ANZ IWL250 OPERATING Manual

MERCHANT OPERATING GUIDE

ANZ POS MOBILE PLUS

SIMPLE AND RELIABLE PAYMENT SOLUTIONS

1

CONTENTS

1. Welcome 4

1.1 Merchant Agreement 4

1.2 Important Contact Details 4

1.3 Authorisation 4

1.4 Floor Limits 5

1.5 Change of Business Details 6

2. Cards You Can Accept 7

3. Merchant Cards 7

4. Equipment Maintenance 8

5. Stationery 9

6. Fraud Minimisation 9

6.1 Card Present Card Checklist 9

6.2 Fraud Minimisation for Credit Cards 10

6.3 Fraud Minimisation for Debit Cards 12

6.4 Cards Left at Premises 12

7. Handling Cardholder information securely & PCI DSS 13

7.1 PCI DSS – Payment Card Industry Data Security Standard 13

7.2 Securing Transaction Records 14

8. Errors and Disputes 15

8.1 Typical Causes of Return and Corrections 15

8.2 Chargebacks 15

9. ANZ POS Mobile Plus 17

9.1 Terminal Features 17

9.2 Terminal Keypad 17

9.3 Card Reader 18

9.4 How to install the ANZ POS Mobile Plus terminal 19

9.5 How to Load Printer Paper 26

9.6 Battery 26

9.7 Communication Mode 27

9.8 How to configure communication mode 27

10. Processing a Sale 34

10.1 How to Process a Cheque or Savings Purchase using a Magnetic Stripe Card or

ChipCard 34

10.2 How to Process a Credit Purchase Transaction using a Magnetic Stripe Card or

ChipCard 35

10.3 How to Process a Purchase Transaction using a Contactless Card or Smartphone 38

2

11. Processing a Cash-out Only Transaction 40

12. Processing a Refund Transaction 41

13. Electronic Fallback (EFB) Processing 48

14. Manual Transaction Processing 51

14.1 Paper Voucher Processing 51

14.2 Hand Key (Manual Entry) Processing 56

15. Mail, Telephone and eCommerce Order Processing 59

15.1 How to Process a Mail Order Transaction (Scheme Cards only) 59

15.2 How to Process a Telephone Order Transaction (Scheme Cards only) 61

15.3 How to Process an eCommerce Order Transaction (Scheme cards only) 63

16. Optional Features 65

16.1 Tip@Terminal (Tip with PIN) Transactions 65

16.2 Pre-Authorisation 68

16.3 Customer Preferred Currency 77

16.4 Low Value Payments 80

17. Terminal Error Messages 82

18. Settlement 85

19. Print Totals 87

20. Reprint the Last Record 87

21. Transaction Detail Report 88

22. Filing and Retention of Transaction Records and Vouchers 88

3

1. WELCOME

We are excited to welcome you as an ANZ Merchant and look forward to a long association

with you.

This Operating Guide provides you with information on cards you can accept, ways to reduce

fraud and what to do if errors or disputes are incurred. It also contains clear and easy-to-follow

instructions on how to process transactions on your ANZ terminal. As your Point of Sale (POS)

system leads the transaction, instructions in this Merchant Operating Guide may instruct you to

refer to your POS manual.

Please take time to read this manual thoroughly and ensure that your staff read it too.

1.1 MERCHANT AGREEMENT

Your ANZ Merchant Agreement contains valuable information and important requirements

relating to operating procedures. Instructions in this Merchant Operating Guide form part of

the ANZ Merchant Agreement and may be changed or replaced by us in accordance with the

terms of the merchant agreement.

ANZ strongly recommends that you follow the security checks and procedures in this guide to assist

in identifying and minimising fraudulent, invalid or unacceptable transactions.

ANZ may conduct an investigation if a transaction is believed to be fraudulent. The operators

of the applicable card schemes may also conduct their own investigations. Your Merchant

Agreement outlines the circumstances in which you will be liable for such transactions. If it is

found that you have processed invalid or unacceptable transactions, you may be liable for the

value of those transactions. Please refer to the General Conditions, ANZ Merchant Services for

more details.

1.2 IMPORTANT CONTACT DETAILS

ANZ Merchant Services (24 hours a day/7 days a week): 1800 039 025 or merchant@anz.com

Online Stationery Ordering: anz.com/merchantconnect

Authorisation Centre:

• Credit Cards (Visa and MasterCard®) 1800 999 205

• Charge Cards (Diners Club) 1800 331 112

• Charge Cards (American Express/JCB) 1300 363 614

• Debit Cards (Cheque/Savings Accounts) 1800 039 025

NOTE: Calls to 1800 numbers from a mobile phone will incur normal mobile phone charges.

1.3 AUTHORISATION

Your terminal is designed to automatically seek authorisation from the cardholder’s Card Issuer

while processing an electronic transaction.

Authorisation confirms that the card number is a valid card number and that there are

sufficient funds in the account. Despite a transaction being ‘authorised’, the merchant bears the

risk that the customer is not the true cardholder.

4

Authorisation does not amount to verification that the transaction is genuine nor does it

authenticate the customer.

NOTE:

• Authorisation of the transaction does not mean that the true cardholder has authorised the transaction

• Authorisation does not protect the merchant from chargebacks

• ANZ cannot guarantee that a transaction has been conducted by the true cardholder.

Authorisation Declined

Where an Authorisation is declined, please seek an alternative method of payment. If the

customer cannot pay, the goods should be reclaimed. For goods that cannot be reclaimed (eg.

food items, petrol etc), request photographic identification such as a Driver’s Licence or take a

description of the person and arrange with the customer to provide an alternative method of

payment. If unsuccessful, report the incident to the Police.

1.4 FLOOR LIMITS

A Floor Limit is a dollar amount set for a particular type of card transaction processed via your

merchant facility. Please note, Floor Limits relate to all transactions. Your Letter of Offer outlines

all Authorised Floor Limits that are specific to your business. Some of these limits are specific to

your business or industry, please insert these Authorised Floor Limits in the appropriate spaces

provided.

Authorised Floor Limits

Credit Card Floor Limits (including Visa and MasterCard Debit Transactions)

Manual (Imprinter):

Electronic Fallback:

Please insert your Authorised Floor Limit

Please insert your Authorised Floor Limit

Internet: $0

Mail Order & Telephone Order: $0

All Other Electronic Transactions: $0

NOTE: Please refer to your Merchant Agreement for further information on Floor Limits that apply to

Manual Imprinter and Electronic Fallback.

Debit Card Floor Limits (not including Visa and MasterCard Transactions)

• All Merchants cash/combined purchase/cash $0

• Service stations, taxis/limousines, liquor and convenience stores $60

• Supermarkets $200

• All Other $100.

Charge Card Floor Limits

Diners Club: ____________________ American Express: ____________________

NOTE: A $0 Floor Limit applies to all Hand Key Mail/Telephone Order and eCommerce Transactions.

5

You must phone the Authorisation Centre for transactions over your Authorised Floor Limit

using the above phone numbers (refer to section 1.2) to verify if the account has sufficient

funds available to cover the transaction. If approval is not obtained for transaction above your

Authorised Floor Limit, you risk the transactions being charged back.

When you contact the Authorisation Centre, a transaction will be ‘approved’ or ‘declined’. If

declined, please advise the customer to contact the Card Issuer and seek an alternative method

of payment.

NOTE: An alpha character may be provided as part of the approval code. Select the numeric key

corresponding to the alpha character and press <▼> key to scroll through options. Example: If character

‘C’ is required, select number ‘2’ on the pinpad and press the <▼>key until you scroll to character ‘C’, then

press ENTER.

NOTE:

• A transaction may still be charged back despite being authorised by the Authorisation Centre

• A $0 oor limit applies to all card transactions.

1.5 CHANGE OF BUSINESS DETAILS

The General Conditions describe various situations in which you must notify us of a change to

your circumstances.

Please visit anz.com/merchantconnect to complete and submit the respective form or contact

ANZ Merchant Services on 1800 039 025 if there are any changes to your:

• Business name and/or address

• Business type or activities including changes in the nature or mode of operation

of your business

• Mailing address

• Ownership

• Bank/branch banking details

• Telephone or fax numbers

• Industry

• Email Address.

Should your business be sold, cease to trade or no longer require an ANZ Merchant Facility,

please contact ANZ Merchant Services on 1800 039 025.

The General Conditions set out your obligations when your business is sold, ceases to trade or

no longer requires an ANZ Merchant Facility.

You must ensure that all stationery, promotional material, Transaction Vouchers, Card Imprinters

and equipment (including Electronic Terminals) is returned to ANZ, based on the closure

instructions provided by ANZ Merchant Services.

Please note that it is the authorised merchant’s responsibility to ensure that the Merchant

Facility is returned. Failure to do so, may result in the continual charge of Terminal Rental Fees

until all equipment is returned in accordance with condition 16(iv) of the ANZ Merchant

Services General Conditions.

6

2. CARDS YOU CAN ACCEPT

Credit Cards

Cardholders can use credit cards (MasterCard®, Visa and UnionPay) to perform transactions

through the ANZ terminal on their credit card accounts. Cardholders can also access cheque

and savings accounts where those accounts are linked to the credit card.

Cardholders can access these accounts through the ANZ terminal using their PIN (Personal

Identification Number) and in some circumstances, their signature. Cardholders can also

use their contactless card or Smartphone to make the purchase by tapping the terminal’s

contactless reader. For contactless transactions under the certain purchase value (AUD

$100.00), PIN or signature may not be required to verify a transaction.

Debit Cards

Cardholders possessing a debit card will use a PIN for verication in most circumstances.

Cardholders can also use their contactless card or Smartphone to make the purchase by

tapping the terminal’s contactless reader. For contactless transactions under or equal to

the certain purchase value (AUD $100.00), PIN or signature may not be required to verify a

transaction.

NOTE: The Electronic fallback, paper voucher and manual transaction are not allowed to process for debit

cards unless the Authorisation has been obtained (refer to section 1.4 Floor Limits).

Charge Cards

Processing charge cards is essentially the same as processing credit card transactions. To

accept charge cards, you must have an agreement with the charge card Issuer (eg. Diners Club,

American Express and JCB).

NOTE: Pre-authorisation transactions still require you to swipe or insert the customer’s debit cards and

credit cards in order to complete the transaction. You are unable to tap the customer’s contactless card or

Smartphone to complete these transactions.

3. MERCHANT CARDS

You have been provided with two different types of Merchant Cards - EFTPOS Merchant Card

(Terminal ID card) and Merchant Summary Card (Merchant ID Card). These are designed to

use for with different purposes, including processing Refund Transactions and Manual Paper

Voucher Transactions.

It is your responsibility to always keep your Merchant Cards - EFTPOS Merchant Card (Terminal

ID card) and Merchant Summary Card (Merchant ID Card) in a safe place, and ensure only

authorised staff have access to these cards. Unauthorised access to these cardscan result in

unauthorised refunds via your merchant facility resulting in theft from your business.

It is important that the correct cards are used at all times.

Replacement Merchant Cards can be ordered from ANZ Merchant Services on 1800 039 025 by the

authorised person from your business.

7

EFTPOS Merchant Card (Terminal ID card)

• To Authorise a Refund Transaction, swipe through

Magnetic Stripe Card Reader

• To exit Security Mode, swipe through Magnetic Stripe

Card Reader

• To imprint your manual EFTPOS Merchant Summary

Vouchers for cheque and savings transactions

• As reference for your Terminal Identification Number

(TID).

Merchant Summary Card (Merchant ID Card)

Your Merchant Summary Card is required when you

imprint your Merchant Summary Voucher for Manual

Credit Card Transactions and as a reference for your

ANZ Merchant Identification Number (MID).

4. EQUIPMENT MAINTENANCE

It is your responsibility to provide a clean operating environment for your terminal. Liquids

and dust may damage the terminal components and can prevent it from operating. To order

a Magnetic Stripe Card Reader Cleaner, please visit anz.com/merchantconnect or contact ANZ

Merchant Services on 1800 039 025.

To prevent fire, power units and cord should be inspected regularly. If any damage to the power

units and cord is found on your terminal, please contact ANZ Merchant Services on 1800 039 025

for assistance. It is important to clean your terminal regularly to maintain its operating efficiency

as you may be charged if it is damaged. The terminal and screen may be wiped clean using a

damp cloth. Do not use abrasive materials. Use a soft brush to keep the keypad dust-free.

NOTE:

• Please do not tamper with or remove the terminal housing

• Do not place the stickers on the terminals

• Do not disconnect your terminal’s power supply or communication line unless instructed to do so by

ANZ Merchant Services.

8

5. STATIONERY

You have been supplied with an initial stock of stationery including:

• 4 x Paper Rolls (for electronic terminals only)

• 25 x Credit Card Summary Envelopes

• 25 x Credit Card Sales Vouchers

• 25 x Credit Card Refund Vouchers

• 25 x Merchant Summary Vouchers

• 25 x Cheque/Savings Summary Envelopes

• 25 x Cheque/Savings Sales Vouchers

• 25 x Cheque/Savings Refund Vouchers

• 25 x EFTPOS Summary Vouchers

• Magnetic Stripe Card Reader Cleaner.

To re-order stationery, please visit anz.com/merchantconnect or contact ANZ Merchant

Services on 1800 039 025. Please note that you are only allowed to use the stationery approved

by ANZ.

6. FRAUD MINIMISATION

Before commencing any transactions, please take time to read through the Fraud Minimisation,

Data Security and Chargeback guide at ANZ.com for further detailed fraud information to assist

you in protecting your business.

6.1 CARD PRESENT CARD CHECKLIST

How to Safeguard Against Fraud:

• Do not let anyone service or remove your terminal without viewing proper identification

• Do not allow equipment to be used by unauthorised persons

• Keep Merchant Cards secure from unauthorised use

• Do not divulge cardholder information (e.g. card names or numbers)

• Retain the card until you have completed the security checks and obtained authorisation for

the transaction

• Do not locate your terminal under a security camera or any other CCTV device.

Be alert for customers acting suspicious or who

• Appear nervous, overly talkative or in a hurry

• Arrive on closing time

• Try to rush you or distract you

• Carry the card loose or by itself

9

• Have no means of identification

• Make numerous purchases under your Authorised Floor Limit

• Make purchases without regard to size, quality or price of goods

• Ask to split transactions into smaller amounts

• Ask for transactions to be manually entered

• Sign the Voucher or transaction Voucher slowly or unnaturally.

What to do if you are suspicious of a transaction

• Ask for photographic identification (e.g. Driver’s Licence or passport) and ensure that the

details match the cardholder’s name. Record the details on your copy of the Transaction

Voucher

Remember:

• Don’t risk it: If you remain suspicious about the transactions, refund the credit transaction

and ask your customer for a direct deposit or some other form of payment (particularly for

large value sales)

Please report all fraudulent activities to the Police immediately.

Split Ticket Transactions

A transaction may be deemed invalid and charged back to you if, in ANZ’s reasonable opinion,

it relates to one or more purchases made in the same merchant establishment which have

been split into two or more transactions.

Chip Card Processing

Chip Cards are embedded with a security microchip that provides further protection to assist in

decreasing the risk of fraudulent transactions and chargeback disputes. Look at the card and if

there is a chip, always insert the card into the chip reader at the first instance.

As with any other transaction, a degree of caution must also be exhibited when processing

chip card transactions.

If:

• The terminal displays “Insert Chip” when the card is swiped through the terminal and the

card in question does not have a chip on it, do not proceed with the transaction

• The terminal displays “Insert Chip” and the chip - when inserted- cannot be read by the

terminal, do not proceed with the transaction.

6.2 FRAUD MINIMISATION FOR CREDIT CARDS

The following checks are vital in helping you identify and minimise fraudulent credit card

transactions via your ANZ Merchant Facility.

Before commencing any transaction:

• Confirm that you are authorised to accept that particular card

• Check whether the card appears damaged or altered.

10

Check on the front of the card that:

• Ensure that the name on the card is appropriate to the customer. Identity theft may have

occurred if you are presented with a card containing the name of a cartoon character, a

feminine name on a card presented by male or other questionable scenarios

• The printing on the card should look professional

• The card must have current validity dates (a card can only be used from the first day of the

‘valid from’ month to the last day of the ‘until end’ month)

NOTE: Some UnionPay cards may be issued with zero's as the expiry date. These cards are still valid.

• Cards should look 3-dimensional and contain familiar security features such as a hologram,

signature panel and CVC2 (explanation to follow). It should not appear suspicious or be

made of inferior material.

Embossed Cards:

• The cardholder name and number should be raised and not flattened (unless it is a genuine

unembossed card)

• The first four digits of the embossed number must match the pre-printed four digits on the

card

• The embossing should be clear and even.

Unembossed Cards:

• A cardholder name may or may not be included

• Can be used for electronic Transactions only

• The cardholder name and number are printed rather than raised

Check the signature during the transaction:

• A signature should appear within the signature panel on the card

• The signature or signature panel should not appear to have been altered

• The customer’s signature on the Transaction Voucher should match the signature on the card.

Card Validation Code (CVC2):

The Card Validation security feature is

activated in all ANZ POS Terminals when

processing Mail Order and Telephone

Order Transactions. To activate the CVC2

for other Transactions please contact

ANZ Merchant Services on 1800 039 025.

If activated, a new screen will appear

when processing financial Transactions.

Card Validation Code

11

Turn the cardholder’s credit card over and locate the last 3-digits of the number printed on

the signature panel. If the transaction is initiated via mail, telephone or Internet, instruct the

cardholder to locate and quote the 3-digits on the signature panel.

Terminal Display

At this display screen, key in the Card Validation Code

VERIFICATION NO?

NOTE: American Express cards have a four digit code located on the front of the card. Diners Club cards

have a three digit code on the reverse of the signature panel.

then press ENTER.

If the Card Validation Code has been bypassed (only press ENTER rather than entering CVC) the

following screen will be displayed:

REASON CODE

1. NOT PROVIDED

2. ILLEGIBLE

3. NO IMPRINT ON CARD

When the transaction has been processed, check:

• The card number details against those printed on the Transaction Record

• The trading name and address details are correct

• Ensure that ‘Approved’ or an approval number/code is printed on the Transaction Record.

6.3 FRAUD MINIMISATION FOR DEBIT CARDS

The following procedures are vital in helping you identify and minimise fraudulent debit card

transactions via your Merchant Facility.

Debit Transactions are to be processed by swiping or inserting the presented card and having

the customer enter their PIN or, in certain circumstances, their signature.

6.4 CARDS LEFT AT PREMISES

From time to time customers may accidentally leave their debit or credit cards behind at your

premises. To ensure any potential fraud is minimised and to better align with broader industry

practices, a change to existing handling process is required.

Upon discovering a card left at your premises, you are to perform the following tasks:

• Retain the card in a safe place for a period of up to two business days;

• Hand the card to the customer claiming the card only after having established the claimant’s

identity by comparing signatures; and

• If the requisite two business days have passed, destroy the card.

• Should the cardholder enquire about their missing card, instruct them to contact their

issuing institution.

12

7. HANDLING CARDHOLDER INFORMATION

SECURELY & PCI DSS

You are responsible for the security of all cardholder and transaction information you receive,

process or store.

Businesses store credit card details for various purposes. While sometimes this is necessary

to support legitimate business practices, storage of card data can lead to theft of customer

information and significant impact to your business. ANZ recommends that card data is never

stored on your systems.

If your business accepts MOTO (Mail Order/Telephone Order), eCommerce, Pre-Authorisation,

Manual or Recurring transactions, you must ensure all cardholder data and transaction records

are received, processed and stored in compliance with the Payment Card Industry Data

Security Standard (PCI DSS).

If you need to process MOTO, eCommerce or recurring transactions regularly, talk to ANZ

about our secure eCommerce payment solutions. Using a secure eCommerce solution, like

a Bank-hosted payment page or PCI-compliant payment gateway, can remove most of the

requirements for your business to store or handle card data directly, ensuring enhanced

security for your business.

7.1 PCI DSS – PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

The PCI DSS is a global security standard developed by Visa, MasterCard, AMEX and other

card schemes to ensure consistent security standards for all organisations that store, process

or transmit cardholder information. Visa and MasterCard require all ANZ merchants to be

compliant with PCI DSS.

PCI DSS covers the following principles:

• Build and Maintain a Secure Network

• Protect Cardholder Data

• Maintain a Vulnerability Management Program

• Implement Strong Access Control Measures

• Regularly Monitor and Test Networks

• Maintain an Information Security Policy.

What are the benets of PCI DSS compliance?

PCI DSS compliance assists your business in protecting Payment Card data and minimising risk

of theft of Cardholder information or compromise of your business systems. Maintaining a PCI

DSS compliance program helps your business identify potential vulnerabilities and may reduce

the financial penalties and remediation costs from a data breach.

13

Validating PCI DSS Compliance

To validate compliance with PCI DSS, your business must complete the following validation tasks:

1) Annual PCI DSS Assessment

The Self-Assessment Questionnaire (SAQ) is a free assessment tool used to assess compliance

with the PCI DSS standards. There are 4 different SAQs, covering a variety of payment

processing environments, available to download from the PCI SSC website at: https://www.

pcisecuritystandards.org/merchants/self_assessment_form.php

Compliance assessments may also be performed by completing an onsite audit with an

independent PCI approved Qualified Security Assessor (QSA). PCI maintains a list of PCI

approved QSAs at: https://www.pcisecuritystandards.org/approved_companies_providers/

index.php

2) Quarterly Network Vulnerability Scans

If your business accepts payments via the Internet, or has any electronic storage of Cardholder

or transaction information, then Quarterly Network Vulnerability Scanning is required to ensure

compliance with PCI DSS.

An external vulnerability scan enables your business to assess your level of security from

potential external threats.

PCI-Approved scanning tools are used to generate traffic that tests your network equipment,

hosts, and applications for known vulnerabilities; the scan is intended to identify such

vulnerabilities so they can be corrected.

ANZ provides a complimentary PCI DSS Compliance Program to our merchants, including PCIapproved Network Vulnerability Scanning – please email pcicompliance@anz.com or contact

ANZ on 1800 039 025 to request access to our PCI DSS program.

7.2 SECURING TRANSACTION RECORDS

In general, no cardholder data should be stored unless it is strictly for use within the business

and absolutely necessary.

However, if you have authority from ANZ to process mail order / telephone order, eCommerce,

recurring or manual payments you may be required to store cardholder data and transaction

records. Please ensure all paper and electronic records containing cardholder data are secured

(e.g. locked filing cabinet), these may include: MOTO order forms, merchant copies of manual

transactions, cardholder records for recurring or pre-authorisation transactions.

Where storage of cardholder data is required, you must ensure both the type of cardholder data

retained, and the method used to store it is compliant with PCI DSS and ANZ requirements.

Here are a few simple guidelines:

• Never email credit card numbers or request your customers provide their credit card number

by email

• Ensure that you process eCommerce transactions with security codes (CVV2/CVC2), but do

not store these codes after they have been authorised

• Keep cardholder data storage to a minimum, only what is necessary for business or legal

needs

14

• Once a transaction is processed, obscure all digits except the first 6 and last 4 digits of the

Credit Card Number (e.g. 1234 56XX XXXX 7890) on all paper and electronic records

• Store cardholder data in a secure environment with strict controls and restricted access

• Use strong passwords which are changed at least every 90 days for all administrator roles

and users with access your customer’s card details

• Avoid storing cardholder data on PC’s, Laptops or mobile phones

• Do not store your customer’s card details online or unencrypted on your computer

• Securely dispose of cardholder data as soon as its use has expired. PCI DSS recommends

shredding, pulping, incinerating or other methods which make it impossible to reconstruct

the cardholder data. ANZ requires you keep transaction records for 30 months minimum.

Under no circumstances should sensitive information be stored; this information includes

security codes (CVV2, CVC2), PIN or magnetic stripe data

The following sources provide guidance on card data storage:

General Conditions – see Section 14 ‘Information Collection, Storage and Disclosure’

For more information, visit the PCI Security Standards Council website at

https://www.pcisecuritystandards.org/index.shtml

8. ERRORS AND DISPUTES

A Return and Correction (R&C) refers to a Voucher from a debit or credit card transaction that

cannot be processed. Consequently the transaction is debited from your bank account and

then the Voucher is returned to you for correction.

8.1 TYPICAL CAUSES OF RETURN AND CORRECTIONS

• Incorrect Vouchers used and incorrect additions on Merchant Summary Vouchers

• Incomplete information e.g. card imprint cannot be read on the Voucher

• Banking of Vouchers from other card schemes e.g. American Express.

When you receive a R&C, an explanation will be given as to why it cannot be processed.

Make sure you rectify the problem before re-submitting the Voucher for processing.

Please ensure that the corrected Vouchers are submitted as soon as possible to ensure that the

Issuing Bank does not reject them as a result of being returned out of time.

8.2 CHARGEBACKS

A Chargeback is the term used for debiting a merchant’s bank account with the amount of a

transaction that had previously been credited. Chargebacks can have a financial impact on your

business. It is important that you are fully aware of your obligations, the processes involved and

possible outcomes. Please take time to carefully read through the Fraud Minimisation, Data

Security and Chargeback guide at anz.com.

15

Please refer to the General Conditions . You may be charged back for the value of a credit or

debit (card schemes-issued) card sale where you have failed to follow the Bank’s procedures as

stated in this Merchant Operating Guide or in the General Conditions.

NOTE: You must retain information about a transaction whether processed manually or electronically for a

period of 30 months from the date of the transaction or such other period required by card schemes, Law

or notied by ANZ.

Chargebacks can occur for a number of reasons including a scenario where a Cardholder or

their issuing bank justifiably disputes liability for the transaction for any reason or where the

Merchant fails to comply with its obligations under the Merchant Agreement in connection

with the transaction.

A Chargeback will also occur if a Retrieval Request is left unanswered or returned out of time

by the merchant or if the supporting documentation supplied to the issuing bank is not

acceptable. In most cases, the value of the disputed transaction will be automatically debited

from the merchant’s account.

Chargebacks can occur for a number of reasons:

• Processing errors

• Unauthorised use of a card

• No signature on the receipt

• Unauthorised Transactions

• Invalid card account number

• Transaction exceeds floor limit

• Card details not imprinted on the sales voucher

• Incorrect Transaction amount

• Expired card

• Transactions performed on a lost or stolen card

• Illegible details on the sales voucher

• Failing to respond to a retrieval request

• Merchandise not received by purchaser or wrong goods sent.

NOTE: The examples given are not an exhaustive list of the circumstances in which a transaction may

be charged back to you. Please refer to the General Conditions of your Merchant Agreement for further

information on Chargebacks.

If you need assistance understanding a particular Return and Correction or Chargeback, please

contact ANZ Merchant Services on 1800 039 025 (24 hours a day, 7 days a week).

16

9. ANZ POS MOBILE PLUS

This Merchant Operating Guide provides important information you need to know about

processing debit and credit Transactions using your ANZ POS Mobile Plus terminal by showing

the terminal screen displays. This terminal is designed to accept payment using Magnetic Stripe

and Chip Cards as well as Contactless Cards and Smartphones.

Please take time to read it thoroughly and ensure that your staff read it too.

9.1 TERMINAL FEATURES

The ANZ POS Mobile Plus incorporates a large colour graphic screen, 18 functional keys, a

Magnetic Strip Card Reader, a Chip Card Reader, a built-in Contactless Reader and a built-in

Printer and Paper Roll component.

Contactless

Status Lights

Printer and Paper

Roll component

Magnetic Stripe

Card Reader

Contactless Reader

Function Key

Soft-function

keys

Enter key

Cancel key

9.2 TERMINAL KEYPAD

SOFT-FUNCTION’ KEYS

These soft-function keys allow you to access the particular account type required. They are also

used as function keys for navigating the ANZ EFTPOS MENU and Sub MENUs.

NUMBER KEYS (Silver)

Use the number keys to enter in the transaction amounts, Authorisation Numbers and when

the hand key function is required.

Clear key

17

ENTER (Green)

The ENTER key will direct you to the ANZ EFTPOS MENU. It confirms that all values and details

(including signatures and PINs) are correct in the EFT portion of the purchase, cash-out (refer to

section 12) and Refund Transactions (refer to section 13). It also confirms that the transaction

can be sent to the Bank for verification and approval.

CANCEL (Red)

The CANCEL key is used to cancel the current function and return the terminal to the idle state.

CLEAR (Yellow)

Press the CLEAR key to correct any invalid data entry. The CLEAR key is also used as a FEED key

by pressing and holding the CLEAR key.

Func (Silver)

Use the Func key to access the terminals function menus and Manual Hand Key processing.

9.3 CARD READER

Magnetic Stripe Card Reader

The card can be read via the Magnetic Stripe Card Reader located on

the right hand side of the terminal.

The card can be read by swiping from the top to the bottom of the

terminal (or vice versa), with the magnetic stripe facing down towards

the terminal.

Use a regular movement to ensure a reliable card reading.

Chip Card Reader

Insert the Chip Card horizontally into the bottom of the terminal with

the metal chip facing upwards. Leave the Chip Card in this position

throughout the transaction.

The Chip Card can be removed from the terminal when signature

verification is required or as instructed by the terminal.

Contactless Reader

Tap the contactless-enabled card or Smartphone within 4cm of the

terminal screen on ANZ Contactless Terminal until the lights are lit in

sequence above the top of the terminal screen, when all four status

lights are illuminated, you will hear the long “Beep", then follow the

Terminal prompts to complete the transaction.

18

9.4 HOW TO INSTALL THE ANZ POS MOBILE PLUS TERMINAL

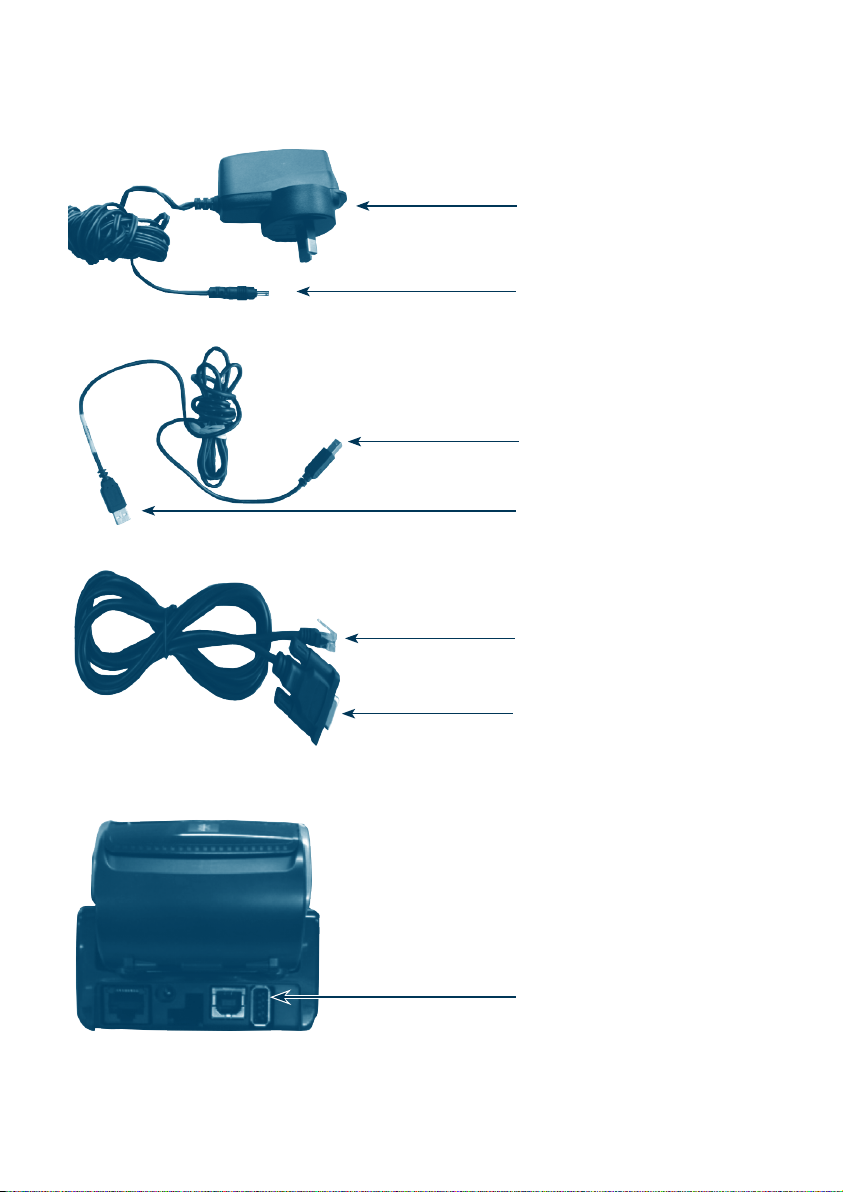

Charger

Connect to your power

outlet

Connect this to your

POS

USB Cable

Connect this to your

POS

Connect this to your

Terminal

Serial Cable

Connect this to your

Terminal

Terminal and Base Rear

Connect this to your

POS

Connect the USB, Serial

and Power cables into

these ports

19

For new terminal installation, please contact your IT support team or Point of Sale (POS) Vendor

for new installation instructions before you follow the below steps.

Please plug in the terminal’s base to your Point of Sale using either the serial or USB

connections. Connect the base to a power outlet using the provided power cable. Once the

terminal is connected to the base, please follow the below instructions when installing your

terminal.

Associate with Base

Swipe your EFTPOS Merchant Card

SWIPE

MERCHANT CARD

(please refer to section 3 for more information).

Note: If you do not have this, press <CLEAR> and

manually key on the Terminal ID, then press <ENTER>.

ASSOCIATE WITH BASE

FUNCTION

ASSOCIATE WITH BASE?

ENTER OR CLEAR

ASSOCIATING

LEAVE ON BASE

PLEASE WAIT

Successful

Conguring Terminal Communications

Press the Func key.

Key in 6634 then press ENTER.

Press ENTER.

Please let the terminal associate with the base.

The terminal has successfully associated with the base.

20

Press the Func key.

FUNCTION

Key in 11112227 then press ENTER.

CONFIGURE TERMINAL COMMS?

SERIAL PORT

COM0

COM1

USB

POS COMMS

SERIAL

IP SSL

PROTOCOL

ASYNC DLE 9600

ASYNC DLE 9600

VLI 38400

VLI 38400

ADVANCED

Press ENTER.

Press the down or up key to cycle between COM0 (for

Serial), COM1 and USB (for USB), press ENTER on your

selection.

Press the down or up key to cycle between Serial and IP

SSL, press ENTER on your selection.

Press ENTER.

PROCESSING PLEASE WAIT

The terminal status is displayed.

The terminal returns to the main screen and displays a

'TMS REQUIRED' message.

21

TMS Logon

This screen is displayed if the terminal is required to log

on to TMS.

FUNCTION

TMS LOGON?

ENTER OR CLEAR

TMS ACTION

CONNECTING

TMS ACTION

LOGON

TMS ACTION

PLEASE WAIT

/

TMS ACTION

LOGON

Press Func Key and key in 2468 then press ENTER.

Press ENTER.

Terminal status is displayed.

This screen is displayed when TMS logon is successful.

22

Conguring the Terminal

The terminal displays: "CONFIG REQUIRED".

Press Func Key.

FUNCTION?

SWIPE MERCHANT CARD

COMMS MODE

1 - DIAL - UP CNP

CONNECTION

1 - STAND ALONE

Key in 9905 then press ENTER.

Swipe your EFTPOS Merchant Card

(please refer to section 3 for more information).

NOTE: if you do not have this, press <CLEAR> and manually

key in the Terminal ID, then press <ENTER>.

Press ENTER.

Press ENTER.

23

ANZ LINE SPEED?

1-1200

Press ENTER.

TMS LINE SPEED?

3-14400

PRE/POST DIAL?

1-PRE - DIAL

DIAL MODE?

1 - TONE

PABX?

0

HOST PHONE NO?

1800XXXXXX

TMS PHONE NO?

1800XXXXXX

Press ENTER.

Press ENTER.

Press ENTER.

Press ENTER.

If a 0 is required for an outside line, please ensure this is shown

on this screen, otherwise press ENTER.

Press ENTER.

Press ENTER.

24

QUICK DIAL?

1- ON

TMS NII?

XXX

ANZ SHA?

48XXXXXXX

Press ENTER.

Press ENTER.

Press ENTER.

Terminal Initialisation

This screen is displayed if the terminal is required to initialise.

FUNCTION

REMOTE INIT?

ENTER OR CLEAR

REMOTE INIT

IN PROGRESS

INITIALISING

PLEASE WAIT

Press Func Key and key in 87 then press ENTER.

Press ENTER.

Terminal status is displayed.

The terminal has completed the Initialisation and will return to

the main screen.

NOTE: If the screen does not display "Initialising Please Wait", please contact ANZ Merchant Services on

1800 039 025 for further assistance. If you have an activation/reference number, please have the number

handy.

25

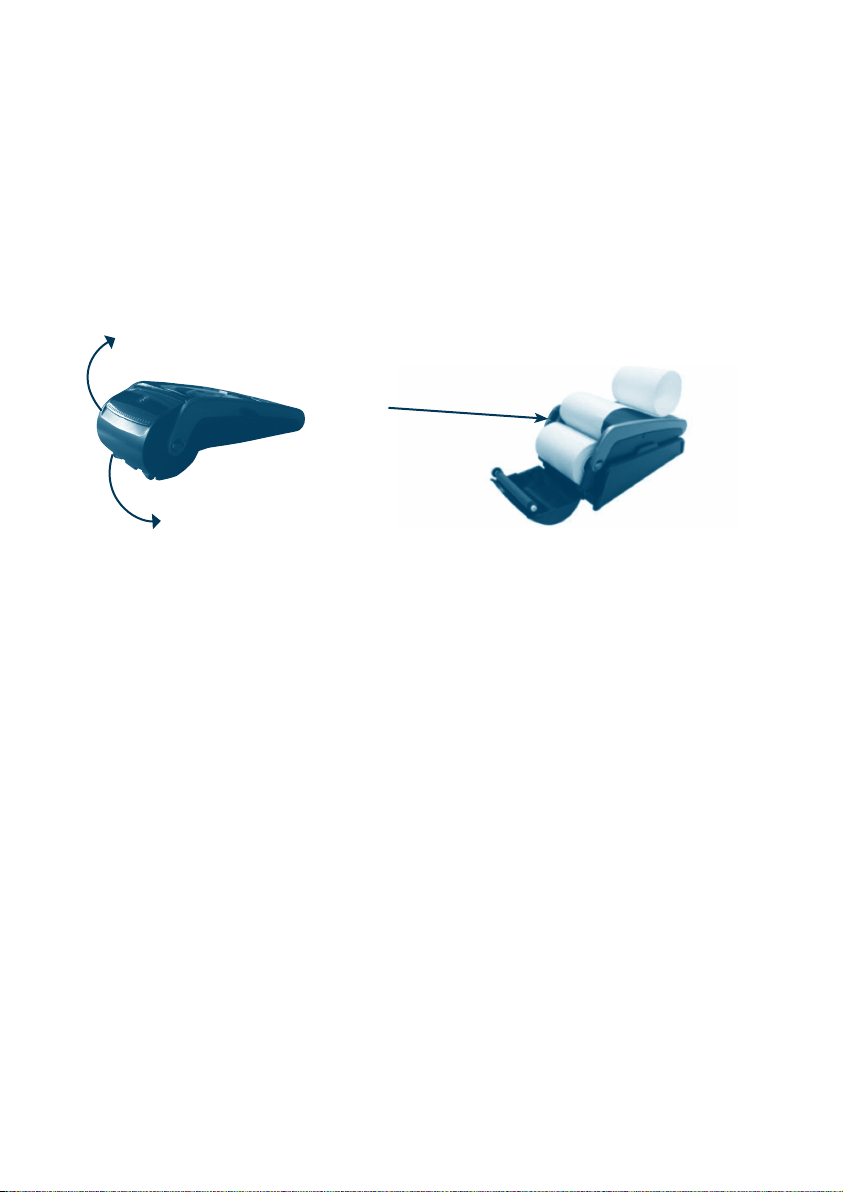

9.5 HOW TO LOAD PRINTER PAPER

• Open the paper compartment by lifting the catch located at the rear of the terminal and pull

the cover to the rear of the terminal

• Insert the paper roll (diameter 40mm) in the compartment and following the directions

shown on the picture

• Pull the paper up to the top of the terminal and hold in position

• Maintain the paper roll position and close the lid

• Press the top of the lid in the centre until it clips into position.

Lift catch up

Correct paper

position

Pull cover open

NOTE: Do not tamper with or remove the terminal housing.

9.6 BATTERY

The ANZ POS Mobile Plus terminal battery that will allow approximately 500 basic Transactions

to be completed with one fully charged battery. A full charge of the battery will take up to 4

hours to complete.

When does the battery need to be charged

• On initial start up, it is important to charge the battery for 16 hours

• Before commencing a shift, please make sure to fully charge the battery to ensure the

maximum number of transactions can be completed

• When used daily, the terminal recharges its batteries each time it is placed on its base

if base power supply is connected to the main power outlet on the wall.

26

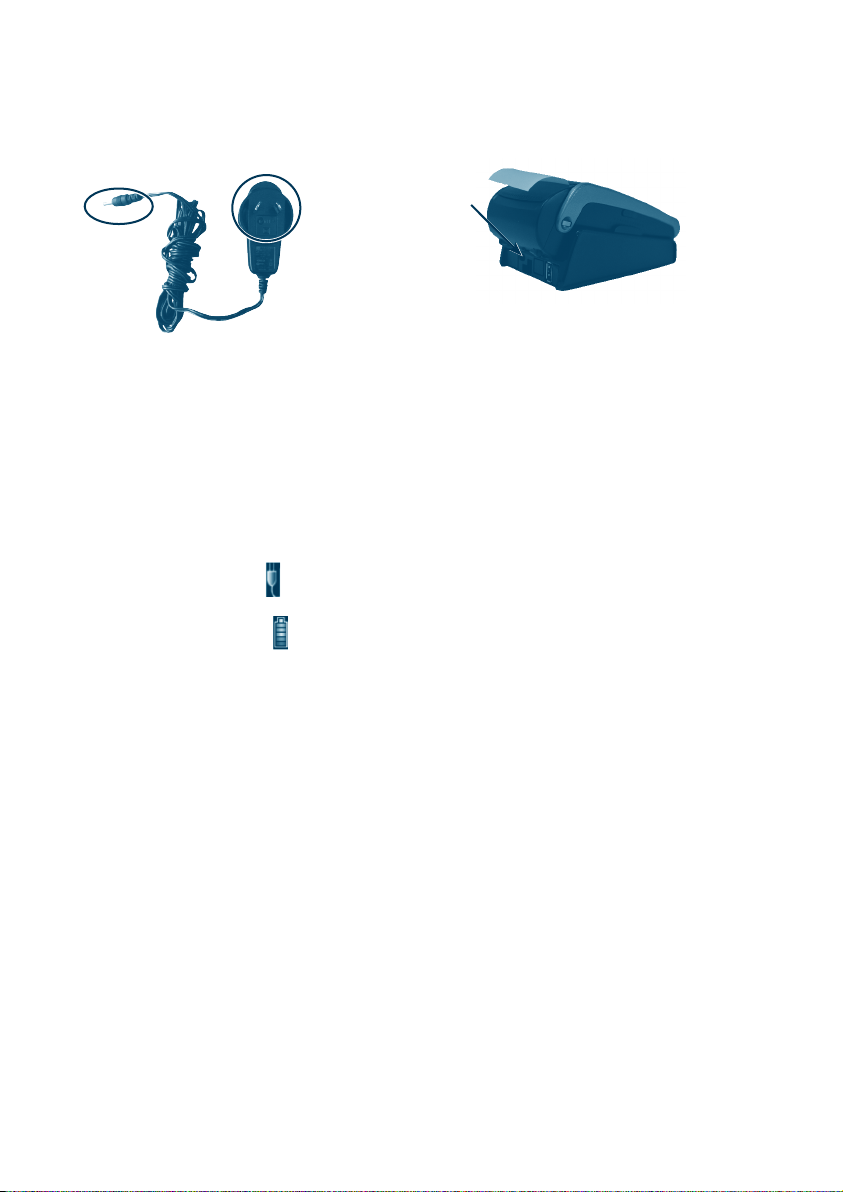

How to charge the terminal battery

1.

2.

Connect the

power supply to

the base socket

here

Example of connecting base power

supply to the base socket

Example of Base power supply

Place the base on a clear, flat surface near the mains power outlet and a telephone socket if

dial-up communication is required. Follow the below instructions to connect your terminal to

the base.

A. Connect the power supply (number 1) to the base socket as shown above.

B. Connect the base power supply (number 2) to the main power outlet on the wall.

C. Place the terminal on the base by securely connecting the terminal to the docking

connector on the base.

D. Check the “plug symbol ”

shown on the upper right hand side of the terminal

screen indicates that the terminal is connected into the power outlet.

E. Check the battery symbol

on the terminal screen that is flashing or moving on the

terminal screen indicates that charging is in progress.

NOTE: It is your responsibility to keep your terminal away from any external heat source (radiator, sun,

enclosed area and etc.) which can have an impact on the terminal battery lifetime and performance.

9.7 COMMUNICATION MODE

The ANZ POS Mobile Plus terminal’s base communicates to ANZ’s network via the Internet

Provider that your Point of Sale System is connected to. The terminal itself communicates to its

base via Bluetooth.

9.8 HOW TO CONFIGURE COMMUNICATION MODE

Please note that IP will be the primary communication mode for your Point of Sale system, if

you do want to change the primary communication mode to Dial-up or GPRS, please follows

the steps as shown below.

27

To congure communication mode to Dial-up

READY

Press the Func key.

FUNCTION?

SWIPE

MERCHANT CARD

INTERFACE TYPE?

5-ANZ PC-EFTPOS

COMMS MODE

1-DIAL-UP CNP

CONNECTION

5-ANZ PC-EFTPOS

ANZ LINE SPEED?

1-1200

Key in 9905 then press ENTER, ENTER.

Swipe your EFTPOS Merchant Card

(please refer to section 3 for more information).

Press ENTER.

Press 1 to choose Dial-up CNP and press ENTER.

Please select 5 for ANZ PC-EFTPOS and press ENTER.

Please select 1 for 1200 and press ENTER.

TMS LINE SPEED?

3-14400

28

Please select 3 for 14400 and press ENTER.

PRE/POST DIAL?

1-PRE-DIAL

Please select 1 for PRE_DIAL and press ENTER.

DIAL MODE?

1-TONE

PABX?

0

HOST PHONE NO?

1800xxxxxx

TMS PHONE NO?

1800xxxxxx

QUICK DIAL

1-ON

TMS NII

xxx

Please select 1 for TONE and press ENTER.

Press ENTER.

If a 0 is required for an outside line, please ensure

this is shown on this screen otherwise press ENTER.

Press ENTER.

Press ENTER.

Press ENTER.

Press ENTER.

ANZ SHA?

48xxxxxxx

INIT REQUIRED

Press ENTER.

The terminal returns to the main screen and displays

an “INIT REQUIRED” message.

29

Terminal Initialisation

INIT REQUIRED

Please refer to your Point of Sale (POS) manual to

initialise the terminal.

REMOTE INIT

IN PROGRESS

INITIALISING

PLEASE WAIT

REMOTE INIT

IN PROGRESS

INITIALISING

PLEASE WAIT

READY

Terminal status is displayed.

The terminal has completed the initialisation and

returns to the main screen.

30

Loading...

Loading...