Page 1

Page 2

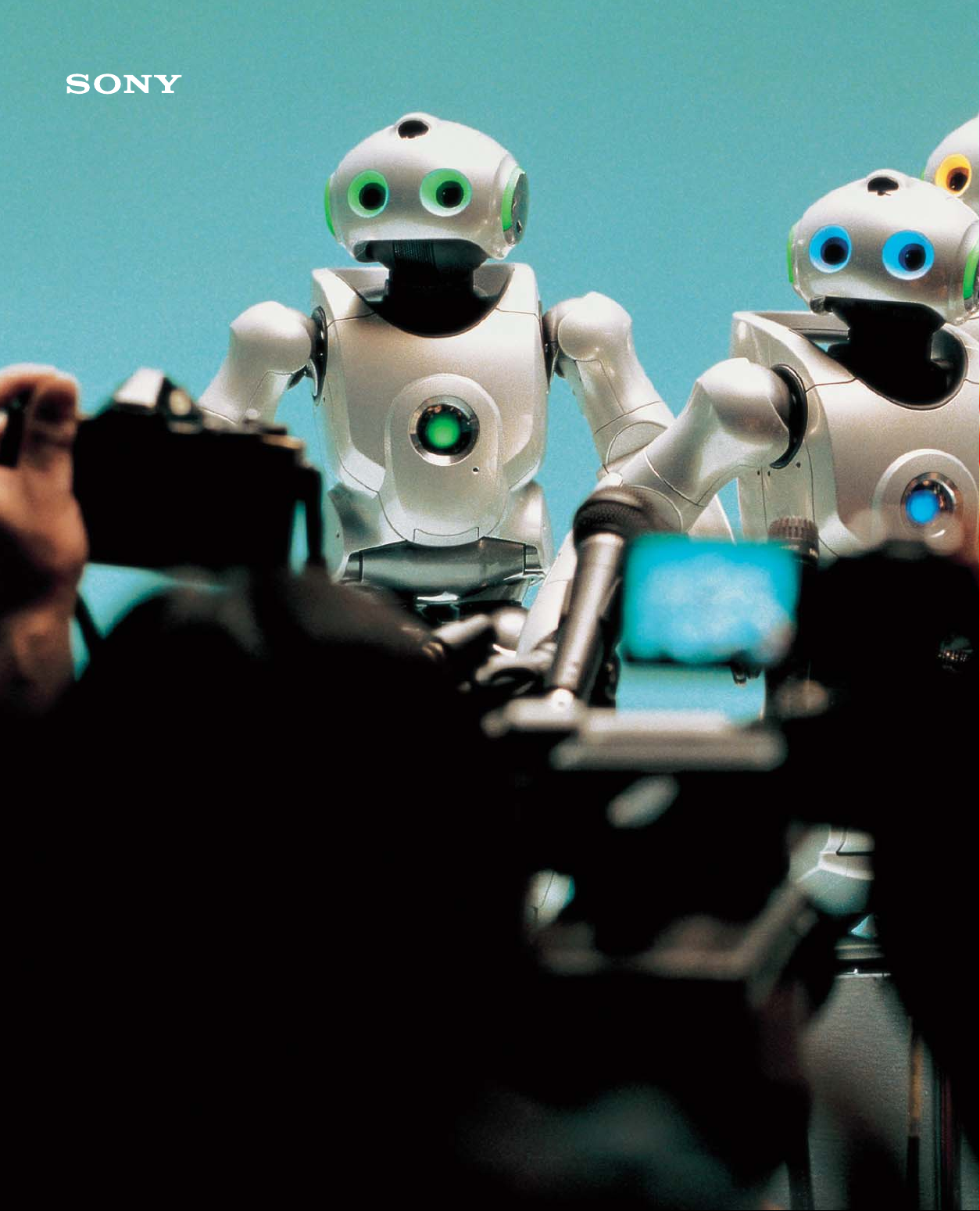

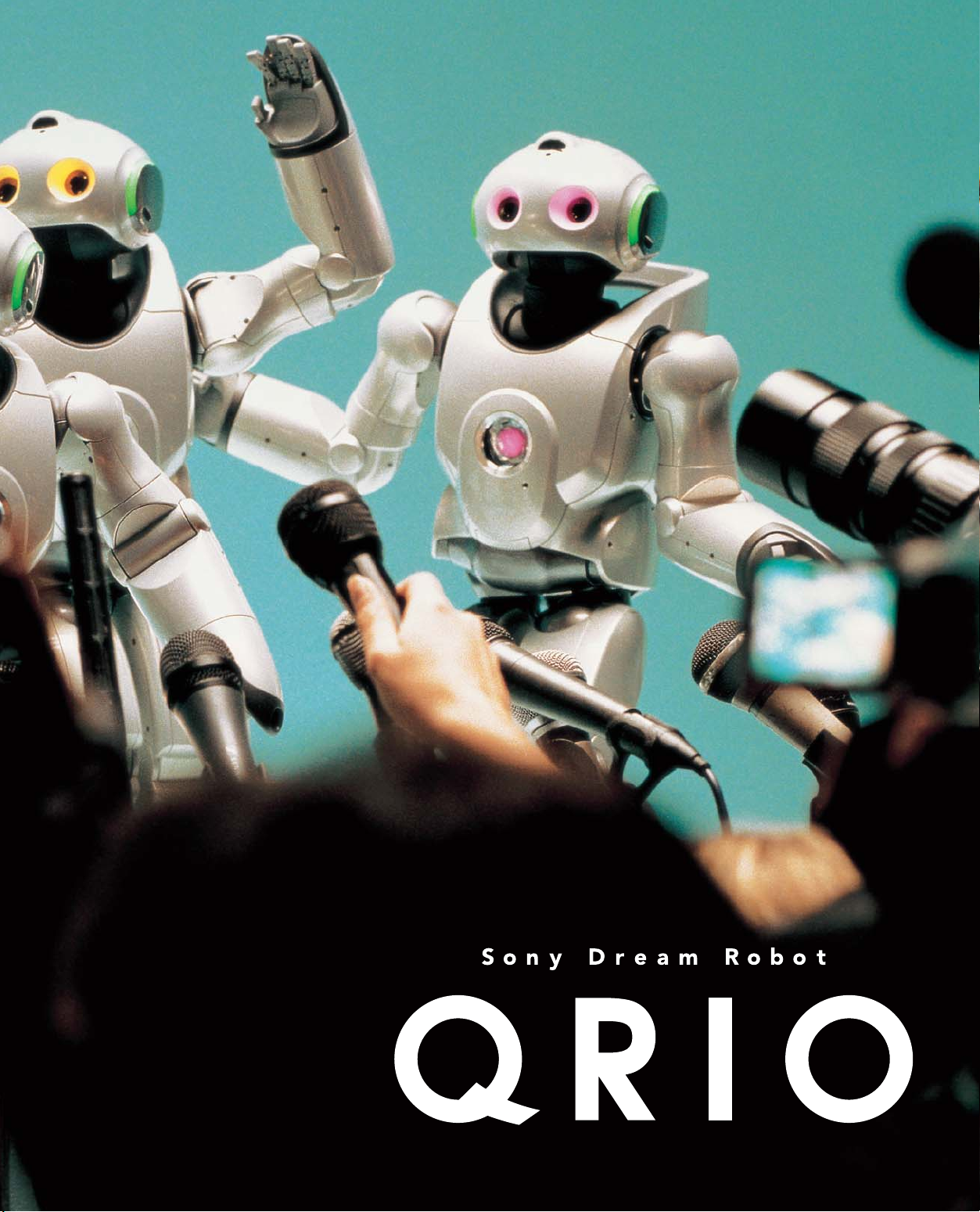

Throughout history, curiosity has been a source of inspiration,

expanding the possibilities for the future.

The fun of discovery; the joy of creation; technology that goes beyond “convenience” to touch the hearts –

these concepts have driven Sony since its founding.

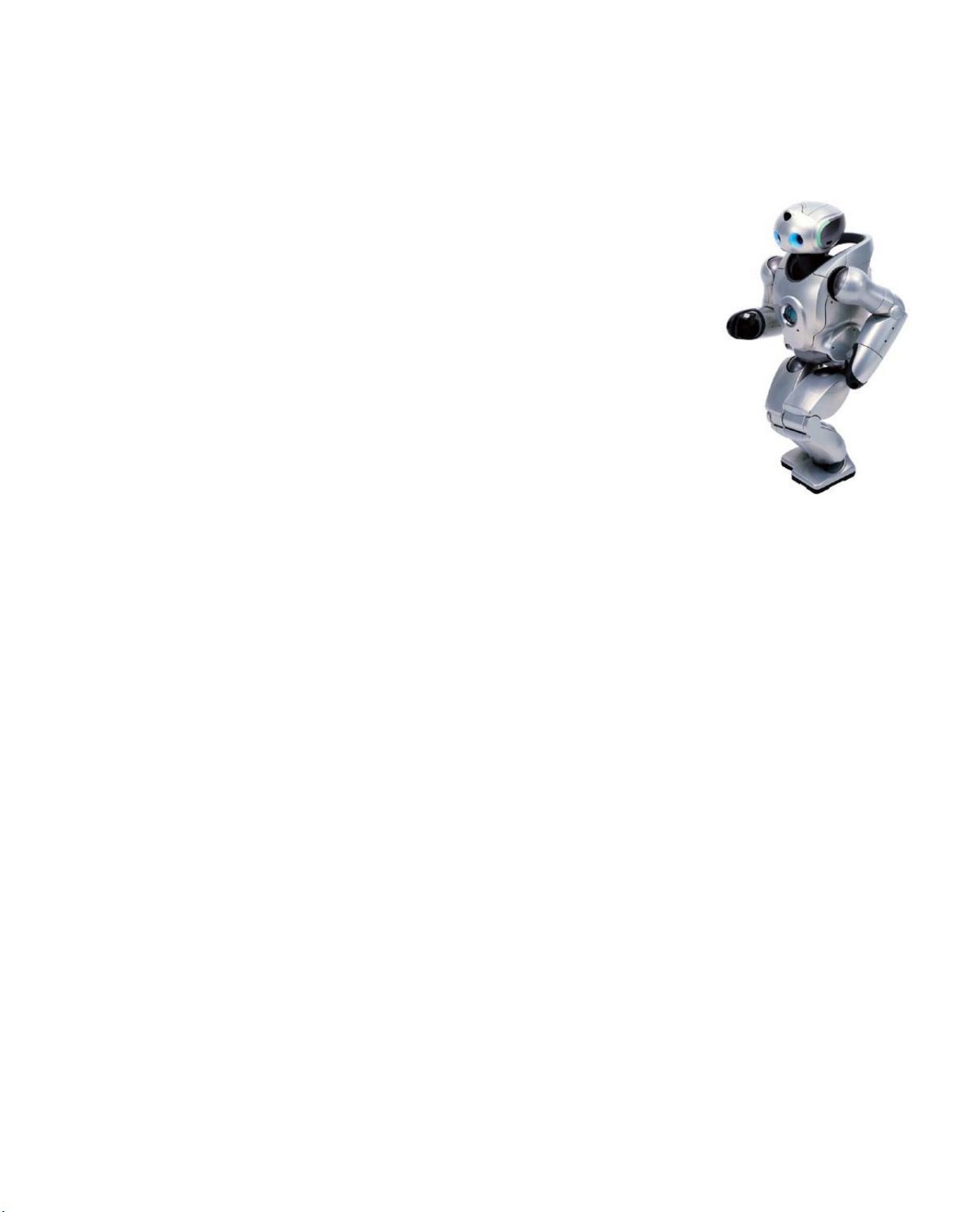

Quest for Curiosity: QRIO.

QRIO embodies Sony’s dreams and most advanced technologies in recognition,

motion control, communications, IT and AI.

Through QRIO’s continued growth and development,

Sony will pursue the infinite possibilities of curiosity.

The resulting technologies will be applied to a wide range of products and services,

beyond robots, to enhance the joy of life.

Let’s discover the future together!

Page 3

1

Page 4

To Our Shareholders

Sony continued to face a challenging business environment during the fiscal year ended March 31, 2004. Nevertheless,

our sales increased as a result of higher sales to outside customers in the Electronics segment and higher revenue in the

Financial Services segment. Measures taken to bolster our lineup of electronics products proved to be particularly

beneficial. Our aggressive launch of new products in such categories as digital still cameras, flat panel televisions and

DVD recorders led to significant sales growth during the 2003 year-end holiday season. Operating income, in contrast,

fell sharply, primarily due to an increase in restructuring expenses and research and development expenses in new

businesses that will foster growth in the years ahead.

In the fiscal year ending March 31, 2005, we will concentrate management resources in businesses with significant

growth potential, making substantial investments in such areas as next generation, multi-purpose processors and other

key components and increasing the number of internally produced key components. By producing these components

internally, we will be able to build in added value — thereby differentiating them from the rest of the market. We are

planning to introduce more products that will be recognized as distinctly “Sony” in both the home and mobile electronics

categories, as well as innovative services, including an online music distribution service. At the same time, we will

continue to strengthen our operations through restructuring initiatives and take steps to improve the efficiency of our

product development and design. Through these and other initiatives, the Sony Group will lay a firm foundation for

growth and higher profitability in the mid- to long-term.

April 27, 2004

Nobuyuki Idei Kunitake Ando

Chairman and Group Chief President and Group Chief

Executive Officer Operating Officer

2

Page 5

Management Message

02 To Our Shareholders

“Continuing to be One of the World’s Leading Consumer Brands”

04

Nobuyuki Idei

07

“Operational Restructuring Aimed at Realizing Outstanding

Efficiency and High Added Value”

Kunitake Ando

Strategy

18 The Future of Key Components

24 Research and Development

28 Sony Craftsmanship

Convergence

40

– A Key to Sony’s Constant Transformation

• Home Electronics

• Mobile Electronics

• Game

• Entertainment

• Financial Services

• Other

Products

11 Sony Products File 01-06

• File 01 – Flat Panel Television “WEGA”

• File 02 – DVD Recorder “Sugoroku”

• File 03 – DVD Recorder “PSX”

• File 04 – PC “VAIO”

• File 05 – Digital Still Camera “Cybershot”

• File 06 – Video Camera “DVD Handycam”

Topics

36 At a Glance: Operating Performance Highlights

55 Sony’s Advertising Around the World

56 Corporate Governance

58 New Members of the Board and Corporate

Executive Officers

107 Investor Information

Report

30 The Inside Story from Sony’s

Nagasaki Fab

People

Sony with You

10 Claude Nobs

23 Eikou Sumura

34 Alejandro M. Lopez

35 Lance Lee

Financial Section

59 Consolidated Financial Information

105 Stock Information

106 Stock Acquisition Rights and Bond Information

Cautionary Statement

Statements made in this annual report with respect to Sony’s current plans, estimates, strategies and beliefs and other statements that are not historical facts are forward-looking statements about the future

performance of Sony. Forward-looking statements include, but are not limited to, those statements using words such as “believe”, “expect”, “plans”, “strategy”, “prospects”, “forecast”, “estimate”,

“project”, “anticipate”, “aim”, “may” or “might” and words of similar meaning in connection with a discussion of future operations, financial performance, events or conditions. From time to time, oral or

written forward-looking statements may also be included in other materials released to the public. These statements are based on management’s assumptions and beliefs in light of the information currently

available to it. Sony cautions you that a number of important risks and uncertainties could cause actual results to differ materially from those discussed in the forward-looking statements, and therefore you

should not place undue reliance on them. You also should not rely on any obligation of Sony to update or revise any forward-looking statements, whether as a result of new information, future events or

otherwise. Sony disclaims any such obligation. Risks and uncertainties that might affect Sony include, but are not limited to (i) the global economic environment in which Sony operates, as well as the

economic conditions in Sony’s markets, particularly levels of consumer spending; (ii) exchange rates, particularly between the yen and the U.S. dollar, the euro and other currencies in which Sony makes

significant sales or in which Sony’s assets and liabilities are denominated; (iii) Sony’s ability to continue to design and develop and win acceptance of its products and services, which are offered in highly

competitive markets characterized by continual new product introductions, rapid development in technology and subjective and changing consumer preferences (particularly in the Electronics, Game, Music

and Pictures segments); (iv) Sony’s ability to implement successfully personnel reduction and other business reorganization activities in its Electronics, Music and Pictures segments; (v) Sony’s ability to implement successfully its network strategy for its Electronics, Music, Pictures and Other segments and to develop and implement successful sales and distribution strategies in its Music and Pictures segments in

light of the Internet and other technological developments; (vi) Sony’s continued ability to devote sufficient resources to research and development and, with respect to capital expenditures, to correctly

prioritize investments (particularly in the Electronics segment); (vii) the success of Sony’s joint ventures and alliances; and (viii) the risk of being able to obtain regulatory approval and successfully form a

jointly owned recorded music company with BMG. Risks and uncertainties also include the impact of any future events with material unforeseen impacts.

33

Page 6

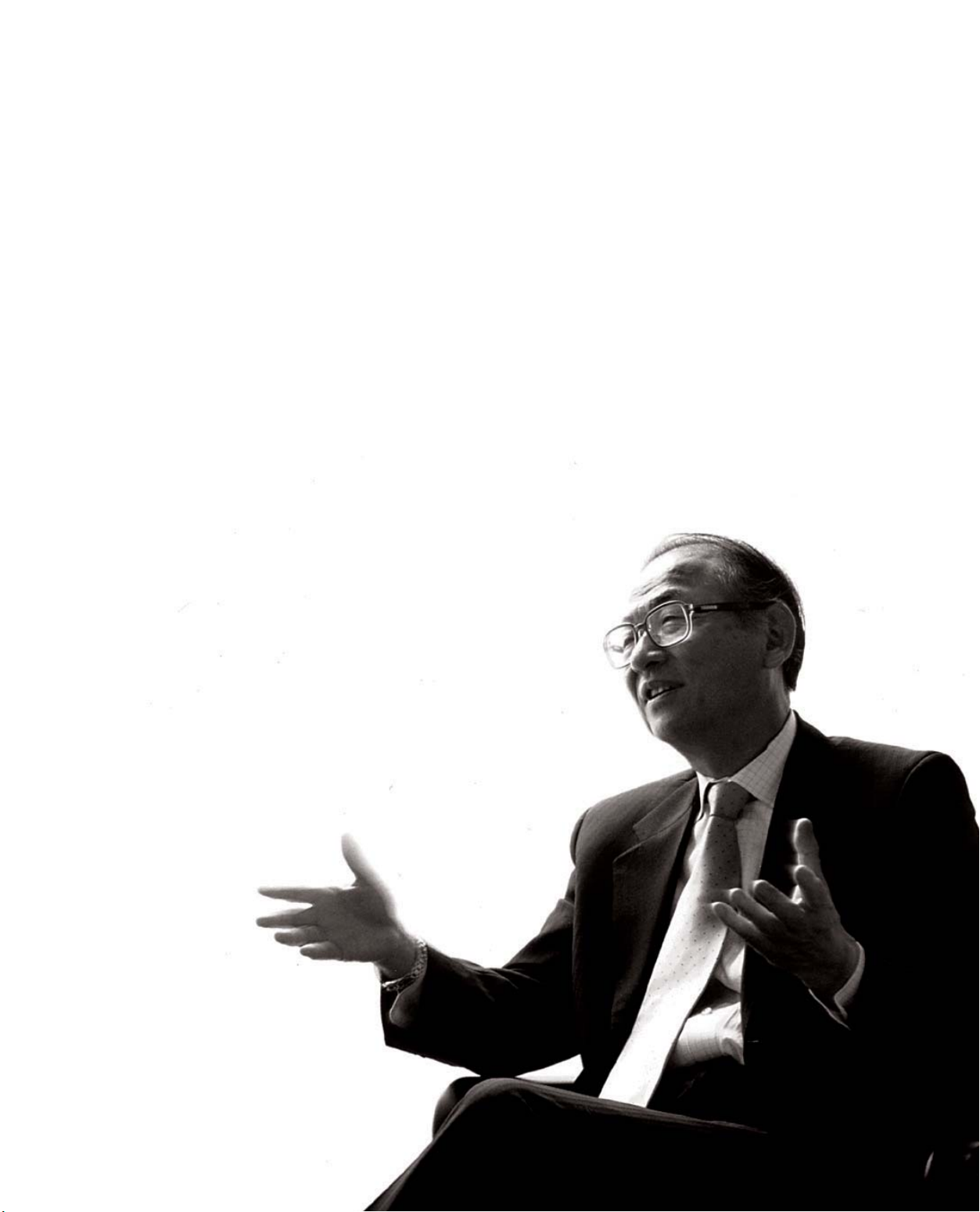

Continuing to be one

of the world’s leading

consumer brands

– Nobuyuki Idei, Chairman

By successfully executing “Transformation

60,” Sony is enacting bold reforms that will

create new value and generate growth

What is your assessment of the current

operating environment, and what are

Sony’s primary goals in this environment?

The markets Sony is involved in are undergoing dramatic changes. In the consumer electronics industry, we are witnessing rapid

advances in cutting-edge technologies in such

areas as networks and semiconductors. The

industry has been further thrust into an age

of mega-competition by the entry of new

participants from other industries and strong

economic growth in countries such as China,

India and Russia. The needs of customers are

becoming more diverse than ever, and advances in network technologies are creating

new ways to enjoy music, movies and other

content. The pace of change will only continue to accelerate.

Sony has been a fountain of groundbreaking

ideas since its inception in 1946. The transistor

radio, the Trinitron color television and

Walkman are just a few of our many innovations that have altered people’s lifestyles. Sony’s

hallmark has always been its ability to identify

trends sparked by changes in the times and in

customer needs, and to use that insight to

create innovative products and services. Some

people believe that today’s remarkable pace

of change makes this a time of chaos. At

Sony, however, we believe this is a time of

unlimited possibilities and opportunities.

In this environment, it is vital that we initiate

reforms in order to remain a youthful, energetic

company for the 21st century. This is why we

formulated a group-wide mid-term corporate

strategy called “Transformation 60” (TR60),

scheduled for completion in 2006, Sony’s 60th

anniversary. Our objective is to position Sony as

a truly global company with an operating framework capable of withstanding dramatic shifts in

business conditions. This will allow us to remain

one of the world’s leading consumer brands.

Sony’s aim is to continue to be a leading

consumer brand and evolve as a 21stcentury global company

To this end, Sony is implementing dramatic

structural reforms and a growth strategy

based on the convergence of management

resources

Can you explain TR60 in more detail?

TR60 can be thought of as having two central

pillars. One is a structural reform to enhance

our operational profitability. The other is a

growth strategy.

The first pillar is designed to enhance the

profit structure of our businesses. We are

doing this by cutting fixed costs through the

downsizing of our workforce and the consolidation of our manufacturing, distribution and

customer service facilities. We are also endeavoring to reduce variable costs by reassessing

our strategy for the procurement of production materials.

The second pillar, our growth strategy, positions home electronics, mobile electronics and

entertainment content as core businesses and

focuses on the convergence and centralization of

management resources within the Sony Group.

In the home electronics category, we believe

that the role of the television as the centerpiece of the living room will be enhanced by its

increasing ability to be linked up with other

electronics devices and access a wide range of

content. In the mobile electronics category, we

plan to accelerate the convergence of mobile

handset communication functions and audiovisual functions, such as those found in video

cameras and digital still cameras, in a manner

similar to that in which functions have already

been added to cellular phones.

Concurrently, Sony is making substantial

investments in key components such as semiconductors that we believe are strategically

important. By increasing the proportion of

key components produced internally, we plan

to increase the proportion of added value

captured by our finished products. We believe

that this will further enhance the differentiation of our products from those of our competitors. An additional goal is to maximize

operating efficiency by leveraging information

systems to strengthen both our demand and

supply chain management operations.

Our convergence strategy for the entertainment business is equally important. We plan to

capitalize on our entertainment assets in

music, pictures and games to increase the

value of our content. At the same time, we will

accelerate the convergence of entertainment

content and electronics products, building a

new business model that is suited to the network era. Through these activities, we intend

to generate further growth in our entertainment business, positioning us even more firmly

as a global media and content company.

44

Page 7

“Transformation 60” is a road map for

transforming Sony into a global

company of the 21st century for the

year 2006, Sony’s 60th anniversary

Transformation 60

“Transformation 60” — a group-wide mid-term

corporate strategy

“Transformation 60” has set in motion sweeping reforms

for the entire Sony Group. The objective is to ensure that

Sony remains as one of the world’s leading consumer

brands in the 21st century by developing attractive

products, content and services.

• Initiate reforms to improve Sony’s profitability

• Execute growth strategies by clearly defining Sony’s business

categories and focusing the allocation of strategic technological

and management resources

5

Page 8

While continuing to be a company that evokes

fascination and excitement, the management

team is working together to build a foundation

for future growth

How did Sony perform in the fiscal year

ended March 31, 2004 vis-à-vis its mid-term

corporate strategy TR60?

Sales for the fiscal year ended March 31,

2004 increased 0.3% to ¥7,496.4 billion. Due

to restructuring expenses, operating income

fell 46.7% to ¥98.9 billion.

In the Electronics segment, we focused on

strengthening our product lineup. Sales of flat

panel televisions increased significantly. We

expanded our LCD and plasma television

product lineups, and Grand Wega, our rearprojection television achieved substantially

higher sales, especially in the U.S. We introduced several new DVD recorder models,

which led to an increase in our market share

from late 2003 to the spring of 2004. In the

intensively price competitive digital still camera

market, the success of our best selling

product, contributed to profitability. We also

retained our leading market share in the video

camera market, which remains the most

profitable category in the Electronics segment. In the PC market, another area of fierce

competition, we significantly increased profitability in our VAIO business by focusing on

value-added models.

In the Game segment, total cumulative

production shipments of the PlayStation 2

(PS2) consoles surpassed 70 million units.

Software remained strong, too, as the annual

number of units shipped increased, proving

that the PS2 business is still in its peak years. In

the Music segment, past restructuring initiatives have resulted in significant improvements

in profitability, allowing us to record an operating profit, compared with an operating loss

in the previous year, despite the continued

contraction of the global music industry. The

Pictures segment achieved record-breaking

revenues on a U.S. dollar basis due to higher

sales within the television business. In the

Financial Services segment, higher insurance

revenues, along with an improvement in

valuation gains and losses from investments,

contributed to an increase in both revenue

and profit. In April 2004, we established Sony

Financial Holdings Inc. (SFH). This financial

holding company will play a pivotal role in our

drive to create synergies among our life insurance, non-life insurance and banking businesses, and to increase the total value of our

financial services business.

What are Sony’s primary objectives for the

fiscal year ending March 31, 2005?

I view the current fiscal year as a time for Sony

to firmly execute the fundamental strategies

that were formulated in the previous fiscal year.

In the Electronics and Game segments, we

will accelerate our convergence strategy and

one of the goals is to introduce highly attractive products in both the home and mobile

electronics categories. In the home electronics

category, we intend to accomplish this by

aggressively pursuing superior display picture

quality and increasing the speed and capacity

of storage devices. We will introduce a rearprojection television with a high resolution

display device and a home server with more

than a terabyte of storage capacity. In the

mobile electronics category, through close

cooperation with Sony Ericsson Mobile

Communications AB, we will promote the

convergence of our electronics products and

wireless technologies in products such as

cellular phones and wireless LANs. New

mobile products in the pipeline include

PlayStation Portable (PSP), a handheld video

game system, and a cellular phone equipped

with FeliCa, a contactless IC card technology.

We will also continue to invest strategically in

key components such as semiconductors.

Examples of ongoing development projects

include the Cell, a next generation multi

purpose microprocessor; imaging devices like

CCDs and CMOS image sensors; display

devices; and storage devices.

As for our entertainment business, our

entertainment and electronics businesses

joined forces in May 2004 to launch a music

download service called Connect in the U.S.,

and to introduce new Sony products compatible with this service. We will see more convergence between our entertainment and

electronics businesses. At the same time, we

will continue to strengthen our capabilities in

content development and develop new business models for the coming network era.

I firmly believe that Sony will remain a

leading consumer brand in the 21st century.

Sony will continue to be a company that

evokes fascination and excitement among its

shareholders and investors, as well as among

its customers, employees and other stakeholders. The management team is dedicated

to building a new foundation that will support expansive growth in the years ahead.

66

Page 9

Operational restructuring aimed at realizing

outstanding efficiency

and high added value

Phase 2 structural reforms are a vital element of “Transformation 60.” Here,

President Kunitake Ando discusses these reforms and his vision of Sony’s future

Structural reforms are an important element of

“Transformation 60” (TR60), Sony’s mid-term

corporate strategy. Would you tell us more

about these reforms?

In 1999, Sony embarked on the first phase of

structural reforms, which included consolidating

operating bases and reducing its workforce. These

reforms produced some benefits. However, the

pace of change in Sony’s operating environment is

accelerating, as evidenced by rapid technological

progress, particularly with respect to semiconductors, and industrial realignment. To assure Sony’s

continued growth as one of the leading consumer

brands, TR60 sets forth a second phase of structural reforms, focusing primarily on our electronics business. These reforms are designed to create

an efficient, value-added operating framework

befitting a leading global company. In concrete

terms, we intend to strengthen our operating

structure through cuts in fixed costs and production

material and other variable costs, and the generation of more added value within the Sony Group,

thereby creating a foundation for implementing a

growth strategy.

For this purpose, we are implementing structural

reforms centered on five themes: (1) intensifying

our focus on strategic businesses; (2) accelerating

reform in global manufacturing activities;

(3) streamlining administrative, sales and marketing operations; (4) transforming design processes,

quality management and the procurement of

production materials; and (5) restructuring the

procurement strategy for non-production materials. In the fiscal year ended March 31, 2004, the

Sony Group, through the implementation of

initiatives to reduce fixed costs, recorded restructuring expenses of ¥168.1 billion.

Breakdown of Restructuring Expenses Recorded in the Fiscal

Year Ended March 31, 2004

(%)

Electronics

Music

Pictures

None of the above

2.7

5.7

6.4

Total:

¥168.1 billion

85.2

Early retirement

Asset sales and disposals

20.6

Total:

¥168.1 billion

79.4

77

7

Page 10

Accelerating the identification of, and focus on,

strategic businesses and shifting management

resources from mature to strategic product

categories

Please outline Sony’s plans to tighten its focus on

strategic businesses, one of the themes of the

structural reform program.

Naturally, improving earnings in the Electronics

segment, which accounts for more than 60% of

Group sales, is a central element of our profit–

structure reform measures. In our consumer electronics business, product life cycles have become

much shorter due to the increasing speed of technological progress. To focus on strategic businesses, we are dividing our electronics business

into two product categories, strategic and mature.

We are concentrating our product design and

development resources in strategic product categories where future growth is expected, such as flat

panel televisions, home servers and mobile devices.

We expect this will lead to higher efficiency and

business expansion.

To add more value to products in strategic

categories, it is essential to strengthen our lineup

of semiconductors and other key components, as

well as to produce a larger share of these components internally. With this in mind, we established

a new unit to centralize the management of the

Sony Group’s semiconductor business. The aim is

to make our semiconductor business more competitive through unified strategies. In the fiscal

year ended March 31, 2004, we designated flat

panel televisions, DVD recorders, digital still

cameras, video cameras and VAIO PCs as strategic

products. We strengthened and expanded our

product lineups in these categories and introduced

new models in a timely manner. This focus produced enormous benefits during the 2003 yearend holiday season.

In contrast to sales in strategic product categories, sales in mature product categories are expected to fall as a share of total sales. However, we

intend to raise efficiency and maximize earnings in

mature product categories by upgrading the design

and production capabilities of our manufacturing

units, as well as by outsourcing work.

Accelerating reform in manufacturing activities

What steps are you taking to accelerate the

reforms of global manufacturing activities?

The goal of our manufacturing reforms is to

achieve a qualitative shift from assembly-oriented

manufacturing to knowledge-intensive methods.

To accomplish this goal, we are reinforcing the

role of global manufacturing bases in adding value

to products. At the same time, we are reviewing

our existing manufacturing systems and overhauling design and production systems to better reflect

the characteristics of each regional market.

At each of our manufacturing facilities, we are

enhancing the technical skills involved in design and

production activities, both of which are essential to

making competitive products. Concurrently, we are

integrating the existing design, production, customer service and logistics functions of factories to

establish a more sophisticated supply chain management system. This will enable us to strengthen our

Customer Front Center (CFC) activities, which

connect us directly to retailers and end users. Based

on this concept, we are restructuring design, manufacturing, logistics and customer service functions

on a global scale. We will also implement factory

realignments and consolidations as part of this

restructuring process. Ultimately, we expect to see

higher efficiency in all manufacturing activities.

Streamlining administrative, sales and marketing operations

What kind of structural reforms are planned for

administrative, sales and marketing operations?

We are streamlining administrative, sales and

marketing operations mainly in Japan, the U.S.

and Europe. One way we are accomplishing this is

by building common platforms that can perform

administrative functions for many business units

and sites. Another is by raising white collar productivity through reviews of administrative business processes and the greater use of IT systems.

In the U.S. and Europe, we are consolidating

our operational bases in each region. In our U.S.

electronics business, for example, we are relocating

our marketing groups so that they may be closer to

our engineering, manufacturing and other headquarter functions. This move will naturally foster

greater levels of cooperation and communication,

thus strengthening our design, manufacturing, sales

and marketing operations as well as increasing the

efficiency of our administrative functions.

Along with these measures, we are revising

personnel systems in Japan. In line with the principle of matching compensation with contribution, we will rigorously implement a merit-based

compensation structure. Our plans also include

enhanced diversity in our workforce and our

employment structure. Through these and other

efforts, we are building new kinds of relationships

between Sony and its employees.

Greater cost reduction through group-wide

initiatives

How is Sony transforming design processes,

quality management and the procurement of

production materials?

We are now pushing through far-reaching reforms

in design processes, quality management and the

procurement of production materials—domains

that support the fabrication of products. In the

area of product design, we are raising efficiency

through the extensive use of standardized design

technologies and components, and becoming

more competitive by sharply reducing the time

required to formulate new designs. For production

materials, we are strategically cutting costs through

the standardization of components and the concentration of procurement with specific suppliers.

Quality is the highest priority of any manufacturer. During the fiscal year ended March 31,

2004, we initiated an exhaustive and group-wide

review of quality-related systems. We will execute

initiatives to enhance quality so that we can deliver

high-quality products to all customers.

Transforming Sony into a leading global

company through TR60 reforms

Please describe what Sony is seeking by carrying

out this second phase of structural reforms.

At Sony the most important theme is building a

powerful operating framework that can constantly

deliver products and services worthy of the Sony

name, even when our markets are undergoing

dramatic changes.

Reforms are inevitably accompanied by challenges.

The Sony Group is fortunate to have employees

who have the motivation to embrace these challenges. Our reforms and growth strategy, progressing side by side, will ensure that Sony continues to

grow as a leading company on the global stage.

(as of May 2004)

8

Page 11

Phase 2 Structural Reforms

(1) Intensifying our focus on strategic businesses

(2) Accelerating reform in global manufacturing activities

(3) Streamlining administrative, sales and marketing operations

(4) Transforming design processes, quality management and

the procurement of production materials

(5) Restructuring the procurement strategy for non-

production materials

Building a powerful operating framework

through structural reforms

9

Page 12

Producer of the

Montreux Jazz Festival,

held annually on the

shore of Lake Geneva

in Switzerland, Mr.

Claude Nobs is a big

fan of Sony products.

Sony is dedicated to creating dreams and experiences that make our

lives more enjoyable and enriching. In this section, we introduce four

Sony enthusiasts who work closely with Sony products every day.

A stellar performer at the Montreux Jazz Festival

Surrounded by Sony at home and in

the studio

Sony products, especially my P900 Sony Ericsson cellular phone, are an

essential part of my life at home and at the Montreux Sounds Video

Studio. At the studio, I use an XPRI HD (high-definition) non-linear

video production system for editing and transferring material. I also

have a D-2, Digital Betacam, Betacam SP (Super Performance) and IMX,

which I use to make copies of video clips in various formats. At home,

my favorite Sony products are my PX40 projector and 50-inch plasma

television. They’re perfect for showing my jazz festival HD video

recordings to important guests and artists. So hardly a day goes by

without Sony.

The late Ray Charles performing at the 1991 Montreux

Jazz Festival

A fascination with innovation

When Sony comes out with a new product, I buy it immediately. I recall buying the first Sony Walkman and

CD player as soon as they went on sale in Europe. I also bought the first SACD (Super Audio CD) player

model and the very first VAIO PC, even though the instruction manual was only available in Japanese. And

I’ve even owned three generations of AIBO entertainment robots.

Claude Nobs CEO, Montreux Jazz Festival

Born in Switzerland in 1936, Claude Nobs gave up a career as a chef to found the Montreux Jazz Festival in 1967. Now a 17-day event held

every July and attended by 200,000 people annually, the festival has grown to feature a wide range of music, from jazz to blues and rock.

Montreux Jazz Festival URL: http://www.montreuxjazz.com

10

Outstanding performance and ease of use

I really count on Sony at the

Montreux Jazz Festival; all my HD

video and audio recordings are

made using Sony products. One of

the best things about Sony

products is their compatibility,

even between consumer and

professional equipment. And

thanks to the compact size of Sony

video cameras and digital cameras,

I’ve been able to assemble an

extensive library of candid shots of

many artists.

Page 13

Sony

Products File

01–06

A look inside Sony’s DNA

“To establish an ideal factory that stresses a spirit of freedom and openmindedness, and where engineers with sincere motivation can exercise their technological skills to the highest level”

This statement of the purpose of incorporation from Sony’s Founding Prospectus

continues to define “Sony’s DNA,” guiding the activities of Sony engineers who

develop new technologies and products. Today, those tackling the challenge of

devising new Sony products are motivated by a single thought—to create unique

products that inspire and bring joy to consumers. The following pages take a close

look at some of these products through interviews with the developers who helped

bring them to life.

11

Page 14

Enjoy a realistic television picture

anytime, anywhere

Television powered by Wega Engine

technology

With the Wega Engine’s high-quality

picture image circuit, users can enjoy the

same breathtaking picture on any

television—LCD Wega, plasma Wega or

Grand Wega.

The Wega Engine’s high-quality picture image circuit

Studio Application, a function

that combines Sony’s expertise

in many fields

Record television programs onto a

Memory Stick and enjoy watching them

anywhere on cellular phones or personal

digital assistants.

File 01: Flat panel television “WEGA”

[KDE-P61-HX2N]

http://www.sony.net/

A stylish remote control that’s

easy to use

The Wega’s aluminum remote control

reflects Sony’s commitment to style and

functionality. Operation is as easy as

pressing the Wega Gate button and using

the jog dial to navigate the control panel

on the television screen. The jog dial

enables the smooth execution of desired

actions from the control panel menu,

which is arranged conveniently by

function.

Making the television experience

more realistic and user friendly

Powered by Wega Engine

High-definition technologies and high resolution

differentiate Sony’s televisions

Sony has almost half a century of experience in

television development. Throughout its history,

Sony has pursued the ideal in picture quality—

“realism”—by bringing transparency, depth,

sharpness and vibrant color together on the

television screen. The Trinitron television, Wega,

the culmination of Sony’s efforts to create the

ideal picture, has inspired and impressed people

everywhere.

The arrival of the broadband era has created an

environment ripe for enjoying an array of content

at home. Moreover, with digital broadcasting

becoming mainstream, demand is expanding for

televisions with higher resolution. To achieve the

same remarkable picture quality made possible

by the Trinitron display technology in plasma and

LCD televisions, as well as in the Grand Wega

rear-projection television, in 2001 Sony embarked

on a project to develop Wega Engine, a highquality, integrated digital picture system, that

capitalizes on Sony’s image processing expertise.

The most distinguishing feature of Wega

Engine is its ability to adapt to the characteristics

of various display devices, digitally processing a

variety of input signals to generate an exception-

12

ally sharp and realistic picture. Drawing on the

expertise of Sony engineers with decades of

experience in analog signal processing, the Wega

Engine’s circuitry can produce a high-quality

picture from digital and analog input signals alike.

The Wega Engine’s picture was created by optimizing the four key elements that determine

image quality—brightness, contrast, color compatibility and sharpness—and was evaluated

extensively in line with Sony’s “realism” ideal.

With Wega Engine, Sony has succeeded in

combining imaging technologies it has cultivated

over the years to create a new digital technology.

This has facilitated the development of a television with a picture so realistic that it can, for

example, precisely reproduce the natural color

and depth of a red flower, thereby creating an

entirely new dimension of viewing excitement.

Wega Gate and Studio Application—Intuitive

controls for enhanced enjoyment

Today’s televisions often come with complicated

remote controls with multiple buttons and thick

owner’s manuals that confuse many users. After

giving considerable thought to this problem,

Sony’s Product Planning Managers came up with

Wega Gate. A push of the Wega Gate button on

the television remote control brings up a control

panel on the screen that enables the user to perform a variety of tasks intuitively. Sony has also

developed Studio Application, which allows users

to watch digital images from a video camera

Handycam and television programs stored in a

VAIO PC on a Wega television. This function was

developed in response to user demand for the

ability to copy recorded television programs and

other content onto a Memory Stick for viewing on

cellular phones or personal digital assistants. With

its firm commitment to both picture quality and

ease of use, Sony achieved the leading share of the

global television market* in the fiscal year ended

March 31, 2004.

* Indicates share of the total global market (by value) for

CRT, rear-projection and flat panel televisions.

Yoshihiro Yamamoto

General Manager

Systems Technology Section

Display Solutions Department

Home Electronics Development Division

Home Electronics Network Company

Noriyasu Yamada

Product Planning Manager

FTV Product Planning Section

Product Planning Department

Television Business Division

Home Electronics Network Company

Page 15

Setting up a program recording

has never been easier

Simply choose a program that you want to

record from the electronic program guide

(EPG). Search for a program recorded on the

hard disc drive (HDD) by its title or use the

keyword recording function, which takes full

advantage of the EPG, to automatically

locate and record all programs related to a

particular keyword. With the “Manage

game extension” function, the recording

time of the baseball game or soccer match

will be extended automatically so that you

don’t miss the end of the event.

File 02: DVD recorder “Sugoroku”

[RDR-HX10]

Compatibility with various disc

formats for stress-free

recording

Dual RW compatibility means the unit

can record and play DVD+RW and DVDRW discs, both rewritable formats. It also

accepts DVD-R discs, providing even

more versatility.

I want to record programs

without worrying about how

much space is left on the HDD

Equipped with a large capacity HDD, the

unit can store many hours of programs,

even those recorded in the highest

picture quality mode. Worrying about

the amount of time left on a videotape

is a thing of the past. Simply record the

programs you want and enjoy them at

your leisure.

Sugoroku’s EPG

I want to copy something onto

a DVD as quickly as possible

Recording from the HDD to a DVD-R can

be performed at a maximum speed of

24x, so it only takes about 150 seconds

to copy a one-hour program. It’s also

possible to delete unnecessary scenes

when making a copy.

http://www.sony.net/

I want the same picture quality

even after watching a

recorded program repeatedly

The unit is equipped with both HQ+, a

high-quality recording mode, and

Dynamic VBR Dubbing, a function that

enables high resolution dubbing of

programs to a DVD. Both allow you to

enjoy high-quality recordings of your

favorite programs over and over again.

Automatic recording of your favorite programs

and many other amazing features

Introducing a DVD recorder with intelligent

recording functionality

Sony has earned a solid reputation for devising

new ways to record television programs through

the launch of such products as the Clip-On hard

disk recorder and the CoCoon channel server. As

the market for DVD recorders began to take off in

early 2003, particularly in Japan, consumers and

retailers began to have high expectations for the

Sony DVD recorder. Determined to develop a

unique DVD recorder, a team of Sony engineers

were at that time involved in the Sugoroku

(“amazing recording”) Project, the goal of which

was to develop a DVD recorder like no other.

Sony’s Sugoroku DVD recorder was an immediate hit following its fall 2003 launch in Japan. The

unit is packed with intelligent recording functionality. First, in order to appeal to the large number of

Japanese customers who record TV programs, the

unit features DVD+RW/-RW/-R disc compatibility. It

also incorporates an electronic program guide

(EPG), along with an automatic recording function

based on keywords. For example, if a user enters

“football” as a keyword, the unit will search

through the EPG and record programs that are

associated with “football.” In addition, the HQ+

recording mode allows users to make high-quality

recordings of programs. To store programs recorded

through the automatic recording and HQ+ recording modes, the unit has a 250GB hard disc drive

(HDD) with enough space for up to 325 recorded

hours. The Sugoroku DVD recorder was made

possible by a combination of the engineering

team’s determination and accumulated know-how

within the company.

The HQ+ recording mode for outstanding

picture quality and Dynamic VBR Dubbing—

The pride of Sony engineers

The Sugoroku DVD recorder has many technologies that cannot be found on conventional models.

One technology is the HQ+ recording mode, which

records a program onto the hard disk at a rate of

approximately 15Mbps. This recording mode is

based on a technology that Sony engineers had

long been working on for producing recordings

with a picture quality indistinguishable from that of

a live broadcast.

Dynamic VBR Dubbing, a new technology used

for dubbing programs from the hard disk to a DVD

has also been successful. Inspired by methods used

to create software for DVDs such as movies etc.,

Sony engineers succeeded in minimizing picture

degradation by allocating the optimum amount of

data based on the amount of information contained in each scene, when a program is recorded

onto the DVD. This makes it possible to make

high-quality dubbing, efficiently utilizing the

capacity of DVDs. It also allows dubbing onto

both DVD+RW and DVD-RW/-R formats.

Yoshihiro Saitoh

Recorder Strategy Manager

Product Planning Section 1

Product Planning Department

Video Group

Home Electronics Network

Company

Hitoshi Hiraga

Senior Manager

Section 1

Department 1

DVD Division

Video Group

Home Electronics Network

Company

Jun Watanabe

Senior Manager

Section 4

Video Products Software Department

Software Technology Division

Home Electronics Development Group

Home Electronics Network Company

13

Page 16

The remote control should be

simple and fun to use

The cross-shaped menu, with controls

aligned vertically, permits smooth and

speedy operations. Press any button

and the action on the screen will

immediately stop, as the image fades

into the background. Never before has

the operation of a remote control

been so easy.

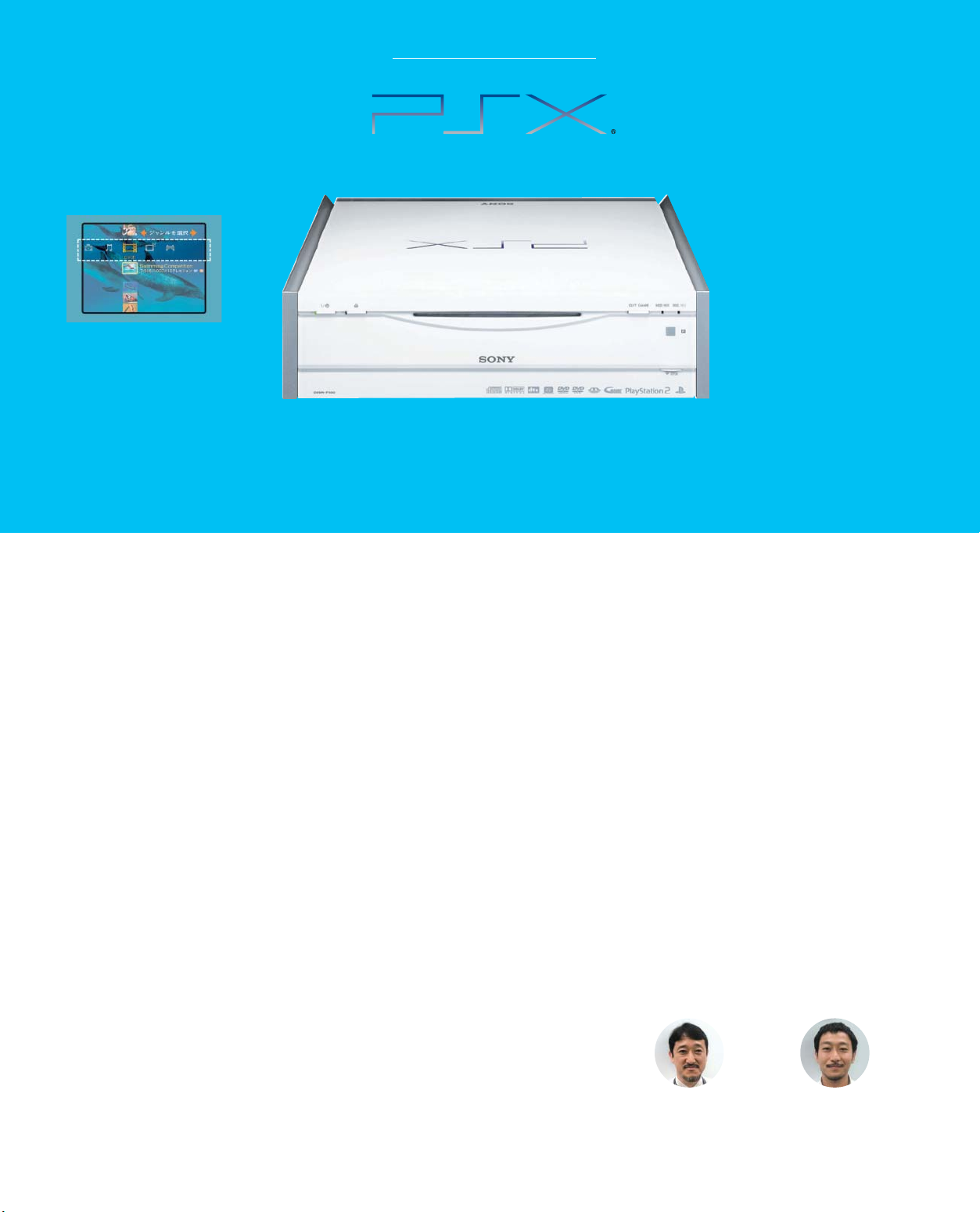

File 03: DVD recorder “PSX”

[DESR-7100]

I want to connect my PSX to

lots of other equipment

PSX comes with a game controller

port, a network port for online

gaming like that on PlayStation 2

(PS2), a USB socket for PS2compatible keyboards and

peripherals, a Memory Stick slot and

much more.

I want a design that goes

with my living room décor

PSX has a stylish design and is only

312mm in width, permitting the unit

to be placed vertically if desired.

Translucent white was chosen so that

the unit would be a handsome

addition to any room.

http://www.sony.net/

I want the freedom to be

able to play games even

while recording a television

program

PSX is compatible with both

PlayStation and PS2 software and

online games. You can even play

games while recording a television

program.

PSX—A world of entertainment in one box

An industry first: The convergence of games and

electronics in a single unit

Enhanced user control thanks to a GUI that is

supported by PlayStation 2 technology

PSX arose from the idea of making a consumer

AV product using state-of-the-art semiconductor

technology developed for PlayStation 2 (PS2)—

the world’s number one home gaming system,

from Sony’s game business. PSX drastically alters

the image of DVD recorders, with differences

extending far beyond its functionality and design.

The feeling of direct control that users experience

is unlike that of any conventional AV device. How

did Sony accomplish this? The answer lies in two

semiconductors at the heart of PS2: the

EmotionEngine (EE) CPU and the Graphics Synthesizer (GS) image processor. In PSX, both the EE

and GS are on a single chip, a feat made possible

by Sony’s unprecedented advances in semiconductor engineering and manufacturing. Furthermore, the tremendous amount of time and

energy taken by engineers to perfect the graphical user interface (GUI) is reflected in its unparalleled usability. Their efforts were not wasted. The

GUI is by far the most popular feature of PSX.

14

A world of entertainment

Enjoy television, DVDs, music, photos and games on

a single unit

Sony had a simple objective: to create a comprehensive entertainment device that can be enjoyed

by everyone, not just a particular user group.

Priority was thus placed on engineering a product

that maximizes usability while providing such basic

functions as an electronic program guide (EPG) for

television timer recording, a high-capacity hard

disc drive (HDD) for recording and a DVD recorder.

As a comprehensive entertainment device, the

PSX houses music, photo and game functions, in

addition to the DVD recorder. Recording music

CDs to the HDD transforms PSX into a jukebox.

Inserting a Memory Stick from a digital still

camera allows you to view photos on a large

screen television. Or you can simply enjoy a PS2

game. PSX is packed with possibilities.

The new PSX model, released in July 2004, has

up to 50 DVD menu, making it easy to choose

from your favorite titles when recording material

onto a DVD, making PSX an increasingly powerful

means of enjoying a world of entertainment

content from the comfort of your living room.

The achievement of a team of engineers who

were willing to tackle unprecedented challenges, PSX

is the first product line to result from Sony’s convergence of its electronics and game technologies.

Yuichi Yazawa

Senior Manager

Section 2

Video Products Software Department

Software Technology Division

Home Electronics Development Group

Home Electronics Network Company

Kenji Matsuoka

Senior Manager

Product Planning Section 2

Product Planning Department

Video Group

Home Electronics Network Company

Page 17

I want to see LCD televisionquality images on my PC

This PC is equipped with Sony’s exclusive

high-quality picture image circuit Motion

Reality. There’s also a fast response 20inch television-grade LCD screen

equipped with broad viewing angles.

Furthermore, the Clear Black LCD delivers

a vivid picture with excellent quality

contrast and brightness even when

displaying light colors or jet black.

High-quality picture image circuit Motion Reality

I only want to see the

keyboard and mouse when

they’re needed

With a wireless keyboard and mouse,

VAIO type V eliminates the need for any

kind of wired connection. The keyboard

and mouse can be put away until

they’re needed again.

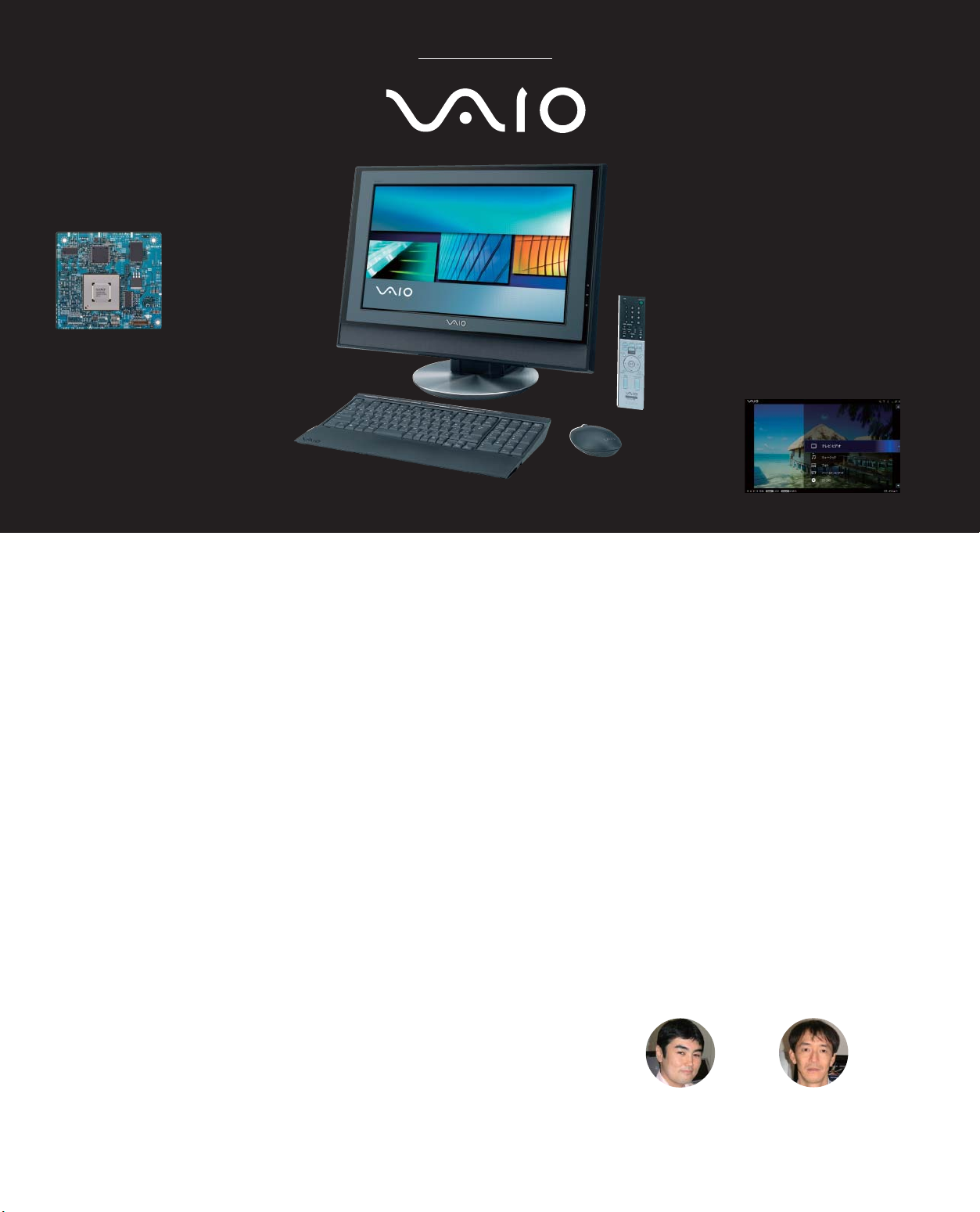

File 04: PC “VAIO”

[VGC-V201]

http://www.sony.net/

Can a PC double as both a

video deck and DVD recorder?

The hard disk drive (HDD) in the VAIO

type V can record up to approximately

103 hours of television programs. The

timer function, used to record programs,

can also be set via the Internet.

It would be great if I could do

everything with a remote

control

The stylish remote control is an integral

part of this PC. At the touch of a button

you can watch television, enter a timer

recording setting, change channels,

adjust the volume or perform various

other tasks.

The VAIO type V’s AV entertainment menu

Chapter two of the VAIO story:

Television picture quality on your PC

Picture quality virtually indistinguishable from an

LCD television—The VAIO type V’s picture quality

has broken the conventions for a PC

Since its debut in 1996, VAIO PC has enhanced

the AV experience of the user through the convergence of audio and visual contents and Sony

took the industry lead through the introduction of

a function that allows users to watch television on

their PC. However, watching television on a PC

used to present problems as, due to the limitations of the PC format, the quality of the television images tended to deteriorate as the screen

size increased. In the search for a solution to this

problem, the developers of VAIO turned their

attention to the television technology of Sony’s

Wega, which facilitates outstanding picture quality. This technology uses a powerful IC chip that,

through Sony’s unique high-quality picture image

circuit Motion Reality, allows the high-quality

display of video images. The engineers thought if

this chip could be utilized, they might be able to

produce images of television quality on a PC

screen. At this point, the developers of VAIO

embarked on a project that would confound the

conventional logic of the PC.

Until then, problems involved with viewing

television on a PC screen had been overcome

through the clever utilization of software or the

optimization of hardware performance. However,

whereas a television screen displays a single, fullscreen image, on a PC the user has the ability to

alter the size of the window, containing the

image as they see fit. Therefore, to produce a

television-quality image on a PC, engineers had to

overcome the challenges of adapting a chip

originally developed for AV devices; optimizing its

performance for the PC; and allowing televisionquality images to be displayed on the adaptable

window sizes of a PC.

VAIO type V is the result of these efforts. Its

20-inch screen generates television images with

quality on a par with those of an LCD television.

With its dazzling picture quality, this new VAIO is

pioneering uncharted territory for PCs.

Never before could a PC have delivered this kind

of enjoyment

But even then, Sony’s engineers chose not to stop

If VAIO type V can be used like a television, then

why can’t it also be used, at the user’s discretion,

to watch television anywhere in the home? To

allow this, the new VAIO has a tilting mechanism

that can be used to angle the screen downward,

a first for a PC. But there’s much more: a 360-

degree swivel stand; a wireless keyboard and

mouse; speakers that deliver high-quality dynamic

sound over a larger area; minimal fan noise; and

much more. All these features add up to make

the VAIO type V everything its creators intended:

a revolutionary PC that is as easy to use as a

television. The PC is also installed with an MPEG

hardware encoder board that can make highquality recordings of television programs. A single

remote control handles everything from television

functions to hard disk recordings and DVD operations. The concept of AV and PC convergence,

central to the VAIO lineup, is now entering a new

phase—one that will open up a new chapter in

PC history.

Yoichiro Hachiya

Assistant Manager

Product Planning Dept.

IT Company

IT & Mobile Solutions Network Company

Naoki Kameyama

Senior Engineering Manager

Hardware Design

Section 3, Department 4

IT Company

IT & Mobile Solutions Network Company

15

Page 18

I want a compact camera that’s

slender, yet durable

Miniaturizing CCD to create an ultracompact, high-resolution digital still camera

was a challenge. Stainless steel was chosen

for the body material of the 17.3mm thick

digital still camera because of its strength

and resilience. The aluminum alloy sliding

cover protects the lens and also serves as

the power switch.

This 5.1 megapixel CCD is approximately

half the size of a conventional CCD.

I want to share my pictures with

friends and family immediately after

taking them

DSC-T1’s large 2.5 inch LCD monitor is

nearly three times the size of a 1.5

inch LCD monitor. The large

monitor makes it simpler to

compose photos and easier

to playback and share photos

with friends and family by using

the monitor as a display.

17.3mm

2.5 inch LCD monitor

File 05: Digital Still Camera “Cybershot”

[DSC-T1]

http://www.sony.net/

I don’t want to miss another great shot

Equipped with Sony’s proprietary Real Imaging

Processor, the camera powers up in about 1.3

seconds, takes approximately one second between

shots and has a shutter lag of about 0.24 seconds and

a release lag of about 0.009 seconds.

I want to enjoy taking photos using a

camera equipped with a Carl Zeiss lens

The newly designed folded-optics lens system was jointly

developed by Sony and Carl Zeiss. The system was

designed specifically to keep the lens within the camera

body and features a 3x optical zoom. Another unique

feature is the Magnifying Mode, which allows users to

shoot objects from as close as a centimeter away.

Newly designed folded-optics lens system

The new Cybershot:

Fun to carry around and take photos

Cybershot DSC-T1—The result of Sony’s desire to

create an entirely new digital still camera

Featuring a large, easy-to-see LCD monitor and

5.1 megapixel CCD in an ultra-compact, slim

body, the Cybershot DSC-T1 has been a bestselling digital still camera in many countries since

its initial release in Japan in fall 2003.

About a year and a half ago, a group of young

engineers, determined to create a new digital still

camera unlike any before it, got together to

develop a next-generation model. The team

started from scratch, rethinking every aspect,

from product concept and design to components.

For example, CCD required a high, 5.1 megapixel

resolution, but also needed to be about half the

volume of a conventional CCD to achieve an

ultra-compact, slim size. A retractable zoom lens

would have made the camera too bulky. The

solution was a folded-optics lens system, codeveloped with Carl Zeiss, which moves within

the camera body instead of projecting in and out.

The result is a unique, ultra-compact, slim camera

with a 3x optical zoom. Further distinguishing

DSC-T1 is a 2.5 inch hybrid LCD monitor that uses

nearly half of the camera’s surface area. This large

display is one more reason this revolutionary

digital still camera continually amazes users.

16

A simple design with capabilities that people

appreciate more with use

Unlike a conventional camera, which has the lens

in the center and is held with two hands, the

innovative design of DSC-T1 was intended to

attract people’s attention. On the front is a sliding

cover made of aluminum alloy that protects the

lens. A specially coated stainless steel was used

for the camera’s body to prevent tarnishing and

preserve its beautiful appearance over the years.

The sliding lens cover also serves as the power

switch. Users can take out DSC-T1 from a shirt

pocket with one hand, open the lens cover,

switch the power on and snap a photo all in one

motion. DSC-T1 incorporates Sony’s latest advanced technologies, including a 5.1 megapixel

Super HAD CCD, Sony’s proprietary Real Imaging

Processor and a thin, high-capacity InfoLITHIUM

T-type battery. Incorporating these technologies

into such a compact space in DSC-T1 represented

yet another plunge into uncharted territory for the

project team. This achievement enables users to

immediately view and share photos with friends and

family on the large 2.5 inch LCD monitor, a capability no conventional digital still camera can match.

Yasushi Noda

Product Manager

Group 2

Product Design 2 Department

DSC Division

Personal Imaging Company

IT & Mobile Solutions Network

Company

Koichi Tanigawa

Department No. 2

Imaging Technology Group

IT & Mobile Solutions Network

Company

Atsushi Kawase

Senior Art Director

Design Center

Page 19

There is no danger of mistakenly

recording over other material

DVD Handycam uses a DVD with a diameter of

8cm. It automatically records new material onto

unused disc space, so there is no need to fast

forward or rewind, or worry about mistakenly

recording over other material.

Rewritable DVD

DVD editing is easy

By using a DVD-RW disc in Video Recording

(VR) mode, DVD Handycam functions as a

simplified editing tool. Users can easily erase

unwanted scenes, split and rearrange scenes,

and perform other basic editing functions.

File 06: Video Camera “DVD Handycam”

[DCR-DVD201]

http://www.sony.net/Products/handycam/

It has never been easier to dub

content and send it to family

and friends

Material stored on DVD Handycam can

be dubbed for family and friends by

using either a DVD recorder with a hard

disk or a PC.

I want to be able to find any

scene I want quickly

With DVD Handycam’s Visual Index

function, the content on the disc can be

checked at a glance. To play a specific

scene, simply select it from the onscreen display.

Example of a Visual Index

Capture it on DVD and watch it on a DVD player

The first-generation consumer DVD based video

camera, DVD Handycam, was a huge hit in the U.S.

In developing the next generation of models,

further miniaturization is the key

Sony’s video camera, DVD Handycam, was a

major hit in the U.S. market during the fiscal year

ended March 31, 2004. As the name suggests,

unlike other conventional video cameras, DVD

Handycam uses a DVD as its storage medium.

Material recorded on the DVD can be viewed

right away on a DVD player at home or can be

copied to another DVD for friends and family. Its

light weight, in particular, has made it very popular among many users, especially among families

who want to capture memories of their children

growing up or family vacations.

Sony’s next goal was to make an even smaller

DVD Handycam so that even more people could

enjoy this technology, and a project team was

established with this aim in mind. Smaller size

naturally requires both smaller components and

lower power consumption. While smaller components reduce the overall size, the circuitry would

overheat if the same level of power were to be

used. Sony engineers solved this problem by

adopting the Intermittent Recording Method, a

technique that is not possible with a videotape.

Normally, when recording to a DVD, the data of

the moving image is simultaneously saved in the

memory and written onto the disc by laser, and it

is this part of the process that consumes the most

energy. Using the Intermittent Recording Method,

disc recording is twice as fast as normal speed,

meaning that recording takes half the time,

thereby lowering power consumption. This innovative approach has facilitated a level of energy

efficiency that eliminates the risk of overheating

and has enabled this second-generation DVD

Handycam to be 30% smaller in size than the

first-generation model.

Taking advantage of features unique to DVDs

One of the biggest challenges in using a DVD

rather than a videotape for this video camera was

the problem of vibration. A shock or jolt can

interrupt the recording process on a DVD, in the

same way that a bump can cause the needle of a

record player to jump. To solve this problem, Sony

engineers applied their broad knowledge of drive

mechanisms, software and electronic circuit

technology to create a mechanism that is capable

of precisely offsetting the force of an external

shock. However, there are many other types of

vibrations and jolts that the video camera must be

able to cope with. During a testing phase that

was nicknamed the “Vibration Project” by those

involved, Sony conducted repeated and rigorous

testing on nearly 100 types of vibration and

impact right up until the start of mass production.

Engineers also focused on achieving an image

with the highest possible resolution by utilizing

Variable Bit Rate (VBR) Recording. With this technique, a fast-moving scene is recorded at a higher

bit rate, while a slower bit rate is used to record

scenes with less movement. Because bit rate

adjusts according to the volume of visual data,

the capacity of the DVD is more efficiently utilized

and picture quality is significantly enhanced.

Another advantage of this technique is that there

is less digital noise compared to Constant Bit Rate

(CBR) Recording, thereby making it possible to

record a wide range of subjects with the same

consistently high-quality picture.

For the next generation of DVD Handycam,

Sony engineers are working hard to pull a few

more exciting surprises out of the hat for video

camera users around the world.

Tadayuki Miyamoto

Project Leader

Design 2 Section 2 Group

Camcorder Business Section

Personal Video Company

IT & Mobile Solutions Network

Company

Yukiko Sakota

Planning Group

Personal Video Product Planning

Section

Personal Video Company

IT & Mobile Solutions Network

Company

Masahiro Shigenobu

Project Manager

Media Technology 3 Group

Camcorder Business Section

Personal Video Company

IT & Mobile Solutions

Network Company

17

Page 20

The future of key components

To reinforce its competitive strength in its core electronics business, Sony is seeking to differentiate its products by implementing a vertically integrated business model that incorporates

internally produced proprietary semiconductors, modules and components. Key components

include Cell, a next generation, multi-purpose microprocessor; imaging components, such as

CCDs and CMOS image sensors; display components, such as LCDs and organic electroluminescence (OEL) displays; Memory Stick; optical devices; and lithium-ion batteries. These

components are essential for producing highly competitive products.

Cell: The next generation, multi-purpose microprocessor

Differentiating products by strategic

component

Over the years, Sony’s ability to develop such

proprietary key components as Trinitron and

CCD internally has been instrumental in creating numerous appealing products, and has

been the foundation of Sony’s evolution.

PlayStation 2 (PS2), for example, features the

EmotionEngine (EE), a 128-bit CPU incorporating highly advanced technology, and the

Graphics Synthesizer (GS), a high performance

image processor. Since its debut, PS2 has

revolutionized the game console market. As

the vital role played by EE and GS in the

success of PS2 showed, highly differentiated,

advanced semiconductors are essential in order

to open up new markets. Currently, Sony is

developing a new microprocessor, Cell, which

is ideally suited for the upcoming era when

the proliferation of broadband networks will

enable people everywhere to enjoy highresolution images.

The heart of next generation digital

consumer electronics

The concept behind Cell is to evolve the conventional microprocessor, which is more of a

narrowband data processor that computes text

and still images mainly for PCs into a broadband data processor for game consoles and

high-definition televisions. Connecting several

multiple processors using a home network or

an IP broadband network will create a processing capability that far exceeds that of a single

processor. The name Cell reflects Sony’s belief

that stand-alone microprocessors will be connected through a broadband network and will

evolve to become a single global processor, in

the same way as organic cells combine to

create a living organism. Accordingly, networkenabled devices, including consumer electronics equipped with Cell, will become a structural

element of the broadband network itself.

Strategic alliance with IBM and Toshiba

expedites the development process

In March 2001, the Sony Group reached an

agreement with IBM Corporation and Toshiba

Corporation to collaborate in research and

development to create the architecture for a

new microprocessor, Cell, which it envisions as

the foundation of the next generation broadband network era. Combining their respective

strengths and technologies, the three companies expect to invest more than $400 million in

this project over five years. By incorporating

several of today’s most advanced semiconductor manufacturing technologies, such as copper interconnects, a silicon-on-insulator (SOI)

process and low-K dielectric material, the

project aims to create a microprocessor that is,

in effect, a supercomputer on a chip.

Investment to facilitate production of

semiconductors for 65 nanometer process

technology—the most advanced in the world

Preparations are under way to fabricate Cell

and a variety of media processors in three

locations: Sony’s Nagasaki Fab; an IBM manufacturing facility in East Fishkill, New York; and

a Toshiba manufacturing facility in Oita, Japan.

In the fiscal year ended March 31, 2004, the

Sony Group recorded capital expenditure of

about ¥69.0 billion for the first stage of

construction of a mass-production facility for

semiconductors that use 65 nanometer (one

nanometer equals 1/1,000 of a micrometer)

process technology. Additional capital expenditure of about ¥120.0 billion is planned for the

second stage of construction, beginning in the

fiscal year ending March 31, 2005. Trial operations at each of the three locations are scheduled to commence during the first half of

2005. Combined monthly production capacity

of the three facilities for 300mm wafers is

expected to be approximately 15,000 wafers.

18

Page 21

Taking the initiative to lead the broadband

network era

Digital consumer electronics and networkenabled devices, which support games, music,

pictures, digital broadcasts and many other

broadband applications, will be the leaders of

the broadband network era. Accordingly,

semiconductors, the key strategic components

in these products, will be one of the key

sources of Sony’s competitiveness.

A chip combining the EE and GS

“Sony’s goal is to be a manufacturer of the world’s preeminent

semiconductors”

Interview with Ken Kutaragi, Executive Deputy President, Corporate Executive Officer

Why are these components so important

to Sony?

Many people believe that digital consumer

electronics goods will become

“commodified,” that is, inexpensive enough

for anybody to buy, thereby preventing

manufacturers from making a profit. In fact,

nothing could be further from the truth. Of

course, it is true that, manufacturers cannot

create any added value by simply procuring

components and using them to assemble

their finished products. However, the story is

different for companies that in addition to

being able to manufacture key components

themselves utilizing their own distinctive

technologies, and being able to take advantage of mass production technology, can also

capture the imagination of consumers. An

enormous amount of value can be added in

this manner. For example, Sony’s Handycam

video camera and Cybershot digital still

camera are making large contributions to our

earnings. That is because we produce CCDs,

the camera’s “electronic eye,” LCD panels,

batteries and other advanced components

ourselves. This allows us to create more competitive, value-added products. The shift of

management resources in order to concentrate on key components is essential to our

pursuit of implementing a vertically integrated business model that will enable us to

create distinctive new products.

Exactly what kind of components are there?

In order to differentiate our products, we

must develop components for display, imaging, storage, semiconductor and many other

types of devices. Among these components,

semiconductors are considered to be the

most important key component, based on

the plans for our future product lineup. In

the near future, semiconductors will become

ever more miniaturized, enabling a vast

number of transistors to be incorporated

onto one chip. The development of this

semiconductor technology will enable the

realization of a diverse range of ideas and

architecture, meaning continued convergence of added-value on the semiconductor.

In addition, as the resolution of displays

improves, there will be more demand for

even better picture quality, whether for

video or still photos. This trend points to an

even more important role for CCDs and

other imaging components used in video

cameras and digital still cameras.

What kind of measures is Sony taking to

secure a stable supply of key components?

To meet the explosive growth in demand

that is foreseen for digital consumer electronics, we are currently making substantial

investments in the construction of manufacturing facilities for key components.

For example, to manufacture Cell we

must introduce state-of-the-art semiconductor production technologies and facilities.

We are working with IBM and Toshiba to

put in place a highly sophisticated massproduction infrastructure.

As for display components, we are striving

to enhance our manufacturing capability of

amorphous silicon TFT LCD panels, enabling

us to keep up with the expected growth in

demand for LCD televisions.

19

Page 22

Image sensors Display components Memory Stick

Tapping the strengths of CCD and CMOS

image sensors

Sony has the leading share of the global market for CCDs. This key component not only

supports our lineup of mobile products, such

as digital still cameras and video cameras, but

also contributes to profitability through sales

to external customers. In July 2003, Sony was

the first company to develop a CCD for consumer digital still cameras that has a four-color

filter: red, green, blue and emerald. This breakthrough will be leveraged to differentiate Sony

cameras from those of its competitors. We will

also strive to make the CCDs smaller, while

simultaneously enhancing picture quality.

Sony is also developing CMOS image sensors.

This component offers the advantages of low

power consumption, faster processing speed,

and the ability to place peripheral circuitry on a

single chip. Traditionally, picture quality from

CMOS image sensors has been thought to be

inferior to that of CCDs. Sony has almost

completed work on a CMOS image sensor that

produces a higher-quality picture. This is being

accomplished by applying manufacturing knowhow that was gained from the production of

CCDs and using sophisticated equipment for

the MOS process. Sony will continue its CMOS

image sensor development program with the

goal of expanding this business.

Joint venture with Samsung to massproduce next generation LCD panels

Demand for flat panel displays is increasing

rapidly, with applications for this technology

ranging from cellular phones, digital still

cameras, televisions, PC monitors and rearprojection televisions. To ensure a stable

supply of LCD panels to meet the expected

growth in demand for large screen LCD

televisions, Sony and Samsung Electronics Co.,

Ltd. established S-LCD Corporation. This joint

venture will develop and manufacture seventhgeneration (1,870mm x 2,200mm glass substrate) amorphous silicon TFT LCD panels to be

used in large screen televisions. Full scale production is scheduled to begin in the fiscal year

ending March 31, 2006.

A rear-projection television with an ultra

high-resolution LCD

As LCD panels with increasingly high-resolution

become available, even small devices will have

the ability to display ultra-fine images. Sony has

developed a display device called the SXRD

(Silicon X-tal Reflective Display) that can produce high-resolution, high-contrast images with

cinematic quality. Sony will use SXRD to produce front projectors and rear-projection televisions that will have a far better picture quality

than those currently available.

Meeting the new demand for increasingly

widespread music distribution and highresolution video recording

Since its debut six years ago, the Memory Stick

business has continued to grow rapidly, fueled

by the growth of the digital still camera market.

As a result, cumulative shipments have surpassed 70 million units. Sony and more than

500 other companies that support this technology are developing new markets for Memory

Stick. Music and e-book distribution services are

two applications that will be added during the

fiscal year ending March 31, 2005, with highresolution video recording as another potential

addition. To ensure ease of use for a broad

range of applications, all Memory Stick media is

equipped with copyright protection technology

and high-speed data transfer capability. Sony

plans to launch higher-capacity media with the

introduction of a 2GB version in 2004 and a

4GB version in 2005.

Memory Stick PRO

Memory Stick PRO Duo

CCD with a four-color filter

20

Practical application for OEL displays

OEL displays can reproduce highly vivid colors

with the fast response required for smooth

video playback. Backlighting is not required

because the panel is self-luminescent, producing three colors: red, green and blue. This

allows for panels to be extremely slim. Sony is

working toward the practical application of the

OEL display to mobile devices.

LCD display component, “4K SXRD”

Memory Stick

Memory Stick Duo

Page 23

Lithium-ion batteries

Optical disc components and digital tuners

Supporting Sony’s mobile products

Demand for rechargeable lithium-ion batteries is

rapidly growing due to its use in a diverse range

of mobile devices, such as notebook PCs, cellular

phones, digital still cameras and video cameras.

With superior safety and high performance,

Sony’s lithium-ion batteries have contributed to

making Sony’s core mobile devices, such as the

digital still camera Cybershot, VAIO PCs and the

video camera Handycam, more slender and

compact. There is no doubt that these batteries

will play a greater role in Sony’s strategy to differentiate its mobile products by making them

even slimmer and lighter.

Aiming to increase sales of lithium-ion

batteries

Sony has secured firm positions in the markets

for both the liquid-electrolyte lithium-ion batteries used in notebook PCs and the lithiumion polymer batteries used in cellular phones.

To reinforce its leading position in the notebook PC battery market, Sony will continue to

increase the capacity and output of liquidelectrolyte lithium-ion batteries. In 3G and

subsequent generations of the cellular phone

market, the goal is to increase sales by taking

advantage of the high capacity and light

weight of polymer batteries, which give them