Page 1

Order Management

Integration Guide

For Professional Use Only

Currently only available in English.

A usage Professional Uniquement

Disponible en Anglais uniquement pour l’instant.

Last updated: March 2008

Page 2

PayPal Order Management Integration Guide

Document Number: 100009.en_US-200803

© 2008 PayPal, Inc. All rights reserved. PayPal is a registered trademark of PayPal, Inc. The PayPal logo is a trademark of PayPal, Inc. Other

trademarks and brands are the property of their respective owners.

The information in this document belongs to PayPal, Inc. It may not be used, reproduced or disclosed without the written approval of PayPal, Inc.

Copyright © PayPal. All rights reserved. PayPal S.à r.l. et Cie, S.C.A., Société en Commandite par Actions. Registered office: 22-24 Boulevard Royal, L2449, Luxembourg, R.C.S. Luxembourg B 118 349

Consumer advisory: The PayPal™ payment service is regarded as a stored value facility under Singapore law. As such, it does not require the approval

of the Monetary Authority of Singapore. You are advised to read the terms and conditions carefully.

Notice of non-liability:

PayPal, Inc. is providing the information in this document to you “AS-IS” with all faults. PayPal, Inc. makes no warranties of any kind (whether express,

implied or statutory) with respect to the information contained herein. PayPal, Inc. assumes no liability for damages (whether direct or indirect), caused

by errors or omissions, or resulting from the use of this document or the information contained in this document or resulting from the application or use

of the product or service described herein. PayPal, Inc. reserves the right to make changes to any information herein without further notice.

Page 3

Contents

1

Preface . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

This Document . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Revision History . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Chapter 1 Introduction . . . . . . . . . . . . . . . . . . . . . . . . . 9

Email . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Reporting. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Differences between Payment Data Transfer (PDT) and Instant Payment Notification (IPN) 10

SSL Not Required for IPN . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

PayPal-Supported Transactional Currencies . . . . . . . . . . . . . . . . . . . . . . . . 11

Chapter 2 Payment Data Transfer (PDT) . . . . . . . . . . . . . . . .13

How PDT Works . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Enabling Payment Data Transfer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Getting and Using the Identity Token . . . . . . . . . . . . . . . . . . . . . . . . . . 18

PDT and PayPal Account Optional . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

PDT Notification Synch . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

Constructing the POST . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

PayPal Response to POST . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

PDT and Auto Return: Messaging to Buyer . . . . . . . . . . . . . . . . . . . . . . . 21

Preventing Fraud. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

Sample Code for PDT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

Chapter 3 Instant Payment Notification (IPN) . . . . . . . . . . . . .23

About IPN . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Setting Up IPN . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

Activating IPN for Your PayPal Account . . . . . . . . . . . . . . . . . . . . . . . . . 24

Setting Up an IPN-Processing Program . . . . . . . . . . . . . . . . . . . . . . . . . 25

Using IPN Notification Validation to Help Prevent Fraud. . . . . . . . . . . . . . . . . . . 26

Using Shared Secrets for Validation . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

Using Postbacks for Validation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

Order Management Integration Guide March 2008 3

Page 4

Contents

1

Using IPN with Multiple Currencies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

payment_gross and payment_fee . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

Examples of Multi-currency IPN Variables. . . . . . . . . . . . . . . . . . . . . . . . 29

Dispute Notification and Downloadable Dispute Report . . . . . . . . . . . . . . . . . . . 31

Downloadable Dispute Report . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

Chapter 4 Transaction History and Reporting Tools . . . . . . . . . .35

Using Monthly Account Statements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

Searching History . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

Basic Searching by Activity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

Advanced Searching by Field Value . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

Specifying Date Ranges for Basic and Advanced History Search . . . . . . . . . . . . 40

Downloading History . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

Selecting Which Fields to Include in the Download . . . . . . . . . . . . . . . . . . . 43

Understanding the Status and Life Cycle of Transactions . . . . . . . . . . . . . . . . 46

Reconciling Transactions using the Balance Impact Column . . . . . . . . . . . . . . 46

Reconciling Transactions Using the Net Amount Column . . . . . . . . . . . . . . . . 47

Reporting Disputed Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

Programmatic Access to Dispute Report . . . . . . . . . . . . . . . . . . . . . . . . 48

Appendix A IPN and PDT Variables. . . . . . . . . . . . . . . . . . . .51

About These Tables of Variables. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

Transaction-Specific Variable Values . . . . . . . . . . . . . . . . . . . . . . . . . . 51

test_ipn Variable in Sandbox . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

IPN Variables in All Posts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52

IPN Version: notify_version . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52

Security Information: verify_sign. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52

Buyer Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52

Basic Information. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53

Advanced and Custom Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54

Website Payments Standard, Website Payments Pro, and Refund Information . . . . . . . 55

Currency and Currency Exchange . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 60

Auctions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62

Mass Payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62

Subscriptions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 64

Subscriptions Variables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 64

Dispute Notification Variables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 68

4 March 2008 Order Management Integration Guide

Page 5

Contents

Miscellaneous and Fee-Related IPN Variables . . . . . . . . . . . . . . . . . . . . . 70

PDT-Specific Variables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70

Appendix B Downloadable History Logs . . . . . . . . . . . . . . . . .71

Index. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .79

1

Order Management Integration Guide March 2008 5

Page 6

1

Contents

6 March 2008 Order Management Integration Guide

Page 7

Preface

P

This Document

This document describes the PayPal features for managing orders, such as Payment Data

Transfer (PDT), Instant Payment Notification (IPN), and Downloadable History Log.

This document is written for merchants who use PayPal to manage order information.

Revision History

TABLE P.1 Revision History

Date Description

March 2008 Corrected the procedure for checking the postback response from PayPal when

performing notification validation of IPNs. See “Using Postbacks for

Validation” on page 27.

January 2008 Added information on how to search for contribution payments in transaction

history and what values the Type column in downloadable history logs carries

for donation activity. See Chapter 4, “Transaction History and Reporting Tools.”

September 2007 Replaced the old PayPal logo in screen shots with the new PayPal logo

August 2007 Added shipping_method to Appendix A, “IPN and PDT Variables”. See the

table of variables for “Website Payments Standard, Website Payments Pro, and

Refund Information” on page 55.

July 2007 Minor bug fixing.

April 2007 Added contact_phone to IPN variables. Added pointer to PayPal Business

Overview page.

October 2006 Details about the Downloadable Dispute Report. Minor additions and

corrections to some variables in Appendix A.

July 2006 Minor correction to values of payment_status IPN variable.

May 2006 Description of the programmatically retrievable Dispute Report. Additional IPN

variable values for txn_type: merch-pmt for the Website Payments Pro monthly

fee and adjustment for a resolved dispute requiring a chargeback.

Order Management Integration Guide March 2008 7

Page 8

P

Revision History

8 March 2008 Order Management Integration Guide

Page 9

1

Introduction

PayPal offers four payment notification methods for back-end integration:

z Email

z Reporting

z Instant Payment Notification (IPN)

z Payment Data Transfer (PDT)

You will receive an email notification in the following cases:

z Successful Payment

z Pending Payment

z Cancelled Payment

If you do not want to receive payment notifications via email:

1. Click the Profile subtab of the My Account tab.

2. Click the Notifications link in the Account Information column.

3. Find the Payment Notifications heading and clear the I receive PayPal Website

4. Click the Save button.

Reporting

PayPal’s Reporting Tools provide you with the information you need to effectively measure

and manage your business. With PayPal’s Reporting Tools, you can:

z Analyze your revenue sources to better understand your customers’ buying behavior

z Automate time-consuming bookkeeping tasks

z Accurately settle and reconcile transactions

Available reports:

Payments and Instant Purchase checkbox.

z Monthly Account Statements: View a summary of all credits and debits that have affected

your account balance each month.

Order Management Integration Guide March 2008 9

Page 10

Introduction

1

Differences between Payment Data Transfer (PDT) and Instant Payment Notification (IPN)

z Merchant Sales Reports: Every week, receive valuable analysis of revenue by sales

channel and currency.

z History Log: View an online record of your received and sent payments.

z Downloadable Logs: Keep track of your transaction history by downloading it into

various file formats (suitable for financial settlements).

For more information about PayPal's reports, see

bin/webscr?cmd=p/xcl/rec/reports-intro-outside.

http://www.paypal.com/cgi-

Differences between Payment Data Transfer (PDT) and Instant

Payment Notification (IPN)

PDT's primary function is to display payment transaction details to buyers when they are

automatically redirected back to your site upon payment completion; however, there are cases

where you will not receive notification of all transactions, such as with pending transactions,

refunds, and reversals. For these reasons, or if you are using this data to fulfill orders, PayPal

strongly recommends that you also enable Instant Payment Notification (IPN).

Both IPN and PDT send back the same data; however, there are several important differences.

PDT:

z Is available only to merchants who integrate PayPal with their websites by using Website

Payments Standard.

z Requires Auto Return to be enabled.

z Auto Return will include an ID that can be used to query PayPal for the complete

transaction details.

z It is possible to miss a notification if the user closes the browser before the redirection is

complete.

IPN:

z Does not require Auto Return to be enabled.

z At the end of the website payment flow, PayPal POSTs the IPN data asynchronously (i.e.

not as part of the website payment flow).

z IPNs will also POST for eCheck clearings, reversals, and refunds.

SSL Not Required for IPN

Because credit card and bank information is not transmitted in Instant Payment Notification

(IPN), PayPal does not require Secure Sockets Layer (SSL) to encrypt IPN transmissions.

10 March 2008 Order Management Integration Guide

Page 11

PayPal-Supported Transactional Currencies

PayPal-Supported Transactional Currencies

The following currencies are supported by PayPal for use in transactions.

TABLE 1.1 PayPal-Supported Currencies and Currency Codes for Transactions

ISO-4217

Code Currency

AUD Australian Dollar

CAD Canadian Dollar

CHF Swiss Franc

CZK Czech Koruna

DKK Danish Krone

EUR Euro

GBP Pound Sterling

Introduction

1

HKD Hong Kong Dollar

HUF Hungarian Forint

JPY Japanese Yen

NOK Norwegian Krone

NZD New Zealand Dollar

PLN Polish Zloty

SEK Swedish Krona

SGD Singapore Dollar

USD U.S. Dollar

Order Management Integration Guide March 2008 11

Page 12

Introduction

1

PayPal-Supported Transactional Currencies

12 March 2008 Order Management Integration Guide

Page 13

Payment Data Transfer (PDT)

2

Merchants who use Website Payments Standard can use Payment Data Transfer (PDT) to

display transaction details to buyers who are redirected back to the merchants’ websites after

they complete their payments.

N OTE: You must enable Auto Return for Website Payments Standard to use Payment Data

Transfer. Auto Return applies to PayPal Website Payments Standard, including Buy

Now, Donation, Subscriptions, Shopping Cart, and Gift Certficate buttons. For more

information about Auto Return, see the PayPal Website Payments Standard Integration

Guide.

How PDT Works

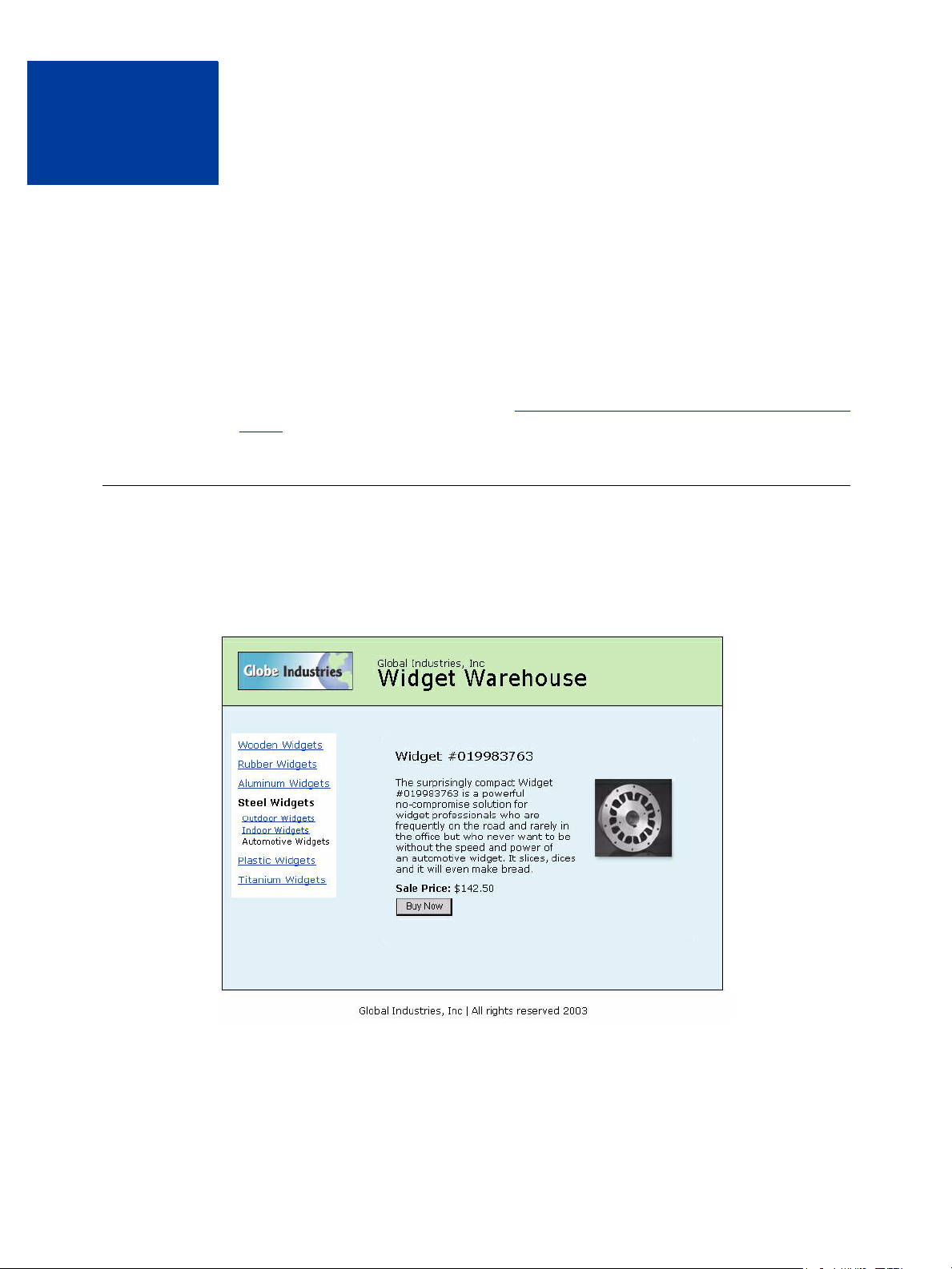

Bob is going to purchase a widget from the Widget Warehouse.

Step 1: Bob goes to the Widget Warehouse website, finds the widget he wants, and clicks the

Buy Now button.

Step 2: Bob is taken to a PayPal Payment Details page which displays the details of the

payment he is about to make.

Order Management Integration Guide March 2008 13

Page 14

Payment Data Transfer (PDT)

2

How PDT Works

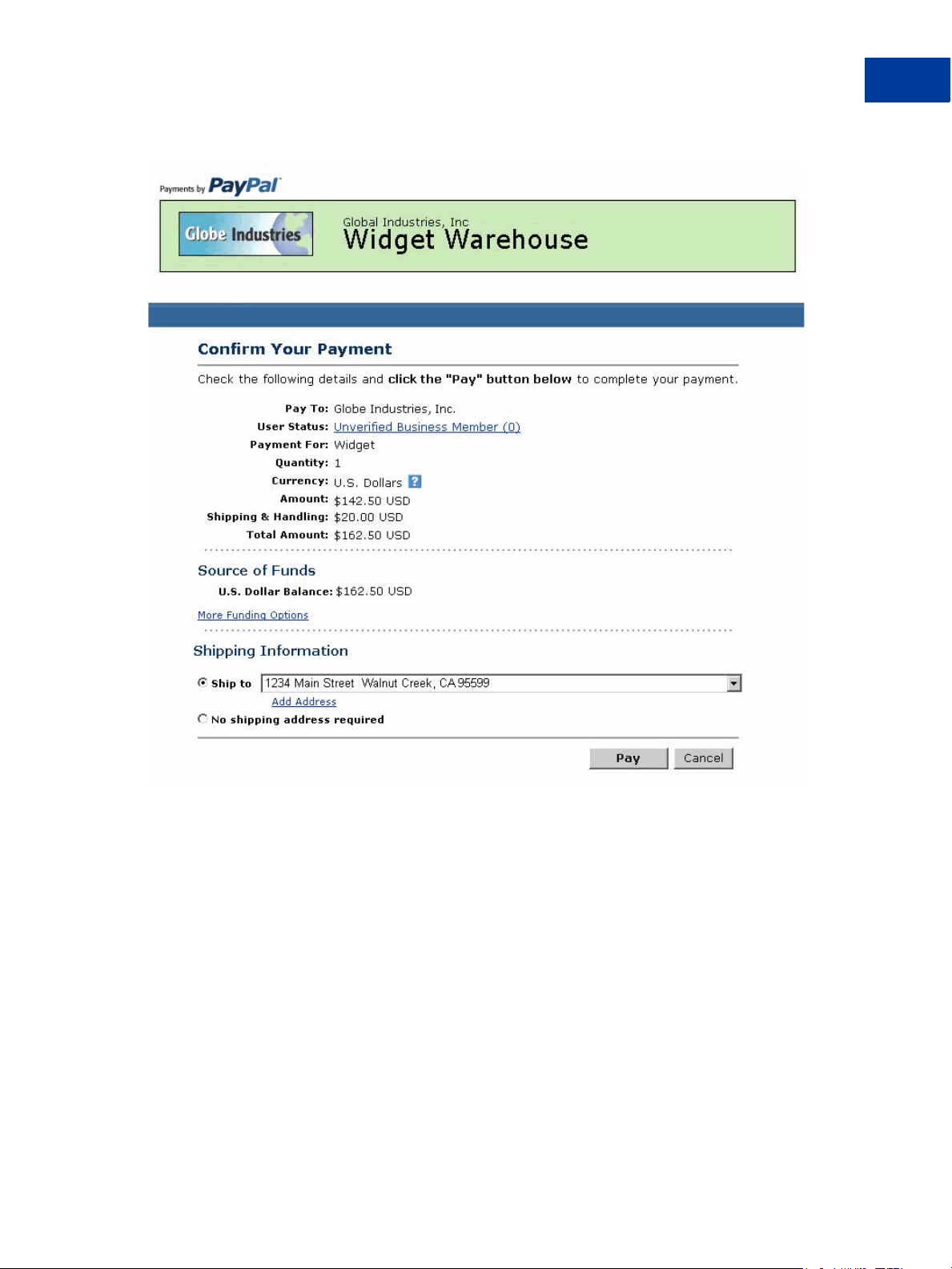

Step 3: Bob enters his PayPal account information into the PayPal Login fields.

Step 4: Bob is then taken to a confirmation page that displays the details of his selection,

information about how his automatic payments will be funded, and his shipping information.

He clicks the Pay button to complete the payment.

14 March 2008 Order Management Integration Guide

Page 15

Payment Data Transfer (PDT)

How PDT Works

2

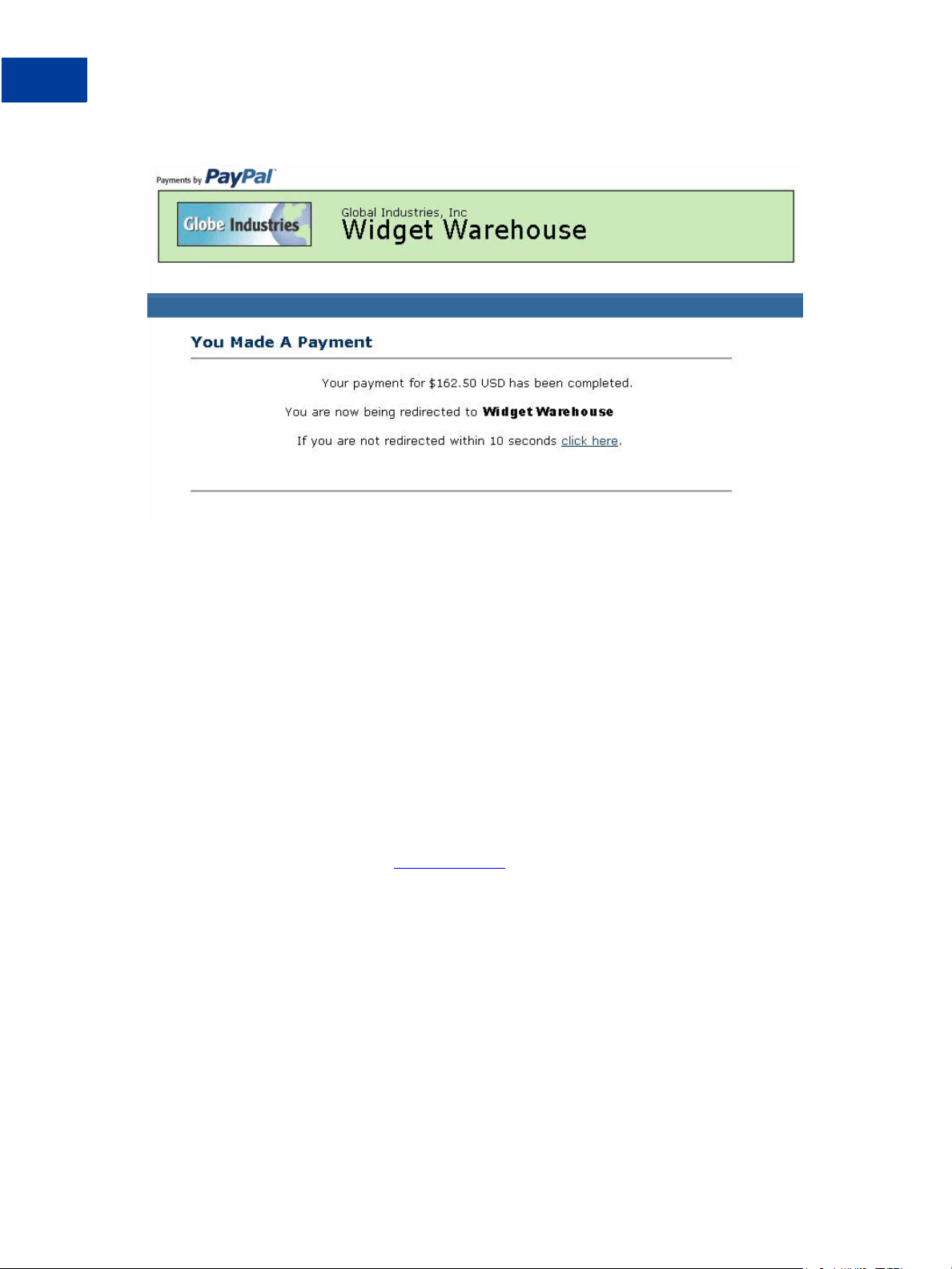

Step 5: A payment confirmation page appears that informs Bob that his payment has been

completed and that he is being redirected back to the Widget Warehouse website.

Order Management Integration Guide March 2008 15

Page 16

Payment Data Transfer (PDT)

2

How PDT Works

Step 6: A transaction token is passed to the return URL provided by the Widget Warehouse.

The Widget Warehouse fetches the transaction token and retrieves the transaction details from

PayPal via an HTTP POST. Included in the HTTP post is the identity token that was given to

the Widget Warehouse when PDT was enabled.

For more information about the PDT identity token, see “Getting and Using the Identity

Token” on page 18. For more information about the HTTP POST, see “PDT Notification

Synch” on page 19.

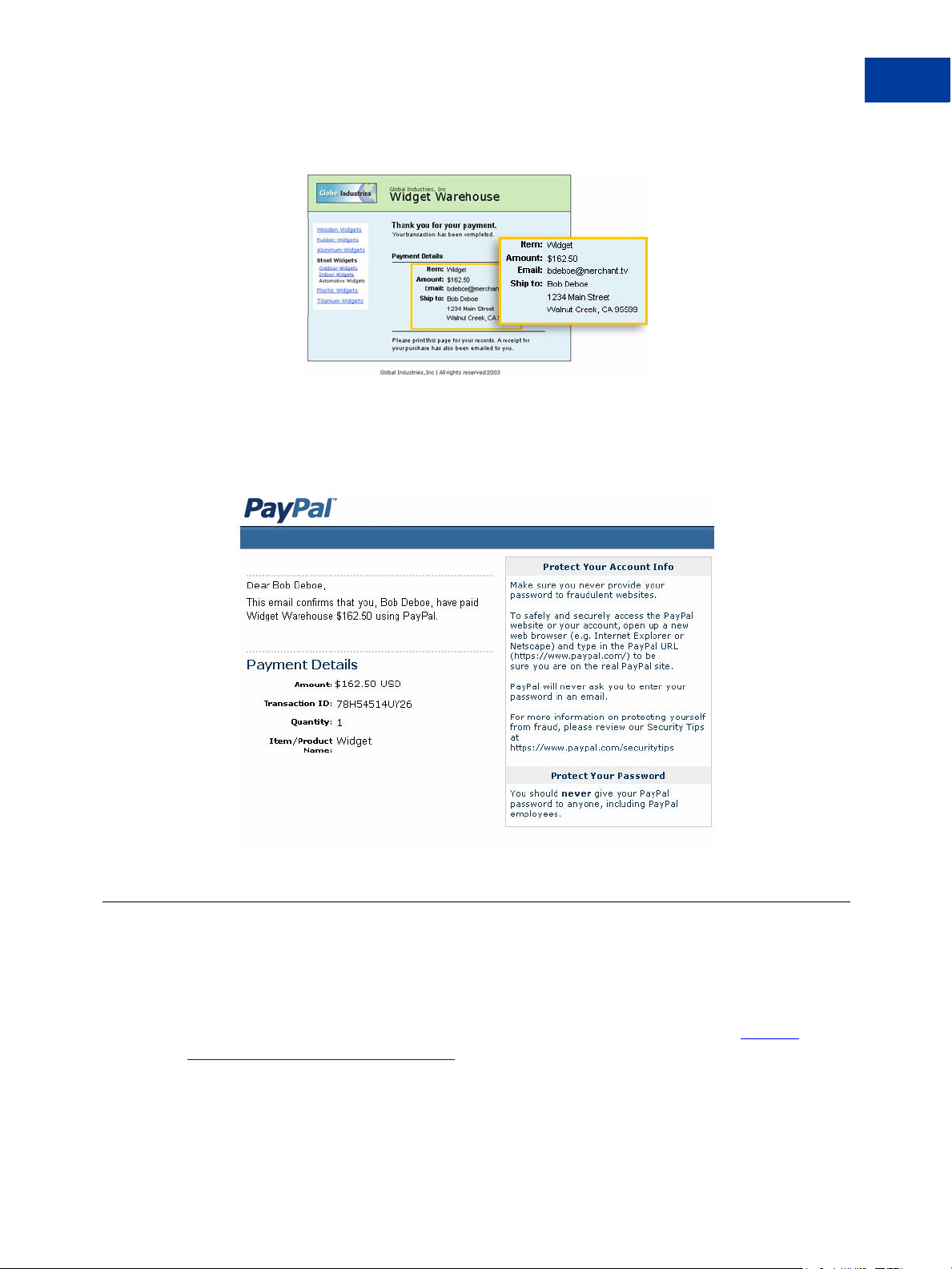

Step 7: The Widget Warehouse's Thank You page appears and displays the transaction

information, again informing Bob that his transaction has been completed and a receipt for the

purchase has been sent to him by email. The page also displays payment details, a link to

PayPal that Bob can use to view more transaction details if necessary, as well as links that he

can use to continue shopping.

For example, as shown in the following diagram: Thank you for your payment. Your

transaction has been completed, and a receipt for your purchase has been emailed to you. You

may log into your account at

www.paypal.com to view details of this transaction.

16 March 2008 Order Management Integration Guide

Page 17

Payment Data Transfer (PDT)

Enabling Payment Data Transfer

Step 8: Bob receives an email receipt for this transaction, confirming his purchase and

including a copy of the payment details, the Widget Warehouse's business information, and his

confirmed shipping address.

2

Enabling Payment Data Transfer

You can enable PDT from your account profile, and you can enable PDT when you use a

button creation tool on the PayPal website to create payment buttons for Website Payments

Standard.

For more information about enabling PDT from a button creation tool, see the Website

Payments Standard Integration Guide.

To enable PD from your account profile:

Order Management Integration Guide March 2008 17

Page 18

Payment Data Transfer (PDT)

2

Enabling Payment Data Transfer

1. Click the My Account tab.

2. Click the Profile subtab.

3. Click the Website Payment Preferences link, as shown in the following snapshot.

The Website Payment Preferences page opens.

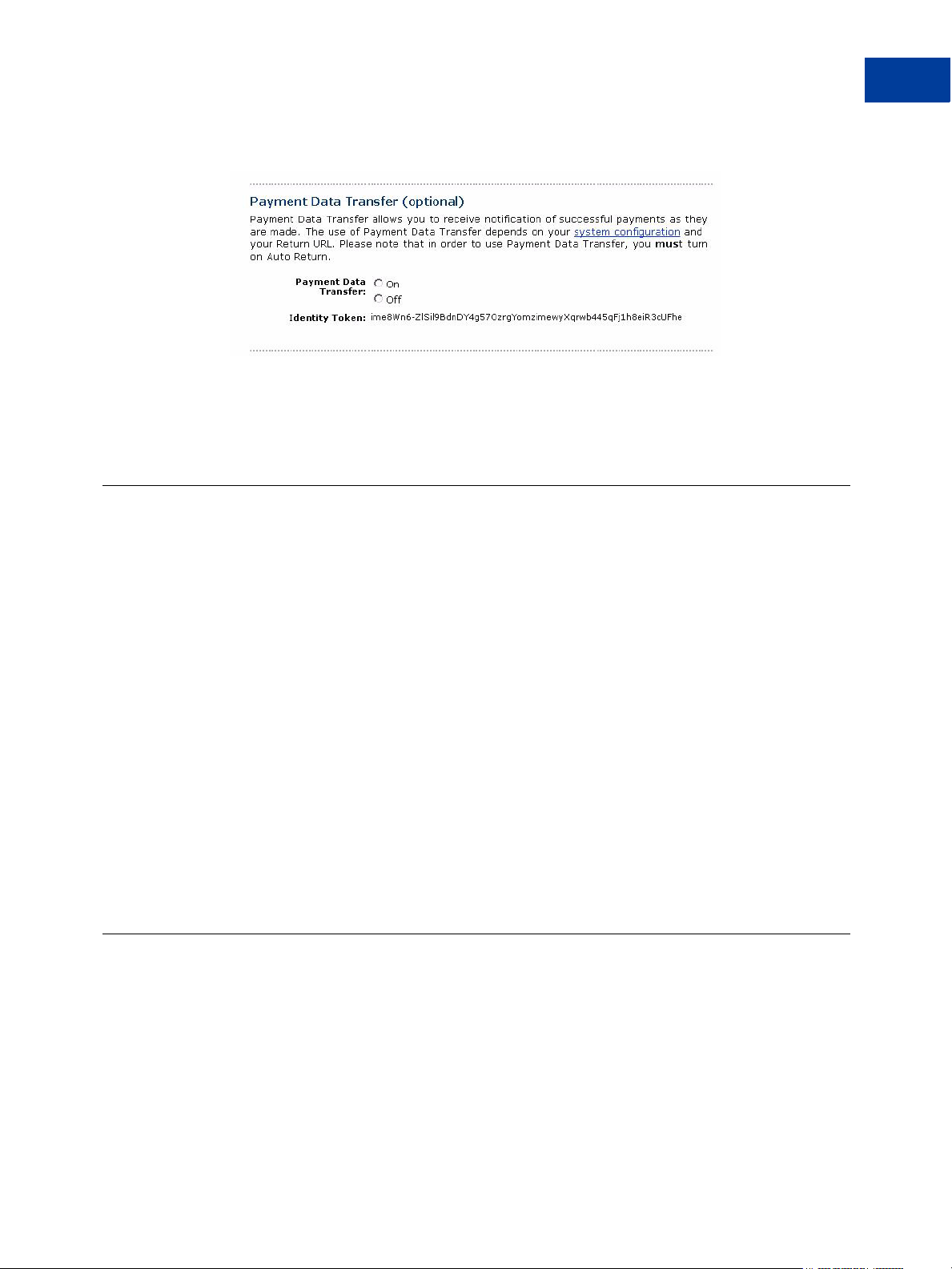

4. Click the Payment Data Transfer On radio button, as shown in the following diagram.

Yo u must enable Auto Return in order to use Payment Data Transfer. Auto Return can also

be enabled from the Website Payment Preferences page.

5. Click the Save button.

Getting and Using the Identity Token

When you click the Save button and save your PDT preferences, a message appears at the top

of the page indicating that you have successfully saved your preferences. Your identity token

also appears in this message.

You will need to pass this identity token, along with the transaction token, to PayPal in order to

receive information that confirms that a payment is complete.

18 March 2008 Order Management Integration Guide

Page 19

For security, the identity token is not sent to you; however, once you have enabled PDT, it

permanently appears below the Payment Data Transfer On/Off radio buttons on the Websit e

Payments Preferences page.

PDT and PayPal Account Optional

Payment Data Transfer (PDT)

PDT and PayPal Account Optional

2

The PayPal Account Optional does not require your customers who are new to PayPal to

create a PayPal account to complete a purchase—they go through an alternate checkout and

have the option to sign up afterward. Customers who already have PayPal accounts will

continue to enjoy the privileges of those accounts, such as payment history and integration

with eBay Auctions, and their checkout experience will remain the same.

This PayPal Account Optional feature is available for Buy Now, Donations, and Shopping

Cart buttons, but not for Subscription buttons.

PayPal Account Optional is enabled by default. If the merchant has turned on Payment Data

Transfer and has not disabled PayPal Account Optional, a new user will not be automatically

directed back to the merchant website, but will be given the option to return. When the buyer

clicks the Continue button, the transaction ID associated with the transaction is sent. The

merchant returns the transaction ID, along with their identity token, and PayPal then sends the

merchant payment information that confirms that the payment is complete. The buyer is

directed back to the merchant site where the transaction information is displayed. However, if

the buyer does not click the Continue button, they will not be directed back to the merchant's

site and PDT will not be initiated.

PDT Notification Synch

After you have activated PDT, every time a buyer makes a website payment and is redirected

to your return URL, a transaction token is sent via a FORM GET variable to this return URL.

To properly use PDT and display transaction details to your customer, you should read the

transaction token from the variable tx and retrieve transaction details from PayPal by

constructing an HTTPS POST to PayPal. This is called notification synch or synchronization.

Order Management Integration Guide March 2008 19

Page 20

Payment Data Transfer (PDT)

2

PDT Notification Synch

Constructing the POST

Here are the guidelines for constructing the PDT HTTPS POST to PayPal for notification

synch:

1. Your POST must be sent to

2. You must include the cmd variable with the value _notify-synch:

cmd=_notify-synch

3. You must include the transaction token in the variable tx and the value of the transaction

token received via PayPal’s GET:

value_of_transaction_token

tx=

4. You must post your identity token using the variable at and the value of your PDT identity

token:

your_identity_token

at=

For information about the identity token, see “Getting and Using the Identity Token” on

page 18.

PayPal Response to POST

PayPal responds to the post with a single word on one line in the body of the response:

SUCCESS or FAIL. When you receive a SUCCESS response, the rest of the body of the

response is the transaction details, one per line, in the format

are both be URL-encoded strings. This response data needs to be parsed appropriately and

then URL-decoded.

https://www.paypal.com/cgi-bin/webscr.

key=value where key and value

Example successful response:

SUCCESS

first_name=Jane+Doe

last_name=Smith

payment_status=Completed

payer_email=janedoesmith%40hotmail.com

payment_gross=3.99

mc_currency=USD

custom=For+the+purchase+of+the+rare+book+Green+Eggs+%26+Ham

...

If the response is FAIL, PayPal recommends making sure that:

z The Transaction token is not bad.

z The ID token is not bad.

z The tokens have not expired.

20 March 2008 Order Management Integration Guide

Page 21

PDT and Auto Return: Messaging to Buyer

With Auto Return, you must display a message on the page displayed by the Return URL that

helps the buyer understand that the payment has been made, that the transaction has been

completed, and that payment transaction details will be sent to the buyer by email. You can

display to your customer whatever payment details you feel are appropriate; however, PayPal

recommends including the following:

z Item name

z Amount paid

z Payer email

z Shipping address

If you are using PDT to determine when to fulfill an order automatically, confirm that the

payment_status is Completed, since the buyer could use methods such as eChecks that do

not immediately clear.

For a list of PDT variables, see Appendix A, “IPN and PDT Variables.”

Payment Data Transfer (PDT)

Preventing Fraud

2

Preventing Fraud

In order to prevent fraud, PayPal recommends that your programs verify the following:

z txn_id is not a duplicate to prevent someone from reusing an old, completed transaction.

z receiver_email is an email address registered in your PayPal account, to prevent the

payment from being sent to a fraudulent account.

z Other transaction details, such as the item number and price, to confirm that the price has

not been changed.

Sample Code for PDT

Sample code for the following development environments is available on the PayPal website

at

https://www.paypal.com/us/cgi-bin/webscr?cmd=p/xcl/rec/pdt-code.

z ASP/VBScript

z ColdFusion

z PERL

z PHP

Order Management Integration Guide March 2008 21

Page 22

Payment Data Transfer (PDT)

2

Sample Code for PDT

22 March 2008 Order Management Integration Guide

Page 23

3

Instant Payment Notification (IPN) allows you to integrate PayPal payments with your

website’s back-end operations. IPN provides immediate notification and confirmation of

PayPal payments you receive.

This chapter details IPN in the following sections:

z “About IPN” on page 23

z “Setting Up IPN” on page 24”

z “Using IPN Notification Validation to Help Prevent Fraud” on page 26”

z “Using IPN with Multiple Currencies” on page 28”

z “Dispute Notification and Downloadable Dispute Report” on page 31

About IPN

Instant Payment Notification (IPN)

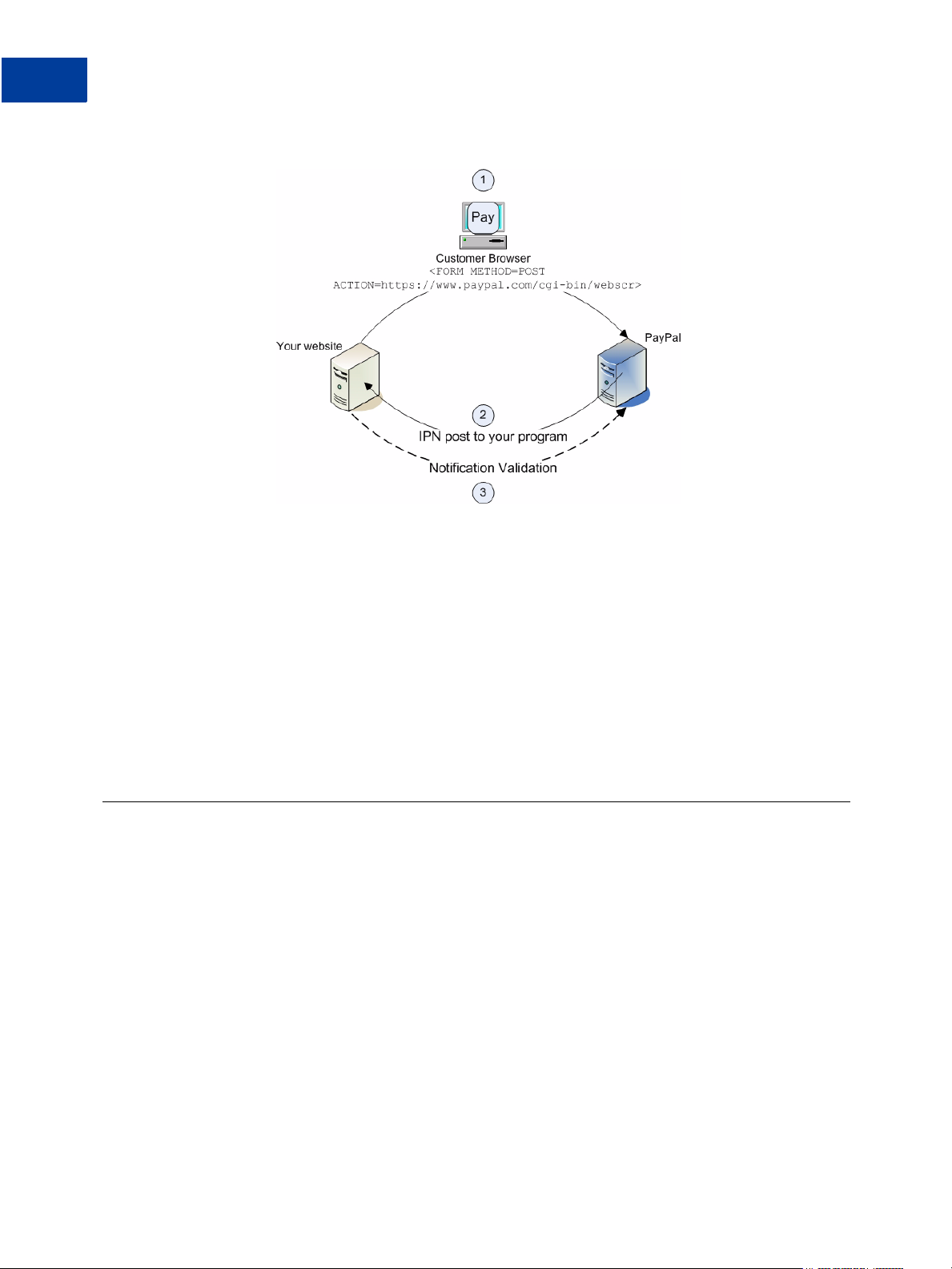

Instant Payment Notification consists of three parts:

1. A customer pays you.

2. PayPal POSTs FORM variables to a URL you specify that runs a program to process the

variables.

3. You validate the notification.

Order Management Integration Guide March 2008 - first technical draft 23

Page 24

Instant Payment Notification (IPN)

3

Setting Up IPN

FIGURE 3.1 How IPN Works: Three General Steps

1. A customer payment or a refund triggers IPN. This payment can be via Website Payments

Standard FORMs or via the PayPal Web Services APIs for Express Checkout, MassPay, or

RefundTransaction. If the payment has a “Pending” status, you receive another IPN when

the payment clears, fails, or is denied.

2. PayPal posts HTML FORM variables to a program at a URL you specify. You can specify

this URL either in your Profile or with the notify_url variable on each transaction. This

post is the heart of IPN. Included in the notification is the customer’s payment information

(such as customer name, payment amount). All possible variables in IPN posts are detailed

in . When your server receives a notification, it must process the incoming data.

3. Your server must then validate the notification to ensure that it is legitimate.

Setting Up IPN

Follow these procedures to set up IPN:

z “Activating IPN for Your PayPal Account” on page 24

z “Setting Up an IPN-Processing Program” on page 25

Activating IPN for Your PayPal Account

You can activate IPN for your PayPal account through your account profile. Separately, you

can activate IPN for specific payments by including a notification URL in the programming

code that your website sends to PayPal when people pay you.

24 March 2008 - first technical draft Order Management Integration Guide

Page 25

Instant Payment Notification (IPN)

Setting Up IPN

Activating IPN Through Your Account Profile

When you activate IPN through your account profile, the notification URL that you specify is

used for all your IPNs, You can override the value on specific payment transactions by

including notification URLs in the programming code that your website sends to PayPal when

people pay you.

To activate IPN through your account profile:

1. Log in to your Business or Premier account.

2. Click the Profile subtab.

3. In the Selling Preferences column, click the Instant Payment Notification Preferences

link.

4. Click the Edit button.

5. Select the checkbox to activate IPN.

6. In the Notification URL text box, enter the URL of the program that will receive and

process IPNs

3

7. Click the Save button.

Activating IPN by Including the Notification URL in Programming Code

You can activate IPN for specific payments by including a notification URL in the

programming code that your website sends to PayPal when people pay you. PayPal sends only

IPNs related to payments that result from the code. PayPal sends them to the URL that you

specified in the code.

For example, if you accept payments from different websites through one PayPal account, you

could include different notification URLs in your programming code to let each website

receive IPNs only for its own payments.

N OTE: Notifcation URLs that you include in programming code override the notification URL

that you may have set in your account profile.

To learn how to include notification URLs in programming code:

z See the Name-Value Pair API Developer Guide and Reference

– or –

z See the Website Payments Standard Integration Guide

Setting Up an IPN-Processing Program

The data sent to you by IPN comes as HTML FORM name/value pairs.

Sample code for the following development environments is available on the PayPal website

at

http://www.paypal.com/us/cgi-bin/webscr?cmd=p/pdn/ipn-codesamples-pop-outside:

z ASP.Net/C#

z ASP/VBScript

Order Management Integration Guide March 2008 - first technical draft 25

Page 26

Instant Payment Notification (IPN)

3

Using IPN Notification Validation to Help Prevent Fraud

z ColdFusion

z Java/JSP

z Perl

z PHP

Using IPN Notification Validation to Help Prevent Fraud

After your server receives an Instant Payment Notification, you must confirm that the

notification is authentic. This is known as notification validation. Performing notification

validation for all the IPNs that you receive helps you and PayPal prevent the kind of fraud that

results from spoofing, or “man-in-the-middle” attacks.

IMPORTANT: If you do not use Encrypted Website Payments (EWP) or shared secret

validation, you must check the price, transaction ID, PayPal receiver email

address and other data sent to you by IPN to ensure that they are correct. By

examining this data, you can avoid being spoofed.

PayPal offers two methods for notification validation:

z Use shared secrets.

PayPal recommends this method because it ensures the validity of the data and decreases

network traffic to and from your website. Use shared secrets for validation if:

– You are not using a shared website hosting service.

– You have enabled SSL on your web server.

– You are using Encrypted Website Payments.

– You use the notify_url variable on each individual payment transaction.

For more information, see “Using Shared Secrets for Validation” on page 26.

z Send a postback to PayPal.

Use postbacks for validation if:

– You rely on a shared website hosting service

– You do not have SSL enabled on your web server

For more information, see “Using Postbacks for Validation” on page 27.

Using Shared Secrets for Validation

You can use shared secrets for IPN notification validation by including them in the

programming code that your website sends to PayPal when people pay you. As an alternative,

can set a shared secret in your account profile.

When your IPN-processing program receives an IPN, it must compare that the shared secret in

the post from PayPal matches the shared secret that you expect for notifications about that

payment. If the secret posted by PayPal does not match the secret that you expect, flag the IPN

for further investigation.

26 March 2008 - first technical draft Order Management Integration Guide

Page 27

Instant Payment Notification (IPN)

Using IPN Notification Validation to Help Prevent Fraud

Including Shared Secrets in Programming Code

If you use shared secrets for IPN notification validation, PayPal recommends that you include

shared secrets in all the programming code that your website sends to PayPal when people pay

you. Add a shared secret variable and value to the value of the notification URL that you

include in your programming code.

Use the following format to specify a shared secret as part of a notification URL in your

programming code:

yourIPNnotificationURL?shared_secret_variable_name=shared_secret_value

where:

yourIPNNotificationURL is the URL where you receive IPNs.

shared_secret_variable_name is any variable name that you want.

shared_secret_value is the shared secret itself.

For example, the value of the notification URL variable might look like this:

https%3A//www.mysite.com/PP-IPN-Validate.cfm?secret=shhhhhhh

N OTE: When you include a shared secret in programming code, the secret is included in IPNs

that are related to payments that result from the code, overriding the shared secret that

you may have set in your account profile.

3

Setting a Shared Secret in Your Account Profile

If you want to use the same shared secret for notification verification of all IPNs, you can set

the secret in your account profile. PayPal includes the secret you set in all IPNs, except for

payments that result from programming code in which you include shared secrets with the

notification URL variable.

Security Considerations with Shared Secrets for Validation

To ensure the security of the shared secrets in HTML button code that you send to PayPal, use

Encrypted Website Payments (EWP). For more information about EWP, see the Website

Payments Standard Integration Guide.

Shared secrets posted to you by PayPal through IPN are not encrypted; they are in clear text

for easier processing. Therefore, the shared secrets are recorded in the clear in the access logs

of your web server. Be sure to practice proper security for these logs. If you use a web server

hosting service, ensure that your provider practices proper security of your data.

Using Postbacks for Validation

If you cannot use shared secrets for notification validation, you can use postbacks to PayPal,

instead. Your postback must include exactly the same variables and values that you receive in

the IPN posted to your server by PayPal, and they must be in the same order.

Constructing Your Postback

Use these guidelines for constructing your postback to PayPal:.

1. Your postback must be sent to

Order Management Integration Guide March 2008 - first technical draft 27

https://www.paypal.com/cgi-bin/webscr.

Page 28

Instant Payment Notification (IPN)

3

Using IPN with Multiple Currencies

N OTE: You can implement IPN without SSL, including your postbacks for validation, but

PayPal recommends against doing so.

2. Your postback must include the variable cmd with the value _notify-validate:

cmd=_notify-validate

3. Your postback must include exactly the same variables and values that you receive in the

IPN from PayPal, and they must be in the same order.

Processing the PayPal Response to Your Postback

PayPal responds to your postbacks with a single word in the body of the response: VERIFIED

or INVALID.

When you receive a VERIFIED postback response, perform the following checks on data in

the IPN:

1. Check that the payment_status is Completed.

2. If the payment_status is Completed, check the txn_id against the previous PayPal

transaction that you processed to ensure it is not a duplicate.

3. Check that the receiver_email is an email address registered in your PayPal account.

4. Check that the price, carried in mc_gross, and the currency, carried in mc_currency, are

correct for the item, carried in item_name or item_number.

After you complete the above checks, notification validation is complete. You can update your

database with the information provided, and you can initiate other appropriate automated

back-end processing.

Handling Invalid Responses to Your Postback

When you receive an INVALID postback response, you should investigate. In some cases,

these responses result from an IPN error, possibly from a change in the IPN format.

To determine if an INVALID response results from an IPN error, first examine your code. Your

postback must include exactly the same variables and values that you receive in the IPN

posted to your server by PayPal, and they must be in the same order.

Using IPN with Multiple Currencies

With multiple currencies, you can accept payments in any of the PayPal-supported currencies

(see “PayPal-Supported Transactional Currencies” on page 11). As a result, your IPN

notifications will then include information about the currency of the payment. The following

overview explains how IPN interacts with multiple currencies.

N OTE: If you are using one of PayPal’s Website Payments solutions (e.g. PayPal Shopping

Cart), and would like to be paid in a currency other than U.S. Dollars, you will need to

set up your buttons for your currency of choice.

28 March 2008 - first technical draft Order Management Integration Guide

Page 29

payment_gross and payment_fee

These variables reflect the amount received and corresponding fee of U.S. Dollar (USD)

payments. If the amount received and fee deducted are in a currency other than USD, the

variables will still appear in your IPN, but will have no values in them.

N OTE: payment_fee is not always present in IPNs, such as when a payment is pending.

These values are absent for non-USD payments so that IPN scripts will not process these

amounts as USD. However, legacy IPN scripts will continue to work as before as long as the

merchant only receives USD payments.

Examples of Multi-currency IPN Variables

IPN notifications that use the payment_gross variable will have the following multicurrency variables added. The variables mc_gross and mc_fee will not be added to IPN

notifications with txn_type: subscr_signup, subscr_cancel, subscr_modify,

subscr_failed, or subscr_eot.

z mc_gross: Full amount of payment received, before transaction fee.

Instant Payment Notification (IPN)

Using IPN with Multiple Currencies

3

N OTE: If payment is in USD, the payment_gross value equals mc_gross.

z mc_fee: Transaction fee associated with the payment. Variable function like

payment_fee variable (variable does not appear when payment pending, and so on).

N OTE: If payment is in USD, the payment_fee value equals mc_fee.

z mc_currency: Currency of mc_gross, mc_fee, payment_gross, and payment_fee

amounts. Possible values are detailed in “” on page 10.

z For subscription IPN notifications, such as signup, cancel, modify, failed, and eot,

mc_currency is the currency of the subscription, rather than the currency of the payment.

Example 1

If a user with a USD balance receives a $100 USD payment, the following variables will be

used for the payment:

z mc_gross = payment_gross

z mc_fee = payment_fee

EXAMPLE 3.1 Multi-currency IPN: USD Payment

payment_status = Completed

payment_gross = 100

payment_fee = 3.00

mc_gross = 100

mc_fee = 3.00

mc_currency = USD

Order Management Integration Guide March 2008 - first technical draft 29

Page 30

Instant Payment Notification (IPN)

3

Using IPN with Multiple Currencies

Example 2

f a user with a CAD balance receives a $100 CAD payment, the following variables will be

used for the payment:

z mc_gross and mc_fee have values.

z payment_gross and payment_fee are blank.

EXAMPLE 3.2 Multi-currency IPN: CAD Payment

payment_status = Completed

payment_gross =

payment_fee =

mc_gross = 100

mc_fee = 3.00

mc_currency = CAD

Example 3

If the account is set to automatically convert payments, these variables will be used to show

the conversion. This example is for a user with a USD balance who receives a payment of 100

GBP:

EXAMPLE 3.3 Multiple-currency IPN: Automatic Conversion of GBP Payment

payment_status = Completed

payment_gross =

payment_fee =

mc_gross = 100

mc_fee = 3.00

mc_currency = GBP

settle_amount = 145.5

settle_currency = USD

exchange_rate = 1.5

Example 4

If a payment received is pending due to pending_reason = multi_currency, the first IPN

received would not have the settle_amount, settle_currency, or exchange_rate.

EXAMPLE 3.4 Multiple-currency IPN: Pending Payment

payment_status = Pending

pending_reason = multi_currency

payment_gross =

mc_gross = 100

mc_currency = GBP

The second IPN contains information about settling the payment. If the payment is accepted

into the account’s primary currency, which is USD in the following example:

EXAMPLE 3.5 Pending - Convert to Primary Currency

payment_status = Completed

30 March 2008 - first technical draft Order Management Integration Guide

Page 31

Instant Payment Notification (IPN)

Dispute Notification and Downloadable Dispute Report

payment_gross =

payment_fee =

mc_gross = 100

mc_fee = 3.00

mc_currency = GBP

settle_amount = 145.5

settle_currency = USD

exchange_rate = 1.5

If the payment is accepted into a balance of the same currency:

EXAMPLE 3.6 Pending - Accept to Currency Balance

payment_status = Completed

payment_gross =

payment_fee =

mc_gross = 100

mc_fee = 3.00

mc_currency = GBP

If the payment is denied:

3

EXAMPLE 3.7 Pending - Denied

payment_status = Denied

payment_gross =

mc_gross = 100

mc_currency = GBP

N OTE: If a user receives a payment into a currency balance and later converts this amount into

another currency balance, the corresponding currency conversion transaction has no

IPN.

Dispute Notification and Downloadable Dispute Report

Buyers can register claims about payments; such claims are called cases. PayPal notifies

merchants about new cases with email and with IPN.

There are two kinds of cases:

z Complaint: A buyer has used the PayPal Resolution Center to register a claim about a

payment to a merchant.

N OTE: After notification about a complaint claim, merchants must log in to PayPal to use

the Resolution Center to respond to the case.

z Chargeback: A buyer has filed a complaint with a credit card company that has resulted in

a chargeback. The credit card company notifies PayPal about the reason for the

chargeback. After investigating the case, PayPal notifies the merchant of any action

required.

Order Management Integration Guide March 2008 - first technical draft 31

Page 32

Instant Payment Notification (IPN)

3

Dispute Notification and Downloadable Dispute Report

The IPN messages for chargebacks resulting from a complaint are asynchronous: the IPN

message for the chargeback can be sent to the merchant before the IPN message relating to the

complaint. You should compare the IPN variable parent_txn_id of all IPN messages to match

the chargeback with the complaint.

IPN variables for cases include the type of case, the reason, and other information about the

case. For details about all variables and their possible values, see “Dispute Notification

Variables” on page 68.

Downloadable Dispute Report

The Downloadable Dispute Report provides details about newly created disputes and changes

in the status of cases already in mid-process. The report is designed for the merchant that

processes payment volumes better handled by programmatic interfaces. Thus, while the report

resembles the Dispute Report available via the Resolution Center on the PayPal site, the

downloadable is different in that it contains all open records (records cannot be filtered) and

the invoice ID, which can use to track dispute cases based on your transaction identifiers.

The report is generated every day based on activity for the previous day. Days in which no

activity occurred create an empty report. Reports are available for seven days, after which the

report is no longer available

The report contains information about all chargebacks and buyer complaints for your account.

This report does not contain information about ACH returns of PayPal-unauthorized

complaints.

First Report

When you are first signed up for the DDR, the report contains:

1. All open Chargebacks, regardless of the date the case was created or the current status of

the case

2. All open Buyer Complaints, regardless of the date the case was created or the current status

of the case

Use this report as a starting point against which you will compare all future reports. If you

want this “first report” re-run, contact your PayPal Account Manager and ask them to generate

a “first day” DDR report.

Subsequent Daily Reports

Reports generated every day following the First DDR report contain information about dispute

activity for your account in the past 24 hours or since the last report was generated, including

the following:

z New cases

z Changed cases, including cases that are closed

Setup

To use the report you must:

32 March 2008 - first technical draft Order Management Integration Guide

Page 33

Instant Payment Notification (IPN)

Dispute Notification and Downloadable Dispute Report

1. Create a unique user with PayPal’s Multi-User Access feature for downloading reports

– Login to your PayPal account.

– Click the Profile subtab.

– Under the Account Information column, click Multi-User Access.

– Click Add.

– On the Multi-User Access page, enter the requested information into the fields provided.

– Click the checkboxes next to each permission you want the alias to have.

– Click Save.

2. Contact your PayPal Account Manager to sign you up for the report.

3. Write a script to download the report from PayPal.

Scripts

You can automate which details you want to be prioritized in your dispute reports by assigning

values shown in the sample HTML below. You can set the values for day, month, and year.

The uname value is the alias you created with the Multi-User Access feature.

<FORM ACTION=”https://www.paypal.com/us/DISPUTE-REPORT-SCHED-LOGIN”

METHOD=”post”>

<INPUT TYPE=”hidden” NAME=”day” VALUE=”16”>

<INPUT TYPE=”hidden” NAME=”month” VALUE=”09”>

<INPUT TYPE=”hidden” NAME=”year” VALUE=”2006”

<INPUT TYPE=”hidden” NAME=”uname” VALUE=”yourAliasUsername”>

<INPUT TYPE=”hidden” NAME=”pword” VALUE=”yourAliasPassword”>

<INPUT TYPE=”image” VALUE=”Submit”>

</FORM>

3

Additional Set Up

You will receive an email informing you that the report is ready. Be sure to monitor your

primary email address for an email stating the download report is ready. This email contains a

hyperlink to the report, which can you access with a browser. You can also use the email as a

trigger for your script that programmatically retrieves the report.

Order Management Integration Guide March 2008 - first technical draft 33

Page 34

Instant Payment Notification (IPN)

3

Dispute Notification and Downloadable Dispute Report

34 March 2008 - first technical draft Order Management Integration Guide

Page 35

4

Transaction History and

Reporting Tools

With transaction history and reporting tools, you can access monthly account statements,

search your account history for different kinds payments and transactions, download history to

your local computer, and access reports about disputed transactions.

N OTE: PayPal offers an additional set of reporting tools from the PayPal Business Overview

page. Visit the page, at https://business.paypal.com

User’s Guide and to use the additional reporting tools.

To access the history and tools described here:

1. Log in to your Business or Premier account.

2. Click the History subtab.

The History page appears, as shown in Figure 4.1 , “The History Page.”

, to access the PayPal Reporting

Order Management Integration Guide March 2008 35

Page 36

Transaction History and Reporting Tools

4

Using Monthly Account Statements

FIGURE 4.1 The History Page

Using Monthly Account Statements

After you activate monthly account statements, you can view them from the History page.

New statements become available on the 15th of each month, and they remain available online

for up to three months.

To activate monthly account statements:

1. From the My Account Overview page, click the History subtab.

The History page appears.

2. Click the View button.

36 March 2008 Order Management Integration Guide

Page 37

3. On the displayed page, click the Ye s radio button.

4. Click the Save button.

Searching History

There are two ways to search your account history for payments and other activity:

Transaction History and Reporting Tools

Searching History

4

z Basic Searching by Activity: specify a kind of account activity, and specify a date range.

z Advanced Searching by Field Value: specify a value or a pattern of values in a specific

field, and specify a date range.

Order Management Integration Guide March 2008 37

Page 38

Transaction History and Reporting Tools

4

Searching History

Basic Searching by Activity

From the History page, you can search your transaction history by specifying the kind of

account activity you want to view.

In the Show dropdown menu, select one of the following types of account activity.

TABLE 4.1 Basic Search: Selectable Activity Types

All Activity - Advanced

Vie w

All Activity - Simple

Vie w

Payments Sent or

Received

Mass Payments Refunds eChecks

Money Requests Currency Conversions Preapproved Payments

38 March 2008 Order Management Integration Guide

Fee Reversals Open Authorizations:

Sent or Received

Subscriptions Shipping PayPal Buyer Credit

BillPay Transactions Balance Affecting

Transactions

Donations Sent or

Received

Page 39

Transaction History and Reporting Tools

T

ABLE 4.1 Basic Search: Selectable Activity Types

Searching History

4

Funds Added or

Withdrawn

Balance Transfer Gift Certificates

The choice All Activity - Simple View is selected by default. You can scroll up the list to

select All Activity - Advanced View, which differs from All Activity - Simple View by

including a Balance column. The Balance column shows an ellipsis (...) for transactions that

do not affect your account balance.

For detailed information on how to specify a date range, see “Specifying Date Ranges for

Basic and Advanced History Search” on page 40.

Advanced Searching by Field Value

From the Search page, you can search your transaction history for a value or a pattern of

values in a specific field.

In the Search For text box, type the value or pattern. From the In dropdown menu, select one

of the following fields.

T

ABLE 4.2 Advanced Transaction Search: Key Fields

Field Matching Criteria

Email The text you enter must exactly match an email address

Transaction ID Exact match

Order Management Integration Guide March 2008 39

Page 40

Transaction History and Reporting Tools

4

Searching History

T

ABLE 4.2 Advanced Transaction Search: Key Fields

Field Matching Criteria

Last Name Any part of the text you enter can match. For example, the

text mit matches Smith and Mitty

Last Name, First Name Any part of text can match

Receipt ID Exact match

Invoice ID Exact match

Billing Agreement Exact match

Profile ID Exact match

For detailed information on how to specify a date range, see “Specifying Date Ranges for

Basic and Advanced History Search” on page 40.

Specifying Date Ranges for Basic and Advanced History Search

You can confine your basic or advanced to search to a specific date range in these ways:

z Select the Within radio button, and select one of these time frames from the dropdown

menu:

–The Past Day

– The Past Week

– The Past Month

–The Past Year

40 March 2008 Order Management Integration Guide

Page 41

Transaction History and Reporting Tools

Downloading History

z Select the From radio button, and specify a date range using the text boxes for the From

and To day, month, and year.

IMPORTANT: The duration of the date range you specify affects how quickly you can view

the search results. The longer the duration, the longer the search results take.

For faster results, narrow the date range.

4

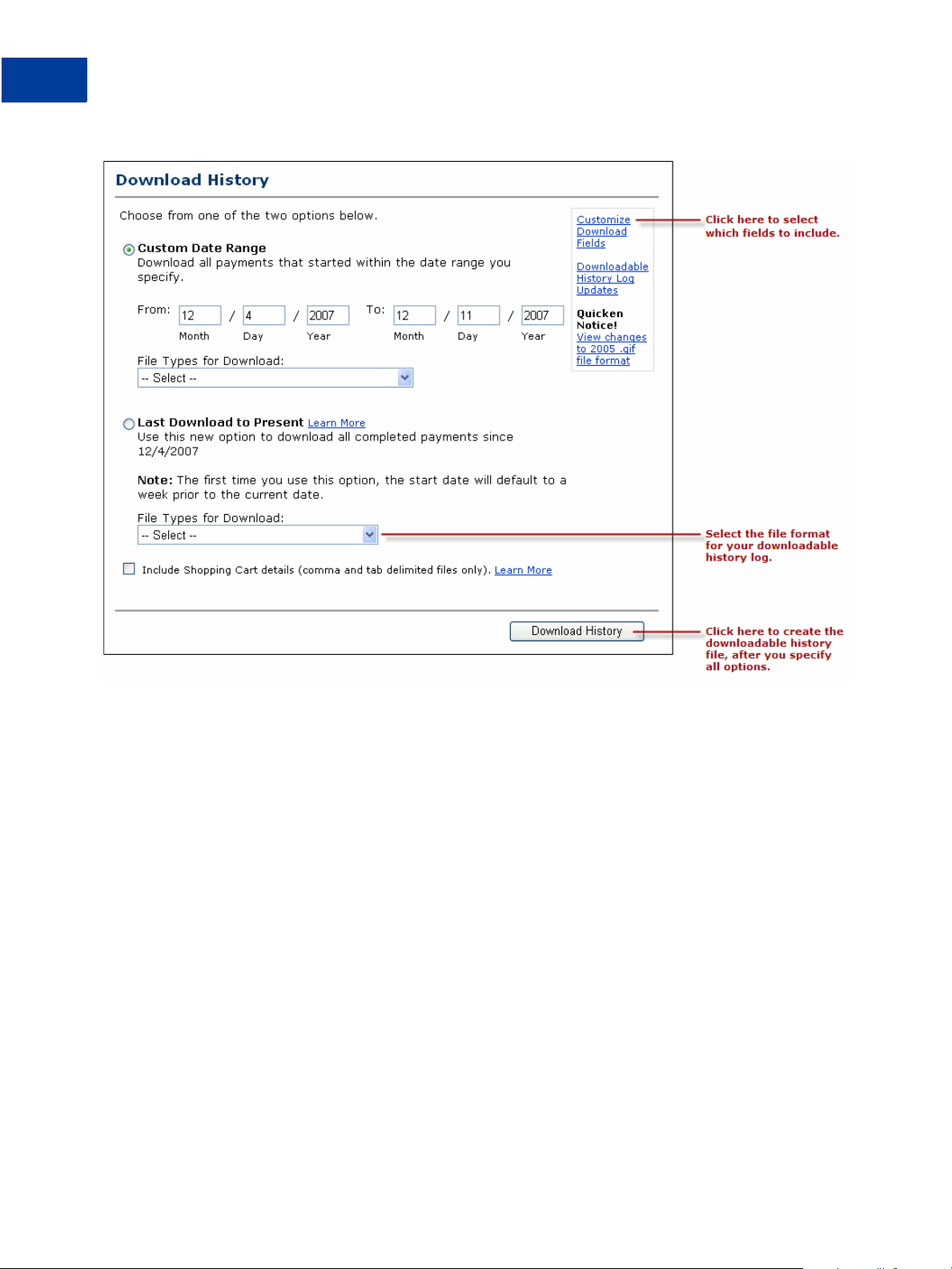

Downloading History

The Download History page lets you specify a time frame for payments and transactions to

include in downloadable history logs, which are files that you save on your local computer.

You can also specify which fields to include and what file format your want.

To to create a downloadable history log and save it on your computer:

1. In the upper left area of the History page, click the Download My History link.

The Download History page appears.

Order Management Integration Guide March 2008 41

Page 42

Transaction History and Reporting Tools

4

Downloading History

FIGURE 4.2 Download History Page

2. In the upper right area of the History Download page, click the Customize Download

Fields link to select which fields you want to include in your downloadable history log.

For more information, see “Selecting Which Fields to Include in the Download” on

page 43.

3. Specify a Custom Date Range for the history you want to download, and select a File

Type for D o w n lo a d .

Your choices are:

– Comma Delimited – All Activity

– Comma Delimited – Completed Payments

– Comma Delimited – Balance Affecting Payments

– Tab Delimited – All Activity

– Tab Delimited – Completed Payments

– Tab Delimited – Balance Affecting Payments

– Intuit Quicken (.qif file format)

42 March 2008 Order Management Integration Guide

Page 43

Transaction History and Reporting Tools

Downloading History

– Intuit QuickBooks (.iif file format)

– or –

Select the Last Download to Present radio button to download transactions that occurred

after the last time you downloaded history, and select a File Type for Download.

Your choices are:

– Comma Delimited – Completed Payments

– Tab Delimited – Completed Payments

– Intuit Quicken (.qif file format)

– Intuit QuickBooks (.iif file format)

4. Select the Include Shopping Cart details checkbox if you want your downloadable history

log to include a row of information for each item associated with shopping cart payments.

5. Click the Download History button.

6. When prompted, select whether to open the downloadable history log or to save it on your

local computer.

4

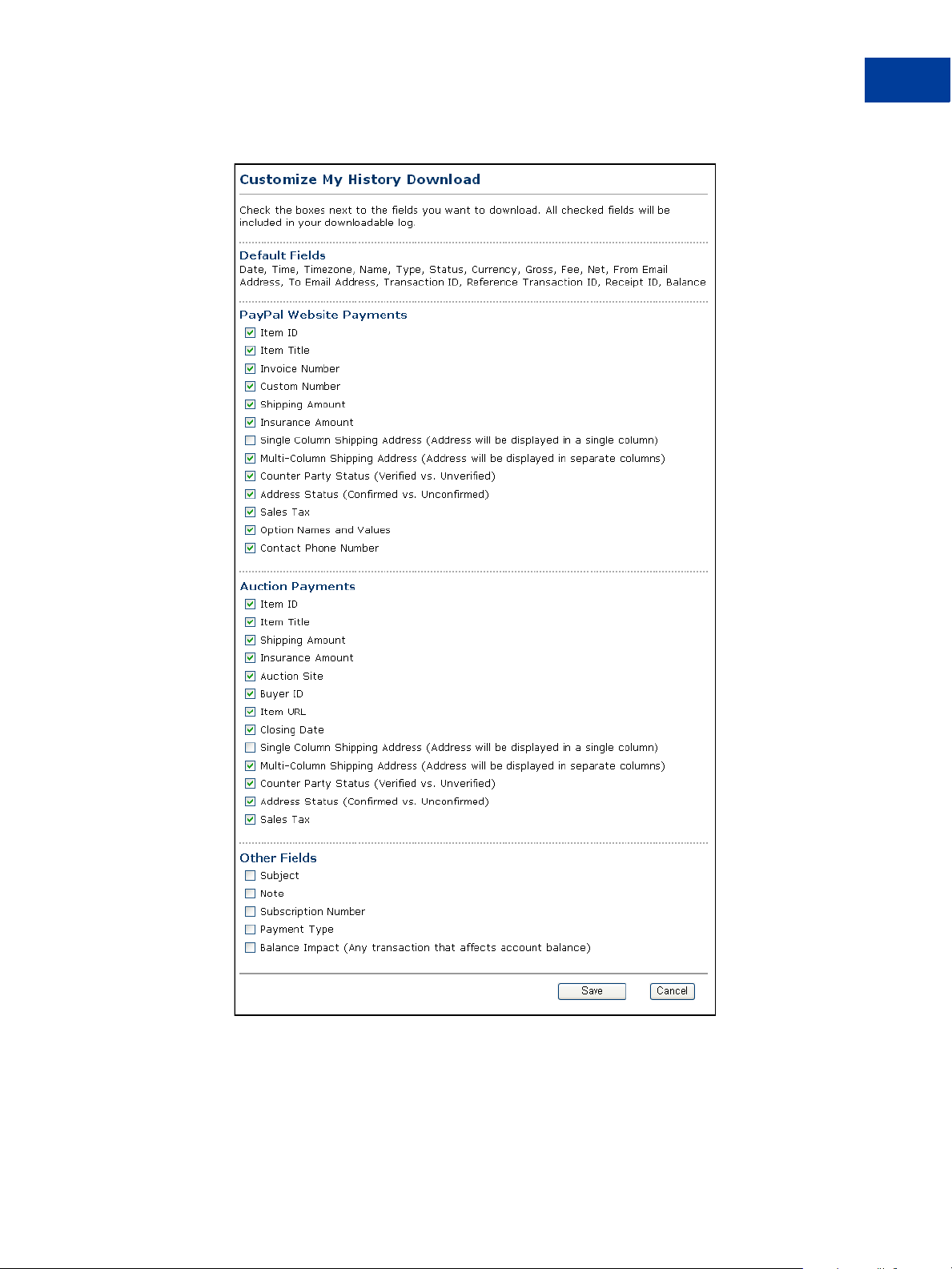

Selecting Which Fields to Include in the Download

Downloadable history logs always contains these fields:

z Date, Time, and Timezone

z Name

z Type, Status and Currency

z Gross, Fee, and Net

z From Email Address and To Email Address

z Transaction ID and Reference Transaction ID

z Receipt ID

z Balance

For details about these default fields, see Appendix B, “Downloadable History Logs.”

In addition, you can select other fields to include, using the Customize My History

Download page.

To select the optional fields you want to include in downloadable history logs:

Order Management Integration Guide March 2008 43

Page 44

Transaction History and Reporting Tools

4

Downloading History

1. In the upper right area of the History Download page, click the Customize Download

Fields link, as shown below.

2. In the Customize My History Download page, select the checkboxes next to the fields

that you want to include.

44 March 2008 Order Management Integration Guide

Page 45

Transaction History and Reporting Tools

FIGURE 4.3 The Customize My History Download Page

Downloading History

4

For details about these optional fields, see Appendix B, “Downloadable History Logs.”

3. Click the Save button to preserve you choices for future downloadable history logs.

Order Management Integration Guide March 2008 45

Page 46

Transaction History and Reporting Tools

4

Downloading History

Understanding the Status and Life Cycle of Transactions

Each row in a downloadable history log shows a transaction, its status at the time of the

download, and its effect on your balance.

Various types of transaction statuses and scenarios can have a negative, positive, or neutral

balance effect. These statuses include:

z Pending

z Held

z Completed

z Denied

z Cancelled

z Reversed

For a complete list of possible transaction statuses, see “Status” on page 73.

Pending to Cleared or Uncleared

When a pending payment, such as an eCheck, clears after the three to four business days, the

transaction status changes from Uncleared to Cleared.

Status of Disputed Transactions

Transactions with a Placed status (for temporary holds) usually involve a customer dispute.

If you are found in favor in a dispute, the transaction will be updated with a new line-item to

indicate a Credit. However, if the opposite is true, the Balance Impact column will not change

from the Debit status for that transaction.

You can generate a dispute report that correlates the transaction to the customer and the reason

for the dispute. For more information, see “Reporting Disputed Transactions” on page 47.

Reconciling Transactions using the Balance Impact Column

The optional Balance Impact column shows the word “Credit” for a positive effect or the word

“Debit” for a negative effect on your PayPal account balance.

Credit

When you receive an instant payment or credit card transaction, the Balance Impact column

indicates a credit. Other possible credits to your account are refunds, reversals and payments

sent but never claimed.

In some cases, a credit line-item can update a debit for a transaction. For example, if you send

a payment initially indicated as a debit, but it is denied by the recipient, a new line-item for

that transaction will indicate a credit.

Debit

Debits are transactions that reduce your available balance. For example, refunded transactions

are recorded as a debit in the Balance Impact column and as completed in the Status column.

46 March 2008 Order Management Integration Guide

Page 47

Transaction History and Reporting Tools

Reporting Disputed Transactions

Memo Entries

The Balance Impact column can display a Memo entry for transactions that do not affect your

balance, such as unclaimed or uncleared transactions. These kinds of transactions have no

effect on your balance, because they never becomes completed transactions.

Reconciling Transactions Using the Net Amount Column

The Net Amount of a transaction can aid in faster reconciliation.

In most cases, the Net Amount is the Gross minus Fee. When a History entry is updated (for

example, in the case of a refund), the Net Amount column indicates the current net value of the

transaction on a separate line-item.

FIGURE 4.4 Gross, Fee and Net Amount Calculations from History Log

4

Reporting Disputed Transactions

With dispute reports, you can focus only on transactions that are disputed by customers for

some reason.

Order Management Integration Guide March 2008 47

Page 48

Transaction History and Reporting Tools

4

Reporting Disputed Transactions

FIGURE 4.5 Dispute Report

Programmatic Access to Dispute Report

The Downloadable Dispute Report (DDR) provides merchants with a regular report of newly

created disputes and changes in the status of those cases that are already open and are in the

midst of processing.

The report is designed for the merchant that processes large volumes of payments. Thus, while

the report resembles the Dispute Report available via the Resolution Center within the PayPal

site, the DDR differs in that it contains all open records and the invoice ID which can be used

to track dispute cases based on your transactional identifiers. The DDR cannot filter on open

records.

N OTE: To use this feature, you must sign up for the report through your PayPal Account

Manager.

Content of the Report

The report contains information about all chargebacks and buyer complaints generated for

your account. This report does not contain information about ACH returns of PayPal

unauthorized complaints.

48 March 2008 Order Management Integration Guide

Page 49

Transaction History and Reporting Tools

Reporting Disputed Transactions

First DDR Report

When you first sign up for the DDR, the report contains:

z All open chargebacks, regardless of the date the case was created or the current status of

the case

z All open buyer complaints, regardless of the date the case was created or the current status

of the case

Use this report as a starting point against which you will read future DDR reports.

N OTE: If you need to regenerate the first report, contact your PayPal Account Manager and

ask them to generate a first day DDR report for you.

Subsequent Daily DDR Reports

Following the first DDR report, reports are generated daily and contain information about

dispute activity for your account in the past 24 hours, or since the last report was generated,

including:

z New cases created

z Cases that were modified, including cases that were closed

4

Frequency / Archiving

The DDR is generated every day based on activity for the previous day. Days with no activity

will generate an empty report.

PayPal will maintain DDR reports for seven days after which the report will not longer be

available.

Report Set Up

To use the DDR you must:

1. Sign up for the report through your PayPal Account Manager

2. Create a unique user to download the report

3. Write code to download the report from a PayPal server

Step 1. Sign up for the report via PayPal Account Management. Contact your PayPal

Account Manager to sign up for the Downloadable Dispute Report.

Step 2. Create a Unique User on PayPal to Download the Report. To use the DDR, you

must use PayPal’s Multi-User Access feature to create a unique user for downloading reports.

1. Login to your PayPal account.

2. Select the Profile subtab.

3. Click the Multi-User Access link under the Account Information column to open the

Multi-User Access page.

4. Click the Add button. On the Multi-User Access page, enter the requested information

into the fields provided.

Order Management Integration Guide March 2008 49

Page 50

Transaction History and Reporting Tools

4

Reporting Disputed Transactions

5. Select the checkboxes next to each of the choices that you want the alias to have.

6. Click the Save button.

Your new user and alias appear on the Multi-User Access page along with a confirmation

message that you have successfully added a new user to your account.

Step 3. Write Code to Download the Report from the PayPal Server. Write code to

request the report from a PayPal server. The code must send an HTTP POST to the PayPal

server. The POST must be sent from a secure server that uses HTTPS. PayPal does not accept

requests from servers using HTTP.

You can automate which details you want to be prioritized in your Settlement File reports by

assigning values as depicted in the sample HTML code.

The HTML code below is an example of the values that your DDR may contain. In the

following example, the uname value is the alias created using the Multi-User Access feature.

<FORM ACTION=”https://www.paypal.com/us/DISPUTE-REPORT-SCHED-LOGIN”

METHOD=”post”>

<INPUT TYPE=”hidden” NAME=”day” VALUE=”16”>

<INPUT TYPE=”hidden” NAME=”month” VALUE=”09”>

<INPUT TYPE=”hidden” NAME=”year” VALUE=”2006”>

<INPUT TYPE=”hidden” NAME=”uname” VALUE=”queuealias2”>

<INPUT TYPE=”hidden” NAME=”pword” VALUE=”22222222”>

<INPUT TYPE=”image” VALUE=”Submit”>

</FORM>

View the Report

You will receive an email when the report is ready. This email contains a link to the report

which can you access via a browser.

You can also use the email as a trigger for your code to programmatically access the report.

50 March 2008 Order Management Integration Guide

Page 51

IPN and PDT Variables

A

IPN and PDT variables are case-sensitive. All values are lowercase, except those for

payment_status, which have an initial capital letter.

In addition, values posted by IPN are URL-encoded. For example, a colon in http:// is

encoded as %3A in the IPN post: http%3A//

About These Tables of Variables

The tables in this appendix group IPN variables by different characteristics:

z “test_ipn Variable in Sandbox” on page 51

z “IPN Variables in All Posts” on page 52

z “Buyer Information” on page 52

z “Basic Information” on page 53

z “Advanced and Custom Information” on page 54

z “Website Payments Standard, Website Payments Pro, and Refund Information” on page 55

z “Currency and Currency Exchange” on page 60

z “Auctions” on page 62

z “Mass Payment” on page 62

z “Subscriptions” on page 64

z “Dispute Notification Variables” on page 68

z “PDT-Specific Variables” on page 70

Transaction-Specific Variable Values

Unless otherwise indicated in the table column labeled Possible Values, the value of an IPN or

PDT variable is always specific to the transaction whose information is being posted.

test_ipn Variable in Sandbox

In the Sandbox environment, IPN includes the additional variable test_ipn with a value of 1

(one). The purpose of test_ipn is to provide testing programs a means to differentiate

between Sandbox IPN and live IPN.

Order Management Integration Guide March 2008 51

Page 52

IPN and PDT Variables

A

IPN Variables in All Posts

IPN Variables in All Posts

IPN Version: notify_version

The value of the notify_version variable is the version number of Instant Payment

Notification that makes the post.

N OTE: The value notify_version is a means for PayPal to track versions of IPN. There is

no need for your programs to store this value or query it.

Security Information: verify_sign

The value of verify_sign is an encrypted string used to validate the authenticity of the

transaction.

Buyer Information

TABLE A.1 IPN and PDT Variables: Buyer Information

Variable

Name

address_

city

address_

country

address_

country_

code

address_

name

address_

state

address_

status

Possible

Values Description

City of customer’s address. 40

Country of customer’s address. 64

Two-character ISO 3166 country code 2

Name used with address (included when the customer provides a

Gift Address)

State of customer’s address 40

confirmed

unconfirmed

Customer provided a confirmed address.

Customer provided an unconfirmed address.

Char

Length

128

address_

street

address_zip Zip code of customer’s address. 20

first_name Customer’s first name 64

Customer’s street address. 200

52 March 2008 Order Management Integration Guide

Page 53

T

ABLE A.1 IPN and PDT Variables: Buyer Information

IPN and PDT Variables

Basic Information

A

Variable

Name

last_name Customer’s last name 64

payer_

business_

name

payer_email Customer’s primary email address. Use this email to provide any

payer_id Unique customer ID. 13

payer_

status

contact_

phone

residence_

country

Possible

Values Description

Customer’s company name, if customer represents a business 127

credits.

verified

unverified

Customer has a Verified PayPal account.

Customer has an Unverified PayPal account.

Customer’s telephone number. 20

Two-character ISO 3166 country code 2

Basic Information

Char

Length

127

ABLE A.2 IPN and PDT Variables: Basic Information

T

Variable

Name

business Email address or account ID of the payment recipient (that is, the

item_name Item name as passed by you, the merchant. Or, if not passed by

item_number Pass-through variable for you to track purchases. It will get

Possible

Values Description

merchant). Equivalent to the values of receiver_email (if

payment is sent to primary account) and business set in the

Website Payment HTML.

N OTE: The value of this variable is normalized to lowercase

characters.

you, as entered by your customer. If this is a shopping cart

transaction, PayPal will append the number of the item (e.g.,

item_name_1, item_name_2, and so forth).

passed back to you at the completion of the payment. If omitted,

no variable will be passed back to you.

Char

Length

127

127

127

Order Management Integration Guide March 2008 53

Page 54

IPN and PDT Variables

A

Advanced and Custom Information

T

ABLE A.2 IPN and PDT Variables: Basic Information

Variable

Name

quantity Quantity as entered by your customer or as passed by you, the

receiver_

email

receiver_id Unique account ID of the payment recipient (i.e., the merchant).

Possible

Values Description

merchant. If this is a shopping cart transaction, PayPal appends

the number of the item (e.g. quantity1, quantity2).

Primary email address of the payment recipient (that is, the

merchant). If the payment is sent to a non-primary email address

on your PayPal account, the receiver_email is still your

primary email.

N OTE: The value of this variable is normalized to lowercase

characters.

This is the same as the recipient's referral ID.

Advanced and Custom Information

T

ABLE A.3 IPN and PDT Variables: Advanced and Custom Information

Char

Length

127

13

Variable

Name

custom Custom value as passed by you, the merchant. These are pass-

invoice Passthrough variable you can use to identify your Invoice

memo Memo as entered by your customer in PayPal Website Payments

option_

name_1

option_

name_2

option_

selection1

Possible

Values Description

through variables that are never presented to your customer

Number for this purchase. If omitted, no variable is passed back.

note field.

Option 1 name as requested by you.

If this is a shopping cart transaction, see Table A.4, “IPN and

PDT Variables: Website Payments Standard, Website Payments

Pro, and Refund Information,” on page 55 for more information.

Option 2 name as requested by you.

If this is a shopping cart transaction, see Table A.4, “IPN and

PDT Variables: Website Payments Standard, Website Payments

Pro, and Refund Information,” on page 55 for more information.

Option 1 choice as entered by your customer.

If this is a shopping cart transaction, see Table A.4, “IPN and

PDT Variables: Website Payments Standard, Website Payments

Pro, and Refund Information,” on page 55 for more information.

Char

Length

255

127

255

64

64

200

54 March 2008 Order Management Integration Guide

Page 55

Website Payments Standard, Website Payments Pro, and Refund Information

T

ABLE A.3 IPN and PDT Variables: Advanced and Custom Information

IPN and PDT Variables

A

Variable

Name

option_

selection2

tax Amount of tax charged on payment.

Possible

Values Description

Option 2 choice as entered by your customer.

If this is a shopping cart transaction, see Table A.4, “IPN and

PDT Variables: Website Payments Standard, Website Payments

Pro, and Refund Information,” on page 55 for more information.

If this is a shopping cart transaction, see Table A.4, “IPN and

PDT Variables: Website Payments Standard, Website Payments

Pro, and Refund Information,” on page 55 for more information.

Char

Length

200

Website Payments Standard, Website Payments Pro, and

Refund Information

T

ABLE A.4 IPN and PDT Variables: Website Payments Standard, Website Payments Pro, and

Refund Information

Variable

Name

Possible

Values Description

Char

Length

auth_id Transaction-

specific

auth_exp Transaction-

specific

auth_amount Transaction-

specific

auth_status Completed

Pending

Voided

mc_gross_

mc_

handling_

x Transaction-

specific for

multiple

currencies

Transactionspecific for

x

multiple

currencies

Authorization identification number 19

Authorization expiration date and time, in the following format:

HH:MM:SS DD Mmm YY, YYYY PST

Authorization amount

Status of authorization

The amount is in the currency of mc_currency, where x is the

shopping cart detail item number. The sum of mc_gross_x

should total mc_gross.

The x is the shopping cart detail item number. The

handling_cart cart-wide Website Payments variable is also

included in the mc_handling variable; for this reason, the sum

of mc_handling_x might not be equal to mc_handling

28

Order Management Integration Guide March 2008 55

Page 56

IPN and PDT Variables

A

Website Payments Standard, Website Payments Pro, and Refund Information

ABLE A.4 IPN and PDT Variables: Website Payments Standard, Website Payments Pro, and

T

Refund Information

Variable

Name

mc_

shipping_

num_cart_

items

option_

name1

option_

name2

option_

selection1_

x

option_

selection2_

x

x

Possible

Values Description

Transactionspecific for

multiple

currencies

This is the combined total of shipping and shipping2

Website Payments Standard variables, where x is the shopping

cart detail item number. The shippingx variable is only shown

when the merchant applies a shipping amount for a specific item.

Because profile shipping might apply, the sum of shippingx

might not be equal to shipping.

If this is a PayPal Shopping Cart transaction, number of items in

cart.

PayPal appends the number of the item where x represents the

number of the shopping cart detail item (e.g., option_name1,

option_name2).

PayPal appends the number of the item where x represents the

number of the shopping cart detail item (e.g., option_name2,

option_name2).

PayPal appends the number of the item (e.g.,

option_selection1, option_selection2), where x

represents the number of the shopping cart detail item.