Page 1

Grundig 2035 "Hastings"

Documentation received with the radio

In those days (1956) there was a trading condition dealing with "Resale Price Maintenance" or RPM whereby manufacturers sold their products to

dealers on the understanding that they adhered to the manufacturers list price. The list price was calculated to allow small dealers to make enough

business by cutting prices. This then was the age of busy high streets. Lots of small shops offering personal service to customers rather than what

we have today... lots of charity shops using the vacant premises of bankrupt dealers and huge supermarkets with perpetual phoney cut-price special

offers.

eavesdropped on the sale and realised they were effectively selling retail they may object. Big shops with a regular turnover of specific makes

would be supplied by manufacturers directly through travelling salesmen called "Reps" or by local wholesalers if sales were ad hoc.

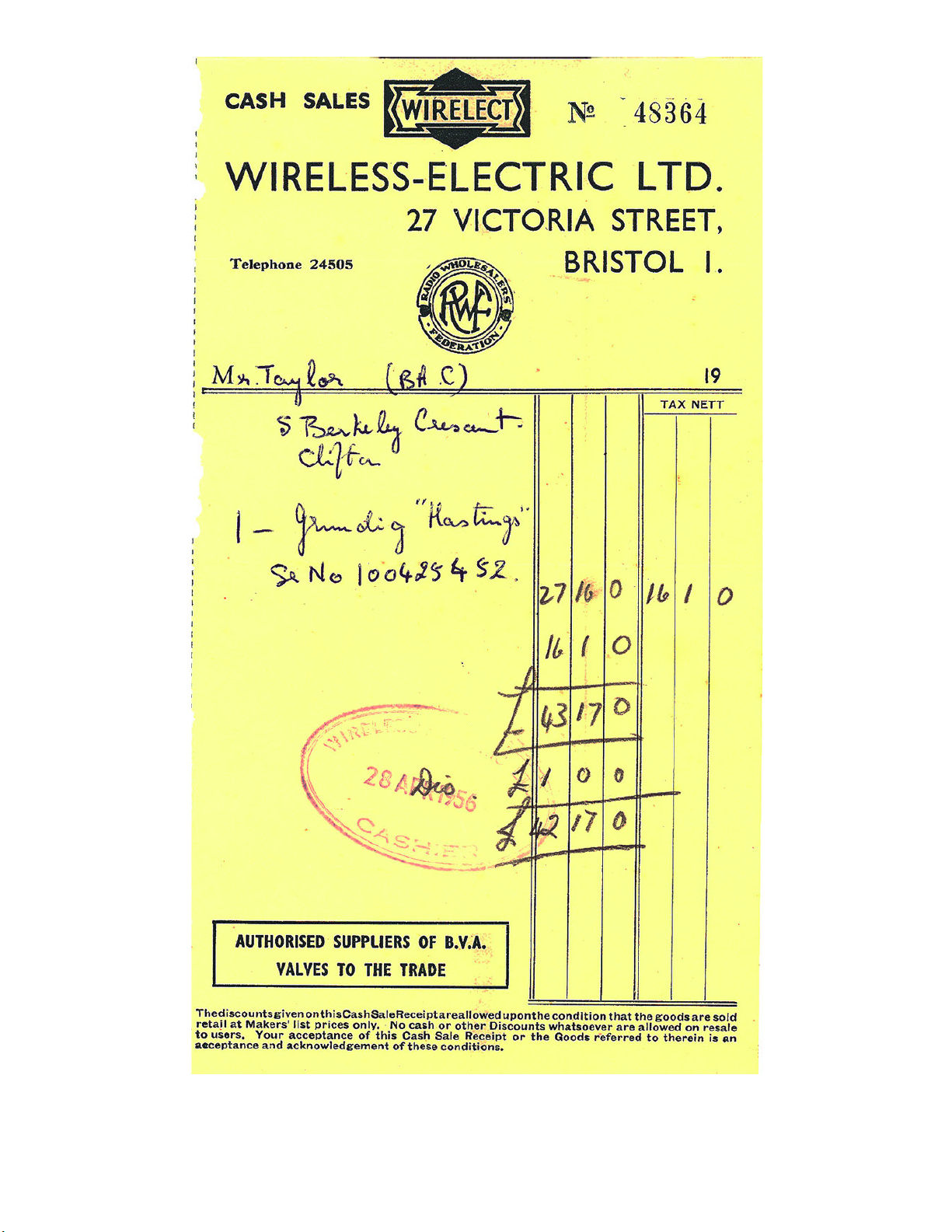

The explanation of how Mr Taylor purchased this radio is in a clue written on the sales brochure pictured later. Large companies often negotiated

to Wireless-Electric Ltd.

The Purchase Tax official sum seems to have been about 38.5%.

The first thing you'll see in the invoice below is the enormous amount of Purchase Tax, at face value equating to 57.7%, but considering the £1

If you've an eye for small print... look at the sales conditions at the bottom of the receipt. What do you make of this?

profit to run their businesses whilst ensuring there was competition between brands. Large chain stores could buy at a quantity discount but were

forced to sell at list prices. This meant two things. Chain stores made a larger profit than small businesses but couldn't force small dealers out of

If you were well connected or knew wholesalers' staff you could buy stuff at decent discounts and this is what Mr Taylor did...

What about the £1 discount below? Well, it's 3.5% and probably not enough to cause waves in the industry, but if it became common practice

might result in Messrs Wireless-Electric Ltd losing their Grundig dealership, and even the supply of radios in general, depending on how their

customers and suppliers reacted. I include "customers" because I think this particular company is a wholesaler and, if another customer

with their suppliers sizeable discounts for their staff. Frequently this was a third off. Not quite as attractive as it sounds however. The list price was

quoted as 55 guineas. Now, in those days quoting a guinea was really cheating as it effectively made a buyer relate 55 guineas to 55 pounds, but of

The receipt mentions "BAC" so Mr Taylor worked for The British Aircraft Company at Bristol and it was that company that guided rich employees

The actual list price of this radio was £57:15:0d (inc PT) so a buyer offered a third off might expect to pay £39:3:4d. Not so because the chancellor

expects to be paid the purchase tax included in the 55 guineas which is £16:1:0d. So, deduct a third from what's left (which is £57:15:0d - £16:1:0d

= £41:14:0d) and you get £27:16:0d then add back the chancellor's cut and you get £43:17:0d. Now this is more than Mr Taylor originally

expected, which was £39:3:4d, so some negotiationg/explaining resulted in a further £1 knocked off; still £3:13:8d extra. This doesn't sound much

discount maybe this is over 60%? However, not all is quite as it first seems...

course a guinea is a pound plus 5%. A sort of imaginary tax.

but was in fact half a weeks wages.

RPM was sort of heavily frowned upon by MPs in 1956 (the year this radio was sold) but by1964 RPM was made illegal. This however instigated

the term "Manufacturers Recommended Price" later used as a bargaining tool by discounters.

Page 2

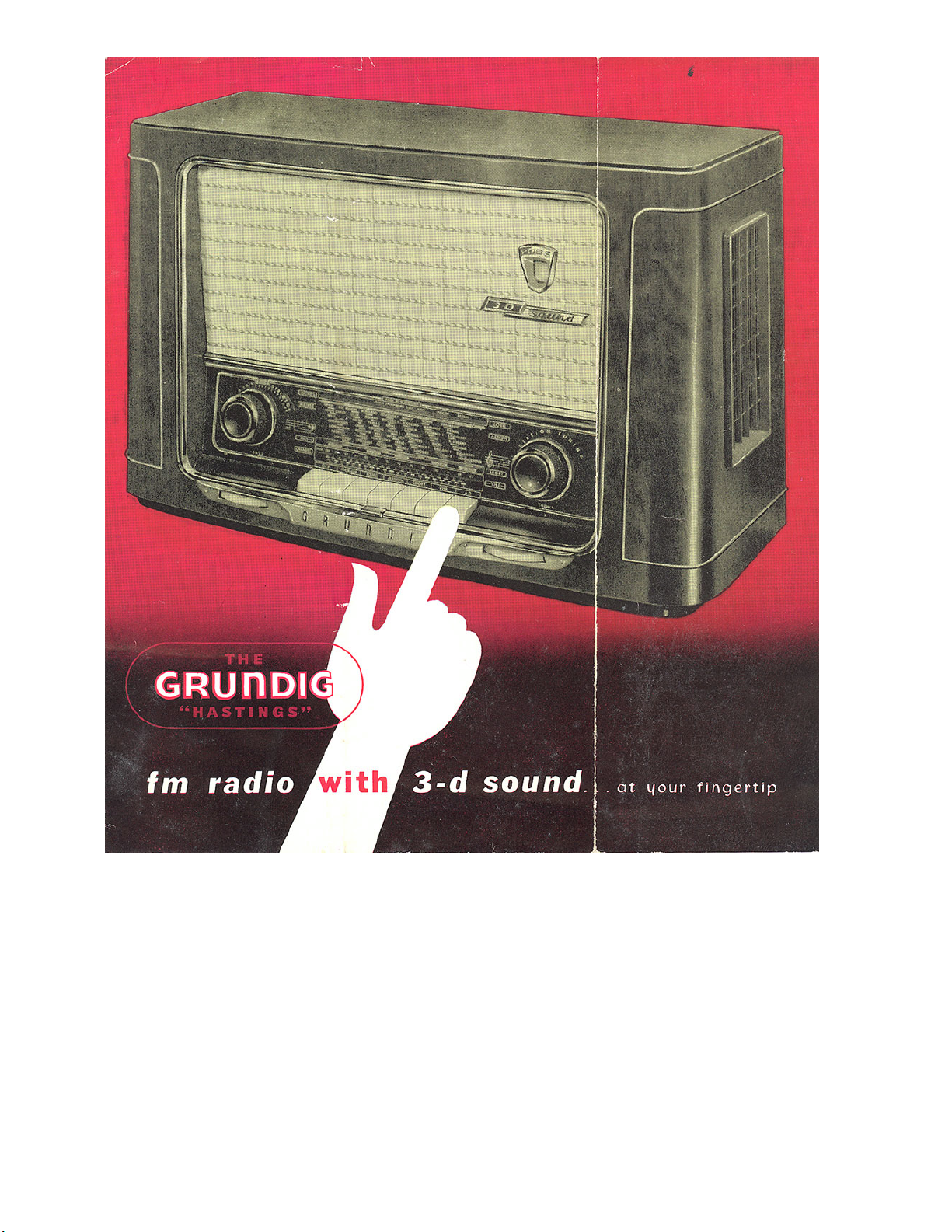

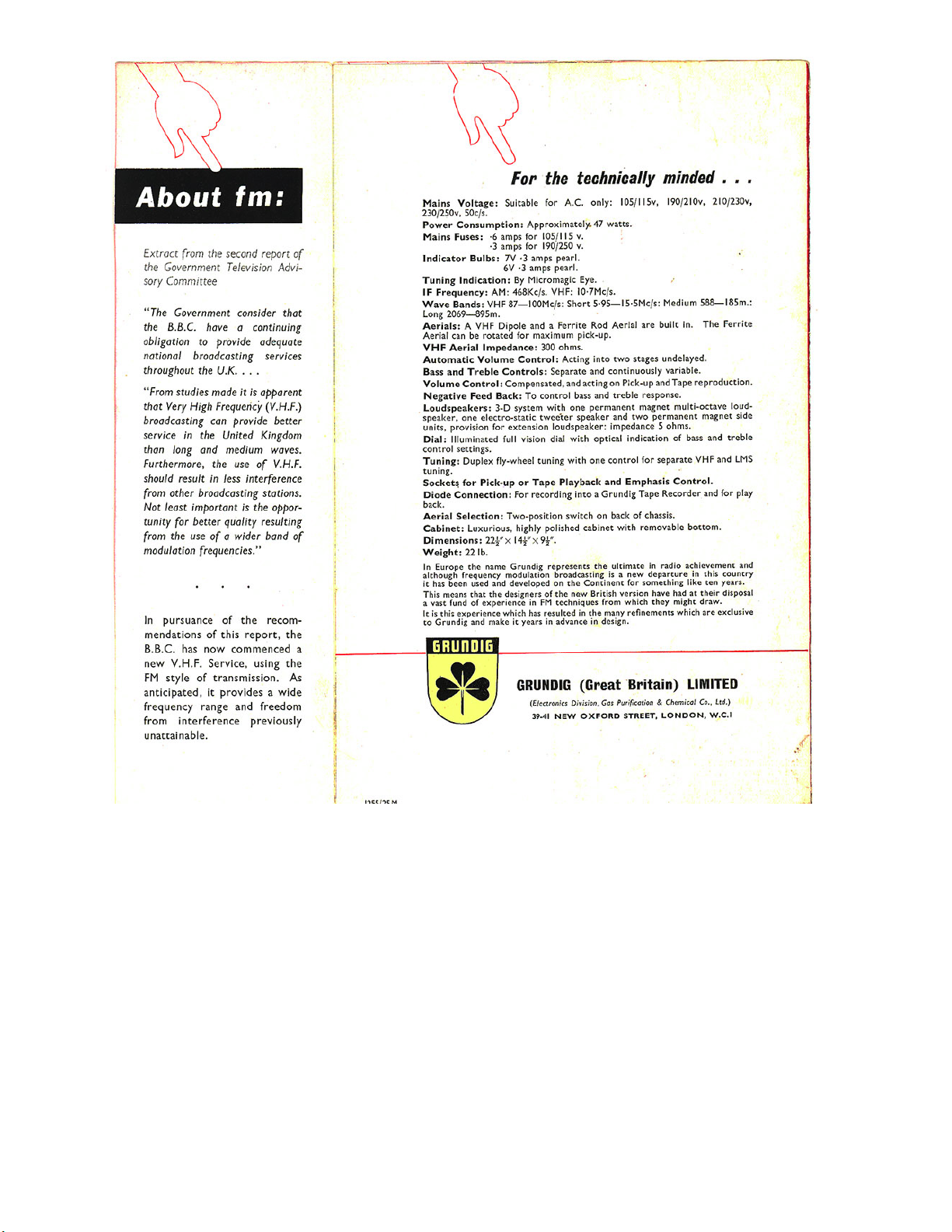

Here's the advertising brochure that decided Mr Taylor to part with his cash... Strangely the Model 2035 brochure has pictures of the Model 2085.

Page 3

Page 4

Page 5

Page 6

Page 7

Alas, after four years or in Grundig's view "some considerable time" Mr Taylors radio was giving trouble...

Was this the reason?

Page 8

Was this extra gadjet purchased? Note that five and a half guineas is really £5:15:6d. Arithmetic was a darned sight harder even in secondary

modern schools in those days than it is now in these new fangled academies.

Page 9

Page 10

And here's a complete technical document.... produced in the good old days when instructions were written by people with a command of the

English language...

Page 11

Page 12

Page 13

Page 14

Page 15

Return to see the refurbishment

Loading...

Loading...