Page 1

PayPal Payments Pro

Integration Guide

Last updated: April 2012

Page 2

PayPal Payments Pro Integration Guide

Document Number: 100001.en_US-201204

© 2010-2011 PayPal, Inc. All rights reserved. PayPal is a registered trademark of PayPal, Inc. The PayPal logo is a trademark of PayPal, Inc. Other

trademarks and brands are the property of their respective owners.

The information in this document belongs to PayPal, Inc. It may not be used, reproduced or disclosed without the written approval of PayPal, Inc.

Copyright © PayPal. All rights reserved. PayPal S.à r.l. et Cie, S.C.A., Société en Commandite par Actions. Registered office: 22-24 Boulevard Royal, L2449, Luxembourg, R.C.S. Luxembourg B 118 349

Consumer advisory: The PayPal™ payment service is regarded as a stored value facility under Singapore law. As such, it does not require the approval

of the Monetary Authority of Singapore. You are advised to read the terms and conditions carefully.

Notice of non-liability:

PayPal, Inc. is providing the information i n this document t o you “AS-IS” with all faults. PayPal, Inc. makes no warranties of any kind (whether express,

implied or statutory) with respect to the information co ntained herein. PayPal, Inc. assumes no liability for damages (whether direct or indirect), caused

by errors or omissions, or resulting from the use of this document or the information contained in this document or resulting f rom the application or use

of the product or service described herein. PayPal, Inc. reserves the right to make changes to any information herein without further notice.

Page 3

Contents

Preface . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Intended Audience . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Revision History . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Where to Go for More Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Documentation Feedback . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Chapter 1 Introducing PayPal Payments Pro. . . . . . . . . . . . . . 9

Getting Related Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

PayPal Payments Pro Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Additional Features of PayPal Payments Pro . . . . . . . . . . . . . . . . . . . . . . . . 10

Settlements and Captured Payments . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Recurring Payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Virtual Terminal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Hosted Solution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Fraud Management Filters. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Event Notification . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

PayPal Payments Pro API Operations. . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Website Payments Pro Regional Differences . . . . . . . . . . . . . . . . . . . . . . . . 15

Credit Cards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Default Currency and Transaction Limits . . . . . . . . . . . . . . . . . . . . . . . . 15

Credit Card Currencies by Country . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

Addresses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Chapter 2 Introducing Direct Payment . . . . . . . . . . . . . . . . .19

The Direct Payment User Experience . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

User Interface Recommendations for Direct Payment Checkout . . . . . . . . . . . . . . 21

Chapter 3 Introducing Express Checkout . . . . . . . . . . . . . . .23

The Express Checkout Experience . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Express Checkout Integration Steps. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

Configuring and Customizing the Express Checkout Experience . . . . . . . . . . . . 25

Additional PayPal API Operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

PayPal Payments Pro Integration Guide April 2012 3

Page 4

Contents

Express Checkout Flow . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

Checkout Entry Point . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

Payment Option Entry Point . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

Express Checkout Building Blocks. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

PayPal Button and Logo Images . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

Express Checkout API Operations . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

Express Checkout Command . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

Express Checkout Token Usage. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

Chapter 4 Getting Started With Direct Payment . . . . . . . . . . . .33

Implementing the Simplest Direct Payment Integration . . . . . . . . . . . . . . . . . . . 33

Testing Direct Payment Using NVP and cURL. . . . . . . . . . . . . . . . . . . . . . . . 34

Direct Payment Authorization and Captures . . . . . . . . . . . . . . . . . . . . . . . . . 38

Sale Payment Action for Direct Payment . . . . . . . . . . . . . . . . . . . . . . . . 38

Authorization and Capture for Direct Payment . . . . . . . . . . . . . . . . . . . . . 38

DoDirectPayment Authorization and Capture Example . . . . . . . . . . . . . . . . . 39

DoDirectPayment Reauthorization and Capture Example. . . . . . . . . . . . . . . . 41

Chapter 5 Getting Started With Express Checkout. . . . . . . . . . . 45

Implementing the Simplest Express Checkout Integration. . . . . . . . . . . . . . . . . . 45

Setting Up the Express Checkout Transaction . . . . . . . . . . . . . . . . . . . . . 45

Obtaining Express Checkout Transaction Details . . . . . . . . . . . . . . . . . . . . 47

Completing the Express Checkout Transaction . . . . . . . . . . . . . . . . . . . . . 48

Testing an Express Checkout Integration . . . . . . . . . . . . . . . . . . . . . . . . . . 49

Handling Payment Settlements With Express Checkout. . . . . . . . . . . . . . . . . . . 53

Sale Payment Action for Express Checkout. . . . . . . . . . . . . . . . . . . . . . . 54

Authorization Payment Action for Express Checkout . . . . . . . . . . . . . . . . . . 54

Order Payment Action for Express Checkout . . . . . . . . . . . . . . . . . . . . . . 55

Issuing Refunds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56

Chapter 6 Integrating Recurring Payments. . . . . . . . . . . . . . .59

How Recurring Payments Work . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59

Limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 60

Recurring Payments Terms . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 60

Recurring Payments With Direct Payment. . . . . . . . . . . . . . . . . . . . . . . . . . 61

Recurring Payments With the Express Checkout API . . . . . . . . . . . . . . . . . . . . 62

Initiating the Processing Flow With SetExpressCheckout . . . . . . . . . . . . . . . 63

4 April 2012 PayPal Payments Pro Integration Guide

Page 5

Contents

Redirecting the Buyer to PayPal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 64

Getting Buyer Details Using GetExpressCheckoutDetails. . . . . . . . . . . . . . . . 65

Creating the Profiles With CreateRecurringPaymentsProfile . . . . . . . . . . . . . . 65

Options for Creating a Recurring Payments Profile . . . . . . . . . . . . . . . . . . . . . 66

Specifying the Regular Payment Period . . . . . . . . . . . . . . . . . . . . . . . . . 66

Including an Optional Trial Period . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67

Specifying an Initial Payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 68

Maximum Number of Failed Payments . . . . . . . . . . . . . . . . . . . . . . . . . 68

Billing the Outstanding Amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 69

Identifying Items as Digital or Physical Goods. . . . . . . . . . . . . . . . . . . . . . 69

Recurring Payments Profile Status. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 69

Getting Recurring Payments Profile Information. . . . . . . . . . . . . . . . . . . . . . . 70

Modifying a Recurring Payments Profile. . . . . . . . . . . . . . . . . . . . . . . . . . . 70

Updating Addresses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 71

Updating the Billing Amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 71

Billing the Outstanding Amount of a Profile . . . . . . . . . . . . . . . . . . . . . . . . . 72

Recurring Payments Notifications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72

Appendix A Getting Started With the PayPal Name-Value Pair API . . .75

PayPal API Client-Server Architecture. . . . . . . . . . . . . . . . . . . . . . . . . . . . 75

PayPal Name-Value Pair API Requests and Responses . . . . . . . . . . . . . . . . 76

UTF-8 Character Encoding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 76

Multiple API Operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 76

Obtaining API Credentials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77

Creating an API Signature. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78

Creating an API Certificate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 79

NVP Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80

Creating an NVP Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80

Specifying the PayPal API Operation . . . . . . . . . . . . . . . . . . . . . . . . . . 80

Specifying an API Credential . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 81

URL Encoding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 82

List Syntax for Name-Value Pairs . . . . . . . . . . . . . . . . . . . . . . . . . . . . 83

Executing NVP API Operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 84

Specifying a PayPal Server . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 84

Logging API Operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 84

Responding to an NVP Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85

Common Response Fields. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85

Error Responses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85

PayPal Payments Pro Integration Guide April 2012 5

Page 6

Contents

URL Decoding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 86

Appendix B Implementing 3-D Secure Transactions (UK Only) . . . . .87

Introduction to 3-D Secure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 87

Integration Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 88

Cardinal Commerce Registration and Installation . . . . . . . . . . . . . . . . . . . . . . 88

Transaction Processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 89

URL to Handle Issuer’s Response. . . . . . . . . . . . . . . . . . . . . . . . . . . . 90

Transaction Flow. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90

3-D Secure Fields for Direct Payment Transaction Requests . . . . . . . . . . . . . . 92

Website Setup . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 93

Examples. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 94

Example 1: Successful 3-D Secure Authentication . . . . . . . . . . . . . . . . . . . 94

Example 2: 3-D Secure with Unsuccessful Authentication . . . . . . . . . . . . . . . 94

Example 3: Card Issuer Not Using 3-D Secure . . . . . . . . . . . . . . . . . . . . . 95

Example 4: Merchant Not Using 3-D Secure . . . . . . . . . . . . . . . . . . . . . . 95

Testing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 95

cmpi_lookup API . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 96

cmpi_lookup Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 96

cmpi_lookup Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 96

Issuer Authentication Fields . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 97

Issuer Authentication Request. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 97

Issuer Authentication Response. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 98

cmpi_authenticate API . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 98

cmpi_authenticate Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 98

cmpi_authenticate Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 98

6 April 2012 PayPal Payments Pro Integration Guide

Page 7

Preface

This document describes PayPal Payments Pro (known as Website Payments Pro outside the

U.S.) integration.

Intended Audience

This document is intended for merchants and developers implementing PayPal Payments Pro.

Revision History

Revision history for PayPal Payments Pro Integration Guide.

Date Description

04/03/12 Updated references to Website Payments Standard and Website Payments

Pro to PayPal Payments Standard and PayPal Payments Pro, respectively.

02/13/12 Updated user experience graphics.

12/20/10 Replaced deprecated field names in examples.

10/26/10 Added a reference to information on Mobile Express Checkout, which is

located in the Epxress Checkout Integration Guide.

08/11/10 Divided the Website Payments Pro Integration Guide into 2 guides: the

Website Payments Pro Integration Guide and the Express Checkout

Advanced Features Guide

05/11/10 Added details for integrating parallel payments using the NVP and SOAP

API, including use with airlines. Added new Immediate Payment

functionality. Updated billing agreements with functionality to obtain the

latest billing address, skip billing agreement creation, and clarify use of the

BAUpdate API.

03/10/10 Consolidated all regions (US, UK, and Canada) into one manual.

Added additional information about Direct Payment.

10/05/09 Added Immediate Payment.

Edited for technical accuracy.

Removed PayPal placement guidelines.

.

06/30/09 Added a section on payment review.

PayPal Payments Pro Integration Guide April 2012 7

Page 8

Where to Go for More Information

Date Description

06/04/09 Added a chapter on pre-populating the PayPal review page. Updated PayPal

Review pages. Moved some customization topics out of this guide. They

are now in the Merchant Setup and Administration Guide.

04/08/09 Added a chapter describing the Instant Update Callback API.

Added Express Checkout feature of passing AMT=0 to create one or more

billing agreements.

12/11/08 Revised the Website Payments Pro introduction and overview chapters.

11/13/08 Added information about integrating dynamic images and added

information about order details that can be displayed on the PayPal Review

page.

06/30/08 Complete revision.

Where to Go for More Information

Express Checkout Advanced Features Guide

Merchant Setup and Administration Guide

Documentation Feedback

Help us improve this guide by sending feedback to:

documentationfeedback@paypal.com

8 April 2012 PayPal Payments Pro Integration Guide

Page 9

Introducing PayPal Payments Pro

1

You can accept credit and debit cards and PayPal payments directly on your website using 2

API-based solutions: Direct Payment and Express Checkout. You must integrate with both

Direct Payment and Express Checkout to use PayPal Payments Pro, known as Website

Payments Pro outside the U.S.

PayPal Payments Pro Overview

Additional Features of PayPal Payments Pro

PayPal Payments Pro API Operations

Website Payments Pro Regional Differences

Getting Related Information

All PayPal documentation is available on x.com, including video demos, forums and developer

resources.

For information about administrative tasks you can perform from your PayPal account such

as adding users, setting up custom page styles, and managing multiple currency balances,

see the

If you use the Payflow API to process transactions with PayPal as your internet merchant

account, see

Merchant Setup and Administration Guide.

Gateway Developer Guide and Reference.

PayPal Payments Pro Overview

PayPal Payments Pro includes Direct Payment, Express Checkout, and additional PayPal

solutions and tools, such as Virtual Terminal, Fraud Management Filters, and reference

transactions.

Direct Payment enables you to accept both debit and credit cards directly from your site.

Express Checkout enables you to accept payments from PayPal accounts in addition to

debit and credit cards.

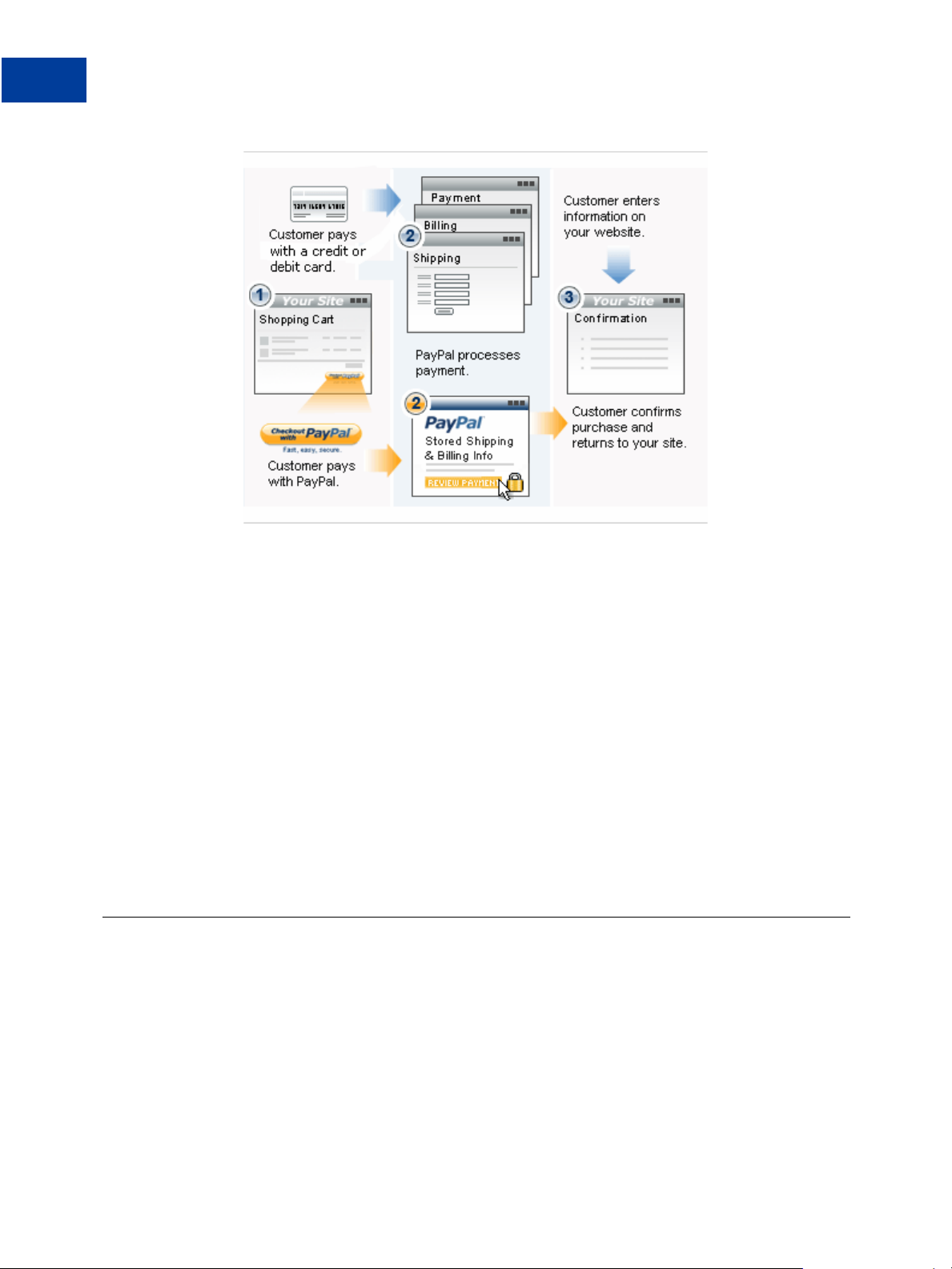

The following diagram shows the relationship between Direct Payment and Express Checkout

to a buyer.

PayPal Payments Pro Integration Guide April 2012 9

Page 10

Introducing PayPal Payments Pro

1

Additional Features of PayPal Payments Pro

From your shopping cart, a buyer can either checkout with Express Checkout, starting from

the Checkout with PayPal button on your Shopping Cart page, or pay directly by credit or

debit card using Direct Payment.

If a buyer pays using Express Checkout, PayPal provides a checkout experience that

streamlines checkout. Even if buyers do not pay using Express Checkout, they can still pay by

credit or debit card using Direct Payment. In this case, buyers might need to enter payment,

billing, and shipping information. In both cases, buyers stay on your website or are sent to the

page of your choice.

You must implement both an Express Checkout flow and a Direct Payment flow to use PayPal

Payments Pro. You implement the Express Checkout flow by calling PayPal’s Express

Checkout API operations, which guides a buyer through the checkout process. You implement

the Direct Payment flow using your own code, for which PayPal provides an API operatio n to

process the credit or debit card payment.

NOTE: Purchases through Direct Payment are not covered by the PayPal Seller Protection

Policy.

Additional Features of PayPal Payments Pro

PayPal Payments Pro consists of APIs for accepting credit card, debit card, and PayPal

payments; these payments can be immediate, authorized for later capture, and they can be

recurring payments. PayPal Payments Pro also includes standalone applications for accepting

payments.

In addition, PayPal Payments Pro includes Fraud Management Filters for automatic review

and management of risk.

10 April 2012 PayPal Payments Pro Integration Guide

Page 11

Settlements and Captured Payments

Often, you accept a payment and ship goods immediately, which is refered to as sale. In

addition to immediate payments, Direct Payment and Express Checkout both allow you to

authorize payments to be captured later, which is referred to as an authorization. An

authorization is useful, for example, when you want to reserve a buyer’s funds pending the

shipment of goods; the actual payment is captured when the goods are shipped. An

authorization can be reauthorized one time if necessary; for example, when you are unable to

ship within 3 days of the authorization.

Express Checkout provides an additional option, called an order, which you use when a single

authorization is insufficient. You can create multiple authorizations and capture them as part

of the same order. This would be useful, for example, when an order is split into multiple

shipments and you need to capture a payment each time part of the order is shipped.

Recurring Payments

You can support recurring payments to manage subscriptions and other payments on a fixed

schedule. Direct Payment and Express Checkout both process recurring payments.

Introducing PayPal Payments Pro

Additional Features of PayPal Payments Pro

1

When you support recurring payments for a buyer, you create a recurring payments profile.

The profile contains information about the recurring payments, including details for an

optional trial period and a regular payment period. Both periods contain information about the

payment frequency and payment amounts, including shipping and tax, if applicable.

After creating a profile, PayPal automatically queues payments based on the billing start date,

billing frequency, and billin g amount. Payments reoccur until th e profile expires, t here are too

many failed payments to continue, or you cancel the profile.

Permission to allow recurring payments is established by the buyer setting up a billing

agreement with the merchant on PayPal. For Express Checkout, the billing agreement can be

established either in advance or when the buyer first makes a purchase; in either case, it occurs

when you call Express Checkout API operations. For direct payment, it occurs when you make

an explicit call to set up the billing agreement.

Recurring payments using reference transactions is an alternative, which enables you to ha ndle

payments for varying amounts of money on a va rying schedule. A reference transaction is a

financial transaction from which subsequent transactions can be derived; for example, a buyer

can make a purchase on your site and the PayPal transaction ID, called a reference transaction

ID, can later be used to initiate another transaction.

NOTE: The use of recurring payments with direct payment may incur additional fees.

Virtual Terminal

PayPal’s Virtual Terminal is a web-based application that allows you to accept credit card

payments. It is available to merchants in the United States, Canada, France, and the United

Kingdom. Virtual Terminal provides your business with the functionality similar to a standalone credit card-processing terminal. Virtual Terminal is ideal when you receive orders by

PayPal Payments Pro Integration Guide April 2012 11

Page 12

Introducing PayPal Payments Pro

1

Additional Features of PayPal Payments Pro

phone, fax, or by mail and want to accept credit cards. An optional card reader is available to

process face-to-face purchases; however, some restrictions apply. You can use Virtual

Terminal on any computer with an internet connection and a web browser.

For more information about Virtual Terminal, see

Hosted Solution

Hosted Solution, which is available to merchants in the United Kingdom as part of PayPal

Payments Pro, is a fast and easy way to add transaction processing to your website. It is a

secure, PayPal-hosted, web-based payment solution that allows you to securely send your

buyers to PayPal’s payment page to authorize and process transactions. Buyers pay with a

debit or credit card, or their PayPal account. You do not have to capture or store credit card

information on your website, thereby helping towards achieving PCI compliance. Hosted

Solution is the choice for merchants who prefer a solution where all financial details are

handled by PayPal.

For more information about Hosted Solution for UK merchants, see

Hosted Solution Integration Guide.

Fraud Management Filters

Fraud Management Filters (FMF) provide you filters that identify potentially fraudulent

transactions. There are 2 categories of filters:

Basic filters screen against data such as the country of origin and the value of transactions.

PayPal provides basic filters for Business accounts and Website Payments Pro accounts.

Virtual Terminal Users Guide.

Website Payments Pro

Advanced filters screen data such as credit card and addresses information, lists of high-

risk indicators, and additional transaction characteristics. Website Payments Pro merchants

can upgrade to use these filters.

NOTE: Using advanced filters might incur additional charges.

For more information about Fraud Management Filters, see

Event Notification

In most cases you can use the GetTransactionDetails API operation to determine the

information you need about a transaction. However, there may be some cases in which you

must set up IPN; for example, when you need automatic notification about actions, such as

disputes and their resolution.

IPN is a message service that PayPal uses to notify you about events, such as:

Instant payments, including Express Checkout, Adaptive Payments, and direct credit card

payments, and authorizations, which indicate a sale whose payment has not yet been

collected

Fraud Management Filters

12 April 2012 PayPal Payments Pro Integration Guide

Page 13

Introducing PayPal Payments Pro

PayPal Payments Pro API Operations

eCheck payments and associated status, such as pending, completed, or denied, and

payments pending for other reasons, such as those being reviewed for potential fraud

Recurring payment and subscription actions

Chargebacks, disputes, reversals, and refunds associated with a transaction

1

For more information about IPN, see

Instant Payment Notification Guide

PayPal Payments Pro API Operations

The PayPal API supports a range of functions related to payment processing. Though most

API operations support both Direct Payment and Express Checkout, some are specific to

Direct Payment and others are specific to Express Checkout.

PayPal API Operation Description

Direct Payment core API operations: (Direct Payment only)

DoDirectPayment Process a credit card payment, such as a sale or

authorization.

DoNonReferencedCredit Issue a credit to a card not referenced by the original

transaction.

NOTE: Contact PayPal to use this API operation; in most

cases, you should use the RefundTransaction

API operation instead.

Express Checkout core API operations: (Express Checkout only)

SetExpressCheckout Initiates an Express Checkout transaction.

GetExpressCheckoutDetails Obtain information about an Express Checkout transaction.

DoExpressCheckoutPayment Completes an Express Checkout transaction.

Common API operations:

GetTransactionDetails Obtain information about a specific transaction.

ManagePendingTransactionStatus Accept or deny a pending transaction held by Fraud

Management Filters.

RefundTransaction Issue a refund to the PayPal account holder associated with a

transaction.

TransactionSearch Search transaction history for transactions that meet the

specified criteria.

Authorization and Capture API operations:

DoCapture Capture an authorized payment.

DoAuthorization Authorize a payment. (Express Checkout only)

PayPal Payments Pro Integration Guide April 2012 13

Page 14

Introducing PayPal Payments Pro

1

PayPal Payments Pro API Operations

PayPal API Operation Description

DoReauthorization Reauthorize a previously authorized payment.

DoVoid Void an order or an authorization.

Recurring Payment API operations:

CreateRecurringPaymentsProfile Create a recurring payments profile.

GetRecurringPaymentsProfileDeta ils Obtain information about a recurring payments profile.

ManageRecurringPaymentsProfileS tatus Cancel, suspend, or reactivate a recurring payments profile.

BillOutstandingAmount Bill the buyer for the outstanding balance associated with a

recurring payments profile.

UpdateRecurringPaymentsProfile Update a recurring payments profile.

DoReferenceTransaction Process a payment from a buyer’s account, which is

identified by a previous transaction.

Recurring Payment Billing Agreement API operations: (Express Checkout only)

BAUpdate Update or delete a billing agreement.

GetBillingAgreementCustomerDeta ils Obtain information about a billing agreement’s PayPal

account holder.

SetCustomerBillingAgreement Initiates the creation of a billing agreement.

Other Express Checkout API operations: (Express Checkout only)

AddressVerify Confirms whether a postal address and postal code match

those of the specified PayPal account holder. (Express

Checkout only)

Callback Define the shipping and handling parameters associated with

Express Checkout.

GetBalance Obtain the available balance for a PayPal account. (Express

Checkout only)

GetPalDetails Obtain your Pal ID, which is the PayPal-assigned merchant

account number, and other information about your account.

MassPay Make a payment to one or more PayPal account holders.

NOTE: If you use the Payflow API to process transactions with PayPal as your internet

merchant account, see

Gateway Developer Guide and Reference.

14 April 2012 PayPal Payments Pro Integration Guide

Page 15

Introducing PayPal Payments Pro

Website Payments Pro Regional Differences

Website Payments Pro Regional Differences

Website Payments Pro is available in the United States, Canada, and the United Kingdom.

Minor regional differences include transaction limits, the kinds of credit cards accepted, and

address information.

The following sections identify regional differences:

Credit Cards

The following table lists the credit cards that are accepted:

Country Accepted credit cards

1

Canada

United Kingdom

United States

Visa

MasterCard

NOTE: Interac debit cards are not accepted.

Visa, including Visa Electron and Visa Debit

MasterCard

Maestro, including Switch

Visa

MasterCard

Discover

American Express

MasterCard is a registered trademark.

NOTE: For direct payment only, American Express restricts direct card acceptance merchants

in certain business categories. Merchants are required to accept the American Express

Card Acceptance agreement in order to process American Express cards directly.

Default Currency and Transaction Limits

The following table lists the default transaction limit in the default currency for each country:

Country Default transaction limit in default currency

Canada 12,500 CAD

United Kingdom 5,500 GBP

United States 10,000 USD

NOTE: Contact PayPal if you want to increase transaction limits.

PayPal Payments Pro Integration Guide April 2012 15

Page 16

Introducing PayPal Payments Pro

1

Website Payments Pro Regional Differences

Credit Card Currencies by Country

The following currencies are supported for Direct Payment:

Currencies and Currency Codes Supported by Express Checkout and Direct Pa yment

Direct Payment

Express

Checkout

Currency

Currency

Code

Currency for

Specified Card in

United States

Direct Payment

Currency for Specified

Card in United Kingdom

Direct Payment

Currency for Specified

Card in Canada

Australian

Dollar

Canadian

Dollar

Czech Koruna CZK Visa, MasterCard Visa, MasterCard

Danish Krone DKK Visa, MasterCard Visa, MasterCard

Euro EUR Visa, MasterCard Visa, MasterCard Visa, MasterCard

Hong Kong

Dollar

Hungarian

Forint

Japanese Yen JPY Visa, MasterCard Visa, MasterCard Visa, MasterCard

Norwegian

Krone

New Zealand

Dollar

Polish Zloty PLN Visa, MasterCard Visa, MasterCard

Pound Sterling GBP Visa, MasterCard Visa, MasterCard, Maestro Visa, MasterCard

AUD Visa, MasterCard Visa, MasterCard Visa, MasterCard

CAD Visa, MasterCard Visa, MasterCard Visa, MasterCard

HKD Visa, MasterCard Visa, MasterCard

HUF Visa, MasterCard Visa, MasterCard

NOK Visa, MasterCard Visa, MasterCard

NZD Visa, MasterCard Visa, MasterCard

Singapore

Dollar

Swedish Krona SEK Visa, MasterCard Visa, MasterCard

Swiss Franc CHF Visa, MasterCard Visa, MasterCard

U.S. Dollar USD Visa, MasterCard,

SGD Visa, MasterCard Visa, MasterCard

Visa, MasterCard Visa, MasterCard

Discover, American

Express

NOTE: Virtual Terminal for France supports the same currencies as Visa or MasterCard for

the UK. Express Checkout supports all of the countries identified in the table.

16 April 2012 PayPal Payments Pro Integration Guide

Page 17

Addresses

For Canada, specify the province abbreviation in the State field.

For Great Britain, the State field is ignored; however, you still may need to specify a value

Introducing PayPal Payments Pro

Website Payments Pro Regional Differences

in the State field; for example you can specify the city for both the city and state.

1

For more information about addresses, see the

PayPal Developer Network.

PayPal Payments Pro Integration Guide April 2012 17

Page 18

Introducing PayPal Payments Pro

1

Website Payments Pro Regional Differences

18 April 2012 PayPal Payments Pro Integration Guide

Page 19

Introducing Direct Payment

2

Direct Payment lets buyers who do not have a PayPal account use their credit cards without

leaving your website. PayPal processes the payment in the background.

The Direct Payment User Experience

User Interface Recommendations for Direct Payment Checkout

The Direct Payment User Experience

Direct Payment enables buyers to pay by credit or debit card during your checkout flow. You

have complete control over the experience; however, you must consider PCI compliance.

When buyers choose to pay with a credit or debit card, they enter their card number and other

information on your website. After they confirm their order and click Pay, you complete the

order in the background by invoking the DoDirectPa yment API operation. Buyers never

leave your site. Although PayPal processes the order , buyers aren’t aware of PayPal’s

involvement; PayPal will not even appear on the buyer’s credit card statement for the

transaction.

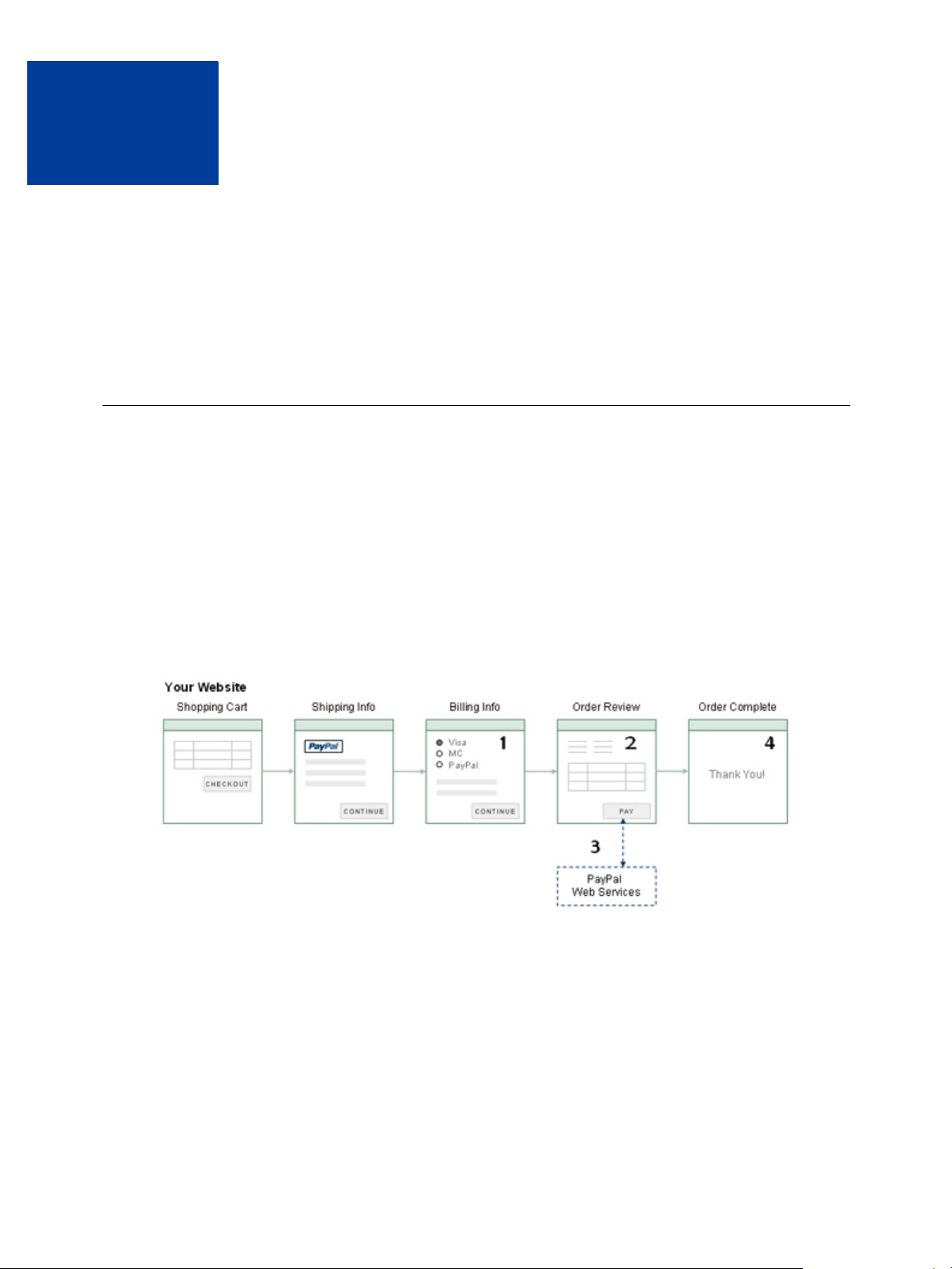

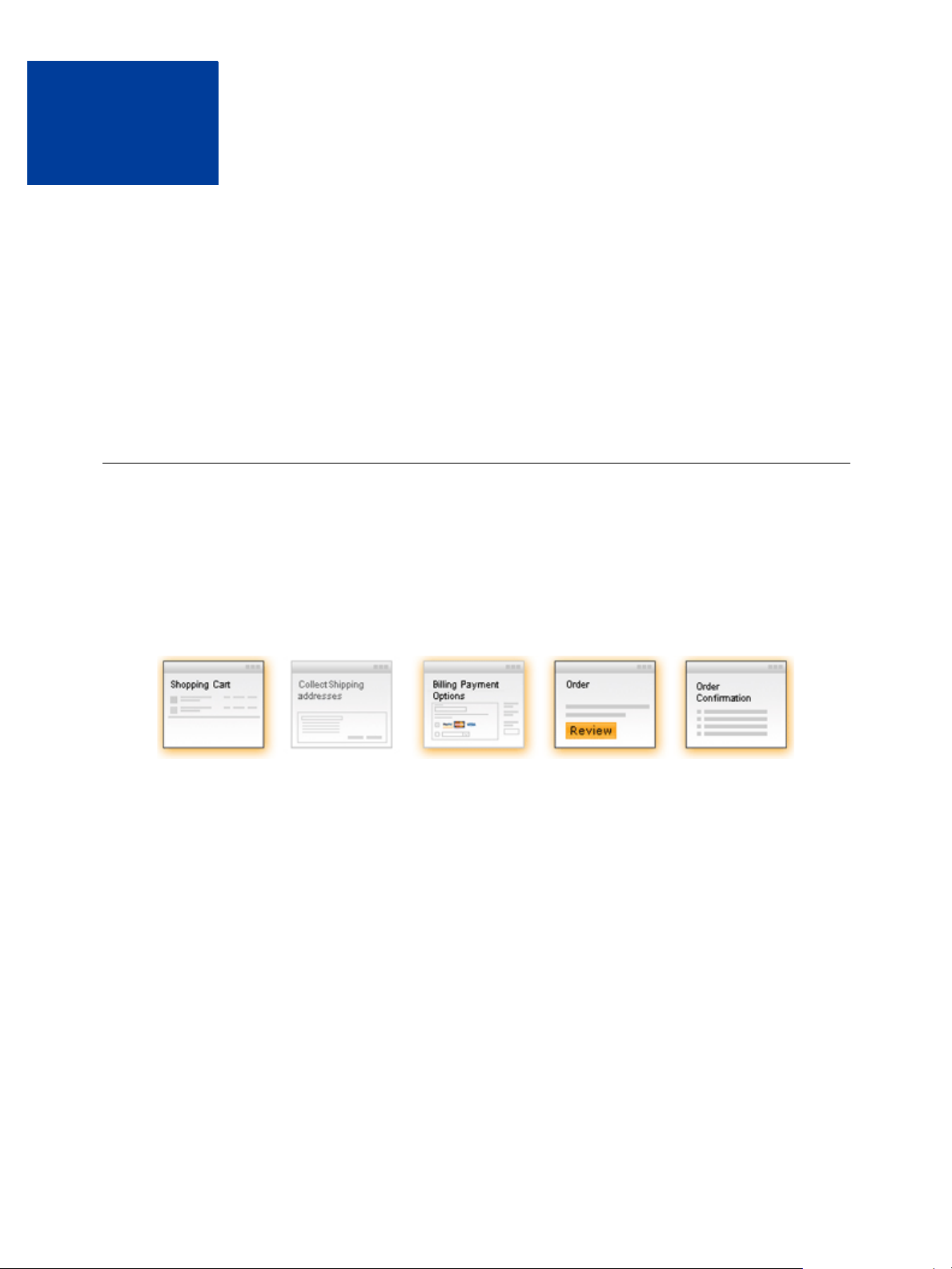

The following diagram shows a typical Direct Payment flow:

The numbers in the diagram correspond to the following implementation steps:

1. On your checkout pages, you need to collect the following information from a buyer to be

used in the DoDirectPayment request:

– Amount of the transaction

– Credit card type

– Credit card number

– Credit card expiration date

PayPal Payments Pro Integration Guide April 2012 19

Page 20

Introducing Direct Payment

2

The Direct Payment User Experience

– Credit card CSC value

– Cardholder first and last name

– Cardholder billing address

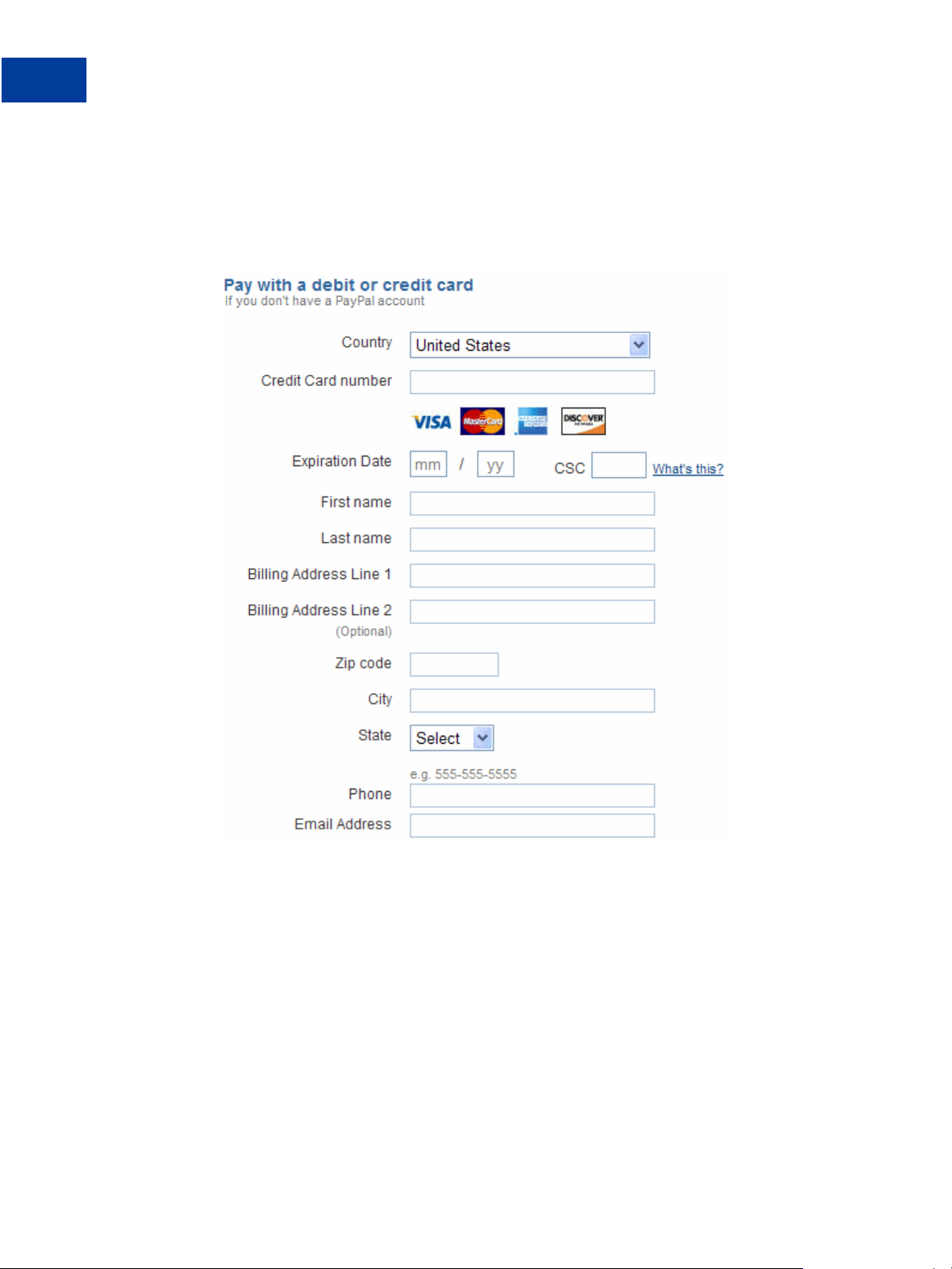

The following example shows the collection of credit card information from a US buyer

after the transaction amount has been determined:

NOTE: In some cases, the billing address and CSC value may be optional. You must also

identify debit on your PCI compliant checkout page when you reference a direct

card checkout image.

2. You must also retrieve the IP address of the buyer's browser and include this with the

request.

3. When a buyer clicks the Pay button, invoke the DoDirectPayment API operation.

4. The PayPal API server executes the request and returns a response.

– Ack code (Success, SuccessWithWarning, or Failure)

– Amount of the transaction

20 April 2012 PayPal Payments Pro Integration Guide

Page 21

Introducing Direct Payment

User Interface Recommendations fo r D ire ct Pay me n t Che cko u t

– AVS response code

– CSC response code

– PayPal transaction ID

– Error codes and messages (if any)

– Correlation ID (unique identifier for the API call)

5. If the ope r ation is successful, you send the buyer to an order confirmation page.

The Ack code determines whether the operation is a success.

– If successful, you should display a message on the order confirmation page.

– Otherwise, you should show the buyer information related to the error. You should also

provide an opportunity to pay using a different payment method.

User Interface Recommendations for Direct Payment Checkout

Your checkout pages must collect all the information you need to create the

DoDirectPayment request. The request information can be collected by your site’ s checkout

pages.

2

The following recommendations help process requests correctly and make it easier for buyers

to provide necessary information:

IMPORTANT: You are responsible for processing card industry (PCI) compliance for

protecting cardholder data. For example, storing the Card Security Code

(CSC) violates PCI compliance. For more information about PCI compliance,

see

PCI Security Standards Council.

Provide a drop-down menu for the state or province fields for addresses in countries that

use them. For U.S. addresses, the state must be a valid 2-letter abbreviation for the state,

military location, or U.S. territory. For Canada, the province must be a valid 2-letter

province abbreviation. For the UK, do not use a drop-down menu; however, you may need

to provide a value for the state in your DoDirectPayment request.

Ensure buyers can enter the correct number of digits for the Card Security Code (CSC).

The value is 3 digits for Visa, MasterCard, and Discover. The value is 4 digits for

American Express.

Show information on the checkout page that shows where to find the CSC code on the card

and provide a brief explanation of its purpose.

Configure timeout settings to allow for the fact that the DoDirectPayment API operation

might take as long as 60 seconds to complete, even though completion in less than 3

seconds is typical. Consider displaying a “processing transaction” message to the buyer

and disabling the Pay button until the transaction finishes.

Use the optional Invoice ID field to prevent duplicate charges. PayPal ensures that an

Invoice ID is used only once per account. Duplicate requests with the same Invoice ID

result in an error and a failed transaction.

PayPal Payments Pro Integration Guide April 2012 21

Page 22

Introducing Direct Payment

2

User Interface Recommendations for Direct Payment Checkout

22 April 2012 PayPal Payments Pro Integration Guide

Page 23

Introducing Express Checkout

3

Express Checkout is PayPal’s premier checkout solution that streamlines the checkout process

for buyers and keeps them on a merchant’s website after making a purchase.

The Express Checkout Experience

Express Checkout Integration Steps

Express Checkout Flow

Express Checkout Building Blocks

The Express Checkout Experience

Express Checkout makes it easier for buyers to pay online. It also enables you to accept PayPal

while retaining control of the buyer and the overall checkout flow.

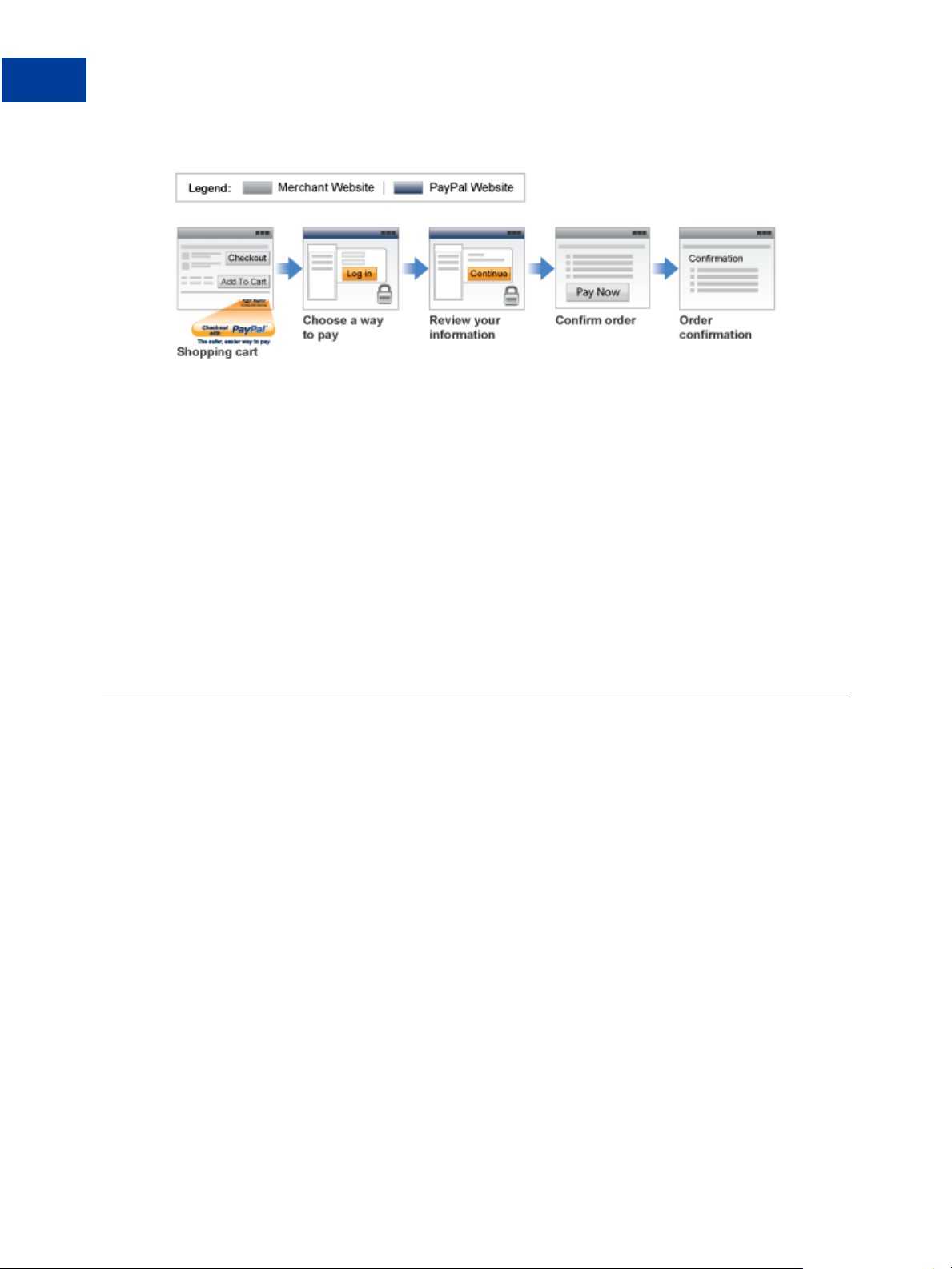

Consider your buyers’ experience before implementing Express Checkout. A generic flow

probably has the following sequence of pages:

A generic checkout flow

In a typical checkout flow, a buyer:

1. Checks out from the shopping cart page

2. Provides shipping information

3. Chooses a payment option and provides billing and payment information

4. Reviews the order and pays

5. Receives an order confirmation

In an Express Checkout flow, a buyer still checks out at the beginning of the flow. However,

the buyer does not enter shipping, billing, or payment information, because PayPal provides

the stored information. This simplifies and expedites the checkout process.

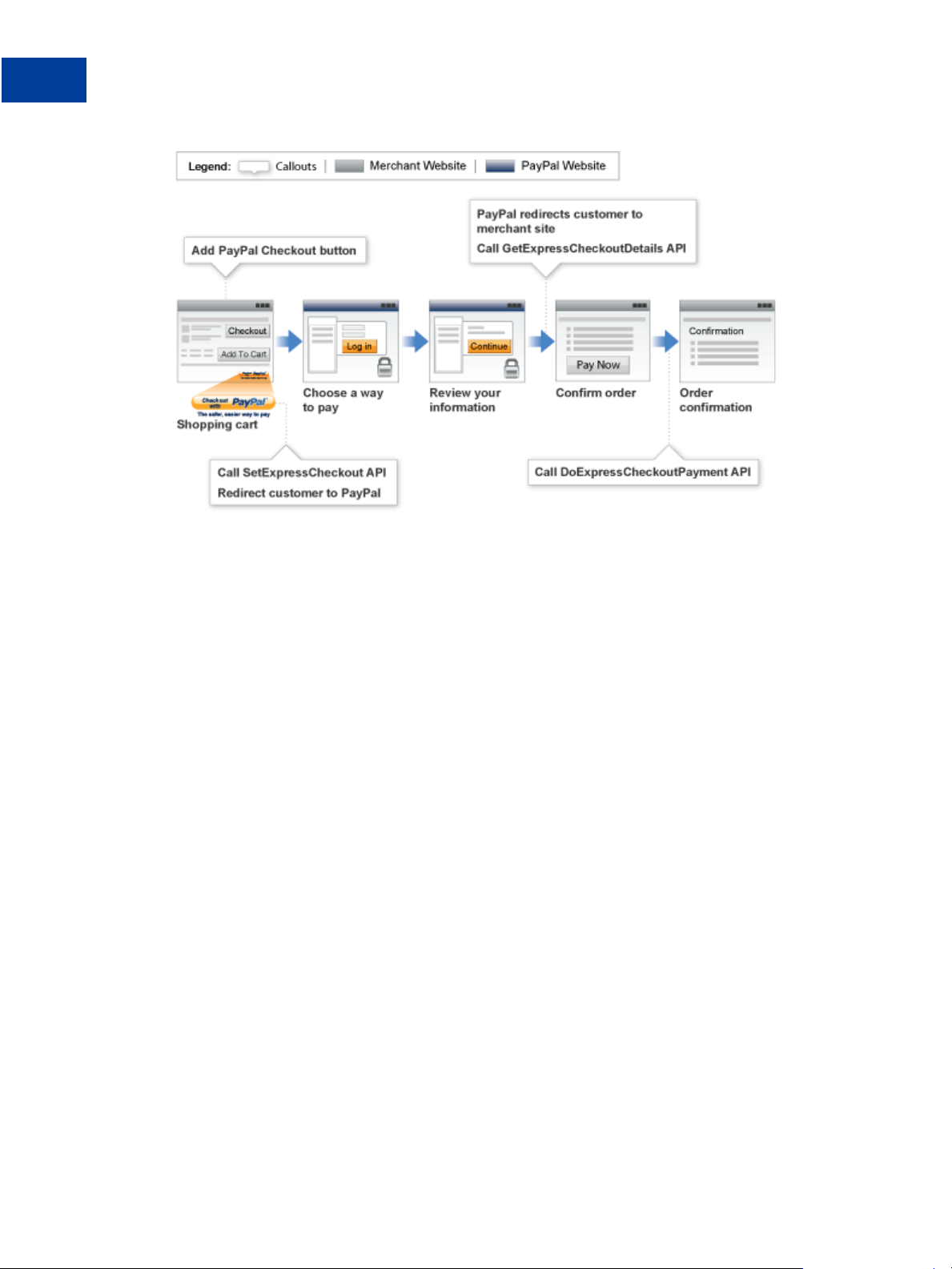

The following diagram shows the Express Checkout flow:

PayPal Payments Pro Integration Guide April 2012 23

Page 24

Introducing Express Checkout

3

Express Checkout Integration Steps

Express Checkout flow

In the Express Checkout flow, the buyer:

1. Chooses Expres s Checkout by clicking Check out with PayPal

2. Logs into PayPal to authenticate his or her identity

3. Reviews the transaction on PayPa l

NOTE: Optionally, (not shown in the diagram), the buyer can then proceed to review the

order on your site. You can also include other checkout steps, including upselling

on your Confirm order page.

4. Confirms the order and pays from your site

5. Receives an order confirmation

Express Checkout Integration Steps

You can implement Express Checkout in 4 steps :

1. Place PayPal checkout buttons and PayPal payment mark images in your checkout flow.

2. For each PayPal button that you place, modify your page to handle the button click.

Use a PayPal Express Checkout API operation to set up the interaction with PayPal and

redirect the browser to PayPal to initiate buyer approval for the payment.

3. On your Confirm order page, use PayPal Express Checkout API operations to obtain the

shipping address and accept the payment.

4. Test your integration using the PayPal Sandbox before taking your pages live.

Because PayPal offers you the flexibility to control your checkout flow, you should first

understand how your current checkout flow works, then, become familiar with the Express

Checkout flow. Start by reviewing Express Checkout Flow. For additional background

information to help you get started, see Express Checkout Building Blocks.

24 April 2012 PayPal Payments Pro Integration Guide

Page 25

Introducing Express Checkout

Express Checkout Integration Steps

Configuring and Customizing the Express Checkout Experience

After you implement and test your basic Express Checkout integration, you should configure

the additional features of Express Checkout to customize it to meet your needs.

Carefully evaluate each feature because the more you streamline the checkout process and

make Express Checkout seamless to buyers, the more likely your sales will increase.

At a minimum, you should:

Set your logo on the PayPal site and provide order details in the transaction history.

Use the PayPal Review your information page as your Confirm order page to further

streamline the user experience when you do not need the benefits associated with paying on

your site. This strategy can lead to a better order completion rate, also known as a

conversion rate.

Configure the look and feel of PayPal pages to match the look and feel of your site by

specifying the:

Logo to display

Gradient fill color of the border around the cart review area

3

Language in which PayPal content is displayed

You should include:

Order details, including shipping and tax, during checkout

IMPORTANT: Not displaying this information is a major cause of shopping cart

abandonment during checkout.

Shipping information for non-digital goods, which can be your address information for the

buyer or the address on file with PayPal; if you use the address on file with PayPal, you can

specify whether or not it must be a confirmed address

You can also activate additional features, including:

Associate a payment with an eBay auction item

Assign an invoice number to a payment

Accept payments with giropay (Germany only)

Additional PayPal API Operations

You can use PayPal API operations to include advanced processing and back-office processes

with Express Checkout. You can:

Capture payments associated with authorizations and orders

Process recurring payments

Issue refunds, search transactions using various criteria, and provide other back-office

operations

PayPal Payments Pro Integration Guide April 2012 25

Page 26

Introducing Express Checkout

3

Express Checkout Flow

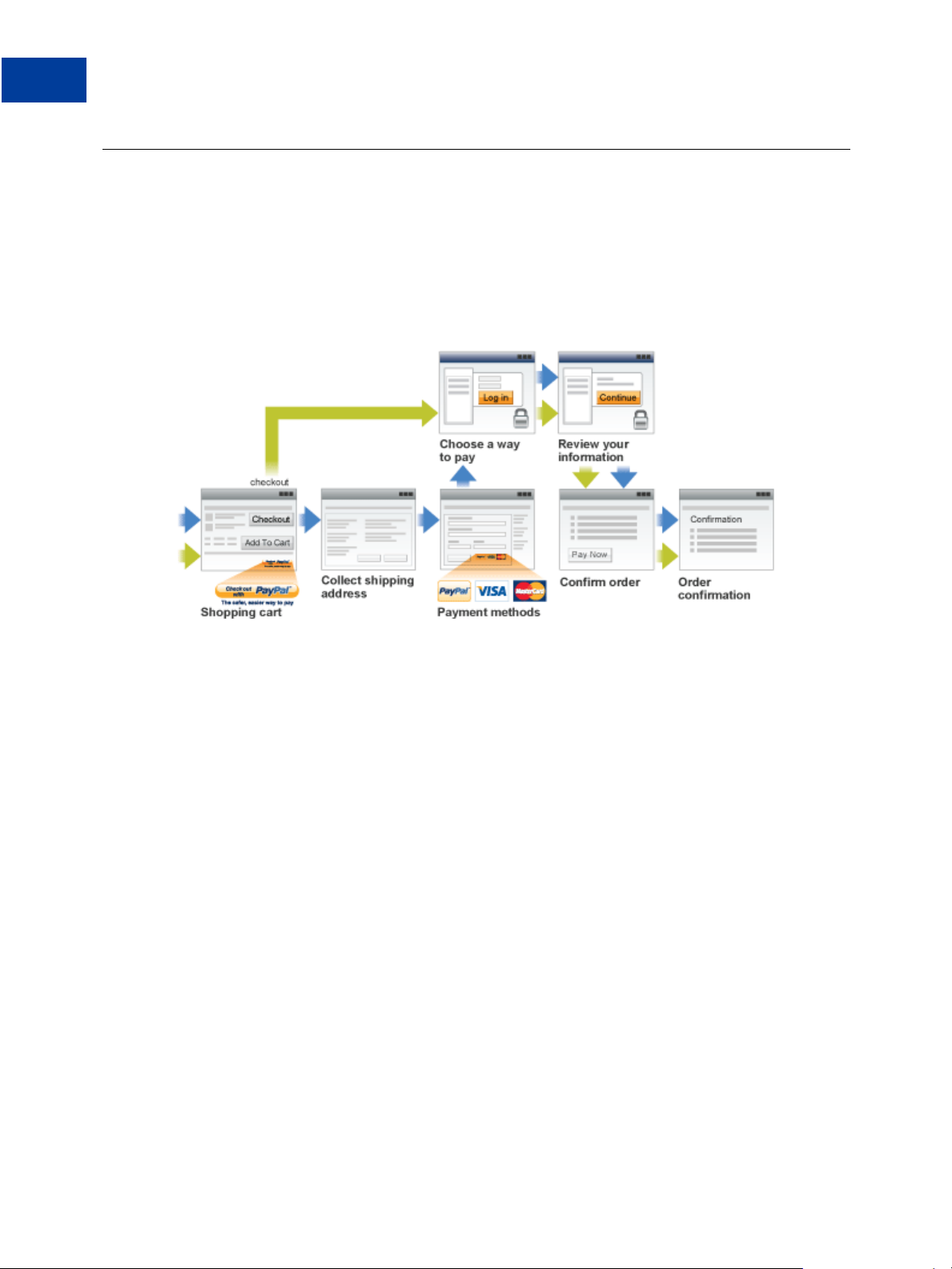

Express Checkout Flow

T o implement Express Checkout, you must offer it both as a checkout option and as a payment

method. Typically, you initiate the Express Checkout flow on your shopping cart page and on

your payment options page.

You add Express Checkout to your existing flow by placing the Checkout with PayPal button

on your Shopping Cart page and by placing the PayPal mark on your Payment Methods

page. The following diagram shows the complete flow:

Make the following changes to implement the complete Express Checkout flow:

On your Shopping cart page, place the Checkout with PayPal button. Handle clicks by

sending the Express Checkout setup request. After receiving the response, redirect your

buyer’s browser to PayPal.

On your Payment methods page, associate the PayPal mark with an option. Handle clicks

by sending the Express Checkout setup request. After receiving the response, redirect your

buyer’s browser to PayPal.

On the page your buyer returns to, obtain shipping information from PayPal and accept the

payment to complete the Express Checkout transaction.

NOTE: You also can allow the buyer to pay on the PayPal Review your information page. In

this case, your checkout flow can omit your Confirm order page and proceed directly

to your Order confirmation page.

Checkout Entry Point

The checkout entry point is one of the places where you must implement Express Checkout.

Buyers initiate the Express Checkout flow on your shopping cart page by clicking the

Checkout with PayPal button.

The following diagram shows how Express Checkout integrates with a typical checkout flow:

26 April 2012 PayPal Payments Pro Integration Guide

Page 27

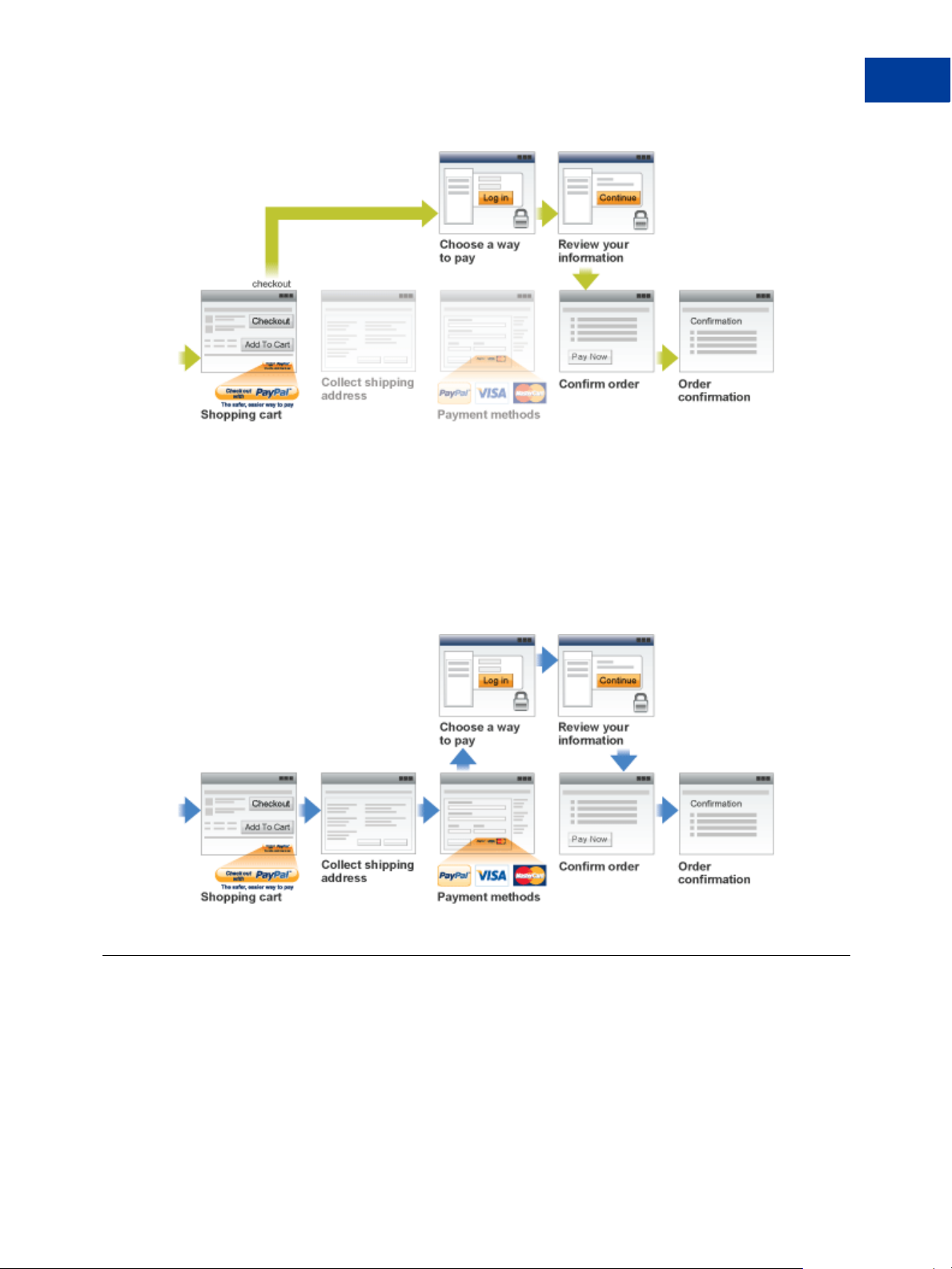

Payment Option Entry Point

The payment option entry point is one of the places where you must implement Express

Checkout. Buyers initiate the Express Checkout flow on your payment methods page by

selecting PayPal as the default option.

Introducing Express Checkout

Express Checkout Building Blocks

3

The following diagram shows how to integrate Express Checkout from your payment methods

page:

Express Checkout Building Blocks

You implement Express Checkout flows with Express Checkout buttons, PayPal API

operations, PayPal commands, and tokens.

The following conceptual diagram identifies the building blocks that you use to integrate

Express Checkout on your website:

PayPal Payments Pro Integration Guide April 2012 27

Page 28

Introducing Express Checkout

3

Express Checkout Building Blocks

A token is a value assigned by PayPal that associates the execution of API operations and

commands with a specific instance of a user experience flow.

NOTE: Tokens are not shown in the diagram.

PayPal Button and Logo Images

To inform buyers that PayPal is accepted on your website, you must place PayPal button and

logo images in your checkout flow. PayPal recommends that you use dynamic images.

PayPal requires that you use Check out with PayPal buttons and PayPal mark images hosted

on secure PayPal servers. When the images are updated, the changes appear automatically in

your application. Do not host copies of the PayPal images locally on your servers. Outdated

PayPal buttons and images reduce buyer confidence in your site.

Express Checkout Image Flavors

The Check out with PayPal button and the PayPal mark image are available in two flavors:

Dynamic image

Static image

The dynamic images enable PayPal to change their appearance dynamically. If, for example,

you have signed up to participate in a PayPal campaign, PayPal can change the appearance of

the image dynamically for the duration of that campaign based on parameter information you

append to the image URL.

The static images cannot be changed dynamically. To participate in a PayPal campaign, you

would have to manually update the image code to change the image displayed and restore the

default image when the campaign is over. The only way you can have image management

taken care of for you is to replace static images in your implementation with dynamic images.

28 April 2012 PayPal Payments Pro Integration Guide

Page 29

Introducing Express Checkout

Express Checkout Building Blocks

Express Checkout Images

The Check out with PayPal button is the image you place on your shopping cart page. The

US version of the image looks like this.

3

To create an Express Checkout button, see

bin/webscr?cmd=xpt/Merchant/merchant/ExpressCheckoutButtonCode-outside. PayPal also

https://www.paypal.com/us/cgi-

provides buttons for other countries. To locate a page for another country, replace the country

abbreviation in the link with another country abbreviation. For example, replace us with uk

for United Kingdom, as follows:

bin/webscr?cmd=xpt/Merchant/merchant/ExpressCheckoutButtonCode-outside. PayPal hosts images

https://www.paypal.com/uk/cgi-

for the countries:

Country-specific buttons and images

URL

Country

Australia au

China cn France fr Germany de Italy it

Japan j1 Netherlands nl Poland pl Spain es

Switzerland ch United

Change Country

Austria at Belgium be Canada ca

Kingdom

NOTE: URL changes are case sensitive. The abbreviation in the URL may not be a country

URL

Change Country

uk United

States

URL

Change Country

us

code.

Payment Mark

URL

Change

The PayPal mark is the image you place on your payment methods page. It looks like this:

To implement PayPal as a payment option, which is part of the Express Checkout experience,

associate the PayPal mark image with your payment options. PayPal recommends using radio

buttons for payment options:

PayPal Payments Pro Integration Guide April 2012 29

Page 30

Introducing Express Checkout

3

Express Checkout Building Blocks

To create a PayPal mark, see https://www.paypal.com/cgi-

bin/webscr?cmd=xpt/Marketing/general/OnlineLogoCenter-outside.

Express Checkout API Operations

The PayPal API provides three API operations for Express Checkout. These API operations

set up the transaction, obtain information about the buyer, and handle the payment and

completes the transaction.

API Operation Description

SetExpressCheckout Sets up the Express Checkout transaction. You can specify information

to customize the look and feel of the PayPal site and the information it

displays. You must include the following information:

URL to the page on your website that PayPal redirects to after the

buyer logs into PayPal and approves the payment successfully.

URL to the page on your website that PayPal redirects to if the buyer

cancels.

T otal amount of the order or your best estimate of the total. It should

be as accurate as possible.

GetExpressCheckout Obtains information about the buyer from PayPal, including shipping

information.

DoExpressCheckoutPayment Completes the Express Checkout transaction, including the actual total

amount of the order.

Express Checkout Command

PayPal provides a command that you use when redirecting your buyer’s browser to PayPal.

This command enables your buyer to log in to PayPal to approve an Express Checkout

payment.

When you redirect your buyer’s browser to PayPal, you must specify the

_ExpressCheckout command for Express Checkout. You also specify the token that

identifies the transaction, which was returned by the SetExpressCheckout API operation.

NOTE: T o enable PayPal to redirect back to your website, you must have already invoked the

SetExpressCheckout API operation, specifying URLs that PayPal uses to redirect

back to your site. PayPal redirects to the success URL when the buyer pays on PayPal;

otherwise, PayPal redirects to the cancel URL.

If the buyer approves the payment, PayPal redirects to the success URL with the following

information:

The token that was included in the redirect to PayPal

The buyer’s unique identifier (Payer ID)

If the buyer cancels, PayPal redirects to the cancel URL with the token that was included in the

redirect to PayPal.

30 April 2012 PayPal Payments Pro Integration Guide

Page 31

Express Checkout Token Usage

Express Checkout uses a token to control access to PayPal and execute Express Checkout API

operations.

The SetExpressCheckout API operation returns a token, which is used by other Express

Checkout API operations and by the _ExpressCheckout command to identify the

transaction. The life of the token is approximately 3 hours.

Introducing Express Checkout

Express Checkout Building Blocks

3

PayPal Payments Pro Integration Guide April 2012 31

Page 32

Introducing Express Checkout

3

Express Checkout Building Blocks

32 April 2012 PayPal Payments Pro Integration Guide

Page 33

Getting Started With Direct

4

Payment

To get started with Direct Payment, implement and test the simplest DoDirectPayment API

operation, which is a sale. Then you can expand your use of Direct Pa yment to include

authorization and capture.

Implementing the Simplest Direct Payment Integration

Testing Direct Payment Using NVP and cURL

Direct Payment Authorization and Captures

Implementing the Simplest Direct Payment Integration

To execute a direct payment transaction, you must invoke the DoDirectPayment API

operation with sufficient information to identify the buyer’s credit or debit card and the

amount of the transaction.

This example assumes that you have set up the mechanism you will use to communicate with

the PayPal server and have a PayPal business account with API credentials. It also assumes

that the payment action is a final sale.

To set up the simplest direct payment transaction

1. Specify the amount of the transaction; include the currency if it is not in US dollars.

Specify the total amount of the transaction if it is known; otherwise, specify the subtotal.

Regardless of the specified currency, the format must have decimal point with exactly two

digits to the right and an optional thousands separator to the left, which must be a comma;

for example, EUR 2.000,00 must be specified as 2000.00 or 2,000.00. The specified

amount cannot exceed USD $10,000.00, regardless of the currency used.

AMT=amount

CURRENCYCODE=currencyID

2. Specify the payment action.

Although the default payment action is a Sale, it is a best practice to explicitly specify the

payment action as one of the following values:

PAYMENTACTION=Sale

PAYMENTACTION=Authorization

3. Spe cify the IP address of the buyer’s computer.

IPADDRESS=192.168.0.1

PayPal Payments Pro Integration Guide April 2012 33

Page 34

Getting Started With Direct Payment

4

Testing Direct Payment Using NVP and cURL

4. Specify information about the credit or debit card.

You must specify the kind of credit or debit card and the account number:

CREDITCARDTYPE=Visa

ACCT=4683075410516684

NOTE: The kind of card, the card issuer, and Payment Receiving Preferences settings in

your PayPal profile may require you set additional fields:

EXPDATE=042011

CVV2=123

NOTE: UK merchants must also specify values for 3D Secure-related fields when using

Maestro.

5. Specify information about the card holder.

You must specify the first and last name and the billing address associated with the card:

FIRSTNAME=...

LASTNAME=...

STREET=...

CITY=...

STATE=...

ZIP=...

COUNTRYCODE=...

NOTE: The state and zip code is not required for all countries.

Testing Direct Payment Using NVP and cURL

To test direct payment, you must first create a test business account in the Sandbox that is

enabled for PayPal Payments Pro. You can then use the account to test credit and debit card

payments using the DoDirectPayment API operation.

You can then simulate debit or credit card payments from cards that exist in the Sandbox. This

example shows how to simulate a DoDirectPayment API operation using cURL to supply

the NVP request values and to call DoDirectPayment.

To test Direct Payment in the Sandbox, you must first ensure that the Sandbox test account is

associated with a credit card and enabled for Website Payments Pro.

The following example uses the curl command to execute the DoDirectPa yment request

and obtain a response. You can use the strategy shown in these steps for initial testing of your

Direct Payment implementation. For more complete testing, you should integrate cURL into

your checkout pages.

34 April 2012 PayPal Payments Pro Integration Guide

Page 35

Getting Started With Direct Payment

Testing Direct Payment Using NVP and cURL

The following steps show how you can test the DoDirectPayment API operation:

1. Execute the DoDirectPayment API operation to complete the transaction.

The following example uses cURL to communicate with PayPal:

curl --insecure ^

https://api-3t.sandbox.paypal. com/nvp ^

-d "VERSION=56.0^

&SIGNATURE=api_signature^

&USER=api_username^

&PWD=api_password^

&METHOD=DoDirectPayment^

&PAYMENTACTION=Sale^

&IPADDRESS=192.168.0.1^

&AMT=8.88^

&CREDITCARDTYPE=Visa^

&ACCT=4683075410516684^

&EXPDATE=042011^

&CVV2=123^

&FIRSTNAME=John^

&LASTNAME=Smith^

&STREET=1 Main St.^

&CITY=San Jose^

&STATE=CA^

&ZIP=95131^

&COUNTRYCODE=US"

4

2. Test that the response to the DoDirectPayment API operation was successful.

The ACK field must contain Success or SuccessWithWarning; however, other fields in

the response can help you decide whether to ultimately accept or refund the payment:

TIMESTAMP=...

&CORRELATIONID=...

&ACK=Success

&VERSION=56%2e0

&BUILD=1195961

&AMT=8%2e88

&CURRENCYCODE=USD

&AVSCODE=X

&CVV2MATCH=M

&TRANSACTIONID=...

NOTE: Values of status fields are simulated because an actual card transaction does not occur.

3. Log into your PayPal test account from the Sandbox.

On the My Account Overview page, you should see the results of your transaction if the

transaction was successful:

PayPal Payments Pro Integration Guide April 2012 35

Page 36

Getting Started With Direct Payment

4

Testing Direct Payment Using NVP and cURL

36 April 2012 PayPal Payments Pro Integration Guide

Page 37

Getting Started With Direct Payment

Testing Direct Payment Using NVP and cURL

4. Click the Details link to see the status of the transaction.

4

PayPal Payments Pro Integration Guide April 2012 37

Page 38

Getting Started With Direct Payment

4

Direct Payment Authorization and Captures

Direct Payment Authorization and Captures

You can use PayPal API operations to handle the capture of payments authorized using

DoDirectPayment.

Sale Payment Action for Direct Payment

Authorization and Capture for Direct Payment

DoDirectPayment Authorization and Capture Example

DoDirectPayment Reauthorization and Capture Example

Sale Payment Action for Direct Payment

A sale payment action represents a single payment that completes a purchase for a specified

amount.

A sale is the default payment action; however, you can also specify the action in your

DoDirectPayment requests:

PAYMENTACTION=Sale

A sale is the most straightforward payment action. Choose this payment action if the

transaction, including shipping of goods, can be completed immediately. Use this payment

action when you intend to fulfill the order immediately, such as would be the case for digital

goods or for items you have in stock for immediate shipment

After you execute the DoDirectPayment API operation, the payment is complete and further

action is unnecessary. You cannot capture a further payment or void any part of the payment

when you use this payment action.

Authorization and Capture for Direct Payment

An authorization payment action represents an agreement to pay and places the buyer’s funds

on hold for up to three days.

To set up an authorization, specify the following payment action in your DoDirectPayme nt

request:

PAYMENTACTION=Authorization

An authorization enables you to capture multiple payments up to 115% of, or USD $75 more

than, the amount you initially specify in the DoDirectPayment request. Choose this payment

action if you need to ship the goods before capturing the payment or if there is some reason not

to accept the payment immediately.

The honor period, for which funds can be held, is 3 days. The valid period, for which the

authorization is valid, is 29 days. You can reauthorize the 3-day honor period at most once

within the 29-day valid period.

38 April 2012 PayPal Payments Pro Integration Guide

Page 39

Getting Started With Direct Payment

Direct Payment Authorization and Captures

Captures attempted outside of the honor period result in PayPal contacting the card issuer to

reauthorize the payment; however, the reauthorization and, thus, the capture might be

declined. If you know that you will capture after the honor period expires, PayPal recommends

that you call DoReauthorization to explicitly reauthorize the honor period before

attempting to capture the payment.

Consider an example in which the buyer orders three $100 items for a total of $300. You

specify Authorization for your pa yment action in the DoDirectPayment request because

the goods might not ship at the same time. For each of these items you call DoCapture to

collect the payment.

On the first day, you ship the first item and on the third day you ship the second item. The

payments for these items succeed because they occur within the honor period. If you ship the

third item on the fifth day , your call to DoC apture might fail if the issuer declined the attempt

by PayPal to reauthorize. Because the honor period has expired, you should explicitly call

DoReauthorization before calling DoCapture to determine whether the buyer’s funds are

still available. Likewise, if all three items were to be shipped together after the honor period

but before the valid period expires, you should explicitly call DoReauthorization before

calling DoCapture.

When you call DoCapture for the final payment, you must set the COMPLE TETYPE field to

Complete. Prior calls to DoCapture must set this field to NotCo mplete. When payments

are complete, any remaining uncaptured amount of the original authorization is automatically

voided and nothing more can be captured.

4

You can explicitly void an authorization, in which case, the uncaptured part of the amount

specified in the DoDirectPayment request becomes void and can no longer be captured. If

no part of the payment has been captured, the entire payment becomes void and nothing can be

captured. For Visa and MasterCard, a hold caused by the authorization is reversed; a bank hold

might remain for 7 to 10 days until reversed by the card issuer.

NOTE: Authorizations become holds on a buyer’s account that typically last 3 days for debit

cards and 7 to 10 days for credit cards, depending on the issuer and region. If you

decide not to capture an authorization, you should void the transaction, which triggers

an authorization reversal.

API operations associated with the Authorization payment action in DoDirectPayment

API Operation Description

DoCapture Capture an authorized payment

DoReauthorization Reauthorize a payment

DoVoid Void an authorization

DoDirectPayment Authorization and Capture Example

This example authorizes a credit card payment using the DoDirectPayment API operation

and then uses the DoCapture API operation to capture the payment.

PayPal Payments Pro Integration Guide April 2012 39

Page 40

Getting Started With Direct Payment

4

Direct Payment Authorization and Captures

IMPORTANT: Never use post actions for live transactions; they are not secure.

In your DoDirectPayment request, set the payment action to Authorization:

<form method=post action=https ://sandbox.paypal. com/nvp>

<input type=hidden name=USER v alue=...>

<input type=hidden name=PWD value=...>

<input type=hidden name=SIGNAT URE value=...>

<input type=hidden name=VERSIO N value= 58.0>

<input type=hidden name=PAYMENTACTI ON value=Authorization>

<input type=hidden name=CREDIT CARDTYPE value=Vis a>

<input type=hidden name=ACCT v alue=...>

<input type=hidden name=STARTD ATE value=112000>

<input type=hidden name=EXPDAT E value=112020>

<input type=hidden name=CVV2 v alue=123>

<input type=hidden name=AMT value=20.0 0>

<input type=hidden name=CURREN CYCODE value=USD>

<input type=hidden name=FIRSTN AME value=...>

<input type=hidden name=LASTNAME value =...>

<input type=hidden name=STREET value=...>

<input type=hidden name=STREET 2 value=>

<input type=hidden name=CITY v alue="San Francisc o">

<input type=hidden name=STATE value=CA >

<input type=hidden name=Zip value=9412 1>

<input type=hidden name=COUNTR YCODE value=US>

<input type=hidden name=EMAIL value=... >

<input type=submit name=METHOD value=DoDirectPay ment>

</form>

If the authorization was successful, the response contains the authorization ID in the

transaction ID field:

TIMESTAMP=2010%2d03%2d08T19%3a 35%3a18Z&CORRELATI ONID=ab12f37f9566&ACK =Succe

ss&VERSION=58%2e0&BUILD=121864 3&AMT=20%2e00&CURR ENCYCODE=USD&AVSCODE= X&CVV2

MATCH=M&TRANSACTIONID=6RH38738 S17889722

Use this ID in the DoCapture request to specify the authorization that you want to capture:

40 April 2012 PayPal Payments Pro Integration Guide

Page 41

Getting Started With Direct Payment

Direct Payment Authorization and Captures

<form method=post action=https ://sandbox.paypal. com/nvp>

<input type=hidden name=USER v alue=...>

<input type=hidden name=PWD value=...>

<input type=hidden name=SIGNAT URE value=...>

<input type=hidden name=VERSIO N value= 58.0>

<input type=hidden name=AUTHOR IZATIONID value=6RH38 738S17889722>

<input type=hidden name=AMT value=5>

<input type=hidden name=CURREN CYCODE value=USD>

<input type=hidden name=COMPLE TETYPE value=Compl ete>

<input type=hidden name=INVNUM value=>

<input type=hidden name=NOTE v alue= March 08 201 0>

<input type=hidden name=SOFTDE SCRIPTOR value=>

<input type=submit name=METHOD value=DoCapture>

</form>

If the capture was successful, the payment status is Completed:

AUTHORIZATIONID=6RH38738S17889 722&TIMESTAMP=2010 %2d03%2d08T19%3a47%3a 39Z&CO

RRELATIONID=d1e8043ae0a12&ACK= Success&VERSION=58 %2e0&BUILD=1218643&TR ANSACT

IONID=5F62121256435650V&PARENT TRANSACTIONID=6RH3 8738S17889722&RECEIPT ID=007

8%2d2642%2d6061%2d5728&TRANSAC TIONTYPE=webaccept &PAYMENTTYPE=instant& EXPECT

EDECHECKCLEARDATE=1970%2d01%2d 01T00%3a00%3a00Z&O RDERTIME=2010%2d03%2d 08T19%

3a47%3a38Z&AMT=5%2e00&FEEAMT=0 %2e45&TAXAMT=0%2e0 0&CURRENCYCODE=USD&PA YMENTS

TATUS=Completed&PENDINGREASON= None&REASONCODE=None& PROTECTIONELIGIBIL ITY=In

eligible

4

NOTE: The DoCapture response returns a new transaction ID as well as the authorization

ID. The authorization ID is also the parent transaction ID for the completed

transaction.

DoDirectPayment Reauthorization and Capture Example

This example authorizes a credit card payment using the DoDirectPayment API operation

and then reauthorizes the payment using the DoReauthorization API operation before

capturing it with the DoCapture API operation.

IMPORTANT: Never use post actions for live transactions; they are not secure.

In your DoDirectPayment request, set the payment action to Authorization:

PayPal Payments Pro Integration Guide April 2012 41

Page 42

Getting Started With Direct Payment

4

Direct Payment Authorization and Captures

<form method=post action=https ://sandbox.paypal. com/nvp>

<input type=hidden name=USER v alue=...>

<input type=hidden name=PWD value=...>

<input type=hidden name=SIGNAT URE value=...>

<input type=hidden name=VERSIO N value= 58.0>

<input type=hidden name=PAYMENTACTI ON value=Authorization>

<input type=hidden name=CREDIT CARDTYPE value=Vis a>

<input type=hidden name=ACCT v alue=...>

<input type=hidden name=STARTD ATE value=112000>

<input type=hidden name=EXPDAT E value=112020>

<input type=hidden name=CVV2 v alue=123>

<input type=hidden name=AMT value=500>

<input type=hidden name=CURREN CYCODE value=USD>

<input type=hidden name=FIRSTN AME value=...>

<input type=hidden name=LASTNAME value =...>

<input type=hidden name=STREET value=...>

<input type=hidden name=STREET 2 value=>

<input type=hidden name=CITY v alue="San Francisc o">

<input type=hidden name=STATE value=CA >

<input type=hidden name=Zip value=9412 1>

<input type=hidden name=COUNTR YCODE value=US>

<input type=hidden name=EMAIL value=... >

<input type=submit name=METHOD value=DoDirectPay ment>

</form>

If the authorization was successful, the response contains the authorization ID in the

transaction ID field:

TIMESTAMP=2010%2d03%2d05T03%3a 55%3a13Z&CORRELATI ONID=2f8b1e854983e&AC K=Succ

ess&VERSION=62%2e0&BUILD=12186 43&AMT=500%2e00&CU RRENCYCODE=USD&AVSCOD E=X&CV

V2MATCH=M&TRANSACTIONID=4HS191 6972552122T

Use the transaction ID in the DoReauthorization request to identify the authorization that

you want to reauthorize:

<form method=post action=https ://sandbox.paypal. com/nvp>

<input type=hidden name=USER v alue=...>

<input type=hidden name=PWD value=...>

<input type=hidden name=SIGNAT URE value=...>

<input type=hidden name=VERSIO N value= 62.0>

<input type=hidden name=AUTHOR IZATIONID value=4HS19 16972552122T>

<input type=hidden name=AMT value=23>

<input type=hidden name=CURREN CYCODE value=USD>

<input type=submit name=METHOD value=DoReauthori zation>

</form>

The response to DoReauthorization contains a new authorization ID:

42 April 2012 PayPal Payments Pro Integration Guide

Page 43

Getting Started With Direct Payment

Direct Payment Authorization and Captures

AUTHORIZATIONID=6HB59926VL9984 15S&TIMESTAMP=2010%2d 03%2d08T20%3a37%3a48Z &CO

RRELATIONID=797da6e380c0&ACK=S uccess&VERSION=62% 2e0&BUILD=1218643&PAY MENTST

ATUS=Pending&PENDINGREASON=aut horization&PROTECT IONELIGIBILITY=Inelig ible

Use the new authorization ID in the DoCapture request:

<form method=post action=https ://sandbox.paypal. com/nvp>

<input type=hidden name=USER v alue=...>

<input type=hidden name=PWD value=...>

<input type=hidden name=SIGNAT URE value=...>

<input type=hidden name=VERSIO N value= 62.0>

<input name=AUTHORIZATIONID value=6 HB59926VL998415S>

<input name=AMT value=45>

<input name=CURRENCYCODE value=USD>

<input name=COMPLETETYPE value=Comp lete>

<input name=INVNUM value=>

<input name=NOTE value=>

<input name=SOFTDESCRIPTOR value=>

<input type=submit name=METHOD value=DoCapture>

</form>

4

If the capture was successful, the payment status is Completed:

AUTHORIZATIONID=6HB59926VL9984 15S&TIMESTAMP=2010 %2d03%2d08T21%3a06%3a 01Z&CO

RRELATIONID=8955b8704da91&ACK= Success&VERSION=62 %2e0&BUILD=1218643&TR ANSACT

IONID=2BG77878LE143642C&PARENT TRANSACTIONID=4HS1 916972552122T&RECEIPT ID=111

5%2d8794%2d3120%2d6892&TRANSAC TIONTYPE=webaccept &PAYMENTTYPE=instant& EXPECT

EDECHECKCLEARDATE=1970%2d01%2d 01T00%3a00%3a00Z&O RDERTIME=2010%2d03%2d 08T21%

3a06%3a00Z&AMT=45%2e00&FEEAMT= 1%2e61&TAXAMT=0%2e 00&CURRENCYCODE=USD&P AYMENT

STATUS=Completed&PENDINGREASON =None&REASONCODE=None &PROTECTIONELIGIBI LITY=I

neligible

NOTE: The DoCapture response returns a new transaction ID as well as the authorization ID

associated with the reauthorization. The authorization ID is also the parent transaction

ID for the completed transaction.

PayPal Payments Pro Integration Guide April 2012 43

Page 44

Getting Started With Direct Payment

4

Direct Payment Authorization and Captures

44 April 2012 PayPal Payments Pro Integration Guide

Page 45

Getting Started With Express

5

Checkout

T o implement Express Checkout, start with the simplest Express Checkout integration and test

it. Then you can decide the kind of payment settlement actions you want to support.

Implementing the Simplest Express Checkout Integration

Testing an Express Checkout Integration

Handling Payment Settlements With Express Checkout

Issuing Refunds

Implementing the Simplest Express Checkout Integration

The simplest Express Checkout integration requires the following PayPal API operations:

SetExpressCheckout, DoExpressCheckoutPa yment, and optionally,

GetExpressCheckoutDetails.

Setting Up the Express Checkout Transaction

Obtaining Express Checkout Transaction Details

Completing the Express Checkout Transaction

Setting Up the Express Checkout Transaction

T o set up an Express Checkout transaction, you must invoke the SetExpressCheckout API

operation to provide sufficient information to initiate the payment flow and redirect to PayPal

if the operation was successful.

This example assumes that you have set up the mechanism you will use to communicate with

the PayPal server and have a PayPal Business account with API credentials. It also assumes

that the payment action is a final sale.

When you set up an Express Checkout transaction, you specify values in the

SetExpressCheckout request and then call the API. The values you specify control the

PayPal page flow and the options available to you and your buyers. You should start by setting

up a standard Express Checkout transaction, which can be modified to include additional

options.

To set up the simplest standard Express Checkout transaction:

1. Specify that you want to execute the SetExpressCheckout API operation and the

version you want to use.

PayPal Payments Pro Integration Guide April 2012 45

Page 46

Getting Started With Express Checkout

5

Implementing the Simplest Express Checkout Inte gr at ion

METHOD=SetExpressCheckout

VERSION=XX.0

2. Specify your API credentials.

Use the following parameters for a signature:

USER=API_username

PWD=API_password

SIGNATURE=API_signature

In the Sandbox, you can always use the following signature:

USER=sdk-three_api1.sdk.com

PWD=QFZCWN5HZM8VBG7Q

SIGNATURE=A-IzJhZZjhg29XQ2qnha puwxIDzyAZQ92FRP5d qBzVesOkzbdUONzmOU

3. Specify the amount of the transaction; include the currency if it is not in US dollars.

Specify the total amount of the transaction if it is known; otherwise, specify the subtotal.

Regardless of the specified currency, the format must have a decimal point with exactly

two digits to the right and an optional thousands separator to the left, which must be a

comma.

For example, EUR 2.000,00 must be specified as 2000.00 or 2,000.00. The specified amount

cannot exceed USD $10,000.00, regardless of the currency used.

PAYMENTREQUEST_0_AMT=amount

PAYMENTREQUEST_0_CURRENCYCODE= currencyID

4. Specify the return URL.

The return URL is the page to which PayPal redirects your buyer’s browser after the buyer