ALLIED Telesis IP Triple Play User Manual

Product | Applications

IP Triple Play

voice|video|data

IP NEXT-GENERATION

NETWORKS

Contents

Executive Summary 3

Access Technologies Overview 5

IP Triple Play Building Blocks 7

Business Case for IP Triple Play in Europe 17

Technology Partner Program 18

Summary 19

Working Together 19

"...the entry of big telcos into the IP Triple Play market using

IPTV will make it a must-have feature for any major provider

of broadband services. However, offers will need to be well

thought-out and innovative to attract customers, and must

take full advantage of the greater flexibility inherent in a TV

proposition based around broadband and IP"

January 2007, Graham Finnie, Senior Analyst, Heavy Reading

The different IPTV strategies pursued by operators are

clearly influenced by a number of factors. If they see IPTV’s

best role as churn prevention and broadband customer

acquisition, then aggressive pricing on similar services that

are already in the market might be the best bet.That is, to

compete on things that customers already understand —

such as speed and price — while at least matching the TV

experience offered by the cable operators. If extra revenue

per customer is the priority, then greater emphasis on

interactive services and pay-TV (exclusive content, perhaps)

might be the best IPTV approach, although more risky and

The mar

.

more costl

greater functionality that IPTV provides compared with

cable TV.

Telecommunications Magazine, September 2006

y

keting push here would be on the

2 | IP Triple Play Solutions Guide

Executive Summary

Delivering Global Solutions

Allied Telesis has fused the worlds of IP/Ethernet and Carrier-

class access technologies to create a truly comprehensive range

of solutions for IP Triple Play Service Providers. All the hallmarks

of the Allied Telesis portfolio of solutions are to be found in

these industry-leading, global internetworking solutions which

span across a wide range of solutions and market segments

including Carriers, Network Service Providers, System Integrators

and Post,Telegraph and Telephone administrations (PTTs)

worldwide. These solutions include: Carrier-class integrated iMAP

Multiservice Access Platforms, iMG intelligent Multiservice

Gateways†, iBG intelligent Business Gateways and the

Provisioning and Management systems: Zero Touch Configurator

(ZTC) and Network Management Software (NMS).

The Challenge Facing Today’s Revenues

Today’s network service providers are faced with on going

pressure to maximize profitability. Revenues from traditional

services (i.e. voice and data) are on the decline as competition

is encroaching on established Operators and Service Providers.

Furthermore, a plain ‘vanilla’ Broadband offering is no longer a

business opportunity and is quickly becoming a commoditized

offering with little or no margin to the Providers. One logical

approach for addressing the margin erosion and revenue

pressures is to generate additional sources of revenue through

new innovative service offerings. These new ser vices need to be

added whilst getting the most from existing infrastructure as

ell as lev

w

that many Providers and System Integrators (SI) are now

focusing attention on is interactive entertainment services.

Broadcast video

(VoD) are just a few of the high-value services that Operators

and System Integrators can provide. Combined with high-speed

Inter

Play’ of voice, video and data can be bundled together in

attractive service packages to significantly improve Providers’

rev

eraging telecom de-regulation frameworks. One area

Pay-Per-View (PPV) and Video-on-Demand

,

net access and traditional voice services, a potent ‘Triple

enues and profits.

he whole is greater than the sum of individual parts

T

The bundled package of services is intended to return more

benefits to end-customers by offering a more affordable service

tariff than the aggregation of charges for individual services.

‘Bundling’ Services

The advantages of ‘bundling’ services have been proven by

traditional cable TV Operators who also offer packaged voice,

video and data services. These Operators have demonstrated

that average revenues per subscriber can be increased and

customer churn can be reduced by service bundling.The

traditional local exchange Carrier or competitive operator can

also realize these benefits by offering their own service bundles.

Recent technology advancements now enable these traditional

wireline Service Providers to offer a ‘Triple Play’ package of

voice, video and data services using either fiber optic or voice-

grade copper facilities. Moreover, emerging Operators from

different industries and sectors such as utilities, hospitalities,

municipalities and housing associations can leverage their

lished infrastructure and customer relationship to offer

estab

advanced innovative services at a more competitive price-

performance point than previously achieved.

Bundling services creates the ‘Halo Effect‡’ with subscribers and

end-customers.

‘stickiness’ and encourages uptake of other service offerings

vailable from the provider.

a

†

mer

or

iMG f

‡

‘Halo Effect’ describes the effect that a positive experience with one aspect of a

The

vice infers about other aspects of a service .The perception is that the overall service is

ser

better than the sum of the individual par

This effect incr

erred to as the ‘Residential Gateway’ or ‘RG’.

y ref

l

eases their lo

ts.

yalty, creates more

IP Triple Play Solutions Guide | 3

The Changing Landscape

Technology and economics advancements in DSL technology

have been the primary enabler of IP Triple Play service

packaging among PTTs and alternative Carriers, due to the

ability to offer high bandwidth over existing copper facilities. In

many countries, these facilities have been ‘opened-up’ unbundled - for competitive use allowing alternative Carriers to

access these subscriber lines as well. With DSL ser vices like

ADSL2+ (Asymmetrical Digital Subscriber Line) providing high

bandwidth access at speeds of up to 26Mbps and VDSL2

providing up to 100Mbps today, it is now possible to provide a

high quality, high definition, video service to multiple TV sets

while simultaneously providing high-speed Internet access and

several telephone lines over a single copper loop. By utilizing

this ‘fixed investment’, these Operators can dramatically improve

profitability, increasing revenues per loop by up to four times

their current revenue.

Video compression technology, a key component of IP Triple

Play, has also improved dramatically over recent years. The

MPEG-2 (Motion Picture Engineer Group 2) standard has been

deployed globally for video compression applications.Video

compression technology is developing and advancing quickly

with the introduction of techniques like MPEG-4 and Windows

Media 9 that are far more efficient and require much less

bandwidth. Soon, Carriers and Service Providers will be able to

stream high quality video at less than 1Mbps.These technologies

will be crucial in the deployment of high bandwidth services

Television (HDTV). Also, the availability

such as High Def

of proven and well-established interactive video platforms

combined with the emergence of video content aggregators

and brok

content.

The Customer Premise Equipment (CPE) pla

role in the delivery of IP Triple Play services. As traditional

broadband CPE devices such as modems and home routers

cannot suppor

er

inition

s is beginning to facilitate access to IP-based video

ys a fundamental

t these new services, Operators will need access

to ‘intelligent’ Multiservice Gateway devices in order to enable

IP Triple Play delivery to customer premises.To be competitive,

the total cost per end-customer connection m

minimum.The price performance ratio for the CPE device is the

key to validating the business model of Service Providers and

Operators. The economies of scale provided by the adoption of

Ethernet technology have helped to pave the way to the ‘right’

price point for the new advanced IP Triple Play ready CPE

devices, proving the business case for the provider.

ust be kept to a

The Allied Telesis Value Proposition

Allied Telesis builds state-of-the-art IP, transport, aggregation,

access and customer premise equipment for next-generation

broadband networks capable of supporting the most rigorous

of IP Triple Play services’ requirements. In addition, Allied Telesis

provides true end-to-end systems with high availability

networking products incorporating latest developments in

Ethernet management and protection for 99.999% reliability.

The solution architecture provides radically improved efficiency

and manageability of network infrastructures whilst solving the

QoS bottleneck for handling time sensitive IP multi-media traffic.

Many vendors are keen to promote the ‘evolutionary not

revolutionary’ angle for their products but Allied Telesis is proud

to describe its Carrier-class Ethernet-based systems as truly

revolutionary. So, regardless of the service provider’s access

network – copper or fiber access – Allied Telesis has an end-to-

end, fully managed solution for providing IP Triple Play services.

With a comprehensive offering of IP next-generation

broadband technologies, services and expertise and dozens of

real IP Triple Play deployments with live paying customers, Allied

Telesis is uniquely positioned to assist Carriers and Providers

with delivering innovative and high-value services to residential

and business customers.

4 | IP Triple Play Solutions Guide

Access Technologies Overview

P

OTS UPSTREAM

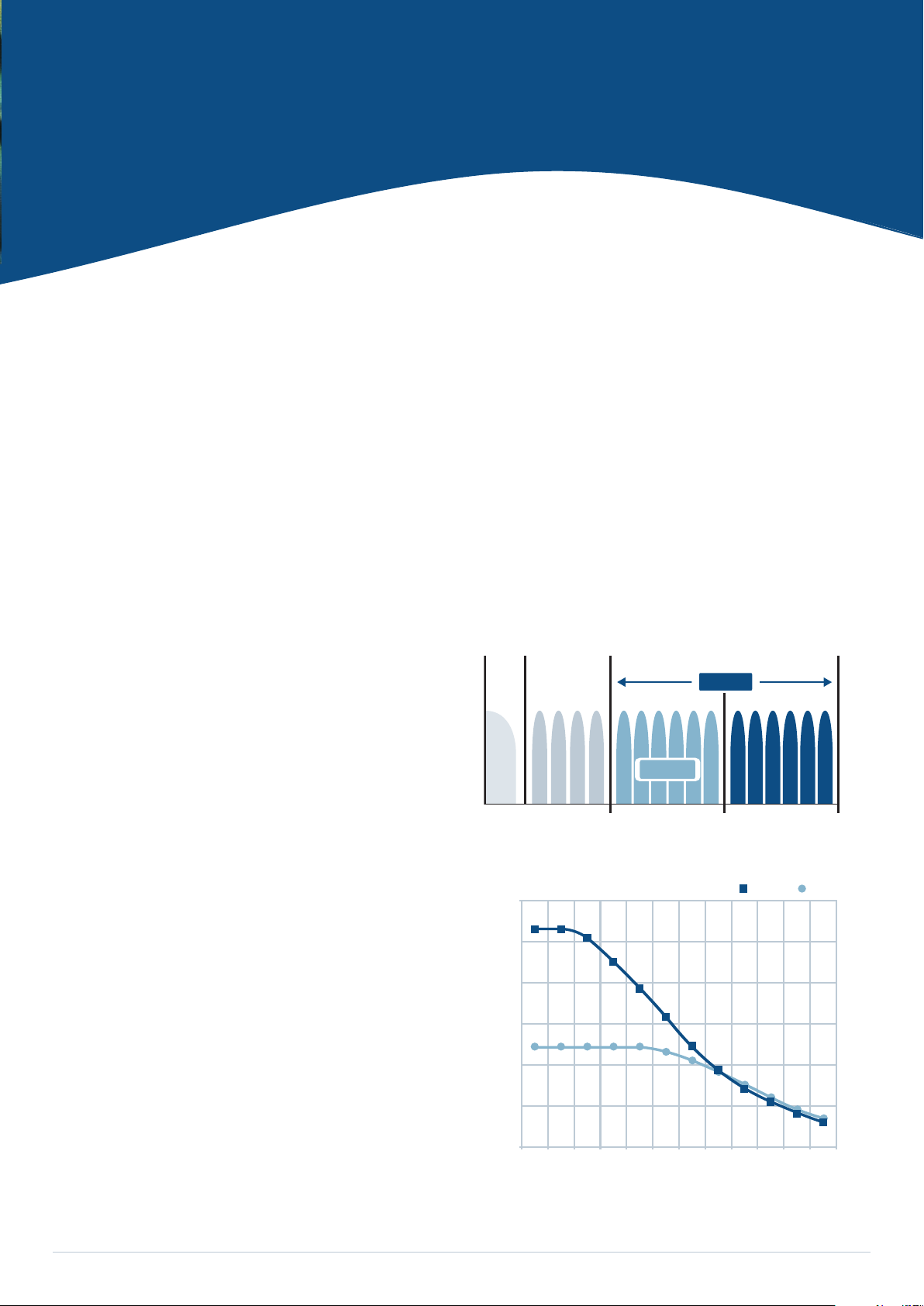

0.14 MHz 1.1 MHz 2.2 MHz

D

OWNSTREAM

ADSL2+

ADSL2

30.0

ADSL2+ ADSL2

25.0

20.0

15.0

10.0

5.0

1 2 3 4 5 6 7 8 9 10 11 12

DATA-RATE (Mbps)

LOOP

LENGTH

Kilofeet

Kilometers

0.3 0.6 0.9 1.2 1.5 1.8 2.1 2.4 2.7 3.0 3.4 3.7

The largest component of any Carrier ser vice deployment is the

‘access’ portion of the network, which connects access nodes to

individual subscr

ibers. Literally, it is the last link, also known as ‘last

mile’ or ‘first mile’, in a network between the customer premises

and the first point of connection to the network infrastructure -

a Point of Presence (PoP), Exchange or Central Office (CO).

The access network has consistently been regarded as a

bottleneck in the provisioning of new communications services.

This is primarily due to the fact that technology tends to be put

in place for a specific purpose and in doing so it has traditionally

been difficult for this same infrastructure to carry new services.

Furthermore, the bandwidth available has lagged behind that

provided within Local Area Networks (LANs) and in the upper

echelons of the network (in Metro and Core networks, for

example), where concentration factors and economies of scale

have allowed optical fiber to unleash significant bandwidth

capacity. It’s worth noting that these dedicated transpor t facilities

to the actual end-subscriber and associated CPE (Customer

Premises Equipment) mak

e up most of the cost of those service

deployments. In fact, at least 50% of all network CAPEX costs are

in the access network and often have a long depreciation period.

The improvements provide better modulation efficiency, lower

framing overhead, and enhanced signal processing algorithms. In

fact,

ADSL2+ doubles the maximum frequency of the

downstream transmission to 2.2 MHz.This translates into the

doubling of the maximum downstream data-rate to 26Mbps at

distances up to 600 meters, with the possibility of achieving rates

of up to 20Mbps on loops less than 1,500 meters in length.

This extended loop reach allows high-speed access to the vast

majority of residential and business subscribers in Europe where

loop lengths tend to be the shortest compared to the rest of

the world.

ADSL2+ doubles the bandwidth used to carry downstream data.

Source: DSL Forum

Fortunately, Service Providers can now utilize access solutions that

are based on the ubiquitous, economical technology of Ethernet in

their deplo

class leader in IP Ethernet-based solutions and can assist Carriers

and Operators in deploying these IP Triple Play solutions with our

state-of-the-ar

Broadband ADSL/ADSL2+ over Copper

ADSL is the most widel

o

enhancements to the ADSL specification have improved the data-

ate and reach to enab

r

voice-grade copper lines.The ADSL2+ enhancement has been

designed to off

riple Play services. Allied Telesis is a world-

yment of IP

t Car

T

rier-class Ethernet products.

y deplo

ed xDSL technology to date with

y

ver 250 million lines in service already.Additions and

y of IP Triple Play services over

le the deliv

er higher data-r

er

ates (26Mbps) o

er longer distances.

v

ADSL2+ doubles the maximum downstream data-rate.

Source: DSL Forum

IP Triple Play Solutions Guide | 5

Fiber-To-The-Home, Business, Building or Node

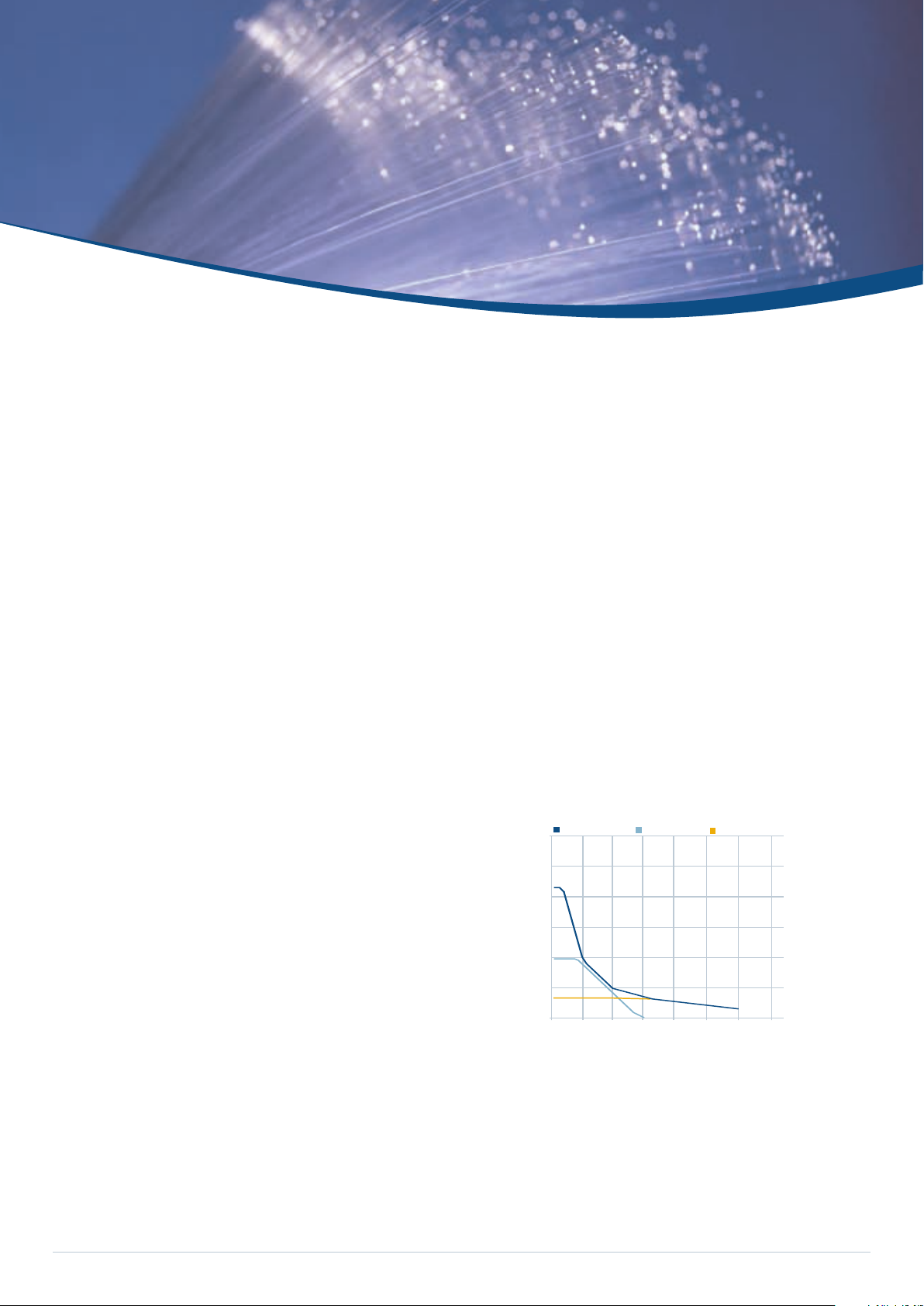

DS ADSL2+ (2.2MHz)

DSVDSL1 (12MHz)

250

200

150

100

50

500 1000 1500 2000 2500 3000

3500

DATA-RATE (Mbps)

Reach / m

Reach / ft

0.6 1.2 1.8 2.4 3.0 3.4 3.7

P

Tripl

Service

Voice

R

Life cycle

DSL ser

Life cycle

DSL ser

DSVDSL2 (30MHz)

VDSL2 =VDSL Speeds with ADSL/2+ Reach and Flexibility

Source:

DSL Forum

VDSL2 Performance

using Ethernet

Fiber is an unparalleled medium to deliver any imaginable

media-rich and interactive portfolio of services. Fiber is a true

‘future proof’ technology providing virtually unlimited bandwidth

and allowing Operators to scale their networks efficiently

depending on service demand and technological developments.

Deploying fiber deeper in the access network and nearer to

subscribers opens up a plethora of revenue opportunities for

Operators and Ser vice Providers.The reach is measured in 10’s

of kilometers and bandwidth is virtually unlimited. Whether it is

Fiber-To-The-Home or to the Business, support of certain

value-added services is only possible on fiber. These services

include high quality video services such as HDTV, video

telephony and surveillance, Peer-to-Peer services and

applications as well as business connectivity services such as

leased lines and VPNs.

In ‘greenfield’ sites, capital expenditure (capex) of a fiber roll-out

is comparable if not less expensive to that of copper. There are

significant savings from the newly-built fiber in reduced

operational expenses (OPEX) as fiber is considered a very low

maintenance technology. Fiber is often described as one access

network, for multiple services, for the next 100 years!

Ethernet and IP

On the technology side, Ethernet has become the de facto

standard in data communication with well over 98% of traffic on

the Internet today, starting and terminating on an Ethernet port.

Ethernet provides a simple ‘flat’ Layer 2 network that can

recognize the economies of scale of Ethernet components to

provide the most simple, high-bandwidth, cost-effective access

network possible.The message is clear: Ethernet is ubiquitous in

the LAN sphere and is now breaking open the ‘last mile’

bottleneck between end-users and high-speed networks. With

rates of up to 100Mbps and 1Gbps full-duplex per subscriber,

there’s enough bandwidth available to ensure that, once a network

is installed, it has the horsepower to cope with all future demands.

Ethernet and IP-based technologies have proven to be much more

scalable and cost-effective than traditional TDM or ATM

technologies. In fact, the fastest growing format for ADSL and FTTx

deployments today is Ethernet/IP-based solutions rather than the

legacy ATM-based multiplexers so prevalent in the 1990s.

When fiber is deployed deeper in the access network and

ed to bring higher

closer to subscr

VDSL2 can be deplo

s,

iber

y

bandwidth over shorter copper loops. VDSL2, the newest and

most advanced standard of xDSL, permits the transmission of

asymmetr

ic and symmetr

voice-grade copper pairs. VSDL2 promises to deliver 100Mbps

ic data rates up to 100Mbps over

at 0.5 km and 50Mbps at 1 km from the Central Office or

remote node

compatibility with ADSL2+ technology allowing already

deployed CPEs to continue to operate normally and only

require upgr

6 | IP Triple Play Solutions Guide

. Furthermore, its main advantage is backward

ading when more advanced services are uptaken.

ade intelligent Ethernet-based DSL

-gr

ier

The Allied T

elesis Car

and FTTx solutions enab

from complex and expensiv

ame Rela

and Fr

advanced ser

IP/Ether

vice off

net data ser

r

le Ser

vice Pro

viders to move away

e circuit technologies such as

y whilst realizing impro

v

itability via

ed prof

erings such as high quality voice, tiered

vices and broadcast quality IP video

TM

A

.

Loading...

Loading...