Page 1

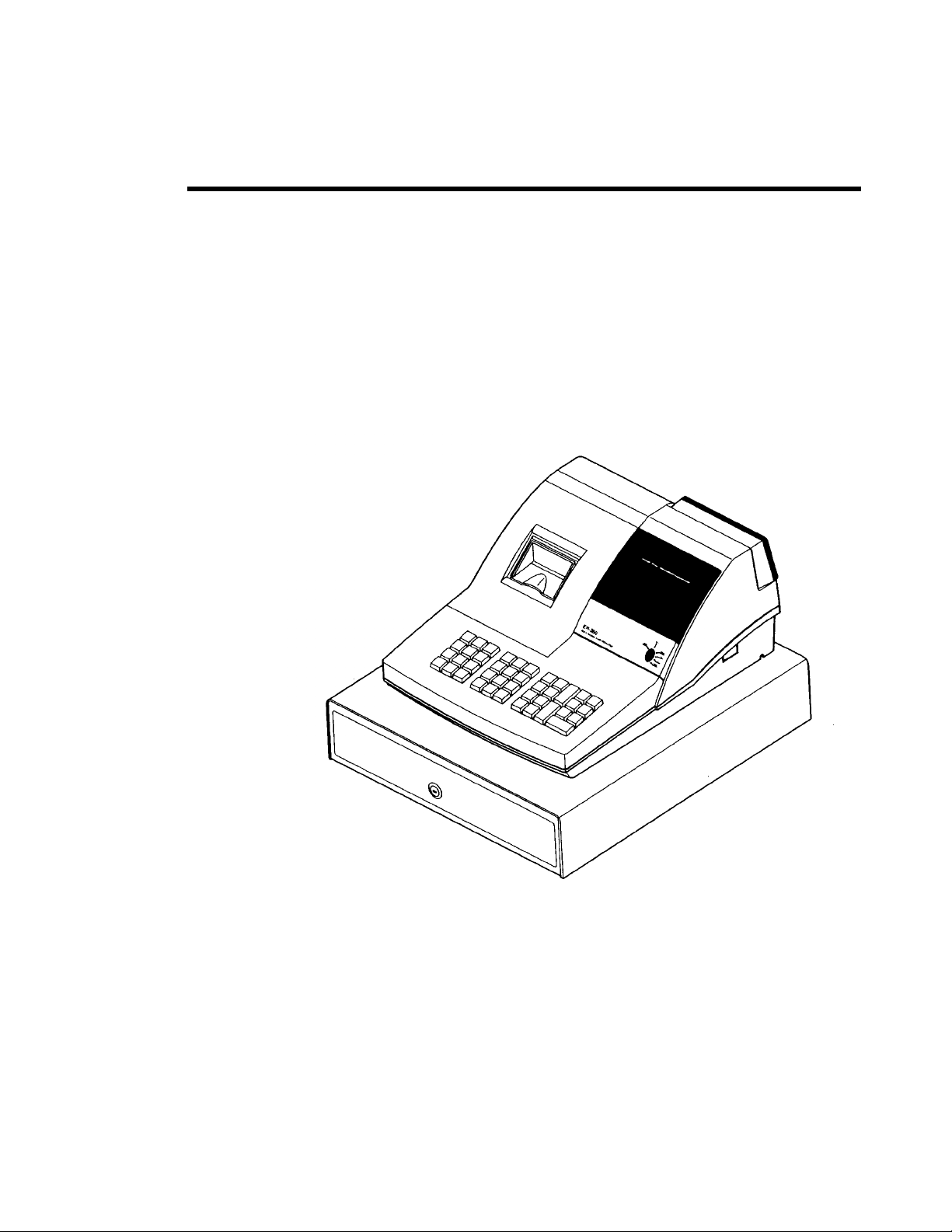

Samsung ER-290 Electronic Cash Register

Operator's and

Programming Manual

M-ER290 Version 2.0

All specifications are subject to change without notice. 2005, CRS Inc.

Page 2

CRS, Inc.

Limited Warranty and Disclaimers of Warranty

This manual has been developed by CRS, Inc. It is intended for the use of its customers and service personnel and should be read in its

entirety before attempting to install, use or program the product(s).

Nothing contained in this manual shall be deemed to be, and this manual does not constitute, a warranty of, or representation with respect

to, the product or any of the products to which this manual applies. This manual is subject to change without notice and CRS, Inc. has no

obligation to provide any updates or corrections to this manual. Further, CRS, Inc. also reserves the right, without prior notice, to make

changes in equipment design or components as it deems appropriate. No representation is made that this manual is complete or accurate in

all respects and CRS, Inc. shall not be liable for any errors or omissions contained in this manual. In no event shall CRS, Inc. be liable for

any incidental or consequential damages relating to or arising out of the use of this manual. This document contains proprietary

information that is protected by copyright. All rights are reserved. No part of this document may be photocopied or reproduced without

prior written consent of CRS, Inc.

NOTICE

IF ANY WARRANTY IS EXTENDED TO YOU WITH REGARD TO THE PRODUCT(S) TO WHICH THIS MANUAL APPLIES, IT

IS A WARRANTY FROM THE ENTITY OR INDIVIDUAL FROM WHOM YOU DIRECTLY PURCHASED THE PRODUCT(S).

SUBJECT TO THE FOREGOING, UNLESS YOU ARE A DIRECT END USER CUSTOMER OF CRS, INC., CRS, INC. DOES NOT

EXTEND TO YOU ANY EXPRESS WARRANTY OR ANY IMPLIED WARRANTY AND EXPRESSLY DISCLAIMS ANY IMPLIED

WARRANTY OF MERCHANTABILITY, FITNESS FOR USE, OR FITNESS FOR ANY PARTICULAR PURPOSE, OR ANY

WARRANTY OF NON-INFRINGEMENT OF INTELLECTUAL PROPERTY RIGHTS IN CONNECTION WITH THE PRODUCT(S)

OR ANY SOFTWARE, DRIVERS, OR PROGRAMMING PRODUCT, WHETHER EMBEDDED IN PRODUCT(S) OR PROVIDED AS

A SEPARATE PROGRAM, OR USED IN CONJUNCTION WITH THIS/THESE PRODUCT(S). CRS, INC. SPECIFICALLY DOES

NOT WARRANT THAT THE OPERATION OF ANY DRIVERS, SOFTWARE, OR PROGRAMMING PRODUCTS LICENSED

HEREUNDER, WHETHER EMBEDDED IN PRODUCTS OR PROVIDED AS SEPARATE PROGRAMS, SHALL BE

UNINTERRUPTED OR ERROR FREE OR THAT FUNCTIONS CONTAINED IN SUCH DRIVERS, SOFTWARE OR

PROGRAMMING PRODUCTS SHALL OPERATE IN COMBINATION(S) WHICH MAY BE SELECTED FOR USE BY YOU OR

OTHERWISE MEET YOUR REQUIREMENTS.

CRS, Inc. is not responsible for any damages or loss, either direct, indirect, special, incidental or consequential, which you may experience

as a result of your purchase or use of the product(s). Your sole remedy in the event that you encounter any difficulties with the product(s)

is against the entity or individual from whom you purchased the product(s).

Revision 2.0 - April 1, 2005

WARNING - U.S.

THIS EQUIPMENT GENERATES, USES AND CAN RADIATE RADIO FREQUENCY ENERGY, AND IF NOT INSTALLED AND USED

IN ACCORDANCE WITH THE INSTRUCTIONS MANUAL, MAY CAUSE INTERFERENCE TO RADIO COMMUNICATIONS. IT HAS

BEEN TESTED AND FOUND TO COMPLY WITH THE LIMITS FOR A CLASS A COMPUTING DEVICE PURSUANT TO SUBPART J

OF PART 15 OF FCC RULES WHICH ARE DESIGNED TO PROVIDE REASONABLE PROTECTION AGAINST SUCH

INTERFERENCE WHEN OPERATED IN A COMMERCIAL ENVIRONMENT. OPERATIONS OF THE EQUIPMENT IN A

RESIDENTIAL AREA IS LIKELY TO CAUSE INTERFERENCE IN WHICH CASE THE USER, AT HIS OWN EXPENSE, WILL BE

REQUIRED TO TAKE WHATEVER MEASURES MAY BE REQUIRED TO CORRECT THE INTERFERENCE.

NOTICE - CANADA

THIS APPARATUS COMPLIES WITH THE CLASS “A” LIMITS FOR RADIO INTERFERENCE AS SPECIFIED IN THE CANADIAN

DEPARTMENT OF COMMUNICATIONS RADIO INTERFERENCE REGULATIONS.

CET APPAREIL EST CONFORME AUX NORMES CLASS “A” D’INTERFERENCE RADIO TEL QUE SPECIFIER PAR MINISTRE

CANADIEN DES COMMUNICATIONS DANS LES REGLEMENTS D’INTERFERENCE RADIO.

ATTENTION

The product that you have purchased may contain a battery that may be recyclable. At the end of its useful life, under various state

and local laws, it may be illegal to dispose of the battery into the municipal waste system.

Check with your local solid waste officials for details concerning recycling options or proper disposal

.

Page 3

Contents

Introduction 1

Using This Manual.................................................................................................................... 1

Basic Features and Functions....................................................................................................2

Quick Setup 7

Unpacking ................................................................................................................................. 7

Installing the Paper.................................................................................................................... 7

Installing the Ribbon ............................................................................................................... 10

Clearing Memory .................................................................................................................... 11

Basic Programming................................................................................................................. 12

Basic Operations ..................................................................................................................... 16

Using Flowcharts ........................................................................................................ 1

Keyboard..................................................................................................................... 2

Control Lock ............................................................................................................... 4

Display ........................................................................................................................ 5

Setting the Date......................................................................................................... 12

Setting the Time........................................................................................................ 12

Programming Tax ..................................................................................................... 13

Programming a Taxable Department ........................................................................ 15

Registering Items ...................................................................................................... 16

Totaling a Cash Sale ................................................................................................. 17

Tendering a Cash Sale .............................................................................................. 17

Tendering a Check Sale ............................................................................................ 18

Total Charge Sale...................................................................................................... 18

Advanced Operating Instructions 19

Department Registrations........................................................................................................20

Open Department...................................................................................................... 20

Preset Price Department............................................................................................ 20

Department Repeat Entry.......................................................................................... 21

Multiplication............................................................................................................ 21

Department Multiplication With Decimal Point ....................................................... 22

Split Pricing .............................................................................................................. 22

Single Item Department ............................................................................................ 23

PLU (Price Look Up) Registrations ........................................................................................ 24

Open PLU ................................................................................................................. 24

Preset Price PLU ....................................................................................................... 24

PLU Repeat Entry ..................................................................................................... 24

PLU Multiplication ................................................................................................... 25

PLU Multiplication With Decimal Point .................................................................. 25

Split Pricing PLU...................................................................................................... 26

ER-290 Electronic Cash Register i

Page 4

Shifting or Exempting Tax...................................................................................................... 27

Shifting Tax .............................................................................................................. 27

Exempting Tax.......................................................................................................... 28

Percent Key (%1 and %2) Operations..................................................................................... 29

Preset Percent on a Department or PLU Item ........................................................... 29

Enter a Percent on a Department or PLU.................................................................. 29

Percent On Sale Total ............................................................................................... 30

Return Merchandise Registrations .......................................................................................... 30

Voids and Corrections............................................................................................................. 31

Void Last Item .......................................................................................................... 31

Void Previous Item ................................................................................................... 31

Cancel ....................................................................................................................... 32

Void Position Operations.......................................................................................... 32

- (Minus) Key Registrations.................................................................................................... 33

No Sale Operations ................................................................................................................. 34

Open Drawer............................................................................................................. 34

Non Add Number...................................................................................................... 34

Received On Account Operations ........................................................................................... 35

Paid Out Operations ................................................................................................................ 35

Totaling and Tendering ........................................................................................................... 36

Subtotaling a Sale ..................................................................................................... 36

Totaling a Cash Sale ................................................................................................. 36

Tendering a Cash Sale .............................................................................................. 37

Tendering a Check Sale ............................................................................................ 37

Totaling a Charge Sale.............................................................................................. 38

Check Cashing .......................................................................................................... 38

Split Tender............................................................................................................... 39

Post Tender ............................................................................................................... 40

Receipt On/Off and Receipt on Request ................................................................... 41

Advanced Programming Instructions 43

Department Programming....................................................................................................... 43

Programming Department Status.............................................................................. 43

Programming Department Entry Limit or Price........................................................ 46

System Option Programming.................................................................................................. 48

System Option Table................................................................................................. 50

Advanced Tax Programming .................................................................................................. 52

Tax Rate Programming ............................................................................................. 52

Tax Table Programming ........................................................................................... 54

%1 and %2 Key Programming................................................................................................ 56

- (Minus) Key Programming................................................................................................... 58

CANCEL Key Programming .................................................................................................. 60

Programming the CANCEL Key .............................................................................. 60

PLU (Price Look Up) Programming ....................................................................................... 61

Programming PLU Status ......................................................................................... 61

Programming PLU Entry Limit or Price................................................................... 64

Setting a Register Number ...................................................................................................... 66

Setting Receipt/Journal Status................................................................................................. 67

Printing a Programming Report .............................................................................................. 67

ii ER-290 Electronic Cash Register

Page 5

Reports 69

Report Summary ..................................................................................................................... 69

Running a Report ...................................................................................................... 70

Cash-In-Drawer Declaration ................................................................................................... 70

Declaring Cash.......................................................................................................... 70

Report Samples ....................................................................................................................... 71

Financial Report........................................................................................................ 71

Hourly Sales Report.................................................................................................. 74

PLU Report ............................................................................................................... 75

Cash-in-Drawer Report............................................................................................. 76

Check-in-Drawer Report........................................................................................... 76

System Balancing.................................................................................................................... 77

Department Sales Total............................................................................................. 77

Net Total ................................................................................................................... 77

Gross Total................................................................................................................ 77

Grand Total ............................................................................................................... 77

ER-290 Electronic Cash Register iii

Page 6

Page 7

Introduction

Using This Manual

Congratulations! You have selected a very flexible electronic cash register designed for years of reliable

service. The ER-290 will fit many retail stores, shops and restaurants. It provides fast transaction

processing, security, and detailed sales information.

z To Get Started turn to “Quick Setup” on page 7. This section covers unpacking, memory

clearing, a few simple programming steps, and instructions for basic cash register

transactions. All of the features of the ER-290 operate immediately, without additional

programming steps. In most cases, all the programming you need to do is covered in this

section.

z For information about reports and balancing see “Reports” on page 69.

This manual also includes detailed information about many additional features that will

help you solve the special calculation problems or security issues that you might face.

z For detailed programming instructions, see “Advanced Programming” on page 43.

z For detailed operations sequences, see “

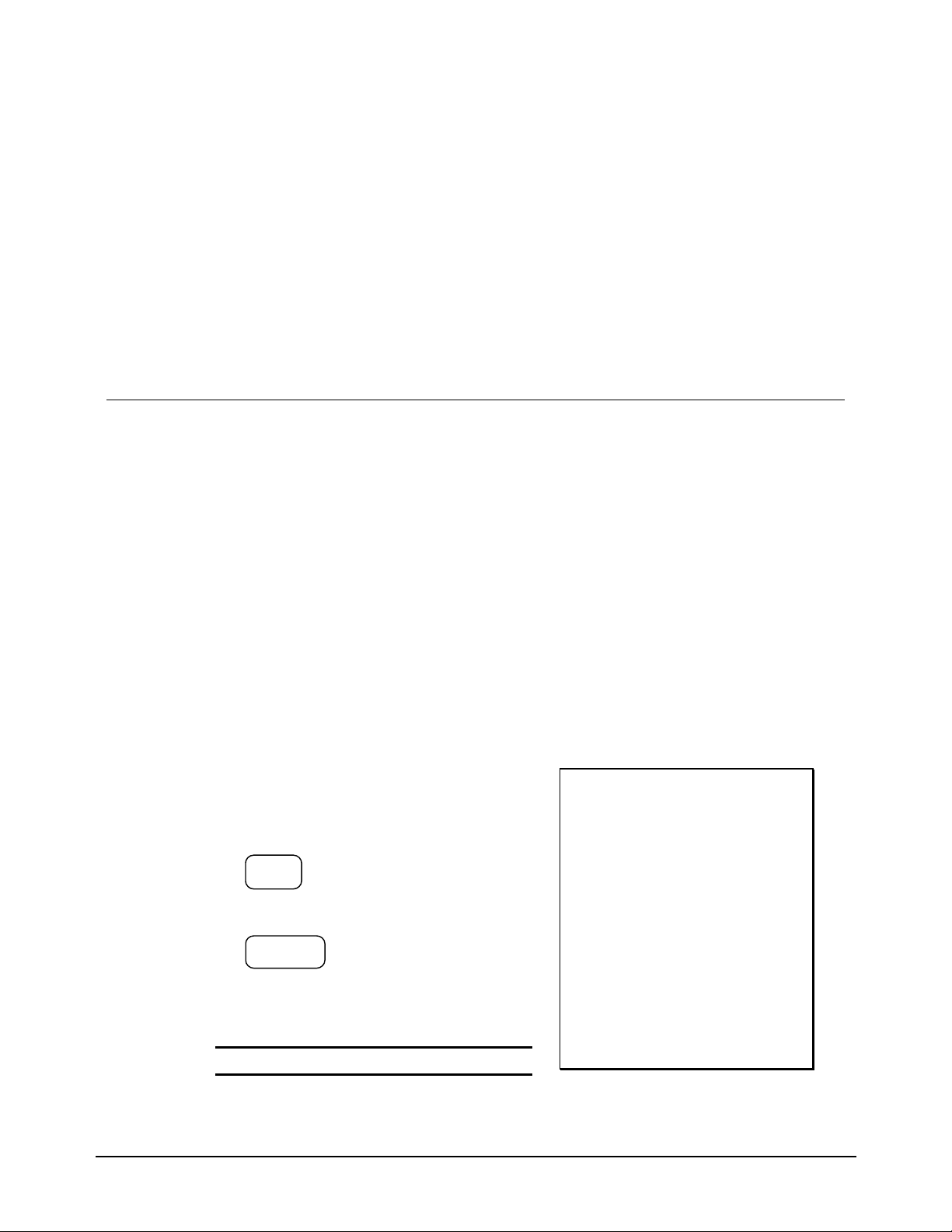

z Total Charge Sale

1. Register the items you wish to sell.

2. To display and print the subtotal of the sale

including tax, press SUBTOTAL:

SUB

TOTAL

3. Press CHARGE1:

CHARGE1

4. The display will indicate “=” for total, the

drawer will open and the receipt will print as

in the example on the right.

Note: Charge tendering is not allowed.

z Advanced Operating Instructions” on page 18.

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

1 . . . . . . 2 . 9 9 T 1

1 . . . . . . 2 . 9 9 T 1

* . . . . . . . . . 4 X

@ . . . . . . 1 . 9 9

2 . . . . . . 7 . 9 6

* . . . . . 1 4 . 3 0 S T

* . . . . . . 5 . 9 8 T 1

* . . . . . . 0 . 3 6 T 1

* . . . . . 1 4 . 3 0 C 1

0 0 0 0 0 6

1 5 . 2 7 0 0

ER-290 Electronic Cash Register Introduction • 1

Page 8

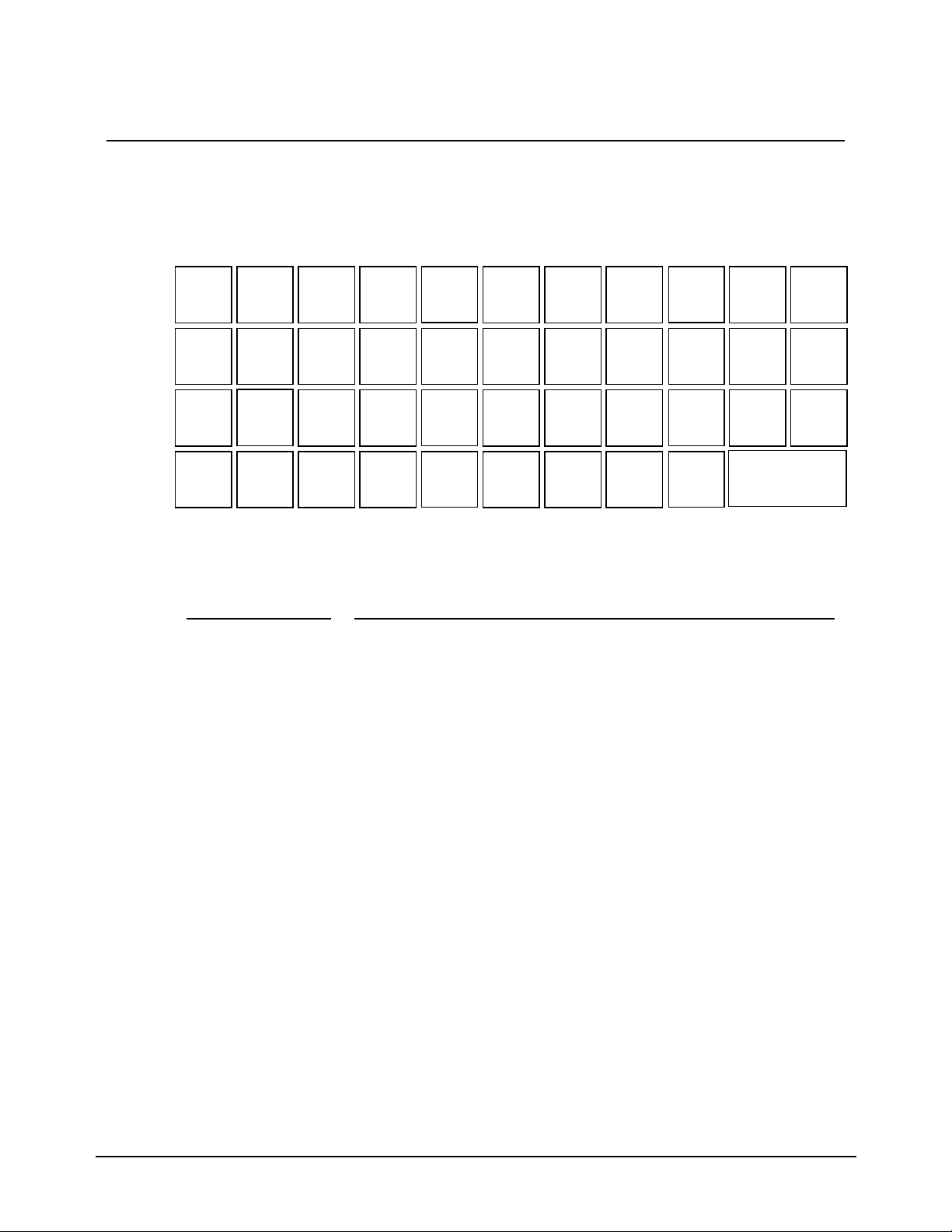

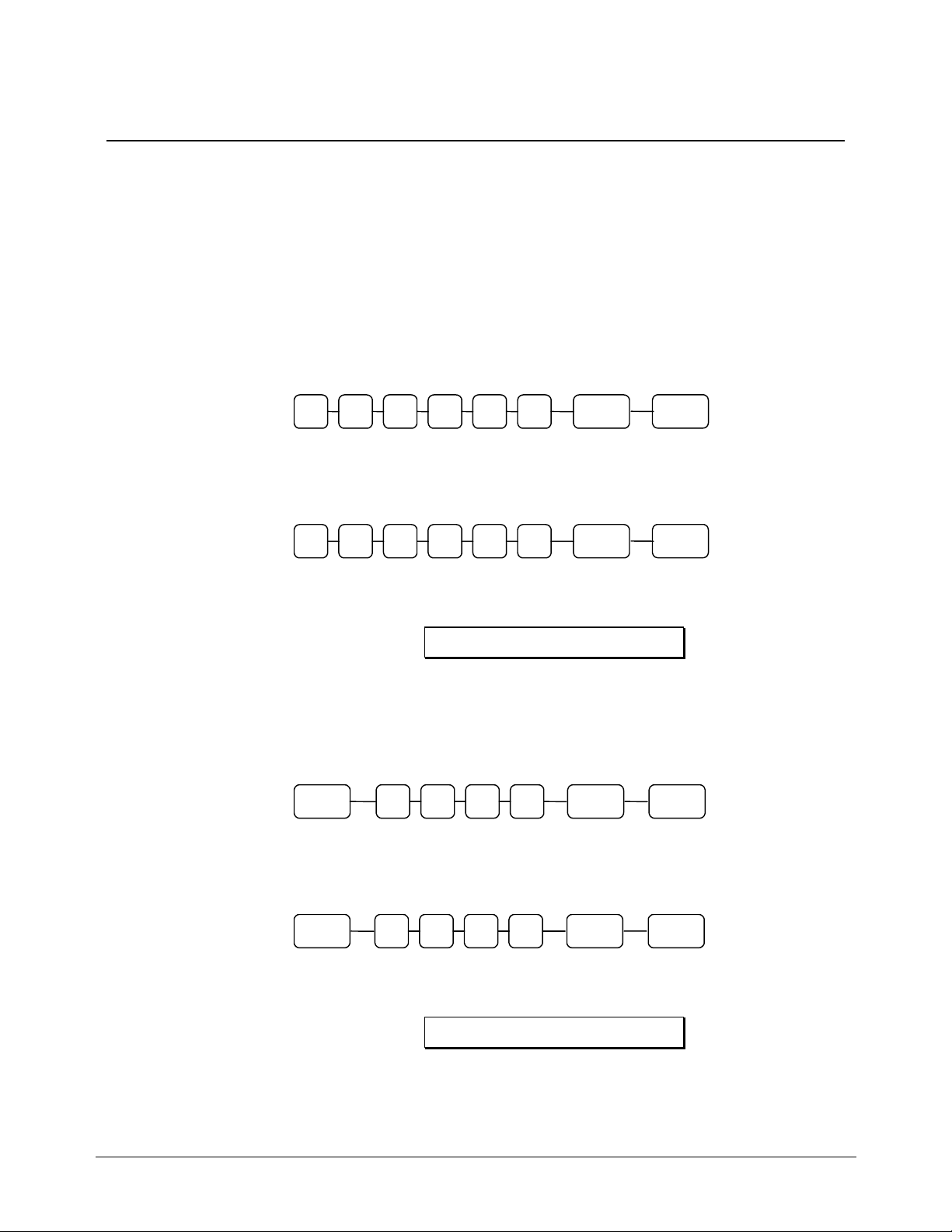

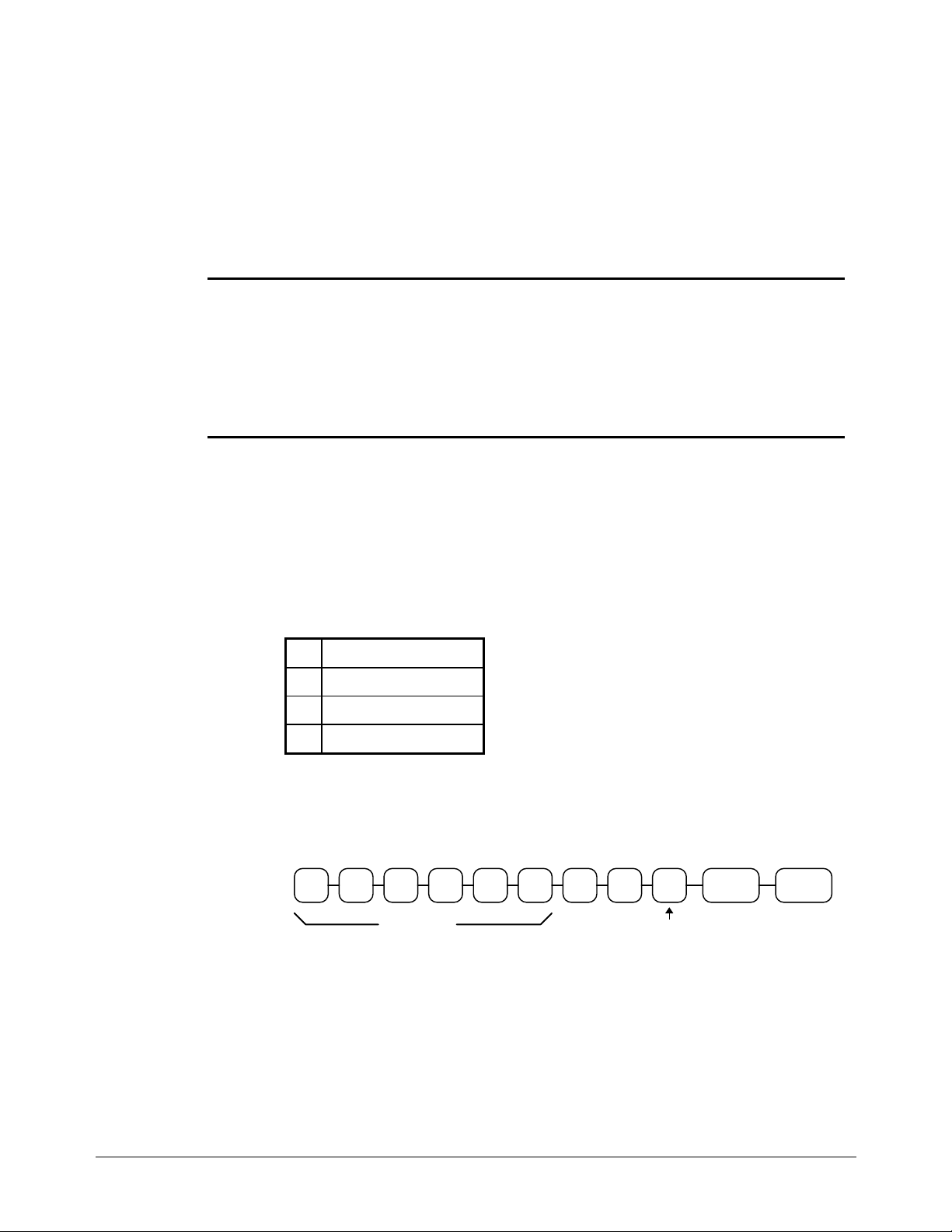

Using Flowcharts

Flowcharts are used to supplement step by step instructions throughout this manual. For example, the

following flowchart describes how to register $1.00 into department 1:

1 0 0

1

This flowchart means:

1. Press numeric key 1.

2. Press numeric key 0.

3. Press numeric key 0.

4. Press department 1.

Follow the flowchart from left to right, pressing the keys in the order they are shown. Numeric keypad

entries are shown as square keys. Department and function keys are shown as rectangular keys.

2 • Introduction ER-290 Electronic Cash Register

Page 9

Basic Features and Functions

L

E

E

Keyboard

PLUPAPER

FEED

-

CANCE

#/NO

SALE

%1

RTRN

MDSE

TAX

SHIFT

Key Descriptions

Key

PAPER FEED

Numeric Keypad:

0-9 and 00

CLEAR

Department Keys

#/NO SALE

@/FOR

VOID

@/

FOR

%2

VOID

CLEAR

7

4

1

0

8

5

2

00

9

4

6

3

3

2

.

1

8

7

6

5

12

11

10

9

PAID

OUT

CHARG

1

SUB

TOTAL

CASH/TEND

RECD

ACCT

CHARG

2

CHECK

TEND

Description

Press to advance the printer paper.

Use the numeric keypad to enter amounts, other numeric values.

Press to clear numeric errors made on keyboard prior to pressing the

registration key. Also press to stop the error alarm when incorrect entries

are made.

There are 12 department keys on the keyboard to register different types of

merchandise. Departments may be used to accept open priced entries, or

may be programmed to register preset prices.

Press to open the cash drawer when you have not already started a

transaction. Also, may be used to print any number (up to 8 digits) on the

printer paper.

Enter a quantity, then press the @/FOR key to enter multiple items. Also

use to enter “split pricing” items, such as 1 item at 3 for $.89.

Press to void (or erase) the last item entered. You can also void an item

previously entered within a transaction by pressing SUBTOTAL, then

VOID then re-entering the item you wish to correct.

ER-290 Electronic Cash Register Introduction • 3

Page 10

RTRN MDSE

If you wish to return or refund an item, press Return Merchandise, then reenter any item you wish.

- (MINUS)

Register a negative amount by entering a price, then pressing the (MINUS) key. For example, you can enter bottle returns or coupons using

the - (MINUS) key.

CANCEL

%1, %2

Press to void (or erase) all items entered thus far in any transaction.

Use the Percent keys to add a percentage surcharge or subtract a percentage

from an item or the subtotal of the sale. You can enter the amount of the

percentage before pressing the %1 or %2 keys, or you can program a

preset percentage if you are consistently using the same percentage. See

“%1 and %2 Key Programming” on page 56 to set a preset percentage.

PLU

RECD ACCT

Use to register a Price Look Up (PLU).

Use to accept cash into the cash drawer when you are not actually selling

merchandise. For example, use the Received on Account key to accept

payments for previously sold merchandise, or record loans to the cash

drawer.

PAID OUT

Use to track cash paid out for merchandise or to record loans from the cash

drawer.

TAX SHIFT

Press to reverse the programmed tax status of a department key. For

example, by using the TAX SHIFT key prior to registering a taxable item,

the item will be sold without sales tax added.

. (Decimal)

Use the Decimal key to enter fractions of percentages. For example to enter

a one third off discount, enter 3 3 . 3 3 before pressing the -% key.

SUB TOTAL

CHARGE1,2

CHECK TEND

Press to see the subtotal of a sale.

Press to total a transaction paid by charge or credit card.

Press to total a transaction paid by check. Also if the check amount is over

the amount purchased, enter the amount of the check, then press the

CHECK TEND key. The drawer will open and the cash change will be

computed.

CASH/TEND

Press to total a transaction paid by cash. Also if the cash amount tendered

is over the amount purchased, enter the amount of the tender, then press the

CASH/TEND key. The drawer will open and the cash change will be

computed.

4 • Introduction ER-290 Electronic Cash Register

Page 11

Control Lock

V

OFF

OID

REG

VOID Use to void (correct) items outside of a sale.

OFF The register is inoperable.

X

Z

REG Use for normal registrations.

X Use to read register reports.

Z Use to read register reports and reset totals to zero.

PGM

PGM Use to program the register.

The ER-290 includes two sets of keys that may be used to access the following key lock positions.

Key

VOID

X

Z

PGM

Positions Accessible

VOID, OFF, REG, X

OFF, REG X

OFF, REG, X, Z

ALL POSITIONS

Note: Keys may be removed from the key lock in the OFF or REG positions.

ER-290 Electronic Cash Register Introduction • 5

Page 12

Display

A

Front Display

MOUNTDPT RPT

DPT

RPT

AMOUNT

Indicates the department number of the registration (1 digits).

Indicates the number of times an item has been repeated.

Displays the amount the amount of the item, subtotal or total.

Display Messages

C

-

E

=

E1

E3

Change Due

Negative entry

Error

Total

Input Error

Printer Error (paper jam)

Rear Display

The rear display may be lifted and turned for easy customer viewing.

6 • Introduction ER-290 Electronic Cash Register

Page 13

Quick Setup

Unpacking

1. Unpack and Unwrap the cash register.

2. Locate in the packing the following items:

z 1 roll of paper

z 1 ribbon

z 1 take up spool

z 1 set of control keys

3. Remove the cardboard protectors from the cash drawer.

4. Plug the register into a grounded outlet (three prong), insert a control key and turn the

key to the REG control lock position.

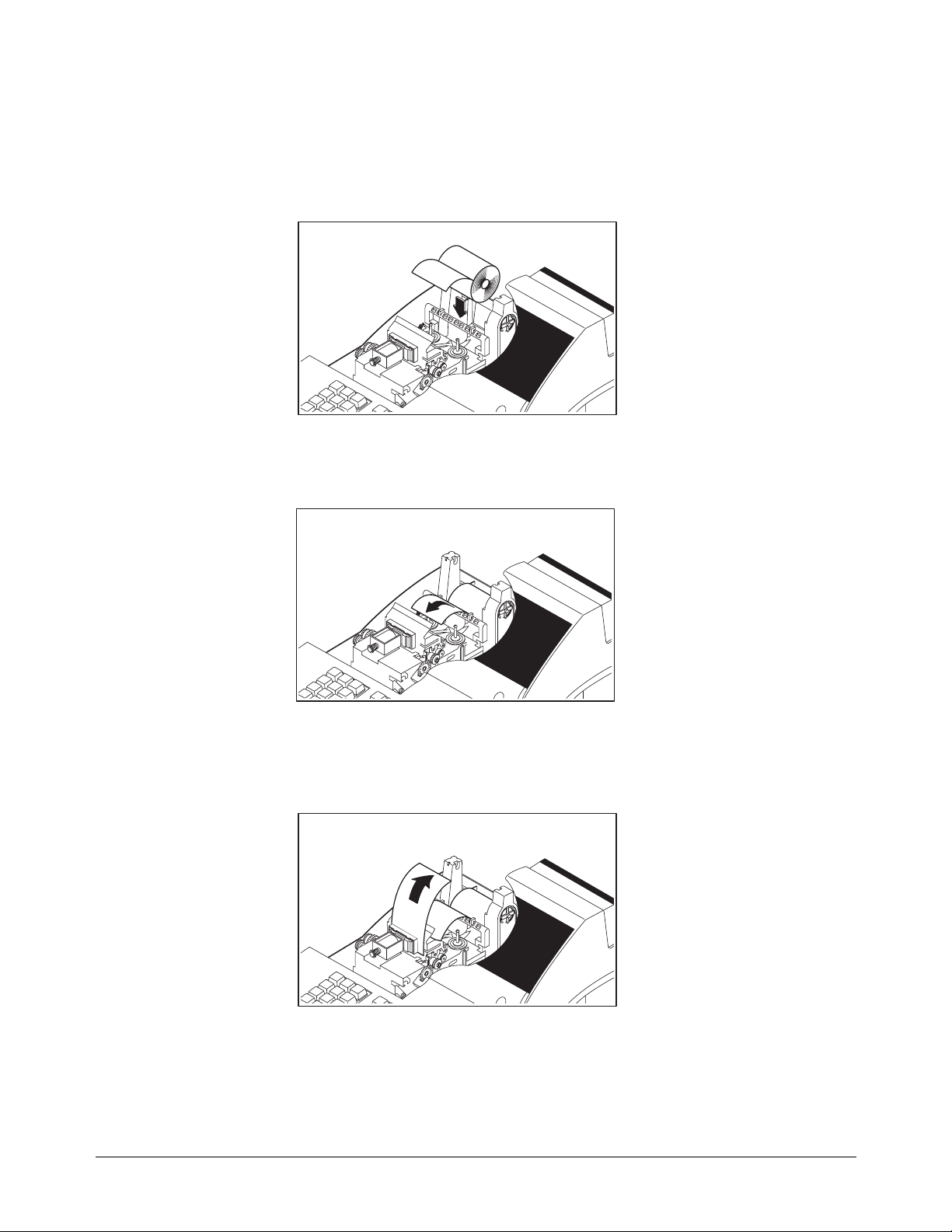

Installing the Paper

1. Remove the printer cover.

ER-290 Electronic Cash Register Quick Setup • 7

Page 14

2. For proper feeding through the print head, cut or tear a straight even edge on the end of

the paper roll. Place the paper roll in the paper holder so that the paper will feed from

the bottom of the roll.

3. Insert the end of the paper into the paper slot.

4. Press the PAPER FEED key until the paper comes out about 8 inches.

8 • Quick Setup ER-290 Electronic Cash Register

Page 15

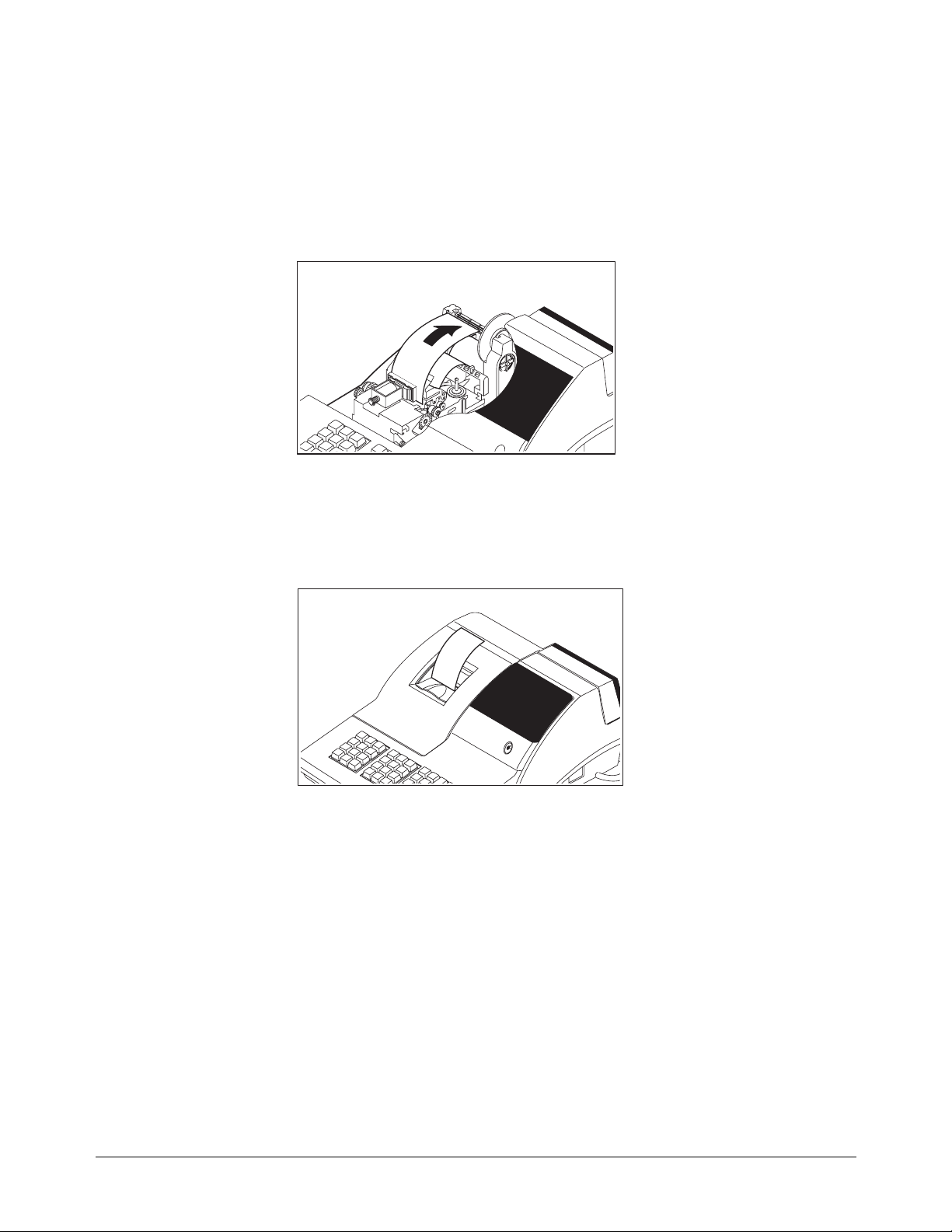

5. If you wish to use the printer to print a sales journal, insert the paper into the paper

take-up spool. Also see “Setting Receipt/Journal Status” on page 67. Wind the paper

two or three turns around the spool shaft and install the spool in the mount.

6. If you wish to use the printer to print customer receipts, pass the paper through the

window of the printer cover and replace the printer cover.

ER-290 Electronic Cash Register Quick Setup • 9

Page 16

Installing the Ribbon

1. Remove the printer cover.

2. Insert the new ribbon firmly into place.

3. Replace the printer cover

10 • Quick Setup ER-290 Electronic Cash Register

Page 17

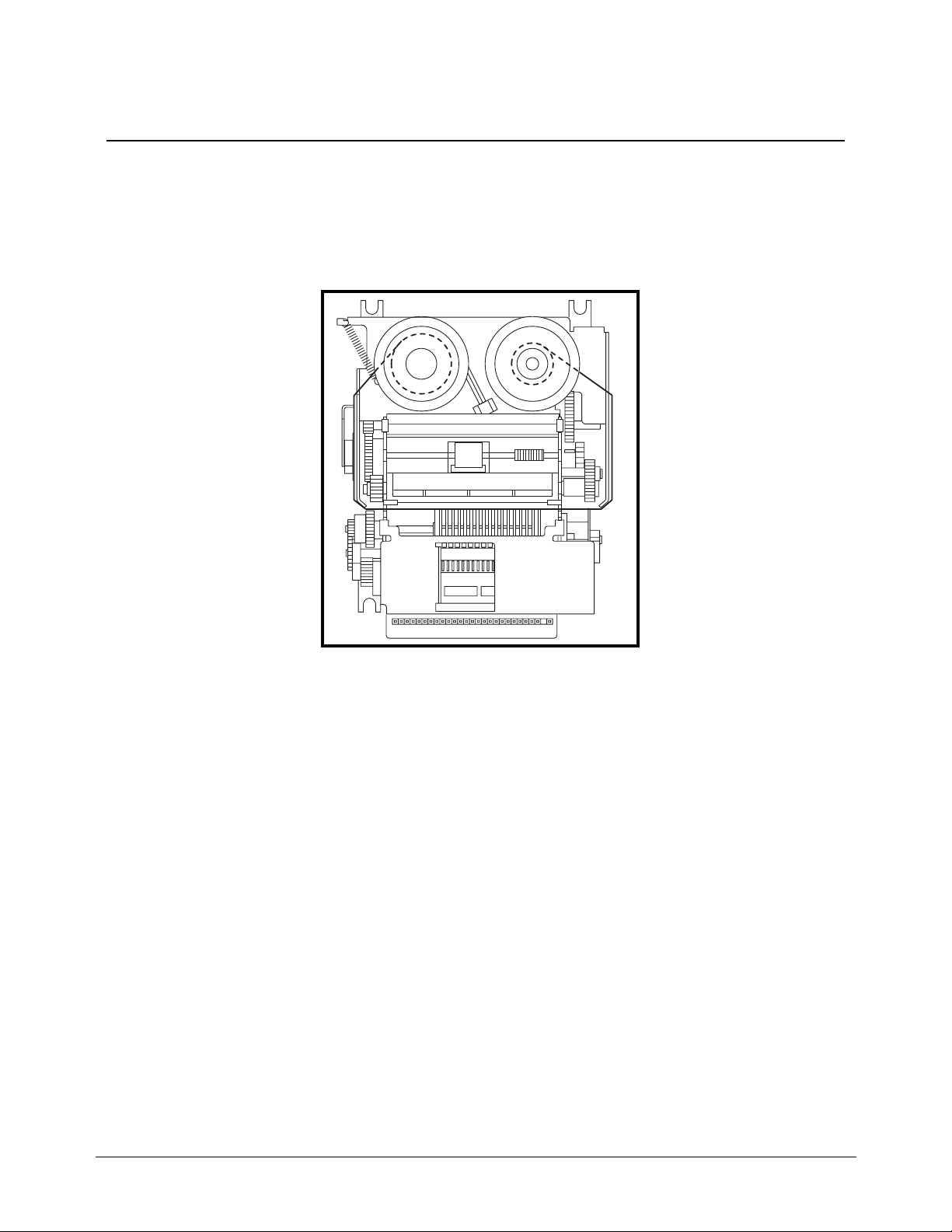

Clearing Memory

This step insures that the cash register is cleared of any totals or programming. After this procedure, the

cash register is ready for programming and operation.

WARNING: This is a one time procedure. Do not repeat this procedure after the

cash register is programmed, it causes all programs and totals to be erased.

1. Unplug the register.

2. Turn the control lock to PGM position.

3. Press and hold the CLEAR key while connecting the AC plug into a power outlet.

CLEAR

4. When memory is cleared, the register prints:

POWER

UP

. . . . . . . . . . C S

ER-290 Electronic Cash Register Quick Setup • 11

Page 18

Basic Programming

This section covers the basic programming necessary to get your cash register running quickly. See

“Advanced Programming” on page 43 for if you wish to program options that are not included in this

section.

Setting the Date

The date sequence is Month-Day-Year.

1. Turn the control lock to the PGM position.

2. Enter the date in the format you have selected and press the @/FOR key:

M M D D

Y Y

@/

FOR

Date Setting Example

If the date is March 1, 1999, enter:

0 3 0 1

9 9

@/

FOR

The date you have entered will display and print on the printer:

0 3 - 0 1 - 1 9 9 9

Setting the Time

1. Turn the control lock to the PGM position.

2. Enter the hour and minute in military time (24 hour time) and press the @/FOR key:

@/

@/

FOR

H H M M

FOR

CASH/

TEND

CASH/

TEND

CASH/

TEND

Time Setting Example

If the time is 3:25 PM, enter:

@/

FOR

1 5 2 5

The time you have entered will display and print on the printer:

1 5 . 2 5

12 • Quick Setup ER-290 Electronic Cash Register

@/

FOR

CASH/

TEND

Page 19

Programming Tax

Most sales taxes can be programmed by entering a tax percentage rate. However, in some cases you

may find that tax that is entered as a percentage does not follow exactly the tax chart that applies in

your area. If this is the case, you must enter your tax using tax table programming. This method will

match tax collection exactly to the break points of your tax table. See “Tax Table Programming” on

page 54.

Important Note: After you have entered your tax program, test for accuracy

by entering several transactions of different dollar amounts. Carefully check

to make sure the tax charged by the cash register matches the tax amounts on

the printed tax chart for your area. As a merchant, you are responsible for

accurate tax collection. If the cash register is not calculating tax accurately, or

if you cannot program your tax properly from the information in this manual,

contact the CRS, Inc. Service Center at 1-888-333-6776 for assistance.

Programming a Tax Rate Percentage

1. Turn the control lock to the PGM position.

2. Enter the rate, with a decimal. 0.000-99.999. It is not necessary to enter proceeding

zeros. For example, for 6%, enter 06.000 or 6.000.)

3. Enter 00.

4. Enter:

to set tax rate 1

1

to set tax rate 2

2

to set tax rate 3

3

to set tax rate 4

4

5. Press the TAX SHIFT key.

6. Press the CASH/TEND key to end programming.

Tax Rate Programming Flowchart

.

Tax Rate

Please Note: After programming the Tax you must program your Department or Departments to

calculate Tax. See page 15 for the programming steps to program a Department

Taxable.

7. See Tax rate programming examples on page 14.

00

Tax #

(1-4)

TAX

SHIFT

CASH/

TEND

ER-290 Electronic Cash Register Quick Setup • 13

Page 20

Tax Rate Programming Example

If tax 1 is 6 percent, enter:

.

0 100 0 06

If tax 2 is 7.5 percent, enter:

.

0 205 0 07

If tax 3 is 10 percent, enter:

0 .

If tax 4 is 15 percent, enter:

5 .

Press the CASH/TEND key to end programming.

CASH/

TEND

The rates you have entered will display and print on the printer:

TAX

SHIFT

TAX

SHIFT

0 300 0 01

0 400 0 01

TAX

SHIFT

TAX

SHIFT

0 0

* . . . . . 6 . 0 0 0 T 1

0 0

* . . . . . 7 . 5 0 0 T 2

0 0

* . . . . 1 0 . 0 0 0 T 3

0 0

* . . . . 1 5 . 0 0 0 T 4

0 0 0 0 0 1

1 5 . 2 6 0 0

14 • Quick Setup ER-290 Electronic Cash Register

Page 21

Programming a Taxable Department

1. Turn the control lock to the PGM position.

2. Complete the tax status table below by adding the status digits for each tax. Then enter

the resulting tax status code.

Taxable by Rate 1? Yes = 1

Taxable by Rate 2? Yes = 2

Taxable by Rate 3? Yes = 4

Taxable by Rate 4? Yes = 8

No = 0

No = 0

No = 0

No = 0

3. Press the @/FOR key.

4. Repeat steps 2, 3 and 4 for each department you wish to program.

5. Press the CASH/TEND key to end programming.

Taxable Department Programming Flowchart

Repeat for each

Department

+

+

+

+

=

Tax

Status

Code

@/

FOR

DEPT

KEY

CASH/

TEND

Taxable Department Programming Example

Set department 1 taxable by tax rate 1:

0

1

Press the CASH/TEND key to end programming.

CASH/

TEND

The tax status you have entered will display and print on the printer:

@/

FOR

1

1 . . . . . . . . 1 T 1

0 0 0 0 0 2

1 5 . 2 6 0 0

ER-290 Electronic Cash Register Quick Setup • 15

Page 22

Basic Operations

Registering Items

1. Enter an amount on the ten key pad. Do not use the decimal key. For example, for

$2.99, enter:

2 9 9

2. Press a department key. For example, press department 1:

Repeating an Item

3. To register a second item exactly as the first, press the department key a second time.

For example, press department 1:

Registering Multiple Items

4. Enter the quantity of items being purchase, press the @/FOR key. For example, enter

4 on the numeric key pad and press the @/FOR key:

4

5. Enter an amount on the ten key pad. Do not use the decimal key. For example, for

$1.99, enter:

1 9 9

6. Press a department key. For example, press department 2:

1

1

@/

FOR

2

16 • Quick Setup ER-290 Electronic Cash Register

Page 23

Totaling a Cash Sale

1. Register the items you wish to sell.

2. To display and print the subtotal of the

sale including tax, press SUBTOTAL:

SUB

TOTAL

3. To total a cash sale, press

CASH/TEND:

CASH/

4. The display will indicate “=” for total,

the drawer will open and the receipt will

print as in the example on the right.

TEND

Tendering a Cash Sale

1. Register the items you wish to sell.

2. To display and print the subtotal of the

sale including tax, press SUBTOTAL:

SUB

TOTAL

3. Enter the amount tendered by the

customer. For example, for $20.00

enter:

4. Press CASH/TEND:

CASH/

5. The display will indicate “C” for change,

the drawer will open and the receipt will

print as in the example on the right.

TEND

0 0 02

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

1 . . . . . . 2 . 9 9 T 1

1 . . . . . . 2 ˙9 9 T 1

* . . . . . . . . . 4 X

@ . . . . . . 1 . 9 9

2 . . . . . . 7 . 9 6

* . . . . . . 5 . 9 8 T 1

* . . . . . . 0 . 3 6 T 1

* . . . . . 1 4 . 3 0 C A

0 0 0 0 0 3

1 5 . 2 6 0 0

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

1 . . . . . . 2 . 9 9 T 1

1 . . . . . . 2 . 9 9 T 1

* . . . . . . . . . 4 X

@ . . . . . . 1 . 9 9

2 . . . . . . 7 . 9 6

* . . . . 1 4 . 3 0 S T

* . . . . . 5 . 9 8 T 1

* . . . . . 0 . 3 6 T 1

* . . . . . 1 4 . 3 0 T L

* . . . . . 2 0 . 0 0 C A

* . . . . . . 5 . 7 0 C

0 0 0 0 0 4

1 5 . 2 7 0 0

ER-290 Electronic Cash Register Quick Setup • 17

Page 24

Tendering a Check Sale

1. Register the items you wish to sell.

2. To display and print the subtotal of the sale

including tax, press SUBTOTAL:

SUB

TOTAL

3. Enter the amount of the check tendered by

the customer. For example, for $20.00 enter:

4. Press CHECK TEND:

CHECK

5. The display will indicate “C” for change, the

drawer will open and the receipt will print as

in the example on the right.

TEND

0 0 02

Total Charge Sale

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

1 . . . . . . 2 . 9 9 T 1

1 . . . . . . 2 . 9 9 T 1

* . . . . . . . . . 4 X

@ . . . . . . 1 . 9 9

2 . . . . . . 7 . 9 6

* . . . . 1 4 . 3 0 S T

* . . . . . 5 . 9 8 T 1

* . . . . . 0 . 3 6 T 1

* . . . . 1 4 . 3 0 T L

* . . . . 2 0 . 0 0 C H

* . . . . . 5 . 7 0 C

0 0 0 0 0 5

1 5 . 2 7 0 0

5. Register the items you wish to sell.

6. To display and print the subtotal of the sale

including tax, press SUBTOTAL:

SUB

TOTAL

7. Press CHARGE1:

CHARGE1

8. The display will indicate “=” for total, the

drawer will open and the receipt will print as

in the example on the right.

Note: Charge tendering is not allowed.

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

1 . . . . . . 2 . 9 9 T 1

1 . . . . . . 2 . 9 9 T 1

* . . . . . . . . . 4 X

@ . . . . . . 1 . 9 9

2 . . . . . . 7 . 9 6

* . . . . . 1 4 . 3 0 S T

* . . . . . . 5 . 9 8 T 1

* . . . . . . 0 . 3 6 T 1

* . . . . . 1 4 . 3 0 C 1

0 0 0 0 0 6

1 5 . 2 7 0 0

18 • Quick Setup ER-290 Electronic Cash Register

Page 25

Advanced Operating Instructions

ER-290 Electronic Cash Register Advanced Operating Instructions • 19

Page 26

Department Registrations

As you make department registrations, you can follow your entries by viewing the display. The

digits marked “DPT” indicate the department used. The digit marked “RPT” counts items as they

are repeated.

Open Department

1. Enter an amount on the ten key pad. Do

not use the decimal key. For example, for

$2.99, enter:

2 9 9

2. Press a department key. For example,

press department 1:

1

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

1 . . . . . . 2 . 9 9 T 1

* . . . . . . 2 . 9 9 T 1

* . . . . . . 0 . 1 8 T 1

* . . . . . . 3 . 1 7 C A

0 0 0 0 0 9

1 5 . 2 8 0 0

Preset Price Department

A preset department registers the price that was previously programmed. See “Department

Programming” on page 43 to program preset prices.

1. Press a preset department key. For

example, press department 5:

5

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

5 . . . . . . 1 . 2 9

* . . . . . . 1 . 2 9 C A

0 0 0 0 1 0

1 5 . 2 8 0 0

20 • Advanced Operating Instructions ER-290 Electronic Cash Register

Page 27

Department Repeat Entry

Open or preset price departments may be repeated as many times as necessary by pressing the same

department again. (Likewise open or preset PLUs may be repeated by pressing the PLU key again.)

1. Enter an amount on the ten key pad. Do

not use the decimal key. For example, for

$2.99, enter:

2 9 9

2. Press a department key. For example,

press department 1:

1

3. To register a second item exactly as the

first, press the department key a second

time. For example, press department 1:

1

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

1 . . . . . . 2 . 9 9 T 1

1 . . . . . . 2 . 9 9 T 1

* . . . . . . 5 . 9 8 T 1

* . . . . . . 0 . 3 6 T 1

* . . . . . . 6 . 3 4 C A

0 0 0 0 0 9

1 5 . 2 8 0 0

Multiplication

When several of the same items are to be entered into the same Department, you can use

multiplication. You may enter a quantity up to 4 figures (1 to 9999) using the @/FOR key. You

may multiply open or preset departments.

1. Enter the quantity of items being

purchased, press the @/FOR key. For

example, enter 4 on the numeric key pad

and press the @/FOR key:

4

2. Enter an amount on the ten key pad. Do

not use the decimal key. For example, for

$1.99, enter:

1 9 9

Press a department key. For example,

press department 1:

@/

FOR

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

* . . . . . . . . . 4 X

@ . . . . . . 1 . 9 9

1 . . . . . . 7 . 9 6 T 1

* . . . . . . 7 . 9 6 T 1

* . . . . . . 0 . 4 8 T 1

* . . . . . . 8 . 4 4 C A

0 0 0 0 1 0

1 5 . 2 8 0 0

1

ER-290 Electronic Cash Register Advanced Operating Instructions • 21

Page 28

Department Multiplication With Decimal Point

If you are selling items by weight, or if you are selling yard goods, you can multiply a fraction of a

unit.

1. Enter the with the decimal point, press the

@/FOR key. For example, for 3 ¾ pounds

of produce, enter:

3 . 7

5

@/

FOR

2. Enter an amount on the ten key pad. Do

not use the decimal key. For example, if

the price is $.99 per pound, enter:

9 9

Press a department key. For example, press

department 1:

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

* . . . . 3 . 7 5 0 X

@ . . . . . 0 . 9 9

1 . . . . . 3 . 7 1 T 1

* . . . . . 3 . 7 1 T 1

* . . . . . 0 . 2 2 T 1

* . . . . . 3 . 9 3 C A

0 0 0 0 1 1

1 5 . 2 9 0 0

1

Split Pricing

When items are priced in groups, i.e. 3 for $1.00, you can enter the quantity purchased and let the

register calculate the correct price.

1. Enter the quantity purchased, press the

@/FOR key. For example, enter:

2

@/

FOR

2. Enter the quantity of the group price, press

the @/FOR key. For example, if the items

are priced 3 for $1.00, enter:

3

@/

FOR

3. Enter an amount on the ten key pad. For

example, if the items are priced 3 for

$1.00, enter:

1 0 0

Press a department key. For example, press

department 1:

1

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

* . . . . . . . . 2 X

* . . . . . . . . 3 X

@ . . . . . 1 . 0 0

1 . . . . . 0 . 6 7 T 1

* . . . . . 0 . 6 7 T 1

* . . . . . 0 . 0 4 T 1

* . . . . . 0 . 7 1 C A

0 0 0 0 1 2

1 5 . 2 9 0 0

22 • Advanced Operating Instructions ER-290 Electronic Cash Register

Page 29

Single Item Department

Single item departments automatically total as a cash sale immediately after registration. Use single

item departments for speedy one item sales. For example if you are selling admission tickets, and all

ticket sales are one item sales, you can assign open or preset single item departments for ticket sales.

After each registration, the drawer will immediately open, and a separate receipt is printed. See

“Department Programming” on page 43 to program a single item department.

1. Press a single item preset department key.

(or enter a price and press a single item

open department key.) For example,

press department 6:

6

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

6 . . . . . . 1 . 2 9

* . . . . . . 1 . 2 9 C A

0 0 0 0 1 3

1 5 . 2 9 0 0

ER-290 Electronic Cash Register Advanced Operating Instructions • 23

Page 30

PLU (Price Look Up) Registrations

PLUs must be programmed before they may be operated. See “PLU (Price Look Up) Programming”

on page 61 to program open or preset PLUs.

Open PLU

1. Enter the PLU number, press the PLU

key. For example, enter:

2 PLU

2. Enter an amount on the ten key pad. Do

not use the decimal key. For example, for

$2.99, enter:

2 9 9

3. Press the PLU key again.

PLU

Preset Price PLU

1. Enter the PLU number, press the PLU key.

For example, enter:

1 PLU

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

* 0 0 2

1 . . . . . . 2 . 9 9 T 1

* . . . . . . 2 . 9 9 T 1

* . . . . . . 0 . 1 8 T 1

* . . . . . . 3 . 1 7 C A

0 0 0 0 1 4

1 5 . 3 1 0 0

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

* 0 0 1

1 . . . . . . 1 . 2 9

* . . . . . . 1 . 2 9 C A

0 0 0 0 1 5

1 5 . 3 1 0 0

PLU Repeat Entry

1. Enter the PLU number, press the PLU

key. For example, enter:

1 PLU

2. To register a second item exactly as the

first, press the PLU key a second time:

PLU

24 • Advanced Operating Instructions ER-290 Electronic Cash Register

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

* 0 0 1

1 . . . . . . 2 . 9 9 T 1

* 0 0 1

1 . . . . . . 2 . 9 9 T 1

* . . . . . . 5 . 9 8 T 1

* . . . . . . 0 . 3 6 T 1

* . . . . . . 6 . 3 4 C A

0 0 0 0 1 6

1 5 . 3 1 0 0

Page 31

PLU Multiplication

When several of the same items are to be entered into the same PLU, you can use multiplication.

You may enter a quantity up to 4 figures (1 to 9999) using the @/FOR key. You may multiply open

or preset PLUs.

1. Enter the quantity of items being

purchased, press the @/FOR key. For

example, enter 4 on the numeric key pad

and press the @/FOR key:

4

2. Enter the PLU number, press the PLU key.

For example, enter:

1 PLU

@/

FOR

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

* . . . . . . . . . 4 X

@ . . . . . . 1 . 9 9

* 0 0 1

1 . . . . . . 7 . 9 6 T 1

* . . . . . . 7 . 9 6 T 1

* . . . . . . 0 . 4 8 T 1

* . . . . . . 8 . 4 4 C A

0 0 0 0 1 7

1 5 . 3 1 0 0

PLU Multiplication With Decimal Point

If you are selling items by weight, or if you are selling yard goods, you can multiply a fraction of a

unit.

1. Enter the with the decimal point, press

the @/FOR key. For example, for 3 ¾

pounds of produce, enter:

3 . 7

2. Enter the PLU number, press the PLU

key. For example, enter:

3 PLU

5

@/

FOR

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

* . . . . . 3 . 7 5 0 X

@ . . . . . . 2 . 9 9

* 0 0 3

1 . . . . . 1 1 . 2 1 T 1

* . . . . . 1 1 . 2 1 T 1

* . . . . . . 0 . 6 7 T 1

* . . . . . 1 1 . 8 8 C A

0 0 0 0 1 8

1 5 . 3 2 0 0

ER-290 Electronic Cash Register Advanced Operating Instructions • 25

Page 32

Split Pricing PLU

When items are priced in groups, i.e. 3 for $1.00, you can enter the quantity purchased and let the

register calculate the correct price.

1. Enter the quantity purchased, press the

@/FOR key. For example, enter:

2

@/

FOR

2. Enter the quantity of the group price, press

the @/FOR key. For example, if the items

are priced 3 for $1.00, enter:

3

@/

FOR

3. Enter the PLU number, press the PLU

key. For example, enter:

4 PLU

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

* . . . . . . . . . 2 X

* . . . . . . . . . 3 X

@ . . . . . . 1 . 0 0

* 0 0 4

1 . . . . . . 0 . 6 7 T 1

* . . . . . . 0 . 6 7 T 1

* . . . . . . 0 . 0 4 T 1

* . . . . . . 0 . 7 1 C A

0 0 0 0 1 9

1 5 . 3 2 0 0

26 • Advanced Operating Instructions ER-290 Electronic Cash Register

Page 33

Shifting or Exempting Tax

Shifting Tax

Taxable Departments and PLUs can be programmed to automatically add the appropriate tax or

taxes. Occasionally, you may need to sell a normally taxable item without tax, or a normally nontaxable item with tax. You can perform this tax shifting with the TAX SHIFT key.

1. Enter the number for the tax you wish to

shift. Press 1 to shift tax 1, press 2 to shift

tax 2 or press 3 to shift tax 3, press 4 to shift

tax 4. Press the TAX SHIFT key. For

example, shift tax 1:

2. Enter an amount on the ten key pad. Do not

use the decimal key. For example, for $2.99,

enter:

3. Press a department key. For example, press

department 1:

4. If department 1 is normally taxable by tax 1.

The registration will be non-taxable by tax 1.

TAX

1

SHIFT

2 9 9

1

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

1 . . . . . . 2 . 9 9

* . . . . . . 2 . 9 9 C A

0 0 0 0 2 0

1 5 . 3 3 0 0

ER-290 Electronic Cash Register Advanced Operating Instructions • 27

Page 34

Exempting Tax

Occasionally, you may need to exempt tax from an entire sale. For example, you might remove all

state and local taxes when you sell to a church or charitable institution.

1. Enter an amount on the ten key pad. Do

not use the decimal key. For example, for

$2.99, enter:

2 9 9

2. Press a taxable department key. For

example, press department 1:

1

3. Press Subtotal:

SUB

TOTAL

4. Enter the number for the tax you wish to

exempt. Press 1 to shift tax 1, press 2 to

shift tax 2 or press 3 to shift tax 3. press 4

to shift tax 4, Press the TAX SHIFT key.

For example, exempt tax 1:

TAX

1

SHIFT

5. Total the sale with CASH/TEND,

CHECK TEND, or CHARGE. The sale

will not include tax 1.

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

1 . . . . . . 2 . 9 9 T 1

* . . . . . . 3 . 1 7 S T

* . . . . . . 2 . 9 9 C A

0 0 0 0 2 1

1 5 . 3 3 0 0

28 • Advanced Operating Instructions ER-290 Electronic Cash Register

Page 35

Percent Key (%1 and %2) Operations

Use the Percent keys to add a percentage surcharge or subtract a percentage from an item or the

subtotal of a sale. You can enter the amount of the percentage before pressing the %1 or %2 keys,

or you can program a preset percentage if you are consistently using the same percentage.

Programming determines whether it is possible to enter a percentage when the key is also

programmed with a preset percentage. See “%1 and %2 Key Programming” on page 56 to set a

preset percentage.

Preset Percent on a Department or PLU Item

In this example the %1 key is preset with a rate of %10.00.

1. Register the discounted item.

2. Press the %1 key:

%1

3. The discount is automatically subtracted.

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

2 . . . . . 1 0 . 0 0

* . . . . 1 0 . 0 0 0 %

* . . . . . - 1 . 0 0

* . . . . . . 9 . 0 0 C A

0 0 0 0 2 2

1 5 . 3 3 0 0

Enter a Percent on a Department or PLU

You can also operate the %1 or %2 keys by entering the percentage of the discount or surcharge. If

necessary, you can enter the percentage with a decimal key (up to 3 digits, i.e. 99.999%).

1. Register the discounted item.

2. Enter the percentage. If you are entering

a fraction of a percent, you must use the

decimal key. For example, for

enter:

3 . 33 3 3

3. Press the %1 key:

%1

4. The discount is automatically subtracted.

1

/3 off

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

2 . . . . . 1 0 . 0 0

* . . . . 3 3 . 3 3 3 %

* . . . . . - 3 . 3 3

* . . . . . . 6 . 6 7 C A

0 0 0 0 2 3

1 5 . 3 3 0 0

ER-290 Electronic Cash Register Advanced Operating Instructions • 29

Page 36

Percent On Sale Total

In this example a surcharge of 15% is applied.

1. Register the items you wish to sell.

2. Press SUBTOTAL:

SUB

TOTAL

3. Enter the percentage. For example, for

15% enter:

4. Press the %2 key:

5. The surcharge is automatically added.

51

%2

Return Merchandise Registrations

If you wish to return or refund an item, press Return Merchandise, then re-enter any item you wish.

You can return merchandise as part of a sale, or you can return merchandise as a separate transaction

and return cash to the customer.

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

2 . . . . . 1 0 . 0 0

* . . . . . 1 0 . 0 0 S T

* . . . . 1 5 . 0 0 0 %

* . . . . . . 1 . 5 0

* . . . . . 1 1 . 5 0 C A

0 0 0 0 2 4

1 5 . 3 4 0 0

1. To return an item, press RTRN MDSE:

RTRN

MDSE

2. Enter the price of the item you wish to

return, then press the department key

where it was registered originally.

3. Total the sale with CASH/TEND,

CHECK TEND, or CHARGE1,2.

30 • Advanced Operating Instructions ER-290 Electronic Cash Register

9 92

2

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

- - - - - - - - - - R T

2 . . . . . - 2 . 9 9 T 1

* . . . . . - 2 . 9 9 T 1

* . . . . . - 0 . 1 8 T 1

* . . . . . - 3 . 1 7 C A

0 0 0 0 2 5

1 5 . 3 4 0 0

Page 37

Voids and Corrections

Void Last Item

This function corrects the last item entered.

1. Register the item you wish to sell.

2. Press the VOID key.

VOID

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

1 . . . . . . 2 . 2 9 T 1

2 . . . . . . 1 . 2 9

- - - - - - - - - - V 1

2 . . . . . - 1 . 2 9

* . . . . . . 2 . 2 9 T 1

* . . . . . . 0 . 1 4 T 1

* . . . . . . 2 . 4 3 C A

0 0 0 0 2 6

1 5 ˙3 4 0 0

Void Previous Item

This function allows you to correct an item registered previously in a transaction.

1. Register an item. Then register a second

item.

2. To correct the first item, press CLEAR,

then press VOID:

VOIDCLEAR

3. Enter the price of the first item, then

press the department key where it was

registered originally.

2 91

2

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

2 . . . . . . 1 . 2 9

1 . . . . . . 2 . 2 9 T 1

- - - - - - - - - V 1

2 . . . . . - 1 . 2 9

* . . . . . . 2 . 2 9 T 1

* . . . . . . 0 . 1 4 T 1

* . . . . . . 2 . 4 3 C A

0 0 0 0 2 7

1 5 . 3 5 0 0

ER-290 Electronic Cash Register Advanced Operating Instructions • 31

Page 38

Cancel

The CANCEL key allows you to stop any transaction. Anything registered within the transaction

before the CANCEL key is pressed is automatically corrected. The CANCEL key may be

inactivated through programming, see “CANCEL Key Programming” on page 60.

1. Register the items you wish to sell.

2. Press the CANCEL key.

CANCEL

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

1 . . . . . . 2 . 2 9 T 1

* . . . . . - 0 . 5 0 -

- - - - - - - - - - V 3

0 0 0 0 2 8

1 5 . 3 5 0 0

Void Position Operations

You can use the Void control lock position to correct any complete transaction. To correct a

transaction:

1. Turn the control lock to the VOID

position.

2. Enter the transaction you wish to correct

exactly as it was entered originally in the

REG control lock position. You can

enter discounts, voids, tax exemptions or

any other function.

3. All totals and counters are corrected as if

the original transaction did not take

place.

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

- - - - - - - - - V 2

1 . . . . . - 2 . 2 9 T 1

2 . . . . . - 1 . 0 0

* . . . . . - 3 . 4 3 S T

* . . . . . - 2 . 2 9 T 1

* . . . . . - 0 . 1 4 T 1

* . . . . . - 3 . 4 3 C A

0 0 0 0 2 9

1 5 . 3 5 0 0

32 • Advanced Operating Instructions ER-290 Electronic Cash Register

Page 39

- (Minus) Key Registrations

You can register a negative amount by entering a price, the pressing the - (Minus) key. For

example, you can enter bottle returns or coupons using the - (Minus) key.

Note: You can program the minus key so that tax is charged on the gross

amount, or on the net amount after the subtraction. See “- (Minus) Key

Programming” on page 58.

1. Register the items you wish to sell.

2. Enter the amount you wish to subtract from

the sale, for example for a $.50 coupon,

enter:

05

3. Press the - (Minus) key.

-

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

1 . . . . . . 2 . 2 9 T 1

* . . . . . - 0 . 5 0 -

* . . . . . . 2 . 2 9 T 1

* . . . . . . 0 . 1 4 T 1

* . . . . . . 1 . 9 3 C A

0 0 0 0 3 0

1 5 . 3 5 0 0

ER-290 Electronic Cash Register Advanced Operating Instructions • 33

Page 40

No Sale Operations

Open Drawer

The #/NO SALE key will open the cash drawer when you have not already started a transaction.

1. Press #/NO SALE:

#/NO

SALE

2. The drawer will open and the receipt will

print as in the example on the right.

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

. . . . . . . . . . N S

0 0 0 0 3 1

1 5 . 3 6 0 0

Non Add Number

You can also use the #/NO SALE key to print any number (up to 8 digits) on the printer paper. You

can enter the number any time during a transaction. For example, if you wish to record a charge

account number, enter the number and press the #/NO SALE key before totaling the sale with the

CHARGE key.

1. Register the items you wish to sell.

2. Enter the number you wish to record, for

example enter:

2 3 41

3. Press #/NO SALE:

#/NO

SALE

4. Press CHARGE1:

CHARGE1

5. The display will indicate “=” for total,

the drawer will open and the receipt will

print as in the example on the right.

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

1 . . . . . . 2 . 9 9 T 1

* . . . . . . 1 2 3 4 #

* . . . . . . 2 . 9 9 T 1

* . . . . . . 0 . 1 8 T 1

* . . . . . . 3 . 1 7 C 1

0 0 0 0 3 2

1 5 . 3 6 0 0

34 • Advanced Operating Instructions ER-290 Electronic Cash Register

Page 41

Received On Account Operations

You can use the Received on Account key to accept cash into the cash drawer when you are not

actually selling merchandise. For example, use the Received on Account key to accept payments for

previously sold merchandise, or record loans to the cash drawer.

1. Enter the amount of cash you are receiving,

for example, enter:

0 0 02

2. Press RECD ACCT:

RECD

ACCT

3. The drawer will open and the receipt will

print as in the example on the right.

Paid Out Operations

You can use the PAID OUT key to track cash paid out for merchandise or to record loans from the

cash drawer.

1. Enter the amount of cash you are paying,

for example, enter:

0 0 02

2. Press PAID OUT:

PAID

OUT

3. The drawer will open and the receipt will

print as in the example on the right.

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

* . . . . . 2 0 . 0 0 R A

0 0 0 0 3 3

1 5 . 3 6 0 0

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

* . . . . . 2 0 . 0 0 P O

0 0 0 0 3 4

1 5 . 3 7 0 0

ER-290 Electronic Cash Register Advanced Operating Instructions • 35

Page 42

Totaling and Tendering

Three keys may be used to total a sale: CHECK TEND, CHARGE1,2 , CASH/TEND key. The

CHECK TEND and CASH/TEND keys can also be used for change calculation.

Subtotaling a Sale

1. Register the items you wish to sell.

2. To display and print the subtotal of the sale

including tax, press SUBTOTAL:

SUB

TOTAL

3. The subtotal will display with “=” indicated

in the left digit position of the display.

Totaling a Cash Sale

1. Register the items you wish to sell.

2. To total a cash sale, press CASH/TEND:

CASH/

TEND

3. The display will indicate “=” for total, the

drawer will open and the receipt will print

as in the example on the right.

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

1 . . . . . . 2 . 9 9 T 1

1 . . . . . . 2 . 9 9 T 1

* . . . . . . . . . 4 X

@ . . . . . . 1 . 9 9

2 . . . . . . 7 . 9 6

* . . . . . 1 4 . 3 0 S T

* . . . . . . 5 . 9 8 T 1

* . . . . . . 0 . 3 6 T 1

* . . . . . 1 4 . 3 0 C A

0 0 0 0 3 5

1 5 . 3 8 0 0

36 • Advanced Operating Instructions ER-290 Electronic Cash Register

Page 43

Tendering a Cash Sale

1. Register the items you wish to sell.

2. Enter the amount tendered by the

customer. For example, for $20.00

enter:

0 0 02

3. Press CASH/TEND:

CASH/

TEND

4. The display will indicate “C” for change,

the drawer will open and the receipt will

print as in the example on the right.

Tendering a Check Sale

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

1 . . . . . . 2 . 9 9 T 1

1 . . . . . . 2 . 9 9 T 1

* . . . . . . . . . 4 X

@ . . . . . . 1 . 9 9

2 . . . . . . 7 . 9 6

* . . . . . . 5 . 9 8 T 1

* . . . . . . 0 . 3 6 T 1

* . . . . . 1 4 . 3 0 T L

* . . . . . 2 0 . 0 0 C A

* . . . . . . 5 . 7 0 C

0 0 0 0 3 6

1 5 . 3 8 0 0

1. Register the items you wish to sell.

2. Enter the amount tendered by the

customer. For example, for $20.00

enter:

0 0 02

3. Press CHECK TEND:

CHECK

TEND

4. The display will indicate “C” for change,

the drawer will open and the receipt will

print as in the example on the right.

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

1 . . . . . . 2 . 9 9 T 1

1 . . . . . . 2 . 9 9 T 1

* . . . . . . . . . 4 X

@ . . . . . . 1 . 9 9

2 . . . . . . 7 . 9 6

* . . . . . . 5 . 9 8 T 1

* . . . . . . 0 . 3 6 T 1

* . . . . . 1 4 . 3 0 T L

* . . . . . 2 0 . 0 0 C H

* . . . . . . 5 . 7 0 C

0 0 0 0 3 7

1 5 . 3 8 0 0

ER-290 Electronic Cash Register Advanced Operating Instructions • 37

Page 44

Totaling a Charge Sale

1. Register the items you wish to sell.

2. Press CHARGE1:

CHARGE1

3. The display will indicate “=” for total,

the drawer will open and the receipt will

print as in the example on the right.

Note: Charge tendering is not

allowed.

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

1 . . . . . . 2 . 9 9 T 1

1 . . . . . . 2 . 9 9 T 1

* . . . . . . . . . 4 X

@ . . . . . . 1 . 9 9

2 . . . . . . 7 . 9 6

* . . . . . . 5 . 9 8 T 1

* . . . . . . 0 . 3 6 T 1

* . . . . . 1 4 . 3 0 C 1

0 0 0 0 3 8

1 5 . 3 8 0 0

Check Cashing

Check cashing means exchanging cash for a check. Normally, this function is not allowed. If you

wish to allow check cashing, you must set system option #15 to a value of 1. See “System Option

Programming” on page 48.

1. Enter the amount of the check tendered

by the customer. For example, for

$20.00 enter:

0 0 02

2. Press CHECK TEND:

CHECK

TEND

3. The display will indicate “C” for change,

the drawer will open and the receipt will

print as in the example on the right.

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

* . . . . . 2 0 . 0 0 C H

* . . . . - 2 0 . 0 0 C A

0 0 0 0 3 9

1 5 . 3 9 0 0

38 • Advanced Operating Instructions ER-290 Electronic Cash Register

Page 45

Split Tender

Split tendering means paying for one sale by different payment methods. For example, a $20.00 sale

could be split so $10.00 is paid in cash, and the remaining $10.00 is charged. If necessary, you can

make several different payments.

Note: If a portion of a sale is to be charged, the charge payment must be

entered last.

1. Register the items you wish to sell.

2. Enter the amount of cash tendered by the

customer. For example, enter $10.00 and

press CASH/TEND:

0 01 0

3. The display will indicate “=” and $10.00,

indicating the amount still due. The

drawer will not open. Press CHARGE1 to

charge the remaining amount:

CHARGE1

4. The display will indicate “=” for total, the

drawer will open and the receipt will print

as in the example on the right.

CASH/

TEND

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

2 . . . . . 2 0 . 0 0

* . . . . . 2 0 . 0 0 S T

* . . . . . 2 0 . 0 0 T L

* . . . . . 1 0 . 0 0 C A

* . . . . . 1 0 . 0 0 T L

* . . . . . 1 0 . 0 0 C 1

0 0 0 0 4 0

1 5 . 3 9 0 0

ER-290 Electronic Cash Register Advanced Operating Instructions • 39

Page 46

Post Tender

Post tendering means computing change after the sale has been totaled and the drawer is open. This

feature is useful when a customer changes the amount of the tender or the clerk becomes confused

counting change manually. Normally, this function is not allowed. If you wish to allow post

tendering, you must set system option #14 to a value of 1. See “System Option Programming” on

page 48.

1. Register the items you wish to sell.

2. Press CASH/TEND:

CASH/

TEND

3. The display will indicate “=” for total, the

drawer will open and the receipt will print

as in the example on the right.

4. Enter the amount of the tender, Press

CASH/TEND:

0 02 0

CASH/

TEND

5. The display will indicate “C” for change

and display $17.88 change due.

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

1 . . . . . . 2 . 0 0 T 1

* . . . . . . 2 . 1 2 S T

* . . . . . . 2 . 0 0 T 1

* . . . . . . 0 . 1 2 T 1

* . . . . . . 2 . 1 2 C A

0 0 0 0 4 1

1 5 . 3 9 0 0

40 • Advanced Operating Instructions ER-290 Electronic Cash Register

Page 47

Receipt On/Off and Receipt on Request

If the receipt is off, you can still issue a receipt after the sale has been completed. Normally, this

function is not allowed. If you wish to allow after sale receipts, you must set system option #16 to a

value of 1. See “System Option Programming” on page 48.

To Turn the Receipt Off

♦ With the control lock in the REG position, press PAID OUT:

PAID

OUT

To Turn the Receipt On

♦ With the control lock in the REG position, press PAID OUT again:

PAID

OUT

Printing a Receipt after the Sale

♦ After the sale has been totaled, but before the next transaction is started, press

CASH/TEND:

CASH/

TEND

Note: Because receipt memory is limited, when a sale has more than 30 items

or more than 3 tenders, the receipt after sale can not print all items. A row of

dots is printed indicating the receipt is incomplete.

ER-290 Electronic Cash Register Advanced Operating Instructions • 41

Page 48

42 • Advanced Operating Instructions ER-290 Electronic Cash Register

Page 49

Advanced Programming Instructions

Department Programming

Programming Department Status

There are two parts to department programming. Department status is set here. Depending on

whether you select open or preset department status is this section, you can also program either the

open department entry limit or the preset department price. See “Programming Department Entry

Limit or Price” on page 46.

Use this section to program the following status options:

z Set negative departments that subtract from the sale, rather than normal positive departments

which add to the sale.

z Enforce the entry of a non-adding number before the department entry. See “Non Add

Number” on page 34 for operation sequences.

z Disable the departments, so that entries are not allowed.

z Choose Open or Preset departments. Open departments accept amount entries. Use open

departments to enter different priced items into the same category. Preset departments

automatically register a preprogrammed price when the department key is pressed. Use preset

departments to register an individual item quickly and accurately. For example, cigarette packs

or food items can be assigned to departments as presets.

When you select preset departments, you can also decide if the department can also accept open

entries. This option is referred to as “preset override”.

z Set single item departments which automatically total as a cash sale immediately after the

department entry. Single item departments are used to speed up one item sales.

z Select a tax status to determine whether sales tax is automatically added.

Unless otherwise programmed, departments are positive, open, not taxable, not single item

departments, and accept unlimited amounts (up to 7 digit entry). Therefore, it is not necessary to

program departments you wish to be open, positive, non-taxable, not single item, with no entry limit.

ER-290 Electronic Cash Register Advanced Programming Instructions • 43

Page 50

Programming Department Status

1. Turn the control lock to the PGM position.

2. Decide if you want a negative, enforced non-add entry, or disabled department. If you

do not want any of these department options, enter 0. If you wish to select any of these

options, complete the table below by adding the status digits for each option. Enter the

resulting digit.

Department is

Negative

Enforce Non-Add

Entry

Department is Disabled Yes =4

3. Decide if you want a preset or single item department. If you do not want any of these

department options, enter 0. If you wish to select any of these options, complete the

table below by adding the status digits for each option. Enter the resulting digit.

Department is Preset Yes = 1

Allow Preset Override Yes = 2

Department is Single

Item

Yes = 1

No = 0

Yes = 2

No = 0

No = 0

No = 0

No = 0

Yes = 4

No = 0

+

+

+

=

+

+

+

=

4. Complete the tax status table below by adding the status digits for each tax. Then enter

the resulting tax status code.

Taxable by Rate 1? Yes = 1

No = 0

Taxable by Rate 2? Yes = 2

No = 0

Taxable by Rate 3? Yes = 4

No = 0

Taxable by Rate 4? Yes = 8

No = 0

+

+

+

+

=

5. Press the @/FOR key.

6. Repeat steps 2 through 5 for each department you wish to program.

7. Press the CASH/TEND key to end programming.

44 • Advanced Programming Instructions ER-290 Electronic Cash Register

Page 51

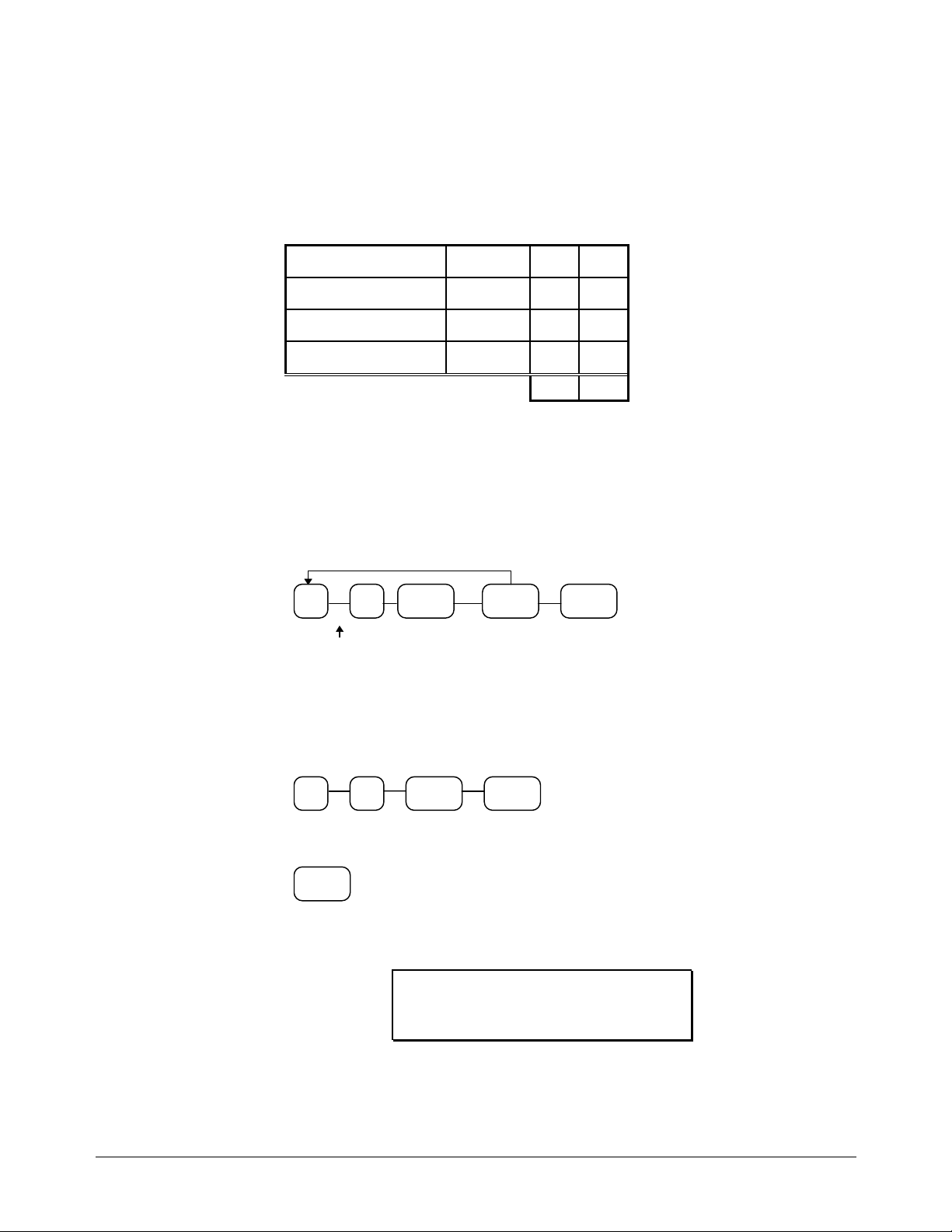

Department Status Programming Flowchart

Repeat for each

Department

@/

FOR

Negative?

Non-Add?

Disabled?

Pres et?

Single

item?

Tax

Status

Code

Department Status Programming Examples

For example, set:

z department 1 open, taxable by rate 1

z department 4 preset, taxable by rate 2

z department 9 negative, preset, taxable by rate 1 & 2

To set Department 1, enter:

0

To set Department 4, enter:

To set Department 9, enter:

10 0

0

20 1

@/

FOR

@/

FOR

DEPT

KEY

1

4

CASH/

TEND

1

1

0

3

Press the CASH/TEND key to end programming.

CASH/

TEND

The status you have entered will print on the printer:

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

1 . . . . . . . . 1 T 1

4 . . . . . . 1 0 2 T 2

9 . . . . . 1 1 0 3 T

0 0 0 0 1 0

0 7 . 0 0 0 0

@/

FOR

9

ER-290 Electronic Cash Register Advanced Programming Instructions • 45

Page 52

Programming Department Entry Limit or Price

Note: Open departments are automatically assigned a 7 digit entry limit. You

do not need to program this section for open departments, unless you wish to

set a different limit.

If you are programming a open department:

z You can limit errors by setting the maximum amount that may be entered into a

department.

If you are programming a preset department:

z You can set the preset price. The price you program here is the amount that is

automatically registered when the department key is pressed.

Programming a Department Entry Limit or Price

1. Turn the control lock to the PGM position.

2. If the department is preset, enter the preset price, up to seven digits (01 to 1234567).

(It is not necessary to enter proceeding zeros. For example enter $1.00 as 100.)

OR,

If the department is open, enter the entry limit you wish to set.

3. Repeat from step 2 above for each department you wish to set.

4. Press the CASH/TEND key to end programming.

46 • Advanced Programming Instructions ER-290 Electronic Cash Register

Page 53

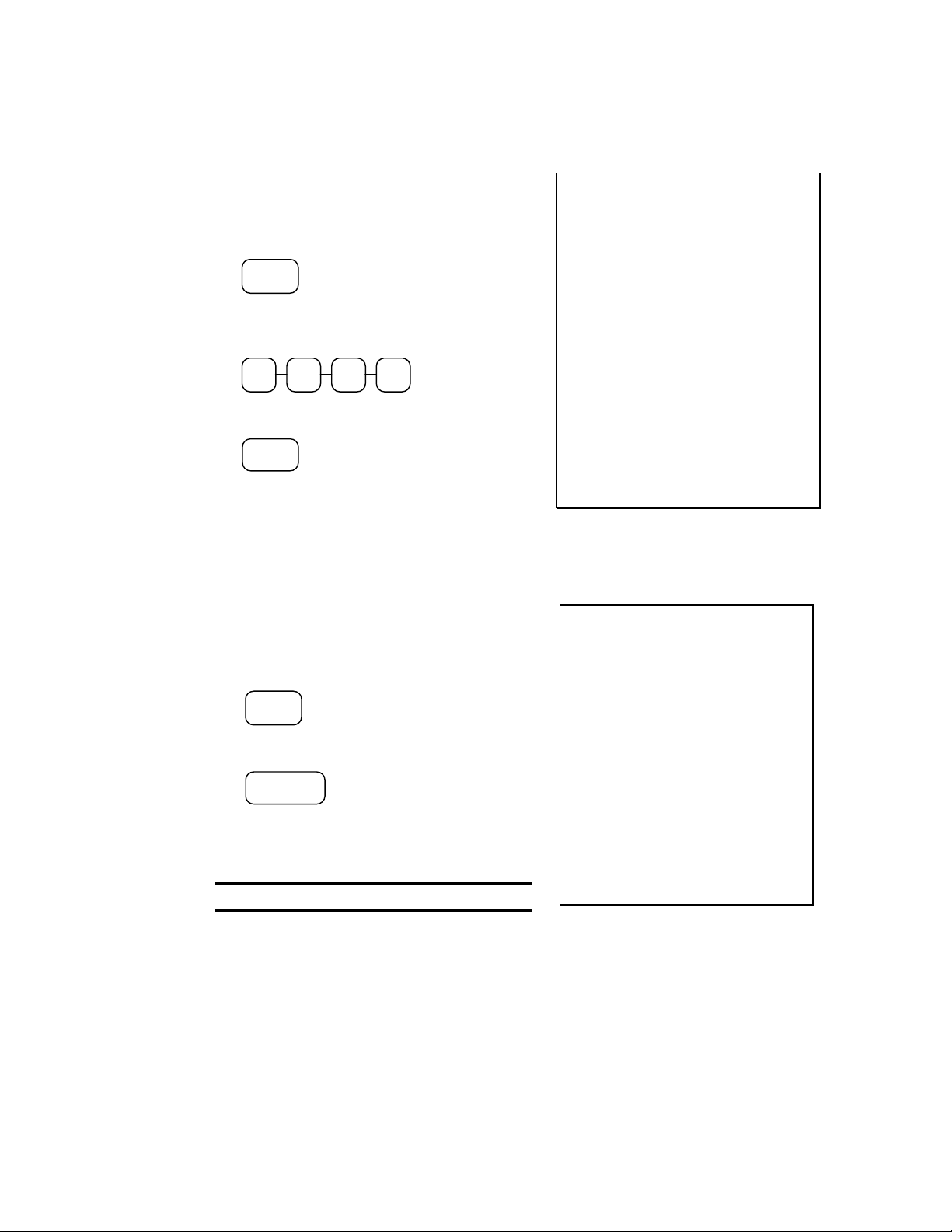

Department Entry Limit or Price Programming Flowchart

Repeat for each Pr eset Department

Pres et Pr ice

High Amount Lock Out

(Leading zeros are not necessary)

or

DEPT

KEY

CASH/

TEND

Department Entry Limit or Price Programming Examples

For example, set:

z department 1 open, with a entry limit of $50.00

z department 4 preset for $2.50

z department 9 preset for $0.99

To set Department 1, enter:

05 0 0

To set Department 4, enter:

02 5

To set Department 9, enter:

1

4

99

9

Press the CASH/TEND key to end programming.

CASH/

TEND

The status you have entered will print on the printer:

YOUR RECEIPT

THANK YOU

0 3 - 0 1 - 1 9 9 9

1 . . . . . 5 0 . 0 0 T 1

4 . . . . . . 2 . 5 0 T 2

9 . . . . . . 0 . 9 9 T

0 0 0 0 1 1

0 7 . 0 1 0 0

ER-290 Electronic Cash Register Advanced Programming Instructions • 47

Page 54

System Option Programming

A

Nineteen system options are provided so that you can configure the ER-290 to your exact

requirements. Refer to the “System Option Table” on page 50 to review the system options. Read

each option carefully to determine if you wish to make any changes.

NOTE: Because after clearing memory all options settings are automatically

set to 0, and because your most likely option selections require a status setting

of 0, you do not need to program this section unless you wish to change the

default status.

Programming a System Option:

1. Turn the control lock to the PGM position.

2. Enter the option number of the system option you wish to change. Press the RECD

ACCT key.

3. Enter the number representing the status you have selected. Press the PAID OUT key.

4. Repeat from step 3 for each system option you wish to change.

5. Press the CASH/TEND key to end programming.

System Option Flowchart

Option #

Repeat for each

System Option

RECD

CCT

Status

PAID

OUT

CASH/

TEND

48 • Advanced Programming Instructions ER-290 Electronic Cash Register

Page 55

System Option Programming Examples

A

A

Set the following options

z Option 15: Allow check cashing.

z Option 17: Enforce cash or check tender at totaling.

To set option 15:

RECT

CCT

151

To set option 17:

RECT

CCT

171

Press the CASH/TEND key to end programming.

CASH/

TEND

PAID

OUT

PAID

OUT

ER-290 Electronic Cash Register Advanced Programming Instructions • 49

Page 56

System Option Table

NOTE: Shaded areas are the default settings, in other words, the shaded area

indicates the way the register is automatically set up.

Option

No.

1

2

3

4

5

6

7

SYSTEM OPTION STATUS

Print the grand total on X,/Z report. YES = 0

NO = 1

Print the gross total on X,/Z report. YES = 0

NO = 1

Reset the consecutive number counter after a Z report. NO = 0

YES = 1

Reset the Z counter after Z report. NO = 0

YES = 1

Skip totals with zero value on X,Z report. YES = 0

NO = 1

Reset the grand total after a Z report. NO = 0

YES = 1

Print the subtotal when pressed. YES = 0

8

9

10

11

NO = 1

Cash must be declared before X/Z report. NO = 0

YES = 1

Allow X reports YES = 0

NO = 1

Decimal point position 0 = none

1 = 1 place

2 = 2 places

3 = 3 places

Select a method for tax printing:

Print Taxable Totals. Print tax amounts separately.0

Print Taxable Totals. Print only total of all taxes. 1

Print Taxable Totals. Do not print tax amounts. 2

50 • Advanced Programming Instructions ER-290 Electronic Cash Register

Page 57

Option

No.

SYSTEM OPTION STATUS

12

13

14

15

16

Do not print Taxable Total. Print tax amounts separately.3

Do not print Taxable Total. Print only total of all taxes. 4

Do not print Taxable Total. Do not print tax amounts. 5