Royal 435DX User Manual

Royal

435dx

Electronic Cash Register

Instruction Manual

16 Departments

800 PLU’s (Price Look-Ups)

8 Clerks Automatic Tax Computation – with 4 Tax Tables (Including Add-on (USA), Canadian and VAT)

Programmable Electronic Cash Register

Easy Set-Up Instructions

QUICK START GUIDE on Page 12

WELCOME...

to the Royal family of fine business machines. We sincerely hope you will enjoy the many benefits of being associated with a distinguished product name that has represented both quality and customer satisfaction since 1905.

This electronic cash register is designed to help your business function smoothly by providing efficient register operations and accurate management reports. Start-up is quick and easy, yet there are many options that can be added and revised so that you can customize your operations for optimum productivity. Here are just a few of the register's many valuable features:

•16 departments

•800 PLU (Price Look-Up) settings

•8 Clerk Totals

•Security System

•Choice of Journal or Customer Receipt printout

•Automatic tax computation for tax rate (Add-on, Canadian Tax and VAT)

•Up to 4 Tax Tables

•Department-linked entry options that streamline and speed-up operation

•Periodic management reporting systems

•Battery back-up / memory protection of records

PLUS...

The ROYAL CONSUMER PRODUCT SUPPORT HOTLINE gives you the opportunity to call for operational assistance and problem resolution. Please call toll-free:

Customer Service: 1-800-272-6229 (USA) 1-888-266-9380 (in Canada) 01-800-849-4826 (in Mexico) Ordering Supplies: 1-888-261-4555

TABLE OF CONTENTS |

|

__________________________________________________________ |

|

INTRODUCING ...YOUR CASH REGISTER ..................................................................................................... |

1 |

STANDARD ACCESSORIES ........................................................................................................................ |

1 |

USING THIS MANUAL................................................................................................................................... |

1 |

SPECIFICATIONS AND SAFETY ...................................................................................................................... |

2 |

SETTING UP AND MAINTAINING THE CASH REGISTER............................................................................. |

3 |

KEYPAD FUNCTIONS..................................................................................................................................... |

4-5 |

THE CONTROL SWITCH ................................................................................................................................... |

6 |

CASH DRAWER ............................................................................................................................................ |

6 |

THE DISPLAY ..................................................................................................................................................... |

7 |

READING THE DISPLAY .............................................................................................................................. |

7 |

Special Symbol Indicators ........................................................................................................................ |

7 |

DISPLAYING THE TIME................................................................................................................................ |

7 |

ERROR CONDITIONS ........................................................................................................................................ |

8 |

THE ERROR ALARM SYSTEM .................................................................................................................... |

8 |

Clearing An Error ...................................................................................................................................... |

8 |

VOIDING ERRORS........................................................................................................................................ |

8 |

Voiding the Entry Just Completed ............................................................................................................ |

8 |

Voiding An Earlier Entry............................................................................................................................ |

8 |

THE BATTERY BACK-UP SYSTEM ................................................................................................................. |

9 |

LOADING PAPER............................................................................................................................................. |

10 |

INSTALLING THE INK ROLL........................................................................................................................... |

11 |

QUICK START ............................................................................................................... |

12-13 |

SETTING PROGRAMS................................................................................................................................ |

14 |

Entering the Program Mode ................................................................................................................... |

14 |

Exiting the Program Mode ...................................................................................................................... |

14 |

Clearing Errors........................................................................................................................................ |

14 |

DATE AND TIME.......................................................................................................................................... |

15 |

Setting the Date and Time...................................................................................................................... |

15 |

SETTING THE CLERK SYSTEM ............................................................................................................... |

16 |

PERCENT DISCOUNT (-%) ........................................................................................................................ |

17 |

Setting a Percent Discount (-%) Rate .................................................................................................... |

17 |

DEPARTMENT PROGRAMMING............................................................................................................... |

18 |

Assigning a Department Tax Status & Multiple Item Sale..................................................................... |

18 |

Programming Departments as Taxable and Non-Taxable.................................................................... |

18 |

ZERO PRICE ENTRY SETTING................................................................................................................. |

19 |

TAX RATE .................................................................................................................................................... |

20 |

Programming the Tax Rate .................................................................................................................... |

21 |

Single Fixed Percentage Tax Rate......................................................................................................... |

21 |

PRICE LOOK UPS ....................................................................................................................................... |

23 |

Creating Price Look-Ups (PLU’s) ........................................................................................................... |

23 |

PLU Confirmation Report........................................................................................................................ |

24 |

SECURITY CODE AND DECIMAL POINT ................................................................................................. |

25 |

Assigning a Security Code ..................................................................................................................... |

25 |

Setting the Decimal Point ....................................................................................................................... |

25 |

SUMMARY OF PROGRAMS ...................................................................................................................... |

27 |

TABLE OF CONTENTS

__________________________________________________________

TRANSACTION EXAMPLES FOR OPERATING THE CASH REGISTER ................................................... |

28 |

SAMPLE RECEIPT ...................................................................................................................................... |

28 |

TRANSACTION SYMBOLS......................................................................................................................... |

28 |

STANDARD TRANSACTIONS.................................................................................................................... |

29 |

Registering a Single Item Sale and Tendering Change ........................................................................ |

29 |

Registering a Sale with Multiple Items ................................................................................................... |

29 |

Registering a Charge Transaction.......................................................................................................... |

29 |

Using Split Tendering.............................................................................................................................. |

30 |

MINUS (-) KEY TRANSACTIONS ............................................................................................................... |

30 |

Registering a (-) Reduction (Coupon) .................................................................................................... |

30 |

PERCENT DISCOUNT (-%) TRANSACTIONS.......................................................................................... |

31 |

Discounting (-%) Individual Items........................................................................................................... |

31 |

Overriding the Preset Discount (-%)....................................................................................................... |

31 |

Using a Preset Discount (-%) on the Total Sale .................................................................................... |

31 |

Using a Preset Discount (-%) on Individual Items ................................................................................. |

31 |

PLU CODES................................................................................................................................................. |

32 |

Using Fixed PLU Price............................................................................................................................ |

32 |

Using Open PLU Price............................................................................................................................ |

32 |

VOIDS........................................................................................................................................................... |

33 |

Voiding the Previous Entry in the Middle of a Sale................................................................................ |

33 |

Voiding a Single Item .............................................................................................................................. |

33 |

Voiding Multiple Items............................................................................................................................. |

33 |

REFUNDS .................................................................................................................................................... |

34 |

Refunding a Single Item ......................................................................................................................... |

34 |

Refunding Multiple Items ........................................................................................................................ |

34 |

TAX OVERRIDE TRANSACTIONS............................................................................................................. |

35 |

Exempting Tax on an Item...................................................................................................................... |

35 |

Exempting Tax on an Entire Sale........................................................................................................... |

35 |

Adding Tax to a Non-Taxed Department ............................................................................................... |

35 |

OTHER TRANSACTIONS ........................................................................................................................... |

36 |

Registering Money Received on Account.............................................................................................. |

36 |

Paying Money Out .................................................................................................................................. |

36 |

Registering an Identification Number ..................................................................................................... |

36 |

Registering a No Sale............................................................................................................................. |

36 |

MANAGEMENT REPORTS.............................................................................................................................. |

37 |

"X" POSITION REPORT .............................................................................................................................. |

37 |

"Z" POSITION REPORT AND RESET ........................................................................................................ |

37 |

PRINTING THE SALES REPORT............................................................................................................... |

37 |

CLEARING THE GRAND TOTAL ............................................................................................................... |

37 |

SAMPLE MANAGEMENT REPORT ........................................................................................................... |

38 |

BALANCING FORMULAS ........................................................................................................................... |

39 |

PLU AND CLERK REPORTS...................................................................................................................... |

40 |

TROUBLESHOOTING (FULL SYSTEM CLEAR PROCEDURE) .................................................................. |

41 |

TAX SYSTEM PRESET .................................................................................................................................... |

42 |

VAT TAX SYSTEM............................................................................................................................................ |

43 |

CANADIAN TAX SYSTEM .......................................................................................................................... |

44-45 |

ACCESSORIES ................................................................................................................................................. |

46 |

LIMITED WARRANTY ...................................................................................................................................... |

47 |

INTRODUCING ... YOUR CASH REGISTER

___________________________________________________________________

STANDARD ACCESSORIES

The following are included in the box with your cash register:

-1 Black, Plastic Journal Winder Spindle

-1 Starter-Roll of 57mm (2 ¼”) Single-Ply, Bond Paper

-1 Ink Roll (already installed)

-2 Cash Drawer (515) Keys

-Instruction Manual

-(3) “AA”-Batteries for Memory Back-up System

USING THIS MANUAL

Your Cash Register manual is organized for easy reference. The front portion contains general information on all features and functions of the cash register. Instructions for setting the optional programs are next. Transaction examples for operating the register are at the back of the manual. Use the TABLE OF CONTENTS to locate a particular item.

Throughout this manual, references to the keypad are shown bolded and in brackets. References to the operational keys are preceded by the word "press". For example: Press [subtotal]. Or: Press [DEPARTMENT 1].

References to the 11-key numeric keypad are preceded by the word "type". For example: Type the number [1].

GETTING STARTED

Important note: The cash register must be first plugged in before installing the back-up batteries.

Before you begin to operate the register or set the programs, check SETTING UP AND MAINTAINING THE CASH REGISTER for installation information. Review KEYPAD FUNCTIONS, THE CONTROL SYSTEM and THE DISPLAY to become familiar with their operations.

NOTE: Programs and transaction information for management reports are stored in the memory of the cash register. The batteries must be installed to save this information.

SETTING THE REGISTER PROGRAM

Transaction examples provide steps for key operations. Sample receipts are included.

Royal's helpful "Quick Start" program (Page 12) will provide you with the most basic programming options for the operation of your new cash register. Many users find "Quick Start" the best way to begin to learn about the many capabilities of the machine.

1

SPECIFICATIONS AND SAFETY

__________________________________________________________________

|

MODEL: |

Royal 435dx |

||

|

|

Electronic Cash Register |

||

|

DISPLAY: |

Two LCD Displays. Front display for cashier and rear display for customer. Symbols for |

||

|

|

error, change, subtotal, minus, total and item count. |

||

|

CAPACITY: |

Total: 9-digit display with 7 numeric-digits input and readout. |

||

|

PRINTER: |

Impact, numeric only serial printer. |

||

|

INK SOURCE: |

Black Ink Roll (ROYAL brand part # 013109) |

||

|

PAPER SUPPLY: |

57MM (2 1/4") Single-Ply, Bond Register Tape (ROYAL brand part # 013129) |

||

|

MEMORY PROTECTION: |

Approximately 30 days after power interruption |

||

|

|

3 Size AA (1.5-Volt) Batteries (User installed. Included with unit.) |

||

|

TECHNOLOGY: |

CMOS RAM |

||

|

POWER CONSUMPTION: |

Standby - 15W, Operating - 47W |

||

OPERATING TEMPERATURE: |

0-40 Degrees Centigrade (32-104 Degrees Fahrenheit) |

|||

|

DIMENSIONS: |

14 1/4" D x 13 1/2" W x 9 1/4" H |

||

|

WEIGHT: |

12 lbs. |

||

|

|

|

|

|

|

|

|

|

|

|

|

SAFETY NOTICE |

||

The main outlet for this cash register must be located near the unit and easily accessible.

Do not use this cash register outdoors, in the rain or near any source of liquid.

WARNING

"This equipment generates, uses and can radiate radio frequency energy and if not installed and used in accordance with the instructions manual, may cause interference to radio communications. It

has been tested and found to comply with the limits for a Class A computing device pursuant to Subpart J of Part 15 of FCC Rules, which are designed to provide reasonable protection against such interference when operated in a commercial environment. Operation of this equipment in a residential area is likely to cause interference in which case the user at his own expense will be required to take whatever measures may be required to correct the interference."

2

SETTING UP AND MAINTAINING THE CASH REGISTER

__________________________________________________________________

SETTING UP YOUR CASH REGISTER

IMPORTANT - Please read this section carefully before attempting to operate the cash register or set the programs.

1.Place on a hard, flat, level surface to permit smooth operation of the cash register.

2.Plug in the electrical connection to an appropriate outlet.

3.Install batteries. (See Page 9) Do not install batteries unless the register is plugged in.

4.Install paper. (See Page 10)

5.Set desired program options using Quick Start (Page 12).

6.Set the Control Switch to “R1” (journal record) or “R2” (customer receipts).

7.The machine is ready for cash register transactions.

MAINTAINING THE CASH REGISTER

-Never cover the cash register when turned on. Doing so will prevent proper cooling of the electronic components.

-Cover the register when not in use to protect components from dust. The cash register should be turned “off” when covered and not in use.

-Take care to keep all liquids away from the machine to avoid spills, which could damage electronic components.

-To clean, use a soft, dry cloth. Do not apply organic solutions such as alcohol.

-Your cash register should be kept in areas free from dust, dampness or extreme hot or cold temperatures.

-If stored in extreme temperatures (below 32 degrees or above 104 degrees Fahrenheit), allow the temperature inside the register to reach room temperature before turning on.

-DO NOT attempt to pull the paper tape when printing or installing paper. Always use the [feed] key to advance the paper. Pulling the tape could damage the print mechanism.

-If electronic service is necessary, an authorized service center is recommended. For a list of the Authorized Service Centers within you local area, please call 1-888-261-3888.

-Familiarize yourself with the safety statements on Page 2.

3

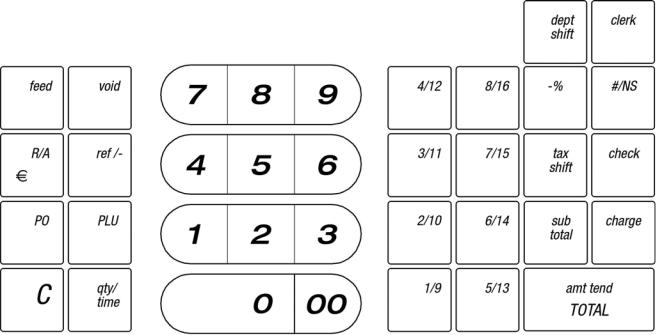

KEY PAD FUNCTIONS

__________________________________________________________________

1.[ feed ] - Paper Feed Key - Advances the paper tape with no effect on register entries.

2.[ void ] - Void/Error Correction - Used to correct an entry after it is printed or to void the previous entry.

3.[ RA ] - Received on Account Key - used to register any money received on account that is not part of a sale; i.e., the start-up money put in the drawer at the start of each business day can be registered as an RA.

4.[ ref/- ] - Dual Function: Coupon - Subtracts the amount from an item or the sales total, such as a coupon deduction. Refund - Subtracts an item that is returned for refund. Minus key totals are shown in the management report.

5.[ PO ] - Paid Out - Registers any money paid out or taken out of the cash drawer that is not part of a sale. Paid out totals appear in the management report.

6.[ PLU ] - Price Look-Up - Registers the transaction, including the preset price, of an individual item linked to the appropriate department.

4

KEY PAD FUNCTIONS

__________________________________________________________________

7.[ C ] - Clear Key - Clears entries made on the keyboard prior to depressing the registration key. Also stops the error alarm when incorrect entries are made.

8.[ qty/time ] - Dual-Function: Multiply & Time Display - Multiplies [DEPARTMENT], [PLU] or [Ref/-] key entries; also displays the current time, if set.

9.Numeric Entry Keys – 11-key Numeric Key Pad, including keys [0] through [9] and double-zero [00].

10.Department Keys - Used to select non-taxable and taxable sales at the pre-programmed tax rate.

11.[ dept shift ] – Department Shift Key - Used to access Department 9 – 16 keys.

12.[ clerk ] – Clerk Key - Used to identify associated transactions with a particular clerk/operator. Supports a clerk identification number for each operator and an optional security code.

13.[ -% ] - Percent Discount Key - Used to subtract a percentage rate from an individual item or an entire sale. The rate can be a pre-programmed percentage rate or any other manually entered percentage rate.

14.[ #/NS ] – Non Ad / No-Sale Key - Used to open the cash drawer without a sale or starting a transaction, such as to make change. Also used to print reference data, any numeric only data up to 7-digits long, on the receipt.

15.[ tax shift ] - Tax Shift Key - Used to enter a non-tax item into a taxable department or to enter a tax item into a nontaxable department.

16.[ check ] - Check Key - Total sales paid by check. Check totals appear in the management report.

17.[ charge ] - Charge Key - Used to total sales that are charged. Charge totals appear in the management report.

18.[ subtotal ] – Sub-Total Key - Used to obtain a sub-total of all entries with tax added. Press this key when finished entering all items of a sales transaction, before collecting cash from the customer. Then collect the cash from the customer, enter the total cash amount and press [ amt tend/TOTAL ] to complete the sale and calculate change.

19.[ amt tend/TOTAL ] - Amount Tendered and Cash Total Key - Used to total transactions and to calculate change from total cash tendered by the customer. In “X” and “Z”-modes this key is used to obtain daily grand totals of all transactions and to run periodic reports and end-of-day reports.

5

THE CONTROL SWITCH

__________________________________________________________________

The Control Switch on the left-edge of the cash register inside the printer compartment must be properly positioned to operate or program the cash register. The Control Switch is also used to access the “X” and “Z” modes to print or reset the totals for the management reports.

Depending on the desired operation, position the Control Switch as follows:

"off" - The cash register is turned off and inoperable.

"R1" (On/Journal Tape) - The cash register is set for standard sales operations, including preset options. A journal record is printed for each transaction.

"R2" (On/Customer Receipt) - The cash register is set for standard sales operations, including preset options. A customer receipt prints for each transaction.

"X" (Prints Mid-Day or Periodic Management Reports) - Prints the "X" management report at anytime and does NOT reset the totals to zero.

"Z" (Prints End-of-Day Management Reports and Resets Totals) - Prints the "Z" management report at the end-of-the-day and resets totals to zero (except "locked-in" grand total).

"prg" (Program Mode) - Used to set and change program settings.

REMOVABLE CASH DRAWER WITH LOCK

This model cash register has a compact cash box that takes up less counter space. The removable cash drawer has 4-bill slots that are sized to accommodate either US, Canadian or Mexican paper currency. It also has a removable coin tray. The coin tray is preset with 4-coin slots, however it can be expanded up to 6-slots to accommodate additional coins if required.

The coin separators, creating the walls between each coin slot, are removable and can be re-positioned in another groove to change the size of each coin slot. Three separators are already installed in the coin tray to create 4-slots. Two additional separators are included in the box with the cash register (please check the packaging thoroughly) and one or both of these can be installed to create a total of 5 or 6-slots. To remove a separator already installed in the coin tray, lift out the removable coin tray from the cash drawer. While squeezing the bottom of the plastic separator where it inserts into the groove opening at the bottom of the coin tray, turn the coin tray upside-down and use a flat-head screw driver from the opposite side to gently push the plastic locking tab out of the groove. Be careful not to break the plastic. To install a separator into the coin tray; line up the separator in a groove with the curved side of the separator facing down and into the coin tray, matching the shape of the coin tray. Be sure the separator is in one groove only; and push it all the way down into the coin tray until the locking tab clicks into position.

The cash drawer will open automatically or electronically after completing a cash, check or charge transaction or by pressing the [#/NS] no-sale key. The cash drawer can also be opened manually by using the hidden emergency lever underneath the register, towards the back of the cash box.

The cash drawer is electronically locked when the control switch is in the "off" position. In addition, the cash drawer is designed with a security “lock and key” that manually locks it and prevents it from opening either electronically or when manually using the hidden emergency lever underneath the register. WARNING: The cash drawer cannot be opened when it is locked using the cash drawer key (# 515) – do NOT lose these keys.

When opened, the cash drawer can be completely removed from the register by lifting up on the front of the open drawer and pulling it towards you away from the register.

6

THE DISPLAY

__________________________________________________________________

READING THE DISPLAY

The display shows entry amounts and related transaction information through use of numbers and special symbols. The display window is situated so that the operator can view the operations.

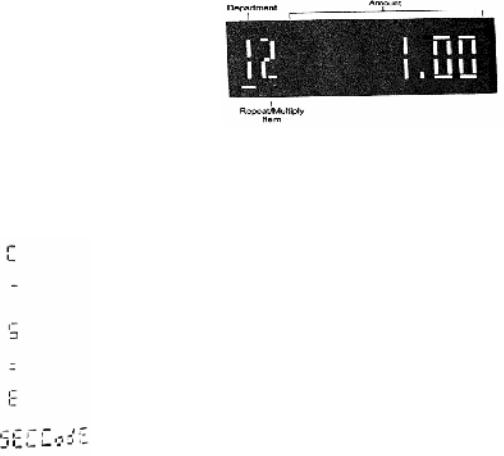

The display is read from left to right as follows.

Department - The first 2-digits display the department number associated for the specific entry.

Repeat/Multiply - The second digit displays the number of items entered at the same price for the same PLU when repeating PLU's or multiplying items using the [qty] key.

Amount - The remainder of the display shows the entry amount. Up to 7 digits can be used for the amount of each entry.

For example, if you register a $1.00 item to Department 1 and repeated the entry, the display would show:

Special Symbol Indicators

Special symbols appear at the far left of the display during operation of the cash register. These symbols identify the amount shown, warn of an error condition or indicate use of the program mode. They include:

(Change) - Indicates the displayed amount is change due to the customer.

(Minus) - Displays for a negative entry. Also displays if subtotal or cash tendered total is a negative number due to a return or refund.

(Subtotal) - Indicates amount shown is a subtotal, including tax if applicable.

(Total) - Indicates amount shown is the total of the transaction.

(Error) - Displays if an error is made during operation or when setting programs. An error tone will sound to alert the operator. To stop the error tone (beep) and to clear the error, press the [C] Clear key

(Security Code) - Displays when a security code has been programmed and an entry is attempted in the “Z” mode.

These symbols clear automatically when you start the next entry or press the [C] Clear key.

DISPLAYING THE TIME

Simply press the [qty/time] key to display the current time. (See SETTING THE DATE AND TIME to set the time). The time is displayed in 24-hour format. (See Page 15). The displayed time is automatically cleared once a transaction is started.

NOTE: Trying to use this feature during a transaction will result in an error tone. If this occurs, press [C] to clear the error.

7

ERROR CONDITIONS

__________________________________________________________________

THE ERROR ALARM SYSTEM

The error alarm system warns of an operator error (usually pressing the wrong key for a specific type of entry) or an error when setting a program option. When the error beep tone sounds, an "E" appears in the display and the keypad locks. An error tone will also occur if the user tries to use a cash register function that has not been programmed yet.

To clear the "E" error, simply press the [C] Clear key.

NOTE: After starting a transaction, moving the Control Switch from "R1" or "R2" to another position before completing a transaction will result in an error condition to remind you to finish and total the transaction.

Clearing an Error:

1.Press the [C] Clear key. The tone ends, the display clears and the keypad unlocks.

2.Determine what error was made.

3.Correct the error, continue with the transaction, finish the transaction or restart the program.

NOTE: The [C] Clear key also clears an incorrect entry from the display prior to pressing a registration key. Once an entry is printed, the [void] key must be used to correct an error.

VOIDING ERRORS

Once an entry is printed on the tape, the [C] Clear key cannot be used to correct the transaction or entry. Use the [void] key to correct an error just registered.

1. Voiding the Entry Just Completed:

If an incorrect entry has been made AND the transaction has not yet been completed (the [subtotal] or [amount tend/TOTAL] keys have NOT been pressed), simply press the [void] key to reverse the last entry BEFORE continuing with any other entries. The entry is reprinted with a "VD" symbol following the amount and reversed or subtracted from the transaction.

2. Voiding an Earlier Entry:

To void an earlier entry in a previous transaction:

1.Complete and total the transaction, which includes the erroneous entry.

2.Start a new void transaction that will off-set the original transaction.

3.Press the [void] key.

4.Re-type the incorrect information for the first item, exactly as originally entered (with the incorrect price or other error).

5.Repeat Steps 3 and 4 for each item in the original transaction.

6.Total the transaction by pressing the [amount tend/TOTAL] key.

7.Then, you can start a new sale with the correct price or correct other information.

8

THE BACK-UP BATTERY SYSTEM

__________________________________________________________________

During cash register operations, all transaction data for the management report is stored in the register's memory. The memory also holds all the optional program information, such as PLU and department information programmed in the register.

The memory is protected by 3 standard "AA"(1.5-Volt) batteries that should be installed before programming the register. Batteries are included with the register.

When properly installed, these batteries provide back-up power to the register memory if the power cord is accidentally disconnected or if a power interruption occurs. The daily transactions, locked-in grand total and all user-programmed information will be retained by the machine without (AC) power because of the memory protection feature. Average battery life protection is approximately 30 days after power interruption. To ensure proper memory protections, batteries should be replaced with new batteries after any lengthy interruption of power, once power has been restored, or once a year with normal use.

TO INSTALL OR REPLACE BATTERIES:

1.Be sure the cash register is plugged-in and there is power to the machine.

2.Move the control switch to the "R1 or "R2" position.

3.Open the printer cover as described on the next page in Figure E. The battery compartment is located inside the printer compartment.

4.Remove the paper roll from the compartment.

5.Remove the battery cover (Figure B), located on the bottom of the printer compartment.

6.Position the batteries as indicated (Figure C), making sure that the positive and negative poles are aligned correctly.

7.Replace the battery cover. (See Figure D).

NOTE: It is important that the unit is plugged in before the batteries are first installed and when replaced.

NOTE: In order to assure continuous battery back-up protection, it is important that the batteries be changed at least once every year.

9

LOADING PAPER

__________________________________________________________________

HOW TO LOAD THE PAPER

This register uses standard 2 ¼ inch (57mm) single-ply bond paper to produce either a customer receipt (outside) or a journal record (inside).

NOTE: It is recommended to use ROYAL brand 2 1/4" (57mm) bond paper, which will help prevent dust deposits on the printer mechanism caused by inexpensive paper rolls. Replace with standard bond quality calculator paper. ROYAL Part #013129.

To order, call the Royal Supply Center toll free at 1-888-261-4555.

1.Plug in your cash register.

2.Grasp the printer cover by the finger tab on front, left side of the cover. Gently pull up on the front of the cover and then raise it towards the back of the cash register (it is on a hinge and can be completely removed from the register). (Figure E)

3.Cut or tear the end of the paper roll evenly for a straight edge to permit proper feeding through the print head.

4.Place the paper roll in the paper holder so that the paper will feed out from the bottom of the roll toward the front of the register.

5.Insert the end of the paper roll into the paper slot (Figure F), the printer, under the black, plastic writing table.

6.Depress the [feed] key until the paper catches and advances through the printer.

7.If the paper does not feed through the printer, make sure the paper has a smooth, straight edge and was inserted in the proper slot.

8.Pass the tape through the receipt window of the printer cover, in front of the metal paper cutting blade, if a customer receipt is desired.

or

If a journal record is desired, wind the tape around the black, plastic journal winder spool. Simply advance the tape approximately 10-12 inches by using the paper feed [feed] key. Remove the left edge of the winder spool. Then, wrap the beginning edge of the paper tape around the inner core or the winder spool and slide the tape under the two forks that extend on both sides of the journal winder spool. (See Figure G). Turn the spindle manually a few times to take up the excess paper. Replace the left edge of the journal winder spool and place the entire spool back into its holder towards the back of the printer compartment. Then press the [feed] key until the journal paper tightens the paper securely around the spindle. (Figure H)

9. Close the printer cover.

10

INSTALLING INK ROLL

__________________________________________________________________

HOW TO CHANGE THE INK ROLL

This register comes equipped with the ink roll installed at the factory. The ink roll releases special ink to the print head, which produces the print on the paper. After a period of time, depending upon the amount of use, the ink in the roll will be used up. When printout becomes faint, the ink roll needs to be replaced.

CAUTION:

The ink roll is NOT designed to be re-inked. Under no circumstances should this be done or permanent damage to your cash register print head will result. Such damage WILL NOT be covered under Royal's warranty.

REPLACE YOUR INK ROLL FOLLOWING THE INSTRUCTIONS BELOW:

1.Open the printer compartment by lifting the black, plastic printer cover.

2.The ink roll is found in the front of the printer compartment, just behind the print head, and is mounted in a plastic cartridge. To remove, grasp the small clip on the left of the ink roll (where the words “PULL UP” may be printed on the ink roll cartridge) and pull up. The ink roll will easily pull up and away from the print head. (Figure I)

3.To replace a new ink roll, insert the ink roll according to markings "L" (Left) and "R" (Right) by pressing downward to lock it into position, then close the printer cover. No tools are necessary.

For best performance, store unopened ink roll package in a cool, dry place until installed.

NOTE: Replace with ROYAL Ink Roll, Part #013109.

To order, call the Royal Supply Center toll free at 1-888-261-4555.

11

QUICK START

__________________________________________________________________

Quick Start is a brief but complete start-up program that allows you to "get started" immediately on the most basic aspects of operating your new cash register. Follow these directions precisely:

1.Read and follow the set-up instructions on pages 1-11. Reminder: It is important that the register is plugged in before the back-up batteries are installed.

2.Install memory back-up batteries, according to the instructions on the previous pages of the manual.

3.Make sure the ink roll is installed in the register (was installed at the factory); and install the cash register paper roll, according to the instructions on the previous pages of the manual.

4.Perform the following Quick Start programming procedures:

A.Slide the control switch to the right to the “prg” (Program) position.

B.Set the current date by typing the current month day and year (mm/dd/yy) using the numeric keys. The month and date must each be entered as a two-digit number; for example, to set March 8, 2006, type [030806]. Finalize by pressing the [#/NS] key.

C.Set the current time using the 24-hour clock format. For example: to set 9:15 A.M., type [0915]; to set 7:15 P.M., type [1915]. Finalize this entry by pressing the [qty/time] key.

D.Set the decimal point for 2-decimal places (U.S./Canada standard): Type [1], [2] and press the [RA] key.

E.To set a fixed add-on Tax Rate (in the USA): Type [1] for tax rate #1, then press the [tax shift] key. Then type the tax rate as a 4-digit number. For example, if your tax rate is 8%, type [8000]; if your tax rate is 7.5%, type [7500]. Then press the [amt tend/TOTAL] key. For Canadian Tax users, please refer to the Canadian Tax section of the manual

F.In these examples, we will program the register to accept a zero price; press [8], [1] and then press the [RA] key.

Please note for the next steps you will use the Department Keys, which are the keys numbered 1 through 16 located directly below the [clerk] key.

G.Program Department 1 as taxable items without any preset price. To do this, type the numeric keys [0] [0] [1] to assign Tax Rate #1, press [check], type the price [000] and finalize by pressing the [Department 1] key. Repeat this procedure for all departments you wish to tax. Optional: If you wish to enter preset department prices, replace the [000] with the actual price you would like to program, or see page 18 for details.

H.Program Department 2 as non-taxable items with a preset price of $1.99. To do this, type the numeric keys [0] [0] [0] to set as non-taxable, press [check], type the price [199] and finalize by pressing the [Department 2] key. Repeat this procedure to all the departments you wish not to tax. Optional: If you wish to enter different preset department prices, replace the [199] with the actual price you would like, or see page 18 for details.

I.Basic programming is now complete.

3.To ring up sales, slide the control switch to the R1 or R2 position (R1 winds a Journal Record on the spindle, whereas R2 gives you Customer Receipts through the window opening, as described fully on page 10). Follow the instructions given in "Transaction Examples", starting on page 28.

4.To print Management Reports, slide the control switch to the “X” or “Z” position as needed, then press the [amt tend/TOTAL] key. Refer to explanation starting on page 37.

12

Loading...

Loading...