Page 1

Vision 2020+ execution fully on track

Ralf P. Thomas, CFO Siemens AG

Commerzbank German Investment Conference

New York, January 13, 2020

siemens.comUnrestricted © Siemens 2020

Page 2

Unrestricted © Siemens 2020

New York, January 13, 2020Page 2 Commerzbank German Investment Conference

Notes and forward-looking statements

This document contains statements related to our future business and financial performance and future events or developments involving

Siemens that may constitute forward-looking statements. These statements may be identified by words such as “expect,” “look forward to,”

“anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,” “will,” “project” or words of similar meaning. We may also make forward-looking

statements in other reports, prospectuses, in presentations, in material delivered to shareholders and in press releases. In addition, our

representatives may from time to time make oral forward-looking statements. Such statements are based on the current expectations and

certain assumptions of Siemens’ management, of which many are beyond Siemens’ control. These are subject to a number of risks,

uncertainties and factors, including, but not limited to, those described in disclosures, in particular in the chapter Report on expected

developments and associated material opportunities and risks in the Annual Report. Should one or more of these risks or uncertainties

materialize, should decisions, assessments or requirements of regulatory authorities deviate from our expectations, or should underlying

expectations including future events occur at a later date or not at all or assumptions prove incorrect, actual results, performance or

achievements of Siemens may (negatively or positively) vary materially from those described explicitly or implicitly in the relevant forwardlooking statement. Siemens neither intends, nor assumes any obligation, to update or revise these forward-looking statements in light of

developments which differ from those anticipated.

This document includes – in the applicable financial reporting framework not clearly defined – supplemental financial measures that are or

may be alternative performance measures (non-GAAP-measures). These supplemental financial measures should not be viewed in isolation

or as alternatives to measures of Siemens’ net assets and financial positions or results of operations as presented in accordance with the

applicable financial reporting framework in its Consolidated Financial Statements. Other companies that report or describe similarly titled

alternative performance measures may calculate them differently.

Due to rounding, numbers presented throughout this and other documents may not add up precisely to the totals provided and percentages

may not precisely reflect the absolute figures.

Page 3

Unrestricted © Siemens 2020

New York, January 13, 2020Page 3 Commerzbank German Investment Conference

Siemens – A position of strength

Unrestricted © Siemens 2020

€98bn

Orders

€87bn

Revenue

€6.41

Earnings

per share

€5.8bn

Free cash flow

Leading in

Electrification,

Automation &

Digitalization

10.8%

Adj. EBITA margin

Industrial

Businesses

€5.6bn

Net profit

Comparable Key Figures FY 2019

Commerzbank German Investment Conference

Page 4

Unrestricted © Siemens 2020

New York, January 13, 2020Page 4 Commerzbank German Investment Conference

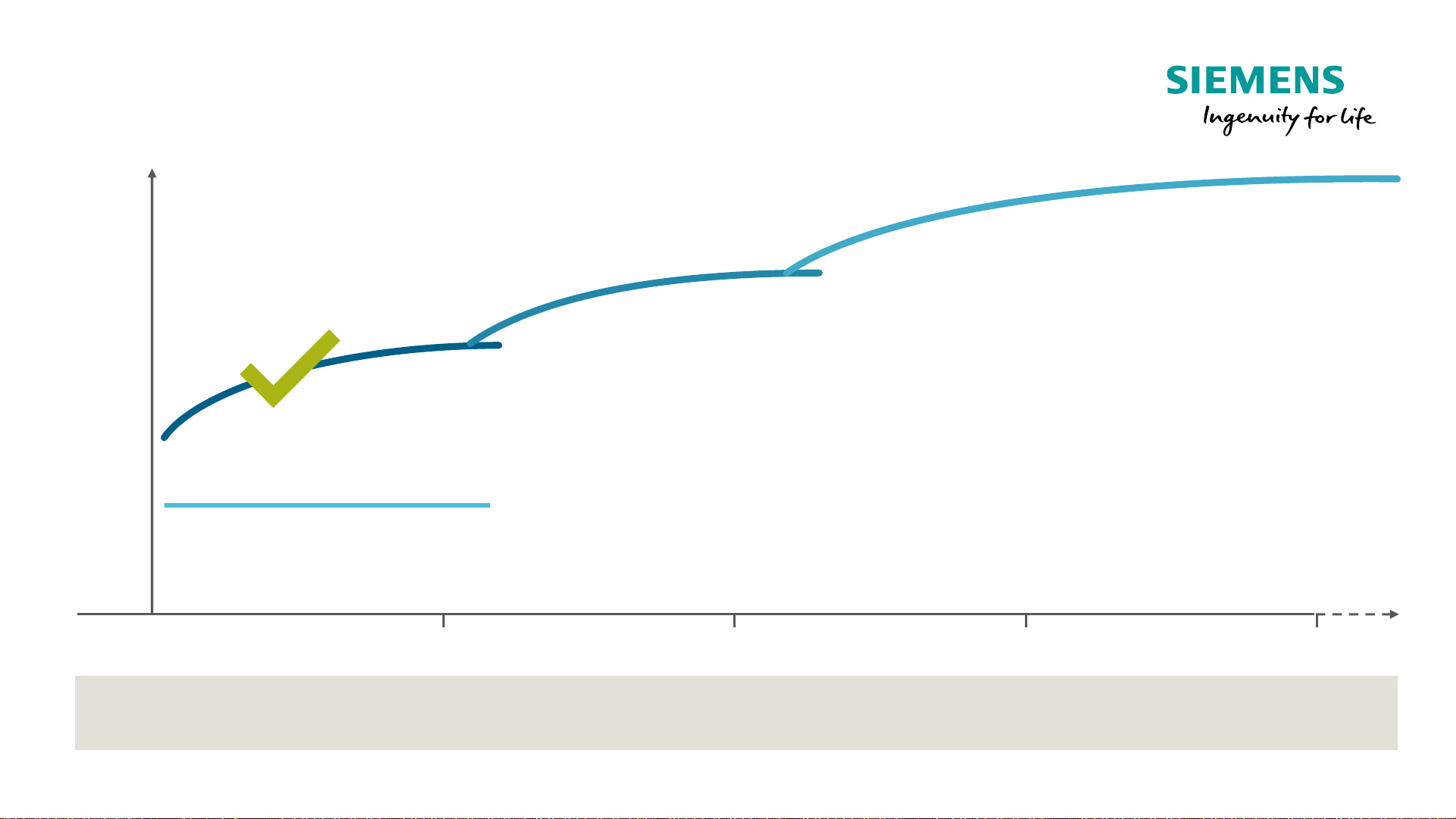

Vision 2020+

Drive transformation to shape change

Key: Foster Ownership Culture and strengthen entrepreneurial focus

Value

2020 2021 20222019

Anticipate markets and trends

Leading in all businesses, shaping change

Transformation

Ultimate value creation

2023

Focus

Accountability

Adaptability

#RaisingTheBar

Page 5

Unrestricted © Siemens 2020

New York, January 13, 2020Page 5 Commerzbank German Investment Conference

Vision 2020+

Current company setup, entrepreneurial freedom for our businesses

Gas and

Power*

Smart

Infrastructure

Digital

Industries

Operating Companies

Siemens

Mobility

*Partial spinoff of Gas and Power planned; transfer of majority stake in SGRE (59%) to new company planned

Siemens

Gamesa*

Siemens

Healthineers

Service Companies (Financial Services, Global Business Services, Real Estate Services)

Corporate Development (e.g., IoT Services, Corporate Technology, Next47, POC

Governance units

€19.3bn

3.8%

€14.6bn

10.0%

€16.1bn

17.9%

€8.9bn

11.0%

€10.2bn

4.7%

€14.5bn

17.0%

+ 2 ppts.

CAGR

Accelerated

comp. revenue

growth

+ 2 ppts.

Margin lift at

Industrial

Business

> revenue

growth

EPS growth

1)

1) on constant minority shareholdings

Strategic Companies Mid-term target

Page 6

Unrestricted © Siemens 2020

New York, January 13, 2020Page 6 Commerzbank German Investment Conference

Focused strategic companies offer value creation opportunities

Siemens Energy

SHL +54%

MDAX

+11%

▪ Attractive market with secular growth trends

▪ World class Imaging, Diagnostics with upside

▪ Sustainable profit and cash flow performance

▪ “Upgrading” phase of Strategy 2025

▪ Attractive asset with significant valuation upside

Siemens Healthineers (85% stake)

Market cap: €43bn

▪ Leading role in energy industry as focused pure play

▪ Driving force of decarbonization

▪ Great portfolio along entire energy value chain

▪ Reliable partner for customers

▪ Siemens with minority stake >25% to <50%

Oil & Gas TransmissionGeneration

Renewables

59% SGRE

Mar-18 Sep-18 Mar-19 Sep-19

Page 7

Unrestricted © Siemens 2020

New York, January 13, 2020Page 7 Commerzbank German Investment Conference

Siemens Energy – Fully on track for public listing by end FY 2020

Jan 13,

2020

March / April

2020

May

2020

June

2020

July

2020

September

2020

Today

Carve out

completed

Spin off

report

Extraordinary

Shareholders’ Meeting

Siemens AG

Capital

Market Day

Prospectus

Listing

Road-

show

Leadership team

in place

Portfolio setup

defined

Company name

announced

Carve out concept

defined for each

country

Page 8

Unrestricted © Siemens 2020

New York, January 13, 2020Page 8 Commerzbank German Investment Conference

Sustainable shareholder return

Attractive dividend policy and ongoing share buyback

20132011 20192010 2012

€2.70

2014 2015 2016 2017 2018

€3.00 €3.00

5.40

€3.80

€3.30

€3.50

€3.60

€3.70

€3.90

3.8%

Dividend

Dividend

yield

1)

3.5% average dividend yield

1)

3.0%2.9%3.9%3.3%

Dividend

payout

ratio

€3.00

3.0%3.7%4.0%3.0%

Up to

3.0

2014 - 2015 2012

1.1

2016 - 2018

4.0

2018 - 2021

2.9

3.0

Share buyback continued (in €bn)

1) Dividend / XETRA closing price at day of AGM 2) XETRA closing price of Sep 30, 2019: €98.25

3) Effect of OSRAM stock distribution to shareholders of €2.40 per share; not reflected in dividend payout ratio

3)

4.0%

2)

38% 52% 49% 53% 61%50%57%51%42%46%

Dividend proposal

to AGM

Target:

40 – 60%

Page 9

Unrestricted © Siemens 2020

New York, January 13, 2020Page 9 Commerzbank German Investment Conference

Outlook FY 2020

EPS as reported

FY 2020e

EPS as reported

FY 2019

6.41

7.00

6.30

Mid point growth

+ 4%

▪ Book-to-bill > 1

▪ Moderate comp. revenue growth

FY20 Framework Siemens non-listed Companies

Comparable

revenue growth

Adj. EBITA margin

expectation

1)

Digital Industries

Flat 17 - 18%

Smart Infrastructure

Moderate 10 - 11%

Mobility

Mid-single digit 10 - 11%

Gas and Power

Moderate 2 - 5%

FY20 Framework Siemens Group

1)

as reported

Page 10

Unrestricted © Siemens 2020

New York, January 13, 2020Page 10 Commerzbank German Investment Conference

Our agenda for FY 2020

Deliver on our FY 2020 financial targets

Drive Vision 2020+ milestones

Ensure stringent capital allocation and cash focus

Execute Siemens Energy spin off

Page 11

Unrestricted © Siemens 2020

New York, January 13, 2020Page 11 Commerzbank German Investment Conference

Appendix

Page 12

Unrestricted © Siemens 2020

New York, January 13, 2020Page 12 Commerzbank German Investment Conference

Upcoming capital market communication

Feb 5, 2020

Q1 Release & AGM

Mar 18, 2020

BAML Conference

London

investorrelations@siemens.com

www.siemens.com/investor

+49 89 636-32474

May 8, 2020

Q2 Release

Aug 6, 2020

Q3 Release

Nov 12, 2020

Q4 Release

May 19, 2020

EPG Conference

Miami

Jun 12, 2020

JPM Conference

London

Sep 10, 2020

MS Conference

London

Loading...

Loading...