Fiscal module FM3000

Service manual

(c) VAROS

Fiscal module FM3000 1/33 www.varos.sk

1. INTRODUCTION

An intelligent fiscal module FM 3000 is going to enable the use of your computer and open

homologised cash register system. An open cash register system is a system that enables to make

operations on PC cash register and also operations that are not related to sale as are letters and faxes

writing, accounting of the salaries and so on. In other words it will extend computer attributes with

the cash register system according the Regulation No. 55/1994 of the Statute roll. The main

advantage of the fiscal module is that in the past, you used for business software convenient for you,

you do not need to replace it with another, homologised software. It is only necessary to put

managing ESC sequences into printing masks of the direct sale, which are used for the

communication with fiscal module FM 3000. By means of this simple step is your computer prepared

for the usage as a cash register system.

2. The conditions for the certificate acknowledgement

Due to the Certificate for cash register system is not issued for fiscal module but for the whole set

(the computer cash register system), user is obliged to:

During the whole period of the cash register system registration on the Tax office is necessary to use

only the devices with the electric homologation from the Slovak State Laboratory, particularly for

computer, screen, and also for printer of the bills. The user guarantees that these devices would not

be replaced with the ones that are not electrically homologised. When used other than electrically

homologised device in the set of the computer cash register system, the user is endangered with the

sanctions due to certification conditions violation, and also user is endangered with the notacknowledgement of the certification with all possible consequences. In case you are obliged backup

sale records, the tape has to be stored on dark and dry place because of the data has to be readable for

five years from the date of the receipt (stub) issuance. If is the control tape stored in electronic form,

data has to be achieved on permanent inerasable media CD ROM for e.g.

3. General information

The device is introduced under a business name FM3000. Device FM3000 is an intelligent fiscal

module with its won processor that communicates with the computer through serial interface RS232

or USB 2.0 interface. FM 3000 sends processed documents directly to connected printer. Module

enables and independent sales records administration and following calculation of balances, which

are stated in Regulation no. 33/1994 of the Statute roll. Module does not communicate with computer

if the printer is disconnected for document printing. Fiscal module is a computer using input and

output peripheral units of superior computer, but is entirely independent from it. If we want to define

functions of the module FM3000, it is basically a small electronic cash register without keyboard,

display and printer. Fiscal module is powered by source of superior computer. Module does not have

own switch, so it is turned on/off when is superior computer or source turned on/off too.

Since the module communicates with a superior system through standard serial interface RS232, the

best option of the installation is in three basic areas:

n UNIX, QNIX and terminal networks (external version),

n Computer network Nowell,

n Applications, where the software used for sale and stock records is suitable for the user and

user intents to use it in future without a supplementary homologation of the cash register

system;

n For the users who want to expand the attributes of their computer with ones of cash register

that meet the standard of Regulation no. 55/1994 of the Statute roll, about ways of keeping

sale records using a cash register.

Fiscal module FM3000 2/33 www.varos.sk

4. Attributes of the fiscal module

From the construction point of view, it is an independent microcomputer system, which passes only

the correct data and registers them in a voltage independent memory EEPROM. This memory is not

erasable, without the fiscal module opening. Fiscal module cooperates with all operation systems,

which are able to communicate through serial port RS232 (MS DOS, MS Windows 9x, 2000, XP,

OS2, UNIX, QNIX ...). Since fiscal module does not require any resident program neither a link

module it is not dependant on a programming language used for creating of a cash receipt (slip, stub).

F3000 controls and records independently from computer program only tax correct data sent to the

receipt printer. So far, the problem consisted in homologation of UNIX cash register systems that are

not adjustable for fiscal module installation, because the terminal does not have disc neither free slots

for expansion cards. Based on these facts, VAROS union started to develop and manufacture an

external kit (set of components, which modifies the internal module to external). FM 3000 is placed

between printer and computer. The module can download characters sent from the computer to

printer and it stores them in its memory and evaluates them according to standard ESC sequences

(control characters). If the data are correct, it processes them and sends them to the printer. At the

same time it actualises figures in tax registers (GT1, GT2, GT3, ordinal number of receipt, taxable

income for 0% and 19%). FM3000 enables processing of daily, monthly and annual balances, while

all the data needed for executing these balances derives from its internal memory and not the

computer memory. All tax data are stored in the non-erasable memory and whatever access or change

is not possible unless the seal is damaged and module opened. Every authorized service engineer has

their own password assigned and through which he can alter the data. That means it is possible to

identify the last person who changed the data, which are not accessible to a common user, who can

access the tax data only by damaging the seal.

The above-mentioned brief description results in necessity of printing masks modification enabling

printing of receipts on printer, It is self-active in printing the header, date, time and numbering of the

slips. It also calculates VAT on the receipts and balance sheets, continuous daily, monthly and annual

balance values, as well as values of GT1-GT3 receipts printing program only sends basic information

and through managing ESC sequences, it informs FM3000 about their importance. Said in the other

words, if you are satisfied with your current business managing software and the program providers

are willing to modify printing output slot in accordance with this guide, the installation of FM3000 is

and ideal solution for you.

5. Technical description

Fiscal module is a device that monitors and stores data of cash receipts. Fiscal module on the base of

input data evaluates type of input file. If there is a cash receipt on the input, connected printer prints it.

If there is not a cash receipt or if there is a file that fiscal module is not able to identify, document is

filtered and printer does not print it.

Fiscal module is a device with own processor, memory modules, and timer and input/output ports.

Incoming input data are evaluated by program that is permanently stored in the processor of the fiscal

module. According to the processor evaluation are particular fiscal data stored in voltage independent

memory with 64MB capacity.

In this memory are stored daily monthly and annual balances. Balances are stored in memory

permanently. It is possible to print any balance using command from superior application.

In memory is created also so-called “electronic control tape” Particular receipts are stored through

system FIFO and after overflowing capacity system overwrites the oldest receipts. Printing copy of the

receipt from control tape can call command from superior application.

Fiscal module FM3000 3/33 www.varos.sk

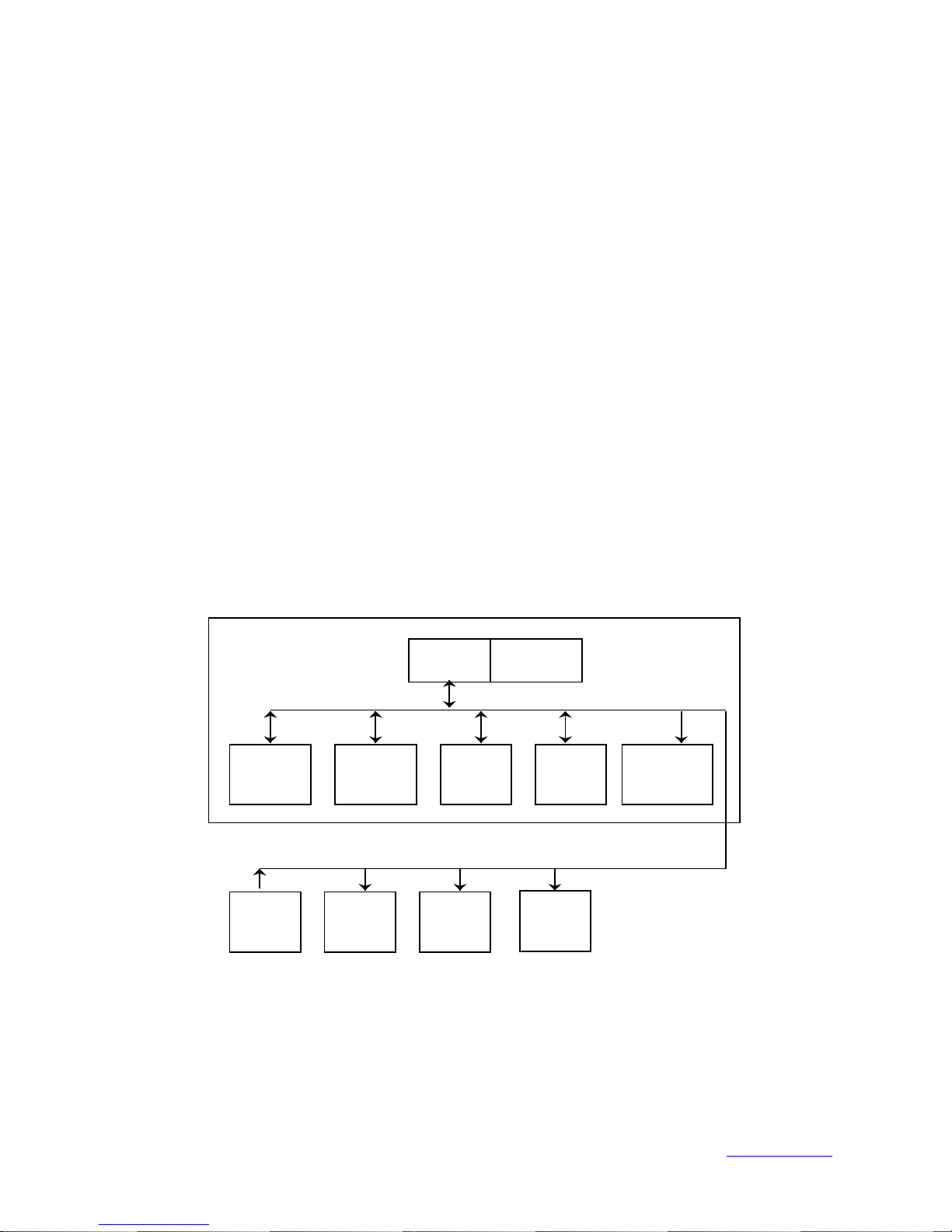

Main module

Procesor

Memory

EEPRO

Memory

MMC

Timer

RTC

Input

RS232

Output

Centronics

Input

USB2.0

Output

RS232

Output

RS232

Program

Output

cash

Fiscal module is device with own logic and evaluation. As input device we can use computer, terminal

or other type of hardware able to communicate through serial line.

The fiscal module configuration is stored into 32 kB EEPROM memory. This memory has hardware

protection and change of any data is possible only through mechanical permission of writing. Timer in

fiscal module has backup battery CR2032 in case the supply voltage disconnection.

There is following information stored in EPROM memory:

· Name and address of tax subject- text heading

· Document footing

· Tax identification number

· Tax code of the cash register

· Printing mask for VAT summary of receipts

· Graphic heading (seal)

· Text chains in particular balances

· Particular rates of VAT

· History with time information about performed change of VAT rate

· 5 types of means of payment (cash, cheques, cards, meal tickets…)

Fiscal module has own timer ( real time clock – RTC). Date and time printed on particular receipts

is automatically supplied from internal timer.

Picture No.1. Block diagram of the fiscal module

Fiscal module FM3000 4/33 www.varos.sk

Memory EEPROM 32kB

Time history of VAT changes

5 VAT rates per program

5 means of payment per program

Permanent text chains in receipts

and particular balance

Printing mask of VAT summary ram

Text footing of receipt 1024B per

Text heading of receipt 2048B

Tax number

Cash register code

Graphic heading 10240B per

Memory MMC 64MB

Storage 3,000 daily balances per program

Storage 200 monthly balances per program

Storage- 50 annual balances per program

Storage of receipts (30,000.00 receipts,

maximum 50 MB of electronic tape)

Computer

Terminal

Handheld

Cash

drawer

DRAWER

Customer

display

DISPLAY

Parallel

printer of the

receipts

PRINTER

Computer with

OS Windows

98-XP

Serial

printer of the

receipts

PRINTER

Fiscal module FM3000

Input

RS23

Input

USB2.0

Output

Centronic

Output

Displa

Output

CASH

Output

RS232

Picture No.2: EEPROM memory.

Whole memory is protected. Writing to EEPROM is possible only

after mechanic short circuit of jumper SW1.

Picture No. 3: Memory MultiMediaCard.

The CRC16 code controls all memory operation

(writing/reading).

Picture No. 4: Cooperation of the fiscal module with other

devices

Picture No.5: Connectors of fiscal module for external device connecting

Fiscal module FM3000 5/33 www.varos.sk

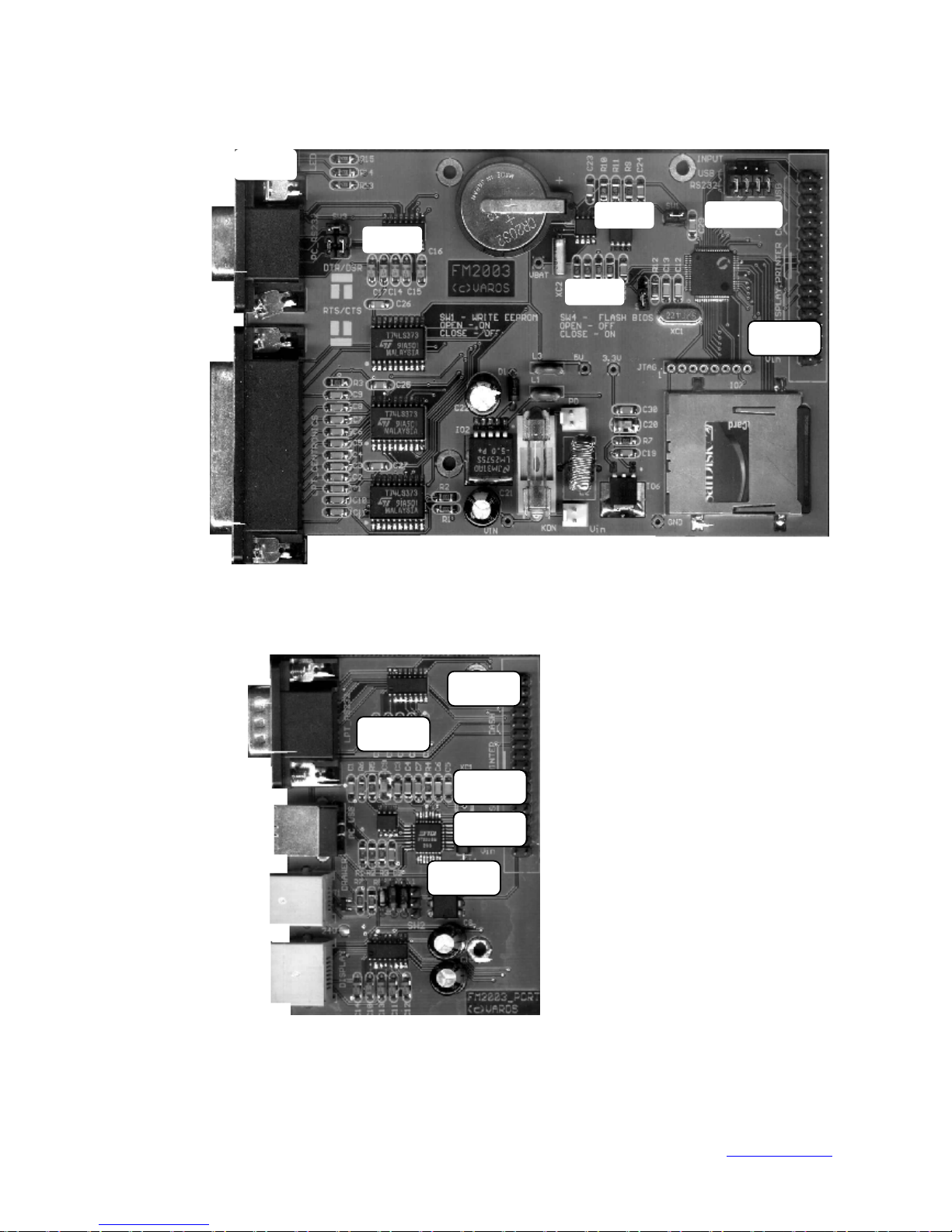

OUTPUT

PRINTER

RS232

INPUT

USB 2.0

OUTPUT

DRAWER

OUTPUT

DISPLAY

SW4

SW6

KON1

SW5

SW7

SW3

SW1

SW2

LED

OUTPUT

PRINTER

Centronics

INPUT

RS232

INPUT

KON1

6. Meaning of the connectors and switchers of fiscal module.

Fiscal module FM3000 – switch base. Serial input RS232, output to paralel printer.

Fiscal module FM3000 is extending input/output module. Extended with USB 2.0, input to serial printer,

connector to connect cash display RS232, connector for cash drawer opening with 12-24V coil.

Meaning of the connectors

SW1 -data protection in EEPROM

OPEN – writing disabled

CLOSE – writing enabled

Default CLOSE.

SW2-Flash BIOS.

Enables BIOS burning in fiscal

module.

OPEN - BIOS is protected HW

CLOSE – it is possible burn

BIOS. After burning it is

necessary to switch writing

protection on.

Default OPEN.

SW3-HW managing data output.

Managing setups DTR/DSR

or RTS/CTS. For correct

characters reception it is

necessary to adjust managing

supported by application for

receipts printing

Jumpers is necessary adjust

according white mark on

Fiscal module FM3000 6/33 www.varos.sk

switch base Default DTR/DSR.

SW4 -output voltage for opening of the cash drawer

For supply voltage of fiscal module 12V

CLOSE 1-2 - voltage 24V for the cash drawer

CLOSE 2-3 - voltage 12V for the cash drawer

For supply voltage of fiscal module 24V

CLOSE 1-2 - *** Do not use this option, it can destroy rectifier doublet ***

CLOSE 2-3 - voltage 24V for the cash drawer

Default CLOSE 1-2.

SW5 -Fiscal module supply from USB port. If is the module supplied from USB port, connector for

cash drawer opening is out of function.

If fiscal module is not supplied from USB port, SW5 has to be opened !

OPEN- fiscal module is supplied from external source.

CLOSE - fiscal module is supplied from USB port of computer

Default OPEN.

SW6 - Input of 5V voltage supply to 9 pin of connector LPT_RS232.

OPEN- 9 PIN of the connector is not connected

CLOSE – the 5V voltage input on 9 PIN of the connector

Default OPEN.

SW7 - Data flow managing on virtual serial port that created by USB driver in computer during

communication of the fiscal module through USB port.

CLOSE 1-2 - DTR/DSR

CLOSE 2-3 - RTS/CTS

Default CLOSE 1-2.

INPUT-Options for data input: from RS232 or USB port.

It is necessary adjust jumpers according to the legend on switch base.

USB input is possible to use for operation systems Apple OS-8, OS-9 and OS-X,

Linux Kernel 2.4.0 and higher, Windows 98 / ME / 2000 / XP, Open BSD version 3.2 and

higher, Free BSD version 4.7 and higher. Default RS232.UT - RS232

KON1-Connector for connection fiscal module with extending input/output module.

LED -After voltage connection fiscal module performs its auto test of proper functionality of

particular internal components. Tests check connection of the

printer for printing receipts.

If printer does not respond or is offline, fiscal module does

not respond any command.

LEDs indicate mode of fiscal module. During the test are LEDs on in compliance with running test. After

the tests finish LED diodes indicates status of fiscal module.

ON - LED is on, OFF – LED is off

LED1 LED2 LED3 Condition of fiscal module FM3000

ON OFF ON The MMC memory does give any response or is not initialised.

OFF ON OFF Normal situation. Module is OK printer is connected.

ON OFF OFF Timer error.

ON ON OFF Printer is in mode BUSY. Test is performed before each printing.

OFF ON ON EEPROM memory does not respond.

OFF OFF ON Loading of the turnover from issued receipts in MMC memory.

ON ON ON The MMC memory formatting or burning new BIOS.

During the MMC memory formatting computer screen shows

message MASTER RESET ZAC. After formatting ended screen

shows text MASTER RESET END. After BIOS burning shows text

FLASH.

Fiscal module FM3000 7/33 www.varos.sk

7. Features of communication ports

There are two connectors on fiscal module. Input RS232 and output Centronics.

Input port.

Standard serial port RS232. Connector CANNON 9F

Parameter of port - number of bits (8)

-number of stop bits (1)

-Transmission speed (9600 or 57600) it is possible adjust in service program

-parity none (N)

- Data flow controlDTR/DSR or RTS/CTS it is possible adjust with help of jumpers.

Specification of serial RS -232C compatible port .

Signal level -Logic „1“ -3 up to -15 V

Logic „0“ 3 up to 15 V

Output port.

Standard parallel port Centronics. Connector CANNON 25F

- Data flow control STROBE/BUSY

Description of pins (male) of Cannon 9PIN connector

9 RI Input Calling indicator

8 CTS Input Readiness for transmission

7 RTS Output Call on transmission

6 DSR Input Data terminal ready. „0“ - PC informs of ability to

receive from fiscal module (module can send data to PC

only if „0“ state is detected on this pin).

5 SG Signal ground

4 DTR Output Data terminal ready. „0“ – fiscal module informs of

ability to receive from PC (PC can send data only if

state „0“ is detected on this pin)

3 TxD Output Data transmission

2 RxD Input Data reception

1 CD Input Carrier signal detector

Pin number Pin name Flow

orientation

Function

Fiscal module FM3000 8/33 www.varos.sk

Description of connecting cable between fiscal module and computer

For connection is used direct serial cable. On side of fiscal module is connector

Cannon 9F (female) and on side of computer is connector Cannon 9M (pins-male), or Cannon 25M

(pins).

Side of fiscal module Side of computer Side of computer

Cannon 9F Cannon 9M Cannon 25M

1 CD 1 CD 8 CD

2 RxD 2 RxD 3 RxD

3 TxD 3 TxD 2 TxD

4 DTR 4 DTR 20 DTR

5 SG 5 SG 7 SG

6 DSR 6 DSR 6 DSR

7 RTS 7 RTS 4 RTS

8 CTS 8 CTS 5 CTS

Description of connecting cable between fiscal module and serial printer

Intersected serial cable is used for connection. On side of fiscal module is connector

Cannon 9M (pins) and on side of computer is connector Cannon 25F (female).

Side of fiscal module Side of printer

Cannon 9M Cannon 25F

1 CD 4 RTS

2 RxD 2 TxD

3 TxD 3 RxD

4 DTR 6 DSR connect with 5 CTS

5 SG 7 SG

6 DSR connect with 8 CTS 20 DTR

7 RTS 8 CD

Description of connecting cable between fiscal module and parallel printer

Classical cable so called Centronics cable is used for connection. On side of module is connector Cannon

25PIN/F (female) and on printer side is connector MC36SP.

! Never use other type of interface than specified!

! Connect the port only when power off!

Fiscal module FM3000 9/33 www.varos.sk

Description of connector RJ11 for cash drawer connecting

Connector RJ11 connects cash drawer with coil 12/24V with fiscal module. Fiscal module automatically

sends impulse for cash drawer opening before printing of the receipt. Command for drawer opening is

possible to call also from superior application by sequence ESC "o", (see programmer manual).

Before connecting into the socket it is necessary to adjust SW4 value voltage for coil. If on SW4 is

connected pin 1-2 the output voltage for coil is double than feeding voltage of fiscal module.

SW4- output voltage value for cash drawer.

If is fiscal module fed from USB port the connector for cash drawer opening does not work.

Feeding voltage of fiscal module 12V.

· CLOSE 1-2 - 24V voltage for cash drawer

· CLOSE 2-3 - 12V voltage for cash drawer

Feeding voltage of fiscal module 24V.

· CLOSE 1-2 - *** Do not use this option, it can destroy rectifier doublet ***

· CLOSE 2-3 - 24V voltage for cash drawer

PIN DESCRIPTION

1, 2 NC - unconnected

3 State of cash drawer. Some drawers are supplied with state switch

(open-closed). Fiscal module detects pin status and sends this information back

to the computer.

4 Drawer IN. Input to coil – voltage for coil 12/24V; see SW4.

5 Drawer OUT. Output from coil – coil switching. Maximum current of coil is

0,8A.

6 GND- grounding. Between 3rd and 6th pin of connector is connected switcher of

cash drawer. If it is connected on 3rd pin, level is 5V.

Description of connector RJ45 for connecting cash register display

Connector RJ45 connects cash register display to fiscal module. From connector RJ45 comes outlet of

serial port RS232. Data to be shown on display are sent with prefix

ESC “>” (see programmer manual)

PIN DESCRIPTION

1, 2 Display feeding voltage 5V

3, 4 GND

5 DSR

6 RxD

7 DTR

8 TxD

Fiscal module FM3000 10/33 www.varos.sk

8. Programmer manual

Control of fiscal module FM3000 is very similar to control and driving of printers. It means that

it has defined operate characters called also ESC sequences. All defined functions are called by these

sequences.

Programmer does no program heading, tax number, cash register number, he/she also does not

calculate daily, monthly and annual balances nor calculates tax on receipts. Module with its processor

ensures above-mentioned functions. Programmer programs particular text items of receipt and

operate ESC sequences that define to module what to perform. If the module does not receive in text

chains ESC sequences that are commands what is to be performed module poses as a perfect filter. It

means that module does not release any data and filters all text chains (it does release anything to

printer). If module receives operate sequences and recognizes them it performs demanded task. For

example, if we want to make annual balance we send ESCd and other things provide FM3000.

Allowed ESC sequences

Sequences used for creating receipts

ESC b - start of receipt

ESC k - information about that comes total sum per receipt

ESC e - end of receipt

ESC Px - x=<1-5>, defines mean of payment that were used to pay receipt (cash, cheques, and

total. More means of payment can be used to pay a receipt.

ESC > -chain that follows after ESC sequence is not processed but it is redirected to

display connector. Redirecting is cancelled after acceptation of characters CR+LF

ESC F -short operate sequences transfer to printer

Positive ESC sequences

ESC 1 - information that item has to be added to turnover in tax rate number 1 (19%)

ESC 2 - information that item has to be added to turnover in tax rate number 2 (x %)

ESC 3 - information that item has to be added to turnover in tax rate number 3 (0 %)

ESC 7 - information that item has to be added to turnover in tax rate number 4 (x %)

ESC 0 - information that item has to be added to turnover in tax rate number 5 (x %)

Negative ESC sequences

ESC 4 x- information that item has to be deducted from turnover in tax rate number 1 (19%)

ESC 5 x- information that item has to be deducted from turnover in tax rate number 2 (x %)

ESC 6 x- information that item has to be deducted from turnover in tax rate number 3 (0 %)

ESC 8 x- information that item has to be deducted from turnover in tax rate number 4 (x %)

ESC 9 x- information that item has to be deducted from turnover in tax rate number 5 (x %)

x - / A, B , C / - specifies information about negative item.

A - cancel

B - discount

C – negative item

Fiscal module FM3000 11/33 www.varos.sk

In negative ESC sequences is possible specify type of negative turnover x. In the framework of

negative ESC sequences is sent more detailed information /A, B, C/. If the negative item is not

specified, it is automatically cumulated in variable negative item.

Sequences used for printing balance

ESC x - running x- balance

ESC d - daily balance

ESC D - copy of last daily balance

ESC m - monthly balance

ESC M - copy of last monthly balance

ESC y - annual balance

ESC Y - copy of last annual balance

ESC CxYYYYMMDDyyyy- copy of defined document or balance stored in MMC memory

Sequences used for the auxiliary functions

ESC c-last document copy

ESC s-condition of printer

ESC t -time setting

ESC n-non- fiscal document

ESC i-identification of fiscal module building

ESC I-information file building

ESC Q-the last document transfer into PC

ESC F-transfer of short operate sequences for printer

ESC o-cash drawer opening (that is connected to fiscal module connector)

ESC > -chain following after ESC sequence is not processed; it is redirected to display

connector. Redirecting is cancelled after acceptation of characters ETX

ESC ~-erasing of the documents from MMC memory after daily balance performing

Meaning and interpretation of characters in instruction:

ESC - character 1B <H> = 27 <D> operate character ESCape

CR - character 0D <H> = 13 <D> cursor home

LF - character 0A <H> = 10 <D> enter

ETX - character 03 <H> = 3 <D> end of chain

FF - character 0C <H> = 12 <D> pagination

<H> - hexa symbol value

<D> - decimal symbol value

Fiscal module FM3000 12/33 www.varos.sk

Ordinal number of

daily balance in

month/ number of

If were means of payment

defined in receipt the

summary of them will be

printed Max. 5

Cumulated values of

grand totals from last

annual balance

In balance are only tax

rates with non-zero

turnover. Max. 5. If

the receipts were

round off there is

expressed round of per

day

If the negative items

were defined it will be

printed summary of

particular negative

items.

9. Balance and auxiliary ESC sequences

Function: Daily balance accomplishing

Command: ESC d

ESC d Yes - extended mode

Format: 1B<H>64<H>

1B<H>64<H>59<H>65<H>73<H>

Description: After particular setting of this sequence the daily balance is automatically

accomplished. During daily balance are calculated particular daily turnovers and

subsistent taxes. Also are accounted daily and cumulated grand totals. A number of

daily balances are increased and daily balance is printed. A number of daily balances

are increased. The values of running balance and ordinal numbers of receipts are

cancelled out. If receipts contained data about means of payment, daily balance will

print summary of means of payment.

If it is activated extended mode (protected against overwriting) after sending ESC d /

fiscal module would print daily balance only after extended command ESC d Yes.

Form of document:

VAROS - združenie

Rudlovská cesta 53

974 00 Banská Bystrica

IC VAT:____________DKP:_________

Docum.: 210 Poc. DB: 5/2

Date: 5.05.2004 Time:15:55

____________________________________

DAILY BALANCE

____________________________________

[Rate] [Tax base][Tax] [Turnover]

19% 1000.00 190.00 1190.00

0 % 500.00 0.00 500.00

________ Turnover summary __________

Turnover total: 1690.00

From that rounded off 5.40

Cancelled: 300.00

Discount: 100.00

Negative: 100.00

M. of pay. 1: 1000.00

M. of pay. 2: 690.00

________ C U M M U L A T E D ________

GT1 Gross: 2190.00

GT2 Net: 1690.00

GT3 Negative: 500.00

____________________________________

Fiscal module FM3000 13/33 www.varos.sk

Poc.MB = ordinal

number of monthly

balance. The number

is annulled after

annual balance

In balance are only tax

rates with non-zero

turnover. Max. 5.

If the negative items

were defined it will be

printed summary of

particular negative

items.

If were means of payment

defined in receipt the

summary of them will be

printed Max. 5

Cumulated values of

grand totals from last

annual balance

Function: Monthly balance accomplishing

Command: ESC m

ESC m Yes - extended mode

Format: 1B<H>6D<H>

1B<H>6D<H>59<H>65<H>73<H>

Description: After particular setting of this sequence the monthly balance is automatically

accomplished. During monthly balance are calculated particular monthly turnovers and subsistent

taxes. Also are accounted monthly and cumulated grand totals. A number of monthly balances are

increased and monthly balance is printed. A number of daily balances are increased. The new values

of grand totals are stored in independent memory. The values of current and daily balance are

cancelled out. The ordinal numbers of daily balances and receipts are cancelled out. If receipts

contained data about means of payment, daily balance will print summary of means of payment.

If it is activated extended mode (protected against overwriting) after sending ESC m / fiscal module

would print monthly balance only after extended command ESC m Yes.

Form of document:

VAROS - združenie

Rudlovská cesta 53

974 00 Banská Bystrica

IC VAT:____________DKP:_________

Poc. MB:2 Date: 31.05.2004 Time:18:00

____________________________________

MONTHLY BALANCE

____________________________________

[Rate] [Tax base][Tax] [Turnover]

19% 10000.00 1900.0011900.00

0 % 5000.00 0.00 5000.00

________ Turnover summary __________

Turnover total: 16900.00

Cancelled: 3000.00

Discount: 1000.00

Negative: 1000.00

____________________________________

M. of pay. 1: 10000.00

M. of pay. 2: 6900.00

________ C U M U L A T E D ________

GT1 Gross: 21900.00

GT2 Net: : 16900.00

GT3 Negative: 5000.00

____________________________________

Note: Monthly balance automatically controls accomplishing of daily balance. If user forgets to

accomplish last daily balance after calling monthly balance device will automatically

accomplish daily balance first.

Fiscal module FM3000 14/33 www.varos.sk

Ordinal number of

following daily

balance in month/

number of balances in

current day

In balance are only tax

rates with non-zero

turnover. Max. 5.

Summary of particular

negative items and

means of payment.

Cumulated values of

grand totals from last

annual balance

Function: Accomplishing of current X_balance

Command: ESC x

Format: 1B<H>78<H>

Description: After particular setting of this sequence the current X-balance is automatically

accomplished. During X-balance are calculated particular current turnovers from last daily

balance also are accounted current cumulated. Values in particular turnovers will stay

unchanged.

Form of document:

VAROS - združenie

Rudlovská cesta 53

974 00 Banská Bystrica

IC VAT:____________DKP:_________

Document: 210 Poc. DB: 5/2

Date: 5.05.2004 Time:15:55

____________________________________

X - BALANCE

____________________________________

[Rate] [Tax base][Tax] [Turnover]

19% 1000.00 190.00 1190.00

________ Turnover summary __________

Turnover total: 1190.00

Cancelled: 300.00

____________________________________

M. of pay. 1: 1190.00

________ C U M U L A T E D ________

GT1 Gross 1490.00

GT2 Net: 1190.00

GT3 Negative: 300.00

____________________________________

Fiscal module FM3000 15/33 www.varos.sk

Poc.AB – ordinal

number of annual

balance.

Cumulated values of

grand totals since last

annual balance.

Function: Annual balance accomplishing

Command: ESC y

ESC y Yes - extended mode

Format: 1B<H>79<H>

1B<H>79<H>59<H>65<H>73<H>

Description: After particular setting of this sequence the annual balance is automatically accomplished.

During monthly balance are calculated particular annual turnovers and annual grand totals.

A number of annual balances are increased and annual balance is printed. Values of

current, daily and monthly balances are cancelled out. The ordinal numbers of daily

balances and monthly balances and receipts are cancelled out. Values of particular

turnovers and grand totals are cancelled out. It is so called fast reset of fiscal module.

Copies of previous daily, monthly and annual balances stay unchanged. It is possible to

print them or read them through service program. If it is activated extended mode

(protected against overwriting) after sending ESC y / fiscal module would print monthly

balance only after extended command ESC y Yes.

! WARNING ! This balance can accomplish only service centre!

The annual balance accomplishing has to be recorded in service book of the cash register!

Form of document:

VAROS - združenie

Rudlovská cesta 53

974 00 Banská Bystrica

IC VAT:____________DKP:_________

Poc. RU:2 Date31.12.2004 Time:24:00

____________________________________

ANNUAL BALANCE

____________________________________

________ C U M U L A T E D ________

GT1 Gross 40200.00

GT2 Net: 24100.00

GT3 Negative: -16100.00

____________________________________

Note : Annual balance automatically controls accomplishing of monthly and daily balance. If

user forgets to accomplish last daily or monthly balance after calling monthly balance

device will automatically accomplish daily and monthly balance first.

Fiscal module FM3000 16/33 www.varos.sk

Function: Accomplishing of daily balance copy

Command: ESC D

Format: 1B<H>44<H>

Description: After particular sequences is automatically accomplished copy of last daily balance.

Difference between copy and original is that on the balance copy is printed current date

and time when was the copy of daily balance accomplished.

Form of document: Look at the form of the daily balance!

Note : Copy of daily balance can be called whenever during the sale until accomplishing

following daily balance. Copy of last daily balance is stored also after monthly balance

accomplishing.

Function: Accomplishing of monthly balance copy

Command: ESC M

Format: 1B<H>4D<H>

Description: After particular sequences is automatically accomplished copy of last monthly balance.

Difference between copy and original is that on the balance copy is printed current date

and time when was copy of monthly balance accomplished.

Form of document: Look at the form of the monthly balance!

Note: Copy of monthly balance can be called whenever during the sale until accomplishing

following monthly balance.

Function: Accomplishing of annual balance copy

Command: ESC Y

Format: 1B<H>59<H>

Description: After particular sequences is automatically accomplished copy of last annual balance.

Difference between copy and original is that on the balance copy is printed current date

and time when was copy of annual balance accomplished.

Form of document: Look at the form of the annual balance!

Note: Copy of annual balance can be called whenever during sale until accomplishing following

annual balance.

Function: Copy of the document from electronic tape

Command: ESC C x YYYYMMDDyyyy CR

Format: 1B<H>43<H> xYYYYMMDDyyyy 0D<H>

Description: Fiscal module enables copy of the document printing or balance from electronic control

tape. Module stores 50 annual, 200 monthly and 3,000 daily balances and 20,000 (or

maximum 50 MB) documents. After particular sequence setting is automatically printed

copy of demanded document. Parameters specify selection of the document. Receipt has

to be defined by all parameters. Parameter yyyy of balances is empty. It demanded

document does not exist printer will be printing it.

x – type of document B - cash receipt

D - daily balance

M - monthly balance

Y - annual balance

YYYY - year of document issuance <2000 - 2999>. It has to contain four digits.

MM - month of document issuance <01 - 12>. It has to contain two digits.

DD - day of document issuance <01 - 31>. It has to contain two digits.

yyyy- number of cash receipt <1-9998>.

Fiscal module FM3000 17/33 www.varos.sk

Balances do not have this parameter. If is as the number of the document set value 9999

device will print all documents performed in particular day. (It is possible to use this

function during printing control tape at the end of the day).

Example: Printing of receipt number 777 issued on 9th May 2004

ESC C B 2 0 0 4 0 5 0 9 7 7 7 CR

1B<H>43<H>42<H>32<H>30<H>30<H>34<H>30<H>35<H>30<H>39<H>37<H>

37<H>37<H>0D<H>

Printing of all cash receipts from 10

th

May 2004

ESC C B 2 0 0 4 0 5 1 0 9 9 9 9 CR

1B<H>43<H>42<H>32<H>30<H>30<H>34<H>30<H>35<H>31<H>30<H>39<H>

39<H>39<H>39<H>0D<H>

Printing of daily balance from 16th August 2004

ESC C D 2 0 0 4 0 8 1 6 CR

1B<H>43<H>44<H>32<H>30<H>30<H>34<H>30<H>38<H>31<H>36<H>0D<H>

Printing of monthly balance from 31

st

December 2003

ESC C M 2 0 0 3 1 2 3 1 CR

1B<H>43<H>4D<H>32<H>30<H>30<H>33<H>31<H>32<H>33<H>31<H>0D<H>

Printing of annual balance from 31

st

December 2004

ESC C Y 2 0 0 4 1 2 3 1 CR

1B<H>43<H>59<H>32<H>30<H>30<H>34<H>31<H>32<H>33<H>31<H>0D<H>

Function: How to detect printer status

Command: ESC s

Format: 1B<H>73<H>

Description: After sending of sequences fiscal module sets up DSR /CTS/ signal as active if it is

printer on and prepared for receiving data and non- active if the printer is not

prepared to receive data. This signal is automatically switched on active state if

printer is active and connected. Sequence can test parallel and serial printers.

Note: DSR /CTS/ signal response time is approximately 300 mS.

Function: The internal timer date and time of adjustment.

Command: ESC t 1 1 1 1 1 6 ”day ones” 7 ”day tens” 8 ”month ones”

9 ”month tens” : ”year ones” ; ”year tens” 4 ”hour ones”

5 ”hour tens” 2 ”minutes ones” 3”minutes tens” CR

Format: 1B<H>74<H>31<H>31<H>31<H>31<H>31<H>36<H>”day ones”

37<H> ”day tens”38<H>”month ones”39<H>”month tens”

A<H>”year ones”3B<H>”year tens”34<H>hour ones”

35<H> hour tens 32<H>”minutes ones”33<H>”minutes tens”0D<H>

Description: Function can adjust only one of the parameters or more parameters at once. Command

has to start with ECS t 11111 and after could decide which of the parameters should be

adjusted. The quoted numbers can have values<0,1,2,3,4,5,6,7,8,9 >. Command has to

finish with 0D<H>.

Note: Fiscal module has its own timer that is not depending from the feeding voltage. This

sequence is used when is synchronized time with PC or when is change to daylight

saving and vice versa.

Fiscal module FM3000 18/33 www.varos.sk

Function: Non-fiscal document printing

Command: ESC n „ text to be printed “ FF

Format: 1B<H>51<H>“Text to be printed“ 0C<H>

Description: With the help of this sequence are printed short non-fiscal documents. Sequence is used

to print lists of coins; withdrawal and deposit cash in cash desk, description of the

recipes in pharmacies etc. After enter this sequence fiscal module prints non-fiscal

document. This kind of the document starts with the text: This is not fiscal document

and this text is periodically repeated after each 15 lines of the entered text.

Note: Text has to finish with characters 0C<H>. If you want to send character of pagination it is

entered character FF<H>. Module converts this character automatically to 0C<H>

Function: Accomplishing of the copy of last document

Command: ESC c

Format: 1B<H>63<H>

Description: After enter of this sequence is accomplished copy of cash receipt.

In the first line of document is printed text. *** Cash receipt copy ***

Date and time of document is like in the original.

Note: This command can call only copy of cash receipt and not copy of balances.

Function: Fiscal module identification

Command: ESC i

Format: 1B<H>69<H>

Description: After sending of this sequence fiscal module gives back information, it provides

identification data: name of fiscal module "FM3000" and firmware version /2Byte/. The

new firmware version can be burnt into module with the help of service program.

Fiscal module communicates with computer through serial or USB interface with HW

data flow control.

Note: Fiscal module communicates with whatever terminal adjust as communication parameters

of the port - 9600,N, 8,1

Function: Short operate sequences transfer

Command: ESC F „ operate sequence “ ETX

Format: 1B<H>46<H>“Operate sequence“ 03<H>

Description:With this sequence are sent short operate sequences to printer. It is used to command

switch to print head of writing recipes, for opening cash register drawer without

printing, for change of fonts ...

Note: Operate sequence has to be ended with characters 03<H>. If the character 03<H>, does

not come, module prints automatically informing text chain, if exceeds 17 characters.

Sequence can be used also in framework of cash receipt printing.

Function: The last document transfer in the PC

Command: ESC Q

Format: 1B<H>51<H>

Description: After sequence sending fiscal module sends to the computer last receipt.

Module communicates with PC through serial or USB interface with HW data flow

control.

Note: This command can transfer to the computer whatever document last printed in cash

register printer.

Fiscal module FM3000 19/33 www.varos.sk

Function: Info file creation

Command: ESC I

Format: 1B<H>49<H>

Description:After particular sequence sending fiscal module accounts and sends to the computer

information file about particular turnovers running values. Module communicates with

computer through serial or USB interface with HW data flow control.

This file contains following data:

· Fiscal module identification code

· Document ordinal number

· Daily and monthly balance ordinal number

· Running turnovers of particular VAT taxes

· Running minus turnover

· Date and time from fiscal module timer

Form of document: 1 Fiscal module identification code

5 Document ordinal number

3 Last daily balance ordinal number

4 Last monthly balance ordinal number

100,00 Running turnover in tax no.1

1000,00 Running turnover in tax no.2

500,00 Running turnover in tax no.3

1500,00 Running turnover in tax no.4 / tax rate 0% /

50,00 Running minus turnover

14.07.2003 13:50 Date and time from fiscal module timer

Note: This command can bring into the computer running data and ordinal numbers of particular

balances. Fiscal module communicates with whatever terminal adjusted for the port

communication parameters - 9600,N, 8,1

Function: Cash register drawer opening

Command: ESC o

Format: 1B<H>6F<H>

Description:After sequences is sent impulse for cash register drawer opening that is connected to

connector RJ11 /DRAWER/ of fiscal module.

Note: Impulse for cash register drawer opening is sent automatically during the printing of each

receipt and balance.

Function: Sending characters to display connected to fiscal module

Command: ESC > "characters to be sent to display " ETX

Format: 1B<H>3E<H>"text chain"03<H>

Description:Through sequences sending are send text chains to connector RJ45 /DISPLAY/

of fiscal module. Fiscal module does not process text chains; it only redirects them to

cash register display

Note: Redirecting is automatically ended after characters ETX are received. It is possible to use

sequence also in the framework of cash register document.

Fiscal module FM3000 20/33 www.varos.sk

Function: Control tape deletion

Command: ESC ~

Format: 1B<H>7E<H>

Description:Through sequence are deleted all cash register documents from electronic control tape.

Fiscal module does not erase balances. Function is used after are cash sale document

downloaded to PC and stored on DVD or CD medium.

Note: Deletion of cash receipts is possible to perform only after daily balance accomplishing.

Fiscal module FM3000 21/33 www.varos.sk

10. The creating of the cash register receipt

During the receipt creating are all entering characters loaded into the fiscal module internal memory.

The fiscal module is processing and evaluating them on the basis of the operate ESC sequences.

According above- mentioned evaluation module prints receipt or filters incoming characters. Incoming

receipt is processed and it is printed consequently as processed

Fiscal module evaluates module evaluates if the end sum of the receipt coming after Esc k equals the

sum accounted by module itself on the basis of the prices of particular items (following the ESC0-ESC9

sequence.)

If sent the sum following ESC does not equal accounted value, fiscal module creates error report and

receipt is not included into daily or cumulated turnovers GT1-GT3.

If is the difference between amounts 0, fiscal modulo prints receipt and includes it into daily and

cumulated turnovers GT1-GT3. If the final sum is not round off 0.50 SKK fiscal module rounds off

automatically. Value of round of is added to turnover.

In service program is defined to which tax group has to be added rounding of cash receipts.

ESC0 - ESC9 sequences define the tax group where will be included the sum following particular

ESCV sequence. Module automatically recognizes (on the base of ESC sequences) tax rate of particular

items. This rate is printed before each item instead of coming

ESC0 - ESC9 sequences.

In the document framework is possible to use also auxiliary ESC sequences.

ESC > - chain following ESC sequence is not processed, it is re-directed to display connector. The

acceptation of the ETX character is cancelling redirection.

ESC F -transfer of short operate sequence to printer (change of the fonts, change oh printing head..)

With the help of this sequence are sent operate ESC sequences of the printer that are sequences

colliding with ESC sequences of fiscal module.

Structure of the cash receipt: 1, cash receipt heading

2, date, time, ordinal number of receipt

3, body of receipt

4, total sum of receipt

5, VAT summary

6, means of payment summary

7, variable footing of cash receipt

8, constant footing of cash receipt

· Cash receipt heading - it is a stabile heading, programmed by service technician to the

independent EEPROM memory of the fiscal module. In the service program is possible to define

graphic and text heading. The parts of text heading are the tax number (DIČ), registration cash

register number and VAT number. When printed, graphic heading is printed before text heading.

Receipt heading is printed after sequences ESC b.

· Date, time and ordinal number of the document - enters fiscal module automatically after

the receipt heading. Date and time is loaded from internal timer that works independently from

computer timer. Date and time is printed after sequences ESC b.

· The body of the receipt itself consists of the particular items of the goods.

The sum for the particular goods should be preceeded by ESC sequence, which informs fiscal

Fiscal module FM3000 22/33 www.varos.sk

module about the tax category of the goods.

In sum can be also characters <+ - , . >. Module ignores these charactes and selects only

characters 0 - 9. The characters <+/-> are not relevant for the sum. Module decides only on the

base of ESC coming before the sum.

It means that value 10,000.00 could be expressed as:

+ 10,000,00 SKK + 10,000.00 SKK 10 000.00 SKK + 10,000.00 SKK etc...

Positive items sent with ESC sequences are positive turnovers ESC1, ESC2, ESC3, ESC7, ESC0/.

ESC 1 - information that item has to be added to turnover in tax rate number 1 (19%)

ESC 2 - information that item has to be added to turnover in tax rate number 2 (x %)

ESC 3 - information that item has to be added to turnover in tax rate number 3 (0 %)

ESC 7 - information that item has to be added to turnover in tax rate number 4 (x %)

ESC 0 - information that item has to be added to turnover in tax rate number 5 (x %)

Negative items are sent with ESC sequences in compliance with negative turnovers /ESC4, ESC5,

ESC6, ESC8, ESC9/. In negative ESC sequences is possible to specify type of negative turnover x.

ESC 4 x- information that item has to be deducted from turnover in tax rate number 1 (19%)

ESC 5 x- information that item has to be deducted from turnover in tax rate number 2 (x %)

ESC 6 x- information that item has to be deducted from turnover in tax rate number 3 (0 %)

ESC 8 x- information that item has to be deducted from turnover in tax rate number 4 (x %)

ESC 9 x- information that item has to be deducted from turnover in tax rate number 5 (x %)

A – cancel

B – discount

C – negative item

If in item is not used specific information “x” about negative item, negative items are automatically

cumulated in variable negative item.

In case the negative item x is used in footing of receipt in daily balance is printed summary of

negative items in structure cancelled/discounts/negative items.

· Final sum of cash receipt – the sum has to be written with two decimals. The sum is

preceeded by ESC k. If the final sum is not rounded off to 0.5 SKK, fiscal module

automatically rounds off receipt as follow:

The decimal sum interval Rounding Example

y = <0,00-0,24> y = 0,00 15,24 = 15,00

y = <0,25-0,74> y = 0,50 15,25 = 15,50 15,74 = 15,50

y = <0,75-0,99> y = 1,00 15,75 = 16,00 15,99 = 16,00

· VAT summary – performed by fiscal module. Tax sum is in particular rates rounded of

to one decimal.

The decimal sum interval Rounding Example

VAT <0,00-0,049> VAT = 0,00 15,049 = 15,00

VAT <0,05-0,099> VAT = 0,10 15,05 = 15,10 15,099 = 15.10

Printed are only these VAR rates with non-zero interval.

· Means of payment of summary – fiscal module can monitor means of payment (cash,

cheques, meal tickets, bank card....) used for cash receipt payment. Through service program is

possible to define 5 means of payment types. Paid sum for particular mean of payment is sent

through sequence ESC P. Paying with particular means of payment is not checked by fiscal

module for final sum, it is just for information. Payment with various means of payment is

printed in the footing of cash receipts. Cumulated values are in daily and running balances.

ESC P 1 - information about payment with mean number 1

Fiscal module FM3000 23/33 www.varos.sk

ESC P 2 - information about payment with mean number 2

ESC P 3 - information about payment with mean number 3

ESC P 4 - information about payment with mean number 4

ESC P 5 - information about payment with mean number 5

Printed are only these means that were used in payment.

· Variable footing of cash receipt – superior program can put in the receipt footing

variable text. (Identification data for customer, thanks for purchase...

· Constant footing of cash receipt – it is the chain programmed by service technician into

independent EEPROM memory of fiscal module. It is constant chain printed automatically at

the end of each cash receipt. It helps to adjust operate sequences for cash drawer opening,

cutting and releasing paper...

Document footing is printed after receiving sequences of the end receipt ESC e.

An example of the receipt creating

Chains and variables in the fiscal module could be change through service program. Preset values of

producer are as follows:

Defined means of payment

---------------------------------------------------------------------------------------------------------------------------

Mean of payment Text Maximum length Adequate Currency code

ESC sequence

--------------------------------------------------------------------------------------------------------------------------Mean of payment 1 Cash: 32 Bytes ESC P1 SKK

Mean of payment 2 Bankcard: 32 Bytes ESC P2 SKK

Mean of payment 3 Meal tickets: 32 Bytes ESC P3 SKK

Mean of payment 4 Cheques: 32 Bytes ESC P4 SKK

Mean of payment 5 EURO: 32 Bytes ESC P5 EURO

---------------------------------------------------------------------------------------------------------------------------

Defined VAT rates and text in the receipt footing

---------------------------------------------------------------------------------------------------------------------------

Tax Currency code Variable for accounting Adequate ESC sequences

/ permanent length 3Byte / Positive negative

--------------------------------------------------------------------------------------------------------------------------Tax number 1 SKK 19% ESC 1 ESC 4

Tax number 2 SKK 0% ESC 2 ESC 5

Tax number 3 SKK 0% ESC 3 ESC 6

Tax number 4 SKK 0% ESC 7 ESC 8

Tax number 5 SKK 0% ESC 0 ESC 9

---------------------------------------------------------------------------------------------------------------------------

Rounding value is adjusted that is added to 19% tax rate.

Text following hyphen is only description for programmer, it is not sent to fiscal module.

In following examples are created more types of receipts. According to used ESC sequences in

document is possible sent additional information to fiscal module about distinguished positive and

negative items (cancelled/discount/negative items), about mean of payment (Cash/Bank card/Meal

tickets/Cheques/EURO. These information uses fiscal module during summary, daily and monthly and

running balances. Means of payment are also printed in cash receipts.

Fiscal module FM3000 24/33 www.varos.sk

According to ESC b fiscal module

prints graphic and text heading,

ordinal receipt number/or

Body of cash receipt. Sequences

ESC 0 - ESC 9 are replaced with

defined VAT rate.

If is the final sum equal to

calculated amout for particular items,

device prints VAT summary.

Document is stored on electronic

Here is printed variable footing of

the document sent from superior

Receipt No.1 – without summary of negative items.

Document sent to fiscal module

ESCb ; ESCb receipt heading

Name Pcs Prc/PU Tax Sum<CR><LF> ; Document body, description line

butter 3ks 25.50 ESC1 51.00 Sk<CR><LF> ; Positive item tax 1

milk 1L 1ks 20.50 ESC1 20.50 Sk<CR><LF> ; Positive item tax 1

bottle 10ks 5.00 ESC3 50.00 Sk<CR><LF>; Positive item tax 3

bottle 1ks 5.00 ESC6 -5.00 Sk<CR><LF>; Negative item tax 3

butter 1pcs 25.50 ESC4 -25.50 Sk<CR><LF>; Negative item tax 1

ESCk 91.00 Sk<CR><LF> ; Total sum

..... ; Variable document footing.

..... Here is information

..... ; about customer

ESCe ; End of cash receipt

If is accepted sum following ESC equal sum calculated by fiscal module (considered are only

numbers following ESCx sequence, positive x=1,2,3,7,0 or negative x=4,5,6,8,9), the complete receipt

footing is printed. At the same moment is receipt stored on electronic control tape.

The length of one receipt line is not limited. So it is possible to use for receipts printing wide paper and

documents can be wider than 40 characters.

Document printed by fiscal module printer:

Product of VAROS union

53 Rudlovska cesta AURIS

974 01 Banska Bystrica

DIC :1020555294 IC VAT:SK1020555294

DKP: xxxxxxxxxxxx

Document: 4/1 Date:25.05.2004 Time:10:45

--------------------------------------------------------Name Pcs Prc/PU Tax Sum

butter 3pcs 25.50 19% 51.00 Sk

milk 1L 1pcs 20.50 19% 20.50 Sk

bottle 10pcs 5.00 0% 50.00 Sk

bottle 1pcs 5.00 - 0% -5.00 Sk

butter 1pcs 25.50 -19% -25.50 Sk

==================================

Price total: 91.00 Sk

==================================

[Rate] [Base] [Tax] [Turnover]

VAT1 19% 38.70 7.30 46.00 Sk

VAT3 0% 45.00 0.00 45.00 Sk

---------------------------------------------------------

Fiscal module FM3000 25/33 www.varos.sk

According to ESC b fiscal module prints

graphic and text heading, ordinal receipt

number/ordinal number of daily

balance, where will be receipt included,

date and time of the receipt.

Body of cash receipt. Sequences

ESC 0 - ESC 9 are replaced with

defined VAT rate.

Final sum is automatically rounded.

Value of rounding is added to VAT

rate adjusted by service program.

VAT summary is printed. Receipt is

Here is printed variable footing of

the document sent from superior

program

Receipt No.2 – without negative items summary, and without total amount rounding off for 0.5 SKK

Document sent to fiscal module

ESCb ; ESCb receipt heading

Name Pcs Prc/PU Tax Sum<CR><LF> ; Receipt body, descriptive line

butter 3pcs 25.50 ESC1 51.00 Sk<CR><LF> ; Positive item tax 1

milk 1L 1pcs 20.50 ESC1 20.70 Sk<CR><LF> ; Positive item tax 1

bottle 10pcs 5.00 ESC3 50.00 Sk<CR><LF>; Positive item tax 3

bottle 1pcs 5.00 ESC6 -5.00 Sk<CR><LF>; Negative item tax 3

butter 1pcs 25.50 ESC4 -25.50 Sk<CR><LF>; Negative item tax 1

ESCk 91.20 Sk<CR><LF> ; Total sum is not

; rounded for 0.5 SKK

..... ; Variable document footing.

..... ; Here is information about

; customer

ESCe ; End of cash receipt

Document printed by printer connected to fiscal module

Product of VAROS union

53 Rudlovska cesta AURIS

974 01 Banska Bystrica

DIC :1020555294 IC VAT:SK1020555294

DKP: xxxxxxxxxxxx

Document: 4/1 Date:25.05.2004 Time:10:45

--------------------------------------------------------Name Pcs Prc/PU Tax Sum

butter 3pcs 25.50 19% 51.00 Sk

milk 1L 1pcs 20.50 19% 20.50 Sk

bottle 10pcs 5.00 0% 50.00 Sk

bottle 1pcs 5.00 - 0% -5.00 Sk

butter 1pcs 25.50 -19% -25.50 Sk

==================================

Rounding: - 0.20 Sk

Price total: 91.00 Sk

==================================

[Rate] [Base] [Tax] [Turnover]

VAT1 19% 38.70 7.30 46.00 Sk

VAT3 0% 45.00 0.00 45.00 Sk

---------------------------------------------------------

Fiscal module FM3000 26/33 www.varos.sk

According to ESC b fiscal module

prints graphic and text heading,

ordinal receipt number/ordinal

number of daily balance, where will

be receipt included, date and time of

the receipt.

Body of cash receipt. Sequences

ESC 0 - ESC 9 are replaced with

defined VAT rate.

If the final sum is no equal sum of

particular items, the correct sum is

shown. Receipt is considered wrong

and it is not stored on tape.

Information about sum non- equality

is printed SUM_IN – sum from PC

SUM_TOTAL – sum calculated.

Receipt No .3 – wrong document - total sum is not equal sum of particular items

Document sent to fiscal module

ESCb ; ESCb receipt heading

Name Pcs Prc/PU Tax Sum<CR><LF> ; Receipt body, descriptive line

butter 3pcs 25.50 ESC1 51.00 Sk<CR><LF> ; Positive item tax 1

milk 1L 1pcs 20.50 ESC1 20.50 Sk<CR><LF> ; Positive item tax 1

bottle 10pcs 5.00 ESC3 50.00 Sk<CR><LF>; Positive item tax 3

bottle 1pcs 5.00 ESC6 -5.00 Sk<CR><LF>; Negative item tax 3

butter 1pcs 25.50 ESC4 -25.50 Sk<CR><LF>; Negative item tax 1

ESCk 91.10 Sk<CR><LF> ; Total sum is not equal to

;particular items sum

..... ; Variable document footing.

..... ; Here is information about

; customer.

ESCe ; End of cash receipt

Document printed by printer connected to fiscal module

Product of VAROS union

53 Rudlovska cesta AURIS

974 01 Banska Bystrica

DIC :1020555294 IC VAT:SK1020555294

DKP: xxxxxxxxxxxx

Document: 4/1 Date:25.05.2004 Time:10:45

--------------------------------------------------------Name Pcs Prc/PU Tax Sum

butter 3pcs 25.50 19% 51.00 Sk

milk 1L 1pcs 20.50 19% 20.50 Sk

bottle 10pcs 5.00 0% 50.00 Sk

bottle 1pcs 5.00 - 0% -5.00 Sk

butter 1pcs 25.50 -19% -25.50 Sk

==================================

Price total: 91.00 Sk

> Nezhoda SUM

SUM_IN: 91.10 - SUM_TOTAL: 91.00

---------------------------------------------------------

Fiscal module FM3000 27/33 www.varos.sk

Body of cash receipt. Sequences

ESC 0 - ESC 9 are replaced with

defined VAT rate.

Final sum is automatically rounded.

Value of rounding is added to VAT

rate adjusted by service program.

VAT summary is printed. Receipt is

Here is printed variable footing of

the document sent from superior

program

Receipt No.4 – with negative items specification

Document sent to fiscal module

ESCb ; ESCb receipt heading

Name Pcs Prc/PU Tax Sum<CR><LF> ; Receipt body, descriptive line

butter 3pcs 25.50 ESC1 51.00 Sk<CR><LF> ; Positive item tax 1

milk 1L 1pcs 20.50 ESC1 20.50 Sk<CR><LF> ; Positive item tax 1

bottle 10pcs 5.00 ESC3 50.00 Sk<CR><LF> ; Positive item tax 3

bottle 1pcs 5.00 ESC6A -5.00 Sk<CR><LF> ; Negative item tax 3 cancelled

butter 1pcs 25.50 ESC4A -25.50 Sk<CR><LF> ; Negative item tax 1 cancelled

Discount 10% 5.00 ESC4B -9.10 Sk<CR><LF> ; Negative item tax 1 discount

ESCk 81.90 Sk<CR><LF> ; Total sum

..... ; Variable document footing.

..... ; Here is information about customer

..... ; about customer

ESCe ; End of cash receipt

Document printed by printer connected to fiscal module

Product of VAROS union

53 Rudlovska cesta AURIS

974 01 Banska Bystrica

DIC :1020555294 IC VAT:SK1020555294

DKP: xxxxxxxxxxxx

Document: 4/1 Date:25.05.2004 Time:10:45

----------------------------------------------------------Name Pcs Prc/PU Tax Sum

butter 3pcs 25.50 19% 51.00 Sk

milk 1L 1pcs 20.50 19% 20.50 Sk

bottle 10pcs 5.00 0% 50.00 Sk

bottle 1pcs 5.00 -0% -5.00 Sk

butter 1pcs 25.50 -19% -25.50 Sk

Discount 10% -19% - 9.10 Sk

==================================

Rounding: 0.10 Sk

Price total: 82.00 Sk

==================================

[Rate] [Base] [Tax] [Turnover]

VAT1 19% 31.10 5.90 37.00 Sk

VAT3 0% 45.00 0.00 45.00 Sk

-----------------------------------------------------------

Note: When you print daily and running balance, negative item are divided into groups as

cancelled/discounts/negative items. Only non-zero items are printed

See example of daily and running balance.

Fiscal module FM3000 28/33 www.varos.sk

According to ESC b fiscal module

prints graphic and text heading,

ordinal receipt number/ordinal

number of daily balance, where will

be receipt included, date and time of

the receipt.

Final sum is automatically rounded.

Value of rounding is added to VAT

rate adjusted by service program.

VAT summary is printed. Receipt is

Body of cash receipt. Sequences

ESC 0 - ESC 9 are replaced with

defined VAT rate.

Here is printed summary of means

payment used for paying receipt.

Here is printed variable footing of

the document sent from superior

Receipt No.5 – with means of payment specification

Document sent to fiscal module

ESCb ; ESCb receipt heading

Name Pcs Prc/PU Tax Sum<CR><LF> ; Receipt body, descriptive line

Bicycle BMX1pcs 50 000.00 ESC1 50 000.00 Sk<CR><LF> ; Positive item tax 1

Allowed discount 5 000.00 ESC4A 5 000.00 Sk<CR><LF>; Negative item tax 1

ESCk 45 000.00 Sk<CR><LF> ; Total sum

ESCP1 5 000.00 Sk<CR><LF> ; Mean of payment1

ESCP2 30 000.00 Sk<CR><LF> ; Mean of payment2

ESCP4 10 000.00 Sk<CR><LF> ; Mean of payment4

..... ; Variable document footing.

..... ; Here is information

..... ; about customer

ESCe ; End of cash receipt

Document printed by printer connected to fiscal module

Product of VAROS union

53 Rudlovska cesta AURIS

974 01 Banska Bystrica

DIC :1020555294 IC VAT:SK1020555294

DKP: xxxxxxxxxxxx

Document: 4/1 Date:25.05.2004 Time:10:45

----------------------------------------------------------Name Pcs Prc/PU Tax Sum

Bicycle BMX 1pcs 50 000.00 19% 50 000.00 Sk

Allowed discount -19% - 5 000.00 Sk

==================================

Price total: 45 000.00 Sk

==================================

[Rate] [Base] [Tax] [Turnover]

VAT1 19% 37815.107184.9045000.00 Sk

==================================

Cash: 5 000.00 Sk

Bank card 30 000.00 Sk

Cheques 10 000.00 Sk

-----------------------------------------------------------

Note: When you print daily and running balance, the cumulated value of used means of

payment id printed. Only non- zero values are printed.

See example of daily and running balance.

Fiscal module FM3000 29/33 www.varos.sk

Receipt No. 6 – Using of all possible ESC sequences for cash receipt

Document sent to fiscal module

ESCb ; ESCb receipt heading

ESCF "wide font adjustment" ETX ; Change of font type

Name Pcs Prc/PU Tax Sum<CR><LF> ; Receipt body, descriptive line

ESCF "normal font adjustment” ETX ; Change of font type

Goods 110pcs 10.00 ESC1 100.00 Sk<CR><LF> ; Positive item tax 1

ESC> "shows item on display connected to FM3000" ETX ; Sending the text on display

Goods 310pcs 10.00 ESC3 100.00 Sk<CR><LF> ; Positive item tax 3

ESC> "shows item on display connected to FM3000" ETX ; Sending the text on display

Cancelled 11pcs 10.00ESC4A -10.00 Sk<CR><LF> ; Negative item tax 1 cancelled

ESC> "shows item on display connected to FM3000" ETX ; Sending the text on display

Cancelled 31pcs 10.00ESC6A -10.00 Sk<CR><LF> ; Negative item tax 3 cancelled

ESC> "shows item on display connected to FM3000" ETX ; Sending the text on display

Discount in tax 1 ESC4B -10.00 Sk<CR><LF>; Negative item tax 1 discount

Negative item in tax1 ESC4C - 9.90 Sk<CR><LF>; Negative item tax 1

ESC>"shows receipt sum display" ETX ; Sending the total sum on display

ESCk 160.00 Sk<CR><LF> ; Total sum

ESCP1 10.00 Sk<CR><LF> ; Mean of payment1

ESCP2 20.00 Sk<CR><LF> ; Mean of payment2

ESCP3 30.00 Sk<CR><LF> ; Mean of payment3

ESCP4 60.00 Sk<CR><LF> ; Mean of payment4

ESCP5 1.00 EURO<CR><LF> ; Mean of payment5

..... ; Variable document footing.

..... ; Here is information about customer

..... ; about customer

ESCe ; End of cash receipt.

Fiscal module FM3000 30/33 www.varos.sk

Body of cash receipt. Sequences

ESC 0 - ESC 9 are replaced with

defined VAT rate.

Final sum is automatically rounded.

Value of rounding is added to VAT

rate adjusted by service program.

VAT summary is printed. Receipt is

Here is printed summary of means

payment used for paying receipt.

Here is printed variable footing of

the document sent from superior

Document printed by printer connected to fiscal module

Product of VAROS union

53 Rudlovska cesta AURIS

974 01 Banska Bystrica

DIC :1020555294 IC VAT:SK1020555294

DKP: xxxxxxxxxxxx

Document: 4/1 Date:25.05.2004 Time:10:45

---------------------------------------------------------

Name PcsPrc/PU Tax Sum

Goods 1 10pcs 10.00 19% 100.00 Sk

Goods 2 10pcs 10.00 0% 100.00 Sk

Cancelled 1 1pcs - 10.00 -19% - 10.00 Sk

Cancelled 21pcs - 10.00 - 0% - 10.00 Sk

Discount tax 1 -19% -10.00 Sk

Negative item tax1 -19% - 9.90 Sk

==================================

Rounding: - 0.10 Sk

Price total: 160.00 Sk

==================================

[Rate] [Base] [Tax] [Turnover]

VAT1 19% 58.80 11.20 70.00 Sk

VAT3 0% 90.00 0.00 90.00 Sk

==================================

Cash: 10.00Sk

Bankcard: 20.00 Sk

Meal tickets: 30.00 Sk

Cheques: 60.00 Sk

EURO: 1.00 EURO

------------------------------------------------------------

Note: When you print daily and running balance, negative item are divided into groups as

cancelled/discounts/negative items. Only non-zero items are printed

When you print daily and running balance, the cumulated value of used means of

payment id printed. Only non- zero values are printed.

See example of daily and running balance.

Fiscal module FM3000 31/33 www.varos.sk

11. Error messages of receipt printing.

Fiscal module during the voltage beginning performs detecting of proper functionality of particular

hardware components. Error state is indicated with light of LEDs and connected printer prints error

message. Printed are only error messages that are possible to print.

Text of error message is possible to change through service program so it can be different from

following message. If fiscal module detects HW error it stops its activity until the error removal.

LED1 LED2 LED3 Text of error message printed by printer

1. ON OFF ON Error 1 - MMC memory

2. OFF ON OFF * Normal state FM3000 is OK, printer is connected.

3. ON OFF OFF Error 2 - Timer error

4. ON ON OFF * Printer is in state BUSY

5. OFF ON ON Error3 - EEPROM error

6. OFF OFF ON * Loading of turnover from issued receipts in MMC memory

7. ON ON ON MASTER RESET ZAC / MASTER RESET END / FLASH

8. OFF OFF OFF * Fiscal module is not connected to feeding voltage.

In states marked with “ * “ cash register printer does not print error message.

Error 1

The MMC memory does not respond its initialisation has failed.

Error 2

Timer error. Timer does respond or adjusting failed.

Error 3

EEPROM memory does not respond or its initialisation has failed.

Error 4

Change backup battery of timer. Timer is back upped by CR2032 battery on device base.

Error 5

Difference of sums. Total sum for receipt not equal sum for particular items of receipt

12. Service book of cash register.

It has to be stored in place where is the cash register used. In case of tax inspection is tax subject obliged

to submit service book to tax office inspections. Service technician records to this book all malfunctions

of cash register emerging during the work of register. The page of the book has to be numbered in

ascending order.

Cash register can be used only with its Tax code of cash register. The code issues Tax office in place of

enterprise registration. The enterprise executive has to submit this service book and the cash register

certificate.

Registration of cash register in Tax office

For cash register code issuance you need document as follows:

1.Application for code issuance

2.Service book of cash register – first page is fill out.

3.Copy of business licence.

4.The cash register certificate- it is a part o fiscal module.

Enterprise executive submits the application. Unregistered cash register without number and cash register

without record from service centre cannot work.

Fiscal module FM3000 32/33 www.varos.sk

Front page of the Service book of cash register- filled out by the service centre.

Type and model: - fill:”FM3000”

Serial number: - fill serial number of cash register from product plate

Put in the operation (date): - date, when the service technician put the cash register in

the operation

Put out of operation (date): - date, when the service technician put the cash register of

operation

Service technician surname and name: - name of person who connected the cash register

Address of the premises where is cash - fill out address

register used (street, place, and postal code:

13. Cash register book

Cash register book is a book where are recorded daily and monthly turnovers, there are also stick daily

and monthly balances of cash register. The part of cash register book can be also service book of cash

register. Pages of the book have to be numbered ascendant. The book can consist from sheets, but the

sheets have to be numbered. In case of tax inspection is tax subject oblige to submit this book for

inspection.

Used terms and expressions

Daily balance (DB):- it is the balance that has to do user of cash register every evening after sale

finishing.

- It is not necessary to accomplish balance if the tax balance per a day was 0.

The balance is stuck in cash register book

- If user accomplished more DB he do not have stick all them into cash register

book.

- Data from daily balance are filled out in cash register book

Monthly balance (MB) - it is the balance that has to do user of cash register in the evening of the last day

in the month or following day in the morning.

- Data from monthly balance are filled out in cash register book

Cumulated turnovers – They are turnovers that should be equal 0 at the moment when is cash register put

in the operation, their value increases. The service technician can reset them after

annual balance accomplishing.

Gross turnover GT1- turnover of all positive sums registered in cash registers.

Net turnover GT2 - real takings of cash register. It is the difference between positive and negative

sums registered by cash register.

- It is according valid formula GT2 = GT1 - GT3

Negative turnover GT3- turnover of all negative sums registered by the cash registers as are cancelled

items, returnable containers…

Daily turnover - turnover since last daily balance

Monthly turnover - turnover since last monthly balance

All values of turnovers, taxes, cumulated grand totals that is necessary to write into the cash register book

after accomplished DB or MB are simply in particular balances printed by fiscal module. We recommend

to fill out values of daily balance in new page (you can check comparison MB with DB for each month).

Loading...

Loading...