Page 1

Website Payments

Pro Integration Guide

Last updated: October 2009

Page 2

Website Payments Pro Integration Guide

Document Number: 100001.en_US-200910

© 2009 PayPal, Inc. All rights reserved. PayPal is a registered trademark of PayPal, Inc. The PayPal logo is a trademark of PayPal, Inc. Other

trademarks and brands are the property of their respective owners.

The information in this document belongs to PayPal, Inc. It may not be used, reproduced or disclosed without the written approval of PayPal, Inc.

Copyright © PayPal. All rights reserved. PayPal (Europe) S.à r.l. et Cie., S.C.A., Société en Commandite par Actions. Registered office: 22-24 Boulevard

Royal, L-2449, Luxembourg, R.C.S. Luxembourg B 118 349.

Consumer advisory: The PayPal™ payment service is regarded as a stored value facility under Singapore law. As such, it does not require the approval

of the Monetary Authority of Singapore. You are advised to read the terms and conditions carefully.

Notice of non-liability:

PayPal, Inc. is providing the information i n this document t o you “AS-IS” with all faults. PayPal, Inc. makes no warranties of any kind (whether express,

implied or statutory) with respect to the information co ntained herein. PayPal, Inc. assumes no liability for damages (whether direct or indirect), caused

by errors or omissions, or resulting from the use of this document or the information contained in this document or resulting f rom the application or use

of the product or service described herein. PayPal, Inc. reserves the right to make changes to any information herein without further notice.

Page 3

Contents

Preface . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Intended Audience . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Where to Go for More Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Revision History . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Chapter 1 Introducing Website Payments Pro . . . . . . . . . . . . .11

Chapter 2 Introducing Direct Payment . . . . . . . . . . . . . . . . .13

Direct Payment Implementation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Additional Recommendations for Checkout With Direct Payment . . . . . . . . . . . . . . 14

Chapter 3 Introducing Express Checkout . . . . . . . . . . . . . . .17

The Express Checkout Experience . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Getting Started . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

Configuring and Customizing the Express Checkout Experience . . . . . . . . . . . . 19

Additional PayPal API Operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

Express Checkout Flow . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

Checkout Entry Point . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

Payment Option Entry Point . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

Complete Express Checkout Flow. . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

Express Checkout Building Blocks. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

Express Checkout Buttons. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Express Checkout API Operations . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Express Checkout Command . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

Express Checkout Token Usage. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

Chapter 4 Express Checkout Button and Logo Image Integration . . .25

About PayPal Button and Logo Images . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

Express Checkout Images. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

Express Checkout Image Flavors . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

Dynamic Images . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

Configuring the Dynamic Image . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

October 2009 3

Page 4

Contents

Set Up the Default Image . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

Set Up Image for Dynamic Use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

Change the Locale. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

Feedback to Buyer Meeting an Incentive . . . . . . . . . . . . . . . . . . . . . . . . 28

Choose the Image . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

Dynamic Image Command Reference . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

Dynamic Image Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

Locale Codes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

Static PayPal Buttons and Images Source Requirements . . . . . . . . . . . . . . . . . . 31

Chapter 5 PayPal Name-Value Pair API Basics. . . . . . . . . . . . . 33

PayPal API Client-Server Architecture. . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

PayPal Name-Value Pair API Requests and Responses . . . . . . . . . . . . . . . . 33

Multiple API Operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

Obtaining API Credentials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

Creating an API Signature. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

Creating an API Certificate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

Creating an NVP Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

Specifying the PayPal API Operation . . . . . . . . . . . . . . . . . . . . . . . . . . 38

Specifying an API Credential . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

URL Encoding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

List Syntax for Name-Value Pairs . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

Executing NVP API Operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

Specifying a PayPal Server . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

Logging API Operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

Responding to an NVP Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

Common Response Fields. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

URL Decoding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

Chapter 6 Implementing the Simplest Express Checkout Integration . 43

Setting Up the Express Checkout Transaction. . . . . . . . . . . . . . . . . . . . . . . . 43

Obtaining Express Checkout Transaction Details . . . . . . . . . . . . . . . . . . . . . . 45

Completing the Express Checkout Transaction . . . . . . . . . . . . . . . . . . . . . . . 45

Chapter 7 Testing an Express Checkout Integration . . . . . . . . . . 47

Chapter 8 Customizing Express Checkout . . . . . . . . . . . . . . .53

4 October 2009

Page 5

Contents

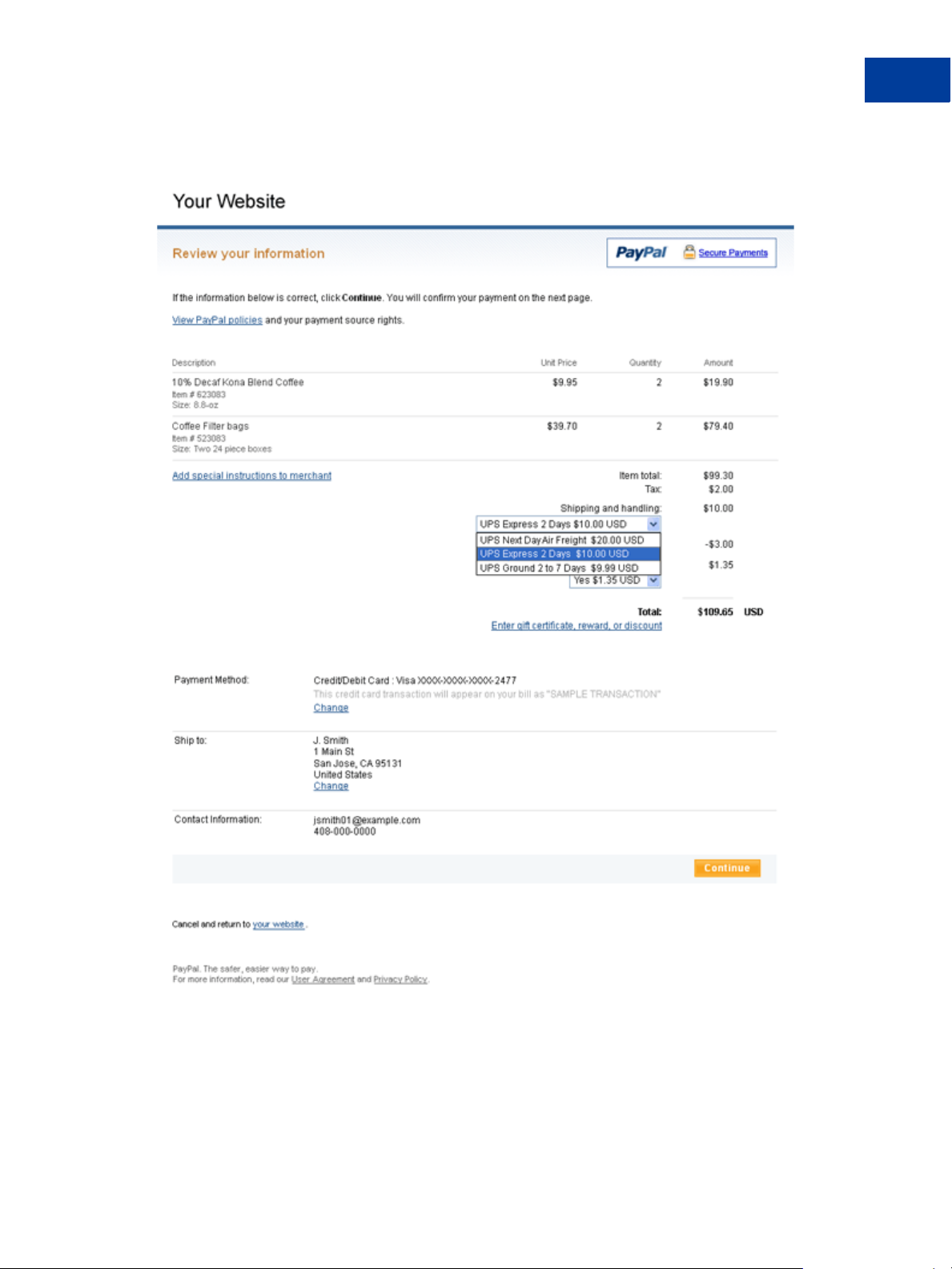

PayPal Review Page Order Details . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53

Special Instructions to Merchant. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55

Integrating Order Details into the Express Checkout Flow . . . . . . . . . . . . . . . 56

eBay-Issued Incentives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59

Integrating eBay Incentives into the Express Checkout Flow . . . . . . . . . . . . . . 60

PayPal Page Style . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62

Custom Page Style . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63

Individual Page Style Characteristics . . . . . . . . . . . . . . . . . . . . . . . . . . 63

Changing the Locale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 66

Handling Shipping Addresses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67

Confirmed Address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 68

Suppressing the Buyer’s Shipping Address . . . . . . . . . . . . . . . . . . . . . . . 69

Shipping Address Override . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 71

Automatically Filling Out the PayPal Login Page . . . . . . . . . . . . . . . . . . . . . . 73

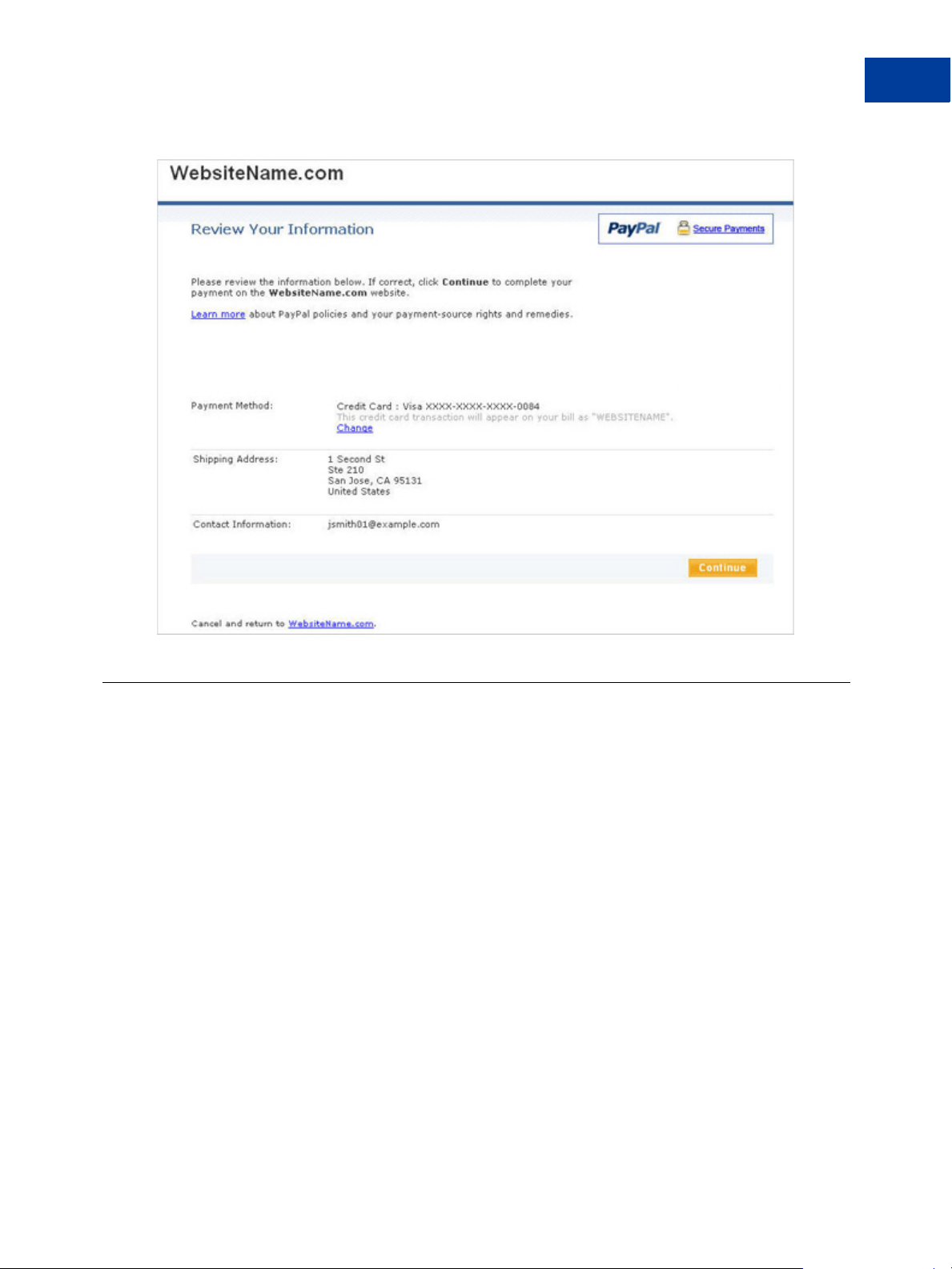

User Confirms Order on PayPal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75

Chapter 9 Implementing the Instant Update API . . . . . . . . . . . .77

About the Instant Update API . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77

Integration Steps. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77

Post-Integration Checkout Experience . . . . . . . . . . . . . . . . . . . . . . . . . 78

How the Callback Works in the Express Checkout Flow. . . . . . . . . . . . . . . . . . . 80

Following Instant Update API Best Practices . . . . . . . . . . . . . . . . . . . . . . . . 81

Setting Up the Callback . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 82

GetExpressCheckoutDetails and DoExpressCheckoutPayment Changes . . . . . . . 83

Other Considerations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 83

Using the Callback . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85

SetExpressCheckout . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85

Callback Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 87

Callback Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 87

Chapter 10 Immediate Payment . . . . . . . . . . . . . . . . . . . . .89

Overview of Immediate Payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 89

How Immediate Payment Works in the Express Checkout Flow . . . . . . . . . . . . 89

Integrating Immediate Payment into the Express Checkout Flow . . . . . . . . . . . . . . 91

The Call to SetExpressCheckout . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91

The Call to DoExpressCheckoutPayment . . . . . . . . . . . . . . . . . . . . . . . . 92

Chapter 11 Handling Payment Settlements . . . . . . . . . . . . . . .93

October 2009 5

Page 6

Contents

Sale Payment Action. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 93

Authorization Payment Action . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 93

Order Payment Action . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 94

Chapter 12 Handling Recurring Payments . . . . . . . . . . . . . . . .97

How Recurring Payments Work . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 97

Limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 98

Recurring Payments Terms . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 98

Recurring Payments With Express Checkout . . . . . . . . . . . . . . . . . . . . . . . . 99

Initiating the Processing Flow With SetExpressCheckout . . . . . . . . . . . . . . .101

Redirecting the Buyer’s Browser to PayPal . . . . . . . . . . . . . . . . . . . . . . .102

Getting Buyer Details Using GetExpressCheckoutDetails. . . . . . . . . . . . . . . .103

Creating the Profiles With CreateRecurringPaymentsProfile . . . . . . . . . . . . . .103

Recurring Payments With Direct Payments . . . . . . . . . . . . . . . . . . . . . . . . .103

Options for Creating a Recurring Payments Profile . . . . . . . . . . . . . . . . . . . . .104

Specifying the Regular Payment Period . . . . . . . . . . . . . . . . . . . . . . . . .104

Including an Optional Trial Period . . . . . . . . . . . . . . . . . . . . . . . . . . . .105

Specifying an Initial Payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .106

Maximum Number of Failed Payments . . . . . . . . . . . . . . . . . . . . . . . . .106

Billing the Outstanding Amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . .107

Recurring Payments Profile Status. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .107

Getting Recurring Payments Profile Information. . . . . . . . . . . . . . . . . . . . . . .107

Modifying a Recurring Payments Profile. . . . . . . . . . . . . . . . . . . . . . . . . . .108

Updating Addresses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .109

Updating the Billing Amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .109

Billing the Outstanding Amount of a Profile . . . . . . . . . . . . . . . . . . . . . . . . .109

Recurring Payments Notifications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .110

Chapter 13 Using Other PayPal API Operations . . . . . . . . . . . . 111

Issuing Refunds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 111

Handling Payment Review. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .112

Chapter 14 Integrating giropay with Express Checkout . . . . . . . . 115

giropay Page Flows . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .115

giropay Payment Page Flow. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .115

Cancelled or Unsuccessful giropay Payment Page Flow . . . . . . . . . . . . . . . .116

giropay Integration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1 17

6 October 2009

Page 7

Contents

Initiate the Flow with SetExpressCheckout . . . . . . . . . . . . . . . . . . . . . . .117

Redirect the Customer to PayPal . . . . . . . . . . . . . . . . . . . . . . . . . . . .117

Complete the Transaction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .118

Receive Transaction Status Notification . . . . . . . . . . . . . . . . . . . . . . . . .118

October 2009 7

Page 8

Contents

8 October 2009

Page 9

Preface

This document describes Website Payments Pro integration.

Intended Audience

This document is intended for merchants and developers implementin g Website Payments Pro.

Where to Go for More Information

For information on the administrative tasks you can perform from your PayPal account, see

the Merchant Setup and Administra tion Guide. The guide is available on the Documentation

page linked to the Library tab in Developer Central.

Revision History

Revision history for Website Payments Pro Integration Guide.

TABLE 1.1 Revision history

Date Description

10/05/2009 Added Immediate Payment.

06/30/2009 Added a section on payment review.

06/04/2009 Added a chapter on pre-populating the PayPal review page. Updated PayPal

04/08/2009 Added a chapter describing the Instant Update Callback API.

12/11/2008 Revised the Website Payments Pro introduction and overview chapters.

11/13/2008 Added information about integrating dynamic images and added

Edited for technical accuracy.

Removed PayPal placement guidelines.

Review pages. Moved some customization topics out of this guide. They

are now in the Merchant Setup and Administration Guide.

Added Express Checkout feature of passing AMT=0 to create one or more

billing agreements.

information about order details that can be displayed on the PayPal Review

page.

Website Payments Pro Integration Guide October 2009 9

Page 10

Revision History

T

ABLE 1.1 Revision history

Date Description

06/30/2008 Complete revision.

10 October 2009 Website Payments Pro Integration Guide

Page 11

1

Introducing Website Payments Pro

PayPal’s Website Payments Pro lets you accept both credit cards and PayPal payments

directly on your website. It consists of two API-based solutions: Direct Payment and Express

Checkout.

Direct Payment lets you accept credit cards on your website. Your customers do not ne ed a

PayPal account to pay. Here’s how it works:

1. Your customer pays on your website with their credit card.

2. The payment information is sent to PayPal using the PayPal DoDirectPayment API

operation.

3. PayPal processes the payment information.

4. The funds from the transaction are sent to your PayPal account.

Express Checkout lets you accept PayPal payments on your website. Your customers benefit

because paying for items is fast. They don't have to spend time typing in financial and

shipping information because their information is already stored in their PayPal account.

Here’s how it works:

1. Your customer chooses to pay with PayPal by entering their email address and PayPal

password, without leaving your website.

2. Your customer makes the payment using PayPal.

3. The payment information is sent to PayPal using PayPal Express Checkout API operations.

4. The funds from the transaction are sent to your PayPal account.

NOTE: If you use Website Payments Pro, you must implement both Direct Payment and

Express Checkout.

NOTE: For information about administrative tasks you can perform from your PayPal account

such as adding users, setting up custom page styles, and managing multiple currency

balances, see the Merchant Setup and Administration Guide. The guide is located on

the Documentation page linked to the Library tab on

Developer Central.

Website Payments Pro Integration Guide October 2009 11

Page 12

Introducing Website Payments Pro

1

12 October 2009 Website Payments Pro Integration Guide

Page 13

Introducing Direct Payment

2

Direct Payment lets your customers who do not have a PayPal account pay using their credit

cards without leaving your website. PayPal then processes the payment in the background.

Direct Payment has a single API operation: DoDirectPaymen t, which allows you to process

a credit card transaction. This API operation also alerts you to potentially fraudulent

transactions by providing you with industry-standard AVS and CVV2 responses for each

transaction.

NOTE: Transactions processed using the DoDirectPayment API operation are not covered

by the PayPal Seller Protection Policy.

Direct Payment Implementation

When customers choose to pay with a credit card, they enter their card number and other

information on your website. After they confirm their order and click Pay, you complete the

order in the background by invoking the DoDirectPayment API operation. Customers never

leave your site. Although PayPal processes the order, customers aren’t aware of PayPal’s

involvement; PayPal will not even appear on the customer’s credit card statement for the

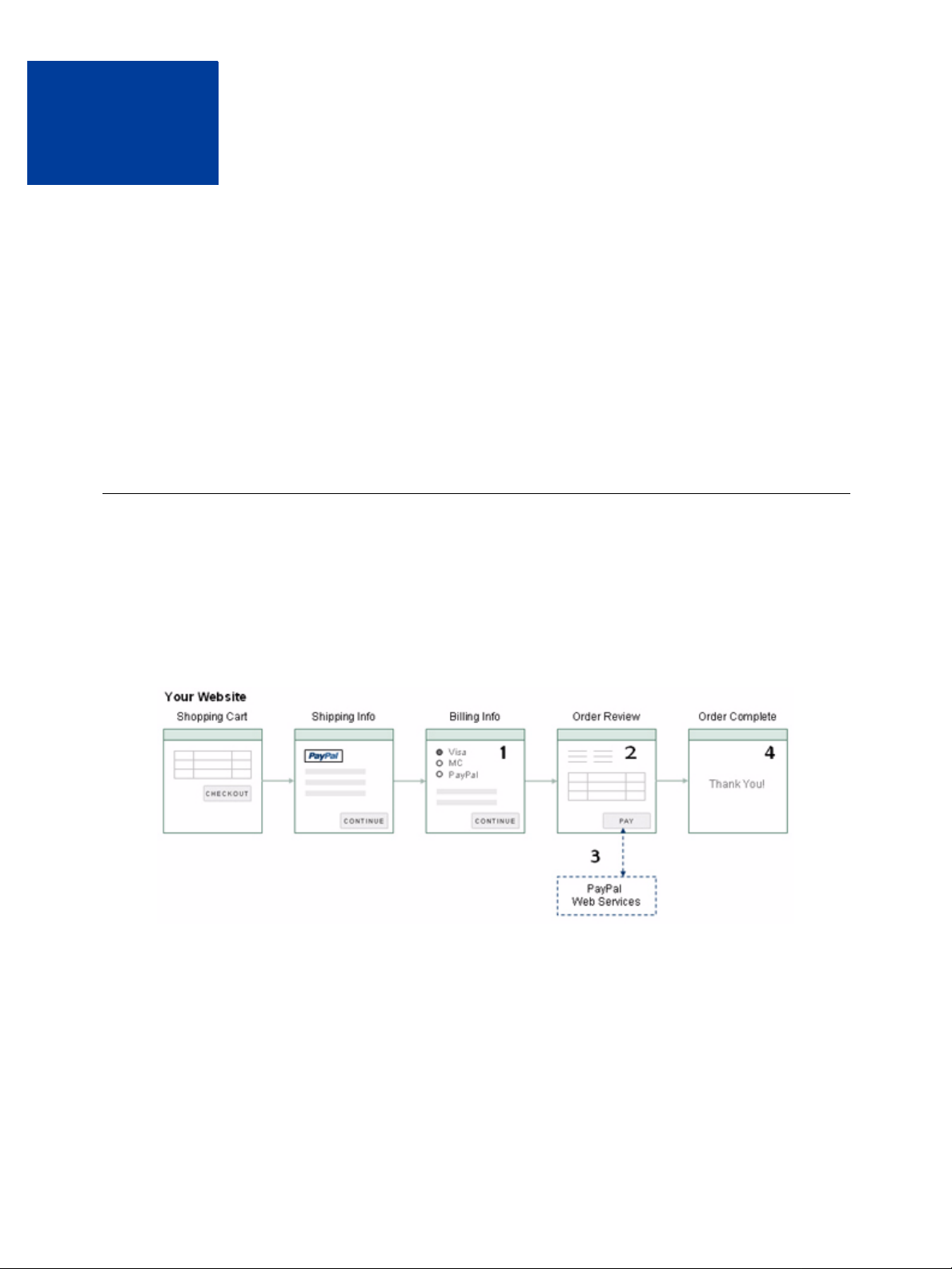

transaction.The following diagram shows a typical Direct Payment flow:

The numbers in the diagram correspond to the following implementation steps:

1. On your checkout pages, you need to collect the following information from your customer

to be used in the DoDirectPayment request:

– Amount of the transaction

– Credit card type

– Credit card number

– Credit card expiration date

Website Payments Pro Integration Guide October 2009 13

Page 14

Introducing Direct Payment

2

Additional Recommendations for Checkout With Direct Payment

– Credit card CVV value

– Cardholder first and last name

– Cardholder billing address

NOTE: You must also retrieve the IP address of customer's browser and include this with

the request.

2. When your customer clicks the Pay button, invoke the DoDirectPayment API operation.

3. The PayPal API server executes the request and returns a response.

– Ack code (Success, SuccessWithWarning, or Failure)

– Amount of the transaction

– AVS response code

– CVV response code

– PayPal transaction ID

– Error codes and messages (if any)

– Correlation ID (unique identifier for the API call)

4. If the operation is successful, you should send your customer to an order confirmation

page.

The Ack code determines whether the operation is a success. If successful, you should

display a message on the order confirmation page.

If not successful, which is either a failure or a success with warning due to Fraud

Management Filters, you should display information related to the error. In addition, you

may want to provide your customer an opportunity to pay using a different payment

method.

Additional Recommendations for Checkout With Direct Payment

Your checkout pages must collect all the information you need to create the

DoDirectPayment request. The following recommendations make it easier for your

customers to provide the needed information and aid in the correct processing of the request:

z Provide a drop-down menu for the “state” or “province” fields. For US addresses, the state

must be two letters, and must be a valid two-letter state, military location, or US territory.

For Canada, the province must be a two-letter Canadian province.

z Ensure customers can enter the correct number of digits for the CVV code. The value is 3

digits for Visa, MasterCard, and Discover. The value is 4 digits for American Express.

z Show information on the checkout page that explains what CVV is, and where to find it on

the card.

z Configure timeout settings to allow for the fact that the DoDirectPayment API operation

can take up to 30 seconds. Consider displaying a “processing transaction” message to your

customer and disabling the Pay button until the transaction finishes.

14 October 2009 Website Payments Pro Integration Guide

Page 15

Introducing Direct Payment

Additional Recommendations for Checkout With Direct Payment

z Use the optional Invoice ID field to prevent duplicate charges. PayPal ensures that an

Invoice ID is used only once per account. Duplicate requests with the same Invoice ID

result in an error and a failed transaction.

2

Website Payments Pro Integration Guide October 2009 15

Page 16

Introducing Direct Payment

2

Additional Recommendations for Checkout With Direct Payment

16 October 2009 Website Payments Pro Integration Guide

Page 17

Introducing Express Checkout

3

Express Checkout is PayPal’s premier checkout solution, which streamlines the checkout

process for buyers and keeps them on the merchant’s site after making a purchase.

z The Express Checkout Experience

z Getting Started

z Express Checkout Flow

z Express Checkout Building Blocks

NOTE: For information about administrative tasks you can perform from your PayPal account

such as adding users, setting up custom page styles, and managing multiple currency

balances, see the Merchant Setup and Administration Guide. The guide is located on

the Documentation page linked to the Library tab on

The Express Checkout Experience

Developer Central.

Express Checkout makes it easier for your customers to pay and allows you to accept PayPal

while retaining control of the buyer and overall checkout flow.

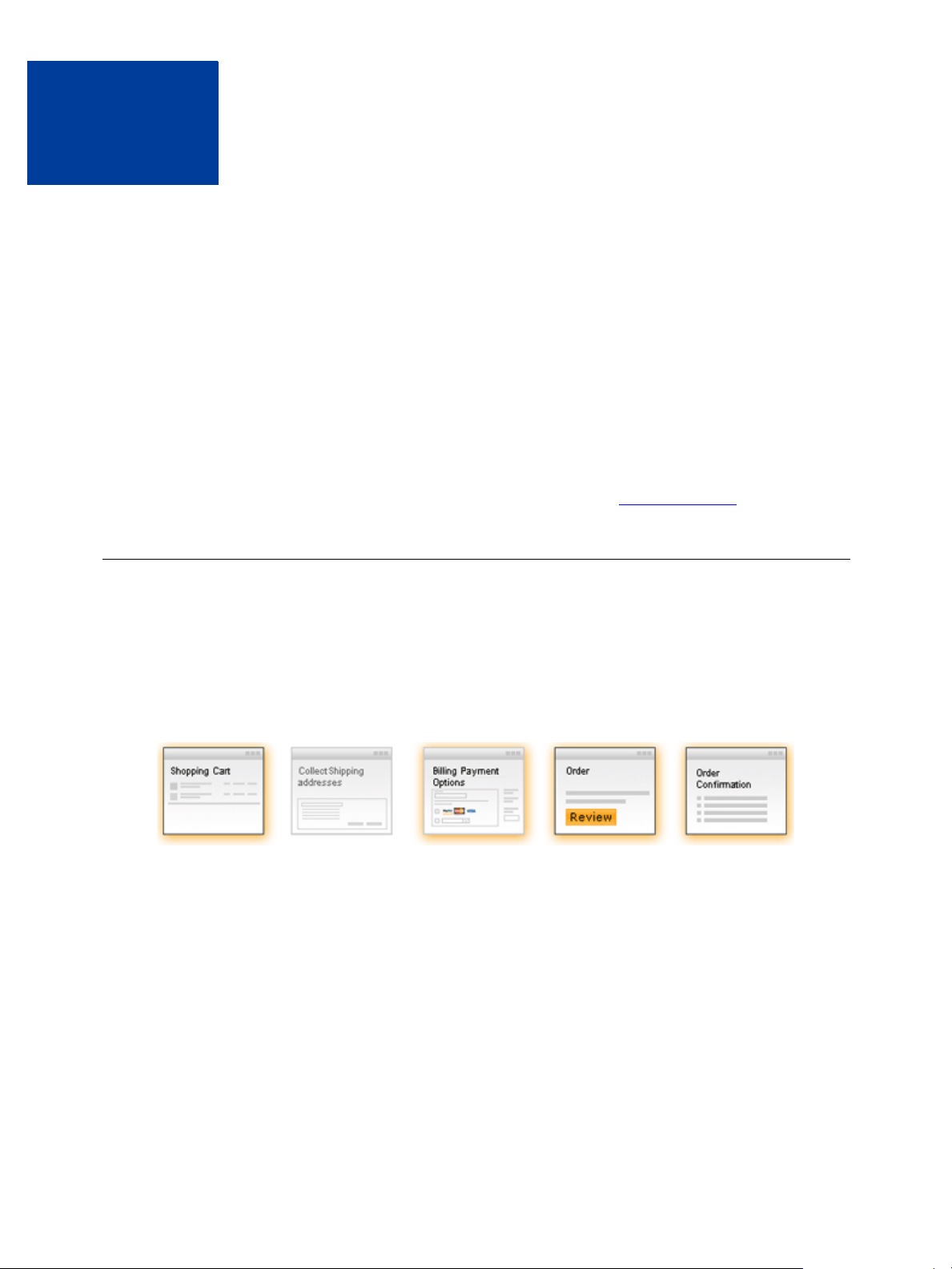

Consider your buyer’s experience before implementing Express Checkout. A generic flow

probably has the following sequence of pages:

A generic checkout flow

In a typical checkout flow, the buyer

1. Checks out from the shopping cart page

2. Provides shipping information

3. Chooses a payment option and provides billing and payment information

4. Reviews the order and pays

5. Receives an order confirmation

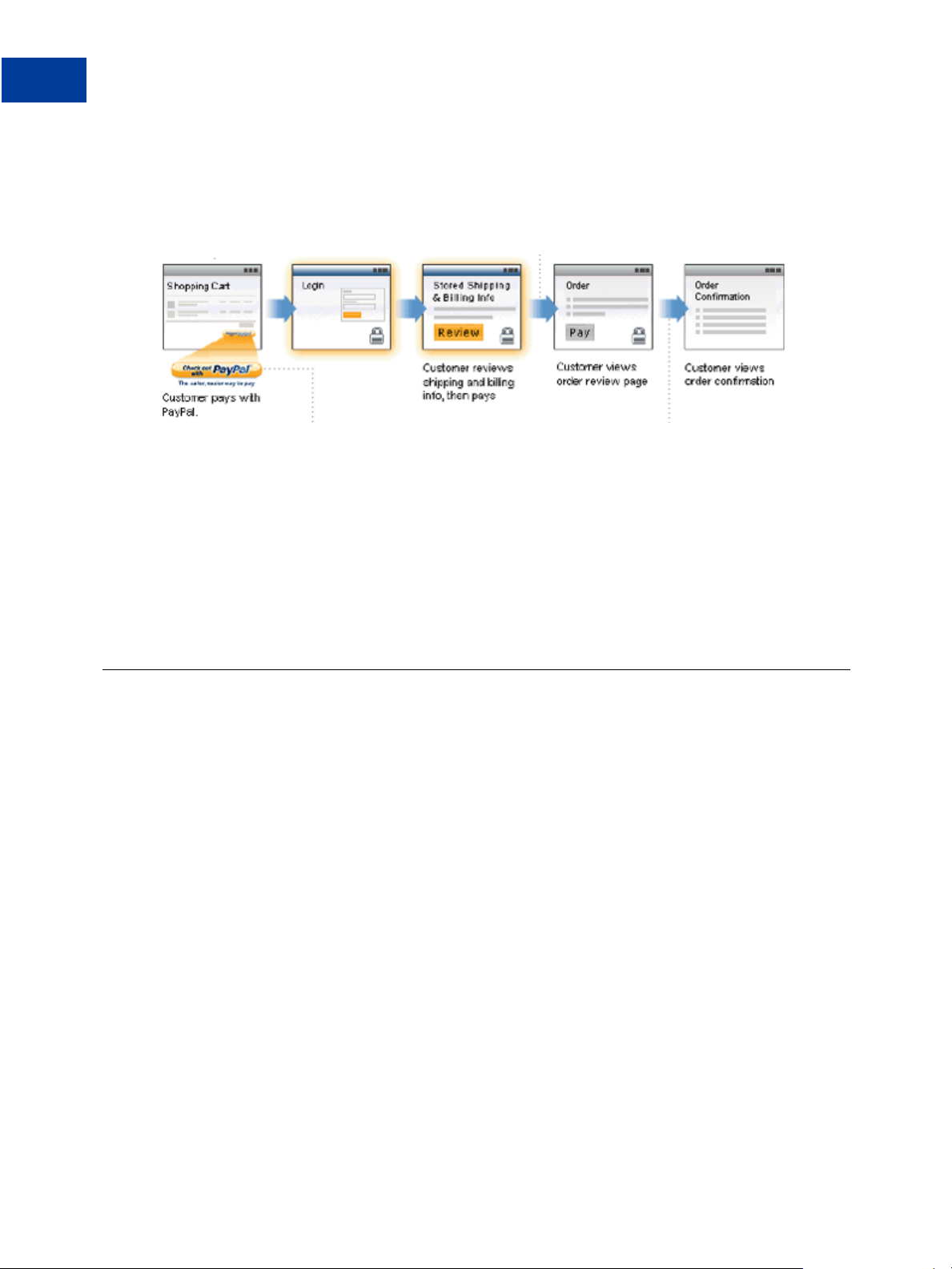

In an Express Checkout flow, a buyer still checks out at the beginning of the flow and pays on

your site; however, the buyer does not reenter shipping, billing, or payment information,

because it is already available from PayPal. This simplifies and expedites the checkout

Website Payments Pro Integration Guide October 2009 17

Page 18

Introducing Express Checkout

3

Getting Started

process. The buyer can then proceed to review the order on your site. You can include other

necessary checkout steps. You can also up-sell to the buyer on your Review Order page.

The following diagram shows the Express Checkout flow:

Express Checkout Flow

In the Express Checkout flow, the buyer

1. Chooses Express Checkout by clicking the Check out with PayPal button

2. Logs into PayPal to authenticate his or her identity

3. Reviews the transaction on PayPal

4. Confirms the order and pays from your site

5. Receives an order confirmation

Getting Started

You can implement Express Checkout in just four steps.

1. Place PayPal checkout buttons and PayPal payment mark images in your checkout flow.

2. For each PayPal button that you place, modify your page to handle the button click.

Use a PayPal API Express Checkout operation to set up the interaction with PayPal and

redirect the browser to PayPal to initiate buyer approval for the payment.

3. On your order confirmation page, obtain the payment authorization from PayPal and use

PayPal API Express Checkout operations to obtain the shipping address and accept the

payment.

4. Test your integration using the PayPal sandbox.

Because PayPal offers you the flexibility and opportunity to control your checkout process,

you should understand how your current checkout flow works and become familiar with the

Express Checkout flow. Start by reviewing Express Checkout Flow. For additional

background information that will help you get started, see Express Checkout Building Blocks.

18 October 2009 Website Payments Pro Integration Guide

Page 19

Introducing Express Checkout

Configuring and Customizing the Express Checkout Experience

After you implement and test your basic Express Checkout integration, you should evaluate

the additional features provided by Express Checkout.

Express Checkout can be configured and customized to fit into your site. Carefully evaluate

each option because the more you do to streamline the checkout process and make Express

Checkout seamless to your customers, the more likely your sales will increase.

At a minimum, you should set your logo on the PayPal site and provide order details in the

transaction history. If you do not need the benefits associated with paying on your site,

consider using the PayPal confirmation page as your Order Review page to further streamline

the user experience. This can lead to better order completion, also know as conversion, rate.

You can configure the look and feel of PayPal pages to match the look and feel of your site by

specifying the

z Logo to display

z Colors for the background and border

z Language in which PayPal content is displayed

Getting Started

3

You should include

z Order details, including shipping and tax, during checkout

IMPORTANT: Not displaying this information is a major cause of shopping cart

abandonment during checkout.

z Shipping information for non-digital goods, which can be your address information for the

buyer or the address on file with PayPal; if you use the address on file with PayPal, you can

specify whether or not it must be a confirmed address

You can also handle special situations, including

z Associating a payment with an eBay auction item or an invoice number

z Accepting payments with giropay

Additional PayPal API Operations

You can use PayPal API operations to include advanced processing and “back office”

processes with Express Checkout, such as

z Capturing payments associated with authorizations and orders

z Handling recurring payments

z Issuing refunds, providing a transaction search capability, and providing other “back

office” operations

Website Payments Pro Integration Guide October 2009 19

Page 20

Introducing Express Checkout

3

Express Checkout Flow

Express Checkout Flow

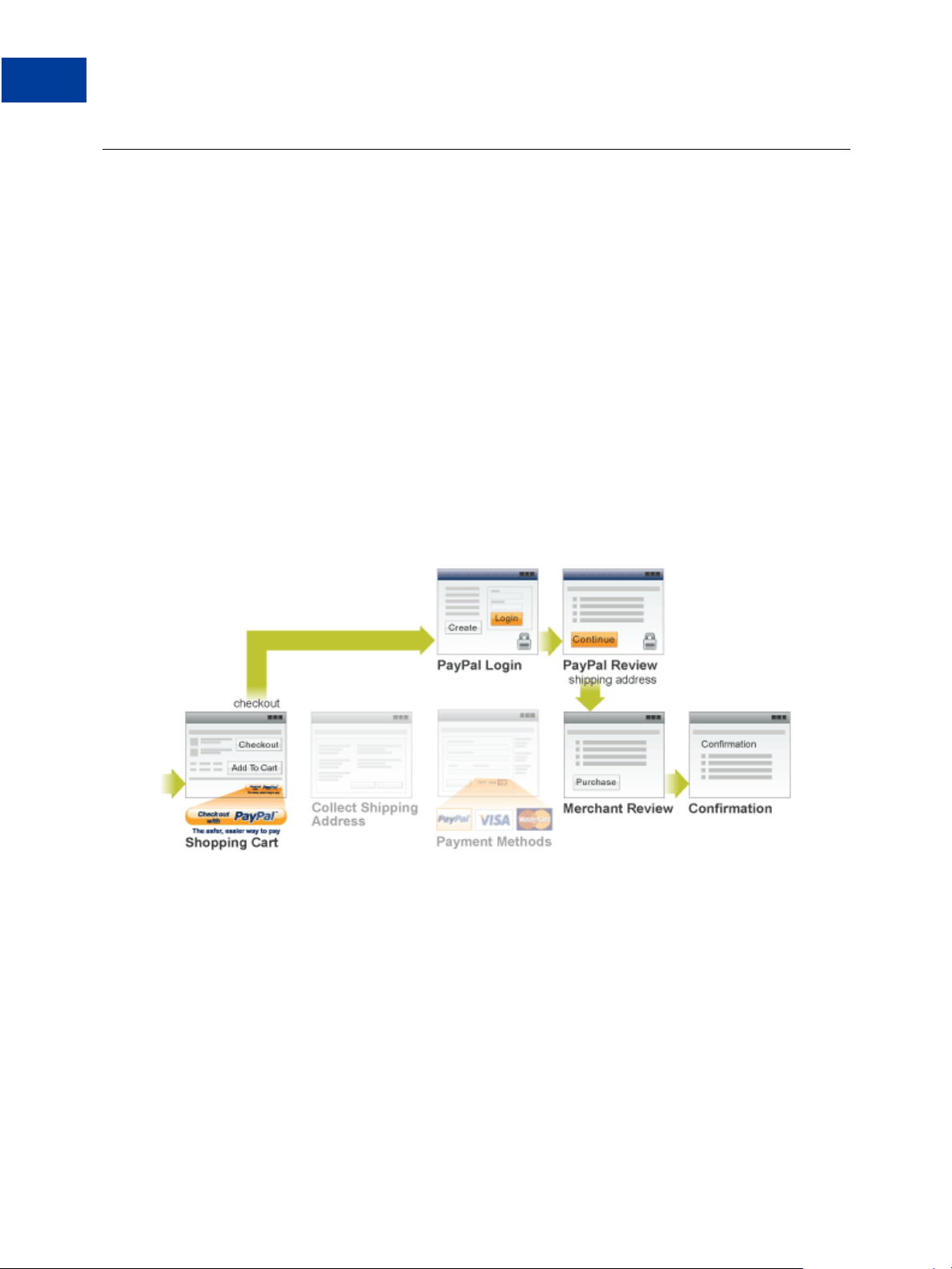

You initiate the Express Checkout flow on your shopping cart page and on your payment

options page.

Express Checkout consists of one flow with two entry points:

z At the beginning of the checkout flow; the buyer clicks the Checkout with PayPal button

z Upon payment; the buyer selects PayPal as a payment option

You must integrate Express Checkout from both entry points. They are explained separately

for simplicity.

Checkout Entry Point

Buyers initiate the Express Checkout flow on your shopping cart page by clicking the

Checkout with PayPal button.

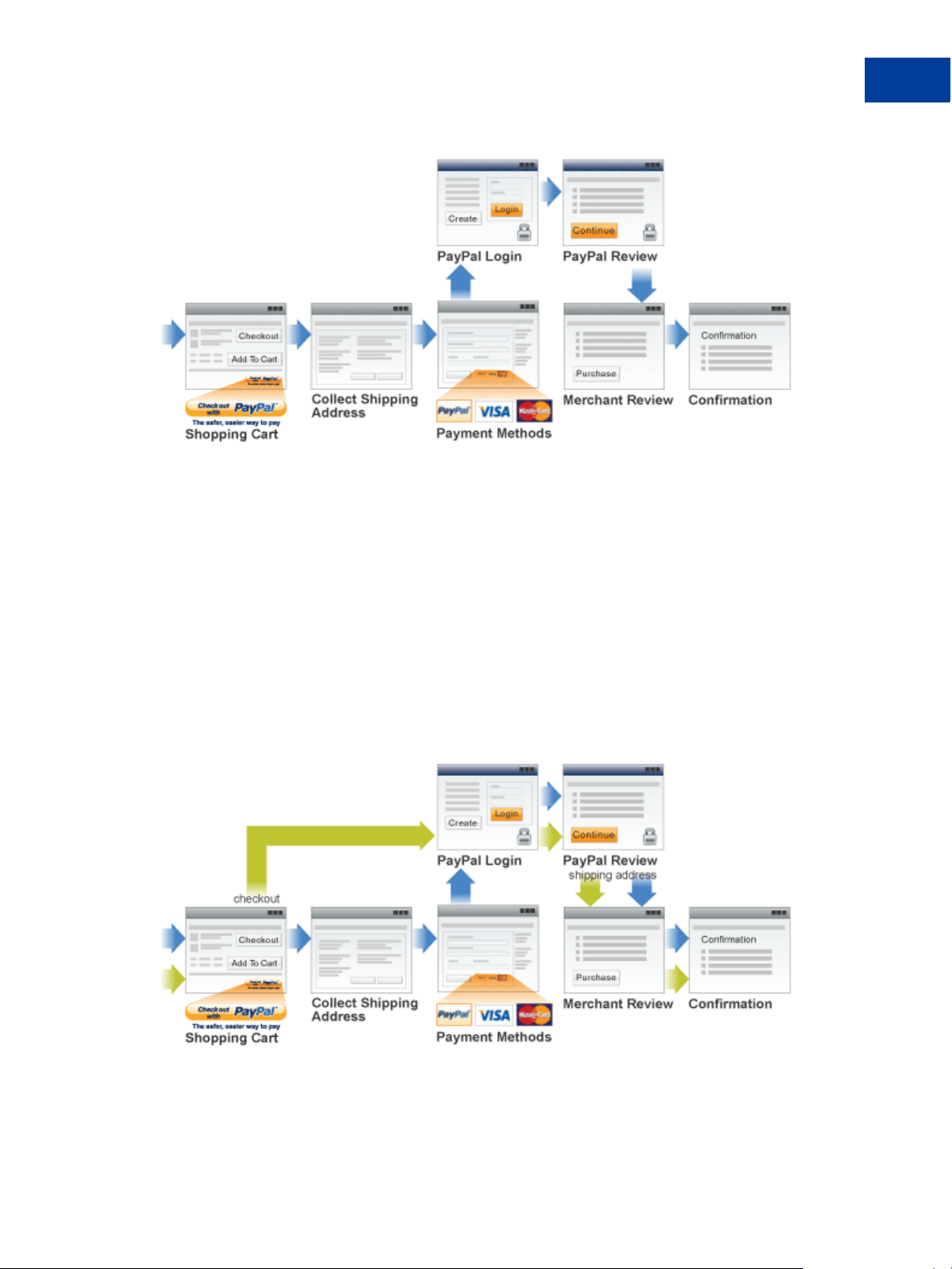

The following diagram shows how Express Checkout integrates with a typical checkout flow:

Integrating Express Checkout from the Shopping Cart page

Payment Option Entry Point

Buyers initiate the Express Checkout flow on your payment methods page by selecting PayPal

as the default option.

The following diagram shows how to integrate Express Checkout from your payment methods

page:

20 October 2009 Website Payments Pro Integration Guide

Page 21

Introducing Express Checkout

Express Checkout Flow

Integrating Express Checkout from the Payment Methodss page

Note that if your checkout flow omits the Merchant Review page and proceeds directly to your

Confirmation page, you can change the text on the PayPal Review page fro m Con tinu e to Pay

Now. For details on how to change the text on the PayPal Review page from ‘Continue’ to

‘Pay Now’ see “User Confirms Order on PayPal” on page 75.

3

Complete Express Checkout Flow

T o implement Express Checkout, you must offer it both as a checkout option and as a payment

method.

You add Express Checkout to your existing flow by placing the Check out with PayPal

button on your checkout page and by providing the PayPal mark on your billing payment

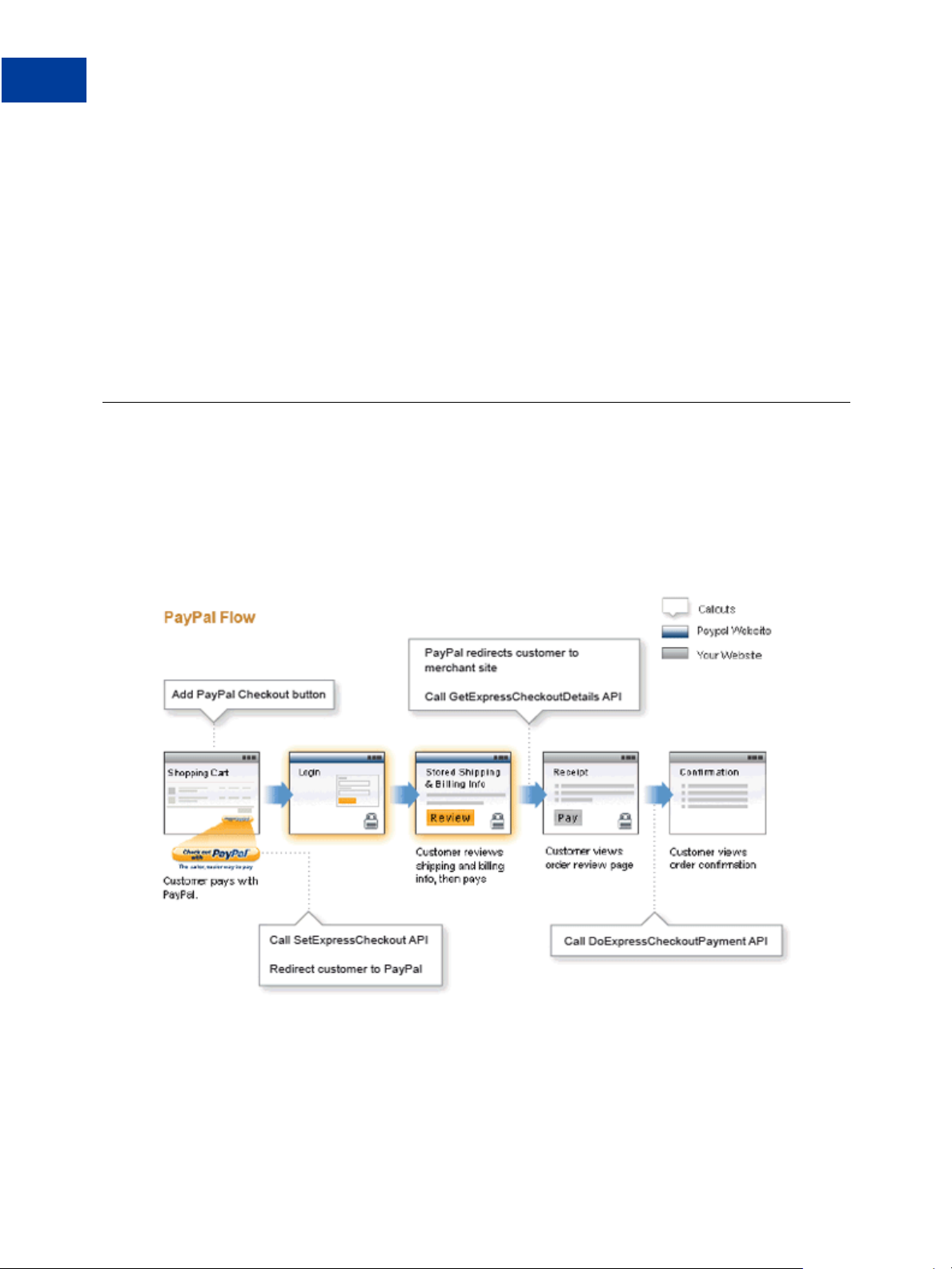

methods page. The following diagram shows the complete flow:

Complete Express Checkout flow

Website Payments Pro Integration Guide October 2009 21

Page 22

Introducing Express Checkout

3

Express Checkout Building Blocks

To implement the complete Express Checkout flow

z On your Shopping Cart page, place the Check out with PayPal button and handle button

clicks by setting up the Express Checkout transaction and redirecting your buyer’s browser

to PayPal.

z On your Payment Methods page, associate the PayPal mark with an option. Handle

selection of the PayPal mark by setting up the Express Checkout transaction and

redirecting your buyer’s browser to PayPal.

z After returning from PayPal, complete the Express Checkout transaction by obtaining

shipping information from PayPal and accepting the payment.

Express Checkout Building Blocks

You implement Express Checkout flows with Express Checkout buttons, PayPal API

operations, PayPal commands, and tokens.

The following conceptual diagram identifies the building blocks that you use to integrate

Express Checkout on your website:

Express Checkout Integration

NOTE: Tokens are not shown in the diagram.

22 October 2009 Website Payments Pro Integration Guide

Page 23

Express Checkout Buttons

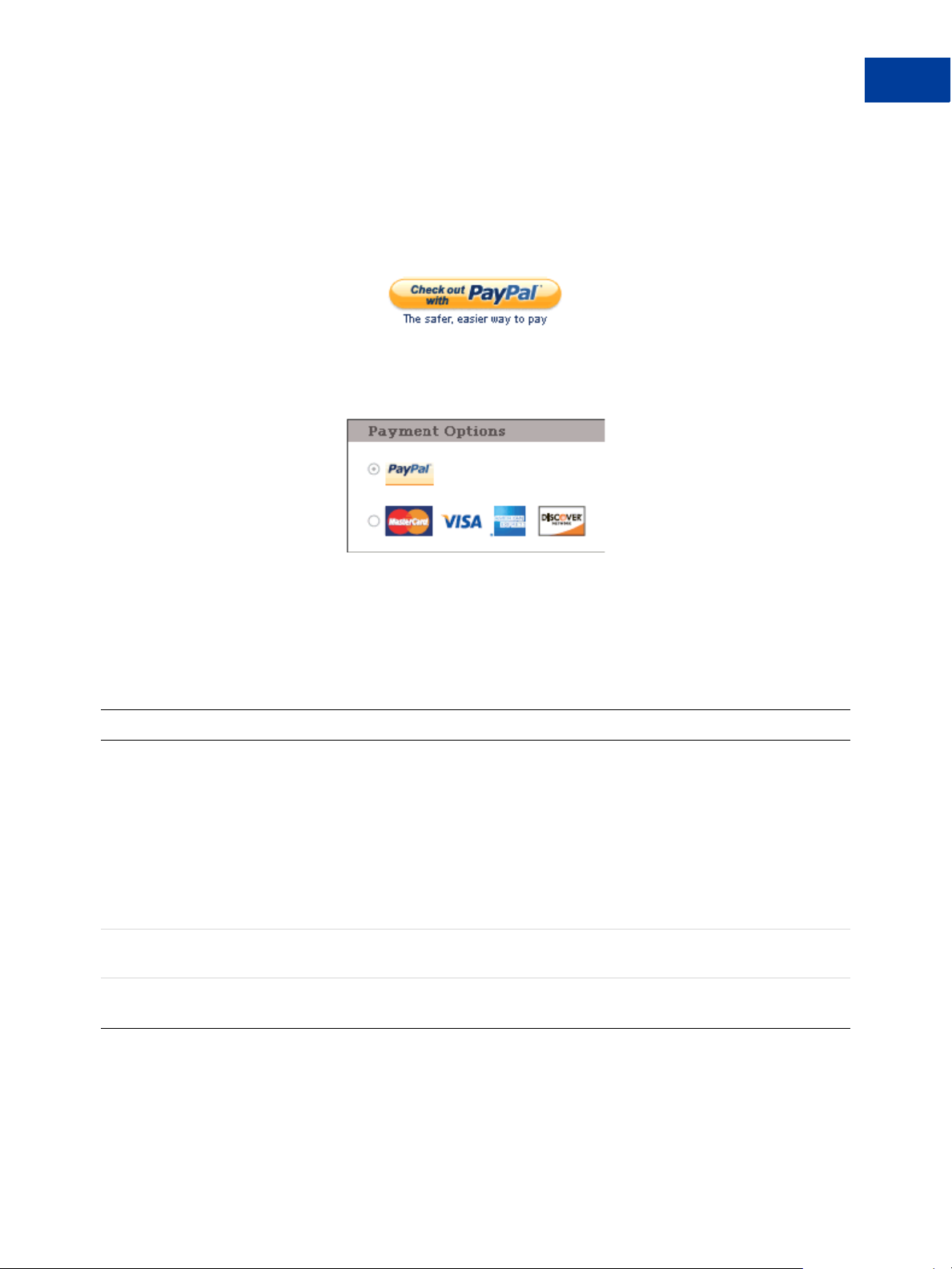

PayPal provides buttons and images for you to place on your website.

To implement Express Checkout, you must place the following button on your Shopping Cart

page:

To implement PayPal as a payment option, which is part of Express Checkout, associate the

PayPal mark image with the option. Using a radio button, as shown in the image below, is the

recommended way to do this:

Introducing Express Checkout

Express Checkout Building Blocks

3

Express Checkout API Operations

The PayPal API provides three operations for Express Checkout, one to set up the transaction,

one to obtain information about the buyer, and one to handle the payment and complete the

transaction.

API Operation Description

SetExpressCheckout Sets up the Express Checkout transaction. You can specify information

to customize the look and feel of the PayPal site and the information it

displays. You must include the following information:

z URL to the page on your website that PayPal redirects to after the

buyer successfully logs into PayPal and approves the payment.

z URL to the page on your website that PayPal redirects to if the buyer

cancels.

z Total amount of the order or your best estimate of the total. It should

be as accurate as possible.

GetExpressCheckout Obtains information about the buyer from PayPal, including shipping

information.

DoExpressCheckoutPayment Completes the Express Checkout transaction, including the actual total

amount of the order.

Website Payments Pro Integration Guide October 2009 23

Page 24

Introducing Express Checkout

3

Express Checkout Building Blocks

Express Checkout Command

PayPal provides a command that you use when redirecting to PayPal, which enables your

buyer to log into PayPal to approve an Express Checkout payment.

When you redirect your buyer’s browser to PayPal, you must specify _ExpressCheckout

command for Express Checkout. You also specify the token that identifies the transaction,

which was returned by the SetExpressCheckout API operation.

IMPORTANT: To enable PayPal to redirect back to your website, you must have already

invoked the SetExpressCheckout API operation, specifying URLs that

PayPal uses to redirect back to your site. PayPal redirects to the success URL

when the buyer pays on PayPal; otherwise, PayPal redirects to the cancel

URL.

If the buyer approves the payment, PayPal redirects to the success URL with the following

information:

z The token that was included in the redirect to PayPal

z The buyer’s unique identifier (Payer ID)

If the buyer cancels, PayPal redirects to the cancel URL with the token that was included in the

redirect to PayPal.

Express Checkout Token Usage

Express Checkout uses a token to control access to PayPal and execute Express Checkout API

operations.

The SetExpressCheckout API operation returns a token, which is used by other Express

Checkout API operations and by the _ExpressCheckout command to identify the

transaction. The life of the token is approximately three hours.

24 October 2009 Website Payments Pro Integration Guide

Page 25

Express Checkout Button and

4

Logo Image Integration

PayPal hosts the PayPal button and logo images that you use on your website. Using PayPal’s

buttons and logos is convenient and standardizes appearance on websites that use PayPal as a

payment option.

z About PayPal Button and Logo Images

z Dynamic Images

z Configuring the Dynamic Image

z Dynamic Image Command Reference

z Static PayPal Buttons and Images Source Requirements

About PayPal Button and Logo Images

To inform buyers that PayPal is accepted on your website, you must place PayPal button and

logo images in your checkout flow.

PayPal Express Checkout requires that you integrate two images. The Check out with PayPal

button and the PayPal Acceptance mark.

Express Checkout Images

The Check out with PayPal button is the image you place on your shopping cart page. The US

version of the image looks like this. PayPal also provides buttons for other locales.

The PayPal Acceptance Mark is the image you place on your payment methods page. It looks

like this:

Express Checkout Image Flavors

The Check out with PayPal button and the PayPal Acceptance mark images are available in

two flavors:

z Dynamic image

Website Payments Pro Integration Guide October 2009 25

Page 26

Express Checkout Button and Logo Image Integration

4

Dynamic Images

z Static image

The dynamic images enable PayPal to change their appearance dynamically. If, for example,

you have signed up to participate in a PayPal campaign, PayPal can change the appearance of

the image dynamically for the duration of that campaign based on parameter information you

append to the image URL. By default, the Express Checkout images appears as shown above.

The static images cannot be changed dynamically. To participate in a PayPal campaign, you

would have to manually update the image code to change the image displayed and restore the

default image when the campaign is over. The only way you can have image management

taken care of for you is to replace static images in your implementation with dynamic images.

Dynamic Images

To use dynamic images, you must pass information to PayPal as parameters appended to the

image URL. Your unique ID tells PayPal whether or not you are participating in events that

require image changes. Other information you pass instructs PayPal on the types of images to

return.

If, for example, you are participating in a PayPal campaign that you have signed up for with

PayPal and you have passed the appropriate parameter information to PayPal, PayPal

automatically updates the image to reflect the campaign information. When the campaign is

over, PayPal restores the default image. You are not responsible for scheduling or making

changes to your website application code before, during, o r af ter the campaign. It is all

handled for you when you set up the dynamic image.

If you require localized campaign images, you can have the localized button image display for

each country in which you participate. Simply assign the correct code for the country to the

locale parameter you append to the dynamic image URL. PayPal will return to the default

button image associated with each locale when the campaign is not available.

Configuring the Dynamic Image

To set up the dynamic image, you provide the name-value pair parameter information in the

image URL. You can pass information in the image URL for any of the following options.

z Set Up the Default Image

z Set Up Image for Dynamic Use

z Change the Locale

z Feedback to Buyer Meeting an Incentive

z Choose the Image

26 October 2009 Website Payments Pro Integration Guide

Page 27

Express Checkout Button and Logo Image Integration

Set Up the Default Image

The following URL points to the default Check out with PayPal image:

https://fpdbs.paypal.com/dynamicimageweb?cmd=_dynamic -image

T o make the image dynamic, you need only add parameters to this URL to specify the changes

you want displayed.

To test in the Sandbox environment, send the image to the following Sandbox URL:

https://fpdbs.sandbox.paypal.com/dynamicimageweb?cmd=_dynamic-image

Set Up Image for Dynamic Use

T o set up the image URL for dynamic use, you associate it with your PayPal merchant account

number or pal. Y o u can obtain your pal by getting it from the Profile page, contacting PayPal,

or calling the GetPalDetails API.

This is an example call to GetPalDetails request.

Request Parameters:

Configuring the Dynamic Image

4

[requiredSecurityParameters]

&METHOD=GetPalDetails

Response Parameters

This GetPalDetails response returns the value of PAL and your country code (LOCALE), as

shown below:

[successResponseFields]

&PAL=SFJCXFDLNFR5U

&LOCALE=en_US

1. Append the pal parameter to the image URL, and set the parameter to the value of your

encrypted PayPal merchant account number.

https://fpdbs.paypal.com/dynamicimagewe b?cmd=_dynamicimage&pal=SFJCXFDLNFR5U

2. You can optionally change the value of LOCALE. See Change the Locale for details.

3. Place the URL with parameter information at the appropriate image locations in your web

application.

The pal alerts PayPal to campaigns in which you are participating. PayPal obtains this

information from your account and replaces the default image with the appropriate

campaign image during that campaign.

NOTE: If you pass in a pal value matching a merchant account that is not yours, PayPal

displays the image for that account. Be sure to pass the pal value matching your

account.

Website Payments Pro Integration Guide October 2009 27

Page 28

Express Checkout Button and Logo Image Integration

4

Dynamic Image Command Reference

Change the Locale

To specify the locale of the image, append the locale parameter set to the code for the

appropriate country to the image URL. If a country does not have a localized image or if you

do not pass a locale value, the default US image displays. This example displays the image

for the Spanish locale:

https://fpdbs.paypal.com/dynamicimagewe b?cmd=_dynamicimage&pal=SFJCXFDLNFR5U&locale=es_ES

If you are participating in a campaign across multiple countries, you can set the image locale

for each country in which you participate. PayPal returns the default image associated with the

locale when the campaign is over.

Feedback to Buyer Meeting an Incentive

Pass the order total amount in the ordertotal parameter so PayPal can determine if the

buyer is eligible for an incentive. Say, for example, that you are participating in a campaign in

which the buyer is eligible for a 20% discount when thei r order meets a minimum of $50.00.

You can pass that value to PayPal in the ordertotal parameter, as shown here:

https://fpdbs.paypal.com/dynamicimagewe b?cmd=_dynamicimage&pal=SFJCXFDLNFR5U&ordertotal=50.0 0

When a buyer’s order meets or exceeds $50.00, PayPal displays the incentive image informing

the buyer of their eligibility for the discount. When a buyer’s order is less than $50.00, PayPal

displays the default image.

NOTE: If ordertotal is not passed, PayPal does not display the incentive image even if the

buyer is eligible for the incentive.

Choose the Image

To specify the image that you want to display, set the value of buttontype. This example

sets buttontype to the PayPal Acceptance Mark image:

https://fpdbs.paypal.com/dynamicimagewe b?cmd=_dynamicimage&pal=SFJCXFDLNFR5U&buttontype=ecma rk

The default value for buttontype is ecshortcut.

Dynamic Image Command Reference

To set up the information that enables dynamic images, you add name-value pairs to the

dynamic image URL. Parameters and values are described below.

28 October 2009 Website Payments Pro Integration Guide

Page 29

Express Checkout Button and Logo Image Integration

Dynamic Image Parameters

The table below describes the dynamic image name-value pair parameters.

Dynamic-Image Command Variable Descriptions

pal Type: encrypted PayPal account number

(Optional) Unique identification number. When merchants sign up for a PayPal

business account, PayPal assigns them an account number. The pal value

represents the pay-to merchant account, not a third party making the API request

on behalf of this merchant.

NOTE: If pal is not passed, PayPal displays the default Check out with PayPal

button.

ordertotal Type: numeric

(Optional) The total cost of the order to the buyer. If shipping and sales tax are

known, include them in this value. If not, this value should be the current subtotal

of the order.

NOTE: If ordertotal is not passed, PayPal does not display the incentive

image even if the buyer is eligible for the incentive.

Character length and limitations: Must not exceed $10,000.00 USD in any

currency. No currency symbol.Must have two decimal places, decimal separator

must be a period (.), and the optional thousands separator must be a comma(,).

Dynamic Image Command Reference

4

locale Ty pe: string

(Optional) The five-character locale code. See Locale Codes.

Any other values default to US.

NOTE: The merchant can participate in one campaign per country.

buttontype Type: string

(Optional) Indicates a dynamic image. The values are:

z (Default) Check out with PayPal button image: ecsh ortcut

z PayPa l Acceptance Mark image: ecmark

Locale Codes

The table below lists the locale values. Country code is the two-letter code for the country.

Language priority is the language associated with the country code where language_0 is the

default.

Website Payments Pro Integration Guide October 2009 29

Page 30

Express Checkout Button and Logo Image Integration

4

Dynamic Image Command Reference

Country codes, language priorities, and locale values

Country code Language priority Locale

AT language_0 de_DE

AT language_1 en_US

AU language_0 en_AU

BE language_0 en_US

BE language_1 nl_NL

BE language_2 fr_FR

C2 language_0 en_US

C2 language_1 zh_XC

C2 language_2 fr_XC

C2 language_3 es_XC

CH language _0 de_DE

CH language_1 fr_FR

CH language_2 en_US

CN language_0 zh_CN

default language_0 en_US

default language_1 fr_XC

default language_2 es_XC

default language_3 zh_XC

DE language_0 de_DE

DE language_1 en_US

ES language_0 es_ES

ES language_1 en_US

FR language_0 fr_FR

FR language_1 en_US

GB language _0 en_GB

GF language_0 fr_FR

GF language_1 en_US

GI language_0 en_US

GP language_0 fr_FR

GP language_1 en_US

30 October 2009 Website Payments Pro Integration Guide

Page 31

Express Checkout Button and Logo Image Integration

Static PayPal Buttons and Images Source Requirements

Country code Language priority Locale

IE language_0 en_US

IT language_0 it_IT

IT language_1 en_US

JP language_0 ja_JP

JP language_1 en_US

MQ language_0 fr_FR

MQ language_1 en_US

NL language_0 nl_NL

NL language_1 en_US

PL language_0 pl_PL

PL language_1 en_US

RE language_0 fr_FR

4

RE language_1 en_US

US language_0 en_US

US language_1 fr_XC

US language_2 es_XC

US language_3 zh_XC

Static PayPal Buttons and Images Source Requirements

Using the static image code on the PayPal servers eliminates the need for you to maintain them

yourself.

PayPal requires that you use Express Checkout images hosted on PayPal’s secure servers,

rather than hosting copies of these images on your own servers. Out-of-date PayPal buttons on

you site could reduce customer confidence. If the buttons are updated, the new buttons will

appear automatically in your application.

T o get the HTML code for the Check out with PayPal button, use the URLs in the table below.

Website Payments Pro Integration Guide October 2009 31

Page 32

Express Checkout Button and Logo Image Integration

4

Static PayPal Buttons and Images Source Requirements

Check out with PayPal button URLs

Country Image URL

Australia https://www.paypal.com/au/cgi-

bin/webscr?cmd=xpt/Merchant/merchant/ExpressCheckoutButtonCode-outside

Austria https://www.paypal.com/at/cgi-

bin/webscr?cmd=xpt/Merchant/merchant/ExpressCheckoutButtonCode-outside

Belgium https://www.paypal.com/be/cgi-

bin/webscr?cmd=xpt/Merchant/merchant/ExpressCheckoutButtonCode-outside

Canada https://www.paypal.com/ca/cgi-

bin/webscr?cmd=xpt/Merchant/merchant/ExpressCheckoutButtonCode-outside

China https://www.paypal.com/cn/cgi-

bin/webscr?cmd=xpt/Merchant/merchant/ExpressCheckoutButtonCode-outside

France https://www.paypal.com/fr/cgi-

bin/webscr?cmd=xpt/Merchant/merchant/ExpressCheckoutButtonCode-outside

Germany https://www.paypal.com/de/cgi-

bin/webscr?cmd=xpt/Merchant/merchant/ExpressCheckoutButtonCode-outside

Italy https://www.paypal.com/it/cgi-

bin/webscr?cmd=xpt/Merchant/merchant/ExpressCheckoutButtonCode-outside

Japan https://www.paypal.com/j1/cgi-

bin/webscr?cmd=xpt/Merchant/merchant/ExpressCheckoutButtonCode-outside

Netherlands https://www.paypal.com/nl/cgi-

bin/webscr?cmd=xpt/Merchant/merchant/ExpressCheckoutButtonCode-outside

Poland https://www.paypal.com/pl/cgi-

bin/webscr?cmd=xpt/Merchant/merchant/ExpressCheckoutButtonCode-outside

Spain https://www.paypal.com/es/cgi-

bin/webscr?cmd=xpt/Merchant/merchant/ExpressCheckoutButtonCode-outside

Switzerland https://www.paypal.com/ch/cgi-

bin/webscr?cmd=xpt/Merchant/merchant/ExpressCheckoutButtonCode-outside

United Kingdom https://www.paypal.com/uk/cgi-

bin/webscr?cmd=xpt/Merchant/merchant/ExpressCheckoutButtonCode-outside

United States https://www.paypal.com/us/cgi-

bin/webscr?cmd=xpt/Merchant/merchant/ExpressCheckoutButtonCode-outside

To get the HTML code for the PayPal Acceptance Mark image and for other general

information about images, change the command value in the URLs above to:

cmd=xpt/Marketing_CommandDriven/general /OnlineLogoCenter-outside

For example, to get the PayPal Acceptance Mark image for Poland, change the URL to:

https://www.paypal.com/pl/cgibin/webscr?cmd=xpt/Marketing_CommandDriven/general/OnlineLogoCenter-outside

32 October 2009 Website Payments Pro Integration Guide

Page 33

PayPal Name-Value Pair API

5

Basics

The PayPal API uses a client-server model in which your site is a client of the PayPal server .

z PayPal API Client-Server Architecture

z Obtaining API Credentials

z Creating an NVP Request

z Executing NVP API Operations

z Responding to an NVP Response

PayPal API Client-Server Architecture

The PayPal API uses a client-server model in which your site is a client of the PayPal server .

You set up web pages on your site that initiate actions on a PayPal API server by sending a

request to the server. The PayPal server responds with a confirmation that the requested action

was taken or that an error occurred. The response may contain additional information related

to the request. The following diagram shows the basic request-response mechanism.

For example, you might want to obtain the customer’s shipping address from PayPal. You

could initiate a request that specifies an API operation that gets customer details. The response

from the PayPal API server would contain information about whether the request was

successful. If the operation was successful, the response would contain the requested

information; in this case, the customer’s shipping address. If the operation fails, there will be

one or more error messages.

PayPal Name-Value Pair API Requests and Responses

To perform a PayPal NVP API operation, you send an NVP-formatted request to a PayPal

NVP server and interpret the response.

In the following diagram, a request is generated on your site. At the PayPal server, the request

is executed, and the response is returned to your site.

Website Payments Pro Integration Guide October 2009 33

Page 34

PayPal Name-Value Pair API Basics

5

PayPal API Client-Server Architecture

The request identifies

z The name of the API operation to be performed and its version; for example,

SetExpressCheckout for version 52.0

z Credentials that identify the PayPal account making the request

z Request-specific information that controls the API operation to be performed

A PayPal API server performs the operation and returns a response. The response contains

z An acknowledgement status that indicates whet her the operation was a success or failure

and whether any warning messages were returned

z Information that can be used by PayPal to track execution of the API operatio n

z Response-specific information required to fulfill the request

Multiple API Operations

Some of the features you want to implement require multiple API operations.

Features, such as Express Checkout, require more than one API operation. Typically, these

features require you to

1. Invoke an API operation, such as SetExpressCheckout, that sets up the return URL to

which PayPal redirects your buyer’s browser after the buyer finishes on PayPal. Other

setup also may be performed.

2. Invoke additional API operations after receiving the buyer’s permission on PayPal, for

example, GetExpressCheckoutDetails or DoExpressC heckoutPayment.

The following diagram shows the execution flow between your site and PayPal:

34 October 2009 Website Payments Pro Integration Guide

Page 35

PayPal Name-Value Pair API Basics

PayPal API Client-Server Architecture

5

Token Security

Typically, the API operation that sets up a redirection to PayPal returns a token, which is

passed as a parameter in the redirect to PayPal. The token also may be required in related API

operations.

Website Payments Pro Integration Guide October 2009 35

Page 36

PayPal Name-Value Pair API Basics

5

Obtaining API Credentials

Obtaining API Credentials

To use the PayPal API, you must have API credentials that identify you as a PayPal business

account holder authorized to perform various API operations.

Although you can use either an API signature or a certificate for credentials, PayPal

recommends you use a signature.

IMPORTANT: You can use either a signature or a certificate; however, you cannot use a

signature and a certificate at the same time.

Creating an API Signature

You must establish credentials to use the PayPal API; typically, you create an API signature.

You must have a PayPal business account.

An API signature is a credential that consists of an API username along with an associated

API password and signature, all of which are assigned by PayPal.

To create an API signature

1. Log into PayPal and click Profile.

2. Click API Access from the Profile menu.

36 October 2009 Website Payments Pro Integration Guide

Page 37

3. Click Request API Credentials.

PayPal Name-Value Pair API Basics

Obtaining API Credentials

5

4. Check Request API signature and click Agree and Submit.

Website Payments Pro Integration Guide October 2009 37

Page 38

PayPal Name-Value Pair API Basics

5

Creating an NVP Request

5. To complete the process, click Done.

Make a note of the API username, API password, and signature. You will need to include

this information whenever you execute a PayPal API operation.

Creating an API Certificate

You must establish credentials to use the PayPal API; however, only create an API certificate

if your site requires it—most often, you will want to create an API signature for your

credentials.

If you really need a certificate, follow the instructions at

https://www.paypal.com/IntegrationCenter/ic_api-certificate.html.

NOTE: The certificate you use for API credentials is not the same as an SSL certificate for

your website; they are separate entities and not related to each other.

Creating an NVP Request

The Name-Value Pair request format specifies the API operation to perform, credentials that

authorize PayPal to access your account, and fields that specify additional information to be

used in the request.

Specifying the PayPal API Operation

For the NVP version of the PayPal API, you must specify the name of the PayPal API

operation to execute and its version in each request.

The following diagram shows the API operation part of an NVP request:

38 October 2009 Website Payments Pro Integration Guide

Page 39

PayPal Name-Value Pair API Basics

Creating an NVP Request

A method specifies the PayPal operation you want to execute. Each method is associated with

a version number; together, the method and version defines the exact behavior of the API

operation. Typically, the behavior of an API operation does not change between versions;

however, you should carefully retest your code whenever you change a version.

To specify a method and version number

1. Choose the PayPal API operation you want to use.

5

METHOD=

operation

2. Choose the appropriate version.

In most cases, you will want to use the latest version of the API operation.

VERSION=

Setting the API operation and version using PHP

function PPHttpPost($methodNam e_, $nvpStr_) {

...

$version = urlencode('52.0'); // NVPRequest for submitting to server

$nvpreq ="METHOD=$methodName_&V ERSION=$version... $nvpStr_";

...

}

version_number

Specifying an API Credential

You must specify API credentials in each request to execute a PayPal API operation.

When you execute a PayPal API operation, you use credentials, such as a signature, to

authenticate that you are requesting the API operation. The following diagram shows the API

credentials part of an NVP request:

To enable PayPal to authenticate your request

Website Payments Pro Integration Guide October 2009 39

Page 40

PayPal Name-Value Pair API Basics

5

Creating an NVP Request

1. Specify the API user name associated with your account.

USER=

2. Specify the password associated with the API user name.

PWD=

3. If you are using an API signature and not an API certificate, specify the API signature

associated with the API username.

SIGNATURE=

Specifying Credentials in PHP

$API_UserName = urlencode('my_ api_username'); // replace with API use rname

$API_Password = urlencode('my_ api_password'); // replace with passwor d

$API_Signature = urlencode('my_api_ signature'); // replace with act ual sig

// NVPRequest for submitting t o server$nvpreq

= "...&PWD=$API_Password&USER=$API_UserName&SIGNATURE=$API_Signature...";

URL Encoding

All requests to execute PayPal API operations sent via HTTP must be URL encoded.

API_username

API_password

API_signature

The PayPal NVP API uses the HTTP protocol to send requests and receive responses from a

PayPal API server. You must encode all data sent using the HTTP protocol because data that is

not encoded could be misinterpreted as part of the HTTP protocol instead of part of the

request. Most programming languages provide a way to encode strings in this way. You

should consistently URL encode the complete API request; otherwise, you may find that

unanticipated data causes an error.

NOTE: An HTTP form is automatically URL encoded by most browsers.

List Syntax for Name-Value Pairs

The PayPal API uses a special syntax for NVP fields defined as lists.

The NVP interface to the PayPal API requires a unique name for each field. In the API, lists

are prefixed by L_. T o identify an element within the list, use the offset from the beginning of

the list, starting with 0 as the first element. For example, L_DESC0 is the first line of a

description, L_DESC1, is the second line, and so on.

40 October 2009 Website Payments Pro Integration Guide

Page 41

Executing NVP API Operations

You execute an PayPal NVP API operation by submitting an HTTP POST request to a PayPal

API server.

Specifying a PayPal Server

You execute a PayPal API operation by submitting the request to a PayPal API server.

T o execute a PayPal NVP API operation, submit your complete request to one of the followi ng

end points:

Server end point Description

PayPal Name-Value Pair API Basics

Executing NVP API Operations

5

https://api3t.sandbox.paypal.com/nvp

https://api-3t.paypal.com/nvp PayPal “live” production server for use with API signatures

https://api.sandbox.paypal.com/ nvp Sandbox server for use with API certificates; use for testing

https://api.paypal.com/nvp PayPal “live” production server for use with API certificates

NOTE: You must use different API credentials for each kind of server. Typically, you obtain

Sandbox server for use with API signatures; use for testing your

API

your API

API credentials when you test in the Sandbox and then obtain another set of

credentials for the production server. You must change each API request to use the

new credentials when you go live.

Logging API Operations

You should log basic information about each PayPal API operation you execute.

All responses to PayPal API operations contain information that may be useful for debugging

purposes. You should log the Correlation ID, which identifies the API operation to PayPal,

and response-specific information, such as the transaction ID, which you can use to review a

transaction on the PayPal website or through the API. You can log other information that may

be useful, such as the timestamp. You could implement a scheme that logs the entire request

and response in a “verbose” mode; however, you should never log the password from a

request.

Website Payments Pro Integration Guide October 2009 41

Page 42

PayPal Name-Value Pair API Basics

5

Responding to an NVP Response

Responding to an NVP Response

The Name-Value Pair response consists of the answer to the request as well as common fields

that identify the API operation and how it was executed.

The following diagram shows fields in the response to a PayPal NVP API operation:

Common Response Fields

The PayPal API always returns common fields in addition to fields that are specific to the

requested PayPal API operation.

A PayPal API response includes the following fields:

Field D escription

ACK Acknowledgement status, which is one of the following values:

z Suc cess indicates a successful operation

z Suc cessWithWarning indicates a successful operation; however, there are

messages returned in the response that you should examine

z Fai lure indicates that the operation failed; the response will also contain one or

more error message explaining the failure.

z Fai lureWithWarning indicates that the operation failed and that there are

messages returned in the response that you should examine

CORRELATIONID Correlation ID, which uniquely identifies the transaction to PayPal

TIMESTAMP The date and time that the requested API operation was performed

VERSION The version of the API

BUILD The sub-version of the API

URL Decoding

All responses to HTTP POST operations used by the PayPal NVP API must be decoded.

The PayPal NVP API uses the HTTP protocol to send requests and receive responses from a

PayPal API server. You must decode all data returned using the HTTP protocol so that it can

be displayed properly. Most programming languages provide a way to decode strings.

NOTE: Most browsers decode responses to HTTP requests automatically.

42 October 2009 Website Payments Pro Integration Guide

Page 43

Implementing the Simplest

6

Express Checkout Integration

The simplest Express Checkout integration requires the following PayPal API operations:

SetExpressCheckout, DoExpressCheckoutPa yment, and optionally,

GetExpressCheckoutDetails.

z Setting Up the Express Checkout Transaction

z Obtaining Express Checkout Transaction Details

z Completing the Express Checkout Transaction

Setting Up the Express Checkout Transaction

T o set up an Express Checkout transaction, you must invoke the SetExpressCheckout API

to provide sufficient information to initiate the payment flow and redirect to PayPal if the

operation was successful.

This example assumes that you have set up the mechanism you will use to communicate with

the PayPal server and have a PayPal business account with API credentials. It also assumes

that the payment action is a final sale.

When you set up an Express Checkout transaction, you specify values in the

SetExpressCheckout request and then call the API. The values you specify control the

PayPal page flow and the options available to you and your buyers. You should start by setting

up a standard Express Checkout transaction, which can be modified to include additional

options.

To set up the simplest standard Express Checkout transaction

1. Specify the amount of the transaction; include the currency if it is not in US dollars.

Specify the total amount of the transaction if it is known; otherwise, specify the subtotal.

Regardless of the specified currency, the format must have decimal point with exactly two

digits to the right and an optional thousands separator to the left, which must be a comma;

for example, EUR 2.000,00 must be specified as 2000.00 or 2,000.00. The specified

amount cannot exceed USD $10,000.00, regardless of the currency used.

AMT=amount

CURRENCYCODE=currencyID

2. Specify the return URL.

The return URL is the page to which PayPal redirects your buyer’s browser after the buyer

logs into PayPal and approves the payment. Typically, this is a secure page

(https://...) on your site.

Website Payments Pro Integration Guide October 2009 43

Page 44

Implementing the Simplest Express Checkout Integration

6

Setting Up the Express Checkout Transaction

NOTE: You can use the return URL to piggyback parameters between pages on your site.

For example, you can set your Return URL to specify additional parameters using

the https://www.

yourcompany.com/page.html?param=value... syntax. The

parameters become available as request parameters on the page specified by the

Return URL.

RETURNURL=return_url

3. Specify the cancel URL.

The cancel URL is the page to which PayPal redirects your buyer’s browser if the buyer

does not approve the payment. Typically, this is the secure page (https://...) on your

site from which you redirected the buyer to PayPal.

NOTE: You can pass SetEx pressCheckout request values as parameters in your URL

to have the values available, if necessary, after PayPal redirects to your URL.

CANCELURL=cancel_url

4. Specify the payment action.

Although the default payment action is a Sale, it is a best practice to explicitly specify the

payment action as one of the following values:

PAYMENTACTION=Sale

PAYMENTACTION=Authorization

PAYMENTACTION=Order

5. Execute the SetExpressCheckout API operation to set up the Express Checkout

transaction.

6. Test that the response to the SetExpressCheckout API operation was successful.

7. If calling the SetExpressCheckout API was successful, redirect the buyer’s browser to

PayPal and execute the _express-che ckout command using the token returned in the

SetExpressCheckout response.

NOTE: The following example uses the PayPal Sandbox server:

https://www.sandbox.paypal.com /webscr

?cmd=_express-checkout&token=tokenV alue

&AMT=amount

&CURRENCYCODE=currencyID

&RETURNURL=return_url

&CANCELURL=cancel_url

44 October 2009 Website Payments Pro Integration Guide

Page 45

Implementing the Simplest Express Checkout Integration

Obtaining Express Checkout Transaction Details

Obtaining Express Checkout Transaction Details

To obtain details about an Express Checkout transaction, you can invoke the

GetExpressCheckoutDetails API operation.

This example assumes that PayPal redirects to your buyer’s browser with a valid token after

the buyer reviews the transaction on PayPal.

Although you are not required to invoke the GetExpressCh eckoutDetails API operation,

most Express Checkout implementations take this action to obtain information about the

buyer. You invoke the GetExpressCheckoutDetails API operation from the page

specified by return URL, which you set in your call to the SetExpressCheckout API.

Typically, you invoke this operation as soon as the redirect occurs and use the information in

the response to populate your review page.

To obtain a buyer’s shipping address and Payer ID

1. Specify the token returned by PayPal when it redirects the buyer’s browser to your site.

PayPal returns the token to use in the token HTTP request parameter when redirecting to

the URL you specified in your call to the SetExpressCheckout API.

6

TOKEN=tokenValue

2. Execute the GetExpressCheckoutDetails API to obtain information about the buyer.

3. Access the fields in the GetExpressCheckoutDetails API response.

NOTE: Only populated fields are returned in the response.

Completing the Express Checkout Transaction

To complete an Express Checkout transaction, you must invoke the

DoExpressCheckoutPayment API operation.

This example assumes that PayPal redirects your buyer’s browser to your website with a valid

token after you call the SetExpressCheckout API. Optionally, you may call the

GetExpressCheckoutDetails API before calling the DoExpress CheckoutPayment

API.

In the simplest case, you set the total amount of the order when you call the

SetExpressCheckout API. However, you can change the amount before calling the

DoExpressCheckoutPayment API if you did not know the total amount when you called

the SetExpressCheckout API.

Website Payments Pro Integration Guide October 2009 45

Page 46

Implementing the Simplest Express Checkout Integration

6

Completing the Express Checkout Transaction

This example assumes the simplest case, in which the total amount was specified in the return

URL when calling the SetExpressCheckout API. Although you can specify additional

options, this example does not use any additional options.

To execute an Express Checkout transaction

1. Specify the token returned by PayPal when it redirects the buyer’s browser to your site.

PayPal returns the token to use in the token HTTP request parameter when redirecting to

the URL you specified in your call to the SetExpressCheckout API.

TOKEN=tokenValue

2. Specify the Payer ID returned by PayPal when it redirects the buyer’s browser to your site.

PayPal returns the Payer ID to use in the token HTTP request parameter when redirecting

to the URL you specified in your call to the SetExpressCheckout API. Optionally, you

can obtain the Payer ID by calling the GetExpressCheckoutDetails API.

PAYERID=id

3. Specify the amount of the order including shipping, handling, and tax; include the currency

if it is not in US dollars.

Regardless of the specified currency, the format must have decimal point with exactly two

digits to the right and an optional thousands separator to the left, which must be a comma;

for example, EUR 2.000,00 must be specified as 2000.00 or 2,000.00. The specified

amount cannot exceed USD $10,000.00, regardless of the currency used.

AMT=amount

CURRENCYCODE=currencyID

4. Specify the payment action.

Although the default payment action is a Sale, it is a best practice to explicitly specify the

payment action as one of the following values:

PAYMENTACTION=Sale

PAYMENTACTION=Authorization

PAYMENTACTION=Order

5. Execute the DoExpressCheckoutPayment API to complete the Express Checkout

transaction.

6. Examine the values returned by the API if the transaction completed successfully.

46 October 2009 Website Payments Pro Integration Guide

Page 47

7

Testing an Express Checkout Integration

You can test your Express Checkout integration in the Sandbox.

This example shows how to simulate your web pages using HTTP forms and supplying the

values for API operations from these forms. You can use this strategy for your initial testing;

however, for more complete testing, you will want to replace these forms with your web pages

containing actual code.

The following diagram shows the Express Checkout execution flow, which uses the Sandbox

as the API server. The pages on the left represent your site.

Website Payments Pro Integration Guide October 2009 47

Page 48

Testing an Express Checkout Integration

7

Express Checkout Execution Flow

The following steps match the circled numbers in the diagram. Perform the actions in each

step to test Express Checkout.

1. Invoke a form on your site that calls the SetExpressCheckout API on the Sandbox.

To invoke the API, set form fields whose names match the NVP names of the fields you want

to set, specify their corresponding values, and then post the form to a PayPal Sandbox server,

such as https://api-3t.sandbox.paypal.com/nvp, as shown in the following

example:

48 October 2009 Website Payments Pro Integration Guide

Page 49

Testing an Express Checkout Integration

<form method=post action=https ://api-3t.sandbox. paypal.com/nvp>

<input type=hidden name=USER v alue= API_username>

<input type=hidden name=PWD value= API_p assword>

<input type=hidden name=SIGNAT URE value= API_signature>

<input type=hidden name=VERSIO N value=2.3>

<input type=hidden name=PAYMENTACTI ON value=Authorization>

<input name=AMT value=19.95>

<input type=hidden name=RETURNURL

value=http://www.YourReturnURL .com>

<input type=hidden name=CANCELURL

value=http://www.YourCancelURL .com>

<input type=submit name=METHOD value=SetExpressC heckout>

</form>

NOTE: The API username is a Sandbox business test account for which a signature exists. See

the Test Certificates tab of the Sandbox to obtain a signature. If you are not using a

signature, you must use a different Sandbox server.

2. Review the response string from the SetExpressCheckout API operation.

7

PayPal responds with a message, such as the one shown below. Note the status, which

should include ACK set to Success, and a token that is used in subsequent steps.

TIMESTAMP=2007%2d04%2d05T23%3a 23%3a07Z

&CORRELATIONID=63cdac0b67b50

&ACK=Success

&VERSION=2%2e300000 &BUILD=1 %2e0006

&TOKEN=EC%2d1NK66318YB717835M

3. If the operation was successful, use the token and redirect your browser to the Sandbox to

log in, as follows:

https://www.sandbox.paypal.com /cgi-bin/webscr?

cmd=_express-checkout

&token=EC-1NK66318YB717835M

You may need to replace hexadecimal codes with ASCII codes; for example, you may need

to replace %2d in the token with a hyphen ( - ).

You must log in to https://developer.paypal.com before you log in to a Sandbox

test account. You then log in to the test account that represents the buyer, not the

API_username business test account that represents you as the merchant.

4. After logging into the buyer test account, confirm the details.

When you confirm, the Sandbox redirects your browser to the return URL you specified

when invoking the SetExpressCheckout API operation, as in the following example:

http://www.YourReturnURL.com/

?token=EC-1NK66318YB717835M&Pa yerID=7AKUSARZ7SAT8

Website Payments Pro Integration Guide October 2009 49

Page 50

Testing an Express Checkout Integration

7

5. Invoke a form on your site that calls the GetExpressCheckout Details API operation

on the Sandbox:

<form method=post action=https ://api-3t.sandbox. paypal.com/nvp

<input type=hidden name=USER v alue=API_username>

<input type=hidden name=PWD value=API_p assword>

<input type=hidden name=SIGNAT URE value=API_signature>

<input type=hidden name=VERSIO N value=2.3>

<input name=TOKEN value=EC-1NK66318 YB717835M>

<input type=submit name=METHOD value=GetExpressC heckoutDetails>

</form>

If the operation was successful, the GetExpressCheckoutDetails API returns

information about the payer, such as the following information:

TIMESTAMP=2007%2d04%2d05T23%3a 44%3a11Z

&CORRELATIONID=6b174e9bac3b3 &ACK=Success

&VERSION=2%2e300000

&BUILD=1%2e0006

&TOKEN=EC%2d1NK66318YB717835M

&EMAIL=Y ourSandboxBuyerAccountEmail

&PAYERID=7AKUSARZ7SAT8

&PAYERSTATUS=verified

&FIRSTNAME=...

&LASTNAME=...

&COUNTRYCODE=US

&BUSINESS=...

&SHIPTONAME=...

&SHIPTOSTREET=...

&SHIPTOCITY=...

&SHIPTOSTATE=CA

&SHIPTOCOUNTRYCODE=US

&SHIPTOCOUNTRYNAME=United%20St ates

&SHIPTOZIP=94666

&ADDRESSID=...

&ADDRESSSTATUS=Confirmed