Page 1

Financial Calculation (TVM)

Software for the

ALGEBRA FX2.0

1. Before Performing Financial Calculations

2. Simple Interest

3. Compound Interest

4. Cash Flow (Investment Appraisal)

5. Amortization

6. Interest Rate Conversion

7. Cost, Selling Price, Margin

8. Day/Date Calculations

9. Depreciation

10. Bonds

11. TVM Graph

Page 2

2

1. Before Performing Financial Calculations

kk

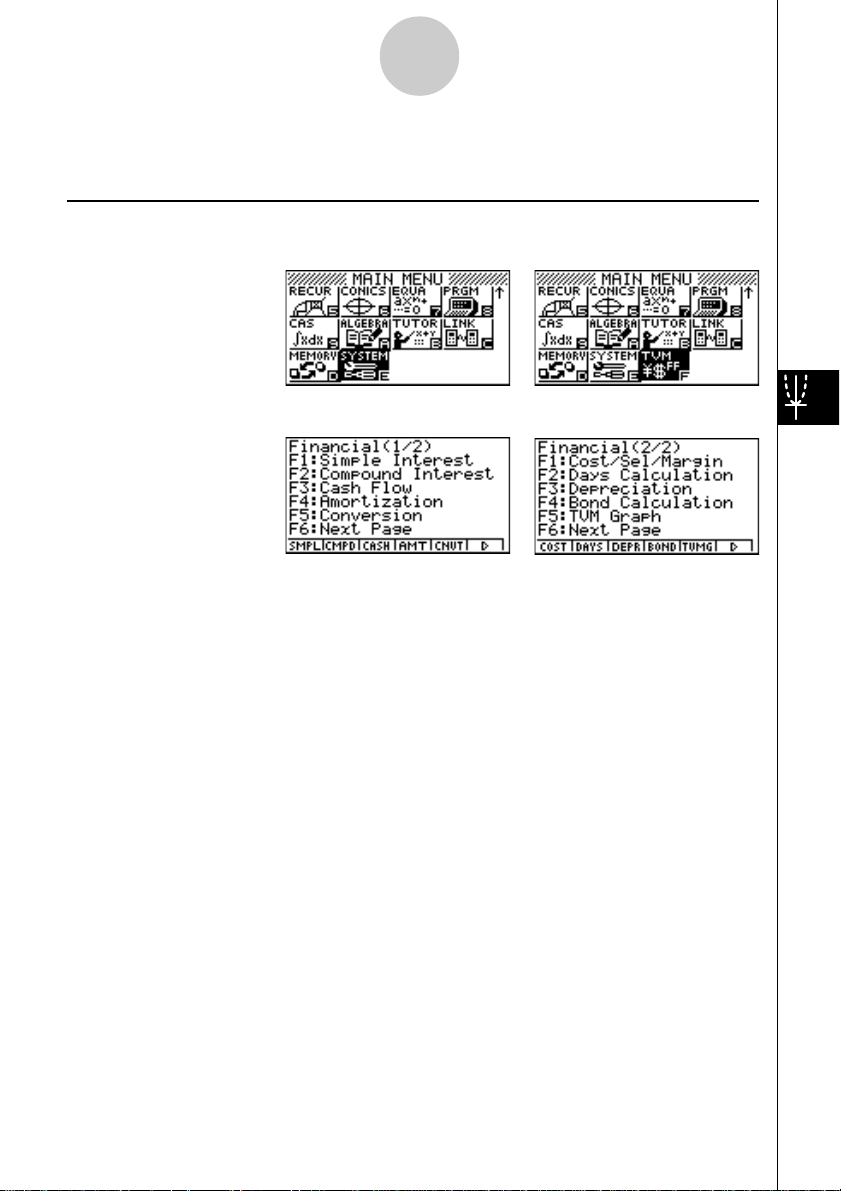

k TVM Mode

kk

Installing the Financial Application on your ALGEBRA FX2.0 adds a TVM icon to the Main

Menu.

Entering the TVM Mode displays the Financial screen like the one shown below.

Financial 1 screen Financial 2 screen

• 1(SMPL)....Simple interest

• 2(CMPD) ... Compound interest

• 3(CASH)....Cash flow (investment appraisal)

• 4(AMT) ...... Amortization

• 5(CNVT)....Interest rate conversion

• 6(g)1(COST) ... Cost, selling price, margin

2(DAYS) ... Day/date calculations

3(DEPR) ... Depreciation

4(BOND) ... Bonds

5(TVMG) ... TVM (compound interest simulation) graph

Page 3

3

kk

k SET UP Items

kk

uu

u Payment

uu

•{BGN}/{END} ........ Specifies {beginning of the period} / {end of the period} payment

uu

u Date Mode

uu

•{365}/{360} ......... Specifies calculation according to a {365-day} / {360-day} year

uu

u Periods/YR. (Bond)

uu

•{Annual}/{SEMI} ... Indicates an {annual} / {semi-annual} period

Note the following points regarding SET UP screen settings whenever using the Financial Mode.

• Drawing a financial graph while the Label item is turned on, displays the label CASH for the

vertical axis (deposits, withdrawals), and TIME for the horizontal axis (frequency). Axis labels do not appear on the TVM graph.

• The number of display digits applied in the Financial Mode is different from the number of

digits used in other modes. The calculators automatically reverts to Norm 1 whenever you

enter the Financial Mode, which cancels a Sci (number of significant digits) or Eng (engineering notation) setting made in another mode.

kk

k Graphing in the TVM Mode

kk

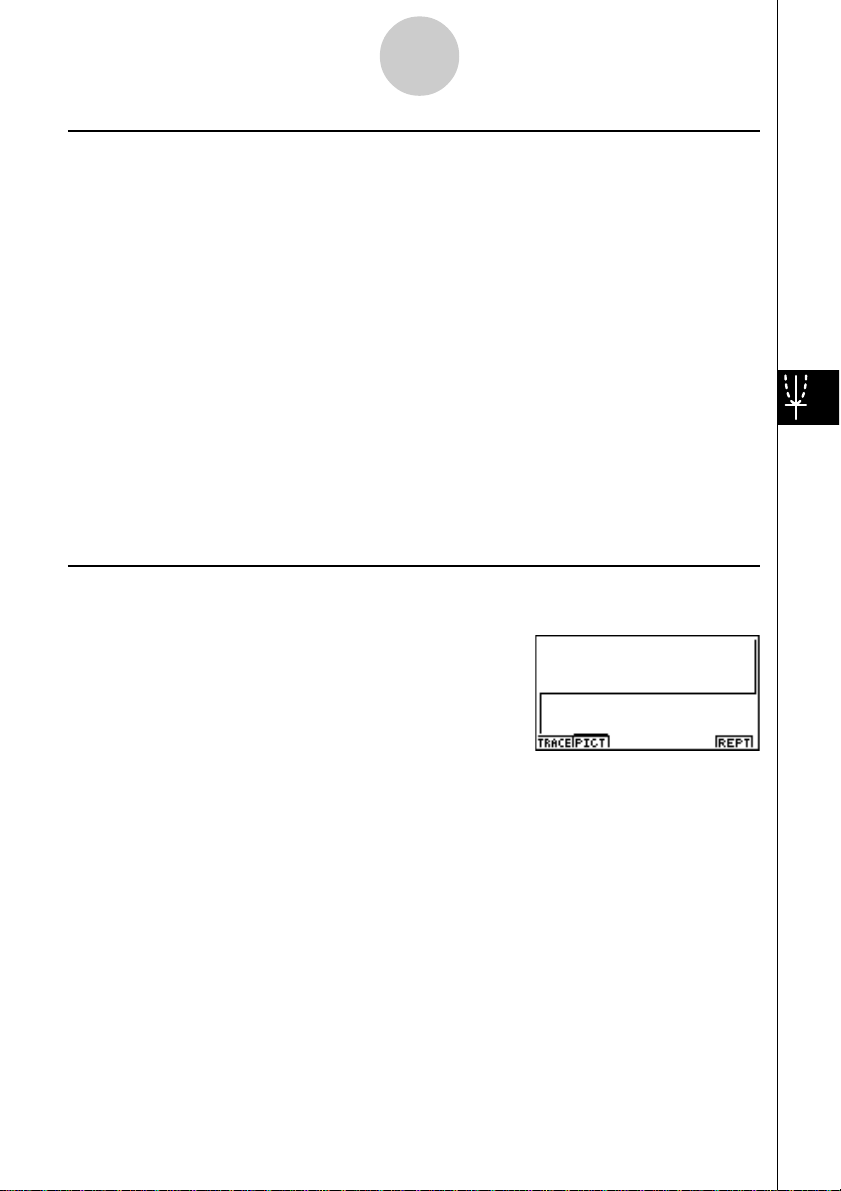

After performing a financial calculation, you can use 6 (GRPH) to graph the results as shown

below.

• Pressing 1 (TRACE) while a graph is on the display activates T race, which can be used to

look up other financial values. In the case of simple interest, for example, pressing e

displays PV, SI, and SFV. Pressing d displays the same values in reverse sequence.

• Zoom, Scroll, and Sketch cannot be used in the Financial Mode.

• Whether you should use a positive or a negative value for the present value (PV) or the

purchase price (PRC) depends on the type of calculation you are trying to perform.

• Note that graphs should be used only for reference purposes when viewing TVM Mode

calculation results.

• Note that calculation results produced in this mode should be regarded as reference values

only.

• Whenever performing an actual financial transaction, be sure to check any calculation results obtained using this calculator with against the figures calculated by your financial institution.

Page 4

4

2. Simple Interest

This calculator uses the following formulas to calculate simple interest.

uu

uFormula

uu

365-day Mode

360-day Mode

SI' =

SI' =

n

365

n

360

× PV × i

× PV × i

i =

i =

I%

100

I%

100

SI : interest

n : number of interest

periods

PV : principal

I% : annual interest

SFV : principal plus interest

SI = –SI'

SFV = –(PV + SI')

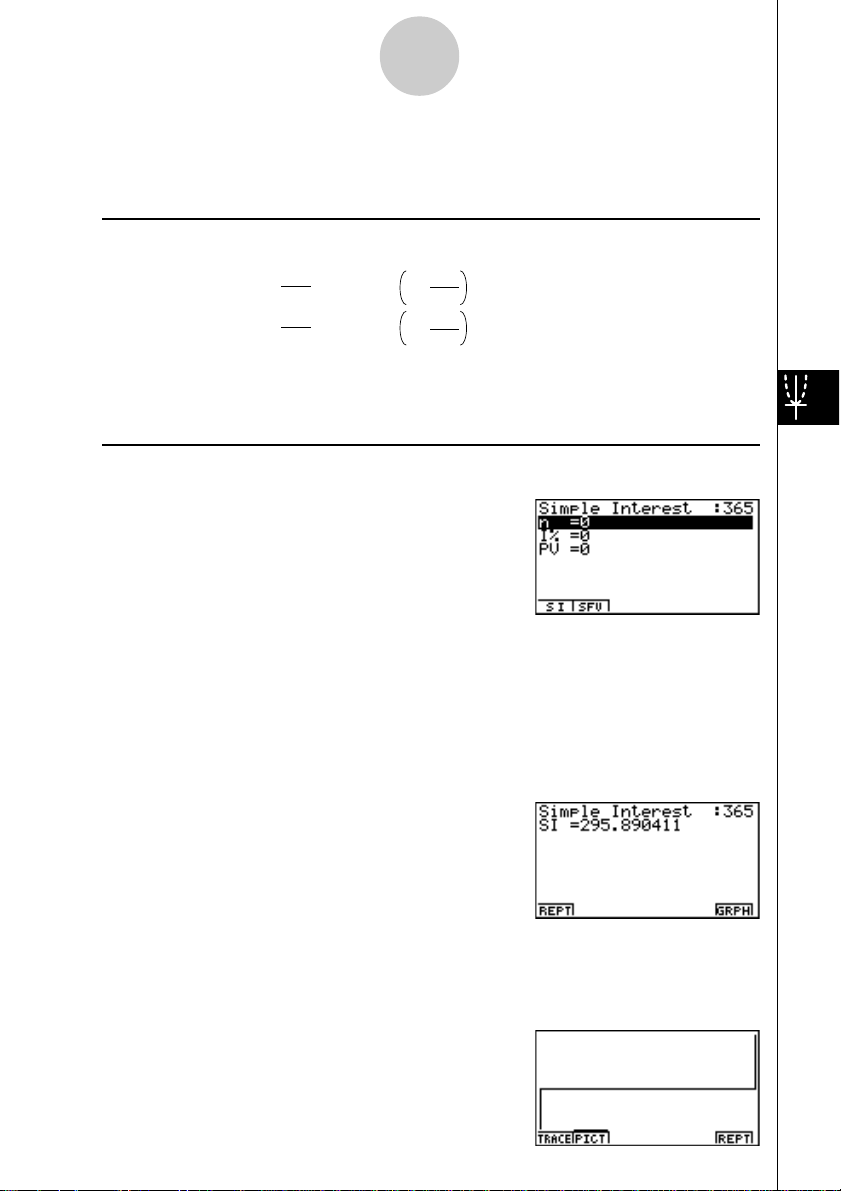

Press 1(SMPL) from the Financial 1 screen to display the following input screen for simple

interest.

• 1(SMPL)

n .................................. number of interest periods (days)

I% ............................... annual interest rate

PV ............................... principal

After configuring the parameters, press one of the function keys noted below to perform the

corresponding calculation.

• 1(SI)....... Simple interest

• 2(SFV)... Simple future value

•An error (Ma ERROR) occurs if parameters are not configured correctly.

Use the following function keys to maneuver between calculation result screens.

• 1(REPT) ...Parameter input screen

• 6(GRPH)... Draws graph

Page 5

5

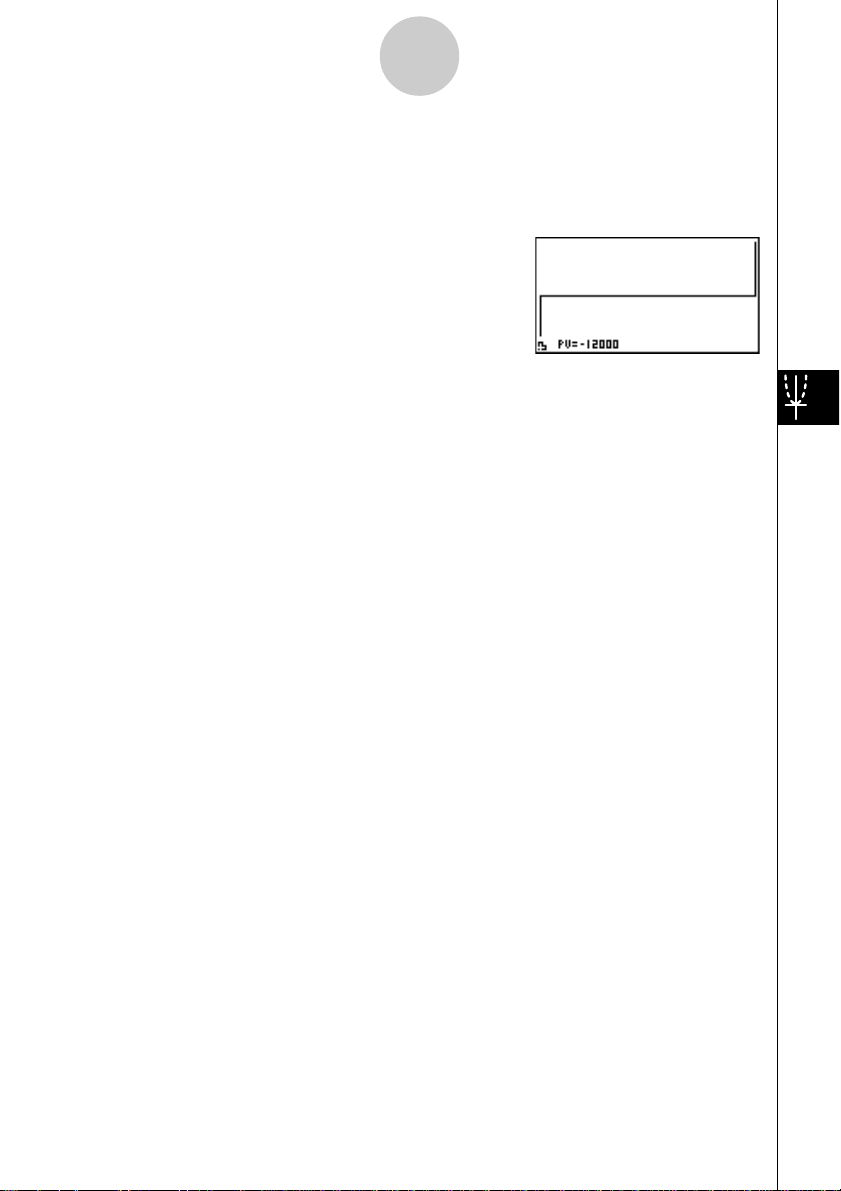

After drawing a graph, you can press 1 (TRACE) to turn on trace and read calculation results

along the graph.

Each press of e while trace is turned on cycles the displayed value in the sequence: present

value (PV) -> simple interest (SI) -> simple future value (SFV). Pressing d cycles in the

reverse direction.

Press i to turn off trace.

Press i again to return to the parameter input screen.

Page 6

6

β

β

)

3. Compound Interest

This calculator uses the following standard formulas to calculate compound interest.

uu

uFormula I

uu

PV+PMT u + FV

Here:

(1+ i u S)[(1+ i)n–1] 1

n

i(1+ i)

(1+ i)

= 0

n

i =

I%

100

PV= –(PMT

PMT

V= –

PMT= –

log

n =

(1+ i u S)[(1+ i)n–1]

α

=

=

β

(1+ i)

F(i) = Formula I

F(i)= –

+S [1–(1+ i)

α

u

+ FV

u )

u

+ PV

α

PV + FV

β

u

α

(1+ i S ) PMT–FVi

{ }

(1+ i S ) PMT+PVi

log(1+ i)

n

i(1+ i

1

n

PMT

(1+ i S)[1– (1+ i)

[

–n

] – FV • n(1+ i)

]

ii

PV : present value

FV : future value

PMT : payment

n : number of compound periods

I

%

: annual interest rate

i is calculated using Newton’s Method.

S = 0 assumed for end of term

S = 1 assumed for beginning of term

–n

]

+ (1+ i S)[n(1+ i)

–n–1

–n–1

]

uu

uFormula II (I% = 0)

uu

PV + PMT × n + FV = 0

Here:

PV = – (PMT u n + FV )

FV = – (PMT u n + PV )

Page 7

7

PMT = –

n = –

• A deposit is indicated by a plus sign (+), while a withdrawal is indicated by a minus sign (–).

uu

uConverting between the nominal interest rate and effective interest rate

uu

The nominal interest rate (I% value input by user) is converted to an effective interest rate (I%')

when the number of installments per year (P/Y) is different from the number of compound

interest calculation periods (C/Y). This conversion is required for installment savings accounts,

loan repayments, etc.

When calculating n, PV, PMT, FV

The following calculation is performed after conversion from the nominal interest rate to the

effective interest rate, and the result is used for all subsequent calculations.

i = I%'÷100

When calculating I%

After I% is obtained, the following calculation is performed to convert to I%'.

I%' =

PV + FV

n

PV + FV

PMT

[C / Y ]

I%' =

(1+ ) –1

{ }

I%

(1+ ) –1

{ }

100

I%

100 × [C / Y ]

[P / Y ]

[C / Y ]

[P / Y ]

×[C / Y ]×100

×100

P/Y: installment

periods per year

C/Y: compounding

periods per year

P/Y: installment

periods per year

C/Y: compounding

periods per year

The value of I%' is returned as the result of the I% calculation.

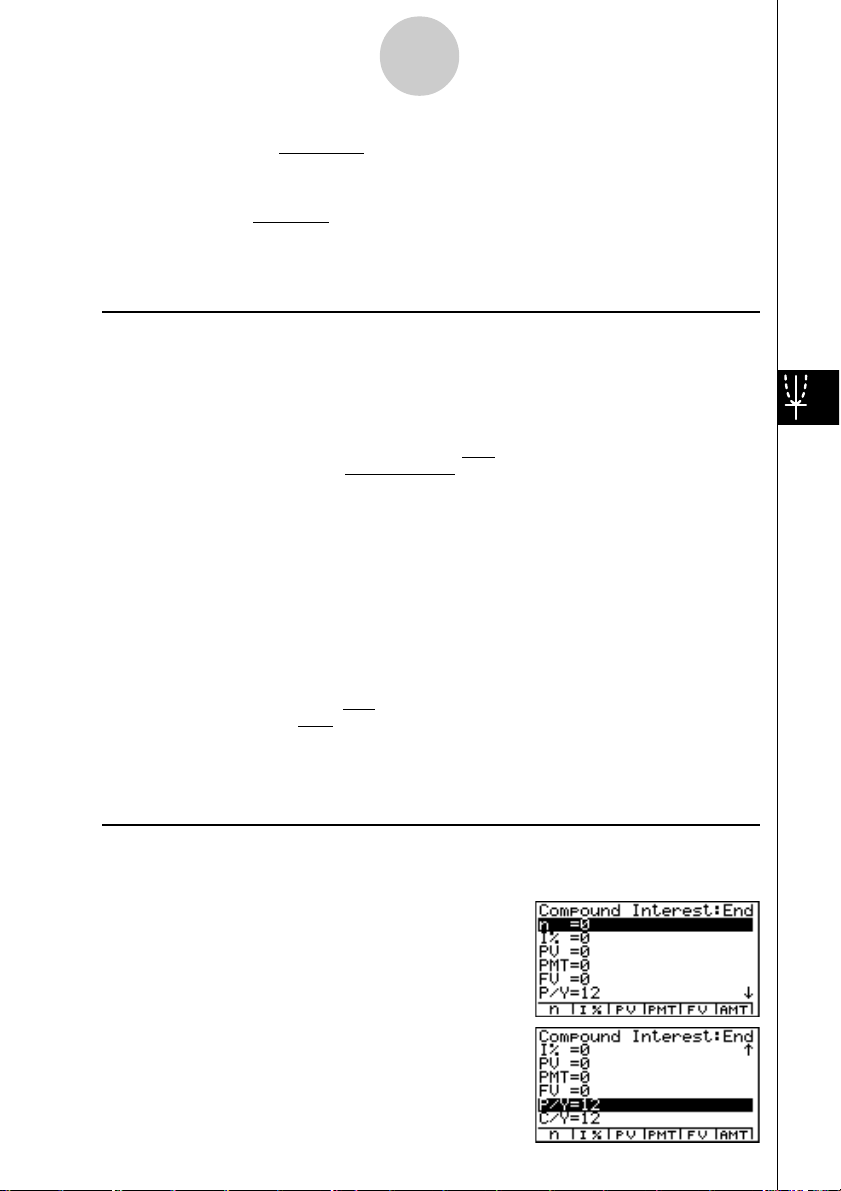

Press 2(CMPD) from the Financial 1 screen to display the following input screen for compound interest.

• 2(CMPD)

Page 8

8

n .................................. number of compound periods

I% ............................... annual interest rate

PV ............................... present value (loan amount in case of loan; principal in case

of savings)

PMT ............................ payment for each installment (payment in case of loan; de-

posit in case of savings)

FV ............................... future value (unpaid balance in case of loan; principal plus

interest in case of savings)

P/Y .............................. installment periods per year

C/Y .............................. compounding periods per year

Inputting Values

A period (n) is expressed as a positive value. Either the present value (PV) or future value

(FV) is positive, while the other (PV or FV) is negative.

Precision

This calculator performs interest calculations using Newton’s Method, which produces approximate values whose precision can be affected by various calculation conditions. Because

of this, interest calculation results produced by this calculator should be used keeping the

above limitation in mind or the results should be verified.

After configuring the parameters, press one of the function keys noted below to perform the

corresponding calculation.

• 1(n) ............ Number of compound periods

• 2(I%) ......... Annual interest rate

• 3(PV) ......... Prevent value

• 4(PMT) ...... Payment

• 5(FV) ......... Future value

• 6(AMT) ...... Amortization screen

(Loan: loan amount; Savings: balance)

(Loan: installment; Savings: deposit)

(Loan: unpaid balance; Savings: principal plus interest)

Page 9

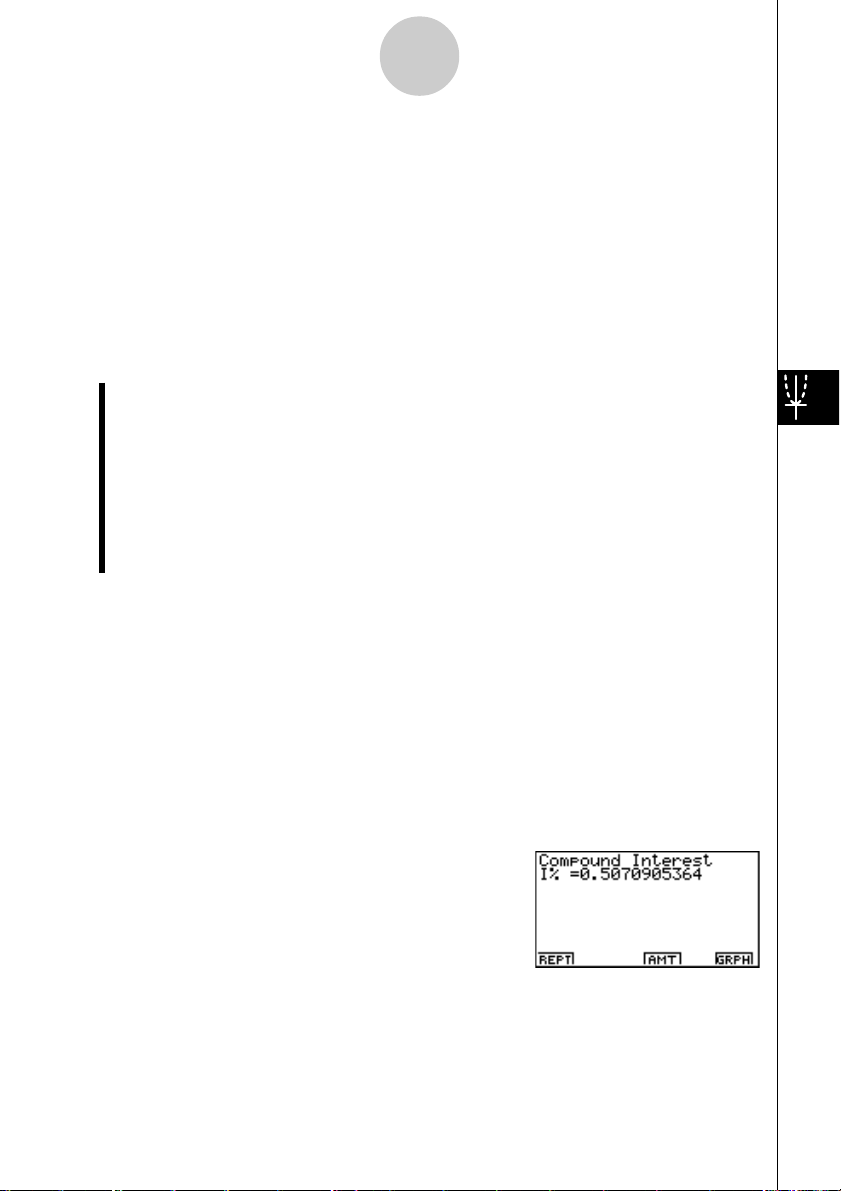

9

•An error (Ma ERROR) occurs if parameters are not configured correctly.

Use the following function keys to maneuver between calculation result screens.

• 1(REPT) .... Parameter input screen

• 4(AMT) ...... Amortization screen

• 6(GRPH).... Draws graph

After drawing a graph, you can press 1(TRACE) to turn on trace and read calculation

results along the graph.

Press i to turn off trace.

Press i again to return to the parameter input screen.

Page 10

10

CF

0

CF

1

CF

2

CF

3

CF

4

CF

5

CF

6

CF

7

4. Cash Flow (Investment Appraisal)

This calculator uses the discounted cash flow (DCF) method to perform investment appraisal

by totalling cash flow for a fixed period. This calculator can perform the following four types of

investment appraisal.

• Net present value (NPV)

• Net future value (NFV)

• Internal rate of return (IRR)

• Pay back period (PBP)

A cash flow diagram like the one shown below helps to visualize the movement of funds.

With this graph, the initial investment amount is represented by CF0. The cash flow one year

later is shown by CF1, two years later by CF2, and so on.

Investment appraisal can be used to clearly determine whether an investment is realizing profits that were originally targeted.

uNPV

1

NPV = CF0 + + + + … +

CF

(1+ i)

CF2

(1+ i)

2

CF3

(1+ i)

3

CFn

(1+ i)

n

i =

I%

100

n: natural number up to 254

uNFV

NFV = NPV × (1 + i )

n

uIRR

1

CF

2

CF

(1+ i)

3

3

CF

(1+ i)

(1+ i)

2

0 = CF0 + + + + … +

In this formula, NPV = 0, and the value of IRR is equivalent to i × 100. It should be noted,

however, that minute fractional values tend to accumulate during the subsequent calculations

performed automatically by the calculator, so NPV never actually reaches exactly zero. IRR

becomes more accurate the closer that NPV approaches to zero.

CF

(1+ i)

n

n

Page 11

11

uu

uPBP

uu

Initial value of N when NPV > 0.

• Press 3 (CASH) from the Financial 1 screen to display the following input screen for Cash

Flow.

• 3(CASH)

I% ............................... interest rate (%)

Csh.............................. list for cash flow

If you have not yet input data into a list, press 5('LIST) and input data into a list.

After configuring the parameters, press one of the function keys noted below to perform the

corresponding calculation.

• 1(NPV) ........ Net present value

• 2(IRR) ......... Internal rate of return

• 3(PBP) ........ Pay back period

• 4(NFV) ........ Net future value

• 5('LIST) .... Inputs data from a list

• 6(LIST) ....... Specifies a list for data input

•An error (Ma ERROR) occurs if parameters are not configured correctly.

Use the following function keys to maneuver between calculation result screens.

• 1(REPT) .... Parameter input screen

• 6(GRPH) .... Draws graph

Page 12

12

After drawing a graph, you can press 1 (TRACE) to turn on trace and read calculation results

along the graph.

Press i to turn off trace.

Press i again to return to the parameter input screen.

Page 13

13

;;;;;;;;;;;

;;;;;;;;;

;;;;;;;

;;;;;

;;;

;

;

;

;

;

;

;

;

;;;;;

;;;;;

;;;

;

5. Amortization

This calculator can be used to calculate the principal and interest portion of a monthly installment,

the remaining principal, and amount of principal and interest repaid up to any point.

uu

uFormula

uu

Amount of single payment

;;;

e

;;;

;;;

;;;

;;;

;;;

;;;

;;;

d

12 mn

a: interest portion of installment PM1 (INT)

b: principal portion of installment PM1 (PRN)

c: balance of principal after installment PM2 (BAL)

d: total principal from installment PM1 to payment of installment PM2 (ΣPRN)

e: total interest from installment PM1 to payment of installment PM2 (ΣINT)

*a + b = one repayment (PMT)

a

b

(Number of payments)

c

a : INT

b : PRN

c : BAL

d : Σ PRN = PRN

PM1

e : Σ INT = INT

PM1

BAL0 = PV (INT1 = 0 and PRN1 = PMT at beginning of installment term)

uu

uConverting between the nominal interest rate and effective interest rate

uu

The nominal interest rate (I% value input by user) is converted to an effective interest rate (I%')

for installment loans where the number of installments per year is different from the number of

compound interest calculation periods.

I%' =

PM1

= I BAL

PM1

PM2

PM2

PM2

(1+ ) –1

{ }

PM1–1

× i I × (PMT sign)

= PMT + BAL

= BAL

PM2–1

+ PRN

PM1

+ PRN

PM1

+ INT

I%

100 × [C / Y ]

PM1–1

× i

PM2

PM1+1

PM1+1

+ … + INT

[C / Y ]

[P / Y ]

+ … + PRN

PM2

×100

PM2

Page 14

14

The following calculation is performed after conversion from the nominal interest rate to the

effective interest rate, and the result is used for all subsequent calculations.

i = I%'÷100

Press 4(AMT) from the Financial 1 screen to display the following input screen for interest

rate conversion.

• 4(AMT)

PM1............................. first installment of installments 1 through n

PM2............................. second installment of installments 1 through n

.................................. installments

n

I% ............................... interest rate

PV ............................... principal

PMT ............................ payment for each installment

FV ............................... balance following final installment

P/Y .............................. installments per year

C/Y .............................. compoundings per year

After configuring the parameters, press one of the function keys noted below to perform the

corresponding calculation.

• 1(BAL) ........ Balance of principal after installment PM2

• 2(INT) ......... Interest portion of installment PM1

• 3(PRN) ....... Principal portion of installment PM1

• 4(Σ INT) ...... Total interest paid from installment PM1 to installment PM2

• 5(Σ PRN) .... Total principal paid from installment PM1 to installment PM2

• 6(CMPD) .... Compound interest screen

Page 15

15

•An error (Ma ERROR) occurs if parameters are not configured correctly.

Use the following function keys to maneuver between calculation result screens.

• 1(REPT) ..... Parameter input screen

• 4(CMPD) .... Compound interest screen

• 6(GRPH) ..... Draws graph

After drawing a graph, you can press 1 (TRACE) to turn on trace and read calculation results

along the graph.

The first press of 1 (TRACE) displays INT and PRN when n = 1. Each press of e shows

INT and PRN when n = 2, n = 3, and so on.

Press i to turn off trace.

Press i again to return to the parameter input screen.

Page 16

16

6. Interest Rate Conversion

The procedures in this section described how to convert between the annual percentage rate

and effective interest rate.

uu

uFormula

uu

APR/100

EFF =

APR =

Press 5(CNVT) in the Financial 1 screen to display the following input screen for interest rate

conversion.

• 5(CNVT)

1+

1+

EFF

100

n

–1 × 100

n

1

n

–1 × n ×100

APR : annual percentage rate (%)

EFF : effective interest rate (%)

n : number of compoundings

n....................................... number of compoundings

I% ............................... interest rate

After configuring the parameters, press one of the function keys noted below to perform the

corresponding calculation.

• 1('EFF) ... Converts annual percent rate to effective interest rate

• 2('APR) ... Converts effective interest rate to annual percent rate

•An error (Ma ERROR) occurs if parameters are not configured correctly.

Use the following function key to maneuver between calculation result screens.

• 1(REPT) ... Parameter input screen

Page 17

17

7. Cost, Selling Price, Margin

Cost, selling price, or margin can be calculated by inputting the other two values.

uu

uFormula

uu

CST

MRG

100

1–

1–

MRG

100

CST

SEL

CST : cost

SEL : selling price

MRG : margin

×100

CST = SEL

SEL =

1–

MRG(%) =

Press 1(COST) from the Financial 2 screen to display the following input screen.

• 6(g)1(COST)

Cst............................... cost

Sel............................... selling price

Mrg .............................. margin

After configuring the parameters, press one of the function keys noted below to perform the

corresponding calculation.

• 1(COST) ...Cost

• 2(SEL) ......Selling price

• 3(MRG) .....Margin

•An error (Ma ERROR) occurs if parameters are not configured correctly.

Use the following function key to maneuver between calculation result screens.

• 1(REPT) ... Parameter input screen

Page 18

18

8. Day/Date Calculations

You can calculate the number of days between two dates, or you can determine what date

comes a specific number of days before or after another date.

Press 2(DAYS) from the Financial 2 screen to display the following input screen for day/date

calculation.

• 6(g)2(DAYS)

d1 ................................ date 1

d2 ................................ date 2

D ................................. number of days

• The set up screen can be used to specify either a 365-day or 360-day year for financial

calculations. Day/date calculations are also performed in accordance with the current setting for number of days in the year, but the following calculations cannot be performed

when the 360-day year is set. Attempting to do so causes an error.

(Date) + (Number of Days)

(Date) – (Number of Days)

• The allowable calculation range is January 1, 1901 to December 31, 2099.

To input a date, first highlight d1 or d2. Pressing a number key to input the month causes an

input screen like the one shown below to appear on the display.

Input the month, day, and year, pressing w after each.

After configuring the parameters, press one of the function keys noted below to perform the

corresponding calculation.

Page 19

19

• 1(PRD) ...... Number of days from d1 to d2 (d2 – d1)

• 2(d1+D) ..... d1 plus a number of days (d1 + D)

• 3(d1 – D) ... d1 minus a number of days (d1 – D)

•An error (Ma ERROR) occurs if parameters are not configured correctly.

Use the following function key to maneuver between calculation result screens.

• 1(REPT) .... Parameter input screen

360-day Date Mode Calculations

The following describes how calculations are processed when 360 is specified for the Date

Mode item in the SET UP screen.

• If d1 is day 31 of a month, d1 is treated as day 30 of that month is used.

• If d2 is day 31 of a month, d2 is treated as day 1 of the following month, unless d1 is day 30.

Page 20

20

9. Depreciation

Any of the following four methods can be used to calculated depreciation.

uu

uStraight-Line Method

uu

The straight-line method calculates depreciation for a given period.

{Y–1}(PV–FV )

SL

SL

SL

1

=

(PV–FV )

j

=

n+1

=

(PV–FV )

u

n 12

n

12–{Y–1}

u

n 12

({Y–1}G12)

Depreciation for an item acquired part way through a year can be calculated by month.

uu

uFixed Percentage Method

uu

Fixed percentage method can be used to calculate depreciation for a given period, or to calculate the depreciation rate.

{Y–1}I%

FP

1

= PV ×

FP

j

= (RDV

n+1

= RDVn ({Y–1}G12)

FP

RDV

1

= PV – FV – FP

RDVj = RDV

100

j–1

+ FV ) ×

j–1

– FP

×

12

I%

100

1

j

SLj : depreciation charge for the jth

year

n : useful life in years

PV : original cost (basis)

FV : scrap value (salvage value)

j : year

Y–1 : number of depreciable months

in first year

FPj : depreciation charge for the jth year

RDVj : remaining depreciable value at the

end of jth year

I

%

: depreciation rate

RDV

n+1

= 0 ({Y–1}G12)

Depreciation for an item acquired part way through a year can be calculated by month.

Page 21

21

12

{Y–1}

n' = n –

n (n +1)

Z =

12

2

(n' integer part +1)(n' integer part + 2*n' fraction part

)

Z' =

SYD

1

=

{Y–1}

12

n

Z

× (PV

– FV )

n'– j+2

Z'

)(PV

– FV – SYD1)( jG1)SYDj = (

RDV

1

= PV – FV – SYD

1

RDVj = RDV

j –1

– SYD

j

n'– (n +1)+2

Z'

)(PV

– FV – SYD1)({Y–1}G12)

12–{Y–1}

12

×SYD

n+1

= (

uu

uSum-of-the-Year's Digits Method

uu

The sum-of-the-year's-digits method calculates depreciation for a given period.

SYDj : depreciation charge for the jth year

RDVj : remaining depreciable value at the

end of jth year

Depreciation for an item acquired part way through a year can be calculated by month.

uu

uDeclining Balance Method

uu

The declining balance method calculates depreciation for a given period.

Y–1I%

DB

1

= PV ×

100n

×

RDV1 = PV – FV – DB

j

= (RDV

DB

RDV

DB

n +1

RDV

j

= RDV

= RDVn

n+1

= 0

j–1

+ FV )

j–1

– DB

j

({Y–1}G12)

({Y–1}G12)

12

1

×

100n

I%

DBj : depreciation charge for the

jth year

RDVj : remaining depreciable

value at the end of jth year

I

%

: factor (%)

Page 22

22

Press 3(DEPR) from the Financial 2 screen to display the following input screen for depreciation.

Depreciation for an item acquired part way through a year can be calculated by month.

• 6(g)3(DEP)

n .................................. useful life in years

I% ............................... depreciation rate/factor

PV ............................... original cost (basis)

FV ............................... scrap value (salvage value)

j ................................... year

Y–1.............................. number of depreciable months in first year

•Parameters can be displayed as integer or decimal values only. Inputting a fraction causes it

to be converted to a decimal value.

After configuring the parameters, press one of the function keys noted below to perform the

corresponding calculation.

• 1(SL).......... Straight-Line Method

• 2(FP) ......... 1.Fixed Percentage Method

............ 2.Depreciation ratio

• 3(SYD)....... Sum-of-the-Year's Digits Method

• 4(DB) ......... Declining Balance Method

•An error (Ma ERROR) occurs if parameters are not configured correctly.

Use the following functions key to maneuver between calculation result screens.

• 1(REPT) .... Parameter input screen

• 6(TABL) ..... Calculation result table

Page 23

23

The following function keys are on the calculation result table screen.

• 1(REPT) .... Parameter input screen

• 6(GRPH) .... Draws graph

After drawing a graph, you can press 1 (TRACE) to turn on trace and read calculation results

along the graph.

Press i to turn off trace.

Press i again to return to the parameter input screen.

Page 24

24

10. Bonds

The bond calculation function calculates the price and yield of a bond.

uu

uFormula

uu

D

Issue date

: price per $100 of face value

PRC

A B

Purchase date Coupon Payment dates

Redemption date

CPN : annual coupon rate (%)

YLD : yield to maturity (%)

A : accrued days

M : number of coupon payments per year (1=annual, 2=semi annual)

N : number of coupon payments between settlement date and maturity date

RDV : redemption price or call price per $100 of face value

D : number of days in coupon period where settlement occurs

B : number of days from settlement date until next coupon payment date = D – A

INT : accrued interest

CST : price including interest

• Less than six months to redemption

CPN

RDV +

PRC = – ()

B MYLD/100

1+ ( × )

D

• Six months or more to redemption

RDV

PRC = +

YLD/100

(1+ )

M

–

DA M

×

CPN

INT =

M

(N–1+B/D )

CPN

×

DA M

N

Σ

k=1

YLD/100

(1+ )

CPN

M

M

(K–1+B/D )

–

DA M

CST = PRC + INT

×

CPN

Page 25

25

Press 4(BOND) from the Financial 2 screen to display the following input screen for band

calculation.

• 6(g)4(BOND)

d1 ................................ purchase date

d2 ................................ redemption date

RDV ............................ redemption price or call price per $100 of face value

CPN ............................ annual coupon rate (%)

PRC ............................ price per $100 of face value

YLD ............................. yield to maturity (%)

To input a date, first highlight d1 or d2. Pressing a number key to input the month causes an

input screen like the one shown below to appear on the display.

Input the month, day, and year, pressing w after each.

After configuring the parameters, press one of the function keys noted below to perform the

corresponding calculation.

• 1(PRC) ... Price per $100 of face value

• 2(YLD) ... Yield to maturity

Page 26

26

•An error (Ma ERROR) occurs if parameters are not configured correctly.

Use the following functions key to maneuver between calculation result screens.

• 1(REPT) ... Parameter input screen

• 5(MEMO) ... Screen of various bond calculation values*

• 6(GRPH) ... Draws Graph

Pressing5 (MEMO) displays various bond calculation values, like those shown here.

*The interest payment date is calculated from d2 when 365 is specified for the Date Mode item

in the SET UP screen.

• w~w

• 6(GRPH)

After drawing a graph, you can press 1 (TRACE) to turn on trace and read calculation results

along the graph.

Press i to turn off trace.

Press i again to return to the parameter input screen.

Page 27

27

11. TVM Graph

The TVM Graph lets you assign two of the five parameters (n, I%, PV, PMT, FV) to the x-axis

and y-axis of a graph, and plot changes in y as the value of x changes.

Press 5(TVM) from the Financial 2 screen to display the following input screen for TVM

Graph.

• 6(g)5(TVM)

After configuring the parameters, press the function keys noted below to assign parameters to

the x-axis and y-axis.

• 1(X) ... Assigns highlighted parameter to the x-axis

• 2(Y) ... Assigns highlighted parameter to the y-axis

After making the required settings, draw the graph.

• 6(GRPH) ... Draws graph

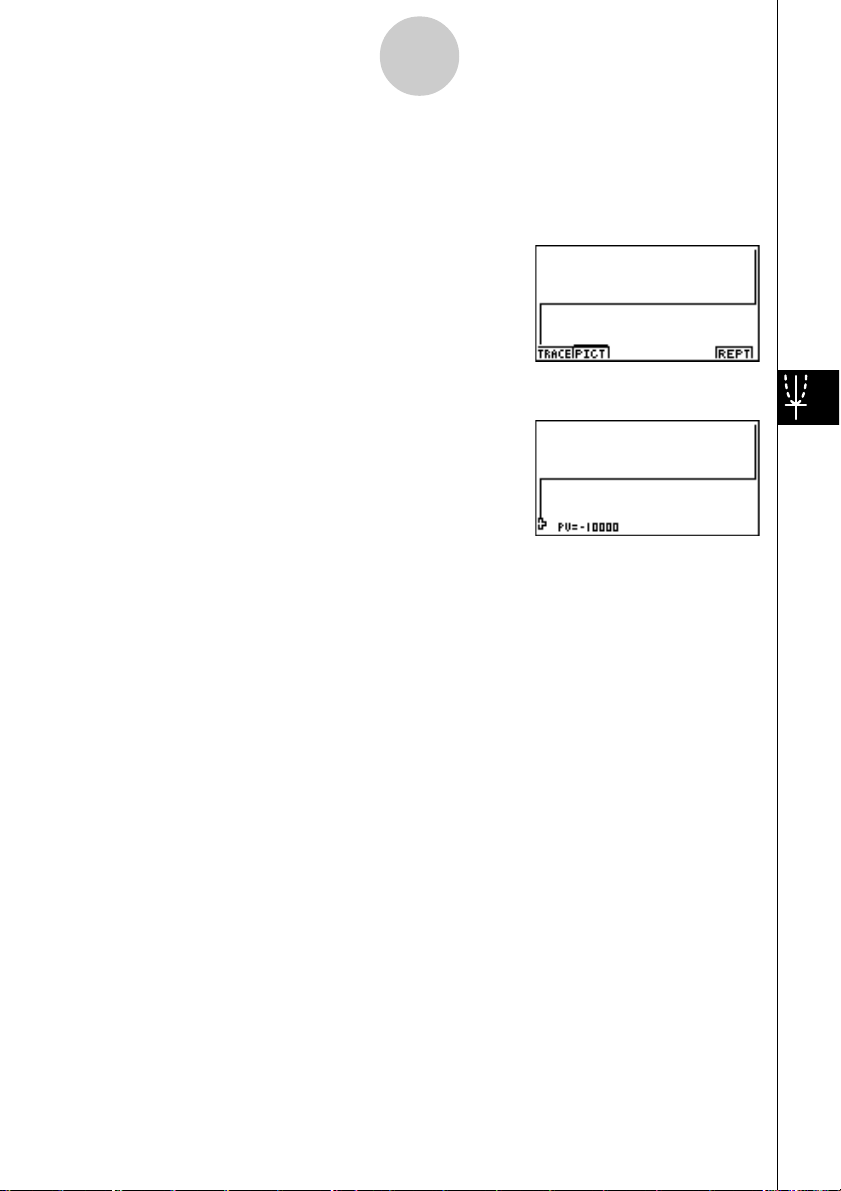

After drawing a graph, you can press 1 (TRACE) to turn on trace and read calculation results

along the graph.

Press i to turn off trace.

Pressing 6 (Y-CAL) after drawing a graph displays the screen shown below.

Inputting an x-axis value on this screen and pressing w displays the corresponding y-axis

value.

Press i again to return to the parameter input screen.

•Calculation may take some time to perform when you specify I% as the y-axis parameter.

Loading...

Loading...