Page 1

XMLPay Developer’s

Guide

Last updated: December 2009

Page 2

Payflow Pro XMLPay Developer’s Guide

Document Number: 200013.en_US-200912

© 2010 PayPal, Inc. All rights reserved. PayPal is a registered trademark of PayPal, Inc. The PayPal logo is a trademark of PayPal, Inc. Other

trademarks and brands are the property of their respective owners.

The information in this document belongs to PayPal, Inc. It may not be used, reproduced or disclosed without the written approval of PayPal, Inc.

Copyright © PayPal. All rights reserved. PayPal (Europe) S.à r.l. et Cie., S.C.A., Société en Commandite par Actions. Registered office: 22-24 Boulevard

Royal, L-2449, Luxembourg, R.C.S. Luxembourg B 118 349.

Consumer advisory: The PayPal™ payment service is regarded as a stored value facility under Singapore law. As such, it does not require the approval

of the Monetary Authority of Singapore. You are advised to read the terms and conditions carefully.

Notice of non-liability:

PayPal, Inc. is providing the information i n this document t o you “AS-IS” with all faults. PayPal, Inc. makes no warranties of any kind (whether express,

implied or statutory) with respect to the information co ntained herein. PayPal, Inc. assumes no liability for damages (whether direct or indirect), caused

by errors or omissions, or resulting from the use of this document or the information contained in t his document or result ing from the ap plication or use

of the product or service described herein. PayPal, Inc. reserves the right to make changes to any information herein without further notice.

Page 3

Contents

Preface . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Intended Audience . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Organization of This Document . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Where to Go For More Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

How to Contact Customer Service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Revision History . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Chapter 1 XMLPay Overview . . . . . . . . . . . . . . . . . . . . . . 9

About XML . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Benefits of XML . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Well-formed XML Document. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Using XMLPay . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

XMLPay Instruments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

XMLPay Operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

XMLPay Processing Models . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Business-to-Consumer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Business-to-Business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

XMLPay Messaging . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

XMLPayRequest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

XMLPayResponse. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Chapter 2 XMLPay Syntax . . . . . . . . . . . . . . . . . . . . . . .15

Syntax Notation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

The XMLPayRequest Document (Transactions). . . . . . . . . . . . . . . . . . . . . . . 15

Transaction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

RequestAuth. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

The XMLPayRequest Document (Recurring Profiles) . . . . . . . . . . . . . . . . . . . . 22

RecurringProfile . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

PayData . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

PayDataAuth. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

Invoice. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

Items. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

MerchantInfo. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

XMLPay Developer’s Guide 3

Page 4

Contents

AdditionalAmounts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

Address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

Tender . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

RPData . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

ExtData . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

The XMLPayResponse Document (Transactions). . . . . . . . . . . . . . . . . . . . . . 37

TransactionResult . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

The XMLPayResponse Document (Recurring Profiles) . . . . . . . . . . . . . . . . . . . 41

BuyerAuthResult. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

RecurringProfileResult. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

Chapter 3 XMLPay Elements . . . . . . . . . . . . . . . . . . . . . . 47

General Transaction Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

Credit Card Transaction Parameters. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48

Retail Credit Card Transaction Parameters . . . . . . . . . . . . . . . . . . . . . . . 48

Level 3 (Commercial) Credit Card Transaction Parameters. . . . . . . . . . . . . . . 52

Buyer Authentication Transaction Parameters. . . . . . . . . . . . . . . . . . . . . . . . 58

Credit Card Transaction Response Parameters . . . . . . . . . . . . . . . . . . . . . . . 58

ACH Transaction Parameters (Norwest). . . . . . . . . . . . . . . . . . . . . . . . . . . 60

PayPal Express Checkout Request Transaction Parameters . . . . . . . . . . . . . . . . 60

PayPal Express Checkout Response Transaction Parameters . . . . . . . . . . . . . . . 63

Chapter 4 XMLPay Transaction Profiles . . . . . . . . . . . . . . . .65

ACH Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65

Buyer Authentication Transactions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65

Card Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 66

Purchase Card Level I . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 66

Purchase Card Level II . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 66

Purchase Card Level III . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 66

Check Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67

PayPal Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 68

Chapter 5 XMLPay Examples . . . . . . . . . . . . . . . . . . . . . . 69

ACH Sale Request. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70

ACH Sale Response. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 71

Card Authorization Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 71

Card Authorization Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72

4 XMLPay Developer’s Guide

Page 5

Contents

Card Capture Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 73

Card Capture Response. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 73

Card Credit Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 74

Card Credit Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75

Card Credit Reference Credit Request . . . . . . . . . . . . . . . . . . . . . . . . . . . 75

Card Credit Reference Credit Response . . . . . . . . . . . . . . . . . . . . . . . . 75

Card Force Capture Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 76

Card Force Capture Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77

Card Sale Request. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77

Card Sale Response. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78

Card Secure Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 79

Card Status Request. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80

Card Status Response. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80

Card Void Request. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 81

Card Void Response. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 81

Check Sale Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 82

Check Sale Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 83

Customer IP . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 83

Express Checkout Authorization Transaction . . . . . . . . . . . . . . . . . . . . . . . . 84

Set Express Checkout Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 84

Set Express Checkout Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85

Get Express Checkout Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85

Get Express Checkout Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . 86

Do Express Checkout Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 87

Do Express Checkout Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . 88

IAVS Result Request. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 88

Level 3 Invoice . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 89

Line Item Sale Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90

Line Item Sale Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 92

Merchant Description and Merchant Service Number . . . . . . . . . . . . . . . . . . . . 92

Processor Result. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 93

Recurring Billing Profile . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 94

ACH Recurring Billing Profile . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 94

Credit Card Recurring Billing Profile. . . . . . . . . . . . . . . . . . . . . . . . . . . 95

Shipping Carrier and Shipping Method . . . . . . . . . . . . . . . . . . . . . . . . . . . 96

Transaction Update . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 97

ValidateAuthentication Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 98

ValidateAuthentication Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 98

XMLPay Developer’s Guide 5

Page 6

Contents

VerifyEnrollment Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 99

VerifyEnrollment Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 99

Appendix A XMLPay Schemas . . . . . . . . . . . . . . . . . . . . . 101

XMLPay Schema. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .101

XMLPay Types Schema . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .114

Appendix B XMLPay DTD. . . . . . . . . . . . . . . . . . . . . . . . 131

Appendix C Transaction Results . . . . . . . . . . . . . . . . . . . . 145

AVS Result Codes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .150

Index . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 153

6 XMLPay Developer’s Guide

Page 7

Preface

This document defines an XML syntax for payment transaction requests, responses, and

receipts in a payment processing network.

Intended Audience

The typical user of XMLPay is an Internet merchant or merchant aggregator who wants to

dispatch credit card, corporate purchase card, Automated Clearing House (ACH), or other

payment requests to a financial processing network.

Organization of This Document

This document is organized as follows:

z Chapter 1, “XMLPay Overview,” describes XML and XMLPay, presenting processing

models, networking, messaging and related specifications.

z Chapter 2, “XMLPay Syntax,” presents the syntax for transaction requests, responses, and

receipts using a simplified notation.

z Chapter 3, “XMLPay Elements,”provides tables defining the existing Payflow SDK

parameters (name/value pairs) and their XMLPay equivalents.

z Chapter 4, “XMLPay Transaction Profiles,” lists the transactions supported for each tender

type—ACH, Card, Check—along with the data elements used for each of those

transactions.

z Chapter 5, “XMLPay Examples,” gives several XMLPay document samples.

z Appendix A, “XMLPay Schemas,” provides standard W3C schemas for XMLPay and

XMLPay Types.

z Appendix B, “XMLPay DTD,” presents the Document Type Definition XMLPay schema.

z Appendix C, “Transaction Results,” lists transaction result codes and response messages as

well as Address Verification Service (AVS) result codes.

Where to Go For More Information

This guide is not the complete source of all the information you need to develop Payflow

applications. Use the Payflow Pro Developer’s Guide along with this guide. It provides

XMLPay Developer’s Guide 7

Page 8

Preface

How to Contact Customer Service

detailed descriptions of all the Payflow name-value pair parameters. In addition, it contains

testing data, the test and live URLs, and error codes.

How to Contact Customer Service

For problems with transaction processing or connections, contact Customer Service by

opening a ticket on the Contact Support tab at http://www.paypal.com/mts.

Revision History

Revision history for Website Payments Pro Payflow Edition—XMLPay Developer’s Guide.

Date Description

December 2009 Added an example of using ExtData to pass values for unsupported NVP tags.

October 2008 Added a card credit request example. Renamed the existing credit request example Card

Refereence Credit Request.

Updated the RESULT values and RESPMSG table.

February 2008 Minor updates for technical accuracy.

December 2007 Updated host addresses in RESULT values and RESPMSG table.

August 2007 Updated RESPMSD text.

Updated PayPal logo.

May 2007 Represents a merge of content from two separate XMLPay developer guides.

Corrections for technical accuracy.

February 2007 Updated transaction RESULT values and RESPMSG text.

August 2006 Updated URLs to PayPal test and live servers.

May 2006 Reformatted in PayPal templates.

Integrated Direct Payment feature.

March 2006 Integrated Express Checkout feature.

8 XMLPay Developer’s Guide

Page 9

1

About XML

XML (eXtensible Markup Language) is derived from Standardized General Markup

Language (SGML) and HyperText Markup Language (HTML). In a sense, XML is SGML

“lite”, but XML manages to maintain SGML’s strength as well as HTML’s simplicity. What’s

more, XML can be converted to HTML.

The main advantage of XML is that text can be meaningfully annotated. In XML, markers

identify and tag the text. But the markers themselves have no defined meaning; it is the

applications that define the markers.

XML allows complex transactions to be structured. Client integration is simplified through the

exchange of XML documents. Since XML provides support for digital signatures, documents

from unknown sources can be trusted. In addition, XML can easily produce large documents

such as transaction logs and reports.

XMLPay Overview

Benefits of XML

The main benefits of XML are that it:

z Allows text annotation

z Presents text, data, and content to applications as a structured document

z Facilitates integration of diverse applications

z In addition to these benefits, XML is easy to:

z Read (all text)

z Parse and validate

z Search for content

z Produce

Well-formed XML Document

A well-formed XML document conforms to XML syntax and must have:

z An XML processing instruction at the beginning (prolog)

z A single root element

z Matching (case sensitive) start and end tags for all elements

z All XML elements properly nested

z Attribute values in quotes

XMLPay Developer’s Guide 9

Page 10

XMLPay Overview

1

Using XMLPay

Example 1

<?xml version=“1.0”?>

<Card>

<CardType> MasterCard </CardTy pe>

<CardNumber>495576040004</Card Number>

<ExpDate>200011</ExpDate>

CVNum>828</CVNum>

</Card>

Example 2

<?xml version=“1.0”?>

<Items ID=“IDTI123”>

<Item Number=“1”>

<Description>Electric Toothbrush< /Description>

<Quantity>1</Quantity>

<UnitPrice>100</UnitPrice>

<TotalAmt>100</TotalAmt>

</Item>

<Item Number=“2”>

<Description>ToothPaste</Descr iption>

<Quantity>20</Quantity>

<UnitPrice>2</UnitPrice>

<TotalAmt>40</TotalAmt>

</Item>

…

</Items>

Using XMLPay

XMLPay defines an XML syntax for payment transaction requests and responses in a payment

processing network.

The typical user of XMLPay is an Internet merchant or merchant aggregator who wants to

dispatch credit card, corporate purchase card, Automated Clearing House (ACH), or other

payment requests to a financial processing network.

Using the data type definitions specified by XMLPay, a user creates a client payment request

and dispatches it—using a mechanism left unspecified by XMLPay—to an associated

XMLPay-compliant server component. Responses (also formatted in XML) convey the results

of the payment requests to the client.

NOTE: For specific examples of how to submit XML documents using the Website Payments

Pro Payflow Edition client service, see the PayPal Manager Download package.

XMLPay Instruments

XMLPay supports payment processing using the following payment instruments:

z Retail credit and debit cards

10 XMLPay Developer’s Guide

Page 11

z Corporate purchase cards: Levels 1, 2, and 3

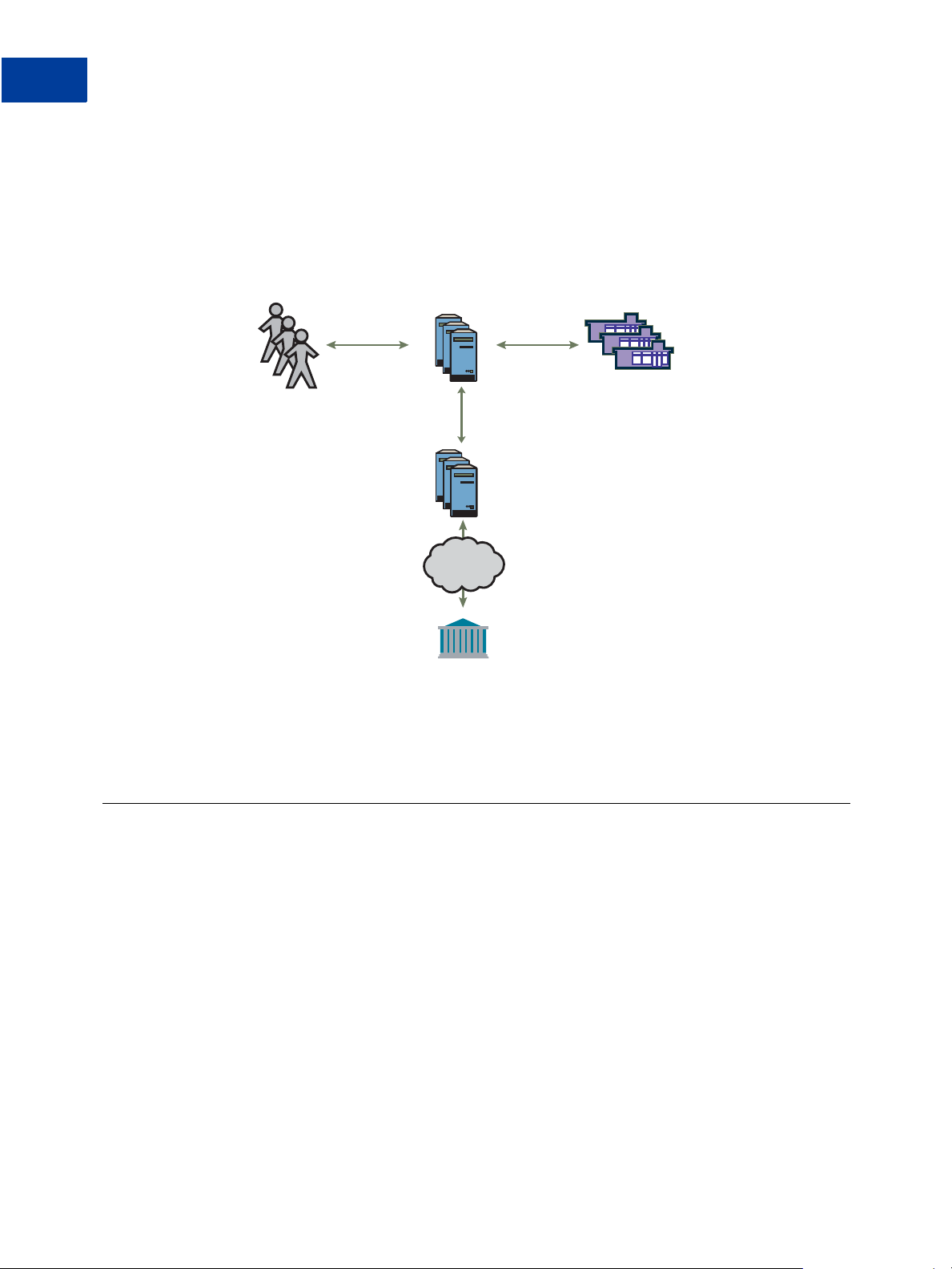

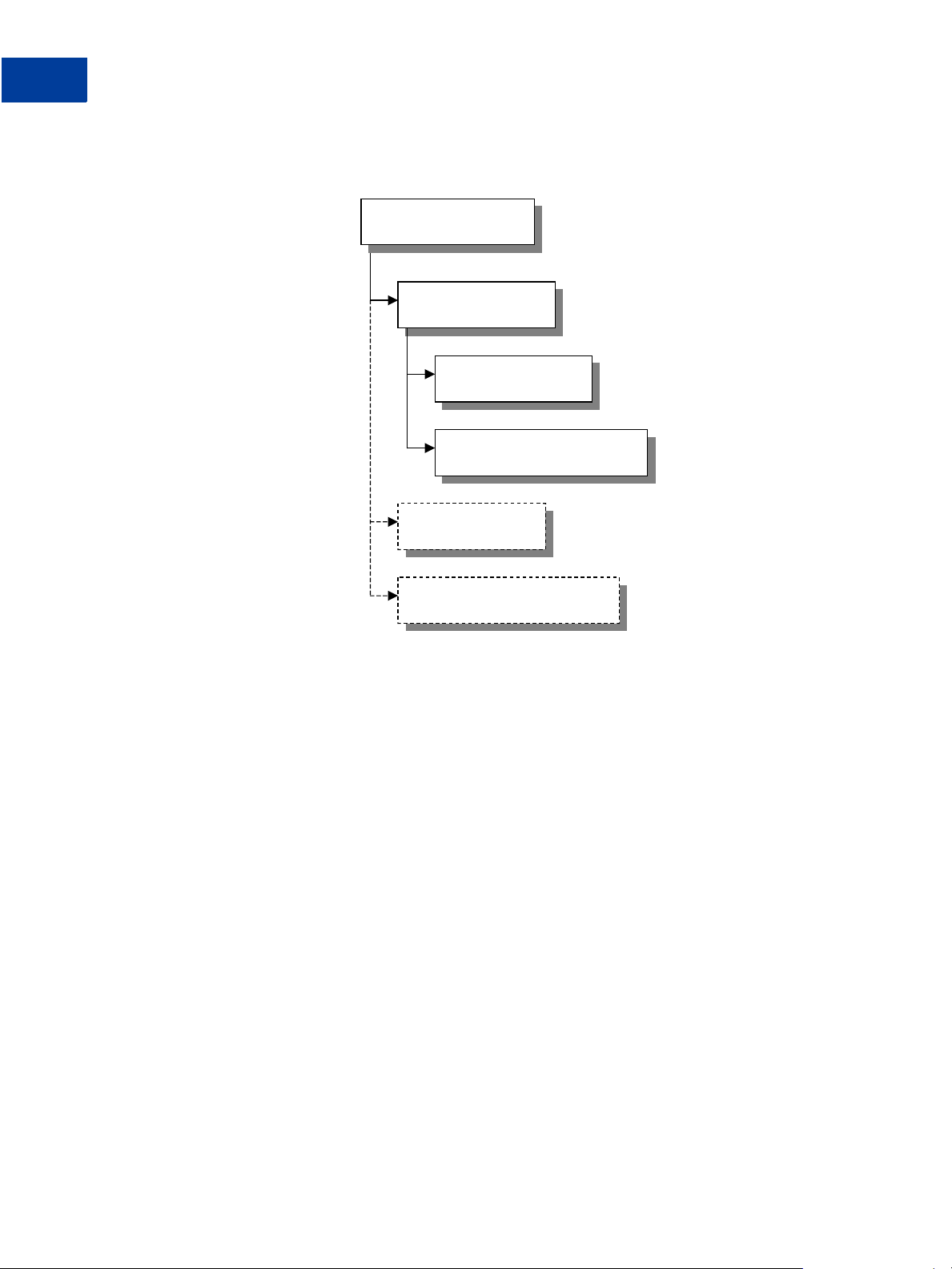

HTTPS (typical)

XMLPay

Payment

Gateway

Seller

Buyer

Payment

Processor

Financial

networks

Merchant

Web Store

Card 3455-342

$37.95

BUY

z Automated Clearing House (ACH)

XMLPay Operations

Typical XMLPay operations include:

z Funds authorization and capture

z Sales and repeat sales

z Voiding of transactions

XMLPay Processing Models

XMLPay is intended for use in both Business-to-Consumer (B2C) and Business-to-Business

(B2B) payment processing applications.

XMLPay Overview

XMLPay Processing Models

1

Business-to-Consumer

In a B2C Sale transaction, the Buyer presents a payment instrument (for example, a credit card

number) to a Seller to transfer money from the Buyer to the Seller.

The Seller uses XMLPay to forward the Buyer’s payment information to a Payment Processor.

The Seller formats an XMLPayRequest and submits it either directly to an XMLPaycompliant payment processor or, as pictured, indirectly via an XMLPay-compliant Payment

Gateway. Responses have the type XMLPayResponse.

The Buyer-to-Seller and Payment Gateway-to-Processor channels are typically left unaffected

by use of XMLPay. For example, XMLPay is typically not used in direct communications

between the buyer and the seller. Instead, conventional HTML form submission or other

Internet communication methods are typically used. Similarly, because Payment Processors

often differ considerably in the formats they specify for payment requests, XMLPay server

logic is usually localized at the Payment Gateway, leaving the legacy connections between

gateways and processors unchanged.

XMLPay Developer’s Guide 11

Page 12

XMLPay Overview

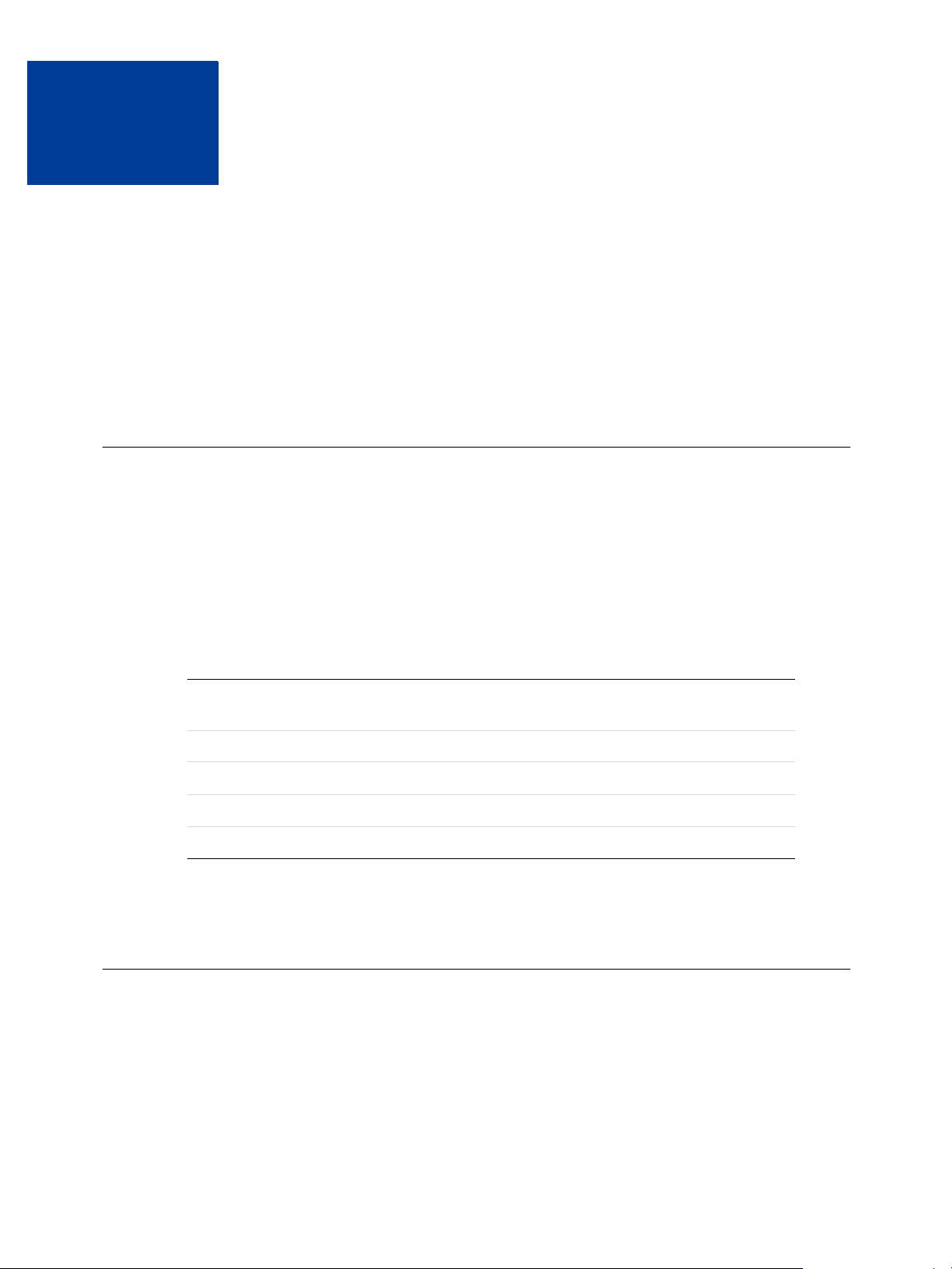

XMLPay

Payment

Gateway

Sellers

Buyers

Payment

Processor

Financial

networks

Trading

Exchange

1

XMLPay Messaging

Business-to-Business

When used in support of B2B transactions, the Seller does not typically initiate XMLPay

requests. Instead, an aggregator or trading exchange uses XMLPay to communicate businessfocused purchasing information (such as level 3 corporate purchase card data) to a payment

gateway.

In this way, the Trading Exchange links payment execution to other XML-based

communications between Buyers and Sellers such as Advance Shipping Notice delivery,

Purchase Order communication, or other B2B communication functions.

XMLPay Messaging

The highest-level XMLPay structures represent payment transaction requests and responses.

12 XMLPay Developer’s Guide

Page 13

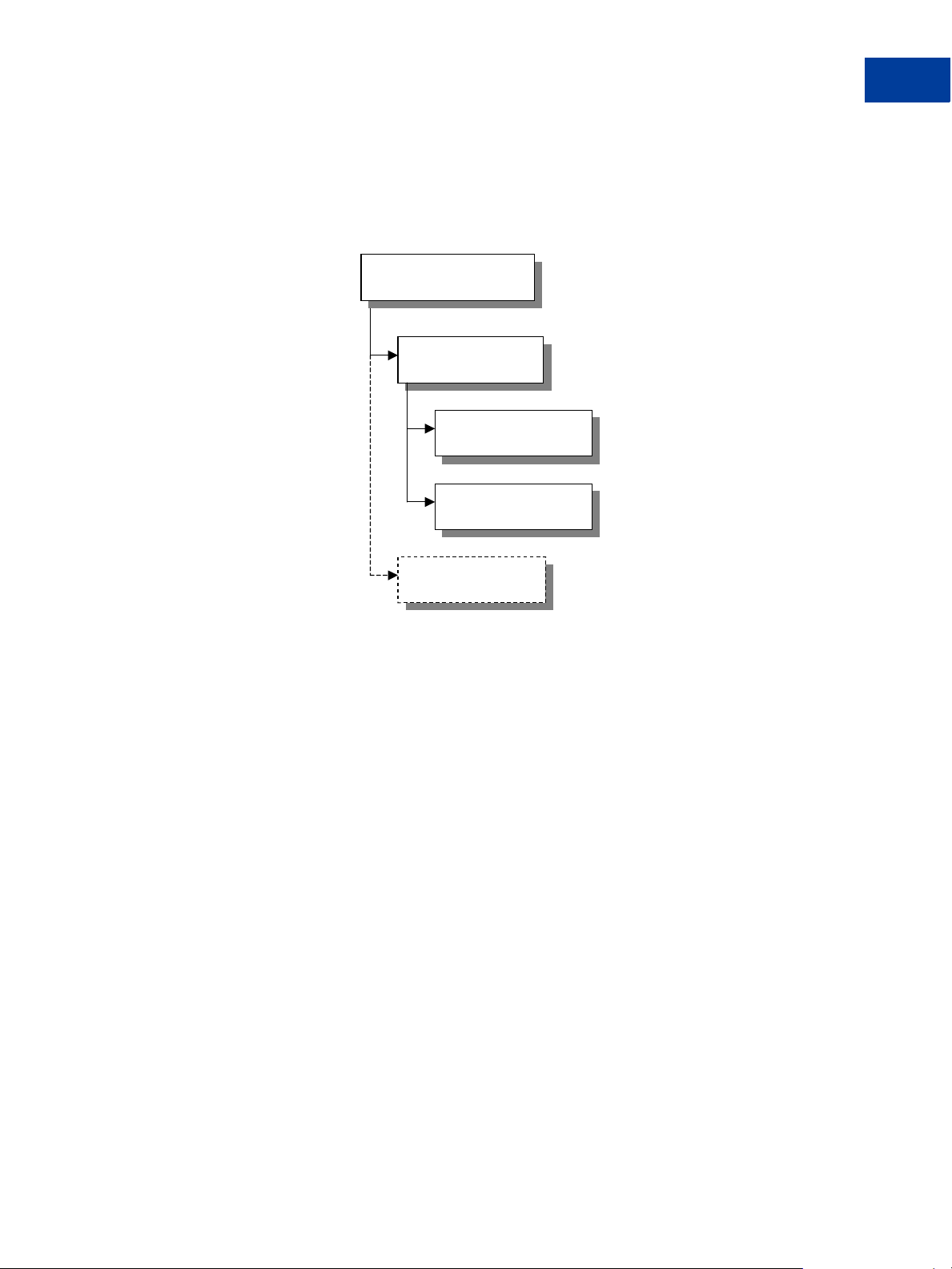

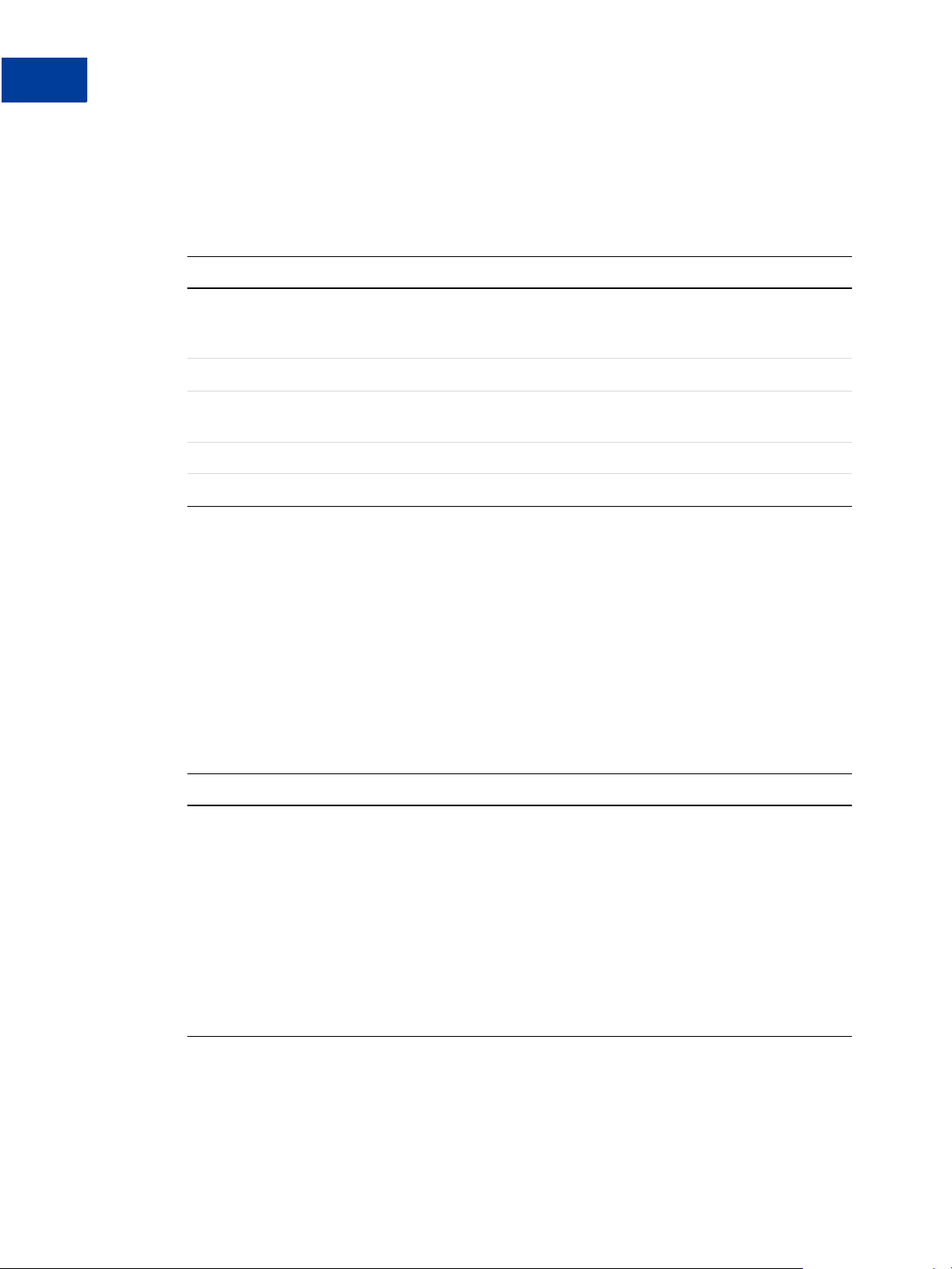

XMLPayRequest

<RequestData>

<MerchantId>

<Transactions>

<RequestAuth>

<XMLPayRequest>

Payment transactions are submitted, one or more at a time, as XMLPayRequest documents.

The high-level structure of a request looks like this:

XMLPay Overview

XMLPay Messaging

1

Merchant ID identifies the merchant of record for the transaction within the target payment

processing network. The merchant of record may be different from the submitting party in a

delegated processing model.

Transactions is the list of payment transactions to be processed. XMLPay supports up to 32

transactions per XMLPay document submission.

RequestAuth is an optional structure used to authenticate the submitting party, in the absence

of transport level authentication.

See Chapter 2, “XMLPay Syntax,” for a detailed description of request documents.

XMLPayResponse

Each XMLPayRequest submission produces a corresponding XMLPayResponse document

containing results for each submitted transaction request. The high-level structure of a

response looks like this:

XMLPay Developer’s Guide 13

Page 14

XMLPay Overview

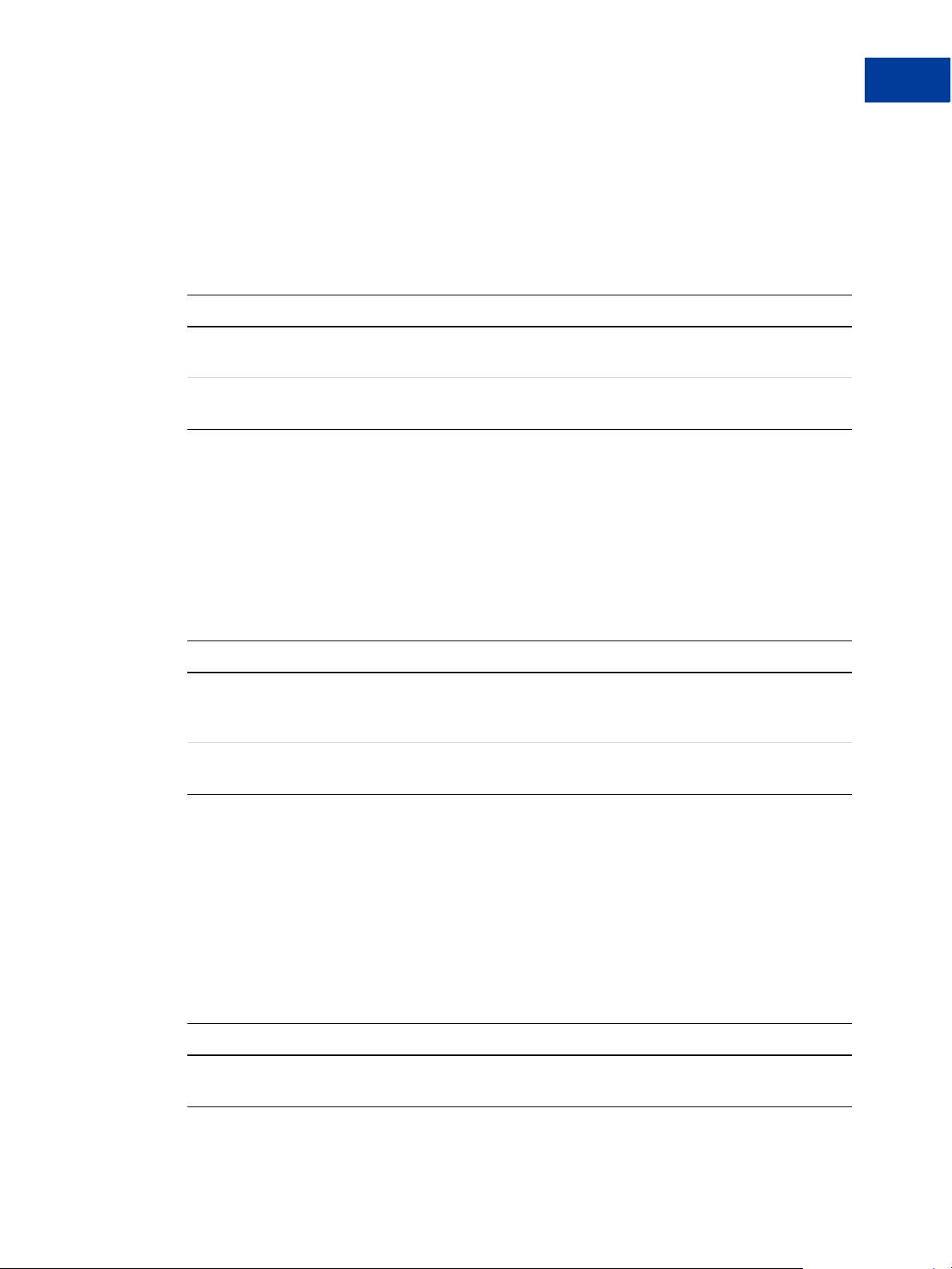

<ResponseData>

<MerchantId>

<TransactionResults>

<Signature>

<XMLPayResponse>

<TransactionReceipts>

1

XMLPay Messaging

NOTE: Signature and TransactionReceipts are not supported on the Payment server.

See Chapter 2, “XMLPay Syntax,” for a detailed description of response documents.

14 XMLPay Developer’s Guide

Page 15

XMLPay Syntax

2

This chapter presents the syntax for transaction requests and responses using a simplified

notation.

z Appendix A, “XMLPay Schemas,” provides the complete syntax, expressed in W3C

XML-schema notation.

z Appendix B, “XMLPay DTD,” provides a document type definition (DTD) representation

of the schema.

Syntax Notation

The following example presents the notation used to describe XMLPay document:

<Example>

(element)

(optionalElement)?

(alternativeElement1|alternati veElement2)

(element)+

(element)*

</Example>

element Indicates the occurrence of a (possibly complex) XML element (for

example, <element>...</element>) defined elsewhere.

? Indicates an optional element.

| Separates alternative elements, any one of which is allowed.

+ Indicates that one or more occurrences of an element are allowed.

* Indicates that zero or more occurrences of an element are allowed.

NOTE: The Payflow SDK SDK download package provides specific examples of XML

documents using the Pro client service.

The XMLPayRequest Document (Transactions)

<XMLPayRequest Timeout="30" ve rsion = "2.0">

<RequestData>

(Vendor)

(Partner)

<Transactions>

XMLPay Developer’s Guide 15

Page 16

XMLPay Syntax

2

The XMLPayRequest Document (Transactions)

(Transaction)+

</Transactions>

</RequestData>

(RequestAuth)?

</XMLPayRequest>

Attribute Description

Vendor Iden tifies the merchant of record for the transaction within the target

Partner Identifies the submitting party.

Transaction Defined on page 16. XMLPay supports up to 32 transactions per

RequestAuth Defined on page 21.

Timeout The value of this attribute is ignored.

payment processing network. In a delegated processing model, the

merchant of record may be different from the submitting party.

XMLPay document submission.

Transaction

XMLPay supports up to 32 transactions per XMLPay document submission.

<Transaction Id=? CustRef=?>

</Transaction>

Attribute Description

Id

(Authorization|Capture|Sale|Cr edit|Void|

ForceCapture|RepeatSale|GetSta tus|

VerifyEnrollment|ValidateAuthe ntication|

TransactionUpdate|SetExpressCh eckout|

GetExpressCheckout|DoExpressCh eckout)

Optional attribute that tracks the transaction through the payment-

processing network. The submitting merchant generates this transaction

identifier, which must be unique among all transactions submitted by that

merchant.

Id need not be globally unique across merchants, since the paymentprocessing network interprets it within the context of the merchant

associated with the transaction. If an Id attribute is provided in a

transaction, it will be included in the matching TransactionResult in the

resultant XMLPayResult.

Similarly, CustRef is a merchant-generated ID identifying a specific

customer of this merchant and associating it with this transaction.

Authorization Transaction

An authorization transaction verifies the availability of funds and reserves them for later

capture.

16 XMLPay Developer’s Guide

Page 17

XMLPay Syntax

The XMLPayRequest Document (Transactions)

<Authorization>

<PayData>

(Invoice)

(Tender)

</PayData>

(ExtData)*

</Authorization>

Attribute Description

PayData Specifies the details of the purchase, within Invoice, as well as the

payment Tender to use.

ExtData Optional element that may carry extended data (outside the syntax of the

XMLPay schema).

Capture Transaction

A capture transaction transfers the funds secured by a previous authorization transaction,

identified by PNRef, into the merchant’s account.

2

<Capture>

(PNRef)

(Invoice)?

(ExtData)*

</Capture>

Attribute Description

Invoice An updated Invoice may optionally be provided, specifying any changes

in the purchase details from the original invoice in the reference

authorization.

ExtData Optional element that may carry extended data (outside the syntax of the

XMLPay schema).

Sale Transaction

A sale transaction verifies the availability of funds and captures funds in one step.

<Sale>

<PayData>

(Invoice)

(Tender)

</PayData>

(ExtData)*

</Sale>

Attribute Description

PayData Specifies the details of the purchase, within Invoice, as well as the

payment Tender to use.

XMLPay Developer’s Guide 17

Page 18

XMLPay Syntax

2

The XMLPayRequest Document (Transactions)

Attribute Description

ExtData Optional element that may carry extended data (outside the syntax of the

Credit Transaction

A credit transaction reverses a previous sale or capture transaction.

<Credit>

(PNRef|Tender)

(Invoice)?

(ExtData)*

</Credit>

Attribute Description

PNRef|Tender The transaction to be credited is identified by PNRef. Acredit may be run

Invoice In the case of a partial credit, you must provide Invoice and provide

XMLPay schema).

without a PNRef by providing the Tender for the account to be credited

and Invoice for the amount.

details on the items being returned.

ExtData Optional element that may carry extended data (outside the syntax of the

XMLPay schema).

Void Transaction

A void transaction cancels a pending sale, capture, or credit.

<Void>

(PNRef)

(ExtData)*

</Void>

Attribute Description

PNRef The transaction to be cancelled is identified by PNRef. If the referenced

transaction has already been processed, the void fails.

SetExpressCheckout Transaction

SetExpressCheckout indicates to the server that you are using Express Checkout to obtain

payment from your customer.

<SetExpressCheckout>

(Authorization|Sale)

(ExtData)*

18 XMLPay Developer’s Guide

Page 19

XMLPay Syntax

The XMLPayRequest Document (Transactions)

</SetExpressCheckout>

Attribute Description

Authorization The Express Checkout transaction: an authorization for payment or a

sale.

ExtData Optional element that may carry extended data (outside the syntax of the

XMLPay schema).

GetExpressCheckout Transaction

GetExpressCheckout returns information about the customer using Express Checkout,

including the name and address on file at PayPal.

<SetExpressCheckout>

(Authorization|Sale)

(ExtData)*

</SetExpressCheckout>

Attribute Description

2

Authorization The Express Checkout transaction: an authorization for payment or a

sale.

ExtData Optional element that may carry extended data (outside the syntax of the

XMLPay schema).

DoExpressCheckout Transaction

DoExpressCheckout obtains payment through Express Checkout for a Sale transaction or

requests an Authorization for a later capture of payment.

<DoExpressCheckout>

(Authorization|Sale)

(ExtData)*

</DoExpressCheckout>

Attribute Description

Authorization The Express Checkout transaction to be carried out: an authorization for

payment or a sale.

ExtData Optional element that may carry extended data (outside the syntax of the

XMLPay schema).

ForceCapture Transaction

A ForceCapture transaction captures funds reserved through an out-of-band authorization (for

example, a voice authorization received over the phone).

<ForceCapture>

<PayData>

(Invoice)

XMLPay Developer’s Guide 19

Page 20

XMLPay Syntax

2

The XMLPayRequest Document (Transactions)

(Tender)

</PayData>

(AuthCode)

(ExtData)*

</ForceCapture>

Attribute Description

AuthCode Authorization code received out-of-band.

PayData Specifies the details of the purchase, within Invoice, as well as the

ExtData Optional element that may carry extended data (outside the syntax of the

GetStatus Transaction

A GetStatus transaction queries the status of a previous transaction.

<GetStatus>

(PNRef)

(ExtData)*

</GetStatus>

payment Tender to use.

XMLPay schema).

Attribute Description

PNRef The transaction to query is identified by PNRef.

ExtData Optional element that may carry extended data (outside the syntax of the

XMLPay schema).

VerifyEnrollment Transaction

For the Buyer Authentication Service, this transaction is used to determine whether the card

holder is enrolled in the 3D-Secure program.

Refer to Payflow Pro Fraud Protection Services User’s Guide on the sequence of steps

involved in performing a Buyer Authentication transaction. This transaction is submitted only

to the Buyer Authentication server and not to the core OLTP server.

<VerifyEnrollment>

<PayData>

(Invoice)

(Tender)

</PayData>

(ExtData)*

</VerifyEnrollment>

Attribute Description

PayData Specifies the details of the credit card used in the purchase.

20 XMLPay Developer’s Guide

Page 21

XMLPay Syntax

The XMLPayRequest Document (Transactions)

Attribute Description

ExtData Optional element that may carry extended data (outside the syntax of the

XMLPay schema).

ValidateAuthentication Transaction

For the Buyer Authentication Service, this transaction validates the signature on the PARes

data returned by the issuing bank and parses the authentication information. Refer to Payflow

Pro Fraud Pr otection Services User’s Guide on the sequence of steps involved in performing a

Buyer Authentication transaction.

<ValidateAuthentication>

<PARes>

(ExtData)*

</ValidateAuthentication>

Attribute Description

PARes The authentication data returned by Issuer's ACS.

2

ExtData Optional element that may carry extended data (outside the syntax of the

RequestAuth

The RequestAuth element provides authentication of the requestor through either a username

and password, using UserPass, or a digital signature, using Signature.

<RequestAuth>

</RequestAuth>

In the case of a digital signature, the W3C XML Signature syntax is used and the signature is

executed over the RequestData.

UserPass

<UserPass>

</UserPass>

Attribute Description

XMLPay schema).

(UserPass|Signature)

(User)

(UserDomain)?

(Password)

User String identifier assigned to a user.

UserDomain Names a partner or a vendor under whose auspice a transaction is being

submitted.

Password User's password (string).

XMLPay Developer’s Guide 21

Page 22

XMLPay Syntax

2

The XMLPayRequest Document (Recurring Profiles)

The XMLPayRequest Document (Recurring Profiles)

A RecurringProfile transaction defines a scheduled payment that enables you to automatically

bill your customers at regular intervals.

<XMLPayRequest Timeout="30" ve rsion = "2.0">

<RequestData>

(Vendor)

(Partner)

<RecurringProfiles>

(RecurringProfile)+

</RecurringProfiles>

</RequestData>

(RequestAuth)?

</XMLPayRequest>

Attribute Description

Vendor Iden tifies the merchant of record for the transaction within the target

payment processing network. In a delegated processing model, the

merchant of record may be different from the submitting party.

Partner Identifies the submitting party.

RecurringProfile Defined on page 22.

RequestAuth Defined on page 21.

Timeout The value of this attribute is ignored.

RecurringProfile

<Profile Id=? CustRef=?>

(Add|Modify|Cancel|Reactivate| Payment|Inquiry

</Profile>

Attribute Description

Id

Optional attribute that tracks the transaction through the payment-

processing network. The submitting merchant generates this transaction

identifier, which should be unique among all transactions submitted by

that merchant.

Id need not be globally unique across merchants, since the paymentprocessing network interprets it within the context of the merchant

associated with the transaction. If an Id attribute is provided in a

transaction, it will be included in the matching TransactionResult in the

resultant XMLPayResult.

Similarly, CustRef is a merchant-generated ID identifying a specific

customer of this merchant and associating it with this transaction.

22 XMLPay Developer’s Guide

Page 23

XMLPay Syntax

The XMLPayRequest Document (Recurring Profiles)

Add Recurring Profile

Add a new recurring profile either by sending all data required to defin e the profile or by

converting an existing transaction into a profile.

<Add>

(RPData)

(Tender)

</Add>

Attribute Description

RPData Describes recurring profile details. Defined on page 36.

Tender Specifies type of payment

Modify Recurring Profile

Modify any profile value by sending any subset of the profile parameters, including an

Optional Transaction.

2

<Modify>

(RPData)

(Tender)

(ProfileID)

</Modify>

Attribute Description

RPData Describes recurring profile details. Defined on page 36.

Tender Specifies type of payment

ProfileID Profile ID of the profile that you want to modify.

Cancel Recurring Profile

Cancel (deactivate) a recurring profile.

<Cancel>

(ProfileID)

</Cancel>

Attribute Description

ProfileID Profile ID of the profile that you want to cancel.

Reactivate Recurring Profile

Reactivate a profile with an inactive status. Profiles can be deactivated for the following

reasons: the term has completed, the profile reached maximum allowable payment failures, or

the profile was canceled.

XMLPay Developer’s Guide 23

Page 24

XMLPay Syntax

2

The XMLPayRequest Document (Recurring Profiles)

<Reactivate>

(RPData)

(Tender)

(ProfileID)

</Reactivate>

Attribute Description

RPData Describes recurring profile details. Defined on page 36.

Tender Specifies type of payment

ProfileID Profile ID of the profile that you want to reactivate.

Payment Recurring Profile

The Payment action performs a real-time retry on a previously failed transaction.

<Payment>

(RPData)

(Tender)

(ProfileID)

</Payment>

Attribute Description

RPData Describes recurring profile details. Defined on page 36.

Tender Specifies type of payment

ProfileID Profile ID of the profile you want to retrying payment for.

Inquiry Recurring Profile

Inquire about the status of a profile.

<Inquiry>

(ProfileID)

</Inquiry>

Attribute Description

ProfileID Profile ID of the profile you want to review.

24 XMLPay Developer’s Guide

Page 25

Core Structures

PayData

<PayData>

(Invoice)

(Tender)

</PayData>

Attribute Description

Invoice Describes the details of a purchase. Defined on page 25.

Tender Describes the payment instrument. Defined on page 32.

PayDataAuth

XMLPay Syntax

Core Structures

2

Invoice

The PayDataAuth element provides authentication of the payer for an associated PayData,

using either a PKCS-7 format or a W3C XML Signature format digital signature.

<PayDataAuth>

(PKCS7Signature|Signature)

</PayDataAuth>

<Invoice>

(CustIP)*

(MerchantDescription)*

(MerchantServiceNum)*

(Recurring)*

(InvNum)?

(OrigInvNum)*

(Date)?

(OrderDateTime)*

<BillFrom>

(Name)?

(Address)?

(EMail)?

(Phone)?

(Fax)?

(URL)?

</BillFrom>

<BillTo>

(CustomerId)*

(Name)?

(Address)?

XMLPay Developer’s Guide 25

Page 26

XMLPay Syntax

2

Core Structures

(EMail)?

(Phone)?

(Phone2)?

(Fax)?

(CustCode)?

(PONum)?

(TaxExempt)?

(PhoneType)?

</BillTo>

<ShipCarrier/>?

<ShipMethod/>?

<ShipFrom>

(Name)?

(Address)?

(EMail)?

(Phone)?

(Fax)?

(ShipFromEU)?

</ShipFrom>

<ShipTo>

(Name)?

(Address)?

(EMail)?

(Phone)?

(Phone2)

(Fax)?

(ShipToEU)?

</ShipTo>

(Description)*

(Items)*

(DiscountAmt)?

(ShippingAmt)?

(DutyAmt)?

(TaxAmt)?

(NationalTaxIncl)?

(TotalAmt)?

(FreightAmt)?

(HandlingAmt)?

(ItemAmt)?

(Comment)?

(Level3Invoice)

(Memo)

(Custom)

(OrderDesc)

(ExtData)*

(MerchantInfo)*

(AdditionalAmounts)*

(SKU)*

(CustomerHostName)*

(CustomerBrowser)*

</Invoice>

26 XMLPay Developer’s Guide

Page 27

XMLPay Syntax

Core Structures

Attribute Description

CustIP Customer IP address (filter transactions).

MerchantDescripton Merchant descriptor. For example, ABCCMPY*FALLCATALOG

MechantServiceNum Merchant telephone number. For example, 603-555-1212

Recurring Identifies the transaction as recurring. This value does not activate the

Recurring Billing Service. If the RECURRING parameter was set to Y

for the original transaction, then the setting is ignored when forming

Credit, Void, and Force transactions. If you subscribe to the Fraud

Protection Services: T o avoid charging you to filter recurring transactions

that you know are reliable, the fraud filters do not screen recurring

transactions. To screen a prospective recurring customer, submit the

transaction data using PayPal Manager's Transaction Terminal page. The

filters screen the transaction in the normal manner. If the transaction

triggers a filter, then you can follow the normal process to review the

filter results. Format: Y or N

2

InvNum Invoice number.

OrigInvNum

Date Invoice date: YYYYMMDD, ISO 8601.

OrderDateTime

BillFrom Name,

Address, EMail, Phone,

Fax, and URL

BillTo CustomerId,

Name, Address, EMail,

Phone, Phone2,

PhoneType, and Fax

BillTo PONum Buyer's purchase order number.

BillTo TaxExempt Indicates that the buyer is a tax exempt entity.

ShipCarrier Shipping carrier.

ShipMethod Shipping method.

ShipFrom and ShipTo Information about the shipping addresses, if different from BillFrom and

Information about the biller.

Information about the buyer.

BillTo respectively.

Description Summary description of the purchase. This field, in the case of an Amex

purchase card, can contain up to four separate descriptions of 40

characters each.

Items Full line-item breakdown of the purchase. Defined on page 28.

XMLPay Developer’s Guide 27

Page 28

XMLPay Syntax

2

Core Structures

Attribute Description

DiscountAmt Discount to be applied to the item subtotal.

ShippingAmt T o tal of shipping and handling charges. For separate shipping and

handling amounts, use FreightAmt and HandlingAmt, respectively.

DutyAmt Duty fees (if applicable)

TaxAmt Total of all taxes.

NationalTaxIncl Boolean which when true, indicates that the national tax in included in

the TaxAmt.

TotalAmt Grand total (item subtotal - DiscountAmt + ShippingAmt (or

HandlingAmt + FreightAmt) + DutyAmt + TaxAmt).

FreightAmt Shipping charges without handling included.

HandlingAmt Handling charges without shipping included.

ItemAmt Sum of cost of all items in this order.

Items

Comment Free-form comment about the purchase.

Level3Invoice See Table 3.3, “Level 3 (commercial) credit card transaction parameters”

on page 52.

Memo Custom memo about the credit.

Custom Free-form field for your own use, such as a tracking number or other

value you want PayPal to return in the GetExpressCheckout response.

OrderDesc Description of items the customer is purchasing.

ExtData Optional element that may carry extended data (outside the syntax of the

XMLPay schema).

MerchantInfo Merchant name and location defined on page 30.

AdditionalAmounts Detail of a charge for additional breakdown of the amount, defined in

“AdditionalAmounts” on page 31.

SKU Merchant product SKU.

CustomerHostName Name of the server that the account holder is connected to.

CustomerBrowser Account holder’s HTTP browser type

Items is a list of line item detail records. Item is defined below.

<Items>

(Item)+

</Items>

28 XMLPay Developer’s Guide

Page 29

XMLPay Syntax

Core Structures

Item

<Item Number=>

(SKU)?

(UPC)?

(Description)?

(Quantity)?

(UnitOfMeasurement)?

(UnitPrice)?

(DiscountAmt)?

(TaxAmt)?

(ShippingAmt)?

(FreightAmt)?

(HandlingAmt)?

(TotalAmt)?

<PickUp>

(Address)?

(Time)?

(Date)?

(RecordNumber)?

</PickUp>

<Delivery>

(Date)?

(Time)?

</Delivery>

(CostCenterNumber)?

(TrackingNumber)?

(CatalogNumber)?

(UNSPSCCode)?

(ExtData)*

</Item>

2

Attribute Description

Number Line number for the item in the invoice.

SKU Merchant's product code for the item (stock keeping unit).

UPC Item's universal product code.

Description Item's description.

Quantity Number of units of this item. UnitOfMeasurement provides the

units for Quantity (ISO 31).

UnitPrice Cost of each unit.

DiscountAmt Discount to be applied to this line item.

TaxAmt Total of all taxes for this line item.

XMLPay Developer’s Guide 29

Page 30

XMLPay Syntax

2

Core Structures

Attribute Description

ShippingAmt Total of shipping and handling charges. For separate shipping

and handling amounts, use FreightAmt and HandlingAmt,

respectively.

FreightAmt Shipping charges without handling included.

HandlingAmt Handling charges without shipping included.

TotalAmt Total amount including tax and discount for this line item:

(Quantity * UnitPrice) + TaxAmt - DiscountAmt.

PickUp Address, Time, Date,

and RecordNumber

Delivery Date and Time Expected delivery date and time.

CostCenterNumber Purchaser's department number to which the item will be billed.

TrackingNumber Shipper’s tracking code

CatalogNumber Merchant’s product code (SKU may also be used for the same

UNSPSCCode Universal Standard Products and Services Classification. Global

ExtData Optional element that may carry extended data (outside the

MerchantInfo

<MerchantInfo>

</MerchantInfo>

Shipment pickup information

purpose).

marketplace classification system developed and managed by the

Electronic Commerce Code Management Association

(ECCMA).

syntax of the XMLPay schema).

(MerchantName)?

(MerchantStreet)?

(MerchantCity)?

(MerchantState)?

(MerchantCountryCode)?

(MerchantZip)?

Attribute Description

MerchantName Merchant’s name.

MerchantStreet Merchant’s street address, including number .

MerchantCity Merchant’s city name.

MerchantState Merchant’s state or province. For US addresses, two character s tate codes

should be used.

30 XMLPay Developer’s Guide

Page 31

Attribute Description

MerchantCountryCode Merchant’s country code (ISO 3166). Default is US.

MerchantZip Merchant’s postal code.

AdditionalAmounts

<AdditionalAmounts>

(Amount1)?

(Amount2)?

(Amount3)?

(Amount4)?

(Amount5)?

</AdditionalAmounts>

Attribute Description

Amount1

XMLPay Syntax

Core Structures

2

Address

Amount2

Amount3

Amount4

Amount5

<Address>

(Street)?

(City)?

(State)?

(Zip)?

(Country)?

</Address>

Attribute Description

Street Street address, including number.

City City name.

State State or province. For US addresses, two character state codes should be

used.

Zip Postal code.

Country Country code (ISO 3166). Default is US.

XMLPay Developer’s Guide 31

Page 32

XMLPay Syntax

2

Core Structures

Tender

<Tender>

(ACH|Card|Check|Debit|PayPal)

</Tender>

ACH

ACH (Automated Clearing House) tender detail.

<ACH>

(AcctType)

(AcctNum)

(ABA)

(Prenote)?

(AuthType)

(CheckNum)

(TermCity)

(TermState)

(DL)

(SS)

(DOB)

(DLState)

(BankName)

(SellerMsg)

(BusName)

(ExtData)*

</ACH>

Attribute Description

AcctType Type of the bank account: checking or savings.

AcctNum Account number.

ABA Bank routing number.

AuthType Method of authorization.

Prenote Boolean. If true, then the purpose of this transaction is not to move

money, but to establish authorization for future transactions to be

submitted on a recurring basis.

ExtData Optional element that may carry extended data (outside the syntax of the

XMLPay schema).

Card

Retail Credit/Debit and Corporate Purchase Card tender detail.

<Card>

(CardType)

(CardNum)

(ExpDate)

32 XMLPay Developer’s Guide

Page 33

XMLPay Syntax

Core Structures

(CVNum)?

(MagData)?

(NameOnCard)?

(ExtData)*

</Card>

Attribute Description

CardType Optional. Identifies the type of card for the merchant’s records. Card

types are:

Visa

MasterCard

Amex

JCB

Discover

DinersClub

The server does not use this value, but rather uses the card number to

determine the card type.

2

CardNum Account num ber.

ExpDate Card expiration date: YYYYMM or ISO 8601.

CVNum Card verification number (typically printed on the back of the card, but

not embossed on the front).

MagData Data located on the magnetic strip of a credit card.

NameOnCard Card holder's name as printed on the card.

ExtData Optional element that may carry extended data (outside the syntax of the

XMLPay schema).

Check

Check tender detail.

<Check>

(CheckType)

(CheckNum)

(MICR)

(DL)?

(SS)?

(DOB)?

(ExtData)*

</Check>

Attribute Description

CheckType Indicates the type of the check: corporate, personal, or government.

CheckNum Account holder's next unused check number.

XMLPay Developer’s Guide 33

Page 34

XMLPay Syntax

2

Core Structures

Attribute Description

MICR Magnetic Ink Check Reader (MICR) is the entire line of numbers at the

bottom of the check. It includes the transit number, account number, and

check number.

DL Account holder's driver's license number. XxNnnnnnnn format, where

Xx is the state code; Nnnnnnnn is the number

SS Account holder's social security number.

DOB Account holder's date of birth YYYYMMDD, ISO 8601

ExtData Optional element that may carry extended data (outside the syntax of the

XMLPay schema).

PayPal

PayPal tender detail.

<PayPal>

(EMail)*

(PayerID)*

(Token)*

(ReturnURL)*

(CancelURL)*

(NotifyURL)*

(ReqConfirmShippiing)*

(NoShipping)*

(AddressOverride)*

(LocaleCode)*

(PageStyle)*

(HeaderImage)*

(HeaderBorderColor)*

(HeaderBackColor)*

(PayflowColor)*

(ButtonSource)*

(ExtData)*

</PayPal>

Attribute Description

EMail Email address of customer as entered during checkout. PayPal uses this

value to pre-fill the PayPal membership signup portion of the PayPal

login page.

PayerId Unique encrypted PayPal customer account identification number

Token A string value returned by Set Express Checkout response.

34 XMLPay Developer’s Guide

Page 35

XMLPay Syntax

Core Structures

Attribute Description

ReturnURL URL to which the customer’s browser is returned after approving use of

PayPal.

Set RETURNURL to your order review page or the page on which the

customer clicked the “Edit Shipping” button or hyperlink.

NotifyURL Your URL for receiving Instant Payment Notification (IPN) about this

transaction.

ReqConfirmShipping Is 1 or 0. The value 1 indicates that you require that the customer’s

shipping address on file with PayPal be a confirmed address.

Setting this element overrides the setting you have specified in your

Merchant Account Profile.

NoShipping Is 1 or 0. The value 1 indicates that on the PayPal pages, no shipping

address fields should be displayed whatsoever.

AddressOverride Is 1 or 0. The value 1 indicates that the PayPal pages should display the

shipping address set by you in the shipping address (SHIPTO*

parameters) passed to this Set Express Checkout request, not the shipping

address on file with PayPal for this customer.

Displaying the PayPal street address on file does not allow the customer

to edit that address.

2

LocaleCode Locale of pages displayed by PayPal during Express Checkout.

PageStyle Sets the Custom Payment Page Style for payment pages associated with

this button/link. PageStyle corresponds to the HTML variable page_style

for customizing payment pages.

The value is the same as the Page Style Name you chose when adding or

editing the page style from the Profile subtab of the My Account tab of

your PayPal account.

HeaderImage A URL for the image you want to appear at the top left of the payment

page. The image has a maximum size of 750 pixels wide by 90 pixels

high. PayPal recommends that you provide an image that is stored on a

secure (https) server.

HeaderBorderColor Sets the border color around the header of the payment page. The border

is a 2-pixel perimeter around the header space, which is 750 pixels wide

by 90 pixels high.

HeaderBackColor Sets the background color for the header of the payment page.

PayflowColor Sets the background color for the payment page.

ButtonSource Identificati on code for use by thi rd-party applications to identify

transactions.

ExtData Optional element that may carry extended data (outside the syntax of the

XMLPay schema).

XMLPay Developer’s Guide 35

Page 36

XMLPay Syntax

2

Core Structures

RPData

Recurring Profile payment and scheduling details.

<RPData>

(Name)?

(TotalAmt)?

(Start)?

(Term)?

(PayPeriod)?

(MaxFailPayments)?

(RetryNumDays)?

(EMail)?

(CompanyName)?

(Comment)?

(OptionalTrans)?

(OptionalTransAmt)?

<BillTo>

(Name)?

(Address)?

(Phone)?

(Fax)?

</BillTo>

<ShipTo>

(Name)?

(Address)?

(Phone)?

(Fax)?

</ShipTo>

(OrigProfileID)?

(PaymentNum)?

(ExtData)*

</RPData>

Attribute Description

Name Account holder's name.

TotalAmt Dollar amount (US dollars) to be billed.

Start Beginning (or restarting) date for the recurring billing cycle used to

calculate when payments should be made.

Term Number of payments to be made over the life of the agreement.

PayPeriod Specifies how often the payment occurs.

MaxFailPayments The number of payment periods (specified by PayPeriod) for which the

transaction is allowed to fail before PayPal cancels a profile.

RetryNumDays The number of consecutive days that PayPal should attempt to process a

failed transaction until Approved status is received.

36 XMLPay Developer’s Guide

Page 37

XMLPay Syntax

The XMLPayResponse Document (Transactions)

Attribute Description

EMail Customer e-mail address.

CompanyName Company name for this profile.

Comment Free-form comment about the purchase.

OptionalTrans Defines an optional Authorization for validating the account information

or for charging an initial fee.

OptionalTransAmt Amount of the Optional Transaction.

2

ExtData

BillTo Name, Address,

Phone, and Fax

ShipTo Name, Address,

Phone, and Fax

OrigProfileID Profile ID of the profile that gets the action.

PaymentNum Payment number identifying the failed payment to be retried.

ExtData Optional element that may carry extended data (outside the syntax of the

<ExtData Name= Value= />

Attribute Description

Name Name of the extended data element.

Value Value of the extended data element.

Information about the buyer.

Information about the shipping addresses, if different from BillTo.

XMLPay schema).

The XMLPayResponse Document (Transactions)

<XMLPayResponse>

<ResponseData>

(Vendor)

(Partner)

<TransactionResults>

(TransactionResult)+

</TransactionResults>

</ResponseData>

(Signature)?

(TransactionReceipts)?

XMLPay Developer’s Guide 37

Page 38

XMLPay Syntax

2

The XMLPayResponse Document (Transactions)

</XMLPayResponse>

Attribute Description

Vendor Iden tifies the merchant of record for the transaction within the payment

Partner Identifies the partner who submitted the transaction on behalf of the

TransactionResult Defined on page 38.

Signature Optional signature over ResponseData, executed by the payment

TransactionReceipts Optional list of receipts from the payment processing network.

processing network.

vendor.

processing gateway using the W3C XML Signature syntax. This

signature may be used to provide integrity protection of the response data

and/or authentication of the responder, if needed (transport-level security

may also be used to provide these protections).

TransactionResult

<TransactionResult Id=?>

(Result)

(BuyerAuthResult)?

(ProcessorResult)?

(FraudPreprocessorResult)?

(FraudPostprocessorResult)?

(CardSecure)?

(IAVSResult)?

(AVSResult)?

(CVResult)?

(Message)?

(PNRef)?

(AuthCode)?

(HostCode)?

(HostURL)?

(OrigResult)?

(Status)?

(ReceiptURL)?

(ACHStatus)?

(OrigPNRef)?

(OrigMessage)?

(PayPalResult)?

(ExtData)*

</TransactionResult>

38 XMLPay Developer’s Guide

Page 39

XMLPay Syntax

The XMLPayResponse Document (Transactions)

Element Description

Result Number that indicates outcome of the transaction (see Appendix C,

“Transaction Results”).

BuyerAuthResult Results of the VerifyEnrollment or ValidateAuthentication

transaction.

ProcessorResult Processor-specific information. Only received if Verbosity is set to

High.

FraudPreprocessorResult Results from the Fraud Protection Service pre-process stage.

FraudPostprocessorResult Results from the Fraud Protection Service post-process stage.

CardSecure CAVV inform ation returned from the processor.

IAVSResult International AVS result value, if appropriate.

AVSResult Results of the AVS check, if appropriate.

CVResult Results of the CV check, if appropriate. Possible values: match, no

match, service not available, or service not requested.

2

Message Descriptive message describing Result.

PNRef Identifier assigned to the transaction by the payment processing

network.

AuthCode Authorization code for the transaction provided by the bank, if any.

HostCode Result code returned by the payment processor, if any. Whereas

Result provides a normalized view the transaction status, HostCode

passes through the back-end processor status unmodified.

HostURL URL returned by the payment processor, if any, to use in referring to

the transaction.

OrigResult Original result for a transacti on queried with GetStatus.

Status Current status for a transaction queried with GetStatus.

ACHStatus Status of the ACH transaction (returned by Inqui ry transaction).

OrigPNRef The PNRef value associated with the original transaction (returned

by Inquiry transaction).

OrigMessage The Message value associated with the original transaction

(returned by Inquiry transaction).

PayPalResult

ReceiptURL URL returned by the payment processor, if any, to use i n referring to

a receipt for the transaction.

XMLPay Developer’s Guide 39

Page 40

XMLPay Syntax

2

The XMLPayResponse Document (Transactions)

Element Description

ExtData Optional element that may carry extended data (outside the syntax

Attribute Description

Result Number that indicates outcome of the transaction (see Appendix C,

CustRef Reference string that identifies the customer.

Duplicate Id entify if the transaction has been run before.

AVSResult

<AVSResult>

(StreetMatch)

(ZipMatch)

</AVSResult>

of the XMLPay schema).

“Transaction Results”).

Attribute Description

StreetMatch Indicates whether or not the billing street address matched the bank 's

records. Possible values: match, no match, service not available, or

service not requested.

ZipMatch Indicates whether or not the billing zip matched the bank's records.

Possible values: match, no match, service not available, or service not

requested.

PayPalResult

<PayPalResult>

(EMail?)

(PayerID?)

(Token?)

(PPRef?)

(FeeAmount)

(PayerStatus?)

(PaymentType?)

(PendingReason?)

(Custom?)

(InvNum?)

(Phone?)

(Name?)

(ShipTo?)

(CorrelationID?)

</PayPalResult>

40 XMLPay Developer’s Guide

Page 41

XMLPay Syntax

The XMLPayResponse Document (Recurring Profiles)

Attribute Description

Email Customer’s email address.

PayerID Unique encrypted PayPal customer account iden tification number

Token Value PayPal originally returns in Set Express Checkout response after

your first call to the Set Express Checkout request.

PPRef Unique transaction ID of the payment.

If the request ACTION was A (Authorization), you should store the value

of PPREF if you need to research a specific transaction with PayPal.

FeeAmount PayPal fee amount char ged for the transaction.

PayerStatus Status of payer.

PaymentType Indicates whether the payment is instant or delayed.

PendingReason The reason the payment is pending. Values are: none, echeck, intl, multi-

currency, verify, other, and completed.

2

Custom Free-form field for your own use.

InvNum Merchant invoice number. The merchant invoice number is used for

authorizations and settlements and, depending on your merchant bank,

will appear on your customer's credit card statement and your bank

reconciliation report. If you do not provide an invoice number, the

transaction ID (PNREF) will be submitted.

Phone Account holder’s telephone number.

ShipTo Name, Address,

EMail, Phone, Phone2,

Fax, and ShipToEU

CorrelationID Value used for tracking this Direct Payment transaction.

Information about the shipping addresses, if different from BillTo.

The XMLPayResponse Document (Recurring Profiles)

<XMLPayResponse>

<ResponseData>

(Vendor)

(Partner)

<RecurringProfileResults>

(RecurringProfileResult)+

</RecurringProfileResults>

</ResponseData>

(Signature)?

(TransactionReceipts)?

XMLPay Developer’s Guide 41

Page 42

XMLPay Syntax

2

The XMLPayResponse Document (Recurring Profiles)

</XMLPayResponse>

Attribute Description

Vendor Identifies the merchant of record for the transaction within the

Partner Identifies the partner who submitted the transaction on behalf of the

RecurringProfileResult Defined on page 43.

Signature Optional signature over ResponseData, executed by the payment

TransactionReceipts Optional list of receipts from the payment processing network.

payment processing network.

vendor.

processing gateway using the W3C XML Signature syntax. This

signature may be used to provide integrity protection of the response

data and/or authentication of the responder, if needed (transport-level

security may also be used to provide these protections).

BuyerAuthResult

Response for Buyer Authentication transactions, VerifyEnrollment and

ValidateAuthentication.

<BuyerAuthResult>

(Status)

(AuthenticationId)?

(PAReq)?

(ACSUrl)?

(ECI)?

(CAVV)?

(XID)?

</BuyerAuthResult>

Attribute Description

Status Status of the transaction.

AuthenticationId Message id for the response.

PAReq Payer authentication request returned if cardholder is enrolled.

ACSUrl The issuer ACS URL at which the cardholder would authenticate by

providing the password.

ECI The Electronic Commerce Indicator value that implies the authentication

outcome. Defaulted to 7 since cardholder has not authenticated yet.

CAVV Cardholder Authentication Verification Value.

XID Transaction ID.

42 XMLPay Developer’s Guide

Page 43

RecurringProfileResult

Non-Inquiries

Response for Add, Modify, Cancel, Reactivate, and Payment actions.

<RecurringProfileResult Id=?>

(Result)

(Message)?

(ProfileID)?

(RPRef)?

(TransactionResult)?

(ExtData)*

</RecurringProfileResult>

Attribute Description

Result Number that indicates outcome of the transaction (see Appendix C,

Message Descriptive message describing Result.

The XMLPayResponse Document (Recurring Profiles)

“Transaction Results”).

XMLPay Syntax

2

ProfileID Profile ID of the profile that gets the action.

RPRef Identifier assigned to the transaction by the payment processing network.

TransactionResult

ExtData Optional element that may carry extended data (outside the syntax of the

XMLPay schema).

Id Identifier assigned to the transaction by the merchant (if one was

provided in the transaction request).

Inquiries

Response for Inquiry action.

<RecurringProfileResult Id=?>

(Result)

(Message)?

(ProfileID)?

(RPRef)?

(Status)?

(Name)?

(Start)?

(Term)?

(End)?

(PayPeriod)?

(MaxFailPayments)?

(RetryNumDays)?

(EMail)?

(CompanyName)?

(Amt)?

XMLPay Developer’s Guide 43

Page 44

XMLPay Syntax

2

The XMLPayResponse Document (Recurring Profiles)

(PaymentsLeft)?

(NextPayment)?

(AggregateAmt)?

(AggregateOptionalTransAmt)?

(NumFailedPayments)?

(Tender)?

(BillTo)?

(ShipTo)?

(ExtData)*

</RecurringProfileResult>

Attribute Description

Result Number that indicates outcome of the transaction (see Appendix C,

Message Descriptive message describing Result.

ProfileID Profile ID of the profile that gets the action.

RPRef Identifier assigned to the transaction by the payment processing

“Transaction Results”).

network.

Status Current stat us of the profile.

Name Account holder's name.

Start Beginning (or restarting) date for the recurring billing cycle used to

calculate when payments should be made.

Term Number of payments to be made over the life of the agreement.

End Date that the last payment is due. Present only if this is not an

unlimited-term subscription.

PayPeriod Specifies how often the payment occurs.

MaxFailPayments The number of payment periods (specified by PayPeriod) for

which the transaction is allowed to fail before PayPal cancels a

profile.

RetryNumDays The number of consecutive days that PayPal should attempt to

process a failed transaction until Approved status is received.

EMail Customer e-mail address.

CompanyName Company name for this profile.

Amt Dollar amount (US dollars) to be billed.

PaymentsLeft Number of payments left to be billed.

NextPayment Date that the next payment is due

AggregateAmt Amount collected so far for scheduled payments.

44 XMLPay Developer’s Guide

Page 45

XMLPay Syntax

The XMLPayResponse Document (Recurring Profiles)

Attribute Description

AggregateOptionalTransAmt Amount collected through sending optional transactions

NumFailedPayments Number of payments that failed.

Tender Specifies payment type.

BillTo Information about the buyer.

ShipTo Information about the shipping addresses, if different from BillTo.

ExtData Optional element that may carry extend ed data (outside the syntax

of the XMLPay schema).

2

XMLPay Developer’s Guide 45

Page 46

XMLPay Syntax

2

The XMLPayResponse Document (Recurring Profiles)

46 XMLPay Developer’s Guide

Page 47

XMLPay Elements

3

The following tables define the existing Payflow SDK parameters (name/value pairs) and their

XMLPay equivalent. Some parameters cannot be processed by specific processors. For details

on what your processor can process, see Payflow Pro Developer’s Guide.

If you are developing applications that use the Recurring Billing Service, see Recurring

Billing Service User’s Guide.That document provides detailed information about Payflow

SDK parameters specific to Recurring Billing.

NOTE: ExtData is an optional XMLPay element for including parameter data not supported by

the schema you are using. Place the data at the appropriate element level in the

XMLPay hierarchy. If you can’t find or are unsure of the appropriate location, place the

data in the Invoice element. See the examples in “Express Checkout Authorization

Transaction” on page 84.

General Transaction Parameters

The following are general parameters accepted in Payflow SDK transactions.

TABLE 3.1 Retail c redit card transac tion paramete rs

Payflow SDK

Parameter Description XMLPay Element

COMMCARD Type of commercial card account number sent. Card

COUNTRYCODE Destination country code. (See the appendix

entitled “ISO Country Codes” in the Payflow

Pro Developer’s Guide .)

COMPANYNAME Billing country code BillTo

CUSTIP IP address of customer Invoice

ECI Values returned from Buyer Auth transaction Card

MERCHDESCR Description of product. Invoice

MERCHSVC Merchant telephone number, including area

code (XXX-XXX-XXXX)

ORDERDATE Date of invoi ce Invoice

RECURRING Recurring transaction? Invoice

UPDATEACTION Update action to take TransactionUpdate

→CommercialCard

ShipTo

→Address→Country

→Address→Company

→CustIP

→BuyerAuthResult→ECI

→MerchantDescription

Invoice

→MerchantServiceNum

→Date

→Recurring

→Action

VERBOSITY Verbosity level of response desired Transaction

XMLPay Developer’s Guide 47

→Verbosity

Page 48

XMLPay Elements

3

Credit Card Transaction Parameters

Credit Card Transaction Parameters

The following parameters are accepted in Payflow SDK credit card transactions.

Retail Credit Card Transaction Parameters

Table 3.2 lists retail credit card transaction parameters.

TABLE 3.2 Retail credit ca rd tran saction parameters

Payflow SDK Parameter Description XMLPay Element

ABA Bank routing number. ABA

ACCT The credit card or purchase card number AcctNum or CardNum

ACCTTYPE Type of the bank account. AcctType or CheckType

AMT Amount in US dollars. Invoice

AUTHCODE The approval code obtained over the phone

from the processing network. Used only

when processing Voice Authorization

transactions.

AUTHTYPE Method of authorization. AuthType

CHKNUM Check number. CheckNum

CHKTYPE Type of the bank account. AcctType

CITY Cardholder’s city. City

COMMCARD Type of commercial card account number

sent.

COMMENT1 Merchant-defined value for reporting and

auditing purposes.

COMMENT2 Merchant-defined value for reporting and

auditing purposes.

COUNTRY Desti nati on country code. (See the appendix

entitled “ISO Country Codes” in the Payflow

Pro Developer’s Guide.)

CUSTCODE Customer co de or customer reference ID. CustCode

→TotalAmt

AuthCode

Card

→CommercialCard

Comment

ExtData

Country

CUSTREF Merchant-defined identifier for reporting and

auditing purposes.

CVV2 The 3 or 4-digit Card Security Code (CSC)

found on the back of a credit card.

DESC General description of the transact ion. Item

CustRef

CVNum

→Description

48 XMLPay Developer’s Guide

Page 49

XMLPay Elements

Credit Card Transaction Parameters

T

ABLE 3.2 Retail credit ca rd tran saction parameters

Payflow SDK Parameter Description XMLPay Element

3

DESC1-4 Up to 4 additional lines describing the

transaction.

DISCOUNT Discount amount on total sale. DiscountAmt

DL Cardholder’s driver’s license number . DL

DOB Cardholder’s date of birth. DOB

DSGUID Transaction ID Id

DUTYAMT Duty or import tax. DutyAmt

EMAIL Email address. Email

ENDTIME Specifies the end of the time period during

which the transaction specified by the

CUSTREF occurred. Optional for Inquiry

transactions when using CUSTREF to specify

the transaction.

EXECUTOR Names a partner or a vendor under whose

auspice a transaction is being submitted.

EXPDATE Expiration date of the credit card. ExpDate

FIRSTNAME The cardh old e r’s name. Name or NameOnCard

FREIGHTAMT Freight amount. FreightAmt or ShippingAmt

Item→Description

ExtData

UserDomain

HANDLINGAMT Handling amount. Item

INVNUM Merchant invoice number. Invoice

INVOICEDATE Invoice date. Date

L_AMT Total line item amount including tax and

discount.

L_CARRIERSHIPMENTNUM Shipment number. ShipmentNumber

L_CATALOGNUM Merchant’s product code. CatalogNumber

L_COSTCENTERNUM Purchaser's department number to which the

item will be billed.

L_COST Cost per item, excluding tax. UnitPrice

L_DELIVERYDATE Delivery date. Date

L_DELIVERYTIME Delivery time. Time

L_DESC Item description. Item

L_DISCOUNT Discount per line item. DiscountAmt

L_FREIGHTAMT Line item freight amount. FreightAmt

→HandlingAmt

→InvNum

Invoice

→TotalAmt

CostCenterNumber

→Description

XMLPay Developer’s Guide 49

Page 50

XMLPay Elements

3

Credit Card Transaction Parameters

ABLE 3.2 Retail credit ca rd tran saction parameters

T

Payflow SDK Parameter Description XMLPay Element

L_HANDLINGAMT Line item hand ling amount. Item→HandlingAmt

L_PICKUPCITY Pickup city. City

L_PICKUPCOUNTRY Pickup record number. Country

L_PICKUPDATE Pickup date. Date

L_PICKUPRECORDNUM Pickup record number. RecordNumber

L_PICKUPSTATE Pickup state. State

L_PICKUPSTREET Pickup address. Street

L_PICKUP TIME Pickup time. Time

L_PICKUPZIP Pickup postal code. Zip

L_PRODCODE Supplier-specific product code. SKU

L_QTY Line item quantity. Item

L_SKU Line item SKU identifier. SKU

L_TAXAMT Line item tax amount. Item

L_TRACKINGNUM Tracking number. TrackingNumber

L_UNSPSCCODE Universal Standard Products and Services

Classification.

L_UOM Item unit of measure. UnitOfMeasurement

L_UPC Item commodity code. UPC

MICR Data located on the magnetic strip of a credit

card.

NATINCL National tax included (true or false). NationalTaxIncl

ORDERDATE Order date. ExtData

ORIGID The Reference ID (PNREF) returned for all

transactions.

PARTNER The ID provided to you by the authorized

Reseller who registered you for the Website

Payments Pro Payflow Edition service. If you

purchased your account directly from PayPal,

use PayPal.

This value is case-sensitive.

→Quantity

→TaxAmt

UNSPSCCode

MagData or MICR

PNRef

Partner

PHONENUM Telephone number. Phone

PHONETYPE Telephone call type identifier BillTo

→PhoneType

50 XMLPay Developer’s Guide

Page 51

XMLPay Elements

Credit Card Transaction Parameters

T

ABLE 3.2 Retail credit ca rd tran saction parameters

Payflow SDK Parameter Description XMLPay Element

3

PONUM Specified by the cardholder to identify the

order. Usually used as a Purchase Order

number.

PRENOTE Identifies the transaction as an authorization

for future transactions.

PWD The 6- to 32-character password that you

defined while registering for the account.