Page 1

FC-200V

FC-100V

User's Guide

E

RCA501407-001V03

http://world.casio.com/edu_e/

Page 2

Important!

CASIO COMPUTER CO., LTD. makes no guarantees

concerning accuracy of the contents of this manual or

their suitability for any commercial purpose or other

particular purpose, or concerning the accuracy of

calculation results (such as financial calculation

simulation results) produced by this calculator.

• Financial calculation rules and practices can differ

according to country, geographic area, or financial

institution. It is up to you to determine whether the

calculation results produced by this calculator are

compatible with the financial calculation rules that

apply to you.

CASIO Europe GmbH

Bornbarch 10, 22848 Norderstedt, Germany

Page 3

About this Manual

• This User’s Guide covers use and operation of the CASIO

FC-200V and FC-100V. Operations apply to both models,

except in cases indicated by the text “FC-200V only”.

•Keycap markings indicate what a key inputs or what

function it performs.

Example: 1, 2, +, -, A, etc.

•Pressing the

performs the alternate function of the second key. The

alternate function is indicated by the text printed above

the key.

Keycap function

• The following shows what the different colors of the

alternate function key text mean.

If key marking

text is this color:

Yellow

Red

•In this manual, a

while an

•The following shows an example of how an alternate

function operation is represented in this User’s Guide.

Example: 17(S-MENU)

SHIFT

ALPHA

or

key followed by a second key

Y}VARS

t

It means this:

SHIFT

Press

access the applicable function.

Press

input the applicable variable or

constant.

SHIFT

ALPHA

key operation is shown as S.

and then the key to

ALPHA

and then the key to

key operation is shown as 1,

Alternate function

Indicates the function that is accessed by the

key operation (17) before it. Note that

this is not part of the actual key operation you

perform.

E-1

Page 4

• The following shows an example of how a key operation

to select an on-screen menu item is represented in this

User’s Guide.

Example: 1(1-VAR)

Indicates the menu item that is selected by the

number key operation (1) before it. Note that

this is not part of the actual key operation you

perform.

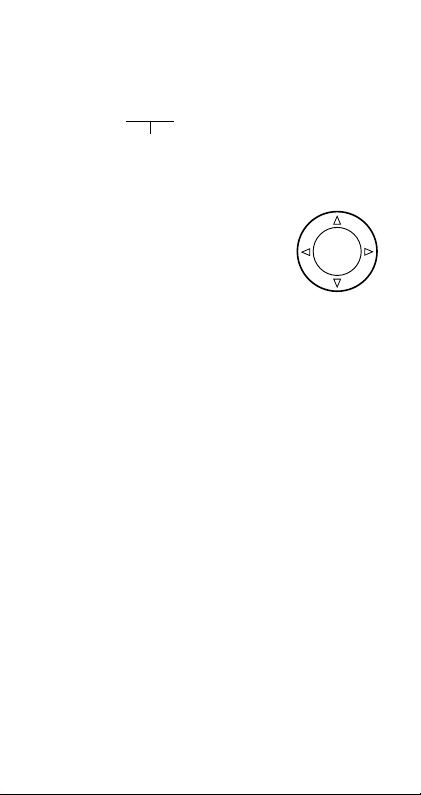

• The cursor key is marked with four

arrows, indicating direction, as shown

in the illustration nearby. In this User’s

Guide, cursor key operation is

indicated as f, c, d, and e.

Some examples in this manual start out assuming that the

calculator is set to a particular angle unit. This is indicated

by the following marks.

REPLAY

z : Degrees

Z : Radians

• The displays and illustrations (such as key markings)

shown in this User’s Guide are for illustrative purposes

only, and may differ somewhat from the actual items they

represent.

•The contents of this manual are subject to change without

notice.

•In no event shall CASIO Computer Co., Ltd. be liable to

anyone for special, collateral, incidental, or consequential

damages in connection with or arising out of the purchase

or use of this product and items that come with it.

Moreover, CASIO Computer Co., Ltd. shall not be liable

for any claim of any kind whatsoever by any other party

arising out of the use of this product and the items that

come with it.

E-2

Page 5

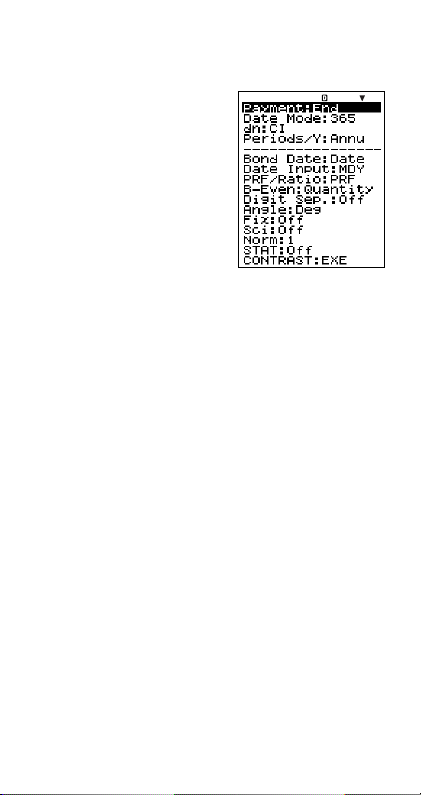

Initializing the Calculator

Perform the following procedure when you want to initialize

the calculator and return the calculation mode and setup

to their initial default settings. Note that this operation also

clears all data currently in calculator memory.

1. O19(CLR)

2. “All:EXE” (cf), then E.

3. E(Yes)

4. A

•To cancel initialization without doing anything, press

E(Cancel) instead of E(Yes).

This setting: Is initialized to this:

Calculation Mode COMP

This setting: Is initialized to this:

Payment End

Date Mode 365

dn CI

Periods/Y Annual (FC-200V only)

Bond Date Date (FC-200V only)

Date Input MDY

PRF/Ratio PRF (FC-200V only)

B-Even Quantity (FC-200V only)

Digit Sep. Off

Angle Deg

Display Digits Norm1

STAT Off

• For information about memory, see “Using Calculator

Memory” on page E-35.

•For information about shortcut keys settings, see

“Shortcuts” on page E-94.

E-3

Page 6

Safety Precautions

Be sure to read the following safety precautions before

using this calculator. Keep this manual handy for later

reference.

Caution

This symbol is used to indicate information that can

result in personal injury or material damage if ignored.

Battery

•After removing the battery from the calculator, put it

in a safe place where it will not get into the hands of

small children and accidentally swallowed.

• Keep batteries out of the reach of small children. If

accidentally swallowed, consult with a physician

immediately.

• Never charge the battery, try to take the battery apart,

or allow the battery to become shorted. Never expose

the battery to direct heat or dispose of it by

incineration.

•Improperly using a battery can cause it to leak and

damage nearby items, and can create the risk of fire

and personal injury.

•Always make sure that the battery’s positive

negative

it into the calculator.

• Remove the battery if you do not plan to use the

calculator for a long time.

• Use only the type of battery specified for this

calculator in this manual.

ends are facing correctly when you load

l

Disposing of the Calculator

• Never dispose of the calculator by burning it. Doing

so can cause certain components to suddenly burst,

creating the risk of fire and personal injury.

k

and

E-4

Page 7

Handling Precautions

• Be sure to press the O key before using the

calculator for the first time.

• Even if the calculator is operating normally, replace

the battery at least once every three years (FC-200V)

or two years (FC-100V).

A dead battery can leak, causing damage to and

malfunction of the calculator. Never leave a dead battery

in the calculator.

• The battery that comes with this unit discharges

slightly during shipment and storage. Because of

this, it may require replacement sooner than the

normal expected battery life.

• Low battery power can cause memory contents to

become corrupted or lost completely. Always keep

written records of all important data.

•Avoid use and storage of the calculator in areas

subjected to temperature extremes.

Very low temperatures can cause slow display response,

total failure of the display, and shortening of battery life.

Also avoid leaving the calculator in direct sunlight, near

a window, near a heater or anywhere else it might be

exposed to very high temperatures. Heat can cause

discoloration or deformation of the calculator’s case, and

damage to internal circuitry.

•Avoid use and storage of the calculator in areas

subjected to large amounts of humidity and dust.

Ta ke care never to leave the calculator where it might be

splashed by water or exposed to large amounts of

humidity or dust. Such conditions can damage internal

circuitry.

• Never drop the calculator or otherwise subject it to

strong impact.

• Never twist or bend the calculator.

Avoid carrying the calculator in the pocket of your trousers

or other tight-fitting clothing where it might be subjected

to twisting or bending.

• Never try to take the calculator apart.

E-5

Page 8

• Never press the keys of the calculator with a ballpoint

pen or other pointed object.

• Use a soft, dry cloth to clean the exterior of the

calculator.

If the calculator becomes very dirty, wipe it off with a cloth

moistened in a weak solution of water and a mild neutral

household detergent. Wring out all excess liquid before

wiping the calculator. Never use thinner, benzene or other

volatile agents to clean the calculator. Doing so can

remove printed markings and can damage the case.

E-6

Page 9

Contents

About this Manual ............................................ 1

Initializing the Calculator ................................ 3

Safety Precautions ........................................... 4

Handling Precautions ...................................... 5

Before Using the Calculator .......................... 10

kRemoving the Hard Case .................................... 10

kTurning Power On and Off ................................... 10

kAdjusting Display Contrast ................................... 10

kAbout the Display .................................................. 11

kDisplay Indicators ................................................. 11

Calculation Modes and Calculator Setup .... 13

kCalculation Modes ............................................... 13

kUsing the Setup Screen ....................................... 13

Inputting Expressions and Values ............... 23

kInputting a Calculation Expression Using

Standard Format .................................................. 23

kCorrecting an Expression .................................... 25

kDisplaying the Location of an Error ...................... 27

Basic Calculations ......................................... 28

kArithmetic Calculations ........................................ 28

kPercent Calculations ............................................ 29

Using Multi-statements in Calculations ....... 32

Using Calculation History Memory and

Replay ............................................................. 33

Using Calculator Memory .............................. 35

kAnswer Memory (Ans) ......................................... 35

kIndependent Memory (M) .................................... 37

kVa riables (A, B, C, D, X, Y) .................................. 38

kFinancial Calculation Variables (VARS) ............... 40

kClearing Memory Contents .................................. 41

E-7

Page 10

Financial Calculation ..................................... 42

kSimple Interest Mode ........................................... 42

kCompound Interest Mode .................................... 44

kCash Flow Mode .................................................. 50

kAmortization Mode ............................................... 55

kConversion Mode ................................................. 59

kCost/Sell/Margin Mode ........................................ 61

kDay Calculation Mode .......................................... 64

kDepreciation Mode (FC-200V only) ..................... 66

kBond Mode (FC-200V only) ................................. 71

kBreak-Even Mode (FC-200V only) ....................... 78

kBEV Sub-mode (Break-Even Mode 1) ................. 78

kMargin of Safety Sub-mode

(Break-Even Mode 2) ........................................... 82

kDegree of Operating Leverage Sub-mode

(Break-Even Mode 3) ........................................... 84

kDegree of Financial Leverage Sub-mode

(Break-Even Mode 4) ........................................... 86

kDegree of Combined Leverage Sub-mode

(Break-Even Mode 5) ........................................... 88

kQuantity Conversion Sub-mode

(Break-Even Mode 6) ........................................... 90

Shortcuts ........................................................ 94

kCustom Shortcut Keys ......................................... 94

kFunction Shortcut Keys ........................................ 96

Function Calculations ................................... 98

kPi (π ) and Natural Logarithm Base e ................... 98

kTrigonometric and Inverse Trigonometric

Functions ............................................................. 98

kHyperbolic and Inverse Hyperbolic Functions ..... 99

kConverting an Input Value to the Calculator’s

Default Angle Unit ................................................ 99

kExponential Functions and Logarithmic

Functions ........................................................... 100

kPower Functions and Power Root Functions .... 101

kRectangular-Polar Coordinate Conversion ........ 103

kOther Functions ................................................. 104

E-8

Page 11

Statistical Calculation .................................. 108

kStatistical Calculation Types .............................. 108

kInputting Sample Data ....................................... 108

kSTAT Calculation Screen .................................... 111

kUsing the STAT Menu ......................................... 112

Technical Information .................................. 134

kCalculation Priority Sequence ............................ 134

kStack Limitations ................................................ 136

kCalculation Ranges, Number of Digits, and

Precision ............................................................ 137

kSpecial Financial Calculation Error Messages .. 139

kError Messages ................................................. 140

kBefore assuming malfunction of the calculator... 142

Reference ...................................................... 143

kPower Requirements and Battery

Replacement ..................................................... 143

Specifications ............................................... 146

E-9

Page 12

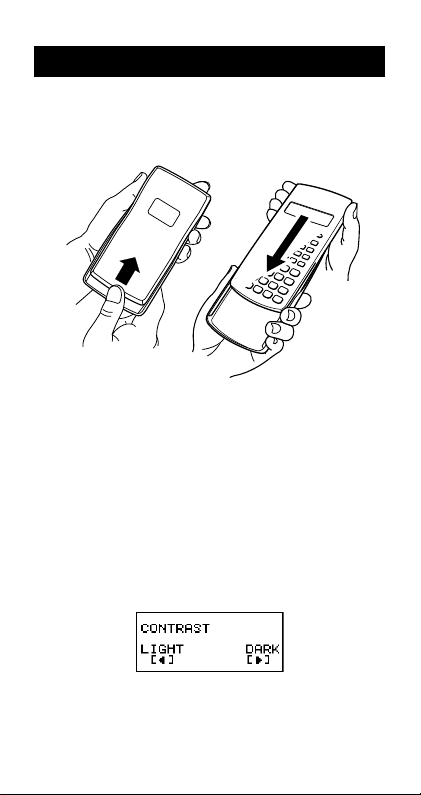

Before Using the Calculator

k Removing the Hard Case

Before using the calculator, slide its hard case downwards

to remove it, and then affix the hard case to the back of

the calculator as shown in the illustration below.

k Turning Power On and Off

•Press O to turn on the calculator.

•Press 1A(OFF) to turn off the calculator.

k Adjusting Display Contrast

1. Press s.

2. Use c to select “CONTRAST:EXE”, and then press

E.

This displays the contrast adjustment screen. Use d and

e to adjust display contrast. After the setting is the way

you want, press E.

Important!

• If adjusting display contrast does not improve display

readability, it probably means that battery power is low.

Replace the battery.

E-10

Page 13

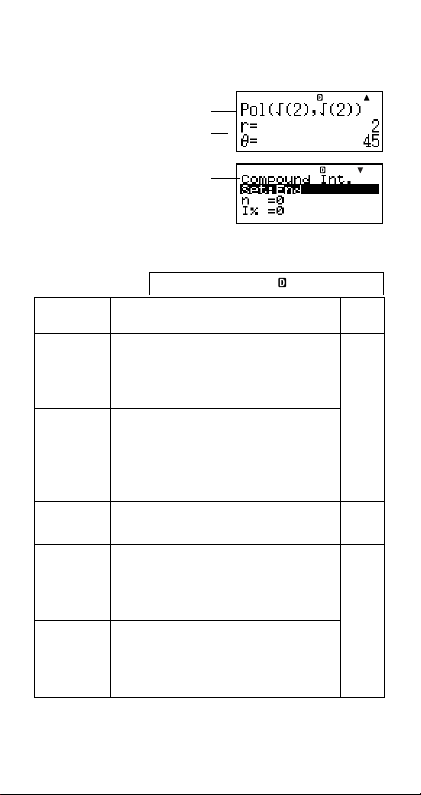

k About the Display

Your calculator has a 31-dot × 96-dot LCD screen.

Example:

Input expression

Calculation result

Financial Calculation Mode

{

k Display Indicators

Sample Display:

This

indicator:

Means this: Page:

The keypad has been shifted by

pressing the 1 key. The keypad

7

will unshift and this indicator will

disappear when you press a key.

The alpha input mode has been

entered by pressing the S key.

3 The alpha input mode will be exited

and this indicator will disappear

when you press a key.

There is a value stored in independ-

M

ent memory.

The calculator is standing by for input

of a variable name to assign a value

STO

to the variable. This indicator appears after you press 1t(STO).

The calculator is standing by for input

of a variable name to recall the vari-

RCL

able’s value. This indicator appears

after you press t.

STAT

E-1

E-37

E-37

E-38

E-94

E-11

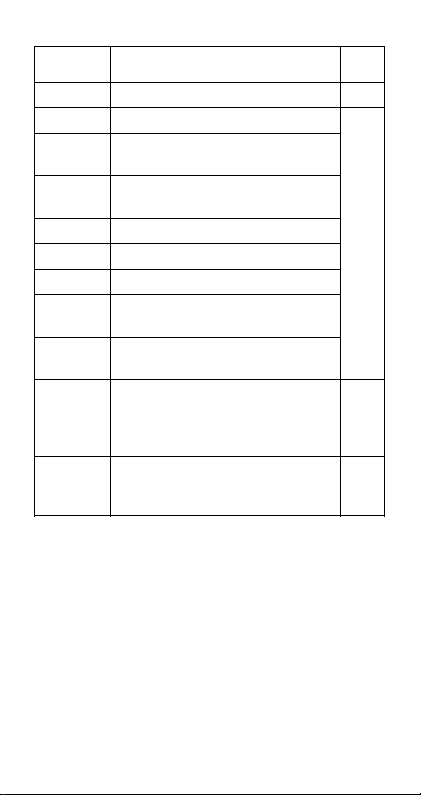

Page 14

This

indicator:

STAT The calculator is in the STAT Mode.

DMY

Means this: Page:

360 360 days in a year.

Simple interest for interest calcula-

SI

tions of odd (partial) months.

Day, month, year (DMY) as the date

format.

7 The default angle unit is degrees.

8 The default angle unit is radians.

9 The default angle unit is grads.

A fixed number of decimal places is

FIX

in effect.

A fixed number of significant digits

SCI

is in effect.

Calculation history memory data is

available and can be replayed, or

$`

there is more data above/below the

current screen.

The display currently shows an in-

Disp termediate result of a multi-state-

ment calculation.

E-108

E-15

E-33

E-32

Important!

•For a very complex calculation or some other type of

calculation that takes a long time to execute, the display

may show only the above indicators (without any value)

while it performs the calculation internally.

E-12

Page 15

Calculation Modes and

Calculator Setup

k Calculation Modes

When you want to perform Press this

this type of operation: key:

Simple interest calculations S E-42

Compound interest calculations c E-44

Cash flow calculations C E-50

Amortization calculations A E-55

General and function calculations m

Statistical and regression

calculations

Interest rate conversion calculations

Cost, selling price, or margin

calculations

Day or date calculations D E-64

Depreciation calculations

(FC-200V only)

Purchase price and annual yield

calculations (FC-200V only)

Break-even point calculations

(FC-200V only)

k Using the Setup Screen

The setup screen lets you configure various conditions and

screen settings used for calculations. You can also use

the setup screen to adjust display contrast.

Page:

E-28

E-98

a E-108

n E-59

o E-61

d E-66

b E-71

B E-78

E-13

Page 16

A Displaying the Setup Screen

There are two different ways to display the setup screen.

•Pressing the s key

• Selecting the “Set:” item on

the menu screen that

appears when you enter

some modes.

The following are the

procedures you need to

perform to access and use the

setup screen using the above

operations.

Important!

All of the example procedures presented in this manual

use the s key procedure to display the setup screen.

To display the setup screen with the s key

1. Press the s key.

This displays a menu of setup items.

• See “Setup Screen Settings” on page E-15 for a

complete list of menu items.

2. Use fc to select the setup item whose setting you

want to change, and then press E.

This displays a screen for configuring the setting of the

setup item you selected.

3. Configure the setting you want.

•You can select a setting by with the cursor and then

press E , or you can input the number that

corresponds to the setting you want to select.

• See “Configuring Settings” on page E-16 for

information about configuring each setting.

To display the setup screen by selecting “Set:” on a

mode menu

Important!

The following procedure is possible only when there is a

“Set:” item on the menu that initially appears when you

enter a mode. It is not available in all modes.

FC-200V

E-14

Page 17

1. On the menu that appears when you initially enter a

mode, use fc to select “Set:”, and then press E.

• This displays a setup screen of settings that apply to

the current mode only. The content of the setup screen

depends on what mode you are currently in.

2. Use fc to select the setup item whose setting you

want to change. You can also select a setup item by

inputting the applicable number.

• See “Setup Screen Settings” below for information

about configuring each setting.

A Setup Screen Settings

Setup

No.

Screen Item

1 Payment

2 Date Mode Number of days in a year E-16

3 dn Odd period interest calculation E-16

4 Periods/Y

5 Bond Date

6 Date Input Date format E-18

7 PRF/Ratio Profit or profit ratio specification E-18

8 B-Even

9 Digit Sep. 3-digit separator symbol E-19

0 Angle Angle unit E-19

! Fix Number of decimal places E-20

@ Sci Number of significant digits E-20

# Norm

$ STAT Statistical display E-21

%

CONTRAST

Payment date (beginning of

term/end of term)

Number of payment periods

per year

Date or number of coupon

payments specification

Sales quantity or sales amount

specification

Value range for exponential

format

Contrast adjustment E-22

Description Page

E-16

E-17

E-17

E-18

E-21

E-15

Page 18

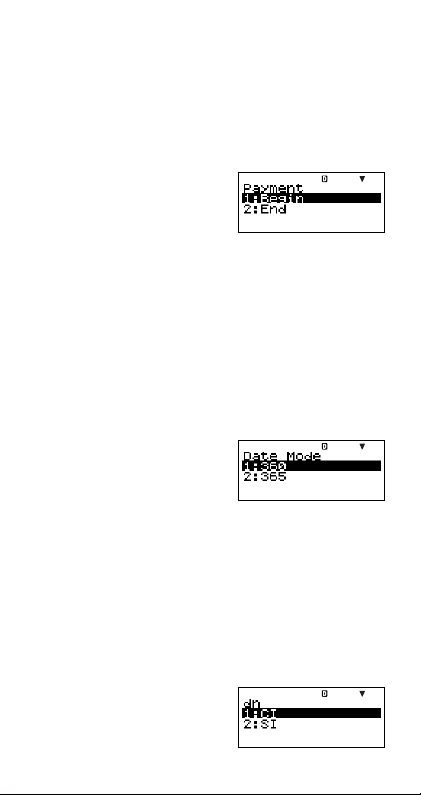

A Configuring Settings

1 Payment: Compound Interest (CMPD) Mode,

This setting specifies the payment date.

1. Use fc to select

“Payment”, and then press

E.

2. Press 1(1:Begin) or 2(2:End) to select the setting

you want.

•You can also use fc to select a setting and then

2 Date Mode: Simple Interest (SMPL) Mode, Day

This setting specifies the number of days in a year.

1. Use fc to select “Date

Mode”, and then press E.

2. Press 1(1:360) or 2(2:365) to select the setting you

want.

•You can also use fc to select a setting and then

3 dn: Compound Interest (CMPD) Mode

This setting specifies whether simple interest or compound

interest for interest calculations of odd (partial) months.

1. Use fc to select “dn”,

and then press E.

Amortization (AMRT) Mode

1:Begin Beginning of period

2:End End of period

press E.

Calculation (DAYS) Mode, Bond (BOND)

Mode (FC-200V only)

1:360 360 days

2:365 365 days

press E.

1:CI Compound interest

2:SI Simple interest

E-16

Page 19

2. Press 1(1:CI) or 2(2:SI) to select the setting you

want.

•You can also use fc to select a setting and then

press E.

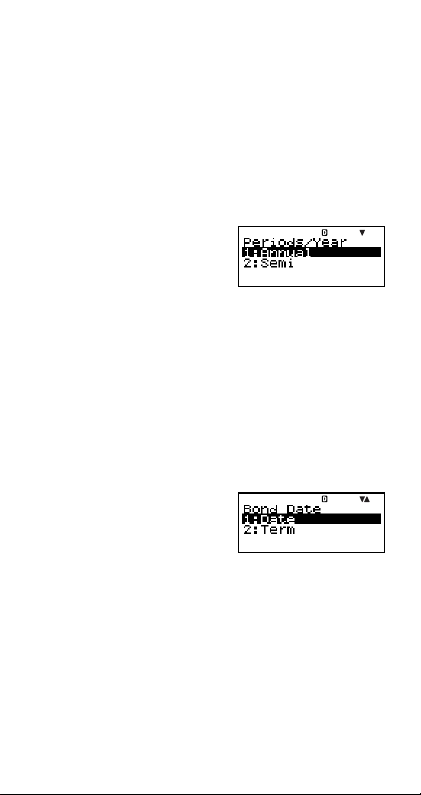

4 Periods/Y: Bond (BOND) Mode (FC-200V only)

This setting specifies once a year (Annual) or twice a year

(Semi-Annual) coupon payments.

1:Annual One coupon payment per year

2:Semi One coupon payment every six months

1. Use fc to select

“Periods/Y”, and then press

E.

2. Press 1(1:Annual) or 2(2:Semi) to select the setting

you want.

•You can also use fc to select a setting and then

press E.

5 Bond Date: Bond (BOND) Mode (FC-200V only)

This setting specifies use of either a date (Date) or a

number of payments (Term) as the term for bond

calculations.

1:Date Date

2:Term Number of payments

1. Use fc to select “Bond

Date”, and then press E.

2. Press 1(1:Date) or 2(2:Term) to select the setting

you want.

•You can also use fc to select a setting and then

press E.

E-17

Page 20

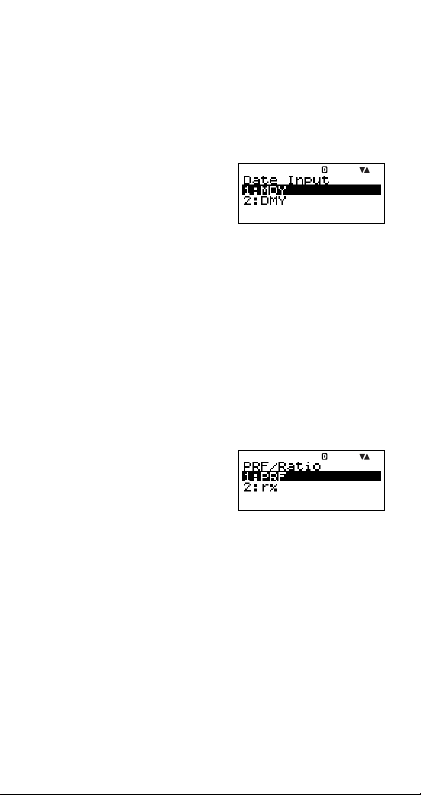

6 Date Input: Day Calculation (DAYS) Mode, Bond

This setting specifies either month, day, year (MDY) or

day, month, year (DMY) as the date format.

1:MDY Month, day, year 06012006 (June 1, 2006)

2:DMY Day, month, year 01062006 (June 1, 2006)

1. Use fc to select “Date

Input”, and then press E.

2. Press 1(1:MDY) or 2(2:DMY) to select the setting

you want.

•You can also use fc to select a setting and then

press E.

7 PRF/Ratio: Break-Even Point Calculation (BEV) Sub-

This setting specifies use of either profit (PRF) or profit

ratio (

r%) for break-even point calculations.

1:PRF Profit

2:

1. Use fc to select “PRF/

Ratio”, and then press E.

(BOND) Mode (FC-200V only)

mode of Break-Even (BEVN) Mode (FC200V only)

r%Profit ratio

2. Press 1(1:PRF) or 2(2:

want.

•You can also use fc to select a setting and then

press E.

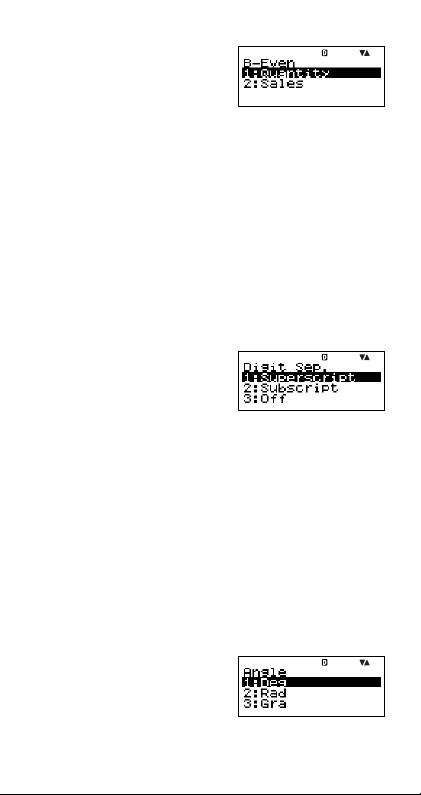

8 B-Even: Break-Even Point Calculation (BEV) Sub-

mode of Break-Even (BEVN) Mode (FC-200V

only)

This setting specifies use of either sales quantity (Quantity)

or sales amount (Sales) for break-even point calculations.

1: Quantity Sales quantity

2: Sales Sales amount

r%) to select the setting you

E-18

Page 21

1. Use fc to select

“B-Even”, and then press

E.

2. Press 1(1:Quantity) or 2(2:Sales) to select the

setting you want.

•You can also use fc to select a setting and then

press E.

9 Digit Sep.: All modes except for the STAT Mode and

This setting specifies what type of 3-digit separator should

be used. Note that the 3-digit separator is not displayed

after you specify a number of significant digits with @ Sci.

1:Superscript Superscript comma 123´456

2:Subscript Subscript comma 123,456

3:Off Separator off 123456

1. Use fc to select “Digit

Sep.”, and then press E.

2. Press 1(1:Superscript), 2(2:Subscript), or 3(3:Off)

to select the setting you want.

•You can also use fc to select a setting and then

press E.

0 Angle: All modes

This setting specifies the angle unit used for trigonometric

functions.

90° = — radians = 100 grads

1:Deg Degrees

2:Rad Radians

3:Gra Grads

1. Use fc to select “Angle”,

and then press E.

COMP Mode

π

2

E-19

Page 22

2. Press 1(1:Deg), 2(2:Rad), or 3(3:Gra) to select

the setting you want.

•You can also use fc to select a setting and then

press E.

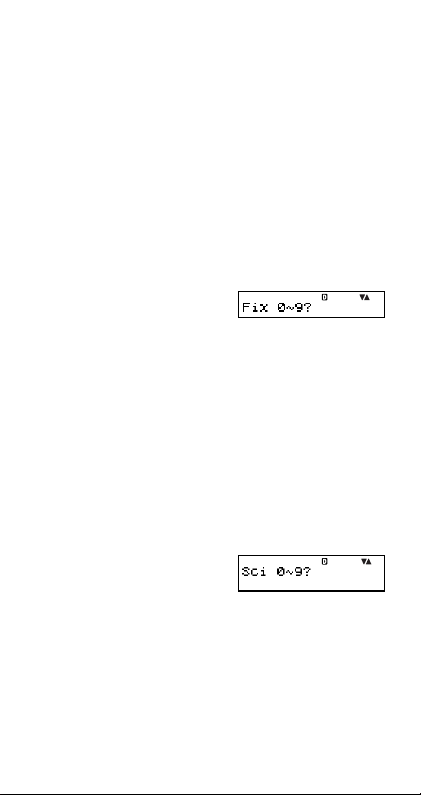

! Fix: All modes

This setting specifies a fixed number of digits to the right

of the decimal place. Calculation results are rounded off

to the specified number of digits before being displayed.

•Changing this setting automatically cancels any previous

settings made for @ Sci and # Norm.

• Specify the number of decimal places by inputting a value

in the range of 0 (round off and then cut fraction part) to

9 (nine decimal places).

1. Use fc to select “Fix”,

and then press E.

2. Input a value from 0 to 9 to specify the number of decimal

places.

Example: 100 ÷ 7 = 14.286 (Fix 3)

= 14.29 (Fix 2)

@ Sci: All modes

This setting specifies the number of significant digits.

Calculation results are rounded off to the specified number

of digits before being displayed.

•Changing this setting automatically cancels any previous

settings made for ! Fix and # Norm.

•You can specify anywhere from 1 significant digit (by

inputting 1) to 10 significant digits (by inputting 0).

1. Use fc to select “Sci”,

and then press E.

2. Input a value from 0 to 9 to specify the number of

significant digits.

Example: 10 ÷ 7 = 1.4286 × 10

= 1.429 × 10

0

0

(Sci 5)

(Sci 4)

E-20

Page 23

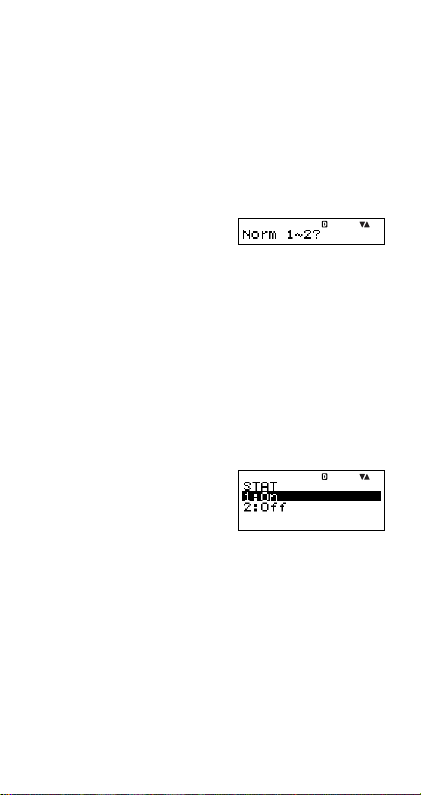

# Norm: All modes

This setting specifies the range that determines when

display of values switches to exponential format.

•Changing this setting automatically cancels any previous

settings made for ! Fix and @ Sci.

Norm1: 10

–2

> x, x > 10

Norm2: 10–9 > x, x > 10

10

10

Example: 1 ÷ 200 = 5 × 10–3(Norm1)

= 0.005 (Norm2)

1. Use fc to select “Norm”,

and then press E.

2. Press 1(Norm1) or 2(Norm2).

$ STAT: Statistics (STAT) Mode, Cash Flow (CASH)

Mode

This setting controls whether a frequency (FREQ) column

is included in the STAT Mode DataEditor.

• The Cash Flow (CASH) Mode uses the same DataEditor

as the STAT Mode. Turning on display of the frequency

column reduces the maximum number of data items that

can be input for investment appraisal.

1:On Frequency (FREQ) column display on

2:Off Frequency (FREQ) column display off

1. Use fc to select

“STAT”, and then press E.

2. Press 1(1:On) or 2(2:Off) to select the setting you

want.

•You can also use fc to select a setting and then

press E.

Important!

• This operation clears DataEditor data. Note that data is

cleared even if you select the setting that corresponds to

the current FREQ column display status. Selecting “On”

while FREQ column display is currently turned on, for

example, will clear DataEditor data.

E-21

Page 24

% CONTRAST: All modes

Select this setting when you want to adjust screen contrast

and make display figures lighter or darker.

1. Use fc to select

“CONTRAST”, and then

press E.

2. Use d and e to adjust display contrast.

3. Press E.

Note

• On a setting screen, the cursor mark displayed on the

upper right of a screen cannot be used.

A Initializing the Setup Screen Settings

1. O19(CLR)

2. “Setup:EXE” (fc), then E.

3. E(Yes)

4. A

•To cancel initialization without doing anything, press

E(Cancel) instead of E(Yes).

• The calculator will automatically enter the COMP Mode

after you initialize the setup screen settings.

E-22

Page 25

Inputting Expressions and

Values

k Inputting a Calculation Expression

Using Standard Format

Your calculator lets you input calculation expressions just

as they are written. Then simply press the E key to

execute it. The calculator automatically judges the

calculation priority sequence for addition, subtraction,

multiplication, and division, functions, and parentheses.

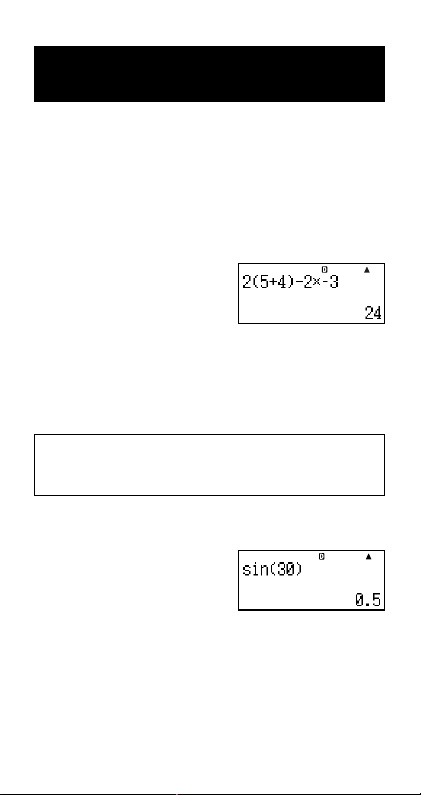

Example: 2 (5 + 4) – 2 × (–3) =

2(5+4)-

2*y3E

A Inputting a Function with Parenthesis

When you input any of the functions shown below, it is

automatically input with the open parenthesis (

Next, you need to input the argument and the closing

parenthesis (

sin(, cos(, tan(, sin–1(, cos–1( , tan–1(, sinh(, cosh(, tanh(,

sinh

x

'(, Abs(, Pol(, Rec(, Rnd(

Example: sin 30 =

)

).

–1

(, cosh–1(, tanh–1(, log(, ln(, e^(, 10^(, ^(, '(, 3'(,

z

1. t

2. “sin(” (fc), then E.

3. 30)E

• Some commonly used functions can also be input using

a direct key operation.

Example: sin 30 =

1. 11(sin)

2. 30)E

(

) character.

E-23

Page 26

A Omitting the Multiplication Sign

You can omit the multiplication sign (×) in any of the

following cases.

• Before an open parentheses (

•Before a function with parenthesis: 2

etc.

• Before a variable name, constant, or random number:

20

× A, 2 × π, etc.

(

): 2 × (5 + 4), etc.

× sin(30), 2 × '(3),

A Final Closed Parenthesis

You can omit one or more closed parentheses that come

at the end of a calculation, immediately before the E key

is pressed. For details, see “Omitting a Final Closed

Parenthesis” on page E-29.

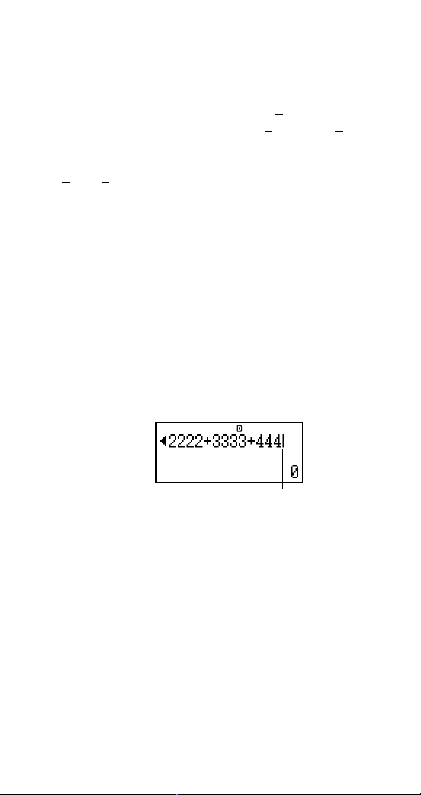

A Displaying a Long Expression

The display can show up to 14 characters at a time.

Inputting the 15th character causes the expression to shift

to the left. At this time, the ] indicator appears to the left

of the expression, indicating that it runs off the left side of

the screen.

Input expression: 1111 + 2222 + 3333 + 444

Displayed portion:

Cursor

•When the ] indicator is displayed, you can scroll left

and view the hidden part by pressing the d key. This

will cause the ' indicator to appear to the right of the

expression. At this time, you can use the e key to scroll

back.

A Number of Input Characters (Bytes)

•You can input up to 99 bytes of data for a single

expression. Basically, each key operation uses up one

byte. A function that requires two key operations to input

(like 11(sin)) also uses only one byte.

E-24

Page 27

• Normally the input cursor appears as a straight vertical

) or horizontal ( ) flashing line on the display screen.

(

I

When there are 10 or fewer bytes of input remaining in

the current expression, the cursor changes shape to

to let you know. If the I cursor appears, terminate the

expression at a convenient point and calculate the result.

k Correcting an Expression

This section explains how to correct an expression as you

are inputting it. The procedure you should use depends

on whether you have insert or overwrite selected as the

input mode.

A About the Insert and Overwrite Input Modes

With the insert mode, the displayed characters shift to the

left to make room when you input a new character. With

the overwrite mode, any new character you input replaces

the character at the current cursor position.

• The cursor is a vertical flashing line (

mode is selected. The cursor is a horizontal flashing line

(

) when the overwrite mode is selected.

• The initial default is the insert mode. You can switch

between the insert mode and the overwrite mode by

pressing 1Y(INS).

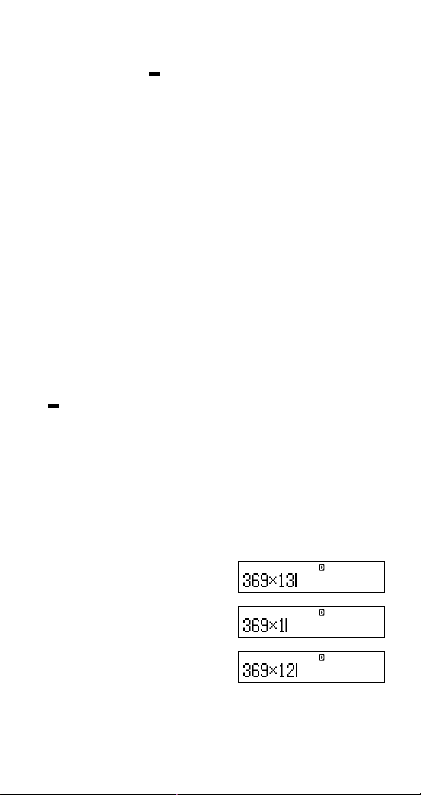

A Changing the Character or Function You

Just Input

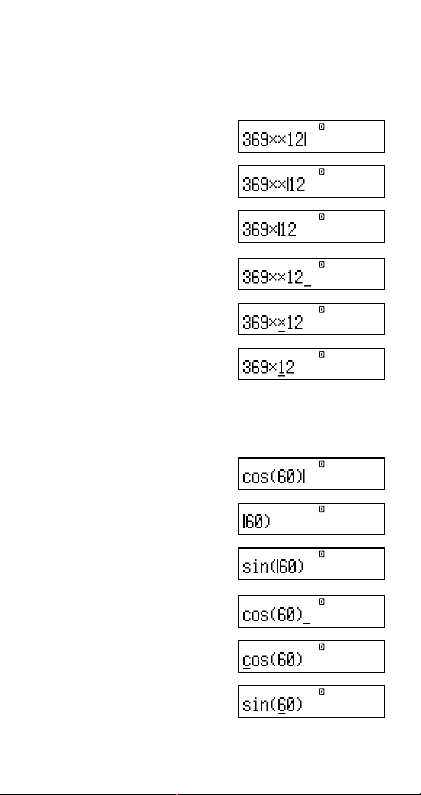

Example: To correct the expression 369 × 13 so it

becomes 369 × 12

369*13

Y

) when the insert

I

I

E-25

2

Page 28

A Deleting a Character or Function

Example: To correct the expression 369 × × 12 so it

Insert Mode:

Overwrite Mode:

becomes 369 × 12

369**12

dd

Y

369**12

ddd

Y

A Correcting a Calculation

Example: To correct cos(60) so it becomes sin(60)

Insert Mode:

12(cos)60)

dddY

11(sin)

Overwrite Mode:

12(cos)60)

dddd

11(sin)

E-26

Page 29

A Inserting input into a Calculation

Always use the insert mode for this operation. Use d or

e to move the cursor to the location where you want to

insert new input, and then input what you want.

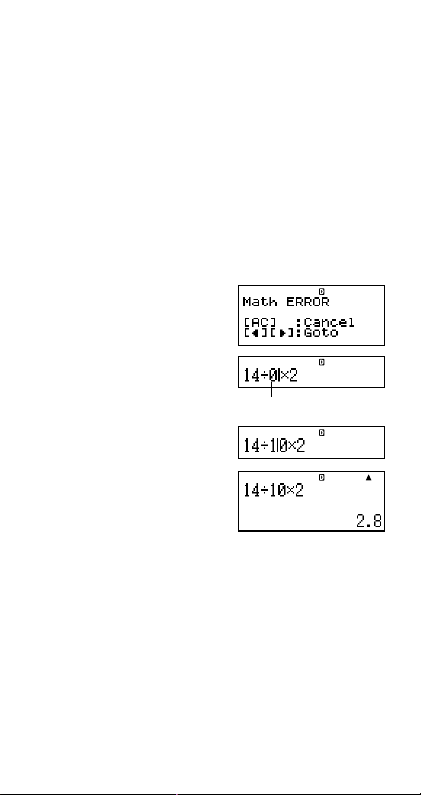

k Displaying the Location of an Error

If an error message (like “Math ERROR” or “Syntax

ERROR”) appears when you press E, press d or e.

This will display the part of the calculation where the error

occurred, with the cursor positioned at the error location.

You can then make necessary corrections.

Example: When you input 14 ÷ 0 × 2 = by mistake instead

Insert Mode:

You can also exit the error screen by pressing A, which

clears the calculation.

of 14 ÷ 10 × 2 =

14/0*2E

Press e or d.

This is causing the error.

d1

E

E-27

Page 30

Basic Calculations

This section explains how to perform arithmetic and percent

calculations.

All calculations in this section are performed in the

COMP Mode (g).

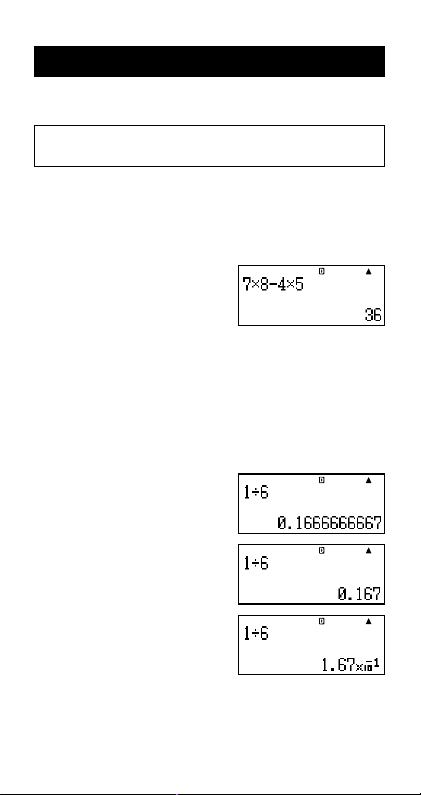

k Arithmetic Calculations

Use the +, -, *, and / keys to perform arithmetic

calculations.

Example: 7 × 8 – 4 × 5 = 36

7*8-4*5E

• The calculator automatically judges the calculation priority

sequence. For more information, see “Calculation Priority

Sequence” on page E-134.

A Number of Decimal Places and Number of

Significant Digits

You can specify a fixed number of decimal places and

significant digits for the calculation result.

Example: 1 ÷ 6 =

Initial default setting (Norm1)

FIX

3 decimal places (Fix3)

SCI

3 significant digits (Sci3)

• For more information, see “Configuring Settings” on page

E-16.

E-28

Page 31

A Omitting a Final Closed Parenthesis

You can omit any closed parenthesis ( ) ) immediately

preceding operation of the E key at the end of a

calculation.

Example: (2 + 3) × (4 – 1) = 15

(2+3)*

(4-1E

k Percent Calculations

Example 1: 2% = 0.02

21((%)E

Example 2: 150 × 20% = 30

150*20

1((%)E

Example 3: To calculate what percentage of 880 is 660.

660/880

1((%)E

Example 4: To increase 2500 by 15%.

2500+

2500*

151((%)E

E-29

Page 32

Example 5: To discount 3500 by 25%.

35003500*

251((%)E

Example 6: To discount the sum of 168, 98, and 734 by

-G*201((%)E

Example 7: If 300 grams are added to a test sample

Example 8: What is the percentage change when a value

Insert Mode:

20%.

168+98+

734E

originally weighing 500 grams, what is the

percentage increase in weight?

300+500

1.(A%)

is increased from 40 to 46? How about to 48?

46-40

1.(A%)

eeeY8E

E-30

Page 33

Example 9: To calculate the selling price and profit when

the purchase price is $480 and the profit rate

to the selling price is 25%.

480*25

1.(A%)

480/25

1.(A%)

Example 10: To calculate the bargain price and loss when

the purchase price is $130 and the loss rate

is 4%.

130*y4

1.(A%)

130/y4

1.(A%)

E-31

Page 34

Using Multi-statements in

Calculations

You can use the colon character (:) to connect two or more

expressions and execute them in sequence from left to

right when you press E.

Example: To create a multi-statement that performs the

Insert Mode:

1. 3+3

2. t

3. “ : ” (fc), then E.

4. 3*3

“Disp” indicates this is an intermediate result of a multi-statement.

following two calculations: 3 + 3 and 3 × 3

Disp

E

E

E-32

Page 35

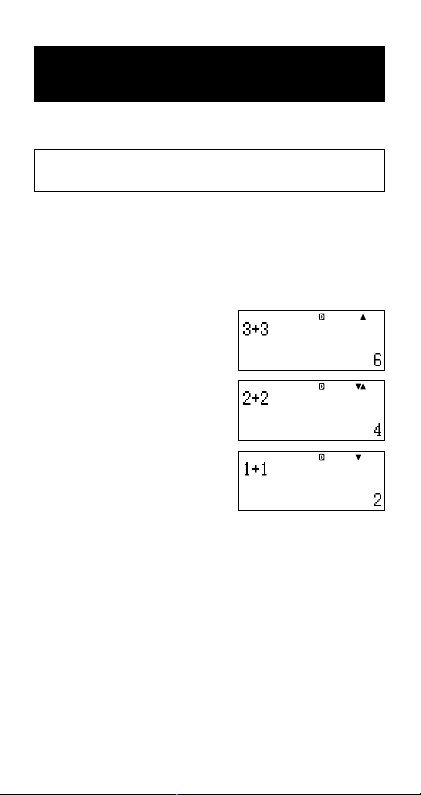

Using Calculation History

Memory and Replay

Calculation history memory maintains a record of each

calculation expression you input and execute, and its result.

You can use calculation history memory in the COMP

Mode (g) only.

A Recalling Calculation History Memory

Contents

Press f to back-step through calculation history memory

contents. Calculation history memory shows both

calculation expressions and results.

Example:

•Note that calculation history memory contents are cleared

whenever you turn off the calculator, press the O key,

change to another mode, or perform the operation under

“Initializing the Calculator” (page E-3) or “Initializing the

Setup Screen Settings” (page E-22).

•Calculation history memory is limited. When the

calculation you are performing causes calculation history

memory to become full, the oldest calculation is deleted

automatically to make room for the new calculation.

1+1E

2+2E

3+3E

f

f

E-33

Page 36

A Replay Function

While a calculation result is on the display, you can press

d or e to edit the expression you used for the previous

calculation.

Example: 4 × 3 + 2.5 = 14.5

4 × 3 – 7.1 = 4.9

4*3+2.5E

A

d

YYYY

-7.1E

E-34

Page 37

Using Calculator Memory

Memory Name Description

Answer Memory Stor es the last c alculation result

Independent Calculation results can be added to

Memory or subtracted from independent

Variables Six variables named A, B, C, D, X,

VARS The following are the names of the

This section uses the COMP Mode (g) to demonstrate

how you can use memory.

k Answer Memory (Ans)

A Answer Memory Overview

• Answer Memory contents are updated whenever you

execute a calculation using any one of the following keys:

E, 9, m, 1m(M–), t, or 1t(STO). Answer

Memory can hold up to 15 digits.

• Answer Memory contents do not change if an error occurs

during the current calculation.

• Answer Memory contents are maintained even if you

press the A key, change the calculation mode, or turn

off the calculator.

•When multiple results are obtained (in polar coordinate

calculations, when “ALL:Solve” is selected in the Simple

Interest Mode, etc.), the result that is displayed at the top

of the screen is the one stored in Answer Memory.

obtained.

memory. The “M” display indicator

indicates data in independent

memory.

and Y can be used for storage of

individual values.

financial calculation variables:

PV, PMT, FV, P/Y, C/Y, PM1, PM2,

Dys.

n, I,

E-35

Page 38

A Using Answer Memory to Perform a Series

123 + 456 = 579 789 – 579 = 210

of Calculations

Example: To d ivide the result of 3 × 4 by 30

3*4E

(Continuing)/30E

Pressing / automatically inputs

•With the above procedure, you need to perform the

second calculation immediately after the first one. If you

need to recall Answer Memory contents after pressing

A, press the G key.

“Ans” command.

A Inputting Answer Memory Contents into an

Expression

Example: To perform the calculations shown below:

123+456E

789-GE

E-36

Page 39

k Independent Memory (M)

You can add calculation results to or subtract results from

independent memory. The “M” appears on the display when

independent memory contains a value.

A Independent Memory Overview

• The following is a summary of the different operations

you can perform using independent memory.

To do this:

Add the displayed value or

result of the expression to m

independent memory

Subtract the displayed value

or result of the expression 1m(M–)

from independent memory

Recall current independent

memory contents

Assign a specific value or 1.3+5

result of the expression to 2. 1t(STO)

independent memory 3. “M:”(fc), then E.

•You can also store financial calculation value in

independent memory.

Example: In the SMPL Mode, store the value of SI in

independent memory (M)

1. Enter the SMPL Mode for calculation of simple interest

(SI). See pages E-42 and E-43 for more information.

2. 1t(STO)

3. “SI”(fc), then E.

4. “M:”(fc), then E.

5. E(Yes)

•A number sign (#) next to the independent memory

variable name indicates that it already contains data.

Performing the following steps will replace any existing

data with the new data.

Perform this key

operation:

Sm(M)

(for example)

4. E(Yes)

E-37

Page 40

• The “M” indicator appears in the upper left of the display

when there is any value other than zero stored in

independent memory.

• Independent memory contents are maintained even if you

press the A key, change the calculation mode, or turn

off the calculator.

A Calculation Examples Using Independent

Memory

• If the “M” indicator is on the display, perform the procedure

under “Clearing Independent Memory” before performing

this example.

Example: 23 + 9 = 32 23+9m

53 – 6 = 47 53-6m

–) 45 × 2 = 90 45*21m(M–)

99 ÷ 3 = 33 99/3m

(Total) 22 Sm(M)E

A Clearing Independent Memory

1. 0

2. 1t(STO)

3. “M:”(fc), then E.

4. E(Yes)

•This clears independent memory and causes the “M”

indicator to disappear from the display.

k Variables (A, B, C, D, X, Y)

A Variable Overview

•You can assign a specific value or a calculation result to

a variable.

Example: To assign the result of 3 + 5 to variable A.

1. 3+5

2. 1t(STO)

3. “A:”(fc), then E.

4. E(Yes)

E-38

Page 41

•Use the following procedure when you want to check the

contents of a variable.

Example: To recall the contents of variable A

• The following shows how you can include variables inside

of an expression.

Example: To multiply the contents of variable A by the

•You can also assign a financial calculation value to a

variable.

Example: In the CMPD Mode, assign the value of PMT to

1. CMPD mode: “PMT”

2. 1t(STO)

3. “A:”(fc), then E.

4. E(Yes)

•A number sign (#) next to a variable name indicates that

there is already data assigned to the variable. Performing

the following steps will replace any existing data with the

new data.

•Variable contents are maintained even if you press the

A key, change the calculation mode, or turn off the

calculator.

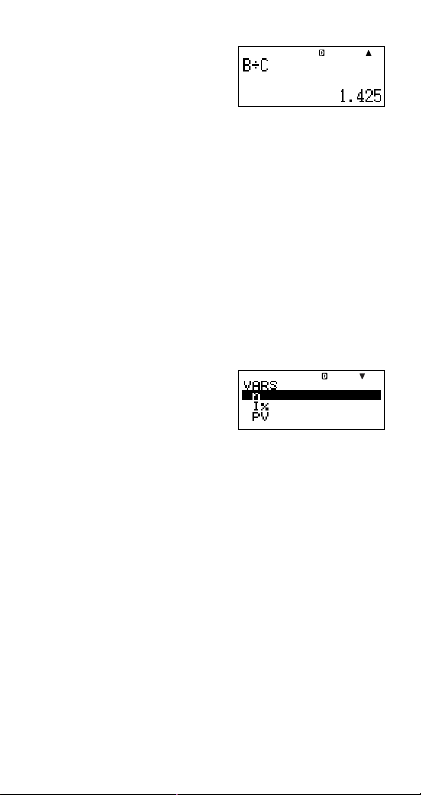

Example:

1. 9*6+3

2. 1t(STO)

3. “B:” (fc), then E.

4. E(Yes)

5. 5*8

6. 1t(STO)

7. “C:” (fc), then E.

8. E(Yes)

Sn(A)

contents of variable B

Sn(A)*So(B)E

variable “A”.

(fc).

9 × 6 + 3

= 1.425

5 × 8

E-39

Page 42

9. So(B)/SD(C)

E

k Financial Calculation Variables (VARS)

• The following are the names of the financial calculation

variables (VARS):

n, I, PV, PMT, FV, P/Y, C/Y, PM1, PM2, Dys.

•Financial calculation variables are used in financial

calculations to store values. See the sections that

describe the various modes for information about which

variables are used in each mode.

•In the COMP Mode, the above variables are used as

arithmetic variables, and are referred to as such in the

section explaining the COMP Mode.

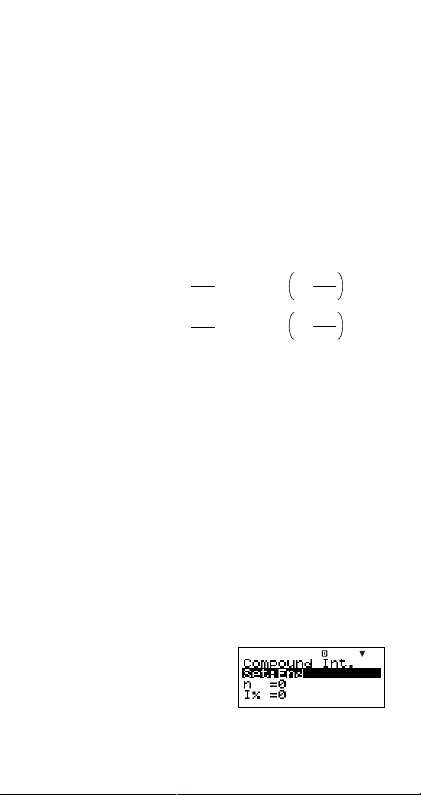

A To select an financial calculation variable

in the COMP mode

1. Press 1t(VARS).

2. On the menu screen that appears, use fc to move

the highlighting to the variable you want to select, and

then press E.

A Clearing the Contents of VARS Memories

Only

1. O19(CLR)

2. “VARS:EXE” (fc), then E.

3. E(Yes)

4. A

•To cancel the clear operation without doing anything,

press E(Cancel) instead of E(Yes).

•VARS Memory Initial Default Values

P/Y, C/Y....................................................................... 1

n, I, PV, PMT, FV, PM1, PM2, Dys.......................... 0

E-40

Page 43

k Clearing Memory Contents

Use the following procedure to clear the contents of Answer

Memory, independent memory, and all of the variables.

This procedure does not clear VARS memory contents.

See “Clearing the Contents of VARS Memories Only” for

more information.

1. O19(CLR)

2. “Memory:EXE” (fc), then E.

3. E(Yes)

4. A

•To cancel the clear operation without doing anything,

press E(Cancel) instead of E(Yes).

E-41

Page 44

Financial Calculation

k Simple Interest Mode

• The Simple Interest (SMPL) Mode lets you calculate the

interest amount and/or simple future value (principal and

interest amount).

A Entering the SMPL Mode

•Press S to enter the SMPL Mode.

Value Input Screen

A Setting Values

No. Display Name

1 Set* Days in Year (Date Mode) 365

2 Dys

3 I Interest Rate (Annual) 5%

4 PV Principal (Present Value) $10,000

* For information about specifying the Date Mode, see the

“Date Mode” item under “Configuring Settings” on page

E-16.

Number of Interest Periods

(Number of Days)

A Basic SMPL Mode Procedure

Example 1: To calculate the interest amount (SI), and the

1. Input the values for 1, 2, 3, and 4 from the Setting

Values table above.

• For this example, use

simple future value (SFV)

fc to select 1 “Set:”,

and then press E.

Values Used

in Examples

120

E-42

Page 45

•Press 2 to select “365”.

•Use fc to select 2

“Dys”, input 120, and then

press E.

•Use fc to select 3 “

E.

•Use fc to select 4 “PV”, input 10000, and then

press E.

2. Select the value you want to calculate.

• For this example, use

fc to select “ALL:

Solve”.

3. Press 9 to perform the

calculation.

•Pressing the E key returns to the value input screen.

•To solve for the items that have “Solve” specified (such

as “ALL:Solve”), you can press E instead of 9.

I”, input 5, and then press

A Other SMPL Mode Calculations

Example 2: To calculate the simple interest (SI) amount

•In step 2 of the basic procedure (Example 1), select

“SI:Solve”.

Example 3: To calculate the simple future value (SFV)

•In step 2 of the basic procedure (Example 1), select

“SFV:Solve”.

only

only

E-43

Page 46

A SMPL Mode Financial Calculation Variables

(VARS)

•Variables Dys, I, and PV are used in the SMPL Mode.

• The values of SMPL Mode variables are retained even if

you change to another mode. Note, however, that SMPL

Mode variables are also used by other modes, so

performing an input or calculation operation may change

the values assigned to them.

• Though SMPL Mode variables are financial calculation

variables, they are also used by arithmetic and function

operations in the COMP Mode.

A Calculation Formulas

365-day Mode

360-day Mode

Dys

× PV × i

SI' =

365

Dys

× PV × i

SI' =

360

SI = –SI'

SFV = –(PV + SI')

i =

i =

I%

100

I%

100

SI : simple interest

Dys : number of interest periods

PV :principal

I

%:interest rate (annual)

SFV :principal plus interest

k Compound Interest Mode

•The Compound Interest (CMPD) Mode lets you calculate

any one of the following values, by inputting values for

the other four: number of compound periods, interest rate,

principal, payment amount, and future value (principal

and interest, or final payment amount).

A Entering the CMPD Mode

•Press c to enter the CMPD Mode.

Value Input Screen

E-44

Page 47

A Setting Values

No. Display Name

1 Set*1Payment Period (Payment) End

2

Number of Compound

n

Periods

3 I Interest Rate 4%

4 PV Present Value (Principal) –$1,000

5 PMT Payment Amount –$300

Future Value (Principal and

6 FV Interest, or Final Payment $16,760

Amount)

7 P/Y

8 C/Y*

Number of Annual Payments

(PMT)

Number of Annual

2

Compoundings

*1• For information about specifying the payment period,

see the “Payment” item under “Configuring Settings”

on page E-16.

•In the case of compound interest calculations, you can

also use the compound interest mode (dn) setting on

the setup screen for interest calculations of odd (partial)

months. See the explanation of the compound interest

mode (dn) setting (page E-16) for more information.

2

*

Specify 2 for semiannual compound interest, or 12 for

monthly compound interest.

Note

•After specifying the 1 Payment Period (Payment) and

inputting values for 7 Number of Annual Payments

(P/Y) and 8 Number of Annual Compoundings, you can

calculate any one of the following by inputting values for

the other four: Number of Compound Periods, Interest

Rate, Principal, Payment Amount, Future Value (principal

and interest, or final payment amount).

•Input money paid out as a negative value, using the y

key to input the minus sign.

E-45

Values Used

in Examples

48

12

12

Page 48

A Basic CMPD Mode Procedure

Example 1: To c alculate the future value (FV) of an

investment vehicle that pays an annual interest rate of

4%, when the initial deposit is $1,000 and additional

deposits of $300 are made each month

1. Input the required values from the Setting Values table

(page E-45).

• For this example, use

fc to select 1 “Set:”,

and then press E.

•Press 2 to select “End”.

•Use fc to select 2

“

n”, input 48, and then

press E.

•Use fc to select 3 “

E.

•Use fc to select 4 “PV”, input –1000, and then

press E.

•Use fc to select 5 “PMT”, input –300, and then

press E.

• Use fc to select 7 “P/Y”, input 12, and then press

E.

•Use fc to select 8 “C/Y”, input 12, and then press

E.

Input Precautions

• Before specifying the number of months when there

is a partial month, see “Calculating the Number of

Months when a Partial Month is Included” (page

E-47).

•Input money paid out as a negative value, using the

y key to input the minus sign.

2. Select the value you want to calculate.

• For this example, use

fc to select “FV”.

I”, input 4, and then press

E-46

Page 49

3. Press l to perform the

calculation.

A Calculating the Number of Compound

Periods (n), Interest Rate (I%), Present

Value (Principal: PV), and Payment Amount

(PMT)

•Use the same procedure as shown under “Example 1”

(page E-46), substituting the required values.

A Calculating the Number of Months when a

Partial Month is Included

The following example shows how to calculate the number

of months (number of days/total days in the month) for the

number of compound periods (

include.

Example 1: When the payment period is 16 months and

20 days

1. Use fc to select “

2. Input the division operation that divides the number of

days in the partial month (20 in this example) by the

total number of days in the month.

• This example assumes

that there are 30 days in

the month.

3. Add the number of full

months (16 in this example).

4. Press E.

n) when a partial month is

n”.

Note

• This calculator always performs calculations assuming

that the partial month comes at the beginning of the

compound periods (

n).

E-47

Page 50

A Selecting Interest Calculation for a Period

V

with a Partial Month

•You can select compound interest or simple interest to

calculate interest for a period with a partial month. Before

performing each type of calculation, first use Configuring

Settings (page E-16) to select either compound interest

or simple interest for the dn setting.

A CMPD Mode Financial Calculation

Variables (VARS)

•Variables n, I, PV, PMT, FV, P/Y, and C/Y are used in

the CMPD Mode.

• The values of CMPD Mode variables are retained even if

you change to another mode. Note, however, that CMPD

Mode variables are also used by other modes, so

performing an input or calculation operation may change

the values assigned to them.

• Though CMPD Mode variables are financial calculation

variables, they are also used by arithmetic and function

operations in the COMP Mode.

A Calculation Formulas

uu

u PV, PMT, FV, n

uu

I % G 0

–α × PMT – × FV

PV =

– × PV – × F

PMT =

γ

– × PV – × PMT

FV =

(1+ iS) × PMT – FV × i

log

{}

(1+ iS) × PMT – PV × i

n =

γ

β

γ

β

α

α

β

log (1+ i)

E-48

Page 51

I % = 0

PV = – (PMT × n + FV )

PMT = –

FV = – (PMT × n + PV)

n =

= (1+ i × S) ×

α

γ

=

0 ............................ Payment : End

S =

1 ............................ Payment : Begin

i =

uu

u I

%

uu

i (effective interest rate)

i (effective interest rate) is calculated using Newton's

Method.

γ

× PV + α × PMT + β × FV = 0

To I % from i (effective interest rate)

I% =

PV + FV

n

PV + FV

–

PMT

1 –

β

, =

β

i

Frac

(n)

(1+ i )

{

1+ i × Frac (n) ....... dn : SI (Setup Screen)

........... dn : CI (Setup Screen)

{

I %

............................... (P/Y = C/Y = 1)

100

{

(1+ ) –1

100 × [C/Y ]

i × 100 ................................. (P/Y = C/Y = 1)

(1+ i )–1

{

{ }

I %

C/Y

P/Y

P/Y

C/Y

×

(–Intg(n))

(1 + i)

(Setup Screen)

(Setup Screen)

(Other than

.....

those above)

C/Y × 100 ...

(Other than

those above)

E-49

Page 52

n : Number of Compound Periods

I

%:Interest Rate

PV :Present Value (Principal)

PMT : Payment Amount

FV : Future Value (Principal and Interest, or Final

Payment Amount)

P/Y : Number of Annual Payments (PMT)

C/Y : Number of Annual Compoundings

Note

• This calculator performs interest (I) calculations using

Newton’s Method, which produces approximate values

whose precision can be affected by various calculation

conditions. Because of this, interest calculation results

produced by this calculator should be used keeping the

above limitation in mind, or the results should be verified.

•When you use f and c to select an item that can be

calculated, the “=” changes to “7”. You can perform a

calculation by inputting the required values for the other

items, and then pressing the l key. Performing the

calculation causes the “7” to change back to “=”.

k Cash Flow Mode

• The Cash Flow (CASH) mode calculates the total of

income and expenses over a fixed period, and then uses

the discounted cash flow (DCF) method to perform

investment appraisal. The following four items are

appraised.

NPV : Net Present Value

IRR :Internal Rate of Return

PBP : Payback Period*

NFV : Net Future Value

* The payback period (PBP) can also be called the

“discounted payback period” (DPP). When the annual

interest rate (

payback period” (SPP).

I) is zero, the PBP is called the “simple

E-50

Page 53

A Entering the CASH Mode

•Press C to enter the CASH Mode.

Value Input Screen

A cash flow diagram like the one shown below helps to

visualize the movement of funds.

CF2

CF3

CF5

CF4

CF6

CF7

CF1

CF0

With this graph, the initial investment amount is represented

by CF

0. The cash flow one year later is shown by CF1, two

years later by CF

2, and so on.

A Setting Values

No. Display Name

1 I Annual Interest 3%

Values Used

in Examples

A Receipt and Payment Summary

Period Receipt/Payment

CF0 Payment –$10,000

CF1 Payment –$1,000

CF2 Receipt $4,500

CF3 Receipt $5,000

CF4 Receipt $4,000

•Input money paid out as a negative value, using the y

key to input the minus sign.

Values Used

in Examples

E-51

Page 54

A Basic CASH Mode Procedure

Example 1: To calculate net present value (NPV)

1. Input the annual interest (

payment values provided on page E-51.

•Use fc to select 1

“I”, input 3, and then

press E.

•Use fc to select “Csh

=D.Editor

x”, and then

press E.

This displays the DataEditor. Only the x-column is used

for calculation. Any values in the

column are not used.

Note

• The STAT editor and the D.Editor x of the CASH Mode

use the same memory area to store data.

• –10000 E(CF

0)

Input money paid out as a

negative value, using the

y key to input the minus

sign.

• –1000 E(CF

• 4500 E(CF

• 5000 E(CF

• 4000 E(CF

1)

2)

3)

4)

2. Press E to return to the value input screen.

3. Select the value you want to calculate.

• For this example, use

fc to select “NPV:

Solve”.

I), and then receipt and

y-column and FREQ-

4. Press l to perform the

calculation.

•Pressing the E key returns to the value input screen.

E-52

Page 55

A Other CASH Mode Calculations

Example 2: To ca lculate the internal rate of return (IRR)

•In step 3 of the basic procedure (Example 1), select

“IRR:Solve”.

• The IRR calculation result is assigned to financial variable

(VARS)

I.

Example 3: To calculate the payback period (PBP)

•In step 3 of the basic procedure (Example 1), select

“PBP:Solve”.

Example 4: To calculate net future value (NFV)

•In step 3 of the basic procedure (Example 1), select “NFV:

Solve”.

A Maximum Number of DataEditor Items

Maximum Number of

Data Items

80 X

40 X, Y or X, FREQ

26 X, Y, FREQ

• Only the

• Normally, you will be able to input up to 80 data items in

•To maximize the number of data items you can input,

•Values you input while “1-VAR” is selected are cleared

x-column is used for calculation. Any values in

the

y-column and FREQ-column are not used.

the DataEditor.

enter the STAT Mode, select “1-VAR”, and then use the

setup screen to select “Off” for the “STAT” setting (page

E-21).

when “2-VAR” is selected in the STAT Mode. Conversely,

values you input while “2-VAR” is selected are cleared

when “1-VAR” is selected in the STAT Mode.

DataEditor Screen

A CASH Mode Financial Calculation Variables

(VARS)

•Variable I is used in the CASH Mode.

• The value of the CASH Mode variable is retained even if

you change to another mode. Note, however, that

also used by other modes, so performing an input or

calculation operation may change the value assigned to

it.

E-53

I is

Page 56

• Though

N

N

I is a financial calculation variable, it is also

used by arithmetic and function operations in the COMP

Mode.

A Calculation Formulas

uNPV

PV = CF0 + + + +

… +

CF

(1+ i)

CF

(1+ i)

1

CF

2

CF

3

2

i =

(1+ i)

I %

100

3

(1+ i)

n

n

n: natural number up to 79

uNFV

NFV = NPV × (1 + i )

n

uIRR

IRR is calculated using Newton’s Method.

1

CF

2

CF

0 = CF0 + + + + … +

In this formula,

to

i × 100. It should be noted, however, that minute

CF

(1+ i)

(1+ i)

NPV = 0, and the value of IRR is equivalent

3

2

3

(1+ i)

CF

(1+ i)

n

n

fractional values tend to accumulate during the subsequent

calculations performed automatically by the calculator, so

NPV never actually reaches exactly zero. IRR becomes

more accurate the closer that

NPV approaches to zero.

uPBP

0 .................................. (

PBP =

n –

{

n

PVn =

Σ

k

= 0

(1

NPV

CF

+ i

k

)

NPV

n

+1

k

– NPV

n

CF

0

(Other than

...

those above)

n

> 0)

n: Smallest positive integer that satisfies the conditions

NPVn < 0, NPVn+1 > 0, or 0.

E-54

Page 57

k Amortization Mode

• The Amortization (AMRT) Mode lets you calculate the

principal balance, and the interest portion and principal

portion of monthly payments, as well as interest and

principal amounts paid to date.

BAL :Principal balance upon completion of payment

PM2

INT :Interest portion of payment PM1

PRN :Principal portion of payment PM1

Σ

INT :Total interest paid from payment PM1 to

payment PM2

ΣPRN :Total principal paid from payment PM1 to

payment PM2

A Entering the AMRT Mode

•Press A to enter the AMRT Mode.

Value Input Screen

a

1 payment

b

1 PM1 PM2 Last.............. ..................... ............

Number of Payments

c

a :Interest portion of payment PM1 (INT)

b :Principal portion of payment PM1 (PRN)

c :Principal balance upon completion of payment PM2

(BAL)

E-55

Page 58

e

1 payment

d

PM2

1PM1

Number of Payments

...............

d :Total principal paid from payment PM1 to payment

PM2 (ΣPRN)

e :Total interest paid from payment PM1 to payment PM2

(ΣINT)

A Setting Values

No. Display Name

1 Set*1Payment Period (Payment) End

2 PM1

3 PM2

4

Payment PM1

(Number of Payments)

Payment PM2

2

*

(Number of Payments)

Number of Compound

3

n*

Periods (Number of Months)

5 I Interest Rate (Annual) 2%

6 PV Principal $100,000

7 PMT Payment Amount –$920

Ending Balance after Last

3

*

8 FV

9 P/Y

0 C/Y*

Payment (Future Value)

Number of Annual Payments

(PMT)

Number of Annual

4

Compoundings

Values Used

in Examples

15

28

—

—

12

12

Last............... ..................

E-56

Page 59

1

For information about specifying the payment period,

*

see the “Payment” item under “Configuring Settings”

on page E-16.

2

*

Make sure the payment you specify for PM2 comes after

the payment you specify for PM1.

3

*

This variable is used by other modes. The value that

initially appears may be a value that was input or

calculated in another mode.

4

*

Specify 2 for semiannual compound interest, or 12 for

monthly compound interest.

•Input money paid out as a negative value, using the y

key to input the minus sign.

A Basic AMRT Mode Procedure

Example 1: To calculate the principal balance (BAL) after

1. Input the values for 1, 2, 3, 5, 6, 7, 9, and 0

from the Setting Values table (page E-56).

• For this example, use

•Press 2 to select “End”.

•Use fc to select 2

• Use fc to select 3 “PM2”, input 28, and then press

•Use fc to select 5 “

•Use fc to select 6 “PV”, input 100000, and then

•Use fc to select 7 “PMT”, input –920, and then

• Use fc to select 9 “P/Y”, input 12, and then press

•Use fc to select 0 “C/Y”, input 12, and then press

payment 28

fc to select 1 “Set:”,

and then press E.

“PM1”, input 15, and then

press E.

E.

I”, input 2, and then press

E.

press E.

press E.

E.

E.

E-57

Page 60

2. Select the value you want to calculate.

• For this example, use

fc to select “BAL:

Solve”.

3. Press l to perform the

calculation.

•Pressing the E key returns to the value input screen.

A Other AMRT Mode Calculations

Example 2: To c a lculate the interest amount (INT)

•In step 2 of the basic procedure (Example 1), select

“INT:Solve”.

Example 3: To calculate the principal amount (PRN)

•In step 2 of the basic procedure (Example 1), select

“PRN:Solve”.

Example 4: To calculate total interest paid (ΣINT) from

•In step 2 of the basic procedure (Example 1), select

“ΣINT:Solve”.

Example 5: To ca lculate total principal paid (ΣPRN) from

•In step 2 of the basic procedure (Example 1), select

“ΣPRN:Solve”.

included in payment 15 (PM1)

included in payment 15 (PM1)

payment 15 (PM1) to payment 28 (PM2)

payment 15 (PM1) to payment 28 (PM2)

A AMRT Mode Financial Calculation Variables

(VARS)

•Variables PM1, PM2, n, I, PV, PMT, FV, P/Y, and C/Y

are used in the AMRT Mode.

• The values of AMRT Mode variables are retained even if

you change to another mode. Note, however, that AMRT

Mode variables are also used by other modes, so

performing an input or calculation operation may change

the values assigned to them.

• Though AMRT Mode variables are financial calculation

variables, they are also used by arithmetic and function

operations in the COMP Mode.

E-58

Page 61

A Calculation Formulas

a:Interest portion of payment PM1 (INT)

INT

PM1

= I BAL

PM1–1

× i I × (PMT sign)

b:Principal portion of payment PM1 (PRN)

PRN

PM1

= PMT + BAL

PM1–1

× i

c:Principal balance upon completion of payment PM2

(BAL)

BALPM2 = BALPM2–1 + PRNPM2

d:Total principal paid from payment PM1 to payment PM2

(ΣPRN)

PM2

PRN = PRN

Σ

PM1

PM1

+ PRN

PM1+1

+ … + PRN

PM2

e:Total interest paid from payment PM1 to payment PM2

(ΣINT)

•

a + b = one repayment (PMT)

PM2

INT = INT

Σ

PM1

BAL0 = PV

INT1 = 0, PRN1 = PMT

Converting between the Nominal Interest Rate and

Effective Interest Rate

The nominal interest rate (

converted to an effective interest rate (

loans where the number of annual payments is different

from the number of annual compoundings calculation

periods.

The following calculation is performed after conversion from

the nominal interest rate to the effective interest rate, and

the result is used for all subsequent calculations.

PM1

+ INT

PM1+1

+ … + INT

....................... Payment: End

I%' =

(1+ ) –1

{}

100 × [C / Y ]

(Setup Screen)

... Payment: Begin

(Setup Screen)

I

% value input by user) is

I%

PM2

I

%´) for installment

[C / Y ]

[P / Y ]

×100

i = I%'÷100

k Conversion Mode

• The Conversion (CNVR) Mode lets you convert between

the nominal interest rate (APR) and effective interest rate

(EFF).

E-59

Page 62

A Entering the CNVR Mode

•Press n to enter the CNVR Mode.

Value Input Screen

A Setting Values

No. Display Name

1 n

2 I Interest Rate (Annual) 3%

Number of Annual

Compoundings

Values Used

in Examples

6

A Basic CNVR Mode Procedure

Example 1: To convert a nominal interest rate (APR) to

1. Input the number of annual compoundings (

interest rate (

above.

• For this example, use

•Use fc to select 2 “

2. Select the value you want to calculate.

• For this example, use

an effective interest rate (EFF)

I) values from the Setting Values table

fc to select 1 “

input 6, and then press

E.

E.

fc to select “EFF:

Solve”.

n”,

n) and

I”, input 3, and then press

3. Press l to perform the calculation.

•Pressing the E key returns to the value input screen.

E-60

Page 63

A Other CNVR Mode Calculations

A

Example 2: To convert an effective interest rate (EFF) to

• In step 2 of the basic procedure (Example 1), select “APR:

Solve”.

a nominal interest rate (APR)

A CNVR Mode Financial Calculation Variables

(VARS)

•Variables n and I are used in the CNVR Mode.

•A value is assigned to

or APR calculation in the CNVR Mode.

• The values of CNVR Mode variables are retained even if

you change to another mode. Note, however, that CNVR

Mode variables are also used by other modes, so

performing an input or calculation operation may change

the values assigned to them.

• Though CNVR Mode variables are financial calculation

variables, they are also used by arithmetic and function

operations in the COMP Mode.

A Calculation Formulas

1+

EFF =

PR =

1+

I whenever you perform an EFF

APR/100

EFF

100

n

–1 × 100

n

1

n

–1 × n ×100

APR : nominal interest rate (%)

EFF :effective interest rate (%)

n : number of annual compoundings

k Cost/Sell/Margin Mode

• The Cost/Sell/Margin (COST) Mode lets you calculate

cost, selling price, or margin after inputting the other two

values. You can input the cost and selling price, for

example, and calculate the margin.

E-61

Page 64

A Entering the COST Mode

•Press o to enter the COST Mode.

Value Input Screen

A Setting Values

No. Display Name

1 CST Cost $40

2 SEL Selling Price $100

3 MRG Margin 60%

Values Used

in Examples

A Basic COST Mode Procedure

Example 1: To calculate the margin (MRG)

1. Input the cost (CST) and selling price (SEL) values from

the Setting Values table above.

• For this example, use

fc to select 1 “CST”,

input 40, and then press

E.

•Use fc to select 2 “SEL”, input 100, and then

press E.

2. Select the value you want to calculate.

• For this example, use

fc to select 3 “MRG”.

3. Press l to perform the

calculation.

E-62

Page 65

A Other COST Mode Calculations

M

Example 2: To c alculate the cost based on margin and

1. Input the margin (MRG) and selling price (SEL) values

in step 1 of the basic procedure (Example 1).

2. Select 1 “CST” in step 2.

Example 3: To calculate the selling price (SEL) based on

1. Input the margin (MRG) and cost (CST) values in step

1 of the basic procedure (Example 1).

2. Select 2 “SEL” in step 2.

selling price

margin and cost

A COST Mode Financial Calculation Variables

(VARS)

•Variables CST, SEL, and MRG are used in the COST

Mode.

• These variables are used in the COST Mode only, and

their values are retained even when you change to

another mode.

A Calculation Formulas

1–

CST

MRG

1–

100

1–

MRG

100

CST

SEL

× 100

CST = SEL

SEL =

RG(%) =

CST : cost

SEL :selling price

MRG :margin

E-63

Page 66

k Day Calculation Mode

• The Day Calculation (DAYS) Mode lets you calculate the

number of dates from one date to another, the date that

falls on a specific number of days after a starting date,

and the date that falls on a specific number of data prior

to an ending date.

•Starting date (d1) and ending date (d2) calculations are

possible within the range of January 1, 1901 through

December 31, 2099.

A Entering the DAYS Mode

•Press D to enter the DAYS Mode.

Value Input Screen

A Setting Values

No. Display Name

1 Set*

2 d1*

3 d2*

4 Dys

1

• For information about specifying the Date Mode, see

*

(Date Mode)

Starting Date 11052004

2

(Month, Day, Year) (November 5, 2004)

Ending Date 04272005

2

(Month, Day, Year) (April 27, 2005)

Number of Days

(Duration)

Days in Year

1

the “Date Mode” item under “Configuring Settings” on

page E-16.

• The following rules apply when a 360-day year is

specified.

When the starting date (d1) is the 31st of a month,

the calculation is performed using the 30th of the same

month.

When the ending date (d2) is the 31st of a month, the

calculation is performed using the 1st of the following

month.

E-64

Values Used

in Examples

365

173

Page 67

2

•You must input two digits for the month and day. This

*

means you should include a leading zero for values

from 1 through 9 (01, 02, 03... etc.).

•You can specify either month, day, year (MDY) or day,

month, year (DMY) as the date input format. See the

“Date Input” setting under “Configuring Settings” (page

E-16).

Note

•After specifying the 1 Days in Year (Date Mode) in the

Day Calculation Mode, you can calculate any one of the

following three values by inputting values for the other

two: 2 Starting Date (d1), 3 Ending Date (d2), and 4

Number of Days (Dys).

A Basic DAYS Mode Procedure

Example 1: To calculate the number of days between two