Page 1

Guide to Using

@RISK

Risk Analysis and Simulation

®

Add-In for Microsoft

Version 4.5

June, 2005

Excel

Palisade Corporation

798 Cascadilla St.

Ithaca, NY USA 14850

(607) 277-8000

(607) 277-8001 (fax)

http://www.palisade.com (website)

sales@palisade.com (e-mail)

Page 2

Copyright Notice

Copyright © 2005, Palisade Corporation.

Trademark Acknowledgments

Microsoft, Excel and Windows are registered trademarks of Microsoft, Inc.

IBM is a registered trademark of International Business Machines, Inc.

Palisade, TopRank, BestFit and RISKview are registered trademarks of Palisade

Corporation.

RISK is a trademark of Parker Brothers, Division of Tonka Corporation and is used under

license.

Page 3

Welcome

@RISK for Microsoft Excel

Welcome to @RISK, the revolutionary software system for the

analysis of business and technical situations impacted by risk! The

techniques of Risk Analysis have long been recognized as powerful

tools to help decision-makers successfully manage situations subject

to uncertainty. Their use has been limited because they have been

expensive, cumbersome to use, and have substantial computational

requirements. However, the growing use of computers in business

and science has offered the promise that these techniques can be

commonly available to all decision-makers.

That promise has been finally realized with @RISK (pronounced "at

risk") — a system which brings these techniques to the industry

standard spreadsheet package, Microsoft Excel. With @RISK and

Excel any risky situation can be modeled, from business to science

and engineering. You are the best judge of what your analysis needs

require, and @RISK, combined with the modeling capabilities of

Excel, allows you to design a model which best satisfies those needs.

Anytime you face a decision or analysis under uncertainty, you can

use @RISK to improve your picture of what the future could hold.

Why You Need Risk Analysis and @RISK

Traditionally, analyses combine single "point" estimates of a model's

variables to predict a single result. This is the standard Excel model

— a spreadsheet with a single estimate of results. Estimates of model

variables must be used because the values which actually will occur

are not known with certainty. In reality, however, many things just

don't turn out the way that you have planned. Maybe you were too

conservative with some estimates and too optimistic with others. The

combined errors in each estimate often lead to a real-life result that is

significantly different from the estimated result. The decision you

made based on your "expected" result might be the wrong decision,

and a decision you never would have made if you had a more

complete picture of all possible outcomes. Business decisions,

technical decisions, scientific decisions ... all use estimates and

assumptions. With @RISK, you can explicitly include the uncertainty

present in your estimates to generate results that show all possible

outcomes.

Welcome i

Page 4

@RISK uses a technique called "simulation" to combine all the

uncertainties you identify in your modeling situation. You no longer

are forced to reduce what you know about a variable to a single

number. Instead, you include all you know about the variable,

including its full range of possible values and some measure of

likelihood of occurrence for each possible value. @RISK uses all this

information, along with your Excel model, to analyze every possible

outcome. It's just as if you ran hundreds or thousands of "what-if"

scenarios all at once! In effect, @RISK lets you see the full range of

what could happen in your situation. It's as if you could "live"

through your situation over and over again, each time under a

different set of conditions, with a different set of results occurring.

All this added information sounds like it might complicate your

decisions, but in fact, one of simulation's greatest strengths is its

power of communication. @RISK gives you results that graphically

illustrate the risks you face. This graphical presentation is easily

understood by you, and easily explained to others.

So when should you use @RISK? Anytime you make an analysis in

Excel that could be affected by uncertainty, you can and should use

@RISK. The applications in business, science and engineering are

practically unlimited and you can use your existing base of Excel

models. An @RISK analysis can stand alone, or be used to supply

results to other analyses. Consider the decisions and analyses you

make every day! If you've ever been concerned with the impact of

risk in these situations, you've just found a good use for @RISK!

Modeling Features

As an "add-in" to Microsoft Excel, @RISK "links" directly to Excel to

add Risk Analysis capabilities. The @RISK system provides all the

necessary tools for setting up, executing and viewing the results of

Risk Analyses. And @RISK works in a style you are familiar with —

Excel style menus and functions.

@RISK Functions

ii Welcome

@RISK allows you to define uncertain cell values in Excel as

probability distributions using functions. @RISK adds a set of new

functions to the Excel function set, each of which allows you to

specify a different distribution type for cell values. Distribution

functions can be added to any number of cells and formulas

throughout your worksheets and can include arguments which are

cell references and expressions — allowing extremely sophisticated

specification of uncertainty. To help you assign distributions to

uncertain values, @RISK includes a graphical pop-up window where

distributions can be previewed and added to formulas.

Page 5

Available Distribution Types

The probability distributions provided by @RISK allow the

specification of nearly any type of uncertainty in cell values in your

spreadsheet. A cell containing the distribution function

NORMAL(10,10), for example, would return samples during a

simulation drawn from a normal distribution (mean = 10, standard

deviation = 10). Distribution functions are only invoked during a

simulation — in normal Excel operations, they show a single cell

value — just the same as Excel before @RISK. Available distribution

types include:

Beta BetaGeneral Beta-Subjective

Binomial Chi-Square Cumulative

Discrete Discrete Uniform Error Function

Erlang Exponential Extreme Value

Gamma General Geometric

Histogram Hypergeometric Inverse Gaussian

IntUniform Logistic Log-Logistic

Lognormal Lognormal2 Negative Binomial

Normal Pareto Pareto2

Pearson V Pearson VI PERT

Poisson Rayleigh Student's t

Triangular Trigen Uniform

Weibull

All distributions may be truncated to allow only samples within a

given ranges of values within the distribution. Also, many

distributions can also use alternate percentile parameters. This allows

you to specify values for specific percentile locations of an input

distribution as opposed to the traditional arguments used by the

distribution.

@RISK Simulation Analysis

@RISK has sophisticated capabilities for specifying and executing

simulations of Excel models. Both Monte Carlo and Latin Hypercube

sampling techniques are supported, and distributions of possible

results may be generated for any cell or range of cells in your

spreadsheet model. Both simulation options and the selection of

model outputs are entered with Windows style menus, dialog boxes

and use of the mouse.

Graphics

High resolution graphics are used to present the output distributions

from your @RISK simulations. Histograms, cumulative curves and

summary graphs for cell ranges all lead to a powerful presentation of

results. And all graphs may be displayed in Excel for further

enhancement and hard copy. An essentially unlimited number of

output distributions may be generated from a single simulation —

allowing for the analysis of even the largest and most complex

spreadsheets!

Welcome iii

Page 6

Advanced Simulation Capabilities

The options available for controlling and executing a simulation in

@RISK are among the most powerful ever available. They include:

• Latin Hypercube or Monte Carlo sampling

• Any number of iterations per simulation

• Any number of simulations in a single analysis

• Animation of sampling and recalculation of the spreadsheet

• Seeding the random number generator

• Real time results and statistics during a simulation

High Resolution Graphic Displays

Product Execution Speed

@RISK graphs a probability distribution of possible results for each

output cell selected in @RISK. @RISK graphics include:

• Relative frequency distributions and cumulative probability

curves

• Summary graphs for multiple distributions across cell ranges

(for example, a worksheet row or column)

• Statistical reports on generated distributions

• Probability of occurrence for target values in a distribution

• Export of graphics as Windows metafiles for further

enhancement

Execution time is of critical importance because simulation is

extremely calculation intensive. @RISK is designed for the fastest

possible simulations through the use of advanced sampling

techniques.

iv Welcome

Page 7

Table of Contents

Chapter 1: Getting Started 1

Introduction.........................................................................................3

Installation Instructions.....................................................................7

Quick Start.........................................................................................11

Chapter 2: An Overview to Risk Analysis 15

Introduction.......................................................................................17

What Is Risk? ....................................................................................19

What Is Risk Analysis? ....................................................................23

Developing an @RISK Model...........................................................25

Analyzing a Model with Simulation.................................................27

Making a Decision: Interpreting the Results.................................29

What Risk Analysis Can (Cannot) Do.............................................33

Chapter 3: Upgrade Guide 35

Introduction.......................................................................................37

New @RISK Model Window.............................................................39

New @RISK Add-in Features...........................................................43

New @RISK Results Window ..........................................................45

New Features in @RISK 4.5 vs @RISK 4.0.....................................49

Table of Contents v

Page 8

Chapter 4: Getting to Know @RISK 57

A Quick Overview to @RISK...........................................................59

Setting Up and Simulating an @RISK Model.................................69

Chapter 5: @RISK Modeling Techniques 91

Introduction ...................................................................................... 93

Modeling Interest Rates and Other Trends ...................................95

Projecting Known Values into the Future...................................... 97

Modeling Uncertain or "Chance" Events.......................................99

Oil Wells and Insurance Claims....................................................101

Adding Uncertainty Around a Fixed Trend..................................103

Dependency Relationships ...........................................................105

Sensitivity Simulation....................................................................107

Simulating a New Product: The Hippo Example.........................109

Finding Value at Risk (VAR) of a Portfolio .................................. 119

Simulating the NCAA Tournament...............................................123

Chapter 6: Distribution Fitting 127

Overview ......................................................................................... 129

Define Input Data............................................................................131

Select Distributions To Fit............................................................. 135

Run The Fit......................................................................................139

Interpret the Results ......................................................................143

Using the Results of a Fit..............................................................151

vi Table of Contents

Page 9

Chapter 7: @RISK Reference Guide 153

Introduction.....................................................................................161

Reference: @RISK Icons................................................................163

Reference: @RISK Add-In Menu Commands 173

File Menu .........................................................................................175

Model Menu.....................................................................................177

Simulate Menu ................................................................................189

Results Menu ..................................................................................203

Options Menu..................................................................................207

Advanced Analyses Menu .............................................................209

Goal Seek.........................................................................................211

Stress Analysis...............................................................................217

Advanced Sensitivity Analysis......................................................229

Reference: @RISK Model Window Commands 247

File Menu .........................................................................................249

Edit Menu.........................................................................................251

View Menu .......................................................................................253

Insert Menu......................................................................................255

Simulation Menu.............................................................................263

Model Menu.....................................................................................265

Correlation Menu............................................................................275

Fitting Menu.....................................................................................283

Graph Menu.....................................................................................309

Table of Contents vii

Page 10

Artist Menu......................................................................................317

Window Menu .................................................................................323

Help Menu.......................................................................................325

Reference: @RISK Results Window Commands 327

File Menu.........................................................................................329

Edit Menu ........................................................................................331

View Menu.......................................................................................335

Insert Menu.....................................................................................337

Simulation Menu.............................................................................353

Results Menu.................................................................................. 355

Graph Menu .................................................................................... 361

Window Menu .................................................................................379

Help Menu.......................................................................................381

Reference: @RISK Functions 383

Introduction .................................................................................... 383

Reference: Distribution Functions...............................................401

Reference: Distribution Property Functions...............................429

Reference: Output Functions........................................................439

Reference: Statistics Functions ...................................................441

Reference: Supplemental Functions............................................ 447

Reference: Graphing Function ..................................................... 449

Reference: @RISK Macros 451

Overview ......................................................................................... 451

viii Table of Contents

Page 11

Using VBA to Modify @RISK Settings and Enter Outputs.........453

Using VBA to Run Simulations, Get Results and Generate

Reports.........................................................................................455

Using VBA to Run Advanced Analyses........................................457

Appendix A: Sampling Methods 459

What is Sampling?..........................................................................459

Appendix B: Using @RISK With Other DecisionTools® 465

The DecisionTools Suite................................................................465

Palisade’s DecisionTools Case Study..........................................467

Introduction to TopRank®..............................................................471

Using @RISK with TopRank..........................................................475

Introduction to PrecisionTree™.....................................................479

Using @RISK with PrecisionTree..................................................483

Appendix C: Glossary 487

Appendix D: Recommended Readings 493

Readings by Category....................................................................493

Table of Contents ix

Page 12

x Table of Contents

Page 13

Chapter 1: Getting Started

Introduction.........................................................................................3

Checking Your Package ..........................................................................3

About This Version .................................................................................3

Working with your Operating Environment ......................................4

If You Need Help .....................................................................................4

@RISK System Requirements................................................................6

Installation Instructions.....................................................................7

General Installation Instructions..........................................................7

The DecisionTools Suite.........................................................................8

Setting Up the @RISK Icons or Shortcuts............................................9

Macro Security Warning Message on Startup ....................................9

Quick Start.........................................................................................11

On-line Tutorial......................................................................................11

Starting On Your Own ..........................................................................11

Quick Start with Your Own Spreadsheets ........................................12

Using @RISK 4.5 Spreadsheets in @RISK 3.5 or earlier..................13

Using @RISK 4.5 Spreadsheets in @RISK 4.0...................................13

@RISK 4.5 Help System © Palisade Corporation, 1999

Chapter 1: Getting Started 1

Page 14

2 @RISK for Microsoft Excel

Page 15

Introduction

This introduction describes the contents of your @RISK package and

shows you how to install @RISK and attach it to your copy of Microsoft

Excel 97 for Windows or higher.

Checking Your Package

Your @RISK package should contain:

The @RISK User’s Guide (this book) with:

• Getting Started

• Overview to Risk Analysis and @RISK

• Upgrade Guide

• Getting to Know @RISK

• @RISK Modeling Techniques

• Distribution Fitting

• @RISK Reference Guide

• Technical Appendices

The @RISK CD-ROM including:

• @RISK Program

• @RISK Tutorial

The @RISK Licensing Agreement

A complete listing of all files contained on the @RISK CD is contained in

the file INSTALL.LOG found in the PROGRAM FILES\PALISADE

\RISK45 directory on your hard disk.

If your package is not complete, please call your @RISK dealer or supplier

or contact Palisade Corporation directly at (607) 277-8000. If you want to

install @RISK from diskettes, please contact Palisade Corporation.

About This Version

This version of @RISK can be installed as a 32-bit program for Microsoft

Excel 97 or higher.

Chapter 1: Getting Started 3

Page 16

Working with your Operating Environment

This User’s Guide assumes that you have a general knowledge of the

Windows operating system and Excel. In particular:

• You are familiar with your computer and using the mouse.

• You are familiar with terms such as icons, click, double-click, menu, window,

command and object.

• You understand basic concepts such as directory structures and file naming.

If You Need Help

Technical support is provided free of charge for all registered users of

@RISK with a current maintenance plan, or is available on a per incident

charge. To ensure that you are a registered user of @RISK, please register

online at www.palisade.com/html/register.html.

If you contact us by telephone, please have your serial number and User’s

Guide ready. We can offer better technical support if you are in front of

your computer and ready to work.

Before Calling

Before contacting technical support, please review the following checklist:

• Have you referred to the on-line help?

• Have you checked this User's Guide and reviewed the on-line multimedia

tutorial?

• Have you read the README.WRI file? It contains current information on

@RISK that may not be included in the manual.

• Can you duplicate the problem consistently? Can you duplicate the problem

on a different computer or with a different model?

• Have you looked at our site on the World Wide Web? It can be found at

http://www.palisade.com. Our Web site also contains the latest FAQ (a

searchable database of tech support questions and answers) and @RISK

patches in our Technical Support section. We recommend visiting our Web

site regularly for all the latest information on @RISK and other Palisade

software.

4 Introduction

Page 17

Contacting Palisade

Palisade Corporation welcomes your questions, comments or suggestions

regarding @RISK. Contact our technical support staff using any of the

following methods:

• E-mail us at tech-support@palisade.com.

• Telephone us at (607) 277-8000 any weekday from 9:00 AM to 5:00 PM,

EST. Press 2 on a touch-tone phone to reach technical support.

• Fax us at (607) 277-8001.

• Mail us a letter at:

Technical Support

Palisade Corporation

798 Cascadilla St

Ithaca, NY 14850 USA

If you want to contact Palisade Europe:

• E-mail us at tech-support@palisade-europe.com.

• Telephone us at +44 (0)2074269950 (UK).

• Fax us at +44(0)2073751229 (UK).

• Mail us a letter at:

Palisade Europe

Technical Support

The Blue House, Unit 1

30 Calvin Street

London E1 6NW UK

If you want to contact Palisade Asia-Pacific:

• E-mail us at tech-support@palisade.com.au

• Telephone us at +61299299799 (AU).

• Fax us at +61299543882(AU).

• Mail us a letter at:

Palisade Asia-Pacific Pty Limited

Suite 101, Level 1

8 Cliff Street

Milsons Point NSW 2061

AUSTRALIA

Regardless of how you contact us, please include the product name, exact

version and serial number. The exact version can be found by by selecting

the Help About command on the @RISK menu in Excel.

Chapter 1: Getting Started 5

Page 18

Student Versions

Telephone support is not available with the student version of @RISK. If

you need help, we recommend the following alternatives:

• Consult with your professor or teaching assistant.

• Log-on to our site on the World Wide Web for answers to frequently asked

questions.

• Contact our technical support department via e-mail or fax.

@RISK System Requirements

System requirements for @RISK 4.5 for Microsoft Excel for Windows

include:

• Pentium PC or faster with a hard disk.

• Microsoft Windows 98 or higher or Windows NT 4.0 or higher.

• Microsoft Excel Version 97 or higher.

6 Introduction

Page 19

Installation Instructions

General Installation Instructions

The Setup program copies the @RISK system files into a directory you

specify on your hard disk. Setup asks you for the location of the Excel

directory on your hard disk, so please note this information before

running Setup. Setup and @RISK require Microsoft Windows to run, so

be sure to start Windows before running these programs.

To run the Setup program in Windows 98 or higher:

1) Insert the @RISK CD-ROM in your CD-ROM drive

2) Click the Start button, click Settings and then click Control Panel

3) Double-click the Add/Remove Programs icon

4) On the Install/Uninstall tab, click the Install button

5) Follow the Setup instructions on the screen

If you encounter problems while installing @RISK, verify that there is

adequate space on the drive to which you’re trying to install. After

you’ve freed up adequate space, try rerunning the installation.

Authorizing Your Copy of @RISK

Chapter 1: Getting Started 7

Within 30 days of installing @RISK you need to authorize your copy of

@RISK.

Authorization can be done over the Internet by clicking the Authorize

Now button and following the prompts on the screen. Alternatively, you

can contact Palisade or Palisade Europe during normal business hours

and authorize your copy of @RISK over the phone.

An authorized copy of @RISK is licensed for use on a single computer

only. If you wish to move your copy of @RISK to a different computer,

please contact Palisade for instructions.

Page 20

Removing @RISK from Your Computer

The DecisionTools Toolbar

Setup creates the file INSTALL.LOG in your @RISK directory. This file

lists the names and locations of all installed files. If you wish to remove

@RISK from your computer, use the Control Panel’s Add/Remove

Programs utility and select the entry for @RISK.

The DecisionTools Suite

@RISK for Excel is a member of the DecisionTools Suite, a set of products

for risk and decision analysis described in Appendix D: Using @RISK

With Other DecisionTools. The default installation procedure of @RISK

puts @RISK in a subdirectory of a main “Program Files\Palisade”

directory. This is quite similar to how Excel is often installed into a

subdirectory of a “Microsoft Office” directory.

One subdirectory of the Program Files\Palisade directory will be the

@RISK directory (by default called RISK45). This directory contains the

@RISK program files (RSKMODEL.EXE and RSKRSLTS.EXE) plus

example models and other files necessary for @RISK to run. Another

subdirectory of Program Files\Palisade is the SYSTEM directory which

contains files which are needed by every program in the DecisionTools

Suite, including common help files and program libraries.

When you launch one of the elements of the Suite (such as @RISK) from

its desktop icon, Excel will load a “DecisionTools Suite” toolbar which

contains one icon for each program of the Suite. This allows you to

launch any of the other products in the suite directly from Excel.

Note: In order for TopRank, the what-if analysis program in the

DecisionTools Suite, to work properly with @RISK, you must have

release TopRank 1.5e or higher.

8 Installation Instructions

Page 21

Setting Up the @RISK Icons or Shortcuts

Creating the Shortcut in the Windows Taskbar

In Windows, setup automatically creates an @RISK command in the

Programs menu of the Taskbar. However, if problems are encountered

during Setup, or if you wish to do this manually another time, follow the

following directions.

1) Click the Start button, and then point to Settings.

2) Click Taskbar, and then click the Start Menu Programs tab.

3) Click Add, and then click Browse.

4) Locate the file RISK.EXE and double click it.

5) Click Next, and then double-click the menu on which you want the

program to appear.

6) Type the name “@RISK”, and then click Finish.

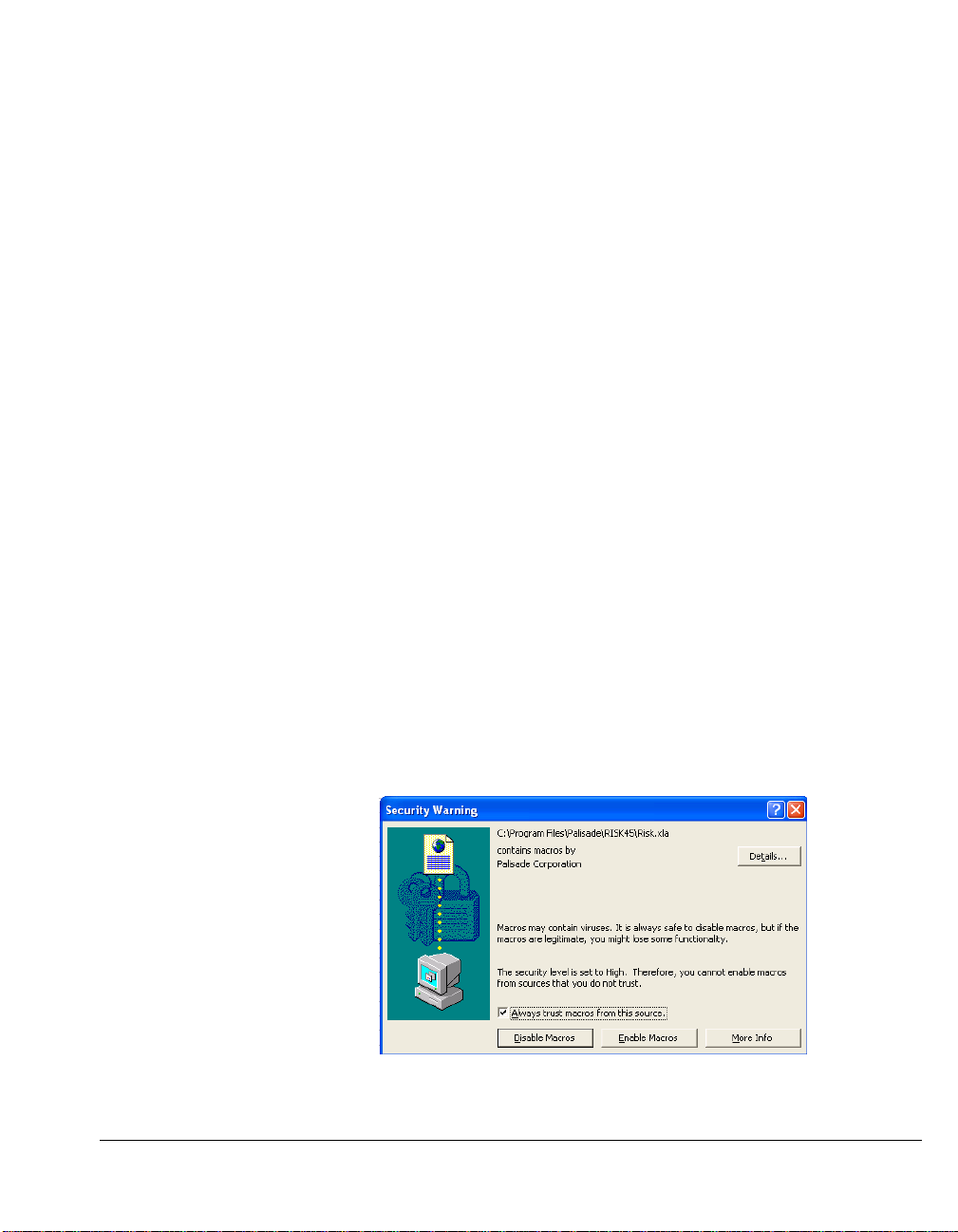

Macro Security Warning Message on Startup

Microsoft Office provides several security settings (under

Tools>Macro>Security) to keep unwanted or malicious macros from

being run in Office applications. A warning message appears each time

you attempt to load a file with macros, unless you use the lowest security

setting. To keep this message from appearing every time you run a

Palisade add-in, Palisade digitally signs their add-in files. Thus, once you

have specified Palisade Corporation as a trusted source, you can open

any Palisade add-in without warning messages. To do this:

• Click Always trust macros from this source when a Security

Warning dialog (such as the one below) is displayed when

starting @RISK.

Chapter 1: Getting Started 9

Page 22

10 Installation Instructions

Page 23

Quick Start

On-line Tutorial

In the on-line tutorial, @RISK experts guide you through sample models

in

streaming .WMV movie format. This tutorial is a multi-media

presentation on the main features of @RISK.

The system requirements for the tutorial are:

• Windows Media Player plug-in

• A computer with audio capability

The tutorial can be run by selecting the Start Menu/ Programs/ Palisade

DecisionTools/ Tutorials/ @RISK Tutorial and clicking on the file

RISK45.html.

Starting On Your Own

If you're in a hurry, or just want to explore @RISK on your own, here's a

quick way to get started.

After attaching @RISK according to the Installation instructions outlined

previously in this section:

1) Click the @RISK icon in the Windows Start Programs Palisade

DecisionTools group. If the Security Warning dialog is displayed, follow

the instructions in the section "Setting Palisade as a Trusted Source" in

this chapter.

2) Use the Excel Open command to open the example spreadsheet

FINANCE.XLS. The default location for the examples is

C:\PROGRAM FILES\PALISADE\RISK45\EXAMPLES.

3) Click the List icon on the @RISK Toolbar — the one on the Toolbar with

the red and blue arrow. The Outputs and Inputs list, listing the

distribution functions in the FINANCE worksheet along with your

output cell C10, NPV at 10%, is displayed.

4) Click the "Simulate" icon — the one with the red distribution curve.

You've just started a risk analysis on NPV for the FINANCE

worksheet. The Simulation analysis is underway. When it is complete,

your risk analysis results will be displayed.

Chapter 1: Getting Started 11

Page 24

To make graphs for Risk Analysis results:

1) When results are shown, right click on the name of an output or input in

the Explorer list and select Histogram. A graph of simulation results for

the highlighted output or input cell will be displayed.

2) To modify a graph, click the right mouse button when the cursor is

located over the graph window. Select Graph Format from the pop-up

menu.

For all analyses, if you want to see @RISK "animate" its operation during

the simulation, turn the Simulation Settings dialog box Update Display

check box on or press the <Num Lock> key during the simulation. @RISK

then will show you how it changes your spreadsheet iteration by iteration

and generates results.

Quick Start with Your Own Spreadsheets

Working through the @RISK On-Line Tutorial and reading the @RISK

Reference Guide is the best method for preparing to use @RISK on your

own spreadsheets. However, if you're in a hurry, or just don't want to

work through the Tutorial, here is a quick step-by-step guide to using

@RISK with your own spreadsheets:

1) Click the @RISK icon in the Windows Start Programs Palisade

DecisionTools group.

2) If necessary, use the Excel Open command to open your spreadsheet

3) Examine your spreadsheet and locate those cells where uncertain

assumptions or inputs are located. You will substitute @RISK

distribution functions for these values.

4) Enter distribution functions for the uncertain inputs which reflect the

range of possible values and their likelihood of occurrence. Start with

the simple distribution types — such as UNIFORM, which just requires

a minimum and maximum possible value, or TRIANG which just

requires a minimum, most likely and maximum possible value.

5) Once you've entered your distributions, select the spreadsheet cell or

cells for which you wish to get simulation results and click the "Add

Output" icon — the one with the single red arrow — on the @RISK

Toolbar.

To run a simulation:

1) Click the "Simulate" icon — the one with the red distribution curve —

on the @RISK Toolbar. A simulation of your spreadsheet will be

executed and results displayed.

12 Quick Start

Page 25

Using @RISK 4.5 Spreadsheets in @RISK 3.5 or earlier

@RISK 4.5 spreadsheets can only be used in @RISK 3.5 or earlier when the

simple forms of distribution functions are used. In the simple distribution

function format only required distribution parameters can be used. No

new @RISK 4.5 distribution property functions can be added. In addition,

RiskOutput functions must be removed and outputs reselected when

simulating in @RISK 3.5.

Using @RISK 4.5 Spreadsheets in @RISK 4.0

@RISK 4.5 spreadsheets can be used directly in @RISK 4.0 with the

following exceptions:

Alternate Parameter functions, such as RiskNormalAlt, will not

work and will return an error.

Cumulative Descending functions, such as RiskCumulD, will

not work and will return an error.

Chapter 1: Getting Started 13

Page 26

14 Quick Start

Page 27

Chapter 2: An Overview to Risk Analysis

Introduction.......................................................................................17

What Is Risk? ....................................................................................19

Characteristics of Risk...........................................................................19

The Need for Risk Analysis.................................................................20

Assessing and Quantifying Risk.........................................................21

Describing Risk with a Probability Distribution ............................22

What Is Risk Analysis? ....................................................................23

Developing an @RISK Model...........................................................25

Variables..................................................................................................25

Output Variables....................................................................................26

Analyzing a Model with Simulation.................................................27

Simulation ...............................................................................................27

How Simulation Works ........................................................................28

The Alternative to Simulation.............................................................28

Making a Decision: Interpreting the Results.................................29

Interpreting a Traditional Analysis....................................................29

Interpreting an @RISK Analysis.........................................................29

Individual Preference............................................................................30

The Distribution "Spread"....................................................................30

Skewness .................................................................................................32

What Risk Analysis Can (Cannot) Do.............................................33

Chapter 2: An Overview to Risk Analysis 15

Page 28

16 Quick Start

Page 29

Introduction

@RISK brings advanced modeling and Risk Analysis to Microsoft Excel.

You might wonder if what you do qualifies as modeling and/or would be

suitable for Risk Analysis. If you use data to solve problems, make

forecasts, develop strategies, or make decisions, then you definitely

should consider doing Risk Analysis.

Modeling is a catch-all phrase that usually means any type of activity

where you are trying to create a representation of a real life situation so

you can analyze it. Your representation, or model, can be used to examine

the situation, and hopefully help you understand what the future might

bring. If you've ever played "what-if" games with your project by

changing the values of various entries, you are well on your way to

understanding the importance of uncertainty in a modeling situation.

Okay, so you do analyses and make models — what is involved in

making these analyses and models explicitly incorporate risk? The

following discussion will try to answer this question. But don't worry,

you don't have to be an expert in statistics or decision theory to analyze

situations under risk, and you certainly don't have to be an expert to use

@RISK. We can't teach you everything in a few pages, but we'll get you

started. Once you begin using @RISK you'll automatically begin picking

up the type of expertise that can't be learned from a book.

Another purpose of this chapter is to give you an overview of how @RISK

works with your spreadsheet to perform analyses. You don't have to

know how @RISK works to use it successfully, but you might find some

explanations useful and interesting. This chapter discusses:

• What risk is and how it can be quantitatively assessed.

• The nature of Risk Analysis and the techniques used in @RISK.

• Running a simulation.

• Interpreting @RISK results.

• What Risk Analysis can and cannot do.

Chapter 2: An Overview to Risk Analysis 17

Page 30

18 Introduction

Page 31

What Is Risk?

Everyone knows that "risk" affects the gambler about to roll the dice, the

wildcatter about to drill an oil well, or the tightrope walker taking that

first big step. But these simple illustrations aside, the concept of risk

comes about due to our recognition of future uncertainty — our inability

to know what the future will bring in response to a given action today.

Risk implies that a given action has more than one possible outcome.

In this simple sense, every action is "risky", from crossing the street to

building a dam. The term is usually reserved, however, for situations

where the range of possible outcomes to a given action is in some way

significant. Common actions like crossing the street usually aren't risky

while building a dam can involve significant risk. Somewhere in

between, actions pass from being nonrisky to risky. This distinction,

although vague, is important — if you judge that a situation is risky, risk

becomes one criterion for deciding what course of action you should

pursue. At that point, some form of Risk Analysis becomes viable.

Characteristics of Risk

Risk derives from our inability to see into the future, and indicates a

degree of uncertainty that is significant enough to make us notice it. This

somewhat vague definition takes more shape by mentioning several

important characteristics of risk.

First, risk can be either objective or subjective. Flipping a coin is an

objective risk because the odds are well known. Even though the

outcome is uncertain, an objective risk can be described precisely based

on theory, experiment, or common sense. Everyone agrees with the

description of an objective risk. Describing the odds for rain next

Thursday is not so clear cut, and represents a subjective risk. Given the

same information, theory, computers, etc., weatherman A may think the

odds of rain are 30% while weatherman B may think the odds are 65%.

Neither is wrong. Describing a subjective risk is open-ended in the sense

that you could always refine your assessment with new information,

further study, or by giving weight to the opinion of others. Most risks are

subjective, and this has important implications for anyone analyzing risk

or making decisions based on a Risk Analysis.

Chapter 2: An Overview to Risk Analysis 19

Page 32

Second, deciding that something is risky requires personal judgment,

even for objective risks. For example, imagine flipping a coin where you

win $1 for a heads and lose $1 for a tails. The range between $1 and -$1

would not be overly significant to most people. If the stakes were

$100,000 and -$100,000 respectively, most people would find the situation

to be quite risky. There would be a wealthy few, however, who would

not find this range of outcomes to be significant.

Third, risky actions and therefore risk are things that we often can choose

or avoid. Individuals differ in the amount of risk they willingly accept.

For example, two individuals of equal net worth may react quite

differently to the $100,000 coin flip bet described above — one may accept

it while the other refuses it. Their personal preference for risk differs.

The Need for Risk Analysis

The first step in Risk Analysis and modeling is recognizing a need for it.

Is there significant risk involved in the situation you are interested in?

Here are a few examples that might help you evaluate your own

situations for the presence of significant risk:

• Risks for New Product Development and Marketing — Will the

R&D department solve the technical problems involved? Will a competitor

get to market first, or with a better product? Will government regulations

and approvals delay product introduction? How much impact will the

proposed advertising campaign have on sales levels? Will production costs

be as forecast? Will the proposed sales price have to be changed to reflect

unanticipated demand levels for the product?

• Risks for Securities Analysis and Asset Management — How will a

tentative purchase affect portfolio value? Will a new management team

affect market price? Will an acquired firm add earnings as forecast? How

will a market correction impact a given industry sector?

• Risks for Operations Management and Planning — Will a given

inventory level suffice for unpredictable demand levels? Will labor costs rise

significantly with upcoming union contract negotiations? How will pending

environmental legislation impact production costs? How will political and

market events affect overseas suppliers in terms of exchange rates, trade

barriers, and delivery schedules?

• Risks for Design and Construction of a Structure (building, bridge,

dam,...) — Will the cost of construction materials and labor be as forecast?

Will a labor strike affect the construction schedule? Will the levels of stress

placed on the structure by peak load crowds and nature be as forecast? Will

the structure ever be stressed to the point of failure?

20 What Is Risk?

Page 33

• Risks for Investment in Exploration for Oil and Minerals — Will

anything be found? If a deposit is found, will it be uneconomical, or a

bonanza? Will the costs of developing the deposit be as forecast? Will some

political event like an embargo, tax reform, or new environmental regulations

drastically alter the economic viability of the project?

• Risks for Policy Planning — If the policy is subject to legislative

approval, will it be approved? Will the level of compliance with any policy

directives be complete or partial? Will the costs of implementation be as

forecast? Will the level of benefits be what you projected?

Assessing and Quantifying Risk

The first step in Risk Analysis and modeling is recognizing a need for it.

Is there significant risk involved in the situation you are interested in?

Here are a few examples that might help you evaluate your own

situations for the presence of significant risk.

Realizing that you have a risky situation is only the first step. How do

you quantify the risk you have identified for a given uncertain situation?

"Quantifying risk" means determining all the possible values a risky

variable could take and determining the relative likelihood of each value.

Suppose your uncertain situation is the outcome from the flip of a coin.

You could repeat the flip a large number of times until you had

established the fact that half of the times it comes up tails and half of the

times heads. Alternatively, you could mathematically calculate this result

from a basic understanding of probability and statistics.

In most real life situations, you can't perform an "experiment" to calculate

your risk the way you can for the flip of a coin. How could you calculate

the probable learning curve associated with introducing new equipment?

You may be able to reflect on past experiences, but once you have

introduced the equipment, the uncertainty is gone. There is no

mathematical formula that you can solve to get the risk associated with

the possible outcomes. You have to estimate the risk using the best

information you have available.

If you can calculate the risks of your situation the way you would for a

coin flip, the risk is objective. This means that everyone would agree that

you quantified the risk correctly. Most risk quantification, however,

involves your best judgment.

Chapter 2: An Overview to Risk Analysis 21

Page 34

There may not be complete information available about the situation, the

situation may not be repeatable like a coin flip, or it just may be too

complex to come up with an unequivocal answer. Such risk

quantification is subjective, which means that someone might disagree

with your evaluation.

Your subjective assessments of risk are likely to change when you get

more information on the situation. If you have subjectively derived a risk

assessment, you must always ask yourself whether additional information

is available that would help you make a better assessment. If it is

available, how hard and how expensive would it be to obtain? How

much would it cause you to change the assessment you already have

made? How much would these changes affect the final results of any

model you are analyzing?

Describing Risk with a Probability Distribution

If you have quantified risk — determined outcomes and probabilities of

occurrence — you can summarize this risk using a probability

distribution. A probability distribution is a device for presenting the

quantified risk for a variable. @RISK uses probability distributions to

describe uncertain values in your Excel worksheets and to present results.

There are many forms and types of probability distributions, each of

which describes a range of possible values and their likelihood of

occurrence. Most people have heard of a normal distribution — the

traditional "bell curve". But there is a wide variety of distribution types

ranging from uniform and triangular distributions to more complex forms

such as gamma and weibull.

All distribution types use a set of arguments to specify a range of actual

values and distribution of probabilities. The normal distribution, for

example, uses a mean and standard deviation as its arguments. The mean

defines the value around which the bell curve will be centered and the

standard deviation defines the range of values around the mean. Over

thirty types of distributions are available to you in @RISK for describing

distributions for uncertain values in your Excel worksheets.

The @RISK Define Distribution window allows you to graphically

preview distributions and assign them to uncertain values. Using its

graphs, you can quickly see the range of possible values your distribution

describes.

22 What Is Risk?

Page 35

What Is Risk Analysis?

In a broad sense, Risk Analysis is any method — qualitative and/or

quantitative — for assessing the impacts of risk on decision situations.

Myriad techniques are used that blend both qualitative and quantitative

techniques. The goal of any of these methods is to help the decisionmaker choose a course of action, given a better understanding of the

possible outcomes that could occur.

Risk Analysis in @RISK is a quantitative method that seeks to determine

the outcomes of a decision situation as a probability distribution. In

general, the techniques in an @RISK Risk Analysis encompass four steps:

• Developing a Model — by defining your problem or situation in Excel

worksheet format

• Identifying Uncertainty — in variables in your Excel worksheet and

specifying their possible values with probability distributions, and

identifying the uncertain worksheet results you want analyzed

• Analyzing the Model with Simulation — to determine the range and

probabilities of all possible outcomes for the results of your worksheet

• Making a Decision — based on the results provided and personal

preferences

@RISK helps with the first three steps, by providing a powerful and

flexible tool that works with Excel to facilitate model building and Risk

Analysis. The results that @RISK generates can then be used by the

decision-maker to help choose a course of action.

Fortunately, the techniques @RISK employs in a Risk Analysis are very

intuitive. As a result, you won't have to accept our methodology on faith.

And you won't have to shrug your shoulders and resort to calling @RISK

a "black box" when your colleagues and superiors query you as to the

nature of your Risk Analysis. The discussion to follow will give you a

firm understanding of just what @RISK needs from you in the way of a

model, and how an @RISK Risk Analysis proceeds.

Chapter 2: An Overview to Risk Analysis 23

Page 36

24 What Is Risk Analysis?

Page 37

Developing an @RISK Model

You are the "expert" at understanding the problems and situations that

you would like to analyze. If you have a problem that is subject to risk,

then @RISK and Excel can help you construct a complete and logical

model.

A major strength of @RISK is that it allows you to work in a familiar and

standard model building environment — Microsoft Excel. @RISK works

with your Excel model, allowing you to conduct a Risk Analysis, but still

preserves the familiar spreadsheet capabilities. You presumably know

how to build spreadsheet models in Excel — @RISK now gives you the

ability to easily modify these models for Risk Analysis.

Variables

Variables are the basic elements in your Excel worksheets that you have

identified as being important ingredients to your analysis. If you are

modeling a financial situation, your variables might be things like Sales,

Costs, Revenues or Profits whereas if you are modeling a geologic

situation, your variables might be things like Depth to Deposit, Thickness

of Coal Seam or Porosity. Each situation has its own variables, identified

by you. In a typical worksheet, a variable labels a worksheet row or

column, for example:

Certain or Uncertain

Chapter 2: An Overview to Risk Analysis 25

You may know the values your variables will take in the time frame of

your model — they are certain, or what statisticians call "deterministic".

Conversely, you may not know the values they will take — they are

uncertain, or "stochastic". If your variables are uncertain you will need to

describe the nature of their uncertainty. This is done with probability

distributions, which give both the range of values that the variable could

take (minimum to maximum), and the likelihood of occurrence of each

value within the range. In @RISK, uncertain variables and cell values are

entered as probability distribution functions, for example:

RiskNormal(100,10)

RiskUniform(20,30)

RiskExpon(A1+A2)

RiskTriang(A3/2.01,A4,A5)

These "distribution" functions can be placed in your worksheet cells and

formulas just like any other Excel function.

Page 38

Independent or Dependent

In addition to being certain or uncertain, variables in a Risk Analysis

model can be either "independent" or "dependent". An independent

variable is totally unaffected by any other variable within your model.

For example, if you had a financial model evaluating the profitability of

an agricultural crop, you might include an uncertain variable called

Amount of Rainfall. It is reasonable to assume that other variables in your

model such as Crop Price and Fertilizer Cost would have no effect on the

amount of rain — Amount of Rainfall is an independent variable.

A dependent variable, in contrast, is determined in full or in part by one

or more other variables in your model. For example, a variable called

Crop Yield in the above model should be expected to depend on the

independent variable Amount of Rainfall. If there's too little or too much

rain, then the crop yield is low. If there's an amount of rain that is about

normal, then the crop yield would be anywhere from below average to

well above average. Maybe there are other variables that affect Crop

Yield such as Temperature, Loss to Insects, etc.

When identifying the uncertain values in your Excel worksheet, you have

to decide whether your variables are correlated. These variables would

all be “correlated” with each other. The Corrmat function in @RISK is

used to identify correlated variables. It is extremely important to correctly

recognize correlations between variables or your model might generate

nonsensical results. For example, if you ignored the relationship between

Amount of Rainfall and Crop Yield, @RISK might choose a low value for

the rainfall at the same time it picked a high value for the crop yield —

clearly something nature wouldn't allow.

Output Variables

Any model needs both input values and output results, and a Risk

Analysis model is no different. An @RISK Risk Analysis generates results

on cells in your Excel worksheet. Results are probability distributions of

the possible values which could occur. These results are usually the same

worksheet cells that give you the results of a regular Excel analysis —

Profit, the "bottom line" or other such worksheet entries.

26 Developing an @RISK Model

Page 39

Analyzing a Model with Simulation

Once you have placed uncertain values in your worksheet cells and have

identified the outputs of your analysis, you have an Excel worksheet that

@RISK can analyze.

Simulation

@RISK uses simulation, sometimes called Monte Carlo simulation, to do a

Risk Analysis. Simulation in this sense refers to a method whereby the

distribution of possible outcomes is generated by letting a computer

recalculate your worksheet over and over again, each time using different

randomly selected sets of values for the probability distributions in your

cell values and formulas. In effect, the computer is trying all valid

combinations of the values of input variables to simulate all possible

outcomes. This is just as if you ran hundreds or thousands of "what-if"

analyses on your worksheet, all in one sitting.

What is meant by saying that simulation "tries all valid combinations of

the values of input variables"? Suppose you have a model with only two

input variables. If there is no uncertainty in these variables, you can

identify a single possible value for each variable. These two single values

can be combined by your worksheet formulas to calculate the results of

interest — also a certain or deterministic value. For example, if the certain

input variables are:

Revenues = 100

Costs = 90

then the result

Profits = 10

would be calculated by Excel from

Profits = 100 - 90

There is only one combination of the input variable values, because there

is only one value possible for each variable.

Now consider a situation where there is uncertainty in both input

variables. For example,

Revenues = 100 or 120

Costs = 90 or 80

gives two values for each input variable. In a simulation, @RISK would

consider all possible combinations of these variable values to calculate

possible values for the result, Profits.

Chapter 2: An Overview to Risk Analysis 27

Page 40

There are four combinations:

Profits = Revenues - Costs

10 = 100 - 90

20 = 100 - 80

30 = 120 - 90

40 = 120 - 80

Profits also is an uncertain variable because it is calculated from uncertain

variables.

How Simulation Works

In @RISK, simulation uses two distinct operations:

• Selecting sets of values for the probability distribution functions contained in the

cells and formulas of your worksheet

• Recalculating the Excel worksheet using the new values

The selection of values from probability distributions is called sampling and each

calculation of the worksheet is called an iteration.

The following diagrams show how each iteration uses a set of single values

sampled from distribution functions to calculate single-valued results. @RISK

generates output distributions by consolidating single-valued results from all the

iterations.

The Alternative to Simulation

There are two basic approaches to quantitative Risk Analysis. Both have the

same goal — to derive a probability distribution that describes the possible

outcomes of an uncertain situation — and both generate valid results. The first

approach is the one just described for @RISK, namely, simulation. This approach

relies on the ability of the computer to do a great deal of work very quickly —

solving your worksheet repeatedly using a large number of possible

combinations of input variable values.

The second approach to Risk Analysis is an analytical approach. Analytical

methods require that the distributions for all uncertain variables in a model be

described mathematically. Then the equations for these distributions are

combined mathematically to derive another equation, which describes the

distribution of possible outcomes. This approach is not practical for most uses

and users. It is not a simple task to describe distributions as equations, and it is

even more difficult to combine distributions analytically given even moderate

complexity in your model. Furthermore, the mathematical skills necessary to

implement the analytical techniques are significant.

28 Analyzing a Model with Simulation

Page 41

Making a Decision: Interpreting the Results

@RISK analysis results are presented in the form of probability

distributions. The decision-maker must interpret these probability

distributions, and make a decision based on the interpretation. How do

you interpret a probability distribution?

Interpreting a Traditional Analysis

Let's start by looking at how a decision-maker would interpret a singlevalued result from a traditional analysis — an "expected" value. Most

decision-makers compare the expected result to some standard or

minimum acceptable value. If it's at least as good as the standard, they

find the result acceptable. But, most decision-makers recognize that the

expected result doesn't show the impacts of uncertainty. They have to

somehow manipulate the expected result to make some allowance for

risk. They might arbitrarily raise the minimum acceptable result, or they

might non rigorously weigh the chances that the actual result could

exceed or fall short of the expected result. At best, the analysis might be

extended to include several other results — such as "worst case" and "best

case" — in addition to the expected value. The decision-maker then

decides if the expected and "best case" values are good enough to

outweigh the "worst case" value.

Interpreting an @RISK Analysis

In an @RISK Risk Analysis, the output probability distributions give the

decision-maker a complete picture of all the possible outcomes. This is a

tremendous elaboration on the "worst-expected-best" case approach

mentioned above. But the probability distribution does a lot more than

just fill in the gaps between these three values:

• Determines a "Correct" Range — Because you have more rigorously

defined the uncertainty associated with every input variable, the possible

range of outcomes may be quite different from a "worst case-best case" range

— different, and more correct.

• Shows Probability of Occurrence — A probability distribution shows

the relative likelihood of occurrence for each possible outcome.

As a result, you no longer just compare desirable outcomes with undesirable

outcomes. Instead, you can recognize that some outcomes are more likely to

occur than others, and should be given more weight in your evaluation. This

process also is a lot easier to understand than the traditional analysis because

a probability distribution is a graph — you can see the probabilities and get a

feel for the risks involved.

Chapter 2: An Overview to Risk Analysis 29

Page 42

Individual Preference

The results provided by an @RISK analysis must be interpreted by you as

an individual. The same results given to different individuals may be

interpreted differently, and lead to different courses of action. This is not

a weakness in the technique, but a direct result of the fact that different

individuals have different preferences with regard to possible choices,

time, and risk. You might feel that the shape of the output distribution

shows that the chances of an undesirable outcome far outweigh the

chances of a desirable outcome. A colleague who is less risk averse might

come to the opposite conclusion.

The Distribution "Spread"

Range and likelihood of occurrence are directly related to the level of risk

associated with a particular event. By looking at the spread and

likelihood of possible results, you can make an informed decision based

on the level of risk you are willing to take. Risk averse decision-makers

prefer a small spread in possible results, with most of the probability

associated with desirable results. But if you are a risk-taker, then you will

accept a greater spread or possible variation in your outcome distribution.

Furthermore, a risk-taker will be influenced by "bonanza" outcomes even

if their likelihood of occurrence is small.

Regardless of your personal risk preferences, there are some general

conclusions about riskiness that apply to all decision-makers. The

following probability distributions illustrate these conclusions:

Probability distribution A represents greater risk than B despite identical shapes

because the range of A includes less desirable results — the spread relative to the

mean is greater in A than B.

A

-10 0 10

30 Making a Decision: Interpreting the Results

B

90 100 110

Page 43

Probability distribution C represents greater risk than D because the probability

of occurrence is uniform across the range for C whereas it is concentrated around

98 for D.

C

90 100 110

D

90 100 110

Probability distribution F represents greater risk than E because the range is

larger and the probability of occurrence is more spread out than for E.

E

F

90 100 110

90 100 110

Chapter 2: An Overview to Risk Analysis 31

Page 44

Skewness

A simulation output distribution also can show skewness — how much

the distribution of possible results deviates from being symmetrical.

Suppose your distribution had a large positive 'tail'. If you saw only a

single number for the expected result, you might not realize the

possibility of a highly positive outcome that could occur in the tail.

Skewness such as this can be very important to decision makers. By

presenting all the information, @RISK "opens up" a decision by showing

you all possible outcomes.

32 Making a Decision: Interpreting the Results

Page 45

What Risk Analysis Can (Cannot) Do

Quantitative analysis techniques have gained a great deal of popularity

with decision-makers and analysts in recent years. Unfortunately, many

people have mistakenly assumed that these techniques are magic "black

boxes" that unequivocally arrive at the correct answer or decision. No

technique, including those used by @RISK, can make that claim. These

techniques are tools that can be used to help make decisions and arrive at

solutions. Like any tools, they can be used to good advantage by skilled

practitioners, or they can be used to create havoc in the hands of the

unskilled. In the context of Risk Analysis, quantitative tools should never

be used as a replacement for personal judgment.

Finally, you should recognize that Risk Analysis cannot guarantee that the

action you choose to follow — even if skillfully chosen to suit your

personal preferences — is the best action viewed from the perspective of

hindsight. Hindsight implies perfect information, which you never have

at the time the decision is made. You can be guaranteed, however, that

you have chosen the best personal strategy given the information that is

available to you. That's not a bad guarantee!

Chapter 2: An Overview to Risk Analysis 33

Page 46

34 What Risk Analysis Can (Cannot) Do

Page 47

Chapter 3: Upgrade Guide

Introduction.......................................................................................37

Key Features............................................................................................37

New @RISK Model Window.............................................................39

Defining Probability Distributions in your Spreadsheet...............40

Review Distributions in the @RISK Model Window .....................41

Using Data to Define Probability Distributions..............................42

New @RISK Add-in Features...........................................................43

New Menus, Icons and Commands....................................................43

New and Enhanced @RISK Functions in Excel................................43

New @RISK Results Window ..........................................................45

New Results Window Options............................................................45

Other Enhancements .............................................................................47

New Features in @RISK 4.5 vs @RISK 4.0.....................................49

Advanced Analyses................................................................................50

Alternate Parameters for Probability Distributions........................52

Cumulative Descending Percentiles...................................................53

Quick Reports.........................................................................................54

Enhanced Define Distribution Window............................................55

Improved Error Reporting....................................................................56

Chapter 3: Upgrade Guide 35

Page 48

36 What Risk Analysis Can (Cannot) Do

Page 49

Introduction

@RISK 4.5 and its predecessor, @RISK 4.0, are major upgrades to earlier

versions of @RISK. @RISK 4.5 brings together features of its companion

programs BestFit and RISKview to provide a fully functional risk analysis

environment, while maintaining compatibility with earlier versions of

@RISK. It also offers enhanced integration with Microsoft Excel to give

easier access to simulation results directly in your spreadsheet. @RISK 4.5

is available in three versions – Standard, Professional and Industrial – to

allow you to select the feature set you need.

Key Features

Key features of @RISK 4.5 include:

•

Fully integrated RISKview (for distribution viewing) in all the

•

Fully integrated BestFit (for distribution fitting) in the Professional

•

Fully integrated RISKOptimizer (for Simulation Optimization) in the

Note: RISKview, BestFit and RISKOptimizer are also available as standalone programs.

versions.

and Industrial versions.

Industrial version.

• New toolbars, graphs and “Explorer” interface

•

Improved integration with Excel with new functions and new

reporting in Excel

Improved performance with faster loading and simulation

•

•

Full compatibility with existing @RISK models and functions

Key enhancements of @RISK 4.5 vs. @RISK 4.0 include:

•

Three new analyses – Goal Seek, Stress Analysis and Advanced

Sensitivity Analysis – for advanced investigations on @RISK models

(Professional and Industrial versions only)

•

Alternate parameters (such as percentiles) can be used for defining

many distribution types, and the distribution functions in Excel have

been added that support alternate parameters

•

Quick reports, designed for printing, for quick, single page reports on

simulation results

•

Integrated support for multiple CPUs in a single PC for high-speed

simulations through parallel processing (Industrial version only)

Chapter 3: Upgrade Guide 37

Page 50

• Enhanced Define Distribution window, including pop-up

distribution pallette, intelligent default parameters, easy entry of

Excel cell references and more

•

Other enhancements, including improved filtering, report formatting

and more

Note: The information provided in this chapter is designed for users

familiar with earlier versions of @RISK. New users should skip this

chapter and continue with Chapter 4: Getting to Know @RISK to gain a

full understanding of the operation and features of @RISK 4.5.

Three Main Components of @RISK 4.5

@RISK 4.5 is comprised of three main components:

1)

@RISK Model window for listing inputs and outputs, viewing input

distributions, fitting distributions, and defining correlations. @RISK

Model also allows the pop-up graphical definition of distributions for

components of cell formulas.

2)

@RISK add-in to Excel, including new menus and icons, new

distribution functions, new statistics functions, new output functions,

and new simulation reports in Excel.

3)

@RISK Results window for interactive graphs of simulation results,

statistics, data, sensitivity and scenario reports.

Each of the three components share a common user interface including an

“Explorer-style” listing of simulation inputs and outputs and

customizable toolbars and icons.

38 Introduction

Page 51

New @RISK Model Window

A new @RISK Model Window provides an entire set of options for

assigning and viewing probability distributions used in your spreadsheet

model, correlating them, and fitting distributions to data. This window

allows you to handle all the tasks necessary for setting up your @RISK

model prior to simulating it.

Chapter 3: Upgrade Guide 39

Page 52

Pop-Up Window for Assigning Distributions

Defining Probability Distributions in your Spreadsheet

With @RISK 4.5 you can easily assign probability distributions to

uncertain values in your spreadsheet model using a “pop-up” window.

This capability will be familiar to users of Palisade’s RISKview program.

Using this pop-up, you can:

•

Preview and assign probabilities to values in Excel cells and

formulas. This allows the quick, graphical assignment of

distributions to any number or entry in an Excel cell formula, plus

editing of previously entered distribution functions.

•

Automatically enter distribution functions to formulas. All edits

made via RISKview pop-up are added directly to the cell formula in

Excel.

•

Fit probability distributions to data in Excel and use the results of

the fit as a probability distribution in a formula.

•

The pop-up window also allows you to edit multiple distributions

in a single cell.

40 New @RISK Model Window

Page 53

Graphical Assessment of Probabilities

Correlation Matrix and Distribution Graphs in the Model Window

With @RISK 4.5’s pop-up Define Distribution window, you can

interactively switch between available probability distributions and

preview the probabilities they describe. While previewing distributions,

you can:

•

Interactively set and compare probabilities using sliding delimiters.

•

Overlay multiple distributions to make comparisons.

•

Change graph type and scaling using toolbars and the mouse.

Review Distributions in the @RISK Model Window

The @RISK Model window provides a complete “Explorer-style” list of all

input probability distributions and simulation outputs described in your

model. This replaces the Outputs and Inputs list found in @RISK version

3.5 and earlier. From this list, you can:

•

Edit any input distribution or output by simply clicking on output

or input in Explorer.

Quickly graph and display all defined inputs.

•

•

Edit and preview correlation matrices.

Chapter 3: Upgrade Guide 41

Page 54

Using Data to Define Probability Distributions

The @RISK Model window fully integrates a new and enhanced version

of Palisade’s BestFit program to allow you to fit probability distributions

to your data (Professional and Industrial versions only). The distributions

which result from a fit are then automatically added to the input

distribution list in the @RISK Model window and added to your

spreadsheet model.

The distribution fitting features of the @RISK Model window include:

Distribution Fitting in @RISK Model Window

42 New @RISK Model Window

•

The fitting of sample data (continuous or discrete) and data from a

density or cumulative curve.

Convenient result display that shows all relevant information about

•

a single fit.

Ranking of fits based on Chi-Squared, Kolmogorov-Smirnov, or

•

Anderson-Darling statistics.