Page 1

Website Payments

Pro Hosted Solution

Integration Guide

(Payflow Edition)

Last updated: December 2011

Page 2

Website Payments Pro Hosted Solution Integration Guide

Document Number: 10112.en_GB-201112

© 2011 PayPal, Inc. All rights reserved. PayPal is a registered trademark of PayPal, Inc. The PayPal logo is a trademark of PayPal, Inc. Other

trademarks and brands are the property of their respective owners.

The information in this document belongs to PayPal, Inc. It may not be used, reproduced or disclosed without the written approval of PayPal, Inc.

Copyright © PayPal. All rights reserved. PayPal (Europe) S.à r.l. et Cie., S.C.A., Société en Commandite par Actions. Registered office: 22-24 Boulevard

Royal, L-2449, Luxembourg, R.C.S. Luxembourg B 118 349.

Consumer advisory: The PayPal™ payment service is regarded as a stored value facility under Singapore law. As such, it does not require the approval

of the Monetary Authority of Singapore. You are advised to read the terms and conditions carefully.

Notice of non-liability:

PayPal, Inc. is providing the information i n this document t o you “AS-IS” with all faults. PayPal, Inc. makes no warranties of any kind (whether express,

implied or statutory) with respect to the information co ntained herein. PayPal, Inc. assumes no liability for damages (whether direct or indirect), caused

by errors or omissions, or resulting from the use of this document or the information contained in this document or resulting f rom the application or use

of the product or service described herein. PayPal, Inc. reserves the right to make changes to any information herein without further notice.

Page 3

Contents

Preface . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

About This Guide. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Intended Audience . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Revision History . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Documentation Feedback . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Chapter 1 Getting Started with Website Payments Pro Hosted Solution 7

Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Features and Benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

How Hosted Solution Works . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Introduction to Integrating with Hosted Solution . . . . . . . . . . . . . . . . . . . . . . . . 9

Chapter 2 Integrating Your Website Using HTML. . . . . . . . . . . .11

Simple Hosted Solution Integration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Sample Integration. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

HTML Variables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Chapter 3 Customising Your PayPal Payment Page . . . . . . . . . . 17

Modifying Your PayPal Account Settings . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Configuration. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Design . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

Adding HTML Variables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

Chapter 4 Integrating iFrame in Your Website . . . . . . . . . . . . .29

Integrating iFrame . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

HTML Integration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

API Integration. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

Chapter 5 Integrating Your Website Using API . . . . . . . . . . . . . 35

Button Hosting . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

Page 4

Contents

Using the Button Manager API with Hosted Solution Checkout . . . . . . . . . . . . . . . 36

Using URL Returned in the Response (Recommended) . . . . . . . . . . . . . . . . 36

Using Form POST . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

Encrypting Buttons Using Public and Private Key . . . . . . . . . . . . . . . . . . . . 39

Example of Initiating Hosted Solution Checkout. . . . . . . . . . . . . . . . . . . . . 39

BMCreateButton API Operation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

BMCreateButton Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

BMCreateButton Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

BMCreateButton Errors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

Chapter 6 Order Processing . . . . . . . . . . . . . . . . . . . . . . 45

Verifying Transaction Status and Authenticity . . . . . . . . . . . . . . . . . . . . . . . . 45

Validate Instant Payment Notification (IPN) . . . . . . . . . . . . . . . . . . . . . . . 45

Fulfilling Order . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

Appendix A Obtaining API Credentials. . . . . . . . . . . . . . . . . .47

Creating an API Signature . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

Creating an API Certificate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

Encrypting Your Certificate Into PKCS12 Format . . . . . . . . . . . . . . . . . . . . . . 48

Importing Your Certificate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49

Appendix B Error Messages . . . . . . . . . . . . . . . . . . . . . . . 51

Appendix C Currency Codes . . . . . . . . . . . . . . . . . . . . . . .69

4

Page 5

Preface

P

About This Guide

The Website Payments Pro Hosted Solution Integration Guide (Payflow Edition) describes

how to integrate with Hosted Solution. It includes information about:

Features and benefits of Hosted Solution.

Integrating your website with Hosted Solution.

Customising your hosted payment page.

Verifying the status and authenticity of the transactions before fulfilling the orders.

Intended Audience

This guide is for Website Payments Pro Payflow Edition (UK) merchants and developers that

want to integrate with Hosted Solution to add transaction processing to their website.

Revision History

The following table lists the history of revisions made to the Website Payments Pro Hosted

Solution Integration Guide (Payflow Edition).

TABLE P.1 Revision History for This Guide

Date Published Description

August 2011 Created Website Payments Pro Hosted Solution Integration Guide

Documentation Feedback

Help us improve this guide by sending feedback to:

documentationfeedback@paypal.com

Page 6

Preface

P

Documentation Feedback

6

Page 7

1

Overview

Hosted Solution is the fast and easy way to add transaction processing to your website. It is a

secure, PayPal-hosted, web-based payment solution that allows you to securely send your

buyers to PayPal’s payment page to authorise and process transactions. Buyers pay with a

debit or credit card, or their PayPal account and you do not have to capture or store credit card

information on your website, thereby helping towards achieving PCI compliance.

Hosted Solution is the choice for merchants who prefer a solution where all financial details

are handled by PayPal.

In addition to Hosted Solution, PayPal recommends that you implement the PayPal Express

Checkout button on your website. The button appears much earlier in the payment flow and

gives existing PayPal account holders the opportunity to use PayPal, thereby increasing the

transaction completion rate.

Getting Started with Website Payments Pro Hosted Solution

Features and Benefits

Here are the features and benefits of Hosted Solution:

PCI compliance - Payment Card Industry (PCI) Data Security Standards (DSS) is a global

security standard which applies to all businesses that collect, store, process, or transmit

card holder information. You can use PayPal’s hosted payment page as part of the PCI

compliance solution for your business.

NOTE: Hosted Solution implementation helps achieving PCI compliance, and does not

necessarily guarantee it.

Supports iFrame - PayPal offers a compact payment form that can be integrated in an

iFrame on your website. The buyer completes the payment on your website and you can

maintain the checkout look and feel in the master frame that surrounds the compact

form.The credit card fields are part of the compact form so you do not have to collect this

information separately. For more information, refer to Chapter 4, “Integrating iFrame in

Your Website.

Support for 3-D Secure Buyer Authentication Protocol - 3-D Secure can help to add an

extra layer of fraud protection for online credit and debit card payments from your buyers.

It can benefit your business by helping to reduce the number of unauthorised chargebacks

you receive and the time it takes to resolve them. You can enable 3-D Secure via the

PayPal-hosted payment page quickly, easily, and at no extra cost.

7

Page 8

Getting Started with Website Payments Pro Hosted Solution

How Hosted Solution Works

Virtual Terminal - PayPal-hosted online payment form, which enables you to accept

phone fax, mail orders for all major credit cards.

Supports Major Credit and Debit Cards - Supports Visa, Visa Debit, Visa Electron,

MasterCard, and Switch/Maestro.

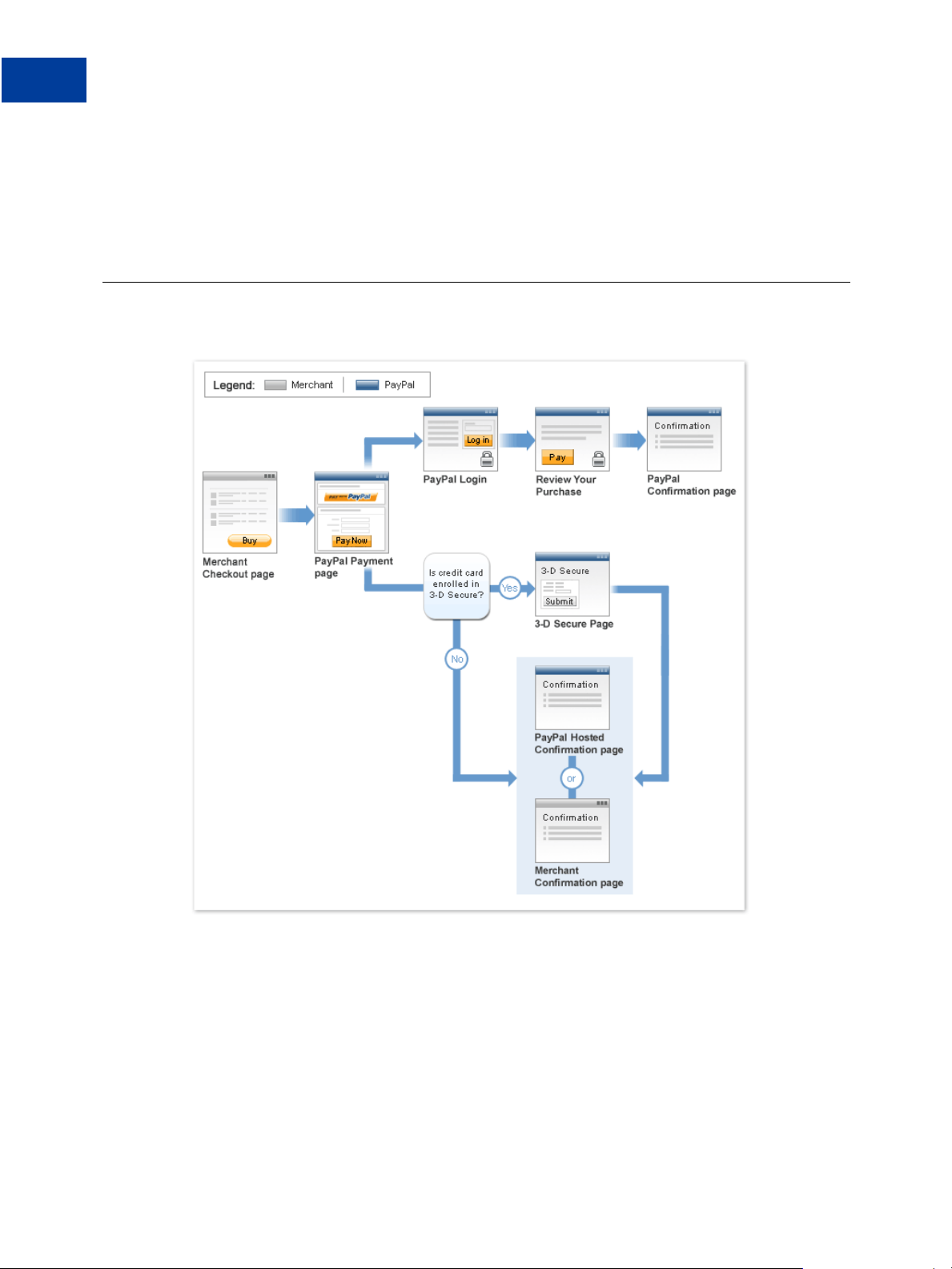

How Hosted Solution Works

In the figure above, the top flow is for paying using your PayPal account and the bottom flow

is for paying with a card.

8

Page 9

Getting Started with Website Payments Pro Hosted Solution

Introduction to Integrating with Hosted Solution

To integrate your website with Hosted Solution:

1. Generate a button in your website checkout flow using HTML or API solution. The button

could be labeled Pay or Buy or similar. When the buyer clicks this button, they are

redirected to the payment page hosted by PayPal.

2. On the payment page, the buyer enters their debit or credit card information and clicks the

Pay Now button. The buyer can also elect to use their PayPal account by clicking the Pay

with PayPal button.

3. If the transaction is successful, the buyer either sees PayPal’s confirmation page or is

redirected to a URL you specify. If the transaction is unsuccessful, an error message is

displayed, and the buyer can rectify the error and retry the transaction.

You can specify the content of the payment page and configure its appearance to reflect the

look and feel of your website (including your logo).

Introduction to Integrating with Hosted Solution

After signing up for Hosted Solution, follow these steps to integrate your website with Hosted

Solution:

1. Connect your website to Hosted Solution: Identify a point in your website checkout flow

where you want to place a Pay or similar button that the buyer clicks on to initiate the

payment. You can do this using HTML or API. Clicking on this button redirects the buyer’ s

browser to PayPal’s payment page for transaction processing. Depending on how you want

to integrate, follow the steps described in Chapter 2, “Integrating Your Website Using

HTML or Chapter 5, “Integrating Your Website Using API.

2. Optionally, customise the appearance and content of your PayPal-hosted payment page by

either sending the appropriate HTTP variables or by editing your PayPal account settings.

Refer to Chapter 3, “Customising Your PayPal Payment Page.

Page 10

Getting Started with Website Payments Pro Hosted Solution

Introduction to Integrating with Hosted Solution

10

Page 11

2

Integrating Your Website Using HTML

This chapter provides instructions for a simple integration that enables you to begin processing

transactions using Hosted Solution.

NOTE: PayPal recommends that you implement the simple integration to familiarise yourself

with Hosted Solution before implementing a more customised integration.

As part of a simple integration, you get the default settings on your payment page. To

customise the look and feel of the page so it matches your website, you can do one of the

following:

Change your settings in your Profile section on PayPal.com, as described in “Modifying

Your PayPal Account Settings” on page 17.

Add the appropriate HTML variables to the payment page, as described in Table 2.1,

“HTML Variables for Settings of Payment Page and Table 3.1, “HTML Variables for Look

and Feel of Payment Page.

IMPORTANT: HTML variables will override the settings you save on your profile page.

Simple Hosted Solution Integration

T o integrate your website with Hosted Solution, identify a point in your website checkout flow

where you want to place a button that the buyer clicks to initiate the payment. The button

should be labeled Continue to Payment, Pay or similar, and when clicked, should execute a

Form POST to PayPal. Clicking on this button redirects the buyer’s browser to the PayPal

payment page where they can pay with debit or credit card, or their PayPal account.

The Form POST contains a set of HTML variables that describe the transaction and associate

it with your Website Payments Pro account. In the Form POST, you must specify the

following:

subtotal OR total - amount of the transaction

partner - the partner must be PayPalUK.

vendor - Your merchant login ID that you created when you registered for the account.

paymentaction - Indicates whether the transaction is for payment on a final sale or an

authorisation for a final sale (to be captured later).

Page 12

Integrating Your Website Using HTML

Simple Hosted Solution Integration

The default currency is USD. Additionally, you can specify the appropriate HTML variables

listed in Table 2.1, “HTML Variables for Settings of Payment Page to customise the

information collected on the payment page or Table 3.1, “HTML Variables for Look and Feel

of Payment Page to customise the look and feel of the page. If the payment is successful, then

the buyer either sees the PayPal confirmation page or is redirected to the URL you specify in

your configuration.

The return URL is appended with a Transaction ID on the query string during the redirect back

from the payment page to your website. This Transaction ID can be used to retrieve the status

and verify the authenticity of the transaction. For detailed information on verifying the

authenticity of the transaction before fulfilling the order, refer to Chapter 6, “Order

Processing.

Sample Integration

Below is an example of a simple Hosted Solution integration:

1. Sample Hosted Solution Form POST:

<form action="https://securepa yments.paypal.com/ cgi-bin/acquiringweb"

method="post">

<input type="hidden" name="cmd " value="_hosted-p ayment">

<input type="hidden" name="tot al" value="50.00">

<input type="hidden" name="par tner" value="PayPalUK ">

<input type ="hidden" name="vendor" va lue="vendorname">

<input type="hidden" name="pay mentaction" value= "sale">

<input type="hidden" name="return"

value="https://yourwebsite.com /receipt_page.html ">

<input type="submit" name="PayButto n" value="Pay">

</form>

The bold text is the value for the corresponding variable. It is recommended that you

enclose the values in quotes. For detailed information on these values, refer to Table 2.1,

“HTML Variables for Settings of Payment Page.

12

2. Output the HTML text into your website at the point where buyers will proceed with their

checkout.

3. Open your checkout page and test the button to ensure that it opens the PayPal payment

page.

Page 13

HTML Variables

The table below lists the Hosted Solution HTML variables you can use to send in additional

transaction information along with your web request. For a list of HTML variables that you

can use to customise the look and feel of your payment page, refer to Table 3.1, “HTML

Variables for Look and Feel of Payment Page.

TABLE 2.1 HTML Variables for Settings of Payment Page

Variable Description Mandatory

Integrating Your Website Using HTML

HTML Variables

address1

address2

address_override

billing_address1

billing_address2

billing_city

billing_country

billing_first_name

billing_last_name

billing_state

billing_zip

bn

Street name of shipping address. (1 of 2 fields) No

Street name of shipping address. (2 of 2 fields) No

The payer is shown the passed-in address but cannot edit

No

it. This variable is overridden if there are errors in the

address. The allowable values are true/false. Default is

false.

Street name of the billing address. (1 of 2 fields) No

Street name of the billing address. (2 of 2 fields) No

City name of the billing address. No

Country code of the billing address. No

First name of person the item is being billed to. No

Last name of person the item is being billed to. No

State name of the billing address. No

Zip code of the billing address. No

Identifies the source that built the code for the button.

Format -

<Company>_<Service>_<Product>_<Country>

No

buyer_email

cancel_return

cbt

city

country

currency_code

Email address of the buyer. No

The browser will be redirected to this URL if the buyer

No

clicks “Return to Merchant” link. Be sure to enter the

complete URL, including http:// or https://.

Sets the text for the “Return to Merchant” link on the

No

PayPal confirmation page. For business accounts, the

return button displays your business name in the place of

the word “Merchant” by default.

City name of shipping address. No

Country name of shipping address. No

The currency of the payment. The default is USD. No

13

Page 14

Integrating Your Website Using HTML

HTML Variables

ABLE 2.1 HTML Variables for Settings of Payment Page (Continued)

T

Variable Description Mandatory

custom

discount

first_name

handling

insurance

invoice

last_name

lc

A free-form field for your own use. This variable is never

No

presented to the buyer and will be returned in IPN

messages.

Shipping discount for this order. Specify the discount as a

No

positive amount.

Nine numeric characers plus decimal (.) character. No

currency symbol. Specify the exact amount to the cent

using a decimal point—use 34.00, not 34. Do not include

comma separators—use 1199.95 not 1,199.95.

First name of person the item is being shipped to. No

Handling charged. This amount is added to subtotal for

No

the total amount.

Total shipping insurance cost for this order.

Nine numeric characers plus decimal (.) character. No

currency symbol. Specify the exact amount to the cent

using a decimal point—use 34.00, not 34. Do not

include comma separators—use 1199.95 not 1,199.95.

Order number in the merchant’s ordering/invoice system. No

Last name of person the item is being shipped to. No

The language of the login or sign-up page. No

14

night_phone_a

night_phone_b

night_phone_c

notify_url

partner

The area code of the U.S. phone number, or the country

code of the phone number outside the U.S. This prepopulates the buyer’s home phone number.

The three-digit prefix for U.S. phone numbers, or the

entire non-U.S. phone number for numbers outside the

U.S., excluding the country code. This pre-populates the

buyer’s home phone number.

NOTE: Use this variable for non-US numbers.

The four-digit phone number for U.S. phone numbers.

This pre-populates the buyer’s home phone number.

The URL to which PayPal posts information about the

transaction in the form of Instant Payment Notification. Be

sure to enter the complete URL, including http:// or

https://.

ID provided to you by the authorized PayPal reseller who

registered you for Payflow. If you purchased your account

directly from PayPal, use PayPalUK.

No

No

No

No

Yes

Page 15

Integrating Your Website Using HTML

HTML Variables

T

ABLE 2.1 HTML Variables for Settings of Payment Page (Continued)

Variable Description Mandatory

paymentaction

return

shipping

state

subtotal

tax

vendor

Indicates whether the transaction is for payment on a final

Yes

sale or an authorisation for a final sale (to be captured

later).

Allowable Values: - authorization or sale

Default Value - sale

The URL to which the buyer’s browser is redirected to

No

after completing the payment. Be sure to enter the

complete URL, including http:// or https://.

Shipping charged. This amount is added to subtotal for

No

the total amount.

State of the shipping address. No

Amount charged for the transaction. If shipping, handling,

Yes

taxes, insurance, and discount are not specified, this is the

total amount charged. The value must include a decimal

and the exact amount to the cent (42.00, not 42). Do not

include comma separators (1234.56, not 1,234.56).

You must either pass

Taxes charged. This amount is added to subtotal for the

subtotal or total.

No

total amount.

Your merchant login ID that you created when you

Yes

registered for the account.

total

zip

Total transaction amount, including shipping, handling,

taxes, insurance, and discount. The value must include a

decimal and the exact amount to the cent (42.00, not 42).

Do not include comma separators (1234.56, not 1,234.56).

Postal code of the shipping address. No

15

Page 16

Integrating Your Website Using HTML

HTML Variables

16

Page 17

Customising Your PayPal

3

Payment Page

You can customise the look and feel of the PayPal payment page in the following two ways:

Modifying Your PayPal Account Settings

Adding HTML Variables

NOTE: HTML variables will override the settings you save on your profile page.

Modifying Your PayPal Account Settings

In your Service Settings section on PayPal Manager, you can change the look and feel of the

payment page by modifying the settings on the following pages under the Hosted Checkout

Pages section.

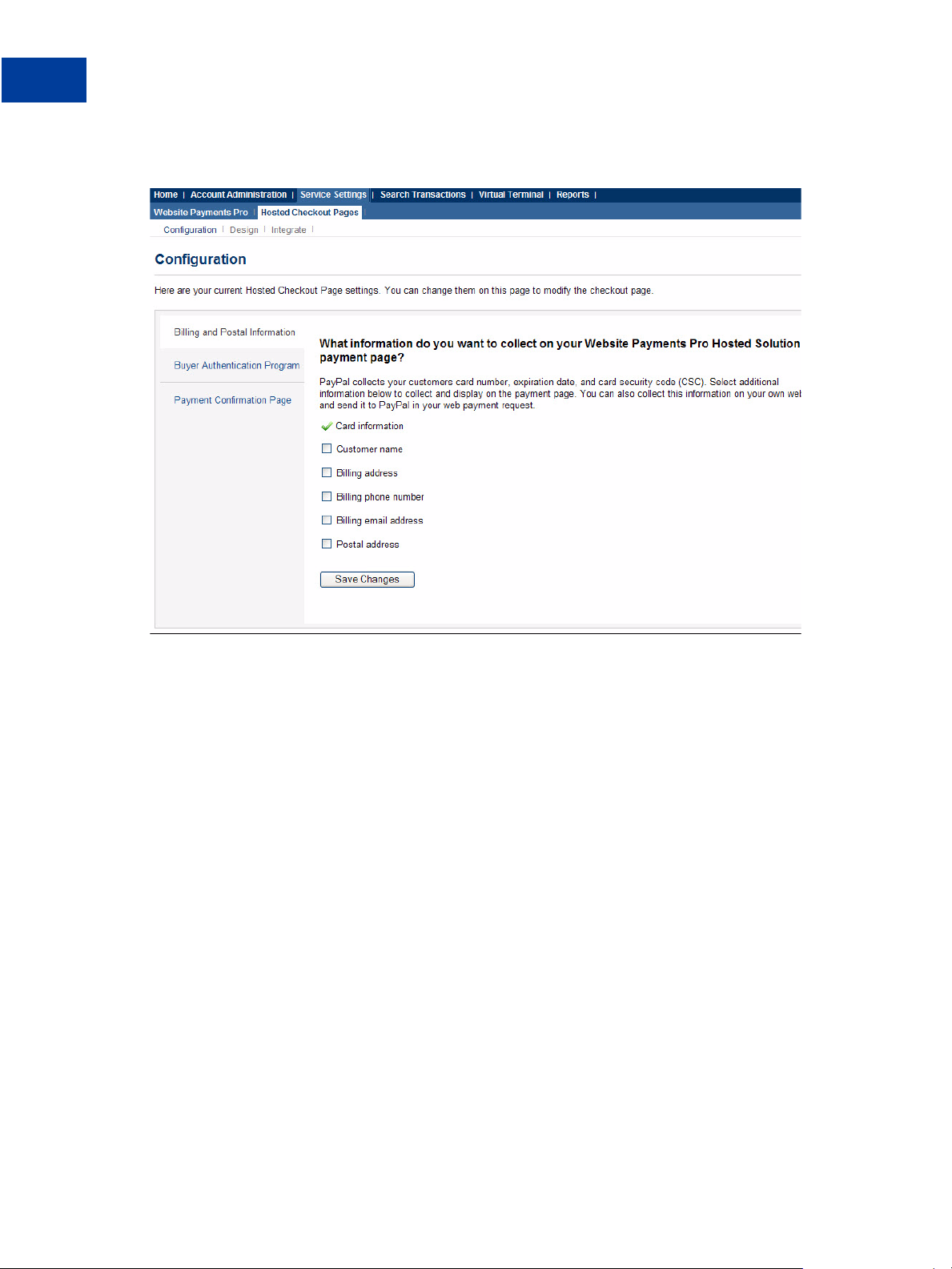

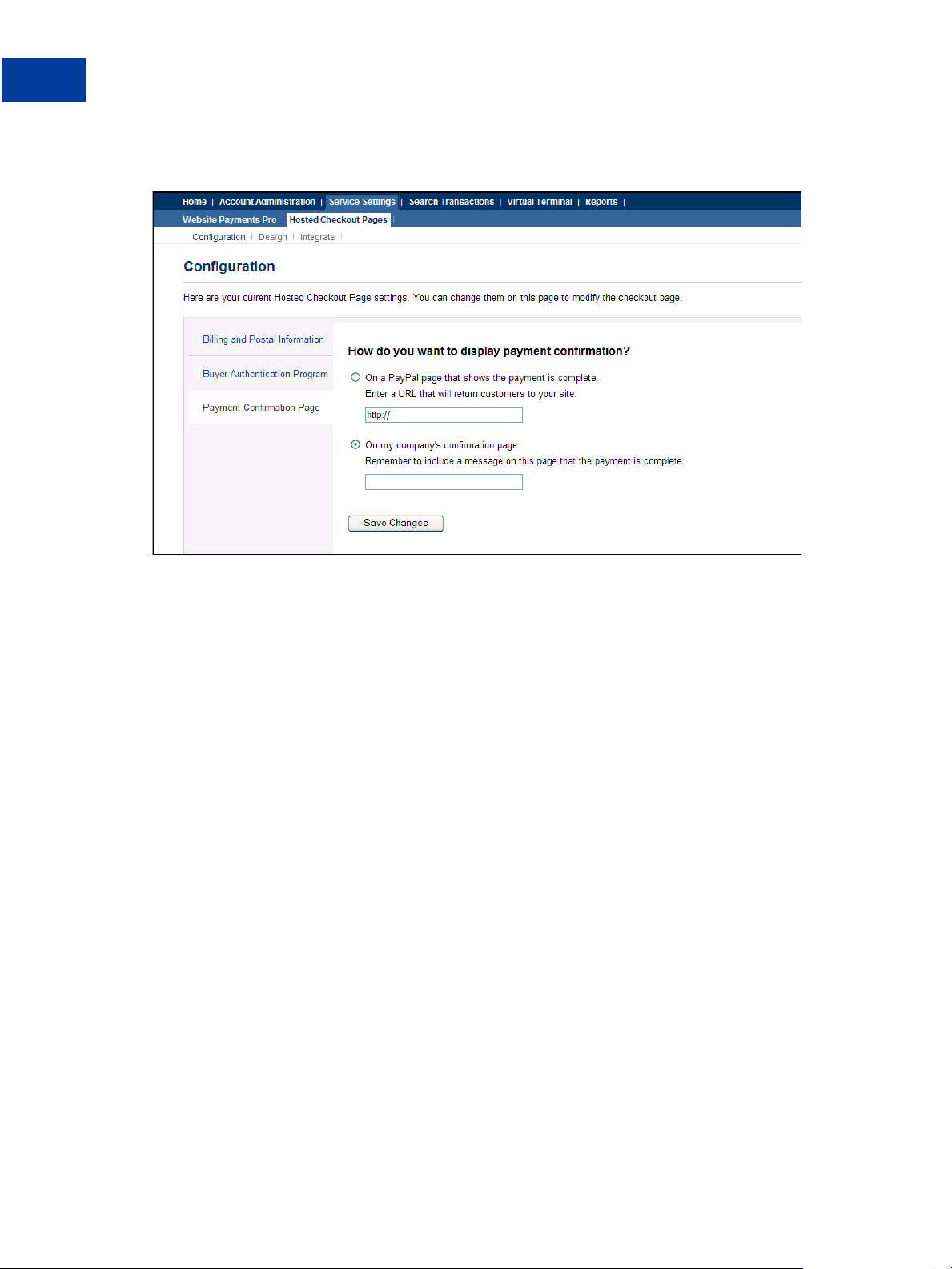

Configuration

Design

Configuration

This page allows you to select the information you want to collect and display on your

payment page, verify enrollment in a buyer authentication program, and decide how you want

to display the payment confirmation.

You can make these selections in the following sections:

Billing and Postal Information

Buyer Authentication Program

Payment Confirmation Page

17

Page 18

Customising Your PayPal Payment Page

Modifying Your PayPal Account Settings

Billing and Postal Information

PayPal recommends that you display as few options as possible on the payment page. For

example, you may have already collected shipping address on your own website in order to

calculate the shipping cost and passed it on to PayPal's payment page. Therefore, it is not

necessary to show this option on the payment page again.

You could have information that has already been collected on your website, but you may

want to pass it to PayPal and display it on the hosted payment page again. This information

will be pre-filled and editable on this page.

You can select the fields that are displayed on your hosted payment page. You have the

following options:

Card Information - Buyer's credit card information. This field is always displayed and

selected by default.

Customer Name - Buyer's first and last name

Billing Address - Buyer's billing address

Billing Phone Number - Buyer's phone number

Billing Email Address - Buyer's email address

Postal Address - Buyer's shipping address.

18

Page 19

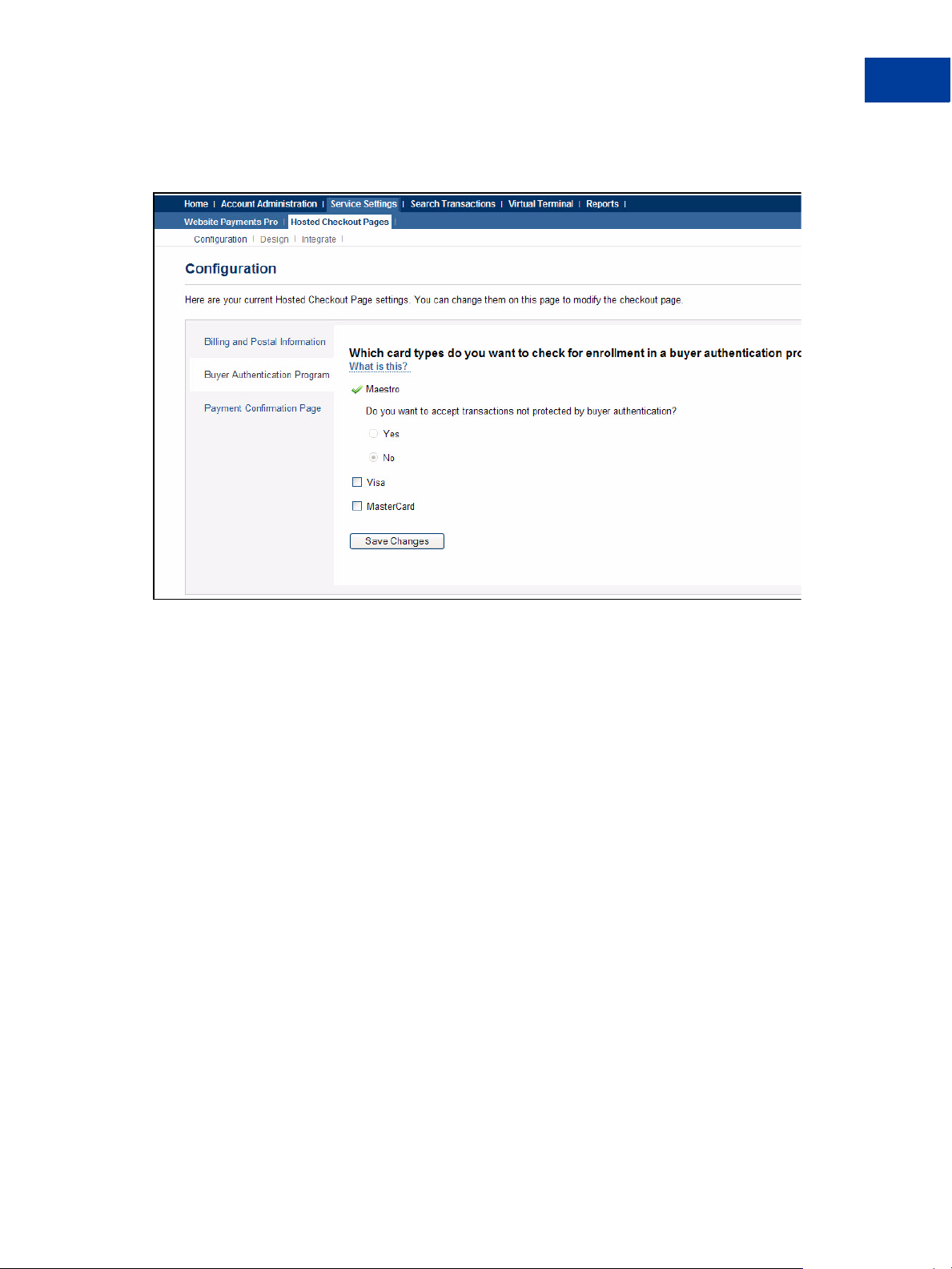

Buyer Authentication Program

Customising Your PayPal Payment Page

Modifying Your PayPal Account Settings

You can check Maestro, Visa, and MasterCard card types for enrollment in a buyer

authentication program like 3-D Secure. 3-D Secure implementation such as Verified by Visa

or MasterCard SecureCode is an additional form of authentication which provides a credit and

debit card holder another layer of security while paying for online purchases. This deters the

unauthorised use of the buyer’s credit or debit card during online purchases and also reduces

the chargeback rate for the merchants implementing this scheme.

NOTE: It is mandatory that Maestro is checked for enrollment in the buyer authentication

program.

After selecting a card type to check for enrollment, you can also choose to accept transactions

that are not protected by buyer authentication (transactions that do not pass the 3-D Secure

check). You have the following options for such transactions:

Yes - PayPal processes these transactions as non-buyer authentication transactions.

No - PayPal rejects these transactions.

Page 20

Customising Your PayPal Payment Page

Modifying Your PayPal Account Settings

Payment Confirmation Page

Once the transaction is successful, you can choose to display your payment confirmation on

either a PayPal's confirmation page or on your own payment confirmation page.

On a PayPal page that shows the payment is complete - The payment confirmation

appears on the PayPal confirmation page. Optionally, you can also provide a URL on the

confirmation page to take your buyer back to your website. To do so, enter the appropriate

URL in the field provided.

On the Company's confirmation page - The payment confirmation will appear on your

own payment confirmation page. For this, enter the URL of the page that will display the

payment confirmation. You will have to message the outcome of the transaction to the

buyer when PayPal redirects back to this URL. Be sure to display specifics of the order so

the buyer sees a meaningful confirmation. You can get the specifics of the order using the

Transaction ID we pass back to you with the return URL.

20

Page 21

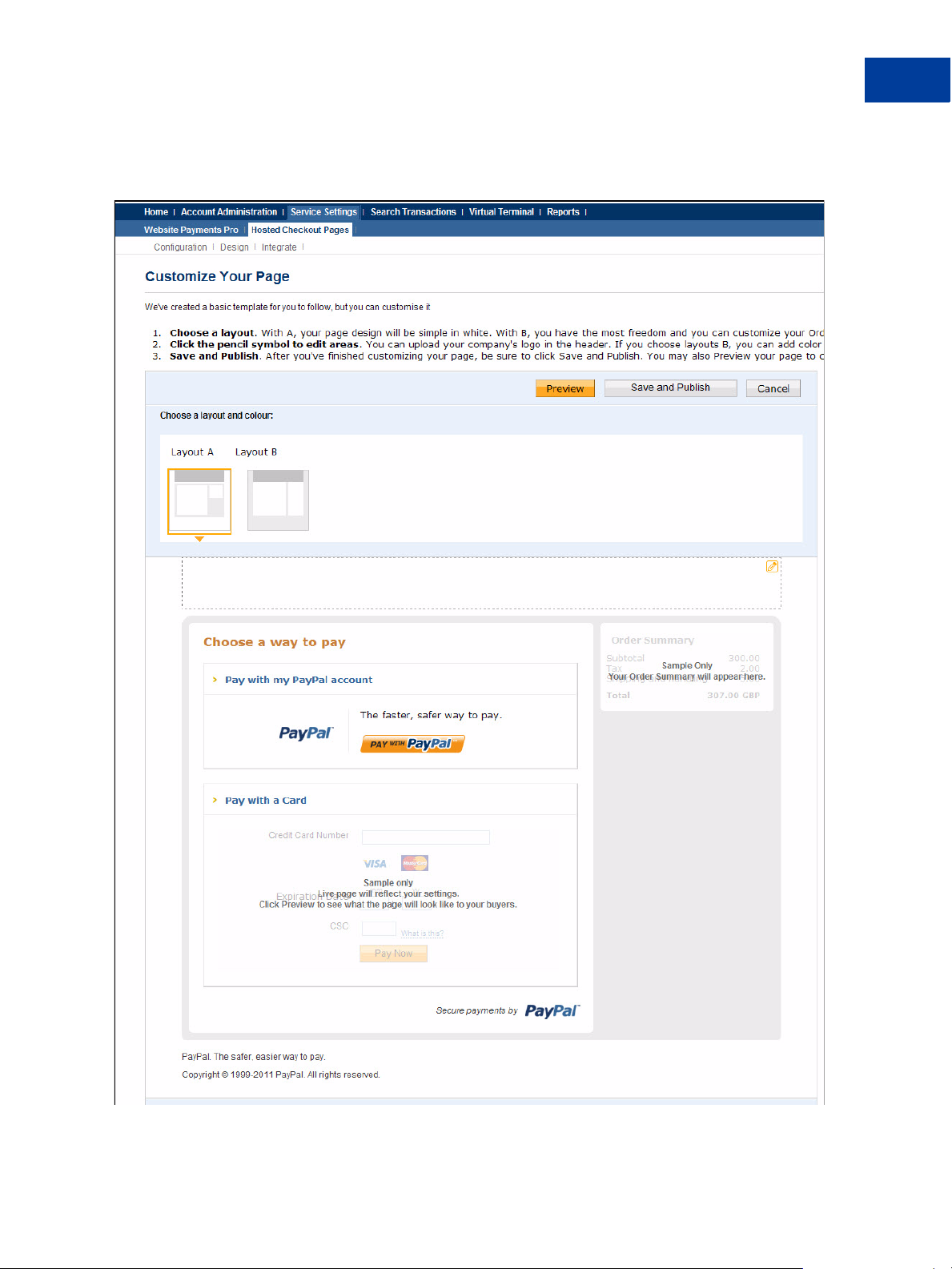

Design

Customising Your PayPal Payment Page

Modifying Your PayPal Account Settings

Page 22

Customising Your PayPal Payment Page

Modifying Your PayPal Account Settings

This page allows you to customise your payment page. You can customise the header,

background, title, button, and the order summary column of your payment page.

PayPal offers two design templates or layouts for you to choose from. Template or Layout A is

the default template, however, you can choose either templates.

NOTE: Your buyers will not see the payment page until you have completed the HTML

integration with your website.

Preview the design of your payment page. You can either change the design of your template,

or select and customise a different template on this page. To make changes, left-click on the

section you are trying to modify or the corresponding Click to Edit button for that section. On

the pop-up that appears, click the color selector to change the color, or enter the appropriate

URL, as needed.

If the buyer pays by logging into PayPal, the look and feel of that flow can be customised

through the customisation options on the Profile page.

After making the changes, click one of the following buttons:

Preview - Preview the changes you have made to your template before saving and

publishing it.

Save and Publish - Save all the changes you have made and publish the updated template.

Your buyers will see the updated payment page.

Cancel - Discard all the changes you have made in this session.

Undo Changes - Discard all changes you have made since the last time you saved the

template. Your buyers will see the last saved template.

NOTE: You must make all modifications (including changing templates) within the same

session, otherwise all changes will be lost and you will have to redo your changes. If

the session times out, the design of the template will remain at the version that was last

published.

22

Page 23

Customising Your PayPal Payment Page

Modifying Your PayPal Account Settings

Choosing a Layout

Choose from the following two design templates or layouts:

Template A Template B

Template A. Selected by default - you can customise the header.

FIGURE 3.1 Template A

Page 24

Customising Your PayPal Payment Page

Modifying Your PayPal Account Settings

Template B. Customise the header, background, title, button, and the order summary column.

FIGURE 3.2 Template B

24

Page 25

Customising Your PayPal Payment Page

Modifying Your PayPal Account Settings

Customising Your Layout

Consider the following when you customise your template:

Header (applicable to Template A and B) - By default, the business name from your

profile is shown in the header. You can change the following:

– Header height and color

– Font type, size, and color

– Swap between displaying the business name or the business logo image

– Position of the business name or the logo

NOTE: We recommend that you host your images on a secure server (https://) to avoid the

security dialog window that may hurt conversion.

Background (applicable to Template B) - You can change the following:

– Background color

– Background image URL

Title and Button (applicable to Template B) - You can change the following:

–Header color

– Title bar color and title text color

– Button color and button text color

Page 26

Customising Your PayPal Payment Page

Adding HTML Variables

Adding HTML Variables

The table below lists the Hosted Solution HTML variables you can use to customise the look

and feel of your payment page.

TABLE 3.1 HTML Variables for Look and Feel of Payment Page

Variable Description

bodyBgColor

bodyBgImg

footerTextColor

headerBgColor

headerHeight

logoFont

logoFontColor

logoFontSize

logoImage

logoImagePosition

logoText

Color of the surrounding background of the payment page.

Image of the surrounding background of the payment page. The file

extension can be .gif, .jpg, .jpeg, or .png format.

Color of the footer text.

Color of the header background.

Height of the header banner. It can be from 50 to 140 pixels. The

width cannot be changed. It is always 940 pixels.

Font type of the logo text.

Color of the logo text.

Font size of the logo text.

Image displayed in the logo. The acceptable file extension formats

are .gif, .jpg, .jpeg, or .png. The width of the image cannot be more

than 940 pixels.

Position of the image in the logo.

Business name displayed on your profile page. This fi eld is editable

and text specified here is displayed on the header if logoImage is not

specified.

26

orderSummaryBgColor

orderSummaryBgImage

pageButtonBgColor

pageButtonTextColor

pageTitleTextColor

sectionBorder

Color of the Order Summary column on the right side of the payment

page. You cannot change the color of the Order Summary box.

Background image you can put in the Order Summary Column. The

acceptable file extension formats are .gif, .jpg, .jpeg, or .png.

Background color of the Pay Now button.

Color of the Pay Now button. You cannot change the text of the

button.

Color of the text used in the title of the page. (Text that says “Choose

a way to pay.”)

Background of the section that displays “Pay with my PayPal

account” or “Pay with a Card”.

Page 27

Customising Your PayPal Payment Page

T

ABLE 3.1 HTML Variables for Look and Feel of Payment Page

Variable Description

Adding HTML Variables

showCustomerName

showBillingAddress

showBillingPhone

showBillingEmail

showHostedThankyouPage

showShippingAddress

Display customer name (first name and last name).

Default Value: true

Allowable Value: true or false, where true = show and false =

hide.

Display billing address information.

Default Value: true

Allowable Value: true or false, where true = show and false =

hide.

Display billing phone number.

Default Value: true

Allowable Value: true or false, where true = show and false =

hide.

Display email address for billing purposes.

Default Value: false

Allowable Value: true or false, where true = show and false =

hide.

Display PayPal’s confirmation page.

Default Value: true

Allowable Value: true or false, where true = show and false =

hide.

Display shipping address.

Default Value: false

Allowable Value: true or false, where true = show and false =

hide.

subheaderText

template

Color of the “Pay with my PayPal account” or “Pay with a Card”

text.

Template used for your payment page. Options are TemplateA and

T emplateB. TemplateD is used for iFrame integration only and is not

an option on the Customization page on PayPal.com.

Page 28

Customising Your PayPal Payment Page

Adding HTML Variables

28

Page 29

4

Integrating iFrame in Your Web si t e

PayPal offers a compact payment form that can be integrated in an iFrame on your website.

Since this form is integrated on your website, the buyer never leaves your website, thereby

reducing potential drop-offs. You can also maintain your checkout look and feel in the master

frame that surrounds the compact payment form. The credit card fields are part of the compact

payment form so you do not have to collect this information separately. The form also supports

3-D Secure frames.

IMPORTANT: Due to security concerns involving iFrame, the following browsers are

supported and secure to use - Internet Explorer 8.0, Opera 10.50, Firefox 8.0,

Chrome 4.1, Safari 4.0. Transactions involving users of other browsers

should not use the iFrame flow or abandon the transaction. Additionally,

there is another risk beyond the iFrame flow - should the PayPal iFrame

become the source of an attack, it would appear that the attack is originating

from the merchant site; do not use the iFrame flow if you wish to avoid this

additional risk.

NOTE: Due to spoof concerns, the form does not contain any PayPal branding.

The compact payment form contains the following fields:

Credit card number

Expiry date

CVV2 number (if applicable, based on the card type)

Any additional fields required for other card types, such as start date and issue number for

Maestro or Switch.

The form also offers the following options:

Remove the Pay with PayPal button. Although the form offers the option to pay using

PayPal account by default, you can contact your account manager or customer support to

turn this option off.

Manually customize the color of the Pay Now button.

IMPORTANT: The compact payment form does not display the buyer's billing address, even

if showBillingAddress=true is passed. However, for some merchants,

it may be necessary to pass the billing address to successfully process the

transactions.

Page 30

Integrating iFrame in Your Website

Integrating iFrame

Integrating iFrame

Choose one of the following methods to integrate the compact payment form in your website:

HTML Integration

API Integration

IMPORTANT: For optimal performance, PayPal recommends that you load the iFrame asset

before other assets such as images and JavaScripts. If there are too many

assets running on your payment page when you load iFrame, the request for

the iFrame may not be placed or might get delayed. This may result in the

buyers seeing a blank iFrame.

HTML Integration

To manually integrate the compact payment form in your website, perform the following

steps:

1. Enter the iFrame tag at the location where you want the compact payment form to appear

on your website. For example:

<iframe name="hss_iframe" widt h="570px" height=" 540px"></iframe>

The allowable size for the compact payment form is 570 pixels in width to 540 pixels in

height.

2. Below is the iFrame code, add the hidden form that is populated with the appropriate

Hosted Solution variables (including the total amount to be paid) and specify the variable

TemplateD. For example,

<form style="display:none" tar get="hss_iframe" n ame="form_iframe"

method="post"

action="https://securepayments .paypal.com/cgi-bi n/acquiringweb">

<input type="hidden" name="cmd " value="_hosted-p ayment">

<input type="hidden" name="tot al" value="50.00">

<input type="hidden" name="par tner" value="PayPa lUK">

<input type="hidden" name="vendor" val ue="vendorname">

<input type="hidden" name="pay mentaction" value= "sale">

<input type="hidden" name="tem plate" value="templat eD">

<input type="hidden" name="return"

value="https://yourwebsite.com /receipt_page.html ">

</form>

30

3. Ensure that the target name matches the iFrame name, as hig hlighted in th e exampl e below:

<iframe name="hss_iframe" widt h="570px" height=" 540px"></iframe>

<form style="display:none" tar get="hss_iframe" name ="form_iframe"

method="post"

action="https://securepayments .paypal.com/cgi-bi n/acquiringweb">

Page 31

Integrating iFrame in Your Website

Integrating iFrame

4. Submit the form using JavaScript. For example:

<script type="text/javascript" >

document.form_iframe.subm it();

</script>

Example of Manual Integration

The complete example as per the above steps is as follows:

<iframe name="hss_iframe" widt h="570px" height=" 540px"></iframe>

<form style="display:none" tar get="hss_iframe" n ame="form_iframe"

method="post"

action="https://securepayments .paypal.com/cgi-bi n/acquiringweb">

<input type="hidden" name="cmd " value="_hosted-p ayment">

<input type="hidden" name="tot al" value="50.00">

<input type="hidden" name="par tner" value="PayPa lUK">

<input type="hidden" name="vendor" val ue="vendorname">

<input type="hidden" name="pay mentaction" value= "sale">

<input type="hidden" name="tem plate" value="temp lateD">

<input type="hidden" name="return"

value="https://yourwebsite.com /receipt_page.html ">

</form>

<script type="text/javascript" >

document.form_iframe.subm it();

</script>

API Integration

To integrate the compact payment form in your website using the API, refer to “Using the

Button Manager API with Hosted Solution Checkout” on page 36.

NOTE: Use template=templateD for this type of integration.

There are two options in the response to initiate the Hosted Solution payment flow:

Using URL Returned in the Response

Using Form POST

31

Page 32

Integrating iFrame in Your Website

Integrating iFrame

Using URL Returned in the Response

In the URL identified in the response as EMAILLINK, add “src” for iFrame as per the

example below to redirect the buyer and initiate the payment flow.

<iframe src="https://www.paypa l.com/...?hosted_b utton_id=HSS-.."

width="570px" height="540px"></if rame>

The allowable size of the compact payment form is 570 pixels in width to 540 pixels in height

Using Form POST

Identify the WEBSITECODE in the response and use the code to create a Pay Now button on

your review page. When your buyer clicks the button, they are redirected to the PayPal hosted

payment page. Like the URL, the button is usable for approximately two hour or until the

payment is successful.

1. Enter the iFrame tag at the location where you want the compact payment form to appear

on your website. For example:

<iframe name="hss_iframe" widt h="570px" height=" 540px"></iframe>

The allowable size for the compact payment form is 570 pixels in width to 540 pixels in

height.

2. Insert the following in the iFrame tag:

<form action="https://www.payp al.com/cgi-bin/web scr" method="post">

<input type="hidden" name="cmd " value="_s-xclick ">

<input type="hidden" name="hos ted_button_id" val ue="HSSbXkpgPTNgZi7CyfIwWTAkWPSDbKzio kU">

<input type="image" src="https://w ww.paypal.com/i/btn/btn_paynow_LG.gif"

border="0" name="submit" alt=" PayPal - The safer , easier way to pay

online.">

<img alt="" border="0" src="ht tps://www.paypal.c om/i/scr/pixel.gif"

width="1" height="1">

</form>

3. Submit the form using JavaScript. For example:

<script type="text/javascript" >

document.form_iframe.subm it();

</script>

32

Page 33

Integrating iFrame in Your Website

Integrating iFrame

Example of API (Form POST) Integration

The complete example as per the above steps is as follows:

<iframe name="hss_iframe" widt h="570px" height=" 540px"></iframe>

<form action="https://www.payp al.com/cgi-bin/web scr" method="post">

<input type="hidden" name="cmd " value="_s-xclick ">

<input type="hidden" name="hos ted_button_id" val ue="HSSbXkpgPTNgZi7CyfIwWTAkWPSDbKzio kU">

<input type="image" src="https://ww w.paypal.com/i/btn/bt n_paynow_LG.gif"

border="0" name="submit" alt=" PayPal - The safer , easier way to pay

online.">

<img alt="" border="0" src="ht tps://www.paypal.c om/i/scr/pixel.gif"

width="1" height="1">

</form>

<script type="text/javascript" >

document.form_iframe.subm it();

</script>

33

Page 34

Integrating iFrame in Your Website

Integrating iFrame

34

Page 35

5

Integrating Your Website Using API

Using the Button Manager API, you can programmatically create the checkout button that

initiates the Hosted Solution checkout flow on your website. You create the checkout button

dynamically when the buyer attempts to checkout on your website. When the buyer clicks on

your checkout button, you call the BMCreateButton API operation to create a checkout

button and display it on your web page. When the buyer clicks on this checkout button, he or

she is redirected to the PayPal payment page where he or she can complete the payment. You

can use 3-D Secure functionality on the PayPal payment page.

HTML variables control the presentation of the PayPal payment pages, the information

contained on the pages, and pages to which your buyer can be returned to when leaving the

payment pages. For a list of HTML variables, refer to

For complete information on the Button Manager API, refer to the Button Manager API (NVP)

or Button Manager API (SOAP).

NOTE: Using the Button Manager API, you can programmatically create the checkout button,

but not manage, edit, or delete it.

“HTML Variables” on page 13.

Button Hosting

For Hosted Solution, using BUTTONTYPE=PAYMENT, you can create the following kinds of

checkout buttons:

Token buttons (BUTTONCODE=TOKEN) are not stored on PayPal. They are dynamic and

initiate the Hosted Solution checkout flow. The parameters associated with this kind of

button are secure. They have a lifetime of approximately two hours, if not used.

Encrypted buttons (BUTTONCODE=ENCRYPTED) are not stored on PayPal. The

parameters associated with this kind of button are encrypted. You must update the web

pages that use an encrypted button each time the button or the associated information

changes.

Clear text buttons (BUTTONCODE=CLEARTEXT) are not stored on PayPal. The

parameters associated with this kind of button are not encrypted. They can be used

dynamically because you can change the value of a parameter anytime. However, if you

use them, recognize the risk that sensitive information can be altered or stolen.

NOTE: Hosted buttons (BUTTONCODE=HOSTED) are not supported for Hosted Solution and

will return an error if used.

For more information about Button Manager API usage, refer to “BMCreateButton API

Operation” on page 42.

Page 36

Integrating Your Website Using API

Using the Button Manager API with Hosted Solution Checkout

Using the Button Manager API with Hosted Solution Checkout

NOTE: Before using the Button Manager API, you must acquire PayPal API credentials. For

more information, refer to

T o create a checkout butto n on your webs ite, you call th e BMCreateButton API operation.

When the buyer clicks on the checkout button, PayPal initiates the Hosted Solution checkout

flow.

You must decode the response from the BMCreateButton API. For information about URL

encoding, refer to the

Name-Value Pair API Developer Guide.

There are two options in the response to initiate the Hosted Solution payment flow:

Using URL Returned in the Response (Recommended)

Using Form POST

Using URL Returned in the Response (Recommended)

Appendix A, “Obtaining API Credentials.

36

Using the URL identified in the response as EMAILLINK, you can redirect the buyer and

initiate the payment flow.

NOTE: PayPal recommends using TOKEN or ENCRYPTED.

Page 37

Integrating Your Website Using API

Using the Button Manager API with Hosted Solution Checkout

Example of TOKEN

EMAILLINK=https://securepaymen ts.paypal.com/cgi- bin/webscr?cmd=_sxclick&hosted_button_id=HSS-1P ncRuoWdOkE2cDn3bIs Tr-5ODQUxac&HOSTEDBUTTONID=HSS-1PncRuo WdOkE2cDn3bIsTr-5O DQU-xac&TIMESTAMP=201 1-0817T22:58:45Z&CORRELATIONID=536 6c981124b1&ACK=Suc cess&VERSION=65.0&BUI LD=206

6255

Example of ENCRYPTED

EMAILLINK=https://securepaymen ts.paypal.com/acqu iringweb?cmd=_hostedpayment¤cy_code=GBP&paym entaction=sale&shi pping=1&tax=1&return= http%3

a%2f%2fwww%2epaypal%2ecom&part ner=PayPalUK&vendo r=ukpro2002&total=7&s ubtota

l=1&TIMESTAMP=2011-0817T22:59:57Z&CORRELATIONID=3b7 6bdaf28f3e&ACK=Suc cess&VERSION=65.0&BUI LD=206

6255

Example of CLEARTEXT

EMAILLINK=https://securepaymen ts.paypal.com/acqu iringweb?cmd=_hostedpayment¤cy_code=GBP&paym entaction=sale&shi pping=1&tax=1&return= http%3

a%2f%2fwww%2epaypal%2ecom&part ner=PayPalUK&vendo r=ukpro2002&total=7&s ubtota

l=1&TIMESTAMP=2011-0817T23:00:57Z&CORRELATIONID=6dc c37afaa5ec&ACK=Suc cess&VERSION=65.0&BUI LD=206

6255

The button variables control the presentation in the flow and the information that is provided

to the buyer initially . Because the URL is associated with a Hosted S olution token, the URL is

usable for approximately two hours after it is created or until the payment is successful.

Using Form POST

37

Page 38

Integrating Your Website Using API

Using the Button Manager API with Hosted Solution Checkout

Identify the WEBSITECODE in the response and use the code to create a Pay Now button on

your review page. When your buyer clicks the button, they are redirected to the PayPal hosted

payment page. Like the URL, the button is usable for approximately two hours or until the

payment is successful.

NOTE: PayPal recommends using TOKEN or ENCRYPTED.

Example for TOKEN

WEBSITECODE=<form action="https://securepayments.paypal.com/cgi-bin/webscr"

method="post">

<input type="hidden" name="cmd " value="_s-xclick ">

<input type="hidden" name="hos ted_button_id" val ue="HSS1PncRuoWdOkE2cDn3bIsTr-5ODQU-x ac">

<input type="image"

src="https://www.paypal.com/en _GB/i/btn/btn_paynow_ LG.gif" border="0"

name="submit" alt="PayPal — Th e safer, easier wa y to pay online.">

<img alt="" border="0" src="ht tps://www.paypal.c om/en_GB/i/scr/pixel. gif"

width="1" height="1">

</form>

Example for ENCRYPTED

WEBSITECODE=<form action="https://securepayments.paypal.com/cgi-bin/webscr"

method="post">

<input type="hidden" name="cmd " value="_s-xclick ">

<input type="hidden" name="encrypte d" value="-----BEGIN PKCS7 ----MIIHkwYJKoZIhvcNAQcEoIIHhDCCB4 ACAQExggE0MIIBMAIB ADCBmDCBkjELMAkGA1UEB hMCVVM

xCzAJBgNVBAgTAkNBMRYwFAYDVQQHE w1Nb3VudGFpbiBWaWV 3MRQwEgYDVQQKEwtQYXlQ YWwgSW

5jLjEVMBMGA1UECxQMc3RhZ2UyX2Nl cnRzMRMwEQYDVQQDFA pzdGFnZTJfYXBpMRwwGgY JKoZIh

vcNAQkBFg1yZUBwYXlwYWwuY29tAgE AMA0GCSqGSIb3DQEBA QUABIGAsqS5KoYWmzqj2c rl/I9v

a72rukNNWuxh2TBBhhx4P7DGcYeIzA 82FzS3MmZTJfY2VydH MEwHwweqfs3yBjMA0GCSq GSIb3D

QEBAQUABIGAdW7vFpnU+jbGW1if7YC AsMiViJbw5HKK3TNke Jvv8pxFZetWb3HO0KWM3z zaPz1v

URBuDCQa8l4RlEb3n/zT7k2/eusAq4 LbS6YEPu2od/AUTDky DSCA32XBjS78yzpJ5KHTW 4eoeff

l8pCEkrcRwfV4hyqsSgTOuvfPOBer3 yA=-----END PKCS7- ---">

<input type="image"

src="https://www.paypal.com/en _GB/i/btn/btn_paynow_ LG.gif" border="0"

name="submit" alt="PayPal — Th e safer, easier wa y to pay online.">

<img alt="" border="0" src="ht tps://www.paypal.c om/en_GB/i/scr/pixel. gif"

width="1" height="1">

</form>

38

Example of CLEARTEXT

WEBSITECODE=<form action="http s://securepayments .paypal.com/acquiring web"

method="post">

<input type="hidden" name="cmd " value="_hosted-p ayment">

<input type="hidden" name="cur rency_code" value= "GBP">

<input type="hidden" name="pay mentaction" value= "sale">

<input type="hidden" name="return" val ue="http://www.yourwe bsite.com">

<input type="hidden" name="par tner" value="PayPa lUK">

<input type="hidden" name="vendor" val ue="ukpro2002">

<input type="hidden" name="tot al" value="7">

Page 39

Integrating Your Website Using API

Using the Button Manager API with Hosted Solution Checkout

<input type="hidden" name="sub total" value="1">

<input type="image"

src="https://www.paypal.com/en _GB/i/btn/btn_paynow_ LG.gif" border="0"

name="submit" alt="PayPal — Th e safer, easier wa y to pay online.">

<img alt="" border="0" src="ht tps://www.paypal.c om/en_GB/i/scr/pixel. gif"

width="1" height="1">

</form>

NOTE: The PayPal payment page displays a button identified as Pay Now to complete the

checkout flow. The Pay Now button on the PayPal page is different than the Pay Now

button created by the BMCreateButton API operation on the review page. You may

need to change the URL for the latter in BUTTONIMAGEURL to avoid confusion.If a

URL is not specified in BUTTONIMAGEURL, then the default Pay Now is used for the

button.

Encrypting Buttons Using Public and Private Key

Using Encrypted Website Payments helps secure payment buttons that you generate or write

manually. Encrypted Website Payments protects the HTML button code that contains pricing

information by encrypting it. HTML button code that you protect by using Encrypted Website

Payments cannot be altered by malicious third parties to create fraudulent payments. For

detailed information, refer to

Payments

Chapter 7, “Protecting Buttons by Using Encrypted Website

Example of Initiating Hosted Solution Checkout

The example shows the NVP parameters using BUTTONCODE=TOKEN for creating a URL to

initiate the Hosted Solution checkout flow. Refer to

parameters in the example.

TABLE 5.1 API Credentials

Parameter Value

USER

PWD

VERSION

SIGNATURE

(Required) Your PayPal API Username

(Required) Your PayPal API Password

(Required) Version number of the NVP API service, such as 80.0

(Optional) Your PayPal API signature string. If you use an API certificate,

do not include this parameter.

Table 5.1 for more information about the

39

Page 40

Integrating Your Website Using API

Using the Button Manager API with Hosted Solution Checkout

<form method=post action=https ://api-3t.paypal.c om/nvp>

<input type=hidden size=40 nam e="USER" value=you r PayPal API usernam e>

<input type=hidden size=40 nam e="PWD" value=your PayPal API password >

<input type=hidden size=80 nam e="SIGNATURE" valu e=Your PayPal API

Signature>

<input type=hidden name="VERSION" value= 80.0>

<input type=hidden name="BUTTONCODE " value=token>

<input type=hidden name="BUTTONTYPE " value=payment>

<input type=hidden size=40 nam e="L_BUTTONVAR0" v alue="paymentaction=s ale">

<input type=hidden size=40 nam e="L_BUTTONVAR1" v alue="partner=PayPalU K">

<input type=hidden size=40 nam e="L_BUTTONVAR2" v alue="your vendor nam e">

<input type=hidden name="L_BUT TONVAR3" value="in voice=12345678">

<input type=hidden name="L_BUT TONVAR4" value="lc =GB">

<input type=hidden name="L_BUT TONVAR5 " value="to tal=0.50">

<input type=hidden name="L_BUTTONVA R6" value="subtotal=0.10">

<input type=hidden name="L_BUTTONVA R7" value="shipping=0.01">

<input type=hidden name="L_BUTTONVA R8" value="handling=0.01">

<input type=hidden name="L_BUTTONVA R9" value="tax=0.01">

<input type=hidden name="L_BUT TONVAR10" value="c urrency_code=GBP">

<input type=hidden size=40 nam e="L_BUTTONVAR11" value="showCardInfo=t rue">

<input type=hidden size=40 nam e="L_BUTTONVAR12"

value="showCustomerName=true">

<input type=hidden size=40 nam e="L_BUTTONVAR13"

value="showBillingAddress=true ">

<input type=hidden size=40 nam e="L_BUTTONVAR14"

value="showBillingPhone=true">

<input type=hidden size=40 nam e="L_BUTTONVAR15"

value="showBillingEmail=true">

<input type=hidden size=40 nam e="L_BUTTONVAR16"

value="showShippingAddress=tru e">

<input type=hidden size=40 nam e="L_BUTTONVAR17"

value="showHostedThankyouPage= true">

<input type=hidden size=40 nam e="L_BUTTONVAR18"

value="notify_url=http://your IPN URL">

<input type=hidden size=40 nam e="L_BUTTONVAR19" value="custom=custom

information here">

<input type=hidden size=40 nam e="L_BUTTONVAR20"

value="cancel_return=http://yo ur merchant URL">

<input type=hidden size=40 nam e="L_BUTTONVAR21" value="return=http:// your

merchant URL">

<input type=hidden name="L_BUT TONVAR22" value="f irst_name=Mr.">

<input type=hidden name="L_BUT TONVAR23" value="l ast_name=Chau">

<input type=hidden name="L_BUT TONVAR24" value="a ddress1=Gardens">

<input type=hidden name="L_BUT TONVAR25" value="a ddress2=99343 ba">

<input type=hidden name="L_BUT TONVAR26" value="c ity=Paris">

<input type=hidden name="L_BUT TONVAR27" value="s tate=Alsac">

<input type=hidden name="L_BUT TONVAR28" value="z ip=75002">

<input type=hidden name="L_BUT TONVAR29" value="c ountry=FR">

<input type=hidden size=40 nam e="L_BUTTONVAR30"

value="billing_first_name=John ">

40

Page 41

Integrating Your Website Using API

Using the Button Manager API with Hosted Solution Checkout

<input type=hidden size=40 nam e="L_BUTTONVAR31"

value="billing_last_name=Tiger ">

<input type=hidden size=40 nam e="L_BUTTONVAR32"

value="billing_address1=5088 C raven Hill Gardens ">

<input type=hidden size=40 nam e="L_BUTTONVAR33"

value="billing_address2=Apt# 1 99343 ba">

<input type=hidden size=40 nam e="L_BUTTONVAR34"

value="billing_city=Wolverhamp ton">

<input type=hidden size=40 nam e="L_BUTTONVAR35" value="billing_state= West

Midlands">

<input type=hidden size=40 nam e="L_BUTTONVAR36" value="billing_zip=W1 24LQ">

<input type=hidden size=40 nam e="L_BUTTONVAR37" value="billing_countr y=GB">

<input type=hidden size=40 nam e="L_BUTTONVAR38"

value="billing_phone=650212220 0">

<input type=hidden size=40 nam e="L_BUTTONVAR39"

value="billing_company_name=Co mpany name">

<input type=hidden size=40 nam e="L_BUTTONVAR40"

value="billing_fax=6502122200" >

<input type=hidden size=40 nam e="L_BUTTONVAR41"

value="billing_middle_name=V">

<input type=hidden size=40 nam e="L_BUTTONVAR42" value="night_phone_a= 408">

<input type=hidden size=40 nam e="L_BUTTONVAR43" value="night_phone_b= 398">

<input type=hidden size=40 nam e="L_BUTTONVAR44" value="night_phone_c= 3065">

<input type=hidden size=40 nam e="L_BUTTONVAR45"

value="buyer_email=john.smith@ email.com">

<input type=hidden size=40 nam e="L_BUTTONVAR46" value="bn=GBD">

<input type=hidden size=40 name="L_BUT TONVAR47" value="cbt=yo ur preferred

business display name">

<input type=hidden size=40 nam e="L_BUTTONVAR48"

value="address_override=true">

<input type=hidden size=40 nam e="L_BUTTONVAR49"

value="cpp_header_image=Red">

<input type=hidden size=40 nam e="L_BUTTONVAR50" value="logoText=PayPa l">

<input type=hidden size=40 nam e="L_BUTTONVAR51"

value="logoImage=http://images .com/logo.gif">

<input type=hidden size=40 nam e="L_BUTTONVAR52"

value="logoImagePosition=cente r">

<input type=hidden size=40 nam e="L_BUTTONVAR53" value="logoFont=Arial

Bold">

<input type=hidden size=40 nam e="L_BUTTONVAR54" value="logoFontSize=2 4px">

<input type=hidden size=40 nam e="L_BUTTONVAR55" value="bodyBgImg=sdf" >

<input type=hidden size=40 nam e="L_BUTTONVAR56" value="headerHeight=7 0px">

<input type=hidden size=40 nam e="L_BUTTONVAR57"

value="orderSummaryBgImage=htt p://images.com/ord ersummary.jpg">

<input type=hidden size=40 nam e="L_BUTTONVAR58" value="template=templ ateA">

<input type=submit name=METHOD value=BMCreateBut ton>

</form>

41

Page 42

Integrating Your Website Using API

BMCreateButton API Operation

BMCreateButton API Operation

Use the BMCreateButton API operation to create Hosted Solution checkout button.

BMCreateButton Request

BMCreateButton Response

BMCreateButton Errors

BMCreateButton Request

The request fields specify the characteristics of your button, which include associated menu

items related to the button. You can specify up to 5 menu items, each of which can include up

to 10 possible selections.

BMCreateButton Request Fields

Field Description

METHOD (Required)

BMCreateButton

BUTTONCODE (Optional) The kind of button code to create. It is one of the following values:

TO KEN - A secure button, not stored on PayPal, used only to initiate the

Hosted Solution checkout flow; default for Pay Now button. Since version

65.2

EN CRYPTED - An encrypted button, not stored on PayPal

CL EARTEXT - An unencrypted button, not stored on PayPal

BUTTONTYPE (Required) The kind of button you want to create.

PAYMENT - Pay Now button; since version 65.2

L_BUTTONVARn (Optional) HTML standard button variables

BMCreateButton Response

The response contains an ID if the button is hosted on PayPal, and code for HTML in a

website and for a link in email.

BMCreateButton Response Fields

Field Description

42

WEBSITECODE HTML code for web pages

EMAILLINK Code for URL for the Hosted Solution checkout flow

HOSTEDBUTTONID ID of a Hosted Solution token

Page 43

Integrating Your Website Using API

BMCreateButton API Operation

BMCreateButton Errors

Error Code Short Message Long Message

10001 Internal Error Internal Error

11923 Invalid Argument The button image value specified is invalid.

11924 Invalid Argument The button image URL specified is invalid.

11925 Invalid Argument The button type specified is invalid.

11926 Invalid Data One of the parameters specified using ButtonVar is invalid.

11937 Invalid Argument A text box name specified is invalid. Text box names must not exceed

64 characters.

11938 Invalid Argument The button code value specified is invalid.

11943 Invalid Argument The button country value specified is invalid.

11945 Invalid Data The button country and language code combination specified is invalid.

11947 Invalid Argument The tax rate specified is invalid. Make sure any punctuation marks are

in the correct places and value specified is in the range 0.0 to 100.

11948 Invalid Argument The amount specified is invalid. Make sure any punctuation marks are

in the correct places.

12210 Invalid Argument The currency code value specified is invalid.

13117 Invalid Argument Subtotal amount is not valid.

13118 Invalid Argument Tax amount is not valid.

13119 Invalid Argument Handling amount is not valid.

13120 Invalid Argument Shipping amount is not valid.

43

Page 44

Integrating Your Website Using API

BMCreateButton API Operation

44

Page 45

Order Processing

6

This chapter walks you through the end to end order processing experience. It includes

information about verifying the status and authenticity of the order before fulfilling it.

Verifying Transaction Status and Authenticity

When the buyer successfully completes a transaction, they are redirected either to the PayPal

confirmation page or a website you specified in the return variable or on the Settings page

in the Profile section (as outlined in “Simple Hosted Solution Integration” on page 11). When

the browser is redirected to the website you specified, a Transaction ID is appended to it.

When you receive the redirect (URL with Transaction ID), you must verify that the order was

completed successfully on PayPal before sending the items to the buyer. You can do so by

checking the confirmation email sent to you by PayPal or by verifying the transaction history.

Validate Instant Payment Notification (IPN)

IPN enables you to receive messages about transaction payments and activity from PayPal

through asynchronous, server-to-server communication. This allows you to integrate your

online payments with your order fulfillment process.

Through IPN, you receive messages for the following:

Payments and their status (pending, complete, or denied)

Authorisations, chargebacks, disputes, reversals, and refunds.

After a transaction has been processed, PayPal sends an IPN to the notification URL specified

in your transaction using the parameter notify_url, or in your PayPal Profile. You must

verify that the Transaction ID, transaction amount, and other order specific parameters such as

Invoice ID that are sent in the IPN match with the information you have in your order

processing system. For more details, refer to

Instant Payment Notification Guide.

Fulfilling Order

After you have verified the authenticity of the payment amount and status, you can fulfil the

order by shipping the item to the buyer.

45

Page 46

Order Processing

Fulfilling Order

46

Page 47

Obtaining API Credentials

A

To use the PayPal APIs, you must have API credentials that identify you as a PayPal account

holder who is authorized to perform various API operations. Although you ca n use either an

API signature or a certificate, PayPal recommends you use a signature.

IMPORTANT: Although you have both a signature and a certificate, you cannot use both at

the same time.

Creating an API Signature

An API consists of an API username along with an associated API password and signature, all

of which are assigned by PayPal. Y ou need to include this information whenever you execute a

PayPal API operation.

You must have a PayPal account to create a signature.

To create an API signature:

1. Log in to PayPal, then click Profile under My Account.

2. Under Account Information, click Request API Credentials.

3. Under Option 1 - PayPal API, click Set up PayPal API credentials and permissions.

4. Under Option 2, click View API Signature.

5. Save the information and click Done to complete the process.

Creating an API Certificate

Create an API certificate only if your website requires it. Typically, you want to create an API

signature for your credentials instead.

You must have a PayPal account to create an API certificate.

NOTE: The certificate for API credentials is not the same as an SSL certificate for your

website; they are not related to each other.

If you do need a certificate, follow these instructions:

1. Log in to PayPal, then click Profile under My Account.

2. Under Account Information, click Request API Credentials.

3. Under Option 1 - PayPal API, click Set up PayPal API credentials and permissions.

47

Page 48

Obtaining API Credentials

Encrypting Your Certificate Into PKCS12 Format

4. Under Option 2, click View API Signature.

5. Save the values for API Username and API Password, and click Done.

6. Click Download Certificate and save the file.

7. Rename the file to something familiar, such as paypal_live_cert.pem. It is not

necessary to keep the .txt file extension. Be sure to remember where you save the file.

After completing this task:

If you use the PayPal SDK for Java, the PayPal SDK for .NET, or the PayPal SDK for

Classic ASP, you must encrypt your certificate in PCKS12 format.

If you use the PayPal SDK for .NET or Classic ASP, you must take additional steps to

import the certificate.

Encrypting Your Certificate Into PKCS12 Format

PayPal SDKs for Java, .NET, and Classic ASP require the additional task of encrypting your

certificate into PKCS12 format. Perform this task for both your Sandbox certificate and your

live certificate.

NOTE: This task is not required if you are using the PayPal SDK for PHP.

The certificate you download from PayPal is in PEM format. It contains both your public

certificate and the associated private key. Although the PEM certificate is not human readable,

the file is not encrypted.

The steps in this task require you to use the OpenSSL encryption tool. On Unix, this tool is

typically installed for you. On Windows, you typically must download OpenSSL yourself; in

this case, accept the defaults when you install OpenSSL and add OpenSSL to the path.

NOTE: In Windows, the Path is a System environment variable, which is accessible from the

Advanced tab when you right-click on your My Computer icon and view its

properties. Do not confuse the System variables path with with the User variables

path. Add OpenSSL to the System variables path.

To encrypt your certificate into PKCS12 format:

1. Use OpenSSL to create the PKCS12-format certificate from the downloaded PEM-format

certificate.

openssl pkcs12 -export -in download.txt -inkey download.txt -out

certificate.p12

48

2. At the prompt, enter an Export Password for the certificate.

3. Save your Export Password.

Page 49

Importing Your Certificate

For either PayPal SDK for .NET or Classic ASP, you must download and execute the

Windows HTTP Services Certificate Configuration Tool, WinHTTPCertCfg. If you use the

.NET platform and develop with the PayPal SDK for .NET , you need to take a few more steps

before your certificate can be used.

You must use WinHTTPCertCfg to import the certificate into the Windows Certificate Store

and grant access to your private key to the user executing your web application. This is a

Windows requirement, not a PayPal requirement. You can download WinHTTPCertCfg

from the Microsoft Windows Server 2003 Resource Kit Tools page. For Microsoft

documentation, see WinHttpCertCfg.exe, a Certificate Configuration Tool.

To import a certificate:

1. Execute WinHTTPCertCfg to import the certificate into the Windows Certificate Store

and grant access to your private key to the party executing your web application.

WinHttpCertCfg -i certificate.p12 -p privateKeyPassword -c

where certificate is your PKCS12 certificate and privateKeyPassword is your Export

Password.

Obtaining API Credentials

Importing Your Certificate

2. Using WinHTTPCertCfg, change the username in LOCAL_MACHINE\My -a

username to one of the following values:

TABLE A.1

Configuration Username value

ASP. NET ASPNET

Windows IIS 5 default

configuration

Windows IIS 6 default

configuration

IWAM_machineName, where machineName is the computer

name

“NETWORK SERVICE” (You must include the quote

marks.)

Page 50

Obtaining API Credentials

Importing Your Certificate

50

Page 51

Error Messages

B

The table below lists error codes and the appropriate correction action.

TABLE B.1 Error Codes and the Corresponding Corrective Actions

Error Code Error Message Corrective Action (if applicable)

1 User authentication failed. Error is caused by one or more of the following:

Login information is incorrect. Verify that USER,

VENDOR, PARTNER, and PASSWORD have been

entered correctly. VENDOR is your merchant ID and

USER is the same as VENDOR unless you created a

Payflow Pro user. All fields are case sensitive.

Invalid Processor information entered. Contact

merchant bank to verify.

"Allowed IP Address" security feature implemented.

The transaction is coming from an unknown IP address.

See PayPal Manager online help for details on how to

use Manager to update the allowed IP addresses.

You are using a test (not active) account to submit a

transaction to the live PayPal servers. Change the host

address from the test server URL to the live server

URL.

2 Invalid tender type. Your merchant bank account does not support the

following credit card type that was submitted.

3 Invalid transaction type.

4 Invalid amount format. Transaction type is not appropriate for this transaction.

For example, you cannot credit an authorization-only

transaction.

5 Invalid merchant

information.

6 Invalid or unsupported

currency code

7 Field format error. Invalid information entered. See RESPMSG.

8 Not a transaction server

9 Too many parameters or

invalid stream

10 Too many line items

Processor does not recognize your merchant account

information. Contact your bank account acquirer to

resolve this problem.

Use valid currency code.

51

Page 52

Error Messages

T

ABLE B.1 Error Codes and the Corresponding Corrective Actions(Continued)

Error Code Error Message Corrective Action (if applicable)

11 Client time-out waiting for

response

12 Declined Check the credit card number, expiration date, and

transaction information to make sure they were entered

correctly. If this does not resolve the problem, have the

customer call their card issuing bank to resolve.

13 Referral. Transaction cannot be approved electronically but can

be approved with a verbal authorization. Contact your

merchant bank to obtain an authorization and submit a

manual Voice Authorization transaction.

14 Invalid Client Certification

ID.

19 Original transaction ID not

found.

20 Cannot find the customer

reference number

22 Invalid ABA number

23 Invalid account number. Check credit card number and re-submit.

24 Invalid expiration date. Check and re-submit.

25 Invalid Host Mapping. Error is caused by one or more of the following:

26 Invalid vendor account. Login information is incorrect. Verify that USER,

Check the HTTP header. If the tag, X-VPS-VITCLIENT-CERTIFICATION -ID, is missing, RESULT

code 14 is returned.

The transaction ID you entered for this transaction is

not valid. See RESPMSG.

Y ou are trying to process a tender type such as Discover

Card, but you are not set up with your merchant bank to

accept this card type.

You are trying to process an Express Checkout

transaction when your account is not set up to do so.

Contact your account holder to have Express Checkout

added to your account.

VENDOR, PARTNER, and PASSWORD have been

entered correctly. VENDOR is your merchant ID and

USER is the same as VENDOR unless you created a

Payflow Pro user. All fields are case sensitive.

27 Insufficient partner

permissions

28 Insufficient user permissions

29 Invalid XML document. This could be caused by an unrecognized XML tag or a

bad XML format that cannot be parsed by the system.

30 Duplicate transaction

52

Page 53

T

ABLE B.1 Error Codes and the Corresponding Corrective Actions(Continued)

Error Code Error Message Corrective Action (if applicable)

31 Error in adding the recurring

profile

32 Error in modifying the

recurring profile

33 Error in canceling the

recurring profile

34 Error in forcing the recurring

profile

35 Error in reactivating the

recurring profile

36 OLTP Transaction failed

37 Invalid recurring profile ID

50 Insufficient funds available

in account

Error Messages

51 Exceeds per transaction limit

99 General error. See RESPMSG.

100 Transaction type not

supported by host

101 Time-out value too small

102 Processor not available

103 Error reading response from

host

104 Timeout waiting for

processor response.

105 Credit error. Mak e sure you have not already credited this

106 Host not available

107 Duplicate suppression time-

out

Try your transaction again.

transaction, or that this transaction ID is for a creditable

transaction. (For example, you cannot credit an

authorization.)

53

Page 54

Error Messages

T

ABLE B.1 Error Codes and the Corresponding Corrective Actions(Continued)

Error Code Error Message Corrective Action (if applicable)

108 Void error. See RESPMSG. Make sure the transaction ID entered

has not already been voided. If not, then look at the

Transaction Detail screen for this transaction to see if it

has settled. (The Batch field is set to a number greater

than zero if the transaction has been settled). If the

transaction has already settled, your only recourse is a

reversal (credit a payment or submit a payment for a

credit).

109 Time-out waiting for host

response

110

111 C apture error. Either an attempt to capture a transaction that is not an

112 Failed AVS check. Address and ZIP code do not match. An authorization

113 Merchant sale total will

114 Card Security Code (CSC)

115 System busy, try again later

116 VPS Internal error. Failed to

117 Failed merchant rule check. One or more of the following three failures occurred:

Referenced auth (against

order) Error

authorization transaction type, or an attempt to capture

an authorization transaction that has already been

captured.

may still exist on the cardholder’s account.

exceed the sales cap with

current transaction. ACH

transactions only.

Mismatch. An authorization

may still exist on the

cardholder’s account.

lock terminal number

An attempt was made to submit a transaction that failed

to meet the security settings specified on the PayPal

Manager Security Settings page. If the transaction

exceeded the Maximum Amount security setting, then

no values are returned for AVS or CSC.

AVS validation failed. The AVS return value should

appear in the RESPMSG.

CSC validation failed. The CSC return value should

appear in the RESPMSG.

118 Invalid keywords found in

string fields

54

Page 55

T

ABLE B.1 Error Codes and the Corresponding Corrective Actions(Continued)