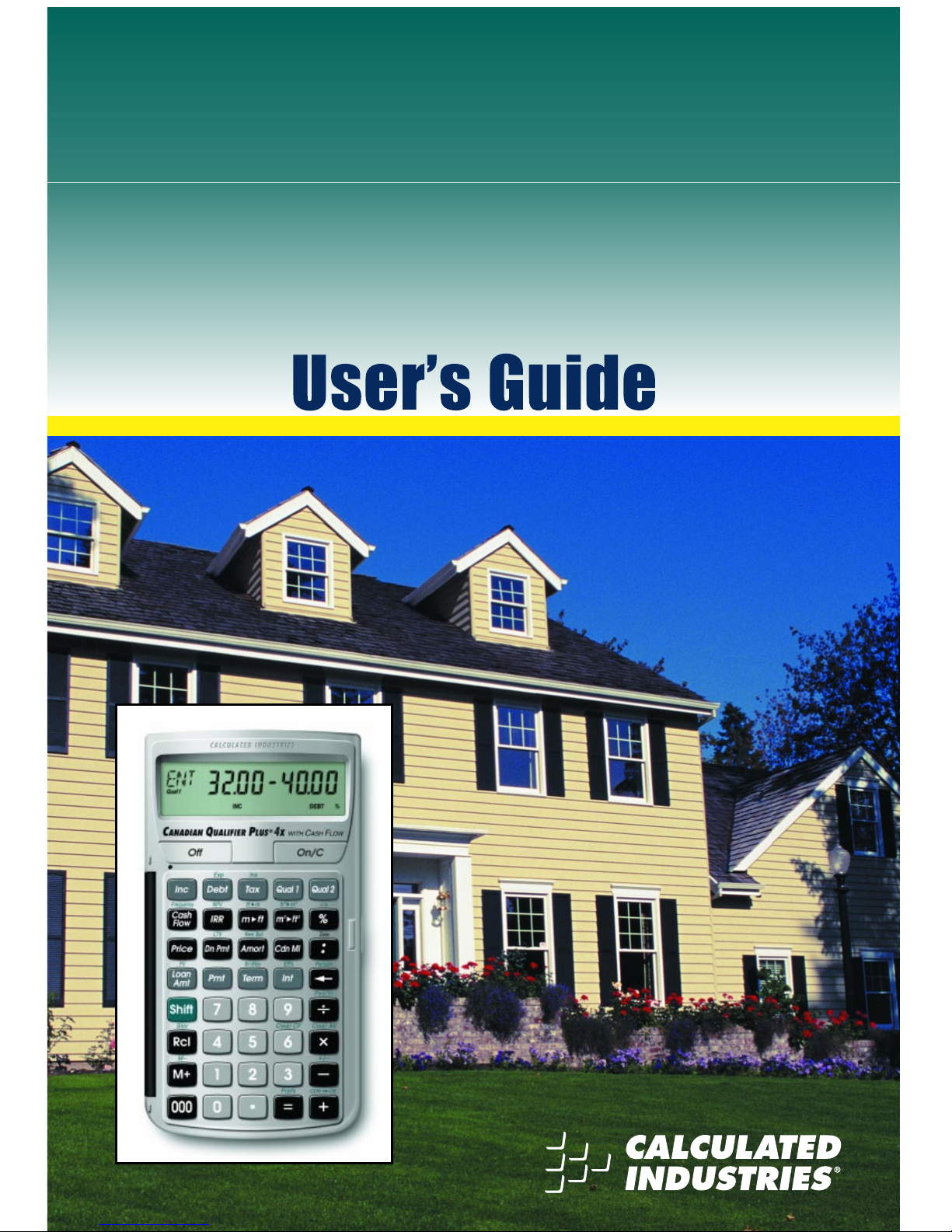

Page 1

Q

UALIFIER

P

LUS

®

4

X

ADVANCED REAL ESTATE FINANCE CALCULATOR with CASH FLOW

and BUILT-IN CANADIAN INTEREST MODE

Model 3423

C

ANADIAN

Page 2

The

Canadian Qualifier Plus 4x

was designed specifically for mortgage lenders, residential real estate agents and brokers for quick

mortgage calculations in the office or out in the field. It’s the most

complete and intuitive calculator of its kind. With the push of a few

buttons,

it will instantly pre-qualify prospective buyers, find monthly

payments, and solve hundreds of mortgage problems!

Features:

• Easy and Complete Buyer Pre-Qualifying — with

“Smart”

Keys

for quick financing solutions or comparisons

• Find Qualifying Mortgage Amount, Income Required and

Maximum Allowable Debt

• Use two different Qualifying Ratios at once to compare

mortgage scenarios

• Compare “Restricted” with “Unrestricted” Qualifying

Mortgage Amount

• Flexible “what-if” Mortgage or TVM Calculations —

Finds

Mortgage Amount, Term, Interest or Payment

• Instant P&I and Total (PITH) Payment

• Includes Property Tax, Mortgage Insurance and

Heating Expense

• Built-in Sales Price and Down Payment

• Instant Loan-to-Value (LTV)

• Works in Annual or Periodic Term and Interest

• Works in Canadian or U.S. Interest

• Date Math, Month Offset, and Odd-Days Interest (ODI)

• Complete Amortization

• Remaining Balance/Balloon Payment

• Bi-Weekly Mortgages

• Trust Deeds

• Future Value and Appreciation

• Also works as a Standard Math Calculator

•

U.S. Mode, including additional features:

APR and Total

Finance Charges, PITI/Total Payment, Interest-Only

Payment and Complete U.S. Buyer Pre-Qualifying, including

Tax, Insurance, and Mortgage Insurance

New!

• Cash Flows/Investment Analysis (IRR, NPV, NFV)

• Effective Interest Rate (EFF%)

• Metric/Imperial Conversions

Introducing the C

ANADIANQUALIFIERPLUS

®

4

X

Mortgage Calculator

Page 3

GETTING STARTED..........................................................................1

KEY DEFINITIONS .........................................................................1

Basic Operation Keys ..................................................................1

Mortgage/Time-Value-of-Money Keys..........................................2

Qualifying Keys............................................................................5

Cash Flow Keys...........................................................................8

U.S. Keys (Used in U.S. Mode)...................................................9

CALCULATOR SETTINGS ...........................................................10

Decimal Place Selection............................................................10

Canadian/U.S. Mode..................................................................11

Preference Settings ...................................................................12

MEMORY......................................................................................14

Accumulative Memory ...............................................................14

Memory Storage Keys (M0-M5).................................................15

Additional Memory Storage Keys (M10-M19) ............................16

BASIC ARITHMETIC EXAMPLES................................................17

Arithmetic...................................................................................17

Percentage Calculations............................................................17

Percent Change.........................................................................17

Figuring Straight Percent Commission......................................18

Reduction in Listing Price (Discount %) ....................................18

Simple, One-Year Home Appreciation (Add-on %)....................18

Delta Percent-Rate of Appreciation ...........................................19

USING THE FEET AND METERS CONVERSIONS ....................19

USING THE DATE FUNCTION .....................................................20

EXAMPLES —

CANADIAN MODE

.................................................21

MORTGAGE/TIME-VALUE-OF-MONEY (TVM)............................21

Finding the Monthly Mortgage Payment....................................22

Finding the Term of a Mortgage.................................................22

Paying Off a Mortgage Early (Making Larger Payments)..........23

Finding the Interest Rate ...........................................................23

Finding the Mortgage Amount....................................................23

Non-Monthly Mortgages.............................................................24

Finding a Quarterly Payment.....................................................24

Bi-Weekly Mortgages.................................................................25

Bi-Weekly Term Reduction and Payment..................................25

Sales Price/Down Payment .......................................................26

Finding Mortgage Amount Based on Sales Price and

Down Payment .......................................................................26

Finding Sales Price and Payment Based on Mortgage Amount

and Down Payment ................................................................26

Finding Loan-to-Value (LTV) Based on Down Payment and

Sales Price..............................................................................27

Setting Property Tax Percent Rate ............................................27

Setting Property Tax Dollar Amount...........................................27

Total Payment (Including Heating Expense) ..............................27

TABLE OF CONTENTS

Page 4

Total Payment (Including Heating Expense and Property Tax

Entered as Percentage) ..........................................................28

Total Payment (Including Heating Expense and Property Tax

Entered as Dollar Amount) .....................................................28

Finding Mortgage Amount (Including Canadian Mortgage

Insurance)...............................................................................29

Finding Monthly Mortgage (P&I) Payment (Including Canadian

Mortgage Insurance)...............................................................30

Amortization and Remaining Balance........................................30

Notes on Amortization ................................................................30

Total Principal and Interest for a 25-Year Mortgage..................32

Total Principal and Interest (Including Canadian Mortgage

Insurance)...............................................................................32

Amortization List for Individual Year(s) —

Using “Next”

Feature

....................................................................................33

Amortization List for Individual Year(s) —

Using Month

Offset

......................................................................................34

Amortization List for Individual Payment(s) ...............................35

Amortization List for a Range of Payments or Years .................36

Balloon Payment/Remaining Balance Needed to Pay Off a

Mortgage .................................................................................36

Future Value...............................................................................37

Appreciation/Future Value..........................................................37

Basic Savings Account Problem (Future Value of an Initial

Deposit)...................................................................................37

Trust Deeds and Discounted Notes ...........................................38

Purchase Price of a Note —

Fully Amortized

............................38

Finding the Yield on a Discounted Note ....................................39

BUYER PRE-QUALIFYING...........................................................40

IMPORTANT NOTE: U.S. vs. Canadian Payment and

Qualifying Calculations...........................................................41

QUALIFYING EXAMPLES............................................................42

Recalling GDS/TDS Qualifying Ratios.......................................42

Storing New GDS/TDS Qualifying Ratios..................................42

Finding Qualifying Mortgage Amount and Sales Price

(Simple Example Excluding Property Tax) .............................43

Qualifying Mortgage Amount and Sales Price

(Including Down Payment, Property Tax and Monthly

Heating/Condo Fees)..............................................................44

Qualifying Mortgage Amount and Sales Price (Including

Canadian Mortgage Insurance)..............................................45

“Restricted” Qualifying ...............................................................46

“Unrestricted” Qualifying............................................................47

Qualifying Comparison (Comparing Two Different Mortgages or

Two Qualifying Ratios at Once)..............................................48

Finding Income Required and Allowable Monthly Debt.............49

Solving for Actual Qualifying Ratios ...........................................50

Page 5

CASH FLOW EXAMPLES.........................................................51

Calculating IRR, NPV, and NFV for Annual Cash Flows...........53

Calculating IRR, NPV, and NFV for Monthly Cash Flows .........54

Recalling and Replacing Cash Flows........................................55

Recalling and Replacing Cash Flow Frequencies.....................55

EXAMPLES —

U.S. MODE

.............................................................56

Finding the Monthly Mortgage Payment (Based on U.S. Interest

Rate).......................................................................................56

Finding the Interest-Only Payment............................................56

Interest-Only Payment (Entry) ...................................................56

Property Taxes, Property/Hazard Insurance and Monthly

Housing Expense....................................................................57

PITI Payment (Tax and Insurance Entered as Percentage)......58

PITI Payment (Tax and Insurance Entered as Dollar Amount)..58

Calculating Tax and Insurance Percentage or Dollar Amount...59

Finding the Interest Rate ...........................................................60

Finding the Term of a Loan........................................................60

Finding the Loan Amount...........................................................60

Finding Sales Price and Payment Based on Loan Amount and

Down Payment .......................................................................61

Total Principal and Interest for a 30-Year Loan .........................61

Amortization List for Individual Year(s) —

Using “Next”

Feature

....................................................................................62

APR, Total Finance Charges (Including Mortgage

Insurance)...............................................................................63

Bi-Weekly Mortgages.................................................................64

Bi-Weekly Term Reduction and Payment..................................64

Qualifying Loan Amount and Sales Price (Complete Example

Including Down Payment, Tax/Insurance, Monthly Association

Dues) ......................................................................................65

“Restricted” Qualifying ...............................................................66

“Unrestricted” Qualifying............................................................66

Finding Qualifying Loan Amount and Sales Price for an

Interest-Only Loan..................................................................67

Finding Income Required and Allowable Monthly Debt.............68

Qualifying Comparison (Comparing Two Different Loans or

Two Qualifying Ratios at Once)..............................................69

APPENDIX .......................................................................................70

Default Settings..........................................................................70

Reset ..........................................................................................70

Error Codes................................................................................71

Auto Shut-Off.............................................................................71

Battery ........................................................................................71

Repair and Return......................................................................72

Warranty.....................................................................................73

Legal Notes................................................................................74

Looking For New Ideas..............................................................74

INDEX .............................................................................................75

Page 6

U

SER’SGUIDE

— 1

KEY DEFINITIONS

Basic Operation Keys

O Turns all power off. The memory and most financial

registers are cleared.

o If calculator is off, turns power on. If calculator is on,

a single press clears the last entry while a second

press in succession clears non-permanent entries.

Note: Clears Loan Amount, Payment, Price, Down Payment,

Income, Debt, Expense, and Canadian Mortgage Insurance.

+ – x Arithmetic operation keys.

÷ =

0 – 9 Keys used for entering numbers.

) Triple-zero key (saves time when entering 000 values).

b Backspace key (deletes incorrect entries one digit at

a time).

• Decimal point.

%

Percent

— Four-function (+, –, x, ÷) percent key.

See page 17 for examples.

µ

Memory

— Adds the displayed number to the inde-

pendent cumulative memory. Pressing s µ

(M–)

will subtract the displayed value from the cumulative

memory. Pressing ® µ recalls and displays the

memory contents. Pressing ® ® displays and

clears the memory. See page 14 for details.

®

Recall

— Recalls and displays the contents of the

financial registers (e.g., ® ˆ). Also used for

Memory functions.

s Used to set the number of displayed decimal places

(see section on Decimal Place Selection, page 10).

Also works with other keys to set or activate additional functions. (Think of it as a “shift” key on a

typewriter.) It will perform the function printed above

the key on the calculator's face.

GETTING STARTED

Page 7

2 — Q

UALIFIERPLUS

®

4

X

s –

Change Sign (+/-)

— Changes the sign of the dis-

played value from positive to negative or vice versa.

s x

Clear All

— Clears all entered values and returns

any stored values to their default settings. Use this

only with caution, as it will reset ratios, payments

per year, decimal places, etc. back to their defaults

(see the Appendix for a list of these settings).

Note: Clear All will not affect any changes made to Preference

Settings.

Canadian Mode: s x will also return your calcu-

lator to Canadian Mode if you previously activated

U.S. Mode via s +.

s =

Preferences (Prefs)

— Activates the Preference Mode,

where you can program custom settings (see page 12).

w

Meters to Feet

— Converts entered value from meters

to feet.

s w

Feet to Meters (ft4m)

— Converts entered value

from feet to meters.

W

Meters2to Feet

2

— Converts entered value from

square meters to square feet.

s W

Feet2 to Meters2 (ft24m2 )

— Converts entered value

from square feet to square meters.

s %

Delta Percent ( )

— Finds the percent change

between two values.

Mortgage/Time-Value-of-Money Keys

The following keys let you solve Mortgage or Time-Value-of-Money

(TVM) problems, such as finding a Mortgage Payment, Term,

Interest, Future Value, or Amortization. Other useful keys, such as

Price and Down Payment, are also included. These keys let you

demonstrate various “what-if” mortgage scenarios to your clients.

l

Loan Amount

— Enters or solves for the initial mort-

gage amount or present value of a financial problem.

Page 8

U

SER’SGUIDE

— 3

p

P&I and Total Payment

— Multi-function payment

key. Enters or solves for the Periodic Principal and

Interest (P&I) payment. In Canadian Mode, a second press of the p key calculates the Total

Payment (includes monthly property tax, insurance,

heating expense, and other applicable housing

expenses, such as condo fees). If entered,

Canadian Mortgage insurance is included in both

P&I and Total Payment. In U.S. mode, a second

press of the p key calculates the PITI payment

(adds monthly property tax and insurance to P&I

payment). Pressing a third time in U.S. mode calculates the total payment (PITI plus expenses).The

fourth press calculates the interest-only payment.

T Enters or solves for the number of years. Second press

gives the number of periods. An entered term greater

than 59 will be classified as periodic, not annual.

Note: Term is stored permanently, until you change it or perform

a Clear All (

s x

). You may enter a periodic term, if you prefer,

by pressing the

s b

(Periodic) keys prior to pressing

T

(e.g.,

3 6 s b T

instead of

3 T

).

ˆ

Interest

— Enters or solves for the annual interest

rate. Second press gives the periodic rate.

Note: Interest is stored permanently, until you change it, by

performing a “Clear All”

(s x)

, or reset.

s ˆ

Effective Interest Rate (Eff%)

— Converts value

stored as interest to equivalent U.S. rate.

s l

Future Value (FV)

— Enters or solves for the future

value of a financial problem.

P

Sales Price

— Enters or calculates Sales Price

based on the entries of Mortgage Amount (or equivalent mortgage components) and Down Payment.

Note: An entered Sales Price will not normally change.

d

Down Payment

— Enters (in either percent or dollars) or calculates Down Payment, based on the

entries of Mortgage Amount (or equivalent mortgage

components) and Sales Price. A second press

changes the entered down payment from a dollar

figure to a percent, or vice versa.

Note: Any number under 100 is assumed to be a percent down

payment. You do not have to label the value as a percent.

Page 9

4 — Q

UALIFIERPLUS

®

4

X

s d

Loan-to-Value (LTV)

— Calculates the Loan-toValue percent when a Down Payment and Sales

Price, Mortgage Amount/Down Payment, or

Mortgage Amount/Sales Price are entered. Also calculates the above dollar values if an LTV percent

and one of the above values are entered (e.g.,

entered Sales Price and LTV percent will calculate

Down Payment and Mortgage Amount).

s b

Periodic

— Used to specify a mortgage component

(Term or Interest) or Amortization/Remaining

Balance entry as periodic rather than yearly. For

example, 3 0 s b T enters 30 periods.

Also used to identify Periodic Income, Tax

Insurance, and Mortgage Insurance.

s ÷

Payments per Year (Pmt/Yr)

— Used to set the

number of payment periods per year. Default value

is 12, for monthly.

Note: You can store the number of payments/year permanently or

semi-permanently. See “Preference Settings” on page 12).

a

Amortization (Amort)

— Finds Total Interest,

Principal, Remaining Balance, and Remaining Term.

The output of this key is as follows:

Press Display or Calculation

1 Displays range of periods

2 Calculates Total Interest for period range

3 Displays Total Principal for range

4 Calculates Total Principal and Interest

5 Calculates Remaining Balance

6 Calculates Remaining Term

s a

Remaining Balance (Rem Bal)

— Displays the

Remaining Balance when preceded by a single year

or range of years (or individual payment or range of

payments by also using the s b keys). Note

that you can also see the Remaining Balance by

cycling through the a key.

:

Colon Separator (Date)

— Used as a separator for

entering dates, qualifying ratios, and amortization

ranges.

Page 10

U

SER’SGUIDE

— 5

s )

Month Offset

— Used to set the first month of pay-

ment if other than January (e.g., Month 3).

s :

Odd-Days Interest (ODI)

— Calculates the pre-paid

interest, or simple interest accumulated (based on a

360-day year) during the days before the first mortgage payment is made, using the interest rate

stored in the Interest register. (U.S. Mode only.)

s T

Bi-Weekly (Bi-Wkly)

— Converts a regular monthly

loan to a Bi-Weekly loan, where the buyer may realize

significant interest savings. After loan variables are

entered, pressing s T displays the Bi-Weekly

Term (i.e., reduced term). The second press of T

shows the total interest savings; third press displays

the total interest paid; fourth press displays the total

principal; and fifth press displays the total principal

and interest paid. Pressing p will calculate the

Bi-Weekly payment. Pressing s T again will exit

Bi-Weekly mode and re-calculate to the original term.

Pressing o twice will also exit Bi-Weekly mode.

Qualifying Keys

What are Canadian Qualifying Ratios?

According to the Canadian Mortgage and Housing Corp. (CMHC),

the first rule in Canadian qualifying is that monthly housing costs

should not exceed 32% of gross monthly income (this is called the

Gross Debt Service, or GDS ratio). Housing costs include monthly

Principal and Interest, Property Taxes and heating expenses. If

applicable, PITH can also include half the condominium fees and the

annual site lease if it’s a leasehold tenure.

The second qualifying rule is that the total monthly costs (i.e.,

monthly housing costs

plus

other long-term debt, such as car loans

and credit card payments) shouldn’t exceed 40% of gross monthly

income (this is called the Total Debt Service, or TDS ratio).

q

(Qualify Based on GDS:TDS ratios of 32%-40%)

— A multi-function key which, based on entered

variables, performs the following pre-qualifying

functions:

(Cont’d)

Page 11

6 — Q

UALIFIERPLUS

®

4

X

(Cont’d)

1) Stores Canadian GDS:TDS ratios for mortgage

qualifying. Entered ratios are separated by the Colon

: key. For example, income and debt ratios of 32%

and 40%, respectively, are entered and permanently

stored as follows: 3 2 : 4 0 q. Default income

and debt ratios for this key are 32% and 40%,

respectively. You may change these ratios, if desired.

2) Calculates the maximum mortgage amount for

which a buyer may qualify, based on the stored

income and debt qualifying ratios and the entered:

• Term

• Interest

• Annual Income

• Monthly Debt

• Down Payment

• Monthly Property Taxes

• Monthly heating expense and other monthly housing

expenses, if applicable (e.g., condo fees)

The output of this key is as follows:

Press Calculation

1 Displays stored Qualifying Ratios

(e.g., 32%:40%)

2 Maximum Qualifying Mortgage Amount

(restricted)*

3 Buyer’s Actual Ratios (Income%:Debt%)

4 Unrestricted Qualifying Mortgage Amount*

5 Maximum Allowable Debt

*The Maximum Qualifying Loan Amount displayed is the “restricted”

loan amount that the buyer may qualify for. This loan amount is

based on whichever of the two ratios, income or debt, limits the buyer

the most. If the buyer’s maximum qualifying loan amount is restricted

by their income, then the unrestricted qualifying loan amount will also

be displayed. The unrestricted qualifying loan amount is based purely

on the buyer’s income and is not restricted by their debt. If the maximum qualifying loan amount is restricted by their debt, the unrestricted qualifying loan amount will not be displayed. This is useful to show

clients what size loan they could qualify for if they paid off debt or

increased income. Here, the calculator will display the loan amount

with “UNR” (for unrestricted) and “INC” (based on income).

Note

: This restricted/unrestricted qualifying mortgage comparison

is useful to show clients what size loan they could qualify for if

they paid off debt or increased income.

Page 12

U

SER’SGUIDE

— 7

3) Calculates the annual income required and

allowable monthly debt for a desired mortgage

amount or sales price based on the stored income

and debt qualifying ratios and the entered:

• Term

• Interest

• Price (down payment) or mortgage amount

4) Also finds buyer's actual income and debt

ratios given both buyer and property data. By

default, the first press of q displays the stored

qualifying ratios and the 2nd press calculates the

buyer's actual ratios.

Note on U.S. Qualifying: If the calculator is in

Canadian Mode

(see page 11) and you want to

qualify in

U.S. Mode

, activate U.S. Mode via s +

and enter new U.S. Qualifying Ratios into the q

and Q keys.

Q

(Qualify Based on 35%-42%)

— Stores additional

Income and Debt ratios and operates identically to

the q key. Default Income and Debt ratios for this

key are 35% and 42%, respectively.

Note: You may store whatever ratios you desire in the

q

or

Q

keys.

i

Income

— Enters the buyer’s

annual

income for

mortgage qualifying. Or, enters a monthly income

when preceded by the s b keys (e.g., 5 )

s b i enters a monthly income of $5,000).

D Enters buyer’s long-term,

monthly

debt (e.g., car

payments, credit cards with large balances/longterm monthly payments).

s D

Expense (Exp)

— Enters monthly heating or other

housing expenses (e.g., condominium fees) for calculating the Total (PITH) Payment or for Qualifying.

C

Canadian Mortgage Insurance

— Used to enter

mortgage insurance. Can be entered as a percentage or a dollar amount. Numbers over ten will automatically be considered a dollar amount.

Page 13

8 — Q

UALIFIERPLUS

®

4

X

t

Property Tax

— Used for calculating PITI and Total

(PITH) payment, and Qualifying. Stores estimated

annual property tax in either percent or dollar

amount. If entered as an annual dollar amount, a

press of t converts to the monthly tax amount,

and pressing t again converts to the annual

percent rate. If entered as a percent, pressing t

converts to the annual dollar amount, and pressing

t once more shows the monthly tax.

Note: Entering a number equal to or less than ten is assumed to

be an annual percent. Property tax is calculated from the sales

price (therefore, you should also enter a Down Payment).

s t

Property Insurance (Ins)

— Used for calculating

the PITI payment and for Qualifying. Stores estimated

annual property or homeowner’s insurance in either

percent or dollar amount. If entered as an annual

dollar amount, a press of ® and s t converts

to the monthly insurance amount or premium, and

pressing t again converts to the annual percentage rate. If entered as a percentage, pressing t

converts to the annual dollar amount, and pressing

t once more shows the monthly insurance.

Cash Flow Keys

The following keys provide quick and easy analysis of cash flow

investment scenarios without all the confusing keys or keystrokes of

typical financial calculators:

c This key allows the entry of up to 20 cash flows

(either positive or negative; use the s – keys to

label a cash flow as a negative value, or cash outlay).

s c

Frequency

—The second function of this key labels a

cash flow that is repeated consecutively, or grouped

(e.g., if a cash flow is repeated three times in a row, first

enter the cash flow value into the c key, then enter

the frequency, or number of occurrences: 3 s c).

Note: to use the Frequency function, a cash flow must repeat

itself consecutively. If it occurs more than once out of order, or

is not consecutive, you must enter it separately, just like other

cash flows (do not use the Frequency function).

R Internal Rate of Return — This multi-function key

calculates, upon consecutive presses:

(Cont’d)

Page 14

U

SER’SGUIDE

— 9

(Cont’d)

Press Display or Calculation

1 IRR%*

2 Net Present Value (NPV)**

3 Net Future Value (NFV)

4 Desired Interest Rate (entered prior to

calculating)***

*IRR: The rate of return at which the discounted future cash flows

equal the initial cash outlay (C-0). An IRR greater than the desired

rate of return is financially attractive (the higher, the better).

**NPV

: Another tool to analyze cash flow scenarios. A positive NPV

indicates that an investment is attractive (again, the higher, the better).

NPV is computed by adding the initial investment (C-0), a negative

cash outlay, to the present value of the estimated future cash flows.

***Interest

: When in Canadian Mode, if an interest rate has been

stored in the Interest function, the calculated Effective Interest

percent will be used for calculating IRR if no desired rate of

return is entered. If a desired rate of return is entered directly

(e.g.,

1 0 R

) the entered rate is used (it is not converted to the

Effective Interest Rate Percentage).

Note

: If there is no initial investment/cash outlay, enter “0” into the

first cash flow register (C-0).

s R

NPV/NFV

— If you wish to skip the IRR% calculation

display (see above), press s R to calculate NPV.

Second press calculates NFV.

s 6

Clear Cash Flows (Clear CF)

— Deletes all cash flows.

Use this before you begin a new cash flow example.

U.S. Keys (Used in U.S. Mode)

Note: Calculator must be set to U.S. Mode. See page 11.

s ˆ

Annual Percentage Rate (APR)

— Calculates APR

(for fixed-rate loans only) based on the entry of points

and/or non-recurring loan fees paid at initiation. It also

calculates total finance charges, monthly mortgage

insurance, and PIMI payment, based on the entry of

mortgage insurance via the s 9 keys.

s 9

U.S. Mortgage Insurance

— Used to enter

Mortgage Insurance as percentage or dollar amount.

s p

Interest-Only Payment

— Enters or calculates

interest-only payments.

s q Used for interest-only qualifying (U.S. mode only).

s Q Used for interest-only qualifying (U.S. mode only).

Page 15

10 — Q

UALIFIERPLUS

®

4

X

CALCULATOR SETTINGS

Decimal Place Selection

With the s key, you have the option of selecting the number of

decimal places you’d like to display. The values are rounded using

conventional 5/4 rounding. You can do this prior to finding an answer

or afterwards.

Press s followed by the number of decimal places you wish to

display:

s 5 0.00000

s 4 0.0000

s 3 0.000

s 2 0.00

s 1 0.0

s 0 0.

s • floating point

To return to the standard two decimal place setting, press s 2.

Page 16

U

SER’SGUIDE

— 11

Canadian/U.S. Mode

Your calculator is factory-set to Canadian (Interest) Mode. If you need

to calculate loan problems using U.S. interest, you must change the

calculator to U.S. (Interest) Mode. To easily switch your calculator from

Canadian Mode to U.S. Mode, press the s and then the + key.

Pressing s + also allows you to toggle between Canadian

Interest and U.S. Interest calculations. In other words, you may

switch from Canadian Interest to U.S. Interest, or vice versa, by

repeating the keystrokes s +.

Note: While converting to Canadian Interest Mode via

s +

, the letters “CDN” will

appear and will also be displayed when the ˆkey is pressed. While converting to

U.S. Mode, the letters “USA” will appear and will also be displayed when the ˆkey

is pressed. If you’re unsure what mode you’re in, press

® ˆ

to see if “CDN” or

“USA” is displayed.

Canadian Mode performs the following:

• Allows entry of Canadian interest rates.

• Enables Effective Interest Rate (Eff%) calculations.

• Disables selected U.S.-only functions (APR, Interest-Only

Payments and U.S. Mortgage insurance).

U.S. Mode performs the following:

• Allows entry of U.S. interest rates.

• Enables selected U.S.-only functions (APR, Interest-Only

Payments, Interest-Only Qualifying and U.S. Mortgage

insurance).

Page 17

12 — Q

UALIFIERPLUS

®

4

X

Preference Settings

Your calculator has a Preference Mode, which allows you to program

the calculator to various settings. For example, it allows you to store

certain values permanently, display certain values, or show values in

a specific order.

To access the Preference Mode, press s, then =, then keep

pressing = to toggle through the settings listed below. Press the +

sign to advance through the sub-settings.

To return the calculator to its default, or factory-set Preference

Settings, perform a Reset (see page 70).

After

s

,

Keep

Description

Pressing (Press +to Advance

=

:

Display

within each category):

1 Decimal Places

- DEC HOLd EntrY — Permanently sets number of decimal places.

(Default)

- DEC OFF 0.00 — Clears decimal place setting/resets

to 0.00 at O.

2 Payments Per Year

- P/Y OFF 12.00 — Resets to 12.00 at O.

(Default)

- P/Y HOLd EntrY — Permanently sets pmts/year.

3 Property Tax/Insurance (T/I)

- Clr OFF TAX INS — Clears all T/I (% and $) values at

O.

(Default)

- HOLd Pct. TAX INS —Holds only T/I percent (%) entries at

O.

- HOLd ALL TAX INS —Holds all T/I (% and $) values at

O.

- Clr Clr TAX INS — Clears all T/I (% and $) values at

double press of o (or o o).

(Cont’d)

Page 18

U

SER’SGUIDE

— 13

(Cont’d)

After

s

,

Keep

Description

Pressing (Press +to Advance

=

:

Display

within each category):

4 Mortgage Insurance (MI)—U.S. Only

- Clr-Clr M Ins — Clears Mortgage Insurance (% and

$) upon o o.

(Default)

- Clr-OFF M Ins — Clears Mortgage Insurance (% and

$) at O.

- HOLd Pct. M Ins — Holds only percent (%) Mortgage

Insurance entry at O.

- HOLd ALL M Ins — Holds (% or $) Mortgage Insurance

entry at O.

5 Amortization/Single Entries

- AMRT Ent-Ent — Displays Amortization for specified

year only (

e.g., enter

5 a

dis-

plays payments 49-60). (Default)

- AMRT 1-Ent — Displays Amortization from beginning to specified year (

e.g., enter

5 a

displays payments 1-60).

6 Display Qualifying Ratios

- Q-R PrESS 1 — Displays ratio at beginning of

sequence.

(Default)

- Q-R At End — Displays ratio at end of sequence.

7 Beginning or End Mode

- TYP End — End Mode.

(Default)

- TYP bEG — Beginning Mode.

Page 19

14 — Q

UALIFIERPLUS

®

4

X

MEMORY

Accumulative Memory

Whenever the µ key is pressed, the displayed value will be added

to cumulative Memory. This value will remain in Memory until cleared

or when the calculator is turned off.

Other Memory functions:

FUNCTION KEYSTROKES

Recall total in Memory ® µ

Display and clear Memory ® ®

Subtract displayed value from Memory s µ

Replace Memory with displayed value s ® µ

The Memory is semi-permanent; that is, it will only be cleared when

you:

1) turn off the calculator;

2) press ® ®; or

3) press s x

(Clear All)

.

Examples:

STEPS KEYSTROKES DISPLAY

Store number into Memory 3 5 5 µ 355.00

Add number to Memory 2 5 5 µ 255.00

Recall total in Memory ® µ 610.00

Subtract from Memory 7 4 5 s µ 745.00

Recall total in Memory ® µ – 135.00

Replace Memory 5 0 s ® µ 50.00

Recall and clear Memory ® ® 50.00

Store 55, recall, and multiply by 40. Then multiply it by 60.

STEPS KEYSTROKES DISPLAY

Clear o o 0.00

Store 55 5 5 µ 55.00

Recall 55 ® µ 55.00

Multiply x 4 0 = 2,200.00

Recall 55 ® µ 55.00

Multiply x 6 0 = 3,300.00

Clear Memory ® ® 55.00

M

M

M

M

M

M

M

M

M

M

M

Page 20

U

SER’SGUIDE

— 15

Memory Storage Keys (M0-M5)

In addition to the standard cumulative Memory (as described on

previous page), your calculator has six independent Storage

Registers — [M0] through [M5] — that can be used to permanently

store single, non-cumulative values. These values will be held when

your calculator is turned off, and will only clear when a “Clear All” is

performed (via s x).

You can replace a value in one of these Memory Registers by storing a new value in place of the stored value.

FUNCTION KEYSTROKES

Store single value in M0 s ® 0

Store single value in M1 s ® 1

Store single value in M2-M5 s ® 2, 3, 4, or 5

Clear register (e.g., M1) 0 s ® 1

Review stored value (e.g., M1) ® 1

Clear stored values* s x

*Perform a

s x

(Clear All) with caution, as it will clear any stored values from your

calculator’s registers.

Example:

Store 175 into M1, recall the value, and store a new value in place

of the first stored value. Then clear M1.

KEYSTROKE DISPLAY

1 7 5 s ® 1 M-1 175.00

O o 0.00

® 1 M-1 175.00

1 5 0 s ® 1 M-1 150.00

0 s ® 1 M-1 0.00

Page 21

16 — Q

UALIFIERPLUS

®

4

X

Additional Memory Storage Keys (M10-M19)

In addition to M0-M5 (as described previously), your calculator has

ten additional independent Storage Registers — [M10] through

[M19] — that can also be used to permanently store

single

, noncumulative values. To access these storage registers, use the following keystrokes: s ® • [#], with [#] being digits 0 – 9. These

Storage Registers operate identically to M0-M5.

Examples:

Store 250 into M10, recall the value, then clear M10.

KEYSTROKE DISPLAY

2 5 0 s ® • 0 M10 250.00

O o 0.00

® • 0 M10 250.00

0 s ® • 0 M10 0.00

Store 350 into M11, recall the value, then clear M11.

KEYSTROKE DISPLAY

3 5 0 s ® • 1 M11 350.00

O o 0.00

® • 1 M11 350.00

0 s ® • 1 M11 0.00

Note: Repeat the above procedure for registers 12-19, using digits 2– 9.

Note: To clear all above values stored in Memory, press

s x

. Use this with caution

as

s x

clears away any stored values from your calculator’s register.

Page 22

U

SER’SGUIDE

— 17

BASIC ARITHMETIC EXAMPLES

Arithmetic

This calculator uses standard chaining logic, which simply means

that you enter your first value, the operator (+, –, x, ÷), the second value and then the equals sign (=).

A. 3 + 2 = 5.00

B. 3 – 2 = 1.00

C. 3 x 2 = 6.00

D. 3 ÷ 2 = 1.50

Percent Calculations

The percent % key can be used for finding a given percent of a

number or for working add-on, discount or division percentage

calculations.

A. 8 0 0 x 2 5 % = 200.00

B. 2 5 0 + 1 0 % = 275.00

C. 2 5 – 5 0 % = 12.50

D. 2 0 0 ÷ 5 0 % = 400.00

The Percent % key has special applications for real estate professionals — especially when figuring a commission amount.

Percent Change

If a home’s value increased from $315,000 (Present Value) to

$350,000 (Future Value), what is the percent increase?

STEPS KEYSTROKES DISPLAY

Subtract appreciated value

from the Present Value 3 5 0 ) – 3 1 5 ) =

35,000.00

Divide the difference by

the Present Value ÷ 3 1 5 ) = 0.11

Calculate % increase x 1 0 0 = 11.11

(or 11.1%)

Page 23

18 — Q

UALIFIERPLUS

®

4

X

Figuring Straight Percent Commission

The commission for the listing office is 3%. If the property sells for

$157,900, what is the listing office’s commission?

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter sales price 1 5 7 9 0 0 157,900.

Multiply by commission % x 3 % = 4,737.00

— DO NOT CLEAR CALCULATOR —

What if the listing agent works on a 50/50 split with his or her broker? What is the listing agent’s share of this commission?

STEPS KEYSTROKES DISPLAY

Multiply by 50% x 5 0 % = 2,368.50

Reduction in Listing Price (Discount %)

A nervous seller has had her property on the market for just over

four months listed at $175,500. Because she is anxious to move into

a new home, she wishes to reduce the listing price by 5%. Calculate

both the amount of reduction in dollars and the new, lowered listing

price.

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter sales price 1 7 5 5 0 0 175,500.

Subtract 5% – 5 % 8,775.00

Find new listing price = 166,725.00

Simple, 1-Year Home Appreciation (Add-on %)

Properties in your area have been going up in value about 6% per

year. If you purchase a $198,000 home today, what would it be

worth in one year, assuming the same rate of appreciation continues?

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter current value 1 9 8 ) 198,000.

Add 6% + 6 % 11,880.00

Find appreciated value = 209,880.00

Note: See page 37 for another example of future value or appreciation.

Page 24

U

SER’SGUIDE

— 19

Delta Percent - Rate of Appreciation

A home originally purchased for $150,000 sold a year later for $185,000.

What is the rate of appreciation?

KEYSTROKES DISPLAY

1 5 0 ) s % 150,000.00

1 8 5 ) = 23.33

USING THE FEET AND METERS CONVERSIONS

Using the w and W keys, you can quickly convert Meters to

Feet, Feet to Meters, Square Meters to Square Feet, and Square

Feet to Square Meters.

Convert 5 meters to feet.

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter 5 Meters 5 5.

Convert to Feet w FEET 16.40

Convert 20 Feet to Meters.

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter 20 Feet 2 0 20.

Convert to Meters s w MET 6.096

Convert 10 Square Meters to Square Feet.

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter 10 Square Meters 1 0 10.

Convert to Square Feet W SQFT 107.64

Convert 20 Square Feet to Square Meters.

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter 20 Square Feet 2 0 20.

Convert to Square Meters s W SQM 1.858

Page 25

20 — Q

UALIFIERPLUS

®

4

X

USING THE DATE FUNCTION

Using the : key, you can quickly solve common real estate date

problems: escrow or closing dates, listing expiration dates, and the

number of days prepaid interest, etc. You enter a date as follows:

Numerical Month :, Numerical Day :, and Numerical Year

(MM : DD : YY).

The date function lets you: 1) add a number of days to a date to find

a second date (in the future), 2) subtract a number of days from a

date to find a second date (in the past), and, 3) subtract one date

from another date to find the number of days in between.

For example, if a 45-day escrow begins September 19, 2007, what

is the closing date and day?

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter month 9 : 9.-

Enter day 1 9 : 9-19-

Enter year 0 7 9-19-07

Add 45 days + 4 5 = SAT 11-03-07

Find the number of days to calculate prepaid interest due at closing,

if the escrow closing date is 11/14/07 and the first payment is due

12/1/07.

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter 1st payment date 1 2 : 1 : 0 7 12-1-07

Subtract closing date to

find number of days – 1 1 : 1 4 : 0 7 = 17.00

Page 26

U

SER’SGUIDE

— 21

MORTGAGE/TIME-VALUE-OF-MONEY (TVM)

1. The financial functions — Loan Amount, Payment, Interest, Term

— work just like you would say them. For example, if you wanted to

borrow $100,000 for 25 years at 8% interest, just enter those three

known variables and press the key for the unknown fourth variable:

p.

2. When calculating future value problems, enter the present value

into the l key.

3. Financial values may be entered in any order you want.

4. Entered values for Term and Interest are permanently stored in

memory. (They do not clear when the calculator is turned off).

5. While in Canadian Mode (default), the calculator will display

“CDN” in the upper left of the display when the ˆ key is pressed.

6. The calculator’s default setting is 12 payments per year, for

monthly mortgages.

7. It is good practice to press o twice after completing a financial

problem to ensure that you have cleared the previous l and p

registers.

8. When solving for a financial component, the calculator may display the word “run” in the display. Solving for interest may take several seconds while the word “run” displays.

9. Once you have calculated an answer, for example, a payment,

you can go back and change any financial variable and recalculate

your new answer

without

re-entering all the other data. This is handy

for demonstrating various “what-if” mortgage problems.

10. Successive presses of the p key will calculate:

1) the principal and interest (P&I) payment;

2) the total payment (includes expenses).

(Cont’d)

EXAMPLES —

CANADIAN MODE

Page 27

22 — Q

UALIFIERPLUS

®

4

X

(Cont’d)

IMPORTANT NOTE:

All of the following examples can also be performed while the calculator is in U.S. Mode. See Canadian/U.S.

Modes on page 11. Just be sure to change the term from 25 to 30

years, where applicable, and of course, the answers will change due

to U.S. interest.

Additional U.S. examples are provided starting on page 56.

Finding the Monthly Mortgage (P&I) Payment

Find the monthly payment on a 25-year fixed-rate mortgage of

$165,000 at 7.5% annual interest. What is the effective rate?

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter Mortgage amount 1 6 5 )* l 165,000.00

Enter Term in years 2 5 T 25.00

Enter Interest 7 • 5 ˆ 7.50

Find monthly P&I Payment p “run” 1,207.07

Solve for effective rate s ˆ 7.39

What is the new payment if the interest rate is lowered to 7%?

STEPS KEYSTROKES DISPLAY

Enter new Interest rate 7 ˆ 7.00

Find monthly P&I Payment p “run” 1,155.69

*Note: Use the

)

key to save keystrokes.

Finding the Term of a Mortgage

How long does it take to pay off a $55,000 mortgage at 7.25% interest, if you make payments of $750 each month?

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter Mortgage Amount 5 5 ) l 55,000.00

Enter Annual Interest Rate 7 • 2 5 ˆ 7.25

Enter monthly P&I Payment 7 5 0 p 750.00

Find Term in years T “run” 8.05

Find periodic Term/Months T 96.65

Page 28

U

SER’SGUIDE

— 23

Paying Off a Mortgage Early (Making Larger Payments)

How long does it take to pay off a 25-year fixed-rate mortgage of

$150,000 at 7.25% interest if you add an extra $200 to the mortgage

payment each month?

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter Mortgage Amount 1 5 0 ) l 150,000.00

Enter Annual Interest Rate 7 • 2 5 ˆ 7.25

Enter Term in years 2 5 T 25.00

Find monthly P&I Payment p “run” 1,073.88

Add add’tl Payment amount + 2 0 0 = 1,273.88

Enter as new P&I Payment p 1,273.88

Find reduced Mortgage TermT “run” 16.95

Finding the Interest Rate

Find the interest rate if the mortgage amount is $98,500, term is 25

years and payment is $765 a month.

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter Mortgage Amount 9 8 5 0 0 l 98,500.00

Enter Term 2 5 T 25.00

Enter monthly P&I Payment 7 6 5 p 765.00

Find annual Interest rate ˆ* “run” 8.21

Find periodic Interest rate ˆ 0.68

*Note: If desired, press

s +

, and press ˆ, and repeat to toggle between

Canadian Mortgage Interest and U.S. Interest modes. Display will read “CDN” when

calculating Canadian interest, and “USA” for U.S. rates.

Finding the Mortgage Amount

Approximately how much could you borrow if the interest rate was

7.8% on a 25-year mortgage, and you could afford $1,500 in monthly payments? What if the interest rate was lowered to 7.5%?

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter Annual Interest Rate 7 • 8 ˆ 7.80

Enter Term in Years 2 5 T 25.00

Enter monthly P&I Payment 1 5 0 0 p 1,500.00

Find Mortgage Amount l “run” 199,869.55

Enter new Interest rate 7 • 5 ˆ 7.50

Find new Mortgage Amount l “run” 205,042.71

Page 29

24 — Q

UALIFIERPLUS

®

4

X

Non-Monthly Mortgages

Most mortgages are paid off monthly. However, if you have a nonmonthly mortgage, you must change the number of payments per

year using a two-key sequence: s ÷. For example, here's how to

set your calculator to four payments per year.

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter # of payments/year 4 s ÷ 4.00

To recall the currently stored number of payments:

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Recall # of payments/year ® ÷ 4.00

IMPORTANT:

To return payments per year to the default value of

12, perform the following steps:

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter # of payments/year 1 2 s ÷ 12.00

Finding a Quarterly Payment

Find the quarterly payment on a ten year mortgage of $15,000 with

an annual interest rate of 12%.

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Set to four payments/year 4 s ÷ 4.00

Enter Mortgage Amount 1 5 ) l 15,000.00

Enter Term in years 1 0 T 10.00

Enter annual Interest rate 1 2 ˆ 12.00

Find quarterly P&I Payment p “run” 644.36

Reset to 12 payments/year 1 2 s ÷ “run” 12.00

Page 30

U

SER’SGUIDE

— 25

Bi-Weekly Mortgages

Your calculator includes a built-in Bi-Weekly mortgage function (s

T), which allows you to convert established, fully amortized

monthly mortgages into Bi-Weeklies (in which one-half the monthly

payment is made every two weeks). Because you make two extra

half-payments per year (e.g., 26 Bi-Weekly payments is like making

13 payments/year), these kinds of mortgages can amount to large

interest savings and a substantial reduction in the time it takes to

pay them off.

You begin solving these problems by setting up the initial monthly

mortgage and then pressing s T. The first press of the T

displays the Bi-Weekly term. The second press of T shows the

total interest savings over the entire mortgage, a third press calculates the total interest paid, a fourth press shows the total principal

paid, and a fifth press shows the total P&I payments. A press of p

will calculate the Bi-Weekly payment.

Bi-Weekly Term Reduction and Payment

Find the monthly P&I payment on a 25-year, $198,500 mortgage at

7.85% annual interest. Then convert it to a Bi-Weekly and find out

how many years it will take to pay off this mortgage, the total interest

savings, total payments and the Bi-Weekly payment.

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter Mortgage Amount 1 9 8 5 0 0 l 198,500.00

Enter Term in years 2 5 T 25.00

Enter annual Interest rate 7 • 8 5 ˆ 7.85

Find monthly P&I Payment p “run” 1,496.02

Find Bi-Weekly Term s T “run” 20.14

Find total Interest savings T 57,191.24

Find total Interest paid T 193,115.09

Find total principal T 198,500.00

Find total Payments T 391,615.09

Find Bi-Weekly Payment p 748.01

Exit Bi-Weekly Mode o o 0.00

Note: Canadian Mortgage insurance will be included in the Bi-Weekly calculations if it

has been entered.

Page 31

26 — Q

UALIFIERPLUS

®

4

X

Sales Price/Down Payment

One of the unique features of this calculator is its ability to work with

not only Mortgage Amount, but with Sales Price and Down Payment.

You can enter two values to find the third (e.g., enter Price and

Down Payment to find Mortgage Amount). You may also enter the

down payment in both percent or dollar format. For example, to

enter 20%, enter 20 and press the d key (you do not have to

label it as a percent). Or enter $20,000 (e.g., 2 0 ) d).

Note: A number under 100 entered as the Down Payment is assumed to be a percent.

Note: When using

P, d

, and

l

keys, it's recommended that you always enter

the two known values (Price and Down Payment), then solve for the third (Mortgage

l

), before calculating financial values.

Finding Mortgage Amount Based on Sales Price and

Down Payment

Find both the down payment dollar amount and mortgage amount if

the sales price is $175,800 and you're planning to put 10% down.

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter sales Price 1 7 5 8 0 0 P 175,800.00

Enter Down Payment % 1 0 d 10.00

Find Down Payment $ d 17,580.00

Find Mortgage Amount l 158,220.00

Finding Sales Price and Payment Based on Mortgage Amount

and Down Payment

Find a home’s sales price if you've been approved for a $185,650,

25-year, 6.85% mortgage and you plan to put 15% down. Also find

your monthly payment.

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter Mortgage Amount 1 8 5 6 5 0 l 185,650.00

Enter Term 2 5 T 25.00

Enter Interest 6 • 8 5 ˆ 6.85

Enter Down Payment % 1 5 d 15.00

Find Down Payment $ d 32,761.76

Find sales Price P 218,411.76

Find monthly P&I Payment p “run” 1,283.17

Page 32

U

SER’SGUIDE

— 27

Finding Loan-to-Value (LTV) Based on Down Payment and

Sales Price

Find the Loan-to-Value if a buyer is putting $15,000 down on a

$197,000 home. Then find the mortgage amount.

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter sales Price 1 9 7 ) P 197,000.00

Enter Down Payment $ 1 5 ) d 15,000.00

Find Down Payment % d 7.61

Find LTV d 92.39

Find Mortgage Amount l 182,000.00

Setting Property Tax Percent Rate

Enter an annual property tax rate of 1.5%.

STEPS KEYSTROKES DISPLAY

Set Tax rate 1 • 5 t 1.50

Clear display o o 0.00

Recall Tax rate ® t 1.50

Setting Property Tax Dollar Amount

Enter annual property taxes estimated at $2,500, then clear.

STEPS KEYSTROKES DISPLAY

Set annual Taxes 2 5 0 0 t 2,500.00

Clear Tax 0 t 0.00

Total Payment (Including Heating Expense)

Find the Total (PITH) payment on a 25-year, 7.63% mortgage if the

home’s selling price is $178,000 and the down payment is 5%.

Monthly heating cost is estimated at $150.

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter Term in years 2 5 T 25.00

Enter annual Interest 7 • 6 3 ˆ 7.63

Enter sales Price 1 7 8 ) P 178,000.00

Enter Down Payment 5 d 5.00

Add mo. heating Expense 1 5 0 s D 150.00

Find Mortgage Amount l 169,100.00

Find P&I Payment p “run” 1,250.90

Find Total (PITH) Payment p 1,400.90

Page 33

28 — Q

UALIFIERPLUS

®

4

X

Total Payment (Including Heating Expense and Property Tax –

Entered as Percentage)

Find the Total (PITH) payment on a 25-year, 7.63% mortgage if the

home’s selling price is $178,000 and the down payment is 5%. The

annual property tax is estimated at 1.3% and the monthly heating

cost is estimated at $150.

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter Term in years 2 5 T 25.00

Enter annual Interest 7 • 6 3 ˆ 7.63

Enter sales Price 1 7 8 ) P 178,000.00

Enter Down Payment 5 d 5.00

Set annual Tax rate 1 • 3 t 1.30

Find annual property Taxes t 2,314.00

Add mo. heating Expense 1 5 0 s D 150.00

Find Mortgage Amount l 169,100.00

Find P&I Payment p “run” 1,250.90

Find Total Payment p 1,593.73

Total Payment (Including Heating Expense and Property Tax –

Entered as Dollar Amount)

Find the Total (PITH) payment on a 25-year, 7.25% mortgage if the

home’s selling price is $227,000 and the down payment is 35%.

Local annual property tax is estimated at $2,270 (or 1% of the sales

price). Monthly heating expense is $100.

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter Term in years 2 5 T 25.00

Enter annual Interest 7 • 2 5 ˆ 7.25

Enter sales Price 2 2 7 ) P 227,000.00

Enter Down Payment % 3 5 d 35.00

Find dollar $ d 79,450.00

Set Tax figure 2 2 7 0 t* 2,270.00

Add mo. heating Expense 1 0 0 s D 100.00

Find Mortgage Amount l 147,550.00

Find P&I Payment p “run” 1,056.34

Find Total (PITH) Payment p 1,345.50

*To view Tax rate in its monthly dollar amount and percent forms, press the Tax key

three times —e.g., press

® t t t

to recall the annual property tax, monthly

property tax and percent (tax rate) of $2,270, $189.17 and 1.00%, respectively.

Page 34

U

SER’SGUIDE

— 29

Finding Mortgage Amount (Including Canadian Mortgage

Insurance)

Find the Mortgage Amount (including Canadian Mortgage Insurance)

on a 25-year mortgage at 7.8% interest if you are considering a

mortgage with a monthly P&I Payment of $1,500. Canadian

Mortgage Insurance of 2.75% will be added to the mortgage amount.

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter annual Interest rate 7 • 8 ˆ 7.80

Enter Term in years 2 5 T 25.00

Enter monthly P&I Payment 1 5 0 0 p 1,500.00

Enter Canadian Mortgage

Insurance 2 • 7 5 C 2.75

Find Mortgage Amount l 199,869.55

Find Mortgage Amount (including

Canadian Mtg Ins) l 205,365.97

Enter new P&I Payment (including

Canadian Mtg Ins) p 1,541.25

— DO NOT CLEAR CALCULATOR —

Recall entered Canadian

Mtg Ins percentage ® C 2.75

Find Canadian Mtg Ins

dollar amount C 5,496.41

Page 35

30 — Q

UALIFIERPLUS

®

4

X

Finding Monthly Mortgage (P&I) Payment (Including Canadian

Mortgage Insurance)

Find the monthly P&I Payment (including Canadian Mortgage

Insurance) on a 25-year mortgage, 300,000 mortgage at 7.8% interest. Canadian Mortgage Insurance of $5,250 will be added to the

mortgage amount.

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter annual Interest rate 7 • 8 ˆ 7.80

Enter Term in years 2 5 T 25.00

Enter Canadian Mortgage

Insurance 5 2 5 0 C 5,250.00

Enter Mortgage Amount 3 0 0 ) l 300,000.00

Find Mortgage Amount (including

Canadian Mtg Ins) l 305,250.00

Find P&I Payment (including

Canadian Mtg Ins) p 2,290.87

— DO NOT CLEAR CALCULATOR —

Recall entered Canadian

Mtg Ins dollar amount ® C 5,250.00

Find Canadian Mtg Ins

percentage C 1.75

Note: Typically, Canadian Mortgage Insurance is entered as a percentage based on

the LTV of a loan, but you may enter a percent or dollar amount into Canadian

Mortgage Insurance order to calculate your Mortgage Amount and P&I/Total

Payments.

Amortization and Remaining Balance

The amortization function is quick and simple. It allows you to find

total interest, principal, and remaining balance for an entire

mortgage, for an individual payment or individual year, or any range

of payments or range of years, for fully or partially amortized

mortgages.

Notes on Amortization

1. When you enter a range of payments using the Colon : key,

you can find all three possible outputs — Interest, Principal and

Remaining Balance — without having to re-enter the range each

time. Simply keep pressing the a key to find the values.

(Cont’d)

Page 36

U

SER’SGUIDE

— 31

(Cont’d)

2. You can also find Remaining Balance using the s a key by

specifying a year or range of years, period or range of periods.

For example, to find the remaining balance after the 10th year,

press 1 0 s a; to find the remaining balance after the

10th period, press 1 0 s b s a.

3. Entered ranges are inclusive, so that a range of 1 to 5 would

include both year 1 and year 5.

4. Entering a numerical value or performing a math operation on

the keyboard will alter the values (including the default settings)

for range of payments calculations. It is therefore best to specify

a range of payments or individual payment before you calculate

any of the above.

5. In some cases, it is the practice to include a final, regular P&I

payment with the “balloon payment.” This calculator will not

include that in the internal calculation of remaining balance; it

will only display the actual principal balance remaining.

6. If the first payment of a mortgage begins in a month other than

January, you can set that month by using the Month Offset function. The default for this setting is 1 (for January). To change the

start month, press the month number, then the s and )

keys. This allows you to calculate the correct number of periods

in the amortization range. For example, if the first payment of a

mortgage begins in April, the value stored in the month offset

would be 4 (4 s )). If requesting amortization values for

year one (1 a), the amortization of periods 1-9 would be displayed. Year two (2 a) would display values for periods 10-

21. Turning your calculator off and back on returns the Month

Offset to 1 (January).

Note: If you have changed your Month Offset, be sure to return it to 1 (e.g.,

1

s )

) before proceeding to the next problem.

7. Your calculator automatically advances to the Next Amortization

Range or Period after the initial sequence is complete, upon

repeated presses of a.

This saves you from entering the next

range or period each time.

Page 37

32 — Q

UALIFIERPLUS

®

4

X

Total Principal and Interest for a 25-Year Mortgage

How much total interest will you pay on a $200,000 mortgage at

7.5% interest over 25 years? What is the total principal and interest

paid?

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter Mortgage Amount 2 0 0 ) l 200,000.00

Enter annual Interest rate 7 • 5 ˆ 7.50

Enter Term in years 2 5 T 25.00

Find monthly P&I Payment p “run” 1,463.11

Find total # of payments a “run” 1-300

Find total interest paid a 238,932.95

Find total principal paid a 200,000.00

Find total principal/interest a 438,932.95

Total Principal and Interest (Including Canadian Mortgage

Insurance)

How much total interest will you pay on a $200,000 mortgage at

7.5% interest over 25 years with 5% down payment and 2.75%

Canadian Mortgage Insurance included in the mortgage? What is

the total principal and interest paid?

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter Mortgage Amount 2 0 0 ) l 200,000.00

Enter annual Interest rate 7 • 5 ˆ 7.50

Enter Term in years 2 5 T 25.00

Enter Down Payment 5 d 5.00

Enter Canadian Mortgage

Insurance 2 • 7 5 C 2.75

Find monthly P&I Payment (including

Canadian Mtg Ins) p 1,503.35

Find total # of payments a “run” 1-300

Find total interest paid a 245,503.61

Find total principal paid a 205,500.00

Find total principal/interest a 451,003.61

Page 38

U

SER’SGUIDE

— 33

Amortization List for Individual Year(s) —

Using “Next” Feature

How much total interest and principal will you pay on a 25-year,

$90,000 mortgage at 8% interest during the first year? The second

year? Third year, etc.? First, find monthly payment to “set-up” this

mortgage. The calculator will automatically advance to the next year

upon subsequent presses of a.

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter Mortgage Amount 9 0 ) l 90,000.00

Enter Interest rate 8 ˆ 8.00

Enter annual Term in years 2 5 T 25.00

Find monthly P&I Payment p “run” 686.89

Enter Year 1 1 a “run” 1-12

Find total interest in Year 1 a 7,040.09

Find total principal in Year 1 a 1,202.62

Find P&I in Year 1 a 8,242.71

Find remaining balance a 88,797.38

Find remaining term a 24.00

Display next year (Year 2) a “run” 13-24

Find total interest in Year 2 a 6,941.95

Find total principal in Year 2 a 1,300.75

Find P&I in Year 2 a 8,242.71

Find remaining balance a 87,496.63

Find remaining term a 23.00

Display next year (Year 3) a “run” 25-36

(etc. — sequence repeats for each year)

Page 39

34 — Q

UALIFIERPLUS

®

4

X

Amortization List for Individual Year(s) —

Using Month Offset

The first payment of a mortgage begins in May. How much total

interest and principal will you pay on a 25-year, $90,000 mortgage at

8% interest during the first year? The second year? Third year, etc.?

(First find the monthly payment to “set-up” this mortgage.)

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Set Month Offset to May 5 s ) 5.00

Enter Mortgage Amount 9 0 ) l 90,000.00

Enter annual Interest rate 8 ˆ 8.00

Enter Term in years 2 5 T 25.00

Find monthly P&I Payment p “run” 686.89

Enter Year 1 1 a “run” 1-8

Find total interest in Year 1 a 4,703.92

Find total principal in Year 1 a 791.22

Find P&I in Year 1 a 5,495.14

Find remaining balance a 89,208.78

Find remaining term a 24.33

Display next year (Year 2) a “run” 9-20

(etc. — sequence repeats for each year.)

Return Month Offset to 1* 1 s ) 1.00

*Note: Remember to reset Month Offset to 1. Check this setting by pressing

® )

.

Page 40

U

SER’SGUIDE

— 35

Amortization List for Individual Payment(s)

For a $175,000 mortgage at 6.85% interest for 25 years, find out

how much interest and how much principal you’ll pay in the first and

second payments.

Note: Use the Per Function

(s b)

keys to specify payments.

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter Mortgage Amount 1 7 5 ) l 175,000.00

Enter Interest 6 • 8 5 ˆ 6.85

Enter Term 2 5 T 25.00

Find monthly P&I Payment p “run” 1,209.56

Enter Payment #1 1 s b a “run” 1-1

Find interest in Payment #1 a 984.99

Find principal in Payment #1 a 224.57

Find P&I in Payment #1 a 1,209.56

Find Rem. Balance in Payment #1

a 174,775.43

Find Remaining Term in Payment #1

a 24.92

Display Payment #2 a “run” 2-2

(etc. — sequence repeats for each payment.)

— DO NOT CLEAR CALCULATOR —

For the same mortgage, find the amount of principal and interest

paid in the 36th payment. Also, find the total payment, remaining

balance and remaining term.

STEPS KEYSTROKES DISPLAY

Enter Payment #36 3 6 s b a “run” 36-36

Find Interest in Pmt #36 a 936.25

Find Principal in Pmt #36 a 273.32

Find P&I Pmt #36 a 1,209.56*

Find Remaining Balance a 166,065.90

Find Remaining Term a 22.00

*Note: Payments are rounded to the nearest whole cent; therefore, the penny difference.

Page 41

36 — Q

UALIFIERPLUS

®

4

X

Amortization List for a Range of Payments or Years

For a $225,000, 25-year mortgage at 7.4% interest, find out how

much interest and principal you'll pay in payments 1-9, and then for

years 1-10.

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter Mortgage Amount 2 2 5 ) l 225,000.00

Enter annual Interest rate 7 • 4 ˆ 7.40

Enter Term in years 2 5 T 25.00

Find monthly P&I Payment p “run” 1,631.89

Enter Payments #1-9 1 : 9 s b a “run” 1-9

Find interest paid a 12,240.39

Find principal paid a 2,446.63

Find P&I paid a 14,687.01

Find remaining balance a 222,553.37

Find remaining term a 24.25

Enter Years #1-10 1 : 1 0 a “run” 1-120

Find interest a 149,169.59

Find principal a 46,657.27

Find P&I paid a 195,826.85

Find remaining balance a 178,342.73

Find remaining term a 15.00

Balloon Payment/Remaining Balance Needed to Pay Off

a Mortgage

You’re looking at a new home with the following financing available:

mortgage amount $225,000 at 6.75% amortized over 25 years but

due and payable after 10 years. What is the balloon payment

(remaining balance) after 10 years?

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter Mortgage Amount 2 2 5 ) l 225,000.00

Enter Interest rate 6 • 7 5 ˆ 6.75

Enter annual Term in years 2 5 T 30.00

Find monthly P&I Payment p “run” 1,541.36

Find balloon/remaining

balance after 10 years 1 0 s a “run” 175,202.35

Page 42

U

SER’SGUIDE

— 37

Future Value

Given any four components to a problem that includes a future

value, you can calculate the fifth.

Appreciation/Future Value

You purchased a home for $210,000 and want to know what it will

be worth in 3 years, figuring an inflation or appreciation rate of 6%.

(Set periods to one per year.)

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Set to 1 payment per year 1 s ÷ 1.00

Enter present value 2 1 0 ) l 210,000.00

Enter term in years 3 T 3.00

Enter appreciation rate 6 ˆ 6.00

Find future value s l “run” 250,750.98

Return to 12 Payments/year 1 2 s ÷ 12.00

Basic Savings Account Problem

(Future Value of an Initial Deposit)

What is the future value of an initial deposit of $15,000 after 5 years,

if interest is compounded monthly and the interest rate is 3%?

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Recall Payments/year* ® ÷ 12.00

Enter savings deposit into Loan

Amount (Present Value) 1 5 ) l 15,000.00

Enter Interest rate 3 ˆ 3.00

Enter Term in years 5 T 5.00

Find Future Value s l 17,408.11

*Calculator must be set to default of 12 periods per year, for compounding monthly. If

it isn’t, enter

1 2 s ÷

.

Page 43

38 — Q

UALIFIERPLUS

®

4

X

Trust Deeds and Discounted Notes

Your calculator easily handles trust deed purchase price and yield

problems. Two things to remember are:

1) when entering or solving for “yield” or “rate of return,” use

the ˆ key.

2) when entering or solving for “purchase price” or “present

value,” use the l key.

Purchase Price of a Note —

Fully Amortized

The mortgage you are thinking about buying has the following terms

and conditions: 15 years remaining, $100 per month incoming payments, and you want a 25% yield or return on your investment. In

this case you are paying for the income stream — the incoming payments — and not the future value. What price should you pay, based

on this desired yield?

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter desired yield 2 5 ˆ 25.00

Enter Term in years 1 5 T 15.00

Enter Payment Amount 1 0 0 p 100.00

Find purchase price l “run” 4,896.97

— DO NOT CLEAR CALCULATOR —

What if you want a 30% yield? Leave all of the above data and reenter the 30% interest over the old rate, then re-calculate the loan

amount.

STEPS KEYSTROKES DISPLAY

Enter your new desired

rate of return 3 0 ˆ 30.00

Find purchase price l “run” 4,179.12

Page 44

U

SER’SGUIDE

— 39

Finding the Yield on a Discounted Note

An individual wants to sell you a note under the following terms: 60

months remaining in the term, a face amount when due of $7,500,

10% interest-only payments of $62.50 (incoming). He says he will

sell this note to you for $6,500 if you buy today. If you buy it, what

will be the yield on your investment?

STEPS KEYSTROKES DISPLAY

Clear calculator o o 0.00

Enter future value of

note when due 7 5 0 0 s l 7,500.00

Enter purchase price 6 5 0 0 l 6,500.00

Enter Remaining Term/Yrs. 5 T 5.00

Enter Payment Amount 6 2 • 5 0 p 62.50

Find your yield ˆ “run” 14.09

— DO NOT CLEAR CALCULATOR —

What should you pay for this trust deed if you want an 18% yield on

your investment?

STEPS KEYSTROKES DISPLAY

Enter your desired yield 1 8 ˆ 18.00

Find purchase price l “run” 5,663.44

Page 45

40 — Q

UALIFIERPLUS

®

4

X

BUYER PRE-QUALIFYING

The Qualifying keys on your calculator let you instantly pre-qualify

prospective buyers. Mortgage lending pros will find these keys useful for doing instant mortgage pre-qualifications on the phone or in

front of clients. Real estate agents/brokers can quickly pre-qualify

clients so they can show them homes in their affordable price range.

The calculator gives you three types of qualifying answers:

1) Mortgage Amount Available given buyer ’s income and debt.

2) Income Required given mortgage amount (or price/down

payment).

3) Actual Ratios given both income/debt and property data.

Here are some notes on qualifying using your calculator:

1. The q and Q keys are multi-function, “smart” keys. In other

words, they deliver a variety of answers based on what is input,

and what is not. The calculator will figure out which qualifying

solutions should be displayed, based on the qualifying variables

you've input.

2. You can use both Qualifying keys q and Q to demonstrate

mortgage scenarios based on different qualifying ratios. The

q key defaults to GDS:TDS Income and Debt Ratios of 32%

and 40%. The Q key defaults to GDS:TDS Ratios of 35% and

42%. However, you may store any ratios you want into these

keys, or change the ratios at any time.

3. A calculated Qualifying Mortgage Amount is automatically stored

in the Loan Amount l register, replacing any existing