Page 1

Payflow Pro Fraud

Protection Services

User’s Guide

For Professional Use Only

Currently only available in English.

A usage Professional Uniquement

Disponible en Anglais uniquement pour l’instant.

Last updated: June 2008

Page 2

Payflow Pro Fraud Protection Services User’s Guide

Document Number: 200011.en_US-200806

© 2008 PayPal, Inc. All rights reserved. PayPal is a registered trademark of PayPal, Inc. The PayPal logo is a trademark of PayPal, Inc. Other

trademarks and brands are the property of their respective owners.

The information in this document belongs to PayPal, Inc. It may not be used, reproduced or disclosed without the written approval of PayPal, Inc.

Copyright © PayPal. All rights reserved. PayPal S.à r.l. et Cie, S.C.A., Société en Commandite par Actions. Registered office: 22-24 Boulevard Royal, L2449, Luxembourg, R.C.S. Luxembourg B 118 349

Consumer advisory: The PayPal™ payment service is regarded as a stored value facility under Singapore law. As such, it does not require the approval

of the Monetary Authority of Singapore. You are advised to read the terms and conditions carefully.

Notice of non-liability:

PayPal, Inc. is providing the information in this document to you “AS-IS” with all faults. PayPal, Inc. makes no warranties of any kind (whether express,

implied or statutory) with respect to the information contained herein. PayPal, Inc. assumes no liability for damages (whether direct or indirect), caused

by errors or omissions, or resulting from the use of this document or the information contained in this document or resulting from the application or use

of the product or service described herein. PayPal, Inc. reserves the right to make changes to any information herein without further notice.

Page 3

Content

Preface . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Intended Audience . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Document Conventions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Document Organization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Customer Service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Revision History . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Chapter 1 Overview. . . . . . . . . . . . . . . . . . . . . . . . . . .11

Growing Problem of Fraud . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Reducing the Cost of Fraud . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Chapter 2 How Fraud Protection Services Protect You . . . . . . . .13

The Threats . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Hacking . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Credit Card Fraud . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Protection Against the Threats—Fraud Filters . . . . . . . . . . . . . . . . . . . . . . . . 13

Example Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Configuring the Filters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Reviewing Suspicious Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Special Considerations. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Merchants With an Instant Fulfillment Model . . . . . . . . . . . . . . . . . . . . . . 14

Merchants using the Recurring Billing Service . . . . . . . . . . . . . . . . . . . . . 14

Chapter 3 Configuring the Fraud Protection Services Filters . . . . . 15

Phase 1: Run Test Transactions Against Filter Settings on Test Transaction Security Servers .

16

Phase 2: Run Live Transactions on Live Transaction Servers in Observe Mode . . . . . . 17

Phase 3: Run All Transactions Through the Live Transaction Security Servers Using Active

Mode . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

Chapter 4 Assessing Transactions that Triggered Filters . . . . . . .19

Reviewing Suspicious Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

3

Page 4

Content

Acting on Transactions that Triggered Filters . . . . . . . . . . . . . . . . . . . . . . 22

Rejecting Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

Fine-tuning Filter Settings—Using the Filter Scorecard . . . . . . . . . . . . . . . . . . . 22

Ensuring Meaningful Data on the Filter Scorecard . . . . . . . . . . . . . . . . . . . 23

Re-running Transactions That Were Not Screened . . . . . . . . . . . . . . . . . . . . . 24

Chapter 5 Activating and Configuring the Buyer Authentication Service

25

Building Customer Confidence. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

Enrolling for the Buyer Authentication Service . . . . . . . . . . . . . . . . . . . . . . . . 25

Downloading the Payflow (Including APIs and API Documentation). . . . . . . . . . . . . 25

Configuring Buyer Authentication . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

Generate Transaction Request Software . . . . . . . . . . . . . . . . . . . . . . . . 27

Testing and Activating the Service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

Chapter 6 Performing Buyer Authentication Transactions Using the

SDK31

Testing the Buyer Authentication Service . . . . . . . . . . . . . . . . . . . . . . . . . . 31

Buyer Authentication Transaction Overview . . . . . . . . . . . . . . . . . . . . . . . . . 31

Buyer Authentication Terminology . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

Buyer Authentication Server URLs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

Detailed Buyer Authentication Transaction Flow. . . . . . . . . . . . . . . . . . . . . . . 33

Call 1: Verify that the cardholder is enrolled in the 3-D Secure program . . . . . . . . 33

Call 2: POST the authentication request to and redirect the customer’s browser to the ACS

URL . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

Call 3: Validate the PARES authentication data returned by the ACS server . . . . . . 36

Call 4: Submit the intended transaction request to the Payflow server . . . . . . . . . 36

Example Buyer Authentication Transactions. . . . . . . . . . . . . . . . . . . . . . . . . 37

Example Verify Enrollment Transaction . . . . . . . . . . . . . . . . . . . . . . . . . 38

Example Verify Enrollment Response . . . . . . . . . . . . . . . . . . . . . . . . . . 38

Example Validate Authentication Transaction . . . . . . . . . . . . . . . . . . . . . . 38

Example Payflow Authorization or Sale Transaction . . . . . . . . . . . . . . . . . . 39

Buyer Authentication Transaction Parameters and Return Values . . . . . . . . . . . . . 40

Transaction Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

Verify Enrollment Transaction Name-Value Pairs . . . . . . . . . . . . . . . . . . . . 40

Validate Authentication Transaction Name-Value Pairs . . . . . . . . . . . . . . . . . 42

Standard Payflow Sale or Authorization Transaction . . . . . . . . . . . . . . . . . . 43

ECI Values . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

4

Page 5

Content

Logging Transaction Information. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

Audit Trail and Transaction Logging . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

Chapter 7 Screening Transactions Using the Payflow SDK . . . . . . 49

Downloading the Payflow SDK (Including APIs and API Documentation) . . . . . . . . . . 49

Transaction Data Required by Filters . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49

Transaction Parameters Unique to the Filters . . . . . . . . . . . . . . . . . . . . . . . . 52

Existing Payflow Parameters Used by the Filters . . . . . . . . . . . . . . . . . . . . . . 53

Response Strings for Transactions that Trigger Filters . . . . . . . . . . . . . . . . . . . 54

RESULT Values Specific to Fraud Protection Services . . . . . . . . . . . . . . . . . 57

Changing the Verbosity Setting . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58

Example Response for an Authentication Transaction With Verbosity=Low . . . . . . 58

Example Response for an Authentication Transaction With Verbosity=Medium . . . . 58

Accepting or Rejecting Transactions That Trigger Filters . . . . . . . . . . . . . . . . . . 62

Logging Transaction Information. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62

Chapter 8 Responses to Credit Card Transaction Requests . . . . . .65

An Example Response String . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65

Contents of a Response to a Credit Card Transaction Request . . . . . . . . . . . . . . . 66

PNREF Value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67

PNREF Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67

RESULT Codes and RESPMSG Values . . . . . . . . . . . . . . . . . . . . . . . . . . . 68

RESULT Values for Transaction Declines or Errors . . . . . . . . . . . . . . . . . . . 68

RESULT Values for Communications Errors . . . . . . . . . . . . . . . . . . . . . . 73

Appendix A Fraud Filter Reference. . . . . . . . . . . . . . . . . . . .77

Filters Included with the Fraud Protection Services . . . . . . . . . . . . . . . . . . . . . 77

Filters Included with the Basic Fraud Protection Services Option . . . . . . . . . . . . 77

Filters Included with the Advanced Fraud Protection Services Option . . . . . . . . . 78

Special Case: Buyer Authentication Failure Filter . . . . . . . . . . . . . . . . . . . . 78

About the Fraud Risk Lists . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78

Filters Applied After Processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 79

Transaction Data Required by Filters . . . . . . . . . . . . . . . . . . . . . . . . . . 79

Unusual Order Filters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 79

Total Purchase Price Ceiling Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . 79

Total Item Ceiling Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80

Shipping/Billing Mismatch Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80

5

Page 6

Content

Product Watch List Filter. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 81

High-risk Payment Filters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 81

AVS Failure Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 81

Card Security Code Failure Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . 83

Buyer Authentication Failure Filter. . . . . . . . . . . . . . . . . . . . . . . . . . . . 84

BIN Risk List Match Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 86

Account Number Velocity Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 86

High-risk Address Filters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 86

ZIP Risk List Match Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 87

Freight Forwarder Risk List Match Filter . . . . . . . . . . . . . . . . . . . . . . . . . 87

USPS Address Validation Failure Filter . . . . . . . . . . . . . . . . . . . . . . . . . 87

IP Address Match Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 88

Email Service Provider Risk List Match Filter . . . . . . . . . . . . . . . . . . . . . . 88

Geo-location Failure Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 89

IP Address Velocity Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90

High-risk Customer Filters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90

Bad Lists . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90

International Order Filters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91

Country Risk List Match Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91

International Shipping/Billing Address Filter . . . . . . . . . . . . . . . . . . . . . . . 91

International IP Address Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 92

International AVS Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 92

Accept Filters. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 93

Good Lists . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 93

Total Purchase Price Floor Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 94

Custom Filters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 94

Appendix B Testing the Transaction Security Filters . . . . . . . . . .95

Good and Bad Lists . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 95

AVS Failure Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 96

BIN Risk List Match Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 96

Country Risk List Match Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 97

Email Service Provider Risk List Match Filter . . . . . . . . . . . . . . . . . . . . . . . . 98

Freight Forwarder Risk List Match Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . 98

Geo-location Failure Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 99

International AVS Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 99

International IP Address Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .100

International Shipping/Billing Address Filter . . . . . . . . . . . . . . . . . . . . . . . . .101

6

Page 7

Content

IP Address Match Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .102

Shipping/Billing Mismatch Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .102

Total Item Ceiling Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .103

Total Purchase Price Ceiling Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .103

Total Purchase Price Floor Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .104

USPS Address Validation Failure Filter . . . . . . . . . . . . . . . . . . . . . . . . . . .104

ZIP Risk List Match Filter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .105

Appendix C Testing Buyer Authentication Transactions Using the Payflow

SDK 107

Testing Buyer Authentication Transactions . . . . . . . . . . . . . . . . . . . . . . . . .107

Buyer Authentication Test Server . . . . . . . . . . . . . . . . . . . . . . . . . . . .107

Payflow Test Server . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .107

Test Case Descriptions and Account Numbers . . . . . . . . . . . . . . . . . . . . . . .107

Test Cases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .108

Expected Result Codes for Buyer Authentication . . . . . . . . . . . . . . . . . . . . . .109

Buyer Authentication Testing Procedures . . . . . . . . . . . . . . . . . . . . . . . . . . 110

Perform the Verify Enrollment Transaction . . . . . . . . . . . . . . . . . . . . . . .110

Verify Enrollment Transaction Test Cases . . . . . . . . . . . . . . . . . . . . . . . 111

Example Return Values . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 111

Validate Authentication Transaction Test Cases . . . . . . . . . . . . . . . . . . . . 113

Procedure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .113

Example Return Values . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 115

Appendix D Deactivating Fraud Protection Services . . . . . . . . . . 117

Index. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 119

7

Page 8

Content

8

Page 9

Preface

This document describes Fraud Protection Services and explains how you can use the Payflow

SDK to perform transactions that will be screened by Fraud Protection Services filters.

For details on how to configure and use Fraud Protection Services and to generate Buyer

Authentication reports through PayPal Manager, see PayPal Manager online help.

Intended Audience

This document is intended for Payflow Pro merchants who subscribe to any Fraud Protection

Services options.

Document Conventions

This document uses the term fraudster to represent an entity (typically a person) attempting

fraudulent activity.

Document Organization

z Chapter 1, “Overview,” presents the Fraud Protection Services suite.

z Chapter 2, “How Fraud Protection Services Protect You,” describes the security tools that

make up the Fraud Protection Services.

z Chapter 3, “Configuring the Fraud Protection Services Filters,” describes how to configure

Fraud Protection Services.

z Chapter 4, “Assessing Transactions that Triggered Filters,” makes recommendations on

how to set up and fine-tune filters.

z Chapter 5, “Activating and Configuring the Buyer Authentication Service,” describes

activating and configuring the Buyer Authentication service.

z Chapter 6, “Performing Buyer Authentication Transactions Using the SDK,” describes and

provides an example of how to use Buyer Authentication.

z Chapter 7, “Screening Transactions Using the Payflow SDK,”describes how to screen

transactions for fraud using the Payflow SDK.

z Chapter 8, “Responses to Credit Card Transaction Requests,” describes the responses to a

credit card transaction request.

Fraud Protection Services User’s Guide 9

Page 10

Preface

Customer Service

z Appendix A, “Fraud Filter Reference,” describes the Transaction filters that make up part

of the Fraud Protection Services.

z Appendix B, “Testing the Transaction Security Filters,” provides Payflow SDK

transactions that you can use to test the filters.

z Appendix C, “Testing Buyer Authentication Transactions Using the Payflow SDK,

provides examples of testing Buyer Authentication transactions.

z Appendix D, “Deactivating Fraud Protection Services,” describes the process of

deactivating Fraud Protection Services.

Customer Service

If you are having problems with Fraud Protection Services, contact Customer Service at:

Email: payflow-support@paypal.com.

Telephone: 1 800 505-4916

Revision History

TABLE 2.1 Revision History

Date Description

June 2008 Updated Payflow server test and live URLs.

February 2008 Updated test and live URLs.

August 2007 AU Enhancements

April 2007 Updated guide to include PayPal Manager User Interface changes.

February 2007 Updated AVS responses rules.

December 2006 Updated buyer auth test URL to pilot-buyerauth.verisign.com

Updated Customer Service information.

Minor edits for technical accuracy.

Added return codes: 51, 110, 119, 120, 121, 132, 133, 200, 201, 402, 403, 404,

600, and 601.

Minor corrections for technical accuracy

10 Fraud Protection Services User’s Guide

Page 11

Overview

1

This chapter discusses how fraud can affect you the merchant and provides an overview of

Fraud Protection Services.

In This Chapter

z “Growing Problem of Fraud” on page 11

z “Reducing the Cost of Fraud” on page 11

Growing Problem of Fraud

Online fraud is a serious and growing problem. While liability for fraudulent card-present or

in-store transactions lies with the credit card issuer, liability for card-not-present transactions,

including transactions conducted online, falls to the merchant. As you probably know, this

means that a merchant that accepts a fraudulent online transaction (even if the transaction is

approved by the issuer) does not receive payment for the transaction and additionally must

often pay penalty fees and higher transaction rates. (One notable exception, Buyer

Authentication, is described in this document.)

Reducing the Cost of Fraud

Fraud Protection Services, in conjunction with your Payflow Pro service’s standard security

tools, can help you to significantly reduce these costs and the resulting damage to your

business.

NOTE: Merchants must meet the following eligibility requirements to enroll in and use the

Fraud Protection Services products:

– Merchant must have a current, paid-in-full Payflow Pro service account.

– Merchant Payflow Pro service account must be activated (in Live mode).

– Merchant must have its business operations physically based in the United States of

America.

– Merchant must use one of the following terminal-based processors: American

Express Phoenix, FDMS Nashville, FDMS North, FDMS South, Global Payments

East, Nova, Paymentech New Hampshire, or Vital.

Fraud Protection Services User’s Guide 11

Page 12

Overview

1

Reducing the Cost of Fraud

12 Fraud Protection Services User’s Guide

Page 13

2

This chapter describes the security tools that make up the Fraud Protection Services.

In This Chapter

z “The Threats” on page 13

z “Protection Against the Threats—Fraud Filters” on page 13

z “Special Considerations” on page 14

The Threats

There are two major types of fraud—hacking and credit card fraud.

Hacking

How Fraud Protection Services Protect You

Fraudsters hack when they illegally access your customer database to steal card information or

to take over your Payflow Pro account to run unauthorized transactions (purchases and

credits). Fraud Protection software filters minimize the risk of hacking by enabling you to

place powerful constraints on access to and use of your PayPal Manager and Payflow Pro

accounts.

Credit Card Fraud

Fraudsters can use stolen or false credit card information to perform purchases at your Web

site, masking their identity to make recovery of your goods or services impossible. To protect

you against credit card fraud, the Fraud Protection filters identify potentially fraudulent

activity and let you decide whether to accept or reject the suspicious transactions.

Protection Against the Threats—Fraud Filters

Configurable filters screen each transaction for evidence of potentially fraudulent activity.

When a filter identifies a suspicious transaction, the transaction is marked for review.

Fraud Protection Services offers two levels of filters: Basic and Advanced. The filters are

described in Appendix B, “Fraud Filter Reference.”

For detailed descriptions of the filter levels, the order and logic of the screening process, and

for specific variations from the simple flow described here, see Appendix A, “How Filters

Work .”

Fraud Protection Services User’s Guide 13

Page 14

How Fraud Protection Services Protect You

2

Special Considerations

Example Filter

The Total Purchase Price Ceiling filter compares the total amount of the transaction to a

maximum purchase amount (the ceiling) that you specify. Any transaction amount that

exceeds the specified ceiling triggers the filter.

Configuring the Filters

Through PayPal Manager, you configure each filter by specifying the action to take whenever

the filter identifies a suspicious transaction (either set the transaction aside for review or reject

it). See PayPal Manager online help for detailed filter configuration procedures.

Typically, you specify setting the transaction aside for review. For transactions that you deem

extremely risky (for example, a known bad email address), you might specify rejecting the

transaction outright. You can turn off any filter so that it does not screen transactions.

For some filters, you also set the value that triggers the filter—for example the dollar amount

of the ceiling price in the Total Purchase Price Ceiling filter.

Reviewing Suspicious Transactions

As part of the task of minimizing the risk of fraud, you review each transaction that triggered a

filter through PayPal Manager to determine whether to accept or reject the transaction. See

PayPal Manager online help for details.

Special Considerations

Merchants With an Instant Fulfillment Model

For businesses with instant fulfillment business models (for example, software or digital goods

businesses), the Review option does not apply to your business—you do not have a period of

delay to review transactions before fulfillment to customers. Only the Reject and Accept

options are applicable to your business model.

In the event of server outage, Fraud Protection Services is designed to queue transactions for

online processing. This feature also complicates an instant fulfillment business model.

Merchants using the Recurring Billing Service

To avoid charging you to filter recurring transactions that you know are reliable, Fraud

Protection Services filters do not screen recurring transactions.

To screen a prospective recurring billing customer, submit the transaction data using PayPal

Manager’s Virtual Terminal. The filters screen the transaction in the normal manner. If the

transaction triggers a filter, then you can follow the normal process to review the filter results.

14 Fraud Protection Services User’s Guide

Page 15

3

Configuring the Fraud Protection Services Filters

This chapter describes how to configure the Fraud Filters for your Payflow Pro account. The

chapter explains a phased approach to implementing the security of transactions. You are not

required to use the approach described in this chapter. However it enables you to fine tune

your use of filters before you actually deploy them in a live environment.

You first make and fine-tune filter settings in a test environment. Then you move to a live

transaction environment to fine-tune operation in an Observe-only mode. Finally, when you

are fully satisfied with your settings, you move to live Active mode to begin screening all live

transactions for fraud.

Filter operation is fully described in Appendix A, “Fraud Filter Reference.”

IMPORTANT:Upon completing the configuration procedures within each of the phases

described below, you must click the Deploy button to deploy the filter settings.

Filter settings take effect only after you deploy them.

Filter setting changes are updated hourly (roughly on the hour). This means

that you might have to wait up to an hour for your changes to take effect. This

waiting period only occurs when you move from one mode to the next.

z Phase 1: Run test transactions in Test mode using test transaction servers

In the test phase of implementation, you configure fraud filter settings for test servers that

do not affect the normal flow of transactions. You then run test transactions against the

filters and review the results offline to determine whether the integration was successful.

Once you are happy with the filter settings, you move to the next phase and the settings that

you decided upon in the test phase are transferred to the live servers.

z Phase 2: Run live transactions on live transaction security servers using Observe mode

When you deploy to Observe mode, the settings that you decided upon in the test phase are

automatically transferred to the live servers.

In Observe mode, the filters examine each live transaction and mark the transaction with

each triggered filter’s action. You can then view the actions that would have been taken on

the live transactions had the filters been active. Regardless of the filter actions, all

transactions are submitted for processing in the normal fashion.

z Phase 3: Run live transactions on live transaction security servers using Active mode

Once you have set all filters to the optimum settings, you deploy the filters to Active mode.

In Active mode, filters on the live servers examine each live transaction and take the

specified action when triggered.

NOTE: Remember that you can test a new filter setting using the test servers at any time

(even if your account is in Active mode), and then, if desired, make an adjustment

to the live filter settings.

Fraud Protection Services User’s Guide 15

Page 16

Configuring the Fraud Protection Services Filters

3

Phase 1: Run Test Transactions Against Filter Settings on Test Transaction Security Servers

Phase 1: Run Test Transactions Against Filter Settings on Test

Transaction Security Servers

In this phase of implementation, you configure filter settings for test servers that do not affect

the normal flow of live transactions. You then run test transactions against the filters and

review the results offline to determine whether the integration was successful. Continue

modifying and testing filters as required.

NOTE: There is no per-transaction fee when you use the test servers.

1. In the Service Summary section of the PayPal Manager home page, click the Basic or

Advanced Fraud Protection link.

Click Service Settings > Fraud Protection >Test Setup.

2. Click Edit Standard Filters. The Edit Standard Filters page appears.

3. For each filter:

– Click the filter check box to enable it and click-to-clear the check box to disable it.

– Select the filter action that should take place when the filter is triggered.

For some filters, you set a trigger value. For example, the Total Purchase Price Ceiling

filter trigger value is the transaction amount that causes the filter to set a transaction

aside.

NOTE: To make decisions about how the filters work, see Appendix B, “Fraud Filter

Reference.”

NOTE: If you have not enrolled for the Buyer Authentication Service, then the Buyer

Authentication Failure filter is grayed-out and you cannot configure it.

Items that you enter in the Test Good, Bad, or Product Watch lists are not carried

over to your configuration for the live servers, so do not spend time entering a

complete list for the test configuration. For details on the Good, Bad, or Product

Watch list filters, see Appendix B, “Fraud Filter Reference.”

4. Once you complete editing the page, click Deploy.

IMPORTANT:If you do not deploy the filters, then your settings are not saved.

5. All filters are now configured, and you can begin testing the settings by running test

transactions. Follow the guidelines outlined in Appendix B, “Testing the Transaction

Security Filters.” To run test transactions, you can use PayPal Manager’s Virtual Terminal.

See PayPal Manager for online help instructions.

6. Review the filter results by following the instructions in Chapter 4, “Assessing

Transactions that Triggered Filters.”

7. Based on your results, you may want to make changes to the filter settings. Simply return

to the Edit Filters page, change settings, and redeploy them. Once you are happy with your

filter settings, you can move to Phase 2.

16 Fraud Protection Services User’s Guide

Page 17

Configuring the Fraud Protection Services Filters

Phase 2: Run Live Transactions on Live Transaction Servers in Observe Mode

Phase 2: Run Live Transactions on Live Transaction Servers in

Observe Mode

In this phase, you configure filters on live servers to the settings that you had fine-tuned on the

test servers. In Observe mode, filters examine each live transaction and mark the transaction

with the filter results. The important difference between Observe and Active mode is that,

regardless of the filter actions, all Observe mode transactions are submitted for processing in

the normal fashion.

Observe mode enables you to view filter actions offline to assess their impact (given current

settings) on your actual transaction stream.

NOTE: You are charged the per-transaction fee to use the live servers in either Observe or

Active mode.

1. Click Service Settings > Fraud Protection >Test Setup. Click Move Test Filter Settings

to Live. The Move Test Filter Setting to Live page appears. Remember that in this phase,

you are configuring the live servers.

2. Click Move Test Filter Settings to Live. On the page that appears, click Move Test Filter

Settings to Live again.

3

3. The Move Test Filter Settings to Live page prompts whether to deploy the filters in

Observe modeor in Active mode. Click Deploy to Observe Mode.

Once you deploy the filters, all transactions are sent to the live servers for screening by the live

filters. In Observe mode, each transaction is marked with the filter action that would have

occurred (Review, Reject, or Accept) had you set the filters to Active mode

This enables you to monitor (without disturbing the flow of transactions) how actual customer

transactions would have been affected by active filters.

IMPORTANT:Deployed filter setting changes are updated hourly (roughly on the hour).

This means that you might have to wait up to an hour for your changes to

take effect. This waiting period only occurs when you move from one mode

to the next.

4. Perform testing of the filters. Follow the procedures outlined in Appendix B, “Testing the

Transaction Security Filters.”

5. Review the filter results by following the instructions in Chapter 4, “Assessing

Transactions that Triggered Filters.” The Filter Scorecard (described on page 22) will be

particularly helpful in isolating filter performance that you should monitor closely and in

ensuring that a filter setting is not set so strictly so as to disrupt normal business.

6. Once you are happy with your filter settings, you can move to Phase 3.

Fraud Protection Services User’s Guide 17

Page 18

Configuring the Fraud Protection Services Filters

3

Phase 3: Run All Transactions Through the Live Transaction Security Servers Using Active Mode

Phase 3: Run All Transactions Through the Live Transaction

Security Servers Using Active Mode

Once you have configured all filters to optimum settings, you convert to Active mode. Filters

on the live servers examine each live transaction and take the specified action.

7. Click Move Test Filter Settings to Live. On the page that appears, click Move Test Filter

Settings to Live again.

8. On the Move Test Filter Settings to Live page, click Deploy to Active Mode.

At the top of the next hour, all live transactions will be inspected by the filters.

9. Use the instructions in Chapter 4, “Assessing Transactions that Triggered Filters,” to detect

and fight fraud.

IMPORTANT:Remember that you can make changes to fine-tune filter settings at any time.

After changing a setting, you must re-deploy the filters so that the changes

take effect.

18 Fraud Protection Services User’s Guide

Page 19

4

Assessing Transactions that Triggered Filters

As part of the task of minimizing the risk of fraud, you review each transaction that triggered a

filter. You decide, based on the transaction’s risk profile, whether to accept or reject the

transaction. This chapter describes how to review transactions that triggered filters, and

provides guidance on deciding on risk.

NOTE: The Fraud Protection Services package (Basic or Advanced) to which you subscribe

determines the number of filters that screen your transactions. Basic subscribers have

access to a subset of the filters discussed in this chapter. Advanced subscribers have

full access. See “Filters Included with the Fraud Protection Services” on page 83 for

complete lists of Basic and Advanced filters.

In This Chapter

z “Reviewing Suspicious Transactions” on page 19

z “Fine-tuning Filter Settings—Using the Filter Scorecard” on page 22

z “Re-running Transactions That Were Not Screened” on page 24

Reviewing Suspicious Transactions

Transactions that trigger filters might or might not represent attempted fraud. It is your

responsibility to analyze the transaction data and then to decide whether to accept or reject the

transaction. Accepting a transaction requires no further action. To reject a transaction, a

separate void of the transaction is required.

The first step in reviewing filtered transactions is to list the transactions.

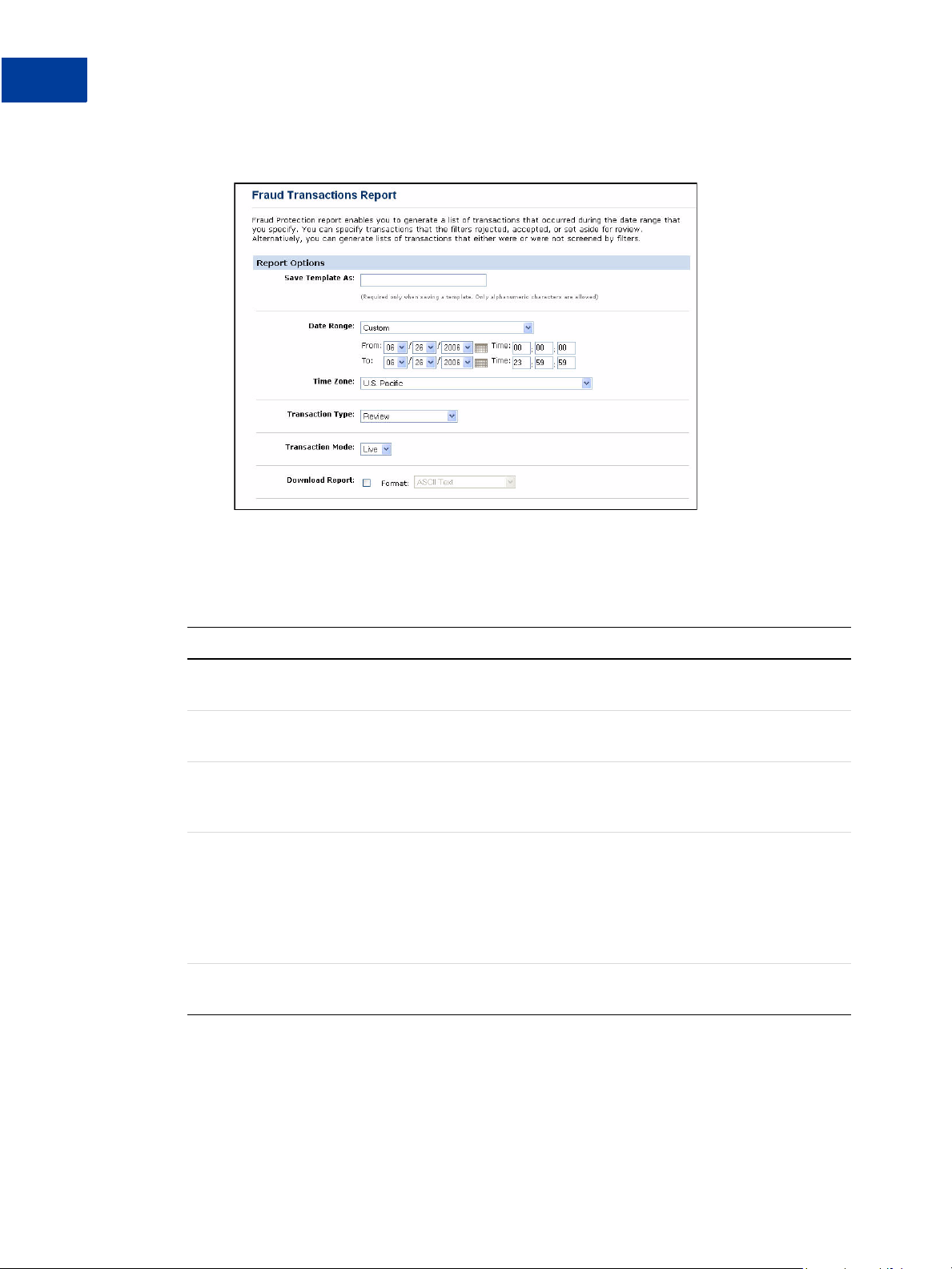

1. Click Reports > Fraud Protection > Fraud Transactions

The Fraud Transactions Report page appears.

Payflow Link Fraud Protection Services User’s Guide 19

Page 20

Assessing Transactions that Triggered Filters

4

Reviewing Suspicious Transactions

FIGURE 4.1 Fraud Transactions Report page

2. Specify the date range of the transactions to review.

3. Specify a Transa ction Type :

TABLE 4.1 Transaction types

Transaction Type Description

Reject Transactions that the filters rejected. These transactions cannot be settled.

The type of filter that took this action is called a Reject filter.

Review Transactions that the filters set aside for your review. The type of filter that

took this action is called a Review filter.

Accept Transactions that the filters allowed through the normal transaction

submission process. The type of filter that took this action is called an Accept

filter.

Not Screened by

Filters

Transactions that were not screened by any filter. This condition (Result Code

127) indicates that an internal server error prevented the filters from

examining transactions. This conditional occurs only in Test mode or Live

mode. In Observe mode all results codes are always 0.

You can re-screen any of these transactions through the filters as described in

“Re-running Transactions That Were Not Screened” on page 24.

Screened by Filters All transactions that were screened by filters, regardless of filter action or

whether any filter was triggered.

4. Specify the Transaction Mode, and click Run Report.

The Fraud Transactions Report page displays all transactions that meet your search

criteria.

20 Payflow Link Fraud Protection Services User’s Guide

Page 21

Assessing Transactions that Triggered Filters

Reviewing Suspicious Transactions

NOTE: If filters are deployed in Observe mode, then all transactions have been submitted for

processing and are ready to settle. Transactions are marked with the action that the

filter would have taken had the filters been deployed in Active mode.

The following information appears in the report:

TABLE 4.2 Transactions Report field descriptions

Heading Description

Report Type The type of report created.

Date Date and time range within which the transactions in this report were

run.

Time Zone Time zone represented in this report.

Transaction Mode Test, Observe, or Active

Transaction ID Unique transaction identifier. Click this value to view the Transaction

Detail page.

Transaction Time Time and date that the transaction occurred.

4

Transaction Type The transaction status that resulted from filter action, as described in

Table 4. 1.

Card Type MasterCard or Visa.

Amount Amount of the transaction.

The following transaction status values can appear in the report:

T

ABLE 4.3 Transaction status values

Report in Which

Transaction

Stage of Review

Screened by filters Pass 0 Approved Approved report

Screened by filters Review 126 Under Review by Fraud Service Approved report

Screened by filters Reject 125 Declined by Fraud Service Declined report

Screened by filters Accept 0 Approved Approved report

Screened by filters Service Outage 127 Unprocessed by Fraud Service Approved report

Status

Result

Code Result Message

the Transaction

Appears

After review by

merchant

Payflow Link Fraud Protection Services User’s Guide 21

Accepted 0 Approved Approved report

Rejected 128 Declined by Merchant Declined report

Page 22

Assessing Transactions that Triggered Filters

4

Fine-tuning Filter Settings—Using the Filter Scorecard

Click the Transaction ID of the transaction of interest.

The Fraud Details page appears, as discussed in the next section.

Acting on Transactions that Triggered Filters

The Fraud Details page displays the data submitted for a single transaction. The data is

organized to help you to assess the risk types and to take action (accept, reject, or continue in

the review state).

The following notes describe data in the Fraud Details page shown in the figure.

1. This transaction was set aside because it triggered the AVS Failure filter.

2. The transaction was not screened by any of the filters in the Skipped Filters section because

the data required by these filters did not appear in the transaction data or was badly

formatted. In special cases, all filters appear here. See “Re-running Transactions That Were

Not Screened” on page 24

3. Specify the action to take on the transaction:

– Review: Take no action. You can return to this page at any time or reject or accept the

transaction. The transaction remains unsettleable.

– Reject: Do not submit the transaction for processing. See “Rejecting Transactions” on

page 22.

– Accept: Submit the transaction for normal processing.

4. You can enter notes regarding the disposition of the transaction or the reasons for taking a

particular action. Do not use the & < > or = characters.

5. Click Submit to save the notes, apply the action, and move to the next transaction.

NOTE: You can also view the Fraud Details page for transactions that were rejected or

accepted. While you cannot change the status of such transactions, the page provides

insight into filter performance.

Rejecting Transactions

If you decide to reject a transaction, you should notify the customer that you could not fulfill

the order. Do not be explicit in describing the difficulty with the transaction because this

provides clues for performing successful fraudulent transactions in the future. Rejected

transactions are never settled.

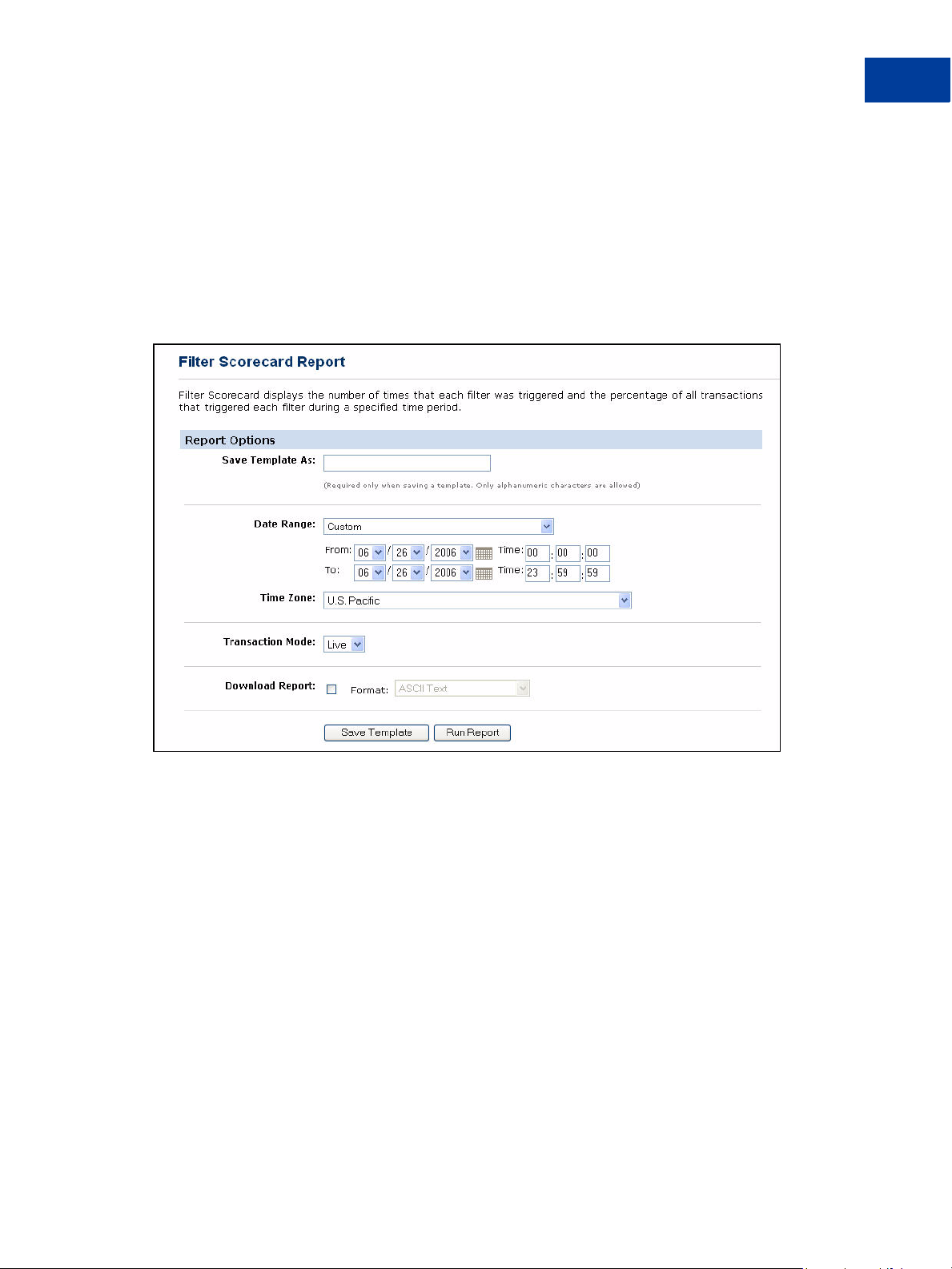

Fine-tuning Filter Settings—Using the Filter Scorecard

The Filter Scorecard displays the number of times that each filter was triggered and the

percentage of all transactions that triggered each filter during a specified time period.

22 Payflow Link Fraud Protection Services User’s Guide

Page 23

Assessing Transactions that Triggered Filters

Fine-tuning Filter Settings—Using the Filter Scorecard

This information is especially helpful in fine-tuning your risk assessment workflow. For

example, if you find that you are reviewing too many transactions, then use the Filter

Scorecard to determine which filters are most active. You can reduce your review burden by

relaxing the settings on those filters (for example, by setting a higher amount for the Purchase

Price Ceiling filter).

1. Click Reports > Filter Scorecard. The Filter Scorecard Report page appears.

FIGURE 4.2 Filter Scorecard Report page

4

2. Specify the date range of the transactions to review.

3. In the Transaction Mode field, specify transactions screened by the live or the test servers.

4. Click Run Report.

The Filter Scorecard Report page displays the number of times that each filter was

triggered and the percentage of all transactions that triggered each filter during the time

span that you specified.

Ensuring Meaningful Data on the Filter Scorecard

The Scorecard shows the total number of triggered transactions for the time period that you

specify, so if you had changed a filter setting during that period, the Scorecard result for the

filter might reflect transactions that triggered the filter at several different settings.

Say, for example, you changed the Total Purchase Price Ceiling on August 1 and again on

August 7. You then run a Filter Scorecard for July 1 to August 31. Between July 1 to August

Payflow Link Fraud Protection Services User’s Guide 23

Page 24

Assessing Transactions that Triggered Filters

4

Re-running Transactions That Were Not Screened

31, three different price ceiling settings caused the filter to trigger, yet the Scorecard would not

indicate this fact.

To ensure meaningful results in the Filter Scorecard, specify a time period during which the

filter settings did not change.

Re-running Transactions That Were Not Screened

Perform the following steps if you wish to re-run a transaction that was not screened by filters

(transactions with Result Code 127):

1. Navigate to Reports > Fraud Protection > Fraud Transaction Report. The Fraud

Transaction Report page appears.

2. Select the appropriate time period for the search, and select the “Not Screened by Filters”

option for Transaction Type.

3. Click RunView Report. The Fraud Transaction Report Results page appears. It contains

all the transactions that were not screened by filters.

4. Click on the Transaction ID of the transaction you would like to re-run. The Confirm Rerun

page appears.

5. Click Ye s to re-run that transaction. The Success page appears if your transaction was

successful.

NOTE: If multiple attempts at screening fail, then the transaction may have data formatting

problems. Validate the data, and contact Customer Service.

If you encounter 50 or more transactions with Result Code 127, then contact Customer

Service, who can resubmit them as a group.

24 Payflow Link Fraud Protection Services User’s Guide

Page 25

Activating and Configuring the

5

Buyer Authentication Service

This chapter describes how to enroll, configure, test, and activate the Buyer Authentication

Service.

In This Chapter

z “Building Customer Confidence” on page 25

z “Enrolling for the Buyer Authentication Service” on page 25

z “Downloading the Payflow (Including APIs and API Documentation)” on page 25

z “Configuring Buyer Authentication” on page 26

z “Testing and Activating the Service” on page 28

Building Customer Confidence

Buyer Authentication reduces your risk and builds your customers' confidence. The card

brands make marketing resources available to you to promote your Web site and logos you can

build into your checkout process.

For more information, visit:

z http://usa.visa.com/business/accepting_visa/ops_risk_management/vbv_marketing_support.html

or

z http://www.securecodemerchant.com

Enrolling for the Buyer Authentication Service

To enroll for the Buyer Authentication Service, click the Buyer Authentication banner on the

PayPal Manager main page. Follow the on-screen instructions to determine whether both your

processor and your acquiring bank support the Buyer Authentication service. If they both

support the service, then you can follow the on-screen instructions to enroll.

Downloading the Payflow (Including APIs and API

Documentation)

The Payflow software development kit (SDK) is available from the PayPal Manager

Downloads page as a .NET or Java library, or you can build your own API by posting directly

to the Payflow servers via HTTPS.

Fraud Protection Services User’s Guide 25

Page 26

Activating and Configuring the Buyer Authentication Service

5

Configuring Buyer Authentication

IMPORTANT:Full API documentation is included with each SDK.

Configuring Buyer Authentication

To enable Buyer Authentication processing on your site, you will need to construct two

transaction requests (messages) and construct a frameset. You can accomplish the tasks in a

few hours.

In the standard Payflow Pro implementation, when the customer submits a purchase request,

your website sends a single Sale transaction request with all purchase details (message with

transaction type S) to the server. With Buyer Authentication, you must submit two additional

transaction requests (types E— Verify Enrollment and Z—validate PARES response) before

the Sale.

Follow these steps:

1. Log in to PayPal Manager at

2. Click Service Settings > Fraud Protection > Buyer Authentication. The Buyer

Authentication Setup page appears.

3. Enter Registration information (complete all fields for both MasterCard and Visa).

– Select your Acquirer (Acquirer Support) for MasterCard and Visa and click Activate to

activate the Acquirer you selected.

– Enter your Business Name.

– Enter the fully qualified URL (be sure to include http:// or https://) of your business.

– Select your Country Code from the drop-down menu.

4. Click Submit. A gray notification box appears towards the top of the page confirming the

changes. If there are any errors, a yellow box appears towards the top of the page stating

the problem.

5. On the main PayPal Manager page click the Download link.

6. Read chapters 5 through 7 and Appendix D of this document

7. Download the Payflow SDK (Software Developer’s Kit) appropriate for your software

environment.

8. Download Payflow Pro Developer’s Guide (PDF format document). Read as much of

Payflow Pro Developer’s Guide as you need.

https://paypal.manager.com.

9. Configure the Payflow SDK as described in the developer’s guide.

26 Fraud Protection Services User’s Guide

Page 27

Activating and Configuring the Buyer Authentication Service

Generate Transaction Request Software

1. Submit a Verify Enrollment transaction request (type E) to determine whether the

cardholder is enrolled in either the Verified by Visa or MasterCard SecureCode service. See

the example on page 38.

2. The response is either Enrolled or Not Enrolled. See the example responses on page 38.

3. If the customer is enrolled, you populate the response data into a form page (hosted on your

server) and post it to the URL of the card issuing bank (ACS) indicated in the response.

Make sure the TermUrl field is properly specified, as this is where the ACS will post the

response. See “Example ACS Redirect Code” on page 35.

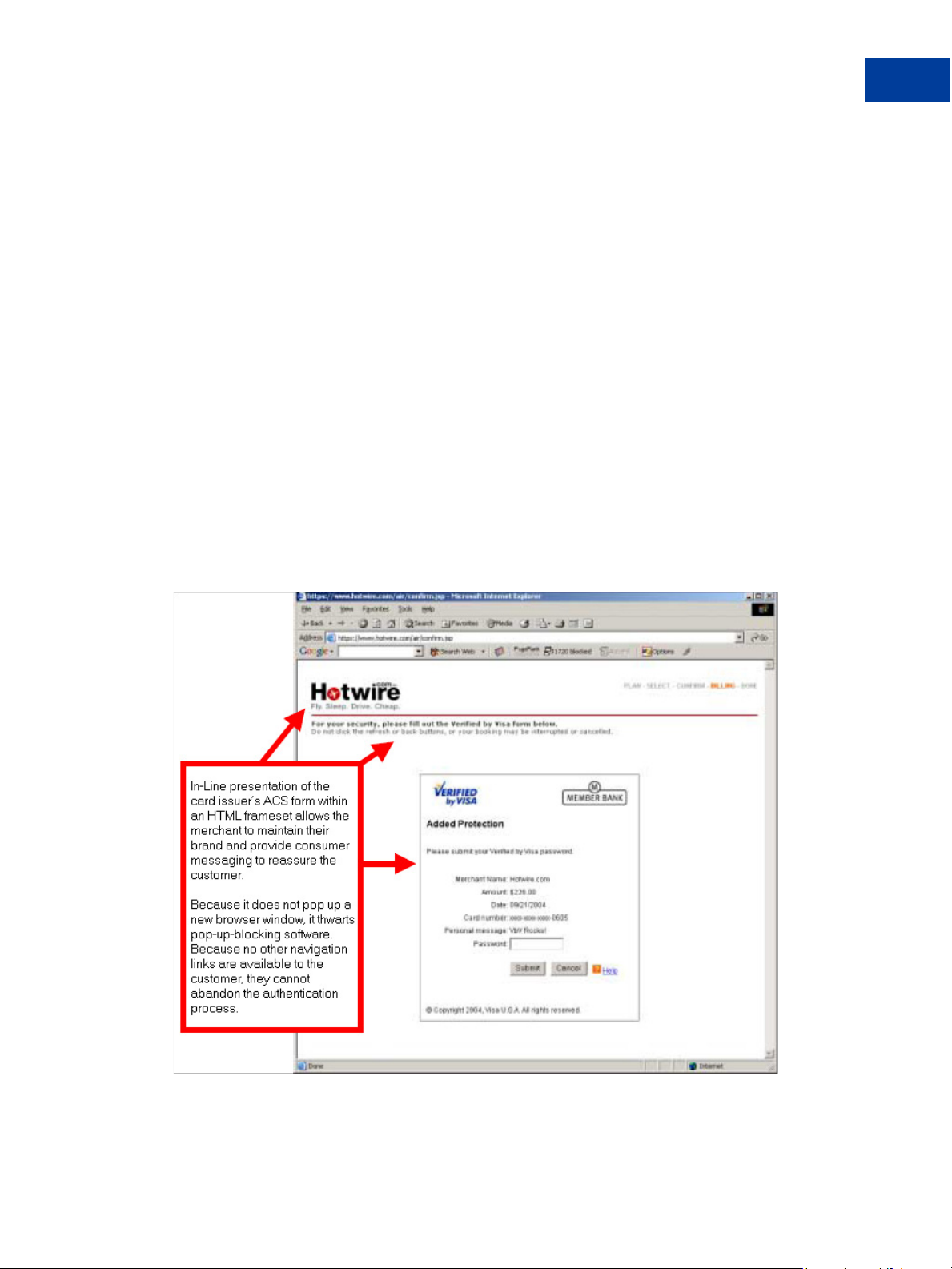

4. The ACS responds to the post by presenting an Authentication window to the customer.

By Visa/MasterCard requirements, the HTML page for displaying the ACS form must be

presented in-line (within the same browser session as the e-commerce transaction),

preferably as framed-inline.

The ACS form should be displayed in a frame set, as shown in the following example. The

message across the top of the frame is required.

Configuring Buyer Authentication

5

NOTE: You should not employ pop-up windows. They will be blocked by pop-up blocking

software.

Fraud Protection Services User’s Guide 27

Page 28

Activating and Configuring the Buyer Authentication Service

5

Testing and Activating the Service

5. When the customer enters their password and clicks Submit, the ACS verifies the

password and posts a response to the TermURL (the page on your site that is configured to

receive ACS responses).

6. Submit a Validate Authentication Response transaction request (type Z) to validate (ensure

that the message has not been falsified or tampered with) and decompose the

Authentication Response from the card-issuing bank (ACS). See “Example Validate

Authentication Response” on page 39.

7. The response contains the following data elements:

–XID

– Authentication Status

– ECI. E-commerce Indicator

– Visa: CAVV. Cardholder Authentication Verification Value

— or —

MasterCard: AAV. Accountholder Authentication Value

Submit these values, along with the standard transaction data, in a standard Sale or

Authorization transaction request, as described in “Call 4: Submit the intended transaction

request to the Payflow server” on page 36.

Testing and Activating the Service

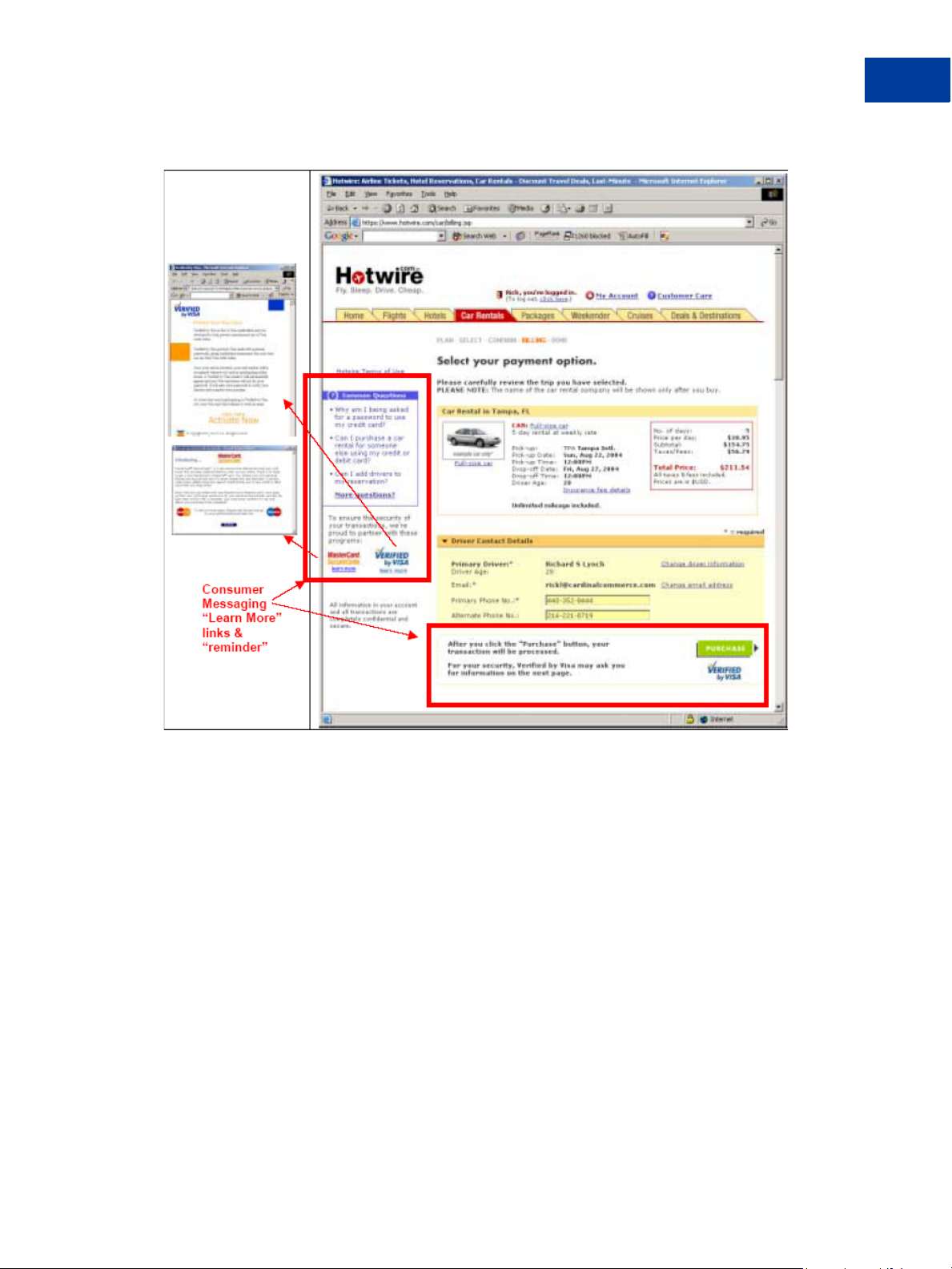

1. Make these other required UI modifications:

Payment page pre-messaging. The example text shown below and in the red boxes in the

figure must appear on your payment page to advise the customer that authentication may

take place.

Example text in “Learn More” box on the left:

z Why am I being asked for a password to use my credit card?

z Can I purchase a car rantal for someone else using my credit or debit card?

z Can I add drivers to my reservation?

More questions?

Example text in “reminder”:

After you check the “Purchase” button, your transaction will be processed.

For your security, Verified by Visa may ask you for information on the next page.

OTE: Buyer Authentication can only be activated when Fraud Protection Services is live.

N

28 Fraud Protection Services User’s Guide

Page 29

Activating and Configuring the Buyer Authentication Service

Testing and Activating the Service

5

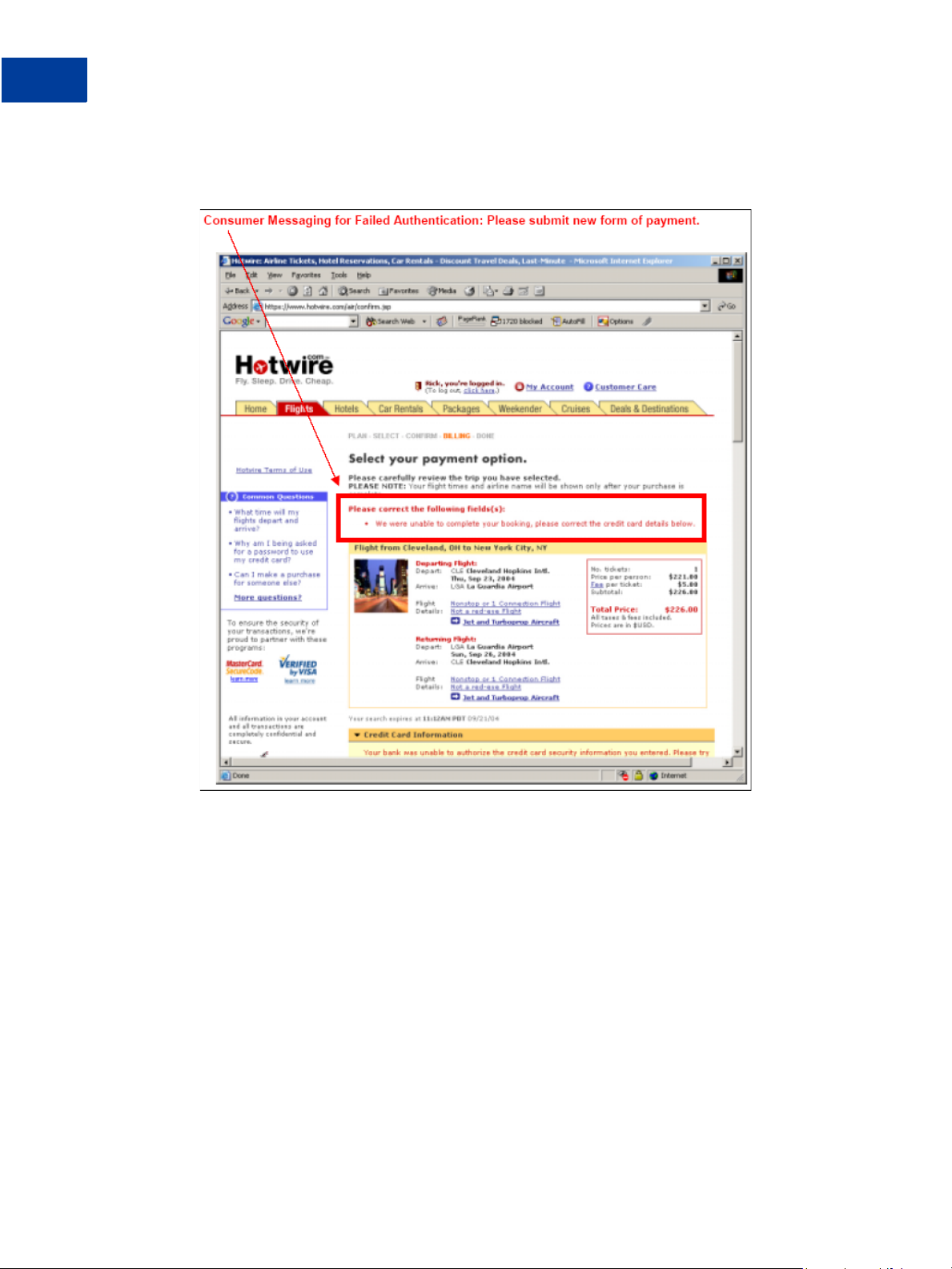

Failure messaging. The example text in the red box handles cases where customers cannot

successfully authenticate themselves. The text requests another form of payment.

Fraud Protection Services User’s Guide 29

Page 30

Activating and Configuring the Buyer Authentication Service

5

Testing and Activating the Service

Consumer Messaging for Failed Authentication: Please submit new form of payment.

2. Perform a last round of test transactions as described in Appendix C, “Testing Buyer

Authentication Transactions Using the Payflow SDK,” to ensure the flow and screen

presentation is correct.

3. Once all message flows and customer messaging and required logos are in place, you can

activate Buyer Authentication to accept live transactions.

30 Fraud Protection Services User’s Guide

Page 31

Performing Buyer Authentication

6

Transactions Using the SDK

This chapter describes the process of performing Buyer Authentication transactions using the

Payflow SDK. For information on using the SDK and on transaction syntax see Payflow Pro

Developer’s Guide.

The content and format of responses to transaction requests are described in “Buyer

Authentication Transaction Parameters and Return Values” on page 40. Standard Payflow Pro

response values are described in Payflow Pro Developer’s Guide.

XMLPay client support for Buyer Authentication is described in Payflow Pro XMLPay

Developer’s Guide.

For information on how to view Buyer Authentication reports in PayPal Manager, see PayPal

Manager online help.

Testing the Buyer Authentication Service

Information on testing Buyer Authentication Service transactions appears in Appendix C,

“Testing Buyer Authentication Transactions Using the Payflow SDK.”

In This Chapter

z “Buyer Authentication Transaction Overview” on page 31

z “Buyer Authentication Terminology” on page 32

z “Buyer Authentication Server URLs” on page 33

z “Detailed Buyer Authentication Transaction Flow” on page 33

z “Example Buyer Authentication Transactions” on page 37

z “Buyer Authentication Transaction Parameters and Return Values” on page 40

z “ECI Values” on page 45

z “Logging Transaction Information” on page 47

Buyer Authentication Transaction Overview

To implement Buyer Authentication, you use the Payflow SDK to write software that:

1. Receives the customer’s account number and determines whether it is enrolled in the

Verified by Visa or MasterCard SecureCode buyer authentication program.

2. If the cardholder is enrolled, then your program redirects the customer to the issuing bank’s

buyer authentication page. The customer submits their username and password. The

Fraud Protection Services User’s Guide 31

Page 32

Performing Buyer Authentication Transactions Using the SDK

6

Buyer Authentication Terminology

issuing bank authenticates the customer’s identity by returning a payer authentication

response value to your program.

3. Your program then validates the authentication response.

4. If the authentication data is valid, then your program submits a standard Payflow

authorization or sale transaction that includes the buyer authentication data.

NOTE: The Buyer Authentication Service supports only Sale and Authorization transaction

types.

Buyer Authentication Terminology

The following terms are used in this chapter:

TABLE 6.1 Buyer Authentication terminology

Term Definition

MPI The Merchant Plug-in software component that implements merchant's client

functionalities in 3-D Secure protocol. The 3-D Secure server at

https://buyerauth.com/DDDSecure/MerchantPlug-In

specification as a payment gateway.

PAREQ The Payer Authentication Request message that you send to the issuing bank’s

buyer authentication page.

PARES Payer Authentication Response, digitally signed by the issuing bank.

CAVV Cardholder Authentication Verification Value. The value generated by card

issuing bank to prove that the cardholder has been authenticated with a

particular transaction.

XID Buyer authentication Transaction ID. Used only by Verified by Visa to identify a

unique buyer authentication transaction.

ECI E-Commerce Indicator. The ECI value indicates the level of security supported

by the merchant when the cardholder provided the payment card data for an

Internet purchase. When returned in a buyer authentication response, it is

determined by the issuing bank.

Authentication

Status

Key component in the 3-D Secure protocol. A server run by card issuer

performing functionalities of enrolling a card for 3-D Secure, verifying card

enrollment, and authenticating cardholder and issuing a digitally signed

payment authentication response (PARES).

implements MPI's

32 Fraud Protection Services User’s Guide

Page 33

Performing Buyer Authentication Transactions Using the SDK

Buyer Authentication Server URLs

Buyer Authentication Server URLs

IMPORTANT:URLs listed here are used only for buyer authentication transactions: Verify

Enrollment (TRXNTYPE=E) and Validate Authentication (TRXNTYPE=Z).

z The production Buyer Authentication server URL is buyerauth.verisign.com

z The test Buyer Authentication server URL is pilot-buyerauth.verisign.com

Detailed Buyer Authentication Transaction Flow

A buyer authentication transaction involves the following four program calls. Examples of

exact syntax appear in “Example Buyer Authentication Transactions” on page 37.

NOTE: XMLPay uses the VerifyEnrollment transaction for Call 1.

Call 1: Verify that the cardholder is enrolled in the 3-D Secure program

6

For the Verify Enrollment call (VerifyEnrollment transaction in XMLPay), you determine

whether the cardholder is enrolled in the 3-D Secure program. Send a transaction

(TRXTYPE=E) to the Buyer Authentication server.

The server returns the AUTHENTICATION_STATUS of enrollment (E means enrolled), an

AUTHENTICATION_ID value, and an ECI value (electronic commerce indicator, defaulted

to 7 [Authentication Unsuccessful] because authentication has not yet occurred). If the

cardholder is enrolled, then the message also includes a PAREQ (payer authentication request)

value and the ACSURL—the URL of the Issuer’s ACS (access control server) page at which

buyers provide their password to authenticate themselves. The PAREQ is used in the next call

to ask the Issuing bank to authenticate the customer.

If the cardholder is not enrolled (AUTHENTICATION_STATUS=O), cannot be verified (X),

or an error occurred (I), skip to Call 4, “Call 4: Submit the intended transaction request to the

Payflow server” and submit a standard Payflow authorization or sale transaction that includes

the AUTHENTICATION_STATUS, AUTHENTICATION_ID, and ECI values.

Fraud Protection Services User’s Guide 33

Page 34

Performing Buyer Authentication Transactions Using the SDK

6

Detailed Buyer Authentication Transaction Flow

Generate the data for the intended transaction

Merchant

Web Store

510551055105

$42.02

BUY

1

Verify

Enrollment

call

Transaction

Data

AMT=42.02

DESCRIPTION=case

ACCT=5105510551055555

EXPDATE=0306

NAME=johnson

TRXTYPE=E

ACCT=5105510551055555

EXPDATE=0308

RESULT=0

AUTH_STATUS=E

AUTH_ID=1A3D4G

PAREQ=J84H+To4vv6K

ACSURL=www.issuer.com

ECI=7

"Is this

cardholder

enrolled?"

Authentication

"Yes, the

cardholder is enrolled, and here's

the URL of the Issuing bank's

ACS page and the Payer

Authentication Request (PAYREQ)

that you'll need when you

ask the Issuing bank to

authenticate the customer."

PayPal's

Buyer

Server

Call 2: POST the authentication request to and redirect the customer’s

browser to the ACS URL

NOTE: XMLPay uses the ValidateAuthentication transaction for Call 2.

If the card is enrolled, you place the following values in an HTTP form and then HTTP POST

the values to the ACS URL (the issuer’s ACS site):

z PAREQ: The value of the PAREQ returned in the Verify Enrollment call.

z TermUrl: Your server—the one that should accept the authentication response.

z MD: (Required) Any data that you want returned (echoed) to the TermUrl by the ACS

server. Typically, this is state information.

(XMLPay uses the ValidateAuthentication transaction for this purpose.)

Your server then redirects the customer’s browser to the ACS URL.

The customer views the ACS form, enters their 3-D Secure password, and submits the form to

the Issuing bank.

The issuer’s ACS server validates the password, authenticates the customer’s identity, and

then generates and digitally signs a PARES value (payer authentication response). The ACS

server then HTTP POSTs the signed PARES and the unchanged value of the MD to the

TermUrl that you specified.

34 Fraud Protection Services User’s Guide

Page 35

2

POST

Redirect

and

Performing Buyer Authentication Transactions Using the SDK

"Please

authenticate

this

customer."

HTTP method="POST"

PaReq=J84H+To4vv6K

TermUrl=http://merchantpage.com

MD=<state info>

Redirect

Customer

HTTP method="POST"

PaRes=Qi84$nFWpx2M93

MD=<echoed state info>

Detailed Buyer Authentication Transaction Flow

Issuer's

ACS server

(providing

ACS

Name

Password

Client

Browser

Username

Password

3-D Secure

Service)

"Yes, the customer

is the valid cardholder,

and here's the digitally signed

Payer Authentication

Response (PaRes) data."

6

Example ACS Redirect Code

The following example HTML page redirects a customer to an ACS URL with a PAREQ and

returns the URL for receiving the PARES. Customize tags marked with $ with your

information.

<HTML>

<head>

<title>Authentication Body</title>

<SCRIPT LANGUAGE="Javascript">

function OnLoadEvent()

{

document.downloadForm.submit();

}

</SCRIPT>

</head>

<body bgcolor="{$BACKCOLOR}" background="{$BACKGROUND}"

onload="OnLoadEvent()">

<form name="downloadForm" action="{$acsUrl}" method="POST">

<noscript>

<br/>

<br/>

<center>

<h1>Processing your 3-D Secure Transaction</h1>

<h2>JavaScript is currently disabled or is not supported

by your

browser.<br/></h2>

Fraud Protection Services User’s Guide 35

Page 36

Performing Buyer Authentication Transactions Using the SDK

oa

6

Detailed Buyer Authentication Transaction Flow

<h3>Click <b>Submit</b> to continue processing your 3-D

Secure

transaction.</h3>

<input type="submit" value="Submit"/>

</center>

</noscript>

<input type="hidden" name="TermUrl" value="{$redirectUrl}"/>

<input type="hidden" name="MD" value="{$messageId}"/>

<input type="hidden" name="PAREQ" value="{$paReq}"/>

</form>

</body>

</HTML>

Call 3: Validate the PARES authentication data returned by the ACS server

Your application at TermUrl performs the Validate Authentication call for security reasons.

You validate that the PARES is the proper data from the Issuer by sending a request for

validation of the digital signature on the PARES to the Buyer Authentication server. Use

TRXTYPE=Z.

The server uses the Issuer’s digital certificate to validate the signature and then returns the

parsed authentication information from the PARES: AUTHENTICATION_STATUS (Y means

valid signature), AUTHENTICATION_ID, CAVV (cardholder authentication verification

value), XID, and ECI.

partner=verisign

partner=verisign

vendor=merchant

Submission

vendor=merchant

partner=verisign

password=a1b2c3

password=a1b2c3

vendor=merchant

amt=42.02

amt=42.02

password=a1b2c3

description=case

description=case

amt=42.02

acct=5105510551055555

acct=5105510551055555

description=case

lastname=johnson

lastname=johnson

acct=5105510551055555

"Is the

lastname=johnson

PaRes

valid?"

TRXTYPE=Z

PARES=Qi84$nFWpx2M93

PayPal's

Buyer

Authentication

Server

3

Validate

Authentication

call

RESULT=0

AUTH_STATUS=Y

AUTH_ID=1A3D4G

CAVV=li409JK4aUv5Kq

ECI=2

XID=3Pm95VwzG8YeJ

"Yes, the signature is valid,

the content of PaRes is valid,

the authentication was successful,

and here's the data that I

parsed from the PaRes ."

Call 4: Submit the intended transaction request to the Payflow server

NOTE: For Call 4 when using XMLPay, pass the following in ExtData for Authorization and

Sale transactions:

AUTHENTICATION_STATUS=<status>, AUTHENTICATION_ID=<id>,

CAVV=<cavv value>, and XID=<xid value>, ECI=<eci value>.

Now that when the buyer authentication process is complete, you submit the intended sale or

authorization payment transaction (TRXNTYPE=S or A) to the Payflow server. In addition to

36 Fraud Protection Services User’s Guide

Page 37

Performing Buyer Authentication Transactions Using the SDK

Example Buyer Authentication Transactions

the standard sale or authorization transaction data, you include buyer authentication data, as

follows:

(Standard values:)

"Here's a Sale transaction,

and I've included

Buyer Authentication data"

4

Standard

TRXTYPE=S

TENDER=C

AMT=42.00

ACCT=5105510551055555

EXPDATE=0308

(Buyer Authentication values:)

AUTH_ID=1A3D4G

AUTH_STATUS=Y

CAVV=li409JK4aUv5Kq

ECI=2

XID=3Pm95VwzG8YeJ

Payflow

Server

Payflow Sale

Transaction

with Buyer

Authentication

data

RESULT=0

PNREF=VXYZ01234569

RESPMSG=APPROVED

"OK, here are the

results for the Sale,

and I've logged the

Buyer Authentication data"

6

Cardholder is Enrolled in the 3-D Secure Program

You perform the intended Payflow authorization or sale payment transaction using the

standard name-value pairs plus the values returned to the Validate Authentication

transaction: AUTHENTICATION_ID, AUTHENTICATION_STATUS, CAVV, XID, and

final ECI.

Cardholder is Not Enrolled

If there is no PAREQ returned in the response to the Verify Enrollment call, then the

cardholder is not enrolled and you do not perform any additional buyer authentication

transactions. You perform the intended Payflow authorization or sale payment transaction

using the standard name-value pairs plus the AUTHENTICATION_ID,

AUTHENTICATION_STATUS, and ECI values returned by the Verify Enrollment call.

XMLPay Users: Pass AUTHENTICATION_STATUS=<status>,

AUTHENTICATION_ID=<id>, CAVV=<cavv value>, XID=<xid value>, and ECI=<eci

value> in the ExtData for Authorization and Sale transactions.

Example Buyer Authentication Transactions

The values returned in the transaction responses shown in these examples are described in

“Buyer Authentication Transaction Parameters and Return Values” on page 40. Standard

Payflow return values are described in Payflow Pro Developer’s Guide.

All return parameter names for transactions with the Buyer Authentication Server include

length tags. Length tags specify the exact number of characters and spaces that appear in the

value. For example, RESPMSG[2]=OK.

Fraud Protection Services User’s Guide 37

Page 38

Performing Buyer Authentication Transactions Using the SDK

6

Example Buyer Authentication Transactions

Example Verify Enrollment Transaction

Use TRXTYPE=E to submit a Verify Enrollment request transaction. The following is an

example name-value pair parameter string.

"TRXTYPE=E&ACCT=5105105105105100&AMT=19.25&CURRENCY=840&EXPDATE=1206&PARTNE

R=PayPal&PWD=p12345&VENDOR=SuperMerchant&USER=SuperMerchant"

Example Verify Enrollment Response

If the cardholder is enrolled, the verify enrollment response contains PAREQ and ACSURL

parameters. These are used to direct the cardholder to their Issuer Web site to perform

authentication.

Cardholder is enrolled in 3-D Secure program

RESULT[1]=0&RESPMSG[2]=OK&AUTHENTICATION_ID[20]=f43669e4921cf8b504c4&AUTHEN

TICATION_STATUS[1]=E&PAREQ[428]=eJxVku1ugjAUhm+FeAH0A3Bozpr48WP+2GK23UA9HJV

ECpYy9e7XCkzXkPS8fcvD6Vvg+2iJ1l+EnSUF79S2+kBRWbxO9mkync4onUmB+3yX8RTTiYLt4p

POCn7ItmVtlIh5LIGN0hMsHrVxCjSel5sPJcMANiioyG7WSgwDWK/B6IrUkloXrfTpVJqDn20Rr

eqq0eYG7O4D1p1x9qbylAMbBXT2pI7ONXPGLpdLvPMU7CHoGTHWFbCwB9ijuW0XqtYzr2Whpi+5

FEWOlGOWU06U7f0HggOFdqQk5wmXIokEn3M5T1Jg93XQVWhCiVksM3/GXkET4IvRCs7zCvioLRk

cjzEqoGtTG/I7fFx/NRTUom99mB59r95CxOh8epngzw8Pad+NgLSKJ6InWg8Ir7HhDtlw3b769x

v8AhQarWM=&ACSURL[66]=http://pilot-buyerauth

post.verisign.com/DDDSecure/Acs3DSecureSim/start

.-

Cardholder is not enrolled

RESULT[1]=0&RESPMSG[2]=OK&AUTHENTICATION_ID[20]=48c92770755039d6bb3d&AUTHEN

TICATION_STATUS[1]=O&ECI[1]=1

Example Validate Authentication Transaction

Use TRXTYPE=Z to submit a Validate Authentication transaction to validate the Issuer’s

digital signature on the PARES, validate the content of the PARES, and to parse the PARES.

The following is an example name-value pair parameter string.

NOTE: Ensure that you include no stray carriage returns with the PARES value, especially at

the end of the string.

"TRXTYPE=Z&PARTNER=PayPal&PWD=p12345&VENDOR=SuperMerchant&USER=SuperMerchan

t&PARES[3648]=eJzdWFmTokoW/isdPW9T0c3iUnLDNiKTXQUrWYU3NllEUUBAfv0kWl1l91TPX

ebhTowRBpmHkyfPfr5gbiRlFHF6FFzKaDFXoqry4uhTGn77PAvH4SQKp1MvmEbTnYcf4efF/AVo

UXVj2HD7XjWCzskU0slkGrG33TzqTsUxwhz0nHhbz4l35U7ecfHPh9/dnIE6N7aLeZ0ePlTqRp9

XtVdfqo

...

oZbuHePyp/FUqxyFTXlgV5I/+jMqjde/12HNLjbqW/Qqgfe7Qw9GjcKgt2OdvtTspJPI2eyuRw0

nbr9JKdp6eVP1u3xUyaKN1qYzVksB9vKCe6kqRlV4qfUJP1jvSWl9OKuSbn5zpK0ouzXl9mNfoA

RhDv30qIt+8n719Wbh9fb5+Eh++Fj5+K/wWCuWQ"

38 Fraud Protection Services User’s Guide

Page 39

Performing Buyer Authentication Transactions Using the SDK

Example Buyer Authentication Transactions

Example Validate Authentication Response

RESULT[1]=0&RESPMSG[2]=OK&AUTHENTICATION_ID[20]=8d4d5ed66ac6e6faac6d&AUTHEN

TICATION_STATUS[1]=Y&CAVV[28]=OTJlMzViODhiOTllMjBhYmVkMGU=&ECI[1]=5&XID[28]

=YjM0YTkwNGFkZTI5YmZmZWE1ZmY

Displaying the ACS Form

The Issuer ACS page presents transaction information to the cardholder. Visa/MasterCard

require that the HTML page for displaying the ACS form must be presented in an in-line

frame set. This window must occur within the same browser session as your e-commerce

transaction.

The window should have the following browser-independent attributes:

width=390 (minimum), height=400 (minimum), resizable=no, scrollbars=yes, toolbar=no,

location=no, directories=no, status=yes, menubar=no

Example Payflow Authorization or Sale Transaction

The Buyer Authentication Service supports only Authorization and Sale transaction types.

6

The name-value pairs that you submit with the intended Payflow transaction depend upon

whether the cardholder is enrolled in the 3-D Secure program, as follows:

Cardholder Enrolled in 3-D Secure Program

You perform the intended transaction using the standard name-value pairs plus the values

returned to the Validate Authentication transaction: AUTHENTICATION_ID,

AUTHENTICATION_STATUS, CAVV, XID, and ECI. The following is an example namevalue pair parameter string.

"TRXTYPE=S&TENDER=C&PARTNER=PayPal&VENDOR=SuperMerchant&USER=SuperMerchant&

PWD=x1y2z3&ACCT=5555555555554444&EXPDATE=0308&AMT=123.00&AUTHENTICATION_ID[

20]=8d4d5ed66ac6e6faac6d&CAVV[28]=OTJlMzViODhiOTllMjBhYmVkMGU=&AUTHENTICATI

ON_STATUS[1]=1&ECI[1]=5&XID[28]=YjM0YTkwNGFkZTI5YmZmZWE1ZmY"

Cardholder Not Enrolled

If there is no PAREQ returned in the response to the Verify Enrollment call, then the

cardholder is not enrolled. You perform the intended transaction using the standard namevalue pairs plus the AUTHENTICATION_ID, AUTHENTICATION_STATUS, and ECI

returned by the Verify Enrollment transaction. The following is an example name-value pair

parameter string.

"TRXTYPE=S&TENDER=C&PARTNER=PayPal&VENDOR=SuperMerchant&USER=SuperMerchant&

PWD=x1y2z3&ACCT=5555555555554444&EXPDATE=0308&AMT=123.00&AUTHENTICATION_ID[

20]=8d4d5ed66ac6e6faac6d&AUTHENTICATION_STATUS[1]=O&ECI[1]=7&"

Example Payflow Authorization or Sale Transaction Response

For Visa transactions, the response includes a CARDSECURE value of Y (card issuer judges

CAVV to be valid), N (card issuer judges CAVV to be invalid), or X (cannot determine

validity of CAVV).

Fraud Protection Services User’s Guide 39

Page 40

Performing Buyer Authentication Transactions Using the SDK

6

Buyer Authentication Transaction Parameters and Return Values

z CAVV Is Valid

RESULT=0&PNREF=VXYZ01234567&RESPMSG=APPROVED&AUTHCODE=123456&AVSADDR=Y&A

VSZIP=N&IAVS=Y&CVV2MATCH=Y&CARDSECURE=Y

z CAVV Is Invalid

RESULT=0&PNREF=VXYZ01234567&RESPMSG=APPROVED&AUTHCODE=123456&AVSADDR=Y&A

VSZIP=N&IAVS=Y&CVV2MATCH=Y&CARDSECURE=N

Buyer Authentication Transaction Parameters and Return

Values

The Buyer Authentication server accepts the parameters listed in this section. This section also

describes expected return values for buyer authentication transactions.

NOTE: Be sure to follow the guidelines for specifying the parameters. Standard Payflow

parameters, parameters that you can pass for reporting purposes, as well as return

values are described in Payflow Pro Developer’s Guide.

Transaction Parameters

In the following tables, ANS indicates alphanumeric-special characters—the set of

alphanumeric characters plus characters like / = + : %.

Verify Enrollment Transaction Name-Value Pairs

TABLE 6.2 Verify enrollment parameters

Name Description Type

TRXTYPE E 1

VENDOR Vendor name

USER User name

PARTNER Partner name

PWD Vendor’s password

ACCT PAN, card number

EXPDATE Expiration mmyy

Max.

Length

AMT Decimal Amount

40 Fraud Protection Services User’s Guide

Page 41

Performing Buyer Authentication Transactions Using the SDK