Page 1

BA Real Estate™

Financial Calculator Guidebook

Page 2

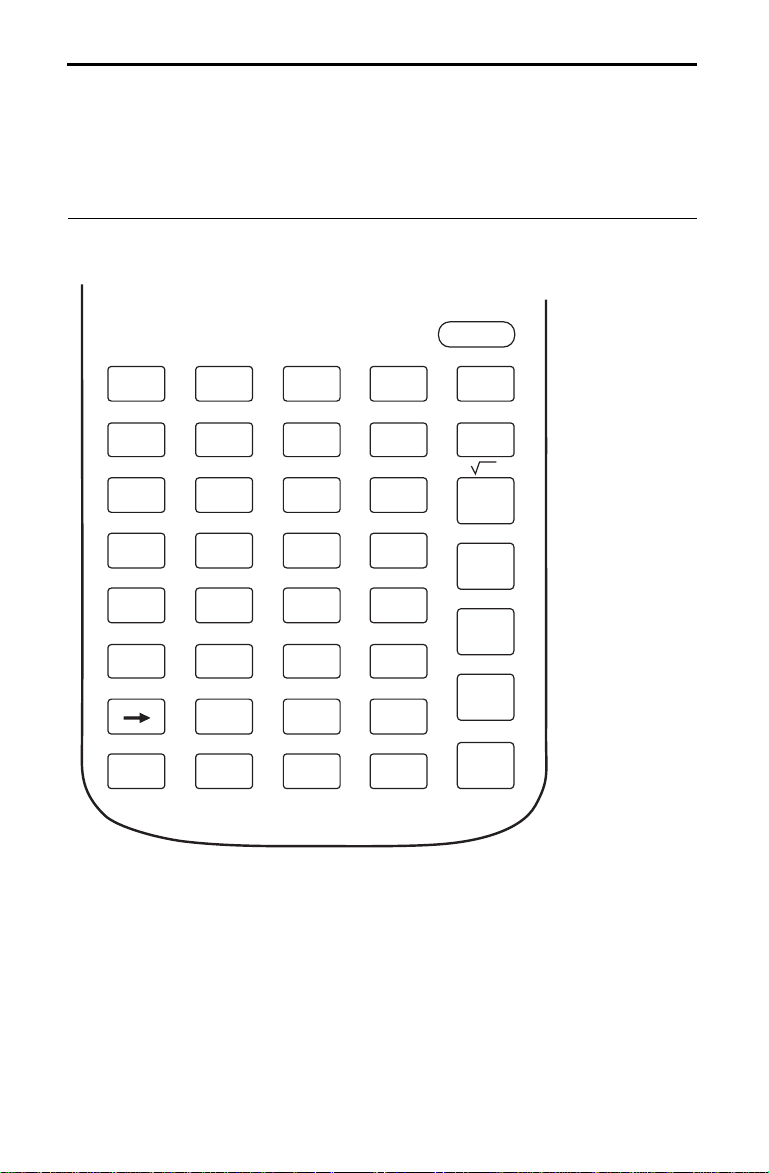

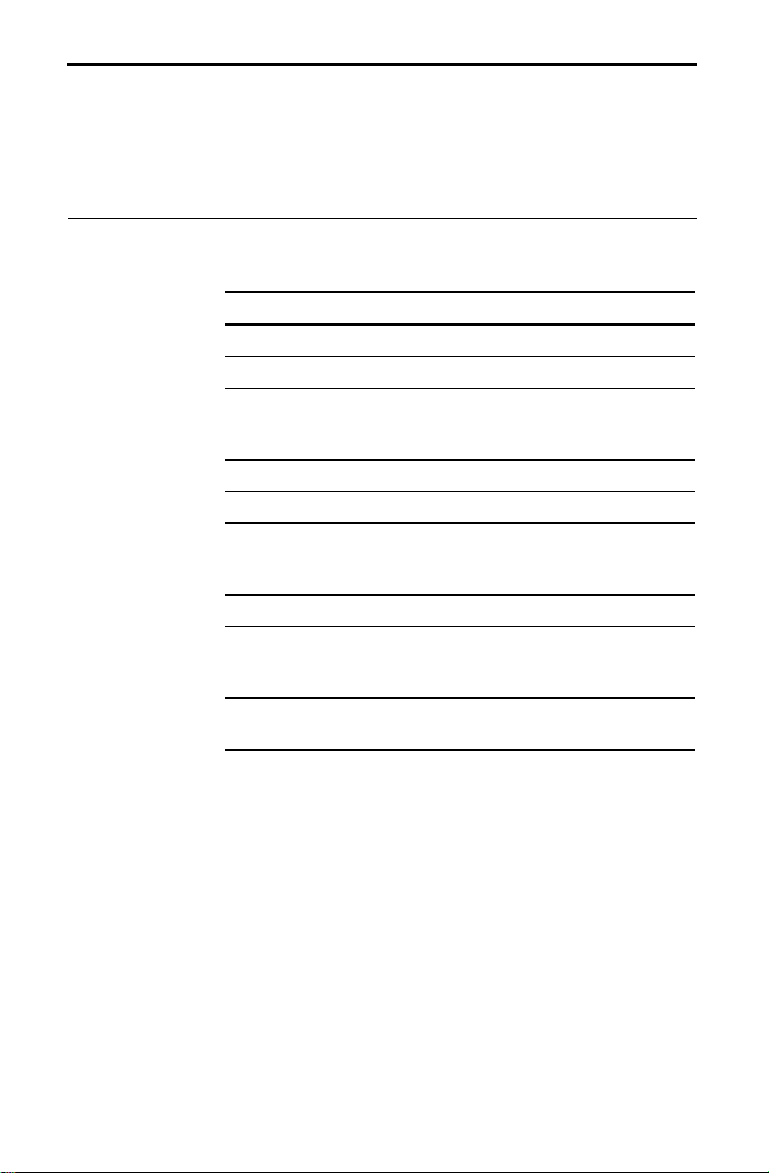

Key Index

To find information about a specific key, refer to the page

number next to the key.

ON/C

84

88 85 46 29 84

2nd

N

16 17 17 16

16 16 16 16 16

TERM

V1

69 69 69 69 89

53 90 89

QUAL INC

TAX&INS$

29

2

89 40 32 74

x

INS %

18

92

STO

TAX %

18

92

RCL

DEBT %

18

87

18

INC %

87

000

CPT

P/Y

I%

V2

QUAL LA

NOM

BI-WKLY

AMORT

LOAN PMT

#PD

52 29

PRICE

EFF

72 72 72

ARM APR

PITI

BGN/END

APPREC

%

PDS/YR

789

456

123

91 86

ROUND

0

FIX

폷

BUSINESS ANALYST

쎵앛앥

89

OFF

CLR TVM

FV

x

앦

쎹

앥

쎵

쏁

89

89

89

89

Page 3

BA Real Estate

FINANCIAL CALCULATOR

GUIDEBOOK

Guidebook Developed by:

The staff of Texas Instruments Instructional

Communications

With Contributions by:

Dave Caldwell

Charlotte Clark

Bob Fedorisko

Mike Keller

Jackie Quiram

Tammy Richards

Gary Rouse

é

This digital apparatus does not exceed the Class B limits

for radio noise emissions from digital apparatus set out in

the Radio Interference Regulations of the Canadian

Department of Communications.

© 1993, 1996 Texas Instruments

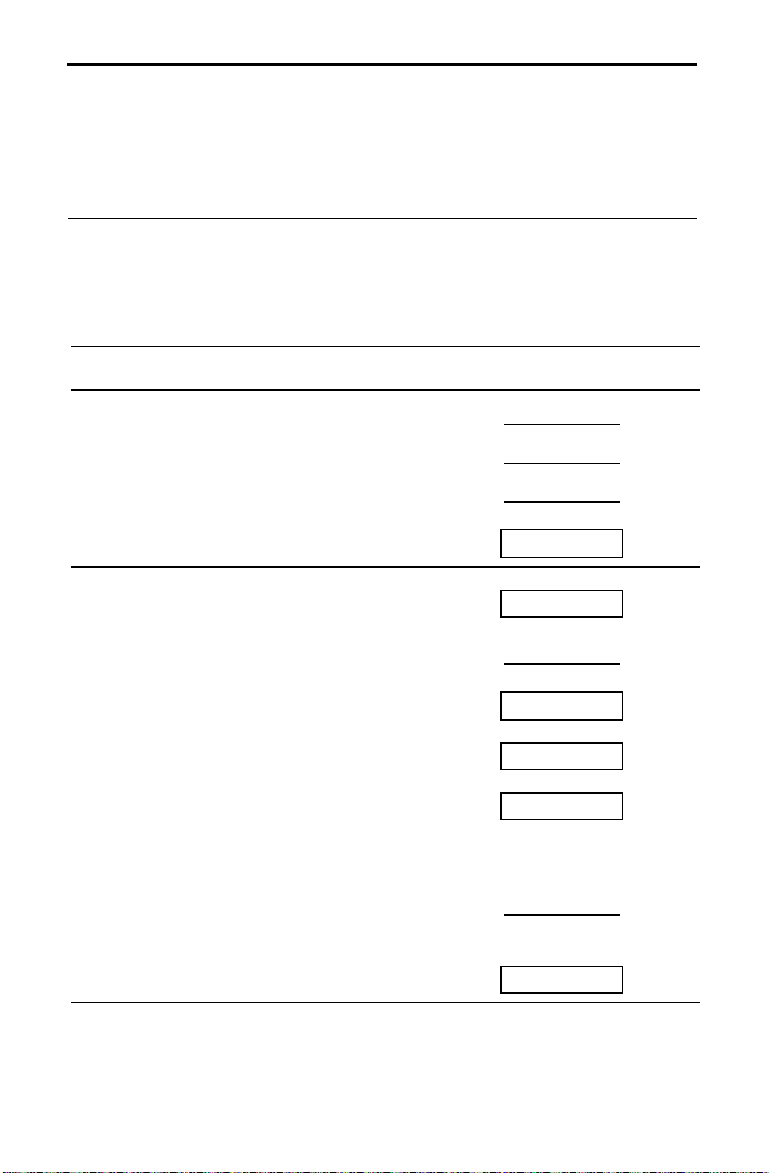

Page 4

Table of Contents

This guidebook begins with a section designed to help

you quickly learn about the BA Real EstateTM calculator

and its capabilities. The remainder of the book contains

examples of and information about specific kinds of

financial calculations. General calculator operation and

service information are discussed in the Appendix.

Getting Started

Chapter 1:

Mortgages and

Amortization

Getting Started ....................................................................... 5

FInding the Monthly Payment on a Loan ............................ 6

Calculating Total Payment (PITI) ........................................ 7

Amortization for the First Year ............................................ 8

Finding a Pay-off Balance ..................................................... 9

Changing the Conditions of the Loan ................................ 10

Estimating Appreciation...................................................... 11

Qualifying a Buyer for a Loan............................................. 12

Going Further ....................................................................... 14

The Time-Value-of-Money (TVM) Model ........................... 16

Changing TVM Settings ....................................................... 17

Setting Default Rates for Your Area .................................. 18

Calculating Down Payments............................................... 19

Computing a Monthly Mortgage Payment......................... 20

Finding the Unpaid Balance on a Mortgage...................... 22

Paying Off a Loan with Larger Payments.......................... 24

Calculating a Balloon Payment .......................................... 26

Finding the Payment for a Mortgage with a Balloon ....... 28

Total Payment Including Taxes and Insurance (PITI)..... 29

Computing Total Payment (PITI)....................................... 30

Adjustable-Rate Mortgage (ARM) ...................................... 32

Finding Periodic Payments for an ARM ............................ 33

Comparing an ARM to a Fixed-Rate Mortgage................. 36

Bi-Weekly Mortgage Payments........................................... 40

Calculating a Mortgage with Bi-Weekly Payments .......... 42

Finding the Balance on a Canadian Loan.......................... 44

Amortization (AMORT) ....................................................... 46

Finding the Principal and Interest Paid............................. 47

Chapter 2:

Buyer

Qualification

Buyer Qualification: Maximum Loan Amount .................. 52

Buyer Qualification: Minimum Income Required............. 53

Finding the Qualifying Loan Amount................................. 54

Finding the Minimum Income Required............................ 56

Finding the Maximum Allowable Debt.............................. 58

Finding the Net Cost of Housing ........................................ 60

3

Page 5

Chapter 3:

Other Financial

Tools

Finding the Future Value of a Lump Sum.......................... 64

Saving for the Future with Regular Deposits.................... 66

Percent Change and Appreciation Model.......................... 69

Calculating Percent Change and Appreciation................. 70

Interest Conversion Model.................................................. 72

Annual Percentage Rate (APR) .......................................... 74

Finding the APR of a Refinanced Loan.............................. 76

Pricing a Note to Meet a Required Yield ........................... 78

Calculating the Yield of a Discounted Mortgage .............. 80

Finding the Net Selling Price after Commission .............. 82

Appendix

Effects of Turning the Calculator On and Off................... 84

The Display and Indicators ................................................. 85

Setting the Fixed-Decimal Format..................................... 86

Entering Numbers and Clearing the Calculator ............... 87

Calculations .......................................................................... 88

Basic Arithmetic................................................................... 89

Percent Calculations............................................................ 90

Rounding Results ................................................................. 91

Using Memory....................................................................... 92

Battery Information ............................................................. 93

Support and Service Information....................................... 94

Warranty Information.......................................................... 95

4

Page 6

Getting Started

Setting

Beginning- or

End-of-Period

Payments

Setting

Payment and

Compounding

Periods

Setting the

Number of

Decimal Places

The examples on the following eight pages introduce you

quickly to the major features of the BA Real Estate

calculator. Try working the examples to find out how easy

it is to solve real estate calculations! Before starting,

however, perform the settings shown on this page to

ensure that the examples give the expected results.

The #

,

key sequence lets you alternate between

TM

beginning-of-period and end-of-period payments. For

example, a savings or lease situation may require

payments at the beginning of each payment period, while

most loans have payments at the end of each period. These

settings affect how interest is calculated.

When the calculator is set to beginning-of-period, the BGN

indicator is displayed. There is no indicator for the end-ofperiod setting.

Note: All of the examples in this section assume end-ofperiod payments.

To set the payment timing to end-of-period, press

# ,

until the BGN indicator is turned off.

(BGN/END is the second function of the 3 key.)

The # + key sequence lets you enter the number of

payments (P/Y) per year and the number of compounding

periods (C/Y) per year.

Most loans have an equal number of payment periods and

compounding periods per year. Other Time Value of

Money (TVM) situations, however, may have differing

periods. For example, a savings account may receive

regular monthly deposits (P/Y = 12), but have daily

compounding (C/Y = 365).

All of the examples in this section have 12 payment

periods and 12 compounding periods per year.

Before starting these examples, be sure that P/Y and C/Y

are set to 12. Press # + 12 j j. (P/Y is the second

function of the 1 key.)

All of the examples in this section (and, in general,

throughout the guidebook) are shown with the decimal set

to two places. To set two decimal places, press

# o

2.

Gettmg Started 5

Page 7

Finding the Monthly Payment on a Loan

The TVM keys make it easy to enter at least three known

values in a TVM (Time Value of Money) problem and then

compute the unknown value. Suppose, for example, you

want to know the monthly payment required for a 30-year,

$130,000 mortgage loan at an annual percentage rate of

8%.

1. Clear any previous TVM values.

Press #

2. Enter the term of the loan

(30 years).

Press 30

3. Enter the 8% interest rate

(annual percentage rate).

Press 8 1.

4. Enter the $130,000 loan

amount.

Press 130 q

-

0

.

2

.

TRM= 30.00

I% = 8.00

.

LN = 130,000.00

0.00

5. Compute the payment

amount.

Press $ 3.

PMT= -953.89

Note: PMT is displayed as a negative number because it is a cash outflow

(an amount you pay).

6 Getting Started

Page 8

Calculating Total Payment (PITI)

Monthly house payments often include not only principal

and interest (the payback on the loan), but also property

taxes and insurance. Using the data you entered in the

previous example, you can compute the total payment

including principal, interest, taxes, and insurance (PITI).

Assume that the local property-tax

rate is 1.5% annually and the annual

insurance rate is 0.5%. If the selling

price of the house is $153,000, what

will be the total monthly payment?

1. Enter the local property-tax rate.

Press 1.5 #

Z

.

TX%= 1.50

2. Enter the annual insurance rate.

Press .5 #

Q

.

IS% = 0.50

3. Enter the selling price.

Press 153 q

@

.

PRC= 153,000.00

4. Compute PITI.

Press $ &.

PITI= -1,208.89

Note: The P&I payment was calculated on the previous page. The property

tax rate (

Z

) and the insurance rate (

Q

) will remain in the calculator

until you change them or remove the batteries. Turning the calculator off

does not clear this information.

Gettmg Started 7

Page 9

Amortization for the First Year

The Amortization model prompts you for the starting and

ending payment numbers to define a range of payment

periods. You can then use the TVM values you entered

earlier to find the loan balance after the last payment and

the total principal and interest paid in the range. Find the

balance, principal, and interest after 12 payments.

1. To start Amortization, press

%

.

2. Enter the number of the first

payment period (P1).

P1 = 1.00

Press 1 j to enter the value for

P1 and advance to P2.

3. Enter the number of the last

payment (P2), and compute

balance, principal, and interest.

Press 12 j to change P2 and

start the list of results. The loan

balance after P2 is displayed.

4. Advance to the amount of

principal paid in the first 12

payments.

Press j.

5. Advance to the amount of

interest paid in the first 12

payments.

Press j.

To leave Amortization, press !.

P2 = 1.00

P2 = 12.00

BAL= 128,914.07

PRN= -1,085.93

INT= -10,360.75

8 Getting Started

Page 10

Finding a Pay-off Balance

If the property is sold after 3.5 years, what amount will be

required to pay off the loan? Use the Amortization model

to find the balance after 3.5 years of payments.

1. To start Amortization, press

%

.

2. Enter the number of the first

payment period (P1).

Press 1 j to enter the value for

P1 and advance to P2.

3. Calculate the number of

payments in 3½ years , enter as

P2, and compute balance,

principal, and interest.

Press 12 O 3.5 j to calculate

and enter P2 and start the list of

results. The loan balance after

P2 is displayed.

P1 = 1.00

P2 = 1.00

P2 = 42.00

4. Show the amount of principal

paid in 3½ years.

j

Press

5. Show the amount of interest

paid in 3½ years.

Press j.

To leave Amortization, press !.

BAL= 125,788.43

PRN= -4,211.57

INT= -35,851.81

Gettmg Started 9

Page 11

Changing the Conditions of the Loan

You can change any of the TVM values and then compute

a new value. Using the values you entered on page 6,

find the monthly payment at 9% interest. Then find the

monthly payment at 9.5% for a 15-year loan.

1. Change the interest rate to

9%.

Press 9 1.

2. Compute the new payment

at the higher interest rate.

Press $ 3.

3. Change the interest rate to

9.5%.

Press 9.5 1.

I% = 9.00

PMT= -1,046.01

I% = 9.50

4. Change the term to 15

years.

Press 15

0

.

5. Compute the new payment

amount (15-year loan).

Press $ 3.

10 Getting Started

TRM= 15.00

PMT= -1,357.49

Page 12

Estimating Appreciation

You are buying a $150,000 home that is expected to

appreciate for the next five years at 3% per year. Estimate

the value of the house at the end of five years.

1. Enter the current price of the

home (starting value).

Press 150 q # 7.

2. Enter the expected annual

appreciation rate.

Press 3 #

:

.

3. Enter the number of periods

(years).

Press 5 # 9.

4. Calculate the expected value at

the end of five years.

Press $ # 8.

V1 = 150,000.00

APP= 3.00

#PD= 5.00

V2 = 173,891.11

Gettmg Started 11

Page 13

Qualifying a Buyer for a Loan

You have a buyer who has a total income of $6,200 per

month, with monthly debts of $580. Assuming a 20% down

payment at 7.5% annual interest for 30 years, a tax rate of

1.5%, an insurance rate of .5%, and an income/debt ratio

of 28/36, what is the maximum sales price this buyer can

consider?

1. Clear any previous TVM values.

Press #

2. Enter income percent.

-

.

0.00

Press 28 #

m

.

3. Enter debt percent.

Press 36 #

d

.

4. Enter the property-tax rate.

Press 1.5 #

Z

.

5. Enter the annual insurance rate.

Press .5 #

Q

.

6. Enter the term of the loan.

Press 30

0

.

7. Enter the interest rate.

Press 7.5 1.

8. Start the qualification.

?

Press

.

9. Enter monthly income amount.

Press 6200 j.

IN% = 28.00

DB%= 36.00

TX%= 1.50

IS% = 0.50

TRM= 30.00

I% = 7.50

INC=

INC= 6,200.00

12 Getting Started

DBT=

Page 14

10. Enter monthly debt amount.

Press 580 j.

11. Enter down payment percent

and compute PITI.

Press 20 j.

12. Compute loan payment.

Press j.

13. Compute loan amount.

Press j.

14. Compute sales price.

Press j.

15. Compute down payment

amount.

Press j.

DBT= 580.00

DN%=

DN%= 20.00

PITI= -1,652.00

PMT= -1,272.77

QLA= 182,028.97

QPR= 227,536.21

DN$ = 45,507.24

The buyer should consider a maximum sales price of $227,536.21 and a

maximum loan of $182,028.97.

Note: The income rate

m

and the debt rate

d

will remain in the

calculator until you change them or remove the batteries. Turning the

calculator off does not clear this information.

Gettmg Started 13

Page 15

A

A

A

Going Further

The BA Real Estate calculator contains built-in financial

formulas, or “models,” designed to solve common

financial and real estate calculations. The remaining

chapters in this book explain how to use the models. If

you need to review general calculator operation, refer to

the Appendix.

Permanent and

Temporary

Models

Activating a

Temporary

Model

Worksheets for

Real Estate Use

The calculator permanently stores some values you enter;

others are retained only while you are using a particular

model. INS %, TAX %, DEBT %, INC %, TAX&INS$, and the

TVM values are stored permanently until you clear them,

change them, or remove the batteries.

Values in the other models share temporary storage space.

To prevent conflicts, only one temporary model can be

active at a time.

Temporary Financial Model Keys

mortization

Buyer Qualification

Interest Conversion

nnual Percentage Rate

djustable Rate Mortgage

Percent Change/Appreciation

Bi-Weekly Mortgage Payments

%

>, ?

F, G, H

N

M

:, 7, 8, 9

L

Entering a value into a temporary model makes it the

active model. If the model was not already active, the

remaining values are set to their defaults.

•

The model remains active until you store a value in

another model or perform a TVM calculation.

•

While a model is active, you can store its values to

memory or to the TVM values.

•

Attempting to use ] or $ with an inactive model

causes an error.

A set of worksheets based on these models is enclosed to

use when working with clients. For most of the examples

in this book, a completed worksheet is included after the

keystroke solution to show how a worksheet can be used.

You may copy the worksheets for your personal use with

clients and customers. However, the worksheets may not

be reproduced in any other publication without the written

consent of Texas Instruments.

14 Getting Started

Page 16

Chapter 1: Mortgages and Amortization

This chapter describes real estate models relating to

mortgages and amortization.

Chapter

Contents

The Time-Value-of-Money (TVM) Model ........................... 16

Changing TVM Settings ....................................................... 17

Setting Default Rates for Your Area .................................. 18

Calculating Down Payments............................................... 19

Computing a Monthly Mortgage Payment......................... 20

Finding the Unpaid Balance on a Mortgage...................... 22

Paying Off a Loan with Larger Payments.......................... 24

Calculating a Balloon Payment .......................................... 26

Finding the Payment for a Mortgage with a Balloon ....... 28

Total Payment Including Taxes and Insurance (PITI)..... 29

Computing Total Payment (PITI)....................................... 30

Adjustable-Rate Mortgage (ARM) ...................................... 32

Finding Periodic Payments for an ARM ............................ 33

Comparing an ARM to a Fixed-Rate Mortgage................. 36

Bi-Weekly Mortgage Payments........................................... 40

Calculating a Mortgage with Bi-Weekly Payments .......... 42

Finding the Balance on a Canadian Loan.......................... 44

Amortization (AMORT) ....................................................... 46

Finding the Principal and Interest Paid............................. 47

Mortgages and Amortization 15

Page 17

0

The Time-Value-of-Money (TVM) Model

The TVM model lets you solve problems involving

regularly occurring, even payments, such as loans. When

you enter TVM values and settings, they are kept in

memory locations reserved specifically for them. Using

the other financial models does not affect these values

and settings.

Cash Inflows (+)

and Outflows (-)

Entering TVM

Values

The formulas for the TVM and Amortization models

distinguish between inflows (cash you receive) and

outflows (cash you pay out).

•

You must enter inflows (money you receive) as

positive values.

•

You must enter outflows (money you pay out) as

negative values.

•

The calculator displays computed inflows as positive

values and computed outflows as negative values.

Key Sequence Function

# -

Sets TVM values to zero and

displays zero. This key sequence

0, # *

does not affect the

settings.

C/Y

* Enters or computes the term of a

BGN/END, P/Y

loan in years (TERM), or the

number of payments (N) required to

repay the loan amount.

1

Enters or computes the annual

interest rate (I%).

2

Enters or computes the loan

amount.

3

Enters or computes the payment

amount (PMT).

4

Enters or computes the future value

(FV).

, or

Example: Set the term of a loan to 30 years.

30

* To avoid conflicting values for N and TERM, the

calculator automatically adjusts one when you enter or

compute the other. If you change the P/Y (payments per

year) setting after entering the term in years, N is

automatically adjusted to avoid a discrepancy.

16 Mortgages and Amortization

TRM= 30.00

Page 18

#

Changing TVM Settings

You can vary settings that affect TVM and Amortization

calculations. These settings allow you to customize the

calculation for the specific loan or savings situation you

are evaluating. The calculator retains the settings until

you change them (or until batteries are replaced).

Selecting

Beginning- or

End-of-period

Payments

Setting P/Y and

C/Y

The #

,

key sequence lets you alternate between

beginning-of-period and end-of-period payments. For

example, a savings or lease situation may require

payments at the beginning of each payment period, while

most loans have payments at the end of each period. These

settings affect how interest is calculated.

When the calculator is set to beginning-of-period, the BGN

indicator is displayed. The factory setting is end-of-period

payments (no indicator).

The # + key sequence lets you enter the number of

payments (P/Y) per year and the number of compounding

periods (C/Y) per year.

The factory default setting is 12 for both P/Y and C/Y; that

is, 12 payment and compounding periods per year. Some

TVM calculations may require that you change these

settings. For example, a savings program may have

regular monthly deposits (P/Y = 12), but daily

compounding (C/Y = 365).

When you press

nn

where

is the current setting. You can press j to

+

, the display shows

P/Y = nn

,

accept the P/Y value, or enter or calculate a new value

(from 1 through 999) and press

.

j

The calculator temporarily displays the new P/Y setting,

copies the P/Y value into C/Y, and advances the display to

C/Y = nn

show

. You can then press j to accept the C/Y

value, or enter or calculate a new value (from 1 through

999) and press

. This sets C/Y, temporarily shows the

j

new C/Y value, and then exits.

Note: You can exit either prompt by pressing !. If you

want to exit after starting to enter a new value for P/Y or

C/Y, press ! twice.

Mortgages and Amortization 17

Page 19

Setting Default Rates for Your Area

The calculator permanently stores the income/debt ratios

and local tax and insurance rates you enter. These

settings are used as defaults in your buyer-qualification

and PITI calculations.

Setting the

Qualifying

Ratios

Setting Tax

and Insurance

Rates

Be sure that you have entered the income/debt ratios

before calculating any buyer qualifications.

1. Enter the income percent used by lenders in your area

for the most commonly used mortgages. For example,

if the qualifying ratio is 28/36, enter 28 for the income

percent.

2. Press #

m

.

3. Enter the debt rate used by lenders in your area. For

example, if the qualifying ratio is 28/36, enter 36 for the

debt percent.

4. Press #

d

.

These settings are useful for finding the general range of

total PITI payments. Later, when you know the tax and

insurance amounts for a specific property, you can

override these settings.

1. Press ! to turn the calculator on.

2. Enter the property-tax rate as an annual rate. For

example, enter 1.5 for 1.5%.

3. Press #

Z

.

4. Enter the insurance rate as an annual rate. For

example, enter .5 for .5%.

5. Press #

Q

.

Entering an annual tax and insurance dollar amount with

the #

For example, if you enter

E

key sequence overrides these settings.

# E

1825

, the

calculator uses this value instead of the rates entered as

TAX% and INS%.

18 Mortgages and Amortization

Page 20

Calculating Down Payments

Mortgage loans are usually stated as 80% loans, 90%

loans, etc. The down payment percentage is the

difference between the stated percentage and 100%. The

down payment percentage is applied to the sales price of

the property to find the down payment amount.

Calculating a

Down Payment

Amount

Calculating

Down Payment

When Sales

Price is Not

Known

If you know the sales price of a property and the down

payment percentage, you can easily compute how much

the down payment will be.

For example, suppose a client is buying a house for

$135,000 on an 80% loan. How much will the down

payment be?

Steps Keystrokes Display

Calculate the down

135 q X 80 A j 27,000.00

payment amount.

You may need to calculate a down payment when the

original sales price of the property is not known. If you

have the loan amount and percentage, you can calculate

the sales price and down payment amount.

Assume that a client borrowed $125,000 on an 85% loan

some years ago. What was the original sales price and

down payment amount?

Steps Keystrokes Display

Divide loan amount

125 q B 85 A j 147,058.82

by loan percent to

find sales price.

Calculate the down

O

15 A

j

22,058.82

payment amount.

Mortgages and Amortization 19

Page 21

# -

#

0

2

3

0

3

Computing a Monthly Mortgage Payment

Find the monthly payment on a home priced at $130,000

if the buyer makes a 10% down payment and finances the

balance with a 30-year mortgage at 9.125% annual

interest. If you are preparing a report for a client, fill in

the worksheet as you calculate the results.

Solution

Press #

Steps Keystrokes Display

,

until the BGN indicator disappears.

Clear TVM values.

Set P/Y and C/Y to 12.

+ 12

P/Y = 12.00

j

C/Y = 12.00

j

Enter term in years.

Enter interest rate on

30

9.125

1

TRM= 30.00

I% = 9.13

the loan.

Enter price less down

payment.

Compute monthly

130 q X 10

j

$

A

LN = 117,000.00

PMT=-951.95

payment.

Find the monthly payment if the term of the loan is 15

years instead of 30.

Steps Keystrokes Display

Change term to 15

15

TRM= 15.00

years.

Compute payment.

$

PMT= -1,195.41

0.00

12.00

20 Mortgages and Amortization

Page 22

Mortgage Payment—Principal and Interest

# -

j

2

0

$ 3

1. Clear TVM values (if not already cleared).

2. Enter sales price.

3. Subtract down payment.

4. Calculate and enter loan amount.

5. Enter term of loan (in years).

6. Enter interest rate.

7. Compute payment amount.

$130,000

X

10

A

$117,000

30

9.125

1

$.951.95

Mortgages and Amortization 21

Page 23

# -

#

0

2

3

#

Finding the Unpaid Balance on a Mortgage

Consider a mortgage loan of $250,000 that is to terminate

in 25 years. At 8.5% annual interest rate, what will the

unpaid balance be in 15 years?

Solution

Press #

Steps Keystrokes Display

Clear TVM values.

Set P/Y and C/Y to 12.

Calculate original

mortgage payment.

Enter the number of

payments made in 15

,

until the BGN indicator disappears.

+ 12

P/Y = 12.00

j

C/Y = 12.00

j

25

8.5

1

250 q

$

15 O 12

*

j

TRM= 25.00

I% = 8.50

LN = 250,000.00

PMT=-2,013.07

N = 180.00

0.00

12.00

180.00

years.

Calculate unpaid

$

4

FV =-162,362.91

balance.

Note: You also can use the Amortization model to

calculate unpaid balance. The answer may be slightly

different, due to rounding differences between the two

methods.

22 Mortgages and Amortization

Page 24

Calculating Unpaid Balance on an Existing Mortgage

# -

0

2

3

#

1. Clear TVM values (if not already cleared).

2. Enter original term of loan (in years).

3. Enter interest rate.

4. Enter original loan amount.

5. Compute payment.

6. Enter number of payments made.

7. Compute unpaid balance.

$

$ 4

25

8.5

$250,000

$.2,013.07

180

$.162,362.91

1

*

Mortgages and Amortization 23

Page 25

# -

#

0

2

3

A

v

3

0

Paying Off a Loan with Larger Payments

A client has just borrowed $125,000 for 30 years at 7.75%.

If she is able to increase her payment amount by $100

per month, how quickly can she pay the note off?

Solution

Press #

Steps Keystrokes Display

Clear TVM values.

Set P/Y and C/Y to 12.

,

until the BGN indicator disappears.

0.00

+ 12

P/Y = 12.00

j

C/Y = 12.00

j

Enter term in years.

Enter interest rate.

Enter loan amount.

Compute payment.

dd extra payment

30

7.75

1

125 q

$

100

a

t

TRM= 30.00

I% = 7.75

LN = 125,000.00

PMT=-895.52

amount as a negative

alue.

Calculate and enter

j

PMT= -995.52

new payment amount.

Compute new term.

$

TRM= 21.56

Your client can pay off the loan in about 21.6 years.

12.00

-

100

24 Mortgages and Amortization

Page 26

Paying Off a Loan Early by Making Larger Payments

# -

0

2

3

3

0

1. Clear TVM values (if not already cleared).

2. Enter term of loan (in years).

3. Enter interest rate.

4. Enter loan amount.

5. Compute monthly payment.

6. Add extra payment amount (as a negative

amount).

7. Calculate and enter new, larger payment.

8. Compute new term.

$

$

30

7.75

1

$125,000

j

$.895.52

a

$100

t

$.995.52

21.56

Mortgages and Amortization 25

Page 27

# -

#

0

2

3

#

3

#

A

# n

Calculating a Balloon Payment

You are buying a $75,000 lake house. With a 10% down

payment, the interest rate will be 9.25% amortized over a

30-year period. However, the loan will be due and

payable at the end of 15 years. How much will the balloon

payment be at the end of 15 years?

Solution

Press #

Steps Keystrokes Display

Clear TVM values.

Set P/Y and C/Y to 12.

Enter TVM values;

compute and enter

loan amount.

Compute payment

and round the result.*

Enter number of

payments made in 15

,

until the BGN indicator disappears.

+ 12

P/Y = 12.00

j

C/Y = 12.00

j

30

9.25

1

75 q X 10

j

$

n

15 O 12

j

*

TRM= 30.00

I% = 9.25

7,500.00

A

LN = 67,500.00

PMT= -555.31

PMT= -555.31

180.00

N = 180.00

0.00

12.00

years.

Compute unpaid

$

4

FV = -53,953.92

balance.

dd monthly payment

] 3

a

j

-54,509.23

to find total balloon

payment.

Note: The balloon payment includes both the unpaid

balance and the final monthly payment. You could, of

course, estimate the balloon payment simply by

calculating the unpaid balance. The only difference

between the two results is the amount of the final monthly

payment.

* The calculator performs its internal computations to 13

digits. The balloon payment should be computed using the

actual amount paid in dollars and cents. Pressing

rounds the internal value to the displayed

value.

26 Mortgages and Amortization

Page 28

Calculating a Balloon Payment to Retire a Mortgage

# -

0

2

$ 3

#

3

#

$ 4

a ] 3

j

1. Clear TVM values (if not already cleared).

2. Enter term of loan (in years).

3. Enter interest rate.

4. Enter loan amount.

5. Compute payment amount

and round the result.

6. Enter the number of payments made.

7. Compute unpaid balance.

8. Add payment computed in

line 5.

9. Calculate the balloon payment.

30

9.25

$67,500

$.555.31

180

$.53,953.92

$.555.31

$.54,509.23

1

n

*

Mortgages and Amortization 27

Page 29

# -

0

2

3

# -

0

2

$ 3

Finding the Payment for a Mortgage with a Balloon

You are making a $70,000 loan at 8% over 30 years, with

a balloon payment of $20,000 due at the end of the loan.

How much will your monthly payment be?

Solution

Press #

Steps Keystrokes Display

,

until the BGN indicator disappears.

Clear TVM values.

Enter term in years.

Enter interest rate.

Enter loan amount.

Enter balloon amount

30

8

1

70 q

20 q t

TRM= 30.00

I% = 8.00

LN = 70,000.00

FV =-20,000.00

4

as a negative.

Compute payment.

$

PMT=-500.22

Calculating Monthly Payment for a Mortgage with a Balloon

Payment

1. Clear TVM values (if not already cleared).

2. Enter term of loan (in years).

3. Enter interest rate.

4. Enter loan amount.

30

8

$70,000

0.00

1

5. Enter amount of balloon payment, as a

6. Compute monthly payment.

28 Mortgages and Amortization

negative value.

$20,000

$.500.22

t 4

Page 30

Total Payment Including Taxes and Insurance (PITI)

You can compute the total monthly payment including

principal, interest, local property taxes, and insurance

(PITI).

Values Used to

Calculate PITI

Procedure

Using Selling

Price

Procedure

Using Tax and

Insurance

Amounts

The PITI calculation uses the selling price, the TVM values,

and the values you have entered for the tax rate

Z

(#

) and the insurance rate (#

actual annual tax and insurance amounts (#

Q

), or the

E

).

If you omit the selling price when calculating PITI with tax

and insurance percentages, PITI will be calculated on the

loan amount, which may underestimate PITI.

1. Press #

-

to clear the TVM values.

2. If you have not set the tax and insurance rates for your

area, follow the instructions on page 18 before

proceeding.

3. Enter the sales price (

@

) of the property.

4. Use the TVM keys to enter TERM, I%, and LOAN.

Note: If the borrower’s mortgage requires private

mortgage insurance, that rate (for example, 1/4% to

3/8%) should be added to the annual interest rate.

5. Press $ & to display the result (PITI).

1. Press #

-

to clear the TVM values.

2. Add the actual annual tax and insurance amounts, and

enter the total with #

E

to override the

settings for tax rates.

3. Use the TVM keys to enter TERM, I%, and LOAN.

Note: If the borrower’s mortgage requires private

mortgage insurance, that rate (for example, 1/4% to

3/8%) should be added to the annual interest rate.

4. Press $ & to display the result (PITI).

Mortgages and Amortization 29

Page 31

# -

#

Z

Q

@

0

2

3

Computing Total Payment (PITI)

A couple is interested in a small lake-front property, for

which the owner is asking $85,000. The buyers need to

know the approximate amount of their total payment on

the property.

Background

Solution

You know that the property taxes and insurance rates for

the lake area average 2.38% and 0.78% respectively. The

couple has $20,000 to use as a down payment. With a

30-year note at 9%, what will their mortgage payment

(PMT) and total monthly payment (PITI) be?

Press #

Steps Keystrokes Display

Clear TVM values.

Set P/Y and C/Y to 12.

Enter local tax rate.

Enter insurance rate.

Enter price of

,

until the BGN indicator disappears.

+ 12

P/Y = 12.00

j

C/Y = 12.00

j

2.38 #

.78 #

85 q

TX%= 2.38

IS% = 0.78

PRC= 85,000.00

0.00

12.00

property.

Enter term in years.

Enter interest rate.

Enter price less down

payment.

Compute mortgage

30

9

1

85 q X 20

j

$

TRM= 30.00

I% = 9.00

q

LN = 65,000.00

PMT= -523.00

payment (principal

and interest).

Compute total

$

&

PITI= -746.83

monthly payment

(PITI).

30 Mortgages and Amortization

Note: If you do not enter a value for sales price, the tax

and insurance percentages will compute PITI based on the

loan amount. The result will be a smaller PITI payment

than expected.

Page 32

PITI—Principal, Interest, Tax, and Insurance Based on

# -

# Z

# Q

@

0

2

3

$ &

Tax and Insurance Percents

1. Clear TVM values (if not already cleared).

2. Enter local property-tax rate (if not

already entered).

3. Enter local insurance rate (if not already

entered).

2.38

0.78

4. Enter price.

5. Enter term of loan (in years).

6. Enter interest rate.

7. Enter loan amount.

8. Compute payment (principal and

interest).

9. Compute PITI.

$85,000

30

9

1

$65,000

$

$.523.00

$.746.83

Mortgages and Amortization 31

Page 33

Adjustable-Rate Mortgage (ARM)

The ARM model lets you find the payment amount for

each range of payments in an adjustable-rate mortgage.

ARM Values

Notes on the

ARM Model

To calculate information on an ARM, set up the mortgage

terms in the TVM model, and then press M to start the

ARM model.

Name Meaning

P1 =

The first payment number in a range of

payments (initial value=1).

P2 =

I% =

The ending payment number in the range.

The interest rate within the range P1 to P2.

Initially, this is a copy of the TVM I% value.

PMT=

The payment amount within the range P1 to

P2.

BAL=

The loan balance after the last payment in the

range P1 to P2.

The model starts with P1=1, and the calculator updates P1

automatically for each range of payments. Attempting to

enter a value for P1 exits the ARM model. Press

j

repeatedly to display the results and to repeat the

sequence for the next range.

At each repetition, the calculator updates P1 and P2

automatically. If the span between P1 and P2 is different

from the previous range, you must enter the new P2 value

manually. You cannot change P1.

•

I% and PMT are not the TVM I% and PMT values,

although I% is initially a copy of the TVM I% value.

Using this model does not change any TVM values.

•

Because a change in the FIX setting would affect

accuracy, the # o key is ignored until you exit the

model.

•

Pressing ! at any time, except when entering a

value, exits the model and leaves the last displayed

value in the display, with no label.

•

You can store a displayed value to memory or to TVM.

Storing to TVM, however, exits the ARM model.

32 Mortgages and Amortization

Page 34

# -

#

v

0

2

M

-

A

-

A

-

Finding Periodic Payments for an ARM

A bank is lending $100,000 on an adjustable rate, 30-year

mortgage at 6% annual interest with an annual cap on the

interest rate of 2% and a lifetime cap of 6%. Find the

payment amount for each adjustment period assuming it

accelerates by the maximum amount at each adjustment

period.

Solution

Press #

Steps Keystrokes Display

,

until the BGN indicator disappears.

Clear TVM values.

Set P/Y and C/Y to 12.

+ 12

P/Y = 12.00

j

C/Y = 12.00

j

Enter the loan

alues.

Start ARM and

accept initial P1.

Change P2 to 12 and

show previous I%.

Show PMT and BAL

for first year.

ccept range for

second year and

show previous I%.

Increase I% by 2%;

show PMT and BAL

for second year.

ccept range for

third year and show

previous I%.

Increase I% by 2%;

show PMT and BAL

for third year.

30

6

1

100 q

j

12

j

j

j

j

j

j

8

j

j

j

j

j

10

j

j

TRM= 30.00

I% = 6.00

LN = 100,000.00

P1 = 1.00

P2 = 1.00

P2 = 12.00

I% = 6.00

PMT=

BAL= 98,772.00

P1 = 13.00

P2 = 24.00

I% = 6.00

I% = 8.00

PMT=

BAL= 97,870.87

P1 = 25.00

P2 = 36.00

I% = 8.00

I% = 10.00

PMT=

BAL= 97,199.12

(continued)

0.00

12.00

599.55

730.86

869.05

Mortgages and Amortization 33

Page 35

A

-

!

Finding Periodic Payments for an ARM

(Continued)

Solution

(Continued)

Steps Keystrokes Display

ccept range for

fourth year and show

previous I%.

Increase I% to the cap

for the loan, and

show PMT and BAL

j

j

12

j

j

P1 = 37.00

P2 = 48.00

I% = 10.00

I% = 12.00

PMT=

BAL= 96,688.17

1,012.28

for fourth year.

Exit ARM.

96,688.17

The payment for the remainder of the loan is $1,012.28.

Note: The worksheet on the next page omits step 1,

clearing the TVM values, due to page size restrictions.

34 Mortgages and Amortization

Page 36

Adjustable Rate Mortgage

#

j

0

2

M

2. Set number of payments per year and number

of compounding periods per year (if not

already set).

3. Enter term of loan (in years).

4. Enter interest rate.

5. Enter loan amount.

6. Start ARM.

7. Accept the number of the initial payment (P1).

8. Enter the number of the ending payment (P2)

for the first adjustment period.

9. Accept the initial interest rate.

10. View monthly payment amount for this

adjustment period.

11. View balance at end of this adjustment period.

12. Return to P1 and accept updated P1 as beginning

payment of second adjustment period.

13. Accept the updated P2, or enter the number of the

ending payment of the second adjustment period.

14. Enter the interest rate for this period.

15. View payment amount for this adjustment period.

+

j

j

j

12

12

30

6

$100,000

1

12

6.00

$.599.55

$98,772.00

13.00

24.00

8

$.730.86

j

1

j

j

j

j

j

16. View balance at end of this adjustment period.

17. Return to P1 and accept updated P1 as the

j

j

number of the beginning payment of the new

adjustment period.

18. Accept updated P2 as the number of the ending

payment of the new adjustment period.

19. Enter the interest rate for this period.

20. View payment amount for this adjustment period.

21. View balance at end of this adjustment period.

j

j

Repeat steps 17 through 21 until the maximum interest rate has been reached.

Mortgages and Amortization 35

$97,870.87

25.00

36.00

10

$.869.05

$97,199.12

j

j

Page 37

# -

0

2

3

Comparing an ARM to a Fixed-Rate Mortgage

For a loan of $145,000, you are comparing a fixed-rate

mortgage of 7.5% for 30 years to a 30-year ARM. The

ARM has an initial rate of 5% with a 2% maximum

adjustment for each 12-month period and a maximum

lifetime adjustment of 6%. Find the breakeven point.

Situation

Solution

You are trying to help a buyer decide whether to use a

fixed-rate mortgage or an adjustable-rate mortgage. You

want to compare the fixed-rate term to the best one-year

adjustable loan you have found. Using the figures given

above and assuming a maximum adjustment at each

period, at what point would the savings from the

adjustable-rate mortgage become exhausted?

Before performing this comparison, complete the

Adjustable Rate Mortgage

worksheet to obtain the ARM

monthly payments for each adjustment period.

Adjustment Period Rate Payment

Initial 5.00% $778.39

Second 7.00% $960.21

Third 9.00% $1,153.34

Fourth (maximum) 11.00% $1,354.86

Steps Keystrokes Display

Clear TVM values.

Enter term.

Enter fixed-rate interest.

Enter amount of loan.

Compute amount of

30

1

7.5

145 q

$

TRM= 30.00

I% = 7 .50

LN = 145,000.00

PMT=-1,013.86

0.00

fixed-rate payment.

Calculate monthly

savings/costs by

t

X 778.39

j

235.47

subtracting amount of

initial ARM payment

from fixed-rate payment.

Multiply monthly

O

12 j T gMEM= 2,825.65

savings/costs by number

of months in this ARM

period and store.

36 Mortgages and Amortization

Page 38

A

A

ARM vs. FixedRate Mortgage

Steps Keystrokes Display

Calculate monthly

savings/costs by

]

X

3

960.21

t

j

subtracting amount of

second period ARM

payment from fixed-rate

payment.

O

Multiply monthly

12

j

savings/costs by number

of months in this ARM

period.

a

dd to stored

savings/costs and store.

Calculate monthly

savings/costs by

]

T

g

]

3

X

1153.34

gj

MEM= 3,469.46

t

j

subtracting amount of

third period ARM

payment from fixed-rate

payment

O

Multiply monthly

12

j

savings/costs by number

of months in this ARM

period.

dd to stored savings

and store.

a

T

] g

g

j

MEM= 1,795.72

53.65

643.81

-

139.48

-

1,673.75

Continue the comparison until the accumulated savings in

the last column are reduced to or below zero. That is the

breakeven point in the comparison. Once it is apparent

that the savings will be exhausted in a given year, divide

the monthly costs into the previous year’s total savings.

This will tell you how many months will occur during that

period before the savings are exhausted. (See lines 19 to

22 in the worksheet example on page 39.)

Mortgages and Amortization 37

Page 39

3

Comparing an ARM to a Fixed-Rate Mortgage

Adjustable Rate Mortgage vs. Fixed-Rate Mortgage

1. Use the Adjustable Rate Mortgage worksheet to calculate

the payments for each adjustment period of the ARM and

record those values in steps 4, 9, 15, and 21 respectively.

2. Use the Mortgage Payment—Principal and Interest

worksheet to calculate the payment for the fixed-rate

mortgage and record that value in steps 3, 8, 14, and 20.

(Cont.)

3. Enter amount of fixed-rate payment.

4. Subtract amount of initial ARM payment.

5. View monthly savings with ARM payment.

6. Multiply monthly savings/costs by

the number of months in the initial

ARM period.

7. Record total savings/costs during this

period.

8. Enter amount of fixed-rate payment.

9. Subtract amount of ARM payment for

second period.

10. View monthly savings/costs during

second period.

11. Multiply monthly savings/costs by

number of months in this adjustment

period.

12. Add to recorded savings/costs from

step 7.

13. Record accumulated savings/costs.

O

O

12

]

12

a ] g

j T g

$.1,013.86

$778.39

X

j

$2825.65

j

$.1,013.86

$960.21

X

j

$643.81

j

$2,825.65

t

$235.47

T g

$2,825.65

t

$53.65

$3,469.46

38 Mortgages and Amortization

Page 40

14. Enter amount of fixed-rate payment.

3

3

15. Subtract amount of ARM payment for

third period.

]

X

$.1,013.86

$1,153.34

t

16. View monthly savings/costs during

j

$.139.48

third period.

17. Multiply monthly savings/costs by

12

O

j

$.1,673.75

number of months in this adjustment

period.

18. Add to recorded savings/costs from

a ] g

$3,469.46

step 13.

19. Record accumulated savings/costs.

20. Enter amount of fixed-rate payment.

21. Subtract amount of ARM payment for

j T g

]

$.1,013.86

$1,354.86

X

$1,795.72

t

fourth period.

22. View monthly savings/costs during

j

$.341.00

fourth period.

23. Multiply monthly savings/costs by

12

O

$.4,091.99

j

number of months in this adjustment

period.

24. Add to recorded savings/costs from

a ] g

$1,795.72

step 19.

25. Record total savings/costs.

j

$.2,296.27

Continue the comparison until the accumulated savings in the last column are

reduced to or below zero. That is the breakeven point in the comparison.

Once it is apparent that the savings will be exhausted in a given year, divide

the monthly costs into the previous year’s total savings. This will tell you how

many months will occur during that period before the savings are exhausted.

For example, line 19 divided by line 22 equals 5.27 months.

Mortgages and Amortization 39

Page 41

Bi-Weekly Mortgage Payments

You can find the effect of making bi-weekly payments (26

half-payments per year) instead of monthly payments.

Values Used by

the Model

To calculate bi-weekly payments, set up the current

mortgage in the TVM model and then press

L

. The

calculator uses the TVM values to compute the results.

Name Meaning

PMT=

N =

The bi-weekly payment required.

The total number of bi-weekly payments

required.

YRS=

SAV=

The number of years required to retire the loan.

The interest saved (rounded to the nearest

dollar) in comparison with monthly payments.

Press j repeatedly to display each result. Press j or

!

at the end of the list to exit the model.

Note: The first result, PMT, is not a copy of the TVM PMT

value. This PMT tells you what the bi-weekly payment

would be.

40 Mortgages and Amortization

Page 42

Benefits of

Bi-weekly

Payments

Making bi-weekly payments instead of monthly payments

allows you to pay off a loan more quickly and thus reduce

the amount of interest paid. This is because the payments

are more frequent and you are making 13 full monthly

payments annually instead of 12.

For example, consider a $115,000 loan at 8% for 30 years.

The monthly mortgage payment would be $843.83.

Compare that payment to the payment for the same loan if

you elected to pay off the loan with bi-weekly payments of

$421.91. The loan would be paid off in less than 23 years,

and you would save $54,498 in interest.

Mortgages and Amortization 41

Page 43

# -

#

0

2

L

-

Calculating a Mortgage with Bi-Weekly Payments

You are borrowing $115,000 at 8% for 30 years. What will

be the effects and savings if you pay off the loan with

bi-weekly payments, instead of monthly payments?

Solution

Press #

Steps Keystrokes Display

,

until the BGN indicator disappears.

Clear TVM values.

Set P/Y and C/Y to 12.

+ 12

P/Y = 12.00

j

C/Y = 12.00

j

Enter the loan values.

Show bi-weekly

payment amount,

number of payments,

years to pay off the

30

8

1

115 q

j

j

j

TRM= 30.00

I% = 8.00

LN = 115,000.00

PMT=

N = 590.84

YRS= 22.66

SAV= 54,498.00

loan, and interest

saved.

Exit.

j

0.00

12.00

421.91

54,498.00

42 Mortgages and Amortization

Page 44

Bi-Weekly Mortgage Payments

# -

0

2

L

1. Clear TVM values (if not already cleared).

2. Enter term of loan (in years).

3. Enter interest rate.

4. Enter loan amount.

5. Start Bi-Weekly and view the bi-weekly

payment amount.

6. View the number of bi-weekly payments

(N) required to pay off loan.

7. View the number of years (YRS) required.

8. View the interest saved at the end of the

term by making bi-weekly payments

instead of monthly payments.

j

j

j

30

8

$115,000

$.421.91

590.84

22.66

$54,498.00

1

Mortgages and Amortization 43

Page 45

# -

#

0

2

3

#

Finding the Balance on a Canadian Loan

A client is moving to Canada and will be living there for

five years. She will purchase a home while she is there

and will sell it when she returns to the U.S. She is looking

at a $185,000 home at 8¼% for 30 years. She has $17,000

to put down. Find her mortgage payment and her

remaining balance after the five-year period.

Solution

Press #

Steps Keystrokes Display

,

until the BGN indicator disappears.

Clear TVM values.

Set payment periods.

Set compounding

12 P/Y 12

+

j

2

j

C/Y = 2.00

periods for Canadian

loan.

Enter term of loan.

Enter interest rate.

Subtract down

payment from price

30

8.25

1

185 q

17 q j

TRM = 30.00

I% = 8.25

X

LN = 168,000.00

to compute loan.

Compute payment.

Enter number of

payments during

$

5 O 12

*

PMT =-1,245.83

j

N = 60.00

period and store as N.

Compute balance after

$

4

FV =-159,879.69

five years.

Note: If you do not normally solve Canadian mortgage

problems, be sure to restore the compounding periods per

year to 12.

0.00

2.00

44 Mortgages and Amortization

Page 46

Payment and Remaining Balance on a Canadian Mortgage

# -

#

0

2

$ 3

#

$ 4

1. Clear TVM values (if not already cleared).

2. Enter number of payment periods per

year.

3. Set compounding periods to semi-annual.

4. Enter term of loan (in years).

5. Enter interest rate.

6. Enter loan amount.

7. Compute payment amount.

8. Enter number of payments made,

and store as N.

9. Compute balance at end of period.

5

O 12

+

j

12

2

30

8.25

$168,000.00

$.1,245.83

60

$.159,879.69

j

j

1

*

Mortgages and Amortization 45

Page 47

v

v

Amortization (AMORT)

You can calculate the principal and interest paid in a

range of payments and the loan balance after the last

payment in the range. The calculator prompts you for the

starting and ending payment numbers and uses the TVM

values to calculate the results.

Amortization

Values

Notes on the

Amortization

Model

To calculate amortization, first enter the TVM values for

the loan and then press

%

. You can exit the

Amortization model at any time by pressing !.

Name Meaning

P1 =

Prompt for first payment in the range. Initial

alue=1.

P2 =

Prompt for ending period in the range. Initial

alue=1.

BAL=

PRN=

Loan balance after payment P2 is made.

Amount of principal paid in the payment range

P1 through P2.

INT=

Amount of interest paid in the payment range

P1 through P2.

Note: Do not change the fixed-decimal setting during

amortization. A change can affect the accuracy of the

results.

•

Pressing ! at any time, except while entering a

value, exits the model and leaves the last displayed

value in the display, with no label.

•

Initially, the display shows P1= 1. You can press j to

accept the P1 value, or you can enter or calculate a

new value and press j. The display temporarily shows

the new value of P1 and then shows P2= 1.

•

You can press j to accept the P2 value, or you can

enter or calculate a new value and press j. The

calculator shows the new value of P2 and then

computes and displays the first item in the result list

(BAL).

•

Press j to display each result. Pressing j at the end

of the list starts the sequence again, with P1 and P2

updated for the next range of payments. This feature

helps you build an amortization schedule.

46 Mortgages and Amortization

Page 48

# -

#

v

0

2

3

%

Finding the Principal and Interest Paid

You are buying a home with a 30-year, $105,000

mortgage with an annual interest rate of 9.125%. Assume

that the first payment is due in May. Find the principal

and interest you will pay on the loan during the first three

tax years.

Solution: First

Tax Year

The first tax year (May through December) includes

payments 1 through 8.

Steps Keystrokes Display

Clear TVM Values.

Set P/Y and C/Y to 12.

+ 12

j

P/Y = 12.00

C/Y = 12.00

j

Enter known loan

alues.

Calculate payment.

Start amortization.

Set P2 for 1st year.

Display balance,

principal, and

interest for the first

tax year.

30

1

9.125

105 q

$

j

8

j

j

j

TRM =30.00

I% = 9.13

LN = 105,000.00

PMT=

P1 = 1.00

P2 8

P2 = 8.00

BAL = 104,540.93

PRN=

INT =-6,375.41

(continued)

0.00

12.00

-

854.31

-

459.07

Mortgages and Amortization 47

Page 49

A

-

-

A

A

-

-

Finding the Principal and Interest Paid

(Continued)

Solution:

Second Tax

Year

Solution: Third

Tax Year

The second tax year (January through December) includes

payments 9 through 20 (12 payments).

Steps Keystrokes Display

j

ccept updated P1,

and advance to P2.

Enter new P2.*

Display balance,

principal, and

interest for the

second year.

j

20 P2 20.00

j

j

j

P1 = 9.00

P2 = 16.00

P2 = 20.00

BAL= 103,798.03

PRN=

INT=

742.90

9,508.82

*The calculator updates P1 to 9.00 and P2 to 16.00,

assuming that the next range is also 8 months. Changing

P2 to 20 establishes a 12-month range so the calculator can

correctly update both P1 and P2 for successive years.

The third tax year (January through December) includes

payments 21 through 32 (12 payments).

Steps Keystrokes Display

j

j

j

j

j

P1 = 21.00

P2 = 32.00

BAL= 102,984.42

PRN=

INT=

813.61

9,438.11

ccept updated P1,

and advance to P2.

ccept updated P2,

and display balance,

principal, and

interest for the third

year.

Note: The worksheet on the next page omits step 1,

clearing the TVM values, due to page size restrictions.

48 Mortgages and Amortization

Page 50

2. Enter term of loan (in years).

0

2

3

%

30

3. Enter interest rate.

4. Enter loan amount.

5. Compute payment (principal and interest).

6. Start Amortization.

7. Accept initial payment period (P1), or enter

the number of the beginning payment period.

8. Accept ending payment period (P2), or enter

the number of the ending payment period.

9. View balance remaining after P2.

0. View principal paid from P1 through P2.

1. View interest paid from P1 through P2.

2. Return to P1 and accept updated P1 as

next beginning payment period.

3. Accept updated P2, or enter the number

of the next ending payment period.

4. View balance remaining after P2.

$

9.125

1

$105,000

$.854.31

1

8

j

j

$104,540.93

j

$.459.07

j

$.6,375.41

j

9

20

j

j

$103,798.03

5. View principal paid from P1 through P2.

6. View interest paid from P1 through P2.

7. Return to P1 and accept updated P1 as

next beginning payment period.

8. Accept updated P2 as the ending period.

9. View balance remaining after P2.

0. View principal paid from P1 through P2.

1. View interest paid from P1 through P2.

j

$.742.90

j

$.9,508.82

j

21

32

j

j

$102,984.42

j

$.813.61

j

$.9,438.11

Mortgages and Amortization 49

Page 51

50 Mortgages and Amortization

Page 52

Chapter 2: Buyer Qualification

This chapter describes real estate models relating to

qualifying the buyer for a mortgage loan.

Chapter

Contents

Buyer Qualification: Maximum Loan Amount.................. 52

Buyer Qualification: Minimum Income Required............. 53

Finding the Qualifying Loan Amount ................................ 54

Finding the Minimum Income Required............................ 56

Finding the Maximum Allowable Debt.............................. 58

Finding the Net Cost of Housing........................................ 60

Buyer Qualification 51

Page 53

Buyer Qualification: Maximum Loan Amount

You can calculate buyer qualification in one of two ways:

by determining the maximum amount the buyer can

afford to borrow, or by calculating the minimum income a

buyer must have. This page describes the model based

on loan amount, while the following page discusses the

model based on minimum required income.

Values Used by

Qualifying Loan

Amount Model

To calculate the maximum loan for which a buyer can

qualify, first enter the term of the loan, the interest rate,

the income/debt ratio used in your area, if not already

entered (see page 18), and one of the following:

The annual tax and insurance percentages applicable

•

to the property (# Q and # Z).

The total annual tax and insurance dollar amount

•

(# E).

Then press ? to start the model. You can exit the

Buyer Qualification model at any time by pressing !.

Name Meaning

INC=

DBT=

DN%=

Enter monthly income and press j.

Enter monthly debt and press j.

Enter the down payment amount, or enter a

two-digit number for the down payment

percent, and then press j.*

PITI=

The total monthly payment including principal,

interest, tax, and insurance.

PMT=

The monthly loan payment for which the buyer

should qualify.

QLA=

The loan amount for which the buyer should

qualify.

QPR=

The sales price for which the buyer should

qualify.

DN$=

The down payment amount (useful if you

entered down payment as a percent).

* The calculator accepts any number greater than 99 as a

down payment dollar amount.

52 Buyer Qualification

Page 54

Buyer Qualification: Minimum Income Required

The Qualifying Income model lets you calculate the

minimum income a buyer must have to qualify for a given

sales price.

Values Used by

Qualifying

Income Model

To calculate the minimum income required to qualify for a

loan, first enter the term of the loan, the interest rate, the

income/debt ratio used in your area, if not already entered

(see page 18), and one of the following:

The annual tax and insurance percentages applicable

•

to the property (# Q and # Z).

The total annual tax and insurance dollar amount

•

(# E).

Then press > to start the model. You can exit the

Buyer Qualification model at any time by pressing !.

Name Meaning

PRC=

Enter the sales price of the property and press

j.

DN%=

Enter the down payment amount, or enter a

two-digit number for the down payment

percent, and then press j.*

DBT=

LN=

PMT=

PITI=

Enter monthly debt and press j.

Loan amount.

Monthly payment for the mortgage loan.

Total payment including principal, interest, tax,

and insurance.

QI=

Monthly income required to qualify for the loan.

* The calculator accepts any number greater than 99 as a

down payment dollar amount.

Buyer Qualification 53

Page 55

Finding the Qualifying Loan Amount

In this example, you know the tax, insurance, and down

payment percentages.

Situation

Solution

You are helping a couple find a home. They have a combined monthly income of $6,500, with one car payment of

$320 and other monthly debts of $175. Assuming an 80%

loan at 8% annual interest for 30 years, a tax rate of 1.5%,

an insurance rate of .5%, and using 28/36 qualifying ratios,

estimate the maximum loan amount and sales price this

couple should consider.

Steps Keystrokes Display

Clear TVM values.

Enter income percent.

Enter debt percent.

Enter tax percent.

Enter insurance

# - 0.00

28 # m IN% = 28.00

36 # d DB%= 36.00

1.5 # Z TX%= 1.50

.5 # Q IS% = 0.50

percent.

Enter term.

Enter interest rate.

Start qualification.

Enter monthly income

amount.

Enter monthly debt

amount.

Enter down payment

percent and compute

30 0 TRM= 30.00

8 1 I% = 8.00

? INC = 0.00

6500 j INC = 6,500.00

DBT= 0.00

320 a 175 j DBT= 495.00

DN%= 0.00

20 j DN%= 20.00

PITI= –1,820.00

PITI.

Compute loan payment.

Compute loan amount.

Compute sales price.

Compute down

j PMT= –1,417.53

j QLA= 193,185.87

j QPR= 241,482.34

j DN$= 48,296.47

payment.

54 Buyer Qualification

Page 56

Finding Qualifying Loan Amount Based on

Tax, Insurance, and Down Payment Percents

1. Clear TVM values (if not already cleared).

# -

2. Enter income percent (if not already entered). 28

3. Enter debt percent (if not already entered). 36

4. Enter tax percent (if not already entered). 1.5

5. Enter insurance percent (if not already entered). .5

6. Enter term of loan (in years). 30

7. Enter interest rate. 8

8. Start the qualification.

?

9. Enter gross monthly income amount (total). $6,500

10. Enter monthly debt amount (total). $495

11. Enter down payment percent (0 to 99). 20

12. Compute PITI.

13. Compute payment.

14. Compute qualifying loan amount.

j

j

j

$.1,820.00

$.1,417.53

$193,185.87

# m

# d

# Z

# Q

0

1

j

j

15. Compute qualifying sales price.

16. Compute down payment amount.

$241,482.34

j

$48,296.47

j

Buyer Qualification 55

Page 57

A

Finding the Minimum Income Required

A couple is interested in a home you are showing. The

asking price is $250,000. Last year’s taxes were $3,750 and

insurance was $1,250. The couple’s monthly debt is $635

and they are able to make a $50,000 down payment. If

they get a 30-year loan at 8%, determine if their combined

monthly income of $7,100 is enough for them to qualify.

Solution

Steps Keystrokes Display

Clear TVM values.

Enter income percent.

Enter debt percent.

dd annual tax and

annual insurance to

# - 0.00

28 # m IN% = 28.00

36 # d DB%= 36.00

3750 a 1250 j

# E T&I= 5,000.00

calculate total tax

and insurance.*

Enter term of loan.

Enter interest rate.

Start qualification.

Enter price.

Enter down payment

amount.

Enter a monthly debt

amount, and compute

30 0 TRM=30.00

8 1 I% = 8.00

> PRC= 0.00

250 q j PRC= 250,000.00

DN%= 0.00

50 q j DN$= 50,000.00

DBT= 0.00

635 j DBT= 635.00

LN = 200,000.00

qualifying loan

amount.

Compute payment.

Compute PITI.

Compute qualifying

j PMT=-1,467.53

j PITI =-1,884.20

j QI = 6,997.78

income.

* The calculator uses the TAX&INS$ amount, ignoring the

TAX% and INS% settings. TAX% and INS% are used only

when TAX&INS$ is zero.

56 Buyer Qualification

Page 58

Finding Qualifying Income Based on

Tax, Insurance, and Down Payment Amounts

1. Clear TVM values (if not already cleared).

2. Enter income percent (if not already

# -

28

entered).

3. Enter debt percent (if not already

36

entered).

4. Enter annual tax amount. $3,750

a

5. Add annual insurance amount, and

$1,250

enter total.

6. Enter term of loan (in years). 30

7. Enter interest rate. 8

8. Start the qualification.

>

9. Enter price. $250,000

10. Enter down payment amount. $50,000

11. Enter monthly debt amount (total). $635.00

12. Compute qualifying loan amount.

13. Compute payment.

$200,000.00

j

$.1,467.53

j

# m

# d

j # E

0

1

j

j

14. Compute PITI.

15. Compute qualifying income.

$.1,884.20

j

$6,997.78

j

Buyer Qualification 57

Page 59

-

-

Finding the Maximum Allowable Debt

Assuming a sales price of $125,000, 10% down payment,

8% annual fixed rate, 30-year term, and an income/debt

ratio of 28/36, determine the maximum debt a buyer can

have and still qualify for the loan. Also assume that the

annual tax rate is 1.5% and the annual insurance rate is

0.5%

Solution

Press # , until the BGN indicator disappears.

Steps Keystrokes Display

Clear TVM values.

Enter income percent.

Enter debt percent.

Enter tax percent.

Enter insurance

# - 0.00

28 # m IN% = 28.00

36 # d DB%= 36.00

1.5 # Z TX%= 1.50

.5 # Q IS%= 0.50

percent.

Enter term.

Enter interest rate.

Start qualification.

Enter price.

Enter down payment

percent (0 to 99).

Enter a zero for

monthly debt amount,

30 0 TRM= 30.00

8 1 I% = 8.00

> PRC= 0.00

125 q j PRC= 125,000.00

DN%= 0.00

10 j DN%= 10.00

DBT= 0.00

0 j DBT= 0.00

LN = 112,500.00

and compute

qualifying loan

amount.

Compute payment.

Compute PITI and

j PMT=

j T g PITI =

1,033.82

store the result.

Compute qualifying

j QI = 3,692.21

income.

Multiply by debt

ratio.

Calculate maximum

O ]

# d A j

a ] g j

1,329.20

debt.

825.49

295.38

58 Buyer Qualification

Page 60

Finding Maximum Allowable Debt

1. Enter income percent (if not already entered). 28

2. Enter debt percent (if not already entered). 36

3. Enter tax percent (if not already entered). 1.5

4. Enter insurance percent (if not already

.5

entered).

5. Enter term of loan (in years). 30

6. Enter interest rate. 8

7. Start the qualification.

>

8. Enter price. $125,000

9. Enter down payment percent (0 to 99). 10

10. Enter a zero for monthly debt amount (total). 0

11. Compute qualifying loan amount.

12. Compute payment.

13. Compute PITI and store it.

$112,500.00

j

$.825.49

j

$.1,033.82

j

# m

#

d

# Z

# Q

0

1

j

j

T g

14. Compute qualifying income.

15. Multiply by debt ratio.

16. Calculate maximum debt.

O ] # d A j

a ] g j

$3,692.21

j

$1,329.20

$295.38

Buyer Qualification 59

Page 61

-

A

-

-

-

Finding the Net Cost of Housing

A couple is considering an $84,000 mortgage to purchase

a $105,000 home. What would their net cost of housing be

if they were in the 28% tax bracket? Use a standard

30-year note and 8% interest for your example. Assume

property tax and insurance rates are 1.5 and .35