo data to practise any functions that you are unsure of. The demo

data is fully interactive and you can enter information into the data set to try out the

functions and work within the system. Whilst you are in the demo data set, you can do

nothing that will influence your real accounts. So don’t worry and try things out.

Remember, you are not on your own. This chapter explains how to use Sage Line 50 on

your computer, the rest of this guide explains procedures and processes with

step-by-step instructions. You also have the Sage Line 50 Help system at your disposal,

which you can search at any time if you are stuck, or press F1 if you are stuck on a

particular screen.

Note: All details in the demonstration data are fictitious. Any similarities in the

demonstration data with real names, addresses or other company details, past or

present, is coincidental.

Page 33

How to Use Sage Line 50

Instructions in This Guide

Sage Line 50 is a fully Windows compatible product which means that all the usual windows

elements are used. This User Guide also uses the same terminology and instruction

conventions that are used in your Windows User Guide, so, if you are familiar with Windows,

you will already know how to navigate around your Sage Line 50 program. If you are not, the

basic elements of Windows are described in this chapter.

This guide takes you through many different procedures, step-by-step, such as recording a

payment or running a report. To make it easy for you to follow, these instructions are written

using the following conventions. For example, a step by step procedure always starts in the

same format and continues as a series of numbered steps, as shown below.

Example

1. Select a record you want to delete from the Records list.

2. Click Delete.

Note: If during a procedure you are asked to type specific text into a box, this text is

always shown in boldface, as shown in step 3 below.

3. In the Command Line text box type d:\setup.exe and then press ENTER.

If you are required to press a specific key on the keyboard, this key is shown in CAPITAL

LETTERS. You will notice that the key you needed to press in step 3 above, the ENTER key,

is written in capital letters.

Italic text is used to refer you to other sections of the guide, for example:

4. To print your VAT Return, click Print. For more information, see Chapter 20, Running

Your VAT Return.

There is also consistent use of command words within the procedures, such as:

Open a menu from the menu bar.

Choose from a drop-down menu.

Select an option button, check box or an item from a list.

Click a command button or an option from a toolbar.

You decide whether to use the keyboard or the mouse to open, choose or select items.

Instructions on how to do this and how to use other elements of Sage Line 50 are contained in

this chapter. The next page explains what the main buttons of Sage Line 50 are used for.

19

Page 34

Sage Line 50 User Guide

The Sage Line 50 Options

Enter your customers’ details and keep track of your sales. Post any invoices or credit notes you raise and

instantly see when payments are due and overdue.

The Suppliers button lets you enter details of each of your suppliers, including invoices and credit notes and

contains all of their transaction details.

All your transactions are posted to the nominal accounts. Looking at these accounts lets you see the exact

state of your finances.

Record your bank and cash payments, receipts, transfers and adjustments. Pay your supplier invoices and log

customer receipts against invoices sent.

Use the Products option to record all of the items and services that you sell. The details can then be transferred

onto the sales invoices you create.

Invoicing lets you generate and print invoices and then updates your ledgers automatically. You can invoice for

items of stock you sell, or for the services your business provides.

Sales Order Processing is only available to users of Financial Controller. It lets you easily complete your sales

orders and automatically updates your ledgers.

Purchase Order Processing is only available to users of Financial Controller. It makes recording your purchase

orders quick and straightforward.

Look at details of your income and expenditure, assets and liabilities, compare your finances against last year’s

figures, and calculate your VAT Return.

Accountant Plus and Financial Controller users can use the Projects option to create and manage projects

and their associated costs, bill customers for work carried out and analyse cost information.

Use Credit Control to keep track of your money and find out how to set payment deadlines for your customers,

how to charge your customers for late payment of bills and how to write off bad debts.

The e-Mail option lets you electronically send and receive invoices and orders. Sage Line 50 then automatically

updates your records with their details.

Use the Period End options to carry out your routine functions at your month and year ends, such as clearing

transactions from the audit trail.

This option lists all of the financial reports that are available. From here you can print off your Balance Sheet,

Profit and Loss and many other reports.

Sage MIS uses your accounting data to give you a snapshot of your finances, sales performance, customers,

products and suppliers, in graphs and tables.

Sage.com is a great resource for your company. Find information on products and services, print your latest

invoice from us or sign up for free newsletters.

Sage Line 50’s Help system has over 1000 pages of support and instructions. If you cannot find what you want

in this User Guide, it will be in the Help system.

20

Page 35

How to Use Sage Line 50

The Sage Line 50 Window

When you double-click on the Sage Line 50 program icon, the Sage Line 50 window appears.

You can choose different views for your window. The first option shows a taskbar with the

toolbar visible. You can get this view by selecting View on the menu bar and putting a tick next

to Taskbar and Status Bar, if you want these to show.

Option 1: The Taskbar and Toolbar View

This is the Sage Line 50 Taskbar.

Open an option by putting the arrow

over the word and clicking the

mouse. When you first open Sage

Line 50, the Shortcuts and Recent

Reports areas will be empty.

This is the Sage Line 50 Menu

Bar. Open a menu by putting the

arrow over the word and clicking

the mouse or Alt + underlined

key.

This is the Sage Line 50 Toolbar.

Open an option by pointing the

cursor to the icon you want and

clicking the mouse.

Click to

minimise,

shrink or

close.

This is the Suppliers window, which appears

when you click Suppliers from the Toolbar. You

can open as many windows as you want, or

close them as you finish with them by using the

X in the top right hand corner. Or, you can

minimise them to use them later.

This is the Status Bar. This figure tells you how

many transactions you have entered onto

your system, the program date and the

financial year start date. You can choose to

show or hide this.

21

Page 36

Sage Line 50 User Guide

Option 2: The Taskbar View

This is the Taskbar. Open an option by

putting the arrow over the word and

clicking the mouse. When you first

open Sage Line 50, the Shortcuts and

Recent Reports areas will be empty.

This is the Sage Line 50 Menu

Bar. Open an option by pointing

the cursor on the option you

want and clicking the mouse.

Click here to

minimise, shrink

or close.

22

This is the Status Bar. This figure tells you how

many transactions you have entered onto your

system, the program date and the financial year

start date. You can choose to show or hide this.

Page 37

How to Use Sage Line 50

T

Option 3: The Toolbar View

The third option is to display the Toolbar only (if you are upgrading, this is the view the Sage Line

50 window defaults to). You can get this view by selecting View on the menu bar and putting a

tick next to Toolbar and Status Bar, if you want it showing (see bottom right of screen shot).

his is the Sage Line 50

Menu Bar. Open a menu by

putting the arrow over the

word and clicking the mouse

or Alt + underlined key.

This is the Sage Line 50

Toolbar. Open an option by

pointing the cursor to the icon

you want and clicking the

mouse.

Click on the minimise button to

display Sage Line 50 as a small icon

at the bottom of the screen, or use

the middle button to shrink the Sage

Line 50 window.

The X button closes the program.

This is the Status Bar. This figure tells you how

many transactions you have entered onto

your system, the program date and the

financial year start date. You can choose to

show or hide this.

23

Page 38

Sage Line 50 User Guide

Using Windows

When you select an option from the Sage Line 50 toolbar, a window appears in which you can

enter or view information. You can open several options at once, so you can move between one

function and another without having to close each one in turn. However, only one window can

be active at any one time. When you open a new screen, a new tab appears in the bottom left

area of the window. Click on these tabs to move between any of the screens.

24

Click on a tab to view any screen that you have opened.

Page 39

How to Use Sage Line 50

Data Entry Windows

In Sage Line 50, your data is entered onto window ‘forms’. Each form is divided into small boxes

into which data can be typed using the keyboard or selected from a list of choices.

Each single piece of information you enter on a screen is called a field. For example, a

customer’s name is a field; so is a price. Fields that accept both letters and numbers, plus a few

symbols such as hyphens or brackets, are called alphanumeric fields. Those that accept only

numbers are called numeric fields and those that accept and display a date are called date

fields.

The width of a field’s box usually denotes the limit of the number of characters it will accept. This

is known as the field length. However, Sage Line 50 will make sure that you only enter the right

type and amount of data in each field. So, for example, you will not be permitted to enter text

in a numeric field. You will also be prevented from entering a date which is not a calendar date.

Other types of field validation ensure that, as far as possible, the right kind of information is

entered into the appropriate field. Any deviation from the expected data may result in the input

being rejected or ignored, or in the screen displaying an error message.

Menu Commands

Each option on the menu bar provides access to a drop-down menu. If you use other software

on your PC, you will probably be familiar with drop-down menus. You can open menus and

choose options using the keyboard or mouse, as described below.

Selecting Menus With a Mouse

Click on the left mouse button when the pointer is on the menu option name, to display the pull

down menu. To select an option, click on the left mouse button again when the mouse pointer

is pointing to the option on the menu that you want.

Selecting Menus With the Keyboard

All menu and option names have one underlined character. You can select a menu by pressing

the ALT key simultaneously with the key corresponding to the underlined character. For

example, to select the Edit menu, you would type ALT and E (ALT+E) at the same time. When

the menu appears, you can select one of the options on the menu by pressing just the character

underlined. For example, having opened the Edit menu, you could select the Delete Row option

by pressing the D key.

25

Page 40

Sage Line 50 User Guide

The Toolbar

The main Sage Line 50 options are on a toolbar, which displays beneath the main menu bar. To

run any of these options, click on the appropriate option with the left mouse button.

When you run one of these options, a separate window will appear with its own toolbar options.

You can however run these options without a mouse by pressing the ALT key and the underlined

character shown on the option, at the same time.

Command Buttons

Command buttons appear in most of the Sage Line 50 option windows. Use these to take

action once you have entered some data or selected a record to work with. Command buttons

appear on virtually every window and include one or more of the following commands:

.

Save Choose the Save button to accept the data you have entered and process the

information, e.g. make the changes in the record. Any data entry boxes on the

screen will be cleared for you to enter details for another record. Save does not

take you out of the option.

Close Close is the button to choose when you want to exit from an option. Close does

not save any data you have entered so make sure you do this first, if

appropriate.

Discard If you choose the Discard button, any data you have just entered in the data

entry boxes will clear from the screen for you to start again.

Note: Discard does not undo any entries you have already saved.

OK The OK button is sometimes shown instead of the Save button. The difference is

that OK will not only save and process your data but will also exit the option.

Cancel The Cancel button is sometimes shown instead of the Discard button. The

difference is that Cancel not only Discards your data entry (or process) but it also

exits the option.

When there are too many buttons to display on the visible window, for example if you are using

a low display resolution, a double-arrow symbol appears to the right-hand side of the command

button bar. Click the arrow symbol to access the remaining available buttons:

26

Page 41

How to Use Sage Line 50

Entering and Editing Data

To type data into a form, you can move the arrow-shaped pointer (the cursor) to the field area

where you want to enter data, at which stage the pointer changes to a vertical bar called the

insertion pointer.

Move the cursor to the part of the field where you want to begin typing and click the left hand

mouse button. If the field is blank, an insertion pointer appears at the far left of the box. If there

is data already in the field, the insertion pointer appears at the same place as the cursor was

positioned when you clicked the mouse button.

The figure below shows a typical data-entry screen.

Find records with this button.

When you click Save, a blank screen appears, ready for another record. If you want to recall

your last record, click on the drop-down list button (represented by a down-ward pointing arrow)

and this will give you a list, in alphanumeric order, of all the records that have been entered. Find

the record reference that you want and select it with your mouse.

Moving Around Fields and Forms

After you have entered data within a field, you can use any of the following keys, found on your