Victor V12 Owner's Manual

V12 Manual

1

Owners Guide

V12 Financial Calculator

Preface

Congratulations on your purchase of the V12

financial calculator from Victor Technology.

Victor has been serving customers since 1918.

Today, Victor offers a complete line of printing,

handheld, desktop, scientific, and financial

calculators. For more information please see

our website at www.victortech.com

or call us at

1-800-628-2420.

Victor: The Choice of Professionals

Copyright © 2007 by Victor Technology LLC

All rights reserved.

V12 Manual

32

Table of Contents

Chapter 1: Where to Start...................................5

Powering On and Off..............................................5

Controlling screen contrast.....................................5

Keyboard Dynamics ...............................................5

Entering Digits........................................................5

Decimal Placement ................................................5

Entering Large Amounts.........................................6

Entering Small Amounts.........................................6

Changing the Sign of a Number .............................7

Using the Clear Function........................................7

ALG and RPN Setting Functions............................7

RPN method...........................................................8

Sequential Calculations in RPN method.................8

Storage Capacity and Recalling Entered Data .......9

Chapter 2: The First Steps to Financial Functions

.....................................................................10

Using the Financial Storage Registers .................10

Saving to a Register.............................................10

Resetting Saved Data ..........................................10

Basic Interest Calculations ...................................10

Basic Financial Calculations.................................13

Positive and Negative Cash Flows.......................13

Payment Function ................................................14

The special relationship between i. and n..........14

Determining Interest Rate: Solving for i. ............14

Determining Present Value: Solving for PV ........16

Determining Payment Amount: Solving for PMT .17

Determining Future Value: Solving for FV..........17

Determining Number of Periods: Solving for n. .18

Loan With a Balloon Payment ..............................19

Amortization Function...........................................20

Chapter 3: Other Financial Calculations .........22

NPV (Net Present Value) .....................................22

Grouped Cash Flows............................................24

Replacing Current Cash Flow Value Data............26

Determining Values with Depreciation..................27

Determining Bond Values………………………….29

Percentages…………………………………………31

Calendar Operations……………………………….34

Determining Number of Days between Dates…...35

Chapter 4: Other Operational Features ............37

Full Figure Display ...............................................39

Other Display Settings..........................................39

LST X ...................................................................40

x ↔ y....................................................................41

Statistical Features and Functions .......................42

Recovering Incorrectly Entered Statistical Data ...43

Standard Deviation Entries...................................44

Mean Values ........................................................44

Linear Estimates for x and y.................................45

V12 Manual

54

Weighted Mean Values ........................................46

Mathematical Features and Functions .................48

Power Features in ALG method ...........................52

Power Features in RPN method...........................52

Chapter 5: The Basics of Programming............53

Creating Your Own Program ................................53

Executing Your Own Program..............................57

Program Memory Basics ......................................57

Determining Program Line Instructions ................58

Program line 000 and the GTO 000 instruction: ...60

Performing a Program One Line at a Time...........61

Setting the Calculator to a Specific Program Line 63

Interrupting a Program During Execution .............63

Stopping a Program During Execution .................65

Chapter 6: Branch & Loop Programs................67

Branching with Conditions....................................67

Storing More Than One Program .........................71

Chapter 7: Editing Your Programs....................72

Inserting Instructions Into a Program....................73

Inserting Instructions at the End of a Program .....76

Chapter 8: Error Messages...............................77

Chapter 1: Where to Start

Powering On and Off

Turn the unit on by touching the ON button. To turn the unit off,

touch the ON button again. The calculator will automatically

power off after 7 minutes if left not used.

When the calculator is experiencing a low battery charge, a

battery icon will appear in the top left corner of the display screen.

Controlling screen contrast

To change the contrast of the display screen for optimal viewing,

hold down the b button and touch X or ÷ keys until desired

contrast is reached.

Keyboard Dynamics

Most buttons perform multiple functions. The primary function is

displayed on the center of the button, while alternative functions

of the same button are imprinted on the bottom side of the button,

below the button, or above the button. Alternate functions are

obtainable by using one of two colored prefix buttons prior to

entering the function desired. The colors of the prefix buttons

match the alternative functions. The prefix buttons are b (blue)

and r (red).

Entering Digits

To enter a digit, touch the number buttons and decimal place ..

button in the same order as they would appear on paper.

Decimal Placement

On the display, digits are separated with commas left of the

decimal place. To change the decimal point period icon to a

comma and the comma icon to a decimal point, turn the V12 off,

touch and hold the decimal point button . , and touch the ON

V12 Manual

76

button. Repeat this process again to reset these placements to

the standard display.

Entering Large Amounts

The V12 displays numbers up to 10 digits. Scientific notation

allows numbers longer than 10 digits to be entered. To perform

this function, enter the number with the decimal point moved to

the left. Keep track of how many positions the decimal point

moved. Next touch the EEX button and enter the number of

positions the decimal point was moved. Touch the ENTER key

to complete the entry.

Example

To enter a value of 7,894,300,000,000 the decimal place should

move 12 spaces to the left leaving a mantissa of 7.8943 with an

exponent of 12.

YALPSID SEIRTNE

7.8943 EEX 12

7.894300 12

Displays the figure in scientific

notation.

These scientific notation numbers can be used in calculations

the same as any number.

Entering Small Amounts

Scientific notation allows numbers more than 10 decimal places

below zero to be entered. To perform this function, enter the

number with the decimal point moved to the right. Keep track of

how many positions the decimal point moved. Next touch the

EEX button and enter the number of positions the decimal point

was moved. Touch the CHS key to make the number negative.

Touch the ENTER key to complete the entry. For example, to

enter the number .00000000047823456 we move the decimal

point 10 positions. We enter 4.7823456, touch EEX, enter 10,

touch CHS, and touch ENTER The display will show 4.782345

-10.

Changing the Sign of a Number

The CHS button allows a changing of the sign of a number. If a

negative value is entered, or comes as a solution, touching the

CHS button will make it a positive. Likewise, touching the CHS

button after a positive value is displayed on the screen will

change its sign to a negative.

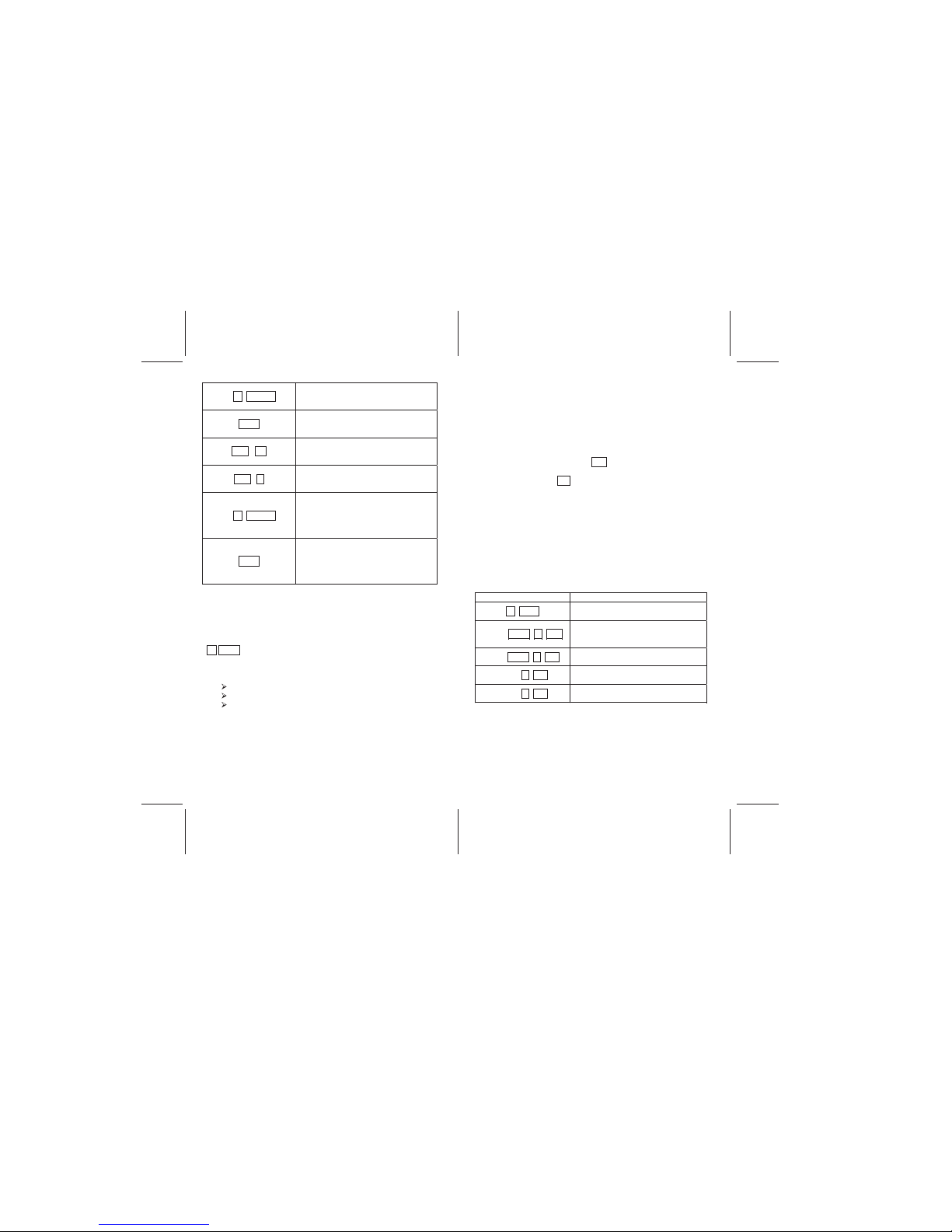

Using the Clear Function

Clearing replaces the displayed value with zero and replaces the

previous instruction with the r GTO 000 instruction when

programming. There are many ways of clearing data, outlined

here:

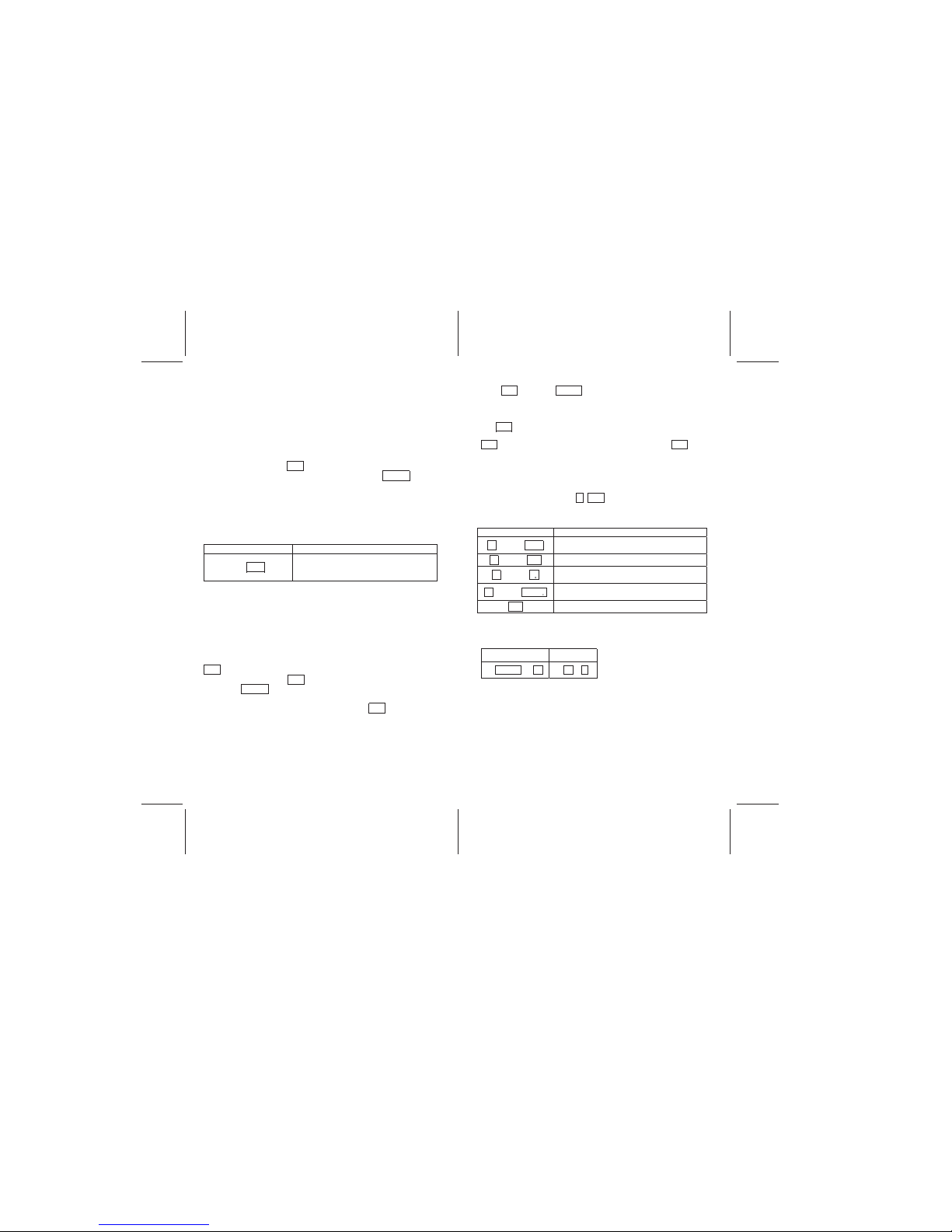

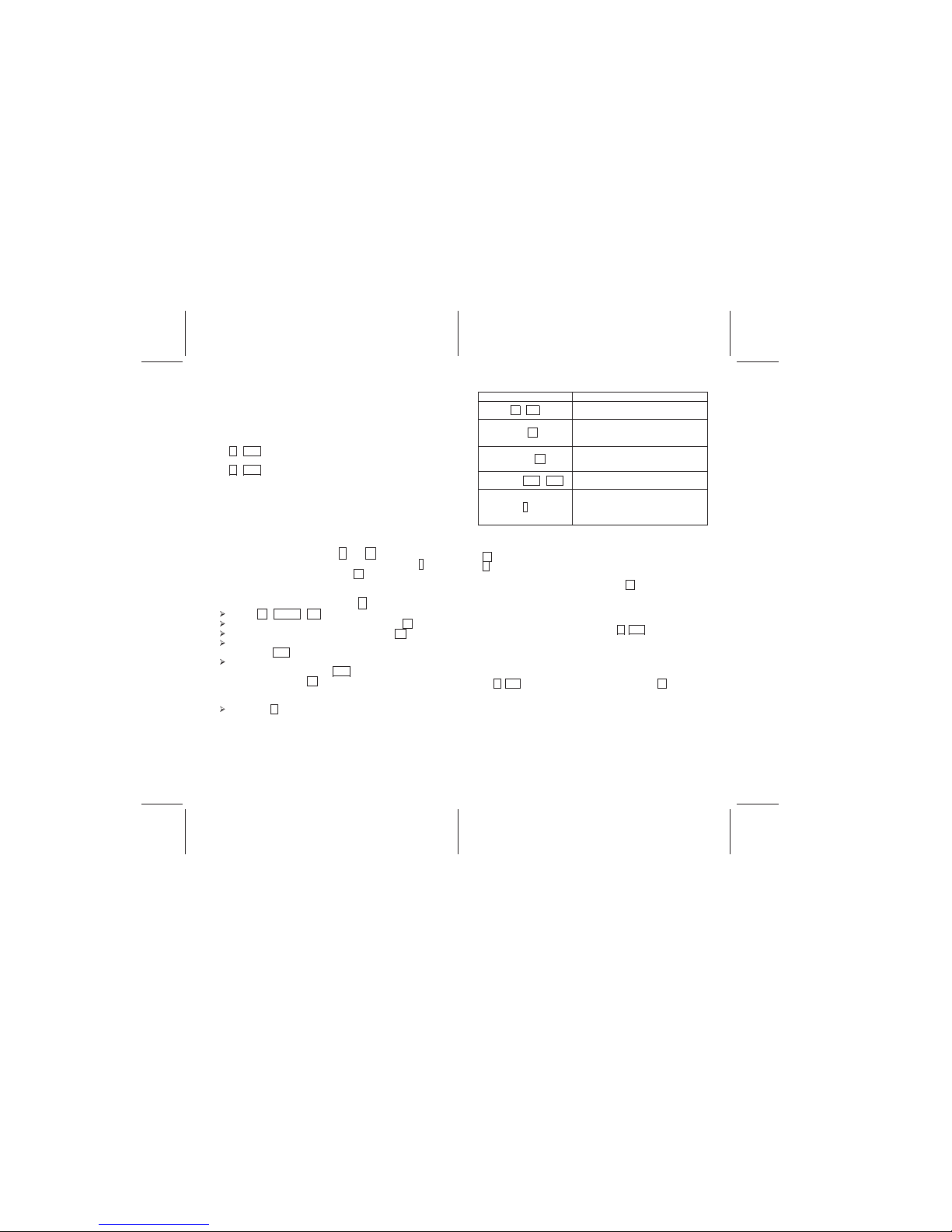

BUTTONS WILL CLEAR

.b CLEAR REG

Storage registers, block and last x register,

and display screen

.b CLEAR FIN

Financial registers

.b CLEAR ∑

Statistical registers (121- R)

1

block registers and display screen

.b CLEAR PRGM

Program memory (when touched in program

mode)

CLX

Display screen and x register

ALG and RPN Setting Functions

ALG MODE RPN MODE

4 ENTER 2 X. 4 X 2 =

V12 Manual

98

The ALG method enables calculations for addition, subtraction,

multiplication, and division (with or without parentheses) in the

standard method.

To select the ALG method. Touch b ALG , and the ALG icon

will appear.

Sequential Calculations in ALG method

To complete a sequential calculation, touch = at the end of your

entries and not after every entry.

Example: 5 X 2 + 3 – 4 ÷ 3 = 3.00

RPN method

To select the RPN method, touch b RPN , and the RPN icon

appears.

With RPN method enabled, you can perform basic calculations

with two numbers and with multiplication, addition, division, or

subtraction. It is necessary to enter both numbers in the

equation, and then select the mathematical operation to be used.

Touching ENTER between number entries allows a separation

of the different values within the calculator, and after entering the

second value, selecting the mathematical operation completes

the calculation.

Sequential Calculations in RPN method

Once a solution from a previous entry has been found and is on

the display screen, enter the next value and select the

mathematical operation to be performed.

Example: 5 ENTER 2 X 3 + 4 - 3 ÷ .

Note: The display will show the answer: 3.00

Storage Capacity and Recalling Entered Data

Information entered into the calculator is stored to memory in

different registers within the calculator. There are registers for

data storage during calculations called blocks (covered later in

this manual) and also a LST X register that stores the value last

on the display screen before an operation when using the RPN

method.

In addition to these storage registers, up to 20 more information

registers are available for storing values manually. The registers

are called R0 through R9, and R . 0 through R . 9 (with the

decimal point in front of the number). Note: In this manual, ..

represents the decimal point key.

To store numbers into a register, touch STO , and then touch

the register number desired [either (0, 1, 2, 3, 4, 5, 6, 7, 8, or 9),

or ( .. 0, . 1, . 2, . 3, . 4, . 5, . 6, . 7, . 8, . 9) ].

To recall a previously stored value, touch RCL , and similarly

select the desired stored value number, R0 through R9, and R ..

0 through R . 9.

To delete stored values, enter zero, touch STO , and select the

register to be deleted, R0 through R9, and R . 0 through R . 9.

(Note: Designating a new value instead of 0 also replaces the

old value set to the register)

V12 Manual

1110

Chapter 2: The First Steps to

Financial Functions

Using the Financial Storage Registers

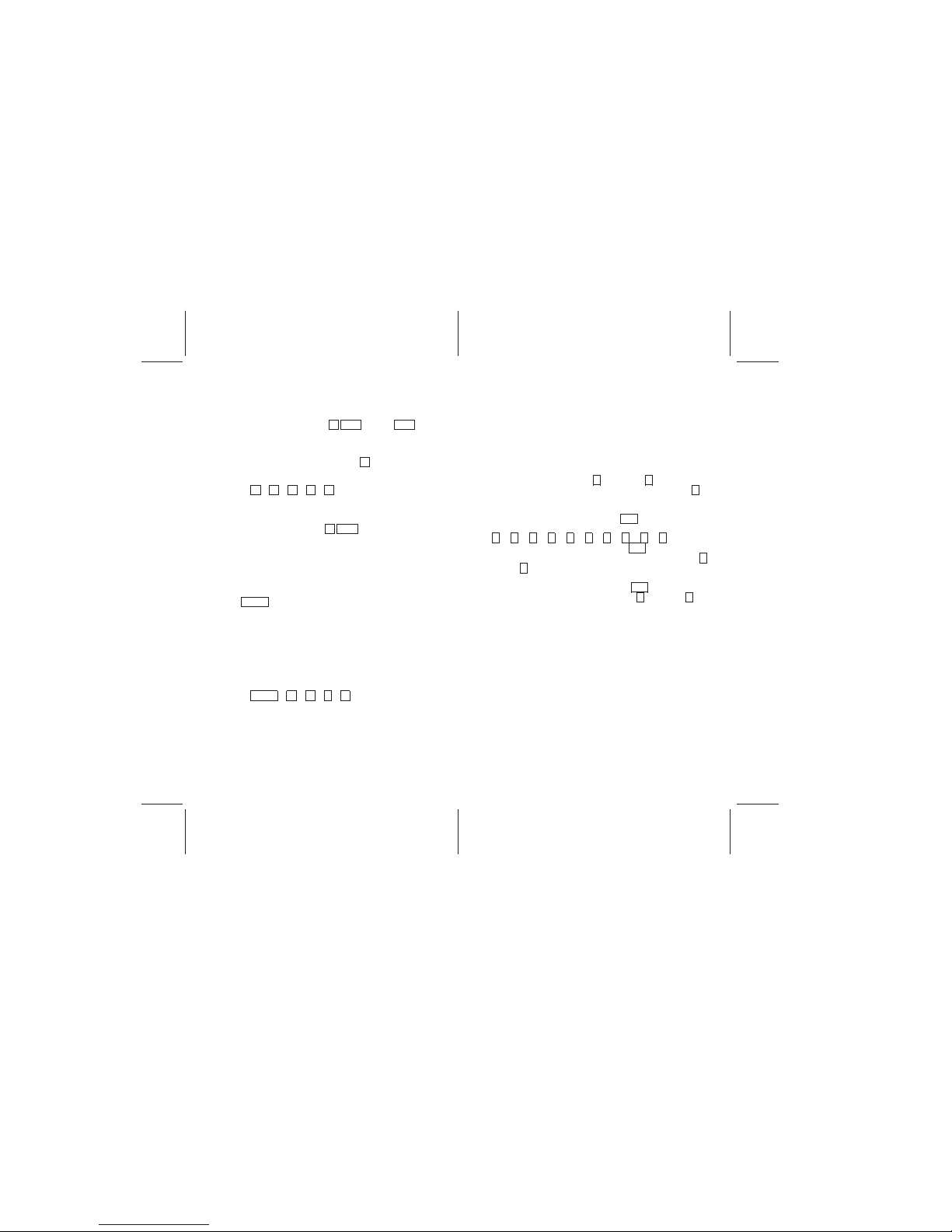

Five specialty registers are used for financial calculations only.

These are n , i , PV , PMT , and FV and are located along

the top row of buttons. Saving data to these storage registers

makes it possible to calculate financial problems such as loan

payments.

Saving to a Register

To set the numbers into the registers, enter the number to be

stored, and touch the button to which the number is to be stored.

To recall the number, touch RCL followed by the register you

would like to recall ( n , i , PV , PMT , or FV )

Resetting Saved Data

To replace current financial register values simply enter the new

value and press the register key. To clear all financial registers

at once, touch b clear FIN. Financial storage registers are also

reset when b REG is entered, or when the continuous memory

is reset.

Basic Interest Calculations

Simple interest can be calculated with either 365-day or 360-day

cycles. Either can be displayed and the total amounts of

principal plus the accrued interest may be found by touching +

in RPN method, or + x ↔ y = in ALG method.

To perform this operation on a 365-day cycle, touch R↓ x↔ y

to find and show interest accrued after determining the 360 day

interest.

Example

Calculate the simple interest on a 100,000 amount with 12%

annual interest for 180 days using the 360 day cycle and the 365

day cycle.

YALPSID SEIRTNE

100000 CHS PV

-100,000.00

Displays the amount.

180 n.

180.00

Displays the number of days for

which interest will be calculated

12 i.

12.00

Displays the annual interest rate

.b INT

6,000.00

Displays the simple interest on a 360

day basis

R↓ x↔y

5,917.81

Displays the simple interest on a 360

day basis

In RPN method, touching + after the calculation places the

total principal and interest accrued into the display.

To display total principal and interest accrued in ALG method,

touch + x ↔ y = .

Example

You take out a loan of $900, which you have 90 days to repay.

You are lent the money at 4.3% simple interest, which is

calculated on a 360-day cycle. You want to find the total amount

of accrued interest you will owe in 90 days, the total amount you

will owe including principal.

ENTRIES (ALG) DISPLAY

900 CHS PV

-900.00

V12 Manual

1312

Displays the amount.

90 n.

90.00

Displays the number of days for

which interest will be calculated

4.3 i.

4.30

Displays the annual interest rate

b INT

9.68

Displays the simple interest on a 360

day basis

.+ x ↔ y =

909.68

Displays the simple interest plus

principal due on a 360 day basis

ENTRIES (RPN) DISPLAY

900 CHS PV

-900.00

Displays the amount.

90 n.

90.00

Displays the number of days for

which interest will be calculated

4.3 i.

4.30

Displays the annual interest rate

b INT

9.68

Displays the simple interest on a 360

day basis

+.

909.68

Displays the simple interest plus

principal due on a 360 day basis

Basic Financial Calculations

Before describing Basic Financial Calculations, it is important to

review and understand five basic terms and keys used with the

V12.

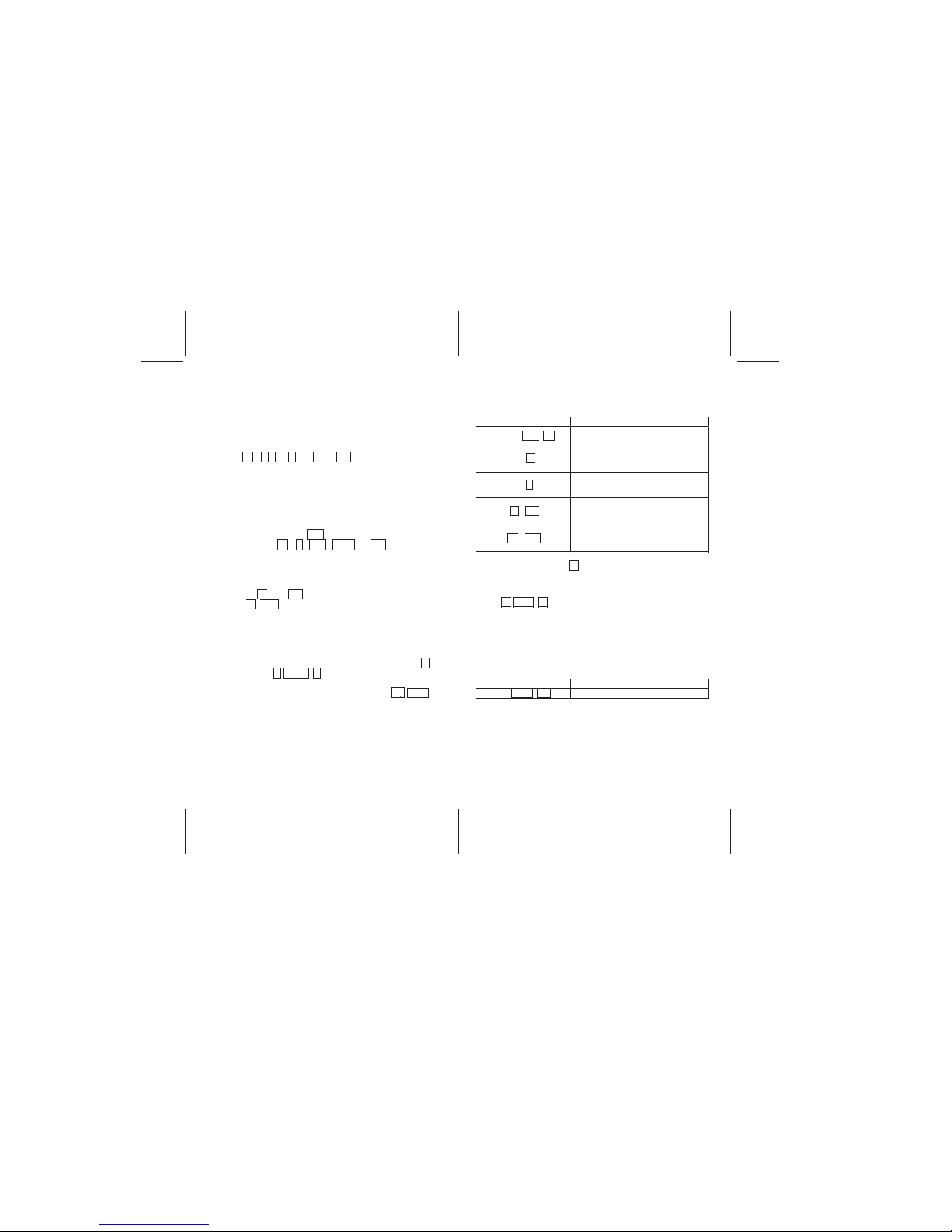

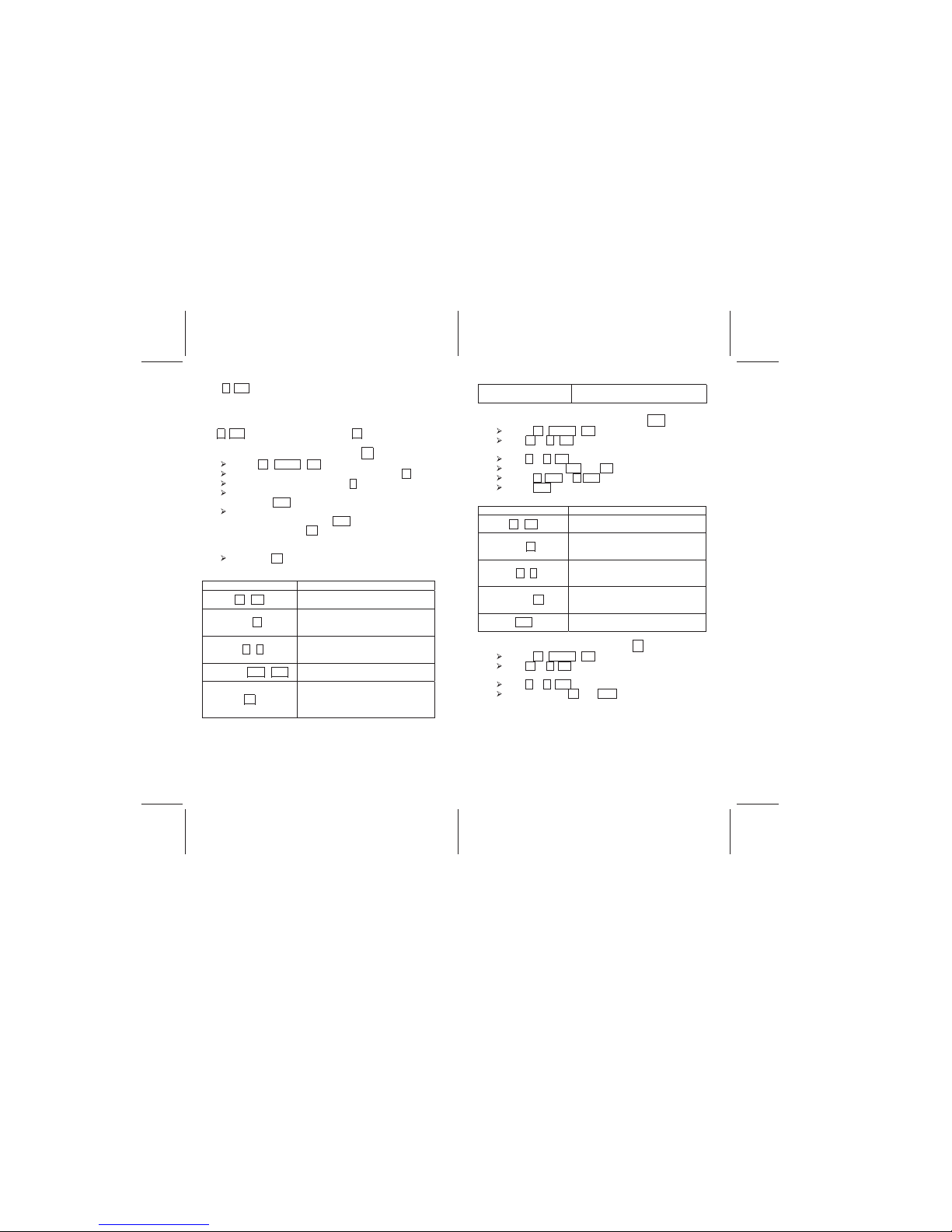

TERM / KEY DEFINITION

n.

The number of periods in the financial

loan, often expressed in days, months, or

years. The interest rate must be defined

per period.

i.

The interest rate per period. Often an

annual rate is converted to monthly by

dividing by 12, weekly by dividing by 52, or

daily by dividing by 365.

PV

The initial cash value received or paid or

the present value of a series of future

payments when discounted at an interest

rate.

PMT

The payment made each period.

FV

The final cash value received or paid or

the future value of a series of payments

assuming an interest rate.

When using the V12, four of these five variables must be known

to perform a calculation. The unknown variable can then be

solved.

Positive and Negative Cash Flows

When performing financial calculations special care must be

taken to enter values with the proper sign. A payment or outflow

of cash must have a negative sign. A receipt of cash must have

a positive sign. For example, the initial cash received in a loan is

a positive amount. The payments are negative amounts.

V12 Manual

1514

Payment Function

Payments in compounding periods may be made either at the

beginning of a period (such as payments in advance, and

annuities due), or at the end of a period (such as regular

annuities or payments in arrears).

To select payment type:

Touch r END if the payment will be made at the end of the

period.

Touch r BEG if the payment will be made at the beginning of

the period.

Most transactions utilize an End of the period payment. Note:

This manual will only show examples using End of the period

payments.

If the BEGIN icon is not showing on the display, the payment

function is set to END.

The special relationship between i. and n.

In compound interest problems, the interest rate entered into i

must correlate to the compounding period n in time (as in years,

days, months, etc.)

Determining Interest Rate: Solving for i.

Touch b CLEAR FIN to reset financial registers

Enter the number of payment periods and touch n.

Enter the present value of the loan and touch PV.

Enter the payment value per period (a negative number)

and touch PMT.

Enter the future value of the amount owed at the end of

the payment periods, touch CHS to make the number

negative, and touch FV. Note: If the amount owed at

the end of the loan period will be zero, this step can be

skipped.

Touch the i key to calculate the interest rate per period.

Example

ENTRIES (RPN) DISPLAY

b FIN

0.00

Clears the financial registers.

360 n.

360.00

Enters 360 months for a 30 year

loan.

400000 PV

400,000.00

Enters the loan amount of $400,000.

2398.202 CHS PMT

-2,398.20

Displays the monthly payment

i.

-----------The V12 is calculating the value.

0.50

Displays the monthly interest rate.

Example

8 % annual interest, which is compounded quarterly for 3 years:

n is number of quarters (3 * 4=12)

i is interest rate per quarter (8% ÷ 4 = 0.02%)

If interest rate was compounded monthly, n would be 8% ÷ 12

=0.006

Since many financial calculations utilize an annual interest rate

compounded monthly, the V12 has two functions to simplify the

entry of interest rate and periods. The r 12÷ function will

divide an annual interest rate by 12 and enter the result as the

monthly interest rate.

Example

24% annual interest which is compounded monthly

24 r 12÷ will enter an interest rate of 2% into the i. register.

V12 Manual

1716

The r 12x function will multiply a number of years by 12 and

enter the result as the number of monthly periods.

Example

30 year loan which is compounded monthly

30 r 12x will enter 360 periods into the n. register.

Determining Present Value: Solving for PV

Touch b CLEAR FIN to reset financial registers

Enter the number of payment periods and touch n.

Enter the interest rate and touch i..

Enter the payment value per period (a negative number)

and touch PMT.

Enter the future value of the amount owed at the end of

the payment periods, touch CHS to make the number

negative, and touch FV. Note: If the amount owed at

the end of the loan period will be zero, this step can be

skipped.

Touch the PV key to calculate the present value.

Example

YALPSID SEIRTNE

.b FIN

0.00

Clears the financial registers.

360 n.

360.00

Displays 360 months for a 30 year

loan.

6 r i.

0.50

Displays the interest rate of 6% per

year or 0.5% per month.

2398.202 CHS PMT

-2,398.20

Displays the monthly payment

PV

-----------The V12 is calculating the value.

400,000.00

Dis

play

s the loan amount or present

value. Actual amount may vary

slightly due to rounding

Determining Payment Amount: Solving for PMT

Touch b CLEAR FIN to reset financial registers

Use n or r 12x to enter number of periods or

payments

Use i or r 12÷ to enter periodic interest rate

Enter values for PV and FV

Touch r BEG or r END to select payment function

Touch PMT to calculate the amount of the payment

Example

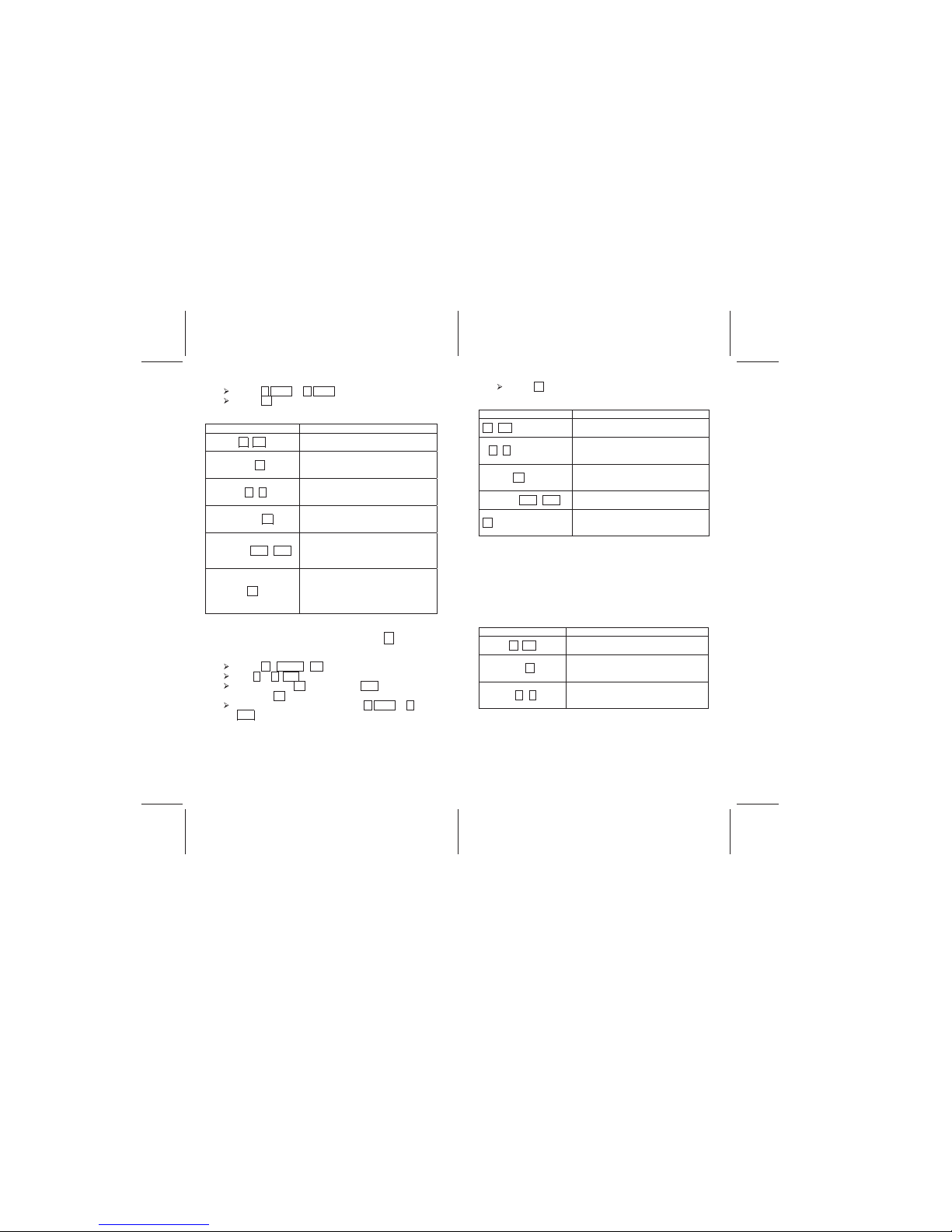

ENTRIES DISPLAY

b FIN

0.00

Clears the financial registers.

360 n.

360.00

Displays 360 months for a 30 year

loan.

6 r i.

0.50

Displays the interest rate of 6% per

year or 0.5% per month.

400000 PV

400.000.00

Displays the loan amount or present

value.

PMT

-2,398.20

Displays the monthly payment

Determining Future Value: Solving for FV

Touch b CLEAR FIN to reset financial registers

Use n or r 12x to enter number of periods or

payments

Use i or r 12÷ to enter annual interest rate

Enter values for PV and PMT

V12 Manual

1918

Touch r BEG or r END to select payment function

Touch FV to calculate the future value

Example

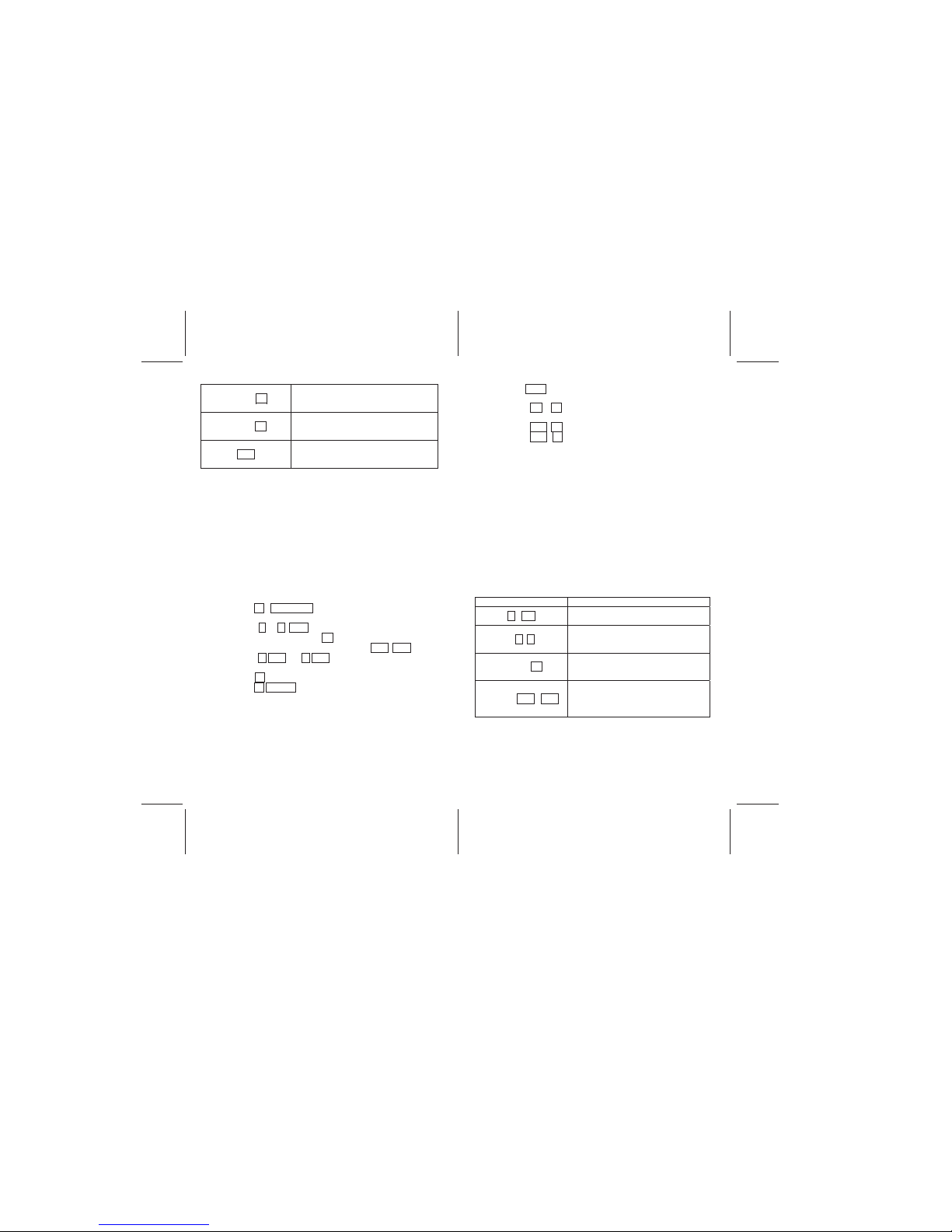

ENTRIES (RPN) DISPLAY

b FIN

0.00

Clears the financial registers.

360 n.

360.00

Displays 360 months for a 30 year

loan.

6 r i.

0.50

Displays the interest rate of 6% per

year or 0.5% per month.

400000 PV

400.000.00

Displays the loan amount or present

value.

2397.202 CHS PMT

-2,397.20

Displays the monthly payment.

Notice the amount is reduced by $1

from previous examples.

FV

-1,004.62

Displays the amount still owed at the

end of the loan period. In this

example, the payments over 30

years did not pay off the entire loan.

Determining Number of Periods: Solving for n.

To determine the number of compounding periods and the

number of payments:

Touch b CLEAR FIN to reset financial registers

Use i or r 12÷ to enter periodic interest rate.

Enter values for PV(present value), PMT (amount of

payment), FV (future value)

Select payment function by touching r BEG or r.

END

Touch n to calculate number of periods or payments

Example

ENTRIES (RPN) DISPLAY

b FIN

0.00

Clears the financial registers.

6 r i.

0.50

Displays the interest rate of 6% per

year or 0.5% per month.

400000 PV

400.000.00

Displays the loan amount or present

value.

2398.202 CHS PMT

-2,398.20

Displays the monthly payment.

n.

360.00

Displays the number of periods

(months) required to pay off the loan.

Loan With a Balloon Payment

A common transaction is a loan with a balloon payment. In this

case, the borrower makes a fixed payment each period until the

end of the loan term. At the end of the term, the borrower makes

one large final payment. The example below illustrates a

$400,000 loan, at 6% annual interest paid monthly for 30 years

with a balloon payment of $70,000.

Example

ENTRIES (RPN) DISPLAY

b FIN

0.00

Clears the financial registers.

360 n.

360.00

Displays 360 months for a 30 year

loan.

6 r i.

0.50

Displays the interest rate of 6% per

year or 0.5% per month.

V12 Manual

2120

400000 PV

400.000.00

Displays the loan amount or present

value.

-70000 FV

-70,000.00

Displays the future value required to

pay off the loan (the balloon payment)

PMT

-2,328.52

Displays the monthly payment required

to reach a $70.000 balloon payment.

Amortization Function

To Amortize is to liquidate a debt, such as a mortgage by

installment payments. Amortization is the gradual elimination of

a liability, such as a mortgage, in regular payments over a

specified period of time. Such payments must be sufficient to

cover both principal and interest. With the Amortization Function

the V12 can calculate the total amount of principle (liability) and

interest paid after a specified number of installments.

The following steps are required to determine the Amortization

status of a loan:

• Push b CLEAR FIN first to reset financial registers of

previous data

• Using i or r 12÷ , enter periodic interest rate

• Enter the principal using PV

• Enter the periodic payment, then push CHS PMT

• Select r BEG or r END to set the payment function

• Enter the number of payments that will be amortized

using n.

• Push b AMORT (will display amount from payments

that will be applied to interest)

• Push x↔y (will display amount from payments that will

be applied to principal)

• Push R↓ R↓ (will display number of payments to be

amortized)

• Push RCL PV (will display remaining balance)

• Push RCL n (will display total number of payments

amortized

If you repeat the Amortization function after an initial calculation,

the V12 picks up where you left off. In other words, after you

calculate the interest and principle paid after one year, the V12

resets the present value of the loan to the principle after one

year. Calculation of Amortization will start from this point.

A common application of the Amortization function is to

determine the amount of interest and principle paid on a

mortgage for a given time period. The example below illustrates

a 30 year loan with a principle of $400,000, a 6% annual interest

rate, and monthly payment of $2,398.20. The task is to

determine the interest and principle paid after 5 years or 60

months.

Example

ENTRIES (RPN) DISPLAY

b FIN

0.00

Clears the financial registers.

6 r i.

0.50

Displays the interest rate of 6% per

year or 0.5% per month.

400000 PV

400.000.00

Displays the loan amount or present

value.

2398.20 CHS PMT

-2,398.20

Displays the payment required to pay

off the loan in 30 years (calculated in

an earlier example)

V12 Manual

2322

60 b AMORT

-116,109.58

Displays the total interest paid after

60 months.

x↔ y

-27,782.42

Displays the total principle paid after

60 months

RCL PV

372,217.58

Displays the remaining principle after

60 months of payments

RCL n

60.00

Displays the number of payments

amortized (60 months)

12 b AMORT

-22,152.81

Displays the amount of interest paid

in the next 12 months of payments

(after the initial 60 months already

amortized)

x↔ y

-6,625.59

Displays the amount of principle paid

in the next 12 months of payments

(after the initial 60 months already

amortized)

Chapter 3: Other Financial

Calculations

NPV (Net Present Value)

b NPV (net present value) represents the value of a series of

future cash flows discounted at a specified rate of return to

reflect the present value.

When NPV is positive, financial value increases.

When NPV is 0, financial value stays the same.

When NPV is negative, financial value decreases.

Therefore, the greater the value of NPV, the greater the increase

in financial value.

To find NPV, add the initial deposit (a negative cash flow) to

present value of future cash flow. (Here, i will describe the rate

of return, and NPV describes the result of the investment.)

Two keys not yet discussed in this manual are required to

perform NPV calculations. The CFo key is used to store the

initial cash flow. When touched, the contents of the x-register

are stored in R

0

. The CFj key is used to store additional cash

flows. When touched, the contents of the x-register are stored in

R

1

. If used again in the same cash flow problem, the contents of

the x-register are stored in first R

2

, then R3, R4, and so on.

Example

You want to buy a yacht for $23,000 and rent it to a skipper for a

share of tour revenue. You expect cash flows of the initial cost

($23,000), ($5000) in the first year for repairs, +$10,000 in the

second year from tours, +$15,000 in the third year, $17,000 in

the fourth year, and then you expect to sell the yacht in the fifth

year for $19,000. Your expected rate of return is 15%.

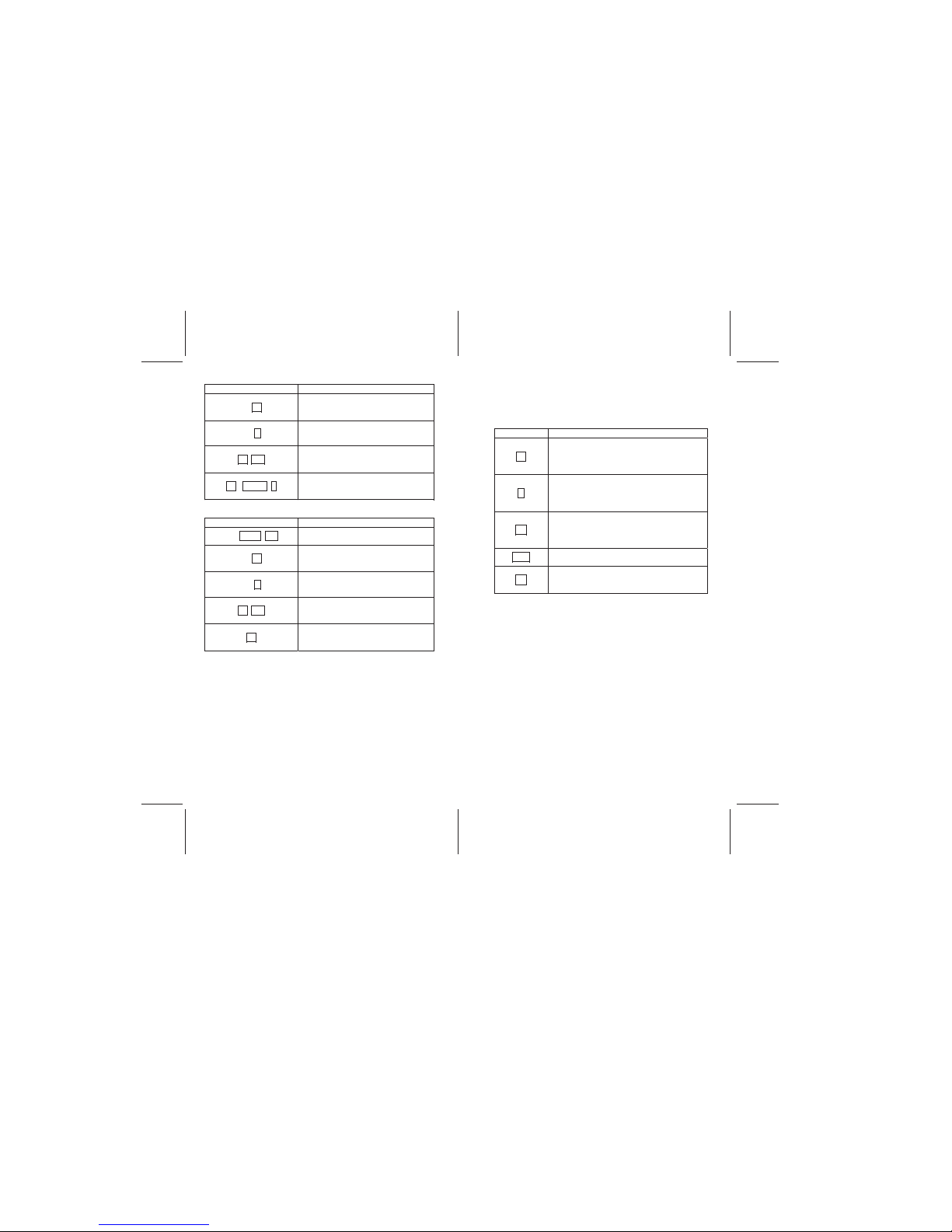

YALPSID SEIRTNE

b REG

0.00

Clears the x register

23000 CHS r CF

0

-23,000.00

Stores the initial cash out flow to buy

the yacht

5000 CHS r CF

j

-5,000.00

Stores the first year cash flow

10000 r CF

j

10,000.00

Stores the second year cash flow

15000 r CF

j

15,000.00

Stores the third year cash flow

Loading...

Loading...