Page 1

BA II PLUS™

Calculator

Page 2

Important Information

Texas Instruments makes no warranty, either express or implied,

including but not limited to any implied warranties of merchantability

and fitness for a particular purpose, regarding any programs or book

materials and makes such materials available solely on an "as-is" basis. In

no event shall Texas Instruments be liable to anyone for special,

collateral, incidental, or consequential damages in connection with or

arising out of the purchase or use of these materials, and the sole and

exclusive liability of Texas Instruments, regardless of the form of action,

shall not exceed the purchase price of this product. Moreover, Texas

Instruments shall not be liable for any claim of any kind whatsoever

against the use of these materials by any other party.

USA FCC Information Concerning Radio Frequency Interference

This equipment has been tested and found to comply with the limits for a

Class B digital device, pursuant to Part 15 of the FCC rules. These limits are

designed to provide reasonable protection against harmful interference in

a residential installation. This equipment generates, uses, and can radiate

radio frequency energy and, if not installed and used in accordance with

the instructions, may cause harmful interference to radio communications.

However, there is no guarantee that interference will not occur in a

particular installation.

If this equipment does cause harmful interference to radio or television

reception, which can be determined by turning the equipment off and

on, you can try to correct the interference by one or more of the

following measures:

• Reorient or relocate the receiving antenna.

• Increase the separation between the equipment and receiver.

• Connect the equipment into an outlet on a circuit different from

that to which the receiver is connected.

• Consult the dealer or an experienced radio/television technician for

help.

Caution: Any changes or modifications to this equipment not expressly

approved by Texas Instruments may void your authority to operate the

equipment.

© 2005 Texas Instruments Incorporated

ii

Page 3

Contents

Important Information................................................................... ii

USA FCC Information Concerning Radio Frequency Interferenceii

1 Overview of Calculator Operations..................................1

Turning On the Calculator ............................................................. 1

Turning Off the Calculator............................................................. 1

Selecting 2nd Functions ................................................................. 2

Reading the Display ....................................................................... 2

Setting Calculator Formats ........................................................... 4

Resetting the Calculator ................................................................ 6

Clearing Calculator Entries and Memories ................................... 6

Correcting Entry Errors................................................................... 7

Math Operations ............................................................................ 8

Memory Operations ..................................................................... 12

Calculations Using Constants....................................................... 13

Last Answer Feature..................................................................... 14

Using Worksheets: Tools for Financial Solutions ........................ 15

2 Time-Value-of-Money and Amortization Worksheets...21

TVM and Amortization Worksheet Variables............................. 22

Entering Cash Inflows and Outflows........................................... 25

Generating an Amortization Schedule ....................................... 25

Example: Computing Basic Loan Interest.................................... 26

Examples: Computing Basic Loan Payments ............................... 27

Examples: Computing Value in Savings ...................................... 28

Example: Computing Present Value in Annuities....................... 29

Example: Computing Perpetual Annuities.................................. 30

Example: Computing Present Value of Variable Cash Flows ..... 31

Example: Computing Present Value of a Lease With Residual

Value........................................................................................ 33

Example: Computing Other Monthly Payments......................... 34

Example: Saving With Monthly Deposits.................................... 35

Example: Computing Amount to Borrow and Down Payment. 36

Example: Computing Regular Deposits for a Specified Future

Amount ................................................................................... 37

Example: Computing Payments and Generating an Amortization

Schedule .................................................................................. 38

Example: Computing Payment, Interest, and Loan Balance After

a Specified Payment ............................................................... 39

3 Cash Flow Worksheet......................................................41

Cash Flow Worksheet Variables................................................... 41

iii

Page 4

Uneven and Grouped Cash Flows................................................42

Entering Cash Flows......................................................................43

Deleting Cash Flows......................................................................43

Inserting Cash Flows .....................................................................44

Computing Cash Flows .................................................................44

Example: Solving for Unequal Cash Flows ..................................46

Example: Value of a Lease with Uneven Payments ....................48

4 Bond Worksheet ............................................................. 51

Bond Worksheet Variables...........................................................52

Bond Worksheet Terminology .....................................................54

Entering Bond Data and Computing Results ..............................54

Example: Computing Bond Price and Accrued Interest..............56

5 Depreciation Worksheet ................................................ 57

Depreciation Worksheet Variables ..............................................57

Entering Data and Computing Results........................................59

Example: Computing Straight-Line Depreciation.......................61

6 Statistics Worksheet ....................................................... 63

Statistics Worksheet Variables .....................................................63

Regression Models........................................................................65

Entering Statistical Data...............................................................66

Computing Statistical Results.......................................................67

7 Other Worksheets ........................................................... 69

Percent Change/Compound Interest Worksheet ........................69

Interest Conversion Worksheet....................................................72

Date Worksheet............................................................................74

Profit Margin Worksheet .............................................................76

Breakeven Worksheet ..................................................................78

Memory Worksheet......................................................................80

A Appendix — Reference Information.............................. 83

Formulas........................................................................................83

Error Messages..............................................................................94

Accuracy Information ...................................................................95

AOS™ (Algebraic Operating System) Calculations.....................96

Battery Information......................................................................97

In Case of Difficulty ......................................................................98

Texas Instruments Support and Service ....................................... 99

Texas Instruments (TI) Warranty Information ........................... 100

Index ............................................................................... 103

iv

Page 5

Overview of Calculator Operations

This chapter describes the basic operation of your BA II PLUS™

calculator, including how to:

• Turn on and turn off the calculator

• Select second functions

• Read the display and set calculator formats

• Clear the calculator and correct entry errors

• Perform math and memory operations

• Use the Last Answer feature

• Use worksheets

Turning On the Calculator

Press $.

• If you turned off the calculator by pressing $, the

calculator returns to the standard-calculator mode

with a displayed value of zero.

All worksheets and formats for numbers, angle units,

dates, separators, and calculation method retain

previous values and configurations.

• If the Automatic Power Down™ (APD™) feature

turned off the calculator, the calculator turns on

exactly as you left it, saving display settings, stored

memory, pending operations, and error conditions.

1

Turning Off the Calculator

Press $.

• The displayed value and any error condition clear.

• Any unfinished standard-calculator operation and worksheet

calculation in progress cancel.

Overview of Calculator Operations 1

Page 6

• The Constant Memory™ feature retains all worksheet values and

settings, including the contents of the 10 memories and all format

settings.

Automatic Power Down™ (APD™) Feature

To prolong battery life, the Automatic Power Down (APD) feature turns

off the calculator automatically after about five minutes of inactivity.

The next time you press $, the calculator turns on exactly as you left

it, saving display settings and stored memory and any pending

operations or error conditions.

Selecting 2nd Functions

The primary function of a key is printed on the key itself.

For example, the primary function of the $ key is to

turn on or turn off the calculator.

Most keys include a second function printed above the key.

To select a second function, press & and the

corresponding key. (When you press &, the 2nd indicator

appears in the upper left corner of the display.)

For example, pressing & U exits the selected

worksheet and returns the calculator to the standardcalculator mode.

Note: To cancel after pressing &, press & again.

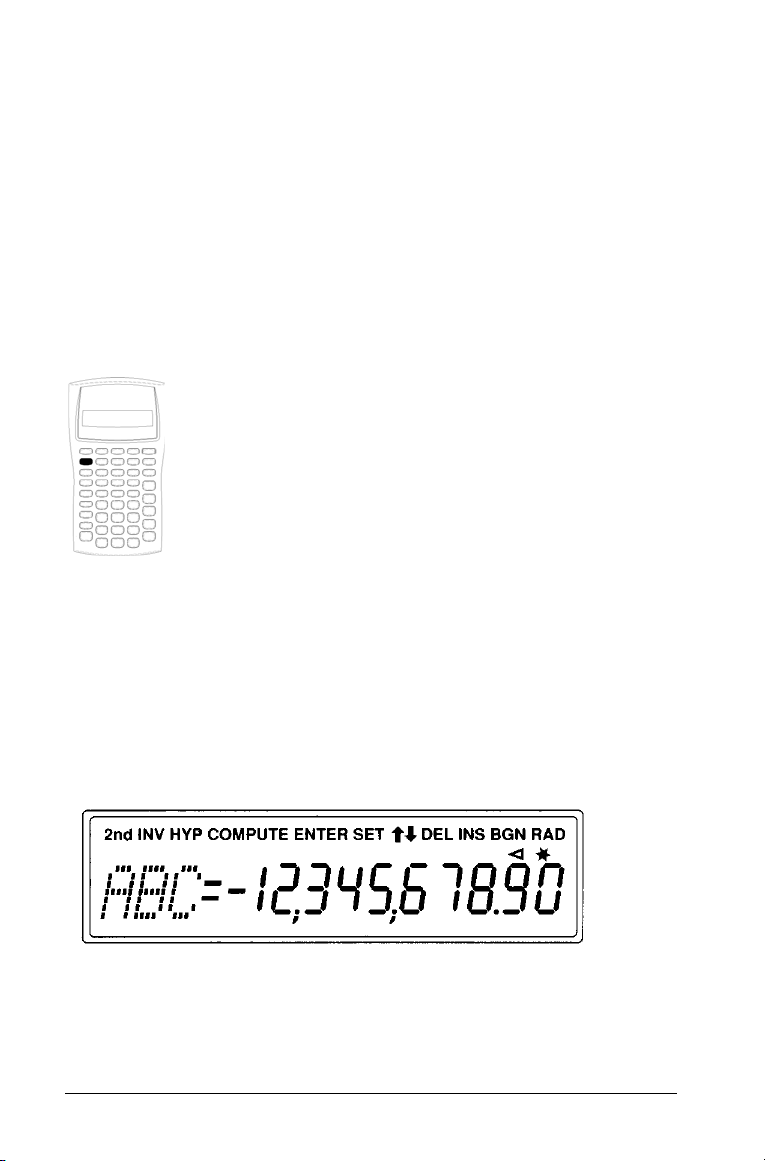

Reading the Display

The display shows the selected variable labels with values up to 10 digits.

(The calculator displays values exceeding 10 digits in scientific notation.)

2 Overview of Calculator Operations

Page 7

The indicators along the top of the display tell you which keys are active

and offer information about the status of the calculator.

Indicator Meaning

2nd Press a key to select its second function.

INV Press a key to select its inverse trigonometric function.

HYP Press a key to select its hyperbolic function.

COMPUTE Press % to compute a value for the displayed variable.

ENTER Press ! to assign the displayed value to the displayed

variable.

SET

# $

DEL Press & W to delete a cash flow or statistical data point.

INS Press & X to insert a cash flow or statistical data point.

BGN TVM calculations use beginning-of-period payments. When

RAD Angle values appear in radians. When

= The displayed variable is assigned the displayed value.

– The displayed value is negative.

Press & V to change the setting of the displayed

variable.

Press " or # to display the previous or next variable in the

worksheet.

Note: To easily scroll up or down through a range of

variables, press and hold # or ".

BGN is not displayed, TVM calculations use end-of-period

payments (END).

RAD is not displayed,

angle values appear and must be entered in degrees.

The displayed value is entered in the selected worksheet.

The indicator clears following a computation.

The displayed value is computed in the selected worksheet.

When a value changes and invalidates a computed value,

the_indicator clears.

Overview of Calculator Operations 3

Page 8

Setting Calculator Formats

You can change these calculator formats:

To Select Press Display Default

Number of

decimal

& | DEC 0–9 (Press 9 for

floating-decimal)

places

Angle units # DEG (degrees)

RAD (radians)

Dates # US (mm-dd-yyyy)

Eur (dd-mm-yyyy)

Number

separators

Calculation

method

# US (1,000.00 )

Eur (1.000,00)

# Chn (chain)

AOSé (algebraic

operating system)

1. To access format options, press & |. The DEC indicator

appears with the selected number of decimal places.

2. To change the number of decimal places displayed, key in a value

and press !.

3. To access another calculator format, press # or " once for each

format.

For example, to access the angle unit format, press #. To access the

number-separator format, press "" "or # # #.

4. To change the selected format, press & V.

5. To change another calculator format, repeat step 3 and step 4.

— or —

To return to the standard-calculator mode, press & U.

— or —

To access a worksheet, press a worksheet key or key sequence.

2

DEG

US

US

Chn

Choosing the Number of Decimal Places Displayed

The calculator stores numeric values internally to an accuracy of 13 digits,

but you can specify the number of decimal places you want to display.

The calculator displays up to 10 digits with the floating-decimal option.

Results exceeding 10 digits appear in scientific notation.

4 Overview of Calculator Operations

Page 9

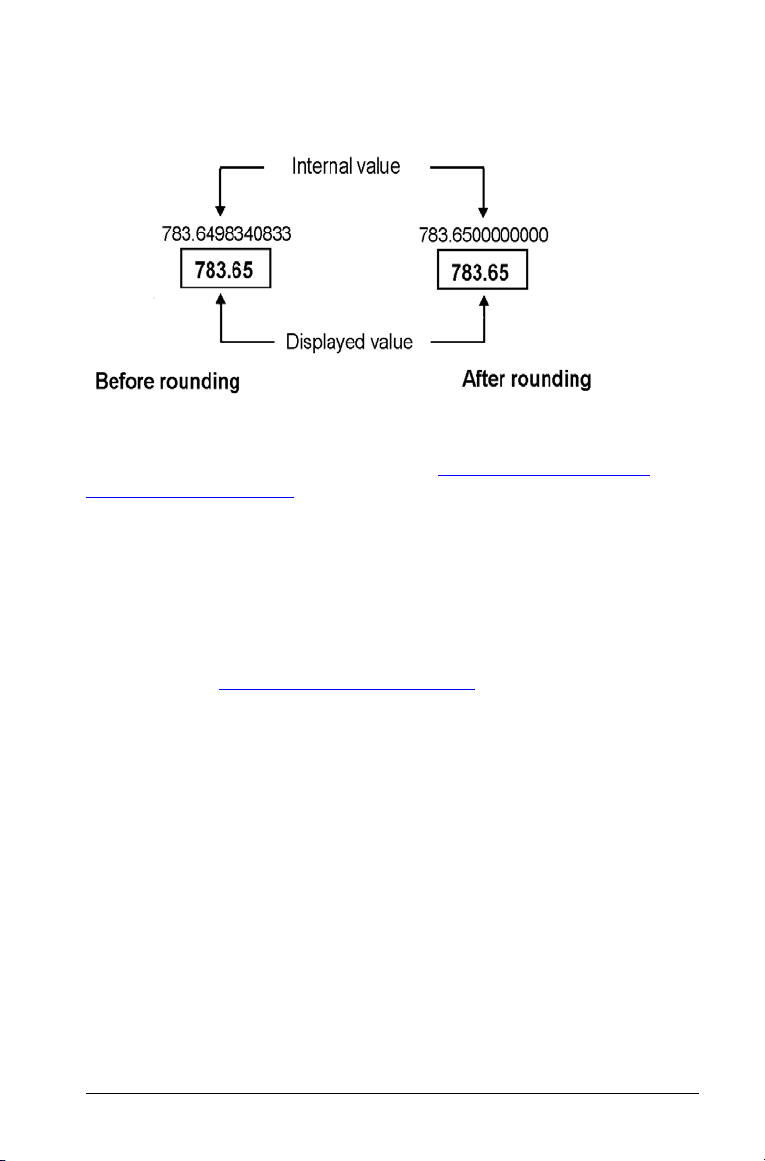

Changing the number of decimal places affects the display only. Except

for amortization and depreciation results, the calculator does not round

internal values. To round the internal value, use the round function.

Note: All examples in this guidebook assume a setting of two decimal

places. Other settings might show different results.

Choosing the Angle Units

The angle unit value affects the display of results in trigonometric

calculations. When you select radians, the RAD indicator appears in the

upper right corner of the display. No indicator appears when you select

the default setting of degrees.

Using Dates

The calculator uses dates with the Bond and Date worksheets and the

French depreciation methods. To enter dates, use this convention:

mm.ddyy (US) or dd.mmyy (European). After you key in the date, press

!.

Choosing Calculation Methods

When you choose the chain (Chn) calculation method, the calculator

solves problems in the order that you enter them. (Most financial

calculators use Chn.)

For example, when you enter 3 H 2 < 4 N, the Chn answer is 20 (3 + 2 = 5,

5 * 4 = 20).

Using AOSé (algebraic operating system), the calculator solves problems

according to the standard rules of algebraic hierarchy, computing

multiplication and division operations before addition and subtraction

operations. (Most scientific calculators use AOS.)

For example, when you enter 3 H 2 < 4 N, the AOS answer is 11 (2 Q 4 =

8; 3 + 8 = 11).

Resetting Default Values

To reset default values for all of the calculator formats, press &

z with one of the formats displayed.

Overview of Calculator Operations 5

Page 10

Resetting the Calculator

Resetting the calculator:

• Clears the display, all 10 memories, any unfinished

calculations, and all worksheet data.

• Restores all default settings

• Returns operation to the standard-calculator mode

Because the calculator includes alternative methods that let you clear

data selectively, use reset carefully to avoid losing data needlessly. (See

“Clearing Calculator Entries and Memories

For example, you might reset the calculator before using it for the first

time, when starting a new calculation, or when having difficulty

operating the calculator and other possible solutions do not work. (See

“In Case of Difficulty

” on page 98.)

Pressing & } !

1. Press & }. The

Note: To cancel reset, press & U. 0.00 appears.

2. Press !. RST and 0.00 appear, confirming that the calculator is

reset.

Note: If an error condition exists, press P to clear the display before

attempting to reset.

RST ? and ENTER indicators appear.

” on page 6.)

Performing a Hard Reset

You can also reset the calculator by gently inserting a pointed object

(such as an unfolded paper clip or similar object) in the hole marked

RESET in back of the calculator.

Clearing Calculator Entries and Memories

Note: To clear variables selectively, see the specific worksheet chapters in

this guidebook.

To clear Press

One character at a time, starting with the last digit

keyed in

An incorrect entry, error condition, or error

message

6 Overview of Calculator Operations

*

P

Page 11

To clear Press

The prompted worksheet and reset default values & z

Calculator format settings and reset default values & |

& z

• Out of the prompted worksheet and return to

& U

standard-calculator mode

• All pending operations in standard-calculator

mode

• In a prompted worksheet, the variable value

P P

keyed in but not entered (the previous value

appears)

• Any calculation started but not completed

TVM worksheet variables and reset default values & U

& ^

One of the 10 memories (without affecting the

others)

Q D and a

memory number

key (0–9)

Correcting Entry Errors

You can correct an entry without clearing a calculation, if

you make the correction before pressing an operation key

(for example, H or 4).

• To clear the last digit displayed, press *.

• To clear the entire number displayed, press P.

Note: Pressing P after you press an operation key clears

the calculation in progress.

Example: You mean to calculate 3 Q 1234.56 but instead enter 1234.86.

To Press Display

Begin the expression. 3 <

Enter a number.

1234.86 1,234.86

Erase the entry error. * *

Key in the correct number.

56 1,234.56

Compute the result. N

3.00

1,234.

3,703.68

Overview of Calculator Operations 7

Page 12

Math Operations

When you select the chain (Chn) calculation method, the calculator

evaluates mathematical expressions (for example, 3 + 2 Q 4) in the order

that you enter them.

Examples of Math Operations

These operations require you to press N to complete.

To Press Display

Add 6 + 4

6 H 4 N

Subtract 6 N 4 6 B 4 N

Multiply 6 Q 4 6 < 4 N

Divide 6 P 4 6 6 4 N

Find universal power: 3

1.25

3 ; 1.25 N

Use parentheses: 7 Q (3 + 5) 7 < 9 3 H 5 : N

Find percent: 4% of $453 453 < 4 2 N

Find percent ratio: 14 to 25 14 6 25 2 N

Find price with percent add-on:

$498 + 7% sales tax

Find price with percent discount:

$69.99 N 10%

Find number of combinations where:

498 H 7 2

N

69.99 B 10 2

N

52 & s 5 N

n = 52, r = 5

Find number of permutations where:

8 & m 3 N

n = 8, r = 3

2,598,960.00

10.00

2.00

24.00

1.50

3.95

56.00

18.12

56.00

34.86

532.86

7.00

62.99

336.00

These operations do not require you to press N to complete.

To Press Display

Square 6.3

2

Find square root:

15.5

6.3 4

15.5 3

Find reciprocal: 1/3.2 3.2 5

Find factorial: 5! 5 & g

Find natural logarithm: ln 203.45 203.45 >

8 Overview of Calculator Operations

39.69

3.94

0.31

120.00

5.32

Page 13

To Press Display

Find natural antilogarithm: e

.69315

.69315 & i

Round 2 P 3 to the set decimal format 2 6 3 N & o

Generate random number* & a

Store seed value D & a

Find sine:** sin(11.54°) 11.54 & d

Find cosine:** cos(120°) 120 & e

Find tangent:** tan(76°) 76 & f

Find arcsine:** sin-1(.2)

Find arccosine:** cos-1(-.5)

Find arctangent:** tan-1(4)

.2 8 d

.5 S 8 e

4 8 f

Find hyperbolic sine: sinh(.5) .5 & c d

Find hyperbolic cosine: cosh(.5) .5 & c e

Find hyperbolic tangent: tanh(.5) .5 & c f

Find hyperbolic arcsine: sinh-1(5)

Find hyperbolic arccosine: cosh-1(5)

Find hyperbolic arctangent: tanh-1(.5)

5 & c 8 d

5 & c 8 e

.5 & c 8 f

2.00

0.67

0.86

0.86

0.20

-0.50

4.01

11.54

120.00

75.96

0.52

1.13

0.46

2.31

2.29

0.55

* The random number you generate might be different.

** Angles can be computed in degrees or radians. Examples show

angles in degrees. (See “Choosing the Angle Units” on page 5.)

Universal Power ;

Press ; to raise the displayed positive number to any power (for

example, 2

Note: Because the reciprocal of an even number (such as, 1/2, 1/4, 1/6) is

a complex number, you can only raise a negative number to an integer

power or the reciprocal of an odd number.

Overview of Calculator Operations 9

-5

or 2

(1/3)

).

Page 14

Parentheses 9 :

Use parentheses to control the order in which the calculator evaluates a

numeric expression in division, multiplication, powers, roots, and

logarithm calculations. The calculator includes up to 15 levels of

parentheses and up to 8 pending operations.

Note: You do not have to press : for expressions ending in a series of

closed parentheses. Pressing N closes parentheses automatically,

evaluates the expression, and displays the final result. To view

intermediate results, press : once for each open parenthesis.

Factorial & g

The number for which you compute a factorial must be a positive integer

less than or equal to 69.

Random Numbers & a

The calculator generates a random real number between zero and one

(0<x<1) from a uniform distribution.

You can repeat a sequence of random numbers by storing a seed value in

the random number generator. Seed values help you recreate

experiments by generating the same series of random numbers.

To store a seed value, key in an integer greater than zero and press D

& a.

Combinations & s

The calculator computes the number of combinations of n items taken r

at a time. Both the n and r variables must be greater than or equal to 0.

n!

-----------------------------

Cr

=

nr)! r!×–(

Permutations & m

The calculator computes the number of permutations of n items taken r

at a time. Both the

Pr

=

n and r variables must be greater than or equal to 0.

n!

------------------ nr)!–(

Rounding & o

The calculator computes using the rounded, displayed form of a number

instead of the internally stored value.

10 Overview of Calculator Operations

Page 15

For example, working in the Bond worksheet, you might want to round a

computed selling price to the nearest penny (two decimal places) before

continuing your calculation.

Note: The calculator stores values to an accuracy of up to 13 digits. The

decimal format setting rounds the displayed value but not the

unrounded, internally stored value. (See “Choosing the Number of

Decimal Places Displayed” on page 4.)

Scientific Notation ;

When you compute a value in the standard-decimal format that is either

too large or small to be displayed, the calculator displays it in scientific

notation, that is, a base value (or mantissa), followed by a blank space,

followed by an exponent.

With AOS™ selected, you can press ; to enter a number in scientific

notation. (See “Choosing Calculation Methods

3

For example, to enter 3 Q 10

, key in 3 < 10 ; 3.

” on page 5.)

Overview of Calculator Operations 11

Page 16

Memory Operations

You can store values in any of 10 memories using the

standard calculator keys.

Note: You can also use the Memory worksheet. (See

“Memory Worksheet

• You can store in memory any numeric value within the

range of the calculator.

• To access a memory M0 through M9, press a numeric

key (0 through 9).

Clearing Memory

Clearing memory before you begin a new calculation is a critical step in

avoiding errors.

• To clear an individual memory, store a zero value in it.

• To clear all 10 calculator memories, press & { & z.

Storing to Memory

To store a displayed value to memory, press D and a numeric key (0–9).

• The displayed value replaces any previous value stored in the

memory.

• The Constant Memory feature retains all stored values when you

turn off the calculator.

” on page 80.)

Recalling From Memory

To recall a number stored in memory, press J and a numeric key (0–9).

Note: The recalled number remains in memory.

Memory Examples

To Pr es s

Clear memory 4 (by storing a zero value in it)

Store 14.95 in memory 3 (M3) 14.95 D 3

Recall a value from memory 7 (M7) J 7

0 D 4

Memory Arithmetic

Using memory arithmetic, you can perform a calculation with a stored

value and store the result with a single operation.

12 Overview of Calculator Operations

Page 17

• Memory arithmetic changes only the value in the affected memory

and not the displayed value.

• Memory arithmetic does not complete any calculation in progress.

The table lists the available memory arithmetic functions. In each case,

the specified memory stores the result.

To Pr es s

D H

Add the displayed value to the value stored in memory 9

M9).

(

Subtract the displayed value from the value stored in

memory 3 (M3).

Multiply the value in memory 0 (M0) by the displayed value. D < 0

Divide the value in memory 5 (M5) by the displayed value. D 6 5

Raise the value in memory 4 (M4) to the power of the

displayed value.

9

D B 3

D ; 4

Calculations Using Constants

To store a constant for use in repetitive calculations, enter

a number and an operation, and then press &`.

To use the stored constant, key in a value and press N.

Note: Pressing a key other than a number or N clears the

constant.

Example: Multiply 3, 7, and 45 by 8

To Press Display

Clear the calculator. & U 0.00

Enter the value for the first calculation.

Enter the operation and a constant value. <

Store the operation and value, and then

calculate.

Calculate 7

Compute 45

Overview of Calculator Operations 13

Q 8.

Q 8.

3

8 8

& ` N 24.00

7 N 56.00

45 N 360.00

3

Page 18

Keystrokes for Constant Calculations

This table shows how to create a constant for various operations.

To* Press**

Add c to each subsequent entry n H & ` c N

Subtract c from each subsequent entry n B & ` c N

Multiply each subsequent entry by cn < & ` c N

Divide each subsequent entry by cn 6 & ` c N

Raise each subsequent entry to the power of cn ; & ` c N

Add c% of each subsequent entry to that entry n H & ` c 2 N

Subtract c% of each subsequent entry from the

entry

*The letter c denotes the constant value.

**Repeat constant calculations with n N.

n B & ` c 2 N

Last Answer Feature

Use the Last Answer (

repeatedly for the same value or to copy a value:

• From one place to another within the same worksheet

• From one worksheet to another

• From a worksheet to the standard-calculator mode

• From the standard-calculator mode to a worksheet

To display the last answer computed, press &x.

Note: The calculator changes the value of the last answer whenever it

calculates a value automatically or whenever you:

• Press ! to enter a value.

• Press % to compute a value.

• Press N to complete a calculation.

ANS) feature with problems that call

Example: Using the Last Answer in a Calculation

To Press Display

Key in and complete a calculation 3 H 1 N 4.00

14 Overview of Calculator Operations

Page 19

To Press Display

Key in a new calculation 2 ; 2.00

Recall the last answer & x 4.00

Complete the calculation N 16.00

Using Worksheets: Tools for Financial Solutions

The calculator contains worksheets with embedded

formulas to solve specific problems. You apply settings or

assign known values to worksheet variables and then

compute the unknown value. Changing the values lets you

ask what if questions and compare results.

Except for TVM variables, accessed in the standardcalculator mode, all variables are prompted.

For example, to assign values to amortization variables, you

must first press & \ to access the Amortization

worksheet.

Each worksheet is independent of the others: operations in a worksheet

do not affect variables in other worksheets. When you exit a worksheet

or turn off the calculator, the calculator retains all worksheet data.

To select Function Press

TVM worksheet

(Chapter 2)

Amortization worksheet

(Chapter 2)

Cash Flow worksheet

(Chapter 3)

Bond worksheet

(Chapter 4)

Depreciation worksheet

(Chapter 5)

Overview of Calculator Operations 15

Analyzes equal cash flows, for

example, annuities, loans,

mortgages, leases, and savings

Performs amortization

calculations and generates an

amortization schedule

Analyzes unequal cash flows by

calculating net present value

and internal rate of return

Computes bond price and yield

to maturity or call

Generates a depreciation

schedule using one of six

depreciation methods

,, -, .,

/, 0, or

& [

& \

& '

& l

& p

Page 20

To select Function Press

Statistics worksheet

(Chapter 6)

Analyzes statistics on one- or

two-variable data using four

& k

regression analysis options

Percent

Change/Compound

Interest worksheet

Computes percent change,

compound interest, and costsell markup

& q

(Chapter 7)

Interest Conversion

worksheet

(Chapter 7)

Converts interest rates

between nominal rate (or

annual percentage rate) and

annual effective rate

Date worksheet

(Chapter 7)

Computes number of days

between two dates, or

date/day of the week a

specified number of days is

from a given date

Profit Margin worksheet

(Chapter 7)

Breakeven worksheet

(Chapter 7)

Computes cost, selling price,

and profit margin

Analyzes relationship between

fixed cost, variable cost, price,

profit, and quantity

Memory worksheet

(Chapter 7)

Accesses storage area for up to

10 values

Accessing the TVM Worksheet Variables

• To assign values to the TVM worksheet variables, use

the five TVM keys (,, -, ., /, 0).

• To access other TVM worksheet functions, press the &

key, and then press a TVM function key (

BGN). (See “TVM and Amortization Worksheet

Variables” on page 22.)

Note: You can assign values to TVM variables while in a

prompted worksheet, but you must return to the

standard-calculator mode to calculate TVM values or

clear the TVM worksheet.

& v

& u

& w

& r

& {

xP/Y, P/Y,

16 Overview of Calculator Operations

Page 21

Accessing Prompted-Worksheet Variables

After you access a worksheet, press # or " to select variables. For

example, press & \ to access the Amortization worksheet, and

then press # or " to select the amortization variables (

).(See “TVM and Amortization Worksheet Variables” on page 22.)

INT

Indicators prompt you to select settings, enter values, or compute results.

For example, the i#

other variables. (See “Reading the Display” on page 2.)

To return to the standard-calculator mode, press & U.

$ indicators remind you to press # or " to select

P1, P2, BAL, PRN,

Types of Worksheet Variables

• Enter-only

• Compute-only

• Automatic-compute

• Enter-or-compute

•Settings

Note: The = sign displayed between the variable label and value

indicates that the variable is assigned the value.

Enter-Only Variables

Values for enter-only variables must be entered, cannot be computed,

and are often limited to a specified range, for example,

value for an enter-only variable can be:

• Entered directly from the keyboard.

• The result of a math calculation.

• Recalled from memory.

• Obtained from another worksheet using the last answer feature.

When you access an enter-only variable, the calculator displays the

variable label and ENTER indicator. The ENTER indicator reminds you to

press ! after keying in a value to assign the value to the variable.

After you press !, the indicator confirms that the value is assigned.

P/Y and C/Y. The

Compute-Only Variables

You cannot enter values manually for compute-only variables, for

example, net present value (

compute-only variable and press %. The calculator computes and

displays the value based on the values of other variables.

Overview of Calculator Operations 17

NPV). To compute a value, display a

Page 22

When you display a compute-only variable, the COMPUTE indicator

reminds you to press % to compute its value. After you press %, the

indicator confirms that the displayed value has been computed.

Automatic-Compute Variables

When you press # or " to display an automatic-compute variable (for

example, the Amortization worksheet

computes and displays the value automatically without you having to

press %.

INT variable), the calculator

Enter-or-Compute Variables in the TVM Worksheet

You can either enter or compute values for the TVM worksheet variables

(N, I/Y, PV, PMT, and FV).

Note: Although you do not have to be in the standard-calculator mode

to assign values to these variables, you must be in the standard-calculator

mode to compute their values.

• To assign the value of a TVM variable, key in a number and press a

variable key.

• To compute the value of a TVM variable, press %, and then press the

variable key. The calculator computes and displays the value based

on the values of other variables.

Enter-or-Compute Variables in Prompted Worksheets

You can either enter or compute values for some prompted worksheet

variables (for example, the Bond worksheet YLD and PRI variables).

When you select an enter-or-compute variable, the calculator displays

the variable label with the

•The

•The COMPUTE indicator prompts you to press % to compute a

ENTER indicator prompts you to press ! to assign the keyed-

in value to the displayed variable.

value for the variable.

ENTER and COMPUTE indicators.

Selecting Worksheet Settings

Many prompted worksheets contain variables consisting of two or more

options, or settings (for example, the Date worksheet ACT/360 variable).

When you select variables with settings, the calculator displays the

indicator and the current setting.

To scroll through the settings of a variable, press & V once for each

setting.

18 Overview of Calculator Operations

SET

Page 23

Display Indicators

•The indicator confirms that the calculator entered the displayed

value in the worksheet.

•The indicator confirms that the calculator computed the displayed

value.

• When a change to the worksheet invalidates either entered or

computed values, the and indicators disappear.

Overview of Calculator Operations 19

Page 24

20 Overview of Calculator Operations

Page 25

2

Time-Value-of-Money and Amortization Worksheets

Use the Time-Value-of-Money (TVM) variables to solve

problems with equal and regular cash flows that are either

all inflows or all outflows (for example, annuities, loans,

mortgages, leases, and savings).

For cash-flow problems with unequal cash flows, use the

Cash Flow worksheet. (See “Cash Flow Worksheet

page 41.)

After solving a TVM problem, you can use the Amortization worksheet to

generate an amortization schedule.

• To access a TVM variable, press a TVM key (,, -, ., /, or 0).

• To access the prompted Amortization worksheet, press & \.

” on

Time-Value-of-Money and Amortization Worksheets 21

Page 26

TVM and Amortization Worksheet Variables

Variable Key Display Type of Variable

Number of periods ,

Interest rate per year -

Present value .

Payment /

Future value 0

Number of payments per year & [

Number of compounding

#

periods per year

End-of-period payments & ]

Beginning-of-period

& V

payments

Starting payment & \

Ending payment #

Balance #

Principal paid #

Interest paid #

N

I/Y

PV

PMT

FV

P/Y

C/Y

END

BGN

P1

P2

BAL

PRN

INT

Enter-or-compute

Enter-or-compute

Enter-or-compute

Enter-or-compute

Enter-or-compute

Enter-only

Enter-only

Setting

Setting

Enter-only

Enter-only

Auto-compute

Auto-compute

Auto-compute

Note: This guidebook categorizes calculator variables by the method of

entry. (See “Types of Worksheet Variables” on page 17.)

Using the TVM and Amortization Variables

Because the calculator stores values assigned to the TVM variables until

you clear or change them, you should not have to perform all steps each

time you work a problem.

• To assign a value to a TVM variable, key in a number and press a TVM

key (,, -, ., /, 0).

• To change the number of payments (

number, and press !. To change the compounding periods (C/Y),

press &[ #, key in a number, and press !.

• To change the payment period (END/BGN), press & ], and then

press & V.

• To compute a value for the unknown variable, press %, and then

press the key for the unknown variable.

22 Time-Value-of-Money and Amortization Worksheets

P/Y), press &[, key in a

Page 27

• To generate an amortization schedule, press & \, enter the

first and last payment number in the range (

P1 and P2), and press "

or # to compute values for each variable (BAL, PRN, and INT).

Resetting the TVM and Amortization Worksheet Variables

• To reset all calculator variables and formats to default values

(including TVM and amortization variables), press & } !:

Variable Default Variable Default

N

I/Y

PV

PMT

FV

P/Y

C/Y

0

0

0

0

0

1

1

END/BGN END

P1

P2

BAL

PRN

INT

1

1

0

0

0

• To reset only the TVM variables (

N, I/Y, PV, PMT, FV) to default values,

press & ^.

• To reset P/Y and C/Y to default values, press & [ & z.

• To reset the Amortization worksheet variables (P1, P2, BAL, PRN,

INT) to default values, press & z while in the Amortization

worksheet.

• To reset END/BGN to the default value, press & ] & z.

Clearing the Unused Variable

For problems using only four of the five TVM variables, enter a value of

zero for the unused variable.

For example, to determine the present value (

PV) of a known future

value (FV) with a known interest rate (I/Y) and no payments, enter 0 and

PMT.

press

Entering Positive and Negative Values for Outflows and

Inflows

Enter negative values for outflows (cash paid out) and positive values for

inflows (cash received).

Note: To enter a negative value, press S after entering the number. To

change a negative value to positive, press S.

Time-Value-of-Money and Amortization Worksheets 23

Page 28

Entering Values for I/Y, P/Y, and C/Y

•Enter I/Y as the nominal interest rate. The TVM worksheet

automatically converts

P/Y and C/Y.

I/Y to a per period rate based on the values of

• Entering a value for P/Y automatically enters the same value for C/Y.

(You can change C/Y.)

Specifying Payments Due With Annuities

Use END/BGN to specify whether the transaction is an ordinary annuity

or an annuity due.

•Set

END for ordinary annuities, in which payments occur at the end

of each payment period. (This category includes most loans.)

•Set BGN for annuities due, in which payments occur at the beginning

of each payment period. (This category includes most leases.)

Note: When you select beginning-of-period payments, the BGN indicator

appears. (No indicator appears for END payments.)

Updating P1 and P2

To update P1 and P2 for a next range of payments, press % with P1 or

P2 displayed.

Different Values for BAL and FV

The computed value for BAL following a specified number of payments

might be different than the computed value for FV following the same

number of payments.

• When solving for

BAL, PRN, and INT, the calculator uses the PMT

value rounded to the number of decimal places specified by the

decimal format.

• When solving for FV, the calculator uses the unrounded value for

PMT.

Entering, Recalling, and Computing TVM Values

• To enter a TVM value, key in the value and store it by pressing a TVM

key (,, -, ., /, 0).

• To display a stored TVM value, press J and a TVM key.

You can enter or recall a value for any of the five TVM variables (

PV, PMT, or FV) in either the standard calculator mode or a worksheet

mode. The information displayed depends on which mode is selected.

• In standard calculator mode, the calculator displays the variable

label, the = sign, and the value entered or recalled.

24 Time-Value-of-Money and Amortization Worksheets

N, I/Y,

Page 29

• In worksheet modes the calculator displays only the value you enter

or recall, although any variable label previously displayed remains

displayed.

Note: You can tell that the displayed value is not assigned to the

displayed variable, because the = indicator is not displayed.

To compute a TVM value, press % and a TVM key in standard-calculator

mode.

Using [xP/Y] to Calculate a Value for N

1. Key in the number of years, and then press & Z to multiply by

the stored

2. To assign the displayed value to

P/Y value. The total number of payments appears.

N for a TVM calculation, press ,.

Entering Cash Inflows and Outflows

The calculator treats cash received (inflows) as a positive value and cash

invested (outflows) as a negative value.

• You must enter cash inflows as positive values and cash outflows as

negative values.

• The calculator displays computed inflows as positive values and

computed outflows as negative values.

Generating an Amortization Schedule

The Amortization worksheet uses TVM values to compute an

amortization schedule either manually or automatically.

Generating an Amortization Schedule Manually

1. Press & \. The current P1 value appears.

2. To specify the first in a range of payments, key in a value for P1 and

press !.

3. Press #. The current P2 value appears.

4. To specify the last payment in the range, key in a value for P2 and

press !.

5. Press # to display each of the automatically computed values:

•

BAL— the remaining balance after payment P2

• PRN— the principal

• INT— the interest paid over the specified range

Time-Value-of-Money and Amortization Worksheets 25

Page 30

6. Press & \.

— or —

INT is displayed, press # to display P1 again.

If

7. To generate the amortization schedule, repeat steps 2 through 5 for

each range of payments.

Generating an Amortization Schedule Automatically

After entering the initial values for P1 and P2, you can compute an

amortization schedule automatically.

1. Press & \.

— or —

INT is displayed, press # to display the current P1 value.

If

2. Press %. Both

next range of payments.

The calculator computes the next range of payments using the same

number of periods used with the previous range of payments. For

example, if the previous range was 1 through 12 (12 payments),

pressing % updates the range to 13 through 24 (12 payments).

3. Press # to display

• If you press % with P1 displayed, a new value for P2 will be

displayed automatically. (You can still enter a new value for P2.)

• If you did not press % with P1 displayed, you can press %

with P2 displayed to enter values for both P1 and P2 in the next

range of payments.

4. Press # to display each of the automatically computed values for

BAL, PRN, and INT in the next range of payments.

5. Repeat steps 1 through 4 until the schedule is complete.

P1 and P2 update automatically to represent the

P2.

Example: Computing Basic Loan Interest

If you make a monthly payment of $425.84 on a 30-year mortgage for

$75,000, what is the interest rate on your mortgage?

To Press Display

Set payments per year to 12. & [

Return to standard-calculator

& U

12 !

mode.

Enter number of payments

30 & Z ,

using the payment multiplier.

26 Time-Value-of-Money and Amortization Worksheets

P/Y=

N=

12.00

0.00

360.00

Page 31

To Press Display

Enter loan amount. 75000 .

Enter payment amount.

425.84 S /

Compute interest rate. % -

PV=

PMT=

I/Y=

75,000.00

-425.84

5.50

Answer: The interest rate is 5.5% per year.

Examples: Computing Basic Loan Payments

These examples show you how to compute basic loan payments on a

$75,000 mortgage at 5.5% for 30 years.

Note: After you complete the first example, you should not have to reenter the values for loan amount and interest rate. The calculator saves

the values you enter for later use.

Computing Monthly Payments

To Press Display

Set payments per year to 12. & [

Return to standard-calculator

& U

mode.

Enter number of payments

30 & Z ,

using payment multiplier.

Enter interest rate.

Enter loan amount.

5.5 -

75000 .

Compute payment. % /

12 !

P/Y=

N=

I/Y=

PV=

PMT=

12.00

0.00

360.00

5.50

75,000.00

-425.84

õ

õ

Answer: The monthly payments are $425.84.

Computing Quarterly Payments

Note: The calculator automatically sets the number of compounding

periods (C/Y) to equal the number of payment periods (P/Y).

To Press Display

Set payments per year to 4. & [ 4 !

Return to standard-calculator

& U

mode.

Enter number of payments

30 & Z ,

using payment multiplier.

Time-Value-of-Money and Amortization Worksheets 27

P/Y=

N=

4.00

0.00

120.00

Page 32

To Press Display

Compute payment. % /

PMT=

-1,279.82

Answer: The quarterly payments are $1,279.82.

Examples: Computing Value in Savings

These examples show you how to compute the future and present values

of a savings account paying 0.5% compounded at the end of each year

with a 20-year time frame.

Computing Future Value

Example: If you open the account with $5,000, how much will you have

after 20 years?

To Press Display

Set all variables to defaults. & }

!

Enter number of payments. 20 ,

Enter interest rate.

Enter beginning balance.

.5 -

5000 S .

Compute future value. % 0

Answer: The account will be worth $5,524.48 after 20 years.

RST 0.00

N=

I/Y=

PV=

FV=

20.00

0.50

-5,000.00

5,524.48

Computing Present Value

Example: How much money must you deposit to have $10,000 in 20

years?

To Press Display

Enter final balance.

10000 0

Compute present value. % .

FV=

PV=

10,000.00

-9,050.63

Answer: You must deposit $9,050.63.

28 Time-Value-of-Money and Amortization Worksheets

Page 33

Example: Computing Present Value in Annuities

The Furros Company purchased equipment providing an annual savings

of $20,000 over 10 years. Assuming an annual discount rate of 10%, what

is the present value of the savings using an ordinary annuity and an

annuity due?

Cost Savings for a Present-Value Ordinary Annuity

Cost Savings for a Present-Value Annuity Due in a Leasing

Agreement

To Press Display

Set all variables to defaults. & } !

Enter number of payments. 10 ,

Enter interest rate per

10 -

RST

N=

I/Y=

0.00

10.00

10.00

payment period.

Enter payment.

Time-Value-of-Money and Amortization Worksheets 29

20000 S /

PMT=

-20,000.00

Page 34

To Press Display

Compute present value

% .

PV=

122,891.34

(ordinary annuity).

Set beginning-of-period

& ] & V

BGN

payments.

Return to calculator mode. & U 0.00

Compute present value

% .

PV=

135,180.48

(annuity due).

Answer: The present value of the savings is $122,891.34 with an ordinary

annuity and $135,180.48 with an annuity due.

Example: Computing Perpetual Annuities

To replace bricks in their highway system, the Land of Oz has issued

perpetual bonds paying $110 per $1000 bond. What price should you pay

for the bonds to earn 15% annually?

To Press Display

Calculate the present value for a

110 6 15 2 N

perpetual ordinary annuity.

Calculate the present value for a

H 110 N

perpetual annuity due.

Answer: You should pay $733.33 for a perpetual ordinary annuity and

$843.33 for a perpetual annuity due.

A perpetual annuity can be an ordinary annuity or an annuity due

consisting of equal payments continuing indefinitely (for example, a

preferred stock yielding a constant dollar dividend).

Perpetual ordinary annuity

733.33

843.33

30 Time-Value-of-Money and Amortization Worksheets

Page 35

Perpetual annuity due

Because the term (1 + I/Y / 100)-N in the present value annuity equations

approaches zero as N increases, you can use these equations to solve for

the present value of a perpetual annuity:

• Perpetual ordinary annuity

PMT

PV

• Perpetual annuity due

--------------------------- -

=

I/Y()100÷

PV PMT

PMT

----------------------------

+=

I/Y()100)⁄

Example: Computing Present Value of Variable Cash Flows

The ABC Company purchased a machine that will save these end-of-year

amounts:

Year

Amount

Time-Value-of-Money and Amortization Worksheets 31

1234

$5000 $7000 $8000 $10000

Page 36

Given a 10% discount rate, does the present value of the cash flows

exceed the original cost of $23,000?

To Press Display

Set all variables to defaults. & }

!

Enter interest rate per cash flow

10 -

period.

Enter 1st cash flow.

Enter 1st cash flow period.

Compute present value of 1st cash

5000 S 0

1 ,

% .

flow.

Store in

M1. D 1

Enter 2nd cash flow. 7000 S 0

Enter 2nd cash flow period.

Compute present value of 2nd

2 ,

% .

cash flow.

Sum to memory. D H

1

Enter 3rd cash flow. 8000 S 0

Enter period number.

Compute present value of 3rd

3 ,

% .

cash flow.

Sum to memory. D H 1

Enter 4th cash flow. 10000 S 0

Enter period number.

4 ,

RST 0.00

I/Y=

FV=

N=

PV=

FV=

N=

PV=

FV=

N=

PV= 6,010.52

FV=

N=

10.00

-5,000.00

1.00

4,545.45

4,545.45

-7,000.00

2.00

5,785.12

5,785.12

-8,000.00

3.00

6,010.52

-10,000.00

4.00

32 Time-Value-of-Money and Amortization Worksheets

Page 37

To Press Display

Compute present value of 4th

cash flow.

Sum to memory. D H

Recall total present value. J 1

Subtract original cost. B 23000 N 171.23

Answer: The present value of the cash flows is $23,171.23, which exceeds

the machine’s cost by $171.23. This is a profitable investment.

Note: Although variable cash flow payments are not equal (unlike

annuity payments), you can solve for the present value by treating the

cash flows as a series of compound interest payments.

The present value of variable cash flows is the value of cash flows

occurring at the end of each payment period discounted back to the

beginning of the first cash flow period (time zero).

% .

1

PV=

6,830.13

6,830.13

23,171.23

Example: Computing Present Value of a Lease With Residual Value

The Peach Bright Company wants to purchase a machine currently leased

from your company. You offer to sell it for the present value of the lease

discounted at an annual interest rate of 22% compounded monthly. The

machine has a residual value of $6500 with 46 monthly payments of

$1200 remaining on the lease. If the payments are due at the beginning

of each month, how much should you charge for the machine?

Time-Value-of-Money and Amortization Worksheets 33

Page 38

The total value of the machine is the present value of the residual value

plus the present value of the lease payments.

To Press Display

Set all variables to defaults. & } !

Set beginning-of-period

& ] & V

RST 0.00

BGN

payments.

Return to standard-calculator

& U 0.00

mode.

Enter number of payments.

Calculate and enter periodic

46 ,

22 6 12 N -

N=

I/Y=

46.00

1.83

interest rate.

Enter residual value of asset.

6500 S 0

Compute residual present value. % .

Enter lease payment amount.

Compute present value of lease

1200 S /

% .

FV=

PV=

PMT=

PV=

-6,500.00

2,818.22

-1,200.00

40,573.18

payments.

Answer: Peach Bright should pay your company $40,573.18 for the

machine.

Example: Computing Other Monthly Payments

If you finance the purchase of a new desk and chair for $525 at 20% APR

compounded monthly for two years, how much is the monthly payment?

To Press Display

Set all variables to defaults. & } !

Set payments per year to 12. & [ 12 !

34 Time-Value-of-Money and Amortization Worksheets

RST 0.00

P/Y=

12.00

Page 39

To Press Display

Return to standard-calculator

& U

0.00

mode

Enter number of payments using

2 & Z ,

N=

24.00

payment multiplier.

Enter interest rate.

Enter loan amount.

20 -

525 .

Compute payment. % /

Answer: Your monthly payment is $26.72.

I/Y=

PV=

PMT=

20.00

525.00

-26.72

Example: Saving With Monthly Deposits

Note: Accounts with payments made at the beginning of the period are

referred to as annuity due accounts. Interest begins accumulating earlier

and produces slightly higher yields.

You invest $200 at the beginning of each month in a retirement plan.

What will the account balance be at the end of 20 years, if the fund earns

an annual interest of 7.5 % compounded monthly, assuming beginningof-period payments?

To Press Display

Set all variables to defaults. & } !

Set payments per year to 12. & [ 12 !

Set beginning-of-period

& ] & V

RST 0.00

P/Y=

BGN

12.00

payments.

Return to standard-calculator

& U

0.00

mode.

Time-Value-of-Money and Amortization Worksheets 35

Page 40

To Press Display

Enter number of payments

20 & Z ,

N=

240.00

using payment multiplier.

Enter interest rate.

Enter amount of payment.

7.5 -

200 S /

Compute future value. % 0

I/Y=

PMT=

FV=

7.50

-200.00

111,438.31

Answer: Depositing $200 at the beginning of each month for 20 years

results in a future amount of $111,438.31.

Example: Computing Amount to Borrow and Down Payment

You consider buying a car for $15,100. The finance company charges

7.5% APR compounded monthly on a 48-month loan. If you can afford a

monthly payment of $325, how much can you borrow? How much do

you need for a down payment?

To Press Display

Set all variables to defaults. & } !

Set payments per year to 12. & [ 12

RST

P/Y=

0.00

12.00

!

Return to standard-calculator

& U

0.00

mode

Enter number of payments using

4 & Z ,

N=

48.00

payment multiplier.

Enter interest rate.

Enter payment.

36 Time-Value-of-Money and Amortization Worksheets

7.5 -

325 S /

I/Y=

PMT=

-325.00

7.50

Page 41

To Press Display

Compute loan amount. % .

Compute down payment H

15,100 S N

PV=

13,441.47

-1,658.53

Answer: You can borrow $13,441.47 with a down payment of $1,658.53.

Example: Computing Regular Deposits for a Specified Future Amount

You plan to open a savings account and deposit the same amount of

money at the beginning of each month. In 10 years, you want to have

$25,000 in the account.

How much should you deposit if the annual interest rate is 0.5% with

quarterly compounding?

Because C/Y (compounding periods per year) is automatically set

Note:

to equal P/Y (payments per year), you must change the C/Y value.

To Press Display

Set all variables to defaults. & } !

Set payments per year to 12. & [ 12 !

Set compounding periods to 4. #

Set beginning-of-period

4 !

& ] & V

RST 0.00

P/Y=

C/Y=

BGN

12.00

4.00

payments.

Return to standard-calculator

& U

0.00

mode.

Enter number of deposits using

10 & Z ,

N=

120.00

payment multiplier.

Enter interest rate.

Enter future value.

.5 -

25,000 0

Compute deposit amount. % /

I/Y=

FV=

PMT=

0.50

25,000.00

-203.13

Answer: You must make monthly deposits of $203.13.

Time-Value-of-Money and Amortization Worksheets 37

Page 42

Example: Computing Payments and Generating an Amortization Schedule

This example shows you how to use the TVM and Amortization

worksheets to calculate the monthly payments on a 30-year loan and

generate an amortization schedule for the first three years of the loan.

Computing Mortgage Payments

Calculate the monthly payment with a loan amount of $120,000 and

6.125% APR.

To Press Display

Set all variables to defaults. & } !

Set payments per year to 12. & [ 12 !

Return to standard-calculator

& U

mode.

Enter number of payments

30 & Z ,

using payment multiplier.

Enter interest rate.

Enter loan amount.

6.125 -

120000 .

Compute payment. % /

Answer: The computed monthly payment, or outflow, is $729.13.

RST 0.00

P/Y=

N=

I/Y=

PV=

PMT=

12.00

0.00

360.00

6.13

120,000.00

-729.13

*

Generating an Amortization Schedule

Generate an amortization schedule for the first three years of the loan. If

the first payment is in April, the first year has nine payment periods.

(Following years have 12 payment periods each.)

To Press Display

Select the Amortization worksheet. & \

Set beginning period to 1. 1 !

Set ending period to 9. # 9 !

Display 1st year amortization data. #

#

#

Change beginning period to 10. #

Change ending period to 21. #

38 Time-Value-of-Money and Amortization Worksheets

10 !

21 !

P1= 0

P1=

P2=

BAL=

PRN=

INT=

P1=

P2=

118,928.63

1.00

9.00

-1071.37*

-5,490.80*

10.00

21.00

*

Page 43

To Press Display

Display 2nd year amortization data. #

#

#

Move to

P1 and press % to enter

# %

BAL=

PRN=

INT=

P1=

117,421.60

_-1,507.03*

-7,242.53*

22.00

next range of payments.

Display

P2. #

Display 3rd year amortization data. #

#

#

P2=

BAL=

PRN=

INT=

33.00

115,819.62

-1601.98*

-7,147.58*

Example: Computing Payment, Interest, and Loan Balance After a Specified Payment

A group of sellers considers financing the sale price of a property for

$82,000 at 7% annual interest, amortized over a 30-year term with a

balloon payment due after five years. They want to know:

• Amount of the monthly payment

• Amount of interest they will receive

• Remaining balance at the end of the term (balloon payment)

Computing the Monthly Payment

*

*

To Press Display

Set all variables to defaults. & } !

Set payments per year to 12. & [

Return to standard-calculator

& U 0.00

12 !

RST

P/Y=

0.00

12.00

mode.

Enter number of payments

30 & Z ,

N=

360.00

using payment multiplier.

Enter interest rate.

Enter loan amount.

7 -

82000 .

Compute payment. % /

Time-Value-of-Money and Amortization Worksheets 39

I/Y=

PV=

PMT=

7.00

82,000.00

-545.55

Page 44

Generating an Amortization Schedule for Interest and

Balloon Payment

To Press Display

Select Amortization worksheet. & \

Enter end period (five years). #

View balance due after five

5 & Z !

#

years (balloon payment).

View interest paid after five

# #

years.

If the sellers financed the sale, they would receive:

• Monthly payment: $545.55 for five years

• Interest: $27,790.72 over the five years

• Balloon payment: $77,187.72

P1=

P2=

BAL=

INT=

60.00

77,187.72

-27,920.72

1.00

40 Time-Value-of-Money and Amortization Worksheets

Page 45

Cash Flow Worksheet

Use the Cash Flow worksheet to solve problems with

unequal cash flows.

To solve problems with equal cash flows, use the TVM

worksheet. (See “Time-Value-of-Money and Amortization

Worksheets” on page 21.)

• To access the Cash Flow worksheet and initial cash

flow value (

• To access the cash flow amount and frequency

variables (Cnn/Fnn), press # or ".

• To access the discount rate variable (

CFo), press '.

3

I), press (.

• To compute net present value (

% for each variable.

• To compute the internal rate of return (

•

NPV), press # or " and

IRR), press ).

Cash Flow Worksheet Variables

Variable Key Display Variable

Type **

Initial cash flow '

Amount of nth cash flow

Frequency of nth cash flow

Discount rate (

Net present value # %

Internal rate of return )%

* nn represents the cash flow (C01–C24) or frequency (F01–F24)

number.

#

#

CFo

Cnn* Enter-only

Fnn* Enter-only

I

NPV

IRR

Enter-only

Enter-only

Compute-only

Compute-only

Cash Flow Worksheet 41

Page 46

** This guidebook categorizes variables by the method of entry. (See

“Types of Worksheet Variables

” on page 17.)

Resetting Variables

• To reset CFo, Cnn, and Fnn to default values, press ' and then

&z.

• To reset NPV to the default value, press ( and then &z.

• To reset IRR to the default value, press ) and then &z.

• To reset all calculator variables and formats to default values,

including all Cash Flow worksheet variables, press &} !.

Entering Cash Flows

• You must enter an initial cash flow (CFo). The calculator accepts up

to 24 additional cash flows (C01–C24). Each cash flow can have a

unique value.

• Enter positive values for cash inflows (cash received) and negative

values for cash outflows (cash paid out). To enter a negative value,

key in a number and press S.

Inserting and Deleting Cash Flows

The calculator displays INS or DEL to confirm that you can press &X

or & W to insert or delete cash flows.

Uneven and Grouped Cash Flows

Uneven Cash Flows

The Cash Flow worksheet analyzes unequal cash flows over equal time

periods. Cash-flow values can include both inflows (cash received) and

outflows (cash paid out).

All cash-flow problems start with an initial cash flow labeled

always a known, entered value.

42 Cash Flow Worksheet

CFo. CFo is

Page 47

Grouped Cash Flows

Cash-flow problems can contain cash flows with unique values as well as

consecutive cash flows of equal value.

Although you must enter unequal cash flows separately, you can enter

groups of consecutive, equal cash flows simultaneously using the

variable.

Fnn

Entering Cash Flows

Cash flows consist of an initial cash flow (CFo) and up to 24 additional

cash flows (C01-C24), each of which can have a unique value. You must

enter the number of occurrences (up to 9,999), or frequency (F), for each

additional cash flow (

• The calculator displays positive values for inflows (cash received) and

negative values for outflows (cash paid out).

• To clear the Cash Flow worksheet, press & z.

To enter cash flows:

1. Press '. The initial cash-flow value (

2. Key in a value for CFo and press !.

3. To select an additional cash-flow variable, press #. The C01 value

appears.

4. To change C01, key in a value and press !.

5. To select the cash-flow frequency variable (

value appears.

6. To change F01, key in a value and press !.

7. To select an additional cash-flow variable, press #. The C02 value

appears.

8. Repeat steps 4 through 7 for all remaining cash flows and

frequencies.

9. To review entries, press # or ".

C01-C24).

CFo) appears.

F01), press #. The F01

Deleting Cash Flows

When you delete a cash flow, the calculator decreases the number of

subsequent cash flows automatically.

Cash Flow Worksheet 43

Page 48

The DEL indicator confirms that you can delete a cash flow.

1. Press # or " until the cash flow you want to delete appears.

2. Press & W. The cash flow you specified and its frequency is

deleted.

Inserting Cash Flows

When you insert a cash flow, the calculator increases the number of the

following cash flows, up to the maximum of 24.

Note: The INS indicator confirms that you can insert a cash flow.

1. Press # or " to select the cash flow where you want to insert the

new one. For example, to insert a new second cash flow, select

2. Press & X.

3. Key in the new cash flow and press !. The new cash flow is

entered at

C02.

C02.

Computing Cash Flows

The calculator solves for these cash-flow values:

• Net present value (

including inflows (cash received) and outflows (cash paid out). A

positive NPV value indicates a profitable investment.

44 Cash Flow Worksheet

NPV) is the total present value of all cash flows,

Page 49

• Internal rate of return (IRR) is the interest rate at which the net

present value of the cash flows is equal to 0.

Computing NPV

1. Press ( to display the current discount rate (I).

2. Key in a value and press !.

3. Press # to display the current net present value (

NPV).

4. To compute the net present value for the series of cash flows

entered, press %.

Computing IRR

1. Press ). The IRR variable and current value are displayed (based on

the current cash-flow values).

2. To compute the internal rate of return, press %. The calculator

displays the IRR value.

When solving for IRR, the calculator performs a series of complex,

iterative calculations that can take seconds or even minutes to complete.

The number of possible IRR solutions depends on the number of sign

changes in your cash-flow sequence.

• When a sequence of cash flows has no sign changes, no

exists. The calculator displays

Error 5.

IRR solution

• When a sequence of cash flows has only one sign change, only one

IRR solution exists, which the calculator displays.

• When a sequence of cash flows has two or more sign changes:

– At least one solution exists.

– As many solutions can exist as there are sign changes.

Cash Flow Worksheet 45

Page 50

When more than one solution exists, the calculator displays the one

closest to zero. Because the displayed solution has no financial

meaning, you should use caution in making investment decisions

based on an

IRR computed for a cash-flow stream with more than

one sign change.

The time line reflects a sequence of cash flows with three sign

changes, indicating that one, two, or three

IRR solutions can exist.

• When solving complex cash-flow problems, the calculator might not

IRR, even if a solution exists. In this case, the calculator displays

find

Error 7 (iteration limit exceeded).

Example: Solving for Unequal Cash Flows

These examples show you how to enter and edit unequal cash-flow data

to calculate:

• Net present value (

NPV)

• Internal rate of return (IRR)

A company pays $7,000 for a new machine, plans a 20% annual return on

the investment, and expects these annual cash flows over the next six

years:

Year Cash Flow Number Cash Flow Estimate

Purchase

1

2–5

6

CFo

C01

C02

C03

-$7,000

3,000

5,000 each year

4,000

As the time line shows, the cash flows are a combination of equal and

unequal values. As an outflow, the initial cash flow (CFo) appears as a

negative value.

46 Cash Flow Worksheet

Page 51

Entering Cash-Flow Data

To Press Display

Select Cash Flow worksheet. '

Enter initial cash flow. 7000 S !

Enter cash flow for first year. #

3000 !

#

Enter cash flows for years

two through five.

Enter cash flow for sixth year. #

5000 !

#

4 !

#

4000 !

#

CFo= 0.00

CFo=

C01=

F01=

C02=

F02=

C03=

F03=

-7,000.00

3,000.00

1.00

5,000.00

4.00

4,000.00

1.00

Editing Cash-Flow Data

After entering the cash-flow data, you learn that the $4,000 cash-flow

value should occur in the second year instead of the sixth. To edit, delete

the $4,000 value for year 6 and insert it for year 2.

To Press Display

Move to third cash flow. "

Delete third cash flow. & W

Move to second cash flow. " "

Insert new second cash flow. & X

#

Move to next cash flow to

verify data.

#

#

4000 !

C03=

C03= 0.00

C02=

C02=

F02=

C03=

F03=

4,000.00

5,000.00

4,000.00

1.00

5,000.00

4.00

Cash Flow Worksheet 47

Page 52

Computing NPV

Use an interest rate per period (I) of 20%.

To Press Display

Access interest rate variable (

Enter interest rate per period. 20 !

Compute net present value. # %

I= 0.00

I=

NPV=

20.00

7,266.44

Answers:

NPV is $7,266.44.

Computing IRR

To Press Display

IRR. )

Access

Compute internal rate of return. # %

Answer: IRR is 52.71%.

IRR= 0.00

IRR=

52.71

Example: Value of a Lease with Uneven Payments

A lease with an uneven payment schedule usually accommodates

seasonal or other anticipated fluctuations in the lessee’s cash position.

A 36-month lease has the following payment schedule and beginning-ofperiod payments.

Number of Months Payment Amount

4$0

8 $5000

3$0

9 $6000

2$0

10 $7000

If the required earnings rate is 10% per 12-month period with monthly

compounding:

• What is the present value of these lease payments?

48 Cash Flow Worksheet

Page 53

• What even payment amount at the beginning of each month would

result in the same present value?

Because the cash flows are uneven, use the Cash Flow worksheet to

determine the net present value of the lease.

Computing NPV

The cash flows for the first four months are stated as a group of four $0

cash flows. Because the lease specifies beginning-of-period payments,

you must treat the first cash flow in this group as the initial investment

CFo) and enter the remaining three cash flows on the cash flow screens

(

(C01 and F01).

Note: The BGN/END setting in the TVM worksheet does not affect the

Cash Flow worksheet.

To Press Display

Set all variables to defaults. & } !

Select Cash Flow worksheet. '

Enter first group of cash flows. #

3 !

#

Enter second group of cash

flows.

Enter third group of cash

flows.

Enter fourth group of cash

flows.

5000 S !

#

# 8 !

#

#

3 !

6000 S !

#

9 !

#

Enter fifth group of cash flows. #

2 !

#

Enter sixth group of cash flows. #

7000 S !

# 10 !

NPV. (

Select

Cash Flow Worksheet 49

RST

CFo= 0.00

C01=

F01=

C02=

F02=

C03=

F03=

C04=

F04=

C05=

F05=

C06=

F06=

I= 0.00

0.00

0.00

3.00

-5000.00

8.00

0.00

3.00