Page 1

User's Manual

SE-G1

PCR-T273

SM-T274

Electronic Cash Register

Page 2

Introduction

Thank you very much for purchasing this CASIO electronic cash register.

START-UP is QUICK and EASY!

For the basic settings of your cash register, please see “Quick Start Guide”.

IMPORTANT

For programming assistance please visit

http://casio4business.com/sa_index.html

CASIO Authorized Service Centers

If your CASIO product needs repair, or you wish to purchase replacement parts,

please visit http://casio4business.com.

Original Carton/Package

If for any reason, this product is to be returned to the store where purchased, it must

be packed in the original carton/package.

Location

Locate the Cash register on a at, stable surface, away from heaters or areas exposed

to direct sunlight, humidity or dust.

Power Supply

Your cash register is designed to operate on standard household current (120 V, 50/60

Hz). Do not overload the outlet by plugging in too many appliances.

Cleaning

Clean the cash register exterior with a soft cloth which has been moistened with a

solution of a mild neutral detergent and water, and wrung out. Be sure that the cloth is

thoroughly wrung out to avoid damage to the printer. Never use paint thinner, benzene,

or other volatile solvents.

The mains plug on this equipment must be used to disconnect mains power. Please

ensure that the socket outlet is installed near the equipment and shall be easily accessible.

E-2

Page 3

What would you like to do with your cash

register?

To use the cash register safely ....................E-4

Precautions for Use ....................................... E-7

To use the cash register’s basic function ...E-9

To Program basic settings ..................................................E-10

To use the cash register’s basic functions .......................E-15

To print sales reports ......................................................... E-25

Useful features ............................................. E-29

Various programming ......................................................... E-31

Various operations ............................................................. E-54

Other operations ................................................................. E-63

Calculator mode .................................................................. E-69

When you consider it as a problem ...................................E-72

Specications ......................................................................E-74

E-3

Page 4

To use the cash register safely

• Congratulations upon your selection of this CASIO product. Be sure to read the

following safety precautions before using it for the rst time. After reading this

guide, keep it close at hand for easy reference.

• Please pay due attention to the following symbols to help you use the product

safely and properly and to avoid any personal injury or damage to the product.

*

Danger

*

Warning

*

Caution

• The gures in this manual have the following meanings.

This symbol means be careful = a warning.

’

The example at left is a warning about an electrical shock.

This symbol indicates something you must not do = prohibited action. The

!

example at left means never disassemble the product.

This symbol indicates something you must do = an instruction.

The example at left indicates you should unplug the product from the

$

outlet. Please note that instructions that are difcult to express by a gure

are indicated by +.

If liquid that leaked from a battery gets in your eye, on your skin or

clothes, deal with it immediately as follows.

1. Immediately rinse it off with lots of water.

-

2. Immediately get medical treatment.

Failing to act may result in a rash or loss of sight.

If this symbol is ignored and the product consequently misused, it can result in serious personal injury and/or death.

If this symbol is ignored and the product consequently misused, it may result in serious personal injury and/or death.

If this symbol is ignored and the product consequently misused, it may result in personal injury and/or property damage.

*

Danger

Handling the register

• Should the register malfunction, start to emit smoke or a strange odor,

$

E-4

or otherwise behave abnormally, immediately shut down the power and

unplug the AC plug from the power outlet. Continued use creates the

danger of re and electric shock. Contact CASIO service representative.

*

Warning

Page 5

To use the cash register safely

*

Warning

• Do not place containers of liquids near the register and do not allow

-

-

!

Power plug and AC outlet

+

+

+

-

any foreign matter to get into it. Should water or other foreign matter get

into the register, immediately shut down the power and unplug the AC

plug from the power outlet. Continued use creates the danger of short

circuit, re and electric shock. Contact CASIO service representative.

• Should you drop the register and damage it, immediately shut down the

power and unplug the AC plug from the power outlet. Continued use

creates the danger of short circuit, re and electric shock.

Attempting to repair the register yourself is extremely dangerous.

Contact CASIO service representative.

• Never try to take the register apart or modify it in any way. High-voltage

components inside the register create the danger of re and electric

shock. Contact CASIO service representative for all repair and maintenance.

• Use only a proper AC electric outlet. Use of an outlet with a different

voltage from the rating creates the danger of malfunction, re, and

electric shock. Overloading an electric outlet creates the danger of

overheating and re.

• Make sure the power plug is inserted as far as it will go. Loose plugs

create the danger of electric shock, overheating, and re.

Do not use the register if the plug is damaged. Never connect to a

power outlet that is loose.

• Use a dry cloth to periodically wipe off any dust built up on the prongs

of the plug. Humidity can cause poor insulation and create the danger

of electric shock and re if dust stays on the prongs.

• Do not allow the power cord or plug to become damaged, and never try

to modify them in any way. Continued use of a damaged power cord

can cause deterioration of the insulation, exposure of internal wiring,

and short circuit, which creates the danger of electric shock and re.

Contact CASIO service representative whenever the power cord or

plug requires repair or maintenance.

*

Caution

• Do not place the register on an unstable or uneven surface. Doing so

-

can cause the register - especially when the drawer is open - to fall,

creating the danger of malfunction, re, and electric shock.

E-5

Page 6

To use the cash register safely

*

Caution

Do not place the register in the following areas.

• Areas where the register will be subject to large amounts of humidity or

+

+

+

-

-

+

dust, or directly exposed to hot or cold air.

• Areas exposed to direct sunlight, in a close motor vehicle, or any other

area subject to very high temperatures.

The above conditions can cause malfunction, which creates the danger

of re.

• Do not overlay bend the power cord, do not allow it to be caught

between desks or other furniture, and never place heavy objects on top

of the power cord. Doing so can cause short circuit or breaking of the

power cord, creating the danger of re and electric shock.

• Be sure to grasp the plug when unplugging the power cord from the

wall outlet. Pulling on the cord can damage it, break the wiring, or

cause short, creating the danger of re and electric shock.

• Never touch the plug while your hands are wet. Doing so creates the

danger of electric shock. Pulling on the cord can damage it, break the

wiring, or cause short, creating the danger of re and electric shock.

• At least once a year, unplug the power plug and use a dry cloth or

vacuum cleaner to clear dust from the area around the prongs of the

power plug.

Never use detergent to clean the power cord, especially power plug.

• Keep small parts out of the reach of small children to make sure it is not

swallowed accidentally.

Only use the specied batteries.

• Do not disassemble, modify or short-circuit them.

-

• Do not put them in re or water or heat them.

• Do not mix new and old batteries or different types of batteries.

• Orient the terminals +- correctly.

• Remove the batteries if the system will not be used for a long time.

• After batteries are spent, dispose of them as per local regulations.

• Do not try to recharge dry cell batteries.

Disposing of batteries:

• Make sure that you dispose of used batteries in accordance with the

-

E-6

rules and regulations in your local area.

Page 7

Precautions for Use

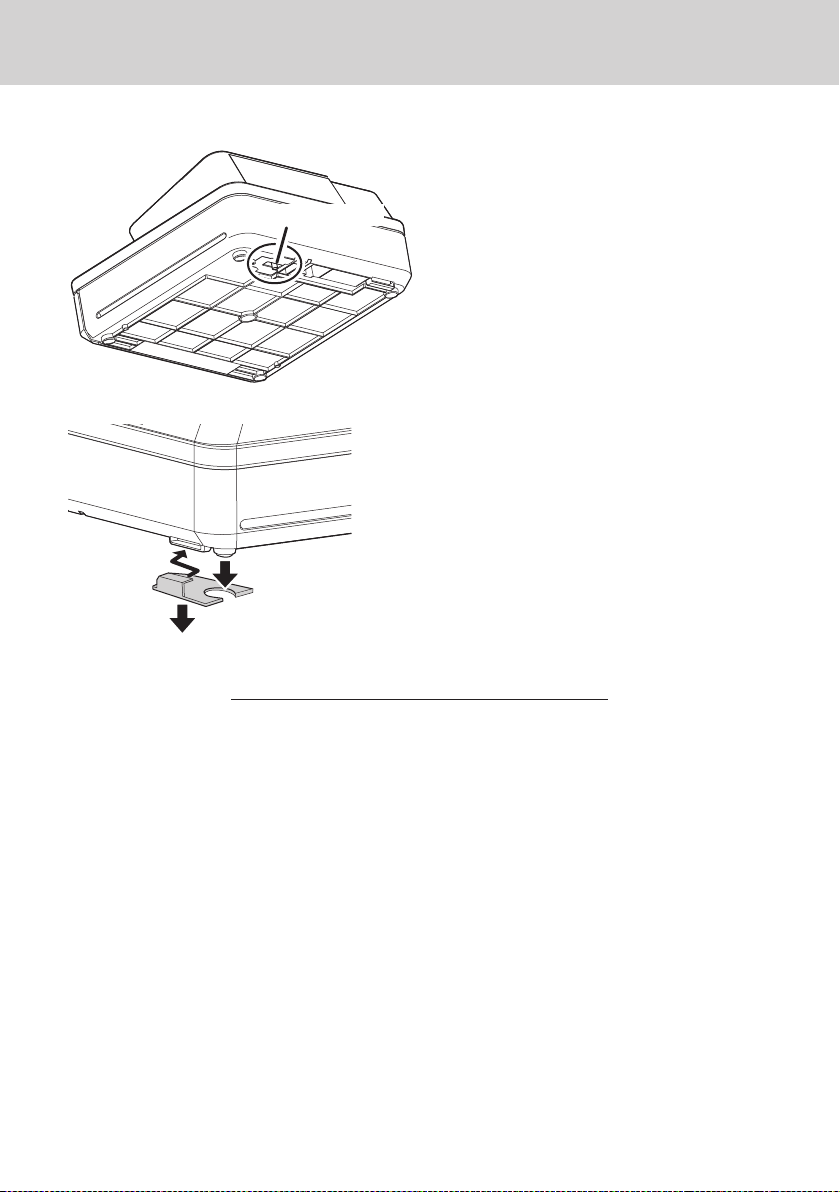

When the cash drawer does not open!

Drawer release lever

About drawer hook

Drawer hook prevents the cash register from

falling caused by weight of coins.

Insert the drawer hook in the ditch of the drawer.

Peel the release paper from the drawer hook

and stick the drawer on the place where the

register is installed.

As it may cause a malfunction of the drawer,

please do not put coins and bills in the drawer

exc e ssively.

In case of power failure or the machine is

in malfunction, the cash drawer does not

open automatically. Even in these cases,

you can open the cash drawer by pulling

drawer release lever (see below).

Important!

The drawer will not open, if it is locked

with a drawer lock key.

LIMITED WARRANTY : ELECTRONIC CASH REGISTERS

This product, exc ept the batter y, is warranted by CASIO to the original purchaser to be free from defects in material

and workmanship under normal use for a per iod, from the date of purchase, of one year for parts and 90 days for

labor. For one year, upon proof of purchase, the product will be repaired or replaced (with the same or a similar model)

at CASIO’s option, at a CASIO Authorized Service Center without charge for parts. Labor will be provided without

charge for 90 days. The terminal resident software and programmable software, if any, included with this product or

any programmable soft ware which may be licensed by CASIO or one of its author ized dealers, is warranted by CASIO

to the original licensee for a per iod of ninety (90) days from the date of license to conform substantially to published

specications and documentation provided it is used with the CASIO hardware and software for which it is designed.

For a period of ninety (90) days, upon proof of license, CASIO will, at its option, replace defective terminal resident

software or programmable software, correct signicant program errors, or refund the lic ense fee for such software.

Signi cant program errors will be signic ant deviations from written documentation or spec ications. These are your

sole remedies for any breach of warranty. In no event will CASIO’s liability exceed the license fee, if any, for such

software. This warranty will not apply if the product has been misused, abused, or altered.

Without limiting the foregoing, battery leakage, bending of the unit, a broken display tube, and any cracks or breaks

in the display will be presumed to have resulted from misuse or abuse. To obtain warranty service you must take or

ship the product, freight prepaid, with a copy of the sales receipt or other proof of purchase and the date of purchase,

to a CASIO Authorized Ser vice Center. Due to the possibility of damage or loss, it is recommended when shipping

the product to a CASIO Authorized Service Center that you package the product securely and ship it insured. CASIO

HEREBY EXPRESSLY DISCLAIMS ALL OTHER WAR RANTIES, E XPRESS OR IMPLIED, INCLUDING ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULA R PURPOSE. NO R ESPONSIBILITY IS ASSUMED FOR ANY INCID ENTAL OR CONSEQUENTIA L DAMAG ES, INCLUDING WITHOUT LIMITATION

DAMAGES RESULTING FRO M MATHEMATICAL INACCUR ACY OF THE PRODUCT OR LOSS OF STORED DATA.

SOME STATES DO NOT ALLOW THE EXCLUSION OR LIMITATION OF INCIDENTAL OR CONSEQUENTIAL DAMAGES, SO THE ABOVE LIMITATIONS OR E XCLUSIONS MAY NOT APPLY TO YOU.

This warranty gives you specic rights, and you may also have other rights whic h vary from state to state.

E-7

Page 8

Precautions for Use

Manufacturer:CASIO COMPUTER CO., LTD.

6-2, Hon-machi 1-chome, Shibuya-ku, Tokyo 151-8543, Japan

Responsible within the European Union:CASIO EUROPE GmbH

CASIO-Platz 1, 22848 Norderstedt, Germany

Please keep all information for future reference.

The declaration of conformity may be consulted at http://world.casio.com/

Laite on liitettävä suojamaadoituskostkettimilla vaurstettuun pistorasiaan

Apparatet må tilkoples jordet stikkontakt

Apparaten skall anslutas till jordat nätuttag.

This mark applies in EU

countries only.

The main plug on this equipment must be used to disconnect mains power.

Please ensure that the socket outlet is installed near the equipment and shall be easily acces sible.

THIS IS A CLASS A PRODUCT. IN A DOMESTIC ENVIRONMENT THIS PRODUCT MAY

CAUSE RADIO INTERFERENCE IN WHICH CASE THE USER MAY BE REQUIRED TO TAKE

ADEQUATE MEASURES.

This product is also designed for IT power distribution

system with phase-to- phase voltage 230 V.

WARNI NG

GUIDELINES LAID DOWN BY FCC RULES FOR USE OF THE UNIT IN THE U.S.A.

(Not applicable to other areas)

WARNING: This equipment has been tested and found to comply with the limits for

a Class A digital device, pursuant to Part 15 of the FCC Rules. These limits are designed

to provide reasonable protection against harmful interference when the equipment is

operated in a commercial environment. This equipment generates, uses, and can radiate

radio frequency energy and, if not installed and used in accordance with the instruction

manual, may cause harmful interference to radio communications. Operation of this

equipment in a residential area is likely to cause harmful interference in which case

the user will be required to correct the interference at his own expense.

FCC WARNING:

the party responsible for compliance could void the user’s authority to operate

the equipment.

Changes or modifications not expressly approved by

E-8

Page 9

To use the cash register’s basic function

To Program basic settings .............................................E-10

To issue receipts .......................................................................... E-10

To set tax table .............................................................................. E-11

Tax tables of each state ............................................................... E-12

To change taxable statuses of departments ............................. E-14

To use the cash register’s basic functions ..................E-15

To open the cash drawer without any transaction .................... E-15

Basic registration ......................................................................... E-15

To register multiple quantity of the same item ......................... E-17

To sell packaged item individually ............................................ E-18

To sell items on charge ................................................................ E-19

To sell items in cash and charge (split sales) ............................E-20

To sell items by cash and check (split sales) ............................E-22

To correct erroneous inputs ........................................................E-23

To print sales reports .................................................... E-25

To print daily management report .............................................. E-25

To obtain periodic reports ........................................................... E-28

Basic function

E-9

Page 10

To use the cash register’s basic function

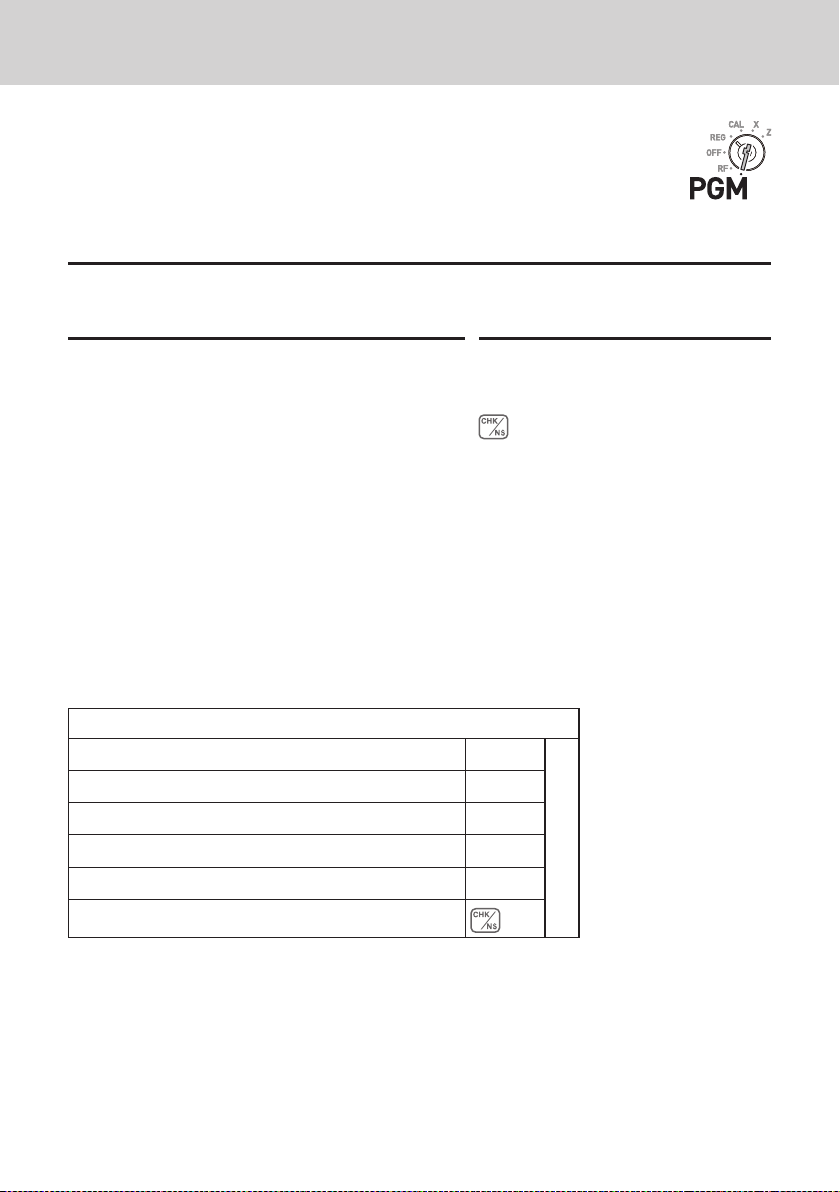

To Program basic settings

This section describes the fundamental programming for basic operations.

To issue receipts

Instead of recording on journal paper, you can issue receipts.

1 Remove the printer cover by lifting up.

2 Lift the take up reel and cut the paper.

3 Replace the printer cover.

4 Turn the Mode switch to PGM position.

“P” appears on the display.

5 Press Zk to set the cash register in program mode.

6 Press Zu to set the register in “Receipt” mode.

Now your cash register issues receipts.

If you wish to restore the register to “Journal” mode, press ?u in step 6.

Mode Switch

E-10

Page 11

To use the cash register’s basic function

To set tax table

To program the tax table, follow these operations.

If you wish to set at tax rate, please see “To set tax tables and

rounding system” on page E- 41.

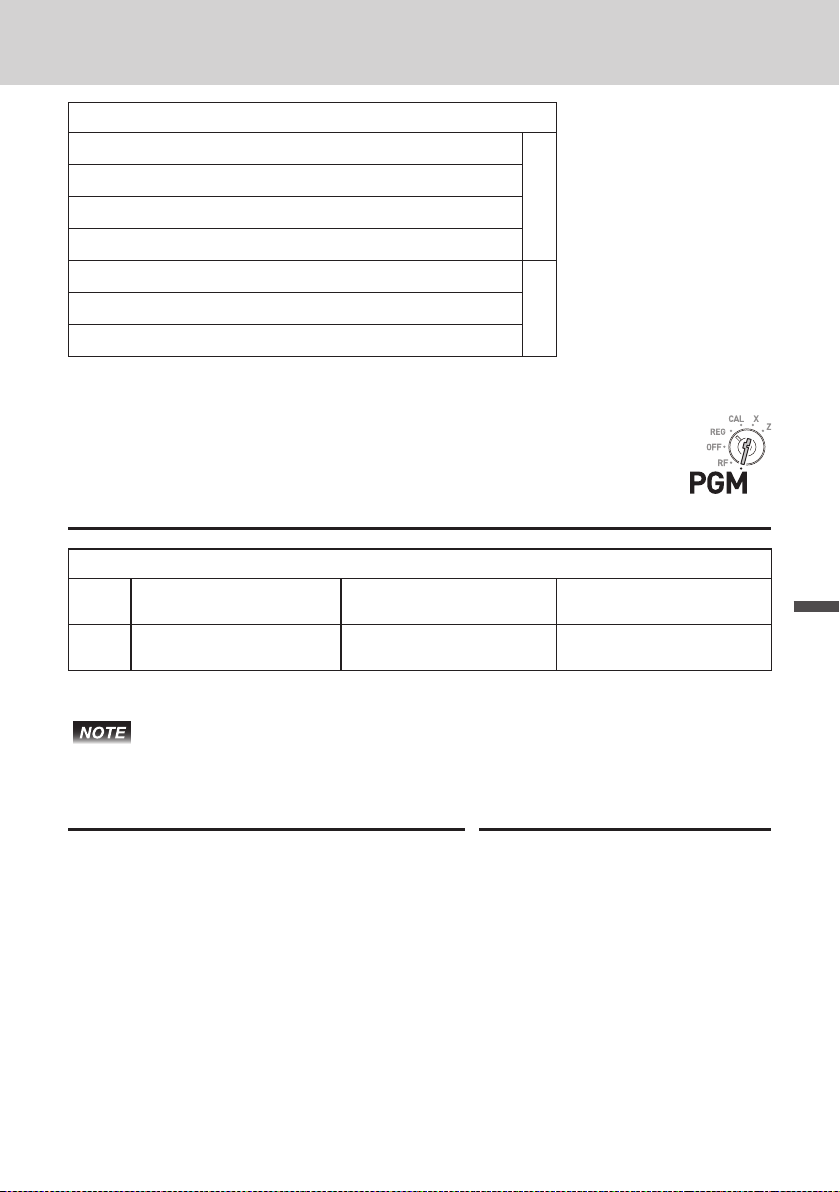

Step Operation

1 Enter C then press k to set the cash

register in program mode.

2 Enter ??XB and press k key.

“0025” is the function code for tax table setting.

3 Refering “Tax tables of each state” on page

E-12, choose tax table of your area and enter

the table number then press p key. The

example shown on the right is choosing tax

table number “0101”.

Ck

??XBk

?Z?Zp

4 If necessary, repeat the step 3 for tax table 2.

5 Press k to complete the setting.

k

Mode Switch

Basic function

E-11

Page 12

To use the cash register’s basic function

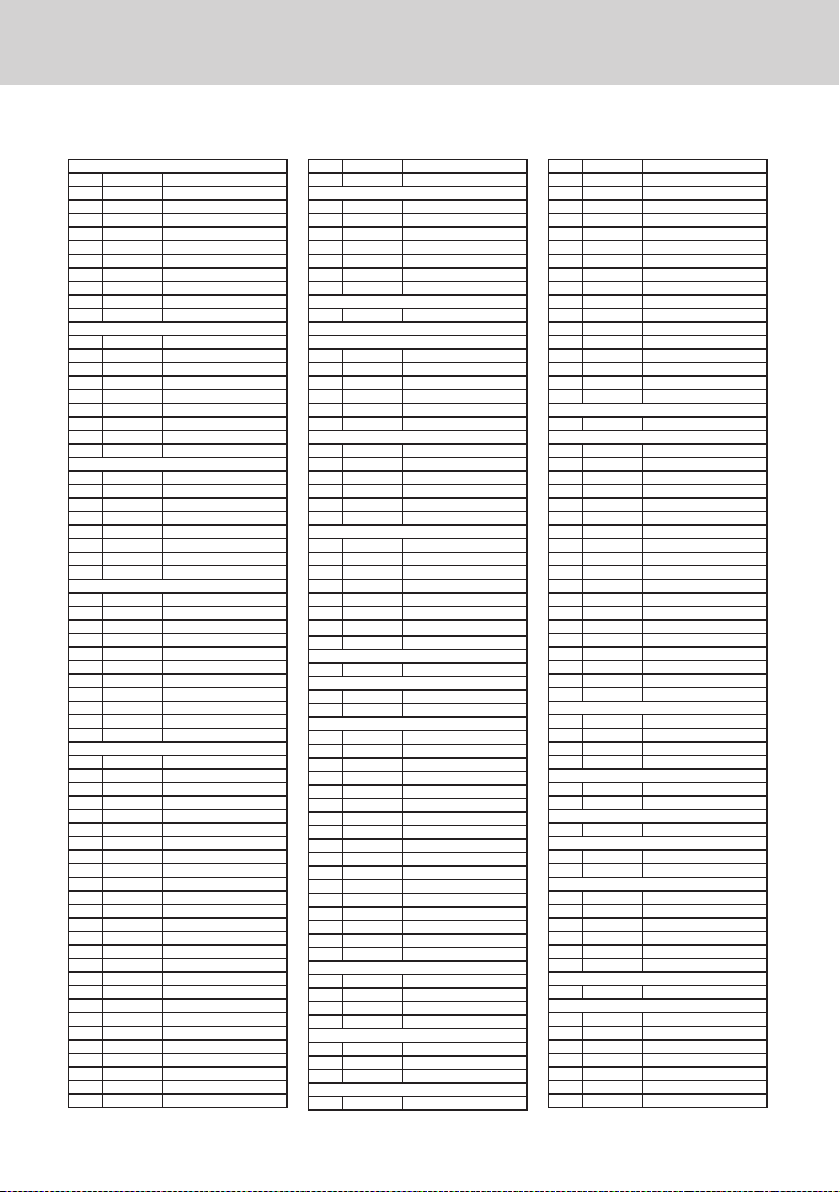

Tax tables of each state

ALABAMA

0101 4% State & Loc al

0102 4.5% State & Loc al

0103 5% State & Loc al

0104 5.5% State & Loc al

0105 6% State & Loca l

0106 6.5% State & Loc al

0107 7% State & Loca l

0108 7. 5% State & Loc al

0109 8% State & Loca l

0110 8.5% State & Loc al

0111 9% State & Local

ALASKA

0201 2% KENAI

0202 3%

0203 3% HOMER

0204 4% HAI NES

0205 4% JUNEAU

0206 5% KENAI

0207 5% SEWA RD

0208 5.5% HOMER

0209 6%

ARIZON A

0301 5.6%

0302 6.8%

0303 7.1%

0304 7.8%

0305 8.1%

0306 8.3%

0307 8.6%

0308 8.8%

ARKANSAS

0401 4.5%

0402 5%

0403 5.5%

0404 6%

0405 6.5%

0406 7. 5%

0407 8.5%

0408 9%

0409 9.5%

0410 10.5%

0411 11. 5%

CALIFORNIA

0501 7%

0502 7.12 5%

0503 7. 25%

0504 7. 37 5%

0505 7. 5%

0506 7. 62 5%

0507 7.7 5%

0508 7. 87 5%

0509 7.925%

0510 7.975%

0511 8%

0512 8.175 %

0513 8.25%

0514 8.275%

0515 8.375%

0516 8.475%

0517 8.5%

0518 8.725%

0519 8.75%

0520 8 .875%

0521 8.975%

0522 9%

0523 9. 25%

0524 9.475%

0525 9. 5%

0526 9 .725%

0527 9 .75%

0528 10 .25%

COLOR ADO

0601 3.75%

0602 5.75%

0603 6 .15%

0604 6.75%

0605 7. 5%

0606 8.5%

0607 2.9%

CONNETICUT

0701 6%

DELAWA RE : No Stat e Sales Tax

COLUMB IA

0901 2%

0902 5%

0903 6%

0904 9%

0905 11%

0906 12%

FLORID A

1001 6%

1002 6.5%

1003 7%

1004 3%

1005 3.5%

1006 4%

GEORGIA

1101 4%

110 2 5%

110 3 6%

110 4 1%

110 5 2%

110 6 3%

1107 6%

110 8 7%

HAWAII

1204 4%

IDAHO

1301 5%

1302 6%

ILLINOIS

1401 6.2 5%

1402 6.5%

1403 6.75%

1404 7%

1405 7.1 25 %

1406 7. 25%

1407 7. 5%

1408 7. 75 %

1409 8%

1410 8.25%

1411 8.5%

1412 8.75%

1413 9%

1414 9.25%

1415 9.5%

1416 9.75%

1417 1%

INDIANA

1501 5%

1502 5% SA LES TA X

1503 6%

1504 7%

IOWA

1601 5% State & Loc al

1602 6% S tate & Loc al

1603 7% S tate & Loc al

KANSAS

1701 2.5%

1702 3%

1703 3.1%

1704 3.25%

1705 3.5%

1706 3.75%

1707 4%

1708 4.1%

1709 4.5%

1710 4.9%

1711 5.4%

1712 5.5%

1713 5.65%

1714 5.9%

1715 6.15%

1716 6.4%

1717 6.5%

1718 6.9%

1719 5.3%

KENTUCKY

1801 6%

LOUISI ANA

1901 4%

1902 4.5%

1903 5%

1904 5.25%

1905 5.5%

1906 5.75%

1907 5.8%

1908 6%

1909 6.25%

1910 6.5%

1911 6.7%

1912 6.8%

1913 7%

1914 7. 5%

1915 7. 8%

1916 8%

1917 8.5%

1918 9%

1919 10%

MAINE

2001 5%

2002 5.5 %

2003 7%

2004 10%

MARYLAND

2101 5%

2102 6%

MASSACHUSETTS

2201 5%

MICHIGAN

2301 6%

2302 4%

MI NN ESOTA

2401 6.5%

2402 7%

2403 7. 5%

2404 9%

2405 9.5%

2406 10%

MISSISSIPPI

2501 7%

MISSOURI

2601 4.225% State

2602 4.6% State & L ocal

2603 4.72 5% State & Lo cal

2604 4.85% State & Loc al

2605 4.975% Sta te & Local

2606 5 .1% Stat e & Local

2607 5.225% State & Loc al

E-12

Page 13

To use the cash register’s basic function

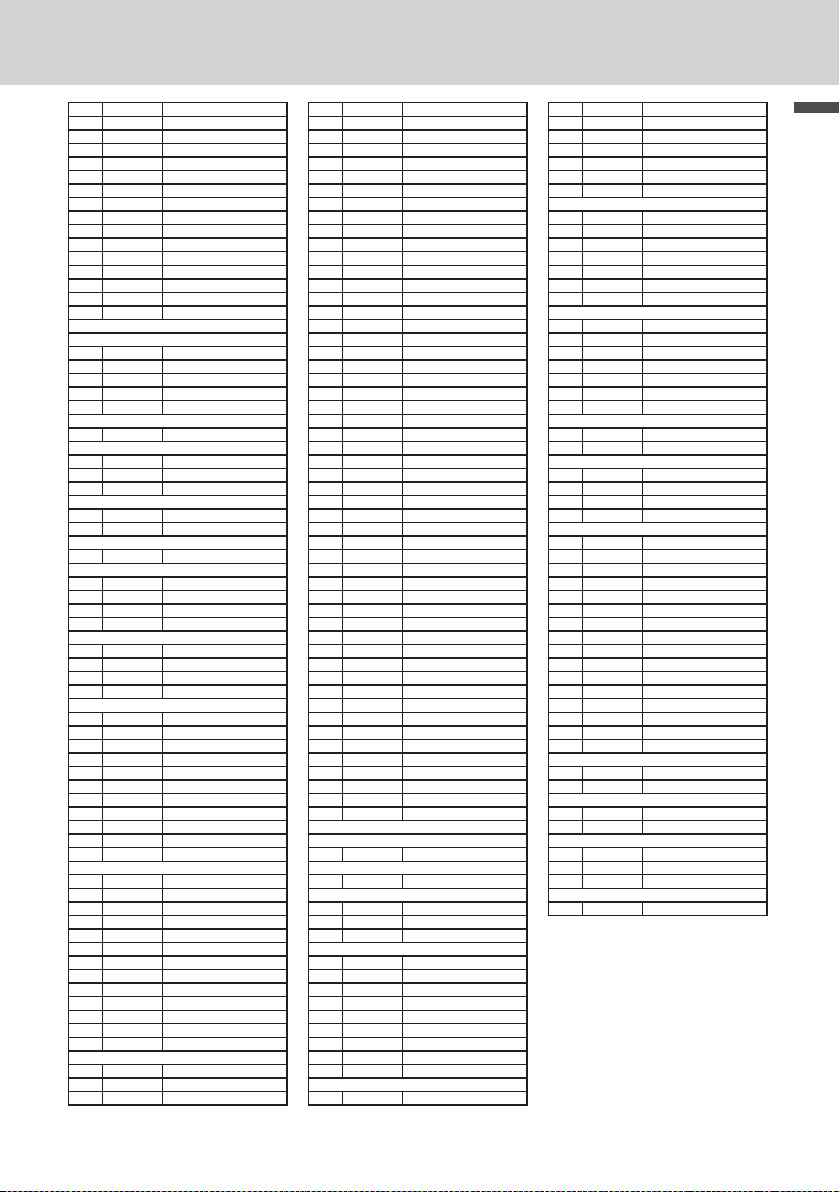

2608 5. 475% St ate & Loca l

2609 5.6% State & Lo cal

2610 5.725% S tate & Loc al

26 11 5. 85% State & Local

2612 5.975% St ate & Loca l

2613 6 .1% Sta te & Local

2614 6.2 25% State & Local

2615 6.35% State & Loc al

2616 6.475 % State & L ocal

2617 6.6% State & Loc al

2618 6.725 % State & Loc al

2619 6.85% State & Loca l

2620 6.975% St ate & Loca l

2621 7.2 25 % St ate & Local

2622 7. 72 5% State & Loc al

2623 1. 225 % Food

MONTANA : N o State Sa les Tax

NEBRASKA

2801 4.5%

2802 5%

2803 5. 5%

2804 6%

2805 6. 5%

NEVADA

2901 6.5%

NEW HAMPSHIRE

3001 7%

3002 7% Rooms & Me als

3003 8% Rooms & Me als

NEW JERS EY

3101 6%

3102 7%

NEW MEXICO

3201 5%

NEW YORK

3301 4% State

3302 5% State & Lo cal

3303 6% State & Loc al

3301 7% St ate & Local

NORTH CAROLINA

3401 3%

3402 4%

3403 6%

3404 6.5%

NORTH DA KOTA

3501 3%

3502 3.5%

3503 4%

3504 5%

3505 5.5%

3506 6%

3507 6.5%

3508 7%

3509 7. 5%

3510 8%

3511 9%

OHIO

3601 5%

3602 5.2 5%

3603 5.5%

3604 5.75%

3605 6%

3606 6.25%

3607 6.5%

3608 6.75%

3609 7%

3610 7. 25 %

36 11 7.5 %

3612 7. 75 %

3613 8%

OKLAHOMA

3701 4.5%

3702 4.7%

3703 4.85%

3704 4.875%

3705 4.917 %

3706 5%

3707 5.25%

3708 5.5%

3709 5.75%

3710 6%

3711 6.1 25 %

3712 6. 25%

3713 6. 35%

3714 6. 5%

3715 6. 625%

3716 6 .75%

3717 6.875%

3718 6 .917%

3719 7%

3720 7.12 5%

3721 7.2 5%

3722 7.3 75%

3723 7.5 %

3724 7.6 %

3725 7.7 %

3726 7.75 %

3727 7.8 5%

3728 7.8 75%

3729 7.9 17%

3730 8%

3731 8 .12 5%

3732 8.2%

3733 8.25%

3734 8.35%

3735 8.375%

3736 8.417 %

3737 8.5%

3738 8.725%

3739 8.75%

3740 8.85%

3741 8.875%

3742 9%

3743 9.12 5%

374 4 9.25%

3745 9.35%

3746 9.375%

3747 9.5%

3748 9.6%

3749 9.625%

3750 9.75%

3751 9.85%

3752 10%

3753 10.25%

3754 10.35%

3755 10.5%

3756 10.75%

OREGON : N o State Sa les Tax

PE NN SYLVA NIA

3901 6%

RHODE ISLAND

4001 7%

SOUTH CA ROLIN A

4101 5%

4102 6%

4103 3%

SOUTH DA KOTA

4201 3%

4202 4%

4203 5%

4204 5.5%

4205 6%

4206 6.5%

4207 7%

4208 7.5 %

4209 8%

TENNESSEE

4301 7%

4302 7. 5%

4303 7. 75 %

4304 8%

4305 8.25%

4306 8.5%

4307 8.75%

4308 6%

TEXAS

4401 6.25%

4402 6.75%

4403 7%

4404 7. 25%

4405 7.7 5%

4406 8%

4407 8.25%

UTA H

4501 5.75% State & Loc al

4202 6% State & Lo cal

4503 6.2 5% State & Loc al

4504 7. 25% S tate & Loc al

4505 8.25% St ate & Local

4506 4.75%

4507 2.75%

VERMONT

4601 5%

4602 6%

VIRGINIA

4701 3.5%

4702 4%

4703 5%

4704 2.5%

WASHIN GTON

4801 7% St ate & Local

4802 7. 3% S tate & Loc al

4803 7. 5% St ate & Loca l

4804 7. 6% State & Lo cal

4805 7.7 % St ate & Local

4806 7. 8% St ate & Local

4807 7.9 % State & Lo cal

4808 8% State & Loc al

4809 8.1 % State & Loca l

4810 8.2% State & Loca l

48 11 8 .3% S tate & Loc al

4812 8. 4% State & L ocal

4813 8.6% State & Lo cal

4814 8.7% St ate & Local

4815 9 .1% State & Loc al

4816 6.5%

WEST VIRGINIA

4901 6%

4902 5%

WISCONSIN

5001 5%

5002 5.5%

WYO MIN G

5101 3% State

5102 4% Sta te & Local

5103 5% State & Lo cal

PUERTO RIC O

5201 7%

Basic function

E-13

Page 14

To use the cash register’s basic function

To change taxable statuses of departments

By default, taxable statuses of departments are as follows.

Dept. 2: Taxable status 1

Depts. 1, and 3 through 24: Non-taxable.

You can change the statuses by the following operations.

Sample Operation

Setting Depts. 1 through 4 as non-taxable and Depts. 9 through 11 as taxable 1.

Step Operation

1 Press Zk then ~ to set the register in

tax program mode.

2 Press corresponding tax status setting key

(see the table below) rst then press Dept.

keys you wish to set. The example on the

right is for setting Depts. 1 through 4 as non-

taxable.

3 Depts. 9 through 24 are assigned by combi-

nations of j and Depts. keys. The example

on the right is for setting Depts. 9 through 11

as taxable status 1.

4 Press k to complete the settings.

Zk~

asdf

A (Depts. 1 through 4)

cjajsjd

A ( Depts. 9 through 11 )

k

Mode SwitchMode Switch

Taxable status selections

Taxable status 1

Taxable status 2

Taxable status 1 and 2

Taxable status 3

Taxable status 4

Non-taxable

Further operations:

• “To set tax tables and rounding system” on page E-41.

c

v

cv

x

u

E-14

A

Page 15

To use the cash register’s basic function

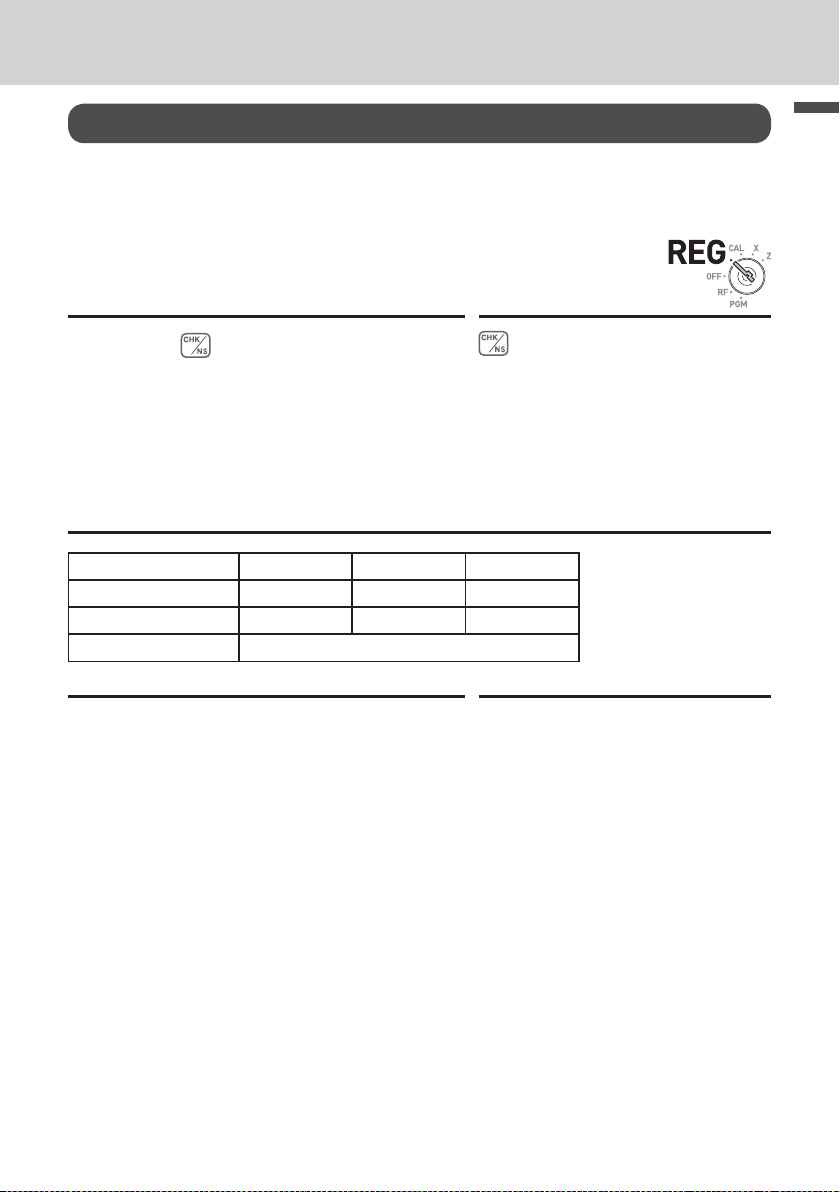

To use the cash register’s basic functions

This section explains the fundamental operations of the cash register. For further usages, please see the pages referred in each operation.

To open the cash drawer without any transaction

You can use this feature for changing money etc.

Step Operation

Mode Switch

1 Just press key.

The cash drawer opens without any registra-

tion.

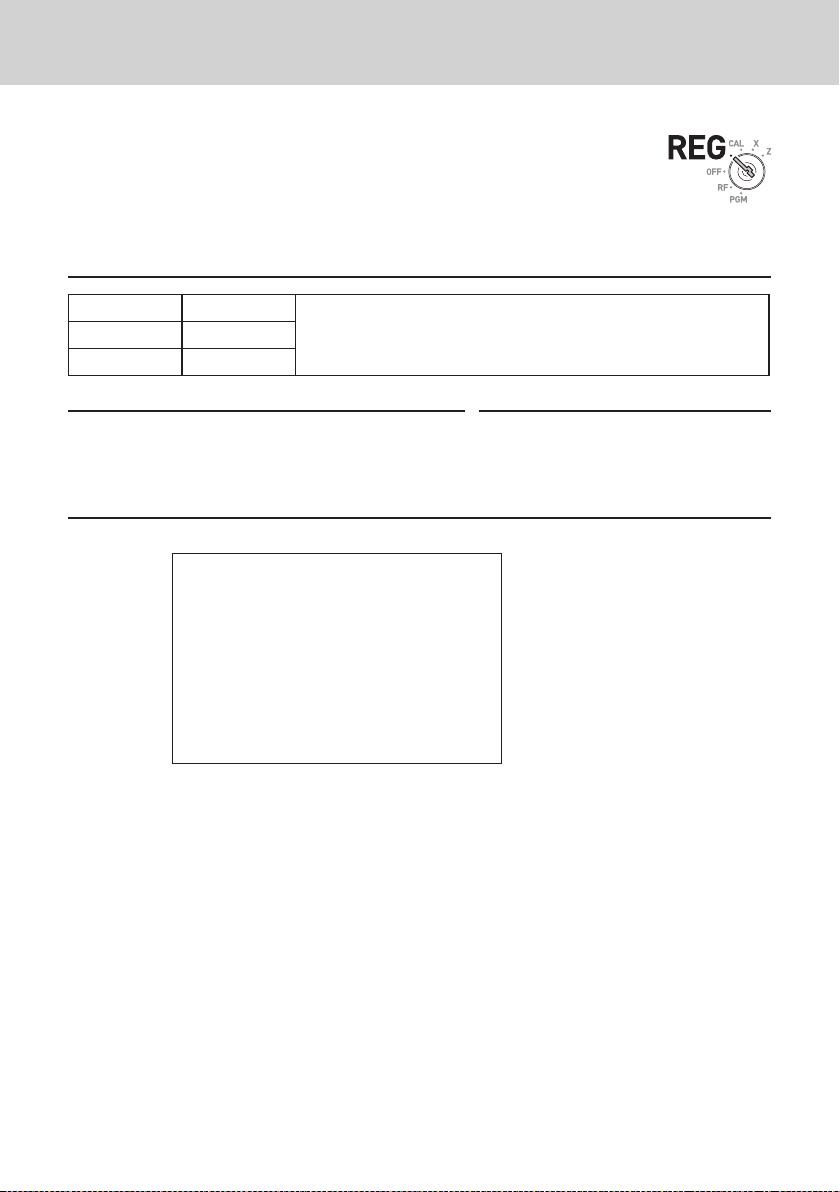

Basic registration

You can register items in corresponding Dept. (department, see below)

Sample Operation

Unit Price $1.00 $2.00 $0.30

Quantity 1 1 1

Dept. 2 13 21

Tendered cash amount $5.00

Step Operation

Basic function

1 Enter 100 then s key.

$1.00 has been registered in Dept. 2.

2 Press j before entering the unit price.

$2.00 is registered in Dept. 13.

Depts. 9 through 24 are selected by the com-

bination of j and a through 8 keys.

3 Press j key twice before inputting the unit

price then 5 key.

$0.30 is registered in Dept. 21

Pressing j key twice and a through 8

keys assign Depts. 17 through 24.

Continues to the next page. 6

Z??s

jX??5

jjC?5

E-15

Page 16

To use the cash register’s basic function

Step Operation

4 Press k key.

The subtotal amount will be displayed.

5 Input tendered cash amount then press

p key.

If received amount is more than the subtotal

amount, the amount of change will be displayed and printed.

Printout

01−21−2013 09:00

REG 0002

DEPT02 T1 $1.00

DEPT13 $2.00

DEPT21 $0.30

TA1 $1.00

TAX1 $0.04

TOTAL $

CASH $5.00

CHANGE $1.66

3.34

k

B??p

— Department No./Unit Price

— Taxable Subtotal

— Tax

— Subtotal

— Cash Amount Tendered

— Change

Further operations:

• “To give discount or premium” on page E-67.

• “To set a unit price in a department key” on page E-31.

• “To set PLU unit price” on page E-40.

• “To link PLUs to departments” on page E-41.

E-16

Page 17

To use the cash register’s basic function

To register multiple quantity of the same item

You can register multiple quantity of items in a department by pressing Dept. key repeatedly or using

Sample Operation

Unit Price $1.00 $1.35

Quantity 2 3

Dept. 2 3

Step Operation

1 Input the unit price then Dept. key. One piece

of an item is registered in the department.

2 Press the same Dept. key again.

Every time you press the Dept. key, the item

is registered in the department.

3 Input the number of quantity then press the

multiplication key.

4 Input the unit price of the item. In this

example, three pieces of $1.35 items are

registered.

5 Complete the transaction by pressing k

and p keys.

x key.

Z??s

s

Cx

ZCBd

kp

Mode Switch

Basic function

Printout

01−21−2013 09:10

REG 0003

DEPT02 T1 $1.00

DEPT02 T1 $1.00

3 X @1.35

DEPT03 T1 $4.05

TA1 $6.05

TAX1 $0.24

CASH $

6.29

— Repeated

— Sales Quantity/Unit Price

E-17

Page 18

To use the cash register’s basic function

To sell packaged item individually

You can sell packaged item individually. The example shown below

is for selling three pieces of an item that is sold $10.00 for 12 pieces.

Sample Operation

Unit Price $10.00 /12

Quantity 3

Dept. 1

Step Operation

1 Input the quantity then press x key.

2 Input the package quantity, in this case 12 then

press x key.

3 Enter package price, in this example 1000

then press a key. The register calculates

the price and shows the amount on the

display.

4 Press k key.

5 Press p key to complete the transac-

tion. If the customer paid an amount more

then the total, enter the tendered amount

before p key.

Cx

ZXx

Z?'a

k

p

Mode Switch

Printout

E-18

01−21−2013 09:15

REG 0004

3 X

12 / @10.00

DEPT01 $2.50

CASH $

2.50

— Sales Quantity

— Packaged Quantity/Packaged Amount

Page 19

To use the cash register’s basic function

To sell items on charge

Instead of cash, you can register charge sales.

Sample Operation

Unit Price $1.00 $2.00

Quantity 1 1

Dept. 1 2

Step Operation

1 Register the sold items in corresponding

Dept. The example on the right is for registering $1.00 in Dept. 1.

2 The example on the right is to registering

$2.00 in Dept. 2.

3 Press subtotal key to display the total

amount.

4 Press u key instead of p key.

Printout

Z??a

X??s

k

u

Mode Switch

Basic function

01−21−2013 09:30

REG 0005

DEPT01 $1.00

DEPT02 T1 $2.00

TA1 $2.00

TAX1 $0.08

CHARGE $

3.08

— Charge sales

E-19

Page 20

To use the cash register’s basic function

To sell items in cash and charge (split sales)

You can sell items partially on cash and the rest on charge.

The total amount of the following example is $9.00 and the payment

is made $5.00 in cash and $4.00 on charge.

Sample Operation

Unit Price $2.00 $3.00 $4.00

Quantity 1 1 1

Dept. 1 2 1

Tendered cash amount $5.00

Step Operation

1 Register the items in corresponding depart-

ment by inputting unit prices and Dept. keys.

2 Inputting $3.00 in Dept. 2.

3 Inputting $4.00 in Dept. 1.

4 Press k key to display the total sales

amount.

5 Enter the amount paid in cash then p

key. The display shows the balance amount.

6 Press u key to pay the rest of the amount

on charge.

Continues to the next page. 6

X??a

C??s

V??a

k

B??p

u

Mode Switch

E-20

Page 21

To use the cash register’s basic function

Printout

01−21−2013 09:50

REG 0007

DEPT01 $2.00

DEPT02 T1 $3.00

DEPT01 $4.00

TA1 $3.00

TAX1 $0.12

TOTAL $

CASH $5.00

CHARGE $4.12

9.12

Basic function

— Tendered Cash amount

— Charged amount

E-21

Page 22

To use the cash register’s basic function

To sell items by cash and check (split sales)

The following example is for paying $20.00 in cash and the rest by

check.

Sample Operation

Unit Price $30.00 $25.00

Quantity 1 1

Dept. 2 3

Tendered cash amount $20.00

Paid by check $36.20

Step Operation

1 Register sold items by entering unit prices

and Dept. keys.

2 Press k. The display indicates the total

amount.

3 Enter tendered cash amount then press

p. The display shows the balance due.

C???s

XB??d

k

X???p

4 Pressing registers as the rest of the

amount paid by a check.

Printout

Mode Switch

E-22

01−21−2013 14:10

REG 0026

DEPT02 T1 $30.00

DEPT03 $25.00

TA1 $30.00

TAX1 $1.20

TOTAL $

CASH $20.00

CHECK $36.20

56.20

Page 23

To use the cash register’s basic function

To correct erroneous inputs

There are two ways to correct wrong inputs one is for correcting numeral entries (before pressing Dept. key) and the other is correcting

stored data (after Dept. key has been pressed).

Correction before pressing Dept. key

Sample Operation

By mistake, entered unit price $4.00 instead of $1.00.

Step Operation

1 Press y key after the wrong entry.

2 Enter the correct unit price then press Dept.

key.

3 Finalize the transaction.

Correction after pressing Dept. key

Pressing Dept. key registers an item in the memory. The g key can-

cels wrong registrations in a department. The followings are examples

to cancel incorrect registrations.

Sample Operation 1

V??y

Z??a

p

Mode Switch

Mode Switch

Basic function

Entered incorrect unit price $5.50 instead of $5.05 and pressed Dept. key.

Step Operation

1 Wrong unit price $5.50 is registered in Dept.

1.

2 Press g key to cancel the registration.

3 Input the correct unit price $5.05 and press

Dept. 1 key.

4 Finalize the transaction.

Continues to the next page. 6

BB?a

g

B?Ba

p

E-23

Page 24

To use the cash register’s basic function

Printout

DEPT01 $5.50

ERR CORR −5.50

DEPT01 $5.05

Sample Operation 2

Entered incorrect unit price $2.20 instead of $2.30 and pressed Dept. key in multiplication registration.

Step Operation

1 Inputting quantity and multiplication key. The

example on the right is selling three pieces of

an item.

2 Incorrect unit price $2.20 has been registered

in Dept. 2.

3 Press g to cancel the registration.

4 Again input the quantity and the multiplication

key.

5 Input the correct unit price $2.30 and press

Dept. key.

6 Finalize the transaction.

Printout

3 X @2.20

DEPT02 T1 $6.60

ERR CORR −6.60

3 X @2.30

DEPT02 T1 $6.90

Cx

XX?s

g

Cx

XC?s

p

E-24

Page 25

To use the cash register’s basic function

To print sales reports

This section describes to print sales data of transactions stored in the register.

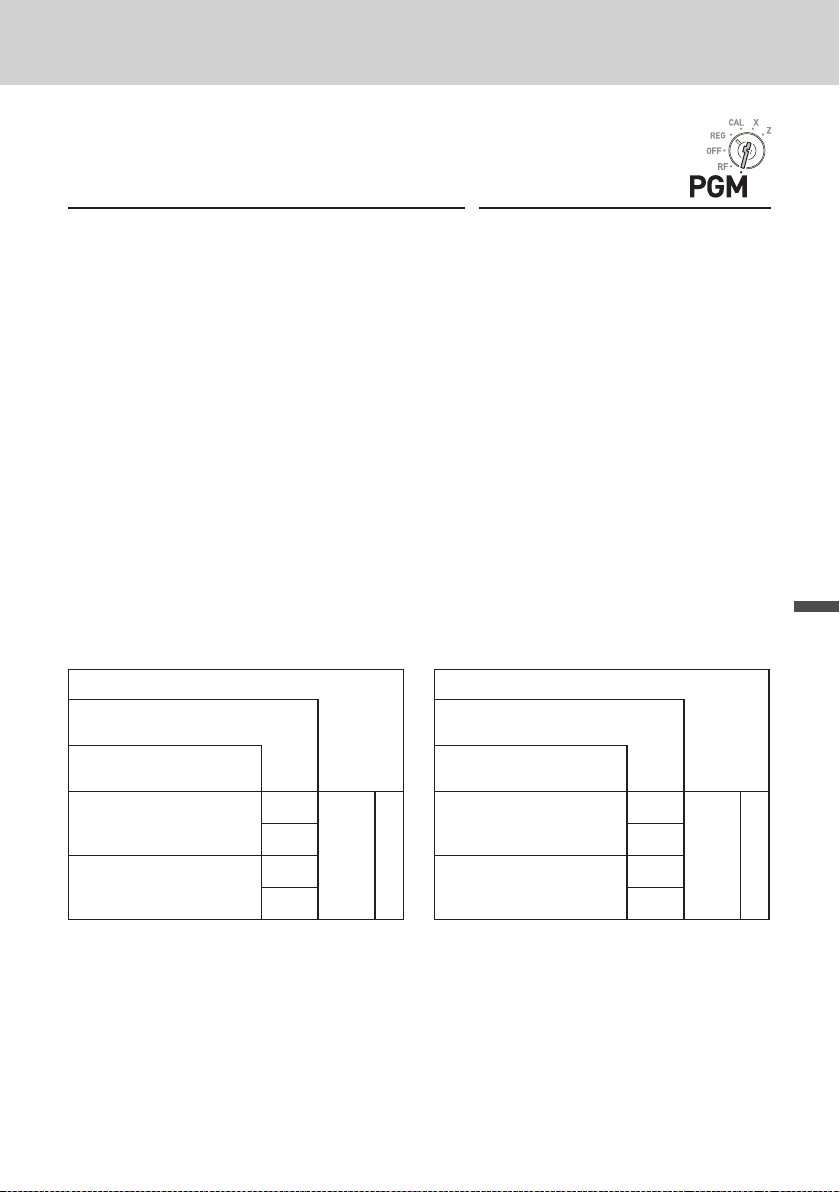

To print daily management report

Flash report

Flash report prints summarized sales data of the present time.

Step Operation

1 Turn the Mode switch to X and press x.

The printer prints ash report.

Printout

01−21−2013 16:50

X 0131

GROSS TOTAL QT 67

$270.48

NET TOTAL No 36

$271.24

CASH−INDW $197.57

CHARGE−INDW $18.19

CHECK−INDW $45.18

FLASH

X

x

— Read Symbol

— Gross Total Quantity

— Gross Sales Amount

— NET Total No. of Customers

— NET Sales Amount

— Cash Total in Drawer

— Charge Total in Drawer

— Check Total in Drawer

Basic function

Mode Switch

E-25

Page 26

To use the cash register’s basic function

Daily read/reset report

At the end of the business day, you can print categorized and summarized results of the day. Reset report (Z) clears all the sales data

whereas the data remains in memory by Read report (X).

Please do not per form the Reset report (Z) printing while your store is open. It

clears all the sales data.

Step Operation

1 Turn the Mode switch to X or Z and press

p

p. The printer prints Read (X) or Reset

(Z) report.

Printout

— Date/

01−21−2013 19:25

Z CLERK01 0073

0000

DAILY

Z 0012

DEPT01 QT 48

$50.10

Time

—

Consecutive No.

— Z Repor t Symbol/Non resettable

consecutive No.

— Dept. Name/ No. of Items

— Amount

DEPT02 QT 28

$76.40

DEPT03 QT 17

$85.80

DEPT20 QT 4

$3.00

•••••••••••••••••••••••

GROSS TOTAL QT 108

$316.80

NET TOTAL No 46

$325.13

CASH−INDW $199.91

CHARGE−INDW $16.22

CHECK−INDW $105.00

TA1 $105.10

TAX1 $4.20

ROUNDING AMT $1.23

RF−MODE TTL No 2

$0.50

— Gross Sales No. of Items

— Gross Sales Amount

— Net Sales No. of Customers

— Net Sales Amount

— Cash in Drawer

— Charge in Drawer

— Check in Drawer

— Taxable Amount for Tax Rate 1

— Tax Amount for Tax Rate 1

— Rounded Amount

— RF Mode Count

— RF Mode Amount

CALCULATOR No 3

Mode Switch

E-26

Page 27

To use the cash register’s basic function

Printout

CALCULATOR No 3

•••••••••••••••••••••••

CASH No 44

$203.91

CHARGE No 3

$16.22

CHECK No 2

$105.00

RA $6.00

PO $10.00

− $0.50

%− $0.66

ERR CORR No 21

NS No 12

•••••••••••••••••••••••

CLERK01 $325.13

•••••••••••••••••••••••

GT $0,000,832,721.20

— No. of p key operation in CA L mode

— Cash Sales Count

— Cash Sales Amount

— Charge Sales Count

— Charge Sales Amount

— Check Sales Count

Check Sales Amount

—

— Received On Account Amount

— Paid Out Amount

—

Reduction Amount

— Premium/Discount Amount

— Error Correction Count

—

No sale Count

— Clerk 1 Sales Amount (Refer to E-62

Cashier Assignment)

— Non- resettable Grand Sales total (Printed

only on RESET report)

Basic function

E-27

Page 28

To use the cash register’s basic function

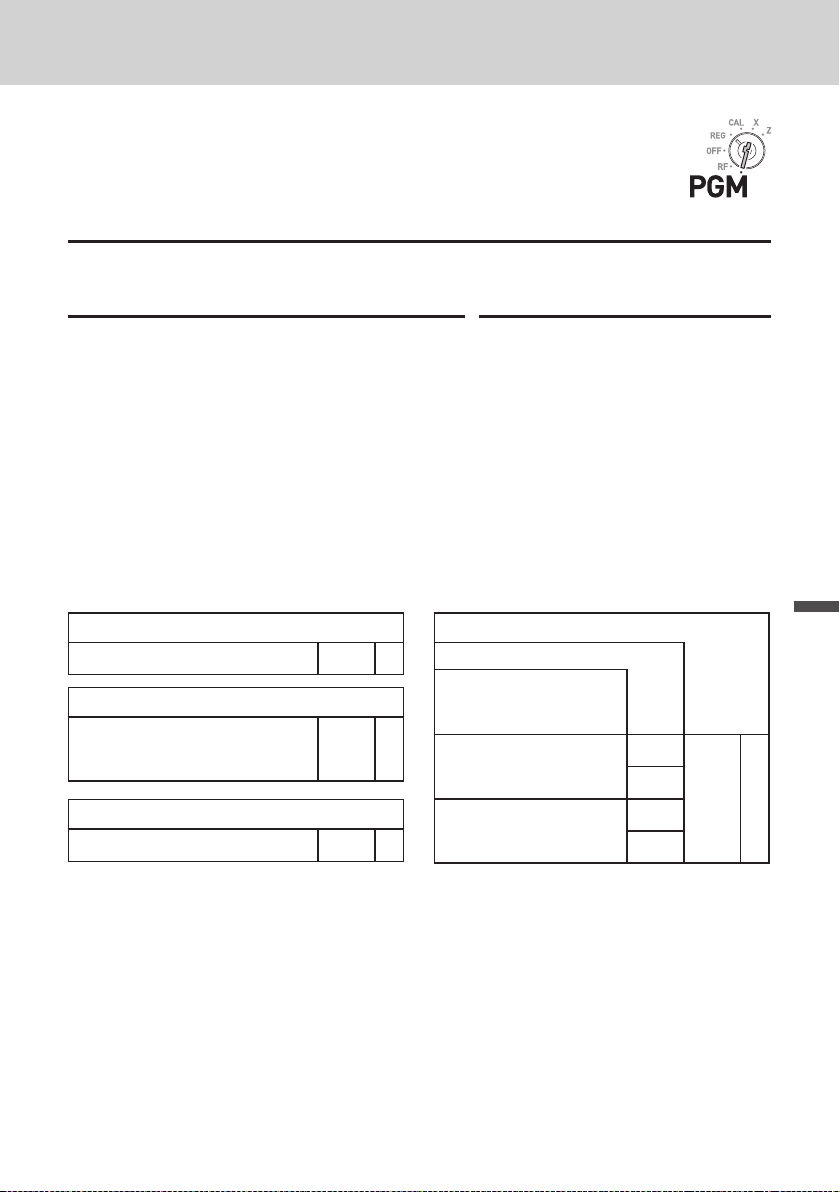

To obtain periodic reports

Apart from daily report, you can obtain periodic sales report. The

register prints gross and net total sales data from the last periodic

report. Namely, if you do this operation monthly, you can obtain

monthly sales reports.

Step Operation

1 Enter the periodic report code “10” then press

p key. Total quantities and amounts ac-

cumulated from the last periodic report will be

printed.

Printout

01−31−2013 20:35

Z 0365

0010 PERIODIC ZZ 0001

GROSS TOTAL QT 67

$270.73

NET TOTAL No 38

$271.24

Z?p

— Date/

Time

—

Consecutive No.

— Periodic Reset Symbol

— Gross Total Quantity

— Gross Sales Amount

— Net Total No. of Customers

— Net Sales Amount

Mode Switch

E-28

Page 29

Useful features

Various programming ................................................... E-31

To set a unit price in a department key ...................................... E-31

To set a rate on the percent key .................................................. E-32

To set a rounding calculation method and discount/premium

settings on the percent key ......................................................... E-32

To change the settings on departments .................................... E-33

To set general controls ................................................................E-35

To set print controls ..................................................................... E-37

To set X and Z reports print controls .........................................E-39

To set PLU unit price ...................................................................E-40

To link PLUs to departments ...................................................... E- 41

To set tax tables and rounding system ...................................... E-41

To change taxable status of the percent key .............................E-43

To change taxable status number of the minus key .................E-44

To set tax status print ..................................................................E- 45

Character keyboard ......................................................................E-46

To program receipt messages ....................................................E- 47

To read preset data other than PLU data ...................................E-50

To read preset PLU data...............................................................E-52

Useful features

Various operations ........................................................ E-53

To register items with preset unit price set in a department ... E-53

To register single item sales .......................................................E-55

To transact by check .................................................................... E-56

To change the tax status in REG mode ...................................... E-57

To input tax amount manually ..................................................... E-58

To use PLU ....................................................................................E-59

To sell single item using PLU ...................................................... E-60

To refund .......................................................................................E- 61

To assign a cashier ......................................................................E-62

Other operations ........................................................... E-63

To display date and time .............................................................. E-63

To adjust time ...............................................................................E-63

To adjust date ...............................................................................E-64

To pay out from the drawer .........................................................E-64

To receive cash on account .........................................................E-65

E-29

Page 30

Useful features

To register a reference number ...................................................E-65

To reduce amount from subtotal ................................................. E-66

To give discount or premium ......................................................E-67

Calculator mode ............................................................ E-69

To use the register as a calculator .............................................E-69

To calculate during registrations ................................................E-69

To set calculator functions .......................................................... E-71

When you consider it as a problem ............................. E-72

Troubleshooting ........................................................................... E-72

In case of power failure ................................................................ E-73

When the L sign appears on the display ................................... E-73

Specications .................................................................E-74

E-30

Page 31

Useful features

Various programming

To set a unit price in a department key

You can preset unit prices in department keys so that you don’t have

to input a unit price before registering it in a department.

The following example is for presetting $2.00 in Dept. 1, $5.50 in

Dept. 2, and $15.00 in Dept. 3.

Sample Operation

Unit Price $2.00 $5.50 $15.0 0

Dept. 1 2 3

Step Operation

1 Press Zk keys. The register is ready to

set unit prices in departments.

2 Input the unit price then press corresponding

Dept. key. $2.00 has been preset in Dept. 1.

3 You don’t have to input the decimal point key.

$5.50 has been preset in Dept. 2

4 $15.00 has been preset in Dept. 3 by the

operation on the right.

5 Press k to complete the settings.

Further operations:

• “To register items with preset unit price set in a department” on page E-53.

Zk

X??a

BB?s

ZB??d

k

Mode Switch

Useful features

E-31

Page 32

Useful features

To set a rate on the percent key

You can preset a percent rate on : key so that you don’t have to

input percent rate for discount sales. The following example is for

setting 2.5% on the : key.

Sample Operation

Discount rate 2.5%

Step Operation

1 Press Zk to set the register in the pro-

gram mode.

2 Input a percent rate you wish to set then

press : key.

3 Press k to complete the setting.

Further operations:

• “To give discount or premium” on page E-67.

Zk

X"B:

k

To set a rounding calculation method and discount/

premium settings on the percent key

You can program rounding method on the percent key. Also you

can assign the percent key to be used as discount or premium

calculations. The following example sets the percent key to perform

premium calculation with cutting off.

Step Operation

Mode Switch

Mode Switch

1 Press Ck to set the register in the pro-

gram mode.

2 Refering the following table, choose the

rounding method (A) and function (B) of the

percent key then press : .

3 Press k to complete the setting.

E-32

Ck

ZZ:

A B

k

Page 33

Useful features

Selections

Roundings of percent calculations.

Round of f (1.54 4=1.54; 1.5 45=1.55)

Cut of f (1.544=1.54; 1.5 45=1.5 4)

Round up (1.544 =1.55; 1.5 45=1.55)

Discount calculation (% –).

Premium calculation (%+).

Assigning the percent key as manual tax key

The default settings: ??

?

Z

X

?

Z

X

A

B

To change the settings on departments

You can program several settings such as restricting entry digits,

prohibiting multiple item registration, etc. on each department.

Sample Operation

Selections

Dept .1

Dept.2

Normal Dept. (A)

?

Minus Dept. (A)

Z

• Minus Dept. is a department that entered unit prices are registered as minus

price and is used for bottle return etc.

• Single item sales Dept. registers one item quickly just by pressing a Dept.

key once and you don’t need to press p key.

Step Operation

1 Press Ck to set the register in the setting

mode.

2 Enter your selection A, B, and C refering the

following tables then press a Dept. key.

The example on the right is setting Dept. 1

as Normal Dept. (A) limiting 4 digits (B), and

Single item sales Dept. (C).

Continues to the next page.

6

Maximum entry digits

V

4 (B)

Maximum entry digits

B

5 (B)

Z

?

Ck

?VZa

A B C

Mode Switch

Single item sales Dept.

(C)

Normal sales Dept. (C)

Useful features

E-33

Page 34

Useful features

Step Operation

3 The example on the right is setting Dept. 2

as Minus Dept. (A) limiting 5 digits (B), and

Normal sales Dept. (C).

4 Press k to complete the settings.

Selections

Normal Dept.

Minus Dept.

No limitation for manual price entry

Maximum digit of manual price entry (up to 7 digits)

Prohibit manual price entry

Normal sales Dept

Single item Dept

The default settings: ???

ZB?s

A B C

k

?

A

Z

?

Z ~ M

B

< or >

?

C

Z

E-34

Page 35

Useful features

To set general controls

This program sets the general controls of the cash register such as

allowing partial cash payment, resetting consecutive number after

the Reset report (Z report) etc.

Step Operation

1 Press Ck to set the register in the setting

mode.

2 “0622” is the program code for general con-

trols and is necessary to input before setting

actual programming.

3 Each digit of A to D corresponds to the set-

tings of tables A to D described below. See

the following description for the setting of

“002 2 ”.

4 Press k to complete the settings.

A … Always “0”.

?

Not allowing minus subtotal value after using g key and reset the con-

B …

?

X

X

secutive number after Z report.

Allowing split check tendering but not allowing split cash tendering, and not

C …

showing seconds on the display.

Cashier has to enter her or his ID number before registrations, and ' key

D …

is not used as 000 key.

Ck

?NXXk

??XXp

A B C D

k

Mode Switch

Useful features

Continues to the next page.

6

E-35

Page 36

Useful features

Always “0”

Reset the consecutive number to

zero after Z repor t.

Allow minus subtotal after

using g key.

Yes

No

No

Yes

Yes

No

Time displays with second.

Allow split cash amount

tendered.

Allow split check

amount tendered.

No

Yes

Yes

Yes

No

No

Yes

No

Yes

Yes

No

No

No

Yes

Selections

A

?

Selections

?

X

B

V

N

Selections

?

Z

X

C

C

V

B

N

M

Selections

Use the ' key as a 000 key.

Cashier assignment systems (sign on) is used.

No

No

Yes

The default setting of ABCD is; ????

Yes

No

Yes

?

Z

X

C

D

E-36

Page 37

Useful features

To set print controls

This setting programs printing methods collectively such as printing

time on receipts, or skipping item print on the journal etc.

Step Operation

1 Press Ck. The register becomes ready

for programming.

2 Enter “0522” then press k. “0522” is the

program code for setting printing controls.

3 Referring the tables shown below, select your

choice and enter the setting code and press

p key.

4 Press k to complete the settings.

A … Prints the total amount and prints on receipts.

B

B … Not compressed journal print.

?

C … Prints time on the receipt or journal.

?

Skips item printing on the journal, prints subtotal and consecutive numbers

D …

N

Continues to the next page.

on receipts or journals.

6

Ck

?BXXk

B??Np

A B C D

k

Mode Switch

Useful features

E-37

Page 38

Useful features

Use the printer to print receipts = R

Use the printer to print a journal = J

Print “T OTAL” line on

receipts or journals

J

No

R

J

Yes

R

Compressed journal print

No

Yes

Print the time on the receipt or

journal.

Yes

No

Selections

?

Z

A

V

B

Selections

?

B

Z

Selections

?

C

V

Selections

Print the consecutive number on

the receipt and journal.

Print the subtotal on the receipt and journal when the

Subtotal Key is pressed.

Skip item print on

journal.

Yes

No

Yes

No

Yes

No

Yes

No

?

Z

X

C

V

B

N

M

No

No

Yes

No

Yes

Yes

The default setting of ABCD is; ????

D

E-38

Page 39

Useful features

To set X and Z reports print controls

This program sets the printing methods of X and Z reports.

Step Operation

1 Press Ck. The register becomes ready

for programming.

2 Enter “0822” then press k. “0822” is the

program code for setting printing controls for

X and Z reports.

3 Referring the following tables, select your

choice and enter the setting code and press

p key.

4 Press k to complete the setting.

Prints number of refunded transactions and refunded amount on X and Z

A …

?

X

Print number of refund operation

and refunded amount

Print Flash report in X

mode or display only.

reports, and prints Flash report in X mode.

Does not print the grand sales total on Z report and does not print the data

B …

that the transaction is not made .

Selections

Yes

Yes

No

No

Yes

No

?

Z

V

B

A

Ck

?<XXk

?Xp

A B

k

Print zero -total line on the X and Z

reports

Print the grand sales total

on the Z reports.

Yes

No

The default setting of AB is; ??

Mode Switch

Selections

No

Yes

No

Yes

?

Z

X

C

Useful features

B

E-39

Page 40

Useful features

To set PLU unit price

Other than departments, you can preset unit prices by using PLU

(Price Look Up) feature. You can call the preset unit price by inputting a PLU number. Your cash register is able to store up to 999

PLUs.

Sample Operation

PLU Number 1 2

Unit Price $1.00 $3.00

Step Operation

1 Press Zk to set the register in the pro-

gram mode.

2 Enter a number you wish to use as a PLU

number then press the PLU key.

3 Enter the unit price you wish to preset then

press p.

4 Enter the next PLU number then press PLU

key.

5 Input the unit price and press p key.

Repeat the steps 4 and 5 for other PLUs.

6 Press k key to complete the settings.

Zk

Zi

Z??p

Xi

C??p

k

Mode Switch

Further operations:

• “To link PLUs to departments” on page E-41.

• “To use PLU” on page E-59.

E-40

Page 41

Useful features

To link PLUs to departments

PLUs are also categorized in departments. For example, categorizing PLU number 111 (apples) in department 01 (Fruits). Registered

PLU items are categorized in assigned departments and printed on

X or Z reports.

Sample Operation

PLU Number 1 100

Dept. 1 7

Step Operation

1 Press Ck. The register becomes ready

for programming.

2 Enter PLU number, i, Dept. number, then

p.

3 The operation on the right links the PLU 100

to Dept. 7.

4 Press k to complete the settings.

• You can link up to 999 PLUs to 24 departments.

• If you assign Dept. 0 or Depts. over 25, the PLU number is linked to Dept. 24.

• If unit price is not preset in the PLU, an error occurs.

Ck

ZiZp

Z??iMp

k

To set tax tables and rounding system

The cash register is able to set four kinds of tax tables and you can

set tax rates, rounding, and add-in or add-on tax systems on each

table. These tables can be applied to departments, percent key and

minus key. Therefore, you have to set the conditions of the tables

rst.

Mode Switch

Useful features

Mode Switch

• If you wish to set at tax rate, please use this program.

Sample Operation

For settings 7.0000 % in tax table 1, rounding up, and add-on tax.

E- 41

Page 42

Useful features

Step Operation

1 Press Ck. The register becomes ready

for programming.

2 Enter tax table number. See the following

table for the four tables. The example on the

right is for the tax table 1.

3 Enter the tax rate in the range of 0.0001 to

99.9999 %. Then press p key. The

example on the right is for setting 7.0%.

4 Enter the rounding system codes (B), (C)

(always “0”), and add-in or add-on tax code

(D).

5 Press k to complete the program.

Taxable status number

Tax table 1

Tax table 2

Tax table 3

Tax table 4

Rounding system

Cut off to 2 decimal places.

Round off to 2 decimal places.

Round up to 2 decimal places.

?ZXB

?XXB

?CXB

?VXB

??

B?

>?

A

B

Ck

?ZXBk

( A )

M"?p

>??Xp

( B ) C D

k

Taxable status number

Always “0”

Add-in/Add-on

No specications

Add-on rate tax.

Add-in rate tax ( VAT).

?

?

X

C

C

D

E-42

Please see “To change taxable statuses of depar tments” on page E-14, “To

change taxable status of the percent key” on page E- 43, and “To change taxable status number of the minus key” on page E-44 for changing tax statuses

on Dept. percent, and minus keys.

Page 43

Useful features

To change taxable status of the percent key

Initially, the percent key is set as taxable status 1. You can change

the status by the following operations.

Sample Operation

Setting the percent key as taxable status 1.

Step Operation

1 Press Zk then press ~ key to set the

register in tax program mode.

2 Referring the following table, press cor-

responding c key and then : key. The

example on the right is for setting the percent

key as taxable status 1.

3 Press k to complete the settings.

Taxable status selections

Taxable status 1

Taxable status 2

Taxable status 1 and 2

Taxable status 3

Taxable status 4

All taxable

Non-taxable

Zk~

c:

A

k

c

v

cv

x

u

cvxu

Mode Switch

Useful features

A

E-43

Page 44

Useful features

To change taxable status number of the minus key

Initially, the minus key is set as non-taxable. You can change the

status by the following operations.

Sample Operation

Setting the percent key as taxable status 1.

Step Operation

1 Press Zk then press ~ key to set the

register in tax program mode.

2 Referring the following table, press cor-

responding c key and then press g key.

The example on the right is for setting the

minus key as taxable status 1

3 Press k to complete the settings.

Taxable status selections

Taxable status 1

Taxable status 2

Taxable status 1 and 2

Taxable status 3

Taxable status 4

All taxable

Non-taxable

Zk~

cg

A

k

c

v

cv

x

u

cvxu

Mode Switch

A

E-44

Page 45

Useful features

To set tax status print

This program sets whether to print tax symbols and taxable amounts

or not.

Sample Operation

Setting print tax status symbols, taxable amount, and add-in tax amount.

Step Operation

1 Press Ck to set the register in the pro-

gram mode.

2 Enter “0326” then press k. “0326” is the

program code for setting tax print program.

3 Referring the tables A, B, C and D shown

below, choose your selection for printing

methods of taxes. After then press p.

4 Press k to complete the settings.

Selections

Always “0”

Selections

Print Tax status symbols.

Not printing tax status symbols

Selections

Always “0”

?

?

X

?

A

B

C

Ck

?CXNk

???Xp

A B C D

(A and C should be always “0”)

k

Print taxable amount.

Print taxable amount and

tax amount for Add-in tax

items.

No

Yes

The default setting of ABCD is; ????

Mode Switch

Selections

Yes

No

Yes

No

?

Z

X

C

Useful features

D

E-45

Page 46

Useful features

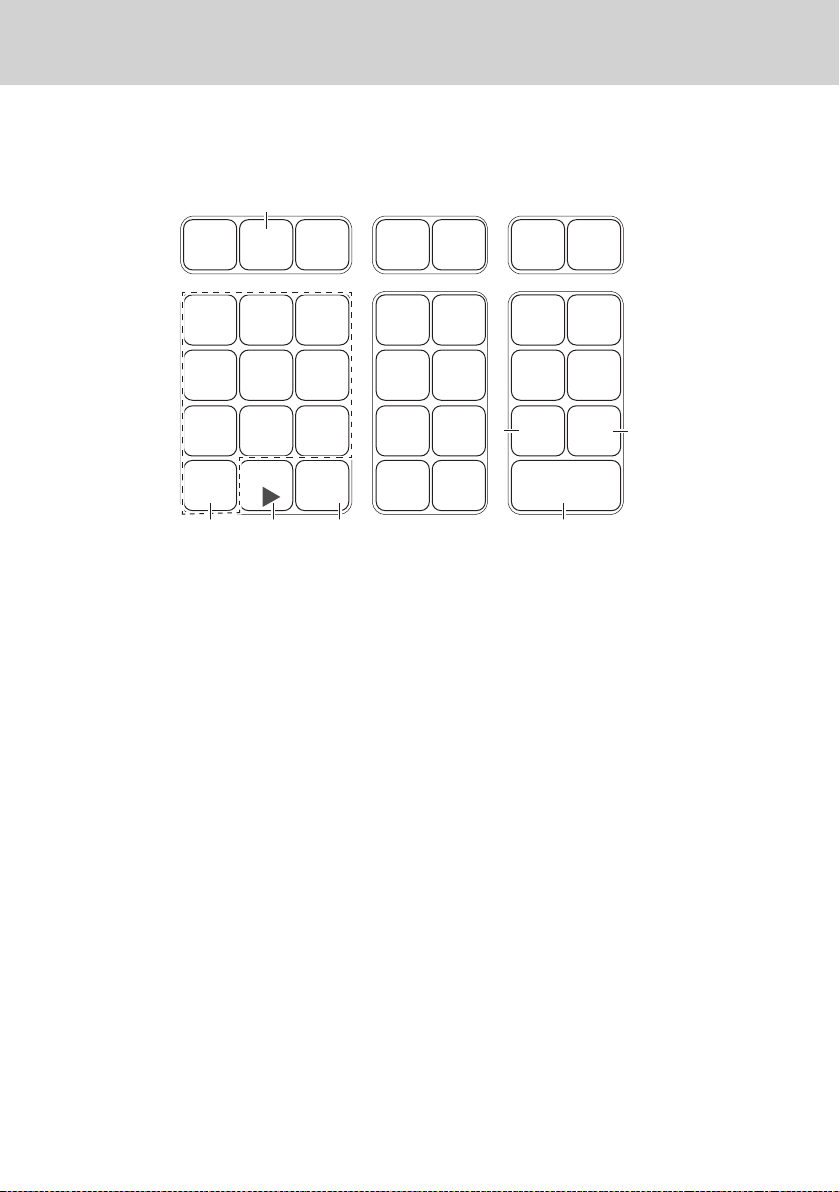

Character keyboard

Using the keyboard, you can program a message on the receipt.

1

DBL

DEFABC

MNOJKLGHI

WXYZTUVPQRS

DEL

2

3 4

1 Double size key

Use this key to specify the next char-

acter to be a double sized character.

Press this key before a character you

wish to be double sized.

2 Alphabet keys

Use these keys to input characters.

Refer to the next page to set characters.

3 Right arrow key

Use this key to set a character that the

next character uses the same key. This

key is also used for inputting a space.

4 Delete key

Use this key to delete preceding char-

ac ter.

6

SUB

TOTAL

CASH/AMT

TEND

7

5

CH

5 Receipt message number key (u

key).

Use this key to program receipt mes-

sages.

6 Program end key (k key)

Use this key to terminate character

programming.

7 Character program key (p key)

Use this key to set characters.

E-46

Page 47

Useful features

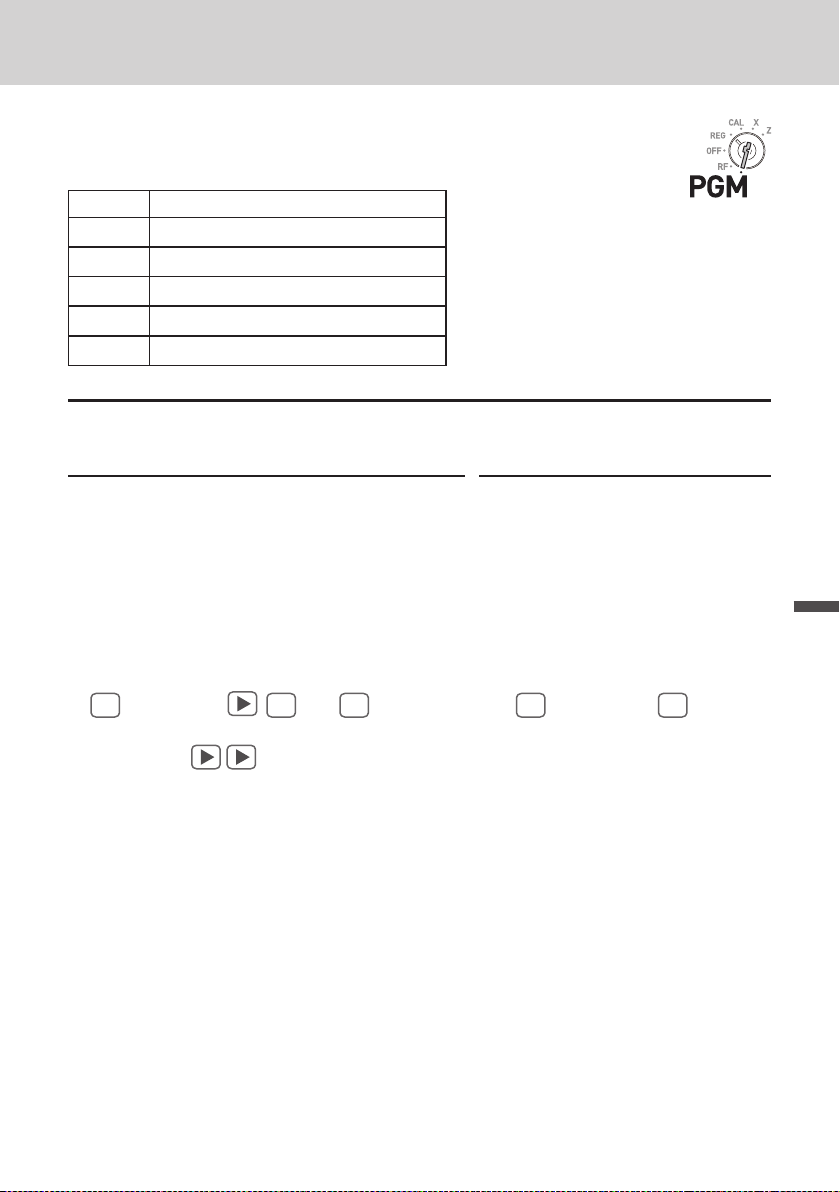

To program receipt messages

By default, your cash register is programmed following receipt message.

Line No. Message

1

2

3

4

5

YOUR RECEIPT

THANK YOU

CALL AGAIN

Sample Operation

To add “

CASIO

SHOP” in the fth line.

Step Operation

1 Press Xk to set the register in the char-

acter setting mode.

2 Enter the line number rst then press u. In

this example, we are adding a message in

the fth line.

Xk

Bu

3 Enter characters as described on the next page then press p.

If you continue to set characters in another line, repeat the steps 2 and 3.

DBL

<<<

( C ) ( A ) ( S ) ( I )

NNN ZZZZVVNNNZp

( O ) (Space) ( S ) ( H ) ( O ) (P)

4 Press k to complete the settings.

DBL

<

DBL

ZZZZ

k

DBL

VVV

Mode Switch

Useful features

DBL

E-47

Page 48

Useful features

Printout

YOUR RECEIPT

CASIO

• When the next character uses the same key, press key.

• For a space, press key twice.

• You can set a message up to ve lines.

• For a double width character, use

• In the above example, “

To print it in the center, insert spaces rst.

THANK YOU

CALL AGAIN

SHOP

CASIO

DBL

key.

SHOP” will be printed as left justied.

E-48

Page 49

Useful features

Character table

By pressing a character setting key, characters shift as shown in the following table.

When the next character uses the same key, press ► key to determine the setting.

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11)

A

B

C

a

b

c

8

Ä

Å

Æ

→

á

→

Ê

→

Ï

→

Ø

→

õ

→ →

Ú

→

→

)

→

¥

→

.

→

Á

ã

Ë

I

Ó

Û

ÿ

*

%

\

<

>

V

B

N

Z

X

C

?

M

→

→

→

→

→

→

→

→

(12) (13) (14) (15) (16) (17 ) (18) (19) (20) (21) (22)

Â

À

Ã

Ç

â

ä

à

→

→

→

→

→

(23)

ç

returns to the beginning

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11)

D

E

F

d

→

→

→

(12) (13) (14) (15) (16) (17 ) (18)

È

→

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11)

G

→

(12) (13) (14) (15) (16) (17 )

Ì

→

(1) (2) (3) (4) (5) (6) (7)

J

→

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11)

M

→

(12) (13) (14) (15) (16) (17 ) (18) (19) (20) (21)

Ô

→

returns to the beginning

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11)

P

→

(12)

ß

returns to the beginning

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11)

T

→

(12) (13) (14) (15) (16) (17 )

Ù

→

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11)

W

→

(12)

returns to the beginning

(1)

0

returns to the beginning

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11)

7

→

(12) (13) (14) (15) (16) (17 ) (18) (19) (20) (21) (22)

#

→

(23) (24) (25) (2 6) (27) (28) (29) (30) (31) (3 2) (33)

&

→

(34) (35) (36) (37) (38) (39) (40) (41) (42)

_

→ ` →

returns to the beginning

→

H

→

Ï

→

K

→

N

→

Ò

→

Q

→

U

→

ü

→

X

→

@

→

+

→ , →

[

→

é

→

I

→

Î

→

L

→

O

→

Õ

→

R

→

V

→

û

→

Y

→

-

→

]

→ ‘‘ →

£

→ √ →

e

→

ê

ë

→

g

h

→

Ì

í

→

j

k

→

m

n

→

ñ

ô

→

S

p

→

t

u

→

ù

ú

→

Z

w

→

/

:

→

^

;

→

{

¿

→

f

→

→

è

→

→ƒreturns to the beginning

i

→

→

→íreturns to the beginning

l

→

→5returns to the beginning

o

→

→

ö

→

→

q

→

→

v

→

→

→µreturns to the beginning

x

→

→

!

→

→

<

→

→

|

→

→

¡

→

→

å

→

9

→

4

Í

→

6

Ñ

→

ò

ø

→

r

s

→

TEL

2

→

y

z

→

?

~

→

=

>

→

}

→ • → “ →

∕

§

→

æ

→

É

→

Î

→

Ö

→

ó

→

1

→

Ü

→

3

→

(

→

$

→

→ space

→

→

→

→

→

→

→

→

→

→

→

→

→

→

→

→

Useful features

→

→

→

→

→

E-49

Page 50

Useful features

To read preset data other than PLU data

You can check the preset data other than PLU.

Step Operation

1 Press p . The printer prints preset data

except PLU settings.

Printout

DEPT01 T1 @1.00

0000

DEPT02 @10.00

0000

DEPT20 @5.00

0000

−

%−(12.34%)*

0000

0122 0022

0522 1020

0622 0000

0822 0000

1022 0000

0326 0002

p

— Dept. No./Tax Status/Unit Price

— Tax Status/Normal Dept./Digit

Limit/Single Item

— Minus/ Tax Status

— Percent Rate/%+ or % –

— Tax Status/Percent Key Controls

— Date order/Add Mode Control (xed)

— Print Controls

— General Controls

— Report Control

— Calculation Controls

— Tax Control

Mode Switch

E-50

Page 51

DEPT01 @1.00

0000

DEPT02 @10.00

0000

DEPT20 @5.00

0000

−

%−(12.34%)*

0000

10200 0

10800 0

0122 0022

0522 1020

0622 0000

0822 0000

1022 0000

0326 0002

CLERK01 01

CLERK02 02

CLERK07 03

CLERK08 08

Useful features

Printout

0125 0 %

0001

0001

10

30

54

73

110

0225 5.25 %

5002

0000

01

02

YOUR RECEIPT

03

THANK YOU

04

CALL AGAIN

05

— Tax Table 1

— Tax Table 2

— Rounding Specications/ Tax

System Specications

— Receipt message

Useful features

E-51

Page 52

Useful features

To read preset PLU data

You can read all the preset PLU data. To stop the printing, press k

key twice.

Step Operation

1 Press Zp.

The printer prints preset PLU settings.

Printout

PLU0001 @1.00

#0001 0000

PLU0002 @2.00

#0002 0002

PLU0003 @3.00

#0003 0000

PLU0004 @4.00

#0004 0000

PLU0199 @1,999.00

#0199 0000

PLU0999 @1,200.00

#0999 0000

Zp

— PLU Name/Unit Price

— PLU No./Linked Dept.

Mode Switch

E-52

Page 53

Useful features

Various operations

To register items with preset unit price set in a

department

When unit prices are preset in departments, you can register items

quickly. Please see “To set a unit price in a department key” on page

E-31 to preset unit prices on departments.

Sample Operation

Preset Unit Price $1.0 0 $2.20 $11. 0 0

Quantity 1 2 4

Dept. 1 2 3

Tendered Amount $50.00

Step Operation

1 Press the Dept. key once if purchased quan-

tity is one.

2 Press the Dept. key repeatedly for the num-

ber of purchased quantity.

3 When you use the multiplication key, enter

the quantity rst.

4 Pressing k key shows the total purchase

amount on the display.

5 Enter the tendered amount. The change

amount will be displayed. Then press p

key to complete the transaction.

Continues to the next page. 6

a

ss

Vxd

k

B???p

Mode Switch

Useful features

E-53

Page 54

Useful features

Printout

01−21−2013 12:50

REG 0018

DEPT01 $1.00

DEPT02 T1 $2.20

DEPT02 T1 $2.20

4 X @11.00

DEPT03 $44.00

TA1 $4.40

TAX1 $0.18

TOTAL $

CASH $50.00

CHANGE $0.42

— Repeat

— Multiplication/Unit Price

49.58

— Cash Amount Tendered

— Change

E-54

Page 55

Useful features

To register single item sales

Single item sales is useful to sell one item quickly. You just press

a Dept. key and you don’t have to press

Dept. key must be programmed to allow single item sales. See “To

change the settings on departments” on page E-33 for the programming.

Sample Operation

Unit price $0.50

Quantity 1

Dept. 3 ( Programmed as allowing single item sales)

Step Operation

1 Enter the unit price then press the Dept. key.

Printout

01−21−2013 13:00

REG 0019

DEPT03 $0.50

CASH $

k or p keys. The

B?d

0.50

— Cash Sales

Mode Switch

Useful features

E-55

Page 56

Useful features

To transact by check

If a customer pays by check, use m instead of p key.

Sample Operation

Unit price $35.00

Quantity 2

Dept. 4

Step Operation

1 Register two pieces of $35.00 item in Dept. 4

2 Press k key. The display indicates the total

amount.

CB??ff

k

3 Press key instead of p.

Printout

01−21−2013 13:20

REG 0021

Mode Switch

E-56

DEPT04 $35.00

DEPT04 $35.00

CHECK $

70.00

— Check Sales

Page 57

Useful features

To change the tax status in REG mode

You can change taxable status of a Dept. key during a transaction.

The example shown below is changing non-taxable status to taxable

status 1 on Dept. 1.

Sample Operation

Unit Price $1.00 $2.00

Quantity 1 1

Dept. 1 2

Programmed taxable status Non-taxable Taxable status 1

Changing taxable status to Taxable status 1 No change

Step Operation

1 Assign taxable status 1 by c key and enter

the unit price then press the Dept. key. In this

example Dept. 1 is assigned as taxable 1.

2 Register the other item and press p key.

Printout

01−21−2013 13:30

REG 0022

cZ??a

X??sp

Mode Switch

Useful features

DEPT01 T1 $1.00

DEPT02 T1 $2.00

TA1 $3.00

TAX1 $0.12

CA $

3.12

E-57

Page 58

Useful features

To input tax amount manually

Instead of set rate, you can enter a tax amount manually if : key is

programmed as Manual Tax key. See “To set a rounding calculation

method and discount/premium settings on the percent key” on page

E-32 for the setting.

Sample Operation

Unit Price $1.00 $2.00

Quantity 1 1

Dept. 1 2

Step Operation

1 A $1.00 item is registered in Dept. 1 as non-

taxable.

2 Enter the tax amount then press : key.

3 A $2.00 item is registered in Dept. 2 with 10%

tax added.

4 Finalize the transaction.

Printout

Dept. 1 is programmed as non-taxable but changing to add $0.10 tax temporarily.

Z??a

Z?:

X??s

p

Mode Switch

E-58

01−21−2013 13:40

REG 0023

DEPT01 $1.00

TAX $0.10

DEPT02 T1 $2.00

TA1 $2.00

TAX1 $0.08

CASH $

3.18

— Manual Tax amount

Page 59

Useful features

To use PLU

By using PLUs, you can register up to 999 items with preset prices

and linked departments. To program PLU items, see “To set PLU

unit price” on page E-40 and “To link PLUs to departments” on page

E- 41.

Sample Operation

PLU No. 1 2

Programmed unit price $1.00 $2.00

Quantity 2 4

Step Operation

1 Enter the item’s PLU number then press i

key repeatedly for the quantity of the item.

2 If you wish to use the multiplication key, enter

the quantity then press x.