Page 1

Secure MICR Printer

User’s Guide

Page 2

ST9720 Secure MICR

Printer

User’s Guide

Source Technolog i es , LLC

2910 Whitehall P ar k Drive

Charlotte, NC 28273

Phone: 1.800.9 22.8501

Fax: 704.969.7 595

www.sourcetech.com

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

Page 3

Copyright

Copyright

Copyright ©2013 by Source Technologies, LLC. All rights reserved.

No part of this document may be reproduced or utilized in any form or by any means,

electronic or mechanical, including photocopying, recording, or by any information

storage and retrieval system, without permission in writing from Source Technologies,

LLC.

Published in the United States of America by:

Source Technologies, LLC

2910 Whitehall Park Drive

Charlotte, NC 28273

Author: Source Technologies, LLC

Notice

This manual serves as a reference for a Source Technologies’ secure MICR printer.

This manual should be used as a reference for learning more about MICR technology

and developing MICR printing applications. This guide was produced to assist IS

technicians and engineers in the integration of Source Technologies’ programmed

printers with their custom MICR applications. The guide also contains information on

MICR related error messages that post to the operator panel.

To the best of our knowledge, the information in this publication is accurate: however,

neither Source Technologies, LLC nor its dealers or affiliates assume any responsibility

or liability for the accuracy or completeness of, or consequences arising from, such

information. Changes, typos, and technical inaccuracies will be corrected in subsequent

publications. This publication is subject to change without notice. The information and

descriptions contained in this manual cannot be copied, disseminated, or distributed

without the express written consent of Source Technologies, LLC. This document is

intended for informational purposes only. Mention of trade names or commercial

products does not constitute endorsement or recommendation for use by Source

Technologies, LLC. Final determination of the suitability of any information or product for

use contemplated by any user, and the manner of that use is the sole responsibility of

the user. We recommend that anyone intending to rely on any recommendation of

materials or procedures mentioned in this publication should satisfy himself as to such

suitability, and that he can meet all applicable safety and health standards.

All trade names or products used in this manual are for identification purposes only and

may be trademarks or registered trademarks of their respective companies.

Document Number: SP1001UG

Revision: A

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

Page 4

Table of Contents

Table of Contents

1. MICR Overview ....................................................................................................... 2

The Check Clearing System ........................................................................................ 2

MICR Printing Standards in the United States Today .................................................. 2

2. MICR Check Design ............................................................................................... 4

General Features of Check Design.............................................................................. 4

Position and Dimension Gauge ................................................................................... 4

Design Elements in Detail ........................................................................................... 4

Data Elements ............................................................................................................. 5

3. Quality Issues ......................................................................................................... 9

Printer Features ......................................................................................................... 10

MICR Toner ............................................................................................................... 10

MICR Check Stock .................................................................................................... 10

4. Security Issues ..................................................................................................... 12

5. MICR Features ...................................................................................................... 14

MICR Mo d e ............................................................................................................... 14

MICR Fonts ............................................................................................................... 14

Secure Fonts ............................................................................................................. 14

MicroPrint .................................................................................................................. 14

Bi-Directional Feedback ............................................................................................ 15

Resource Storage ..................................................................................................... 16

MICR Me n u ............................................................................................................... 16

Entering MICR Mode ................................................................................................. 17

MICR Mode Commands ............................................................................................ 18

DES and AES Decryption .......................................................................................... 22

Custom Character Conversion Command ................................................................. 24

MICRpoint Feature .................................................................................................... 25

6. Host Programming Features and Examples....................................................... 27

Hex Transfer ............................................................................................................. 27

Escape Character Translation ................................................................................... 31

7. Audit Trail Reports ............................................................................................... 33

Report Details ........................................................................................................... 33

Audit Trail Menu ........................................................................................................ 33

Audit Location ........................................................................................................... 33

Audit Record Sorting ................................................................................................. 33

Overlay ...................................................................................................................... 33

Sum Field 4 ............................................................................................................... 33

Print Audit Report ...................................................................................................... 34

8. Error Messages .................................................................................................... 43

Appendix A: E13B MICR Font Mapping ..................................................................... 47

Appendix B: CMC7 MICR Font Mapping .................................................................... 48

Appendix C: Secure Numeric Font Mapping ............................................................. 50

Appendix D: ICR Secure Numeric Font Mapping ...................................................... 53

Appendix E: MICR Mode Command Summary .......................................................... 54

Appendix F: Audit Report Command Summary ........................................................ 55

Appendix G: PJL Based MICR Commands ................................................................ 56

PJL MICRJOB ........................................................................................................... 56

Fonts and Secured Resources .................................................................................. 57

PJL Unlock Sequence ............................................................................................... 57

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

Page 5

PJL Re-Lock Sequence ............................................................................................. 57

PJL Re-Lock Sequence With A New Password Value ............................................... 57

PCL Font Call Commands ......................................................................................... 58

MICR Font Note ........................................................................................................ 58

PJL MICR Command Example .................................................................................. 59

PJL Unlock Sequence ............................................................................................... 59

PCL Initial Set-Up ...................................................................................................... 59

PCL Macro Call ......................................................................................................... 59

PCL Font Calls, Positioning Commands and Variable Print Data .............................. 59

PJL Re-Lock Sequence ............................................................................................. 60

Appendix H: Accounts Payable .................................................................................. 61

Photoconductor Kit Replacement Guide…………………………………………………63

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

Page 6

1. MICR Overv iew

MICR Overview | 1

MICR stands for Magnetic Ink Character Recognition. All MICR documents have a MICR

line with numbers and symbols printed in a unique MICR font with magnetically

chargeable ink or toner. Each character of the MICR font has a unique waveform when

sensed magnetically. Financial institutions and the Federal Reserve use the MICR line to

identify and sort checks. The high-speed automated processing of checks and other

financial documents depends on the accuracy and the integrity of the data printed in the

MICR line. Your new Source Technologies Secure MICR Printer is specifically designed

to produce high quality MICR documents.

The Check Clearing System

The Check Clearing for the 21st Century Act (Check 21) was signed into law October 28,

2003. Prior to Check 21, checks traveled through the bank’s high speed reader/sorter

equipment an average of near seven times in the Check Clearing process. Some checks

could be read up to 30 times or more by these machines.

In today’s environment high and low speed check readers can capture a picture or

image of the check allowing for images to be exchanged between financial institutions,

the Federal Reserve, and other clearing houses. This new law, Check 21, defines what

is called a “Substitute Check”, and removed barriers that existed in converting physical

checks to check images for clearing. The original physical check can now be truncated

by the first institution that converts the check to image. The original check can now be

destroyed.

United States and International MICR Standards still require the printed MICR line

information to be of the highest quality and durability, and be printed with magnetic ink or

toner. Additionally, issues related to check fraud continue to place high importance on

print quality. For these reasons, the quality and durability of information printed with

Source Technologies’ Secure MICR Printers remains a key new product development

criterion.

MICR Printing Standards in the United States Today

Congress established the Federal Reserve System (FRS) in 1913. Today most

commercial banks in the United States belong to the FRS. Many other depository

institutions provide banking and checking account services to the public. These other

institutions, such as some credit unions, savings and loan associations and non-member

banks, are not formally part of the FRS. However, they have access to the payment

services it provides and are subject to many of the FRS regulations.

In 1958, because of the explosive growth of check usage, the American Bankers

Association selected the E-13B MICR font and the MICR system as the technology for

high-speed check processing. Today, check standards are determined by the Accredited

Standards Committee X9AB Payments Subcommittee of which Source Technologies is

a voting member. The latest versions of the standards and technical guidelines are

available from:

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

2

Page 7

Hardcopy: Softcopy:

MICR Overview | 1

Global Engineering Documents X9 Electronic Bookstore

Phone 800-854-7179 or 303-397-7956 www.X9.org - click ESS

Fax 303-397-2740 www.ansi.org - click ESS

global@ihs.com or

http://global.ihs.com http://webstore.ansi.org

The key standards that address check documents are as follows:

ANSI X9.100-160 Specifications for Placement and Location of MICR Printing

ANSI X9.100-10 Paper Specifications for Checks

ANSI X9.100-20 Print and Test Specifications for Magnetic Ink Character Recognition

ANSI X9.100-30 Optical Background Measurements for MICR Documents

ANSI X9.100-110 Document Imaging Capability

For those with an interest or need there are also US standards that address Deposit

Tickets, Check Endorsements (the back of the check), image interchange file formats,

and other MICR areas.

Users of our Secure MICR Printers are not required to have access to the above

standards. Our Technical Support staff maintains current knowledge of the standards

and changes that affect the check industry in the US and other countries with unique

requirements.

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

3

Page 8

2. MICR Check Design

MICR Check Design | 2

General Features of Check Design

To be a legal and negotiable document, the necessary data elements required on a

check are the date, amount, payee name, payer’s bank name, and payer’s signature.

Other elements included in a good check design are: the amount in words, account title,

check serial number, fractional routing number and MICR line.

A good check design contains security features and is formatted to be easily read by

both machines and the human eye. If the format is complicated, the depositor, bank

employee or reader/sorter machine may make an error in reading the data.

Position and Dimension Gauge

A MICR position and dimension gauge, like the one available from Source Technologies

(part number 205-1000MGE or 220-M1027-34, is an important tool for use in designing

checks. During check design, check your output against this gauge to determine if the

data elements (date, amount, payee name, payer’s bank name, and payer’s signature)

are correctly positioned on your document.

Design Elements in Detail

Paper

The ideal paper for check production is 24 to 28 lb. laser bond. Source

Technologies’ MICR lab has tested paper stock from most major manufacturers

and has compiled a list of products that produce superior results. Contact your

sales representative for this information. For a fee, Source Technologies will test

your paper for proper MICR adherence and check reader/sorter performance.

There are also many security features available to aid in the overall security of

your MICR documents. Please refer to Chapter 5, Security Issues, for more

information on check stock specifications and security features.

Size

The size of check documents must be:

6.00 inches to 8.75 inches in length

2.75 inches to 3.66 inches in height

We recommend standard 8.5" X 11" letter size stock or 8.5" X 14" legal size

stock for proper feeding through your ST Secure MICR Printer. The number of

checks per page is determined by your application. Custom size stock other than

letter or legal can be done with proper planning and application programming

within the paper size specifications for the base printer.

MICR Clear Band

The MICR clear band is an area at the bottom of the check where the MICR line

prints. No other magnetic printing should appear in this area on both the front

and back of the document. The clear band is an area 0.625 (5/8) inches high

from the bottom of the check running the entire length of the check. Exact MICR

line placement in this area is very important. Please refer to Figure 3.1 for more

information on MICR line placement.

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

4

Page 9

Data Elements

MICR Check Design | 2

Date

The date is a required data element for a check. It represents the day upon which

or aft er which the tr ansfer of the check amount may take place. The date is

usually placed in the upper right portion of the check so it does not interfere with

the convenience amount field. The common format is Month, Day and Year,

however, the military format of Day, Month and Year is also acceptable.

Amount

The amount of the check is a required data element for negotiation. The amount

usually appears at least twice on the check. The amount printed in numbers is

called the convenience amount. The amount printed in words is sometimes

refer red to as the lega l amount; t his is the amount that applies if there is a

difference between the two amount fields. The amount may also be printed a

third time on the check in a secure font, intended to make alteration of the

amount field difficult. Please refer to Chapter 6 and Appendix B for information on

Source Technologies’ Secure Numeric Font.

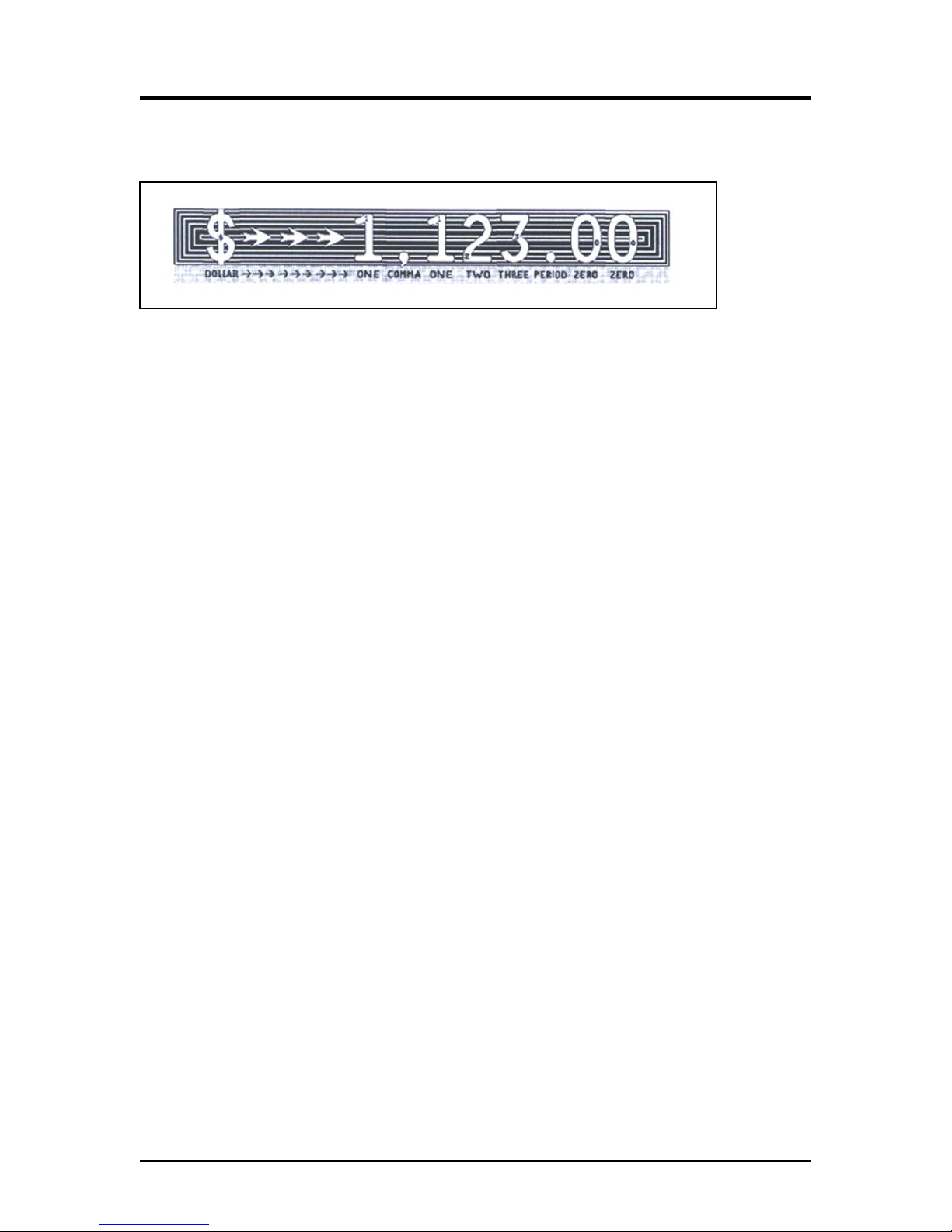

Convenience Amount

The convenience amount location is specified in ANSI X9.100-110. The basic

location is illustrated in Figure 3.1. Since this amount can be machine scanned,

its location and design should be kept within the specifications. The amount

beginning with the dollar sign should be left justified within the scan area with

numbers spaced normally to the right. The dollars and cents should be

separated by a decimal point with the cents printed in the same size font as the

rest of the field. Embedded commas should not be used. The convenience

amount background should have good reflectance so it does not interfere with

optical scanning.

The convenience amount should be printed in a simple, fixed pitch font. We

recommend our ICR Secure Numeric Font (see Appendix C). It was designed to

be easily read by image capture equipment and is also a fraud deterrent. A fixed

pitch courier font, or if available, OCR-B, are also acceptable fonts to print the

convenience amount.

Note: The Source Technologies’ Secure Numeric Font (see Appendix B)

should not be used in the convenience amount since it is not a machine

readable font.

Amount in Words

The amount in words (sometimes called the legal amount) is normally located

either above or below and to the left of the convenience amount. The area for

the amount in words should be entirely filled to make alterations difficult. The

amount should start at the far left of the line with the words placed immediately

adjacent to each other. The cents need not be written out. They may be

expressed as a fraction (60/100), and should be placed immediately to the right

of the dollar amount and followed by a line or other space filler to inhibit

alteration.

Example: One hundred forty-four and 62/100---------------DOLLARS

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

5

Page 10

Given the available area on the document, you may need to use a smaller font

MICR Check Design | 2

when printing larger value amounts.

Payee Area

The payee is a necessary data element for a negotiable document. The payee

area is generally to the left side of the document either above or below the

amount in words. It is often preceded by the words “Pay to the Order Of.” The

payee data should not enter the MICR clear band which extends 5/8 of an inch

above the bottom of the check. Some financial institutions have established

specific print requirements for the Payee Name and optional address. Consult

your bank for details on their print requirements.

Signature Area

A sign ature is a requir ed data element for a negotiable document. The signature

or signatures authorize the bank to honor the check; therefore, it must match the

bank’s records. The signature area should be beneath the convenience amount

area but the signatures should not enter the convenience amount area or the

MICR clear band. This is especially true if you print the signature with MICR

toner.

Drawee Institution Name

The name of the institution where the maker’s account is located is referred to as

the drawee institution. The bank’s name, city, and state are required.

Account Title

The account title is normally printed in the upper left corner of the check. It

includes the name of the account holder and other information such as

addresses, telephone numbers, and logos. The data in the title should be legible

and sufficiently complete so that if the MICR data account number is destroyed,

the drawee institution can refer to the account title in order to trace the account

number.

Memo Line

This line is located in the lower left quadrant of the check, and is not required.

Data printed here does not contain any legal significance. Printing in this area

with magnetic toner should not extend downward into the MICR clear band which

is 5/8 of an inch above the bottom of the check.

Check Serial Number

The check serial number is generally printed in the upper right quadrant of the

check. Although the check number is not required for the check to be negotiable,

the account holder and financial institution use these numbers to reconcile

statements and execute stop payments. The check serial number should also

appear a second time in the MICR line, and these numbers should match. The

number of digits in the check serial number is controlled by the financial

institution and the MICR line format. Consult your banking institution for their

requirements.

Fractional Routing Number

The fractional routing number should be printed in a fractional format in the upper

right quadrant of the check. This number is assigned to identify the Federal

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

6

Page 11

MICR Check Design | 2

Reserve District and drawee institution. Consult with your bank for the proper

routing number and format for each of your accounts.

MICR Line

Accurate high-speed processing of your checks by financial institutions is

enabled by the accuracy and integrity of the data in the MICR line. Refer to

figure 3.1 for the location of the following MICR line fields. The MICR line is read

from right-to-left with position one being the right most position proceeding to

position sixty-five on the left. The MICR line must be printed at exactly eight

characters per inch.

Auxiliary On-Us Field—Positions 65 to 45

This field usually contains the check serial number for commercial size checks

and possibly account control information. It is bounded by On-Us symbols

. It is not included on personal, small size checks.

External Processing Code (EPC) Field—Position 44

This one digit field is position 44 of the MICR line. This field is usually left

blank. The use of this field is reserved and is controlled by the ASC X9AB

Standards Committee.

Routing Field—Positions 43 to 33

The routing field is bounded by Transit symbols in positions 43 and 33. It

contains fixed format i nformation about the drawee institution. Consult with

your bank for the specific data field to be placed here for each of your

accounts.

On-Us Field —Positi ons 32 to 14

The On-Us f ield contains the makers’ account number. The structure and

content of this field is left to the drawee bank. On personal checks this field

also contains the check serial numbers. The On-Us field may not consist of

more than 19 characters. An On-Us symbol must appear immediately to

the right of the account number.

Blank Field—Position 13

Position 13 is always left blank.

Amount Field—Positions 1 to 12

The amount field is the right most field in the MICR line. It remains blank until

it is printed by the bank of first deposit. When the check enters the banking

system, the bank of first deposit encodes this field from data in the

convenience amount field. It will be bounded by Amount symbols .

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

7

Page 12

Figure 2.1: Sample Check

MICR Check Design | 2

A. Serial Number: Must be in the upper right corner and match the serial number in the

MICR line (see D for further explanation).

B. Fractional Routing Transit Number: Should be in the upper right corner and must

match the routing transit number in the MICR line with the exception of the state

prefix number (ex. 66 = NC, 67 = SC, 64 = GA, etc.) and the preceding zeros.

C. Bank Name, State, City: The bank logo is optional. Name of bank, city and state

where the account will be assigned/opened are required fields.

D. Aux On-Us (46-55): This is a required field if the customer desires services offered

by the bank which require a serial number. The serial number format is controlled by

the payer’s bank. A & D should match.

E. Routing Number (34-42): Designates the Federal Reserve district and financial

institution. Each city, state or region that the bank serves has a unique institution

identifier. IMPORTANT: positions 35-42 are the Routing Numbers; position 34 is the

check digit.

F. Account Number: This is a unique number assigned to the customer’s account.

G. Optional Serial Number: Used for personal accounts (checks only). This should be

a 4-digit, zero-filled field that matches the serial number in the upper right corner.

H. Convenience Amount Area: should be in the general location shown above in the

diagram. The illustrated box in the diagram is optional and if used, should conform

to ANSI X9.100-110. A single vertical stroke dollar sign is required.

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

8

Page 13

3. Quality Issues

Quality Issues | 3

A high quality MICR document can be read by bank reader/sorter equipment many times

with no readability issues and does not result in damage to bank equipment. This quality

is the result of a well-designed printer, an originally manufactured MICR toner and highquality check stock.

MICR Printing Supplies

The ST9720 Secure MICR Printer has two user replaceable MICR components relative

to printing MICR documents. Both components must be MICR capable units and be

installed in the printer as a paired set.

MICR Cartridge

There are two size versions of the ST MICR cartridge. A new printer ships with a

5K or 5,000 page yield cartridge. Both 5K and 12K versions can be ordered for

replacement. The cartridge yield is based on printing pages at an average print

coverage of 5% in continuous printing mode. The yield claim has been certified

by the procedures governed by the international standard ISO 19752.

Print applications that are more transactional and averaging near 5% coverage

but nearer to a 1 to 3 page average print job, will see yield nearer to 85 to 95% of

the stated yield. When the printer alerts the user that 0 pages remain and a new

cartridge is needed, the cartridge is empty.

MICR Imaging Unit or IU

The imaging unit contains a majority of the components needed to transfer an

image to paper. The unit also contains a Refuse Bin f or st oring any waste toner

cleaned from the photoconductor or OPC. In terms of component wear and

waste capacity, the IU useful life should be near 40K or 40,000 pages or sides

assuming some duplex printing. The 40K is based on an average print coverage

of 5% and an average print job size of three pages or page sides. Lower actual

average print coverage and/or a larger average page count per job may increase

the useful life of the IU. Higher actual average print coverage above 5% and/or a

smaller average page count below three will shorten the useful life. Internally, the

printer automatically adjusts unit alarms or replacement alerts based on the

actual printing factors. If the actual print averages extend the useful life beyond

the 40K page forecast, the printer will not exceed 60K due to wear OPC factors.

The printer will stop printing and request a new unit.

Interchanging MICR and non-MICR Components

For non-MICR print jobs the MICR cartridge and IU can be replaced with

standard Lexmark components. Both units must be swapped as a pair. A

“mismatched cartridge and imaging unit” error will occur if only one component is

swapped. Extra care should be taken with protecting components from damage

when not installed in the printer. All internal end-of-life tracking informati on is kept

separate for all components in the printer and matched to the appropriate

component serial numbers.

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

9

Page 14

Quality Issues | 3

Printer Features

Your secure MICR printer is equipped with some features to ensure high-quality MICR

documents.

Paper Type

When the printer senses the presence of a Source Technologies’ MICR toner

cartridge, internal operating points that affect the print engine and fuse grade are

optimized for MICR documents and the MICR toner. For the optimum MICR

quality we recommend that the printer paper trays with check paper have the

Paper / Texture / Weight settings set to Bond / Rough / Heavy. See the base

printer’s User’s Guide regarding paper tray settings.

Print Density

For optimum MICR quality and maintaining compliance to the check printing

standards, the Print Density should be set to density 8, the default value, when

printing MICR documents.

MICR Toner and Imaging Unit (IU) nearing end-of-life

Internal alarms are set to alert the end user that the print cartridge or IU is

approaching the end of useful life and will require replacement soon. The alarms

are set to 10% and 5% life remaining for the cartridge and IU respectively. See

the base printer’s User’s Guide for custom alarm alternatives. See Section 9 of

this manual for information on the relative messages displayed.

MICR Toner and Imaging Unit end-of-life

When the toner cartridge or the IU is determined to be at end-of-life, the printer

will stop printing. To continue printing, a new cartridge or IU will need to be

installed. See Section 9 for information on the relative messages displayed.

MICR Toner

Use only Source Technologies’ MICR toner when printing MICR documents. It is

specifically engineered to print quality MICR documents with your printer. The printer’s

MICR toner sensor is designed to work with the Source Technologies’ MICR toner

cartridge to prevent printing checks with regular toner present.

Source Technologies does not recommend the use of refilled or remanufactured MICR

toner cartridges. Refilled cartridges may result in expensive printer repairs and bank

check reject fees due to an inferior MICR toner formulation.

MICR Check Stock

Check stock has a significant impact on the resulting quality and security of your MICR

document. Here are a few features that should be considered when selecting a check

stock. Please see Chapter 5: Security Issues for more information on check stock

security features.

Quality

Quality MICR check printing with your Source Technologies’ secure MICR printer

requires check stock that matches the printer’s requirements. Source

Technologies can supply paper specifically made for our printers. If you wish to

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

10

Page 15

order check stock from other suppliers, please show the following requirements

Quality Issues | 3

to your sales representative. We will test other suppliers’ paper for a nominal fee.

Layout

Layout your check design before any paper is purchased or layout your design to

existing check stock. Keep perforations, orientation, special logos and any color

elements in mind. The printer can print just about anything as long as it is black.

Weight

We recommend 24 lb. - 29 lb. paper.

Stiffness

We recommend Taber M.D. 2.5 and C.D. 1.1 minimum.

Smoothness

For best toner fusing, we recommend rougher surfaces within the base printers’

specifications, and the Paper Specifications for Checks, X9.100.10. We

recommend a smoothness range of 150 to 200, Sheffield.

Paper Grain Direction

When using 24 lb. - 29 lb. bond paper we generally support either long or short

paper grain. Overall performance in the bank’s reader/sorters is best when the

resultant grain direction is left to right when viewing the check.

Perforations

All perforations in the stock should be Laser-Cut or Micro-Perfs (20 or more cuts

per inch). Larger perforations can produce excessive paper chaff and result in

damage to the toner cartridge. Perforations should be ironed by the paper

supplier to reduce nesting and potential double-feeding.

Moisture

The paper moisture content should be between 4.7 and 5.5%. Storage conditions

have much to do with the final moisture content of most papers. Store your check

stock in a cool, dry, environmentally stable and secure area. Protective

wrappings should be removed just prior to use.

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

11

Page 16

4. Security Issues

Security Issues | 4

Printing negotiable documents from blank paper on desktop MICR laser printers makes

security a top priority for any company embarking on a desktop check printing project.

Combating fraud is a moving target. As soon as a new weapon is developed, malicious

forces are at work to devise workarounds to it. Good security programs integrate

hardware, software, your employees, processes, and your financial institution into a

secure check production system. The ultimate liability for fraudulent documents rests

with the banks and their customers, and there can be many vulnerable points throughout

the overall system. Customers must have systems designed and documented to show

“Ordinary Care and Good Faith Effort” is in place to avoid liability. In the past, financial

institutions generally credited corporations when fraud was discovered. Today,

regulations attempt to define who may have been negligent in the transaction and put

the liability on that party or parties. If a fraudulent occurrence can be traced to a

corporation’s lack of security procedures or the design of their negotiable documents,

the regulations will protect the banks, or at best case the loss will be shared.

The following internal and external security measures will help minimize your risk of

check fraud.

1. Stay abreast of current check fraud methods and the latest in fraud detection.

Many financial institutions offer seminars to educate corporate clients.

2. Financial institutions should train tellers to look at the check, not the person

presenting the check. The check, not the person, is the item that must be

verified.

3. I ncor porat e security features into your base check stock and utilize printed

security features that address both alteration and counterfeiting of original

items. We have found the following check stock security features to be of

merit:

Artificial Watermarks - White on white printing generally on the back reveals

words or patterns when held at an angle. You should state on the front of the

check that this feature is present. True watermarks are valuable but more

costly.

Laid Lines - Background lines that make cut and paste alteration difficult.

These are normally on the back of the check.

Fuse Enhancing Additive - Coatings or additives to the paper that improve

the bonding of toner to the paper. This helps prevent altering of critical data

such as the amount, or payee name.

Chemical Additives - If an ink eradicator (bleach, acetone, etc.) is applied to

the document, the eradicator creates a permanent stain.

Numbered Check Stock - Sequential numbering printed in dye that

penetrates to the reverse side of the check can be used to verify authenticity.

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

12

Page 17

Security Issues | 4

This also provides for inventory control of blank check stock. This number

should not be linked or be equal to the check serial number due to the

potential of double feeding in laser printers.

Note: These features serve as a general guide for check security. You

should not consider these features as an all-inclusive list. We

recommend consulting with your paper supplier for any additional

comments or suggestions.

4. Firm s accepting checks should be aware of damaged MICR lines.

Intentionally damaging the MICR line can increase the time necessary to

process an item, giving the forger enough time to leave town. Discoloration

could be an indication of alteration as well.

5. Safeguard check stock paper, and limit access only to necessary employees.

6. When generating final negotiable items:

• The document always includes the amount value in words

• The document should not include information that limits the value

range, i.e. “Not valid over $500.” This only guides the fraudulent

attempt. Use your application software to detect out of range items

• All levels of hardware and software password protection should be

utilized

7. Unders t and and approve the security procedures of your check stock

suppliers to safeguard stock in their custody.

8. Consider “Positive Pay” check services from your financial institution. You

should provide the check number, check date, dollar amounts, and

sometimes the payee name to your bank when checks are issued. The bank

will match these values and alert you to mismatches before clearing the

check to your account. Financial institutions should encourage full

participation of corporate clients.

9. Move methods of fraud detection to the item’s point of entry into the clearing

system. For example, low cost readers can detect low magnetic strength in

the MICR line which is a good indication of attempts to copy an original.

10. Review and document your internal negotiable document printing procedures.

Investigate employee backgrounds before assigning security authority. Split

the responsibilities. For example, an accounts payable production/security

officer should not also balance the account.

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

13

Page 18

5. MICR Features

MICR Features | 5

Source Technologies’ secure MICR printers are designed to allow both general office

document printing and secure MICR document printing. You may print a variety of

conventional jobs with regular Lexmark toner using all of the printer features available

such as network printer utilities. Source Technologies’ printers support multiple printer

languages (for example - HP’s PCL5 & PCL6, PostScript Level 2 emulations). The

MICR features require the PCL5e print data stream. Source Technologies has designed

features to enhance these printers with MICR mode specific operation that allows you to

securely print high-quality negotiable documents.

MICR Mode

Your secure MICR printer has two operational states: normal and MICR mode. When the

printer is in normal printing mode, your MICR resources cannot be accessed. Once the

printer enters MICR mode your secure resources become available and the printer

begins the process of confirming readiness to print a negotiable document. There are

two conditions which must be met before MICR mode is activated:

The correct password command must be received by the printer from the

software application prior to printing any MICR documents.

If the front panel combination lock feature is activated, the correct eight digit

combination must be entered from the front panel.

MICR Fonts

The E-13B and CMC7 MICR fonts reside in the printer. Examples of these fonts are in

the Appendix of this manual. They can only be accessed after MICR mode is activated

by your software. A MICR toner cartridge must be present to print the MICR fonts.

Secure Fonts

Source Technologies has designed two fonts: Secure Numeric Font and ICR Secure

Numeric Font. These are resident in your printer as well. Examples of these fonts are in

the Appendix of this manual. Like MICR fonts, these secure fonts can only be accessed

after MICR mode is activated by your software.

• The ICR Secure Numeric Font is designed for the convenience area of your

check. It can be read by the imaging equipment used by many financial

institutions.

• The Secure Numeric Font should not be used in this area since the reverse

image aspect of this font prevents it from being read by this equipment.

We recommend using both of these fonts on your checks as they are designed to deter

check fraud.

MicroPrint

Your secure MICR printer also contains the MicroPrint font. MicroPrint is text less than

.010” tall. It can easily be read with a magnifying glass but appears to be a solid line to

an unaided eye. This font provides protection against reproduction by most scanners

and copiers because they cannot successfully print the tiny letters.

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

14

Page 19

Most check printers use this font in the signature area of their preprinted checks. We

MICR Features | 5

recommend using this font to help deter check fraud. The text in this font can either be

fixed, such as the name of your organization, or it can be variable, such as the check

amount and payee name. The use of variable text provides an additional method of

protection against check counterfeiters.

Use of the “MP” designate symbol, to identify the line as MicroPrint, is optional. The

MicroPrint font only contains alphanumeric characters. Punctuation marks and spaces

are ignored by this font and do not print.

Bi-Directional Feedback

Your secure MICR printer can provide MICR status messages to the check printing

application. This feature is valuable in a networked environment with multiple printers or

with users utilizing a print er located in another area. The application can get information

on MICR settings such as toner cartridge type (MICR or regular), locked trays (which

trays are locked to non-MICR applications), resident fonts/macros and audit trail

settings. The printer can send the application MICR error messages such as “load MICR

toner.”

When the printer receives the “@PJL INFO STVARIABLES” command it will report all

MICR variables to the host. The MICR variables can also be seen by accessing the

printer’s front panel menu. Select Reports > Menu Settings page. The second page of

this menu shows the current MICR variable configuration.

If USTATUS DEVICE=On, the printer will report PJL error 40020 for any MICR error

which causes the printer to go off-line. It will appear in this format:

@PJL USTATUS DEVICE

CODE=40020

DISPLAY=”MICR Password Error Press Go”

ONLINE=FALSE (formfeed----HEX 0C)

The code will always be 40020, only the display line will change to indicate the specific

error.

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

15

Page 20

Resource Storage

MICR Features | 5

Check-related resources, such as form overlays and signatures, are stored in your

printer with unique identification numbers. ID numbers must be less than 32767.

Number 5001 is reserved for the Audit Trail overlay. Your secure MICR printer has two

areas where you may store these resources: flash and RAM memory.

The ST9720 secure MICR printer has 256 megabytes of resident flash memory. It is

user-managed and its resources can be designated as “secure” or “unsecure.” Secure

resources are loaded to flash with the STL command and have ID numbers greater than

or equal to 10000. They can only be accessed by using the STP command when the

printer is in MICR mode. Unsecure resources do not require a password and should be

assigned an ID number less than 10000. Resources stored in flash memory are not

deleted when the printer is powered off. Flash memory is required for all audit trail

features.

Storing resources in RAM is also an option. Resources in RAM are deleted when the

printer is powered off or reset. For this reason, check-related resources may need to be

loaded frequently. Resources stored in RAM cannot be password protected.

We recommend storing all check-related resources in secured flash memory.

MICR Menu

Your secure MICR printer contains a front panel menu specific to MICR applications.

The complete menu is as follows:

Option Card Menu > MICR Menu

Security Lock – Future Feature

Audit Menu

Audit Location - Flash/Disk

Record Sorting

Overlay

Sum Field 4

Print Report

Setup Menu

Hex Transfer

Density Control

MICRpoint

PDF 417 Processing

Demo Menu

MICR Font Demo

Starter Checks

Accounts Payable

Cashier’s Check

Use the menu button on the front of your printer to toggle through the menu options. To

select an option press the select (√) button. An item is selected when it has a checkmark

after it.

The Security Lock option allows the user to activate and set a front panel combination

for additional security. This feature prevents a user from printing checks without the

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

16

Page 21

proper 8-digit combination. See the MICR Mode Commands section of this chapter for

MICR Features | 5

more information.

Hex Transfer and Density Control are normally reserved for Source Technologies’

Technical Support.

MICRpoint is a feature that allows for fine positioning of the MICR line by the operator.

PDF Processing can be turned ON to print PDF417 barcodes using a subset of

prescribe commands.

The Audit Menu deals with the optional Audit Trail Report settings. See chapter 7 for

more information.

Entering MICR Mode

To print MICR documents, your secure MICR printer uses special alphanumeric text

commands called MICR Mode commands.

There are two different commands which activate MICR mode printing:

&%STFPASSWORD$ and &%STHPASSWORD$. &%STF is the default command and

is recommended for most applications.

To use the &%STF command, it must be entered at the beginning of the job datastream.

The &%STH command can be entered anywhere prior to accessing secured resources.

The &%STH command is not as powerful as the &%STF command because it does not

set as many parameters for MICR printing. Both commands and descriptions are as

follows:

&%STF Command

When entering MICR mode with the &%STF mode, the printer will:

• Check to see if the proper front panel combination has been entered

(when enabled).

• Allow access to secure check printing resources such as MICR fonts and

secure fonts stored in printer ROM.

• Allow access to protected signatures, overlays, logos and other important

resources stored in password-protected, nonvolatile, flash memory.

• Display “MICR Mode Active” on the printer’s front panel.

• Disable the printer’s front panel menu system.

• Set printer resolution to 600 dpi for printing MICR fonts.

• Disable jam recovery.

• Set the copies parameter to 1.

• Sets toner low alarm.

• Turn hex transfer ON.

Note: The &%STF command must be entered at the beginning of the print

job before any other print data is received.

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

17

Page 22

&%STH Command

MICR Features | 5

The &%STH command does not set-up the printer for check printing activity as

completely as the &%STF command mode. This alternate MICR mode command

forces the user to manually program some commands through their host

application. It is used when programmers cannot place &%STFPASSWORD$ at

the beginning of their job. Use the &%STH command if you experience page

ejects while in &%STF mode.

When entering MICR mode with the &%STH command, the printer will:

• Verify if the proper front panel combination has been entered (when

enabled).

• Allow access to secure check printing resources such as MICR fonts and

secure fonts which are stored in printer ROM. It also allows access to

protected signatures, overlays, logos and other important resources

stored in password protected nonvolatile flash memory.

• Turn hex transfer ON.

Note: The &%STH command can occur within a datastream after the page

has started. The &%STH command, unlike the &%STF command, can be

issued anywhere on the page.

MICR Mode Commands

Password Command &%STFPASSWORD$ or &%STHPASSWORD$

&%STF or &%STH Lead in sequence

PASSWORD User defined password, 8 characters, case sensitive,

unprintable characters allowed. Factory default is

PASSWORD. See also New Password Command.

$ Command terminator

MICR Definition Command &%SMCPxxxx$ (optional)

&%SMCP Lead in sequence

xxxx MICR count, the number of MICR lines to be printed

during this print job. (4 bytes in hex)

$ Command terminator

Example: &%SMCP0010$

This command prints 16 (Hex 10) MICR lines before disabling MICR mode. This

command defines how many MICR lines may print in the current job. When the count

decrements to zero, MICR mode is terminated.

Set New Password Command &%STExxxxxxxx$

&%STE Lead in sequence

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

18

Page 23

xxxxxxxx New password, must be 8 characters either printable

MICR Features | 5

or non-printable. Dollar ($) sign is an invalid password

character.

$ Command terminator.

In order to set a new password the current password must first be sent.

Caution: Errors made in sending the new password command could lead to

setting it to an unknown value. If the Password is unknown the printer must be

returned to Source Technologies to be reset to PASSWORD.

Activate/Set Front Panel Combination Lock &%STSxxxxxxxx$ (optional)

&%STS Lead in sequence

xxxxxxxx Eight digit sequence, valid characters 0-9

$ Command terminator

This command sets and activates the front panel MICR combination lock. If this feature

is activated, MICR mode cannot be entered until the front panel combination is entered

correctly. All MICR features will be inaccessible until this combination is entered.

Sending an &%STS command and eight zeros deactivates the security lock.

Caution: If the front panel combination is set and then forgotten, the printer must

be returned to Source Technologies for the combination to be deactivated.

Print MICR E-13B Font &%SMDddd...ddd$

&%SMD Lead in sequence

ddd...ddd Data to be printed in E-13B MICR font

$ Command terminator

This command prints the specified data in the E-13B MICR font which is used in the

United States, Canada and Mexico. The correct spacing begins at the cursor position

modified by the MICRpoint adjustment setting at the start of the command. After the

terminator is sent, the printer is returned to its default font. After each Print E-13B

command, the MICR count is decremented by one. Upon receiving this command the

printer will verify that a MICR to ner cartridge is installed and set the copies parameter to

1. See Appendix A for MICR E-13B font character mapping.

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

19

Page 24

Print MICR CMC7 Font &%SM7ddd...ddd$

MICR Features | 5

&%SM7 Lead in sequence

ddd...ddd Data to be printed in CMC7 font

$ Command terminator

This command prints the specified data in the CMC7 MICR font which is used in Europe

and South America. The font and its correct spacing begin at the current cursor position

modified by the MICRpoint adjustment setting at the start of the command. After the

terminator is sent, the printer will return to its default font, and the MICR count will be

decremented by one. Upon receiving this command the printer will check to ensure a

MICR toner cartridge is installed and set the copies parameter to 1. See Appendix B for

CMC7 character mapping.

Print Secure Numeric Font &%SMFddd..ddd~

&%SMF Lead in sequence

ddd...ddd Data to be printed in this font

~ Command terminator

The dollar sign ($) is not a command terminator for this command. For both security

fonts the tilde ~ (hex 7E) is the command terminator since the dollar sign is a valid

character.

Print ICR Secure Numeric Font &%SMIxxxxxx~

&%SMI Lead in sequence

xxxxxxxx Data variables to be printed in this font

~ Command terminator

Print MicroPrint Line &%SMMxxxxxxxxx!$

&%SMM Lead in sequence

xxxxxx Data to be printed in this font

! MP designator (optional)

$ Command terminator

If the exclamation point (!) is used, the “MP” designate will print just above and to the

right of the last character. This is optional and is typically used to notify the check

recipient of the presence of MicroPrinting (Only 0-9, A-Z [upper and lower case] print).

Special characters and spaces will disappear.

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

20

Page 25

Load Flash Resource &%STLxxxxxyyyyyyzdd....dd

MICR Features | 5

&%STL Lead in sequence

xxxxx Resource number in decimal, must be 5 digits

yyyyyy Byte count of resource file in Hex, must be 6 positions

z Format of the resource file

S = Single byte binary format

D = Double byte text format

dd...dd Flash resource file. e.g. forms overlay, signatures etc.

Resource number values may be between 00001 to 32767. Values of 10000 and above

are password protected and will require the user to enter MICR mode with a valid

password before they can be unlocked with the STP command. Values below 10000 will

be unsecured.

Resource number 5001 is reserved for the Audit Trail overlay. Please see chapter 7 for

more information.

Format Flash Memory &%SFF$

&%SFF Lead in sequence

$ Command terminator

This command formats flash memory. A valid password command must precede this

command.

Caution: All flash contents will be lost. This includes all electronic forms,

signatures, logos, etc.

Secure Flash Resource Unlock Command &%STPxxxxx$

&%STP Unlock flash resource command

xxxxx Flash resource number, must be 5 digits

$ Command terminator

This command unlocks a secure flash resource.

Tray Lock Command &%STTL#$

&%STTL Lock tray command

# The tray to be locked (choose from 1, 2 or 3 only)

$ Command terminator

This command prevents other applications from accessing a particular printer paper tray.

Tray Unlock Command &%STTU#$

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

21

Page 26

&%STTU# Unlocks tray

MICR Features | 5

# The tray to be unlocked (choose from 1, 2 or 3 only)

$ Command terminator

Tray Swapping Commands &%STTSON$ / &%STTSOFF$

&%STTSON Turns tray swapping on

&%STTSOFF Turns tray swapping off

$ Command terminator

This command allows the user to redefine the PCL values for Trays 2 and 3 to allow

software and operational consistency with older printers in the system. Swapping ON

causes any <esc>&l4H to be replaced with 5H and vice-versa.

DES and AES Decryption

Data Encryption Standard (DES) and the Advanced Encryption Standard (AES) are both

supported in the Source Technologies secure MIC R printers. The minimum code level

support for AES is 8.5j. Levels 8.5i. and lower only support DES.

DES originated at IBM in 1977 and was adopted by the U.S. Department of Defens e.

The controlling standards for DES are ANSI X3.92 and X3.106 and in the Federal

Information Processing Standard (FIPS) 46-3 standard. An alternative to DES, called

Triple DES, is not supported in Source Technologies’ secure MICR printers.

AES is documented in a FIPS standard, FIPS 197, dated 11/26/2001. Three key sizes

are documented in the standard, 128-bit, 192-bit, & 256-bit. We currently only support

the most commonly used 128-bit key size.

The algorithm selected for AES is Rijndael. Developed in Belgium, an English

pronunciation alternative is “Rain Doll”. In addition to U.S. Government implementations,

it is anticipated that AES will be adopted by businesses, organizations, institutions, and

individuals outside of government, and outside of the United States as was the case for

DES.

We only support decryption for DES and AES. Encrypted printer data streams can be

decrypted using the key stored prior to the message. Keys for both DES and AES are

stored separately so that both AES and DES are supported simultaneously. The keys

messages themselves can be encrypted with either DES or AES for either DES or AES.

Only one DES and one AES key exists at any one point in time. Old keys are not saved.

To change either a DES or an AES key requires the MICR Password Command.

The secure MICR printer does not have any capability to encrypt a return or Bidirectional message.

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

22

Page 27

Decryption Commands

MICR Features | 5

Decryption requires printer processing overhead. In our testing encrypted printer data

steams near or below 100K bytes per page do not seem to affect printer speed in term of

pages per minute or first page out timings. Some testing done with print files from 500K

to 1 MB per page revealed up to a 30% degradation in speed. It is therefore

recommended the encryption be reserved for the confidential portions of the data when

large file sizes are anticipated.

Set DES Decryption Key Command – &%STSETDESKEY<16 Hex Characters>$

The command requires a MICR Password Command be sent prior t o the Key

Command. The Key Command could itself be encrypted and then decrypted in the

printer. The command requires the key data be in a double-byte hex format. The 8 byte

value must be converted to the 16 byte format. The only values that can be contained in

the 16 command bytes are 0 thr ough 9, and A through F. Alpha key characters can be

upper or lower case. Command characters must be upper case. Here is an example of a

valid key command - &%STSETDESKEY5f00FF7E3DA938eb$. The key value remains

in the printer until another key command is received. Printer power cycles and printer

reset commands do not affect the key value.

The dollar sign ($) is the command terminator and is required.

Set AES Decryption Key Command – &%STSETAESKEY<32 Hex Characters>$

The command also requires a MICR Password Command be sent prior to the Key

Command.

The key data is similar to DES, but is twice in length with 32 Hex character format

representing the 16 byte or 128-bit key value.

Turn DES Decryption ON – &%STDON$

Turn AES Decryption ON – &%STAON$

All data following the $ command terminator will be decrypted using the current key

value stored in the printer and the DES or AES algorithm. Decryption continues until a

Decryption OFF command is received, a printer panel reset occurs, or printer power is

cycled. Printer software language resets do not stop decryption.

Turn DES Decryption OFF – &%STDOFF$

Turn AES Decryption OFF – &%STAOFF$

The OFF command resides within the encrypted data, and must also be encrypted. The

OFF occurs after an 8-byte block (DES) or 16-byte block (AES) is received and

decrypted. The last block containing the OFF should either have the command right

justified or padded out to the block boundary. Any padding bytes after the $ command

terminator will be discarded.

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

23

Page 28

MICR Features | 5

Custom Character Conversion Command

The Custom Character Conversion Command can be used to resolve some problems in

printer data streams. An example might be to remove a special command character in

an existing data stream that was used by your previous printer hardware. Without

changing your data stream, these special characters can either be removed, converted

to Nulls, or converted to other sets of data to accomplish what is required.

An example of this might convert a Skip Command used by an older generation printer

to multiple Carriage Return / Line Feed commands. You could also store a PCL5

command in the SIMM and call it with one character in your data stream. Only one type

of conversion is permitted at any particular point in time, but the function can be modified

within a datastream multiple times.

The conversion information is stored in NVRAM and is retained through power-off /

power-on cycles. This means you could send the command one time and all future print

jobs would be converted. Special precautions are required if printer fonts and macro’s

are downloaded to your printer. This might require you to disable the function during

downloads and re-enable prior to your print data.

&%STCxx[yy...]$

xx is a double-byte character to convert - the following characters are not allowed:

&, %, S, T, C and $.

yy is a double-byte string to convert to - can be 0 to 16 characters long

$ command terminator

Example:

&%STC1E0D0A$ – sets the convert character to 1E - the printer will replace any 1E

character in the data stream with 0D 0A (carriage return, line feed)

&%STC1E$ – replace 1E with nothing - simply removes all 1E characters from the data

&%STC00$ – turns character conversion off

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

24

Page 29

MICRpoint Feature

MICR Features | 5

Fine positioning of the MICR Line characters is accomplished using the MICRpoint

feature. The feature only works with the SMD & SM7 MICR Print Commands using the

printer’s resident MICR fonts.

The exact location of the entire MICR Line can be moved left or right, up or down by the

printer operator through the printer’s front panel. Only the MICR Line is moved. All other

printed information is not affected. This allows the operator, using a MICR Positioning

Gauge and the MICRpoint feature, to precisely locate the MICR characters on the

specific printer in use to address slight print location variances.

Each value entered by the operator is equal to 1/10th of a Point, a decipoint (720

Decipoints = 1 inch). The maximum value that can be entered is +/- 99 Decipoints

allowing the entire MICR Line to move up or down, left or right a maximum of 0.1375

inches from the print data stream’s intended location.

The figure below shows proper MICR character placement using a MICR Positioning

Gauge. The best location has the right side of the characters at or near the right edge of

the location boxes. An operator may have to choose a compromise location that best

addresses the entire line.

To enter MICRpoint values, access the MICR Menu through the operator panel, select

the SETUP MENU, and then select the MICRpoint Adjustment feature. Horizontal and

vertical options are displayed. It’s through these horizontal and vertical options we can

enter maximum value of 99, and also choose + / - . A + horizontal value moves the

characters to the right. A + vertical value moves the characters down.

For instructional value, assume the current MICRpoint values are at 0, the default

values. For best positioning from using a gauge and the current printed output, the MICR

line needs to move up about 1/20th of an inch, and to the right ¼ of the typical character

width. The MICR character 0 is 0.091 inches wide. Move the line up 36 decipoints and to

the right about 15 decipoints. While in the MICR Menu with MICRpoint Adjustment

selected, select Horizontal. There should be two values: first a +/- choice followed by

some value. In this case, it’s 0 or Default. To Move horizontal 15 points, use the

UP/DOWN arrow keys to select +, a positive value. Then press the RIGHT arrow key.

Using the printer keypad, enter 15. Then select the OK key to save the values. Again

from the Horizontal / Vertical options, use the UP/DOWN arrow keys, and OK key to

enter Vertical values. To move the MICR line UP requires a – or negative value. Use the

UP/DOWN keys to select -, and then use the RIGHT key to enter a value. In this

instructional case it’s 36. Using the key pad enter 36. Select the OK key to save the

value. The values are stored in internal FLASH memory in the printer and will remain the

same until changed by the operator. Power ON/OFF cycles do not reset the values.

Assuming the measurements are correct, when test or production checks are printed,

the MICR Line should now be at the new location on the page.

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

25

Page 30

MICR Features | 5

If you wish to utilize the MICRpoint feature of your printer, please call Sales Support at

1-800-922-8501, and have your printer’s serial number readily available to receive the

MICR Positioning Gauge (shown above). The Positioning Gauge will be sent to you free

of charge.

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

26

Page 31

6. Host Programming Features and Examples

Host Programming Features and Examples | 6

Hex Transfer

The Hex Transfer feature allows the user to send PCL escape sequence printer

commands to the printer with simple text strings. You may send any valid command or

string of commands with no limit on the length or complexity. Form macros, signatures,

or simple commands may be passed through any platform to the printer since they are

simple text. The printer will convert them back to ESC (escape) sequences when they

arrive at the printer. Hex Transfer is automatically enabled while in MICR Mode. To

enable it for all applications use the following commands:

Turning Hex Transfer On

To enable Hex Transfer, send the following command:

&&??&%

Once Hex Transfer is enabled, the character sequence &% will act as a trigger

sequence. Any data following these trigger characters will not be printed and will be

treated as Hex Transfer data until the Hex Transfer ending character $ is encountered.

Turning Hex Transfer Off

To turn Hex Transfer off, send the following command:

&&??!!

This command will clear the trigger sequence and allow the &% characters to print. This

clear command may be sent at any time to assure that Hex Transfer is disabled. When

MICR Mode is entered, Hex Transfer will automatically be turned on, and when MICR

Mode is exited, Hex Transfer will be turned off unless it has previously been activated

outside of MICR Mode with the &&??&% string.

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

27

Page 32

Hex Transfer Examples

&&??&%

This command enables Hex Transfer On

&%1B 26 6C 34 48 $

Sends the PCL Esc sequence–

which the paper will be pulled.

&% 1B 45$

&% 1B $E

This command is a printer reset PCL command which

may be sent by simply putting the Esc character in Hex.

Host Programming Features and Examples | 6

-or&% 1B $& l 4H

-or-

Note: Hex Transfer can now be set ON or OFF via the MICR Menu. Please review

Section 6, MICR Menu for more information.

<Esc>&l4H

–which is a paper source command identifying the tray from

consists of the Esc character and printable E character. It

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

28

Page 33

Figure 6.1 MICR Mode Command Example

Host Programming Features and Examples | 6

The following example shows the MICR Mode commands and Hex Transfer commands

in use. This datastream would print the check on the following page (assuming the check

macro and the signature are loaded as flash resources).

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

29

Page 34

The commands in Figure 6.1 in order of appearance:

Host Programming Features and Examples | 6

&%STFPASSWORD$ Password Command.

&%SMCP0001$ MICR Definition Command with the count set to one.

&%STP10001$ Unlock Flash Resource number 10001.

&%STP20000$ Unlock Flash Resource number 20000.

&%1B26...3358$ PCL sequence in hex which sets the page format and

enables macro number 10001.

&%1B$(s1p16v0s3b4148T PCL sequence which changes the font to Univers 16

point. After the check serial number prints (1000), the

printer is returned to its default font with the following

command.

&%1B$(3@ PCL command to return to default font.

&%SMF$2014.44~ Print Secure font command.

Note: The tilde ~ is the command terminator.

&%1B$(s0p12h1s0b4099T PCL command to change the font to Courier 12 pitch

Italic. Print PCL Fonts from the Front Panel menu for a

list of fonts with their call commands.

&%1B$(3@ PCL command to return to the default font.

&%1B$(20000X! PCL command to print font number 20000. In this

example font 20000 is a signature previously loaded into

flash memory. Here we call it and print it with an

exclamation point (!).

&%1B$(3@ PCL command to return to the default font.

&%1B$&f0S PCL command to Push (store) the current cursor

position.

&%1B$*p296x3184Y PCL command to move the cursor to 296X , 3184Y. At

300 units of measure, this is .97 inches across and 10.61

inches down. We are precisely positioning the MICR

line.

&%SMD....$ Pr in t E-13B MICR Command. This prints the MICR line.

Note: Refer the MICR font character mapping in

Appendix A.

&%1B$&f1S PCL command to Pop (return) the cursor to the pushed

position.

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

30

Page 35

Escape Character Translation

Host Programming Features and Examples | 6

In many IBM host environments, the programmer cannot send an ESC character (ASCII

hex 1B) to the printer from within the application. Your secure MICR printer allows you to

define the ESC character as a printable character or a combination of two printable

characters. You can select combinations of 1 or 2 characters which are translated to a

Hex 1B when they are sent to the printer.

The command &%STYxxyy$ is used to select the character or character combination.

The pair xx represents the first characters’ ASCII hex value; yy represents the second

characters hex value.

Example: The symbols @@ should be translated into the escape character.

&%STY4040$

After this is sent to the printer, anytime an @ @ is received in exact sequence, the pair

is translated into the ESC character (Hex 1B). A single @ would print normally.

If yy is equal to 00, only the first character is used for the escape character.

Example: The symbol @ should translate into the escape character.

&%STY4000$

After this is sent to the printer, anytime an @ is received it is translated into the ESC

character. This means that the printer will never print the @ character. The only invalid

single characters are the & (HEX 26) and a null (00).

Example: &%STY2300$ #&l8D

The printer would translate the number sign (Hex 23) to the ESC character and it would

act on the sequence Esc&l8D which will set line spacing to 8 lines per inch.

To reset the ESC character translation from the previous settings, send the &%STY

Command to deactivate the translation.

Example: &%STY0000$ 8

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

31

Page 36

Figure 6.2: Sample Check

Host Programming Features and Examples | 6

Note: The printed output from the commands listed in Figure 7.1 is shown below.

Source Technologies, LLC ST9720 Secure MICR Printer User’s Guide

32

Page 37

7. Audit Trail Reports

Audit Trail Reports | 7

The Audit Trail Report feature provides a report of the printer’s MICR printing activity.

The printer must have flash memory to utilize this option. Details of each flagged check

record sent to the printer are provided since the last audit report was purged from flash

memory.

Report Details

A record (check) must be bounded by a start of record command and an end of record

command. Within each record, fields to be included in the Audit Trail Report must be

flagged. The printer stores each record in flash memory. After the check is successfully

printed, its record is designated as a successfully printed document in flash.

The report is built by printing each of these check records as a line item. At the end of

the report, an exception report is generated which highlights any records received by the

printer but not successfully printed.

Each record (check) has a maximum of seven fields with a total of 146 bytes. Two of

the flagged fields, SQ1 and SQ7 are Audit Report fields only. They are not printed

on the MICR document. Flagging other fields for inclusion in the Audit Report does not

affect how they print on a check.

Audit Trail Menu

The MICR menu contains a section for the Audit Trail options. Menu options are Audit

Location, Record Sorting, Overlay, Sum Field 4 and Print Report.

Audit Location

Choose to store audit data on flash or disk. The display will show “No Device” if neither

is installed. Flash is the default if both are present.

Audit Record Sorting

This enables sorting of the report by the first 20 digits in the MICR line field. In an

unsorted report the records are in the order in which they were printed.

Overlay

To assist in reading an Audit Trail report you have the option of using a form overlay.

This overlay can provide lines, boxes and shading for a more user friendly report format.

The Audit Trail Report overlay can be stored in printer flash or RAM. We recommend

storing it in flash. It must have an ID of 5001. It is enabled by accessing the MICR menu

via the printer’s front panel. Select Audit Menu > Overlay. This overlay will now be