Page 1

MODEL

EL-738F

FINANCIAL CALCULATOR

OPERATION MANUAL

Contents

Introduction ..................... 3

Getting Started ................ 5

General Information ........ 11

Financial Functions ......... 17

Scientific Functions ........ 60

Statistical Functions ....... 64

Appendix .......................... 72

Index ................................. 83

Page

Page 2

Page 3

NOTICE

• SHARP makes no guarantee that this product or this

manual is suitable or accurate for any purpose, commercial or otherwise.

• Rules and practices in fi nancial calculation vary ac-

cording to country, locality, or fi nancial institution. It

is the consumer’s responsibility to determine whether

or not the results produced by this product conform

to applicable rules and regulations.

• SHARP will not be liable nor responsible for any incidental

or consequential economic or property damage caused

by misuse and/or malfunctions of this product and its

peripherals, unless such liability is acknowledged by law.

• The material in this manual is supplied without representation or warranty of any kind. SHARP assumes no

responsibility and shall have no liability of any kind, consequential or otherwise, from the use of this material.

• SHARP assumes no responsibility, directly or indirectly,

for fi nancial losses or claims from third persons resulting

from the use of this product and any of its functions, the

loss of or alteration of stored data, etc.

• SHARP strongly recommends that separate permanent

written records be kept of all important data. Data may be

lost or altered in virtually any electronic memory product

under certain circumstances. Therefore, SHARP assumes

no responsibility for data lost or otherwise rendered unusable whether as a result of improper use, repairs, defects,

battery replacement, use after the specifi ed battery life

has expired, or any other cause.

1

Page 4

Contents

Introduction .................................................................. 3

Operational Notes ...............................................................3

Key Notations in This Manual ..............................................4

Chapter 1: Getting Started ..........................................5

Preparing to Use the Calculator ..........................................5

Resetting the Calculator In Case of Diffi culty ......................5

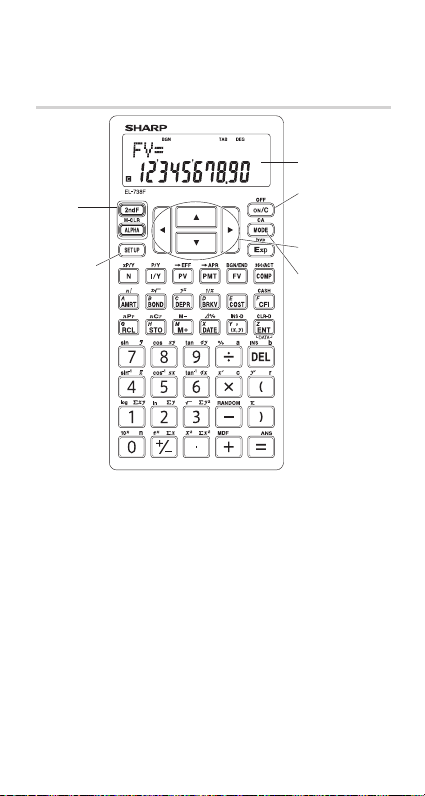

Calculator and Display Layout .............................................6

The SET UP Menu ..............................................................8

Operating Modes...............................................................10

Chapter 2: General Information ................................ 11

Basic Calculations .............................................................11

Clearing the Entry and Memories .....................................11

Editing and Correcting an Entry ........................................13

Memory Calculations ........................................................14

Chapter 3: Financial Functions ................................ 17

General Information ..........................................................17

TVM (Time Value of Money) Solver ..................................22

Amortization Calculations .................................................33

Discounted Cash Flow Analysis ........................................37

Bond Calculations .............................................................44

Depreciation Calculations .................................................48

Conversion between APR and EFF ..................................51

Day and Date Calculations ................................................52

Percent Change/Compound Interest Calculations ............54

Cost/Sell/Margin/Markup Calculations ..............................56

Breakeven Calculations .....................................................58

Chapter 4: Scientifi c Functions ................................ 60

Constant Calculations .......................................................60

Chain Calculations ............................................................60

Scientifi c Calculations .......................................................61

Random Functions ............................................................62

Modify Function .................................................................63

Chapter 5: Statistical Functions ............................... 64

Statistical Calculations and Variables ................................67

Appendix .................................................................... 72

Financial Calculation Formulas .........................................72

Statistical Calculation Formulas ........................................75

Errors and Calculation Ranges .........................................76

Battery Replacement ........................................................80

Priority Levels in Calculations ...........................................81

Specifi cations ....................................................................82

Index ...........................................................................83

2

Page 5

Introduction

Thank you for purchasing a SHARP Financial Calculator.

After reading this manual, store it in a convenient location for

future reference.

• Display of examples shown in this manual may not look exactly the same as what is seen on the product. For instance,

screen examples will show only the symbols necessary for

explanation of each particular calculation.

• All company and/or product names are trademarks and/or

registered trademarks of their respective holders.

• Some of the models described in this manual may not be

available in some countries.

Operational Notes

• Do not carry the calculator around in your back pocket, as it

may break when you sit down. The display is made of glass

and is particularly fragile.

• Keep the calculator away from extreme heat such as on a car

dashboard or near a heater, and avoid exposing it to excessively humid or dusty environments.

Since this product is not waterproof, do not use it or store it where

•

fl uids, for example water, can splash onto it. Raindrops, water spray,

juice, coffee, steam, perspiration, etc. will also cause malfunction.

•

Clean with a soft, dry cloth. Do not use solvents or a wet cloth. Avoid

using a rough cloth or anything else that may cause scratches.

• Do not drop the calculator or apply excessive force.

• Never dispose of batteries in a fi re.

• Keep batteries out of the reach of children.

• This product, including accessories, may change due to upgrading without prior notice.

Hard Case

3

Page 6

Key Notations in This Manual

Key operations are described in this manual as follows:

To specify log : . h .....................

To specify 1 : 1 or 1 .......................

To specify Σxy : i V .....................

1

2

3

To specify CLR-D : . ? .....................

To specify ENT :

To specify Z : i Z .....................

To specify DATA : J ..............................

1

Functions that are printed in orange above the key require

to be pressed fi rst before the key.

.

2

Number entry examples are shown with ordinary numbers

(i.e., “100” will be indicated instead of “1 0 0”).

3

To specify a memory function (printed in green), press

fi rst.

i

4

Functions that are printed in black adjacent to the keys are

effective in specifi c modes.

Using the . and i keys

Press s .

A x ,

• .

mean you have to press .

followed by ) key and i

followed by * key.

Notes:

• The multiplication instruction “×” and alphabetic letter “X” are

distinguished as follows:

Key Display

Multiplication instruction → x

Alphabetic letter → X X

• Examples in this manual are performed using default settings

(e.g., SET UP menu items) unless values are otherwise assigned.

and i A

10.

Q

i

πA˚_

1

3

4

10

-

×

4

Page 7

Chapter 1

Getting Started

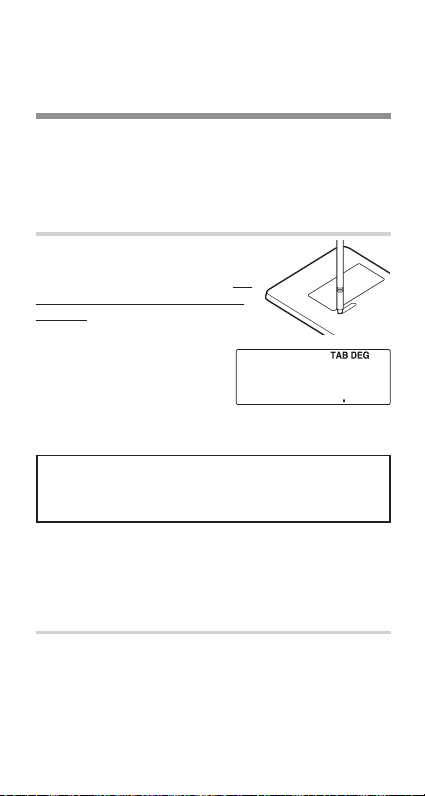

Preparing to Use the Calculator

Before using your calculator for the fi rst time, you must reset

(initialize) it.

Resetting the calculator

Press the RESET switch located on

the back of the calculator with the tip

of a ball-point pen or similar object. Do

not use an object with a breakable or

sharp tip.

• After resetting the calculator,

the initial display of the NORMAL mode appears.

Resetting the Calculator In Case of Diffi culty

Caution:

The RESET operation will erase all data stored in

memory and restore the calculator’s default setting.

In rare cases, all the keys may cease to function if the calculator

is subjected to strong electrical noise or heavy shock during use.

If pressing any of the keys (including s) has no effect, reset

the calculator.

Resetting the calculator

See the above procedure.

Note: Pressing . k and 1 = will also erase all

data stored in memory and restore the calculator’s default

setting.

000

5

Page 8

Calculator and Display Layout

Calculator layout

1

Display

screen

2

Power

3 Key

operation

keys

4

SET UP

key

Display screen: The calculator display consists of a 12-char-

1

acter dot matrix character line and a 12-digit 7-segment

character line (10-digit mantissa and 2-digit exponent).

Power ON/OFF and Clear key: Turns the calculator ON.

2

This key also clears the display. To turn off the calculator,

press ., then c.

Key operation keys:

3

: Activates the second function (printed in orange) as-

.

signed to the following key.

: Activates the memory (printed in green) assigned to

i

the following key.

SET UP key: Displays the SET UP menu to select the

4

display notation, angular unit, depreciation method and date

format.

Cursor keys: Move the cursor.

5

MODE key: Switches between NORMAL and STAT modes.

6

6

ON/OFF and

Clear key

5

Cursor keys

6

MODE key

Page 9

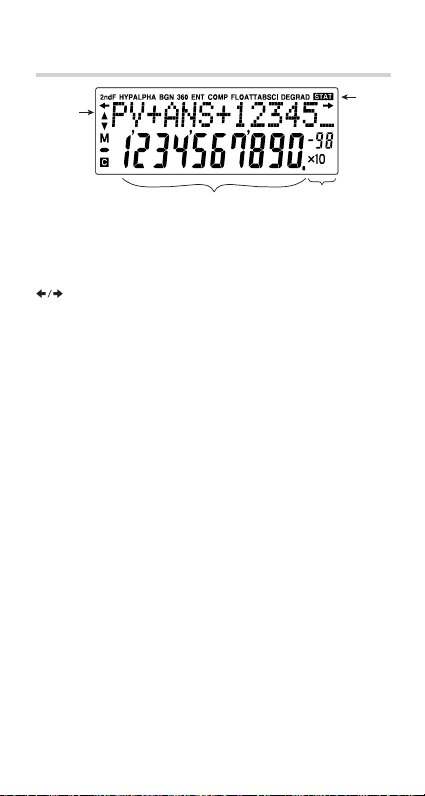

Display layout

Equation/

variable

name

display

Symbol

Mantissa

Exponent

• During actual use, not all symbols are displayed at the same

time.

• Only the symbols required for the operation being explained

are shown in the screen examples of this manual.

:

Appears when the entire equation cannot be displayed.

Press g / y to see the remaining (hidden) part.

:

Indicates that variables or data are present above/be-

c /d

low the screen. Press z / i to scroll up/down.

2ndF : Appears when . is pressed, indicating that the

functions shown in orange are enabled.

HYP : Indicates that . ] has been pressed and the

hyperbolic functions are enabled.

ALPHA : Indicates that i, g or f has been pressed,

and storing or recalling memory values or TVM solvers/statistics variables can be performed.

BGN : Indicates that calculations are annuity due (payment

at the beginning of each interval) calculations. When

BGN is not displayed, calculations are ordinary annu-

ity (payment at the end of each interval) calculations.

:

360

Indicates that date calculations are based on a

360-day year (12 months with 30 days). When 360 is

not displayed, date calculations use the actual calendar.

:

ENT

Indicates that a value can be assigned to the displayed

variable using Q.

COMP : Indicates that the displayed variable can be solved for

by using @.

FLOAT A / FLOAT B / TAB / SCI: Indicates the notation used to

display values. It can be changed in the SET UP menu.

7

Page 10

DEG / RAD / GRAD : Indicates which angular units are in use.

It can be changed in the SET UP menu.

: Appears when statistics mode is selected.

M : Indicates that a numerical value is stored in the inde-

pendent memory (M).

: Indicates that the value of the displayed variable has

not been calculated yet (for variables that can be calculated).

The SET UP Menu

Press ~ to display the SET UP menu.

DSP DRG DEPR

02

1

• A menu item can be selected by:

• Using g / y to select a number (the selected number

will blink), then pressing =, or

• pressing the number key corresponding to the menu item

number.

• If c or d is displayed on the screen, press z or i to

view the previous/next part of the menu.

• Press s to exit the SET UP menu.

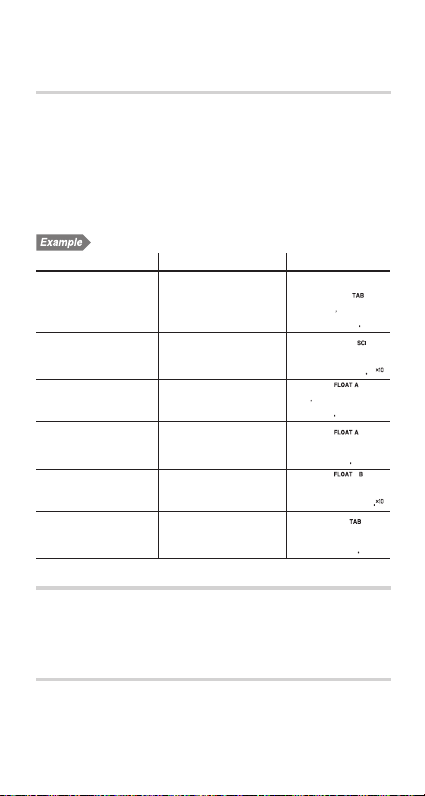

Selecting the display notation and number of decimal

places

The calculator has three display notation systems (fi xed decimal

point, scientifi c notation and fl oating point) for displaying calculation results.

• If ~ 0 0 (TAB) is pressed, “DIG(0-9)?” will be

displayed and the number of decimal places can be set to any

value between 0 and 9.

• If ~ 0 1 (SCI) is pressed, “SIG(0-9)?” will be displayed and the number of signifi cant digit can be set to any

value between 0 and 9. Entering 0 will set a 10-digit display.

• If a fl oating point number does not fi t in the specifi ed range,

the calculator will display the result in scientifi c notation (exponential notation). See the next section for details.

• The default setting is a fi xed decimal point with two decimal

places.

→

i

8

DAtE

3

Page 11

Selecting the fl oating point number system in scientifi c notation

The calculator has two settings for displaying a fl oating point

number:

FLO_A (FLOAT A) and FLO_B (FLOAT B). In each display setting, a number is automatically displayed in scientifi c notation

outside the following preset ranges:

• FLO_A ~ 0 2: 0.000000001

• FLO_B ~ 0 3: 0.01

| X | ≤ 9,999,999,999

≤

| X | ≤ 9,999,999,999

≤

Switching the notation setting

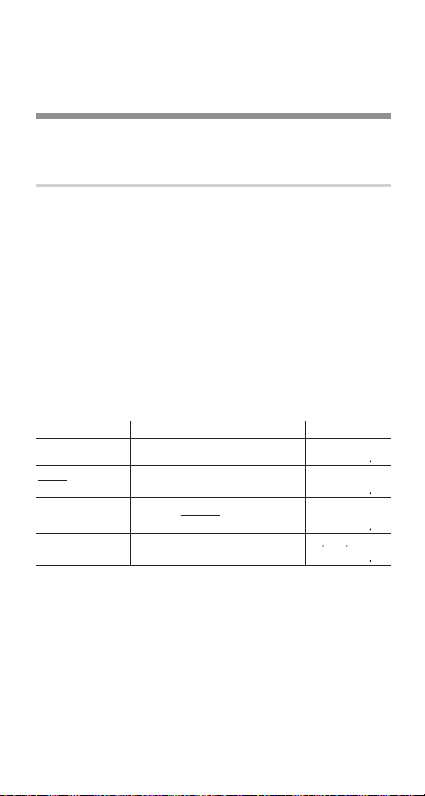

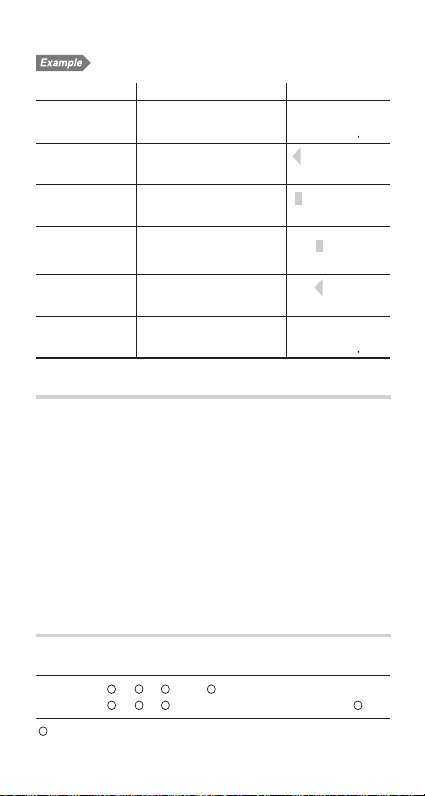

Procedure Key operation Display

100000

3 8

(see page 61)

1

2

8 3

2

1000

2

1

—————©3=

3333333

1

—————©3=

1

—————©3=

3333333333

3©1

———=

0003

3©1

———=

3©1

———=

000

(see page 48)

1

2

33

3

-03

100000 ÷ 3 =

Fixed decimal point

with two decimal

places

Scientifi c notation

→

(SCI) with two

signifi cant digits

Floating point

→

(FLO_A)

3 ÷ 1000 =

Floating point

(FLO_A)

Floating point

→

(FLO_B)

Fixed decimal point

→

with two decimal

places

s

=

~ 0 1

~ 0 2

s

=

~ 0 3

~ 0 0

Selecting the angular unit

• DEG (°) : ~ 1 0 (default setting)

• RAD (rad) : ~ 1

• GRAD (g) : ~ 1

Selecting the depreciation method

• SL (Straight-line method): ~ 2 0 (default setting)

• SYD (Sum-of-the-years’ digits method): ~ 2

• DB (Declining balance method): ~ 2

9

04

Page 12

Selecting the date format

• US (Month-Day-Year): ~ 3 0 (default setting)

• EU (Day-Month-Year): ~ 3

(see page 44)

1

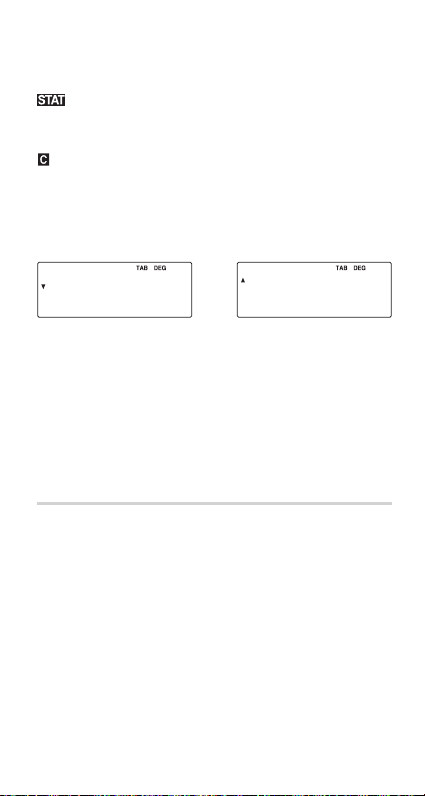

Operating Modes

This calculator has two operating modes, which can be selected

using the MODE key.

Selecting a mode

1. Press m.

The menu display appears.

NORMAL StAt

01

2. Press 0 or = to se-

lect NORMAL mode.

000

• Press 1 or y =

to select STAT mode.

Operations available in each mode

NORMAL mode:

Allows you to perform fi nancial, arithmetic, or scientifi c

calculations.

STAT (statistics) mode:

Allows you to perform statistical, arithmetic, or scientifi c

calculations. The

symbol appears in the display.

SD LINE QUAD

1

02

10

Page 13

Chapter 2

General Information

Basic Calculations

Entering numbers and arithmetic operations

• Use the number keys 0 to 9, decimal point key .,

and sign change key , to enter numbers into the calculator. To clear the display or entry, press s.

• Use the S key to enter a value in scientifi c notation.

• Use the arithmetic keys + - x 8 to perform the

standard arithmetic calculations of addition, subtraction, multiplication, and division. Press = to perform each calculation.

• Use the ( and ) keys to place parentheses around

inner parts of expressions. The closing parenthesis ) just

before = or h may be omitted.

• When you enter a series of operations in one sequence, the

calculator performs the calculation according to the priority

levels in calculation on page 81.

Example Key operation Result

45 + 285 ÷ 3 =

18 + 6

=

15 – 8

42 × (–5) + 120 =

(5 × 103) ÷ (4 × 10–3) =

s

(

(

42

1

(5 ,)

*

5

S 3 8 4 S

,

Clearing the Entry and Memories

The following methods of clearing the calculator (restoring default settings) are available:

285

45 +

18 + 6 )

15 - 8

x , 5 +

3

=

8 3

=

1

*

8

120

=

=

125000000

14000

343

-9000

11

Page 14

Listed

Cash

A-H,

(MEM)

(RESET)

Entry

(display)

M, X-Z

×

×

×

Operation

s

. b

(Mode selection)

m

. k 0

. k 1

RESET switch

: Cleared or restored to the default setting : Retained

1

N, I/Y, PV, PMT, and FV (P/Y and C/Y are not included.)

*

2

Note that listed fi nancial variables sharing common memory

*

with TVM variables, such as “COUPON (PMT)” used in bond

calculations, are also cleared or restored to default settings.

3

Listed variables used in fi nancial calculations (such as “RATE

*

(I/Y),” etc.) including P/Y and C/Y

4

When you press * to enter a fi nancial calculation, AMRT

*

P1 and AMRT P2 both revert to their default values. The

same holds true for YEAR when you press O.

5

With one of the variables of a listed group (such as those

*

used in bond calculations) displayed, when . b is

pressed, all the variables in the listed group are cleared or

restored to their default settings. Note that TVM variables

sharing common memory with listed fi nancial variables are

also cleared or restored to default settings.

6

Press . b when a cash fl ow value is displayed.

*

7

Statistical data (entered data) and variables (n, x, etc.)

*

8

Are cleared when changing between sub-modes in STAT mode.

*

Notes:

• To clear any of the “A-H, M, X-Z” or “ANS” memories, press

g and then specify the memory.

s

• To clear or restore to the default setting one variable or value

of TVM variables, listed fi nancial variables, cash fl ow data, or

STAT, refer t o the relevant section.

• If you turn off the calculator (by pressing . c or by letting it turn itself off automatically), it will resume wherever you

left off when you turn it on again.

TVM

variables

ANS

× ×××

×

*2*

×

×

financial

1

variables

*

3

flow

*

4

data

STAT

*

6

5

*

×

Delete key

To delete a number/function, move the cursor to the number/

function you wish to delete, then press L. If the cursor is

located at the right end of an equation or if you are entering a

value, the L key will function as a back space key.

12

7

*

×

8

×

*

Page 15

Memory clear key

Press . k to display the

menu.

• To clear all (A-H, M, X-Z, ANS,

TVM variables, listed fi nancial

variables, cash fl ow data, and STAT), press 0 0 or

0 =

• To RESET the calculator, press 1 0 or 1 =.

The RESET operation erases all data stored in memory, and

restore the calculator’s default settings.

.

MEM RESEt

0

1

Editing and Correcting an Entry

Cursor keys

• In a menu, such as the SET UP menu, use g or y to

select a number (the selected number will blink), then press =.

If you need to scroll up or down the screen, use z or i.

• In fi nancial calculations, such as bond calculations, press

or z to move through the variables (items).

i

Playback function

After obtaining an answer, pressing g brings you to the end

of the equation and pressing y brings you to the beginning.

Press g or y to move the cursor. Press . g or

. y

equation.

Insert and overwrite modes in the equation display

• This calculator has two editing modes: insert mode (default),

• To insert a number in the insert mode, move the cursor to the

• This mode setting will be retained until you press . d

to jump the cursor to the beginning or end of the

and overwrite mode. Pressing . d switches between

the two modes. A triangular cursor indicates an entry will be

inserted at the cursor, while the rectangular cursor indicates

existing data will be overwritten as you make entries.

place immediately after where you wish to insert, then make

the desired entry. In the overwrite mode, data under the cursor

will be overwritten by the number you enter.

or RESET the calculator.

13

Page 16

Changing “15 ÷ 3 =” into “25 ÷ 13 =”

Procedure Key operation Display

15 ÷ 3 =

s

15 8 3

=

15©3=

500

Enter the playback

function.

Switch to overwrite

mode.

Change “15” to “25”

and move the cursor to “3”.

Change to insert

mode.

Change “3” to “13”

and calculate.

Errors

An error will occur if an operation exceeds the calculation

ranges, or if a mathematically illegal operation is attempted.

When an error occurs, pressing g or y automatically

moves the cursor to the place in the equation/number where the

error occurred. Edit the equation/number or press s to clear

the equation. For details, see page 76.

y

.

2

y

.

1

=

d

d

y

15©3

15©3

25©3

25©3

25©13=

192

Memory Calculations

This calculator has 11 temporary memories (A-H and X-Z), one

independent memory (M) and one last answer memory (ANS).

It also has various variables for use in fi nancial calculations and

statistical calculations.

Memory use in each mode for memory calculations

TVM

Mode

NORMAL

STAT

A-H,

X-Z

M

: Available : Unavailable

×

ANS

variables

×

14

Listed financial

1

*

variables

Statistical

2

*

×

×

variables

×

*

3

Page 17

1

N, I/Y, PV, PMT, FV

*

2

All fi nancial variables, except for TVM variables

*

3

x, sx,

*

σ

Temporary memories (A-H, X-Z)

Press g and the variable key to store a value in memory.

Press f and the variable key to recall a value from the

memory.

x, n

2

x

x

,

,

, y, sy,

Σ

Σ

2

y

y

y

xy, r, a, b, c

,

,

,

σ

Σ

Σ

Σ

To place a variable in an equation, press i and the variable key.

Independent memory (M)

In addition to all the other features of temporary memories, a

value can be added to or subtracted from an existing memory

value.

Press s g M to clear the independent memory (M).

Last answer memory (ANS)

• The calculation result obtained by pressing = or any other

calculation ending instruction (including storing and recalling

operations) is automatically stored in the last answer memory.

• Listed fi nancial variables are automatically stored in the last

answer memory by displaying the variable and the value.

TVM variables

TVM variables can be recalled using f in the same way as

temporary memories. It is not necessary to press g to store

a value.

Listed fi nancial variables

Financial variables are specifi c to the type of calculation they

are used in. For example, the variable N is available to the TVM

solver but not to discounted cash fl ow analysis calculations. If

you want to carry a value from a variable over into a different

type of calculation, use one of the following methods:

Last answer memory (ANS): Within the original calculation, dis-

•

play the variable and value that you wish to carry over. The value

is automatically entered into last answer memory. Press s to

exit the calculation (the listed fi nancial variables will disappear

from the screen), and press i / to bring up the value

from the previous calculation. M-D-Y (D-M-Y) 1 and M-D-Y (DM-Y) 2 are not stored in last answer memory.

•

Variables common to both calculations: If the value that you

wish to carry over is held in a variable that exists in both types

15

Page 18

of calculation (for example, both bond calculations and the TVM

solver use the variable I/Y), you can retrieve the value simply by

switching calculation types and bringing up the variable.

Statistical variables

Statistical data is not entered into variables. Statistical variables

are the results of the calculation of statistical data. Therefore,

you cannot enter values directly into statistical variables. After

calculation, however, you can use the values held in statistical

variables in subsequent calculations.

Note: Use of f or i will recall the value stored in

memory using up to 14 digits.

Memory calculations

Example Key operation Result

8 x 2 g

24 ÷ (8 × 2) =

(8 × 2) × 5 =

$150×3:M

1

+)$250:M2=M1+250

5%

–)M

×

2

M

$1 = ¥110

¥26,510 = $?

$2,750 = ¥?

r = 3 cm (r→Y)

2

= ?

r

π

24

= 2.4...(A)

4 + 6

3 × (A) + 60 ÷ (A) =

s

24

8 i M

M x 5

i

g

s

150

x 3

250

h

M x 5 .

f

. j

110

g

26510

8 f Y

2750

x f Y

3

g

Y

.

;

.

24

8 ( 4 + 6 ) =

3

x i / + 60 8

/

i

=

M

h

f

M

Y

i Y*

=

=

M

=

%

=

=

1600

150

8000

000

45000

25000

3500

66500

11000

24100

30250000

300

2827

240

3220

* Entry of the multiplication procedure is omitted between “π”

and a variable.

16

Page 19

Chapter 3

Financial Functions

General Information

Financial calculations

The following fi nancial functions are available. Use NORMAL

mode to perform fi nancial calculations.

TVM (Time Value of Money) solver: Analyze equal and regular

cash fl ows. These include calculations for mortgages, loans,

leases, savings, annuities and contracts or investments with

regular payments.

Amortization calculations: Calculate and create amortization

schedules using values stored in the TVM solver.

Discounted cash fl ow analysis: Analyze unequal cash fl ows

and calculate NPV (net present value) and IRR (internal rate of

return).

Bond calculations: Solve bond prices or yields to maturity with

accrued interest.

Depreciation calculations: Obtain depreciation base values

using three types of calculation methods.

Conversion between APR and EFF: Interest rates can be converted between APR (annual, or nominal percentage rate) and

EFF (effective interest rate).

Day and date calculations: Calculate dates and the number of

days between dates.

Percent change/Compound interest calculations: Calculate

percent change (increase or decrease) and compound interest

rates.

Cost/Sell/Margin/Markup calculations: Calculate cost, selling

price and margin/markup.

Breakeven calculations: Calculate breakeven points (quantity)

using fi xed costs, variable costs per unit, unit prices, and profi t.

17

Page 20

Variables used in fi nancial calculations

Financial calculations use multiple variables. By entering known

values into variables, you can obtain unknown values. Variables

used in fi nancial calculations are categorized into the following

two types, depending on the entry method.

TVM variables:

Variables that are used in the TVM solver. These include N,

I/Y, PV, PMT and FV. You can store, recall or calculate values

directly using the corresponding keys.

Listed fi nancial variables:

Variables that are organized into lists in different categories. These

variables can be accessed using the z/i cursor keys in

each calculation. P/Y and C/Y in the TVM solver are of this type of

variable.

Variables shared among calculations

Financial variables are specifi c to the type of calculation they

are used in. Values are stored in these variables and recalled

as required. Some variables are shared (in the memory area)

among calculations. If you change the value of a variable in one

calculation, the value will change in all the other calculations

as well. The following list shows the variables shared between

calculations. While calculating, be aware of the values stored in

these variables.

Discounted

TVM

cash fl ow

solver

analysis

N — CPN/Y (N) LIFE (N) PERIODS (N) —

I/Y RATE (I/Y) YIELD (I/Y) DB (I/Y) % (I/Y) —

PV — PRICE (PV) COST (PV) OLD PRC (PV) —

PMT —

FV —

——

——

*The variable names vary according to the data format settings.

Bond

calculations

COUPON

(PMT)

REDEMPT

(FV)

M-D-Y 1

D-M-Y 1

M-D-Y 2

D-M-Y 2

Depreciation

calculations

SALVAGE (FV) NEW PRC (FV) —

*

*

Percent change/

Compound inter-

est calculations

———

——

——

18

Day and date

calculations

M-D-Y 1

D-M-Y 1

M-D-Y 2

D-M-Y 2

*

*

Page 21

Basic variable operations

TVM variables (N, I/Y, PV, PMT, FV)

A. Entering a value

Enter a value and then press the corresponding TVM vari-

able key.

Note: You can also enter values into variables using arithmetic

operations.

Ex. 100 x 12

B. Displaying a value

Press f and the corresponding TVM variable key.

C. Executing calculation

Press @ and the corresponding TVM variable key.

Listed fi nancial variables

A. Entering a value

1. Select the desired fi nancial calculation method by pressing the corresponding fi nancial calculation key.

2. Use z/i to select the variable you wish to enter.

3. Enter the value and press Q when the “ENT” symbol

appears.

Note: In step 3, you can also enter values into variables using

arithmetic operations.

Ex. 100 x 12

B. Displaying a value

Use z/i to show the variable and value.

C. Executing calculation

1. Use z/i to select the variable you wish to calculate.

2. Press @ when the “COMP” symbol appears.

Note: Pressing . b resets all the variables in the dis-

played listed fi nancial group to the default values. For

details, see the relevant sections for each fi nancial calculation.

u

Q

19

Page 22

The ENT and COMP symbols

Listed fi nancial variables are categorized by whether they are

known or unknown. When the variable is selected (displayed),

the “ENT” and/or “COMP” symbols will appear to indicate that

the current variable may be entered (known variable) and/or

calculated (unknown variable), respectively. For details, refer to

the explanations or examples for each fi nancial function.

Note: TVM variables (N, I/Y, PV, PMT and FV) can be entered

(known variables) and calculated (unknown variables),

however, neither “ENT” nor “COMP” will appear on the

display.

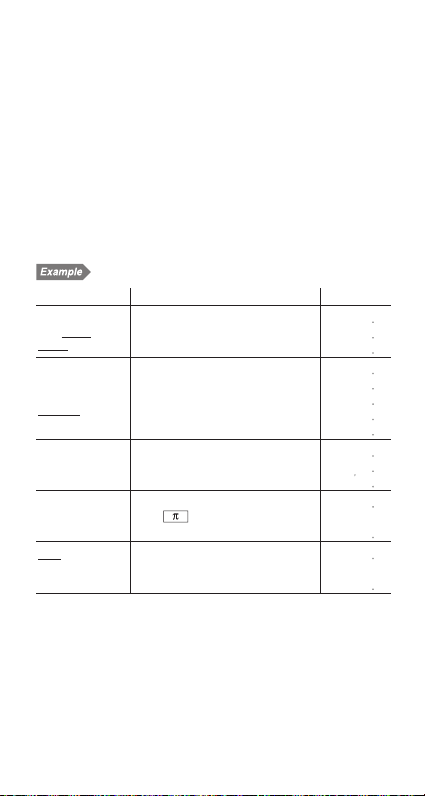

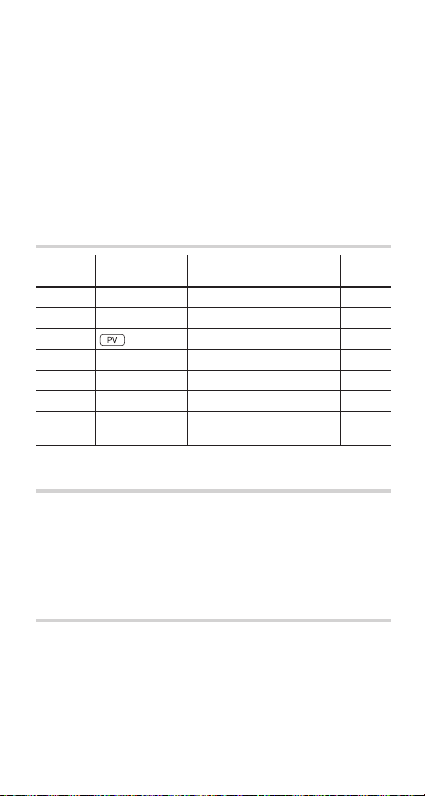

Category Display symbols Descriptions

For entry only ENT

For calculation only COMP

For entry or calculation

Calculated automatically

ENT COMP

—

Notes:

• During fi nancial calculation, the word “calculating!” will be

displayed on the screen. You can press s at this time to

cancel the calculation.

• Calculation-only and automatically calculated variables have

no default values.

• The

symbol will be displayed if the value of the displayed

variable has not been calculated yet (for variables that can be

calculated).

Variable can be used as

a known, but not as an

unknown.

Variable can be used as

an unknown, but not as

a known.

Variable can be used

as either a known or an

unknown.

Unknown variable, but

the calculator calculates

the value automatically.

20

Page 23

Compound interest

This calculator assumes interest is compounded periodically in

fi nancial calculations (compound interest). Compound interest accumulates at a predefi ned rate on a periodic basis. For

example, money deposited in a passbook saving account at

a bank accumulates a certain amount of interest each month,

increasing the account balance. The amount of interest received

each month depends on the balance of the account during that

month, including interest added in previous months. Interest

earns interest, which is why it is called compound interest.

It is important to know the compounding period of a loan or

investment before starting, because the whole calculation is

based on it. The compounding period is specifi ed or assumed

(usually monthly).

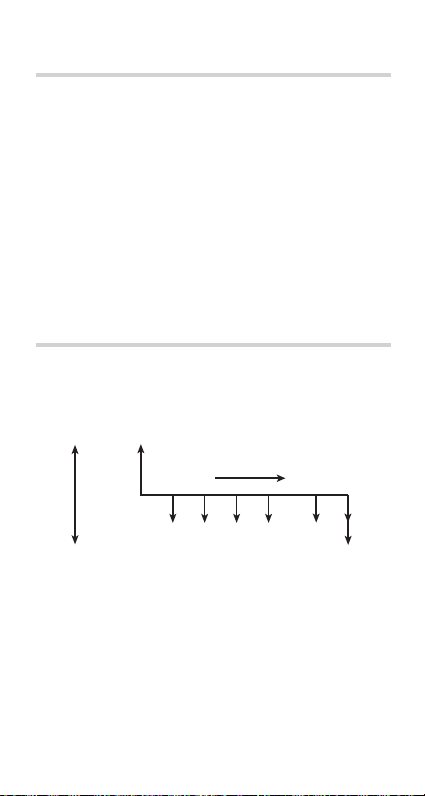

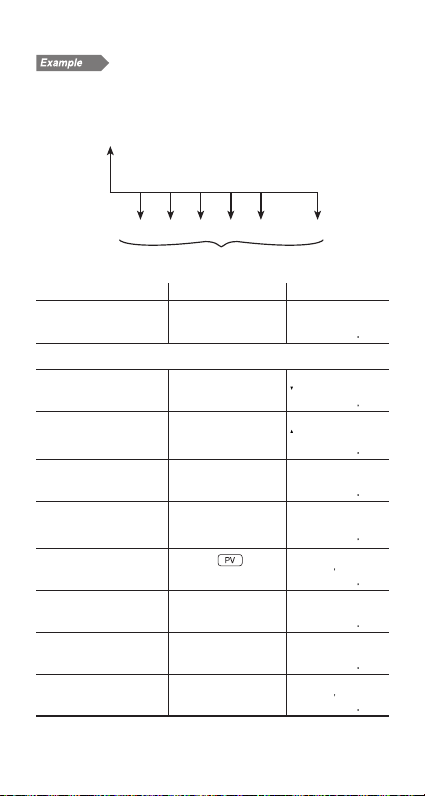

Cash fl ow diagrams

The direction of arrows indicates the direction of cash movement

(infl ow and outfl ow) with time. This manual uses the following

cash fl ow diagrams to describe cash infl ows and outfl ows.

Present

Inflow (+)

Cash

flow

Outflow (–)

value (PV)

Payment (PMT)

Time

......

Future

value (FV)

21

Page 24

TVM (Time Value of Money) Solver

Analyze equal and regular cash fl ows. These include calculations for mortgages, loans, leases, savings, annuities, and

contracts or investments with regular payments.

Note: Discounted cash fl ow analysis can be done using un-

equal cash fl ows (see page 37).

An amortization schedule can be calculated using the

information stored in the TVM solver (see page 33).

Variables used in the TVM solver

Corresponding

Variable

N

I/Y

PV

PMT

FV

P/Y

C/Y

variable key

N

f

u

t

. w

. w i

Description

Total number of payments 1

Interest rate per year 0

Present value 0

Payment 0

Future value 0

Number of payments per year 1

Number of compounding

periods per year

Setting the payment period (payment due)

You can toggle between ordinary annuity (payment at the end

of the period) and annuity due (payment at the beginning of the

period) using . ". The default setting is ordinary annuity

(BGN is not displayed).

Refer to page 28 for details.

Basic operations

Refer to page 19 for basic variable operations.

1. Press s to clear the display.

• Make sure the calculator is in NORMAL mode.

• All the TVM solver variables retain their previously entered

values. If you wish to clear all the data, press . b.

2. Select ordinary annuity or annuity due using . ".

22

Default

value

1

Page 25

3. Enter values into TVM solver variables.

• Enter a value and press the appropriate TVM variable key

(N, f,

, u, t).

• Press . w and then enter a value for P/Y. The

same value is automatically assigned to C/Y as well. Values entered into P/Y or C/Y must be positive. After entering values, press s to quit the P/Y and C/Y settings.

• After setting P/Y (number of payments per year), you can

use . < to enter N (total number of payments).

Enter the number of years and press . <. The

calculator automatically calculates the total number of

payments.

• By pressing

f

you can use the result of the pre-

/

vious normal calculation stored in ANS memory as a TVM

variable.

• Note that some variables are shared by other calculations

and may have values assigned by those calculations.

4. Press @ and the TVM variable key that you wish to solve.

• The calculation is performed and the obtained values are

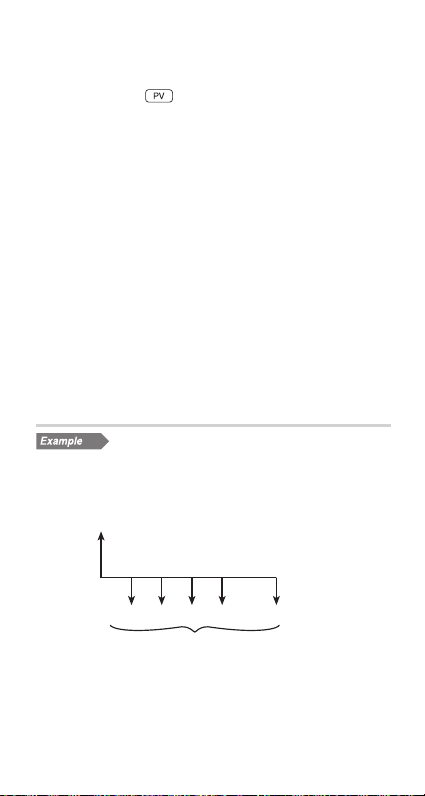

displayed.

Basic examples for the TVM solver

1

Calculating basic loan interest

A $56,000 mortgage loan (compounded monthly) requires

monthly payments of $440 during its 20-year amortization period. Calculate the annual interest rate on the mortgage.

PV = $56,000

FV = 0

......

PMT = –$440

N = 12 × 20 years = 240

Default values for the number of payments per year (P/Y) and

the number of compounding periods per year (C/Y) are both set

to 1. Set these values before entering TVM variable values.

I/Y = ?%

23

Page 26

Procedure Key operation Display

Set all the variables to

default values.

Make sure ordinary annuity is set (BGN is not displayed).

Set the number of payments per year to 12.

The number of compounding periods per year is automatically set to the

same value as P/Y.

Confi rm the number of

compounding periods

per year.

Quit the P/Y and C/Y

settings.

Calculate the total number of payments and

store in N.

Enter the present value.

b

.

. w

i

s

. <

20

56000

000

12

Q

P/Y=

1200

C/Y=

1200

000

N

ANS~N

24000

56———~PV

5600000

Enter payment.

,

440

u

(-44—)~PMT

-44000

Enter the future value.

0

t

—~FV

000

Calculate the annual

interest rate.

Answer: The annual interest rate is 7.17%.

Note: If you make a mistake, press L to erase the number

and enter the correct number to continue.

After pressing the TVM variable key, you must re-enter

values from the beginning.

@ f

I/Y=

717

24

Page 27

2

Calculating basic loan payments

Calculate the quarterly payment for a $56,000 mortgage loan

at 6.5% compounded quarterly during its 20-year amortization

period.

PV = $56,000

I/Y = 6.5%

PMT = ?

N = 4 × 20 years = 80

Procedure Key operation Display

Set all the variables to

default values.

Make sure ordinary annuity is set (BGN is not displayed).

Set the number of payments per year to 4.

Confi rm the number of

compounding periods per

year.

Quit the P/Y and C/Y settings.

Calculate the total

number of payments and

store in N.

Enter the present value.

b

.

. w

i

s

. <

20

56000

4

Q

N

FV = 0

......

000

P/Y=

400

C/Y=

400

000

ANS~N

8000

56———~PV

5600000

Enter the future value.

0

t

—~FV

000

Enter the annual interest

rate.

Calculate the quarterly

payment.

Answer: The quarterly payments are $1,255.86.

6.5

f

@ u

25

6.5~I/Y

650

PMT=

-125586

Page 28

3

Calculating future value

You will pay $200 at the end of each month for the next three

years into a savings plan that earns 6.5% compounded quarterly. What amount will you have at the end of period if you

continue with the plan?

FV = ?

I/Y = 6.5% (quarterly)

PV = 0

......

PMT = –$200

PMT = –$200

N = 12 × 3 years = 36

Procedure Key operation Display

Set all the variables to

default values.

Make sure ordinary annuity is set (BGN is not displayed).

Set the number of payments per year to 12.

Set the number of compounding periods per

year to 4.

Quit the P/Y and C/Y

settings.

Calculate the total number of payments and

store in N.

Enter the present value.

b

.

. w

4

i

Q

s

. <

3

0

000

12

Q

P/Y=

1200

C/Y=

400

000

N

ANS~N

3600

—~PV

000

Enter payment.

,

200

u

(-2——)~PMT

-20000

Enter the annual interest rate.

Calculate the future

value.

Answer: You will have $7,922.19 at the end of the three-year

period.

6.5

f

@ t

6.5~I/Y

650

FV=

792219

26

Page 29

4

Calculating present value

You open an account that earns 5% compounded annually. If

you wish to have $10,000 twenty years from now, what amount

of money should you deposit now?

FV = $10,000

N = 20 years

PV = ? I/Y = 5%

Procedure Key operation Display

Set all the variables to

default values.

Make sure ordinary annuity is set (BGN is not displayed).

Set the number of payments per year to 1.

The number of compounding periods per year is automatically set to 1.

Press s to exit the P/Y and C/Y settings.

Enter the total number

of payments.

Enter the future value.

b

.

. w

20

s

10000

t

1

N

Q

000

P/Y=

100

2—~N

2000

1————~FV

1000000

Set payment to zero.

0

u

—~PMT

000

Enter the annual interest rate.

Calculate the present

value.

Answer: You should deposit $3,768.89 now.

5

@

f

5~I/Y

500

PV=

-376889

27

Page 30

Specifying payments due (

This calculator can select ordinary annuity or annuity due depending on the regular cash fl ow (payment) conditions.

. "

)

Ordinary annuity (END):

This is the default setting for fi nancial calculations. BGN is not

displayed. A regular cash fl ow (payment) is received at end of

each payment period. Often applied to loan calculations, etc.

Annuity due (BGN):

BGN appears on the display. A regular cash fl ow (payment) is

received at the beginning of each payment period. Often applied

to the fi nance lease of an asset.

To toggle between ordinary annuity and annuity due, press

.

"

.

Note: The above selection only affects the TVM solver.

Ordinary annuity

1

Your company wishes to accumulate a fund of $300,000 over the

next 18 months in order to open a second location. At the end of

each month, a fi xed amount will be invested in a money market

savings account with an investment dealer. What should the

monthly investment be in order to reach the savings objective, assuming the account will earn 3.6% interest compounded monthly?

FV = $300,000

PV = 0

I/Y = 3.6%

......

PMT = ?

N = 18

Procedure Key operation Display

Set all the variables to

default values.

Make sure ordinary annuity is set (BGN is not displayed).

Set the number of payments per year to 12.

The number of compounding periods per year is automatically set to

12. Press s to exit the P/Y and C/Y settings.

b

.

. w

12

Q

000

P/Y=

1200

28

Page 31

Procedure Key operation Display

Enter the total number

of payments.

Enter the future value.

18

s

300000

N

t

18~N

1800

3—————~FV

30000000

Set the present value to

zero.

Enter the annual interest rate.

Calculate payment.

0

3.6

f

@ u

—~PV

000

3.6~I/Y

360

PMT=

-1624570

Answer: The monthly investment should be $16,245.70.

2

Calculating lease payments (Annuity due)

You plan to purchase a new car with a value of $87,918 on a

60-month lease. If the annual interest rate is 6.75%, the contractual

purchase option price at lease end is $17,500, and payment is due

at the beginning of each month, how much should you pay each

month?

PV = $87,918

I/Y = 6.75%

....................

PMT = ?

N = 60

Procedure Key operation Display

Set all the variables to

default values.

Set to annuity due

(BGN is displayed).

Set the number of payments per year to 12.

b

.

. "

. w

12

29

Q

FV = –$17,500

P/Y=

1200

000

000

Page 32

Procedure Key operation Display

The number of compounding periods per year is automatically set to

12. Press s to exit the P/Y and C/Y settings.

Enter the total number

of payments.

Enter the future value.

Enter the present value.

Enter the annual interest rate.

Calculate payment.

Answer: You should pay $1,476.20 each month.

Calculating the present value of a lease with

3

Your client wishes to buy a machine currently leased from your

company. On a fi ve-year lease with payments of $200 at the

beginning of each month, the machine has a trade-in value of

$1,500 with 34 monthly payments remaining. If your company

sells the machine at the present value of the lease, discounted

at an annual interest rate of 18%, compounded monthly, how

much should your company charge for the machine?

trade-in value

PMT = –$200

s

,

87918

6.75

@ u

PV = ?

60

17500

f

N

t

I/Y = 18%

......

N = 34

6

—~N

6000

175

(-

——)~FV

-1750000

87918

~PV

8791800

6.75

~I/Y

675

PMt=

-147620

FV = –$1,500

30

Page 33

Procedure Key operation Display

Set all the variables to

default values.

Set to annuity due

(BGN is displayed).

Set the number of payments per year to 12.

The number of compounding periods per year is automatically set to

12. Press s to exit the P/Y and C/Y settings.

Enter the total number

of payments.

Enter payment.

Enter the annual interest rate.

Enter the future value. ,

Calculate the present

value.

b

.

. "

. w

34

s

200

,

18

f

1500

@

12

N

u

t

Q

000

000

P/Y=

1200

34

~N

3400

(-2——)~PMt

20000

-

18

~I/Y

1800

(-15——)~FV

-150000

PV=

627995

Answer: $6,279.95 should be charged for the machine.

4

Calculating down payment and amount to

borrow

You wish to buy a house for $180,000. The fi nance company

charges a 5.5% APR, compounded monthly, on a 25-year loan.

If you can afford a monthly payment of $900, how much can you

borrow? How much do you need for a down payment?

PV = ?

PMT = –$900

N = 12 × 25 years = 300

I/Y = 5.5%

......

31

FV = 0

Page 34

Procedure Key operation Display

Set all the variables to

default values.

Make sure ordinary annuity is set (BGN is not displayed).

Set the number of payments per year to 12.

The number of compounding periods per year is automatically set to 12.

Press s to exit the P/Y and C/Y settings.

Enter the total number

of payments.

Enter payment.

b

.

. w

25 . <

s

N

900

,

12

u

Q

000

P/Y=

1200

ANS~N

30000

(-9——)~PMT

-90000

Enter the annual interest rate.

Set the future value to

zero.

Calculate the present

value.

Calculate the down

payment.

Answer: You can borrow $146,558.92 in total. The price of the

house is $180,000, so:

Down payment = $180,000 – present value

= $180,000 – $146,558.92

You need $33,441.08 for a down payment.

5.5

0

t

@

s

f

f

180000

=

-

5.5~I/Y

550

—~FV

000

PV=

14655892

18————-PV=

3344108

32

Page 35

Amortization Calculations

Calculate and create amortization schedules using values

stored in the TVM solver.

Note: Prior to using amortization, you need to enter values into

TVM variables.

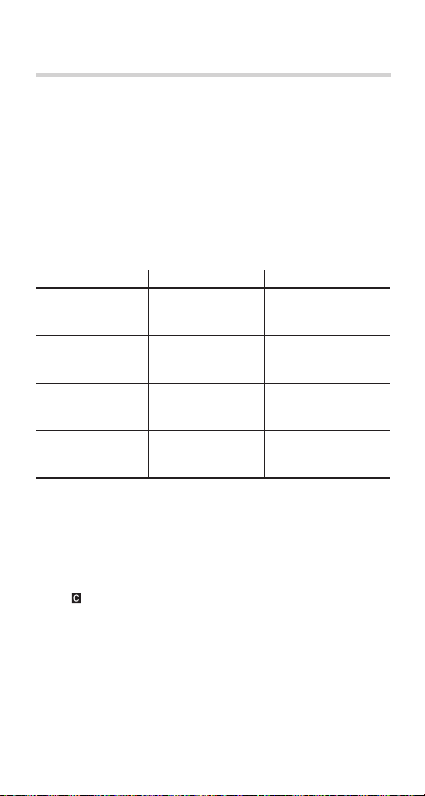

Variables used in amortization

Variable Description Default value

AMRT P1 Start of payment (nth time) 1

AMRT P2 End of payment (nth time) 1

BALANCE Remaining balance after payment —

PRINCIPAL Principal paid —

Σ

INTEREST Interest paid over the specifi ed periods —

Σ

• BALANCE, ΣPRINCIPAL and ΣINTEREST are calculated

automatically, so no default values are set.

• AMRT P1 and AMRT P2 must be between 1 and 9,999.

Basic operations

Refer to page 19 for basic variable operations.

1. Press s to clear the display.

• Make sure the calculator is in NORMAL mode.

• All the TVM solver variables retain their previously entered

values. If you wish to clear all the data, press

2. Select ordinary annuity or annuity due using

3. Enter the appropriate numeric values for the variables used

in the TVM solver.

• Confi rm the values of N, I/Y, PV, PMT, FV, P/Y and C/Y.

4. Press * to use amortiza-

tion calculation.

5. Enter a value for “AMRT P1”

and press Q.

6. Press i, enter a value for “AMRT P2” and press Q.

7. Display values for BALANCE, ΣPRINCIPAL and ΣINTEREST

by pressing i once for each. Each value is calculated

automatically.

33

AMRt P1=

.

.

b

.

"

100

.

Page 36

8. Press i to calculate the next period of the amortization

schedule.

9. Repeat steps 5 to 7 above.

• If you press @ during “AMRT P1” and “AMRT P2” entry,

the values for the next period of payment will be automatically

calculated and displayed.

• To end amortization calculations, press s. Pressing s

during entry will clear the value entered.

Calculating mortgage payments and generat-

1

ing an amortization schedule

1. Calculate the monthly payment of a 20-year loan with a loan

amount of $90,000 and a 5.45% APR.

Procedure Key operation Display

Set all the variables to

default values.

Make sure ordinary annuity is set (BGN is not displayed).

Set TVM solver variables and calculate

payment.

b

.

. w

20 . <

s

90000

N

5.45

t

u

12 Q

f @

000

0

PMT=

-61656

Answer: The monthly payment is $616.56.

Now generate an amortization schedule for the fi rst 5 years of the

loan. If the fi rst payment is in August, the fi rst year has 5 payment

periods and the following years have 12 payment periods each.

2. Calculate the amortization schedule for the fi rst year.

Procedure Key operation Display

Change to amortization

calculation and enter 1

(August) for the starting

payment.

Enter 5 (December) for

the ending payment.

Display the remaining

balance.

*

i

i

1

Q

AMRT P1=

100

5

Q

AMRT P2=

500

BALANCE=

8895148

34

Page 37

Procedure Key operation Display

Display the principal

paid.

Display the interest

paid.

3. Calculate the amortization schedule for the second year.

Procedure Key operation Display

Change amortization

schedule to the second

year and enter 6 (January) for the starting

payment.

Enter 17 (December)

for the ending payment.

Display the remaining

balance.

Display the principal

paid.

Display the interest

paid.

4. Calculate the amortization schedule for the third year.

Procedure Key operation Display

Change amortization

schedule to the third

year and enter the next

12 months automatically.

Display the remaining

balance.

Display the principal

paid.

Display the interest

paid.

5. Repeat the above operation for the fourth and fi fth years.

i

i

6

i

Q

17

i

Q

i

i

i

i @ i

i

i

i

ÍPRINCIPAL=

-104852

ÍINTEREST=

-203428

AMRT P1=

600

AMRT P2=

1700

BALANCE=

8633592

ÍPRINCIPAL=

-261556

ÍINTEREST=

-478316

AMRT P2=

2900

BALANCE=

8357421

ÍPRINCIPAL=

-276171

ÍINTEREST=

-463701

35

Page 38

2

Calculating payments, interest, and loan bal-

ance after a specifi ed payment

You have taken out a 30-year loan for $500,000, with an annual

interest rate of 8.5%. If, after the 48th period, you want a balloon

payment due, what amount of monthly payment must you make

with monthly compounding and how much will the balloon payment be?

Procedure Key operation Display

Set all the variables to

default values.

Make sure ordinary annuity is set (BGN is not displayed).

Set TVM solver variables and calculate

payment.

s .

. w

30 . <

s

500000

N

8.5

t

u

b

12 Q

f @

0

PMT=

000

-384457

Answer: The monthly payment is $3,844.57.

Now generate an amortization schedule from the fi rst to the

48th payments.

Procedure Key operation Display

Change to amortization

calculation and enter 1

for the starting payment.

Enter 48 (December)

for the ending payment.

Display the balance after 48 months. (balloon

payment)

Display the principal

paid over 48 months.

Display the interest

paid over 48 months.

*

i

i

i

i

1

48

Q

Q

AMRT P1=

100

AMRT P2=

4800

BALANCE=

48275524

ÍPRINCIPAL=

-1724476

ÍINTEREST=

-16729460

Answer: The balloon payment after the 48th period would be

$482,755.24.

36

Page 39

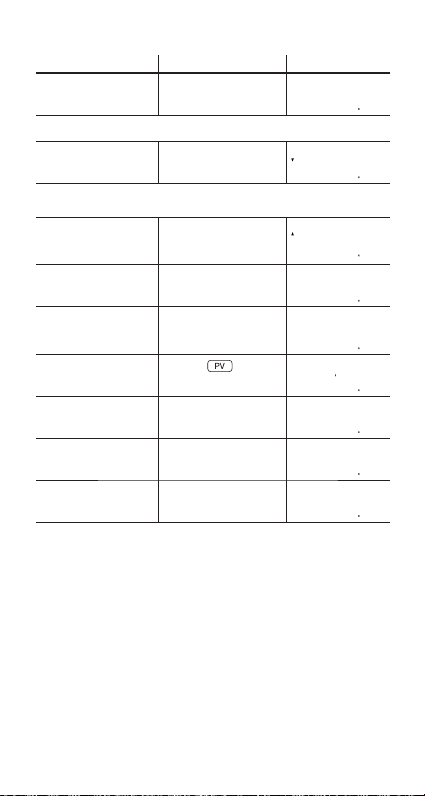

Discounted Cash Flow Analysis

–

Analyze unequal cash fl ows and calculate the net present value

(NPV) and the internal rate of return (IRR).

Note: Use the TVM solver for equal and regular cash fl ow

analysis (see page 22).

Entering cash fl ow data

To fi nd NPV and IRR using discounted cash fl ow analysis, enter

cash fl ow data, one data item at a time, in the following format:

Single cash fl ows

Cash fl ow value

Repeated cash fl ows

Cash fl ow value > frequency value

Notes:

• Before entering data, press > . b to clear any

previously entered cash fl ow data.

• Press , to enter a negative cash fl ow (outfl ow).

• Make sure the calculator is in NORMAL mode. It is not pos-

sible to enter cash fl ow data when listed fi nancial variables are

shown on the display. Press s to exit.

• You can enter a total of up to 100 cash fl ow and/or statistical

data items. A single cash fl ow value is counted as one data

item, while a cash fl ow value with an associated frequency

value is counted as two.

• Frequency values must be integers between 1 and 999.

• If you wish to correct a value before pressing J, press

s

Entering cash fl ow data

Enter cash fl ow data according to the following cash fl ow diagram.

J

J

to delete the entry and enter the correct value.

$7,000 $9,000 $5,000 $5,000

$8,000

$25,000

37

Page 40

Procedure Key operation Display

Bring up the initial display in NORMAL mode.

Enter cash fl ow data.

s

,

7000

1

*

25000

J

J

000

DATA SET:CF

000

DATA SET:CF

2

*

100

9000

J

DATA SET:CF

200

5000

> 2

J

DATA SET:CF

300

8000

J

DATA SET:CF

400

1

*

If there is cash fl ow data stored, press > . b to

clear it.

2

*

The format of the data set (cash fl ow and frequency values)

number, which is initially set to “0.00,” is dependent on calculator display notation settings.

Confi rming and editing data

Confi rming data

Press > to display any previously entered cash fl ow data.

The data is displayed in order by data item (identifi er, number,

and value).

Use z/i to display a data item from a previously entered

data set.

Cash flow

identifier

Frequency

identifier

CF D—=

-2500000

CF N—=

100

Data set

number

Cash flow

value

Data set

number

Frequency

value

38

Page 41

• Press . z or . i to jump to the fi rst or the last

–

data item, respectively.

• Each data item is displayed in the form CF Dn= (cash fl ow

value) or CF Nn= (frequency), where n indicates the data set

number.

Editing data

• Display the data item you wish to modify by using z/i,

enter a new value and press J.

• If a frequency value is set to zero, then the associated data

set is deleted.

Deleting data

• Display the data item to be deleted by using z/i, and

press . ?.

• If a cash fl ow value/frequency is deleted, the corresponding

frequency/cash fl ow value is also deleted.

• If you wish to delete all data, press . b.

Inserting data

Using the z and i keys, specify the correct place to

insert your new data by displaying the value that is to come

directly after, and then press . e. A new data set with

a cash fl ow value of zero and a frequency value of one will be

inserted. Modify the new data set to include your data.

Correcting cash fl ow data

Currently the cash fl ow data is that shown in chart A. Change it

according to chart B.

Chart A

$7,000 $9,000 $5,000 $5,000 $8,000

Chart B

$7,000 $9,000 $6,000 $5,000 $8,000

$25,000

Display previously

entered cash fl ow data.

(Example on page 37)

–$30,000

Procedure Key operation Display

s >

CF D—=

-2500000

39

Page 42

Procedure Key operation Display

Change the fi rst cash

fl ow value from –25,000

to –30,000.

Change the frequency

of 5000 from 2 to 1.

Add a new data set

(6000) immediately

before 5000.

30000

,

i i i i

i i i

. e

6000

J

1

J

J

CF D—=

-3000000

CF N3=

CF D3=

600000

100

To confi rm the corrections, press . z to jump to the fi rst

data item and press i to browse through each data item.

Variables used in discounted cash fl ow analysis

Variable Description Default value

RATE (I/Y) Internal rate of return (IRR) 0

NET_PV Net present value (NPV) —

• The variable RATE (I/Y) is shared by the variable I/Y. NET_PV

is for calculation only and has no default value.

• The BGN/END setting is not available for discounted cash fl ow

analysis.

NPV and IRR

The calculator solves the following cash fl ow values:

Net present value (NPV):

The total present value of all cash fl ows, including cash paid out

(outfl ows) and cash received (infl ows). A profi table investment is

indicated by a positive NPV value.

Internal rate of return (IRR):

The interest rate that gives a net present value of zero.

Basic operations

Refer to page 19 for basic variable operations.

1. Press s to clear the display.

• Make sure the calculator is in NORMAL mode.

40

Page 43

2. Enter cash fl ow data.

–

• Refer to page 37 for instructions on entering cash fl ow data.

3. Press . < to begin discounted cash fl ow analysis.

• If a previously entered cash fl ow value is displayed, press

to exit and then press . <.

s

4. To fi nd NPV or IRR, do the following:

To obtain NPV:

Enter the interest rate (discounted rate) into RATE(I/Y) and

press Q. Move to NET_PV and calculate by pressing i

and @.

To obtain IRR:

Press @ to calculate IRR (RATE(I/Y)).

Note: If “Error 5” is displayed in step 4, or if you want to fi nd

another IRR, enter an estimated value into RATE(I/Y) and

calculate again in step 4.

1

Solving for unequal cash fl ows

Your company pays $12,000 for a new network system, and

expects the following annual cash fl ows: $3,000 for the fi rst year,

$5,000 for the second to fourth years, and $4,000 for the fi fth

year. At what IRR does the net present value of the cash fl ows

equal zero?

$3,000 $5,000 $5,000 $5,000

$4,000

$12,000

1. Enter cash fl ow data.

Procedure Key operation Display

Bring up the initial display in NORMAL mode.

s

1

*

000

41

Page 44

Procedure Key operation Display

Enter cash fl ow data.

,

12000

J

DATA SET:CF

000

3000

J

DATA SET:CF

100

5000

> 3

J

DATA SET:CF

200

4000

J

DATA SET:CF

300

Return to the initial display in NORMAL mode.

1

*

If there is cash fl ow data stored, press > . b to

clear it.

2. Calculate IRR.

Procedure Key operation Display

Select discounted cash

fl ow analysis, and set all

the variables to default

values.

Calculate IRR (RATE

(I/Y)).

Answer: The net present value of the cash fl ows equals zero at

an IRR of 23.14%.

2

Calculating the present value of variable cash

Your company has prepared forecasts for the development costs

and operating profi ts of the next generation of your product.

Development costs for each of the next three years (Years 1 to

3) will be $50,000. Manufacturing equipment costing $100,000

will be purchased at the end of Year 3. Annual profi ts for the

fi ve-year product life (from Year 4 to Year 8) are projected to be

$80,000. The salvage value of the manufacturing equipment at

the end of Year 8 is $20,000. Given a 12% discount rate, should

your company proceed with the product development?

fl ows

s

. < .

@

b

000

RATE(I/Y)=

000

RATE(I/Y)=

2314

42

Page 45

$80,000 $80,000 $80,000 $80,000 $80,000

–

$50,000

–$50,000

–$50,000

–$100,000

1. Enter the cash fl ow data.

Procedure Key operation Display

Bring up the initial display in NORMAL mode.

Enter cash fl ow data.

Return to the initial display in NORMAL mode.

1

*

If there is cash fl ow data stored, press > . b to

s

,

J

,

80000

60000

s

1

*

50000

150000

> 4

J

> 2

J

J

DATA SET:CF

DATA SET:CF

DATA SET:CF

DATA SET:CF

clear it.

2. Calculate NPV.

Procedure Key operation Display

Select discounted cash

fl ow analysis, and set all

the variables to default

values.

Enter the discount rate.12

Calculate NPV

(NET_PV).

. < .

i @

Q

b

RATE(I/Y)=

RATE(I/Y)=

NET_PV=

Answer: As NPV = 6,627.52 > 0, the product can be developed.

43

–$20,000

000

000

100

200

300

000

000

1200

662752

Page 46

Bond Calculations

Using bond calculations, you can obtain bond prices, yields to

maturity, and accrued interest.

Variables used in bond calculations

Variable Description Default value

COUPON (PMT) Annual coupon rate (%) 0

REDEMPT (FV) Redemption value 0

2

*

M-D-Y 1 Settlement date (date of bond pur-

M-D-Y 2 Redemption date 1-1-2001

CPN/Y (N) Number of coupons per year 1

YIELD (I/Y) Yield to maturity (%) 0

PRICE (PV) Bond price 0

ACCU INT Accrued interest —

1

*

Redemption value of the security per $100 par value.

2

*

You can change the date format to D-M-Y (see page 10).

3

*

You can only enter “1” or “2” — “1” for annual coupons and “2”

for semi-annual coupons.

4

*

Per $100 par value.

Note: Bonds are associated with payment methods known as

chase)

2

*

3

*

coupons. A coupon is like an “interest-only payment,” and

it is based on the future value of the bond. COUPON is

a percentage of the bond par value, usually annually, by

the owner of the bond.

For bonds that have annual coupons, the owner receives

one payment of the coupon amount each year. Some

bonds have semi-annual coupons. For these, each year’s

coupon amount is paid in two equal payments six months

apart. The date on which a coupon payment is made is

called the “coupon date.” The bond maturity date is usually the last coupon date.

Setting the day-count method

You can toggle between the actual calendar (365 days plus leap

years) and a 360-day calendar (12 months of 30 days each)

using . &. The actual calendar is set by default (360 is

not displayed). The calendar range is from January 1, 1901 to

December 31, 2099.

1

*

1-1-2001

4

*

44

Page 47

Basic operations

Refer to page 19 for basic variable operations.

1. Press s to clear the display.

• Make sure the calculator is in NORMAL mode.

2. Select bond calculations by

pressing #.

• To end bond calculations,

press s.

• If you press s during entry, any entered values will be

cleared.

3. Change the day-count setting, if necessary, by pressing

. &

4. Enter the coupon rate (%) into COUPON (PMT) by entering

the value and pressing Q.

5. Enter the redemption value into REDEMPT (FV) by pressing

i

6. Enter the date of bond purchase into M-D-Y 1 (or D-M-Y 1)

by pressing i, entering the date, and pressing Q.

• For date entry, refer to page 47, ”Entering dates”.

7. Enter the redemption date into M-D-Y 2 (or D-M-Y 2) by

pressing i, entering the date, and pressing Q.

• For date entry, refer to page 47, ”Entering dates”.

8. Enter the number of coupon payments per year into CPN/Y

(N) by pressing i, entering the value, and pressing Q.

9. To fi nd bond price or yield to maturity, do the following:

To obtain bond price (PRICE (PV)):

Enter annual yield (%) into YIELD(I/Y) by pressing i, entering the value, and pressing Q. Move to PRICE (PV) and

calculate by pressing i and @. Display the accrued

interest (ACCU INT) by pressing i. The accrued interest is

calculated automatically.

To obtain yield to maturity (YIELD (I/Y)):

Move to PRICE (PV) and enter the bond price by pressing i

i

yield, YIELD (I/Y) and calculate by pressing z @. Display

the accrued interest (ACCU INT) by pressing i i. The

accrued interest is calculated automatically.

.

, entering the value, and pressing Q.

, entering the value, and pressing Q. Move to annual

COUPON(PMt)=

000

45

Page 48

Calculating bond price and accrued interest

A $100, 20-year, 6.5% coupon bond is issued to mature on August

15, 2023. It was sold on November 3, 2006 to yield the purchaser

7.2% compounded semiannually until maturity. At what price did

the bond sell? Also calculate the accrued coupon interest.

Procedure Key operation Display

Bring up the initial display in NORMAL mode.

Select bond calculations.

Make sure the actual calendar is set (360 is not displayed).

Enter the coupon rate

(%).

Enter the redemption

value.

Enter the settlement

date.

Enter the redemption

date.

Enter the number of

coupon payments per

year.

Enter the annual yield

(%).

Calculate bond price.

s

#

6.5

Q

100

i

11032006

i

08152023

i

2

i

Q

7.2

i

i @

Q

Q

COUPON(PMT)=

COUPON(PMT)=

REDEMPT(FV)=

Q

M-D-Y 1=[FR]

11- 3-2006

Q

M-D-Y 2=[TU]

8-15-2023

CPN/Y(N)=

YIELD(I/Y)=

PRICE(PV)=

000

000

650

10000

200

720

9323

Calculate the accrued

interest.

Calculate bond price

including accrued

interest.

Answer: The bond sold at $93.23 and the accrued coupon

interest was $1.41 (the bond price including accrued

interest would be $94.64).

The asking price on the above bond is $92.50. What will your

yield be?

i

s

i

i

/

ACCU INT=

141

+

=

46

PV+ANS=

9464

Page 49

Procedure Key operation Display

Change the bond price

to $92.50.

Calculate the yield.

# i i i

i i i

Q

z @

92.5

PRICE(PV)=

9250

YIELD(I/Y)=

728

Answer: The yield will be 7.28%.

Entering dates

Refer to the following notes for date entry.

• Enter using US date format (MM-DD-YYYY) or EU date for-

mat (DD-MM-YYYY). Refer to the previous example and the

following explanation.

Month entry

Enter two digits. From 2 to 9, the preceding zero may be omitted.

Day entry

Enter two digits. From 4 to 9, the preceding zero may be omitted.

Year entry

Enter four digits. From 2010 to 2099, the zero following the

fi rst “2” may be omitted. From 1901 to 1989, the “9” following

the fi rst “1” may be omitted.

• After entry, the date will be stored and the abbreviated day of

the week will be displayed.

• [SU]: Sunday, [MO]: Monday, [TU]: Tuesday, [WE]: Wednesday, [TH]: Thursday, [FR]: Friday, [SA]: Saturday.

• The default value for dates is: January 1, 2001 (1-1-2001).

• The effective range of dates is: January 1, 1901 to December

31, 2099.

• If an inappropriate date is entered (e.g., February 31), an error

message (Error 7) will appear immediately after pressing Q.

In this case, follow either of the following procedures:

• Press s to return to the display before the entry, enter

the appropriate date, and press Q.

• Press g/y to go back to the display that was shown

before you pressed Q. Press s or L, enter the

appropriate date, and press Q again.

• If you wish to correct numbers during entry, use L as a

backspace key.

47

Page 50

Depreciation Calculations

Using depreciation calculations, you can obtain depreciation

base values using three types of calculation methods: the

straight-line method, the sum-of-the-years’ digits method, and

the declining balance method.

Variables used in depreciation calculations

Variable Description Default value

1

*

DB (I/Y) Interest per year 0

LIFE (N) Years of depreciation 1

START MONTH Starting month 1

COST (PV) Cost of asset 0

SALVAGE (FV) Salvage value 0

YEAR

DEPRECIATE Depreciation value of above year —

RBV Remaining book value —

RDV Remaining depreciation value —

1

*

DB (I/Y) appears only when you select DB (declining balance

Year for calculating depreciation value

method) for the depreciation method.

Setting the depreciation method

• Select the depreciation method in the SET UP menu. It is

initially set to SL.

Key operation Description

~ 2 0

~ 2 1

~ 2 2

SL (Straight-line method)

SYD (Sum-of-the-years’ digits method)

DB (Declining balance method)

Basic operations

Refer to page 19 for basic variable operations.

1. Press s to clear the display.

• Make sure the calculator is in NORMAL mode.

1

48

Page 51

2. Select the depreciation method (see page 48).

3. Select depreciation calculations

by pressing O.

• When using the declining

balance method, DB (I/Y) appears. Enter the number and press Q.

• To end depreciation calculations, press s. If you press

during entry, any entered values will be cleared.

s

4. Enter the number of years of depreciation into LIFE (N) by

pressing i, entering the value, and pressing Q.

• When using the straight-line method, the value should be a

positive real number, while for the SYD or DB methods, it

should be a positive integer.

5. Enter the starting month into START MONTH by pressing

, entering the value, and pressing Q.

i

• You can enter values between 1 and 13.

• Generally, it is not necessary to enter a decimal value.

However, if you wish to enter, for example, the middle of

July, enter 7.5; where the decimal is equal to the number

value of the given date divided by the total number of days

in the month.

6. Enter the cost of asset into COST (PV) by pressing i,

entering the value, and pressing Q.

7. Enter the salvage value into SALVAGE (FV) by pressing i,

entering the value, and pressing Q.

8. Enter

the year for calculating depreciation value

pressing i, entering the value, and pressing Q.

•

The year for calculating depreciation value

Pressing @ increments this number by 1.

•

This value must be a positive integer

9. Calculate depreciation for the year by pressing i.

10. Calculate the remaining book value by pressing i.

11. Calculate the remaining depreciation by pressing i.

12. To calculate depreciation value for another year, press z

three times to go back to YEAR, enter a value for the new

year, and recalculate.

SL

----------

into YEAR by

is initially 1.

.

49

Page 52

Calculating straight-line depreciation